Mid-Atlantic Road Show Sponsored by Sidoti & Company, LLC January 30, 2020 Exhibit 99.1

Forward Looking Statements and Other Disclosures Safe Harbor Statement: Some of the Statements in this document concerning future Company performance will be forward-looking within the meanings of the securities laws. Actual results may materially differ from those discussed in these forward-looking statements, and you should refer to the additional information contained in Chesapeake Utilities Corporation’s 2018 Annual Report on Form 10-K filed with the SEC and our other SEC filings concerning factors that could cause those results to be different than contemplated in today’s discussion. REG G Disclosure: Today’s discussion includes certain non-GAAP financial measures as defined under SEC Regulation G. Although non-GAAP measures are not intended to replace the GAAP measures for evaluation of Chesapeake’s performance, Chesapeake believes that the portions of the presentation, which include certain non-GAAP financial measures, provide a helpful comparison for an investor’s evaluation purposes. Gross Margin (non-GAAP measure): Gross Margin is determined by deducting the cost of sales from operating revenue. Cost of sales includes the purchased fuel cost for natural gas, electric and propane distribution operations and the cost of labor spent on different revenue-producing activities and excludes depreciation, amortization and accretion. Other companies may calculate gross margin in a different manner. Adjusted EPS (non-GAAP measure): Diluted Earnings per share excluding the impact of certain significant new non-cash items, including, but not limited to, the following: the impact of unrealized mark-to-market changes and one-time charges, such as severance charges. The Company calculates "adjusted earnings” by adjusting reported (GAAP) earnings to exclude the impact of certain significant non-cash items, including the impact of unrealized MTM gains (losses), one-time charges such as severance charges, and any prior year tax savings retained by our regulated businesses as a result of current year regulatory authorizations.

Investor Overview Key Projects Driving Growth ESG Sustainability Initiatives Organic Natural Gas Growth Pipeline Expansions Marlin Gas Services Boulden Propane Acquisition Elkton Gas Acquisition 3

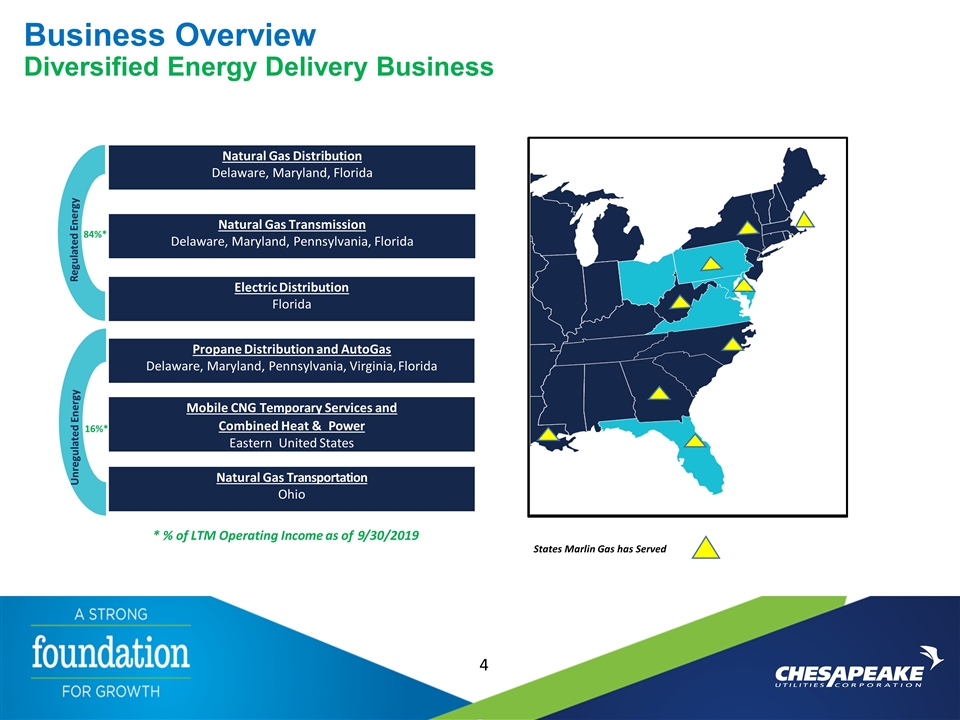

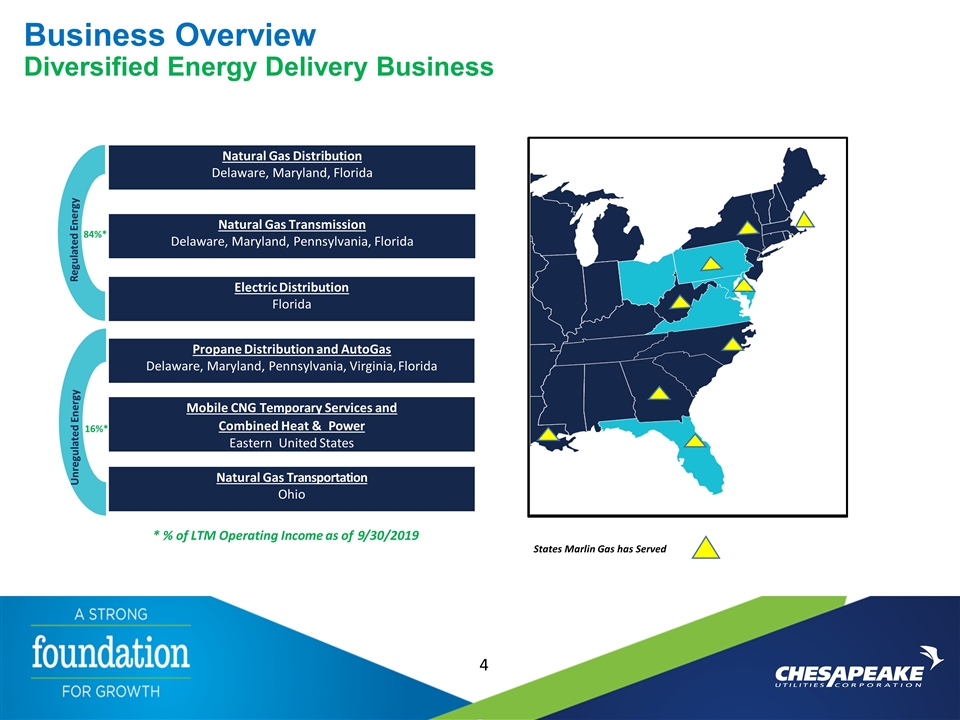

Business Overview Diversified Energy Delivery Business Natural Gas Distribution Delaware, Maryland, Florida Electric Distribution Florida Propane Distribution and AutoGas Delaware, Maryland, Pennsylvania, Virginia, Florida Natural Gas Transmission Delaware, Maryland, Pennsylvania, Florida Mobile CNG Temporary Services and Combined Heat & Power Eastern United States Regulated Energy Unregulated Energy 84%* 16%* * % of LTM Operating Income as of 9/30/2019 Natural Gas Transportation Ohio States Marlin Gas has Served 4

Commitment to Sustainability and ESG Corporate Governance is the foundation of our processes and decision making - Recently Honored by Corporate Secretary as “Governance Team of the Year” among small and mid-cap companies - Honored as “2018 Best North American Utility for Corporate Governance” Connecting with our Customers and Communities - Chesapeake Utilities recognizes that customers expect safe, efficient and reliable service , as well as providing enhanced business connection options, more convenience and modern solutions - In 2018 Chesapeake employees volunteered over 3,900 hours making personal connections and having a significant impact where we live, work and serve Employee-Centric company focused on sustaining our aspiring and caring culture - Eight years in row being recognized as a Top Workplace 5 Clean Energy Initiatives - Modern pipeline infrastructure with zero miles of cast iron - Invested $142 million in Gas Reliability and Infrastructure Project in Florida - New pipeline construction – Northwest FL, Callahan Project, Palm Beach County Project, Del-Mar Energy Pathway - Eight Flags – 20 mw natural gas CHP plant serving FPU’s electric system on Amelia Island, Florida (Displaces Coal) - Marlin Gas Services – Mobile equipment, RNG opportunities - Propane Community Gas Systems - Propane AutoGas - Delaware Government Vehicles, Private Fleets (Displaces diesel fuel for trucks) - Energy Lane Operation Center, Dover, DE – Green Globes Green Energy Certification

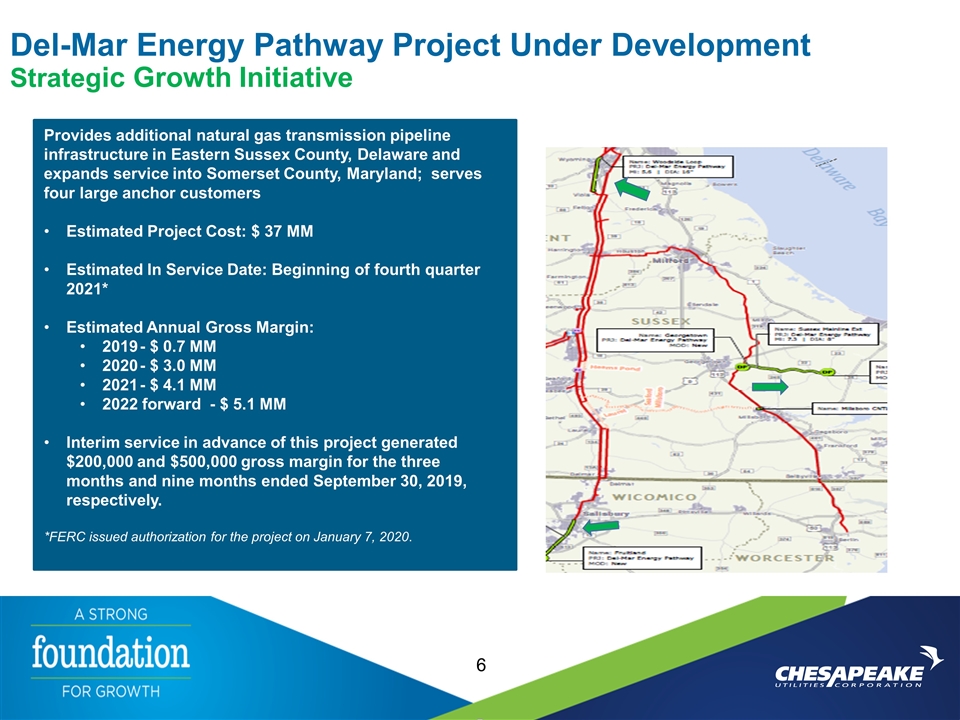

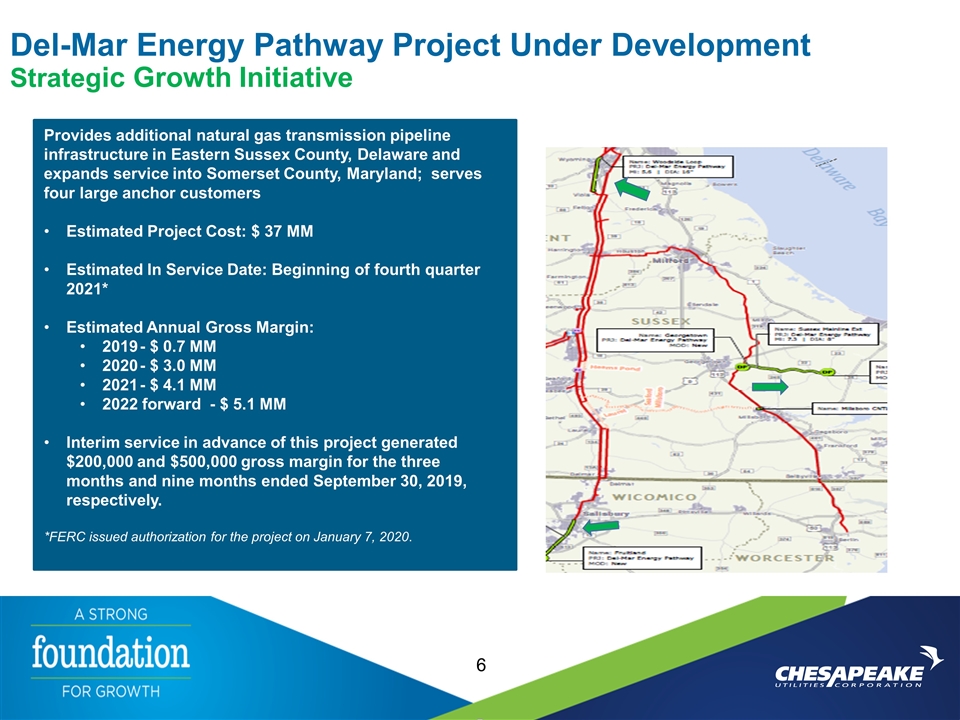

Del-Mar Energy Pathway Project Under Development Strategic Growth Initiative 6 Provides additional natural gas transmission pipeline infrastructure in Eastern Sussex County, Delaware and expands service into Somerset County, Maryland; serves four large anchor customers Estimated Project Cost: $ 37 MM Estimated In Service Date: Beginning of fourth quarter 2021* Estimated Annual Gross Margin: 2019- $ 0.7 MM 2020- $ 3.0 MM 2021- $ 4.1 MM 2022 forward - $ 5.1 MM Interim service in advance of this project generated $200,000 and $500,000 gross margin for the three months and nine months ended September 30, 2019, respectively. *FERC issued authorization for the project on January 7, 2020.

