UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 20-F

(Mark One)

☒ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report: Not applicable

For the transition period from _______ to _______

Commission file number: [ ]

1397468 B.C. Ltd.

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant's name into English)

British Columbia

(Jurisdiction of incorporation or organization)

300 - 900 West Hastings Street, Vancouver, British Columbia, V6C 1E5

(Address of principal executive offices)

Alexi Zawadzki

300 - 900 West Hastings Street, Vancouver, British Columbia, V6C 1E5

Telephone: 604-785-4453

Facsimile: 604-629-0726

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of class | Trading Symbol(s) | Name of exchange on which

registered |

| Common Shares without par value | LAC | Toronto Stock Exchange

New York Stock Exchange

|

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report: Not applicable.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ☐ Yes ☐ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☐ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

☐ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☒ |

| | | Emerging growth company ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term "new or revised financial accounting standard" refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.(1) ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b).(1) ☐

(1) Check boxes are blank until we are required to have a recovery policy under the applicable listing standard of the New York Stock Exchange.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ☐ International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ Other ☐

If "Other" has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

TABLE OF CONTENTS

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This registration statement on Form 20-F contains certain forward-looking statements. Forward-looking statements include, but are not limited to, statements regarding our or our management's expectations, hopes, beliefs, intentions or strategies regarding the future and other statements that are other than statements of historical fact. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words "anticipate," "believe," "continue," "could," "estimate," "expect," "intend," "may," "might," "plan," "possible," "potential," "predict," "project," "should," "would" and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

In particular, this registration statement contains forward-looking information, including, without limitation, with respect to the following matters or the Company's expectations relating to such matters: statements concerning the completion and proposed terms of, and matters relating to, the Separation (as defined herein) and the expected timing related thereto; the tax treatment of the Separation; the expected operations, financial results and condition of the Company following the Separation; the Company's future objectives and strategies to achieve those objectives, including the future prospects of the Company as an independent company; the listing of the Company on the TSX and NYSE; any market created for the common shares of the Company; the estimated cash flow, capitalization and adequacy thereof for the Company following the Separation; the expected benefits of the Separation to, and resulting treatment of, Shareholders and the Company; the anticipated effects of the Separation; the estimated costs of the Arrangement; the satisfaction of the conditions to consummate the Separation; the capital structure, principal shareholders, directors and officers, compensation arrangements and structure, audit committee and corporate governance practices, auditors and transfer agent, and the material contracts of the Company; development of the Thacker Pass Project (as defined herein), including timing, progress, approach, continuity or change in plans, construction, commissioning, milestones, anticipated production and results thereof and expansion plans; expectations regarding accessing funding from the ATVM Loan Program (as defined herein); expectations and anticipated impact of the COVID-19 pandemic; anticipated timing to resolve, and the expected outcome of, any complaints or claims made or that could be made concerning the environmental permitting process in the United States for the Thacker Pass Project, including the lawsuit against the BLM (as defined herein) and the appeal filed in the United States Court of Appeals for the Ninth Circuit (the "Ninth Circuit"), both filed in February 2023; capital expenditures and programs; estimates, and any change in estimates, of the Mineral Resources and Mineral Reserves at the Thacker Pass Project; development of Mineral Resources and Mineral Reserves; government regulation of mining operations and treatment under governmental and taxation regimes; the future price of commodities, including lithium; the realization of Mineral Resources and Mineral Reserves estimates, including whether certain Mineral Resources will ever be developed into Mineral Reserves and information and underlying assumptions related thereto; the timing and amount of future production; currency exchange and interest rates; the Company's ability to raise capital; expected expenditures to be made by the Company on the Thacker Pass Project; ability to produce high purity battery grade lithium products; settlement of agreements related to the operation and sale of mineral production as well as contracts in respect of operations and inputs required in the course of production; the timing, cost, quantity, capacity and product quality of production at the Thacker Pass Project; successful development of the Thacker Pass Project, including successful results from the Company's testing facility and third- party tests related thereto; capital costs, operating costs, sustaining capital requirements, after tax net present value and internal rate of return, payback period, sensitivity analyses, and net cash flows of the Thacker Pass Project; the Company's expected capital expenditures for the construction of the Thacker Pass Project; ability to achieve capital cost efficiencies; expectations and anticipated impact of the COVID-19 pandemic; the GM Transaction and the potential for additional financing scenarios for the Thacker Pass Project; the expected timetable for completing Tranche 2 of the GM Transaction; the ability of the Company to complete Tranche 2 of the GM Transaction on the terms and timeline anticipated, or at all; the receipt of required stock exchange and regulatory approvals and authorizations, and the securing of sufficient funding to complete the initial development of towards the targeted production capacity of 40,000 tonnes per annum ("tpa") of lithium carbonate ("Phase 1") at the Thacker Pass Project, required for Tranche 2 of the GM Transaction; the expected benefits of the GM Transaction; the expected timetable for completing the Separation; the ability of the Company to complete the Separation on the terms and timeline anticipated, or at all; the receipt of board of directors and required third party, stock exchange and regulatory approvals required for the Separation; the expected holdings and assets of Company following the Separation; the expected benefits of the Separation for the Company and the Company's shareholders and other stakeholders; and the strategic advantages, future opportunities and focus of the Company as a result of the Separation.

The forward-looking statements in this registration statement are based upon various assumptions, many of which are based, in turn, upon further assumptions, including without limitation, management's examination of historical operating trends, data contained in our records and other data available from third parties. Although we believe that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond our control, we cannot assure you that we will achieve or accomplish these expectations, beliefs or projections. As a result, you are cautioned not to rely on any forward-looking statements.

Many of these statements are based on our assumptions about factors that are beyond our ability to control or predict and are subject to risks and uncertainties that are described more fully in "Item 3. Key Information - D. Risk Factors." Any of these factors or a combination of these factors could materially affect our future results of operations and the ultimate accuracy of the forward-looking statements. In addition to these important factors, important factors that, in our view, could cause actual results to differ materially from those discussed in the forward-looking statements include among other things:

- ability of the Company to fund, advance and develop the Thacker Pass Project (as defined herein) and produce battery grade lithium;

- the respective benefits and impacts of the Thacker Pass Project when production operations commence;

- settlement of agreements related to the operation and sale of mineral production as well as contracts in respect of operations and inputs required in the course of production;

- the Company's ability to operate in a safe and effective manner, and without material adverse impact from the effects of climate change or severe weather conditions;

- uncertainties relating to receiving and maintaining mining, exploration, environmental and other permits or approvals in Nevada;

- demand for lithium, including that such demand is supported by continued growth in the electric vehicle market;

- current technological trends;

- the impact of increasing competition in the lithium business, and the Company's competitive position in the industry;

- continuing support of local communities and the Fort McDermitt Paiute and Shoshone Tribe (the "Tribe") for the Thacker Pass Project, continuing constructive engagement with these and other stakeholders, and any expected benefits of such engagement;

- the stable and supportive legislative, regulatory and community environment in the jurisdictions where the Company operates;

- impacts of inflation, currency exchange rates, interest rates and other general economic and stock market conditions;

- the impact of unknown financial contingencies, including litigation costs, environmental compliance costs and costs associated with the impacts of climate change, on the Company's operations;

- estimates of and unpredictable changes to the market prices for lithium and lithium products;

- development and construction costs for the Thacker Pass Project, and costs for any additional exploration work at the project;

- estimates of Mineral Resources and Mineral Reserves, including whether certain Mineral Resources will ever be developed into Mineral Reserves;

- reliability of technical data;

- anticipated timing and results of exploration, development and construction activities, including the impact of ongoing supply chain disruptions and availability of equipment and supplies on such timing;

- timely responses from governmental agencies responsible for reviewing and considering the Company's permitting activities at the Thacker Pass Project;

- availability of technology, including low carbon energy sources and water rights, on acceptable terms to advance the Thacker Pass Project;

- the Company's ability to obtain additional financing on satisfactory terms or at all, including the outcome of LAC's U.S. Department of Energy ("DOE") loan application;

- government regulation of mining operations and M&A activity, and treatment under governmental, regulatory and taxation regimes;

- ability to realize expected benefits from investments in or partnerships with third parties;

- accuracy of development budgets and construction estimates;

- changes to the Company's current and future business plans and the strategic alternatives available to the Company; and

- other factors discussed in "Item 3. Key Information - D. Risk Factors."

