1 Fourth Quarter & Full-Year 2024 Earnings Call Presentation February 27, 2025 scan here for an electronic copy

2 Safe Harbor for Forward-Looking Statements Safe Harbor Statement Some of the statements in this presentation are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and other applicable law. Such forward-looking statements may be identified by the use of words, such as “project,” “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “continue,” “potential,” “forecast” or other similar words, or future or conditional verbs such as “may,” “will,” “should,” “would” or “could.” These statements represent our intentions, plans, expectations, assumptions and beliefs about our future financial performance, business strategy, projected plans and objectives. These statements are subject to many risks and uncertainties and actual results may materially differ from those expressed in these forward-looking statements. Please refer to Chesapeake Utilities Annual Report on Form 10-K for the year ended December 31, 2024 filed with the SEC and other SEC filings concerning factors that could cause those results to be different than contemplated in this presentation. Non-GAAP Financial Information This presentation includes non-GAAP financial measures including Adjusted Gross Margin, Adjusted Net Income and Adjusted Earnings Per Share (“EPS*”). A "non-GAAP financial measure" is generally defined as a numerical measure of a company's historical or future performance that includes or excludes amounts, or that is subject to adjustments, so as to be different from the most directly comparable measure calculated or presented in accordance with GAAP. Our management believes certain non- GAAP financial measures, when considered together with GAAP financial measures, provide information that is useful to investors in understanding period-over-period operating results separate and apart from items that may, or could, have a disproportionately positive or negative impact on results in any particular period. The Company calculates Adjusted Gross Margin by deducting the purchased cost of natural gas, propane and electricity and the cost of labor spent on direct revenue- producing activities from operating revenues. The costs included in Adjusted Gross Margin exclude depreciation and amortization and certain costs presented in operations and maintenance expenses in accordance with regulatory requirements. The Company calculates Adjusted Net Income and Adjusted EPS by deducting costs and expenses associated with significant acquisitions that may affect the comparison of period-over-period results. These non-GAAP financial measures are not in accordance with, or an alternative to, GAAP and should be considered in addition to, and not as a substitute for, the comparable GAAP measures. The Company believes that these non-GAAP measures are useful and meaningful to investors as a basis for making investment decisions and provide investors with information that demonstrates the profitability achieved by the Company under allowed rates for regulated energy operations and under the Company's competitive pricing structures for unregulated energy operations. The Company's management uses these non-GAAP financial measures in assessing a business unit and Company performance. Other companies may calculate these non-GAAP financial measures in a different manner. See Appendix for a reconciliation of Gross Margin, Net Income and EPS, all as defined under GAAP, to our non-GAAP measures of Adjusted Gross Margin, Adjusted Net Income, and Adjusted EPS for each of the periods presented. *Unless otherwise noted, EPS and Adjusted EPS information is presented on a diluted basis.

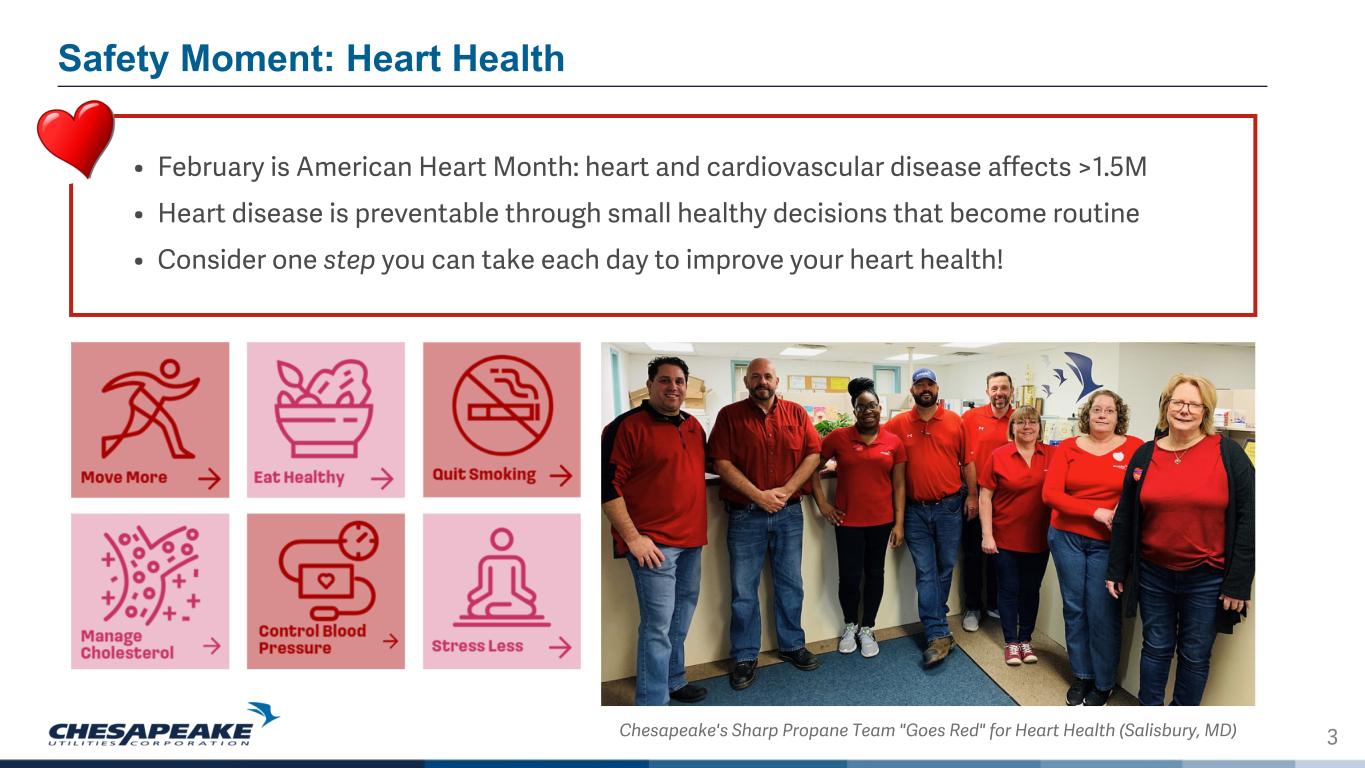

3 Safety Moment: Heart Health • February is American Heart Month: heart and cardiovascular disease affects >1.5M • Heart disease is preventable through small healthy decisions that become routine • Consider one step you can take each day to improve your heart health! Chesapeake's Sharp Propane Team "Goes Red" for Heart Health (Salisbury, MD)

4 Today’s Presenters Jeff Householder Chair of the Board, President & Chief Executive Officer Beth Cooper Executive Vice President, Chief Financial Officer, Treasurer & Asst. Corporate Secretary Lucia Dempsey Head of Investor Relations Jim Moriarty Executive Vice President, General Counsel, Corporate Secretary & Chief Policy and Risk Officer

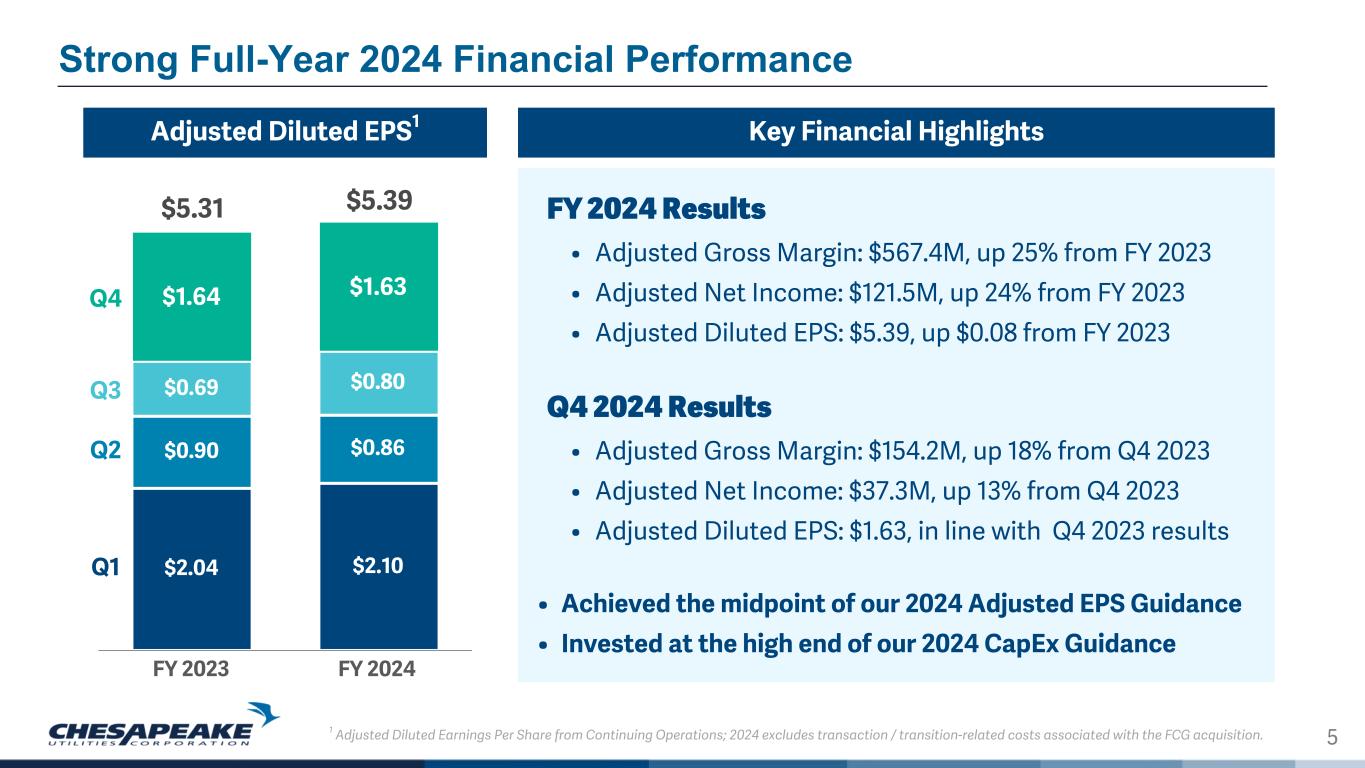

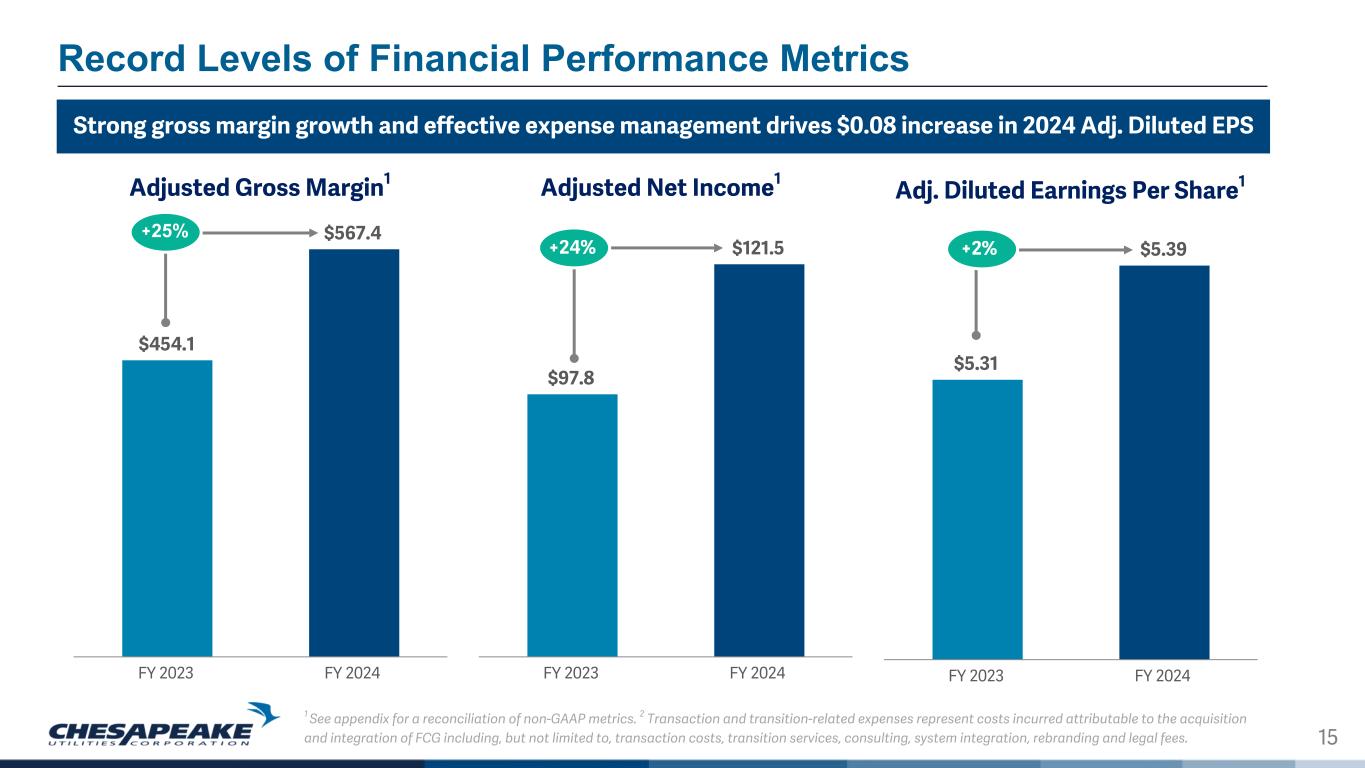

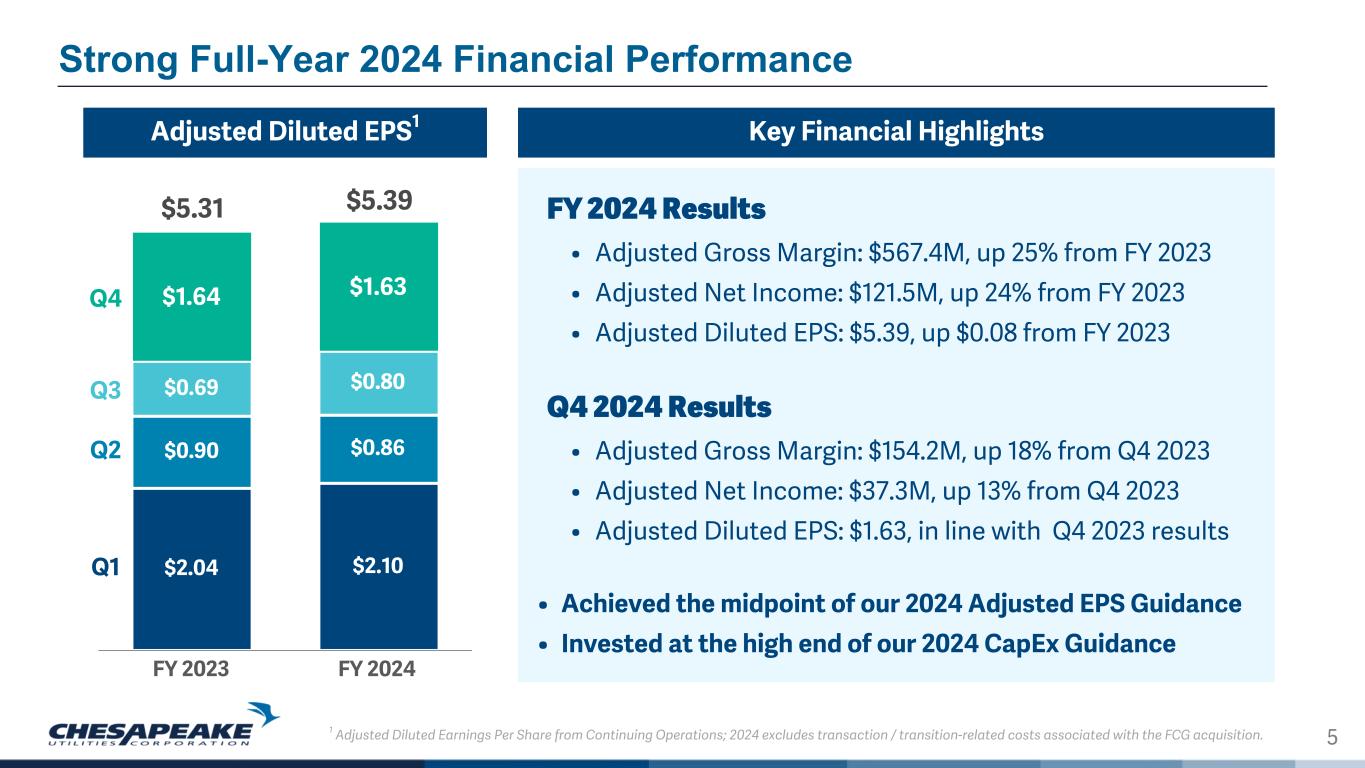

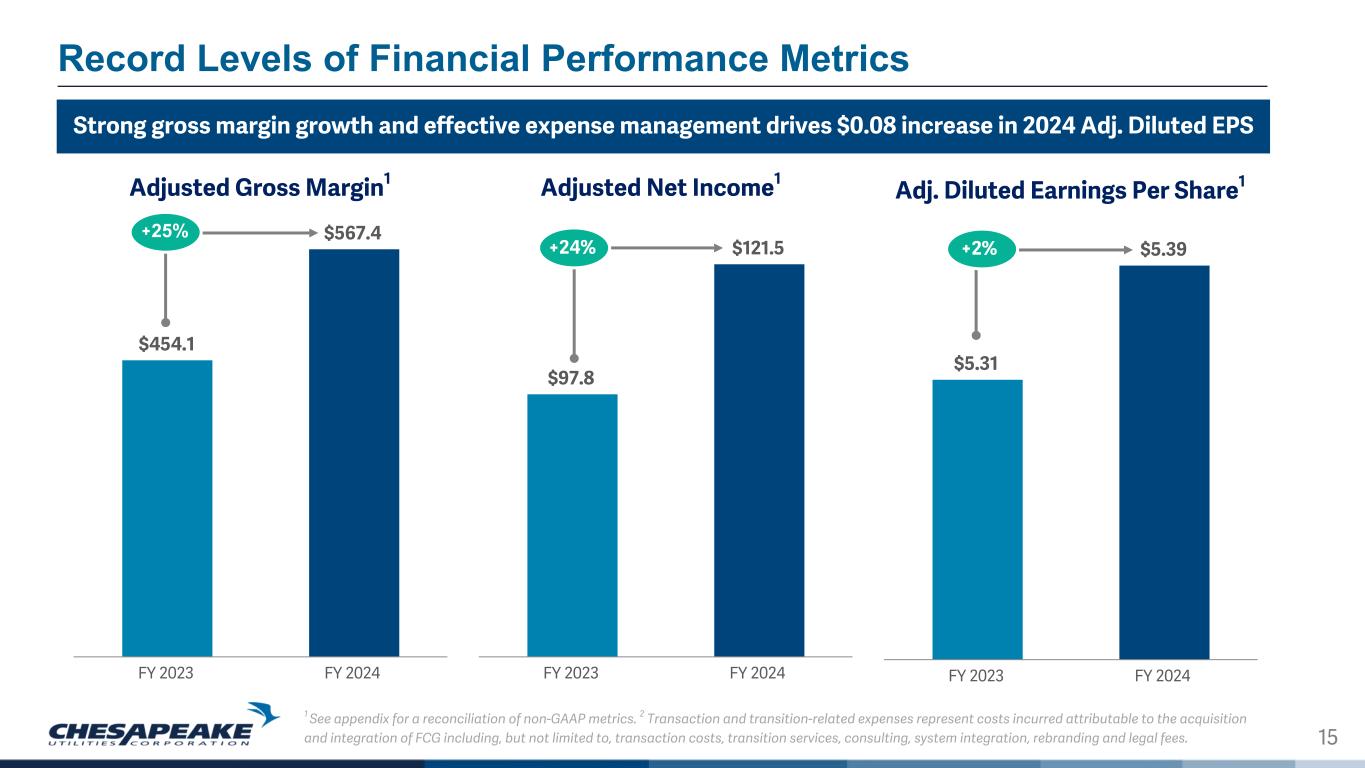

5 Adjusted Diluted EPS1 Strong Full-Year 2024 Financial Performance 1 Adjusted Diluted Earnings Per Share from Continuing Operations; 2024 excludes transaction / transition-related costs associated with the FCG acquisition. $2.04 $2.10 $0.90 $0.86 $0.69 $0.80 $1.64 $1.63 FY 2023 FY 2024 Q1 Q2 FY 2024 Results • Adjusted Gross Margin: $567.4M, up 25% from FY 2023 • Adjusted Net Income: $121.5M, up 24% from FY 2023 • Adjusted Diluted EPS: $5.39, up $0.08 from FY 2023 Q4 2024 Results • Adjusted Gross Margin: $154.2M, up 18% from Q4 2023 • Adjusted Net Income: $37.3M, up 13% from Q4 2023 • Adjusted Diluted EPS: $1.63, in line with Q4 2023 results • Achieved the midpoint of our 2024 Adjusted EPS Guidance • Invested at the high end of our 2024 CapEx Guidance Key Financial Highlights Q3 Q4 $5.31 $5.39

6 Delivering With Purpose in 2024 Achieved Adj. Diluted EPS of $5.39, at the midpoint of our 2024 Adj. EPS Guidance Invested $356M of capital, at the top end of our 2024 capital guidance range Integrated the Florida City Gas acquisition, generating a meaningful contribution within the first year Added nearly 11,000 new customers Filed and received approval for 13 new capital projects Filed 8 substantial regulatory filings, including three rate cases and two depreciation studies Implemented 1CX: SAP Customer Billing System to consolidate regulated operations onto one platform Accelerated the return to our target capital structure and strengthened our balance sheet Jeff Householder greets teammates at the 1CX Celebration Event in DE

