#97172800v16 ARCADIUM LITHIUM PLC COMPENSATION POLICY FOR NON-EMPLOYEE DIRECTORS (Effective as of January 4, 2024) PART I - GENERAL PROVISIONS 1. Purpose. The purpose of this Policy is to provide a compensation program to attract and retain qualified individuals not employed by the Company, its subsidiaries or its Affiliates to serve on the Board and to further align the interests of the directors of the Company with those of the shareholders of the Company by providing that a substantial portion of compensation will be linked directly to increases in shareholder value. 2. Definitions. Except as otherwise defined herein, terms used herein in capitalized form will have the meanings attributed to them as set forth below or in the Plan. (a) “Annual Retainer” means the retainer fee established by the Board and paid to a director for services on the Board for a year in accordance with Section 1 of Part II of this Policy. (b) “Audit Committee Fee” means the fee established by the Board and paid to a director for service as a member of the Audit Committee of the Board (other than the chair of the Audit Committee) in accordance with Section 4 of Part II of this Policy. (c) “Board” means the Board of Directors of the Company. (d) “Change in Control” has the meaning set forth in the Plan; provided that in no event will a Change in Control be deemed to have occurred with respect to the Participant if the Participant is part of a purchasing Person which consummates the Change in Control. The Participant will be deemed to be “part of a purchasing group” for purposes of the preceding sentence if the Participant is an equity participant in the purchasing Person (except for: (i) passive ownership of less than 3% of the stock of the purchasing Person; or (ii) ownership of equity participation in the purchasing Person which is otherwise not significant, as determined prior to the Change in Control by a majority of the non-employee continuing directors of the Board). (e) “Code” means the U.S. Internal Revenue Code of 1986, as amended from time to time, and any successor thereto. (f) “Committee Chair Fee” means the fee established by the Board and paid to a director for service as chair of any committee of the Board in accordance with Section 3 of Part II of this Policy. (g) “Company” means Arcadium Lithium plc, a public limited company incorporated under the laws of the Bailiwick of Jersey. Exhibit 10.2

2 #97172800v16 (h) “Compensation Committee Fee” means the fee established by the Board and paid to a director for service as a member of the Compensation Committee of the Board (other than the chair of the Compensation Committee) in accordance with Section 5 of Part II of this Policy. (i) “Lead Director Fee” means the retainer fee established by the Board and paid to a director for service as the Lead Director of the Board for a year in accordance with Section 2 of Part II of this Policy. (j) “Nominating Committee Fee” means the fee established by the Board and paid to a director for service as a member of the Nominating and Corporate Governance Committee of the Board (other than the chair of the Nominating and Corporate Governance Committee) in accordance with Section 6 of Part II of this Policy. (k) “Non-Employee Director” means a member of the Board who is not an employee of the Company or any of its subsidiaries or Affiliates, as determined in the discretion of the Board. (l) “Participant” means a Non-Employee Director who is eligible to participate in this Policy. (m) “Plan” means the Arcadium Lithium plc Omnibus Incentive Plan, dated as of January 4, 2024, as may be amended from time to time. (n) “Policy” means the Arcadium Lithium plc Compensation Policy for Non- Employee Directors, as may be amended from time to time. (o) “Separation Date” means the date on which the Participant’s Separation from Service occurs. (p) “Separation from Service” means the termination of the Participant’s service on the Board for any reason. (q) “Sustainability Committee Fee” means the fee established by the Board and paid to a director for service as a member of the Sustainability Committee of the Board (other than the chair of the Sustainability Committee) in accordance with Section 7 of Part II of this Policy. 3. Effective Date. This Policy is effective as of January 4, 2024. PART II - COMPENSATION 1. Annual Retainer. Each Participant will be entitled to receive an Annual Retainer in such amount as will be determined from time to time by the Board. Until changed by resolution of the Board, the Annual Retainer will be $100,000, which will be payable in cash in equal installments at the end of each calendar year quarter.