Should one or more of the foregoing risks or uncertainties materialize, or should any of the Company's assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. Consequently, there can be no assurance that actual results or developments anticipated by the Company will be realized or, even if substantially realized, that they will have the expected consequences to, or effects, on us. Given these uncertainties, prospective investors are cautioned not to place undue reliance on such forward-looking statements.

The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable laws. If one or more forward-looking statements are updated, no inference should be drawn that additional updates will be made with respect to those or other forward-looking statements.

EXPLANATORY NOTE

The Separation

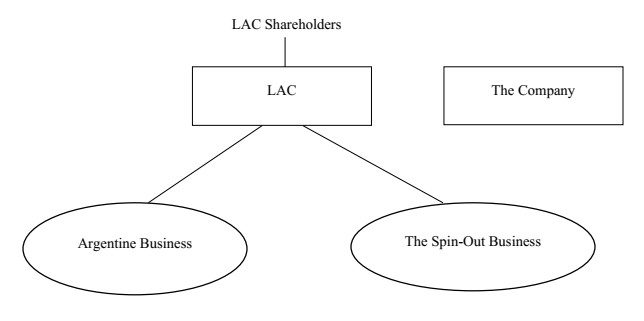

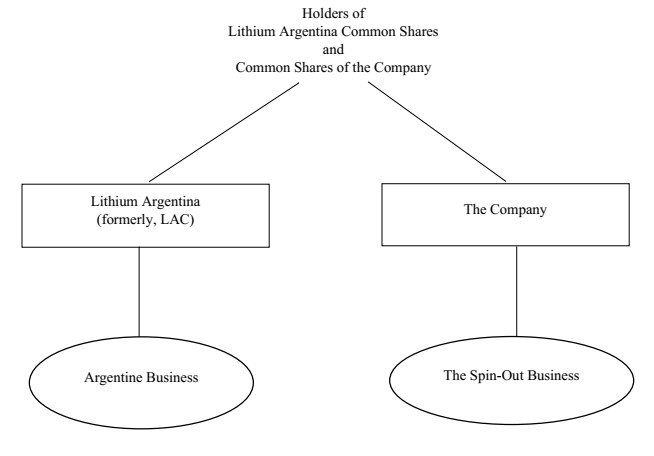

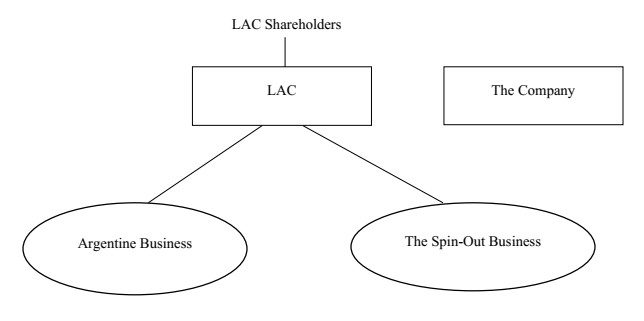

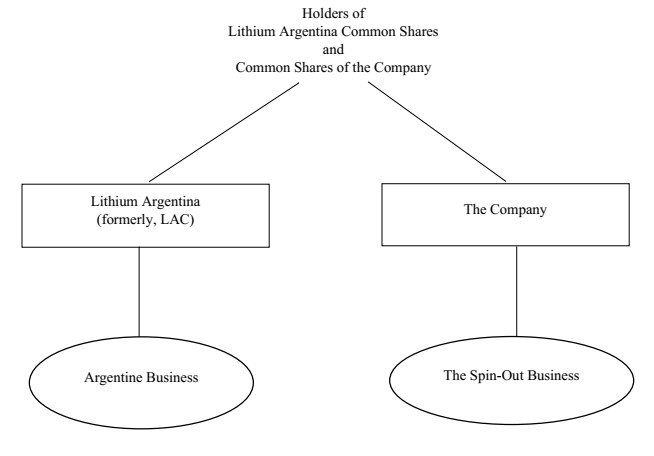

1397468 B.C. Ltd. (the "Company") was incorporated by Lithium Americas Corp. ("LAC") under the laws of British Columbia, as part of a reorganization of LAC, a public company listed on the Toronto Stock Exchange (the "TSX") and the New York Stock Exchange (the "NYSE"), that will result in the separation of LAC's North American and Argentina business units into two independent public companies (the "Separation") that include: (i) an Argentina focused lithium company owning LAC's current interest in its Argentine lithium assets, including the Caucharí-Olaroz lithium brine project in Jujuy, Argentina (the "Caucharí-Olaroz Project"), which recently achieved first lithium production and continues to move towards reaching full production, and the Pastos Grandes lithium brine mineral project located in the Province of Salta in Northwest Argentina (the "Pastos Grandes Project"), which company will be named "Lithium Americas (Argentina) Corp." upon completion of the Separation ("Lithium Argentina"), and (ii) the Company, a North America focused lithium company owning the Thacker Pass Project (as defined below) and LAC's North American investments, which will be re-named "Lithium Americas Corp." upon completion of the Separation.

