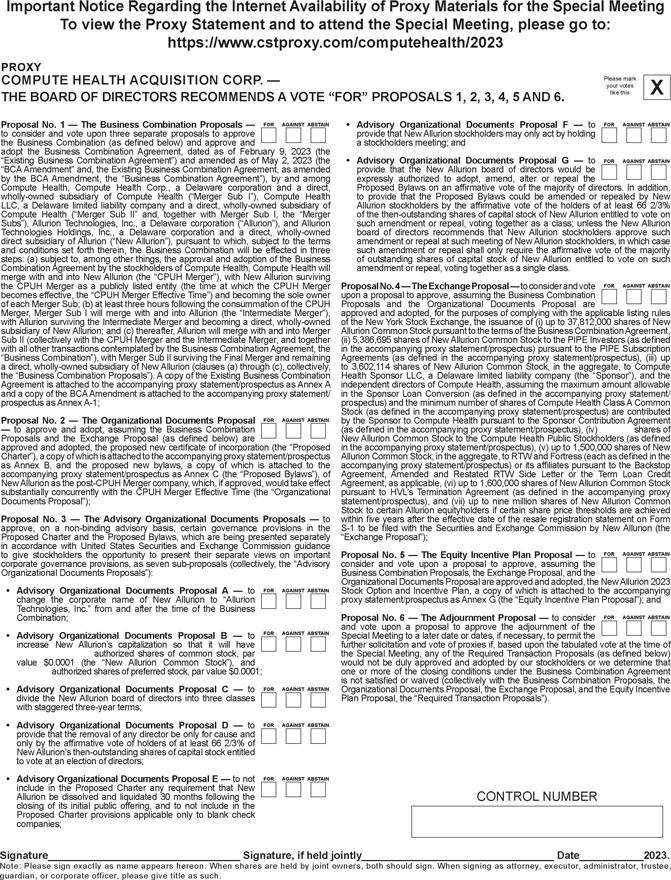

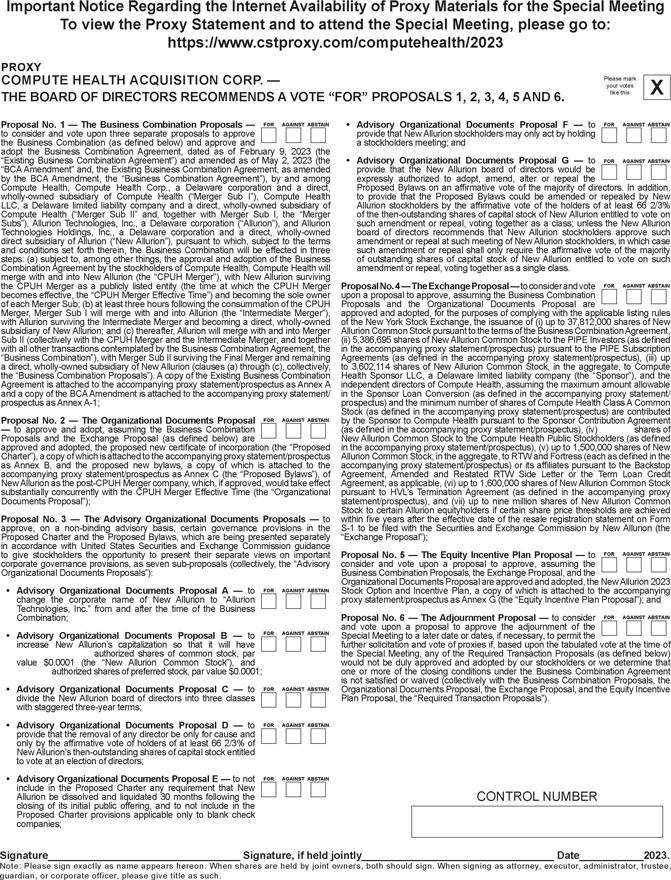

Important Notice Regarding the Internet Availability of Proxy Materials for the Special Meeting To view the Proxy Statement and to attend the Special Meeting, please go to: https://www.cstproxy.com/computehealth/2023 PROXY COMPUTE HEALTH ACQUISITION CORP. — Please mark your votes THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSALS 1, 2, 3, 4, 5 AND 6. like this X Proposal No. 1 — The Business Combination Proposals — FOR AGAINST ABSTAIN • Advisory Organizational Documents Proposal F — to FOR AGAINST ABSTAIN to consider and vote upon three separate proposals to approve provide that New Allurion stockholders may only act by holding the Business Combination (as defined below) and approve and a stockholders meeting; and adopt the Business Combination Agreement, dated as of February 9, 2023 (the “BCA “Existing Amendment” Business Combination and, the Existing Agreement”) Business and Combination amended Agreement, as of May as 2, 2023 amended (the • Advisory provide that Organizational the New Allurion Documents board of Proposal directors would G — be to FOR AGAINST ABSTAIN by the BCA Amendment, the “Business Combination Agreement”), by and among expressly authorized to adopt, amend, alter or repeal the Compute Health, Compute Health Corp., a Delaware corporation and a direct, Proposed Bylaws on an affirmative vote of the majority of directors. In addition, wholly-owned subsidiary of Compute Health (“Merger Sub I”), Compute Health to provide that the Proposed Bylaws could be amended or repealed by New LLC, a Delaware limited liability company and a direct, wholly-owned subsidiary of Allurion stockholders by the affirmative vote of the holders of at least 66 2/3% Compute Health (“Merger Sub II” and, together with Merger Sub I, the “Merger of the then-outstanding shares of capital stock of New Allurion entitled to vote on Subs”), Allurion Technologies, Inc., a Delaware corporation (“Allurion”), and Allurion such amendment or repeal, voting together as a class; unless the New Allurion Technologies Holdings, Inc., a Delaware corporation and a direct, wholly-owned board of directors recommends that New Allurion stockholders approve such direct subsidiary of Allurion (“New Allurion”), pursuant to which, subject to the terms amendment or repeal at such meeting of New Allurion stockholders, in which case and conditions set forth therein, the Business Combination will be effected in three such amendment or repeal shall only require the affirmative vote of the majority steps: (a) subject to, among other things, the approval and adoption of the Business of outstanding shares of capital stock of New Allurion entitled to vote on such Combination Agreement by the stockholders of Compute Health, Compute Health will amendment or repeal, voting together as a single class. merge with and into New Allurion (the “CPUH Merger”), with New Allurion surviving the CPUH Merger as a publicly listed entity (the time at which the CPUH Merger Proposal No. 4 — The Exchange Proposal — to consider and vote FOR AGAINST ABSTAIN becomes effective, the “CPUH Merger Effective Time”) and becoming the sole owner upon a proposal to approve, assuming the Business Combination of each Merger Sub; (b) at least three hours following the consummation of the CPUH Proposals and the Organizational Documents Proposal are Merger, Merger Sub I will merge