ir.burkeandherbertbank.com burkeandherbertbank.com Coming Together to Create an Exceptional Community Bank Team Member Packet Filed by Burke & Herbert Financial Services Corp. (Commission File No. 001-41633) Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 Subject Company: Summit Financial Group, Inc. (Commission File No. 000-16587) Date: August 25, 2023

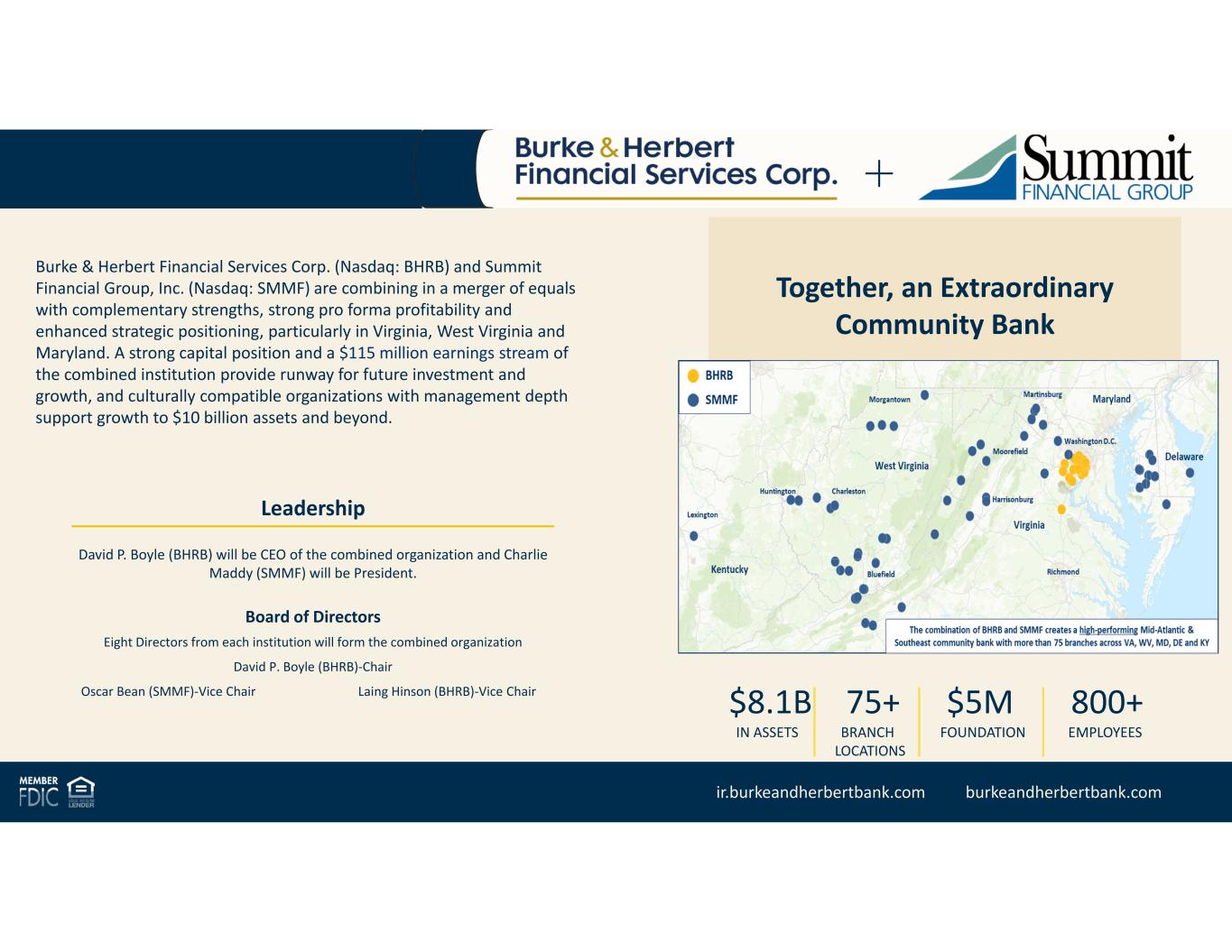

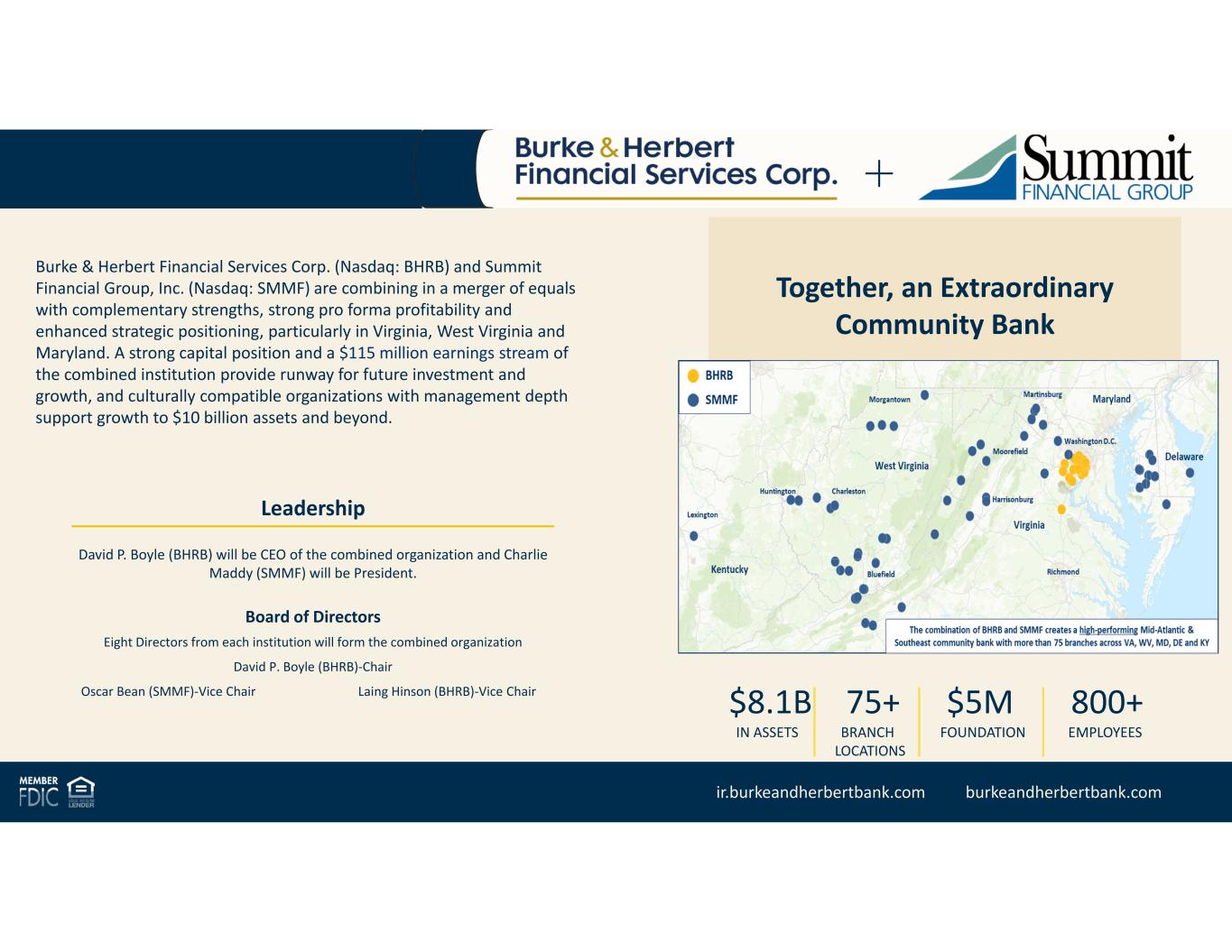

ir.burkeandherbertbank.com burkeandherbertbank.com Together, an Extraordinary Community Bank $8.1B 75+ $5M 800+ IN ASSETS BRANCH FOUNDATION EMPLOYEES LOCATIONS Burke & Herbert Financial Services Corp. (Nasdaq: BHRB) and Summit Financial Group, Inc. (Nasdaq: SMMF) are combining in a merger of equals with complementary strengths, strong pro forma profitability and enhanced strategic positioning, particularly in Virginia, West Virginia and Maryland. A strong capital position and a $115 million earnings stream of the combined institution provide runway for future investment and growth, and culturally compatible organizations with management depth support growth to $10 billion assets and beyond. Leadership Board of Directors Eight Directors from each institution will form the combined organization David P. Boyle (BHRB)‐Chair Oscar Bean (SMMF)‐Vice Chair Laing Hinson (BHRB)‐Vice Chair David P. Boyle (BHRB) will be CEO of the combined organization and Charlie Maddy (SMMF) will be President.

