UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23875

Madison ETFs Trust

(Exact name of registrant as specified in charter)

550 Science Drive

Madison, Wisconsin 53711

(Address of principal executive offices) (Zip code)

Greg Hoppe

Madison ETFs Trust

550 Science Drive

Madison, Wisconsin 53711

(Name and address of agent for service)

800-767-0300

Registrant’s telephone number, including area code

Date of fiscal year end: June 30

Date of reporting period: June 30, 2024

Item 1. Reports to Stockholders.

| (a) | A copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (“Act”), is filed herewith. |

| | |

| Madison Short-Term Strategic Income ETF | |

| MSTI (Principal U.S. Listing Exchange: NYSE) |

| Annual Shareholder Report | June 30, 2024 |

This annual shareholder report contains important information about the Madison Short-Term Strategic Income ETF for the period of September 5, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.madisonfunds.com/etfs/#documents. You can also request this information by contacting us at 800-767-0300.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Madison Short-Term Strategic Income ETF | $34* | 0.40% |

| * | Amount shown reflects the expenses of the Fund from inception date through June 30, 2024. Expenses would be higher if the Fund had been in operations for the full year. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Madison Short-Term Strategic Income ETF (NAV) returned 5.71% and (market) 5.74% from its inception through June 30th, 2024. Both outperforming the Bloomberg U.S. 1–5-year government/credit index which returned 4.28%.

The primary drivers of performance were an overweight to risk assets, specifically investment grade and high yield corporate bonds and asset-backed securities (ABS). Performance was also positively impacted by a yield advantage over the benchmark. The largest detractor to performance was the Treasury allocation given the strong risk asset performance. The fund was overweight financials, especially bank bonds maturing in three to five years, which had strong performance relative to other sub-sectors in investment grade corporate bonds. High yield corporate bonds also performed well given strong equity markets and positive economic growth. ABS performed well given attractive spreads and a shorter duration during a period of falling front-end interest rates. Finally, Mortgage Backed Securities performance was mixed as interest rate volatility was elevated and the yield curve continued to be inverted.

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment in the Fund noted. The chart uses total return NAV and market performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| Madison Short-Term Strategic Income ETF | PAGE 1 | TSR_AR_557441201 |

ANNUAL AVERAGE TOTAL RETURN (%)

| |

| | Since Inception

(09/05/2023) |

Madison Short-Term Strategic Income ETF NAV | 5.71 |

Madison Short-Term Strategic Income ETF Market | 5.74 |

Bloomberg 1-5 Year Government/Credit Index | 4.28 |

Visit https://www.madisonfunds.com/etfs/#documents for more recent performance information.

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Net Assets | $59,797,928 |

Number of Holdings | 96 |

Net Advisory Fee | $183,162 |

Portfolio Turnover | 17% |

Average Credit Quality | Baa2 |

Effective Duration | 2.43 yrs |

30-Day SEC Yield | 5.02% |

Visit https://www.madisonfunds.com/etfs/#documents for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

| |

Top Sectors (% of net assets) | |

Financials | 31.5% |

Asset Backed Securities | 12.5% |

Government | 8.9% |

Mortgage Securities | 8.6% |

Communications | 6.9% |

Industrials | 6.8% |

Technology | 6.5% |

Energy | 5.1% |

Health Care | 4.0% |

Cash & Other | 9.2% |

| |

Top 10 Issuers (% of net assets) | |

United States Treasury Note/Bond | 7.6% |

Federal Home Loan Mortgage Corp. | 3.2% |

Federal National Mortgage Association | 2.8% |

GM Financial Consumer Automobile Receivables Trust | 2.2% |

Discover Financial Services | 2.2% |

Bank of America Corp. | 2.1% |

Netflix, Inc. | 2.1% |

Goldman Sachs Group, Inc. | 2.0% |

PNC Financial Services Group, Inc. | 2.0% |

JPMorgan Chase & Co. | 2.0% |

Changes to Fund’s Investment Adviser or Sub Adviser.

Madison Investment Holdings, Inc., the holding company parent of the Funds’ advisor, Madison Asset Management, LLC (“MAM”), and distributor, MFD Distributor, LLC (“MFD”) underwent a change of control effective December 1, 2023. There were no material changes to the operations of the Fund, MAM or MFD as a result of the change of control.

Effective as of November 1, 2023, the Fund’s investment subadvisor, Toroso Investments, LLC underwent a name change and is now known as Tidal Investments LLC (“Tidal”). Effective October 1, 2023, Tidal waived the fees it receives from MAM for this Fund.

This is a summary of certain changes to the Fund since inception. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by October 31, 2024 at https://www.madisonfunds.com/etfs/#documents or upon request at 800-767-0300.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.madisonfunds.com/etfs/#documents

| Madison Short-Term Strategic Income ETF | PAGE 2 | TSR_AR_557441201 |

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Madison Investment Advisors, LLC documents not be householded, please contact Madison Investment Advisors, LLC at 800-767-0300, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Madison Investment Advisors, LLC or your financial intermediary.

| Madison Short-Term Strategic Income ETF | PAGE 3 | TSR_AR_557441201 |

105711057410428

| | |

| Madison Aggregate Bond ETF | |

| MAGG (Principal U.S. Listing Exchange: NYSE ) |

| Annual Shareholder Report | June 30, 2024 |

This annual shareholder report contains important information about the Madison Aggregate Bond ETF for the period of August 28, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.madisonfunds.com/etfs/#documents. You can also request this information by contacting us at 800-767-0300.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Madison Aggregate Bond ETF | $34* | 0.40% |

| * | Amount shown reflects the expenses of the Fund from inception date through June 30, 2024. Expenses would be higher if the Fund had been in operations for the full year. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

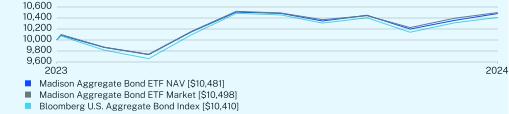

The Madison Aggregate Bond ETF (NAV) returned 4.81% and (market) 4.98% from its inception through June 30th, 2024. Both outperforming the Bloomberg U.S. Aggregate Index which returned 4.10%.

The primary drivers of performance were an overweight to risk assets, specifically investment grade corporate bonds, higher coupon mortgage-backed securities (MBS) and asset-backed securities (ABS). Performance was also positively impacted by a yield advantage over the benchmark. The largest detractor to performance was the Treasury allocation given a longer duration and a steepening yield curve during the period. The fund was overweight financials, especially bank bonds, which had strong performance relative to other sub-sectors in investment grade corporate bonds. Within the securitized sector, the fund was overweight 4.50% to 5.50% coupon, thirty-year MBS, which outperformed lower-coupon securities. Finally, ABS performed well given attractive spreads and a shorter duration during a period of falling front-end interest rates.

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment in the Fund noted. The chart uses total return NAV and market performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| Madison Aggregate Bond ETF | PAGE 1 | TSR_AR_557441300 |

ANNUAL AVERAGE TOTAL RETURN (%)

| |

| | Since Inception

(08/28/2023) |

Madison Aggregate Bond ETF NAV | 4.81 |

Madison Aggregate Bond ETF Market | 4.98 |

Bloomberg U.S. Aggregate Bond Index | 4.10 |

Visit https://www.madisonfunds.com/etfs/#documents for more recent performance information.

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Net Assets | $54,479,727 |

Number of Holdings | 199 |

Net Advisory Fee | $161,267 |

Portfolio Turnover | 19% |

Average Credit Quality | AA3 |

Effective Duration | 5.56 yrs |

30-Day SEC Yield | 4.80% |

Visit https://www.madisonfunds.com/etfs/#documents for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

| |

Security Type (% of net assets) | |

Mortgage-Backed Securities | 32.8% |

Corporate Bonds | 32.3% |

U.S. Treasury Securities | 23.2% |

Asset-Backed Securities | 5.3% |

Collateralized Mortgage Obligations | 3.5% |

Cash & Other | 2.9% |

| |

Top 10 Issuers (% of net assets) | |

United States Treasury Note/Bond | 23.2% |

Federal Home Loan Mortgage Corp. | 17.7% |

Federal National Mortgage Association | 16.6% |

Chase Auto Owner Trust | 1.3% |

AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 1.2% |

Energy Transfer LP | 1.0% |

AbbVie, Inc. | 1.0% |

GE HealthCare Technologies, Inc. | 1.0% |

PNC Financial Services Group, Inc. | 0.9% |

Towd Point Mortgage Trust | 0.9% |

Changes to Fund’s Investment Adviser or Sub Adviser.

Madison Investment Holdings, Inc., the holding company parent of the Funds’ advisor, Madison Asset Management, LLC (“MAM”), and distributor, MFD Distributor, LLC (“MFD”) underwent a change of control effective December 1, 2023. There were no material changes to the operations of the Fund, MAM or MFD as a result of the change of control.

Effective as of November 1, 2023, the Fund’s investment subadvisor, Toroso Investments, LLC underwent a name change and is now known as Tidal Investments LLC (“Tidal”). Effective October 1, 2023, Tidal waived the fees it receives from MAM for this Fund.

This is a summary of certain changes to the Fund since inception. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by October 31, 2024 at https://www.madisonfunds.com/etfs/#documents or upon request at 800-767-0300.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.madisonfunds.com/etfs/#documents

| Madison Aggregate Bond ETF | PAGE 2 | TSR_AR_557441300 |

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Madison Investment Advisors, LLC documents not be householded, please contact Madison Investment Advisors, LLC at 800-767-0300, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Madison Investment Advisors, LLC or your financial intermediary.

| Madison Aggregate Bond ETF | PAGE 3 | TSR_AR_557441300 |

104811049810410

| | |

| Madison Covered Call ETF | |

| CVRD (Principal U.S. Listing Exchange: NYSE) |

| Annual Shareholder Report | June 30, 2024 |

This annual shareholder report contains important information about the Madison Covered Call ETF for the period of August 21, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.madisonfunds.com/etfs/#documents. You can also request this information by contacting us at 800-767-0300.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Madison Covered Call ETF | $80* | 0.90% |

| * | Amount shown reflects the expenses of the Fund from inception date through June 30, 2024. Expenses would be higher if the Fund had been in operations for the full year. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

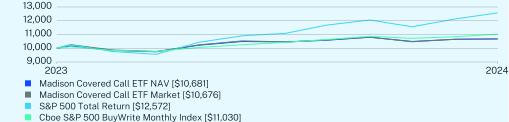

The Madison Covered Call ETF (NAV) returned 6.82% and (market) 6.76% from its inception through June 30th, 2024. Both lagged the CBOE S&P BuyWrite Index (BXM) Index which returned 10.30% and the S&P 500 Total Return Index which returned 25.72%.

