UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. __ )

| | | | | | | | |

☒ Filed by the Registrant | | ☐ Filed by a Party other than the Registrant |

| | | | | |

| Check the appropriate box: |

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 |

VERALTO CORPORATION

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Notice of 2025 Annual Meeting of Shareholders

Items of Business

| | | | | |

| 1 | To elect the four Class II directors named in the attached Proxy Statement to hold office until the 2028 annual meeting of shareholders and until their successors are elected and qualified. |

| 2 | To ratify the selection of Ernst & Young LLP as Veralto’s independent registered public accounting firm for the year ending December 31, 2025. |

| 3 | To approve on an advisory basis the Company’s named executive officer compensation. |

| 4 | To approve amendments to Veralto’s amended and restated certificate of incorporation to (a) phase out the classification of the Board of Directors, and (b) eliminate the supermajority voting requirements. |

| 5 | To consider and act upon such other business as may properly come before the meeting or at any postponement or adjournment thereof. |

| |

Who Can Vote

Shareholders of Veralto common stock at the close of business on March 24, 2025 can vote at Veralto’s 2025 Annual Meeting. YOUR VOTE IS IMPORTANT. PLEASE SUBMIT YOUR PROXY OR VOTING INSTRUCTIONS AT YOUR EARLIEST CONVENIENCE, WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING.

Date of Mailing

We intend to mail the Notice Regarding the Availability of Proxy Materials (Notice of Internet Availability), or the Proxy Statement and proxy card as applicable, to our shareholders on or about March 28, 2025.

| | | | | | | | |

| | |

| May 14, 2025 9:00 a.m. Eastern Time Location: virtualshareholdermeeting.com/VLTO2025 | |

| | |

REVIEW YOUR PROXY STATEMENT AND VOTE IN ONE OF THE FOLLOWING WAYS:

| | | | | |

| VIA THE INTERNET Visit the website listed on your Notice of Internet Availability, proxy card or voting instruction form |

| BY TELEPHONE Call the telephone number on your proxy card or voting instruction form |

| BY MAIL Sign, date and return your proxy card or voting instruction form in the enclosed envelope |

| DURING THE ANNUAL MEETING While we encourage you to vote before the meeting, shareholders may vote online during the meeting by following the instructions on page 92 |

Please refer to the enclosed proxy materials or the information forwarded by your bank, broker, trustee or other intermediary to see which voting methods are available to you.

Attending the Meeting

The meeting will be held online. To attend the virtual meeting, you will need to enter the 16-digit control number included on your proxy card, Notice of Internet Availability or voting instruction form.

By order of the Board of Directors,

JAMES A. TANAKA

Vice President, Securities & Governance and Secretary

| | |

|

|

IMPORTANT NOTICE Regarding the Availability of Proxy Materials for the Shareholder Meeting to be held on May 14, 2025. This Proxy Statement and the accompanying Annual Report are available free of charge at: materials.proxyvote.com/92338C or investors.veralto.com/annual-report-and-proxy. |

Proxy Statement Summary

To assist you in reviewing the proposals to be acted upon at our 2025 Annual Meeting of Shareholders (the Annual Meeting), below is summary information regarding the meeting, each proposal to be voted upon at the meeting and Veralto Corporation’s business performance, corporate governance, sustainability program and executive compensation. The following description is only a summary and does not contain all of the information you should consider before voting. For more information about these topics, please review Veralto’s Annual Report on Form 10-K for the year ended December 31, 2024 and the complete Proxy Statement. In this Proxy Statement, the terms “Veralto” or the “Company” refer to Veralto Corporation, Veralto Corporation and its consolidated subsidiaries or the consolidated subsidiaries of Veralto Corporation, as the context requires. All financial data in this Proxy Statement refers to continuing operations unless otherwise indicated.

2025 Annual Meeting of Shareholders

| | | | | | | | |

| | |

| TIME AND DATE | LOCATION | RECORD DATE |

9:00 a.m. Eastern time Wednesday, May 14, 2025 | Webcast in a virtual format at virtualshareholdermeeting.com/VLTO2025 | March 24, 2025 |

Voting Matters

| | | | | | | | | | | | | | | | | |

| Proposal | | Description | | Board Recommendation |

PROPOSAL 1 – ELECTION OF CLASS II DIRECTORS (PAGE 10) | | We are asking our shareholders to elect each of the four Class II directors identified below to serve until the 2028 Annual Meeting of shareholders. | | | FOR each nominee |

PROPOSAL 2 – RATIFICATION OF THE APPOINTMENT OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM (PAGE 38) | | We are asking our shareholders to ratify our Audit Committee’s selection of Ernst & Young LLP (E&Y) to act as the independent registered public accounting firm for Veralto for 2025. Although our shareholders are not required to approve the selection of E&Y, our Board believes that it is advisable to give our shareholders an opportunity to ratify this selection. | | | FOR |

PROPOSAL 3 – ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION (PAGE 86) | | We are asking our shareholders to cast a non-binding, advisory vote on the compensation of the executive officers named in the Summary Compensation Table (the named executive officers or NEOs). In evaluating this year’s “say-on-pay” proposal, shareholders should review our Compensation Discussion and Analysis, which explains how and why the Compensation Committee of our Board arrived at its executive compensation actions and decisions for 2024. | | | FOR |

PROPOSALS 4A AND 4B – APPROVE AMENDMENTS TO VERALTO’S AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO (A) PHASE OUT THE CLASSIFICATION OF THE BOARD OF DIRECTORS AND (B) ELIMINATE THE SUPERMAJORITY VOTING REQUIREMENTS. (PAGE 88) | | We are asking our shareholders to approve corporate governance enhancements to our amended and restated certificate of incorporation. Approval of each proposal requires the affirmative vote of the holders of at least two-thirds of the total voting power of the outstanding shares of all classes of capital stock of the Company entitled to vote thereon, voting as a single class. | | | FOR each proposal |

Please see the sections titled “General Information About the Meeting” and “Other Information” beginning on page 91 for important information about the proxy materials, voting, the Annual Meeting, Company documents, communications and the deadlines to submit shareholder proposals and director nominations for next year’s annual meeting of shareholders.

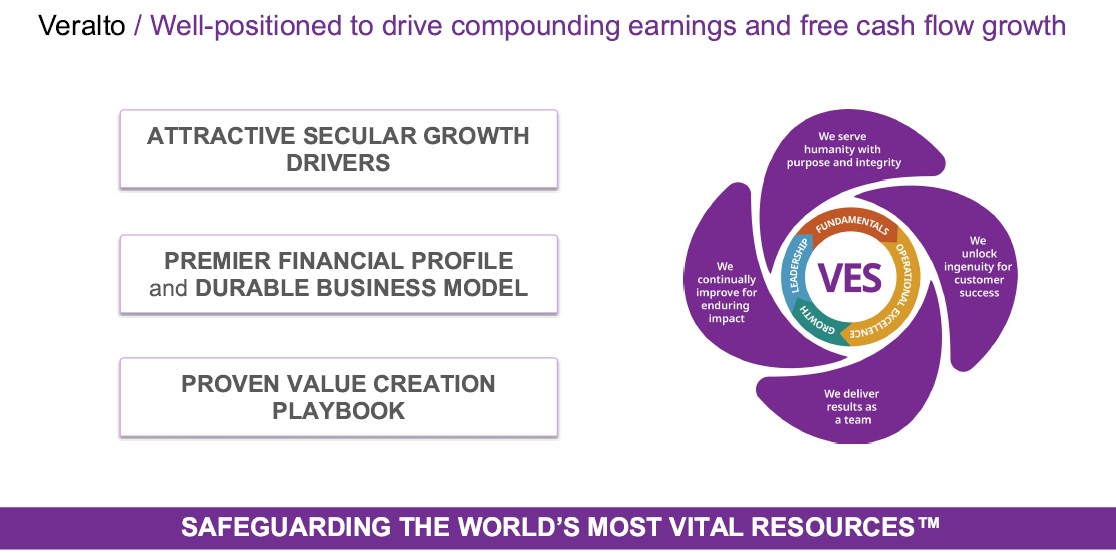

Company Overview

Veralto’s unifying purpose is Safeguarding the World’s Most Vital ResourcesTM. Our leading operating companies provide essential technology solutions that monitor, enhance and protect key resources around the globe — helping ensure access to clean water, safe food and trusted essential goods. We are committed to the advancement of public health and safety and believe we are well-positioned to support our customers as they address large global challenges including environmental resource sustainability, water scarcity, management of severe weather events, food and pharmaceutical security, and the impact of an aging workforce. For decades, we have used our scientific expertise and innovative technologies to address complex challenges our customers face across regulated industries – including municipal utilities, food and beverage, pharmaceutical and industrials – where the consequence of failure is high. Through our core offerings in water analytics, water treatment, marking and coding, and packaging and color, customers look to our solutions to help ensure the safety, quality, efficiency and reliability of their products, processes and people globally. Veralto is headquartered in Waltham, Massachusetts with a workforce of nearly 17,000 associates strategically located in more than 60 countries.

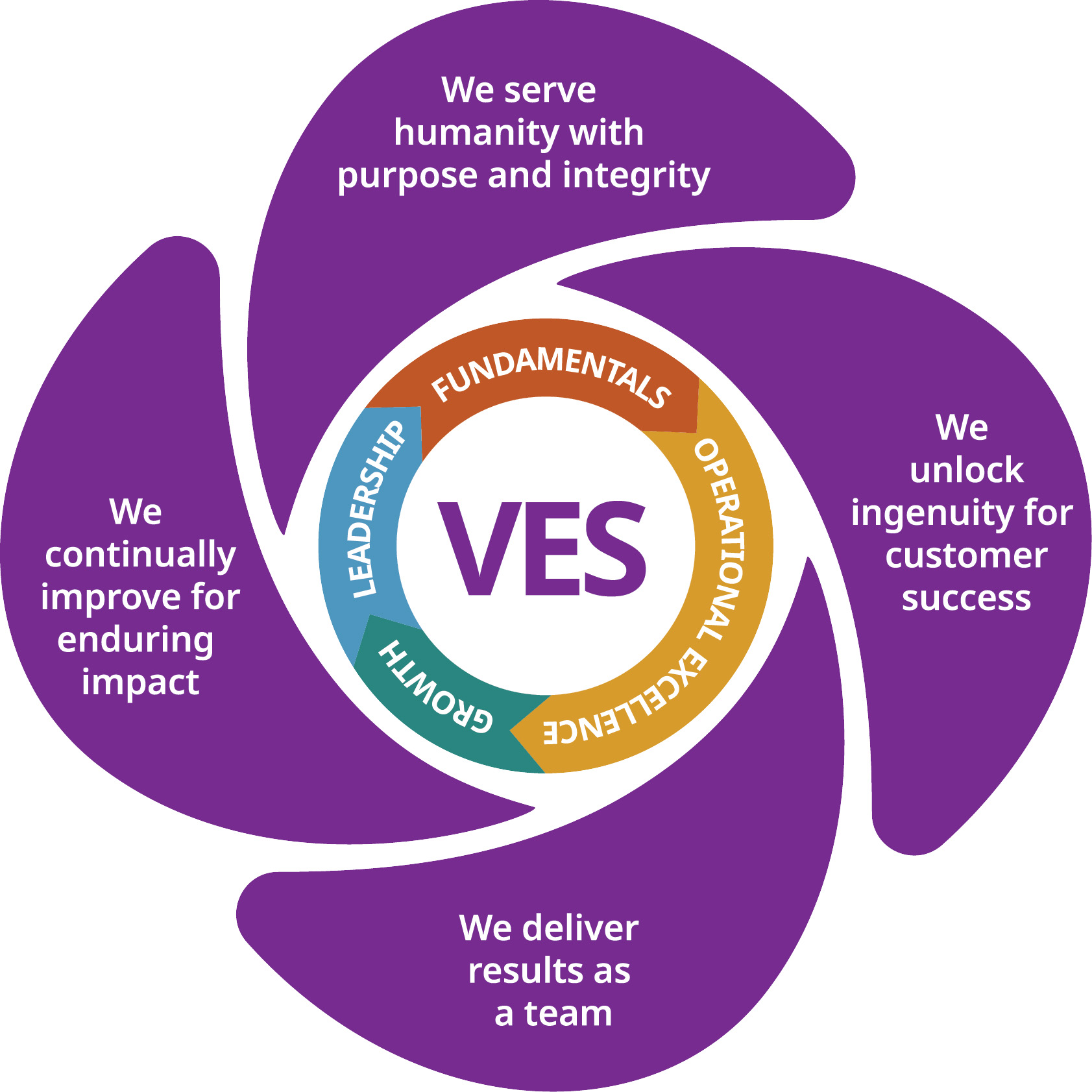

The Veralto Enterprise System (VES) and strong corporate governance help us to accomplish our goals according to our values. VES is a business management system that applies our culture of continuous improvement, along with transparency and accountability, to create enduring impact. These principles underpin who we are and how we act as an organization.

