Investor Presentation 1

Forward-Looking Statements FORWARD-LOOKING STATEMENTS. NCR Atleos LLC ("NCR Atleos,” “Atleos” or the "Company"), cautions that comments made during this presentation and in these materials contain "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 (the "Act"). Forward-looking statements use words such as "expect," "target," "anticipate," "outlook," "intend," "plan," "confident," "believe," "will," "would," "potential," "positioned," "may," and words of similar meaning, as well as other words or expressions referencing future events, conditions or circumstances. We intend for these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Act. Statements that describe or relate to the Company's plans, targets, goals, intentions, strategies, or financial outlook, and statements that do not relate to historical or current fact, are examples of forward-looking statements. Examples of forward-looking statements in these materials include, without limitation, statements regarding the planned separation of the Company from NCR Corporation, to be renamed NCR Voyix ("NCR Voyix"), into an independent public company including, but not limited to, the future commercial or financial performance of the Company following such planned transaction, and value creation and ability to innovate and drive growth generally as a result of such transaction; the expected financial performance of the Company for year-end 2023 and targets for 2027; the expected manufacturing volume for the Company and optimization in fixed costs and working capital trends for year-end 2023; the expected hardware margin expansion for the Company through 2027; the Company's net leverage ratio targets for year-end 2024 and long-term; our expectations of demand for our solutions and execution, and the impact thereof on our financial results in 2023; our expected areas of focus and strategy to drive growth and profitability and create longterm stockholder value, including key performance indicator targets and expectations for 2023 and year-end 2027; our expectations regarding compound annual growth rate ("CAGR"), including CAGR targets for our key drivers for 2023 through 2027; expectations regarding the growing total addressable market and growing market opportunity for the Company, including expectations regarding growing cash withdrawal rates and cardholder adoption of branded ATMs through 2027; the Company's focus on advancing strategic growth initiatives and transforming the Company into a software-led ATM-as-a-service company with a higher mix of recurring revenue streams, including the Company's focus on driving efficiencies and standardizing cloud-native service offerings; statements regarding redeployment priorities, and future capital allocation priorities and our expected free cash flow for 2027; expectations regarding future dividend payout ratios; and our expectations of NCR Atleos' ability to deliver increased value to customers and stockholders. Forward-looking statements are based on our current beliefs, expectations and assumptions, which may not prove to be accurate, and involve a number of known and unknown risks and uncertainties, many of which are out of the Company's control, including factors related to the risk of an unexpected failure to complete, or unexpected delays in completing, the necessary actions for the planned spin-off or to obtain the necessary approvals or third party consents to complete these actions, the failure of NCR Atleos to achieve some or all of the expected strategic benefits or opportunities expected from the spin-off, that NCR Atleos may incur material costs and expenses as a result of the spin-off, that NCR Atleos has no history operating as an independent, publicly traded company, and NCR Atleos's historical and pro forma financial information is not necessarily representative of the results that it would have achieved as a separate, publicly traded company and therefore may not be a reliable indicator of its future results, NCR Atleos's obligation to indemnify NCR Voyix pursuant to the agreements entered into connection with the spin-off (including with respect to material taxes) and the risk NCR Voyix may not fulfill any obligations to indemnify NCR Atleos under such agreements, that under applicable tax law, NCR Atleos may be liable for certain tax liabilities of NCR Voyix following the spin-off if NCR Voyix were to fail to pay such taxes, that agreements binding on NCR Atleos restrict it from taking certain actions after the distribution that could adversely impact the intended U.S. federal income tax treatment of the distribution and related transactions, potential liabilities arising out of state and federal fraudulent conveyance laws, the fact that NCR Atleos may receive worse commercial terms from third-parties for services it presently receives from NCR Voyix, that after the spin-off, certain of NCR Atleos's executive officers and directors may have actual or potential conflicts of interest because of their previous positions at NCR Voyix, potential difficulties in maintaining relationships with key personnel, NCR Atleos will not be able to rely on the earnings, assets or cash flow of NCR Voyix and NCR Voyix will not provide funds to finance NCR Atleos's working capital or other cash requirements. Forward-looking statements are not guarantees of future performance, and there are a number of important factors that could cause actual outcomes and results to differ materially from the results contemplated by such forward-looking statements. As you read and consider this presentation, you should understand that these statements are not guarantees of performance or results. Although the Company believes that assumptions underlying the forward-looking statements contained herein are reasonable should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, any of these statements included herein may prove to be inaccurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by us or any other person that the results or conditions described in such statements or our objectives and plans will be achieved. You should not place undue reliance on forward- looking statements, which speak only as of the date they are made. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties. Additional information concerning these and other factors can be found in the Company's filings with the U.S. Securities and Exchange Commission ("SEC"), including the Company's registration statement on Form 10 and amendments thereto, the final information statement, included as an exhibit to the Company's current report on Form 8-K filed with the SEC on August 15, 2023, and quarterly reports on Form 8-K. These materials are dated September 25, 2023, and neither the Company nor its advisors undertakes any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. You should read this presentation with the understanding that the Company’s actual future results, levels of activity, performance and events and circumstances may be materially different from the Company’s expectations. 2

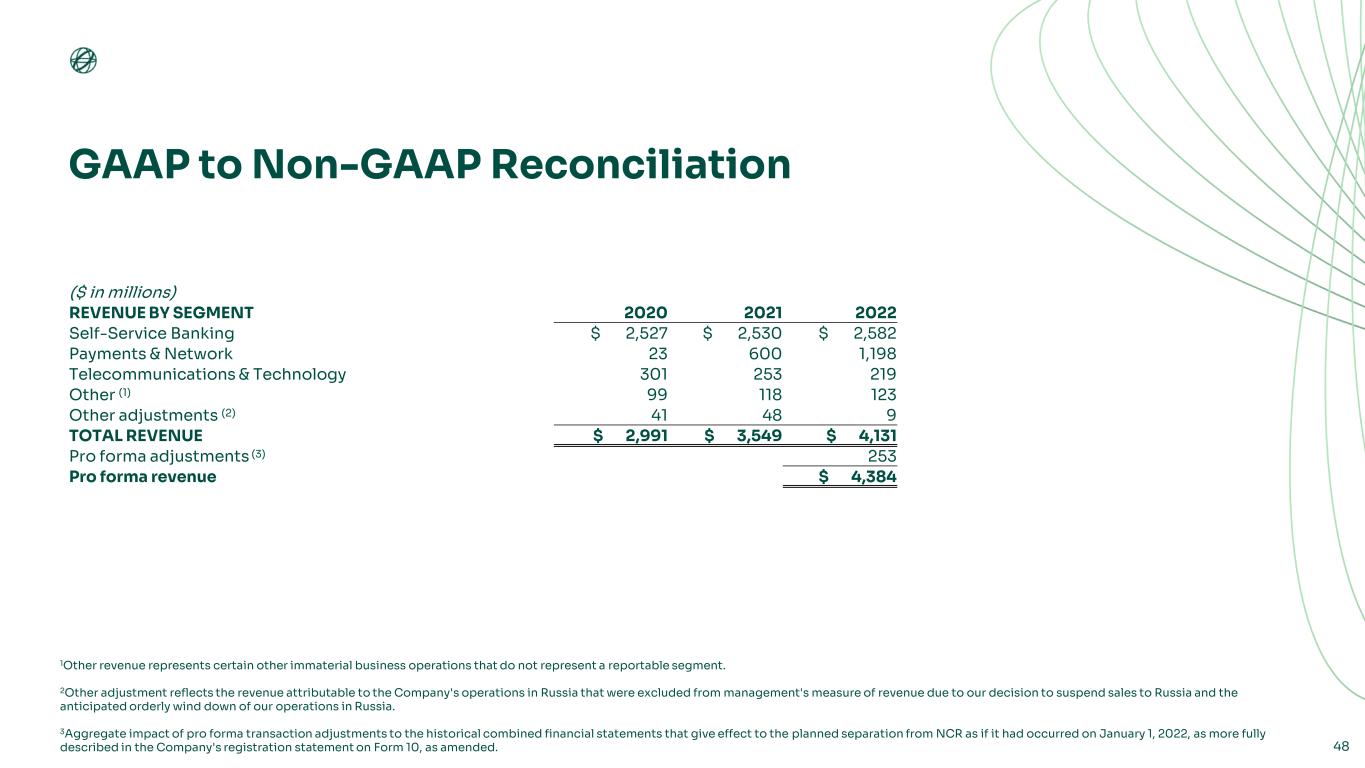

Notes to Investors SEGMENTS AND PRO-FORMA FINANCIAL INFORMATION. Following the completion of the planned separation from NCR Voyix, the Company plans to manage its business in a manner that is expected to result in the Company having three reportable segments as identified in these materials -- Self-Service Banking, Payments & Network, and Telecommunications and Technology. There are certain revenue transactions that will be reported in multiple reportable segments and eliminated to reconcile to total NCR Atleos.. All historic NCR Atleos information provided in this presentation reflects the segment structure described above and gives effect to the planned separation from NCR Voyix as if it had occurred on the dates indicated. The NCR Atleos financial information provided in this presentation consists of estimates of NCR Atleos' operations and financial results upon its planned separation and reflects transactions related to the planned separation, subject to the assumptions and adjustments described in this presentation and in NCR Atleos' Form 10, and should be read in conjunction with the unaudited pro forma combined financial statements included in NCR Atleos' Form 10. NCR Atleos' management believes these assumptions and adjustments are reasonable under the circumstances given the information available at this time. PROJECTIONS. These materials contain projections based on management’s current expectations and were based upon numerous estimates or expectations, beliefs, opinions and assumptions with respect to NCR Atleos’s business, including its results of operations and financial condition, and with respect to general business, economic, market, regulatory and financial conditions and other future events, all of which are difficult to predict and many of which are beyond NCR Atleos’s control and may not prove to be accurate. The projections also cover multiple years and such information by its nature becomes less reliable with each successive quarter and year. For further discussion regarding the risks inherent in evaluating forward-looking statements such as the projections in these materials, please see the disclaimers above under the heading “Forward-Looking Statements.” The projections contained in these materials are not a guarantee of future performance and the future financial results of NCR Atleos may materially differ from those expressed herein, in particular due to factors that are beyond NCR Atleos’s ability to control or predict. MARKET AND INDUSTRY DATA. Unless indicated otherwise, the information concerning our industry contained in this presentation is based on the Company's general knowledge of and expectations concerning the industry. The Company's market position, market share and industry market size are based on estimates using our internal data and estimates, based on data from various industry analyses, our internal research and adjustments and assumptions that we believe to be reasonable. The Company has not independently verified data from industry analyses and cannot guarantee their accuracy or completeness. In addition, we believe the data regarding the industry, market size, market share and our market position within such industry provide general guidance but are inherently imprecise. Further, our estimates and assumptions involve risks and uncertainties and are subject to change based on various factors. These and other factors could cause results to differ materially from those expressed in the estimates and assumptions. NON-GAAP MEASURES. While the Company reports its results in accordance with generally accepted accounting principles in the United States, or GAAP, comments made during this presentation and in these materials will include or make reference to certain "non-GAAP" measures, including selected measures such as adjusted EBITDA, adjusted EBITDA margin, adjusted EBITDA CAGR, net debt, net leverage ratio, and free cash flow. This presentation also discusses targeted adjusted EBITDA, adjusted EBITDA margin, and adjusted EBITDA CAGR growth. These measures are included to provide additional useful information regarding the Company's financial results, and are not a substitute for their comparable GAAP measures. NCR Atleos' definitions and calculations of these non-GAAP measures may differ from similarly-titled measures reported by other companies and cannot, therefore, be compared with similarly-titled measures of other companies. This data should be read in conjunction with NCR Atleos' registration statement on Form 10, as amended, filed with the SEC. These non-GAAP measures should not be considered as substitutes for, or superior to, results determined in accordance with GAAP. Explanations of these non-GAAP measures, reconciliations of these non-GAAP measures to their respective most directly comparable GAAP measures, as well as a statement of usefulness and purpose of each such measure are included in the accompanying "Supplementary Information" unless noted therein and are included in NCR Atleos' registration statement on Form 10. These presentation materials and the associated remarks made during this presentation are integrally related and are intended to be presented and understood together. TRADEMARKS. All trademarks, service marks and trade names appearing in this presentation are, to our knowledge, the property of their respective owners. We do not intend our use or display of other companies’ trademarks, service marks, copyrights or trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies. FUTURE DIVIDENDS. These materials contain statements about expected future dividends and the expected future dividend policy of NCR Atleos. We cannot assure you that our dividend policy will remain the same in the future, or that any expected dividends described herein will be paid or sustained if NCR Atleos commences paying dividends at all. The payment of any dividends in the future to our stockholders, and the timing and amount thereof, will fall within the sole discretion of the NCR Atleos Board of Directors and will depend on many factors, such as our financial condition, earnings, capital requirements, potential obligations in planned financings, industry practice, legal requirements (including Maryland distribution requirements) and other factors that the NCR Atleos Board of Directors deems relevant. NCR Atleos’s ability to pay dividends will depend on its ongoing ability to generate cash from operations and on NCR Atleos’s access to the capital markets. For further discussion regarding the risks inherent in evaluating forward-looking statements such as our statements in these materials about expected dividend payments, please see the disclaimers above under the heading “Forward-Looking Statements.” NOT AN OFFER. The information in this presentation is for informational purposes only and shall not constitute, or form a part of, an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities. 3

Strategic Overview Tim Oliver, Chief Executive Officer Stuart Mackinnon, Chief Operating Officer Paul Campbell, Chief Financial Officer 4

Investment Thesis 5 1 Steady global demand for cash and physical transactions suggests sustained demand for ATM capability. 2 Market leader with unmatched scale and installed base will enable above-market growth. 3 Best positioned to benefit from accelerating bank outsourcing, branch rationalization, and neobank growth. 4 Emphasis on Network and ATM as a Service offerings delivers more recurring revenue and more predictable profitability and cash flows. 5 Prudent capital deployment that prioritizes high return organic growth opportunities, reducing leverage, and paying a dividend.

Proven Management Team 6 Presenter Tim Oliver Chief Executive Officer Stuart Mackinnon Chief Operating Officer Paul Campbell Chief Financial Officer Dan Antilley Chief Security & Cash Operations Officer Len Graves Global Operations LaShawne Meriwether Chief Human Resources Officer Carolyn Muise Chief Customer Officer Jennifer Personette Chief Marketing Officer Patty Watson Chief Information & Technology Officer Ricardo Nunez General Counsel Diego Navarrete Global Sales Kristen Brady Corporate Operations & Strategy

Introducing Atleos Industry Leading Comprehensive ATM Platform of Scale1 #1 Retail surcharge-free network #1 Provider of multi-vendor ATM software applications and middleware 69% No. 1 branch transformation technologies (ITM) US SHARE2 +600K Devices under management +80K ATM locations we own and operate +140 Countries supported by our ATMs Diverse, blue-chip customer base 7 #1 Across 30+ countries for ATM installs +20K Employees globally 1. Data as of June 23, 2023. 2. RBR and management estimate.

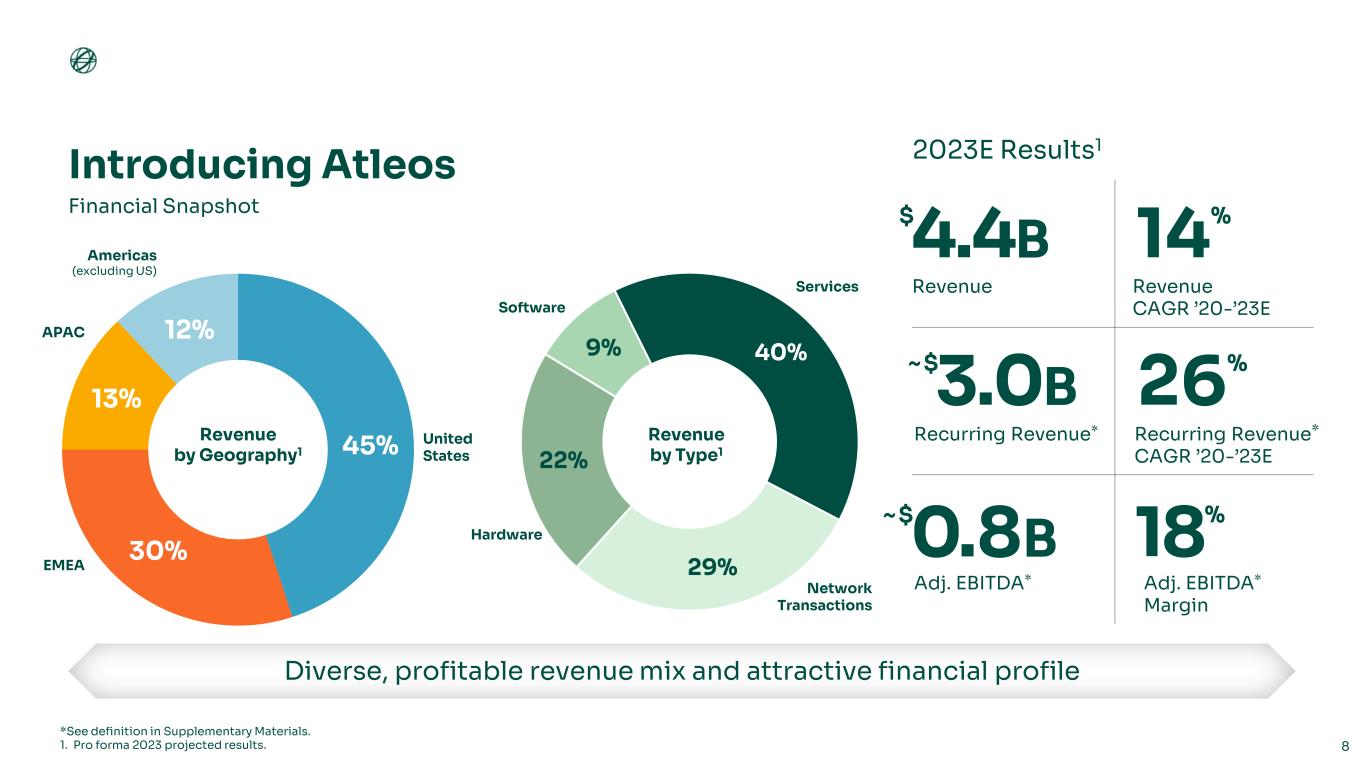

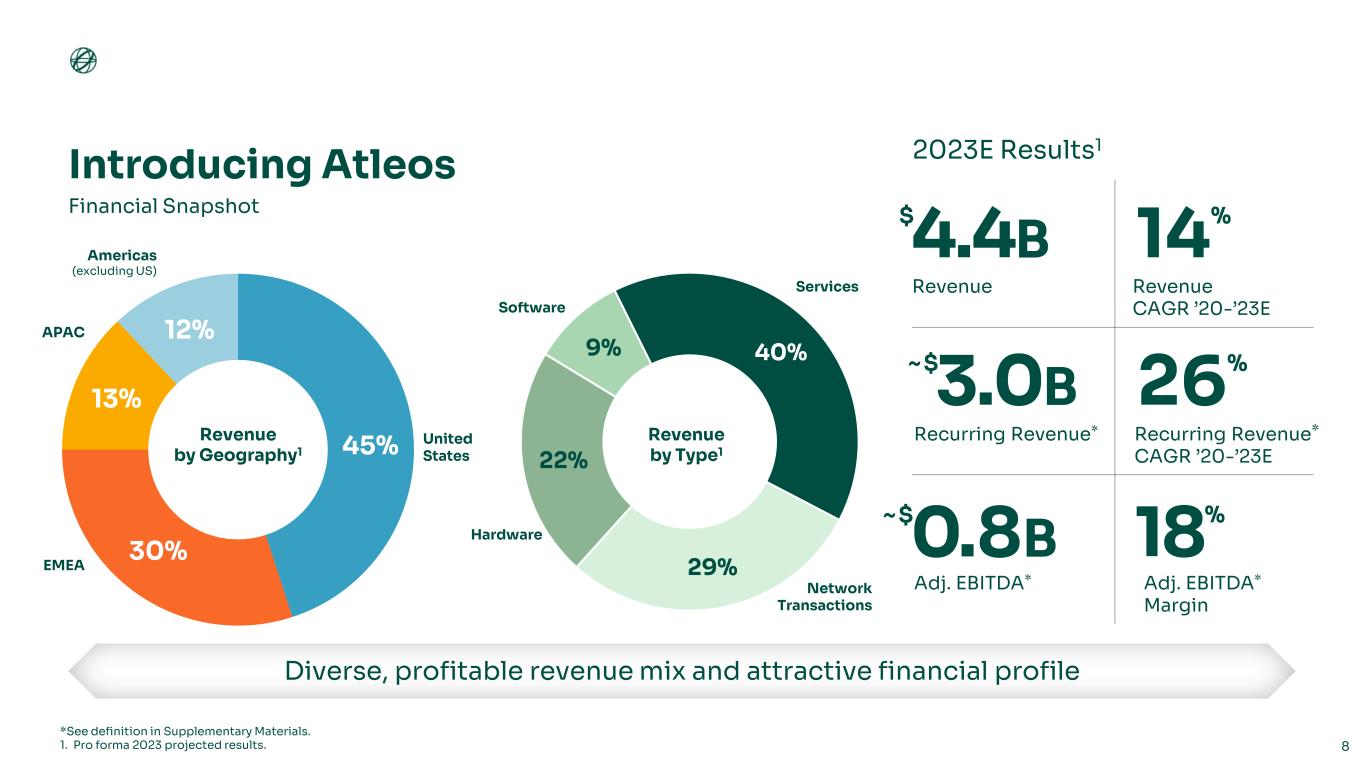

Introducing Atleos 8 Revenue by Geography1 45% 30% 13% 12% Americas (excluding US) APAC EMEA United States Revenue by Type1 Diverse, profitable revenue mix and attractive financial profile 2023E Results1 *See definition in Supplementary Materials. 1. Pro forma 2023 projected results. Financial Snapshot $4.4B Revenue 26% Recurring Revenue* CAGR ’20-’23E ~ $3.0B Recurring Revenue* 18% Adj. EBITDA* Margin ~ $0.8B Adj. EBITDA* 14% Revenue CAGR ’20-’23E 22% 9% 40% 29% Software Hardware Network Transactions Services