Even though we understand that equity markets are inherently cyclical, there are periods of cognitive dissonance whereby the vast consensus believes the only direction for stocks is higher. Investors focus on very narrow drivers (Fed rate cuts, “AI”) while ignoring danger signs. That has certainly been the case since November of 2023. With the S&P 500 increasingly dominated by a handful of mega-cap growth stocks, the Fund was unable to keep up with the overall index since that rally began late last year. The Fund entered the year defensively postured as we grew increasingly wary of weakening economic and company fundamentals. A very small number of companies have had an undue influence on performance and perceived earnings growth of the overall index. In reality, this influence can also work in reverse order. Over the period, the Fund’s sector allocation somewhat detracted from performance as the Technology, Communication Services and Consumer Discretionary sectors were slightly underweight the index. These sectors hold the mega-cap growth companies that dominated performance. The Fund was also underweight in those mega-cap growth companies where most of the index performance came from. The Fund’s option overlay also held back performance relative to the S&P 500 Index which is normally the case during periods of strong upward market momentum.

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment in the Fund noted. The chart uses total return NAV and market performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| Madison Covered Call ETF | PAGE 1 | TSR_AR_557441409 |

ANNUAL AVERAGE TOTAL RETURN (%)

| |

| | Since Inception

(08/21/2023) |

Madison Covered Call ETF NAV | 6.82 |

Madison Covered Call ETF Market | 6.76 |

S&P 500 Total Return | 25.72 |

Cboe S&P 500 BuyWrite Monthly Index | 10.30 |

Visit https://www.madisonfunds.com/etfs/#documents for more recent performance information.

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Net Assets | $71,238,013 |

Number of Holdings | 87 |

Net Advisory Fee | $533,677 |

Portfolio Turnover | 205% |

30-Day SEC Yield | 1.51% |

30-Day SEC Yield Unsubsidized | 1.36% |

Visit https://www.madisonfunds.com/etfs/#documents for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

| |

Top Sectors (% of net assets) | |

Technology | 26.8% |

Financials | 13.2% |

Health Care | 12.3% |

Consumer Discretionary | 10.1% |

Industrials | 8.8% |

Consumer Staples | 6.8% |

Communications | 6.5% |

Energy | 5.3% |

Materials | 3.2% |

Cash & Other | 7.0% |

| |

Top 10 Issuers (% of net assets) | |

Danaher Corp. | 3.7% |

Las Vegas Sands Corp. | 3.2% |

Cisco Systems, Inc. | 3.1% |

Adobe, Inc. | 3.1% |

CME Group, Inc. | 3.1% |

Constellation Brands, Inc. | 2.9% |

Lowe’s Cos., Inc. | 2.8% |

Microchip Technology, Inc. | 2.9% |

Texas Instruments, Inc. | 2.7% |

Accenture PLC | 2.6% |

Changes to Fund’s Investment Adviser or Sub Adviser.

Madison Investment Holdings, Inc., the holding company parent of the Funds’ advisor, Madison Asset Management, LLC (“MAM”), and distributor, MFD Distributor, LLC (“MFD”) underwent a change of control effective December 1, 2023. There were no material changes to the operations of the Fund, MAM or MFD as a result of the change of control.

Effective as of November 1, 2023, the Fund’s investment subadvisor, Toroso Investments, LLC underwent a name change is is now known as Tidal Investments LLC.

This is a summary of certain changes to the Fund since inception. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by October 31, 2024 at https://www.madisonfunds.com/etfs/#documents or upon request at 800-767-0300.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.madisonfunds.com/etfs/#documents

| Madison Covered Call ETF | PAGE 2 | TSR_AR_557441409 |

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Madison Investment Advisors, LLC documents not be householded, please contact Madison Investment Advisors, LLC at 800-767-0300, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Madison Investment Advisors, LLC or your financial intermediary.

| Madison Covered Call ETF | PAGE 3 | TSR_AR_557441409 |

10681106761257211030

| | |

| Madison Dividend Value ETF | |

| DIVL (Principal U.S. Listing Exchange: NYSE) |

| Annual Shareholder Report | June 30, 2024 |

This annual shareholder report contains important information about the Madison Dividend Value ETF for the period of August 14, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.madisonfunds.com/etfs/#documents. You can also request this information by contacting us at 800-767-0300.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Madison Dividend Value ETF | $58* | 0.65% |

| * | Amount shown reflects the expenses of the Fund from inception date through June 30, 2024. Expenses would be higher if the Fund had been in operations for the full year. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

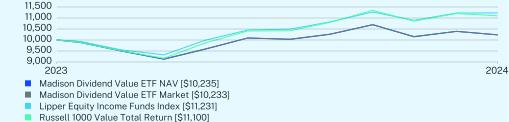

For the period from inception through June 30, 2024, the Madison Dividend Value ETF (NAV) returned 2.35% and (market) 2.33%, which compared to the Russell 1000 Value return of 11.00% and the Lipper Equity funds Index return of 12.31%. The two primary factors that impacted performance were dividend stocks had among the lowest returns in the market and were historically out-of-favor vs the index. Additionally, the benchmark had some large Technology holdings that outperformed and don’t pay a dividend and are therefore outside of the fund’s investable universe.

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment in the Fund noted. The chart uses total return NAV and market performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| Madison Dividend Value ETF | PAGE 1 | TSR_AR_557441508 |

ANNUAL AVERAGE TOTAL RETURN (%)

| |

| | Since Inception

(08/14/2023) |

Madison Dividend Value ETF NAV | 2.35 |

Madison Dividend Value ETF Market | 2.33 |

Lipper Equity Income Funds Index | 12.31 |

Russell 1000 Value Total Return | 11.00 |

Visit https://www.madisonfunds.com/etfs/#documents for more recent performance information.

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Net Assets | $55,581,123 |

Number of Holdings | 37 |

Net Advisory Fee | $361,104 |

Portfolio Turnover | 60% |

30-Day SEC Yield | 2.40% |

30-Day SEC Yield Unsubsidized | 2.40% |

Visit https://www.madisonfunds.com/etfs/#documents for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

| |

Top Sectors (% of net assets) | |

Financials | 22.3% |

Industrials | 18.9% |

Energy | 12.1% |

Technology | 10.4% |

Health Care | 10.0% |

Utilities | 7.0% |

Consumer Discretionary | 6.6% |

Consumer Staples | 4.8% |

Materials | 3.2% |

Cash & Other | 4.7% |

| |

Top 10 Issuers (% of net assets) | |

NextEra Energy, Inc. | 4.2% |

Texas Instruments, Inc. | 4.0% |

AbbVie, Inc. | 4.0% |

Automatic Data Processing, Inc. | 4.0% |

Morgan Stanley | 3.9% |

Fastenal Co. | 3.9% |

EOG Resources, Inc. | 3.8% |

Bank of America Corp. | 3.8% |

Home Depot, Inc. | 3.6% |

Medtronic PLC | 3.5% |

Changes to Fund’s Investment Adviser or Sub Adviser.

Madison Investment Holdings, Inc., the holding company parent of the Funds’ advisor, Madison Asset Management, LLC (“MAM”), and distributor, MFD Distributor, LLC (“MFD”) underwent a change of control effective December 1, 2023. There were no material changes to the operations of the Fund, MAM or MFD as a result of the change of control.

Effective as of November 1, 2023, the Fund’s investment subadvisor, Toroso Investments, LLC underwent a name change is is now known as Tidal Investments LLC.

This is a summary of certain changes to the Fund since inception. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by October 31, 2024 at https://www.madisonfunds.com/etfs/#documents or upon request at 800-767-0300.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.madisonfunds.com/etfs/#documents

| Madison Dividend Value ETF | PAGE 2 | TSR_AR_557441508 |

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Madison Investment Advisors, LLC documents not be householded, please contact Madison Investment Advisors, LLC at 800-767-0300, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Madison Investment Advisors, LLC or your financial intermediary.

| Madison Dividend Value ETF | PAGE 3 | TSR_AR_557441508 |

10235102331123111100

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and principal financial officer. The registrant has not made any substantive amendments to its code of ethics during the period covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report.

The registrant undertakes to provide to any person without charge, upon request, a copy of its code of ethics by mail when they call the registrant at 800-767-0300.

Item 3. Audit Committee Financial Expert.

The registrant’s board of trustees has determined that there is at least one audit committee financial expert serving on its audit committee. Richard E. Struthers is the “audit committee financial expert” and is considered to be “independent” as each term is defined in Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

The registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and other services since inception. “Audit services” refer to performing an audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. These services were for the completion of the Funds federal and state income tax returns, excise tax returns, and review of excise tax calculations. “Other services” refer to other services rendered by the registrant’s principal accountant to the registrant other than those reported under the "audit services", "audit-related services", and "tax services”. The following table details the aggregate fees billed or expected to be billed since inception for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

| | FYE 6/30/2024 | |

| (a) Audit Fees | 49,500 | |

| (b) Audit-Related Fees | 0 | |

| (c) Tax Fees | 12,000 | |

| (d) All Other Fees | 0 | |

(e)(1) The audit committee of the registrant has adopted pre-approval policies and procedures that require the audit committee to pre-approve all audit and non-audit services of the registrant, including services provided to any entity affiliated with the registrant. The audit committee may delegate to one or more of its members the authority to grant such pre-approvals. Any decision of any member to whom such authority is delegated shall be presented to the full audit committee at the next regularly scheduled meeting of the registrant’s board of trustees.

