Filed Pursuant to Rule 433 of the Securities Act of 1933

Issuer Free Writing Prospectus dated June 20, 2024

Registration Statement No. 333-272817

Inspired Substrates Investor Presentation June 2024

2 This Presentation (the “Presentation”) contains sensitive business and financial information. It is being delivered on behalf of the Company by Boustead Securities, LLC (“BSL”). The sole purpose of this Presentation is to assist the recipient in deciding whether to pro cee d with a further inquiry of the Company. This Presentation does not purport to be all - inclusive or to necessarily contain all the information that a prospec tive investor may desire in evaluating a possible business transaction with the Company. By accepting this Presentation, the recipient agrees to keep confidential the information contained herein or made available in connection with any further inquiry of the Company. This Presentation may not be photocopied, reproduced or distributed to others at any time wit hou t the prior written consent of Boustead Securities, LLC. Upon request, the recipient will promptly return all materials received from the Company or BSL (including this Presentation) without retaining any copies thereof, all in accordance with the Confidentiality Agreement. This Presentation has been prepared for informational purposes relating to this transaction only and upon the express underst and ing that it will be used only for the purposes set forth above. Neither the Company nor BSL makes any express or implied representation or warranty as to the accuracy or completeness of the information contained herein or made available in connection with any further investigation of the Compan y. Each of the Company and BSL expressly disclaims any and all liability which may be based on such information, errors therein or omissions there f rom . The recipient shall be entitled to rely solely on the representations and warranties made to it in any definitive agreement and the due diligence th at recipient conducts. In furnishing this Presentation, neither the Company nor BSL undertakes any obligation to provide the recipient with access t o a ny additional information. This Presentation shall neither be deemed an indication of the state of affairs of the Company nor constitute an in dication that there has not been any change in the Company or affairs of the Company since the date hereof, nor an indication that BSL has performed any due diligence on the Company or its affairs. This Presentation does not constitute an offer to sell or solicitation of an offer to buy securities in any jurisdiction wher e, or to any person to whom, it is unlawful to make such offer or solicitation in such jurisdiction. Investments in private placements may be illiquid, highly s pec ulative and you may lose your entire investment. This Presentation includes certain statements, estimates and projections with respect to the anticipated future performance o f t he Company. Such statements, estimates and projections are based on significant assumptions and subjective judgment concerning anticipated res ult s. These assumptions and judgments are inherently subject to risks, variability and contingencies, many of which are beyond the Compan y’s control. These assumptions and judgments may or may not prove to be correct and there can be no assurance that any projected results are obt ain able or will be realized. Actual results likely will vary from those projected, and such variations may be material. In addition, this Presen tat ion does not describe certain risks associated with the Company’s business. All communications or inquires relating to the Company or this Presenta tio n should be directed to the representative of Boustead Securities, LLC. No personnel at the Company may be contacted directly unless expressly per mit ted by BSL © 2021 All rights reserved. Disclosures

3 Boustead Securities, LLC is registered with the Securities and Exchange Commission (SEC) as a broker - dealer and is a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC). Brokerage and investment advisory services and fees differ and it is important for you to understand these differences. Free and simple tools are available to research firms and financial professionals at Investor.gov/CRS, which also provides educational materials about broker - dealers, investment advisers, and investing. When we provide you with a recommendation, we have to act in your best interest and not put our interest ahead of yours. At the same time, the way we make money creates a conflict with your interests. Please strive to understand and ask us about these conflicts because they can affect the recommendations, we provide you. There are many risks involved with investing. For Boustead Securities customers and clients, please see our Regulation Best Interest Relationship Guide on the Form CRS Reg BI page on our website at https://www.boustead1828.com/form - crs - reg - bi. Please also carefully review and verify the accuracy of the information you provide us on account applications, subscription documents and others. Form CRS / Reg BI

4 This document contains forward - looking statements. In addition, from time to time, we or our representatives may make forward - looking statements orally or in writing. We base these forward - looking statements on our expectations and projections about future events, which we derive from the information currently available to us. Such forward - looking statements relate to future events or our future performance, including: our financial performance and projections; our growth in revenue and earnings; and our business prospects and opportunities. You can identify forward - looking statements by those that are not historical in nature, particularly those that use terminology such as “may,” “should,” “expects,” “anticipates,” “contemplates,” “estimates,” “believes,” “plans,” “projected,” “predicts,” “potential,” or “hopes” or the negative of these or similar terms. In evaluating these forward - looking statements, you should consider various factors, including: our ability to change the direction of the Company; our ability to keep pace with new technology and changing market needs; and the competitive environment of our business. These and other factors may cause our actual results to differ materially from any forward - looking statement. Forward - looking statements are only predictions. The forward - looking events discussed in this document and other statements made from time to time by us or our representatives, may not occur, and actual events and results may differ materially and are subject to risks, uncertainties and assumptions about us. We are not obligated to publicly update or revise any forward - looking statement, whether as a result of uncertainties and assumptions, the forward - looking events discussed in this document and other statements made from time to time by us or our representatives might not occur. Cautionary Statement Concerning forward Looking Statements

5 This Presentation highlights basic information about the Company and the offering . Because it is a summary that has been prepared solely for informational purposes, it does not contain all of the information that you should consider before investing in our Company . Except as otherwise indicated, this presentation speaks only as of the date hereof . This Presentation does not constitute an offer to sell, nor a solicitation of an offer to buy, any securities by any person in any jurisdiction in which it is unlawful for such person to make such an offering or solicitation . Neither the United States Securities and Exchange Commission (the “SEC”) nor any other regulatory body has approved or disapproved of our securities or passed upon the accuracy or adequacy of this presentation . Any representation to the contrary is a criminal offense . This Presentation includes industry and market data that we obtained from industry publications and journals, third - party studies and surveys, internal company studies and surveys, and other publicly available information . Industry publications and surveys generally state that the information contained therein has been obtained from sources believed to be reliable . Although we believe the industry and market data to be reliable as of the date of this presentation, this information could prove to be inaccurate . Industry and market data could be wrong because of the method by which sources obtained their data and because information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties . In addition, we do not know all of the assumptions that were used in preparing the forecasts from the sources relied upon or cited herein . Free Writing Prospectus

