UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant x | Filed by a Party other than the Registrant ¨ |

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| x | Definitive Proxy Statement |

| | |

| ¨ | Definitive Additional Materials |

| | |

| ¨ | Soliciting Material under Rule 14a-12 |

Mercer Bancorp, Inc.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| | |

| ¨ | Fee paid previously with preliminary materials. |

| | |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Mercer Bancorp, Inc.

1100 Irmscher Blvd

Celina, Ohio 45822

(419) 586-5158

January 22, 2025

Dear Fellow Stockholder:

We cordially invite you to attend the 2025 Annual Meeting of Stockholders of Mercer Bancorp, Inc. The Annual Meeting will be held at the office of Mercer Savings Bank located at 1100 Irmscher Blvd, Celina, Ohio on February 25, 2025, at 1:30 p.m., local time.

The enclosed Notice of Annual Meeting and Proxy Statement describe the formal business to be transacted. During the Annual Meeting we will also report on the operations of Mercer Bancorp, Inc. Also enclosed for your review is our Annual Report for the year ended September 30, 2024, which contains information concerning our activities and operating performance. Our directors and officers will be present to respond to any questions that stockholders may have.

The business to be conducted at the Annual Meeting consists of the election of two directors, the approval of the Mercer Bancorp, Inc. 2025 Equity Incentive Plan, and the ratification of the appointment of S.R. Snodgrass, P.C. as independent registered public accounting firm for the year ending September 30, 2025. The Board of Directors has determined that the matters to be considered at the Annual Meeting are in the best interest of Mercer Bancorp, Inc. and its stockholders, and the Board of Directors unanimously recommends a vote “FOR” each matter to be considered.

It is important that your shares be represented at the Annual Meeting, whether or not you plan to attend personally. Please complete, sign and date the enclosed proxy card and return it as soon as possible in the postage-paid envelope provided so that your shares will be represented at the Annual Meeting. Alternatively, you may vote through the Internet. Information and applicable deadlines for voting through the Internet are set forth in the enclosed proxy card instructions. You may revoke your proxy at any time prior to its exercise, and you may attend the Annual Meeting and vote in person, even if you have previously returned your proxy card or voted via the Internet. However, if you are a stockholder whose shares are not registered in your own name, you will need additional documentation from your record holder in order to vote personally at the Annual Meeting.

| | Sincerely, |

| | |

| |  |

| | |

| | Barry Parmiter |

| | President and Chief Executive Officer |

Mercer Bancorp, Inc.

1100 Irmscher Blvd

Celina, Ohio 45822

(419) 586-5158

NOTICE OF

ANNUAL MEETING OF STOCKHOLDERS

To Be Held On February 25, 2025

Notice is hereby given that the 2025 Annual Meeting of Stockholders of Mercer Bancorp, Inc. will be held at the office of Mercer Savings Bank located at 1100 Irmscher Blvd, Celina, Ohio on February 25, 2025 at 1:30 p.m., local time.

A Proxy Card and Proxy Statement for the Annual Meeting are enclosed. The Annual Meeting is for the purpose of considering and acting upon:

| 1. | the election of two directors; |

| 2. | the approval of the Mercer Bancorp, Inc. 2025 Equity Incentive Plan; |

| 3. | the ratification of the appointment of S.R. Snodgrass, P.C. as independent registered public accounting firm for the year ending September 30, 2025; and |

such other matters as may properly come before the Annual Meeting, or any adjournments thereof. The Board of Directors is not aware of any other business to come before the Annual Meeting.

Any action may be taken on the foregoing proposals at the Annual Meeting on the date specified above, or on the date or dates to which the Annual Meeting may be adjourned. Stockholders of record at the close of business on December 26, 2024 are the stockholders entitled to vote at the Annual Meeting, and any adjournments thereof.

EACH STOCKHOLDER, REGARDLESS OF WHETHER THEY PLAN TO ATTEND THE ANNUAL MEETING, IS REQUESTED TO SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD WITHOUT DELAY IN THE ENCLOSED POSTAGE-PAID ENVELOPE OR VOTE THROUGH THE INTERNET AS DIRECTED ON YOUR PROXY CARD. ANY PROXY GIVEN BY THE STOCKHOLDER MAY BE REVOKED AT ANY TIME BEFORE IT IS VOTED. A PROXY MAY BE REVOKED BY FILING WITH THE CORPORATE SECRETARY OF MERCER BANCORP, INC. A WRITTEN REVOCATION OR A DULY EXECUTED PROXY CARD BEARING A LATER DATE. ANY STOCKHOLDER PRESENT AT THE ANNUAL MEETING MAY REVOKE HIS OR HER PROXY AND VOTE PERSONALLY ON EACH MATTER BROUGHT BEFORE THE ANNUAL MEETING. HOWEVER, IF YOU ARE A STOCKHOLDER WHOSE SHARES ARE NOT REGISTERED IN YOUR OWN NAME, YOU WILL NEED TO TAKE ADDITIONAL STEPS TO PARTICIPATE IN THE ANNUAL MEETING AS DESCRIBED IN THE PROXY STATEMENT. ATTENDANCE AT THE ANNUAL MEETING WILL NOT IN ITSELF CONSTITUTE REVOCATION OF YOUR PROXY.

| | By Order of the Board of Directors |

| | |

| |  |

| | Jose W. Faller |

| | Corporate Secretary |

Celina, Ohio

January 22, 2025

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS: THE PROXY STATEMENT, INCLUDING THE NOTICE OF THE ANNUAL MEETING OF STOCKHOLDERS, AND MERCER BANCORP, INC.’S ANNUAL REPORT FOR THE YEAR ENDED SEPTEMBER 30, 2024 ARE EACH AVAILABLE ON THE INTERNET AT: https://annualgeneralmeetings.com/msbb2025.

PROXY STATEMENT

Mercer Bancorp, Inc.

1100 Irmscher Blvd

Celina, Ohio 45822

(419) 586-5158

ANNUAL MEETING OF STOCKHOLDERS

February 25, 2025

This Proxy Statement is furnished in connection with the solicitation of proxies on behalf of the Board of Directors of Mercer Bancorp, Inc. (“Mercer Bancorp”) to be used at the Annual Meeting of Stockholders, which will be held at 1100 Irmscher Blvd, Celina, Ohio on February 25, 2025, at 1:30 p.m., local time, and all adjournments of the Annual Meeting. The accompanying Notice of Annual Meeting of Stockholders and this Proxy Statement are first being mailed to stockholders on or about January 22, 2025.

REVOCATION OF PROXIES

Stockholders who execute proxies in the form solicited hereby retain the right to revoke them in the manner described below. Unless revoked, the shares represented by such proxies will be voted at the Annual Meeting and all adjournments thereof. Proxies solicited on behalf of the Board of Directors of Mercer Bancorp will be voted in accordance with the directions given thereon. Please vote through the Internet or sign and return your proxy card in the postage paid envelope provided. Where no instructions are indicated on the proxy card, signed proxies will be voted “FOR” the election of the nominee for director named herein, “FOR” the approval of the Mercer Bancorp, Inc. 2025 Equity Incentive Plan, and “FOR” the ratification of the appointment of S.R. Snodgrass, P.C. as our independent registered public accounting firm for the year ending September 30, 2025.

Proxies may be revoked by sending written notice of revocation to the Corporate Secretary of Mercer Bancorp at the address shown above, by filing a duly executed proxy bearing a later date, or by attending and voting at the Annual Meeting. The presence at the Annual Meeting of any stockholder who had given a proxy shall not revoke such proxy unless the stockholder votes at the Annual Meeting or delivers a written revocation to our Corporate Secretary prior to the voting of such proxy.

If you have any questions about giving your proxy or require assistance, please call Barry Parmiter, President and Chief Executive Officer, at (419) 586-5158.

If you are a stockholder whose shares are not registered under your own name, you will need appropriate documentation from your record holder to vote in person at the Annual Meeting.

SOLICITATION OF PROXIES; EXPENSES

We will pay the cost of this proxy solicitation. Our directors, executive officers and other employees may solicit proxies by mail, personally, by telephone, by press release, by facsimile transmission or by other electronic means. No additional compensation will be paid to our directors, executive officers or employees for such services. We will reimburse brokerage firms and other custodians, nominees, and fiduciaries for reasonable expenses incurred by them in sending proxy materials to the beneficial owners of our common stock. Mercer Bancorp has also engaged Alliance Advisors, LLC to assist in the solicitation of proxies for a fee of $10,000 plus reimbursement of out-of-pocket fees and expenses not to exceed $3,500.

VOTING SECURITIES AND PRINCIPAL HOLDERS

Except as otherwise noted below, holders of record of Mercer Bancorp’s shares of common stock, par value $0.01 per share, as of the close of business on December 26, 2024 are entitled to one vote for each share then held. As of December 26, 2024, there were 1,022,970 outstanding shares of common stock. Our Articles of Incorporation provide that record holders of our common stock who beneficially own, either directly or indirectly, more than 10% of our outstanding shares are not entitled to any vote with respect to the shares held in excess of the 10% limit.

