- SLRN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

Acelyrin (SLRN) 425Business combination disclosure

Filed: 6 Feb 25, 7:51pm

Filed by ACELYRIN, INC. Pursuant to Rule 425 under the Securities Act of 1933, as amended, and deemed fileable pursuant to Rule 14a-12 under the Securities Exchange Act of 1934, as amended Subject Company: ACELYRIN, INC. Commission File No.: 001-41696 | Alumis and ACELYRIN Merger Investor Presentation February 6, 2025 Transform Therapies. Reimagine Lives.

Disclaimer Financial Disclaimer Alumis' and ACELYRIN's audited consolidated financial statements for the year ended December 31, 2024 are not yet available. Accordingly, the information presented herein regarding cash, cash equivalents and marketable securities as of December 31, 2024, reflects each of Alumis' and ACELYRIN's preliminary financial data, subject to the completion of Alumis' and ACELYRIN's financial closing procedures and any adjustments that may result from the completion of the review and audit of Alumis' and ACELYRIN's consolidated financial statements for the year ended December 31, 2024, respectively. Actual financial results that will be reflected in each of Alumis' and ACELYRIN's Annual Reports on Form 10-K for the year ended December 31, 2024, when they are completed and publicly disclosed may differ from the preliminary results presented here. Forward-Looking Statements This communication contains forward-looking statements within the meaning of federal securities laws, including the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Such statements are based upon current plans, estimates and expectations of management of Alumis Inc. (“Alumis”) and ACELYRIN, Inc. (“ACELYRIN”) in light of historical results and trends, current conditions and potential future developments, and are subject to various risks and uncertainties that could cause actual results to differ materially from such statements. The inclusion of forward-looking statements should not be regarded as a representation that such plans, estimates and expectations will be achieved. Words such as “anticipate,” “expect,” “project,” “intend,” “believe,” “may,” “will,” “should,” “plan,” “could,” “continue,” “target,” “contemplate,” “estimate,” “forecast,” “guidance,” “predict,” “possible,” “potential,” “pursue,” “likely,” and words and terms of similar substance used in connection with any discussion of future plans, actions or events identify forward-looking statements. All statements, other than statements of historical facts, including express or implied statements regarding the proposed transaction; the conversion of equity interests contemplated by the agreement and plan of merger, dated as of February 6, 2025, by and among the parties (the “merger agreement”); the issuance of common stock of Alumis contemplated by the merger agreement; the expected filing by Alumis with the Securities and Exchange Commission (the “SEC”) of a registration statement on Form S-4 (the “registration statement”) and a joint proxy statement/prospectus of Alumis and ACELYRIN to be included therein (the “joint proxy statement/prospectus”); the expected timing of the closing of the proposed transaction; the ability of the parties to complete the proposed transaction considering the various closing conditions; the expected benefits of the proposed transaction; the sufficiency of the combined company’s capital resources; the combined company’s cash runway; the competitive ability and position of the combined company;the clinical pipeline of the combined company; and any assumptions underlying any of the foregoing, are forward-looking statements. Risks and uncertainties include, among other things, (i) the risk that the proposed transaction may not be completed in a timely basis or at all, which may adversely affect Alumis's and ACELYRIN's businesses and the price of their respective securities; (ii) the potential failure to receive, on a timely basis or otherwise, the required approvals of the proposed transaction, including stockholder approvals by both Alumis's stockholders and ACELYRIN's stockholders, and the potential failure to satisfy the other conditions to the consummation of the transaction; (iii) the effect of the announcement, pendency or completion of the proposed transaction on each of Alumis's or ACELYRIN's ability to attract, motivate, retain and hire key personnel and maintain relationships with partners, suppliers and others with whom Alumis or ACELYRIN does business, or on Alumis's or ACELYRIN's operating results and business generally; (iv) that the proposed transaction may divert management’s attention from each of Alumis's and ACELYRIN's ongoing business operations; (v) the risk of any legal proceedings related to the proposed transaction or otherwise, or the impact of the proposed transaction thereupon, including resulting expense or delay; (vi) that Alumis or ACELYRIN may be adversely affected by other economic, business and/or competitive factors; (vii) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement, including in circumstances which would require Alumis or ACELYRIN to pay a termination fee; (viii) the risk that restrictions during the pendency of the proposed transaction may impact Alumis's or ACELYRIN's ability to pursue certain business opportunities or strategic transactions; (ix) the risk that the anticipated benefits and synergies of the proposed transaction may not be fully realized or may take longer to realize than expected; (x) the impact of legislative, regulatory, economic, competitive and technological changes; (xi) risks relating to the value of Alumis securities to be issued in the proposed transaction; (xii) the risk that integration of the proposed transaction post closing may not occur as anticipated or the combined company may not be able to achieve the growth prospects expected