6 We have filed a preliminary prospectus supplement (the “Preliminary Prospectus”) on June 4 , 2024 , pursuant to our registration statement on Form S - 1 (File No . 333 - 272817 ) (as amended, the “Registration Statement”) with the SEC, with respect to the offering of our securities to which this communication relates . Before you invest, you should read the Preliminary Prospectus (including the risk factors described therein), the Registration Statement and, when available, the final prospectus relating to the offering, and the other documents we have filed with the SEC, for more complete information about the Company and the offering . You may obtain these documents, including the Preliminary Prospectus and Registration Statement, for free by visiting EDGAR on the SEC website at http : //www . sec . gov . Alternatively, copies of the prospectus may be obtained, when available, from : Boustead Securities, LLC by written request addressed to Adam Carles (telephone number ( 714 ) 615 - 2156 ) or by emailing adam . carles@boustead 1828 . com . Free Writing Prospectus (cont’d)

7 We operate in highly competitive markets; Our business is impacted by fluctuations in raw material, supply shortages, energy and freight costs, including the impact of tariffs, trade and similar matters; Our business could be harmed by changes in consumer lifestyle, eating habits, nutritional preferences and health - related and environmental or sustainability concerns; If we fail to maintain satisfactory relationships with our major customers, our results of operations could be adversely affected; Loss of any of our key manufacturing equipment or facilities or equipment failure could have an adverse effect on our financial conditions or results of operations; We depend on a small number of suppliers for our raw materials and any interruption in our supply of raw materials would harm our business and financial performance; We are subject to governmental regulation, and we may incur material liabilities under, or costs in order to comply with, existing or future laws and regulations; We are subject to increasingly stringent environmental, health and safety laws, regulations and permits in connection with the disposability and recyclability of our packaging and paper products, and we could incur significant costs in complying with, or liabilities and obligations related to, such laws, regulations and permits; We are affected by seasonality and cyclicality; Loss of our key management and other personnel, or an inability to attract new management and other personnel, could impact our business; If we are unable to develop new products or stay abreast of rapidly evolving technology in our industry, our profits may decline; Our earnings are highly dependent on volumes; Risks Related to Our Business

