As filed with the U.S. Securities and Exchange Commission on February 12, 2025

Registration Statement No. 333-277574

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Post-Effective

Amendment No. 3 to FORM F-1 on

FORM F-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

VAST RENEWABLES LIMITED

(Exact name of Registrant as Specified in its Charter)

N/A

(Translation of registrant name into English)

| | | | | | | | | | | | | | |

| Australia | | 4911 | | Not Applicable |

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (IRS Employer

Identification Number) |

Suite 7.02, 124 Walker Street,

North Sydney, NSW 2060

Australia

+61 2 4072 2889

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, Delaware 19711

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

Joel Rennie

Elliott Smith

White & Case LLP

1221 Avenue of the Americas New York, New York 10020

(212) 819-8200

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after the effectiveness of this registration statement.

If only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans,please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 (as amended, the “Securities Act”), check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933. Emerging growth company x

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. o

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

__________________

†The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

EXPLANATORY NOTE

Vast Renewables Limited (the "Company") filed Amendment No. 1 to the Registration Statement on Form F-1 (File No. 333-277574) on March 7, 2024, which was originally declared effective by the Securities and Exchange Commission (the “SEC”) on March 11, 2024, amended by Post-Effective Amendment No. 1 thereto filed on April 25, 2024 and declared effective by the SEC on April 26, 2024 and amended by Post-Effective Amendment No. 2 thereto filed on November 7, 2024 and declared effective by the SEC on November 12, 2024 (as amended, the “F-1 Registration Statement,”), relating to (a) the issuance by the Company of up to 27,529,987 Class A Ordinary Shares that are issuable by us upon the exercise of Warrants (as defined therein) and (b) the offer and sale, from time to time, by the selling security holders named therein of up to (i) 46,036,985 Ordinary Shares of the Company and up to (ii) 12,856,500 Warrants. This Post-Effective Amendment No. 3 to Form F-1 on Form F-3 is being filed to convert the F-1 Registration Statement into a Registration Statement on Form F-3 (the “F-3 Registration Statement”) and to update and supplement certain information contained in the F-1 Registration Statement.

All applicable registration fees for previously registered securities were paid at the time of the original filing of the Prior Registration Statement .

The information in this prospectus is not complete and may be changed. Neither we nor the Selling Securityholders may sell or distribute the securities described herein until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This prospectus is not an offer to sell and is not soliciting an offer to buy the securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED February 12, 2025

PRELIMINARY PROSPECTUS

VAST RENEWABLES LIMITED

Primary Offering of

27,529,887 Ordinary Shares Underlying Warrants

Secondary Offering of

41,530,920 Ordinary Shares

12,856,500 Warrants to Purchase Ordinary Shares

This prospectus relates to the offer and sale by Vast Renewables Limited, an Australian public company limited by shares (f/k/a Vast Solar Pty Ltd, an Australian proprietary company limited by shares) (“us,” “we,” “Vast,” or the “Company”) of (i) up to 13,799,887 ordinary shares in the capital of the Company (“Ordinary Shares”) that are issuable by us upon the exercise of 13,799,887 public warrants of the Company, each initially exercisable at $11.50 for one Ordinary Share (“Public Warrants”) and (ii) up to 13,730,000 Ordinary Shares that are issuable by us upon the exercise of 13,730,000 private warrants of the Company, each initially exercisable at $11.50 for one Ordinary Share (“Private Warrants” and, together with the Public Warrants, the “Warrants”).

This prospectus also relates to the offer and resale from time to time by the selling securityholders (including their transferees, donees, pledgees and other successors-in-interest) named in this prospectus (the “Selling Securityholders”) of up to:

(i)23,474,421 Ordinary Shares held by certain holders entitled to resale registration rights pursuant to the shareholder and registration rights agreement, dated as of December 18, 2023 (the “Shareholder and Registration Rights Agreement”) or other agreements, including:

(a)1,804,588 of the 1,809,588 Ordinary Shares issued to certain members of Nabors Energy Transition Sponsor LLC, a Delaware limited liability company (the “NETC Sponsor”) in exchange for the Founder Shares (as defined below) which were initially purchased at a purchase price of approximately $0.004 per share;

(b)350,000 Ordinary Shares issued to Nabors Lux 2 S.a.r.l. (“Nabors Lux”) pursuant to the Nabors Backstop Agreement (as defined below) as partial consideration for Nabors Lux’s obligations under the Nabors Backstop Agreement;

(c)681,620 Ordinary Shares issued pursuant to the Nabors Backstop Agreement at a purchase price of $10.20 per Ordinary Share as partial consideration for Nabors Lux’s obligations under the Nabors Backstop Agreement;

(d)1,500,000 Ordinary Shares issued to certain members of the NETC Sponsor pursuant to the Nabors Backstop Agreement issued as an acceleration of a portion of the Earnback Shares (as defined below) as partial consideration for Nabors Lux’s obligations under the Nabors Backstop Agreement;

(e)2,187,147 of the 2,301,433 Ordinary Shares issued to certain employees of Vast and to an employee share trust in settlement of all outstanding shares granted under the Management Equity Plan Deed dated on or around July 30, 2020, as amended on February 14, 2023 (the “MEP Deed” and, such shares, the “MEP Shares”) pursuant to the MEP De-SPAC Side Deed (as defined below);

(f)15,292,421 of the 18,198,566 Ordinary Shares issued to AgCentral Energy Pty Ltd. (“AgCentral”) in exchange for settlement and cancellation of (i) 25,129,140 Legacy Vast Shares for which AgCentral paid an average price of approximately $0.09 per share and (ii) convertible notes and other indebtedness of Vast pursuant to which the Vast owed AgCentral an aggregate of approximately $21,455,453, resulting in an implied investment price per share of approximately $1.31;

(g)1,250,014 Ordinary Shares issued to Nabors Lux and AgCentral upon conversion of the Senior Convertible Notes (as defined below) at a conversion rate of $10.20 per Ordinary Share;

(h)1,715,686 Ordinary Shares issued to Nabors Lux and AgCentral pursuant to the Equity Subscription Agreements (as defined below) at a purchase price of $10.20 per Ordinary Share;

(i)171,569 Ordinary Shares issued to Guggenheim Securities, LLC pursuant to its amended engagement letter with Nabors Energy Transition Corp., a Delaware Corporation (“NETC”) at an implied purchase price of $10.20 per Ordinary Share;

(j)2,010 Ordinary Shares purchased on the open market at a purchase price of $3.83 per Ordinary Share;

(ii)up to an aggregate 2,799,999 Ordinary Shares (“Earnout Shares”) that are issuable to certain parties to the Shareholder and Registration Rights Agreement pursuant to the Business Combination Agreement (as defined below) upon the occurrence of specified events, for no additional consideration;

(iii)2,400,000 Ordinary Shares (“Earnback Shares”) that are issuable to NETC Sponsor pursuant to the Support Agreement (as defined below), for no additional consideration;

(iv)12,416,500 Private Warrants originally issued in a private placement at a purchase price of $1.00 per private warrant in connection with the NETC IPO (as defined below), held by certain parties to the Shareholder and Registration Rights Agreement;

(v)12,416,500 Ordinary Shares issuable upon exercise of Private Warrants, at an exercise price of $11.50 per share, subject to adjustment, held by certain parties to the Shareholder and Registration Rights Agreement;

(vi)440,000 Public Warrants purchased on the open market at purchase prices ranging from $0.10 to$0.15 per Public Warrant, held by certain parties to the Shareholder and Registration Rights Agreement and

(vii)440,000 Ordinary Shares issuable upon exercise of Public Warrants, at an exercise price of $11.50 per share, subject to adjustment, held by certain parties to the Shareholder and Registration Rights Agreement (such securities described in clauses (i) through (vii) collectively, the “Resale Securities”).