Principal Holders

Persons and groups who beneficially own in excess of 5% of the shares of common stock are required to file certain reports with the Securities and Exchange Commission regarding such ownership. The following table sets forth, as of December 26, 2024, the shares of common stock beneficially owned by our directors and executive officers, individually and as a group, and by each person who was known to us as the beneficial owner of more than 5% of the outstanding shares of common stock. The mailing address for each of our directors and executive officers is 1100 Irmscher Blvd, Celina, Ohio 45822.

| | | Shares of | | | | |

| | | Common Stock | | | Percent of | |

| | | Beneficially | | | Shares of | |

| | | Owned as of the | | | Common Stock | |

| Persons Owning Greater than 5% | | Record Date (1) | | | Outstanding (2) | |

| Mercer Savings Bank Employee Stock Ownership Plan | | | 81,838 | | | | 8.0 | % |

| 1100 Irmscher Blvd | | | | | | | | |

| Celina, Ohio 45822 | | | | | | | | |

| | | | | | | | | |

| Directors | | | | | | | | |

| Michael J. Boley | | | 15,000 | | | | 1.5 | % |

| Jose W. Faller | | | 8,500 | | | | * | |

| Kristin M. Fee | | | 4,317 | (3) | | | * | |

| David L. Keiser | | | 15,019 | (4) | | | 1.5 | % |

| Barry Parmiter | | | 18,371 | (5) | | | 1.8 | % |

| | | | | | | | | |

| Executive Officers who are not Directors | | | | | | | | |

| Timothy L. Bigham | | | 1,165 | (6) | | | * | |

| Trever A. Bransteter | | | 2,654 | (7) | | | * | |

| Sherman Crum | | | 0 | | | | * | |

| Ryan Moorman | | | 839 | (8) | | | * | |

| | | | | | | | | |

| All directors and officers as a group (9 persons) | | | 65,865 | | | | 6.4 | % |

| * | Less than 1%. |

| (1) | In accordance with Rule 13d-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), a person is deemed to be the beneficial owner, for purposes of this table, of any shares of Mercer Bancorp common stock if he or she has or shares voting or investment power with respect to such common stock or has a right to acquire beneficial ownership at any time within 60 days from December 26, 2024. As used herein, “voting power” is the power to vote or direct the voting of shares and “investment power” is the power to dispose or direct the disposition of shares. Except as otherwise noted, ownership is direct and the named individuals and group exercise sole voting and investment power over the shares of Mercer Bancorp common stock. |

| (2) | Based on a total of 1,022,970 shares of common stock outstanding as of December 26, 2024. |

| (3) | Includes 4,317 shares of common stock held in a Director Retirement Agreement Trust for the benefit of Ms. Fee. |

| (4) | Includes 5,319 shares of common stock held in a Director Retirement Agreement Trust for the benefit of Mr. Keiser. |

| (5) | Includes 17,500 shares of common stock held in an IRA for the benefit of Mr. Parmiter and 871 shares allocated to Mr. Parmiter as a participant in the Mercer Savings Bank Employee Stock Ownership Plan (the “ESOP”). |

| (6) | Includes 800 shares of common stock held in an IRA for the benefit of Mr. Bigham and 365 shares allocated to Mr. Bigham as a participant in the ESOP. |

| (7) | Includes 654 shares allocated to Mr. Bransteter as a participant in the ESOP. |

| (8) | Includes 339 shares allocated to Mr. Moorman as a participant in the ESOP. |

Attending the Meeting

All stockholders are invited to attend the Annual Meeting. If you hold your shares in “street name,” you will need proof of ownership from the owner of record to be admitted to the meeting. Examples of proof of ownership are a recent brokerage account statement or a letter from your bank or broker.

Quorum

The presence at the Annual Meeting or by proxy of holders of a majority of the total number of outstanding shares of common stock entitled to vote is necessary to constitute a quorum at the Annual Meeting. Abstentions and broker non-votes will be counted for purposes of determining that a quorum is present. In the event there are not sufficient votes for a quorum, or to approve or ratify any matter being presented at the time of the Annual Meeting, the Annual Meeting may be adjourned in order to permit the further solicitation of proxies.

Votes Required

As to the election of directors, a stockholder may: (i) vote FOR ALL nominees proposed by the Board; (ii) vote to WITHHOLD for ALL nominees; or (iii) vote to WITHHOLD for one or more of the nominees being proposed. Directors are elected by a plurality of votes cast, without regard to either broker non-votes or proxies as to which the authority to vote for the nominees being proposed is withheld. Plurality means that individuals who receive the highest number of votes cast are elected, up to the maximum number of directors to be elected at the Annual Meeting.

As to the approval of the Mercer Bancorp, Inc. 2025 Equity Incentive Plan, a stockholder may: (i) vote FOR the approval; (ii) vote AGAINST the approval; or (iii) ABSTAIN from voting on such matter. The approval of this matter shall be determined by a majority of the votes represented at the Annual Meeting and entitled to vote on the matter, without regard to proxies marked ABSTAIN or broker non-votes.

As to the ratification of the appointment of S.R. Snodgrass, P.C. as our independent registered public accounting firm for the year ending September 30, 2025, a stockholder may: (i) vote FOR the ratification; (ii) vote AGAINST the ratification; or (iii) ABSTAIN from voting on such ratification. The ratification of this matter shall be determined by a majority of the votes represented at the Annual Meeting and entitled to vote on the matter, without regard to proxies marked ABSTAIN or broker non-votes.

Effect of Not Casting Your Vote

If you hold your shares in “street name,” you are considered the beneficial owner of your shares and your broker, bank or other holder of record is sending these proxy materials to you. As the beneficial owner, you have the right to direct your broker, bank or other holder of record how to vote by completing a voting instruction form provided by your broker, bank or other holder of record that accompanies your proxy materials. If you hold your shares in street name, it is critical that you cast your vote if you want it to count in the election of directors. Current regulations restrict the ability of your bank, broker or other holder of record to vote your shares in the election of directors and certain other matters on a discretionary basis. Therefore, if you hold your shares in street name and you do not instruct your bank, broker or other holder of record on how to vote in the election of directors, no votes will be cast on your behalf. These are referred to as “broker non-votes.” Your bank, broker or other holder of record, however, does continue to have discretion to vote any shares for which you do not provide instructions on how to vote on the ratification of the appointment of the independent registered public accounting firm. If you are a stockholder of record and you do not cast your vote, no votes will be cast on your behalf on any of the items of business at the Annual Meeting.

