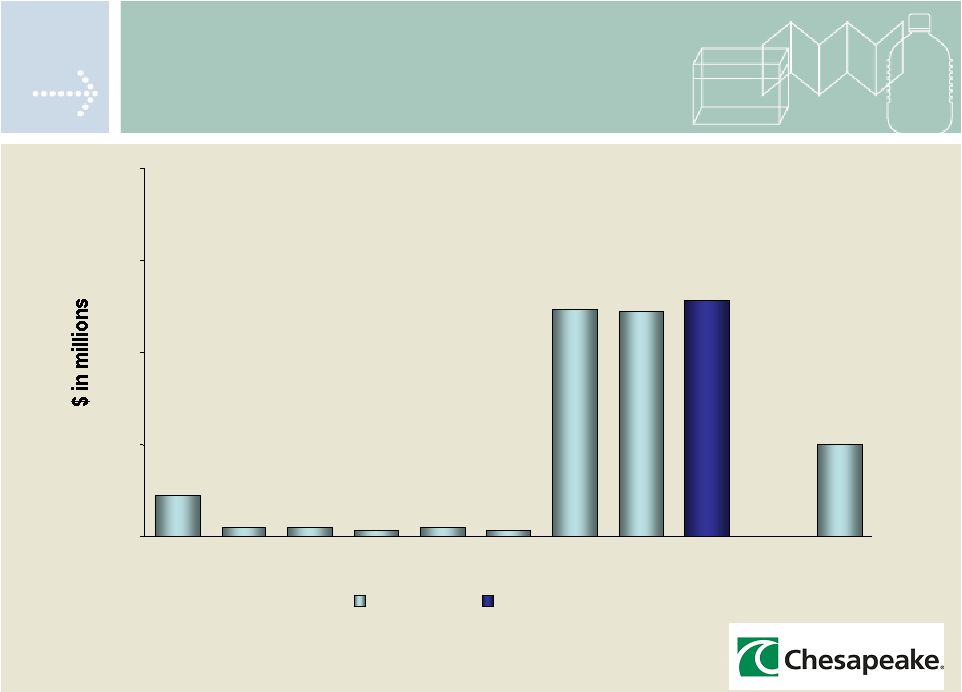

2 Disclaimer This presentation includes forward-looking statements that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Changes in the following important factors, among others, could cause Chesapeake’s actual results to differ materially from those expressed in the forward-looking statements: the Company’s inability to realize the full extent of the expected savings or benefits from the cost savings program and to complete such activities in accordance with its planned timetable and within expected cost range; competitive products and pricing; production costs (particularly for raw materials such as folding carton and plastics materials); fluctuations in demand; possible recessionary trends in U.S. and global economies; governmental policies and regulations; interest rates; currency translation movements; the ability of the Company to remain in compliance with its debt covenants; and other risks that are detailed from time to time in reports filed by the Company with the Securities and Exchange Commission. This presentation speaks only as of the date of this presentation and Chesapeake assumes no obligation to update the presentation. Users of the presentation are advised to review public disclosure by Chesapeake subsequent to the date of this presentation. Non-GAAP Financial Measures Chesapeake defines Adjusted EBITDA as income from continuing operations before interest, income taxes, depreciation, amortization and gains or losses on divestitures and on sales of non-strategic land, restructuring expenses, asset impairments and other exit costs. Normalized Adjusted EBITDA is defined as Adjusted EBITDA further adjusted by the effects of changes in foreign currency rates, increases in pension expense and the historical results of the Company’s French luxury packaging business that was sold in July 2006. Adjusted EBITDA and Normalized Adjusted EBITDA are not a measure of performance defined by GAAP and should not be considered in isolation or as a substitute for net income or cash flows from operating activities, which have been prepared in accordance with GAAP. We believe Adjusted EBITDA and Normalized Adjusted EBITDA provide useful information regarding our ability to service our debt and are used by investors and analysts to evaluate companies within the packaging industry. Adjusted EBITDA may be adjusted for certain cash and non-cash charges to determine compliance with certain financial covenants under our senior credit facility. Adjusted EBITDA and Normalized Adjusted EBITDA, as presented, may not be comparable to the calculation of similarly titled measures reported by other companies. Reconciliations of these measures to income (loss) from continuing operations before interest, extinguishment of debt and taxes (EBIT) are presented herein. |