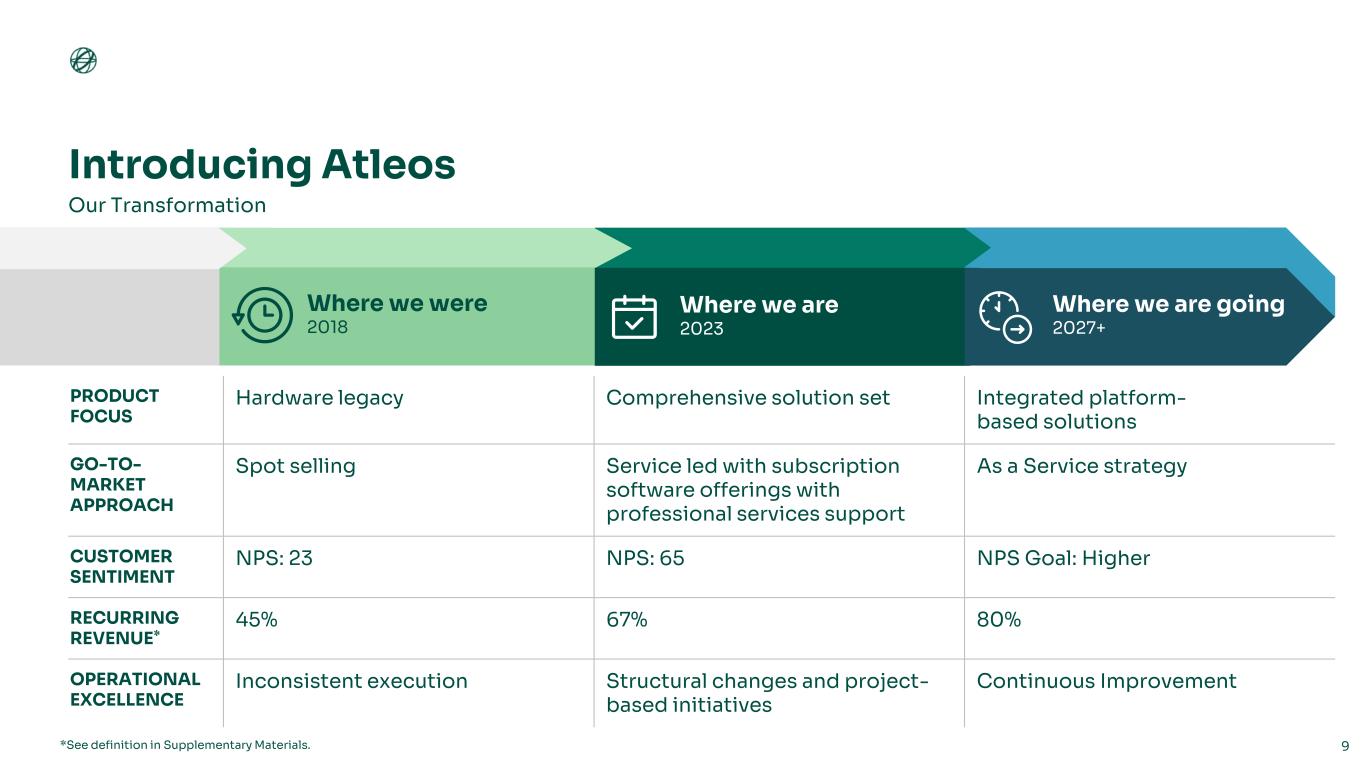

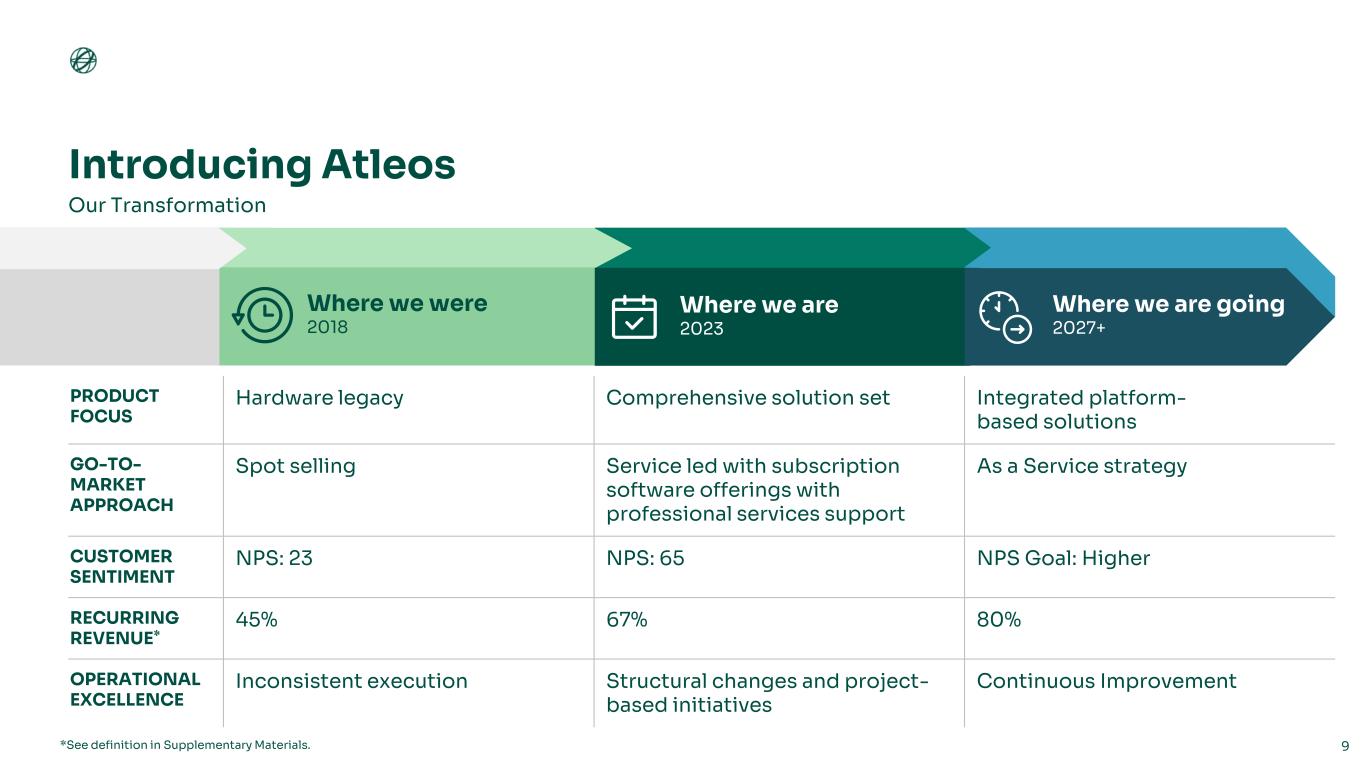

9 Where we are 2023 Introducing Atleos Our Transformation PRODUCT FOCUS Hardware legacy Comprehensive solution set Integrated platform- based solutions GO-TO- MARKET APPROACH Spot selling Service led with subscription software offerings with professional services support As a Service strategy CUSTOMER SENTIMENT NPS: 23 NPS: 65 NPS Goal: Higher RECURRING REVENUE* 45% 67% 80% OPERATIONAL EXCELLENCE Inconsistent execution Structural changes and project- based initiatives Continuous Improvement *See definition in Supplementary Materials. Where we were 2018 Where we are going 2027+

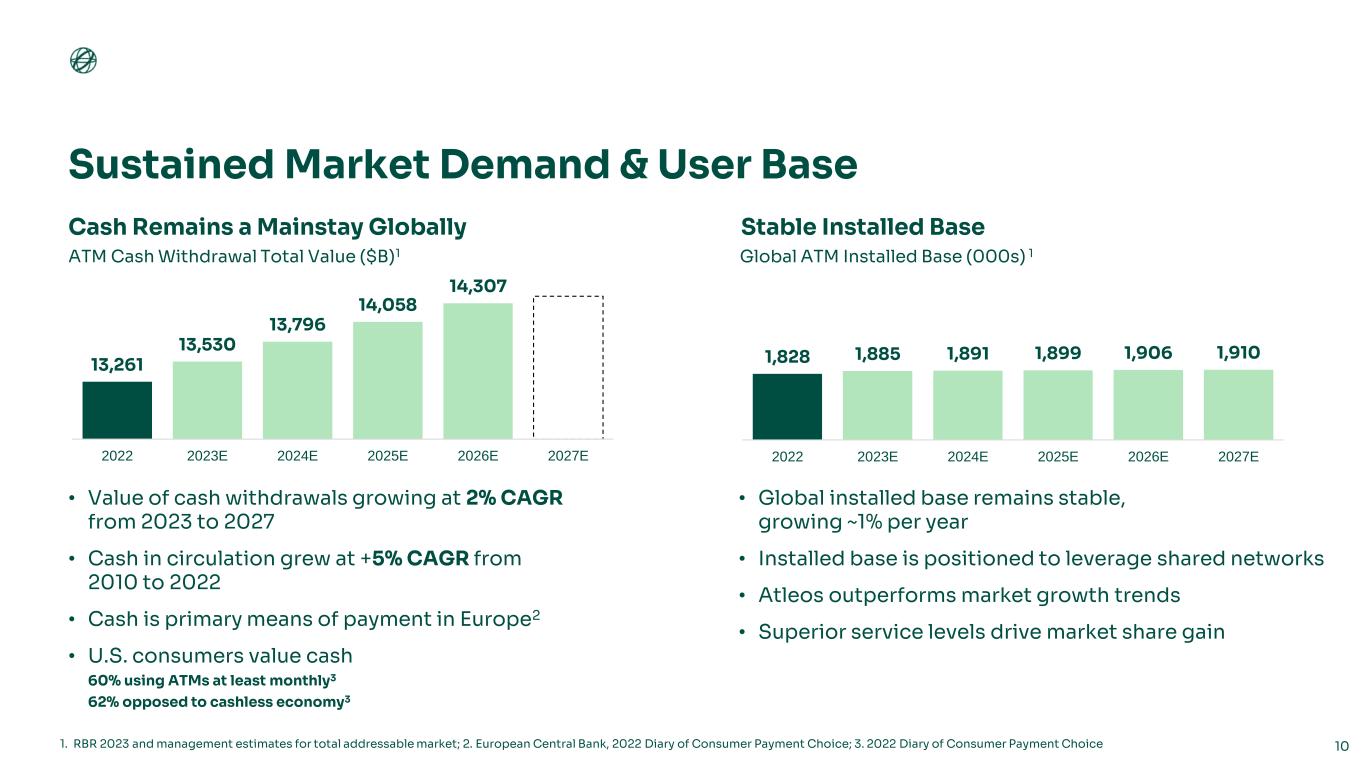

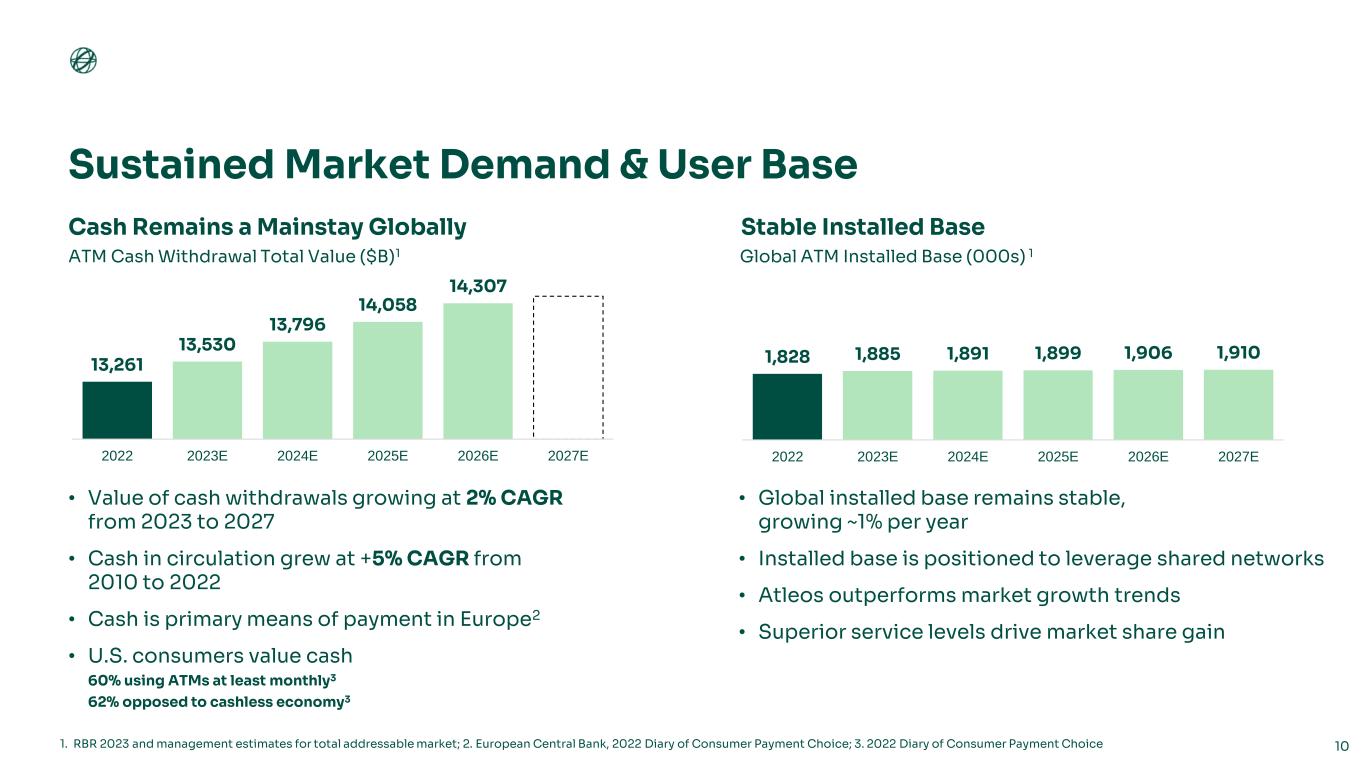

Sustained Market Demand & User Base Cash Remains a Mainstay Globally 10 Stable Installed Base ATM Cash Withdrawal Total Value ($B)1 Global ATM Installed Base (000s) 1 1. RBR 2023 and management estimates for total addressable market; 2. European Central Bank, 2022 Diary of Consumer Payment Choice; 3. 2022 Diary of Consumer Payment Choice • Global installed base remains stable, growing ~1% per year • Installed base is positioned to leverage shared networks • Atleos outperforms market growth trends • Superior service levels drive market share gain • Value of cash withdrawals growing at 2% CAGR from 2023 to 2027 • Cash in circulation grew at +5% CAGR from 2010 to 2022 • Cash is primary means of payment in Europe2 • U.S. consumers value cash 60% using ATMs at least monthly3 62% opposed to cashless economy3 1,828 1,885 1,891 1,899 1,906 1,910 2022 2023E 2024E 2025E 2026E 2027E 13,261 13,530 13,796 14,058 14,307 2022 2023E 2024E 2025E 2026E 2027E

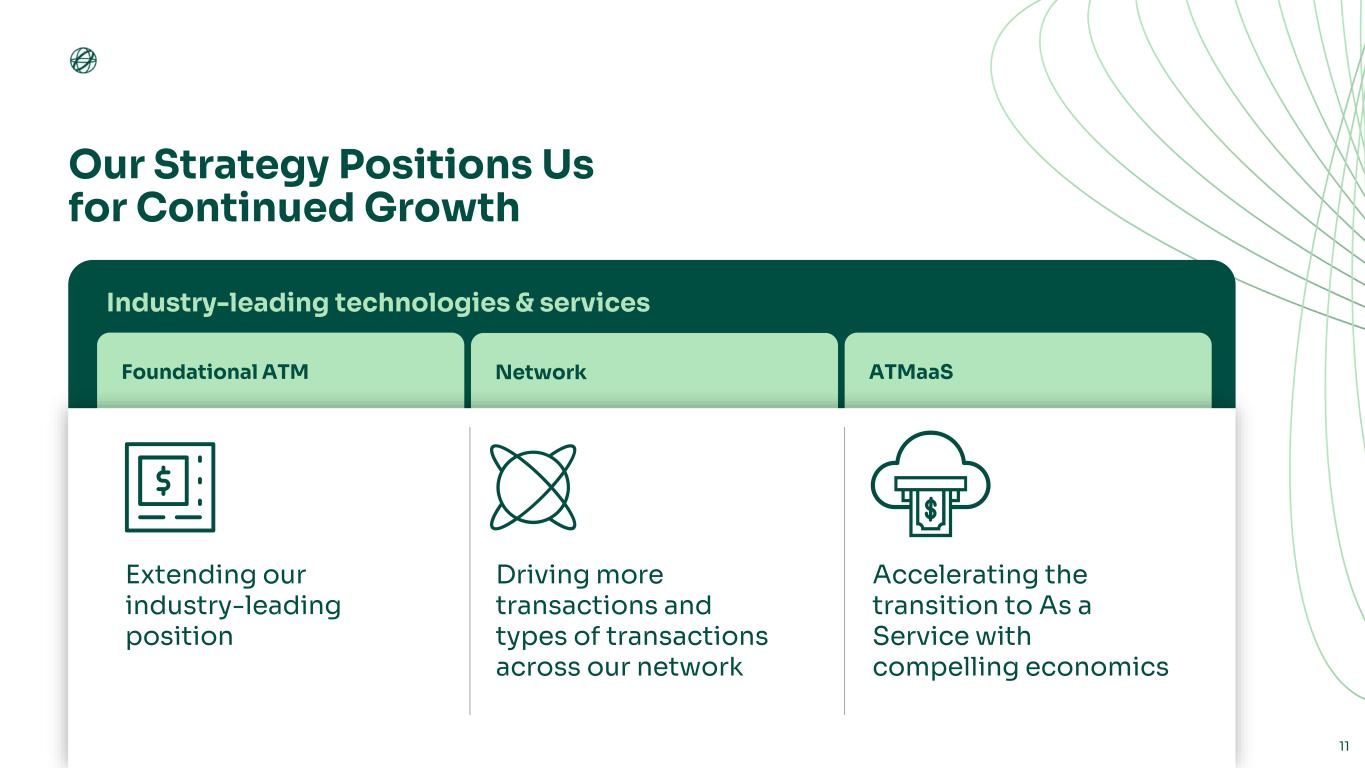

Industry-leading technologies & services ATMaaSNetworkFoundational ATM Our Strategy Positions Us for Continued Growth 11 Extending our industry-leading position Driving more transactions and types of transactions across our network Accelerating the transition to As a Service with compelling economics

Foundational ATM Position Unmatched scale and capabilities globally 12 Diverse Hardware Portfolio Leading ATM Software Global Remote and Onsite Field Services Efficient maintenance for hardware systems leveraging big data and mobile technology Solving the digital first strategies of our customers Valuable on-ramp to broader software and managed service offerings 17% of total revenue 10% of total revenue 31% of total revenue

CustomerDispatchHelp desk ATM Field Services Overview Delivering seamless customer experience with the highest-quality services 13 Manage • Managed Services • Cash management • Preventative maintenance Maintain • Remote diagnosis • On-site resolution Deploy • Site preparation • Staging activities • Installations Improve • Customer experience • Lifecycle focus • Design iteration Customer 24 16M service calls Remote resolution 25+ languages supported 4,200 Customers 6M fixes on-site 1. All figures 2023E.

Our Differentiated Hardware Solutions Evolving the Word’s Most Complete Portfolio 14 Single Function Cash Dispensers Full Function Cash Recyclers Multi-Function ATMs/ITMs/Branch Platform & architecture Single cash dispense module Single module in lower enclosure (cash recycler) Dual modules in lower enclosure (Dispenser, recycler, mixed media, check) Footprint Compact Compact Standard Core capabilities Cash dispense Cash Recycling & Full function Multi-function Additional capabilities Software Full Function modules in Topbox (Check & Coin Dispense) Assisted Services ITM peripherals & Enhanced Services via sidecars SelfServ™ 20 series SelfServ™ 60 series SelfServ™ 80 series

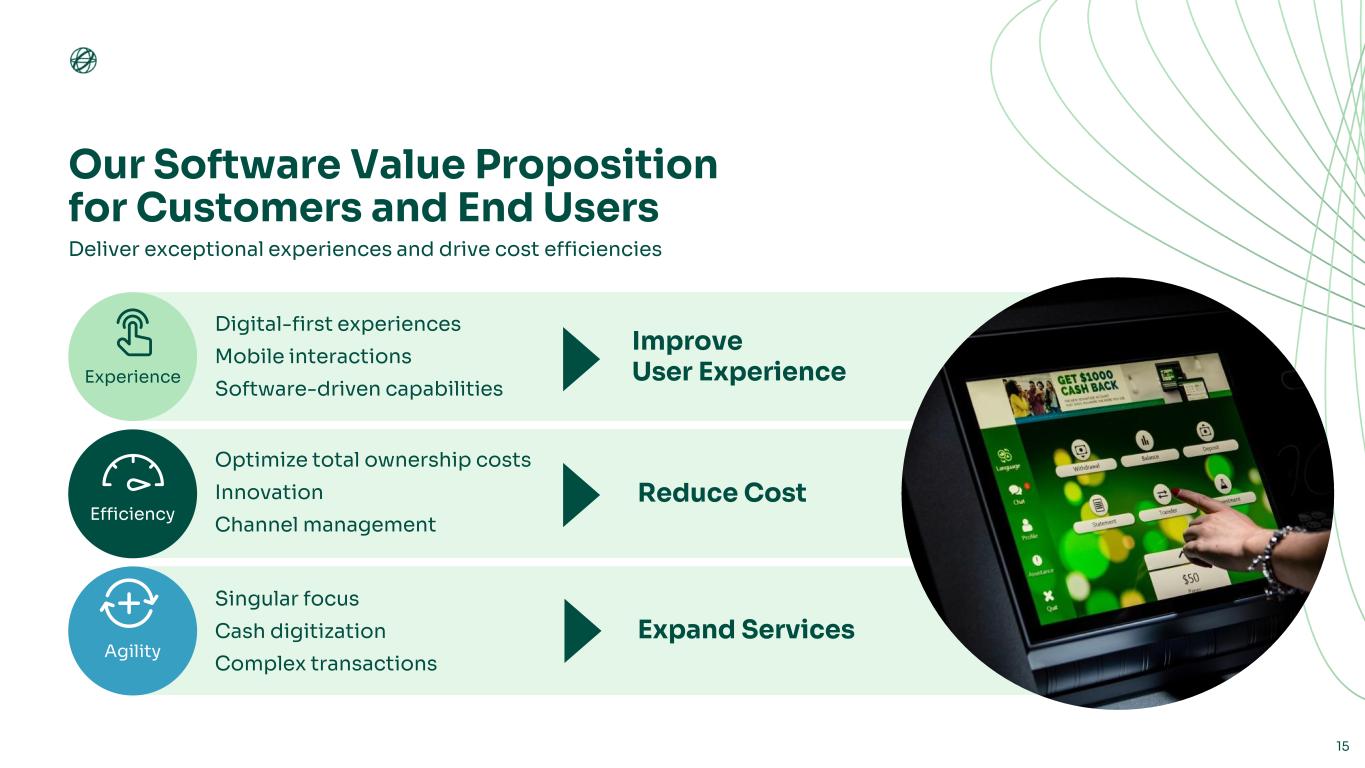

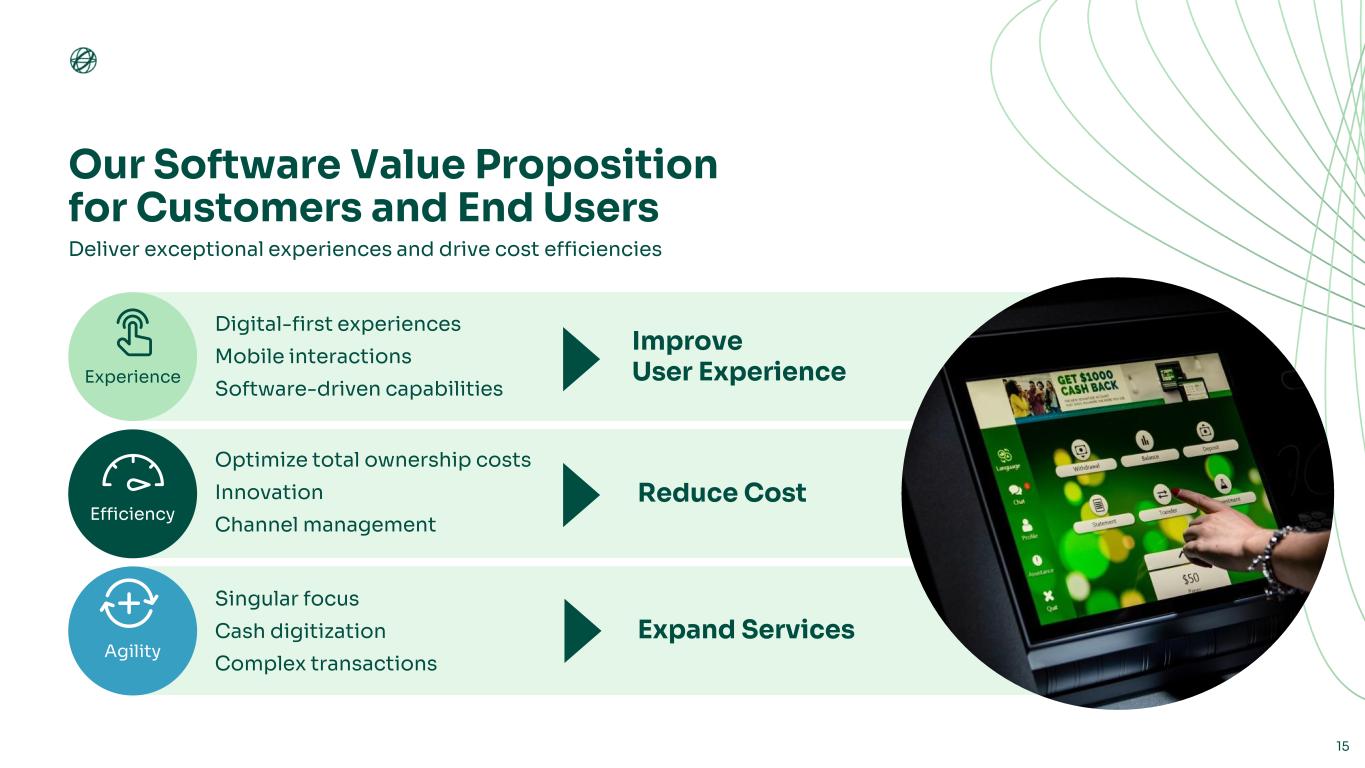

Experience Efficiency Agility Our Software Value Proposition for Customers and End Users Improve User Experience Deliver exceptional experiences and drive cost efficiencies 15 Reduce Cost Expand Services Digital-first experiences Mobile interactions Software-driven capabilities Optimize total ownership costs Innovation Channel management Singular focus Cash digitization Complex transactions

Atleos Digitization Delivers Cash Without the Card 16 Embedded Application Programming Interface (API) within existing partner applications Global Ready Over 40,000 ATMs enabled Flexible Enable cardless cash in & out that meets business needs Frictionless, secure One time use code with time expiration Bill payment Cash deposit Crypto currency Rebates / rewards P2P Digital wallet loads Money transfer CASH-OUT CASH-IN

