UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-23872)

Themes ETF Trust

(Exact name of registrant as specified in charter)

34 East Putnam Avenue Suite 112

Greenwich, CT 06830

(Address of principal executive offices) (Zip code)

Themes Management Company, LLC

34 East Putnam Avenue Suite 112

Greenwich, CT 06830

(Name and address of agent for service)

(646) 206-1788

Registrant’s telephone number, including area code

Date of fiscal year end: 9/30

Date of reporting period: 3/31/2024

Item 1. Reports to Stockholders.

Themes ETF Trust

SEMI-ANNUAL REPORT

March 31, 2024

(Unaudited)

Themes Airlines ETF │ AIRL

Themes Cloud Computing ETF │ CLOD

Themes Cybersecurity ETF │ SPAM

Themes European Luxury ETF │ FINE

Themes Generative Artificial Intelligence ETF │ WISE

Themes Global Systemically Important Banks ETF │ GSIB

Themes Gold Miners ETF │ AUMI

Themes Natural Monopoly ETF │ CZAR

Themes US Cash Flow Champions ETF │ USCF

Themes US R&D Champions ETF │ USRD

Themes US Small Cap Cash Flow Champions ETF │ SMCF

Table of Contents

(Unaudited)

Themes ETFs

Expense Example

Period Ended March 31, 2024 (Unaudited)

As a shareholder of the Funds you incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of Fund shares, and (2) ongoing costs, including management fees and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other funds. The examples are based on an investment of $1,000 invested for the period of time as indicated in the table below.

Actual Expenses

The first line of the table provides information about actual account values based on actual returns and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then, multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table provides information about hypothetical account values based on a hypothetical return and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. If these transactional costs were included, your costs would have been higher.

| Fund Name | | Beginning Account Value 10/1/2023 | | | Ending Account Value 3/31/2024 | | | Expenses Paid During the Period | | | Annualized Expense Ratio During the Period | |

| Themes Airlines ETF | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | (6) | | $ | 1,061.90 | | | $ | 1.14 | | | | 0.35 | %(2) |

| Hypothetical (5% annual) | | | 1,000.00 | | | | 1,023.25 | | | | 1.77 | | | | 0.35 | %(1)(5) |

| Themes Cloud Computing ETF | | | | | | | | | | | | | | | | |

| Actual | | | 1,000.00 | (8) | | | 1,074.60 | | | | 1.08 | | | | 0.35 | %(4) |

| Hypothetical (5% annual) | | | 1,000.00 | | | | 1,023.25 | | | | 1.77 | | | | 0.35 | %(1)(5) |

| Themes Cybersecurity ETF | | | | | | | | | | | | | | | | |

| Actual | | | 1,000.00 | (6) | | | 1,112.10 | | | | 1.27 | | | | 0.38 | %(2) |

| Hypothetical (5% annual) | | | 1,000.00 | | | | 1,023.10 | | | | 1.92 | | | | 0.38 | %(1)(5) |

| Themes European Luxury ETF | | | | | | | | | | | | | | | | |

| Actual | | | 1,000.00 | (8) | | | 1,025.80 | | | | 1.06 | | | | 0.35 | %(4) |

| Hypothetical (5% annual) | | | 1,000.00 | | | | 1,023.25 | | | | 1.77 | | | | 0.35 | %(1)(5) |

| Themes Generative Artificial Intelligence ETF | | | | | | | | | | | | | | | | |

| Actual | | | 1,000.00 | (6) | | | 1,215.10 | | | | 1.23 | | | | 0.35 | %(2) |

| Hypothetical (5% annual) | | | 1,000.00 | | | | 1,023.25 | | | | 1.77 | | | | 0.35 | %(1)(5) |

| Themes Global Systemically Important Banks ETF | | | | | | | | | | | | | | | | |

| Actual | | | 1,000.00 | (8) | | | 1,103.40 | | | | 1.10 | | | | 0.35 | %(4) |

| Hypothetical (5% annual) | | | 1,000.00 | | | | 1,023.25 | | | | 1.77 | | | | 0.35 | %(1)(5) |

| Themes Gold Miners ETF | | | | | | | | | | | | | | | | |

| Actual | | | 1,000.00 | (7) | | | 1,178.00 | | | | 1.16 | | | | 0.35 | %(3) |

| Hypothetical (5% annual) | | | 1,000.00 | | | | 1,023.25 | | | | 1.77 | | | | 0.35 | %(1)(5) |

Themes ETFs

Expense Example

Period Ended March 31, 2024 (Unaudited) (Continued)

| Fund Name | | Beginning Account Value 10/1/2023 | | | Ending Account Value 3/31/2024 | | | Expenses Paid During the Period | | | Annualized Expense Ratio During the Period | |

| Themes Natural Monopoly ETF | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | (7) | | $ | 1,111.70 | | | $ | 1.15 | | | | 0.36 | %(3) |

| Hypothetical (5% annual) | | | 1,000.00 | | | | 1,023.20 | | | | 1.82 | | | | 0.36 | %(1)(5) |

| Themes US Cash Flow Champions ETF | | | | | | | | | | | | | | | | |

| Actual | | | 1,000.00 | (7) | | | 1,153.10 | | | | 1.04 | | | | 0.32 | %(3) |

| Hypothetical (5% annual) | | | 1,000.00 | | | | 1,023.40 | | | | 1.62 | | | | 0.32 | %(1)(5) |

| Themes US R&D Champions ETF | | | | | | | | | | | | | | | | |

| Actual | | | 1,000.00 | (7) | | | 1,183.10 | | | | 0.96 | | | | 0.29 | %(3) |

| Hypothetical (5% annual) | | | 1,000.00 | | | | 1,023.55 | | | | 1.47 | | | | 0.29 | %(1)(5) |

| Themes US Small Cap Cash Flow Champions ETF | | | | | | | | | | | | | | | | |

| Actual | | | 1,000.00 | (7) | | | 1,204.70 | | | | 1.00 | | | | 0.30 | %(3) |

| Hypothetical (5% annual) | | | 1,000.00 | | | | 1,023.50 | | | | 1.52 | | | | 0.30 | %(1)(5) |

| (1) | Expenses are calculated using the Fund’s annualized expense ratio, multiplied by the average account value during the period, multiplied by 183/366 (to reflect the six-month period). |

| (2) | Expenses are calculated using the Fund’s annualized expense ratio, multiplied by the average account value during the period, multiplied by 116/366 (to reflect the period since the Fund’s inception). |

| (3) | Expenses are calculated using the Fund’s annualized expense ratio, multiplied by the average account value during the period, multiplied by 111/366 (to reflect the period since the Fund’s inception). |

| (4) | Expenses are calculated using the Fund’s annualized expense ratio, multiplied by the average account value during the period, multiplied by 109/366 (to reflect the period since the Fund’s inception). |

| (5) | For comparative purposes only as the Fund was not in operation for the full six-month period. |

| (6) | The Fund commenced operations on December 7, 2023. The Beginning Account Value is representative of this commencement date. |

| (7) | The Fund commenced operations on December 12, 2023. The Beginning Account Value is representative of this commencement date. |

| (8) | The Fund commenced operations on December 14, 2023. The Beginning Account Value is representative of this commencement date. |

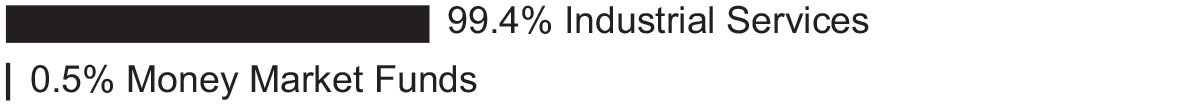

THEMES ETF TRUST

Themes Airlines ETF

Schedule of Investments

as of March 31, 2024 (Unaudited)

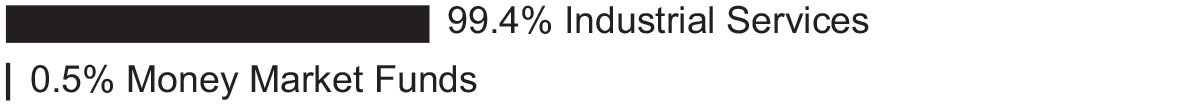

Sector Diversification as of March 31, 2024

Percentages are stated as a percent of net assets.

| | | Shares | | | Value | |

| COMMON STOCKS – 99.4% | | | | | | | | |

| Industrial Services – 99.4%(a) | | | | | | | | |

| Air Canada(b) | | | 1,567 | | | $ | 22,686 | |

| Air France-KLM(b) | | | 1,054 | | | | 11,742 | |

| Air Transport Services Group, Inc.(b) | | | 450 | | | | 6,192 | |

| Alaska Air Group, Inc.(b) | | | 620 | | | | 26,653 | |

| Allegiant Travel Co. | | | 143 | | | | 10,755 | |

| American Airlines Group, Inc.(b) | | | 1,596 | | | | 24,499 | |

| ANA Holdings, Inc. | | | 1,100 | | | | 22,961 | |

| Cathay Pacific Airways Ltd. | | | 5,470 | | | | 6,213 | |

| Copa Holdings SA – Class A | | | 230 | | | | 23,957 | |

| Delta Air Lines, Inc. | | | 546 | | | | 26,137 | |

| Deutsche Lufthansa AG | | | 2,681 | | | | 21,060 | |

| easyJet PLC | | | 3,543 | | | | 25,524 | |

| Exchange Income Corp. | | | 395 | | | | 14,438 | |

| Frontier Group Holdings, Inc.(b) | | | 349 | | | | 2,830 | |

| Hawaiian Holdings, Inc.(b) | | | 433 | | | | 5,772 | |

| International Consolidated Airlines Group SA(b) | | | 11,999 | | | | 26,767 | |

| Japan Airlines Co. Ltd. | | | 1,200 | | | | 22,758 | |

| JetBlue Airways Corp.(b) | | | 3,011 | | | | 22,342 | |

| Mainfreight Ltd. | | | 524 | | | | 21,821 | |

| Norwegian Air Shuttle ASA | | | 6,152 | | | | 9,276 | |

| Qantas Airways Ltd.(b) | | | 6,319 | | | | 22,442 | |

| Ryanair Holdings PLC – ADR | | | 179 | | | | 26,061 | |

| Singapore Airlines Ltd. | | | 4,679 | | | | 22,178 | |

| Skymark Airlines, Inc. | | | 300 | | | | 1,996 | |

| SkyWest, Inc.(b) | | | 360 | | | | 24,869 | |

| Southwest Airlines Co. | | | 774 | | | | 22,593 | |

| Spirit Airlines, Inc. | | | 986 | | | | 4,772 | |

| Sun Country Airlines Holdings, Inc.(b) | | | 320 | | | | 4,829 | |

| United Airlines Holdings, Inc.(b) | | | 519 | | | | 24,850 | |

| Wizz Air Holdings PLC(b)(c) | | | 699 | | | | 18,933 | |

| | | | | | | | 527,906 | |

| TOTAL COMMON STOCKS (Cost $500,587) | | | | | | | 527,906 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS – 0.5% | | | | | | | | |

| Money Market Funds – 0.5% | | | | | | | | |

| First American Treasury Obligations Fund – Class X, 5.22%(d) | | | 2,562 | | | | 2,562 | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $2,562) | | | | | | | 2,562 | |

| | | | | | | | | |

| TOTAL INVESTMENTS – 99.9% (Cost $503,149) | | | | | | $ | 530,468 | |

| Other Assets in Excess of Liabilities – 0.1% | | | | | | | 458 | |

| TOTAL NET ASSETS – 100.0% | | | | | | $ | 530,926 | |

Percentages are stated as a percent of net assets.