ir.burkeandherbertbank.com burkeandherbertbank.com Burke & Herbert Bank and Summit Community Bank are Combining to Create a Diversified Mid‐Atlantic & Southeast Community Bank with Exceptional Performance and Scale For our Customers: Greater capabilities and an expanded product suite Increased scale that will drive continued technology investment and customer experience improvements Expanded wealth platform Increased lending capacity that allows us to further support our customers as they grow For our Communities: Significant community involvement and encouragement of economic momentum The establishment of a new charitable foundation focused on the support of our collective communities Almost no footprint overlap limits disruption in the support of our combined communities Commitment to diversity, equity and financial inclusion across the combined footprint For our Employees: Strong cultural alignment Shared beliefs and company missions Balanced leadership composition will be inclusive of each team Greater scale provides additional career mobility for our combined associates Strengthens our ability to recruit and retain top‐tier talent across our combined markets For our Shareholders: Significant earnings power: >$115 million combined earnings stream Creates significant franchise value via scale and efficiencies Benefits of synergies accrue to both sets of shareholders Significant upside for all shareholders with successful integration, execution and delivery of estimated performance metrics

ir.burkeandherbertbank.com burkeandherbertbank.com What is the process involved with the merger? The Burke & Herbert Bank and Summit Community Bank teams will work to form a cross‐functional team to develop our integration plan over the next several months. This planning will be thoughtful with representation from both sides. Will anything happen to my job? For all of us, this change represents opportunity. The combined organization will provide opportunities for employees to have new and expanded roles throughout the company. The key to success will come from the combined skills and experiences of the team. As we bring the organizations together, we will continue to communicate as updates are available. What should I do if someone from the media contacts me? Employees, officers and directors are not authorized spokespersons for the organizations and any media inquiries should be referred to David Boyle and Roy Halyama. ONE BRAND, ONE VISION Our employees, who live our company culture and deliver exceptional customer experiences, are the foundation of our success. Together, under one brand, we will form an extraordinary organization with a combined positive impact on our communities.

ir.burkeandherbertbank.com burkeandherbertbank.com What was announced and what does it mean for Burke & Herbert Bank and Summit Community Bank, Inc.? On August 24, 2023, we announced that Burke & Herbert Financial Services Corp. and Summit Financial Group signed a merger agreement to become a combined company. Please refer to the press release at ir.burkeandherbertbank.com. The combined organization will have a footprint of more than 75 branches across Kentucky, West Virginia, Virginia, Maryland, and Delaware. Who is Summit Financial Group, Inc.? Summit Financial Group, Inc. is an organization with a strong leadership team along with a high‐performing culture. The Summit team is committed to the communities it serves through its branch network spanning throughout West Virginia, Kentucky, Virginia, the Eastern Shore of Maryland, and Delaware. It is headquartered in Moorefield, WV. Why is this merger taking place? Both Burke & Herbert Bank and Summit Community Bank have a rich history in our respective states. We believe through this combination we are creating a diversified Mid‐Atlantic & Southeast community bank that will provide exceptional performance and scale to our collective customers, communities, employees, and shareholders. As a combined organization, we believe our shared beliefs and company missions will result in a strong cultural alignment that will strengthen our ties to our combined communities. It also allows us to create a community foundation dedicated to supporting our combined footprint. Will Burke & Herbert Bank’s name or headquarters location change? The combined organization will operate under the Burke & Herbert Bank name and brand, and will remain headquartered in Alexandria, Virginia. Additionally, we will have a significant operational presence in Moorefield, WV. What is the timing of the merger? Subject to customary closing conditions, including receipt of regulatory and shareholder approvals, we expect the transaction to close in the first quarter of 2024. Will any Burke & Herbert Bank branch or Summit Community Bank branch close as a result of this announcement? The combined branch footprint of our organization has no overlap in the communities we serve and will allow us to limit the disruption to our collective customers and their communities. Does this change anything about the way I bank today with Burke & Herbert Bank or Summit Community Bank? You may continue banking with either institution the same way you have been. There will be no changes to daily operations between now and the closing date. The two banks will continue to operate independently during this time. Our conversion plan will be communicated through our website. Where can I find additional information? We will continue to provide additional information as it is available.