We are registering the offer and sale and/or resale of these securities to satisfy certain registration obligations we have and certain registration rights we have granted. The Selling Securityholders may offer all or part of the Resale Securities for resale from time to time through public or private transactions, at either prevailing market prices or at privately negotiated prices. The Resale Securities are being registered to permit the Selling Securityholders to sell Resale Securities from time to time, in amounts, at prices and on terms determined at the time of offering. The Selling Securityholders may sell the Resale Securities through ordinary brokerage transactions, in underwritten offerings, directly to market makers of our securities or through any other means described in the section entitled “Plan of Distribution” herein. In connection with any sales of Resale Securities offered hereunder, the Selling Securityholders, any underwriters, agents, brokers or dealers participating in such sales may be deemed to be “underwriters” within the meaning of the Securities Act, or the Exchange Act. We are registering the Resale Securities for resale by the Selling Securityholders, or their donees, pledgees, transferees, distributees or other successors-in-interest selling our Ordinary Shares or Vast Warrants or interests in our Ordinary Shares or Vast Warrants received after the date of this prospectus from the Selling Securityholders as a gift, pledge, partnership distribution or other transfer.

Certain Resale Securities held by the Selling Securityholders party to the Shareholder and Registration Rights Agreement are subject to contractual lock-up restrictions that prohibit them from selling such securities at this time, subject to certain exceptions. See the section of this prospectus entitled “Description of Securities.”

Some of the Ordinary Shares being registered for resale were acquired by the Selling Securityholders for prices considerably below the current market price of the Ordinary Shares. Even though the current market price ($0.96 closing price on January 31, 2025) is significantly below the $10.00 per unit price offered in the NETC IPO, certain Selling Securityholders may have an incentive to sell because they have purchased their Ordinary Shares or Warrants at effective prices significantly lower than our public investors or the current trading price of the Ordinary Shares or Warrants and may profit significantly so even under circumstances in which our public shareholders or certain other Selling Securityholders would experience losses in connection with their investment. For additional information, see “Risk Factors — Risks Relating to Ownership of Our Securities — Certain of the Selling Securityholders acquired their Ordinary Shares at a price that is less than the market price of the Ordinary Shares as of the date of this prospectus, may earn a positive rate of return even if the price of the Ordinary Shares declines and may be willing to sell their Ordinary Shares at a price less than shareholders that acquired Ordinary Shares in the public market.”

On December 18, 2023 (the “Closing Date”), we consummated the business combination pursuant to the Business Combination Agreement, dated as of February 14, 2023, as amended on October 19, 2023 (the “Business Combination Agreement,” and the transactions contemplated thereby, the “Business Combination”), by and among the Company, NETC, Neptune Merger Sub, Inc., a Delaware corporation and wholly owned direct subsidiary of the Company (“Merger Sub”), the NETC Sponsor (solely with respect to Sections 5.20, 7.10(a) and 7.16 thereto), and Nabors Industries Ltd. (“Nabors”) (solely with respect to Sections 7.8(d) and 7.18 thereto), pursuant to which, among other things and subject to the terms and conditions contained therein, Merger Sub merged with

and into NETC (the “Merger”), with NETC continuing as the surviving corporation and a wholly owned direct subsidiary of the Company (the “Surviving Corporation”).

Immediately prior to the effective time of the Merger (the “Effective Time”):

•We caused all outstanding MEP Shares granted under the MEP Deed, to be settled by way of a conversion and subdivision of those MEP Shares into Ordinary Shares in accordance with the MEP Deed and the Management Equity Plan De-SPAC Side Deed, dated on or around February 14, 2023 (the “MEP De-SPAC Side Deed” and such conversion and subdivision, the “MEP Share Conversion”), and after the MEP Share Conversion, all of the MEP Shares ceased to be outstanding and ceased to exist, and each holder of MEP Shares ceased to have any rights with respect to such MEP Shares;

•AgCentral caused (i) all of the outstanding convertible promissory notes we issued held by AgCentral and (ii) all of the principal outstanding and accrued interest under each loan agreement between us and AgCentral to be converted into Ordinary Shares (collectively, the “Existing AgCentral Indebtedness Conversion”), in each case, pursuant to the terms of that certain Noteholder Support and Loan Termination Agreement, dated as of February 14, 2023, by and between us and AgCentral (the “Noteholder Support and Loan Termination Agreement”); and

•We caused a conversion of Ordinary Shares (the “Split Adjustment”), to occur immediately following the MEP Share Conversion and the Existing AgCentral Indebtedness Conversion, whereby the aggregate number of Ordinary Shares outstanding immediately following the Split Adjustment and immediately prior to the Effective Time was 20,499,999 Ordinary Shares.

At the Effective Time, by virtue of the Merger and without any action on the part of the Company, NETC, Merger Sub or any of the holders of any of their securities, the following events took place simultaneously:

•all shares of NETC Class A common stock, par value $0.0001 per share, prior to the Closing Date (the “NETC Class A Common Stock”), NETC Class B common stock, par value $0.0001 per share, prior to the Closing Date (the “NETC Class B Common Stock”), and NETC Class F common stock, par value $0.0001 per share, prior to the Closing Date (the “NETC Class F Common Stock” and together with the NETC Class B Common Stock and the NETC Class A Common Stock issued upon conversion of the NETC Class B Common Stock, the “Founder Shares”), held in the treasury of NETC were cancelled without any conversion thereof and no payment or distribution was made with respect thereof;

•(i) each share of NETC Class A Common Stock (other than the Redemption Shares (as defined below)) issued and outstanding immediately prior to the Effective Time was exchanged for one Ordinary Share, (ii) the shares of NETC Class F Common Stock and the shares of NETC Class B Common Stock issued and outstanding and held by the NETC Sponsor or its transferees (based on a transfer following the date of the Business Combination Agreement) immediately prior to the Effective Time were collectively exchanged for 2,825,000 validly issued and fully paid Ordinary Shares, (iii) each share of NETC Class B Common Stock issued and outstanding and not held by the NETC Sponsor or its transferees immediately prior to the Effective Time was exchanged for one Ordinary Share, and (iv) each share of NETC Class F Common Stock issued and outstanding and not held by the NETC Sponsor or its transferees immediately prior to the Effective Time was exchanged for one Ordinary Share, in each case, after giving effect to the Split Adjustment (collectively, the “Per Share Merger Consideration”) and thereafter, each share of NETC Class A Common Stock, NETC Class F Common Stock and NETC Class B Common Stock was automatically cancelled and ceased to exist and each holder of NETC Class A Common Stock, NETC Class F Common Stock and NETC Class B Common Stock ceased to have any rights with respect thereto except the right to receive the Per Share Merger Consideration (other than pursuant to and in accordance with that certain letter agreement, dated as of February 14, 2023, by and among NETC, the NETC Sponsor, Vast, Nabors Lux and NETC’s independent directors (as amended on October 19, 2023, the “Support Agreement”);

•each share of common stock, par value $0.0001 per share, of Merger Sub issued and outstanding immediately prior to the Effective Time was converted into one validly issued, fully paid and non-assessable share of common stock, par value $0.0001 per share, of the Surviving Corporation, which share constitutes the only outstanding share of capital stock of the Surviving Corporation as of immediately after the Effective Time; and

•we assumed (i) the private warrant agreement, dated as of November 16, 2021, by and between NETC and Continental Stock Transfer & Trust Company, as warrant agent (the “Original Private Warrant Agreement”) by virtue of the private warrant assignment, assumption and amendment agreement, dated as of December 18, 2023, by and among the Company, NETC and Continental Stock Transfer & Trust Company, as warrant agent (the Original Private Warrant Agreement, as amended by the private warrant assignment, assumption and amendment agreement, the “Private Warrant Agreement”) , and (ii) the public warrant agreement, dated as of November 16, 2021, by and between NETC and Continental Stock Transfer & Trust Company, as warrant agent (the “Original Public Warrant Agreement,” and together with the Original Private Warrant Agreement, the “NETC Warrant Agreements”) by virtue of the public warrant assignment, assumption and amendment agreement, dated as of December 18, 2023, by and among the Company, NETC and Continental Stock Transfer & Trust

Company, as warrant agent (the Original Public Warrant Agreement, as amended by the public warrant assignment, assumption and amendment agreement, the “Public Warrant Agreement” and, together with the Private Warrant Agreement, the “Vast Warrant Agreements”), and each warrant granted under the NETC Warrant Agreements (the “NETC Warrants”) then outstanding and unexercised automatically, without any action on the part of its holder, converted into a warrant to acquire Ordinary Shares (each such warrant issued under the Private Warrant Agreement, became a Private Warrant, and each such warrant issued under the Public Warrant Agreement, became a Public Warrant. Each Vast Warrant is subject to the same terms and conditions (including exercisability terms) as were applicable to the corresponding NETC Warrant immediately prior to the Effective Time, except to the extent such terms or conditions are rendered inoperative by the Business Combination.