from the transaction; (xiii) the effect of the announcement, pendency or completion of the proposed transaction on the market price of the common stock of each of Alumis and ACELYRIN; (xiv) the implementation of each of Alumis's and ACELYRIN's business model and strategic plans for product candidates and pipeline, and challenges inherent in developing, commercializing, manufacturing, launching, marketing and selling potential existing and new products and product candidates; (xv) the scope, progress, results and costs of developing Alumis's and ACELYRIN's product candidates and any future product candidates, including conducting preclinical studies and clinical trials, and otherwise related to the research and development of Alumis's and ACELYRIN's pipeline; (xvi) the timing and costs involved in obtaining and maintaining regulatory approval for Alumis's and ACELYRIN's current or future product candidates, and any related restrictions, limitations and/or warnings in the label of any approved product; (xvii) the market for, adoption (including rate and degree of market acceptance) and pricing and reimbursement of Alumis's and ACELYRIN's product candidates, if approved, and their respective abilities to compete with therapies and procedures that are rapidly growing and evolving; (xviii) uncertainties in contractual relationships, including collaborations, partnerships, licensing or other arrangements and the performance of third party suppliers and manufacturers; (xix) the ability of each of Alumis and ACELYRIN to establish and maintain intellectual property protection for products or avoid or defend claims of infringement; (xx) Alumis’s ability to successfully integrate ACELYRIN’s operations and personnel and; (xxi) potential delays in initiating, enrolling or completing preclinical studies and clinical trials. These risks, as well as other risks related to the proposed transaction, will be described in the registration statement and the joint proxy statement/prospectus that will be filed with the SEC in connection with the proposed transaction. While the list of factors presented here and the list of factors to be presented in the registration statement are considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. For additional information about other factors that could cause actual results to differ materially from those described in the forward looking statements, please refer to Alumis’s and ACELYRIN’s respective periodic reports and other filings with the SEC, including the risk factors identified in Alumis’s and ACELYRIN’s most recent Quarterly Reports on Form 10-Q and/or Annual Reports on Form 10-K. The risks and uncertainties described above and in the SEC filings cited above are not exclusive and further information concerning Alumis and ACELYRIN and their respective businesses, including factors that potentially could materially affect their respective businesses, financial conditions or operating results, may emerge from time to time. Readers are urged to consider these factors carefully in evaluating these forward looking statements, and not to place undue reliance on any forward-looking statements, which speak only as of the date hereof. Readers should also carefully review the risk factors described in other documents Alumis and ACELYRIN file from time to time with the SEC. The forward-looking statements included in this communication are made only as of the date hereof. Alumis assumes no obligation and does not intend to update these forward-looking statements, even if new information becomes available in the future, except as required by law. Additional Information and Where to Find It In connection with the proposed merger, Alumis intends to file with the SEC the registration statement, which will include the joint proxy statement/prospectus. After the registration statement has been declared effective by the SEC, the joint proxy statement/prospectus will be delivered to stockholders of Alumis and ACELYRIN. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, SECURITY HOLDERS OF Alumis AND ACELYRIN ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER DOCUMENTS RELATING TO THE MERGER THAT WILL BE FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. Investors and security holders will be able to obtain copies of the joint proxy statement/prospectus (when available) and other documents filed by Alumis and ACELYRIN with the SEC, without charge, through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by Alumis will be available free of charge under the SEC Filings heading of the Investor Relations section of Alumis’s website at investors.alumis.com. Copies of the documents filed with the SEC by ACELYRIN will be available free of charge under the Financials & Filings heading of the Investor Relations section of ACELYRIN’s website investors.ACELYRIN.com. Participants in the Solicitation Alumis and ACELYRIN and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about Alumis’s directors and executive officers is set forth in Alumis’s registration statement on Form S-1/A (File No. 333-280068), which was filed with the SEC on June 24, 2024. Information about ACELYRIN’s directors and executive officers is set forth in the proxy statement for ACELYRIN’s 2024 Annual Meeting of Stockholders, which was filed with the SEC on April 22, 2024, and ACELYRIN’s Current Reports on Form 8-K filed with the SEC on May 28, 2024, August 13, 2024 and December 10, 2024. Stockholders may obtain additional information regarding the interests of such participants by reading the registration statement and the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed merger when they become available. Investors should read the joint proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. No Offer or Solicitation This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. 2 © Alumis