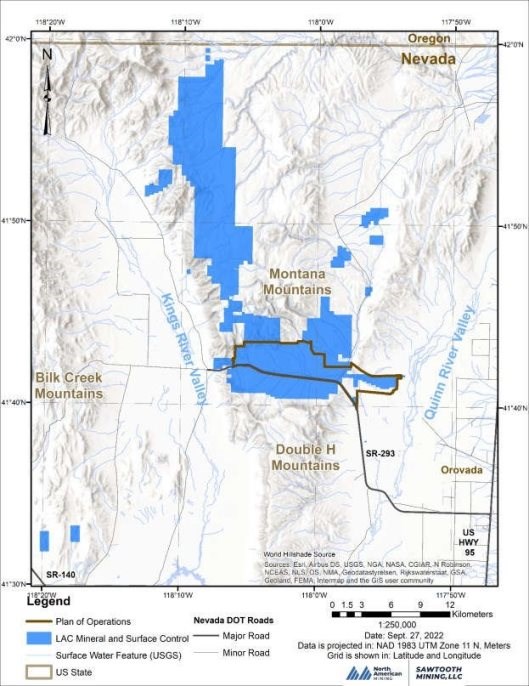

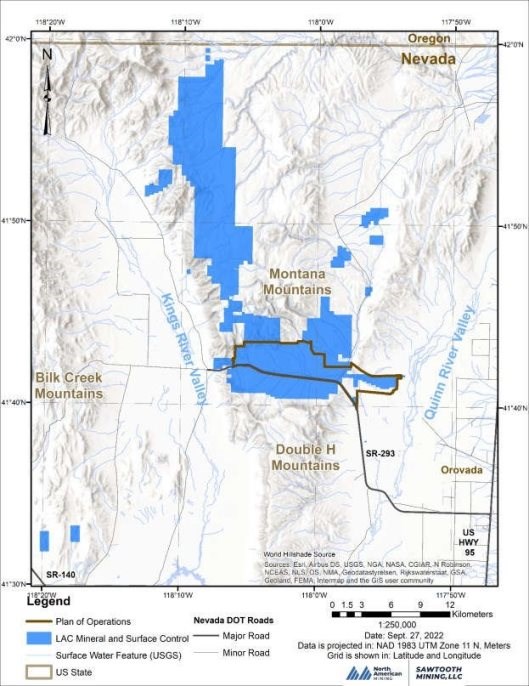

The Separation is to be implemented by way of a plan of arrangement (the "Plan of Arrangement") under the laws of British Columbia (the "Arrangement") pursuant to an amended and restated arrangement agreement entered into between the Company and LAC on June 14, 2023 (the "Arrangement Agreement"). The Plan of Arrangement was approved by special resolution of the shareholders of LAC ("LAC Shareholders") at a meeting held on July 31, 2023 (the “Meeting”) and by final order of the Supreme Court of British Columbia issued on August 4, 2023 (the “Final Order”). Under the Arrangement, LAC will, among other things, contribute its interest in the Thacker Pass lithium project property located in Humboldt County, Nevada (the "Thacker Pass Project"), LAC's North American investments in the shares of certain companies, certain intellectual property rights and cash (collectively, the "Spin- Out Business") to the Company and the Company will distribute its common shares (the "Common Shares") to LAC Shareholders in a series of share exchanges. The "Preliminary Feasibility Study S-K 1300 Technical Report Summary for the Thacker Pass Project Humboldt County, Nevada, USA" with an effective date of December 31, 2022 (the "Thacker Pass 1300 Report") is filed as Exhibit 15.1 to this registration statement.

The Separation will be pro rata to the LAC Shareholders, such that holders will maintain the same proportionate interest in LAC (which will be Lithium Argentina after the Separation) and in the Company both immediately before and immediately after the Separation. More specifically, LAC Shareholders will receive, for every one common share in the capital of LAC (each, a "LAC Common Share") owned immediately before the effective time of the Arrangement (the "Arrangement Effective Time"), one common share of Lithium Argentina (the "Lithium Argentina Common Shares") and one Common Share of the Company. Registered LAC Shareholders will receive direct registration statements representing their Common Shares and Lithium Argentina Common Shares upon submitting the share certificates or direct registration statements representing the LAC Common Shares and a letter of transmittal to a depositary appointed by LAC within three years following the completion of the Arrangement. The Arrangement will be effective on the third business day (or such other date as the parties may agree in writing) after the date upon which Lithium Argentina and the Company have confirmed in writing that all conditions to the completion of the Plan of Arrangement have been satisfied or waived in accordance with the Arrangement Agreement and all documents and instruments required under the Arrangement Agreement, the Plan of Arrangement and the Final Order have been delivered (the "Arrangement Effective Date"). Incentive securities of LAC outstanding immediately before the Arrangement Effective Time will be exchanged for one equivalent incentive security of Lithium Argentina and one of the Company, subject to adjustment, as described in more detail under "Item 6.B - Compensation" and "Item 10.C - Material Contracts - Arrangement Agreement - Plan of Arrangement."

Under this registration statement on Form 20-F, the Company is applying to register its Common Shares under Section 12(b) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). The Company has applied to have its Common Shares listed on the TSX and the NYSE under the ticker symbol "LAC." The TSX has conditionally approved the listing of the Common Shares. There is no assurance that the NYSE will approve the Company's listing application. The listing of the Common Shares will be subject to the Company fulfilling all of the requirements of the TSX and the NYSE, respectively. Upon consummation of the Separation and the successful listing of the Common Shares on the TSX and the NYSE, the Company and LAC will be independent publicly traded companies with separate boards of directors and management, although, at the time of the Separation, certain of the directors and officers of the LAC will hold similar positions at the Company.

Certain financial statements presented in this registration statement are carve-out financial statements derived from LAC's consolidated historical financial statements. The carve-out financial statements in this registration statement include audited carve-out financial statements of the Spin-Out Business for the fiscal years ended December 31, 2022, 2021 and 2020 and interim unaudited carve-out financial statements of the Spin-Out Business for the period ended March 31, 2023. The Company has no assets, liabilities or operations prior to the completion of the Separation. This registration statement also includes unaudited pro forma condensed consolidated financial statements of the Company as at and for the period ended March 31, 2023, and for the year ended December 31, 2022, which assume that the Separation was completed on January 1, 2022. This registration statement also includes audited financial statements for the period from incorporation on January 23, 2023 to March 31, 2023.

Unless otherwise indicated or required by the context in this registration statement, the Company's disclosure assumes that the consummation of the Separation has occurred. Although the Company will not acquire the Spin-Out Business until the Separation is effective pursuant to the Arrangement, the operating and other statistical information with respect to the business is presented as of and for the years ended December 31, 2022, 2021 and 2020, and as of and for the period ended March 31, 2023, unless otherwise indicated, as if the Company owned such business as of such date.

IMPLICATIONS OF BEING AN EMERGING GROWTH COMPANY

The Company qualifies as an "emerging growth company" as defined in Section 2(a) of the Securities Act of 1933, as amended (the "Securities Act"), as modified by the Jumpstart Our Business Startups Act of 2012, or the "JOBS Act." As an emerging growth company, the Company may take advantage of specified reduced disclosure and other exemptions from requirements that are otherwise applicable to public companies that are not emerging growth companies. These provisions include:

Reduced disclosure about the Company's executive compensation arrangements;

Exemptions from non-binding shareholder advisory votes on executive compensation or golden parachute arrangements; and

Exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting.

The Company does not intend to take advantage of the extended transition period allowed for emerging growth companies for complying with new or revised accounting guidance as allowed by Section 107 of the JOBS Act and Section 7(a)(2)(B) of the Securities Act.

The Company may take advantage of these exemptions for up to five years after the date of first sale of securities under a Securities Act registration statement or such earlier time that the Company is no longer an emerging growth company. The Company would cease to be an emerging growth company if it has more than $1.235 billion in annual revenues as of the end of a fiscal year, if it is deemed to be a large-accelerated filer under the rules of the Securities and Exchange Commission (the "SEC") or if it issues more than $1.0 billion of non-convertible debt over a three-year period.

PART I

Unless the context otherwise requires, as used in this registration statement, the terms "Company," "we," "us," and "our" refer to 1397468 B.C. Ltd. and any or all of its subsidiaries, and "1397468 B.C. Ltd." refers only to 1397468 B.C. Ltd. and not to its subsidiaries. References in this registration statement to "LAC" refer to Lithium Americas Corp.

Unless otherwise indicated, all references to "U.S. dollars," "dollars," "US$" and "$" in this registration statement are to the lawful currency of the United States of America.

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

A. Directors and Senior Management

For information regarding our directors and senior management, see "Item 6. Directors, Senior Management and Employees - A. Directors and Senior Management."

B. Advisers

Not applicable.

