Exhibit 99.1

BUSINESS COMBINATION OVERVIEW FEBRUARY 2025

About This Presentation This presentation and any accompanying materials (together with any oral statements made in connection herewith, this “Presentation”) is provided for informational purposes only and has been prepared to assist interested parties in making their own evaluation with respect to the proposed business combination (the “Proposed Business Combination”) between Inflection Point Acquisition Corp . II (“IPXX”) and USA Rare Earth, LLC (together with its direct and indirect subsidiaries, collectively, the “Company” or “USARE”) . The information contained in this Presentation does not purport to be all - inclusive or necessarily contain all the information that a prospective investor may desire in investigating a prospective investment in the securities of IPXX or USARE, and none of IPXX, USARE, or their respective representatives or affiliates makes any representation or warranty, express or implied, as to the accuracy, completeness, or reliability of the information contained in this Presentation (and any other information, whether written or oral, that has been or may be provided to you) . The information contained in this Presentation is preliminary and is subject to update, completion, revision, verification, and amendment without notice, and such changes may be material . This Presentation is being provided to you on the understanding that as a sophisticated investor, you will understand and accept its inherent limitations, will not rely on it in making any investment decision with respect to any securities that may be issued, and will use it only for purpose of discussing with your advisors your preliminary interest in investing in IPXX or USARE in connection with the Proposed Business Combination . No statement contained herein should be considered binding on any party . This Presentation (and any other information, whether written or oral, that has been or may be provided to you) constitutes confidential information, is intended for the recipient hereof only, and is provided to you on the condition that you agree that you will hold it in strict confidence and not reproduce, disclose, forward, or distribute it in whole or in part without the prior written consent of IPXX and USARE . Completion of the Proposed Business Combination is subject to, among other matters, approval by IPXX’s shareholders and the satisfaction of the closing conditions of the business combination agreement . No assurances can be given that the Proposed Business Combination will be consummated on the terms or in the timeframe currently contemplated, if at all . No Offer or Solicitation This Presentation does not constitute (i) a solicitation of a proxy, consent, or authorization with respect to any securities or in respect of the Proposed Business Combination, or (ii) an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any security of IPXX, USARE, or any of their respective affiliates . No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933 , as amended (the “Securities Act”), or an exemption therefrom, nor shall any sale of securities in any states or jurisdictions in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction be effected . You should not construe this Presentation as legal, tax, accounting or investment advice, or a recommendation . You should consult your own counsel, tax, and financial advisors as to legal and other considerations concerning the matters described in this Presentation and, by accepting this Presentation, you confirm that you are not relying upon the information contained in this Presentation to make any decision, investment or otherwise . No securities commission or securities regulatory authority in the United States or any other jurisdiction has in any way passed upon the merits of the Proposed Business Combination or the accuracy or adequacy of this Presentation . By accepting this Presentation, you acknowledge that you are (i) aware that the United States securities laws prohibit any person who has material, non - public information concerning a company from purchasing or selling securities of such company or from communication such information to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell such securities, and (ii) familiar with the Securities Exchange Act of 1934 , as amended, and the rules and regulations promulgated thereunder (collectively, the “Exchange Act”), and that you will neither use, nor cause any third - party to use, this Presentation or any information contained in this Presentation in contravention of the Exchange Act, including, without limitation, Rule 10 b - 5 thereunder . Cautionary Note Regarding Forward - Looking Statements This Presentation includes “forward - looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 . These forward - looking statements may include, without limitation, statements regarding or similar to : estimates and forecasts of financial and operational metrics ; plans, goals, ambitions, targets, future business and operations regarding future mining capabilities, operations, manufacturing capacity and plant performance ; projections of market opportunity and market share ; estimates and projections of adjacent industry sector opportunities ; USARE’s commercialization costs and timeline ; USARE’s ability to timely and effectively meet construction and mining timelines and scale its production and manufacturing processes ; USARE’s ability to maintain, protect, and enhance its intellectual property ; development of favorable regulations and government demand, contracts, and incentives affecting the markets in which USARE operates ; USARE’s ability to receive and/or maintain the necessary permits and other government approvals necessary to operate its business ; any estimates with respect to the rare earth and critical element and mineral deposits in the Round Top Deposit ; IPXX’s and USARE’s expectations with respect to future performance of USARE’s (and, after the Proposed Business Combination, the Combined Company’s) business ; the expected funding of the PIPE investment and any additional pre - funded investment, to the extent they remain unfunded ; anticipated financial impacts of the Proposed Business Combination ; the satisfaction of the closing conditions to the Proposed Business Combination ; and the timing of the completion of the Proposed Business Combination . For example, projections of future enterprise value, revenue, market share, and other metrics are forward - looking statements . In some cases, you can identify forward - looking statements by terminology such as “anticipate,” “believe,” “continue” “estimate,” “expect,” “intend,” “may,” “potential,” “predict,” “should,” or “will,” or, or the negatives of these terms or variations of them or similar terminology, although not all forward - looking statements contain such identifying words . 2 Disclaimer

Disclaimer (2) 3 These forward - looking statements are based upon estimates and assumptions that, while considered reasonable by IPXX, USARE, and their respective management, as the case may be, are inherently uncertain . These forward - looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction, or a definitive statement of fact or probability . Actual events and circumstances are difficult or impossible to predict and will differ from assumptions . Many actual events and circumstances are beyond the control of IPXX and USARE . Such forward - looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward - looking statements . Factors that may cause actual results to differ materially from current expectations include, but are not limited to : ( 1 ) changes in domestic and foreign business, market, financial, political conditions, and in applicable laws and regulations, ( 2 ) the occurrence of any event, change or other circumstances that could give rise to the termination of definitive agreements and any negotiations with respect to the Proposed Business Combination ; ( 3 ) the outcome of any legal proceedings that may be instituted against IPXX, USARE, the Combined Company, or others ; ( 4 ) the inability to complete the Proposed Business Combination due to the failure to obtain approval of the stockholders of IPXX for the Proposed Business Combination or to satisfy other conditions to closing ; ( 5 ) changes to the proposed structure of the Proposed Business Combination that may be required or appropriate as a result of applicable laws or regulations ; ( 6 ) the ability to meet stock exchange listing standards following the consummation of the Proposed Business Combination ; ( 7 ) the risk that the Proposed Business Combination disrupts current plans and operations of IPXX or USARE as a result of the announcement and consummation of the Proposed Business Combination ; ( 8 ) the ability to recognize the anticipated benefits of the Proposed Business Combination, which may be affected by, among other things : competition, the ability of the Combined Company to grow and manage growth profitably, the ability of the Combined Company to build or maintain relationships with customers and suppliers and retain its management and key employees, the supply and demand for rare earth magnets and minerals, the timing and amount of future production, costs of production, capital expenditures and requirements for additional capital, timing of future cash flow provided by operating activities, if any, uncertainty in any mineral estimates, uncertainty in any geological, metallurgical, and geotechnical studies and opinions, and transportation risks ; ( 9 ) costs related to the Proposed Business Combination ; ( 10 ) the possibility that USARE or the Combined Company may be adversely affected by other economic, business, and/or competitive factors ; ( 11 ) estimates of expenses and profitability and underlying assumptions with respect to stockholder redemptions and purchase price and other adjustments ; and ( 12 ) risks related to the development of USARE's magnet production facility and the timing of expected production milestones, and ( 13 ) other risks and uncertainties set forth in Appendix A of this Presentation, the section entitled “Risk Factors” and “Cautionary Note Regarding Forward - Looking Statements” in IPXX’s final prospectus relating to its initial public offering dated May 24 , 2023 , and the sections with the same titles in the registration statement on Form S - 4 relating to the Proposed Business Combination (as amended or supplemented from time to time, the "Registration Statement"), and in subsequent IPXX filings with the U . S . Securities and Exchange Commission (the “SEC”), including periodic Exchange Act reports filed with the SEC such as its Annual Reports on Form 10 - K, Quarterly Reports on Form 10 - Q, and Current Reports on Form 8 - K . The recipient of this Presentation should carefully consider the foregoing risk factors and the other risks and uncertainties which will be more fully described in the “Risk Factors” section of the Registration Statement discussed below and other documents filed by IPXX from time to time with the SEC . If any of these risks materialize or USARE’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward - looking statements . There may be additional risks that neither IPXX nor USARE presently know or that they currently believe are immaterial that could also cause actual results to differ from those contained in the forward - looking statements . In addition, forward - looking statements reflect IPXX and USARE’s expectations, plans, or forecasts of future events and views as of the date of this Presentation . Nothing in this communication should be regarded as a representation by any person that the forward - looking statements set forth herein will be achieved or that any of the contemplated results of such forward - looking statements will be achieved . These forward - looking statements speak only as of the date of this Presentation . IPXX, USARE, and their respective representatives and affiliates specifically disclaim any obligation to, and do not intend to, update or revise these forward - looking statements, whether as a result of new information, future events, or otherwise, except as may be required under applicable securities law . Accordingly, these forward - looking statements should not be relied upon as representing IPXX’s, USARE’s, or any of their respective representatives or affiliates’ assessments as of any date subsequent to the date of this Presentation, and therefore undue reliance should not be placed upon the forward - looking statements . This Presentation contains preliminary information only, is subject to change at any time, and is not, and should not be assumed to be, complete or constitute all of the information necessary to adequately make an informed decision regarding any potential investment in connection with the Proposed Business Combination . Additional Information About the Proposed Business Combination and Where to Find It The Proposed Business Combination will be submitted to the shareholders of IPXX for their consideration . The Registration Statement includes include a preliminary proxy statement/prospectus and certain other related documents, which will serve as both the proxy statement to be distributed to IPXX’s shareholders in connection with IPXX’s solicitation for proxies for the vote by IPXX’s shareholders in connection with the Proposed Business Combination and other matters described in the Registration Statement, as well as the prospectus relating to the offer and sale of the securities to be issued (or deemed issued) to IPXX’s securityholders and USARE’s equityholders in connection with the completion of the Proposed Business Combination . After the Registration Statement is declared effective, IPXX will mail a definitive proxy statement and other relevant documents to its shareholders as of the record date established for voting on the Proposed Business Combination . IPXX’s shareholders and other interested persons are advised to read the Registration Statement, the preliminary proxy statement/prospectus included in the Registration Statement and any amendments thereto and, once available, the definitive proxy statement/prospectus and documents incorporated by reference therein filed in connection with the Proposed Business Combination, in connection with IPXX’s solicitation of proxies for its extraordinary general meeting to be held to approve, among other things, the Proposed Business Combination, as well as other documents filed with the SEC in connection with the Proposed Business Combination, as these documents contain, or will contain, important information about IPXX, USARE, and the Proposed Business Combination .

Disclaimer (3) 4 Securityholders of IPXX and equity holders of USARE may obtain a copy of the preliminary or definitive proxy statement/prospectus, once available, as well as other documents filed by IPXX with the SEC that will or may be incorporated by reference in the proxy statement/prospectus, without charge, at the SEC’s website located at www . sec . gov or by directing a written request to IPXX at Inflection Point Acquisition Corp . II, 167 Madison Avenue Suite 205 # 1017 New York, New York 10016 . Participants in the Solicitation of Proxies IPXX and its directors and executive officers may be deemed participants in the solicitation of proxies from IPXX’s stockholders with respect to the Proposed Business Combination . A list of the names of those directors and executive officers and a description of their interests in IPXX is contained in the Registration Statement in the sections entitled "Beneficial Ownership of Securities" and “The Business Combination — Interests of Certain Inflection Point Persons in the Business Combination” of the Registration Statement, the latest amendment of which is available free of charge at the SEC’s website at www . sec . gov and at the following URL : https : //www . sec . gov/Archives/edgar/data/ 1787434 / 000121390025000922 /ea 0220524 - 02 . htm . USARE’s managers and executive officers may also be deemed to be participants in the solicitation of proxies from the stockholders of Inflection Point in connection with the Proposed Business Combination . A list of the names of such managers and executive officers and information regarding their interests in the Proposed Business Combination has been and will be included in the sections entitled “Beneficial Ownership of Securities” and “The Business Combination Proposal — Interests of the USARE Directors and Executive Officers” of the Registration Statement, the latest amendment of which is available free of charge at the SEC’s website at https : //www . sec . gov/ix?doc=/Archives/edgar/data/ 0001970622 / 000121390025000922 /ea 0220524 - 02 . htm . Industry and Market Data This Presentation has been prepared by IPXX and USARE and includes market data and other statistical information from third - party sources, including independent industry publications, government publications, and other published independent sources . Some data is also based on the estimates of IPXX and/or USARE, which are derived from their respective review of internal sources as well as third - party sources including those described above . None of IPXX, USARE, or any of their respective representatives or affiliates has independently verified any third - party information and cannot guarantee its accuracy or completeness . Trademarks and Trade Names IPXX and USARE own or have rights to various trademarks, service marks, trade names, and copyrights that they use in connection with the operation of their respective businesses . This Presentation also contains trademarks, service marks, and/or trade names of third parties, which are the property of their respective owners . The use or display of third parties’ trademarks, service marks, trade names, and/or products in this Presentation is not intended to, and does not, imply a relationship with IPXX or USARE, or an endorsement or sponsorship by or of IPXX or USARE . Solely for convenience, the trademarks, service marks, and/or trade names referred to in this Presentation may appear without the ©, TM, or SM symbols, but such references are not intended to indicate, in anyway, that IPXX or USARE, or the applicable rights owner will not asset, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks, and/or trade names . Certain Defined Terms For purposes of this Presentation, ( 1 ) the term “Combined Company” refers to the Company subsequent to the close of the Proposed Business Combination ; ( 2 ) the terms “our”, “we”, and similar terms refer to USARE prior to the close of the Proposed Business Combination and to the Combined Company subsequent to the close of the Proposed Business Combination ; ( 3 ) the term “Round Top Deposit” means the rare earth and critical minerals deposits at Round Top Mountain ; ( 4 ) “Round Top Mountain” means that certain mountain known as "Round Top mountain" located at the western end of the Sierra Blanca area in Hudspeth County, Texas near the town of Sierra Blanca ; ( 5 ) the term “Round Top Project” means USARE's (and the Combined Company's, after the consummation of the Proposed Business Combination) operations and rights related to Round Top Mountain and the Round Top Deposit, including, but not limited to, land rights, water rights, and USARE's Wheat Ridge, Colorado facility, which support's USARE's operations at Round Top Mountain ; ( 6 ) the terms "plant" and "Stillwater Facility" refer to our rare earth magnet manufacturing facility in Stillwater, Oklahoma . No Incorporation by Reference The information contained in any hyperlinks or the third - party citations referenced in this Presentation are not incorporated by reference into this Presentation. The contents of any website of IPXX or USARE are not incorporated herein by reference.

Our mission is to establish a U.S. rare earth magnet supply chain supporting the future state of energy, mobility, and national security

A Unique Value Creation Opportunity We’re Building a 310k sqf Rare Earth Magnet Manufacturing Facility to Support a $41B (1) Market • Revenue potential up to an estimated $700M - $800M in revenue (2) at full 4,800 ton nameplate annual capacity in Oklahoma • Commissioning of initial line to support 1,200 ton nameplate annual capacity planned for 2026 • We expect to begin prototyping to potential customers in Q2 2025 after anticipated Q1 commissioning of our Innovations Lab • Focus on quality and speed to revenue with a variety of customers, while planning and building for a higher volume future We Control Mining Rights to Round Top: a Unique Deposit of Heavy Rare Earth and Other Critical Minerals • 15 of 17 rare earths, significant gallium, beryllium and lithium deposits - all critical to commercial and defense technologies • All heavy rare earths, such as dysprosium and terbium, are present – a significant differentiator to other mines • We believe fairly low costs today could potentially unlock tremendous value as we hit key milestones Development of In - House Mineral Processing Capabilities Well Advanced • China controls over 90% of processing capabilities globally today – including those of our closest competitors • We have been developing our own in - house Continuous Ion Exchange (CIX) process which is now well advanced • We have successfully separated materials from our Round Top Deposit at pilot scale, including dysprosium and terbium • Significant progress has been made toward achieving a flow sheet that would allow transition into pre - feasibility work at Round Top We Have the Know How and Team to Execute Our Strategy • We have key magnet and rare earth expertise in - house to support engineering of and production at plant and mine • Our initial supply chain for feedstock is in place to support manufacturing in 2026 and 2027 • Focus on filling out the team in 2025 to support rapid growth in coming years Entering into a Proposed Business Combination with Inflection Point Acquisition Corp. II (“IPXX”) • Post - transaction combined value of approximately $902.6 million (excluding earn - out achievement) (3) • Alignment of incentives of sponsor and new investors including up to 12 - month lock - ups on holdings and earn - out schedules based on success (4) (1) : Estimated total addressable market for 2035 estimated by management from data provided by industry reports. Assumes pricing of at least avg. sales price per kg of $125 and excludes China demand. (2) : This is a current management estimate only and is subject to change. These figures are dependent on product mix and market pricing at that time and may not be updated in the future to account for changes in circumstances or the applicable market pricing. (3) : Assumes USARE value of $800M, SPAC rollover and PIPE of $43M. 6 (4): Lock up periods include (i) a six - month lock - up period on the transfer of shares of the combined company and (ii) an additional six - month period of restricted ability to transfer more than 50% of their respective holdings. Lock - ups are subject to waiver in the Company's discretion. Certain waivers are likely to be needed, including in connection with Nasdaq listing requirements.

Our Story Is About Execution, Not New Technology We know how to build - out and commission the plant. Potential customers want to secure their supply chains - we have the answer. Mining a Low - Cost, High Value Option We believe the relatively low spend to establish a preliminary feasibility study today could unlock high value if successful. (1): This is a current management estimate only and is subject to change. These figures are dependent on product mix and market pricing at that time and may not be updated in the future to account for changes Magnet Manufacturing We have among the best magnet expertise in the business building our plant, supported by one of the strongest engineering firms in the United States. Scalable Business (1) Our plant, once fully built out to current plans, should support up to $700M - $800M in estimated annual revenue and our first line up to $200M. We have the land to expand further. Equipment and Process Our base magnet manufacturing equipment was bought from a multinational manufacturing and construction equipment company and has proven capability in addition to being supported by our highly experienced engineering team. in circumstances or the applicable market pricing. 7