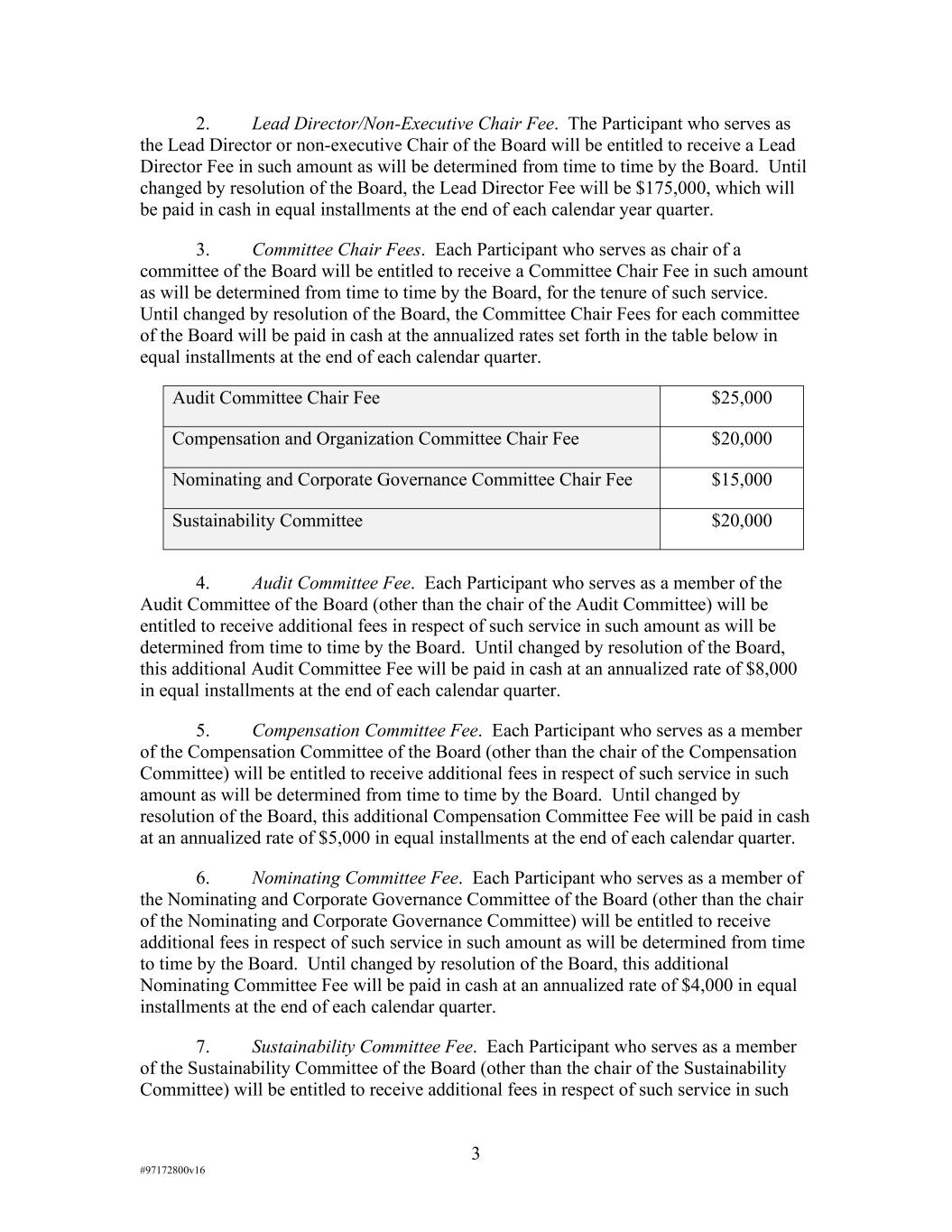

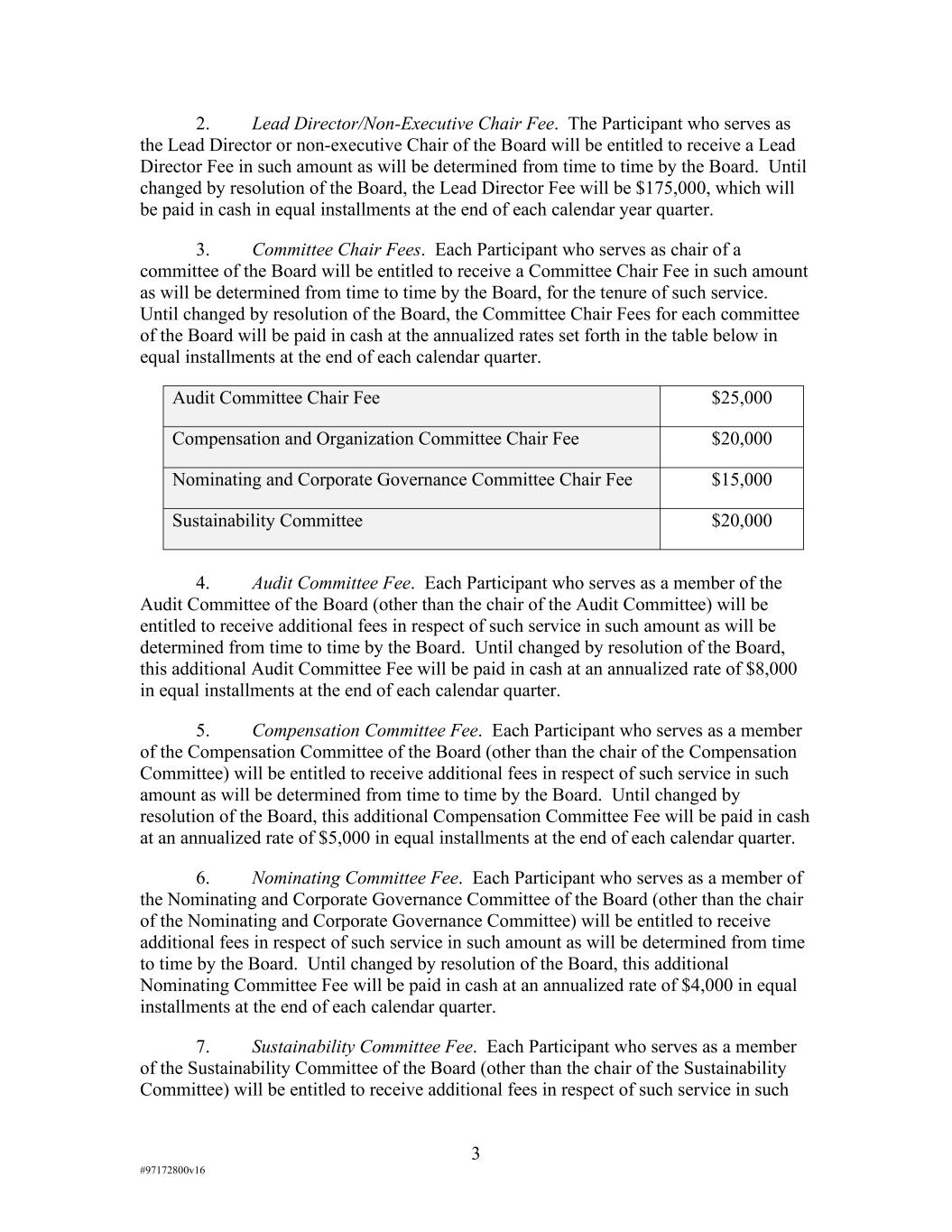

3 #97172800v16 2. Lead Director/Non-Executive Chair Fee. The Participant who serves as the Lead Director or non-executive Chair of the Board will be entitled to receive a Lead Director Fee in such amount as will be determined from time to time by the Board. Until changed by resolution of the Board, the Lead Director Fee will be $175,000, which will be paid in cash in equal installments at the end of each calendar year quarter. 3. Committee Chair Fees. Each Participant who serves as chair of a committee of the Board will be entitled to receive a Committee Chair Fee in such amount as will be determined from time to time by the Board, for the tenure of such service. Until changed by resolution of the Board, the Committee Chair Fees for each committee of the Board will be paid in cash at the annualized rates set forth in the table below in equal installments at the end of each calendar quarter. Audit Committee Chair Fee $25,000 Compensation and Organization Committee Chair Fee $20,000 Nominating and Corporate Governance Committee Chair Fee $15,000 Sustainability Committee $20,000 4. Audit Committee Fee. Each Participant who serves as a member of the Audit Committee of the Board (other than the chair of the Audit Committee) will be entitled to receive additional fees in respect of such service in such amount as will be determined from time to time by the Board. Until changed by resolution of the Board, this additional Audit Committee Fee will be paid in cash at an annualized rate of $8,000 in equal installments at the end of each calendar quarter. 5. Compensation Committee Fee. Each Participant who serves as a member of the Compensation Committee of the Board (other than the chair of the Compensation Committee) will be entitled to receive additional fees in respect of such service in such amount as will be determined from time to time by the Board. Until changed by resolution of the Board, this additional Compensation Committee Fee will be paid in cash at an annualized rate of $5,000 in equal installments at the end of each calendar quarter. 