UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-23883

The 2023 ETF Series Trust

(Exact name of registrant as specified in charter)

The 2023 ETF Series Trust

c/o Foreside Management Series, LLC

Three Canal Plaza, Suite 100

Portland, ME 04101

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

1209 Orange Street

Wilmington, DE 19801

(Name and address of agent for service)

Registrant's telephone number, including area code: 1-614-416-9058

Date of fiscal year end: June 30

Date of reporting period: June 30, 2024

Item 1. Reports to Stockholders.

| (a) | Include a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1). |

Eagle Capital Select Equity ETF

ANNUAL SHAREHOLDER REPORT | June 30, 2024

The annual shareholder report contains important information about the Eagle Capital Select Equity ETF for the period of March 22, 2024 to June 30, 2024. You can find additional information about the Fund at https://www.eaglecap.com/strategy/eagle-capital-select-equity-etf#Documents-Section . You can also request this information by contacting us at (833) 782-2211.

What were the Fund’s cost for the period?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Eagle Capital Select Equity ETF | $23Footnote Reference1 | 0.80% |

| Footnote | Description |

Footnote1 | Based on the period March 22, 2024(commencement of operations) through June 30, 2024. Expenses would have been higher if based on the full reporting period. |

Management's Discussion of Fund Performance

SUMMARY OF RESULTS

For the Fiscal Year to Date ended June 30, 2024 (noting that the Fund’s commencement of operations date was 3/22/24), the Eagle Capital Select Equity ETF returned 5.23% (based on net asset value), outperforming the 4.56% return of its benchmark.

Narrow market leadership persisted, with the Magnificent 7 (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla) driving more than 100% of the S&P 500’s return during Q2 2024.

TOP PERFORMANCE CONTRIBUTORS

Industrials | A top contributor for the quarter was GE Vernova, an industrial power company that spun out of GE. The company supplies roughly one-third of the world’s electricity through its installed base of gas and wind turbines.

Healthcare | Humana, one of our managed care companies with significant exposure to the senior market, contributed positively to performance after a challenging start to the year for the sector.

Consumer Discretionary | Our Consumer Discretionary holdings, particularly our position in Amazon, also contributed to positive relative performance.

TOP PERFORMANCE DETRACTORS

Technology | While Eagle’s Technology positions, and particularly Taiwan Semiconductor, had solid performance during the period, our overall performance in the sector lagged the benchmark as we didn’t hold NVIDIA and Apple – two companies that we view as expensive.

Energy | Our exposure to the Energy sector detracted from performance, driven primarily by ConocoPhillips. The company’s announced acquisition of Marathon Oil, which was negatively received by investors, along with weaker gas prices challenged the stock.

Financial Services | Aon’s stock faced pressure in the quarter from the departure of CFO, Christa Davies, coupled with short-term noise following the NFP integration.

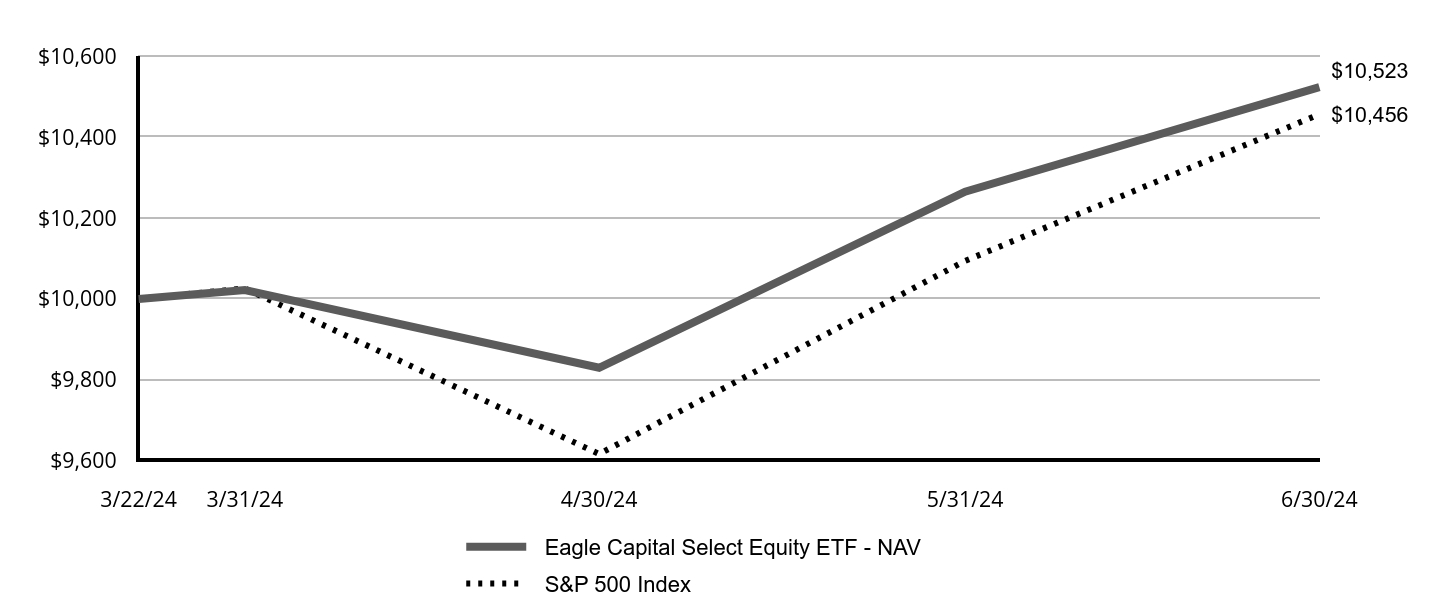

Growth of an Assumed $10,000 Investment

| Eagle Capital Select Equity ETF - NAV | S&P 500 Index |

|---|

| 3/22/24 | $10,000 | $10,000 |

| 3/31/24 | $10,022 | $10,026 |

| 4/30/24 | $9,830 | $9,617 |

| 5/31/24 | $10,265 | $10,094 |

| 6/30/24 | $10,523 | $10,456 |

| AVERAGE ANNUAL TOTAL RETURN Fund/Index | Commencement of OperationsFootnote Reference* |

|---|

| Eagle Capital Select Equity ETF - NAV | 5.23% |

| Eagle Capital Select Equity ETF - Market | 5.29% |

| S&P 500 Index | 4.56% |

| Footnote | Description |

Footnote* | Since Commencement of operations March 22, 2024 |

The fund's past performance is not a good predictor of how the fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

The following table outlines key Fund statistics that you should pay attention to:

| Fund net assets | $1,986,599,057 |

| Total advisory fees paid | $4,146,416 |

| Total number of portfolio holdings | 30 |

| Period portfolio turnover Rate | 1% |

Tabular Representation of Holdings

The table below shows the investment makeup of the Fund.

| Sectors | | % of Net Assets |

| Communication Services | | 19.0% |

| Information Technology | | 14.1% |

| Consumer Discretionary | | 13.3% |

| Health Care | | 13.1% |

| Financials | | 12.8% |

| Energy | | 11.9% |

| Industrials | | 10.9% |

| Materials | | 1.8% |

| Money Market Funds | | 3.1% |

| Liabilities in Excess of Other Assets | | (0.0)% |

| Total | | 100.0% |

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting at the website address or contact number included at the beginning of this shareholder report.