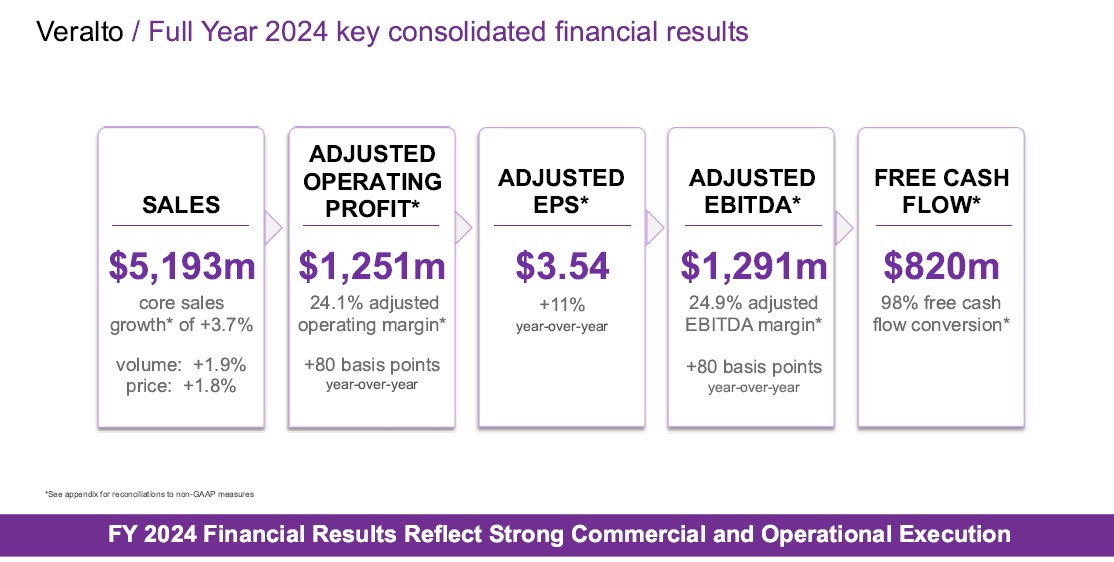

2024 Performance Highlights

In 2024, our first full year as a public company, we grew our business, strengthened our portfolio, and delivered attractive value creation for all stakeholders. In doing so, three notable accomplishments stand out:

•We delivered on our financial commitments

•We increased our growth investments

•We strengthened our portfolio and increased our dividend

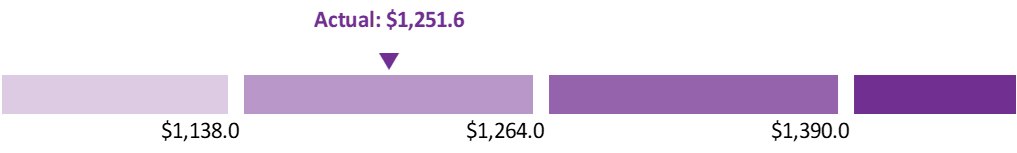

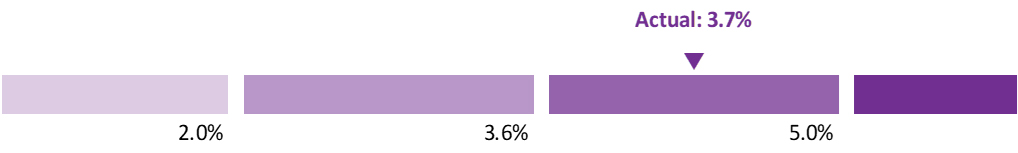

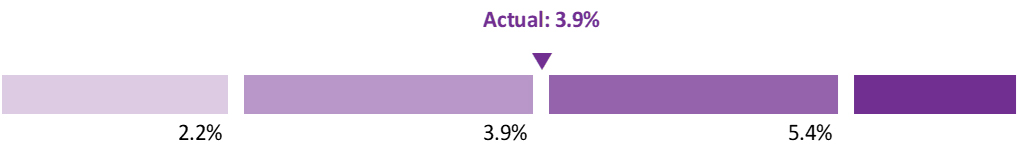

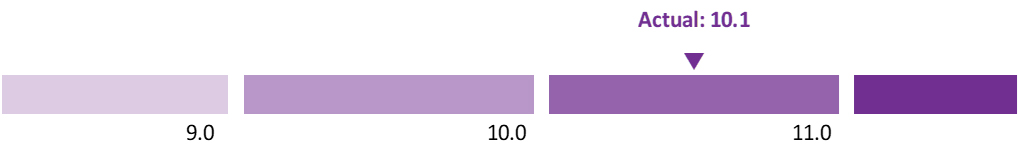

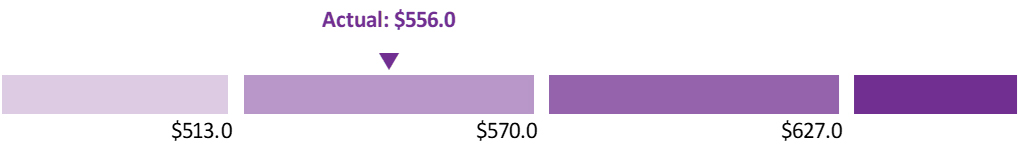

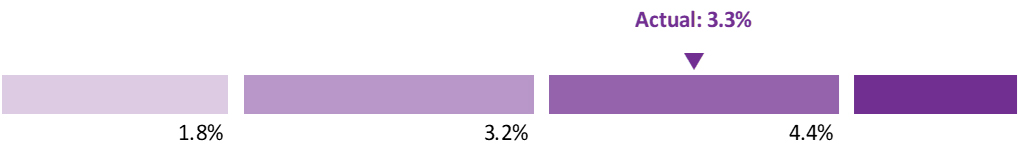

Looking at our financial performance for the year, we delivered core sales growth, adjusted operating profit margin expansion, double-digit growth in adjusted earnings per share growth and strong cash flow. Our growth in 2024 demonstrates the durability of our businesses, fortified by the Veralto Enterprise System. Our simplification of VES and focus on leveraging high impact tools drove sales growth and margin expansion. Our results reflect our team’s focus and application of VES tools to enhance commercial architecture, improve funnel management and increase lead generation.

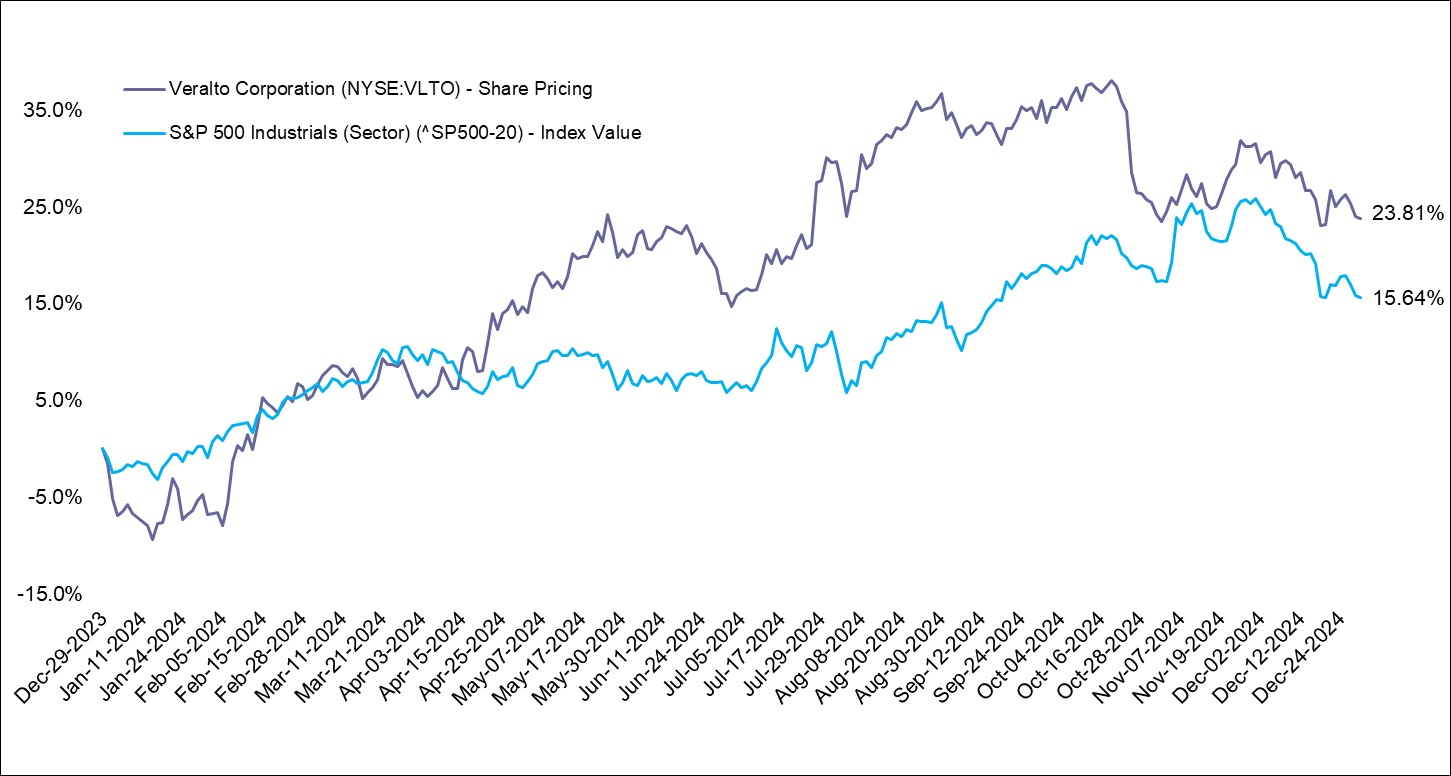

2024 Veralto Share Price Performance:

Corporate Governance Highlights

Our Board recognizes that Veralto’s success over the long term requires a robust framework of corporate governance that serves the best interests of all shareholders. In light of its dedication to strong corporate governance, our Board has approved the following corporate governance matters following the separation of Veralto from Danaher Corporation (Danaher) in 2023 (the Separation):

Recent governance actions:

| | | | | | | | | | | | | | |

| Board composition is critical, and, together with the Board purposefully-built as part of the Separation, Veralto continues to seek to optimize the mix of skills and expertise represented on our Board, as evidenced by the appointment of an additional independent director with new digital skills and expertise. |

| Declassification of the Board of Directors to provide for the annual election of directors after a sunset period. The classified board structure was approved by Danaher, our former parent, prior to the Separation. Our Board approved, at the recommendation of our Nominating and Governance Committee, the phased declassification of the Board, subject to the approval by our shareholders of Proposal 4A described further in this proxy. |

| Elimination of the supermajority voting requirements applicable to shares of common stock in our governance documents. The supermajority voting requirements were approved by Danaher prior to the Separation. Our Board approved, at the recommendation of our Nominating and Governance Committee, the elimination of the supermajority voting requirements, subject to the approval of our shareholders of Proposal 4B described further in this proxy. |

| In 2024, every member of the Veralto executive team had sustainability goals tied to their personal performance objectives, which are linked to compensation. |

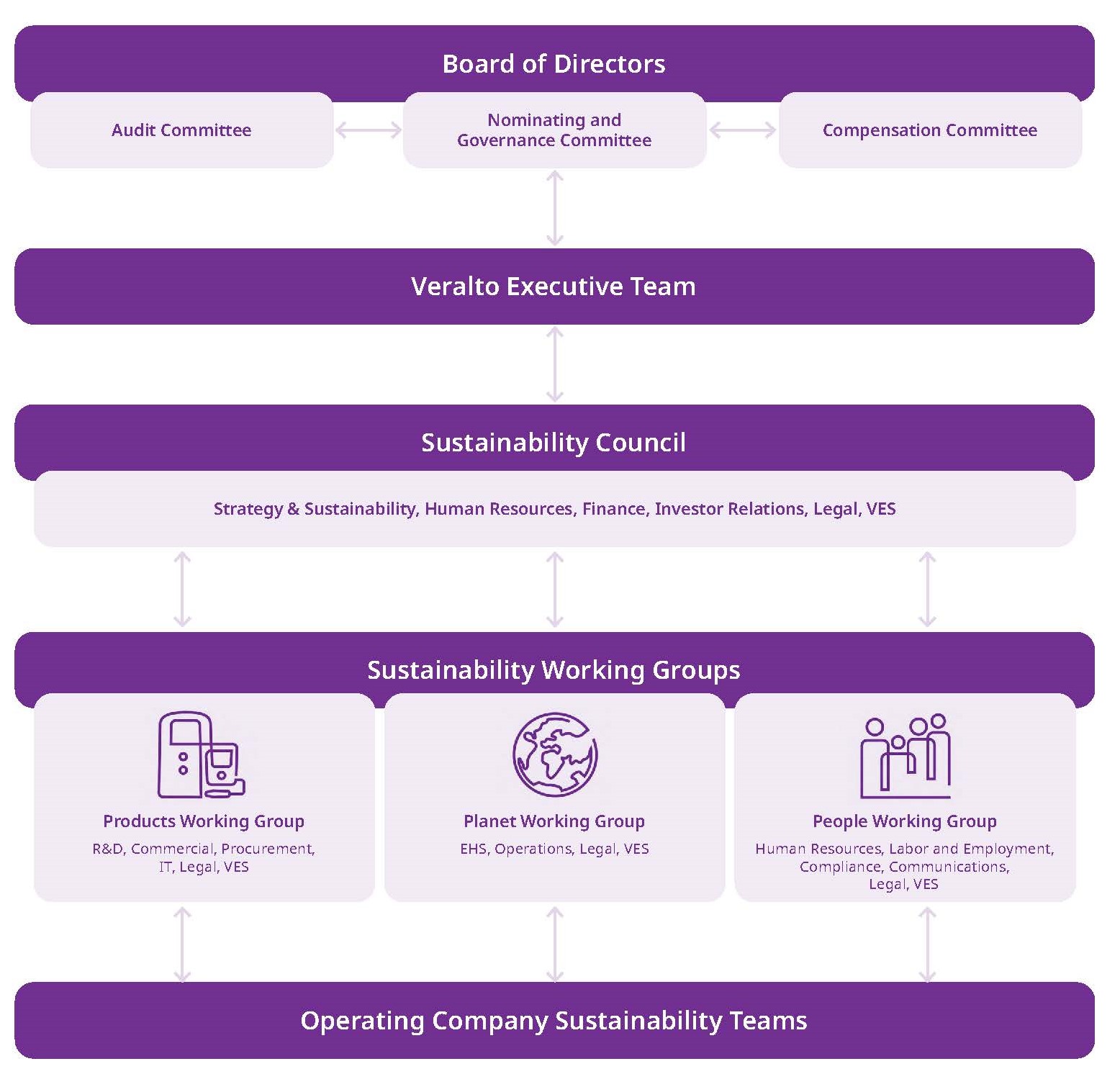

| Implemented a sustainability program, with oversight by the Nominating and Governance Committee, and launched our inaugural and second Sustainability Reports. |

| Conducted our inaugural annual self-assessment process to assess, in detail, the effectiveness of the Board and each of its committees. |

| Enhanced the existing anti-overboarding provisions in our corporate governance guidelines to limit directors who are public company executives to only one additional board membership. |