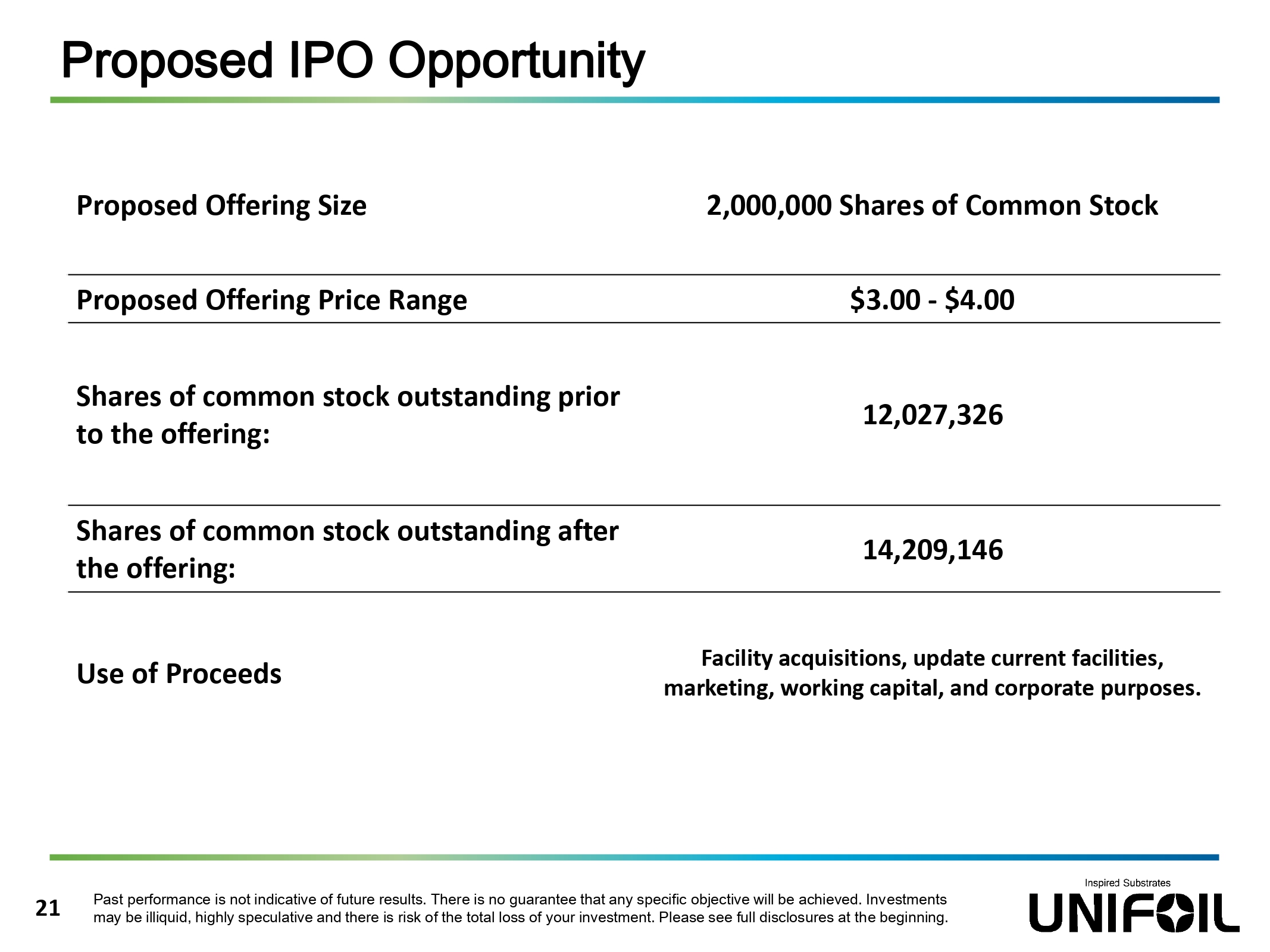

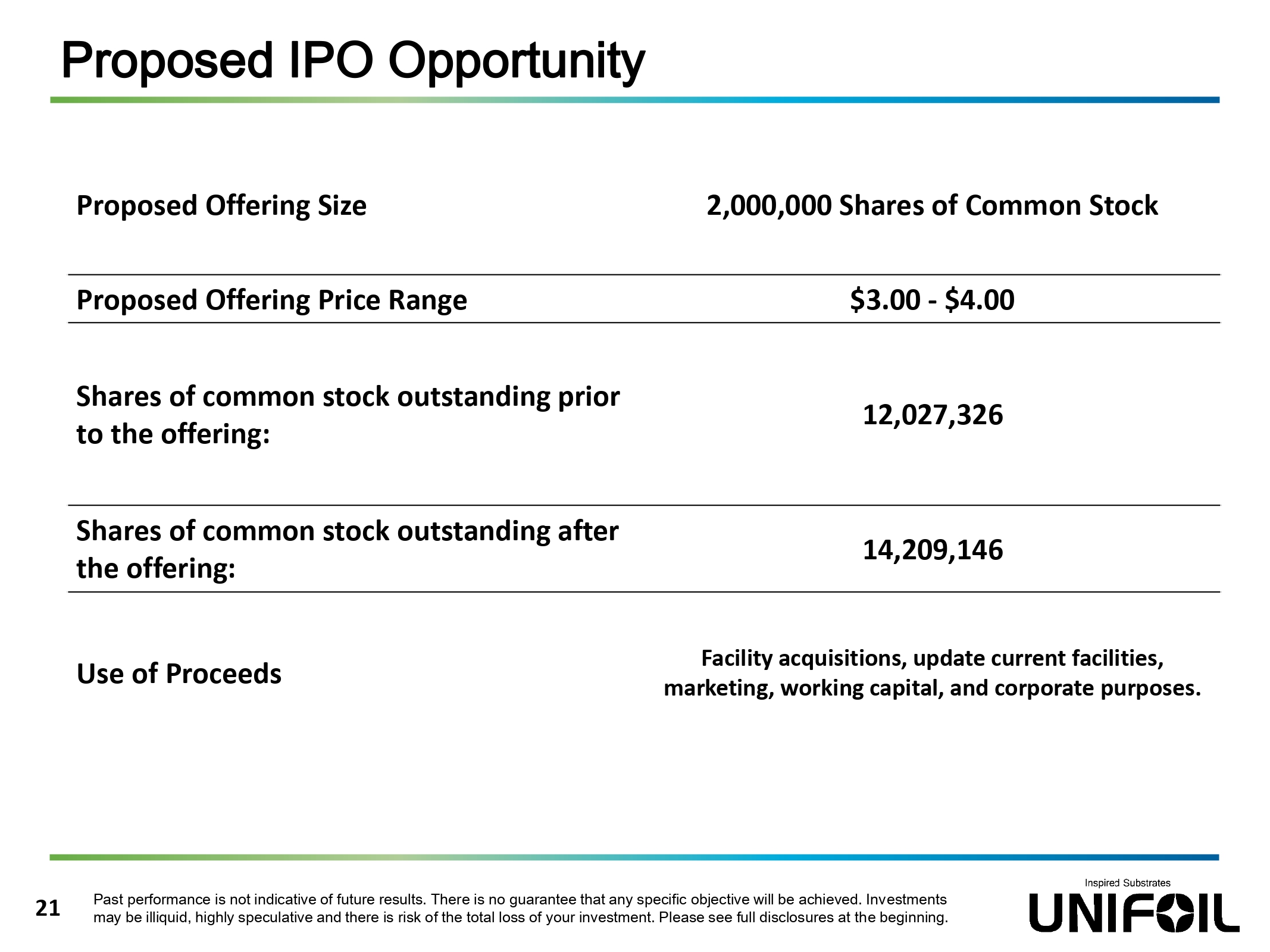

8 Past performance is not indicative of future results. There is no guarantee that any specific objective will be achieved. Inv est ments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please see full disclosures at the be gin ning. 2,000,000 Shares of Common Stock Proposed Offering Size $3.00 - $4.00 Proposed Offering Price Range 12,027,326 Shares of common stock outstanding prior to the offering: 14,209,146 Shares of common stock outstanding after the offering: Facility acquisitions, update current facilities, marketing, working capital, and corporate purposes. Use of Proceeds Proposed IPO Opportunity

9 Past performance is not indicative of future results. There is no guarantee that any specific objective will be achieved. Inv est ments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please see full disclosures at the be gin ning. Who are we? For 50 years Unifoil has specialized in meeting the dynamic needs in specialty packaging and printing for some of the world ’s largest brands. Our products, solutions and services are designed to give you the competitive advantage that may help you win in today’s market. The acquisition and technology transfer of Unilustre into Poland has allowed us to expand our reach for our international customers. JH0

10 Past performance is not indicative of future results. There is no guarantee that any specific objective will be achieved. Inv est ments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please see full disclosures at the be gin ning. Partners and Clients

11 Past performance is not indicativ e of future results. There is no guarantee that any specific objective will be achieved. Investments may be illiquid, highly speculative an d there is risk of the total loss of your investment. Please see full disclosures at the beginning. Inspired Substrates Facilities and Equipment Fairfield, New Jersey 100,000 sq. ft. manufacturing 25,000 sq. ft. warehouse 4 x lamination & Uniluster transfer lines All lines are reel / reel to sheet compatible with online coating Gdansk, Poland 4,000 sqm. Manufacturing & warehouse 2 x lamination & Uniluster transfer lines Dedicated line for reel to reel and reel to sheet. • Foils • Films (Silver, Holographic, and Lens) • Papers • Coatings • Metallizing • Precision Slitters • Precision Slitters with eye mark • registration for lens production

12 Facilities For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specific ob jective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please s ee full disclosures at the beginning.