Distributed by Foreside Fund Services, LLC.

Item 2. Code of Ethics.

| (a) | The registrant, as of the end of the period covered by this report, has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party (the “Code of Ethics”). |

| | (b) | No disclosures are required by this Item 2(b). |

| (c) | During the period covered by this report, no amendments were made to the provisions of the code of ethics adopted in 2(a) above. |

| (d) | During the period covered by this report, no implicit or explicit waivers to the provisions of the code of ethics adopted in 2(a) above were granted. |

| (f) | A copy of the Code of Ethics is filed as an Exhibit hereto. |

Item 3. Audit Committee Financial Expert.

| (a)(1) | The Registrant’s board of trustees has determined that the Registrant has at least one audit committee financial expert serving on the audit committee |

| (a)(2) | The audit committee financial expert is Joan Binstock who is independent as defined in Form N-CSR Item 3(a)(2). |

Item 4. Principal Accountant Fees and Services.

Audit Fees

| | | Current Fiscal Year (1) | |

| (a) Audit Fees | | $ | 39,000 | |

| (b) Audit-Related Fees | | $ | - | |

| (c) Tax Fees(2) | | $ | 10,000 | |

| (d) All Other Fees | | $ | - | |

| (1) | No fees were required to be approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X during the current fiscal year. |

| (2) | The nature of the services includes tax compliance and tax filings. |

| (a) | The aggregate fees billed for each of the last two fiscal years for professional services rendered by the principal accountant for the audit of the registrant's annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years are $39,000 2024 and $0 for 2023. |

Audit-Related Fees

| (b) | The aggregate fees billed in each of the last two fiscal years for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant's financial statements and are not reported under paragraph (a) of this Item are $0 for 2024 and $0 for 2023. |

Tax Fees

| (c) | The aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning are $10,000 for 2024 and $0 for 2023. |

The nature of the services includes tax compliance and tax filings.

All Other Fees

| (d) | The aggregate fees billed in each of the last two fiscal years for products and services provided by the principal accountant, other than the services reported in paragraphs (a) through (c) of this Item are $0 for 2024 and $0 for 2023. |

| (e)(1) | Audit committee's pre-approval policies and procedures described in paragraph (c)(7) of Rule 2-01 of Regulation S-X. |

All services to be performed by the Registrant's principal auditors must be pre-approved by the Registrant's audit committee.

| (e)(2) | No services described in paragraphs (b) through (d) were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. |

| (g) | The aggregate non-audit fees billed by the registrant's accountant for services rendered to the registrant, and rendered to the registrant's investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant for each of the last two fiscal years of the registrant was $10,000 for 2024 and $0 for 2023. |

Item 5. Audit Committee of Listed Registrants.

Item 6. Investments.

| (a) | The Schedule of Investments is included as part of the Report to Shareholders filed under Item 7(a) of this Form. |

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a) The annual financial statements are attached herewith.

June 30, 2024

Annual Financial Statements and

Other Information

The 2023 ETF Series Trust

Eagle Capital Select Equity ETF (EAGL)

Table of Contents

| Schedule of Investments | 3 |

| Statement of Assets and Liabilities | 6 |

| Statement of Operations | 7 |

| Statement of Changes in Net Assets | 8 |

| Financial Highlights | 9 |

| Notes to Financial Statements | 10 |

| Report of Independent Registered Public Accounting Firm | 15 |

| Board Review of Investment Management Agreement | 16 |

| Additional Information | 18 |

This report is provided for the general information of shareholders and is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

