As Confidentially Submitted to the Securities and Exchange Commission on January 25, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Suke Limited

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s Name into English)

| Cayman Islands | 4841 | Not Applicable | ||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

Level 10, Wisma IAV

No. 86 Jalan Pasar, 55100 Kuala Lumpur, Malaysia

+603 9226 2253

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

[ ]

(Names, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Kevin (Qixiang) Sun, Esq. Bevilacqua PLLC 1050 Connecticut Avenue, NW, Suite 500 Washington, DC 20036 (202) 869-0888 | Fang Liu, Esq. VCL Law LLP 1945 Old Gallows Road, Suite 630 Vienna, VA 22182 (703) 919-7285 |

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED [ ], 2024

Suke Limited

[ ] Ordinary Shares

This is the initial public offering of Suke Limited, an exempted company with limited liability incorporated under the laws of the Cayman Islands whose principal place of business is in Malaysia. We are offering on a firm commitment basis [ ] ordinary shares, par value $0.001 per share (the “Ordinary Shares”). We anticipate that the initial public offering price per ordinary share will be between $[ ] and $[ ].

Prior to this offering, there has been no public market for the Ordinary Shares. We intend to apply for listing our Ordinary Shares on the Nasdaq Capital Market under the symbol “SUKE.” The closing of this offering is conditioned upon Nasdaq’s final approval of our listing application. No assurance can be given that our application will be approved.

Investors are cautioned that you are not buying shares of a Malaysia-based operating company but instead are buying shares of a holding company incorporated in Cayman Islands that operates through its subsidiary in Malaysia.

Investing in our Ordinary Shares involves risks. See “Risk Factors” beginning on page 9 of this prospectus for a discussion of information that should be considered in connection with an investment in our Ordinary Shares.

We are an “emerging growth company” and a “foreign private issuer,” each as defined under the U.S. federal securities laws, and, as such, are eligible for reduced public company reporting requirements for this and future filings. See “Risk Factors—Risks Related to This Offering and Ownership of Our Ordinary shares—We will be subject to ongoing public reporting requirements that are less rigorous than Exchange Act rules for companies that are not emerging growth companies, and our shareholders could receive less information than they might expect to receive from more mature public companies” and “Risk Factors—Risks Related to This Offering and Ownership of Our Ordinary shares—We are a foreign private issuer within the meaning of the rules under the Exchange Act, and as such we are exempt from certain provisions applicable to U.S. domestic public companies” for more information.

| Per Share | Total | |||||||

| Initial public offering price | $ | $ | ||||||

| Underwriting discounts and commissions(1) | $ | $ | ||||||

| Proceeds to us, before expenses | $ | $ | ||||||

| (1) | Represents underwriting discount and commissions equal to 7.5% per ordinary share. We have also agreed to issue warrants to purchase Ordinary Shares to the representative of the underwriters and reimburse the underwriters for certain expenses in connection with this offering. See “Underwriting” beginning on page 101 for additional information regarding total underwriting compensation, including information on underwriting discounts and offering expenses. |

We have granted the underwriter an option, exercisable for 45 days from the date of the closing of this offering, to purchase up to an additional [ ] Ordinary Shares on the same terms as the other shares being purchased by the underwriter from us to cover over-allotments.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriter expects to deliver the Ordinary Shares to purchasers in this offering on or about [ ], 2024.

Pacific Century Securities, LLC

The date of this prospectus is [ ], 2024

[Page intentionally left blank for graphics]

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. Neither we, nor the underwriter has authorized anyone to provide you with different information. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus, or any free writing prospectus, as the case may be, or any sale of ordinary shares.

For investors outside the United States: Neither we, nor the underwriter has done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the Ordinary Shares and the distribution of this prospectus outside the United States.

i

COMMONLY USED DEFINED TERMS

Except as otherwise indicated by the context and for the purposes of this prospectus only, references in this prospectus to:

| ● | “ASEAN” are to the Association of Southeast Asian Nations, currently comprised of ten member states in Southeast Asia, namely Indonesia, Malaysia, Philippines, Singapore, Thailand, Brunei Darussalam, Viet Nam, Lao PDR, Myanmar and Cambodia; |

| ● | “DNF” are to Suke Limited’s wholly-owned subsidiary DNF Group Sdn. Bhd., a private company limited by shares incorporated under the laws of Malaysia; |

| ● | “RM” or “Ringgit Malaysia” are to the legal currency of Malaysia; |

| ● | “U.S. dollars,” “dollars,” “USD” or “$” are to the legal currency of the United States; and |

| ● | “we,” “us,” “the Company,” “our,” “our company” or “Suke Limited” are to the combined business of Suke Limited, an exempted company with limited liability incorporated under the laws of the Cayman Islands, and its consolidated subsidiary; |

As all of our operations are conducted in Malaysia, all of our revenues are denominated in RM and our consolidated financial statements are presented in USD. This prospectus contains translations of RM amounts into USD at specific rates solely for the convenience of the reader. We make no representation that any RM could have been, or could be, converted into USD, as the case may be, at any particular rate, at the rates stated below, or at all. The Malaysian government imposes control over its foreign currency reserves in part through direct regulation of the conversion of RM into foreign exchange and through restrictions on foreign trade.

The following table sets forth, for the periods indicated, information concerning exchange rates between the RM and the USD. These rates are provided solely for your convenience and are not necessarily the exchange rates that we used in this prospectus or any other information to be provided to you.

| For the year ended December 31, 2021 | For the year ended December 31, 2022 | For the six months ended June 30, 2023 | ||||||||||

| Period Ended RM: USD exchange rate | 4.14 | 4.40 | 4.67 | |||||||||

| Period Average RM: USD exchange rate | 4.18 | 4.40 | 4.46 | |||||||||

Numerical figures included in this registration statement have been subject to rounding adjustments. Accordingly, numerical figures shown as totals in various tables may not be arithmetic aggregations of the figures that precede them.

Our fiscal year end is December 31. References to a particular “fiscal year” are to our fiscal year ended December 31 of that calendar year. Our audited consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States, or U.S. GAAP.

This prospectus includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe these industry publications and third-party research, surveys and studies are reliable, you are cautioned not to give undue weight to this information.

We have proprietary rights to trademarks used in this prospectus that are important to our business. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus are without the ®, ™ and other similar symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks and trade names.

This prospectus may contain additional trademarks, service marks and trade names of others. All trademarks, service marks and trade names appearing in this prospectus are, to our knowledge, the property of their respective owners. We do not intend our use or display of other companies’ trademarks, service marks or trade names to imply a relationship with, or endorsement or sponsorship of us by, any other person.

ii

This summary highlights information that we present more fully in the rest of this prospectus. This summary does not contain all of the information you should consider before buying shares in this offering. This summary contains forward-looking statements that involve risks and uncertainties, such as statements about our plans, objectives, expectations, assumptions or future events. These statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from any future results, performances or achievements expressed or implied by the forward-looking statements. See “Special Note Regarding Forward-Looking Statements.” You should read the entire prospectus carefully, including the “Risk Factors” section and the financial statements and the notes to those statements.