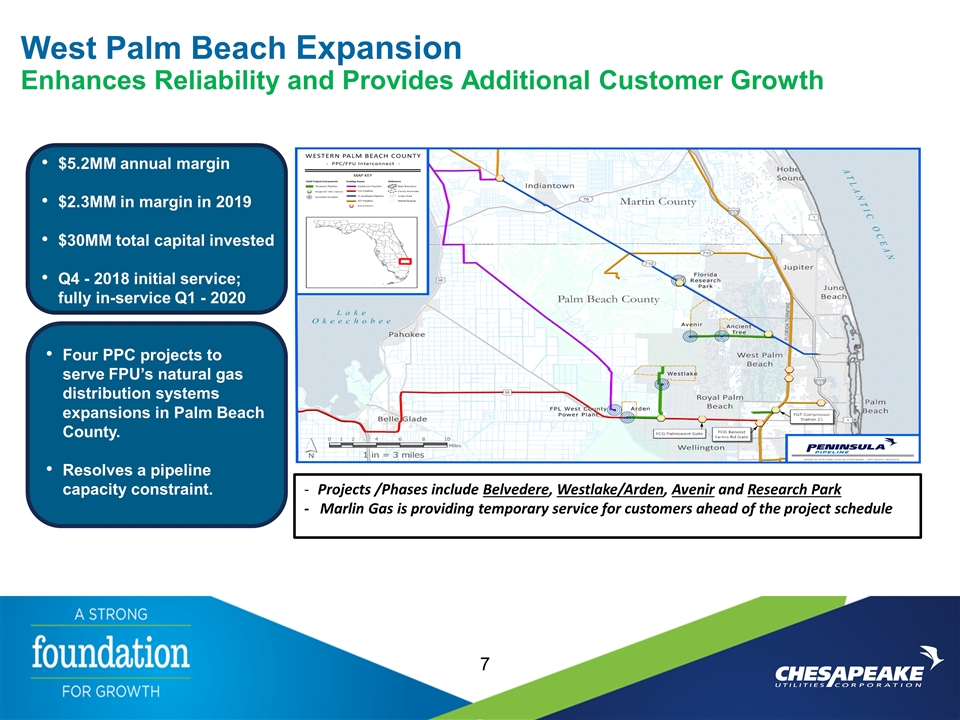

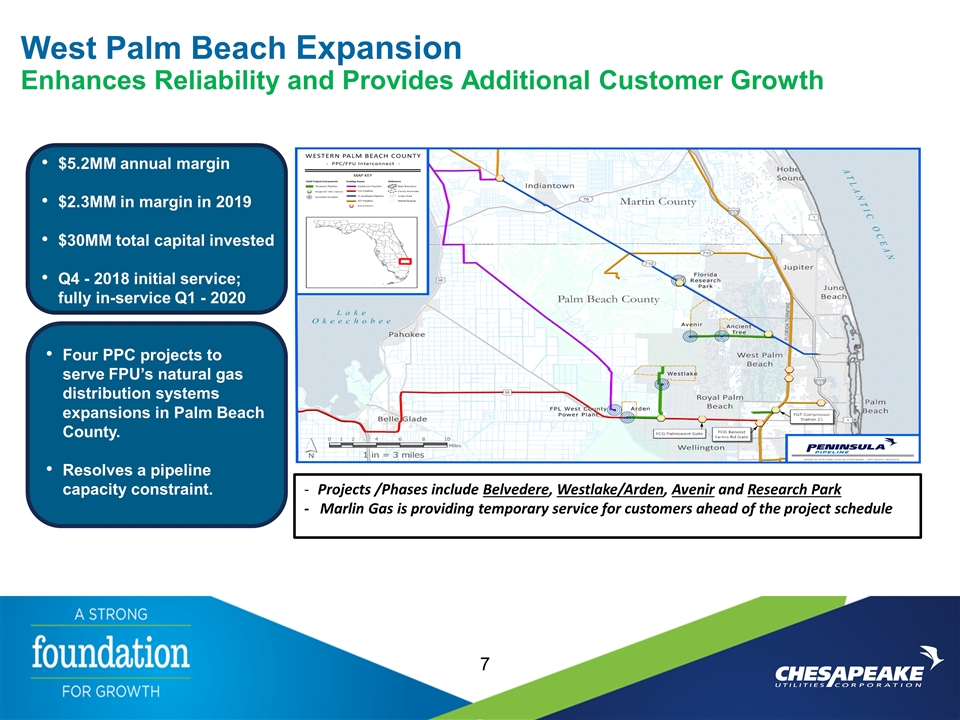

West Palm Beach Expansion Enhances Reliability and Provides Additional Customer Growth 7 $5.2MM annual margin $2.3MM in margin in 2019 $30MM total capital invested Q4 - 2018 initial service; fully in-service Q1 - 2020 Four PPC projects to serve FPU’s natural gas distribution systems expansions in Palm Beach County. Resolves a pipeline capacity constraint. Projects /Phases include Belvedere, Westlake/Arden, Avenir and Research Park - Marlin Gas is providing temporary service for customers ahead of the project schedule

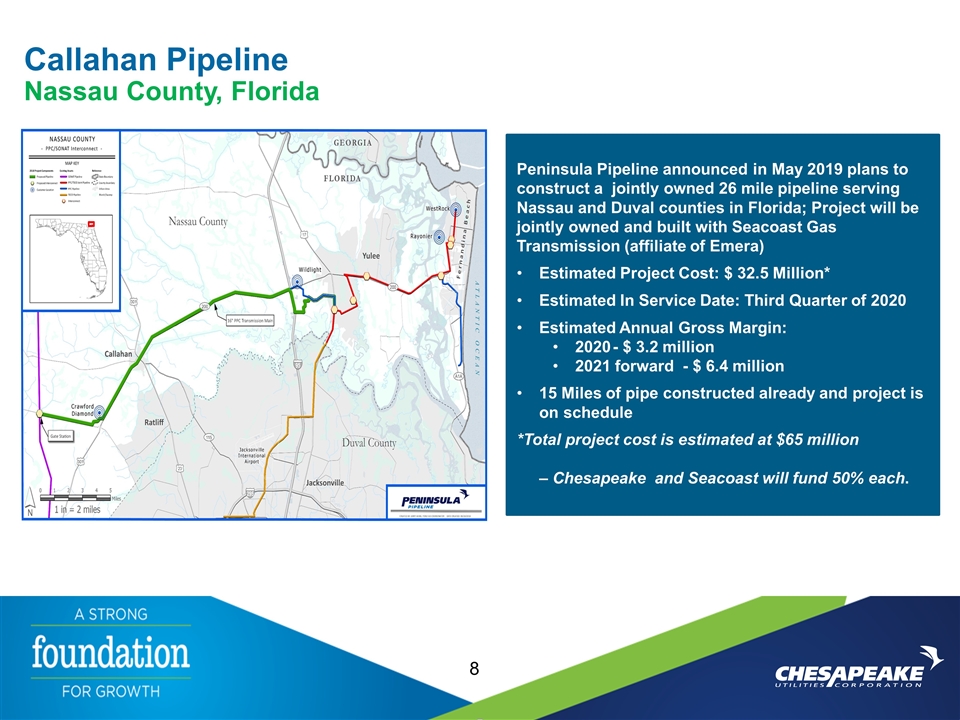

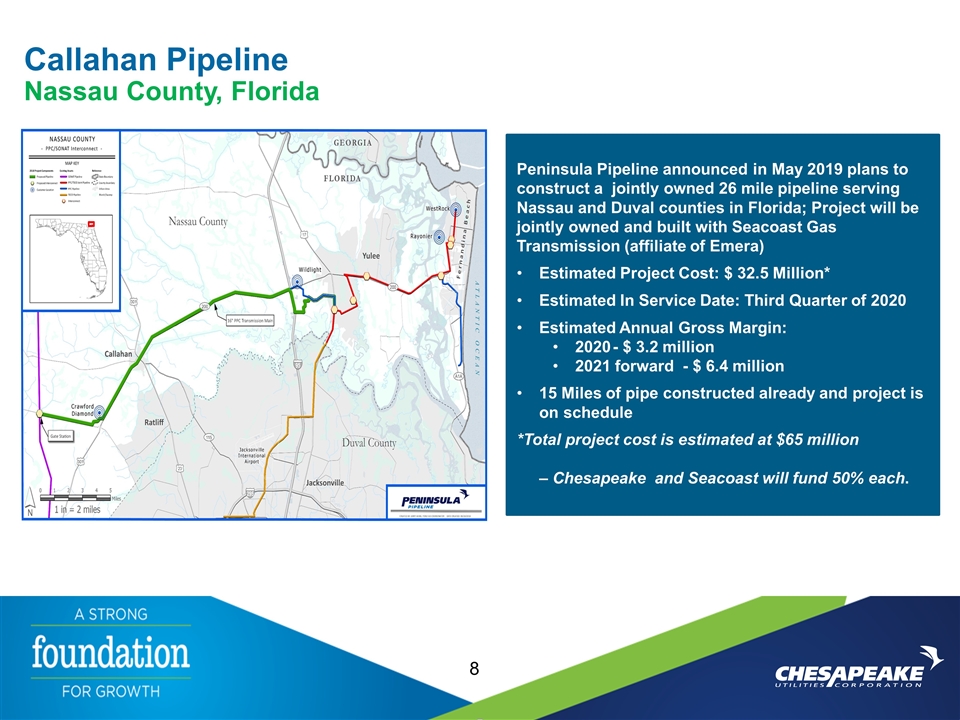

Callahan Pipeline Nassau County, Florida 8 Peninsula Pipeline announced in May 2019 plans to construct a jointly owned 26 mile pipeline serving Nassau and Duval counties in Florida; Project will be jointly owned and built with Seacoast Gas Transmission (affiliate of Emera) Estimated Project Cost: $ 32.5 Million* Estimated In Service Date: Third Quarter of 2020 Estimated Annual Gross Margin: 2020- $ 3.2 million 2021 forward - $ 6.4 million 15 Miles of pipe constructed already and project is on schedule *Total project cost is estimated at $65 million – Chesapeake and Seacoast will fund 50% each.