Fast growing market expected to continue for the next decade

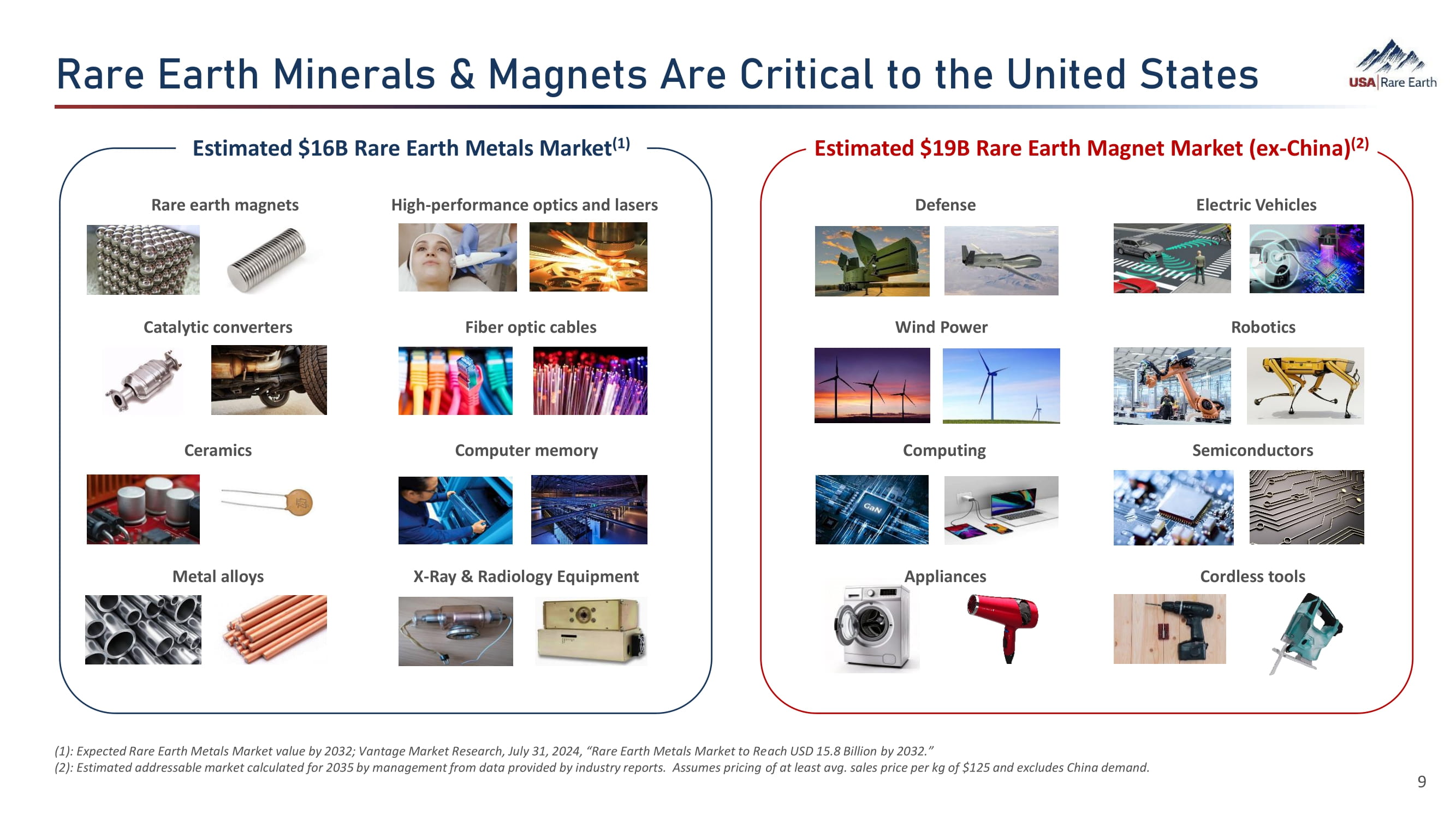

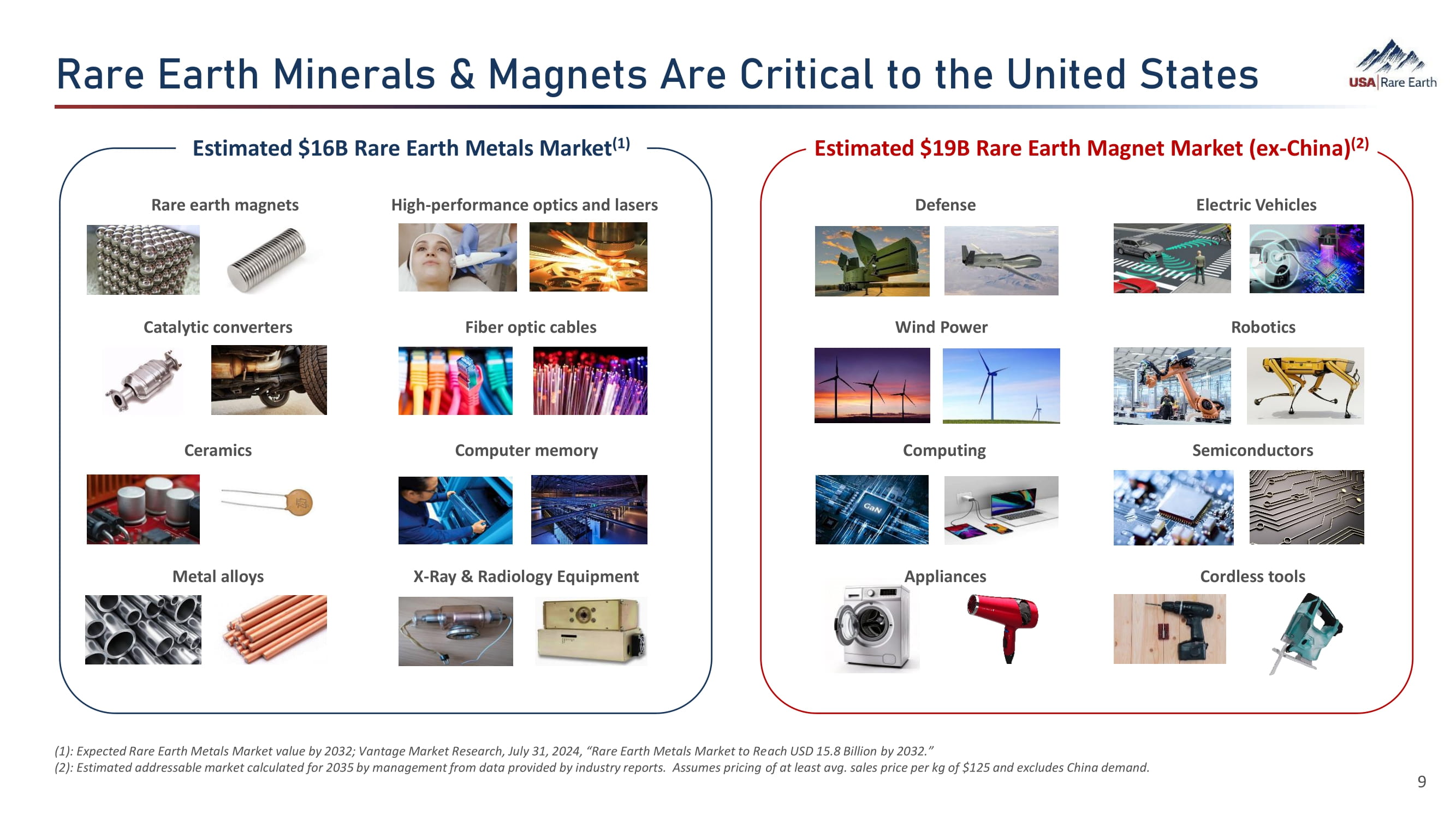

Rare Earth Minerals & Magnets Are Critical to the United States (1): Expected Rare Earth Metals Market value by 2032; Vantage Market Research, July 31, 2024, “Rare Earth Metals Market to Reach USD 15.8 Billion by 2032.” Catalytic converters Fiber optic cables Wind Power Robotics Ceramics Computer memory Computing Semiconductors Metal alloys X - Ray & Radiology Equipment Appliances Cordless tools Estimated $16B Rare Earth Metals Market (1) Estimated $19B Rare Earth Magnet Market (ex - China) (2) Rare earth magnets High - performance optics and lasers Defense Electric Vehicles (2): Estimated addressable market calculated for 2035 by management from data provided by industry reports. Assumes pricing of at least avg. sales price per kg of $125 and excludes China demand. 9

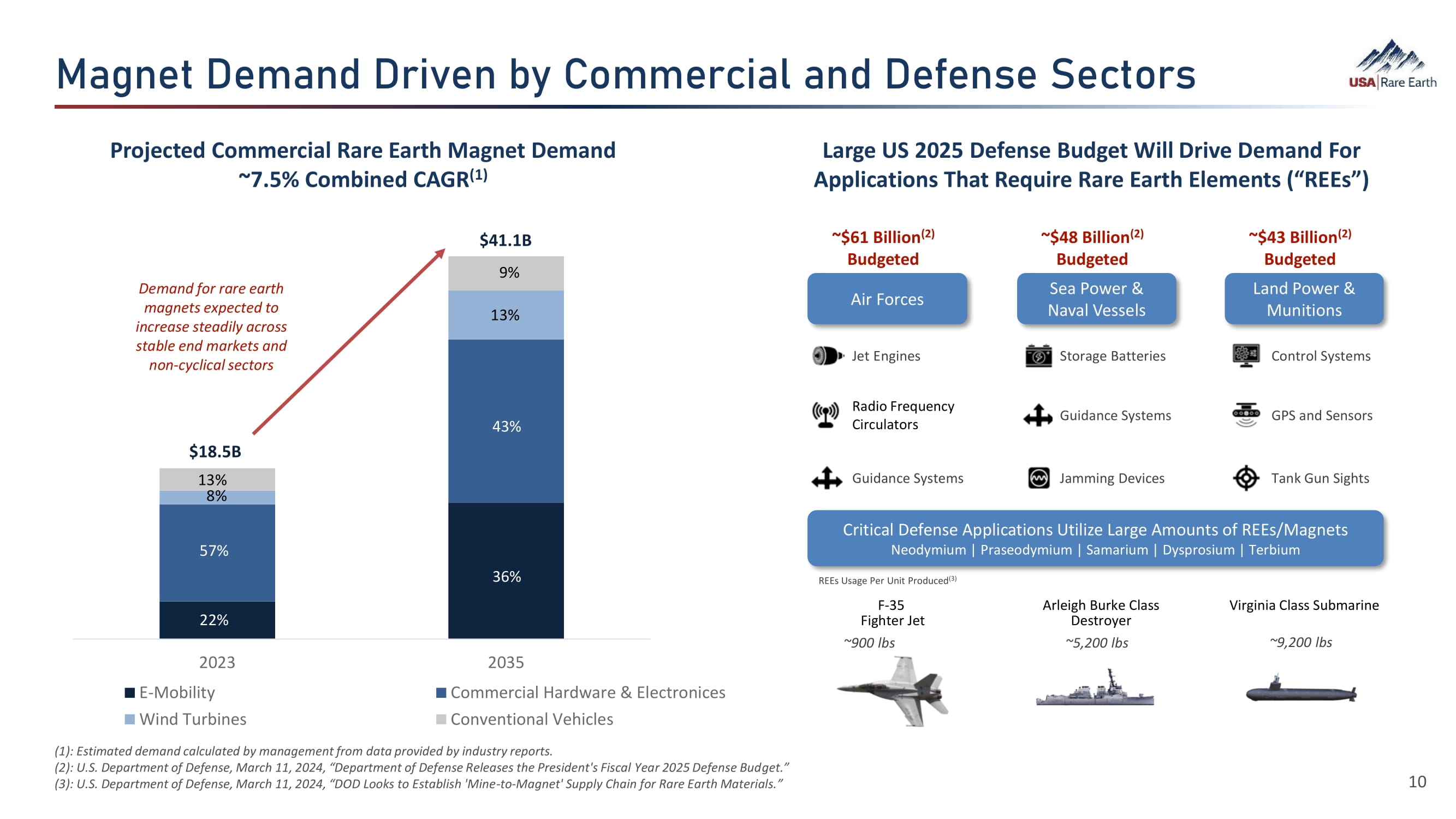

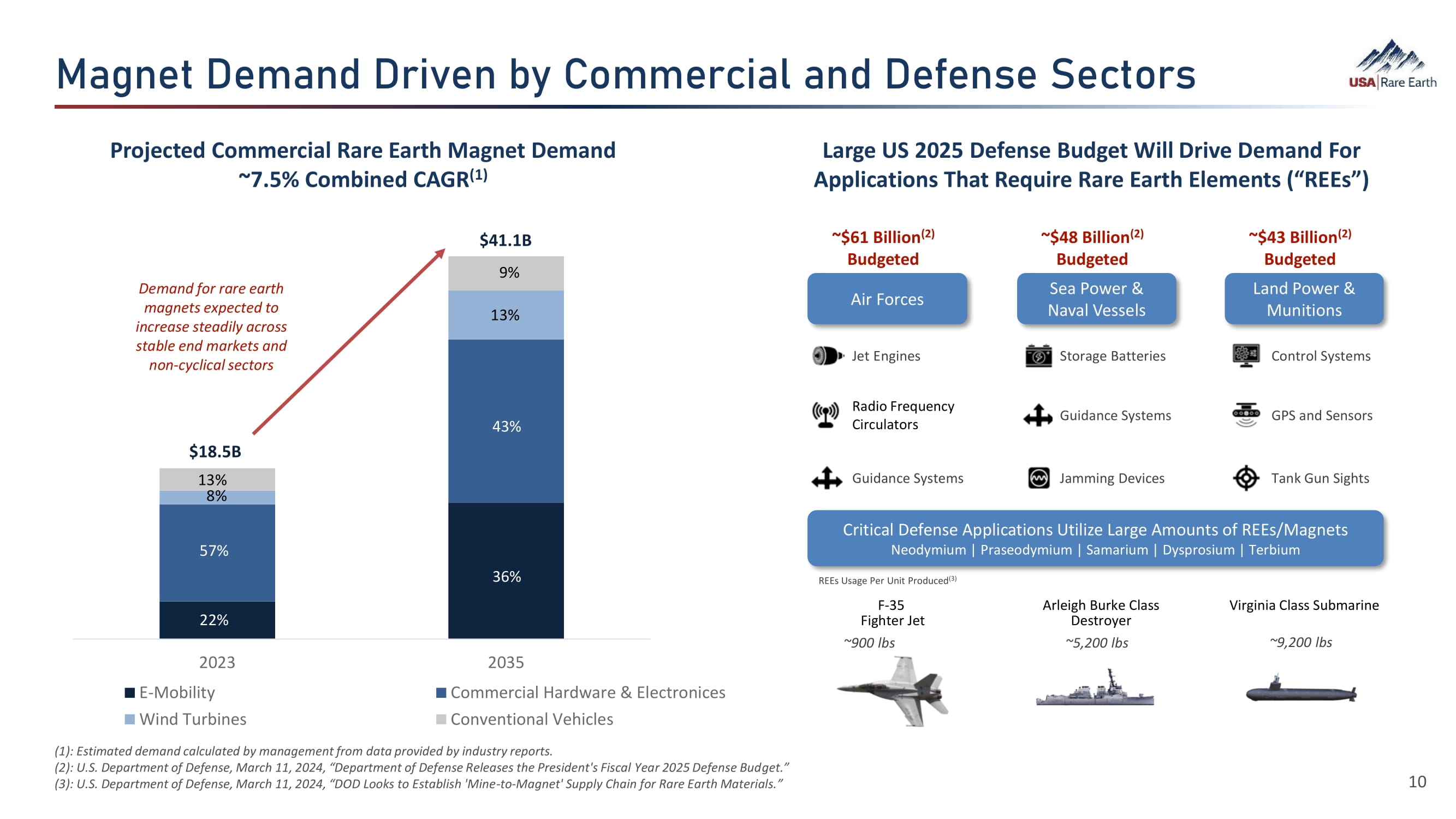

Magnet Demand Driven by Commercial and Defense Sectors (1) : Estimated demand calculated by management from data provided by industry reports. (2) : U.S. Department of Defense, March 11, 2024, “Department of Defense Releases the President's Fiscal Year 2025 Defense Budget.” (3) : U.S. Department of Defense, March 11, 2024, “DOD Looks to Establish 'Mine - to - Magnet' Supply Chain for Rare Earth Materials.” 10 Projected Commercial Rare Earth Magnet Demand ~7.5% Combined CAGR (1) Large US 2025 Defense Budget Will Drive Demand For Applications That Require Rare Earth Elements (“REEs”) $41.1B Demand for rare earth magnets expected to increase steadily across stable end markets and non - cyclical sectors $18.5B Guidance Systems Jamming Devices Tank Gun Sights Guidance Systems GPS and Sensors Radio Frequency Circulators Air Forces ~$48 Billion (2) Budgeted Sea Power & Naval Vessels ~$43 Billion (2) Budgeted Land Power & Munitions F - 35 Fighter Jet ~900 lbs Arleigh Burke Class Destroyer ~5,200 lbs Virginia Class Submarine ~9,200 lbs Critical Defense Applications Utilize Large Amounts of REEs/Magnets Neodymium | Praseodymium | Samarium | Dysprosium | Terbium ~$61 Billion (2) Budgeted REEs Usage Per Unit Produced (3) Jet Engines Storage Batteries Control Systems 2023 E - Mobility Wind Turbines 2035 Commercial Hardware & Electronices Conventional Vehicles 22% 57% 8% 13% 36% 43% 13% 9%

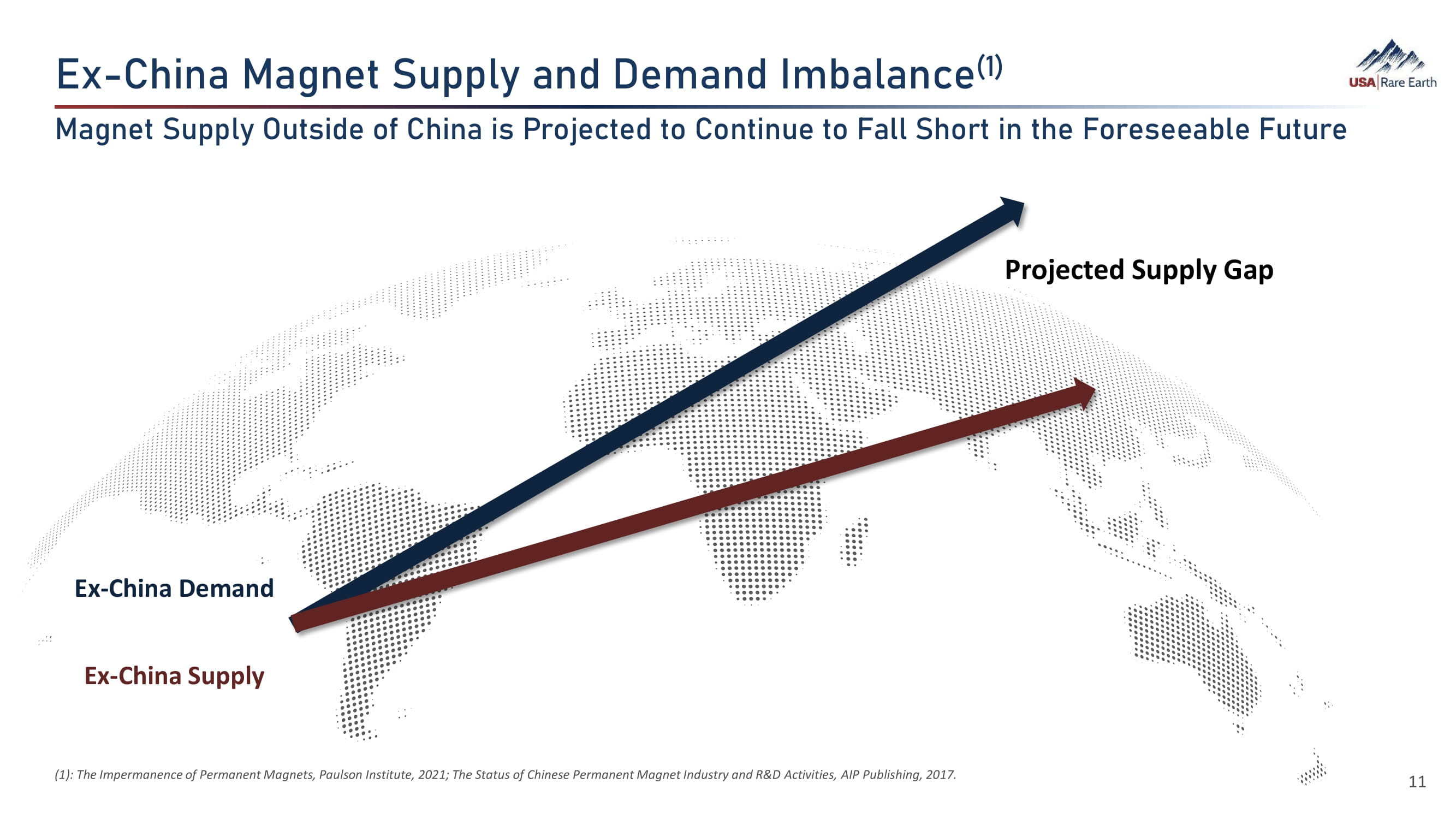

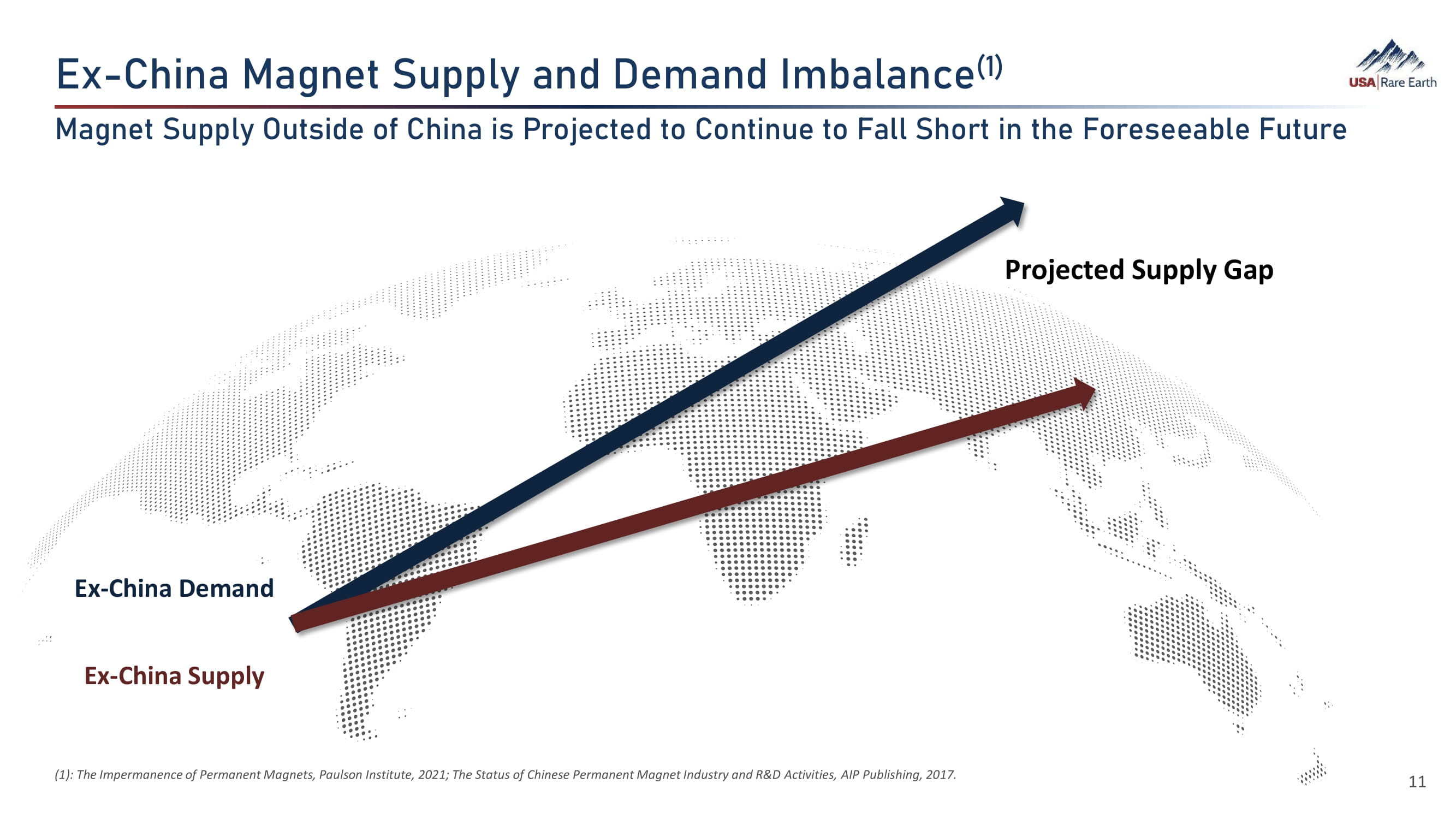

Ex - China Magnet Supply and Demand Imbalance (1) (1): The Impermanence of Permanent Magnets, Paulson Institute, 2021; The Status of Chinese Permanent Magnet Industry and R&D Activities, AIP Publishing, 2017. 11 Magnet Supply Outside of China is Projected to Continue to Fall Short in the Foreseeable Future Ex - China Demand Ex - China Supply Projected Supply Gap

