| FREE WRITING PROSPECTUS | ||

| FILED PURSUANT TO RULE 433 | ||

| REGISTRATION FILE NO.: 333-257737-07 |

PRELIMINARY COLLATERAL TERM SHEET

STRICTLY CONFIDENTIAL

| FOR DISTRIBUTION TO QUALIFIED INSTITUTIONAL BUYERS (RULE 144A), INSTITUTIONAL ACCREDITED INVESTORS (IAIs) AND REGULATION S BUYERS ONLY |

WIT Industrial Portfolio Trust Subordinate Companion Loan

$225,000,000

Bank of Montreal

German American Capital Corporation

Barclays Capital Real Estate Inc.

UBS AG

As Loan Sellers

March 2, 2023

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-257737) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor, Barclays Capital Inc., BMO Capital Markets Corp., UBS Securities LLC, Deutsche Bank Securities, Inc. or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-603-5847.

The information in this file (the “File”) does not contain all information that is required to be included in the prospectus. This File should be reviewed only in conjunction with the entire prospectus. Prospective investors are advised to read carefully, and should rely on, the prospectus relating to the certificates referred to herein in making their investment decision. The information in this File should not be viewed as projections, forecasts, predictions or opinions with respect to value.

The information in this File is preliminary and may be amended and/or supplemented prior to the time of sale. The information in this File supersedes any contrary information contained in any prior File relating to the certificates and will be superseded by any contrary information contained in any subsequent File prior to the time of sale.

This File contains certain tables and other statistical analyses (the “Computational Materials”). Numerous assumptions were used in preparing the Computational Materials, which may or may not be stated in this File. As such, no assurance can be given as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. These Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice.

This File contains forward-looking statements. These forward looking statements are found in this File, including certain of the tables. Forward-looking statements are also found elsewhere in this File and include words like “expects”, “intends”, “anticipates”, “estimates” and other similar words. These statements intend to convey projections or expectations as of the date of this File. These statements are subject to certain risks and uncertainties that could cause the success of collections and the actual cash flow generated to differ materially from the information set forth in this File.

The securities related to this File are being offered when, as and if issued. This free writing prospectus is not an offer to sell or a solicitation of an offer to buy such securities in any state or other jurisdiction where such offer, solicitation or sale is not permitted. Such securities do not represent an interest in or obligation of the depositor, the sponsors, the originators, the master servicer, the special servicers, the trustee, the certificate administrator, the operating advisor, the asset representations reviewer, the controlling class representative, the risk retention consultation party, the companion loan holders (or their representatives), the underwriters or any of their respective affiliates. Neither such securities nor the underlying mortgage loans are insured or guaranteed by any governmental agency or instrumentality or private insurer.

Any legends, disclaimers or other notices that may appear at the bottom of the email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation being made that these materials are accurate or complete and that these materials may not be updated or (3) these materials possibly being confidential, are, in each case, not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

| Strictly private and confidential | Workspace Industrial Trust Portfolio |

This Preliminary Collateral Term Sheet (this “Term Sheet”) is a confidential document. Any reproduction or distribution of this Term Sheet, in whole or in part, and any disclosure of its contents or use of any information herein for any purpose other than considering an investment in all or a portion of the WIT Industrial Portfolio Trust Subordinate Companion Loan (or any certificates representing an interest therein) described in this Term Sheet is strictly prohibited.

Nothing in this Term Sheet constitutes an offer of securities for sale in the United States or any other jurisdiction. Neither this Term Sheet nor anything contained in this Term Sheet forms the basis of any contract or commitment whatsoever. This Term Sheet has been provided to you for informational purposes only and may not be relied upon by you in evaluating the merits of investing in any of the assets described in this Term Sheet. The information contained in this Term Sheet is preliminary as of the date of this Term Sheet, supersedes any previous version of such information delivered to you and will be superseded by any such information subsequently delivered. This Term Sheet is subject to change, completion, supplement and amendment from time to time.

This Term Sheet contains certain tables and other statistical analyses (the “Computational Materials”). Numerous assumptions were used in preparing the Computational Materials, which may or may not be stated in this Term Sheet. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. These Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountants and other advisors as to the legal, tax, business, financial and related aspects of a purchase of the assets described in this Term Sheet. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the WIT Industrial Portfolio Whole Loan, including the WIT Industrial Portfolio Trust Subordinate Companion Loan, will occur at rates higher or lower than the rates shown in the Computational Materials.

Certain information in this Term Sheet is based on information set forth in third-party reports or other third-party sources or has been provided by the Borrowers and/or their affiliates. Appraisals, market studies, environmental, accounting engineering, financial and other reports, studies or surveys prepared or produced by third party appraisal firms and/or other firms or information provided by the Borrowers or their affiliates to the extent included in this Term Sheet, are for informational purposes only and should not be relied upon as indicators of the value or the future performance of the WIT Industrial Portfolio Whole Loan (including the WIT Industrial Portfolio Trust Subordinate Loan) or any Property or for any other purpose. Neither of the originators nor the loan sellers have participated in the preparation of any of these materials, nor have the originators or the loan sellers independently verified the information contained therein. You may not rely upon the conclusions or other data set forth in any such underwriting, financial, appraisal or other reports, studies or surveys. Neither of the originators nor the loan sellers or any of their respective affiliates makes any representation as to the accuracy or completeness thereof or the reasonableness of any assumptions or other statements set forth therein.

This Term Sheet contains forward-looking statements. These forward looking statements are found in this Term Sheet, including certain of the tables. Forward-looking statements are also found elsewhere in this Term Sheet and include words like “expects”, “intends”, “anticipates”, “estimates” and other similar words. These statements intend to convey our projections or expectations as of the date of this Term Sheet. These statements are subject to certain risks and uncertainties that could cause the success of collections and the actual cash flow generated to differ materially from the information set forth in this Term Sheet. While such information reflects projections prepared in good faith based upon methods and data that are believed to be reasonable and accurate as of the dates thereof, none of the loan sellers or originators undertakes any obligation to revise these forward-looking statements to reflect subsequent events or circumstances. Individuals should not place undue reliance on forward-looking statements and are advised to make their own independent analysis and determination with respect to the forecasted periods, which reflect any loan seller’s or originator’s view only as of the date of this Term Sheet.

Capitalized terms used herein may be defined below or above in this Term Sheet. Capitalized terms used in this Term Sheet but not separately defined herein have the meanings assigned to them in the Private Placement Memorandum related to any securities backed by the WIT Industrial Portfolio Trust Subordinate Companion Loan or, if not defined therein, in the loan documents for the WIT Industrial Portfolio Whole Loan (the “Loan Documents”).

Notwithstanding anything to the contrary in this Term Sheet, as of the date of this Term Sheet, the WIT Industrial Portfolio Whole Loan has not been originated. Therefore, the descriptions of the terms of the WIT Industrial Portfolio Whole Loan and the WIT Industrial Portfolio Trust Subordinate Companion Loan in this Term Sheet are based on their expected terms if and when the WIT Industrial Portfolio Whole Loan is originated by the Mortgage Lenders. As a result, the terms of the WIT Industrial Portfolio Whole Loan and the WIT Industrial Portfolio Trust Subordinate Companion Loan and the respective descriptions thereof in this Term Sheet are subject to revision. None of the Mortgage Lenders, any of their affiliates, or any other person is obligated to make the WIT Industrial Portfolio Whole Loan and there can be no assurance that the WIT Industrial Portfolio Whole Loan will be made.

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | 3 |

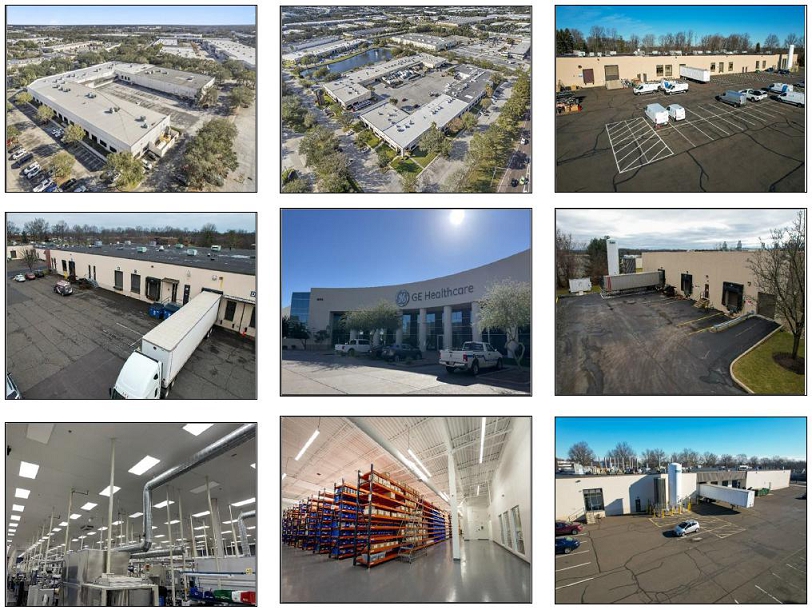

| Strictly private and confidential | Workspace Industrial Trust Portfolio |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | 4 |

