As filed with the U.S. Securities and Exchange Commission on October 25, 2023.

Registration No. 333-274635

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________

AMENDMENT NO. 1

TO

FORM F-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

__________________________________________

ACBA Merger Sub I Limited

(Exact name of Registrant as specified in its charter)

__________________________________________

British Virgin Islands | | 6770 | | Not Applicable |

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification No.) |

Rm. 806, 8/F, Tower 2, Lippo Centre, No. 89 Queensway,

Admiralty, Hong Kong

Tel: (852) 2151 5198 / 2151 5598

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

__________________________________________

Cogency Global Inc.

122 East 42nd Street, 18th Floor,

New York, NY 10168

(Name, address, including zip code, and telephone number, including area code, of agent for service)

__________________________________________

Copies of communications to: |

Jon Venick

DLA Piper LLP (US)

1251 Avenue of the Americas

New York, NY 10020

917-778-8651 – Facsimile | | Lawrence Venick

Loeb & Loeb LLP

2206-19 Jardine House

1 Connaught Place

Central, Hong Kong

+852 3923 1100 – Facsimile |

__________________________________________

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after this Registration Statement becomes effective and after all of the conditions set forth in the Merger Agreement are satisfied or waived.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ☐

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933. Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the Securities and Exchange Commission declares our registration statement effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction or state where the offer or sale is not permitted.

PRELIMINARY — SUBJECT TO COMPLETION, DATED OCTOBER 25, 2023

PROXY STATEMENT FOR EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS OF

ACE GLOBAL BUSINESS ACQUISITION LIMITED

AND PROSPECTUS FOR UNITS, ORDINARY SHARES AND WARRANTS

OF ACE GLOBAL BUSINESS ACQUISITION LIMITED

Proxy Statement/Prospectus dated , 2023

and first mailed to the shareholders of Ace Global Business Acquisition Limited

on or about , 2023

To the Shareholders of Ace Global Business Acquisition Limited:

You are cordially invited to attend the extraordinary general meeting of the Shareholders of Ace Global Business Acquisition Limited (“Ace”, “ACBA”, “we”, “our Company”, “Ace Parent”, or “us”), which will be held at , Hong Kong Time, on , 2023, at (the “Extraordinary General Meeting”). Ace is a British Virgin Islands business company incorporated as a blank check company for the purpose of entering into a merger, share exchange, asset acquisition, stock purchase, recapitalization, reorganization or other similar business combination with one or more businesses or entities, which we refer to as a “target business”. Subject to the satisfaction or waiver of the conditions set forth in the Merger Agreement (as defined below), the proposed business combination will be completed through a two-step process consisting of (i) the Reincorporation Merger (as defined below), and (ii) the Acquisition Merger (as defined below). The Reincorporation Merger and the Acquisition Merger are collectively referred to herein as the “Business Combination”.

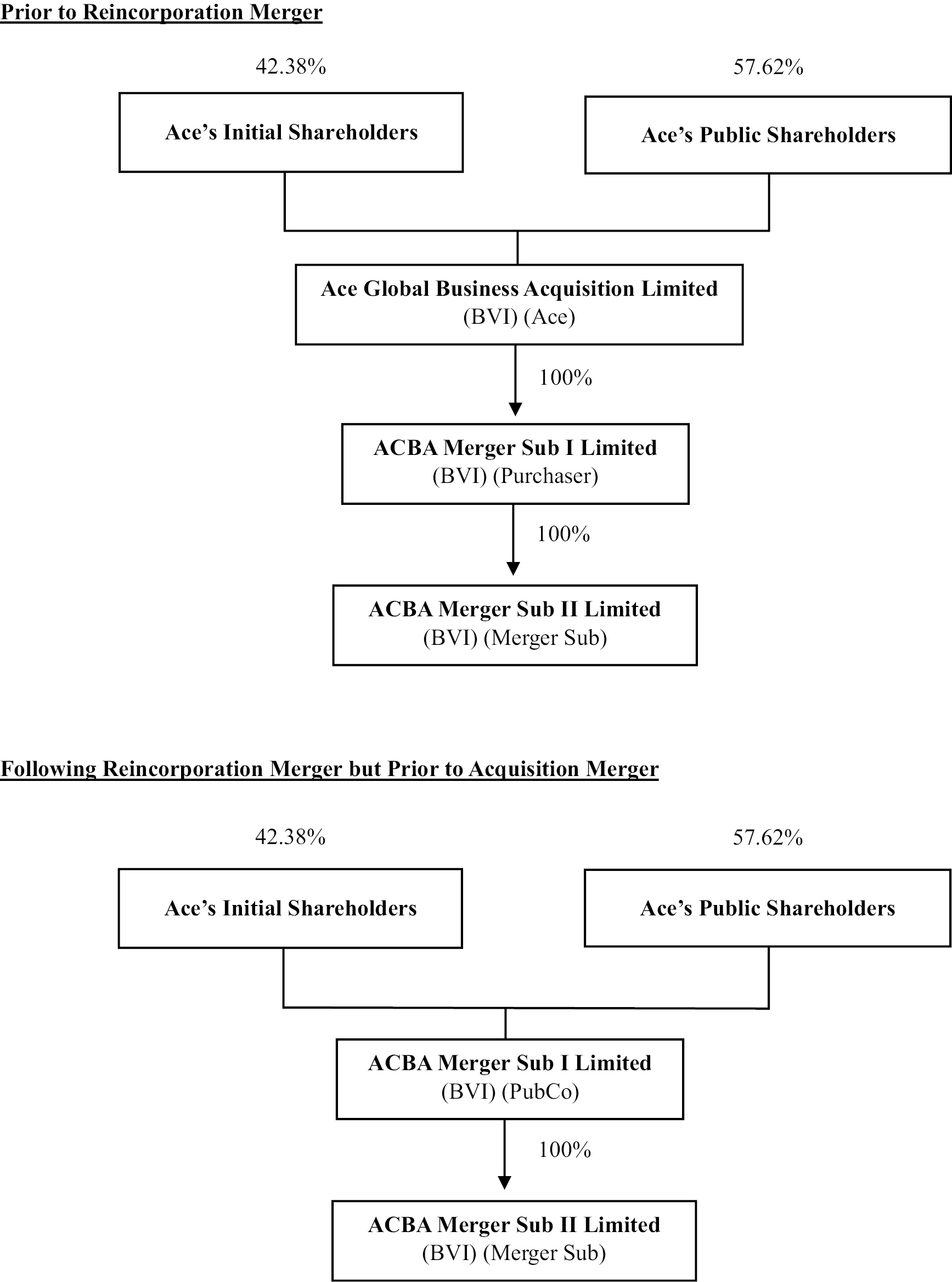

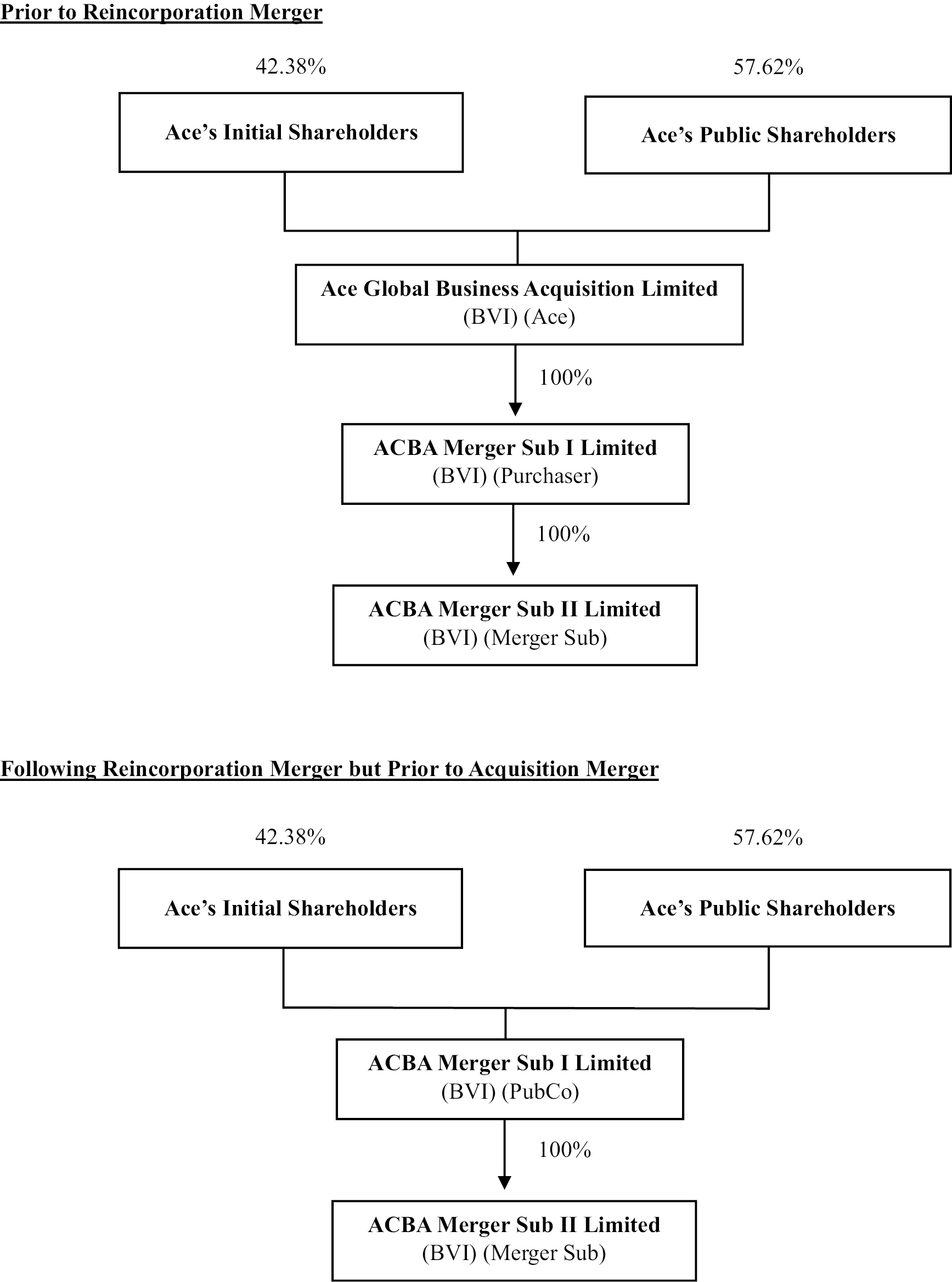

As announced on December 23, 2022, Ace has entered into a business combination agreement with LE Worldwide Limited, a British Virgin Islands business company (“LEW”), dated as of December 23, 2022, as amended on July 6, 2023 and on September 19, 2023 (collectively, the “Merger Agreement”), which provides for, subject to the satisfaction or waiver of the conditions set forth in the Merger Agreement, the proposed Business Combination between Ace and LEW. Subject to the satisfaction or waiver of the conditions set forth in the Merger Agreement (including, but not limited to, the approval and adoption of the Merger Agreement by the shareholders of Ace), the Business Combination is to be effected in two steps: (i) Ace will merge with and into ACBA Merger Sub I Limited, a British Virgin Islands business company and wholly owned subsidiary of Ace (such company before the Reincorporation Merger is sometimes referred to as the “Purchaser” and upon and following the Reincorporation Merger is hereinafter sometimes referred to as “PubCo”), with PubCo remaining as the surviving publicly traded entity (the “Reincorporation Merger”); (ii) immediately after the consummation of the Reincorporation Merger, ACBA Merger Sub II Limited, (“Merger Sub”), a British Virgin Islands business company and wholly owned subsidiary of PubCo, will be merged with and into LEW, resulting in LEW becoming the surviving entity and wholly owned subsidiary of PubCo (the “Acquisition Merger”). On March 2, 2023, the Purchaser and Merger Sub each executed a joinder agreement to the Merger Agreement along with Ace and LEW, making the Purchaser and Merger Sub parties to the Merger Agreement. As more thoroughly described below, the aggregate consideration for the Acquisition Merger is $110,000,000, payable in the form of 11,000,000 newly issued ordinary shares of PubCo (“PubCo Ordinary Shares”) valued for purposes of calculating the merger consideration at $10.00 per share (the “Merger Consideration Shares”). Upon the consummation of the transactions, PubCo, a British Virgin Islands company, will change its corporate name to “AG DataWorks Limited.”