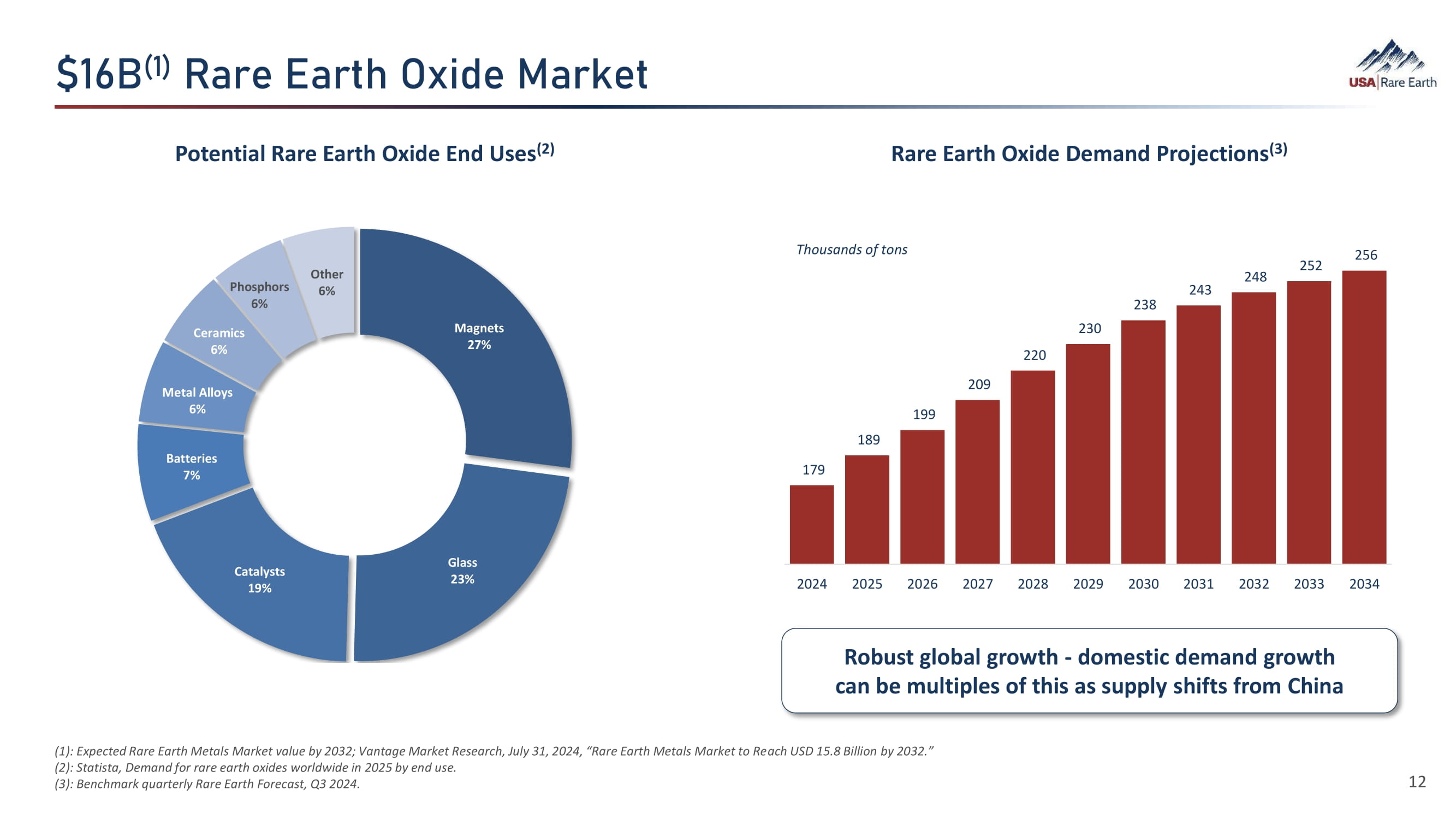

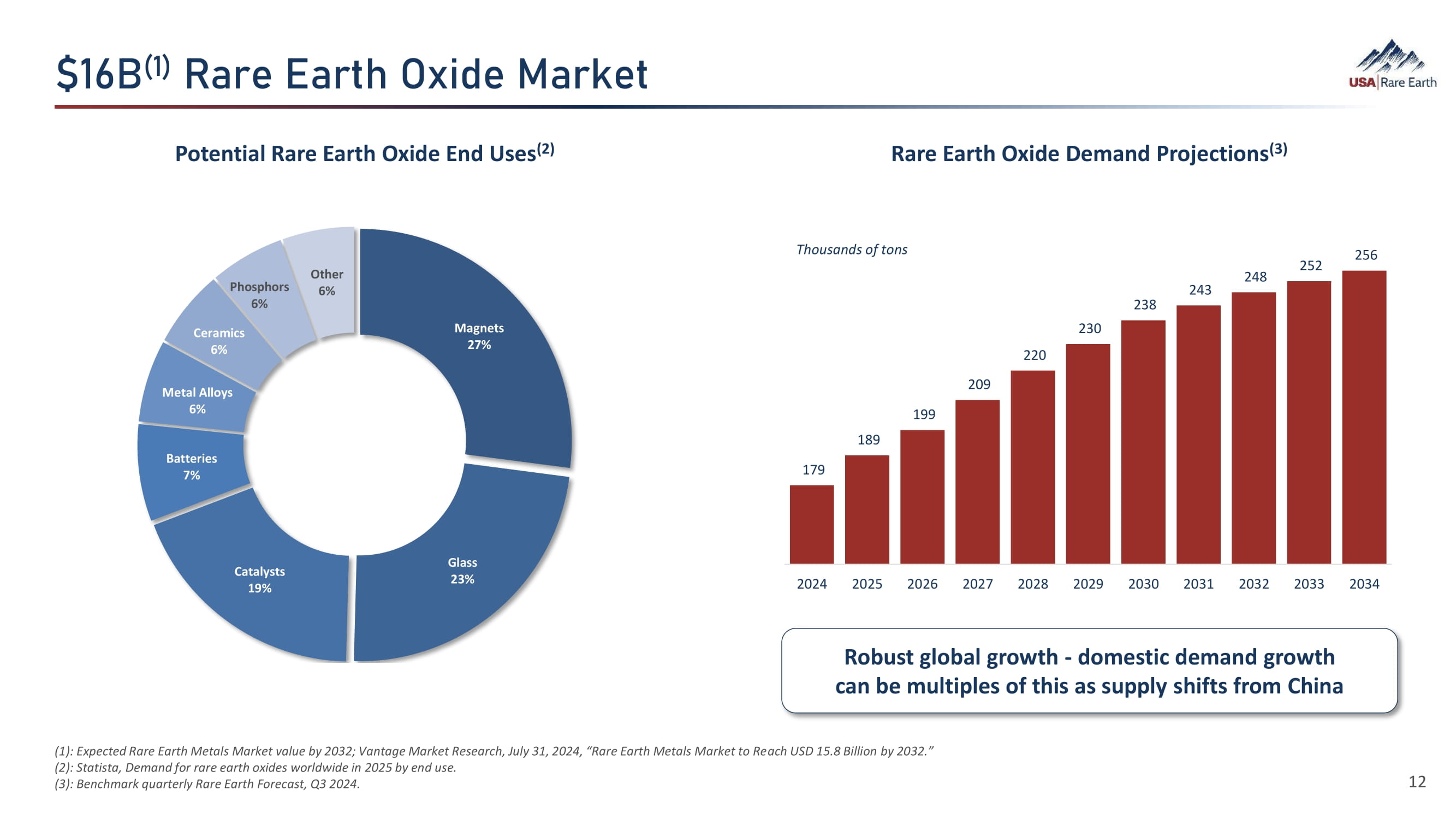

$16B (1) Rare Earth Oxide Market (1) : Expected Rare Earth Metals Market value by 2032; Vantage Market Research, July 31, 2024, “Rare Earth Metals Market to Reach USD 15.8 Billion by 2032.” (2) : Statista, Demand for rare earth oxides worldwide in 2025 by end use. (3) : Benchmark quarterly Rare Earth Forecast, Q3 2024. 12 179 189 199 209 220 230 238 243 248 252 256 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 Thousands of tons Robust global growth - domestic demand growth can be multiples of this as supply shifts from China Magnets 27% Glass 23% Catalysts 19% Batteries 7% Metal Alloys 6% Ceramics 6% Phosphors 6% Other 6% Potential Rare Earth Oxide End Uses (2) Rare Earth Oxide Demand Projections (3)

Gallium Beryllium Other Tech Metals in Round Top Deposit • Semiconductors - commercial and defense • Nuclear weapons • Photovoltaic cells • Aerospace • Wireless infrastructure, cable transmission • Optical fibers • Nuclear power • X - rays • Radio communications • Military radar • MRIs • Metal alloys 13 Source: The Business Research Company - Global Market Research Reports. Gallium Global Market Size estimated to reach $5.4 billion in the next three years Beryllium Global Market Size estimated to reach $130 million in the next seven years Applications / Uses

China dominates critical rare earth mining, processing and magnet manufacturing at a time of rising geopolitical tensions and tariffs, which increases the risk to supply for critical commercial and defense technologies

Current US Administration Committed to Changing Course Marco Rubio Secretary of State 2024 Senate confirmation hearing "If we stay on the road we’re on right now, in less than 10 years , virtually everything that matters to us will depend on whether China allows us to have it or not . Everything from the blood pressure medicine we take, to what movies we get to watch, and everything in between … . They have come to dominate the critical mineral industry [and] supplies throughout the world . … Even those who want to see more electric cars, no matter where you make them, those batteries are almost entirely dependent on … [China] . So, if we don't change course, we’re going to live in a world where everything that matters to us on a daily basis, from our security to our health, will be dependent on whether the Chinese allow us to have it or not . That is an unacceptable outcome . ” 15

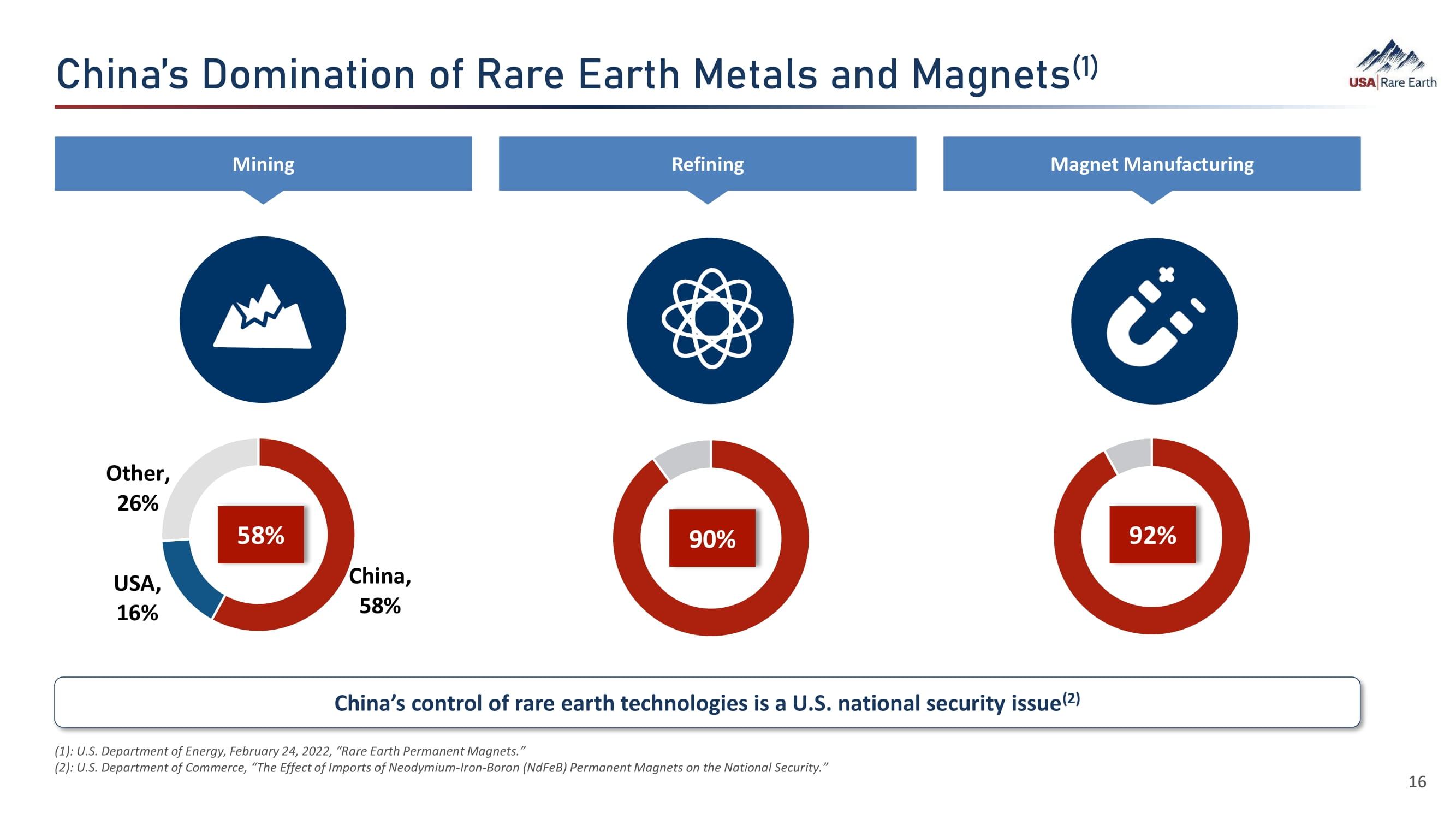

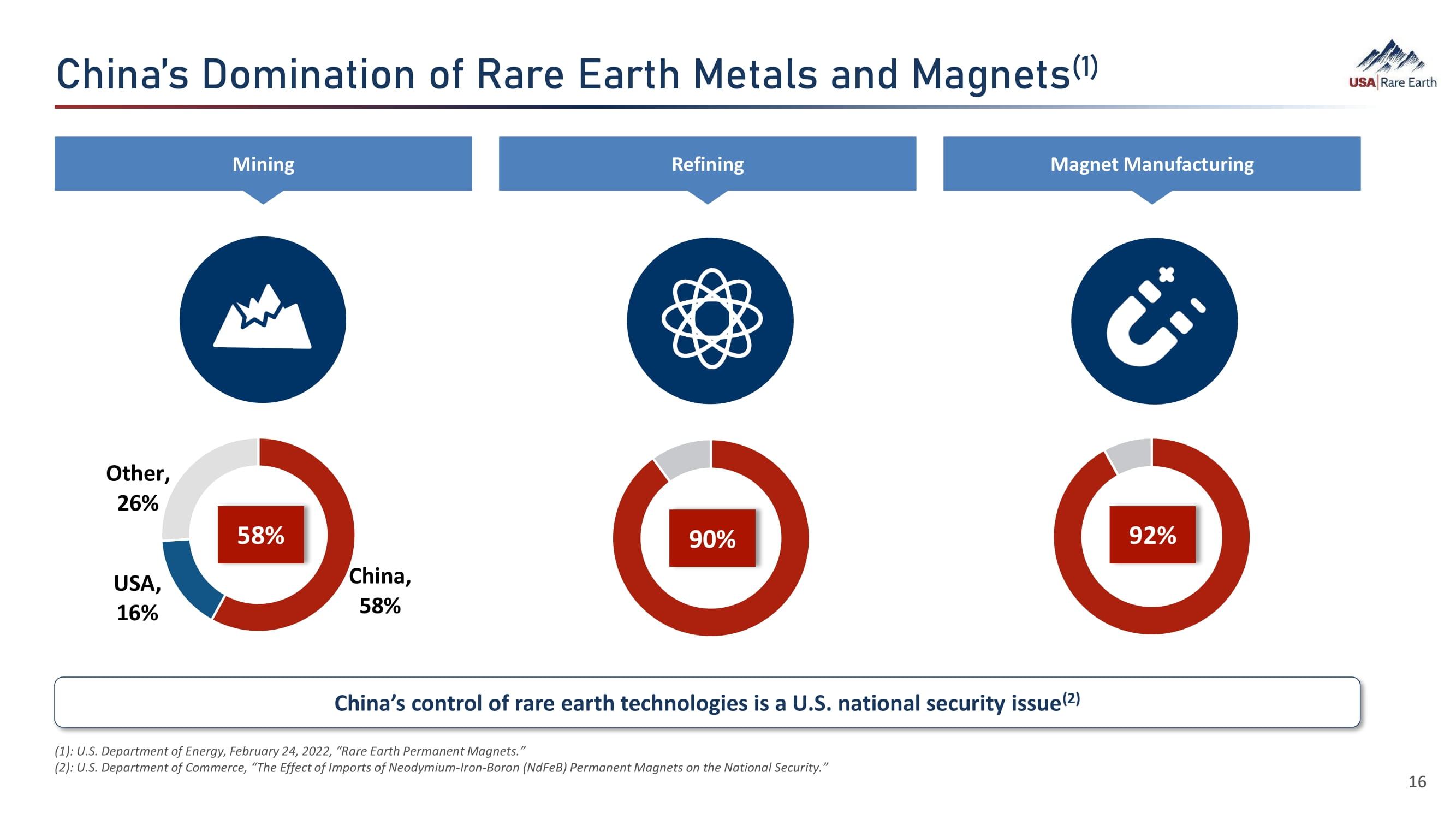

China’s Domination of Rare Earth Metals and Magnets (1) (1) : U.S. Department of Energy, February 24, 2022, “Rare Earth Permanent Magnets.” (2) : U.S. Department of Commerce, “The Effect of Imports of Neodymium - Iron - Boron (NdFeB) Permanent Magnets on the National Security.” China’s control of rare earth technologies is a U.S. national security issue (2) Mining Refining Magnet Manufacturing China, 58% USA, 16% Other, 26% 58% 90% 92% 16

Geopolitics are Driving Increasing Trade Restrictions Strategic Vulnerabilities and Supply Chain Disruption Likely if Us Continues Its Reliance on China Bans on Gallium and Germanium Exports Could Cost the U.S. Billions China Bans Export of Rare Earth Processing Tech Over National Security Precious rare earth metals belong to the state, China declares Trump to unleash nearly 40% tariffs on China in early 2025 NATO's Defense Vulnerable to China's Control Over Seven Materials China Adds to Sanctions of U.S. Defense Contractors Over Taiwan Arms Sales Former Vice Chairman of the CCP Deng Xiaoping in 1992: “The Middle East has oil; China has rare earths.”(1) (1): Center for Strategic & International Studies, August 20, 2019, “Rare Earths: Next Element in the Trade War?” 17

We are rapidly moving to build one of the more flexible and largest rare earth magnet manufacturing facilities in the United States