| Strictly private and confidential | Workspace Industrial Trust Portfolio |

| Map |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | 5 |

| Strictly private and confidential | Workspace Industrial Trust Portfolio |

| Philadelphia |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | 6 |

| Strictly private and confidential | Workspace Industrial Trust Portfolio |

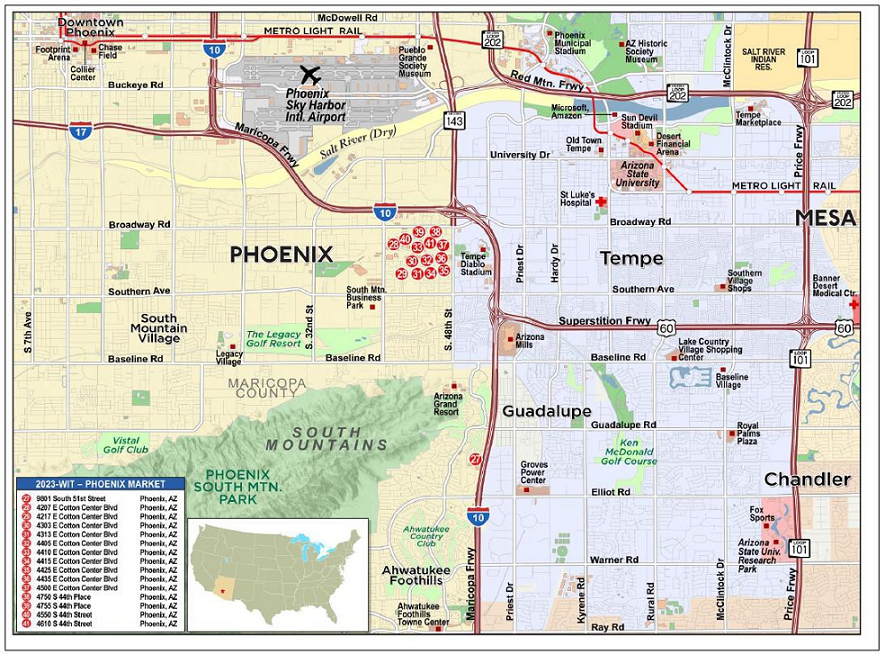

| Phoenix |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | 7 |

| Strictly private and confidential | Workspace Industrial Trust Portfolio |

| Tampa |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | 8 |

| Strictly private and confidential | Workspace Industrial Trust Portfolio |

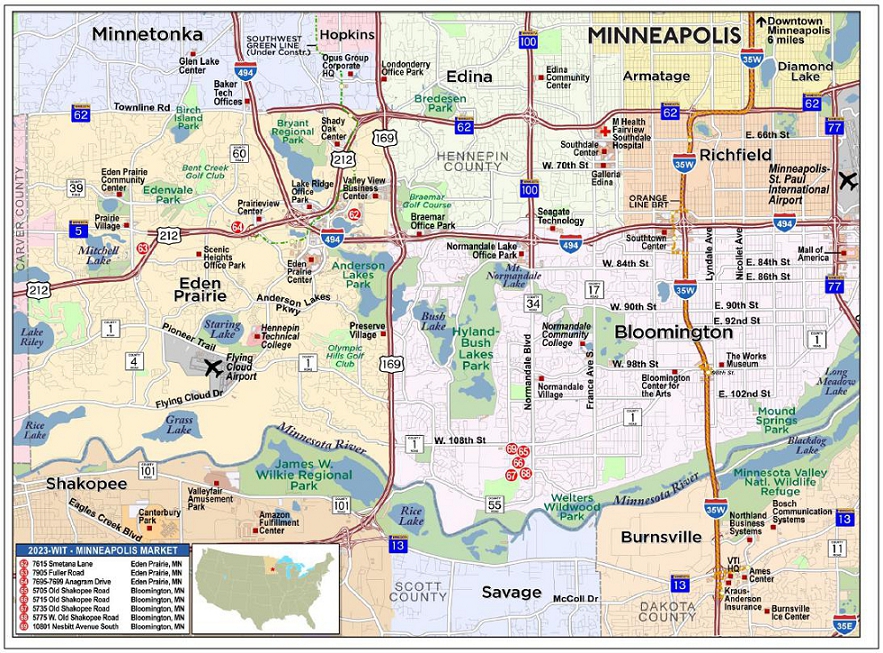

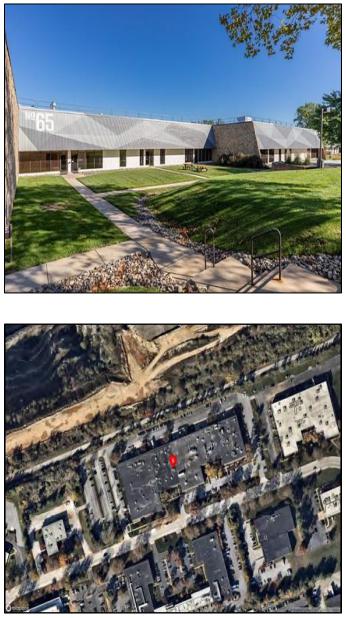

| Minneapolis |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | 9 |

| Strictly private and confidential | Workspace Industrial Trust Portfolio |

| I. | Executive Summary | |

| II. | Overview of Whole Loan Terms | |

| III. | Portfolio and Market Overview | |

| IV. | Historical and Underwritten Net Cash Flow | |

| V. | Borrower Sponsor Overview |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | 10 |

| Strictly private and confidential | Workspace Industrial Trust Portfolio |

| I. | Executive Summary |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | 11 |

| Strictly private and confidential | Workspace Industrial Trust Portfolio |

| Executive Summary | |

The loan is a five-year interest-only fixed rate subordinate companion loan with an initial principal balance of $225,000,000 (the “WIT Industrial Portfolio Trust Subordinate Companion Loan”). The WIT Industrial Portfolio Trust Subordinate Companion Loan is part of a whole mortgage loan structure with an aggregate initial principal balance of $625,000,000 (the “WIT Industrial Portfolio Whole Loan” or the “Whole Loan”) consisting of (i) the WIT Industrial Portfolio Trust Subordinate Companion Loan, and (ii) one or more WIT Industrial Portfolio Senior Loans (as defined below). Collateral for the WIT Industrial Portfolio Whole Loan will be the Workspace Industrial Trust Portfolio, which is comprised of 69 Industrial / R&D / Flex (“IRDF”) properties (each, a “Property” and collectively, the “Portfolio” or the “Properties”) totaling 4,223,400 square feet (“SF”) of net rentable area. The sponsor for the WIT Industrial Portfolio Whole Loan will be Workspace Property Trust L.P., a Delaware Limited Partnership (the “Sponsor” or “WPT”). The Properties will continue to be managed by Workspace Property Management, L.P. (“WPM”). WPT and Workspace Industrial Trust L.P. (“WIT") are the non-recourse guarantors for the Whole Loan.

| ● | The WIT Industrial Portfolio Whole Loan is expected to be originated on or prior to the closing date of the securitization of the WIT Industrial Portfolio Trust Subordinate Companion Loan (the “Origination Date”) as follows: (i) Bank of Montreal, a Canadian chartered bank (“BMO”), Deutsche Bank AG, New York Branch, (“DBNY”), Barclays Capital Real Estate Inc., a Delaware corporation (“Barclays”) and UBS AG, by and through its branch office at 1285 Avenue of the Americas, New York, New York (“UBS AG” and collectively with BMO, DBNY and Barclays, together with their respective successors and assigns, individually or collectively, as the context may require, the “Mortgage Lender”) are expected to originate the WIT Industrial Portfolio Trust Subordinate Companion Loan evidenced by four (4) separate subordinate pari passu promissory notes in the aggregate principal amount of $225,000,000 (collectively, “WIT Industrial Portfolio Trust Subordinate Notes”), and (ii) BMO, DBNY, Barclays and UBS AG are expected to originate the senior loan (the “WIT Industrial Portfolio Senior Loans”) evidenced by various separate senior pari passu promissory notes in the aggregate principal amount of $400,000,000 (collectively, the “WIT Industrial Portfolio Senior Notes”), made for the benefit of the applicable Mortgage Lender by WIT Horsham LP, WIT Malvern LP, WIT Minneapolis LP, WIT Phoenix LP and WIT Tampa LP (collectively, the “Borrowers”). The Borrowers are indirectly controlled by WIT, a newly capitalized subsidiary of Sponsor. The Borrowers are special purpose entities that own the Properties. |

| ● | The Portfolio consists of 69 IRDF Properties and is spread across five markets in four states. As of January 31, 2023, the Portfolio is 87.7% leased with a granular rent roll featuring 187 unique tenants and a weighted average remaining lease term (“WALT”) of approximately 3.5 years. |

| ● | The Portfolio is comprised of several industrial business parks, centrally located in densely populated areas within high-income MSAs. The Properties are designed to be attractive to user groups across numerous industries, including healthcare and research, life sciences, manufacturing, transportation & utilities, construction and engineering, wholesale and retail trade, professional services and agriculture. The Portfolio is granular, with the top five Properties accounting for 20.6% of the total underwritten net operating income of $50.0 million (the “UW NOI” or “Portfolio UW NOI”) with no other Property accounting for more than 3.0% of UW NOI. Furthermore, the largest tenant and top ten tenants account for 9.5% and 36.7% of UW Gross rent, respectively. The Portfolio also benefits from a diverse tenant roster. The Portfolio’s tenants utilize their space for lab, warehouse, light manufacturing, and research and development. |

| ● | The Portfolio’s 69 IRDF Properties (100.0% of UW NOI) are located within the Phoenix, Arizona (29.8% of UW NOI), Tampa, Florida (23.9%) Malvern, Pennsylvania (21.8%), Horsham, Pennsylvania (13.6%) and Minneapolis, Minnesota (10.9%) markets. Vacancy rates within these industrial markets range from 3.0% to 4.5%. |

The proceeds of the WIT Industrial Portfolio Whole Loan will be used to retire approximately $495 million of outstanding CMBS and bank loans, pay approximately $70 million in release premiums, fund upfront reserves, escrows and unrestricted working capital, and cover closing costs. 68 Properties were collateral for a whole loan that was previously securitized in multiple securitization transactions and has remained current in payment throughout its term. The Borrowers will be entities controlled by WIT, which is a newly capitalized platform created by WPT to acquire additional IRDF properties and expand its flex industrial footprint.