Additional highlights of our corporate governance framework:

| | | | | | | | | | | | | | |

| Our Chair and CEO positions are separate, with an independent Chair. |

| Independent directors meet regularly without management. |

| We hold a say-on-pay advisory vote every year. |

| We have robust stock ownership requirements for our directors and executive officers. |

| We maintain a comprehensive clawback policy to both time-based and performance-based awards with expanded recoupment provisions beyond SEC requirements. |

| We maintain VES-focused orientation and continuing education programs for directors. |

| We have no shareholder rights plan. |

| We maintain a related person transaction policy with oversight by the Nominating and Governance Committee. |

| 75% of members of the Audit Committee are audit committee financial experts. |

| All members of our Audit, Compensation and Nominating and Governance Committees are independent as defined by the New York Stock Exchange listing standards and applicable SEC rules. |

Shareholder Engagement

We actively seek and highly value feedback from our shareholders. During 2024, our Investor Relations outreach efforts focused on engaging shareholders and investors in connection with topics including our business strategy, acquisitions, end market trends, financial performance, governance and sustainability initiatives. Attendees included members of our senior management. We shared feedback received during these meetings with our Board, informing their oversight.

Board of Directors

Below is an overview of each of the Class II director nominees you are being asked to elect at the Annual Meeting and of each of our continuing directors.

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Committee Memberships |

| Name and Principal Occupation | Independent | Age | Director Class | Director Since | A | C | N |

Jennifer L. Honeycutt President and Chief Executive Officer, Veralto Corporation | | 55 | III | 2023 | | | |

Linda Filler Chair of the Board Former President of Retail Products, Chief Marketing Officer, and Chief Merchandising Officer, Walgreen Co. | | 65 | III | 2023 | | | |

Françoise Colpron Retired Group President, North America Valeo SA | | 54 | I | 2023 | | | |

Daniel L. Comas Retired Executive Vice President, Danaher Corporation | | 61 | II | 2023 | | | |

Shyam P. Kambeyanda President and Chief Executive Officer and Director, ESAB Corporation | | 54 | I | 2023 | | | |

William H. King Retired Senior Vice President—Strategic Development, Danaher Corporation | | 57 | I | 2023 | | | |

Walter G. Lohr, Jr. Retired Partner, Hogan Lovells | | 81 | II | 2023 | | | C |

Heath A. Mitts Executive Vice President and Chief Financial Officer, TE Connectivity | | 54 | III | 2023 | | | |

Vijay P. Sankaran Chief Technology Officer, Johnson Controls | | 51 | I | 2024 | | | |

John T. Schwieters Former Principal, Perseus TDC | | 85 | II | 2023 | C | | |

Cindy L. Wallis-Lage Retired Executive Director, Sustainability and Resilience Black & Veatch Holding Company | | 62 | II | 2023 | | | |

Thomas L. Williams Retired Executive Chairman, Parker Hannifin Corporation | | 66 | III | 2023 | | C | |

A = Audit Committee C = Compensation Committee N = Nominating and Governance Committee

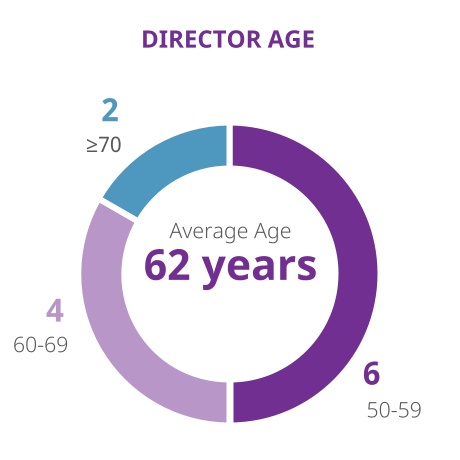

Director Demographics

Skills and Experience

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Global/International | 11 | | | Product Innovation | 7 | | | Accounting | 4 |

l l l l l l l l l l l l | | l l l l l l l l l l l l | | l l l l l l l l l l l l |

| | | | | | | | | | |

| Water Quality (Segment) | 6 | | | Digital | 5 | | | Finance | 7 |

l l l l l l l l l l l l | | l l l l l l l l l l l l | | l l l l l l l l l l l l |

| | | | | | | | | | |

| Sustainability | 8 | | | Corporate Strategy, Capital Allocation, M&A | 11 | | | Branding/Marketing | 5 |

l l l l l l l l l l l l | | l l l l l l l l l l l l | | l l l l l l l l l l l l |

| | | | | | | | | | |

| Product Quality & Innovation (Segment) | 6 | | | Public Company CEO and/or President | 6 | | | Government or Regulatory | 5 |

l l l l l l l l l l l l | | l l l l l l l l l l l l | | l l l l l l l l l l l l |

2024 Meeting Attendance

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| 100% Directors Attended All Board and Committee Meetings | | | | 7 There were 7 Board Meetings in 2024 | |

| | | | | | |

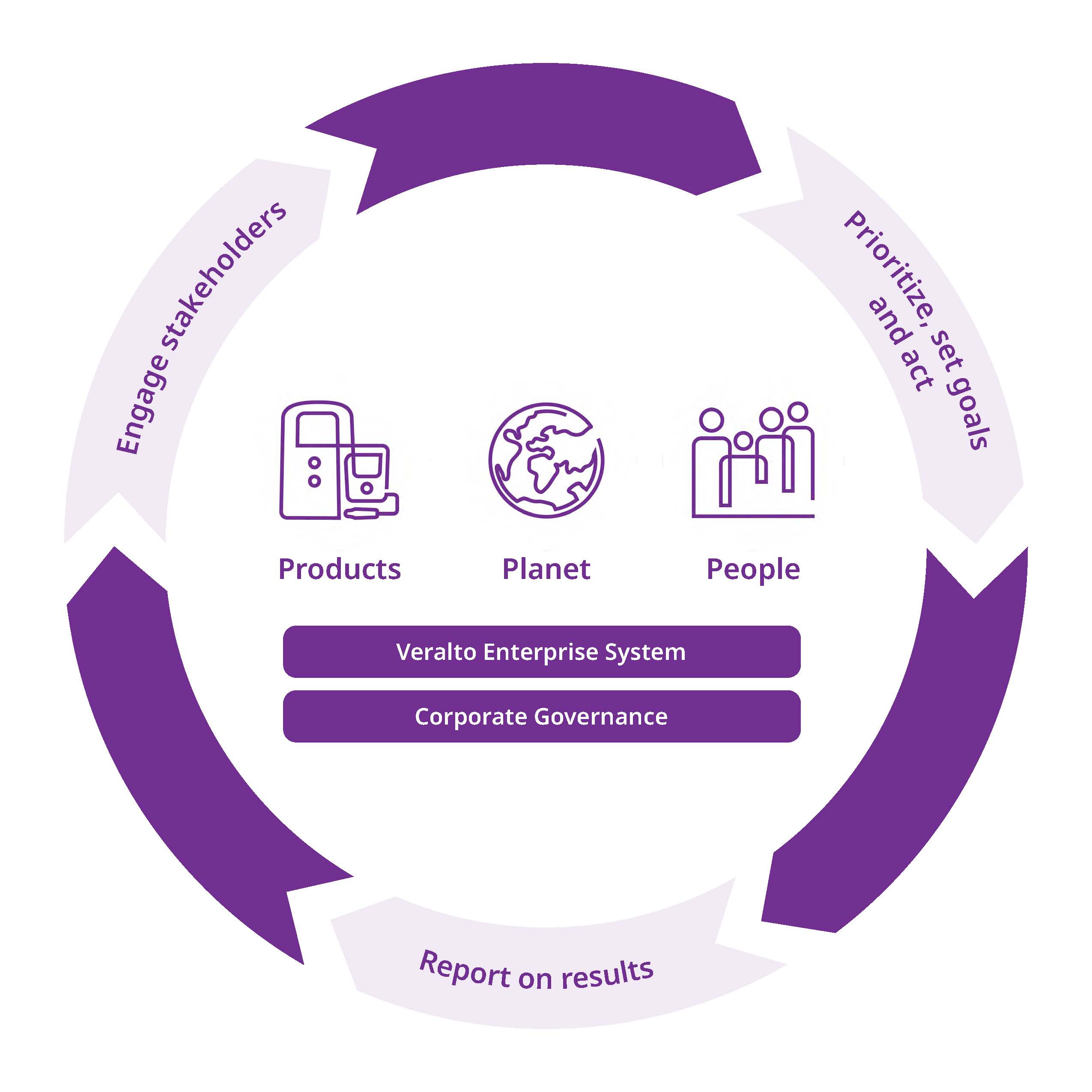

Sustainability at Veralto

| | | | | |

| Products Our products monitor, enhance and protect vital resources. •3.4 billion people around the world benefit from Hach solutions that help ensure clean water for daily use. •81 billion gallons of water that ChemTreat helped customers save. •13 trillion gallons of water treated and recycled through Trojan Technology systems. •10 billion products marked and coded daily by Videojet customers to support customers. Additionally, Veralto set an initial target for our EcoVadis responsible supply chain program to cover at least 40% of our annual supplier spend. |

| Planet We mitigate our impact on the planet by continually improving how we work. In 2024: •We set a climate target to reduce our combined Scope 1+2 GHG emissions by 54.6% from a 2023 baseline by 2033. •We published a Water Stewardship Policy detailing Veralto’s commitments to responsible water management. •In November 2024, we committed to setting a Science-Based Target within two years. •We participated in the CDP Climate and Water Security scorecards for the first time as a public company. |

| People Our people create innovative solutions, breakthrough thinking, and a strong company community. •58% of new hires in the U.S. were diverse (women and/or POC). •100% pay equity was maintained in the U.S. (gender/race). •In 2024, every member of the Veralto executive team had sustainability goals tied to their personal performance objectives, which are linked to compensation. |

| Unless otherwise noted, all data presented is as of December 31, 2023. |

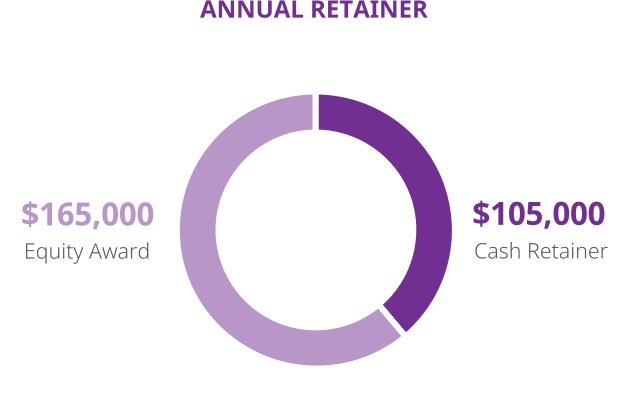

Executive Compensation Highlights

Overview of Executive Compensation Program

As discussed in detail under “Compensation Discussion and Analysis,” with the goal of building long-term value for our shareholders, we have developed an executive compensation program designed to:

•attract and retain executives with the leadership skills, attributes and experience necessary to succeed in an enterprise with Veralto’s size, complexity and global footprint;

•motivate executives to demonstrate exceptional personal performance and perform consistently at or above the levels that we expect, over the long term and through a range of economic cycles; and

•link compensation to the achievement of corporate goals that we believe best correlate with the creation of long-term shareholder value.

