- Company Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

AngloGold Ashanti 6-KCurrent report (foreign)

Filed: 19 Feb 25, 6:03am

QUARTER 4 2024 EARNINGS RELEASE | 2 |  | |||

AngloGold Ashanti delivers nine-fold increase in 2024 free cash flow* to $942m versus prior year; Adjusted EBITDA* +93% year-on-year and H2 dividend growth of 263% to 69 US cents per share; total cash costs* +4% for FY 2024, below group inflation. |

QUARTER 4 2024 EARNINGS RELEASE | 3 |  | |||

| ||||||

2024 I GROUP PERFORMANCE | ||||||

QUARTER 4 2024 EARNINGS RELEASE | 4 |  | |||

| ||||||

GROUP I FINANCIAL AND OPERATING RESULTS | ||||||

Financial Results | Quarter | Quarter | Year | Year | ||

ended | ended | % | ended | ended | % | |

Dec | Dec | Variance | Dec | Dec | Variance | |

US Dollar million, except as otherwise noted | 2024 | 2023 | 2024 | 2023 | ||

Average gold price received *(1)(2)(3) ($/oz) | 2,653 | 1,971 | 35% | 2,394 | 1,930 | 24% |

Adjusted EBITDA* ($m) | 884 | 574 | 54% | 2,747 | 1,420 | 93% |

Headline earnings(5) ($m) | 405 | 87 | 366% | 954 | (46) | 2,174% |

Capital expenditure - Group(2)(3) ($m) | 369 | 357 | 3% | 1,215 | 1,127 | 8% |

Net cash flow from operating activities ($m) | 690 | 404 | 71% | 1,968 | 971 | 103% |

Free cash flow* ($m) | 389 | 293 | 33% | 942 | 109 | 764% |

Adjusted net debt* ($m) | 567 | 1,268 | (55)% | 567 | 1,268 | (55)% |

Operating Results | Quarter | Quarter | Year | Year | ||

ended | ended | % | ended | ended | % | |

Dec | Dec | Variance | Dec | Dec | Variance | |

US Dollar million, except as otherwise noted | 2024 | 2023 | 2024 | 2023 | ||

Gold production - Group(1)(2)(3)(4) (koz) | 750 | 738 | 2% | 2,661 | 2,644 | 1% |

Gold production - Managed ops(1)(2)(3)(4)(koz) | 670 | 645 | 4% | 2,352 | 2,301 | 2% |

Total cash costs - Group(1)(2)(3) ($/oz) | 1,144 | 1,050 | 9% | 1,157 | 1,115 | 4% |

Total cash costs - Managed ops(1)(2)(3) ($/oz) | 1,165 | 1,092 | 7% | 1,187 | 1,162 | 2% |

AISC - Group(1)(2)(3) ($/oz) | 1,647 | 1,598 | 3% | 1,611 | 1,544 | 4% |

AISC - Managed ops(1)(2)(3) ($/oz) | 1,702 | 1,701 | —% | 1,672 | 1,634 | 2% |

* Refer to “Non-GAAP disclosure” for definitions and reconciliations. | ||||

QUARTER 4 2024 EARNINGS RELEASE | 5 |  | |||

| ||||||

FINANCIAL AND OPERATING RESULTS I AT A GLANCE | ||||||

Prioritise people, safety, health and sustainability | ZERO | 1.06 injuries per million hours worked | ||||||

Fatalities at Company managed operations (including contractors) | Total Recordable Injury Frequency Rate | |||||||

0% (2023 Q4: 0) | 25% (2023 Q4: 0.85) | |||||||

Maintain financial flexibility | $389m | $690m | $567m | |||||

Free cash flow* | Net cash flow from operating activities | Adjusted net debt* | ||||||

33% (2023 Q4: $293m) | 71% (2023 Q4: $404m) | (55%) (2023 Q4: $1,268m) | ||||||

Optimise overhead, costs and capital expenditure | $1,144/oz | $1,647/oz | $369m | |||||

Total cash costs* | All-in sustaining costs* | Capital expenditure | ||||||

9% (2023 Q4: $1,050/oz) | 3% (2023 Q4: $1,598/oz) | 3% (2023 Q4: $357m) | ||||||

Maintain long-term optionality | 0.21X | $567m | $884m | |||||

Adjusted net debt* : Adjusted EBITDA* | Adjusted net debt* | Adjusted EBITDA* | ||||||

(76%) (2023 Q4: 0.89x) | (55%) (2023 Q4: $1,268m) | 54% (2023 Q4: $574m) | ||||||

*Refer to “Non-GAAP disclosure” for definitions and reconciliations. | ||||||||

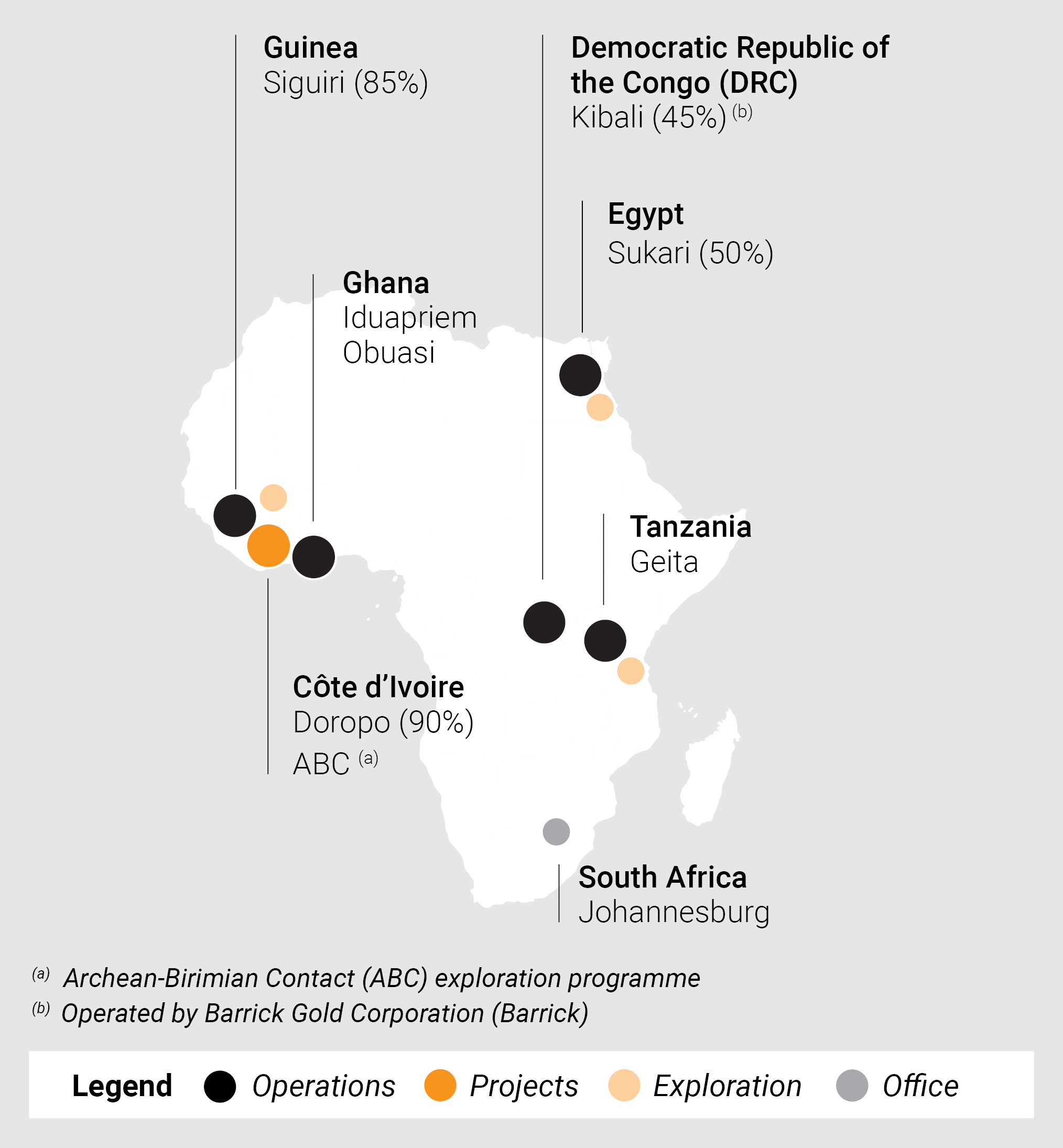

Improve portfolio quality | CENTAMIN ACQUISITION | OBUASI NEW UHDF MINING METHOD | ||||||

Centamin acquisition was completed on 22 November 2024 including flagship Sukari Mine in Egypt, which brought another Tier 1 gold mine into our portfolio as well as prospective exploration properties in Egypt’s Eastern Desert and projects in Côte d’Ivoire. The acquisition improved cash flow and long-term value of the business as it increased gold production and decreased our cost profile, further diversifying the portfolio, | The Underhand Drift and Fill mining method (“UHDF”) has been safely and successfully trialed. UHDF will be scaled up to form part of a hybrid mining approach alongside sub-level open stoping, to underpin a progressive increase in anticipated gold production to a rate of approximately 400,000oz per annum by 2028. | |||||||

QUARTER 4 2024 EARNINGS RELEASE | 6 |  | |||

| ||||||

FINANCIAL AND OPERATING RESULTS I AT A GLANCE | ||||||

Prioritise people, safety, health and sustainability | One | 0.98injuries per million hours worked | ||||||

Fatalities at Company managed operations (including contractors) | Total Recordable Injury Frequency Rate | |||||||

(2023 : 0) | (10%) (2023: 1.09) | |||||||

Maintain financial flexibility | $942m | $1,968m | $567m | |||||

Free cash flow* | Net cash flow from operating activities | Adjusted net debt* | ||||||

764% (2023: $109m) | 103% (2023: $971m) | (55%) (2023 : $1,268m) | ||||||

Optimise overhead, costs and capital expenditure | $1,157/oz | $1,611/oz | $1,215m | |||||

Total cash costs* | All-in sustaining costs* | Capital expenditure | ||||||

4% (2023: $1,115/oz) | 4% (2023: $1,544/oz) | 8% (2023: $1,127m) | ||||||

Maintain long-term optionality | $2,747m | 67.1Moz | 55.0Moz | |||||

Adjusted EBITDA* | Measured and Indicated Mineral Resource | Inferred Mineral Resource | ||||||

93% (2023 : $1,420m) | 12% (2023: 59.9Moz) | 18% (2023 : 46.4Moz) | ||||||

*Refer to “Non-GAAP disclosure” for definitions and reconciliations. | ||||||||

Improve portfolio quality | FULL ASSET POTENTIAL PROGRAMME | |||||||

Drives strong cost performance, offsetting inflationary impacts which delivers significant efficiencies, greater predictability and much improved resilience to withstand gold production disruptions. Since the implementation of the programme, total cash costs in real terms have declined 5% over Q1 2021 to Q4 2024. Furthermore, this has resulted in $621m in incremental Adjusted EBITDA since 2022. | ||||||||

QUARTER 4 2024 EARNINGS RELEASE | 7 |  | |||

| ||||||

GROUP I FINANCIAL AND OPERATING KEY STATISTICS | ||||||

Key Statistics | Quarter | Quarter | Year | Year | |

ended | ended | ended | ended | ||

Dec | Dec | Dec | Dec | ||

US Dollar million, except as otherwise noted | 2024 | 2023 | 2024 | 2023 | |

Operating review | |||||

Gold | |||||

Produced - Group (1) (2) (3) (4) | - oz (000) | 750 | 738 | 2,661 | 2,644 |

Produced - Managed operations (1) (2) (3) (4) | - oz (000) | 670 | 645 | 2,352 | 2,301 |

Produced - Non-managed joint ventures (2) | - oz (000) | 80 | 93 | 309 | 343 |

Sold - Group (1) (2) (3) (4) | - oz (000) | 725 | 711 | 2,679 | 2,624 |

Sold - Managed operations(1) (2) (3) (4) | - oz (000) | 647 | 619 | 2,370 | 2,281 |

Sold - Non-managed joint ventures (2) | - oz (000) | 78 | 92 | 309 | 343 |

Financial review | |||||

Gold income | - $m | 1,716 | 1,223 | 5,673 | 4,480 |

Cost of sales - Group | - $m | 1,144 | 1,023 | 4,106 | 3,913 |

Cost of sales - Managed operations | - $m | 1,043 | 929 | 3,726 | 3,541 |

Cost of sales - Non-managed joint ventures | - $m | 101 | 94 | 380 | 372 |

Total operating costs | - $m | 815 | 740 | 2,911 | 2,870 |

Gross profit | - $m | 707 | 327 | 2,067 | 1,041 |

Average gold price received per ounce* - Group (1) (2) (3) | - $/oz | 2,653 | 1,971 | 2,394 | 1,930 |

Average gold price received per ounce* - Managed operations (1) (2) (3) | - $/oz | 2,652 | 1,969 | 2,393 | 1,927 |

Average gold price received per ounce* - Non-managed joint ventures (2) | - $/oz | 2,662 | 1,984 | 2,401 | 1,948 |

All-in sustaining costs per ounce* - Group (1) (2) (3) | - $/oz | 1,647 | 1,598 | 1,611 | 1,544 |

All-in sustaining costs per ounce* - Managed operations (1) (2) (3) | - $/oz | 1,702 | 1,701 | 1,672 | 1,634 |

All-in sustaining costs per ounce* - Non-managed joint ventures (2) | - $/oz | 1,188 | 907 | 1,146 | 951 |

All-in costs per ounce* - Group (1) (2) (3) | - $/oz | 1,840 | 1,794 | 1,846 | 1,754 |

All-in costs per ounce* - Managed operations (1) (2) (3) | - $/oz | 1,895 | 1,909 | 1,910 | 1,857 |

