1 2Q24 Update (Nasdaq: BHRB) July 2024

2 Cautionary Statement Regarding Forward-Looking Information This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, with respect to the beliefs, goals, intentions, and expectations of the Company regarding revenues, earnings, earnings per share, loan production, asset quality, and capital levels, among other matters; our estimates of future costs and benefits of the actions we may take; our assessments of expected losses on loans; our assessments of interest rate and other market risks; our ability to achieve our financial and other strategic goals; the expected cost savings, synergies, returns, and other anticipated benefits from the integration of Summit following the recently completed merger of Summit with and into the Company; and other statements that are not historical facts. Forward–looking statements are typically identified by such words as “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “will,” “should,” and other similar words and expressions, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Additionally, forward–looking statements speak only as of the date they are made; the Company does not assume any duty, does not undertake, and specifically disclaims any obligation to update such forward–looking statements, whether written or oral, that may be made from time to time, whether because of new information, future events, or otherwise, except as required by law. Furthermore, because forward–looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those indicated in or implied by such forward-looking statements because of a variety of factors, many of which are beyond the control of the Company. Accordingly, you should not place undue reliance on forward-looking statements. The risks and uncertainties that could cause actual results to differ from those described in the forward-looking statements include, but are not limited to, the following: costs or difficulties associated with newly developed or acquired operations; risks related to our ability to successfully integrate Summit into the Company and operate the combined company; changes in general economic trends (either nationally or locally in the areas in which we conduct, or will conduct, business), including inflation, interest rates, market and monetary fluctuations; increased competition; changes in consumer demand for financial services; our ability to control costs and expenses; adverse developments in borrower industries or declines in real estate values; changes in and compliance with federal and state laws and regulations that pertain to our business and capital levels; our ability to raise capital as needed; the effects of any cybersecurity breaches; and the other factors discussed in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section of the Company’s Annual Report on Form 10–K for the year ended December 31, 2023, the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, and other reports the Company files with the SEC. Non-GAAP Financial Measures This presentation contains certain financial measures determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Such non-GAAP financial measures may include the following: fully tax-equivalent net interest margin, core operating earnings, core net income, tangible book value per common share, total risk-based capital ratio, tier one leverage ratio, tier one capital ratio, and the tangible common equity to tangible assets ratio. Management uses these non-GAAP financial measures to assess the performance of the Company’s core business and the strength of its capital position. Management believes that these non-GAAP financial measures provide meaningful additional information about the Company to assist investors in evaluating operating results, financial strength, and capitalization. The non-GAAP financial measures should be considered as additional views of the way our financial measures are affected by significant charges for credit costs and other factors. These non-GAAP financial measures should not be considered as a substitute for operating results determined in accordance with GAAP and may not be comparable to other similarly titled measures of other companies. The computations of the non-GAAP financial measures used in this presentation are referenced in a footnote or in the appendix to this presentation.

3 Introduction • Thank you for your interest in Burke & Herbert Financial Services Corp. and its wholly owned subsidiary Burke & Herbert Bank & Trust Company. A quintessential community banking institution, we are headquartered in Old Town Alexandria, Virginia and have served the banking, borrowing and investing needs of generations of businesses, organizations, families and individuals since 1852. • As a true community bank, we are deeply tied to the people, neighborhoods and institutions where we live and work. Our employees form a diverse, dedicated, close- knit team that upholds a culture of customer service and forges strong and lasting relationships with our customers and shared communities. We are selective in our hiring, proud of the caliber of our people, and encourage a collegial environment in which each individual feels valued. • On May 3, 2024, we merged with Summit Financial Group, Inc. (Summit), creating an $8 billion financial institution with more than 75 branches across Virginia, West Virginia, Maryland, Delaware, and Kentucky, with more than 800 employees serving our communities.

4 Business Model • Our business model is built on customer service - Being a trusted advisor by understanding our customers’ financial goals and offering our diverse products and services to help them achieve financial prosperity • Our approach is concentrated on growing and deepening relationships across our businesses that meet our risk/return measures • We are focused on our strategic priorities which are designed to enhance value over the long term - Profitably expanding our market share - Deepening customer relationships by delivering fee-based financial solutions - Leveraging technology to create efficiencies that help us better serve customers