(e)(2) The percentage of fees billed by Cohen & Company, Ltd applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows:

| | FYE 6/30/2024 | |

| Audit-Related Fees | 0% | |

| Tax Fees | 0% | |

| All Other Fees | 0% | |

(f) Not applicable.

(g) The following table indicates the non-audit fees billed or expected to be billed by the registrant’s accountant for services to the registrant and to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant since inception.

| Non-Audit Related Fees | FYE 6/30/2024 | |

| Registrant | None | |

| Registrant’s Investment Adviser | None | |

(h) Because no such non-audit services were rendered, the audit committee of the board of trustees did not consider whether the provision of non-audit services that were rendered to the registrant’s investment adviser (not including any subadviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X, is compatible with maintaining the principal accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants.

(a) The registrant is an issuer as defined in Rule 10A-3 under the Securities Exchange Act of 1934, (the “Act”) and has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Act. The independent members of the committee are as follows: Steven P. Riege and Richard E. Struthers.

(b) Not applicable.

Item 6. Investments.

| (a) | Schedule of Investments is included within the financial statements filed under Item 7(a) of this Form. |

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

| (a) | The registrant’s Financial Statements are filed herewith. |

Madison ETFs Trust

Core Financial Statements

June 30, 2024

TABLE OF CONTENTS

Madison Short-Term Strategic Income ETF

Schedule of Investments

June 30, 2024

| | | | | | | |

CORPORATE BONDS - 68.4%

| | | | | | |

Communications - 6.9%

| | | | | | |

Lamar Media Corp., 4.88%, 01/15/2029 | | | $620,000 | | | $595,800 |

Netflix, Inc., 6.38%, 05/15/2029 | | | 1,180,000 | | | 1,243,693 |

Sprint LLC, 7.63%, 03/01/2026 | | | 1,150,000 | | | 1,181,690 |

VeriSign, Inc., 4.75%, 07/15/2027 | | | 1,140,000 | | | 1,120,277 |

| | | | | | 4,141,460 |

Consumer Discretionary - 2.0%

| | | | | | |

Royal Caribbean Cruises Ltd.,

7.50%, 10/15/2027 | | | 400,000 | | | 420,337 |

Williams Scotsman, Inc.,

6.13%, 06/15/2025(a) | | | 748,000 | | | 746,747 |

| | | | | | 1,167,084 |

Consumer Staples - 2.3%

| | | | | | |

Lamb Weston Holdings, Inc.,

4.88%, 05/15/2028(a) | | | 600,000 | | | 581,184 |

Performance Food Group, Inc.,

5.50%, 10/15/2027(a) | | | 800,000 | | | 782,456 |

| | | | | | 1,363,640 |

Energy - 5.1%

| | | | | | |

Murphy Oil USA, Inc.,

5.63%, 05/01/2027 | | | 1,175,000 | | | 1,161,330 |

Sunoco LP / Sunoco Finance Corp., 6.00%, 04/15/2027 | | | 793,000 | | | 791,973 |

Valero Energy Partners LP,

4.50%, 03/15/2028 | | | 1,155,000 | | | 1,126,547 |

| | | | | | 3,079,850 |

Financials - 31.5%(b)

| | | | | | |

AerCap Ireland Capital DAC / AerCap Global Aviation Trust,

4.63%, 10/15/2027 | | | 1,033,000 | | | 1,006,666 |

American Express Co.,

4.20%, 11/06/2025 | | | 920,000 | | | 906,381 |

Bank of America Corp.,

3.50%, 04/19/2026 | | | 1,318,000 | | | 1,277,674 |

Bank of New York Mellon Corp.,

4.60% to 07/26/2029 then SOFR + 1.76%, 07/26/2030 | | | 1,023,000 | | | 1,000,357 |

Boston Properties LP,

6.75%, 12/01/2027 | | | 715,000 | | | 733,541 |

Capital One Financial Corp.,

3.80%, 01/31/2028 | | | 1,043,000 | | | 992,013 |

Discover Financial Services,

4.10%, 02/09/2027 | | | 1,348,000 | | | 1,295,923 |

Fifth Third Bancorp,

4.77% to 07/28/2029 then SOFR + 2.13%, 07/28/2030 | | | 1,188,000 | | | 1,143,374 |

Fiserv, Inc., 3.20%, 07/01/2026 | | | 920,000 | | | 882,782 |

Goldman Sachs Group, Inc.,

4.48% to 08/23/2027 then SOFR + 1.73%, 08/23/2028 | | | 1,243,000 | | | 1,214,644 |

Huntington Bancshares, Inc./OH,

6.21% to 08/21/2028 then SOFR + 2.02%, 08/21/2029 | | | 973,000 | | | 993,891 |

| | | | | | | |

| | | | | | | |

Iron Mountain, Inc.,

4.50%, 02/15/2031(a) | | | $575,000 | | | $519,059 |

JPMorgan Chase & Co.,

4.20% to 07/23/2028 then 3 mo. Term SOFR + 1.52%, 07/23/2029 | | | 1,233,000 | | | 1,187,102 |

KeyCorp, 4.10%, 04/30/2028 | | | 1,028,000 | | | 972,081 |

LPL Holdings, Inc.,

4.00%, 03/15/2029(a) | | | 1,150,000 | | | 1,072,550 |

Morgan Stanley,

3.77% to 01/24/2028 then 3 mo. Term SOFR + 1.40%, 01/24/2029 | | | 1,180,000 | | | 1,123,921 |

PNC Financial Services Group, Inc., 5.35% to 12/02/2027 then SOFR + 1.62%, 12/02/2028 | | | 1,188,000 | | | 1,189,103 |

RHP Hotel Properties LP / RHP Finance Corp., 7.25%, 07/15/2028(a) | | | 625,000 | | | 646,368 |

SBA Communications Corp.,

3.88%, 02/15/2027 | | | 713,000 | | | 679,563 |

| | | | | | 18,836,993 |

Health Care - 4.0%

| | | | | | |

Centene Corp., 4.25%, 12/15/2027 | | | 768,000 | | | 733,564 |

HCA, Inc., 5.88%, 02/15/2026 | | | 1,150,000 | | | 1,151,482 |

UnitedHealth Group, Inc.,

5.25%, 02/15/2028 | | | 523,000 | | | 530,046 |

| | | | | | 2,415,092 |

Industrials - 6.8%

| | | | | | |

Boeing Co., 6.30%, 05/01/2029(a) | | | 1,000,000 | | | 1,014,672 |

Clean Harbors, Inc.,

6.38%, 02/01/2031(a) | | | 625,000 | | | 626,581 |

Roller Bearing Co. of America, Inc., 4.38%, 10/15/2029(a) | | | 575,000 | | | 529,169 |

TransDigm, Inc., 6.88%, 12/15/2030(a) | | | 750,000 | | | 765,678 |

United Rentals North America, Inc., 5.50%, 05/15/2027 | | | 1,150,000 | | | 1,141,319 |

| | | | | | 4,077,419 |

Materials - 3.3%

| | | | | | |

Ball Corp., 4.88%, 03/15/2026 | | | 988,000 | | | 972,286 |

Celanese US Holdings LLC,

6.17%, 07/15/2027 | | | 963,000 | | | 977,508 |

| | | | | | 1,949,794 |

Technology - 6.5%

| | | | | | |

Booz Allen Hamilton, Inc.,

3.88%, 09/01/2028(a) | | | 1,053,000 | | | 991,262 |

CDW LLC / CDW Finance Corp.,

4.13%, 05/01/2025 | | | 935,000 | | | 919,488 |

Gartner, Inc., 4.50%, 07/01/2028(a) | | | 953,000 | | | 918,491 |

Oracle Corp., 6.15%, 11/09/2029 | | | 998,000 | | | 1,044,301 |

| | | | | | 3,873,542 |

TOTAL CORPORATE BONDS

(Cost $40,080,993) | | | | | | 40,904,874 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Madison Short-Term Strategic Income ETF

Schedule of Investments

June 30, 2024(Continued)

