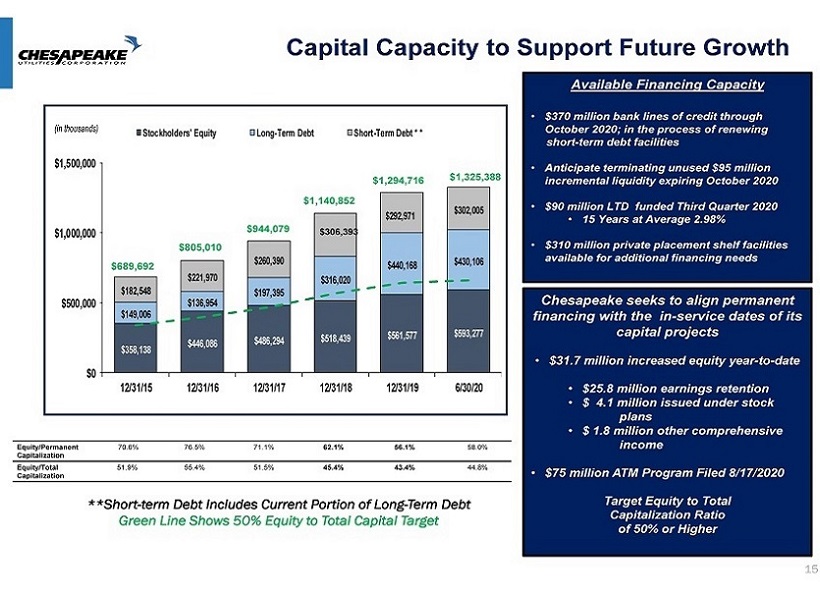

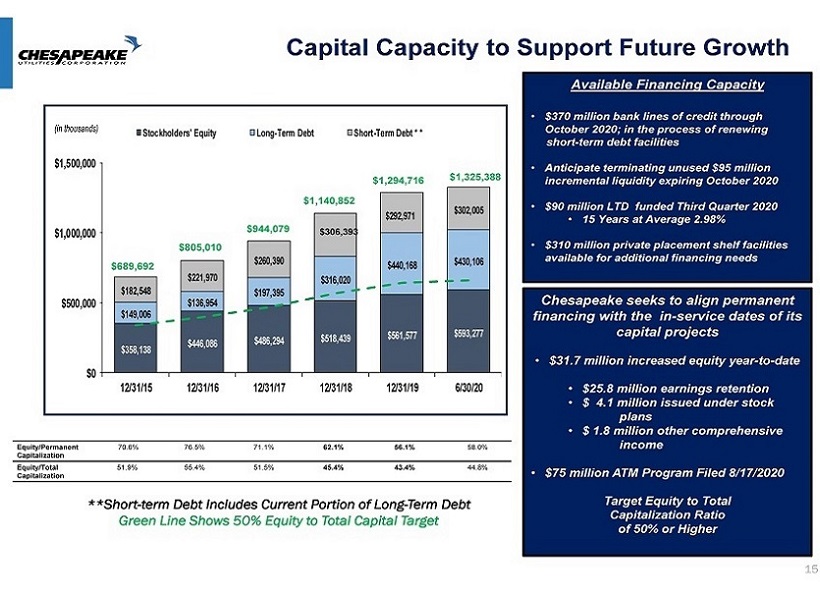

Capital Capacity to Support Future Growth (in thousands) Stockholders’ Equity Long-Term Debt Short-Term Debt * * $1,500,000 $1,294,716 $1,325,388 $1,140,852 $302,005 $292,971 $1,000,000 $944,079 $306,393 $805,010 $260,390 $440,168 $430,106 $689,692 $221,970 $316,020 $182,548 $197,395 $500,000 $136,954 $149,006 $561,577 $593,277 $486,294 $518,439 $446,086 $358,138 $0 12/31/15 12/31/16 12/31/17 12/31/18 12/31/19 6/30/20 Equity/Permanent 70.6% 76.5% 71.1% 62.1% 56.1% 58.0% Capitalization Equity/Total 51.9% 55.4% 51.5% 45.4% 43.4% 44.8% Capitalization **Short-term Debt Includes Current Portion of Long-Term Debt Green Line Shows 50% Equity to Total Capital Target Available Financing Capacity $370 million bank lines of credit through October 2020; in the process of renewing short-term debt facilities Anticipate terminating unused $95 million incremental liquidity expiring October 2020 $90 million LTD funded Third Quarter 2020 • 15 Years at Average 2.98% $310 million private placement shelf facilities available for additional financing needs Chesapeake seeks to align permanent financing with the in-service dates of its capital projects $31.7 million increased equity year-to-date $25.8 million earnings retention $ 4.1 million issued under stock plans $ 1.8 million other comprehensive income $75 million ATM Program Filed 8/17/2020 Target Equity to Total Capitalization Ratio of 50% or Higher 15