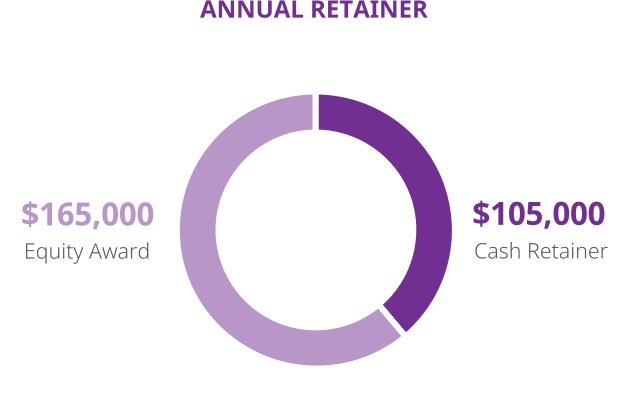

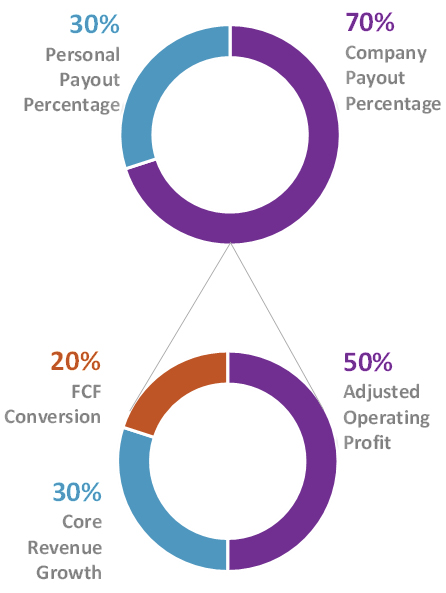

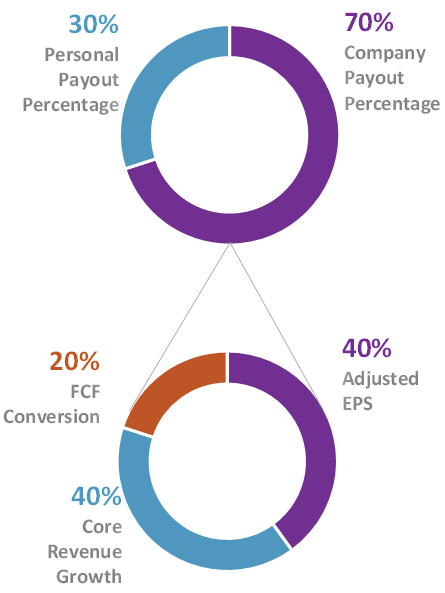

To achieve these objectives, in particular, beginning in 2024, our first full fiscal year as an independent public company, our compensation program combines annual and long-term components, cash and equity, and fixed and variable elements, with a bias toward long-term, performance-based equity awards tied closely to shareholder returns and subject to significant vesting periods. Our executive compensation program rewards our executive officers when they help increase long-term shareholder value, achieve annual business goals and build long-term careers with Veralto.

Compensation Governance

Our Compensation Committee also recognizes that the success of our executive compensation program over the long term requires a robust framework of compensation governance. As a result, our Compensation Committee has established a process to regularly review external executive compensation practices and trends. The Company engages in leading compensation practices as follows:

| | | | | | | | | | | | | | |

| WHAT WE DO | | WHAT WE DON’T DO |

| Four-year vesting requirement for stock options and RSUs; three-year performance period for PSUs | | | No tax gross-up provisions (except as applicable to management employees generally such as relocation policy) |

| Incentive compensation programs feature multiple, different performance measures aligned with the Company’s strategic performance metrics | | | No “single trigger” change of control benefits |

| Short-term and long-term performance metrics that balance our absolute performance and our relative performance versus peer companies | | | No U.S. defined benefit pension programs |

| Rigorous, no-fault clawback policy that is triggered even in the absence of wrongdoing, in addition to a robust policy allowing recoupment from executives engaging in detrimental behavior. | | | No permitted hedging of Veralto securities |

| Minimum one-year vesting requirement for 95% of shares granted under the Company’s stock plan | | | No long-term incentive compensation is denominated or paid in cash |

| Stock ownership requirements for all executive officers | | | No above-market returns on deferred compensation plans |

| Limited perquisites | | | No overlapping performance metrics between short-term and long-term incentive compensation programs |

| All Veralto executives have adopted sustainability performance objectives aligned with Veralto’s purpose of Safeguarding the World’s Most Vital ResourcesTM | | | |

| Independent compensation consultant that performs no other services for the Company | | | |

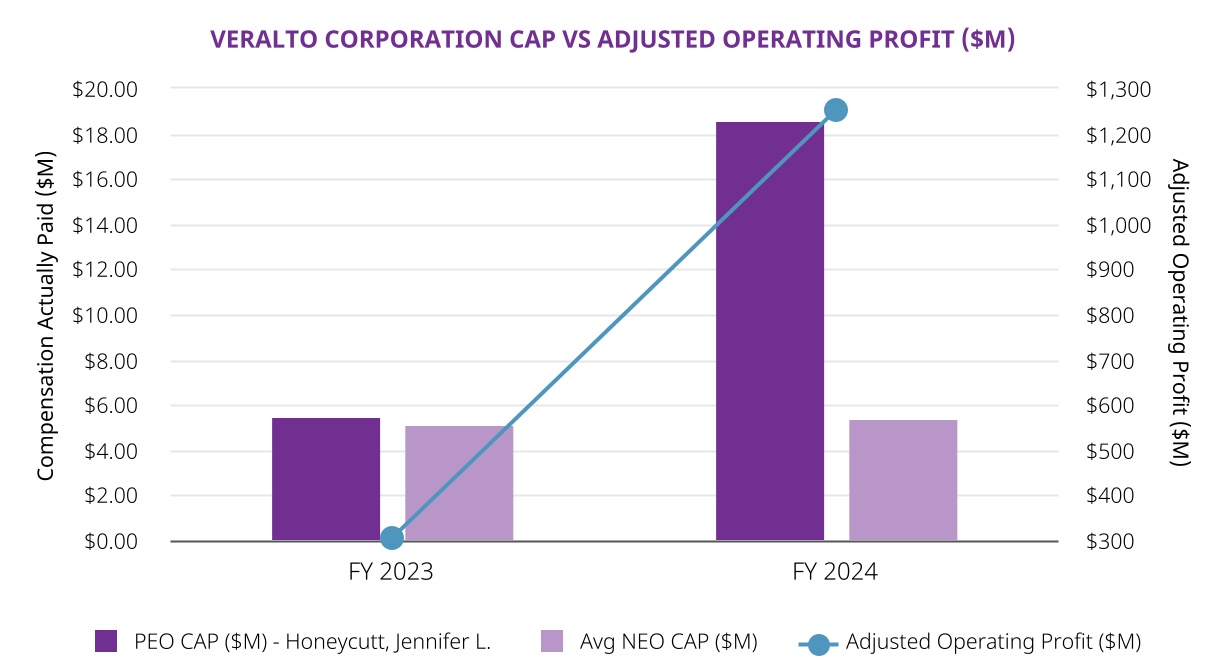

Named Executive Officers’ 2024 Compensation

The Company believes in pay for performance and aligning pay with shareholder interests and the Company’s business objectives.