Eagle Capital Select Equity ETF

Schedule of Investments

June 30, 2024

| | | Shares | | | Value | |

| Common Stocks – 96.9% | | | | | | | | |

| Communication Services – 19.0% | | | | | | | | |

| Alphabet, Inc., Class A | | | 655,566 | | | $ | 119,411,347 | |

| Charter Communications, Inc., Class A* | | | 190,525 | | | | 56,959,354 | |

| Comcast Corp., Class A | | | 1,228,181 | | | | 48,095,568 | |

| Meta Platforms, Inc., Class A | | | 212,935 | | | | 107,366,086 | |

| Netflix, Inc.* | | | 68,635 | | | | 46,320,389 | |

| | | | | | | | 378,152,744 | |

| Consumer Discretionary – 13.3% | | | | | | | | |

| Amazon.com, Inc.* | | | 849,540 | | | | 164,173,605 | |

| Hilton Worldwide Holdings, Inc. | | | 180,219 | | | | 39,323,786 | |

| Prosus NV, ADR, (China) | | | 8,409,654 | | | | 60,044,929 | |

| | | | | | | | 263,542,320 | |

| Energy – 11.9% | | | | | | | | |

| ConocoPhillips | | | 932,307 | | | | 106,637,274 | |

| Occidental Petroleum Corp. | | | 629,226 | | | | 39,660,115 | |

| Shell PLC, ADR | | | 1,249,893 | | | | 90,217,277 | |

| | | | | | | | 236,514,666 | |

| Financials – 12.8% | | | | | | | | |

| Aon PLC, Class A | | | 265,536 | | | | 77,956,059 | |

| Capital One Financial Corp. | | | 444,675 | | | | 61,565,254 | |

| Goldman Sachs Group, Inc. (The) | | | 72,554 | | | | 32,817,625 | |

| Visa, Inc., Class A | | | 138,373 | | | | 36,318,761 | |

| Wells Fargo & Co | | | 775,713 | | | | 46,069,595 | |

| | | | | | | | 254,727,294 | |

| Health Care – 13.1% | | | | | | | | |

| Bayer AG, ADR, (Germany) | | | 6,565,732 | | | | 46,222,753 | |

| Elevance Health, Inc. | | | 104,687 | | | | 56,725,698 | |

| Humana, Inc. | | | 214,646 | | | | 80,202,478 | |

| UnitedHealth Group, Inc. | | | 152,924 | | | | 77,878,076 | |

| | | | | | | | 261,029,005 | |

| Industrials – 10.9% | | | | | | | | |

| AerCap Holdings NV, (Ireland) | | | 802,765 | | | | 74,817,698 | |

| GE Vernova, Inc.* | | | 316,603 | | | | 54,300,581 | |

| Safran SA, ADR, (France) | | | 998,829 | | | | 53,187,644 | |

| Woodward, Inc. | | | 193,222 | | | | 33,694,052 | |

| | | | | | | | 215,999,975 | |

| Information Technology – 14.1% | | | | | | | | |

| Microsoft Corp. | | | 223,740 | | | | 100,000,593 | |

| SAP SE, ADR, (Germany) | | | 322,491 | | | | 65,049,659 | |

| Taiwan Semiconductor Manufacturing Co. Ltd., ADR, (Taiwan) | | | 422,659 | | | | 73,462,361 | |

| Workday, Inc., Class A* | | | 183,155 | | | | 40,946,132 | |

| | | | | | | | 279,458,745 | |

| Materials – 1.8% | | | | | | | | |

| Alcoa Corp. | | | 881,782 | | | | 35,077,288 | |

| Total Common Stocks (Cost $1,303,202,815) | | | | | | | 1,924,502,037 | |

| | | | | | | | | |

| Money Market Funds – 3.1% | | | | | | | | |

| BlackRock Liquidity Funds Treasury Trust Fund Portfolio, Institutional Class, 5.20%(a) | | | | | | | | |

| (Cost $62,399,186) | | | 62,399,186 | | | | 62,399,186 | |

See Notes to Financial Statements.

Eagle Capital Select Equity

ETF Schedule of Investments (Continued)

June 30, 2024

| | | Value | |

| Total Investments – 100.0% | | | |

| (Cost $1,365,602,001) | | $ | 1,986,901,223 | |

| Liabilities in Excess of Other Assets – (0.0)%† | | | (302,166 | ) |

| Net Assets – 100.0% | | $ | 1,986,599,057 | |

| (a) | Rate shown reflects the 7-day yield as of June 30, 2024. |

| ADR : | American Depositary Receipt |

| PLC : | Public Limited Company |

Summary of Investment Type

| Sector | | % of Net Assets | |

| Communication Services | | | 19.0 | % |

| Information Technology | | | 14.1 | % |

| Consumer Discretionary | | | 13.3 | % |

| Health Care | | | 13.1 | % |

| Financials | | | 12.8 | % |

| Energy | | | 11.9 | % |

| Industrials | | | 10.9 | % |

| Materials | | | 1.8 | % |

| Money Market Funds | | | 3.1 | % |

| Total Investments | | | 100.0 | % |

| Liabilities in Excess of Other Assets | | | (0.0 | )%† |

| Net Assets | | | 100.0 | % |

See Notes to Financial Statements.

(This page intentionally left blank)

Statement of Assets and Liabilities

June 30, 2024

| | | Eagle Capital Select Equity ETF | |

| Assets | | | |

| Investments, at fair value | | $ | 1,986,901,223 | |

| Cash | | | 22,505 | |

| Receivables: | | | | |

| Capital shares | | | 793,650 | |

| Dividends | | | 763,307 | |

| Foreign tax reclaim | | | 167,731 | |

| Total assets | | | 1,988,648,416 | |

| | | | | |

| Liabilities | | | | |

| Payables: | | | | |

| Investment advisory fees | | | 1,278,375 | |

| Securities purchased | | | 766,984 | |

| Other payables | | | 4,000 | |

| Total liabilities | | | 2,049,359 | |

| Net Assets | | $ | 1,986,599,057 | |

| | | | | |

| Net Assets Consist of | | | | |

| Paid-in capital | | $ | 1,364,620,494 | |

| Distributable earnings (loss) | | | 621,978,563 | |

| Net Assets | | $ | 1,986,599,057 | |

| Number of Common Shares outstanding | | | 75,093,490 | |

| Net Asset Value, offering and redemption price per share | | $ | 26.46 | |

| Investments, at cost | | $ | 1,365,602,001 | |

See Notes to Financial Statements.

Statement of Operations

Period Ended June 30, 2024

| | | Eagle Capital Select Equity ETF(1) | |

| Investment Income | | | | |

| Dividend income* | | $ | 7,189,070 | |

| | | | | |

| Expenses | | | | |

| Investment advisory fees | | | 4,146,416 | |

| Total expenses | | | 4,146,416 | |

| Net investment income (loss) | | | 3,042,654 | |

| | | | | |

| Net Realized and Unrealized Gain (Loss) | | | | |

| Net realized gain (loss) from: | | | | |

| Investments | | | (2,369,593 | ) |

| In-kind redemptions | | | 341,459,265 | |

| Net realized gain (loss) | | | 339,089,672 | |

| Net change in unrealized appreciation (depreciation) on: | | | | |

| Investments | | | (246,692,685 | ) |

| Net change in unrealized appreciation (depreciation) | | | (246,692,685 | ) |

| Net realized and unrealized gain (loss) | | | 92,396,987 | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | | $ | 95,439,641 | |

| * Withholding tax | | $ | 310,871 | |

| (1) | For the period March 22, 2024 (commencement of operations) through June 30, 2024. |

See Notes to Financial Statements.

