, 2023

Dear Danaher Corporation Stockholder:

On September 14, 2022, we announced our intention to separate our Environmental & Applied Solutions businesses to create a separate, publicly traded company, which will occur by means of a spin-off of all of the outstanding shares of common stock of a newly formed company named Veralto Corporation (“Veralto”) to Danaher stockholders. We believe that the spin-off will position Danaher and Veralto to further grow their respective businesses and enhance long-term value for all of our stockholders, customers and associates. We further believe that Veralto can be more effective as a stand-alone company, with greater focus on both organic growth and inorganic investment opportunities. The principles of the Danaher Business System will remain the foundation of both companies.

Veralto will have outstanding brands and market-leading positions in a broad range of water quality and product quality and innovation related instruments, consumables, software and services. It will be comprised of the businesses included in Danaher’s existing Environmental & Applied Solutions segment, which consists of Danaher’s existing Water Quality and Product Quality & Innovation (previously referred to as Product Identification) businesses. As a stand-alone entity, Veralto will be better positioned to accelerate its growth trajectory, drive margin expansion, and pursue acquisition opportunities. We believe that the separation will support an even more attractive earnings profile for Veralto going forward.

Following the spin-off, Danaher will continue to hold leading positions in areas of biotechnology, life sciences and diagnostics that are exposed to favorable secular and structural growth trends. These positions are comprised of leading brands that share common characteristics including: a high percentage of recurring revenue, an attractive growth and margin profile, and, predominantly, a direct to end customer commercial strategy. Danaher will be well positioned to grow organically, improve profitability, and deploy capital to generate substantial earnings growth.

The spin-off will provide current Danaher stockholders with ownership interests in both Danaher and Veralto, and will be in the form of a pro rata distribution of all of the outstanding shares of Veralto common stock to holders of Danaher common stock. Each Danaher stockholder will receive one share of Veralto common stock for every three shares of Danaher common stock held at the close of business on September 13, 2023, the record date for the distribution. You do not need to take any action to receive shares of Veralto common stock to which you are entitled as a Danaher stockholder. You do not need to pay any consideration or surrender or exchange your shares of Danaher common stock to participate in the spin-off.

The distribution is intended to be tax-free to Danaher stockholders for U.S. federal income tax purposes, except for any cash received by stockholders in lieu of fractional shares. You should consult your own tax advisor as to the particular consequences of the distribution to you, including the applicability and effect of any U.S. federal, state and local and non-U.S. tax laws.

I encourage you to read the attached information statement, which is being provided to all Danaher stockholders who held shares on the record date for the distribution. The information statement describes the separation in detail and contains important business and financial information about Veralto.

We believe that the spin-off is a positive step for Danaher and Veralto and is in the best interests of Danaher and its stockholders. We remain committed to working on your behalf to continue to build long-term stockholder value.

| | |

| Sincerely, |

|

| Rainer M. Blair |

| President and Chief Executive Officer |

| Danaher Corporation |

, 2023

Dear Future Veralto Stockholder:

I am excited for you to get to know our business and look forward to welcoming you as a stockholder of Veralto Corporation (“Veralto”) when we become a separate publicly traded company. We plan to list Veralto on the New York Stock Exchange under the ticker symbol “VLTO”. Veralto is a leader in public health and safety with an attractive operating profile and a proven business system designed to create long-term shareholder value. This strong foundation was born from our rich heritage at Danaher, and we are committed to building on our legacy of growth, innovation, and continuous improvement by carrying forward the principles of the Danaher Business System as we transition to the Veralto Enterprise System (“VES”).

Veralto stands for our commitment to the highest levels of excellence in pursuit of our unifying purpose: Safeguarding the World’s Most Vital ResourcesTM. We are committed to the advancement of public health and safety and believe we are well positioned to help address some of the world’s most challenging environmental and sustainability issues.

Veralto is comprised of long-established operating companies with leading brands focused on solving global challenges, including water quality, water scarcity, food safety, and labor shortages in our served industries. The breadth of our product offering is complemented by technical applications expertise, digital capabilities, and customer service; all of which help support our customers’ objectives to reduce operating costs, minimize their environmental impact, and support consumer health and safety.

Strong secular trends continue to shape the industries in which we participate and provide opportunities for future growth. These trends include increasing regulatory standards for drinking water and wastewater discharge, growing global demand for safe and affordable water, enhanced focus on product safety, along with a heightened focused on sustainability. Given Veralto's history of helping customers navigate significant regulatory, sustainability and product safety challenges, we believe we are well positioned to capitalize on these secular trends.

Veralto’s leadership team is diverse, talented and experienced and includes a balance of Danaher veterans and external hires with public company experience. Our team of 16,000 associates is data driven and results oriented with a growth and continuous improvement mindset. We strive to create and sustain a culture of empowerment and accountability where our associates feel a sense of belonging in an inclusive workplace that is challenging, rewarding and offers the ability to make meaningful, enduring contributions to humanity.

As a separate publicly traded company we see significant opportunities to create future value by executing against three strategic imperatives:

1.Safeguarding the world’s most vital resourcesTM: We seek to have a positive, enduring impact by supporting public health and safety, delivering quality and reliability, and fostering trust and innovation. We believe our track record of innovation and performance, combined with regulatory, environmental and sustainability secular growth drivers position Veralto to play a leading role in helping ensure the vitality of everyday life.

2.Drive operational excellence through the application of VES: Our operating businesses have leveraged DBS (known as VES at Veralto) to continuously improve their operational and financial results across our business for over 20 years. VES is paramount to our results-oriented, growth, innovation, and continuous improvement mindset. In the spirit of continuous improvement, we intend to tailor VES to our culture and portfolio of operating businesses to maximize its impact across our enterprise.

3.Execute strategic, disciplined capital allocation: We intend to re-invest the substantial free cash flow we expect from our operations, after taking into account any debt servicing payments and potential dividends, towards actions that we believe drive long-term shareholder value creation - prioritizing accretive organic growth initiatives and acquisitions that strategically expand the offerings of our businesses and help us address new and emerging challenges impacting our customers, while maintaining our flexibility to return capital to shareholders.

I personally invite you to learn more about Veralto by reading the attached information statement. Our team looks forward to earning your trust as we focus on delivering results through customer-inspired ingenuity and continuous improvement that leaves an enduring impact.

| | |

| Sincerely, |

|

| Jennifer L. Honeycutt |

| President & Chief Executive Officer |

| Veralto Corporation |

Information contained herein is subject to completion or amendment. A Registration Statement on Form 10 relating to these securities has been filed with the U.S. Securities and Exchange Commission under the U.S. Securities Exchange Act of 1934, as amended, but has not yet become effective.

PRELIMINARY AND SUBJECT TO COMPLETION, DATED AUGUST 30, 2023

INFORMATION STATEMENT

Veralto Corporation

____________

This information statement is being furnished in connection with the distribution by Danaher Corporation (“Danaher”) to its stockholders of all of the outstanding shares of common stock of Veralto Corporation, a wholly owned subsidiary of Danaher that will hold, directly or indirectly, substantially all of the assets and liabilities associated with Danaher’s existing Environmental & Applied Solutions segment (consisting of Danaher’s existing Water Quality and Product Identification businesses) (“Veralto”). To implement the distribution, Danaher will distribute all of the shares of Veralto common stock on a pro rata basis to the Danaher stockholders.

For every three shares of Danaher common stock held of record by you as of the close of business on September 13, 2023, the record date for the distribution, you will receive one share of Veralto common stock. You will receive cash in lieu of any fractional shares of Veralto common stock that you would have received after application of the above ratio. As discussed under “The Separation and Distribution—Trading Between the Record Date and Distribution Date,” if you sell your shares of Danaher common stock “regular-way” after the record date and before the distribution, you also will be selling your right to receive shares of Veralto common stock in connection with the separation. Veralto expects the shares of Veralto common stock to be distributed by Danaher on September 30, 2023. We refer to the date of the distribution of the shares of Veralto common stock as the “distribution date.” Because September 30, 2023 is a Saturday and not a business day, the shares are expected to be credited to “street name” stockholders through the Depository Trust Company (“DTC”) on the first trading day thereafter, Monday, October 2, 2023.

The distribution is expected to be tax-free to Danaher stockholders for U.S. federal income tax purposes, except for any cash received in lieu of fractional shares.

No vote of Danaher stockholders is required for the distribution. Therefore, you are not being asked for a proxy, and you are requested not to send Danaher a proxy, in connection with the distribution. You do not need to pay any consideration, exchange or surrender your existing shares of Danaher common stock or take any other action to receive your shares of Veralto common stock.

There is no current trading market for Veralto common stock, although Veralto expects that a limited market, commonly known as a “when-issued” trading market, will develop on the third trading day prior to the distribution date, and Veralto expects “regular-way” trading of Veralto common stock to begin on the first trading day following the distribution. Veralto has applied to have its common stock authorized for listing on the New York Stock Exchange (the “NYSE”) under the symbol “VLTO.” Following the distribution, Danaher will continue to trade on the NYSE under the symbol “DHR.”

____________

In reviewing this information statement, you should carefully consider the matters described under the caption “Risk Factors” beginning on page 17. Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined if this information statement is truthful or complete. Any representation to the contrary is a criminal offense.