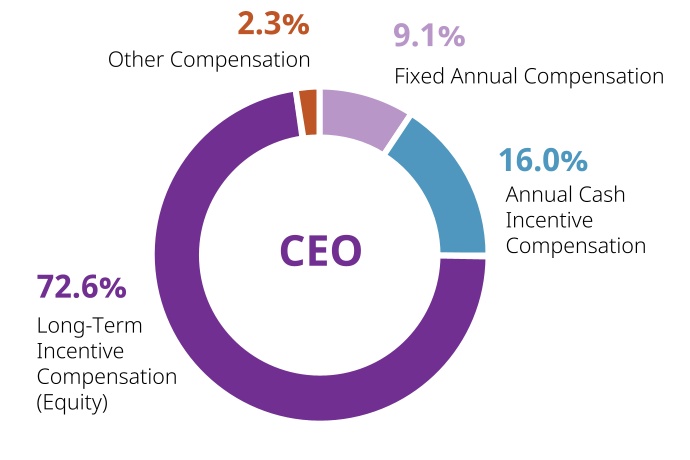

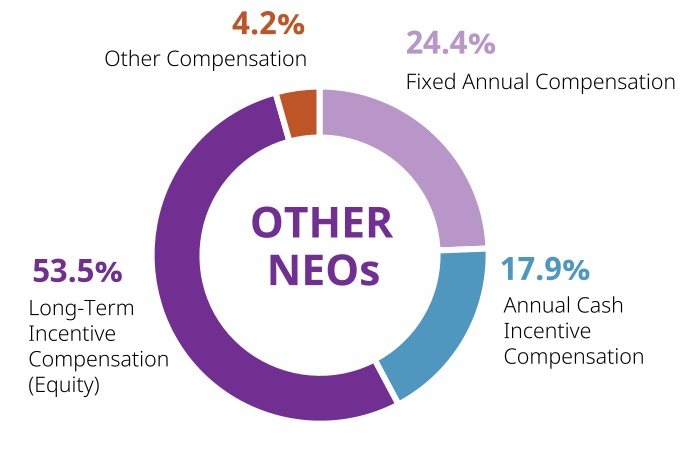

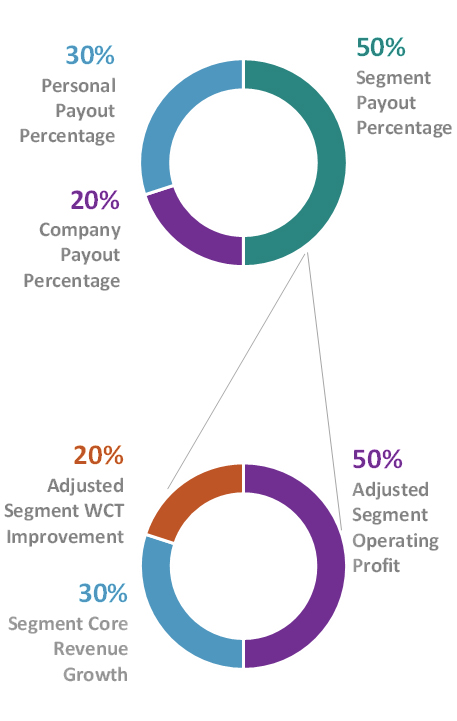

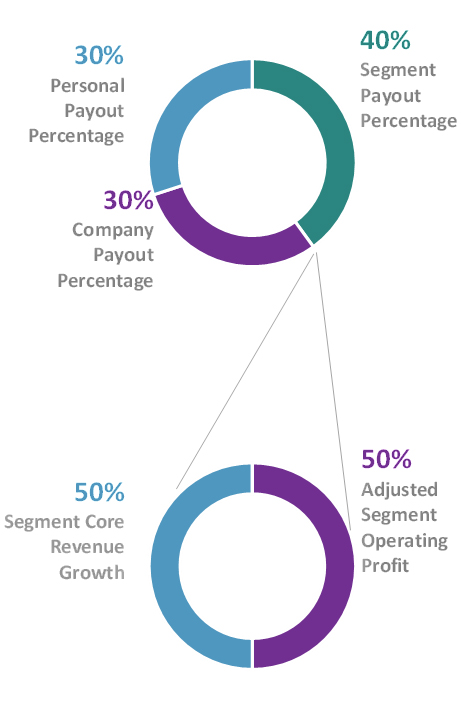

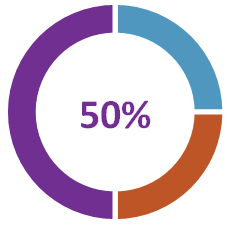

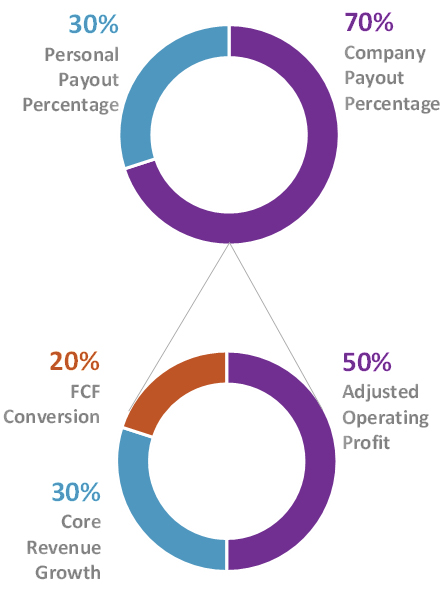

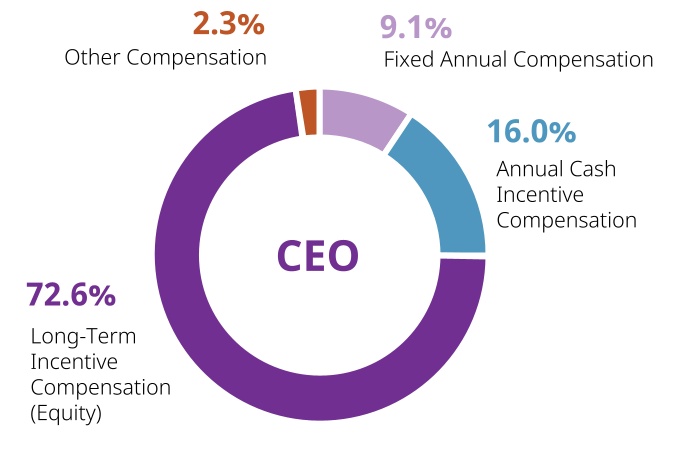

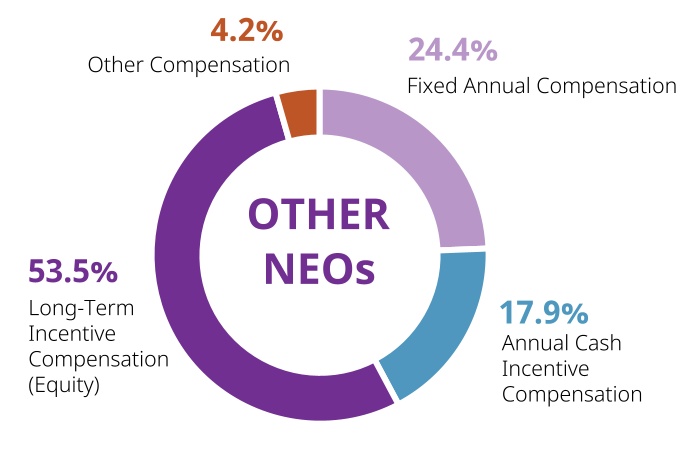

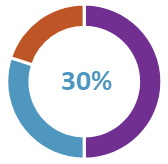

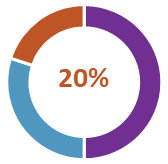

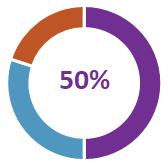

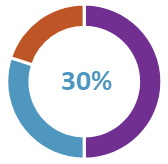

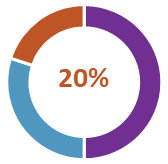

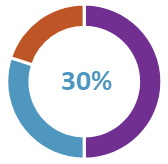

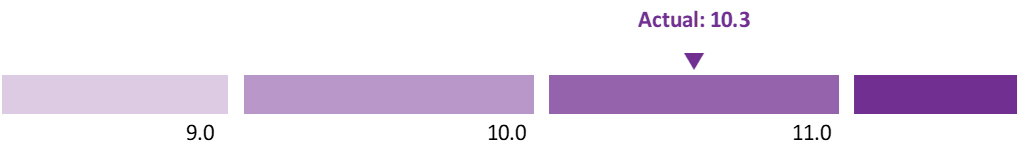

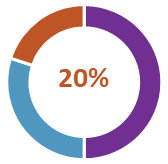

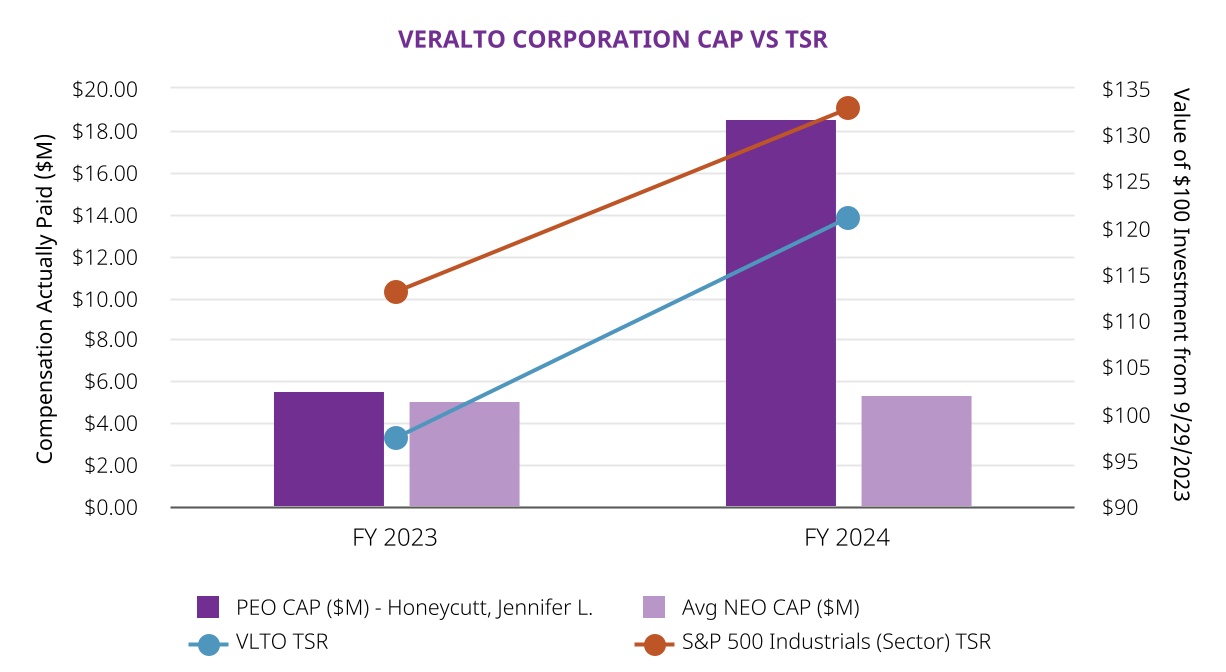

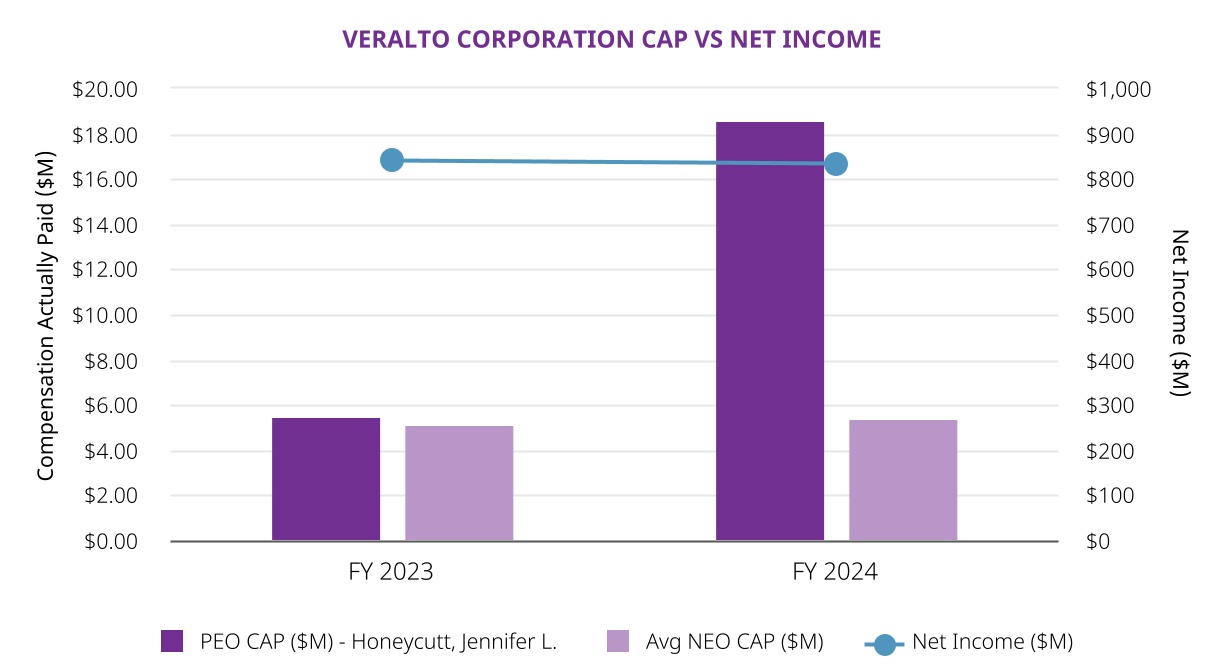

In 2024, the majority of executive compensation is tied to performance in the form of annual incentives and long-term equity compensation (such as performance share units). As displayed in the charts below, in 2024, 88.6% of the target compensation for Ms. Honeycutt was in the form of performance-based and/or equity based compensation, with the remaining 11.4% set as fixed pay or other compensation. For our other NEOs, 71.4% of their target compensation was performance-based and/or equity based compensation with the remaining 28.6% set as fixed pay or other compensation.

We encourage you to read our Compensation Discussion and Analysis (CD&A), which begins on page 41 and describes our pay for performance philosophy and each element of compensation. Our Board of Directors recommends approval, on an advisory basis, of the compensation of our NEOs, as further described in the CD&A and “Proposal 3 – Advisory Vote on Executive Compensation” beginning on page 86. The graphics below illustrate, for Ms. Honeycutt and separately for the other NEOs in aggregate, the percentage of 2024 compensation that each element of compensation accounted for (based on the amounts reported in the 2024 Summary Compensation Table):

PROPOSAL 1

Election of Directors

Our board currently consists of 12 members. Pursuant to Veralto’s amended and restated certificate of incorporation (Certificate of Incorporation) adopted prior to the Separation and prior to the appointment of any of the current directors other than Ms. Honeycutt, the Board is constituted into three classes as follows:

Class I: Françoise Colpron, Shyam P. Kambeyanda, William H. King and Vijay P. Sankaran, whose terms expire at the 2027 Annual Meeting of Shareholders;

Class II: Daniel L. Comas, Walter G. Lohr, Jr., John T. Schwieters and Cindy L. Wallis-Lage, whose terms expire at the Annual Meeting; and

Class III: Jennifer L. Honeycutt, Linda Filler, Heath A. Mitts and Thomas L. Williams, whose terms expire at the 2026 Annual Meeting of Shareholders.

At the Annual Meeting, shareholders will be asked to elect each of the current Class II director nominees identified below (who have been recommended by the Nominating and Governance Committee and nominated by the Board and currently serve as Class II directors of Veralto) to serve until the 2028 Annual Meeting of Shareholders and until his or her successor is duly elected and qualified.

We have set forth below information as of March 24, 2025 relating to each nominee for election as director and each director continuing in office, including: his or her principal occupation and any board memberships at other public companies during the past five years; the other experience, qualifications, attributes or skills that led the Board to conclude that he or she should continue to serve as a director of Veralto; the year in which he or she became a director; and age. Please see “Corporate Governance – Board Selection” for a further discussion of the Board’s process for nominating Board candidates. In the unlikely event a nominee declines or is unable to serve, the proxies may be voted in the discretion of the proxy holders for a substitute nominee designated by the Board, or the Board may reduce the number of directors to be elected.

Class II Director Nominees

| | | | | | | | | | | | | | | | | |

| DANIEL L. COMAS | | Age 61 | |

Class II Director since 2023 Committees: • None Other Public Directorships: • Fortive Corporation

| | Mr. Comas served as Executive Vice President of Danaher from April 2005 through December 2020, including as Chief Financial Officer from April 2005 through December 2018, and currently serves as an advisor to Danaher. From the time he joined Danaher in 1991 until his appointment as Executive Vice President, Mr. Comas served in various roles with responsibilities over corporate development, treasury, finance and risk management. Mr. Comas has also served on the board of directors of Fortive Corporation since March 2021, where he also serves on the compensation committee. Mr. Comas has deep expertise in finance, strategy, corporate development, capital allocation, accounting, human capital management, and risk management. His role in Danaher’s mergers and acquisition program is a domain expertise that is particularly valuable to Veralto given the importance of its acquisition program. In addition, through his extensive leadership experience at Danaher, he has direct understanding of the principles of VES and its culture of continuous improvement. |

| |

| SKILLS AND QUALIFICATIONS: | | | |

| •Global/International •Water Quality (Segment) •Product Quality & Innovation (Segment) | •Corporate Strategy, Capital Allocation, M&A •Accounting •Finance | •Government, Legal or Regulatory |

| | | | |

PROPOSAL 1: ELECTION OF DIRECTORS

| | | | | | | | | | | | | | | | | |

| WALTER G. LOHR, JR. | | Age 81 | INDEPENDENT |

Class II Director since 2023 Committees: • Nominating and Governance (Chair) Other Public Directorships: • None | | Mr. Lohr was a partner of Hogan Lovells, a global law firm, until retiring in 2012, and has also served on the boards of private and non-profit organizations. Prior to his tenure at Hogan Lovells, Mr. Lohr served as assistant attorney general for the State of Maryland. Mr. Lohr also served on the board of directors of Danaher from 1983 to 2024, where he served on its audit, compensation, and nominating and governance committees. Mr. Lohr has extensive experience advising companies in a broad range of transactional matters, including mergers and acquisitions, contests for corporate control and securities offerings. His extensive knowledge of the legal strategies, issues and dynamics that pertain to mergers and acquisitions and capital raising is a critical resource for Veralto given the importance of its acquisition program. |

| |

| SKILLS AND QUALIFICATIONS: | | | |

| •Corporate Strategy, Capital Allocation, M&A | •Government, Legal or Regulatory |