C. Auditors

Our auditors are PricewaterhouseCoopers LLP, Chartered Professional Accountants.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. [Reserved]

B. Capitalization and Indebtedness

The following table sets forth our consolidated capitalization and indebtedness as at March 31, 2023, reflecting the completion of the Arrangement as at such date. The financial data included herein is derived from the Spin-Out Business, also known as LAC North America. The annual financial statements have been prepared in accordance with IFRS and the interim financial statements have been prepared in accordance with IFRS applicable to the preparation of interim financial statements, including International Accounting Standard 34, Interim Financial Reporting. This table should be read in conjunction with "Item 5. Operating and Financial Review and Prospects," the audited carve-out financial statements, the interim unaudited financial statements, the pro forma financial statements and other information provided in this registration statement.

| | | As at March 31, 2023 | |

| | | Actual | | | Pro Forma As

Adjusted | |

| | | (in thousands of US$) | |

| Total capitalization: | | | | | | |

| Loan from LAC | $ | 44,458 | | $ | - | |

| | | | | | | |

| Net LAC investment | $ | 514,231 | | $ | - | |

| Share Capital | | - | | $ | 634,680 | |

| Deficit | $ | (262,143 | ) | $ | (263,715 | ) |

| Total shareholders' equity | $ | 252,088 | | $ | 370,965 | |

| Total capitalization | $ | 296,546 | | $ | 370,965 | |

| | | | | | | |

| Amounts held in cash and cash equivalents | | | | | | |

| Cash and cash equivalents(1) | $ | 308,537 | | $ | 383,537 | |

Notes:

(1) See also "Cash to be Transferred to the Company" below.

Cash to be Transferred to the Company

As at March 31, 2023, the Spin-Out Business to be transferred to the Company as part of the Separation had $308.5 million in cash and cash equivalents (which includes unspent net proceeds from Tranche 1 (as defined below) of the GM Transaction (as defined below). Such funds are utilized by LAC for the advancement of the Thacker Pass Project and will be reduced accordingly until the completion of the Separation. The Plan of Arrangement contemplates the transfer of an additional $75 million from LAC to the Company, to establish sufficient working capital of the Company, provided however that in the event the Separation takes effect later than September 1, 2023, the actual amount of cash to be transferred will be to subject to adjustments at the discretion of the board of directors of LAC. LAC will be monitoring working capital requirements and progress of business operations for each of the business units during the period through to completion of the Separation, and such adjustments will be determined, in particular, based on the funding needs of Lithium Argentina as the Caucharí-Olaroz Project ramps-up towards full production to provide sufficient funds to cover any additional cash needs that may be required.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

You should carefully consider the risks described below, together with all of the other information included in this Form 20-F, in evaluating the Company and its Common Shares. The following risk factors could adversely affect the Company's business, financial condition, results of operations and the price of the Common Shares.

In this section "Risk Factors," references to the "Company" are to the Company, and/or as applicable, LAC prior to the Separation as it relates to the Company following the Separation and the Spin-Out Business.

Risks Relating to the Company and the Spin-Out Business

The demand for lithium and the growth of the lithium market are uncertain.

The development of lithium operations at the Thacker Pass Project is highly dependent upon the currently projected demand for and uses of lithium-based end products. This includes lithium-ion batteries for electric vehicles and other large format batteries that currently have limited market share and whose projected adoption rates are not assured. To the extent that such markets do not develop in the manner contemplated by the Company, then the long-term growth in the market for lithium products will be adversely affected, which would inhibit the potential for development of the Thacker Pass Project, its potential commercial viability and would otherwise have a negative effect on the business and financial condition of the Company. In addition, as a commodity, lithium market demand is subject to the substitution effect in which end-users adopt an alternate commodity as a response to supply constraints or increases in market pricing. To the extent that these factors arise in the market for lithium, it could have a negative impact on overall prospects for growth of the lithium market and pricing, which in turn could have a negative effect on the Company and its projects.

The Company may be unable to complete the development of the Thacker Pass Project.

The Company's business strategy depends in substantial part on developing the Thacker Pass Project into a commercially viable mine and chemical manufacturing facility. Whether a mineral deposit will be commercially viable depends on numerous factors, including but not limited to: the attributes of the deposit, such as size and grade; proximity to available infrastructure; economics for new infrastructure; market conditions for battery-grade lithium products; processing methods and costs; and government permitting and regulations.

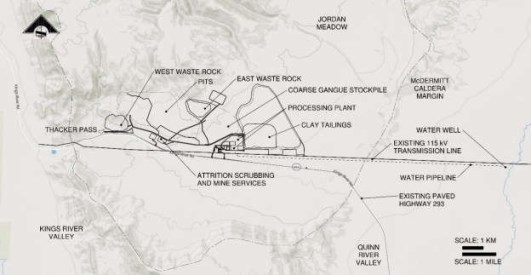

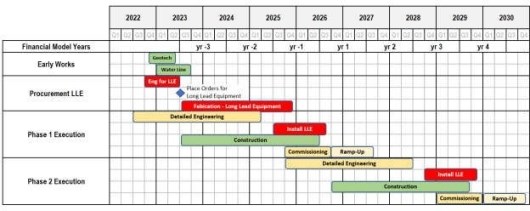

On February 6, 2023, the Company received a favorable ruling from the U.S. District Court, District of Nevada (the "Federal District Court") in respect of the appeal of the issuance of the Record of Decision (the "ROD") for the Thacker Pass Project. The Federal District Court declined to vacate the ROD for the Thacker Pass Project, ordered the U.S. Department of the Interior Bureau of Land Management (the "BLM") to determine whether the Company possesses adequate mining-claim rights to the lands over the area designated for waste storage and tailings and did not impose any restrictions expected to impact the construction timeline of the Thacker Pass Project. The Company commenced construction activities, including site preparation, geotechnical drilling, water well drilling, water pipeline development and associated infrastructure after having selected an engineering, procurement and construction management firm to develop and execute the construction plan for the Thacker Pass Project. The Company is also focused on the development of a North American supply chain, and continues to progress the DOE Advanced Technology Vehicles Manufacturing Loan program ("ATVM Loan Program") application for financing of the Thacker Pass Project.

There are many additional factors that could impact the project's development, including terms and availability of financing, cost overruns, litigation or administrative appeals concerning the project, delays in development, and any permitting changes, among other factors. The Thacker Pass Project is also subject to the development and operational risks described elsewhere in this registration statement. Accordingly, there can be no assurance that the Company will complete development of the Thacker Pass Project as currently contemplated, or at all. If the Company is unable to develop the Thacker Pass Project into a commercial operating mine, its business and financial condition could be materially adversely affected.

There is no assurance as to the outcome of the Company's application to the DOE for funding to be used at the Thacker Pass Project through the ATVM Loan Program.

The DOE's invitation to enter into confirmatory due diligence and term sheet negotiations is not an assurance that DOE will offer a term sheet to the applicant, or that the terms and conditions of any term sheet will be consistent with the terms proposed by the applicant. The outcome of the Company's application to the DOE for funding to be used at the Thacker Pass Project through the ATVM Loan Program is dependent on the results of DOE advanced due diligence and DOE's determination whether to proceed, and there can be no assurances as to the outcome of such due diligence review, whether the DOE will determine to proceed and as to the terms and conditions of any term sheet that may be offered, if any.

The ability to generate profitable operations on the Thacker Pass Project will be significantly affected by changes in the market price of lithium.

The ability to generate profitable operations on the Thacker Pass Project, if and to the extent the project is developed and enter commercial operation, will be significantly affected by the market price of lithium-based end products, such as lithium carbonate and lithium hydroxide. The market price of these products fluctuates widely and is affected by numerous factors beyond the Company's control, including world supply and demand, pricing characteristics for alternate energy sources such as oil and gas, government policy and laws, interest rates, the rate of inflation and the stability of currency exchange rates. Such external economic factors are influenced by changes in international investment patterns, various political developments and macro-economic circumstances. Furthermore, the price of lithium products is significantly affected by their purity and performance, and by the specifications of end-user battery manufacturers. If the products produced from the Company's projects do not meet battery-grade quality and/or do not meet customer specifications, pricing will be reduced from that expected for battery-grade products. In turn, the availability of customers may also decrease. The Company may not be able to effectively mitigate against pricing risks for its products. Depressed pricing for the Company's products will affect the level of revenues expected to be generated by the Company, which in turn could affect the value of the Company, its share price and the potential value of its properties.