____________

This information statement does not constitute an offer to sell or the solicitation of an offer to buy any securities.

The date of this information statement is [l], 2023.

A notice of Internet Availability of Information Statement Materials containing instructions describing how to access this information statement was first mailed to Danaher stockholders on or about [l], 2023. This information statement will be mailed to Danaher’s stockholders who previously elected to receive a paper copy of Danaher’s materials.

TABLE OF CONTENTS

Presentation of Information

Unless the context otherwise requires, (i) references in this information statement to “Veralto,” the “Company,” “we,” “us” and “our” refer to Veralto Corporation, a Delaware corporation, and its consolidated subsidiaries after giving effect to the separation, (ii) references in this information statement to the “Environmental & Applied Solutions businesses,” “Water Quality and Product Quality & Innovation businesses” or the Company’s historical business and operations refer to the business and operations of Danaher’s Environmental & Applied Solutions segment (consisting of Danaher’s Water Quality and Product Identification businesses) that will be transferred to the Company in connection with the separation and distribution and (iii) references in this information statement to “Danaher” and “Parent” refer to Danaher Corporation, a Delaware corporation, and its consolidated subsidiaries, unless the context otherwise requires.

In connection with the separation and distribution, we will enter into a series of transactions with Danaher pursuant to which Danaher will transfer substantially all of the assets and liabilities of its Environmental & Applied Solutions segment to us in exchange for shares of our common stock and a Cash Distribution (as defined herein). As used herein, (i) the “separation” refers to the separation of the Environmental & Applied Solutions businesses from Danaher and the creation of a separate company holding the Environmental & Applied Solutions businesses and (ii) the “distribution” refers to the distribution of all of the shares of Veralto common stock owned by Danaher to Danaher stockholders as of the record date. Except as otherwise indicated or unless the context otherwise requires, the information included in this information statement about Veralto assumes the completion of all of the transactions referred to in this information statement in connection with the separation and distribution.

Market, Industry and Other Data

Unless otherwise indicated, information contained in this information statement concerning Veralto’s industry and the markets in which Veralto operates, including its general expectations and market position, market opportunity and market share, is based on information from third-party sources and management estimates. Veralto’s management estimates are derived from publicly available information, Veralto’s knowledge of its industry and assumptions based on such information and knowledge, which Veralto believes to be reasonable. Veralto’s management estimates have not been verified by any independent source. In addition, assumptions and estimates of Veralto and its industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause future performance to differ materially from Veralto’s assumptions and estimates. For additional information, please refer to “Cautionary Statement Concerning Forward-Looking Statements.”

Trademarks, Trade Names and Service Marks

The name and mark, Veralto, and other trademarks, trade names and service marks of the Company appearing in this information statement are Veralto’s property or, as applicable, licensed to Veralto, or, as applicable, are the property of Danaher. The name and mark, Danaher, and other trademarks, trade names and service marks of Danaher appearing in this information statement are the property of Danaher. This information statement also contains additional trade names, trademarks and service marks belonging to other companies. Veralto does not intend its use or display of other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of Veralto by, these other parties.

QUESTIONS AND ANSWERS ABOUT THE SEPARATION AND DISTRIBUTION

| | | | | |

What is Veralto and why is Danaher separating Veralto’s businesses and distributing Veralto common stock? | Veralto, which is currently a wholly owned subsidiary of Danaher, was formed to hold Danaher’s Environmental & Applied Solutions businesses. The separation of Veralto from Danaher and the distribution of Veralto common stock are intended to provide you with equity investments in two separate, publicly traded companies that will be able to focus on each of their respective business strategies. Danaher and Veralto believe that the separation will result in enhanced long-term performance of each business for the reasons discussed in “The Separation and Distribution—Background” and “The Separation and Distribution—Reasons for the Separation.” |

| |

Why am I receiving this document? | Danaher is delivering this document to you because you are a holder of Danaher common stock. If you are a holder of Danaher common stock as of the close of business on September 13, 2023, the record date for the distribution, you will be entitled to receive one share of Veralto common stock for every three shares of Danaher common stock that you held at the close of business on such date. This document will help you understand how the separation and distribution will affect your investment in Danaher and your investment in Veralto after the separation. |

| |

How will the separation of Veralto from Danaher work? | To accomplish the separation, Danaher will distribute all of the outstanding shares of Veralto common stock to Danaher stockholders on a pro rata basis in a distribution intended to be tax-free for U.S. federal income tax purposes, except for cash received in lieu of fractional shares. |

| |

Why is the separation of Veralto structured as a distribution? | Danaher believes that a distribution of shares of Veralto common stock to Danaher stockholders that is tax-free for U.S. federal income tax purposes is an efficient way to separate the Environmental & Applied Solutions businesses in a manner that will create long-term value for Danaher and its stockholders. |

| |

What is the record date for the distribution? | The record date for the distribution will be the close of business on September 13, 2023. |

| |

When will the distribution occur? | It is expected that all of the shares of Veralto common stock will be distributed by Danaher on September 30, 2023, to holders of record of Danaher common stock at the close of business on September 13, 2023, the record date for the distribution. Because September 30, 2023 is a Saturday and not a business day, the shares are expected to be credited to “street name” stockholders through DTC on the first trading day thereafter, Monday, October 2, 2023. |

| |

| | | | | |

What do stockholders need to do to participate in the distribution? | Stockholders of Danaher as of the record date for the distribution will not be required to take any action to receive Veralto common stock in the distribution, but you are urged to read this entire information statement carefully. No stockholder approval of the distribution is required. You are not being asked for a proxy. You do not need to pay any consideration, exchange or surrender your existing shares of Danaher common stock or take any other action to receive your shares of Veralto common stock. Please do not send in your Danaher stock certificates. The distribution will not affect the number of outstanding Danaher shares or any rights of Danaher stockholders, although it will affect the market value of each outstanding share of Danaher common stock. |

| |

How will shares of Veralto common stock be issued? | You will receive shares of Veralto common stock through the same or substantially similar channels that you currently use to hold or trade shares of Danaher common stock, whether through a brokerage account, 401(k) plan or other channel. Receipt of shares of Veralto common stock will be documented for you in substantially the same manner that you typically receive stockholder updates, such as monthly broker statements and 401(k) statements. |

| |

| If you own shares of Danaher common stock as of the close of business on the record date for the distribution, including shares owned in certificate form, Danaher, with the assistance of Computershare Trust Company, N.A. (“Computershare”), the settlement and distribution agent, will electronically distribute shares of Veralto common stock to you or to your brokerage firm on your behalf in book-entry form. Computershare will mail you a book-entry account statement that reflects your shares of Veralto common stock, or your bank or brokerage firm will credit your account for the shares. |

| |

How many shares of Veralto common stock will I receive in the distribution? | Danaher will distribute to you one share of Veralto common stock for every three shares of Danaher common stock held by you as of the record date for the distribution. Based on approximately 738,185,234 shares of Danaher common stock outstanding as of June 30, 2023, assuming a distribution of all of the shares of Veralto common stock and applying the distribution ratio (without accounting for cash to be distributed in lieu of fractional shares), Veralto expects that a total of approximately 246,061,744 shares of Veralto common stock will be distributed to Danaher’s stockholders. For additional information on the distribution, please refer to “The Separation and Distribution.” |

| |

Will Veralto issue fractional shares of its common stock in the distribution? | No. Veralto will not issue fractional shares of its common stock in the distribution. Fractional shares that Danaher stockholders would otherwise have been entitled to receive will be aggregated into whole shares and sold in the public market by the distribution agent. The aggregate net cash proceeds of these sales will be distributed pro rata (based on the fractional share such holder would otherwise be entitled to receive) to those stockholders who would otherwise have been entitled to receive fractional shares. Recipients of cash in lieu of fractional shares will not be entitled to any interest on the amounts of payment made in lieu of fractional shares. The receipt of cash in lieu of fractional shares will generally be taxable to the recipient stockholders for U.S. federal income tax purposes as described in “U.S. Federal Income Tax Considerations.” |

| | | | | |

| |

What are the conditions to the distribution? | The distribution is subject to the satisfaction (or, to the extent permitted by applicable law, waiver by Danaher in its sole discretion) of the following conditions: |