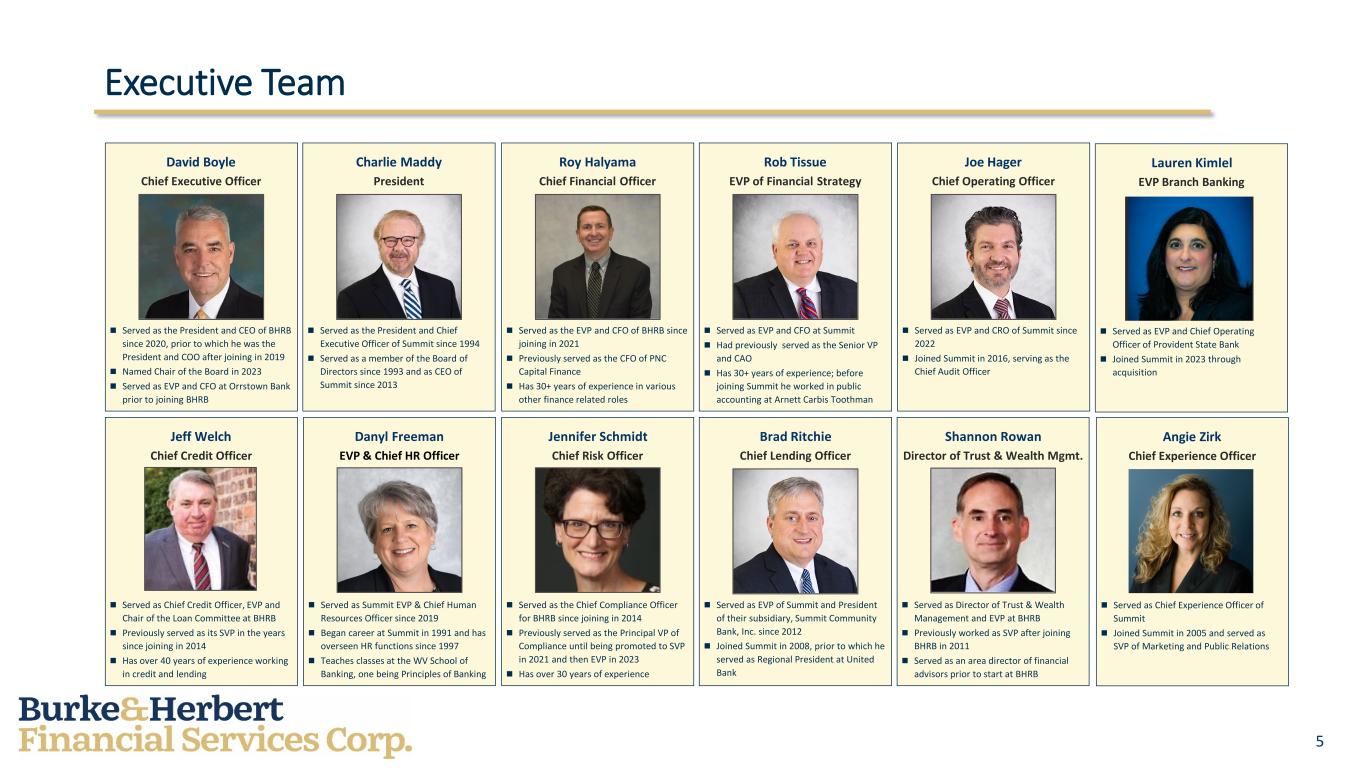

5 Executive Team Served as the President and CEO of BHRB since 2020, prior to which he was the President and COO after joining in 2019 Named Chair of the Board in 2023 Served as EVP and CFO at Orrstown Bank prior to joining BHRB David Boyle Chief Executive Officer Served as Chief Credit Officer, EVP and Chair of the Loan Committee at BHRB Previously served as its SVP in the years since joining in 2014 Has over 40 years of experience working in credit and lending Jeff Welch Chief Credit Officer Served as the President and Chief Executive Officer of Summit since 1994 Served as a member of the Board of Directors since 1993 and as CEO of Summit since 2013 Charlie Maddy President Served as EVP and CFO at Summit Had previously served as the Senior VP and CAO Has 30+ years of experience; before joining Summit he worked in public accounting at Arnett Carbis Toothman Rob Tissue EVP of Financial Strategy Served as EVP of Summit and President of their subsidiary, Summit Community Bank, Inc. since 2012 Joined Summit in 2008, prior to which he served as Regional President at United Bank Brad Ritchie Chief Lending Officer Served as EVP and CRO of Summit since 2022 Joined Summit in 2016, serving as the Chief Audit Officer Joe Hager Chief Operating Officer Served as the EVP and CFO of BHRB since joining in 2021 Previously served as the CFO of PNC Capital Finance Has 30+ years of experience in various other finance related roles Roy Halyama Chief Financial Officer Served as the Chief Compliance Officer for BHRB since joining in 2014 Previously served as the Principal VP of Compliance until being promoted to SVP in 2021 and then EVP in 2023 Has over 30 years of experience Jennifer Schmidt Chief Risk Officer Served as Director of Trust & Wealth Management and EVP at BHRB Previously worked as SVP after joining BHRB in 2011 Served as an area director of financial advisors prior to start at BHRB Shannon Rowan Director of Trust & Wealth Mgmt. Served as Summit EVP & Chief Human Resources Officer since 2019 Began career at Summit in 1991 and has overseen HR functions since 1997 Teaches classes at the WV School of Banking, one being Principles of Banking Danyl Freeman EVP & Chief HR Officer Served as Chief Experience Officer of Summit Joined Summit in 2005 and served as SVP of Marketing and Public Relations Angie Zirk Chief Experience Officer Served as EVP and Chief Operating Officer of Provident State Bank Joined Summit in 2023 through acquisition Lauren Kimlel EVP Branch Banking

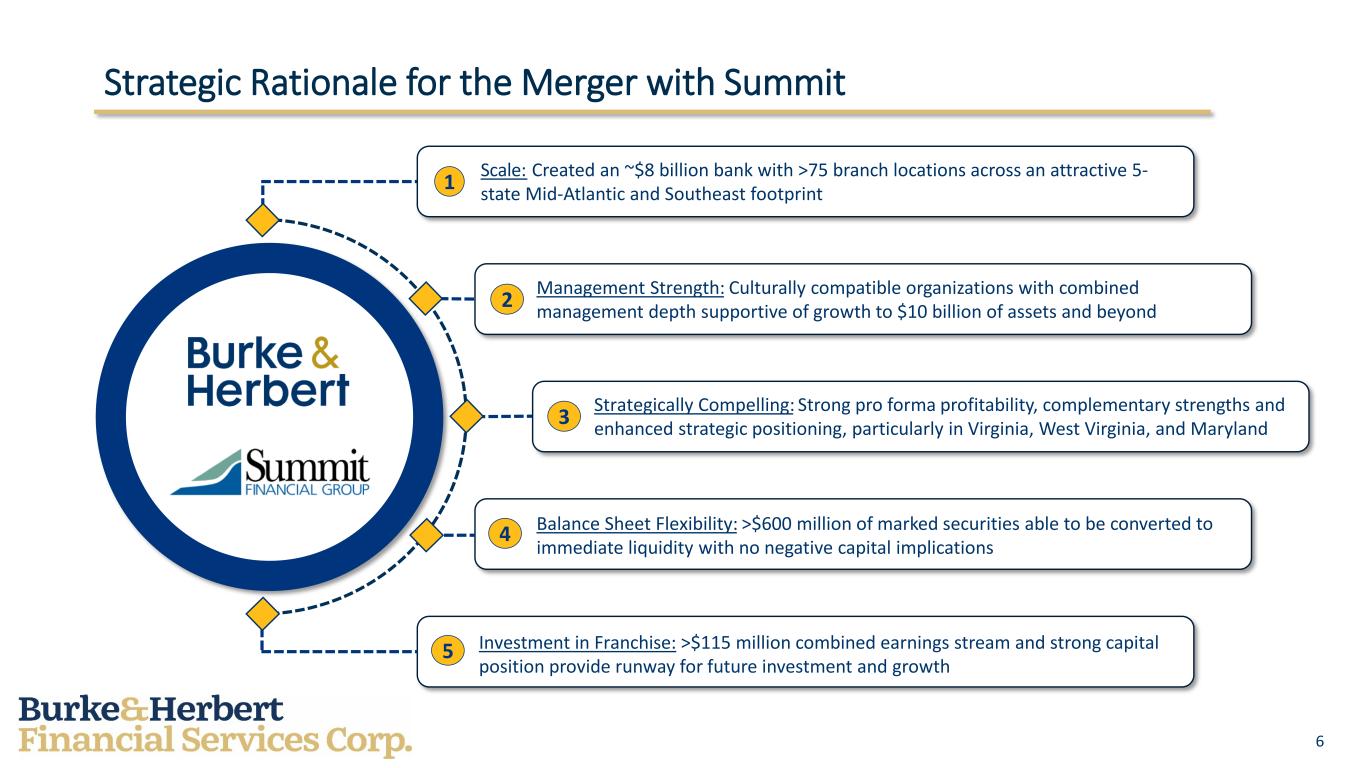

6 Strategic Rationale for the Merger with Summit 1 2 3 4 5 Strategically Compelling: Strong pro forma profitability, complementary strengths and enhanced strategic positioning, particularly in Virginia, West Virginia, and Maryland Scale: Created an ~$8 billion bank with >75 branch locations across an attractive 5- state Mid-Atlantic and Southeast footprint Management Strength: Culturally compatible organizations with combined management depth supportive of growth to $10 billion of assets and beyond Investment in Franchise: >$115 million combined earnings stream and strong capital position provide runway for future investment and growth Balance Sheet Flexibility: >$600 million of marked securities able to be converted to immediate liquidity with no negative capital implications