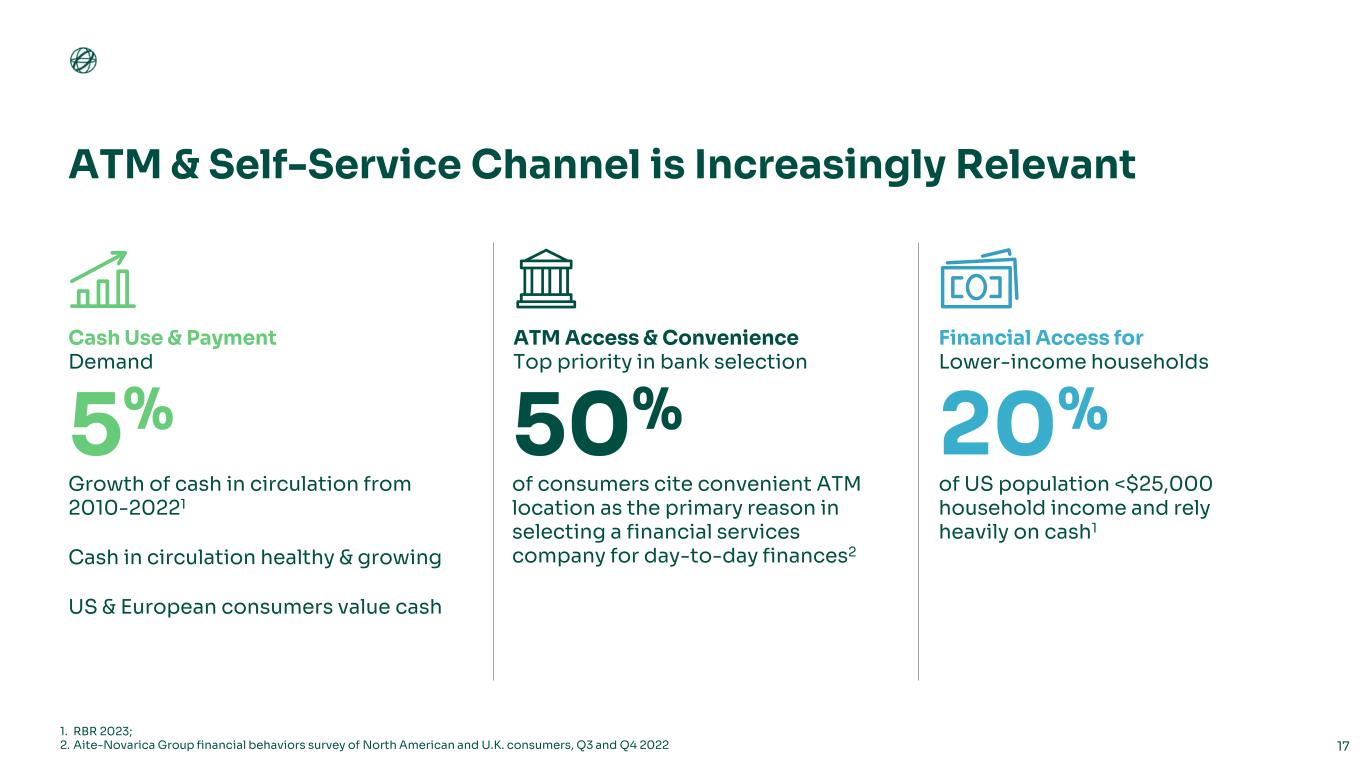

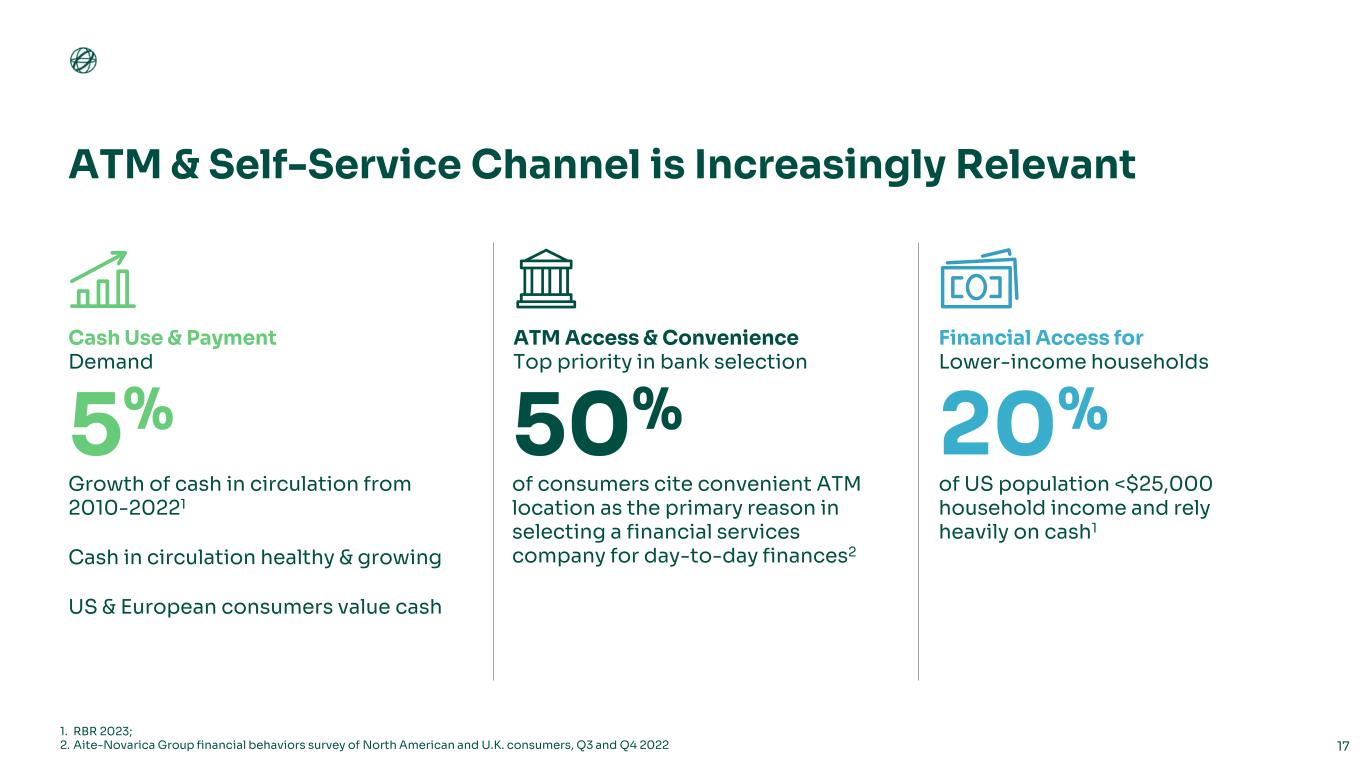

ATM & Self-Service Channel is Increasingly Relevant 17 1. RBR 2023; 2. Aite-Novarica Group financial behaviors survey of North American and U.K. consumers, Q3 and Q4 2022 Cash Use & Payment Demand ATM Access & Convenience Top priority in bank selection Financial Access for Lower-income households 5% 50% 20% Growth of cash in circulation from 2010-20221 Cash in circulation healthy & growing US & European consumers value cash of consumers cite convenient ATM location as the primary reason in selecting a financial services company for day-to-day finances2 of US population <$25,000 household income and rely heavily on cash1

Retail Network of +80,000 ATMs Drive Durable Organic Revenue 18 BrandingRetail Allpoint Only OEM that owns and operates an estate of ATMs at scale • Trusted by largest banks in the world • Delivering frictionless self-service experience • Migrating transactions from teller and retail service desk to the ATM • Meeting demand of retailers and financial institutions • Consolidating store kiosks • Traditional and emerging revenue streams • Surcharge, DCC, Digital Currency Located in Blue Chip Retail Partners

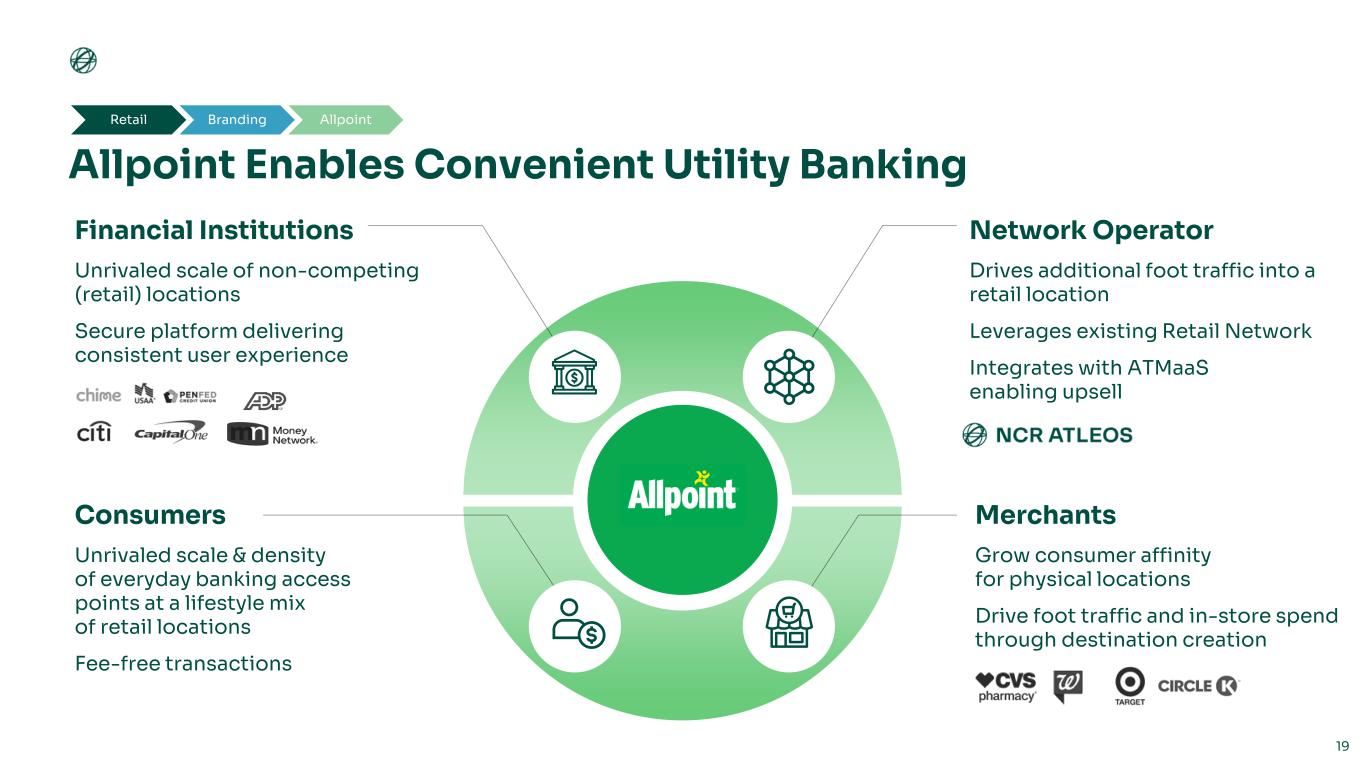

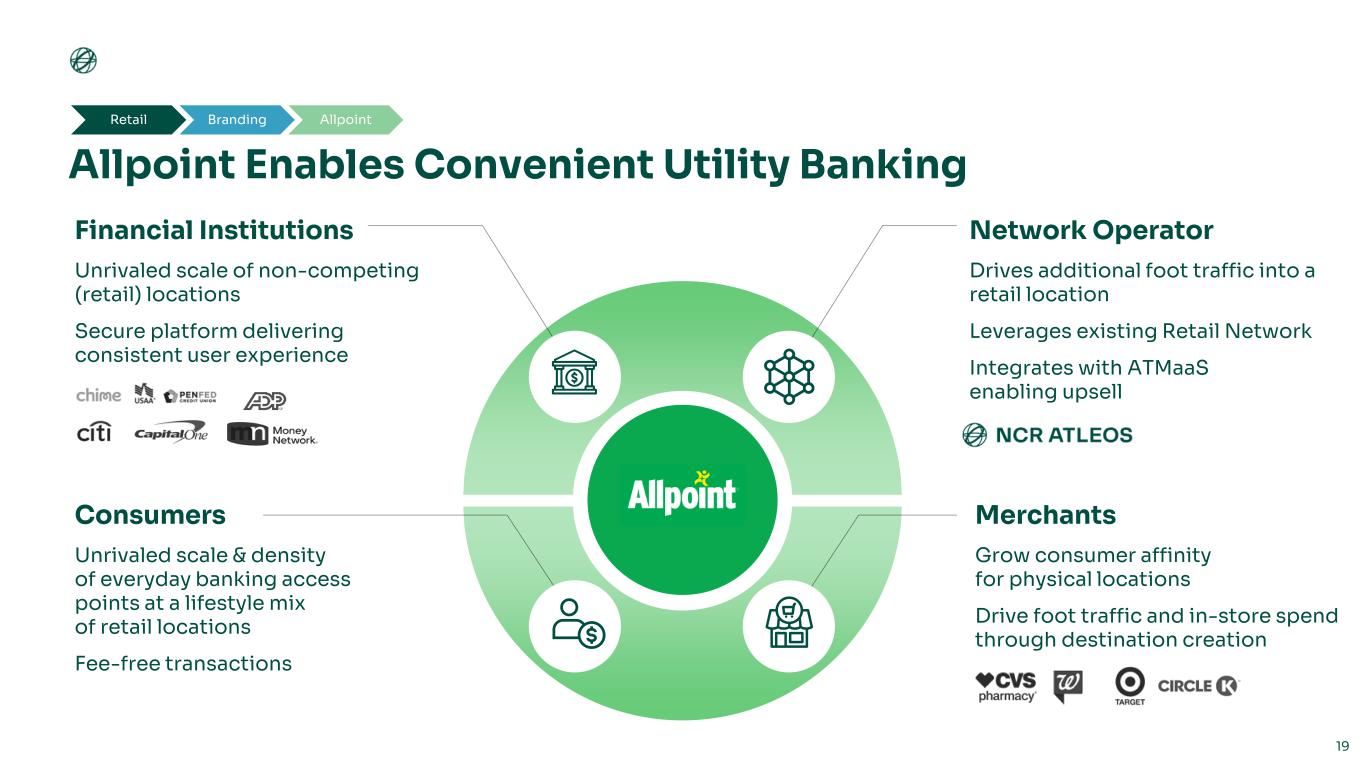

Allpoint Enables Convenient Utility Banking 19 Financial Institutions Unrivaled scale of non-competing (retail) locations Secure platform delivering consistent user experience Network Operator Drives additional foot traffic into a retail location Leverages existing Retail Network Integrates with ATMaaS enabling upsell Merchants Grow consumer affinity for physical locations Drive foot traffic and in-store spend through destination creation Consumers Unrivaled scale & density of everyday banking access points at a lifestyle mix of retail locations Fee-free transactions BrandingRetail Allpoint

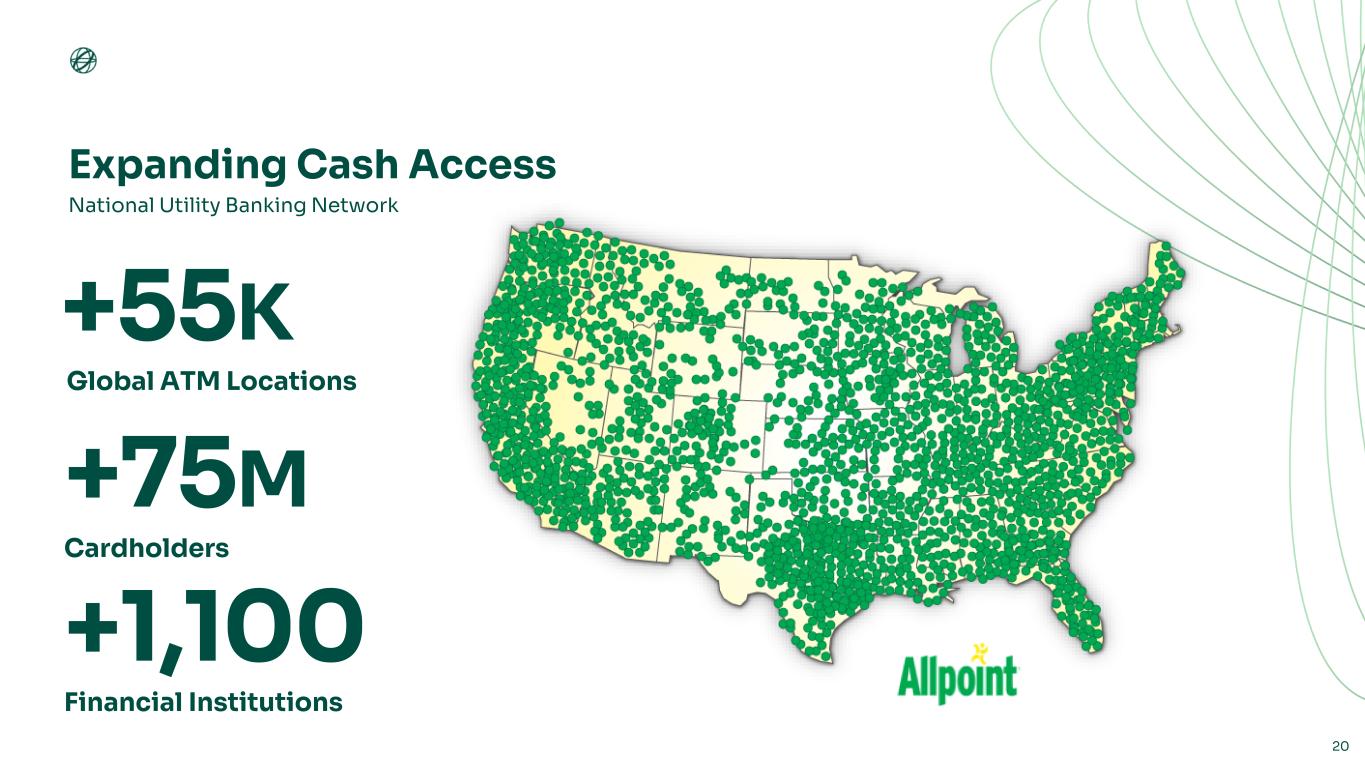

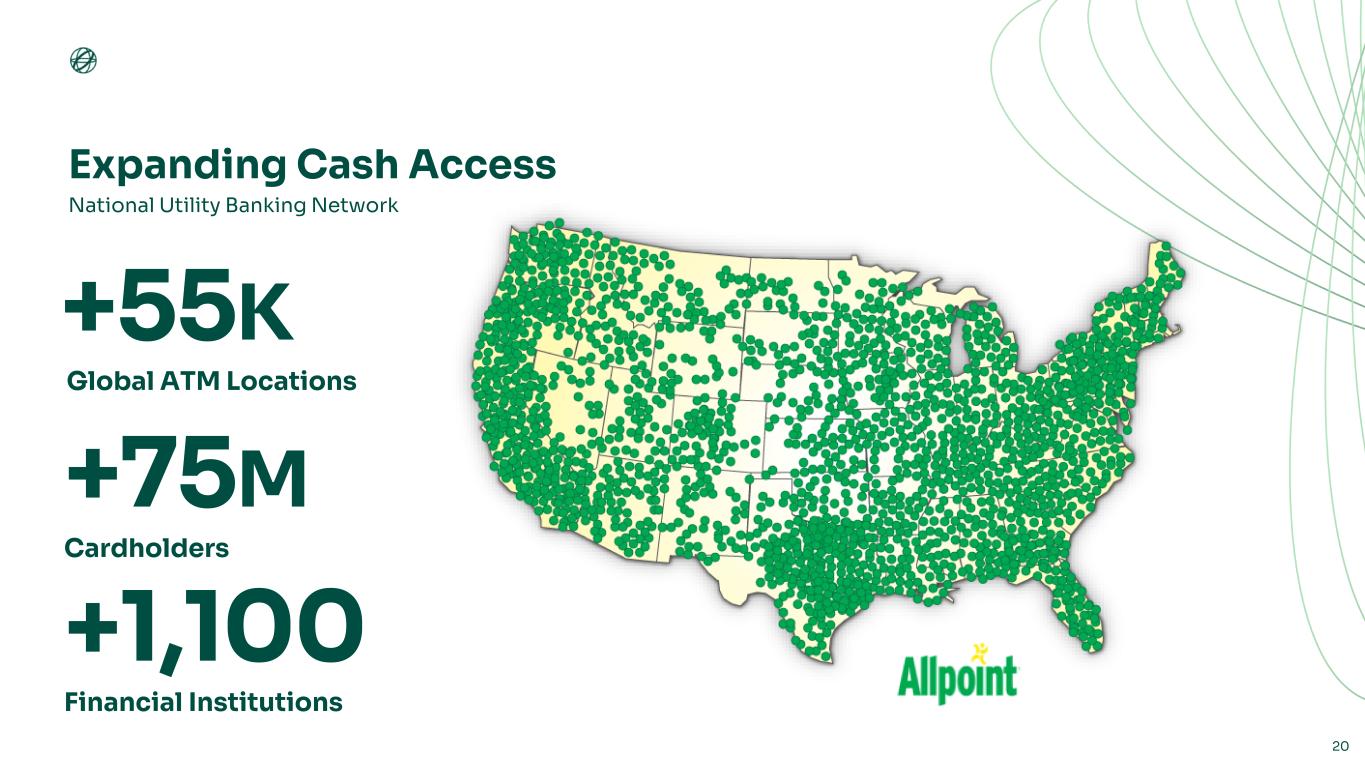

Expanding Cash Access National Utility Banking Network 20 +55K Global ATM Locations +75M Cardholders +1,100 Financial Institutions

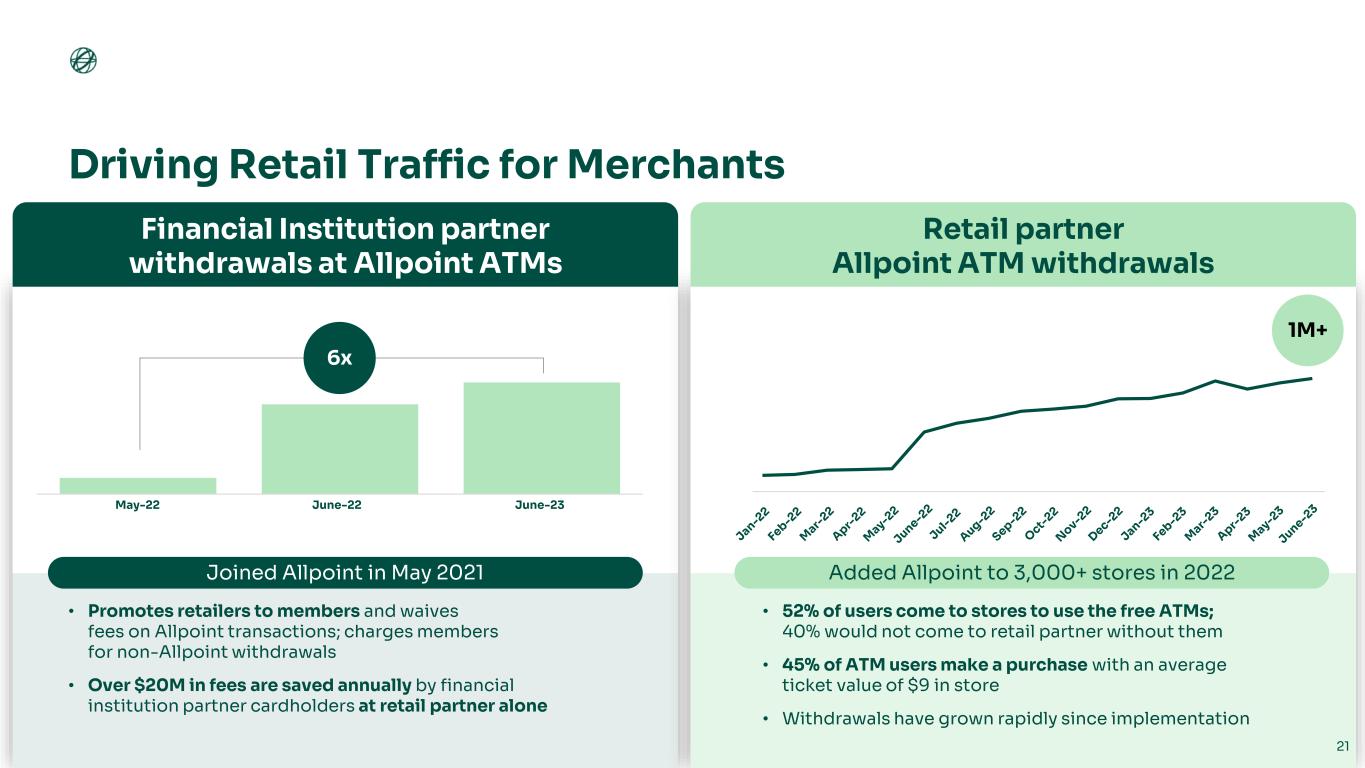

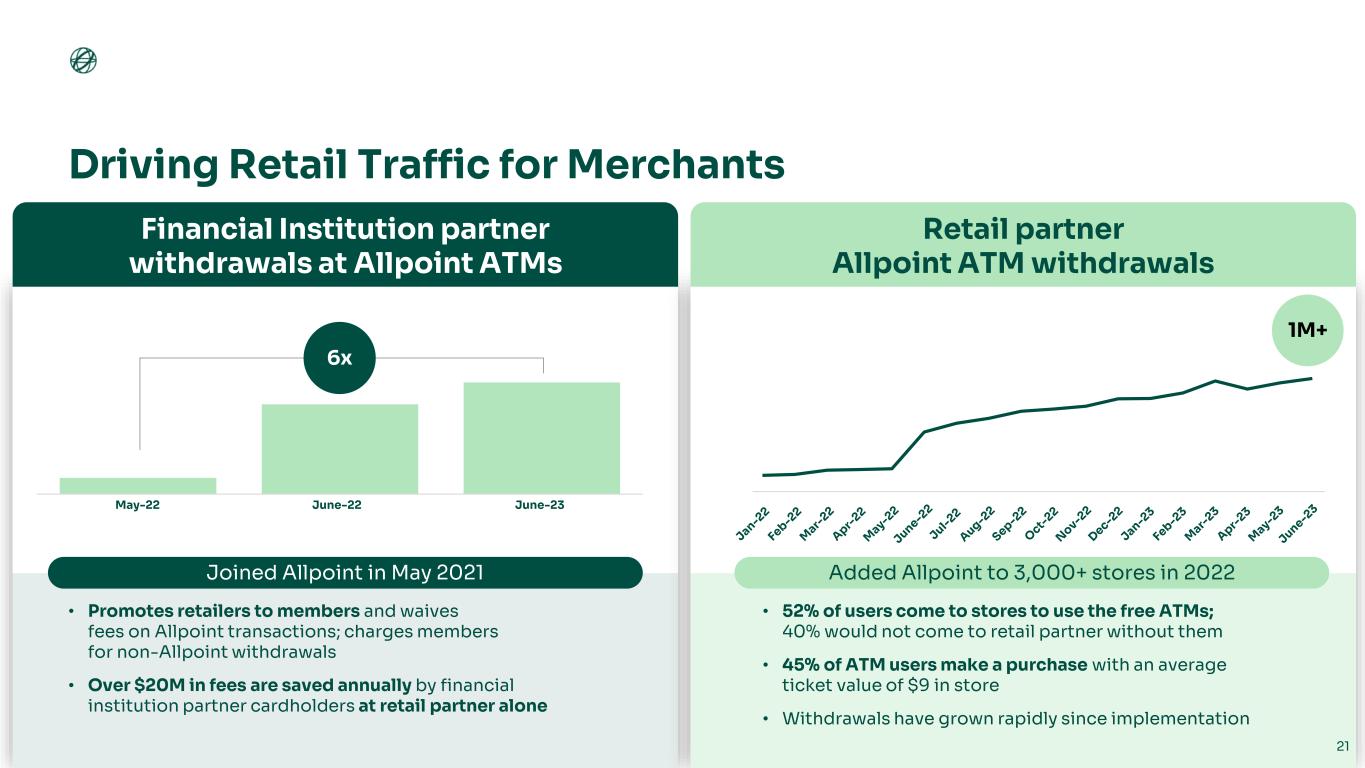

Driving Retail Traffic for Merchants 21 1M+ • Promotes retailers to members and waives fees on Allpoint transactions; charges members for non-Allpoint withdrawals • Over $20M in fees are saved annually by financial institution partner cardholders at retail partner alone • 52% of users come to stores to use the free ATMs; 40% would not come to retail partner without them • 45% of ATM users make a purchase with an average ticket value of $9 in store • Withdrawals have grown rapidly since implementation Retail partner Allpoint ATM withdrawals Financial Institution partner withdrawals at Allpoint ATMs May '21 Jun '22 Jun '23 6x ay-22 June-22 June-23 Added Allpoint to 3,000+ stores in 2022Joined Allpoint in May 2021