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | 12 |

| Strictly private and confidential | Workspace Industrial Trust Portfolio |

| Executive Summary (continued) | |

| ● | Founded in 2015, WPT is a privately-held, vertically integrated, full-service commercial real estate company specializing in the ownership, management, leasing and development of suburban office and IRDF space across the United States. WPT owns and operates approximately 18 million feet of space across the country, including 13 of the top 20 U.S. metropolitan areas. In 2013, Thomas Rizk (Chairman and Chief Executive Officer) founded Rizk Ventures, which focuses on real estate, healthcare and technology, and today the Rizk Ventures’ real estate platforms include WPT and SpareBox Self Storage. Roger Thomas (President and Chief Operating Officer) has over 30 years of experience in real estate and structuring, negotiating, completing and implementing all aspects of complex transactions including real estate acquisitions, disposition and development, corporate securities and compliance matters, risk management, human resources and marketing. Christopher Allen (Executive Vice President and Chief Financial Officer) has more than 17 years of real estate investment trust (“REIT”) executive management and real estate investment banking experience. |

| ● | Based on the whole loan amount of $625,000,000 and the portfolio appraised value of $860,000,000 (approximately $204 PSF) (the “Portfolio Appraised Value”), prepared by an independent appraiser, the Whole Loan represents a loan-to-value ratio (“LTV”) of 72.7%. The Whole Loan features a 5-year term, is interest only for the full Whole Loan term, and accrues interest at a fixed rate of [7.10000]% per annum. Based on the UW NOI of approximately $50.0 million and the total underwritten net cash flow (“UW NCF”) of approximately $49.4 million, the Whole Loan exhibits an UW NOI debt yield and UW NCF debt service coverage ratio (“UW NCF DSCR”) of 8.0% and 1.10x, respectively. |

| ● | Notwithstanding anything to the contrary in this Term Sheet, as of the date of this Term Sheet, the WIT Industrial Portfolio Whole Loan has not been originated. Therefore, the descriptions of the terms of the WIT Industrial Portfolio Whole Loan and the WIT Industrial Portfolio Trust Subordinate Companion Loan in this Term Sheet are based on their expected terms if and when the WIT Industrial Portfolio Whole Loan is originated by the Mortgage Lenders. As a result, the terms of the WIT Industrial Portfolio Whole Loan and the WIT Industrial Portfolio Trust Subordinate Companion Loan and the respective descriptions thereof in this Term Sheet are subject to revision. None of the Mortgage Lenders, any of their affiliates, or any other person is obligated to make the WIT Industrial Portfolio Whole Loan and there can be no assurance that the WIT Industrial Portfolio Whole Loan will be made. |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | 13 |

| Strictly private and confidential | Workspace Industrial Trust Portfolio |

| Transaction Sources & Uses | |

| ● | The proceeds of the Whole Loan will be used to (i) retire approximately $495 million of outstanding CMBS and bank loans, (ii) pay approximately $70 million in associated release premiums, (iii) fund upfront reserves, escrows and unrestricted working capital, and (iv) cover closing costs. The sources and uses are outlined below: |

| Sources | Amount | PSF | % | Uses | Amount | PSF | % | |

| Whole Loan | $625,000,000 | $148 | 100.0% | Retire Existing Debt | $495,364,173 | $117 | 79.3% | |

| CMBS Release Premium | $69,862,500 | $17 | 11.2% | |||||

| Closing Costs | $19,773,327 | $5 | 3.2% | |||||

| Upfront Rollover Reserves | $10,558,500 | $3 | 1.7% | |||||

| Escrows & Outstanding Obligations | $9,441,500 | $2 | 1.5% | |||||

| Unrestricted Working Capital(1) | $20,000,000 | $5 | 3.2% | |||||

| Total Sources | $625,000,000 | $148 | 100.0% | Total Uses | $625,000,000 | $148 | 100.0% |

| (1) | Based on the amount budgeted by the Sponsor. Such amount will not be held by the Mortgage Lender and will not be collateral for the Whole Loan. |

| ● | Based on a loan amount of $625,000,000 and the Portfolio Appraised Value of $860,000,000, the As-Is LTV is 72.7%, the UW NOI debt yield is 8.0%, and the UW NCF DSCR is 1.10x. |

| Capital Structure | ||||

| Tranche | Cumulative Basis PSF(1) | As-Is LTV(2) | UW NOI Debt Yield(3) | UW NCF DSCR(4) |

| WIT Industrial Portfolio Senior Notes $400,000,000 | $98 | 46.5% | 12.5% | 1.71x |

| WIT Industrial Portfolio Trust Subordinate Companion Notes $225,000,000 | $148 | 72.7% | 8.0% | 1.10x |

| $235,000,000 Equity | $204 |

| (1) | Based on 4,223,400 SF of NRA. |

| (2) | Based on the Portfolio Appraised Value of $860,000,000. Based on the Aggregate Individual Appraised Value of $810,050,000, the LTV is 77.2%. |

| (3) | Based on the UW NOI of $50,011,445. |

| (4) | Based on the UW NCF of $49,377,935. |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | 14 |

| Strictly private and confidential | Workspace Industrial Trust Portfolio |

| Transaction Highlights | |

Strong Historical Occupancy & Performance

The Portfolio has maintained strong occupancy averaging 90.5% over the past five years (2017 – 2022). Across the 69 Properties, 25 Properties (43.1% of UW NOI) have averaged 100.0% occupancy over this same period. Of notable strength is the Malvern PA industrial park (21.8% of UW NOI), consisting of 15 Properties largely occupied by life science tenants, which has averaged 97.7% occupancy from 2017 to 2022. The Portfolio has also grown profits, with net operating income increasing from approximately $45.4 million in 2018 to approximately $49.3 million over the trailing 12-month September 2022 period.

Credit Tenancy

24 tenants within the Portfolio have investment grade ratings or investment grade parent companies, representing 35.1% of the total net rentable area (approximately 4.2 million SF) (“NRA”) and 36.6% of the UW Gross Rent (approximately $69.6 million). Including investment grade tenants, a total of 34 tenants within the Portfolio have credit ratings or credit rated parent companies, representing 41.5% of the NRA and 42.5% of the UW Gross Rent.

Granular Rent Roll

The Portfolio is comprised of 187 unique tenants, with no tenant representing more than 6.8% of the NRA or 9.5% of the UW Gross Rent. The top five tenants by UW NOI represent 20.7% of the SF, and 26.3% of the UW Gross Rent across all Properties. Approximately 72.0% of the UW Base Rent rolls through the next five years ending 2027, with no year accounting for more than 27.4%.

Diverse Portfolio

The Portfolio consists of 69 Properties in five markets and four states. No market accounts for more than 27.4% of the NRA or 29.8% of the UW NOI, and no state accounts for more than 32.7% of the NRA or 35.4% of the UW NOI. The tenant base is diversified, with Life Sciences representing the largest concentration having a 22.4% share of UW Gross Rents, followed by Healthcare & Research (18.4%), Professional Services (17.5%), Manufacturing (17.0%), Transportation & Utilities (6.7%), Wholesale & Retail Trade (4.7%), Construction & Engineering (2.7%), Agriculture, Forestry and Fishing (0.6%) and other industries (9.6%).

Strong Sponsorship

Founded in 2015, WPT is a privately-held, vertically integrated, full-service commercial real estate company that owns and operates approximately 18 million feet of suburban office and IRDF space across more than 200 properties spread over the country, including 13 of the top 20 U.S. metropolitan areas. All functions are performed in-house by approximately 100 employees, with over $10 billion of capital transactions executed by senior management in the suburban office and industrial sectors. Co-founder and Chief Executive Officer, Thomas Rizk and Co-founder and President, Roger Thomas previously led the family-owned real estate partnership, Cali Associates, through its initial public offering (“IPO”) as Cali Realty Corporation, a REIT traded on the NYSE. The original portfolio grew from 12 properties at the time of the IPO to more than 200 properties totaling over 28.0 million square feet. Additionally, during Mr. Rizk’s tenure, total market capitalization grew from $300 million to over $3.6 billion, completing more than $3.0 billion in acquisitions.

Equity Investments & Whole Loan Structure

In July 2021, Oak Hill Advisors led a $325 million equity investment into WPT, demonstrating a substantial new commitment to the Portfolio. WPM is also currently negotiating with new institutional investors to potentially invest approximately $75.0 million of preferred equity into WIT after the Origination Date. While there is no certainty that this investment will be completed, the Sponsor has indicated that it expects that such transaction will occur shortly after the closing of the Whole Loan. The Whole Loan structure includes $20 million in escrows as well as upfront reserves for funding leasing costs over the course of the Whole Loan term.

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | 15 |

| Strictly private and confidential | Workspace Industrial Trust Portfolio |

| II. | Overview of Whole Loan Terms |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | 16 |

| Strictly private and confidential | Workspace Industrial Trust Portfolio |

| Notwithstanding anything to the contrary in this Term Sheet, as of the date of this Term Sheet, the WIT Industrial Portfolio Whole Loan has not been originated. Therefore, the descriptions of the terms of the WIT Industrial Portfolio Whole Loan and the WIT Industrial Portfolio Trust Subordinate Companion Loan in this Term Sheet are based on their expected terms if and when the WIT Industrial Portfolio Whole Loan is originated by the Mortgage Lenders. As a result, the terms of the WIT Industrial Portfolio Whole Loan and the WIT Industrial Portfolio Trust Subordinate Companion Loan and the respective descriptions thereof in this Term Sheet are subject to revision. None of the Mortgage Lenders, any of their affiliates, or any other person is obligated to make the WIT Industrial Portfolio Whole Loan and there can be no assurance that the WIT Industrial Portfolio Whole Loan will be made. |

| ● | Whole Loan Amount: | $625,000,000 |

| ● | Whole Loan Interest Rate: | [7.10000]% |

| ● | Amortization: | None. |

| ● | Upfront Reserves: | Taxes and Insurance: On the Origination Date, the Borrowers will be required to make an initial deposit with the Mortgage Lender in the amount of $[4,325,977] for the payments of taxes and insurance premiums. Required Repairs: On the Origination Date, the Borrowers will be required to make a deposit with the Mortgage Lender in the amount of $[61,325] (110% of the amount of such repairs as reasonably determined by the Mortgage Lender) for payment of required repairs at the properties. Rollover Reserve: On the Origination Date, the Borrowers will be required to make an initial deposit with the Mortgage Lender in the amount of $[10,558,500] for payment of tenant improvement and leasing commission obligations incurred following the date of closing. Free Rent Reserve: On the Origination Date, the Borrowers will be required to make an initial deposit with the Mortgage Lender in the amount of $[907,356] for payment to Borrowers of any free rent credit due to any tenant pursuant to such tenant’s lease. TI/LC Reserve: On the Origination Date, the Borrowers will be required to make an initial deposit with the Mortgage Lender in the amount of $[4,146,843] for the payment of any outstanding tenant improvement and leasing commission obligations. In lieu of the upfront reserves, the Borrowers will be permitted to deliver an evergreen letter of credit meeting rating agency criteria and otherwise reasonably acceptable to the Mortgage Lender. |

| ● | Ongoing Reserves: | Ongoing reserves for taxes and insurance, replacements, tenant improvements and leasing commissions will only be required during the continuance of a Trigger Period. During a Trigger Period, insurance reserves may be waived if the Portfolio is covered under a blanket policy. TI/LC Reserves: During a Trigger Period (as defined below), the Borrowers are required to make monthly deposits into a TI/LC reserve in an amount equal to $0.30 per square foot per annum. |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | 17 |

| Strictly private and confidential | Workspace Industrial Trust Portfolio |

Replacement Reserves: During a Trigger Period, the Borrowers are required to make monthly deposits into a replacement reserve in an amount equal to $0.20 psf per annum (subject to adjustment based on the Mortgage Lender’s review of the property condition report).

