UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment 2

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

MARKY CORP.

(Exact name of Registrant as specified in its charter)

| Wyoming | 7370 | 32-0689703 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

Best Wyoming Registered Agent LLC

30 N Gould St. Sheridan,

WY 82801

(307) 655-7303

(Name, address, telephone number of agent for service)

Kos Ramirez Maximiliano,

San Sebastian 309, Martinica León,

Guanajuato, Mexico

+ 18609730746

email@markycopr.com

(Address and Telephone Number of Registrant’s Principal

Executive Offices and Principal Place of Business)

Approximate date of proposed sale to the public: As soon as practicable and from time to time after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

| (Do not check if a smaller reporting company) | Emerging Growth Company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Amount to be Registered | Proposed Maximum Offering Price per Share | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee | ||||||||||||

| Common Stock, par value $0.001 per share | 4,000,000 | $ | 0.03 | $ | 120,000 | $ | 13.22 | |||||||||

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Commission, acting pursuant to such Section 8(a), may determine.

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION DATED JUNE 13, 2023

Marky Corp.

(a Wyoming Corporation)

4,000,000 COMMON STOCK SHARES

This is an initial offering of Marky Corp. Common Shares has no public market for the securities offered. Marky Corp. is offering 4,000,000 of its Common Shares for sale on a "self-subscribe" and "best effort" basis. The shares will be offered at a fixed price of US$0.03 per share. The offering shall terminate on the earlier of (i) when the offering period ends (300 days from the effective date of this prospectus), (ii) the date when the sale of all 4,000,000 shares is completed, (iii) when the Board of Directors decides that it is in the best interest of the Company to terminate the offering prior to the completion of the sale of all 4,000,000 shares registered under the Registration Statement of which this Prospectus is part. The offer is being made voluntarily, on a best effort basis, which means that our President Kos Ramirez Maximiliano will try to sell the shares. We are making this offer without the involvement of underwriters or broker-dealers.

There is no minimum number of shares required to be purchased. This offering is on a best effort basis, meaning, no minimum number of shares must be sold. See "Use of Proceeds" and "Plan of Distribution".

3

Following the completion of this offering, Mr. Maximiliano will own 100% of our outstanding common stock if no shares are sold and 46.7% of our outstanding common stock if all 4,000,000 shares are sold. Due to this he can make and control corporate decisions that may be disadvantageous to minority shareholders.

Prior to this offering, there has been no public market for our common stock and we have not applied for the listing or quotation of our common stock on any public market. We have arbitrarily determined the offering price of $0.03 per share in relation to this offering.

The offering price bears no relationship to our assets, book value, earnings or any other customary investment criteria. After the effective date of the registration statement, we intend to seek a market maker to file an application with the Financial Industry Regulatory Authority (“FINRA”) to have our common stock quoted on the OTC Markets. We currently have no market maker who is willing to list quotations for our stock. There is no assurance that Marky Corp. qualifies as an “emerging growth company” as defined in the Jumpstart our Business Startups Act (the “JOBS Act”).

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information about our business besides this prospectus. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or the sale of our shares of common stock.

Subscription funds accepted by the Company will be credited directly to its checking account and will not be held in escrow. The funds will be available for immediate use by the Company. The Company has no minimum capitalization requirements; therefore, no other subscription, escrow, or forfeiture accounts are created for the Offering. and are not returned to investors.

Our business is subject to many risks and an investment in our shares of common stock will also involve a high degree of risk. You should carefully consider the factors described under the heading “risk factors” beginning on page 12 before investing in our shares of common stock. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We do not consider ourselves a shell company or a blank check company. We are committed to implementing our business plan as described in this Prospectus on a long-term basis. As for today we already have a website and intend to develop and launch subscription-based news. We do not have any plans or intentions to be acquired by or merge with the operating company, nor do we, our management, or any of our shareholders have any plans to change control or similar transaction or change our direction.

We have made no written communications as defined under Rule 405 of the Securities Act to prospective investors or investors.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the SEC is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

4

Investing in our Common Stock is highly speculative and involves a high degree of risk.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should carefully consider the risks and uncertainties described under the heading “Risk Factors” beginning on page 12 of this prospectus before making a decision to purchase our Common Stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

This Prospectus is dated June 13, 2023.

5

TABLE OF CONTENTS

| PAGE | |

| Prospectus Summary | 7 |

| The Offering | 11 |

| Risk Factors | 12 |

| Cautionary Statement Regarding Forward-Looking Statements | 31 |

| About this Prospectus | 33 |

| Use of Proceeds | 35 |

| Determination of Offering Price | 36 |

| Dilution | 37 |

| Expenses of Registration | 38 |

| Dividend Policy | 38 |

| Plan of Distribution | 38 |

| Description of Securities | 41 |

| Interest of Named Experts | 44 |

| Description of Business | 44 |

| Legal Proceedings | 48 |

| Management’s Discussion and Analysis of Financial Condition and Results of Operations | 50 |

| Directors, Executive Officers, Promoters and Corporate Governance | 54 |

| Corporate Governance | 56 |

| Transactions with Related Persons, Promoters and Certain Control Persons | 59 |

| Disclosure of Commission Position on Indemnification of Securities Act Liabilities | 60 |

| Legal Matters | 60 |

| Available Information | 61 |

| Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 61 |

| Financial Statements | 62 |

| Information Not Required in Prospectus | 71 |

| Signatures | 75 |

6

Please read this Prospectus carefully and in its entirety. This Prospectus contains disclosure regarding our business, our financial condition and results of operations and risk factors related to our business and our Common Stock, among other material disclosure items. We have prepared this Prospectus so that you will have the information necessary.

You should rely only on information contained in this Prospectus. We have not authorized any other person to provide you with different information. This Prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any state where the offer or sale is not permitted. The information in this Prospectus is complete and accurate as of the date on the front cover, but the information may have changed since that date.

The Registration Statement containing this Prospectus, including the exhibits to the Registration Statement, provides additional information about our Company and the Common Stock offered under this Prospectus. The Registration Statement, including the exhibits and the documents incorporated herein by reference, can be read on the Securities and Exchange Commission website or at the Securities and Exchange Commission offices mentioned under the heading “Where You Can Find More Information.”

PROSPECTUS SUMMARY

Unless the context otherwise requires, we use the terms “we”, “us,” “our,” “company,” and “corporation” in this prospectus to refer to Marky Corp., Inc., a Wyoming incorporated entity. Website is referred to herein as “information platform”. Our Chief Executive Officer, Director, Mr. Maximiliano, Kos Ramirez Maximiliano is referred to herein as “Kos Ramirez Maximiliano.”

This summary contains basic information about us and the offering. Because it is a summary, it does not contain all the information that you should consider before investing. You should read the entire prospectus carefully, including the risk factors and our financial statements and the related notes to those statements included in this prospectus.

7

We have not authorized anyone to provide you with different information and you must not rely on any unauthorized information or representation. We are not making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. This document may only be used where it is legal to sell these securities. You should assume that the information appearing in this prospectus is accurate only as of the date on the front of this prospectus, regardless of the time of delivery of this prospectus, or any sale of our common stock. Our business, financial condition and results of operations may have changed since the date on the front of this prospectus. We urge you to carefully read this prospectus before deciding whether to invest in any of the common stock being offered.

