UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________________

FORM 10-Q

_______________________________________________

| (Mark One) | |||||

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

For the quarterly period ended June 30, 2024

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

For the transition period from to

Commission File Number 000-56564

Invesco Commercial Real Estate Finance Trust, Inc.

(Exact name of registrant as specified in its charter)

_______________________________________________

| Maryland | 92-1080856 | |||||||

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |||||||

| 2300 N Field Street, Suite 1200 Dallas, Texas | 75201 | |||||||

| (Address of principal executive offices) | (Zip Code) | |||||||

(972) 715-7400

(Registrant’s telephone number, including area code)

2001 Ross Avenue, Suite 3400 Dallas, Texas

(Former Name, Former Address and Former Fiscal Year, If Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Act: None

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||||||||||||

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||||||||||||||||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||||||||||||||||

| Emerging growth company | ☒ | |||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of August 9, 2024, there were 14,667,616 outstanding shares of common stock of Invesco Commercial Real Estate Finance Trust, Inc. comprised of 60,631 Class S common stock, 4,524,858 Class S-1 common stock, 54,677 Class D common stock, 1,917,244 Class I common stock, 174,206 Class E common stock, and 7,936,000 Class F common stock.

Invesco Commercial Real Estate Finance Trust, Inc.

Table of Contents

| Page | ||||||||

| Item 1. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

PART I

ITEM 1. FINANCIAL STATEMENTS

Invesco Commercial Real Estate Finance Trust, Inc.

Condensed Consolidated Balance Sheets

Unaudited

| $ in thousands except share amounts | June 30, 2024 | December 31, 2023 | |||||||||

| ASSETS | |||||||||||

| Commercial real estate loan investments, at fair value (including pledged loans of $1,082,910 and $591,003, respectively) | $ | 1,121,010 | $ | 613,503 | |||||||

| Cash and cash equivalents | 6,169 | 1,975 | |||||||||

| Restricted cash | 9,927 | 23,566 | |||||||||

| Interest receivable | 3,997 | 2,448 | |||||||||

| Due from affiliates | 675 | — | |||||||||

| Other assets | 287 | 151 | |||||||||

| Total assets | $ | 1,142,065 | $ | 641,643 | |||||||

| LIABILITIES | |||||||||||

| Repurchase agreements, at fair value | $ | 849,754 | $ | 457,861 | |||||||

| Revolving credit facility, at fair value | 10,000 | 14,000 | |||||||||

| Interest payable | 2,472 | 1,687 | |||||||||

| Dividends and distributions payable (including $36 and $2,363 due to related party, respectively) | 1,599 | 3,138 | |||||||||

| Accounts payable, accrued expenses and other liabilities | 12,003 | 23,978 | |||||||||

| Due to affiliates | 22,522 | 10,167 | |||||||||

| Total liabilities | 898,350 | 510,831 | |||||||||

| Commitments and contingencies (See Note 12) | |||||||||||

| Redeemable common stock - related party (see Note 7) | $ | 5,660 | $ | 105,340 | |||||||

| STOCKHOLDERS’ EQUITY | |||||||||||

| Preferred stock, $0.01 par value per share, 50,000,000 shares authorized: | |||||||||||

| 12.5% Series A Cumulative Redeemable Preferred Stock, 228 shares issued and outstanding ($228 aggregate liquidation preference) | 205 | 205 | |||||||||

| Common stock, Class S shares, $0.01 par value per share, 500,000,000 shares authorized | — | — | |||||||||

| Common stock, Class S-1 shares, $0.01 par value per share, 500,000,000 shares authorized | 39 | 11 | |||||||||

| Common stock, Class D shares, $0.01 par value per share, 500,000,000 shares authorized | — | — | |||||||||

| Common stock, Class I shares, $0.01 par value per share, 500,000,000 shares authorized | 15 | 3 | |||||||||

| Common stock, Class E shares, $0.01 par value per share, 500,000,000 shares authorized | 1 | — | |||||||||

| Common stock, Class F shares, $0.01 par value per share, 500,000,000 shares authorized | 47 | — | |||||||||

| Additional paid-in capital | 250,304 | 32,549 | |||||||||

| Accumulated deficit | (12,556) | (7,296) | |||||||||

| Total stockholders’ equity | 238,055 | 25,472 | |||||||||

| Total liabilities, redeemable common stock and stockholders’ equity | $ | 1,142,065 | $ | 641,643 | |||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

1

,

Invesco Commercial Real Estate Finance Trust, Inc.

Condensed Consolidated Statements of Operations

Unaudited

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| $ in thousands except share and per share amounts | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| Net Interest Income | |||||||||||||||||||||||

| Commercial real estate loan interest income | $ | 20,415 | $ | 1,520 | $ | 35,555 | $ | 1,520 | |||||||||||||||

| Other interest income | 587 | — | 828 | — | |||||||||||||||||||

| Interest expense | (13,843) | (1,588) | (24,249) | (1,588) | |||||||||||||||||||

| Net interest income | 7,159 | (68) | 12,134 | (68) | |||||||||||||||||||

| Other Income (Expense) | |||||||||||||||||||||||

| Unrealized gain (loss) on commercial real estate loan investments, net | 285 | — | 1,203 | — | |||||||||||||||||||

| Unrealized gain (loss) on repurchase agreements, net | (199) | — | (922) | — | |||||||||||||||||||

| Commitment fee income, net of related party expense of $2,120, $3,518, $868 and $868 for the three and six months ended June 30, 2024 and 2023, respectively | 2,120 | 867 | 3,518 | 867 | |||||||||||||||||||

| Other income | 249 | 36 | 350 | 36 | |||||||||||||||||||

| Total other income (expense), net | 2,455 | 903 | 4,149 | 903 | |||||||||||||||||||

| Expenses | |||||||||||||||||||||||

| Management and performance fees - related party | 952 | — | 1,302 | — | |||||||||||||||||||

| Debt issuance and other financing costs related to borrowings, at fair value | 3,221 | 1,735 | 3,690 | 2,387 | |||||||||||||||||||

| Organizational costs | 14 | 154 | 19 | 604 | |||||||||||||||||||

| General and administrative | 1,800 | 551 | 2,958 | 576 | |||||||||||||||||||

| Total expenses | 5,987 | 2,440 | 7,969 | 3,567 | |||||||||||||||||||

| Net income (loss) | 3,627 | (1,605) | 8,314 | (2,732) | |||||||||||||||||||

| Dividends to preferred stockholders | (7) | (1) | (14) | (1) | |||||||||||||||||||

| Net income (loss) attributable to common stockholders | $ | 3,620 | $ | (1,606) | $ | 8,300 | $ | (2,733) | |||||||||||||||

| Earnings (loss) per share: | |||||||||||||||||||||||

| Net income (loss) attributable to common stockholders | |||||||||||||||||||||||

| Basic | $ | 0.34 | $ | (2,147.96) | $ | 0.93 | $ | (7,151.30) | |||||||||||||||

| Diluted | $ | 0.34 | $ | (2,147.96) | $ | 0.93 | $ | (7,151.30) | |||||||||||||||

| Weighted average number of shares of common stock | |||||||||||||||||||||||

| Basic | 10,729,623 | 748 | 8,956,409 | 382 | |||||||||||||||||||

| Diluted | 10,729,651 | 748 | 8,956,715 | 382 | |||||||||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

2

Invesco Commercial Real Estate Finance Trust, Inc.

Condensed Consolidated Statements of Changes in Stockholders’ Equity and Redeemable Common Stock

