Exhibit 99.1

2025 INFLECTION POINT ACQUISITION CORP. II PLEASE DO NOT RETURN THE PROXY CARD IF YOU ARE VOTING ELECTRONICALLY. 194973 Inflection Point Acquisition Corp. II Proxy Card Rev6 Front to vote your shares in the same manner as if you marked, signed and returned your proxy card . Votes submitted electronically over the Internet must be received by 11 : 59 p . m . , Eastern Time, on [ ––––– ], 2025 . INTERNET – www.cstproxyvote.com Use the Internet to vote your proxy. Have your proxy card available when you access the above website. Follow the prompts to vote your shares. VOTE AT THE MEETING – If you plan to attend the virtual online Extraordinary General Meeting, you will need your 12 digit control number to vote electronically at the Extraordinary General Meeting. To attend the Extraordinary General Meeting, visit: https://www.cstproxy.com/ inflectionpointacquisitionii/2025 MAIL – Mark, sign and date your proxy card and return it in the postage - paid envelope provided. YOUR VOTE IS IMPORTANT. PLEASE VOTE TODAY. Vote by Internet - QUICK YYY EASY IMMEDIATE - 24 Hours a Day, 7 Days a Week or by Mail Your Internet vote authorizes the named proxies FOLD HERE • DO NOT SEPARATE • INSERT IN ENVELOPE PROVIDED THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS INFLECTION POINT ACQUISITION CORP. II NOTICE OF EXTRAORDINARY GENERAL MEETING TO BE HELD ON [ ––––– ] , 2025 The undersigned appoints Michael Blitzer and Peter Ondishin, and each of them, as proxies, each with the power to appoint their substitute, and authorizes each of them to represent and to vote, as designated on the reverse hereof, all of the ordinary shares of Inflection Point Acquisition Corp . II (“ Inflection Point ”) held of record by the undersigned at the close of business on [ ––––– ], 2025 at the Extraordinary General Meeting (the “ extraordinary general meeting ”) to be held at [ –– ] : 00 a . m . Eastern Time, on [ ––––– ], 2025 at the offices of White & Case LLP located at 1221 Avenue of the Americas, New York, NY 10020 , and virtually via live webcast at https : //www . cstproxy . com/inflectionpointacquisitionii/ 2025 and any adjournment thereof . THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED AS INDICATED . IF NO CONTRARY INDICATION IS MADE, THE PROXY WILL BE VOTED IN FAVOR OF ALL PROPOSALS, AND IN ACCORDANCE WITH THE JUDGMENT OF THE PERSONS NAMED AS PROXY HEREIN ON ANY OTHER MATTERS THAT MAY PROPERLY COME BEFORE THE EXTRAORDINARY GENERAL MEETING . THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS . PLEASE MARK, SIGN, DATE AND RETURN THE PROXY CARD PROMPTLY . PLEASE MARK, SIGN, DATE AND RETURN THE PROXY CARD PROMPTLY . (Continued, and to be marked, dated and signed, on the other side)

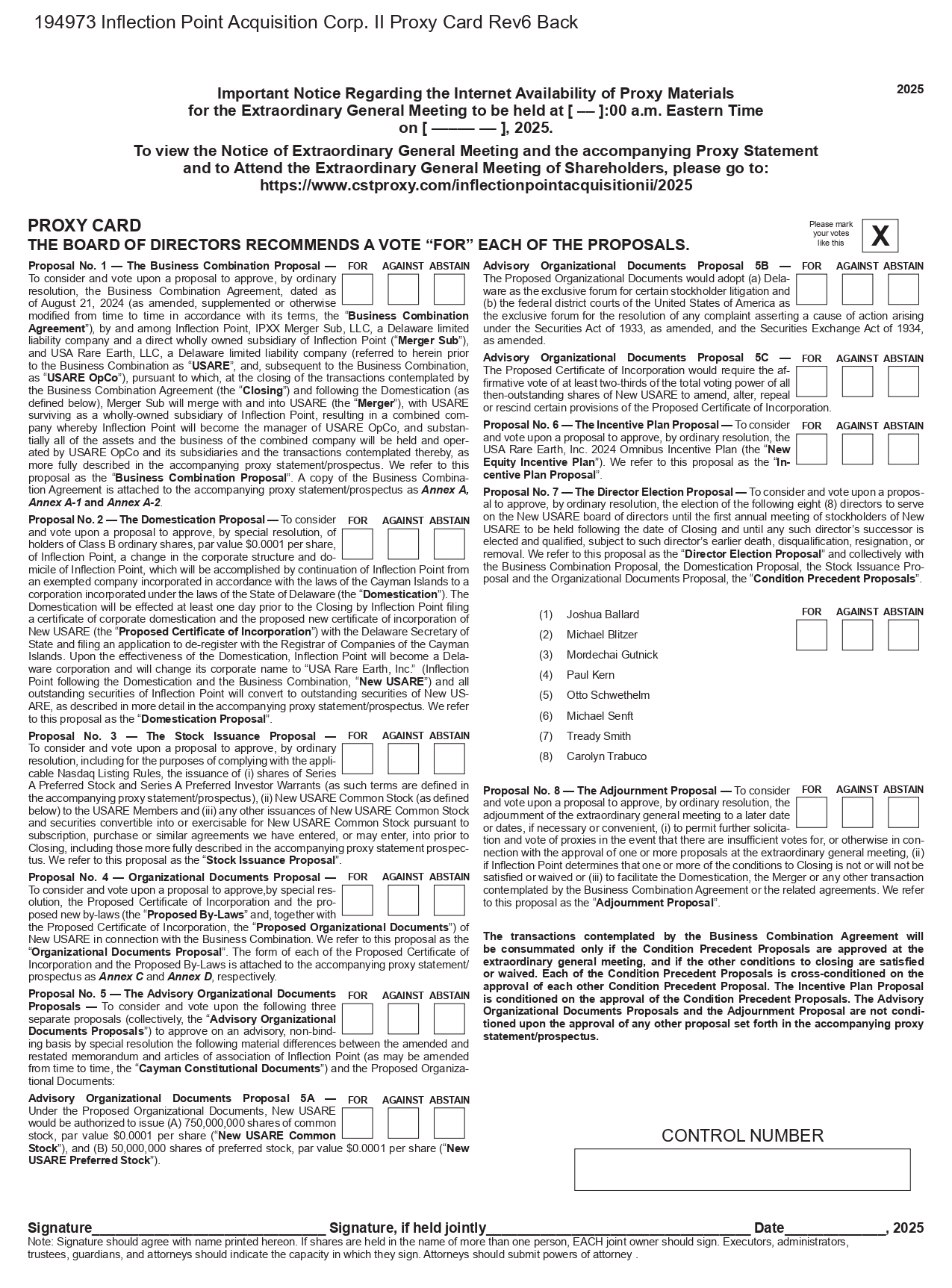