Statement of Changes in Net Assets

| | | Eagle Capital

Select Equity

ETF | |

| | | For the period

March 22,

2024(1) to

June 30, 2024 | |

| Increase (Decrease) in Net Assets from Operations | | | |

| Net investment income (loss) | | $ | 3,042,654 | |

| Net realized gain (loss) | | | 339,089,672 | |

| Net change in net unrealized appreciation (depreciation) | | | (246,692,685 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 95,439,641 | |

| | | | | |

| Fund Shares Transactions | | | | |

| Proceeds from shares sold | | | 2,394,765,464 | |

| Value of shares redeemed | | | (503,706,048 | ) |

| Net increase (decrease) in net assets resulting from fund share transactions | | | 1,891,059,416 | |

| Total net increase (decrease) in net assets | | | 1,986,499,057 | |

| | | | | |

| Net Assets | | | | |

| Beginning of period | | $ | 100,000 | (2) |

| End of period | | $ | 1,986,599,057 | |

| | | | | |

| Changes in Common Shares Outstanding | | | | |

| Shares outstanding, beginning of period | | | 4,000 | (2) |

| Shares sold | | | 94,999,490 | |

| Shares redeemed | | | (19,910,000 | ) |

| Shares outstanding, end of period | | | 75,093,490 | |

| (1) | Commencement of operations. |

| (2) | Beginning capital of $100,000 was contributed in exchange for 4,000 shares of the Fund in connection with the inception of the Fund. |

See Notes to Financial Statements.

Financial Highlights

Eagle Capital Select Equity ETF Selected Per Share Data | | Period Ended June 30, 2024(a) | |

| Net Asset Value, beginning of period | | $ | 25.14 | |

| Income (loss) from investment operations: | | | | |

| Net investment income (loss)(b) | | | 0.04 | |

| Net realized and unrealized gain (loss) | | | 1.28 | (c) |

| Total from investment operations | | | 1.32 | |

| Net Asset Value, end of period | | $ | 26.46 | |

| Total Return (%) | | | 5.23 | (d) |

| Ratios to Average Net Assets and Supplemental Data | | | | |

| Net Assets, end of period ($ millions) | | $ | 1,987 | |

| Ratio of expenses (%) | | | 0.80 | (e) |

| Ratio of net investment income (loss) (%) | | | 0.59 | (e) |

| Portfolio turnover rate (%)(f) | | | 1 | (d) |

| (a) | For the period March 22, 2024 (commencement of operations) through June 30, 2024. |

| (b) | Per share numbers have been calculated using the average shares outstanding method. |

| (c) | Per share net realized and unrealized gain (loss) may not correspond with the aggregate realized and change in unrealized gains and losses in the Fund’s investments due to in-kind purchases processed at original security cost. |

| (f) | Excludes the impact of in-kind transactions related to the processing of capital share transactions in Creation Units. |

See Notes to Financial Statements.

Eagle Capital Select Equity ETF

Notes to Financial Statements

June 30, 2024

1. Organization

Eagle Capital Select Equity ETF (the “Fund”) is a newly organized, non-diversified, separate operating series of The 2023 ETF Series Trust (“Trust”), a Delaware statutory trust since January 23, 2023, that is registered with the Securities and Exchange Commission as an open-end management investment company. The Fund is managed by Eagle Capital Management, LLC, an investment adviser registered under the Investment Advisers Act of 1940, as amended, and serves as the Fund’s investment adviser (the “Adviser”).

The Fund is an actively managed exchange-traded fund (“ETF”) that seeks to attain its investment objective by utilizing a long only investment strategy and by investing primarily in the equity securities of companies that the Adviser believes are undervalued. The Fund began operations on March 22, 2024.

In connection with the Fund’s launch, a contribution of securities was made by certain investors (the “Initial Investors”) to the newly formed ETF. Each Initial Investor simultaneously and separately transferred solely a pool of diversified securities (“Contributed Assets”) to the Fund in exchange for Fund shares with a net asset value equal to the market value of the Contributed Assets on the day of the contribution (the “Contribution”). Each of the Initial Investors’ basis in the ETF shares received with respect to the Contribution is equal to each of the Initial Investors’ basis in the Contributed Assets.

On March 21, 2024 (“Contribution Date”), the Initial Investors completed a tax-free contribution under Section 351(a) of the Internal Revenue Code of 1986, as amended. The Initial Investors contributed a total market value of $1,781,803,803 on the Contribution Date, which was comprised of a cost basis of assets contributed of $913,811,896 and unrealized appreciation of $867,991,907. The Contribution resulted in the issuance of 70,869,490 shares to the Initial Investors. The Fund experienced an unrealized loss of $(246,692,685) for the period from March 22, 2024 (commencement of operations) to June 30, 2024 (the “Period”).

The Fund is classified as a non-diversified investment company under the Investment Company Act of 1940 (the “1940 Act”). A “non-diversified” classification means that the Fund is not limited by the 1940 Act with regard to the percentage of its assets that may be invested in the securities of a single issuer.

The Fund offers shares that are listed and traded on the NYSE Arca, Inc.

2. Significant Accounting Policies

The Fund is an investment company that applies the accounting and reporting guidance issued in Topic 946, “Financial Services- Investment Companies”, by the Financial Accounting Standards Board (“FASB”). The following is a summary of significant accounting policies consistently followed by the Funds. These policies are in conformity with generally accepted accounting principles (“GAAP”) in the United States of America.

(a) Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates and assumptions.

(b) Investment Valuation

The Fund’s investments are valued daily at market value or, in the absence of market value with respect to any portfolio securities, at fair value. Market value prices represent readily available market quotations such as last sale or official closing prices from a national or foreign exchange (i.e., a regulated market) and are primarily obtained from third-party pricing services. Fair value prices represent any prices not considered market value prices and are either obtained from a third-party pricing service or are determined by the Valuation Committee of the Funds’ Adviser, in accordance with valuation procedures approved by the Trust’s Board of Trustees, and in accordance with provisions of the 1940 Act and rules thereunder.

The Trust has adopted GAAP accounting principles related to fair value accounting standards which establish a definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion of changes in valuation techniques and related inputs during the period. These inputs are summarized in the three broad levels listed below:

| | • | Level 1 – Quoted prices in active markets for identical assets that the fund have the ability to access. |

| | | |

| | • | Level 2 – Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). |

| | | |

| | • | Level 3 – Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Eagle Capital Select Equity ETF

Notes to Financial Statements (Continued)

June 30, 2024

The following is a summary of the valuations as of June 30, 2024 for the Fund based upon the three levels defined above:

Eagle Capital Select Equity ETF

| Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 1,924,502,037 | | | $ | — | | | $ | — | | | $ | 1,924,502,037 | |

| Money Market Funds | | | 62,399,186 | | | | — | | | | — | | | | 62,399,186 | |

| TOTAL | | $ | 1,986,901,223 | | | $ | — | | | $ | — | | | $ | 1,986,901,223 | |

(c) Share Valuation

The net asset value (“NAV”) per share of the Fund is computed by dividing the value of the net assets of the Fund (i.e., the value of its total assets less total liabilities and withholdings) by the total number of shares of the Fund outstanding, rounded to the nearest cent.