Each share of NETC Class A Common Stock issued and outstanding immediately prior to the Effective Time with respect to which a NETC stockholder validly exercised its redemption rights (the “Redemption Shares”) was not entitled to receive the Per Share Merger Consideration and was converted immediately prior to the Effective Time into the right to receive from NETC, in cash, an amount per share calculated in accordance with such stockholder’s redemption rights.

Certain other related agreements were entered into in connection with the Business Combination, including the Notes Subscription Agreements, the Equity Subscription Agreements, the Canberra Subscription Agreement, the Nabors Backstop Agreement, the Shareholder and Registration Rights Agreement, the Support Agreement, the Noteholder Support and Loan Termination Agreement, the MEP Deed, MEP De-SPAC Side Deed, the Services Agreement, the Development Agreement, the October Notes Subscription Agreement, the EDF Note Purchase Agreement, the JDA, the Parent Company Guarantee, the Nabors Backstop Agreement Amendment and the Nabors Backstop Loan each as defined and described elsewhere in this prospectus.

At the Effective Time, Vast issued:

•An aggregate of 804,616 Ordinary Shares upon conversion of shares of NETC Class A Common Stock to the holders thereof;

•An aggregate of 3,000,000 Ordinary Shares upon conversion of Founder Shares to the holders thereof;

•An aggregate of 1,500,000 Ordinary Shares to former members of NETC Sponsor as acceleration of a portion of the Earnback Shares, pursuant to the Nabors Backstop Agreement;

•350,000 Ordinary Shares to Nabors Lux pursuant to the Nabors Backstop Agreement;

•An aggregate of 1,250,014 Ordinary Shares upon conversion of Senior Convertible Notes (as defined below) held by AgCentral and Nabors Lux;

•An aggregate of 1,715,686 Ordinary Shares to AgCentral and Nabors Lux pursuant to their respective Equity Subscription Agreements (as defined below); and

•171,569 Ordinary Shares to Guggenheim Securities pursuant to its amended engagement letter with NETC.

On January 12, 2024, Vast issued an additional 681,620 Ordinary Shares to Nabors Lux pursuant to the Nabors Backstop Agreement.

The Ordinary Shares being offered for resale by the Selling Securityholders pursuant to this prospectus represent approximately 65.1% of our total issued and outstanding Ordinary Shares on a fully diluted basis (assuming and after giving effect to the issuance of 27,529,887 Ordinary Shares upon exercise of all outstanding Warrants, 2,799,999 Earnout Shares issuable upon the occurrence of all Triggering Events, and 2,400,000 Earnback Shares issuable upon the occurrence of all Triggering Events, the conversion of the EDF Note) and the Warrants being offered for resale pursuant to this prospectus represent approximately 46.7% of our current total outstanding Warrants. Upon expiration of the contractual lock-up restrictions mentioned above and described in our most recent Annual Report on Form 20-F under section entitled “Certain Relationships and Related Persons Transactions,” the Selling Securityholders, including AgCentral (who holds approximately 27.9% of our total issued and outstanding Ordinary Shares on a fully diluted basis and has voting power over approximately 30.5% of our total issued and outstanding Ordinary Shares on a fully diluted basis) and Nabors Lux (who is a beneficial owner of approximately 18.7% of our total issued and outstanding Ordinary Shares on a fully diluted basis), will be able to sell all of their Resale Securities registered for resale hereunder for so long as this registration statement of which this prospectus forms a part is available for use. Given the substantial number of Resale Securities being registered for potential resale by the Selling Securityholders pursuant to the registration statement of which this prospectus forms a part, the sale of such Resale Securities by the Selling Securityholders, or the perception in the market that the Selling Securityholders may or intend to sell all or a significant portion of such Resale Securities, could increase the volatility of the market price of our Ordinary Shares or Public Warrants or result in a significant decline in the public trading price of our Ordinary Shares or Public Warrants. The Selling Securityholders acquired, or have the option to acquire, the Ordinary Shares covered by this prospectus at prices ranging from less than $0.01 per share to $11.50 per share. By comparison, the offering price to public stockholders in the NETC IPO was $10.00 per unit, each of which consisted of one share of NETC Class A Common Stock and one-half of one redeemable NETC Public Warrant.

Consequently, certain Selling Securityholders may realize a positive rate of return on the sale of their Resale Securities covered by this prospectus even though the market price of Ordinary Shares is currently $0.96 (based on the closing price on January 31, 2025) which is significantly below the $10.00 per unit price offered in the NETC IPO and public shareholders and/or warrantholders may experience a negative rate of return on their investment. The contractual lock-up restrictions are subject to certain exceptions, including an exception that permits sales of Resale Securities during the lock-up period to satisfy tax obligations of Selling Securityholders.

We will not receive any proceeds from the sale of the Resale Securities by the Selling Securityholders. We will receive the proceeds upon exercise of Vast Warrants to the extent such Vast Warrants are exercised for cash. Assuming the exercise of all outstanding Vast Warrants for cash, we would receive aggregate proceeds of approximately $316.6 million. However, we will only receive such proceeds if all Vast Warrant holders fully exercise their Vast Warrants for cash. The exercise price of the Vast Warrants is $11.50 per share. We believe that the likelihood that holders determine to exercise their Vast Warrants, and therefore the amount of cash proceeds that we would receive, is dependent upon the market price of our Ordinary Shares. If the market price for our Ordinary Shares is less than the exercise price of the Vast Warrants (on a per share basis), we believe that holders will be very unlikely to exercise any of their Vast Warrants, and accordingly, we will not receive any such proceeds. There is no assurance that the Vast Warrants will be “in the money” prior to their expiration or that the holders will exercise their Vast Warrants. Vast Warrant holders have the option to exercise their Vast Warrants on a cashless basis in accordance with the Vast Warrant Agreements. To the extent that any Vast Warrants are exercised on a cashless basis, the amount of cash we would receive from the exercise of Vast Warrants will decrease.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read this entire prospectus and any amendments or supplements carefully before you make your investment decision. Our Ordinary Shares and Public Warrants are listed on The Nasdaq Stock Market LLC, (“Nasdaq”) under the trading symbols “VSTE” and “VSTEW,” respectively. On January 31, 2025, the closing prices for our Ordinary Shares and Public Warrants on Nasdaq were $0.96 per share and $0.0589 per warrant, respectively.

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 and are therefore eligible to take advantage of certain reduced reporting requirements applicable to other public companies.

We are also a “foreign private issuer” as defined in the Exchange Act and are exempt from certain rules under the Exchange Act that impose certain disclosure obligations and procedural requirements for proxy solicitations under Section 14 of the Exchange Act. In addition, our officers, directors and principal shareholders are exempt from the reporting and “short-swing” profit recovery provisions under Section 16 of the Exchange Act with respect to their purchases and sales of Ordinary Shares. Moreover, we are not required to file periodic reports and financial statements with the SEC as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act. See our most recent Annual Report on Form 20-F, “Risk Factors — Risks Related to Ownership of Our Securities — As a “foreign private issuer” under the rules and regulations of the SEC, we are permitted to, and will, file less or different information with the SEC than a company incorporated in the United States or otherwise not filing as a “foreign private issuer,” and will follow certain home country corporate governance practices in lieu of certain Nasdaq requirements applicable to U.S. issuers. Accordingly, there will be less publicly available information concerning the Company than there is for issuers that are not foreign private issuers.”