The Merger Agreement dated as of December 23, 2022, prior to its amendment on July 6, 2023, is sometimes referred to herein as the “Original Merger Agreement.” The July 6, 2023 amendment to the Original Merger Agreement is sometimes referred to herein as the “First Amendment.” The September 19, 2023 amendment to the Original Merger Agreement, as amended by the First Amendment, is sometimes referred to herein as the “Second Amendment.”

We are registering (i) [*] PubCo Ordinary Shares issuable to Ace’s shareholders, (ii) [*] PubCo Warrants issuable to holders of ACBA Warrants in exchange for the ACBA Warrants, (iii) [*] PubCo Ordinary Shares underlying the PubCo Warrants, in each instance in connection with the Reincorporation Merger; and (iv) 11,000,000 PubCo Ordinary Shares issuable to LEW’s shareholders in connection with the Acquisition Merger.

With respect to the 11,000,000 Merger Consideration Shares to be received by LEW shareholders upon the closing of the Business Combination, 550,000 PubCo Ordinary Shares are to be issued and held by PubCo (the “Holdback Shares”) for a period of time after closing in order to satisfy any indemnification obligations incurred under the Merger Agreement, and the remaining 10,450,000 Merger Consideration Shares, (the “Closing Payment Shares”) shall be delivered at the closing.

Table of Contents

At the Extraordinary General Meeting, Ace’s shareholders will be asked to consider and vote upon the following proposals:

1. Approval of the Reincorporation Merger, which we refer to as the “Reincorporation Merger Proposal” or “Proposal No. 1”;

2. Approval of the Acquisition Merger, which we refer to as the “Acquisition Merger Proposal” or “Proposal No. 2”;

3. Approval, for purposes of complying with applicable listing rules of The Nasdaq Stock Market LLC, the issuance of up to an aggregate of 11,000,000 PubCo Ordinary Shares in connection with the Business Combination and related financings, which we refer to as the “Nasdaq Proposal” or “Proposal No. 3”;

4. Approval of the adoption of, on a non-binding advisory basis, certain differences in the governance provisions set forth in PubCo’s Amended and Restated Memorandum and Articles of Association, which we refer to as the “Governance Proposal” or “Proposal No. 4”;

5. Approval of PubCo’s 2023 Equity Incentive Plan, which we refer to as the “Incentive Plan Proposal” or “Proposal No. 5”. A copy of the Incentive Plan is attached to the accompanying proxy statement as Annex C;

6. Approval of the amendment and restatement of the Ace third amended and restated memorandum and articles of association to expand the methods that Ace may employ to not become subject to the “penny stock” rules of the Securities and Exchange Commission by deleting Article 25.1.7 that “Under no circumstances will the Company redeem its public shares in an amount that would cause the Company’s net tangible assets to be less than $5,000,001” in its entirety, which we refer to as the “NTA Requirement Amendment Proposal” or “Proposal No. 6”; and

7. Approval to adjourn the Extraordinary General Meeting under certain circumstances, which is more fully described in the accompanying proxy statement/prospectus, which we refer to as the “Adjournment Proposal” or “Proposal No. 7”; and, together with the Reincorporation Merger Proposal, the Acquisition Merger Proposal, the Nasdaq Proposal, the Governance Proposals, the Incentive Plan Proposal and the NTA Requirement Amendment Proposal, collectively, the “Proposals”.

If Ace’s shareholders approve the Reincorporation Merger Proposal and the Acquisition Merger Proposal, (i) immediately prior to the consummation of the Business Combination, all outstanding units, including the Private Units (as defined below) of Ace (each of which consists of one ACBA Ordinary Share and one ACBA Warrant) (the “ACBA Units”) will separate into their individual components of ACBA Ordinary Shares and ACBA Warrants, and will cease separate existence and trading and (ii) upon the consummation of the Business Combination, the current equity holdings of Ace’s shareholders shall be exchanged as follows:

(i) Each Ace’s ordinary share, par value $0.001 per share (“ACBA Ordinary Shares”), issued and outstanding immediately prior to the effective time of the Reincorporation Merger (other than any redeemed shares and any Dissenting Shares (as defined herein)), will automatically be cancelled and cease to exist and for each such ACBA Ordinary Share, PubCo shall issue to each Ace’s shareholder (other than Dissenting Shareholders (as hereinafter defined) and Ace’s shareholders who exercise their redemption rights in connection with the Business Combination) one validly issued PubCo Ordinary Share, which shall be fully paid (with PubCo being a British Virgin Islands company);

(ii) Each ACBA Ordinary Share, issued and outstanding immediately prior to the closing held by each holder of ACBA Ordinary Shares who has validly exercised such holder’s right to dissent from the Reincorporation Merger in accordance with Section 179 of the British Virgin Islands Business Companies Act, 2004, as amended (the “BVI BC Act”) (a “Dissenting Shareholder”), and who has not effectively withdrawn its right to such dissent (collectively, the “Dissenting Shares”) will be cancelled in exchange for the right to receive payment resulting from the procedure in Section 179 of the BVI BC Act and such Dissenting Shareholder shall not be entitled to receive any PubCo Ordinary Shares otherwise to be issued in connection with the Reincorporation Merger with respect to such Dissenting Shares; and

(iii) Each warrant to purchase one ACBA Ordinary Share (“ACBA Warrant”) issued and outstanding immediately prior to effective time of the Reincorporation Merger will convert into a warrant to purchase one PubCo Ordinary Share (each, a “PubCo Warrant”) (or equivalent portion thereof). The PubCo Warrants will have substantially the same terms and conditions as set forth in the ACBA Warrants, other than with respect to the security for which they are exercisable.

Table of Contents

The Reincorporation Merger Proposal and the Acquisition Merger Proposal are dependent upon each other. It is important for you to note that in the event that either of the Reincorporation Merger Proposal or the Acquisition Merger Proposal is not approved, then Ace will not consummate the Business Combination.

The following shows the cash value of the securities that (i) the public shareholders, (ii) the public warrant holders, (iii) the private warrant holders, (iv) the Sponsor and directors, (v) the current LEW shareholders, (vi) PIPE investors and (vii) finders, will receive in connection with the Reincorporation Merger and Acquisition Merger.

| | | | As of 6/30/2023

No. of shares | | | | |

| | | | | Per share | | Cash value |

(i) | | Public shareholders | | 1,977,179 | | $ | 10.00 | | 19,771,790 |

(ii) | | Public warrant holders(1) | | 4,600,000 | | $ | 11.50 | | 52,900,000 |

(iii) | | Private warrant holders(2) | | 711,849 | | $ | 11.50 | | 8,186,264 |

(iv) | | Sponsor and directors | | 1,861,849 | | $ | 10.00 | | 18,618,490 |

(v) | | Current LEW shareholders(3) | | 11,000,000 | | $ | 10.00 | | 110,000,000 |

(vi) | | PIPE Investors | | 2,000,000 | | $ | 10.00 | | 20,000,000 |

(vii) | | Finders | | 165,000 | | $ | 10.00 | | 1,650,000 |

The following shows the ownership percentage and the voting power of (i) the public shareholders, (ii) the Sponsor and directors, (iii) PIPE investors, (iv) the Significant LEW Shareholder, (v) the other LEW shareholders in total and (vi) Finders, following the consummation of the Business Combination and no exercise of public and private warrants.