|

| | | | |

| | | | | | | | | | | | | | | | | |

| JOHN T. SCHWIETERS | | Age 85 | INDEPENDENT |

Class II Director since 2023 Committees: • Audit (Chair) Other Public Directorships: • Danaher Corporation | | Mr. Schwieters served as Principal of Perseus TDC, a real estate investment and development firm, from 2013 until May 2023. He also served as a Senior Executive of Perseus, LLC, a merchant bank and private equity fund management company, from 2012 to 2016, and as Senior Advisor from 2009 to 2012. Mr. Schwieters has served on the board of directors of Danaher since 2003, where he has served on its nominating and governance committee and as chair of its audit committee. In addition to his roles with Perseus, Mr. Schwieters led the Mid-Atlantic region of one of the world’s largest accounting firms after previously leading that firm’s tax practice in the Mid-Atlantic region, and has served on the boards and chaired the audit committees of several NYSE-listed public companies. He brings to Veralto extensive knowledge and experience in the areas of public accounting, tax accounting and finance, which are areas of critical importance to Veralto as a large, global and complex public company. |

| |

| SKILLS AND QUALIFICATIONS: | | | |

| •Global/International •Sustainability | •Corporate Strategy, Capital Allocation, M&A | •Accounting •Finance |

| | | | |

| | | | | | | | | | | | | | | | | |

| CINDY L. WALLIS-LAGE | | Age 62 | INDEPENDENT |

Class II Director since 2023 Committees: • Nominating and Governance Other Public Directorships: • Comfort Systems USA | | Ms. Wallis-Lage served as Executive Director, Sustainability and Resilience of Black & Veatch Holding Company, a private engineering, consulting and construction company with a more than 100-year track history of innovation in sustainable infrastructure, from January 2022 to September 2022. In this role, Ms. Wallis-Lage focused on driving a sustainability brand and establishing and integrating environmental, social and governance policies and practices. Prior to that, she served as President, Global Water Business of Black & Veatch from January 2012 to December 2021. Ms. Wallis-Lage also served as a board director and executive committee member for Black & Veatch from March 2012 to September 2022. A 36-year veteran of Black & Veatch, Ms. Wallis-Lage was an active champion of water's true value and its impact on sustainable communities. In addition, Ms. Wallis-Lage has served on numerous not-for-profit boards within the water industry. Ms. Wallis-Lage currently serves on the board of Metiri Group, a laboratory company serving the US-based water sector since May 2023, and has served on the Comfort Systems USA board of directors since May 2021, where she served on various committees and currently serves as chair of its nominating, governance and sustainability committee. Ms. Wallis-Lage is well-known in the industry for her expertise in the treatment and reuse of water and wastewater resources. Her extensive senior executive experience leading strategies, development and operations of a global water-related business, including the development of sustainability practices and digital platforms, is a key asset to Veralto in light of its portfolio and strategic priorities. Ms. Wallis-Lage also provides valuable insight from her public board experience. |

| |

| SKILLS AND QUALIFICATIONS: | | | |

| •Global/International •Water Quality (Segment) | •Digital •Sustainability | •Finance •Branding/Marketing |

| | | | |

| | | | | |

| |

| THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF THE FOREGOING CLASS II DIRECTOR NOMINEES. |

PROPOSAL 1: ELECTION OF DIRECTORS

Continuing Directors

| | | | | | | | | | | | | | | | | | | | | | | |

| FRANÇOISE COLPRON | | Age 54 | INDEPENDENT |

Class I Director since 2023 Committees: • Compensation • Nominating and Governance Other Public Directorships: • Celestica Inc. • Sealed Air Corporation | | Ms. Colpron served as Group President, North America of Valeo SA, a global automotive supplier enabling smart mobility, from March 2008 to July 2022, and was responsible for Valeo’s activities in the United States, Mexico and Canada. She joined Valeo in 1998 in the legal department and held several positions, first as Legal Director for the Climate Control branch in Paris, and then as General Counsel for North and South America, from 2005 to 2015. Before joining Valeo, Ms. Colpron began her career as a lawyer at Ogilvy Renault in Montreal, Canada (now part of the Norton Rose Group). Ms. Colpron’s global business experience includes prior work assignments in Europe, Asia and North America. Since October 2022, Ms. Colpron has served as a director of Celestica Inc., a global leader in high reliability design, manufacturing and supply chain solutions, where she currently serves as the chair of its governance committee. Since May 2019, Ms. Colpron has served as a director of Sealed Air Corporation, a global packaging solutions company, where she has served on various committees, including its people and compensation committee since May 2021, where she served as chair until December 2024. Ms. Colpron previously served as a director of Alstom, a rail transportation manufacturing company, from July 2017 to September 2019, as well as on the boards of directors of other industry associations. Ms. Colpron has received recognition by various automotive industry and business organizations, and was inducted into the French Légion d’Honneur in 2015. A corporate director and strategic leader with over 30 years of global business and legal experience, Ms. Colpron provides international expertise coupled with extensive board experience. |

| |

| SKILLS AND QUALIFICATIONS: | | | |

| •Global/International •Product Quality & Innovation (Segment) •Product Innovation •Sustainability | •Corporate Strategy, Capital Allocation, M&A •Public Company CEO and/or President | •Finance •Government, Legal or Regulatory |

| | | | |

| | | | | | | | | | | | | | | | | |

| LINDA FILLER | | Age 65 | INDEPENDENT |

Board Chair and Class III Director since 2023 Committees: • Compensation Other Public Directorships: • Danaher Corporation • The Carlyle Group | | Ms. Filler retired as President of Retail Products, Chief Marketing Officer and Chief Merchandising Officer at Walgreen Co., a retail pharmacy company, in April 2017. Prior to Ms. Filler’s role at Walgreen, she served in executive roles for leading consumer products and retail organizations, including President, North America for Claire’s, Executive Vice President-Merchandising at Walmart, Inc., Executive Vice President-Global Strategy at Kraft Foods, and CEO of the largest branded apparel unit of Hanesbrands/Sara Lee. Her responsibilities have straddled U.S. and international general management roles, corporate strategy, product innovation, marketing and merchandising responsibilities, manufacturing and logistics operations, retail logistics and operations, and corporate social responsibility. Understanding and responding to the needs of our customers is fundamental to Veralto’s business strategy, and Ms. Filler’s expertise with customers, brand management and portfolio strategy benefit Danaher and is a valuable resource to Veralto’s Board. Her prior leadership experiences with large global public companies, and in particular her focus on global portfolio strategy, capital allocation and strategic brand development, is a key asset to Veralto. Ms. Filler has served as a director for Danaher since 2005 and as its Lead Independent Director since 2020, where she also has served on various committees, including as chair of its nominating and governance committee. Ms. Filler has also served on The Carlyle Group Inc. board of directors since 2022. Ms. Filler also serves or has served on private and philanthropic boards. |

| |

| SKILLS AND QUALIFICATIONS: | | | |

| •Global/International •Product Quality & Innovation (Segment) •Product Innovation | •Sustainability •Corporate Strategy, Capital Allocation, M&A •Public Company CEO and/or President | •Accounting •Finance •Branding/Marketing |

| | | | |

PROPOSAL 1: ELECTION OF DIRECTORS

| | | | | | | | | | | | | | | | | |

| JENNIFER L. HONEYCUTT | | Age 55 | CHIEF EXECUTIVE OFFICER |

Class III Director since 2023 Committees: • None Other Public Directorships: • None | | Ms. Honeycutt serves as Veralto’s President and Chief Executive Officer and a member of the Board, and served as Executive Vice President with responsibility for Danaher’s Environmental & Applied Solutions segment from July 2022 through September 2023. Prior to that, Ms. Honeycutt served in leadership positions in a variety of different functions and businesses since joining Danaher in 1999, including most recently as Executive Vice President for Danaher’s Life Sciences Tools Platform and Global High Growth Markets from January 2021 through September 2022, Vice President & Group Executive within Danaher’s Life Sciences Platform from May 2019 through January 2021, and as President of Pall Corporation from January 2017 through January 2021. |

| |

| SKILLS AND QUALIFICATIONS: | | | |

| •Global/International •Water Quality (Segment) •Product Quality & Innovation (Segment) •Digital | •Product Innovation •Sustainability •Corporate Strategy, Capital Allocation, M&A | •Public Company CEO and/or President •Branding/Marketing •Government, Legal or Regulatory |

| | | | |

| | | | | | | | | | | | | | | | | |

| SHYAM P. KAMBEYANDA | | Age 54 | INDEPENDENT |

Class I Director since 2023 Committees: • Audit Other Public Directorships: • ESAB Corporation

| | Mr. Kambeyanda has served as President and Chief Executive Officer and a director of ESAB Corporation, an American-Swedish diversified industrial company and manufacturer of equipment and consumables and automation solutions for use in cutting, welding and gas control applications, since April 2022. From May 2016 to April 2022, he served in a series of progressively responsible executive roles at Colfax Corporation, from which ESAB was spun-off. Mr. Kambeyanda oversaw the growth of ESAB’s fabrication technology business, expanding ESAB’s global operations, improving financial performance and driving ESAB Business Excellence (EBX) throughout the business. Prior to joining Colfax and ESAB, Mr. Kambeyanda served in executive roles at Eaton Corporation from 1995 to 2016, with a strong supply chain, strategy and operations focus. Mr. Kambeyanda maintains a keen international perspective on driving growth and business development in emerging markets. He brings extensive senior executive and leadership experience, in particular for global businesses, which we believe is of key importance for Veralto. |

| | |

| | SKILLS AND QUALIFICATIONS: | | | |

| | •Global/International •Digital •Product Innovation •Sustainability | •Corporate Strategy, Capital Allocation, M&A •Public Company CEO and/or President | •Accounting •Branding/Marketing •Government, Legal or Regulatory |

| | | | |

| | | | | | | | | | | | | | | | | |

| WILLIAM H. KING | | Age 57 | |

Class I Director since 2023 Committees: • None Other Public Directorships: • None | | Mr. King served as Senior Vice President - Strategic Development of Danaher from 2014 until his retirement in February 2025, after having served as Vice President – Strategic Development from 2005 to 2014. From the time he joined Danaher in 1998 until his appointment as Vice President - Strategic Development, Mr. King served in various general management and functional roles with responsibilities over sales, marketing and business development. Mr. King’s long-standing experience leading Danaher’s strategy function gives him keen insights into Veralto’s strategy, served industries and opportunities for future growth. His role in Danaher’s mergers and acquisition program is a domain expertise that is particularly valuable to Veralto given the importance of its acquisition program. In addition, through his extensive leadership experience at Danaher, he has direct understanding of the principles of VES and its culture of continuous improvement. Mr. King has served as a director of W.L.Gore Inc., a family-owned medical and industrial products company, since January 2025. |

| | |

| | SKILLS AND QUALIFICATIONS: | | | |

| | •Global/International •Water Quality (Segment) | •Product Quality & Innovation (Segment) •Product Innovation | •Corporate Strategy, Capital Allocation, M&A •Public Company CEO and/or President |

| | | | | |

PROPOSAL 1: ELECTION OF DIRECTORS

| | | | | | | | | | | | | | | | | |

| HEATH A. MITTS | | Age 54 | INDEPENDENT |

Class III Director since 2023 Committees: • Audit Other Public Directorships: • TE Connectivity | | Mr. Mitts has served since September 2016 as Executive Vice President, Chief Financial Officer of TE Connectivity, a technology company that designs and manufactures connectors and sensors for several industries, where he is responsible for developing and implementing financial strategy. Mr. Mitts has also served as a director of TE Connectivity since March 2021. Prior to that, Mr. Mitts served as Senior Vice President and Chief Financial Officer and in other executive financial roles for IDEX Corporation, an applied solutions company specializing in fluid and metering technologies, health and science technologies, and fire, safety and other diversified products, from 2005 to September 2016, and as Chief Financial Officer PerkinElmer, Asia, based in Singapore, from 2001 to 2005. Prior to his service with PerkinElmer, Mr. Mitts held various senior financial leadership positions during his tenure at Honeywell International from 1996 to 2001. Mr. Mitts also served as a director of Columbus McKinnon Corporation, a material handling and motion control manufacturer, from May 2015 to January 2024, where he served on the audit and compensation committees. Mr. Mitts’ extensive senior financial leadership experience at decentralized, business-system driven publicly traded companies, including expertise leading acquisitions and water sector knowledge, as well as his public board expertise, make him a valuable addition to the Veralto Board. |

| |

| SKILLS AND QUALIFICATIONS: | | | |

| •Global/International •Water Quality (Segment) | •Corporate Strategy, Capital Allocation, M&A | •Finance |

| | | | |

| | | | | | | | | | | | | | | | | |

| VIJAY P. SANKARAN | | Age 51 | INDEPENDENT |

Class I Director since 2024 Committees: • Audit Other Public Directorships: • None | | Mr. Sankaran has served as Vice President and Chief Digital and Information Officer of Johnson Controls International PLC, a global leader in smart, healthy, and sustainable buildings, since January 2025. Previously, he was Vice President and Chief Technology Officer from May 2021 to December 2024, where he focused on accelerating product software engineering development and expanding customer solutions through the company’s digital platform. Mr. Sankaran has held leadership roles in technology transformation across a spectrum of industries, including various positions at TD Ameritrade and the Ford Motor Company. Mr. Sankaran’s broad executive leadership and deep expertise in digital technology management bring invaluable perspectives to the Veralto Board. |

| |

| SKILLS AND QUALIFICATIONS: | | | |

| •Global/International •Product Quality & Innovation (Segment) •Digital | •Sustainability •Corporate Strategy, Capital Allocation, M&A | •Product Innovation •Finance •Branding/Marketing |