Under U.S. federal securities legislation, our common stock will be “penny stock”. Penny stock is any equity that has a market price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require that a broker or dealer approve a potential investor’s account for transactions in penny stocks, and the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. In order to approve an investor’s account for transactions in penny stocks, the broker or dealer must obtain financial information and investment experience objectives of the person, and make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prepared by the Commission relating to the penny stock market, which, in highlight form sets forth the basis on which the broker or dealer made the suitability determination. Brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock. Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions.

8

Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

Our management has determined that it is in our best interests to become a reporting company under the Securities and Exchange Act of 1933 as amended (“Exchange Act”), and endeavor to establish a public trading market for our common stock on the OTCQB. Our management believes that establishing a public market: (i) will increase our profile as an active company in the licensing of our planned information platform, giving us greater identity and recognition: and (ii) will make it easier for us to attract capital, which we need to expand our business. There is no assurance that we will accomplish any of the foregoing goals and prospective investors are cautioned to carefully read the risk factors set forth herein prior to making an investment decision.

Overview

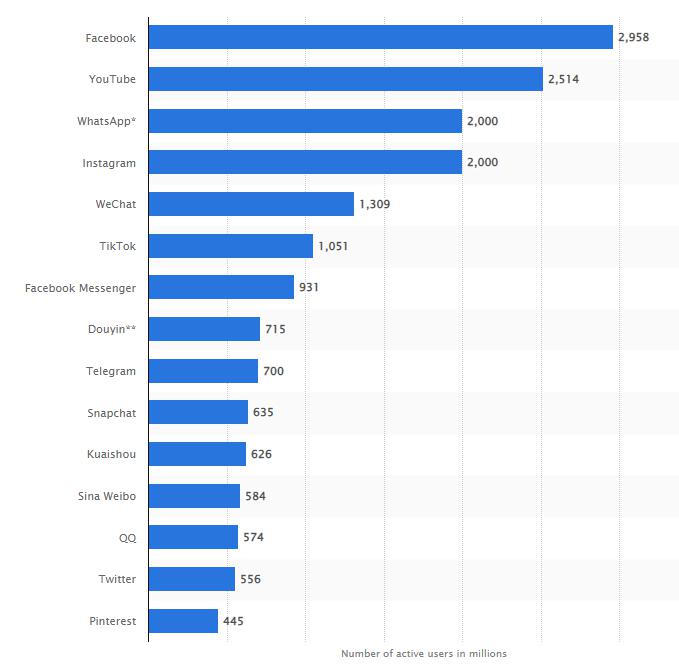

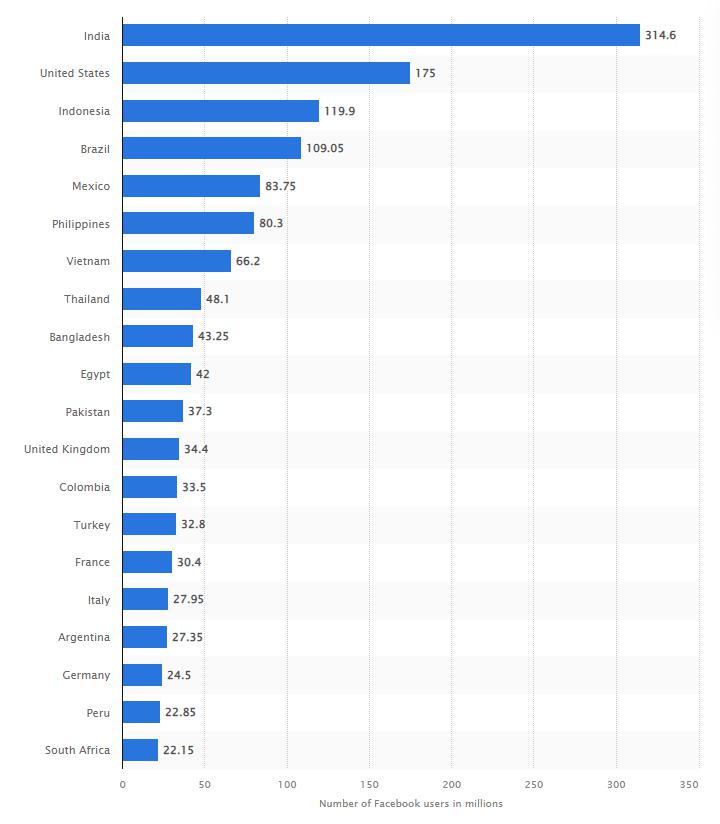

Our company plans to provide paid subscription-based information services in the field of social media marketing through a unique information platform. We intend to expand the range of news sources to offer our subscribers informative content. With our growing expertise in marketing and social media advertising, we aim to establish a notable presence in the industry.

Corporate Background

We were incorporated under the laws of the state of Wyoming on April 28, 2022.

Where You Can Find Us

Our principal executive office is San Sebastian 309, Martinica, León, Guanajuato, Mexico.

Our email address is email@markycopr.com.

9

Our Web-site

Our information platform is located at https://markycopr.com.

Summary of Risk Factors Applicable to Our Business

Investments in our securities involve a high degree of risk. The occurrence of one or more of the events or circumstances described in the Risk Factors section, alone or in combination with other events or circumstances, could have a material adverse effect on our business, financial condition, and results of operations. In this case, the trading price of our securities may decrease, and you may lose all or part of your investment. Such risks include, but are not limited to:

| o | We are a development-stage company and we have a short operating history. Therefore, we may never be able to carry out our proposed plan of operations or achieve any significant revenue or profitability. |

| o | We are selling this offering without an underwriter and may be unable to sell any shares. |

| o | We may not be able to further implement our business strategy unless sufficient funds are raised in this offering. |

| o | There is substantial doubt about our ability to continue as a going concern. |

| o | We may continue to lose money, and if we do not achieve profitability, we may not be able to continue our business. |

| o | We have limited sales and marketing experience, which increases the risk that our business will fail. |

| o | We may be unable to comply with disclosure controls and procedures necessary to make required public filings. |

| o | There are no substantial barriers to entry into the marketplace for the product we intend to develop and sell. |

10

THE OFFERING

| Common Stock offered by this offering | 4,000,000 Common Stock Shares | |

| Common Stock outstanding before the offering | 3,500,000 Common Stock Shares | |

| Common Stock outstanding after the offering | 7,500,000 Common Stock Shares | |

| Terms of the Offering | Our President, Kos Ramirez Maximiliano, will sell the 4,000,000 shares of common stock on behalf of the company, upon effectiveness of this registration statement, on a BEST-EFFORTS basis.

| |

Termination of the Offering

| Our offering will terminate on the earlier of (i) when the offering period ends (300 days from the effective date of this prospectus), (ii) the date when the sale of all 4,000,000 shares is completed, (iii) when the Board of Directors decides that it is in the best interest of the Company to terminate the offering prior to the completion of the sale of all 4,000,000 shares registered under the Registration Statement of which this Prospectus is part.

| |

| Trading Market | There is currently no market for our securities. Our common stock is not currently listed for trading on any exchange. It is our intention to seek quotation on the OTCQX or OTCQB but an application to trade our common stock has not been filed by a market maker on our behalf as of the date of this prospectus. There can be no assurance that our common stock will be approved for trading on the OTCQX or OTCQB, or any other trading exchange. | |

| Use of Proceeds | We intend to use the gross proceeds to us for developing and promoting our intended platform, advertising, marketing costs, and offering expenses. More detailed information https://markycopr.com is contained in ‘Use of Proceeds’ section.