| | | | | | | |

ASSET-BACKED SECURITIES - 12.5%

|

Capital One Financial Corp.,

Series 2022-A3, Class A,

4.95%, 10/15/2027 | | | $100,000 | | | $99,498 |

CarMax Auto Owner Trust,

Series 2022-3, Class A4,

4.06%, 02/15/2028 | | | 500,000 | | | 488,594 |

Chase Auto Owner Trust,

Series 2023-AA, Class A2,

5.90%, 03/25/2027(a) | | | 363,040 | | | 363,471 |

CNH Equipment Trust

| | | | | | |

Series 2021-C, Class B,

1.41%, 04/16/2029 | | | 735,000 | | | 688,197 |

Series 2023-A, Class A3,

4.81%, 08/15/2028 | | | 300,000 | | | 297,530 |

Enterprise Fleet Financing

| | | | | | |

Series 2022-1, Class A2,

3.03%, 01/20/2028(a) | | | 235,428 | | | 233,064 |

Series 2022-4, Class A2,

5.76%, 10/22/2029(a) | | | 167,125 | | | 167,245 |

Series 2023-1, Class A2,

5.51%, 01/22/2029(a) | | | 148,313 | | | 148,051 |

GM Financial Consumer Automobile Receivables Trust

| | | | | | |

Series 2020-3, Class A4,

0.58%, 01/16/2026 | | | 282,542 | | | 281,823 |

Series 2020-3, Class C,

1.37%, 01/16/2026 | | | 145,000 | | | 144,676 |

Series 2021-4, Class B,

1.25%, 10/18/2027 | | | 975,000 | | | 916,673 |

Hertz Global Holdings, Inc.,

Series 2021-1A, Class A,

1.21%, 12/26/2025(a) | | | 1,000,000 | | | 986,752 |

Hertz Vehicle Financing LLC, Series 2022-1A, Class A,

1.99%, 06/25/2026(a) | | | 150,000 | | | 145,712 |

Honda Auto Receivables Owner Trust, Series 2021-3, Class A3,

0.41%, 11/18/2025 | | | 185,734 | | | 182,974 |

JPMorgan Chase Bank NA,

Series 2021-2, Class B,

0.89%, 12/26/2028(a) | | | 30,798 | | | 30,455 |

LAD Auto Receivables Trust, Series 2022-1A, Class A,

5.21%, 06/15/2027(a) | | | 351,560 | | | 350,395 |

PHH Arval

| | | | | | |

Series 2023-1A, Class A1,

5.65%, 05/15/2035(a) | | | 142,215 | | | 142,157 |

Series 2023-2A, Class A1,

6.16%, 10/15/2035(a) | | | 103,353 | | | 104,057 |

Santander Consumer USA Holdings, Inc., Series 2022-2, Class B,

3.44%, 09/15/2027 | | | 90,747 | | | 89,639 |

Santander Consumer USA, Inc., Series 2022-6, Class B,

4.72%, 06/15/2027 | | | 500,000 | | | 496,528 |

| | | | | | | |

| | | | | | | |

Santander Revolving Auto Loan Trust, Series 2019-A, Class C,

3.00%, 01/26/2032(a) | | | $325,000 | | | $320,268 |

Towd point HE Trust,

Series 2021-HE1, Class A1,

0.92%, 02/25/2063(a)(c) | | | 80,409 | | | 77,127 |

Towd Point Mortgage Trust,

Series 2024-CES1, Class A1A,

5.85%, 01/25/2064(a)(c) | | | 697,526 | | | 695,279 |

TOTAL ASSET-BACKED SECURITIES

(Cost $7,417,998) | | | | | | 7,450,165 |

U.S. TREASURY SECURITIES - 7.6%

| | | | | | |

United States Treasury Note/Bond

| | | | | | |

4.63%, 02/28/2025 | | | 1,000,000 | | | 995,908 |

4.25%, 10/15/2025 | | | 925,000 | | | 916,292 |

4.63%, 03/15/2026 | | | 715,000 | | | 712,514 |

4.13%, 06/15/2026 | | | 450,000 | | | 444,850 |

4.13%, 09/30/2027 | | | 500,000 | | | 494,492 |

4.63%, 09/30/2028 | | | 1,000,000 | | | 1,008,985 |

TOTAL U.S. TREASURY SECURITIES

(Cost $4,567,254) | | | | | | 4,573,041 |

COLLATERALIZED MORTGAGE OBLIGATIONS - 7.1%

| | | | | | |

Commercial Mortgage Pass Through Certificates

| | | | | | |

Series 2015-CR26, Class A4,

3.63%, 10/10/2048 | | | 290,000 | | | 281,190 |

Series 2015-DC1, Class A5,

3.35%, 02/10/2048 | | | 100,000 | | | 98,491 |

Federal Home Loan Mortgage Corp.

| | | | | | |

Series 3187, Class Z,

5.00%, 07/15/2036 | | | 77,491 | | | 77,669 |

Series 4037, Class B,

3.00%, 04/15/2027 | | | 103,645 | | | 100,937 |

Series 4838, Class VA,

4.00%, 03/15/2036 | | | 280,675 | | | 275,871 |

Series K066, Class A2,

3.12%, 06/25/2027 | | | 800,000 | | | 761,202 |

Series KJ17, Class A2,

2.98%, 11/25/2025 | | | 228,408 | | | 224,680 |

Federal National Mortgage Association

| | | | | | |

Series 2005-79, Class LT,

5.50%, 09/25/2035 | | | 164,793 | | | 168,003 |

Series 2011-31, Class DB,

3.50%, 04/25/2031 | | | 140,491 | | | 135,306 |

Series 2011-36, Class QB,

4.00%, 05/25/2031 | | | 221,068 | | | 216,035 |

Series 2020-44, Class TI,

5.50%, 12/25/2035(d) | | | 576,721 | | | 86,508 |

Series 2023-29, Class JA,

5.50%, 05/25/2036 | | | 623,133 | | | 620,741 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Madison Short-Term Strategic Income ETF

Schedule of Investments

June 30, 2024(Continued)

| | | | | | | |

COLLATERALIZED MORTGAGE

OBLIGATIONS - (Continued)

|

FREMF Mortgage Trust

| | | | | | |

Series 2014-K41, Class B,

3.96%, 11/25/2047(a)(c) | | | $250,000 | | | $247,615 |

Series 2015-K44, Class B,

3.84%, 01/25/2048(a)(c) | | | 460,000 | | | 453,216 |

JP Morgan Mortgage Trust,

Series 2024-5, Class A4, 6.00%, 11/25/2054(a)(c) | | | 500,000 | | | 498,854 |

TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS

(Cost $4,219,374) | | | | | | 4,246,318 |

MORTGAGE-BACKED SECURITIES - 1.5%

|

Federal Home Loan Mortgage Corp.,

Pool SD8276, 5.00%, 12/01/2052 | | | 453,173 | | | 439,361 |

Federal National Mortgage Association

| | | | | | |

Pool 254904, 5.50%, 10/01/2033 | | | 60,108 | | | 60,399 |

Pool 555880, 5.50%, 11/01/2033 | | | 101,744 | | | 102,236 |

Pool 890696, 3.00%, 09/01/2030 | | | 44,413 | | | 42,354 |

Pool MA0919, 3.50%, 12/01/2031 | | | 161,118 | | | 154,282 |

Pool MA2177, 4.00%, 02/01/2035 | | | 89,717 | | | 86,604 |

TOTAL MORTGAGE-BACKED SECURITIES

(Cost $884,329) | | | | | | 885,236 |

U.S. GOVERNMENT AGENCY ISSUES - 1.3%

|

Federal Home Loan Banks,

6.05%, 11/21/2031 | | | 250,000 | | | 249,556 |

United States of America,

5.48%, 10/02/2028 | | | 500,000 | | | 499,700 |

TOTAL U.S. GOVERNMENT AGENCY ISSUES

(Cost $750,000) | | | | | | 749,256 |

TOTAL INVESTMENTS - 98.4%

(Cost $57,919,948) | | | | | | $58,808,890 |

Money Market Deposit

Account - 0.5%(e) | | | | | | 317,994 |

Other Assets in Excess of

Liabilities - 1.1% | | | | | | 671,044 |

TOTAL NET ASSETS - 100.0% | | | | | | $59,797,928 |

| | | | | | | |

Percentages are stated as a percent of net assets.

SOFR - Secured Overnight Financing Rate

(a)

| Security is exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may only be resold in transactions exempt from registration to qualified institutional investors. As of June 30, 2024, the value of these securities total $14,157,935 or 23.7% of the Fund’s net assets.

|

(b)

| To the extent that the Fund invests more heavily in a particular industry or sector of the economy, its performance will be especially sensitive to developments that significantly affect those industries or sectors.

|

(c)

| Coupon rate is variable based on the weighted average coupon of the underlying collateral. To the extent the weighted average coupon of the underlying assets which comprise the collateral increases or decreases, the coupon rate of this security will increase or decrease correspondingly. The rate disclosed is as of June 30, 2024.

|

(d)

| Interest only security.

|

(e)

| The U.S. Bank Money Market Deposit Account (the “MMDA”) is a short-term vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on market conditions and is subject to change daily. The rate as of June 30, 2024 was 5.24%. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Madison Aggregate Bond ETF