ir.burkeandherbertbank.com burkeandherbertbank.com Forward‐looking Statements This presentation includes "forward‐looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, with respect to the beliefs, goals, intentions, and expectations of Burke & Herbert Financial Services Corp. (“BHRB”) and Summit Financial Group, Inc. (“SMMF”) regarding the proposed transaction, revenues, earnings, earnings per share, loan production, asset quality, and capital levels, among other matters; our estimates of future costs and benefits of the actions we may take; our assessments of expected losses on loans; our assessments of interest rate and other market risks; our ability to achieve our financial and other strategic goals; the expected timing of completion of the proposed transaction; the expected cost savings, synergies, returns and other anticipated benefits from the proposed transaction; and other statements that are not historical facts. Forward–looking statements are typically identified by such words as "believe," "expect," "anticipate," "intend," "outlook," "estimate," "forecast," "project," "will," "should," and other similar words and expressions, and are subject to numerous assumptions, risks, and uncertainties, which change over time. These forward‐looking statements include, without limitation, those relating to the terms, timing and closing of the proposed transaction. Additionally, forward–looking statements speak only as of the date they are made; BHRB and SMMF do not assume any duty, and do not undertake, to update such forward–looking statements, whether written or oral, that may be made from time to time, whether as a result of new information, future events, or otherwise. Furthermore, because forward–looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those indicated in or implied by such forward‐looking statements as a result of a variety of factors, many of which are beyond the control of BHRB and SMMF. Such statements are based upon the current beliefs and expectations of the management of BHRB and SMMF and are subject to significant risks and uncertainties outside of the control of the parties. Caution should be exercised against placing undue reliance on forward‐ looking statements. The factors that could cause actual results to differ materially include the following: the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the definitive merger agreement between BHRB and SMMF; the outcome of any legal proceedings that may be instituted against BHRB or SMMF; the possibility that the proposed transaction will not close when expected or at all because required regulatory, shareholder or other approvals are not received or other conditions to the closing are not satisfied on a timely basis or at all, or are obtained subject to conditions that are not anticipated (and the risk that required regulatory approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the proposed transaction); the ability of BHRB and SMMF to meet expectations regarding the timing, completion and accounting and tax treatments of the proposed transaction; the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of the common stock of either or both parties to the proposed transaction; the possibility that the anticipated benefits of the proposed transaction will not be realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where BHRB and SMMF do business; certain restrictions during the pendency of the proposed transaction that may impact the parties' ability to pursue certain business opportunities or strategic transactions; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; diversion of management's attention from ongoing business operations and opportunities; the possibility that the parties may be unable to achieve expected synergies and operating efficiencies in the merger within the expected timeframes or at all and to successfully integrate SMMF's operations and those of BHRB; such integration may be more difficult, time‐consuming or costly than expected; revenues following the proposed transaction may be lower than expected; BHRB's and SMMF’s success in executing their respective business plans and strategies and managing the risks involved in the foregoing; the dilution caused by BHRB's issuance of additional shares of its capital stock in connection with the proposed transaction; effects of the announcement, pendency or completion of the proposed transaction on the ability of BHRB and SMMF to retain customers and retain and hire key personnel and maintain relationships with their suppliers, and on their operating results and businesses generally; and risks related to the potential impact of general economic, political and market factors on the companies or the proposed transaction and other factors that may affect future results of BHRB and SMMF; and the other factors discussed in the "Risk Factors" section of BHRB's Registration Statement on Form 10, as amended and as ordered effective by the SEC on April 21, 2023, and SMMF's Annual Report on Form 10–K for the year ended December 31, 2022, in the "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" sections of each of BHRB’s and SMMF’s Quarterly Reports on Form 10–Q for the quarters ended March 31, 2023 and June 30, 2023, and other reports BHRB and SMMF file with the SEC. Disclaimer

ir.burkeandherbertbank.com burkeandherbertbank.com Additional Information and Where to Find It In connection with the proposed transaction, BHRB will file a registration statement on Form S‐4 with the SEC. The registration statement will include a joint proxy statement of BHRB and SMMF, which also constitutes a prospectus of BHRB, that will be sent to shareholders of BHRB and shareholders of SMMF seeking certain approvals related to the proposed transaction. The information contained herein does not constitute an offer to sell or a solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. INVESTORS AND SHAREHOLDERS OF BHRB AND SMMF AND THEIR RESPECTIVE AFFILIATES ARE URGED TO READ, WHEN AVAILABLE, THE REGISTRATION STATEMENT ON FORM S‐4, THE JOINT PROXY STATEMENT/PROSPECTUS TO BE INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S‐4 AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT BHRB, SMMF AND THE PROPOSED TRANSACTION. Investors and shareholders will be able to obtain a free copy of the registration statement, including the joint proxy statement/prospectus, as well as other relevant documents filed with the SEC containing information about BHRB and SMMF, without charge, at the SEC's website www.sec.gov. Copies of documents filed with the SEC by BHRB will be made available free of charge in the "Investor Relations" section of BHRB's website, www.burkeandherbertbank.com. Copies of documents filed with the SEC by SMMF will be made available free of charge in the "News" section of SMMF's website, www.summitfgi.com, under the heading "News and Filings." Participants in Solicitation BHRB, SMMF, and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction under the rules of the SEC. Information regarding BHRB's directors and executive officers is available in its Registration Statement on Form 10, as amended and as ordered effective by the SEC on April 21, 2023. Information regarding SMMF's directors and executive officers is available in its definitive proxy statement, which was filed with the SEC on March 31, 2023, and certain other documents filed by SMMF with the SEC. Other information regarding the participants in the solicitation of proxies in respect of the proposed transaction and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC. Free copies of these documents, when available, may be obtained as described in the preceding paragraph. Disclaimer