| |

| Subscriptions | All subscriptions once accepted by us are irrevocable. | |

| Registration Costs | We estimate our total offering registration costs to be approximately $8,500. | |

| Reasons for Conducting this Offering and Filing an S-1 Registration Statement | We are filing an S-1 Registration Statement to become an SEC reporting company. | |

| Risk Factors | The Common Stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See “Risk Factors” beginning on page 12. |

11

RISK FACTORS

An investment in our securities involves a high degree of risk. You should carefully read and consider all of the risks described below, together with all of the other information contained or referred to in this prospectus, before making an investment decision concerning our securities. If any of the following events occur, our financial condition, business, and results of operations (including cash flows) may be materially adversely affected. In that event, the market price of our Class A common stock could decline, and you could lose all or part of your investment.

risks related to the offering

AS THERE IS NO MINIMUM FOR OUR OFFERING, IF ONLY A FEW PERSONS PURCHASE SHARES, THEY WILL LOSE THEIR INVESTMENT WITHOUT THE COMPANY BEING ABLE TO MAKE A SIGNIFICANT ATTEMPT TO IMPLEMENT ITS BUSINESS PLAN.

Since there is no minimum number of shares that must be sold directly by the company under this offering, if a limited number of shares are sold, we may not have enough capital to fully implement our proposed plan of operations. As such, we may not be able to meet the objectives we state in this prospectus or eliminate the "going concern" modification in the reports of our auditors as to uncertainty with respect to our ability to continue as a going concern. If we fail to raise sufficient capital, we would expect to have insufficient funds for our ongoing operating expenses. Any significant lack of funds will curtail the development and growth of our business and may cause our business to fail. If our business fails, investors will lose their entire investment.

12

WE ARE A DEVELOPMENT-STAGE COMPANY AND WE HAVE A SHORT OPERATING HISTORY. THEREFORE, WE MAY NEVER BE ABLE TO CARRY OUT OUR PROPOSED PLAN OF OPERATIONS OR ACHIEVE ANY SIGNIFICANT REVENUE OR PROFITABILITY.

Our business focuses on creating an information resource for specialists in the field of Internet and social media marketing. This involves a website featuring informational articles on a non-paid basis. We are currently in the development stage of our platform and are actively working on filling it with news to provide monthly up-to-date information. In line with this, we are also working on providing subscriptions for our clients, which includes purchasing an RSS feed and developing subscription features to enhance the user experience.

However, it is important to note that as a new business enterprise, we are subject to the risks inherent in establishing a new venture. To date, we have not generated any revenues. Our future profitability will be dependent upon the successful development and implementation of our proposed income/expense product and its successful marketing and sale, which are subject to numerous risk factors as set forth herein. Accordingly, we may not be able to successfully carry out our plan of operations and investors may lose their entire investment.

WE ARE SELLING THIS OFFERING WITHOUT AN UNDERWRITER AND MAY BE UNABLE TO SELL ANY SHARES.

This offering is self-underwritten, that is, we are not going to engage the services of an underwriter to sell the shares. We intend to sell our shares through Mr. Maximiliano, our sole officer and director, who will receive no commissions or other remuneration from any sales made. Mr. Maximiliano will offer the shares to friends, family members, and business associates; however, there is no guarantee that he will be able to sell any of the shares. Unless Mr. Maximiliano is successful in selling all of the shares and we receive the maximum amount of proceeds from this offering, we may have to seek alternative financing to implement our plan of operations.

13

WE MAY NOT BE ABLE TO FURTHER IMPLEMENT OUR BUSINESS STRATEGY UNLESS SUFFICIENT FUNDS ARE RAISED IN THIS OFFERING.

We may not raise sufficient proceeds from this offering to further business development, or to provide adequate cash flow for our planned business activities.

As of January 31, 2023, we had cash on hand in amount of $4,629 and have sustained a net loss of $362. We have not generated any revenue from our operations to date. At this rate, we expect to continue operations and obtain additional funding or begin to generate revenue. Accordingly, we anticipate that additional funding will be needed for general administrative expenses, the design and development of our proposed income/expense tracking application, business development and marketing costs.

Our sole officer and director Mr. Maximiliano, has agreed to lend the Company up to $70,000.00 in funds so it can remain a current issuer. The written agreement with Mr. Maximiliano is filed hereto as Exhibit 10.1. Given past expenditures, the Company will be able to conduct its business with current funding for an additional two to three years.

As of April 28, 2022, our sole director has loaned to the Company $70,000. This loan is unsecured, non-interest bearing and due on demand.

Our ability to obtain additional financing will be subject to a number of factors, including general market conditions, investor acceptance of our plan of operations and initial results from our business operations. There is no assurance that any additional financing will be available or, if available, on terms that will be acceptable to us. Failure to secure additional financing will cause us to go out of business. If this happens, you could lose all or part of your investment.

If our resources are insufficient to satisfy our cash requirements, we may seek to sell additional equity or debt securities or obtain a credit facility. The sale of additional equity securities could result in additional dilution to our stockholders. The incurrence of indebtedness would result in increased debt service obligations and could result in operating and financing covenants that would restrict our operations. We cannot assure you that financing will be available in amounts or on terms acceptable to us, if at all.

14

THERE IS SUBSTANTIAL DOUBT ABOUT OUR ABILITY TO CONTINUE AS A GOING CONCERN.

Our financial statements for the period from inception to January 31, 2023 have been prepared assuming that we will continue as a going concern. This factor, among others, raise a substantial doubt about our ability to continue as a going concern. Our ability to generate future revenue will depend on a number of factors, many of which are beyond our control. These factors include general economic conditions, market acceptance of our proposed product and competitive efforts. Due to these factors, we cannot anticipate with any degree of certainty what our revenue will be in future periods. As such, our independent certified public accountants have expressed substantial doubt about our ability to continue as a going concern. This opinion could materially limit our ability to raise additional funds by issuing new debt or equity securities or otherwise. You should carefully consider our independent certified public accountants' comments when determining if an investment in the company is suitable.

WE ARE AN "EMERGING-GROWTH COMPANY" UNDER THE JOBS ACT, AND WE CANNOT BE CERTAIN IF THE REDUCED DISCLOSURE REQUIREMENTS APPLICABLE TO EMERGING GROWTH COMPANIES WILL MAKE OUR COMMON STOCK LESS ATTRACTIVE TO INVESTORS.

We are an “emerging growth company”, as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not "emerging growth companies" including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved.

We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

15

In addition, Section 107 of the JOBS Act also provides that an "emerging growth company" can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended, for complying with new or revised accounting standards. In other words, an "emerging growth company" can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies.

We will remain an "emerging growth company" for up to five years, although we will lose that status sooner if our revenues exceed $1,235 billion, if we issue more than $1 billion in non-convertible debt in a three-year period, or if the market value of our common stock that is held by non-affiliates exceeds $700 million.

WE HAVE COMMENCED INITIAL OPERATIONS IN OUR BUSINESS. WE EXPECT TO INCUR SIGNIFICANT OPERATING LOSSES FOR THE FORESEEABLE FUTURE.