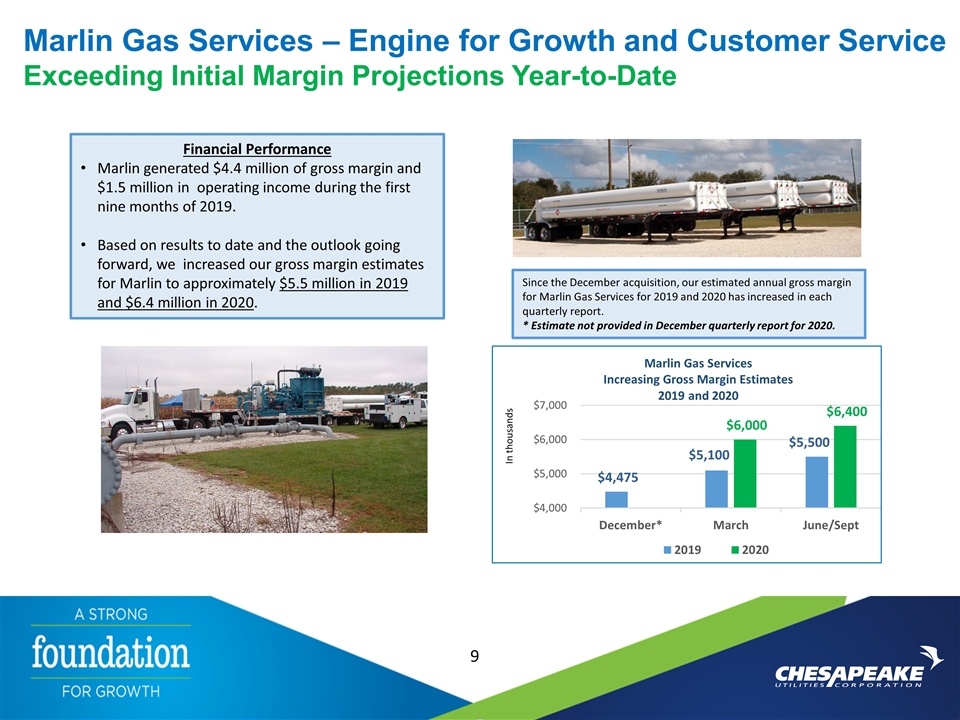

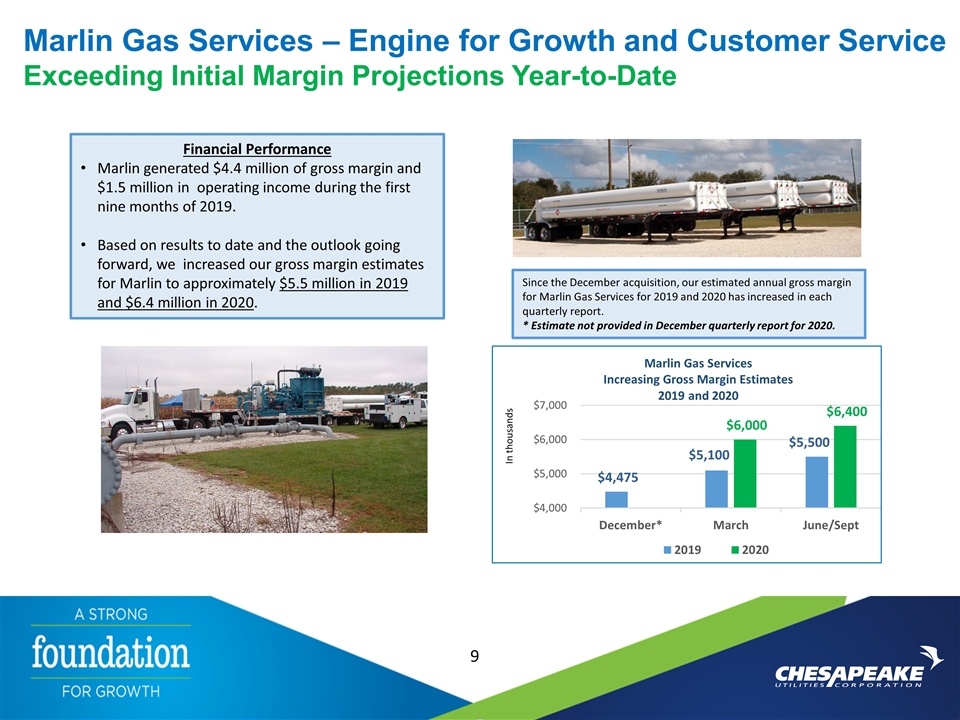

Marlin Gas Services – Engine for Growth and Customer Service Exceeding Initial Margin Projections Year-to-Date Financial Performance Marlin generated $4.4 million of gross margin and $1.5 million in operating income during the first nine months of 2019. Based on results to date and the outlook going forward, we increased our gross margin estimates for Marlin to approximately $5.5 million in 2019 and $6.4 million in 2020. 9 In thousands Since the December acquisition, our estimated annual gross margin for Marlin Gas Services for 2019 and 2020 has increased in each quarterly report. * Estimate not provided in December quarterly report for 2020.

Aspire Energy – Natural Gas Pipeline Project Guernsey Power Station In December 2017, Aspire executed a binding precedent agreement with Guernsey Power Station, LLC (GPS) providing for the relocation of an existing 6” steel Aspire pipeline (completed March 2018). Aspire received the exclusive rights to provide natural gas transportation services for a ten year period (300,000 Dths per day for a proposed 1,650 MW power plant). Guernsey Power Station began construction in Q4 2019. Aspire is finishing design and reviewing bids for construction of interconnect facilities between the Tallgrass Energy Partners Rockies Express Pipeline (REX) and GPS. GPS is expected to be in service by late 2021. Capital Expenditures $5.5MM Margin $1.4MM 10

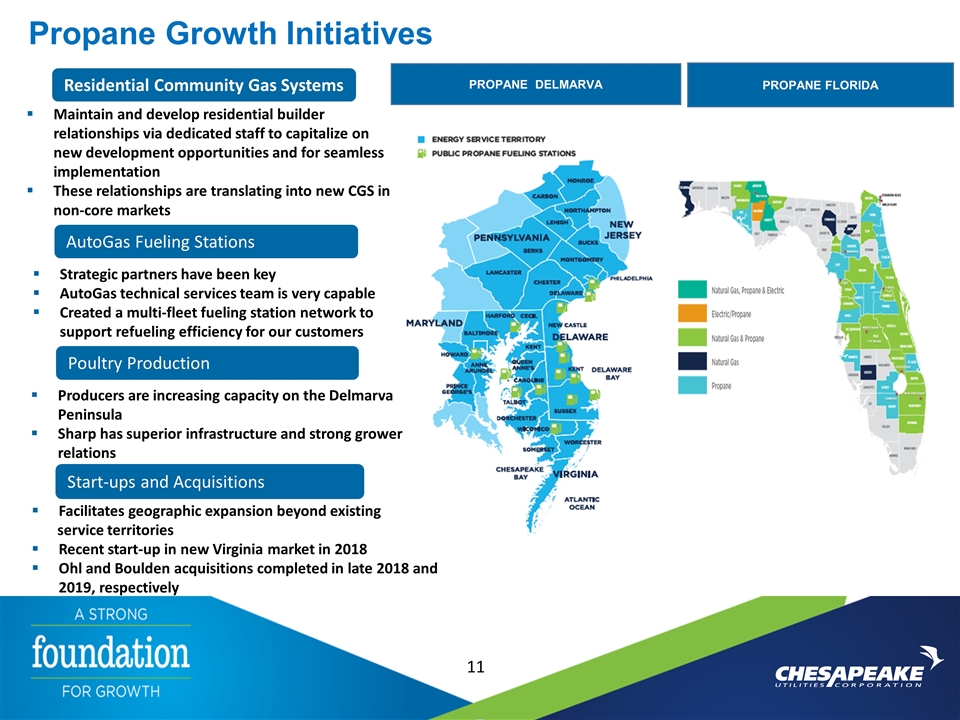

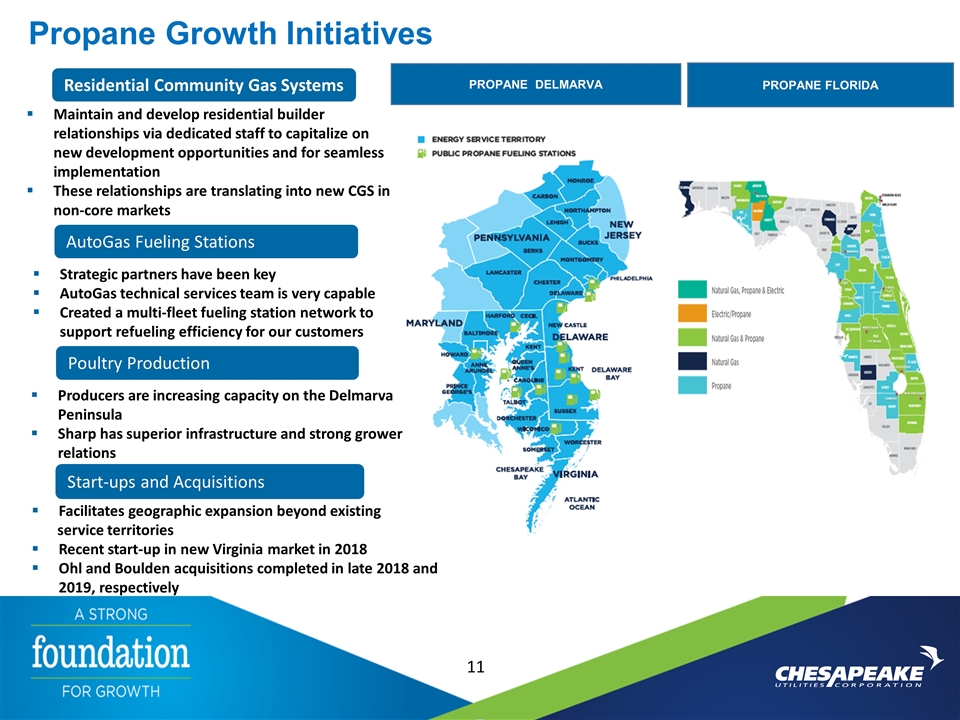

Propane Growth Initiatives Maintain and develop residential builder relationships via dedicated staff to capitalize on new development opportunities and for seamless implementation These relationships are translating into new CGS in non-core markets AutoGas Fueling Stations Strategic partners have been key AutoGas technical services team is very capable Created a multi-fleet fueling station network to support refueling efficiency for our customers Start-ups and Acquisitions Facilitates geographic expansion beyond existing service territories Recent start-up in new Virginia market in 2018 Ohl and Boulden acquisitions completed in late 2018 and 2019, respectively Poultry Production Producers are increasing capacity on the Delmarva Peninsula Sharp has superior infrastructure and strong grower relations Residential Community Gas Systems 25 11 PROPANE FLORIDA PROPANE DELMARVA