| | As of 6/30/2023

No. of shares | | % ownership

and voting

power |

Public shareholders | | 1,977,179 | | 11.63 | % |

Sponsor and director | | 1,861,849 | | 10.95 | % |

PIPE Investors | | 2,000,000 | | 11.76 | % |

Significant LEW Shareholder | | 4,407,709 | | 25.92 | % |

Other LEW shareholders in total | | 6,592,291 | | 38.77 | % |

Finders | | 165,000 | | 0.97 | % |

Total | | 17,004,028 | | 100.0 | % |

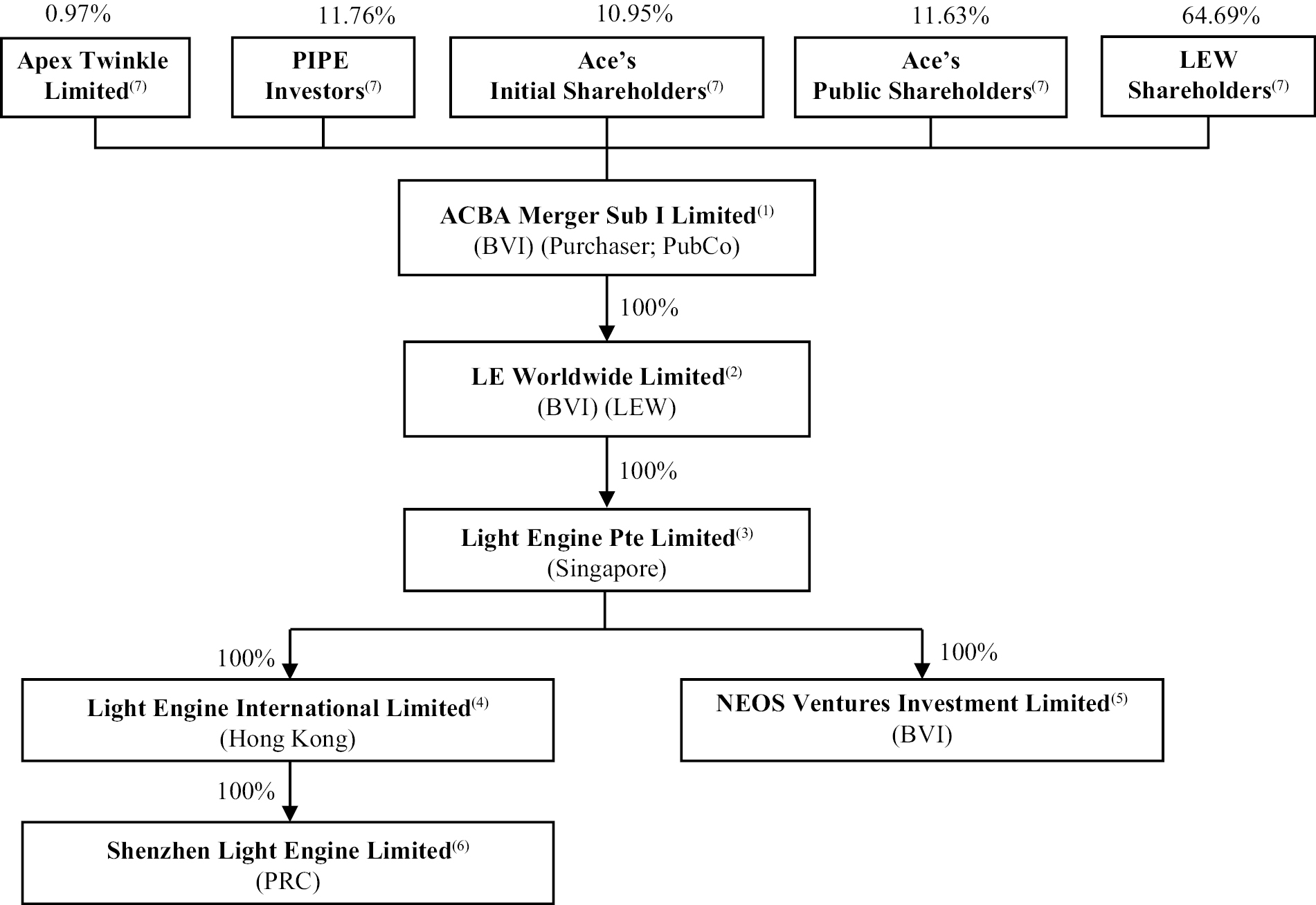

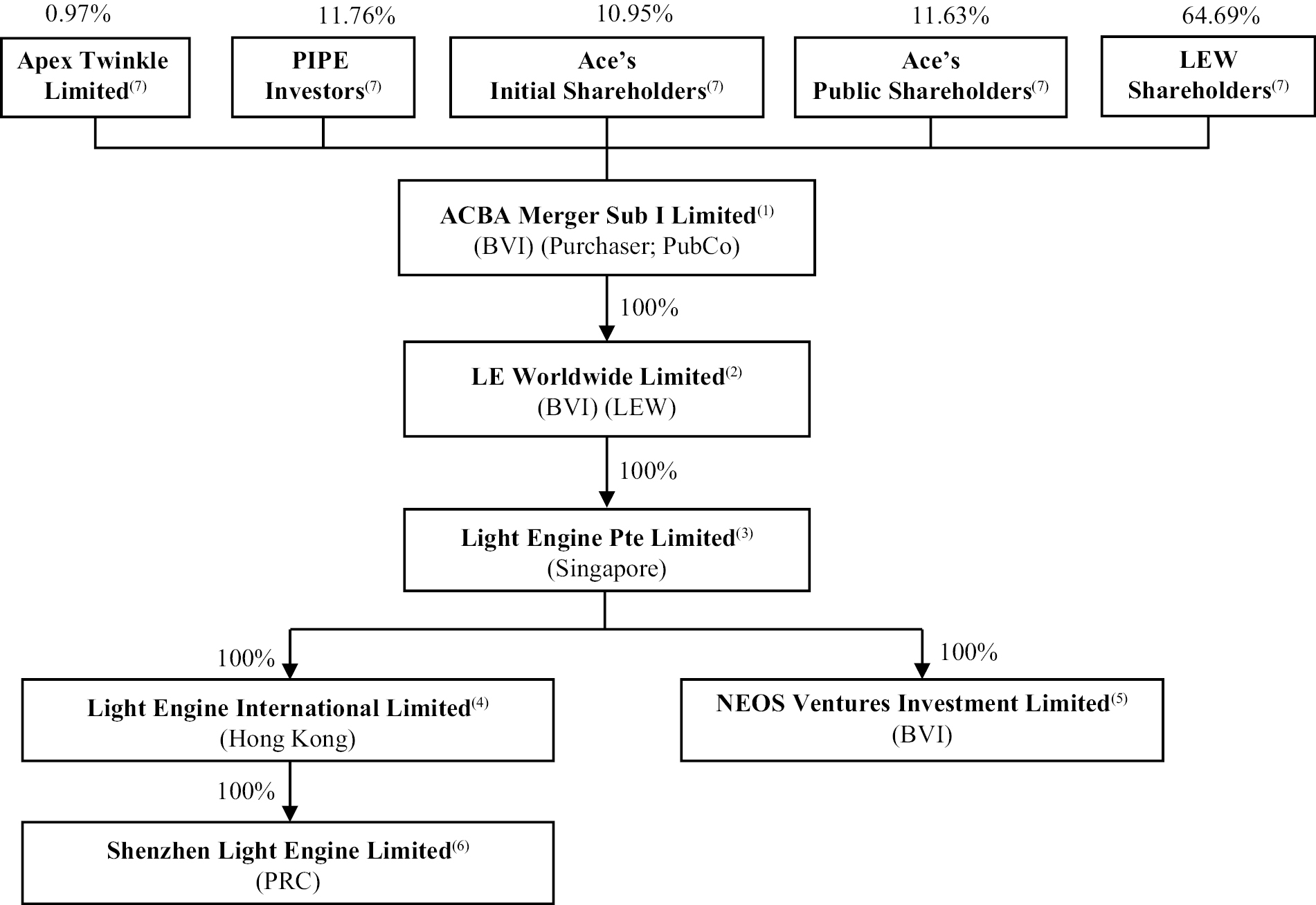

Subject to the assumptions set forth below, it is anticipated that, upon consummation of the Business Combination, Ace’s existing shareholders, including the initial shareholders, will own approximately 22.58% of the issued PubCo Ordinary Shares, and LEW’s current shareholders (including the Significant LEW Shareholder) will own approximately 64.69% of the issued PubCo Ordinary Shares; as of such time, the Significant LEW Shareholder will own approximately 25.92% of the issued PubCo Ordinary Shares. These relative percentages assume that (i) none of Ace’s existing public shareholders exercise their redemption rights or dissenter rights, each as further discussed herein; (ii) there is no exercise or conversion of Ace Warrants prior to the consummation of the Business Combination; and (iii) the Notes (defined below) have been converted into ACBA Ordinary Shares at the price of $10.00 per share immediately before the closing of the Business Combination. If any of Ace’s existing public shareholders exercise their redemption rights or dissenter rights, the anticipated percentage ownership of Ace’s existing shareholders will be reduced. Furthermore, if any of the other assumptions are not accurate as of the closing of the Business Combination the anticipated percentage ownership of Ace’s existing shareholders will be modified. You should read “Summary of the Proxy Statement/Prospectus — The Business Combination and the Merger Agreement” and “Unaudited Pro Forma Condensed Combined Financial Statements” for further information.

Table of Contents

The table below sets forth the number of PubCo Ordinary Shares that will be owned by public shareholders, the PIPE Investors, current LEW shareholders and the Sponsor and its affiliates immediately after the Business Combination assuming exercise of the Public and Private Warrants, and their respective voting power under (i) an actual redemption scenario, (ii) an interim redemption scenario, assuming 50% redemptions, and (iii) a maximum redemption scenario:

| | Actual redemption | | Interim redemption | | Maximum redemption |

| | | Number of

PubCo

Ordinary

Shares | | % | | Number of

PubCo

Ordinary

Shares | | % | | Number of

PubCo

Ordinary

Shares | | % |

Public shareholders | | 1,977,179 | | | 8.86 | | 988,590 | | | 4.63 | | — | | | 0.00 |

PIPE Investors | | 2,000,000 | | | 8.97 | | 2,000,000 | | | 9.38 | | 2,000,000 | | | 9.83 |

Current LEW shareholders | | 11,000,000 | | | 49.29 | | 11,000,000 | | | 51.58 | | 11,000,000 | | | 54.08 |

Sponsor and director# | | 1,861,849 | | | 8.34 | | 1,861,849 | | | 8.73 | | 1,861,849 | | | 9.16 |

Finder | | 165,000 | | | 0.74 | | 165,000 | | | 0.77 | | 165,000 | | | 0.81 |

Public warrants (as exercised) | | 4,600,000 | | | 20.61 | | 4,600,000 | | | 21.57 | | 4,600,000 | | | 22.62 |

Private warrants (as exercised) | | 711,849 | | | 3.19 | | 711,849 | | | 3.34 | | 711,849 | | | 3.50 |

Total shares (projected to be issued and outstanding) | | 22,315,877 | | | 100.00 | | 21,327,288 | | | 100.00 | | 20,338,698 | | | 100.00 |

| | | | | | | | | | | | | | | | |

Underwriting fee | | | | | | | | | | | | | | | |

Deferred underwriting fee as a percentage of aggregate proceeds from IPO, net of redemption, or | | 4.00 | % | | | | 4.00 | % | | | | 4.00 | % | | |

Minimum fee charge | | 500,000 | | | | | 500,000 | | | | | 500,000 | | | |

Assuming exercise and conversion of all ACBA securities held by the Sponsor, immediately upon consummation of the Business Combination, the Sponsor will own 2,488,698 PubCo Ordinary Shares, representing 11.15%, 11.67% and 12.24% of PubCo’s total issued shares under (i) a no redemption scenario, (ii) an interim redemption scenario, assuming 50% redemptions, and (iii) a maximum redemption scenario, respectively.

The PubCo Ordinary Shares issuable to the Sponsor in respect of the ACBA securities held by the Sponsor include (i) 1,065,000 ACBA Ordinary Shares; (ii) 304,000 ACBA Ordinary Shares included as part of the Private Units; (iii) 304,000 ACBA Ordinary Shares underlying ACBA Warrants included as part of the Private Units; and (iv) 407,849 ACBA Ordinary Shares; and (v) 407,849 ACBA Ordinary Shares underlying ACBA Warrants, both included as part of the ACBA Units into which the notes and related party payables will be converted at $10.00 per unit.