Investing in our securities involves a high degree of risk. See the section entitled "Risk Factors" of this prospectus and other risk factors contained in the documents incorporated by reference herein, including those included in the section entitled “Risk Factors” of our most recent Annual Report on Form 20-F for a discussion of information that should be considered in connection with an investment in our securities. Neither the SEC nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

PROSPECTUS DATED ,2025

TABLE OF CONTENTS

You should rely only on the information contained or incorporated by reference in this prospectus or any supplement. Neither we nor the Selling Securityholders have authorized anyone else to provide you with different information. The securities offered by this prospectus are being offered only in jurisdictions where the offer is permitted. You should not assume that the information in this prospectus or any supplement is accurate as of any date other than the date on the front of each document. Our business, financial condition, results of operations and prospects may have changed since that date.

Except as otherwise set forth in this prospectus, neither we nor the Selling Securityholders have taken any action to permit a public offering of these securities outside the United States or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of these securities and the distribution of this prospectus outside the United States.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the U.S. Securities and Exchange Commission (the “SEC”) utilizing a “shelf” registration process. By using a shelf registration statement, we may issue up to 27,529,887 Ordinary Shares underlying Warrants, and the Selling Securityholders may offer for resale (i) up to 41,530,920 Ordinary Shares of the Company and up to (ii) 12,856,500 Warrants, as described in this prospectus.

We have not, and the Selling Securityholders have not, authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus, any applicable prospectus supplement or any free writing prospectuses prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. You should assume that the information appearing in this prospectus and the applicable prospectus supplement to this prospectus is accurate only as of the date on its respective cover, that the information appearing in any applicable free writing prospectus is accurate only as of the date of that free writing prospectus, and that any information incorporated by reference is accurate only as of the date of the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations and prospects may have changed since those dates. This prospectus incorporates by reference, and any prospectus supplement or free writing prospectus may contain and incorporate by reference, market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information. Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently verified this information. In addition, the market and industry data and forecasts that may be included or incorporated by reference in this prospectus, any prospectus supplement or any applicable free writing prospectus may involve estimates, assumptions and other risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” contained in this prospectus, the applicable prospectus supplement and any applicable free writing prospectus, and under similar headings in other documents that are incorporated by reference into this prospectus. Accordingly, investors should not place undue reliance on this information.

The Selling Securityholders may offer and sell the securities directly to purchasers, through agents selected by us and/or the Selling Securityholders, or to or through underwriters or dealers. A prospectus supplement, if required, may describe the terms of the plan of distribution and set forth the names of any agents, underwriters or dealers involved in the sale of securities. See “Plan of Distribution.”

This prospectus does not constitute an offer to sell, or a solicitation of an offer to buy, any securities, in any jurisdiction to or from any person to whom it is unlawful to make any such offer or solicitation in such jurisdiction.

CERTAIN DEFINED TERMS

The following terms used in this prospectus have the meanings indicated below:

“Accelerated Earnback Shares” are to the 1,500,000 Ordinary Shares issued by Vast to the NETC Sponsor in the Merger as acceleration of a portion of the Earnback Shares pursuant to the Nabors Backstop Agreement;

“AgCentral” are to AgCentral Energy Pty Ltd., an Australian proprietary company limited by shares;

“AgCentral Loan Agreements” are to the loan agreements between Vast and AgCentral pursuant to which the AgCentral Loans were made.

“AgCentral Loans” are to the indebtedness of Vast held by AgCentral prior to the Effective Time;

“AgCentral Subscription Agreement” are to the Subscription Agreement entered into February 14, 2023, by and between Vast and AgCentral;

“ASIC” are to the Australian Securities and Investments Commission;

“ASIO” are to the Australian Security Intelligence Organization Act 1979 (Cth);

“ASX” are to the Australian Securities Exchange Ltd;

“ASX Listing Rules” are to the exchange listing rules of the ASX.

“Balance of Plant” are to all the supporting components and auxiliary systems of a power plant needed to deliver the energy, other than the generating unit itself;

“BCA Amendment” are to the Amendment and Waiver to the Business Combination Agreement, dated October 19, 2023, by and between NETC, the NETC Sponsor, Vast and Merger Sub;

“BESS” are to battery energy storage systems;

“Business Combination Agreement” are to that certain Business Combination Agreement, dated as of February 14, 2023, by and among NETC, Merger Sub, Vast, the NETC Sponsor and Nabors, as amended by the BCA Amendment;

“CAG” are to Capital Airport Group;

"CAG Non-Redemption Agreement"are to the agreement, dated as of December 13, 2023, by and between CAG and NETC, pursuant to which CAG invested $2.0 million in Ordinary Shares by purchasing shares of NETC from existing NETC stockholders who previously elected to redeem their shares in connection with the Capital Reorganisation and whose redemption election were reversed prior to the Closing.

“Canberra Subscription Agreement” are to the Subscription Agreement entered into September 18, 2023, by and between Vast and CAG, as amended on December 13, 2023;

“Canberra Subscription” are to CAG’s subscription for and purchase up to the number of Ordinary Shares provided for in the Canberra Subscription Agreement in exchange for the purchase price and on the terms and subject to the conditions set forth therein;

“Capital Reorganisation” are to the transactions contemplated by the Business Combination Agreement;

“Closing” are to the closing of the Capital Reorganisation;

“Closing Date” are to December 18, 2023;

“Code” are to the U.S. Internal Revenue Code of 1986, as amended;

“Constitution” are to the constitution of Vast;

“Convertible Financing” are to the private offering of the Senior Convertible Notes to AgCentral and Nabors Lux for an aggregate purchase price of $10.0 million;

“Corporations Act” are to the Australian Corporations Act 2001 (Cth);

“CSP” are to concentrated solar thermal power;

“CSPv3.0” are to the Company’s new power generation technology that combines the modularity and reliability benefits of Parabolic Trough CSP systems with the economies of scale of Central Tower CSP systems and delivers cost-competitive, reliable, and efficient CSP.

“CSP 1.0” or “first generation CSP Systems” are to parabolic trough CSP systems;

“CSP 2.0” or “second generation CSP Systems” are to central tower CSP systems;

“CST” are to concentrated solar thermal;

“DGCL” are to the General Corporation Law of the State of Delaware;

“DTC” are to The Depository Trust Company;

“Earnback Shares” are to up to 2,400,000 Ordinary Shares that may be issued to the NETC Sponsor upon the achievement of certain share price targets during the Earnout Period;

“Earnout Period” are to the time period between the day that is seventy (70) days after the Closing Date and the five-year anniversary of the Closing Date;

“Earnout Shares” are to the up to 2,799,999 additional Ordinary Shares in the aggregate eligible to be received by Eligible Vast Shareholders during the Earnout Period;

“EDF” are to EDF Australia Pacific Pty Ltd;

“EDF Note” are to the exchangeable promissory note issued by Vast HoldCo to EDF on December 18, 2023 with an aggregate principal amount of Euro 10,000,000 pursuant to the EDF Note Purchase Agreement;

“EDF Note Purchase Agreement” are to the Note Purchase Agreement, dated December 7, 2023, by and among the Company, Vast HoldCo and EDF;

“Effective Time” are to the effective time of the Merger;

“EGC” are to an emerging growth company, as defined in Section 2(a)(19) of the Securities Act;

“Eligible Vast Shareholder” means a holder of an Ordinary Share (after taking into account the Existing AgCentral Indebtedness Conversion in accordance with the Noteholder Support and Loan Termination Agreement and the MEP Share Conversion) immediately prior to the Effective Time; provided, that no person that became a holder of Ordinary Shares prior to the Effective Time solely as a result of the consummation of the Convertible Financing or the PIPE Financing shall be an Eligible Vast Shareholder with respect to such Ordinary Shares;

“EPC” are to engineering, procurement and construction;