All-in costs per ounce* - Non-managed joint ventures (2) | - $/oz | 1,388 | 1,023 | 1,351 | 1,074 |

Total cash costs per ounce* - Group (1) (2) (3) | - $/oz | 1,144 | 1,050 | 1,157 | 1,115 |

Total cash costs per ounce* - Managed operations (1) (2) (3) | - $/oz | 1,165 | 1,092 | 1,187 | 1,162 |

Total cash costs per ounce* - Non-managed joint ventures (2) | - $/oz | 967 | 761 | 935 | 802 |

Profit before taxation | - $m | 698 | 144 | 1,672 | 63 |

Adjusted EBITDA* | - $m | 884 | 574 | 2,747 | 1,420 |

Total borrowings | - $m | 2,125 | 2,410 | 2,125 | 2,410 |

Adjusted net debt* | - $m | 567 | 1,268 | 567 | 1,268 |

Profit (loss) attributable to equity shareholders | - $m | 470 | 28 | 1,004 | (235) |

- US cents/share | 103 | 7 | 233 | (56) | |

Headline earnings (loss) (5) | - $m | 405 | 87 | 954 | (46) |

- US cents/share | 89 | 21 | 221 | (11) | |

Net cash inflow from operating activities | - $m | 690 | 404 | 1,968 | 971 |

Free cash flow* | - $m | 389 | 293 | 942 | 109 |

Capital expenditure - Group(2)(3) | - $m | 369 | 357 | 1,215 | 1,127 |

Capital expenditure - Managed operations(2)(3) | - $m | 333 | 334 | 1,090 | 1,042 |

Capital expenditure - Non-managed joint ventures (2) | - $m | 36 | 23 | 125 | 85 |

(1)All financial periods within the financial year ended 31 December 2023 have been adjusted to exclude the Córrego do Sítio (“CdS”) operation that was placed on care and maintenance in August 2023. All gold production, gold sold, average gold price received per ounce*, all-in sustaining costs per ounce*, all-in costs per ounce* and total cash costs per ounce* metrics in this document have been adjusted to exclude the CdS operation, unless otherwise stated. | |||||

(2)The term “managed operations” refers to subsidiaries managed by AngloGold Ashanti and included in its consolidated reporting, while the term “non-managed joint ventures” (i.e., Kibali) refers to equity-accounted joint ventures that are reported based on AngloGold Ashanti’s share of attributable earnings and are not managed by AngloGold Ashanti. Managed operations are reported on a consolidated basis. Non-managed joint ventures are reported on an attributable basis. | |||||

(3)On 22 November 2024, the acquisition of Centamin was successfully completed. Centamin was included in the financial year ended 31 December 2024 from the effective date of the acquisition. | |||||

(4)Includes gold concentrate from the Cuiabá mine sold to third parties. | |||||

(5)The financial measures “headline earnings (loss)” and “headline earnings (loss) per share” are not calculated in accordance with IFRS® Accounting Standards, but in accordance with the Headline Earnings Circular 1/2023, issued by the South African Institute of Chartered Accountants (SAICA), at the request of the Johannesburg Stock Exchange Limited (JSE). These measures are required to be disclosed by the JSE Listings Requirements and therefore do not constitute Non-GAAP financial measures for purposes of the rules and regulations of the US Securities and Exchange Commission (“SEC”) applicable to the use and disclosure of Non-GAAP financial measures. | |||||

* Refer to “Non-GAAP disclosure” for definitions and reconciliations. | |||||

$ represents US Dollar, unless otherwise stated. | |||||

Rounding of figures may result in computational discrepancies. | |||||

QUARTER 4 2024 EARNINGS RELEASE | 8 |  | |||

| ||||||

GROUP I FINANCIAL AND OPERATING RESULTS | ||||||

QUARTER 4 2024 EARNINGS RELEASE | 9 |  | |||

| ||||||

REGIONS I FINANCIAL AND OPERATING RESULTS | ||||||

QUARTER 4 2024 EARNINGS RELEASE | 10 |  | |||

| ||||||

REGIONS I FINANCIAL AND OPERATING RESULTS | ||||||

QUARTER 4 2024 EARNINGS RELEASE | 11 |  | |||

| ||||||

GROUP I FINANCIAL AND OPERATING RESULTS | ||||||

FREE CASH FLOW* | Quarter | Quarter | Year | Year |

ended | ended | ended | ended | |

Dec | Dec | Dec | Dec | |

2024 | 2023 | 2024 | 2023 | |

US Dollar million, except as otherwise noted | Unaudited | Unaudited | Unaudited | Unaudited |

Cash generated from operations | 713 | 306 | 2,063 | 871 |

Dividends received from joint ventures | 44 | 94 | 88 | 180 |

Taxation refund | — | 36 | 6 | 36 |

Taxation paid | (67) | (32) | (189) | (116) |

Net cash inflow from operating activities | 690 | 404 | 1,968 | 971 |

Corporate restructuring costs | — | 238 | 2 | 268 |

Capital expenditure on tangible and intangible assets | (333) | (334) | (1,090) | (1,042) |

Net cash from operating activities after capital expenditure | 357 | 308 | 880 | 197 |

Repayment of lease liabilities | (23) | (27) | (91) | (94) |

Finance costs accrued and capitalised | (33) | (37) | (139) | (132) |

Net cash flow after capital expenditure and interest | 301 | 244 | 650 | (29) |

Repayment of loans advanced to joint ventures | 10 | — | 149 | — |

Other net cash inflow from investing activities | 42 | 47 | 113 | 125 |

Other | 26 | 2 | 35 | 4 |

Add backs: | ||||

Cash restricted for use | 10 | — | (5) | 9 |

Free cash flow*(1) | 389 | 293 | 942 | 109 |

QUARTER 4 2024 EARNINGS RELEASE | 12 |  | |||

| ||||||

GROUP I FINANCIAL AND OPERATING RESULTS | ||||||

2025 Guidance | ||

Gold production | Gold production (koz) | |

–Managed operations | 2,590 - 2,885 | |

–Non-managed joint ventures | 310 - 340 | |

–Group | 2,900 - 3,225 | |

Africa | 1,935 - 2,160 | |

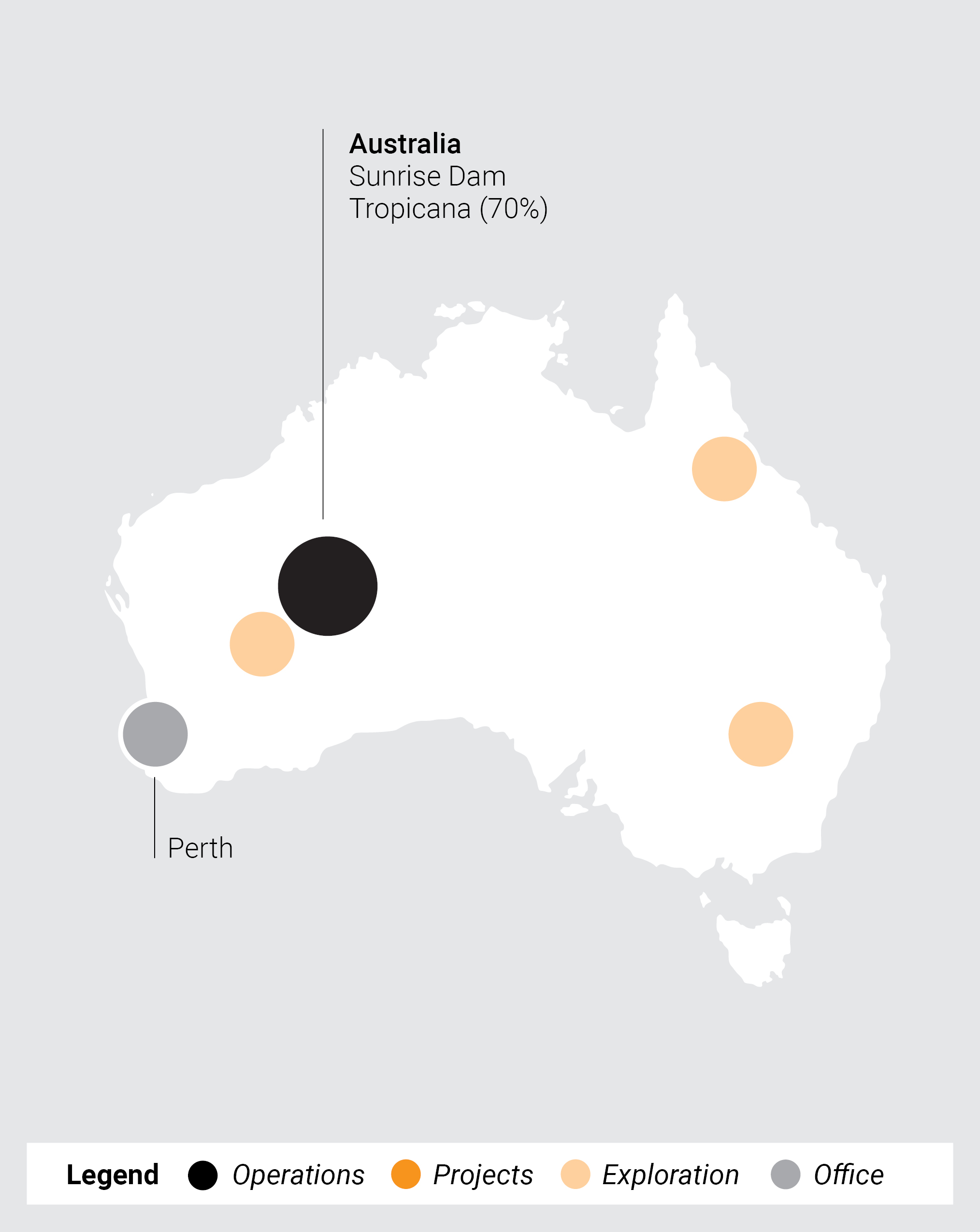

Australia | 500 - 550 | |

Americas | 465 - 515 | |

Costs(1) | All-in sustaining costs per ounce* ($/oz) | |

–Managed operations | 1,600 - 1,725 | |

–Non-managed joint ventures | 1,160 - 1,260 | |

–Group | 1,580 - 1,705 | |

Africa | 1,530 | |

Australia | 1,700 | |

Americas | 1,700 | |

Total cash costs per ounce* ($/oz) | ||

–Managed operations | 1,130 - 1,230 | |

–Non-managed joint ventures | 970 - 1,050 | |

–Group | 1,125 - 1,225 | |

Africa | 1,090 | |

Australia | 1,425 | |

Americas | 1,225 | |

Capital expenditure(1) | Capital expenditure ($m) | |

–Managed operations | 1,505 - 1,635 | |

–Non-managed joint ventures | 115 - 135 | |

–Group | 1,620 - 1,770 | |

Sustaining capital expenditure* ($m) | ||

–Managed operations | 1,035 - 1,125 | |

–Non-managed joint ventures | 50 - 60 | |

–Group | 1,085 - 1,185 | |

Non-sustaining capital expenditure* ($m) | ||

–Managed operations | 470 - 510 | |

–Non-managed joint ventures | 65 - 75 | |

–Group | 535 - 585 | |

QUARTER 4 2024 EARNINGS RELEASE | 13 |  | |||

| ||||||

REGIONS I FINANCIAL AND OPERATING RESULTS | ||||||

2026 Guidance(1) | ||

Gold production | Gold production (koz) - Group | 2,900 - 3,225 |

Costs(1) | All-in sustaining costs per ounce* ($/oz) - Group | 1,580 - 1,705 |

Total cash costs per ounce* ($/oz) - Group | 1,125 - 1,225 | |

Capital expenditure(1) | Capital expenditure ($m) - Group | 1,710 - 1,860 |

Sustaining capital expenditure* ($m) - Group | 1,085 - 1,185 | |

Non-sustaining capital expenditure* ($m) - Group | 625 - 675 | |

QUARTER 4 2024 EARNINGS RELEASE | 14 |  | |||

| ||||||

REGIONS I FINANCIAL AND OPERATING RESULTS | ||||||

QUARTER 4 2024 EARNINGS RELEASE | 15 |  | |||

| ||||||

REGIONS I FINANCIAL AND OPERATING RESULTS | ||||||

QUARTER 4 2024 EARNINGS RELEASE | 16 |  | |||

| ||||||

REGIONS I FINANCIAL AND OPERATING RESULTS | ||||||

QUARTER 4 2024 EARNINGS RELEASE | 17 |  | |||

| ||||||

REGIONS I FINANCIAL AND OPERATING RESULTS | ||||||

QUARTER 4 2024 EARNINGS RELEASE | 18 |  | |||

| ||||||

REGIONS I FINANCIAL AND OPERATING RESULTS | ||||||

QUARTER 4 2024 EARNINGS RELEASE | 19 |  | |||

| ||||||

OBUASI I UPDATE | ||||||

QUARTER 4 2024 EARNINGS RELEASE | 20 |  | |||

| ||||||

OBUASI I UPDATE | ||||||

Period | Gold production |

2025 | 250koz - 300koz |

2026 | 300koz - 350koz |

2027 | 325koz - 375koz |

2028 | 375koz - 425koz |

QUARTER 4 2024 EARNINGS RELEASE | 21 |  | |||

| ||||||

GROUP I CORPORATE UPDATE | ||||||

QUARTER 4 2024 EARNINGS RELEASE | 22 |  | |||

| ||||||

GROUP I FINANCIAL RESULTS | ||||||

GROUP INCOME STATEMENT | Quarter | Quarter | Year | Year |

ended | ended | ended | ended | |

Dec | Dec | Dec | Dec | |

2024 | 2023 | 2024 | 2023 | |

US Dollar million, except as otherwise noted | Unaudited | Unaudited | Unaudited | Unaudited |