The Company

Our Business

We believe we are one of the fastest growing media and entertainment networks in Malaysian history in terms of viewership, with approximately 1,000,000 unique TV viewers tuning in from across Malaysia within the first 3 months of our broadcasting debut in April 2022. Our platform connects merchants, the majority of which are celebrity-owned small and micro enterprises, to sell their products and services to primarily Bahasa-speaking customers, a region-wide audience of potentially 100 million across Malaysia, Indonesia, Singapore, and Brunei. Our business was founded in 2021 by Dato’ Mizal Zaini, our Chairman and Chief Executive Officer, known professionally as AC Mizal who has, for over three decades, been a prominent figure in the Malaysian entertainment industry, with diverse roles as an actor, singer, comedian, TV host, and former radio presenter. Building on Dato’ Mizal Zaini’s extensive industry experience and vision, we are dedicated to providing micro, small & medium-sized enterprises with accessible broadcast reach to a regional audience.

We pioneered SUKE TV, a celebrity-driven 24/7 free-to-air and over-the-top (“OTT”) shopping channel in Malaysia. It offers a holistic, one-stop platform that includes full in-house media content production, custom program development, logistics and delivery, and advertising services, driven by a full service e-commerce platform, OTT video streaming (available on our YouTube channel and the iQIYI platform), live video commerce and experiential shopping, accessible through both TV and digital mediums.

In our two years of operations, our products and services have proven to create exceptional value for both merchants, customers and viewers alike. Our channel, SUKE TV, was the first in Malaysia to introduce a one-stop entertainment-based celebrity-backed advertising vehicle paired with a delivery network, which has replaced the traditional model of using multiple platforms for e-commerce, advertising, celebrity endorsement and logistics, and has represented an industry trend.

Our services generally have an entry price from selling of a product of RM100.00 (approximately $22.7) to production service of RM80,000.00 (approximately $18,181.8), with flexible options to choose from regular programming features, to dedicated sponsored series and feature tele-films. We have developed a partnership network to grow our presence, with exclusive rights to stream SUKE TV-produced content on iQIYI, Inc., which operates IQIYI, an online video platform based in China with over 101.4 million paid subscribers worldwide, which we believe will provide us with convenient entry into new regions beyond Malaysia. This extensive network, seamlessly integrated with our centralized e-commerce platform and logistics management system, has enabled a fast and highly seamless viewing-to-transaction process.

Our shopper-attainment platform model is designed to ease the buying decision process and can be made directly using mobile devices, and deliveries generally are fulfilled within five days of purchase. SUKE GO, our next-day delivery service for major Malaysian cities, was introduced in September 2022 delivering superior user experience. In addition, through this geographically dispersed network, we have gained a large and increasing volume of transactions, growing our unique viewers to 1.5 million. The breadth and depth of data provided by our own and third-party platforms have allowed us to provide enhanced services, expand our inventory and improve overall customer experience.

Additionally, we have established a partnership with GX Digital Sdn Bhd, a retail company focused on an online to offline (O2O) Business model operating under the name “Go King Kong” in Malaysia. This provided us access to an inventory of electronics, home appliances, health & beauty, fashion, F&B, groceries, and lifestyle items – bringing our inventory to over 20,000 products, in addition to products sold and endorsed by over 50 celebrities. In June 2023, we entered into a collaboration arrangement with Shop Channel, a leading TV shopping and e-commerce platform in Thailand. Under this arrangement, DNF and Shop Global (Thailand) Co. Ltd agreed to cross-sell each other’s products and market them through our respective TV and digital channels.

1

We believe that our services have the power to transform advertising from an expense item into an investable asset. By offering high-quality and low-risk opportunities that are not easily accessible through other channels, we enable brands to turn their advertising expenses into strategic investments.

We have achieved significant growth in recent years. Our revenue increased from approximately $6,588 for the fiscal year ended December 31, 2021 to approximately $2.2 million for the fiscal year ended December 31, 2022, an increase of $2.2 million, or 33,000%. Our revenue increased from approximately $76,728 for the six months ended June 30, 2022 to approximately $675,246 for the six months ended June 30, 2023, an increase of $598,518, or 780%. Our net loss increased from approximately $445,376 for the fiscal year ended December 31, 2021 to approximately $913,103 for the fiscal year ended December 31, 2022, an increase of 105%. Our net loss decreased from approximately $1.28 million for the six months ended June 30, 2022 to approximately $789,357 for the six months ended June 30, 2023, a decrease of 38.5%. For additional information regarding our financial performance, see “Summary Consolidated Financial Information” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

We generate revenues primarily from advertising fees charged to merchants for our facilitation, production, and management of advertising. We also charge percentage fees to merchants for fulfilling their sales via our SUKE Shop platform, which generates our e-commerce revenue. Our e-commerce revenue for the two fiscal years ended December 31, 2022, and the six months ended June 30, 2023 and up to the date of this prospectus has been immaterial.

Our Historical Performance

The Company’s independent registered public accounting firm has expressed substantial doubt as to the Company’s ability to continue as a going concern. As of December 31, 2022, we had a working capital deficiency of $1,583,377 and shareholders’ deficit of $898,916. As of June 30, 2023, we had a working capital deficiency of $1,562,944 and shareholders’ deficit of $958,778.

In addition, we have entered into a master facility agreement with Malaysia Debt Ventures Berhad, or MDV, under which we have borrowed RM7.2 million ($1,636,289) from MDV and were originally required to repay this loan within 60 months from the date of disbursement, including a grace period of 12 months. Under the original terms of this loan, we were required to make (i) a monthly principal payment of RM150,000 (approximately $34,089), (ii) a monthly profit payment at an adjustable profit rate (up to a maximum of 12% per annum), and (iii) a monthly deposit of RM33,750 (approximately $7,670) in a sinking fund, starting from January 1, 2023 after the expiration of the 12-month grace period. As we were not meeting such repayment obligations, we negotiated with MDV to delay our payments. On December 21, 2023, we entered into a Supplemental Letter of Offer 3 with MDV, pursuant to which MDV agreed to extend the loan term from 60 months to 74 months and modified the payment schedule as follows: (i) January – April 2023, principal payment of RM150,000 each month; (ii) May 2023 – June 2024, monthly principal payments of RM150,000 are waived; (iii) July 2024 – February 2028, principal payment of RM150,000 each month; (iv) profits due from June 2023 until March 2024 are deferred and will be paid equally over the remainder of the term; (v) monthly sinking fund deposits of RM33,750 (approximately $7,670) are deferred until April 2024.

As of December 31, 2023, there was no overdue payment under the banking facilities with MDV, and only a penalty fee of approximately RM1,658 (approximately $377) was due. We plan to use approximately 5% of gross proceeds from this offering, or $[ ] million, to repay a portion of the outstanding debt owed to MDV. Pursuant to the Supplemental Letter of Offer 3, we provided MDV with an irrevocable letter of undertaking to remit 5% of gross proceeds from this offering to MDV. For additional information on our master facility agreement with MDV, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Banking Facilities.”