“Equity Subscription” are to Nabors Lux’s and AgCentral’s subscription for and purchase of up to the number of Ordinary Shares provided for in the Equity Subscription Agreements in exchange for the purchase price and on the terms and subject to the conditions set forth therein;

“Equity Subscription Agreements” are to the AgCentral Subscription Agreement and the Nabors Lux Subscription Agreement;

“ESG” are to environmental, social and governance;

“Exchange Act” are to the Securities Exchange Act of 1934, as amended;

“Existing Vast Convertible Notes” are to the convertible promissory notes of Vast held by AgCentral prior to the Effective Time;

“Financings” are to the Convertible Financing, the Equity Subscription, the Incremental Funding and PIPE Financing, collectively;

“FIRB” are to the Foreign Investment Review Board of Australia;

“Founder Shares” are to the NETC Class F Common Stock, the NETC Class B Common Stock issuable upon conversion of the NETC Class F Common Stock and the NETC Class A Common Stock issuable upon conversion of the NETC Class B Common Stock;

“Guggenheim Securities” are to Guggenheim Securities, LLC;

“HTF” are to Heat Transfer Fluid;

“IASB” are the International Accounting Standards Board;

“IEA” are to the International Energy Agency;

“IEP” are to independent energy producer;

“IFRS”are the International Financial Reporting Standards as issued by the IASB;

“Incremental Funding” are to the $2.5 million purchase price paid to Vast by Nabors Lux as consideration for the Senior Convertible Note issued pursuant to the October Notes Subscription Agreement;

“Incremental Funding Commitment Fee” are to the 350,000 Ordinary Shares issued to Nabors Lux by Vast pursuant to the Nabors Backstop Agreement;

“IRS” are to the U.S. Internal Revenue Service;

“ITC” are to investment tax credits;

“JOBS Act” are to the Jumpstart Our Business Startups Act of 2012;

“JSS Demonstration Plant” are to the Jemalong Solar Station operated from early 2018 until its decommissioning in 2020;

“LCOE” are to levelized cost of energy;

“Legacy Vast shareholders” are to the former holders of Legacy Vast Shares;

“Legacy Vast Shares” are to all of the shares in the capital of Vast that existed prior to the Closing;

“Letter Agreement” are to the letter agreement, dated November 16, 2021, among NETC, its officers and directors, the NETC Sponsor and Nabors Lux;

“MEP Deed” are to Vast’s Management Equity Plan Deed dated on or around July 30, 2020, as amended on February 14, 2023;

“MEP De-SPAC Side Deed” are to Vast’s Management Equity Plan De-SPAC Side Deed, dated on or around February 14, 2023;

“MEP Shares” are to all shares granted under the MEP Deed prior to the MEP Share Conversion;

“Merger” are to the merger of Merger Sub with and into NETC, with NETC surviving the merger as a wholly owned direct subsidiary of Vast;

“Merger Sub” are to Neptune Merger Sub, Inc., a Delaware corporation;

“Merger Sub Common Stock” are to the common stock, par value of $0.0001 per share, of Merger Sub;

“Nabors” are to Nabors Industries Ltd., a Bermuda exempted company;

“Nabors Backstop” are to the $10.0 million commitment by Nabors to purchase Ordinary Shares at a purchase price of $10.20 per share pursuant to the Nabors Backstop Agreement;

“Nabors Backstop Agreement” are to the Backstop Agreement, dated October 19, 2023, by and between Vast and Nabors Lux, as amended on December 8, 2023;

“Nabors Corporate” are to Nabors Corporate Services, Inc., a Delaware corporation.

“Nabors Lux” are to Nabors Lux 2 S.a.r.l., a Luxembourg private limited liability company (société à responsabilité limitée);

“Nabors Lux Subscription Agreement” are to the Subscription Agreement, entered into February 14, 2023, by and between Vast and Nabors Lux;

“Nasdaq” are to the Nasdaq Stock Market LLC.

“Nasdaq Listing Rules” are to the exchange listing rules of Nasdaq;

“NEM” are to the Australian National Electricity Market;

“NETC” are to Nabors Energy Transition Corp., a Delaware corporation;

“NETC Board” are to the board of directors of NETC;

“NETC Charter” are to NETC’s second amended and restated certificate of incorporation, dated May 12, 2023;

“NETC Class A Common Stock” are to NETC’s Class A common stock, par value $0.0001 per share, prior to the Closing of the Capital Reorganisation;

“NETC Class B Common Stock” are to NETC’s Class B common stock, par value $0.0001 per share, prior to the Closing of the Capital Reorganisation;

“NETC Class F Common Stock” are to NETC’s Class F common stock, par value $0.0001 per share, prior to the Closing of the Capital Reorganisation;

“NETC Common Stock” are to the NETC Class A Common Stock, NETC Class F Common Stock and the NETC Class B Common Stock, collectively;

“NETC independent directors” are to Colleen Calhoun, Maria Jelescu Dreyfus and Jennifer Gill Roberts;

“NETC initial stockholders” are to the former holders of shares of NETC Class F Common Stock, which included the NETC Sponsor and NETC’s independent directors;

“NETC IPO” are to NETC’s initial public offering of NETC Units, which closed on November 18, 2021;

“NETC management” are to NETC’s former officers and directors;

“NETC Preferred Stock” are to NETC’s preferred stock, par value $0.0001 per share, prior to the Closing of the Capital Reorganisation;

“NETC private placement warrants” are to the NETC Warrants issued to Nabors Lux, certain of NETC’s independent directors and certain other parties in a private placement simultaneously with the closing of the NETC IPO;

“NETC public shares” are to shares of NETC Class A Common Stock sold as part of the NETC Units in the NETC IPO (whether they were purchased in the NETC IPO or thereafter in the open market), which were subject to possible redemption;

“NETC public stockholders” are to the former holders of NETC public shares;

“NETC public warrants” are to the NETC Warrants sold as part of the NETC Units in the NETC IPO (whether they were purchased in the NETC IPO or thereafter in the open market);

“NETC special meeting” are to the special meeting of stockholders of NETC for the approval of, inter alia, the Merger and the Capital Reorganisation and any adjournments or postponements thereof;

“NETC Sponsor” are to Nabors Energy Transition Sponsor LLC, a Delaware limited liability company; “NETC stockholders” are to the NETC initial stockholders and the NETC public stockholders, collectively;

“NETC Units” are to the units of NETC sold in the NETC IPO, each of which consisted of one share of NETC Class A Common Stock and one-half of one NETC Public Warrant;

“NETC unitholders” are to the former holders of NETC Units;

“NETC Warrants” are to the NETC private placement warrants and the NETC public warrants, collectively;

“NETC Warrant Agreements” are to the Original Private Warrant Agreement and Original Public Warrant Agreement, collectively;

“NETC warrant holders” are to the former holders of NETC Warrants;

“NETV” are to Nabors Energy Transition Ventures, LLC, a Delaware limited liability company;

“Noteholder Support and Loan Termination Agreement” are to that certain letter agreement, dated as of February 14, 2023, by and between Vast and AgCentral;

“Notes Subscription Agreements” are to the notes subscription agreements, dated as of February 14, 2023, by and between the Company and each of AgCentral and Nabors Lux, pursuant to which, among other things, each of Nabors Lux and AgCentral agreed to subscribe for and purchase up to $5.0 million (or $10.0 million in aggregate principal amount) of Senior Convertible Notes;

“NZE” are to the IEA's net zero emissions scenario;

“October Agreements” are to the Nabors Backstop Agreement, the BCA Amendment, the Support Agreement Amendment and the October Notes Subscription Agreement;

“October Notes Subscription Agreement” are to the Notes Subscription Agreement, dated October 19, 2023, by and between Vast and Nabors Lux relating to the purchase of $2.5 million of Senior Convertible Notes;

“OEM” are to original equipment manufacturing;

“Ordinary Shares” are to the ordinary shares in the capital of Vast;