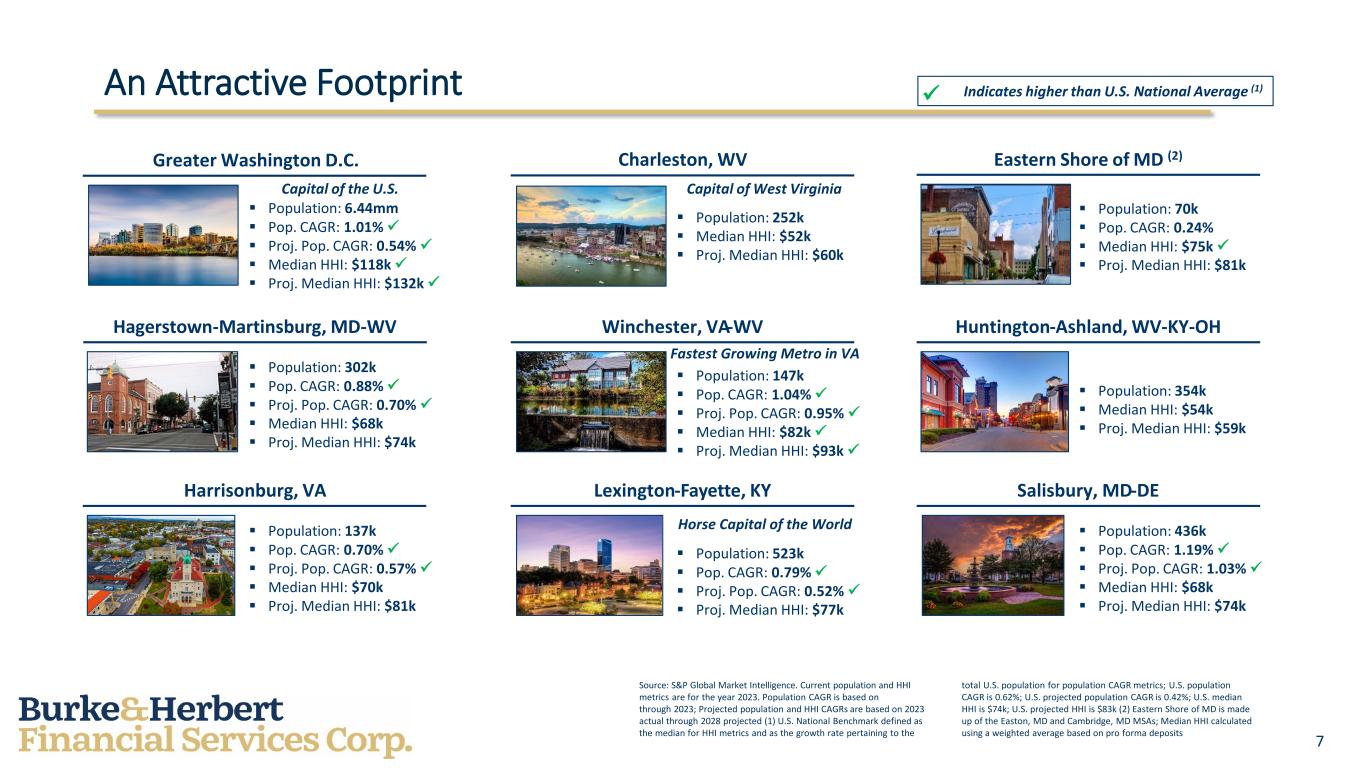

7 An Attractive Footprint Population: 137k Pop. CAGR: 0.70% Proj. Pop. CAGR: 0.57% Median HHI: $70k Proj. Median HHI: $81k Harrisonburg, VA Eastern Shore of MD (2) Population: 70k Pop. CAGR: 0.24% Median HHI: $75k Proj. Median HHI: $81k Charleston, WV Population: 252k Median HHI: $52k Proj. Median HHI: $60k Hagerstown-Martinsburg, MD-WV Population: 302k Pop. CAGR: 0.88% Proj. Pop. CAGR: 0.70% Median HHI: $68k Proj. Median HHI: $74k Population: 6.44mm Pop. CAGR: 1.01% Proj. Pop. CAGR: 0.54% Median HHI: $118k Proj. Median HHI: $132k Greater Washington D.C. Lexington-Fayette, KY Population: 523k Pop. CAGR: 0.79% Proj. Pop. CAGR: 0.52% Proj. Median HHI: $77k Population: 147k Pop. CAGR: 1.04% Proj. Pop. CAGR: 0.95% Median HHI: $82k Proj. Median HHI: $93k Winchester, VA-WV Huntington-Ashland, WV-KY-OH Population: 354k Median HHI: $54k Proj. Median HHI: $59k Salisbury, MD-DE Population: 436k Pop. CAGR: 1.19% Proj. Pop. CAGR: 1.03% Median HHI: $68k Proj. Median HHI: $74k Fastest Growing Metro in VA Horse Capital of the World Capital of the U.S. Capital of West Virginia Indicates higher than U.S. National Average (1) Source: S&P Global Market Intelligence. Current population and HHI metrics are for the year 2023. Population CAGR is based on through 2023; Projected population and HHI CAGRs are based on 2023 actual through 2028 projected (1) U.S. National Benchmark defined as the median for HHI metrics and as the growth rate pertaining to the total U.S. population for population CAGR metrics; U.S. population CAGR is 0.62%; U.S. projected population CAGR is 0.42%; U.S. median HHI is $74k; U.S. projected HHI is $83k (2) Eastern Shore of MD is made up of the Easton, MD and Cambridge, MD MSAs; Median HHI calculated using a weighted average based on pro forma deposits

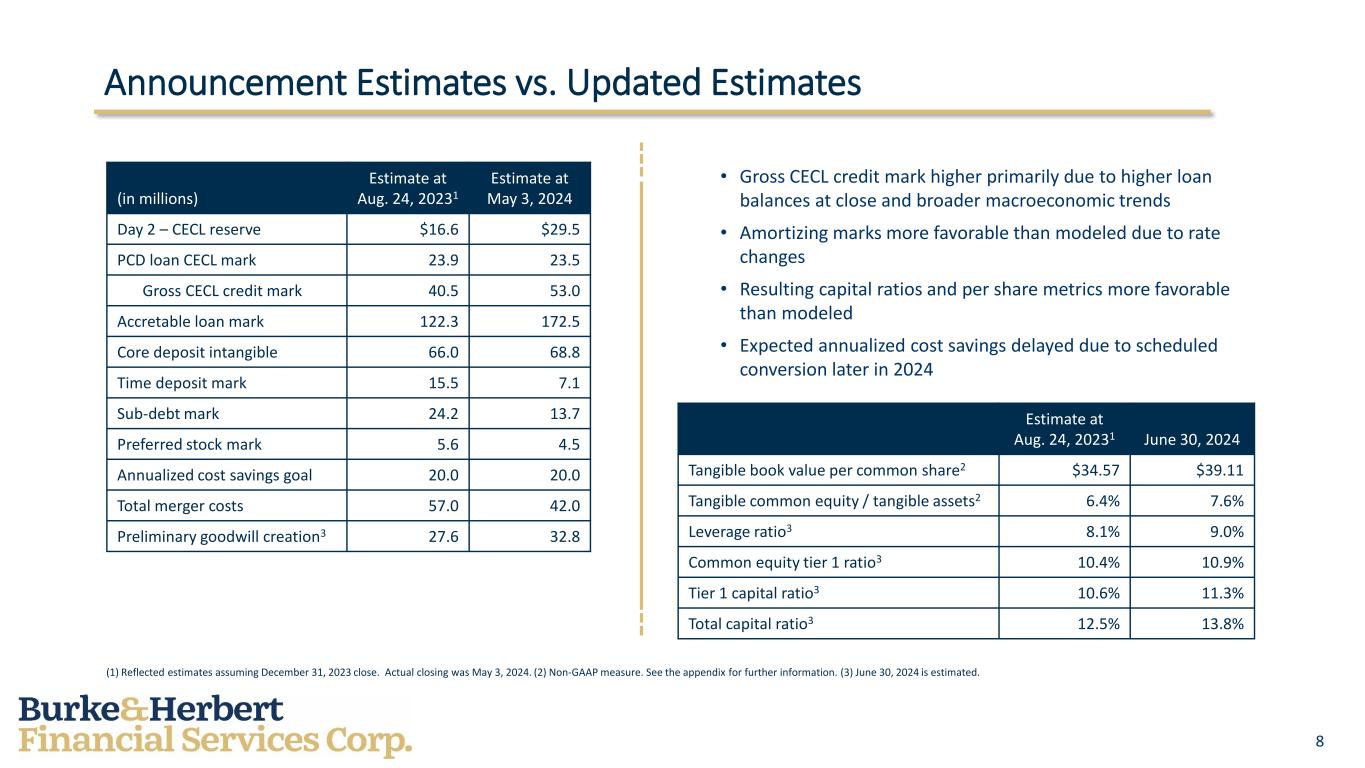

8 Announcement Estimates vs. Updated Estimates (in millions) Estimate at Aug. 24, 20231 Estimate at May 3, 2024 Day 2 – CECL reserve $16.6 $29.5 PCD loan CECL mark 23.9 23.5 Gross CECL credit mark 40.5 53.0 Accretable loan mark 122.3 172.5 Core deposit intangible 66.0 68.8 Time deposit mark 15.5 7.1 Sub-debt mark 24.2 13.7 Preferred stock mark 5.6 4.5 Annualized cost savings goal 20.0 20.0 Total merger costs 57.0 42.0 Preliminary goodwill creation3 27.6 32.8 Estimate at Aug. 24, 20231 June 30, 2024 Tangible book value per common share2 $34.57 $39.11 Tangible common equity / tangible assets2 6.4% 7.6% Leverage ratio3 8.1% 9.0% Common equity tier 1 ratio3 10.4% 10.9% Tier 1 capital ratio3 10.6% 11.3% Total capital ratio3 12.5% 13.8% (1) Reflected estimates assuming December 31, 2023 close. Actual closing was May 3, 2024. (2) Non-GAAP measure. See the appendix for further information. (3) June 30, 2024 is estimated. • Gross CECL credit mark higher primarily due to higher loan balances at close and broader macroeconomic trends • Amortizing marks more favorable than modeled due to rate changes • Resulting capital ratios and per share metrics more favorable than modeled • Expected annualized cost savings delayed due to scheduled conversion later in 2024

