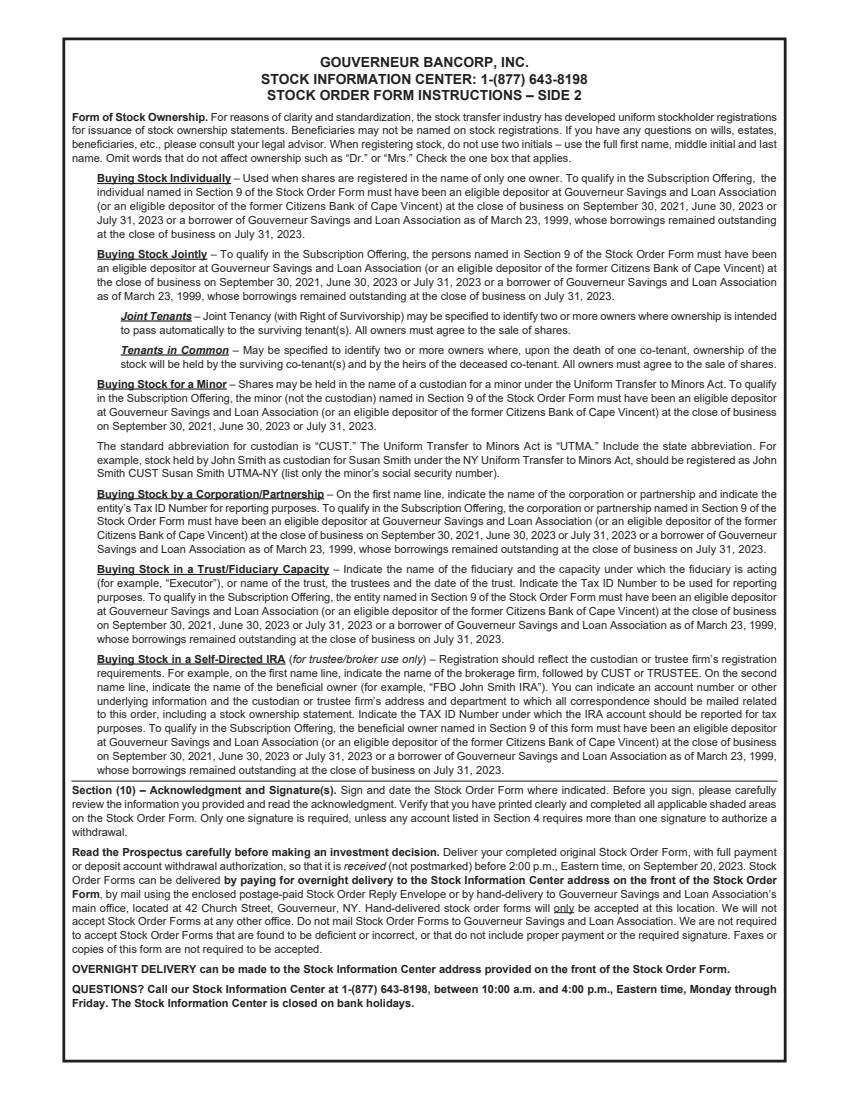

| GOUVERNEUR BANCORP, INC. STOCK INFORMATION CENTER: 1-(877) 643-8198 STOCK ORDER FORM INSTRUCTIONS – SIDE 2 Form of Stock Ownership. For reasons of clarity and standardization, the stock transfer industry has developed uniform stockholder registrations for issuance of stock ownership statements. Beneficiaries may not be named on stock registrations. If you have any questions on wills, estates, beneficiaries, etc., please consult your legal advisor. When registering stock, do not use two initials – use the full first name, middle initial and last name. Omit words that do not affect ownership such as “Dr.” or “Mrs.” Check the one box that applies. Buying Stock Individually – Used when shares are registered in the name of only one owner. To qualify in the Subscription Offering, the individual named in Section 9 of the Stock Order Form must have been an eligible depositor at Gouverneur Savings and Loan Association (or an eligible depositor of the former Citizens Bank of Cape Vincent) at the close of business on September 30, 2021, June 30, 2023 or July 31, 2023 or a borrower of Gouverneur Savings and Loan Association as of March 23, 1999, whose borrowings remained outstanding at the close of business on July 31, 2023. Buying Stock Jointly – To qualify in the Subscription Offering, the persons named in Section 9 of the Stock Order Form must have been an eligible depositor at Gouverneur Savings and Loan Association (or an eligible depositor of the former Citizens Bank of Cape Vincent) at the close of business on September 30, 2021, June 30, 2023 or July 31, 2023 or a borrower of Gouverneur Savings and Loan Association as of March 23, 1999, whose borrowings remained outstanding at the close of business on July 31, 2023. Joint Tenants – Joint Tenancy (with Right of Survivorship) may be specified to identify two or more owners where ownership is intended to pass automatically to the surviving tenant(s). All owners must agree to the sale of shares. Tenants in Common – May be specified to identify two or more owners where, upon the death of one co-tenant, ownership of the stock will be held by the surviving co-tenant(s) and by the heirs of the deceased co-tenant. All owners must agree to the sale of shares. Buying Stock for a Minor – Shares may be held in the name of a custodian for a minor under the Uniform Transfer to Minors Act. To qualify in the Subscription Offering, the minor (not the custodian) named in Section 9 of the Stock Order Form must have been an eligible depositor at Gouverneur Savings and Loan Association (or an eligible depositor of the former Citizens Bank of Cape Vincent) at the close of business on September 30, 2021, June 30, 2023 or July 31, 2023. The standard abbreviation for custodian is “CUST.” The Uniform Transfer to Minors Act is “UTMA.” Include the state abbreviation. For example, stock held by John Smith as custodian for Susan Smith under the NY Uniform Transfer to Minors Act, should be registered as John Smith CUST Susan Smith UTMA-NY (list only the minor’s social security number). Buying Stock by a Corporation/Partnership – On the first name line, indicate the name of the corporation or partnership and indicate the entity’s Tax ID Number for reporting purposes. To qualify in the Subscription Offering, the corporation or partnership named in Section 9 of the Stock Order Form must have been an eligible depositor at Gouverneur Savings and Loan Association (or an eligible depositor of the former Citizens Bank of Cape Vincent) at the close of business on September 30, 2021, June 30, 2023 or July 31, 2023 or a borrower of Gouverneur Savings and Loan Association as of March 23, 1999, whose borrowings remained outstanding at the close