“Original Private Warrant Agreement” are to the Private Warrant Agreement, dated as of November 16, 2021, by and between NETC and Continental Stock Transfer & Trust Company, as warrant agent;

“Original Public Warrant Agreement” are to the Public Warrant Agreement, dated as of November 16, 2021, by and between NETC and Continental Stock Transfer & Trust Company, as warrant agent;

“O&M” are to operations and maintenance;

“PHES” are to pumped hydro energy storage;

“PIPE Financing” are to the private offering of the Ordinary Shares to AgCentral and Nabors Lux for a purchase price of $10.20 per share, for an aggregate purchase price of $30 million, in connection with the Capital Reorganisation (in each case, reduced dollar for dollar by the proceeds received from Nabors Lux and AgCentral, as applicable, pursuant to their respective Notes Subscription Agreement and the October Notes Subscription Agreement);

“PIPE Shares” are to the Ordinary Shares issued in the PIPE Financing;

“PPAs” are to power purchase agreements;

“Prior NETC Charter” are to NETC’s amended and restated certificate of incorporation, dated November 16, 2021;

“Private Warrants” are to the Warrants into which the NETC private placement warrants automatically converted at the Effective Time;

“Public Warrants” are to the Warrants into which the NETC public warrants automatically converted at the Effective Time;

“PV” are to photovoltaic electricity generation systems;

“PTC” are to production tax credits;

“P50” are to the annual level of generation that there is a 50% probability of exceeding over a year;

“P90” are to the annual level of generation that there is a 90% probability of exceeding over a year;

“Redemption Shares” are to the shares of NETC Class A Common Stock with respect to which a NETC public stockholder has validly exercised its redemption rights in accordance with the NETC Charter;

“RRA Parties” are to the parties, other than the Company, listed as signatories to the Shareholder and Registration Rights Agreement;

“SAF” are to sustainable aviation fuels;

“Sarbanes-Oxley Act” are to the Sarbanes-Oxley Act of 2002;

“SEC” are to the U.S. Securities and Exchange Commission;

“Securities Act” are to the Securities Act of 1933, as amended;

“Senior Convertible Notes” are to the senior convertible notes issued in the Convertible Financing and the senior convertible notes issued pursuant to the October Notes Subscription Agreement;

“SGS” are to steam generation systems;

“Shareholder and Registration Rights Agreement” are to the shareholder and registration rights agreement, dated December 18, 2023, by and among the Company and the parties thereto;

“SM1” or “Solar Methanol 1” are to a 20 ton per day solar methanol demonstration facility that will be co-located with and partially powered by VS1;

“Split Adjustment” are to the conversion of Ordinary Shares (whether by way of subdivision or consolidation), that occurred immediately following the MEP Share Conversion and the Existing AgCentral Indebtedness

Conversion, whereby the aggregate number of Ordinary Shares outstanding immediately following such adjustment was 20,499,999;

“STEPS” refers to the IEA’s stated energy policies scenario;

“Support Agreement” are to that certain letter agreement, dated as of February 14, 2023, by and among NETC, the NETC Sponsor, Vast, Nabors Lux and NETC’s independent directors, as amended by the Support Agreement Amendment;

“Support Agreement Amendment” are to Amendment No. 1 to Support Agreement, dated October 19, 2023, by and between the NETC Sponsor, NETC, Vast, Nabors Lux and the NETC independent directors;

“TES” are to thermal energy storage;

“Trading Day” means any day on which the Ordinary Shares are actually traded on the principal securities exchange or securities market on which the Ordinary Shares are then traded;

“Triggering Event I” are to the date on which the volume-weighted average closing sale price of one Ordinary Share quoted on the exchange on which Ordinary Shares are then listed is greater than or equal to $12.50 for any twenty (20) Trading Days within any thirty (30) consecutive Trading Day period within the Earnout Period;

“Triggering Event II” means the date on which the volume-weighted average closing sale price of one Ordinary Share quoted on the exchange on which Ordinary Shares are then listed is greater than or equal to $15.00 for any twenty (20) Trading Days within any thirty (30) consecutive Trading Day period within the Earnout Period;

“Triggering Event III” means the date on which the volume-weighted average closing sale price of one Vast Ordinary Share quoted on the exchange on which Ordinary Shares are then listed is greater than or equal to $17.50 for any twenty (20) Trading Days within any thirty (30) consecutive Trading Day period within the Earnout Period;

“Triggering Event IV” means the date on which a notice to proceed is issued (as determined in good faith by the Vast Board) under a contract in respect of the procurement of a 30MW/288MWhr concentrated solar power project at Port Augusta in South Australia;

“Triggering Events” means Triggering Event I, Triggering Event II, Triggering Event III and Triggering Event IV, collectively;

“Trust Account” are to the trust account that held the proceeds (including interest not previously released to NETC to pay its taxes) from the NETC IPO and the concurrent private placement of the NETC private placement warrants;

“U.S. GAAP” are to generally accepted accounting principles in the United States;

“Vast Board” are to the board of directors of Vast;

“Vast Directors” are to the directors of Vast;

“Vast HoldCo” are to Vast Intermediate HoldCo Pty Ltd, a direct wholly owned subsidiary of the Company;

“Vast Warrants” are to the warrants to purchase one whole Ordinary Share, including the Private Warrants and the Public Warrants;

“Vast shareholders” are to the holders of Ordinary Shares;

“VS1” or “Vast Solar 1” are to a 30 MW / 288 MWh reference CSP plant to be located in Port Augusta, South Australia;

“VS2” or “Vast Solar 2” are to the North West Queensland Hybrid Power Project, a 50 MW hybrid baseload CSP/PV/BESS/gas project to be located in Mount Isa;

“VWAP” are to the volume-weighted average price; and

“1414 Degrees” are to 1414 Degrees Limited.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements contained in this prospectus constitute forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. Forward-looking statements reflect our current views with respect to, among other things, our respective capital resources, portfolio performance and results of operations. Likewise, all of our statements regarding anticipated growth in operations, anticipated market conditions, demographics and results of operations are forward-looking statements. In some cases, you can identify these forward-looking statements by the use of terminology such as “anticipates,” “approximately,” “believes,” “continues,” “could,” “estimates,” “expects,” “intends,” “may,” “outlook,” “plans,” “potential,” “predicts,” “seeks,” “should,” “will” or the negative version of these words or other comparable words or phrases.

Forward-looking statements contained in this prospectus together with any applicable prospectus supplements and the documents incorporated by reference in this prospectus and any applicable prospectus supplements, reflect Vast’s views, as applicable, about future events and are subject to numerous known and unknown risks, uncertainties, assumptions and changes in circumstances that may cause its actual results to differ significantly from those expressed in any forward-looking statement. Vast does not guarantee that the transactions and events described will happen as described (or that they will happen at all). There are important factors that could cause our actual results, levels of activity, performance or achievements to differ materially from the results, performance or achievements expressed or implied by the forward-looking statements. These important factors include, among others, the items in the following list, which also summarizes some of our most principal risks:

•If the demand for our CSP technology does not grow as anticipated, it will negatively impact our revenue and harm our overall performance.

•Expanding our operations beyond Australia is a planned avenue for growth, but this strategy comes with additional risks that may not be encountered domestically. These risks could have a material adverse effect on our business and financial performance.

•Commercial deployment of new power generation technology, such as CSPv3.0, is difficult because incumbent technologies benefit from proven track records, installed bases and lower prices.

•The green hydrogen and downstream derivative production (e.g., green methanol, green ammonia) industry is an emerging market and it may not receive widespread market acceptance.

•We may not be able to successfully finish or operate our projects in a way that makes a profit and / or meets our customers’ requirements.

•The failure of our suppliers to continue to deliver necessary raw materials or other components (including any specialty materials and components) required for our projects in a timely manner or at all, or our inability to obtain substitute sources of these components on a timely basis or on terms acceptable to us, could adversely affect our business.

•Our business and growth strategy relies on having continued access to sodium metal used as the primary Heat Transfer Fluid (“HTF”).