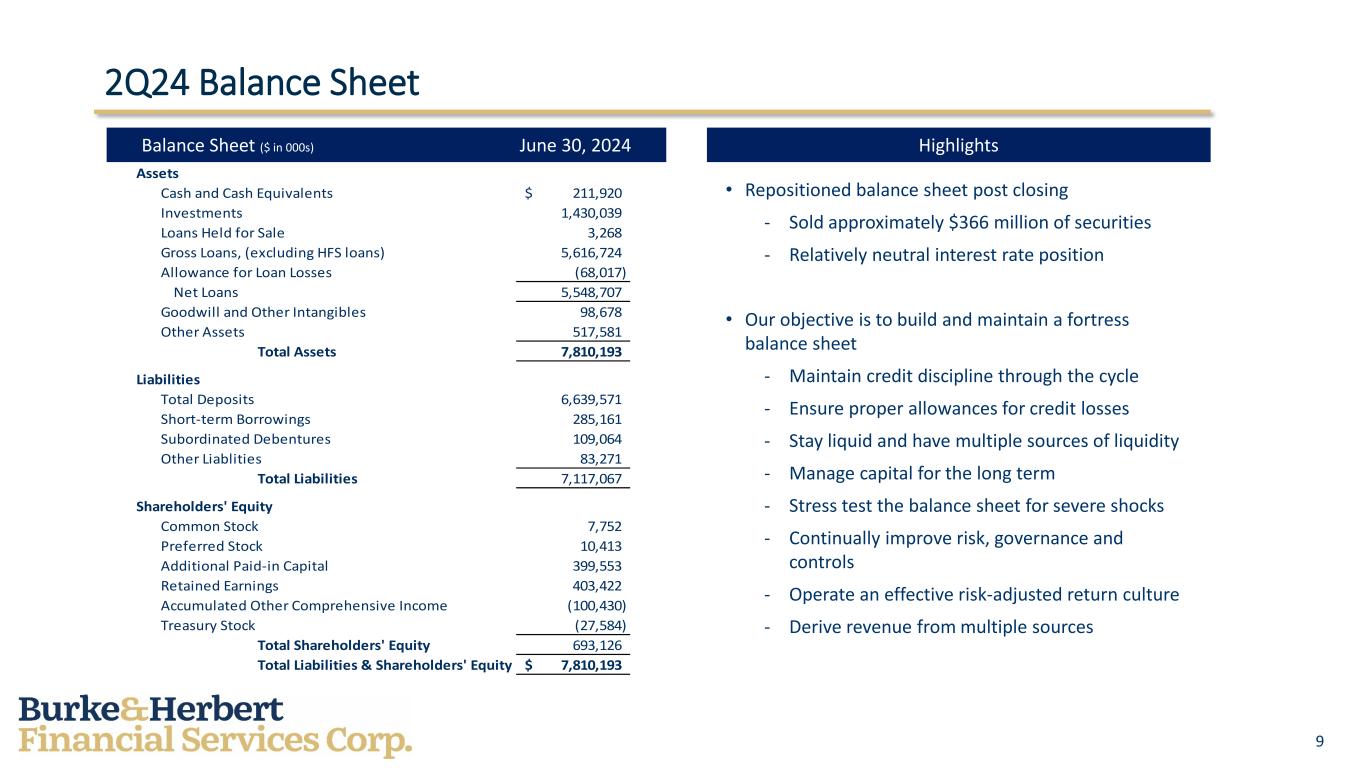

9 2Q24 Balance Sheet Highlights • Repositioned balance sheet post closing - Sold approximately $366 million of securities - Relatively neutral interest rate position • Our objective is to build and maintain a fortress balance sheet - Maintain credit discipline through the cycle - Ensure proper allowances for credit losses - Stay liquid and have multiple sources of liquidity - Manage capital for the long term - Stress test the balance sheet for severe shocks - Continually improve risk, governance and controls - Operate an effective risk-adjusted return culture - Derive revenue from multiple sources Balance Sheet ($ in 000s) June 30, 2024 Assets Cash and Cash Equivalents 211,920$ Investments 1,430,039 Loans Held for Sale 3,268 Gross Loans, (excluding HFS loans) 5,616,724 Allowance for Loan Losses (68,017) Net Loans 5,548,707 Goodwill and Other Intangibles 98,678 Other Assets 517,581 Total Assets 7,810,193 Liabilities Total Deposits 6,639,571 Short-term Borrowings 285,161 Subordinated Debentures 109,064 Other Liablities 83,271 Total Liabilities 7,117,067 Shareholders' Equity Common Stock 7,752 Preferred Stock 10,413 Additional Paid-in Capital 399,553 Retained Earnings 403,422 Accumulated Other Comprehensive Income (100,430) Treasury Stock (27,584) Total Shareholders' Equity 693,126 Total Liabilities & Shareholders' Equity 7,810,193$