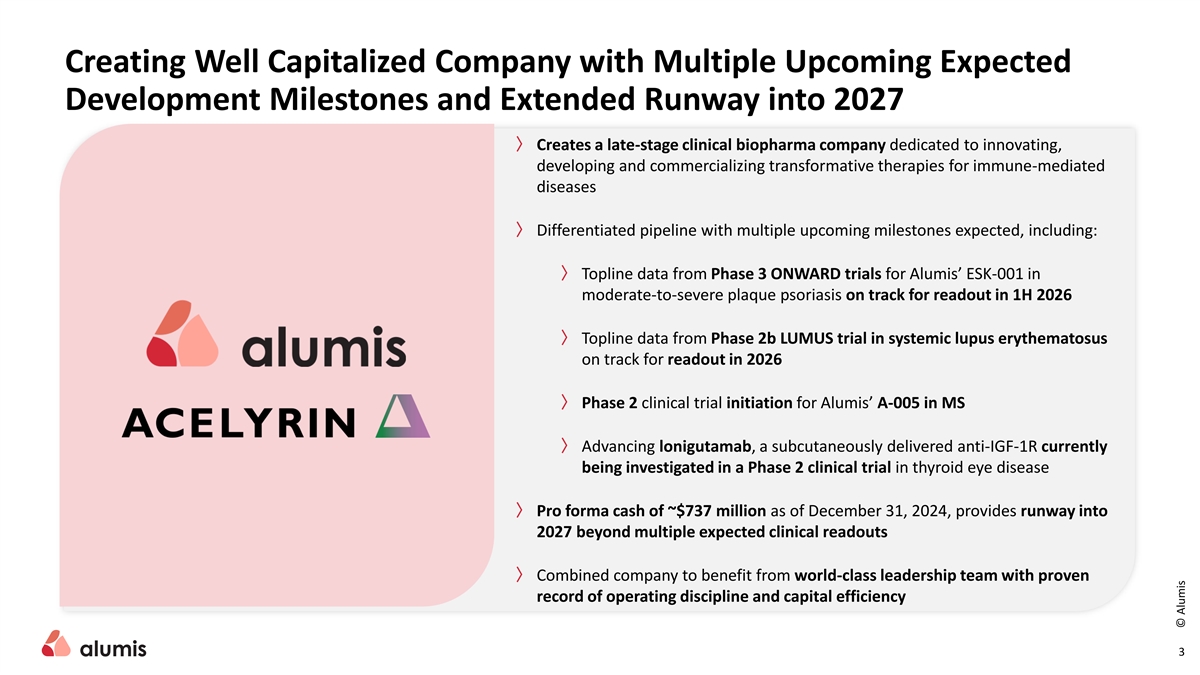

Creating Well Capitalized Company with Multiple Upcoming Expected Development Milestones and Extended Runway into 2027 〉 Creates a late-stage clinical biopharma company dedicated to innovating, developing and commercializing transformative therapies for immune-mediated diseases 〉 Differentiated pipeline with multiple upcoming milestones expected, including: 〉 Topline data from Phase 3 ONWARD trials for Alumis’ ESK-001 in moderate-to-severe plaque psoriasis on track for readout in 1H 2026 〉 Topline data from Phase 2b LUMUS trial in systemic lupus erythematosus on track for readout in 2026 〉 Phase 2 clinical trial initiation for Alumis’ A-005 in MS 〉 Advancing lonigutamab, a subcutaneously delivered anti-IGF-1R currently being investigated in a Phase 2 clinical trial in thyroid eye disease 〉 Pro forma cash of ~$737 million as of December 31, 2024, provides runway into 2027 beyond multiple expected clinical readouts 〉 Combined company to benefit from world-class leadership team with proven record of operating discipline and capital efficiency 3 © Alumis