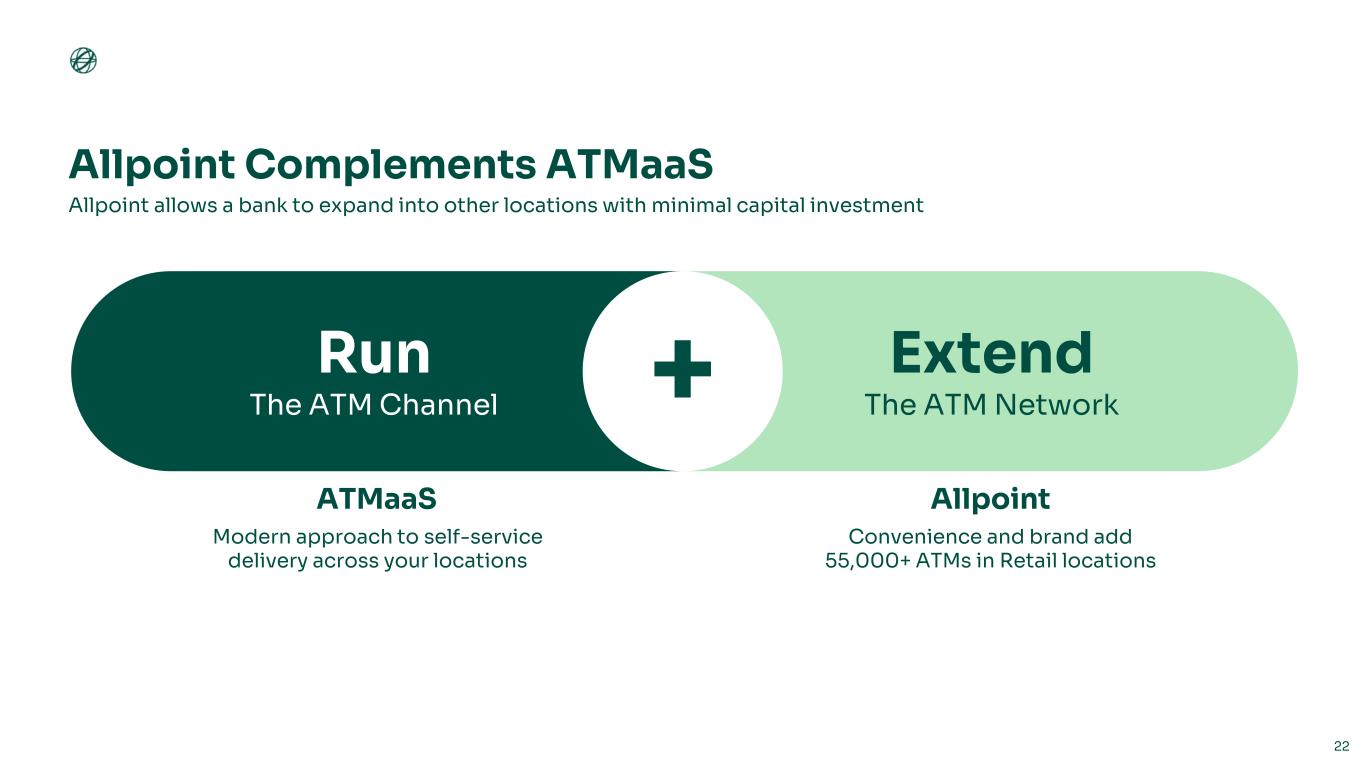

Allpoint Complements ATMaaS Allpoint allows a bank to expand into other locations with minimal capital investment 22 Run The ATM Channel Extend The ATM Network+ ATMaaS Modern approach to self-service delivery across your locations Allpoint Convenience and brand add 55,000+ ATMs in Retail locations

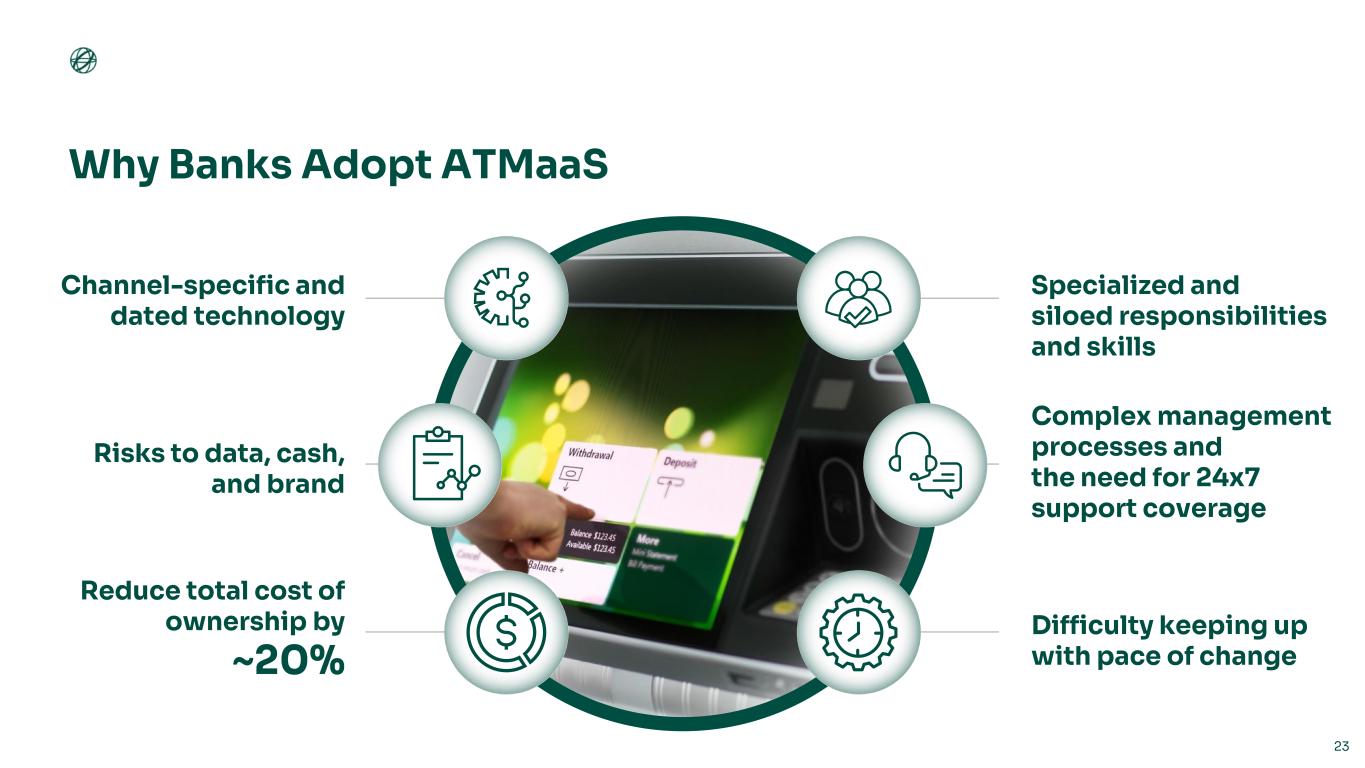

Why Banks Adopt ATMaaS 23 Channel-specific and dated technology Specialized and siloed responsibilities and skills Risks to data, cash, and brand Complex management processes and the need for 24x7 support coverage Reduce total cost of ownership by ~20% Difficulty keeping up with pace of change

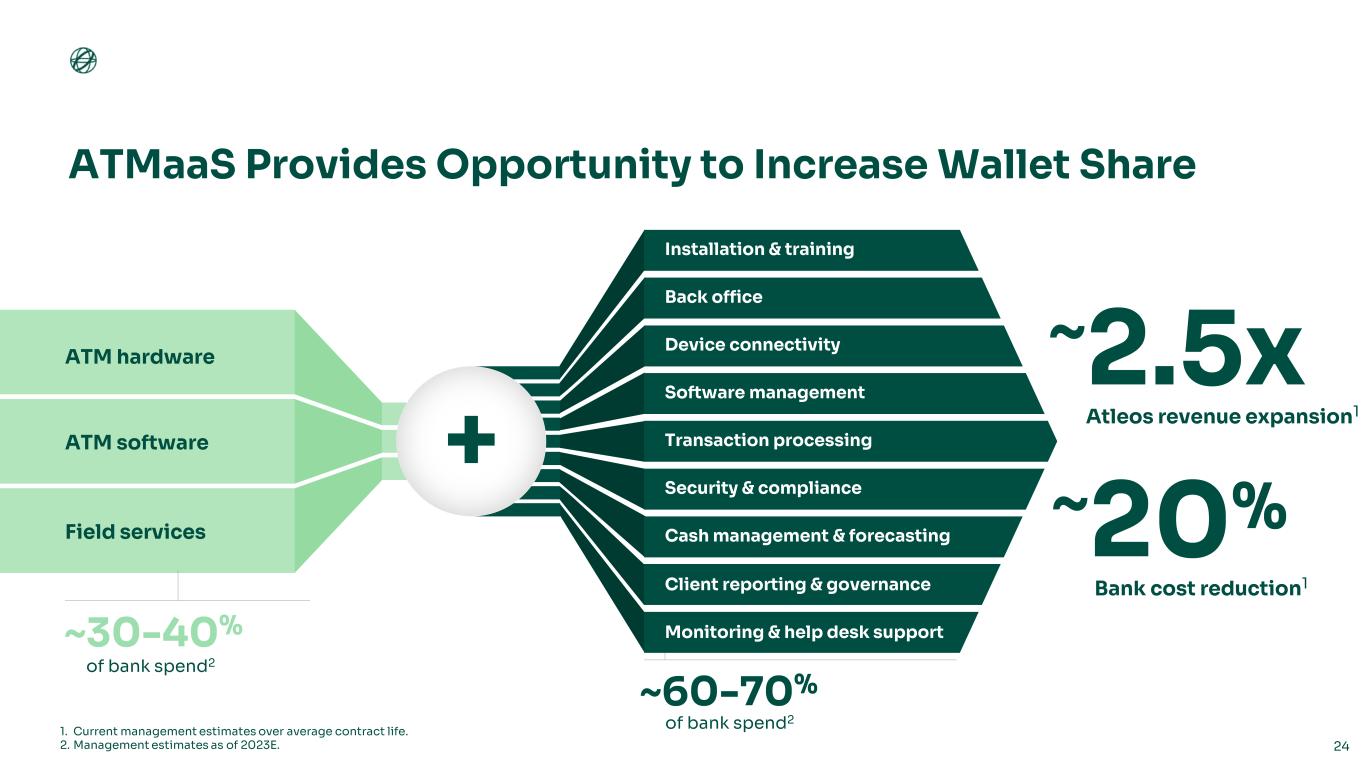

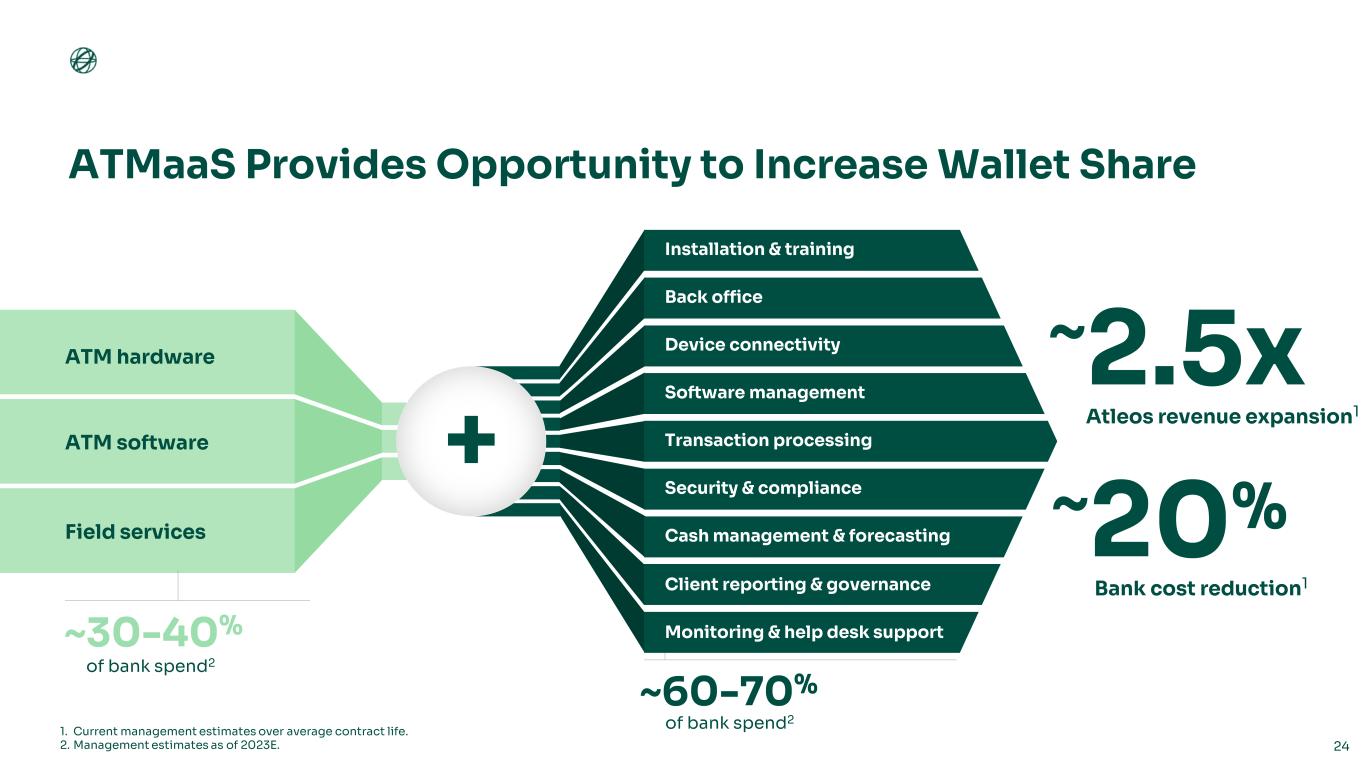

ATMaaS Provides Opportunity to Increase Wallet Share 24 1. Current management estimates over average contract life. 2. Management estimates as of 2023E. Back office Device connectivity Software management Transaction processing Security & compliance Cash management & forecasting Installation & training Client reporting & governance Monitoring & help desk support + ATM hardware ATM software Field services ~30-40% ~60-70% of bank spend2 of bank spend2 ~2.5x Atleos revenue expansion1 ~20% Bank cost reduction1

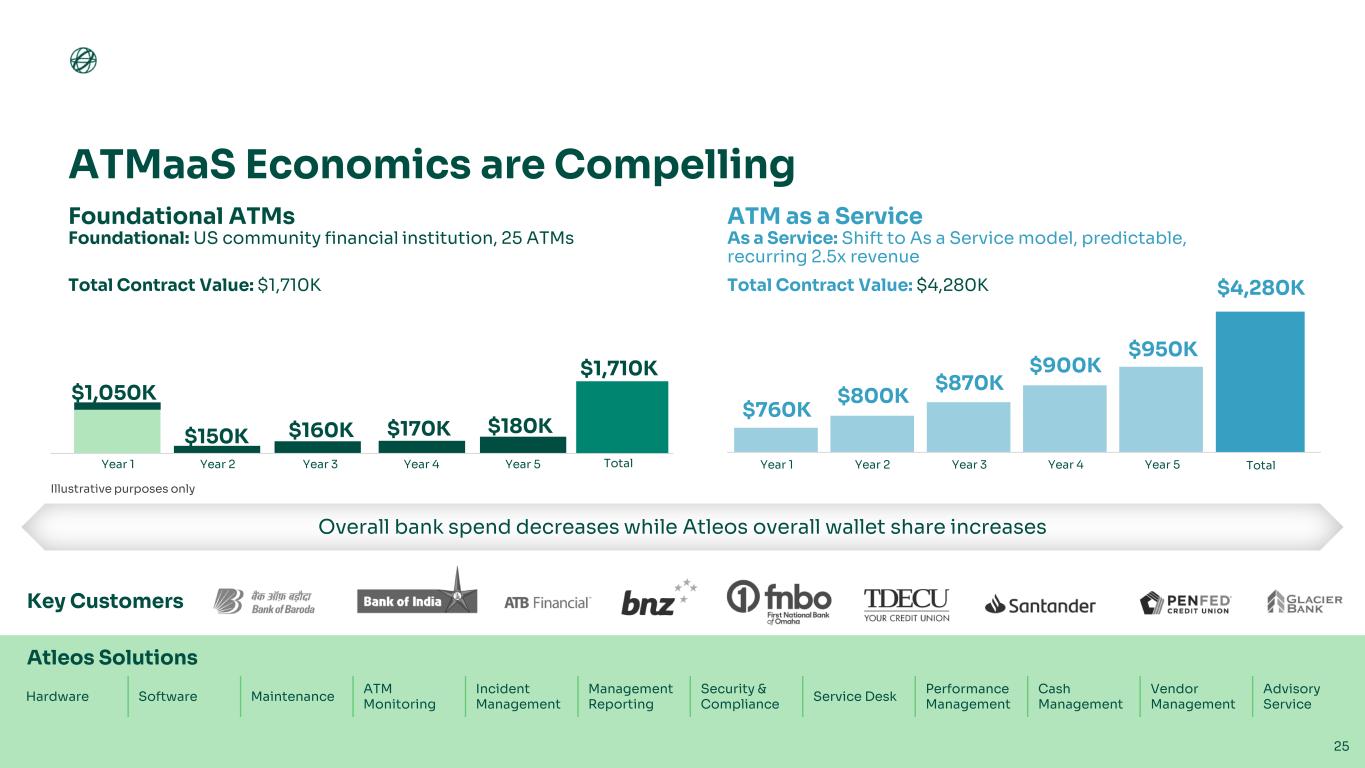

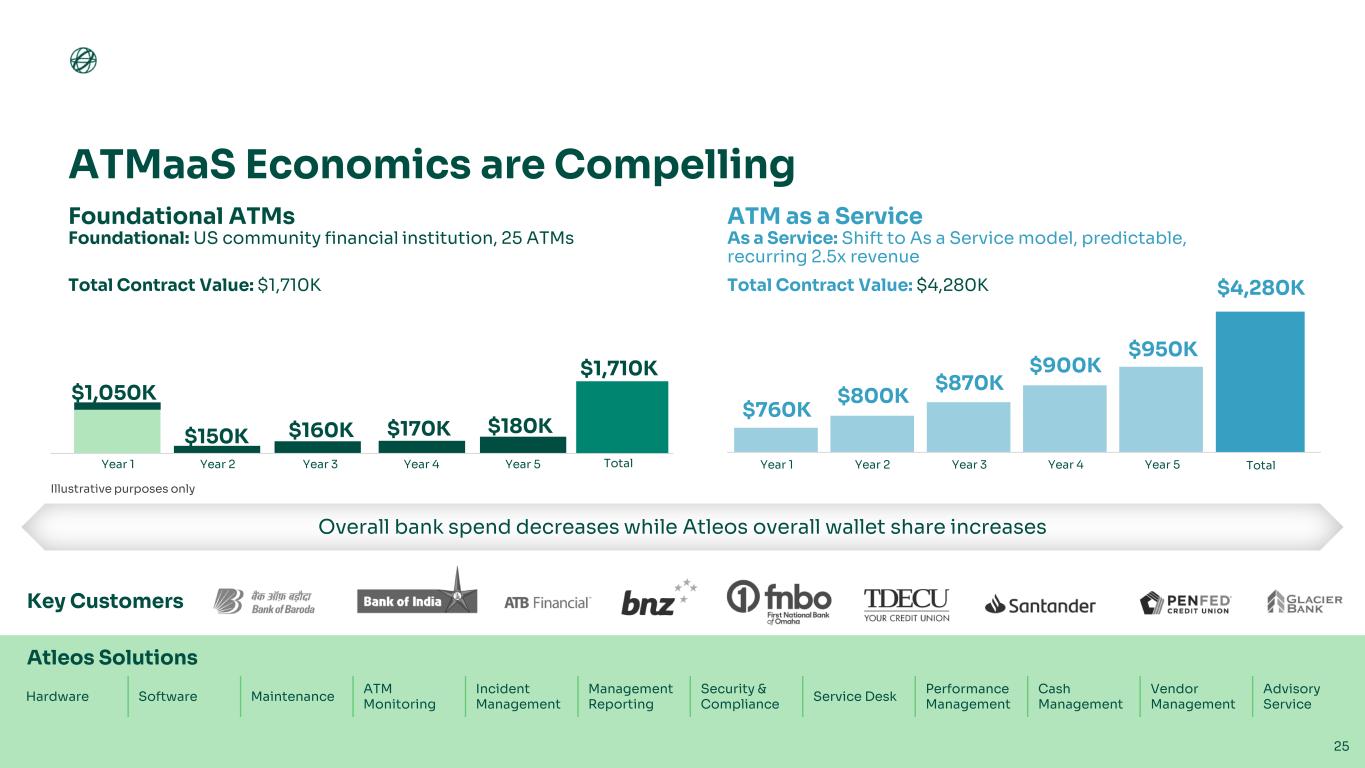

ATMaaS Economics are Compelling 25 Atleos Solutions Hardware Software Maintenance ATM Monitoring Incident Management Management Reporting Security & Compliance Service Desk Performance Management Cash Management Vendor Management Advisory Service Foundational ATMs Foundational: US community financial institution, 25 ATMs ATM as a Service As a Service: Shift to As a Service model, predictable, recurring 2.5x revenue Total Contract Value: $1,710K Total Contract Value: $4,280K Key Customers Year 5 $1,050K $150K $160K $170K $180K Year 4Year 3Year 2Year 1 Total $1,710K Year 5 $760K $800K $870K $900K $950K Year 4Year 3Year 2Year 1 Total $4,280K Illustrative purposes only Overall bank spend decreases while Atleos overall wallet share increases

