Filed Pursuant to Rule 424(b)(3)

Registration No. 333-272867

AngloGold Ashanti plc

WE ARE NOT ASKING YOU FOR A PROXY BY MEANS OF THIS PROSPECTUS. THIS IS NOT A PROXY STATEMENT.

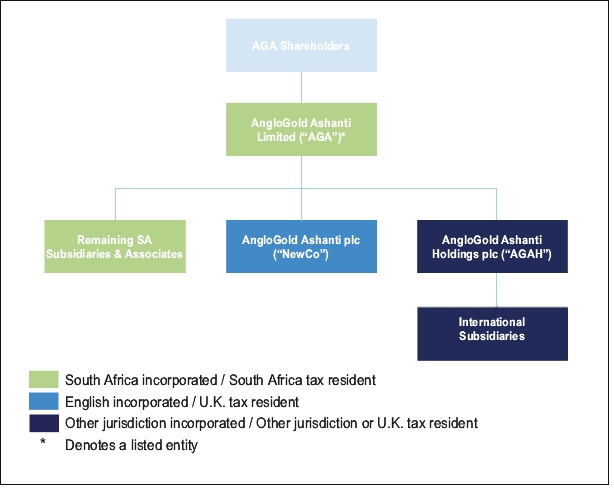

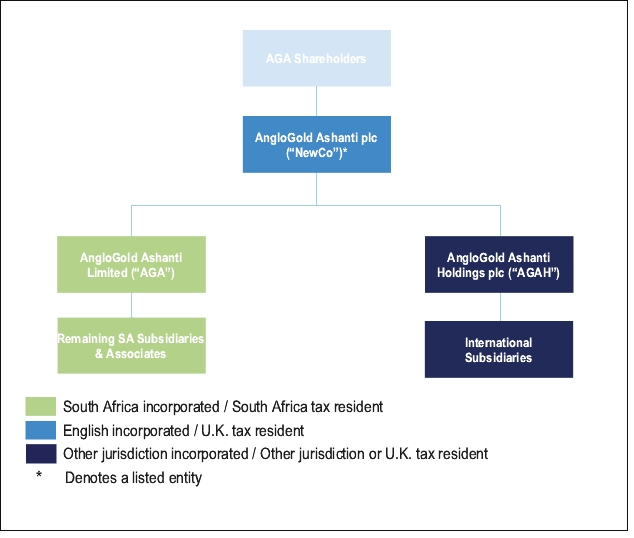

The Board of Directors of AngloGold Ashanti Limited (“AGA”) has approved a reorganization transaction. AGA is proposing to its shareholders to establish a new holding company incorporated under the laws of England and Wales, AngloGold Ashanti plc (“NewCo” ), and expects to implement this proposal in three sequential, separate and fully interconditional steps consisting of (i) AGA effecting a distribution in specie to all holders of ordinary shares of AGA (“AGA Ordinary Shares”) (including holders of AGA Ordinary Shares represented by American Depositary Shares (“AGA ADSs”)), pursuant to which AGA will direct NewCo, its wholly owned subsidiary, to issue 46,000 ordinary shares of NewCo (“NewCo Ordinary Shares”) to such AGA shareholders on a pro rata basis, with the aggregate subscription price of USD 46,000 paid by AGA (the “Spin-Off”), resulting in NewCo ceasing to be a subsidiary of AGA; (ii) NewCo making and AGA accepting an irrevocable offer to purchase 100 per cent. (100%) of the shares in AngloGold Ashanti Holdings plc (“AGAH”), which holds all of the operations and assets of AGA and its subsidiaries located outside of the Republic of South Africa (the “AGAH Sale”); and (iii) AGA implementing a scheme of arrangement pursuant to Section 114(1) and Section 115 of the South African Companies Act, No. 71 of 2008, as amended (the “South African Companies Act”) in which its shareholders will exchange their AGA Ordinary Shares (including AGA Ordinary Shares represented by AGA ADSs) for the right and obligation to receive, ipso facto and without any action on the part of such shareholders, the respective pro rata portions of the NewCo Ordinary Shares (the “Scheme”).

In this prospectus, the Spin-Off, the AGAH Sale and the Scheme are referred to collectively as the “Reorganization” and the “Group” refers to (i) AGA and its consolidated subsidiaries prior to the Reorganization and (ii) NewCo and its consolidated subsidiaries upon completion of the Reorganization. Upon completion of the Reorganization, AngloGold Ashanti plc will be the ultimate parent company of the Group and each of AGA and AGAH will be a direct, wholly owned subsidiary of NewCo.

As a result of the Reorganization, each AGA shareholder will own one NewCo Ordinary Share for each AGA Ordinary Share (including AGA Ordinary Shares represented by AGA ADSs) held on the record date for the Spin-Off and the Scheme (the “Reorganization Consideration Record Date”), and the existing AGA shareholders are expected to own the same percentage of NewCo Ordinary Shares as they held of AGA Ordinary Shares on such record date (subject to adjustments to reflect any exercise of appraisal rights as described under “Terms of the Reorganization and the Shareholders’ Meeting—Dissenters’, Appraisal, Cash Exit or Similar Rights”).