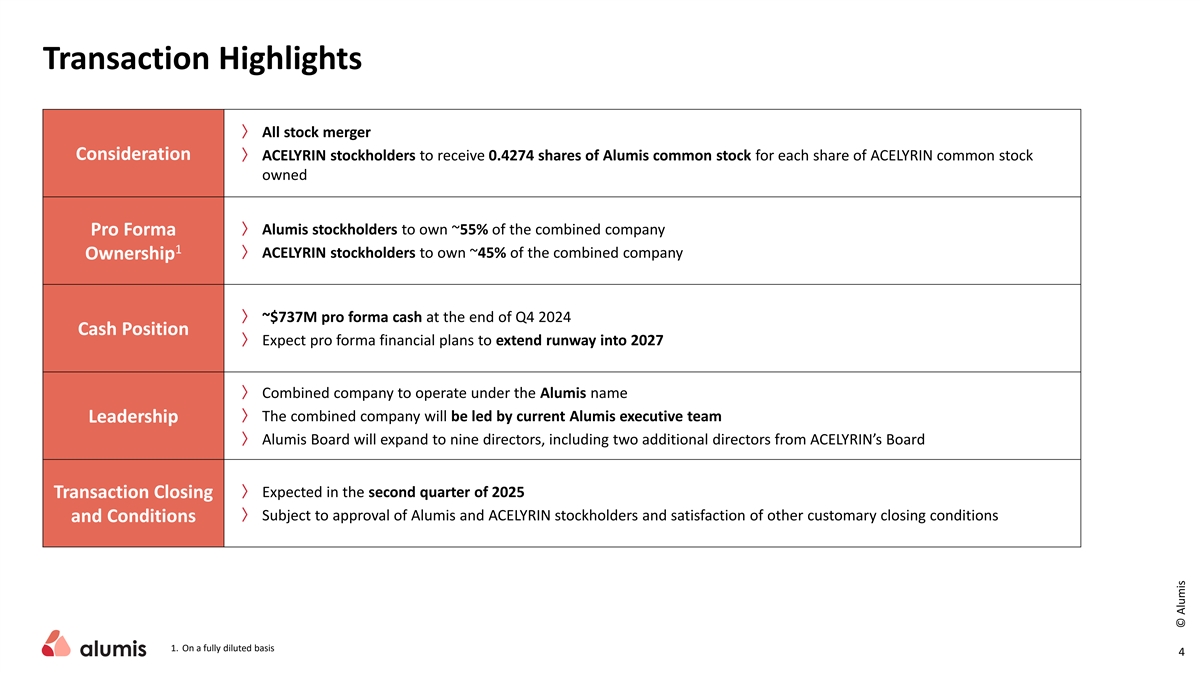

Transaction Highlights 〉 All stock merger Consideration 〉 ACELYRIN stockholders to receive 0.4274 shares of Alumis common stock for each share of ACELYRIN common stock owned 〉 Alumis stockholders to own ~55% of the combined company Pro Forma 1 〉 ACELYRIN stockholders to own ~45% of the combined company Ownership 〉 ~$737M pro forma cash at the end of Q4 2024 Cash Position 〉 Expect pro forma financial plans to extend runway into 2027 〉 Combined company to operate under the Alumis name 〉 The combined company will be led by current Alumis executive team Leadership 〉 Alumis Board will expand to nine directors, including two additional directors from ACELYRIN’s Board 〉 Expected in the second quarter of 2025 Transaction Closing 〉 Subject to approval of Alumis and ACELYRIN stockholders and satisfaction of other customary closing conditions and Conditions 1. On a fully diluted basis 4 © Alumis

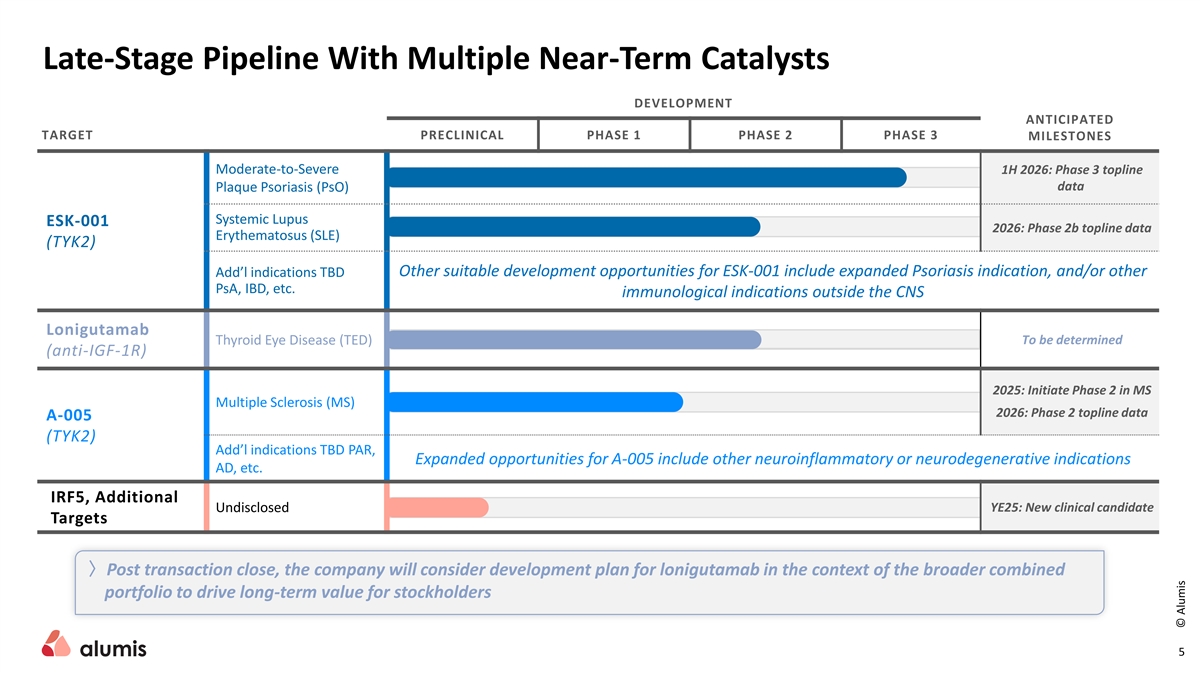

Late-Stage Pipeline With Multiple Near-Term Catalysts DEVELOPMENT ANTICIPATED TARGET PRECLINICAL PHASE 1 PHASE 2 PHASE 3 MILESTONES Moderate-to-Severe 1H 2026: Phase 3 topline data Plaque Psoriasis (PsO) Systemic Lupus ESK-001 2026: Phase 2b topline data Erythematosus (SLE) (TYK2) Other suitable development opportunities for ESK-001 include expanded Psoriasis indication, and/or other Add’l indications TBD PsA, IBD, etc. immunological indications outside the CNS Lonigutamab Thyroid Eye Disease (TED) To be determined (anti-IGF-1R) 2025: Initiate Phase 2 in MS Multiple Sclerosis (MS) 2026: Phase 2 topline data A-005 (TYK2) Add’l indications TBD PAR, Expanded opportunities for A-005 include other neuroinflammatory or neurodegenerative indications AD, etc. IRF5, Additional Undisclosed YE25: New clinical candidate Targets 〉Post transaction close, the company will consider development plan for lonigutamab in the context of the broader combined portfolio to drive long-term value for stockholders 5 © Alumis