Schedule of Investments

June 30, 2024

| | | | | | | |

MORTGAGE-BACKED SECURITIES - 32.8%

|

Federal Home Loan Mortgage Corp. | | | | | | |

Pool G06168, 3.50%, 11/01/2040 | | | $136,254 | | | $125,661 |

Pool G08653, 3.00%, 07/01/2045 | | | 222,690 | | | 195,825 |

Pool G60722, 3.00%, 10/01/2046 | | | 281,682 | | | 247,029 |

Pool Q04092, 4.00%, 10/01/2041 | | | 181,574 | | | 171,853 |

Pool Q35614, 3.50%, 08/01/2045 | | | 289,511 | | | 263,222 |

Pool Q52955, 3.50%, 12/01/2047 | | | 124,550 | | | 112,861 |

Pool QA1033, 3.00%, 07/01/2049 | | | 215,187 | | | 185,905 |

Pool RA7380, 3.50%, 05/01/2052 | | | 434,447 | | | 387,192 |

Pool RA8278, 5.00%, 12/01/2052 | | | 226,629 | | | 219,802 |

Pool RB5105, 2.00%, 03/01/2041 | | | 108,219 | | | 91,661 |

Pool SB0546, 2.00%, 01/01/2036 | | | 394,123 | | | 349,734 |

Pool SC0151, 2.50%, 06/01/2041 | | | 366,285 | | | 319,348 |

Pool SD0960, 3.50%, 04/01/2052 | | | 542,903 | | | 486,794 |

Pool SD1859, 5.50%, 11/01/2052 | | | 133,311 | | | 132,138 |

Pool SD1921, 4.50%, 12/01/2052 | | | 359,936 | | | 342,580 |

Pool SD2172, 5.50%, 02/01/2053 | | | 369,320 | | | 367,754 |

Pool SD2875, 5.00%, 05/01/2053 | | | 857,651 | | | 840,608 |

Pool SD3174, 5.50%, 06/01/2053 | | | 471,694 | | | 468,141 |

Pool SD3739, 6.00%, 09/01/2053 | | | 537,867 | | | 544,193 |

Pool SD4901, 5.50%, 02/01/2054 | | | 296,668 | | | 293,544 |

Pool SD7552, 2.50%, 01/01/2052 | | | 667,837 | | | 556,429 |

Pool SD7556, 3.00%, 08/01/2052 | | | 499,597 | | | 431,156 |

Pool SD8214, 3.50%, 05/01/2052 | | | 87,941 | | | 78,036 |

Pool SD8266, 4.50%, 11/01/2052 | | | 273,747 | | | 258,656 |

Pool SD8267, 5.00%, 11/01/2052 | | | 179,000 | | | 173,590 |

Pool SD8268, 5.50%, 11/01/2052 | | | 108,933 | | | 107,959 |

Pool SD8276, 5.00%, 12/01/2052 | | | 453,173 | | | 439,361 |

Pool SD8299, 5.00%, 02/01/2053 | | | 231,774 | | | 224,618 |

Pool SD8363, 6.00%, 09/01/2053 | | | 741,802 | | | 744,811 |

Pool V80025, 3.00%, 04/01/2043 | | | 114,050 | | | 100,917 |

Pool V80026, 3.00%, 04/01/2043 | | | 270,214 | | | 239,096 |

Pool ZS8641, 2.50%, 02/01/2032 | | | 114,917 | | | 107,131 |

Federal National Mortgage Association

| | | | | | |

Pool 890696, 3.00%, 09/01/2030 | | | 122,991 | | | 117,286 |

Pool AB2080, 4.00%, 01/01/2041 | | | 164,981 | | | 155,951 |

Pool AB8818, 3.00%, 03/01/2043 | | | 90,065 | | | 79,588 |

Pool AJ4046, 4.00%, 10/01/2041 | | | 171,957 | | | 163,389 |

Pool AL3072, 3.00%, 02/01/2043 | | | 377,359 | | | 333,705 |

Pool AL8924, 3.00%, 12/01/2030 | | | 147,916 | | | 142,102 |

Pool AO4134, 3.50%, 06/01/2042 | | | 231,138 | | | 212,122 |

Pool AP2133, 3.50%, 08/01/2042 | | | 212,030 | | | 194,301 |

Pool AP7363, 4.00%, 10/01/2042 | | | 245,292 | | | 231,071 |

Pool BV4133, 2.50%, 03/01/2052 | | | 348,617 | | | 286,363 |

Pool CB2548, 2.50%, 01/01/2052 | | | 106,533 | | | 87,853 |

Pool CB2601, 2.00%, 01/01/2052 | | | 128,192 | | | 102,559 |

Pool CB3105, 2.00%, 03/01/2052 | | | 654,796 | | | 522,904 |

Pool CB3115, 3.00%, 03/01/2052 | | | 613,336 | | | 529,006 |

Pool CB3845, 3.50%, 06/01/2052 | | | 442,783 | | | 394,643 |

Pool CB4383, 4.50%, 08/01/2052 | | | 452,421 | | | 429,927 |

Pool FM5530, 4.00%, 11/01/2050 | | | 390,503 | | | 362,390 |

Pool FS1704, 4.00%, 05/01/2052 | | | 251,265 | | | 232,965 |

| | | | | | | |

| | | | | | | |

Pool FS2605, 4.50%, 08/01/2052 | | | $118,555 | | | $ 112,141 |

Pool FS4049, 2.50%, 09/01/2036 | | | 413,371 | | | 376,773 |

Pool FS4138, 2.50%, 04/01/2052 | | | 409,370 | | | 339,041 |

Pool FS4296, 3.00%, 01/01/2049 | | | 445,604 | | | 393,840 |

Pool FS4996, 4.50%, 07/01/2053 | | | 416,270 | | | 394,858 |

Pool FS5575, 5.50%, 09/01/2053 | | | 141,488 | | | 140,605 |

Pool FS7759, 5.50%, 05/01/2054 | | | 248,387 | | | 245,308 |

Pool MA2177, 4.00%, 02/01/2035 | | | 176,812 | | | 170,676 |

Pool MA4571, 2.50%, 03/01/2042 | | | 536,488 | | | 460,244 |

Pool MA4806, 5.00%, 11/01/2052 | | | 557,689 | | | 541,356 |

Pool MA4841, 5.00%, 12/01/2052 | | | 180,189 | | | 174,908 |

Pool MA4842, 5.50%, 12/01/2052 | | | 243,389 | | | 240,460 |

Pool MA5013, 4.50%, 05/01/2038 | | | 103,324 | | | 101,117 |

TOTAL MORTGAGE-BACKED SECURITIES

(Cost $17,845,440) | | | | | | 17,877,057 |

CORPORATE BONDS - 32.3%

| | | | | | |

Communications - 0.8%

| | | | | | |

AT&T, Inc.

| | | | | | |

4.25%, 03/01/2027 | | | 150,000 | | | 146,491 |

2.25%, 02/01/2032 | | | 90,000 | | | 73,158 |

Verizon Communications, Inc.,

4.33%, 09/21/2028 | | | 200,000 | | | 194,573 |

| | | | | | 414,222 |

Consumer Discretionary - 1.6%

| | | | | | |

General Motors Financial Co., Inc., 5.85%, 04/06/2030 | | | 130,000 | | | 131,668 |

Hilton Domestic Operating Co., Inc., 5.38%, 05/01/2025(a) | | | 260,000 | | | 259,177 |

Lowe’s Cos., Inc., 4.25%, 04/01/2052 | | | 150,000 | | | 118,539 |

Royal Caribbean Cruises Ltd.,

7.50%, 10/15/2027 | | | 100,000 | | | 105,084 |

Tractor Supply Co.,

5.25%, 05/15/2033 | | | 225,000 | | | 223,418 |

| | | | | | 837,886 |

Consumer Staples - 0.9%

| | | | | | |

J M Smucker Co.

| | | | | | |

5.90%, 11/15/2028 | | | 100,000 | | | 103,049 |

6.20%, 11/15/2033 | | | 200,000 | | | 210,314 |

Performance Food Group, Inc.,

5.50%, 10/15/2027(a) | | | 190,000 | | | 185,833 |

| | | | | | 499,196 |

Energy - 4.3%

| | | | | | |

Diamondback Energy, Inc.,

5.40%, 04/18/2034 | | | 150,000 | | | 148,690 |

Energy Transfer LP

| | | | | | |

5.25%, 04/15/2029 | | | 200,000 | | | 199,268 |

6.55%, 12/01/2033 | | | 275,000 | | | 291,412 |

5.60%, 09/01/2034 | | | 60,000 | | | 59,618 |

Enterprise Products Operating LLC, 5.35%, 01/31/2033 | | | 130,000 | | | 131,300 |

Exxon Mobil Corp., 4.11%, 03/01/2046 | | | 275,000 | | | 227,819 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Madison Aggregate Bond ETF

Schedule of Investments

June 30, 2024(Continued)

| | | | | | | |

CORPORATE BONDS - (Continued)

|

Energy - (Continued)

|

Kinder Morgan, Inc.,

5.55%, 06/01/2045 | | | $200,000 | | | $187,297 |

Marathon Petroleum Corp.,

4.70%, 05/01/2025 | | | 300,000 | | | 297,517 |

MPLX LP, 4.80%, 02/15/2029 | | | 100,000 | | | 98,076 |

Murphy Oil USA, Inc.,

5.63%, 05/01/2027 | | | 200,000 | | | 197,673 |

ONEOK, Inc., 5.80%, 11/01/2030 | | | 100,000 | | | 102,425 |

Phillips 66 Co., 4.95%, 12/01/2027 | | | 100,000 | | | 99,737 |

Schlumberger Holdings Corp.,

3.90%, 05/17/2028(a) | | | 150,000 | | | 143,295 |

Valero Energy Corp.,

4.00%, 06/01/2052 | | | 200,000 | | | 147,345 |

| | | | | | 2,331,472 |

Financials - 13.9%

| | | | | | |

AerCap Ireland Capital DAC / AerCap Global Aviation Trust,

4.63%, 10/15/2027 | | | 650,000 | | | 633,430 |

Air Lease Corp., 1.88%, 08/15/2026 | | | 90,000 | | | 83,465 |

Alexandria Real Estate Equities, Inc., 4.75%, 04/15/2035 | | | 150,000 | | | 139,928 |

Ally Financial, Inc., 6.85% to 01/03/2029 then SOFR + 2.82%, 01/03/2030 | | | 250,000 | | | 257,162 |

American Express Co.

| | | | | | |

4.05%, 05/03/2029 | | | 20,000 | | | 19,313 |

5.28% to 07/27/2028 then SOFR + 1.28%, 07/27/2029 | | | 350,000 | | | 350,871 |

Bank of America Corp.

| | | | | | |

1.66% to 03/11/2026 then SOFR + 0.91%, 03/11/2027 | | | 90,000 | | | 84,352 |

4.95% to 07/22/2027 then SOFR + 2.04%, 07/22/2028 | | | 175,000 | | | 173,624 |

5.02% to 07/22/2032 then SOFR + 2.16%, 07/22/2033 | | | 130,000 | | | 127,548 |

Bank of New York Mellon Corp.,

4.60% to 07/26/2029 then SOFR + 1.76%, 07/26/2030 | | | 275,000 | | | 268,913 |

Berkshire Hathaway Finance Corp., 3.85%, 03/15/2052 | | | 30,000 | | | 23,312 |

BlackRock, Inc., 4.75%, 05/25/2033 | | | 200,000 | | | 196,481 |

Capital One Financial Corp.

| | | | | | |

5.47% to 02/01/2028 then SOFR + 2.08%, 02/01/2029 | | | 125,000 | | | 124,481 |

6.31% to 06/08/2028 then SOFR + 2.64%, 06/08/2029 | | | 170,000 | | | 174,022 |

Citigroup, Inc., 4.91% to 05/24/2032 then SOFR + 2.09%, 05/24/2033 | | | 130,000 | | | 125,056 |

Discover Financial Services,

6.70%, 11/29/2032 | | | 200,000 | | | 209,058 |

Fifth Third Bancorp

| | | | | | |

4.77% to 07/28/2029 then SOFR + 2.13%, 07/28/2030 | | | 175,000 | | | 168,426 |

| | | | | | | |

| | | | | | | |

4.34% to 04/25/2032 then SOFR + 1.66%, 04/25/2033 | | | $120,000 | | | $109,529 |