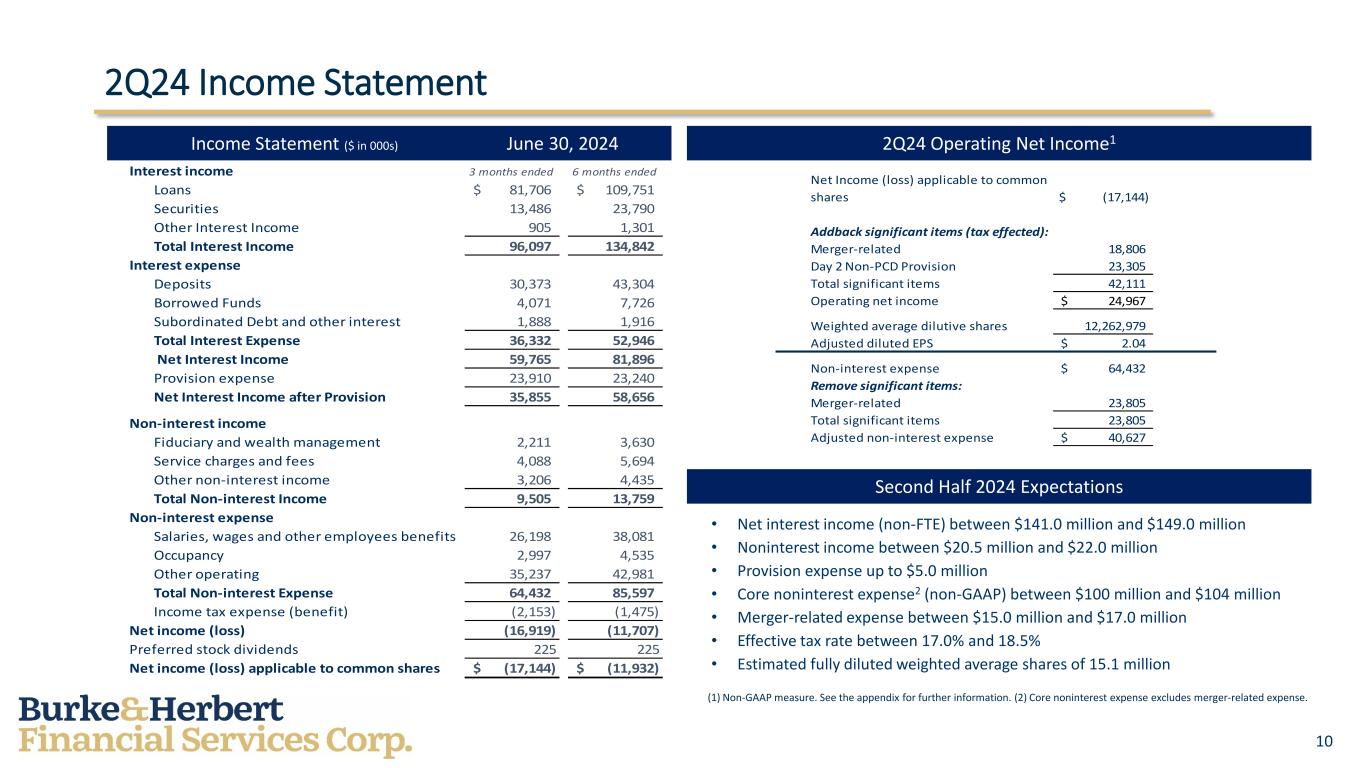

10 2Q24 Income Statement Second Half 2024 Expectations Income Statement ($ in 000s) June 30, 2024 2Q24 Operating Net Income1 (1) Non-GAAP measure. See the appendix for further information. (2) Core noninterest expense excludes merger-related expense. • Net interest income (non-FTE) between $141.0 million and $149.0 million • Noninterest income between $20.5 million and $22.0 million • Provision expense up to $5.0 million • Core noninterest expense2 (non-GAAP) between $100 million and $104 million • Merger-related expense between $15.0 million and $17.0 million • Effective tax rate between 17.0% and 18.5% • Estimated fully diluted weighted average shares of 15.1 million Net Income (loss) applicable to common shares $ (17,144) Addback significant items (tax effected): Merger-related 18,806 Day 2 Non-PCD Provision 23,305 Total significant items 42,111 Operating net income 24,967$ Weighted average dilutive shares 12,262,979 Adjusted diluted EPS 2.04$ Non-interest expense 64,432$ Remove significant items: Merger-related 23,805 Total significant items 23,805 Adjusted non-interest expense 40,627$ Interest income 3 months ended 6 months ended Loans 81,706$ 109,751$ Securities 13,486 23,790 Other Interest Income 905 1,301 Total Interest Income 96,097 134,842 Interest expense Deposits 30,373 43,304 Borrowed Funds 4,071 7,726 Subordinated Debt and other interest 1,888 1,916 Total Interest Expense 36,332 52,946 Net Interest Income 59,765 81,896 Provision expense 23,910 23,240 Net Interest Income after Provision 35,855 58,656 Non-interest income Fiduciary and wealth management 2,211 3,630 Service charges and fees 4,088 5,694 Other non-interest income 3,206 4,435 Total Non-interest Income 9,505 13,759 Non-interest expense Salaries, wages and other employees benefits 26,198 38,081 Occupancy 2,997 4,535 Other operating 35,237 42,981 Total Non-interest Expense 64,432 85,597 Income tax expense (benefit) (2,153) (1,475) Net income (loss) (16,919) (11,707) Preferred stock dividends 225 225 Net income (loss) applicable to common shares (17,144)$ (11,932)$

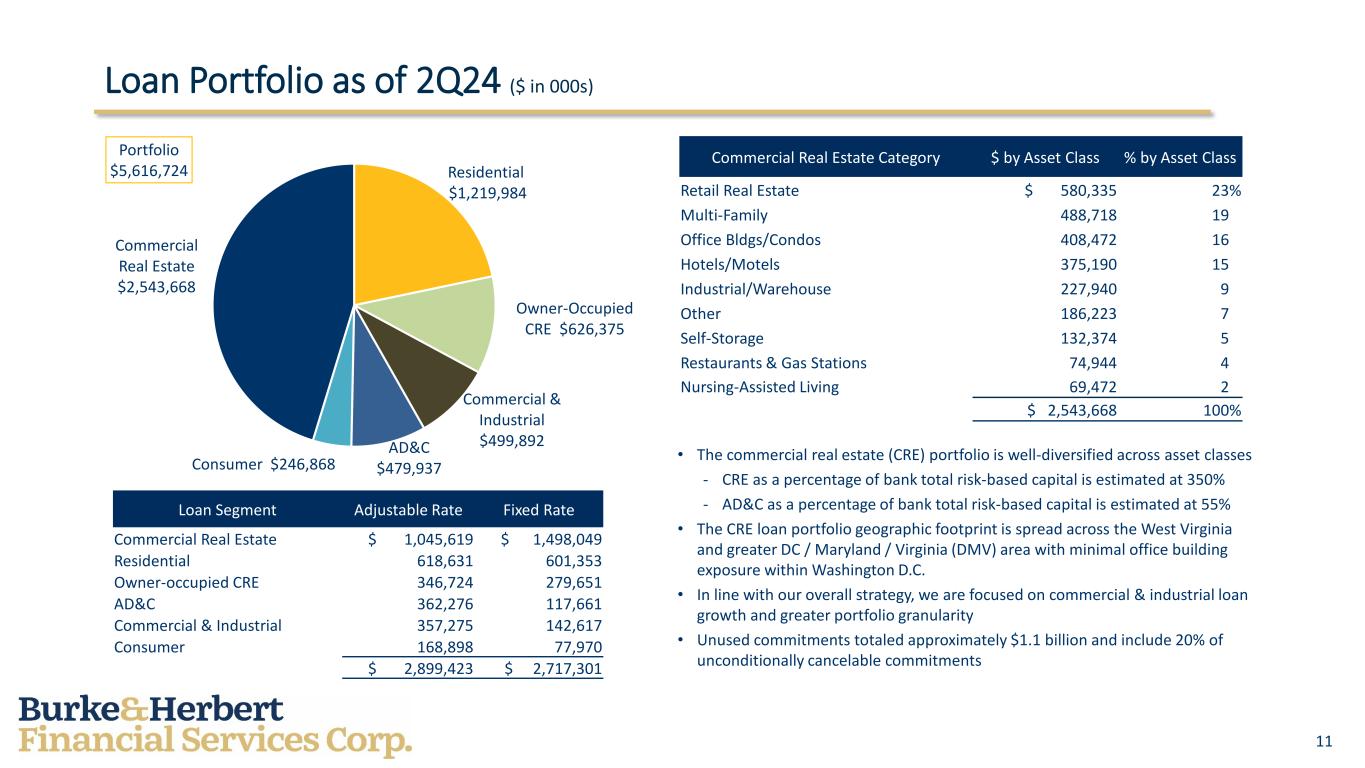

11 Loan Portfolio as of 2Q24 ($ in 000s) Residential $1,219,984 Owner-Occupied CRE $626,375 Commercial & Industrial $499,892 AD&C $479,937 Consumer $246,868 Commercial Real Estate $2,543,668 Portfolio $5,616,724 Loan Segment Adjustable Rate Fixed Rate Commercial Real Estate $ 1,045,619 $ 1,498,049 Residential 618,631 601,353 Owner-occupied CRE 346,724 279,651 AD&C 362,276 117,661 Commercial & Industrial 357,275 142,617 Consumer 168,898 77,970 $ 2,899,423 $ 2,717,301 • The commercial real estate (CRE) portfolio is well-diversified across asset classes - CRE as a percentage of bank total risk-based capital is estimated at 350% - AD&C as a percentage of bank total risk-based capital is estimated at 55% • The CRE loan portfolio geographic footprint is spread across the West Virginia and greater DC / Maryland / Virginia (DMV) area with minimal office building exposure within Washington D.C. • In line with our overall strategy, we are focused on commercial & industrial loan growth and greater portfolio granularity • Unused commitments totaled approximately $1.1 billion and include 20% of unconditionally cancelable commitments Commercial Real Estate Category $ by Asset Class % by Asset Class Retail Real Estate $ 580,335 23% Multi-Family 488,718 19% Office Bldgs/Condos 408,472 16% Hotels/Motels 375,190 15% Industrial/Warehouse 227,940 9% Other 186,223 7% Self-Storage 132,374 5% Restaurants & Gas Stations 74,944 4% Nursing-Assisted Living 69,472 2% $ 2,543,668 100%