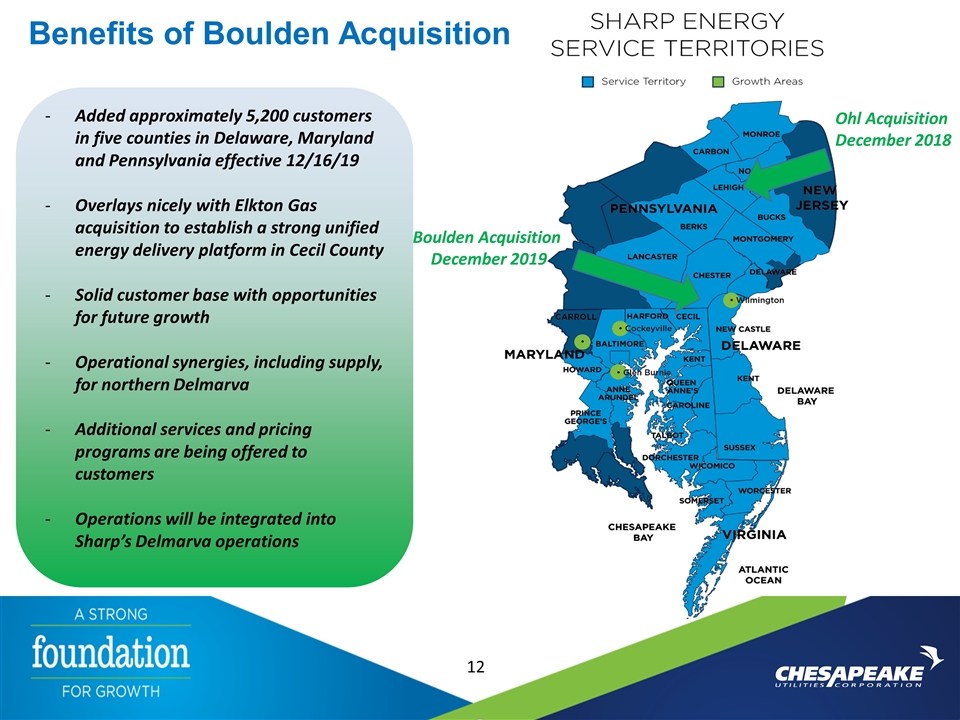

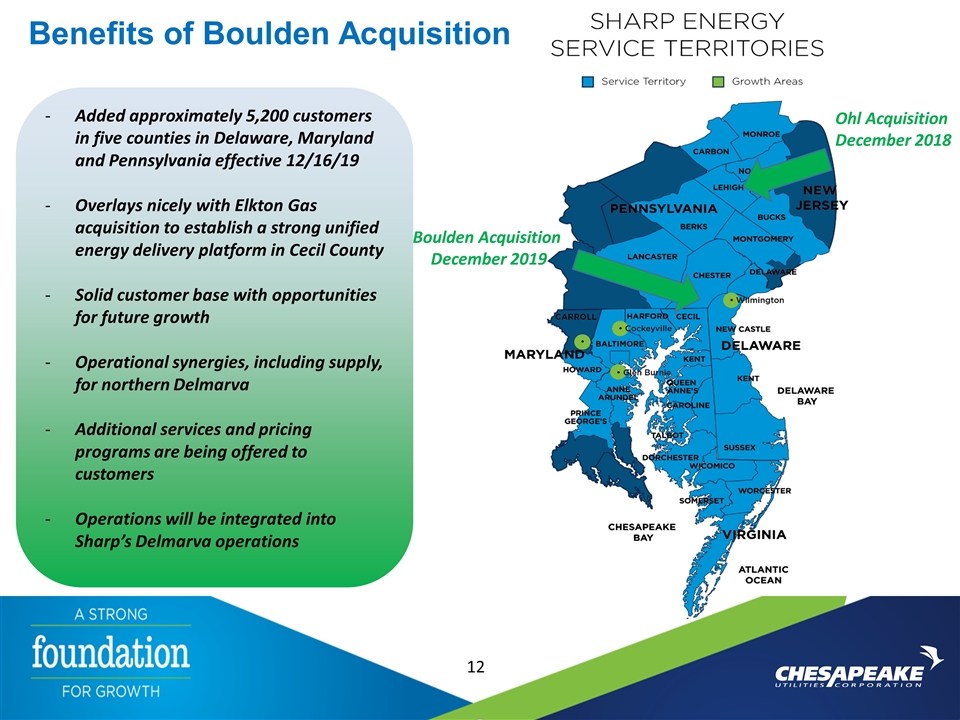

Benefits of Boulden Acquisition 25 12 Ohl Acquisition December 2018 Added approximately 5,200 customers in five counties in Delaware, Maryland and Pennsylvania effective 12/16/19 Overlays nicely with Elkton Gas acquisition to establish a strong unified energy delivery platform in Cecil County Solid customer base with opportunities for future growth Operational synergies, including supply, for northern Delmarva Additional services and pricing programs are being offered to customers Operations will be integrated into Sharp’s Delmarva operations Boulden Acquisition December 2019

Elkton Gas Company Strategic Acquisition for Delmarva Natural Gas Summary of Transaction: On December 5, 2019, Chesapeake Utilities and South Jersey Industries entered into an agreement under which Chesapeake will acquire Elkton Gas Company for approximately $15 million The transaction is expected to close by the end of the third quarter 2020, subject to receiving approval from the Maryland Public Service Commission Elkton Gas serves approximately 7,000 customers within a franchised area of Cecil County, Maryland Its territory is contiguous to Chesapeake’s franchised service territory in Cecil County, Maryland Elkton Gas has been a customer of Chesapeake’s interstate transmission pipeline subsidiary, Eastern Shore Natural Gas, since 1959 when natural gas first became available to serve the town of Elkton Elkton Gas will continue to operate out of its existing office with the same local personnel With the expanded presence in Cecil County, the gas distribution system can be serviced locally with Chesapeake personnel rather than remotely from our Dover, DE operations center

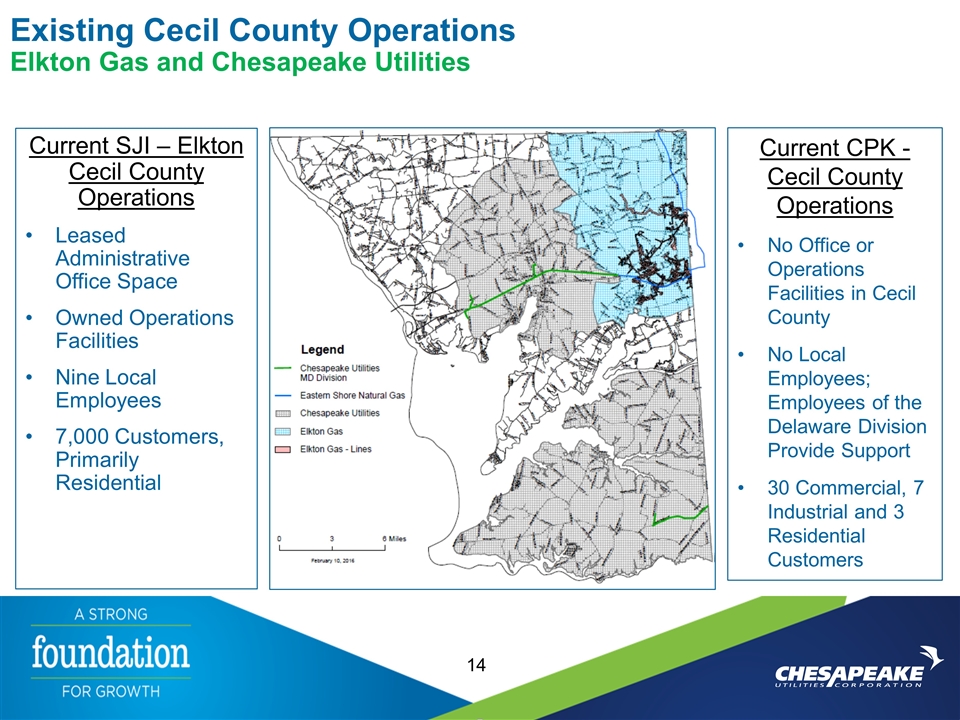

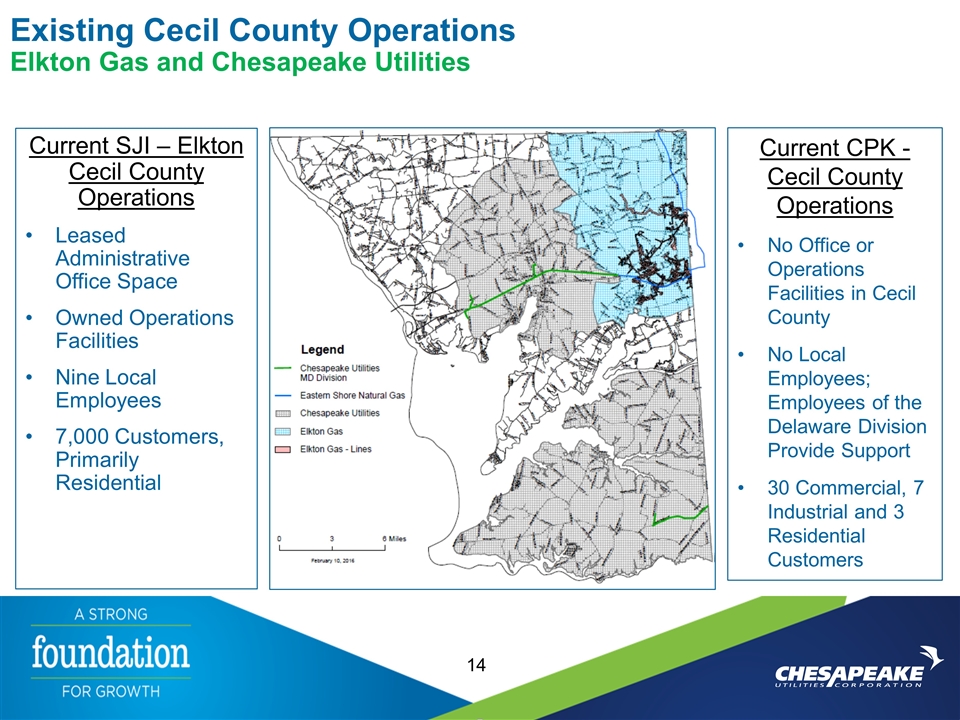

Existing Cecil County Operations Elkton Gas and Chesapeake Utilities Current SJI – Elkton Cecil County Operations Leased Administrative Office Space Owned Operations Facilities Nine Local Employees 7,000 Customers, Primarily Residential Current CPK - Cecil County Operations No Office or Operations Facilities in Cecil County No Local Employees; Employees of the Delaware Division Provide Support 30 Commercial, 7 Industrial and 3 Residential Customers

Elkton Gas Company Strategic Fit Elkton Gas gives CPK an operational platform in Cecil County including personnel, a contractor pool and an operations center which will enable Chesapeake to more quickly expand our footprint in Cecil County Additional growth is expected in the area, due to its proximity to I-95 and the potential for a new interchange which is expected to spur additional commercial and industrial development A new 623 acre mixed use development has been proposed that would potentially add 4,289,000 sq. ft. of industrial/warehouse space, 257,600 sq. ft. of commercial/retail space and 1,205 homes Access to I-95 also provides potential opportunities for Marlin to expand its CNG and LNG business The acquisition will provide access to additional upstream capacity resources