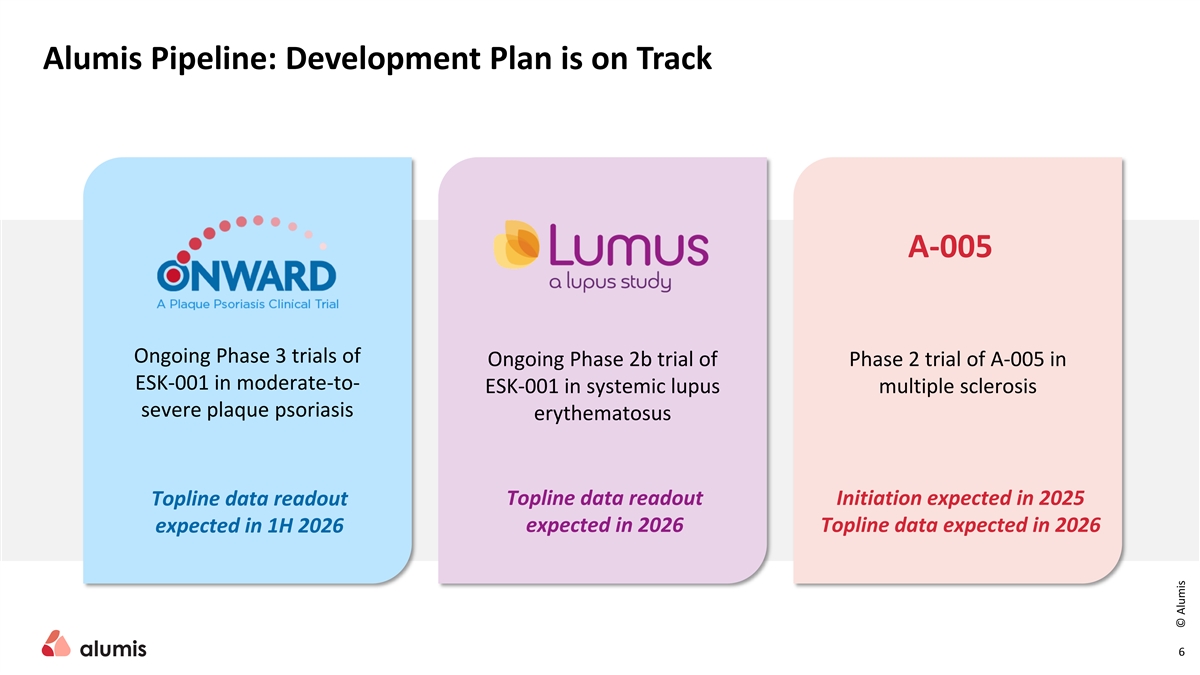

Alumis Pipeline: Development Plan is on Track A-005 Ongoing Phase 3 trials of Ongoing Phase 2b trial of Phase 2 trial of A-005 in ESK-001 in moderate-to- ESK-001 in systemic lupus multiple sclerosis severe plaque psoriasis erythematosus Topline data readout Initiation expected in 2025 Topline data readout expected in 1H 2026 expected in 2026 Topline data expected in 2026 6 © Alumis

ACELYRIN’s Lonigutamab A Next-Generation Subcutaneous Anti-IGF-1R Therapy With Best-in-Class Potential in TED Evaluating Lonigutamab Development Plan 〉 Lonigutamab is a unique asset given its mechanism of action and has best-in- class potential 〉 ACELYRIN plans to re-evaluate the development program for lonigutamab to Best-In-Class Potential confirm its differentiation in a capital efficient manner 〉 Uniquely differentiated MOA: non-competitively binding IGF-1R antagonist in TED 〉 Following closing of the transaction, Alumis will continue this work and 〉 Robust and compelling Phase 1/2 clinical data that development of lonigutamab in the context of the broader combined may enable selection of dose that optimizes efficacy portfolio to drive long-term value for stockholders and safety 〉 Potential for commercially attractive product profile with IV-like efficacy and reduced safety barriers for adoption 7 © Alumis