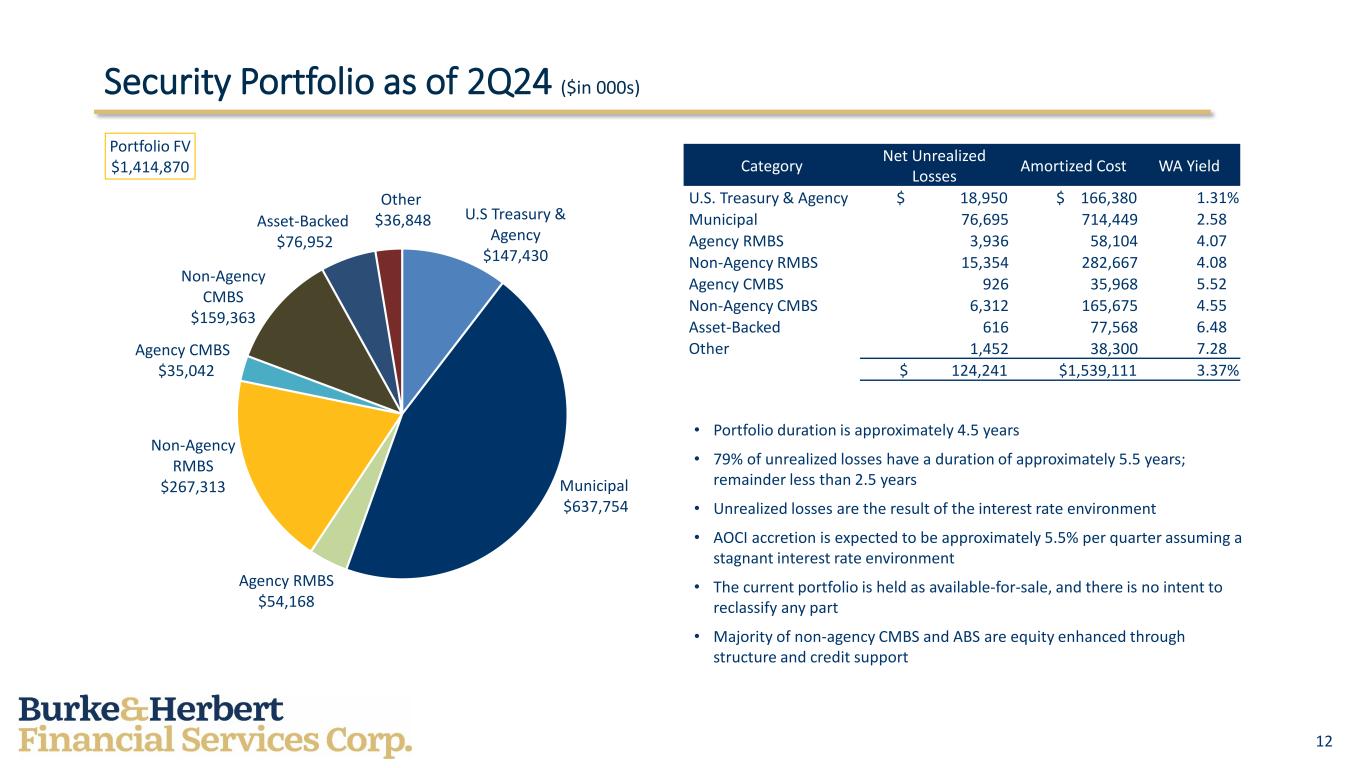

12 Security Portfolio as of 2Q24 ($in 000s) U.S Treasury & Agency $147,430 Municipal $637,754 Agency RMBS $54,168 Non-Agency RMBS $267,313 Agency CMBS $35,042 Non-Agency CMBS $159,363 Asset-Backed $76,952 Other $36,848 Portfolio FV $1,414,870 • Portfolio duration is approximately 4.5 years • 79% of unrealized losses have a duration of approximately 5.5 years; remainder less than 2.5 years • Unrealized losses are the result of the interest rate environment • AOCI accretion is expected to be approximately 5.5% per quarter assuming a stagnant interest rate environment • The current portfolio is held as available-for-sale, and there is no intent to reclassify any part • Majority of non-agency CMBS and ABS are equity enhanced through structure and credit support Category Net Unrealized Losses Amortized Cost WA Yield U.S. Treasury & Agency $ 18,950 $ 166,380 1.31% Municipal 76,695 714,449 2.58% Agency RMBS 3,936 58,104 4.07% Non-Agency RMBS 15,354 282,667 4.08% Agency CMBS 926 35,968 5.52% Non-Agency CMBS 6,312 165,675 4.55% Asset-Backed 616 77,568 6.48% Other 1,452 38,300 7.28% $ 124,241 $1,539,111 3.37%