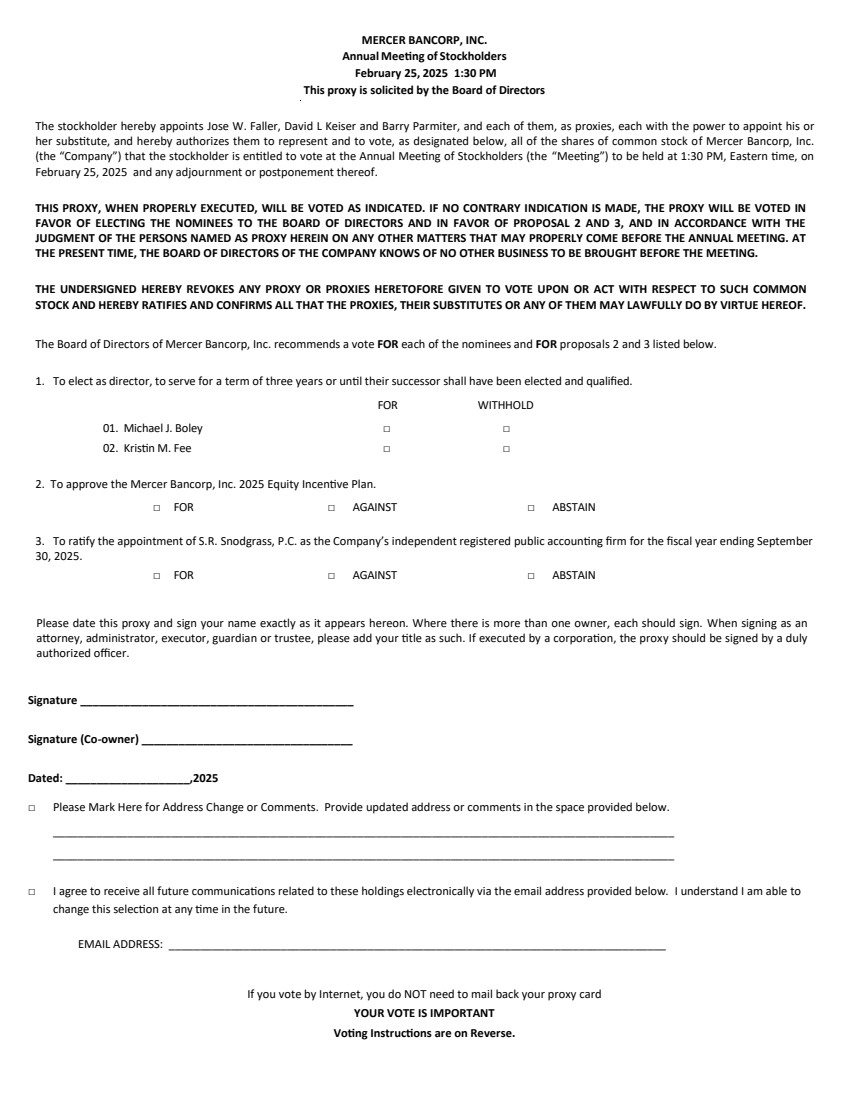

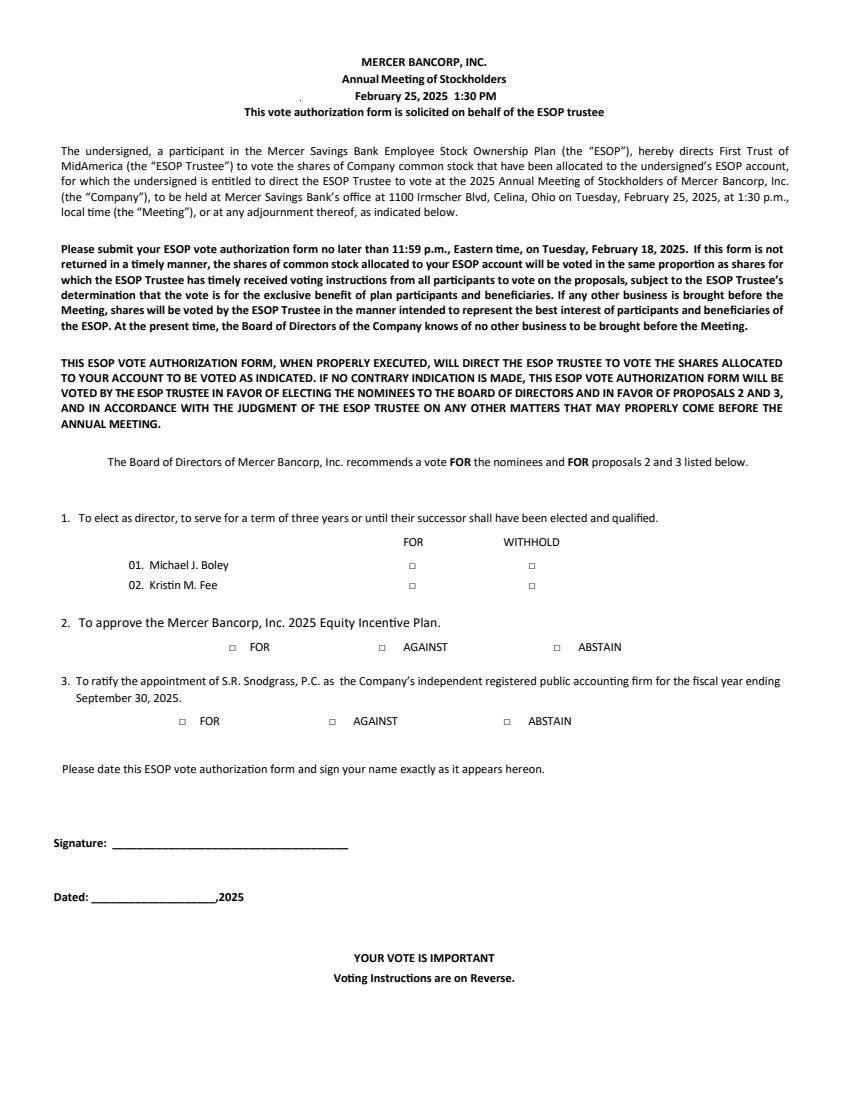

Participants in the Mercer Savings Bank Employee Stock Ownership Plan

If you participate in the Mercer Savings Bank Employee Stock Ownership Plan (the “ESOP”), you will receive a Vote Authorization Form for the ESOP that reflects all of the shares you may direct the trustee to vote on your behalf under the ESOP. Under the terms of the ESOP, the ESOP trustee votes all shares held by the ESOP, but each ESOP participant may direct the trustee how to vote the proportionate interest of shares of our common stock allocated to his or her account. The ESOP trustee, subject to the exercise of its fiduciary responsibilities, will vote all unallocated shares of our common stock held by the ESOP and allocated shares for which no voting instructions are received in the same proportion as shares for which it has received timely voting instructions, subject to a determination that such vote is in the best interest of ESOP participants. The deadline for returning your ESOP Vote Authorization Form is Tuesday, February 18, 2025 at 11:59 p.m., Eastern time.

PROPOSAL I—ELECTION OF DIRECTORS

Our Board of Directors is currently comprised of five members. Our Bylaws provide that directors are divided into three classes as nearly equal in number as possible, with one class of directors elected annually. Our directors are generally elected to serve for a three-year period and until their respective successors have been elected and qualified. The Nominating and Governance Committee of the Board of Directors has nominated Michael J. Boley and Kristin M. Fee for election at the Annual Meeting, to serve for a three-year period and until their respective successors have been elected and qualified. Each nominee is currently a director of Mercer Bancorp and Mercer Savings Bank.

The Board of Directors recommends a vote “FOR” the election of the nominees.

The following sets forth certain information regarding the nominees and the other current members of our Board of Directors, and executive officers who are not directors, including the terms of office of board members. It is intended that the proxies solicited on behalf of the Board of Directors (other than proxies in which the vote is withheld as to any nominee) will be voted at the Annual Meeting for the election of the proposed nominees. If any nominee is unable to serve, the shares represented by all such proxies will be voted for the election of such substitute as the Board of Directors may determine. At this time, the Board of Directors knows of no reason why any nominee might be unable to serve, if elected. There are no arrangements or understandings between any nominee or continuing director and any other person pursuant to which such nominee or continuing director was selected.

| | | Position(s) Held With | | | | | Director | | | Current Term | |

| Name | | Mercer Bancorp | | Age(1) | | | Since(2) | | | Expires | |

| | | NOMINEES | | | | | | | | | |

| Michael J. Boley | | Director | | | 58 | | | | 2022 | | | | 2025 | |

| Kristin M. Fee | | Vice Chair | | | 50 | | | | 2013 | | | | 2025 | |

| | | CONTINUING DIRECTORS | | | | | | | | | | | | |

| David L. Keiser | | Chairman | | | 68 | | | | 2014 | | | | 2026 | |

| Barry Parmiter | | Director, President and Chief Executive Officer | | | 54 | | | | 2022 | | | | 2026 | |

| Jose W. Faller | | Director | | | 47 | | | | 2018 | | | | 2027 | |

| | | EXECUTIVE OFFICERS WHO ARE NOT DIRECTORS | | | | | | | | | | | | |

| Trever A. Bransteter | | Senior Vice President of Mortgage Lending | | | 43 | | | | N/A | | | | N/A | |

| Timothy L. Bigham | | Senior Vice President of Operations | | | 59 | | | | N/A | | | | N/A | |

| Sherman Crum | | Controller | | | 57 | | | | N/A | | | | N/A | |

| Ryan Moorman | | Senior Vice President of Indirect Lending | | | 49 | | | | N/A | | | | N/A | |

| (1) | As of December 26, 2024. |

| (2) | Includes service as a director of Mercer Savings Bank. |

The Business Background of Our Directors and Executive Officers

The business experience for the past five years of each of our nominees, continuing directors and executive officers is set forth below. With respect to nominees and continuing directors, the biographies also contain information regarding the person’s experience, qualifications, attributes or skills that caused the Nominating and Governance Committee and the Board of Directors to determine that the person should serve as a director. Each director is also a director of Mercer Savings Bank. Unless otherwise indicated, directors and executive officers have held their positions as directors and executive officers of Mercer Bancorp or Mercer Savings Bank for the past five years.

Nominee and Continuing Directors

Michael J. Boley is the President and Chief Executive Officer of Wabash Mutual Telephone Company, a customer-owned broadband communications company headquartered in Celina, Ohio, and its subsidiary, Wabash Communications, Inc., which offers a wireless broadband network in Mercer County and surrounding areas. Mr. Boley joined Wabash Mutual Telephone Company as Accountant in 1987, was appointed General Manager in 1997, and was ultimately promoted to President and Chief Executive Officer in 2007. Mr. Boley also serves as a trustee of the Ohio Rural Broadband Association and is a member of the board of directors of Com Net Inc. and Independents Fiber Network. Mr. Boley’s extensive business and community network and insight into the local economic environment are valuable assets to the board of directors.