ADR – American Depositary Receipt

Themes ETF Trust

Themes Airlines ETF

Schedule of Investments (Continued)

as of March 31, 2024 (Unaudited)

AG – Aktiengesellschaft

ASA – Advanced Subscription Agreement

PLC – Public Limited Company

SA – Sociedad Anónima

| (a) | To the extent that the Fund invests more heavily in a particular industry or sector of the economy, its performance will be especially sensitive to developments that significantly affect those industries or sectors. |

| (b) | Non-income producing security. |

| (c) | Security is exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may only be resold in transactions exempt from registration to qualified institutional investors. As of March 31, 2024, the value of these securities total $18,933 or 3.6% of the Fund’s net assets. |

| (d) | The rate shown represents the 7-day effective yield as of March 31, 2024. |

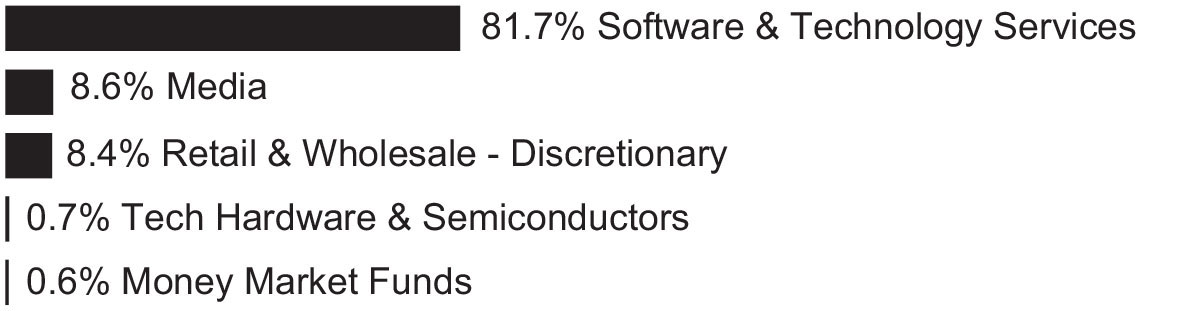

Themes ETF Trust

Themes Cloud Computing ETF

Schedule of Investments

as of March 31, 2024 (Unaudited)

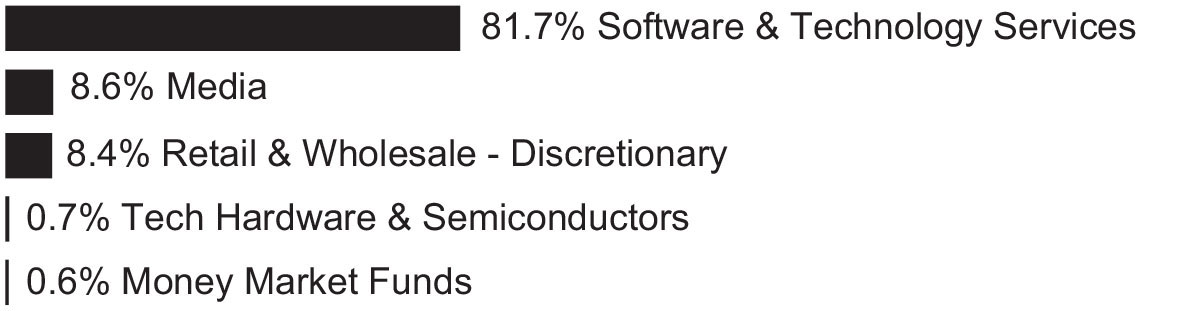

Sector Diversification as of March 31, 2024

Percentages are stated as a percent of net assets.

| | | Shares | | | Value | |

| COMMON STOCKS – 99.4% | | | | | | | | |

| Media – 8.6% | | | | | | | | |

| Alphabet, Inc. – Class A(a) | | | 406 | | | $ | 61,277 | |

| GoDaddy, Inc. – Class A(a) | | | 95 | | | | 11,275 | |

| Prosus NV | | | 1,005 | | | | 31,525 | |

| VeriSign, Inc.(a) | | | 62 | | | | 11,750 | |

| | | | | | | | 115,827 | |

| Retail & Wholesale – Discretionary – 8.4% | | | | | | | | |

| Amazon.com, Inc.(a) | | | 376 | | | | 67,823 | |

| MercadoLibre, Inc.(a) | | | 30 | | | | 45,359 | |

| | | | | | | | 113,182 | |

| Software & Technology Services – 81.7%(b) | | | | | | | | |

| Adobe, Inc.(a) | | | 98 | | | | 49,451 | |

| Akamai Technologies, Inc.(a) | | | 102 | | | | 11,094 | |

| ANSYS, Inc.(a) | | | 59 | | | | 20,482 | |

| Atlassian Corp. – Class A(a) | | | 105 | | | | 20,487 | |

| Autodesk, Inc.(a) | | | 146 | | | | 38,021 | |

| Booz Allen Hamilton Holding Corp. | | | 88 | | | | 13,063 | |

| CACI International, Inc. – Class A(a) | | | 15 | | | | 5,682 | |

| Cadence Design Systems, Inc.(a) | | | 184 | | | | 57,276 | |

| Check Point Software Technologies Ltd.(a) | | | 62 | | | | 10,169 | |

| Cloudflare, Inc. – Class A(a) | | | 195 | | | | 18,882 | |

| CommVault Systems, Inc.(a) | | | 30 | | | | 3,043 | |

| Confluent, Inc. – Class A(a) | | | 140 | | | | 4,273 | |

| Crowdstrike Holdings, Inc. – Class A(a) | | | 150 | | | | 48,089 | |

| CyberArk Software Ltd.(a) | | | 28 | | | | 7,438 | |

| Dassault Systemes SE | | | 456 | | | | 20,190 | |

| Datadog, Inc. – Class A(a) | | | 195 | | | | 24,102 | |

| Dropbox, Inc. – Class A(a) | | | 170 | | | | 4,131 | |

| Dynatrace, Inc.(a) | | | 176 | | | | 8,173 | |

| Fortinet, Inc.(a) | | | 456 | | | | 31,150 | |

| Gen Digital, Inc. | | | 424 | | | | 9,498 | |

| HubSpot, Inc.(a) | | | 32 | | | | 20,050 | |

| Intuit, Inc. | | | 95 | | | | 61,750 | |

| Microsoft Corp. | | | 151 | | | | 63,528 | |

| MongoDB, Inc.(a) | | | 47 | | | | 16,856 | |

| Nice Ltd. – ADR(a) | | | 43 | | | | 11,207 | |

| Nutanix, Inc. – Class A(a) | | | 165 | | | | 10,184 | |

Themes ETF Trust

Themes Cloud Computing ETF

Schedule of Investments (Continued)

as of March 31, 2024 (Unaudited)

| | | Shares | | | Value | |

| Software & Technology Services – 81.7%(b) (Continued) | | | | | | | | |

| Okta, Inc.(a) | | | 100 | | | $ | 10,462 | |

| Oracle Corp. | | | 556 | | | | 69,838 | |

| Palo Alto Networks, Inc.(a) | | | 183 | | | | 51,996 | |

| Salesforce, Inc. | | | 219 | | | | 65,957 | |

| SAP SE | | | 366 | | | | 71,256 | |

| ServiceNow, Inc.(a) | | | 81 | | | | 61,754 | |

| Snowflake, Inc. – Class A(a) | | | 185 | | | | 29,896 | |

| Synopsys, Inc.(a) | | | 103 | | | | 58,865 | |

| The Sage Group PLC | | | 686 | | | | 10,957 | |

| Trend Micro, Inc. | | | 100 | | | | 5,063 | |

| Twilio, Inc. – Class A(a) | | | 123 | | | | 7,521 | |

| Wix.com Ltd.(a) | | | 36 | | | | 4,949 | |

| Workday, Inc. – Class A(a) | | | 141 | | | | 38,458 | |

| Zoom Video Communications, Inc. – Class A(a) | | | 170 | | | | 11,113 | |

| Zscaler, Inc.(a) | | | 60 | | | | 11,558 | |

| | | | | | | | 1,097,912 | |

| Tech Hardware & Semiconductors – 0.7% | | | | | | | | |

| F5, Inc.(a) | | | 40 | | | | 7,584 | |

| InterDigital, Inc. | | | 16 | | | | 1,703 | |

| | | | | | | | 9,287 | |

| TOTAL COMMON STOCKS (Cost $1,309,572) | | | | | | | 1,336,208 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS – 0.6% | | | | | | | | |

| Money Market Funds – 0.6% | | | | | | | | |

| First American Treasury Obligations Fund – Class X, 5.22%(c) | | | 7,657 | | | | 7,657 | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $7,657) | | | | | | | 7,657 | |

| | | | | | | | | |

| TOTAL INVESTMENTS – 100.0% (Cost $1,317,229) | | | | | | $ | 1,343,865 | |

| Liabilities in Excess of Other Assets – 0.0%(d) | | | | | | | (628 | ) |

| TOTAL NET ASSETS – 100.0% | | | | | | $ | 1,343,237 | |

Percentages are stated as a percent of net assets.

ADR – American Depositary Receipt

NV – Naamloze Vennootschap

PLC – Public Limited Company

| (a) | Non-income producing security. |

| (b) | To the extent that the Fund invests more heavily in a particular industry or sector of the economy, its performance will be especially sensitive to developments that significantly affect those industries or sectors. |

| (c) | The rate shown represents the 7-day effective yield as of March 31, 2024. |

| (d) | Represents less than 0.05% of net assets. |

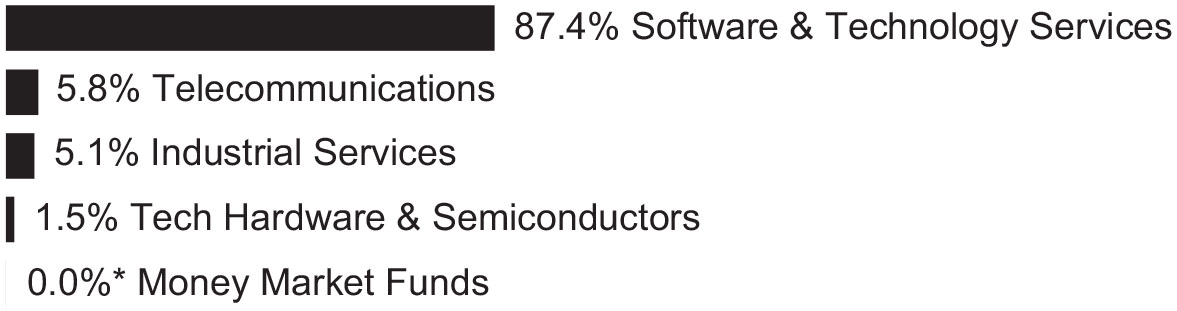

Themes ETF Trust

Themes Cybersecurity ETF

Schedule of Investments

as of March 31, 2024 (Unaudited)

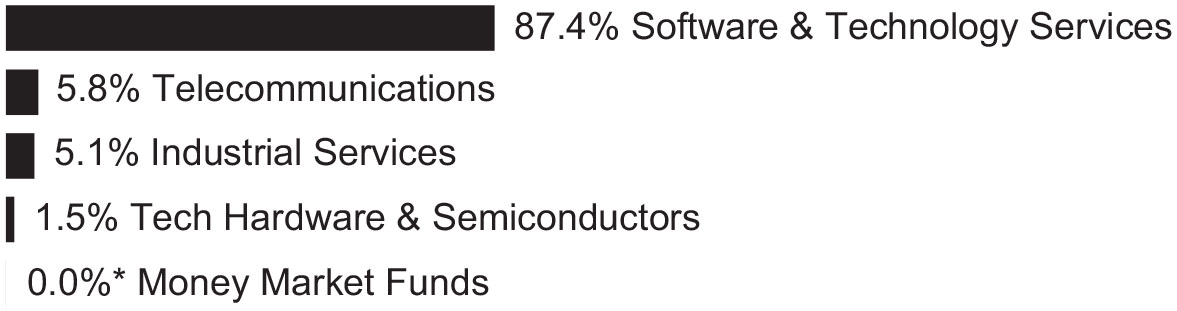

Sector Diversification as of March 31, 2024

Percentages are stated as a percent of net assets.