We estimate that we will be able to conduct our planned operations using currently available capital resources for at least the next twelve months. However, in order to meet our growth expectations, we will need to raise funds beyond our current working capital balance in order to finance future development and meet our debt obligations until such time as future profitable revenues are achieved. We will seek to fund our operations through public offerings, including this offering, private equity offerings, debt financings, and government or other third-party funding. However, the Company may not be able to raise adequate funds for capital expenditures, working capital and other cash requirements from capital markets on acceptable terms, or at all. Advances from an officer or shareholder may likewise be unavailable. The Company’s failure to raise capital as and when needed and generate significantly higher revenues than operating expenses to achieve profitability would impact its going concern status and would have a negative impact on its financial condition and its ability to pursue its business strategy and continue as a going concern. For further discussion, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Going Concern”.

Our Competitive Strengths

We believe the following competitive strengths are essential to our success and differentiate us from our competitors:

| ● | Fully-licensed 24/7 free-to-air and OTT shopping channel. |

| ● | 360-degree e-commerce with TV, web and social media. |

| ● | Celebrity powered experiential shopping with celebrities and influencers. |

| ● | Affordable entry cost in comparison with competitors. |

| ● | Full in-house capabilities and industry expertise. |

Our Growth Strategies

We will focus on expanding our broadcasting reach in the ASEAN region and beyond in the next 24-36 months, based on our current business model of providing attractive commissions to merchants and airing sponsored content on our channel, SUKE TV. To achieve this, we plan to expand our footprint in the region by implementing a broadcast license model.

2

In the first phase, we aim to target Thailand; in the second phase, we will be looking to expand into Indonesia, Singapore, and Brunei; and in the third phase, we intend to enter the Middle Eastern market. By expanding into new markets and leveraging local knowledge and expertise, we will position ourselves for long-term success in the broadcasting industry. As we continue to grow and expand, we expect that we will adapt our business model, by investing in technology, hiring local talent, building strong partnerships and exploring new revenue streams, in order to meet the changing needs of our audience and remain competitive in an increasingly crowded market.

Our Risks and Challenges

Our prospects should be considered in light of the risks, uncertainties, expenses and difficulties frequently encountered by similar companies. Our ability to realize our business objectives and execute our strategies is subject to risks and uncertainties, including, among others, the following:

| ● | Our independent registered public accounting firm has expressed substantial doubt as to our ability to continue as a going concern in its report. |

| ● | We have a limited operating history and experience in the media broadcasting industry, which may make it difficult to evaluate our business and prospects and may not be indicative of our future growth or financial results. |

| ● | We are a holding company, and we are accordingly dependent upon distributions from our subsidiary to pay dividends, if any, taxes and other expenses. |

| ● | We will likely need to increase the size and capabilities of our organization, and we may experience difficulties in managing our growth. |

| ● | We are subject to credit risks associated with accounts receivable, and if we are unable to collect accounts receivable from our customers, our results of operations and cash flows could be materially adversely affected. |

| ● | We depend on a limited number of customers for a large portion of our revenues. |

| ● | We have incurred indebtedness and may incur other debt in the future, which may adversely affect our financial condition and future financial results. |

| ● | The media broadcasting and retail industries in Malaysia are highly competitive and we may be unable to compete effectively. |

| ● | We depend on television distributors and online streaming service providers that carry our programming. There is no assurance that we will be able to maintain and renew our access or license agreements with them on favorable terms or at all. |

| ● | We may be subject to claims for representations made in connection with the sale and promotion of merchandise or for harm experienced by customers who purchase merchandise from us. |

| ● | The processing, storage, sharing, use, disclosure and protection of personal data are subject to various legal and regulatory requirements. Failure to comply with these requirements could expose us to potential liabilities arising from legal action, regulatory enforcement, reputational harm, or other adverse consequences. |

| ● | A failure or breach of our security systems or infrastructure as a result of cyber-attacks could disrupt our business, result in the disclosure or misuse of confidential or proprietary information, damage our reputation, increase our costs and cause losses. |

| ● | We rely on independent shipping companies to deliver certain products we sell. |

| ● | We are dependent on relationships with vendors, manufacturers and other third parties, and any adverse changes in these relationships could result in a failure to meet customer expectations which could result in lost revenue. |

| ● | We are dependent on the continued services and performance of our management and other key employees, the loss of any of whom could adversely affect our business, operating results and financial condition. |

3

| ● | The COVID-19 pandemic and future pandemics or epidemics may negatively impact our business, results of operations and financial condition. |

| ● | Any lack of effective internal controls over financial reporting may affect our ability to accurately report our financial results or prevent fraud which may affect the market for and price of our Ordinary Shares. |

| ● | Failure to comply with existing laws, rules and regulations, or to obtain and maintain required licenses and rights, could subject us to additional liabilities. |

| ● | Fluctuations in exchange rates could adversely affect our business and the value of our securities. |

| ● | Because our principal assets are located outside of the United States and all our existing directors and officers reside outside of the United States, it may be difficult for you to enforce your rights based on U.S. federal securities laws against us or our officers and directors or to enforce a judgment of a United States court against us or our officers and directors in Malaysia. |

| ● | There has been no public market for our Ordinary Shares prior to this offering and an active trading market for our Ordinary Shares may not develop following the completion of this offering. |

| ● | Our Ordinary Shares may be volatile or may decline regardless of our operating performance, and you may not be able to resell your shares at or above the initial public offering price. |

| ● | As our initial public offering price is substantially higher than our net tangible book value per share, you will experience immediate and substantial dilution. |

| ● | We have broad discretion as to the use of the net proceeds from this offering and our use of the offering proceeds may not yield a favorable return on your investment. Additionally, we may use these proceeds in ways with which you may not agree or in the most effective way. |

| ● | We will be subject to ongoing public reporting requirements under Exchange Act rules that are less rigorous than those for companies that are not emerging growth companies, and our shareholders could receive less information than they might expect to receive from more mature public companies. |

| ● | As a foreign private issuer, we are permitted to rely on exemptions from certain Nasdaq corporate governance standards applicable to domestic U.S. issuers. This may afford less protection to holders of our shares. |

In addition, we face other risks and uncertainties that may materially affect our business prospects, financial condition, and results of operations. You should consider the risks discussed in “Risk Factors” beginning on page 9 and elsewhere in this prospectus before investing in our Ordinary Shares.

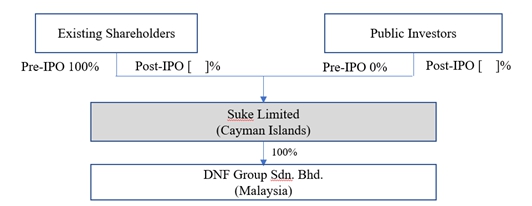

Our Corporate History and Structure

On March 21, 2023, Suke Limited was incorporated under the laws of Cayman Islands. Upon our incorporation, one (1) ordinary share, $0.001 par value, was allotted and issued to Ogier Global Subscriber (Cayman) Limited, who transferred the share to our CEO and Chairman, Dato’ Mizal Zaini on March 31, 2023. On March 31, 2023, Suke Limited issued one additional ordinary share to Dato’ Mizal Zaini.