| ||

| ● | Prepayment of the Whole Loan: | Defeasance: At any time after the earlier to occur of two (2) years from the closing date of the last securitization of a note or four (4) years from the Origination Date, the Borrowers may defease the WIT Industrial Portfolio Whole Loan in whole; provided that, no event of default is then continuing, the Borrowers give at least 30 days written notice to the Mortgage Lender and Borrower deliver to the Mortgage Lender non-callable U.S. Treasury Securities whose cash flows are equal to and occur as close as possible, but before, the dates for the remaining scheduled interest and principal payments required under the WIT Industrial Portfolio Whole Loan through and including the Open Prepayment Date (defined below), and rating agency confirmation. In the event the WIT Industrial Portfolio Whole Loan is defeased on a day that is not a regular monthly payment date, such defeasance amount will be required to include the amount of interest that would have accrued on the principal amount of the WIT Industrial Portfolio Whole Loan through the end of the accrual period during which such defeasance occurs. Provided no event of default has occurred, from and after the date that is six (6) months prior to the maturity date (the “Open Prepayment Date”), the Borrowers will have the right to prepay the WIT Industrial Portfolio Whole Loan in whole or in part without payment of any yield maintenance premium or other fee or premium.

Yield Maintenance: On and after the second (2nd) anniversary of the first payment date (the “Permitted Prepayment Date”), the Borrowers will have the right to prepay the WIT Industrial Portfolio Whole Loan in whole (or in part, but only in connection with a release of an Individual Property or Release Parcel); provided that if such prepayment occurs prior to the Open Prepayment Date, such prepayment will be accompanied by a yield maintenance premium.

Notwithstanding anything to the contrary above, including prior to the Open Prepayment Date, the Borrowers are permitted to prepay amounts that do not, in the aggregate, exceed 10.0% of the principal balance of the initial Whole Loan amount (the “Initial 10% Prepayments”) at any time without payment of any yield maintenance premium or other prepayment penalty or fee, subject to certain conditions in the Mortgage Loan Agreement. Any Initial 10% Prepayments will be applied between the WIT Industrial Portfolio Senior Loans and WIT Industrial Portfolio Trust Subordinate Companion Loan on a pro-rata basis.

|

| ● | Property Releases: | The Borrowers may release one or more Properties from the lien of the related mortgage, subject to: (i) prepayment in an amount equal to 115% of the allocated loan amount of the applicable Property or Properties in the event of a purchase of the released Property or Properties by a third party purchaser or prepayment in amount equal to 120% of the allocated loan amount of the released Property or Properties in the event of a purchase of the released Property or Properties by an affiliate of any of the Borrowers; (ii) debt yield following the release will be equal to or greater than the (a) debt yield at the Origination Date and (b) the debt yield immediately prior to the contemplated release; (iii) if such release is to an affiliate of any of the Borrowers, the loan-to-value ratio for the Properties then remaining will be equal to or less than the lesser of (a) the loan-to-value at the Origination Date or (b) the loan-to-value ratio for all of the Properties immediately prior to giving effect to the such release; |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | 18 |

| Strictly private and confidential | Workspace Industrial Trust Portfolio |

and (iv) principal paydowns from releases will be applied pro-rata between the WIT Industrial Portfolio Senior Loans and WIT Industrial Portfolio Trust Subordinate Companion Loan.

| ||

| ● | Lockbox and Cash Management:

| All revenues from the Properties will be required to flow through an account (the “Clearing Account”) established by the Borrowers with a financial institution reasonably acceptable to the Mortgage Lender. Prior to a Trigger Period, amounts deposited in the Clearing Account will be required to be released to the Borrowers’ operating account daily. During a Trigger Period, amounts deposited in the Clearing Account will be swept on a daily basis into an account established by the Mortgage Lender (the “Cash Management Account”). During a Trigger Period so long as no event of default is continuing, monthly debt service, reserve payments, monthly disbursements to the Borrowers for budgeted operating and capital expenditures in accordance with the Mortgage Lender-approved budget and other payments due under the WIT Industrial Portfolio Whole Loan documents will be funded from the Cash Management Account and revenues of the Properties remaining after all such payments and disbursements have been made (“Excess Cash Flow”) will be retained by the Mortgage Lender as additional cash collateral for the WIT Industrial Portfolio Whole Loan. All Excess Cash Flow then on deposit with the Mortgage Lender will be released to the Borrowers when the Trigger Period is cured, and no event of default then exists.

“Trigger Period” means any period during which (i) an event of default is continuing or (ii) the debt yield falls below the Trigger Level for two (2) consecutive quarters until the debt yield exceeds the Trigger Level for two (2) consecutive quarters.

“Trigger Level” means a debt yield of [7.25]%. The debt yield will be tested by the Mortgage Lender quarterly on a trailing 12- month basis by dividing net operating income by the outstanding amount of the WIT Industrial Portfolio Whole Loan. |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | 19 |

| Strictly private and confidential | Workspace Industrial Trust Portfolio |

| III. | Portfolio and Market Overview |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | 20 |

| Strictly private and confidential | Workspace Industrial Trust Portfolio |

| Portfolio Overview | |

| ● | The Portfolio consists of 69 IRDF Properties totaling approximately 4.2 million SF of NRA located throughout four states. The table below provides a snapshot of key statistics of the Portfolio. |

| Portfolio Overview | ||||||||||||

| ID | Campus | Property | City | State | Year Built / Renovated(1) | Total SF(2) | Number of Tenants(2) | In-Place Occupancy(1) | Dock Doors | Clear Heights | UW NOI(2) | % UW NOI |

| 1 | Horsham Pennsylvania | 102 Rock Road | Horsham | PA | 1985 / 2017 | 40,472 | 1 | 100.0% | 4 | 15 | $673,239 | 1.3% |

| 2 | Horsham Pennsylvania | 101-111 Rock Road | Horsham | PA | 1975 / 2009 | 37,884 | 2 | 100.0% | 6 | 14 | $530,573 | 1.1% |

| 3 | Horsham Pennsylvania | 113-123 Rock Road | Horsham | PA | 1975 / 2015 | 37,500 | 1 | 100.0% | 6 | 15 | $411,811 | 0.8% |

| 4 | Horsham Pennsylvania | 123-135 Rock Road | Horsham | PA | 1975 / 2021 | 37,500 | 2 | 100.0% | 6 | 15 | $543,362 | 1.1% |

| 5 | Horsham Pennsylvania | 111-159 Gibraltar Road | Horsham | PA | 1981 / 2022 | 63,036 | 8 | 93.8% | 5 | 13 | $803,037 | 1.6% |

| 6 | Horsham Pennsylvania | 103-109 Gibraltar Road | Horsham | PA | 1978 / 2022 | 42,000 | 3 | 100.0% | 8 | 16 | $504,189 | 1.0% |

| 7 | Horsham Pennsylvania | 161-175 Gibraltar Road | Horsham | PA | 1976 / 2008 | 49,732 | 1 | 100.0% | 8 | 16 | $656,990 | 1.3% |

| 8 | Horsham Pennsylvania | 181-187 Gibraltar Road | Horsham | PA | 1982 / 2005 | 48,870 | 1 | 100.0% | 8 | 14 | $614,103 | 1.2% |

| 9 | Horsham Pennsylvania | 231-253 Gibraltar Road | Horsham | PA | 1981 / 2020 | 60,000 | 5 | 100.0% | 9 | 15 | $899,667 | 1.8% |

| 10 | Horsham Pennsylvania | 261-283 Gibraltar Road | Horsham | PA | 1978 / 2020 | 60,000 | 3 | 100.0% | 9 | 15 | $807,187 | 1.6% |

| 11 | Horsham Pennsylvania | 201-223 Witmer Road | Horsham | PA | 1972 / 2021 | 60,000 | 5 | 61.3% | 12 | 15 | $372,268 | 0.7% |

| 12 | Great Valley Parkway | 1 Great Valley Parkway | Malvern | PA | 1982 / 2022 | 60,880 | 5 | 100.0% | 8 | 16 | $962,169 | 1.9% |

| 13 | Great Valley Parkway | 27-43 Great Valley Parkway | Malvern | PA | 1977 / 2018 | 60,623 | 1 | 100.0% | 3 | 18 | $568,193 | 1.1% |

| 14 | Great Valley Parkway | 30 Great Valley Parkway | Malvern | PA | 1975 / 2000 | 12,000 | 1 | 100.0% | 2 | 18 | $113,054 | 0.2% |

| 15 | Great Valley Parkway | 45-67 Great Valley Parkway | Malvern | PA | 1974 / 2022 | 128,011 | 4 | 100.0% | 17 | 20 | $1,630,559 | 3.3% |

| 16 | Great Valley Parkway | 75 Great Valley Parkway | Malvern | PA | 1977 / 2017 | 11,600 | 1 | 100.0% | 2 | 18 | $138,240 | 0.3% |

| 17 | Great Valley Parkway | 77-123 Great Valley Parkway | Malvern | PA | 1978 / 2021 | 103,099 | 10 | 98.3% | 17 | 16 | $1,550,622 | 3.1% |

| 18 | Great Valley Parkway | 155 Great Valley Parkway | Malvern | PA | 1981 / 2020 | 71,200 | 1 | 100.0% | 4 | 18 | $784,008 | 1.6% |

| 19 | Great Valley Parkway | 257-275 Great Valley Parkway | Malvern | PA | 1983 / 2019 | 71,122 | 7 | 100.0% | 10 | 16 | $1,071,180 | 2.1% |