| * | Amount is less than 0.05%. |

| | Shares | | | Value | |

| COMMON STOCKS – 99.8% | | | | | | | | |

| Industrial Services – 5.1% | | | | | | | | |

| Alarm.com Holdings, Inc.(a) | | | 962 | | | $ | 69,716 | |

| | | | | | | | | |

| Software & Technology Services – 87.4%(b) | | | | | | | | |

| BlackBerry Ltd.(a) | | | 12,701 | | | | 35,055 | |

| Booz Allen Hamilton Holding Corp. | | | 465 | | | | 69,026 | |

| CACI International, Inc. – Class A(a) | | | 180 | | | | 68,189 | |

| Change Holdings, Inc. | | | 900 | | | | 7,586 | |

| Check Point Software Technologies Ltd.(a) | | | 380 | | | | 62,324 | |

| Clear Secure, Inc. – Class A | | | 1,871 | | | | 39,796 | |

| Crowdstrike Holdings, Inc. – Class A(a) | | | 209 | | | | 67,003 | |

| Cyber Security Cloud, Inc.(a) | | | 300 | | | | 5,698 | |

| CyberArk Software Ltd.(a) | | | 270 | | | | 71,720 | |

| Darktrace PLC(a) | | | 10,601 | | | | 58,444 | |

| Digital Arts, Inc. | | | 400 | | | | 11,428 | |

| ELEMENTS, Inc.(a) | | | 300 | | | | 1,732 | |

| Everbridge, Inc.(a) | | | 910 | | | | 31,695 | |

| Fastly, Inc. – Class A(a) | | | 2,710 | | | | 35,149 | |

| FFRI Security, Inc. | | | 300 | | | | 3,882 | |

| Fortinet, Inc.(a) | | | 962 | | | | 65,713 | |

| Hennge KK(a) | | | 400 | | | | 3,195 | |

| Netcompany Group A/S(a)(c) | | | 977 | | | | 40,274 | |

| Okta, Inc.(a) | | | 702 | | | | 73,444 | |

| OneSpan, Inc.(a) | | | 745 | | | | 8,664 | |

| Palo Alto Networks, Inc.(a) | | | 186 | | | | 52,848 | |

| Qualys, Inc.(a) | | | 311 | | | | 51,897 | |

| Radware Ltd.(a) | | | 801 | | | | 14,995 | |

| Rapid7, Inc.(a) | | | 1,086 | | | | 53,257 | |

| Safie, Inc.(a) | | | 400 | | | | 1,686 | |

| SentinelOne, Inc. – Class A(a) | | | 2,407 | | | | 56,107 | |

| Tenable Holdings, Inc.(a) | | | 1,275 | | | | 63,023 | |

| Trend Micro, Inc. | | | 1,000 | | | | 50,634 | |

| Varonis Systems, Inc.(a) | | | 1,301 | | | | 61,368 | |

| Zscaler, Inc.(a) | | | 259 | | | | 49,891 | |

| | | | | | | | 1,215,723 | |

| Tech Hardware & Semiconductors – 1.5% | | | | | | | | |

| A10 Networks, Inc. | | | 1,532 | | | | 20,973 | |

Themes ETF Trust

Themes Cybersecurity ETF

Schedule of Investments (Continued)

as of March 31, 2024 (Unaudited)

| | Shares | | | Value | |

| Telecommunications – 5.8% | | | | | | | | |

| Applied Digital Corp.(a) | | | 1,406 | | | $ | 6,018 | |

| NEXTDC Ltd.(a) | | | 6,481 | | | | 75,133 | |

| | | | | | | | 81,151 | |

| TOTAL COMMON STOCKS (Cost $1,337,357) | | | | | | | 1,387,563 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS – 0.0%(d) | | | | | | | | |

| Money Market Funds – 0.0%(d) | | | | | | | | |

| First American Treasury Obligations Fund – Class X, 5.22%(e) | | | 244 | | | | 244 | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $244) | | | | | | | 244 | |

| | | | | | | | | |

| TOTAL INVESTMENTS – 99.8% (Cost $1,337,601) | | | | | | $ | 1,387,807 | |

| Other Assets in Excess of Liabilities – 0.2% | | | | | | | 2,357 | |

| TOTAL NET ASSETS – 100.0% | | | | | | $ | 1,390,164 | |

Percentages are stated as a percent of net assets.

PLC – Public Limited Company

| (a) | Non-income producing security. |

| (b) | To the extent that the Fund invests more heavily in a particular industry or sector of the economy, its performance will be especially sensitive to developments that significantly affect those industries or sectors. |

| (c) | Security is exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may only be resold in transactions exempt from registration to qualified institutional investors. As of March 31, 2024, the value of these securities total $40,274 or 2.9% of the Fund’s net assets. |

| (d) | Represents less than 0.05% of net assets. |

| (e) | The rate shown represents the 7-day effective yield as of March 31, 2024. |

Themes ETF Trust

Themes European Luxury ETF

Schedule of Investments

as of March 31, 2024 (Unaudited)

Sector Diversification as of March 31, 2024

Percentages are stated as a percent of net assets.

| | | Shares | | | Value | |

| COMMON STOCKS – 95.5% | | | | | | | | |

| Consumer Discretionary Products – 63.5%(a) | | | | | | | | |

| Aston Martin Lagonda Global Holdings PLC(b)(c) | | | 7,425 | | | $ | 15,922 | |

| Beneteau SACA | | | 1,464 | | | | 21,607 | |

| Burberry Group PLC | | | 1,149 | | | | 17,591 | |

| Capri Holdings Ltd.(b) | | | 354 | | | | 16,036 | |

| Cie Financiere Richemont SA | | | 134 | | | | 20,430 | |

| Coats Group PLC | | | 19,716 | | | | 20,181 | |

| Ermenegildo Zegna NV | | | 1,759 | | | | 25,770 | |

| Ferrari NV | | | 52 | | | | 22,665 | |

| Hermes International SCA | | | 9 | | | | 22,973 | |

| Kering SA – ADR | | | 472 | | | | 18,701 | |

| LVMH Moet Hennessy Louis Vuitton SE | | | 25 | | | | 22,486 | |

| PRADA SpA | | | 3,068 | | | | 24,303 | |

| Salvatore Ferragamo SpA | | | 1,529 | | | | 18,591 | |

| The Swatch Group AG | | | 73 | | | | 16,950 | |

| Tod’s SpA(b) | | | 535 | | | | 24,819 | |

| Watches of Switzerland Group PLC(b)(c) | | | 3,669 | | | | 16,606 | |

| | | | | | | | 325,631 | |

| Consumer Discretionary Services – 16.5% | | | | | | | | |

| Accor SA | | | 467 | | | | 21,816 | |

| InterContinental Hotels Group PLC | | | 192 | | | | 19,973 | |

| Playa Hotels & Resorts NV(b) | | | 2,230 | | | | 21,631 | |

| TUI AG(b) | | | 2,589 | | | | 21,338 | |

| | | | | | | | 84,758 | |

| Consumer Staple Products – 3.9% | | | | | | | | |

| Interparfums SA | | | 358 | | | | 20,161 | |

| | | | | | | | | |

| Materials – 4.0% | | | | | | | | |

| Givaudan SA – ADR | | | 231 | | | | 20,611 | |

| | | | | | | | | |

| Retail & Wholesale – Discretionary – 7.6% | | | | | | | | |

| Brunello Cucinelli SpA | | | 195 | | | | 22,300 | |

| HUGO BOSS AG | | | 286 | | | | 16,853 | |

| | | | | | | | 39,153 | |

| TOTAL COMMON STOCKS (Cost $468,578) | | | | | | | 490,314 | |

Themes ETF Trust

Themes European Luxury ETF

Schedule of Investments (Continued)

as of March 31, 2024 (Unaudited)

| | | Shares | | | Value | |

| PREFERRED STOCKS – 3.9% | | | | | | | | |

| Consumer Discretionary Products – 3.9% | | | | | | | | |

| Porsche Automobil Holding SE | | | 373 | | | $ | 19,766 | |

| TOTAL PREFERRED STOCKS (Cost $19,808) | | | | | | | 19,766 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS – 0.3% | | | | | | | | |

| Money Market Funds – 0.3% | | | | | | | | |

| First American Treasury Obligations Fund – Class X, 5.22%(d) | | | 1,284 | | | | 1,284 | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $1,284) | | | | | | | 1,284 | |

| | | | | | | | | |

| TOTAL INVESTMENTS – 99.7% (Cost $489,670) | | | | | | $ | 511,364 | |

| Other Assets in Excess of Liabilities – 0.3% | | | | | | | 1,561 | |

| TOTAL NET ASSETS – 100.0% | | | | | | $ | 512,925 | |

Percentages are stated as a percent of net assets.

ADR – American Depositary Receipt

AG – Aktiengesellschaft

NV – Naamloze Vennootschap

PLC – Public Limited Company

SA – Sociedad Anónima

| (a) | To the extent that the Fund invests more heavily in a particular industry or sector of the economy, its performance will be especially sensitive to developments that significantly affect those industries or sectors. |

| (b) | Non-income producing security. |

| (c) | Security is exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may only be resold in transactions exempt from registration to qualified institutional investors. As of March 31, 2024, the value of these securities total $32,528 or 6.3% of the Fund’s net assets. |

| (d) | The rate shown represents the 7-day effective yield as of March 31, 2024. |

Themes ETF Trust

Themes Generative Artificial Intelligence ETF

Schedule of Investments

as of March 31, 2024 (Unaudited)

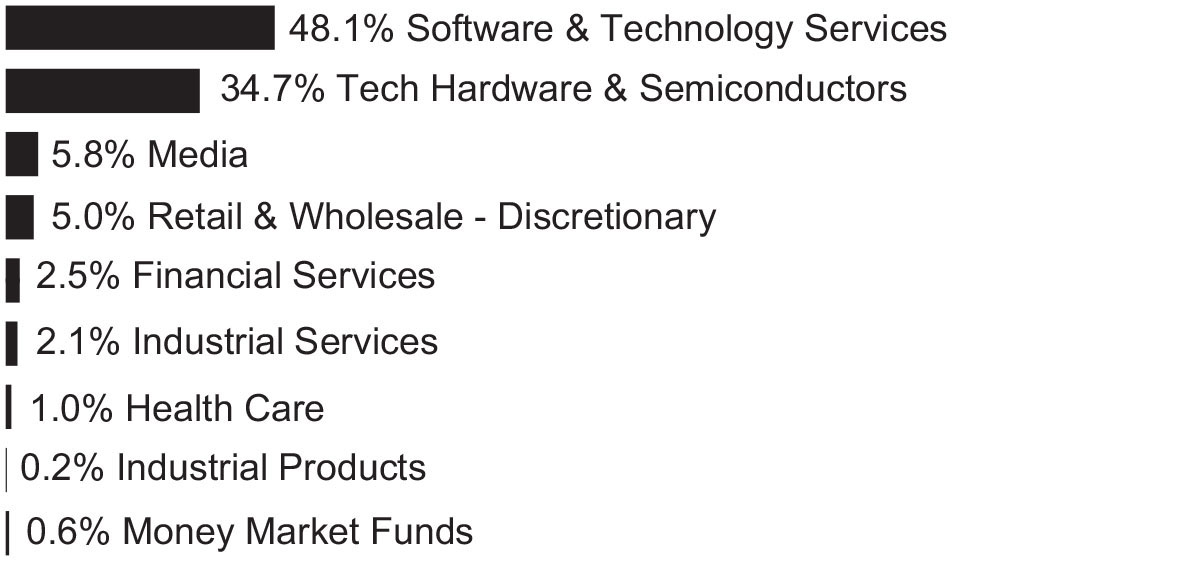

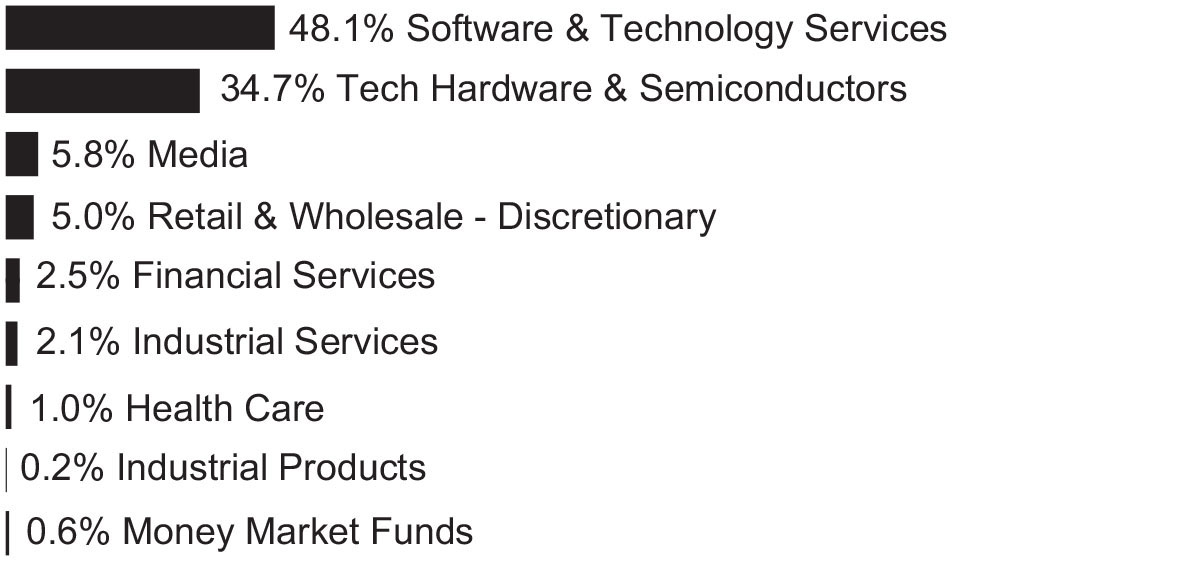

Sector Diversification as of March 31, 2024

Percentages are stated as a percent of net assets.