The NAV per share of the Fund is determined as of the close of regular trading on the New York Stock Exchange (“NYSE”), generally at 4:00 p.m. Eastern time. Any assets or liabilities denominated in currencies other than the U.S. dollar are typically translated into U.S. dollars at the close of regular trading on the NYSE, generally at 4:00 p.m. Eastern time, at then current exchange rates or at such other rates as deemed appropriate.

(d) Investment Transactions and Related Income

For financial reporting purposes, investment transactions are reported on the trade date. However, for daily NAV determination, portfolio securities transactions are reflected no later than in the first calculation on the first business day following trade date. Dividend income is recorded on the ex-dividend date. Interest income is recognized on an accrual basis and includes, where applicable, the amortization of premium or accretion of discount based on effective yield. Gains or losses realized on sales of securities are determined using the specific identification method by comparing the identified cost of the security lot sold with the net sales proceeds. Dividend Income on the Statement of Operations is shown net of any foreign taxes withheld on income from foreign securities, which are provided for in accordance with a Fund’s understanding of the applicable tax rules and regulations.

(e) Foreign Currency Translation and Transactions

The accounting records of the Fund are maintained in U.S. dollars. Financial instruments and other assets and liabilities of the Fund denominated in a foreign currency, if any, are translated into U.S. dollars at current exchange rates. Purchases and sales of financial instruments, income receipts and expense payments are translated into U.S. dollars at the exchange rate on the date of the transaction. The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates from those resulting from changes in values to financial instruments. Such fluctuations are included with the net realized and unrealized gains or losses from investments. Realized foreign exchange gains or losses arise from transactions in financial instruments and foreign currencies, currency exchange fluctuations between the trade and settlement date of such transactions, and the difference between the amount of assets and liabilities recorded and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities, including financial instruments, resulting from changes in currency exchange rates. The Fund may be subject to foreign taxes related to foreign income received, capital gains on the sale of securities and certain foreign currency transactions (a portion of which may be reclaimable). All foreign taxes are recorded in accordance with the applicable regulations and rates that exist in the foreign jurisdictions in which the Fund invests.

(f) Federal Income Tax

It is the policy of the Fund to continue to qualify each year as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986 (the “Code”) and to distribute substantially all of its net investment income and capital gains, if any, to its shareholders. Therefore, no federal income tax provision is required as long as the Fund qualifies as a regulated investment company.

Management of the Fund has evaluated tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether it is more-likely-than-not (i.e., greater than 50%) that each tax position will be sustained upon examination by a taxing authority based on the technical merits of the position. A tax position that meets the more-likely-than-not recognition threshold is measured to determine the amount of benefit to recognize in the financial statements. Differences between tax positions taken in a tax return and amounts recognized in the financial statements will generally result in an increase in a liability for taxes payable (or a reduction of a tax refund receivable), including the recognition of any related interest and penalties as an operating expense. In general, tax positions taken in previous tax years remain subject to examination by tax authorities (generally three years for federal income tax purposes). The determination has been made that there are not any uncertain tax positions that would require the Fund to record a tax liability and, therefore, there is no impact to the Fund’s financial statements. The Fund’s policy is to classify interest and penalties associated with underpayment of federal and state income taxes, if any, as income tax expense on its Statements of Operations. As of June 30, 2024, the Fund did not have any interest or penalties associated with the underpayment of any income taxes.

Eagle Capital Select Equity ETF

Notes to Financial Statements (Continued)

June 30, 2024

(g) Distributions to Shareholders

The Fund pays out dividends from its net investment income annually and distributes its net capital gains, if any, to investors at least annually. The Fund may make distributions on a more frequent basis to comply with the distributions requirement of the Code, in all events in a manner consistent with the provisions of the 1940 Act.

The amount of distributions from net investment income and net realized gains are determined in accordance with federal income tax regulations, which may differ from GAAP. These “book/tax” differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature (e.g., return of capital and distribution reclassifications), such amounts are reclassified within the composition of net assets based on their federal tax basis treatment; temporary differences (e.g., wash sales and straddles) do not require a reclassification.

(h) Indemnification

Under the Fund’s organizational documents, its officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. The Fund may enter into contracts that contain representations and that provide general indemnifications. The Fund’s maximum liability exposure under these arrangements is unknown, as future claims that have not yet occurred may be made against the Fund.

3. Investment Advisory Fee and Other Transactions with Affiliates

(a) Investment Advisory and Administrative Services

Eagle Capital Management, LLC (the “Adviser”) serves as the investment advisor to the Fund pursuant to an investment advisory agreement with the Trust (the “Advisory Agreement”). For such investment advisory services, the Fund has agreed to pay the Adviser a unitary advisory fee payable at the annual rate of 0.80% of the Fund’s average daily net assets. Under the Advisory Agreement, the Adviser bears all of its own costs associated with providing services to the Fund.

Under the investment advisory agreement, the Advisor has agreed to pay all expenses incurred by the Fund except for the advisory fee; interest charges on any borrowings; taxes; brokerage commissions and other expenses incurred in placing orders for the purchase and sale of securities and other investment instruments; proxy and shareholder meeting expenses (unless the need for a shareholder meeting is caused by the Adviser, such as a change of control of the Adviser); fees and expense related to the provision of securities lending services; acquired fund fees and expenses; taxes, including accrued deferred tax liability; legal fees or expenses in connection with any arbitration, litigation, or pending or threatened arbitration or litigation, including any settlements in connection therewith; extraordinary expenses (as mutually determined by the Board and the Advisor); and distribution fees and expenses paid by the Trust under any distribution plan adopted pursuant to Rule 12b-1 under the 1940 Act.

(b) Distribution Arrangement

The Fund has adopted a Distribution Plan (the “Distribution Plan”) that allows the Fund to pay distribution fees to Foreside Fund Services, LLC (the “Distributor”) and other firms that provide distribution services (“Service Providers”). Under the Distribution Plan, if a Service Provider provides distribution services, the Fund would pay distribution fees to the Distributor at an annual rate not to exceed 0.25% of average daily net assets, pursuant to Rule 12b-1 under the 1940 Act. The Distributor would, in turn, pay the Service Provider out of its fees. The Board currently has determined not to implement any 12b-1 fees pursuant to the Plan. 12b-1 fees may only be imposed after approval by the Board.