•Delays in the construction of our projects or significant cost overruns could present significant risks to our business and could have a material adverse effect on our business, financial condition and results of operations.

•Our ability to operate our business effectively depends in large part on certain administrative and other support functions provided to us by Nabors Corporate and NETV pursuant to the Services Agreement and Development Agreement, respectively, and our ability to operate our business effectively may suffer if we are unable to cost-effectively establish our own administrative and other support functions following the expiration or termination of the Services Agreement and/or the Development Agreement.

•If we are not successful in securing new contracts and / or developing the projects in our pipeline, it could negatively impact our business operations and financial performance.

•We have not yet completed contracting, construction and commissioning of our current projects. Although we are not yet able to predict with specificity the capital expenditures that will be required to bring VS1 and SM1 online, we now believe that it will cost significantly more than our previous estimates. There can be no assurance that our projects will be contracted, constructed, commissioned and operated as described in this prospectus, or at all.

•Our technology has not yet been proven at utility scale and we have limited direct experience with manufacturing our product suite.

•We do not have any operating history / onsite measured data at a commercial scale. Energy production forecasts may be lower than estimated by production modelling forecasts.

•We have a history of operating losses and will likely incur substantial additional expenses and operating losses in the future. Management has concluded that there is, and the report of our independent registered public accounting firm contains an explanatory paragraph that expresses, substantial doubt about our ability to continue as a “going concern”.

•We will require a significant amount of capital to achieve our growth plans but obtaining it may be uncertain as we may not be able to secure additional financing on favorable terms, or at all.

•Our business benefits in part from federal, state and local government support for renewable energy, and a decline in such support could harm our business.

•The VS1 reference project is important to the future of the business and requires a substantial scale up relative to the Jemalong Solar Station (“JSS Demonstration Plant”) and carries significant risk associated with factors such as technology readiness, organizational capability to deliver and production ramp up.

•We may be unable to adapt our technologies and products to meet shifting customer preferences or industry regulations, and our rivals could create products that reduce the demand for our offerings.

•We have not yet integrated molten salt TES into our overall technology offering.

•Our performance and dynamic models have limited validation at a commercial scale and are primarily based on in-silico analyses.

•Concentration of ownership among the RRA Parties, including AgCentral, our executive officers, directors, Nabors Lux, previous officers and directors of NETC and their affiliates may prevent new investors from influencing significant corporate decisions.

•Certain of the Selling Securityholders acquired their Ordinary Shares at a price that is less than the market price of the Ordinary Shares as of the date of this prospectus, may earn a positive rate of return even if the price of the Ordinary Shares declines and may be willing to sell their Ordinary Shares at a price less than shareholders that acquired Ordinary Shares in the public market.

•We may redeem unexpired Public Warrants prior to their exercise at a time that is disadvantageous to warrant holders, thereby making such warrants worthless.

•As a “foreign private issuer” under the rules and regulations of the SEC, we are permitted to, and will, file less or different information with the SEC than a company incorporated in the United States or otherwise not filing as a “foreign private issuer,” and will follow certain home country corporate governance practices in lieu of certain Nasdaq requirements applicable to U.S. issuers. Accordingly, there will be less publicly available information concerning the Company than there is for issuers that are not foreign private issuers.

While forward-looking statements reflect our good faith beliefs, they are not guarantees of future performance. We disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, new information, data or methods, future events or other changes after the date of this prospectus, except as required by applicable law. For a further discussion of these and other factors that could cause our future results, performance or transactions to differ significantly from those expressed in any forward-looking statement, please see the section of this prospectus entitled "Risk Factors" as well as those listed under “Item 3. Key Information – Risk Factors” of our most recent Annual Report on Form 20-F under the section entitled “Risk Factors.” You should not place undue reliance on any forward-looking statements, which are based only on information currently available to us (or to third parties making the forward-looking statements).

PROSPECTUS SUMMARY

Overview

Vast is an Australian public company limited by shares incorporated on March 27, 2009. We are a leading renewable energy company that has developed concentrated solar power (CSP) systems to generate, store and dispatch carbon free, utility-scale electricity and industrial heat, and to enable the production of green fuels. Our unique approach to CSP utilizes a proprietary, modular sodium loop to efficiently capture and convert solar heat into these end products. Our vision is to provide continuous carbon-free energy globally by deploying our CSP technology and complementary technologies (e.g., intermittent solar PV and wind) to deliver renewable and dispatchable electricity, heat and storage on a continuous basis. We believe our CSP technology is capable of providing competitive, dispatchable and carbon-free power for on- and off-grid power generation applications, energy storage, process heat, and has the potential to unlock green fuels production.

Our executive offices are located at Suite 7.02, 124 Walker Street, North Sydney, NSW 2060, Australia, and our telephone number is +61 2 4072 2889.

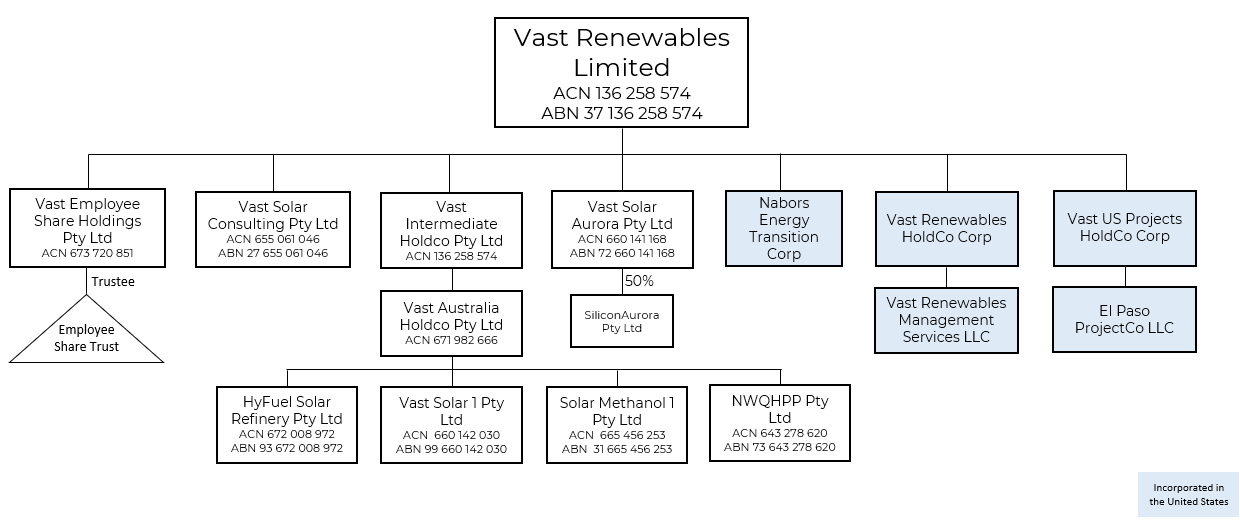

Structure of Vast

The following diagram depicts the simplified organizational structure of the Company and its subsidiaries:

Status as Emerging Growth Company

We are an “emerging growth company” as defined in the JOBS Act. The Company may take advantage of exemptions from various reporting requirements that are applicable to most other public companies, including, but not limited to, an exemption from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that the Company’s independent registered public accounting firm provide an attestation report on the effectiveness of its internal control over financial reporting and reduced disclosure obligations regarding executive compensation. If some investors find the Company less attractive as a result, there may be a less active trading market for the Company’s securities and the prices of the Company’s securities may be more volatile.