| | | Shares | | | Value | |

| COMMON STOCKS – 99.4% | | | | | | | | |

| Financial Services – 2.5% | | | | | | | | |

| Upstart Holdings, Inc.(a) | | | 18,673 | | | $ | 502,117 | |

| | | | | | | | | |

| Health Care – 1.0% | | | | | | | | |

| Exscientia PLC – ADR(a) | | | 33,801 | | | | 193,342 | |

| | | | | | | | | |

| Industrial Products – 0.2% | | | | | | | | |

| Evolv Technologies Holdings, Inc.(a) | | | 9,356 | | | | 41,634 | |

| | | | | | | | | |

| Industrial Services – 2.1% | | | | | | | | |

| CorVel Corp.(a) | | | 1,621 | | | | 426,258 | |

| | | | | | | | | |

| Media – 5.8% | | | | | | | | |

| Alphabet, Inc. – Class A(a) | | | 6,557 | | | | 989,648 | |

| Meta Platforms, Inc. – Class A | | | 364 | | | | 176,751 | |

| | | | | | | | 1,166,399 | |

| Retail & Wholesale – Discretionary – 5.0% | | | | | | | | |

| Amazon.com, Inc.(a) | | | 5,663 | | | | 1,021,492 | |

| | | | | | | | | |

| Software & Technology Services – 48.1%(b) | | | | | | | | |

| Accenture PLC – Class A | | | 681 | | | | 236,041 | |

| Augmedix, Inc.(a) | | | 80,962 | | | | 331,135 | |

| Bairong, Inc.(a)(c) | | | 597,178 | | | | 845,383 | |

| BigBear.ai Holdings, Inc.(a) | | | 33,750 | | | | 69,188 | |

| C3.ai, Inc. – Class A(a) | | | 25,280 | | | | 684,330 | |

| Cerence, Inc.(a) | | | 19,007 | | | | 299,360 | |

| ExlService Holdings, Inc.(a) | | | 11,440 | | | | 363,792 | |

| Fair Isaac Corp.(a) | | | 408 | | | | 509,841 | |

| Five9, Inc.(a) | | | 7,377 | | | | 458,185 | |

| Grid Dynamics Holdings, Inc.(a) | | | 10,776 | | | | 132,437 | |

| Heroz, Inc.(a) | | | 59,800 | | | | 653,779 | |

| International Business Machines Corp. | | | 542 | | | | 103,500 | |

| Microsoft Corp. | | | 2,240 | | | | 942,412 | |

| Northern Data AG(a) | | | 14,541 | | | | 421,212 | |

| PKSHA Technology, Inc.(a) | | | 19,900 | | | | 709,869 | |

Themes ETF Trust

Themes Generative Artificial Intelligence ETF

Schedule of Investments (Continued)

as of March 31, 2024 (Unaudited)

| | | Shares | | | Value | |

| Software & Technology Services – 48.1%(b) (Continued) | | | | | | | | |

| Salesforce, Inc. | | | 1,125 | | | $ | 338,828 | |

| Snowflake, Inc. – Class A(a) | | | 106 | | | | 17,130 | |

| SoundHound AI, Inc. – Class A(a) | | | 53,858 | | | | 317,224 | |

| Synopsys, Inc.(a) | | | 1,088 | | | | 621,792 | |

| TELUS International CDA, Inc.(a) | | | 38,906 | | | | 329,447 | |

| UiPath, Inc. – Class A(a) | | | 30,570 | | | | 693,022 | |

| Verisk Analytics, Inc. | | | 511 | | | | 120,458 | |

| Zeta Global Holdings Corp. – Class A(a) | | | 56,857 | | | | 621,447 | |

| | | | | | | | 9,819,812 | |

| Tech Hardware & Semiconductors – 34.7%(b) | | | | | | | | |

| Advanced Micro Devices, Inc.(a) | | | 5,584 | | | | 1,007,856 | |

| Ambarella, Inc.(a) | | | 12,076 | | | | 613,099 | |

| Apple, Inc. | | | 1,512 | | | | 259,278 | |

| Arista Networks, Inc.(a) | | | 1,614 | | | | 468,028 | |

| CEVA, Inc.(a) | | | 35,143 | | | | 798,098 | |

| Intel Corp. | | | 20,113 | | | | 888,391 | |

| Lattice Semiconductor Corp.(a) | | | 10,875 | | | | 850,751 | |

| NVIDIA Corp. | | | 1,390 | | | | 1,255,948 | |

| QuickLogic Corp.(a) | | | 56,599 | | | | 907,282 | |

| | | | | | | | 7,048,731 | |

| TOTAL COMMON STOCKS (Cost $20,510,771) | | | | | | | 20,219,785 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS – 0.6% | | | | | | | | |

| Money Market Funds – 0.6% | | | | | | | | |

| First American Treasury Obligations Fund – Class X, 5.22%(d) | | | 129,407 | | | | 129,407 | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $129,407) | | | | | | | 129,407 | |

| | | | | | | | | |

| TOTAL INVESTMENTS – 100.0% (Cost $20,640,178) | | | | | | $ | 20,349,192 | |

| Other Assets in Excess of Liabilities – 0.0%(e) | | | | | | | 3,458 | |

| TOTAL NET ASSETS – 100.0% | | | | | | $ | 20,352,650 | |

Percentages are stated as a percent of net assets.

ADR – American Depositary Receipt

AG – Aktiengesellschaft

PLC – Public Limited Company

| (a) | Non-income producing security. |

| (b) | To the extent that the Fund invests more heavily in a particular industry or sector of the economy, its performance will be especially sensitive to developments that significantly affect those industries or sectors. |

| (c) | Security is exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may only be resold in transactions exempt from registration to qualified institutional investors. As of March 31, 2024, the value of these securities total $845,383 or 4.2% of the Fund’s net assets. |

| (d) | The rate shown represents the 7-day effective yield as of March 31, 2024. |

| (e) | Represents less than 0.05% of net assets. |

Themes ETF Trust

Themes Global Systemically Important Banks ETF

Schedule of Investments

as of March 31, 2024 (Unaudited)

Sector Diversification as of March 31, 2024

Percentages are stated as a percent of net assets.

| | | Shares | | | Value | |

| COMMON STOCKS – 99.6% | | | | | | | | |

| Banking – 81.7%(a) | | | | | | | | |

| Agricultural Bank of China Ltd. – Class H | | | 46,012 | | | $ | 19,399 | |

| Banco Santander SA – ADR | | | 4,327 | | | | 20,942 | |

| Bank of America Corp. | | | 531 | | | | 20,136 | |

| Bank of China Ltd. – Class H | | | 46,731 | | | | 19,285 | |

| Bank of Communications Co. Ltd. – Class H | | | 28,592 | | | | 18,777 | |

| Barclays PLC – ADR | | | 2,104 | | | | 19,883 | |

| BNP Paribas SA – ADR | | | 566 | | | | 20,229 | |

| China Construction Bank Corp. – Class H | | | 30,643 | | | | 18,479 | |

| Citigroup, Inc. | | | 323 | | | | 20,426 | |

| Credit Agricole SA – ADR | | | 2,685 | | | | 19,923 | |

| Deutsche Bank AG | | | 1,288 | | | | 20,311 | |

| HSBC Holdings PLC – ADR | | | 494 | | | | 19,444 | |

| Industrial & Commercial Bank of China Ltd. – ADR | | | 1,849 | | | | 18,523 | |

| ING Groep NV – ADR | | | 1,239 | | | | 20,432 | |

| JPMorgan Chase & Co. | | | 101 | | | | 20,230 | |

| Mitsubishi UFJ Financial Group, Inc. – ADR | | | 1,844 | | | | 18,864 | |

| Mizuho Financial Group, Inc. – ADR | | | 4,831 | | | | 19,227 | |

| Royal Bank of Canada | | | 190 | | | | 19,167 | |

| Societe Generale SA – ADR | | | 3,672 | | | | 19,939 | |

| Standard Chartered PLC – ADR | | | 1,135 | | | | 19,545 | |

| Sumitomo Mitsui Financial Group, Inc. – ADR | | | 1,628 | | | | 19,162 | |

| Toronto-Dominion Bank | | | 315 | | | | 19,020 | |

| Wells Fargo & Co. | | | 329 | | | | 19,069 | |

| | | | | | | | 450,412 | |

| Financial Services – 17.9% | | | | | | | | |

| Bank of New York Mellon Corp. | | | 347 | | | | 19,994 | |

| Goldman Sachs Group, Inc. | | | 48 | | | | 20,049 | |

| Morgan Stanley | | | 213 | | | | 20,056 | |

| State Street Corp. | | | 264 | | | | 20,413 | |

| UBS Group AG | | | 600 | | | | 18,432 | |

| | | | | | | | 98,944 | |

| TOTAL COMMON STOCKS (Cost $501,972) | | | | | | | 549,356 | |

Themes ETF Trust

Themes Global Systemically Important Banks ETF

Schedule of Investments (Continued)

as of March 31, 2024 (Unaudited)

| | | Shares | | | Value | |

| SHORT-TERM INVESTMENTS – 0.1% | | | | | | | | |

| Money Market Funds – 0.1% | | | | | | | | |

| First American Treasury Obligations Fund – Class X, 5.22%(b) | | | 761 | | | $ | 761 | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $761) | | | | | | | 761 | |

| | | | | | | | | |

| TOTAL INVESTMENTS – 99.7% (Cost $502,733) | | | | | | $ | 550,117 | |

| Other Assets in Excess of Liabilities – 0.3% | | | | | | | 1,582 | |

| TOTAL NET ASSETS – 100.0% | | | | | | $ | 551,699 | |

Percentages are stated as a percent of net assets.

ADR – American Depositary Receipt

AG – Aktiengesellschaft

NV – Naamloze Vennootschap

PLC – Public Limited Company

SA – Sociedad Anónima

| (a) | To the extent that the Fund invests more heavily in a particular industry or sector of the economy, its performance will be especially sensitive to developments that significantly affect those industries or sectors. |

| (b) | The rate shown represents the 7-day effective yield as of March 31, 2024. |

Themes ETF Trust

Themes Gold Miners ETF

Schedule of Investments

as of March 31, 2024 (Unaudited)

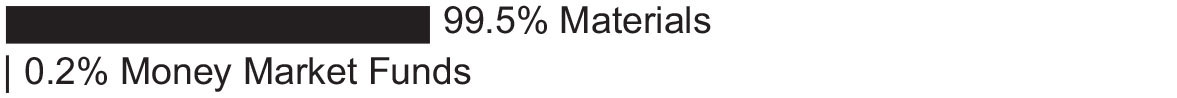

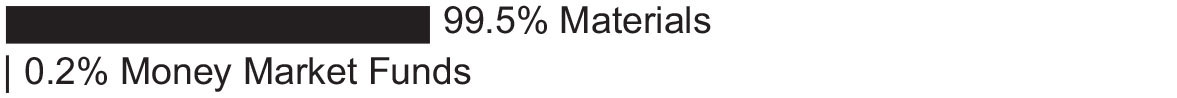

Sector Diversification as of March 31, 2024

Percentages are stated as a percent of net assets.

| | | Shares | | | Value | |

| COMMON STOCKS – 99.5% | | | | | | | | |

| Materials – 99.5%(a) | | | | | | | | |

| Agnico Eagle Mines Ltd. | | | 1,239 | | | $ | 73,880 | |

| Alamos Gold, Inc. – Class A | | | 4,904 | | | | 72,299 | |

| Anglogold Ashanti PLC | | | 3,364 | | | | 74,681 | |

| B2Gold Corp. | | | 22,611 | | | | 59,259 | |

| Capricorn Metals Ltd.(b) | | | 15,649 | | | | 52,518 | |

| Centamin PLC | | | 49,870 | | | | 71,063 | |

| De Grey Mining Ltd.(b) | | | 73,394 | | | | 60,501 | |

| Endeavour Mining PLC | | | 3,513 | | | | 71,373 | |

| Equinox Gold Corp.(b) | | | 12,452 | | | | 75,105 | |

| Gold Fields Ltd. – ADR | | | 4,256 | | | | 67,628 | |

| Gold Road Resources Ltd. | | | 51,133 | | | | 52,647 | |

| IAMGOLD Corp.(b) | | | 22,480 | | | | 75,014 | |

| K92 Mining, Inc.(b) | | | 11,240 | | | | 52,277 | |

| Kinross Gold Corp. | | | 11,191 | | | | 68,655 | |

| Lundin Gold, Inc. | | | 4,992 | | | | 70,169 | |

| Northern Star Resources Ltd. | | | 6,897 | | | | 65,034 | |

| OceanaGold Corp. | | | 28,535 | | | | 64,462 | |

| Perseus Mining Ltd. | | | 52,738 | | | | 73,888 | |

| Ramelius Resources Ltd. | | | 55,781 | | | | 67,610 | |

| Regis Resources Ltd.(b) | | | 38,120 | | | | 50,054 | |

| Torex Gold Resources, Inc.(b) | | | 4,328 | | | | 63,711 | |

| Zhaojin Mining Industry Co. Ltd. – Class H | | | 60,655 | | | | 82,301 | |

| | | | | | | | 1,464,129 | |

| TOTAL COMMON STOCKS (Cost $1,305,164) | | | | | | | 1,464,129 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS – 0.2% | | | | | | | | |

| Money Market Funds – 0.2% | | | | | | | | |

| First American Treasury Obligations Fund – Class X, 5.22%(c) | | | 3,585 | | | | 3,585 | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $3,585) | | | | | | | 3,585 | |

| | | | | | | | | |

| TOTAL INVESTMENTS – 99.7% (Cost $1,308,749) | | | | | | $ | 1,467,714 | |

| Other Assets in Excess of Liabilities – 0.3% | | | | | | | 4,816 | |

| TOTAL NET ASSETS – 100.0% | | | | | | $ | 1,472,529 | |

Percentages are stated as a percent of net assets.