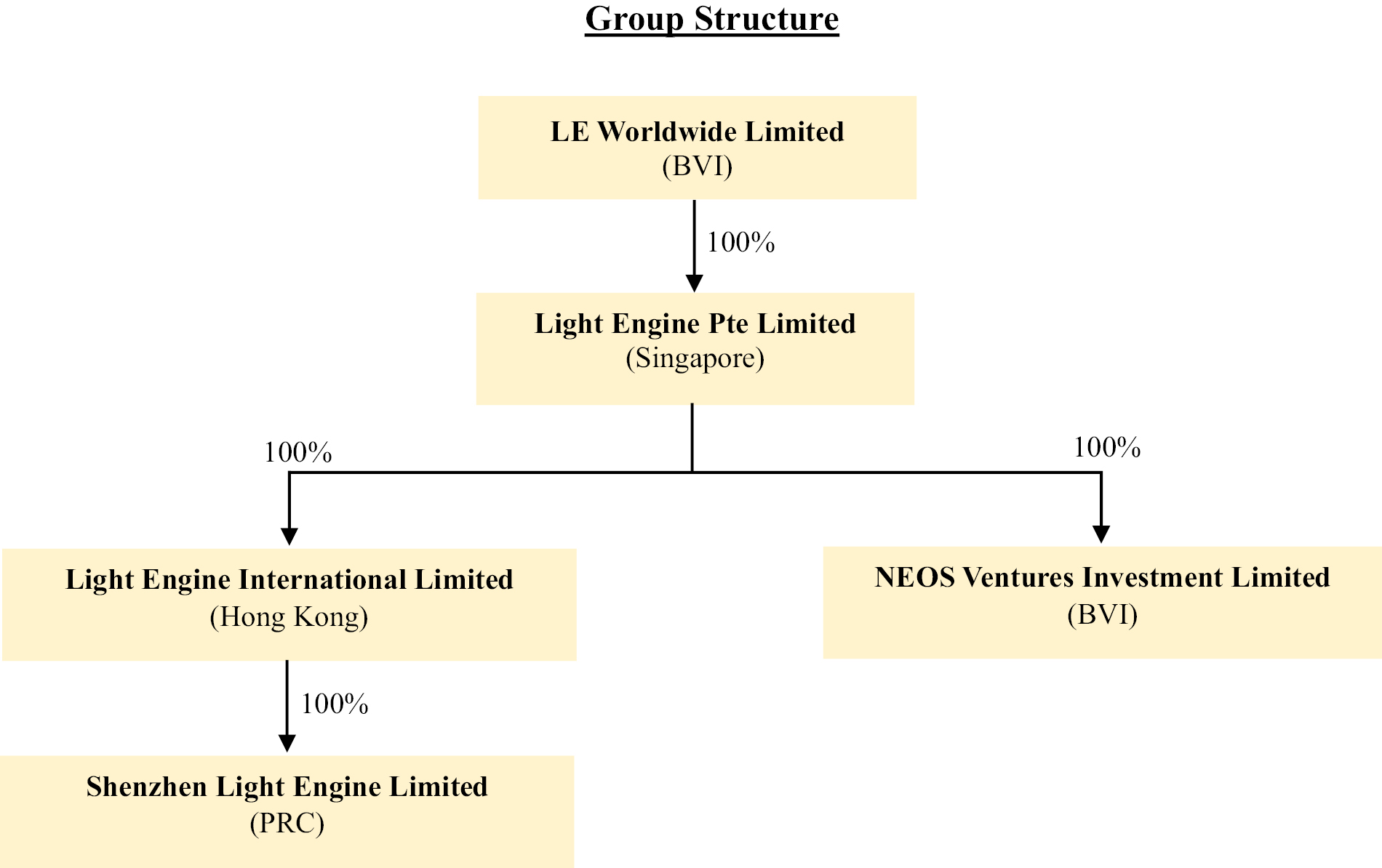

Purchaser is a British Virgin Islands holding company, and is not a Hong Kong operating company. As a holding company with no material operations of its own, Purchaser will, upon consummation of the Business Combination, conduct all of its operations in Hong Kong, Singapore, and the PRC through LEW’s Hong Kong, Singaporean, and PRC subsidiaries, in particular, Light Engine International Limited (“LEIL”), its Hong Kong operating subsidiary. In addition, LEIL recently formed Shenzhen Light Engine Limited, its wholly owned PRC subsidiary which has no material operations at the moment but will facilitate the selling of products to horticultural farms based in the PRC. Investors in PubCo Ordinary Shares should be aware that they do not, and may never, hold equity interests in its operating subsidiaries, but rather are holding equity interests solely in PubCo, our British Virgin Islands holding company.

Table of Contents

Both Ace and LEW’s auditors, Adeptus Partners, LLC and Marcum Asia CPAs LLP, are headquartered in the U.S. and have been inspected by the PCAOB on a regular basis, and are subject to laws in the U.S. pursuant to which the PCAOB conducts regular inspections to assess its compliance with the applicable professional standards. We do not expect that the Holding Foreign Companies Accountable Act and related regulations will be applicable to PubCo. You should read “Risks Relating to Ace’s Business — The securities of the Post-Combination Company may be delisted or prohibited from being traded “over-the-counter” under the Holding Foreign Companies Accountable Act and the Accelerated Holding Foreign Companies Accountable Act if the PCAOB were unable to fully inspect the company’s auditor“ for further information. PubCo will maintain cash management policies upon consummation of the Business Combination that dictate the purpose, amount and procedure of cash transfers between PubCo, its subsidiaries, or investors. In particular, PubCo is expected to adopt cash management policies requiring that, for each cash transfer, the requesting staff member shall submit a request for a competent supervisor to review and verify, and then payment will only be transferred to the cashier upon approval. Any voucher will be stamped after payment and the payee will sign the request for payment as receipt. In addition, all payments shall be made by remittance, crossed and stamped non-endorsed transfer cheques except for certain specified cash payables. When transferring any inter-group funds, the cash management procedures will be the same as the cash management policies for external payment as set out above. Funds can and are expected to be transferred in accordance with applicable laws and regulations and in accordance with our operating needs. The structure of cash flows within PubCo’s organization upon consummation of the Business Combination, and a summary of the applicable regulations, are as follows:

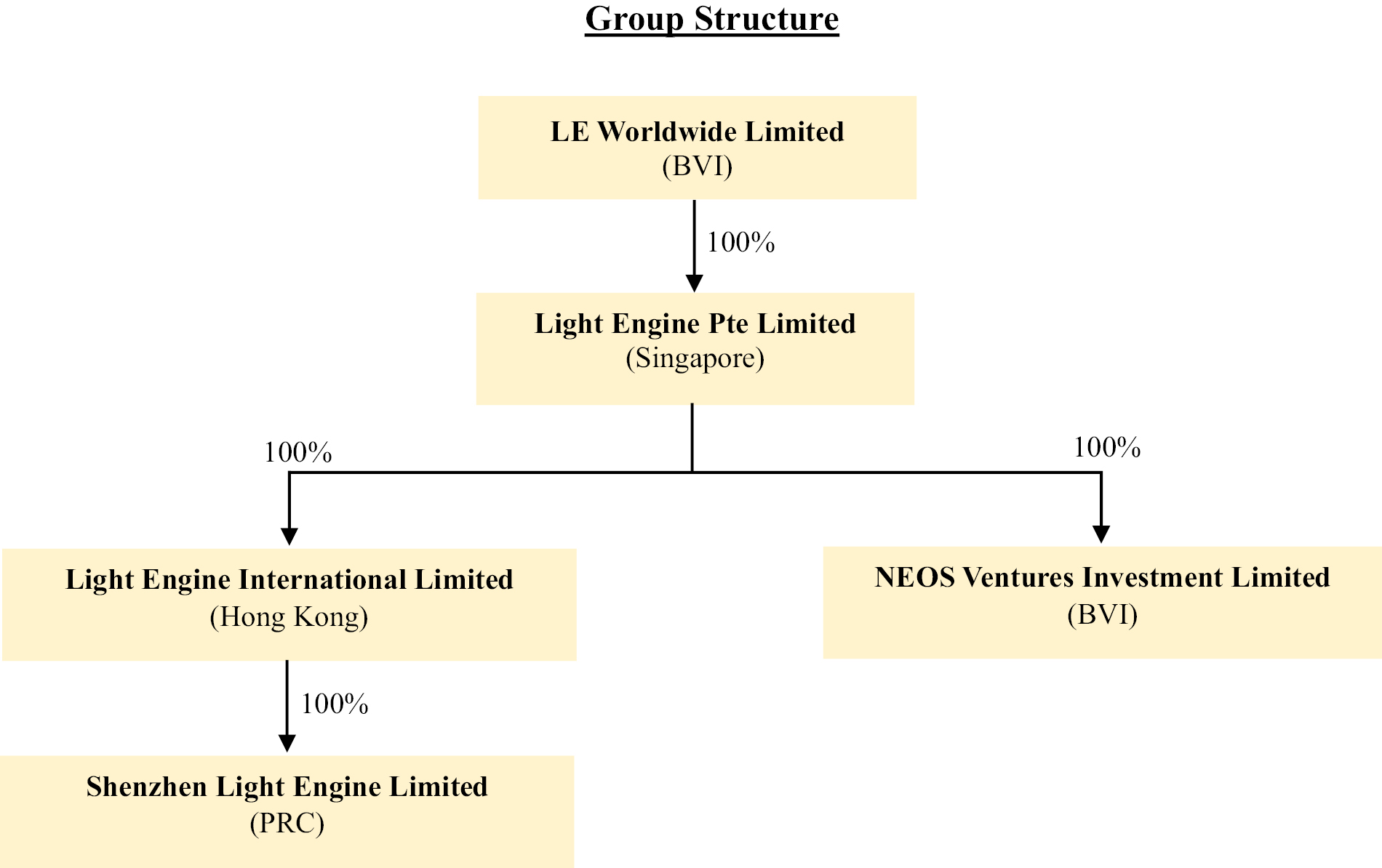

1. PubCo’s equity structure is an indirect holding structure: the overseas entity to be listed in the U.S., ACBA Merger Sub I Limited, a British Virgin Islands company which as of the Closing shall change its corporate name to “AG DataWorks Limited”, will own 100% of LEW, which in turn owns 100% of Light Engine Pte Limited (“LEPL”), a Singapore holding company. LEPL in turn has two direct wholly-owned subsidiaries: Light Engine International Limited, a Hong Kong operating subsidiary (“LEIL”), and NEOS Ventures Investment Limited (“NVIL”), a British Virgin Islands asset holding subsidiary; and LEIL wholly owns Shenzhen Light Engine Limited, its PRC subsidiary (“SLEL”).

2. Within PubCo’s holding structure, the cross-border transfer of funds within PubCo’s corporate group is legal and compliant with the laws and regulations of the respective jurisdictions where PubCo’s subsidiaries are established, namely the PRC, Hong Kong, Singapore and the British Virgin Islands. After foreign investors’ funds enter PubCo, the funds can be directly transferred to LEW, then transferred to LEPL, and finally to LEIL, NVIL and SLEL. Such transfer of funds may be through loans or capital contributions. However, there is no assurance that the PRC government will not intervene or impose restrictions on the ability of PubCo or its subsidiaries to transfer cash into or out of China and Hong Kong.

3. If PubCo intends to distribute dividends in the future, as a holding company, it will be dependent on the receipt of funds from its Hong Kong operating subsidiary LEIL and PRC subsidiary SLEL by way of dividend payments. SLEL will transfer the dividends to LEIL in accordance with the laws and regulations of PRC. LEIL will transfer the dividends to LEPL in accordance with the laws and regulations of Hong Kong, and then LEPL will transfer the dividends to LEW and then to PubCo, and the dividends will be distributed from PubCo to all shareholders respectively in proportion to the shares they hold, regardless of whether the shareholders are U.S. investors or investors in other countries or regions.

There are limitations on our ability to transfer cash within the PubCo’s organization upon consummation of the Business Combination, and there is no assurance that China’s government will not intervene or impose restrictions on the ability of us and our subsidiaries to transfer cash.