Jose W. Faller is the Director of Human Resources and Technology at Cooper Farms, a farm and food company based in northwest Ohio. Mr. Faller joined Cooper Farms in 2002. Previously, he worked as a network administrator for the U.S. Army. Mr. Faller also served as a member of the Fort Recovery Local Schools Board of Education from 2012 to 2019. Mr. Faller is a graduate of the University of Dayton with a bachelor’s degree in exercise science and holds an MBA from Wright State University. Mr. Faller brings valuable management experience and unique information technology expertise to the board of directors.

Kristin M. Fee is the Vice Chair of the board of directors of Mercer Savings Bank. Ms. Fee has been the owner of Tribute Funeral Homes since 2007, with locations in Greenville, New Madison and Fort Recovery, Ohio. She has also served as Executive Director of EUM Church in Greenville, Ohio since 2010. Ms. Fee is a graduate of the University of Dayton and the World Harvest Bible College. Ms. Fee’s experience in marketing, operations and human resources and community connections are a valuable asset to the board of directors.

David L. Keiser serves as Chairman of the board of directors of Mercer Savings Bank, a position he has held since 2021. He is an owner and the President of Littman Thomas Insurance Agency, Inc., which serves Darke County, Ohio and surrounding areas, which he joined as owner and partner in 1989. He previously served as a member of the board of directors of several non-profit organizations, including Boys & Girls Club, Darke County Chamber Ambassador, Darke County United Way and Darke County Economic Development. Mr. Keiser’s extensive business and community network and insight into the local economic environment are valuable assets to the board of directors.

Barry Parmiter has served as President and Chief Executive Officer of Mercer Savings Bank since February 2022. Previously, he served as the President and Chief Executive Officer of Community Savings, Caldwell, Ohio, from 1998 to February 2022. Mr. Parmiter is a graduate of Ohio University with a Bachelor of Business Administration with a focus on accounting and holds an MBA from The University of Findlay. Mr. Parmiter provides the board with a perspective on the day-to-day operations of Mercer Savings Bank and assists the board in assessing the trends and developments in the financial institutions industry on a local and national basis. Additionally, Mr. Parmiter has business relationships and community ties that support our business generation.

Executive Officers Who Are Not Directors

Trever A. Bransteter became the Senior Vice President of Mortgage Lending of Mercer Savings Bank in March 2023. He joined Mercer Savings Bank as a loan officer in 2014. Mr. Bransteter attended The Ohio State University, majoring in Business and Marketing.

Timothy L. Bigham became the Senior Vice President of Operations of Mercer Savings Bank in January 2021. Previously, he served as Mercer Savings Bank’s Vice President of Operations from 2014 through 2020 and as Assistant Vice President from June 1994 through 2013. Prior to joining Mercer Savings Bank, Mr. Bigham was a Branch Manager at American Budget Company. Mr. Bigham attended Edison State Community College and The Ohio State University Fisher College of Business program for financial executives. He is currently a member of the board of trustees of the Celina-Mercer County Chamber of Commerce, where he has served since 2014. He formerly served as a president, trustee or board member of numerous local community organizations, including the St. Mary’s Area Chamber of Commerce, Auglaize County Historical Society, and the Auglaize/Mercer Family YMCA.

Sherman Crum became the Controller of Mercer Savings Bank in July 2024. Mr. Crum, age 57, previously served as Controller at Community Savings in Caldwell, Ohio, from August 2005 to July 2024, and Controller at Gasel Transportation from August 1994 to August 2005. Mr. Crum holds a B.A. from Malone College and is a graduate of the Barret School of Banking.

Ryan Moorman became the Senior Vice President of Indirect Lending of Mercer Savings Bank in July 2022. He has over five years’ experience in indirect automobile lending, having led the development of an automobile dealership network at Community Savings, where he served as a dealer representative from October 2017 until February 2022. Mr. Moorman attended The Ohio State University.

Board Independence

The Board of Directors of Mercer Bancorp has determined that each of our directors, with the exception of President and Chief Executive Officer Barry Parmiter, is “independent” as defined in the listing standards of the Nasdaq Stock Market. Mr. Parmiter is not independent because he is one of our executive officers. In evaluating the independence of our independent directors, the Board considered transactions and other relationships between Mercer Bancorp or Mercer Savings Bank and our independent directors that are not required to be reported in this proxy statement under “—Transactions With Certain Related Persons,” including communications services provided to Mercer Savings Bank by Wabash Mutual Telephone, where Mr. Boley serves as president.

Board Leadership Structure and Risk Oversight

The Board of Directors currently separates the positions of Chairman of the Board and Chief Executive Officer. Our Board of Directors is chaired by David L. Keiser, who is an independent director. This ensures a greater role for the independent directors in the oversight of Mercer Bancorp and Mercer Savings Bank and active participation of the independent directors in setting agendas and establishing priorities and procedures for the work of the Board. We believe that our leadership structure, in which the roles of Chairman and Chief Executive Officer are separate, together with experienced and engaged independent directors and independent key committees, will be effective and is the optimal structure for Mercer Bancorp and its stockholders at this time.

To further assure effective independent oversight, the Board of Directors has adopted a number of governance practices, including:

| · | a majority independent Board of Directors; |

| · | periodic meetings of the independent directors; and |

| · | an annual performance evaluation of the President and Chief Executive Officer by the Compensation Committee. |

The Board of Directors recognizes that, depending on the circumstances, other leadership models might be appropriate. Accordingly, the Board of Directors periodically reviews its leadership structure.

The Board of Directors is actively involved in oversight of risks that could affect Mercer Bancorp. This oversight is conducted primarily through committees of the Board of Directors, but the full Board of Directors has retained responsibility for general oversight of risks. The Board of Directors also satisfies this responsibility through reports by the committee chair of all board committees regarding the committees’ considerations and actions, through review of minutes of committee meetings and through regular reports directly from officers responsible for oversight of particular risks within Mercer Bancorp. Risks relating to the direct operations of Mercer Savings Bank are further overseen by the Board of Directors of Mercer Savings Bank, all of whom are the same individuals who serve on the Board of Directors of Mercer Bancorp. The Board of Directors of Mercer Savings Bank also has additional committees that conduct risk oversight. All committees are responsible for the establishment of policies that guide management and staff in the day-to-day operation of Mercer Bancorp and Mercer Savings Bank such as lending, risk management, asset/liability management, investment management and others.

References to our Website Address

References to our website address throughout this proxy statement and the accompanying materials are for informational purposes only, or to fulfill specific disclosure requirements of the Securities and Exchange Commission’s rules. These references are not intended to, and do not, incorporate the contents of our website by reference into this proxy statement or the accompanying materials.

Delinquent Section 16(a) Reports

Our common stock is registered with the SEC pursuant to Section 12(g) of the Exchange Act. Our executive officers and directors and beneficial owners of greater than 10% of our common stock (“10% beneficial owners”) are required to file reports on Forms 3, 4 and 5 with the Securities and Exchange Commission disclosing beneficial ownership and changes in beneficial ownership of the common stock. Securities and Exchange Commission rules require disclosure in our Proxy Statement and Annual Report on Form 10-K of the failure of an executive officer, director or 10% beneficial owner of our common stock to file a Form 3, 4, or 5 on a timely basis.

Based solely on our review of ownership reports filed and written representations from reporting persons, we believe that no executive officer, director or 10% beneficial owner of our shares of common stock failed to file an ownership report on a timely basis, except that Mr. Crum filed a late Form 3.

Code of Ethics for Senior Officers

Mercer Bancorp has adopted a Code of Ethics that is applicable to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. The Code of Ethics for Senior Officers is available at the Corporate Information page on our website at mercersavings.com/investor-relations/. Amendments to, and waivers from, the Code of Ethics will also be disclosed on our website.

Policy Regarding Insider Trading

Mercer Bancorp has adopted a Policy Regarding Insider Trading, which is filed as an exhibit to our Annual Report on Form 10-K, that governs the purchase, sale, and other dispositions of Mercer Bancorp securities by directors, officers and employees and that is designed to promote compliance with insider trading laws, rules and regulations.

Anti-Hedging Policy

Mercer Bancorp has adopted a policy that prohibits directors and officers of Mercer Bancorp or any of its subsidiaries, and their related persons, from purchasing or selling, or offering to purchase or offering to sell, derivative securities relating to Mercer Bancorp’s common stock, whether or not issued by Mercer Bancorp, that hedge or offset, or are designed to hedge or offset, any decrease in the market value of Mercer Bancorp’s common stock. In addition, directors and officers are generally prohibited from engaging in short sales of Mercer Bancorp Stock, buying or sells “puts” and “calls,” pledging Mercer Bancorp stock as collateral for any loan or holding Mercer Bancorp stock in a margin account. The Board of Directors may approve an exception to this policy for a pledge of Mercer Bancorp stock as collateral for a loan from a third party (not including margin debt) where the borrower clearly demonstrates the financial capacity to repay the loan without resort to the pledged securities.