| 20 | Great Valley Parkway | 277-293 Great Valley Parkway | Malvern | PA | 1984 / 2019 | 28,800 | 5 | 100.0% | 5 | 13 | $413,266 | 0.8% |

| 21 | Great Valley Parkway | 420-500 Lapp Rd | Malvern | PA | 1989 / 2016 | 91,312 | 5 | 100.0% | 5 | 16 | $1,423,691 | 2.8% |

| 22 | Great Valley Parkway | 508 Lapp Rd | Malvern | PA | 1984 / 2017 | 50,200 | 1 | 100.0% | 3 | 18 | $523,168 | 1.0% |

| 23 | Great Valley Parkway | 510 Lapp Rd | Malvern | PA | 1983 / 2018 | 27,167 | 1 | 100.0% | 9 | 18 | $201,999 | 0.4% |

| (1) | Year Built and In-Place Occupancy are weighted by SF. |

| (2) | Figures based on the underwritten rent roll dated January 31, 2023. |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | 21 |

| Strictly private and confidential | Workspace Industrial Trust Portfolio |

| Portfolio Overview (continued) | |

| Portfolio Overview (continued) | ||||||||||||

| ID | Campus | Property | City | State | Year Built / Renovated(1) | Total SF(2) | Number of Tenants(2) | In-Place Occupancy(1) | Dock Doors | Clear Heights | UW NOI(2) | % UW NOI |

| 24 | Great Valley Parkway | 300 Technology Drive | Malvern | PA | 1985 / 2014 | 22,500 | 1 | 100.0% | 2 | 18 | $278,592 | 0.6% |

| 25 | Great Valley Parkway | 425 Technology Drive | Malvern | PA | 1998 / 2019 | 22,407 | 2 | 100.0% | 2 | 16 | $315,457 | 0.6% |

| 26 | Great Valley Parkway | 333 Phoenixville Pike | Malvern | PA | 1985 / 2020 | 84,000 | 1 | 100.0% | 4 | 18 | $934,737 | 1.9% |

| 27 | 9801 South 51st Street | 9801 South 51st Street | Phoenix | AZ | 2012 / 2015 | 71,550 | - | 0.0% | 1 | 25 | ($273,477) | (0.5%) |

| 28 | Workspace Cotton Center | 4207 E Cotton Center Blvd | Phoenix | AZ | 2006 / 2016 | 24,900 | 1 | 100.0% | 1 | 24 | $506,258 | 1.0% |

| 29 | Workspace Cotton Center | 4217 E Cotton Center Blvd | Phoenix | AZ | 2006 / 2022 | 88,140 | 2 | 68.9% | 4 | 34 | $883,357 | 1.8% |

| 30 | Workspace Cotton Center | 4303 E Cotton Center Blvd | Phoenix | AZ | 2002 / 2020 | 64,000 | 1 | 94.5% | 4 | 34 | $689,642 | 1.4% |

| 31 | Workspace Cotton Center | 4313 E Cotton Center Blvd | Phoenix | AZ | 2002 / 2018 | 108,874 | 1 | 72.0% | 6 | 34 | $1,334,308 | 2.7% |

| 32 | Workspace Cotton Center | 4405 E Cotton Center Blvd | Phoenix | AZ | 2001 / 2012 | 54,551 | 1 | 57.0% | 6 | 34 | $374,050 | 0.7% |

| 33 | Workspace Cotton Center | 4410 E Cotton Center Blvd | Phoenix | AZ | 2007 | 101,269 | 1 | 100.0% | 12 | 34 | $1,268,244 | 2.5% |

| 34 | Workspace Cotton Center | 4415 E Cotton Center Blvd | Phoenix | AZ | 2001 / 2021 | 35,463 | 1 | 100.0% | 5 | 34 | $557,505 | 1.1% |

| 35 | Workspace Cotton Center | 4425 E Cotton Center Blvd | Phoenix | AZ | 2001 / 2022 | 165,000 | 1 | 100.0% | 1 | 34 | $3,021,419 | 6.0% |

| 36 | Workspace Cotton Center | 4435 E Cotton Center Blvd. | Phoenix | AZ | 2007 | 25,505 | - | 0.0% | 6 | 34 | ($169,750) | (0.3%) |

| 37 | Workspace Cotton Center | 4500 E. Cotton Center Blvd. | Phoenix | AZ | 2007 / 2012 | 139,403 | 2 | 100.0% | 24 | 34 | $2,509,771 | 5.0% |

| 38 | Workspace Cotton Center | 4750 S 44th Place | Phoenix | AZ | 2015 | 79,496 | 3 | 100.0% | 15 | 34 | $1,570,257 | 3.1% |

| 39 | Workspace Cotton Center | 4755 S 44th Place | Phoenix | AZ | 2018 | 80,000 | 1 | 100.0% | 15 | 34 | $1,504,314 | 3.0% |

| 40 | Workspace Cotton Center | 4550 S 44th Street | Phoenix | AZ | 2007 / 2008 | 54,489 | - | 0.0% | 1 | 34 | ($251,521) | (0.5%) |

| 41 | Workspace Cotton Center | 4610 S 44th Street | Phoenix | AZ | 2007 | 66,012 | 1 | 100.0% | 5 | 34 | $1,363,203 | 2.7% |

| 42 | Brittany Way | 111 Kelsey Lane | Tampa | FL | 1990 | 60,200 | 6 | 100.0% | 8 | 16 | $703,881 | 1.4% |

| 43 | Brittany Way | 131 Kelsey Lane | Tampa | FL | 1985 | 89,290 | 1 | 100.0% | 2 | 18 | $1,336,878 | 2.7% |

| 44 | Brittany Way | 150-182 Kelsey Lane | Tampa | FL | 2007 | 54,400 | - | 0.0% | 20 | 16 | ($238,477) | (0.5%) |

| 45 | Brittany Way | 206-34 Kelsey Lane | Tampa | FL | 2006 | 45,600 | - | 0.0% | 5 | 16 | ($194,077) | (0.4%) |

| 46 | Brittany Way | 8900-34 Brittany Way | Tampa | FL | 2005 | 48,000 | 5 | 100.0% | 3 | 15 | $574,913 | 1.1% |

| (1) | Year Built and In-Place Occupancy are weighted by SF. |

| (2) | Figures based on the underwritten rent roll dated January 31, 2023. |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | 22 |

| Strictly private and confidential | Workspace Industrial Trust Portfolio |

| Portfolio Overview (continued) | |

| Portfolio Overview (continued) | ||||||||||||

| ID | Campus | Property | City | State | Year Built / Renovated(1) | Total SF(2) | Number of Tenants(2) | In-Place Occupancy(1) | Dock Doors | Clear Heights | UW NOI(2) | % UW NOI |

| 47 | Brittany Way | 9001-9015 Brittany Way | Tampa | FL | 2000 | 30,000 | 3 | 100.0% | 6 | 18 | $402,798 | 0.8% |

| 48 | Brittany Way | 9002-9036 Brittany Way | Tampa | FL | 2004 | 59,080 | 4 | 100.0% | 6 | 16 | $655,308 | 1.3% |

| 49 | Brittany Way | 501 US Highway 301 South | Tampa | FL | 2005 | 59,080 | 8 | 100.0% | 7 | 15 | $752,052 | 1.5% |

| 50 | Brittany Way | 701-725 US Highway 301 South | Tampa | FL | 2000 | 65,380 | 6 | 100.0% | 6 | 16 | $905,746 | 1.8% |

| 51 | Brittany Way | 901-933 US Highway 301S | Tampa | FL | 2001 | 65,200 | 8 | 100.0% | 10 | 16 | $808,616 | 1.6% |

| 52 | Crosspoint 3110 | 3102,3104,3110 Cherry Palm | Tampa | FL | 1986 | 74,397 | 14 | 63.2% | 21 | 12 | $405,432 | 0.8% |

| 53 | Woodland Corporate Center | 7920 Woodland Ctr Blvd | Tampa | FL | 1997 | 52,627 | 2 | 100.0% | 2 | 17 | $914,458 | 1.8% |

| 54 | Woodland Corporate Center | 7930,8010-20 Woodland Ctr Blvd | Tampa | FL | 1990 | 89,758 | 7 | 97.1% | 19 | 18 | $1,186,011 | 2.4% |

| 55 | Woodland Corporate Center | 8202 Woodland Ctr Blvd | Tampa | FL | 1996 | 39,155 | 1 | 100.0% | 2 | 20 | $583,992 | 1.2% |

| 56 | Woodland Corporate Center | 8152-8198 Woodland Ctr Blvd | Tampa | FL | 1988 | 45,382 | 9 | 87.5% | 6 | 13 | $535,417 | 1.1% |

| 57 | Woodland Corporate Center | 8102-42 Woodland Ctr Blvd | Tampa | FL | 1995 | 39,155 | 1 | 100.0% | 2 | 14 | $559,181 | 1.1% |

| 58 | Woodland Corporate Center | 7802-50 Woodland Ctr Blvd | Tampa | FL | 1999 | 44,350 | 3 | 100.0% | 2 | 13 | $735,575 | 1.5% |

| 59 | Woodland Corporate Center | 7852-98 Woodland Ctr Blvd | Tampa | FL | 1999 | 44,350 | 2 | 32.3% | 10 | 14 | $95,873 | 0.2% |

| 60 | Woodland Corporate Center | 7624 Bald Cypress Place | Tampa | FL | 2003 | 15,035 | 1 | 100.0% | 14 | 17 | $195,791 | 0.4% |

| 61 | Northport Business Park | 8401-8406 Benjamin Rd | Tampa | FL | 1986 | 94,766 | 17 | 94.3% | 35 | 16 | $1,035,276 | 2.1% |

| 62 | Golden Triangle | 7615 Smetana Lane | Eden Prairie | MN | 2001 | 93,444 | 2 | 100.0% | 6 | 24 | $1,053,367 | 2.1% |

| 63 | Fuller Road | 7905 Fuller Road | Eden Prairie | MN | 1994 | 74,224 | 1 | 100.0% | 9 | 16 | $961,297 | 1.9% |

| 64 | Anagram Drive | 7695-7699 Anagram Drive | Eden Prairie | MN | 1997 | 39,390 | 2 | 100.0% | 2 | 16 | $568,054 | 1.1% |