Any future determination related to PubCo’s dividend policy will be made at the discretion of PubCo’s board of directors after considering our financial condition, results of operations, capital requirements, contractual requirements, business prospects and other factors the board of directors deems relevant, and subject to the restrictions contained in any future financing instruments. Subject to the BVI BC Act and PubCo’s Memorandum and Articles of Association, PubCo’s board of directors may authorize and declare a dividend to shareholders at such time and of such an amount as they think fit if they are satisfied, on reasonable grounds, that immediately following the dividend the value of PubCo’s assets will exceed its liabilities and PubCo will be able to pay its debts as they become due. There is no further BVI statutory restriction on the amount of funds which may be distributed by PubCo by dividend.

Table of Contents

Under Hong Kong law, dividends can only be paid out of distributable profits (that is, accumulated realized profits less accumulated realized losses) or other distributable reserves. Dividends cannot be paid out of share capital. Under the current practice of the Inland Revenue Department of Hong Kong, no tax is payable in Hong Kong in respect of dividends paid by LEIL. There are no restrictions on foreign exchange and there are no limitations on the abilities of PubCo to transfer cash to or from LEIL or to U.S. investors under Hong Kong Law. There are no restrictions or limitation under the laws of Hong Kong imposed on the conversion of HK dollar into foreign currencies and the remittance of currencies out of Hong Kong, nor is there any restriction on foreign exchange to transfer cash between PubCo and LEIL, across borders and to U.S. investors.

Under existing PRC foreign exchange regulations, payment of current account items, such as profit distributions and trade and service-related foreign exchange transactions, can be made in foreign currencies without prior approval from the State Administration of Foreign Exchange, or the SAFE, by complying with certain procedural requirements. Therefore, our PRC subsidiary, SLEL, is able to pay dividends in foreign currencies to us without prior approval from SAFE, subject to the condition that the remittance of such dividends outside of the PRC complies with certain procedures under PRC foreign exchange regulations, such as the overseas investment registrations by our shareholders or the ultimate shareholders of our corporate shareholders who are PRC residents. Approval from, or registration with, appropriate government authorities is, however, required where the RMB is to be converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of loans denominated in foreign currencies. The PRC government may also at its discretion restrict access in the future to foreign currencies for current account transactions. Current PRC regulations permit our PRC subsidiary to pay dividends to the Company only out of their accumulated profits, if any, determined in accordance with Chinese accounting standards and regulations.

4. In the reporting periods presented in this proxy statement/prospectus and up to the date of this proxy statement/prospectus, save for cash transfers among LEW and its subsidiaries that are made in the ordinary course of business as set forth below, no cash and other asset transfers have occurred among from LEW and its subsidiaries to investors; and no dividends or distributions from any of the subsidiaries has been made to LEW or to investors.

The following are the aggregate intra-group cash transfers made in the ordinary course of business for the nine months ended June 30, 2023 and the years ended September 30, 2022, and 2021 and up to the date of this proxy statement/prospectus:

Month | | From | | To | | Amount | | Purpose of transfer |

February 2023 | | LEW | | LEIL | | $ | 2,480,000 | | Cash transfer for the settlement of accounts payable and operating costs incurred by LEIL |

March 2023 | | LEIL | | LEW | | $ | 20,000 | | Cash transfer for the settlement of its transaction costs |

See “Selected Historical Consolidated Financial Data of Lew” and LEW’s consolidated financial statements and related notes included elsewhere in this proxy statement/prospectus. For the foreseeable future after the Business Combination, we intend to use PubCo’s earnings to further expand the business and as general working capital. As a result, in the foreseeable future, we do not expect to pay any cash dividends on PubCo’s securities.

The ACBA Units, ACBA Ordinary Shares and ACBA Warrants are currently listed on the Nasdaq Capital Market under the symbols “ACBAU”, “ACBA”, and “ACBAW” respectively. PubCo intends to apply to list the PubCo Ordinary Shares and PubCo Warrants on the Nasdaq Stock Market under the symbols “[*]” and “[*]” respectively, in connection with the closing of the Business Combination. Ace cannot assure you that the PubCo Ordinary Shares and PubCo Warrants will be approved for listing on Nasdaq.

One of the conditions to the obligations of LEW to consummate the closing of the Business Combination is that PubCo shall remain listed on Nasdaq and the additional listing application for the Closing Payment Shares shall have been approved by Nasdaq. The terms of the Merger Agreement provide that this condition may not be waived without resolicitation or recirculation. If Nasdaq does not approve the listing of PubCo’s securities, or if PubCo is otherwise unable to list its securities on a national securities exchange following the Business Combination, we could face significant material adverse consequences, including (i) reduced liquidity, or a lack of liquidity, for PubCo’s securities and PubCo’s shareholders; (ii) a limited availability of market quotations for PubCo’s securities; (iii) a determination that PubCo Ordinary Shares are a “penny stock” which will require brokers trading in PubCo’s securities to adhere to more stringent rules and possibly result in a reduced level of trading activity in the secondary trading market for PubCo’s securities; (iv) a limited amount of news and analyst coverage for PubCo; and (v) a decreased ability to issue additional securities or obtain additional financing in the future.

Table of Contents

Investing in PubCo securities involves a high degree of risk. See “Risk Factors” beginning on page 28 for a discussion of information that should be considered in connection with an investment in PubCo securities.

LEW’s current operations are substantially based in Hong Kong, a Special Administrative Region of China. Although Hong Kong has its own governmental and legal system that is independent from China, it is uncertain whether in the future the Hong Kong government will implement regulations and policies of the Chinese government or adopt regulations and policies of its own that are substantially the same as those of the Chinese government. Moreover, LEIL recently formed SLEL, its wholly owned PRC subsidiary which has no material operations at the moment but will facilitate the selling of products to horticultural farms based in the PRC. As a result, the legal and operational risks associated with operating in China also apply to LEW’s operations in Hong Kong and in China. Given that changes in policies, regulations, rules, and the enforcement of laws of the Chinese government may occur quickly with little advance notice, being subject to various risks that are specific to doing business in China may result in a material change in LEW’s operations and the value of PubCo Ordinary Shares following the Business Combination, or could significantly limit or completely hinder our ability to offer or continue to offer PubCo’s securities to investors and cause the value of such securities to significantly decline or be worthless. Some major potential risks specific to doing business in China include, among others, the following:

• The Chinese government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. If such policy extends to cover Hong Kong, our ability to operate in Hong Kong may be harmed by changes in its laws and regulations, including those relating to taxation, environmental regulations, land use rights, property and other matters. Such policy also affects our ability to expand our business to China or adversely affect our future operations in China. Given recent statements by the Chinese government indicating an intent to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers, any such action could significantly limit or completely hinder our ability to offer or continue to offer securities to investors or accept foreign investments and cause the value of PubCo’s securities to significantly decline or become worthless.

• The Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, or the M&A Rules, adopted by the Chinese government requires an overseas special purpose vehicle formed for listing purposes through acquisitions of PRC domestic companies and controlled by PRC companies or individuals to obtain the approval of the China Securities Regulatory Commission (“CSRC”) prior to the listing and trading of such special purpose vehicle’s securities on an overseas stock exchange. On February 17, 2023, the CSRC released the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies, or the Trial Measures, and five supporting guidelines, which came into effect on March 31, 2023. Pursuant to the Trial Measures, domestic companies that seek to offer or list securities overseas, both directly and indirectly, should fulfill the filing procedure and report relevant information to the CSRC. Although LEW currently conducts part of its business in China through SLEL, our PRC counsel, Fangda Partners, is of the opinion that the Business Combination with LEW is not currently subject to CSRC approval. Accordingly, we believe that we are not required to obtain CSRC approval for the Business Combination pursuant to the Trial Measures. However, if we inadvertently conclude that such permissions or approvals are not required, or applicable laws, regulations, or interpretations change, or the Chinese government extends such rules to cover companies with operations in Hong Kong, and CSRC approval is required for the Business Combination, it is uncertain whether it would be possible for us to obtain the approval, and any failure to obtain or delay in obtaining CSRC approval for the Business Combination would subject us to sanctions imposed by the CSRC and other PRC regulatory agencies. It may hinder PubCo’s ability to list on a U.S. or other foreign exchange and to offer, or continue to offer, securities to investors, and the value of PubCo’s securities might significantly decline or become worthless.

• Recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in China with little advance notice, including adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. On June 5, 2023, LEW, through its indirect subsidiary LEIL, established SLEL, a wholly owned subsidiary in

Table of Contents

mainland China. Our PRC counsel, Fangda Partners, is of the opinion that LEW will not be required to conduct cybersecurity review with the Cyberspace Administration of China, or the “CAC,” under the Cybersecurity Review Measures which became effective on February 15, 2022, and is also not subject to cybersecurity review by the CAC. However, if in the future the Chinese government extends such rules to cover companies with operations in Hong Kong or we become subject to such rules because of SLEL’s operations in the Chinese market, LEW may be subject to such reviews and there is no guarantee it can obtain the requisite approvals and its operations could be adversely affected.

See “Risk Factors — Risks Relating to Doing Business in China or Hong Kong” for more details.

As of September 30, 2023, there was approximately $22,827,616 in Ace’s trust account. On [•], 2023, the last sale price of ACBA Ordinary Shares was $[•].

Pursuant to Ace’s third amended and restated memorandum and articles of association, Ace is providing its public shareholders with the opportunity to redeem all or a portion of their ACBA Ordinary Shares at a per-share price, payable in cash, equal to the aggregate amount then on deposit in Ace’s trust account as of two business days prior to the consummation of the Business Combination, including interest, less taxes payable, divided by the number of then outstanding ACBA Ordinary Shares that were sold as part of the ACBA Units in Ace’s initial public offering (“IPO”), subject to the limitations described herein. Ace currently estimates that the per-share price at which public shares may be redeemed from cash held in the Company’s trust account will be approximately $11.50 at the time of the Extraordinary General Meeting, although such amount can change as hereinafter discussed. Ace’s public shareholders may elect to redeem their shares even if they vote for the Reincorporation Merger or the Acquisition Merger or do not vote at all. Ace has no specified maximum redemption threshold under Ace’s memorandum and articles of association. Holders of outstanding ACBA Warrants do not have voting or redemption rights in connection with the Business Combination.

Ace is providing this proxy statement/prospectus and accompanying proxy card to its shareholders in connection with the solicitation of proxies to be voted at the Extraordinary General Meeting and at any adjournments or postponements of the Extraordinary General Meeting.

Each shareholder’s vote is very important. Whether or not you plan to attend the Extraordinary General Meeting in person, please submit your proxy card without delay. Ace’s shareholders may revoke proxies at any time before they are voted at the meeting. Voting by proxy will not prevent a shareholder from voting in person if such shareholder subsequently chooses to attend the Extraordinary General Meeting. If you are a holder of record and you attend the Extraordinary General Meeting and wish to vote in person, you may withdraw your proxy and vote in person. Assuming that a quorum is present, attending the Extraordinary General Meeting either in person or by proxy and abstaining from voting will have the same effect as voting against all the Proposals, and broker non-votes will have no effect on any of the Proposals.