Attendance at Annual Meetings of Stockholders

Mercer Bancorp does not have a written policy regarding director attendance at Annual Meetings of Stockholders, although directors are expected to attend these meetings absent unavoidable scheduling conflicts. All directors attended the 2024 Annual Meeting of Stockholders.

Communications with the Board of Directors

Any stockholder who wishes to contact our Board of Directors or an individual director may do so by writing to: Mercer Bancorp, Inc., 1100 Irmscher Blvd, Celina, Ohio 45822, Attention: Board of Directors. The letter should indicate that the sender is a stockholder and, if shares are not held of record, should include appropriate evidence of stock ownership. Communications are reviewed by the Corporate Secretary and are then distributed to the Board of Directors or the individual director, as appropriate, depending on the facts and circumstances outlined in the communications received. The Corporate Secretary may attempt to handle an inquiry directly (for example, where it is a request for information about Mercer Bancorp or it is a stock-related matter). The Corporate Secretary has the authority not to forward a communication if it is primarily commercial in nature, relates to an improper or irrelevant topic, or is unduly hostile, threatening, illegal or otherwise inappropriate. At each Board of Directors meeting, the Corporate Secretary shall present a summary of all communications received since the last meeting that were not forwarded and make those communications available to the directors on request.

Meetings and Committees of the Board of Directors

The business of Mercer Bancorp is conducted at regular and special meetings of the Board of Directors and its committees. In addition, the “independent” members of the Board of Directors (as defined in the listing standards of the Nasdaq Stock Market) meet in executive sessions. The standing committees of the Board of Directors of Mercer Bancorp are the Audit Committee, the Compensation Committee and the Nominating and Governance Committee.

The Board of Directors of Mercer Bancorp and Mercer Savings Bank held 12 regular meetings and 1 special meeting during the year ended September 30, 2024. No member of the Board of Directors or any committee thereof attended fewer than 75% of the aggregate of: (i) the total number of meetings of the Board of Directors (held during the period for which he/she has been a director); and (ii) the total number of meetings held by all committees on which he/she served (during the periods that he/she served).

Audit Committee. The Audit Committee consists of Directors Keiser, Fee and Faller. The Audit Committee meets with our independent registered public accounting firm to review quarterly and annual filings, the results of the annual audit and other related matters. The Audit Committee met four times during the year ended September 30, 2024. Each member of the Audit Committee is “independent” as defined in the listing standards of NASDAQ and Securities and Exchange Commission Rule 10A(m)-3. The Audit Committee does not currently have an “audit committee financial expert” as defined under applicable Securities and Exchange Commission rules. The Board of Directors believes that the current composition of the Audit Committee is sufficient because each Audit Committee member has the ability to analyze and evaluate Mercer Bancorp’s financial statements as well as an understanding of and ability to fulfill the Audit Committee’s functions. In addition, Directors Keiser and Fee have experience in overseeing and assessing the financial statements of their own businesses.

The Audit Committee meets periodically with the independent registered public accounting firm and management to review accounting, auditing, internal control structure and financial reporting matters. The committee also receives and reviews the reports and findings and other information presented to them by Mercer Bancorp’s officers regarding financial reporting policies and practices. The Audit Committee also reviews the performance of Mercer Bancorp’s independent registered public accounting firm, the internal audit function and oversees policies associated with financial risk assessment and risk management. The Audit Committee selects the independent registered public accounting firm and meets with them to discuss the results of the annual audit and any related matters. Our Board of Directors has adopted a written charter for the Audit Committee, which is available on our website at mercersavings.com/investor-relations/.

Compensation Committee. The Compensation Committee is comprised of Directors Keiser, Fee and Boley. The Compensation Committee of Mercer Bancorp met one time during the year ended September 30, 2024.

With regard to compensation matters, the Compensation Committee’s primary purposes are to discharge the Board’s responsibilities relating to the compensation of the Chief Executive Officer and other executive officers, to oversee Mercer Bancorp’s compensation equity and incentive plans, policies and programs, and to oversee Mercer Bancorp’s management development and succession plans for executive officers. Mercer Bancorp’s Chief Executive Officer will not be present during any committee deliberations or voting with respect to his compensation. The Compensation Committee may form and delegate authority and duties to subcommittees as it deems appropriate.

The Compensation Committee operates under a written charter which is available on our website at mercersavings.com/investor-relations/. This charter sets forth the responsibilities of the Compensation Committee and reflects the Compensation Committee’s commitment to create a compensation structure that encourages the achievement of long-range objectives and builds long-term value for our stockholders.

The Compensation Committee considers a number of factors in their decisions regarding executive compensation, including, but not limited to, the level of responsibility and performance of the individual executive officers, the overall performance of Mercer Bancorp and a peer group analysis of compensation paid at institutions of comparable size and complexity. The Compensation Committee did not engage a compensation advisor in 2024. The Compensation Committee also considers the recommendations of the Chief Executive Officer with respect to the compensation of executive officers other than the Chief Executive Officer.

Nominating and Governance Committee. The Nominating and Governance Committee is comprised of Directors Keiser, Fee and Boley. The Nominating and Governance Committee met one time during the year ended September 30, 2024.

The committee seeks Board members who represent a mix of backgrounds that will reflect the diversity of our stockholders, employees, and customers, and experiences that will enhance the quality of the Board of Directors’ deliberations and decisions. As the holding company for a community bank, the Board of Directors also seeks directors who can continue to strengthen Mercer Savings Bank’s position in its community and can assist Mercer Savings Bank with business development through business and other community contacts. A candidate must meet the eligibility requirements set forth in our Bylaws, which include an age limitation provision, a residency requirement and a requirement that the candidate not have been subject to certain criminal or regulatory actions. The Nominating and Governance Committee operates under a written charter which is available on our website at mercersavings.com/investor-relations/.

The committee considers the following criteria in evaluating and selecting candidates for nomination:

| · | Contribution to Board – Mercer Bancorp endeavors to maintain a Board of Directors that possesses a wide range of abilities. Thus, the committee will assess the extent to which the candidate would contribute to the range of talent, skill and expertise appropriate for the Board of Directors. |

| · | Experience – Mercer Bancorp is the holding company for an insured depository institution. Because of the complex and heavily regulated nature of Mercer Bancorp’s business, the committee will consider a candidate’s relevant financial, regulatory and business experience and skills, including the candidate’s knowledge of the banking and financial services industries, familiarity with the operations of public companies and ability to read and understand fundamental financial statements, as well as real estate and legal experience. |

| · | Familiarity with and Participation in Local Community – Mercer Bancorp is a community-orientated organization that serves the needs of local consumers and businesses. In connection with the local character of Mercer Bancorp’s business, the committee will consider a candidate’s familiarity with Mercer Bancorp’s market area (or a portion thereof), including without limitation the candidate’s contacts with and knowledge of local businesses operating in Mercer Bancorp’s market area, knowledge of the local real estate markets and real estate professionals, experience with local governments and agencies and political activities, and participation in local business, civic, charitable or religious organizations. |

| · | Integrity – Due to the nature of the financial services provided by Mercer Bancorp and its subsidiaries, Mercer Bancorp is in a special position of trust with respect to its customers. Accordingly, the integrity of the Board of Directors is of utmost importance to developing and maintaining customer relationships. In connection with upholding that trust, the committee will consider a candidate’s personal and professional integrity, honesty and reputation, including, without limitation, whether a candidate or any entity controlled by the candidate is or has in the past been subject to any regulatory orders, involved in any regulatory or legal action, or been accused or convicted of a violation of law, even if such issue would not result in disqualification for service under Mercer Bancorp’s Bylaws. |

| · | Stockholder Interests and Dedication – A basic responsibility of directors is the exercise of their business judgment to act in what they reasonably believe to be in the best long-term interests of Mercer Bancorp and its stockholders. In connection with such obligation, the committee will consider a candidate’s ability to represent the best long-term interests of Mercer Bancorp and its stockholders, including past service with Mercer Bancorp or Mercer Savings Bank and contributions to their operations, the candidate’s experience or involvement with other local financial services companies, the potential for conflicts of interests with the candidate’s other pursuits, and the candidate’s ability to devote sufficient time and energy to diligently perform his or her duties, including the candidate’s ability to personally attend board and committee meetings. |

| · | Independence – The committee will consider the absence or presence of material relationships between a candidate and Mercer Bancorp (including those set forth in applicable listing standards) that might impact objectivity and independence of thought and judgment. In addition, the committee will consider the candidate’s ability to serve on any Board committees that are subject to additional regulatory requirements (e.g. Securities and Exchange Commission regulations and applicable listing standards). If Mercer Bancorp should adopt independence standards other than those set forth in the Nasdaq Stock Market listing standards, the committee will consider the candidate’s potential independence under such other standards. |

| · | Diversity – Mercer Bancorp understands the importance and value of diversity in gender, age, background and ethnicity on the Board of Directors and will consider these attributes when considering highly qualified individuals to include in the pool from which candidates are chosen. |

| · | Equity Holdings – The committee believes that having a proprietary interest in Mercer Bancorp serves as an incentive to contribute to the success of Mercer Bancorp and to help increase shareholder value. Thus, the committee will consider a candidate’s equity holdings in Mercer Bancorp. |

| · | Additional Factors – The committee will also consider any other factors it deems relevant to a candidate’s nomination that are consistent with our policies and strategic plan and the Board of Directors’ goal of promoting the long-term success of Mercer Bancorp and providing value to its stockholders. The committee also may consider the current composition and size of the Board of Directors, the balance of management and independent directors, and the need for audit committee expertise. |