On May 23, 2023, Suke Limited, DNF, Dato’ Mizal Zaini and Datin Emelia being the holders of all of DNF’s ordinary shares (the “DNF Shareholders”), Universal AM Fund (“UAFund”) and Metapixel Sdn Bhd (Metapixel) entered into a share exchange agreement, pursuant to which (i) Suke Limited as purchaser purchased 2,850,000 ordinary shares in the share capital of DNF from the DNF shareholders, and as consideration for the acquisition of such shares of DNF, Suke Limited allotted and issued an aggregate of 2,849,998 of its Ordinary Shares to the DNF shareholders; and (ii) Suke Limited allotted and issued 203,754 and 647,546 Ordinary Shares to UAFund and Metapixel, respectively, as settlement and payment of total advances of RM3 million that UAFund and Metapixel previously provided to DNF. Following the consummation of the transactions contemplated by the share exchange agreement, Suke Limited became the holding company of the operating subsidiary DNF that conducts our media broadcasting and e-commerce businesses through the SUKE TV channel and SUKE Shop platform in Malaysia.

On January 17, 2024, the Company’s shareholders then effected a number of share transfers, including (a) Dato’ Mizal Zaini transferred (i) 203,754 Ordinary Shares to Starbeam International Holdings Limited, (ii) 83,865 Ordinary Shares to Omen Wealth Limited, (iii) 95,410 Ordinary Shares to Flourishing Profits Venture Limited and (iv) a total of 197,090 Ordinary Shares to three other shareholders each of whom holds less than 5% of the Company’s total Ordinary Shares issued and outstanding after the transfers; (b) Datin Emelia transferred (i) 203,754 Ordinary Shares to Ultimate Vision Capital Limited, (ii) 83,865 Ordinary Shares to Omen Wealth Limited, (iii) 95,410 Ordinary Shares to Flourishing Profits Venture Limited and (iv) a total of 197,090 Ordinary Shares to three other shareholders each of whom holds less than 5% of the Company’s total Ordinary Shares issued and outstanding after the transfers; (c) Metapixel transferred (i) 26,740 Ordinary Shares to Omen Wealth Limited and (ii) a total of 101,896 Ordinary Shares to three other shareholders each of whom holds less than 5% of the Company’s total Ordinary Shares issued and outstanding after the transfers; and (d) UAFund transferred 203,754 Ordinary Shares to One Fatboyz Limited.

As of the date of this prospectus, Suke Limited has 3,701,300 Ordinary Shares issued and outstanding.

4

The following diagram illustrates our corporate structure as of the date of this prospectus and upon completion of this offering (assuming the underwriters do not exercise the over-allotment option). For more information on our operating subsidiary DNF in Malaysia, see “Corporate History and Structure.”

Corporate Information

Our principal executive offices are located at Level 10, Wisma IAV, No. 86 Jalan Pasar, 55100 Kuala Lumpur, Malaysia. The telephone number at our executive offices is +603 9226 2253.

Suke Limited’s registered office is currently located at the office of Ogier Global (Cayman) Limited, 89 Nexus Way, Camana Bay, Grand Cayman, KY1-9009, Cayman Islands, which may be changed from time to time at the discretion of directors.

Suke Limited’s agent for service of process in the United States is [ ], located at [ ].

Our website can be found at suketv.com. The information contained on our website is not a part of this prospectus, nor is such content incorporated by reference herein, and should not be relied upon in determining whether to make an investment in our Ordinary Shares.

Implications of Being an Emerging Growth Company

We had less than $1.235 billion in annual gross revenue during our last fiscal year. As a result, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and may take advantage of reduced public reporting requirements. These provisions include, but are not limited to:

| ● | being permitted to present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations; |

| ● | not being required to comply with the auditor attestation requirements in the assessment of our internal control over financial reporting; |

| ● | reduced disclosure regarding executive compensation in periodic reports, proxy statements and registration statements; and |

| ● | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. |

We may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of the date of the first sale of our Ordinary Shares pursuant to this offering. However, if certain events occur before the end of such five-year period, including if we become a “large accelerated filer,” if our annual gross revenues exceed $1.235 billion or if we issue more than $1.0 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company before the end of such five-year period.

Section 107 of the JOBS Act provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the “Securities Act”), for complying with new or revised accounting standards.

5

Implications of Being a Foreign Private Issuer

Upon consummation of this offering, we will report under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as a non-U.S. company with “foreign private issuer” status. Even after we no longer qualify as an emerging growth company, so long as we qualify as a foreign private issuer under the Exchange Act, we will be exempt from certain provisions of the Exchange Act and the rules thereunder that are applicable to U.S. domestic public companies, including:

| ● | the rules under the Exchange Act that require U.S. domestic public companies to issue financial statements prepared under U.S. GAAP; |

| ● | sections of the Exchange Act that regulate the solicitation of proxies, consents or authorizations in respect of any securities registered under the Exchange Act; |

| ● | sections of the Exchange Act that require insiders to file public reports of their share ownership and trading activities and that impose liability on insiders who profit from trades made in a short period of time; and |

| ● | the rules under the Exchange Act that require the filing with the SEC of quarterly reports on Form 10-Q, containing unaudited financial and other specified information, and current reports on Form 8-K, upon the occurrence of specified significant events. |

We will file with the SEC, within four months after the end of each fiscal year (or such other reports required by the SEC), an annual report on Form 20-F containing financial statements audited by an independent registered public accounting firm.

We may take advantage of these exemptions until such time as we are no longer a foreign private issuer. We would cease to be a foreign private issuer at such time as more than 50% of our outstanding voting securities are held by U.S. residents and any of the following three circumstances applies: (i) the majority of our executive officers or directors are U.S. citizens or residents, (ii) more than 50% of our assets are located in the United States or (iii) our business is administered principally in the United States.

Both foreign private issuers and emerging growth companies are also exempt from certain of the more extensive SEC executive compensation disclosure rules. Therefore, if we no longer qualify as an emerging growth company but remain a foreign private issuer, we will continue to be exempt from such rules and will continue to be permitted to follow our home country practice as to the disclosure of such matters.

6

The Offering

| Shares offered | [ ] Ordinary Shares (or [ ] Ordinary Shares if the underwriter exercises the over-allotment option in full). | |

| Offering price | We currently estimate that the initial public offering price will be between $[ ] and $[ ] per share. | |

| Ordinary Shares outstanding immediately before the offering | 3,701,300 Ordinary Shares. See “Description of Share Capital” for more information. | |

| Ordinary Shares outstanding immediately after the offering | [ ] Ordinary Shares (or [ ] Ordinary Shares if the underwriter exercises the over-allotment option in full). | |

| Over-allotment option | We have granted to the underwriter a 45-day option to purchase from us up to an additional 15.0% of the Ordinary Shares sold in the offering (up to [ ] additional shares) at the initial public offering price, less the underwriting discounts and commissions to cover over-allotments. | |

| Underwriter warrants | Upon the closing of this offering, we will issue to the underwriter warrants to purchase 5.0% of the total number of Ordinary Shares being sold in this offering. The exercise price of the underwriter warrants is equal to 120% of the offering price of the Ordinary Shares offered hereby. The warrants are exercisable commencing six (6) months from the date of this offering and will terminate 2-5 years after such date. The registration statement of which this prospectus is a part also covers the Ordinary Shares issuable upon the exercise of such warrants. | |

| Use of proceeds | We expect to receive net proceeds of approximately $[ ] million from this offering, assuming an initial public offering price of $[ ] per ordinary share, being the midpoint of the estimated initial public offering price range set forth on the cover page of this prospectus, and no exercise of the underwriter’s over-allotment option, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