| |

| •the transfer of assets and liabilities to Veralto in accordance with the separation and distribution agreement by and between Danaher and Veralto (the “separation agreement”) will have been completed, other than any assets and liabilities intended to transfer after the distribution; •Danaher will have received (i) a private letter ruling from the IRS with respect to certain aspects of the anticipated non-taxable nature of the transactions (the “Ruling”) and (ii) an opinion of Skadden, Arps, Slate, Meagher & Flom LLP, tax counsel to Danaher, regarding the qualification of the distribution and certain related transactions as a reorganization within the meaning of Sections 355(a) and 368(a)(1)(D) of the Internal Revenue Code of 1986, as amended (the “Code”); •the making of a cash distribution of approximately $2.7 billion (the “Cash Distribution”) from Veralto to Danaher as partial consideration for the contribution of assets to Veralto by Danaher in connection with the separation; •the U.S. Securities and Exchange Commission (the “SEC”) will have declared effective the registration statement on Form 10 of which this information statement forms a part, no stop order relating to the registration statement will be in effect, no proceedings seeking such stop order will be pending before or threatened by the SEC, and this information statement will have been distributed to Danaher stockholders; •all registrations, consents and filings required under applicable U.S. federal, U.S. state or other securities laws will have been received or made; •no order, injunction or decree issued by any court of competent jurisdiction or other legal restraint or prohibition preventing the consummation of the separation, the distribution or any of the related transactions will be in effect; •the Danaher board of directors will have declared the distribution and approved all related transactions (and such declaration or approval will not have been withdrawn); •the agreements relating to the separation will have been duly executed and delivered by the parties to those agreements; •the shares of Veralto common stock to be distributed will have been accepted for listing on the NYSE, subject to official notice of distribution; •the financing described under “Description of Certain Indebtedness” will have been completed; and •no other event or development will have occurred or exist that, in the judgment of Danaher’s board of directors, in its sole discretion, makes it inadvisable to effect the separation, the distribution or the other related transactions. |

| |

| | | | | |

| Danaher and Veralto cannot assure you that any or all of these conditions will be met, or that the distribution will be consummated even if all of these conditions are met. Danaher can decline at any time to go forward with the distribution. In addition, each of these conditions may be waived by Danaher (to the extent permitted by applicable law). The fourth, fifth, sixth and seventh conditions listed above may not be waived pursuant to applicable law. If the distribution is completed and the Danaher board of directors waived any such condition, such waiver could have a material adverse effect on Veralto’s business and financial statements, the trading price of Veralto’s common stock, or the ability of Veralto stockholders to sell their shares after the distribution, including, without limitation, as a result of illiquid trading due to the failure of Veralto common stock to be accepted for listing. If Danaher elects to proceed with the distribution notwithstanding that one or more of the conditions to the distribution has not been met, Danaher has informed us that it would issue a press release publicly announcing any such decision. For a complete discussion of all of the conditions to the distribution, see “The Separation and Distribution—Conditions to the Distribution.” |

| |

What is the expected date of completion of the separation and distribution? | The completion and timing of the separation and distribution are dependent upon a number of conditions. It is expected that the shares of Veralto common stock will be distributed by Danaher at 12:01 a.m., Eastern time, on September 30, 2023 to the holders of record of shares of Danaher common stock at the close of business on September 13, 2023, the record date for the distribution. However, no assurance can be provided as to the timing of the separation or that all conditions to the distribution will be met. Because September 30, 2023 is a Saturday and not a business day, the shares are expected to be credited to “street name” stockholders through DTC on the first trading day thereafter, Monday, October 2, 2023. |

| |

Can Danaher decide to cancel the distribution of Veralto common stock even if all the conditions have been met? | Yes. The distribution is subject to the satisfaction or waiver (to the extent permitted by applicable law) of certain conditions. See “The Separation and Distribution—Conditions to the Distribution.” Until the distribution has occurred, Danaher has the right to terminate or modify the distribution, even if all of the conditions are satisfied. |

| |

What if I want to sell my Danaher common stock or my Veralto common stock? | You should consult with your financial advisors, such as your stockbroker, bank or tax advisor. |

| |

What is “regular-way” and “ex-distribution” trading of Danaher stock? | Beginning on the third trading day prior to the distribution date and continuing up to and through the distribution date, it is expected that there will be two markets in Danaher common stock: a “regular-way” market and an “ex-distribution” market. Shares of Danaher common stock that trade in the “regular-way” market will trade with an entitlement to shares of Veralto common stock distributed pursuant to the distribution. Shares that trade in the “ex-distribution” market will trade without an entitlement to shares of Veralto common stock distributed pursuant to the distribution. |

| |

| | | | | |

| If you decide to sell any shares of Danaher common stock before the distribution date, you should make sure your stockbroker, bank or other nominee understands whether you want to sell your Danaher common stock with or without your entitlement to Veralto common stock pursuant to the distribution. |

| |

Where will I be able to trade shares of Veralto common stock? | Veralto intends to apply to list its common stock on the NYSE under the symbol “VLTO.” Veralto anticipates that trading in shares of its common stock will begin on a “when-issued” basis on the third trading day prior to the distribution date and will continue up to the distribution date and that “regular-way” trading in Veralto common stock will begin on the first trading day following the completion of the distribution. If trading begins on a “when-issued” basis, you may purchase or sell Veralto common stock up to the distribution date, but your transaction will not settle until after the distribution date. Veralto cannot predict the trading prices for its common stock before, on or after the distribution date. |

| |

What will happen to the listing of Danaher common stock? | Danaher common stock will continue to trade on the NYSE after the distribution under the symbol “DHR.” |

| |

Will the number of shares of Danaher common stock that I own change as a result of the distribution? | No. The number of shares of Danaher common stock that you own will not change as a result of the distribution. |

| |

Will the distribution affect the market price of my Danaher shares? | Yes. As a result of the distribution, Danaher expects the trading price of shares of Danaher common stock immediately following the distribution to be lower than the “regular-way” trading price of such shares immediately prior to the distribution because the trading price will no longer reflect the value of the Environmental & Applied Solutions businesses held by Veralto. There can be no assurance that the aggregate market value of the Danaher common stock and the Veralto common stock following the separation will be higher or lower than the market value of Danaher common stock if the separation did not occur. This means, for example, that the combined trading prices of one share of Danaher common stock and one-third of a share of Veralto common stock after the distribution (representing the number of shares of Veralto common stock to be received per every one share of Danaher common stock in the distribution) may be equal to, greater than or less than the trading price of one share of Danaher common stock before the distribution. |

| |

What are the U.S. federal income tax consequences of the separation and the distribution? | Assuming that the distribution, together with certain related transactions, qualifies as a transaction that is tax-free to Danaher and Danaher’s stockholders, for U.S. federal income tax purposes, under Sections 368(a)(1)(D) and 355 of the Code, Danaher stockholders will not recognize any gain or loss, for U.S. federal income tax purposes (except with respect to any cash received in lieu of fractional shares) or to include any amount in their income, upon the receipt of shares of Veralto’s common stock pursuant to the distribution. |

| |

| | | | | |

| See “U.S. Federal Income Tax Considerations” for further information regarding the potential U.S. federal income tax considerations to Danaher stockholders of the distribution, together with certain related transactions. You should consult your tax advisor as to the particular tax consequences of the separation and distribution to you. |

| |

How will I determine my tax basis in the shares I receive in the distribution? | Assuming that the distribution is tax-free to Danaher stockholders, except for cash received in lieu of fractional shares, for U.S. federal income tax purposes, your aggregate basis in the common shares that you hold in Danaher and the new Veralto common stock received in the distribution (including any fractional share interest in Veralto common stock for which cash is received) immediately following the distribution will equal the aggregate basis in the shares of Danaher common stock held by you immediately before the distribution, allocated between your Danaher common stock and the Veralto common stock (including any fractional share interest in Veralto common stock for which cash is received) you receive in the distribution in proportion to the relative fair market value of each on the distribution date. |

| |

| You should consult your tax advisor about the particular tax consequences of the separation and distribution to you, including the application of the tax basis allocation rules and the application of state, local and foreign tax laws. |

| |

What will Veralto’s relationship be with Danaher following the separation? | Veralto expects to enter into a separation and distribution agreement with Danaher to effect the separation and provide a framework for Veralto’s relationship with Danaher after the separation and to enter into certain other agreements, including a transition services agreement, an employee matters agreement, a tax matters agreement, an intellectual property matters agreement and a Danaher Business System (“DBS”) license agreement. These agreements will govern the separation between Veralto and Danaher of the assets, employees, liabilities and obligations (including its investments, property and employee benefits and tax-related assets and liabilities) of Danaher and its subsidiaries attributable to periods prior to, at and after Veralto’s separation from Danaher and will govern certain relationships between Veralto and Danaher after the separation. For additional information regarding the separation agreement and other transaction agreements, see “Risk Factors—Risks Related to the Separation and our Relationship With Danaher” and “Certain Relationships and Related Person Transactions.” |

| |

| |

| |

Who will manage Veralto after the separation? | Veralto benefits from having in place a management team with an extensive background in the industries in which our Water Quality and Product Quality & Innovation businesses operate. Led by Jennifer L. Honeycutt, who will be Veralto’s President and Chief Executive Officer after the separation, Veralto’s management team possesses deep knowledge of, and extensive experience in, its industry. For more information regarding Veralto’s management, see “Management.” |

| |

| | | | | |

Are there risks associated with owning Veralto common stock? | Yes. Ownership of Veralto common stock is subject to both general and specific risks, including those relating to Veralto’s businesses, the industries in which it operates, its ongoing contractual relationships with Danaher after the separation and its status as a separate, publicly traded company. Ownership of Veralto common stock is also subject to risks relating to the separation. These risks are described in the “Risk Factors” section of this information statement beginning on page 17. You are encouraged to read that section carefully. |