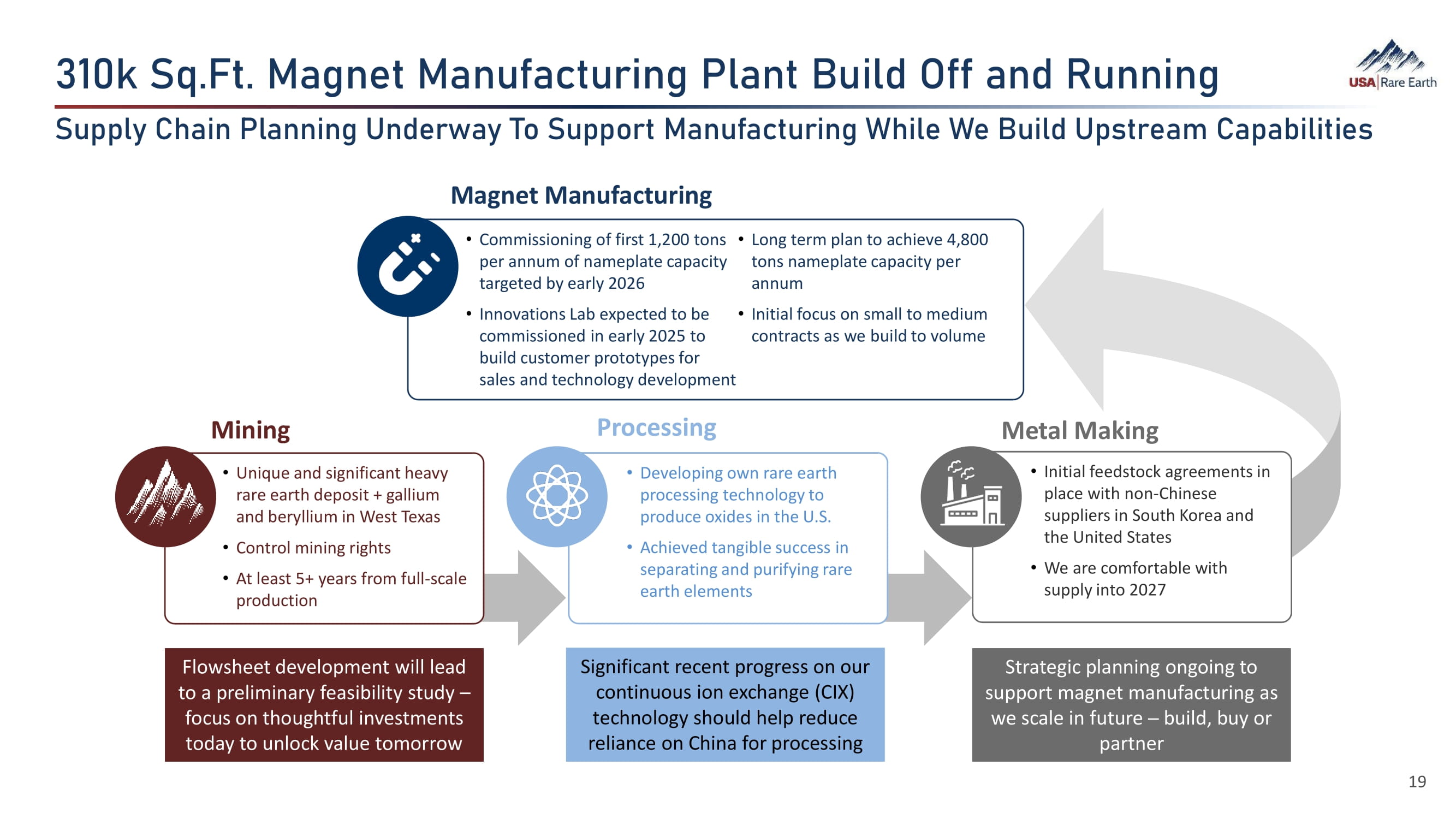

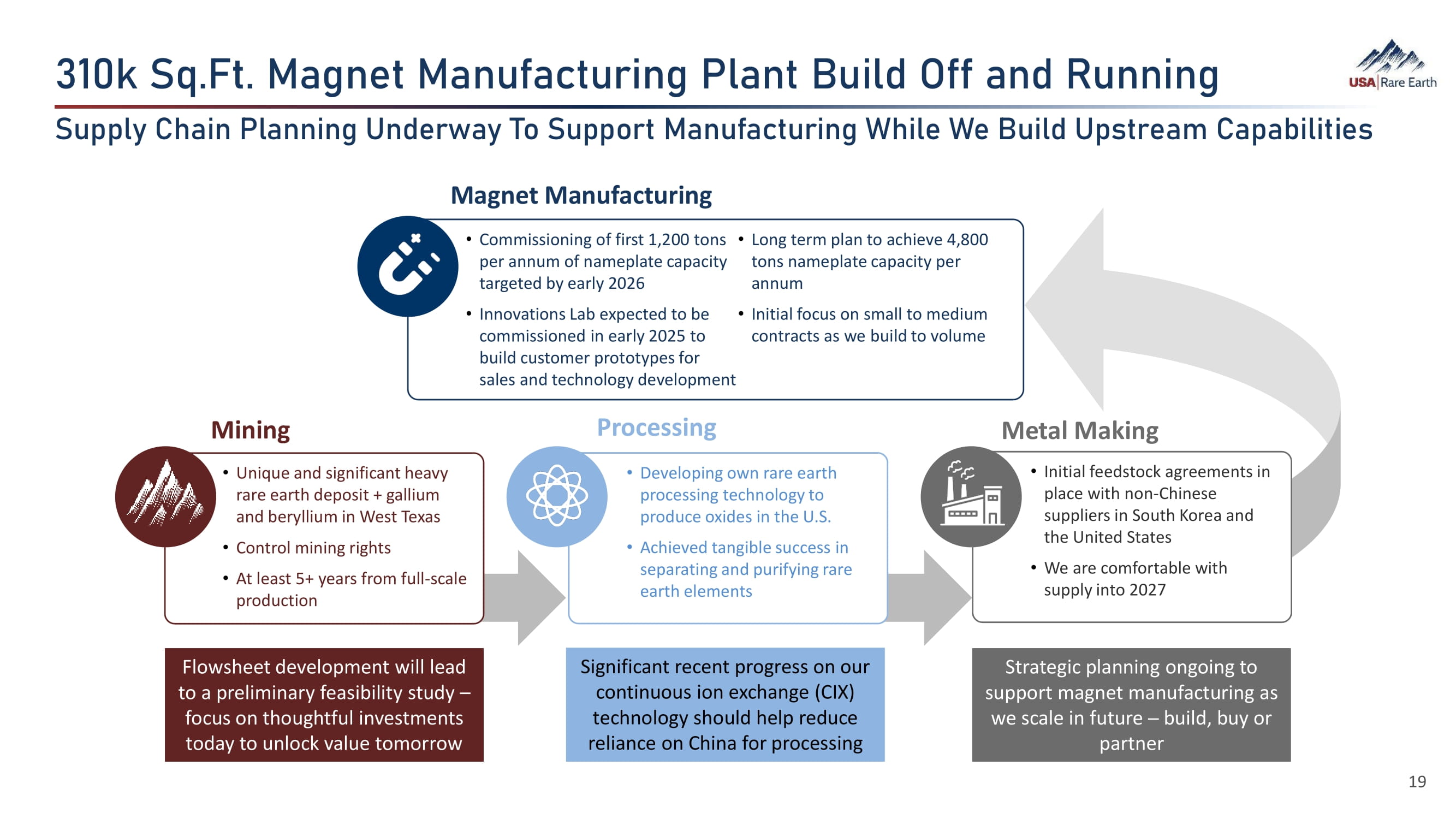

310k Sq.Ft. Magnet Manufacturing Plant Build Off and Running Supply Chain Planning Underway To Support Manufacturing While We Build Upstream Capabilities Magnet Manufacturing • Commissioning of first 1 , 200 tons per annum of nameplate capacity targeted by early 2026 • Innovations Lab expected to be commissioned in early 2025 to build customer prototypes for sales and technology development • Long term plan to achieve 4,800 tons nameplate capacity per annum • Initial focus on small to medium contracts as we build to volume Mining Processing Metal Making • Developing own rare earth processing technology to produce oxides in the U.S. • Achieved tangible success in separating and purifying rare earth elements • Unique and significant heavy rare earth deposit + gallium and beryllium in West Texas • Control mining rights • At least 5+ years from full - scale production • Initial feedstock agreements in place with non - Chinese suppliers in South Korea and the United States • We are comfortable with supply into 2027 Flowsheet development will lead to a preliminary feasibility study – focus on thoughtful investments today to unlock value tomorrow 19 Significant recent progress on our continuous ion exchange (CIX) technology should help reduce reliance on China for processing Strategic planning ongoing to support magnet manufacturing as we scale in future ─ build, buy or partner

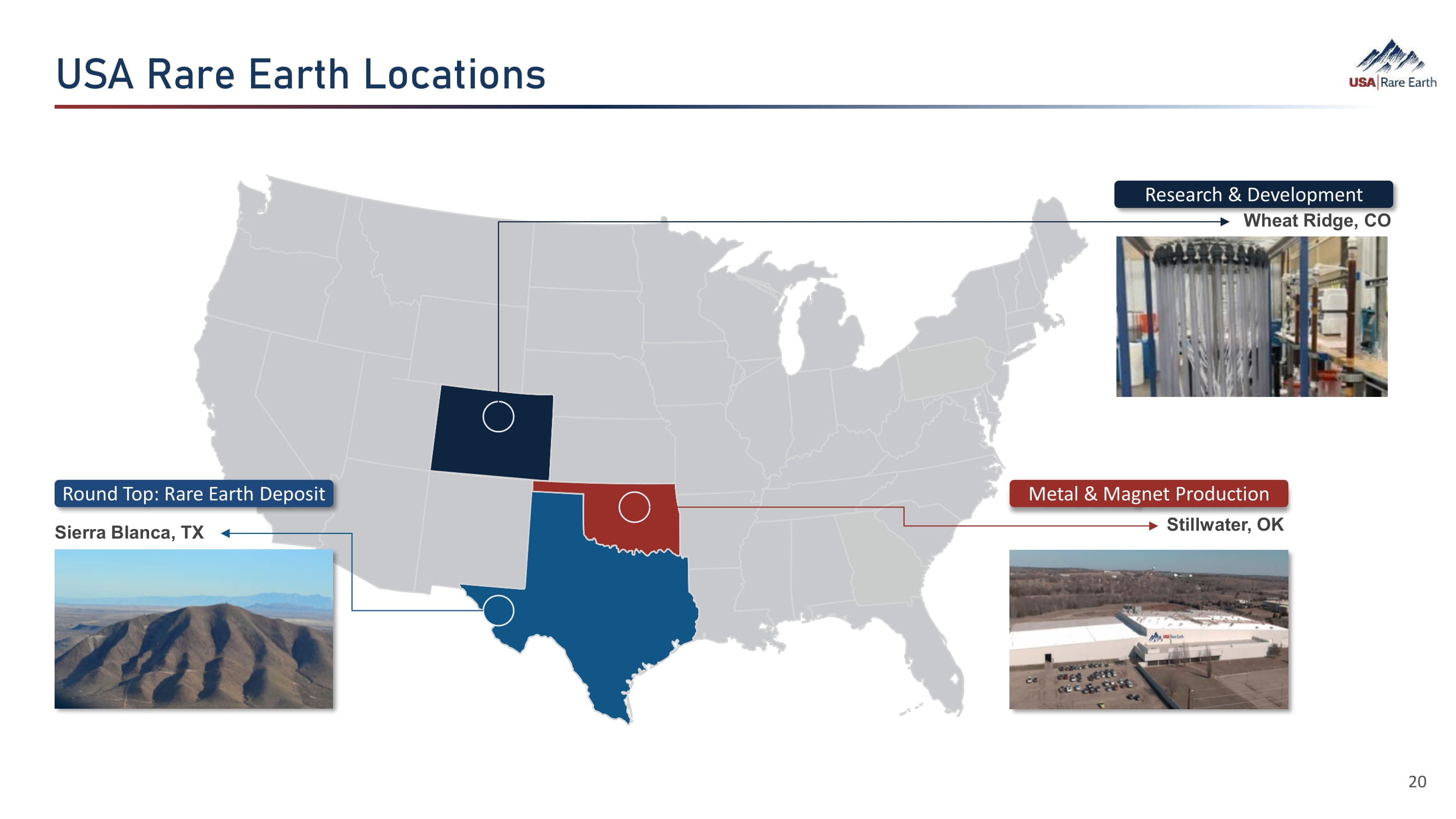

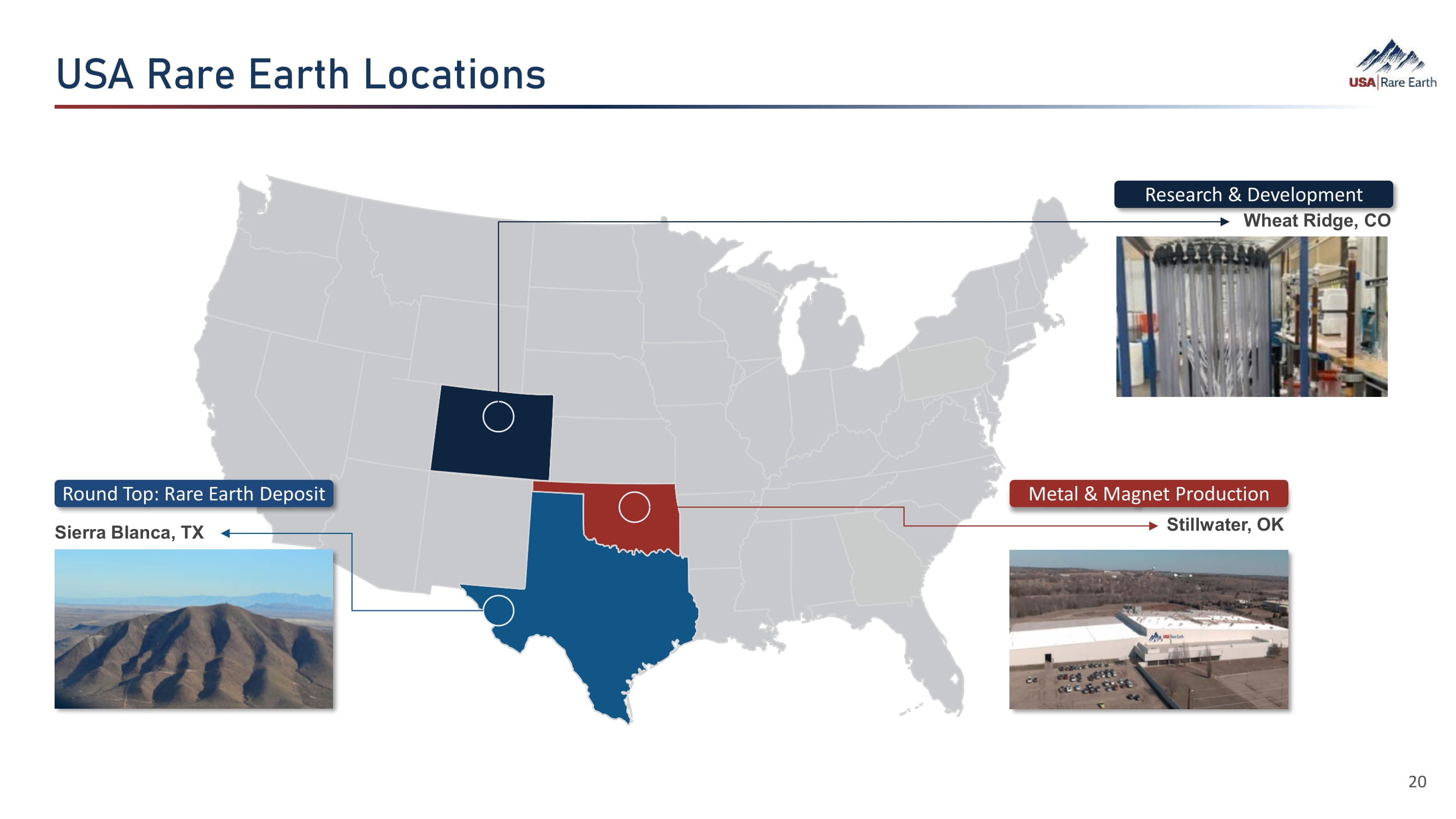

USA Rare Earth Locations Metal & Magnet Production Stillwater, OK Round Top: Rare Earth Deposit Sierra Blanca, TX Research & Development Wheat Ridge, CO 20

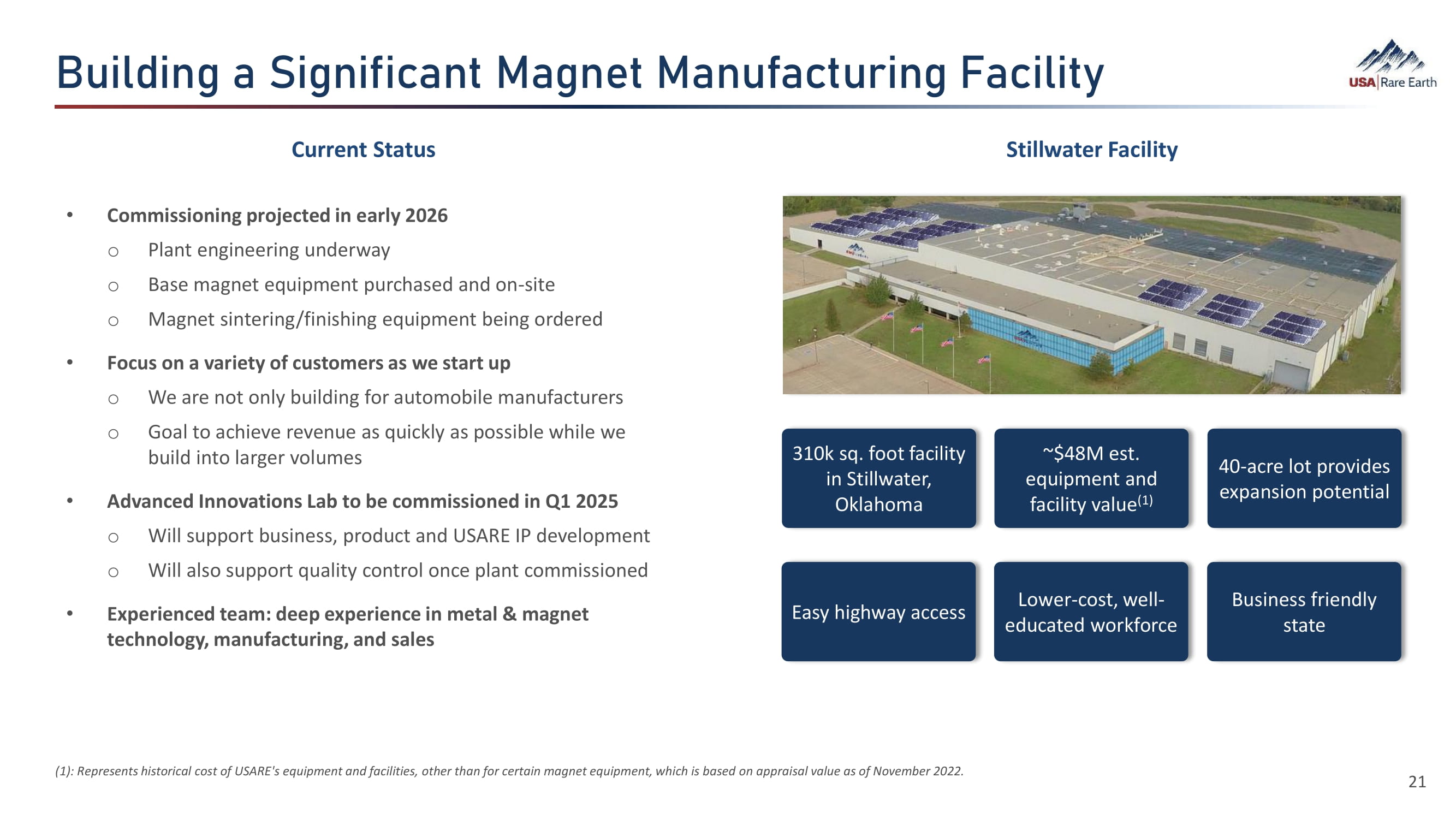

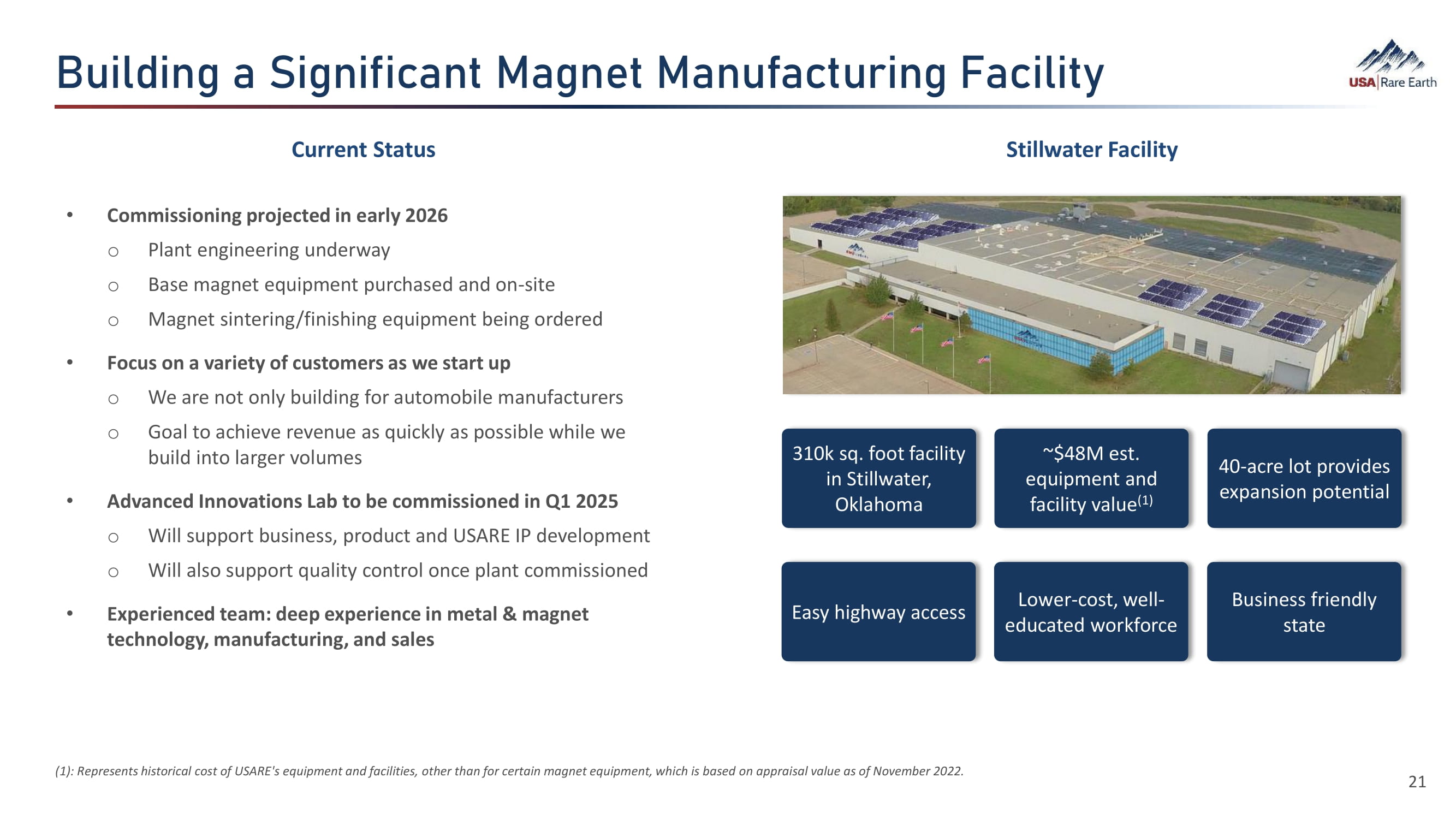

Building a Significant Magnet Manufacturing Facility Current Status Stillwater Facility • Commissioning projected in early 2026 o Plant engineering underway o Base magnet equipment purchased and on - site o Magnet sintering/finishing equipment being ordered • Focus on a variety of customers as we start up 310k sq. foot facility in Stillwater, Oklahoma ~$48M est. equipment and facility value (1) 40 - acre lot provides expansion potential Easy highway access Lower - cost, well - educated workforce Business friendly state 21 (1): Represents historical cost of USARE's equipment and facilities, other than for certain magnet equipment, which is based on appraisal value as of November 2022. o We are not only building for automobile manufacturers o Goal to achieve revenue as quickly as possible while we build into larger volumes • Advanced Innovations Lab to be commissioned in Q1 2025 o Will support business, product and USARE IP development o Will also support quality control once plant commissioned • Experienced team: deep experience in metal & magnet technology, manufacturing, and sales