Unaudited

| Series A Preferred Stock | Class S Common Stock | Class S-1 Common Stock | Class D Common Stock | Class I Common Stock | Class E Common Stock | Class F Common Stock | Additional Paid-in Capital | Retained Earnings (Accumulated Deficit) | Total Stockholders' Equity | Redeemable Common Stock | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ in thousands | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance as of December 31, 2023 | $ | 205 | $ | — | $ | 11 | $ | — | $ | 3 | $ | — | $ | — | $ | 32,549 | $ | (7,296) | $ | 25,472 | $ | 105,340 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — | — | — | — | — | — | 4,687 | 4,687 | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Issuance of common stock, net of offering costs | — | — | 14 | — | 7 | 1 | — | 52,949 | — | 52,971 | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common stock distribution reinvestment | — | — | — | — | — | — | — | 773 | — | 773 | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common stock dividends | — | — | — | — | — | — | — | — | (6,311) | (6,311) | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Preferred stock dividends | — | — | — | — | — | — | — | — | (7) | (7) | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Amortization of equity based compensation | — | — | — | — | — | — | — | 17 | — | 17 | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance as of March 31, 2024 | $ | 205 | $ | — | $ | 25 | $ | — | $ | 10 | $ | 1 | $ | — | $ | 86,288 | $ | (8,927) | $ | 77,602 | $ | 105,340 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — | — | — | — | — | 3,627 | 3,627 | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Issuance of common stock, net of offering costs | — | — | 13 | — | 5 | — | 47 | 161,565 | — | 161,630 | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Issuance of redeemable common stock | — | — | — | — | — | — | — | — | — | — | 145 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common stock distribution reinvestment | — | — | 1 | — | — | — | — | 2,635 | — | 2,636 | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common stock dividends | — | — | — | — | — | — | — | — | (7,249) | (7,249) | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Preferred stock dividends | — | — | — | — | — | — | — | — | (7) | (7) | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Amortization of equity based compensation | — | — | — | — | — | — | — | 20 | — | 20 | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Repurchase of common stock | — | — | — | — | — | — | — | (29) | — | (29) | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Repurchase of redeemable common stock | — | — | — | — | — | — | — | — | — | — | (100,000) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjustment to the carrying value of redeemable common stock | — | — | — | — | — | — | — | (175) | — | (175) | 175 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance as of June 30, 2024 | $ | 205 | $ | — | $ | 39 | $ | — | $ | 15 | $ | 1 | $ | 47 | $ | 250,304 | $ | (12,556) | $ | 238,055 | $ | 5,660 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Series A Preferred Stock | Class S Common Stock | Class S-1 Common Stock | Class D Common Stock | Class I Common Stock | Class E Common Stock | Additional Paid-in Capital | Retained Earnings (Accumulated Deficit) | Total Stockholders' Equity | Redeemable Common Stock | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ in thousands | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at December 31, 2022 | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — | — | — | — | — | (1,127) | (1,127) | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at March 31, 2023 | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | (1,127) | $ | (1,127) | $ | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — | — | — | — | — | (1,605) | (1,605) | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Issuance of preferred stock, net of offering costs | 100 | — | — | — | — | — | — | — | 100 | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Issuance of common stock, net of offering costs | — | — | — | — | — | — | 47 | — | 47 | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Preferred stock dividends | — | — | — | — | — | — | — | (1) | (1) | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at June 30, 2023 | $ | 100 | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 47 | $ | (2,733) | $ | (2,586) | $ | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

3

Invesco Commercial Real Estate Finance Trust, Inc.

Condensed Consolidated Statements of Cash Flows

Unaudited

| Six Months Ended June 30, 2024 | Six Months Ended June 30, 2023 | ||||||||||||||||||||||

| $ in thousands | |||||||||||||||||||||||

| Cash flows from operating activities: | |||||||||||||||||||||||

| Net income (loss) | $ | 8,314 | $ | (2,732) | |||||||||||||||||||

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | |||||||||||||||||||||||

| Unrealized (gain) loss on commercial real estate loan investments, net | (1,203) | — | |||||||||||||||||||||

| Unrealized (gain) loss on repurchase agreements, net | 922 | — | |||||||||||||||||||||

| Debt issuance costs | 2,090 | 1,835 | |||||||||||||||||||||

| Amortization of equity based compensation | 37 | — | |||||||||||||||||||||

| Change in operating assets and liabilities: | |||||||||||||||||||||||

| Increase in operating assets | (1,763) | (774) | |||||||||||||||||||||

| Increase in due from affiliates | (675) | — | |||||||||||||||||||||

| Increase in operating liabilities | 2,341 | 1,164 | |||||||||||||||||||||

| Increase in due to affiliates | 8,463 | 2,204 | |||||||||||||||||||||

| Net cash provided by (used in) operating activities | 18,526 | 1,697 | |||||||||||||||||||||

| Cash flows from investing activities: | |||||||||||||||||||||||

| Originations and fundings of commercial real estate loans | (506,304) | (157,405) | |||||||||||||||||||||

| Net cash used in investing activities | (506,304) | (157,405) | |||||||||||||||||||||

| Cash flows from financing activities: | |||||||||||||||||||||||

| Proceeds from revolving credit facility | 192,000 | 116,000 | |||||||||||||||||||||

| Repayment of revolving credit facility | (196,000) | (75,300) | |||||||||||||||||||||

| Proceeds from repurchase agreements | 439,447 | 117,140 | |||||||||||||||||||||

| Repayment of repurchase agreements | (48,476) | — | |||||||||||||||||||||

| Proceeds from issuance of common stock, net of offering costs | 194,465 | 47 | |||||||||||||||||||||

| Proceeds from issuance of preferred stock, net of offering costs | — | 100 | |||||||||||||||||||||

| Repurchase of redeemable common stock | (100,000) | — | |||||||||||||||||||||

| Subscriptions received in advance | 9,927 | — | |||||||||||||||||||||

| Repayment of related party loan | — | (30) | |||||||||||||||||||||

| Cash paid for debt issuance costs | (1,326) | — | |||||||||||||||||||||

| Payments of dividends | (11,704) | (1) | |||||||||||||||||||||

| Net cash provided by financing activities | 478,333 | 157,956 | |||||||||||||||||||||

| Net change in cash, cash equivalents and restricted cash | (9,445) | 2,248 | |||||||||||||||||||||

| Cash, cash equivalents and restricted cash, beginning of period | 25,541 | 30 | |||||||||||||||||||||

| Cash, cash equivalents and restricted cash, end of period | $ | 16,096 | $ | 2,278 | |||||||||||||||||||

| Supplemental disclosures: | |||||||||||||||||||||||

| Interest paid | $ | 23,464 | $ | 1,361 | |||||||||||||||||||

| Non-cash investing and financing activities: | |||||||||||||||||||||||

| Dividends and distributions declared not paid | $ | 1,599 | — | ||||||||||||||||||||

| Common stock distribution reinvestment | $ | 3,409 | $ | — | |||||||||||||||||||

| Issuance of redeemable common stock for payment of management fees | $ | 145 | $ | — | |||||||||||||||||||

| Adjustment to carrying value of redeemable common stock | $ | 175 | $ | — | |||||||||||||||||||

| Deferred offering costs due to affiliate | $ | (78) | $ | 463 | |||||||||||||||||||

| Offering costs due to affiliates | $ | 3,352 | $ | — | |||||||||||||||||||

| Debt issuance costs due to affiliate | $ | 685 | $ | — | |||||||||||||||||||

| Accrued common stock repurchases | $ | 29 | $ | — | |||||||||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

Invesco Commercial Real Estate Finance Trust, Inc.

Notes to Condensed Consolidated Financial Statements

1.Organization and Business Purpose

Invesco Commercial Real Estate Finance Trust, Inc. (the “Company” or “we”) is a Maryland corporation incorporated in October 2022. Our primary investment strategy is to originate, acquire and manage a diversified portfolio of loans and debt-like preferred equity interests secured by, or unsecured but related to, commercial real estate. We commenced investing activities in May 2023 and have one operating segment.

We are externally managed by Invesco Advisers, Inc. (the “Adviser”), a registered investment adviser and an indirect, wholly-owned subsidiary of Invesco Ltd. (“Invesco”), an independent global investment management firm.

We intend to qualify to be taxed as a real estate investment trust (“REIT”) for U.S. federal income tax purposes beginning with the taxable year ended December 31, 2023. We operate our business in a manner that permits our exclusion from the definition of an “Investment Company” under the Investment Company Act of 1940, as amended (the “Investment Company Act”).

We are engaging in a continuous, unlimited private offering of our common stock to “accredited investors” (as defined by Rule 501 under the Securities Act) (the “Continuous Offering”) under exemptions provided by Section 4(a)(2) of the Securities Act and applicable state securities laws.

2.Summary of Significant Accounting Policies

Basis of Presentation and Consolidation

Certain disclosures included in our Annual Report on Form 10-K are not required to be included on an interim basis in our quarterly reports on Form 10-Q. We have condensed or omitted these disclosures. Therefore, this Form 10-Q should be read in conjunction with our Annual Report on Form 10-K for the year ended December 31, 2023.

Our condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP”) and consolidate the financial statements of the Company and its controlled subsidiaries. All significant intercompany transactions, balances, revenues and expenses are eliminated upon consolidation. In the opinion of management, the condensed consolidated financial statements reflect all adjustments, consisting of normal recurring accruals, which are necessary for a fair statement of our financial condition and results of operations for the period presented.

All numbers in these notes, except in the tables herein, are stated in full amounts, unless otherwise indicated.

Reclassifications

Certain prior period reported amounts have been reclassified to be consistent with the current presentation. Such reclassifications have no impact on total assets, net income or equity attributable to common stockholders.

Use of Estimates

The preparation of condensed consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in our condensed consolidated financial statements and accompanying notes. Examples of estimates may include, but are not limited to, estimates of the fair values of financial instruments and estimated payment periods for certain stockholder servicing fee liabilities. Actual results may differ from those estimates.