| 65 | West Bloom Technology Park | 5705 Old Shakopee Road | Bloomington | MN | 2007 | 74,594 | 3 | 37.9% | 3 | 14 | $118,599 | 0.2% |

| 66 | West Bloom Technology Park | 5715 Old Shakopee Road | Bloomington | MN | 2002 | 63,463 | 2 | 100.0% | 2 | 14 | $773,902 | 1.5% |

| 67 | West Bloom Technology Park | 5735 Old Shakopee Road | Bloomington | MN | 2002 | 63,463 | 2 | 50.3% | 4 | 14 | $115,689 | 0.2% |

| 68 | West Bloom Technology Park | 5775 W. Old Shakopee Road | Bloomington | MN | 2002 | 103,050 | 5 | 95.9% | 4 | 14 | $1,166,060 | 2.3% |

| 69 | West Bloom Technology Park | 10801 Nesbitt Avenue South | Bloomington | MN | 2001 | 56,000 | 2 | 100.0% | 5 | 14 | $686,888 | 1.4% |

| Total Portfolio | 1994 / 2009 | 4,223,400 | 187 | 87.7% | - | 21 | $50,011,445 | 100.0% | ||||

| (1) | Year Built and In-Place Occupancy are weighted by SF. |

| (2) | Figures based on the underwritten rent roll dated January 31, 2023. |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | 23 |

| Strictly private and confidential | Workspace Industrial Trust Portfolio |

| Portfolio Overview (continued) | |

| Portfolio Snapshot | |||||||||

| Number of | Number of | Number of | In-Place | UW Gross Rent | Remaining | % of Total | UW NOI DY | ||

| Property Type | Properties | Total SF | States | Markets | Occupancy(1) (2) | PSF(1) (2) | WALT(1) (3) | ||

| Industrial-R&D/Flex | 69 | 4,223,400 | 4 | 5 | 87.7% | $18.80 | 3.5 | 100.0% | 8.0% |

| (1) | Based on the underwritten rent roll dated January 31, 2023. |

| (2) | Based on occupied SF. |

| (3) | Weighted by UW Gross Rent. |

| ● | The Portfolio has shown strong historical occupancy, averaging approximately 90.5% over the last 5 years. The following table presents the historical occupancy of the Portfolio. |

| Historical Occupancy | ||||||

| 2018 | 2019 | 2020 | 2021 | 2022 | Avg. | |

| Occupancy | 91.7% | 90.8% | 90.3% | 89.8% | 90.6% | 90.5% |

| ● | The top ten Properties by UW NOI in the Portfolio comprise approximately 24.9% of NRA, and approximately 34.5% of UW NOI, and exhibit a remaining WALT of 3.4 years. The following chart details the top ten Properties in the Portfolio based on UW NOI. |

| Top 10 Properties (by UW NOI) | ||||||||

| Property | Remaining WALT(1)(2) | Total SF | % of NRA | In-Place Occupancy(2)(3) | UW NOI | % of UW NOI | # of Tenants(2) | Largest Tenant |

| 4425 East Cotton Center Boulevard | 1.1 | 165,000 | 3.9% | 100.0% | $3,021,419 | 6.0% | 1 | United Healthcare Services, Inc. |

| 4500 East Cotton Center Boulevard | 0.8 | 139,403 | 3.3% | 100.0% | $2,509,771 | 5.0% | 2 | Aetna Life Insurance Company |

| 45-67 Great Valley Parkway | 6.3 | 128,011 | 3.0% | 100.0% | $1,630,559 | 3.3% | 4 | Marken, LLP |

| 4750 South 44th Place | 1.1 | 79,496 | 1.9% | 100.0% | $1,570,257 | 3.1% | 3 | Aetna Life Insurance Company |

| 77-123 Great Valley Parkway | 4.0 | 103,099 | 2.4% | 98.3% | $1,550,622 | 3.1% | 10 | Puresyn, Inc. |

| 4755 South 44th Place | 5.9 | 80,000 | 1.9% | 100.0% | $1,504,314 | 3.0% | 1 | Aetna Life Insurance Company |

| 420-500 Lapp Road | 3.0 | 91,312 | 2.2% | 100.0% | $1,423,691 | 2.8% | 5 | ifm Prover USA, Inc. |

| 4610 South 44th Street | 7.8 | 66,012 | 1.6% | 100.0% | $1,363,203 | 2.7% | 1 | Caris MPI, Inc. |

| 131 Kelsey Lane | 1.6 | 89,290 | 2.1% | 100.0% | $1,336,878 | 2.7% | 1 | United Healthcare Services, Inc. |

| 4313 East Cotton Center Boulevard | 5.6 | 108,874 | 2.6% | 72.0% | $1,334,308 | 2.7% | 1 | GE Parallel Design, Inc. |

| Top 10 Total / Wtd. Avg. | 3.4 | 1,050,497 | 24.9% | 96.9% | $17,245,024 | 34.5% | 29 | |

| Other | 3.5 | 3,172,903 | 75.1% | 84.7% | $32,766,421 | 65.5% | 158 | |

| Total / Wtd. Avg. | 3.5 | 4,223,400 | 100.0% | 87.7% | $50,011,445 | 100.0% | 187 | |

| (1) | Weighted by UW Gross Rent. |

| (2) | Based on the underwritten rent roll dated January 31, 2023. |

| (3) | Based on occupied SF. |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | 24 |

| Strictly private and confidential | Workspace Industrial Trust Portfolio |

| Portfolio Overview (continued) | |

| ● | The Portfolio is located in four states, the largest concentration of which is located in Pennsylvania, which represents approximately 32.7% of NRA and approximately 35.4% of the UW NOI. The following chart outlines the Portfolio by state concentration. |

| Stratification by State | ||||||||||

| State | # of Properties | Wtd. Avg. Year Built(1) | Remaining WALT(2) | Total SF | % of NRA | In-Place Occupancy(3) | UW Gross Rent(4) | UW Gross Rent PSF(3)(4) | UW NOI | % of UW NOI |

| Pennsylvania | 26 | 1980 | 3.8 years | 1,381,915 | 32.7% | 97.9% | $23,903,669 | $17.67 | $17,725,363 | 35.4% |

| Arizona | 15 | 2006 | 3.6 years | 1,158,652 | 27.4% | 79.6% | $20,028,136 | $21.72 | $14,887,581 | 29.8% |

| Florida | 20 | 1996 | 2.8 years | 1,115,205 | 26.4% | 84.7% | $16,886,715 | $17.89 | $11,954,644 | 23.9% |

| Minnesota | 8 | 2001 | 3.7 years | 567,628 | 13.4% | 85.5% | $8,822,292 | $18.17 | $5,443,856 | 10.9% |

| Total / Wtd. Avg. | 69 | 1994 | 3.5 years | 4,223,400 | 100.0% | 87.7% | $69,640,813 | $18.80 | $50,011,445 | 100.0% |

| (1) | Weighted by SF. |

| (2) | Weighted by UW Gross Rent. |

| (3) | Based on occupied SF. |

| (4) | Based on the underwritten rent roll dated January 31, 2023. |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | 25 |

| Strictly private and confidential | Workspace Industrial Trust Portfolio |

| Portfolio Overview (continued) | |

Portfolio Tenancy

| ● | The Portfolio is 87.7% leased to a rent roll of 187 unique tenants as of January 31, 2023. The top 10 tenants account for approximately 30.8% of NRA and approximately 36.7% of UW Gross Rent. No individual tenant accounts for more than 6.8% of NRA or 9.5% of UW Gross Rent. |

| Top 10 Tenants (by UW Gross Rent) | ||||||||||

| # | Tenant | Total SF(1) | % of NRA | Lease Start(1) | Lease Expiration(1) | UW Gross Rent(1) | % UW Gross | UW Gross PSF(1) | Rem. WALT(1) (2) | S&P / M / Fitch(3) |

| 1 | Aetna Life Insurance Company | 288,497 | 6.8% | Various | Various | $6,637,377 | 9.5% | $23.01 | 2.3 years | BBB / Baa2 / NR |

| 2 | United Healthcare Services, Inc. | 254,290 | 6.0% | Various | Various | $5,404,903 | 7.8% | $21.25 | 1.2 years | A+ / A3 / AA- |

| 3 | Caris MPI, Inc. | 111,877 | 2.6% | Various | Various | $2,761,050 | 4.0% | $24.68 | 6.2 years | NR / NR / NR |

| 4 | Cruise, LLC | 101,269 | 2.4% | 03/01/2017 | 09/30/2024 | $1,769,169 | 2.5% | $17.47 | 1.6 years | BBB / Baa3 / BBB- |

| 5 | Janssen Biotech | 117,603 | 2.8% | Various | Various | $1,756,800 | 2.5% | $14.94 | 6.3 years | AAA / Aaa / NR |

| 6 | GE Parallel Design, Inc. | 78,335 | 1.9% | 06/01/2010 | 09/30/2028 | $1,753,059 | 2.5% | $22.38 | 5.6 years | BBB+ / Baa1 / BBB |

| 7 | Dell Marketing L. P. | 85,366 | 2.0% | 03/01/2013 | 08/31/2024 | $1,462,405 | 2.1% | $17.13 | 1.5 years | NR / Baa3 / BBB |

| 8 | Acist Medical Systems, Inc. | 74,224 | 1.8% | 05/01/2015 | 10/31/2029 | $1,415,749 | 2.0% | $19.07 | 6.7 years | NR / NR / NR |

| 9 | Havpak, Inc. | 103,498 | 2.5% | Various | 06/30/2026 | $1,371,391 | 2.0% | $13.25 | 3.3 years | NR / NR / NR |

| 10 | Colorcon, Inc. | 84,000 | 2.0% | 09/15/2007 | 09/14/2024 | $1,231,440 | 1.8% | $14.66 | 1.5 years | NR / NR / NR |

| Top 10 Tenants | 1,298,959 | 30.8% | $25,563,342 | 36.7% | $19.68 | 3.2 years | ||||

| Remaining Tenants | 2,406,009 | 57.0% | $44,077,471 | 63.3% | $18.32 | 3.7 years | ||||

| Total Occupied | 3,704,968 | 87.7% | $69,640,813 | 100.0% | $18.80 | 3.5 years | ||||

| Total Vacant | 518,432 | 12.3% | ||||||||

| Total Collateral | 4,223,400 | 100.0% | ||||||||

| (1) | Based on the underwritten rent roll as of January 31, 2023. |

| (2) | Weighted by UW Gross Rent. |

| (3) | Ratings are those of the parent company whether or not the parent company guarantees the lease. |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | 26 |

| Strictly private and confidential | Workspace Industrial Trust Portfolio |

Portfolio Overview (continued)