Financial Update 16

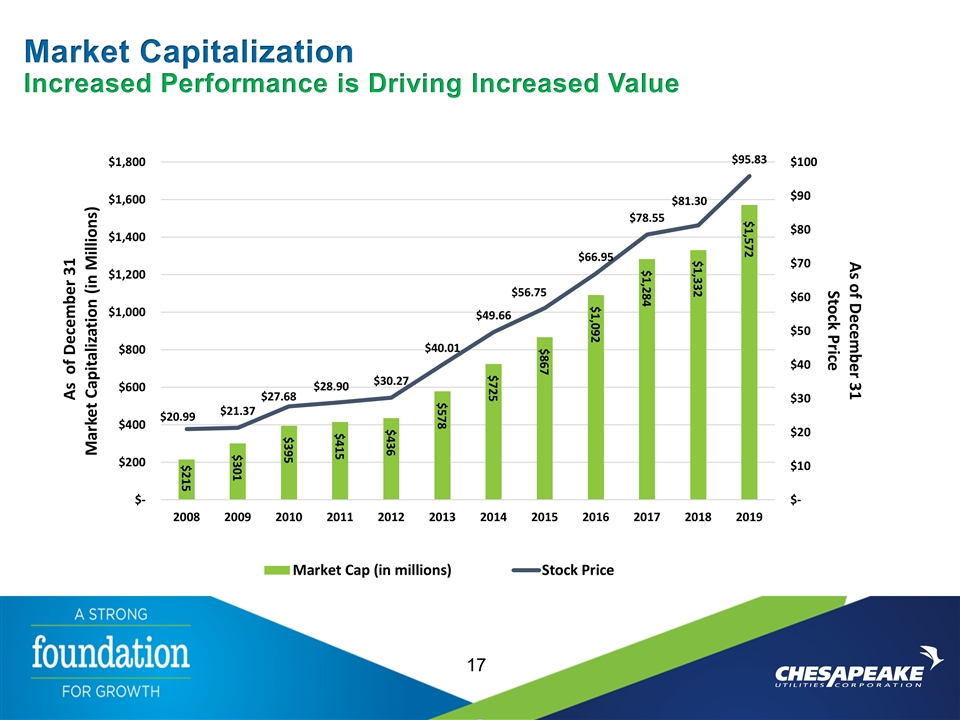

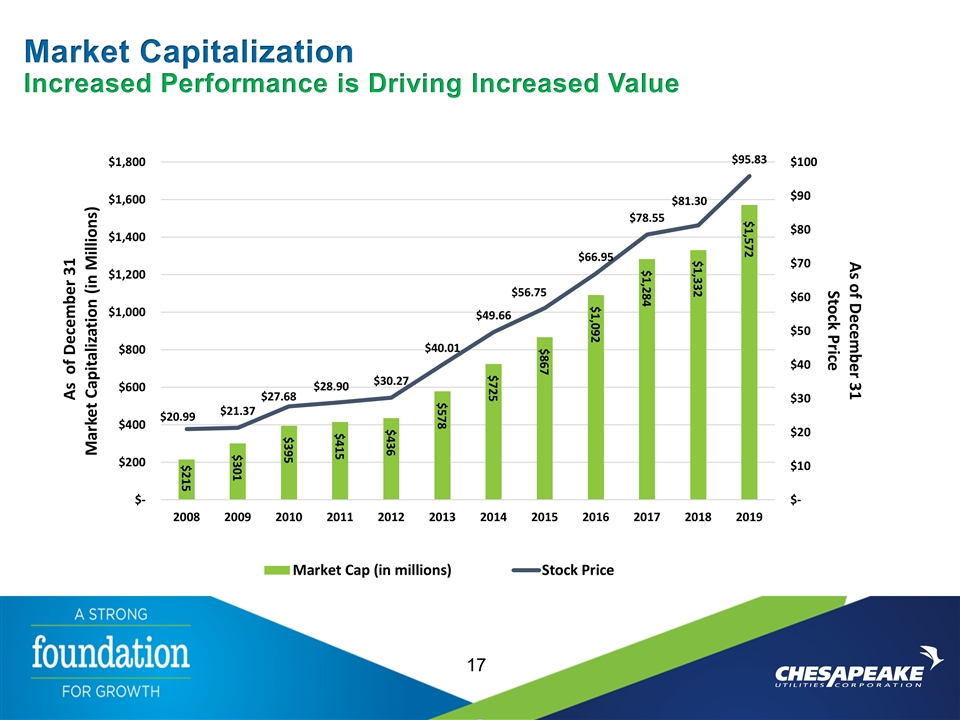

Market Capitalization Increased Performance is Driving Increased Value

Long-term Earnings Track Record Positioned for Growth and Total Return 18 $4.20 $4.55 ¹ 2017 GAAP $3.55; Adjusted $2.89; ² 2018 GAAP $3.45; Adjusted $3.31 Outlook for earnings growth within the range of previous guidance remains strong Commitment to achieve the target range is demonstrated by our long-term track record of delivering superior growth Expansion projects, organic growth and regulatory and efficiency initiatives will continue to drive increased earnings We will continue to pursue accretive, related opportunities like Marlin, Aspire and Eight Flags Annualized EPS Growth Target 7.75% to 9.5%

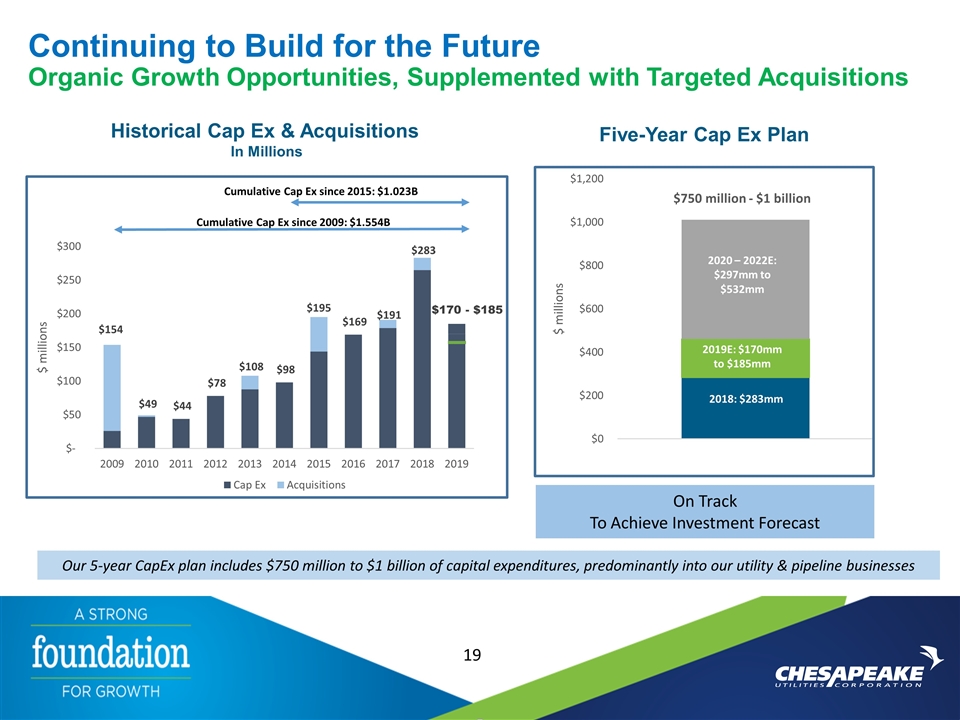

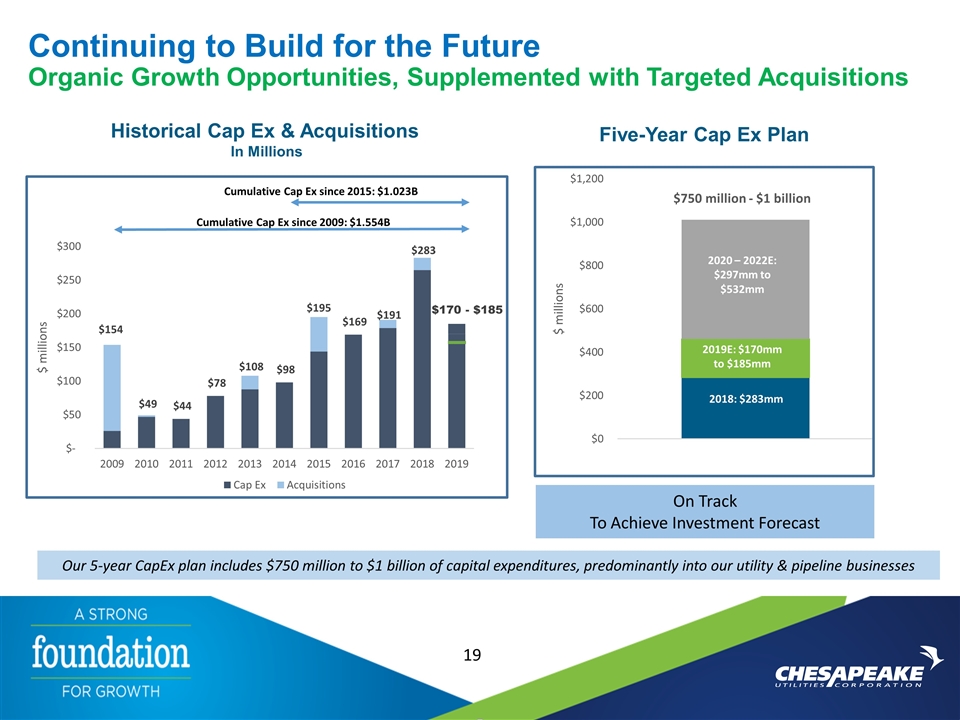

Continuing to Build for the Future Organic Growth Opportunities, Supplemented with Targeted Acquisitions Five-Year Cap Ex Plan Historical Cap Ex & Acquisitions In Millions Our 5-year CapEx plan includes $750 million to $1 billion of capital expenditures, predominantly into our utility & pipeline businesses 2019E: $170mm to $185mm 2018: $283mm 2020 – 2022E: $297mm to $532mm $750 million - $1 billion On Track To Achieve Investment Forecast