| |

Does Veralto plan to pay dividends? | We have not yet determined the extent to which we will pay any dividends on our common stock. The payment of any dividends in the future, and the timing and amount thereof, is within the discretion of the board of directors of Veralto (the “Board”). The Board’s decisions regarding the payment of dividends will depend on many factors, such as our financial condition, earnings, capital requirements, debt service obligations, restrictive covenants in our then existing debt agreements, industry practice, legal requirements and other factors that our Board deems relevant. Our ability to pay dividends will depend on our ongoing ability to generate cash from operations and on our access to the capital markets. We cannot guarantee that we will pay a dividend in the future or continue to pay any dividends if we commence paying dividends. Please refer to “Dividend Policy.” |

| |

What will govern my rights as a Veralto stockholder? | Your rights as a Veralto stockholder will be governed by Delaware law, as well as our amended and restated certificate of incorporation and our amended and restated bylaws. Except with respect to (i) the plurality voting standard for the election of directors, (ii) classified board, (iii) removal of directors, (iv) requirement of stockholder supermajority vote to amend certain provisions of the certificate of incorporation and the bylaws, (v) stockholder’s right to call special meetings, (vi) stockholder action by written consent, (vii) exculpation of officers (in addition to directors) from personal liability for breaches of the fiduciary duty of care other than claims brought by or in the name of Veralto, and (viii) exclusive forum with respect to Securities Act claims, at the time of the distribution, we expect that there will be no other material differences in stockholder rights between Danaher common stock and Veralto common stock. For additional details regarding the Veralto common stock and Veralto stockholder rights, please refer to “Description of Veralto’s Capital Stock.” |

| |

Will Veralto incur any indebtedness prior to or at the time of the distribution? | Yes. Veralto anticipates issuing unsecured notes in multiple tranches with terms and maturities to be determined, which is expected to yield proceeds of approximately $2.6 billion in connection with the separation, which proceeds (together with approximately $100 million of cash on hand) are expected to be paid to Danaher as partial consideration for the contribution of assets to Veralto by Danaher in connection with the separation. In addition, prior to the separation and distribution, Veralto will enter into a credit agreement with a syndicate of banks providing for a five-year $1.5 billion senior revolving credit facility. Veralto also anticipates implementing a commercial paper program (supported by the revolving credit facility) prior to the separation and distribution. Veralto does not anticipate borrowing under this facility or issuing commercial paper prior to the separation and distribution. For more information, please refer to the sections entitled “Description of Certain Indebtedness” and “Risk Factors—Risks Related to Veralto’s Business.” |

| |

| | | | | |

Who will be the distribution agent, transfer agent, registrar and information agent for the Veralto common stock? | The distribution agent, transfer agent and registrar for the Veralto common stock will be Computershare. For questions relating to the transfer or mechanics of the distribution, you should contact: |

| |

| Computershare Trust Company, N.A.

P.O. Box 43006

Providence, RI 02940-3006

United States

800-568-3476 |

| |

| If your shares are held by a bank, broker or other nominee, you may call the information agent for the distribution, Computershare, toll-free at 800-568-3476. |

| |

Where can I find more information about Danaher and Veralto? | Before the distribution, if you have any questions relating to Danaher’s business performance, you should contact: Danaher Corporation 2200 Pennsylvania Ave. N.W., Suite 800W Washington, D.C., 20037-1701 Attention: Investor Relations After the distribution, Veralto stockholders who have any questions relating to Veralto’s business performance should contact Veralto at: Veralto Corporation 225 Wyman St., Suite 250 Waltham, Massachusetts 02451 Attention: Investor Relations We maintain an Internet website at www.veralto.com. Our website, and the information contained therein, or connected thereto, is not incorporated by reference into this information statement or the registration statement of which this information statement forms a part. |

INFORMATION STATEMENT SUMMARY

This summary highlights information included elsewhere in this information statement and does not contain all of the information that may be important to you. You should read this entire information statement carefully, including the sections entitled “Risk Factors,” “Cautionary Statement Concerning Forward-Looking Statements,” “Unaudited Pro Forma Combined Financial Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our Combined Financial Statements and the notes thereto (the “Combined Financial Statements”).

Our Company

Veralto’s unifying purpose is Safeguarding the World’s Most Vital Resources. Our diverse group of leading operating companies provide essential technology solutions that monitor, enhance and protect key resources around the globe. We are committed to the advancement of public health and safety and believe we are positioned to support our customers as they address large global challenges including environmental resource sustainability, water scarcity, management of severe weather events, food and pharmaceutical security, and the impact of an aging workforce. For decades, we have used our scientific expertise and innovative technologies to address complex challenges our customers face across regulated industries – including municipal utilities, food and beverage, pharmaceutical and industrials – where the consequence of failure is high. Through our core offerings in water analytics, water treatment, marking and coding, and packaging and color, customers look to our solutions to help ensure the safety, quality, efficiency and reliability of their products, processes and people globally. Upon the separation, Veralto will be headquartered in Waltham, Massachusetts with a workforce of approximately 16,000 associates strategically located in more than 45 countries.

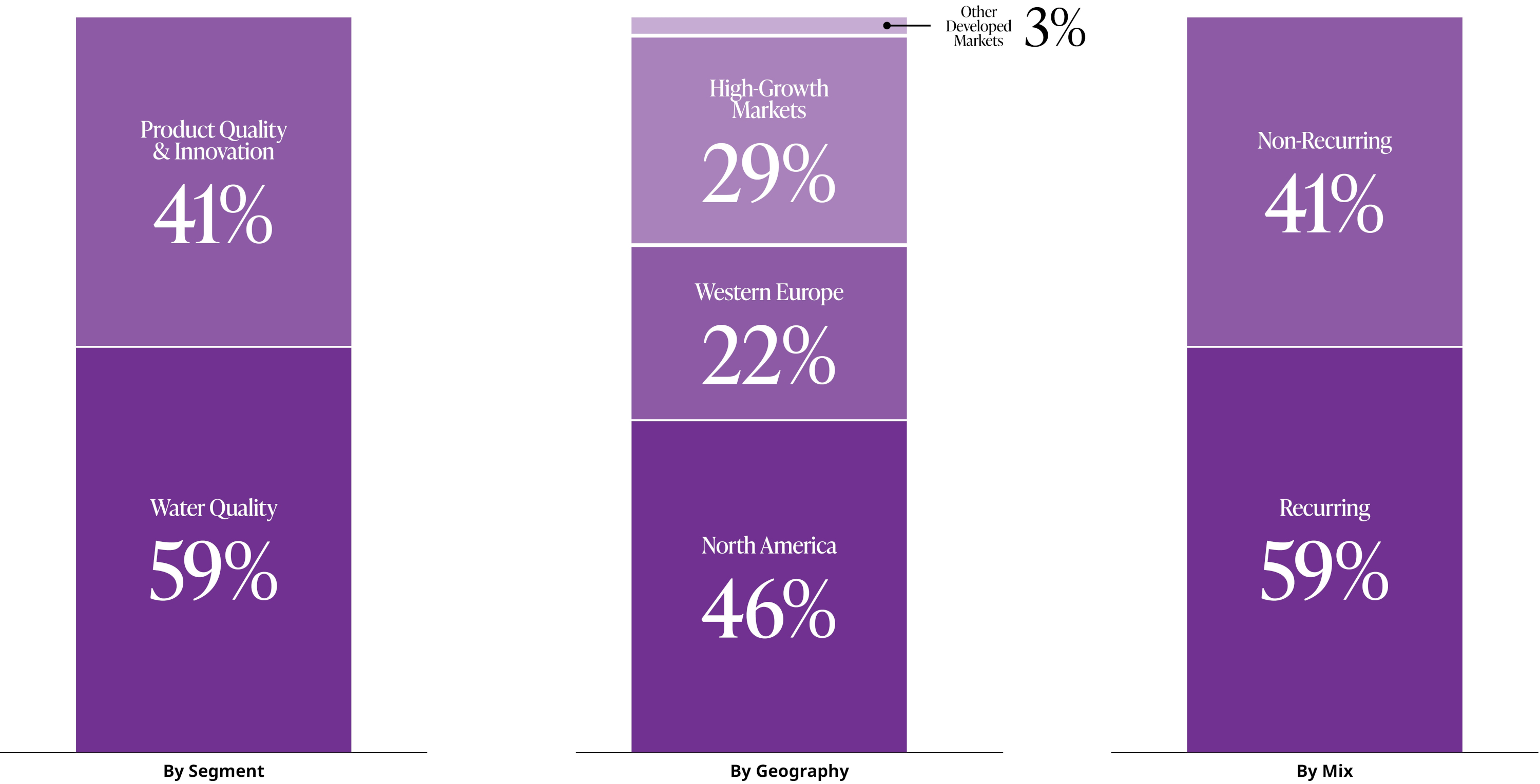

Veralto operates through two segments – Water Quality (“WQ”) and Product Quality & Innovation (“PQI”). Our businesses within these segments have strong globally recognized brands as a result of our leadership in served markets over several decades. Through WQ, we improve the quality and reliability of water through leading brands including Hach, Trojan Technologies and ChemTreat. Through PQI, we promote consumer trust in products and help enable product innovation through leading brands including Videojet, Linx, Esko, X-Rite and Pantone. We believe our leading positions result from the strength of our commercial organizations, our legacy of innovation, and our close and long-term connectivity to our customers and knowledge of their workflows, underpinned by our culture of continuous improvement. This has resulted in a large installed base of instruments that drive ongoing consumables and software sales to support our customers. As a result, our business generates recurring sales which represented approximately 59% of total sales during the year ended December 31, 2022. Our business model also supports a strong margin profile with limited capital expenditure requirements and has generated attractive cash flows. We believe these attributes allow us to deliver financial performance that is resilient across economic cycles.