13 Expansion Plans For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specific ob jective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please s ee full disclosures at the beginning. Ongoing Expansion Plans • New UniLustre line installed in US by Q4, 2023. Machine under construction. Most state of the art, fully automated and customized line made by the manufacturer. • 7 th laminating line to be installed in Poland by Q4 2025 . This line will add capacity to convert an additional 2.5 million linear mtrs. per month. This will be again fully integrated most state of the art reel to sheet line. • Another plant expansion in Mexico is being contemplated by the Unifoil Board of Directors for early 2025. • We aim for continuous expansion in Europe.

14 Past performance is not indicative of future results. There is no guarantee that any specific objective will be achieved. Inv est ments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please see full disclosures at the be gin ning. The 100% recyclable, repulpable, film/plastic free, metallized paperboard that is pushing the boundaries of the printing and packaging industry . Key Sustainability Benefits 100% Recyclable & Repulpable – Western Michigan University Certified 100% Water based – UV Free – No plasticizers (Film/Plastic Free) Performs like Paper Gauge & Weight Efficiency Cost Competitive Compared to Other Decorative Options No Additional Capitalization Required JH0

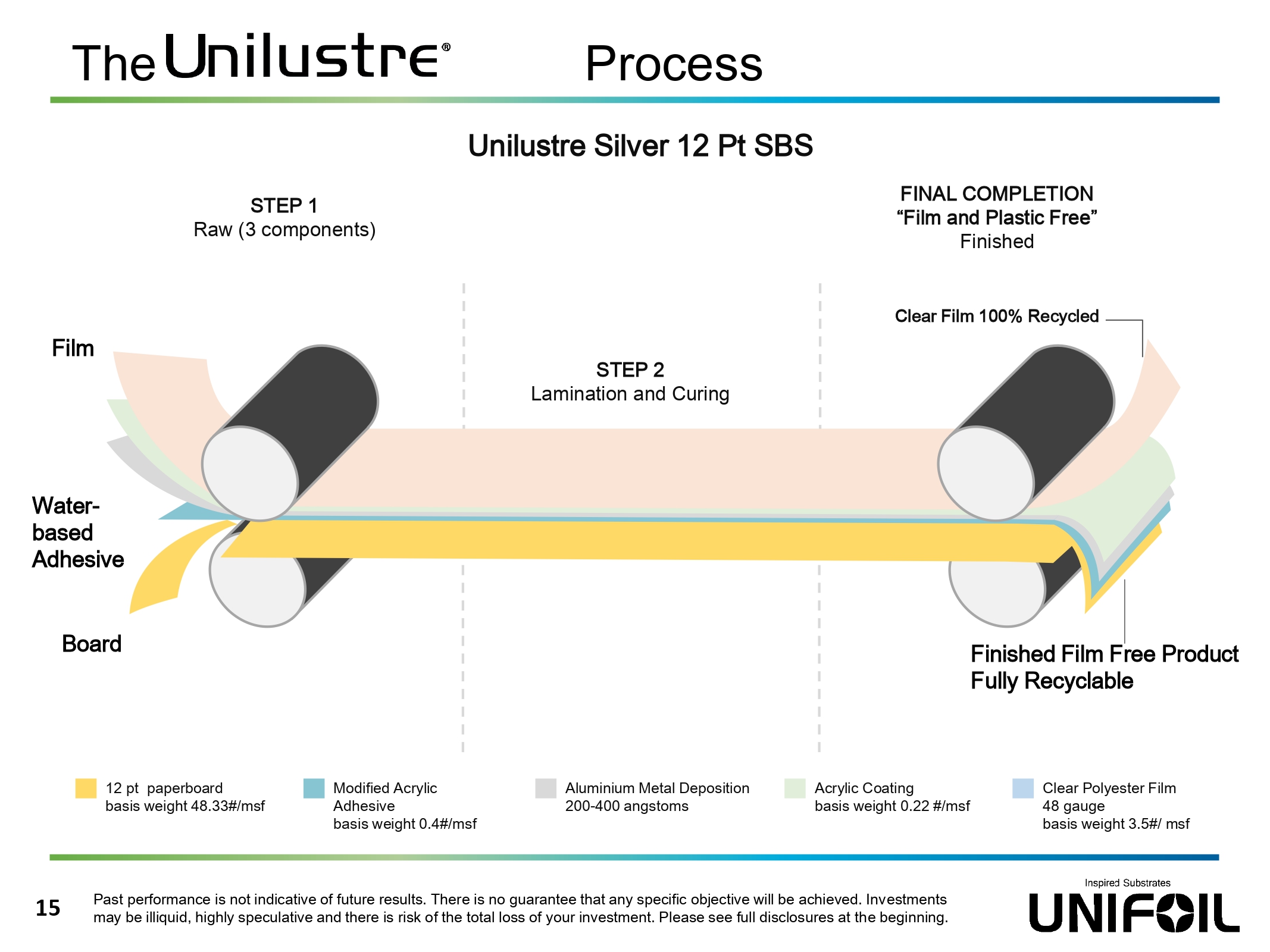

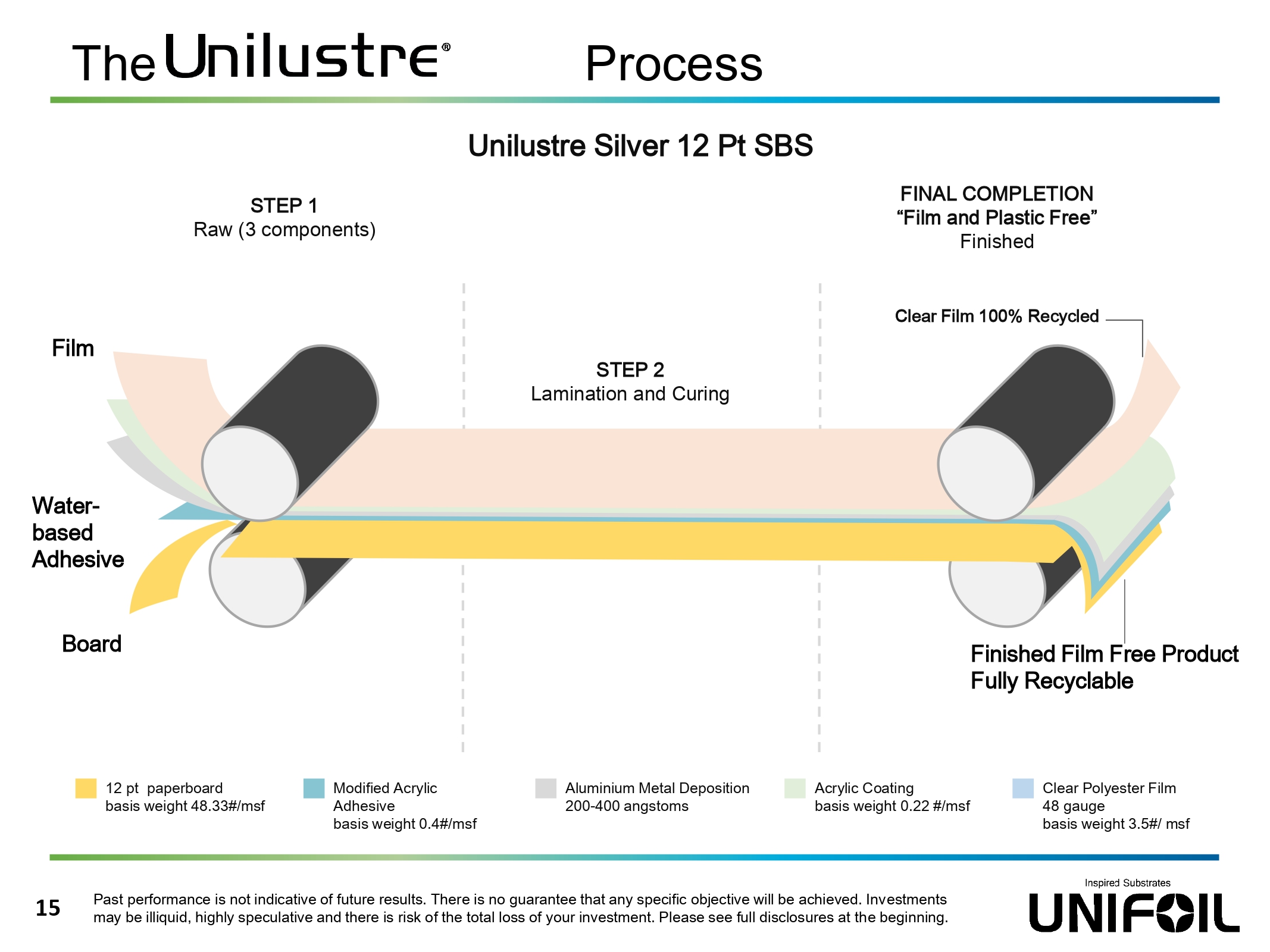

The Process 15 Past performance is not indicative of future results. There is no guarantee that any specific objective will be achieved. Inv est ments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please see full disclosures at the be gin ning. STEP 1 Raw (3 components) STEP 2 Lamination and Curing FINAL COMPLETION “Film and Plastic