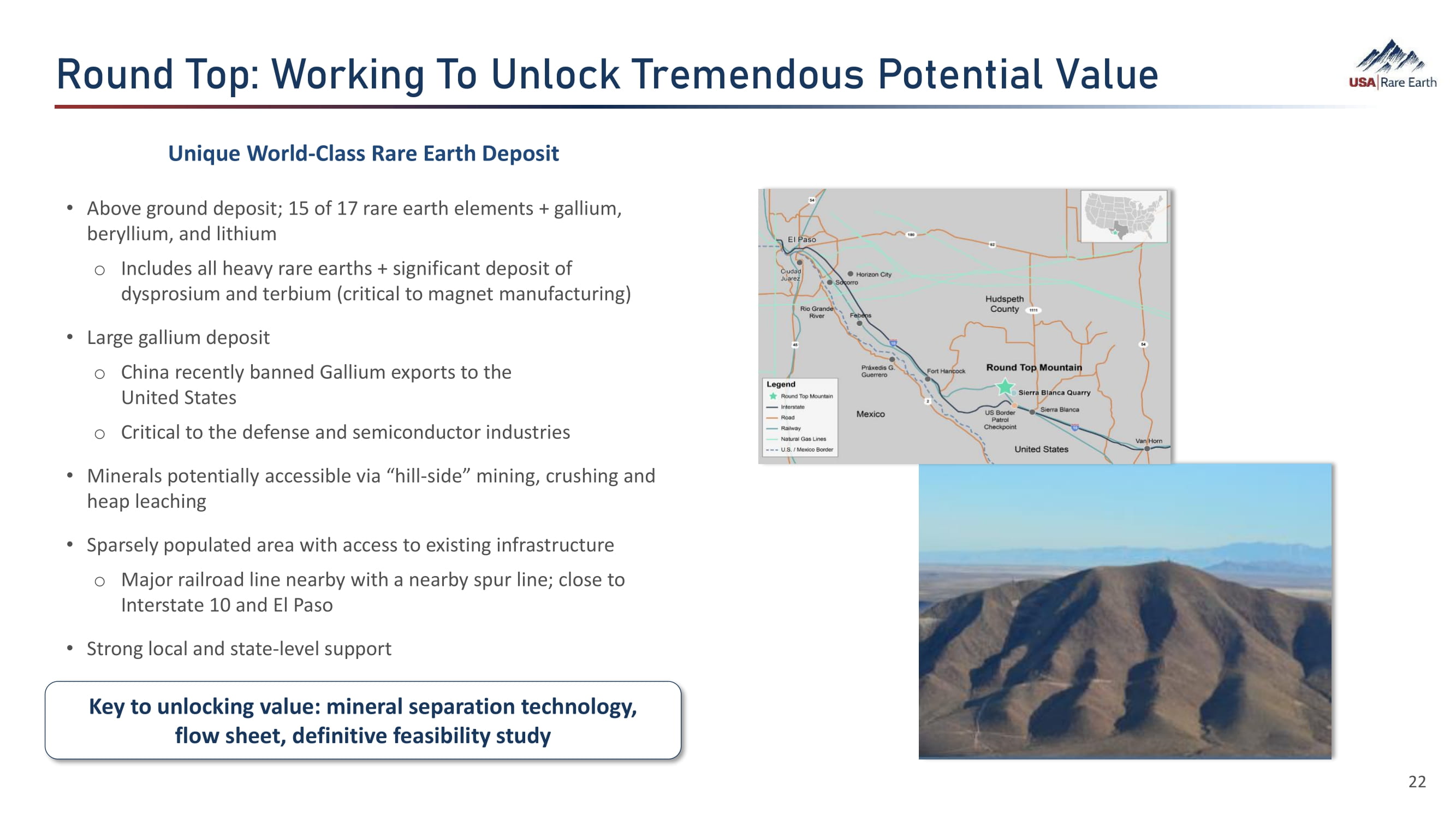

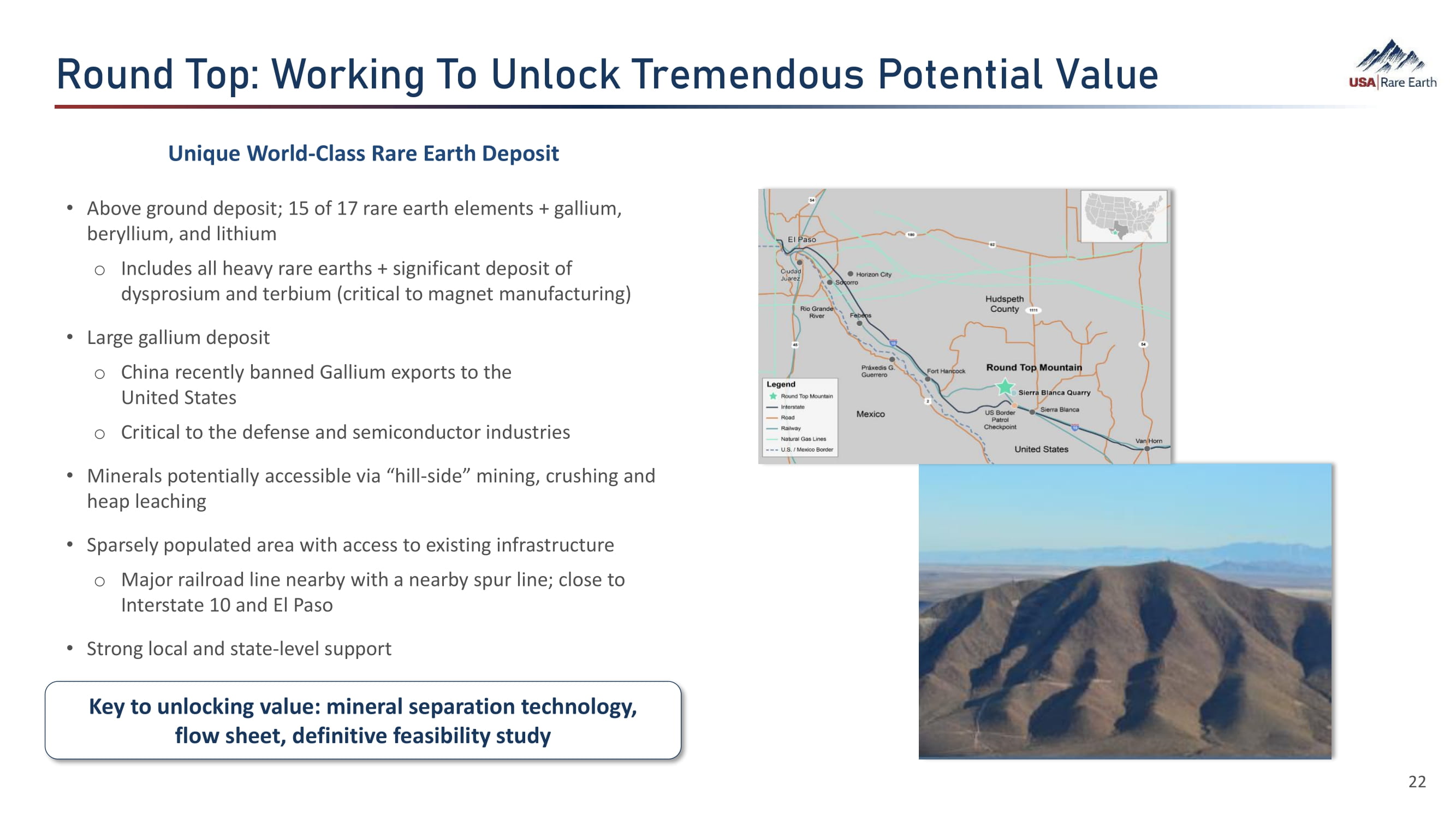

Round Top: Working To Unlock Tremendous Potential Value Unique World - Class Rare Earth Deposit • Above ground deposit; 15 of 17 rare earth elements + gallium, beryllium, and lithium o Includes all heavy rare earths + significant deposit of dysprosium and terbium (critical to magnet manufacturing) • Large gallium deposit o China recently banned Gallium exports to the United States o Critical to the defense and semiconductor industries • Minerals potentially accessible via “hill - side” mining, crushing and heap leaching • Sparsely populated area with access to existing infrastructure o Major railroad line nearby with a nearby spur line; close to Interstate 10 and El Paso • Strong local and state - level support Key to unlocking value: mineral separation technology, flow sheet, definitive feasibility study 22

Estimated Timeline • Mine : Timing of buildout contingent on the successful completion of the flowsheet and subsequent feasibility studies (1) : “tpa” refers to tons per annum (nameplate capacity). (2) : Future potential revenue will be dependent on product mix and market pricing at that time. This is a current management estimate only and is subject to change. These figures may not be updated in the future to account for changes in circumstances or the applicable market pricing. 23 • Magnet Revenue : targeted by early 2026, dependent on final construction and commissioning schedule o Once completed, the first line is estimated to support up to $200 million in revenue (2) o Time of completion of lines 2 - 4 to maximize capacity will be contingent on customer orders and other factors Magnet Manufacturing Mining and Processing Innovation Lab Plant Infrastructure Production Lines 2025 2026 2027 2028+ Commission Innovations Lab Q1 Q2 Q3 Q4 Engineering and Plant Build Lines 2, 3 & 4 (+3,600 tpa) Lines 1 (1,200 tpa (1) ) Flowsheet, Pre - feasibility Study, Demonstration Plant, Definitive Feasibility Study, Construction and Commissioning

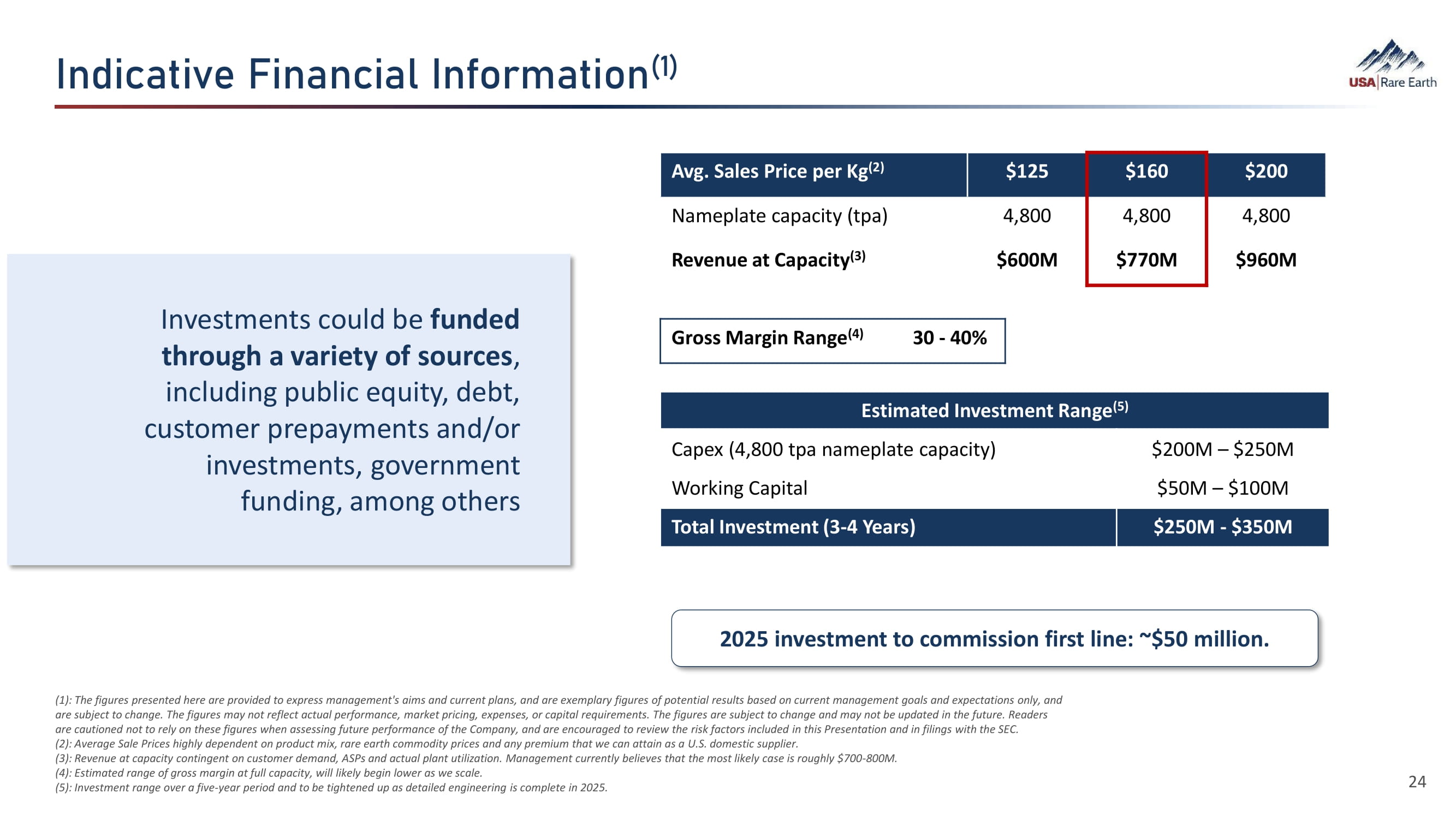

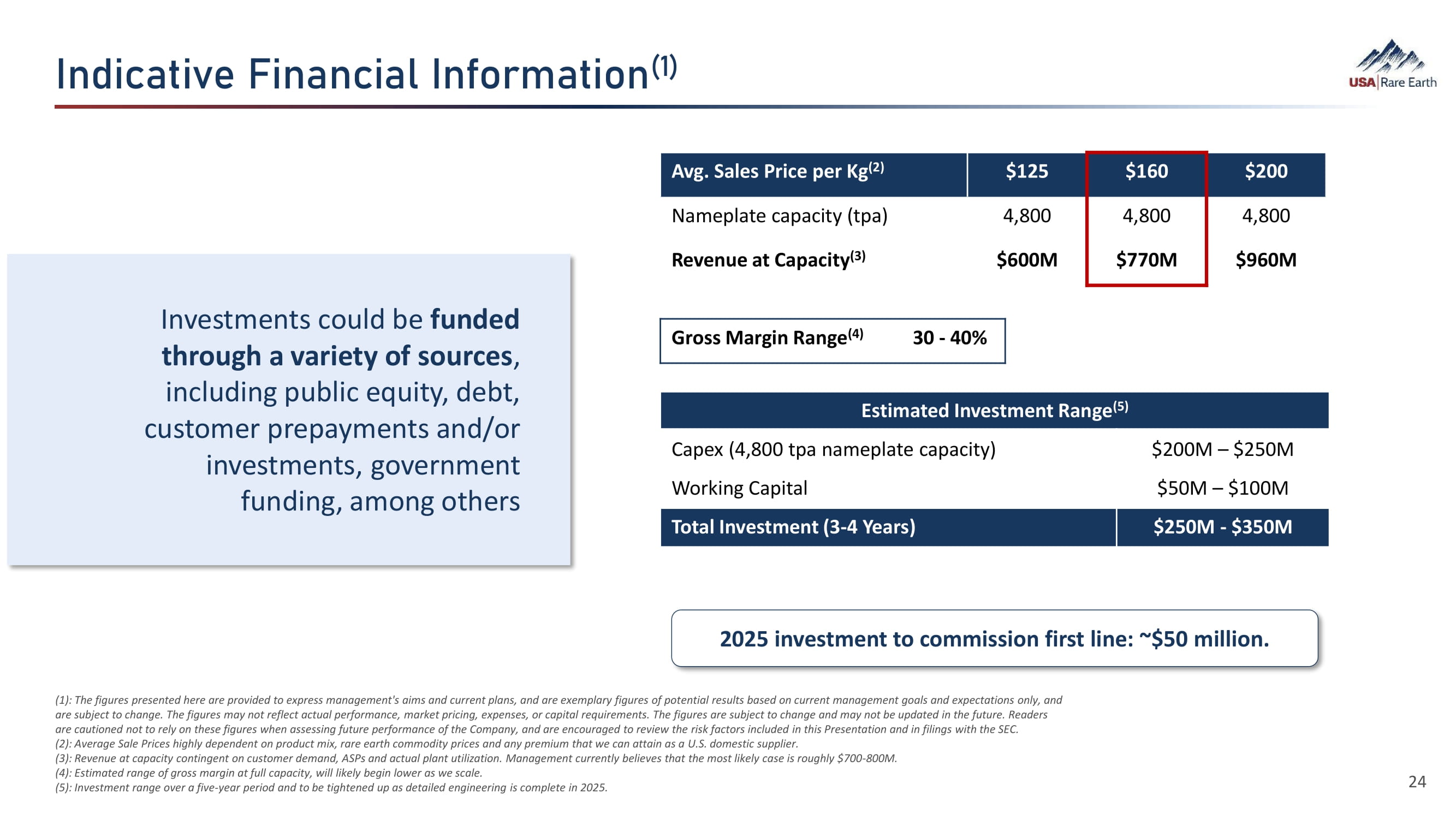

Indicative Financial Information (1) Investments could be funded through a variety of sources , including public equity, debt, customer prepayments and/or investments, government funding, among others $200 $160 $125 Avg. Sales Price per Kg (2) 4,800 4,800 4,800 Nameplate capacity (tpa) $960M $770M $600M Revenue at Capacity (3) 30 - 40% Gross Margin Range (4) Estimated Investment Range (5) $200M – $250M Capex (4,800 tpa nameplate capacity) $50M – $100M Working Capital $250M - $350M Total Investment (3 - 4 Years) 2025 investment to commission first line: ~$50 million. (1) : The figures presented here are provided to express management's aims and current plans, and are exemplary figures of potential results based on current management goals and expectations only, and are subject to change. The figures may not reflect actual performance, market pricing, expenses, or capital requirements. The figures are subject to change and may not be updated in the future. Readers are cautioned not to rely on these figures when assessing future performance of the Company, and are encouraged to review the risk factors included in this Presentation and in filings with the SEC. (2) : Average Sale Prices highly dependent on product mix, rare earth commodity prices and any premium that we can attain as a U.S. domestic supplier. (3) : Revenue at capacity contingent on customer demand, ASPs and actual plant utilization. Management currently believes that the most likely case is roughly $700 - 800M. (4) : Estimated range of gross margin at full capacity, will likely begin lower as we scale. (5) : Investment range over a five - year period and to be tightened up as detailed engineering is complete in 2025. 24