We plan to use the net proceeds of this offering for (i) brand promotion and content production, (ii) software and systems update, (iii) debt reduction, (iv) expansion in ASEAN, (v) strategic acquisitions or investment in complementary businesses or assets, and (vi) working capital and general corporate purposes. See “Use of Proceeds” for more information on the use of proceeds. | |

| Risk factors | Investing in our Ordinary Shares involves risks and purchasers of our Ordinary Shares may lose part or all of their investment. See “Risk Factors” for a discussion of factors you should carefully consider before deciding to invest in our Ordinary Shares. | |

| Lock-up | We, our directors, officers and any holder of more than five percent (5%) of the Company’s outstanding shares are expected to enter into lock-up agreements with the underwriter to agree not to sell, transfer or dispose of any Ordinary Shares or securities exercisable for or convertible into Ordinary Shares, without the underwriter’s prior written consent, in the case of our company, for a period of three (3) months after the closing of this offering, and in the case of our directors, officers and five percent (5%) beneficial owners, for a period of six (6) months from the date of commencement of sales of the offering. See “Underwriting.” | |

| Proposed trading market and symbol | We intend to apply to list our Ordinary Shares on the Nasdaq Capital Market under the symbol “SUKE”. | |

| Transfer Agent | [ ] |

7

Summary Consolidated Financial Information

The following summary historical financial information should be read in conjunction with our consolidated financial statements and related notes included elsewhere in the prospectus and the information contained in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” below.

The following summary consolidated financial data as of December 31, 2022 and 2021 and for the years then ended have been derived from our audited consolidated financial statements included elsewhere in this prospectus. The following summary consolidated financial data as of June 30, 2023 and 2022 and for the six months then ended have been derived from our unaudited condensed consolidated financial statements included elsewhere in this prospectus.

These financial statements have been prepared in accordance with U.S. GAAP. Our historical results for any period are not necessarily indicative of our future performance.

| Six Months Ended June 30, | Years Ended December 31, | |||||||||||||||

| 2023 | 2022 | 2022 | 2021 | |||||||||||||

| Statements of Income Data | ||||||||||||||||

| Total revenue | $ | 675,246 | 76,728 | $ | 2,227,222 | 6,588 | ||||||||||

| Total cost of revenue | (642,194 | ) | (311,872 | ) | (1,093,600 | ) | (4,688 | ) | ||||||||

| Total administrative expenses | (735,709 | ) | (995,545 | ) | (1,919,187 | ) | (442,299 | ) | ||||||||

| Operating loss | (735,709 | ) | (1,215,281 | ) | (766,469 | ) | (440,399 | ) | ||||||||

| Total other operating income | - | 15,408 | 19,096 | - | ||||||||||||

| Loss before income taxes | (789,357 | ) | (1,283,190 | ) | (913,103 | ) | (445,376 | ) | ||||||||

| Income tax expense | - | - | - | - | ||||||||||||

| Net loss | $ | (789,357 | ) | (1,283,190 | ) | $ | (913,103 | ) | (445,376 | ) | ||||||

| Earnings per ordinary share | ||||||||||||||||

| Basic and diluted | $ | (0.26 | ) | (0.45 | ) | $ | (0.32 | ) | (0.16 | ) | ||||||

| Weighted average Ordinary Shares outstanding | ||||||||||||||||

| Basic and diluted | 3,033,430 | 2,850,000 | 2,850,000 | 2,850,000 | ||||||||||||

| As of June 30, 2023 | As of December 31 2022 | As of December 31, 2021 | ||||||||||

| Balance Sheet Data | ||||||||||||

| Cash and cash equivalents | $ | 6,369 | $ | 112,055 | $ | 123,420 | ||||||

| Current assets | 1,934,866 | 1,650,313 | 892,954 | |||||||||

| Total assets | 2,588,259 | 2,532,528 | 1,277,327 | |||||||||

| Current liabilities | 3,504,179 | 3,345,745 | 275,062 | |||||||||

| Total liabilities | 3,547,037 | 3,431,444 | 1,382,571 | |||||||||

| Shareholders’ equity/(deficit) | (958,778 | ) | (898,916 | ) | (105,244 | ) | ||||||

| Total liabilities and shareholders’ equity | $ | 2,588,259 | $ | 2,532,528 | $ | 1,277,327 | ||||||

8

The Ordinary Shares being offered by us are highly speculative in nature, involve a high degree of risk and should be purchased only by persons who can afford to lose the entire amount invested. Before purchasing any of our shares, you should carefully consider the following factors relating to our business and prospects. You should pay particular attention to the fact that we conduct substantially all of our operations outside the US and are governed by legal and regulatory environments that in some respects differ significantly from the environment that may prevail in the U.S. If any of the following risks actually occurs, our business, financial condition or operating results will suffer, the trading price of our shares could decline, and you may lose all or part of your investment.

Risks Related to Our Business

Our independent registered public accounting firm has expressed substantial doubt as to our ability to continue as a going concern in its report.

As of December 31, 2022, we had a working capital deficiency of $1,583,377 and shareholders’ deficit of $898,916. As of June 30, 2023, we had a working capital deficiency of $1,562,944 and shareholders’ deficit of $958,778. In addition, we have entered into a master facility agreement with Malaysia Debt Ventures Berhad, or MDV, under which we have borrowed RM7.2 million ($1,636,289) from MDV and were originally required to repay this loan within 60 months from the date of disbursement, including a grace period of 12 months. Under the original terms of this loan, we were required to make (i) a monthly principal payment of RM150,000 (approximately $34,089), (ii) a monthly profit payment at an adjustable profit rate (up to a maximum of 12% per annum), and (iii) a monthly deposit of RM33,750 (approximately $7,670) in a sinking fund, starting from January 1, 2023 after the expiration of the 12-month grace period. As we were not meeting such repayment obligations, we negotiated with MDV to delay our payments. On December 21, 2023, we entered into a Supplemental Letter of Offer 3 with MDV, pursuant to which MDV agreed to extend the loan term from 60 months to 74 months and modified the payment schedule as follows: (i) January – April 2023, principal payment of RM150,000 each month; (ii) May 2023 – June 2024, monthly principal payments of RM150,000 are waived; (iii) July 2024 – February 2028, principal payment of RM150,000 each month; (iv) profits due from June 2023 until March 2024 are deferred and will be paid equally over the remainder of the term; (v) monthly sinking fund deposits of RM33,750 (approximately $7,670) are deferred until April 2024. As of December 31, 2023, there was no overdue payment under the banking facilities with MDV, and only a penalty fee of approximately RM1,658 (approximately $377) was due. For additional information on our master facility agreement with MDV, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Banking Facilities.”