Flexibility and Runway to Advance Late-stage Therapies 〉Standalone: Alumis and ACELYRIN had cash, cash equivalents and marketable securities of ~$289 million and ~$448 million, respectively, on a preliminary basis, as of December 31, 2024 〉Combined Company: Pro forma cash of ~$737 million as of December 31, 2024 〉Strong Financial Position: Provides runway into 2027 to advance expanded pipeline through multiple planned key data readouts across several clinical trials 8 © Alumis

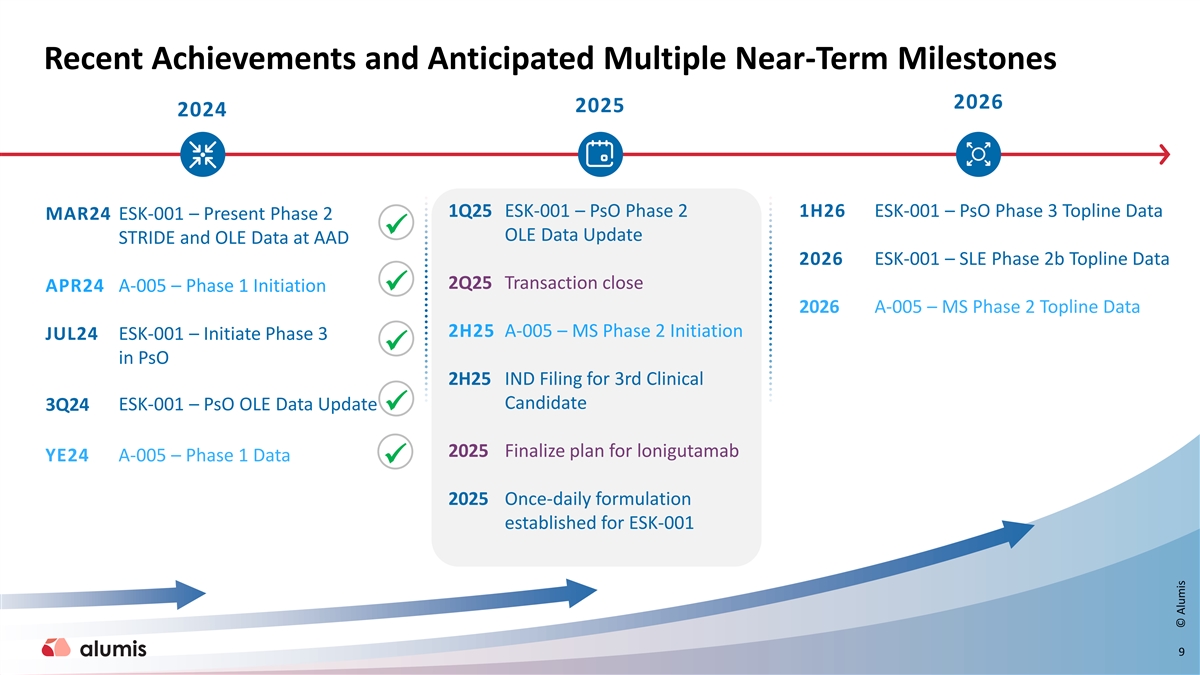

Recent Achievements and Anticipated Multiple Near-Term Milestones 2026 2025 2024 1Q25 ESK-001 – PsO Phase 2 1H26 ESK-001 – PsO Phase 3 Topline Data MAR24 ESK-001 – Present Phase 2 ✓ OLE Data Update STRIDE and OLE Data at AAD 2026 ESK-001 – SLE Phase 2b Topline Data 2Q25 Transaction close APR24 A-005 – Phase 1 Initiation ✓ 2026 A-005 – MS Phase 2 Topline Data 2H25 A-005 – MS Phase 2 Initiation JUL24 ESK-001 – Initiate Phase 3 ✓ in PsO 2H25 IND Filing for 3rd Clinical Candidate ESK-001 – PsO OLE Data Update 3Q24 ✓ 2025 Finalize plan for lonigutamab YE24 A -005 – Phase 1 Data ✓ 2025 Once-daily formulation established for ESK-001 9 © Alumis

Alumis/ACELYRIN Combination Late-Stage Clinical Biopharma Company Dedicated to Innovating, Developing and Commercializing Transformative Therapies for Immune-mediated Diseases Strong Portfolio, Large Opportunity 〉 Three potential best-in-class molecules: two advanced clinical TYK2 inhibitors and an IGF-1R inhibitor provide strategic opportunities across a broad range of immune-mediated diseases 〉 ESK-001: Near term pivotal data with two major value inflection points expected in large indications, high efficacy oral molecules provide significant market maker potential 〉 A-005: Potentially first-in-class fully CNS-penetrant TYK2 inhibitor expands breadth of addressable indications, including those within the CNS 〉 Lonigutamab: Potentially differentiated profile with favorable efficacy and safety data in TED Well capitalized and proven leadership to execute 〉 Pro forma combined cash of ~$737 million as of December 31, 2024 provides runway into 2027 beyond multiple expected clinical readouts 〉 Experienced team with strong track record of operating discipline, capital efficiency and value creation 10 © Alumis

Thank You!