Since the incorporation and to the date, we have been involved primarily in organizational activities. We have commenced initial business operations. Accordingly, we have no way to evaluate the likelihood that our business will be successful. Potential investors should be aware of the difficulties normally encountered by new companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the operations that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to the ability to generate sufficient cash flow to operate our business, and additional costs and expenses that may exceed current estimates. We anticipate that we will incur increased operating expenses without realizing significant revenues. We expect that we may incur significant losses into the foreseeable future.

16

We recognize that if the effectiveness of our business plan is not forthcoming, we will not be able to continue business operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and it is doubtful that we will generate additional revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

KOS RAMIREZ MAXIMILIANO, OUR PRINCIPAL STOCKHOLDER, BENEFICIALLY OWNS GREATER THAN 47% OF OUR OUTSTANDING SHARES OF COMMON STOCK, WHICH CAUSES US TO BE DEEMED A “CONTROLLED COMPANY”.

Our sole director currently controls approximately 100% of the voting power of our capital stock. As a result, he owns more than 47% of our outstanding shares and as such, we are a “controlled company” under certain governance rules. Under these rules, a company of which more than 50% of the voting power is held by an individual, a group or another company is a “controlled company” and, as such, can elect to be exempt from certain corporate governance requirements, including requirements that:

● a majority of the Board of Directors consist of independent directors;

● the board maintain a nominations committee with prescribed duties and a written charter; and

● the board maintain a compensation committee with prescribed duties and a written charter and comprised solely of independent directors.

As a “controlled company,” we may elect to rely on some or all of these exemptions, however, we do not intend take advantage of any of these exemptions. Despite the fact we do not intend to take advantage of these exemptions, our status as a “controlled company” could make our common stock less attractive to some investors or otherwise harm our stock price.

17

WE HAVE LIMITED SALES AND MARKETING EXPERIENCE, WHICH INCREASES THE RISK THAT OUR BUSINESS WILL FAIL.

We have limited experience in the marketing of online platforms. Our future success will depend, among other factors, upon whether our services can be sold at a profitable price and the extent to which subscribers acquire, adopt, and continue to use them. There can be no assurance that our company will gain wide acceptance in its targeted markets or that we will be able to effectively market our services.

WE MAY BE UNABLE TO COMPLY WITH DISCLOSURE CONTROLS AND PROCEDURES NECESSARY TO MAKE REQUIRED PUBLIC FILINGS.

Given our limited resources, we may be unable to maintain effective controls to ensure that we are able to make all required public filings in a timely manner. If we are successful in having our common stock listed on a stock exchange or quotation service, and if we do not make all public filings in a timely manner, our shares of common stock may be delisted, and we could also be subject to regulatory action and/or lawsuits by stockholders.

WE ARE IN A COMPETITIVE MARKET, WHICH COULD IMPACT OUR ABILITY TO GAIN MARKET SHARE WHICH COULD HARM OUR FINANCIAL PERFORMANCE.

The business of niche software and website development is very competitive. Barriers to entry are relatively low, and we face competitive pressures from companies anxious to join this niche. There are a number of successful competitors, such as Sociallyin, SmartSites and NinjaPromo. They are operated by proven companies that offer similar niche services, which may prevent us from gaining enough market share to become successful. These competitors have existing customers that may form a large part of our targeted client base, and such clients may be hesitant to switch over from already established competitors to our service. If we cannot gain enough market share, our business and our financial performance will be adversely affected.

18

If we are unable to raise additional capital to fund our operations, we will be unable to continue our business activities and you will lose all of your investment.

If we are unable to secure additional capital, at prices acceptable to the Company, we will be unable to continue our business activities. There can be no assurance that the Company will be successful in obtaining adequate funding from third parties at a cost consistent with the resources of the Company. If we are unable to continue our business activities, you will lose all of your investment.

risks related to the business

WE ENTIRELY DEPEND ON THE EFFORTS OF KOS RAMIREZ MAXIMILIANO, OUR SOLE OFFICER AND DIRECTOR.

We are entirely dependent on the efforts of Kos Ramirez Maximiliano, our sole officer and director, because of the time and effort that he devotes to Marky Corp. Mr. Maximiliano is in charge of overseeing all business development strategies, supervising any/all future personnel, including any consultants or contractors that we will engage to assist in developing our proposed income/expense product, and the establishment of our future sales and marketing efforts. The loss of Mr. Maximiliano, or other key personnel in the future, could have a material adverse effect on our business, financial condition and results of operations. Our success will depend on the performance of Mr. Maximiliano and our ability to attract and motivate other key personnel.

FOREIGN OFFICERS COULD RESULT IN DIFFICULTY ENFORCING RIGHTS.

Kos Ramirez Maximiliano, our sole officer and director is located outside the USA, and as such, investors may have difficulty in enforcing their legal rights under the United States securities laws. Under this Registration Statement and the Offering, the non-US Officers of the Company will be offering shares of Marky Corp. to their friends and relatives and the investors. If ever attracted, will be non-US residents.

19

The investors may face certain risks in:

1. effecting service of process within the U.S. on your officers and directors;

| 2. | enforcing judgments obtained in U.S. courts based on the civil liability provisions of the U.S. federal securities laws against your officers and directors; |

| 3. | enforcing judgments of U.S. courts based on the civil liability provisions of the U.S. federal securities laws in foreign courts against your officers and directors; and |

| 4. | bringing an original action in foreign courts to enforce liabilities based on the U.S. federal securities laws against your officers and directors. |

WE MAY NOT BE ABLE TO BUY OR KEEP SUBSCRIBERS.

We must attract customers to subscribe to our information platform to generate income and achieve profitability. If customers do not believe that our information platform is of high value and quality, or if we fail to create an information resource tailored to the needs and interests of our customers, we will not be able to attract or retain customers.

We believe that many of our subscribers will come from verbal and non-paid referrals from other subscribers. Therefore, we must ensure that these subscribers remain satisfied and loyal to our company to continue to receive these referrals. Once we have built a subscriber base, if our efforts to meet the needs of our loyal subscri-bers are not successful, we may not be able to attract new subscribers in sufficient numbers to continue growing our business, or we may need to incur significantly higher marketing expenses to acquire new customers. A decrease in the number of subscribers or their satisfaction will adversely affect our business, financial condition, and results of operations.

20

We currently have no subscribers and provide information on our web portal free of charge. Even if we get subscribers, there is no guarantee that we will make a profit. If we cannot make a profit, we will have to suspend or terminate operations. You will likely lose your entire investment if we cannot sell the product we offer at a price and quantity that makes a profit.

IF WE FAIL TO ESTABLISH AND UPLOAD EFFECTIVE INTERNAL CONTROLS, OUR ABILITY TO PRODUCE ACCURATE FINANCIAL STATEMENTS OR COMPLY WITH APPLICABLE REGULATIONS COULD BE COMPROMISED.

In accordance with Section 404 of the Sarbanes-Oxley Act, our management will be obligated to assess and report on the effectiveness of our internal control over financial reporting. Meeting the standards for this assessment involves complex regulations, requiring extensive documentation, testing, and potential remediation. As a reporting company under the Exchange Act, we may need to implement additional financial and management controls, reporting systems, procedures, and potentially hire more accounting and finance staff to ensure compliance. If we or, if required, our auditors are unable to conclude that our internal control over financial reporting is effective, investors may lose confidence in our financial reporting and the trading price of our common stock may decline.