If you sign, date and return your proxy card without indicating how you wish to vote, your shares will be voted in favor of each of the Proposals presented at the Extraordinary General Meeting. If you fail to return your proxy card or fail to instruct your bank, broker or other nominee how to vote, and do not attend the Extraordinary General Meeting in person, the effect will be that your shares will not be counted for purposes of determining whether a quorum is present at the Extraordinary General Meeting and, if a quorum is present, will have the effect of a vote against all the Proposals. If you are a shareholder of record and you attend the Extraordinary General Meeting and wish to vote in person, you may withdraw your proxy and vote in person.

We encourage you to read this proxy statement/prospectus carefully. In particular, you should review the matters discussed under the caption “Risk Factors” beginning on page 28.

Ace’s board of directors has unanimously approved the Merger Agreement and the Plans of Merger (which, for the avoidance of doubt, include both the Reincorporation Merger as well as the Acquisition Merger), and unanimously recommends that Ace’s shareholders vote “FOR” approval of each of the Proposals. When you consider Ace’s board of directors’ recommendation of these Proposals, you should keep in mind that Ace’s directors and officers have interests in the Business Combination that may conflict or differ from your interests as a shareholder. See “Proposal No. 2 The Acquisition Merger Proposal — Interests of Certain Persons in the Business Combination”.

Table of Contents

On behalf of Ace’s board of directors, I thank you for your support and we look forward to the successful consummation of the Business Combination.

| | Sincerely, |

| | | /s/ Eugene Wong |

| | | Eugene Wong |

| | | Chief Executive Officer and Chairman |

| | | Ace Global Business Acquisition Limited |

| | | |

| | | [*], 2023 |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued in the Business Combination or otherwise or passed upon the adequacy or accuracy of this proxy statement/prospectus. Any representation to the contrary is a criminal offense.

Table of Contents

HOW TO OBTAIN ADDITIONAL INFORMATION

If you would like to receive additional information or if you want additional copies of this document, agreements contained in the appendices or any other documents filed by Ace with the Securities and Exchange Commission, such information is available without charge upon written or oral request. Please contact Ace at the following address:

Ace Global Business Acquisition Limited

Rm. 806, 8/F, Tower 2, Lippo Centre, No. 89 Queensway, Admiralty, Hong Kong

Attn: Eugene Wong, Chief Executive Officer

Tel: (852) 2151 5198 / 2151 5598

If you would like to request documents, please do so no later than [•], 2023 to receive them before the Extraordinary General Meeting. Please be sure to include your complete name and address in your request. Please see “Where You Can Find More Information” to find out where you can find more information about Ace, the Purchaser, Merger Sub and LEW. You should rely only on the information contained in this proxy statement/prospectus in deciding how to vote on the Business Combination. Neither Ace, the Purchaser, Merger Sub nor LEW has authorized anyone to give any information or to make any representations other than those contained in this proxy statement/prospectus. Do not rely upon any information or representations made outside of this proxy statement/prospectus. The information contained in this proxy statement/prospectus may change after the date of this proxy statement/prospectus. Do not assume after the date of this proxy statement/prospectus that the information contained in this proxy statement/prospectus is still correct.

Table of Contents

USE OF CERTAIN TERMS

Unless otherwise stated in this proxy statement/prospectus:

• “ACBA”, “Ace”, “we”, “us”, “Company” or “Ace Parent” refers to Ace Global Business Acquisition Limited.

• “Ace Board” refers to Ace’s board of directors.

• “BVI” refers to the British Virgin Islands and “BVI BC Act” refers to the BVI Business Companies Act, 2004.

• “Closing Date” refers to the date on which the Business Combination is consummated.

• “Significant LEW Shareholder” refers to Mr. Chung Wai Paul LO, who currently beneficially controls 40.07% of the equity shares of LEW, controls Huizhou Light Engine Limited, a company which is LEW’s main supplier, and is the father of Yeung Man Teddy LO, who is the Chief Executive Officer of LEW and, whereupon the consummation of the Business Combination, will be the Chief Executive Officer and a director of PubCo.

• “DLA” refers to DLA Piper LLP (US).

• “Exchange Act” refers to the Securities Exchange Act of 1934, as amended.

• “Initial Shareholders” refers to the Sponsor and Ace’s directors and officers.

• “IPO” refers to the initial public offering of 4,600,000 units (including 600,000 units after Ladenburg exercised its over-allotment option) of Ace consummated on April 8, 2021.

• “Ladenburg” refers to Ladenburg Thalmann & Co. Inc.

• “LEW” refers to LE Worldwide Limited, its consolidated subsidiaries and its consolidated affiliated entities.

• “Loeb” refers to Loeb & Loeb LLP.

• “LOI” refers to a letter of intent.

• “Merger Agreement” refers to the merger agreement dated as of December 23, 2022, between Ace and LEW (as supplemented by a joinder agreement dated as of March 2, 2023, executed by Ace, LEW, the Purchaser and Merger Sub) and as amended on July 6, 2023 and as further amended on September 19, 2023.

• “Merger Sub” refers to ACBA Merger Sub II Limited, the wholly owned subsidiary of ACBA Merger Sub I Limited.

• “Note” or “Notes” refers to the unsecured promissory notes issued by Ace to the Sponsor or its affiliates or designees in exchange for the Sponsor or its affiliates or designees depositing such amounts (as applicable) into Ace’s trust account in order to extend the amount of time it has available to complete a business combination.

• “Plan of Merger” refers to a plan of merger by and among Ace and the Purchaser and/or Merger Sub and LEW as the context requires.

• “PRC Subsidiary” or “SLEL” means Shenzhen Light Engine Limited, a company organized under the laws of the People’s Republic of China and a wholly owned subsidiary of LEIL.

• “Purchaser” refers to ACBA Merger Sub I Limited, a British Virgin Islands business company and wholly owned subsidiary of Ace Global Business Acquisition Limited (such company before the Reincorporation Merger is sometimes referred to as “Purchaser” and upon and following the Reincorporation Merger is hereinafter sometimes referred to as “PubCo”).

• “Sponsor” refers to Ace Global Investment Limited.

• “US Dollars”, “$”, “US$” and “USD” refers to the legal currency of the United States.

• “U.S. GAAP” refers to accounting principles generally accepted in the United States.

• “VWAP” refers to, for any security as of any date(s), the dollar volume-weighted average price for such security on the principal securities exchange or securities market on which such security is then traded during normal trading hours of such exchange or market, as reported by Bloomberg through its “HP” function (set to weighted average) or, if the foregoing does not apply, the dollar volume-weighted average price of such security in the over-the-counter market on the electronic bulletin board for such security during normal trading hours of such market, as reported by Bloomberg, or, if no dollar volume-weighted average price is reported for such security

Table of Contents

by Bloomberg for such hours, the average of the highest closing bid price and the lowest closing ask price of any of the market makers for such security as reported by OTC Markets Group Inc. If the VWAP cannot be calculated for such security on such date(s) on any of the foregoing bases, the VWAP of such security on such date(s) shall be the fair market value as determined reasonably and in good faith by a majority of the disinterested directors of the board of directors (or equivalent governing body) of the applicable issuer. All such determinations shall be appropriately adjusted for any stock or share dividend, stock split or share subdivision, stock combination or share consolidation, recapitalization or other similar transaction during such period.

Unless otherwise noted, all translations from Renminbi or Hong Kong Dollars to U.S. dollars and from U.S. dollars to Renminbi or Hong Kong Dollars, as the case may be, in this proxy statement/prospectus are made at [ ] Renminbi to US$1.00 and [ ] Hong Kong Dollars to US$1.00, respectively, representing, in each instance the noon buying rate set forth in the H.10 statistical release of the U.S. Federal Reserve Board on [ ]. We make no representation that any of the aforementioned currencies could have been, or could be, converted into any of the other aforementioned currencies, at any particular rate, the rates stated above, or at all. On [ ], the noon buying rate for Renminbi was [ ] to US$1.00, and the noon buying rate for Hong Kong Dollars was [ ] to US$1.00.

Table of Contents

Ace Global Business Acquisition Limited

Rm. 806, 8/F, Tower 2, Lippo Centre, No. 89 Queensway,

Admiralty, Hong Kong

(852) 2151 5198 / 2151 5598

NOTICE OF EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON , 2023

TO THE SHAREHOLDERS OF ACE GLOBAL BUSINESS ACQUISITION LIMITED:

NOTICE IS HEREBY GIVEN that an Extraordinary General Meeting of shareholders of Ace Global Business Acquisition Limited, a British Virgin Islands business company (“Ace”), will be held on , 2023 at [10:00 AM Hong Kong] Time as a teleconference using the following dial-in information:

US Toll Free | | |

International Toll | | |

Participant Passcode | | |

The Extraordinary General Meeting will be held for the following purposes:

I. To approve the merger of Ace with and into the Purchaser, its wholly owned subsidiary, with PubCo surviving the merger. We refer to the merger as the Reincorporation Merger. This proposal is referred to as the Reincorporation Merger Proposal or Proposal No. 1. Holders of ACBA Ordinary Shares as of record date are entitled to vote on this proposal.

II. To approve the authorization for PubCo to, immediately following the consummation of the Reincorporation Merger, complete the merger of Merger Sub into LEW, resulting LEW becoming a wholly owned subsidiary of PubCo. We refer to the merger as the Acquisition Merger. This proposal is referred to as the Acquisition Merger Proposal or Proposal No. 2. Holders of ACBA Ordinary Shares as of record date are entitled to vote on this proposal.

III. To approve, for purposes of complying with applicable listing rules of The Nasdaq Stock Market LLC, the issuance of up to an aggregate of 11,000,000 PubCo Ordinary Shares in connection with the Business Combination and related financings. This proposal is referred to as the Nasdaq Proposal or Proposal No. 3.

IV. To approve the adoption of, on a non-binding advisory basis, certain differences in the governance provisions set forth in PubCo’s Amended and Restated Memorandum and Articles of Association. This proposal is referred to as the Governance Proposal or Proposal No. 4;

V. To approve PubCo’s 2023 Equity Incentive Plan. This proposal is referred to as the Incentive Plan Proposal or Proposal No. 5. A copy of the Incentive Plan is attached to the accompanying proxy statement as Annex C;

VI. To approve the amendment and restatement of the Ace third amended and restated memorandum and articles of association to expand the methods that Ace may employ to not become subject to the “penny stock” rules of the Securities and Exchange Commission by deleting Article 25.1.7 that “Under no circumstances will the Company redeem its public shares in an amount that would cause the Company’s net tangible assets to be less than $5,000,001” in its entirety. This proposal is referred to as the NTA Requirement Amendment Proposal or Proposal No. 6; and

VII. To approve the adjournment of the Extraordinary General Meeting in the event Ace does not receive the requisite shareholder vote to approve any of the above Proposals. This proposal is called the Adjournment Proposal or Proposal No. 7.

All of the proposals set forth above are sometimes collectively referred to herein as the “Proposals”. The Reincorporation Merger Proposal and the Acquisition Merger Proposal are dependent upon each other. It is important for you to note that in the event that either of the Reincorporation Merger Proposal or the Acquisition Merger Proposal is not approved, then Ace will not consummate the Business Combination. In the absence of shareholder approval for a further extension, if Ace does not consummate the Business Combination and fails to complete an initial business combination by November 8, 2023 (or up to April 8, 2024, if the time period is extended, as described herein), Ace will be required to dissolve and liquidate in accordance with its organizational documents.