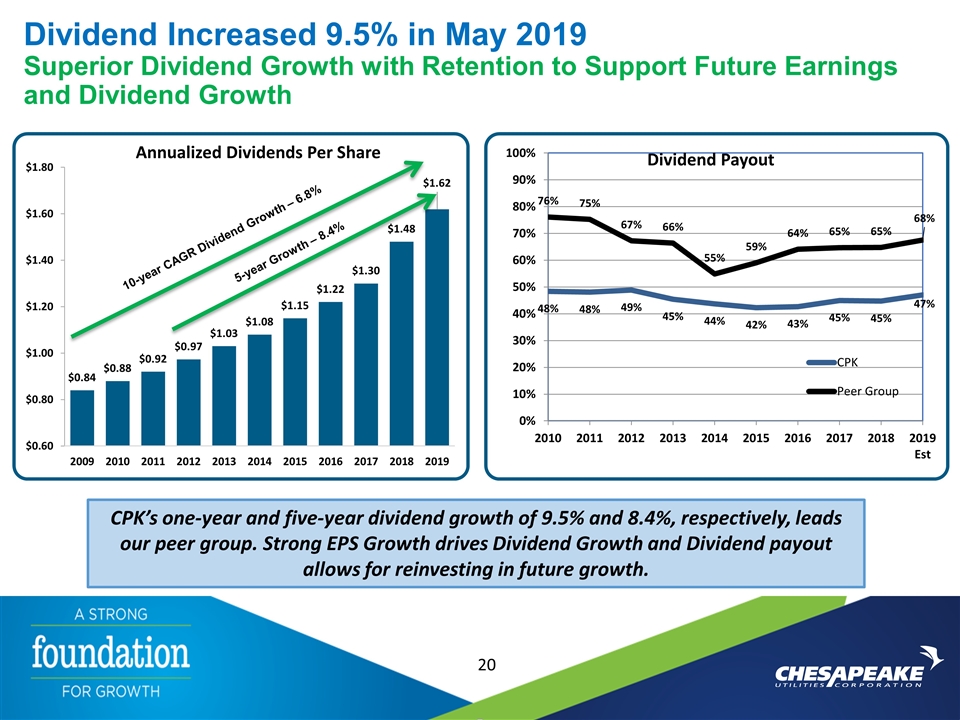

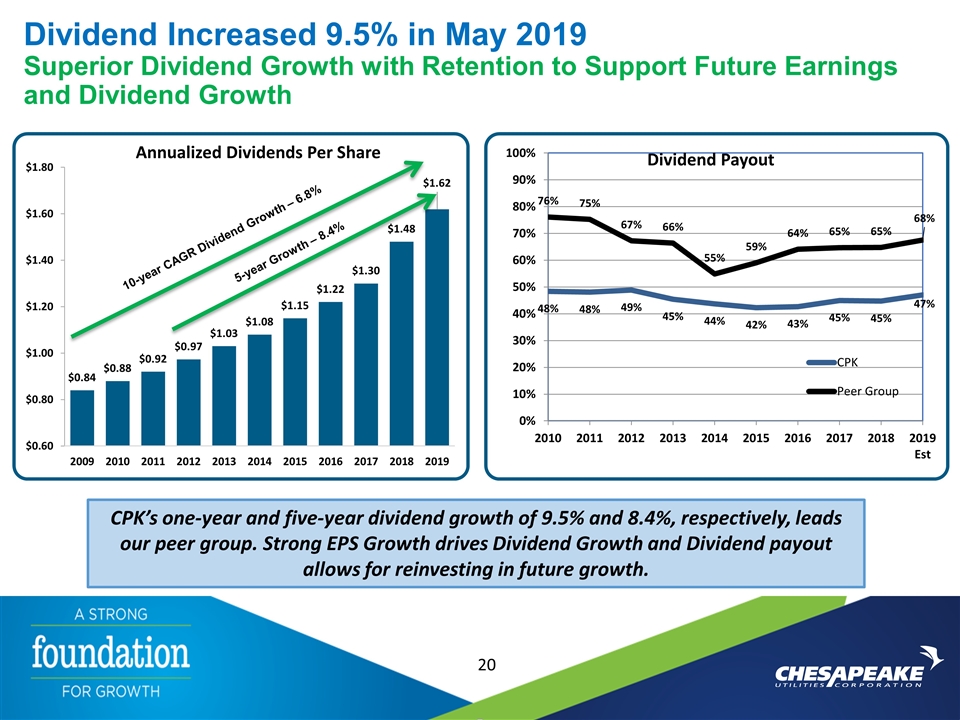

Dividend Increased 9.5% in May 2019 Superior Dividend Growth with Retention to Support Future Earnings and Dividend Growth CPK’s one-year and five-year dividend growth of 9.5% and 8.4%, respectively, leads our peer group. Strong EPS Growth drives Dividend Growth and Dividend payout allows for reinvesting in future growth. 20 10-year CAGR Dividend Growth – 6.8% 5-year Growth – 8.4%

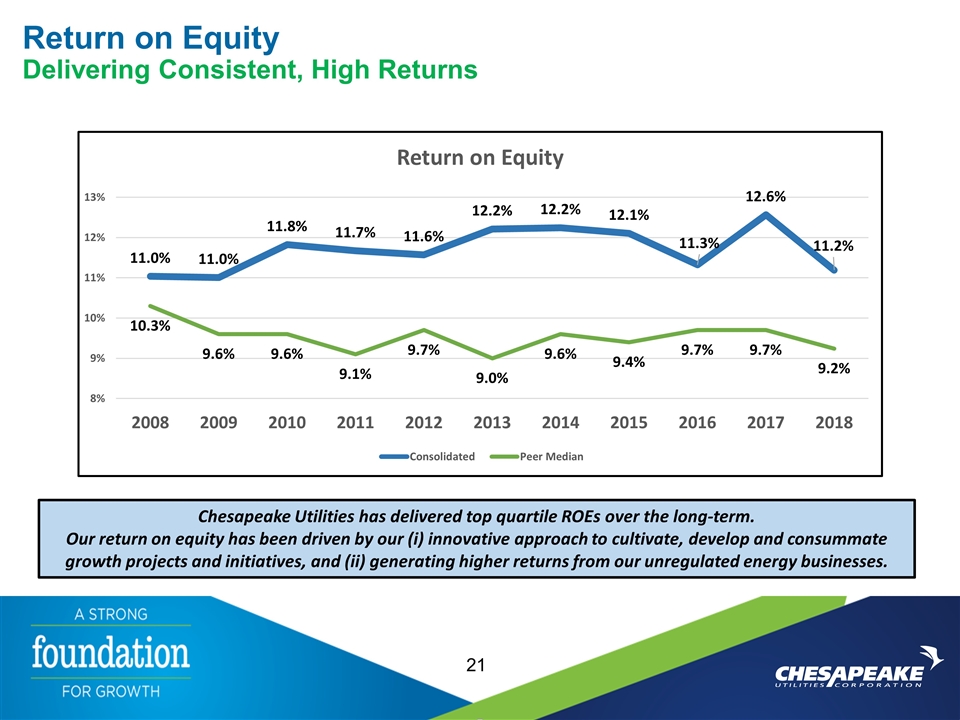

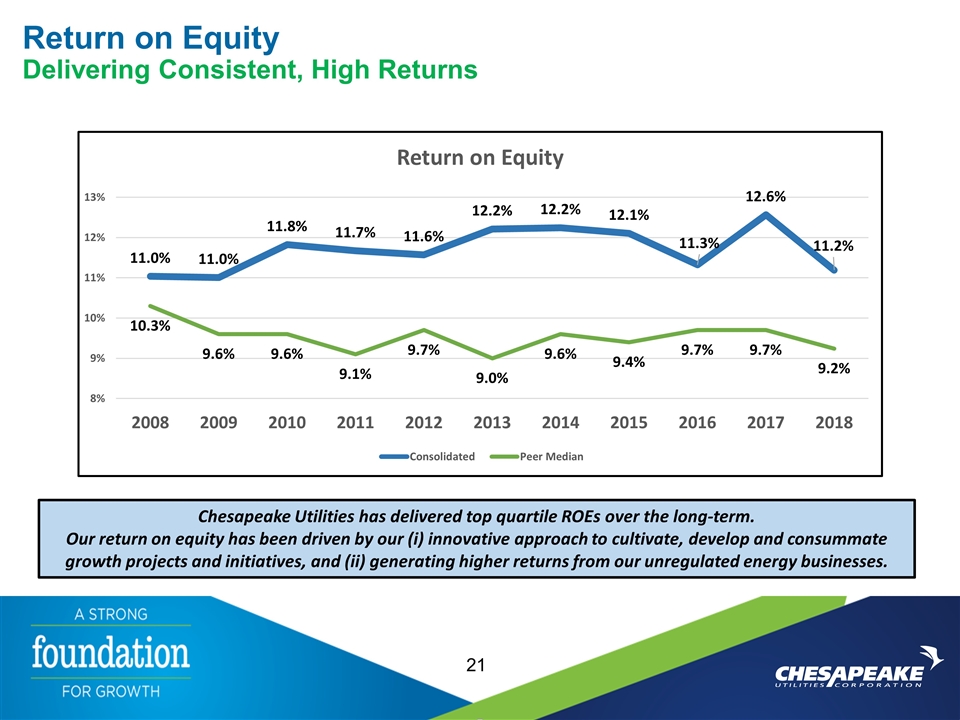

Return on Equity Delivering Consistent, High Returns 21 Chesapeake Utilities has delivered top quartile ROEs over the long-term. Our return on equity has been driven by our (i) innovative approach to cultivate, develop and consummate growth projects and initiatives, and (ii) generating higher returns from our unregulated energy businesses.

Chesapeake Utilities Corporation Committed to Superior Performance We seek to identify and develop opportunities to drive our future earnings growth and increase shareholder value. Executing on Our Strategy: Seek development projects to serve new customers, provide new services and expand into new service areas. Investing in pipeline systems that provide natural gas service to downstream customers such as LDCs, cooperatives, municipalities, industrial end-users and power plants. Pursue expansion projects that serve long-term commercial and industrial customers. Investing in propane opportunities to access new markets with significant growth potential. Pursuing new platforms for growth given our Marlin investment (CNG, LNG, RNG) Engagement strategies with employees to continually build our strategic infrastructure for sustainable growth. Investing in our talent with targeted development plans, training and resources. Engaging with communities where we work and live Pursue excellence through safety awards, top workplace, employee engagement and community service

Thank You! Beth Cooper Executive Vice President, CFO and Asst. Secretary bcooper@chpk.com Any Questions? Thomas E. Mahn Vice President and Treasurer tmahn@chpk.com