We also believe that Veralto’s history with the Danaher Business System (“DBS”) provides the Company with a strong foundation for competitive differentiation. DBS is a business management system that consists of a philosophy, processes and tools that guide what Danaher does and measure how well Danaher executes, grounded in a culture of continuous improvement. The DBS processes and tools are organized around the areas of Lean, Growth and Leadership, and are rooted in foundational tools known as the DBS Fundamentals, which are relevant to every associate and business function. The DBS Fundamentals are focused on core competencies such as using visual representations of processes to identify inefficiencies, defining and solving problems in a structured way, and continuously improving processes to drive consistent execution.

Members of the team that will serve as Veralto management have served as Danaher leaders and have been integral to the evolution of DBS. For example, Veralto’s President and Chief Executive Officer has practiced and championed DBS in multiple operating companies across multiple geographies and industries since 1999 and has contributed meaningfully to the evolution of DBS over that period. Veralto’s Senior Vice President, Water Quality previously led the Danaher Business System Office, which bears central responsibility for stewardship of the DBS processes and tools and development of DBS practitioners who support the operating companies and train business leaders in the application of DBS. Many of the other Danaher associates who will become Veralto senior leaders have years of experience practicing DBS and deploying it in their particular businesses and functions.

Danaher will license to Veralto the DBS tools and processes as they exist at the separation. Following the separation, Veralto will use and evolve those tools and processes as the Veralto Enterprise System (“VES”). We expect to use VES tools to improve our profitability and cash flows, which support our ability to expand our addressable market and improve our market position through investments in areas such as our commercial organization and research and development (“R&D”), including software and digital solutions. Our cash flows also support acquisitions to enhance our product capabilities and expansion into new and attractive markets, which we have successfully done through the acquisition of approximately 80 businesses over more than two decades.

Our two segments are described below:

Our Water Quality segment provides one of the most comprehensive portfolios of water analytics and differentiated water treatment solutions that enable the reliable delivery of safe drinking water by public and private utilities - from source water to the consumer and back into the water cycle. In addition, we help improve the efficiency of processes and production operations of our customers and ensure that their wastewater discharge meets regulatory standards and corporate targets. Under our Hach, ChemTreat, Trojan Technologies and other globally recognized WQ brands, we provide proprietary precision instrumentation and advanced water treatment technologies that our customers rely on to measure, analyze and treat the world’s water in residential, commercial, municipal, industrial, research and natural resource applications. In addition to instrumentation, our suite of water solutions includes elements used on a recurring basis such as chemical reagents, services and digital solutions. Together, these offerings help promote the quality and reliability of water and optimize our customers’ operations, decision making and regulatory compliance activities.

WQ focuses on what management believes are the most attractive sub-segments of the water value chain helping our customers address some of their most pressing and complex challenges, such as water scarcity, water safety, severe weather events and management of precious natural resources. Our businesses have been at the forefront of delivering breakthrough innovations to our customers. For example, Hach has been a leading player in the field of turbidity testing for over 60 years, pioneering the first regulated method used and introducing multiple new generations of instruments and related products. Today, we have one of the most complete portfolios of solutions allowing our customers to test the broadest range of analytical parameters and the ability to harness their data across installed assets. Increasingly, our customers leverage our digital solutions to support regulatory compliance, automate workflows and allow for remote operations and predictive capabilities to address new challenges posed by changing regulations and an aging and less experienced workforce.

Our key WQ brands provide solutions that our customers rely upon to manage critical operations involving water.

•Hach, the best known of our global brands in the WQ segment, recognized for simple and reliable tests, offers analytical measurement instruments, digital solutions and related consumables that test water quality; it serves over 125,000 customers, including small community water utilities, large public and private water utilities and industrial customers and helps to ensure safe water for more than 3.4 billion people every day - approximately 40% of the global population.

•ChemTreat associates work alongside industrial customers to understand their water challenges and tailor chemical treatment plans and dosing protocols to help optimize customers’ water usage and maximize reuse; our solutions helped customers save over 80 billion gallons of water in 2022.

•Trojan Technologies offers UV and membrane filtration systems for water disinfection and contaminant removal; our systems treat and support the recycling of 12 trillion gallons of water annually and in turn help to improve access to clean water for more than 250 million people every day.