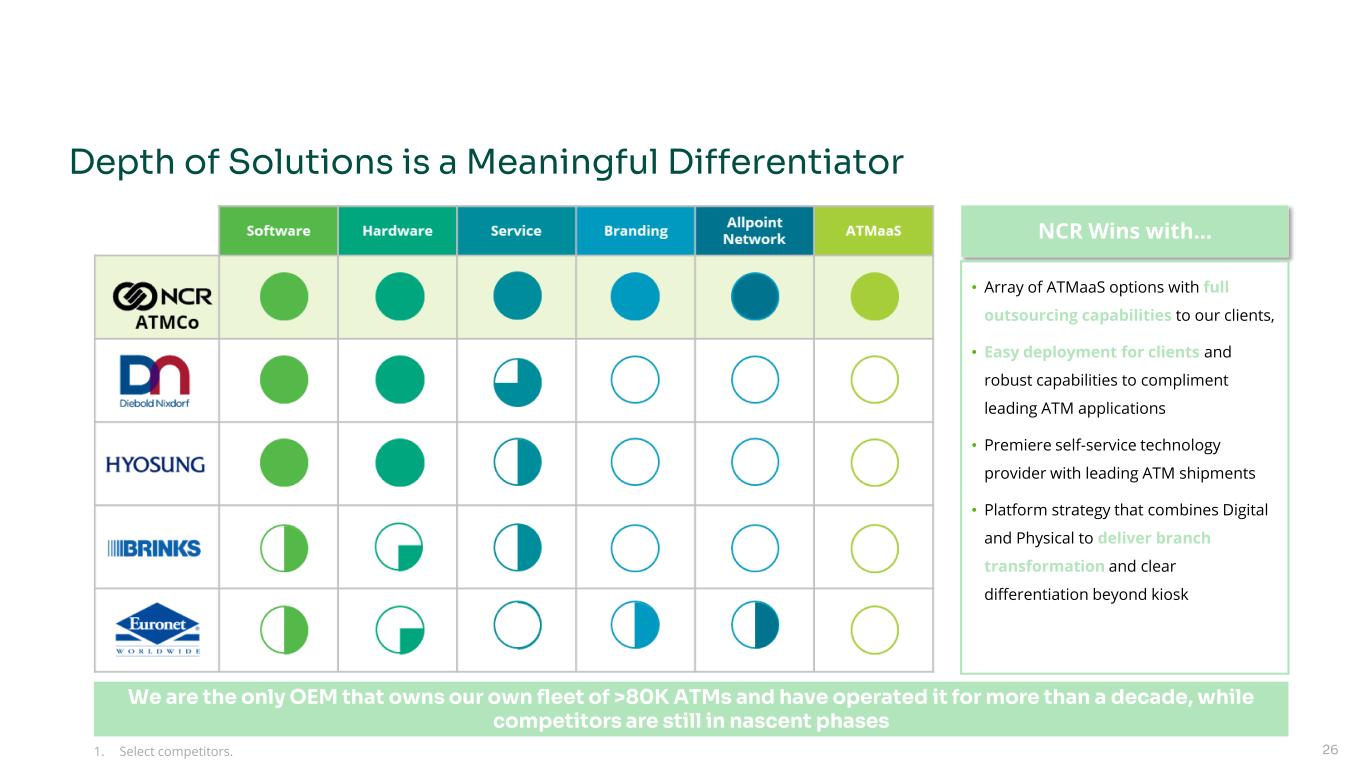

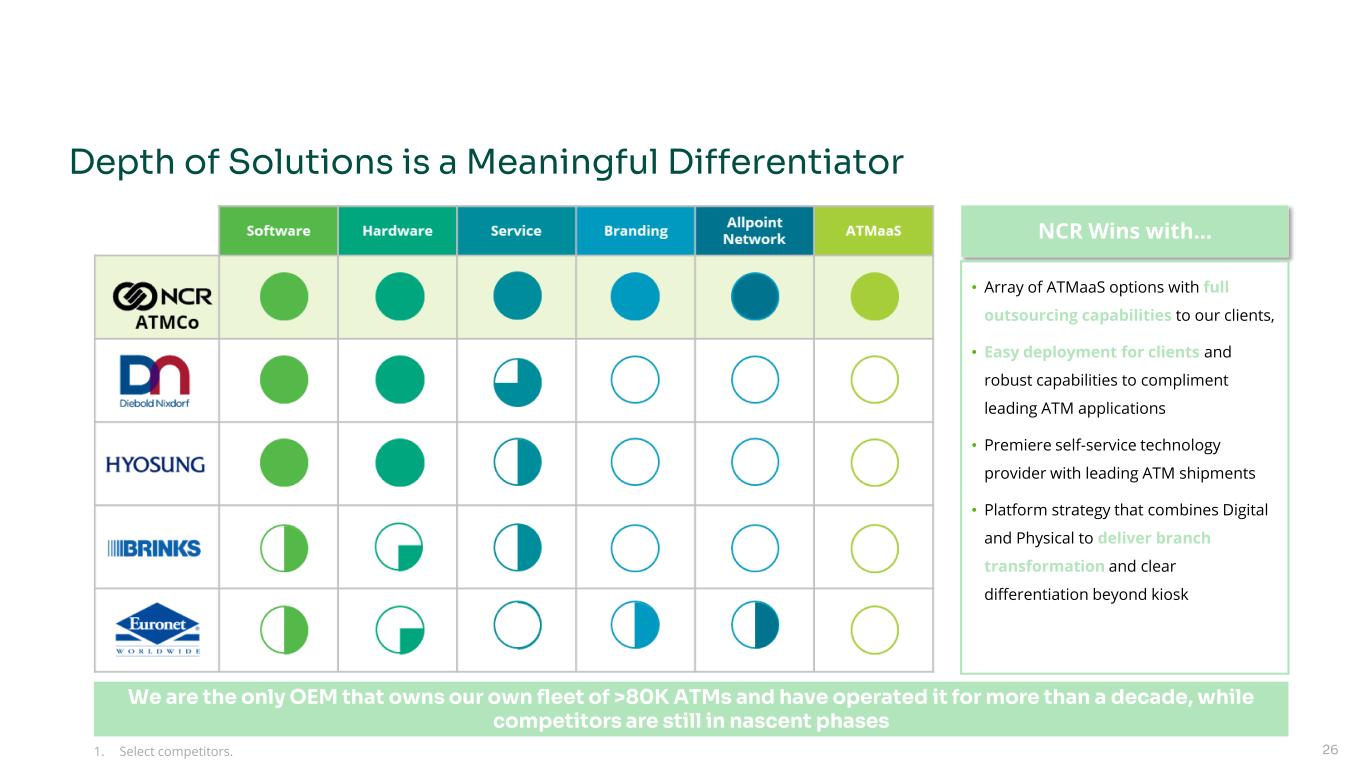

NCR Wins with… • Array of ATMaaS options with full outsourcing capabilities to our clients, • Easy deployment for clients and robust capabilities to compliment leading ATM applications • Premiere self-service technology provider with leading ATM shipments • Platform strategy that combines Digital and Physical to deliver branch transformation and clear differentiation beyond kiosk 1. Select competitors. We are the only OEM that owns our own fleet of >80K ATMs and have operated it for more than a decade, while competitors are still in nascent phases 26 Depth of Solutions is a Meaningful Differentiator

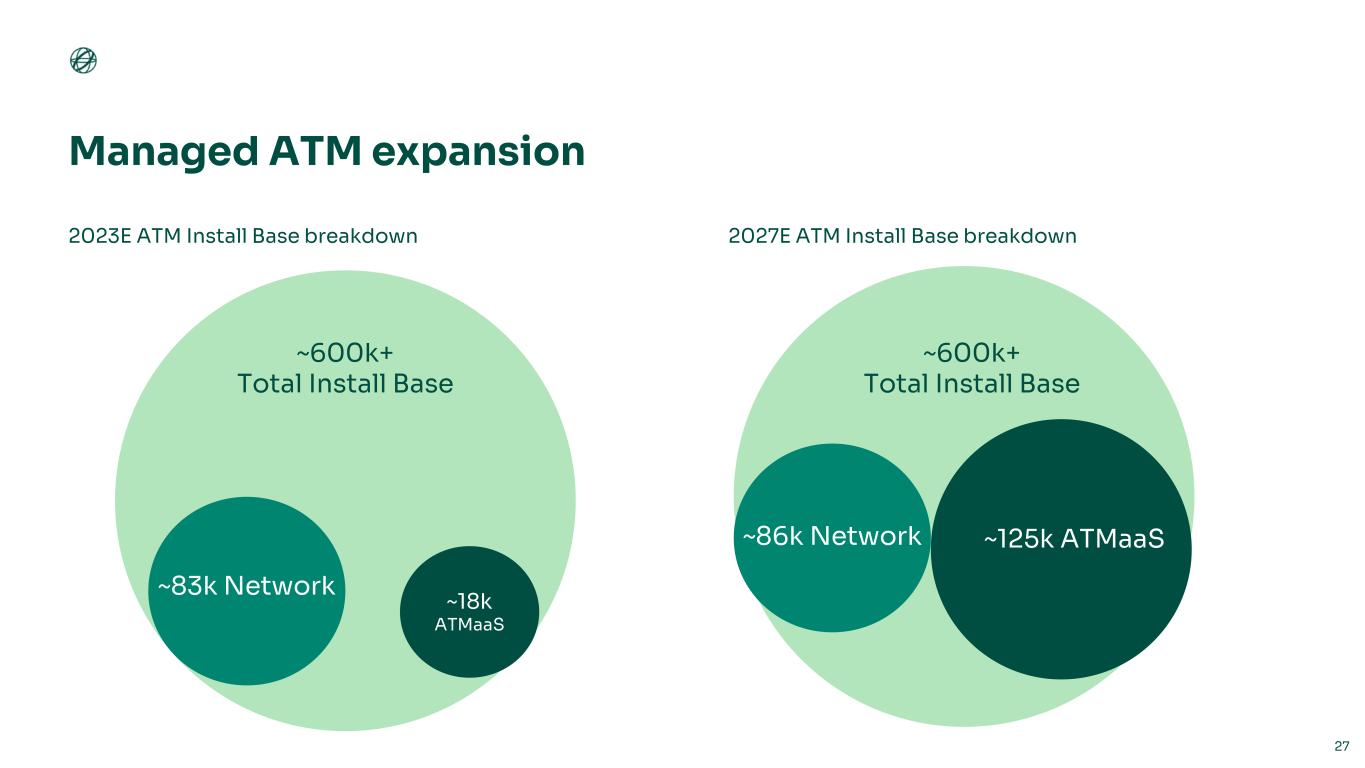

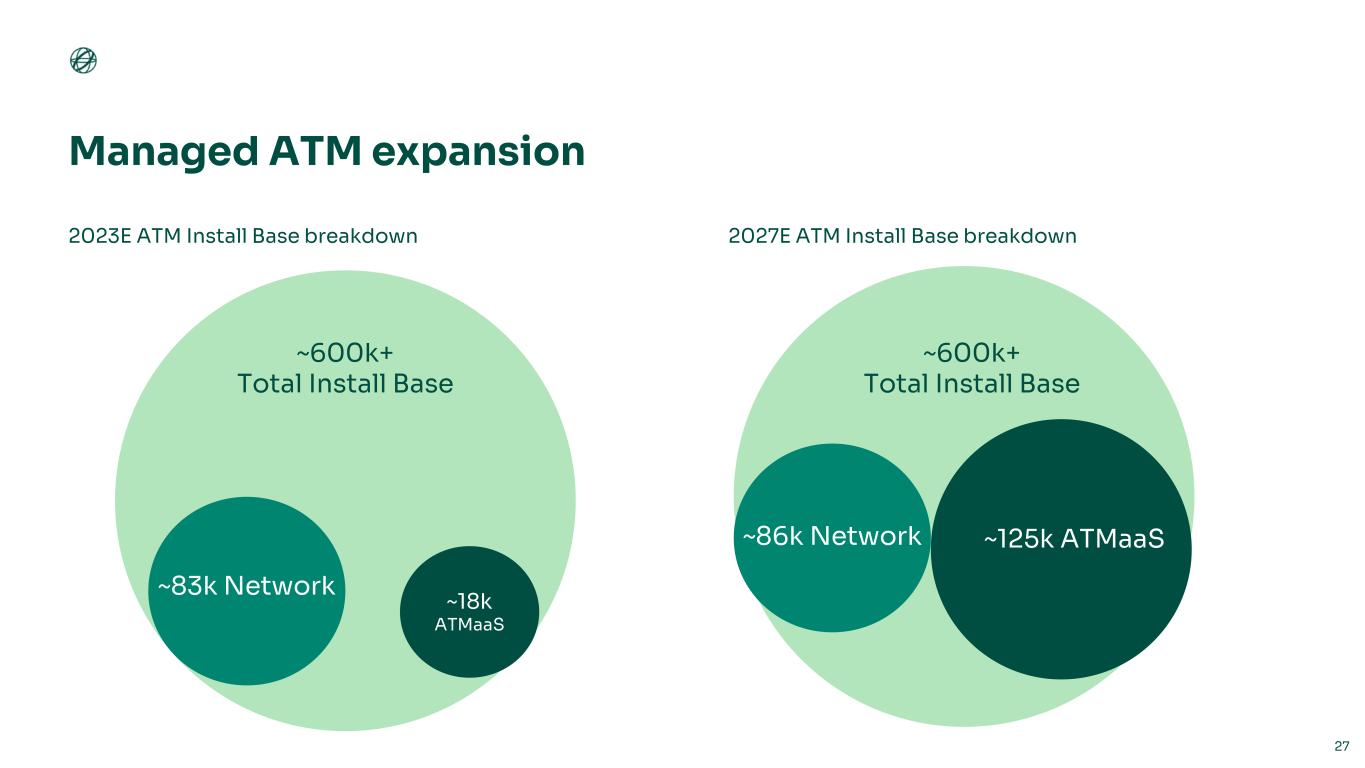

Managed ATM expansion 27 2023E ATM Install Base breakdown 2027E ATM Install Base breakdown ~600k+ Total Install Base ~600k+ Total Install Base ~18k ATMaaS ~86k Network ~125k ATMaaS ~83k Network

2027 Financial Targets 28*See definition in Supplementary Materials. Total Revenue 6% CAGR ’23E-’27E Adj. EBITDA* 15% CAGR ’23E-’27E Free Cash Flow* $5.5B $1.4B $0.5B Increasing recurring revenue* profile to 80% with 11% CAGR ’23E-’27E 25% Adj. EBITDA* margins 30% FCF conversion* Revenue Margins Cash Flow

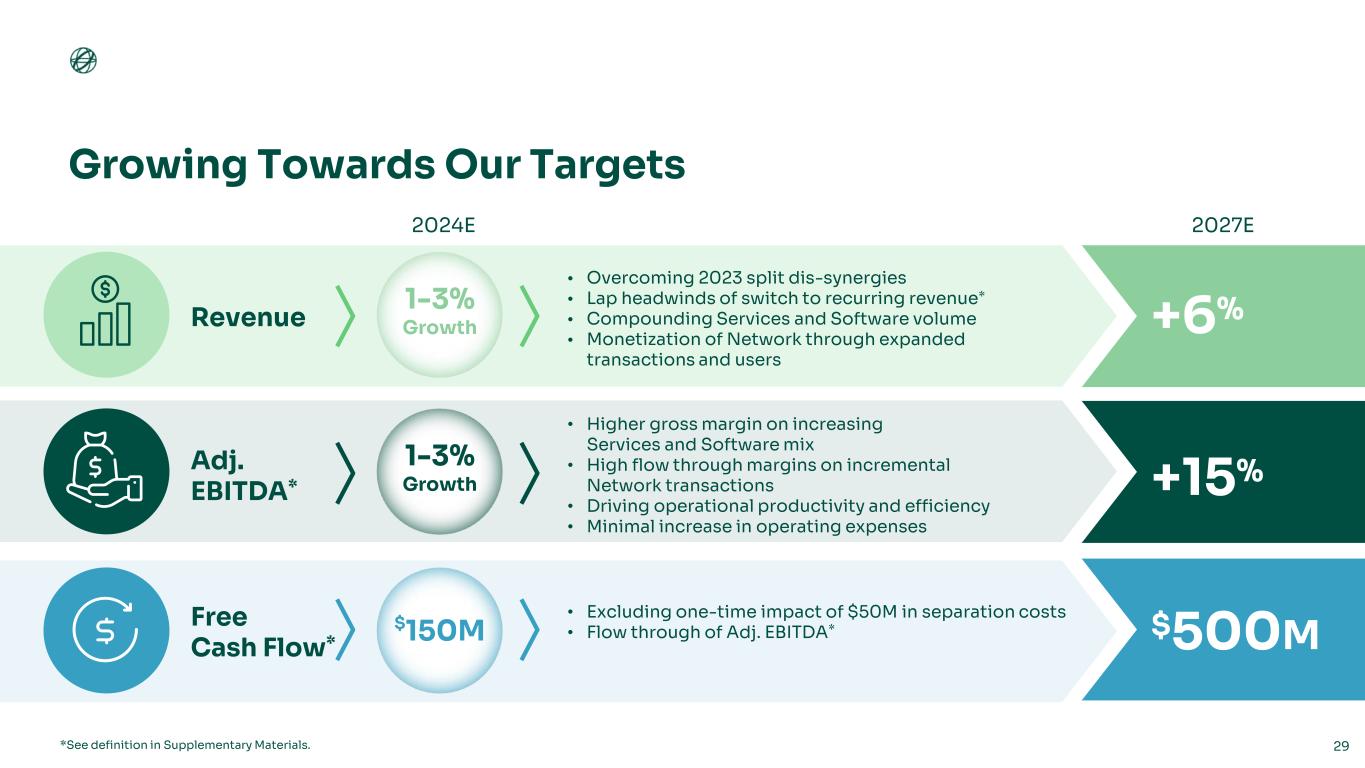

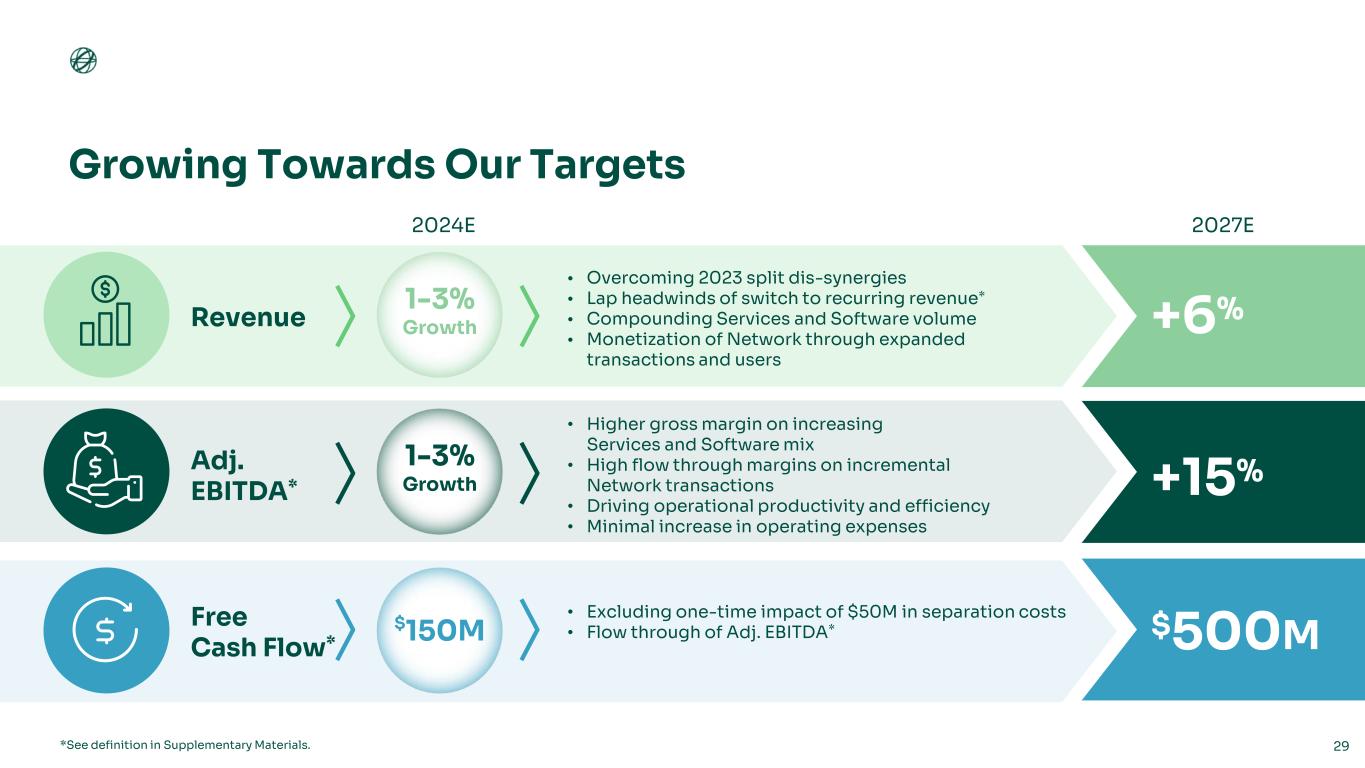

Growing Towards Our Targets 29*See definition in Supplementary Materials. Revenue Adj. EBITDA* Free Cash Flow* • Overcoming 2023 split dis-synergies • Lap headwinds of switch to recurring revenue* • Compounding Services and Software volume • Monetization of Network through expanded transactions and users • Higher gross margin on increasing Services and Software mix • High flow through margins on incremental Network transactions • Driving operational productivity and efficiency • Minimal increase in operating expenses • Excluding one-time impact of $50M in separation costs • Flow through of Adj. EBITDA* +6% +15% $500M 2027E2024E 1-3% Growth 1-3% Growth $150M

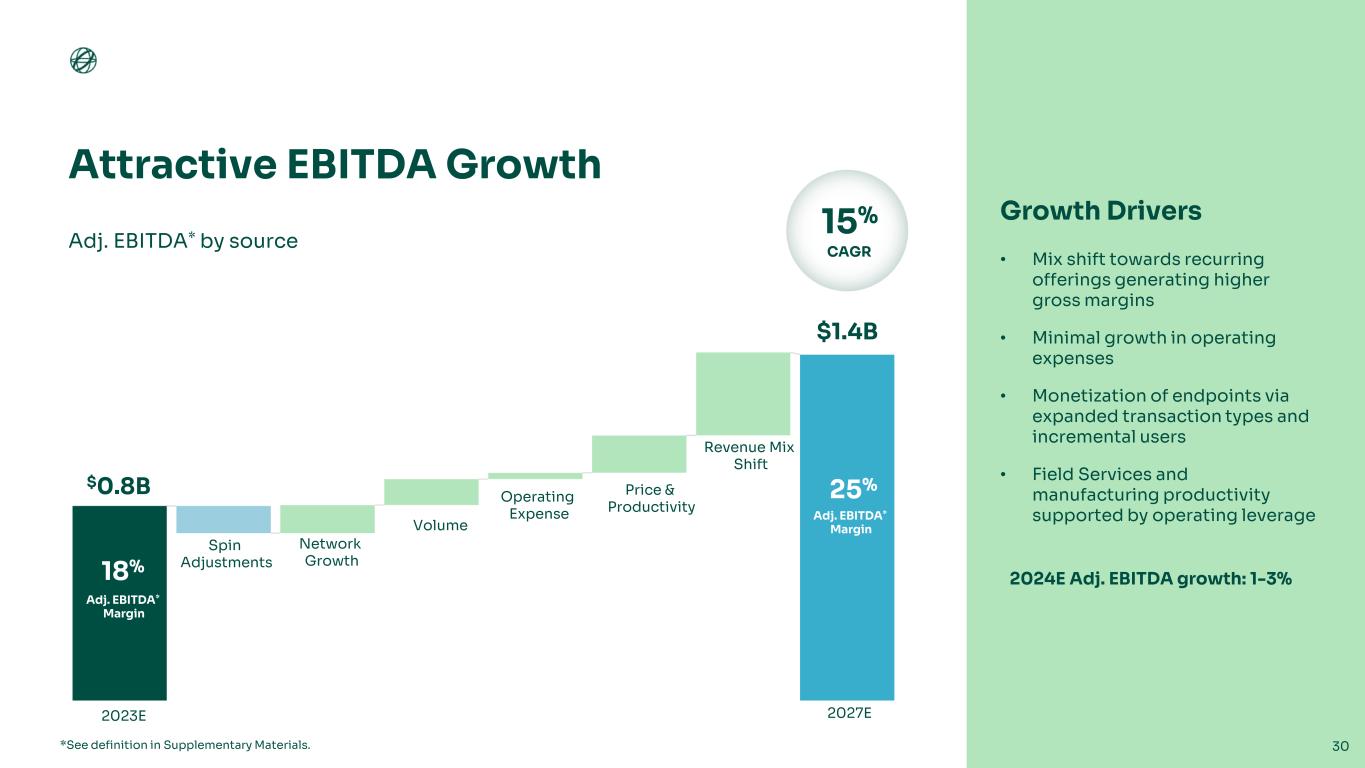

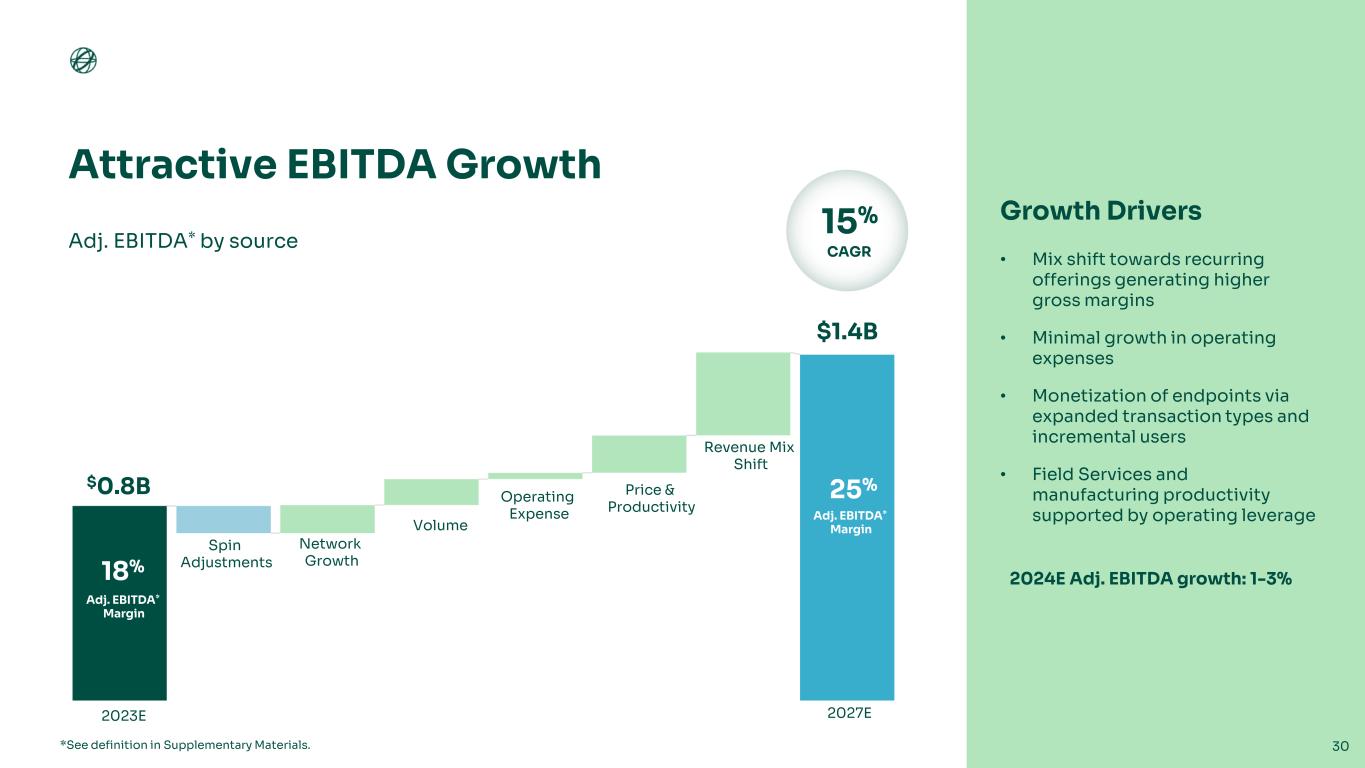

Attractive EBITDA Growth *See definition in Supplementary Materials. 25% 15% CAGR $1.4B $0.8B Spin Adjustments 2023E 2027E Network Growth Volume Price & Productivity Revenue Mix Shift 18% Adj. EBITDA* Margin Operating Expense Adj. EBITDA* Margin Adj. EBITDA* by source 30 Growth Drivers • Mix shift towards recurring offerings generating higher gross margins • Minimal growth in operating expenses • Monetization of endpoints via expanded transaction types and incremental users • Field Services and manufacturing productivity supported by operating leverage 2024E Adj. EBITDA growth: 1-3%