6. Nominating Committee Fee. Each Participant who serves as a member of the Nominating and Corporate Governance Committee of the Board (other than the chair of the Nominating and Corporate Governance Committee) will be entitled to receive additional fees in respect of such service in such amount as will be determined from time to time by the Board. Until changed by resolution of the Board, this additional Nominating Committee Fee will be paid in cash at an annualized rate of $4,000 in equal installments at the end of each calendar quarter. 7. Sustainability Committee Fee. Each Participant who serves as a member of the Sustainability Committee of the Board (other than the chair of the Sustainability Committee) will be entitled to receive additional fees in respect of such service in such

4 #97172800v16 amount as will be determined from time to time by the Board. Until changed by resolution of the Board, this additional Sustainability Committee Fee will be paid in cash at an annualized rate of $4,000 in equal installments at the end of each calendar quarter. 8. Payments. In the event of a Change in Control or a Separation from Service, Participants will be paid any unpaid cash amounts contemplated by this Part II (including, for the avoidance of doubt, the Annual Retainer and any relevant committee fees) with respect to service prior to such Separation from Service or Change in Control, as applicable, as soon as reasonably practicable after the effective date of such Change in Control or Separation from Service (and, in any event, no later than 15 days thereafter). PART III - SHARE COMPENSATION 1. Annual Equity Grant. (a) Effective as of the first trading date following the date of the annual meeting of the Company’s shareholders (beginning with the 2024 annual meeting of the Company’s shareholders), each Participant will be granted a number of Restricted Share Units determined by dividing $135,000 by the Fair Market Value on the date of grant. Notwithstanding the foregoing, the Nominating and Corporate Governance Committee may determine in its sole discretion that based on individual director’s geographical location, legal or tax considerations, an alternative form of Award (as defined in the Plan) may be granted in lieu of such Restricted Share Units. Restricted Share Units (or such alternative Award) granted under this Section 1 are hereinafter referred to as “Annual Units.” Annual Units will be granted pursuant to, and subject to the terms of, the Plan. (b) As soon as reasonably practicable following the date of adoption of this Policy, each Participant as of such date will be granted an award of Annual Units, prorated for the period of service commencing on January 4, 2024 and ending on the date of the Company’s 2024 annual shareholders’ meeting (as reasonably determined by the Nominating and Corporate Governance Committee). (c) Annual Units will vest on the earliest of (i) the first anniversary of the date of grant of the Annual Units, (ii) the date of the next annual meeting of the Company’s shareholders and (iii) a Change in Control; provided in each case that the Participant has remained in service on the Board through the applicable time. Notwithstanding the foregoing, in the event of the Participant’s Separation from Service as a result of his or her death, a pro rata portion of his or her unvested Annual Units will vest and become payable, determined based on the portion of the vesting period that has elapsed as of the Separation Date. Except as set forth in the preceding sentence, any portion of a Participant’s Annual Units that have not vested on or prior to his or her Separation from Service will be forfeited and all rights of the Participant to or with respect to such Annual Units will automatically terminate. 2. Fractional Units. All Restricted Share Units (or alternative Awards) will be credited in whole units, with any fractional unit being rounded up to the nearest whole number.

5 #97172800v16 3. Rights. Except to the extent otherwise set forth herein or in the applicable Notice or award agreement, Participants will not have any of the rights of a shareholder with respect to Restricted Share Units. 4. Payments of Shares Upon Death. In the event of the Participant’s death, payments with respect to any vested Restricted Share Units (or alternative Awards) will be made to the beneficiary designated by the Participant or, in the absence of a duly executed and filed beneficiary designation form, to the person(s) legally entitled thereto, as designated under his or her will or determined under the laws of intestacy for the jurisdiction of his or her domicile. PART IV - ADDITIONAL PROVISIONS 1. Administration. The Nominating and Corporate Governance Committee administers the Policy. The Nominating and Corporate Governance Committee has full power to interpret the Policy, formulate additional details and regulations for carrying out the Policy and amend or terminate the Policy as from time to time it deems proper and in the best interest of the Company. Any decision or interpretation of the Nominating and Corporate Governance Committee is final, conclusive and binding on all persons. 2. Awards Issued Pursuant to the Policy. All equity-based awards described herein (including any Restricted Share Units or alternative Awards) will be granted under, and subject to the terms of, the Plan (or any successor plan thereto) and the applicable Notice and/or other award agreement thereunder. Notwithstanding anything to the contrary in this Policy, the Nominating and Corporate Governance Committee retains the right to determine that a Participant shall receive the form of Award that is deemed to be the most appropriate in the context of local legal and tax frameworks affecting the relevant Participant. 3. Payment of Certain Costs of the Participant. If a dispute arises regarding the interpretation or enforcement of this Policy and the Participant (or in the event of his or her death, his beneficiary) obtains a final judgment in his or her favor from a court of competent jurisdiction from which no appeal may be taken, whether because the time to do so has expired or otherwise, or his or her claim is settled by the Company prior to the rendering of such a judgment, all reasonable legal and other professional fees and expenses incurred by the Participant in contesting or disputing any such claim or in seeking to obtain or enforce any right or benefit provided for in this Policy or in otherwise pursuing his or her claim will be promptly paid by the Company with interest thereon at the highest Bailiwick of Jersey statutory rate for interest on judgments against private parties from the date of payment thereof by the Participant to the date of reimbursement by the Company. 4. Reservation of Rights. Nothing in this Policy will be construed to (a) create any obligation on the part of the Board to nominate any Participant for reelection by the Company’s shareholders or (b) limit in any way the right of the Board to remove a Participant as a director of the Board.

6 #97172800v16 5. Amendment or Termination. The Board may, at any time by resolution, terminate or amend this Policy; provided that no such termination or amendment will adversely affect the rights of Participants or beneficiaries of Participants with respect to cash or equity based awards granted under this Policy prior to such termination or amendment, without the consent of the Participant or, if applicable, the Participant’s beneficiaries. 6. Withholding. The Company will have the right to deduct or withhold from all payments of compensation any taxes required by law to be withheld with respect to such payments. 7. Directors Elected Between Annual Shareholders’ Meetings. Notwithstanding anything to the contrary in this Policy, unless otherwise determined by the Board, the compensation hereunder of an individual who becomes a Participant as a result of his or her election to the Board other than at an annual meeting of the Company’s shareholders will be prorated for the period of service commencing with his or her initial election and ending on the Company’s next annual shareholders’ meeting. 8. Sections 409A and 457A of the Code. This Policy and any compensation granted hereunder is intended to comply with, or be exempt from, the provisions of Sections 409A and 457A of the Code. If any provision of the Policy would otherwise frustrate or conflict with this intent, the provision, term or condition shall be interpreted and deemed amended so as to avoid this conflict. Notwithstanding the foregoing, the tax treatment of the benefits provided under the Policy is not warranted or guaranteed, and in no event shall the Company be liable for all or any portion of any taxes, penalties, interest or other expenses that may be incurred by any Participant on account of non-compliance with Sections 409A and 457A of the Code. Notwithstanding any other provision in this Policy, to the extent compliance with the requirements of Treas. Reg. § 1.409A-3(i)(2) is necessary to avoid the application of an additional tax under Section 409A of the Code, any amounts hereunder that constitutes “deferred compensation” subject to Section 409A of the Code that are otherwise issuable upon the Participant’s Separation from Service will be deferred (without interest) and issued to the Participant immediately following the six-month delay period.