We cannot guarantee that there will be no material weaknesses or significant deficiencies in our internal control over financial reporting in the future. The inability to maintain proper internal control over financial reporting could have a significant impact on our ability to accurately disclose our financial condition, results of operations, and cash flows. If we are unable to determine the effectiveness of our internal control over financial reporting, or if our independent registered public accounting firm identifies a material weakness or significant deficiency during their Section 404 reviews, it may result in a loss of investor trust in the accuracy and completeness of our financial reports. This, in turn, could lead to a decline in the market price of our common stock and potential investigations or sanctions by regulatory bodies such as the SEC or other authorities. Failure to address any material weaknesses in our internal control over financial reporting, or the failure to implement and maintain effective control systems required for public companies, may also restrict our future access to capital markets.

21

AS OUR SOLE OFFICER AND DIRECTOR WILL ONLY BE ALLOCATIONG LIMITED TIME TO OUR OPERATIONS, THERE MAY BE SPORADIC PERIODS OF ACTIVITY THAT COULD LEAD TO INTERMITTENT INTERUPTIONS OR SUSPENSIONS IN OUR OPERATIONS. THIS COULD PREVENT US FROM ATTRACTING A SUFFICIENT CUSTOMER BASE AND GENERATE REVENUES, LEADING TO A CESSATION OF OUR OPERATIONS.

Due to the limited time commitment from our sole officer and director, Kos Ramirez Maximiliano, our operations may experience sporadic occurrences even if he dedicates approximately 40 hours per week to our business. This may not be sufficient to sustain consistent operations. Consequently, there is a risk of periodic interruptions or suspensions in our activities, potentially leading to a lack of revenue and, ultimately, the potential discontinuation of our operations.

THERE ARE NO SUBSTANTIAL BARRIERS TO ENTRY INTO THE MARKETPLACE FOR THE PRODUCT WE INTEND TO DEVELOP AND SELL.

Because our information platform for social media marketers is not yet fully developed, others may develop the same or nearly identical web portal and bring it to market before us. In addition, others may attempt to copy aspects of our business, including our information platform design, products, or marketing materials.

Any infringement of our corporate information, including unauthorized use of our business name, use of a similar name by a competitor, or litigation brought against us for breach of another company's confidential information or misuse of their trademark, may affect our ability to build brand awareness. Brand, mislead customers and/or adversely affect our business. Litigation or proceedings in the United States or international trademark offices may be required to enforce our intellectual property rights, protect our trade secrets and domain name, and/or determine the validity and scope of other parties' property rights. Any such breach, litigation, or adverse proceeding could result in high costs and diversion of resources and could seriously harm our business operations and/or results of operations.

22

WE WILL BE EXPOSED TO LOCAL BUSINESS RISKS IN DIFFERENT COUNTRIES, WHICH COULD HAVE A SIGNIFICANT ADVERSE IMPACT ON OUR FINANCIAL CONDITION OR RESULTS OF OPERATIONS.

We intend to market and sell our proposed income/expense product internationally, and we expect clients to be located in many countries. Our international operations will be subject to the risks inherent in doing business in foreign countries, including but not limited to:

| · | New and different legal and regulatory requirements in local jurisdictions; |

| · | Potentially adverse tax consequences, including the imposition or increase of transaction or withholding taxes and other taxes on money transfers and other payments; |

| · | Risk of nationalization of private enterprises by foreign governments; |

| · | Legal restrictions on doing business in certain countries or with certain parties, certain parties, and/or specific products; as well as, |

23

| · | Local economic, political, and social conditions, including the possibility of hyperinflation and political instability. |

| · | We may be unable to develop and implement policies and strategies to address the above factors in a timely and effective manner in the locations where we intend to do business. Therefore, one or more of the above factors could have a material adverse effect on our business and our financial position, and the results of operations. |

| · | Since the informational platform we offer will be available for subscription via the Internet in foreign countries, and we will have customers living in other countries, foreign jurisdictions may require us to comply with the requirements for doing business in their countries. We may be required to comply with specific laws and regulations in each country in which we do business, including rules and regulations currently in force or which may apply to Internet information services available to residents of each country. |

FAILURE TO COMPLY WITH EXISTING U.S. AND NON-U.S. PRIVACY LAWS AND REGULATIONS, OR THE ENACTMENT OF NEW PRIVACY LAWS OR REGULATIONS, COULD ADVERSELY AFFECT OUR BUSINESS.

Various U.S. and non-U.S. laws and regulations govern consumer data collection, use, retention, sharing, and security. Existing privacy-related laws and regulations are evolving and are subject to potentially differing interpretations. In addition, U.S. and non-U.S. legislative and regulatory bodies may expand current laws or enact new laws regarding privacy matters. We intend to post privacy policies and practices concerning subscriber data collection, use, and disclosure on our information platform. Several U.S. states have adopted legislation that requires businesses to implement and maintain reasonable security procedures and practices to protect sensitive personal information and to provide notice to consumers in the event of a security breach. Any failure, or perceived failure, by us to comply with our posted privacy policies or with any data-related consent orders, U.S. Federal Trade Commission requirements or charges, or other U.S. or non-U.S. privacy or consumer protection-related laws, regulations, or industry self-regulatory principles could result in claims, proceedings or actions against us by governmental entities or others, or other liabilities, which could adversely affect our business. In addition, a failure or perceived failure to comply with industry standards or our privacy policies and practices could result in a loss of subscribers and adversely affect our business.

24

WE MAY BE DEEMED TO BE A “SHELL COMPANY” AND AS SUCH SHAREHOLDERS MAY NOT BE ABLE TO RELY ON THE PROVISIONS OF RULE 144 FOR RESALE OF THEIR SHARES UNTIL CERTAIN CONDITIONS ARE MET.

We do not believe that the Company is a “shell company” as described under Rule 405 of Regulation C under the Securities Act of 1933, that has: no or nominal operations; and either (a) no or nominal assets; (b) assets consisting solely of cash and cash equivalents; or (c) assets consisting of any amount of cash and cash equivalents and nominal other assets. However, a designation as a “shell company” could result in the application of Rule 144(i), which would limit the availability of the exemption from registration provided in Rule 144 for certain shares of Company common stock and could result in certain persons affiliated with the Company being deemed “statutory underwriters under Rule 145(c). Some of the presently outstanding shares of our common stock are "restricted securities" as defined under Rule 144 promulgated under the Securities Act and may only be sold pursuant to an effective registration statement or an exemption from registration, if available. Pursuant to Rule 144, if we were designated a "shell company" as defined in Rule 405 of the Securities Act and Rule 12b-2 of the Exchange Act, one year would be required to elapse from the time, we ceased to be a "shell company" and filed a Form 8-K addressing Item 5.06 with such information as may be required in a Form 10 Registration Statement with the SEC, before our restricted shareholders could resell their holdings in reliance on Rule 144. The Form 10 information or disclosure is equivalent to the information that a company would be required to file if it were registering a class of securities on Form 10 under the Exchange Act. Under amended Rule 144, restricted or unrestricted securities that were initially issued by a reporting or non-reporting shell company, or a company that was at any time previously a reporting or non-reporting shell company, can only be resold in reliance on Rule 144 if the following conditions are met:

1. the issuer of the securities that was formerly a reporting or non-reporting shell company has ceased to be a shell company;

2. the issuer of the securities is subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act;

3. the issuer of the securities has filed all reports and material required to be filed under Section 13 or 15(d) of the Exchange Act, as applicable, during the preceding twelve months (or shorter period that the Issuer was required to file such reports and materials), other than Form 8-K reports; and

4. at least one year has elapsed from the time the issuer filed the current Form 10 type information with the SEC reflecting its status as an entity that is not a shell company.