Atleos Adjusted EBITDA Margin Rate Expansion *See definition in Supplementary Materials. ~15% CAGR ~25% ~18%% Adj. EBITDA* Margin Adj. EBITDA* Margin 31 • 2024 margin impacted by one time spin costs offset by cost savings initiatives • Topline revenue growth with minimal increase to cost driving ~500 bps of margin improvement • Lowered operating costs with continued cost saving initiatives driving ~200 bps of margin improvement 0-150 bps 150-250 bps 200-300 bps Growth Drivers Adj. EBITDA margin* growth: 1-3% $0.8B $1.4B 200-300 bps Productivity augmented by mix shift Mix shift and scale leverage augmented by productivity

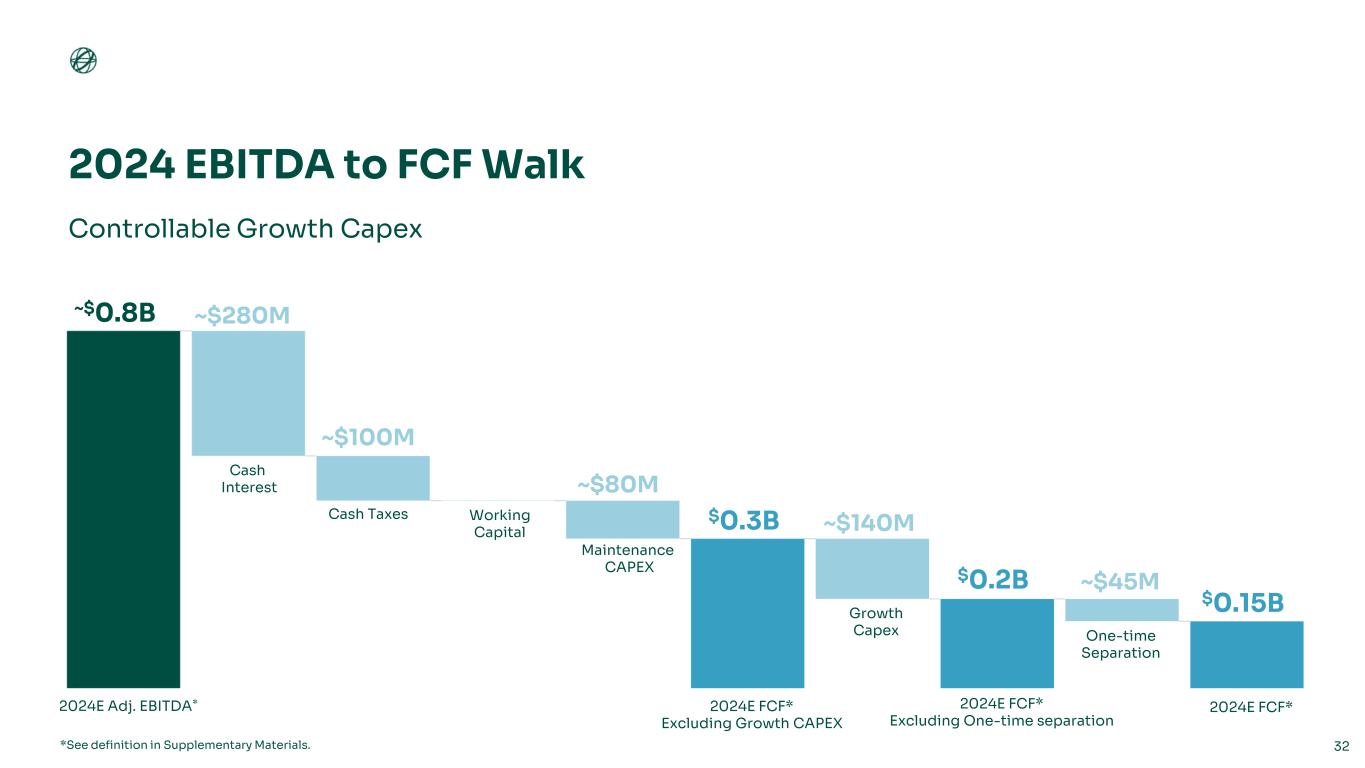

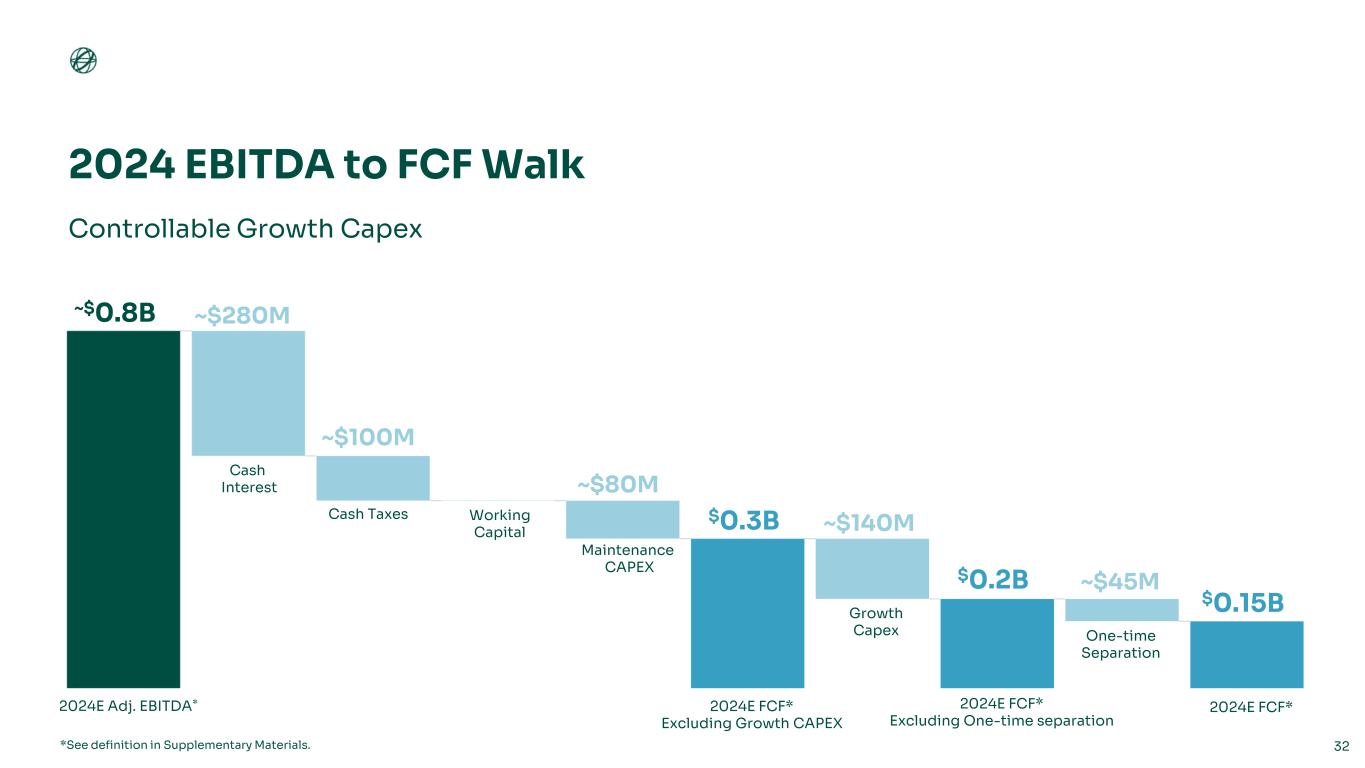

2024 EBITDA to FCF Walk 32*See definition in Supplementary Materials. Cash Taxes 2024E Adj. EBITDA* 2024E FCF* Working Capital Maintenance CAPEX $0.15BGrowth Capex Cash Interest ~$0.8B $0.3B ~$280M 2024E FCF* Excluding Growth CAPEX ~$100M ~$80M ~$140M One-time Separation ~$45M$0.2B 2024E FCF* Excluding One-time separation Controllable Growth Capex

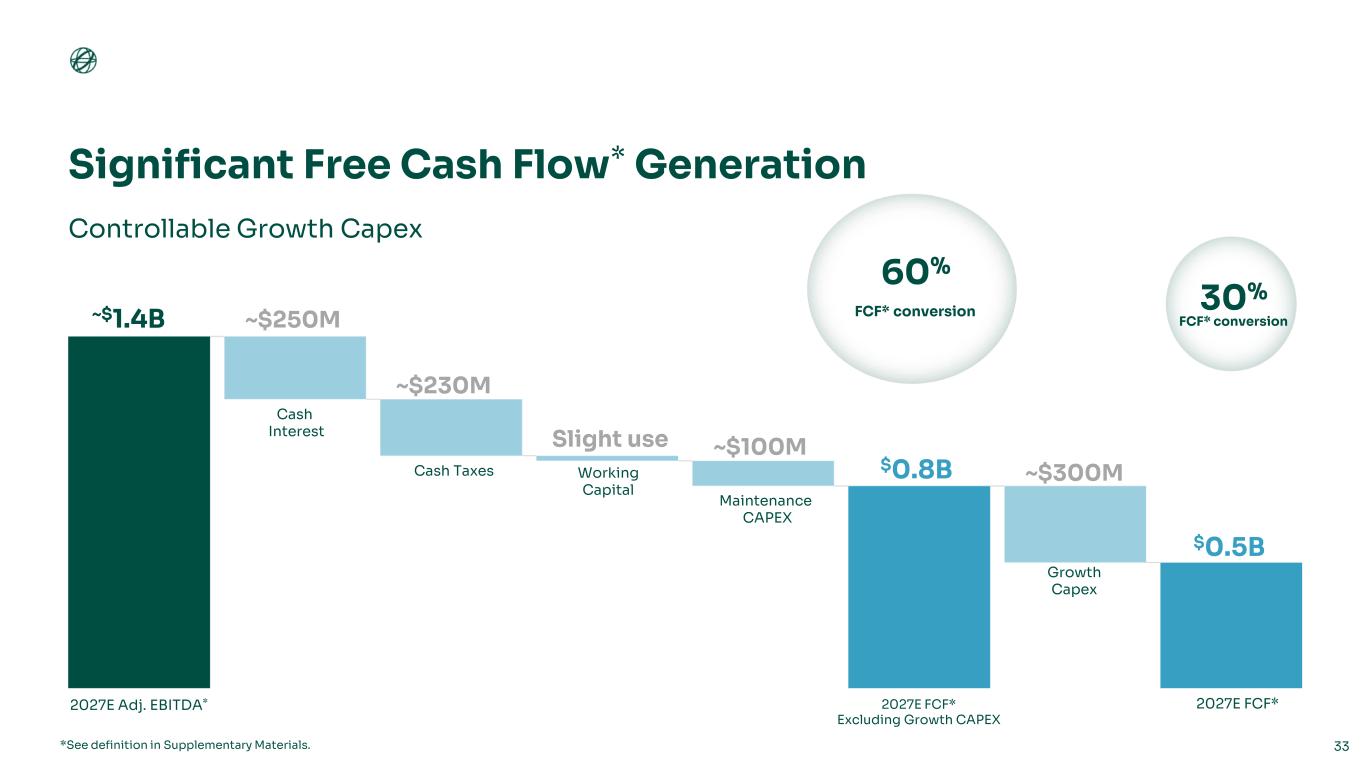

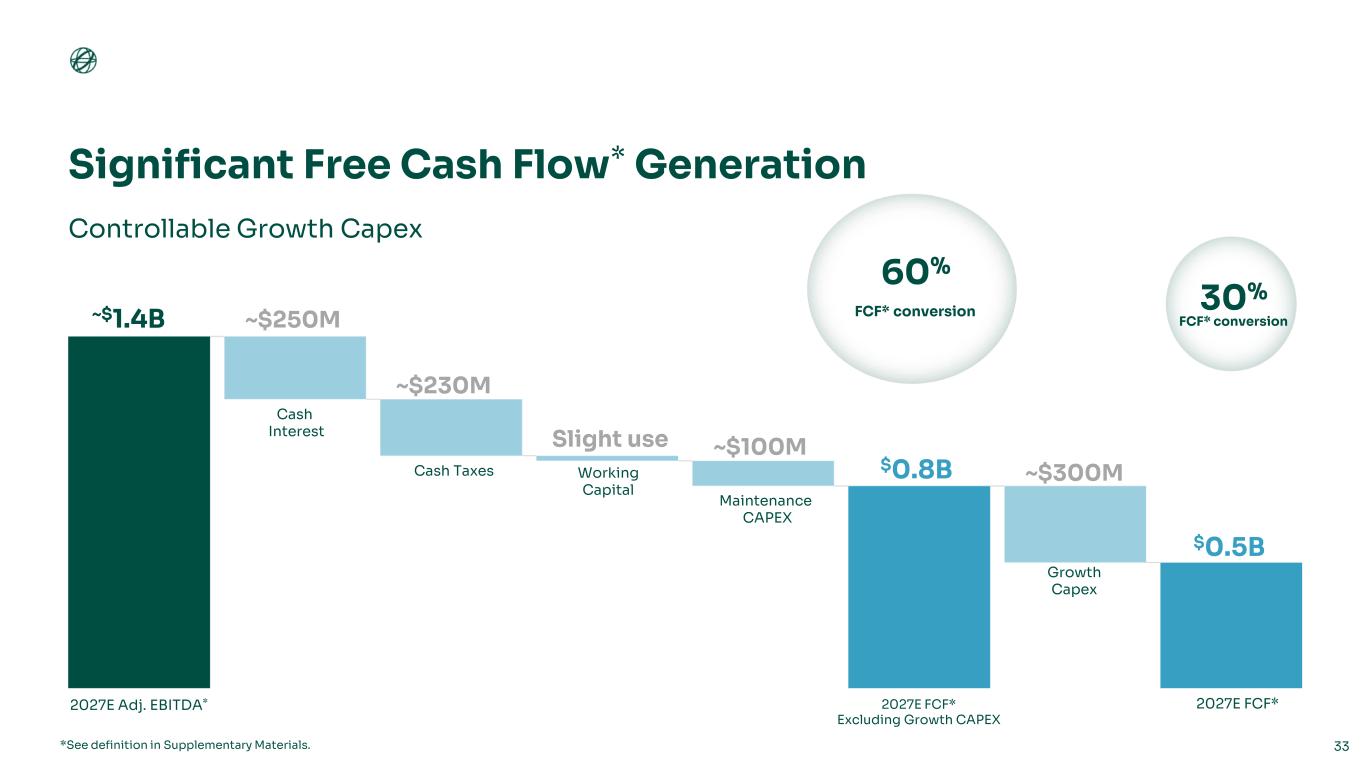

Significant Free Cash Flow* Generation 33*See definition in Supplementary Materials. Cash Taxes 2027E Adj. EBITDA* 2027E FCF* Working Capital Maintenance CAPEX $0.5B Growth Capex Cash Interest ~$1.4B 60% FCF* conversion $0.8B ~$250M 2027E FCF* Excluding Growth CAPEX ~$230M Slight use ~$100M ~$300M 30% FCF* conversion Controllable Growth Capex

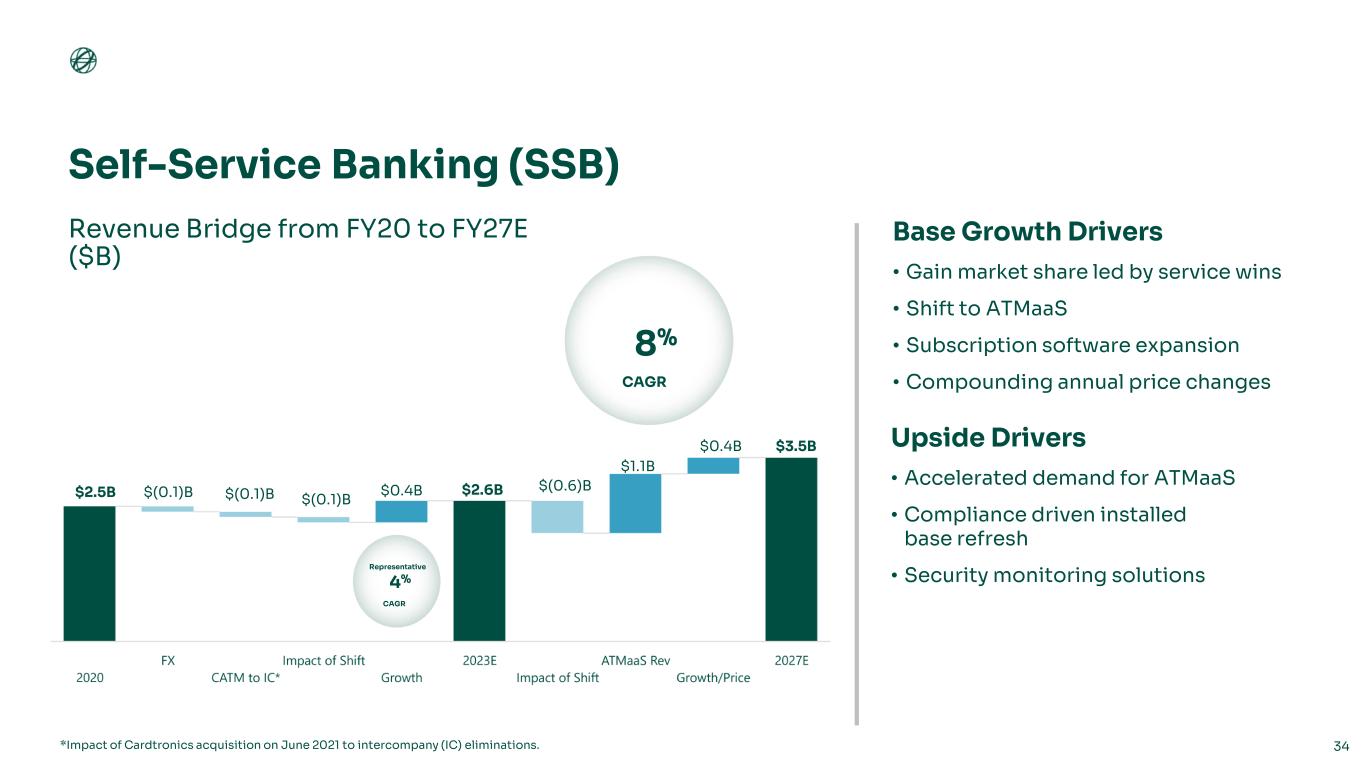

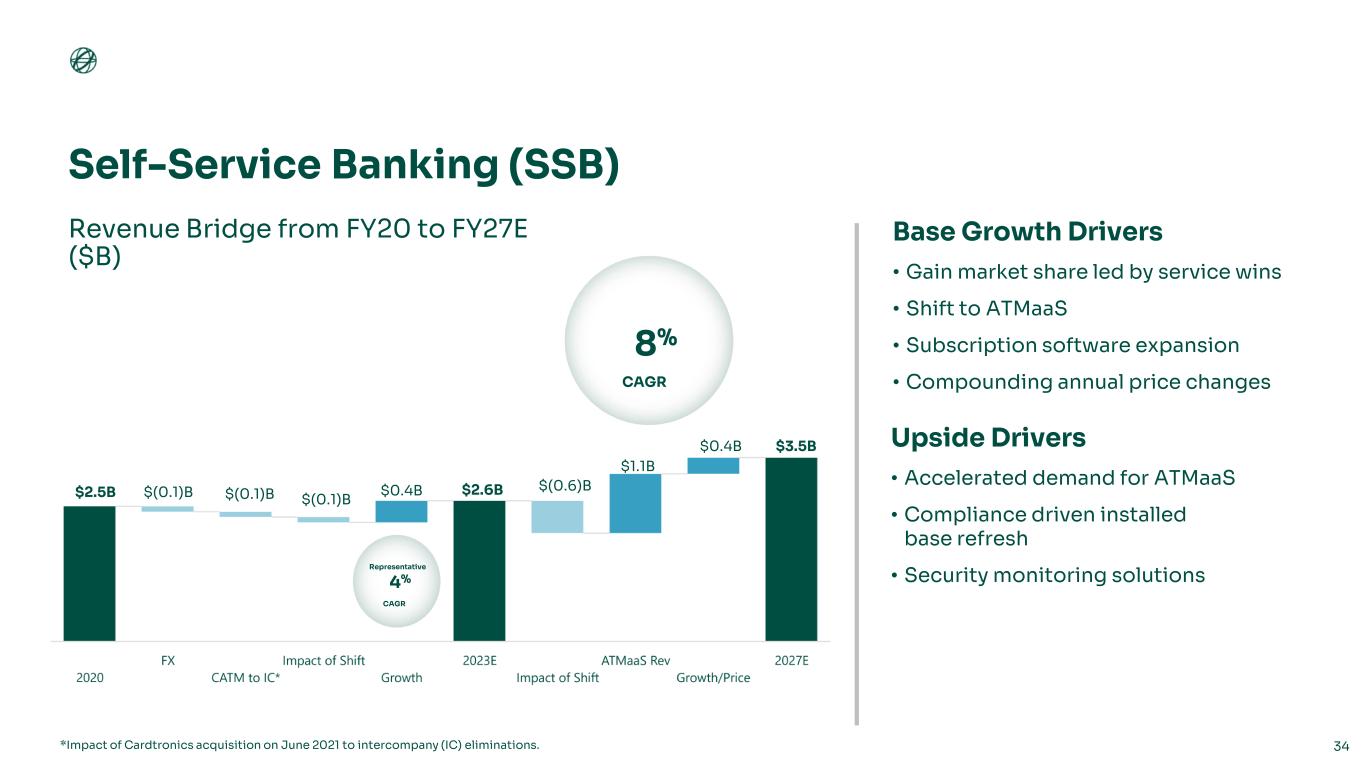

*Impact of Cardtronics acquisition on June 2021 to intercompany (IC) eliminations. Self-Service Banking (SSB) 34 Revenue Bridge from FY20 to FY27E ($B) Base Growth Drivers • Gain market share led by service wins • Shift to ATMaaS • Subscription software expansion • Compounding annual price changes Upside Drivers • Accelerated demand for ATMaaS • Compliance driven installed base refresh • Security monitoring solutions 8% CAGR 4% CAGR Representative $2.5B $(0.1)B $(0.1)B $(0.1)B $0.4B $(0.6)B $1.1B $0.4B $3.5B $2.6B