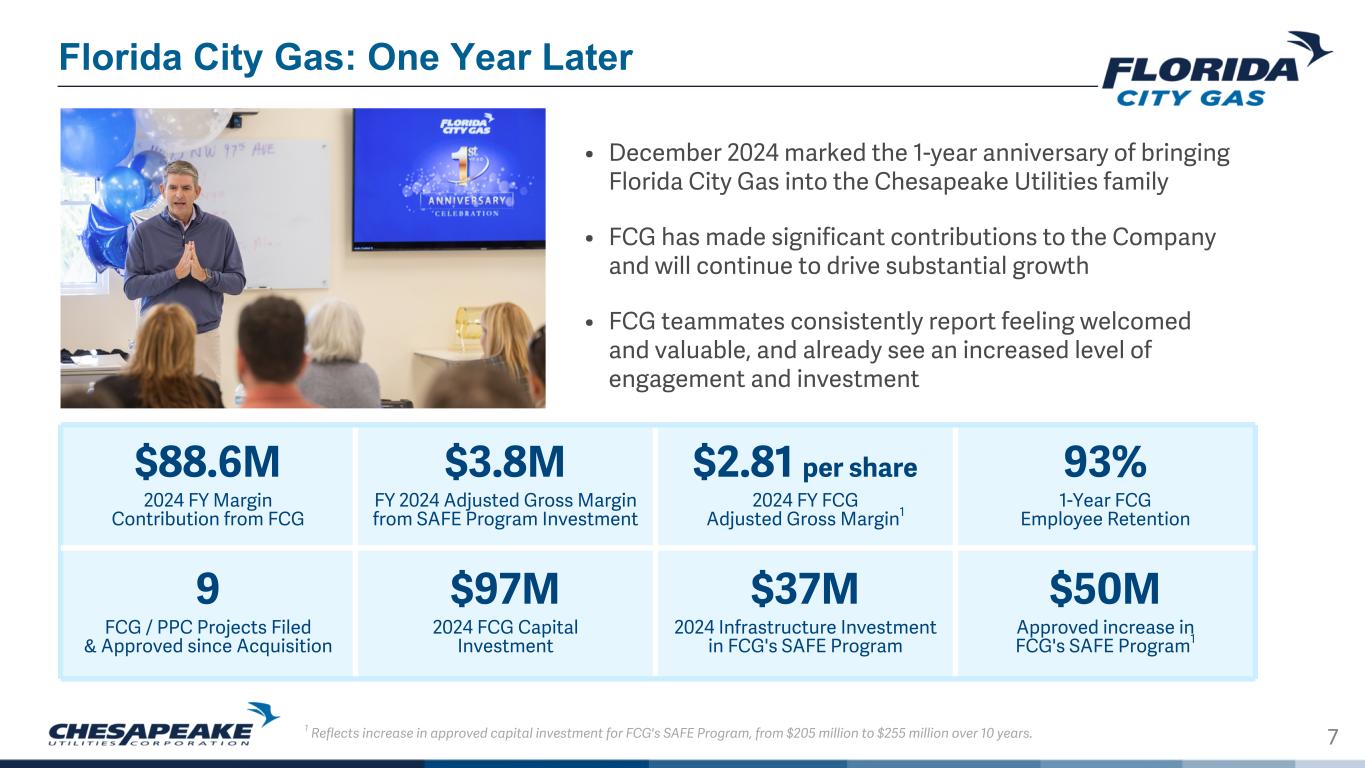

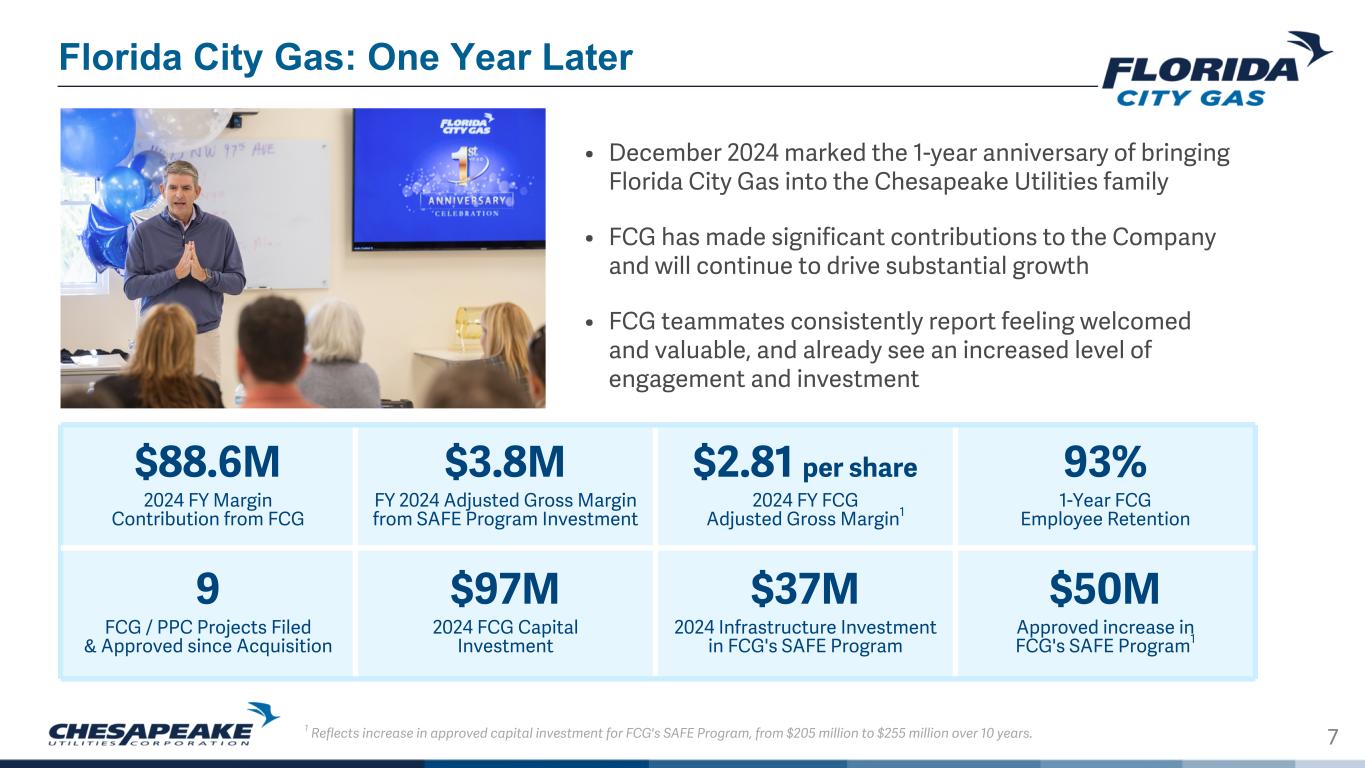

7 Florida City Gas: One Year Later $88.6M 2024 FY Margin Contribution from FCG $3.8M FY 2024 Adjusted Gross Margin from SAFE Program Investment $2.81 per share 2024 FY FCG Adjusted Gross Margin1 93% 1-Year FCG Employee Retention 9 FCG / PPC Projects Filed & Approved since Acquisition $97M 2024 FCG Capital Investment $37M 2024 Infrastructure Investment in FCG's SAFE Program $50M Approved increase in FCG's SAFE Program1 • December 2024 marked the 1-year anniversary of bringing Florida City Gas into the Chesapeake Utilities family • FCG has made significant contributions to the Company and will continue to drive substantial growth • FCG teammates consistently report feeling welcomed and valuable, and already see an increased level of engagement and investment 1 Reflects increase in approved capital investment for FCG's SAFE Program, from $205 million to $255 million over 10 years.

8 Growth in earnings to support growth and increased shareholder value Foundation of operational excellence across the organization Executing On Our Long-Term Growth Plan Continually execute on business transformation Proactively manage regulatory agenda Prudently deploy investment capital

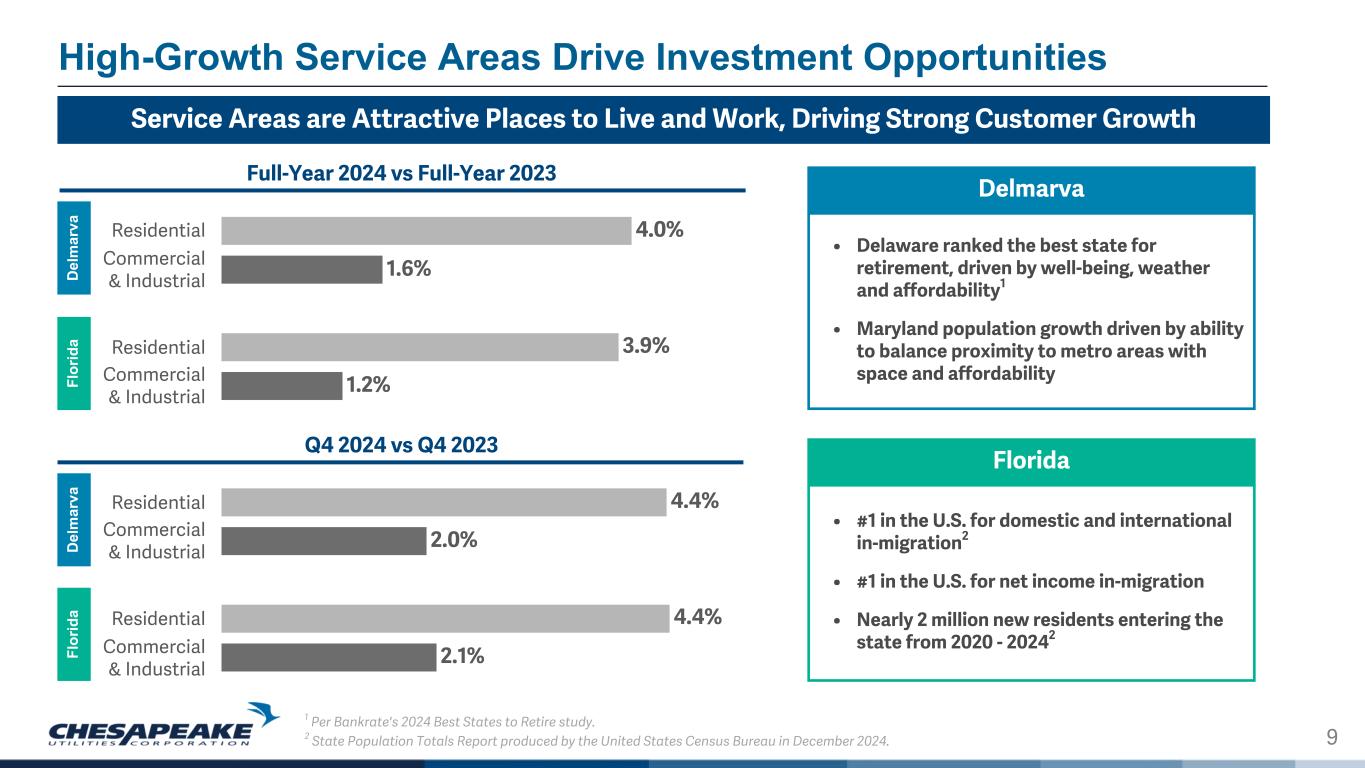

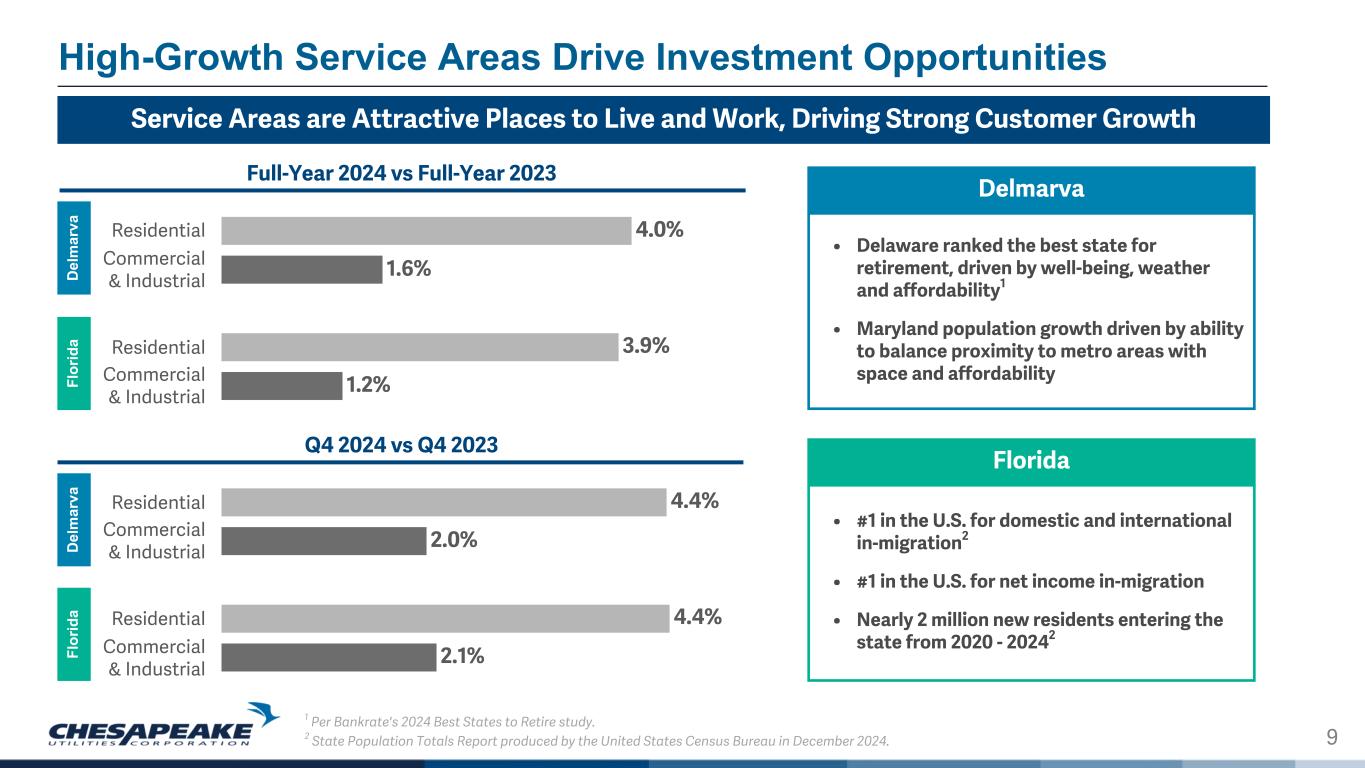

9 4.0% 1.6% 3.9% 1.2% 4.4% 2.0% 4.4% 2.1% Residential Commercial & Industrial Residential Commercial & Industrial Residential Commercial & Industrial Residential Commercial & Industrial Full-Year 2024 vs Full-Year 2023 D el m ar va Q4 2024 vs Q4 2023 Fl or id a High-Growth Service Areas Drive Investment Opportunities D el m ar va Fl or id a Service Areas are Attractive Places to Live and Work, Driving Strong Customer Growth • Delaware ranked the best state for retirement, driven by well-being, weather and affordability1 • Maryland population growth driven by ability to balance proximity to metro areas with space and affordability Delmarva • #1 in the U.S. for domestic and international in-migration2 • #1 in the U.S. for net income in-migration • Nearly 2 million new residents entering the state from 2020 - 20242 Florida 1 Per Bankrate's 2024 Best States to Retire study. 2 State Population Totals Report produced by the United States Census Bureau in December 2024.

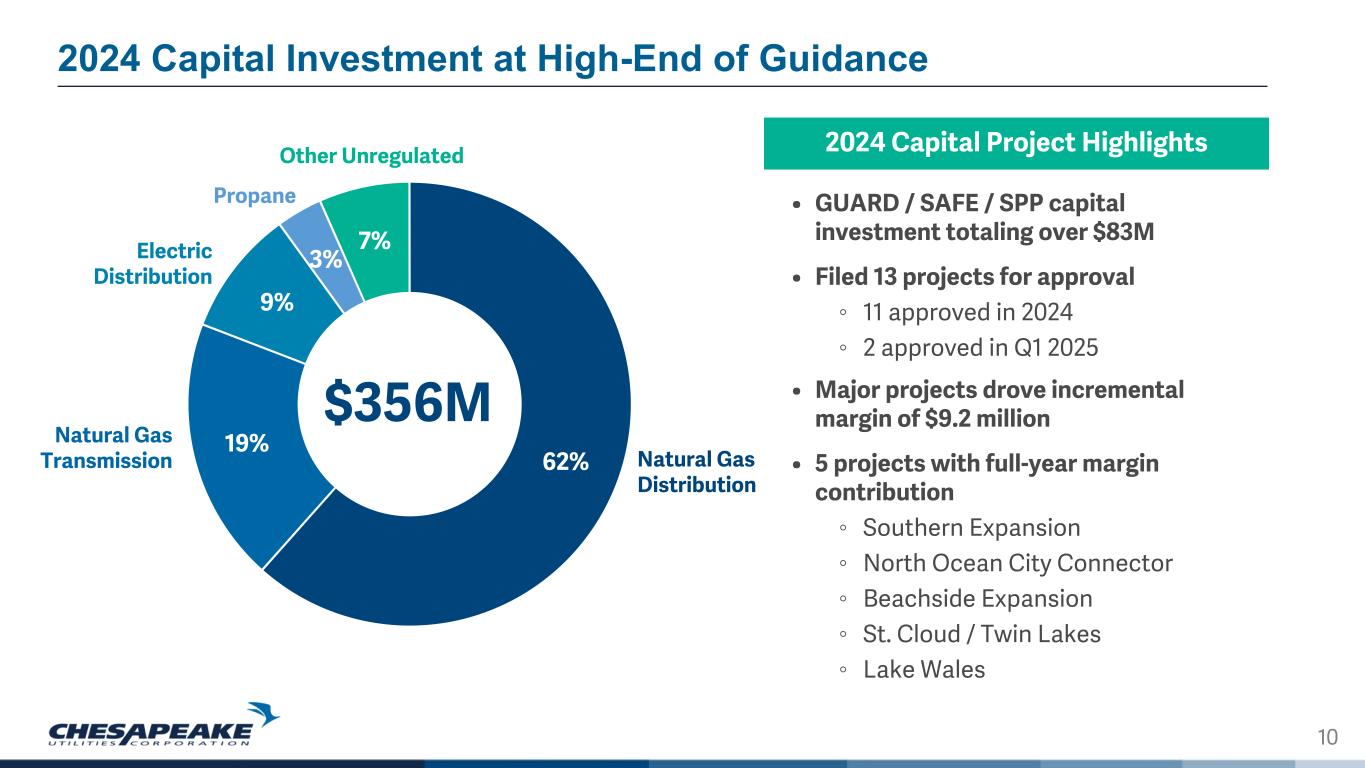

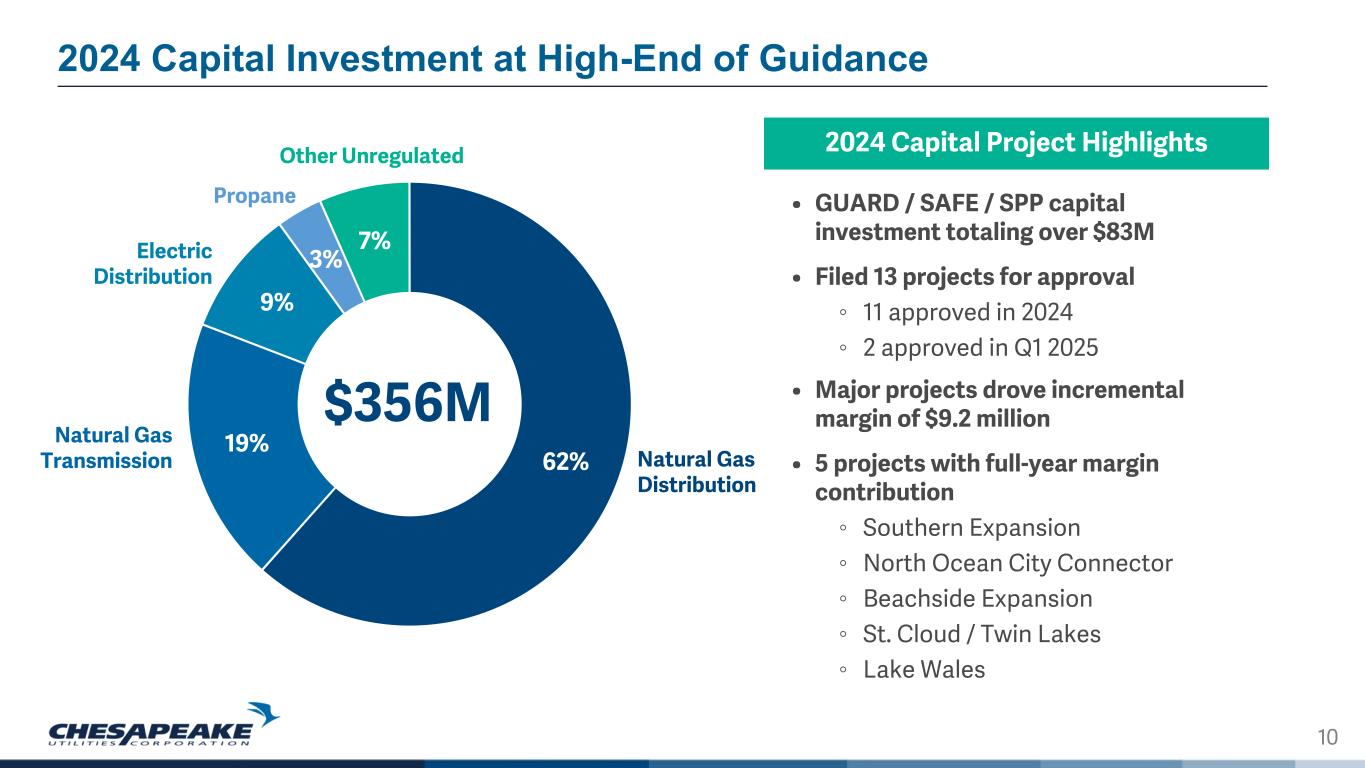

10 62% 19% 9% 3% 7% 2024 Capital Investment at High-End of Guidance $356M • GUARD / SAFE / SPP capital investment totaling over $83M • Filed 13 projects for approval ◦ 11 approved in 2024 ◦ 2 approved in Q1 2025 • Major projects drove incremental margin of $9.2 million • 5 projects with full-year margin contribution ◦ Southern Expansion ◦ North Ocean City Connector ◦ Beachside Expansion ◦ St. Cloud / Twin Lakes ◦ Lake Wales Natural Gas Distribution Electric Distribution Natural Gas Transmission Other Unregulated Propane 2024 Capital Project Highlights

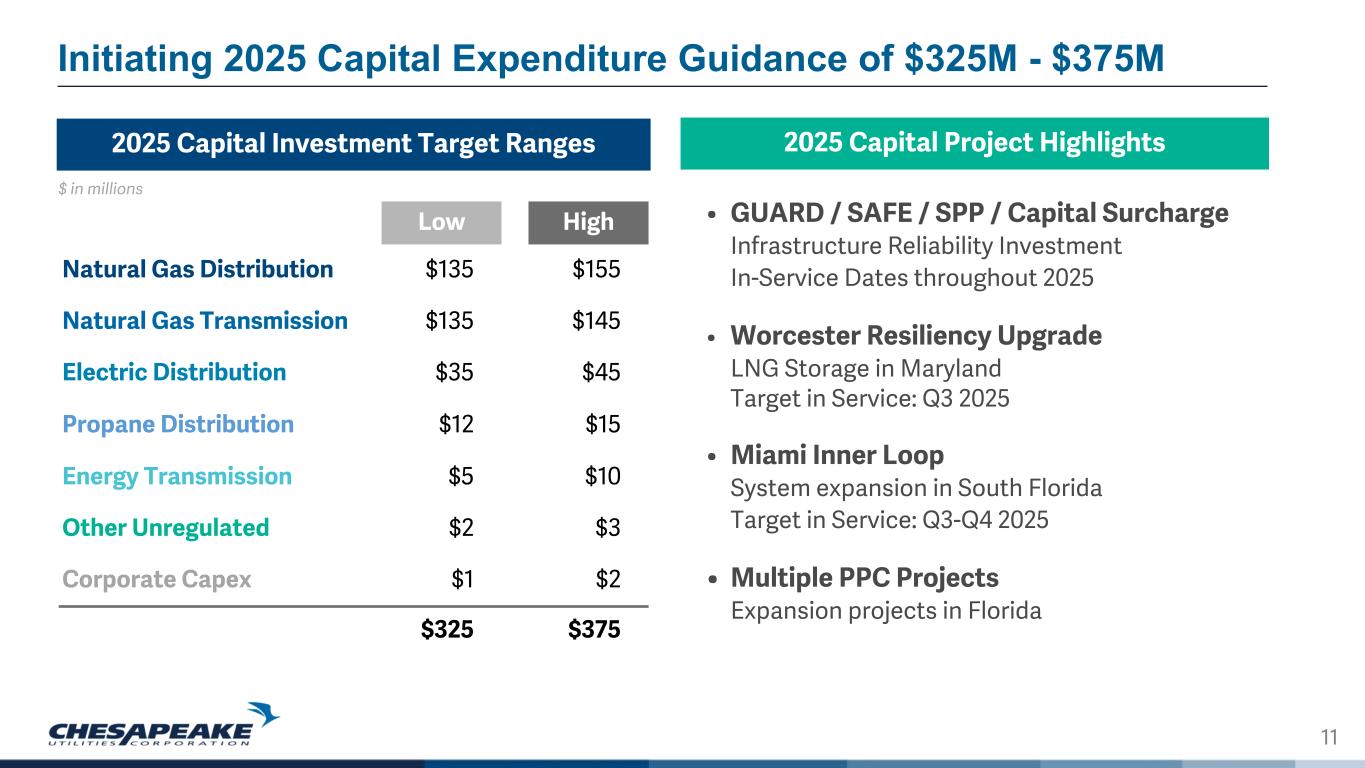

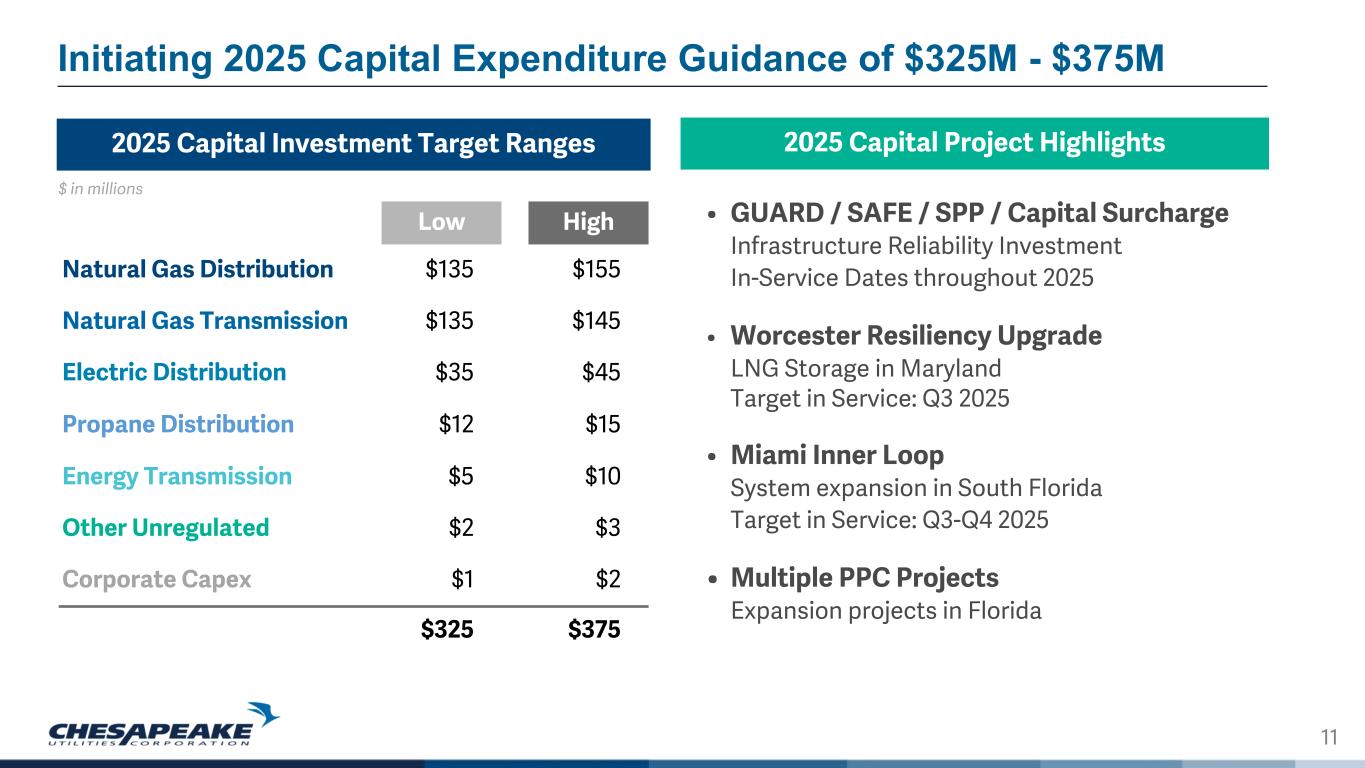

11 • GUARD / SAFE / SPP / Capital Surcharge Infrastructure Reliability Investment In-Service Dates throughout 2025 • Worcester Resiliency Upgrade LNG Storage in Maryland Target in Service: Q3 2025 • Miami Inner Loop System expansion in South Florida Target in Service: Q3-Q4 2025 • Multiple PPC Projects Expansion projects in Florida Low High Natural Gas Distribution $135 $155 Natural Gas Transmission $135 $145 Electric Distribution $35 $45 Propane Distribution $12 $15 Energy Transmission $5 $10 Other Unregulated $2 $3 Corporate Capex $1 $2 $325 $375 2025 Capital Investment Target Ranges $ in millions 2025 Capital Project Highlights Initiating 2025 Capital Expenditure Guidance of $325M - $375M