Significant Accounting Policies

With the exception of the below, there have been no changes to our accounting policies included in Note 2 to the consolidated financial statements of our Annual Report on Form 10-K for the year ended December 31, 2023.

5

Debt Issuance and Other Financing Costs

We finance our investments using a variety of debt instruments. When we incur debt issuance costs prior to a debt facility closing, we expense the costs as incurred if we intend to elect the fair value option to account for the debt facility and the closing is probable as of the balance sheet date. When we incur financing costs on our existing debt facilities for which we have elected the fair value option, we expense the costs as incurred.

3.Commercial Real Estate Loan Investments

The table below summarizes our investments in commercial real estate loans as of June 30, 2024 and December 31, 2023.

| $ in thousands | ||||||||||||||||||||||||||||||||

| Loan Type | Loan Amount(1) | Principal Balance Outstanding | Fair Value | Weighted Average Interest Rate(2) | Weighted Average Life (years)(3) | |||||||||||||||||||||||||||

| June 30, 2024 | ||||||||||||||||||||||||||||||||

Senior loans(4) | $ | 1,378,571 | $ | 1,119,807 | $ | 1,121,010 | 8.41 | % | 4.47 | |||||||||||||||||||||||

| Total | $ | 1,378,571 | $ | 1,119,807 | $ | 1,121,010 | 8.41 | % | 4.47 | |||||||||||||||||||||||

| December 31, 2023 | ||||||||||||||||||||||||||||||||

Senior loans(4) | $ | 671,406 | $ | 613,503 | $ | 613,503 | 8.53 | % | 4.69 | |||||||||||||||||||||||

| Total | $ | 671,406 | $ | 613,503 | $ | 613,503 | 8.53 | % | 4.69 | |||||||||||||||||||||||

(1)Loan amount consists of outstanding principal balance plus unfunded loan commitments.

(2)Represents weighted average interest rate of the most recent interest period in effect for each loan as of period end. Loans earn interest at the one-month Term Secured Overnight Financing Rate (“SOFR”) plus a spread.

(3)Assumes all extension options are exercised by the borrower; however, loans may be repaid prior to such date. Extension options are subject to certain conditions as defined in the respective loan agreement.

(4)Senior loans include senior mortgages and similar credit quality loans, including related contiguous subordinate loans and accommodation mezzanine loans in connection with the senior mortgage financing.

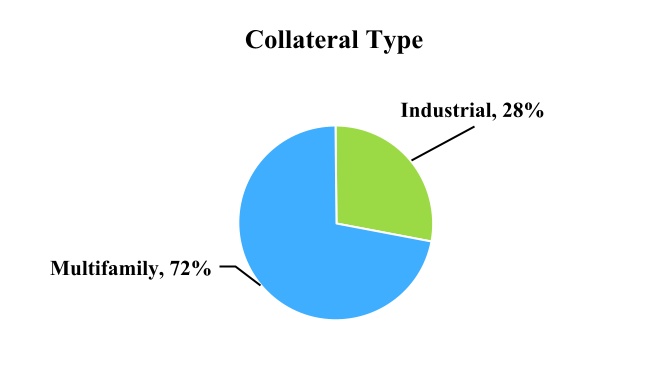

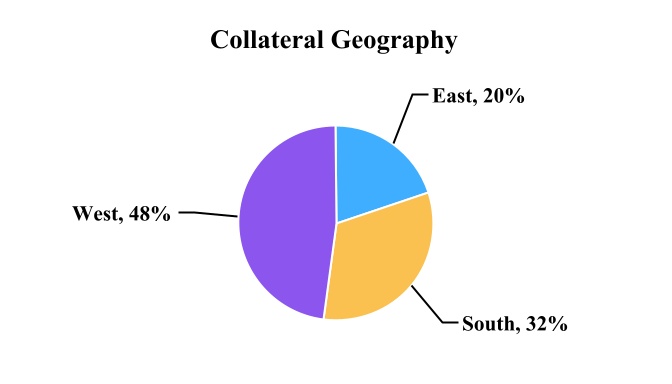

The tables below detail the property type and geographic distribution of the properties securing our commercial real estate loans as of June 30, 2024 and December 31, 2023.

| $ in thousands | June 30, 2024 | December 31, 2023 | ||||||||||||||||||||||||

| Property Type | Fair Value | Percentage | Fair Value | Percentage | ||||||||||||||||||||||

| Multifamily | $ | 804,336 | 71.8 | % | $ | 346,760 | 56.5 | % | ||||||||||||||||||

| Industrial | 316,674 | 28.2 | % | 266,743 | 43.5 | % | ||||||||||||||||||||

| Total | $ | 1,121,010 | 100.0 | % | $ | 613,503 | 100.0 | % | ||||||||||||||||||

| $ in thousands | June 30, 2024 | December 31, 2023 | ||||||||||||||||||||||||

Geographic Location(1) | Fair Value | Percentage | Fair Value | Percentage | ||||||||||||||||||||||

| West | $ | 543,467 | 48.5 | % | $ | 311,852 | 50.8 | % | ||||||||||||||||||

| South | 358,821 | 32.0 | % | 173,991 | 28.4 | % | ||||||||||||||||||||

| East | 218,722 | 19.5 | % | 127,660 | 20.8 | % | ||||||||||||||||||||

| Total | $ | 1,121,010 | 100.0 | % | $ | 613,503 | 100.0 | % | ||||||||||||||||||

(1) All of the properties securing our commercial real estate loans are located within the United States.

The weighted average loan-to-value ratio, a metric utilized in the fair value measurement of our commercial real estate loan investments, for our 22 loan investments was approximately 62% based on the initial loan amount and the independent property appraisals at the time of origination.

6

4.Borrowings

The table below summarizes our repurchase agreement and revolving line of credit borrowings as of June 30, 2024 and December 31, 2023.

| June 30, 2024 | December 31, 2023 | |||||||||||||||||||||||||||||||||||||||||||||||||

| $ in thousands | Maturity Date(1) | Weighted Average Interest rate(2) | Maximum Facility Size | Amount Outstanding | Fair Value | Amount Outstanding | Fair Value | |||||||||||||||||||||||||||||||||||||||||||

| Repurchase Agreements: | ||||||||||||||||||||||||||||||||||||||||||||||||||

Morgan Stanley Bank N.A.(3) | 5/25/2025 | 7.61% | $ | 500,000 | $ | 318,637 | $ | 318,957 | $ | 174,209 | $ | 174,209 | ||||||||||||||||||||||||||||||||||||||

| Citibank N.A. | 6/20/2026 (current); 6/20/2028 (fully extended) | 7.39% | 535,000 | 206,926 | 207,210 | 61,464 | 61,464 | |||||||||||||||||||||||||||||||||||||||||||

Bank of Montreal(4) | 7/18/2025 | 7.45% | 223,424 | 217,709 | 217,982 | 222,188 | 222,188 | |||||||||||||||||||||||||||||||||||||||||||

Barclays(5) | 4/24/2027 | 7.33% | 250,000 | 47,200 | 47,245 | — | — | |||||||||||||||||||||||||||||||||||||||||||

| Wells Fargo | 5/23/2026 (current); 5/23/2029 (fully extended) | 7.25% | 200,000 | 58,360 | 58,360 | — | — | |||||||||||||||||||||||||||||||||||||||||||

| Total Repurchase Agreements | 7.48% | 1,708,424 | 848,832 | 849,754 | 457,861 | 457,861 | ||||||||||||||||||||||||||||||||||||||||||||

Revolving Credit Facility(6) | 8.23% | 100,000 | 10,000 | 10,000 | 14,000 | 14,000 | ||||||||||||||||||||||||||||||||||||||||||||

| Total | 7.48% | $ | 1,808,424 | $ | 858,832 | $ | 859,754 | $ | 471,861 | $ | 471,861 | |||||||||||||||||||||||||||||||||||||||

(1) For Repurchase Agreements, maturity date represents the current borrowing facility maturity date and the maximum maturity for borrowing facilities with extension options that are at our option, subject to compliance with certain financial and administrative covenants, as well as payment of applicable extension fees.

(2) Represents weighted average interest rate of the most recent interest period in effect for each borrowing as of period end. Borrowings under our repurchase agreements and revolving credit facility carry interest at one-month Term SOFR plus a spread.

(3) Borrowing facility has an extension option of one year, subject to lender approval and compliance with certain financial and administrative covenants.

(4) Borrowing facility has three extension options of one year each, subject to lender approval and compliance with certain financial and administrative covenants.

(5) Borrowing facility has two extension options of one year each, subject to lender approval and compliance with certain financial and administrative covenants.