Table of Contents

As of September 30, 2023, there were 3,431,179 ACBA Ordinary Shares issued and outstanding and entitled to vote at the Extraordinary General Meeting or any adjournment thereof. Only Ace’s shareholders who hold shares of record as of the close of business on [•], 2023 are entitled to vote at the Extraordinary General Meeting or any adjournment of the Extraordinary General Meeting. This proxy statement/prospectus is first being mailed to Ace’s shareholders on or about [•], 2023. Approval of each of (i) the Reincorporation Merger Proposal, and (ii) the Acquisition Merger Proposal, in each instance, will require the affirmative vote in excess of 50% of the issued and outstanding ACBA Ordinary Shares present and entitled to vote at the Extraordinary General Meeting or any adjournment thereof. Approval of each of the Nasdaq Proposal, the Governance Proposal, the Incentive Plan Proposal, the NTA Requirement Amendment Proposal and the Adjournment Proposal will, in each instance, require the affirmative vote in excess of 50% of the issued and outstanding ACBA Ordinary Shares present and entitled to vote at the Extraordinary General Meeting or any adjournment thereof. Assuming that a quorum is present, attending the Extraordinary General Meeting either in person or by proxy and abstaining from voting will have the same effect as voting against the Proposals, and failing to instruct your bank, brokerage firm or nominee to attend and vote, your shares will have no effect on any of the Proposals.

Holders of ACBA Ordinary Shares are entitled to dissenter rights under the BVI BC Act in connection with the Reincorporation Merger. In accordance with Section 179 of the BVI BC Act, a holder of ACBA Ordinary Shares is entitled to payment of the fair value of all of its shares upon validly dissenting from the Reincorporation Merger. Holders of ACBA Ordinary Shares may only dissent in respect of all shares that they hold in Ace. Upon a holder of ACBA Ordinary Shares validly exercising its entitlement under Section 179 of the BVI BC Act, such Dissenting Shareholder shall cease to have any rights (including redemption rights) of a shareholder of Ace except the right to be paid the fair value of its ACBA Ordinary Shares determined in accordance with Section 179 of the BVI BC Act.

A holder of ACBA Ordinary Shares who desires to exercise its dissenter right (i.e., the entitlement to payment of the fair value of all of its ACBA Ordinary Shares in connection with the Reincorporation Merger) is required to give us written objection to the Reincorporation Merger before the Extraordinary General Meeting or before the vote on the Reincorporation Merger Proposal at the Extraordinary General Meeting. Within 20 days immediately following the date on which the approval of Ace’s shareholders is obtained at the Extraordinary General Meeting (or any adjourned meeting), Ace shall give written notice of the approval to each Ace shareholder who gave a valid written objection to the Reincorporation Merger, except for those Ace’s shareholders who after giving the written objection subsequently voted to approve the Reincorporation Merger Proposal at the Extraordinary General Meeting (or any adjourned meeting). Any such holder of ACBA Ordinary Shares who elects to dissent is required, within 20 days immediately following the date on which the notice of approval by Ace referred to above is given, to give Ace a written notice of its decision to elect to dissent, stating: (a) its name and address; (b) the number of ACBA Ordinary Shares in respect of which it dissents; and (c) a demand for payment of the fair value of its ACBA Ordinary Shares. On the effective date of the Reincorporation Merger, a Dissenting Shareholder shall have its ACBA Ordinary Shares automatically cancelled in exchange for the right to receive payment resulting from the procedure in Section 179 of the BVI BC Act and a Dissenting Shareholder shall not be entitled to receive PubCo Ordinary Shares pursuant to the Reincorporation Merger. If the Reincorporation Merger is not approved and therefore the Business Combination is not consummated, the aforementioned election under Section 179 of the BVI BC Act will be given no effect, and the underlying ACBA Ordinary Shares held by the Dissenting Shareholder will remain issued and outstanding in accordance with their terms.

An Ace shareholder who elects to dissent under Section 179 of the BVI BC Act and validly exercises its dissenter right giving it the entitlement to payment of the fair value of the ACBA Ordinary Shares it holds following the procedures set forth above will not be entitled to have its ACBA Ordinary Shares redeemed. If an Ace shareholder has elected to have its ACBA Ordinary Shares redeemed but later elects to dissent, upon receipt of the written notice of such an Ace shareholder’s decision to elect to dissent, Ace shall instruct its transfer agent to return the ACBA Ordinary Shares (physically or electronically) delivered to the transfer agent in connection with such Ace shareholder’s demand for redemption to the Ace shareholder.

Whether or not you plan to attend the Extraordinary General Meeting in person, please submit your proxy card without delay to Advantage Proxy not later than the time appointed for the Extraordinary General Meeting or adjourned meeting. Voting by proxy will not prevent you from voting your shares in person if you subsequently choose to attend the Extraordinary General Meeting. If you fail to return your proxy card and do not attend the meeting in person, the effect will be that your shares will not be counted for purposes of determining whether a quorum is present at the Extraordinary General Meeting. You may revoke a proxy at any time before it is voted at the Extraordinary General Meeting by executing and returning a proxy card dated later than the previous one, by attending the Extraordinary

Table of Contents

General Meeting in person and casting your vote by ballot or by submitting a written revocation to Advantage Proxy, P.O. Box 13581, Des Moines, WA 98198. Attention: Karen Smith, Telephone: 877-870-8565, that is received by proxy solicitor before we take the vote at the Extraordinary General Meeting. If you hold your shares through a bank or brokerage firm, you should follow the instructions of your bank or brokerage firm regarding revocation of proxies.

Ace’s board of directors unanimously recommends that you vote “FOR” approval of each of the Proposals.

By Order of the Board of Directors, | | |

/s/ Eugene Wong | | |

Eugene Wong | | |

Chief Executive Officer and Chairman of | | |

Ace Global Business Acquisition Limited | | |

[__________], 2023 | | |

Table of Contents

i

Table of Contents

ii

Table of Contents

ABOUT THIS PROXY STATEMENT/PROSPECTUS

This document, which forms part of a registration statement on Form F-4 filed by Purchaser (File No. 333-274635) with the SEC, constitutes a prospectus of Purchaser under Section 5 of the Securities Act, with respect to the issuance and the registration of (i) the PubCo Ordinary Shares issuable to Ace’s shareholders, (ii) the PubCo Warrants issuable to holders of ACBA Warrants in exchange for the ACBA Warrants, (iii) the PubCo Ordinary Shares underlying the PubCo Warrants, in each instance in connection with the Reincorporation Merger; and (iv) the PubCo Ordinary Shares issuable to LEW’s shareholders in connection with the Acquisition Merger. This document also constitutes a notice of meeting and a proxy statement under Section 14(a) of the Exchange Act, with respect to the Extraordinary General Meeting at which Ace’s shareholders will be asked to consider and vote upon the Proposals, including with respect to the proposals to approve the Reincorporation Merger and the Acquisition Merger.

This proxy statement/prospectus does not constitute an offer to sell, or a solicitation of an offer to buy, any securities, or the solicitation of a proxy, in any jurisdiction to or from any person to whom it is not lawful to make any such offer or solicitation in such jurisdiction.

iii

Table of Contents

WHERE YOU CAN FIND MORE INFORMATION

Ace files reports, proxy statements and other information with the SEC as required by the Exchange Act. You can read Ace’s SEC filings, including this proxy statement/prospectus, over the Internet at the SEC’s website at http://www.sec.gov.

Information and statements contained in this proxy statement/prospectus, or any annex to this proxy statement/prospectus, are qualified in all respects by reference to the copy of the relevant contract or other annex filed with this proxy statement/prospectus.

If you would like additional copies of this proxy statement/prospectus, or if you have questions about the Business Combination, you should contact Ace at the following address:

Ace Global Business Acquisition Limited

Rm. 806, 8/F, Tower 2, Lippo Centre, No. 89 Queensway, Admiralty, Hong Kong

Attn: Eugene Wong, Chief Executive Officer

Tel: (852) 2151 5198 / 2151 5598

All information contained in this proxy statement/prospectus relating to Ace, Purchaser and Merger Sub has been supplied by Ace, and all information relating to LEW has been supplied by LEW. Information provided by either Ace or LEW does not constitute any representation, estimate or projection of the other party.

Neither Ace, PubCo, Purchaser nor LEW has authorized anyone to give any information or make any representation about the Business Combination or their companies that is different from, or in addition to that contained in this proxy statement/prospectus or in any of the materials that have been incorporated into this proxy statement/prospectus by reference. Therefore, if anyone does give you any such information, you should not rely on it. If you are in a jurisdiction where offers to exchange or sell, or solicitations of offers to exchange or purchase the securities offered by this proxy statement/prospectus or the solicitation of proxies is unlawful, or if you are a person to whom it is unlawful to direct these types of activities, then the offer presented in this proxy statement/prospectus does not extend to you. The information contained in this proxy statement/prospectus speaks only as of the date of this proxy statement/prospectus unless the information specifically indicates that another date applies.

iv

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This proxy statement/prospectus contains forward-looking statements, including statements about the parties’ ability to close the Business Combination, the anticipated benefits of the Business Combination, the financial conditions, results of operations, earnings outlook and prospects of PubCo, Ace and/or LEW and may include statements for the period following the consummation of the Business Combination. Forward-looking statements appear in a number of places in this proxy statement/prospectus including, without limitation, in the sections titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations of LEW”, and “Business of LEW”. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Forward-looking statements are typically identified by words such as “plan”, “believe”, “expect”, “anticipate”, “intend”, “outlook”, “estimate”, “forecast”, “project”, “continue”, “could”, “may”, “might”, “possible”, “potential”, “predict”, “should”, “would”, and other similar words and expressions, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements are based on the current expectations of the management of Ace and LEW, as applicable, and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of such statement. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in “Risk Factors”, those discussed and identified in public filings made with the SEC by Ace and the following:

• expectations regarding LEW’s strategies and future financial performance, including LEW’s future business plans or objectives, prospective performance and opportunities and competitors, ability to finance its research and development activities, revenues, customer acquisition and retention, products and services, pricing, marketing plans, operating expenses, market trends, liquidity, cash flows and uses of cash, capital expenditures, ability to remediate material weaknesses to its internal control over financial reporting, and LEW’s ability to invest in growth initiatives and pursue acquisition opportunities;

• the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement;

• the outcome of any legal proceedings that may be instituted against LEW, Ace and others following announcement of the Merger Agreement and transactions contemplated therein;

• the inability to complete the Business Combination due to, among other things, the failure to obtain Ace shareholders’ approval;

• the risk that the proposed Business Combination disrupts current plans and operations of LEW as a result of the announcement and consummation of the Business Combination;

• the ability to recognize the anticipated benefits of the Business Combination;

• unexpected costs related to the proposed Business Combination;

• the amount of any redemptions by existing holders of ACBA Ordinary Shares being greater than expected;

• the management and board composition of PubCo following the proposed Business Combination;

• the ability to list PubCo’s securities on Nasdaq;

• limited liquidity and trading of Ace’s and PubCo’s securities;

• geopolitical risk and changes in applicable laws or regulations;

• the possibility that LEW, PubCo and/or Ace may be adversely affected by other economic, business, and/or competitive factors;

• operational risk;

v

Table of Contents

• the possibility that the COVID-19 pandemic, or another major disease, or the conflict in the Ukraine or other similar macro event disrupts LEW’s business;

• litigation and regulatory enforcement risks, including the diversion of management time and attention and the additional costs and demands on LEW’s resources; and

• the risks that the consummation of the Business Combination is substantially delayed or does not occur.