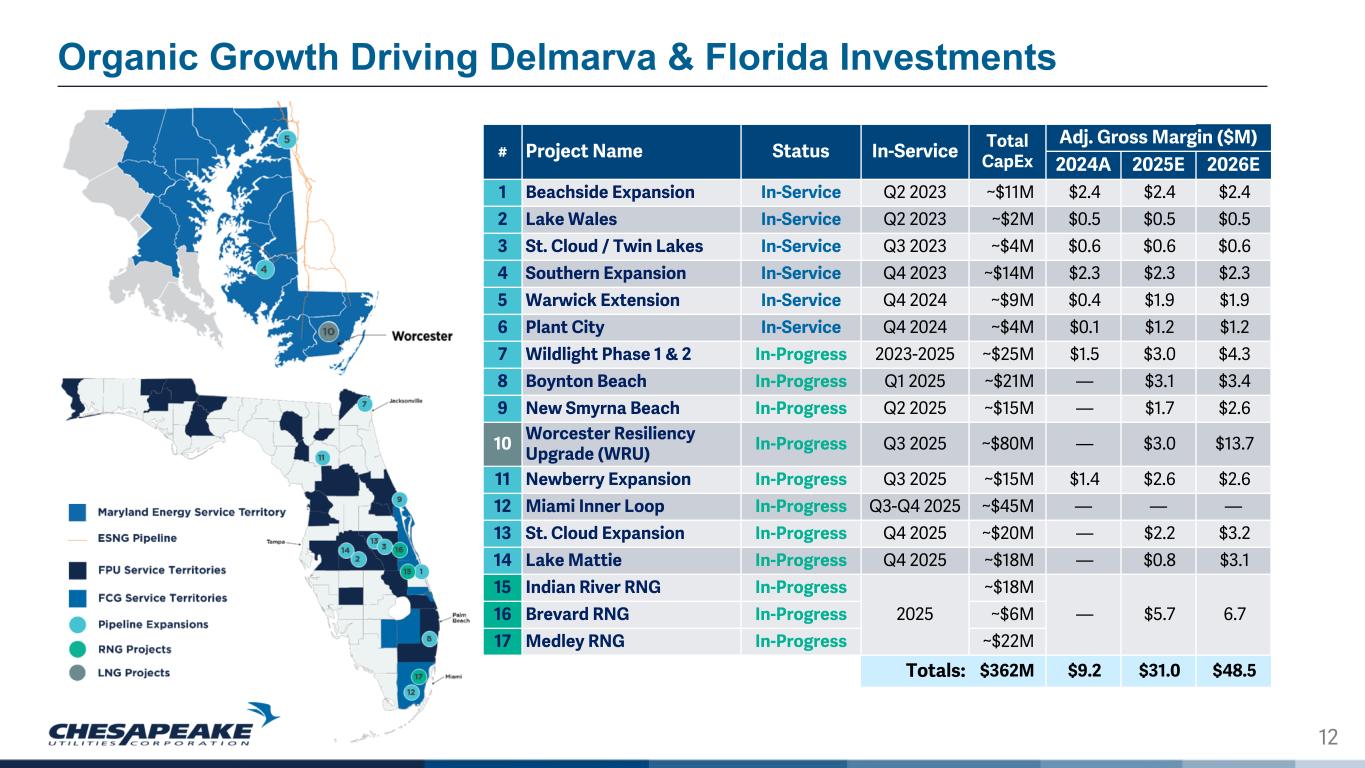

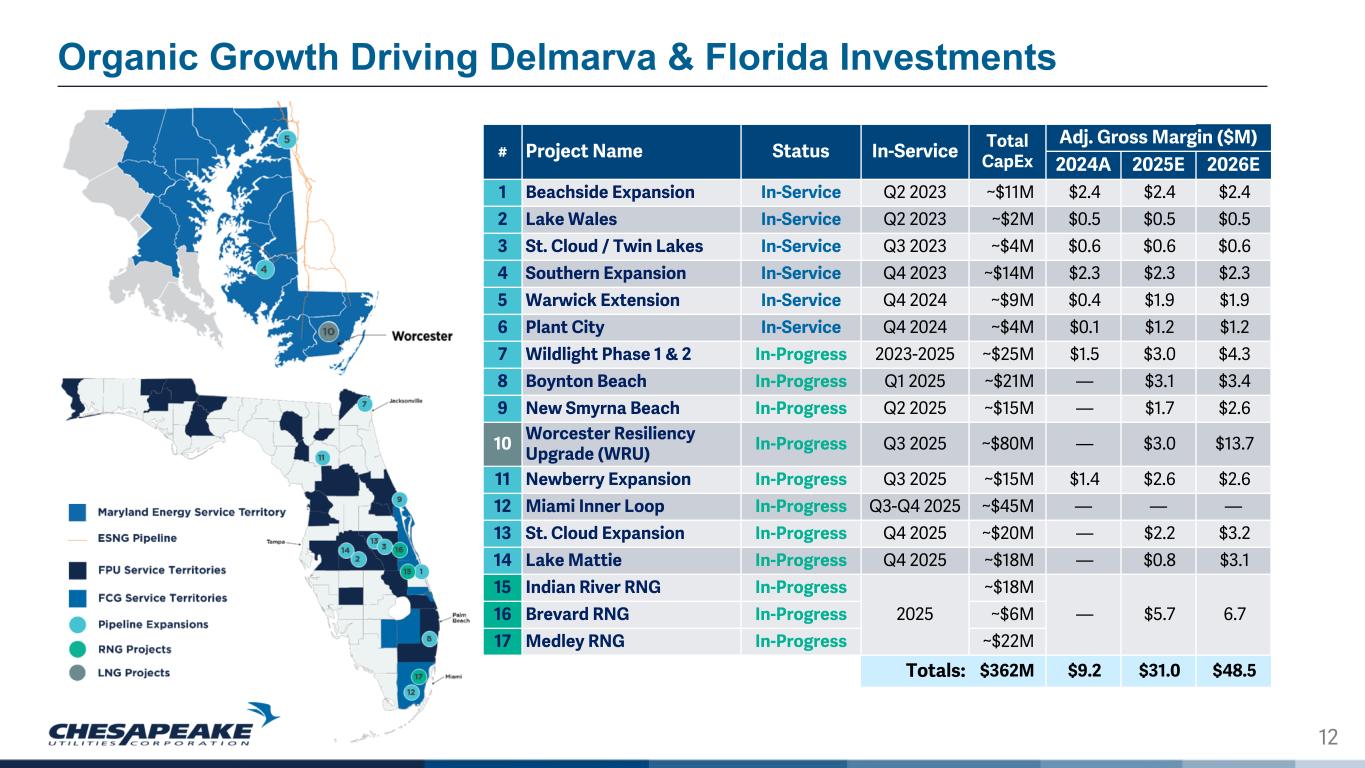

12 Organic Growth Driving Delmarva & Florida Investments # Project Name Status In-Service Total CapEx Adj. Gross Margin ($M) 2024A 2025E 2026E 1 Beachside Expansion In-Service Q2 2023 ~$11M $2.4 $2.4 $2.4 2 Lake Wales In-Service Q2 2023 ~$2M $0.5 $0.5 $0.5 3 St. Cloud / Twin Lakes In-Service Q3 2023 ~$4M $0.6 $0.6 $0.6 4 Southern Expansion In-Service Q4 2023 ~$14M $2.3 $2.3 $2.3 5 Warwick Extension In-Service Q4 2024 ~$9M $0.4 $1.9 $1.9 6 Plant City In-Service Q4 2024 ~$4M $0.1 $1.2 $1.2 7 Wildlight Phase 1 & 2 In-Progress 2023-2025 ~$25M $1.5 $3.0 $4.3 8 Boynton Beach In-Progress Q1 2025 ~$21M — $3.1 $3.4 9 New Smyrna Beach In-Progress Q2 2025 ~$15M — $1.7 $2.6 10 Worcester Resiliency Upgrade (WRU) In-Progress Q3 2025 ~$80M — $3.0 $13.7 11 Newberry Expansion In-Progress Q3 2025 ~$15M $1.4 $2.6 $2.6 12 Miami Inner Loop In-Progress Q3-Q4 2025 ~$45M — — — 13 St. Cloud Expansion In-Progress Q4 2025 ~$20M — $2.2 $3.2 14 Lake Mattie In-Progress Q4 2025 ~$18M — $0.8 $3.1 15 Indian River RNG In-Progress 2025 ~$18M — $5.7 6.716 Brevard RNG In-Progress ~$6M 17 Medley RNG In-Progress ~$22M Totals: $362M $9.2 $31.0 $48.5

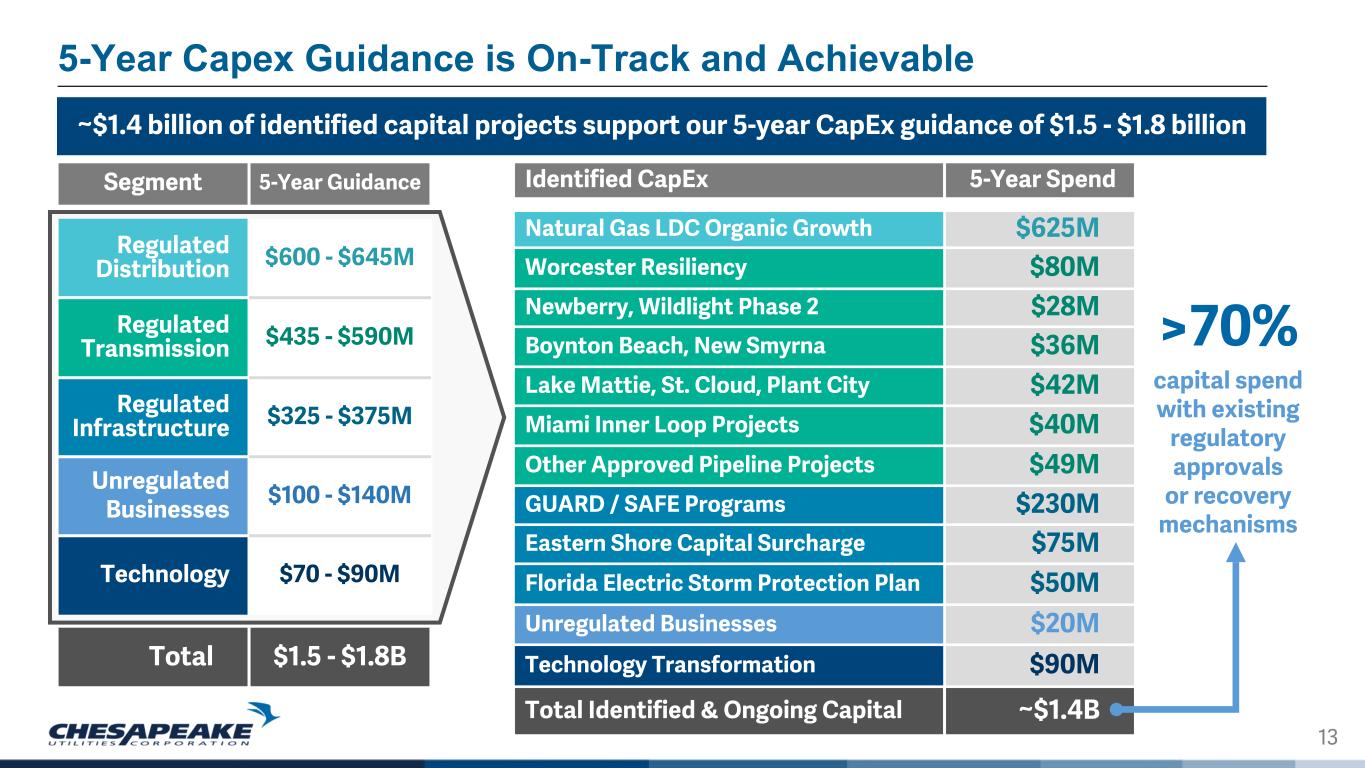

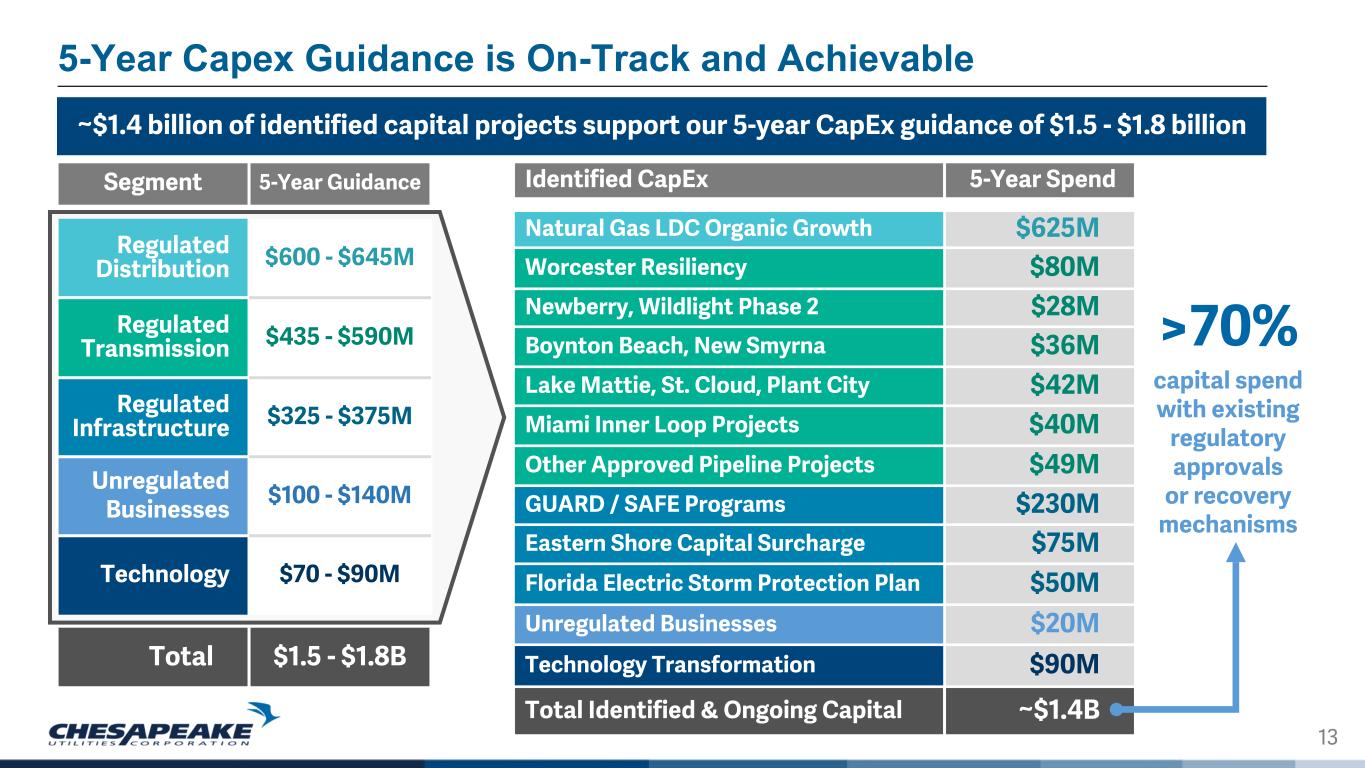

13 >70% capital spend with existing regulatory approvals or recovery mechanisms 5-Year Capex Guidance is On-Track and Achievable ~$1.4 billion of identified capital projects support our 5-year CapEx guidance of $1.5 - $1.8 billion Identified CapEx 5-Year Spend Natural Gas LDC Organic Growth $625M Worcester Resiliency $80M Newberry, Wildlight Phase 2 $28M Boynton Beach, New Smyrna $36M Lake Mattie, St. Cloud, Plant City $42M Miami Inner Loop Projects $40M Other Approved Pipeline Projects $49M GUARD / SAFE Programs $230M Eastern Shore Capital Surcharge $75M Florida Electric Storm Protection Plan $50M Unregulated Businesses $20M Technology Transformation $90M Total Identified & Ongoing Capital ~$1.4B Segment 5-Year Guidance Regulated Distribution $600 - $645M Regulated Transmission $435 - $590M Regulated Infrastructure $325 - $375M Unregulated Businesses $100 - $140M Technology $70 - $90M Total $1.5 - $1.8B

14 Business Transformation: 2024 Successes and 2025 Opportunities Drivers of consolidation, centralization and standardization: • "One Company" approach • 1CX Implementation • FCG integration • Cross-functional reorganizations within Customer Care, Construction Services, Enterprise Health & Safety, and Business Information Systems • 1CX implementation for FCG • Launching a multi-year ERP transformation • Technology upgrades ◦ Operational programs, artificial intelligence and cyber security 2024 Transformational Activity 2025 Transformational Goals Delmarva-based teammates and their families gathered to support the Habitat for Humanity of Central Delaware "Framing Frenzy" event, demonstrating that teamwork, process improvement and collaboration deliver exceptional results.

15 $5.31 $5.39 FY 2023 FY 2024 +2% $454.1 $567.4 FY 2023 FY 2024 $97.8 $121.5 FY 2023 FY 2024 +24% Record Levels of Financial Performance Metrics 1 See appendix for a reconciliation of non-GAAP metrics. 2 Transaction and transition-related expenses represent costs incurred attributable to the acquisition and integration of FCG including, but not limited to, transaction costs, transition services, consulting, system integration, rebranding and legal fees. Strong gross margin growth and effective expense management drives $0.08 increase in 2024 Adj. Diluted EPS Adjusted Gross Margin1 Adj. Diluted Earnings Per Share1Adjusted Net Income1 +25%

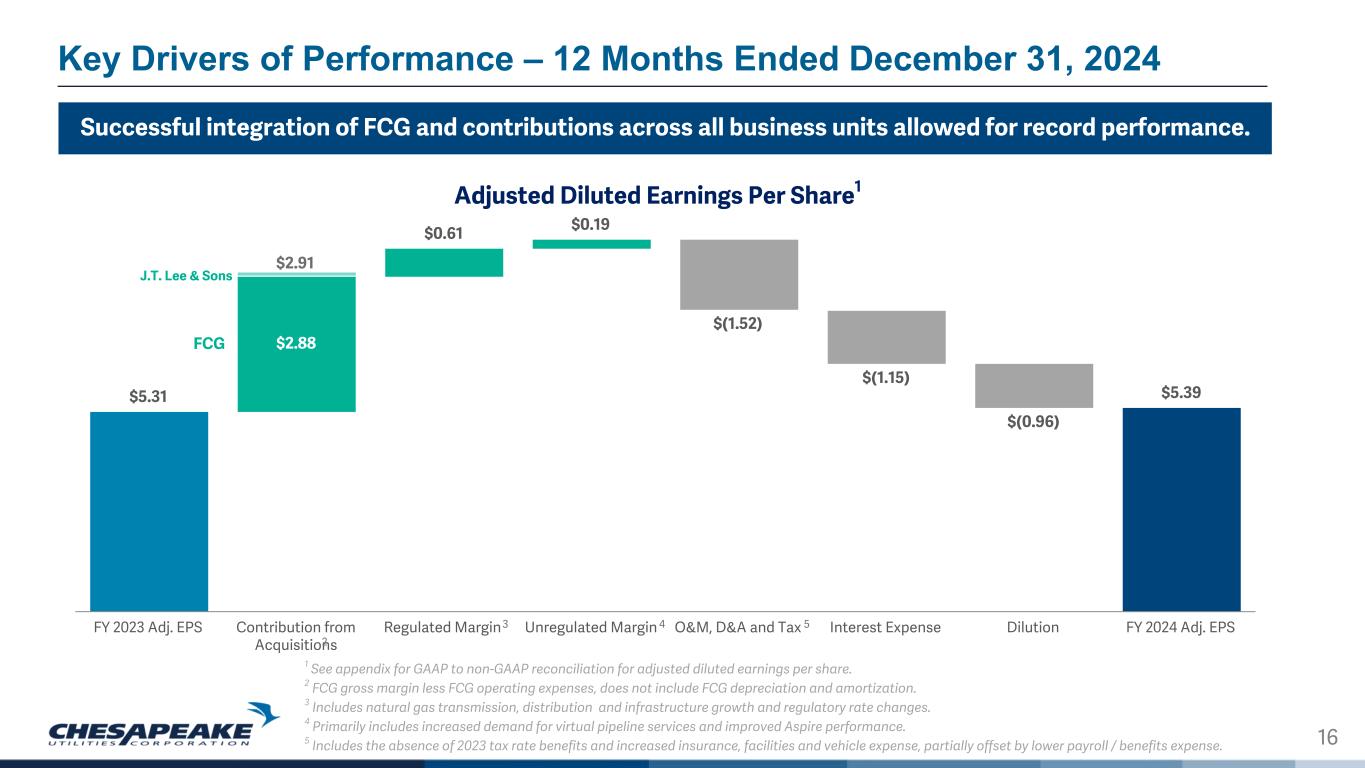

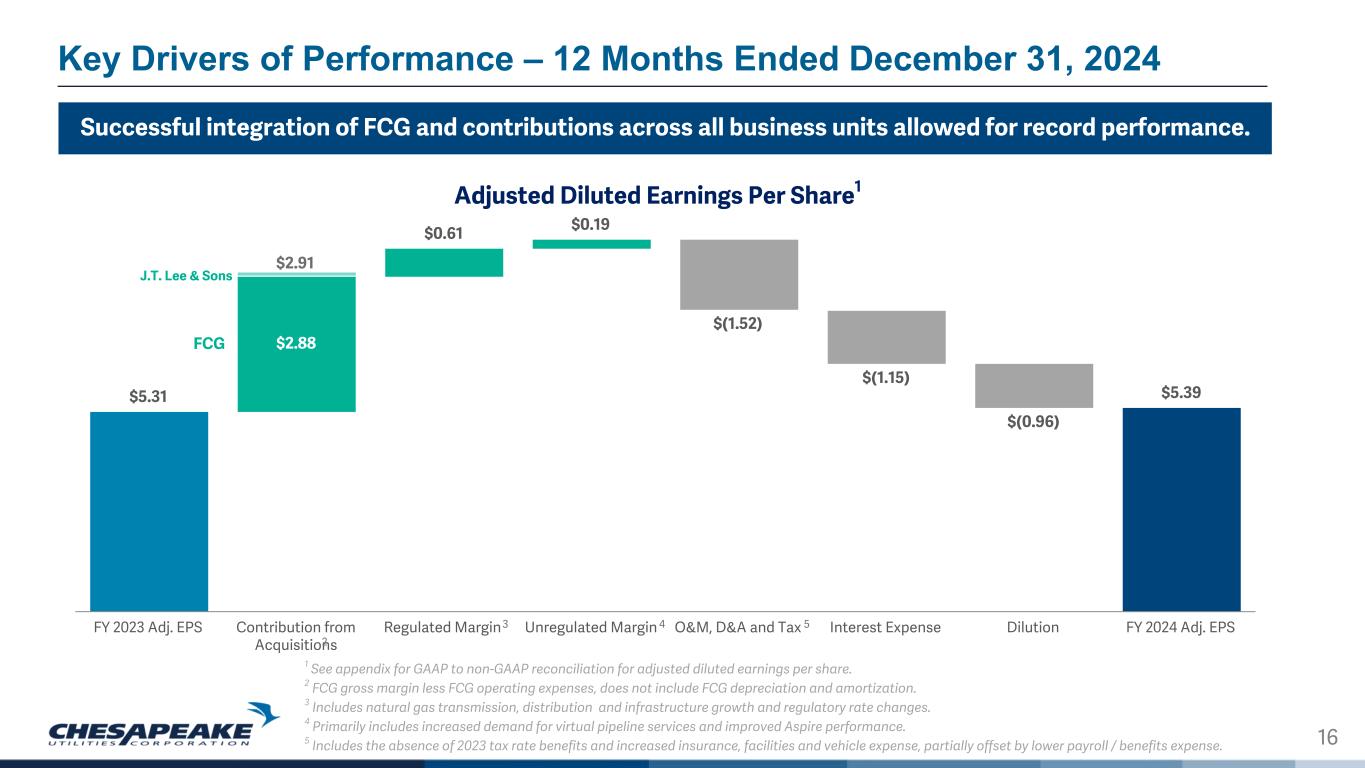

16 $5.31 $2.91 $0.61 $0.19 $(1.52) $(1.15) $(0.96) $5.39 FY 2023 Adj. EPS Contribution from Acquisitions Regulated Margin Unregulated Margin O&M, D&A and Tax Interest Expense Dilution FY 2024 Adj. EPS Key Drivers of Performance – 12 Months Ended December 31, 2024 1 See appendix for GAAP to non-GAAP reconciliation for adjusted diluted earnings per share. 2 FCG gross margin less FCG operating expenses, does not include FCG depreciation and amortization. 3 Includes natural gas transmission, distribution and infrastructure growth and regulatory rate changes. 4 Primarily includes increased demand for virtual pipeline services and improved Aspire performance. 5 Includes the absence of 2023 tax rate benefits and increased insurance, facilities and vehicle expense, partially offset by lower payroll / benefits expense. Successful integration of FCG and contributions across all business units allowed for record performance. Adjusted Diluted Earnings Per Share1 2 3 4 5 . $2.88FCG J.T. Lee & Sons