of business on July 31, 2023. Buying Stock in a Trust/Fiduciary Capacity – Indicate the name of the fiduciary and the capacity under which the fiduciary is acting (for example, “Executor”), or name of the trust, the trustees and the date of the trust. Indicate the Tax ID Number to be used for reporting purposes. To qualify in the Subscription Offering, the entity named in Section 9 of the Stock Order Form must have been an eligible depositor at Gouverneur Savings and Loan Association (or an eligible depositor of the former Citizens Bank of Cape Vincent) at the close of business on September 30, 2021, June 30, 2023 or July 31, 2023 or a borrower of Gouverneur Savings and Loan Association as of March 23, 1999, whose borrowings remained outstanding at the close of business on July 31, 2023. Buying Stock in a Self-Directed IRA (for trustee/broker use only) – Registration should reflect the custodian or trustee firm’s registration requirements. For example, on the first name line, indicate the name of the brokerage firm, followed by CUST or TRUSTEE. On the second name line, indicate the name of the beneficial owner (for example, “FBO John Smith IRA”). You can indicate an account number or other underlying information and the custodian or trustee firm’s address and department to which all correspondence should be mailed related to this order, including a stock ownership statement. Indicate the TAX ID Number under which the IRA account should be reported for tax purposes. To qualify in the Subscription Offering, the beneficial owner named in Section 9 of this form must have been an eligible depositor at Gouverneur Savings and Loan Association (or an eligible depositor of the former Citizens Bank of Cape Vincent) at the close of business on September 30, 2021, June 30, 2023 or July 31, 2023 or a borrower of Gouverneur Savings and Loan Association as of March 23, 1999, whose borrowings remained outstanding at the close of business on July 31, 2023. Section (10) – Acknowledgment and Signature(s). Sign and date the Stock Order Form where indicated. Before you sign, please carefully review the information you provided and read the acknowledgment. Verify that you have printed clearly and completed all applicable shaded areas on the Stock Order Form. Only one signature is required, unless any account listed in Section 4 requires more than one signature to authorize a withdrawal. Read the Prospectus carefully before making an investment decision. Deliver your completed original Stock Order Form, with full payment or deposit account withdrawal authorization, so that it is received (not postmarked) before 2:00 p.m., Eastern time, on September 20, 2023. Stock Order Forms can be delivered by paying for overnight delivery to the Stock Information Center address on the front of the Stock Order Form, by mail using the enclosed postage-paid Stock Order Reply Envelope or by hand-delivery to Gouverneur Savings and Loan Association’s main office, located at 42 Church Street, Gouverneur, NY. Hand-delivered stock order forms will only be accepted at this location. We will not accept Stock Order Forms at any other office. Do not mail Stock Order Forms to Gouverneur Savings and Loan Association. We are not required to accept Stock Order Forms that are found to be deficient or incorrect, or that do not include proper payment or the required signature. Faxes or copies of this form are not required to be accepted. OVERNIGHT DELIVERY can be made to the Stock Information Center address provided on the front of the Stock Order Form. QUESTIONS? Call our Stock Information Center at 1-(877) 643-8198, between 10:00 a.m. and 4:00 p.m., Eastern time, Monday through Friday. The Stock Information Center is closed on bank holidays. |