Based on the current number of issued AGA Ordinary Shares, NewCo will issue up to 421,703,798 NewCo Ordinary Shares in the Reorganization (subject to any adjustments to reflect the exercise of appraisal rights as described under “Terms of the Reorganization and the Shareholders’ Meeting—The Shareholders’ Meeting—Dissenters’, Appraisal, Cash Exit or Similar Rights”).

AGA has resolved to terminate the AGA ADS facility upon completion of the Reorganization. Each outstanding AGA ADS currently represents one AGA Ordinary Share. If any action is required by a holder of AGA ADSs to obtain full access to NewCo Ordinary Shares to be issued in the Reorganization, holders of AGA ADSs will receive separate instructions from the U.S. Exchange Agent (as defined herein).

The purpose of the Reorganization is to enhance the Group’s strategic position. While the business carried out by the Group following the implementation of the Reorganization will remain the same, AGA intends to change its primary listing from the Johannesburg Stock Exchange (“JSE”) to the New York Stock Exchange (“NYSE”) in connection with the transaction. We believe that a primary listing on the NYSE will broaden the appeal of the Group to North American and international investors, which could generate incremental demand and share trading liquidity and improve valuation comparisons with North American industry peers. Additionally, NewCo’s incorporation in the United Kingdom will take the Group to a leading, low-risk jurisdiction where the Group already has a corporate presence. See “The Reorganization—Reasons for the Reorganization”.

Approval of each of the AGAH Sale and the Scheme will require the affirmative vote of holders representing at least 75 per cent. (75%) of the voting rights exercised on the applicable resolution by the holders of AGA Ordinary Shares (including AGA Ordinary Shares represented by AGA ADSs) present or represented by proxy at a duly convened general meeting of the shareholders of AGA (the “Shareholders’ Meeting”) and entitled to vote thereon, provided that AGA shareholders representing at least 25 per cent. (25%) of all of the voting rights that are entitled to be exercised in respect of each matter to be decided at the meeting are in attendance, by electronic communication or by proxy (not being less than 3 (three) AGA shareholders). No approval of the Spin-Off is being sought from holders of AGA Ordinary Shares or AGA ADSs.

The Shareholders’ Meeting is scheduled for August 18, 2023, beginning at 2:00 p.m. South African Standard Time and will be conducted entirely by way of electronic communication, or such other postponed date and time or location as determined in accordance with the provisions of the Memorandum of Incorporation of AGA (the “AGA MOI”), the South African Companies Act and the JSE Listings Requirements (the “JSE Listings Requirements”). AGA will issue a notice to call the Shareholders’ Meeting at least 15 business days prior to the expected date of the Shareholders’ Meeting, in accordance with South African law.

The Reorganization is expected to be completed on or around September 25, 2023, subject to the fulfillment or waiver, as applicable, of certain conditions prior to such date, several of which are not under our control. See “Terms of the Reorganization and the Shareholders’ Meeting—The Shareholders’ Meeting—Operative Date of the Reorganization”.

WE ARE NOT ASKING YOU FOR A PROXY BY MEANS OF THIS PROSPECTUS. THIS IS NOT A PROXY STATEMENT. The NewCo Ordinary Shares are exempt from the proxy rules of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the registration statement on Form F-4 of which this prospectus forms a part has been prepared solely to fulfill registration requirements under the U.S. Securities Act of 1933, as amended (the “Securities Act”). A separate circular has been prepared in connection with the Reorganization for the AGA shareholders in accordance with the South African Companies Act, the Companies Regulations, 2011 (the “Companies Regulations”) and the JSE Listings Requirements (the “Reorganization Circular”). The Reorganization Circular will, among other things, provide AGA shareholders with information regarding the Reorganization and the manner in which they may have their vote recorded in relation to the Reorganization. If you hold AGA Ordinary Shares through an intermediary such as a broker/dealer or clearing agency, or if you hold AGA ADSs, you should consult with your intermediary or The Bank of New York Mellon, the depositary for the AGA ADS Program (the “ADS Depositary”), as applicable, about how to obtain information on the Shareholders’ Meeting.

NewCo will apply to list the NewCo Ordinary Shares on the NYSE under the symbol “AU”. Additionally, NewCo will apply to list the NewCo Ordinary Shares on the JSE and the A2X Markets (the “A2X”) under the symbol “ANG”, where trading in the NewCo Ordinary Shares is expected to commence three business days prior to the Operative Date (as defined herein), in the form of NewCo Ordinary Share entitlements. NewCo also intends to apply for a listing of NewCo Ordinary Shares on the Ghana Stock Exchange (the “GhSE”) under the symbol “AGA” and Ghanaian depositary shares (“NewCo GhDSs”), under the symbol “AAD” (each representing one hundredth of a NewCo Ordinary Share).

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of the securities offered in this prospectus, passed on the merits or fairness of the transaction or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

We encourage you to read this prospectus carefully in its entirety, including the “Risk Factors” section beginning on page

33 of this prospectus.

Prospectus dated July 10, 2023