ADR – American Depositary Receipt

PLC – Public Limited Company

| (a) | To the extent that the Fund invests more heavily in a particular industry or sector of the economy, its performance will be especially sensitive to developments that significantly affect those industries or sectors. |

| (b) | Non-income producing security. |

| (c) | The rate shown represents the 7-day effective yield as of March 31, 2024. |

Themes ETF Trust

Themes Natural Monopoly ETF

Schedule of Investments

as of March 31, 2024 (Unaudited)

Sector Diversification as of March 31, 2024

Percentages are stated as a percent of net assets.

| | | Shares | | | Value | |

| COMMON STOCKS – 99.3% | | | | | | | | |

| Consumer Discretionary Products – 1.5% | | | | | | | | |

| Ferrari NV | | | 10 | | | $ | 4,358 | |

| Stellantis NV | | | 148 | | | | 4,207 | |

| | | | | | | | 8,565 | |

| Consumer Staple Products – 6.1% | | | | | | | | |

| British American Tobacco PLC | | | 213 | | | | 6,469 | |

| Coca-Cola Co. | | | 106 | | | | 6,485 | |

| General Mills, Inc. | | | 96 | | | | 6,717 | |

| Haleon PLC | | | 276 | | | | 1,160 | |

| PepsiCo, Inc. | | | 36 | | | | 6,300 | |

| Procter & Gamble Co. | | | 42 | | | | 6,815 | |

| | | | | | | | 33,946 | |

| Financial Services – 8.8% | | | | | | | | |

| Blackstone, Inc. | | | 123 | | | | 16,159 | |

| Singapore Exchange Ltd. | | | 2,146 | | | | 14,638 | |

| Synchrony Financial | | | 423 | | | | 18,239 | |

| | | | | | | | 49,036 | |

| Health Care – 12.6% | | | | | | | | |

| AbbVie, Inc. | | | 67 | | | | 12,200 | |

| Amgen, Inc. | | | 36 | | | | 10,236 | |

| FUJIFILM Holdings Corp. | | | 300 | | | | 6,714 | |

| IQVIA Holdings, Inc.(a) | | | 7 | | | | 1,770 | |

| Johnson & Johnson | | | 66 | | | | 10,441 | |

Themes ETF Trust

Themes Natural Monopoly ETF

Schedule of Investments (Continued)

as of March 31, 2024 (Unaudited)

| | | Shares | | | Value | |

| Health Care – 12.6% (Continued) | | | | | | | | |

| Laboratory Corp of America Holdings | | | 8 | | | $ | 1,748 | |

| Novo Nordisk A/S | | | 100 | | | | 12,746 | |

| Ramsay Health Care Ltd. | | | 48 | | | | 1,768 | |

| Siemens Healthineers AG(b) | | | 29 | | | | 1,775 | |

| Vertex Pharmaceuticals, Inc.(a) | | | 25 | | | | 10,450 | |

| | | | | | | | 69,848 | |

| Industrial Products – 13.1% | | | | | | | | |

| AMETEK, Inc. | | | 32 | | | | 5,853 | |

| Assa Abloy AB – Class B | | | 169 | | | | 4,849 | |

| Atlas Copco AB – Class A | | | 283 | | | | 4,780 | |

| General Dynamics Corp. | | | 57 | | | | 16,102 | |

| Halma PLC | | | 508 | | | | 15,183 | |

| Hexagon AB – Class B | | | 1,231 | | | | 14,571 | |

| Nibe Industrier AB – Class B(a) | | | 494 | | | | 2,426 | |

| Schneider Electric SE | | | 24 | | | | 5,428 | |

| Snap-on, Inc. | | | 12 | | | | 3,555 | |

| | | | | | | | 72,747 | |

| Industrial Services – 4.4% | | | | | | | | |

| CSX Corp. | | | 69 | | | | 2,558 | |

| FedEx Corp. | | | 10 | | | | 2,897 | |

| Ferguson PLC | | | 5 | | | | 1,092 | |

| JB Hunt Transport Services, Inc. | | | 12 | | | | 2,391 | |

| Kuehne + Nagel International AG | | | 7 | | | | 1,948 | |

| Quanta Services, Inc. | | | 6 | | | | 1,559 | |

| Republic Services, Inc. | | | 8 | | | | 1,532 | |

| Rollins, Inc. | | | 67 | | | | 3,100 | |

| Vinci SA | | | 11 | | | | 1,409 | |

| Waste Connections, Inc. | | | 16 | | | | 2,751 | |

| Waste Management, Inc. | | | 7 | | | | 1,492 | |

| WSP Global, Inc. | | | 10 | | | | 1,667 | |

| | | | | | | | 24,396 | |

| Insurance – 6.5% | | | | | | | | |

| Aon PLC – Class A | | | 55 | | | | 18,355 | |

| Arthur J Gallagher & Co. | | | 71 | | | | 17,753 | |

| | | | | | | | 36,108 | |

| Materials – 4.1% | | | | | | | | |

| Agnico Eagle Mines Ltd. | | | 34 | | | | 2,027 | |

| BHP Group Ltd. | | | 52 | | | | 1,500 | |

| CRH PLC | | | 26 | | | | 2,243 | |

| Ecolab, Inc. | | | 12 | | | | 2,771 | |

| Holcim AG | | | 26 | | | | 2,354 | |

| James Hardie Industries PLC(a) | | | 46 | | | | 1,847 | |

| Linde PLC | | | 6 | | | | 2,785 | |

| Nippon Paint Holdings Co. Ltd. | | | 300 | | | | 2,149 | |

| Sherwin-Williams Co. | | | 8 | | | | 2,779 | |

| Sika AG | | | 8 | | | | 2,383 | |

| | | | | | | | 22,838 | |

Themes ETF Trust

Themes Natural Monopoly ETF

Schedule of Investments (Continued)

as of March 31, 2024 (Unaudited)

| | | Shares | | | Value | |

| Media – 5.8% | | | | | | | | |

| Booking Holdings, Inc. | | | 1 | | | $ | 3,628 | |

| Charter Communications, Inc. – Class A(a) | | | 8 | | | | 2,325 | |

| Comcast Corp. – Class A | | | 67 | | | | 2,904 | |

| Meta Platforms, Inc. – Class A | | | 48 | | | | 23,309 | |

| | | | | | | | 32,166 | |

| Oil & Gas – 3.4% | | | | | | | | |

| Aker BP ASA | | | 130 | | | | 3,231 | |

| Delek Group Ltd. | | | 29 | | | | 3,793 | |

| Inpex Corp. | | | 300 | | | | 4,556 | |

| ORLEN SA | | | 227 | | | | 3,699 | |

| Woodside Energy Group Ltd. | | | 178 | | | | 3,538 | |

| | | | | | | | 18,817 | |

| Retail & Wholesale – Discretionary – 1.7% | | | | | | | | |

| Bunzl PLC | | | 26 | | | | 1,000 | |

| Genuine Parts Co. | | | 8 | | | | 1,239 | |

| ZOZO, Inc. | | | 300 | | | | 7,426 | |

| | | | | | | | 9,665 | |

| Retail & Wholesale – Staples – 5.3% | | | | | | | | |

| Dollar General Corp. | | | 52 | | | | 8,115 | |

| Dollar Tree, Inc.(a) | | | 47 | | | | 6,258 | |

| Endeavour Group Ltd. | | | 1,890 | | | | 6,786 | |

| Koninklijke Ahold Delhaize NV | | | 234 | | | | 6,998 | |

| Sysco Corp. | | | 15 | | | | 1,218 | |

| | | | | | | | 29,375 | |

| Software & Technology Services – 15.5% | | | | | | | | |

| Accenture PLC – Class A | | | 48 | | | | 16,638 | |

| Corpay, Inc.(a) | | | 9 | | | | 2,777 | |

| CoStar Group, Inc.(a) | | | 194 | | | | 18,740 | |

| Equifax, Inc. | | | 10 | | | | 2,675 | |

| Mastercard, Inc. – Class A | | | 6 | | | | 2,889 | |

| Open Text Corp. | | | 404 | | | | 15,676 | |

| Pro Medicus Ltd. | | | 26 | | | | 1,758 | |

| RELX PLC | | | 66 | | | | 2,852 | |

| The Sage Group PLC | | | 1,176 | | | | 18,784 | |

| Visa, Inc. – Class A | | | 10 | | | | 2,791 | |

| | | | | | | | 85,580 | |

| Tech Hardware & Semiconductors – 6.8% | | | | | | | | |

| Analog Devices, Inc. | | | 74 | | | | 14,636 | |

| Applied Materials, Inc. | | | 30 | | | | 6,187 | |

| Broadcom, Inc. | | | 13 | | | | 17,231 | |

| | | | | | | | 38,054 | |

Themes ETF Trust

Themes Natural Monopoly ETF

Schedule of Investments (Continued)

as of March 31, 2024 (Unaudited)

| | | Shares | | | Value | |

| Telecommunications – 1.4% | | | | | | | | |

| Rogers Communications, Inc. – Class B | | | 36 | | | $ | 1,475 | |

| SoftBank Corp. | | | 100 | | | | 1,282 | |

| TELUS Corp. | | | 93 | | | | 1,488 | |

| T-Mobile US, Inc. | | | 10 | | | | 1,632 | |

| Verizon Communications, Inc. | | | 44 | | | | 1,846 | |

| | | | | | | | 7,723 | |

| Utilities – 2.3% | | | | | | | | |

| Eversource Energy | | | 42 | | | | 2,510 | |

| Fortis, Inc. | | | 66 | | | | 2,608 | |

| Iberdrola SA | | | 210 | | | | 2,604 | |

| National Grid PLC | | | 201 | | | | 2,704 | |

| NextEra Energy, Inc. | | | 43 | | | | 2,748 | |

| | | | | | | | 13,174 | |

| TOTAL COMMON STOCKS (Cost $505,908) | | | | | | | 552,038 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS – 0.3% | | | | | | | | |

| Money Market Funds – 0.3% | | | | | | | | |

| First American Treasury Obligations Fund – Class X, 5.22%(c) | | | 1,558 | | | | 1,558 | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $1,558) | | | | | | | 1,558 | |

| | | | | | | | | |

| TOTAL INVESTMENTS – 99.6% (Cost $507,466) | | | | | | $ | 553,596 | |

| Other Assets in Excess of Liabilities – 0.4% | | | | | | | 2,232 | |

| TOTAL NET ASSETS – 100.0% | | | | | | $ | 555,828 | |

Percentages are stated as a percent of net assets.