Portfolio Rollover

| · | The Portfolio has 224 suites rolling through 2028, aggregating approximately 83.2% of UW Base Rent. |

| · | The remaining WALT of the Portfolio is 3.5 years. |

| · | The following chart table presents certain information regarding the expiration of leases across the Portfolio. |

| Rollover Profile(1) | |||||||||||||

| Year of Expiration | Expiring SF | % NRA | Cumulative SF | Cumulative % of Total SF | Annual Total Rent PSF | UW Base Rent ($) | % of UW Base Rent Rolling | Cumulative Total UW Base Rent ($) | Cumulative % of UW Base Rent Rolling | ||||

| MTM | 20,032 | 0.5% | 20,032 | 0.5% | $8.04 | $161,072 | 0.3% | $161,072 | 0.3% | ||||

| 2023 | 385,394 | 9.1% | 405,426 | 9.6% | $14.47 | $5,867,866 | 11.7% | $6,028,938 | 12.1% | ||||

| 2024 | 1,035,367 | 24.5% | 1,440,793 | 34.1% | $9.53 | $13,728,695 | 27.4% | $19,757,633 | 39.5% | ||||

| 2025 | 317,670 | 7.5% | 1,758,463 | 41.6% | $2.21 | $3,889,626 | 7.8% | $23,647,259 | 47.3% | ||||

| 2026 | 427,648 | 10.1% | 2,186,111 | 51.8% | $2.33 | $5,101,061 | 10.2% | $28,748,320 | 57.5% | ||||

| 2027 | 566,056 | 13.4% | 2,752,167 | 65.2% | $2.63 | $7,243,731 | 14.5% | $35,992,051 | 72.0% | ||||

| 2028 | 372,710 | 8.8% | 3,124,877 | 74.0% | $1.81 | $5,642,522 | 11.3% | $41,634,573 | 83.2% | ||||

| 2029 | 237,284 | 5.6% | 3,362,161 | 79.6% | $1.05 | $3,533,189 | 7.1% | $45,167,762 | 90.3% | ||||

| 2030 | 175,570 | 4.2% | 3,537,731 | 83.8% | $0.76 | $2,689,441 | 5.4% | $47,857,203 | 95.7% | ||||

| 2031 | 44,197 | 1.0% | 3,581,928 | 84.8% | $0.12 | $446,434 | 0.9% | $48,303,637 | 96.6% | ||||

| 2032 | 123,498 | 2.9% | 3,705,426 | 87.7% | $0.46 | $1,717,169 | 3.4% | $50,020,806 | 100.0% | ||||

| Beyond | 0 | 0.0% | 3,705,426 | 87.7% | $0.00 | $0 | 0.0% | $50,020,806 | 100.0% | ||||

| Vacant | 517,974 | 12.3% | 4,223,400 | 100.0% | $0.00 | $0 | 0.0% | $50,020,806 | 100.0% | ||||

| Total | 4,223,400 | 100.0% | $50,020,806 | $50,020,806 | 100.0% | ||||||||

| (1) | Based on the underwritten rent roll dated January 31, 2023. |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | 27 |

| Strictly private and confidential | Workspace Industrial Trust Portfolio |

Property Overview – Top 10 Properties (by UW NOI)

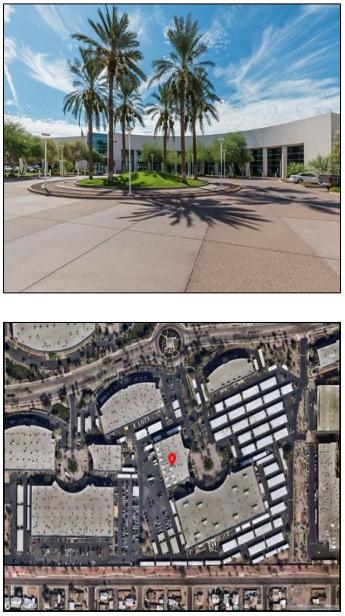

#1 - 4425 East Cotton Center Boulevard

| PROPERTY OVERVIEW | |

| Property Name: | 4425 East Cotton Center Boulevard |

| Address: | 4425 East Cotton Center Boulevard |

| City, State: | Phoenix, AZ |

| Property Type | Industrial-R&D/Flex |

| Ownership Interest: | Fee Simple |

| Year Built / Renovated: | 2001 / 2022 |

| Clear Heights (Feet): | 34 |

| Dock Doors: | 1 |

| % Currently used as Office: | 100.0% |

| NRA: | 165,000 |

| UW Leased %: | 100.0% |

| Wtd. Average Lease Expiration: | 03/31/2024 |

| Mortgage ALA ($ Amount / %): | $28,410,841 (4.5%) |

| % of Portfolio UW NOI: | 6.0% |

| RENT ROLL | ||||

| Tenant Name | SF | UW Gross | PSF | Lease Expiration |

| United Healthcare Services, Inc. | 165,000 | $3,669,105 | $22.24 | 03/31/2024 |

| - | - | - | - | - |

| - | - | - | - | - |

| Total Other Tenants | - | - | - | - |

| Total Vacant | - | - | - | - |

| Total / Wtd. Average | 165,000 | $3,669,105 | $22.24 | 03/31/2024 |

| UNDERWRITING | |||

| Budget 2023 | UW | PSF | |

| Base Rents | $3,092,819 | $2,905,182 | $17.61 |

| Rent Steps | - | $72,573 | $0.44 |

| Vacancy Lease Up | - | - | - |

| Free Rent | - | - | - |

| SL Rent | - | - | - |

| Total Reimbursements | $720,039 | $691,350 | $4.19 |

| Gross Potential Rent | $3,812,858 | $3,669,105 | $22.24 |

| Total Other Income | - | - | - |

| Total Vacancy | - | - | - |

| Effective Gross Income | $3,812,858 | $3,669,105 | $22.24 |

| Total Expenses | $605,654 | $647,686 | $3.93 |

| Net Operating Income | $3,207,204 | $3,021,419 | $18.31 |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | 28 |

| Strictly private and confidential | Workspace Industrial Trust Portfolio |

Property Overview – Top 10 Properties (continued)

#2 - 4500 East Cotton Center Boulevard

| PROPERTY OVERVIEW | |

| Property Name: | 4500 East Cotton Center Boulevard |

| Address: | 4500 East Cotton Center Boulevard |

| City, State: | Phoenix, AZ |

| Property Type | Industrial-R&D/Flex |

| Ownership Interest: | Fee Simple |

| Year Built / Renovated: | 2007 / 2012 |

| Clear Heights (Feet): | 34 |

| Dock Doors: | 24 |

| % Currently used as Office: | 100.0% |

| NRA: | 139,403 |

| UW Leased %: | 100.0% |

| Wtd. Average Lease Expiration: | 12/31/2023 |

| Mortgage ALA ($ Amount / %): | $24,484,139 (3.9%) |

| % of Portfolio UW NOI: | 5.0% |

| RENT ROLL | ||||

| Tenant Name | SF | UW Gross Rent | UW Gross Rent PSF | Lease Expiration |

| Aetna Life Insurance Company | 139,403 | $3,062,684 | $21.97 | 12/31/2023 |

| Electric Lightwave, LLC | - | - | - | 05/31/2025 |

| - | - | - | - | - |

| Total Other Tenants | - | - | - | - |

| Total Vacant | - | - | - | - |

| Total / Wtd. Average | 139,403 | $3,062,684 | $21.97 | 12/31/2023 |

| UNDERWRITING | |||

| Budget 2023 | UW | PSF | |

| Base Rents | $3,092,819 | $2,326,636 | $16.69 |

| Rent Steps | - | $58,549 | $0.42 |

| Vacancy Lease Up | - | - | - |

| Free Rent | - | - | - |

| SL Rent | - | - | - |

| Total Reimbursements | $720,039 | $691,350 | $4.86 |

| Gross Potential Rent | $3,812,858 | $3,669,105 | $21.97 |

| Total Other Income | - | - | $0.43 |

| Total Vacancy | - | - | - |

| Effective Gross Income | $3,812,858 | $3,669,105 | $22.40 |

| Total Expenses | $605,654 | $647,686 | $4.40 |

| Net Operating Income | $3,207,204 | $2,509,771 | $18.00 |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | 29 |

| Strictly private and confidential | Workspace Industrial Trust Portfolio |

Property Overview – Top 10 Properties (continued)

#3 - 45-67 Great Valley Parkway

| PROPERTY OVERVIEW | |

| Property Name: | 45-67 Great Valley Parkway |

| Address: | 45-67 Great Valley Parkway |

| City, State: | Malvern, PA |

| Property Type | Industrial-R&D/Flex |

| Ownership Interest: | Fee Simple |

| Year Built / Renovated: | 1974 / 2022 |

| Clear Heights (Feet): | 20 |

| Dock Doors: | 17 |

| % Currently used as Office: | 0.0% |

| NRA: | 128,011 |

| UW Leased %: | 100.0% |

| Wtd. Average Lease Expiration: | 06/07/2029 |

| Mortgage ALA ($ Amount / %): | $19,941,484 (3.2%) |

| % of Portfolio UW NOI: | 3.3% |

| RENT ROLL | ||||

| Tenant Name | SF | UW Gross Rent | UW Gross Rent PSF | Lease Expiration |

| Janssen Biotech | 32,691 | $636,494 | $19.47 | 05/31/2032 |

| Marken, LLP | 39,645 | $634,127 | $16.00 | 02/28/2026 |

| Clinigen Clinical Supplies Management, Inc. | 24,800 | $420,236 | $16.95 | 09/30/2032 |

| Total Other Tenants | 30,875 | $413,663 | $13.40 | 06/30/2026 |

| Total Vacant | - | - | - | - |

| Total / Wtd. Average | 128,011 | $2,104,520 | $16.44 | 06/07/2029 |

| UNDERWRITING | |||

| Budget 2023 | UW | PSF | |

| Base Rents | $1,527,606 | $1,513,187 | $11.82 |

| Rent Steps | - | $40,912 | $0.32 |

| Vacancy Lease Up | - | - | - |

| Free Rent | - | - | - |

| SL Rent | - | - | - |

| Total Reimbursements | $569,084 | $550,421 | $4.30 |

| Gross Potential Rent | $2,096,690 | $2,104,520 | $16.44 |

| Total Other Income | - | $6,274 | $0.05 |

| Total Vacancy | - | - | - |

| Effective Gross Income | $2,096,690 | $2,110,794 | $16.49 |

| Total Expenses | $464,250 | $480,235 | $3.75 |

| Net Operating Income | $1,632,440 | $1,630,559 | $12.74 |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | 30 |

| Strictly private and confidential | Workspace Industrial Trust Portfolio |

Property Overview – Top 10 Properties (continued)