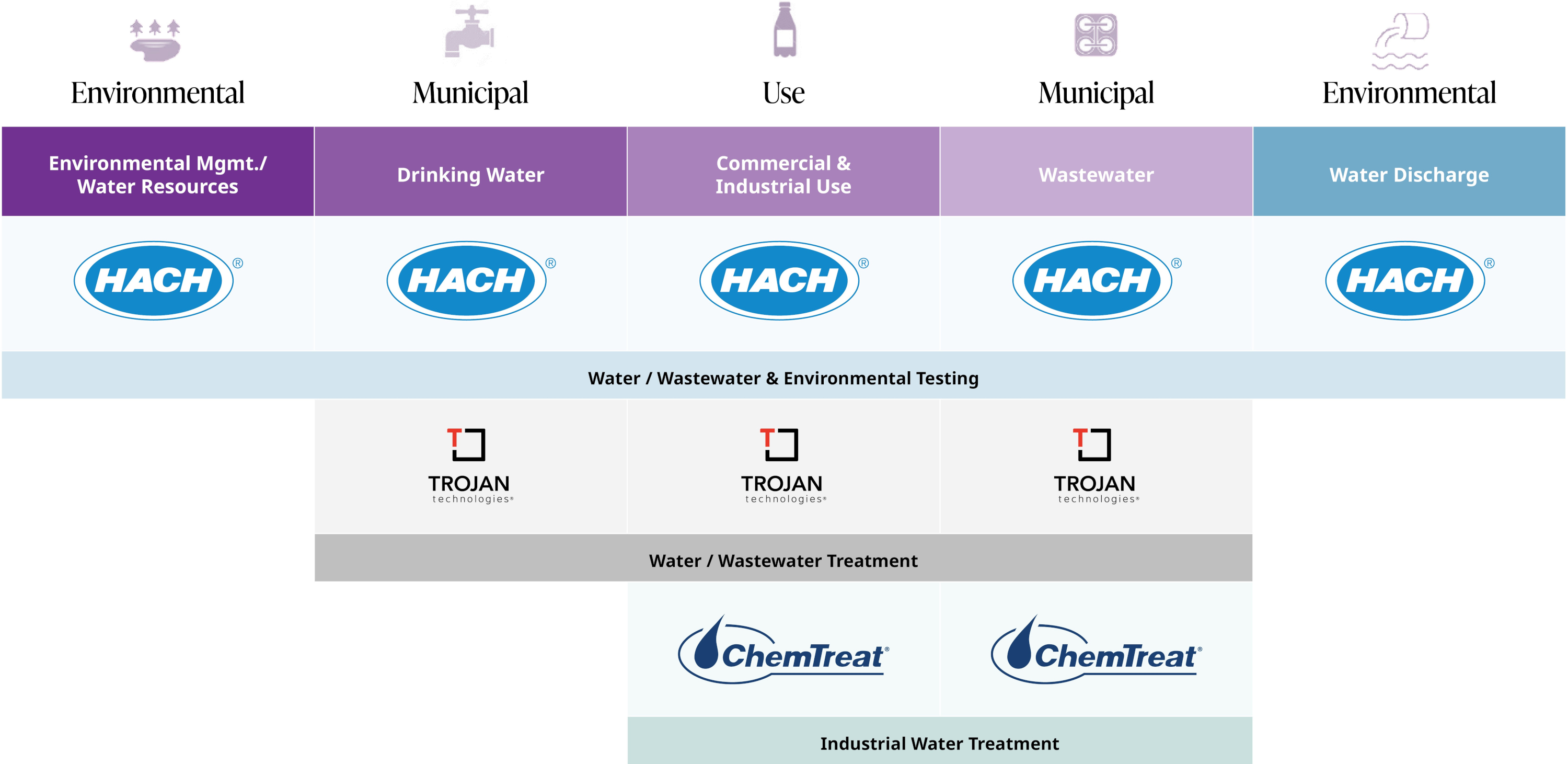

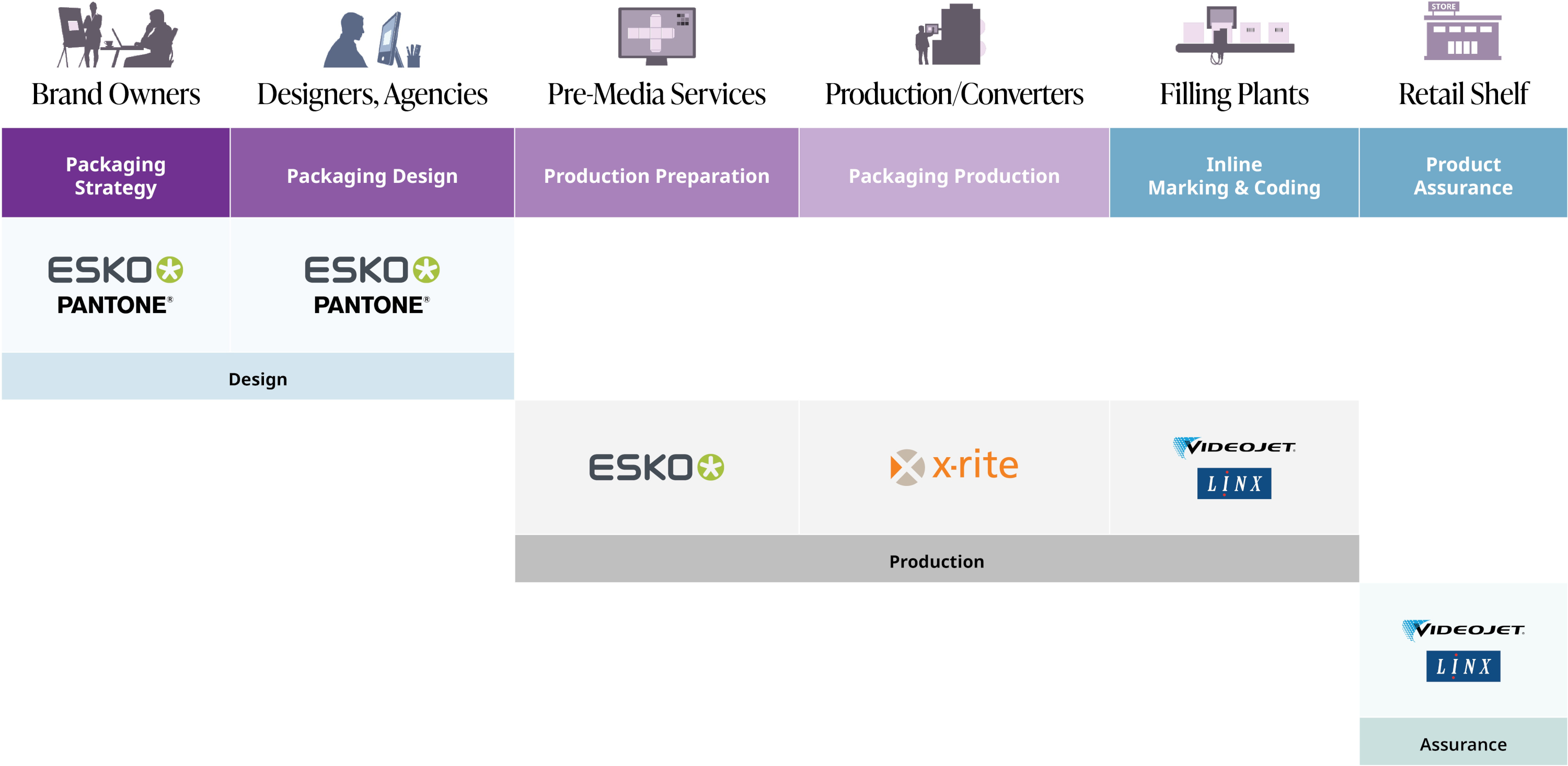

Our Product Quality & Innovation segment provides a broad set of solutions for brand owners and consumer packaged goods companies that enable speed to market as well as traceability and quality control of their products. Our solutions play a central role in helping our customers ensure the quality and safety of their products and build trust with consumers. Under our Videojet, Esko, Linx, X-Rite, Pantone and other globally recognized PQI brands, we provide marking and coding, and packaging and color instrumentation and related consumables. Our customers across consumer, pharmaceutical and industrial sectors utilize our offerings to bring products to market, mark packaging in compliance with industry and regulatory standards and convey the safety of products to customers. Our solutions also enable the effective execution of product recalls, thereby helping to mitigate public health risks. Our software solutions are designed to address higher-value, design-oriented portions of the packaging management value chain, such as digital asset management (“DAM”), marketing resource management (“MRM”) and product information management (“PIM”), that help our customers maximize efficiency of operations while generating an attractive source of recurring sales for us. We estimate that a majority of the top 25 global consumer packaged goods (“CPG”) brands (based on 2022 revenues) and a majority of the top 20 pharmaceutical brands (based on 2022 revenues) use PQI’s solutions, enabling confidence and trust in the brands and products consumers use daily.

Our PQI brands provide brand owners and consumer packaged goods companies with essential solutions that improve their ability to develop, maintain and ensure authenticity of their brands.

•Videojet, our largest operating company within PQI, and Linx offer technologies that mark and code packaged goods and related consumables. Videojet is a leading provider of inline printing solutions for products and packaging with marking and coding systems used by many of the top global consumer brands. Our solutions help ensure transparency, safety, authenticity, tracking and traceability of an estimated more than 10 billion codes printed around the world daily.

•Esko facilitates the creation of new packaging designs through design software and imaging systems. Esko’s offerings are used by over 25,000 established and emerging brands and their suppliers in over 140 countries.

•X-Rite serves over 13,000 brands across 140 countries by providing color management solutions that measure the quality and consistency of color and appearance on printed packages and consumer and industrial products.

•Pantone is the preeminent color standard in the design industry leveraged by more than 10 million designers, marketers and others in the creative community, not only to ensure color standardization but also to understand the impact of color on consumers.

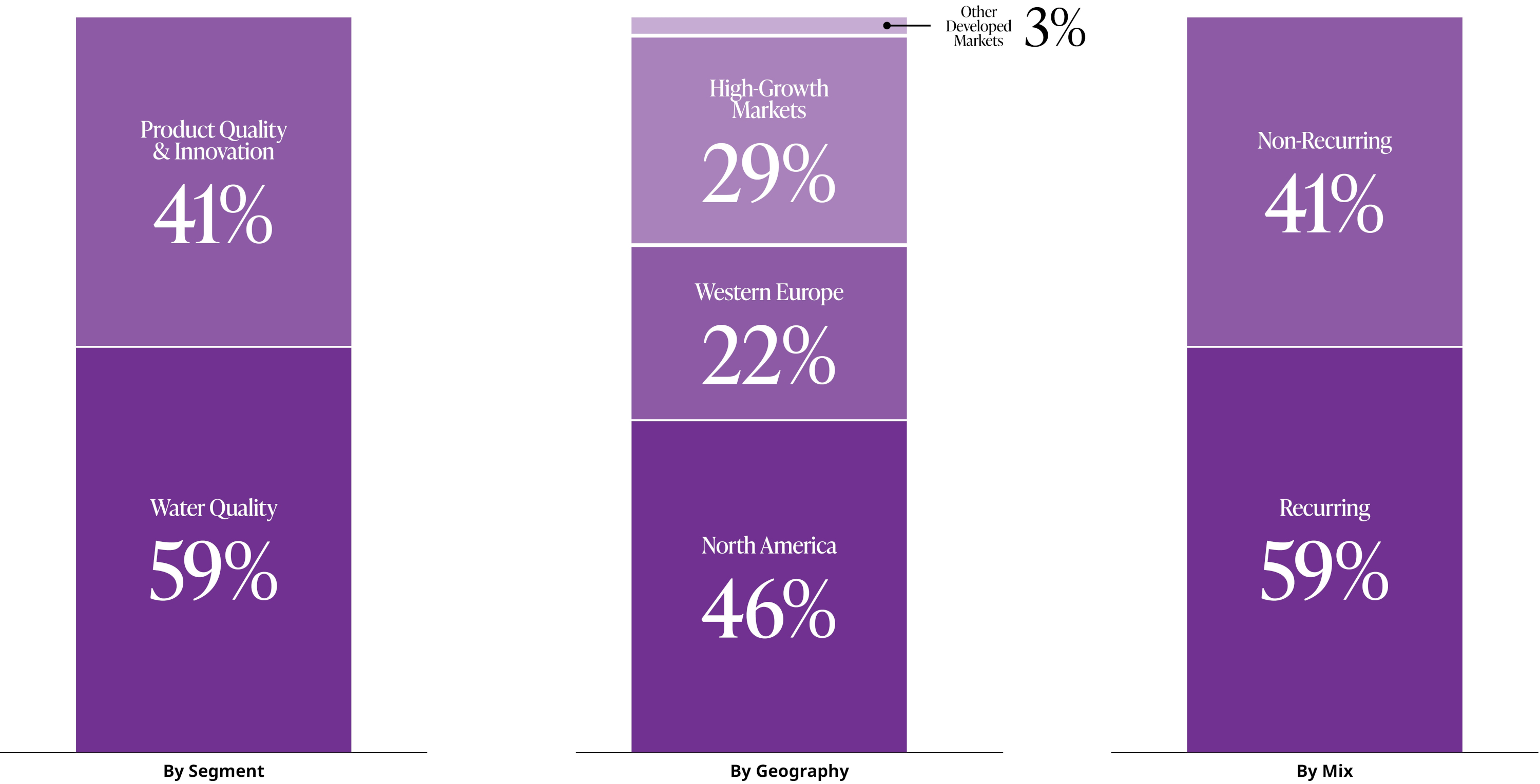

In 2022, Veralto generated $4.9 billion in sales derived from a business mix that is highly diversified by geography and end-market. Our business model is highly resilient with approximately 59% of our sales derived from consumables (e.g., reagents, inks and process chemicals), spare parts, services (e.g., maintenance and inspection),

and software (including Software-as-a-Service, or “SaaS”, and term-based licenses). We serve a broad range of customers spanning the municipal, industrial, food & beverage (“F&B”) and CPG end markets, many of which are highly regulated. We generated 46% of our 2022 sales from North America, 22% from Western Europe, 3% from other developed markets and 29% from high-growth markets. We define other developed markets as Japan, Australia and New Zealand. We define high-growth markets as developing markets of the world experiencing extended periods of accelerated growth in gross domestic product and infrastructure, which encompass all markets outside of the developed markets and consist of Eastern Europe, the Middle East, Africa, Latin America and Asia Pacific (with the exception of Japan, Australia and New Zealand). Our strategic investments in these markets have scaled our presence in high-growth markets to approximately 5,000 associates with 10 local manufacturing facilities.