The committee identifies nominees by first evaluating the current members of the Board of Directors willing to continue in service, including the current members’ board and committee meeting attendance and performance, length of board service, experience and contributions, and independence. Current members of the Board of Directors with skills and experience that are relevant to Mercer Bancorp’s business and who are willing to continue in service are considered for re-nomination, balancing the value of continuity of service by existing members of the Board of Directors with that of obtaining a new perspective. If there is a vacancy on the Board of Directors because any member of the Board of Directors does not wish to continue in service or if the committee decides not to re-nominate a member for re-election, the Board of Directors would determine the desired skills and experience of a new nominee (including a review of the skills set forth above), may solicit suggestions for director candidates from all board members and may engage in other search activities.

During the year ended September 30, 2024 we did not pay a fee to any third party to identify or evaluate or assist in identifying or evaluating potential nominees for director.

The Board of Directors may consider qualified candidates for director suggested by our stockholders. Stockholders can suggest qualified candidates for director by writing to our Corporate Secretary at 1100 Irmscher Blvd, Celina, Ohio 45822. The Board of Directors has adopted a procedure by which stockholders may recommend nominees to the Board of Directors. Stockholders who wish to recommend a nominee must write to Mercer Bancorp’s Corporate Secretary and such communication must include:

| · | A statement that the writer is a stockholder and is proposing a candidate for consideration by the Board of Directors; |

| · | The name and address of the stockholder as they appear on Mercer Bancorp’s books, and of the beneficial owner, if any, on whose behalf the nomination is made; |

| · | The class or series and number of shares of Mercer Bancorp’s capital stock that are owned beneficially or of record by such stockholder and such beneficial owner; |

| · | A description of all arrangements or understandings between such stockholder and each proposed nominee and any other person or persons (including their names) pursuant to which the nomination(s) are to be made by such stockholder; |

| · | A representation that such stockholder intends to appear in person or by proxy at the meeting to nominate the nominee named in the stockholder’s notice; |

| · | The name, age, personal and business address of the candidate, the principal occupation or employment of the candidate and the number of shares of common stock of Mercer Bancorp that are owned by the candidate; |

| · | The candidate’s written consent to serve as a director; |

| · | A statement of the candidate’s business and educational experience and all other information relating to such person that would indicate such person’s qualification to serve on Mercer Bancorp’s Board of Directors; and |

| · | Such other information regarding the candidate or the stockholder as would be required to be included in Mercer Bancorp’s proxy statement pursuant to Securities and Exchange Commission Regulation 14A. |

To be timely, the submission of a candidate for director by a stockholder must be received by the Corporate Secretary at least 60 days prior to the anniversary date of the proxy statement relating to the preceding year’s Annual Meeting of stockholders.

Submissions that are received and that satisfy the above requirements are forwarded to the Board of Directors for further review and consideration, using the same criteria to evaluate the candidate as it uses for evaluating other candidates that it considers.

There is a difference between the recommendations of nominees by stockholders pursuant to this policy and a formal nomination (whether by proxy solicitation or at a meeting) by a stockholder. Stockholders have certain rights under applicable law with respect to nominations, and any such nominations must comply with applicable law and provisions of the Bylaws of Mercer Bancorp. See “Stockholder Proposals and Nominations.”

Audit Committee Report

The Audit Committee has issued a report that states as follows:

| · | We have reviewed and discussed with management our audited consolidated financial statements for the year ended September 30, 2024; |

| · | We have discussed with the independent registered public accounting firm the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the Securities and Exchange Commission; and |

| · | We have received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence and have discussed with the independent registered public accounting firm their independence. |

Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements be included in our Annual Report on Form 10-K for the year ended September 30, 2024 for filing with the Securities and Exchange Commission.

This report shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except to the extent that Mercer Bancorp specifically incorporates this information by reference and shall not otherwise be deemed filed under such Acts.

This report has been provided by the Audit Committee:

David L. Keiser

Jose W. Faller

Kristin M. Fee

TRANSACTIONS WITH CERTAIN RELATED PERSONS

Federal law generally prohibits publicly traded companies from making loans and extensions of credit to their executive officers and directors, but it contains a specific exemption from such prohibition for loans made by federally insured financial institutions, such as Mercer Savings Bank, to their executive officers and directors in compliance with federal banking regulations. Federal regulations permit executive officers and directors to receive the same terms that are widely available to other employees as long as the director or executive officer is not given preferential treatment compared to the other participating employees.

Mercer Savings Bank makes loans to its employees and directors through an employee loan program pursuant to which loans are made at a reduced rate. Mortgage loans on a personal residence are available at 1.00% above Mercer Savings Bank’s cost of funds, adjusted annually, with the privilege limited to one outstanding loan per individual; consumer loans are available at 2.00% below the interest rate then offered to the public, but can never be less than 1.00% above Mercer Savings Bank’s cost of funds at the time the loan is granted, with the privilege limited to two outstanding loans per individual; and home equity lines of credit are available at the U.S. Prime Rate as published in The Wall Street Journal, adjusted as any changes to the U.S. Prime Rate occur, with the privilege limited to one outstanding loan per individual. The chart below lists our directors and executive officers who participated in the employee loan program during the years ended September 30, 2024 and 2023, and certain information with respect to their loans.

| Name | | Type of Loan | | Largest

Aggregate

Balance

10/1/23 to

9/30/24 | | | Principal

Balance

9/30/24 | | | Principal Paid

10/1/23 to

9/30/24 | | | Interest Paid

10/1/23 to

9/30/24 | | | Interest

Rate | |

| Timothy L. Bigham | | Home mortgage | | $ | 85,516.92 | | | $ | 82,923.08 | | | $ | 2,593.84 | | | $ | 1,355.08 | | | | 2.403 | % |

| Timothy L. Bigham | | Automobile loan | | $ | 17,129.48 | | | $ | 12,079.46 | | | $ | 5,050.02 | | | $ | 667.82 | | | | 4.375 | % |

| Trever Bransteter | | Home mortgage | | $ | 576,235.07 | | | $ | 563,686.52 | | | $ | 12,548.55 | | | $ | 13,335.13 | | | | 2.980 | % |

| Trever Bransteter | | Land | | $ | 100,000.00 | | | $ | 99,373.99 | | | $ | 626.01 | | | $ | 1,217.74 | | | | 7.125 | % |

| Jose W. Faller | | Home mortgage | | $ | 154,295.65 | | | $ | 148,840.15 | | | $ | 5,455.50 | | | $ | 2,821.55 | | | | 2.468 | % |

| Jose W. Faller | | Home equity line of credit | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | | | | 8.000 | % |

| Jon Fee (1) | | Home mortgage | | $ | 337,107.71 | | | $ | 328,732.63 | | | $ | 8,375.08 | | | $ | 5,774.23 | | | | 2.403 | % |

| Kristen M. Fee | | Automobile loan | | $ | 27,026.12 | | | $ | 18,868.36 | | | $ | 8,157.76 | | | $ | 333.83 | | | | 1.409 | % |

| Name | | Type of Loan | | Largest

Aggregate

Balance

10/1/22 to

9/30/23 | | | Principal

Balance

9/30/23 | | | Principal Paid

10/1/22 to

9/30/23 | | | Interest Paid

10/1/22 to

9/30/23 | | | Interest

Rate | |

| Timothy L. Bigham | | Home mortgage | | $ | 88,955 | | | $ | 85,768 | | | $ | 3,187 | | | $ | 1,133 | | | | 1.510 | % |

| Timothy L. Bigham | | Automobile loan | | $ | 22,324 | | | $ | 17,536 | | | $ | 4,788 | | | $ | 882 | | | | 4.375 | % |

| Jose W. Faller | | Home mortgage | | $ | 161,165 | | | $ | 154,812 | | | $ | 6,353 | | | $ | 2,047 | | | | 1.426 | % |

| Jose W. Faller | | Home equity line of credit | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | | 8.500 | % |

| Jon Fee (1) | | Home mortgage | | $ | 346,757 | | | $ | 337,890 | | | $ | 8,866 | | | $ | 4,008 | | | | 1.150 | % |

| Kristen M. Fee | | Automobile loan | | $ | 36,532 | | | $ | 27,763 | | | $ | 8,770 | | | $ | 458 | | | | 1.409 | % |

| David L. Keiser | | Home equity line of credit | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | | 8.500 | % |

| David L. Keiser | | Home mortgage | | $ | 52,070 | | | $ | 43,053 | | | $ | 9,017 | | | $ | 583 | | | | 1.544 | % |

(1) Mr. Fee is Director Fee’s husband.