At the present time, we are not classified as a "shell company" under Rule 405 of the Securities Act Rule 12b-2 of the Exchange Act. However, in the event we were to be so designated, you would be unable to sell your shares under Rule 144.

25

MALFUNCTION OF THIRD-PARTY SYSTEMS OR OF THIRD-PARTY SERVICE PROVIDERS AND SOFTWARE ON WHICH WE WILL RELY ON MAY HAVE A NEGATIVE EFFECT ON OUR BUSINESS.

We will rely on specific computer systems or third-party service and software providers, including data centers, technology platforms, back-office systems, and internet service providers. Any interruption of these third-party services or deterioration in their performance or quality could adversely affect our business. If our agreement with any third party is terminated, we may not be able to find alternative systems or service providers promptly or on commercially reasonable terms. It could have a material adverse effect on our business, financial condition, results of operations, and cash flows.

We plan to host our information platform and serve all of our potential subscribers from third-party Internet servers, which will be located in various data centers. Issues that these data centers experience or the network service providers they may contract with may negatively impact our subscribers' experience. Our business could be adversely affected if these data centers fail to meet our growing capacity needs or close without proper notice. Any changes in the levels of third-party services in these data centers or any errors, defects, failures, or other performance issues in these services may damage our reputation and adversely affect the performance of the information platform we offer. Interruptions in these services may result in a reduction in our sales revenue, expose us to potential liability and, as such, adversely affect our business, financial condition, results of operations, and cash flows.

We cannot guarantee that our information platform will operate without interruptions or errors. We are bound only by an obligation to do our best for operation and continuity of service. Although we are not responsible for fraudulent data access and/or accidental transmission through viruses or other harmful activities in connection with the use of our information platform, a failure in operation will adversely affect our business and financial position, results of operations, and cash flows.

THERE IS A RISK THAT WE MAY BE UNABLE TO CONTINUE TO PROVIDE OUR INFORMATION PLATFORM OR CONTINUE OPERATIONS IF WE EXPERIENCE UNINSURED LOSSES OR AN ACT OF GOD.

We may, but are not required to, obtain comprehensive liability insurance and other business insurance commonly supported by businesses like ours. However, certain types of emergencies may either be uninsurable or economically uninsurable. For example, in the event of a major earthquake, our computer systems could be down for an extended period, impairing our ability to maintain our information platform, advertise and sell our income/consumable offering, and collect revenue, which would negatively impact our financial health. In the event of major civil unrest, our operations may also be adversely affected. If such an uninsured loss occurs, we may lose significant income and financial opportunities in amounts that insurance proceeds will not partially or wholly offset.

26

WE CAN NOT BE ASSURED THAT WE WILL BE ABLE TO MANAGE OUR COMPANY'S GROWTH EFFECTIVELY.

We anticipate experiencing rapid growth in demand for our proposed income/expense product. We expect the number of our consultants, service providers, and customers to increase over time once we launch our sales and marketing campaign. We expect our growth to continue for the foreseeable future. The development and expansion of our business and product offerings could place significant demands on our management and operational and financial resources. We will need to manage multiple relationships with various consultants, customers, website and app developers, and other third parties. To effectively manage the growth of our company, we will need to continually implement operational plans and strategies, improve and expand our infrastructure of people and information systems, and train and manage our future employee and third-party service provider base. Our inability to effectively manage the growth of our company would harm our business, financial condition, and results of operations.

WE ARE EXPOSED TO THE RISKS ASSOCIATED WITH THE PAYMENTS.

We plan to accept payment for subscribing to our informational platform through various methods, including credit and debit cards. We may be subject to additional rules, compliance requirements, and fraud as we offer consumers new payment options. As a non-financial institution, we cannot belong to or have direct access to credit card associations such as American Express, VISA, MasterCard, etc. As a result, we will have to rely on banks or payment processors to process transactions for us. If these companies are unwilling or unable to provide these services to us, our business and customer services will likely suffer significant disruption. For specific payment methods, including credit and debit cards, we will be subject to transaction fees and other fees, which may increase over time, increase our operating costs and reduce our profitability. We are also subject to the rules of the payment card association, certification requirements, and rules governing electronic funds transfers, which may be changed or reinterpreted in a way that makes it difficult or impossible to comply with them. Suppose we do not abide by these rules or requirements. In that case, we may be subject to fines and higher transaction fees, and we may not be able to accept credit and debit card payments from consumers or make other types of online payments. The results of our activities and activities may be reduced or adversely affected.

27

risks related to our common stock

INVESTING IN OUR COMPANY'S COMMON SHARES IS A HIGHLY SPECULATIVE INVESTMENT AND MAY RESULT IN THE LOSS OF YOUR ENTIRE INVESTMENT.

The purchase of the shares offered in this prospectus is highly speculative and involves significant risks. Any person who cannot afford to lose all their investments should not buy the shares offered. Our business objectives are also hypothetical, and we may not be able to meet these objectives. The shareholders of our company may not be able to understand that they may lose their entire investment in our company. For this reason, each potential purchaser of the shares offered should read this prospectus and all of its appendices carefully and consult their attorney, business, and/or investment adviser.

IF OUR SHARES ARE PUBLICLY TRADED, THE PRICE OF OUR SHARES MAY BE UNSTABLE.

In the event of a public sale of our shares, the market price of our ordinary shares is likely to be highly volatile. It could fluctuate widely in price in response to a variety of potential factors, many of which are beyond the Company's control, including the following:

• Changes in the reliability or availability of our proposed product by our potential competitors or us;

• Additions or departures of key personnel;

• The company's ability to execute its business plan;

• Operating results that fall below expectations;

• Industry developments;

In addition, the securities markets experience significant price and volume fluctuations from time to time that are not related to specific companies' operations. These market fluctuations can also materially and adversely affect the market price of the company's ordinary shares.

AS A PUBLIC COMPANY, WE WILL INCUR SUBSTANTIAL EXPENSES.

Upon declared effectiveness of this registration statement by the Securities and Exchange Commission, we will become subject to the information and reporting requirements of the U.S. securities laws. The U.S. securities laws require, among other things, review, audit, and public reporting of our financial results, business activities, and other matters. Recent Securities and Exchange Commission regulation, including regulation enacted as a result of the Sarbanes-Oxley Act of 2002, has substantially increased the accounting, legal, and other costs related to becoming and remaining a Securities and Exchange Commission reporting company. If we do not have current information about our company available to market makers, they will not be able to trade our stock. The public company costs of preparing and filing annual and quarterly reports and other information with the Securities and Exchange Commission and furnishing audited statements to stockholders will cause our expenses to be higher than they would be if we were privately held. These increased costs may be material and may include hiring additional employees and/or retaining other advisors and professionals. As a result, we may not have sufficient funds to grow our operations. Additionally, our failure to comply with the U.S. securities laws could result in private or governmental legal action against the company and/or our officers and directors, which could have a detrimental effect on our business and finances, the value of our common stock, and the ability of stockholders to resell their stock.