#4 - 4750 South 44th Place

| PROPERTY OVERVIEW | |

| Property Name: | 4750 South 44th Place |

| Address: | 4750 South 44th Place |

| City, State: | Phoenix, AZ |

| Property Type | Industrial-R&D/Flex |

| Ownership Interest: | Fee Simple |

| Year Built / Renovated: | 2015 |

| Clear Heights (Feet): | 34 |

| Dock Doors: | 15 |

| % Currently used as Office: | 86.9% |

| NRA: | 79,496 |

| UW Leased %: | 100.0% |

| Wtd. Average Lease Expiration: | 04/09/2024 |

| Mortgage ALA ($ Amount / %): | $10,933,169 (1.7%) |

| % of Portfolio UW NOI: | 3.3% |

| RENT ROLL | ||||

| Tenant Name | SF | UW Gross Rent | UW Gross Rent PSF | Lease Expiration |

| Aetna Life Insurance Company | 69,094 | $1,670,693 | $24.18 | 12/31/2023 |

| Caris MPI, Inc. | 10,402 | $265,979 | $25.57 | 12/31/2025 |

| Electric Lightwave, LLC | - | - | - | 05/31/2025 |

| Total Other Tenants | - | - | - | - |

| Total Vacant | - | - | - | - |

| Total / Wtd. Average | 79,496 | $1,936,672 | $24.36 | 04/09/2024 |

| UNDERWRITING | |||

| Budget 2023 | UW | PSF | |

| Base Rents | $1,453,357 | $1,449,652 | $18.24 |

| Rent Steps | - | $39,748 | $0.50 |

| Vacancy Lease Up | - | - | - |

| Free Rent | - | - | - |

| SL Rent | - | - | - |

| Total Reimbursements | $445,903 | $447,272 | $5.63 |

| Gross Potential Rent | $3,812,858 | 1,936,672 | $24.36 |

| Total Other Income | $47,640 | - | $0.60 |

| Total Vacancy | - | - | - |

| Effective Gross Income | $1,946,900 | $1,984,312 | $24.96 |

| Total Expenses | $387,497 | $414,055 | $5.21 |

| Net Operating Income | $1,559,404 | $1,570,257 | $19.75 |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | 31 |

| Strictly private and confidential | Workspace Industrial Trust Portfolio |

Property Overview – Top 10 Properties (continued)

#5 - 77-123 Great Valley Parkway

| PROPERTY OVERVIEW | |

| Property Name: | 77-123 Great Valley Parkway |

| Address: | 77-123 Great Valley Parkway |

| City, State: | Malvern, PA |

| Property Type | Industrial-R&D/Flex |

| Ownership Interest: | Fee Simple |

| Year Built / Renovated: | 1978 / 2021 |

| Clear Heights (Feet): | 16 |

| Dock Doors: | 17 |

| % Currently used as Office: | 0.0% |

| NRA: | 103,099 |

| UW Leased %: | 98.3% |

| Wtd. Average Lease Expiration: | 03/02/2027 |

| Mortgage ALA ($ Amount / %): | $17,400,678 (2.8%) |

| % of Portfolio UW NOI: | 3.1% |

| RENT ROLL | ||||

| Tenant Name | SF | UW Gross Rent | UW Gross Rent PSF | Lease Expiration |

| United Healthcare Services, Inc. | 34,348 | $669,443 | $19.49 | 03/31/2027 |

| - | 13,712 | $287,266 | $20.95 | 03/31/2028 |

| - | 9,530 | $208,974 | $21.93 | 08/31/2027 |

| Total Other Tenants | 43,798 | $815,687 | $18.62 | 08/06/2026 |

| Total Vacant | 1,711 | - | - | - |

| Total / Wtd. Average | 103,099 | $1,981,370 | $19.22 | 03/02/2027 |

| UNDERWRITING | |||

| Budget 2023 | UW | PSF | |

| Base Rents | $1,363,078 | $1,420,749 | $13.78 |

| Rent Steps | - | $27,128 | $0.26 |

| Vacancy Lease Up | - | $33,365 | $0.32 |

| Free Rent | - | - | - |

| SL Rent | - | - | - |

| Total Reimbursements | $517,971 | $533,493 | $5.17 |

| Gross Potential Rent | $1,881,049 | $2,014,734 | $19.54 |

| Total Other Income | - | $6,740 | $0.07 |

| Total Vacancy | - | ($33,365) | ($0.32) |

| Effective Gross Income | $1,881,049 | $1,988,110 | $19.28 |

| Total Expenses | $442,787 | $437,488 | $4.24 |

| Net Operating Income | $1,438,262 | $1,550,622 | $15.04 |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | 32 |

| Strictly private and confidential | Workspace Industrial Trust Portfolio |

Property Overview – Top 10 Properties (continued)

#6 - 4755 South 44th Place

| PROPERTY OVERVIEW | |

| Property Name: | 4755 South 44th Place |

| Address: | 4755 South 44th Place |

| City, State: | Phoenix, AZ |

| Property Type | Industrial-R&D/Flex |

| Ownership Interest: | Fee Simple |

| Year Built / Renovated: | 2018 |

| Clear Heights (Feet): | 34 |

| Dock Doors: | 15 |

| % Currently used as Office: | 100.0% |

| NRA: | 80,000 |

| UW Leased %: | 100.0% |

| Wtd. Average Lease Expiration: | 01/31/2029 |

| Mortgage ALA ($ Amount / %): | $17,554,666 (2.8%) |

| % of Portfolio UW NOI: | 2.8% |

| RENT ROLL | ||||

| Tenant Name | SF | UW Gross Rent | UW Gross Rent PSF | Lease Expiration |

| Aetna Life Insurance Company | 80,000 | $1,904,000 | $23.80 | 01/31/2029 |

| - | - | - | - | - |

| - | - | - | - | - |

| Total Other Tenants | - | - | - | - |

| Total Vacant | - | - | - | - |

| Total / Wtd. Average | 80,000 | $1,904,000 | $23.80 | 01/31/2029 |

| UNDERWRITING | |||

| Budget 2023 | UW | PSF | |

| Base Rents | $1,502,871 | $1,420,800 | $17.76 |

| Rent Steps | - | $42, 400 | $0.53 |

| Vacancy Lease Up | - | - | - |

| Free Rent | - | - | - |

| SL Rent | - | - | - |

| Total Reimbursements | $455,125 | $440,800 | $5.51 |

| Gross Potential Rent | $1,957,996 | $1,904,000 | $23.80 |

| Total Other Income | - | - | - |

| Total Vacancy | - | - | - |

| Effective Gross Income | $1,957,996 | $1,904,000 | $23.80 |

| Total Expenses | $376,806 | $399,686 | $5.00 |

| Net Operating Income | $1,581,191 | $1,504,314 | $18.80 |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | 33 |

| Strictly private and confidential | Workspace Industrial Trust Portfolio |

Property Overview – Top 10 Properties (continued)

#7 - 420-500 Lapp Road

| PROPERTY OVERVIEW | |

| Property Name: | 420-500 Lapp Road |

| Address: | 420-500 Lapp Road |

| City, State: | Malvern, PA |

| Property Type | Industrial-R&D/Flex |

| Ownership Interest: | Fee Simple |

| Year Built / Renovated: | 1989 / 2016 |

| Clear Heights (Feet): | 16 |

| Dock Doors: | 5 |

| % Currently used as Office: | 0.0% |

| NRA: | 91,312 |

| UW Leased %: | 100.0% |

| Wtd. Average Lease Expiration: | 02/18/2026 |

| Mortgage ALA ($ Amount / %): | $16,399,754 (2.6%) |

| % of Portfolio UW NOI: | 2.8% |

| RENT ROLL | ||||

| Tenant Name | SF | UW Gross Rent | UW Gross Rent PSF | Lease Expiration |

| ifm Prover USA, Inc. | 36,837 | $725,689 | $19.70 | 03/31/2024 |

| Baudax Bio | 17,369 | $382,118 | $22.00 | 12/31/2027 |

| Akzo Nobel Coatings, Inc. | 17,295 | $334,139 | $19.32 | 08/31/2024 |

| Total Other Tenants | 19,811 | $433,469 | $21.88 | 10/12/2028 |

| Total Vacant | - | - | - | - |

| Total / Wtd. Average | 91,312 | $1,875,416 | $20.54 | 02/18/2026 |

| UNDERWRITING | |||

| Budget 2023 | UW | PSF | |

| Base Rents | $1,025,690 | $1,324,689 | $14.51 |

| Rent Steps | - | ($819) | ($0.01) |

| Vacancy Lease Up | - | - | - |

| Free Rent | - | - | - |

| SL Rent | - | - | - |

| Total Reimbursements | $496,650 | $551,545 | $6.04 |

| Gross Potential Rent | $1,522,340 | $1,875,416 | $20.54 |

| Total Other Income | - | $5,264 | $0.06 |

| Total Vacancy | - | - | - |

| Effective Gross Income | $1,522,340 | $1,880,679 | $20.60 |

| Total Expenses | $455,730 | $456,989 | $5.00 |

| Net Operating Income | $1,066,610 | $1,423,691 | $15.59 |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | 34 |

| Strictly private and confidential | Workspace Industrial Trust Portfolio |