Network Revenue Bridge 35 2020 to 2027E Revenue ($B) $0.3B $1.3B $1B $1.7B$0.4B 9% CAGR 7% CAGR *The 2020 Network revenue has been adjusted to reflect the historical revenue of Cardtronics plc prior to its acquisition in June 2021

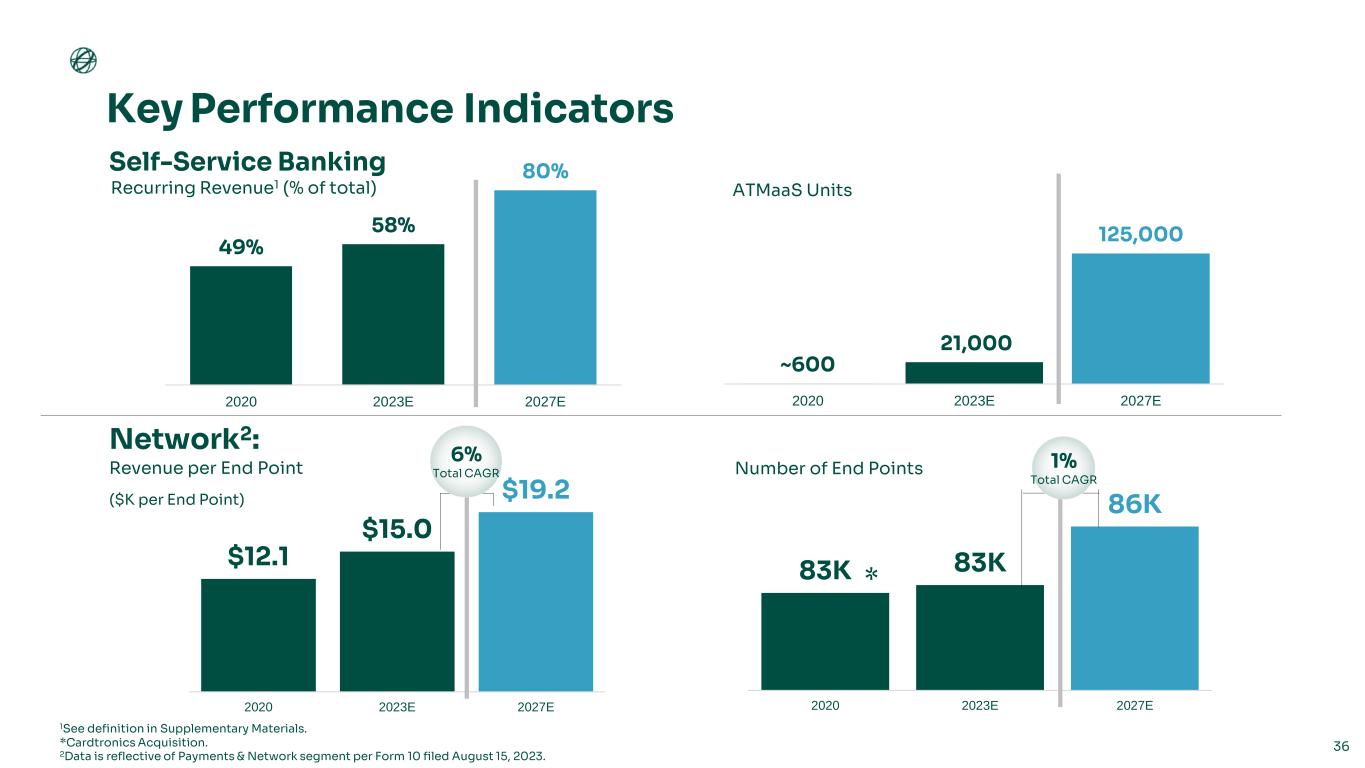

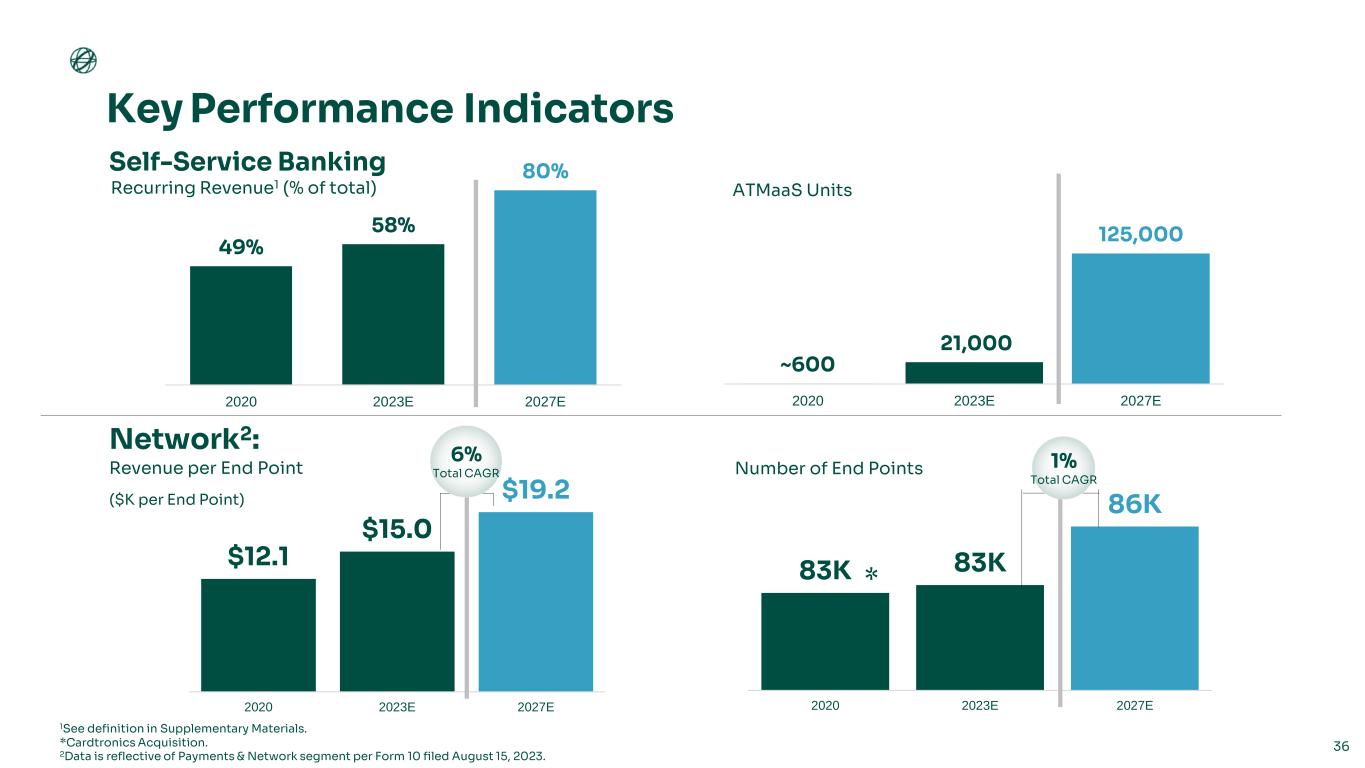

Self-Service Banking 36 Recurring Revenue1 (% of total) ATMaaS Units 49% 58% 80% 2020 2023E 2027E ~600 21,000 125,000 2020 2023E 2027E 1See definition in Supplementary Materials. Network2: Key Performance Indicators Revenue per End Point ($K per End Point) $12.1 $15.0 $19.2 2020 2023E 2027E Number of End Points 83K 83K 86K 2020 2023E 2027E 1% Total CAGR 6% Total CAGR * *Cardtronics Acquisition. 2Data is reflective of Payments & Network segment per Form 10 filed August 15, 2023.

Balance Sheet 37 Pro Forma Capital Structure ($M) 1,2 Total Debt 2,935 Cash Balance (net of $150M pension payment) 300 Revolver ($500M undrawn at close) - Net Debt* 2,635 Adj. EBITDA* 779 Net Leverage Ratio* 3.4x Targeting 3.0x by mid 2025 Long Term Target: 2.5x – 3.0x No debt expected to mature through 2027 Limited expected exposure to mandatory pension contributions Expecting sufficient liquidity to support operations and capital allocation priorities Pension Assumptions ($M)1 Unfunded US Pension as of December 31, 2022 407 Atleos Contribution at Close (150) Estimated position as of December 31, 2023 257 Net Leverage Ratio* including pension 3.7x *See definition in Supplementary Materials. 1. As filed in Form 10 dated August 15, 2023. 2. Adjusted EBITDA reflects management estimate for full year 2023E.

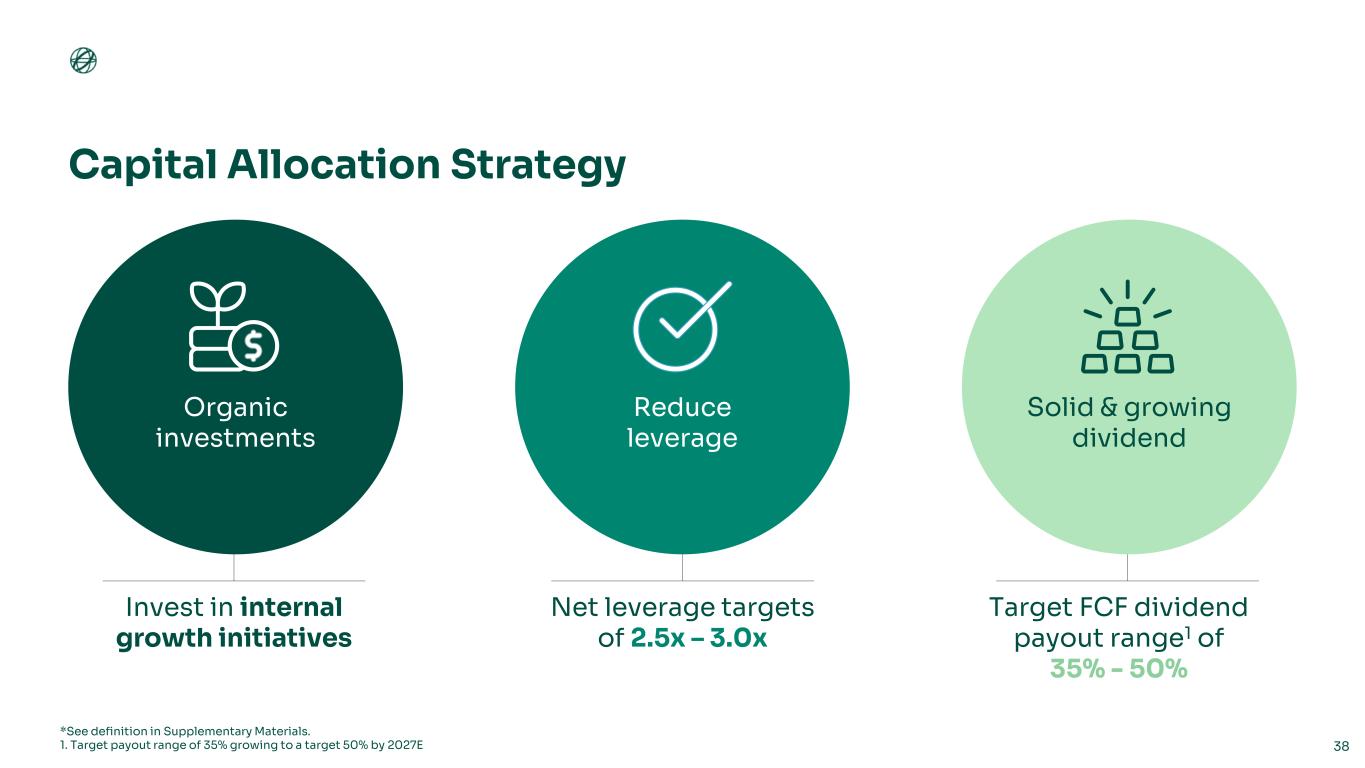

*See definition in Supplementary Materials. 1. Target payout range of 35% growing to a target 50% by 2027E Capital Allocation Strategy 38 Organic investments Reduce leverage Solid & growing dividend Invest in internal growth initiatives Net leverage targets of 2.5x – 3.0x Target FCF dividend payout range1 of 35% - 50%

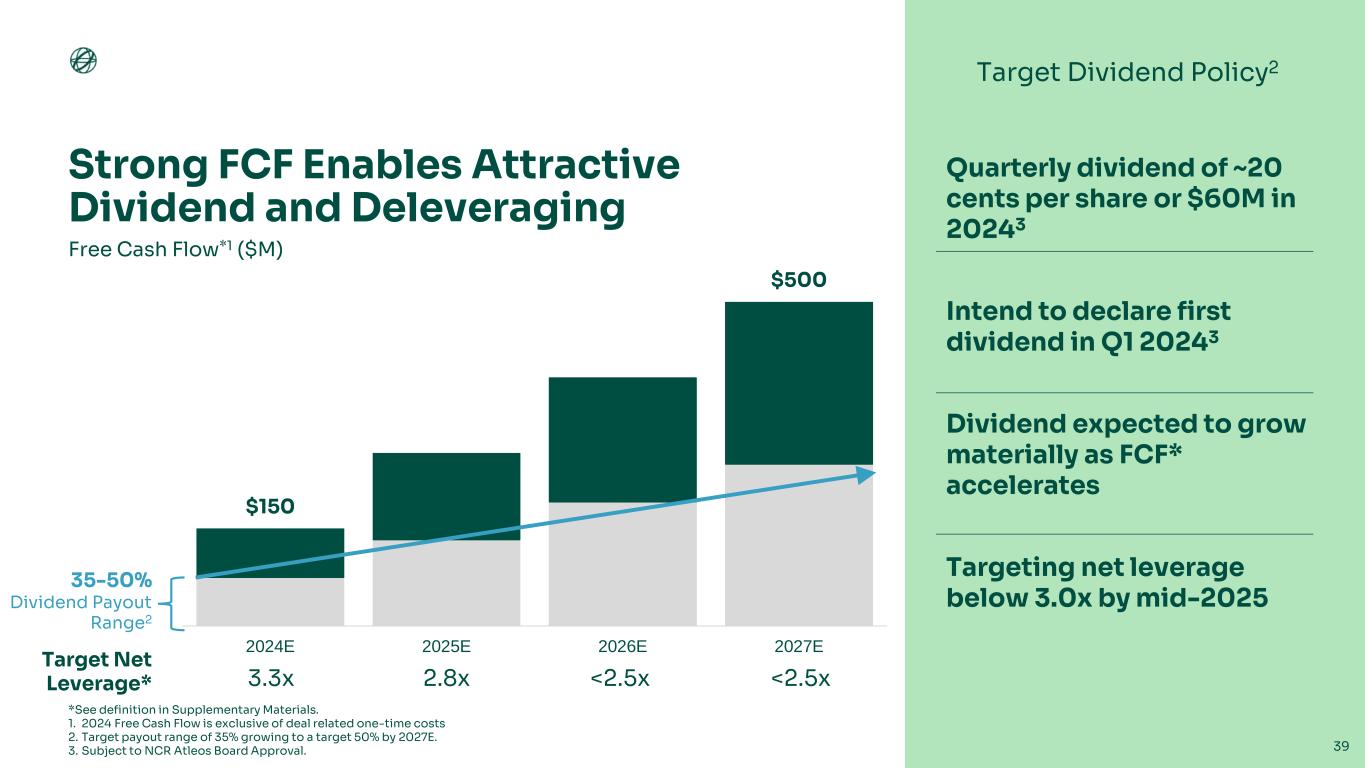

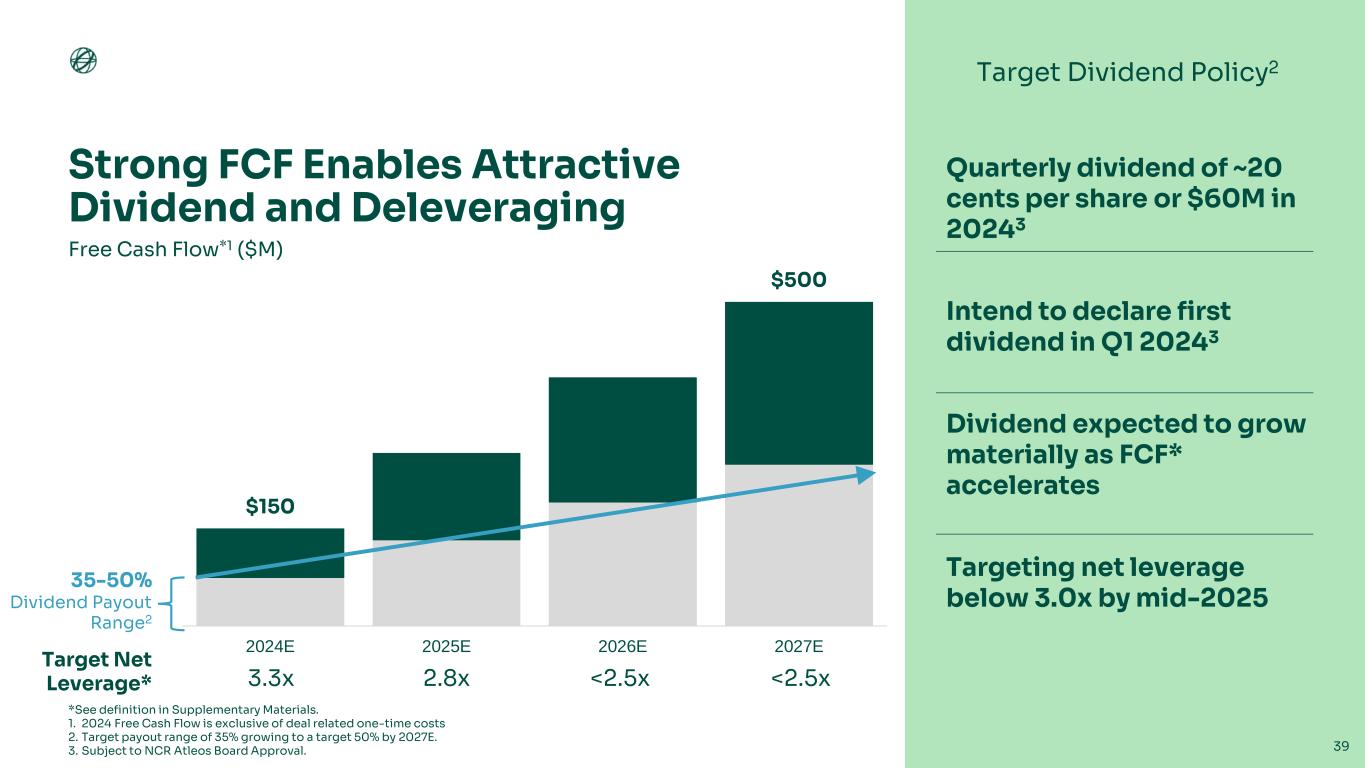

Strong FCF Enables Attractive Dividend and Deleveraging $150 $500 2024E 2025E 2026E 2027E *See definition in Supplementary Materials. 1. 2024 Free Cash Flow is exclusive of deal related one-time costs 2. Target payout range of 35% growing to a target 50% by 2027E. 3. Subject to NCR Atleos Board Approval. 35-50% Dividend Payout Range2 3.3x 2.8x <2.5x <2.5x Target Net Leverage* Free Cash Flow*1 ($M) 39 Target Dividend Policy2 Quarterly dividend of ~20 cents per share or $60M in 20243 Intend to declare first dividend in Q1 20243 Dividend expected to grow materially as FCF* accelerates Targeting net leverage below 3.0x by mid-2025

Investment Thesis 40 1 Steady global demand for cash and physical transactions suggests sustained demand for ATM capability. 2 Market leader with unmatched scale and installed base will enable above-market growth. 3 Best positioned to benefit from accelerating bank outsourcing, branch rationalization, and neobank growth. 4 Emphasis on Network and ATM as a Service offerings delivers more recurring revenue and more predictable profitability and cash flows. 5 Prudent capital deployment that prioritizes high return organic growth opportunities, reducing leverage, and paying a dividend.

Q&A 41

Supplementary Materials 42

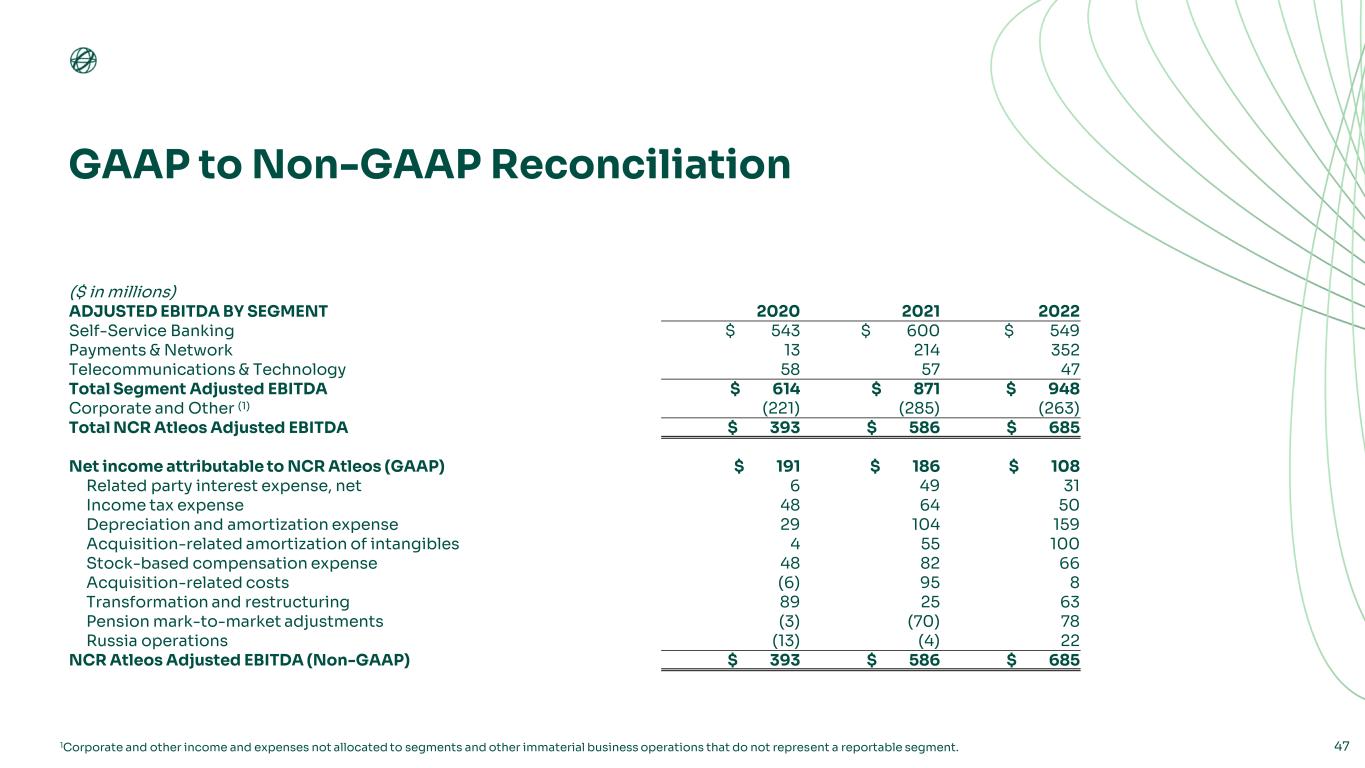

Non-GAAP Measures Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (“Adjusted EBITDA”) NCR Atleos’s management uses the non-GAAP measure Adjusted EBITDA because it provides useful information to investors as an indicator of performance of the Company's ongoing business operations. NCR Atleos determines Adjusted EBITDA based on GAAP Net income attributable to NCR Atleos plus interest expense, net; plus income tax expense (benefit); plus depreciation and amortization; plus acquisition-related costs; plus pension mark-to-market adjustments, pension settlements, pension curtailments and pension special termination benefits; plus separation-related costs; plus transformation and restructuring charges (which includes integration, severance and other exit and disposal costs); plus stock-based compensation expense; plus other (expense) income items. These adjustments are considered non-operational or non-recurring in nature and are excluded from the Adjusted EBITDA metric utilized by our chief operating decision maker (“CODM”) in evaluating segment performance and are separately delineated to reconcile back to total reported income attributable to NCR Atleos. This format is useful to investors because it allows analysis and comparability of operating trends. It also includes the same information that is used by NCR Atleos management to make decisions regarding our segments and to assess our financial performance. Adjusted EBITDA margin is calculated based on Adjusted EBITDA as a percentage of total revenue. Adjusted EBITDA CAGR is the compound annual growth rate of Adjusted EBITDA over the relevant disclosed period of time. Special Item Related to Russia The war in Eastern Europe and related sanctions imposed on Russia and related actors by the United States and other jurisdictions required us to commence the orderly wind down of our operations in Russia in the first quarter of 2022. As of June 30, 2023, we have ceased operations in Russia and are in the process of dissolving our only subsidiary in Russia. As a result, for the six and twelve months ended June 30, 2023 and twelve months ended December 31, 2022, our presentation of segment revenue and Adjusted EBITDA excludes the immaterial impact of our operating results in Russia, as well as the impact of impairments taken to write down the carrying value of assets and liabilities, severance charges, and the assessment of collectability on revenue recognition. We consider this to be a non-recurring special item and management has reviewed the results of its business segments excluding these impacts. NCR Atleos reports its results in accordance with generally accepted accounting principles (GAAP) in the United States, comments made during this presentation and in these materials will include or make reference to certain non-GAAP measures. These measures are included to provide additional useful information regarding NCR Atleos’s financial results and are not a substitute for their comparable GAAP measures. NCR Atleos’s definitions and calculations of these non-GAAP measures may differ from similarly titled measures reported by other companies and cannot, therefore, be compared with similarly titled measures of other companies. These non-GAAP measures should not be considered as substitutes for, or superior to, results determined in accordance with GAAP. 43