28

IN THE EVENT THAT OUR SHARES ARE PUBLICLY TRADED, THEY MAY TRADE UNDER $5.00 PER SHARE AND THUS WILL BE A "PENNY STOCK."

In the event that our shares are publicly traded, and our stock trades below $5.00 per share, our stock would be known as a "penny stock," which is subject to various regulations involving disclosures to be given prior to the purchase of any penny stock. The U.S. Securities and Exchange Commission has adopted regulations which generally define a "penny stock" to be any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. Depending on market fluctuations, our common stock could be considered to be a "penny stock." A penny stock is subject to rules that impose additional sales practice requirements on broker/dealers who sell these securities to persons other than established customers and accredited investors. For transactions covered by these rules, the broker/dealer must make a special suitability determination for the purchase of these securities. In addition, he must receive the purchaser's written consent to the transaction prior to the purchase. He must also provide certain written disclosures to the purchaser. Consequently, the "penny stock" rules may restrict the ability of broker/dealers to sell our securities and may negatively affect the ability of holders of shares of our common stock to resell them. These disclosures require acknowledgement that the investor understands the risks associated with buying penny stocks and can absorb the loss of the entire investment. Penny stocks are low priced securities that do not have a very high trading volume. Consequently, the price of the stock is often volatile, and an investor may not be able to buy or sell the stock when desired.

DUE TO THE LACK OF A TRADING MARKET FOR OUR SEQURITIES, YOU MAY HAVE DIFFICULTY SELLING ANY SHARES YOU PURCHASE IN THIS OFFERING.

We are not registered on any market or public stock exchange. There is presently no

demand for our common stock and no public market exists for the shares being offered in this prospectus. We plan to contact a market maker immediately following the completion of the offering and apply to have the shares quoted on the OTCQB Venture Market. The OTCQB is a regulated quotation service that displays real-time quotes, last sale prices and volume information in over-the-counter securities. The OTCQB is not an issuer listing service, market or exchange. Although the OTCQB does not have any listing requirements, to be eligible for quotation on the OTCQB, issuers must remain current in their filings with the SEC or applicable regulatory authority. If we are not able to pay the expenses associated with our reporting obligations, we will not be able to apply for quotation on the OTC Venture Market. Market makers are not permitted to begin quotation of a security whose issuer does not meet this filing requirement. Securities already quoted on the OTCQB that become delinquent in their required filings will be removed following a 30 to 60-day grace period if they do not make their required filing during that time. We cannot guarantee that our platform will be accepted or approved, and our stock listed and quoted for sale. As of the date of this filing, there have been no discussions or understandings between Marky Corp. and anyone acting on our behalf, with any market maker regarding participation in a future trading market for our securities. If no market is ever developed for our common stock, it will be difficult for you to sell any shares you purchase in this offering. In such a case, you may find that you are unable to achieve any benefit from your investment or liquidate your shares without considerable delay, if at all. In addition, if we fail to have our common stock quoted on a public trading market, your common stock will not have a quantifiable value and it may be difficult, if not impossible, to ever resell your shares, resulting in an inability to realize any value from your investment.

29

IN THE EVENT THAT OUR SHARES ARE PUBLICLY TRADED, FINRA RULES MAY LIMIT A STOCKHOLDER'S ABILITY TO BUY AND SELL OUR STOCK.

The Financial Industry Regulatory Authority (FINRA) has adopted rules that relate to the application of the Securities and Exchange Commission's "penny stock" rules and require that a broker/dealer have reasonable grounds for believing that the investment is suitable for that customer, prior to recommending the investment. Prior to recommending speculative, low-priced securities to their non-institutional customers, broker/dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative, low-priced securities will not be suitable for at least some customers. In the event that our shares are publicly traded and are considered to be a "penny stock," these FINRA requirements will make it more difficult for broker/dealers to recommend that their customers buy our common stock, which may have the effect of reducing the level of trading activity and liquidity of our common stock. Further, many brokers charge higher transactional fees for penny stock transactions. As a result, fewer broker/dealers may be willing to make a market in our common stock, reducing a shareholder's ability to resell shares of our common stock.

IF WE ARE LIQUIDATED, IT IS UNLIKELY THAT THERE WILL BE ENOUGH ASSETS TO BE DISTRIBUTED TO SHAREHOLDERS.

In the event of our dissolution, any proceeds from the liquidation of our assets will be distributed to shareholders only after all claims of our creditors have been satisfied. In this case, the ability of buyers of the offered shares to recover any portion of the purchase price for the offered shares will depend on the number of funds realized and the claims to be satisfied.

INVESTORS WILL PAY FOR OUR COMMON SHARES MORE THAN A PROPORTIONATE PART OF OUR ASSETS WORTH. INVESTING IN OUR COMMON SHARES MAY CAUSE IMMEDIATE LOSSES AS A RESULT.

The offering price and other terms and conditions concerning our shares have been determined by us arbitrarily. They have no relation to assets, earnings, book value, or any other objective value criteria. In addition, since we are a newly formed company with only a limited history of operations and no earnings, the offered share price is not based on our past earnings. No investment banker, appraiser, or other

independent third party has been consulted regarding the offering price of shares or

the fairness of the price used for shares.

The optional offering price of $0.03 per ordinary share is significantly higher than our common shares' net tangible book value per share. Our holdings do not support a share price of $0.03 per share. This share price premium applies to the terms of this offer. It does not attempt to reflect any future share price once we have been listed on any exchange or become listed on an over-the-counter bulletin board or over-the-counter market. Markets, if anything.

OUR MANAGEMENT MAY ISSUE ADDITIONAL SHARES OR CREATE AND ISSUE ADDITIONAL SHARE CLASSES, THEREFORE DILUTING THE SHAREHOLDER CAPITAL OF OUR CURRENT SHAREHOLDERS.

We have 75,000,000 authorized shares of common stock with a par value of $0.001 per share, of which 3,500,000 shares of common stock are currently in issue and outstanding. If this offer is fully subscribed, 7,500,000 ordinary shares will be issued and outstanding after the offering is terminated. We only have one class of shares (i.e., common shares) and do not plan to create any additional types of shares in the foreseeable future. Our management may, without the consent of our then existing shareholders, issue significantly more shares or create and issue additional classes of shares, which could potentially lead to a significant dilution of the capital of our then existing shareholders. In addition, large issuances of our shares tend to harm our share price. It is possible that due to an additional allocation of shares or the creation and distribution of additional classes of shares, you may lose a significant amount or all of your investment.

30

BECAUSE OUR SOLE OFFICER AND DIRECTOR WILL OWN 46.7% OF OUR OUTSTANDING COMMON STOCK, IF ALL THE SHARES BEING OFFERED ARE SOLD, HE WILL MAKE AND CONTROL CORPORATE DECISIONS THAT MAY BE DISADVANTAGEOUS TO MINORITY SHAREHOLDERS.

If maximum-offering shares will be sold, Kos Ramirez Maximiliano, our sole officer and director, will own 46.7% of the outstanding shares of our common stock. Accordingly, he will have significant influence in determining the outcome of all corporate transactions or other matters, including the election of directors, mergers, consolidations and the sale of all or substantially all of our assets, and also the power to prevent or cause a change in control. The interests of Mr. Maximiliano may differ from the interests of the other stockholders and may result in corporate decisions that are disadvantageous to other shareholders.