Appendices

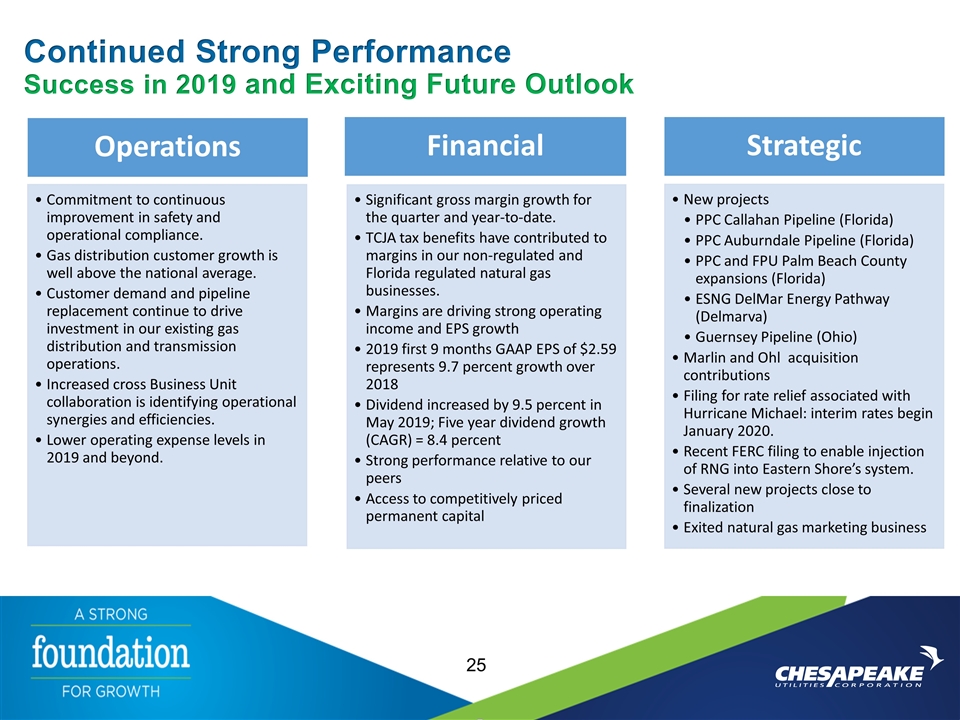

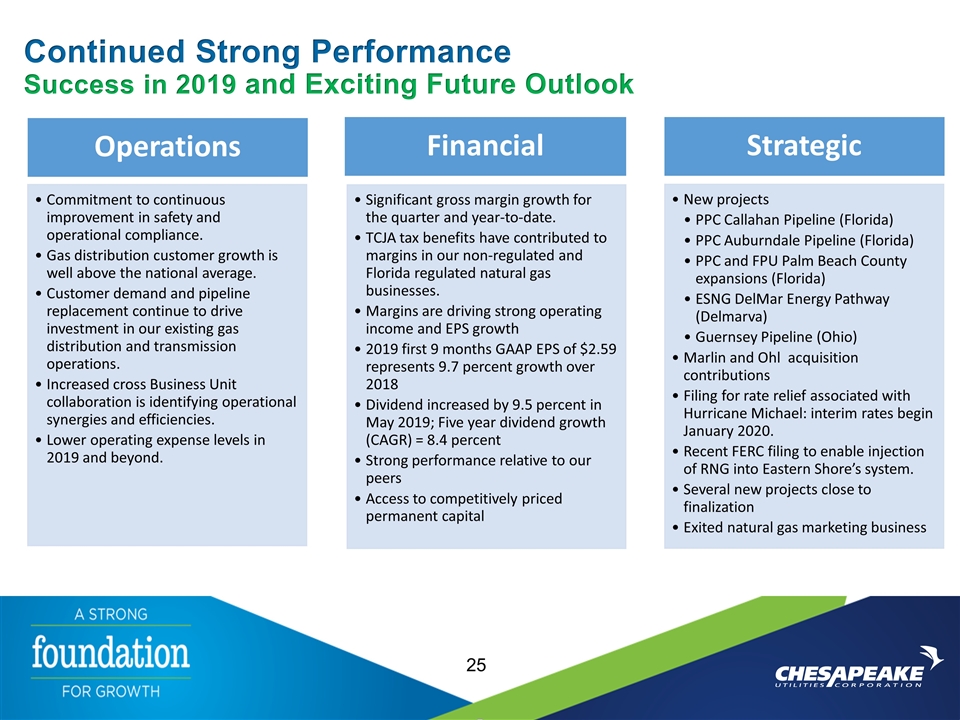

Continued Strong Performance Success in 2019 and Exciting Future Outlook Operations Significant gross margin growth for the quarter and year-to-date. Margins are driving strong operating income and EPS growth Financial New projects Several new projects close to finalization Strategic Customer demand and pipeline replacement continue to drive investment in our existing gas distribution and transmission operations. PPC Callahan Pipeline (Florida) PPC Auburndale Pipeline (Florida) Guernsey Pipeline (Ohio) Filing for rate relief associated with Hurricane Michael: interim rates begin January 2020. Strong performance relative to our peers Access to competitively priced permanent capital Recent FERC filing to enable injection of RNG into Eastern Shore’s system. Commitment to continuous improvement in safety and operational compliance. 2019 first 9 months GAAP EPS of $2.59 represents 9.7 percent growth over 2018 Marlin and Ohl acquisition contributions Exited natural gas marketing business Gas distribution customer growth is well above the national average. Increased cross Business Unit collaboration is identifying operational synergies and efficiencies. Lower operating expense levels in 2019 and beyond. Dividend increased by 9.5 percent in May 2019; Five year dividend growth (CAGR) = 8.4 percent TCJA tax benefits have contributed to margins in our non-regulated and Florida regulated natural gas businesses. PPC and FPU Palm Beach County expansions (Florida) ESNG DelMar Energy Pathway (Delmarva)

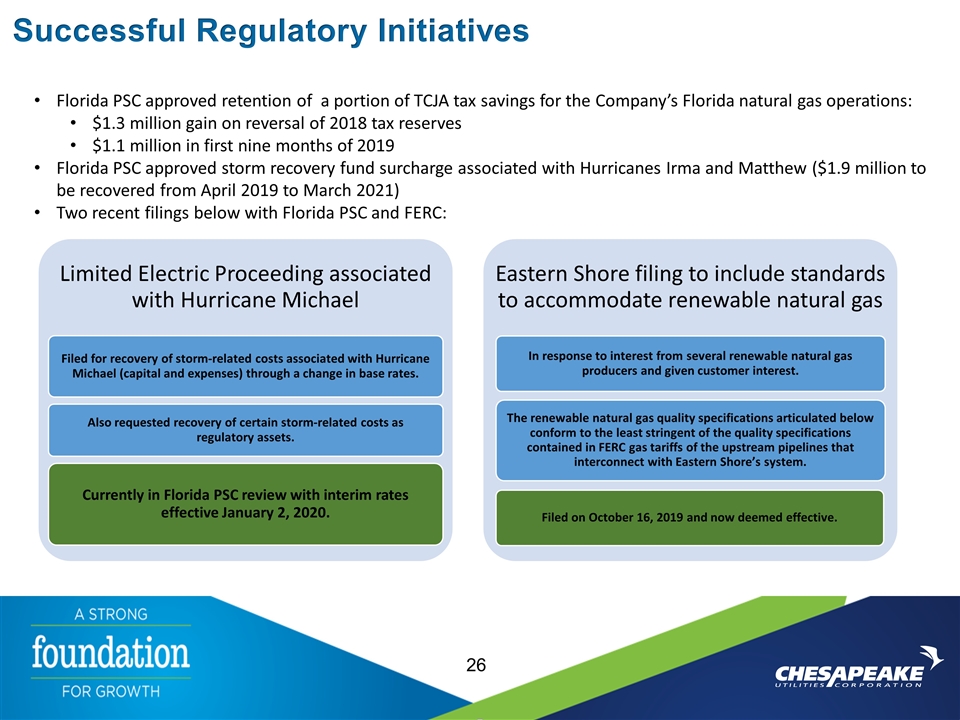

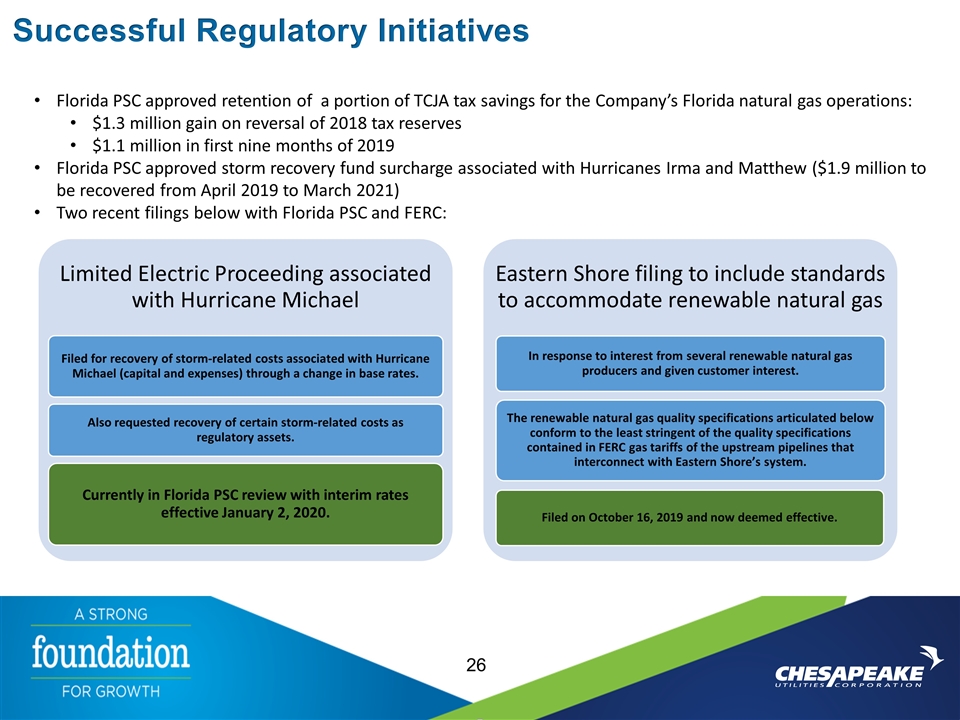

Successful Regulatory Initiatives 26 Florida PSC approved retention of a portion of TCJA tax savings for the Company’s Florida natural gas operations: $1.3 million gain on reversal of 2018 tax reserves $1.1 million in first nine months of 2019 Florida PSC approved storm recovery fund surcharge associated with Hurricanes Irma and Matthew ($1.9 million to be recovered from April 2019 to March 2021) Two recent filings below with Florida PSC and FERC: Limited Electric Proceeding associated with Hurricane Michael Filed for recovery of storm-related costs associated with Hurricane Michael (capital and expenses) through a change in base rates. Eastern Shore filing to include standards to accommodate renewable natural gas In response to interest from several renewable natural gas producers and given customer interest. Also requested recovery of certain storm-related costs as regulatory assets. Currently in Florida PSC review with interim rates effective January 2, 2020. The renewable natural gas quality specifications articulated below conform to the least stringent of the quality specifications contained in FERC gas tariffs of the upstream pipelines that interconnect with Eastern Shore’s system. Filed on October 16, 2019 and now deemed effective.

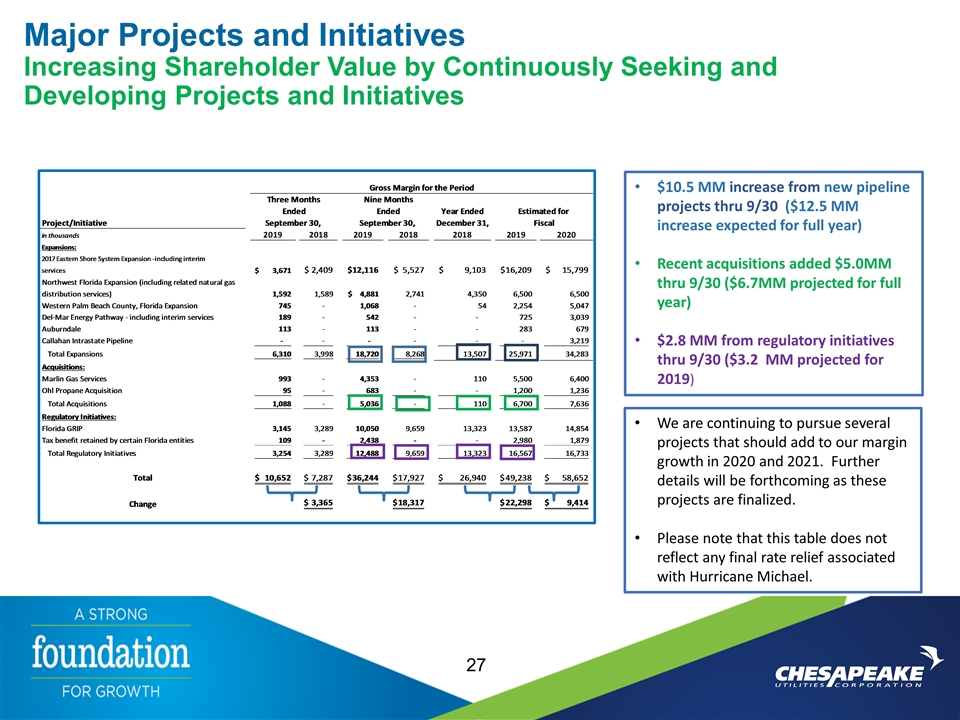

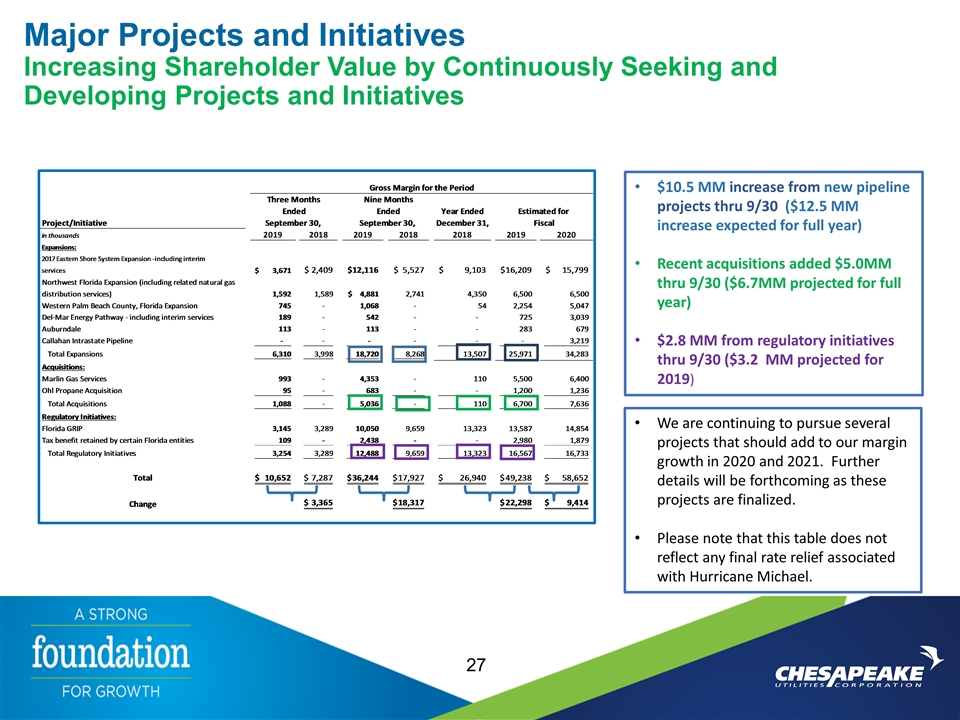

Major Projects and Initiatives Increasing Shareholder Value by Continuously Seeking and Developing Projects and Initiatives 27 $10.5 MM increase from new pipeline projects thru 9/30 ($12.5 MM increase expected for full year) Recent acquisitions added $5.0MM thru 9/30 ($6.7MM projected for full year) $2.8 MM from regulatory initiatives thru 9/30 ($3.2 MM projected for 2019) We are continuing to pursue several projects that should add to our margin growth in 2020 and 2021. Further details will be forthcoming as these projects are finalized. Please note that this table does not reflect any final rate relief associated with Hurricane Michael.