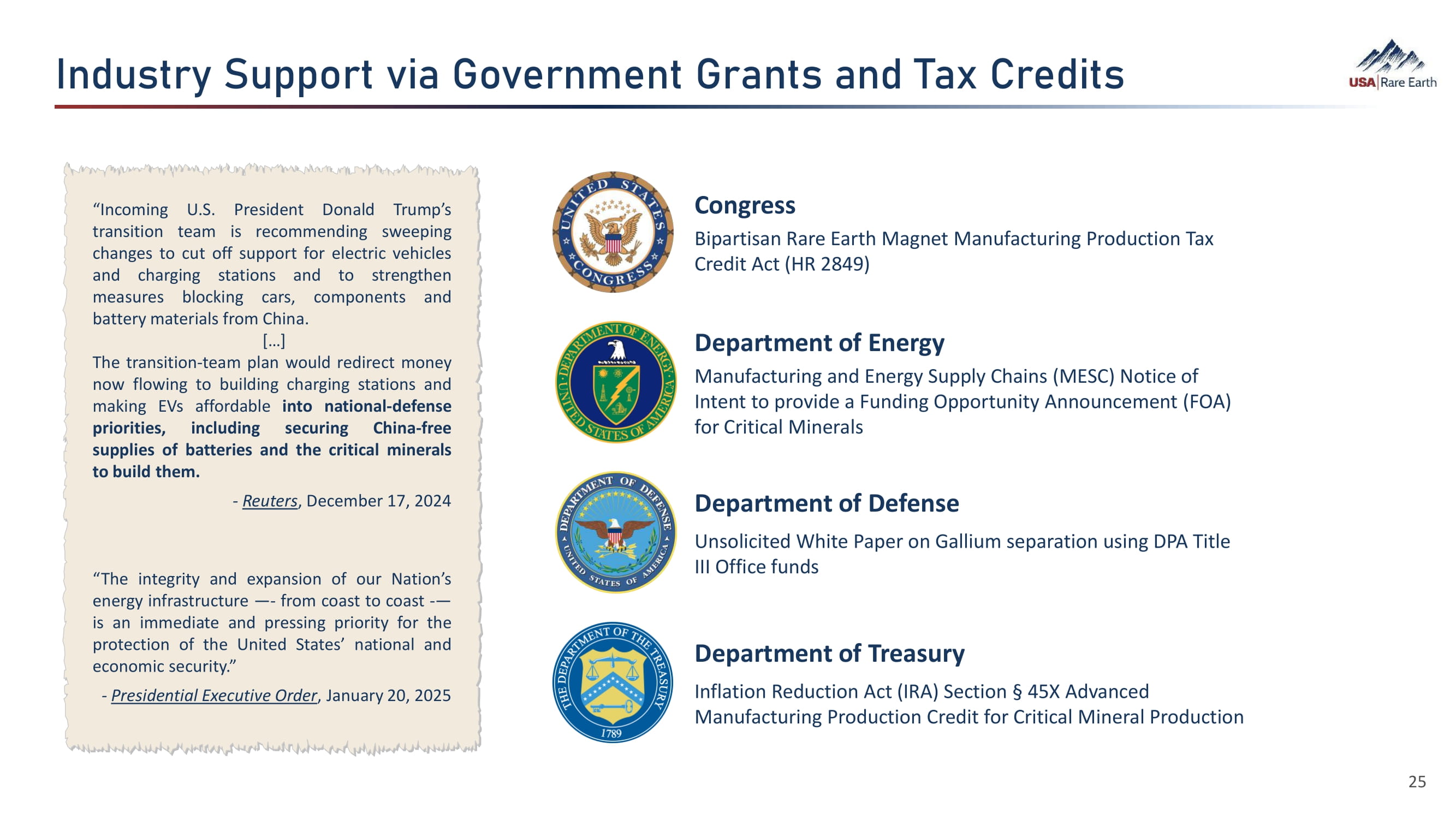

Industry Support via Government Grants and Tax Credits Congress Bipartisan Rare Earth Magnet Manufacturing Production Tax Credit Act (HR 2849) Department of Energy Manufacturing and Energy Supply Chains (MESC) Notice of Intent to provide a Funding Opportunity Announcement (FOA) for Critical Minerals Department of Defense Unsolicited White Paper on Gallium separation using DPA Title III Office funds Department of Treasury Inflation Reduction Act (IRA) Section Α 45X Advanced Manufacturing Production Credit for Critical Mineral Production “Incoming U.S. President Donald Trump’s transition team is recommending sweeping changes to cut off support for electric vehicles and charging stations and to strengthen measures blocking cars, components and battery materials from China . […] The transition - team plan would redirect money now flowing to building charging stations and making EVs affordable into national - defense priorities, including securing China - free supplies of batteries and the critical minerals to build them . - Reuters , December 17 , 2024 25 “The integrity and expansion of our Nation’s energy infrastructure — - from coast to coast - — is an immediate and pressing priority for the protection of the United States’ national and economic security . ” - Presidential Executive Order , January 20 , 2025

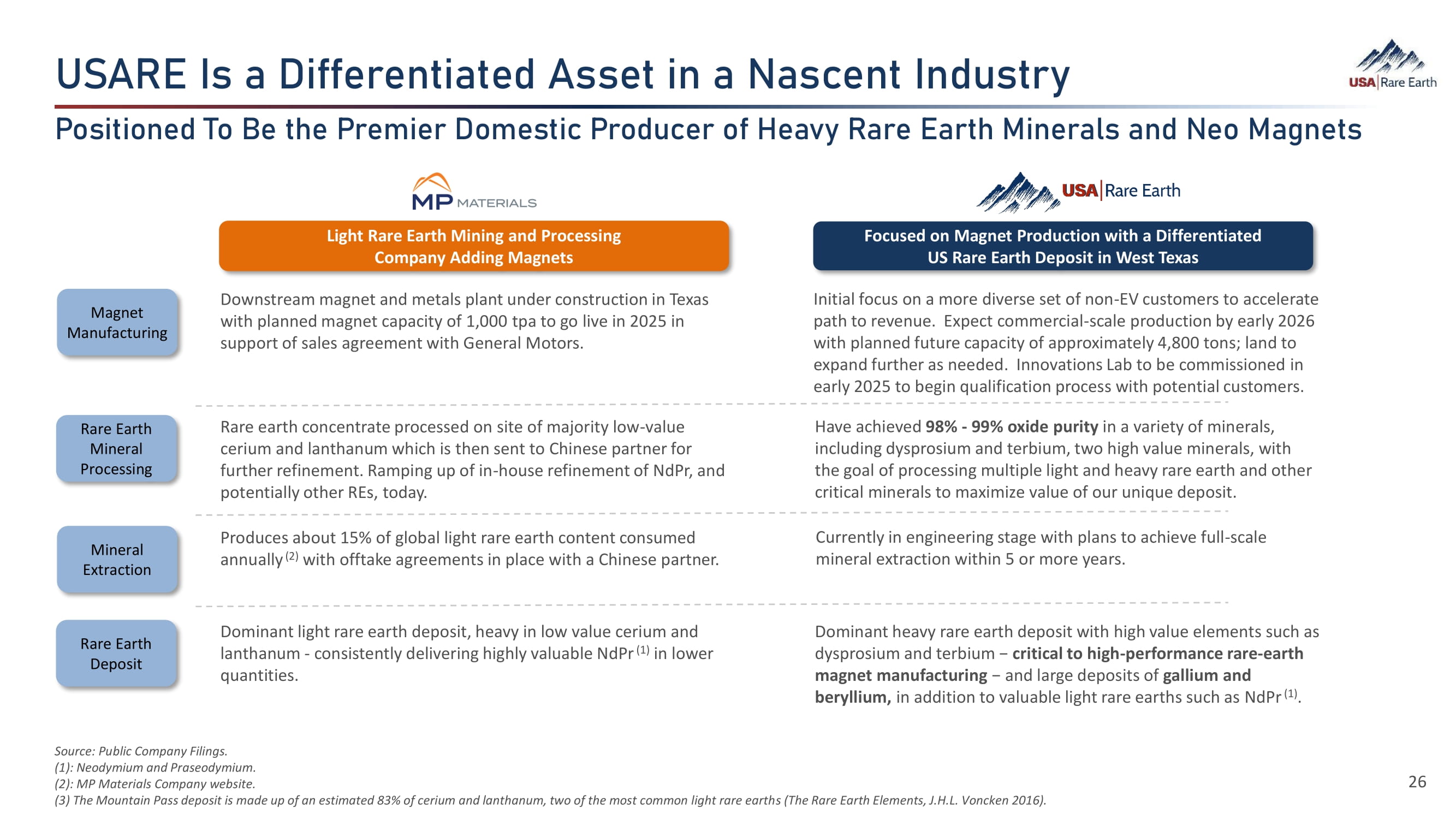

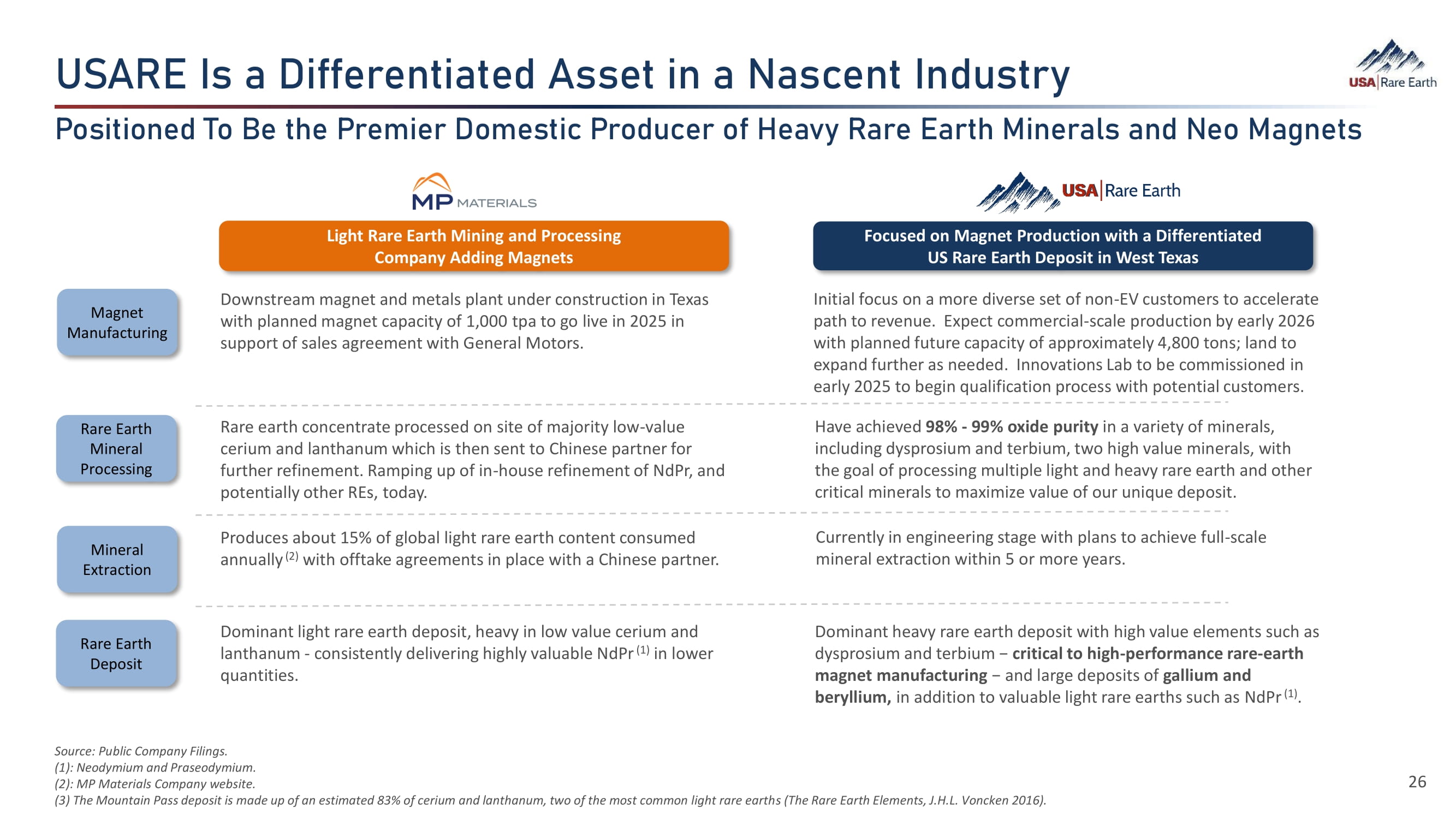

USARE Is a Differentiated Asset in a Nascent Industry Source: Public Company Filings. (1) : Neodymium and Praseodymium. (2) : MP Materials Company website. (3) The Mountain Pass deposit is made up of an estimated 83% of cerium and lanthanum, two of the most common light rare earths (The Rare Earth Elements, J.H.L. Voncken 2016). 26 Positioned To Be the Premier Domestic Producer of Heavy Rare Earth Minerals and Neo Magnets Light Rare Earth Mining and Processing Company Adding Magnets Focused on Magnet Production with a Differentiated US Rare Earth Deposit in West Texas Mineral Extraction Produces about 15% of global light rare earth content consumed annually (2) with offtake agreements in place with a Chinese partner. Currently in engineering stage with plans to achieve full - scale mineral extraction within 5 or more years. Rare Earth Deposit Dominant light rare earth deposit, heavy in low value cerium and lanthanum - consistently delivering highly valuable NdPr (1) in lower quantities. Dominant heavy rare earth deposit with high value elements such as dysprosium and terbium − critical to high - performance rare - earth magnet manufacturing − and large deposits of gallium and beryllium, in addition to valuable light rare earths such as NdPr (1) . Rare Earth Mineral Processing Rare earth concentrate processed on site of majority low - value cerium and lanthanum which is then sent to Chinese partner for further refinement. Ramping up of in - house refinement of NdPr, and potentially other REs, today. Have achieved 98% - 99% oxide purity in a variety of minerals, including dysprosium and terbium, two high value minerals, with the goal of processing multiple light and heavy rare earth and other critical minerals to maximize value of our unique deposit. Downstream magnet and metals plant under construction in Texas with planned magnet capacity of 1,000 tpa to go live in 2025 in support of sales agreement with General Motors. Initial focus on a more diverse set of non - EV customers to accelerate path to revenue. Expect commercial - scale production by early 2026 with planned future capacity of approximately 4,800 tons; land to expand further as needed. Innovations Lab to be commissioned in early 2025 to begin qualification process with potential customers. Magnet Manufacturing

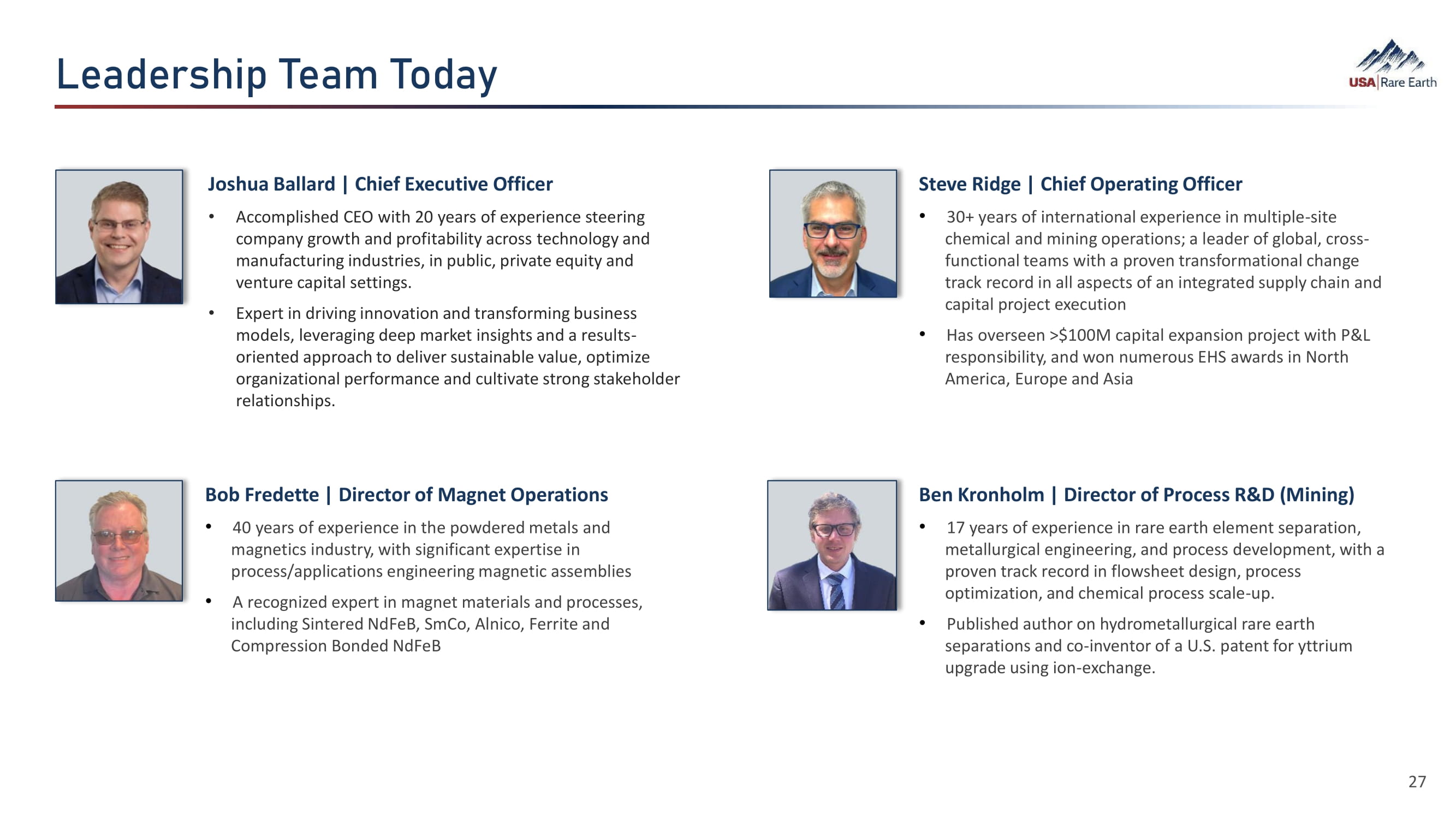

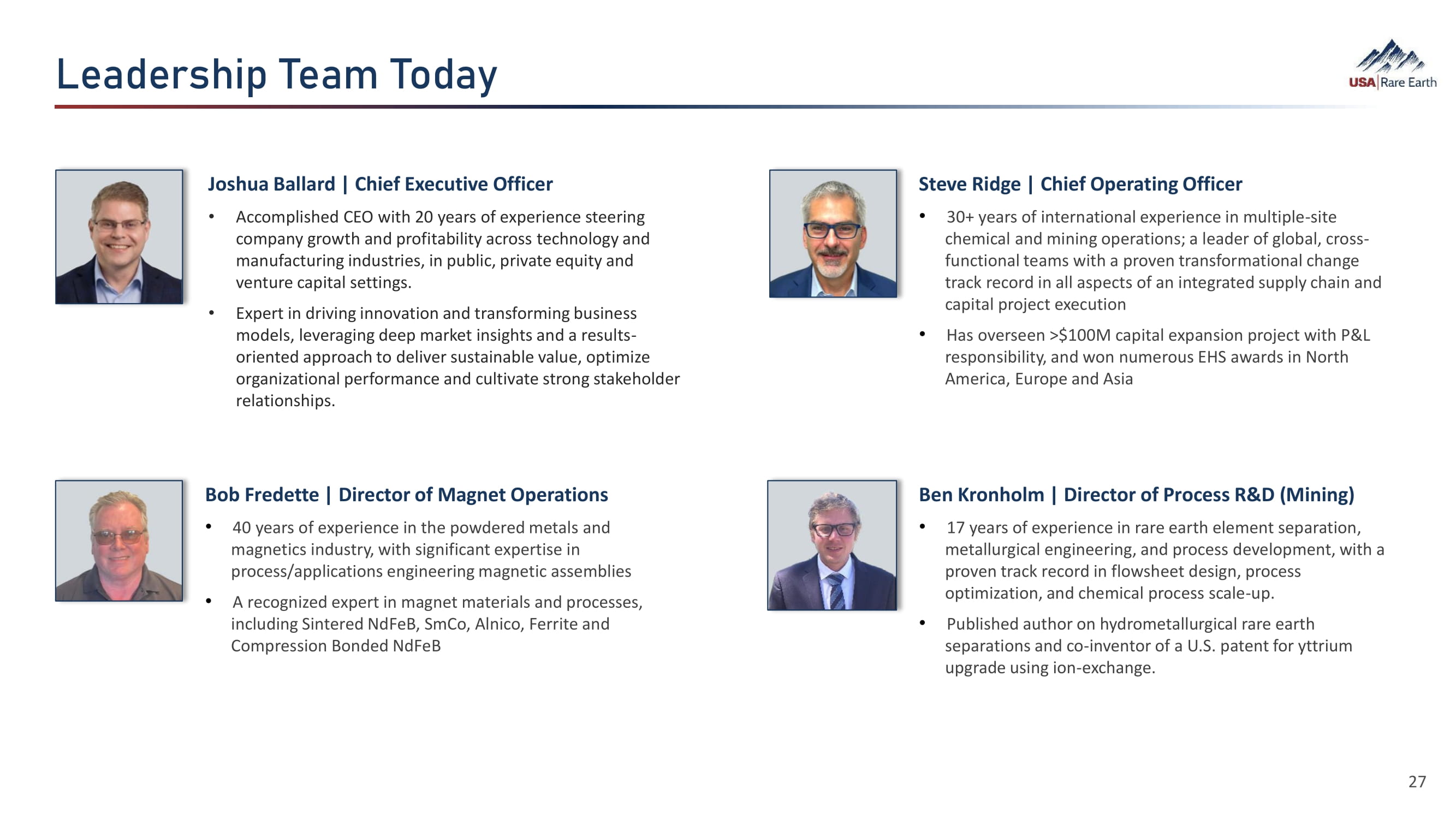

Leadership Team Today Bob Fredette | Director of Magnet Operations • 40 years of experience in the powdered metals and magnetics industry, with significant expertise in process/applications engineering magnetic assemblies • A recognized expert in magnet materials and processes, including Sintered NdFeB, SmCo, Alnico, Ferrite and Compression Bonded NdFeB Steve Ridge | Chief Operating Officer • 30+ years of international experience in multiple - site chemical and mining operations; a leader of global, cross - functional teams with a proven transformational change track record in all aspects of an integrated supply chain and capital project execution • Has overseen >$100M capital expansion project with P&L responsibility, and won numerous EHS awards in North America, Europe and Asia Joshua Ballard | Chief Executive Officer • Accomplished CEO with 20 years of experience steering company growth and profitability across technology and manufacturing industries, in public, private equity and venture capital settings. • Expert in driving innovation and transforming business models, leveraging deep market insights and a results - oriented approach to deliver sustainable value, optimize organizational performance and cultivate strong stakeholder relationships. Ben Kronholm | Director of Process R&D (Mining) • 17 years of experience in rare earth element separation, metallurgical engineering, and process development, with a proven track record in flowsheet design, process optimization, and chemical process scale - up. • Published author on hydrometallurgical rare earth separations and co - inventor of a U.S. patent for yttrium upgrade using ion - exchange. 27