(6) The final maturity date of the Revolving Credit Facility is aligned with the Company’s ability to call remaining outstanding capital under certain subscription agreements, as further explained below.

7

The following table shows the aggregate amount of maturities of our outstanding borrowings over the next five years and thereafter as of June 30, 2024:

| Year | Repurchase Agreements(1) | Revolving Credit Facility | Total | |||||||||||||||||

| $ in thousands | ||||||||||||||||||||

| 2024 (remaining) | $ | — | $ | 10,000 | $ | 10,000 | ||||||||||||||

| 2025 | 536,346 | — | 536,346 | |||||||||||||||||

| 2026 | — | — | — | |||||||||||||||||

| 2027 | 47,200 | — | 47,200 | |||||||||||||||||

| 2028 | 206,926 | — | 206,926 | |||||||||||||||||

| 2029 | 58,360 | — | 58,360 | |||||||||||||||||

| Thereafter | — | — | — | |||||||||||||||||

| Total | $ | 848,832 | $ | 10,000 | $ | 858,832 | ||||||||||||||

(1) Assumes all extension options are exercised for borrowing facilities that may be extended at our option, subject to compliance with certain financial and administrative covenants.

Repurchase Agreements

We have pledged our commercial real estate loan investments with a fair value of approximately $1.1 billion as collateral for our repurchase agreements. We segregate the commercial real estate loans that we have pledged as collateral in our books and records. Our repurchase agreement counterparties have the right to resell or repledge the collateral posted but have the obligation to return the pledged collateral upon maturity of the repurchase agreement.

We may be required to post margin under our repurchase agreements if there is a material adverse change in the credit characteristics of a particular loan with respect to the underlying property, borrower, or particular real estate market. We were not required to post any margin under our repurchase agreements as of June 30, 2024 and December 31, 2023. A margin deficiency may generally result from either a decline in the underlying loan’s market value or a shortfall in operating performance of the property. Our repurchase agreement counterparties generally retain the right to determine the fair value of the underlying collateral in their sole discretion. Subject to applicable thresholds, we would generally be required to post cash as collateral. We may finance multiple commercial loan investments under a repurchase agreement; therefore, a margin excess in one asset could help mitigate a margin deficiency in another asset under the same repurchase agreement. We intend to maintain a level of liquidity that will enable us to meet margin calls.

Our repurchase agreements are subject to certain liquidity, tangible net worth and leverage covenants. We were in compliance with these covenants as of June 30, 2024.

Revolving Credit Facility

Our revolving credit facility is secured by uncalled capital subscriptions under the terms of the Invesco Subscription Agreement and the Class F Subscription Agreement. See Note 7 - “Redeemable Common Stock - Related Party” and Note 8 - “Stockholders’ Equity”, respectively, where each is more fully described. Borrowings under the facility bear interest at one-month Term SOFR or the prime rate plus a spread. The revolving credit facility allows for the ability to obtain tranches of term financing in addition to general borrowings under an Uncommitted Tranche (as defined in the credit agreement). At June 30, 2024, the amount outstanding under the facility was drawn from the Uncommitted Tranche. The Uncommitted Tranche is due on demand (15 business days after notice); any Funded Tranche (as defined in the credit agreement) is due no later than (a) three years from issuance or (b) 360 days after notice; and all amounts outstanding under the facility are due 30 days prior to the last date on which capital calls may be issued. As of June 30, 2024, we had an available balance of $90.0 million under the facility. The facility is prepayable without penalty.

Our revolving credit facility is subject to certain affirmative and negative covenants including a limitation on indebtedness. We were in compliance with these covenants as of June 30, 2024.

8

5.Loan Payable - Related Party

In December 2022, we entered into a revolving credit agreement with an affiliate of Invesco that provided for maximum borrowings of $30,000. Principal on loans made under the agreement is due nine months after the date each loan is made. We incur interest on loans made under the agreement at the short-term applicable federal rate in effect at the time each borrowing is made.

We incurred $649 of interest expense on the loan in the six months ended June 30, 2023. We repaid the loan, which had an outstanding balance of $30,000 and accrued interest expense in June 2023.

6.Accounts payable, accrued expenses and other liabilities

The following table details the components of accounts payable, accrued expenses and other liabilities as of June 30, 2024 and December 31, 2023.

| $ in thousands | June 30, 2024 | December 31, 2023 | ||||||||||||

| Accounts payable and accrued expenses | $ | 548 | $ | 14 | ||||||||||

Subscriptions paid in advance (1) | 9,927 | 23,566 | ||||||||||||

| Accrued common stock repurchases | 29 | — | ||||||||||||

| Other liabilities | 1,499 | 398 | ||||||||||||

| Total | $ | 12,003 | $ | 23,978 | ||||||||||

(1) Represents subscriptions received by our transfer agent prior to the date the subscriptions are effective.

7.Redeemable Common Stock - Related Party

Invesco Realty, Inc. (“Invesco Realty”), an affiliate of Invesco, has committed to purchase up to $300.0 million in shares of our common stock (the “Invesco Subscription Agreement”). We may call (i) $150.0 million in capital in one or more closings through March 23, 2028 and (ii) $150.0 million in additional capital if needed to avoid triggering any third party concentration limits associated with distribution or placement of our shares. Invesco Realty may not submit its shares for repurchase under the share repurchase plan described in Note 8 - “Stockholders’ Equity” until the earlier of March 23, 2028 and the date that our aggregate NAV is at least $1.5 billion. We can only accept a repurchase request from Invesco Realty after all requests from unaffiliated stockholders have been fulfilled. We may elect to repurchase all or any portion of the shares acquired by Invesco Realty at any time at a per share price equal to the most recently determined NAV per share for each class (or another transaction price we believe reflects the NAV per share more appropriately than the prior month’s NAV per share). The Adviser or its affiliate must continue to hold at least $200,000 in shares for so long as Invesco or any affiliate thereof serves as our external adviser.

As of June 30, 2024, we may call $144.7 million of the initial $150.0 million in capital under the Invesco Subscription Agreement.

As discussed in Note 11 - “Related Party Transactions”, our management and performance fees are payable in cash or Class E shares at the option of the Adviser. Because the Adviser may elect to have the Company repurchase shares issued as payment for management fees or performance fees, we classify these shares as redeemable common stock. Class E shares issued to the Adviser as payment for management or performance fees are not subject to the repurchase limits of the Company’s share repurchase plan described in Note 8 - “Stockholders’ Equity,” any lockup period applicable to the Adviser, or any reduction penalty for an early repurchase. The Adviser also has the option to exchange Class E shares issued as payment for management or performance fees for Class S, Class S-1, Class D, Class F, or Class I shares. During the three months ended June 30, 2024, we issued 5,792 Class E shares to the Adviser as payment for the management fees payable as of March 31, 2024.

9

The following table summarizes the changes in redeemable common stock for the six months ended June 30, 2024:

| $ in thousands | Class S Redeemable Common Shares | Class D Redeemable Common Shares | Class I Redeemable Common Shares | Class E Redeemable Common Shares | Total Redeemable Common Stock | ||||||||||||||||||||||||

| Balance as of December 31, 2023 | $ | 26,335 | $ | 26,335 | $ | 26,335 | $ | 26,335 | $ | 105,340 | |||||||||||||||||||

| Issuance of redeemable common stock | — | — | — | — | — | ||||||||||||||||||||||||

| Adjustment to carrying value of redeemable common stock | — | — | — | — | — | ||||||||||||||||||||||||

| Balance as of March 31, 2024 | $ | 26,335 | $ | 26,335 | $ | 26,335 | $ | 26,335 | $ | 105,340 | |||||||||||||||||||

| Issuance of redeemable common stock | — | — | — | 145 | 145 | ||||||||||||||||||||||||

| Repurchase of redeemable common stock | (25,000) | (25,000) | (25,000) | (25,000) | (100,000) | ||||||||||||||||||||||||

| Adjustment to carrying value of redeemable common stock | 35 | 35 | 13 | 92 | 175 | ||||||||||||||||||||||||

| Balance as of June 30, 2024 | $ | 1,370 | $ | 1,370 | $ | 1,348 | $ | 1,572 | $ | 5,660 | |||||||||||||||||||

The following table summarizes the changes in our outstanding shares of redeemable common stock for the six months ended June 30, 2024:

| Class S Redeemable Common Shares | Class D Redeemable Common Shares | Class I Redeemable Common Shares | Class E Redeemable Common Shares | Total | |||||||||||||||||||||||||

| Total Outstanding Shares as of December 31, 2023 | 1,052,487 | 1,052,487 | 1,052,487 | 1,052,464 | 4,209,925 | ||||||||||||||||||||||||

| Issuance of redeemable common stock | — | — | — | — | — | ||||||||||||||||||||||||

| Total Outstanding Shares as of March 31, 2024 | 1,052,487 | 1,052,487 | 1,052,487 | 1,052,464 | 4,209,925 | ||||||||||||||||||||||||

| Issuance of redeemable common stock | — | — | — | 5,792 | 5,792 | ||||||||||||||||||||||||

| Repurchase of redeemable common stock | (997,920) | (997,921) | (998,825) | (995,972) | (3,990,638) | ||||||||||||||||||||||||

| Total Outstanding Shares as of June 30, 2024 | 54,567 | 54,566 | 53,662 | 62,284 | 225,079 | ||||||||||||||||||||||||

For the three and six months ended June 30, 2024, we recorded an increase to redeemable common stock and a decrease to additional paid-in-capital of $175,000 to adjust the value of the redeemable common shares outstanding to our June 30, 2024 NAV per share for each respective share class. The change in the redemption value does not affect income available to common stockholders.