Free” Finished Unilustre Silver 12 Pt SBS 12 pt paperboard basis weight 48.33#/msf Modified Acrylic Adhesive basis weight 0.4#/msf Aluminium Metal Deposition 200 - 400 angstoms Acrylic Coating basis weight 0.22 #/msf Clear Polyester Film 48 gauge basis weight 3.5#/ msf Clear Film 100% Recycled Film Water - based Adhesive Board Finished Film Free Product Fully Recyclable

Sustainability Benefits 16 Past performance is not indicative of future results. There is no guarantee that any specific objective will be achieved. Inv est ments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please see full disclosures at the be gin ning. Key Sustainability Benefits • Film/Plastic Free • 100%Waterbased • UV Free • No Plasticizers • Curl Free • Performs Like Paper • Excellent Scoring & Embossing • Glueability • Source Reduction • Gauge & Weight Efficiency • Cost Competitive Compared to Other Decorative Options • Security Capabilities can Be Incorporated • Selective UniLustre can Be Incorporated • No Capitalization Required - Existing Artworks, • No Printing Machine Production Limits • Same Printing & Finishing Setup for final converted cartons Unilustre® A metallized paperboard that is revolutionizing the Printing and Packaging industry % RECYCLABLE REPULPABLE PLASTIC FREE FILM FREE 100 JH0

17 For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specific ob jective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please s ee full disclosures at the beginning. Metal Contents Vs. Competitors 14.9 11.6 1.2 .92 .12 0 2 4 6 8 10 12 14 16 .00035 AL Foil .000285 AL Foil Bronzing Metallic Inks LBS/REAM 24x36 Uniluster Brilliance, but NOT at the cost of NatureJH0

18 For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specific ob jective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please s ee full disclosures at the beginning. Sustainability