No assurance can be given that production estimates will be achieved generally or at the stated costs.

This registration statement and the Thacker Pass 1300 Report contain estimates relating to future production and future production costs for the Thacker Pass Project. No assurance can be given that production estimates will be achieved generally or at the stated costs. These production estimates are dependent on, among other things, the accuracy of mineral reserve estimates, the accuracy of assumptions regarding ore grades and recovery rates, ground conditions, physical conditions of ores, assumed metallurgical characteristics and the accuracy of estimated rates and costs of mining and processing. For the Thacker Pass Project, ore grade or type may be lower quality than expected, which may result in levels lower than expected. The failure of the Company to achieve production estimates could have a material and adverse effect on any or all of its cash flows, profitability, results of operations and financial condition.

The Thacker Pass 1300 Report may prove to be unreliable if the assumptions or estimates do not reflect actual facts and events.

The expected capital and operating costs for the Thacker Pass Project are based on the interpretation of geological and metallurgical data, feasibility studies, economic factors, anticipated climatic conditions and other factors that may prove to be inaccurate. Therefore, the Thacker Pass 1300 Report may prove to be unreliable if the assumptions or estimates do not reflect actual facts and events. The Thacker Pass 1300 Report estimated life of mine project capital costs for the Thacker Pass Project of $5,505.8 million for both Phase 1 and 2, but any of following events, among the other events and uncertainties described therein, could affect the ultimate accuracy of such estimates: uncertainties in the interpreted geological data based on wide-spaced drill holes not being representative of the mineral deposit locally, in particular, unrecognized faults or basaltic units that could require changes to the mine plan or increased mine dilution or mine losses; unrecognized geotechnical conditions that could require flattening of the pit slope increasing the strip ratio and mining costs, and area required for waste rock storage; unanticipated changes to the process flowsheet; increase in capital costs for any reason; and adverse weather conditions that could reduce mine equipment performance and require waste management storage areas to be redesigned.

There can be no certainty that current permits will be maintained, permitting changes such as changes to the mine plan or increases to planned capacity will be approved, or additional local, state or provincial permits or approvals required to carry out development and production at the Thacker Pass Project will be obtained, projected timelines for permitting decisions to be made will be met, or the projected costs of permitting will be accurate.

Although the Company has obtained all key environmental permits for the Thacker Pass Project for an initial stage of construction, there can be no certainty that current permits will be maintained, permitting changes such as changes to the mine plan or increases to planned capacity will be approved, or additional local, state or provincial permits or approvals required to carry out development and production at the Thacker Pass Project will be obtained, projected timelines for permitting decisions to be made will be met, or the projected costs of permitting will be accurate.

In addition, there is the risk that existing permits will be subject to challenges of regulatory administrative process, and similar litigation and appeal processes. Litigation and regulatory review processes can result in lengthy delays, with uncertain outcomes. Such issues could impact the expected development timelines of the Company's Thacker Pass Project and consequently have a material adverse effect on the Company's prospects and business.

The processes contemplated by the Company for production of lithium carbonate from a sedimentary deposit such as that of the Thacker Pass Project have not yet been demonstrated at commercial scale.

The processes contemplated by the Company for production of lithium carbonate from a sedimentary deposit such as that of the Thacker Pass Project have not previously been demonstrated at commercial scale. To mitigate this risk, the Company developed the Lithium Technical Development Center in Reno, Nevada ("LiTDC"), a new integrated process testing facility in Reno, Nevada to test the process chemistry. The LiTDC continues to operate based on the Thacker Pass Project flowsheet processing raw ore to final battery-quality lithium carbonate to produce product samples for potential customers and partners. The results of ongoing test work to de-risk each step of the flowsheet continue to be in line with expectations. However, there are risks that the process chemistry will not be demonstrated at scale, efficiencies of recovery and throughput capacity will not be met, or that scaled production will not be cost effective or operate as expected. In addition, the novel nature of the deposit could result in unforeseen costs, additional changes to the process chemistry and engineering, and other unforeseen circumstances that could result in additional delays to develop the project or increased capital or operating costs from those estimated in the Thacker Pass TR (as defined below) and the Thacker Pass 1300 Report, which could have a material adverse effect on the development of the Thacker Pass Project.

The Company may be subject to geopolitical risks.

The Company's business is international in scope, with its incorporating jurisdiction and head office located in Canada and the Thacker Pass Project located in the United States. Changes, if any, in mining, investment or other applicable policies or shifts in political attitude in any of the jurisdictions in which the Company operates, or towards such political jurisdictions, may adversely affect the Company's operations or profitability and may affect the Company's ability to fund its ongoing expenditures at its projects.

More specifically, as a result of increased concerns around global supply chains, the lithium industry has become subject to increasing political involvement, including in the United States and Canada. This reflects the critical role of lithium as an input in the development of batteries for the burgeoning transition to electric vehicles in the automotive industry, combined with worldwide supply constraints for lithium production and geopolitical tensions between Western countries such as the United States and Canada on the one hand and China on the other, arising from the dominant role of China in the production of inputs for the battery industry. The resulting political involvement appears to be evolving into a form of industrial policy by several governments, including those of Canada and the United States, in which they employ steps to encourage the development of domestic supply such as tax incentives and low-interest loans to domestic and other Western actors, as well as undertake steps to discourage the involvement of participants from non- Western countries, including the expansion of legal oversight and an expansion of the scope of discretionary authority under laws and regulations to impose restrictions on ownership, influence and investment. These factors are of particular relevance to the Company, with its Canadian incorporation, U.S.-based Thacker Pass Project and predominant connection to Canada and the United States through its stock exchange listings, shareholder base and board and management composition. This evolving industrial policy is resulting in benefits to the Company as a result of its connection to Canada and the United States, including the prospect of tax incentives and, potentially, financial support being made available for the development of the Thacker Pass Project. The Company is also having to manage the more restrictive aspects of this increased government involvement, which is expected to result in limitations on the extent to which the Company will be able to undertake business operations with non-Western parties and limitations on ownership and influence of non-Western parties in its business. The Company has and intends to continue to fully comply with legislation and policies in all jurisdictions where it operates, including steps under this policy. At this time, the Company does not believe that any of these steps will result in a substantive adverse change to its business or operations, or the intended geographic focus of its business.

Changes in mining, investment or other applicable policies or shifts in political attitude may adversely affect the Company's operations.

The Company wholly-owns a mineral property in the United States. Changes, if any, in mining, investment or other applicable policies or shifts in political attitude in any of the jurisdictions in which the Company operates may adversely affect the Company's operations or profitability and may affect the Company's ability to fund its ongoing expenditures at its projects. Regardless of the economic viability of the properties in which the Company holds interests, and despite being beyond the Company's control, such political changes could have a substantive impact on the Company that may prevent or restrict mining of some or all of any deposits on the Company's properties, including the financial results therefrom.

The Company has no history of mining operations.