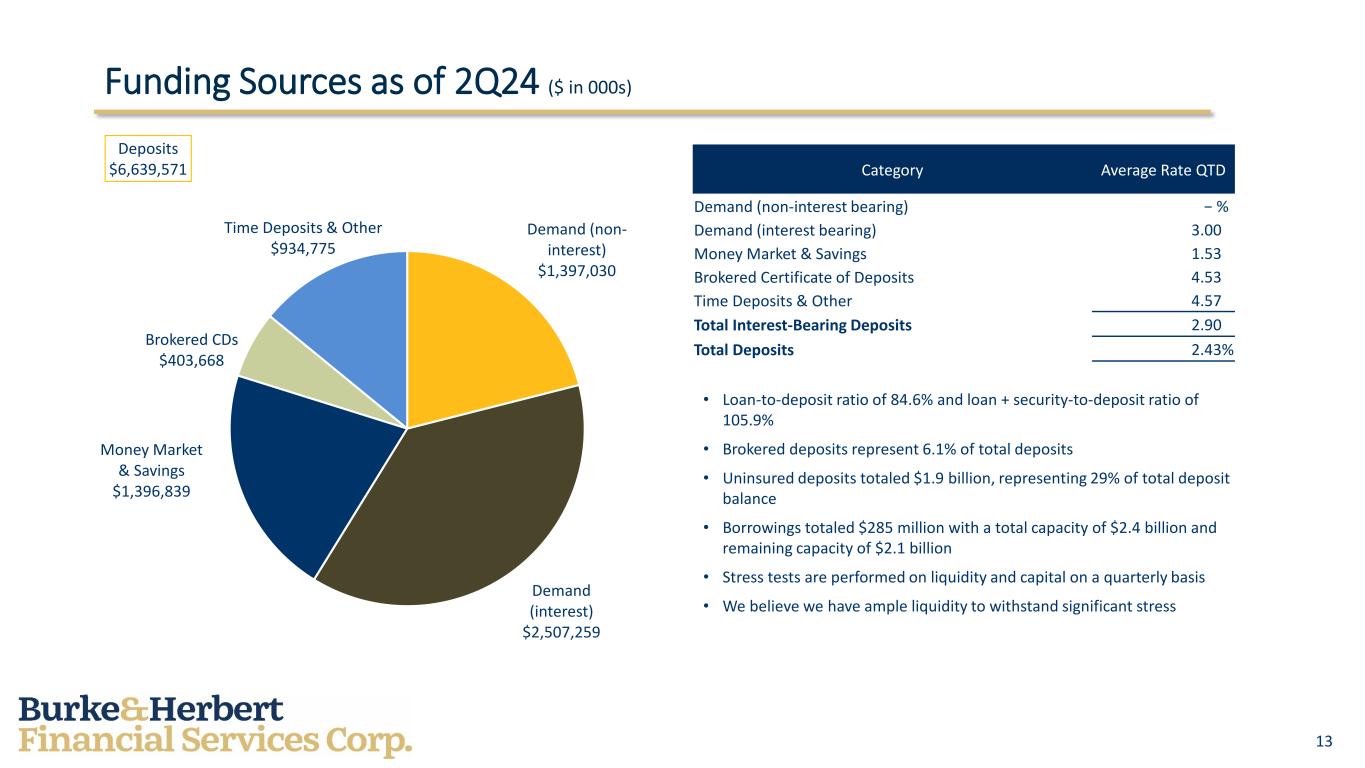

13 Funding Sources as of 2Q24 ($ in 000s) Demand (non- interest) $1,397,030 Demand (interest) $2,507,259 Money Market & Savings $1,396,839 Brokered CDs $403,668 Time Deposits & Other $934,775 Deposits $6,639,571 Category Average Rate QTD Demand (non-interest bearing) − % Demand (interest bearing) 3.00% Money Market & Savings 1.53% Brokered Certificate of Deposits 4.53% Time Deposits & Other 4.57% Total Interest-Bearing Deposits 2.90% Total Deposits 2.43% • Loan-to-deposit ratio of 84.6% and loan + security-to-deposit ratio of 105.9% • Brokered deposits represent 6.1% of total deposits • Uninsured deposits totaled $1.9 billion, representing 29% of total deposit balance • Borrowings totaled $285 million with a total capacity of $2.4 billion and remaining capacity of $2.1 billion • Stress tests are performed on liquidity and capital on a quarterly basis • We believe we have ample liquidity to withstand significant stress

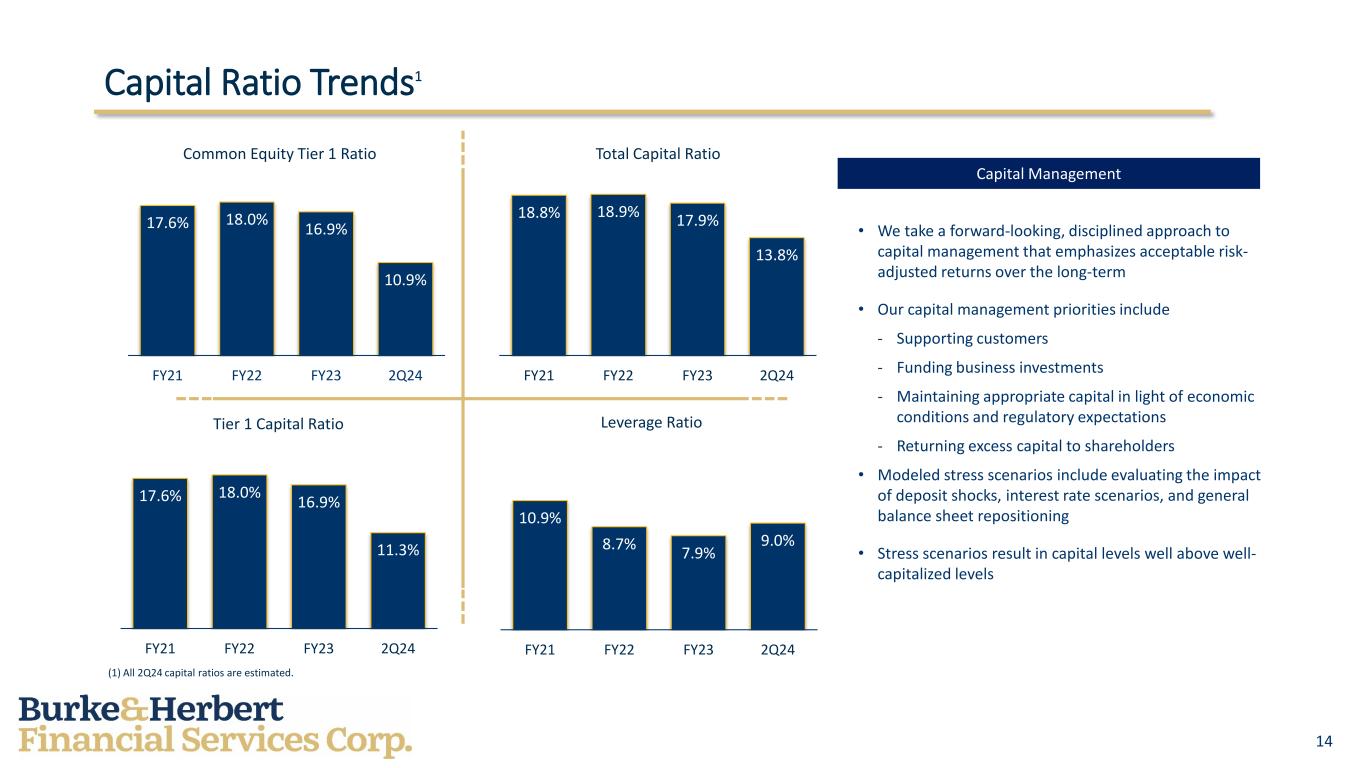

14 Capital Ratio Trends1 17.6% 18.0% 16.9% 10.9% FY21 FY22 FY23 2Q24 Common Equity Tier 1 Ratio 17.6% 18.0% 16.9% 11.3% FY21 FY22 FY23 2Q24 Tier 1 Capital Ratio 18.8% 18.9% 17.9% 13.8% FY21 FY22 FY23 2Q24 Total Capital Ratio 10.9% 8.7% 7.9% 9.0% FY21 FY22 FY23 2Q24 Leverage Ratio Capital Management • We take a forward-looking, disciplined approach to capital management that emphasizes acceptable risk- adjusted returns over the long-term • Our capital management priorities include - Supporting customers - Funding business investments - Maintaining appropriate capital in light of economic conditions and regulatory expectations - Returning excess capital to shareholders • Modeled stress scenarios include evaluating the impact of deposit shocks, interest rate scenarios, and general balance sheet repositioning • Stress scenarios result in capital levels well above well- capitalized levels (1) All 2Q24 capital ratios are estimated.