Should one or more of these risks or uncertainties materialize or should any of the assumptions made by the management of Ace, LEW and PubCo prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements.

All subsequent written and oral forward-looking statements concerning the Business Combination or other matters addressed in this proxy statement/prospectus and attributable to LEW, Ace, Purchaser or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this proxy statement/prospectus. Except to the extent required by applicable law or regulation, Purchaser, LEW and Ace undertake no obligation to update these forward-looking statements to reflect events or circumstances after the date of this proxy statement/prospectus or to reflect the occurrence of unanticipated events.

vi

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE BUSINESS COMBINATION and

THE EXTRAORDINARY GENERAL MEETING

Questions and Answers About the Merger

Q: Why are Ace and LEW proposing to enter into the Business Combination?

A: Ace is a blank check company formed specifically as a vehicle to effect a merger, capital stock exchange, asset acquisition, stock purchase, reorganization, recapitalization or similar business combination with one or more businesses. In the course of Ace’s search for a business combination partner, Ace investigated the potential acquisition of many entities in various industries, including LEW, and concluded that LEW was the best candidate for a business combination with Ace. The following is a brief summary of factors that the Ace Board considered when approving the Business Combination. The Ace Board determined that LEW met, in some fashion, all the criteria set for Ace’s target company screening, namely: (i) strong market positioning; (ii) strong fundamentals with the potential to improve their performance with support from Ace’s management; (iii) distinguished management team; (iv) resilient business model; and (v) potential benefit from capital markets access. The Ace Board also considered the following uncertainties, risks and potentially negative factors concerning the Business Combination with LEW, including: (i) macroeconomic risks; (ii) benefits may not be achieved; (iii) operational risks; (iv) intense competition; (v) no guarantee of sustainable profitable results; and (vi) other risks. For more details on Ace’s search for a business combination partner and the board’s reasons for selecting LEW as Ace’s Business Combination partner, see “Proposal No. 2 The Acquisition Merger Proposal — Background of the Business Combination”. For more details on the referenced macroeconomic risks, operational risks, and other risks that the Ace Board considered, see “Proposal No. 2 The Acquisition Merger Proposal — Ace’s Board of Directors’ Reasons for Approving the Business Combination” included in this proxy statement/prospectus.

Q: What is the purpose of this document?

A: Ace and LEW are proposing to consummate the Business Combination. The Business Combination consists of the Reincorporation Merger and the Acquisition Merger, each of which is described in this proxy statement/ prospectus. In addition, the Merger Agreement and the Plan of Merger are attached to this proxy statement/prospectus as Annex A and is incorporated into this proxy statement/prospectus by reference. This proxy statement/prospectus contains important information about the proposed Business Combination and the other matters to be acted upon at the Extraordinary General Meeting. You are encouraged to carefully read this proxy statement/prospectus, including “Risk Factors” and all the annexes hereto.

Approval of the Reincorporation Merger and the Acquisition Merger will each require the affirmative vote in excess of 50% of the issued and outstanding ACBA Ordinary Shares present and entitled to vote at the Extraordinary General Meeting or any adjournment thereof. Approval of each of the Reincorporation Merger Proposal and the Acquisition Merger Proposal are dependent upon each other. It is important for you to note that in the event that either of the Reincorporation Merger Proposal or the Acquisition Merger Proposal is not approved, then Ace will not consummate the Business Combination. Approval of the Nasdaq Proposal, the Governance Proposal, the Incentive Plan Proposal, the NTA Requirement Amendment Proposal and the Adjournment Proposal will each require the affirmative vote in excess of 50% of the issued and outstanding ACBA Ordinary Shares present and entitled to vote at the Extraordinary General Meeting or any adjournment thereof.

Approval of the Merger Agreement also will require either the affirmative vote of a majority in excess of 50% of LEW shareholders at a duly convened meeting or written consent of a majority in excess of 50% of LEW shareholders as described in the memorandum and articles of association of LEW.

Q. Are any of the proposals conditioned on one another?

A: Yes, the Reincorporation Merger Proposal and the Acquisition Merger Proposal are dependent upon each other. It is important for you to note that in the event that either of the Reincorporation Merger Proposal or the Acquisition Merger Proposal is not approved, Ace will not consummate the Business Combination. In the absence of shareholder approval for a further extension, if Ace does not consummate the Business Combination and fails to complete an initial business combination by November 8, 2023, (or up to April 8, 2024, if the time period is extended, as described herein), Ace will be required to dissolve and liquidate. Adoption of each of the Nasdaq Proposal, the Governance Proposal, the Incentive Plan Proposal, the NTA Requirement Amendment Proposal and the Adjournment Proposal are not conditioned upon the adoption of any of the other Proposals.

vii

Table of Contents

The matters for which the consent of the shareholders of LEW are being sought are not conditioned on one another.

Q: When is the Business Combination expected to occur?

A: Assuming the requisite shareholder approvals are received, and the other conditions precedent set forth in the Merger Agreement are satisfied, Ace currently expects that the Business Combination will occur as soon as practicable following the Extraordinary General Meeting and no later than November 8, 2023, but only after Ace holds a statutory meeting of shareholders, which is expected to be held 10 days after the date of this proxy statement/prospectus.

However, if Ace anticipates that it may not be able to consummate its initial business combination on or before November 8, 2023, Ace may, but is not obligated to, further extend the period of time to consummate a business combination through April 8, 2024. As disclosed in Ace’s prospectus in relation to the IPO, Ace originally had 12 months after the consummation of the IPO to consummate an initial business combination and may extend such period to a total of 21 months after the consummation of the IPO. As approved by its shareholders at the annual meeting of Ace’s Shareholders held on January 5, 2023, Ace entered into an amendment to the investment management trust agreement, dated April 5, 2021, with Continental Stock Transfer & Trust Company and filed a second amended and restated memorandum and articles of association, giving Ace the right to extend the time to complete a business combination a total of five (5) times, as follows: (i) two (2) times for an additional three (3) months each time from January 8, 2023 to July 8, 2023 by depositing into the Company’s trust account $0.15 for each three-month extension for each issued and outstanding ACBA Ordinary Share issued in the IPO that has not been redeemed, followed by (ii) three (3) times for an additional one (1) month each time from July 8, 2023 to October 8, 2023 by depositing into the Company’s trust account $0.05 for each one-month extension for each issued and outstanding ACBA Ordinary Share issued in the IPO that has not been redeemed. Subsequently, as approved by its shareholders at the special meeting of Ace’s Shareholders held on September 19, 2023, Ace entered into a second amendment to the investment management trust agreement, dated April 5, 2021 and as amended on January 5, 2023, with Continental Stock Transfer & Trust Company and filed a third amended and restated memorandum and articles of association, giving Ace the right to extend the time to complete a business combination a total of six (6) times for an additional one (1) month each time from October 8, 2023 to April 8, 2024 by depositing into the Company’s trust account $0.05 for each one-month extension for each issued and outstanding ACBA Ordinary Share issued in the IPO that has not been redeemed. On March 28, 2022, July 6, 2022, September 28, 2022, January 5, 2023, March 24, 2023, June 13, 2023, July 13, 2023, August 15, 2023, and September 26, 2023, Ace issued Notes in the aggregate principal amount of $455,400, $455,400, $455,400, $350,332, $350,332, $116,777, $116,777, $116,777 and $98,859 respectively to the Sponsor, pursuant to which such amount had been deposited into the Company’s trust account in order to extend the amount of available time to complete a business combination until November 8, 2023. The Notes do not bear interest and mature upon closing of a business combination by the Company. In addition, the Notes may be converted by the holder into units of the Company identical to the units issued in the Company’s initial public offering at a price of $10.00 per unit.

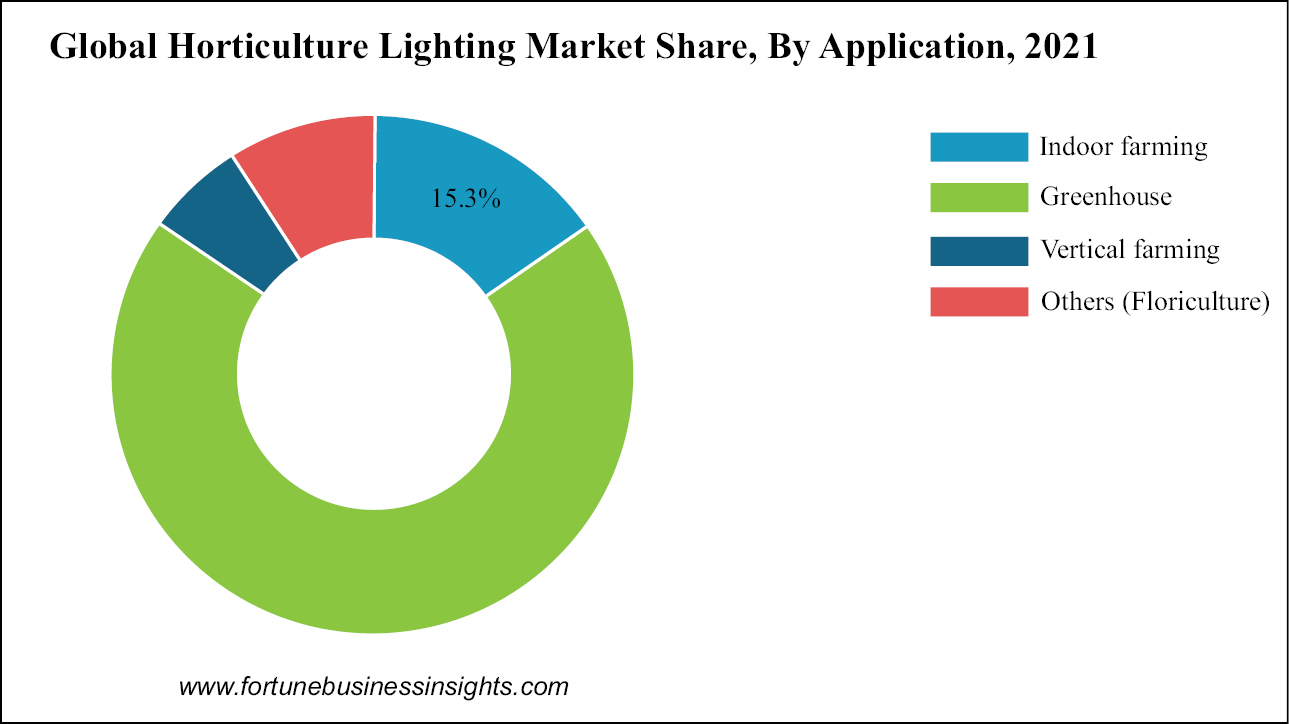

Q: Who will manage PubCo?