Post - Transaction Board of Directors 28 Michael Blitzer. Chairman . Mr. Blitzer is currently the Chief Executive Officer and Chairman of Inflection Point Acquisition Corp. II (IPXX). Previously, he was the Chief Executive Office of Inflection Point Acquisition Corp, which later merged with Intuitive Machines (LUNR). He is currently a director of Intuitive Machines. Mr. Blitzer is also the founder and co - CIO of Kingstown Capital Management, which he founded in 2006 and grew to a multi - billion asset manager with some of the world’s largest endowments and foundations as clients. He began his career at JP Morgan Securities and holds degrees from Cornell University and Columbia Business School. Tready A. Smith. Ms. Smith is the founder and CEO of Bayshore Capital, a Florida - based investment firm that was established in 2001. Ms. Smith has been instrumental in fostering early - stage investments, including Bayshore’s pivotal role as an early investor in USA Rare Earth. She has served on the Board of USA Rare Earth since 2020 where she has been pivotal in driving the company's strategic direction. Ms. Smith also serves on the Board of Directors of Semantic AI, a California - based software firm. Prior to founding Bayshore, Ms. Smith was a Senior Consultant at Deloitte Consulting. She has previously served on many non - profit boards including the University of North Carolina at Chapel Hill Arts and Science Foundation Board and the Florida Wildlife Corridor Foundation. Mordi Gutnick. Mordechai "Mordi" Gutnick is a seasoned investor with extensive experience in the mining sector, particularly in rare earth elements and technology metals. As a co - founder and manager at USA Rare Earth, Mr. Gutnick was instrumental in advancing the Company as he recognized the unique potential of the Round Top deposit, along with the need to establish downstream processing, including magnet manufacturing. General Paul Kern. General Kern retired after almost 38 years with the US Army as the Commanding General of the Army Materiel Command. The command of more than 50,000 personnel has worldwide responsibility for supply and maintenance support to the Department of Defense, manages the Army depot system, and conducts research for all the ground and rotary wing equipment. He served as President and Chief Operating Officer of AM General from 2008 to 2010 and currently serves on a number of business boards and chairs the Defense Industrial Board for Functional Fabrics. He has served as a member of Defense Science Board for many years and Senior Counselor with The Cohen Group. Carolyn Trabuco. Ms. Trabuco is a business and finance professional in the fields of global equity research, strategic advisory, commodities and governance. She has over 25 years of global growth investing and fund management experience including over 10 years in the metals, mining, and resources sectors. Ms. Trabuco is cofounder and Board Director of Azul Brazilian Airline (NYSE: AZUL), Board Director of Shimmick (NASDAQ: SHIM), and former Board Director of Critical Metals Corp (NASDAQ:CRML) and Sizzle Acquisition (NASDAQ:SZZL). Ms. Trabuco is founder of strategic advisory firm, Thistledown Advisory Group, LLC.. She is an adjunct professor of finance at Sacred Heart University. Otto C . Schwethelm . Mr . Schwethelm has over 45 years experience and held significant positions such as CFO at Capital Precast Holdings LLC, MP Materials, M . S . Al Suwaidi Industrial Services Ltd . , OQ (formerly Oman Oil Refineries and Petroleum Industries Company), and Tesoro Corporation . Currently, he serves on the Board of Directors for Paint Rock Bancshares and First State Bank of Paint Rock . Mr . Schwethelm holds credentials as a Certified Public Accountant (licensed in Texas), Certified Internal Auditor, and Certified Fraud Examiner . Michael Senft. Mr. Senft is a former CFO and investment banker who has served on multiple public company boards. Mr. Senft is currently the Lead Independent Director for Molekule Group and a Senior Advisor to Critical Response Group. Earlier in his career, he was Director at B/E Aerospace, Inc. and CFO of KLX, Inc., a B/E Aerospace, Inc. spin - off until its acquisition by The Boeing Company in 2018. He began his career as banker at Merrill Lynch & Co. and CIBC World Markets. His expertise spans from external capital markets and M&A, to internal organizational transformation, SOX compliance, internal controls and executive compensation structuring.

TRANSACTION OVERVIEW

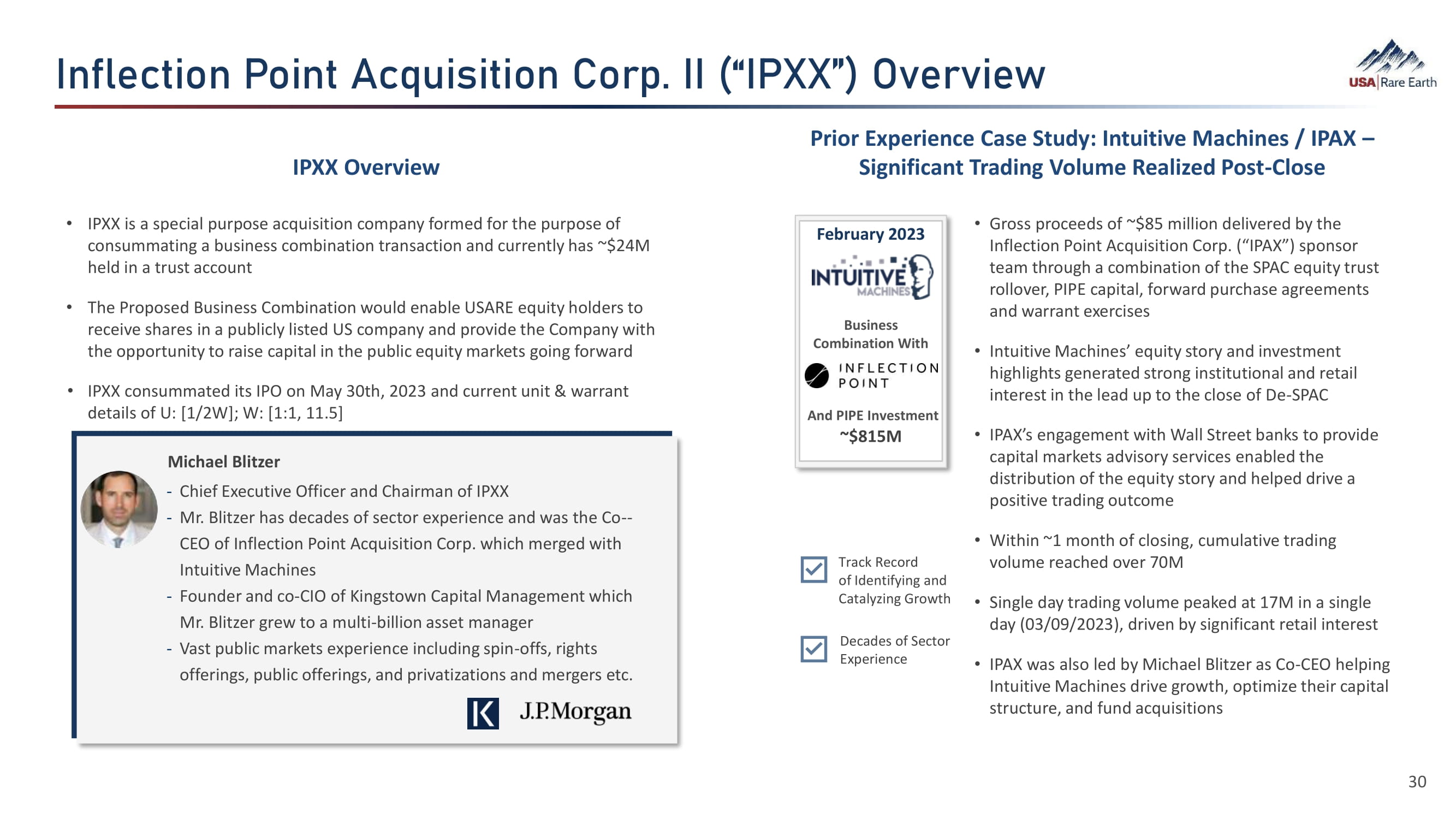

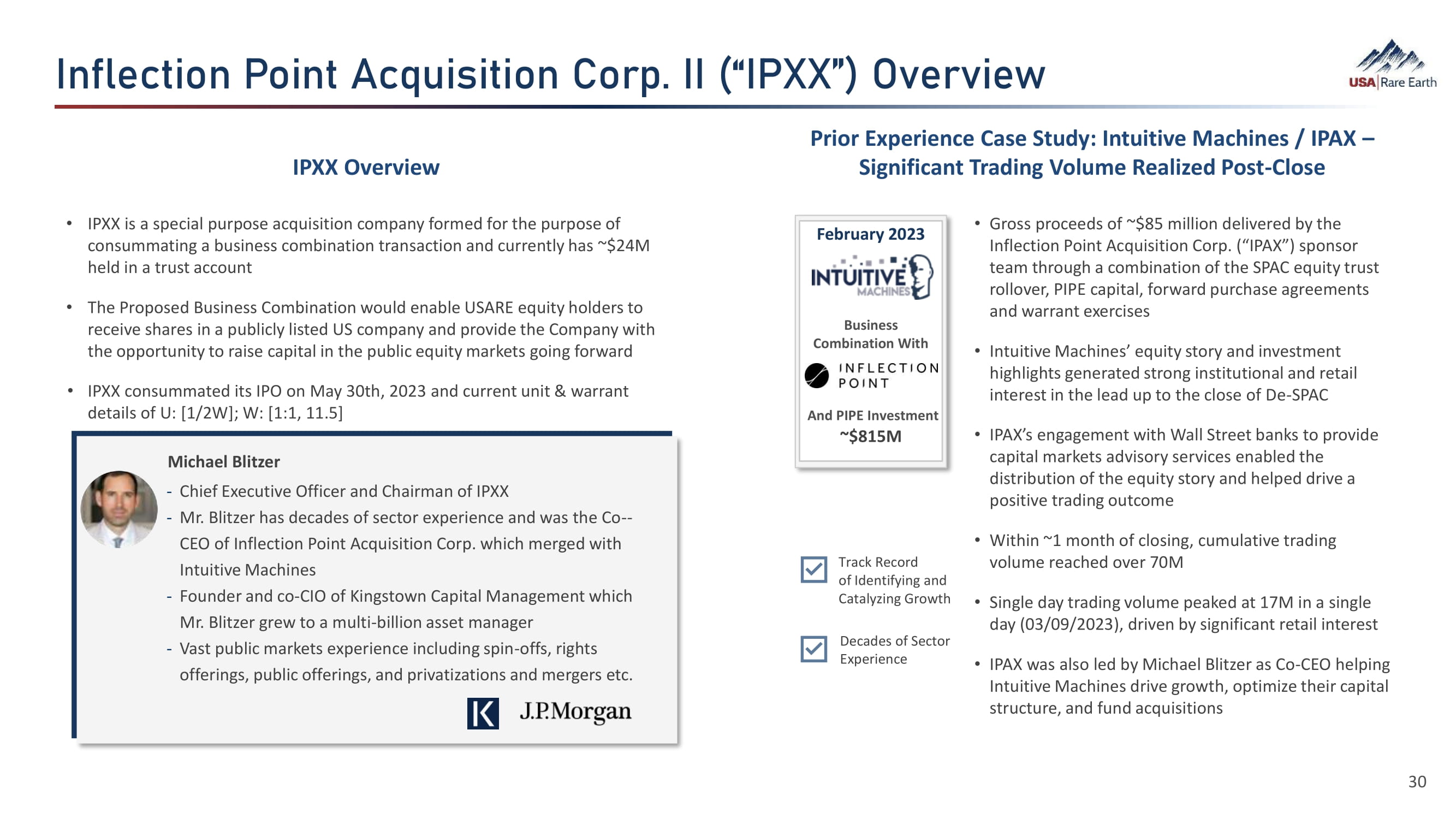

IPXX Overview • IPXX is a special purpose acquisition company formed for the purpose of consummating a business combination transaction and currently has ~$24M held in a trust account • The Proposed Business Combination would enable USARE equity holders to receive shares in a publicly listed US company and provide the Company with the opportunity to raise capital in the public equity markets going forward • IPXX consummated its IPO on May 30th, 2023 and current unit & warrant details of U: [1/2W]; W: [1:1, 11.5] Decades of Sector Experience Track Record of Identifying and Catalyzing Growth Michael Blitzer - Chief Executive Officer and Chairman of IPXX - Mr. Blitzer has decades of sector experience and was the Co - - CEO of Inflection Point Acquisition Corp. which merged with Intuitive Machines - Founder and co - CIO of Kingstown Capital Management which Mr. Blitzer grew to a multi - billion asset manager - Vast public markets experience including spin - offs, rights offerings, public offerings, and privatizations and mergers etc. February 2023 Business Combination With 30 And PIPE Investment ~$815M Prior Experience Case Study: Intuitive Machines / IPAX – Significant Trading Volume Realized Post - Close • Gross proceeds of ~$85 million delivered by the Inflection Point Acquisition Corp. (“IPAX”) sponsor team through a combination of the SPAC equity trust rollover, PIPE capital, forward purchase agreements and warrant exercises • Intuitive Machines’ equity story and investment highlights generated strong institutional and retail interest in the lead up to the close of De - SPAC • IPAX’s engagement with Wall Street banks to provide capital markets advisory services enabled the distribution of the equity story and helped drive a positive trading outcome • Within ~1 month of closing, cumulative trading volume reached over 70M • Single day trading volume peaked at 17M in a single day (03/09/2023), driven by significant retail interest • IPAX was also led by Michael Blitzer as Co - CEO helping Intuitive Machines drive growth, optimize their capital structure, and fund acquisitions Inflection Point Acquisition Corp. II (“IPXX”) Overview