Sales Diversification for the Year Ended December 31, 2022

Our History

Veralto was established over the past 25 years through strategic acquisitions in attractive and highly regulated markets. These strategic acquisitions, combined with the application of DBS and investment in innovation and commercial resources, have resulted in compounded sales and earnings growth. In turn, Veralto has grown from approximately $770 million in sales in 2002 to $4.9 billion in sales in 2022 with an operating profit margin of 23%.

Danaher’s acquisition of Hach Company in 1999 solidified our foundation in the attractive water analytics sub-segment of the water industry. We successfully applied DBS to expand our commercial opportunity and bring innovative new products to market, while also optimizing costs to enhance our margin profile. As part of an effort to expand the strategic scope of WQ beyond water measurement, we added water treatment capabilities by acquiring Trojan Technologies in 2004 and ChemTreat in 2007. In addition to approximately 50 acquisitions, we have continued to expand the scope of our leading brands technically and geographically through organic investments in commercial resources and new product innovations, transforming our WQ segment from approximately $485 million in sales in 2002 to $2.9 billion in sales in 2022 with an operating profit margin of 23%.

We entered the product quality and innovation industry through the acquisition of Videojet in 2002. Under Danaher’s ownership, Videojet applied DBS to enhance its profit margins and sales growth through operational improvements, strengthened commercial execution and speed of innovation. Since then, we have expanded the business through acquisitions, most notably EskoArtwork in 2011 and X-Rite in 2012. In total, we have acquired and integrated approximately 30 businesses over the past 20 years, transforming our PQI segment from

approximately $285 million in sales in 2002 to approximately $2.0 billion in sales in 2022 with an operating profit margin of 25%.

The history of WQ and PQI charts the evolution of DBS, a cornerstone of our culture and source of our competitive advantage. DBS, and now VES, is a set of tools at the core of our operating model centered around improving commercial execution, product innovation, operations and talent acquisition and management. As long-time practitioners of VES (and its predecessor, DBS), the Veralto team will continue to use these tools to better understand and address the technical problems of the markets we serve and our customers’ evolving needs.

We have made strategic acquisitions in both WQ and PQI to add digital and software capabilities to address our customers’ evolving digitization requirements and offer more comprehensive workflow solutions. Within WQ, a combination of acquisitions of software capabilities together with Hach’s organic development of its Claros software platform, accelerated our ability to streamline workflows across our customers’ enterprises, improving data management, remote operations, asset utilization and maintenance and regulatory compliance reporting. Within PQI, a major milestone was the acquisition of EskoArtwork. Subsequent additional investments have enhanced Esko’s scope to encompass modern cloud-based SaaS offerings, tools which automate and connect the packaging development and production workflows, and systems which accelerate the go-to-market processes for brand owners and consumer packaged goods companies. These enhanced and expanded digital capabilities enable us to better serve and support our customers through solutions that are integrated throughout the customers’ value chain – design to consumer – and by allowing them to leverage data in real time to help maximize up-time and optimize production.

Industry Overview

Water Quality Industry Overview

The global water quality industry is large and growing given the criticality of water management and conservation and the increasingly stringent regulation around water safety. Product and service solutions offered in this industry help customers accurately measure and treat water across a range of parameters, drive water management efficiencies, ensure compliance with regulatory requirements and meet their environmental and sustainability goals.

Management estimates that the global water industry generated over $800 billion in sales during 2022, which includes all aspects of the water value chain. However, Veralto has strategically selected what management believes are some of the most attractive segments of this industry to participate in based on opportunities for growth and our ability to help our customers manage their greatest challenges, such as water scarcity, water safety, severe weather events and management of precious natural resources. Currently, the segments of the water quality industry we participate in include measurement (including environmental testing) and water and wastewater treatment. Geographically, North America and Europe are the most mature regions and we believe high-growth markets present an attractive opportunity given the relative scarcity of drinking water, the rising need for the treatment of sewage and drainage water and increasing regulatory compliance requirements.

We believe continued growth in the global water quality industry will be driven by a variety of factors that we are well positioned to benefit from, including:

•Increasing global demand for safe and affordable water

•Increasing government funding to support water and wastewater infrastructure

•Increasing threats to water access from growing scarcity and frequency of severe weather events

•The need to upgrade and optimize wastewater treatment facilities to cope with rising costs, energy demands and increasing capacity challenges

•Increasing regulatory standards and reporting requirements for drinking water supply and wastewater discharge

•Growing need to detect and destroy emerging water contaminants that are increasingly impacting public health

•Heightened focus on achieving environmental targets and the sustainable use of resources by the public and private sectors

•Increasing adoption of digitization and demand for automation-based platforms and predictive capabilities by the industry driven by an aging and less experienced workforce and increased compliance requirements

•Growing demand for environmental resource conservation and renewable energy

Product Quality & Innovation Industry Overview

The product quality and innovation industry spans the full design, color, packaging, and marking and coding value chain. Product and service solutions offered in this industry seek to help customers streamline workflows, reduce time to market of new products, and ensure traceability of products throughout the supply chain — from manufacturer to distributor to retailer. The industry is broad and rapidly changing with the adoption of new technologies that digitize customers’ design and operational workflows and help optimize the supply chain.

The segments of the product quality and innovation industry we currently participate in include marking and coding (e.g., lot, date, and bar codes applied at filling plants and stored for supply chain tracking) and packaging and color (e.g., front-end packaging strategy, design, artwork preparation and packaging printing). PQI focuses on the broader horizontal workflow addressing needs across the entire product quality and innovation industry.

We believe continued growth in the global product quality and innovation industry will be driven by a variety of factors that we are well positioned to benefit from, including:

•Increasing regulation and consumer pressure on brands to help ensure product safety and transparency

•Growing regulatory pressure and customer priorities to minimize the environmental impact of packaging

•Labor shortages and the need for greater speed to market driving adoption of digitization, automation, and connected devices

•Changes in brand strategies and the proliferation of smaller brands, leading to faster packaging cycles and more frequent press runs

•Growing need to centralize and control product code management to improve efficiency and product security

Our Competitive Strengths

We believe Veralto has significant competitive strengths driven by our company culture with VES tools at its core and our leadership position across key market segments and geographies. Some of our key competitive strengths are:

•Strategically Positioned with Leading Brands and Technologies in the Most Attractive Parts of our Industries. Many of our operating companies have been leaders in their respective markets for decades and have built strong brand recognition and competitive positions. Our historic focus on product innovation has resulted in differentiated solutions that solve critical customer needs. Moreover, we expect our leading brands and competitive positions will drive future consumable and aftermarket opportunities.

•Global Presence and Reach. We operate globally, with diverse sales channels, manufacturing operations and product development capabilities that help us competitively address local requirements. We have experienced management teams located in key geographies around the world, providing a strong local presence and a deep understanding of our customers’ workflows, needs and challenges. This customer intimacy is reflected in the fact that 75% of Veralto’s sales in 2022 were direct sales to customers.

•Uniquely Positioned to Address Customers’ Regulatory and Sustainability Priorities. We have a long history of helping customers navigate regulatory changes, address sustainability priorities and ensure the safety of consumer products. For instance, our WQ chemical treatment solutions help customers save water and reduce energy consumption and PQI’s package design and pallet optimization software helps customers reduce energy and packaging material consumption and waste. More broadly, several of our businesses help customers understand the impact of climate change and support the advancement of renewable energies, such as solar and wind.

•Superior Execution and Customer Impact Through the Application of VES. Our operating businesses have leveraged DBS to continuously improve operational and financial results across the business for over 20 years. DBS, which will be known as VES under Veralto, supports commercial execution, product innovation, operations and talent acquisition and management. Our use of VES to continuously refine our processes also contributes to our effectiveness in supporting our customers as they seek to optimize their own operations and achieve their ESG objectives. We believe that our ability to use VES to improve across these dimensions will increase customer satisfaction and help us maintain and grow our competitive advantage.