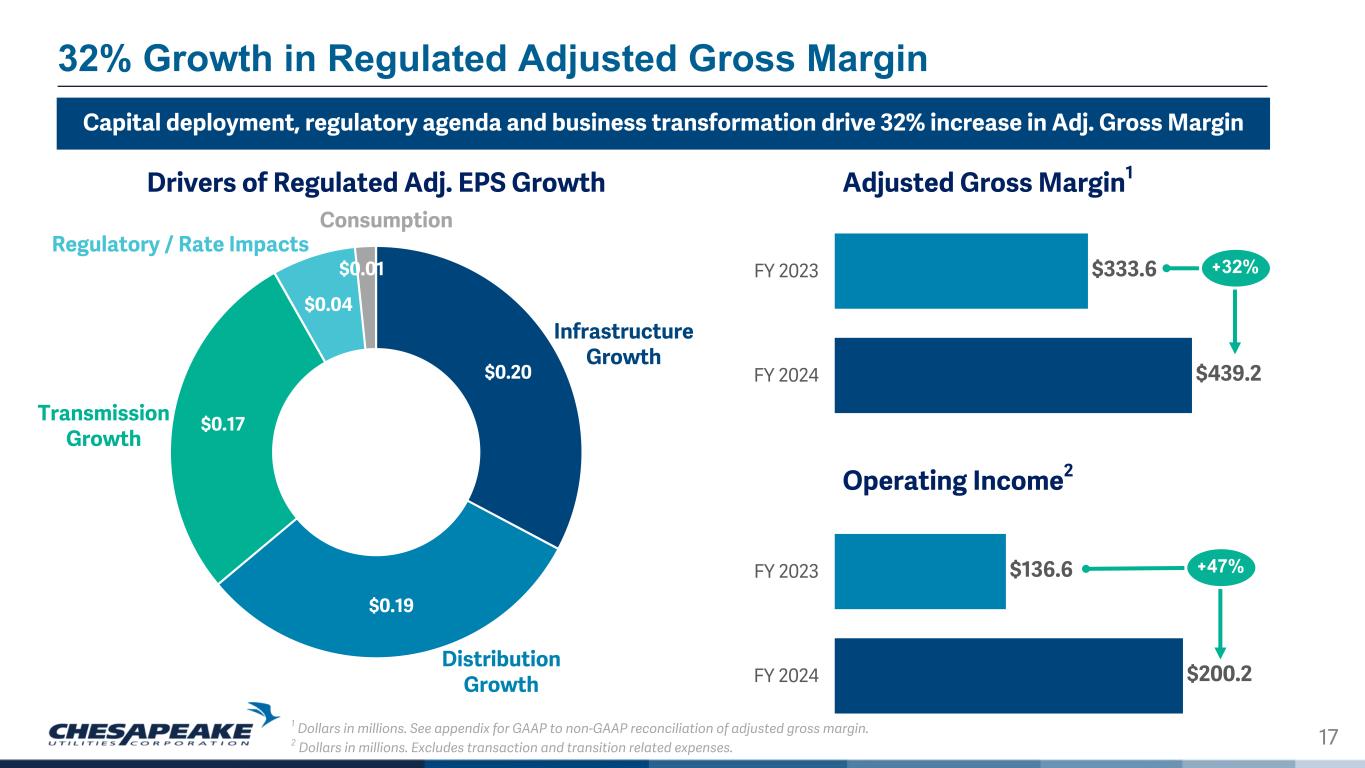

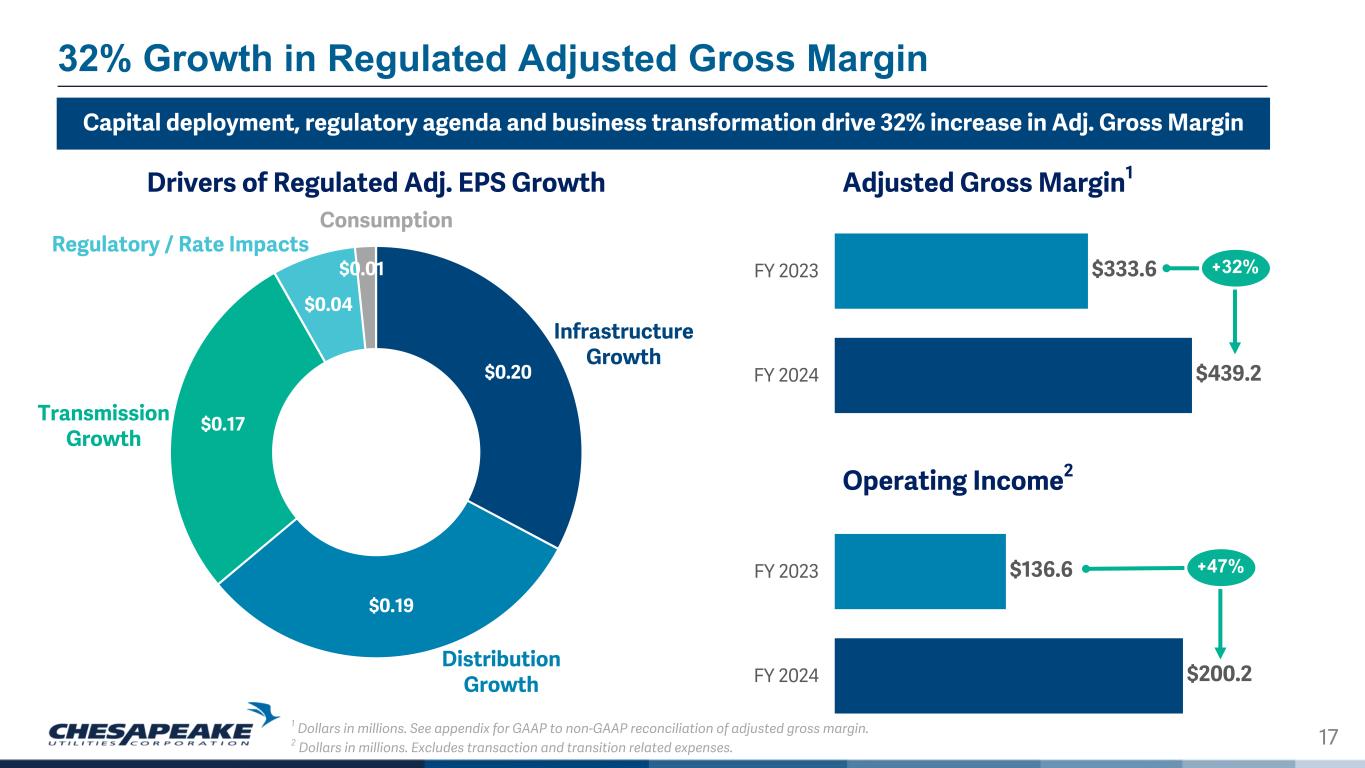

17 32% Growth in Regulated Adjusted Gross Margin Drivers of Regulated Adj. EPS Growth $0.20 $0.19 $0.17 $0.04 $0.01 Infrastructure Growth Distribution Growth Transmission Growth Regulatory / Rate Impacts Consumption Adjusted Gross Margin1 Operating Income2 $333.6 $439.2 FY 2023 FY 2024 $136.6 $200.2 FY 2023 FY 2024 +32% +47% Capital deployment, regulatory agenda and business transformation drive 32% increase in Adj. Gross Margin 1 Dollars in millions. See appendix for GAAP to non-GAAP reconciliation of adjusted gross margin. 2 Dollars in millions. Excludes transaction and transition related expenses.

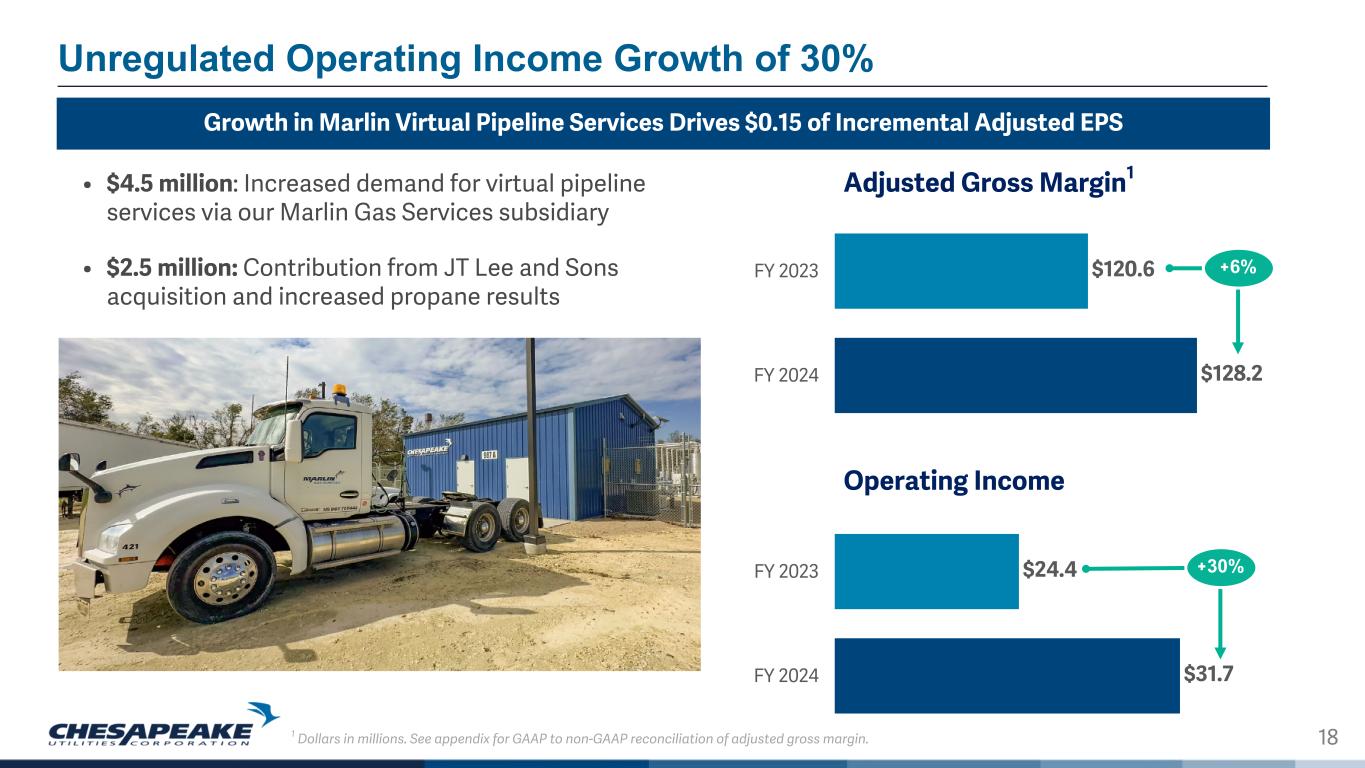

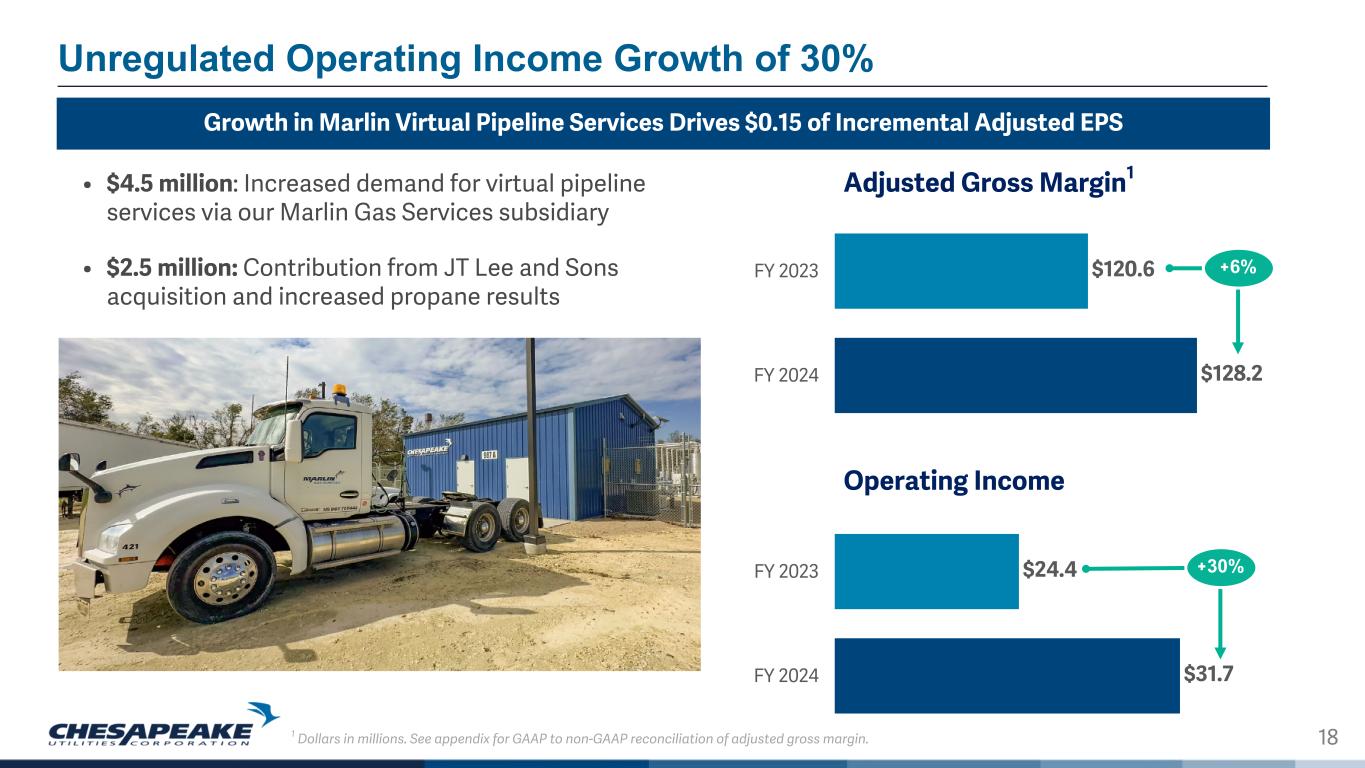

18 Unregulated Operating Income Growth of 30% Growth in Marlin Virtual Pipeline Services Drives $0.15 of Incremental Adjusted EPS Adjusted Gross Margin1 Operating Income $120.6 $128.2 FY 2023 FY 2024 $24.4 $31.7 FY 2023 FY 2024 +6% +30% 1 Dollars in millions. See appendix for GAAP to non-GAAP reconciliation of adjusted gross margin. • $4.5 million: Increased demand for virtual pipeline services via our Marlin Gas Services subsidiary • $2.5 million: Contribution from JT Lee and Sons acquisition and increased propane results

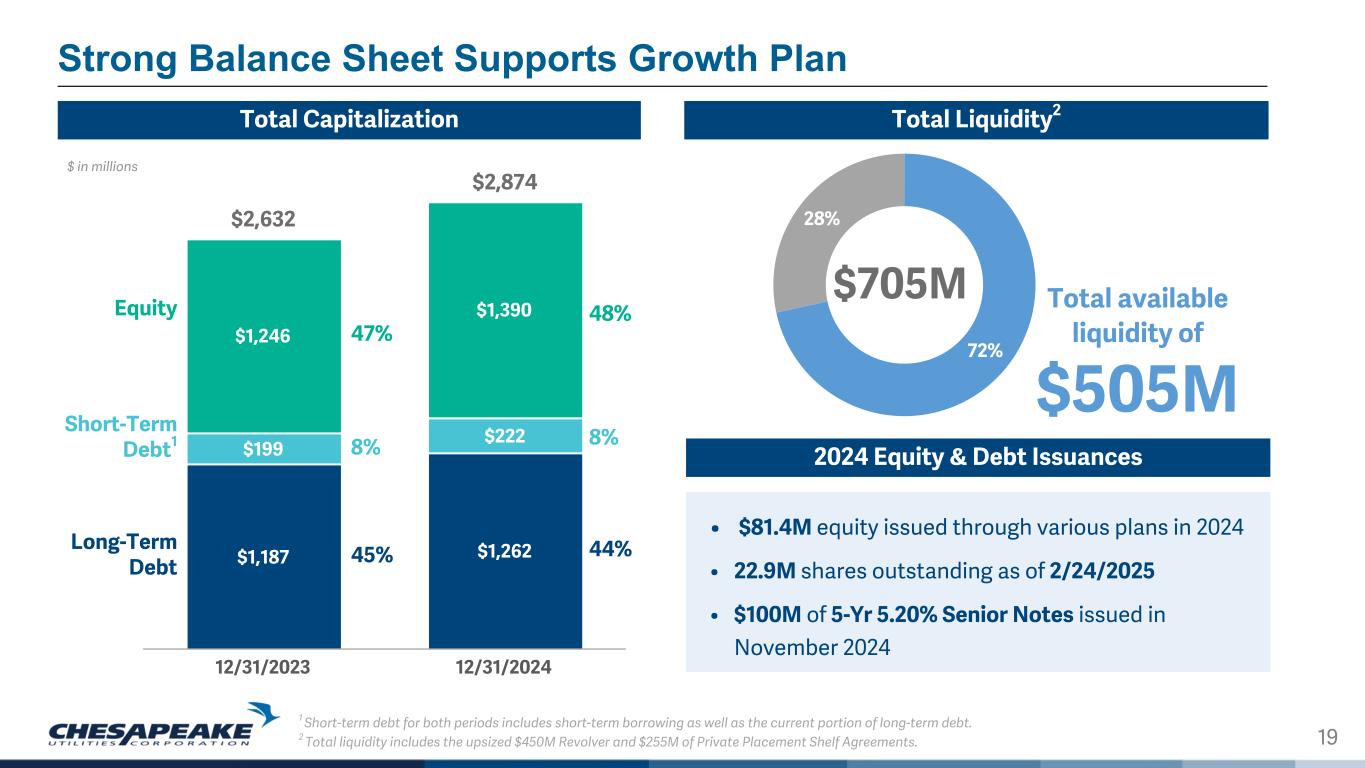

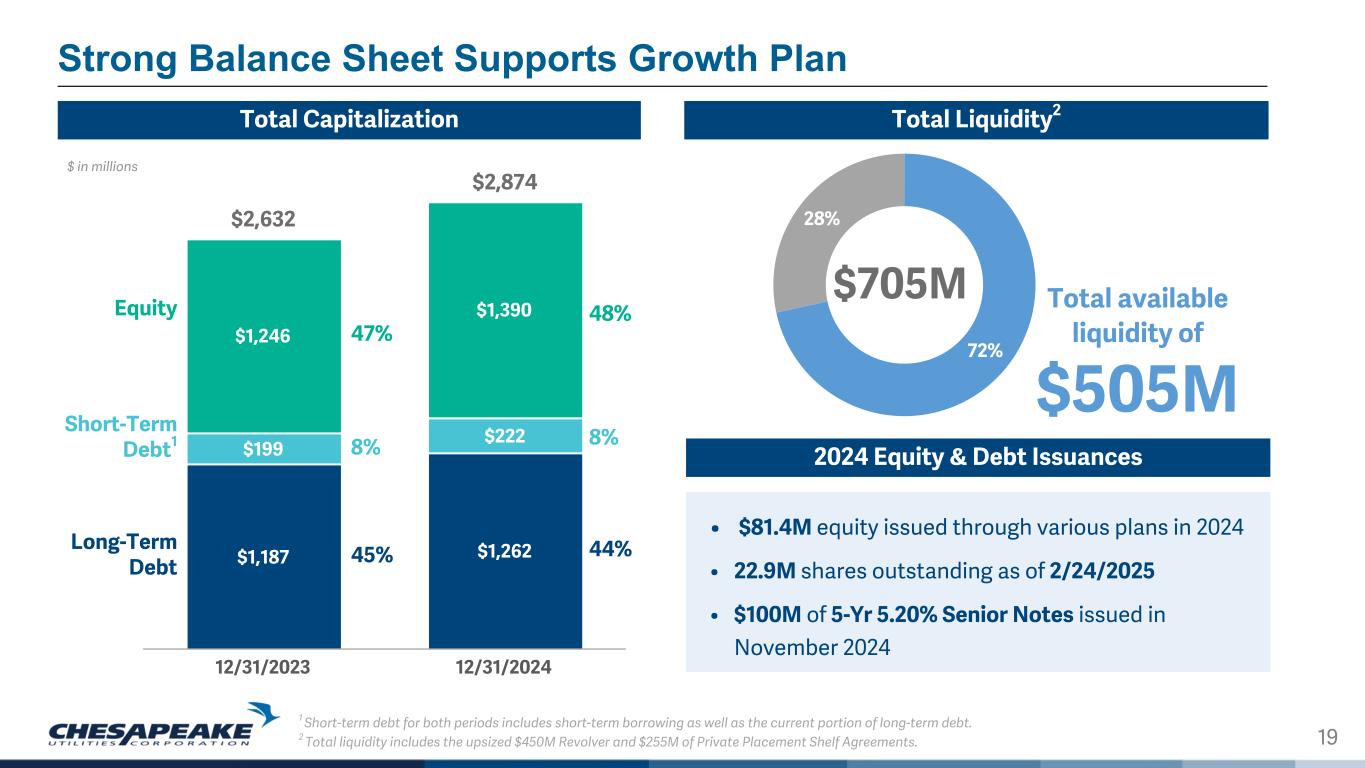

19 Strong Balance Sheet Supports Growth Plan $2,632 $2,874 $1,187 $1,262 $199 $222 $1,246 $1,390 12/31/2023 12/31/2024 Total Capitalization Equity Short-Term Debt1 Long-Term Debt 47% 8% 45% 48% 8% 44% Total Liquidity2 72% 28% 1 Short-term debt for both periods includes short-term borrowing as well as the current portion of long-term debt. 2 Total liquidity includes the upsized $450M Revolver and $255M of Private Placement Shelf Agreements. 2024 Equity & Debt Issuances • $81.4M equity issued through various plans in 2024 • 22.9M shares outstanding as of 2/24/2025 • $100M of 5-Yr 5.20% Senior Notes issued in November 2024 Total available liquidity of $505M $ in millions $705M