(c) Other Servicing Agreements

The Bank of New York Mellon, a wholly-owned subsidiary of The Bank of New York Mellon Corporation, serves as Administrator, Custodian, Accounting Agent and Transfer Agent for each Fund.

Certain officers and trustees of the Trust are also officers of the Advisor and receive no compensation directly from the Fund for serving in their role.

4. Investment Transactions

Purchases and sales of investments, excluding in-kind transactions and short-term investments, for the period ended June 30, 2024 were as follows:

| Fund | | Purchases | | | Sales | |

| Eagle Capital Select Equity ETF | | $ | 473,528,223 | | | $ | 26,972,823 | |

Purchases and sales of in-kind transactions for the period ended June 30, 2024 were as follows:

| Fund | | Purchases | | | Sales | |

| Eagle Capital Select Equity ETF | | $ | 104,574,521 | | | $ | 500,828,606 | |

Eagle Capital Select Equity ETF

Notes to Financial Statements (Continued)

June 30, 2024

5. Capital Share Transactions

Fund Shares are listed and traded on the Exchange each day that the Exchange is open for business (“Business Day”). The Fund’s Shares may only be purchased and sold on the Exchange through a broker-dealer. Because the Fund’s Shares trade at market prices rather than at its NAV, Shares may trade at a price equal to NAV, greater than NAV (premium) or less than NAV (discount).

The Fund issues and redeems its shares on a continuous basis, at NAV, only in Creation Units. Except when aggregated in Creation Units, Shares are not redeemable securities of a Fund. Fund Shares may only be purchased from or redeemed directly from a Fund by certain financial institutions (“Authorized Participants”). An Authorized Participant is either (i) a broker-dealer or other participant in the clearing process through the Continuous Net Settlement System of the National Securities Clearing Corporation or (ii) a Depository Trust Company (“DTC”) participant and, in each case, must have executed a Participant Agreement with the Distributor. Creation Units are available for purchase and redemption on each Business Day and are offered and redeemed on an in-kind basis, together with the specified cash amount, or for an all cash amount.

To the extent contemplated by a Participant Agreement, in the event an Authorized Participant has submitted a redemption request in proper form but is unable to transfer all or part of the shares comprising a Creation Unit to be redeemed by the Distributor, on behalf of each Fund, by the time as set forth in a Participant Agreement, the Distributor may nonetheless accept the redemption request in reliance on the undertaking by the Authorized Participant to deliver the missing shares as soon as possible, which undertaking shall be secured by the Authorized Participant’s delivery and maintenance of collateral equal to a percentage of the market value as set forth in the Participant Agreement. A Participant Agreement may permit each Fund to use such collateral to purchase the missing shares, and could subject an Authorized Participant to liability for any shortfall between the cost of each Fund acquiring such shares and the value of the collateral.

Most retail investors will not qualify as Authorized Participants or have the resources to buy and sell whole Creation Units. Therefore, they will be unable to purchase or redeem the Shares directly from each Fund. Rather, most retail investors will purchase Shares in the secondary market with the assistance of a broker, which will be subject to customary brokerage commissions or fees.

A purchase (i.e., creation) transaction fee may be imposed for the transfer and other transaction costs associated with the purchase of Creation Units, and investors will be required to pay a creation transaction fee regardless of the number of Creation Units created in the transaction. A Fund may adjust the creation transaction fee from time to time based upon actual experience. In addition, a variable fee may be imposed for cash purchases, non-standard orders, or partial cash purchases of Creation Units. The variable fee is primarily designed to cover non-standard charges, e.g., brokerage, taxes, foreign exchange, execution, market impact, and other costs and expenses, related to the execution of trades resulting from such transaction. A Fund may adjust the non-standard charge from time to time based upon actual experience. Investors who use the services of an Authorized Participant, broker or other such intermediary may be charged a fee for such services which may include an amount for the creation transaction fee and non-standard charges. Investors are responsible for the costs of transferring the securities constituting the deposit securities to the account of the Trust. The Adviser may retain all or a portion of the transaction fee to the extent the Adviser bears the expenses that otherwise would be borne by the Trust in connection with the issuance of a Creation Unit, which the transaction fee is designed to cover. The standard Creation Unit transaction fees for Eagle Capital Select Equity ETF is $100, regardless of the number of Creation Units created in the transaction.

A redemption transaction fee may be imposed for the transfer and other transaction costs associated with the redemption of Creation Units, and Authorized Participants will be required to pay a redemption transaction fee regardless of the number of Creation Units created in the transaction. The redemption transaction fee is the same no matter how many Creation Units are being redeemed pursuant to any one redemption request. A Fund may adjust the redemption transaction fee from time to time based upon actual experience. In addition, a variable fee, payable to the Fund, may be imposed for cash redemptions, non-standard orders, or partial cash redemptions for the Fund. The variable fee is primarily designed to cover non-standard charges, e.g., brokerage, taxes, foreign exchange, execution, market impact, and other costs and expenses, related to the execution of trades resulting from such transaction. Investors who use the services of an Authorized Participant, broker or other such intermediary may be charged a fee for such services which may include an amount for the redemption transaction fees and non-standard charges. Investors are responsible for the costs of transferring the securities constituting each Fund’s securities to the account of the Trust. The non-standard charges are payable to the Fund as it incurs costs in connection with the redemption of Creation Units, the receipt of the Fund’s securities and the cash redemption amount and other transactions costs. The standard redemption transaction fees for Eagle Capital Select Equity ETF is $100, regardless of the number of Creation Units redeemed in the transaction.

6. Federal Income Taxes

At June 30, 2024, the effect of permanent book/tax reclassifications resulted in increase/(decrease) to the components of net assets as follows:

| Fund | | Distributable earnings (loss) | | | Paid-in Capital | |

| Eagle Capital Select Equity ETF | | $ | (341,452,985 | ) | | $ | 341,452,985 | |

Eagle Capital Select Equity ETF

Notes to Financial Statements (Continued)

June 30, 2024

The differences between book-basis and tax-basis components of net assets are primarily attributable to Redemption In-Kind Sales.