AG – Aktiengesellschaft

ASA – Advanced Subscription Agreement

NV – Naamloze Vennootschap

PLC – Public Limited Company

SA – Sociedad Anónima

| (a) | Non-income producing security. |

| (b) | Security is exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may only be resold in transactions exempt from registration to qualified institutional investors. As of March 31, 2024, the value of these securities total $1,775 or 0.3% of the Fund’s net assets. |

| (c) | The rate shown represents the 7-day effective yield as of March 31, 2024. |

Themes ETF Trust

Themes US Cash Flow Champions ETF

Schedule of Investments

as of March 31, 2024 (Unaudited)

Sector Diversification as of March 31, 2024

Percentages are stated as a percent of net assets.

| | | Shares | | | Value | |

| COMMON STOCKS – 99.2% | | | | | | | | |

| Banking – 9.3% | | | | | | | | |

| Huntington Bancshares Inc. | | | 192 | | | $ | 2,678 | |

| JPMorgan Chase & Co. | | | 151 | | | | 30,245 | |

| M&T Bank Corp. | | | 22 | | | | 3,200 | |

| PNC Financial Services Group, Inc. | | | 53 | | | | 8,565 | |

| US Bancorp | | | 198 | | | | 8,851 | |

| | | | | | | | 53,539 | |

| Consumer Discretionary Products – 1.6% | | | | | | | | |

| Lennar Corp. – Class A | | | 33 | | | | 5,676 | |

| PulteGroup, Inc. | | | 28 | | | | 3,377 | |

| | | | | | | | 9,053 | |

| Consumer Staple Products – 2.1% | | | | | | | | |

| Altria Group, Inc. | | | 239 | | | | 10,425 | |

| Molson Coors Beverage Co. – Class B | | | 24 | | | | 1,614 | |

| | | | | | | | 12,039 | |

| Financial Services – 9.0% | | | | | | | | |

| American Express Co. | | | 79 | | | | 17,987 | |

| Ameriprise Financial, Inc. | | | 14 | | | | 6,138 | |

| Bank of New York Mellon Corp. | | | 101 | | | | 5,820 | |

| Capital One Financial Corp. | | | 51 | | | | 7,593 | |

| Cboe Global Markets, Inc. | | | 14 | | | | 2,572 | |

| Discover Financial Services | | | 33 | | | | 4,326 | |

| Fidelity National Financial, Inc. | | | 36 | | | | 1,912 | |

| Synchrony Financial | | | 56 | | | | 2,415 | |

| T Rowe Price Group, Inc. | | | 30 | | | | 3,658 | |

| | | | | | | | 52,421 | |

Themes ETF Trust

Themes US Cash Flow Champions ETF

Schedule of Investments (Continued)

as of March 31, 2024 (Unaudited)

| | | Shares | | | Value | |

| Health Care – 22.9% | | | | | | | | |

| AbbVie, Inc. | | | 169 | | | $ | 30,774 | |

| Bristol-Myers Squibb Co. | | | 281 | | | | 15,239 | |

| Cardinal Health, Inc. | | | 34 | | | | 3,805 | |

| CVS Health Corp. | | | 171 | | | | 13,639 | |

| Gilead Sciences, Inc. | | | 167 | | | | 12,233 | |

| Humana, Inc. | | | 17 | | | | 5,894 | |

| McKesson Corp. | | | 18 | | | | 9,662 | |

| Pfizer, Inc. | | | 771 | | | | 21,395 | |

| Quest Diagnostics, Inc. | | | 16 | | | | 2,130 | |

| Regeneron Pharmaceuticals, Inc.(a) | | | 14 | | | | 13,475 | |

| Royalty Pharma PLC – Class A | | | 50 | | | | 1,519 | |

| Viatris, Inc. | | | 160 | | | | 1,910 | |

| | | | | | | | 131,675 | |

| Industrial Products – 0.4% | | | | | | | | |

| Snap-on, Inc. | | | 7 | | | | 2,074 | |

| | | | | | | | | |

| Insurance – 13.8% | | | | | | | | |

| Aflac, Inc. | | | 72 | | | | 6,182 | |

| Allstate Corp. | | | 36 | | | | 6,228 | |

| Arch Capital Group Ltd.(a) | | | 50 | | | | 4,622 | |

| Chubb Ltd. | | | 55 | | | | 14,252 | |

| Cincinnati Financial Corp. | | | 22 | | | | 2,732 | |

| Everest Group Ltd. | | | 4 | | | | 1,590 | |

| Globe Life, Inc. | | | 12 | | | | 1,396 | |

| Hartford Financial Services Group Inc. | | | 41 | | | | 4,225 | |

| Markel Group, Inc.(a) | | | 2 | | | | 3,043 | |

| MetLife, Inc. | | | 84 | | | | 6,225 | |

| Principal Financial Group, Inc. | | | 32 | | | | 2,762 | |

| Progressive Corp. | | | 78 | | | | 16,133 | |

| Travelers Cos, Inc. | | | 31 | | | | 7,134 | |

| W R Berkley Corp. | | | 28 | | | | 2,476 | |

| | | | | | | | 79,000 | |

| Materials – 3.0% | | | | | | | | |

| Dow, Inc. | | | 95 | | | | 5,503 | |

| LyondellBasell Industries NV – Class A | | | 34 | | | | 3,478 | |

| Mosaic Co. | | | 46 | | | | 1,493 | |

| Nucor Corp. | | | 34 | | | | 6,729 | |

| | | | | | | | 17,203 | |

| Media – 1.0% | | | | | | | | |

| Expedia Group, Inc.(a) | | | 20 | | | | 2,755 | |

| Fox Corp. – Class A | | | 33 | | | | 1,032 | |

| Omnicom Group, Inc. | | | 26 | | | | 2,516 | |

| | | | | | | | 6,303 | |

| Oil & Gas – 25.7%(b) | | | | | | | | |

| Cheniere Energy, Inc. | | | 32 | | | | 5,161 | |

| Chevron Corp. | | | 176 | | | | 27,762 | |

| ConocoPhillips | | | 162 | | | | 20,619 | |

| Coterra Energy, Inc. | | | 100 | | | | 2,788 | |

Themes ETF Trust

Themes US Cash Flow Champions ETF

Schedule of Investments (Continued)

as of March 31, 2024 (Unaudited)

| | | Shares | | | Value | |

| Oil & Gas – 25.7%(b) (Continued) | | | | | | | | |

| Devon Energy Corp. | | | 85 | | | $ | 4,265 | |

| Diamondback Energy, Inc. | | | 24 | | | | 4,756 | |

| EOG Resources, Inc. | | | 78 | | | | 9,972 | |

| Exxon Mobil Corp. | | | 261 | | | | 30,339 | |

| Marathon Petroleum Corp. | | | 54 | | | | 10,881 | |

| Occidental Petroleum Corp. | | | 93 | | | | 6,044 | |

| Phillips 66 | | | 60 | | | | 9,800 | |

| Pioneer Natural Resources Co. | | | 31 | | | | 8,138 | |

| Valero Energy Corp. | | | 47 | | | | 8,022 | |

| | | | | | | | 148,547 | |

| Retail & Wholesale – Discretionary – 1.3% | | | | | | | | |

| Best Buy Co, Inc. | | | 28 | | | | 2,297 | |

| eBay, Inc. | | | 71 | | | | 3,747 | |

| LKQ Corp. | | | 36 | | | | 1,923 | |

| | | | | | | | 7,967 | |

| Retail & Wholesale – Staples – 1.7% | | | | | | | | |

| Archer-Daniels-Midland Co. | | | 71 | | | | 4,460 | |

| Kroger Co. | | | 95 | | | | 5,427 | |

| | | | | | | | 9,887 | |

| Software & Technology Services – 0.9% | | | | | | | | |

| Cognizant Technology Solutions Corp. – Class A | | | 70 | | | | 5,130 | |

| | | | | | | | | |

| Tech Hardware & Semiconductors – 6.5% | | | | | | | | |

| Broadcom, Inc. | | | 23 | | | | 30,485 | |

| HP, Inc. | | | 132 | | | | 3,989 | |

| NetApp, Inc. | | | 28 | | | | 2,939 | |

| | | | | | | | 37,413 | |

| TOTAL COMMON STOCKS (Cost $500,993) | | | | | | | 572,251 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS – 0.7% | | | | | | | | |

| Money Market Funds – 0.7% | | | | | | | | |

| First American Treasury Obligations Fund – Class X, 5.22%(c) | | | 3,911 | | | | 3,911 | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $3,911) | | | | | | | 3,911 | |

| | | | | | | | | |

| TOTAL INVESTMENTS – 99.9% (Cost $504,904) | | | | | | $ | 576,162 | |

| Other Assets in Excess of Liabilities – 0.1% | | | | | | | 401 | |

| TOTAL NET ASSETS – 100.0% | | | | | | $ | 576,563 | |

Percentages are stated as a percent of net assets.

NV – Naamloze Vennootschap

PLC – Public Limited Company

| (a) | Non-income producing security. |

| (b) | To the extent that the Fund invests more heavily in a particular industry or sector of the economy, its performance will be especially sensitive to developments that significantly affect those industries or sectors. |

| (c) | The rate shown represents the 7-day effective yield as of March 31, 2024. |

Themes ETF Trust

Themes US R&D Champions ETF

Schedule of Investments

as of March 31, 2024 (Unaudited)

Sector Diversification as of March 31, 2024

Percentages are stated as a percent of net assets.

| | | Shares | | | Value | |

| COMMON STOCKS – 99.5% | | | | | | | | |

| Consumer Discretionary Products – 2.2% | | | | | | | | |

| General Motors Co. | | | 292 | | | $ | 13,242 | |

| | | | | | | | | |

| Health Care – 17.9% | | | | | | | | |

| Align Technology, Inc.(a) | | | 38 | | | | 12,461 | |

| Edwards Lifesciences Corp.(a) | | | 132 | | | | 12,613 | |

| Eli Lilly & Co. | | | 15 | | | | 11,669 | |

| Hologic, Inc.(a) | | | 153 | | | | 11,928 | |

| Intuitive Surgical, Inc.(a) | | | 29 | | | | 11,574 | |

| Johnson & Johnson | | | 72 | | | | 11,390 | |

| Medtronic PLC | | | 132 | | | | 11,504 | |

| Regeneron Pharmaceuticals, Inc.(a) | | | 12 | | | | 11,550 | |

| STERIS PLC | | | 50 | | | | 11,241 | |

| | | | | | | | 105,930 | |

| Industrial Products – 6.2% | | | | | | | | |

| Keysight Technologies, Inc.(a) | | | 70 | | | | 10,947 | |

| Northrop Grumman Corp. | | | 25 | | | | 11,967 | |

| Trimble, Inc.(a) | | | 214 | | | | 13,772 | |

| | | | | | | | 36,686 | |

| Materials – 2.0% | | | | | | | | |

| Corteva, Inc. | | | 210 | | | | 12,111 | |

| | | | | | | | | |

| Media – 8.0% | | | | | | | | |

| Alphabet, Inc. – Class A(a) | | | 75 | | | | 11,320 | |

| Electronic Arts, Inc. | | | 80 | | | | 10,614 | |

| Meta Platforms, Inc. – Class A | | | 24 | | | | 11,654 | |

| The Trade Desk, Inc. – Class A(a) | | | 157 | | | | 13,725 | |

| | | | | | | | 47,313 | |

| Renewable Energy – 1.9% | | | | | | | | |

| Enphase Energy, Inc.(a) | | | 92 | | | | 11,130 | |

Themes ETF Trust

Themes US R&D Champions ETF

Schedule of Investments (Continued)

as of March 31, 2024 (Unaudited)

| | | Shares | | | Value | |

| Software & Technology Services – 38.2%(b) | | | | | | | | |

| Adobe, Inc.(a) | | | 18 | | | $ | 9,083 | |

| Akamai Technologies, Inc.(a) | | | 88 | | | | 9,571 | |

| Amdocs Ltd. | | | 125 | | | | 11,296 | |

| ANSYS, Inc.(a) | | | 32 | | | | 11,109 | |

| Autodesk, Inc.(a) | | | 42 | | | | 10,938 | |

| Cadence Design Systems, Inc.(a) | | | 36 | | | | 11,206 | |

| CoStar Group, Inc.(a) | | | 135 | | | | 13,040 | |

| Fortinet, Inc.(a) | | | 158 | | | | 10,793 | |

| International Business Machines Corp. | | | 60 | | | | 11,457 | |

| Intuit, Inc. | | | 17 | | | | 11,050 | |

| Microsoft Corp. | | | 27 | | | | 11,359 | |

| Oracle Corp. | | | 96 | | | | 12,058 | |

| Paycom Software, Inc. | | | 60 | | | | 11,941 | |

| PayPal Holdings, Inc.(a) | | | 191 | | | | 12,795 | |

| Roper Technologies, Inc. | | | 20 | | | | 11,217 | |

| Salesforce, Inc. | | | 39 | | | | 11,746 | |

| ServiceNow, Inc.(a) | | | 14 | | | | 10,674 | |

| Synopsys, Inc.(a) | | | 19 | | | | 10,859 | |

| Veeva Systems, Inc. – Class A(a) | | | 52 | | | | 12,048 | |

| Zoom Video Communications, Inc. – Class A(a) | | | 171 | | | | 11,178 | |

| | | | | | | | 225,418 | |

| Tech Hardware & Semiconductors – 23.1% | | | | | | | | |

| Advanced Micro Devices, Inc.(a) | | | 65 | | | | 11,732 | |

| Applied Materials, Inc. | | | 61 | | | | 12,580 | |

| Arista Networks, Inc.(a) | | | 40 | | | | 11,599 | |

| Cisco Systems, Inc. | | | 224 | | | | 11,180 | |

| Hewlett Packard Enterprise Co. | | | 724 | | | | 12,837 | |

| KLA Corp. | | | 17 | | | | 11,876 | |

| Lam Research Corp. | | | 12 | | | | 11,659 | |

| NetApp, Inc. | | | 124 | | | | 13,016 | |

| NVIDIA Corp. | | | 16 | | | | 14,458 | |

| QUALCOMM, Inc. | | | 74 | | | | 12,528 | |

| Zebra Technologies Corp. – Class A(a) | | | 44 | | | | 13,263 | |

| | | | | | | | 136,728 | |

| TOTAL COMMON STOCKS (Cost $509,532) | | | | | | | 588,558 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS – 0.5% | | | | | | | | |

| Money Market Funds – 0.5% | | | | | | | | |

| First American Treasury Obligations Fund – Class X, 5.22%(c) | | | 3,148 | | | | 3,148 | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $3,148) | | | | | | | 3,148 | |

| | | | | | | | | |

| TOTAL INVESTMENTS – 100.0% (Cost $512,680) | | | | | | $ | 591,706 | |

| Liabilities in Excess of Other Assets – 0.0%(d) | | | | | | | (178 | ) |

| TOTAL NET ASSETS – 100.0% | | | | | | $ | 591,528 | |

Percentages are stated as a percent of net assets.