The Company has no prior history of completing the development of a mining project or conducting mining operations. The future development of properties found to be economically feasible will require the construction and operation of mines, processing plants and related infrastructure. While certain proposed members of management and employees have mining development and operational experience, the Company does not have vast experience as a collective organization. As a result of these factors, it is difficult to evaluate the Company's prospects, and the Company's future success is more uncertain than if it had a proven history.

The Company's activities may not result in profitable mining operations.

The Company is and will continue to be subject to all risks inherent with establishing new mining operations including: the time and costs of construction of mining and processing facilities and related infrastructure; the availability and costs of skilled labor and mining equipment and supplies; the need to obtain and maintain necessary environmental and other governmental approvals, licenses and permits, and the timing of the receipt of those approvals, licenses and permits; the availability of funds to finance construction and development activities; potential opposition from non-governmental organizations, indigenous peoples, environmental groups or local groups which may delay or prevent development activities; and potential increases in construction and operating costs due to various factors, including changes in the costs of fuel, power, labor, contractors, materials, supplies and equipment.

It is common in new mining operations to experience unexpected costs, problems and delays during construction, commissioning and mine start- up. In addition, delays in the early stages of mineral production often occur. Accordingly, the Company cannot provide assurance that its activities will result in profitable mining operations at the Thacker Pass Project and any other mineral properties the Company advances or acquires in the future.

Capital costs, operating costs, production and economic returns, and other estimates may differ significantly from those anticipated by the Company's current estimates.

Feasibility reports and other mining studies, including the technical report for the Thacker Pass Project, are inherently subject to uncertainties. Capital costs, operating costs, production and economic returns, and other estimates may differ significantly from those anticipated by the Company's current estimates, and there can be no assurance that the Company's actual capital, operating and other costs will not be higher than currently anticipated. The Company's actual costs and production may vary from estimates for a variety of reasons, including, but not limited to: lack of availability of resources or necessary supplies or equipment; inflationary pressures flowing from global supply chain shortages and increased transportation costs and other international events, which in turn are causing increased costs for supplies and equipment; increasing labor and personnel costs; unexpected construction or operating problems; cost overruns; lower than expected realized lithium prices; lower than expected ore grade; revisions to construction plans; risks and hazards associated with construction, mineral production and chemical plant operations; natural phenomena such as floods, fires, droughts or water shortages; unexpected labor shortages or strikes; general inflationary pressures and interest and currency exchange rates. Many of these factors are beyond the Company's control and could have a material effect on the Company's operating cash flow, including the Company's ability to service its indebtedness.

The Company's operations are subject to all of the hazards and risks normally incidental to the exploration for, and the development and operation of, mineral properties and associated chemical plants, including an onsite sulfuric acid plant.

The Company's operations are subject to all of the hazards and risks normally incidental to the exploration for, and the development and operation of, mineral properties and associated chemical plants, including an onsite sulfuric acid plant. The Company has implemented a comprehensive suite of health and safety measures designed to comply with government regulations and protect the health and safety of the Company's workforce in all areas of its business. The Company also strives to comply with environmental regulations in its operations. Nonetheless, mineral exploration, development and exploitation involves a high degree of risk, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Unusual or unexpected formations, formation pressures, fires, power outages, shutdowns due to equipment breakdown or failure, aging of equipment or facilities, unexpected maintenance and replacement expenditures, unexpected material handling problems, unexpected equipment capacity constraints, human error, labor disruptions or disputes, inclement weather, higher than forecast precipitation, flooding, shortages of water, explosions, releases of hazardous materials, deleterious elements materializing in mined resources, cave-ins, slope and embankment failures, landslides, earthquakes and industrial accidents, protests and other security issues, and the inability to obtain adequate machinery, equipment or labor due to shortages, strikes or public health issues such as pandemics, are some of the risks involved in mineral exploration and exploitation activities, which may, if as either a significant occurrence or a sustained occurrence over a significant period of time, result in a material adverse effect. The Company expects to rely on third- party owned infrastructure in order to successfully develop and operate its projects, such as power, utility and transportation infrastructure. Any failure of this infrastructure, or problems with the achieving agreements that facilitate use of this infrastructure (if any are required), without adequate replacement or alternatives may also have a material impact on the Company.

Ore grade, composition or type at the Thacker Pass Project may be lower quality than expected, which may result in actual production levels being lower than expected.

Changes to government laws and regulations may affect the development of the Thacker Pass Project.

Changes to government laws and regulations may affect the development of the Thacker Pass Project. Such changes could include laws relating to taxation, royalties, restrictions on production, export controls, environmental, biodiversity and ecological compliance, mine development and operations, mine safety, permitting and numerous other aspects of the business.

The Company must comply with stringent environmental regulation in the United States, which may change or otherwise result in delay and/or increase the cost of exploration and development of the Thacker Pass Project.

The Company must comply with stringent environmental regulation in the United States. Such regulations relate to many aspects of the project operations for the Thacker Pass Project, including but not limited to water usage and water quality, air quality and emissions, reclamation requirements, biodiversity such as impacts on flora and fauna, disposal of any hazardous substances and waste, tailings management and other environmental impacts associated with its development and proposed operating activities.

Environmental regulations are evolving in a manner that is expected to require stricter standards and enforcement, increased fines and penalties for non‐compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. Applicable environmental laws and regulations may require enhanced public disclosure and consultation. It is possible that a legal protest could be triggered through one of these requirements or processes that could delay development activities. No assurance can be given that new environmental laws and regulations will not be enacted or that existing environmental laws and regulations will not be applied in a manner that could limit or curtail the Company's development programs. Such changes in environmental laws and regulations and associated regulatory requirements could delay and/or increase the cost of exploration and development of the Thacker Pass Project.

Tailings are a potential environmental risk for the Company as it moves toward production. Tailings are the materials remaining after a target mineral, such as lithium, is extracted from the ore. Tailings management is subject to regulatory requirements and industry best practice standards, as there are a number of environmental risks and water usage requirements associated with them. Given the location of the Thacker Pass Project, which is in an arid, generally flat and less populated region of Nevada, and the design of the mine plans and processes to manage waste and water for the Thacker Pass Project, many of the risks associated with tailings management are expected to be mitigated for the project. Tailings generated at the Thacker Pass Project will be filtered and stacked, which generally has fewer risks and environmental impacts than other tailings management methods. Nonetheless, risks associated with tailings cannot be eliminated. Certain risks such as the potential failure of water diversion and water impoundment structures and a weather event exceeding the design criteria of water diversion and water impoundment structures will continue to exist. The occurrence of any of these events, some of which are heightened risks given the potential effects of climate change, could result in significant impacts to property and the environment. This in turn could restrict operations, result in additional remediation and compliance costs, trigger investigations by regulatory authorities, and have a material adverse effect on the Company's planned operations and financial condition.

The Company has completed previous mining for small amounts of clay on a portion of the lands comprising the Thacker Pass Project in connection with its former organoclay business, which had an environmental impact on the property. Although the Company has performed reclamation work on the property to address such environmental impacts, and much of the disturbance is expected to be subsumed by the Thacker Pass Project, there can be no assurance that additional environmental liability will not arise in the future.

The Company does not have a diversified portfolio of assets and is dependent on the Thacker Pass Project.

The Company has only one material mining project, the Thacker Pass Project. Unless it acquires other mineral properties or makes new discoveries for certain areas where the Company owns the mineral rights, the Company will be dependent on the Thacker Pass Project being successfully developed and brought into production. Failure to successfully develop, bring into production and operate the Thacker Pass Project could have an adverse impact on the Company's business, financial condition and results of operations. Until such time as the Company acquires or develops other significant assets, the Company will continue to be dependent on the success of its activities at the Thacker Pass Project.