with and into Allurion (the “Intermediate Merger”), approved and adopted, for the purposes of complying with the applicable listing rules with Allurion surviving the Intermediate Merger and becoming a direct, wholly-owned of the New York Stock Exchange, the issuance of (i) up to 37,812,000 shares of New subsidiary of New Allurion; and (c) thereafter, Allurion will merge with and into Merger Allurion Common Stock pursuant to the terms of the Business Combination Agreement, Sub II (collectively with the CPUH Merger and the Intermediate Merger, and together (ii) 5,386,695 shares of New Allurion Common Stock to the PIPE Investors (as defined with all other transactions contemplated by the Business Combination Agreement, the in the accompanying proxy statement/prospectus) pursuant to the PIPE Subscription “Business Combination”), with Merger Sub II surviving the Final Merger and remaining Agreements (as defined in the accompanying proxy statement/prospectus), (iii) up a direct, wholly-owned subsidiary of New Allurion (clauses (a) through (c), collectively, to 3,602,114 shares of New Allurion Common Stock, in the aggregate, to Compute the “Business Combination Proposals”). A copy of the Existing Business Combination Health Sponsor LLC, a Delaware limited liability company (the “Sponsor”), and the Agreement is attached to the accompanying proxy statement/prospectus as Annex A independent directors of Compute Health, assuming the maximum amount allowable and a copy of the BCA Amendment is attached to the accompanying proxy statement/ in the Sponsor Loan Conversion (as defined in the accompanying proxy statement/ prospectus as Annex A-1; prospectus) and the minimum number of shares of Compute Health Class A Common Stock (as defined in the accompanying proxy statement/prospectus) are contributed Proposal No. 2 — The Organizational Documents Proposal FOR AGAINST ABSTAIN by the Sponsor to Compute Health pursuant to the Sponsor Contribution Agreement — to approve and adopt, assuming the Business Combination (as defined in the accompanying proxy statement/prospectus), (iv) shares of Proposals and the Exchange Proposal (as defined below) are New Allurion Common Stock to the Compute Health Public Stockholders (as defined approved and adopted, the proposed new certificate of incorporation (the “Proposed in the accompanying proxy statement/prospectus), (v) up to 1,500,000 shares of New Charter”), a copy of which is attached to the accompanying proxy statement/prospectus Allurion Common Stock, in the aggregate, to RTW and Fortress (each as defined in the as Annex B, and the proposed new bylaws, a copy of which is attached to the accompanying proxy statement/prospectus) or its affiliates pursuant to the Backstop accompanying proxy statement/prospectus as Annex C (the “Proposed Bylaws”), of Agreement, Amended and Restated RTW Side Letter or the Term Loan Credit New Allurion as the post-CPUH Merger company, which, if approved, would take effect Agreement, as applicable, (vi) up to 1,600,000 shares of New Allurion Common Stock substantially concurrently with the CPUH Merger Effective Time (the “Organizational pursuant to HVL’s Termination Agreement (as defined in the accompanying proxy Documents Proposal”); statement/prospectus), and (vii) up to nine million shares of New Allurion Common Stock to certain Allurion equityholders if certain share price thresholds are achieved Proposal No. 3 — The Advisory