PLC – Public Limited Company

| (a) | Non-income producing security. |

| (b) | To the extent that the Fund invests more heavily in a particular industry or sector of the economy, its performance will be especially sensitive to developments that significantly affect those industries or sectors. |

| (c) | The rate shown represents the 7-day effective yield as of March 31, 2024. |

| (d) | Represents less than 0.05% of net assets. |

Themes ETF Trust

Themes US Small Cap Cash Flow Champions ETF

Schedule of Investments

as of March 31, 2024 (Unaudited)

Sector Diversification as of March 31, 2024

Percentages are stated as a percent of net assets.

| | | Shares | | | Value | |

| COMMON STOCKS – 98.8% | | | | | | | | |

| Banking – 11.6% | | | | | | | | |

| Axos Financial, Inc.(a) | | | 74 | | | $ | 3,999 | |

| Bank OZK | | | 150 | | | | 6,819 | |

| East West Bancorp, Inc. | | | 194 | | | | 15,346 | |

| First BanCorp Puerto Rico | | | 243 | | | | 4,262 | |

| First Bancorp/Southern Pines NC | | | 55 | | | | 1,987 | |

| First Horizon Corp. | | | 763 | | | | 11,750 | |

| Heartland Financial USA, Inc. | | | 55 | | | | 1,933 | |

| Hope Bancorp, Inc. | | | 158 | | | | 1,819 | |

| International Bancshares Corp. | | | 74 | | | | 4,154 | |

| S&T Bancorp, Inc. | | | 53 | | | | 1,700 | |

| SouthState Corp. | | | 104 | | | | 8,843 | |

| TriCo Bancshares | | | 42 | | | | 1,545 | |

| Trustmark Corp. | | | 78 | | | | 2,193 | |

| WSFS Financial Corp. | | | 84 | | | | 3,792 | |

| | | | | | | | 70,142 | |

| Consumer Discretionary Products – 5.1% | | | | | | | | |

| Taylor Morrison Home Corp.(a) | | | 145 | | | | 9,015 | |

| Toll Brothers, Inc. | | | 150 | | | | 19,405 | |

| Vista Outdoor, Inc.(a) | | | 77 | | | | 2,524 | |

| | | | | | | | 30,944 | |

| Consumer Discretionary Services – 0.3% | | | | | | | | |

| Perdoceo Education Corp. | | | 88 | | | | 1,545 | |

Themes ETF Trust

Themes US Small Cap Cash Flow Champions ETF

Schedule of Investments (Continued)

as of March 31, 2024 (Unaudited)

| | | Shares | | | Value | |

| Financial Services – 7.2% | | | | | | | | |

| Artisan Partners Asset Management, Inc. – Class A | | | 93 | | | $ | 4,257 | |

| Bread Financial Holdings, Inc. | | | 68 | | | | 2,532 | |

| Enova International, Inc.(a) | | | 42 | | | | 2,639 | |

| Evercore, Inc. – Class A | | | 49 | | | | 9,437 | |

| MGIC Investment Corp. | | | 393 | | | | 8,787 | |

| Stifel Financial Corp. | | | 142 | | | | 11,100 | |

| Virtu Financial, Inc. – Class A | | | 125 | | | | 2,565 | |

| Virtus Investment Partners, Inc. | | | 9 | | | | 2,232 | |

| | | | | | | | 43,549 | |

| Health Care – 5.9% | | | | | | | | |

| Dynavax Technologies Corp.(a) | | | 176 | | | | 2,184 | |

| Innoviva, Inc.(a) | | | 90 | | | | 1,372 | |

| Ironwood Pharmaceuticals, Inc.(a) | | | 210 | | | | 1,829 | |

| Molina Healthcare, Inc.(a) | | | 74 | | | | 30,401 | |

| | | | | | | | 35,786 | |

| Industrial Products – 2.4% | | | | | | | | |

| Mueller Industries, Inc. | | | 154 | | | | 8,305 | |

| NEXTracker, Inc. – Class A(a) | | | 104 | | | | 5,852 | |

| | | | | | | | 14,157 | |

| Industrial Services – 5.3% | | | | | | | | |

| API Group Corp.(a) | | | 293 | | | | 11,506 | |

| Matson, Inc. | | | 49 | | | | 5,508 | |

| Sterling Infrastructure, Inc.(a) | | | 41 | | | | 4,523 | |

| TriNet Group, Inc. | | | 77 | | | | 10,202 | |

| | | | | | | | 31,739 | |

| Insurance – 9.6% | | | | | | | | |

| American Equity Investment Life Holding Co.(a) | | | 85 | | | | 4,779 | |

| Axis Capital Holdings Ltd. | | | 107 | | | | 6,957 | |

| CNA Financial Corp. | | | 30 | | | | 1,363 | |

| Genworth Financial, Inc. – Class A(a) | | | 634 | | | | 4,077 | |

| Hanover Insurance Group, Inc. | | | 49 | | | | 6,672 | |

| NMI Holdings, Inc. – Class A(a) | | | 113 | | | | 3,654 | |

| Old Republic International Corp. | | | 364 | | | | 11,182 | |

| Reinsurance Group of America, Inc. | | | 92 | | | | 17,745 | |

| SiriusPoint Ltd.(a) | | | 127 | | | | 1,614 | |

| | | | | | | | 58,043 | |

| Materials – 12.5% | | | | | | | | |

| Alpha Metallurgical Resources, Inc. | | | 16 | | | | 5,298 | |

| Boise Cascade Co. | | | 54 | | | | 8,282 | |

| CF Industries Holdings, Inc. | | | 269 | | | | 22,383 | |

| CONSOL Energy, Inc. | | | 43 | | | | 3,602 | |

| Encore Wire Corp. | | | 22 | | | | 5,781 | |

| Peabody Energy Corp. | | | 155 | | | | 3,760 | |

| Ternium SA – ADR | | | 272 | | | | 11,321 | |

| UFP Industries, Inc. | | | 84 | | | | 10,333 | |

| Warrior Met Coal, Inc. | | | 71 | | | | 4,310 | |

| | | | | | | | 75,070 | |

Themes ETF Trust

Themes US Small Cap Cash Flow Champions ETF

Schedule of Investments (Continued)

as of March 31, 2024 (Unaudited)

| | | Shares | | | Value | |

| Oil & Gas – 22.6% | | | | | | | | |

| Antero Resources Corp.(a) | | | 384 | | | $ | 11,136 | |

| APA Corp. | | | 426 | | | | 14,646 | |

| Chord Energy Corp. | | | 56 | | | | 9,981 | |

| Civitas Resources, Inc. | | | 113 | | | | 8,578 | |

| CVR Energy, Inc. | | | 41 | | | | 1,462 | |

| Hess Midstream LP – Class A | | | 77 | | | | 2,782 | |

| HF Sinclair Corp. | | | 189 | | | | 11,411 | |

| Magnolia Oil & Gas Corp. – Class A | | | 249 | | | | 6,462 | |

| Marathon Oil Corp. | | | 853 | | | | 24,175 | |

| Matador Resources Co. | | | 152 | | | | 10,149 | |

| Murphy Oil Corp. | | | 205 | | | | 9,369 | |

| PBF Energy, Inc. – Class A | | | 155 | | | | 8,923 | |

| Permian Resources Corp. | | | 481 | | | | 8,494 | |

| SM Energy Co. | | | 164 | | | | 8,175 | |

| | | | | | | | 135,743 | |

| Retail & Wholesale – Discretionary – 13.4% | | | | | | | | |

| Asbury Automotive Group, Inc.(a) | | | 28 | | | | 6,602 | |

| Builders FirstSource, Inc.(a) | | | 160 | | | | 33,368 | |

| Dillard’s, Inc. – Class A | | | 11 | | | | 5,188 | |

| Group 1 Automotive, Inc. | | | 19 | | | | 5,552 | |

| Penske Automotive Group, Inc. | | | 25 | | | | 4,050 | |

| Williams-Sonoma, Inc. | | | 83 | | | | 26,355 | |

| | | | | | | | 81,115 | |

| Tech Hardware & Semiconductors – 2.9% | | | | | | | | |

| Flex Ltd.(a) | | | 610 | | | | 17,452 | |

| TOTAL COMMON STOCKS (Cost $505,593) | | | | | | | 595,285 | |

| | | | | | | | | |

| REAL ESTATE INVESTMENT TRUSTS – 0.5% | | | | | | | | |

| Equity Commonwealth(a) | | | 145 | | | | 2,738 | |

| TOTAL REAL ESTATE INVESTMENT TRUSTS (Cost $2,793) | | | | | | | 2,738 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS – 0.7% | | | | | | | | |

| Money Market Funds – 0.7% | | | | | | | | |

| First American Treasury Obligations Fund – Class X, 5.22%(b) | | | 4,500 | | | | 4,500 | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $4,500) | | | | | | | 4,500 | |

| | | | | | | | | |

| TOTAL INVESTMENTS – 100.0% (Cost $512,886) | | | | | | $ | 602,523 | |

| Liabilities in Excess of Other Assets – 0.0%(c) | | | | | | | (186 | ) |

| TOTAL NET ASSETS – 100.0% | | | | | | $ | 602,337 | |

Percentages are stated as a percent of net assets.

ADR – American Depositary Receipt

SA – Sociedad Anónima

| (a) | Non-income producing security. |

| (b) | The rate shown represents the 7-day effective yield as of March 31, 2024. |

| (c) | Represents less than 0.05% of net assets. |

Themes ETF Trust

Statements of Assets and Liabilities (Unaudited)

March 31, 2024

| | | Themes

Airlines ETF | | | Themes Cloud

Computing ETF | | | Themes

Cybersecurity ETF | | | Themes European

Luxury ETF | | | Themes Generative

Artificial

Intelligence ETF | |

| ASSETS: | | | | | | | | | | | | | | | | | | | | |

| Investments, at value | | $ | 530,468 | | | $ | 1,343,865 | | | $ | 1,387,807 | | | $ | 511,364 | | | $ | 20,349,192 | |

| Dividends and interest receivable | | | 650 | | | | 126 | | | | 830 | | | | 369 | | | | 794 | |

| Foreign currency, at value | | | 421 | | | | – | | | | 2,512 | | | | 1,726 | | | | 8,899 | |

| Cash | | | – | | | | – | | | | – | | | | – | | | | 175 | |

| Prepaid expenses and other assets | | | – | | | | – | | | | – | | | | 13 | | | | 370 | |

| Total assets | | | 531,539 | | | | 1,343,991 | | | | 1,391,149 | | | | 513,472 | | | | 20,359,430 | |

| | | | | | | | | | | | | | | | | | | | | |

| LIABILITIES: | | | | | | | | | | | | | | | | | | | | |

| Payable to adviser | | | 546 | | | | 747 | | | | 962 | | | | 493 | | | | 6,780 | |

| Dividends payable | | | 67 | | | | – | | | | 23 | | | | 54 | | | | – | |

| Payable to custodian foreign currency, at value | | | – | | | | 7 | | | | – | | | | – | | | | – | |

| Total liabilities | | | 613 | | | | 754 | | | | 985 | | | | 547 | | | | 6,780 | |

| NET ASSETS | | $ | 530,926 | | | $ | 1,343,237 | | | $ | 1,390,164 | | | $ | 512,925 | | | $ | 20,352,650 | |

| | | | | | | | | | | | | | | | | | | | | |

| NET ASSETS CONSISTS OF: | | | | | | | | | | | | | | | | | | | | |

| Paid-in capital | | $ | 501,088 | | | $ | 1,315,159 | | | $ | 1,333,144 | | | $ | 501,104 | | | $ | 20,406,950 | |

| Total distributable earnings/(accumulated losses) | | | 29,838 | | | | 28,078 | | | | 57,020 | | | | 11,821 | | | | (54,300 | ) |

| Total net assets | | $ | 530,926 | | | $ | 1,343,237 | | | $ | 1,390,164 | | | $ | 512,925 | | | $ | 20,352,650 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value | | $ | 530,926 | | | $ | 1,343,237 | | | $ | 1,390,164 | | | $ | 512,925 | | | $ | 20,352,650 | |

| Shares issued and outstanding(a) | | | 20,000 | | | | 50,000 | | | | 50,000 | | | | 20,000 | | | | 670,000 | |

| Net asset value per share | | $ | 26.55 | | | $ | 26.86 | | | $ | 27.80 | | | $ | 25.65 | | | $ | 30.38 | |

| | | | | | | | | | | | | | | | | | | | | |

| Cost: | | | | | | | | | | | | | | | | | | | | |

| Investments cost | | $ | 503,149 | | | $ | 1,317,229 | | | $ | 1,337,601 | | | $ | 489,670 | | | $ | 20,640,178 | |

| Foreign currency cost | | $ | 420 | | | $ | – | | | $ | 2,511 | | | $ | 1,761 | | | $ | 8,926 | |

| | | | | | | | | | | | | | | | | | | | | |

| Proceeds: | | | | | | | | | | | | | | | | | | | | |

| Foreign currency proceeds | | $ | – | | | $ | 6 | | | $ | – | | | $ | – | | | $ | – | |

| (a) | Unlimited shares authorized without par value. |

Themes ETF Trust

Statements of Assets and Liabilities (Unaudited) (Continued)