All of our loans to directors and executive officers were made in the ordinary course of business and, except for the discounted rates described above, were made on substantially the same terms, including collateral, as those prevailing at the time for comparable loans with persons not related to Mercer Savings Bank, and did not involve more than the normal risk of collectability or present other unfavorable features. These loans were performing according to their original terms at September 30, 2024, and were made in compliance with federal banking regulations.

Pursuant to our Policy and Procedures for Approval of Related Person Transactions, the Audit Committee periodically reviews, no less frequently than twice a year, a summary of transactions in excess of $120,000 with our directors, executive officers, and their family members, for the purpose of determining whether the transactions are within our policies and should be ratified and approved. Additionally, pursuant to our Code of Business Conduct and Ethics, all of our executive officers and directors must disclose any personal or financial interest in any matter that comes before Mercer Bancorp.

EXECUTIVE COMPENSATION

Summary Compensation Table. The following information is furnished for our principal executive officer and the next two most highly compensated executive officers whose total compensation exceeded $100,000 for the year ended September 30, 2024. These individuals are sometimes referred to in this proxy statement as the “named executive officers.”

| Name and Principal Position | | Year | | | Salary | | | Bonus (1) | | | Non-Equity

Incentive Plan

Compensation | | | All Other

Compensation (2) | | | Total | |

| Barry Parmiter | | | 2024 | | | $ | 195,000 | | | $ | 29,250 | | | $ | — | | | $ | 17,540 | | | $ | 241,790 | |

| President and Chief Executive Officer | | | 2023 | | | | 189,750 | | | | 19,300 | | | | — | | | | 2,100 | | | | 211,150 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Trever A. Bransteter | | | 2024 | | | $ | 87,615 | | | $ | — | | | $ | 107,140 | | | $ | 13,178 | | | $ | 207,933 | |

| Senior Vice President of Mortgage Lending | | | 2023 | | | | 82,513 | | | | — | | | | 69,943 | | | | 6,098 | | | | 158,554 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Timothy L. Bigham | | | 2024 | | | $ | 80,926 | | | $ | 10,000 | | | $ | — | | | $ | 7,348 | | | $ | 98,274 | |

| Senior Vice President of Operations | | | 2023 | | | | 84,878 | | | | 13,500 | | | | — | | | | 3,935 | | | | 102,313 | |

(1) Represents discretionary bonuses for 2024.

(2) For 2024, All Other Compensation consists of the following:

| Name | | 401(k) Profit-Sharing

Contribution | | | ESOP Contribution | | | Total | |

| Mr. Parmiter | | $ | 8,830 | | | $ | 8,710 | | | $ | 17,540 | |

| Mr. Bransteter | | $ | 6,634 | | | $ | 6,544 | | | $ | 13,178 | |

| Mr. Bigham | | $ | 3,699 | | | $ | 3,649 | | | $ | 7,348 | |

Employment Agreements. Mercer Savings Bank has entered into employment agreements with Barry Parmiter, our President and Chief Executive Officer and Timothy L. Bigham, our Senior Vice President of Operations. Our continued success depends to a significant degree on the skills and competence of Messrs. Parmiter and Bigham and the employment agreements are intended to ensure that we maintain a stable management base.

Mr. Parmiter’s employment agreement has a term of three years. Commencing as of each January 1, the term of the agreement extends for an additional year (following a performance review of Mr. Parmiter), so that the remaining term will again become three years. The base salary for Mr. Parmiter for 2024 was $195,000. In addition to base salary, the agreement provides for, among other things, participation in bonus programs and other benefit plans and arrangements applicable to executive and other employees. We may terminate Mr. Parmiter’s employment for cause at any time, in which event he would have no right to receive compensation or other benefits under the employment agreement for any period after his termination of employment.

Certain events resulting in Mr. Parmiter’s termination or resignation entitle him to payments of severance benefits following the termination of his employment. In the event of Mr. Parmiter’s involuntary termination for reasons other than for cause or in the event he resigns during the term of the agreement following (a) the failure to appoint him to the executive position set forth in the agreement or the failure to re-nominate him as a member of the board of directors, (b) a material change in his function, duties or responsibilities resulting in a reduction of the responsibility, scope, or importance of his position, (c) a relocation of his office by more than 30 miles, (d) a material reduction in the benefits or perquisites paid to him unless the reduction is part of a reduction that is generally applicable to employees of Mercer Savings Bank, (e) a liquidation or dissolution of Mercer Savings Bank or (f) a material breach of the employment agreement by Mercer Savings Bank, then Mr. Parmiter would become entitled to a lump sum cash severance payment equal to the base salary and bonuses he would have earned for the remaining unexpired term of the employment agreement. In addition, Mr. Parmiter would become entitled, at no expense to him, to the continuation of life insurance and non-taxable medical and dental coverage for the remaining unexpired term of the employment agreement, or if the coverage is not permitted by applicable law or if providing the benefits would subject Mercer Savings Bank to penalties, he would receive a cash lump sum payment equal to the value of the benefits.

In the event of a change in control of Mercer Savings Bank or Mercer Bancorp followed by Mr. Parmiter’s involuntary termination other than for cause or upon his resignation for one of the reasons set forth above, he would become entitled to a lump sum cash severance payment equal to three times his “base amount,” as that term is defined for purposes of Internal Revenue Code Section 280G (i.e., the average annual taxable income paid to him for the five taxable years preceding the taxable year in which the change in control occurs). In addition, Mr. Parmiter would become entitled, at no expense to him, to the continuation of life insurance and non-taxable medical and dental coverage for twenty-four (24) months following his termination of employment, or if the coverage is not permitted by applicable law or if providing the benefits would subject Mercer Savings Bank to penalties, he would receive a cash lump sum payment equal to the value of the benefits.

Under the employment agreement, if Mr. Parmiter becomes disabled as set forth in the employment agreement, he will receive benefits under any short-term or long-term disability plans maintained by Mercer Savings Bank.

Under the employment agreement, if Mr. Parmiter retires following his attainment of age 65, he will receive benefits under any applicable retirement or other plans maintained by Mercer Savings Bank.

In the event of Mr. Parmiter’s death, his estate or beneficiaries will be paid his base salary through the end of the month in which his death occurs and his dependents will be entitled to continued non-taxable medical, dental and other insurance for one year following his death.

Upon termination of Mr. Parmiter’s employment (other than following a change in control), he will be subject to certain restrictions on his ability to compete or to solicit business or employees of Mercer Savings Bank for a period of one year following his termination of employment.

Mercer Savings Bank has also entered into an employment agreement with Timothy L. Bigham.

The employment agreement has a term of one year and renews each January 1 unless Mr. Bigham or Mercer Savings Bank provides notice of non-renewal to the other. The base salary for Mr. Bigham for 2024 was $81,640. In addition to base salary, the agreement provides for, among other things, participation in bonus programs and other benefit plans and arrangements applicable to executive and other employees. We may terminate Mr. Bigham’s employment for cause at any time, in which event he would have no right to receive compensation or other benefits under the employment agreement for any period after his termination of employment.

Certain events resulting in Mr. Bigham’s termination or resignation entitle him to payments of severance benefits following the termination of his employment. In the event of Mr. Bigham’s involuntary termination for reasons other than for cause or in the event he resigns during the term of the agreement following (a) a material diminution of his base compensation, (b) a material change in his authority, duties or responsibilities, (c) a material relocation of his office, (d) a material diminution in the budget over which he retains authority or (e) a material breach of the employment agreement by Mercer Savings Bank, then Mr. Bigham would become entitled to a lump sum cash severance payment equal to the 50% of the annual salary he would have earned for the remaining unexpired term of the employment agreement. In addition, if Mr. Bigham elects coverage under COBRA, he would become entitled, at no expense to him, to the continuation of health, life and disability insurance until the earlier of he and his spouse attaining age 65 or until he become a full-time employee with another employer.

In the event of Mr. Bigham’s involuntary termination for reasons other than for cause within six months prior to or one year following a change in control or in the event he resigns for one of the reasons set forth above within one year following a change in control, he would become entitled to a lump sum cash severance payment equal to 50% of his base salary and highest annual bonus for the five year preceding his termination of employment. In addition, Mr. Bigham would become entitled, at no expense to him, to reimbursement of 50% of the premiums due for coverage under COBRA should he elect such coverage, as well as 50% of the premiums for life and disability insurance for 18 months.

Under the employment agreement, if Mr. Bigham becomes disabled as set forth in the employment agreement, he will receive benefits under any short-term or long-term disability plans maintained by Mercer Savings Bank.