| | | | |

| | | | | | | | | | | | | | | | | |

| THOMAS L. WILLIAMS | | Age 66 | INDEPENDENT |

Class III Director since 2023 Committees: • Compensation (Chair) Other Public Directorships: • Sherwin-Williams | | Mr. Williams served as Executive Chairman of Parker Hannifin Corporation, which manufactures and sells motion and control technologies and systems for mobile, industrial and aerospace markets, from January 2023 to December 2023. From the time he joined Parker Hannifin in 2003, Mr. Williams served as Chief Executive Officer and director of Parker Hannifin from February 2015 to December 2022, as Chairman of the board of directors of Parker Hannifin from January 2016 to December 2022. From 2006 to January 2015, he was Executive Vice President and Operating Officer of Parker Hannifin with responsibility for Parker’s Aerospace, Engineered Materials, Filtration, Instrumentation and Asia Pacific groups and its Strategic Pricing department. From 2003 to 2006, Mr. Williams was VP of Operations for Hydraulics and President of the Instrumentation Group. Prior to joining Parker Hannifin, Mr. Williams held a number of key management positions at General Electric Company, a diversified manufacturing company. Mr. Williams is currently a director of Sherwin-Williams, a paint and coatings company, since July 2023 and serves on its compensation committee. Previously, he served as a director at Chart Industries, Inc., a global manufacturer of highly-engineered equipment serving the clean energy and industrial gas markets, from 2008 to 2019, and a director of Goodyear Tire & Rubber Company from February 2019 to April 2024. Mr. Williams’ significant chief executive officer experience and operational leadership at public companies, including his deep knowledge of executive compensation and governance expertise from his service on the boards of multiple public companies, are a valuable resource to the Veralto Board. |

| |

| SKILLS AND QUALIFICATIONS: | | | |

| •Global/International •Digital •Product Innovation | •Sustainability •Corporate Strategy, Capital Allocation, M&A | •Public Company CEO and/or President |

| | | | |

PROPOSAL 1: ELECTION OF DIRECTORS

Board Selection

Director Selection

The Board and our Nominating and Governance Committee believe that it is important that our directors demonstrate the standards and qualifications set out in our Corporate Governance Guidelines, including:

•personal and professional integrity and character;

•prominence and reputation in his or her profession;

•skills, knowledge and expertise (including business or other relevant experience) that, in aggregate, are useful and appropriate to the effective oversight of Veralto’s business;

•the extent to which the interplay of his or her skills, knowledge expertise and background with that of the other Board members will help build a Board that is effective in collectively meeting Veralto’s strategic needs and serving the long-term interests of Veralto’s shareholders;

•the capacity and desire to represent the interests of the shareholders as a whole; and

•availability to devote sufficient time to the affairs of Veralto.

The Nominating and Governance Committee is responsible for identifying and recommending to the Board a slate of nominees for election at each annual meeting of shareholders. Nominees may be suggested by directors, members of management, shareholders or, in some cases, by a third-party search firm engaged by the Committee. The Nominating and Governance Committee considers a wide range of factors when assessing potential director nominees. This includes consideration of the current composition of the Board, any perceived need for one or more particular areas of expertise, the balance of management and independent directors, the need for committee-specific expertise, the evaluations of other prospective nominees and the qualifications of each potential nominee relative to the attributes, skills and experience described above.

When Veralto recruits a director candidate, either a search firm engaged by the Nominating and Governance Committee or a member of the Board contacts the prospect to assess interest and availability. The candidate will then meet with members of the Board and at the same time, the Nominating and Governance Committee with the support of the search firm will conduct such further inquiries as the Committee deems appropriate. A background check is completed before a final recommendation is made to appoint a candidate to the Board.

A shareholder who wishes to recommend a prospective nominee for the Board should notify the Nominating and Governance Committee in writing using the procedures described below under “Other Information – Communications with the Board of Directors” with supporting materials the shareholder considers appropriate. If a prospective nominee has been identified other than in connection with a director search process initiated by the Nominating and Governance Committee, the Committee will make an initial determination as to whether to conduct a full evaluation of the candidate. The Nominating and Governance Committee’s determination of whether to conduct a full evaluation will be based primarily on the Committee’s view as to whether a new or additional Board member is necessary or appropriate at such time, the likelihood that the prospective nominee can satisfy the evaluation factors described above and any other factors as the Committee may deem appropriate. The Nominating and Governance Committee will take into account information provided to the Committee with the recommendation of the prospective candidate and any additional inquiries the committee may in its discretion conduct or have conducted with respect to such prospective nominee.

Director Skills, Expertise, and Composition

The Board believes that the Board, taken as a whole, should broadly embody differences in professional experience and skills, global experience, education, and other individual qualities and attributes, which is appropriate in light of Veralto’s business need and important to serving the long-term interests of our shareholders. Furthermore, the Board does not assign any particular weighting of any characteristic in evaluating nominees and directors.

PROPOSAL 1: ELECTION OF DIRECTORS

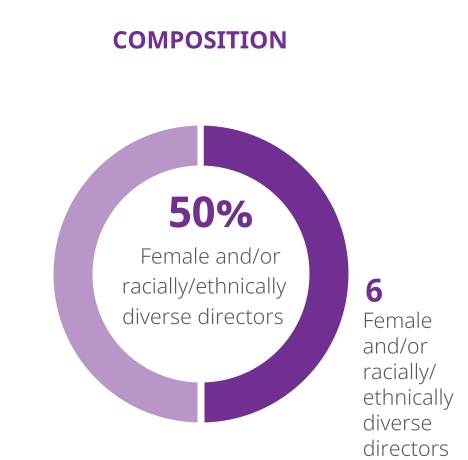

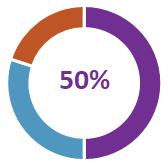

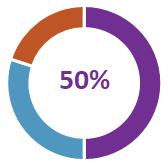

The chart that follows illustrates the broad skills and expertise represented on our Board. In addition, approximately 50% of our Board members represent different genders and/or racial/ethnic backgrounds, and our Board includes a broad range of ages and national origins.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SKILLS AND EXPERTISE | Colpron | Comas | Filler | Honeycutt | Kambeyanda | King | Lohr | Mitts | Sankaran | Schwieters | Wallis-Lage | Williams |

| Global/International | | | | | | | | | | | | |

| Water Quality (segment) | | | | | | | | | | | | |

| Product Quality & Innovation (segment) | | | | | | | | | | | | |

| Digital | | | | | | | | | | | | |

| Product Innovation | | | | | | | | | | | | |

| Sustainability | | | | | | | | | | | | |

| Corporate Strategy, Capital Allocation, M&A | | | | | | | | | | | | |

| Public company CEO and/or President | | | | | | | | | | | | |

| Accounting | | | | | | | | | | | | |

| Finance | | | | | | | | | | | | |

| Branding/Marketing | | | | | | | | | | | | |

| Government, legal or regulatory | | | | | | | | | | | | |

Board Orientation and Continuing Education

Our new director orientation program includes extensive meetings with Veralto management and familiarizes new directors with Veralto’s businesses, strategies, policies and VES; assists them in developing company and industry knowledge to optimize their Board service; and educates them with respect to their fiduciary duties and legal responsibilities and Veralto’s sustainability framework.

In addition, our director continuing education program provides ongoing learning opportunities through meetings with management, external speakers relevant to Veralto’s strategy, onsite operating company visits, and attendance at Veralto’s annual leadership conference, as well as access to corporate governance resources.

Corporate Governance

Corporate Governance Overview

Our Board recognizes that Veralto’s success over the long term requires a robust framework of corporate governance that serves the best interests of all our shareholders and promotes robust risk oversight. In light of its dedication to strong corporate governance, our Board has approved the following corporate governance matters following the Separation in 2023:

Recent governance actions:

| | | | | | | | | | | | | | |

| Board composition is critical, and, together with the Board purposefully-built as part of the Separation, Veralto continues to seek to optimize the mix of skills and expertise represented on our Board, as evidenced by the appointment of an additional independent director with new digital skills and expertise. |

| Declassification of the Board of Directors to provide for the annual election of directors after a sunset period. The classified board structure was approved by Danaher, our former parent, prior to the Separation. Our Board approved, at the recommendation of our Nominating and Governance Committee, the phased declassification of the Board, subject to the approval by our shareholders of Proposal 4A described further in this proxy. |

| Elimination of the supermajority voting requirements applicable to shares of common stock in our governance documents. The supermajority voting requirements were approved by Danaher prior to the Separation. Our Board approved, at the recommendation of our Nominating and Governance Committee, the elimination of the supermajority voting requirements, subject to the approval of our shareholders of Proposal 4B described further in this proxy. |

| In 2024, every member of the Veralto executive team had sustainability goals tied to their personal performance objectives, which are linked to compensation. |

| Implemented a sustainability program, with oversight by the Nominating and Governance Committee, and launched our inaugural and second Sustainability Reports. |

| Conducted our inaugural annual self-assessment process to assess, in detail, the effectiveness of the Board and each of its committees. |

| Enhanced the existing anti-overboarding provisions in our corporate governance guidelines to limit directors who are public company executives to only one additional board membership. |

Additional highlights of our corporate governance framework:

| | | | | | | | | | | | | | |

| Our Chair and CEO positions are separate, with an independent Chair. |

| Independent directors meet regularly without management. |

| We hold a say-on-pay advisory vote every year. |

| We have robust stock ownership requirements for our directors and executive officers. |

| We maintain a comprehensive clawback policy to both time-based and performance-based awards with expanded recoupment provisions beyond SEC requirements. |

| We maintain VES-focused orientation and continuing education programs for directors. |

| We have no shareholder rights plan. |

| We maintain a related person transaction policy with oversight by the Nominating and Governance Committee. |

| 75% of members of the Audit Committee are audit committee financial experts. |

| All members of our Audit, Compensation and Nominating and Governance Committees are independent as defined by the New York Stock Exchange listing standards and applicable SEC rules. |

Board Leadership Structure and Oversight

Board Leadership Structure

The Board has separated the positions of Chair and Chief Executive Officer (CEO) because it believes that the separation of the positions best enables the Board to ensure that Veralto’s business, risks, opportunities and affairs are managed effectively and in the best interests of shareholders.

The entire Board selects the Chair, and our Board has selected Linda Filler, an independent director, as its Chair, in light of Ms. Filler’s independence and her extensive experience with corporate governance, board management, shareholder engagement, risk management and corporate strategy. Ms. Filler’s prior leadership experiences with large global public companies, and in particular her focus on global portfolio strategy, capital allocation and strategic brand development, are a key asset to Veralto.

Moreover, Ms. Filler uses her management and director experience and Danaher board tenure and leadership to help ensure that the non-management directors have a keen understanding of Veralto’s business as well as the strategic and other risks and opportunities that the Company may face. This enables the Board to more effectively provide insight and direction to, and exercise oversight of, Veralto’s CEO and the rest of the management team responsible for the Company’s day-to-day business (including with respect to risk management).

As the independent Chair, Ms. Filler leads the activities of the Board, including:

•calling and presiding at all meetings of the Board;

•together with the CEO and the Corporate Secretary, setting the agenda for the Board;

•calling and presiding at the executive sessions of non-management directors and of the independent directors;

•advising the CEO on strategic aspects of Veralto’s business, including developments and decisions that are to be discussed with, or would be of interest to, the Board;

•acting as a liaison as necessary between the non-management directors and the management of the Company; and

•acting as a liaison as necessary between the Board and the committees of the Board.

In the event that the Chair is not an independent director, the Corporate Governance Guidelines provide that the independent directors, upon recommendation from the Nominating and Governance Committee, will select by majority vote an independent director to serve as the Lead Independent Director with the authority to:

•preside at all meetings of the Board at which the Chairman is not present, including the executive sessions;

•call meetings of the independent directors;

•act as a liaison as necessary between the independent directors and the CEO; and

•advise with respect to the Board’s agenda.

The Board’s non-management directors meet in executive session following the Board’s regularly-scheduled meetings, with the executive sessions chaired by the independent Chair. In addition, the independent directors meet as a group in executive session at least once a year.

Board Oversight

Strategy

One of the Board’s primary responsibilities is overseeing management’s development and execution of the Company’s strategy.

At least quarterly, the CEO, our executive leadership team and other business leaders provide detailed business and strategy updates to the Board. The Board annually conducts an in-depth review of the Company’s overall strategy. At these reviews, the Board engages with our executive leadership team and other business leaders regarding business objectives and the application of VES, the competitive landscape, economic trends and other developments. On an annual basis the Board also reviews the Company’s human capital, risk assessment/risk management, compliance and sustainability programs as well as the Company’s operating budget, and at meetings occurring throughout the year the Board reviews acquisitions, strategic investments and other capital allocation topics as well as the Company’s operating and financial performance, among other matters. The Board also looks to the expertise of its committees to inform strategic oversight in their areas of focus.