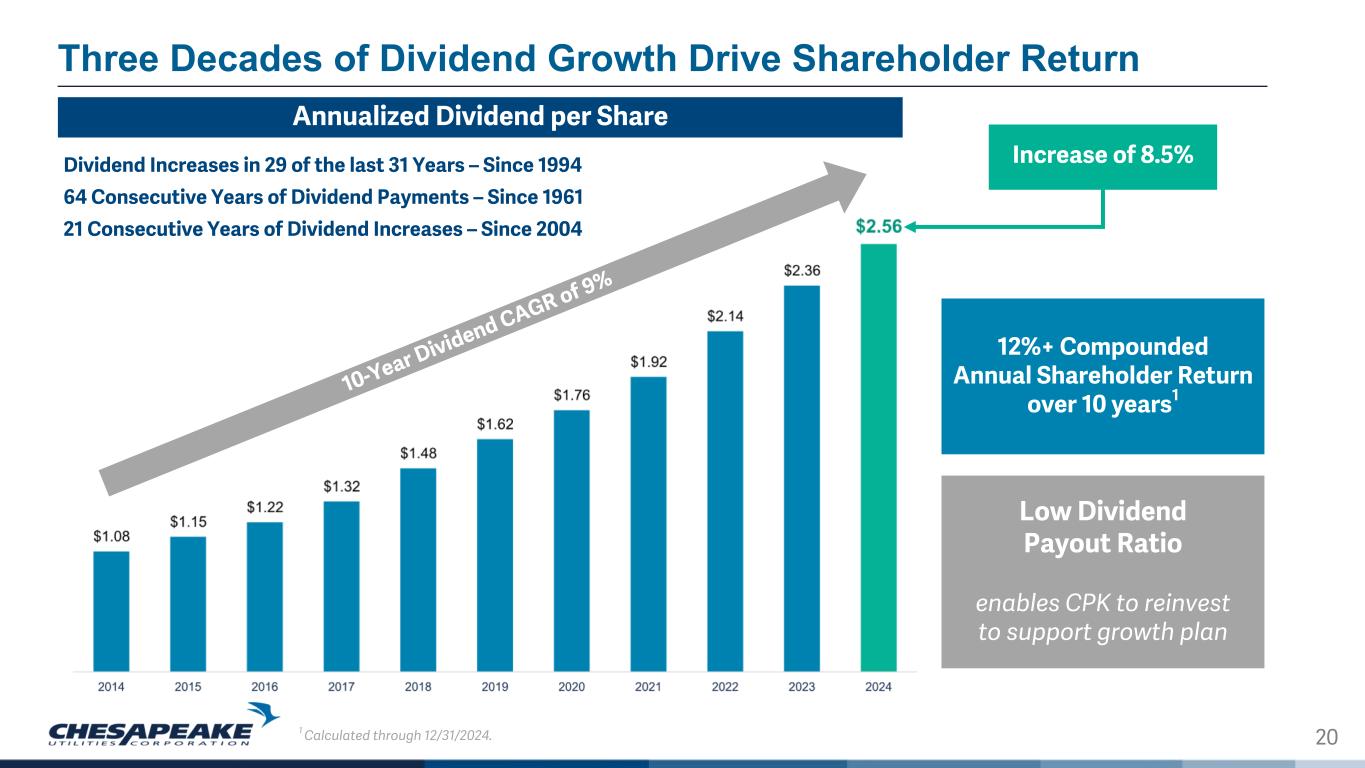

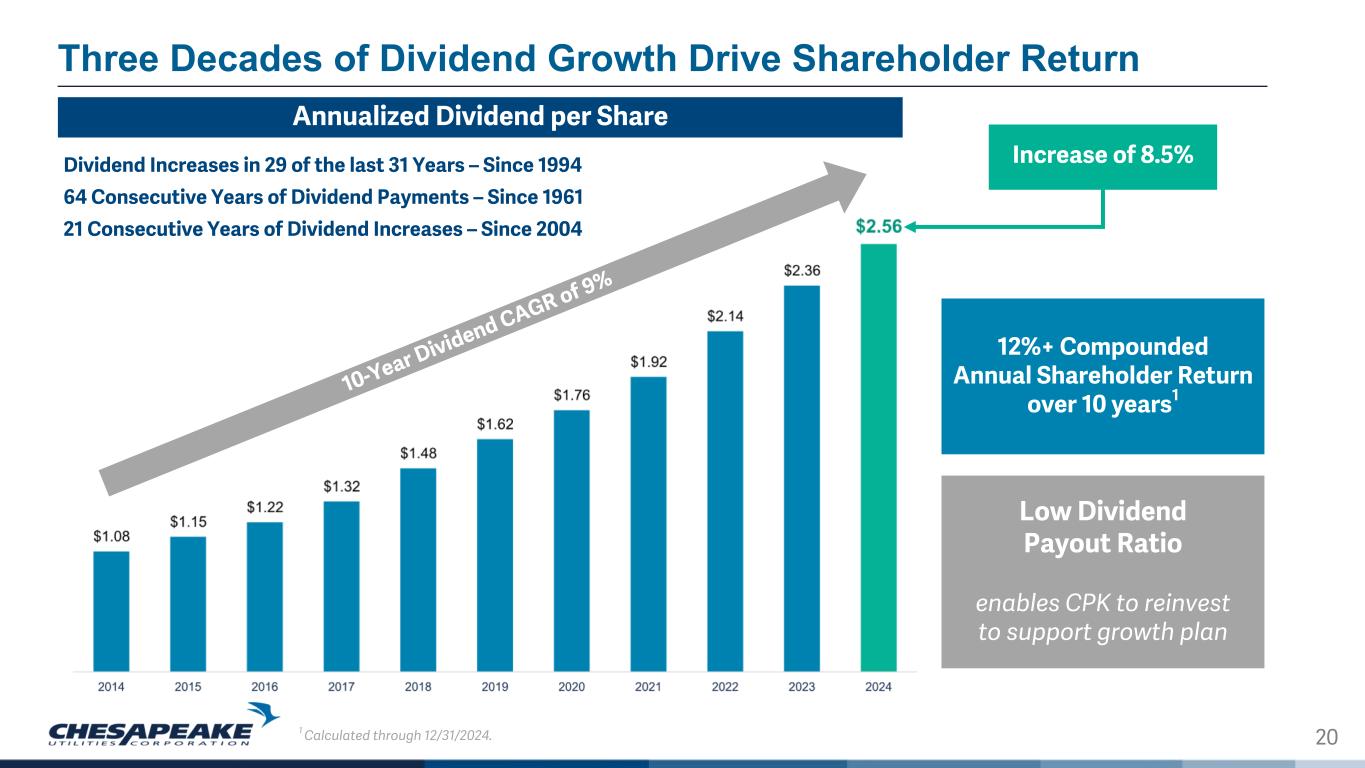

20 Three Decades of Dividend Growth Drive Shareholder Return Annualized Dividend per Share 1 Calculated through 12/31/2024. 10-Year Dividend CAGR of 9% Dividend Increases in 29 of the last 31 Years – Since 1994 64 Consecutive Years of Dividend Payments – Since 1961 21 Consecutive Years of Dividend Increases – Since 2004 12%+ Compounded Annual Shareholder Return over 10 years1 Increase of 8.5% Low Dividend Payout Ratio enables CPK to reinvest to support growth plan

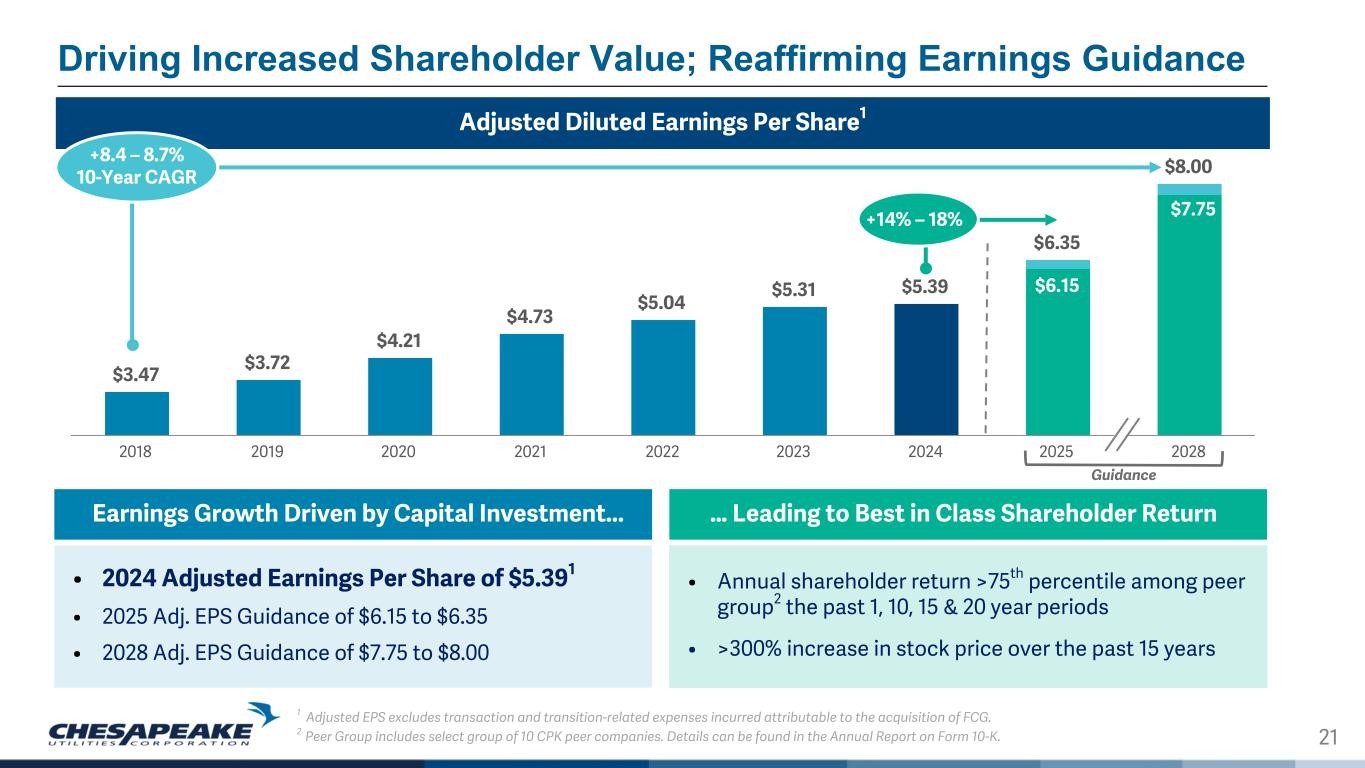

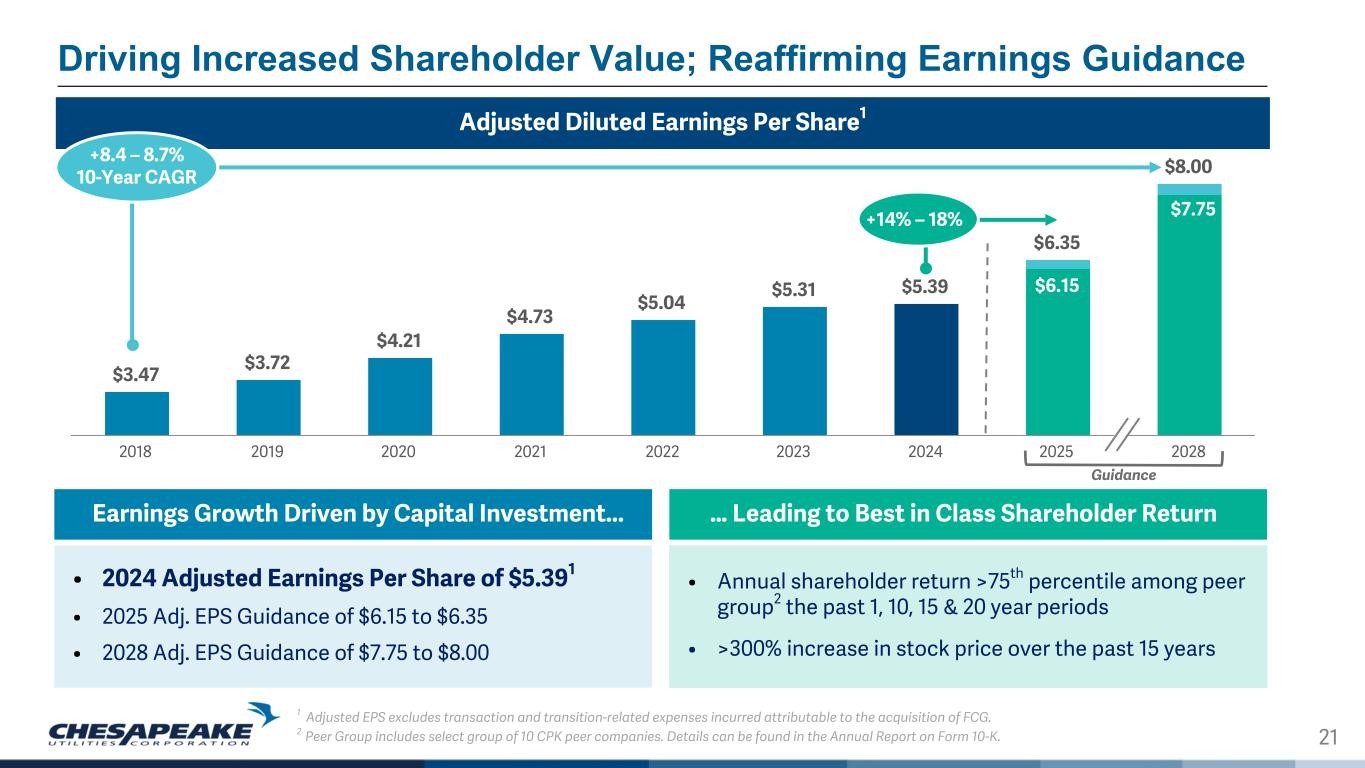

21 $3.47 $3.72 $4.21 $4.73 $5.04 $5.31 $5.39 $6.35 $8.00 $3.47 $3.72 2018 2019 2020 2021 2022 2023 2024 2025 2028 Guidance Driving Increased Shareholder Value; Reaffirming Earnings Guidance Adjusted Diluted Earnings Per Share1 • 2024 Adjusted Earnings Per Share of $5.391 • 2025 Adj. EPS Guidance of $6.15 to $6.35 • 2028 Adj. EPS Guidance of $7.75 to $8.00 • Annual shareholder return >75th percentile among peer group2 the past 1, 10, 15 & 20 year periods • >300% increase in stock price over the past 15 years 1 Adjusted EPS excludes transaction and transition-related expenses incurred attributable to the acquisition of FCG. 2 Peer Group includes select group of 10 CPK peer companies. Details can be found in the Annual Report on Form 10-K. Earnings Growth Driven by Capital Investment... … Leading to Best in Class Shareholder Return $6.15 $7.75 +8.4 – 8.7% 10-Year CAGR +14% – 18%

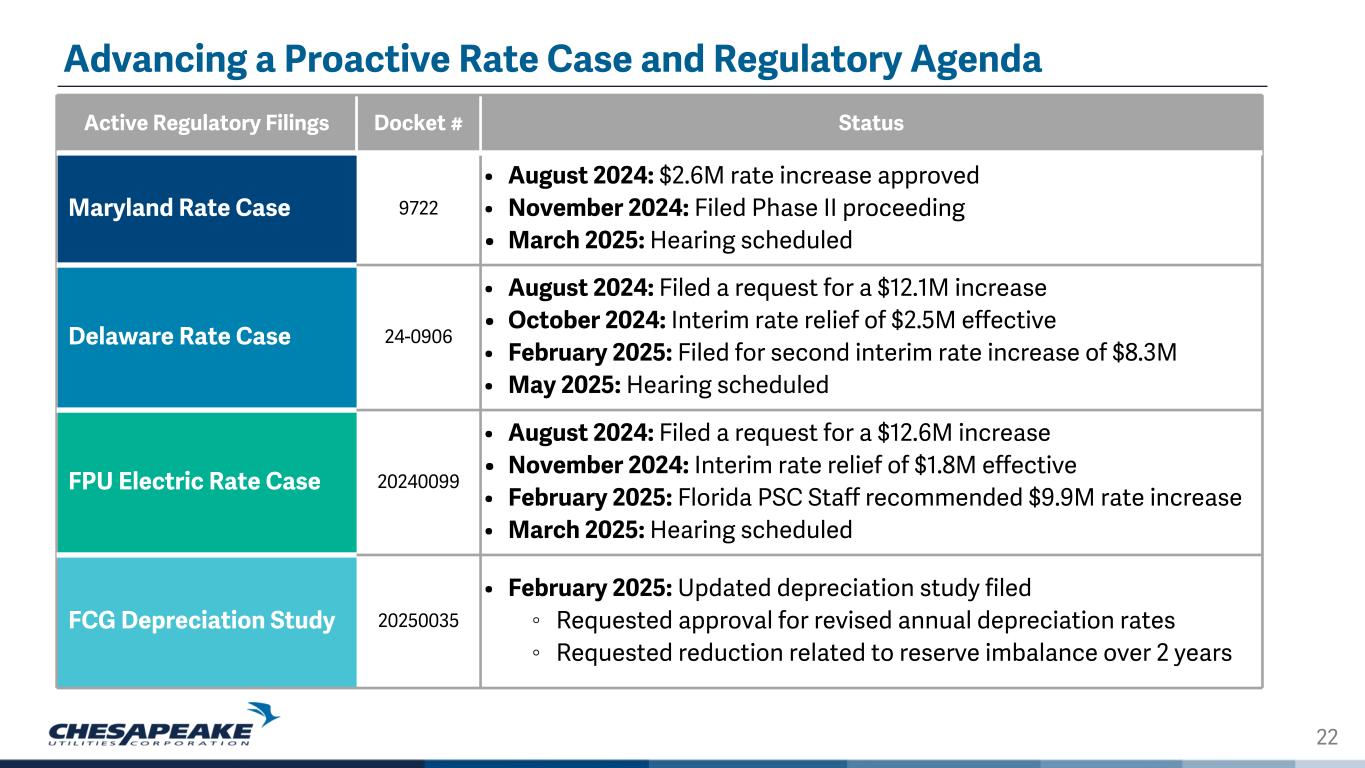

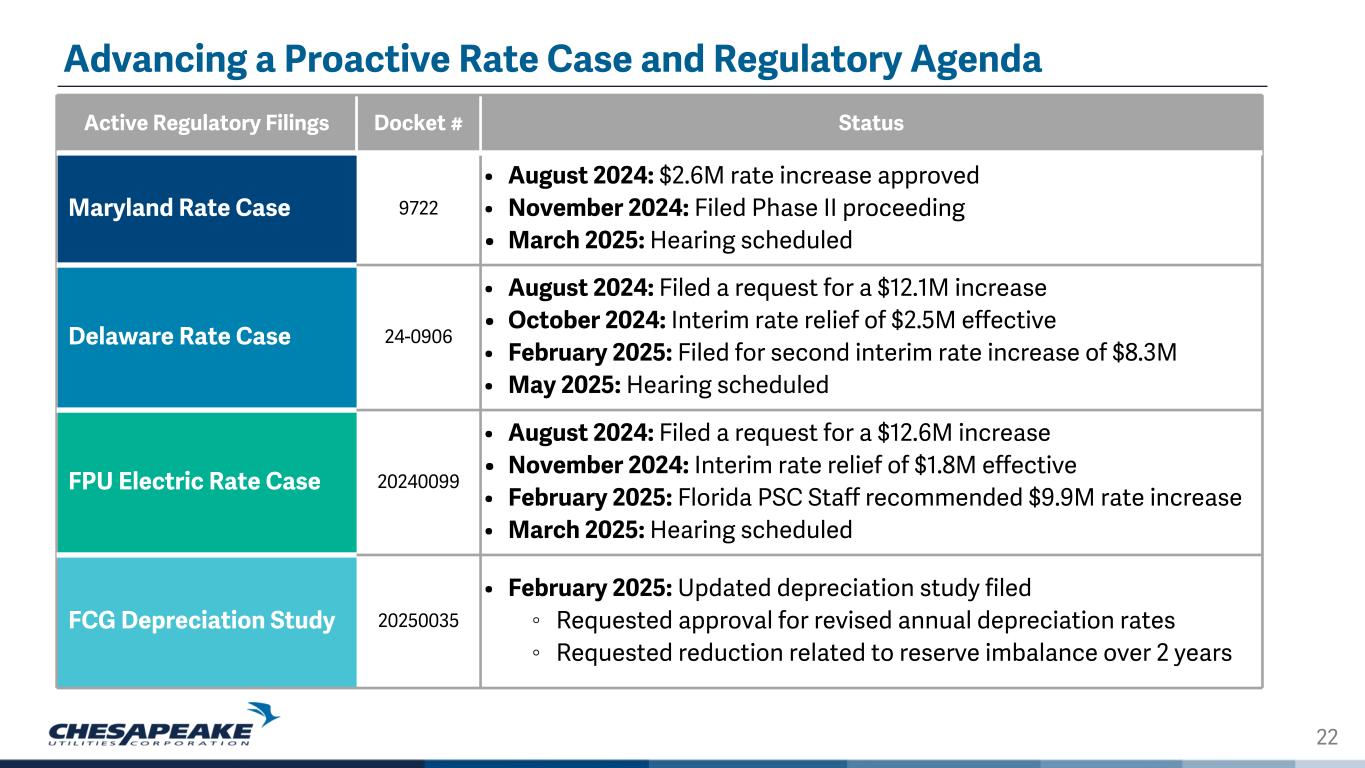

22 Advancing a Proactive Rate Case and Regulatory Agenda Active Regulatory Filings Docket # Status Maryland Rate Case 9722 • August 2024: $2.6M rate increase approved • November 2024: Filed Phase II proceeding • March 2025: Hearing scheduled Delaware Rate Case 24-0906 • August 2024: Filed a request for a $12.1M increase • October 2024: Interim rate relief of $2.5M effective • February 2025: Filed for second interim rate increase of $8.3M • May 2025: Hearing scheduled FPU Electric Rate Case 20240099 • August 2024: Filed a request for a $12.6M increase • November 2024: Interim rate relief of $1.8M effective • February 2025: Florida PSC Staff recommended $9.9M rate increase • March 2025: Hearing scheduled FCG Depreciation Study 20250035 • February 2025: Updated depreciation study filed ◦ Requested approval for revised annual depreciation rates ◦ Requested reduction related to reserve imbalance over 2 years

23 Worcester Resiliency Upgrade Project Approved and On Schedule ESNG LNG Storage project designed to meet critical energy service to customers during the peak winter heating season • $80 million planned LNG storage facility in Bishopville, MD • Project consists of five low-profile horizontal storage tanks allowing for up to 500K gallons of storage plus pipeline looping and additional upgrades • Incremental storage capacity will protect against weather- related disruptions, support affordable energy prices and prepare for incremental growth in southern Maryland • The project received FERC approval in January 2025 • Tank construction is complete and tanks are being shipped to our service area • Construction remains on track to be completed in Q3 2025 Note: FERC = Federal Energy Regulatory Commission. Tanks are wrapped and prepared for shipment

24 A Year of Exceptional Community Engagement 6,823 hours volunteered by CPK teammates $356K 2024 FY charitable donations $219K 2024 FY community sponsorships 75+ orgs supported by charitable giving $30k+ scholarships awarded to high school seniors Sharp Teammates Support Flags for Veterans in Maryland "Making Strides" Breast Cancer Event in Miami, FL Teammates volunteer at the Food Bank of Delaware in Milford Sea and sunshine bring a large group for Fishing with Special Friends in North Carolina Teammates at the Cradles to Crayons Event in Wilmington, DE