Non-GAAP Measures Net Debt NCR Atleos determines Net Debt based on its total debt less cash and cash equivalents, with total debt being defined as estimated total indebtedness expected to be incurred in connection with the planned spin-off of NCR Atleos from NCR, which is expected in the fourth quarter of 2023. Net Debt should not be considered an alternative to, or more meaningful than, total debt, the most directly comparable GAAP measure. NCR Atleos believes that Net Debt provides useful information to investors because NCR Atleos’s management reviews Net Debt as part of its management of overall liquidity, financial flexibility, capital structure and leverage. In addition, Net Debt is a measure in common use elsewhere and certain debt rating agencies and credit analysts are expected to monitor NCR Atleos’s Net Debt as part of their assessments of NCR Atleos’s business and its ability to repay its expected future debt. NCR Atleos believes that its Net Leverage Ratio, defined as Net Debt divided by trailing twelve months of Adjusted EBITDA, provides useful information to investors because it is an indicator of the Company’s ability to meet its future financial obligations. In addition, the Net Leverage Ratio is a measure frequently used by investors and credit rating agencies to assess financial position. 44

Non-GAAP Measures Adjusted Free Cash Flow–Unrestricted (“Free Cash Flow” or “FCF”) NCR Atleos defines Adjusted free cash flow-unrestricted as net cash provided by operating activities less capital expenditures for property, plant and equipment, less additions to capitalized software, plus/minus the change in restricted cash settlement activity, and plus non-recurring or discretionary pension contributions and settlements. Restricted cash settlement activity represents the net change in amounts collected on behalf of, but not yet remitted to, certain of the Company’s merchant customers or third-party service providers that are pledged for a particular use or restricted to support these obligations. These amounts can fluctuate significantly period to period based on the number of days for which settlement to the merchant has not yet occurred or day of the week on which a reporting period ends. NCR Atleos’s management believes Adjusted free cash flow-unrestricted information is useful for investors because it indicates the amount of cash available after these adjustments for, among other things, investments in NCR Atleos’s existing businesses, and strategic acquisitions. Adjusted free cash flow-unrestricted does not represent the residual cash flow available, since there may be other non-discretionary expenditures that are not deducted from the measure. Adjusted free cash flow-unrestricted does not have a uniform definition under GAAP, and therefore NCR Atleos’s definition may differ from other companies’ definitions of this measure. This non-GAAP measure should not be considered a substitute for, or superior to, cash flows from operating activities under GAAP. Free Cash Flow (“FCF”) Conversion is defined as Adjusted Free Cash Flow-unrestricted divided by Adjusted EBITDA. 45

Non-GAAP Measures Non-GAAP Reconciliations With respect to our Adjusted EBITDA, Adjusted EBITDA margin, Net leverage ratio, and Adjusted free cash flow-unrestricted estimates for fiscal years 2023 and 2027, we are not providing a reconciliation of the respective GAAP measures because we are not able to predict with reasonable certainty the reconciling items that may affect the GAAP Net income attributable to NCR Atleos, GAAP total debt, and GAAP cash flow from operating activities without unreasonable effort. The reconciling items are primarily the future impact of special tax items, capital structure transactions, restructuring, pension mark- to-market transactions, acquisitions or divestitures, or other events. These reconciling items are uncertain, depend on various factors and could significantly impact, either individually or in the aggregate, the GAAP measures. 46

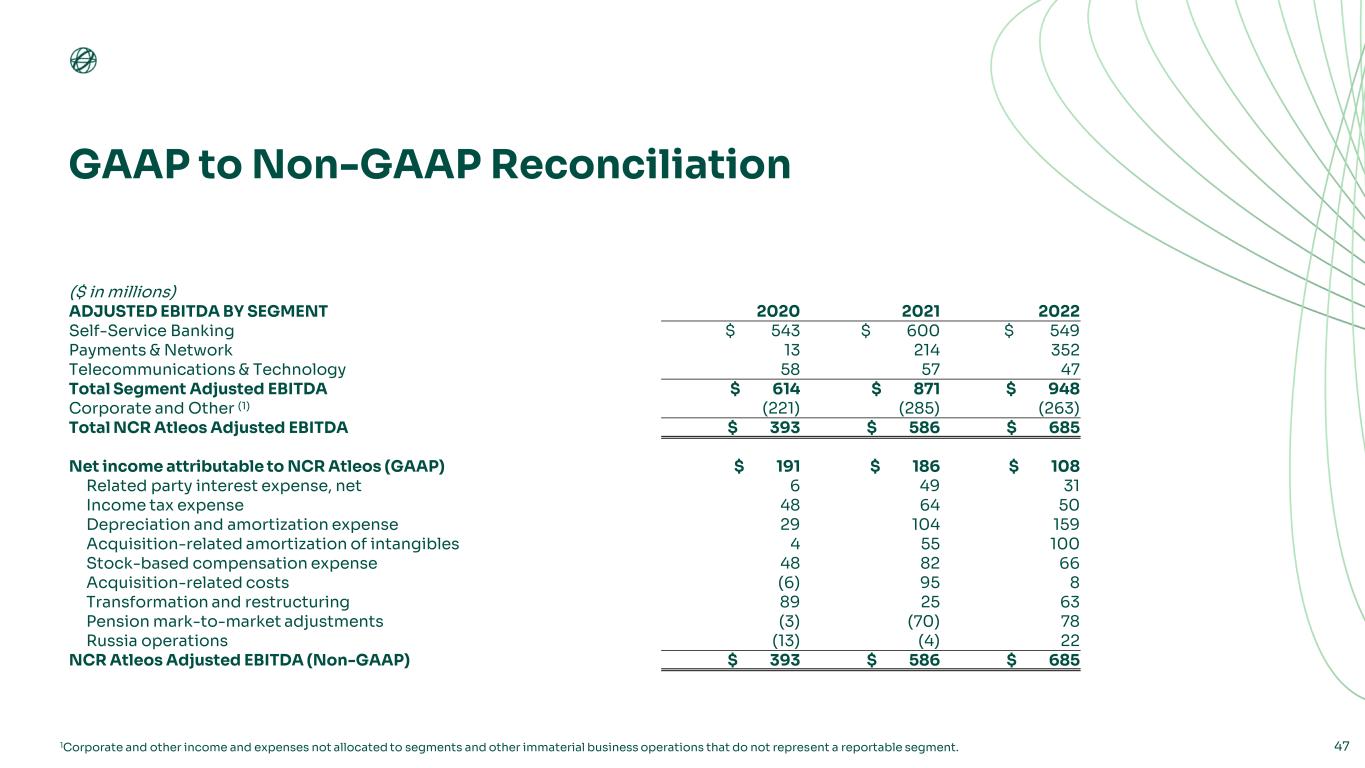

GAAP to Non-GAAP Reconciliation 471Corporate and other income and expenses not allocated to segments and other immaterial business operations that do not represent a reportable segment. ($ in millions) ADJUSTED EBITDA BY SEGMENT 2020 2021 2022 Self-Service Banking $ 543 $ 600 $ 549 Payments & Network 13 214 352 Telecommunications & Technology 58 57 47 Total Segment Adjusted EBITDA $ 614 $ 871 $ 948 Corporate and Other (1) (221) (285) (263) Total NCR Atleos Adjusted EBITDA $ 393 $ 586 $ 685 Net income attributable to NCR Atleos (GAAP) $ 191 $ 186 $ 108 Related party interest expense, net 6 49 31 Income tax expense 48 64 50 Depreciation and amortization expense 29 104 159 Acquisition-related amortization of intangibles 4 55 100 Stock-based compensation expense 48 82 66 Acquisition-related costs (6) 95 8 Transformation and restructuring 89 25 63 Pension mark-to-market adjustments (3) (70) 78 Russia operations (13) (4) 22 NCR Atleos Adjusted EBITDA (Non-GAAP) $ 393 $ 586 $ 685

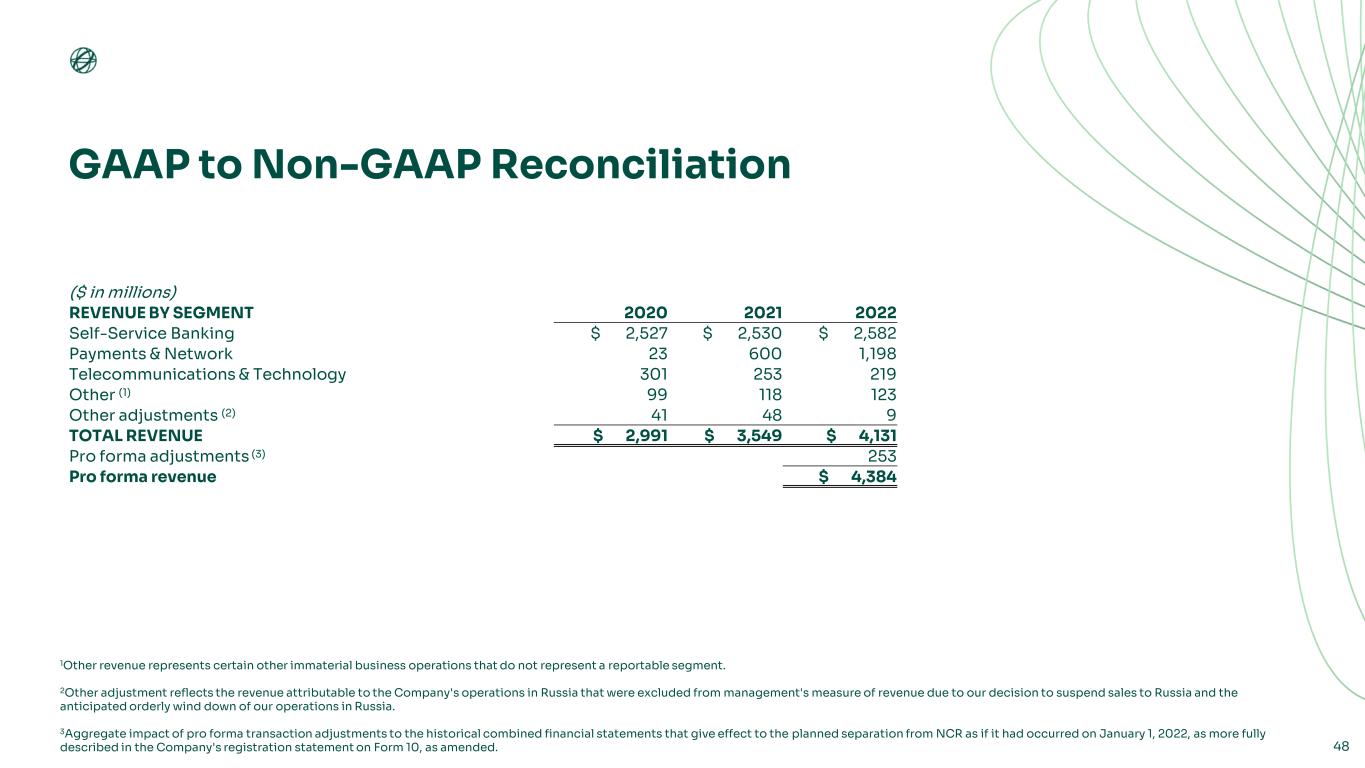

GAAP to Non-GAAP Reconciliation 48 1Other revenue represents certain other immaterial business operations that do not represent a reportable segment. 2Other adjustment reflects the revenue attributable to the Company's operations in Russia that were excluded from management's measure of revenue due to our decision to suspend sales to Russia and the anticipated orderly wind down of our operations in Russia. 3Aggregate impact of pro forma transaction adjustments to the historical combined financial statements that give effect to the planned separation from NCR as if it had occurred on January 1, 2022, as more fully described in the Company's registration statement on Form 10, as amended. ($ in millions) REVENUE BY SEGMENT 2020 2021 2022 Self-Service Banking $ 2,527 $ 2,530 $ 2,582 Payments & Network 23 600 1,198 Telecommunications & Technology 301 253 219 Other (1) 99 118 123 Other adjustments (2) 41 48 9 TOTAL REVENUE $ 2,991 $ 3,549 $ 4,131 Pro forma adjustments (3) 253 Pro forma revenue $ 4,384

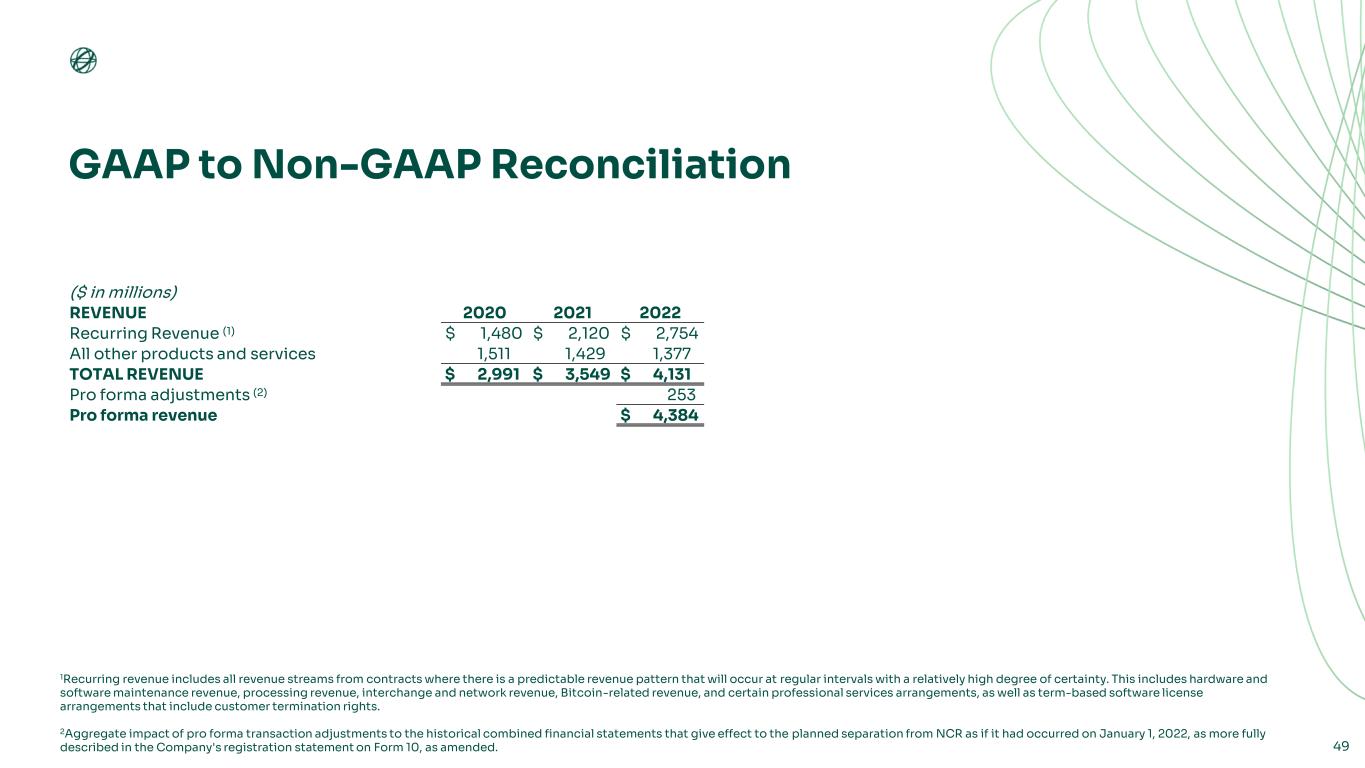

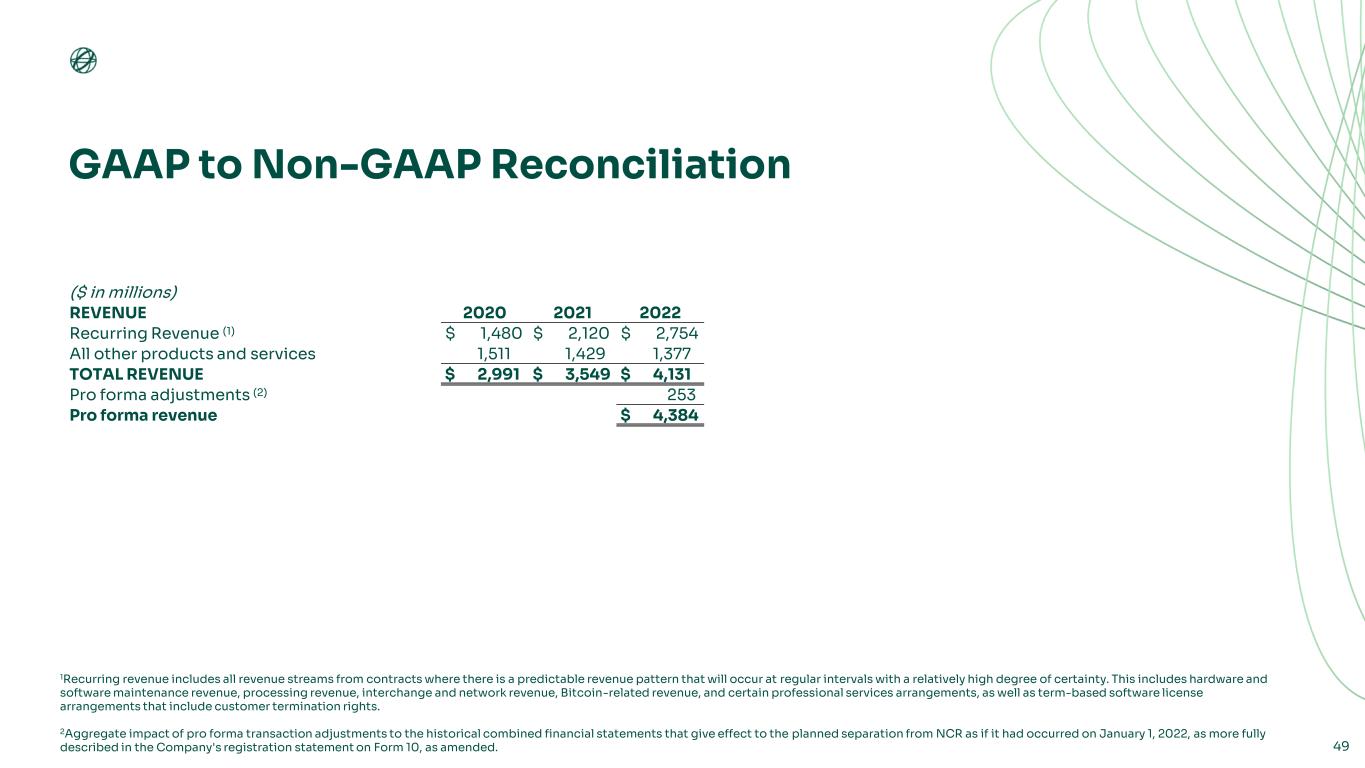

GAAP to Non-GAAP Reconciliation 49 1Recurring revenue includes all revenue streams from contracts where there is a predictable revenue pattern that will occur at regular intervals with a relatively high degree of certainty. This includes hardware and software maintenance revenue, processing revenue, interchange and network revenue, Bitcoin-related revenue, and certain professional services arrangements, as well as term-based software license arrangements that include customer termination rights. 2Aggregate impact of pro forma transaction adjustments to the historical combined financial statements that give effect to the planned separation from NCR as if it had occurred on January 1, 2022, as more fully described in the Company's registration statement on Form 10, as amended. ($ in millions) REVENUE 2020 2021 2022 Recurring Revenue (1) $ 1,480 $ 2,120 $ 2,754 All other products and services 1,511 1,429 1,377 TOTAL REVENUE $ 2,991 $ 3,549 $ 4,131 Pro forma adjustments (2) 253 Pro forma revenue $ 4,384

Certain Terms & Key Performance Indicators (KPIs) Recurring revenue - all revenue streams from contracts where there is a predictable revenue pattern that will occur at regular intervals with a relatively high degree of certainty. This includes hardware and software maintenance revenue, processing revenue, interchange and network revenue, Bitcoin-related revenue, and certain professional services arrangements, as well as term-based software license arrangements that include customer termination rights. Annual recurring revenue or “ARR” - recurring revenue, excluding software licenses sold as a subscription, for the last three months times four, plus the rolling four quarters for term-based software license arrangements that include customer termination rights. TS – Transaction Services ATM – Automated teller machine ITM – Interactive teller machine ATM-as-a-Service (“ATMaaS”) - our turnkey, end-to-end ATM platform solution, whereby we own the ATM and provide comprehensive managed services solutions to financial institutions TAM – Total addressable market EMEA – Geographic region including Europe, the Middle East and Africa APAC – Geographic region including Asia Pacific Americas – Geographic region including North and South America SSB – Our Self-Service Banking reportable segment Network transactions – revenue related to or number of payments processed across the ATM and Allpoint networks as well as Bitcoin-related revenue Hardware revenue – revenue related to ATM hardware sales Software revenue – revenue related to software license, software maintenance and professional installation services Services revenue – revenue related to hardware maintenance, professional services and ATMaaS DCC – Dynamic currency conversion fee NPS – Net Promoter Score, a measure of customer sentiment 50

Cash Usage and ATM Install Base – Additional Supporting Articles 51 • ATM market has grown in more than half of countries analyzed by RBR • U.S. ATM count grew by 21,000 terminals in 2022 • 21 states have enacted or are progressing cashless ban legislation • Cash withdrawal value recovers after pandemic impact • Cash remains a key economic driver in the Middle East / North Africa, even for e-commerce payments • INCREASE IN CASH PEOPLE HAVE 1) IN THEIR WALLET AND 2) STORED AT HOME, CAR, ETC (SOURCE: US Diary of Payment Choices 2022) • The value of cash held in a consumer’s pocket, purse, or wallet (called on-person holdings) averaged $67 in 2021, compared to $60 in 2019. [NOTE: It rose to $76 in the first pandemic year, and then fell back to $67 in 2021, which is still meaningfully higher than the average between 2016 – 2019] • The value of cash held in a consumer’s home, car, or elsewhere (called store-of-value holdings) remained elevated at $347 in 2021, compared to $299 in 2020 and $241 in 2019. • USA - CASH IS PARTICULARLY IMPORTANT FOR LOWER INCOME HOUSEHOLDS (SOURCE: US Diary of Payment Choices 2022) • Consumers in lower income households continued to rely on cash for Payments. Use of cash use is correlated with a consumer’s household income. On average, consumers in households with lower income have a higher share of cash use than those in higher income households. In 2021, the share of cash use for consumers in households making less than $25,000 was approximately three times higher (36 percent) than that of those living in households making more than $150,000 (11 percent). • USA - THE PERCENT OF CONSUMERS AGAINST A ‘CASHLESS’ SOCIETY IS INCREASING, WITH 62% AGAINST, UP FROM 57% IN 2020 (SOURCE) • The number of consumers against the idea of a cashless society, rose from 57% in 2020 to 62% in 2022, according to data from Civic Source, based on more than 11,000 responses. Only 6% of consumers said they were “all for” a cashless society, compared to 8% in 2020. • USA - THE US HOUSE OF REPRESENTATIVES HAS INTRODUCED “THE RETAILERS PAYMENT CHOICE ACT” (H.R. 4395) WHICH GUARANTEES THE RIGHT TO PAY IN CASH FOR ALL RETAIL TRANSACTIONS UNDER $2,000 (SOURCE) • The Payment Choice Act guarantees the right to pay in cash for all retail transactions under $2,000. Currently, there are 55 million Americans who lack a bank account or credit card and need to use cash to pay for goods and services. These Americans would be left out of the economy completely if cash is banned. • EURO REGION - CASH REMAINS THE MOST FREQUENTLY USED MEANS OF PAYMENT (SOURCE) • The study demonstrates that cash is still the most frequently used means of payment at point of sale, although its use in the euro area has declined. In 2016 and 2019, 79% and 72% of the total number of transactions at points of sale, such as shops and restaurants, were made in cash. • More than half of all day-to-day transactions in shops, restaurants, etc. are made using coins and banknotes. Many languages in Europe have expressions such as “cash is king” or “nur Bares ist Wahres” • GERMANY - CASH REMAINS MOST FREQUENTLY USED MEANS OF PAYMENT IN GERMANY (SOURCE - 06.07.2022 Press release Deutsche Bundesbank DE) • Cash continues to be the most frequently used means of payment in Germany, although cashless payments are increasing their share. These are the findings of the Bundesbank’s sixth study on payment behaviour in Germany for 2021. Respondents used banknotes and coins to make a total of 58% of their payments for purchases of goods and services, • Individuals carried around €100 in their wallets on average, almost as much as they did four years ago (€103). The vast majority of respondents (69%) said they intend to continue paying in cash in the future as hitherto. • NCR View : Cash use has a very long tail despite the projections of overly steep declines (SOURCE)