Organizational Documents Proposals — to within five years after the effective date of the resale registration statement on Form approve, on a non-binding advisory basis, certain governance provisions in the S-1 to be filed with the Securities and Exchange Commission by New Allurion (the Proposed Charter and the Proposed Bylaws, which are being presented separately “Exchange Proposal”); in accordance with United States Securities and Exchange Commission guidance to give stockholders the opportunity to present their separate views on important Proposal No. 5 — The Equity Incentive Plan Proposal — to FOR AGAINST ABSTAIN corporate governance provisions, as seven sub-proposals (collectively, the “Advisory consider and vote upon a proposal to approve, assuming the Organizational Documents Proposals”): Business Combination Proposals, the Exchange Proposal, and the Organizational Documents Proposal are approved and adopted, the New Allurion 2023 • Advisory Organizational Documents Proposal A — to FOR AGAINST ABSTAIN Stock Option and Incentive Plan, a copy of which is attached to the accompanying change the corporate name of New Allurion to “Allurion proxy statement/prospectus as Annex G (the “Equity Incentive Plan Proposal”); and Technologies, Inc.” from and after the time of the Business Combination; Proposal No. 6 — The Adjournment Proposal — to consider FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN and vote upon a proposal to approve the adjournment of the • Advisory Organizational Documents Proposal B — to Special Meeting to a later date or dates, if necessary, to permit the increase New Allurion’s capitalization so that it will have further solicitation and vote of proxies if, based upon the tabulated vote at the time of authorized shares of common stock, par the Special Meeting, any of the Required Transaction Proposals (as defined below) value $0.0001 (the “New Allurion Common Stock”), and would not be duly approved and adopted by our stockholders or we determine that authorized shares of preferred stock, par value $0.0001; one or more of the closing conditions under the Business Combination Agreement is not satisfied or waived (collectively with the Business Combination Proposals, the • Advisory Organizational Documents Proposal C — to FOR AGAINST ABSTAIN Organizational Documents Proposal, the Exchange Proposal, and the Equity Incentive divide the New Allurion board of directors into three classes Plan Proposal, the “Required Transaction Proposals”). with staggered three-year terms; • Advisory provide that Organizational the removal of any Documents director be Proposal only for cause D — and to FOR AGAINST ABSTAIN only by the affirmative vote of holders of at least 66 2/3% of New Allurion’s then-outstanding shares of capital stock entitled to vote at an election of directors; • Advisory Organizational Documents Proposal E — to not FOR AGAINST ABSTAIN include in the Proposed Charter any requirement that New Allurion be dissolved and liquidated 30 months following the CONTROL NUMBER closing of its initial public offering, and to not include in the Proposed Charter provisions applicable only to blank check companies; Signature Signature, if held jointly Date 2023. Note: Please sign exactly as name appears hereon. When shares are held by joint owners, both should sign. When signing as attorney, executor, administrator, trustee, guardian, or corporate officer, please give title as such.