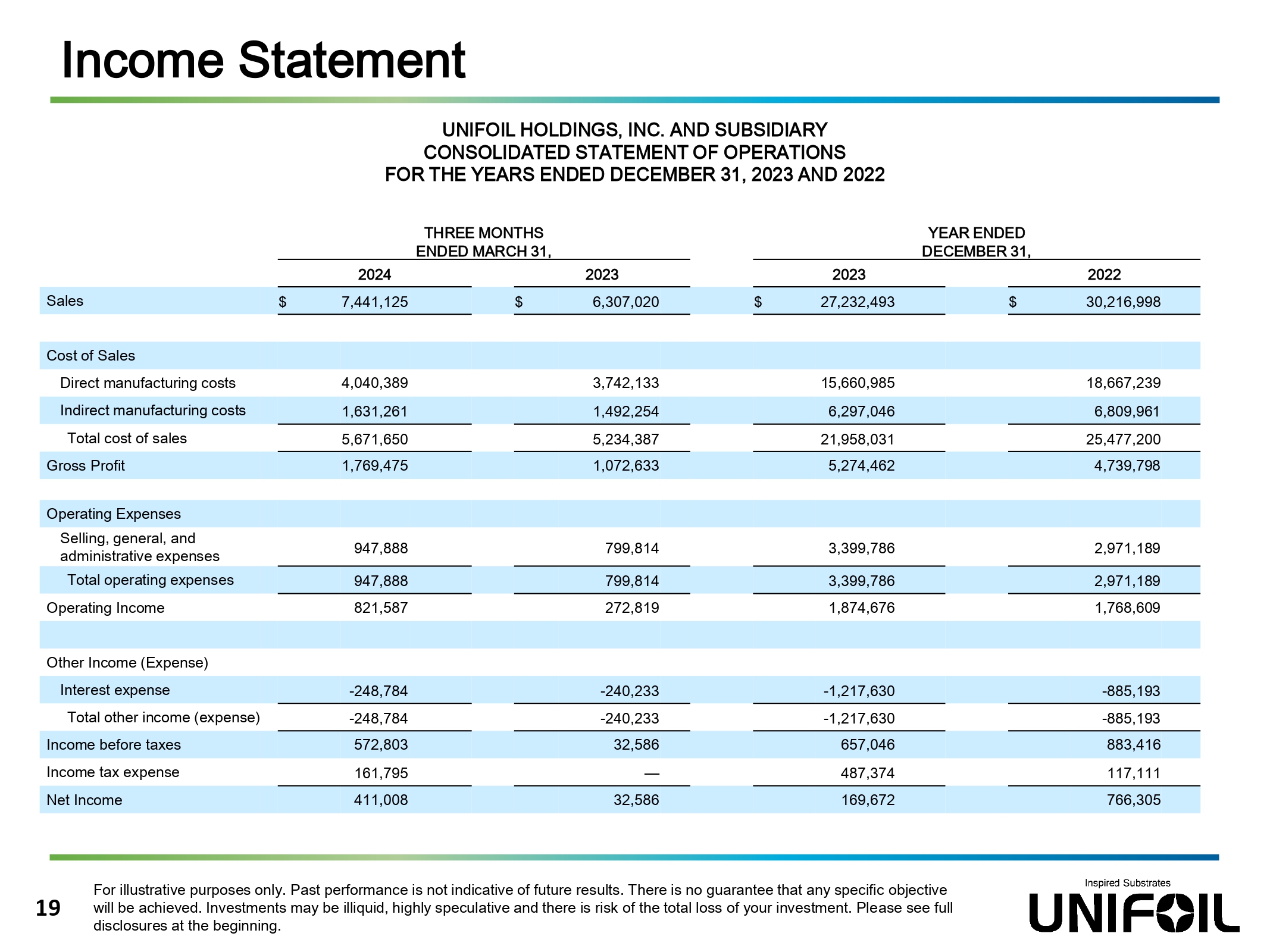

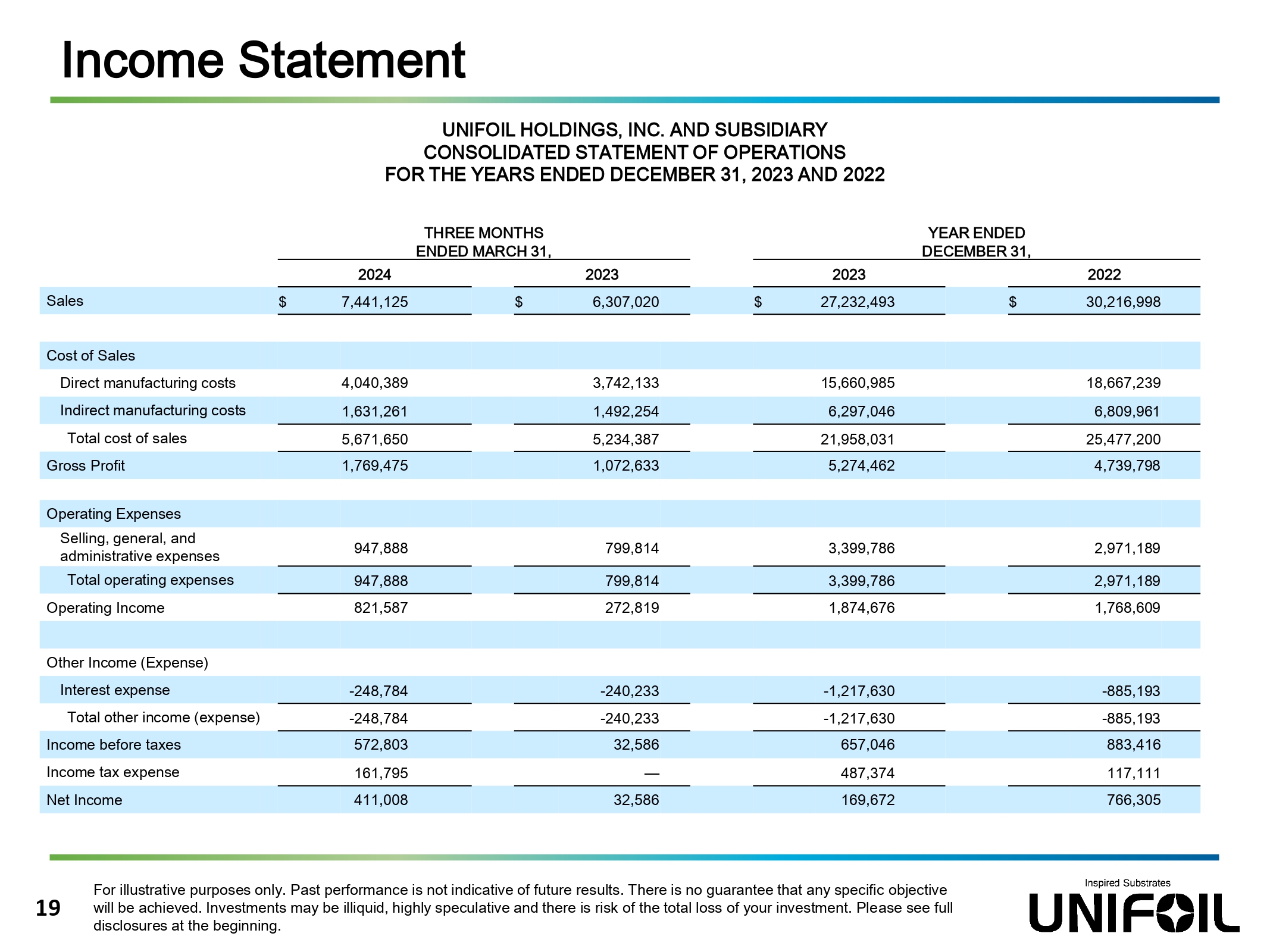

19 For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specific ob jective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please s ee full disclosures at the beginning. Income Statement UNIFOIL HOLDINGS, INC. AND SUBSIDIARY CONSOLIDATED STATEMENT OF OPERATIONS FOR THE YEARS ENDED DECEMBER 31, 2023 AND 2022 YEAR ENDED THREE MONTHS DECEMBER 31, ENDED MARCH 31, 2022 2023 2023 2024 30,216,998 $ 27,232,493 $ 6,307,020 $ 7,441,125 $ Sales Cost of Sales 18,667,239 15,660,985 3,742,133 4,040,389 Direct manufacturing costs 6,809,961 6,297,046 1,492,254 1,631,261 Indirect manufacturing costs 25,477,200 21,958,031 5,234,387 5,671,650 Total cost of sales 4,739,798 5,274,462 1,072,633 1,769,475 Gross Profit Operating Expenses 2,971,189 3,399,786 799,814 947,888 Selling, general, and administrative expenses 2,971,189 3,399,786 799,814 947,888 Total operating expenses 1,768,609 1,874,676 272,819 821,587 Operating Income Other Income (Expense) - 885,193 - 1,217,630 - 240,233 - 248,784 Interest expense - 885,193 - 1,217,630 - 240,233 - 248,784 Total other income (expense) 883,416 657,046 32,586 572,803 Income before taxes 117,111 487,374 — 161,795 Income tax expense 766,305 169,672 32,586 411,008 Net Income