Fiserv, Inc., 3.50%, 07/01/2029 | | | 100,000 | | | 92,523 |

Goldman Sachs Group, Inc.,

4.48% to 08/23/2027 then SOFR + 1.73%, 08/23/2028 | | | 275,000 | | | 268,726 |

Huntington Bancshares, Inc./OH

| | | | | | |

4.44% to 08/04/2027 then SOFR + 1.97%, 08/04/2028 | | | 15,000 | | | 14,533 |

6.21% to 08/21/2028 then SOFR + 2.02%, 08/21/2029 | | | 200,000 | | | 204,294 |

Intercontinental Exchange, Inc.,

4.60%, 03/15/2033 | | | 90,000 | | | 86,059 |

Iron Mountain, Inc.,

4.50%, 02/15/2031(a) | | | 150,000 | | | 135,407 |

Jefferies Financial Group, Inc.,

6.20%, 04/14/2034 | | | 200,000 | | | 202,656 |

JPMorgan Chase & Co.,

4.91% to 07/25/2032 then SOFR +

2.08%, 07/25/2033 | | | 300,000 | | | 291,860 |

KeyCorp, 4.10%, 04/30/2028 | | | 100,000 | | | 94,560 |

LPL Holdings, Inc.,

4.00%, 03/15/2029(a) | | | 275,000 | | | 256,479 |

Morgan Stanley

| | | | | | |

5.45% to 07/20/2028 then SOFR + 1.63%, 07/20/2029 | | | 250,000 | | | 251,653 |

1.93% to 04/28/2031 then SOFR + 1.02%, 04/28/2032 | | | 90,000 | | | 72,435 |

PNC Financial Services Group, Inc.

| | | | | | |

5.35% to 12/02/2027 then SOFR + 1.62%, 12/02/2028 | | | 250,000 | | | 250,232 |

6.88% to 10/20/2033 then SOFR + 2.28%, 10/20/2034 | | | 200,000 | | | 218,287 |

Public Storage Operating Co.,

5.13%, 01/15/2029 | | | 175,000 | | | 176,583 |

Regions Financial Corp.,

1.80%, 08/12/2028 | | | 200,000 | | | 172,833 |

State Street Corp., 5.82% to 11/04/2027 then SOFR + 1.72%, 11/04/2028 | | | 125,000 | | | 127,560 |

Synchrony Financial, 3.70%, 08/04/2026 | | | 275,000 | | | 262,410 |

Truist Financial Corp.

| | | | | | |

4.12% to 06/06/2027 then SOFR + 1.37%, 06/06/2028 | | | 125,000 | | | 120,549 |

5.87% to 06/08/2033 then SOFR + 2.36%, 06/08/2034 | | | 80,000 | | | 80,757 |

US Bancorp

| | | | | | |

4.55% to 07/22/2027 then SOFR + 1.66%, 07/22/2028 | | | 200,000 | | | 195,532 |

4.84% to 02/01/2033 then SOFR + 1.60%, 02/01/2034 | | | 190,000 | | | 180,461 |

Wells Fargo & Co.

| | | | | | |

5.57% to 07/25/2028 then SOFR + 1.74%, 07/25/2029 | | | 175,000 | | | 176,679 |

4.90% to 07/25/2032 then SOFR + 2.10%, 07/25/2033 | | | 20,000 | | | 19,273 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Madison Aggregate Bond ETF

Schedule of Investments

June 30, 2024(Continued)

| | | | | | | |

CORPORATE BONDS - (Continued)

|

Financials - (Continued)

|

5.39% to 04/24/2033 then SOFR + 2.02%, 04/24/2034 | | | $150,000 | | | $148,573 |

Weyerhaeuser Co., 3.38%, 03/09/2033 | | | 250,000 | | | 214,574 |

| | | | | | 7,584,459 |

Health Care - 3.6%

| | | | | | |

AbbVie, Inc.

| | | | | | |

3.20%, 11/21/2029 | | | 240,000 | | | 220,465 |

5.40%, 03/15/2054 | | | 325,000 | | | 323,201 |

Amgen, Inc., 5.65%, 03/02/2053 | | | 250,000 | | | 247,545 |

Centene Corp., 2.45%, 07/15/2028 | | | 150,000 | | | 133,164 |

CVS Health Corp., 5.13%, 07/20/2045 | | | 140,000 | | | 123,769 |

GE HealthCare Technologies, Inc.,

6.38%, 11/22/2052 | | | 485,000 | | | 529,053 |

Pfizer Investment Enterprises Pte Ltd., 5.30%, 05/19/2053 | | | 250,000 | | | 242,476 |

UnitedHealth Group, Inc.,

4.20%, 05/15/2032 | | | 125,000 | | | 117,839 |

Zoetis, Inc., 3.00%, 05/15/2050 | | | 50,000 | | | 32,779 |

| | | | | | 1,970,291 |

Industrials - 2.1%

| | | | | | |

BAE Systems PLC,

5.30%, 03/26/2034(a) | | | 200,000 | | | 198,572 |

Boeing Co., 6.86%, 05/01/2054(a) | | | 250,000 | | | 257,741 |

Nordson Corp., 5.80%, 09/15/2033 | | | 100,000 | | | 102,803 |

Norfolk Southern Corp.,

5.95%, 03/15/2064 | | | 250,000 | | | 255,982 |

Textron, Inc., 2.45%, 03/15/2031 | | | 100,000 | | | 83,923 |

United Rentals North America, Inc., 5.50%, 05/15/2027 | | | 260,000 | | | 258,037 |

| | | | | | 1,157,058 |

Materials - 0.9%

| | | | | | |

Ball Corp., 4.88%, 03/15/2026 | | | 190,000 | | | 186,978 |

Packaging Corp. of America,

4.05%, 12/15/2049 | | | 100,000 | | | 78,957 |

Vulcan Materials Co.,

3.50%, 06/01/2030 | | | 110,000 | | | 100,465 |

WRKCo, Inc., 3.90%, 06/01/2028 | | | 150,000 | | | 142,793 |

| | | | | | 509,193 |

Technology - 2.6%

| | | | | | |

Booz Allen Hamilton, Inc.,

3.88%, 09/01/2028(a) | | | 250,000 | | | 235,343 |

Cisco Systems, Inc., 5.05%, 02/26/2034 | | | 250,000 | | | 250,339 |

Dell International LLC / EMC Corp., 3.45%, 12/15/2051 | | | 200,000 | | | 136,208 |

Gartner, Inc., 4.50%, 07/01/2028(a) | | | 180,000 | | | 173,482 |

Intel Corp., 3.73%, 12/08/2047 | | | 240,000 | | | 177,190 |

Intuit, Inc., 5.20%, 09/15/2033 | | | 250,000 | | | 251,491 |

Oracle Corp.

| | | | | | |

6.15%, 11/09/2029 | | | 150,000 | | | 156,959 |

3.95%, 03/25/2051 | | | 55,000 | | | 40,898 |

| | | | | | 1,421,910 |

| | | | | | | |

| | | | | | | |

Utilities - 1.6%

| | | | | | |

AES Corp., 1.38%, 01/15/2026 | | | $300,000 | | | $281,104 |

Duke Energy Corp., 4.30%, 03/15/2028 | | | 180,000 | | | 174,711 |

Florida Power & Light Co.,

2.88%, 12/04/2051 | | | 300,000 | | | 191,772 |

National Rural Utilities Cooperative Finance Corp., 4.80%, 03/15/2028 | | | 100,000 | | | 99,241 |

PECO Energy Co., 3.05%, 03/15/2051 | | | 200,000 | | | 130,746 |

| | | | | | 877,574 |

TOTAL CORPORATE BONDS

(Cost $17,282,251) | | | | | | 17,603,261 |

U.S. TREASURY SECURITIES - 23.2%

|

United States Treasury Note/Bond

| | | | | | |

4.50%, 07/15/2026 | | | 1,700,000 | | | 1,692,762 |

4.00%, 06/30/2028 | | | 1,750,000 | | | 1,724,160 |

4.38%, 08/31/2028 | | | 525,000 | | | 524,631 |

4.88%, 10/31/2028 | | | 1,850,000 | | | 1,885,410 |

4.00%, 07/31/2030 | | | 2,000,000 | | | 1,963,906 |

3.50%, 02/15/2033 | | | 2,300,000 | | | 2,159,574 |

4.38%, 05/15/2034 | | | 250,000 | | | 250,625 |

3.88%, 05/15/2043 | | | 900,000 | | | 815,520 |

4.13%, 08/15/2053 | | | 1,750,000 | | | 1,639,805 |

TOTAL U.S. TREASURY SECURITIES

(Cost $12,762,806) | | | | | | 12,656,393 |

ASSET-BACKED SECURITIES - 5.3%

|

CarMax Auto Owner Trust,

Series 2022-3, Class A4,

4.06%, 02/15/2028 | | | 130,000 | | | 127,034 |

Chase Auto Owner Trust,

Series 2023-AA, Class A2,

5.90%, 03/25/2027(a) | | | 726,080 | | | 726,942 |

CNH Equipment Trust,

Series 2023-A, Class A3,

4.81%, 08/15/2028 | | | 200,000 | | | 198,354 |

Dell Equipment Finance Trust, Series 2023-2, Class A2,

5.84%, 01/22/2029(a) | | | 133,392 | | | 133,439 |

Enterprise Fleet Financing

| | | | | | |

Series 2022-4, Class A2,

5.76%, 10/22/2029(a) | | | 33,425 | | | 33,449 |

Series 2023-1, Class A2,

5.51%, 01/22/2029(a) | | | 37,078 | | | 37,013 |

GM Financial Consumer Automobile Receivables Trust, Series 2020-3, Class A4, 0.58%, 01/16/2026 | | | 241,489 | | | 240,874 |

Honda Auto Receivables Owner Trust, Series 2021-3, Class A3,

0.41%, 11/18/2025 | | | 371,468 | | | 365,947 |

LAD Auto Receivables Trust, Series 2023-2A, Class A2,

5.93%, 06/15/2027(a) | | | 72,428 | | | 72,497 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Madison Aggregate Bond ETF

Schedule of Investments

June 30, 2024(Continued)

| | | | | | | |

ASSET-BACKED SECURITIES - (Continued)

|

Nissan Auto Receivables Owner Trust, Series 2022-B, Class A4,

4.45%, 11/15/2029 | | | $50,000 | | | $ 49,309 |

PHH Arval

| | | | | | |

Series 2023-1A, Class A1,

5.65%, 05/15/2035(a) | | | 142,215 | | | 142,157 |

Series 2023-2A, Class A1,

6.16%, 10/15/2035(a) | | | 248,047 | | | 249,735 |

Santander Revolving Auto Loan Trust, Series 2019-A, Class C,

3.00%, 01/26/2032(a) | | | 25,000 | | | 24,636 |

Towd Point Mortgage Trust, Series

2024-CES1, Class A1A,

5.85%, 01/25/2064(a)(b) | | | 465,018 | | | 463,519 |

TOTAL ASSET-BACKED SECURITIES

(Cost $2,859,098) | | | | | | 2,864,905 |

COLLATERALIZED MORTGAGE OBLIGATIONS - 3.5%

|

Fannie Mae Connecticut Avenue Securities, Series 2022-R01, Class 1M1, 6.34% (30 day avg SOFR US + 1.00%), 12/25/2041(a) | | | 195,474 | | | 195,687 |