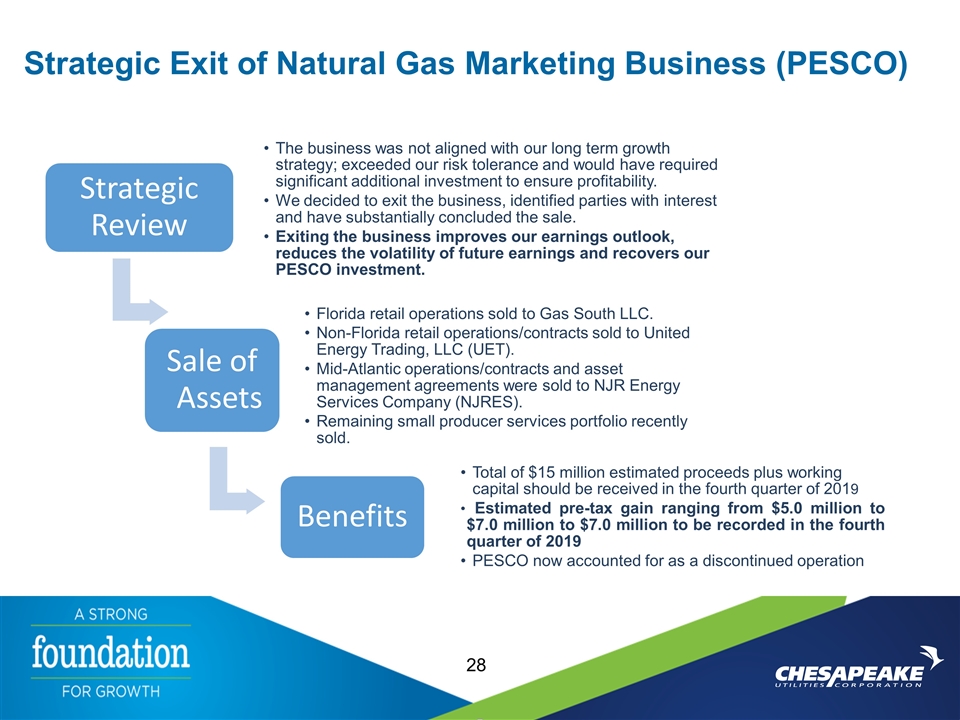

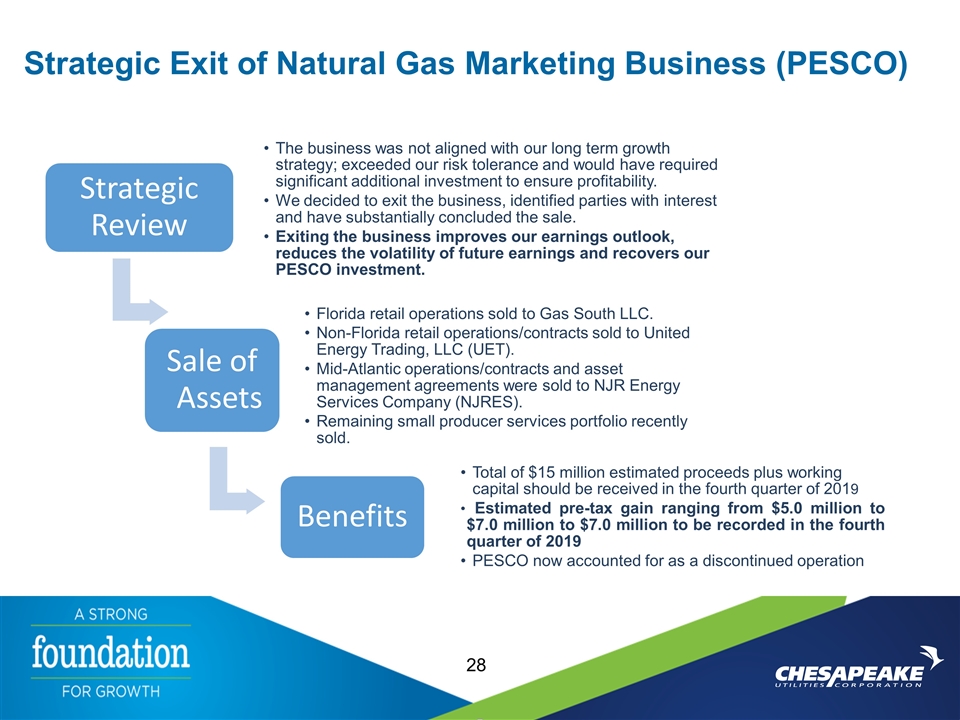

Strategic Exit of Natural Gas Marketing Business (PESCO) 28 Strategic Review The business was not aligned with our long term growth strategy; exceeded our risk tolerance and would have required significant additional investment to ensure profitability. Florida retail operations sold to Gas South LLC. Benefits Total of $15 million estimated proceeds plus working capital should be received in the fourth quarter of 201 9 Non-Florida retail operations/contracts sold to United Energy Trading, LLC (UET). Mid-Atlantic operations/contracts and asset management agreements were sold to NJR Energy Services Company (NJRES). PESCO now accounted for as a discontinued operation Remaining small producer services portfolio recently sold. We decided to exit the business, identified parties with interest and have substantially concluded the sale. Sale of Assets Exiting the business improves our earnings outlook, reduces the volatility of future earnings and recovers our PESCO investment. Estimated pre-tax gain ranging from $5.0 million to $7.0 million to $7.0 million to be recorded in the fourth quarter of 2019

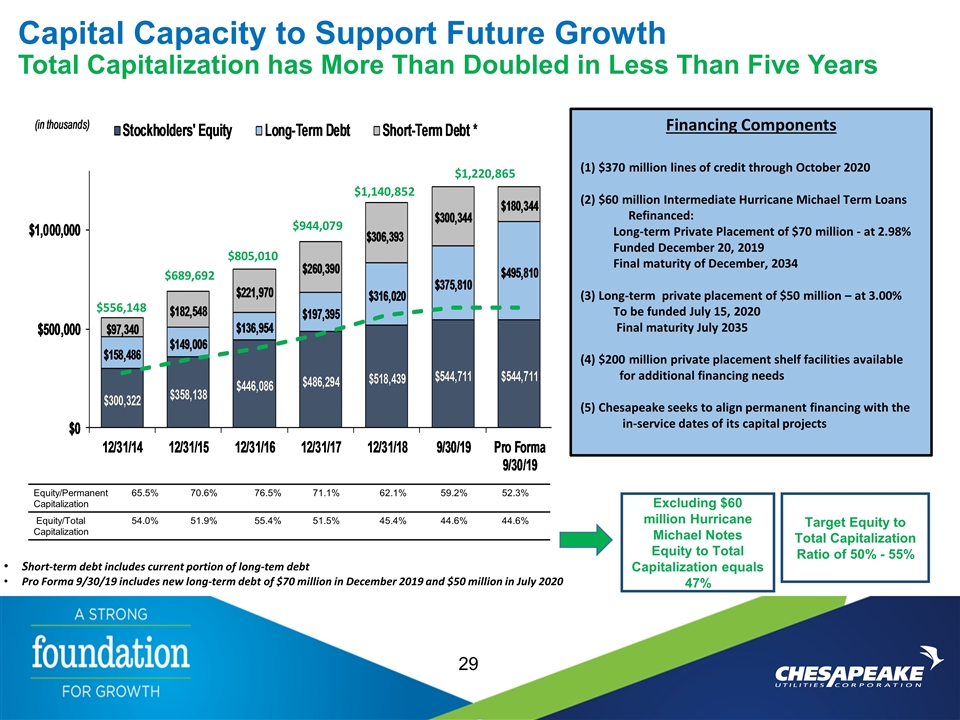

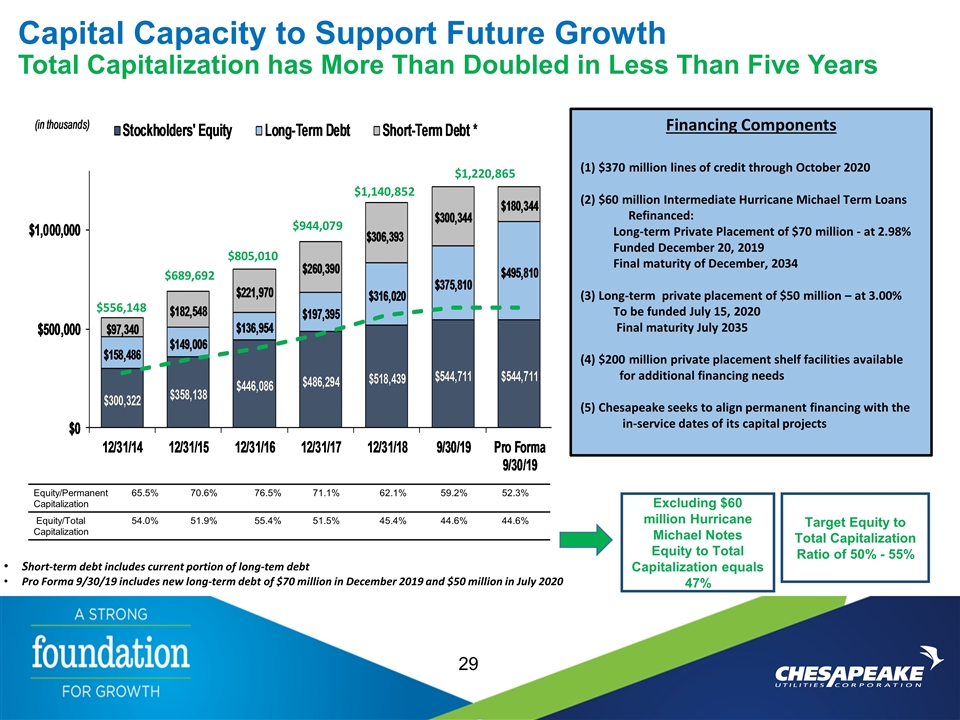

Capital Capacity to Support Future Growth Total Capitalization has More Than Doubled in Less Than Five Years 29 Equity/Permanent Capitalization 65.5% 70.6% 76.5% 71.1% 62.1% 59.2% 52.3% Equity/Total Capitalization 54.0% 51.9% 55.4% 51.5% 45.4% 44.6% 44.6% $556,148 $689,692 $805,010 $944,079 $1,220,865 Target Equity to Total Capitalization Ratio of 50% - 55% Excluding $60 million Hurricane Michael Notes Equity to Total Capitalization equals 47% $1,140,852 Short-term debt includes current portion of long-tem debt Pro Forma 9/30/19 includes new long-term debt of $70 million in December 2019 and $50 million in July 2020 Financing Components (1) $370 million lines of credit through October 2020 (2) $60 million Intermediate Hurricane Michael Term Loans Refinanced: Long-term Private Placement of $70 million - at 2.98% Funded December 20, 2019 Final maturity of December, 2034 (3) Long-term private placement of $50 million – at 3.00% To be funded July 15, 2020 Final maturity July 2035 (4) $200 million private placement shelf facilities available for additional financing needs (5) Chesapeake seeks to align permanent financing with the in-service dates of its capital projects