In the event of Mr. Bigham’s death, his estate or beneficiaries will be paid his base salary through the end of the month in which his death occurs.

Upon termination of Mr. Bigham’s employment, he will be subject to certain restrictions on his ability to compete or to solicit business or employees of Mercer Savings Bank for a period of one year following his termination of employment.

Director Compensation

The following table sets forth for the year ended September 30, 2024 certain information as to the total remuneration we paid to our non-employee directors.

| Name | | Fees Earned or

Paid in Cash | | | All Other

Compensation | | | Total | |

| Michael J. Boley | | $ | 19,200 | | | | — | | | $ | 19,200 | |

| Jose W. Faller | | | 19,200 | | | | — | | | | 19,200 | |

| Kristin M. Fee | | | 16,800 | | | | — | | | | 16,800 | |

| David L. Keiser | | | 21,600 | | | | — | | | | 21,600 | |

| Richard A. Mosier (1) | | | 5,600 | | | | — | | | | 5,600 | |

| (1) | Mr. Mosier retired from the Board of Directors effective January 16, 2024. |

Director Fees. Directors of Mercer Savings Bank receive a monthly fee of $1,600 for directors not participating in a Director Retirement Agreement or $1,400 for directors who participate in a Director Retirement Agreement. The Chairman, or the Vice Chair in the absence of the Chairman, receives an additional fee of $400 per month. Employees who serve on the board of directors do not receive director fees. No additional fees are paid for attending meetings of the Board of Directors or of its committees.

Each individual who serves as a director of Mercer Savings Bank also serves as a director of Mercer Bancorp. Currently, each director will receive director fees only in their capacity as a director of Mercer Savings Bank.

Director Retirement Agreements. Mercer Savings Bank has entered into Director Retirement Agreements with Mr. Mosier, who retired from the Board on January 16, 2024, and Mr. Keiser and Ms. Fee. Under the Director Retirement Agreement with Mr. Mosier, Mr. Mosier is entitled to a normal retirement benefit based on a schedule attached to the agreements. The annual normal retirement benefit for Mr. Mosier equals $18,736. In connection with its mutual-to-stock conversion, Mercer Savings Bank amended the Director Retirement Agreements with Mr. Keiser and Ms. Fee to convert the agreements to a defined contribution form of benefit with the initial account balance equal to the accrual balance of the directors’ then current benefit. Each year, Mercer Savings Bank will contribute an additional amount to the agreements on behalf of Mr. Keiser and Ms. Fee with the intent that the account balance will equal what was the anticipated accrual balance prior to the amendment (i.e., so that the directors will receive the same benefit equivalent after the amendment to the agreements prior to any adjustment for earnings on the account balances). The amendments were intended to allow Mr. Keiser and Ms. Fee to invest their account balance in the stock of Mercer Bancorp by making a one-time election to use the account balance to subscribe for shares in the offering.

The normal retirement age for Messrs. Mosier and Keiser is 70 and 72, respectively, and the normal retirement age for Ms. Fee is 71. The directors vest in their benefits under the Director Retirement Agreements at the rate of 33% after six years of service, 66% after ten years of service and 100% after 18 years of service. The normal retirement benefit is paid monthly for ten years. Directors become 100% vested in their normal retirement benefit upon becoming disabled and receive the benefit in the same form as the normal retirement benefit but commencing on the first day of the month following their disability.

If the director separates from service prior to their normal retirement age, they become entitled to a lump sum payment equal to the amount set forth on a schedule to the agreements within 60 days following their separation from service. If the director separates from service within 24 months of a change in control, the director will fully vest in the normal retirement benefit and receive the benefit in a lump sum within 60 days following their separation from service. If a director dies while in service, the director’s beneficiary will receive 100% of the normal retirement benefit, paid monthly for ten years. If the director dies while in pay-status under the agreements, the director’s beneficiary will receive the same benefits the director would have received had the director survived.

PROPOSAL II—APPROVAL OF THE MERCER BANCORP, INC.

2025 EQUITY INCENTIVE PLAN

Overview

Mercer Bancorp’s Board of Directors has unanimously approved and unanimously recommends that stockholders approve the Mercer Bancorp, Inc. 2025 Equity Incentive Plan (the “2025 Equity Plan” or the “Plan”). The 2025 Equity Plan will become effective on February 25, 2025 (the “Plan Effective Date”) if stockholders approve the Plan on that date. No awards have been made under the 2025 Equity Plan. However, initial awards to our non-employee directors are set forth in the Plan document and will be self-executing on the day following the approval of the Plan by stockholders.

No awards may be granted under the 2025 Equity Plan after the day immediately before the tenth anniversary of the Plan Effective Date. However, awards outstanding under the 2025 Equity Plan at that time will continue to be governed by the 2025 Equity Plan and the award agreements under which they were granted.

Best Practices

The 2025 Equity Plan reflects the following equity compensation plan best practices:

| ⮚ | The Plan limits the maximum number of shares that may be issued to any one employee or one non-employee director, respectively, and to all non-employee directors as a group. For these purposes, we have generally adopted the limits set forth under the mutual-to stock conversion regulations for equity plans adopted no earlier than six months and no later than one year after a conversion stock offering, even though the 2025 Equity Plan, which is being submitted to our stockholders more than one year after our mutual-to-stock conversion offering, is not otherwise subject to these limits; |

| ⮚ | The Plan provides for a minimum vesting requirement of one year for all equity-based awards, except that up to 5% of the awards may be issued (or accelerated) pursuant to awards that do not meet this requirement, and any award may provide for accelerated vesting for death, disability or an involuntary termination without cause or resignation for good reason in connection with a change in control; |

| ⮚ | Under the Plan, performance goals may be established by the Compensation Committee (the “Committee”) in connection with the grant of any award; |

| ⮚ | The Plan prohibits grants of stock options with a below-market exercise price; |

| ⮚ | The Plan prohibits repricing of stock options and cash buyout of underwater stock options without prior stockholder approval; |

| ⮚ | The Plan does not provide for accelerated vesting upon retirement; |

| ⮚ | The Plan prohibits the payment of dividends on restricted stock or dividend equivalent rights on restricted stock units (“RSUs”) until the vesting or settlement date of the underlying award and does not permit the payment of dividend equivalent rights on stock options; |

| ⮚ | The Plan does not contain a liberal “change in control” definition; |

| ⮚ | The Plan does not permit liberal share recycling. Shares withheld to satisfy tax withholding or to pay the exercise price of a stock option will not be available for future grants; |

| ⮚ | The Plan requires “double trigger” vesting of awards upon a change in control, requiring both a change in control plus an involuntary termination or a resignation for “good reason,” except to extent an acquiror fails or refuses to assume the awards or replace them with awards issued by the acquiror; and |

| ⮚ | Awards under the Plan are subject to Mercer Bancorp’s clawback policies, as they may be amended from time to time, including clawback under Section 954 of the Dodd-Frank Act, as well as Mercer Bancorp’s trading policy restrictions and hedging/pledging policy restrictions. |

| ⮚ | The full text of the 2025 Equity Plan is attached as Appendix A to this proxy statement, and the description of the 2025 Equity Plan is qualified in its entirety by reference to Appendix A. |

Why Mercer Bancorp Believes You Should Vote to Approve the 2025 Equity Plan

Our Board of Directors believes that equity-based incentive awards will play a key role in the success of Mercer Bancorp by encouraging and enabling employees, officers and non-employee directors of Mercer Bancorp and Mercer Savings Bank, upon whose judgment, initiative and efforts Mercer Bancorp has depended and continues to largely depend for the successful conduct of its business, to acquire an ownership stake in Mercer Bancorp, thereby stimulating their efforts on behalf of Mercer Bancorp and strengthening their desire to remain with Mercer Bancorp. The details of the key design elements of the 2025 Equity Plan are set forth in the section entitled “Plan Summary,” below.

We view the ability to use Mercer Bancorp common stock as part of our compensation program as an important component to our future success because we believe it will enhance a pay-for-performance culture that is an important element of our overall compensation philosophy. Equity-based compensation will further align the compensation interests of our employees and directors with the investment interests of our stockholders as it promotes a focus on long-term value creation through time-based and/or performance-based vesting criteria.

If the 2025 Equity Plan is not approved by stockholders, Mercer Bancorp will have to rely on the cash component of its employee compensation program to attract new employees and to retain our existing employees, which may not align our employees’ interests with the investment interests of Mercer Bancorp’s stockholders. In addition, if the 2025 Equity Plan is not approved and Mercer Bancorp is not able to use stock-based awards to recruit and compensate its directors, officers and other key employees, it could be at a competitive disadvantage for key talent, which could impede our future growth plans and other strategic priorities. The inability to provide equity-based awards would likely increase cash compensation expense over time and use up cash that might be better utilized if reinvested in Mercer Bancorp’s business or returned to Mercer Bancorp’s stockholders.