Besides cash flows from revenue generated from our advertising services and sale of products, we will seek to fund our operations through public offerings, including this offering, private equity offerings, debt financings, and government or other third-party funding. Adequate additional financing may not be available to us on acceptable terms, or at all. Our failure to raise capital as and when needed and generate significantly higher revenues than operating expenses to achieve profitability would impact our going concern status and would have a negative impact on our financial condition and our ability to pursue our business strategy and continue as a going concern. We cannot assure you that our plans to raise sufficient capital or achieve profitability will be successful. These factors, among others, raise substantial doubt about our ability to continue as a going concern. The financial statements contained elsewhere in this prospectus do not include any adjustments that might result from our inability to consummate this offering or our inability to continue as a going concern.

We have a limited operating history and experience in the media broadcasting industry, which may make it difficult to evaluate our business and prospects and may not be indicative of our future growth or financial results.

With broadcasting operations officially launched in April 2022, we are a new entrant to this market. We were able to reach approximately 2-4 million viewers in the first quarter of debut. For the fiscal year ended December 31, 2022, we recorded revenue of $2.2 million from operations. For the six months ended June 30, 2023, we recorded revenue of $675,246 million from operations. However, due to our limited operating history and experience in the Malaysian media broadcasting industry, our recent rapid growth may not be indicative of our future growth or financial results and makes an evaluation of our business and prospects difficult and highly speculative. There is no assurance that we will be able to maintain our historical growth rates in future periods. Our growth prospects should be considered in light of the risks and uncertainties that fast-growing companies with a limited operating history and experience in our industry may encounter, including, among others, risks and uncertainties regarding our ability to:

| ● | introduce new offerings and improve existing offerings; |

| ● | retain existing clients and attract new clients; |

| ● | adjust and optimize our business model; |

| ● | successfully compete with other companies that are currently in, or may in the future enter, our industry or similar industries; and |

| ● | observe and strategize on the latest market trends. |

9

All these endeavors involve risks and will require significant allocation of management and employee resources. We cannot assure you that we will be able to effectively manage our growth or implement our business strategies effectively. If the market for our media broadcasting services does not develop as we expect or if we fail to address the needs of this dynamic market, our business, results of operations, and financial condition will be materially and adversely affected.

We are a holding company, and we are accordingly dependent upon distributions from our subsidiary to pay dividends, if any, taxes and other expenses.

We are a holding company incorporated under the laws of the Cayman Islands and have no material assets other than ownership of equity interests in our subsidiary. We have no independent means of generating revenue. We intend to cause our subsidiary to make distributions to their shareholders in an amount sufficient to cover all applicable taxes payable and dividends, if any, declared by us. Our ability to service our debt, if any, depends on the results of operations of our subsidiary and upon the ability of such subsidiary to provide us with cash, whether in the form of dividends, loans or other distributions, to pay amounts due on our obligations. Financing arrangements, such as our master facility agreement with Malaysia Debt Ventures Berhad, or MDV, contain negative covenants that limit the ability of our subsidiary to declare or pay dividends or make distributions. See also “Dividend Policy.” Our subsidiary is separate and distinct legal entities; to the extent that we need funds, and our subsidiary is restricted from declaring or paying such dividends or making such distributions under applicable law or regulations or are otherwise unable to provide such funds (for example, due to restrictions in financing arrangements that limit the ability of our operating subsidiary to distribute funds), our liquidity and financial condition could be materially harmed.

We will likely need to increase the size and capabilities of our organization, and we may experience difficulties in managing our growth.

In order to execute our business plans, we expect that we will need to increase the number of our employees and the magnitude of our operations. Our future financial performance and our ability to deliver media broadcasting services that engage viewers and to compete effectively will depend, in part, on our ability to manage any future growth effectively. To manage our anticipated future growth, we will need to continue to implement and improve our managerial, operational and financial systems, expand our facilities and continue to recruit and train additional qualified personnel. In addition, the expansion of our systems and infrastructure may require us to commit financial, operational and managerial resources before our revenues increase and without assurances that our revenues will increase. Moreover, continued growth could strain our ability to maintain reliable service levels for our customers. If we fail to achieve the necessary level of efficiency as we grow, our growth rate may decline and investors’ perceptions of our business and our prospects may be adversely affected, and the market price of our securities could decline.

We are subject to credit risks associated with accounts receivable, and if we are unable to collect accounts receivable from our customers, our results of operations and cash flows could be materially adversely affected.

As of December 31, 2022 and 2021, we had approximately $1.38 million and $2,491 in accounts receivable. As of December 31, 2022, approximately 52% of the total accounts receivable, or $722,694, was related to barter arrangements with customers. As of June 30, 2023, we had approximately $1.49 million in accounts receivable, and approximately 46% of the total accounts receivable, or $681,672, was related to barter arrangements with customers. Such barter arrangements with customers represented certain receivables from our advertising revenue and will be exchanged for services promised by the customers. Once the promised services are delivered by the customers, the accounts receivable will be offset, and the relevant costs will be recorded to cost of revenue.

Typically, we extend a credit period of 30 days to customers who purchase our advertising services. Due to uncertainty of the timing of collection, we establish allowance for doubtful account based on individual account analysis and historical collection trends. We establish a provision for doubtful receivables when there is objective evidence that we may not be able to collect amounts due. The allowance is based on management’s best estimates of specific losses on individual exposures, as well as on past trends of collections. Considering customers’ credit and ongoing relationship, management makes conclusions whether any balances outstanding at the end of the period will be deemed uncollectible on an individual basis and on aging analysis basis. The provision is recorded against account receivable balance, with a corresponding charge recorded in the consolidated statements of operations and other comprehensive income. Delinquent account balances are written-off against the allowance for doubtful accounts after management has determined that the likelihood of collection is not probable. We did not have any bad debt write-off during the years ended December 31, 2022 and 2021, or the six months ended June 30, 2023.

10

Although we manage credit risk related to our customers by performing periodic evaluations of credit worthiness and applying other credit risk monitoring procedures, if there is an occurrence of circumstances that affect our customers’ ability to pay us such as deteriorating conditions in, bankruptcies, or financial difficulties of a customer or within their industries generally, our operating cash flow will be under significant pressure, and we could experience payment delays or default in payment to our suppliers or other creditors, which may result in material and adverse impact on our business, results of operations and financial condition.

We depend on a limited number of customers for a large portion of our revenues.

For the fiscal year ended December 31, 2022, the four customers who each accounted for more than 10% of the Company’s trade receivables, net balance at December 31, 2022 made up 75.4% of the Company’s total revenues. For the six months ended June 30, 2023, the three customers who each accounted for more than 10% of the Company’s trade receivables, net balance at June 30, 2023 made up approximately 99.7% of the Company’s total revenues. We expect that a significant portion of our revenues will continue to be derived from a small number of customers. The loss of, or a substantial decrease in the volume of, revenues by any of our top customers could harm our revenues and profitability. In addition, an adverse change in the terms of our dealings with, or in the financial wherewithal or viability of, one or more of our significant customers could harm our business, financial condition and results of operations.