Foreign Private Issuer

Vast is a “foreign private issuer” as defined in the Exchange Act. As a “foreign private issuer,” we are exempt from certain rules under the Exchange Act, including certain disclosure and procedural requirements applicable to proxy solicitations under Section 14 of the Exchange Act, our board, officers and principal shareholders are exempt

from the reporting and “short-swing” profit recovery provisions of Section 16 of the Exchange Act with respect to their purchases and sales of our Ordinary Shares, and we are not required to file periodic reports and financial statements with the SEC as frequently or as promptly as companies whose securities are registered under the Exchange Act but are not foreign private issuers. Foreign private issuers are also not required to comply with Regulation Fair Disclosure (“Regulation FD”), which restricts the selective disclosure of material non-public information. Accordingly, there may be less publicly available information concerning the Company than there is for companies whose securities are registered under the Exchange Act but are not foreign private issuers, and such information may not be provided as promptly as it is provided by such companies. As a “foreign private issuer,” the Company is also permitted to follow certain home country corporate governance practices in lieu of the requirements of the Nasdaq Listing Rules pursuant to Nasdaq Rule 5615(a)(3), which provides for such exemption to compliance with the Nasdaq Rule 5600 Series and certain other Nasdaq Listing Rules. We rely on the exemptions available to foreign private issuers listed in the section entitled “Management — Foreign Private Issuer Status” of our most recent Annual Report on Form 20-F, and we may rely on additional exemptions in the future.

Recent Developments

On October 29, 2024, the Company announced that its wholly owned subsidiary, Vast Renewables Holdco Corp. and Project Bravo, signed a development services agreement with GGS Energy LLC a leading energy transition development company with deep project development experience, to pursue a commercial-scale synthetic fuels project in the Southwest United States (Project Bravo).

On November 6, 2024, Kurt Drewes reduced his role as Chief Technology Officer of the Company, effective November 1, 2024. Mr. Drewes’s role change was not a result of any disagreement with the Company on any matter relating to the Company’s operations, policies or practices. Pursuant to a Service Agreement entered into on November 6, 2024 between the Company and Mr. Drewes, he will remain with the Company in a senior technical advisory role, during which time he will be paid a quarterly retainer and additional fees for services rendered.

On November 18, 2024, Masters & Young Pty Ltd and Vast Renewables Ltd executed an Exclusive Collaboration Agreement. Masters & Young is a manufacturer of printed circuit boards. The parties have agreed to collaborate exclusively in relation to Heliostat PCBs, master transmitted PCBs, Vast Master Controller, Vast Master Transmitter and Vast Master Drive boards, with a view of Masters & Young supplying such products to any project developed by or supplied by Vast that uses Vast’s CSP technology, including VS1.

On November 25, 2024, the Company announced it has signed an updated funding agreement to access up to $30 million of its existing $65 million grant from the Australian Renewable Energy Agency (“ARENA”). The funding will support Vast’s green technology manufacturing and project development activities as it deploys its next generation concentrated solar thermal power (CSP) solution to deliver the clean, dispatchable power and heat that the world needs. CSP is an obvious technology to deploy in Australia’s energy transition in one of the sunniest countries on earth. By capturing and storing the sun’s energy as heat, CSP can power homes, industry and transport with green, reliable and affordable energy. The technology’s dispatchable capacity will be a critical complement to intermittent solar PV and wind in Australia’s energy mix, delivering longer-lasting power that’s cost effective when the sun isn’t shining and the wind isn’t blowing. Vast has pioneered the next generation of proprietary CSP technology, promising superior performance at lower cost and risk. It has a global pipeline of projects that will help to decarbonise electricity generation and power the production of green methanol and sustainable aviation fuels. Proven at its grid-connected pilot project in New South Wales, Vast’s leading technology is set to be deployed at utility-scale at Vast Solar 1 (“VS1”), a 30MW power plant with 8 hours of storage located in the Port Augusta Green Energy Hub, South Australia.Vast’s Port Augusta utility-scale CSP project will generate clean, dispatchable electricity which will be sold into the National Electricity Market, and it will help to power a world-first co-located green methanol production facility, Solar Methanol 1 (“SM1”), also being developed by Vast. A real world, in-demand application for hydrogen, green methanol has the potential to decarbonise shipping and is already being used to power major container vessels.Vast’s internationally awarded, Australian-made technology is currently produced at its Queensland facility. ARENA’s funding will see Vast scale up its Australian green technology manufacturing to supply VS1 and future projects. The $30 million funding will also support Vast in the final project development activities ahead of Final Investment Decision (FID) on VS1 in early 2025. Vast’s Australian projects and manufacturing facility are anticipated to create dozens of green manufacturing and construction jobs, and long-

term plant operations roles.The support of the Australian Government has been key for Vast, which has the potential to be a catalyst for a domestic CSP industry and expects to export its green technology around the world to its global pipeline of projects.

The $30 million non-dilutive grant will be released from $65 million of funding announced in February 2023 by ARENA. Construction of VS1 is anticipated to begin in Q2 2025, with capital expenditures estimated to be in the range of AUD360 million - AUD390 million.

On February 11, 2025, the Company announced achieving a breakthrough with the successful launch of a first-of-its-kind concentrated solar thermal power receiver tower. The receiver tower is the final component of Vast’s next generation clean energy solution to be built and tested at operational scale. The technology is set to be deployed at Vast’s Port Augusta Green Energy Hub to power South Australia’s grid and green fuels production. The milestone reinforces Vast’s readiness to deliver solutions with best-in-class performance and is an important step toward financial close for VS1, the company’s 30MW utility scale reference project with 8 hours of storage.

Risk Factors

Investing in any securities offered pursuant to this prospectus and any applicable prospectus supplement involves risks. You should carefully consider the risk factors set forth on page 6 of this prospectus, in the Annual Report on Form 20-F incorporated by reference into this prospectus and in our updates, if any, to those risk factors in our reports on Form 6-K incorporated by reference into this prospectus, and all other information contained or incorporated by reference into this prospectus, as updated by our subsequent filings under the Exchange Act and the risk factors and other information contained in the applicable prospectus supplement and any applicable free writing prospectus before acquiring any of such securities. The occurrence of any of these risks might cause you to lose all or part of your investment in the offered securities.

THE OFFERING

The summary below describes the principal terms of the offering. The “Description of Securities” section of this prospectus contains a more detailed description of our Ordinary Shares and Vast Warrants.

| | | | | | | | |

| Issuer | | Vast Renewables Limited |

| | |

| Ordinary Shares offered by us | | Up to 27,529,887 Ordinary Shares, consisting of: (i) 13,799,887 Ordinary Shares that are issuable by us upon the exercise of 13,799,887 Public Warrants and (ii) 13,730,000 Ordinary Shares that are issuable by us upon the exercise of 13,730,000 Private Warrants. |

| | |

| Ordinary Shares that may be offered and sold from time to time by the Selling Securityholders | | Up to 41,530,920 Ordinary Shares, including up to (i) 23,474,421 Ordinary Shares held by certain holders entitled to resale registration rights pursuant to the Shareholder and Registration Rights Agreement or other agreements, (ii) up to an aggregate 2,799,999 Earnout Shares that are issuable to certain parties to the Shareholder and Registration Rights Agreement pursuant to the Business Combination Agreement upon the occurrence of specified events, (iii) up to 2,400,000 Earnback Shares that are issuable to NETC Sponsor pursuant to the Support Agreement upon the occurrence of specified events, (iv) 12,416,500 Ordinary Shares issuable upon exercise of Private Warrants held by certain parties to the Shareholder and Registration Rights Agreement, and (v) 440,000 Ordinary Shares issuable upon exercise of Public Warrants held by certain parties to the Shareholder and Registration Rights Agreement. |

| | |

| Warrants that may be offered and sold from time to time by the Selling Securityholders | | 12,416,500 Private Warrants and 440,000 Public Warrants. |

| | |

| Terms of offering | | We will issue Ordinary Shares upon exercise of Warrants pursuant to the terms of the Vast Warrant Agreements. The Resale Securities offered for resale by this prospectus may be offered and sold at prevailing market prices, privately negotiated prices or such other prices as the Selling Securityholders may determine. See “Plan of Distribution.” |

| | |

| Terms of Warrants | | Each Warrant entitles the holder to purchase one Ordinary Shares at an exercise price of $11.50 per share, subject to adjustment pursuant to the terms of the Vast Warrant Agreements. All Warrants expire on December 18, 2028 at 5:00 p.m., New York City time. |

| | |

| | | | | | | | |