At June 30, 2024, the components of distributable earnings/loss on a tax basis were as follows:

| Fund | | Undistributed Ordinary Income | | | Net Unrealized Appreciation (Depreciation) | | | Accumulated Capital and Other Losses | | | Distributable earnings (loss) | |

| Eagle Capital Select Equity ETF | | $ | 3,042,654 | | | $ | 620,718,695 | | | $ | (1,782,786 | ) | | $ | 621,978,563 | |

At June 30, 2024, gross unrealized appreciation and depreciation of investments owned by the Fund, based on cost for federal income tax purposes were as follows:

| Fund | | Tax Cost | | | Gross Unrealized Appreciation | | | Gross Unrealized Depreciation | | | Net Unrealized Appreciation (Depreciation) | |

| Eagle Capital Select Equity ETF | | $ | 1,366,182,528 | | | $ | 655,134,754 | | | $ | (34,416,059 | ) | | $ | 620,718,695 | |

At June 30, 2024, for Federal income tax purposes, the Fund have capital loss carryforwards available as shown in the table below, to the extent provided by regulations, to offset future capital gains for an unlimited period. To the extent that these capital loss carryforwards are used to offset future capital gains, it is probable that the capital gains so offset will not be distributed to shareholders.

| Fund | | Short-Term | | | Long-Term | | | Total Amount | |

| Eagle Capital Select Equity ETF | | $ | — | | | $ | 1,782,786 | | | $ | 1,782,786 | |

7. Risk Factors

Significant market disruptions, such as those caused by pandemics (e.g. Covid-19 pandemic), war (e.g. Russia’s invasion of Ukraine or war in the Middle East), natural disasters, acts of terrorism, or other events, may adversely impact global economic and market activity, and contribute to significant volatility in financial markets. Any such disruptions could have an adverse impact on the prices and liquidity of the Fund’s investments.

8. Subsequent Events

In preparing these financial statements, the Trust has evaluated events and transactions for potential recognition or disclosure through the date the financial statements were available to be issued. The Trust has concluded that there are no subsequent events to note.

Report of Independent Registered Public Accounting Firm

To the Shareholders of Eagle Capital Select Equity ETF and the Board of Trustees of The 2023 ETF Series Trust:

Opinion on the Financial Statements and Financial Highlights

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Eagle Capital Select Equity ETF (the “Fund”) one of the Funds constituting The 2023 ETF Series Trust, as of June 30, 2024, the related statements of operations, changes in net assets, and financial highlights for the period from March 22, 2024 (commencement of operations) through June 30, 2024, and the related notes. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Fund as of June 30, 2024, and the results of its operations, changes in its net assets, and the financial highlights for the period from March 22, 2024 (commencement of operations) through June 30, 2024 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. Our procedures included confirmation of securities owned as of June 30, 2024, by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audit provides a reasonable basis for our opinion.

| /s/ DELOITTE & TOUCHE LLP | |

| | |

| Chicago, Illinois | |

| August 23, 2024 | |

We have served as the auditor of Eagle Capital Select Equity ETF since 2024.

Board Review of Investment Management Agreement (Unaudited)

At a meeting held on May 31, 2023 (the “Meeting”), the Board of Trustees (the “Board”) of The 2023 ETF Series Trust (“Trust”) considered and approved, for an initial two year term, the Investment Advisory Agreement (the “Agreement”) between the Trust and Eagle Capital Management, LLC (“Eagle”) with respect to the Eagle Capital Select Equity ETF (the “Fund”) pursuant to which Eagle will provide advisory services to the Fund, a new series of the Trust. The Board, which is comprised solely of Trustees who are not “interested persons” of the Trust within the meaning of the Investment Company Act of 1940 (the “Independent Trustees”), were advised by legal counsel throughout the process.

To evaluate the Agreement, the Board requested, and Eagle, the Fund’s investment adviser, provided such materials as the Board, with the advice of counsel, deemed reasonably necessary. The Board also met with representatives of Eagle at the Meeting, during which the Independent Trustees and the Eagle representatives discussed the materials that had been provided as well as other related matters concerning the Fund. In determining whether to approve the Agreement, the Board considered various factors, including (i) the nature, extent and quality of services to be provided by Eagle to the Fund; (ii) the investment objective and strategy for the Fund and, because the Fund is new and therefore has no performance record, how the Fund’s strategy might be expected to perform in the future; (iii) the profits anticipated to be realized by Eagle from providing advisory services to the Fund; (iv) fees charged to comparable funds; (v) the extent to which economies of scale would be shared as the Fund grows; and (vi) other factors the Board deemed to be relevant.

Nature, Extent and Quality of Services

The Board considered the nature, extent and quality of services to be provided by Eagle. The Board reviewed the Agreement and Eagle’s anticipated responsibilities with respect to providing investment advisory services to the Fund, including developing, implementing, and maintaining the Fund’s investment program; portfolio management, including evaluating and selecting investments for the Fund; trading portfolio securities and other investment instruments on behalf of the Fund; selecting broker-dealers to execute purchase and sale transactions; overseeing general portfolio compliance with relevant law; monitoring compliance with various policies and procedures and applicable securities regulations; periodic reporting to the Board; and implementing Board directives as they relate to the Fund.

The Board considered the background, sophistication and experience of Eagle’s senior management, including those individuals responsible for portfolio management and regulatory compliance of the Fund. The Board also considered Eagle’s extensive administrative and compliance infrastructures. The Board appreciated the fact that Eagle has deep experience and expertise serving as the investment adviser to other pooled investment vehicles.

The Board considered Eagle’s portfolio management resources, structures and practices, including those associated with monitoring and seeking to ensure the Fund’s compliance with its investment objective and policies and with applicable laws and regulations. The Board also considered information about Eagle’s overall investment management business, including the financial resources available to it needed to deliver high quality advisory services to the Fund.

Investment Performance

Because the Fund is new and had not yet commenced operations, the Board noted that there was no historical performance record to consider. The Board discussed with representatives of Eagle the proposed portfolio management team and the investment strategy to be employed in the management of the Fund’s assets. The Board considered Eagle’s reputation and experience, including other accounts managed by Eagle that employ investment strategies similar to those of the Fund.

Fees Charged to Comparable Funds

The Board reviewed the advisory fee to be paid by the Fund to Eagle under the Agreement. The Board reviewed a report prepared by Broadridge, an independent third-party, comparing the Fund’s advisory fee to those paid by a group of peer funds. The Board took into consideration that the advisory fee for the Fund is a “unitary fee,” meaning that the Fund pays no expenses other than the advisory fee and certain expenses customarily excluded from unitary fee arrangements, such as brokerage commissions, taxes, and interest. The Board noted that, under the Agreement, Eagle is responsible for compensating the Fund’s other service providers and paying the Fund’s other expenses out of its own fee and resources.