OVERSIGHT OF STRATEGIC ACQUISITIONS

The Board oversees Veralto’s strategic acquisition and integration process. Veralto views acquisitions as an important element of our strategy to deliver long-term shareholder value. Our Board includes 12 members with extensive business combination experience. That depth of experience allows the Board to constructively engage with management and effectively evaluate acquisitions for alignment with our strategy, culture and financial goals. Management is charged with identifying potential acquisition targets, executing transactions and managing integration, and our Board’s oversight extends to each of these elements. Management and the Board regularly discuss potential acquisitions and their role in the Company’s overall business strategy. These discussions address acquisitions in process and potential future acquisitions, and cover a broad range of matters which may include valuation, due diligence, risk and anticipated synergies with Veralto’s businesses and strategy. With respect to more significant acquisitions, the Board discusses and evaluates a proposed opportunity over multiple meetings. The Board’s acquisition oversight also extends across transactions and over time; at least annually the Board reviews and provides feedback regarding the operational and financial performance of our acquisitions.

OVERSIGHT OF HUMAN CAPITAL MANAGEMENT AND CEO SUCCESSION PLANNING

The Board and Compensation Committee engage with our senior leadership team and human resources executives on a regular basis across a range of human capital management topics. As discussed above, Veralto is committed to attracting, developing, engaging and retaining the best people from around the world to sustain and grow our science and technology leadership. Working with management, the Board and Compensation Committee oversee our human capital strategy spanning multiple key dimensions, including culture, governance, recruitment, engagement, succession planning and development, competitive compensation and benefits, performance management, talent development, and career mobility. The Board reviews the Company’s human capital strategy annually and at other times during the year in connection with significant initiatives and acquisitions, supported by the Compensation Committee’s oversight of our executive and equity compensation programs.

With the support of our Nominating and Governance Committee, our Board also maintains and annually reviews both a long-term succession plan and emergency succession plan for the CEO position. The foundation of the long-term CEO succession planning process is a CEO development model consisting of three dimensions: critical experiences, leadership capabilities and personal characteristics/traits. The Board uses the development model as a guide in preparing candidates, and also in evaluating candidates for the CEO and other executive positions at the Board’s annual talent review and succession planning session. At the annual session, the Board evaluates candidates using the development model, and reviews a candidate’s development actions, progress and performance over time. The candidate evaluations are supplemented with periodic 360-degree performance appraisals, and the Board also regularly interacts with any candidate through Board meeting presentations and at the Company’s annual leadership conferences.

Risk

The Board’s role in risk oversight at the Company is consistent with our leadership structure, with management having day-to-day responsibility for assessing and managing our risk exposure and the Board and its committees overseeing those efforts, with particular emphasis on the most significant risks facing the Company. Each of the Audit, Compensation and Nominating and Governance Committees reports to the full Board on a regular basis, including as appropriate with respect to each committee’s risk oversight activities. Since risk issues often overlap, committees from time to time request that the full Board discuss particular risks.

The Board administers its risk oversight responsibilities both through active review and discussion of key risks facing the Company and by delegating certain risk oversight responsibilities to its committees, with oversight responsibility delegated to its committees where it believes each committee’s focused domain expertise will support efficient and effective oversight, and each committee typically has responsibility with respect to risks that are associated with the purpose of, and responsibilities delegated to, that committee. The timeframe over which the Board and its committees evaluate risk typically varies depending on the nature of the risk. From time to time, the Board and/or its committees may consider inputs from outside advisors with respect to certain risks and risk trends. With respect to the manner in which the Board’s risk oversight function impacts the Board’s leadership structure, as described above, our Board believes that Ms. Filler’s management and director experience and prior tenure at Danaher help the Board to more effectively exercise its risk oversight function.

In determining to separate the position of the CEO and the Chair, and in determining the appointment of the Chair of the Board and the chairs of the committees, the Board and the Nominating and Governance Committee considered the implementation of a governance structure and appointment of chairpersons with appropriate and relevant risk management experience that would enable the Company to efficiently and effectively assess and oversee its risks.

The graphic below summarizes the primary areas of risk overseen by the Board and by each of its committees.

| | | | | | | | | | | | | | | | | | | | | | | |

Board Risks associated with Veralto's strategic plan, acquisition and capital allocation program, capital structure, liquidity, organizational structure and other significant risks, and overall risk assessment and risk management policies. |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Audit Committee Major financial risk exposures, significant legal, compliance, reputational, cybersecurity, privacy risks and climate change and overall risk assessment and risk management policies. | | Compensation Committee Risks associated with compensation policies and practices, including incentive compensation. | | Nominating and Governance Committee Risks related to corporate governance, effectiveness of Board and committee oversight and review of director candidates, conflicts of interest, director independence and sustainability (including climate). |

| | | | | | | |

| | | | | | | |

Management Responsibility for assessing and managing Veralto's risk exposure. |

| | | | | | | |

OVERSIGHT OF ENTERPRISE RISK

The Board oversees the Company’s risk management processes directly and through its committees. In general, the Board oversees the management of risks inherent in the operation of the Company’s businesses, the implementation of its strategic plan, its acquisition and capital allocation program, its capital structure and liquidity and its organizational structure, and also oversees the Company’s risk assessment and risk management policies. In addition, at least on an annual basis or more frequently as deemed appropriate by the Board, the Board reviews with senior leaders of the Company, the Company’s enterprise risk management, with particular focus on the enterprise risks and opportunities with the greatest impact and highest probability. Furthermore, at least on an annual basis or more frequently as deemed appropriate by the Board, the Board reviews our insurance policies, including our director and officer insurance policy, general liability policy, and our cyber liability insurance policy.

OVERSIGHT OF PORTFOLIO AND OPERATING SEGMENT RISK

At each Board meeting, the Board oversees the Company’s performance and execution against the strategic goals for the Company’s operating segments, overall portfolio, and innovation.

OVERSIGHT OF CYBERSECURITY RISK

The Company takes a risk-based approach to cybersecurity and has implemented cybersecurity policies throughout its operations that are designed to address cybersecurity threats and incidents.

The Company’s cybersecurity program and policies articulate the expectations and requirements with respect to acceptable use, risk management, data privacy, education and awareness, security incident management and reporting, identity and access management, vendor due diligence, security (with respect to physical assets, products, networks, and systems), security monitoring and vulnerability identification. The cybersecurity program and policies are operated by a dedicated cybersecurity operations team. The program and policies are aligned with the Company’s enterprise risk management program.

The Company’s cyber risk management program identifies, tracks, escalates, remediates, and reports risks at the corporate level and across each operating company. These risk areas include internal, product, vendor, supply chain, and external services leveraged across the Company. These risks are assessed, prioritized, and both tactically and strategically addressed via process, technology, and personnel improvements to help ensure ongoing mitigation and tracking.

The Company’s cybersecurity strategy is guided by prioritized risk, identified areas for improvement based on the National Institute for Standards and Technology (NIST) Cybersecurity Framework, and emerging business needs. This strategy is shared with the executive leadership at least annually. The Company maintains a global incident response plan, coupled with a global continuous monitoring program. This plan and program include incident alerting, comprehensive incident criticality assessments, and escalation processes to support teams, senior leadership, and the Board. This escalation process also includes cross-functional materiality determinations and applicable reporting requirements.

The Company’s cybersecurity operations team manages all facets of the security monitoring and global incident program, coordinating with a sourced managed services security provider and internal analysts across our operating companies. Applicable company employees are provided cybersecurity awareness training, which includes topics on the Company’s policies and procedures for reporting potential incidents. The Company’s cybersecurity team is continuously evaluating emerging risks, regulations, and compliance matters and updating the policies and procedures accordingly.

Cybersecurity threats, including as a result of any previous cybersecurity incidents, have not materially affected the Company, including its business strategy, results of operations or financial condition. The Company does not believe that cybersecurity threats resulting from any previous cybersecurity incidents of which it is aware are reasonably likely to materially affect the Company.

OVERSIGHT OF COMPLIANCE RISK

The Board has delegated to the Audit Committee the responsibility of exercising oversight with respect to the Company’s compliance program and Code of Conduct. Consistent with such delegation, our Chief Legal Officer and Chief Compliance Officer provide periodic reports to the Audit Committee regarding the Company’s compliance program, including updates on complaints and questions received through the Company’s Speak Up! hotline and progress on the Company’s annual compliance training. Our Chief Compliance Officer reports directly to our Chief Legal Officer. In administering our Code of Conduct, our compliance team works closely with other corporate functions, including legal, human resources, internal audit and finance, to ensure and monitor compliance. We evaluate and manage risks relating to compliance as part of our enterprise risk management program.

OVERSIGHT OF SUSTAINABILITY RISK

The Board has delegated to the Nominating and Governance Committee the responsibility of exercising oversight with respect to the Company’s sustainability programming and strategy. Consistent with such delegation, management provides periodic reports and updates to the Nominating and Governance Committee regarding the Company’s sustainability program and strategies, including the corresponding risks and opportunities, goals, progress, shareholder engagement and disclosure. Additionally, the Nominating and Governance Committee coordinates with the Audit Committee, which oversees the Company’s sustainability reporting with respect to climate change risk, and with the Compensation Committee, which oversees sustainability performance objectives linked to executive compensation. We evaluate and manage risks relating to sustainability issues, including climate-related risks, as part of our enterprise risk management program. See page 28 for further discussion on our Sustainability program. ENTERPRISE RISK MANAGEMENT COMMITTEE

In 2024, the Company established its Enterprise Risk Management (ERM) Committee (consisting of members of executive and senior management) to lead the Company’s enterprise risk management program. The ERM Committee inventories, assesses and prioritizes the most significant risks facing the Company as well as related monitoring of mitigation efforts. This oversight includes review and approval of the Company’s enterprise risk management framework and policies to ensure that they are comprehensive, robust and upgraded regularly to reflect changes in the internal and external environment.

| | | | | | | | | | | | | | |

| Board composition is critical, and, together with the Board purposefully-built as part of the Separation, Veralto continues to seek to optimize the mix of skills and expertise represented on our Board, as evidenced by the appointment of an additional independent director with new digital skills and expertise. |

| Declassification of the Board of Directors to provide for the annual election of directors after a sunset period. The classified board structure was approved by Danaher, our former parent, prior to the Separation. Our Board approved, at the recommendation of our Nominating and Governance Committee, the phased declassification of the Board, subject to the approval by our shareholders of Proposal 4A described further in this proxy. |

| Elimination of the supermajority voting requirements applicable to shares of common stock in our governance documents. The supermajority voting requirements were approved by Danaher prior to the Separation. Our Board approved, at the recommendation of our Nominating and Governance Committee, the elimination of the supermajority voting requirements, subject to the approval of our shareholders of Proposal 4B described further in this proxy. |

| In 2024, every member of the Veralto executive team had sustainability goals tied to their personal performance objectives, which are linked to compensation. |

| Implemented a sustainability program, with oversight by the Nominating and Governance Committee, and launched our inaugural and second Sustainability Reports. |

| Conducted our inaugural annual self-assessment process to assess in detail the effectiveness of the Board and each of its committees. |

| Enhanced the existing anti-overboarding provisions in our corporate governance guidelines to limit directors who are public company executives to only one additional board membership. |

The ERM Committee will periodically update the Audit Committee on its processes and at least annually, the ERM Committee will report to the Board the high priority risks identified by the ERM process and the success of mitigation efforts.

DISCLOSURE COMMITTEE

Our disclosure controls and procedures are part of, and therefore are uniformly aligned with, our risk oversight process. The Company’s Disclosure Committee (consisting of members of senior management) is responsible for maintaining and monitoring our disclosure controls and procedures. Each quarter our Disclosure Committee evaluates, with the participation of our principal executive officer and principal financial officer, the effectiveness of our disclosure controls and procedures as of the end of the period and facilitates disclosure in our periodic reports of management's conclusions regarding the effectiveness of our disclosure controls and procedures. Prior to such public disclosure, those evaluations and conclusions are discussed with the Audit Committee in connection with its review of our annual and quarterly reports, including our financial and risk disclosures contained in those reports, enabling the Board and its committees to provide effective risk oversight.

Veralto’s disclosure controls and procedures documentation specifically references our annual enterprise risk assessment process as an element of our disclosure controls and procedures, and requires membership overlap between the Disclosure Committee and ERM Committee.

Board of Directors and Committees of the Board

General

Our classified board structure was approved by the Danaher board prior to the Separation. Our Board met seven times in 2024. All directors attended 100% of the total number of meetings of the Board and of the committees of the Board on which they served held during the period they served. Veralto convenes a Board meeting in conjunction with each annual meeting of shareholders and as a general matter expects that the members of the Board will attend the annual meeting.

The membership of each of the Board’s committees as of March 24, 2025 is set forth below. While each of the committees is authorized to delegate its powers to sub-committees, none of the committees did so during 2024. The Audit, Compensation and Nominating and Governance Committees report to the Board on their actions and recommendations at each regularly scheduled Board meeting. Each such committee typically meets in executive session, without the presence of management, at its regularly scheduled meetings.

| | | | | | | | | | | |

| Name of Director | Audit | Compensation | Nominating and Governance |

| Jennifer L. Honeycutt | | | |

| Linda Filler | | | |

| Françoise Colpron | | | |

| Daniel L. Comas | | | |

| Shyam P. Kambeyanda | | | |

| William H. King | | | |

| Walter G. Lohr, Jr. | | | C |

| Heath A. Mitts | | | |

| Vijay P. Sankaran | | | |

| John T. Schwieters | C | | |

| Cindy L. Wallis-Lage | | | |

| Thomas L. Williams | | C | |

| # OF MEETINGS HELD IN 2024 | 7 | 4 | 6 |

| | | | | | | | |

| AUDIT COMMITTEE | | |