We have incurred substantial indebtedness and may incur other debt in the future, which may adversely affect our financial condition and future financial results.

As of December 31, 2022 and June 30, 2023, we had an aggregate of $1.6 million and $1.6 million in outstanding indebtedness, respectively. In September 2021, the Company’s subsidiary DNF obtained a non-revolving project financing (the “Loan”) in the principal amount of RM7,200,000 (approximately $1,636,289) from Malaysia Debt Ventures Berhad, or MDV. The full amount of the Loan was drawn down in June 2022. Under the original terms of the Loan, the Loan, with a ceiling profit rate of 12% per annum, had an effective profit rate equal to MDV’s effective cost of funds plus 2.4%, or 9% per annum, subject to change at MDV’s discretion based on its periodic review. Originally, the Loan, with a grace period of 12 months from the date of first disbursement, was payable in monthly principal installments of RM150,000 (approximately $34,089) each from 13th month onwards until the 60th month and would mature in December 2026; for the first year of the Loan term, the profit was payable 12 months in advance for disbursement and the interest was deducted from the principal amount disbursed; and, for the second year onwards, the profit was payable on a monthly basis in advance. On December 21, 2023, we entered into a Supplemental Letter of Offer 3 with MDV, pursuant to which MDV agreed to extend the loan term from 60 months to 74 months and modified the payment schedule as follows: (i) January – April 2023, principal payment of RM150,000 each month; (ii) May 2023 – June 2024, monthly principal payments of RM150,000 are waived; (iii) July 2024 – February 2028, principal payment of RM150,000 each month; (iv) profits due from June 2023 until March 2024 are deferred and will be paid equally over the remainder of the term; (v) monthly sinking fund deposits of RM33,750 (approximately $7,670) are deferred until April 2024. The profit rate has increased to an amount equal to MDV’s effective cost of funds plus 2.65%, or 9.5% per annum currently, but has the same ceiling rate of 12%. The Loan is secured by (i) all present and future assets including intellectual property to be developed or developed by DNF, (ii) joint and several guarantees by certain directors of the Company and (iii) deposit over sinking fund to be collected monthly of RM33,750 (approximately $7,670) per month, commencing from 13th month onwards till the Loan matures. The sinking fund will be released to DNF upon release and cancellation of the Loan, provided that none of the DNF’s accounts with MDV is in default and all monies owing under the Loan have been fully settled. The sinking fund can be utilized for the purpose of principal or profit payments, and other related financing costs. Any shortfall in the sinking fund resulting from the utilization of the above shall be made good by DNF in the subsequent month. In connection with the Supplemental Letter of Offer 3, an additional asset has been added as a security – a condo property owned by our director and officer, Datin Emelia. We are permitted to incur additional debt or conduct additional financing of any nature with prior written consent of MDV being obtained. See also “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Banking Facilities.”

Our existing debts, and any debt which may be incurred in the future, may adversely affect our financial condition and future financial results by, among other things:

| ● | increasing our vulnerability to downturns in our business, to competitive pressures and to adverse economic and industry conditions; |

| ● | requiring the dedication of a portion of our expected cash from operations to service our indebtedness, thereby reducing the amount of expected cash flow available for other purposes, including capital expenditures; and |

| ● | limiting our flexibility in planning for, or reacting to, changes in our businesses and our industries. |

If we are unable to generate sufficient cash flow from operations in the future to service our debt, we may be required, among other things, to seek additional financing in the debt or equity markets, refinance or restructure all or a portion of our indebtedness, sell selected assets or reduce or delay planned capital, operating or investment expenditures. Such measures may not be sufficient to enable us to service our debt.

We have failed to make adequate contributions or tax deductions for our employees as required by Malaysian laws and regulations.

As of December 31, 2022 and June 30, 2023, a total of $163,602 and $213,818, respectively, in expenses related to employees’ provident fund contributions, income tax deductions and social security contributions, was outstanding beyond due dates. As of the date of this prospectus, $213,818 of such amounts remained outstanding. Under Malaysian laws and regulations, such as Employees Provident Fund Act 1991, Employees’ Social Security Act 1969 and Income Tax Act 1967, directors of our Malaysian subsidiary, DNF, are jointly and severally liable for any outstanding contributions.

11

The media broadcasting and retail industries in Malaysia are highly competitive and we may be unable to compete effectively.

Currently, we are principally involved in the provision of media broadcasting services with a focus on TV home shopping and production of variety shows. The Malaysian media broadcasting industry, currently comprising TV, radio and digital media is characterized by strong competition and dynamic changes in technology and content consumption. We compete with other providers of televised, online and radio entertainment and content for access to customers and audience share. Our TV home shopping business is situated in a highly competitive retail business environment in Malaysia, and competes with large department stores, specialty shops, e-commence retailers, direct marketing retailers, wholesale clubs, discount retailers, other televised shopping retailers such as Astro Go Shop and WOWShop, infomercial retailers, Internet retailers, including livestream shopping retailers, and mail-order and catalog companies. Many of our current and potential competitors have greater resources, longer histories, more customers and greater brand recognition than we do. They may secure better terms from vendors, adopt more aggressive pricing, offer free or subsidized shipping and devote more resources to technology, fulfillment and marketing. Other companies also may enter into business combinations or alliances that strengthen their competitive positions. Such business combinations or alliances may result in competitors with greatly improved financial resources, improved access to merchandise, greater market penetration than they previously enjoyed and other improvements in their competitive positions. Our inability to keep pace with competitors in our content, marketing, service, price, location, reputation or technologies could have a material adverse effect.

Our financial performance is partially dependent on our ability to predict or respond to consumer preferences.

Our revenues and operating results depend, in part, on our ability to predict or respond to changes in consumer preferences and fashion trends in a timely manner. We aim to continuously develop new retail concepts and adjust our product mix to appeal to evolving customer demands. Consumer preferences may be affected by many factors outside of our control, including responses of competitors and general economic conditions. Any sustained failure by us to identify and respond to emerging trends in lifestyle and consumer preferences could have a material adverse effect on our relationship with our customers and the demand for our TV home shopping products.

If we fail to attract or retain viewers, our business will be adversely affected.

We have experienced significant viewership growth over the past year. Our ability to continue to attract and retain viewers will depend in part on our ability to consistently provide our viewers with compelling content offerings, as well as a quality experience for shopping on our e-commerce platform. Furthermore, the relative service levels, offerings, pricing and related features of competitors to our offerings may adversely impact our ability to attract and retain viewers and customers.

If consumers do not perceive our offerings to be of value, including if we introduce new or adjust existing features, adjust pricing or offerings, or change the mix of content in a manner that is not favorably received by them, we may not be able to attract and retain viewers. In addition, some of our customers originate from word-of-mouth advertising from existing customers. If our efforts to satisfy our existing customers are not successful, we may not be able to attract new customers, and as a result, our ability to maintain and/or grow our business will be adversely affected. If we are unable to successfully compete with current and new competitors in providing compelling content, retaining our existing customers and attracting new customers, our business will be adversely affected.

We depend on television distributors and online streaming service providers that carry our programming. There is no assurance that we will be able to maintain and renew our access or license agreements with them on favorable terms or at all.