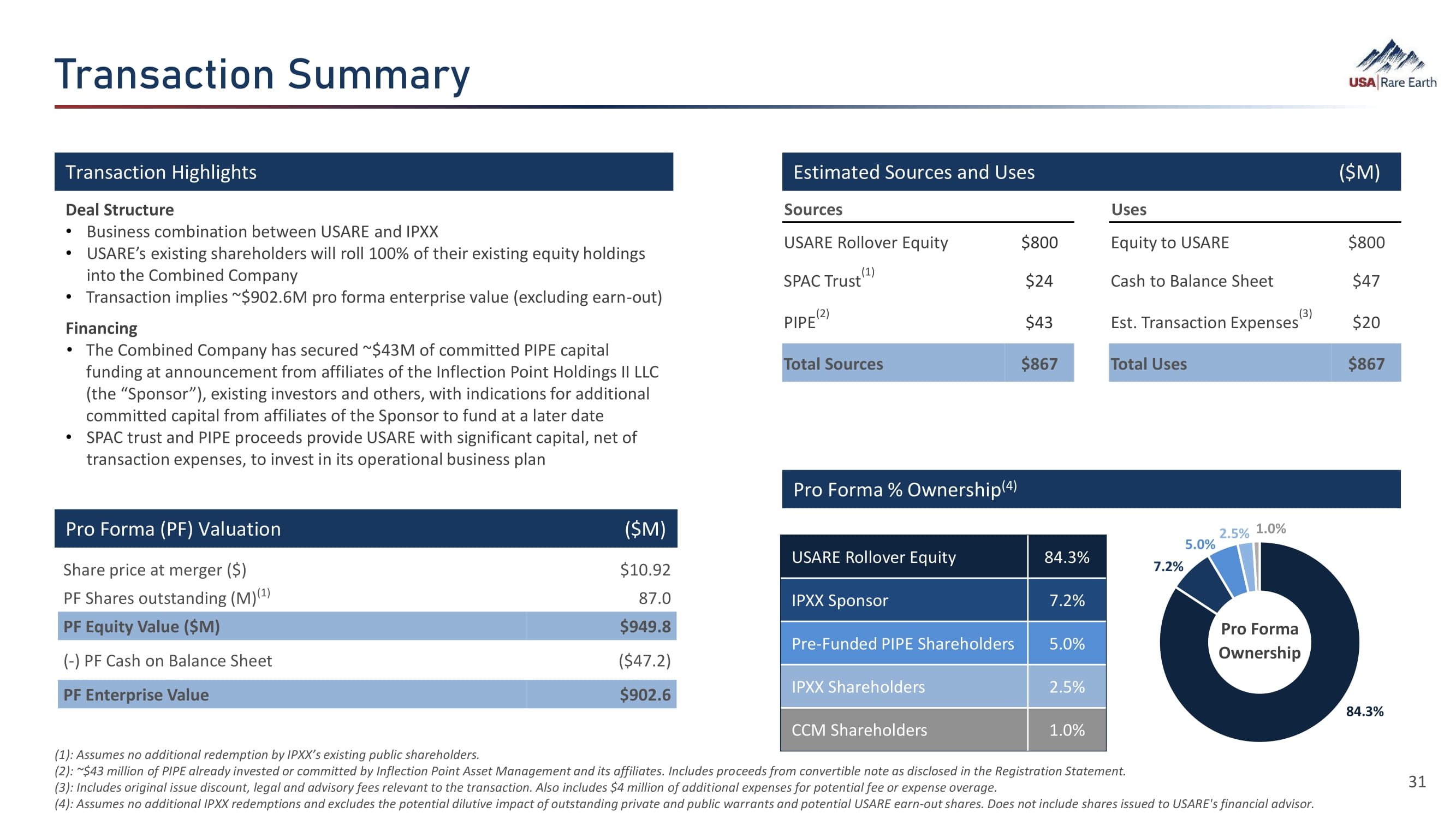

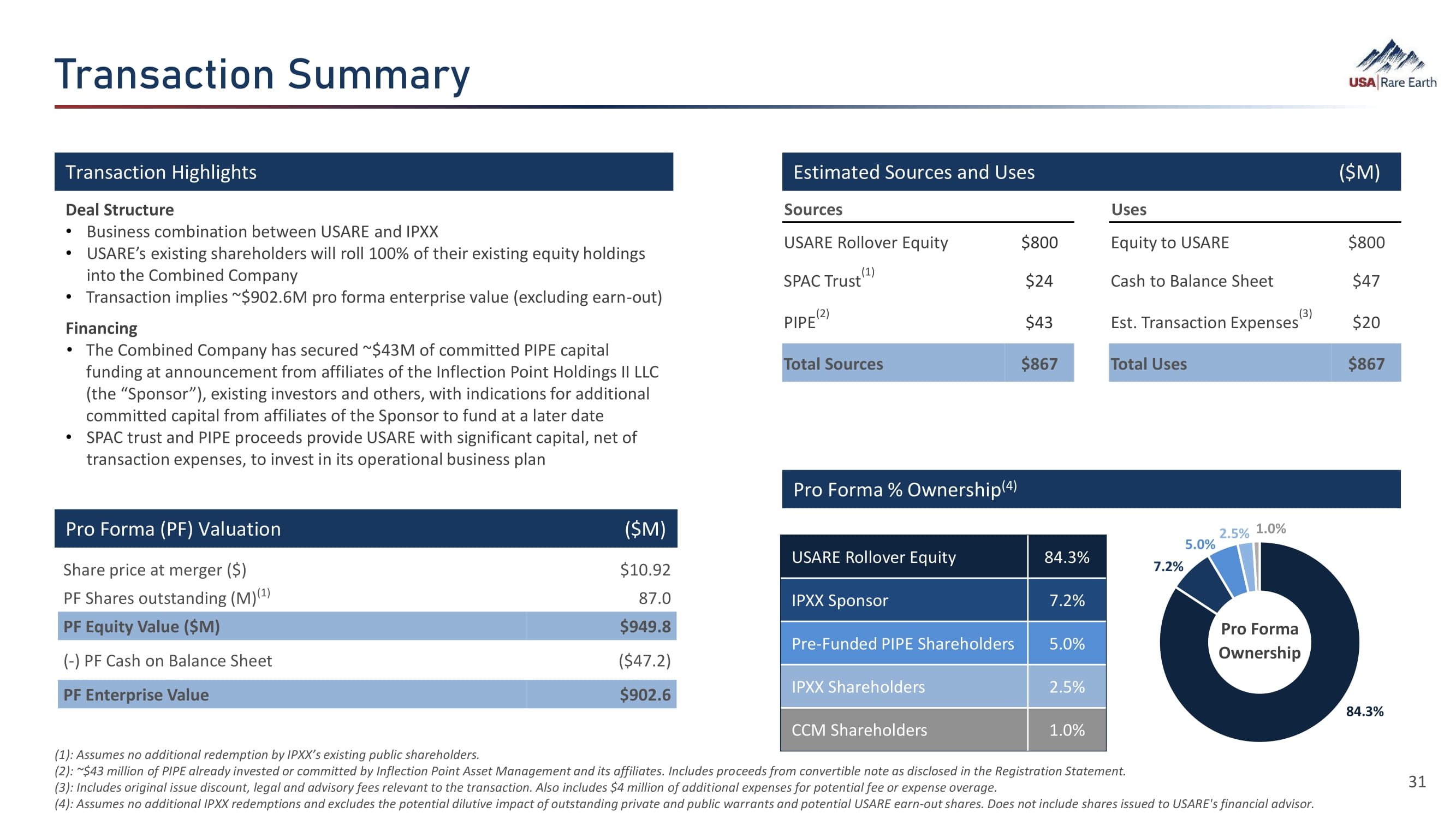

Transaction Summary Transaction Highlights Estimated Sources and Uses ($M) Deal Structure • Business combination between USARE and IPXX • USARE’s existing shareholders will roll 100% of their existing equity holdings into the Combined Company • Transaction implies ~$902.6M pro forma enterprise value (excluding earn - out) Financing • The Combined Company has secured ~$43M of committed PIPE capital funding at announcement from affiliates of the Inflection Point Holdings II LLC (the “Sponsor”), existing investors and others, with indications for additional committed capital from affiliates of the Sponsor to fund at a later date • SPAC trust and PIPE proceeds provide USARE with significant capital, net of transaction expenses, to invest in its operational business plan Pro Forma % Ownership (4) $10.92 Share price at merger ($) 87.0 PF Shares outstanding (M) (1) $949.8 PF Equity Value ($M) ($47.2) ( - ) PF Cash on Balance Sheet $902.6 PF Enterprise Value Pro Forma (PF) Valuation ($M) 84.3% USARE Rollover Equity 7.2% IPXX Sponsor 5.0% Pre - Funded PIPE Shareholders 2.5% IPXX Shareholders 1.0% CCM Shareholders 31 (1): Assumes no additional redemption by IPXX’s existing public shareholders. (2) : ~$43 million of PIPE already invested or committed by Inflection Point Asset Management and its affiliates. Includes proceeds from convertible note as disclosed in the Registration Statement. (3) : Includes original issue discount, legal and advisory fees relevant to the transaction. Also includes $4 million of additional expenses for potential fee or expense overage. (4) : Assumes no additional IPXX redemptions and excludes the potential dilutive impact of outstanding private and public warrants and potential USARE earn - out shares. Does not include shares issued to USARE's financial advisor. Uses Sources $800 Equity to USARE $800 USARE Rollover Equity $47 Cash to Balance Sheet $24 (1) SPAC Trust $20 (3) Est. Transaction Expenses $43 (2) PIPE $867 Total Uses $867 Total Sources 7.2% Pro Forma Ownership 84.3% 5.0% 2.5% 1.0%

RISK FACTORS

Risk Factors 33 The risks presented below are non - exhaustive descriptions of certain of the risks related to the business of USARE, IPXX, the Combined Company, and the Proposed Business Combination, and such list is not exhaustive . The list below has been prepared solely for purposes of inclusion in this Presentation and not for any other purpose . You should carefully consider these risks and uncertainties and should carry out your own diligence, including review of the risk factors in the Registration Statement and the definitive proxy statement/prospectus when available, and consult with your own financial and legal advisors concerning the risks presented by the business of USARE, IPXX, the Combined Company and the Proposed Business Combination . Risks relating to the business of USARE and IPXX, the Proposed Business Combination, and the business of the Combined Company have been and will be disclosed in documents filed or furnished by IPXX or the Combined Company with the SEC, including the Registration Statement and other documents filed or furnished in connection with the Proposed Business Combination . The risks presented in such filings will be consistent with SEC filings typically relating to a public company, including with respect to the business and securities of IPXX, USARE, and the Combined Company, and the Proposed Business Combination, and may differ significantly from, and be more extensive than, those presented below . The use of “we”, “our”, or the “Company”, with respect to USARE’s business (or the Combined Company’s) after the Proposed Business Combination, shall generally refer to USARE before the Proposed Business Combination or the Combined Company after the Proposed Business Combination, respectively . Risks Relating to Our Business and Industry ● USARE’s magnet production facility in Stillwater, Oklahoma (the “ Stillwater Facility ”) is under development and is not yet completed, USARE has not commenced producing and selling NdFeB magnets, and USARE has no history in commercial operations and the lack of commercial operations limits the accuracy of any forward - looking forecasts, prospects or business outlook or plans. ● We may not be able to generate positive cashflow from our expected future business operations. Our long - term success will depend on implementing the business strategy and operational plan of USARE, as well as our ability to generate revenues, achieve and maintain profitability and develop positive cash flows from our magnet production. ● We may experience time delays, unforeseen expenses, increased capital costs, and other complications while developing our Stillwater Facility and Round Top Project (collectively, our “ Projects ”) that could delay the start of revenue - generating activities and increase development costs. ● Until our Round Top Project is capable of satisfying our feedstock needs, if ever, our business is subject to the availability of REE oxide and metal feedstock, in quantities and prices that allow USARE to develop and commercially operate its Stillwater Facility. ● We may be adversely affected by fluctuations in supply and demand for, and prices of, NdFeB magnets, magnet materials, and necessary feedstock. ● We may not be able to convert current commercial discussions and/or memorandums of understanding with customers for the sale of our NdFeB magnets and other products into definitive contracts, which may have a negative effect on our business. ● The success of our business will depend, in part, on the growth of existing and emerging uses for NdFeB magnets. ● An increase in the global supply of NdFeB magnets or, dumping, predatory pricing and other tactics by our competitors or state actors may adversely affect our profitability. ● The Round Top Project is at the exploration stage and USARE has not commenced construction or commission of the mine nor related facilities, and the development of the Round Top Project into a producing mine is subject to a variety of risks, any number of which may cause the development of the Round Top Project into a producing mine to not occur, be delayed, or not result in the commercial extraction of minerals. ● We operate in a highly competitive industry in a high demand and growth environment and additional manufacturing, refining and mining competitors could result in a reduction in revenue. ● Changes in China’s or the United States’ political environment and policies, including changes in export/import policy may adversely affect our business. ● The production of NdFeB magnets is a capital - intensive business that requires the commitment of substantial resources; if we do not have sufficient capital or other resources necessary to provide for such production, it could negatively impact our business. ● The amount of capital required for completion and build - out of USARE’s Projects may increase materially from our current estimates, and we expect to raise further funds through equity or debt financing, joint ventures, production sharing arrangements or other means. Consequently, we depend on our ability to successfully access the capital and financial markets. Any inability to access the capital or financial markets may limit our ability to fund our ongoing operations, execute our business plan or pursue capital investments that we may rely on for future growth. ● Any failure by management to manage growth properly could negatively impact our business. ● A power or other utility disruption or shortage at our Projects could temporarily delay operations and increase costs, which may negatively impact our business. ● Increasing costs, including rising electricity and other utility costs, or limited access to raw materials may adversely affect our profitability. ● Fluctuations in transportation costs or disruptions in transportation services or damage or loss during transport could decrease our competitiveness or impair our ability to deliver products to our customers. ● We will need to produce our products to exacting specifications in order to provide future customers with a consistently high - quality product. An inability to meet individual customer specifications would negatively impact our business. ● Diminished access to water may adversely affect our operations. ● Work stoppages or similar difficulties, breakdown in labor relations, or a shortage of skilled technicians and engineers could significantly disrupt our operations and reduce our revenues. ● We depend on key personnel for the success of our business. If we fail to retain our key personnel or if we fail to attract additional qualified personnel, we may not be able to achieve our desired level of growth and our business could suffer. ● The hiring and retention of a highly qualified Chief Financial Officer may be necessary for USARE’s future success. ● We are subject to certain agreements with government entities that have provided us with certain incentives and favorable financing and contain conditions and obligations, including local investment, job creation, and repayment terms, that, if not complied with, could negatively impact our business or require us to repay that financing or lose access to those incentives. ● The holders of our preferred stock have certain approval rights over actions taken by the Company, including related to incurring debt. If we are unable to secure those approvals or do so in a timely manner, we may fail to access debt capital when otherwise necessary or advisable. ● Our business may be adversely affected by force majeure events outside our control, including labor unrest, civil disorder, war, subversive activities or sabotage, extreme weather conditions, fires, floods, tornados, explosions or other catastrophes, epidemics or quarantine restrictions.

Risk Factors (2) 34 ● Our success depends on developing and maintaining relationships with local communities and stakeholders. ● Since its inception, the Company has generated negative operating cash flows and we may experience negative cash flow from operations in the future. Our consolidated financial statements have been prepared on a going concern basis. Risks Related to Legal, Compliance, and Regulations ● Our operations at our Projects are subject, or may become subject, to extensive and costly environmental requirements; and current and future laws, regulations and permits impose or may impose significant costs, liabilities or obligations or could limit or prevent our ability to continue our current operations or to undertake new operations. ● We will be required to obtain and sustain governmental permits and approvals to develop and operate the Projects, a process which is often costly and time - consuming. Failure to obtain or retain any necessary permits or approvals for our planned operations may negatively impact our business. ● Our failure to comply with applicable anti - corruption, anti - bribery, anti - money laundering and similar laws and regulations could negatively impact our reputation and results of operations. ● Our operations at our Projects are subject, or may become subject, to environmental, health and safety regulations, which could impose additional costs and compliance requirements, and we may face claims and liability for breaches, or alleged breaches, of such regulations and other applicable laws. ● The impacts of climate change may adversely affect our operations and/or result in increased costs to comply with changes in regulations. ● We are exposed to possible litigation risks, including permit disputes (including in respect of access and/or validity of tenure), environmental claims, occupational health and safety claims and employee claims. Further, we may be involved in disputes with other parties in the future that may result in litigation. Current or future litigation or administrative proceedings could have a negative impact on our business. ● If we take federal monies, we could become subject to federal regulations. This could delay timing and increase costs. Risks Related to Intellectual Property and Technology ● If we infringe, or are accused of infringing, the intellectual property rights of third parties, it may increase our costs or prevent us from being able to commercialize new products. ● We may not be able to adequately protect our intellectual property rights. If we fail to adequately enforce or defend our intellectual property rights, our business may be harmed. ● We are dependent upon information technology systems, which are subject to cyber threats, disruption, damage and failure. Any unauthorized access to, disclosure, or theft of personal information we gather, store, or use could harm our reputation and subject us to claims or litigation. Further, a failure of our information technology and data security infrastructure could adversely affect our business and operations. Risks Related to IPXX and the Proposed Business Combination ● Directors and officers of IPXX, Inflection Point Holdings II LLC (the “ Sponsor ”), and their affiliates have interests in the Proposed Business Combination and the proposals described in this proxy statement/prospectus that are different from, or in addition to and/or in conflict with, those of IPXX’s shareholders generally. ● The Sponsor and IPXX’s directors and officers have agreed to vote in favor of the Proposed Business Combination, regardless of how IPXX’s public shareholders vote. ● The ability of IPXX’s public shareholders to exercise redemption rights with respect to a large number of IPXX public shares could increase the probability that the Proposed Business Combination will be unsuccessful and that you would have to wait for liquidation in order to redeem your public shares. ● The Sponsor, IPXX’s or USARE’s directors, managers, officers, advisors and their affiliates may elect to purchase public shares or Public Warrants (as defined below), which may influence a vote on the Proposed Business Combination and reduce the public “float” of the public shares or Public Warrants. ● Past performance by IPXX’s management team, IPXX’s advisors and their respective affiliates, including investments and transactions in which they have participated and businesses with which they have been associated, may not be indicative of future performance of an investment in the Combined Company. ● IPXX cannot assure you that its diligence review has identified all material risks associated with the Proposed Business Combination, and you may be less protected as an investor from any material issues with respect to USARE’s business, including any material omissions or misstatements contained in the Registration Statement or this Presentation relating to the Proposed Business Combination, than an investor in an underwritten initial public offering. ● IPXX (or the Combined Company) will not have any right to make damage claims against USARE for the breach of any representation, warranty or covenant made by USARE in the Business Combination Agreement. ● IPXX’s shareholders will experience dilution due to the issuance of shares of the Combined Company’s common stock (“ New USARE Common Stock ”) and securities convertible into the shares of New USARE Common Stock to the USARE members as consideration in the Proposed Business Combination and the issuance of securities in the Series A private placement in connection with the closing of the Proposed Business Combination. ● Subsequent to the consummation of the Proposed Business Combination, the Combined Company may be required to take write - downs or write - offs, restructuring and impairment or other charges that could have a significant negative effect on the Combined Company’s financial condition, results of operations and stock price, which could cause you to lose some or all of your investment. ● The Combined Company’s actual financial position and results of operations may differ materially from the unaudited pro forma financial information included in the Registration Statement. ● The projections and forecasts presented in this Presentation or in the Registration Statement may not be an indication of the actual results of the transaction or the Combined Company’s future results. ● There can be no assurance that the New USARE Common Stock and New USARE Warrants issued in connection with the Proposed Business Combination will be approved for listing on Nasdaq following the closing of the Proposed Business Combination, or if approved, will remain listed on Nasdaq in the future. ● There is substantial doubt about IPXX’s ability to continue as a going concern. ● If third parties bring claims against IPXX, the proceeds held in IPXX’s trust account (the “ Trust Account ”) could be reduced and the per - share redemption amount received by shareholders may be less than $10.05 per share. ● IPXX’s directors may decide not to enforce the indemnification obligations of the Sponsor, resulting in a reduction in the amount of funds in the Trust Account available for distribution to IPXX’s public shareholders. ● IPXX may not have sufficient funds to satisfy indemnification claims of IPXX’s directors and officers.

Risk Factors (3) 35 ● If, before distributing the proceeds in the Trust Account to IPXX’s public shareholders, IPXX files a bankruptcy or insolvency petition or an involuntary bankruptcy or insolvency petition is filed against IPXX that is not dismissed, the claims of creditors in such proceeding may have priority over the claims of IPXX’s shareholders and the per - share amount that would otherwise be received by IPXX’s shareholders in connection with IPXX’s liquidation may be reduced. ● If, after IPXX distributes the proceeds in the Trust Account to its public shareholders, it files a bankruptcy or insolvency petition or an involuntary bankruptcy or insolvency petition is filed against it that is not dismissed, a bankruptcy or insolvency court may seek to recover such proceeds, and the members of the IPXX board of directors the (“ IPXX Board ”) may be viewed as having breached their fiduciary duties to IPXX’s creditors, thereby exposing the members of the IPXX Board and IPXX to claims of punitive damages. ● The SEC has recently issued final rules to regulate special purpose acquisition companies. Certain of the procedures that IPXX may determine to undertake in connection with such rules may increase IPXX’s costs and the time needed to complete the Proposed Business Combination or any other initial business combination and may constrain the circumstances under which IPXX could complete the Proposed Business Combination, or any other initial business combination. ● There is a risk that the 1% U.S. federal excise tax may be imposed on IPXX in connection with redemptions of IPXX’s public shares. ● If IPXX is deemed to be an investment company under the Investment Company Act, IPXX may be required to institute burdensome compliance requirements and IPXX’s activities may be restricted, which may make it difficult for IPXX to complete the Proposed Business Combination or another initial business combination or force IPXX to abandon its efforts to complete an initial business combination. ● IPXX may not be able to complete the Proposed Business Combination, or another initial business combination, since such initial business combination may be subject to regulatory review and approval requirements, including foreign investment regulations and review by government entities such as the Committee on Foreign Investment in the United States (“ CFIUS ”), or may be ultimately prohibited. ● IPXX’s shareholders may be held liable for claims by third parties against IPXX to the extent of distributions received by them upon redemption of their shares. ● IPXX’s letter agreement with the Sponsor and IPXX’s officers and directors may be amended without shareholder approval. ● If you or a “group” of shareholders are deemed to hold in excess of 15% of the IPXX public shares, you may lose the ability to redeem all such shares in excess of 15% of our IPXX public shares. ● You will not have any rights or interests in funds from the Trust Account, except under certain limited circumstances. Therefore, to liquidate your investment, you may be forced to sell your IPXX public shares and/or warrants, potentially at a loss. ● An IPXX public shareholder’s decision whether to redeem its shares for a pro rata portion of the Trust Account may not put such shareholder in a better future economic position. ● The net cash available to the Combined Company from the Trust Account and the financings described in the Registration Statement in respect of each IPXX public share that is not redeemed will be materially less than the price per share ascribed in the Business Combination Agreement to the shares of New USARE Common Stock to be issued to the USARE members. ● If an IPXX public shareholder fails to receive notice of IPXX’s offer to redeem its public shares in connection with the Proposed Business Combination, or fails to comply with the procedures for submitting or tendering its public shares, such public shares may not be redeemed. ● If IPXX is unable to consummate the Proposed Business Combination or another initial business combination by the date required in the Cayman Constitutional Documents, IPXX’s public shareholders may be forced to wait beyond such date before redemption from the Trust Account. ● The completion of the Proposed Business Combination is subject to certain closing conditions, including satisfaction of all closing conditions in the Business Combination Agreement, and any such conditions may not be satisfied on a timely basis, if at all. ● The exercise of IPXX’s management’s discretion in agreeing to changes or waivers in the terms of the Proposed Business Combination may result in a conflict of interest when determining whether such changes to the terms of the Proposed Business Combination or waivers of conditions are appropriate and in the IPXX’s shareholders’ best interest. ● IPXX may be targeted by securities class action and derivative lawsuits that could result in substantial costs and may delay or prevent the Proposed Business Combination from being completed. ● The terms of the Public Warrants (as defined below) may be amended in a manner that may be adverse to holders with the approval by the holders of at least 50% of the then outstanding Public Warrants. ● The IPXX public warrant agreement (the “ Warrant Agreemen t”) designates the courts of the State of New York or the United States District Court for the Southern District of New York as the sole and exclusive forum for certain types of actions and proceedings that may be initiated by holders of IPXX’s warrants, which could limit the ability of warrant holders to obtain a favorable judicial forum for disputes. ● An anti - dilution provision of the Warrant Agreement may make it more difficult for IPXX to consummate the Proposed Business Combination. Risks Related to the Domestication and the Proposed Business Combination ● The continuation of IPXX by way of domestication of IPXX into a Delaware corporation under the applicable provisions of the Companies Act (as revised) of the Cayman Islands and the Delaware General Corporation Law, as amended, may result in adverse tax consequences for holders of IPXX class A ordinary shares and IPXX warrants. Risks Related to the Adjournment Proposal ● If the Adjournment Proposal is not approved, and a quorum is present, but an insufficient number of votes have been obtained to approve the Business Combination Proposal, the IPXX Board will not have the ability to adjourn the extraordinary general meeting to a later date in circumstances where such adjournment is necessary to permit the Proposed Business Combination to be approved. Risks Related to the Combined Company’s Securities Following the Consummation of the Proposed Business Combination ● If the benefits of the Proposed Business Combination do not meet the expectations of investors or securities analysts, the market price of the Combined Company’s securities may decline. ● Even if IPXX and USARE consummate the Proposed Business Combination, there is no guarantee that the warrants received in exchange for IPXX warrants (“ New USARE Warrants ”) will ever be in the money, and they may expire worthless. ● Your unexpired New USARE Warrants may be redeemed prior to their exercise at a time that is disadvantageous to you, thereby making your warrants worthless.

Risk Factors (4) 36 ● The New USARE Warrants and the other warrants to be issued by the Combined Company may have an adverse effect on the market price of the Combined Company’s common stock. ● You may only be able to exercise warrants included in IPXX units sold in IPXX’s IPO (whether they were purchased in the IPO as part of a IPXX unit or thereafter in the open market) (such warrants, “ Public Warrants ”) on a “cashless basis” under certain circumstances, and if you do so, you will receive fewer shares of the Combined Company’s common stock from such exercise than if you were able to exercise such Public Warrants for cash. ● The requirements of being a public company in the United States, if the Proposed Business Combination is completed, may strain the Combined Company’s resources and divert management’s attention, and the increases in legal, accounting and compliance expenses that will result from being a public company in the United States may be greater than we anticipate. ● If the merger in the Proposed Business Combination does not qualify as a reorganization under Section 368(a) of the Code, U.S. Holders of USARE securities may be required to pay substantial U.S. federal income taxes. ● The proposed New USARE Certificate of Incorporation will provide, subject to limited exceptions, that the courts of the State of Delaware will be the sole and exclusive forum for certain stockholder litigation matters, which could limit our stockholders’ ability to obtain a favorable judicial forum for disputes with us or our directors, officers, employees or stockholders.