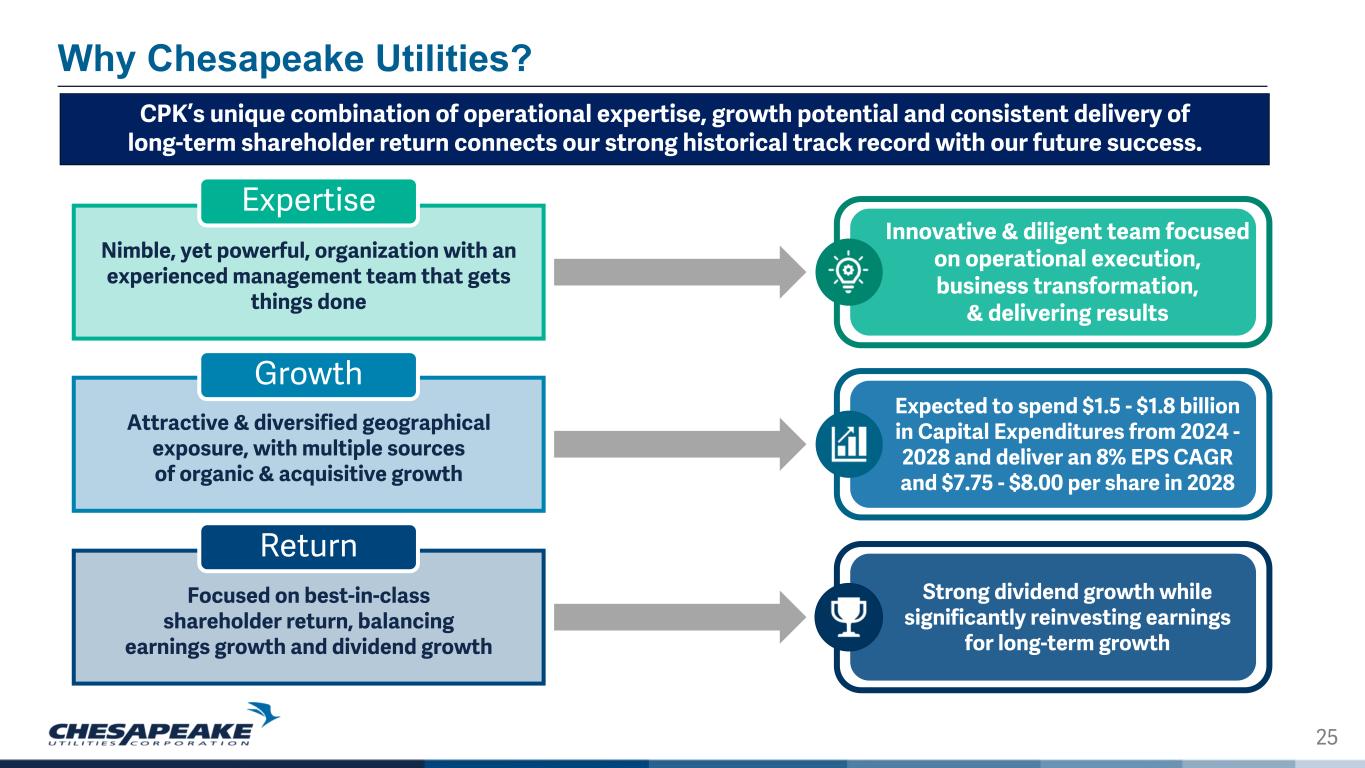

25 Why Chesapeake Utilities? CPK’s unique combination of operational expertise, growth potential and consistent delivery of long-term shareholder return connects our strong historical track record with our future success. Innovative & diligent team focused on operational execution, business transformation, & delivering results Nimble, yet powerful, organization with an experienced management team that gets things done Expertise Expected to spend $1.5 - $1.8 billion in Capital Expenditures from 2024 - 2028 and deliver an 8% EPS CAGR and $7.75 - $8.00 per share in 2028 Attractive & diversified geographical exposure, with multiple sources of organic & acquisitive growth Growth Strong dividend growth while significantly reinvesting earnings for long-term growth Focused on best-in-class shareholder return, balancing earnings growth and dividend growth Return

26 Appendix

27 Quarterly Earnings Cadence Year Q1 Q2 Q3 Q4 FY 2024 $2.10 $0.86 $0.80 1.63 5.39 % of FY 39% 16% 15% 30% 2023 $2.04 $0.90 $0.692 $1.64 $5.31 % of FY 38% 17% 13% 31% 2022 $2.08 $0.96 $0.54 $1.47 $5.04 % of FY 41% 19% 11% 29% 2021 $1.96 $0.78 $0.71 $1.28 $4.73 % of FY 41% 16% 15% 27% 2020 $1.77 $0.64 $0.56 $1.24 $4.21 % of FY 42% 15% 13% 29% 2019 $1.75 $0.54 $0.38 $1.04 $3.72 % of FY 47% 15% 10% 28% 5yr % Band 38% - 47% 15% - 19% 10% - 15% 27% - 31% Note: Historic Adjusted EPS presented from continuing operations. 1 Beginning in the third quarter of 2023, the Company’s earnings per share metric was adjusted to exclude transaction-related expenses attributable to the announced acquisition of FCG including, but not limited to, legal, consulting, audit and financing fees. 2 The sum of the four quarters does not equal the full year amount due to rounding and the impact of average share counts. Adjusted EPS1

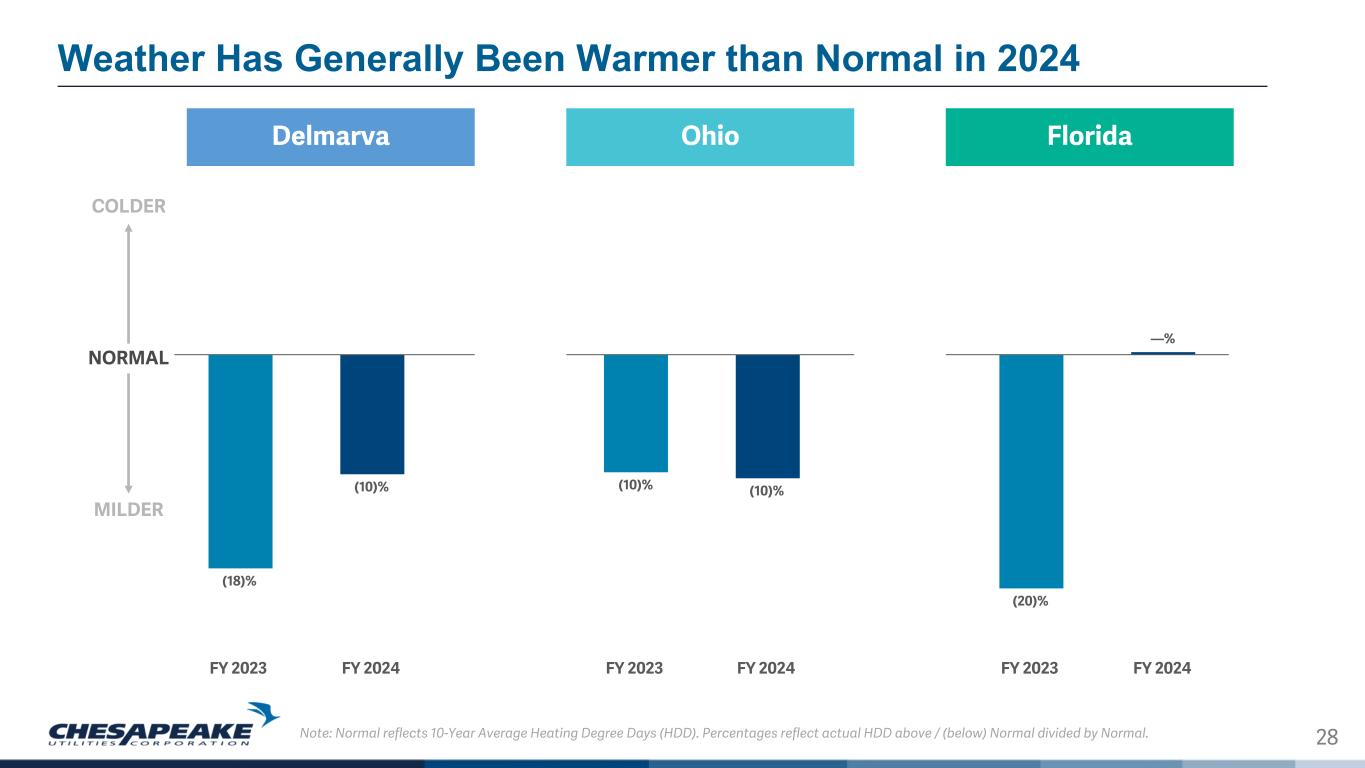

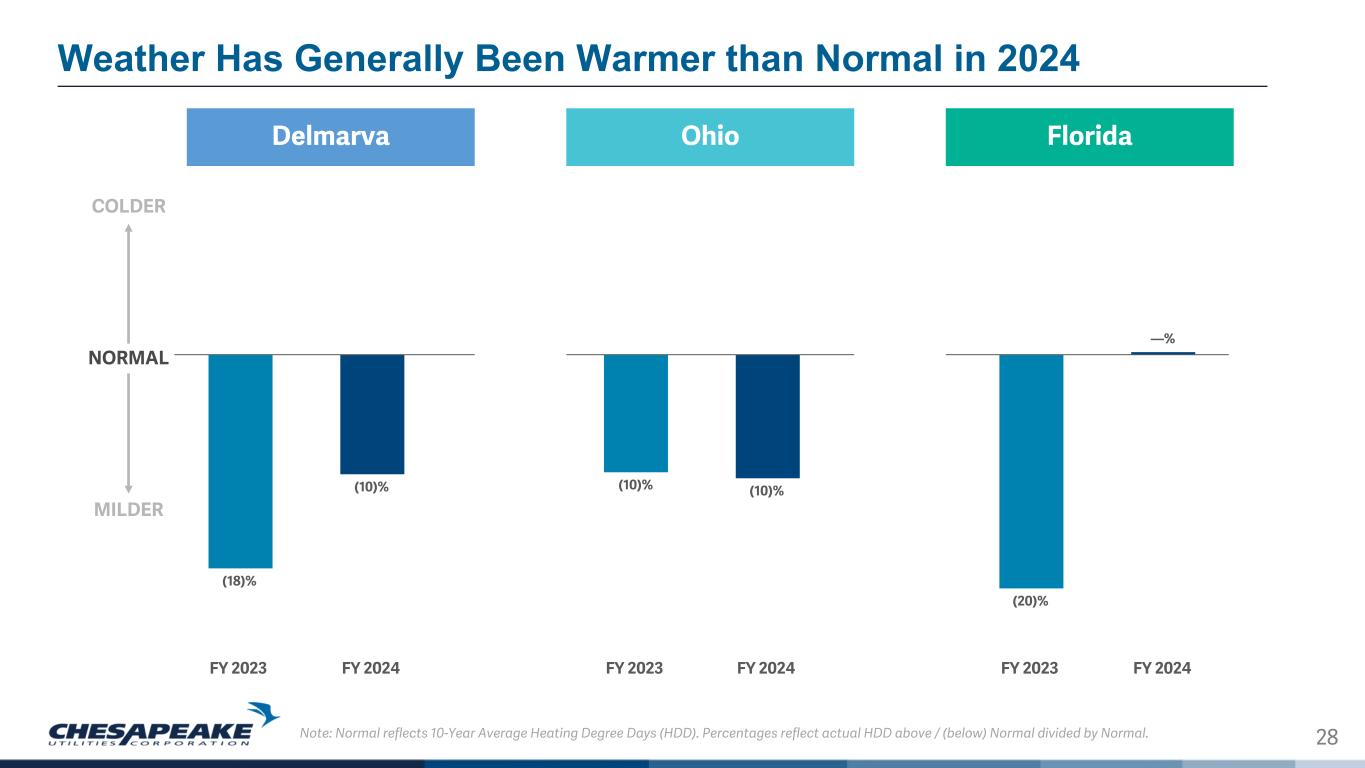

28 Weather Has Generally Been Warmer than Normal in 2024 OhioDelmarva Florida (18)% (10)% (10)% (10)% (20)% —% FY 2023 FY 2024 FY 2023 FY 2024 FY 2023 FY 2024 NORMAL Note: Normal reflects 10-Year Average Heating Degree Days (HDD). Percentages reflect actual HDD above / (below) Normal divided by Normal. MILDER COLDER

29 Aligning our Work with a Higher-Level Purpose Our Vision We will be a leader in delivering energy that contributes to a sustainable future. Our Values Care Integrity Excellence We deliver energy that makes life better for the people and communities we serve. Our Mission We put people first. We tell the truth. We achieve great things together.

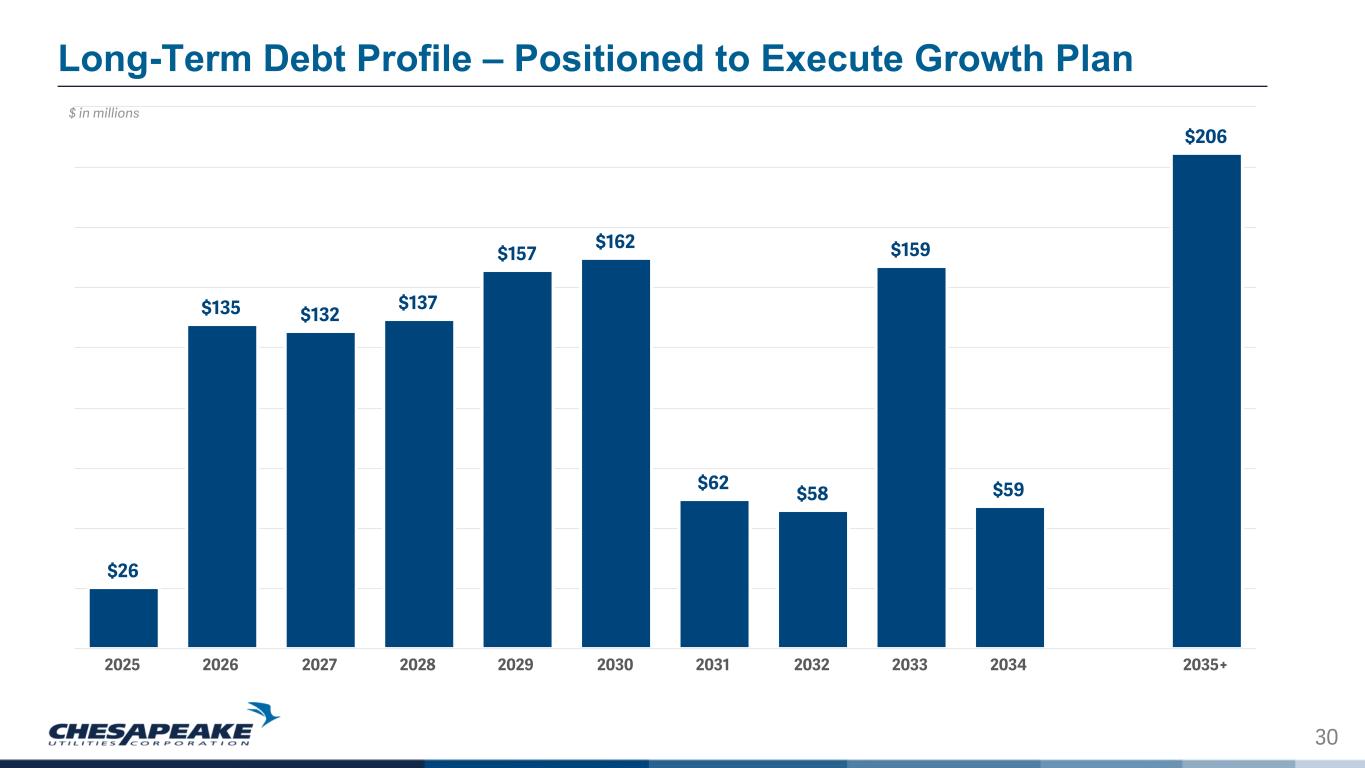

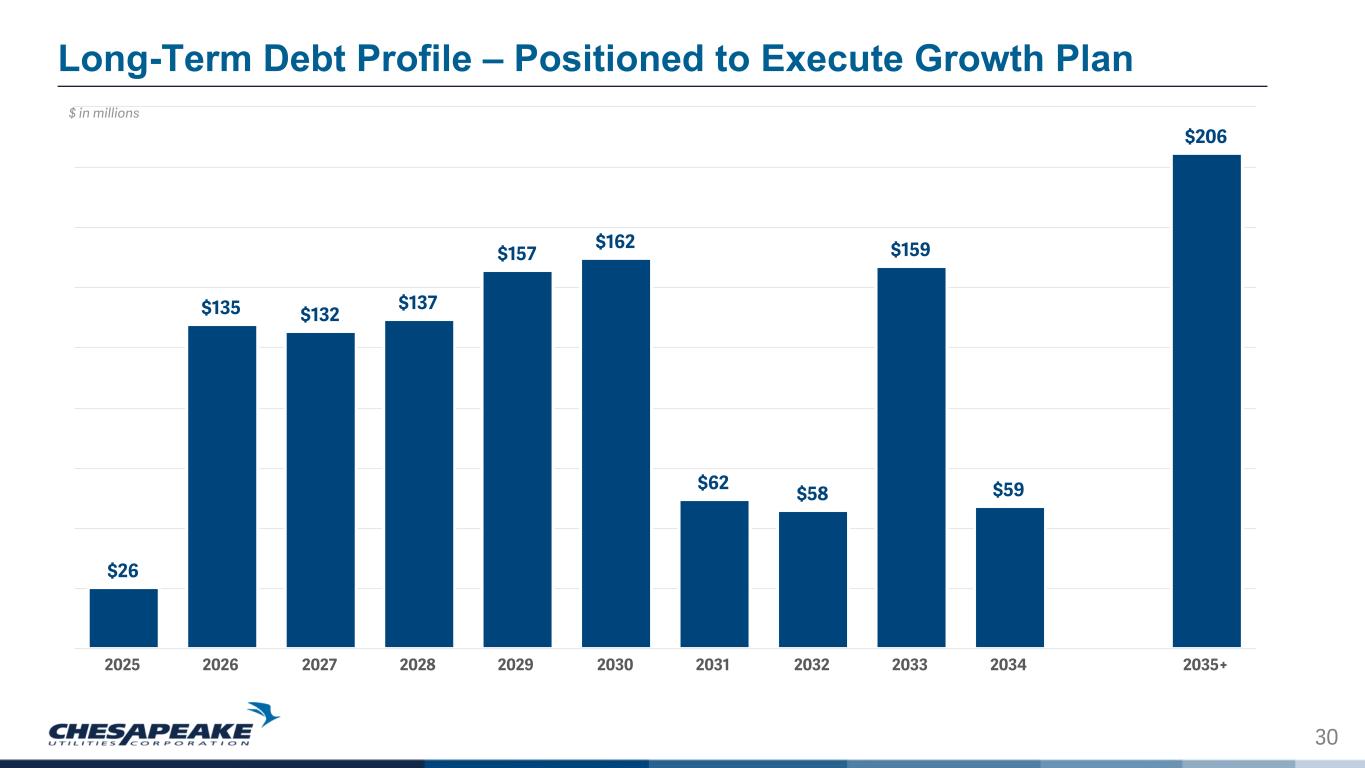

30 Long-Term Debt Profile – Positioned to Execute Growth Plan $26 $135 $132 $137 $157 $162 $62 $58 $159 $59 $206 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035+ $ in millions

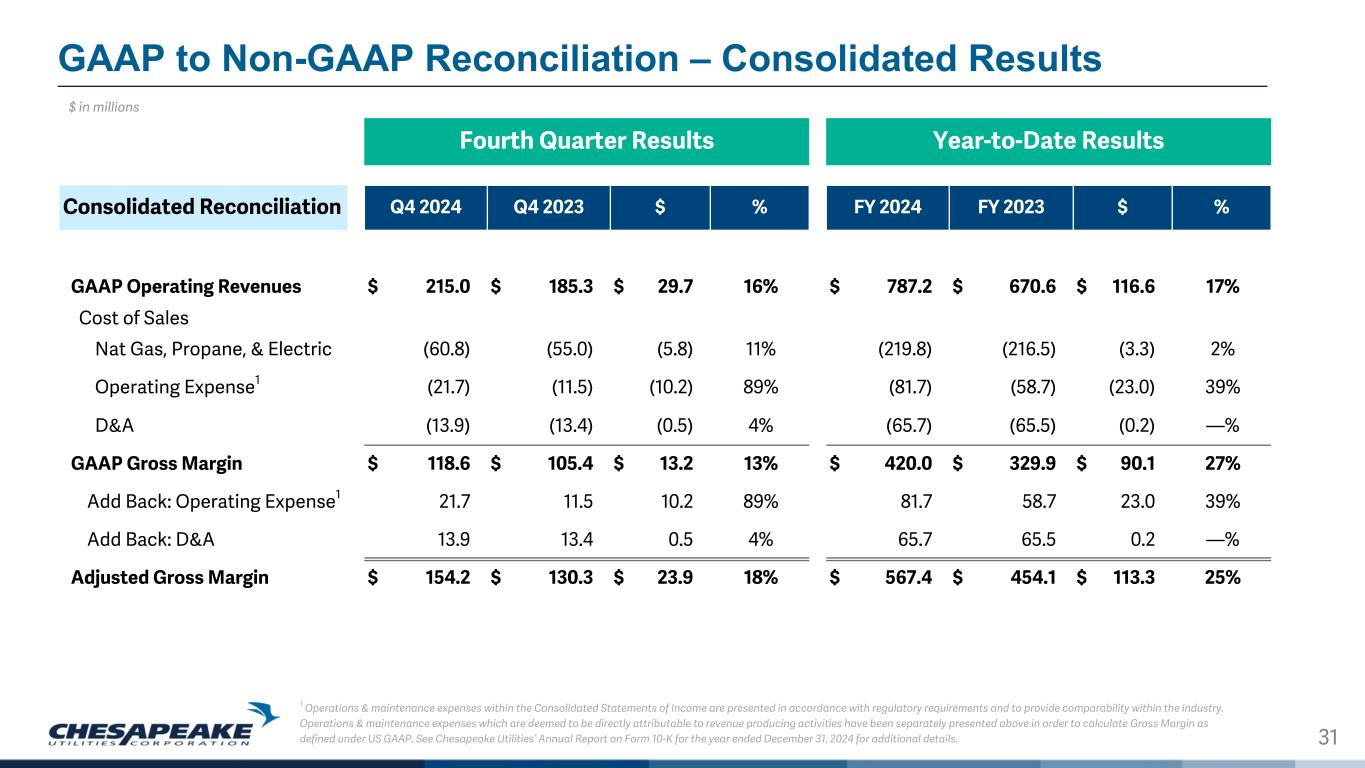

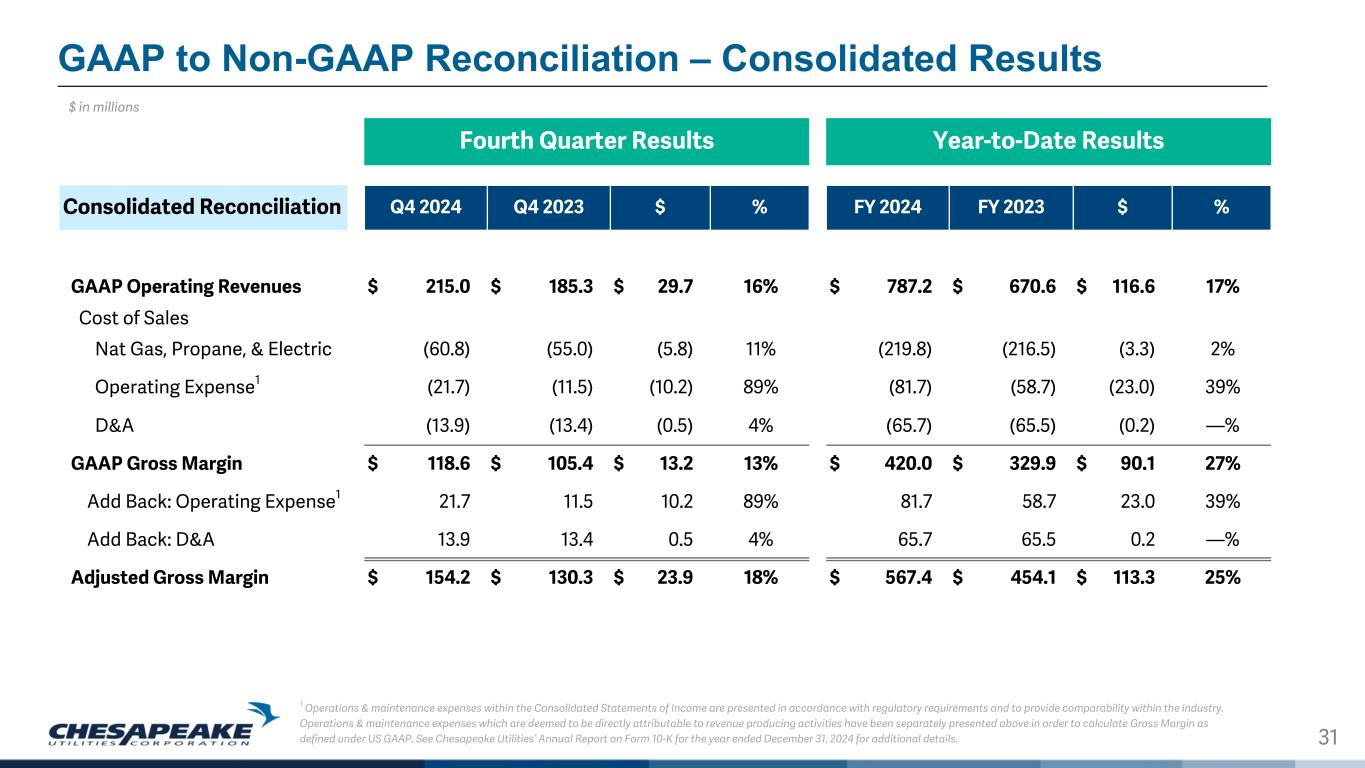

31 GAAP to Non-GAAP Reconciliation – Consolidated Results Fourth Quarter Results Year-to-Date Results Consolidated Reconciliation Q4 2024 Q4 2023 $ % FY 2024 FY 2023 $ % GAAP Operating Revenues $ 215.0 $ 185.3 $ 29.7 16% $ 787.2 $ 670.6 $ 116.6 17% Cost of Sales Nat Gas, Propane, & Electric (60.8) (55.0) (5.8) 11% (219.8) (216.5) (3.3) 2% Operating Expense1 (21.7) (11.5) (10.2) 89% (81.7) (58.7) (23.0) 39% D&A (13.9) (13.4) (0.5) 4% (65.7) (65.5) (0.2) —% GAAP Gross Margin $ 118.6 $ 105.4 $ 13.2 13% $ 420.0 $ 329.9 $ 90.1 27% Add Back: Operating Expense1 21.7 11.5 10.2 89% 81.7 58.7 23.0 39% Add Back: D&A 13.9 13.4 0.5 4% 65.7 65.5 0.2 —% Adjusted Gross Margin $ 154.2 $ 130.3 $ 23.9 18% $ 567.4 $ 454.1 $ 113.3 25% 1 Operations & maintenance expenses within the Consolidated Statements of Income are presented in accordance with regulatory requirements and to provide comparability within the industry. Operations & maintenance expenses which are deemed to be directly attributable to revenue producing activities have been separately presented above in order to calculate Gross Margin as defined under US GAAP. See Chesapeake Utilities’ Annual Report on Form 10-K for the year ended December 31, 2024 for additional details. $ in millions