Insurance may not be available to insure against all such risks, or the costs of such insurance may be uneconomic.

In the course of exploration, development and production of mineral properties, certain risks, and in particular, risks related to operational and environmental incidents may occur. Although the Company maintains insurance to protect against certain risks associated with its business, insurance may not be available to insure against all such risks, or the costs of such insurance may be uneconomic. The Company may also elect not to obtain insurance for other reasons. Insurance policies maintained by the Company may not be adequate to cover the full costs of actual liabilities incurred by the Company, or may not be continued by insurers for reasons not solely within the Company's control. The Company maintains liability insurance in accordance with industry standards. However, losses from uninsured and underinsured liabilities have the potential to materially affect the Company's financial position and prospects. The anticipated costs of environmental reclamation are fully bonded by the Company through a third-party insurer. Reclamation cost estimates and bond submissions are reviewed and approved by the BLM; the State of Nevada also approves the reclamation cost estimate.

There can be no assurance of title to any of the Company's property interests, or that such title will ultimately be secured.

The U.S. Mining Act and other federal and state laws govern the Company's ability to develop, mine and process the minerals on the unpatented mining claims and/or mill site claims that form the Thacker Pass Project, which are locatable under the U.S. Mining Act. There can be no assurance of title to any of the Company's property interests, or that such title will ultimately be secured. The Company's property interests may also be subject to prior unregistered agreements or transfers or other land claims, and title may be affected by undetected defects and adverse laws and regulations.

The Company cannot guarantee that the validity of its unpatented mining claims will not be contested by the United States. A successful contest of the unpatented mining claims could result in the Company being unable to develop minerals on the contested unpatented mining claims or being unable to exercise its rights as the owner or locater of the unpatented mining claims.

The Company must apply for and obtain approvals and permits from federal and state agencies to conduct exploration, development and mining on its properties. Although the Company has applied for and has received, or anticipates receipt of, such approvals and permits for certain areas where the Company owns mineral rights, there is no assurance that the Company's rights under them will not be affected by legislation or amendment of regulations governing the approvals and permits, or that applicable government agencies will not seek to revoke or significantly alter the conditions of the applicable exploration and mining approvals or permits, or that they will not be challenged or impugned by third parties. See "Item 4.D - Property, Plants and Equipment - Recent Developments."

The mining industry is competitive.

The mining industry is competitive in all of its phases and requires significant capital, technical resources, personnel and operational experience to effectively compete. Because of the high costs associated with exploration, the expertise required to analyze a project's potential and the capital required to develop a mine, larger companies with significant resources may be in a position to compete for such resources and capital more effectively than the Company.

Competition is also intense for mining equipment, supplies, qualified service providers and personnel in all jurisdictions where the Company operates. If qualified expertise cannot be sourced and at cost effective rates in Canada and the United States, the Company may need to procure those services elsewhere, which could result in additional delays and higher costs to obtain work permits.

As a result of such competition, the Company may be unable to maintain or acquire financing, retain existing personnel or hire new personnel, or maintain or acquire technical or other resources, supplies or equipment, all on terms it considers acceptable to complete the development of its projects.

The mineral exploration, development and production business carries an inherent risk of liability related to worker health and safety.

The mineral exploration, development and processing business carries an inherent risk of liability related to worker health and safety, including the risk of government-imposed orders to remedy unsafe conditions, potential penalties for contravention of health and safety laws, requirements for permits and other regulatory approvals, and potential civil liability. Compliance with health and safety laws, and any changes to such laws, and the requirements of applicable permits and other regulatory requirements remains material to the Company's business. The Company may become subject to government orders, investigations, inquiries or other proceedings (including civil claims) relating to health and safety matters. The occurrence of any of these events or any changes, additions to or more rigorous enforcement of health and safety laws, permits or other approvals could have a significant impact on operations and result in additional costs or penalties. In turn, these could have a material adverse effect on the Company's reputation, operations and future prospects.

The estimation of Mineral Resources and Mineral Reserves carries with it many inherent uncertainties.

Mineral Resources and Mineral Reserves figures disclosed in this registration statement are estimates only. Estimated tonnages and grades may not be achieved if the projects are brought into production; differences in grades and tonnage could be material; and, estimated levels of recovery may not be realized. The estimation of Mineral Resources and Mineral Reserves carries with it many inherent uncertainties, of which many are outside the control of the Company. Estimation is by its very nature a subjective process, which is based on the quality and quantity of available data, engineering assumptions, geological interpretation and judgements used in the engineering and estimation processes. Estimates may also need to be revised based on changes to underlying assumptions, such as commodity prices, drilling results, metallurgical testing, production, and changes to mine plans of operation. Any material decrease in estimates of Mineral Resources or Mineral Reserves, or an inability to extract Mineral Reserves could have a material adverse effect on the Company, its business, results of operations and financial position.

Any estimates of Inferred Mineral Resources included in this registration statement are also subject to a high degree of uncertainty, and may require a significant amount of exploration work in order to determine if they can be upgraded to a higher category.

The Thacker Pass Project may have opponents, and substantial opposition could result in delays or prevent the project from proceeding.

The Thacker Pass Project, like many mining projects, may have opponents. Opponents of other mining projects have, in some cases, been successful in bringing public and political pressure against mining projects. Substantial opposition to the Company's mining project could result in delays to project development or business plans, or prevent the project from proceeding at all, despite the commercial viability of the project.

Climate change may impact the sufficiency of water available to support planned Phase 1 operations for the Thacker Pass Project, which may have a material adverse effect on the Company's operations and prospects.

Water management regulations are in place in Nevada where the Thacker Pass Project is located. Water rights have been acquired that are expected to be sufficient to support all Phase 1 operations for the Thacker Pass Project as contemplated by the Thacker Pass 1300 Report. However, given the unpredictable impact of climate change on the environment, water levels, weather conditions and weather events, such as drought, in the region where the Thacker Pass Project is located, there is a risk that the aquifers in the watersheds where the Company has acquired water rights to date may not be able to provide enough water for planned operations for the estimated mine life set out in the plan of operations. To reduce the Thacker Pass Project's environmental footprint, and as a mitigation measure, the processing facility at Thacker Pass Project has been designed to minimize water usage to the extent possible by incorporating recycling technologies. However, going forward, availability of water and water rights at cost effective pricing may become of increasing importance to the Company's operations and prospects, a risk that may be heightened by the potential effects of climate change and could have a material adverse effect on the Company's operations and prospects.

The Company may face increasing operating costs as a result of compliance with climate change regulations or the physical risks of climate change.

The introduction of climate change legislation is an increasing focus of various levels of government worldwide, with emissions regulations and reporting regimes being enacted or enhanced, and energy efficiency requirements becoming increasingly stringent. As a development stage company with a focus on lithium production, the Company is committed to developing its business with a view to contributing to the low carbon economy. To that end, the Company is designing facilities to reduce carbon emissions at the Thacker Pass Project. This includes incorporating sustainable energy sources and minimizing the use of non-renewable sources of energy to the extent that renewable sources are available with sufficient capacity, at cost effective pricing and that meet the required performance criteria. However, the use of such low carbon technologies may be more costly in certain instances than non-renewable options in the near-term, or may result in higher design costs, long-term maintenance costs or replacement costs. Additionally, if the trend toward increasing regulations continues, the Company may face increasing operating costs at its projects to comply with these changing regulations.