Appendix

Alumis: A Well Characterized Late-Stage Portfolio with Significant Opportunity Large Two highly differentiated advanced clinical TYK2 inhibitors provide strategic opportunities Opportunity across a broad range of immune mediated diseases Genomic, proteomic and clinical insights validate and drive our Research and Development High PTS strategy and increase the probability of technical success (PTS) of our programs Market Maker High efficacy oral molecules provide significant market maker potential Near Term ESK-001: Two major value inflection points in large indications Pivotal Data A-005: First-in-class fully CNS-penetrant TYK2 inhibitor expands breadth of addressable First-in-class indications, including those within the CNS Proven Experienced team with strong track record of operating discipline, capital efficiency Leadership and value creation 13 © Alumis

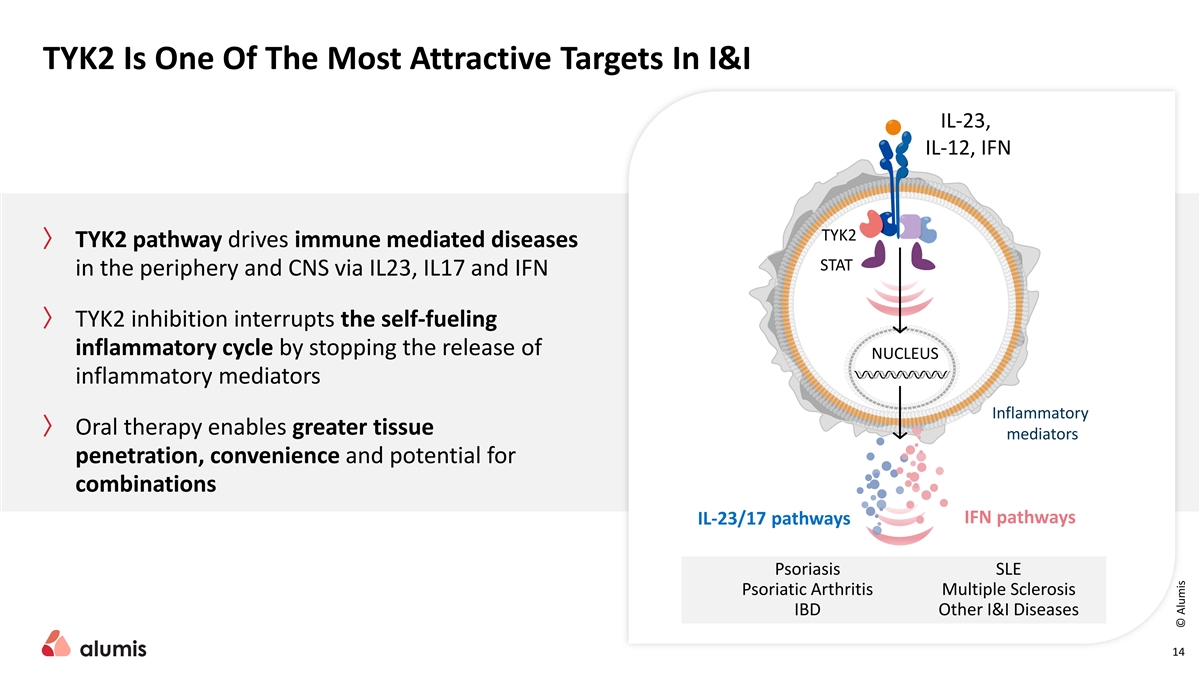

TYK2 Is One Of The Most Attractive Targets In I&I IL-23, IL-12, IFN … TYK2 〉 TYK2 pathway drives immune mediated diseases STAT in the periphery and CNS via IL23, IL17 and IFN 〉 TYK2 inhibition interrupts the self-fueling inflammatory cycle by stopping the release of NUCLEUS inflammatory mediators Inflammatory 〉 Oral therapy enables greater tissue mediators penetration, convenience and potential for combinations IFN pathways IL-23/17 pathways Psoriasis SLE Psoriatic Arthritis Multiple Sclerosis IBD Other I&I Diseases 14 © Alumis

ESK-001 and A-005: A Highly Differentiated TYK2i Portfolio ESK-001: next-generation TY2 inhibitor for immune-mediated diseases 〉 Maximal Target Inhibition Phase 3 dose fully inhibits TYK2 by every measure in skin and blood* 〉 High Response Oral Long term PASI and sPGA response rates competitive with high efficacy biologics 〉 Long Term Safety No major safety signals to date with up to two years of active therapy A-005: first-in-class CNS-penetrant TYK2 inhibitor for neuroinflammatory diseases 〉 Full CNS Penetration Significant and prolonged cerebral spinal fluid (CSF) exposure 〉 Maximal Target Inhibition High peripheral and CSF exposure achieves maximal target inhibition 〉 Phase 2 Ready Chronic tox ongoing, CMC and clinical pharmacology support Phase 2 *in vitro HWB, ex vivo Ph1 PD assays in HV, and RNAseq of Ph2 PsO patients 15 © Alumis