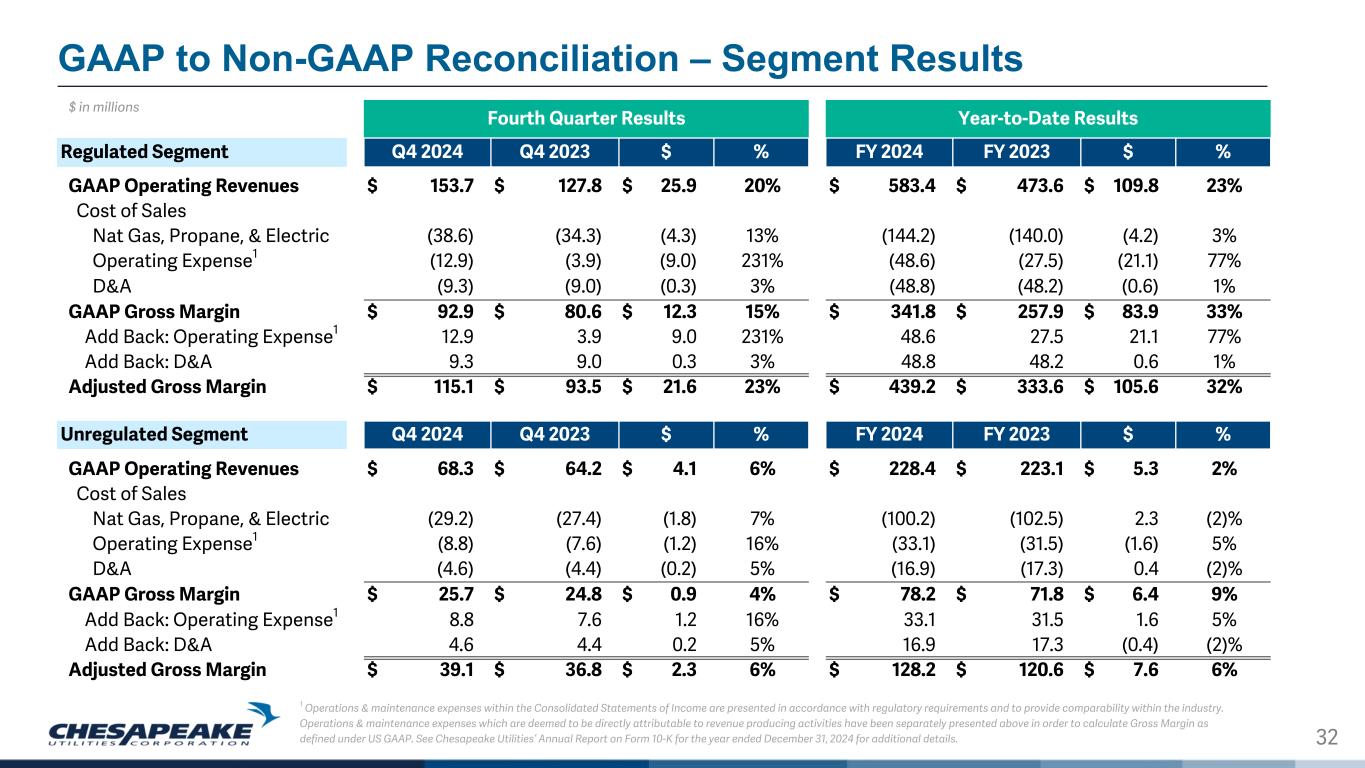

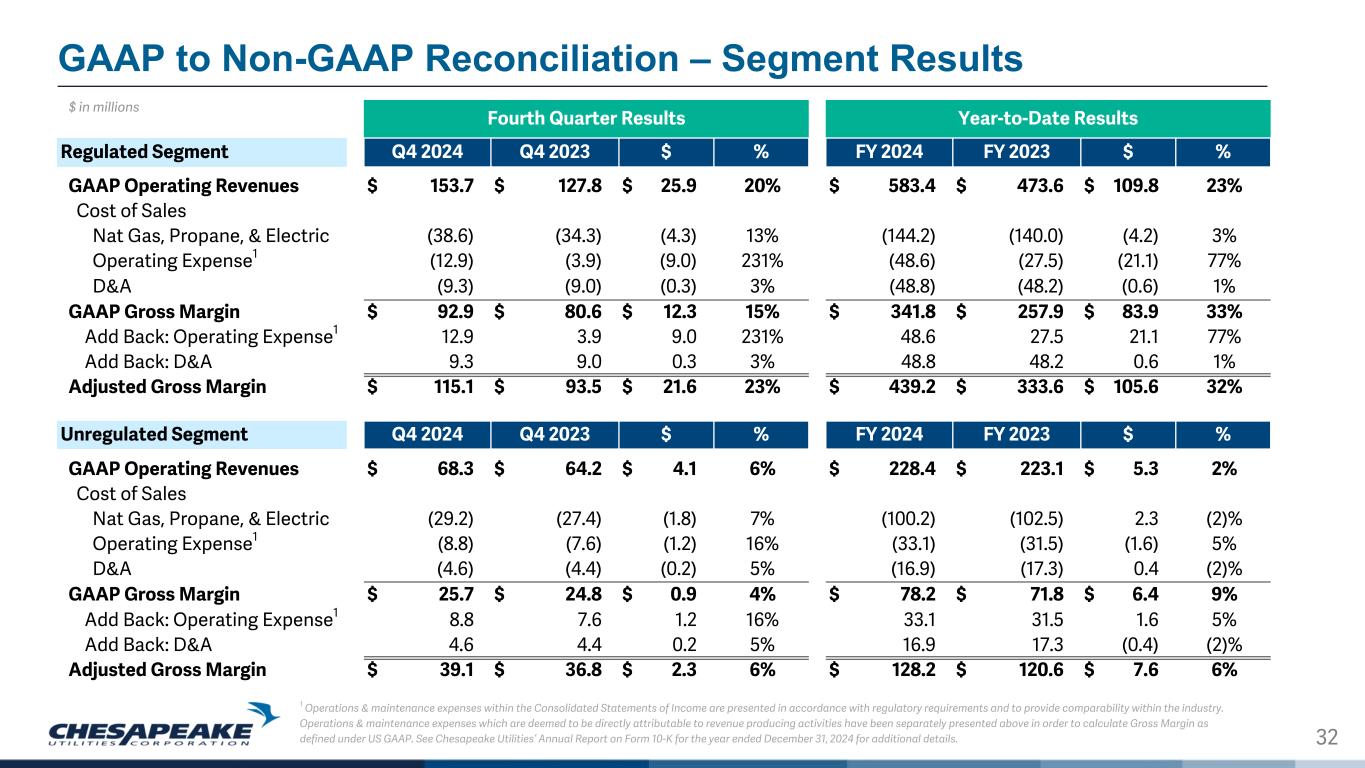

32 GAAP to Non-GAAP Reconciliation – Segment Results 1 Operations & maintenance expenses within the Consolidated Statements of Income are presented in accordance with regulatory requirements and to provide comparability within the industry. Operations & maintenance expenses which are deemed to be directly attributable to revenue producing activities have been separately presented above in order to calculate Gross Margin as defined under US GAAP. See Chesapeake Utilities’ Annual Report on Form 10-K for the year ended December 31, 2024 for additional details. Fourth Quarter Results Year-to-Date Results Regulated Segment Q4 2024 Q4 2023 $ % FY 2024 FY 2023 $ % GAAP Operating Revenues $ 153.7 $ 127.8 $ 25.9 20% $ 583.4 $ 473.6 $ 109.8 23% Cost of Sales Nat Gas, Propane, & Electric (38.6) (34.3) (4.3) 13% (144.2) (140.0) (4.2) 3% Operating Expense1 (12.9) (3.9) (9.0) 231% (48.6) (27.5) (21.1) 77% D&A (9.3) (9.0) (0.3) 3% (48.8) (48.2) (0.6) 1% GAAP Gross Margin $ 92.9 $ 80.6 $ 12.3 15% $ 341.8 $ 257.9 $ 83.9 33% Add Back: Operating Expense1 12.9 3.9 9.0 231% 48.6 27.5 21.1 77% Add Back: D&A 9.3 9.0 0.3 3% 48.8 48.2 0.6 1% Adjusted Gross Margin $ 115.1 $ 93.5 $ 21.6 23% $ 439.2 $ 333.6 $ 105.6 32% Unregulated Segment Q4 2024 Q4 2023 $ % FY 2024 FY 2023 $ % GAAP Operating Revenues $ 68.3 $ 64.2 $ 4.1 6% $ 228.4 $ 223.1 $ 5.3 2% Cost of Sales Nat Gas, Propane, & Electric (29.2) (27.4) (1.8) 7% (100.2) (102.5) 2.3 (2)% Operating Expense1 (8.8) (7.6) (1.2) 16% (33.1) (31.5) (1.6) 5% D&A (4.6) (4.4) (0.2) 5% (16.9) (17.3) 0.4 (2)% GAAP Gross Margin $ 25.7 $ 24.8 $ 0.9 4% $ 78.2 $ 71.8 $ 6.4 9% Add Back: Operating Expense1 8.8 7.6 1.2 16% 33.1 31.5 1.6 5% Add Back: D&A 4.6 4.4 0.2 5% 16.9 17.3 (0.4) (2)% Adjusted Gross Margin $ 39.1 $ 36.8 $ 2.3 6% $ 128.2 $ 120.6 $ 7.6 6% $ in millions

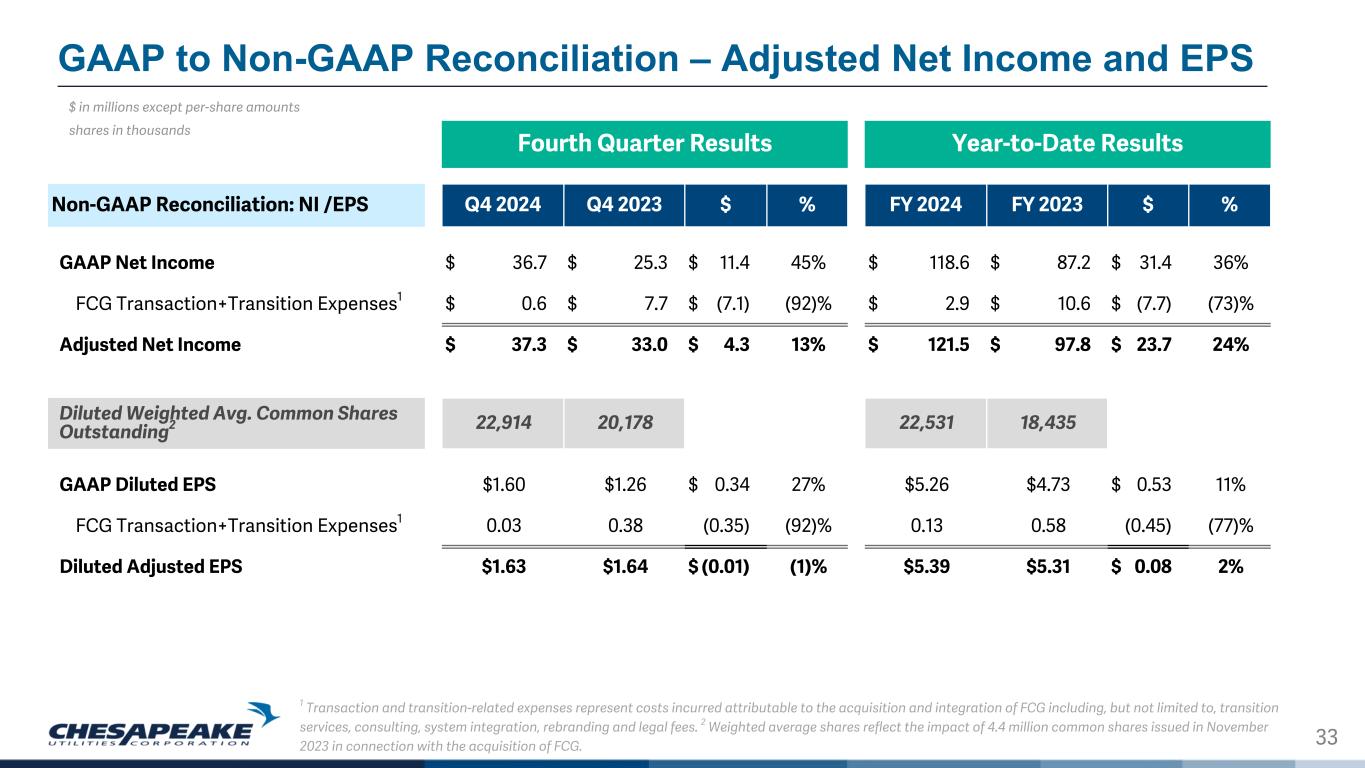

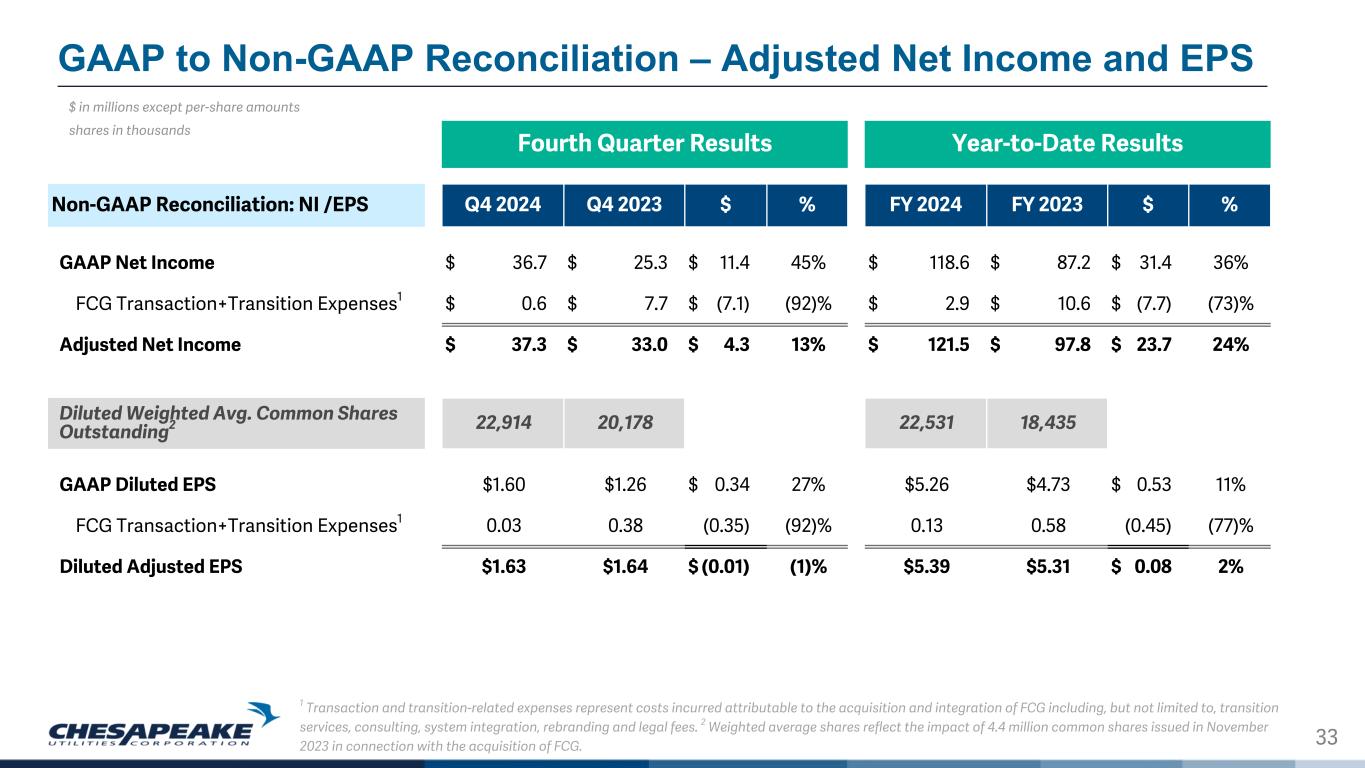

33 GAAP to Non-GAAP Reconciliation – Adjusted Net Income and EPS 1 Transaction and transition-related expenses represent costs incurred attributable to the acquisition and integration of FCG including, but not limited to, transition services, consulting, system integration, rebranding and legal fees. 2 Weighted average shares reflect the impact of 4.4 million common shares issued in November 2023 in connection with the acquisition of FCG. Fourth Quarter Results Year-to-Date Results Non-GAAP Reconciliation: NI /EPS Q4 2024 Q4 2023 $ % FY 2024 FY 2023 $ % GAAP Net Income $ 36.7 $ 25.3 $ 11.4 45% $ 118.6 $ 87.2 $ 31.4 36% FCG Transaction+Transition Expenses1 $ 0.6 $ 7.7 $ (7.1) (92)% $ 2.9 $ 10.6 $ (7.7) (73)% Adjusted Net Income $ 37.3 $ 33.0 $ 4.3 13% $ 121.5 $ 97.8 $ 23.7 24% Diluted Weighted Avg. Common Shares Outstanding2 22,914 20,178 22,531 18,435 GAAP Diluted EPS $1.60 $1.26 $ 0.34 27% $5.26 $4.73 $ 0.53 11% FCG Transaction+Transition Expenses1 0.03 0.38 (0.35) (92)% 0.13 0.58 (0.45) (77)% Diluted Adjusted EPS $1.63 $1.64 $ (0.01) (1)% $5.39 $5.31 $ 0.08 2% $ in millions except per-share amounts shares in thousands

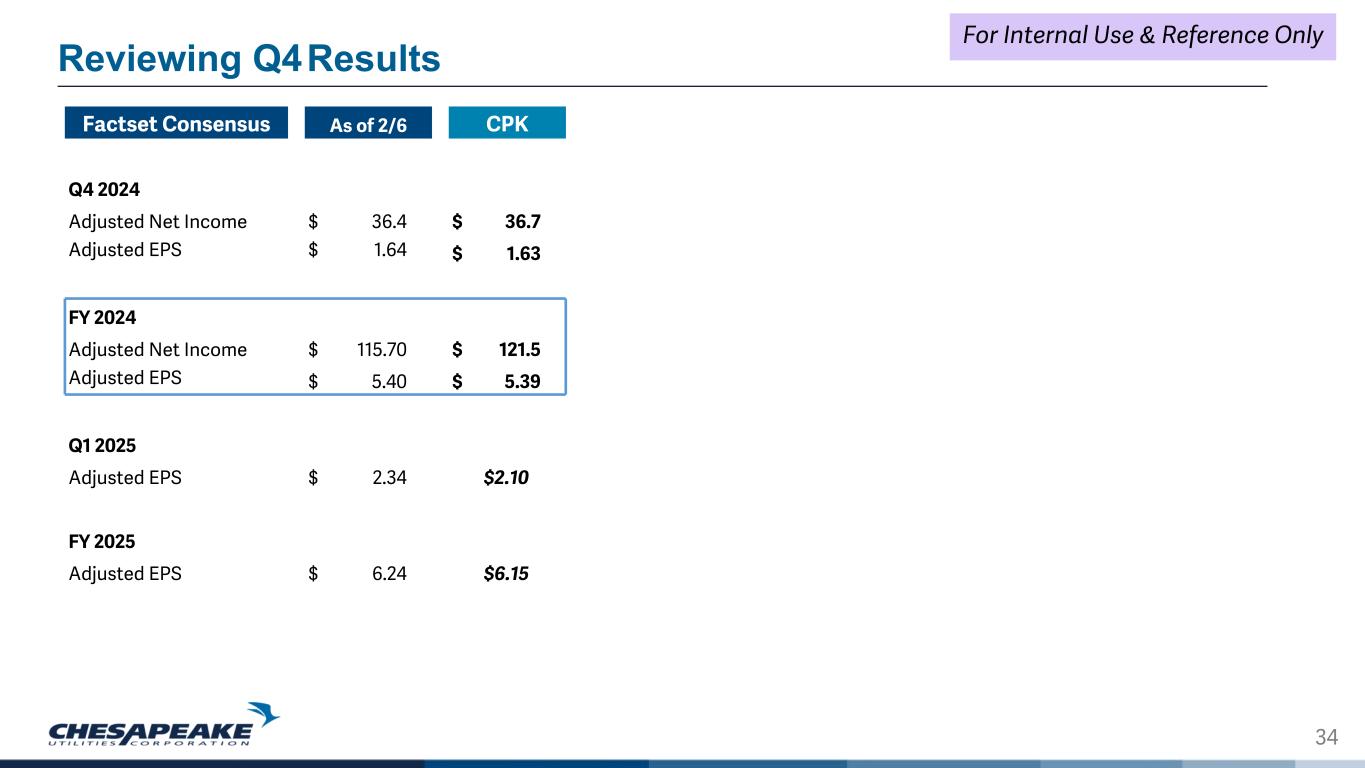

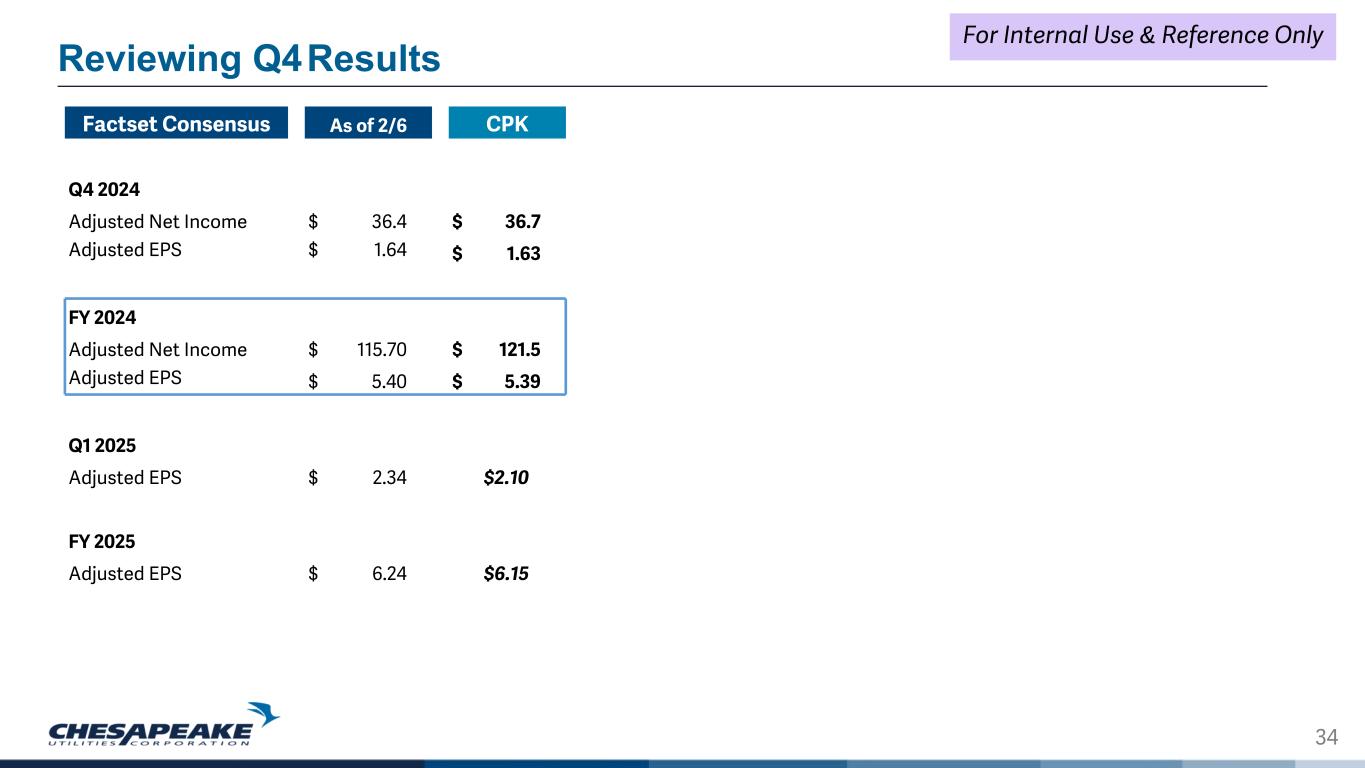

34 Reviewing Q4 Results For Internal Use & Reference Only Factset Consensus As of 2/6 CPK Q4 2024 Adjusted Net Income $ 36.4 $ 36.7 Adjusted EPS $ 1.64 $ 1.63 FY 2024 Adjusted Net Income $ 115.70 $ 121.5 Adjusted EPS $ 5.40 $ 5.39 Q1 2025 Adjusted EPS $ 2.34 $2.10 FY 2025 Adjusted EPS $ 6.24 $6.15