Federal Home Loan Mortgage Corp., Series K066, Class A2,

3.12%, 06/25/2027 | | | 100,000 | | | 95,150 |

Federal National Mortgage Association

| | | | | | |

Series 2017-M15, Class ATS2,

3.20%, 11/25/2027(b) | | | 211,848 | | | 202,048 |

Series 2020-44, Class TI,

5.50%, 12/25/2035(c) | | | 576,721 | | | 86,508 |

Series 2022-M1, Class A2,

1.72%, 10/25/2031(b) | | | 530,000 | | | 426,896 |

Flagstar Mortgage Trust, Series 2021-9INV, Class A1, 2.50%,

09/25/2041(a)(b) | | | 212,530 | | | 184,783 |

Freddie Mac Structured Agency Credit Risk Debt Notes, Series 2021-DNA3, Class M1, 6.09% (30 day avg SOFR US + 0.75%), 10/25/2033(a) | | | 16,106 | | | 16,101 |

FREMF Mortgage Trust

| | | | | | |

Series 2015-K44, Class B,

3.84%, 01/25/2048(a)(b) | | | 80,000 | | | 78,820 |

Series 2020-K106, Class B,

3.68%, 03/25/2053(a)(b) | | | 100,000 | | | 90,572 |

| | | | | | | |

| | | | | | | |

JP Morgan Mortgage Trust

| | | | | | |

Series 2021-6, Class A4,

2.50%, 10/25/2051(a)(b) | | | $102,919 | | | $88,914 |

Series 2024-5, Class A4,

6.00%, 11/25/2054(a)(b) | | | 250,000 | | | 249,427 |

Sequoia Mortgage Trust, Series 2013-7, Class A2, 3.00%, 06/25/2043(b) | | | 241,589 | | | 209,345 |

TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS

(Cost $1,903,009) | | | | | | 1,924,251 |

TOTAL INVESTMENTS - 97.1%

(Cost $52,652,604) | | | | | | $52,925,867 |

Money Market Deposit

Account - 2.0% (d) | | | | | | 1,077,670 |

Other Assets in Excess of

Liabilities - 0.9% | | | | | | 476,190 |

TOTAL NET ASSETS - 100.0% | | | | | | $54,479,727 |

| | | | | | | |

Percentages are stated as a percent of net assets.

PLC - Public Limited Company

SOFR - Secured Overnight Financing Rate

(a)

| Security is exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may only be resold in transactions exempt from registration to qualified institutional investors. As of June 30, 2024, the value of these securities total $4,633,020 or 8.5% of the Fund’s net assets.

|

(b)

| Coupon rate is variable based on the weighted average coupon of the underlying collateral. To the extent the weighted average coupon of the underlying assets which comprise the collateral increases or decreases, the coupon rate of this security will increase or decrease correspondingly. The rate disclosed is as of June 30, 2024.

|

(c)

| Interest only security.

|

(d)

| The U.S. Bank Money Market Deposit Account (the “MMDA”) is a short-term vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on market conditions and is subject to change daily. The rate as of June 30, 2024 was 5.24%. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Madison Covered Call ETF

Schedule of Investments

June 30, 2024

| | | | | | | |

COMMON STOCKS - 97.5%

| | | | | | |

Communications - 7.2%

| | | | | | |

Alphabet, Inc. - Class C(a) | | | 8,500 | | | $1,559,070 |

Comcast Corp. - Class A | | | 44,800 | | | 1,754,368 |

T-Mobile US, Inc.(a) | | | 10,200 | | | 1,797,036 |

| | | | | | 5,110,474 |

Consumer Discretionary - 10.1%

| | | | | | |

Amazon.com, Inc.(a)(b) | | | 7,000 | | | 1,352,750 |

Las Vegas Sands Corp. | | | 52,700 | | | 2,331,975 |

Lowe's Cos., Inc.(a) | | | 9,500 | | | 2,094,370 |

Starbucks Corp.(a) | | | 18,200 | | | 1,416,870 |

| | | | | | 7,195,965 |

Consumer Staples - 6.8%

| | | | | | |

Archer-Daniels-Midland Co. | | | 25,400 | | | 1,535,430 |

Constellation Brands, Inc. - Class A(a) | | | 8,300 | | | 2,135,424 |

PepsiCo, Inc.(a) | | | 7,200 | | | 1,187,496 |

| | | | | | 4,858,350 |

Energy - 5.4%

| | | | | | |

APA Corp. | | | 36,000 | | | 1,059,840 |

ConocoPhillips(a) | | | 8,000 | | | 915,040 |

Matador Resources Co.(a) | | | 19,000 | | | 1,132,400 |

Transocean Ltd.(b) | | | 135,000 | | | 722,250 |

| | | | | | 3,829,530 |

Financials - 13.2%

| | | | | | |

BlackRock, Inc.(a) | | | 2,100 | | | 1,653,372 |

Charles Schwab Corp.(a) | | | 17,500 | | | 1,289,575 |

CME Group, Inc.(a) | | | 11,200 | | | 2,201,920 |

Morgan Stanley(a) | | | 12,000 | | | 1,166,280 |

PayPal Holdings, Inc.(a)(b) | | | 26,900 | | | 1,561,007 |

Visa, Inc. - Class A(a) | | | 5,800 | | | 1,522,326 |

| | | | | | 9,394,480 |

Health Care - 12.3%

| | | | | | |

Abbott Laboratories | | | 15,000 | | | 1,558,650 |

Agilent Technologies, Inc.(a) | | | 7,500 | | | 972,225 |

Danaher Corp.(a) | | | 10,600 | | | 2,648,410 |

Gilead Sciences, Inc.(a) | | | 27,500 | | | 1,886,775 |

Medtronic PLC(a) | | | 22,000 | | | 1,731,620 |

| | | | | | 8,797,680 |

Industrials - 8.8%

| | | | | | |

Amphenol Corp.(a) | | | 22,000 | | | 1,482,140 |

Fastenal Co. | | | 10,500 | | | 659,820 |

Honeywell International, Inc.(a) | | | 7,000 | | | 1,494,780 |

Union Pacific Corp.(a) | | | 5,100 | | | 1,153,926 |

United Parcel Service, Inc. - Class B(a) | | | 10,700 | | | 1,464,295 |

| | | | | | 6,254,961 |

Materials - 3.2%

| | | | | | |

Air Products and Chemicals, Inc.(a) | | | 5,100 | | | 1,316,055 |

CF Industries Holdings, Inc.(a) | | | 13,000 | | | 963,560 |

| | | | | | 2,279,615 |

| | | | | | | |

| | | | | | | |

Technology - 27.5%(c)

| | | | | | |

Accenture PLC - Class A(a) | | | 6,400 | | | $1,941,824 |

Adobe, Inc.(a)(b) | | | 4,400 | | | 2,444,376 |

Ciena Corp.(a)(b) | | | 32,900 | | | 1,585,122 |

Cisco Systems, Inc.(a) | | | 46,600 | | | 2,213,966 |

Corning, Inc.(a) | | | 50,200 | | | 1,950,270 |

International Business Machines

Corp.(a) | | | 10,200 | | | 1,764,090 |

Microchip Technology, Inc.(a) | | | 22,200 | | | 2,031,300 |

Microsoft Corp.(a) | | | 4,100 | | | 1,832,495 |

Oracle Corp.(a) | | | 13,300 | | | 1,877,960 |

Texas Instruments, Inc.(a) | | | 10,000 | | | 1,945,300 |

| | | | | | 19,586,703 |

Utilities - 3.0%

| | | | | | |

AES Corp.(a) | | | 59,000 | | | 1,036,630 |

NextEra Energy, Inc.(a) | | | 15,300 | | | 1,083,393 |

| | | | | | 2,120,023 |

TOTAL COMMON STOCKS

(Cost $73,320,048) | | | | | | 69,427,781 |

REAL ESTATE INVESTMENT TRUSTS - 2.3%

|

American Tower Corp.(a) | | | 8,500 | | | 1,652,230 |

TOTAL REAL ESTATE INVESTMENT TRUSTS

(Cost $1,693,926) | | | | | | 1,652,230 |

TOTAL INVESTMENTS - 99.8%

(Cost $75,013,974) | | | | | | $71,080,011 |

Money Market Deposit

Account - 2.4% (d) | | | | | | 1,729,462 |

Liabilities in Excess of Other

Assets - (2.2)% | | | | | | (1,571,460) |

TOTAL NET ASSETS - 100.0% | | | | | | $71,238,013 |

| | | | | | | |

Percentages are stated as a percent of net assets.