WE DO NOT HAVE AN ESCROW OR TRUST ACCOUNT FOR INVESTOR SUBSCRIPTIONS.

Invested funds for this offering will not be placed in an escrow or trust account. Accordingly, if we file for bankruptcy protection or creditors file a petition for involuntary bankruptcy against us, investor funds will become part of the bankruptcy estate and be administered according to the bankruptcy laws. As such, investors will lose their investment, and their funds will be used to pay creditors and will not be used for developing our business.

WE DO NOT ANTICIPATE PAYING DIVIDENDS IN THE FORESEEABLE FUTURE.

We do not anticipate paying dividends on our common stock or any class of preferred stock that may be created and issued in the foreseeable future. Instead, we plan to retain earnings, if any, for our business's operation, growth, and expansion.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

Information in this prospectus includes "forward-looking statements". All statements, besides statements of historical fact included in this prospectus, regarding our strategy, future performance, financial position, expected income and losses, projected costs, management's prospects, plans and objectives, are forward-looking. As used in this prospectus, the words "could", "believe", "anticipate", "intend", "estimate", "expect", "project" and similar expressions are intended to refer to forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on our current expectations and assumptions about future events and information currently available about the results and timing of future events. You should be aware of the risk factors and other cautionary statements described in the Risk Factors section when considering forward-looking statements. These forward-looking statements are based on management's current opinion and currently available information regarding the outcome and timing of future events. The following factors, among others, could cause our actual results and performance to differ materially from the results and performance projected in, or implied by, the forward-looking statements:

31

Forward-looking statements may include statements about:

• business strategy;

• the financial strategy, liquidity, and capital required for our operations;

•our ability to respond quickly to changes and updates in social media marketing;

• the ability to raise capital to finance business growth;

• the ability to maintain relationships with our third-party vendors;

• the ability to retain management and key personnel;

• general economic conditions;

• our future operating results; as well as

• our plans, goals, expectations, and intentions.

We caution that these forward-looking statements are subject to all risks and uncertainties, most of which are difficult to predict and many of which are beyond our control. These risks include but are not limited to operational risks, regulatory changes, cash flows and access to capital, the timing of capital expenditures, and other risks described in the Risk Factors section.

Should one or more of the risks or uncertainties described in this prospectus arise, or if the underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward-looking statements.

Unless otherwise required by applicable law, we disclaim any obligation to update forward-looking statements, all of which are expressly outlined in the statements in this section, to reflect events or circumstances after the date of this prospectus.

32

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-1 that we filed with the SEC using the “shelf” registration process. Under this shelf registration process, the Selling Stockholders may, from time to time, sell the Registered Shares offered by them described in this prospectus. We will not receive any proceeds from the sale by such Selling Stockholders of the Registered Shares offered by them described in this prospectus. Neither we nor the Selling Stockholders have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus or any applicable prospectus supplement or any free writing prospectuses prepared by or on behalf of us or to which we have referred you. Neither we nor the Selling Stockholders take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. Neither we nor the Selling Stockholders will make an offer to sell these Registered Shares in any jurisdiction where the offer or sale is not permitted. We may also provide a prospectus supplement or post-effective amendment to the registration statement to add information to, or update or change information contained in, this prospectus. You should read both this prospectus and any applicable prospectus supplement or post-effective amendment to the registration statement together with the additional information to which we refer you in the sections of this prospectus entitled “Where You Can Find More Information.” Unless the context indicates otherwise, references in this prospectus to the “Company,” “we,” “us,” “our” and similar terms refer to Marky Corp.

SUMMARY

This summary is an overview of selected information contained elsewhere in this prospectus. It does not include all the information you should consider before buying the shares we offer. You should carefully read the more detailed information in this prospectus and review our financial statements.

BUSINESS OVERVIEW

Marky Corp. was incorporated in the State of Wyoming as a Corporation on April 28, 2022, and has a fiscal year-end of January 31. We are an emerging-growth development-stage company. As for today we already have a website and intend to develop and launch subscription-based news and education application. We plan to capitalize our information and education platform for specialized industries. We will offer our readers several options: a monthly subscription for one month, three months and half a year.

Our information platform is a web-based information portal, accessed through a web browser. It allows end users to access information on any device of their choice, features social media marketing news, updates, tips, and tutorials on promoting your business on social media. There can be no guarantee that our efforts to develop the offered service will be successful or that we will be able to sell the offered service if it is designed.

33

Emerging Growth Company Status

We qualify as an “emerging growth company” under the JOBS Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements. Some of them include the following:

- to include less extensive narrative disclosure than required of other reporting companies, particularly in the description of executive compensation

- to provide audited financial statements for two fiscal years, in contrast to other reporting companies, which must provide audited financial statements for three fiscal years

- not to provide an auditor attestation of internal control over financial reporting under Sarbanes-Oxley Act Section 404(b)

- to defer complying with certain changes in accounting standards and

- to use test-the-waters communications with qualified institutional buyers and institutional accredited investors

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies.

We will remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our total annual gross revenues is $1, 235 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, which would occur if the market value of our ordinary shares that is held by non-affiliates is $700 million as of the last business day of our most recently completed second fiscal quarter or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

Until such time, however, we cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

34

Notwithstanding the above, we are also currently a “smaller reporting company”, meaning that we are not an investment company, an asset-backed issuer, or a majority-owned subsidiary of a parent company that is not a smaller reporting company and have a public float of less than $75 million and annual revenues of less than $50 million during the most recently completed fiscal year. In the event that we are still considered a “smaller reporting company”, at such time are we cease being an “emerging growth company”, the disclosure we will be required to provide in our SEC filings will increase but will still be less than it would be if we were not considered either an “emerging growth company” or a “smaller reporting company”. Specifically, similar to “emerging growth companies”, “smaller reporting companies” are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal control over financial reporting; and have certain other decreased disclosure obligations in their SEC filings, including, among other things, being required to provide only two years of audited financial statements in annual reports. Decreased disclosures in our SEC filings due to our status as an “emerging growth company” or “smaller reporting company” may make it harder for investors to analyze the Company’s results of operations and financial prospectus.

USE OF PROCEEDS

If 25% of Shares Sold | If 50% of Shares Sold | If 75% of Shares Sold | If 100% of Shares Sold | ||||||||||||||||

| GROSS PROCEEDS FROM THIS OFFERING | $ | 30,000 | $ | 60,000 | $ | 90,000 | $ | 120,000 | |||||||||||

| EXPENSES RELATED TO THIS OFFERING | |||||||||||||||||||

| Legal | $ | 2,500 | $ | 2,500 | $ | 2,500 | $ | 2,500 | |||||||||||

| Auditing | $ | 4,000 | $ | 4,000 | $ | 4,000 | $ | 4,000 | |||||||||||

| Third-party EDGAR Services | $ | 986 | $ | 986 | $ | 986 | $ | 986 | |||||||||||

| Transfer Agent and Certificate Printing | $ | 1,000 | $ | 1,000 | $ | 1,000 | $ | 1,000 | |||||||||||

| U.S. Securities and Exchange Commission Registration Fee | $ | 14 | $ | 14 | $ | 14 | $ | 14 | |||||||||||