Climate change risks also extend to the physical risks of climate change. These include risks of variable and extreme precipitation, reduction in water availability or water shortages, extreme weather events, changing temperatures, wildfire, changing sea levels and shortages of resources. These physical risks of climate change could have a negative effect on the project site for the Thacker Pass Project, access to local infrastructure and resources, and the health and safety of employees and contractors at the Company's operations. The occurrence of such events is difficult to predict and develop a response plan for that will effectively address all potential scenarios. Although the Company has attempted to design project facilities to address certain climate related risks, the potential exists for these measures to be insufficient in the face of unpredictable climate related events. As such, climate related events have the potential to have a material adverse effect on the Company's operations and prospects.

Risks related to increasing climate change related litigation is another potential risk factor that may impact the Company's future prospects, after production begins at the Thacker Pass Project. Until then, the risk of occurrence of such litigation is low.

If the Company is classified as a ''passive foreign investment company,'' U.S. investors who acquire Common Shares could be subject to adverse U.S. federal income tax consequences.

If the Company is classified as a "passive foreign investment company" ("PFIC") within the meaning of Section 1297 of the Internal Revenue Code of 1986, as amended (the "Code") for U.S. federal income tax purposes, a U.S. Shareholder (as defined below) who owns Common Shares could be subject to adverse tax consequences, including a greater tax liability than might otherwise apply, an interest charge on certain taxes deemed deferred as a result of the Company's non-U.S. status, and additional U.S. tax reporting obligations. In general, a non-U.S. corporation will be a PFIC during a taxable year if, taking into account the income and assets of certain of its affiliates, (i) 75% or more of its gross income constitutes passive income or (ii) 50% or more of its assets produce, or are held for the production of, passive income. Passive income generally includes interest, dividends, and other investment income.

The determination of whether the Company is a PFIC depends upon the composition of its income and assets and the nature of its activities from time to time and must be made annually as of the close of each taxable year. The PFIC determination also depends on the application of complex U.S. federal income tax rules that are subject to differing interpretations. Based on its current and expected income, assets and activities, the Company may be classified as a PFIC for the current taxable year or in the foreseeable future. Thus, there can be no assurance that the Company will not be classified as a PFIC for any taxable year, or that the United States Internal Revenue Service (the "IRS") or a court will agree with the Company's determination as to its PFIC status. In addition, in the event that the Common Shares that a U.S. Shareholder received pursuant to the Arrangement is treated as stock of a PFIC, the U.S. federal income tax treatment is not entirely clear. A U.S. Shareholder, however, can be treated as holding stock of a PFIC in periods prior to the Arrangement, and therefore may not be able to make a timely QEF Election for such stock and may be subject to the adverse U.S. tax treatment described below under the heading "Material U.S. Federal Income Tax Considerations - Passive Foreign Investment Company Rules."

Potential investors who are U.S. Shareholders are urged to consult their own tax advisors regarding the application of the PFIC rules, including the related reporting requirements and the advisability of making any available election under the PFIC rules, with respect to their ownership and disposition of Common Shares. This risk factor is qualified in its entirety by the discussion below under the heading "Material U.S. Federal Income Tax Considerations - Passive Foreign Investment Company Rules." Each potential investor who is a U.S. Shareholder should consult its own tax advisor regarding the tax consequences of the PFIC rules and the acquisition, ownership, and disposition of the Common Shares.

Proposed legislation in the U.S. Congress, including changes in U.S. tax law, and the Inflation Reduction Act of 2022 may adversely impact the Company and the value of the Common Shares.

Changes to U.S. tax laws (which changes may have retroactive application) could adversely affect the Company or holders of the Common Shares. In recent years, many changes to U.S. federal income tax laws have been proposed and made, and additional changes to U.S. federal income tax laws are likely to continue to occur in the future.

The U.S. Congress is currently considering numerous items of legislation which may be enacted prospectively or with retroactive effect, which legislation could adversely impact the Company's financial performance and the value of the Common Shares. Additionally, states in which the Company operates or owns assets may impose new or increased taxes. If enacted, most of the proposals would be effective for the current or later years. The proposed legislation remains subject to change, and its impact on the Company and purchasers of Common Shares is uncertain.

In addition, the Inflation Reduction Act of 2022 includes provisions that will impact the U.S. federal income taxation of corporations. Among other items, this legislation includes provisions that will impose a minimum tax on the book income of certain large corporations and an excise tax on certain corporate stock repurchases that would be imposed on the corporation repurchasing such stock. It is unclear how this legislation will be implemented by the U.S. Department of the Treasury and the Company cannot predict how this legislation or any future changes in tax laws might affect the Company or purchasers of the Common Shares.

Proposed changes to Canadian tax law may adversely impact the Company and the value of the Common Shares.

On March 28, 2023, the government of Canada released its 2023 federal budget which includes provisions that will impact the Canadian federal income taxation of corporations. Similar to the U.S. measure relating to corporate stock repurchases, Canada has proposed a 2% tax on the net value of equity repurchases by certain publicly traded entities. The application of the tax will be subject to certain exceptions and anti-avoidance provisions. As of the date of this registration statement, draft legislation has yet to be released and the impact of this legislation or any future changes in tax laws on the Company and shareholders of the Company cannot be predicted.

The COVID-19 pandemic, the Russian war in Ukraine, inflation and other factors may have a significant adverse effect on the Company's operations, business and financial condition.

The COVID-19 pandemic, the Russian war in Ukraine, inflation and other factors continue to impact global markets and cause general economic uncertainty, the impact of which may have a significant adverse effect on the Company's operations, business and financial condition.

The impacts of the COVID-19 pandemic, and governmental response thereto, on global commerce have and continue to be extensive and far- reaching. There has been significant stock market volatility, volatility in commodity and foreign exchange markets, restrictions on the conduct of business in many jurisdictions and the global movement of people has been restricted from time to time. The current global uncertainty with respect to COVID-19, the rapidly evolving nature of the pandemic, including the occurrence of new variants, and local and international developments related thereto and its effect on the broader global economy and capital markets may have a negative effect on the Company and the advancement of the Thacker Pass Project. The precise impact of further COVID-19 outbreak or the emergence of new diseases on the Company remains uncertain, rapid spread of COVID-19 and declaration of the outbreak as a global pandemic has resulted in travel advisories and restrictions, certain restrictions on business operations, social distancing precautions and restrictions on group gatherings which had direct impacts on businesses in Canada, the United States and around the world and could again result in travel bans, work delays, difficulties for contractors and employees to work at site, and diversion of management attention all of which in turn could have a negative impact on development of the Thacker Pass Project and the Company generally. Although many of these impacts appear to be lessening in most jurisdictions, there continues to be significant ongoing uncertainty surrounding COVID-19 and the extent and duration of the impacts that it, or governmental responses to it, may have on the advancement of the Thacker Pass Project, on the Company's suppliers, on the Company's employees and on global financial markets which may have a material adverse effect on the Company's operations, business and financial condition.

These concerns, together with concerns over general global economic conditions, fluctuations in interest and foreign exchange rates, stock market volatility, geopolitical issues, Russia's war in Ukraine and inflation have contributed to increased economic uncertainty and diminished expectations for the global economy. This global economic uncertainty may have a material adverse effect on our operations, business and financial condition.

Concerns over global economic conditions may also have the effect of heightening many of the other risks described herein, including, but not limited to, risks relating to: fluctuations in the market price of lithium-based products, the development of Thacker Pass Project, the terms and availability of financing, cost overruns, geopolitical concerns, and changes in law, policies or regulatory requirements.

Risks Relating to the Company's Common Shares following the Separation

The Company will have a significant shareholder and a commercial relationship with such significant shareholder.