2025 Proposal No . 2 — The Domestication Proposal — To consider and vote upon a proposal to approve, by special resolution, of holders of Class B ordinary shares, par value $ 0 . 0001 per share, of Inflection Point, a change in the corporate structure and do - micile of Inflection Point, which will be accomplished by continuation of Inflection Point from an exempted company incorporated in accordance with the laws of the Cayman Islands to a corporation incorporated under the laws of the State of Delaware (the “ Domestication ”) . The Domestication will be effected at least one day prior to the Closing by Inflection Point filing a certificate of corporate domestication and the proposed new certificate of incorporation of New USARE (the “ Proposed Certificate of Incorporation ”) with the Delaware Secretary of State and filing an application to de - register with the Registrar of Companies of the Cayman Islands . Upon the effectiveness of the Domestication, Inflection Point will become a Dela - ware corporation and will change its corporate name to “USA Rare Earth, Inc . ” (Inflection Point following the Domestication and the Business Combination, “ New USARE ”) and all outstanding securities of Inflection Point will convert to outstanding securities of New US - ARE, as described in more detail in the accompanying proxy statement/prospectus . We refer to this proposal as the “ Domestication Proposal ” . Proposal No . 5 — The Advisory Organizational Documents Proposals — To consider and vote upon the following three separate proposals (collectively, the “ Advisory Organizational Documents Proposals ”) to approve on an advisory, non - bind - ing basis by special resolution the following material differences between the amended and restated memorandum and articles of association of Inflection Point (as may be amended from time to time, the “ Cayman Constitutional Documents ”) and the Proposed Organiza - tional Documents : Advisory Organizational Documents Proposal 5 A — Under the Proposed Organizational Documents, New USARE would be authorized to issue (A) 750 , 000 , 000 shares of common stock, par value $ 0 . 0001 per share (“ New USARE Common Stock ”), and (B) 50,000,000 shares of preferred stock, par value $0.0001 per share (“ New USARE Preferred Stock ”). Advisory Organizational Documents Proposal 5 C — The Proposed Certificate of Incorporation would require the af - firmative vote of at least two - thirds of the total voting power of all then - outstanding shares of New USARE to amend, alter, repeal or rescind certain provisions of the Proposed Certificate of Incorporation. Proposal No . 6 — The Incentive Plan Proposal — To consider and vote upon a proposal to approve, by ordinary resolution, the USA Rare Earth, Inc . 2024 Omnibus Incentive Plan (the “ New Equity Incentive Plan ”) . We refer to this proposal as the “ In - centive Plan Proposal ” . Proposal No . 7 — The Director Election Proposal — To consider and vote upon a propos - al to approve, by ordinary resolution, the election of the following eight ( 8 ) directors to serve on the New USARE board of directors until the first annual meeting of stockholders of New USARE to be held following the date of Closing and until any such director’s successor is elected and qualified, subject to such director’s earlier death, disqualification, resignation, or removal . We refer to this proposal as the “ Director Election Proposal ” and collectively with the Business Combination Proposal, the Domestication Proposal, the Stock Issuance Pro - posal and the Organizational Documents Proposal, the “ Condition Precedent Proposals ” . (1) Joshua Ballard (2) Michael Blitzer (3) Mordechai Gutnick (4) Paul Kern (5) Otto Schwethelm (6) Michael Senft (7) Tready Smith (8) Carolyn Trabuco Proposal No . 