In Malaysia, our content currently is aired via our channel, Suke TV, which airs on a diverse range of broadcasters such as free-to-air (“FTA”) TV broadcasters and over-the-top video streaming platforms. We have entered into access or license agreements with these broadcasters or platforms. Our agreements with such distributors have limited terms. For example, our access agreement with MYTV as supplemented by supplemental agreements, which allows our programming to broadcast on national television, has a term of three years effective from June 29, 2022, upon expiry of a three-month trial period from March 28 to June 29, 2022, and may be renewed for a further term of two years. Our license agreement with IQIYI will expire when all licensed titles reach the end of the 12-month license period. In renewal discussions, we may have disagreements with the distributors over the terms of our carriage, such as channel placement or other contract terms. If not resolved through business negotiation, such disagreements could result in termination of an existing agreement. Termination of an existing agreement resulting in the loss of distribution of our programming to a material portion of our television households or online viewers may adversely affect our growth, revenue and earnings.

12

We may be unable to obtain renewals with our current distributors on acceptable terms, if at all. We may also be unable to successfully negotiate access or license agreements with new or existing distributors to carry our programming and no assurance can be given that we will be successful in negotiating renewals with these distributors or that the financial and other terms of these renewals will be acceptable. If that happens, our viewership, operating results, cash flows and prospect would be materially adversely affected.

The failure to secure suitable placement for our programming or to keep up with the rise of online video streaming services would adversely affect our ability to grow our viewership.

We are dependent upon the continued ability of our programming to compete for viewers. Effectively competing for television viewers is dependent, in part, on our ability to negotiate and maintain placement of our programming at a favorable channel position. Less favorable channel position for our programming, such as placement adjacent to programming that does not complement our programming, a position next to our televised home shopping competitors or isolation in a “shopping” tier could adversely affect our ability to attract television viewers to our programming.

Distribution platforms for viewing content over the internet have been, and will likely continue to be, increasing that further intensify the competition in the media broadcasting landscape. These distribution platforms are driving changes in consumer behavior as consumers seek more control over when, where and how they consume content. We have made our offerings available through online video streaming platforms as well as our website such that viewers can access our content directly over the internet rather than through traditional television services. However, we may be unable to successfully anticipate and adapt to technological changes and to offer elements of our programming via new technologies in a cost-effective manner that meets customer demands and evolving industry standards. Our failure to effectively anticipate or adapt to emerging technologies or competitors or changes in consumer behavior, including among younger consumers, could have an adverse effect on our competitive position, businesses and results of operations.

We may be subject to claims for representations made in connection with the sale and promotion of merchandise or for harm experienced by customers who purchase merchandise from us.

The manner in which we sell and promote merchandise and related claims and representations made in connection with these efforts is subject to regulatory oversight in Malaysia. We may be exposed to potential liability from claims by purchasers or by regulators and law enforcement agencies, including without limitation, claims for personal injury, wrongful death and damage to personal property relating to merchandise sold and misrepresentation of merchandise features and benefits. In certain instances, we have the right to seek indemnification for related liabilities from our vendors and may require such vendors to carry minimum levels of product liability and errors and omissions insurance. These vendors, however, may be unable to satisfy indemnification claims, obtain suitable coverage or maintain this coverage on acceptable terms, or insurance may provide inadequate coverage or be unavailable with respect to a particular claim. If we face legal claims related to product representations or harm experienced by customers who have purchased merchandise from us, it will divert management’s attention and resources, and may have a material adverse effect on our reputation, business operating results and financial condition.

We may fail to adequately protect our intellectual property rights or may be accused of infringing intellectual property rights of third parties.

We regard our intellectual property rights, including service marks, trademarks and domain names, trade secrets and similar intellectual property, as critical to our success. Our business also relies upon software codes, informational databases and other components that are integral to our business operations.

From time to time, we may become subject to legal proceedings and claims in the ordinary course of business, including claims of alleged infringement of the trademarks, patents, copyrights and other intellectual property rights of third parties. In addition, litigation may be necessary to enforce our intellectual property rights, protect trade secrets or to determine the validity and scope of proprietary rights claimed by others. Any litigation of this nature, regardless of outcome or merit, could result in substantial costs and diversion of management and technical resources, any of which could adversely affect our business, financial condition and results of operations. Our failure to protect our intellectual property rights, particularly our proprietary brands, in a meaningful manner or third party challenges to related contractual rights could result in erosion of brand names and limit our ability to control marketing on or through the Internet using our domain names or otherwise, which could adversely affect our business, financial condition and results of operations.

13

The Company has engaged in transactions with related parties, and such transactions present possible conflicts of interest that could have an adverse effect on its business and results of operations.

We have engaged in transactions with our directors, officers and principal shareholders. See “Related Party Transactions” beginning on page 84. We believe the terms obtained or consideration that we paid or received, as applicable, in connection with these transactions were comparable to terms available or the amounts that would be paid or received, as applicable, in arm’s-length transactions. In addition, we may enter into additional transactions in the future in which any of our directors, officers or principal shareholders, or any members of their immediate family, have a direct or indirect material interest. Such transactions present potential for conflicts of interest, as the interests of these entities and their shareholders may not align with the interests of the Company and its unaffiliated shareholders with respect to the negotiation of, and certain other matters related to, the transactions with such entities. Conflicts of interest may also arise in connection with the exercise of contractual remedies under these transactions, such as for events of default.

Our Board of Directors intends to authorize the Audit Committee upon its formation to review and approve all material related party transactions. We rely on the laws of the Cayman Islands, which provide that the directors owe a duty of care and a duty of loyalty to our company. Under Cayman Islands law, our directors have a duty to act honestly, in good faith, and view our best interests. Our directors also have a duty to exercise the care, diligence, and skills that a reasonably prudent person would exercise in comparable circumstances. Nevertheless, we may have achieved more favorable terms if such transactions had not been entered into with related parties. These transactions, individually or in the aggregate, may have an adverse effect on our business and results of operations or may result in litigation or enforcement actions by the SEC or other agencies.

Potential conflicts of interest may arise due to external engagements that may be undertaken by our Chairman and Chief Executive Officer, Dato’ Mizal Zaini

Our Chairman and Chief Executive Officer, Dato’ Mizal Zaini, is renowned as a celebrity and entertainer in Malaysia. While he is wholeheartedly dedicated to our company’s operations, he may occasionally undertake engagements outside of his role with our company. Production houses or TV stations may approach Dato’ Mizal Zaini for roles or appearances, and he might choose to accept such invitations. Although we have policies and procedures that require our management to review such requests, weighing the potential benefits against risks, like preserving his popularity or enhancing our brand’s recognition, there is no guarantee that potential conflicts of interest will not occur. Dato’ Mizal Zaini’s external engagements could potentially divert the attention and time of Dato’ Mizal Zaini from his responsibilities to our company. Additionally, there may be unforeseen circumstances where the interests of these outside engagements conflict with or oppose the interests of our company. For instance, unforeseen incidents related to these appearances might tarnish the reputation of the participants. If such risks materialize, it could harm our business, financial condition, and results of operations.

We are subject to payment processing risk.