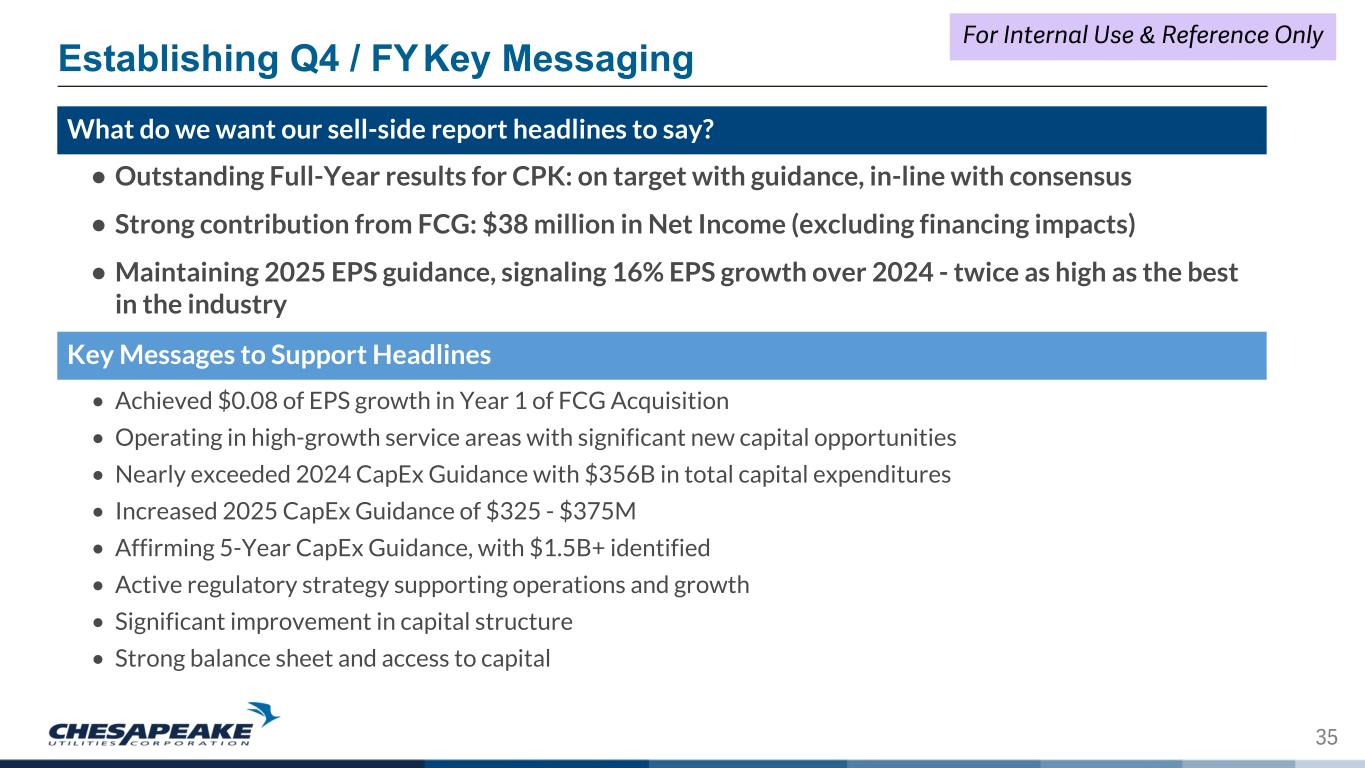

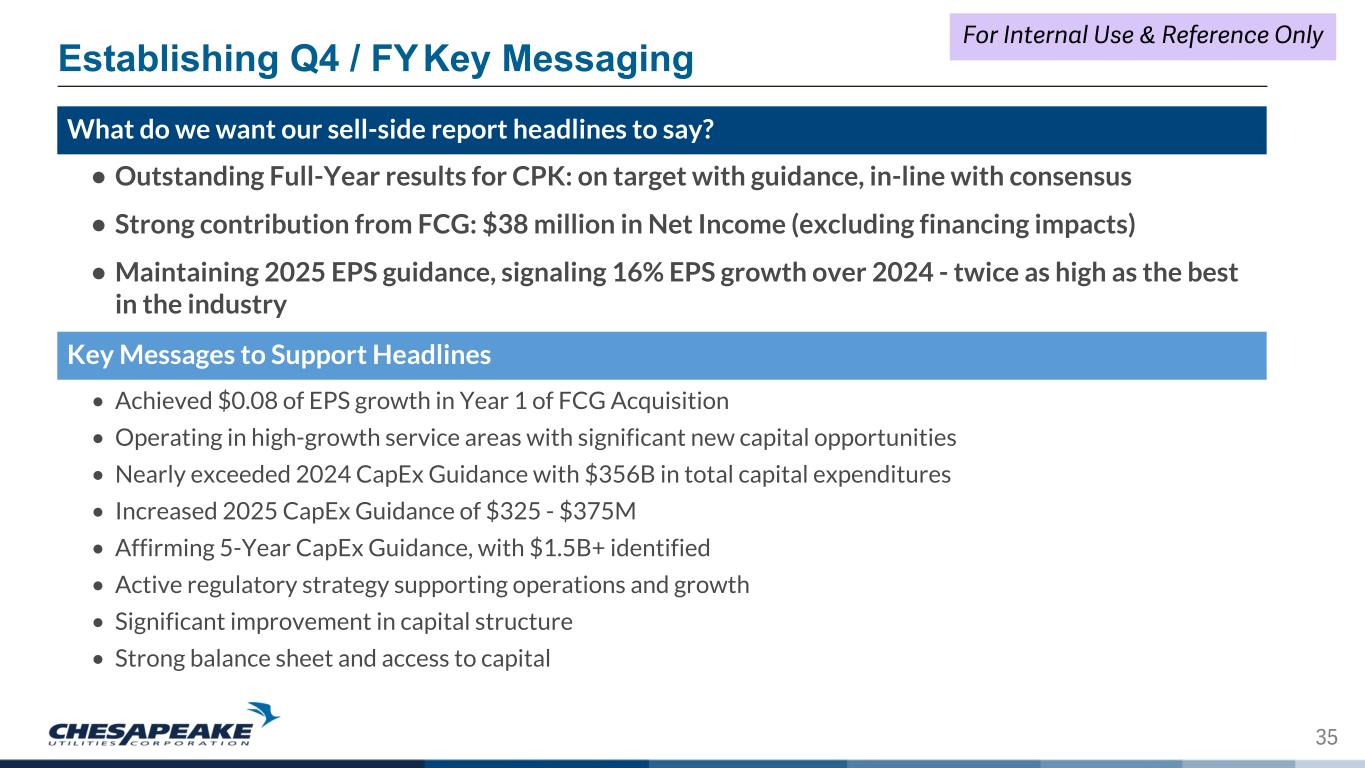

35 Establishing Q4 / FY Key Messaging What do we want our sell-side report headlines to say? • Outstanding Full-Year results for CPK: on target with guidance, in-line with consensus • Strong contribution from FCG: $38 million in Net Income (excluding financing impacts) • Maintaining 2025 EPS guidance, signaling 16% EPS growth over 2024 - twice as high as the best in the industry Key Messages to Support Headlines • Achieved $0.08 of EPS growth in Year 1 of FCG Acquisition • Operating in high-growth service areas with significant new capital opportunities • Nearly exceeded 2024 CapEx Guidance with $356B in total capital expenditures • Increased 2025 CapEx Guidance of $325 - $375M • Affirming 5-Year CapEx Guidance, with $1.5B+ identified • Active regulatory strategy supporting operations and growth • Significant improvement in capital structure • Strong balance sheet and access to capital For Internal Use & Reference Only

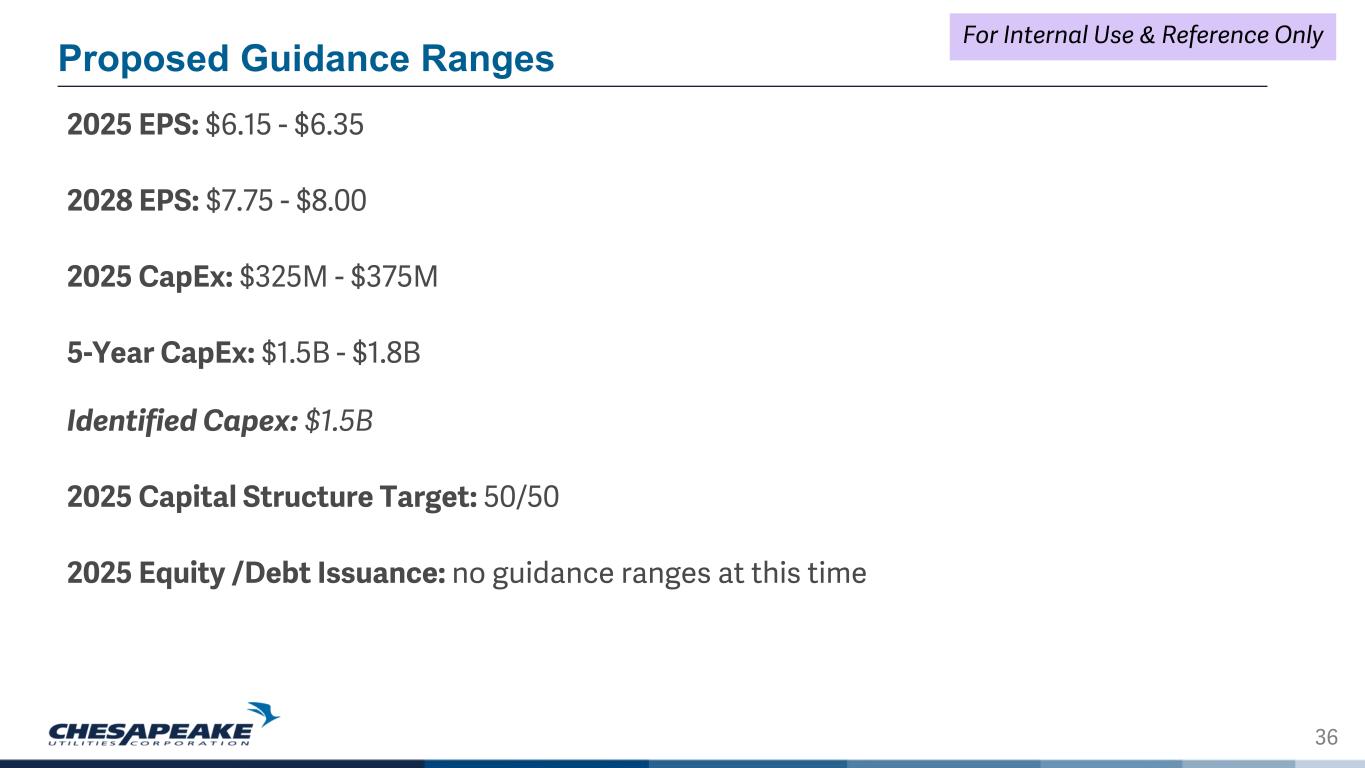

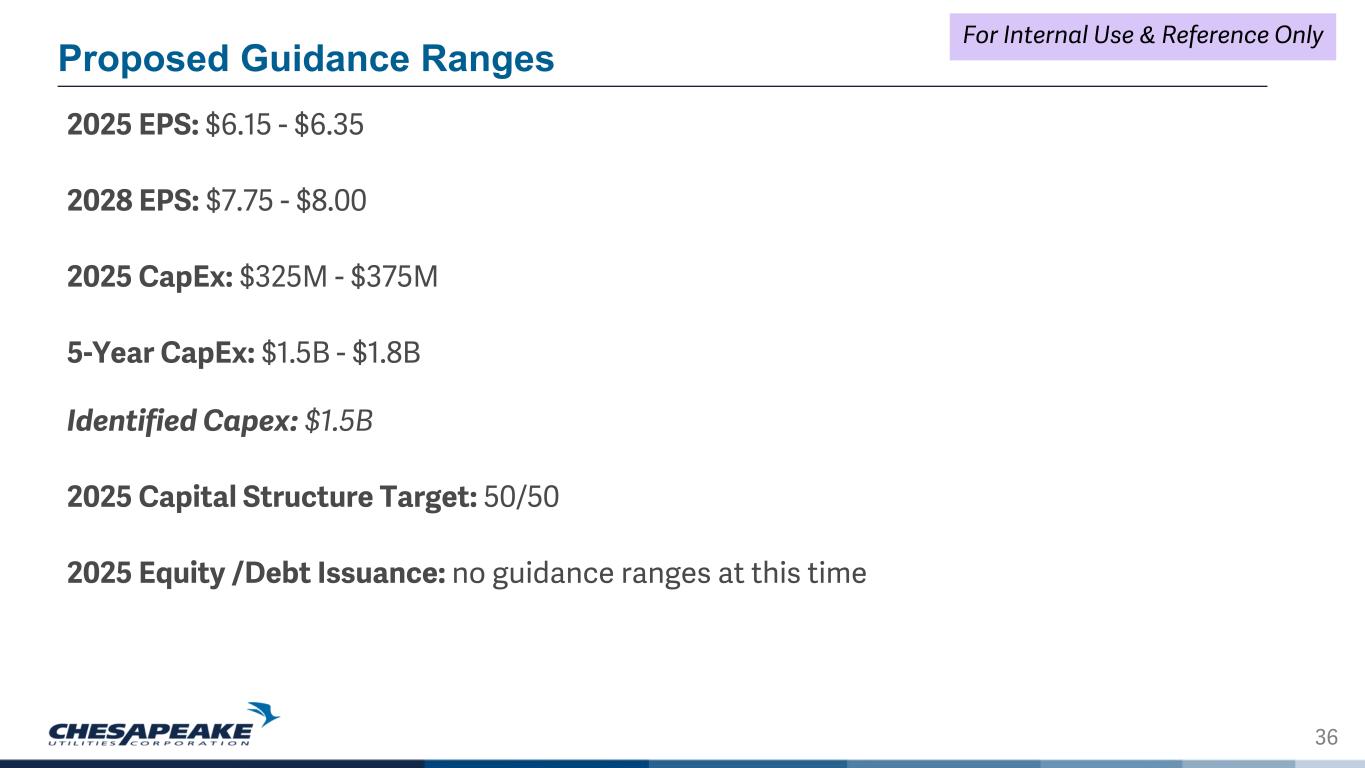

36 Proposed Guidance Ranges For Internal Use & Reference Only 2025 EPS: $6.15 - $6.35 2028 EPS: $7.75 - $8.00 2025 CapEx: $325M - $375M 5-Year CapEx: $1.5B - $1.8B Identified Capex: $1.5B 2025 Capital Structure Target: 50/50 2025 Equity /Debt Issuance: no guidance ranges at this time

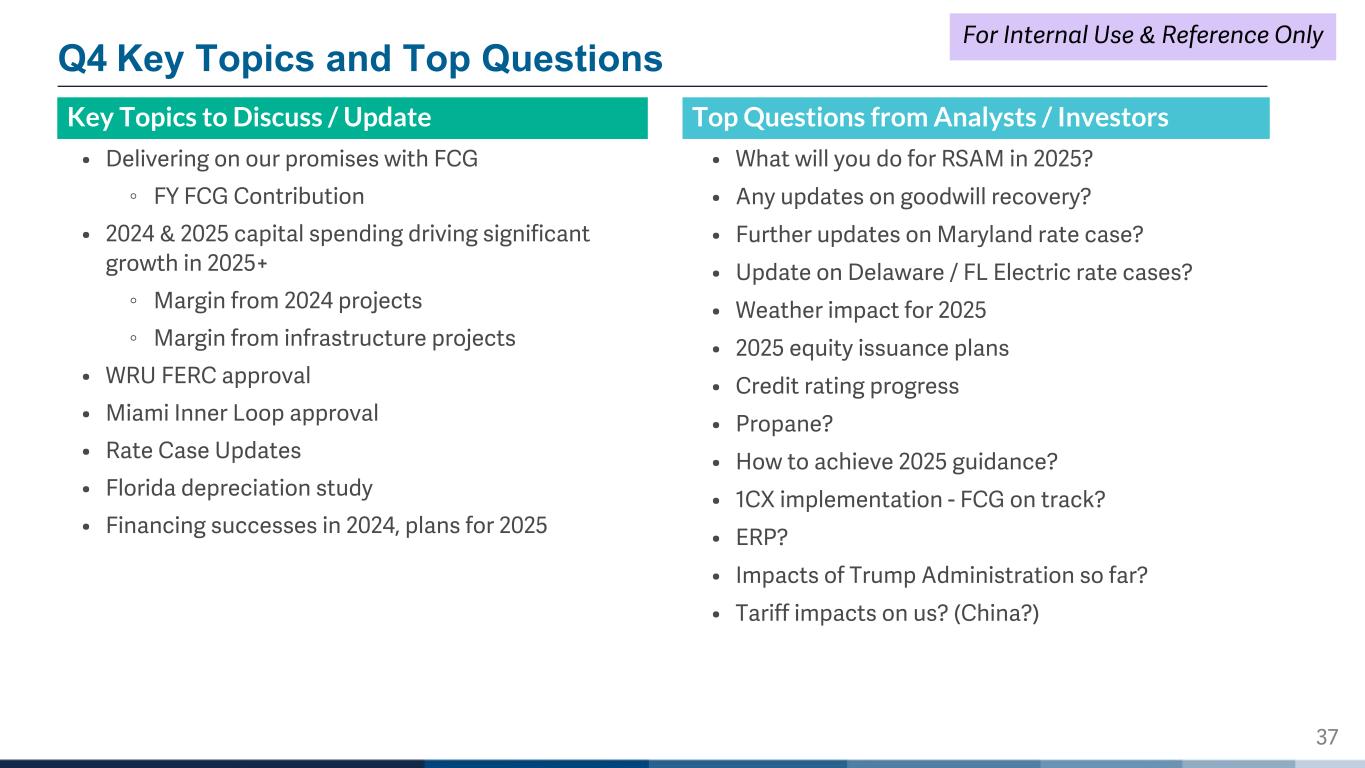

37 Q4 Key Topics and Top Questions Key Topics to Discuss / Update • Delivering on our promises with FCG ◦ FY FCG Contribution • 2024 & 2025 capital spending driving significant growth in 2025+ ◦ Margin from 2024 projects ◦ Margin from infrastructure projects • WRU FERC approval • Miami Inner Loop approval • Rate Case Updates • Florida depreciation study • Financing successes in 2024, plans for 2025 Top Questions from Analysts / Investors • What will you do for RSAM in 2025? • Any updates on goodwill recovery? • Further updates on Maryland rate case? • Update on Delaware / FL Electric rate cases? • Weather impact for 2025 • 2025 equity issuance plans • Credit rating progress • Propane? • How to achieve 2025 guidance? • 1CX implementation - FCG on track? • ERP? • Impacts of Trump Administration so far? • Tariff impacts on us? (China?) For Internal Use & Reference Only

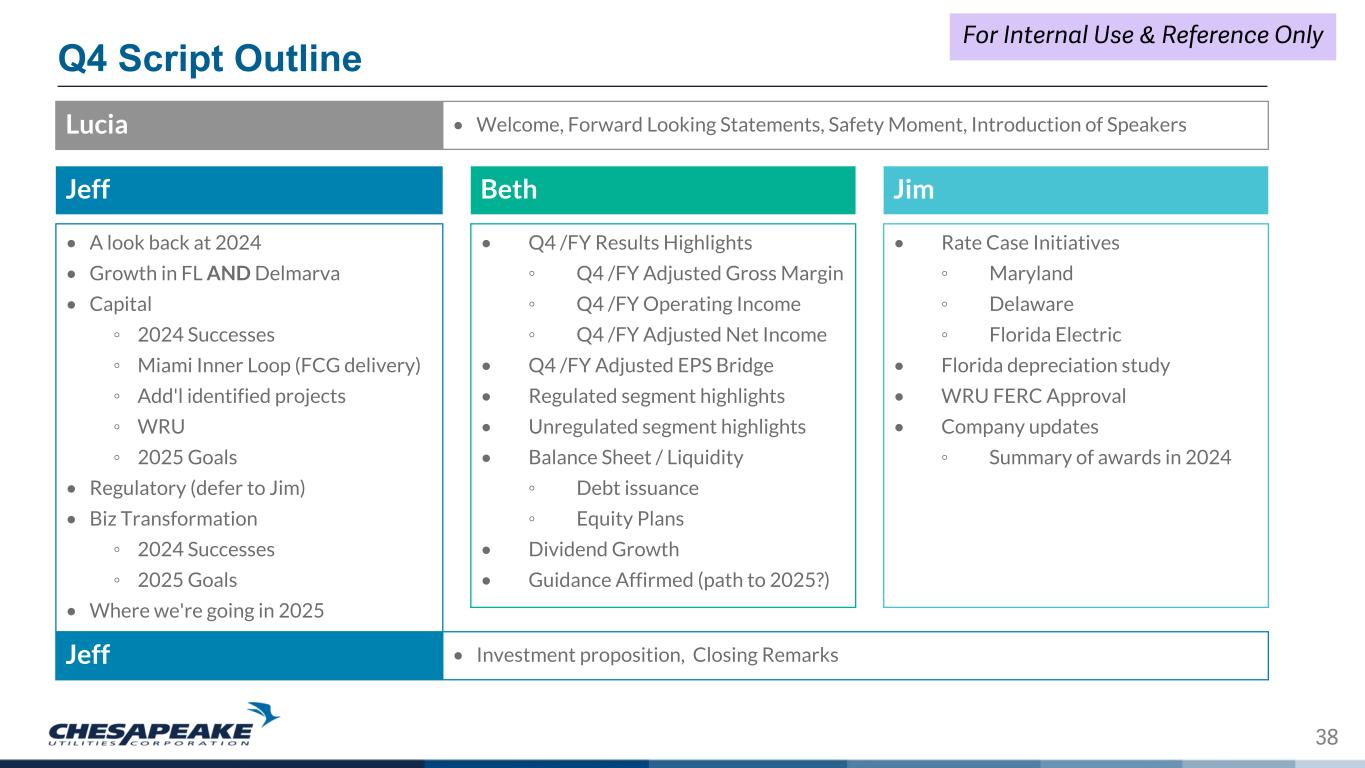

38 Q4 Script Outline Jeff Beth • A look back at 2024 • Growth in FL AND Delmarva • Capital ◦ 2024 Successes ◦ Miami Inner Loop (FCG delivery) ◦ Add'l identified projects ◦ WRU ◦ 2025 Goals • Regulatory (defer to Jim) • Biz Transformation ◦ 2024 Successes ◦ 2025 Goals • Where we're going in 2025 • Q4 /FY Results Highlights ◦ Q4 /FY Adjusted Gross Margin ◦ Q4 /FY Operating Income ◦ Q4 /FY Adjusted Net Income • Q4 /FY Adjusted EPS Bridge • Regulated segment highlights • Unregulated segment highlights • Balance Sheet / Liquidity ◦ Debt issuance ◦ Equity Plans • Dividend Growth • Guidance Affirmed (path to 2025?) Jim • Rate Case Initiatives ◦ Maryland ◦ Delaware ◦ Florida Electric • Florida depreciation study • WRU FERC Approval • Company updates ◦ Summary of awards in 2024 Lucia • Welcome, Forward Looking Statements, Safety Moment, Introduction of Speakers • Investment proposition, Closing RemarksJeff For Internal Use & Reference Only