8 — The Adjournment Proposal — To consider and vote upon a proposal to approve, by ordinary resolution, the adjournment of the extraordinary general meeting to a later date or dates, if necessary or convenient, (i) to permit further solicita - tion and vote of proxies in the event that there are insufficient votes for, or otherwise in con - nection with the approval of one or more proposals at the extraordinary general meeting, (ii) if Inflection Point determines that one or more of the conditions to Closing is not or will not be satisfied or waived or (iii) to facilitate the Domestication, the Merger or any other transaction contemplated by the Business Combination Agreement or the related agreements . We refer to this proposal as the “ Adjournment Proposal ” . The transactions contemplated by the Business Combination Agreement will be consummated only if the Condition Precedent Proposals are approved at the extraordinary general meeting, and if the other conditions to closing are satisfied or waived . Each of the Condition Precedent Proposals is cross - conditioned on the approval of each other Condition Precedent Proposal . The Incentive Plan Proposal is conditioned on the approval of the Condition Precedent Proposals . The Advisory Organizational Documents Proposals and the Adjournment Proposal are not condi - tioned upon the approval of any other proposal set forth in the accompanying proxy statement/prospectus . 194973 Inflection Point Acquisition Corp. II Proxy Card Rev6 Back Signature Signature, if held jointly Date , 2025 Note: Signature should agree with name printed hereon. If shares are held in the name of more than one person, EACH joint owner should sign. Executors, administrators, trustees, guardians, and attorneys should indicate the capacity in which they sign. Attorneys should submit powers of attorney . CONTROL NUMBER PROXY CARD THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF THE PROPOSALS. Please mark like this X your votes Proposal No . 1 — The Business Combination Proposal — FOR AGAINST ABSTAIN To consider and vote upon a proposal to approve, by ordinary resolution, the Business Combination Agreement, dated as of August 21 , 2024 (as amended, supplemented or otherwise modified from time to time in accordance with its terms, the “ Business Combination Agreement ”), by and among Inflection Point, IPXX Merger Sub, LLC, a Delaware limited liability company and a direct wholly owned subsidiary of Inflection Point (“ Merger Sub ”), and USA Rare Earth, LLC, a Delaware limited liability company (referred to herein prior to the Business Combination as “ USARE ”, and, subsequent to the Business Combination, as “ USARE OpCo ”), pursuant to which, at the closing of the transactions contemplated by the Business Combination Agreement (the “ Closing ”) and following the Domestication (as defined below), Merger Sub will merge