8.Stockholders’ Equity

Stapled Unit Offerings of Preferred and Common Stock

As of June 30, 2024 and December 31, 2023, 111 Stapled Units and 117 New Stapled Units were issued and outstanding. Each Stapled Unit consists of one share of 12.5% Series A Cumulative Redeemable Preferred Stock (the “Series A Preferred Stock”), one Class S share, one Class D share and one Class I share. Each New Stapled Unit consists of one share of Series A Preferred Stock and one Class S-1 share. The Stapled Unit and New Stapled Unit holders cannot separate the individual shares of stock that constitute the Stapled Unit and New Stapled Units and can only sell or transfer the Stapled Unit and New Stapled Units as a unit. Holders of Stapled Units and New Stapled Units are not eligible to participate in the share repurchase plan discussed below.

The Series A Preferred Stock has a liquidation value of $1,000 per share. Holders of our Series A Preferred Stock are entitled to receive dividends at an annual rate of 12.5% of the liquidation preference, or $125.00 per share per annum. Dividends are cumulative and payable annually. We can call the Series A Preferred Stock at any time through December 31, 2024 at a 5% redemption premium above the liquidation value. The Series A Preferred Stock has no redemption premium on or after January 1, 2025, and we can call the Series A Preferred Stock for $1,000 per share at any time on or after January 1, 2025. We can call the common shares issued in these offerings at any time at the current transaction price for the respective class of common stock. Each class of common shares is separately redeemable from the Series A Preferred Stock and each other class of common shares. If we elect to redeem any class of common shares included in the Stapled Unit or New Stapled Unit, we will redeem all common shares of that class included in the Stapled Units or New Stapled Units, as applicable.

Common Stock

In December 2023, we entered into a subscription agreement (the “Class F Subscription Agreement”) with an institutional investor to purchase up to $200 million of Class F shares. The initial purchase price for Class F shares was the prior month’s

10

NAV per share of Class E shares. For a discussion of fees paid to the Adviser with respect to Class F shares, see Note 11 - “Related Party Transactions - Management Fee and Performance Fee”.

During the three months ended June 30, 2024, we called $120.0 million of capital under the Class F Subscription Agreement, issuing 4,747,348 Class F shares. As of June 30, 2024, we may call an additional $80.0 million of the $200.0 million capital committed under the Class F Subscription Agreement.

The table below summarizes the changes in our outstanding shares of common stock as of the six months ended June 30, 2024 and 2023

| Six Months Ended June 30, 2024 | |||||||||||||||||||||||||||||||||||||||||

| Class S Shares | Class S-1 Shares | Class D Shares | Class I Shares | Class E Shares | Class F Shares | Total | |||||||||||||||||||||||||||||||||||

Total Outstanding Shares as of December 31, 2023(1) | 1,052,598 | 1,054,174 | 1,052,598 | 1,383,506 | 1,067,805 | — | 5,610,681 | ||||||||||||||||||||||||||||||||||

| Issuance of common stock | — | 1,467,311 | — | 656,221 | 57,994 | — | 2,181,526 | ||||||||||||||||||||||||||||||||||

| Common stock distribution reinvestment | — | 21,860 | — | 8,245 | 622 | — | 30,727 | ||||||||||||||||||||||||||||||||||

| Total Outstanding Shares as of March 31, 2024 | 1,052,598 | 2,543,345 | 1,052,598 | 2,047,972 | 1,126,421 | — | 7,822,934 | ||||||||||||||||||||||||||||||||||

| Issuance of common stock | 5,757 | 1,258,476 | — | 448,043 | 10,707 | 4,747,348 | 6,470,331 | ||||||||||||||||||||||||||||||||||

Stock awards(2) | — | — | — | — | 3,340 | — | 3,340 | ||||||||||||||||||||||||||||||||||

Issuance of redeemable common stock(3) | — | — | — | — | 5,792 | — | 5,792 | ||||||||||||||||||||||||||||||||||

| Common stock distribution reinvestment | — | 71,248 | — | 31,704 | 1,582 | — | 104,534 | ||||||||||||||||||||||||||||||||||

| Repurchase of common stock | — | — | — | (1,200) | — | (1,200) | |||||||||||||||||||||||||||||||||||

| Repurchase of redeemable common stock | (997,920) | — | (997,921) | (998,825) | (995,972) | — | (3,990,638) | ||||||||||||||||||||||||||||||||||

| Total Outstanding Shares as of June 30, 2024 | 60,435 | 3,873,069 | 54,677 | 1,527,694 | 151,870 | 4,747,348 | 10,415,093 | ||||||||||||||||||||||||||||||||||

(1) Total Outstanding Shares includes 4,209,925 shares, 4,209,925 shares and 225,079 shares at December 31, 2023, March 31, 2024 and June 30, 2024, respectively, that are classified as redeemable common stock. See Note 7 - “Redeemable Common Stock - Related Party”.

(2) Represents shares issued to independent directors under the Incentive Plan. See Share-Based Compensation Plan below.

(3) Consists of shares issued to the Adviser for the payment of management fees that are classified as redeemable common stock. See Note 7 - “Redeemable Common Stock - Related Party”.

| Six Months Ended June 30, 2023 | |||||||||||||||||||||||||||||||||||||||||

| Class S Shares | Class S-1 Shares | Class D Shares | Class I Shares | Class E Shares | Class F Shares | Total | |||||||||||||||||||||||||||||||||||

| Total Outstanding Shares as of December 31, 2022 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Issuance of common stock | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Total Outstanding Shares as of March 31, 2023 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

Issuance of common stock(1) | 511 | — | 511 | 511 | 400 | — | 1,933 | ||||||||||||||||||||||||||||||||||

| Total Outstanding Shares as of June 30, 2023 | 511 | — | 511 | 511 | 400 | — | 1,933 | ||||||||||||||||||||||||||||||||||

(1) Includes 1,600 shares issued to an affiliate of Invesco under the Invesco Subscription Agreement.

Distributions

For the three and six months ended June 30, 2024, we declared distributions of $7.3 million and $13.6 million, respectively. We accrued $1.6 million for distributions payable, of which $36,000 was accrued for distributions payable to related parties, in our condensed consolidated balance sheets as of June 30, 2024. For the year ended December 31, 2023, we declared distributions of $7.8 million. We accrued $3.1 million for distributions payable, of which $2.4 million was accrued for distributions payable to related parties, in our condensed consolidated balance sheets as of December 31, 2023.

11

The table below details the aggregate distributions declared per share for each applicable class of stock for the three and six months ended June 30, 2024.

| Three Months Ended June 30, 2024 | |||||||||||||||||||||||||||||||||||||||||

| Class S Shares | Class S-1 Shares | Class D Shares | Class I Shares | Class E Shares | Class F Shares | ||||||||||||||||||||||||||||||||||||

| Aggregate distribution declared per share | $ | 0.7800 | $ | 0.7800 | $ | 0.7800 | $ | 0.7800 | $ | 0.7800 | $ | 0.7800 | |||||||||||||||||||||||||||||

| Stockholder servicing fee per share | (0.0017) | (0.0529) | — | — | — | — | |||||||||||||||||||||||||||||||||||

| Net distribution declared per share | $ | 0.7783 | $ | 0.7271 | $ | 0.7800 | $ | 0.7800 | $ | 0.7800 | $ | 0.7800 | |||||||||||||||||||||||||||||

| Six Months Ended June 30, 2024 | |||||||||||||||||||||||||||||||||||||||||

| Class S Shares | Class S-1 Shares | Class D Shares | Class I Shares | Class E Shares | Class F Shares | ||||||||||||||||||||||||||||||||||||

| Aggregate distribution declared per share | $ | 1.6400 | $ | 1.6400 | $ | 1.6400 | $ | 1.6400 | $ | 1.6400 | $ | 0.7800 | |||||||||||||||||||||||||||||

| Stockholder servicing fee per share | (0.0017) | (0.1063) | — | — | — | — | |||||||||||||||||||||||||||||||||||

| Net distribution declared per share | $ | 1.6383 | $ | 1.5337 | $ | 1.6400 | $ | 1.6400 | $ | 1.6400 | $ | 0.7800 | |||||||||||||||||||||||||||||

Share Repurchase Plan

We have adopted a share repurchase plan for our common stock. On a monthly basis, our stockholders may request that we repurchase all or any portion of their shares. We may choose, in our discretion, to repurchase all, some or none of the shares that have been requested to be repurchased at the end of any month, subject to the limitations in the share repurchase plan.