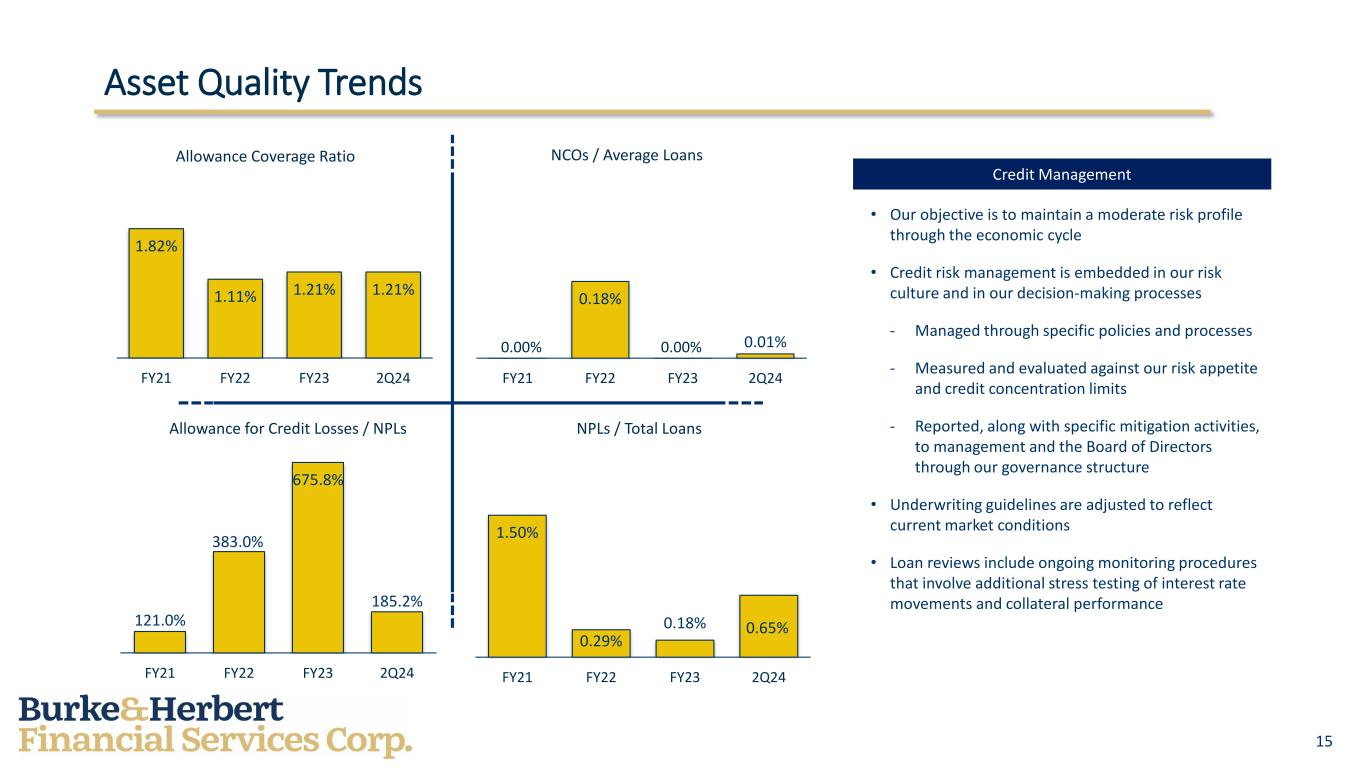

15 Asset Quality Trends 1.82% 1.11% 1.21% 1.21% FY21 FY22 FY23 2Q24 Allowance Coverage Ratio 0.18% 0.01% FY21 FY22 FY23 2Q24 NCOs / Average Loans 121.0% 383.0% 675.8% 185.2% FY21 FY22 FY23 2Q24 Allowance for Credit Losses / NPLs 1.50% 0.29% 0.18% 0.65% FY21 FY22 FY23 2Q24 NPLs / Total Loans Credit Management • Our objective is to maintain a moderate risk profile through the economic cycle • Credit risk management is embedded in our risk culture and in our decision-making processes - Managed through specific policies and processes - Measured and evaluated against our risk appetite and credit concentration limits - Reported, along with specific mitigation activities, to management and the Board of Directors through our governance structure • Underwriting guidelines are adjusted to reflect current market conditions • Loan reviews include ongoing monitoring procedures that involve additional stress testing of interest rate movements and collateral performance 0.00% 0.00%

16 Final Thoughts • Our business model is built on customer service and being a trusted advisor • Our approach is concentrated on growing and deepening relationships across our businesses that meet our risk/return measures • We are focused on our strategic priorities which are designed to enhance value over the long term - Profitably expanding our market share - Deepening customer relationships by delivering fee-based financial solutions - Leveraging technology to create efficiencies that help us better serve customers • With the Summit merger closed, we are focused on a seamless integration and delivering what our constituencies expect of us

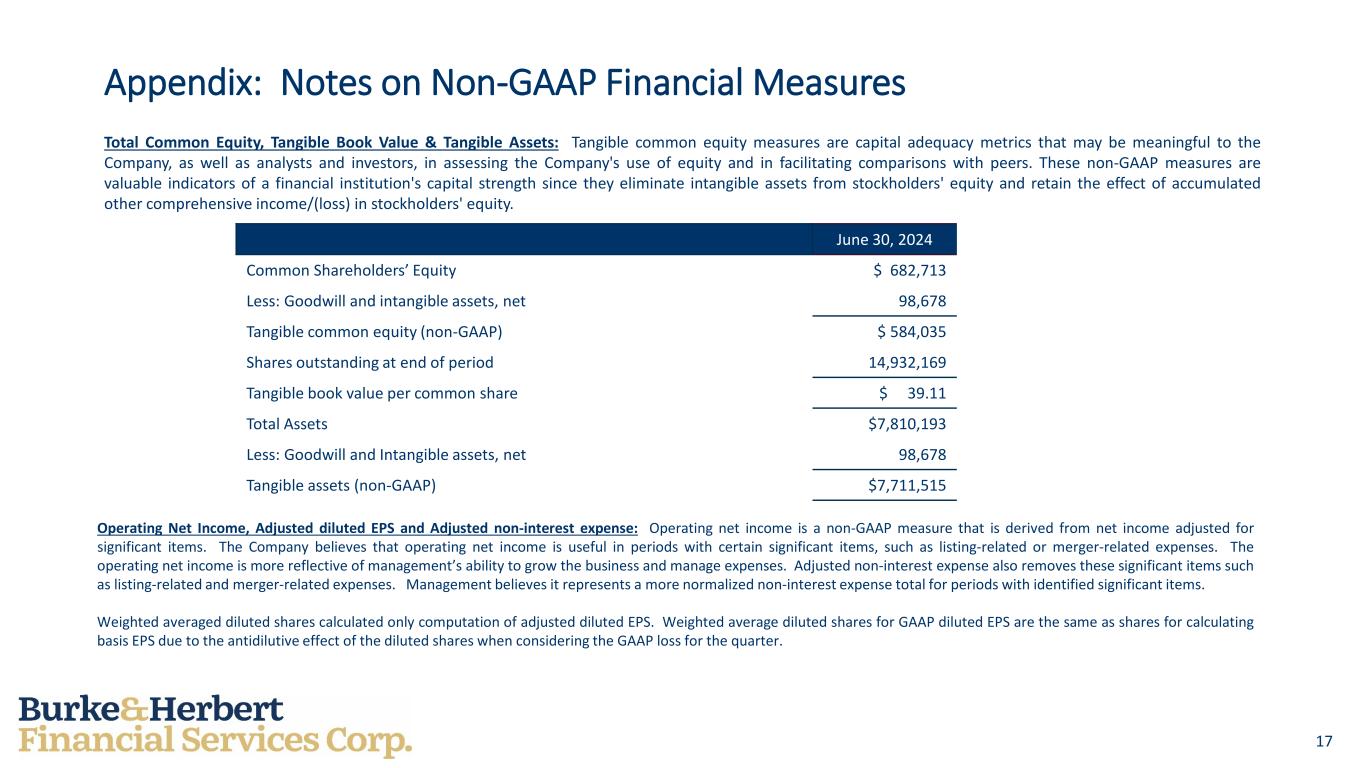

17 Appendix: Notes on Non-GAAP Financial Measures Total Common Equity, Tangible Book Value & Tangible Assets: Tangible common equity measures are capital adequacy metrics that may be meaningful to the Company, as well as analysts and investors, in assessing the Company's use of equity and in facilitating comparisons with peers. These non-GAAP measures are valuable indicators of a financial institution's capital strength since they eliminate intangible assets from stockholders' equity and retain the effect of accumulated other comprehensive income/(loss) in stockholders' equity. June 30, 2024 Common Shareholders’ Equity $ 682,713 Less: Goodwill and intangible assets, net 98,678 Tangible common equity (non-GAAP) $ 584,035 Shares outstanding at end of period 14,932,169 Tangible book value per common share $ 39.11 Total Assets $7,810,193 Less: Goodwill and Intangible assets, net 98,678 Tangible assets (non-GAAP) $7,711,515 Operating Net Income, Adjusted diluted EPS and Adjusted non-interest expense: Operating net income is a non-GAAP measure that is derived from net income adjusted for significant items. The Company believes that operating net income is useful in periods with certain significant items, such as listing-related or merger-related expenses. The operating net income is more reflective of management’s ability to grow the business and manage expenses. Adjusted non-interest expense also removes these significant items such as listing-related and merger-related expenses. Management believes it represents a more normalized non-interest expense total for periods with identified significant items. Weighted averaged diluted shares calculated only computation of adjusted diluted EPS. Weighted average diluted shares for GAAP diluted EPS are the same as shares for calculating basis EPS due to the antidilutive effect of the diluted shares when considering the GAAP loss for the quarter.