with and into USARE (the “ Merger ”), with USARE surviving as a wholly - owned subsidiary of Inflection Point, resulting in a combined com - pany whereby Inflection Point will become the manager of USARE OpCo, and substan - tially all of the assets and the business of the combined company will be held and oper - ated by USARE OpCo and its subsidiaries and the transactions contemplated thereby, as more fully described in the accompanying proxy statement/prospectus . We refer to this proposal as the “ Business Combination Proposal ” . A copy of the Business Combina - tion Agreement is attached to the accompanying proxy statement/prospectus as Annex A, Annex A - 1 and Annex A - 2 . Advisory Organizational Documents Proposal 5 B — FOR AGAINST ABSTAIN The Proposed Organizational Documents would adopt (a) Dela - ware as the exclusive forum for certain stockholder litigation and (b) the federal district courts of the United States of America as the exclusive forum for the resolution of any complaint asserting a cause of action arising under the Securities Act of 1933 , as amended, and the Securities Exchange Act of 1934 , as amended . FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN Proposal No . 3 — The Stock Issuance Proposal — To consider and vote upon a proposal to approve, by ordinary resolution, including for the purposes of complying with the appli - cable Nasdaq Listing Rules, the issuance of (i) shares of Series A Preferred Stock and Series A Preferred Investor Warrants (as such terms are defined in the accompanying proxy statement/prospectus), (ii) New USARE Common Stock (as defined below) to the USARE Members and (iii) any other issuances of New USARE Common Stock and securities convertible into or exercisable for New USARE Common Stock pursuant to subscription, purchase or similar agreements we have entered, or may enter, into prior to Closing, including those more fully described in the accompanying proxy statement prospec - tus . We refer to this proposal as the “ Stock Issuance Proposal ” . Proposal No . 4 — Organizational Documents Proposal — FOR AGAINST ABSTAIN To consider and vote upon a proposal to approve,by special res - olution, the Proposed Certificate of Incorporation and the pro - posed new by - laws (the “ Proposed By - Laws ” and, together with the Proposed Certificate of Incorporation, the “ Proposed Organizational Documents ”) of New USARE in connection with the Business Combination . We refer to this proposal as the “ Organizational Documents Proposal ” . The form of each of the Proposed Certificate of Incorporation and the Proposed By - Laws is attached to the accompanying proxy statement/ prospectus as Annex C and Annex D , respectively . FOR AGAINST ABSTAIN Important Notice Regarding the Internet Availability of Proxy Materials for the Extraordinary General Meeting to be held at [ –– ]:00 a.m. Eastern Time on [ ––––– –– ], 2025. To view the Notice of Extraordinary General Meeting and the accompanying Proxy Statement and to Attend the Extraordinary General Meeting of Shareholders, please go to: https://www.cstproxy.com/inflectionpointacquisitionii/2025 FOR AGAINST ABSTAIN