Under the Invesco Subscription Agreement described in Note 7 - “Redeemable Common Stock - Related Party”, Invesco Realty may not participate in our share repurchase plan until the earlier of March 23, 2028 and the date that our aggregate NAV is at least $1.5 billion. We can only accept a repurchase request from Invesco Realty after all requests from unaffiliated stockholders have been fulfilled.

Under its subscription agreement, the Class F stockholder may not participate in our share repurchase plan until the earlier of (i) the date our NAV reaches $1.5 billion and (ii) March 23, 2028. However, the Class F stockholder is entitled to request that we repurchase their shares in the event that there is a key person event or a material strategy change as defined in the terms of the Class F subscription agreement.

Class E shares issued to the Adviser as payment for management fees or performance fees are not subject to the repurchase limits of our share repurchase plan, any lockup period applicable to the Adviser or any reduction penalty for an early repurchase.

For the three and six months ended June 30, 2024, we repurchased 1,200 shares of common stock and fulfilled all repurchase requests that were made under the share repurchase plan. For the three and six months ended June 30, 2023, we did not repurchase any shares under the share repurchase plan.

Distribution Reinvestment Plan

We have adopted a distribution reinvestment plan whereby stockholders will have their cash distributions automatically reinvested in additional shares of common stock unless they elect to receive their distributions in cash. The per share purchase price for shares purchased under the distribution reinvestment plan is equal to the transaction price at the time the distribution is payable.

12

Share-Based Compensation Plan

In May 2024 and November 2023, we granted 3,340 and 2,989 restricted shares of Class E common stock, respectively, to our independent directors under the terms of our 2023 Equity Incentive Plan (the “Incentive Plan”). The restricted shares granted in November 2023 became vested in March 2024. The restricted shares granted in May 2024 will become unrestricted shares of common stock on the first anniversary of the grant date unless forfeited, subject to certain conditions that accelerate vesting. For the three and six months ended June 30, 2024, we recognized $20,000 and $37,000, respectively, of compensation expense related to these awards. As of June 30, 2024, we had 1,093,671 shares of common stock available for future issuance under the Incentive Plan.

9.Earnings per Common Share

Earnings per share for the three and six months ended June 30, 2024 and 2023 is computed as presented in the table below.

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| $ in thousands, except share and per share amounts | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| Numerator (Income) | |||||||||||||||||||||||

| Basic Earnings: | |||||||||||||||||||||||

| Net income (loss) available to common stockholders | $ | 3,620 | $ | (1,606) | $ | 8,300 | $ | (2,733) | |||||||||||||||

| Denominator (Weighted Average Shares) | |||||||||||||||||||||||

| Basic Earnings: | |||||||||||||||||||||||

| Shares available to common stockholders | 10,729,623 | 748 | 8,956,409 | 382 | |||||||||||||||||||

| Effect of dilutive securities: | |||||||||||||||||||||||

| Restricted stock awards | 28 | — | 306 | — | |||||||||||||||||||

| Dilutive Shares | 10,729,651 | 748 | 8,956,715 | 382 | |||||||||||||||||||

| Earnings (loss) per share: | |||||||||||||||||||||||

| Net income (loss) attributable to common stockholders | |||||||||||||||||||||||

| Basic | $ | 0.34 | $ | (2,147.96) | $ | 0.93 | $ | (7,151.30) | |||||||||||||||

| Diluted | $ | 0.34 | $ | (2,147.96) | $ | 0.93 | $ | (7,151.30) | |||||||||||||||

10.Fair Value of Financial Instruments

A three-level valuation hierarchy exists for disclosure of fair value measurements based upon the transparency of inputs to the valuation of an asset or liability as of the measurement date. Observable inputs reflect readily obtainable data from independent sources, while unobservable inputs reflect our market assumptions. The three levels are defined as follows:

Level 1 — quoted prices are available in active markets for identical investments as of the measurement date. We do not adjust the quoted price for these investments.

Level 2 — quoted prices are available in markets that are not active or model inputs are based on inputs that are either directly or indirectly observable as of the measurement date.

Level 3 — pricing inputs are unobservable and include instances where there is minimal, if any, market activity for the investment. These inputs require significant judgment or estimation by management or third parties when determining fair value and generally represent anything that does not meet the criteria of Levels 1 and 2. Due to the inherent uncertainty of these estimates, these values may differ materially from the values that would have been used had a ready market for these investments existed.

13

Valuation of Financial Instruments Measured at Fair Value

The following table details our financial instruments measured at fair value on a recurring basis:

| June 30, 2024 | |||||||||||||||||||||||

| Fair Value Measurements Using: | |||||||||||||||||||||||

| $ in thousands | Level 1 | Level 2 | Level 3 | Total at Fair Value | |||||||||||||||||||

| Assets: | |||||||||||||||||||||||

| Commercial real estate loan investments | $ | — | $ | — | $ | 1,121,010 | $ | 1,121,010 | |||||||||||||||

| Liabilities: | |||||||||||||||||||||||

| Revolving credit facility | — | — | 10,000 | 10,000 | |||||||||||||||||||

| Repurchase agreements | — | — | 849,754 | 849,754 | |||||||||||||||||||

| Total liabilities | $ | — | $ | — | $ | 859,754 | $ | 859,754 | |||||||||||||||

| December 31, 2023 | |||||||||||||||||||||||

| Fair Value Measurements Using: | |||||||||||||||||||||||

| $ in thousands | Level 1 | Level 2 | Level 3 | Total at Fair Value | |||||||||||||||||||

| Assets: | |||||||||||||||||||||||

| Commercial real estate loan investments | $ | — | $ | — | $ | 613,503 | $ | 613,503 | |||||||||||||||

| Liabilities: | |||||||||||||||||||||||

| Revolving credit facility | — | — | 14,000 | 14,000 | |||||||||||||||||||

| Repurchase agreements | — | — | 457,861 | 457,861 | |||||||||||||||||||

| Total liabilities | $ | — | $ | — | $ | 471,861 | $ | 471,861 | |||||||||||||||

Valuation of Commercial Real Estate Loan Investments

Our commercial real estate loan investments consist of senior mortgages and similar credit quality loans, including related contiguous subordinate loans, and are classified as Level 3. The commercial loans are carried at fair value based on significant unobservable inputs. The following table shows a reconciliation of the beginning and ending fair value measurements of our commercial real estate loan investments:

| $ in thousands | Three Months Ended June 30, 2024 | Six Months Ended June 30, 2024 | |||||||||||||||

| Beginning Balance | $ | 824,333 | $ | 613,503 | |||||||||||||

| Loan originations and fundings | 296,392 | 506,304 | |||||||||||||||

| Net unrealized gain (loss) | 285 | 1,203 | |||||||||||||||

| Balance as of June 30, 2024 | $ | 1,121,010 | $ | 1,121,010 | |||||||||||||

The following tables summarize the significant unobservable inputs used in the fair value measurement of our investments in commercial loans:

| June 30, 2024 | ||||||||||||||||||||||||||||||||

| Type | Valuation Technique | Unobservable Input | Weighted Average Rate | Range | Weighted Average Life (years)(1) | |||||||||||||||||||||||||||

| Commercial loans | Discounted cash flow | Discount rate | 8.18% | 7.83% - 8.43% | 0.72 | |||||||||||||||||||||||||||

(1) Based on expected cash flows and potential prepayments.

14

| December 31, 2023 | ||||||||||||||||||||||||||||||||

| Type | Valuation Technique | Unobservable Input | Weighted Average Rate | Range | Weighted Average Life (years) | |||||||||||||||||||||||||||

| Commercial loans | Discounted cash flow | Discount rate | 8.52% | 8.16% - 8.71% | 2.12 | |||||||||||||||||||||||||||

The discount rate above is subject to change based on changes in economic and market conditions, in addition to changes in the underlying economics of the arrangement, such as changes in the underlying property valuation and debt service. These rates are also based on the location, type and nature of each underlying property and related industry publications. Changes in discount rates result in increases or decreases in the fair values of these investments. The discount rate encompasses, among other things, uncertainties in the valuation models with respect to the amount and timing of cash flows. It is not possible for us to predict the effect of future economic or market conditions based on our estimated fair values.