Maximal Target Inhibition Led to 15-20% Increase in Clinical Response (PASI) Clinical Outcomes at 28 Weeks Maximal Target Inhibition Maintained Across 24-hour (OLE Phase 2, PASI as observed) Dosing Period (Phase 1 multidose trough PK) 1000 100 93 IC90 80 72.9 71.8 100 IC50 60 47.1 10 35.2 40 20 20 1 0 2 4 6 8 10 12 14 Time (days) 0 PASI 75 PASI 90 PASI 100 20 mg QD 10 mg QD 20 mg BID 30 mg BID 60 mg QD 40 mg BID 40 mg QD 40 mg BID 16 ESK-001 Mean Trough Concentration (ng/mL) Patients with Response (%) © Alumis

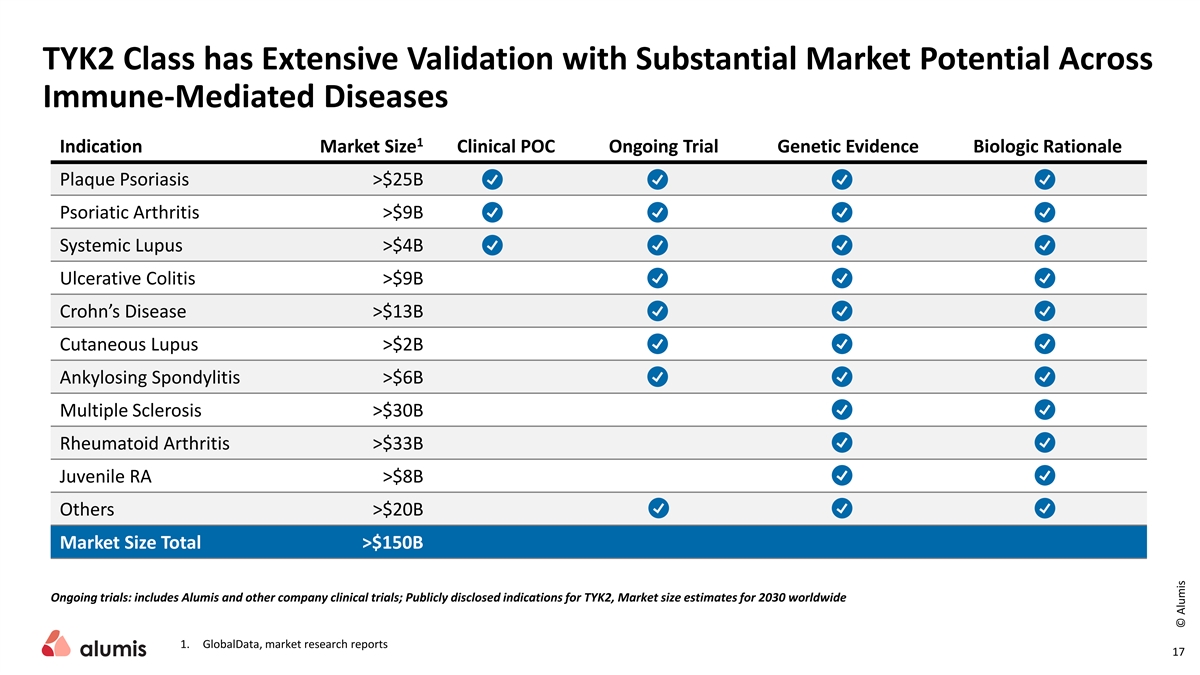

TYK2 Class has Extensive Validation with Substantial Market Potential Across Immune-Mediated Diseases 1 Indication Market Size Clinical POC Ongoing Trial Genetic Evidence Biologic Rationale Plaque Psoriasis >$25B Psoriatic Arthritis >$9B Systemic Lupus >$4B Ulcerative Colitis >$9B Crohn’s Disease >$13B Cutaneous Lupus >$2B Ankylosing Spondylitis >$6B Multiple Sclerosis >$30B Rheumatoid Arthritis >$33B Juvenile RA >$8B Others >$20B Market Size Total >$150B Ongoing trials: includes Alumis and other company clinical trials; Publicly disclosed indications for TYK2, Market size estimates for 2030 worldwide 1. GlobalData, market research reports 17 © Alumis

Lonigutamab – A Unique Mechanism for TED Patients 〉 Robust subcutaneous efficacy in TED Patients comparable to SoC and investigational anti-IGF-1R IV agents 〉 First clinical subcutaneous data in TED patients informs clinical development 〉 Optimized safety profile: potential for lower risks of hearing impairment, menstrual disorders and hyperglycemia 〉 Ability to be used chronically and flexibly to tailor to patient treatment goals 〉 Smallest, lowest volume autoinjector for an anti-IGF-1R agent 18 © Alumis