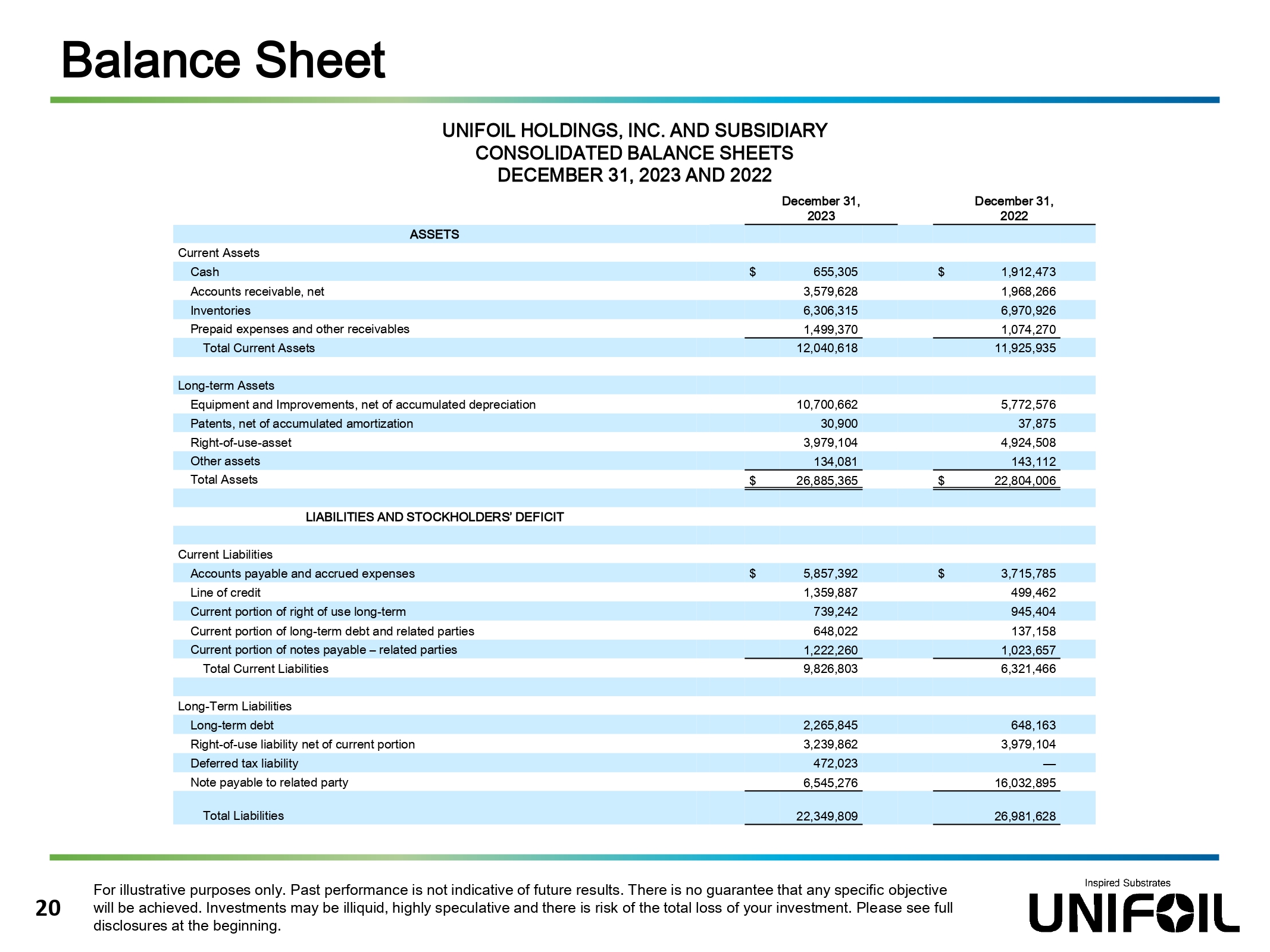

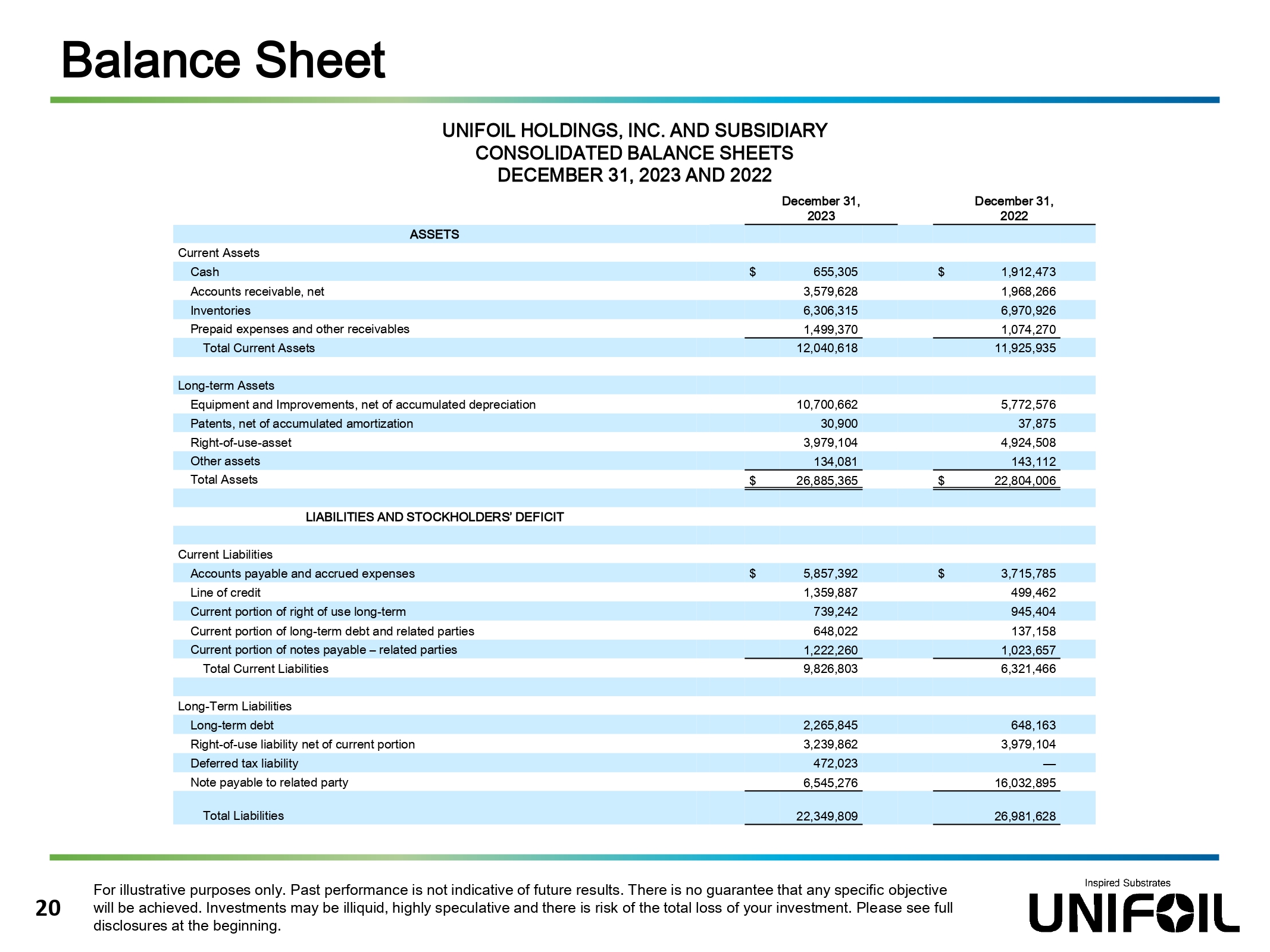

20 For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specific ob jective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please s ee full disclosures at the beginning. Balance Sheet December 31, 2022 December 31, 2023 ASSETS Current Assets 1,912,473 $ 655,305 $ Cash 1,968,266 3,579,628 Accounts receivable, net 6,970,926 6,306,315 Inventories 1,074,270 1,499,370 Prepaid expenses and other receivables 11,925,935 12,040,618 Total Current Assets Long - term Assets 5,772,576 10,700,662 Equipment and Improvements, net of accumulated depreciation 37,875 30,900 Patents, net of accumulated amortization 4,924,508 3,979,104 Right - of - use - asset 143,112 134,081 Other assets 22,804,006 $ 26,885,365 $ Total Assets LIABILITIES AND STOCKHOLDERS’ DEFICIT Current Liabilities 3,715,785 $ 5,857,392 $ Accounts payable and accrued expenses 499,462 1,359,887 Line of credit 945,404 739,242 Current portion of right of use long - term 137,158 648,022 Current portion of long - term debt and related parties 1,023,657 1,222,260 Current portion of notes payable – related parties 6,321,466 9,826,803 Total Current Liabilities Long - Term Liabilities 648,163 2,265,845 Long - term debt 3,979,104 3,239,862 Right - of - use liability net of current portion — 472,023 Deferred tax liability 16,032,895 6,545,276 Note payable to related party 26,981,628 22,349,809 Total Liabilities UNIFOIL HOLDINGS, INC. AND SUBSIDIARY CONSOLIDATED BALANCE SHEETS DECEMBER 31, 2023 AND 2022

21 Past performance is not indicative of future results. There is no guarantee that any specific objective will be achieved. Inv est ments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please see full disclosures at the be gin ning. 2,000,000 Shares of Common Stock Proposed Offering Size $3.00 - $4.00 Proposed Offering Price Range 12,027,326 Shares of common stock outstanding prior to the offering: 14,209,146 Shares of common stock outstanding after the offering: Facility acquisitions, update current facilities, marketing, working capital, and corporate purposes. Use of Proceeds Proposed IPO Opportunity

Extensive Applications 22 For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specific ob jective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please s ee full disclosures at the beginning.

Ex t ens i v e Applications For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specific ob jective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please see full disclosures at th e b eginning.

Thank you Joe Funicelli CEO/ President jfunicelli@unifoil.com (201) 506 - 9226 Brinson Lingenfelter Managing Director brinson@boustead1828.com (949) 375 - 6879 Adam Carles Senior Associate adam.carles@boustead1828.com (714) 615 - 2156 24 Past performance is not indicative of future results. There is no guarantee that any specific objective will be achieved. Inv est ments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please see full disclosures at the beginning. Inspired Substrates