Valuation of Revolving Credit Facility

Given the uncertainty of future cash flows, including our ability to prepay without penalty, we determined the fair value of our revolving credit facility to approximate par.

The following table shows a reconciliation of the beginning and ending fair value measurements of our revolving credit facility:

| $ in thousands | Three Months Ended June 30, 2024 | Six Months Ended June 30, 2024 | |||||||||

| Beginning Balance | $ | 18,000 | $ | 14,000 | |||||||

| Proceeds from revolving credit facility | 101,000 | 192,000 | |||||||||

| Repayment of revolving credit facility | (109,000) | (196,000) | |||||||||

| Net unrealized (gain) loss | — | — | |||||||||

| Balance as of June 30, 2024 | $ | 10,000 | $ | 10,000 | |||||||

Valuation of Repurchase Agreements

We have entered into repurchase agreement facilities to provide floating rate financing for our commercial real estate loan investments. Our repurchase agreements are carried at fair value based on significant unobservable inputs and are classified as Level 3.

The following table shows a reconciliation of the beginning and ending fair value measurements of our repurchase agreements:

| $ in thousands | Three Months Ended June 30, 2024 | Six Months Ended June 30, 2024 | |||||||||

| Beginning Balance | $ | 609,981 | $ | 457,861 | |||||||

| Borrowings under repurchase agreements | 288,050 | 439,447 | |||||||||

| Repayments of repurchase agreements | (48,476) | (48,476) | |||||||||

| Net unrealized (gain) loss | 199 | 922 | |||||||||

| Balance as of June 30, 2024 | $ | 849,754 | $ | 849,754 | |||||||

The following tables summarize the significant unobservable inputs used in the fair value measurement of our repurchase agreements:

| June 30, 2024 | ||||||||||||||||||||||||||||||||

| Type | Valuation Technique | Unobservable Input | Weighted Average Rate | Range | Weighted Average Life (years)(1) | |||||||||||||||||||||||||||

| Repurchase agreements | Discounted cash flow | Discount rate | 7.24% | 6.98% - 7.53% | 0.73 | |||||||||||||||||||||||||||

(1) Based on expected cash flows and potential prepayments.

| December 31, 2023 | ||||||||||||||||||||||||||||||||

| Type | Valuation Technique | Unobservable Input | Weighted Average Rate | Range | Weighted Average Life (years) | |||||||||||||||||||||||||||

| Repurchase agreements | Discounted cash flow | Discount rate | 7.62% | 7.31% - 7.86% | 1.48 | |||||||||||||||||||||||||||

15

The discount rate above is subject to change based on changes in economic and market conditions, in addition to changes in the underlying economics of the pledged commercial real estate loan, such as changes in the loan-to-value ratio, credit profile and debt service. These rates are also based on the location, type and nature of each pledged property underlying the commercial real estate loan and related industry publications. Changes in discount rates result in increases or decreases in the fair values of these investments. The discount rate encompasses, among other things, uncertainties in the valuation models with respect to the amount and timing of cash flows. It is not possible for us to predict the effect of future economic or market conditions based on our estimated fair values.

11.Related Party Transactions

Due to/from Affiliates

Our due from affiliates balance consists of amounts paid by the Company that are due to us from the Adviser under the terms of our advisory agreement and totaled $675,000 as of June 30, 2024. (December 31, 2023: None).

The following table details the components of due to affiliates as of June 30, 2024 and December 31, 2023.

| $ in thousands | June 30, 2024 | December 31, 2023 | |||||||||||||||

| Adviser commitment fee payable | $ | 2,120 | $ | 113 | |||||||||||||

| Advanced organizational costs | 724 | 707 | |||||||||||||||

| Advanced offering costs | 1,261 | 1,293 | |||||||||||||||

| Advanced debt issuance and other financing costs | 7,001 | 3,727 | |||||||||||||||

Advanced general and administrative expenses(1) | 5,497 | 2,993 | |||||||||||||||

| Accrued stockholder servicing fees | 4,717 | 1,334 | |||||||||||||||

| Accrued management fee | 307 | — | |||||||||||||||

| Accrued performance fee | 850 | — | |||||||||||||||

| Other | 45 | — | |||||||||||||||

| Total | $ | 22,522 | $ | 10,167 | |||||||||||||

(1) Advanced general and administrative expenses as of June 30, 2024 and December 31, 2023 includes approximately $287,000 and $73,000, respectively, of prepaid expenses which are included in other assets on our condensed consolidated balance sheets.

Adviser Commitment Fee

We charge a commitment fee to borrowers in connection with the origination of each new loan. The commitment fee is calculated as a percentage of the whole loan at the time of the loan closing. We pay the Adviser 50% of the commitment fee (not to exceed 0.5% of the loan amount) as compensation for sourcing, structuring and negotiating the loan. The commitment fee income and related expense to the Adviser is reported as commitment fee income, net of related party expense on the condensed consolidated statements of operations.

Organizational Costs and Offering Expenses

Under the terms of our amended and restated advisory agreement dated April 24, 2024, the Adviser advanced all of our organizational costs and offering expenses (other than upfront selling commissions and ongoing stockholder servicing fees) incurred through May 31, 2024. We will reimburse the Adviser for all of our organizational costs and offering expenses advanced through May 31, 2024 ratably over 52 months commencing December 1, 2024. We will reimburse the Adviser on a quarterly basis for organizational and offering expenses incurred on our behalf subsequent to May 31, 2024.

Under the terms of our advisory agreement, organizational costs and offering expenses became a liability of the Company on March 23, 2023. Organizational costs and offering expenses include costs incurred by the Adviser prior to entering into the advisory agreement with the Company.

16

Operating Expenses Reimbursement

Under the terms of our amended and restated advisory agreement dated April 24, 2024, the Adviser advanced our operating expenses, including debt issuance costs and general and administrative expenses, incurred through May 31, 2024. We will reimburse the Adviser for all of our operating expenses advanced through May 31, 2024 ratably over 52 months commencing December 1, 2024.

Following May 31, 2024, we will reimburse the Adviser quarterly for total operating expenses paid by the Adviser on our behalf. However, we may not reimburse the Adviser at the end of any fiscal quarter for total operating expenses (as defined in our charter) that, in the four consecutive fiscal quarters then ended, exceed the greater of 2% of average invested assets or 25% of net income determined without reduction for any non-cash reserves and excluding any gain from the sale of our assets for that period (the “2%/25% Guidelines”). We may reimburse the Adviser for expenses in excess of the 2%/25% Guidelines if a majority of our independent directors determines that such excess expenses are justified based on unusual and non-recurring factors.

For the three and six months ended June 30, 2024, the Adviser had incurred expenses on our behalf of $45,000 subsequent to May 31, 2024, of which $45,000 is accrued as a component of due to affiliates on our condensed consolidated balance sheets as of June 30, 2024 and included within Other in the table above.

Stockholder Servicing Fees and Other Selling Commissions

The Dealer Manager is entitled to receive upfront selling commissions and stockholder servicing fees for Class S, Class S-1 and Class D shares sold in the Continuous Offering. The Dealer Manager reallows (pays) all or a portion of the stockholder servicing fees to participating broker-dealers and servicing broker-dealers for ongoing stockholder services performed by such broker-dealers and will waive stockholder servicing fees to the extent a broker-dealer is not eligible to receive it for failure to provide such service.

We accrue the full amount of stockholder servicing fees payable as an offering cost at the time each Class S-1, Class S, and Class D share is sold during the Continuous Offering. During the three months and six months ended June 30, 2024, we paid approximately $159,000 and $245,000 of stockholder servicing fees, respectively, with respect to the outstanding Class S-1 shares and did not pay stockholder servicing fees with respect to the outstanding Class S and Class D shares. During the year ended December 31, 2023, we paid approximately $15,000 of stockholder servicing fees with respect to the outstanding Class S-1 shares and did not pay stockholder servicing fees with respect to the outstanding Class S and Class D shares.