PLC - Public Limited Company

(a)

| Held in connection with written option contracts. See Schedule of Written Options for further information.

|

(b)

| Non-income producing security.

|

(c)

| To the extent that the Fund invests more heavily in a particular industry or sector of the economy, its performance will be especially sensitive to developments that significantly affect those industries or sectors.

|

(d)

| The U.S. Bank Money Market Deposit Account (the “MMDA”) is a short-term vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on market conditions and is subject to change daily. The rate as of June 30, 2024 was 5.24%. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Madison Covered Call ETF

Schedule of Written Options

June 30, 2024

| | | | | | | | | | |

WRITTEN OPTIONS - (2.4)%(a)(b)

| | | | | | | | | |

Call Options - (2.4)%

| | | | | | | | | |

Abbott Laboratories, Expiration: 09/20/2024; Exercise Price: $110.00 | | | $ (1,558,650) | | | (150) | | | $ (26,700) |

Accenture PLC, Expiration: 09/20/2024; Exercise Price: $320.00 | | | (1,941,824) | | | (64) | | | (40,320) |

Adobe, Inc., Expiration: 08/16/2024; Exercise Price: $510.00 | | | (2,444,376) | | | (44) | | | (233,860) |

AES Corp., Expiration: 08/16/2024; Exercise Price: $20.00 | | | (1,036,630) | | | (590) | | | (11,800) |

Agilent Technologies, Inc., Expiration: 07/19/2024; Exercise Price: $160.00 | | | (972,225) | | | (75) | | | (750) |

Air Products and Chemicals, Inc., Expiration: 09/20/2024; Exercise Price: $280.00 | | | (1,316,055) | | | (51) | | | (20,145) |

Alphabet, Inc., Expiration: 07/19/2024; Exercise Price: $185.00 | | | (1,559,070) | | | (85) | | | (29,750) |

Amazon.com, Inc., Expiration: 07/19/2024; Exercise Price: $190.00 | | | (1,352,750) | | | (70) | | | (50,750) |

American Tower Corp., Expiration: 08/16/2024; Exercise

Price: $200.00 | | | (1,652,230) | | | (85) | | | (41,225) |

Amphenol Corp., Expiration: 07/19/2024; Exercise Price: $60.00 | | | (1,482,140) | | | (220) | | | (170,500) |

BlackRock, Inc., Expiration: 08/16/2024; Exercise Price: $840.00 | | | (1,653,372) | | | (21) | | | (15,435) |

CF Industries Holdings, Inc., Expiration: 08/16/2024; Exercise

Price: $85.00 | | | (963,560) | | | (130) | | | (5,525) |

Charles Schwab Corp., Expiration: 08/16/2024; Exercise Price: $75.00 | | | (1,289,575) | | | (175) | | | (40,688) |

Ciena Corp., Expiration: 07/19/2024; Exercise Price: $55.00 | | | (1,585,122) | | | (329) | | | (3,290) |

Cisco Systems, Inc., Expiration: 07/19/2024; Exercise Price: $52.50 | | | (2,213,966) | | | (466) | | | (1,165) |

CME Group, Inc., Expiration: 09/20/2024; Exercise Price: $210.00 | | | (2,201,920) | | | (112) | | | (25,760) |

Comcast Corp., Expiration: 09/20/2024; Exercise Price: $42.50 | | | (1,754,368) | | | (448) | | | (32,032) |

ConocoPhillips, Expiration: 09/20/2024; Exercise Price: $120.00 | | | (915,040) | | | (80) | | | (20,320) |

Constellation Brands, Inc., Expiration: 09/20/2024; Exercise

Price: $265.00 | | | (2,135,424) | | | (83) | | | (57,270) |

Corning, Inc., Expiration: 08/16/2024; Exercise Price: $35.00 | | | (1,950,270) | | | (502) | | | (218,370) |

Danaher Corp., Expiration: 07/19/2024; Exercise Price: $270.00 | | | (2,648,410) | | | (106) | | | (5,300) |

Gilead Sciences, Inc., Expiration: 09/20/2024; Exercise Price: $75.00 | | | (1,886,775) | | | (275) | | | (24,750) |

Honeywell International, Inc., Expiration: 08/16/2024; Exercise Price: $220.00 | | | (1,494,780) | | | (70) | | | (20,300) |

International Business Machines Corp., Expiration: 08/16/2024; Exercise Price: $185.00 | | | (1,764,090) | | | (102) | | | (28,866) |

Las Vegas Sands Corp., Expiration: 09/20/2024; Exercise Price: $49.00 | | | (2,331,975) | | | (527) | | | (59,024) |

Lowe's Cos., Inc., Expiration: 09/20/2024; Exercise Price: $230.00 | | | (2,094,370) | | | (95) | | | (55,812) |

Matador Resources Co., Expiration: 09/20/2024; Exercise

Price: $65.00 | | | (1,132,400) | | | (190) | | | (28,025) |

Medtronic PLC, Expiration: 09/20/2024; Exercise Price: $82.50 | | | (1,731,620) | | | (220) | | | (34,980) |

Microchip Technology, Inc., Expiration: 07/19/2024; Exercise Price: $105.00 | | | (2,031,300) | | | (222) | | | (2,220) |

Microsoft Corp., Expiration: 09/20/2024; Exercise Price: $460.00 | | | (1,832,495) | | | (41) | | | (60,475) |

Morgan Stanley, Expiration: 08/16/2024; Exercise Price: $105.00 | | | (1,166,280) | | | (120) | | | (9,660) |

NextEra Energy, Inc., Expiration: 08/16/2024; Exercise Price: $75.00 | | | (1,083,393) | | | (153) | | | (18,207) |

Oracle Corp., Expiration: 08/16/2024; Exercise Price: $135.00 | | | (1,412,000) | | | (100) | | | (84,750) |

PayPal Holdings, Inc., Expiration: 07/19/2024; Exercise Price: $65.00 | | | (1,561,007) | | | (269) | | | (3,631) |

PepsiCo, Inc., Expiration: 08/16/2024; Exercise Price: $170.00 | | | (1,187,496) | | | (72) | | | (16,056) |

Starbucks Corp., Expiration: 08/16/2024; Exercise Price: $85.00 | | | (1,416,870) | | | (182) | | | (26,390) |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Madison Covered Call ETF

Schedule of Written Options

June 30, 2024(Continued)

| | | | | | | | | | |

Texas Instruments, Inc. | | | $0 | | | 0 | | | $— |

Expiration: 07/19/2024; Exercise Price: $210.00 | | | (1,167,180) | | | (60) | | | (2,520) |

Expiration: 08/16/2024; Exercise Price: $200.00 | | | (778,120) | | | (40) | | | (20,500) |

T-Mobile US, Inc., Expiration: 08/16/2024; Exercise Price: $170.00 | | | (1,797,036) | | | (102) | | | (97,920) |

Union Pacific Corp., Expiration: 09/20/2024; Exercise Price: $235.00 | | | (1,153,926) | | | (51) | | | (26,775) |

United Parcel Service, Inc., Expiration: 08/16/2024; Exercise Price: $145.00 | | | (1,464,295) | | | (107) | | | (24,557) |

Visa, Inc., Expiration: 09/20/2024; Exercise Price: $280.00 | | | (1,522,326) | | | (58) | | | (21,315) |

Total Call Options | | | | | | | | | $ (1,717,688) |

TOTAL WRITTEN OPTIONS

(Premiums received $1,526,655) | | | | | | | | | $(1,717,688) |

| | | | | | | | | | |

Percentages are stated as a percent of net assets.

(b)

| 100 shares per contract. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Madison Dividend Value ETF

Schedule of Investments

June 30, 2024

| | | | | | | |

COMMON STOCKS - 96.8%

| | | | | | |

Communications - 1.5%

| | | | | | |

Comcast Corp. - Class A | | | 21,190 | | | $829,800 |

Consumer Discretionary - 6.6%

| | | | | | |

Home Depot, Inc. | | | 5,819 | | | 2,003,133 |

Lowe’s Cos., Inc. | | | 7,509 | | | 1,655,434 |

| | | | | | 3,658,567 |

Consumer Staples - 4.8%

| | | | | | |

Colgate-Palmolive Co. | | | 6,726 | | | 652,691 |

PepsiCo, Inc. | | | 7,161 | | | 1,181,064 |

Procter & Gamble Co. | | | 5,210 | | | 859,233 |

| | | | | | 2,692,988 |

Energy - 12.1%

| | | | | | |

Chevron Corp. | | | 11,844 | | | 1,852,638 |

ConocoPhillips | | | 14,102 | | | 1,612,987 |

EOG Resources, Inc. | | | 16,875 | | | 2,124,056 |

Exxon Mobil Corp. | | | 9,724 | | | 1,119,427 |

| | | | | | 6,709,108 |

Financials - 22.3%

| | | | | | |

Bank of America Corp. | | | 53,058 | | | 2,110,117 |

BlackRock, Inc. | | | 2,349 | | | 1,849,415 |

CME Group, Inc. | | | 9,493 | | | 1,866,324 |

JPMorgan Chase & Co. | | | 8,965 | | | 1,813,261 |

Morgan Stanley | | | 22,282 | | | 2,165,587 |

Prudential Financial, Inc. | | | 15,074 | | | 1,766,522 |

US Bancorp | | | 21,347 | | | 847,476 |

| | | | | | 12,418,702 |

Health Care - 10.0%

| | | | | | |

Abbott Laboratories | | | 5,441 | | | 565,374 |

AbbVie, Inc. | | | 12,867 | | | 2,206,948 |

Johnson & Johnson | | | 5,672 | | | 829,020 |

Medtronic PLC | | | 24,978 | | | 1,966,018 |

| | | | | | 5,567,360 |

Industrials - 18.9%

| | | | | | |

Automatic Data Processing, Inc. | | | 9,206 | | | 2,197,380 |

Caterpillar, Inc. | | | 1,885 | | | 627,894 |

Cummins, Inc. | | | 3,668 | | | 1,015,779 |

Fastenal Co. | | | 33,955 | | | 2,133,732 |

Honeywell International, Inc. | | | 8,341 | | | 1,781,137 |

Paychex, Inc. | | | 9,367 | | | 1,110,552 |

Union Pacific Corp. | | | 7,163 | | | 1,620,700 |

| | | | | | 10,487,174 |

| | | | | | | |

| | | | | | | |

Materials - 3.2%

| | | | | | |

Air Products and Chemicals, Inc. | | | 3,009 | | | $776,472 |

Dow, Inc. | | | 19,173 | | | 1,017,128 |

| | | | | | 1,793,600 |

Technology - 10.4%

| | | | | | |

Analog Devices, Inc. | | | 4,108 | | | 937,692 |

Hewlett Packard Enterprise Co. | | | 76,747 | | | 1,624,734 |

International Business Machines Corp. | | | 5,692 | | | 984,432 |

Texas Instruments, Inc. | | | 11,506 | | | 2,238,262 |

| | | | | | 5,785,120 |

Utilities - 7.0%

| | | | | | |

Dominion Energy, Inc. | | | 31,269 | | | 1,532,181 |