Liquidity and Going Concern Consideration

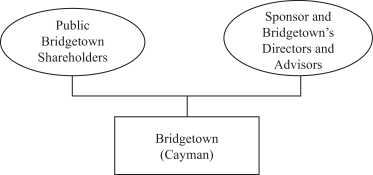

On October 20, 2020, Bridgetown consummated its IPO of 55,000,000 Units at a price of $10.00 per Unit, generating gross proceeds of $550,000,000. Simultaneously with the closing of the IPO, Bridgetown consummated the sale of 6,000,000 Private Placement Warrants to Sponsor at a price of $1.50 per Private Placement Warrant generating gross proceeds of $9,000,000.

On October 29, 2020, Bridgetown issued an additional 4,499,351 Units issued for total gross proceeds of $44,993,510 in connection with the underwriters’ partial exercise of their over-allotment option. Simultaneously with the partial closing of the over-allotment option, Bridgetown also consummated the sale of an additional 449,936 Private Placement Warrants at $1.50 per Private Placement Warrant, generating total proceeds of $674,902.

Following the IPO, the partial exercise of their over-allotment option and the sale of the Private Placement Warrants, a total of $594,993,510 was placed in the Trust Account. We incurred $26,628,771 in transaction costs, including $8,174,902 of underwriting fees net of $2,724,968 reimbursed from the underwriters, $17,849,805 of deferred underwriting fees and $604,064 of other offering costs.

For the three months ended March 31, 2023, cash used in operating activities was $222,032. Net loss of $2,766,365 was affected by change in fair value of warrant liabilities of $1,378,652, and interest earned on marketable securities held in the Trust Account of $1,166,703. Changes in operating assets and liabilities provided $2,332,384 of cash from operating activities.

For the three months ended March 31, 2022, cash used in operating activities was $204,575. Net income of $8,780,301 was affected by change in fair value of warrant liability of $9,065,237, and interest earned on marketable securities held in the Trust Account of $66,267. Changes in operating assets and liabilities provided $146,628 of cash from operating activities.

For the year ended December 31, 2022, cash used in operating activities was $1,933,708. Net income of $23,216,044 was affected by change in fair value of warrant liabilities of $20,366,950, and interest earned on marketable securities held in the Trust Account of $4,550,111. Changes in operating assets and liabilities used $232,691 of cash from operating activities.

For the year ended December 31, 2021, cash used in operating activities was $2,258,971. Net income of $89,047,007 was affected by change in fair value of warrant liabilities of $92,635,679, and interest earned on marketable securities held in the Trust Account of $330,450. Changes in operating assets and liabilities provided $1,660,151 of cash from operating activities.

As of March 31, 2023, Bridgetown had marketable securities held in the Trust Account of $153,529,696. Bridgetown intends to use substantially all of the funds held in the Trust Account, including any amounts representing interest earned on the Trust Account, which interest shall be net of taxes payable and excluding deferred underwriting commissions, to complete its business combination. Bridgetown may withdraw interest from the Trust Account to pay taxes, if any. To the extent that Bridgetown’s share capital or debt is used, in whole or in part, as consideration to complete a business combination, the remaining proceeds held in the Trust Account will be used as working capital to finance the operations of the target business or businesses, make other acquisitions and pursue its growth strategies.

As of March 31, 2023, Bridgetown had cash of $251,367. Bridgetown intends to use the funds held outside the Trust Account primarily to identify and evaluate target businesses, perform business due diligence on prospective target businesses, travel to and from the offices, plants or similar locations of prospective target businesses or their representatives or owners, review corporate documents and material agreements of prospective target businesses, structure, negotiate and complete a business combination.

254