March 31, 2024

| | | Themes Global

Systemically

Important Banks ETF | | | Themes Gold

Miners ETF | | | Themes Natural

Monopoly ETF | | |

Themes US

Cash Flow

Champions ETF | | | Themes US

R&D Champions ETF | |

| ASSETS: | | | | | | | | | | | | | | | | | | | | |

| Investments, at value | | $ | 550,117 | | | $ | 1,467,714 | | | $ | 553,596 | | | $ | 576,162 | | | $ | 591,706 | |

| Dividends and interest receivable | | | 1,955 | | | | 1,139 | | | | 868 | | | | 663 | | | | 297 | |

| Cash | | | 130 | | | | 743 | | | | 144 | | | | 198 | | | | – | |

| Foreign currency, at value | | | 9 | | | | 4,308 | | | | 1,799 | | | | – | | | | – | |

| Total assets | | | 552,211 | | | | 1,473,904 | | | | 556,407 | | | | 577,023 | | | | 592,003 | |

| | | | | | | | | | | | | | | | | | | | | |

| LIABILITIES: | | | | | | | | | | | | | | | | | | | | |

| Payable to adviser | | | 512 | | | | 1,333 | | | | 553 | | | | 460 | | | | 475 | |

| Dividends payable | | | – | | | | 42 | | | | 26 | | | | – | | | | – | |

| Total liabilities | | | 512 | | | | 1,375 | | | | 579 | | | | 460 | | | | 475 | |

| NET ASSETS | | $ | 551,699 | | | $ | 1,472,529 | | | $ | 555,828 | | | $ | 576,563 | | | $ | 591,528 | |

| | | | | | | | | | | | | | | | | | | | | |

| NET ASSETS CONSISTS OF: | | | | | | | | | | | | | | | | | | | | |

| Paid-in capital | | $ | 500,216 | | | $ | 1,313,565 | | | $ | 501,300 | | | $ | 500,487 | | | $ | 500,044 | |

| Total distributable earnings/(accumulated losses) | | | 51,483 | | | | (1,154,836 | ) | | | (446,485 | ) | | | 76,076 | | | | 91,484 | |

| Total net assets | | $ | 551,699 | | | $ | 1,472,529 | | | $ | 555,828 | | | $ | 576,563 | | | $ | 591,528 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value | | $ | 551,699 | | | $ | 1,472,529 | | | $ | 555,828 | | | $ | 576,563 | | | $ | 591,528 | |

| Shares issued and outstanding(a) | | | 20,000 | | | | 50,000 | | | | 20,000 | | | | 20,000 | | | | 20,000 | |

| Net asset value per share | | $ | 27.58 | | | $ | 29.45 | | | $ | 27.79 | | | $ | 28.83 | | | $ | 29.58 | |

| | | | | | | | | | | | | | | | | | | | | |

| Cost: | | | | | | | | | | | | | | | | | | | | |

| Investments cost | | $ | 502,733 | | | $ | 1,308,749 | | | $ | 507,466 | | | $ | 504,904 | | | $ | 512,680 | |

| Foreign currency cost | | $ | 9 | | | $ | 4,301 | | | $ | 1,810 | | | $ | – | | | $ | – | |

| (a) | Unlimited shares authorized without par value. |

Themes ETF Trust

Statements of Assets and Liabilities (Unaudited) (Continued)

March 31, 2024

| | | Themes US

Small Cap Cash Flow

Champions ETF | |

| ASSETS: | | | | |

| Investments, at value | | $ | 602,523 | |

| Dividends and interest receivable | | | 213 | |

| Cash | | | 72 | |

| Total assets | | | 602,808 | |

| | | | | |

| LIABILITIES: | | | | |

| Payable to adviser | | | 471 | |

| Total liabilities | | | 471 | |

| NET ASSETS | | $ | 602,337 | |

| | | | | |

| NET ASSETS CONSISTS OF: | | | | |

| Paid-in capital | | $ | 500,893 | |

| Total distributable earnings | | | 101,444 | |

| Total net assets | | $ | 602,337 | |

| | | | | |

| Net asset value | | $ | 602,337 | |

| Shares issued and outstanding(a) | | | 20,000 | |

| Net asset value per share | | $ | 30.12 | |

| | | | | |

| Cost: | | | | |

| Investments cost | | $ | 512,886 | |

| (a) | Unlimited shares authorized without par value. |

Themes ETF Trust

Statements of Operations (Unaudited)

For the Period Ended March 31, 2024

| | | Themes

Airlines ETF | | | Themes Cloud

Computing ETF | | | Themes

Cybersecurity ETF | | | Themes European

Luxury ETF | | | Themes Generative

Artificial

Intelligence ETF | |

| INVESTMENT INCOME: | | | | | | | | | | | | | | | | | | | | |

| Dividend income | | $ | 2,301 | | | $ | 321 | | | $ | 3,506 | | | $ | 575 | | | $ | 2,750 | |

| Less: Dividend withholding taxes | | | (102 | ) | | | – | | | | – | | | | (125 | ) | | | – | |

| Interest income | | | 20 | | | | 71 | | | | 14 | | | | 12 | | | | 613 | |

| Other income | | | 9 | | | | 7 | | | | 31 | | | | – | | | | – | |

| Total investment income | | | 2,228 | | | | 399 | | | | 3,551 | | | | 462 | | | | 3,363 | |

| | | | | | | | | | | | | | | | | | | | | |

| EXPENSES: | | | | | | | | | | | | | | | | | | | | |

| Investment advisory fee | | | 546 | | | | 747 | | | | 962 | | | | 493 | | | | 6,780 | |

| Income tax expense | | | 7 | | | | – | | | | 88 | | | | – | | | | – | |

| Total expenses | | | 553 | | | | 747 | | | | 1,050 | | | | 493 | | | | 6,780 | |

| NET INVESTMENT INCOME/(LOSS) | | | 1,675 | | | | (348 | ) | | | 2,501 | | | | (31 | ) | | | (3,417 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| REALIZED AND UNREALIZED GAIN/(LOSS) | | | | | | | | | | | | | | | | | | | | |

| Net realized gain/(loss) from: | | | | | | | | | | | | | | | | | | | | |

| Investments | | | 1,647 | | | | 1,789 | | | | 4,594 | | | | (9,856 | ) | | | 239,958 | |

| Foreign currency translation | | | (804 | ) | | | 2 | | | | (282 | ) | | | 49 | | | | 172 | |

| Net realized gain/(loss) | | | 843 | | | | 1,791 | | | | 4,312 | | | | (9,807 | ) | | | 240,130 | |

| Net change in unrealized appreciation/(depreciation) on: | | | | | | | | | | | | | | | | | | | | |

| Investments | | | 27,319 | | | | 26,636 | | | | 50,206 | | | | 21,694 | | | | (290,986 | ) |

| Foreign currency translation | | | 1 | | | | (1 | ) | | | 1 | | | | (35 | ) | | | (27 | ) |

| Net change in unrealized appreciation/(depreciation) | | | 27,320 | | | | 26,635 | | | | 50,207 | | | | 21,659 | | | | (291,013 | ) |

| Net realized and unrealized gain/(loss) | | | 28,163 | | | | 28,426 | | | | 54,519 | | | | 11,852 | | | | (50,883 | ) |

| NET INCREASE/(DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 29,838 | | | $ | 28,078 | | | $ | 57,020 | | | $ | 11,821 | | | $ | (54,300 | ) |

Themes ETF Trust

Statements of Operations (Unaudited) (Continued)

For the Period Ended March 31, 2024

| | | Themes Global

Systemically

Important Banks ETF | | | Themes Gold

Miners ETF | | | Themes Natural

Monopoly ETF | | | Themes US Cash Flow Champions ETF | | | Themes US R&D

Champions ETF | |

| INVESTMENT INCOME: | | | | | | | | | | | | | | | | | | | | |

| Dividend income | | $ | 3,494 | | | $ | 6,871 | | | $ | 3,082 | | | $ | 5,039 | | | $ | 1,170 | |

| Less: Dividend withholding taxes | | | (82 | ) | | | (642 | ) | | | (114 | ) | | | – | | | | – | |

| Interest income | | | 25 | | | | 95 | | | | 27 | | | | 47 | | | | 33 | |

| Other income | | | – | | | | – | | | | 79 | | | | – | | | | – | |

| Total investment income | | | 3,437 | | | | 6,324 | | | | 3,074 | | | | 5,086 | | | | 1,203 | |

| | | | | | | | | | | | | | | | | | | | | |

| EXPENSES: | | | | | | | | | | | | | | | | | | | | |

| Investment advisory fee | | | 512 | | | | 1,333 | | | | 553 | | | | 460 | | | | 475 | |

| Income tax expense | | | 4 | | | | – | | | | 11 | | | | 40 | | | | 3 | |

| Total expenses | | | 516 | | | | 1,333 | | | | 564 | | | | 500 | | | | 478 | |

| NET INVESTMENT INCOME | | | 2,921 | | | | 4,991 | | | | 2,510 | | | | 4,586 | | | | 725 | |

| | | | | | | | | | | | | | | | | | | | | |

| REALIZED AND UNREALIZED GAIN | | | | | | | | | | | | | | | | | | | | |

| Net realized gain/(loss) from: | | | | | | | | | | | | | | | | | | | | |

| Investments | | | 1,178 | | | | (5,231 | ) | | | 5,934 | | | | 232 | | | | 11,733 | |

| Foreign currency translation | | | – | | | | 235 | | | | (31 | ) | | | – | | | | – | |

| Net realized gain/(loss) | | | 1,178 | | | | (4,996 | ) | | | 5,903 | | | | 232 | | | | 11,733 | |

| Net change in unrealized appreciation on: | | | | | | | | | | | | | | | | | | | | |

| Investments | | | 47,384 | | | | 158,965 | | | | 46,130 | | | | 71,258 | | | | 79,026 | |

| Foreign currency translation | | | – | | | | 4 | | | | (15 | ) | | | – | | | | – | |

| Net change in unrealized appreciation | | | 47,384 | | | | 158,969 | | | | 46,115 | | | | 71,258 | | | | 79,026 | |

| Net realized and unrealized gain | | | 48,562 | | | | 153,973 | | | | 52,018 | | | | 71,490 | | | | 90,759 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 51,483 | | | $ | 158,964 | | | $ | 54,528 | | | $ | 76,076 | | | $ | 91,484 | |

Themes ETF Trust

Statements of Operations (Unaudited) (Continued)

For the Period Ended March 31, 2024

| | | Themes US Small Cap Cash Flow Champions ETF | |

| INVESTMENT INCOME: | | | | |

| Dividend income | | $ | 3,036 | |

| Less: Dividend withholding taxes | | | (6 | ) |

| Interest income | | | 50 | |

| Total investment income | | | 3,080 | |

| | | | | |

| EXPENSES: | | | | |

| Investment advisory fee | | | 471 | |

| Income tax expense | | | 16 | |

| Total expenses | | | 487 | |

| NET INVESTMENT INCOME | | | 2,593 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN | | | | |

| Net realized gain from: | | | | |

| Investments | | | 9,214 | |

| Net realized gain | | | 9,214 | |

| Net change in unrealized appreciation on: | | | | |

| Investments | | | 89,637 | |

| Net change in unrealized appreciation | | | 89,637 | |

| Net realized and unrealized gain | | | 98,851 | |