Revenue from product sales | 1,750 | 1,256 | 5,793 | 4,582 |

Cost of sales | (1,043) | (929) | (3,726) | (3,541) |

Gross profit | 707 | 327 | 2,067 | 1,041 |

Corporate administration, marketing and related expenses | (32) | (31) | (118) | (94) |

Exploration and evaluation costs | (75) | (71) | (252) | (254) |

Reversal of impairment (net impairment), (derecognition of assets) and profit (loss) on disposal | 72 | (65) | 58 | (221) |

Corporate restructuring costs | — | (3) | — | (314) |

Other (expenses) income | (26) | (24) | (144) | (104) |

Finance income | 38 | 35 | 160 | 127 |

Foreign exchange and fair value adjustments (1) | 29 | (48) | (87) | (168) |

Finance costs and unwinding of obligations | (41) | (44) | (167) | (157) |

Share of associates and joint ventures’ profit | 26 | 68 | 155 | 207 |

Profit before taxation | 698 | 144 | 1,672 | 63 |

Taxation | (204) | (109) | (623) | (285) |

Profit (loss) for the period | 494 | 35 | 1,049 | (222) |

Attributable to: | ||||

Equity shareholders | 470 | 28 | 1,004 | (235) |

Non-controlling interests | 24 | 7 | 45 | 13 |

494 | 35 | 1,049 | (222) | |

Basic earnings (loss) per ordinary share (US cents) (2) | 103 | 7 | 233 | (56) |

Diluted earnings (loss) per ordinary share (US cents) (3) | 103 | 7 | 233 | (56) |

(1) The loss on non-hedge derivatives and other commodity contracts of $1m and $71m for Q4 2024 and 2024 respectively (Q4 2023: $21m; 2023: $14m) which was previously included in gross profit has been reclassified to the foreign exchange and fair value adjustments line. | ||||

(2) Calculated on the basic weighted average number of ordinary shares. | ||||

(3) Calculated on the diluted weighted average number of ordinary shares. | ||||

QUARTER 4 2024 EARNINGS RELEASE | 23 |  | |||

| ||||||

GROUP I FINANCIAL RESULTS | ||||||

GROUP STATEMENT OF FINANCIAL POSITION | As at | As at | |

Dec | Dec | ||

2024 | 2023 | ||

US Dollar million, except as otherwise noted | Unaudited | Unaudited | |

ASSETS | |||

Non-current assets | |||

Tangible assets (1) | 8,256 | 4,419 | |

Right of use assets | 123 | 142 | |

Intangible assets | 98 | 107 | |

Investments in associates and joint ventures | 530 | 599 | |

Other investments | 54 | 1 | |

Loan receivable | 203 | 358 | |

Inventories (1) | 208 | 2 | |

Trade, other receivables and other assets | 243 | 254 | |

Reimbursive right for post-retirement benefits | 49 | 35 | |

Deferred taxation | 12 | 50 | |

Cash restricted for use | 41 | 34 | |

9,817 | 6,001 | ||

Current assets | |||

Loan receivable | 260 | 148 | |

Inventories (1) | 1,067 | 829 | |

Trade, other receivables and other assets (1)(2) | 373 | 181 | |

Taxation (2) | 1 | 18 | |

Cash restricted for use | 20 | 34 | |

Cash and cash equivalents (1) | 1,425 | 964 | |

3,146 | 2,174 | ||

Total assets | 12,963 | 8,175 | |

EQUITY AND LIABILITIES | |||

Share capital and premium | 526 | 420 | |

Accumulated profits and other reserves | 6,103 | 3,291 | |

Shareholders’ equity | 6,629 | 3,711 | |

Non-controlling interests (1) | 1,690 | 29 | |

Total equity | 8,319 | 3,740 | |

Non-current liabilities | |||

Borrowings | 1,901 | 2,032 | |

Lease liabilities | 65 | 98 | |

Environmental rehabilitation and other provisions (1) | 656 | 636 | |

Provision for pension and post-retirement benefits | 57 | 64 | |

Trade and other payables | 6 | 5 | |

Deferred taxation | 519 | 395 | |

3,204 | 3,230 | ||

Current liabilities | |||

Borrowings | 83 | 207 | |

Lease liabilities | 76 | 73 | |

Environmental rehabilitation and other provisions | 109 | 80 | |

Trade and other payables (1) | 957 | 772 | |

Taxation | 187 | 64 | |

Bank overdraft | 28 | 9 | |

1,440 | 1,205 | ||

Total liabilities | 4,644 | 4,435 | |

Total equity and liabilities | 12,963 | 8,175 | |

QUARTER 4 2024 EARNINGS RELEASE | 24 |  | |||

| ||||||

GROUP I FINANCIAL RESULTS | ||||||

GROUP STATEMENT OF CASH FLOWS | Quarter | Quarter | Year | Year | |

ended | ended | ended | ended | ||

Dec | Dec | Dec | Dec | ||

2024 | 2023 | 2024 | 2023 | ||

US Dollar million, except as otherwise noted | Unaudited | Unaudited | Unaudited | Unaudited | |

Cash flows from operating activities | |||||

Cash generated from operations | 713 | 306 | 2,063 | 871 | |

Dividends received from joint ventures | 44 | 94 | 88 | 180 | |

Taxation refund | — | 36 | 6 | 36 | |

Taxation paid | (67) | (32) | (189) | (116) | |

Net cash inflow from operating activities | 690 | 404 | 1,968 | 971 | |

Cash flows from investing activities | |||||

Capital expenditure on tangible and intangible assets | (333) | (334) | (1,090) | (1,042) | |

Dividends from associates and other investments | 12 | 6 | 12 | 12 | |

Proceeds from disposal of tangible assets | 15 | 9 | 16 | 14 | |

Deferred compensation received | — | — | 5 | — | |

Other investments and assets acquired | (1) | — | (30) | — | |

Proceeds from disposal of other investments | — | 20 | — | 20 | |

Payment upon disposal of joint venture and associate | (2) | — | (2) | — | |

Loans advanced | — | — | (1) | (1) | |

Acquisition of subsidiary, net of cash acquired (1) | 68 | — | 68 | — | |

Decrease (increase) in cash restricted for use | (10) | — | 5 | (9) | |

Interest received | 25 | 31 | 106 | 109 | |

Repayment of loans advanced to joint ventures | 10 | — | 149 | — | |

Net cash outflow from investing activities | (216) | (268) | (762) | (897) | |

Cash flows from financing activities | |||||

Share securities tax on redomicile and reorganisation | — | (19) | — | (19) | |

Proceeds from borrowings | 180 | 250 | 655 | 343 | |

Repayment of borrowings | (338) | — | (909) | (87) | |

Repayment of lease liabilities | (23) | (27) | (91) | (94) | |

Finance costs – borrowings | (36) | (36) | (126) | (111) | |

Finance costs – leases | (3) | (3) | (11) | (11) | |

Other borrowing costs | — | — | (1) | (1) | |

Dividends paid | (65) | (2) | (244) | (107) | |

Net cash (outflow) inflow from financing activities | (285) | 163 | (727) | (87) | |

Net increase (decrease) in cash and cash equivalents | 189 | 299 | 479 | (13) | |

Translation | (17) | (69) | (37) | (138) | |

Cash and cash equivalents at beginning of period (net of bank overdraft) | 1,225 | 725 | 955 | 1,106 | |

Cash and cash equivalents at end of period (net of bank overdraft) | 1,397 | 955 | 1,397 | 955 | |

QUARTER 4 2024 EARNINGS RELEASE | 25 |  | |||

| ||||||

GROUP I SEGMENTAL | ||||||

GOLD INCOME | Quarter | Quarter | Year | Year | |

ended | ended | ended | ended | ||

Dec | Dec | Dec | Dec | ||

2024 | 2023 | 2024 | 2023 | ||

US Dollar million, except as otherwise noted | Unaudited | Unaudited | Unaudited | Unaudited | |

AFRICA | 1,114 | 841 | 3,756 | 3,068 | |

Kibali - Attributable 45% | 208 | 183 | 741 | 668 | |

Iduapriem | 125 | 151 | 563 | 522 | |

Obuasi | 157 | 114 | 530 | 439 | |

Siguiri | 182 | 131 | 653 | 505 | |

Geita | 323 | 262 | 1,150 | 934 | |

Sukari | 119 | — | 119 | — | |

AUSTRALIA | 441 | 293 | 1,394 | 1,081 | |

Sunrise Dam | 176 | 124 | 626 | 495 | |

Tropicana - Attributable 70% | 265 | 169 | 768 | 586 | |

AMERICAS | 369 | 272 | 1,264 | 999 | |

Cerro Vanguardia | 116 | 83 | 439 | 317 | |

AngloGold Ashanti Mineração (1) | 195 | 139 | 634 | 515 | |

Serra Grande | 58 | 50 | 191 | 167 | |

1,924 | 1,406 | 6,414 | 5,148 | ||

Equity-accounted joint venture included above | (208) | (183) | (741) | (668) | |

1,716 | 1,223 | 5,673 | 4,480 | ||

BY-PRODUCT REVENUE | |||||

US Dollar million, except as otherwise noted | Unaudited | Unaudited | Unaudited | Unaudited | |

AFRICA | 1 | 1 | 6 | 5 | |

Kibali - Attributable 45% | — | — | 2 | 2 | |

Iduapriem | — | — | — | — | |

Obuasi | — | — | 1 | 1 | |

Siguiri | — | — | 1 | — | |

Geita | 1 | 1 | 2 | 2 | |

Sukari | — | — | — | — | |

AUSTRALIA | 1 | 1 | 5 | 4 | |

Sunrise Dam | — | — | 2 | 1 | |

Tropicana - Attributable 70% | 1 | 1 | 3 | 3 | |

AMERICAS | 32 | 31 | 111 | 95 | |

Cerro Vanguardia | 30 | 31 | 109 | 93 | |

AngloGold Ashanti Mineração | 2 | — | 2 | 2 | |

34 | 33 | 122 | 104 | ||

Equity-accounted joint venture included above | — | — | (2) | (2) | |

34 | 33 | 120 | 102 | ||

QUARTER 4 2024 EARNINGS RELEASE | 26 |  | |||

| ||||||

GROUP I SEGMENTAL | ||||||

COST OF SALES | Quarter | Quarter | Year | Year | |

ended | ended | ended | ended | ||

Dec | Dec | Dec | Dec | ||

2024 | 2023 | 2024 | 2023 | ||

US Dollar million, except as otherwise noted | Unaudited | Unaudited | Unaudited | Unaudited | |

AFRICA | 658 | 552 | 2,304 | 2,111 | |

Kibali - Attributable 45% | 101 | 94 | 380 | 372 | |

Iduapriem | 91 | 104 | 351 | 387 | |

Obuasi | 101 | 81 | 360 | 313 | |

Siguiri | 134 | 134 | 518 | 473 | |

Geita | 148 | 139 | 612 | 566 | |

Sukari | 83 | — | 83 | — | |

AUSTRALIA | 259 | 237 | 945 | 867 | |

Sunrise Dam | 114 | 103 | 430 | 399 | |

Tropicana - Attributable 70% | 135 | 126 | 479 | 438 | |

Administration and other | 10 | 8 | 36 | 30 | |

AMERICAS | 230 | 231 | 858 | 931 | |

Cerro Vanguardia | 99 | 83 | 368 | 307 | |

AngloGold Ashanti Mineração | 98 | 103 | 352 | 453 | |

Serra Grande | 32 | 45 | 136 | 169 | |

Administration and other | 1 | — | 2 | 2 | |

CORPORATE AND OTHER | (3) | 3 | (1) | 4 | |

1,144 | 1,023 | 4,106 | 3,913 | ||

Equity-accounted joint venture included above | (101) | (94) | (380) | (372) | |

1,043 | 929 | 3,726 | 3,541 | ||

GROSS PROFIT (1) | |||||

US Dollar million, except as otherwise noted | Unaudited | Unaudited | Unaudited | Unaudited | |

AFRICA | 458 | 291 | 1,459 | 961 | |

Kibali - Attributable 45% | 107 | 90 | 363 | 297 | |

Iduapriem | 34 | 47 | 213 | 135 | |

Obuasi | 57 | 33 | 171 | 127 | |

Siguiri | 48 | (2) | 136 | 31 | |

Geita | 176 | 123 | 540 | 370 | |

Sukari | 36 | — | 36 | — | |

Administration and other | — | — | — | 1 | |

AUSTRALIA | 184 | 58 | 453 | 220 | |

Sunrise Dam | 63 | 21 | 197 | 99 | |

Tropicana - Attributable 70% | 131 | 44 | 292 | 151 | |

Administration and other | (10) | (7) | (36) | (30) | |

AMERICAS | 169 | 72 | 517 | 162 | |

Cerro Vanguardia | 47 | 31 | 180 | 102 | |

AngloGold Ashanti Mineração | 98 | 36 | 283 | 63 | |

Serra Grande | 25 | 5 | 56 | (2) | |

Administration and other | (1) | — | (2) | (1) | |

CORPORATE AND OTHER | 3 | (4) | 1 | (5) | |

814 | 417 | 2,430 | 1,338 | ||

Equity-accounted joint venture included above | (107) | (90) | (363) | (297) | |

707 | 327 | 2,067 | 1,041 |

QUARTER 4 2024 EARNINGS RELEASE | 27 |  | |||

| ||||||

GROUP I SEGMENTAL | ||||||

AMORTISATION | Quarter | Quarter | Year | Year | |

ended | ended | ended | ended | ||

Dec | Dec | Dec | Dec | ||

2024 | 2023 | 2024 | 2023 | ||

US Dollar million, except as otherwise noted | Unaudited | Unaudited | Unaudited | Unaudited | |

AFRICA | 142 | 115 | 455 | 419 | |

Kibali - Attributable 45% | 25 | 25 | 92 | 99 | |

Iduapriem | 19 | 31 | 79 | 129 | |

Obuasi | 22 | 18 | 75 | 61 | |

Siguiri | 14 | 17 | 51 | 39 | |

Geita | 42 | 24 | 138 | 91 | |

Sukari | 20 | — | 20 | — | |

AUSTRALIA | 58 | 59 | 190 | 163 | |

Sunrise Dam | 19 | 19 | 77 | 58 | |

Tropicana - Attributable 70% | 39 | 40 | 112 | 104 | |

Administration and other | — | — | 1 | 1 | |

AMERICAS | 62 | 47 | 195 | 170 | |

Cerro Vanguardia | 21 | 11 | 61 | 39 | |

AngloGold Ashanti Mineração | 33 | 24 | 112 | 88 | |

Serra Grande | 8 | 12 | 22 | 43 | |

CORPORATE AND OTHER | 1 | 1 | 4 | 5 | |

263 | 222 | 844 | 757 | ||

Equity-accounted joint venture included above | (25) | (25) | (92) | (99) | |

238 | 197 | 752 | 658 | ||

CAPITAL EXPENDITURE | |||||

US Dollar million, except as otherwise noted | Unaudited | Unaudited | Unaudited | Unaudited | |

AFRICA | 247 | 247 | 814 | 710 | |

Kibali - Attributable 45% | 36 | 23 | 125 | 85 | |

Iduapriem | 50 | 43 | 169 | 142 | |

Obuasi | 54 | 76 | 202 | 214 | |

Siguiri | 29 | 41 | 102 | 78 | |

Geita | 58 | 64 | 196 | 191 | |

Sukari | 20 | — | 20 | — | |

AUSTRALIA | 40 | 31 | 153 | 135 | |

Sunrise Dam | 26 | 15 | 65 | 47 | |

Tropicana - Attributable 70% | 14 | 16 | 88 | 87 | |

Administration and other | — | — | — | 1 | |

AMERICAS | 66 | 63 | 209 | 254 | |

Cerro Vanguardia | 24 | 26 | 71 | 75 | |

AngloGold Ashanti Mineração | 30 | 23 | 98 | 124 | |

Serra Grande | 12 | 14 | 40 | 55 | |

PROJECTS | 16 | 15 | 38 | 27 | |

Colombian projects | 8 | 4 | 13 | 11 | |

North American projects | 8 | 11 | 25 | 16 | |

CORPORATE AND OTHER | — | 1 | 1 | 1 | |

369 | 357 | 1,215 | 1,127 | ||

Equity-accounted joint venture included above | (36) | (23) | (125) | (85) | |

333 | 334 | 1,090 | 1,042 | ||

QUARTER 4 2024 EARNINGS RELEASE | 28 |  | |||

| ||||||

GROUP I SEGMENTAL | ||||||

TOTAL ASSETS | As at | As at | |

Dec | Dec | ||

2024 | 2023 | ||

US Dollar million, except as otherwise noted | Unaudited | Unaudited | |

AFRICA | 8,887 | 4,414 | |

Kibali - Attributable 45% | 950 | 1,066 | |

Iduapriem | 579 | 526 | |

Obuasi | 1,481 | 1,288 | |

Siguiri | 591 | 486 | |

Geita | 1,231 | 1,042 | |

Sukari | 4,049 | — | |

Administration and other | 6 | 6 | |

AUSTRALIA | 845 | 942 | |

AMERICAS | 1,460 | 1,254 | |

Cerro Vanguardia | 626 | 524 | |

AngloGold Ashanti Mineração | 668 | 584 | |

Serra Grande | 148 | 127 | |

Administration and other | 18 | 19 | |

PROJECTS | 991 | 833 | |

Colombian projects | 207 | 194 | |

North American projects | 784 | 639 | |

CORPORATE AND OTHER | 780 | 732 | |

12,963 | 8,175 | ||

By order of the Board | ||||

J TILK Chairman | A CALDERON Chief Executive Officer | G DORAN Chief Financial Officer | ||

18 February 2025 | ||||

QUARTER 4 2024 EARNINGS RELEASE | 29 |  | |||

| ||||||

GROUP I MINERAL RESOURCE AND MINERAL RESERVE | ||||||

QUARTER 4 2024 EARNINGS RELEASE | 30 |  | |||

| ||||||

GROUP I MINERAL RESOURCE AND MINERAL RESERVE | ||||||

MINERAL RESOURCE (1) | AT 31 DECEMBER 2024 | |||||||||||||||

Measured | Indicated | Total Measured and Indicated | Inferred | |||||||||||||

GOLD | Tonnes (3) | Grade | Contained Gold | Tonnes (3) | Grade | Contained Gold | Tonnes (3) | Grade | Contained Gold | Tonnes (3) | Grade | Contained Gold | ||||

Million | g/t | Tonnes | Moz | Million | g/t | Tonnes | Moz | Million | g/t | Tonnes | Moz | Million | g/t | Tonnes | Moz | |

Africa Region | 61.60 | 2.00 | 123.19 | 3.96 | 380.84 | 1.83 | 697.70 | 22.43 | 442.44 | 1.86 | 820.90 | 26.39 | 319.24 | 2.31 | 739.01 | 23.76 |

Democratic Republic of the Congo | 6.16 | 2.94 | 18.12 | 0.58 | 27.83 | 2.71 | 75.34 | 2.42 | 33.99 | 2.75 | 93.46 | 3.00 | 12.44 | 2.32 | 28.80 | 0.93 |

Kibali (45%) (2)(4)(13) | 6.16 | 2.94 | 18.12 | 0.58 | 27.83 | 2.71 | 75.34 | 2.42 | 33.99 | 2.75 | 93.46 | 3.00 | 12.44 | 2.32 | 28.80 | 0.93 |

Ghana | 5.68 | 6.64 | 37.75 | 1.21 | 111.63 | 2.95 | 329.67 | 10.60 | 117.32 | 3.13 | 367.42 | 11.81 | 85.18 | 4.85 | 413.56 | 13.30 |

Iduapriem (13) | 0.09 | 0.91 | 0.08 | 0.00 | 65.93 | 1.40 | 92.33 | 2.97 | 66.02 | 1.40 | 92.42 | 2.97 | 37.38 | 1.48 | 55.47 | 1.78 |

Obuasi (5)(13) | 5.59 | 6.74 | 37.67 | 1.21 | 45.70 | 5.19 | 237.33 | 7.63 | 51.29 | 5.36 | 275.00 | 8.84 | 47.81 | 7.49 | 358.09 | 11.51 |

Guinea | — | — | — | — | 139.75 | 1.09 | 152.42 | 4.90 | 139.75 | 1.09 | 152.42 | 4.90 | 94.07 | 1.21 | 113.88 | 3.66 |

Siguiri (85%) (2)(13) | — | — | — | — | 139.75 | 1.09 | 152.42 | 4.90 | 139.75 | 1.09 | 152.42 | 4.90 | 94.07 | 1.21 | 113.88 | 3.66 |

Tanzania | 10.28 | 2.58 | 26.58 | 0.85 | 49.84 | 1.84 | 91.86 | 2.95 | 60.12 | 1.97 | 118.45 | 3.81 | 48.80 | 2.21 | 107.84 | 3.47 |

Geita (6)(13) | 10.28 | 2.58 | 26.58 | 0.85 | 49.84 | 1.84 | 91.86 | 2.95 | 60.12 | 1.97 | 118.45 | 3.81 | 48.80 | 2.21 | 107.84 | 3.47 |

Egypt | 39.43 | 1.03 | 40.69 | 1.31 | 28.12 | 0.86 | 24.31 | 0.78 | 67.55 | 0.96 | 65.01 | 2.09 | 20.97 | 0.80 | 16.88 | 0.54 |

Sukari (50%) (2)(7)(8)(13) | 39.43 | 1.03 | 40.69 | 1.31 | 28.12 | 0.86 | 24.31 | 0.78 | 67.55 | 0.96 | 65.01 | 2.09 | 20.97 | 0.80 | 16.88 | 0.54 |

Côte d'Ivoire | 0.05 | 0.87 | 0.04 | — | 23.67 | 1.02 | 24.10 | 0.77 | 23.71 | 1.02 | 24.14 | 0.78 | 57.79 | 1.00 | 58.05 | 1.87 |

Doropo (90%) (2)(7)(12) | 0.05 | 0.87 | 0.04 | 0.00 | 23.67 | 1.02 | 24.10 | 0.77 | 23.71 | 1.02 | 24.14 | 0.78 | 6.63 | 1.23 | 8.16 | 0.26 |

ABC (7)(11) | — | — | — | — | — | — | — | — | — | — | — | — | 51.16 | 0.98 | 49.89 | 1.60 |

Americas Region | 16.51 | 3.70 | 61.11 | 1.96 | 35.16 | 3.09 | 108.61 | 3.49 | 51.68 | 3.28 | 169.72 | 5.46 | 49.99 | 3.92 | 195.83 | 6.30 |

Argentina | 7.02 | 2.48 | 17.43 | 0.56 | 12.40 | 2.53 | 31.40 | 1.01 | 19.41 | 2.52 | 48.83 | 1.57 | 3.99 | 3.01 | 12.02 | 0.39 |

Cerro Vanguardia (92.5%) (2)(13) | 7.02 | 2.48 | 17.43 | 0.56 | 12.40 | 2.53 | 31.40 | 1.01 | 19.41 | 2.52 | 48.83 | 1.57 | 3.99 | 3.01 | 12.02 | 0.39 |

Brazil | 9.50 | 4.60 | 43.68 | 1.40 | 22.77 | 3.39 | 77.21 | 2.48 | 32.26 | 3.75 | 120.89 | 3.89 | 46.01 | 4.00 | 183.81 | 5.91 |

AGA Mineração - Córrego do Sítio (9) | 3.03 | 3.31 | 10.04 | 0.32 | 7.80 | 3.16 | 24.66 | 0.79 | 10.83 | 3.20 | 34.70 | 1.12 | 20.45 | 3.94 | 80.56 | 2.59 |

AGA Mineração - Cuiabá (13) | 2.57 | 7.87 | 20.22 | 0.65 | 4.13 | 5.20 | 21.51 | 0.69 | 6.70 | 6.23 | 41.73 | 1.34 | 10.47 | 5.19 | 54.33 | 1.75 |

AGA Mineração - Lamego (13) | 1.05 | 3.32 | 3.49 | 0.11 | 2.93 | 2.47 | 7.23 | 0.23 | 3.98 | 2.69 | 10.71 | 0.34 | 2.14 | 2.36 | 5.05 | 0.16 |

Serra Grande (13) | 2.84 | 3.49 | 9.94 | 0.32 | 7.91 | 3.01 | 23.81 | 0.77 | 10.75 | 3.14 | 33.75 | 1.08 | 12.95 | 3.39 | 43.88 | 1.41 |

Australia Region | 42.12 | 1.65 | 69.37 | 2.23 | 35.10 | 1.91 | 66.95 | 2.15 | 77.21 | 1.77 | 136.32 | 4.38 | 47.40 | 2.21 | 104.66 | 3.37 |

Sunrise Dam (13) | 31.29 | 1.75 | 54.75 | 1.76 | 25.79 | 1.87 | 48.17 | 1.55 | 57.09 | 1.80 | 102.92 | 3.31 | 27.66 | 2.04 | 56.46 | 1.82 |

Butcher Well (70%) (2)(11) | — | — | — | — | — | — | — | — | — | — | — | — | 2.70 | 3.84 | 10.35 | 0.33 |

Tropicana (70%) (2)(13) | 10.83 | 1.35 | 14.62 | 0.47 | 9.30 | 2.02 | 18.78 | 0.60 | 20.13 | 1.66 | 33.40 | 1.07 | 17.04 | 2.22 | 37.85 | 1.22 |

Projects | 69.48 | 0.46 | 32.19 | 1.03 | 1,185.81 | 0.78 | 927.81 | 29.83 | 1,255.29 | 0.76 | 960.00 | 30.86 | 996.82 | 0.67 | 670.28 | 21.55 |

Colombia | 45.15 | 0.37 | 16.93 | 0.54 | 982.40 | 0.79 | 776.20 | 24.96 | 1,027.55 | 0.77 | 793.13 | 25.50 | 523.83 | 0.43 | 225.50 | 7.25 |

La Colosa (10)(11) | — | — | — | — | 833.49 | 0.87 | 726.31 | 23.35 | 833.49 | 0.87 | 726.31 | 23.35 | 217.89 | 0.71 | 154.86 | 4.98 |

Quebradona (12)(14) | 45.15 | 0.37 | 16.93 | 0.54 | 148.91 | 0.34 | 49.89 | 1.60 | 194.06 | 0.34 | 66.82 | 2.15 | 305.94 | 0.23 | 70.64 | 2.27 |

United States of America | 24.33 | 0.63 | 15.26 | 0.49 | 203.41 | 0.75 | 151.61 | 4.87 | 227.74 | 0.73 | 166.87 | 5.37 | 472.98 | 0.94 | 444.78 | 14.30 |

North Bullfrog (12) | — | — | — | — | 45.94 | 0.28 | 12.70 | 0.41 | 45.94 | 0.28 | 12.70 | 0.41 | 38.58 | 0.24 | 9.31 | 0.30 |

Expanded Silicon (11)(16) | — | — | — | — | 121.56 | 0.87 | 105.90 | 3.40 | 121.56 | 0.87 | 105.90 | 3.40 | 391.14 | 1.03 | 401.65 | 12.91 |

Mother Lode (11)(14) | 24.33 | 0.63 | 15.26 | 0.49 | 35.91 | 0.92 | 33.01 | 1.06 | 60.24 | 0.80 | 48.28 | 1.55 | 9.86 | 0.55 | 5.39 | 0.17 |

Sterling (15) | — | — | — | — | — | — | — | — | — | — | — | — | 33.41 | 0.85 | 28.43 | 0.91 |

AngloGold Ashanti Total | 189.72 | 1.51 | 285.86 | 9.19 | 1,636.91 | 1.10 | 1,801.08 | 57.91 | 1,826.63 | 1.14 | 2,086.94 | 67.10 | 1,413.45 | 1.21 | 1,709.78 | 54.97 |

QUARTER 4 2024 EARNINGS RELEASE | 31 |  | |||

| ||||||

GROUP I MINERAL RESOURCE AND MINERAL RESERVE | ||||||

MINERAL RESOURCE (1) | AT 31 DECEMBER 2024 | |||||||||||||||

Measured | Indicated | Total Measured and Indicated | Inferred | |||||||||||||

COPPER | Tonnes (2) | Grade | Contained Copper | Tonnes (2) | Grade | Contained Copper | Tonnes (2) | Grade | Contained Copper | Tonnes (2) | Grade | Contained Copper | ||||

Million | %Cu | Tonnes Million | Pounds Million | Million | %Cu | Tonnes Million | Pounds Million | Million | %Cu | Tonnes Million | Pounds Million | Million | %Cu | Tonnes Million | Pounds Million | |

Projects | 45.15 | 0.69 | 0.31 | 684 | 148.91 | 0.68 | 1.01 | 2,218 | 194.06 | 0.68 | 1.32 | 2,902 | 305.94 | 0.48 | 1.47 | 3,231 |

Colombia | 45.15 | 0.69 | 0.31 | 684 | 148.91 | 0.68 | 1.01 | 2,218 | 194.06 | 0.68 | 1.32 | 2,902 | 305.94 | 0.48 | 1.47 | 3,231 |

Quebradona (3) | 45.15 | 0.69 | 0.31 | 684 | 148.91 | 0.68 | 1.01 | 2,218 | 194.06 | 0.68 | 1.32 | 2,902 | 305.94 | 0.48 | 1.47 | 3,231 |

AngloGold Ashanti Total | 45.15 | 0.69 | 0.31 | 684 | 148.91 | 0.68 | 1.01 | 2,218 | 194.06 | 0.68 | 1.32 | 2,902 | 305.94 | 0.48 | 1.47 | 3,231 |

QUARTER 4 2024 EARNINGS RELEASE | 32 |  | |||

| ||||||

GROUP I MINERAL RESOURCE AND MINERAL RESERVE | ||||||

MINERAL RESOURCE (1) | AT 31 DECEMBER 2024 | |||||||||||||||

Measured | Indicated | Total Measured and Indicated | Inferred | |||||||||||||

SILVER | Tonnes (3) | Grade | Contained Silver | Tonnes (3) | Grade | Contained Silver | Tonnes (3) | Grade | Contained Silver | Tonnes (3) | Grade | Contained Silver | ||||

Million | g/t | Tonnes | Moz | Million | g/t | Tonnes | Moz | Million | g/t | Tonnes | Moz | Million | g/t | Tonnes | Moz | |

Americas Region | 7.02 | 50.04 | 351.20 | 11.29 | 12.40 | 63.96 | 792.83 | 25.49 | 19.41 | 58.93 | 1,144.03 | 36.78 | 3.99 | 91.04 | 362.95 | 11.67 |

Argentina | 7.02 | 50.04 | 351.20 | 11.29 | 12.40 | 63.96 | 792.83 | 25.49 | 19.41 | 58.93 | 1,144.03 | 36.78 | 3.99 | 91.04 | 362.95 | 11.67 |

Cerro Vanguardia (92.5%) (2)(6) | 7.02 | 50.04 | 351.20 | 11.29 | 12.40 | 63.96 | 792.83 | 25.49 | 19.41 | 58.93 | 1,144.03 | 36.78 | 3.99 | 91.04 | 362.95 | 11.67 |

Projects | 69.48 | 3.25 | 226.09 | 7.27 | 352.32 | 3.43 | 1,210.01 | 38.90 | 421.80 | 3.40 | 1,436.10 | 46.17 | 745.52 | 2.59 | 1,932.76 | 62.14 |

Colombia | 45.15 | 4.52 | 203.91 | 6.56 | 148.91 | 4.63 | 688.92 | 22.15 | 194.06 | 4.60 | 892.84 | 28.71 | 305.94 | 3.66 | 1,121.25 | 36.05 |

Quebradona (5)(7) | 45.15 | 4.52 | 203.91 | 6.56 | 148.91 | 4.63 | 688.92 | 22.15 | 194.06 | 4.60 | 892.84 | 28.71 | 305.94 | 3.66 | 1,121.25 | 36.05 |

United States of America | 24.33 | 0.91 | 22.18 | 0.71 | 203.41 | 2.56 | 521.09 | 16.75 | 227.74 | 2.39 | 543.26 | 17.47 | 439.58 | 1.85 | 811.51 | 26.09 |

North Bullfrog (5) | — | — | — | — | 45.94 | 0.28 | 13.03 | 0.42 | 45.94 | 0.28 | 13.03 | 0.42 | 38.58 | 0.32 | 12.46 | 0.40 |

Expanded Silicon (4)(8) | — | — | — | — | 121.56 | 3.98 | 483.31 | 15.54 | 121.56 | 3.98 | 483.31 | 15.54 | 391.14 | 2.01 | 786.63 | 25.29 |

Mother Lode (4)(9) | 24.33 | 0.91 | 22.18 | 0.71 | 35.91 | 0.69 | 24.75 | 0.80 | 60.24 | 0.78 | 46.93 | 1.51 | 9.86 | 1.26 | 12.42 | 0.40 |

AngloGold Ashanti Total | 76.50 | 7.55 | 577.29 | 18.56 | 364.71 | 5.49 | 2,002.84 | 64.39 | 441.21 | 5.85 | 2,580.13 | 82.95 | 749.51 | 3.06 | 2,295.71 | 73.81 |

QUARTER 4 2024 EARNINGS RELEASE | 33 |  | |||

| ||||||

GROUP I MINERAL RESOURCE AND MINERAL RESERVE | ||||||

MINERAL RESOURCE (1) | AT 31 DECEMBER 2024 | |||||||||||||||

Measured | Indicated | Total Measured and Indicated | Inferred | |||||||||||||

MOLYBDENUM | Tonnes (2) | Grade | Contained Molybdenum | Tonnes (2) | Grade | Contained Molybdenum | Tonnes (2) | Grade | Contained Molybdenum | Tonnes (2) | Grade | Contained Molybdenum | ||||

Million | ppm | Kilo- tonnes | Pounds Million | Million | ppm | Kilo- tonnes | Pounds Million | Million | ppm | Kilo- tonnes | Pounds Million | Million | ppm | Kilo- tonnes | Pounds Million | |

Projects | 45.15 | 168 | 7.58 | 17 | 148.91 | 155 | 23.12 | 51 | 194.06 | 158 | 30.70 | 68 | 305.94 | 135 | 41.35 | 91 |

Colombia | 45.15 | 168 | 7.58 | 17 | 148.91 | 155 | 23.12 | 51 | 194.06 | 158 | 30.70 | 68 | 305.94 | 135 | 41.35 | 91 |

Quebradona (3) | 45.15 | 168 | 7.58 | 17 | 148.91 | 155 | 23.12 | 51 | 194.06 | 158 | 30.70 | 68 | 305.94 | 135 | 41.35 | 91 |

AngloGold Ashanti Total | 45.15 | 168 | 7.58 | 17 | 148.91 | 155 | 23.12 | 51 | 194.06 | 158 | 30.70 | 68 | 305.94 | 135 | 41.35 | 91 |

MINERAL RESOURCE (1) | AT 31 DECEMBER 2024 | |||||||||||||||

Measured | Indicated | Total Measured and Indicated | Inferred | |||||||||||||

SULPHUR | Tonnes (2) | Grade | Contained Sulphur | Tonnes (2) | Grade | Contained Sulphur | Tonnes (2) | Grade | Contained Sulphur | Tonnes (2) | Grade | Contained Sulphur | ||||

Million | %S | Tonnes Million | Pounds Million | Million | %S | Tonnes Million | Pounds Million | Million | %S | Tonnes Million | Pounds Million | Million | %S | Tonnes Million | Pounds Million | |

Americas Region | 3.62 | 5.6 | 0.20 | 445 | 7.06 | 3.1 | 0.22 | 475 | 10.68 | 3.9 | 0.42 | 920 | 12.61 | 4.0 | 0.50 | 1,101 |

Brazil | 3.62 | 5.6 | 0.20 | 445 | 7.06 | 3.1 | 0.22 | 475 | 10.68 | 3.9 | 0.42 | 920 | 12.61 | 4.0 | 0.50 | 1,101 |

AGA Mineração - Cuiabá (3) | 2.57 | 6.2 | 0.16 | 353 | 4.13 | 3.3 | 0.14 | 298 | 6.70 | 4.4 | 0.30 | 651 | 10.47 | 4.0 | 0.42 | 923 |

AGA Mineração - Lamego (3) | 1.05 | 4.0 | 0.04 | 92 | 2.93 | 2.7 | 0.08 | 177 | 3.98 | 3.1 | 0.12 | 269 | 2.14 | 3.8 | 0.08 | 179 |

AngloGold Ashanti Total | 3.62 | 5.6 | 0.20 | 445 | 7.06 | 3.1 | 0.22 | 475 | 10.68 | 3.9 | 0.42 | 920 | 12.61 | 4.0 | 0.50 | 1,101 |

QUARTER 4 2024 EARNINGS RELEASE | 34 |  | |||

| ||||||

GROUP I MINERAL RESOURCE AND MINERAL RESERVE | ||||||

MINERAL RESERVE | AT 31 DECEMBER 2024 | |||||||||||

Proven | Probable | Total Mineral Reserve | ||||||||||

GOLD | Tonnes (2) | Grade | Contained Gold | Tonnes (2) | Grade | Contained Gold | Tonnes (2) | Grade | Contained Gold | |||

Million | g/t | Tonnes | Moz | Million | g/t | Tonnes | Moz | Million | g/t | Tonnes | Moz | |

Africa Region | 92.34 | 1.80 | 166.04 | 5.34 | 242.00 | 2.22 | 536.54 | 17.25 | 334.34 | 2.10 | 702.58 | 22.59 |

Democratic Republic of the Congo | 13.44 | 3.28 | 44.10 | 1.42 | 33.47 | 2.93 | 98.00 | 3.15 | 46.91 | 3.03 | 142.10 | 4.57 |

Kibali (45%) (1)(3)(8) | 13.44 | 3.28 | 44.10 | 1.42 | 33.47 | 2.93 | 98.00 | 3.15 | 46.91 | 3.03 | 142.10 | 4.57 |

Ghana | 7.35 | 5.75 | 42.28 | 1.36 | 53.99 | 4.14 | 223.47 | 7.18 | 61.34 | 4.33 | 265.75 | 8.54 |

Iduapriem (8)(11) | 3.84 | 1.01 | 3.86 | 0.12 | 38.26 | 1.36 | 51.97 | 1.67 | 42.10 | 1.33 | 55.82 | 1.79 |

Obuasi (4)(8) | 3.52 | 10.92 | 38.42 | 1.24 | 15.73 | 10.90 | 171.50 | 5.51 | 19.25 | 10.91 | 209.92 | 6.75 |

Guinea | 4.74 | 0.71 | 3.38 | 0.11 | 71.83 | 0.88 | 62.98 | 2.03 | 76.57 | 0.87 | 66.37 | 2.13 |

Siguiri (85%) (1)(8)(14) | 4.74 | 0.71 | 3.38 | 0.11 | 71.83 | 0.88 | 62.98 | 2.03 | 76.57 | 0.87 | 66.37 | 2.13 |

Tanzania | 15.84 | 0.99 | 15.76 | 0.51 | 37.04 | 2.30 | 85.20 | 2.74 | 52.89 | 1.91 | 100.96 | 3.25 |

Geita (5)(8)(11) | 15.84 | 0.99 | 15.76 | 0.51 | 37.04 | 2.30 | 85.20 | 2.74 | 52.89 | 1.91 | 100.96 | 3.25 |

Egypt | 49.82 | 1.18 | 58.56 | 1.88 | 12.39 | 1.32 | 16.34 | 0.53 | 62.21 | 1.20 | 74.90 | 2.41 |

Sukari (50%) (1)(6)(7)(8) | 49.82 | 1.18 | 58.56 | 1.88 | 12.39 | 1.32 | 16.34 | 0.53 | 62.21 | 1.20 | 74.90 | 2.41 |

Côte d'Ivoire | 1.13 | 1.73 | 1.96 | 0.06 | 33.27 | 1.52 | 50.54 | 1.63 | 34.40 | 1.53 | 52.51 | 1.69 |

Doropo (90%) (1)(6)(9) | 1.13 | 1.73 | 1.96 | 0.06 | 33.27 | 1.52 | 50.54 | 1.63 | 34.40 | 1.53 | 52.51 | 1.69 |

Americas Region | 7.51 | 3.89 | 29.20 | 0.94 | 15.11 | 3.55 | 53.57 | 1.72 | 22.62 | 3.66 | 82.78 | 2.66 |

Argentina | 2.43 | 3.16 | 7.68 | 0.25 | 5.62 | 2.35 | 13.19 | 0.42 | 8.05 | 2.59 | 20.87 | 0.67 |

Cerro Vanguardia (92.5%) (1)(8) | 2.43 | 3.16 | 7.68 | 0.25 | 5.62 | 2.35 | 13.19 | 0.42 | 8.05 | 2.59 | 20.87 | 0.67 |

Brazil | 5.08 | 4.23 | 21.52 | 0.69 | 9.49 | 4.25 | 40.39 | 1.30 | 14.57 | 4.25 | 61.91 | 1.99 |

AGA Mineração - Córrego do Sítio (10)(11) | 0.84 | 3.10 | 2.62 | 0.08 | 2.01 | 4.42 | 8.89 | 0.29 | 2.86 | 4.03 | 11.50 | 0.37 |

AGA Mineração - Cuiabá (8)(12) | 1.92 | 6.26 | 12.03 | 0.39 | 3.80 | 5.61 | 21.36 | 0.69 | 5.72 | 5.83 | 33.38 | 1.07 |

AGA Mineração - Lamego (8)(12) | 0.74 | 3.04 | 2.26 | 0.07 | 1.06 | 3.18 | 3.36 | 0.11 | 1.80 | 3.12 | 5.62 | 0.18 |

Serra Grande (8) | 1.58 | 2.93 | 4.63 | 0.15 | 2.62 | 2.59 | 6.78 | 0.22 | 4.20 | 2.72 | 11.40 | 0.37 |

Australia Region | 24.31 | 1.34 | 32.61 | 1.05 | 16.99 | 2.33 | 39.52 | 1.27 | 41.30 | 1.75 | 72.13 | 2.32 |

Sunrise Dam (8)(15) | 10.55 | 1.64 | 17.29 | 0.56 | 4.42 | 2.90 | 12.84 | 0.41 | 14.97 | 2.01 | 30.13 | 0.97 |

Tropicana (70%) (1)(8)(11) | 13.77 | 1.11 | 15.32 | 0.49 | 12.57 | 2.12 | 26.68 | 0.86 | 26.33 | 1.59 | 42.00 | 1.35 |

Projects | — | — | — | — | 197.03 | 0.58 | 114.47 | 3.68 | 197.03 | 0.58 | 114.47 | 3.68 |

Colombia | — | — | — | — | 120.01 | 0.67 | 80.83 | 2.60 | 120.01 | 0.67 | 80.83 | 2.60 |

Quebradona (9)(13) | — | — | — | — | 120.01 | 0.67 | 80.83 | 2.60 | 120.01 | 0.67 | 80.83 | 2.60 |

United States of America | — | — | — | — | 77.01 | 0.44 | 33.64 | 1.08 | 77.01 | 0.44 | 33.64 | 1.08 |

North Bullfrog (9) | — | — | — | — | 77.01 | 0.44 | 33.64 | 1.08 | 77.01 | 0.44 | 33.64 | 1.08 |

AngloGold Ashanti Total | 124.16 | 1.84 | 227.86 | 7.33 | 471.12 | 1.58 | 744.11 | 23.92 | 595.29 | 1.63 | 971.97 | 31.25 |

QUARTER 4 2024 EARNINGS RELEASE | 35 |  | |||

| ||||||

GROUP I MINERAL RESOURCE AND MINERAL RESERVE | ||||||

MINERAL RESERVE | AT 31 DECEMBER 2024 | |||||||||||

Proven | Probable | Total Mineral Reserve | ||||||||||

COPPER | Tonnes (1) | Grade | Contained Copper | Tonnes (1) | Grade | Contained Copper | Tonnes (1) | Grade | Contained Copper | |||

Million | %Cu | Tonnes Million | Pounds Million | Million | %Cu | Tonnes Million | Pounds Million | Million | %Cu | Tonnes Million | Pounds Million | |

Projects | — | — | — | — | 120.01 | 1.23 | 1.47 | 3,250 | 120.01 | 1.23 | 1.47 | 3,250 |

Colombia | — | — | — | — | 120.01 | 1.23 | 1.47 | 3,250 | 120.01 | 1.23 | 1.47 | 3,250 |

Quebradona (2) | — | — | — | — | 120.01 | 1.23 | 1.47 | 3,250 | 120.01 | 1.23 | 1.47 | 3,250 |

AngloGold Ashanti Total | — | — | — | — | 120.01 | 1.23 | 1.47 | 3,250 | 120.01 | 1.23 | 1.47 | 3,250 |

QUARTER 4 2024 EARNINGS RELEASE | 36 |  | |||

| ||||||

GROUP I MINERAL RESOURCE AND MINERAL RESERVE | ||||||

MINERAL RESERVE | AT 31 DECEMBER 2024 | |||||||||||

Proven | Probable | Total Mineral Reserve | ||||||||||

SILVER | Tonnes (2) | Grade | Contained Silver | Tonnes (2) | Grade | Contained Silver | Tonnes (2) | Grade | Contained Silver | |||

Million | g/t | Tonnes | Moz | Million | g/t | Tonnes | Moz | Million | g/t | Tonnes | Moz | |

Americas Region | 2.43 | 61.07 | 148.48 | 4.77 | 5.62 | 69.52 | 390.58 | 12.56 | 8.05 | 66.97 | 539.06 | 17.33 |

Argentina | 2.43 | 61.07 | 148.48 | 4.77 | 5.62 | 69.52 | 390.58 | 12.56 | 8.05 | 66.97 | 539.06 | 17.33 |

Cerro Vanguardia (92.5%) (1)(4) | 2.43 | 61.07 | 148.48 | 4.77 | 5.62 | 69.52 | 390.58 | 12.56 | 8.05 | 66.97 | 539.06 | 17.33 |

Projects | — | — | — | — | 197.03 | 5.00 | 985.65 | 31.69 | 197.03 | 5.00 | 985.65 | 31.69 |

Colombia | — | — | — | — | 120.01 | 7.29 | 874.33 | 28.11 | 120.01 | 7.29 | 874.33 | 28.11 |

Quebradona (3)(5) | — | — | — | — | 120.01 | 7.29 | 874.33 | 28.11 | 120.01 | 7.29 | 874.33 | 28.11 |

United States of America | — | — | — | — | 77.01 | 1.45 | 111.32 | 3.58 | 77.01 | 1.45 | 111.32 | 3.58 |

North Bullfrog (3)(6) | — | — | — | — | 77.01 | 1.45 | 111.32 | 3.58 | 77.01 | 1.45 | 111.32 | 3.58 |

AngloGold Ashanti Total | 2.43 | 61.07 | 148.48 | 4.77 | 202.64 | 6.79 | 1,376.23 | 44.25 | 205.08 | 7.43 | 1,524.71 | 49.02 |

MINERAL RESERVE | AT 31 DECEMBER 2024 | |||||||||||

Proven | Probable | Total Mineral Reserve | ||||||||||

SULPHUR | Tonnes (1) | Grade | Contained Sulphur | Tonnes (2) | Grade | Contained Sulphur | Tonnes (2) | Grade | Contained Sulphur | |||

Million | %S | Tonnes Million | Pounds Million | Million | %S | Tonnes Million | Pounds Million | Million | %S | Tonnes Million | Pounds Million | |

Americas Region | 2.66 | 4.5 | 0.12 | 265 | 4.86 | 3.6 | 0.17 | 384 | 7.52 | 3.9 | 0.29 | 649 |

Brazil | 2.66 | 4.5 | 0.12 | 265 | 4.86 | 3.6 | 0.17 | 384 | 7.52 | 3.9 | 0.29 | 649 |

AGA Mineração - Cuiabá (2) | 1.92 | 5.3 | 0.10 | 226 | 3.80 | 3.9 | 0.15 | 330 | 5.72 | 4.4 | 0.25 | 556 |

AGA Mineração - Lamego (2) | 0.74 | 2.4 | 0.02 | 40 | 1.06 | 2.3 | 0.02 | 54 | 1.80 | 2.4 | 0.04 | 93 |

AngloGold Ashanti Total | 2.66 | 4.5 | 0.12 | 265 | 4.86 | 3.6 | 0.17 | 384 | 7.52 | 3.9 | 0.29 | 649 |

QUARTER 4 2024 EARNINGS RELEASE | 37 |  | |||

| ||||||

2024 I DIVIDENDS | ||||||

2025 | ||

Ex-dividend on NYSE | Friday, 14 March | |

Record date | Friday, 14 March | |

Payment date | Friday, 28 March | |

2025 | ||

Declaration date | Wednesday, 19 February | |

Currency conversion rate for South African rands announcement date | Friday, 7 March | |

Last date to trade ordinary shares cum dividend | Tuesday, 11 March | |

Ordinary shares trade ex-dividend | Wednesday, 12 March | |

Record date | Friday, 14 March | |

Payment date | Friday, 28 March | |

2025 | |||

Currency conversion date | Friday, 7 March | ||

Last date to trade and to register shares cum dividend | Tuesday, 11 March | ||

Shares trade ex-dividend | Wednesday, 12 March | ||

Record date | Friday, 14 March | ||

Approximate payment date of dividend | Friday, 28 March | ||

2025 | |||

Currency conversion date | Friday, 7 March | ||

Last date to trade and to register GhDSs cum dividend | Tuesday, 11 March | ||

GhDSs trade ex-dividend | Wednesday, 12 March | ||

Record date | Friday, 14 March | ||

Approximate payment date of dividend | Friday, 28 March | ||

QUARTER 4 2024 EARNINGS RELEASE | 38 |  | |||

| ||||||

NON-GAAP DISCLOSURE I RESULTS | ||||||

QUARTER 4 2024 EARNINGS RELEASE | 39 |  | |||

| ||||||

NON-GAAP DISCLOSURE I RESULTS | ||||||

QUARTER 4 2024 EARNINGS RELEASE | 40 |  | |||

| ||||||

NON-GAAP DISCLOSURE I RESULTS | ||||||

QUARTER 4 2024 EARNINGS RELEASE | 41 |  | |||

| ||||||

NON-GAAP DISCLOSURE I RESULTS | ||||||

QUARTER 4 2024 EARNINGS RELEASE | 42 |  | |||

| ||||||

NON-GAAP DISCLOSURE I NOTE A | ||||||

ALL-IN SUSTAINING COSTS | FOR THE QUARTER ENDED 31 DECEMBER 2024 | ||||||||||||||

AFRICA | AUSTRALIA | ||||||||||||||

Corporate and other(3) | Kibali | Other | Non- managed joint ventures | Iduapriem | Obuasi | Siguiri | Geita | Sukari | Africa other | Managed operations | Sunrise Dam | Tropicana | Australia other | Australia | |

in US Dollar million, except as otherwise noted | |||||||||||||||

Cost of sales per segmental information (2) | (3) | 101 | — | 101 | 91 | 101 | 134 | 148 | 83 | — | 557 | 114 | 135 | 10 | 259 |

By-product revenue | — | — | — | — | — | — | — | (1) | — | — | (1) | — | (1) | — | (1) |

Realised other commodity contracts | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — |

Amortisation of tangible, intangible and right of use assets | (1) | (25) | — | (25) | (19) | (22) | (14) | (42) | (20) | — | (117) | (19) | (39) | — | (58) |

Adjusted for decommissioning and inventory amortisation | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — |

Corporate administration, marketing and related expenses | 31 | — | — | — | — | — | — | — | — | — | — | — | — | — | — |

Lease payment sustaining | 1 | (3) | — | (3) | 1 | — | 1 | 6 | — | — | 8 | 4 | 3 | — | 7 |

Sustaining exploration and study costs | — | — | — | — | — | 1 | 2 | (2) | — | — | 1 | — | — | — | — |

Total sustaining capital expenditure | — | 19 | — | 19 | 28 | 34 | 26 | 52 | 20 | — | 160 | 26 | 11 | — | 37 |

All-in sustaining costs (5) | 28 | 93 | — | 93 | 100 | 113 | 150 | 161 | 83 | — | 607 | 125 | 109 | 10 | 244 |

Non-sustaining capital expenditure | — | 17 | — | 17 | 22 | 20 | 3 | 6 | — | — | 51 | — | 3 | — | 3 |

Non-sustaining lease payments | — | — | — | — | — | — | — | 1 | — | — | 1 | — | — | — | — |

Non-sustaining exploration and study costs | 1 | — | — | — | 1 | — | 3 | 2 | 3 | 1 | 10 | 2 | 2 | 7 | 11 |

Care and maintenance | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — |

Closure and social responsibility costs not related to current operations | 1 | (1) | — | (1) | 1 | (16) | — | — | — | — | (15) | — | — | — | — |

Other provisions | — | — | — | — | 1 | 1 | 2 | — | — | — | 4 | — | — | 4 | 4 |

All-in costs (5) | 29 | 108 | — | 108 | 125 | 119 | 157 | 170 | 86 | 1 | 658 | 127 | 114 | 21 | 262 |

Gold sold - oz (000) | — | 78 | — | 78 | 47 | 59 | 69 | 122 | 44 | — | 341 | 66 | 100 | — | 166 |

All-in sustaining costs per ounce - $/oz (1) | — | 1,188 | — | 1,188 | 2,131 | 1,905 | 2,186 | 1,327 | 1,858 | — | 1,780 | 1,888 | 1,086 | — | 1,465 |

All-in costs per ounce - $/oz (1) | — | 1,384 | — | 1,388 | 2,658 | 1,996 | 2,290 | 1,395 | 1,945 | — | 1,928 | 1,922 | 1,137 | — | 1,574 |

(1) In addition to the operational performances of the mines, “all-in sustaining costs per ounce”, “all-in costs per ounce” and “total cash costs per ounce” are affected by fluctuations in the foreign currency exchange rate. AngloGold Ashanti reports “all-in sustaining costs per ounce” and “all-in costs per ounce” calculated to the nearest US dollar amount and gold sold in ounces. AngloGold Ashanti reports “total cash costs per ounce” calculated to the nearest US dollar amount and gold produced in ounces. “All-in sustaining costs (per ounce)”, “all-in costs (per ounce)” and “total cash costs (per ounce)” may not be calculated based on amounts presented in this table due to rounding. | |||||||||||||||

(2) Refer to Segmental reporting. | |||||||||||||||

(3) Corporate includes non-gold producing managed operations. | |||||||||||||||

(4) Total including equity-accounted non-managed joint ventures. | |||||||||||||||

(5) “Total cash costs”, “all-in sustaining costs” and “all-in costs” may not be calculated based on amounts presented in this table due to rounding. | |||||||||||||||

(6) Adjusted to exclude the Sukari operation which was acquired on 22 November 2024 as part of the Centamin acquisition. | |||||||||||||||

Rounding of figures may result in computational discrepancies. | |||||||||||||||

QUARTER 4 2024 EARNINGS RELEASE | 43 |  | |||

| ||||||

NON-GAAP DISCLOSURE I NOTE A | ||||||

ALL-IN SUSTAINING COSTS | FOR THE QUARTER ENDED 31 DECEMBER 2024 | |||||||||||

AMERICAS | GROUP | ADJUSTED TO EXCLUDE THE SUKARI OPERATION | ||||||||||

Cerro Vanguardia | AngloGold Ashanti Mineração | Serra Grande | Americas other | Americas | Projects | Non- managed joint ventures | Managed operations | Group total (4) | Managed operations (6) | Group total (4)(6) | ||

in US Dollar million, except as otherwise noted | ||||||||||||

Cost of sales per segmental information (2) | 99 | 98 | 32 | 1 | 230 | — | 101 | 1,043 | 1,144 | 960 | 1,061 | |

By-product revenue | (30) | (2) | — | — | (32) | — | — | (34) | (34) | (34) | (34) | |

Realised other commodity contracts | — | — | — | — | — | — | — | — | — | — | — | |

Amortisation of tangible, intangible and right of use assets | (21) | (33) | (8) | — | (62) | — | (25) | (238) | (263) | (218) | (243) | |

Adjusted for decommissioning and inventory amortisation | 6 | — | — | — | 6 | — | — | 6 | 6 | 6 | 6 | |

Corporate administration, marketing and related expenses | — | — | — | — | — | 1 | — | 32 | 32 | 32 | 32 | |

Lease payment sustaining | — | 6 | 3 | — | 9 | — | (3) | 25 | 22 | 25 | 22 | |

Sustaining exploration and study costs | 1 | 1 | — | — | 2 | — | — | 3 | 3 | 3 | 3 | |

Total sustaining capital expenditure | 24 | 30 | 12 | — | 66 | 3 | 19 | 266 | 285 | 246 | 265 | |

All-in sustaining costs (5) | 79 | 100 | 40 | — | 219 | 4 | 93 | 1,102 | 1,195 | 1,019 | 1,112 | |

Non-sustaining capital expenditure | — | — | — | — | — | 13 | 17 | 67 | 84 | 67 | 84 | |

Non-sustaining lease payments | — | — | — | — | — | — | — | 1 | 1 | 1 | 1 | |

Non-sustaining exploration and study costs | 7 | — | — | 3 | 10 | 38 | — | 70 | 70 | 67 | 67 | |

Care and maintenance | — | (29) | — | — | (29) | — | — | (29) | (29) | (29) | (29) | |

Closure and social responsibility costs not related to current operations | — | 21 | (1) | — | 20 | — | (1) | 6 | 5 | 6 | 5 | |

Other provisions | — | — | 1 | — | 1 | — | — | 9 | 9 | 9 | 9 | |

All-in costs (5) | 86 | 93 | 40 | 3 | 222 | 55 | 108 | 1,226 | 1,334 | 1,140 | 1,248 | |

Gold sold - oz (000) | 44 | 74 | 22 | — | 140 | — | 78 | 647 | 725 | 603 | 681 | |

All-in sustaining costs per ounce - $/oz (1) | 1,811 | 1,344 | 1,842 | — | 1,574 | — | 1,188 | 1,702 | 1,647 | 1,691 | 1,633 | |

All-in costs per ounce - $/oz (1) | 1,971 | 1,250 | 1,834 | — | 1,593 | — | 1,388 | 1,895 | 1,840 | 1,891 | 1,834 | |

Rounding of figures may result in computational discrepancies. | ||||||||||||

QUARTER 4 2024 EARNINGS RELEASE | 44 |  | |||

| ||||||

NON-GAAP DISCLOSURE I NOTE A | ||||||

TOTAL CASH COSTS | FOR THE QUARTER ENDED 31 DECEMBER 2024 | |||||||||||||

AFRICA | AUSTRALIA | |||||||||||||

Corporate and other(3) | Kibali | Non- managed joint ventures | Iduapriem | Obuasi | Siguiri | Geita | Sukari | Africa other | Managed operations | Sunrise Dam | Tropicana | Australia other | Australia | |

in US Dollar million, except as otherwise noted | ||||||||||||||

Cost of sales per segmental information (2) | (3) | 101 | 101 | 91 | 101 | 134 | 148 | 83 | — | 557 | 114 | 135 | 10 | 259 |

- By-product revenue | — | — | — | — | — | — | (1) | — | — | (1) | — | (1) | — | (1) |

- Inventory change | — | 1 | 1 | 6 | (1) | 11 | 17 | (17) | — | 16 | (1) | — | — | (1) |

- Amortisation of tangible assets | (1) | (25) | (25) | (18) | (22) | (13) | (37) | (19) | — | (109) | (15) | (37) | — | (52) |

- Amortisation of right of use assets | — | — | — | (1) | — | (1) | (5) | (1) | — | (8) | (4) | (2) | — | (6) |

- Amortisation of intangible assets | — | — | — | — | — | — | — | — | — | — | — | — | — | — |

- Rehabilitation and other non-cash costs | — | — | — | (3) | (7) | (2) | (1) | — | — | (13) | (1) | (2) | — | (3) |

- Retrenchment costs | — | — | — | — | — | — | — | — | — | — | — | — | — | — |

Total cash costs (5) | (4) | 77 | 77 | 74 | 71 | 129 | 121 | 46 | — | 441 | 93 | 93 | 9 | 195 |

Gold produced - oz (000) | — | 80 | 80 | 50 | 60 | 74 | 136 | 40 | — | 360 | 66 | 100 | — | 166 |

Total cash costs per ounce - $/oz (1) | — | 967 | 967 | 1,478 | 1,169 | 1,747 | 892 | 1,165 | — | 1,225 | 1,406 | 924 | — | 1,171 |

Rounding of figures may result in computational discrepancies. | ||||||||||||||

QUARTER 4 2024 EARNINGS RELEASE | 45 |  | |||

| ||||||

NON-GAAP DISCLOSURE I NOTE A | ||||||

TOTAL CASH COSTS | FOR THE QUARTER ENDED 31 DECEMBER 2024 | |||||||||||

AMERICAS | GROUP | ADJUSTED TO EXCLUDE THE SUKARI OPERATION | ||||||||||

Cerro Vanguardia | AngloGold Ashanti Mineração | Serra Grande | Americas other | Americas | Projects | Non- managed joint ventures | Managed operations | Group total (4) | Managed operations (6) | Group total (4)(6) | ||

in US Dollar million, except as otherwise noted | ||||||||||||

Cost of sales per segmental information (2) | 99 | 98 | 32 | 1 | 230 | — | 101 | 1,043 | 1,144 | 960 | 1,061 | |

- By-product revenue | (30) | (2) | — | — | (32) | — | — | (34) | (34) | (34) | (34) | |

- Inventory change | 9 | (1) | 1 | — | 9 | — | 1 | 24 | 25 | 41 | 42 | |

- Amortisation of tangible assets | (21) | (27) | (7) | — | (55) | — | (25) | (217) | (242) | (198) | (223) | |

- Amortisation of right of use assets | — | (6) | (1) | — | (7) | — | — | (21) | (21) | (21) | (21) | |

- Amortisation of intangible assets | — | — | — | — | — | — | — | — | — | — | — | |

- Rehabilitation and other non-cash costs | (2) | 2 | 4 | — | 4 | — | — | (12) | (12) | (12) | (12) | |

- Retrenchment costs | — | (1) | — | — | (1) | — | — | (1) | (1) | (1) | (1) | |

Total cash costs (5) | 54 | 64 | 30 | 1 | 149 | — | 77 | 781 | 858 | 735 | 812 | |

Gold produced - oz (000) | 47 | 75 | 22 | — | 144 | — | 80 | 670 | 750 | 630 | 710 | |

Total cash costs per ounce - $/oz (1) | 1,155 | 859 | 1,338 | — | 1,035 | — | 967 | 1,165 | 1,144 | 1,165 | 1,143 | |

Rounding of figures may result in computational discrepancies. | ||||||||||||

QUARTER 4 2024 EARNINGS RELEASE | 46 |  | |||

| ||||||

NON-GAAP DISCLOSURE I NOTE A | ||||||

ALL-IN SUSTAINING COSTS | FOR THE QUARTER ENDED 31 DECEMBER 2023 | |||||||||||||

AFRICA | AUSTRALIA | |||||||||||||

Corporate and other(3) | Kibali | Other | Non-managed joint ventures | Iduapriem | Obuasi | Siguiri | Geita | Africa other | Managed operations | Sunrise Dam | Tropicana | Australia other | Australia | |

in US Dollar million, except as otherwise noted | ||||||||||||||

Cost of sales per segmental information (2) | 3 | 94 | — | 94 | 104 | 81 | 134 | 139 | — | 458 | 103 | 126 | 8 | 237 |

By-product revenue | — | — | — | — | — | — | — | (1) | — | (1) | — | (1) | — | (1) |

Realised other commodity contracts | 2 | — | — | — | — | — | — | — | — | — | — | — | — | — |

Amortisation of tangible, intangible and right of use assets | (1) | (25) | — | (25) | (31) | (18) | (17) | (24) | — | (90) | (19) | (40) | — | (59) |

Adjusted for decommissioning and inventory amortisation | — | — | — | — | — | — | — | (1) | — | (1) | — | — | — | — |

Corporate administration, marketing and related expenses | 30 | — | — | — | — | — | — | — | — | — | — | — | — | — |

Lease payment sustaining | — | 2 | — | 2 | 1 | — | — | 7 | — | 8 | 8 | 3 | — | 11 |

Sustaining exploration and study costs | — | — | — | — | — | 1 | 1 | 5 | — | 7 | — | — | — | — |

Total sustaining capital expenditure | 1 | 13 | — | 13 | 33 | 56 | 41 | 61 | — | 191 | 15 | 16 | — | 31 |

All-in sustaining costs (5) | 35 | 84 | — | 84 | 107 | 120 | 159 | 186 | — | 572 | 107 | 104 | 8 | 219 |

Non-sustaining capital expenditure | — | 10 | — | 10 | 10 | 20 | — | 3 | — | 33 | — | — | — | — |

Non-sustaining lease payments | — | — | — | — | — | — | — | 1 | — | 1 | — | — | — | — |

Non-sustaining exploration and study costs | — | — | — | — | — | — | 2 | 2 | — | 4 | 2 | 2 | 6 | 10 |

Care and maintenance | — | — | — | — | — | — | — | — | — | — | — | — | — | — |

Closure and social responsibility costs not related to current operations | 1 | 1 | — | 1 | — | 4 | — | — | 1 | 5 | — | — | — | — |

Other provisions | — | — | — | — | — | — | — | — | — | — | — | — | — | — |

All-in costs (5) | 36 | 94 | — | 94 | 117 | 143 | 161 | 193 | 1 | 615 | 109 | 106 | 14 | 229 |

Gold sold - oz (000) | — | 92 | — | 92 | 76 | 57 | 67 | 131 | — | 331 | 63 | 85 | — | 148 |

All-in sustaining costs per ounce - $/oz (1) | — | 907 | — | 907 | 1,407 | 2,081 | 2,397 | 1,423 | — | 1,729 | 1,696 | 1,228 | — | 1,478 |

All-in costs per ounce - $/oz (1) | — | 1,020 | — | 1,023 | 1,543 | 2,507 | 2,421 | 1,473 | — | 1,859 | 1,740 | 1,247 | — | 1,547 |

(1) In addition to the operational performances of the mines, “all-in sustaining costs per ounce”, “all-in costs per ounce” and “total cash costs per ounce” are affected by fluctuations in the foreign currency exchange rate. AngloGold Ashanti reports “all-in sustaining costs per ounce” and “all-in costs per ounce” calculated to the nearest US dollar amount and gold sold in ounces. AngloGold Ashanti reports “total cash costs per ounce” calculated to the nearest US dollar amount and gold produced in ounces. “All-in sustaining costs (per ounce)”, “all-in costs (per ounce)” and “total cash costs (per ounce)” may not be calculated based on amounts presented in this table due to rounding. | ||||||||||||||

(2) Refer to Segmental reporting. | ||||||||||||||

(3) Corporate includes non-gold producing managed operations. | ||||||||||||||

(4) Total including equity-accounted non-managed joint ventures. | ||||||||||||||

(5) “Total cash costs”, “all-in sustaining costs” and “all-in costs” may not be calculated based on amounts presented in this table due to rounding. | ||||||||||||||

(6) Adjusted to exclude the Córrego do Sítio (CdS) operation which was placed on care and maintenance in August 2023. | ||||||||||||||

Rounding of figures may result in computational discrepancies. | ||||||||||||||

QUARTER 4 2024 EARNINGS RELEASE | 47 |  | |||

| ||||||

NON-GAAP DISCLOSURE I NOTE A | ||||||

ALL-IN SUSTAINING COSTS | FOR THE QUARTER ENDED 31 DECEMBER 2023 | ||||||||||||||

AMERICAS | GROUP | ADJUSTED TO EXCLUDE THE CÓRREGO do SITIO OPERATION | |||||||||||||

Cerro Vanguardia | AngloGold Ashanti Mineração | Serra Grande | Americas other | Americas | Projects | Non- managed joint ventures | Managed operations | Group total (4) | Córrego do Sítio | AngloGold Ashanti Mineração(6) | Americas(6) | Managed operations (6) | Group total (4)(6) | ||

in US Dollar million, except as otherwise noted | |||||||||||||||

Cost of sales per segmental information (2) | 83 | 103 | 45 | — | 231 | — | 94 | 929 | 1,023 | 3 | 100 | 228 | 926 | 1,020 | |

By-product revenue | (31) | — | — | — | (31) | — | — | (33) | (33) | — | — | (31) | (33) | (33) | |

Realised other commodity contracts | — | — | — | — | — | — | — | 2 | 2 | — | — | — | 2 | 2 | |

Amortisation of tangible, intangible and right of use assets | (11) | (24) | (12) | — | (47) | — | (25) | (197) | (222) | — | (24) | (47) | (197) | (222) | |

Adjusted for decommissioning and inventory amortisation | — | (4) | — | — | (4) | — | — | (5) | (5) | — | (4) | (4) | (5) | (5) | |

Corporate administration, marketing and related expenses | — | — | — | — | — | — | — | 30 | 30 | — | — | — | 30 | 30 | |

Lease payment sustaining | — | 7 | 2 | — | 9 | — | 2 | 28 | 30 | — | 7 | 9 | 28 | 30 | |

Sustaining exploration and study costs | 1 | — | — | — | 1 | — | — | 8 | 8 | — | — | 1 | 8 | 8 | |

Total sustaining capital expenditure | 26 | 21 | 14 | — | 61 | 11 | 13 | 295 | 308 | — | 21 | 61 | 295 | 308 | |

All-in sustaining costs (5) | 68 | 103 | 49 | — | 220 | 11 | 84 | 1,057 | 1,141 | 3 | 100 | 217 | 1,054 | 1,138 | |

Non-sustaining capital expenditure | — | 2 | — | — | 2 | 4 | 10 | 39 | 49 | 2 | — | — | 37 | 47 | |

Non-sustaining lease payments | — | 1 | — | — | 1 | — | — | 2 | 2 | 1 | — | — | 1 | 1 | |

Non-sustaining exploration and study costs | 1 | 2 | — | 1 | 4 | 45 | — | 63 | 63 | 1 | 2 | 3 | 62 | 62 | |

Care and maintenance | — | 35 | — | — | 35 | 1 | — | 36 | 36 | 25 | 10 | 10 | 11 | 11 | |

Closure and social responsibility costs not related to current operations | — | 8 | 2 | — | 10 | — | 1 | 16 | 17 | — | 8 | 10 | 16 | 17 | |

Other provisions | — | — | — | — | — | — | — | — | — | — | — | — | — | — | |

All-in costs (5) | 69 | 152 | 50 | 1 | 272 | 62 | 94 | 1,214 | 1,308 | 32 | 120 | 240 | 1,182 | 1,276 | |

Gold sold - oz (000) | 41 | 76 | 25 | — | 142 | — | 92 | 621 | 713 | 2 | 74 | 140 | 619 | 711 | |

All-in sustaining costs per ounce - $/oz (1) | 1,660 | 1,350 | 1,925 | — | 1,543 | — | 907 | 1,701 | 1,598 | 1,587 | 1,343 | 1,542 | 1,701 | 1,598 | |

All-in costs per ounce - $/oz (1) | 1,673 | 1,994 | 1,988 | — | 1,907 | — | 1,023 | 1,954 | 1,833 | 15,896 | 1,619 | 1,708 | 1,909 | 1,794 | |

Rounding of figures may result in computational discrepancies. | |||||||||||||||

QUARTER 4 2024 EARNINGS RELEASE | 48 |  | |||

| ||||||

NON-GAAP DISCLOSURE I NOTE A | ||||||

TOTAL CASH COSTS | FOR THE QUARTER ENDED 31 DECEMBER 2023 | ||||||||||||

AFRICA | AUSTRALIA | ||||||||||||

Corporate and other(3) | Kibali | Non-managed joint ventures | Iduapriem | Obuasi | Siguiri | Geita | Africa other | Managed operations | Sunrise Dam | Tropicana | Australia other | Australia | |

in US Dollar million, except as otherwise noted | |||||||||||||

Cost of sales per segmental information (2) | 3 | 94 | 94 | 104 | 81 | 134 | 139 | — | 458 | 103 | 126 | 8 | 237 |

- By-product revenue | — | — | — | — | — | — | (1) | — | (1) | — | (1) | — | (1) |

- Inventory change | — | 1 | 1 | 3 | 4 | (1) | 11 | — | 17 | (1) | 14 | — | 13 |

- Amortisation of tangible assets | (1) | (25) | (25) | (30) | (18) | (17) | (20) | — | (85) | (12) | (38) | — | (50) |

- Amortisation of right of use assets | — | — | — | (1) | — | — | (4) | — | (5) | (7) | (2) | — | (9) |

- Amortisation of intangible assets | — | — | — | — | — | — | — | — | — | — | — | — | — |

- Rehabilitation and other non-cash costs | — | 2 | 2 | — | (3) | (4) | (3) | — | (10) | (2) | (3) | — | (5) |

- Retrenchment costs | — | — | — | — | — | — | — | — | — | — | — | — | — |

Total cash costs (5) | 2 | 71 | 71 | 76 | 64 | 112 | 123 | — | 375 | 81 | 97 | 7 | 185 |

Gold produced - oz (000) | — | 93 | 93 | 79 | 61 | 66 | 142 | — | 348 | 62 | 96 | — | 158 |

Total cash costs per ounce - $/oz (1) | 761 | 761 | 962 | 1,040 | 1,693 | 868 | — | 1,076 | 1,314 | 1,015 | — | 1,177 | |

Rounding of figures may result in computational discrepancies. | |||||||||||||

QUARTER 4 2024 EARNINGS RELEASE | 49 |  | |||

| ||||||

NON-GAAP DISCLOSURE I NOTE A | ||||||

TOTAL CASH COSTS | FOR THE QUARTER ENDED 31 DECEMBER 2023 | ||||||||||||||

AMERICAS | GROUP | ADJUSTED TO EXCLUDE THE CÓRREGO do SITIO OPERATION | |||||||||||||

Cerro Vanguardia | AngloGold Ashanti Mineração | Serra Grande | Americas other | Americas | Projects | Non- managed joint ventures | Managed operations | Group total (4) | Córrego do Sítio | AngloGold Ashanti Mineração(6) | Americas(6) | Managed operations (6) | Group total (4)(6) | ||

in US Dollar million, except as otherwise noted | |||||||||||||||

Cost of sales per segmental information (2) | 83 | 103 | 45 | — | 231 | — | 94 | 929 | 1,023 | 3 | 100 | 228 | 926 | 1,020 | |

- By-product revenue | (31) | — | — | — | (31) | — | — | (33) | (33) | — | — | (31) | (33) | (33) | |

- Inventory change | (4) | (4) | (1) | — | (9) | — | 1 | 21 | 22 | — | (4) | (9) | 21 | 22 | |

- Amortisation of tangible assets | (11) | (19) | (11) | — | (41) | — | (25) | (177) | (202) | — | (19) | (41) | (177) | (202) | |

- Amortisation of right of use assets | — | (5) | (1) | — | (6) | — | — | (20) | (20) | — | (5) | (6) | (20) | (20) | |

- Amortisation of intangible assets | — | — | — | — | — | — | — | — | — | — | — | — | — | — | |

- Rehabilitation and other non-cash costs | 1 | — | 1 | — | 2 | — | 2 | (13) | (11) | — | (1) | 2 | (13) | (11) | |

- Retrenchment costs | — | (1) | — | — | (1) | — | — | (1) | (1) | — | (1) | (1) | (1) | (1) | |

Total cash costs (5) | 39 | 73 | 32 | — | 144 | — | 71 | 706 | 777 | 3 | 70 | 141 | 703 | 774 | |

Gold produced - oz (000) | 41 | 75 | 25 | — | 141 | — | 93 | 647 | 740 | 2 | 73 | 139 | 645 | 738 | |

Total cash costs per ounce - $/oz (1) | 943 | 970 | 1,307 | — | 1,023 | — | 761 | 1,093 | 1,051 | 1,431 | 957 | 1,017 | 1,092 | 1,050 | |

Rounding of figures may result in computational discrepancies. | |||||||||||||||

QUARTER 4 2024 EARNINGS RELEASE | 50 |  | |||

| ||||||

NON-GAAP DISCLOSURE I NOTE A | ||||||

ALL-IN SUSTAINING COSTS | FOR THE YEAR ENDED 31 DECEMBER 2024 | ||||||||||||||

AFRICA | AUSTRALIA | ||||||||||||||

Corporate and other (3) | Kibali | Other | Non-managed joint ventures | Iduapriem | Obuasi | Siguiri | Geita | Sukari | Africa other | Managed operations | Sunrise Dam | Tropicana | Australia other | Australia | |

in US Dollar million, except as otherwise noted | |||||||||||||||

Cost of sales per segmental information (2) | (1) | 380 | — | 380 | 351 | 360 | 518 | 612 | 83 | — | 1,924 | 430 | 479 | 36 | 945 |

By-product revenue | — | (2) | — | (2) | — | (1) | (1) | (2) | — | — | (4) | (2) | (3) | — | (5) |

Realised other commodity contracts | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — |

Amortisation of tangible, intangible and right of use assets | (4) | (92) | — | (92) | (79) | (75) | (51) | (138) | (20) | — | (363) | (77) | (112) | (1) | (190) |

Adjusted for decommissioning and inventory amortisation | — | — | — | — | — | — | — | (1) | — | — | (1) | (1) | — | — | (1) |

Corporate administration, marketing and related expenses | 115 | — | — | — | — | — | — | — | — | — | — | — | — | — | — |

Lease payment sustaining | 1 | (1) | — | (1) | 6 | — | 3 | 22 | — | — | 31 | 18 | 10 | 1 | 29 |

Sustaining exploration and study costs | — | — | — | — | — | 2 | 6 | 6 | — | — | 14 | 1 | — | — | 1 |

Total sustaining capital expenditure | 1 | 68 | — | 68 | 108 | 145 | 93 | 181 | 20 | — | 547 | 65 | 37 | — | 102 |

All-in sustaining costs (5) | 112 | 354 | — | 354 | 385 | 430 | 569 | 680 | 83 | — | 2,147 | 434 | 411 | 36 | 881 |

Non-sustaining capital expenditure | — | 57 | — | 57 | 61 | 57 | 9 | 15 | — | — | 142 | — | 51 | — | 51 |

Non-sustaining lease payments | — | — | — | — | — | — | — | 2 | — | — | 2 | — | — | — | — |

Non-sustaining exploration and study costs | 3 | — | — | — | 3 | 2 | 6 | 11 | 3 | 2 | 27 | 9 | 7 | 24 | 40 |

Care and maintenance | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — |

Closure and social responsibility costs not related to current operations | 5 | 5 | 1 | 6 | 2 | (25) | — | — | — | — | (23) | — | — | — | — |

Other provisions | 1 | — | — | — | 1 | 1 | 2 | (3) | — | — | 1 | — | — | 4 | 4 |

All-in costs (5) | 121 | 416 | 1 | 417 | 451 | 466 | 586 | 705 | 86 | 2 | 2,296 | 443 | 469 | 64 | 976 |

Gold sold - oz (000) | — | 309 | — | 309 | 238 | 222 | 272 | 479 | 44 | — | 1,255 | 261 | 317 | — | 578 |

All-in sustaining costs per ounce - $/oz (1) | — | 1,146 | — | 1,146 | 1,614 | 1,942 | 2,093 | 1,418 | 1,858 | — | 1,709 | 1,665 | 1,297 | — | 1,526 |

All-in costs per ounce - $/oz (1) | — | 1,349 | — | 1,351 | 1,891 | 2,101 | 2,154 | 1,471 | 1,945 | — | 1,828 | 1,701 | 1,479 | — | 1,690 |

(1) In addition to the operational performances of the mines, “all-in sustaining costs per ounce”, “all-in costs per ounce” and “total cash costs per ounce” are affected by fluctuations in the foreign currency exchange rate. AngloGold Ashanti reports “all-in sustaining costs per ounce” and “all-in costs per ounce” calculated to the nearest US dollar amount and gold sold in ounces. AngloGold Ashanti reports “total cash costs per ounce” calculated to the nearest US dollar amount and gold produced in ounces. “All-in sustaining costs (per ounce)”, “all-in costs (per ounce)” and “total cash costs (per ounce)’’ may not be calculated based on amounts presented in this table due to rounding. | |||||||||||||||

(2) Refer to Segmental reporting. | |||||||||||||||

(3) Corporate includes non-gold producing managed operations. | |||||||||||||||

(4) Total including equity-accounted non-managed joint ventures. | |||||||||||||||

(5) “Total cash costs”, “all-in sustaining costs” and “all-in costs” may not be calculated based on amounts presented in this table due to rounding. | |||||||||||||||

(6) Adjusted to exclude the Sukari operation which was acquired on 22 November 2024 as part of the Centamin acquisition. | |||||||||||||||

Rounding of figures may result in computational discrepancies. | |||||||||||||||

QUARTER 4 2024 EARNINGS RELEASE | 51 |  | |||

| ||||||

NON-GAAP DISCLOSURE I NOTE A | ||||||

ALL-IN SUSTAINING COSTS | FOR THE YEAR ENDED 31 DECEMBER 2024 | |||||||||||

AMERICAS | GROUP | ADJUSTED TO EXCLUDE THE SUKARI OPERATION | ||||||||||

Cerro Vanguardia | AngloGold Ashanti Mineração | Serra Grande | Americas other | Americas | Projects | Non- managed joint ventures | Managed operations | Group total (4) | Managed operations (6) | Group total (4)(6) | ||

in US Dollar million, except as otherwise noted | ||||||||||||

Cost of sales per segmental information (2) | 368 | 352 | 136 | 2 | 858 | — | 380 | 3,726 | 4,106 | 3,643 | 4,023 | |