•Leading Track Record of Innovation and Customer-Centric Solutions. Management believes our decades of experience and our customer-centric approach has allowed us to develop high levels of technical know-how, process expertise, and customer intimacy. We leveraged these abilities to innovate solutions to address challenges faced by our customers. For example, in our Hach business, automatic samplers and digitally enabled instrumentation combined with Hach’s Claros SaaS offerings help municipal and industrial water operators optimize their processes, remotely operate, monitor and maintain equipment, comply with regulations, and analyze data to facilitate predictive operations. In our Esko business, our workflow software helps to simplify packaging design for users, reduce the design process timeline and associated labor costs and maximize yield from production runs.

•Durable Business Model with High Recurring Sales. Our businesses typically sell low-cost, high value-add systems that generate attractive aftermarket revenue through the sale of consumables (e.g., chemicals, reagents), spare parts, software and services used in the ongoing operation of our installed systems. Many of our products were launched to help customers comply with new regulations, resulting in sustainable positions in complex workflows with multiple stakeholders. Our business model drives recurring sales which represented approximately 59% of total sales for the year ended December 31, 2022, reducing volatility and cyclicality across our business portfolio. Our businesses are primarily exposed to customers’ operating expense budgets rather than capital expenditure budgets and given the operationally essential nature of our solutions in customers’ workflows, our businesses have a track record of resilient performance across economic cycles.

•Attractive Margins and Cash Flow Profile. We believe our products provide high value, differentiated solutions for customers’ critical workflows, which has helped us achieve attractive operating profit margins. Additionally, VES helps us drive efficiency in our cost structure promoting strong profitability and cash flows from operations. These factors, along with our modest capital expenditure requirements, help us deliver a high free cash flow to net income conversion ratio.

•Experienced Management Team with Extensive Danaher and Sector Experience. Our management team includes long-tenured leaders from Danaher with a proven track record of applying DBS, and now VES, to execute our strategic and operational goals. Our executive officer team has extensive water and product quality and innovation industry experience. Under their leadership, we believe we have positioned our business for organic and inorganic growth and diversified our sales globally.

Our Business Strategy

Our strategy is to maximize stockholder value and advance public health and safety through several key initiatives:

•Sustainable Competitive Advantage Through Innovation and Customer Applications Expertise. We believe our businesses are leaders in attractive segments of the markets they serve, which are generally characterized by significant growth and relative profitability. Our focus on customers’ needs and our associates’ application expertise has guided our innovation, and in turn has helped us maintain and grow our industry position, particularly in areas of public health and safety, resource management, and environmental sustainability. In many end markets, we believe we are a leader in the evolution of technology – for example, the development of enabled and connected instruments, and software-driven products and business models. As our customers face increasingly complex challenges that extend beyond their operations into their enterprises and communities, we seek opportunities to address those challenges with innovative solutions that integrate into existing workflows.

•Drive Operational Excellence Through the Application of VES. VES has helped us deliver what we believe is above market core sales growth and operating profit margins. We will continue to evolve VES to drive continuous improvement in our processes around commercial execution, product innovation, operational improvements, and talent acquisition and management. We believe this focus on operational excellence and understanding customer needs has underpinned our long-term track record of growth and long-term, recurring customer relationships.

•Redeploy Our Free Cash Flow to Grow and Improve Our Businesses. We intend to re-invest the substantial free cash flow we expect from our operations, after taking into account any debt servicing payments and potential dividends, towards actions we believe drive long-term shareholder value creation - prioritizing accretive organic growth initiatives and acquisitions that strategically expand the offerings of our businesses and help us address new and emerging challenges impacting our customers while maintaining our flexibility to return capital to shareholders. We have identified several attractive areas for investment across our businesses, including R&D, facility improvement and expansion, and organic market expansion. We believe that our management team has considerable skill and experience deploying capital to drive growth, improve our leadership positioning and maximize stockholder value.

•Growth Through Acquisitions. As demonstrated through approximately 80 acquisitions completed as part of Danaher, we have developed an effective acquisition playbook to complement our core organic growth strategy. We plan to build upon our track record of success in acquiring and effectively integrating acquisitions with solutions that expand our capabilities to help customers and communities advance public health and safety. In addition to target identification, target cultivation and transaction execution, our M&A playbook supports the efficient on-boarding of acquisitions. Longer term, we expect the application of VES at acquired businesses to facilitate improved sales growth, profitability and cash flows. Our plan to continue to build upon our track record of success in targeting and effectively integrating acquisitions is an important aspect of our growth strategy. We believe that our free cash flow from operations and leverage profile will enable us to grow through acquisitions after giving effect to any dividend payments and debt servicing obligations.

•Leverage and Expand Our Global Business Presence. Approximately 54% of our sales are generated outside North America, and we have significant operations around the world in key geographic markets. We expect this reach to facilitate our entry into new markets as we leverage existing sales channels, our familiarity with local customer needs and regulations, and the experience of our locally based management teams. We expect to continue prioritizing the development of localized solutions for high-growth markets with local manufacturing and product development capabilities.

•Attract and Retain Talent. We believe that our team of talented associates, united by a customer-centric approach, commitment to advance public health and safety and common culture of employing VES in pursuit of continuous improvement, allows us to maintain a significant competitive advantage. We seek to

continue to attract, develop and retain world-class leaders and associates globally and to drive their engagement with our customers and broader workforce. We intend to closely align individual incentives to the objectives of the Company and its stockholders.

The Separation and Distribution

On September 14, 2022, Danaher announced its intention to separate its Environmental & Applied Solutions businesses from the remainder of its businesses.

It is expected that the Danaher board of directors will approve the distribution of all of Veralto’s issued and outstanding shares of common stock on the basis of one share of Veralto common stock for every three shares of Danaher common stock held as of the close of business on September 13, 2023, the record date for the distribution. Danaher has received a private letter ruling from the Internal Revenue Service (“IRS”) to the effect that, among other things, the distribution and certain related transactions will qualify as a transaction that is tax-free for U.S. federal income tax purposes under Sections 355 and 368(a)(1)(D) of the Internal Revenue Code, or the Code (the “Ruling”).

Veralto’s Post-Separation Relationship with Danaher

Veralto is a wholly owned subsidiary of Danaher, and all of Veralto’s outstanding shares of common stock are owned by Danaher. Following the separation and distribution, Veralto and Danaher will operate separately, each as a public company.

Prior to the completion of the distribution, Veralto will enter into a separation and distribution agreement with Danaher, which is referred to in this information statement as the “separation agreement.” Veralto will also enter into various other agreements to effect the separation and provide a framework for its relationship with Danaher after the separation, including a transition services agreement, an employee matters agreement, a tax matters agreement, an intellectual property matters agreement and a DBS license agreement. These agreements will provide for the allocation between Veralto and Danaher of Danaher’s assets, employees, services, liabilities and obligations (including its investments, property and employee benefits and tax-related assets and liabilities) attributable to periods prior to, at and after Veralto’s separation from Danaher and will govern certain relationships between Veralto and Danaher after the separation. In exchange for the transfer of the assets and liabilities of Danaher’s Environmental & Applied Solutions businesses to Veralto, Veralto will deliver to Danaher shares of Veralto common stock and a Cash Distribution in the amount of approximately $2.7 billion. For additional information regarding the separation agreement and such other transaction agreements, see the sections entitled “Risk Factors—Risks Related to the Separation and Veralto’s Relationship With Danaher,” “Certain Relationships and Related Person Transactions” and “The Separation and Distribution.”

Reasons for the Separation

The Danaher board of directors believes that separating Danaher’s Environmental & Applied Solutions businesses from the remainder of Danaher’s businesses is in the best interests of Danaher and its stockholders. The Danaher board of directors considered the following potential benefits of the separation:

•Enhanced strategic and management focus. The separation will allow each of Danaher and Veralto to more effectively pursue its distinct operating priorities and strategies and enable its respective management to focus exclusively on its unique opportunities for long-term growth and profitability;

•More efficient allocation of capital. The separation will permit Veralto to concentrate its financial resources solely on its own operations without having to compete with other Danaher businesses for investment capital. This will provide greater flexibility to invest capital in Veralto’s businesses in a time and manner appropriate for its distinct strategy and business needs;

•Distinct investment identity. The separation will allow investors to separately value each of Danaher and Veralto based on its distinct investment identity. Veralto’s businesses differ from Danaher’s other businesses in several respects, such as the market for products and services, manufacturing processes and

R&D capabilities. The separation will enable investors to evaluate the merits, performance and future prospects of each company’s respective businesses and to invest in each company separately based on their distinct characteristics;

•Direct access to capital markets. The separation will create a separate equity structure that will afford Veralto direct access to the capital markets and facilitate Veralto’s ability to capitalize on its unique growth opportunities and effect future acquisitions utilizing its common stock; and

•Alignment of incentives with performance objectives. The separation, and Veralto’s status as a separate publicly traded company, will further enhance Veralto’s ability to attract talent. The separation will permit the Company to offer stock-based incentive compensation to its employees and executives that is more closely aligned with the performance of Veralto’s businesses.

Neither Veralto nor Danaher can assure you that, following the separation, any of the benefits described above or otherwise will be realized to the extent anticipated or at all.

The Danaher board of directors also considered the following potentially negative factors in evaluating the separation: