UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________________________________________

FORM 10-K

_______________________________________________________________________

| | | | | |

| ☒ | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2024

or

| | | | | |

| ☐ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from _______ to _______

Commission File Number 001-38694

__________________________________________________________________________

ARCADIUM LITHIUM PLC

__________________________________________________________________________

| | | | | | | | | | | |

| Bailiwick of Jersey | | | 98-1737136 |

(State or other jurisdiction of

incorporation or organization) | | | (I.R.S. Employer

Identification No.) |

| | | |

| 1818 Market Street | | | Suite 12, Gateway Hub |

| Suite 2550 | | | Shannon Airport House |

| Philadelphia, PA | | | Shannon, Co. Clare |

| United States | | | Ireland |

| 19103 | | | V14 E370 |

| | | |

| (Address of principal executive offices) (Zip Code) |

| 215-299-5900 | | | 353-1-6875238 |

| (Registrant’s telephone number, including area code) |

__________________________________________________________________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol (s) | Name of each exchange on which registered |

| Ordinary Shares, $1.00 par value per share | ALTM | New York Stock Exchange

|

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ☒

| | Accelerated filer | | ☐ |

| | | | | | |

| Non-accelerated filer | | ¨

| | Smaller reporting company | | ☐ |

| | | | | | |

| | | | Emerging growth company | | ☐ |

| | | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | | ☐ |

| |

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☒ No ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ¨

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of voting shares held by non-affiliates of the registrant as of June 30, 2024, the last day of the registrant’s second fiscal quarter, was $3,608,469,742. The market value of voting shares held by non-affiliates excludes the value of those shares held by executive officers and directors of the registrant.

Indicate the number of shares outstanding of each of the registrant’s classes of ordinary shares, as of the latest practicable date.

| | | | | | | | |

| Class | | February 25, 2025 |

| Ordinary Shares, par value $1.00 per share | | 1,076,858,925 |

DOCUMENTS INCORPORATED BY REFERENCE

| | | | | | | | |

| | |

| | |

| Portions of the registrant's definitive proxy statement to be filed with the Securities and Exchange Commission in connection with the registrant's annual meeting of shareholders or on an amendment on Form 10-K/A are incorporated by reference in Part III. |

Arcadium Lithium plc

2024 Form 10-K

Table of Contents

Glossary of Terms

When the following terms and abbreviations appear in the text of this report, they have the meanings indicated below:

| | | | | | |

| 2025 Notes | $245.75 million principal amount 4.125% Convertible Senior Notes due 2025 | |

| Allkem | Allkem Pty Ltd, a proprietary company limited by shares incorporated in Australia and a wholly owned subsidiary of Arcadium beginning in 2024, previously known as Allkem Limited, a public company limited by shares and converted from a public to a proprietary limited company on March 6, 2024 | |

| Allkem Transaction Agreement | Transaction Agreement entered into on May 10, 2023 (as amended on August 2, 2023, November 5, 2023 and December 20, 2023), by and among Livent, Allkem, Arcadium, Merger Sub and Arcadium Lithium Intermediate IRL Limited, a private company limited by shares and incorporated and registered in Ireland, providing for the Allkem Livent Merger | |

| Allkem Livent Merger | The combination of Livent and Allkem in a stock-for-stock transaction pursuant to the Allkem Transaction Agreement. The transaction closed on January 4, 2024. | |

| AOCL | Accumulated other comprehensive loss | |

| Acquisition Date | January 4, 2024, the date the Allkem Livent Merger transaction closed | |

| Arcadium, Arcadium Lithium, the "Company," "we," "us" or "our" | Arcadium Lithium plc, previously known as Allkem Livent plc, a public limited company incorporated under the laws of the Bailiwick of Jersey (originally incorporated as Lightning-A Limited, a private limited company incorporated under the laws of the Bailiwick of Jersey), the registrant | |

| Arcadium Plan | Arcadium Lithium plc Omnibus Incentive Plan | |

| ARO | Asset Retirement Obligation | |

| ASC | Accounting Standards Codification, under U.S. GAAP | |

| ASC 842 | Accounting Standards Codification Topic 842 - Leases | |

| ASC 321 | Accounting Standards Codification Topic 321 - Investments - Equity Securities | |

| ASU | Accounting Standards Update, under U.S. GAAP | |

| bgs | below ground surface | |

| Buyer | Rio Tinto BM Subsidiary Limited, a private limited company incorporated under the laws of England & Wales, a party to the Rio Tinto Transaction Agreement | |

| CCAA | The Companies’ Creditors Arrangement Act | |

| CCAA Court | The Superior Court of Québec where Nemaska Lithium, Nemaska Lithium Inc. and certain affiliates filed for creditor protection in Canada under the CCAA | |

| CERCLA | Comprehensive Environmental Response, Compensation and Liability Act | |

| CRA | Canada Revenue Agency | |

| CSR | Corporate Social Responsibility | |

| Credit Agreement | As amended, provides for a $500 million senior secured revolving credit facility | |

| | |

| E&E | Exploration and evaluation | |

| | |

| ETS | BloombergNEF’s Economic Transition Scenario, primarily driven by techno-economic trends and market forces, and assumes no new policies or regulations are enacted that impact the market, the ETS is in line with previous edition of the Long-Term Electric Vehicle Outlook report | |

| ESG | Environmental, social and governance | |

| ESM | ESM ILiAD, LLC, parent of ILiAD Technologies, LLC, both subsidiaries of EnergySource Materials, LLC | |

| EURIBOR | Euro Interbank Offered Rate | |

| Exchange Act | Securities and Exchange Act of 1934 | |

| Exchange Ratio | Pursuant to the Allkem Transaction Agreement, each share of Livent common stock, par value $0.001 per share, was converted into the right to receive 2.406 Arcadium Lithium ordinary shares | |

| EV | Electric vehicle | |

| FASB | Financial Accounting Standards Board | |

| FinCo | Arcadium Lithium Financing IRL DAC, an Irish private company limited by shares that was formed in connection with the Allkem Livent Merger, a wholly owned subsidiary of Arcadium | |

| FMC | FMC Corporation | |

| GDP | Gross domestic product | |

| | | | | | |

| HCM | Human Capital Management | |

| IFRS | International Financial Reporting Standards | |

| ILiAD | Integrated Lithium Adsorption Desorption | |

| IPO | Initial public offering | |

| IQ | Investissement Québec, a company established by the Government of Québec to favor investment in Québec by Québec-based and international companies | |

| Irish IntermediateCo | Arcadium Lithium Intermediate IRL Limited, an Irish private company limited by shares that was formed in connection with the Allkem Livent Merger, a wholly owned subsidiary of Arcadium | |

| IRA | Inflation Reduction Act of 2022 | |

| ISSB | International Sustainability Standards Board, the standard-setting body established in 2021-2022 under the International Financial Reporting Standards Board Foundation | |

| JBNQA | James Bay and Northern Québec Agreement | |

| JEMSE | Jujuy Energia Minera Sociedad del Estado, which owns 8.5% of SDJ | |

| kMT | Thousand metric tons | |

| LCE | Lithium carbonate equivalent | |

| Li2O | Lithium oxide | |

| Livent | Livent Corporation, a Delaware corporation, a wholly owned subsidiary of Arcadium and Arcadium's predecessor | |

| MdA | Minera del Altiplano SA, the local operating subsidiary in Argentina for the Fénix operations | |

| MdA Holdings LLC | MdA Lithium Holdings LLC, a Delaware Limited Liability Company and wholly owned subsidiary of Arcadium, which owns 94.9% of MdA | |

| Merger Sub | Lightning-A Merger Sub, Inc., a Delaware corporation | |

| MT | Metric ton | |

| Naraha Plant | Our lithium hydroxide manufacturing plant in Naraha, Japan, in which we have a 49% ownership interest and 75% economic interest through our investment in TLC, an unconsolidated affiliate accounted for under the equity method of accounting | |

| Nemaska Lithium or NLI | Nemaska Lithium Inc., a non-public lithium company not yet in the production stage domiciled in Québec, Canada | |

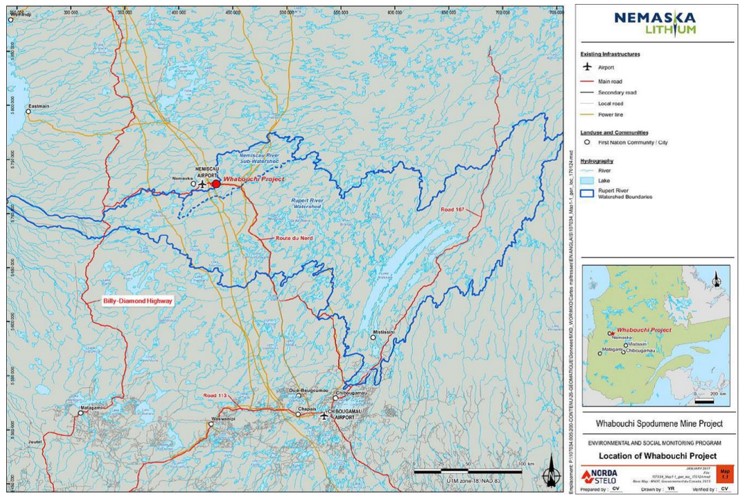

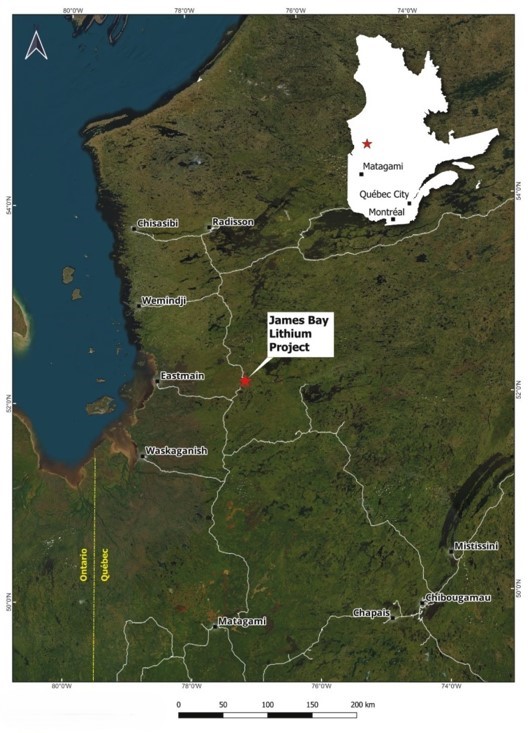

| Nemaska Lithium Project | Through our subsidiary, QLP, in which we own a 50% equity interest in NLI, we are developing the Nemaska Lithium Project, which will consist of the Whabouchi Mine and concentrator in the James Bay region of Québec and a lithium hydroxide conversion plant in Bécancour, Québec | |

| | |

| | |

| NQSP | Arcadium Non-Qualified Savings Plan | |

| Offering | On June 15, 2021, Livent closed on the issuance of 14,950,000 shares of its common stock, par value $0.001 per share, at a public offering price of $17.50 per share, in an underwritten public offering, total net proceeds from the offering were $252.2 million, after deducting underwriters' fees and offering expenses payable by the Livent | |

| Olaroz Plant | Our lithium extraction and manufacturing plant in Jujuy, Argentina, in which we own a 66.5% indirect equity interest through our subsidiaries SDJ Pte and SDJ | |

| OM&M | Operation, maintenance and monitoring of site environmental remediation | |

| Orion | Orion Mine Finance | |

| Parent | Rio Tinto Western Holdings Limited, a private limited company incorporated under the laws of England & Wales, a party to the Rio Tinto Transaction Agreement along with Buyer and Arcadium | |

| ppm | parts per million | |

| PRSU | Performance-based restricted share unit | |

| QC/QA procedures | Quality control and quality assurance procedures | |

| QLP | Québec Lithium Partners (UK) Limited, a wholly owned subsidiary of Arcadium, which owns a 50% equity interest in the Nemaska Lithium Project | |

| QLP Merger | On June 6, 2022, Livent closed on the Transaction Agreement and Plan of Merger with The Pallinghurst Group to provide Livent with a 50% equity interest in Nemaska Lithium, Livent issued 17,500,000 shares of its common stock to acquire the remaining 50% share of Québec Lithium Partners (UK) Limited, previously owned by The Pallinghurst Group and certain of its investors | |

| | | | | | |

| QLP Note | On December 1, 2020, QLP was assigned a deferred payment note, dated November 26, 2020, by Nemaska Lithium Shawinigan Transformation Inc. in favor of OMF (Cayman) Co-VII Ltd., with initial principal amount of $12.5 million | |

| QP | Qualified Person as defined in Item 1300 under subpart 1300 of Regulation S-K | |

| RCRA | Resource Conservation and Recovery Act | |

| REACH | Registration, Evaluation, Authorization and Restriction of Chemicals | |

| REMSA | Recursos Energeticos y Mineros Salta, S.A., local natural-gas sub-distributor in Argentina | |

| Revolving Credit Facility | Arcadium's $500 million senior secured revolving credit facility, as provided by the Credit Agreement | |

| Rio Tinto | Parent and Buyer, collectively Rio Tinto plc | |

| Rio Tinto Transaction | Acquisition of all of the outstanding ordinary shares of Arcadium (including those represented by CDIs) by Rio Tinto for cash equal to $5.85 per Arcadium ordinary share as provided by the Rio Tinto Transaction Agreement, currently expected to close shortly after the sanction hearing for the Royal Court of Jersey set on March 5, 2025, subject to satisfaction of closing conditions. | |

| Rio Tinto Transaction Agreement | Transaction Agreement entered into on October 9, 2024, by and among Parent, Buyer and Arcadium, providing for the Rio Tinto Transaction | |

| ROU | Right-of-use | |

| RVO | Approval and Vesting Order | |

| RSU | Restricted share unit | |

| | |

| SdHM | Salar del Hombre Muerto, in Catamarca Province, Argentina | |

| SDJ Pte | Sales de Jujuy Pte Ltd, Allkem's 72.68% owned subsidiary in Singapore which owns 91.5% of SDJ | |

| SDJ | Sales de Jujuy S.A., Allkem's 66.5% indirectly owned operating subsidiary in Argentina which operates the Olaroz Plant | |

| SDV | Galaxy Lithium (SAL DE VIDA) S.A., Allkem's 100% indirectly owned subsidiary in Argentina which is developing a lithium extraction and manufacturing facility in the Salar del Hombre Muerto, the Sal de Vida Project | |

| SEC | Securities and Exchange Commission | |

| Securities Act | Securities Act of 1933 | |

| Separation | On October 15, 2018, Livent Corporation completed the IPO and sold 20 million shares of Livent common stock to the public at a price of $17.00 per share | |

| SOFR | Secured Overnight Financing Rate | |

| TCFD | Task Force for Climate-Related Financial Disclosures | |

| TLC | Toyotsu Lithium Corporation | |

| TLP | Toyotsu Lithium Pte Ltd, a subsidiary of TTC with a 27.32% ownership in SDJ Pte | |

| TMA | Tax Matters Agreement | |

| Transaction Agreement | Transaction Agreement entered into on May 10, 2023 (as amended on August 2, 2023, November 5, 2023 and December 20, 2023), by and among Livent, Allkem, Arcadium, Merger Sub and Arcadium Lithium Intermediate IRL Limited, a private company limited by shares and incorporated and registered in Ireland, providing for the Allkem Livent Merger | |

| TSR | Total Shareholder Return | |

| TTC | Toyota Tsusho Corporation | |

| U.S. GAAP | United States Generally Accepted Accounting Principles | |

| VAT | Value-added tax | |

Note Regarding Industry and Market Data

Information regarding market and industry statistics contained in this Annual Report has been obtained from industry and other publications that we believe to be reliable, but that are not produced for purposes of securities filings. We have not independently verified any market, industry or similar data presented in this Annual Report and cannot assure you of its accuracy or completeness. Further, we have not reviewed or included data from all sources. Forecasts and other forward-looking information obtained from third-party sources are subject to the same qualifications and the additional uncertainties accompanying any estimates of future market size, revenue and market acceptance of products and services. As a result, investors should not place undue reliance on any such forecasts and other forward-looking information.

PART I

ITEM 1. BUSINESS

Pending Rio Tinto Transaction

On October 9, 2024, Arcadium Lithium entered into the Transaction Agreement (the "Rio Tinto Transaction Agreement") with Rio Tinto Western Holdings Limited, a private limited company incorporated under the laws of England & Wales ("Parent"), and Rio Tinto BM Subsidiary Limited, a private limited company incorporated under the laws of England & Wales ("Buyer").

The Rio Tinto Transaction Agreement provides that pursuant to a scheme of arrangement (the "Scheme") under the Companies (Jersey) Law 1991, at the effective time of the Scheme, all of the ordinary shares, par value $1.00 per share, of the Company (the "Company Shares"), including the Company Shares represented by CHESS depositary interests issued by the Company and listed on the securities exchange operated by ASX Limited, then outstanding will be transferred from the shareholders of the Company to Buyer (or an affiliate of Buyer) in exchange for the right to receive an amount in cash, without interest, equal to $5.85 per Company Share (the "Rio Tinto Transaction").

If the Rio Tinto Transaction is consummated, the Company’s ordinary shares will be delisted from the New York Stock Exchange and the Company’s registration under the Exchange Act of 1934, as amended, will be terminated as promptly as practicable after the effective time of the Rio Tinto Transaction, and the quotation on the Australian Securities Exchange Ltd of the CHESS depositary interests issued by the Company will be suspended immediately prior to the effective time of the Rio Tinto Transaction.

The closing of the Rio Tinto Transaction is subject to customary closing conditions under the Rio Tinto Transaction Agreement, including, among others: the approval of the Scheme by the Company’s shareholders (which has been obtained); all applicable governmental consents under specified antitrust and investment screening laws having been obtained and remaining in full force and effect and all applicable waiting periods having expired, lapsed or been terminated (as applicable) (which consents have been obtained and applicable waiting periods expired); no governmental entity of a competent jurisdiction having issued any order that is in effect and restrains, enjoins or otherwise prohibits the consummation of the Rio Tinto Transaction and no governmental entity having jurisdiction over any party having adopted any law that is in effect and makes consummation of the Rio Tinto Transaction illegal or otherwise prohibited; the representations and warranties of each of the Company and Parent being true and correct to the extent required by, and subject to the applicable materiality standards set forth in, the Rio Tinto Transaction Agreement; each of the Company, Parent and Buyer having in all material respects performed the obligations and complied with the covenants required to be performed or complied with by it under the Rio Tinto Transaction Agreement; and there having been no material adverse effect (as defined in the Rio Tinto Transaction Agreement). The timing surrounding whether these conditions will be satisfied or waived, if at all, is uncertain. Additionally, other events could intervene to delay or result in the failure to close the Rio Tinto Transaction. The Rio Tinto Transaction is currently expected to close shortly after the sanction hearing for the Royal Court of Jersey set on March 5, 2025, subject to satisfaction of the closing conditions.

If the Rio Tinto Transaction has not closed by October 9, 2025 (subject to extension until April 9, 2026 in order to obtain antitrust or investment screening law or other regulatory approvals), either the Company or Parent may choose to terminate the Rio Tinto Transaction Agreement. The Rio Tinto Transaction Agreement provides that, if the Rio Tinto Transaction Agreement is terminated, the Company will pay a $200 million termination fee to Rio Tinto in the case of certain events described in the Rio Tinto Transaction Agreement, including if the Rio Tinto Transaction Agreement is terminated in certain circumstances and the Company enters into an agreement for an alternative transaction within twelve months of such termination. However, this right to terminate the Rio Tinto Transaction Agreement will not be available to the Company or Parent if such party has materially breached the Rio Tinto Transaction Agreement and the breach is the principal cause of the failure of the closing to have occurred prior to such date. The Company or Parent may elect to terminate the Rio Tinto Transaction Agreement in certain other circumstances, and the Company and Parent can mutually decide to terminate the Rio Tinto Transaction Agreement at any time prior to the closing.

The Company expects to incur total transaction costs of approximately $129 million if the Rio Tinto Transaction closes, $23.2 million of which have been expensed and accrued in the Company's consolidated statement of operations and balance sheet for the year ended and as of December 31, 2024, respectively.

The foregoing summary of the Rio Tinto Transaction Agreement and the Rio Tinto Transaction contemplated thereby does not purport to be complete and is qualified in its entirety by reference to the terms and conditions of the Rio Tinto Transaction Agreement, a copy of which is filed as Exhibit 2.5 to this Form 10-K.

Merger of Allkem and Livent

On January 4, 2024, Arcadium Lithium plc ("Arcadium Lithium") completed the previously announced transactions (collectively, the "Allkem Livent Merger") contemplated by the Transaction Agreement, dated as of May 10, 2023, as amended on August 2, 2023, November 5, 2023, and December 20, 2023 (as amended, the "Transaction Agreement"), by and among Livent Corporation, a Delaware corporation ("Livent"), Allkem Limited, an Australian public company limited by shares ("Allkem"), Arcadium Lithium, Lightning-A Merger Sub, Inc., a Delaware corporation ("Merger Sub"), and Arcadium Lithium Intermediate IRL Limited, a private company limited by shares and incorporated and registered in Ireland ("Irish IntermediateCo"). The transaction was consummated by way of (a) a scheme of arrangement under Australian law (the "scheme"), pursuant to which each issued, fully paid ordinary share of Allkem held by Allkem shareholders was exchanged for (i) where the Allkem shareholder did not elect to receive ordinary shares, par value $1.00 per share, of Arcadium Lithium (each, an "Arcadium Lithium Share"), one Arcadium Lithium CHESS Depositary Instrument (a "CDI") quoted on the Australian Stock Exchange, each CDI representing a beneficial ownership interest in one Arcadium Lithium Share and (ii) where the Allkem shareholder elected to receive Arcadium Lithium Shares, one Arcadium Lithium Share, with Allkem becoming a wholly owned subsidiary of Arcadium Lithium and (b) a merger, whereby Merger Sub, a wholly owned subsidiary of Irish IntermediateCo (a direct wholly owned subsidiary of Arcadium Lithium) merged with and into Livent, with Livent surviving the Allkem Livent Merger as an indirect wholly owned subsidiary of Arcadium Lithium, and pursuant to which each share of Livent common stock, par value $0.001 per share (each, a "Livent Share"), was converted into the right to receive 2.406 Arcadium Lithium Shares, and such Arcadium Lithium Shares were issued at the effective time of the Allkem Livent Merger. Arcadium is the successor registrant to Livent pursuant to Rule 12g-3(a) under the Exchange Act.

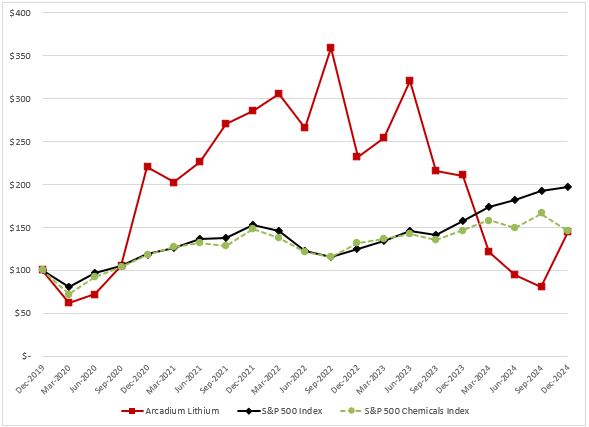

On January 4, 2024, Arcadium Lithium's shares started trading on the New York Stock Exchange under the trading symbol ALTM.

In this Annual Report on Form 10-K, the results of the Company as of December 31, 2024 and for the year ended December 31, 2024 include the financial position and operations of Allkem. Because Arcadium Lithium plc is the successor company to Livent in the Allkem Livent Merger, we are presenting the results of predecessor Livent’s operations as of December 31, 2023 and for the years ended December 31, 2023 and 2022, which do not include the financial position or operations of Allkem. Refer to Note 4 for further information related to the Allkem Livent Merger.

Throughout this Annual Report on Form 10-K, except where otherwise stated or indicated by the context, "Arcadium", "Arcadium Lithium", the "Company", "we," "us," or "our" means Arcadium Lithium plc and its consolidated subsidiaries and when referring to the operations of our predecessor, to Livent and its consolidated subsidiaries. Copies of the annual, quarterly and current reports we file with or furnish to the Securities and Exchange Commission ("SEC"), and any amendments to those reports, are available free of charge on our website at www.arcadiumlithium.com as soon as reasonably practicable after we file such materials with, or furnish them to, the SEC. We also make available, free of charge on our website, the reports filed with the SEC by our officers, directors and 10% stockholders pursuant to Section 16 under the Exchange Act as soon as reasonably practicable after copies of those filings are provided to us by those persons. The SEC also maintains a website, at www.sec.gov, that contains reports, proxy and information statements and other information regarding us and other issuers that file electronically. The information contained on, or that can be accessed through, our website is not a part of or incorporated by reference in this Annual Report on Form 10-K.

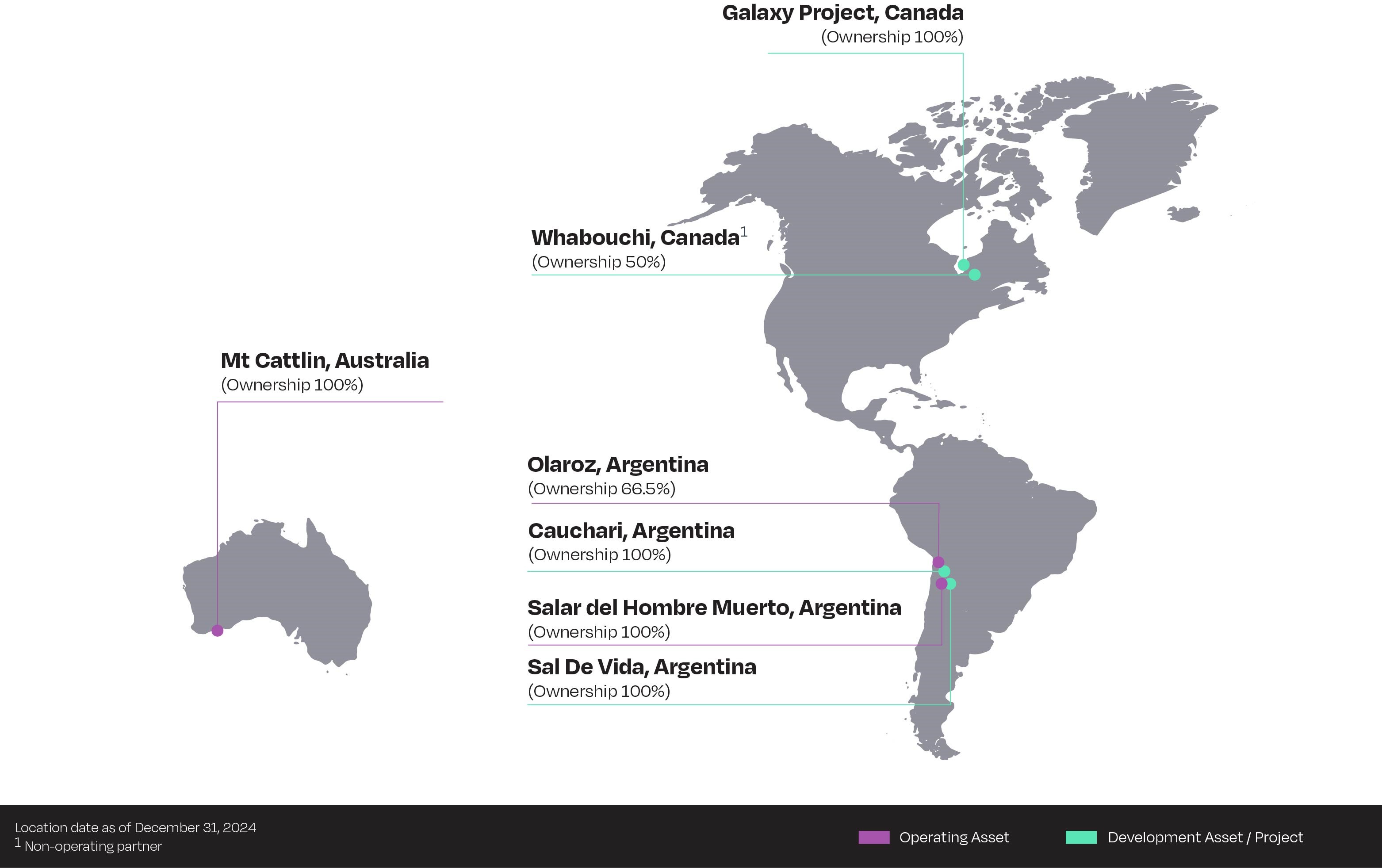

General

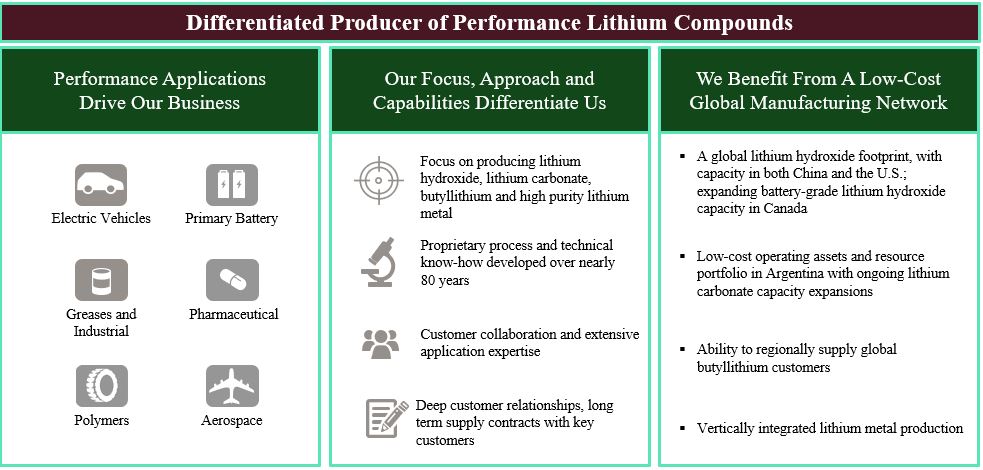

Arcadium Lithium, whose business is the result of the Allkem Livent Merger, is a leading global lithium chemicals producer with a diversified product offering and business-critical scale, including a presence in three major lithium geographies (i.e., the South American "lithium triangle," Western Australia and Canada) and a lithium deposit base that is among the largest in the world.

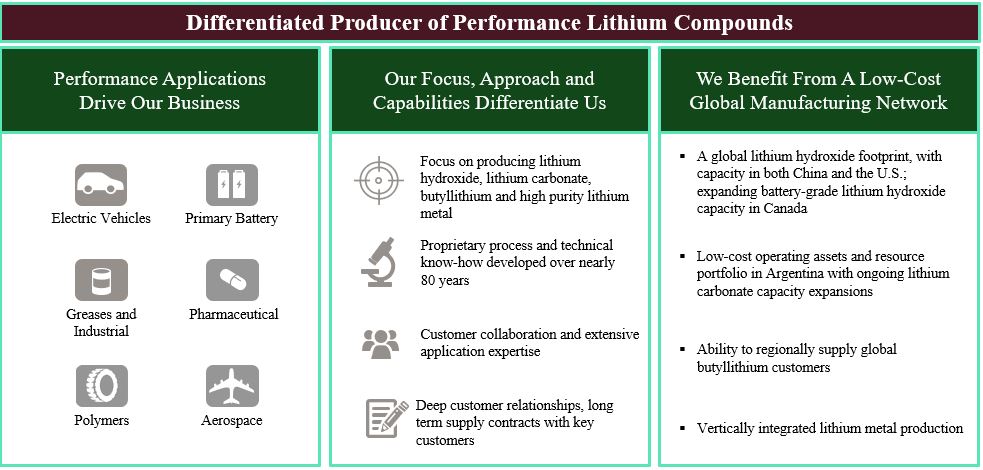

Livent, a Delaware corporation formed in 2018, is the predecessor of Arcadium Lithium and is now a wholly owned subsidiary of Arcadium Lithium. Livent is a pure-play, fully integrated lithium company, with a long, proven history of producing performance lithium compounds. Livent's primary products, namely battery-grade lithium hydroxide, lithium carbonate, butyllithium and high purity lithium metal are critical inputs used in various performance applications.

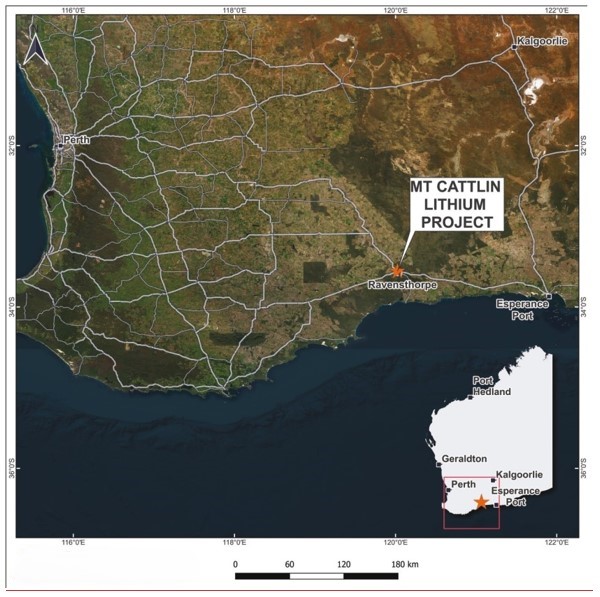

Allkem, which subsequent to the Allkem Livent Merger is a wholly owned subsidiary of Arcadium Lithium, is a lithium company with a global portfolio of lithium chemical and spodumene concentrate operations and projects. Its portfolio includes lithium brine operations and development projects in Argentina, a hard rock lithium operation in Australia, a hard rock development project in Québec, and a lithium hydroxide conversion facility in Japan.

We have benefited from the integration of Livent’s and Allkem’s complementary skillsets, including conventional brine extraction, direct lithium brine extraction, hard rock mining, chemical processing and production of battery grade and specialty lithium products. These capabilities have assisted Arcadium Lithium in streamlining its existing lithium production processes and optimizing the design of future developments. Through the integration of Livent's and Allkem's operations, Arcadium Lithium has scaled its exposure to upstream and downstream lithium operations, forming a more global and vertically integrated lithium chemicals producer.

We produce lithium compounds for use in applications that have specific and constantly changing performance requirements, including battery-grade lithium hydroxide and battery-grade lithium carbonate for use in high performance lithium-ion batteries. We believe the demand for our compounds will continue to grow as the electrification of transportation accelerates. We expect demand for our lithium hydroxide to increase as the use of high nickel content cathode materials increases in the next generation of battery technology products. Additionally, we expect to benefit from strong lithium iron phosphate cathode demand that predominantly uses lithium carbonate. We also supply butyllithium, which is used in the production of polymers and pharmaceutical products, as well as a range of specialty lithium compounds including high purity lithium metal, which is used in non-rechargeable batteries and in the production of lightweight materials for aerospace applications. It is in these applications that we have established a differentiated position in the market through our ability to consistently produce and deliver performance lithium compounds.

Arcadium Lithium Strategy

We believe that growth in EV sales will drive significant growth in demand for performance lithium compounds and that we are well positioned to benefit from this trend due to our leading position, long-standing customer relationships and favorable sustainability profile. We view sustainability as central to our mission and a key consideration in all of our investment and operational decisions.

To fully capitalize on our growth opportunities, our strategy will involve investing in our assets, our technology capabilities and our people to ensure we can continue to meet our customers’ growing demands, as well as our broader commitments to other key stakeholders, including investors, employees, regulators and our local communities.

Arcadium Lithium has a large and complementary asset footprint with a presence in key lithium regions. We expect that our increased economies of scale and asset base from legacy Livent's and Allkem's geographically adjacent asset portfolios in Argentina and North America will enable us to enhance production and project execution efficiency. Our lithium chemical manufacturing facilities are located in close proximity to key lithium customers, enabling us to deliver our range of lithium performance chemicals to meet the growing demand of those customers.

Expand our Production Capacities

We remain focused on expanding our lithium carbonate and lithium hydroxide capacities and are currently prioritizing the development of Nemaska Lithium and Sal de Vida. In response to recent lithium market conditions, the Company decided to defer or slow down development for some of its expansion projects. The Company still sees a strong long-term growth trajectory for lithium demand and is committed to developing its portfolio of expansion opportunities on a timeline that is supported by the market and its customers.

Nemaska Lithium, in which we currently have a 50% ownership interest, is a fully integrated development project in Québec, Canada with a spodumene mine and concentrator in Whabouchi feeding into a new lithium hydroxide facility in Bécancour. Construction continues to progress. We expect to continue to lend our expertise to Nemaska Lithium, including technical support to progress the project and provide assistance with the development of an appropriate technical and commercial strategy, given our experience in qualifying and selling battery grade lithium products globally.

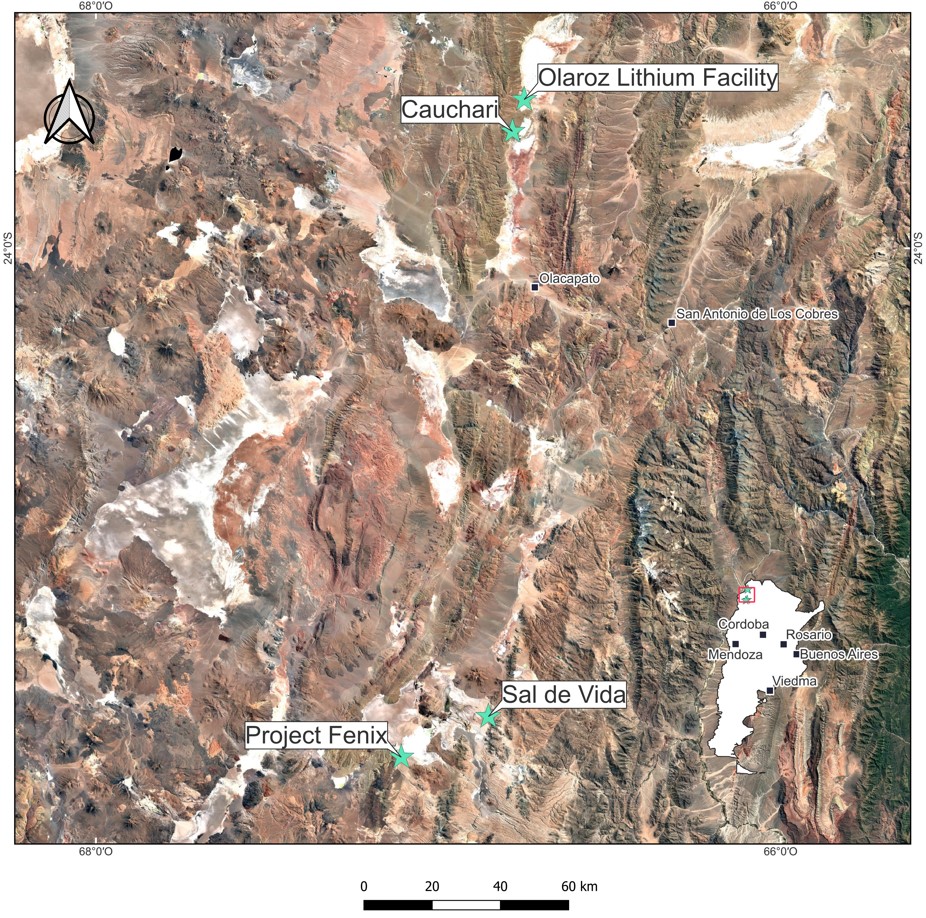

Additionally, Arcadium Lithium has adjusted the sequencing of its combined 25,000 metric ton lithium carbonate projects at the Salar del Hombre Muerto in Argentina. Rather than execute Fénix Phase 1B and Sal de Vida Stage 1 simultaneously as previously announced, the projects will now be completed sequentially with Sal de Vida Stage 1 expected to be finished first.

As part of the ongoing production start-up at Olaroz Stage 2, a 25,000 metric ton lithium carbonate expansion in Argentina, the Company is evaluating the potential need for further capital in order to address production quality and reliability while scaling to nameplate capacity.

Arcadium Lithium is pausing investment in its 40,000 metric ton lithium carbonate equivalent ("LCE") spodumene Galaxy project in Canada (formerly "James Bay"). The pause in spending is structured to minimize both cost and timing disruption when the project is ultimately resumed.

We will continue to evaluate our butyllithium capacity regionally and add capacity as demand continues to increase. For high purity lithium metal, we are evaluating expansion opportunities, including expansion of lithium chloride as a feedstock, to align with the potential increase in demand for lithium metal as customers develop next generation battery technologies. As part of this strategy, on August 2, 2024, Arcadium announced it acquired the lithium metal division of Li-Metal Corp. The all-cash $11 million USD transaction includes the intellectual property and physical assets related to lithium metal production, including a pilot production facility in Ontario, Canada. Arcadium Lithium uses lithium metal to manufacture specialty products, including high purity lithium metal ("HPM") for primary battery applications and next-generation batteries, and LIOVIX®, a proprietary printable lithium metal formulation. Arcadium Lithium also processes lithium metal into butyllithium, as well as other lithium specialty chemicals used in medicine, agriculture, electronics and other industries.

As a result of the Allkem Livent Merger, the complementary expertise of Livent and Allkem in hard rock mining and conventional and direct lithium extraction-based processes has enabled us to reduce the risks associated with developing our pipeline of advanced and complementary growth projects. Allkem's operating mineral extraction facilities acquired in the Allkem Livent Merger include the Mt Cattlin hard rock facility in Western Australia, the Olaroz brine and lithium carbonate facility in Jujuy, Argentina and an interest in a lithium hydroxide conversion facility in Japan. Allkem's mineral development projects acquired in the Allkem Livent Merger include the Sal de Vida and Cauchari brine and lithium carbonate projects in Catamarca and Jujuy, Argentina, respectively, and the Galaxy hard rock project in Québec, Canada. Further information about our mineral properties may be found under Item 2, Mineral Properties.

Diversify our Sources of Supply

We continue to pursue additional sources of lithium, which may include further expansion in Argentina, increasing our 50% ownership stake in the Nemaska Lithium Inc. development project and assets, acquisition and development of new resources, entering into long-term agreements with other producers, or some combination thereof. We will continually assess new resources that offer the potential to provide alternative sources of lithium products and will look to invest in developing such resources where it makes sense to do so.

Expand our Applications and Process Technology Capabilities

Our market position today depends on our ability to consistently provide our customers with the products they need, in a sustainable and responsible manner. To maintain this position, we are continuously investing to improve our application, process and extraction technologies, on both existing and new potential resources, and to reduce our environmental footprint. As we work with our customers to understand their evolving lithium needs, we will focus on expanding our extraction and processing capabilities and our ability to adapt the properties of our products, whether chemical or physical, to meet those needs. This may require us to invest in and potentially acquire new capabilities, hire people or acquire new technical resources.

In 2023, we acquired a minority stake in the parent company of ILiAD Technologies, LLC ("ILiAD Technologies") which is a subsidiary of EnergySource Minerals, LLC, a developer of lithium projects in the Salton Sea Known Geothermal Resource Area in California. ILiAD Technologies will seek to commercialize while continuing to develop its Integrated Lithium Adsorption Desorption ("ILiAD") technology platform.

In connection with this investment, Arcadium Lithium will have the right to license ILiAD technology for anticipated deployment at its lithium brine resources in Argentina and is evaluating opportunities for future production use across its portfolio. The ILiAD solution is complementary to Arcadium Lithium's proprietary process technologies and readily fits into the Company's existing plant designs. Additionally, ILiAD offers the potential for significant improvements in Arcadium Lithium's energy usage and carbon footprint as well as continued improvements in water use.

Develop Next Generation Lithium Compounds

We believe that the evolution of battery technologies will lead to the adoption of lithium-based applications in the anode and electrolyte within the battery. This evolution will require new forms of lithium to be produced, such as new lithium metal powders or printable lithium products. We will continue to invest in our research and development efforts to help us create new products, such as LIOVIX®, and we will also invest with and partner with our customers to further their own research and development efforts.

Invest in Our People

Our business requires that we continue to hire, retain and engage research scientists, engineers and technical sales agents. We will continue to invest in our people through training and developing our employees to retain talent. We will look to continue to cultivate an inclusive and positive work environment that (i) creates and supports diversity; (ii) prioritizes equal opportunity and fairness in the Company’s management systems and practices; and (iii) fosters a sense of belonging for employees with diverse perspectives, backgrounds and expertise.

Focus on Sustainability

We believe lithium will continue to play an important role in enabling a cleaner, healthier, and more sustainable world, including the transition to a lower carbon future and the fight against climate change. Likewise, we believe that meeting the growing demand for lithium compounds must be balanced with considerations for responsible production across the spectrum of Environmental, Social and Governance ("ESG") issues and concerns. Our core values reflect this commitment to sustainability. We believe that operating in a safe, ethical, socially conscious and sustainable manner is important for our business.

As such, we intend to continue to better integrate ESG and sustainability considerations into our business, operations and investment decisions. In addition, we are determined to help set the standard in the lithium industry for sustainability, performance, transparency and independent validation. We believe that our ESG and sustainability efforts will continue to help us differentiate ourselves from competitors and help us develop and strengthen relationships with customers and other key stakeholders.

We encourage you to review our historical annual Sustainability Reports (located at www.arcadiumlithium.com/sustainability) for more detailed information regarding our ESG programs and initiatives as well as sustainability goals. Nothing on our website, including Sustainability Reports or sections thereof, shall be deemed incorporated by reference into this Form 10-K.

Financial Information About Our Business

We operate as one reportable segment based on the commonalities among our products and services, the types of customers we serve and the manner in which we review and evaluate operating performance. As we earn a substantial amount of our revenues through the sale of lithium products, we have concluded that we have one operating segment for reporting purposes.

The financial statements contained herein are as of December 31, 2024 and 2023 and for the three years ended December 31, 2024, a period that includes periods prior to the date of the completion of the Allkem Livent Merger. Therefore, the financial statements and other information contained herein as of December 31, 2023 and for the years ended December 31, 2023 and 2022 relate to Livent (our predecessor) prior to giving effect to the Allkem Livent Merger, and therefore do not include the results of Allkem.

Business Overview

Our business, which following the consummation of the Allkem Livent Merger reflects the combined operations of Livent and Allkem, is a leading global lithium chemicals producer with a lithium deposit base that is among the largest in the world.

As a result of our focus on supplying performance lithium compounds for use in the rapidly growing EV and broader energy storage battery markets, we expect our revenue generated from lithium hydroxide and lithium carbonate, and from energy storage applications to increase over time. We also expect our revenue by geography to remain at similar proportions until supply chains further regionalize in North America and Europe. We intend to maintain our leadership positions in other high performance markets such as non-rechargeable batteries, greases, pharmaceuticals and polymers.

We believe that we have earned a reputation as a leading supplier in the markets we serve, based on the performance of our products in our customers’ production processes and our ability to provide application know-how and technical support. In the EV market, we are one of a small number of lithium suppliers whose battery-grade lithium hydroxide has been qualified by global customers for use in their cathode material production that is ultimately used in numerous global EV programs at scale. Throughout our history, as end market application technologies have evolved, we have worked closely with our customers to understand their changing performance requirements and have developed products to address their needs.

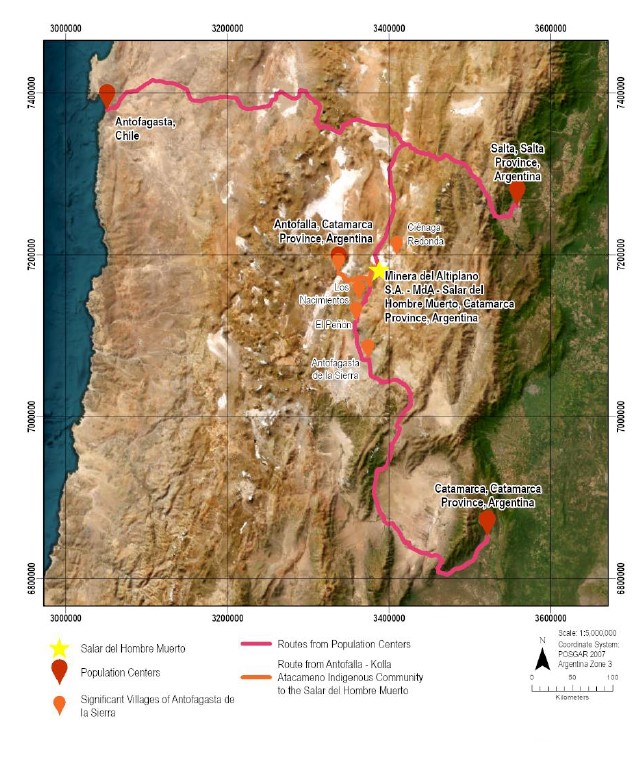

As a vertically integrated lithium producer, we benefit from operating some of the lowest cost lithium mineral deposits in the world that also have a favorable, industry leading sustainability footprint. Legacy Livent has been extracting lithium brine at its operations at the Salar del Hombre Muerto in Argentina for more than 25 years, and has been producing various lithium

compounds for approximately 80 years. Our operational history provides us with a deep understanding of the process of extracting lithium compounds from brine safely and sustainably. We have developed proprietary process knowledge that enables us to produce high quality, low impurity lithium carbonate and lithium chloride, and helps us to produce industry leading quality downstream products. We source the majority of our lithium for use in the production of performance lithium compounds from these low cost operations in Argentina. Our operations in Argentina are expandable, giving us the ability to increase our lithium carbonate and lithium chloride production to meet increasing demand. We have the operational flexibility to procure lithium carbonate from third party suppliers as needed, allowing us to better manage our production requirements and produce more end-products for customers. We also have a hard rock mining facility in Australia producing spodumene concentrate.

We are one of a few lithium compound producers with global manufacturing capabilities. The battery-grade lithium hydroxide in the U.S., China and Japan that we produce today uses lithium carbonate as feedstock. We use lithium chloride to produce lithium metal, a key feedstock in the production of butyllithium products in the U.S., the United Kingdom and China, as well as in the production of high purity lithium metal in the U.S. We have significant know-how and experience in lithium hydroxide, butyllithium and high purity lithium metal production processes and product applications, which we believe provide us with a competitive advantage in these markets.

As a result of the Allkem Livent Merger, Arcadium Lithium has enhanced business critical scale, a more resilient supply chain, enhanced operational flexibility and greater capacity to meet customer demand through the complementary and vertically integrated business models of Allkem and Livent, which include hard rock mining, conventional and direct lithium extraction-based processes and lithium carbonate and hydroxide production.

Capacity and Production

The chart below presents a breakdown of Arcadium Lithium's year-end nameplate capacity and production as of and for the years ended, respectively, December 31, 2024, 2023 and 2022 by product type and category presented in product basis metric tons ("MT"):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2024 | | 2023 (1) | | 2022 (1) |

| Product | | Capacity | | Production | | Capacity | | Production | | Capacity | | Production |

Lithium Hydroxide (2) | | 45,000 | | | 22,297 | | | 30,000 | | | 21,252 | | | 30,000 | | | 21,493 | |

| Butyllithium | | 3,145 | | | 1,945 | | | 3,145 | | | 2,029 | | | 3,265 | | | 2,520 | |

High Purity Lithium Metal (3) | | 250 | | | 39 | | | 250 | | | 35 | | | 250 | | | 88 | |

Lithium Carbonate (4) (5) | | 70,500 | | | 44,115 | | | 18,000 | | | 17,852 | | | 18,000 | | | 16,950 | |

Lithium Chloride (4) | | 9,000 | | | 4,541 | | | 9,000 | | | 4,976 | | | 9,000 | | | 4,750 | |

Spodumene Concentrate (6) (7) | | 330,000 | | | 158,409 | | | — | | | — | | | — | | | — | |

____________________

1.Because Arcadium Lithium is the successor company to Livent in the Allkem Livent Merger, we are presenting the nameplate capacity and production of predecessor Livent as of and for the years ended, respectively, December 31, 2023 and 2022, which do not include the capacity and production of Allkem.

2.Current lithium hydroxide capacity converts lithium carbonate to lithium hydroxide. Production includes some re-processed volume that does not require additional lithium carbonate feedstock in the given production year. Excludes 10,000 MT of lithium carbonate to lithium hydroxide capacity at Naraha Plant where Arcadium owns a 75% economic interest.

3.Excludes other specialty product capacities and production.

4.Represents theoretical capacity for lithium carbonate and lithium chloride at Fénix of 28,000 MT and 9,000 MT, respectively. Actual combined production of both products at Fénix is lower and limited by a tradeoff between the two based on our current lithium production process. Combined lithium carbonate and lithium chloride production was approximately 47,600 MT on a lithium carbonate equivalent ("LCE") basis for 2024, approximately 21,500 MT for 2023 and approximately 20,500 MT for 2022, resulting in the total production shown in the chart.

5.Includes Olaroz Stage 1 and Olaroz Stage 2 capacity of 17,500 MT and 25,000 MT, respectively, of lithium carbonate on a 100% basis. Through the Olaroz joint venture, Arcadium owns a 66.5% interest in Olaroz.

6.Production capacity is stated on the basis of metric tons of spodumene concentrate.

7.Spodumene concentrate production amounts shown as metric tons of spodumene at an average lithium oxide ("Li2O") grade of approximately 5.2% to 5.5%.

The charts below detail Arcadium Lithium's 2024 revenues by product, application and geography.

_____ _______________

_______________ 1.Includes lithium carbonate by-product revenues.

2.Includes low grade spodumene sales and minimal other products.

3.Company internal estimates.

4.Includes spodumene and third-party technical carbonate sales for further processing.

Products and Markets

Our performance lithium compounds are frequently produced to meet specific customer application and performance requirements. We have developed our capabilities in producing performance lithium compounds through decades of interaction with our customers, and our products are key inputs into their production processes. Our customer relationships provide us with first-hand insight into our customers’ production objectives and future needs in terms of product volume, mix and specifications, which we in turn use to further develop our products.

Other specialties include lithium phosphate, pharmaceutical-grade lithium carbonate and specialty organics. A portion of the lithium carbonate and most of the lithium chloride that we produce today is consumed as feedstock in the process of producing downstream performance lithium compounds. The spodumene we produce today is largely sold to customers for use as feedstock in the process of producing downstream performance lithium compounds.

Allkem Livent Merger - Vertical Integration and Geographic Footprint

As a result of the Allkem Livent Merger, Arcadium Lithium has additional capacity and production capabilities for multiple lithium products. We have stronger vertical integration across the lithium value chain than Livent and Allkem on a standalone basis. Arcadium Lithium now has a broad product offering that is highly scalable across both potential resource and production assets. This enhances operational flexibility and reliability, resulting in lower costs across the lithium value chain. Arcadium Lithium also brings together complementary expertise in hard rock, brine and lithium chemical processing, with proven ability to produce products that are sought after by leading battery manufacturers and EV original equipment manufacturers ("OEMs").

Competition and Industry Overview

We sell our performance lithium compounds worldwide. Most markets for lithium compounds are global, with significant growth occurring in Asia, eventually expected to follow in Europe, and North America. This is being driven primarily by the development and manufacturing of cathode active material for lithium-ion batteries. Cathode material capacity and production is currently concentrated in Asia, particularly China, Japan and Korea. Over the next few years, significant cathode material capacity and production is expected to come online in Europe and North America while capacity and production in China, Japan, Korea also increases. The market for lithium compounds faces barriers to entry, including access to an adequate and stable supply of lithium feedstock, the need to produce sufficient quality and quantity, technical expertise and development lead time. We expect capacity to be added by existing and new producers over time. We believe our lithium brine operations in Argentina, which have a favorable sustainability profile and are considered by the industry to be some of the lowest-cost sources of lithium, provide us with a distinct competitive advantage against current and future entrants. Additionally, as the EV supply chain gradually regionalizes to Europe and North America, our lithium resources in Argentina, downstream capabilities in the U.S. and the potential development of Nemaska Lithium and Galaxy in Canada (See subsection "Mineral Properties" to Item 2 for more information) position us well for partnering with leading automakers for their regional electrification roadmaps.

We compete by providing advanced technology, high product quality, reliability, quality customer and technical service, and by operating in a cost-efficient manner and prioritizing safety and sustainability. We also enjoy competitive advantages from our vertically integrated manufacturing approach, low production costs and history of efficient capital deployment. We believe that we are a leading provider of battery-grade lithium hydroxide in EV battery applications and in performance grease applications. We currently have lithium hydroxide capacity in multiple locations globally. We are also the only fully integrated producer of high purity lithium metal in the Western Hemisphere. We believe that we are one of only two global suppliers of butyllithium. Our primary competitors for performance lithium compounds are Albemarle Corporation and Ganfeng Lithium. We are a leading provider of different grades of lithium carbonate for a range of applications.

As a result of the Allkem Livent Merger, our ability to compete globally is enhanced because of our combined asset footprint, experience in upstream operations and downstream capacity.

Growth

According to BloombergNEF's 2024 Long-Term Electric Vehicle Outlook, under the Economic Transition Scenario ("ETS"), EV (battery electric and plug-in hybrid electric passenger vehicles) sales are expected to be approximately 42 million units in 2030, rising to approximately 73 million units in 2040, representing a penetration rate of approximately 45% and 73%, respectively, of all passenger vehicles sold. According to EV Volumes' December 2024 global battery electric and plug-in hybrid electric passenger cars and light commercial vehicles forecast, sales are expected to be approximately 43 million units in 2030, rising to approximately 70 million units in 2035, representing a penetration rate of approximately 45% and 69%, respectively, of all passenger cars and light commercial vehicles sold. Both BloombergNEF, and EV Volumes expect battery electric vehicles to comprise a clear majority of the EV sales mix.

According to EV Volumes, 2024 global light-duty EV (Battery Electric Vehicles and Plug-in Hybrid Electric Vehicles) sales increased approximately 25% vs 2023. Global light-duty EV adoption increased from approximately 17% in 2023 to approximately 20% in 2024; China’s light-duty EV adoption increased from approximately 34% in 2023 to approximately 45% in 2024. The strong EV demand growth in 2024 was driven by automakers' increased product offering, increased consumer awareness and adoption, national and regional governments' announced incentives, subsidies and more stringent fuel economy/carbon dioxide emissions regulations to support electrification efforts. Throughout 2024, numerous automakers announced large investments towards drivetrain electrification and laid out roadmaps for launching a growing number of competitive models across various segments and increasing targets for share of EV sales in their overall unit sales. Adoption of electric drivetrains also increased in other modes of transportation such as buses, medium- and heavy-duty commercial vehicles, two- and three-wheelers.

In 2025 and beyond, fuel economy/carbon dioxide emissions regulations for commercial vehicles coupled with environmental commitments of an increasing number of corporations are likely to propel electric commercial vehicle sales. According to BloombergNEF's 2024 Long-Term Electric Vehicle Outlook, under the ETS, electric commercial vehicles (battery electric, plug-in hybrid electric, and range extender electric light-, medium-, heavy-duty commercial vehicles) sales are expected to increase from approximately 0.6 million units in 2023 to approximately 6 million units in 2030, and to approximately 18 million units in 2040. By 2040, according to BloombergNEF, electric light-duty commercial vehicles will have 67% share of all light-duty commercial vehicles sold, electric medium- and heavy-duty commercial vehicles will have 38% share of all medium- and heavy-duty commercial vehicles sold. Additionally, BloombergNEF estimate electric buses to have 76% share of all bus sales in 2040.

Besides electrification of transportation, electricity generation continued its decarbonization trend with solar and wind installations crossing new milestones; many of these commercial-, retail- and utility-scale installations are coupled with lithium-

ion battery-based energy storage systems. In 2024, battery demand growth rates for energy storage systems outpaced battery demand growth for electric passenger vehicles.

In line with varying consumer preferences across regions, automakers are launching an increasing number of EVs across segments and for shorter-ranges and longer-ranges. For regions such as North America, automakers have been introducing longer-range, bigger size, premium-performance-luxury EV models using higher energy density batteries and are doing so in part by using high (>60%) nickel content cathode materials. Demand for high nickel content cathode materials for automotive applications will require battery-grade lithium hydroxide in the production of cathode materials. Additionally, since late 2020 automakers have been increasing adoption of lithium iron phosphate cathode material, initially for the China passenger vehicles market and subsequently for markets outside China. Lithium iron phosphate is predominantly synthesized using lithium carbonate, and thereby lithium carbonate demand has been witnessing strong growth.

As an existing, proven global producer of battery-grade lithium hydroxide and lithium carbonate, we are well positioned to benefit from the expected increase in lithium demand from EV growth. As one of the pioneers in the lithium industry, we have relationships throughout the lithium-ion battery value chain. Across the battery value chain, product performance requirements have continued to evolve since the first lithium-ion batteries and cathode materials were introduced in the early 1990s. We have developed our application and materials knowledge by working with our customers over time to produce performance lithium compounds which meet evolving customer needs.

Our growth efforts focus on developing environmentally compatible and sustainable lithium products. We are committed to providing unique, differentiated products to our customers by acquiring and further developing technologies as well as investing in innovation to extend product life cycles.

Raw Materials

Lithium

Our primary raw material is lithium, and we obtain the substantial majority of lithium from our operations in Argentina. We extract lithium from naturally occurring lithium-rich brines located in the Andes Mountains of Argentina, which are believed to be one of the world’s most significant and lowest cost sources of lithium, through proprietary selective adsorption and solar evaporation process. Arcadium processes the brine into lithium carbonate at our Argentina manufacturing facilities in Fénix and Olaroz, and into lithium chloride at our nearby manufacturing facility in Güemes, Argentina.

For the year ended December 31, 2024, which includes Allkem's historical operations, our lithium operations produced approximately 44.1 kMT of lithium carbonate. For the years ended December 31, 2023 and 2022, which include only predecessor Livent and do not include Allkem's historical operations, our lithium operations produced approximately 18.0 kMT and 17.0 kMT of lithium carbonate, respectively. Approximately 4.5 kMT of lithium chloride was produced for the year ended December 31, 2024 which includes Allkem's historical operations. For the years ended December 31, 2023 and 2022, which include only predecessor Livent and does not include Allkem's historical operations, we produced approximately 5.0 kMT and 5.0 kMT of lithium chloride, respectively. For the year ended December 31, 2024, which includes Allkem's historical operations, Arcadium Lithium's combined production of lithium carbonate and lithium chloride, on a LCE basis, was approximately 47.6 kMT. For the years ended December 31, 2023 and 2022, which include only predecessor Livent and does not include Allkem's historical operations, Livent's combined production of lithium carbonate and lithium chloride, on a LCE basis, was approximately 21.5 kMT and 20.5 kMT, respectively.

On occasion, we have also historically purchased a portion of our lithium carbonate raw materials from other suppliers as needed.

Information about our mining properties and mineral concession rights may be found under Item 2., Mineral Properties.

Water

Our operations require water. MdA, one of our subsidiaries through which we operate the Salar del Hombre Muerto property, has water rights and all necessary permits for the supply of raw water (i.e., untreated water as it exists natively) for its existing operations from the Trapiche aquifer, from which raw water is pumped from a battery of wells and is treated before use in our facilities. For MdA's capacity expansion, it has secured water rights for the supply of raw water from the Los Patos aquifer and the Los Patos wells and water supply is now in service. MdA has secured the necessary permits for the current phases of its expansion, and will apply for the necessary permits for future phases of its expansion when needed. MdA and the Catamarca province regularly monitor the water and salinity levels of the Trapiche and Los Patos aquifer.

SDV, our subsidiary currently under development in the Salar del Hombre Muerto, has water rights as well as all necessary permits to obtain raw water from the Los Patos aquifer. There, raw water is pumped from one well to its facilities, while a second authorized well (not yet in service) will provide the required need once SDV reaches its operation phase. SDV has secured the necessary permits for its initial development and planned production, and will apply for the necessary permits for future phases of its expansion and production when needed. SDV regularly monitors water and salinity levels of the Los Patos aquifer as part of monitoring programs.

For our Olaroz brine-based operations in Jujuy, Argentina, operated by our subsidiary, SDJ, brine is extracted by controlled pumping wells and transferred through a brine pipeline to a system of solar evaporation ponds to obtain a concentrated brine. The industrial mining process to produce lithium carbonate and other by-products also consumes raw water pumped from wells located in the same salt flat. SDJ has secured the necessary permits for the current phase, and will apply for the necessary permits for future phases when needed.

For our hard rock lithium operations at Mt Cattlin, Australia (operated by Allkem prior to the Allkem Livent Merger), the majority of water used for processing is sourced from in-pit dewatering and recycled water decanted from the tailings storage facility. Additional water needs are met by water sourced from licensed groundwater bores adjacent to the site as well as from rainwater collected on site.

MdA has only had to temporarily suspend water extraction once, in January 2015, due to a dispute with the Catamarca province, and its access to the water source was quickly restored. MdA also regularly evaluates supplemental supplies of raw water. The grant of water concessions and other water rights is subject to local governmental approvals, the timing and availability of which are uncertain and may be subject to delay or denial.

In October 2015, MdA, the Province of Catamarca, and the trustee (currently the Banco de la Nación Argentina) signed an agreement to establish the "Salar del Hombre Muerto Water Trust". The agreement was amended by Amendment No. 1 on August 1, 2016, Amendment No. 2 on January 25, 2018, and Amendment No. 3 on May 27, 2020. Under Amendment No. 2, the contributions changed from being fixed to variable. As a result, MdA began contributing an amount equal to 1.2% of its annual sales (calculated using the annual Contractual Price described under Item 2., Mineral Properties), in lieu of any water use fees. These payments are fully reflected in our financial statements.

Energy

Our operations rely on a steady source of energy. In 2015, MdA completed construction of a 135 kilometer natural gas pipeline from Pocitos, within the Salta province, to our Fénix facilities at Salar del Hombre Muerto, which eliminated our reliance on natural gas shipments by truck. This pipeline is governed by various agreements between MdA and Recursos Energeticos y Mineros Salta, S.A., or ("REMSA"), a local natural gas sub-distributor, including a subdistribution agreement providing for contracted capacity through 2027. We are in discussions to increase our contracted capacity in advance of our needs for all phases of our expansion plans and may need to invest in additional infrastructure to support this expansion. REMSA or Naturgy S.A., another local natural gas distributor that operates in the northeast of Argentina, have no obligation to provide us the additional capacity on a timely basis or at all. If we cannot obtain such additional capacity, we would need to secure alternative arrangements to meet the increased energy needs of the planned expansion and such alternative arrangements may be less cost effective.

We have already financed and completed the construction of a gas compression plant along the natural gas pipeline and are financing the construction of a second gas compression plant to be built along the natural gas pipeline as well. The completed plant has been commissioned, started up, and is in the ramp up stage. It was jointly financed with two other parties and is subject to joint control and management. The second gas compression plant is being solely financed by, and will be solely controlled and managed by, MdA. MdA is currently negotiating an engineering, procurement, and construction agreement with a third party for this second gas compression plant.

In 2024, MdA entered into two (2) natural gas supply contracts, one with Panamerican Energy S.A. and one with Tecpetrol S.A., providing for the supply of natural gas to our Fénix manufacturing facility for a one-year term. YPF SA is our supplier of diesel fuel and gasoline to our Fénix, Pocitos and Güemes manufacturing facilities.

At SDV, the energy supply will initially consist of a diesel-fueled generation center located at the processing plant substation. The power configuration will provide 9 MW of maximum active power and an electrical distribution system that will serve the process plant, camp, ponds, water and brine wells. During the first years of SDV's operation, this power generation plant will be operated by an external supplier.

In the future at SDV, a more comprehensive long-term energy supply strategy is being defined to obtain synergy between our Salar del Hombre Muerto operations. In furtherance of this, in 2024 SDV entered into a power purchase agreement with Industrias Juan F. Secco for the supply of electric power from a diesel generating plant for a three (3) year term extendable to five (5) years.

At Olaroz in Jujuy, Argentina, energy is generated by natural gas generators and by a co-generation system (electrical and thermal) to power processes in the production plant and provide electricity to the camp site. Diesel is used on site for machinery and the transport fleet. Our greatest source of energy for Olaroz is supplied by direct solar radiation which is used for concentrating brine in the evaporation ponds.

For our hard rock lithium operations at Mt Cattlin, Australia, diesel is used for electricity generation and for the transport fleet, plant and machinery.

Other raw materials

We purchase raw materials and chemical intermediates for use in our production processes, including materials for use in our production of the proprietary adsorbent used to selectively extract lithium from our brine in Argentina, soda ash, or sodium carbonate, for use in our production of lithium carbonate, and lithium metal for our production of butyllithium. In 2024, costs of major raw materials for Arcadium Lithium represented 13% of our revenues. For 2023 and 2022, costs of major raw materials for predecessor Livent represented 10% and 18% respectively, of Livent's revenues. In 2023 and 2022, costs of major raw materials for Allkem represented 10% and 6% respectively, of Allkem’s total revenues. Major raw materials used in our current operations include soda ash, solvents, butyl chloride, hydrochloric acid, quicklime, metal, caustic soda, other reagents and CO2. We generally satisfy our requirements through spot purchases and medium- or long-term contractual relationships. In general, where we have limited sources of raw materials, we have developed contingency plans to minimize the effect of any interruption or reduction in supply, such as sourcing from other suppliers or maintaining safety stocks. Lime is procured locally from various suppliers with a mixture of medium-term contracts with prices tied to key consumables and long-standing relationships. Soda ash is imported from different international suppliers with a mix of medium- or long-term contractual relationships.

Temporary shortages of raw materials may occasionally occur and cause temporary price increases. For example, Arcadium has had past regional interruptions in raw material supply, notably in China. In recent years, these shortages have not resulted in any material unavailability of raw materials. However, the continuing availability and price of raw materials are affected by many factors, including domestic and world market and political conditions, as well as the direct or indirect effect of governmental regulations. During periods of high demand, our raw materials are subject to significant price fluctuations, and such fluctuations may have an adverse impact on our results of operations. In addition, there could be inflationary pressure on costs of the raw materials and/or services that could impact our results of operations. The impact of any future raw material shortages on our business as a whole or in specific geographic regions, including China, or in specific business lines cannot be accurately predicted. We continue to see price increases for certain of our raw materials as a result of global inflationary pressures.

Seasonality

Our operations in Argentina are seasonally impacted by weather, including varying evaporation rates and amounts of rainfall during different seasons, which can be heavy at times. These changes impact the concentration in large evaporation ponds, with greater impact on those ponds in our brine operations that use conventional evaporation than on our ponds that use direct lithium extraction, and can have an impact on the downstream processes to produce lithium carbonate and lithium chloride. Heavy rainfall can damage pond liners, lead to loss of product, and make the ponds generally difficult to maintain. Our operations team continuously measures pond concentrations and models how they will change based on operating decisions. Our processes use proprietary and traditional technologies to minimize the variation of concentrations at the inlet to our plants.

Argentine Law and Regulation

We are subject to various regulatory requirements in Argentina under the Argentine Mining Code, the Argentine Mining Investment Law and certain federal and provincial regulations, including with respect to environmental compliance. In addition, the respective relationships between us, MdA and the Catamarca provincial government, and between Sales de Jujuy S.A. ("SDJ") and the Jujuy Energia y Mineria Sociedad del Estado ("JEMSE"), are regulated through contractual frameworks. Under the agreement between SDJ and JEMSE, SDJ may, in certain circumstances, be required to sell at market prices up to 5% of its production to the Jujuy provincial government.

The Argentine Mining Code, which sets forth the rights and obligations of mining companies, is the principal regulatory framework under which we conduct our operations in Argentina. The Argentine Mining Code provides for the terms under which the provinces regulate and administer the granting of mining rights to third parties.

The Argentine Mining Code establishes two basic means of granting title to mining property: the exploration permit and the mining concession, both of which convey valid mining title in Argentina.

Exploration permits grant their holders the right to freely explore for minerals within the boundaries of the territory covered by that permit as well as to request the mining concession for any discoveries within the covered territory.

Once a mining concession is granted, the recipient owns all in-place mineral deposits within the boundaries of the territory covered by the concession. Mining concessions are freely tradable by the title holder and can be sold, leased or otherwise transferred to third parties. Two requirements must be met to keep a mining concession in good standing: (i) the concession holder must make regular payments of a semi-annual fee known as a canon; and (ii) the concession holder must file and perform an initial five-year expenditure plan. In addition, prior to commencing mining activities, the concession holder must submit environmental impact studies, which must be renewed at least every two years, for approval by the relevant environmental authorities.

In addition to the Argentine Mining Code, we are also subject to the Argentine Mining Investment Law. The Argentine Mining Investment Law offers specific financial incentives to mining investors, including a 30-year term fiscal stability of national, provincial and municipal tax rates upon the presentation of a suitable feasibility study; a deduction from income tax for prospecting, exploration and feasibility study expenditures; a refund of Value Added Tax fiscal credits resulting from exploration works; accelerated depreciation of fixed assets; and a 3% cap on royalties payable out of production to the province where the deposit is located. MdA's 30-year term fiscal stability certificate expires in 2026, while SDJ's 30-year term fiscal stability certificate expires in 2041. Although Sal de Vida has not yet been awarded a 30-year term fiscal stability certificate, it submitted a feasibility study in 2013. If granted, Sal de Vida's 30-year term fiscal stability certificate would expire in 2043.

MdA's fiscal stability rights under the Argentine Mining Investment Law have been challenged by the imposition of certain export taxes on our lithium chloride and carbonate exports that did not exist at the time MdA obtained its 30-year term fiscal stability certificate. For instance, in 2018, the Federal Government imposed an export duty on lithium carbonate and chloride through Decree No. 793/2018, which was in effect until December 31, 2020. In December 2019, after the change of presidential administration, the Argentine Congress passed Law No. 27,541 creating a new legal framework for export duties and establishing a new rate for mining and hydrocarbon exports not to exceed 8% on the taxable amounts or the FOB value. In December 2020, the Executive Power issued Decree No. 1060/2020 establishing a new export duty applicable to all kinds of goods effective from January 1, 2021. In the case of lithium chloride and lithium carbonate, the applicable tax rate amounts to 4.5% and no cap has been set. In 2022, Argentine authorities established a reference price for exports of certain grades of lithium carbonate, with any exports below this price being subject to investigation by Customs authorities and the possible payment of higher export duties and corporate taxes. In January 2023, the Argentina Ministry of Economy issued a resolution to cancel an export rebate regime relating to lithium products, which was followed by Presidential Decree No. 57/2023 in February, 2023. The Presidential Decree prospectively canceled all export rebates for lithium products. However, in November 2023, Presidential Decree No. 557/2023 reinstated a 1.5% reimbursement for lithium carbonate. To date, this has not impacted MdA's operations or finances. SDJ has been conducting its own evaluation of the impact of these differing export taxes and legal regimes.

Under MdA and SDJ's 30-year term fiscal stability certificates, we are entitled to reimbursement or set-off (against other federal taxes) of any amount paid in excess of the total federal taxable burden applicable to us under each such certificate. Although MdA is litigating to exercise its fiscal stability rights and are requesting an administrative reimbursement with respect to the imposition of certain of such export taxes, there can be no assurance that we will seek, or be able to obtain, reimbursement or set-off.

In addition, on June 27, 2024, the National Congress in Argentina approved the Bases and Starting Point of the Freedom of Argentines Law No. 27,742 (Ley de Bases y Puntos de Partida para la Libertad de los Argentinos) which, in addition to amending several existing laws, created the Incentive Regime for Large Investments ("RIGI", its acronym in Spanish). This statute became effective on July 8, 2024. The RIGI is a promotional regime that is applicable to the mining sector and provides guarantees of regulatory, fiscal, customs, and exchange rate stability to projects that qualify under it for a term of 30 years from the inclusion date. On August 23, 2024, the National Government issued Decree No. 749 that approved the regulation of RIGI. The Provinces of Jujuy (through Law No 6409 published in its official gazette on August 14, 2024), Salta (through Law No. 8451 published in its official gazette on September 19, 2024) and Catamarca (through Law 5863 published in its official gazette on September 27, 2024) have agreed to adhere to RIGI. The Company is currently conducting an analysis to determine the scope and application of RIGI to its own operations.

Australian Law and Regulation