Profitability and Economies of Scale

The Board considered information concerning the anticipated profitability of Eagle from managing the Fund. The Board appreciated that, because the Fund is new, information concerning Eagle profitability with respect to the Fund was based on estimates and therefore, to a large degree, speculative. The Board noted that it will have opportunities in the future to consider and evaluate Eagle’s profitability from managing the Fund after the Fund commences operations and Eagle begins receiving advisory fees. The Board also considered whether economies of scale or other efficiencies might result as the Fund’s assets grow. As the Fund had not yet commenced operations, the Board observed that it is difficult to draw any meaningful conclusions. However, the Board noted the commitment being made by Eagle by structuring its advisory fee as a unitary fee, which effectively acts as a cap on the Fund’s total expense ratio. The Board noted that it intends to monitor for the existence of economies of scale with respect to the management of the Fund.

Board Review of Investment Management Agreement (Unaudited) (Continued)

Other Benefits

The Board considered other benefits that might be derived by Eagle from its relationship with the Fund. The Board noted that Eagle has the ability to realize soft dollar benefits from its relationship with the Fund. The Board also considered the potential benefits flowing to Eagle from sponsoring for the first time an exchange-traded fund.

Conclusion

After reviewing these and other factors, the Board concluded, in the context of its overall review of the Agreement, that the nature, extent and quality of services to be provided supported its approval of the Fund’s management agreement and that the fee to be charged under that Agreement was reasonable. In the Independent Trustees’ deliberations, each Trustee gave specific factors the weight that Trustee thought appropriate. No single factor was determinative of the Board’s decision to approve the Agreement on behalf of the Fund; rather, the Board based its determination on the total mix of information available to it.

Additional Information (Unaudited)

Proxy Voting Policies and Procedures

The Fund’s policies and procedures for voting proxies for portfolio securities and information about how the Fund voted proxies related to its portfolio securities during the most recent 12-month period ended June 30 are available on our Web site at www.eaglecap.com or on the SEC’s Web site — www.sec.gov. To obtain a written copy of the Fund’s policies and procedures without charge, upon request, call us toll free at (833) 782-2211.

Portfolio Holdings Information

The Funds are required to file their complete schedule of portfolio holdings with the SEC for their first and third fiscal quarters on Form N-PORT. Copies of the filings are available without charge, upon request on the SEC’s website at www.sec.gov and are available by calling the Trust at (833) 782-2211.

Discount & Premium Information

The Fund is new and therefore does not have any information regarding how often its shares traded on the Exchange at a price above (i.e., at a premium) or below (i.e., at a discount) its NAV. This information will be available, however, at www.eaglecap.com after the Fund’s shares have traded on the Exchange for a full calendar quarter.

Tax Information

Form 1099-DIV and other year-end tax information provide shareholders with actual calendar year amounts that should be included in their tax returns. Shareholders should consult their tax advisors.

The Fund designates the following amounts or, if subsequently determined to be different, the maximum allowable for its period ended June 30, 2024.

| Fund | | Qualified Dividend Income* | | | Dividends Received Deduction | |

| Eagle Capital Select Equity ETF | | | 0.00 | % | | | 0.00 | % |

| * | The above percentage is based on ordinary income dividends paid to shareholders during the Fund’s fiscal year. |

This report must be preceded or accompanied by a prospectus.

(This page intentionally left blank)

Investment Adviser Eagle Capital Management LLC 499 Park Avenue, 17th floor New York, NY 10022 | | | | Custodian, Administrator & Transfer Agent The Bank of New York 240 Greenwich Street New York, NY 10286 |

| | | | | |

Distributor Foreside Fund Services, LLC Three Canal Plaza, Suite 100 Portland, ME 04101 | | Independent Registered Public Accounting Firm Deloitte & Touche LLP 500 College Road East Princeton, NJ 08540 | | Legal Counsel Morgan, Lewis & Bockius LLP 1111 Pennsylvania Avenue NW Washington, DC 20004 |

(b) The registrant’s Financial Highlights are included as part of the Financial Statements filed under Item 7(a) of this Form.

Item 8. Changes in and Disagreements with Accountants for Open-End Management Investment Companies.

Not applicable.

Item 9. Proxy Disclosures for Open-End Management Investment Companies.

Not applicable.

Item 10. Remuneration Paid to Directors, Officers, and Others of Open-End Management Investment Companies.

Not applicable.

Item 11. Statement Regarding Basis for Approval of Investment Advisory Contract.

Included as part of the Financial Statements filed under item 7(a) of this Form.

Item 12. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 13. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 14. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 15. Submission of Matters to a Vote of Security Holders.

There have been no material changes to the procedures by which shareholders may recommend nominees to the registrant’s Board of Trustees.

Item 16. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended) within 90 days of the filing date and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date.

(b)There were no changes to the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940, as amended) during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 17. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

Not applicable.

Item 18. Recovery of Erroneously Awarded Compensation.

Not Applicable.

Item 19. Exhibits.

(a)(1) The registrant’s Code of Ethics is attached hereto.

(a)(2) Any policy required by the listing standards adopted pursuant to Rule 10D-1 under the Exchange Act (17 CFR 240.10D-1) by the registered national securities exchange or registered national securities association upon which the registrant’s securities are listed.

Not applicable.

(a)(3) Certifications pursuant to Rule 30a-2(a) under the 1940 Act and Section 302 of the Sarbanes-Oxley Act of 2002 are attached herewith.

(a)(4) There were no written solicitations to purchase securities under Rule 23c-1 under the Act (17 CFR 270.23c-1) sent or given during the period covered by the report by or on behalf of the Registrant to 10 or more persons.

(a)(5) There was no change in the Registrant’s independent public accountant during the period covered by the report.

(b) Certifications pursuant to Rule 30a-2(b) under the 1940 Act (17 CFR 270.30a-2(b)) and Section 906 of the Sarbanes-Oxley Act of 2002 are filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| (Registrant) | The 2023 ETF Series Trust | |

| By (Signature and Title) | /s/ Trent Statczar | |

| | Trent Statczar, President | |

| | (Principal Executive Officer) | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By (Signature and Title) | /s/ Trent Statczar | |

| | Trent Statczar, President | |

| | (Principal Executive Officer) | |

| By (Signature and Title) | /s/ Michael Minella | |

| | Michael Minella | |

| | (Principal Financial Officer) | |