The following table summarizes the upfront selling commissions for each class of shares payable at the time of subscription and the stockholder servicing fee we pay the Dealer Manager on an annualized basis as a percentage of the NAV for such class:

| Class S Shares | Class S-1 Shares | Class D Shares | Class I Shares | Class E Shares | Class F Shares | ||||||||||||||||||||||||||||||

| Maximum Upfront Selling Commissions (% of Transaction Price) | up to 3.5% | up to 3.5% | up to 1.5% | — | — | — | |||||||||||||||||||||||||||||

| Stockholder Servicing Fee (% of NAV) | 0.85% | 0.85% | 0.25% | — | — | — | |||||||||||||||||||||||||||||

We will cease paying the stockholder servicing fee with respect to any Class S share or Class D share held in a stockholder’s account at the end of the month in which the Dealer Manager, in conjunction with the transfer agent, determines that total upfront selling commissions and stockholder servicing fees paid with respect to the shares held by the stockholder would exceed, in the aggregate, 8.75% of the gross proceeds from the sale of such shares (including the gross proceeds of any shares issued under our distribution reinvestment plan upon the reinvestment of distributions paid with respect thereto or with respect to any shares issued under our distribution reinvestment plan directly or indirectly attributable to such shares). At the end of such month, such Class S share or Class D share will convert into a number of Class I shares (including any fractional shares), with an equivalent aggregate NAV as such share. Such servicing fee limit does not apply to the Class S-1 shares.

17

Management Fee and Performance Fee

We will pay the Adviser a management fee equal to 1.0% per annum of NAV, calculated monthly before giving effect to any accruals for the management fee, stockholder servicing fees, performance fees or any distributions with respect to our Class S shares, Class S-1 shares, Class D shares and Class I shares. We will also pay the Adviser a Performance Fee equal to 10% of our “Performance Fee Income” with respect to our Class S shares, Class S-1 shares, Class D shares and Class I shares. Performance Fee Income with respect to each class of common shares subject to a performance fee means the net income (determined in accordance with U.S. GAAP) allocable to such class of common shares subject to adjustment as defined under the terms of our advisory agreement. During the period that the Adviser is advancing our organizational, offering and operating expenses, net income for purposes of the performance fee calculation will exclude these advanced expenses for the period incurred under US GAAP. After the period that the Adviser is advancing our organizational, offering and operating expenses, net income for purposes of the performance fee calculation will include previously advanced expenses that are to be repaid to the Adviser during the period. We will not pay the Adviser a performance fee with respect to any class of shares that has a negative total return per share for the calendar year. For purposes of the performance fee calculation, total return per share is defined as an amount equal to: (i) the cumulative distributions per share accrued with respect to such class of common shares since the beginning of the calendar year plus (ii) the change in NAV per share of such class of common shares since the beginning of the calendar year, prior to giving effect to (y) any accrual for performance fees with respect to such class of common shares or (z) any applicable stockholder servicing fees. We will not pay the Adviser a management or performance fee with respect to our Class E shares.

The management fee and the performance fee are payable in cash or Class E shares at the option of the Adviser.

We will not pay the Adviser a management fee with respect to our Class F shares. We will pay the Adviser a performance fee with respect to the Class F shares. The Class F performance fee payable with respect to each calendar year will be an amount equal to 10% of the excess of Performance Fee Income allocable to Class F shares over a 6% annualized return on the Class F NAV per share. No performance fee is payable if the Performance Fee Income allocable to Class F is below the annualized 6% return in any calendar year or for a rolling two-year period.

Management fees and performance fees began to accrue on March 1, 2024. Management fees will be accrued monthly and paid quarterly in arrears and performance fees will be paid annually. During the three and six months ended June 30, 2024, we incurred management fees of $307,000 and $452,000, respectively, of which $307,000 is accrued as a component of due to affiliates on our condensed consolidated balance sheets as of June 30, 2024. During the three and six months ended June 30, 2024, we incurred performance fees of $645,000 and $850,000, respectively, of which $850,000 is accrued as a component of due to affiliates on our condensed consolidated balance sheets as of June 30, 2024. During the three and six months ended June 30, 2024, we issued 5,792 Class E Redeemable Common Stock shares as payment for the management fees earned. The shares issued to the Adviser for payment of the management fee were issued at the applicable NAV per share at the end of each quarter for which the fee was earned.

The initial term of our advisory agreement expires on March 31, 2025. The advisory agreement is subject to automatic renewals for successive one-year periods unless otherwise terminated in accordance with the provisions of the agreement. If the advisory agreement is terminated, the Adviser will be entitled to receive its prorated management fee and performance fee owed through the date of termination. If we elect not to renew our advisory agreement based on unsatisfactory performance and not for cause, we owe our Adviser a termination fee equal to three times the sum of our average annual management fee during the 24-month period before termination, calculated as of the end of the most recently completed fiscal quarter.

Our Adviser is subject to the supervision and oversight of our Board and has only such functions and authority as we delegate to it. The Adviser and its affiliates provide us with our management team, including our officers and appropriate support personnel. Each of our officers is an employee of the Adviser or one of its affiliates. We do not have any employees. We incurred $218,000 and $450,000, respectively, of costs for support personnel provided by the Adviser for the three and six months ended June 30, 2024 that are recorded as a component of due to affiliates on our consolidated balance sheets. During the three and six months ended June 30, 2023, we incurred $46,000 and $46,000, respectively, of costs for support personnel provided by the Adviser.

18

Related Party Share Ownership

The table below summarizes the number of shares and the total purchase price of the shares that have been purchased by affiliates as of June 30, 2024.

| $ in thousands, except share amounts | Class S Shares | Class S-1 Shares | Class D Shares | Class I Shares | Class E Shares | Class F Shares | Total Purchase Price | ||||||||||||||||||||||||||||||||||

Invesco Realty, Inc.(1) | 54,567 | — | 54,567 | 53,662 | 56,491 | — | $ | 5,340 | |||||||||||||||||||||||||||||||||

Invesco Advisers, Inc.(2) | — | — | — | — | 5,792 | — | 145 | ||||||||||||||||||||||||||||||||||

Members of our board of directors (3) | — | — | — | — | 14,732 | — | 84 | ||||||||||||||||||||||||||||||||||

| Total | 54,567 | — | 54,567 | 53,662 | 77,015 | — | $ | 5,569 | |||||||||||||||||||||||||||||||||

(1) Shares issued to Invesco Realty, Inc. are governed by the terms of the Invesco Subscription Agreement and classified as redeemable common shares on our condensed consolidated balance sheets. See Note 7 - “Redeemable Common Stock - Related Party” for further information.

(2) Shares issued to Invesco Advisers, Inc. are governed by the terms of our advisory agreement and classified as redeemable common shares on our condensed consolidated balance sheets. See Note 7 - “Redeemable Common Stock - Related Party” for further information.

(3) Represents shares issued to members of our board of directors, including stock awards under our Share-Based Compensation Plan.

12.Commitments and Contingencies

Commitments and contingencies may arise in the ordinary course of business. As of June 30, 2024, we had unfunded commitments of $258.8 million for 18 of our commercial real estate loan investments. The unfunded commitments consist of funding for leasing costs, interest reserves and capital expenditures. Funding depends on timing of lease-up, renovation and capital improvements as well as satisfaction of certain cash flow tests. Therefore, the exact timing and amounts of such future loan fundings are uncertain. We expect to fund our loan commitments over the weighted average remaining term of the related loans of 3.00 years.

We have also committed to pay counterparty legal, diligence and other fees in connection with new financing facilities in the ordinary course of business.

From time to time, we may be involved in various claims and legal actions arising in the ordinary course of business. As of June 30, 2024, the Company was not involved in any material legal proceedings.

13.Subsequent Events

Investment Portfolio Activity

Subsequent to June 30, 2024, we originated four commercial real estate loans with an aggregate outstanding principal amount of $175.3 million and a total loan amount of $178.9 million. The loans earn interest at one-month term SOFR plus a spread for a weighted average interest rate of 8.25% based on the interest rate in effect at origination.

Financing Activity

Subsequent to June 30, 2024, we entered into a secured financing agreement which provides for current and future financings of up to $837.5 million on a non-mark-to-market, match-term basis to the underlying loans. We also entered into a secured financing agreement which provides for current and future financings of up to $300.0 million on a non-mark-to-market, match-term basis to the underlying loans.

These secured financing agreements increased our total aggregate maximum facility size on our borrowings from $1.8 billion as of June 30, 2024 to $2.7 billion.

19

Stockholders’ Equity

Subsequent to June 30, 2024, we issued the following stock:

| $ in thousands except share amounts | Shares Issued to Third-Parties | Shares Issued to Affiliates(1)(2) | DRP Shares(3) | |||||||||||||||||

| Common Stock: | ||||||||||||||||||||

| Class S | 196 | — | — | |||||||||||||||||

| Class S-1 | 639,333 | — | 12,456 | |||||||||||||||||

| Class D | — | — | — | |||||||||||||||||

| Class I | 383,648 | — | 5,902 | |||||||||||||||||

| Class E | 9,931 | 12,142 | 263 | |||||||||||||||||

| Class F | 3,158,612 | — | 30,040 | |||||||||||||||||

| Total | 4,191,720 | 12,142 | 48,661 | |||||||||||||||||