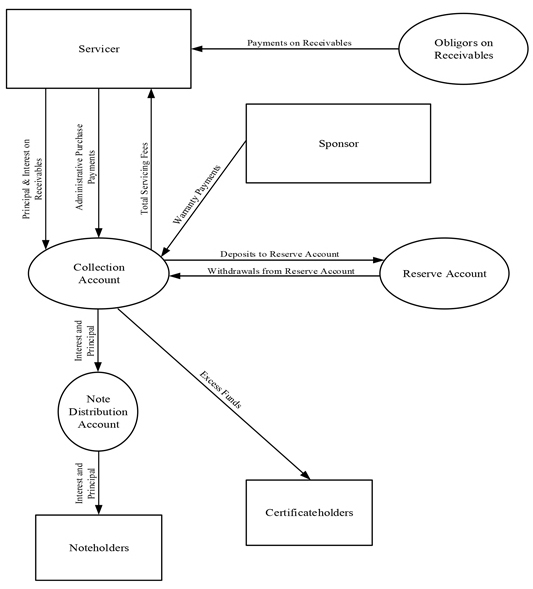

(11) the balance of the reserve account, if any, on that date, after giving effect to changes in that reserve account on that date,

(12) the amount, if any, of excess cash distributed from the reserve account to the depositor or the certificateholders,

(13) cash flows received during the related monthly period and their sources,

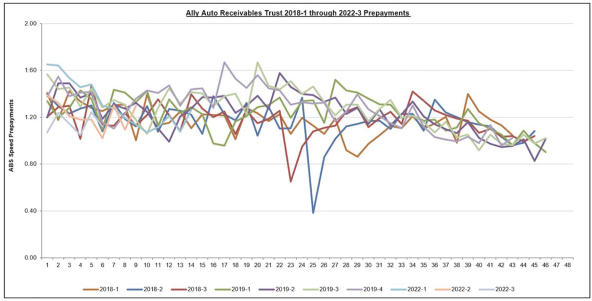

(14) the number and dollar amount of receivables at the beginning and end of the applicable monthly period, and updated pool composition information as of the end of the monthly period, such as weighted average coupon, weighted average life, weighted average remaining term and prepayments,

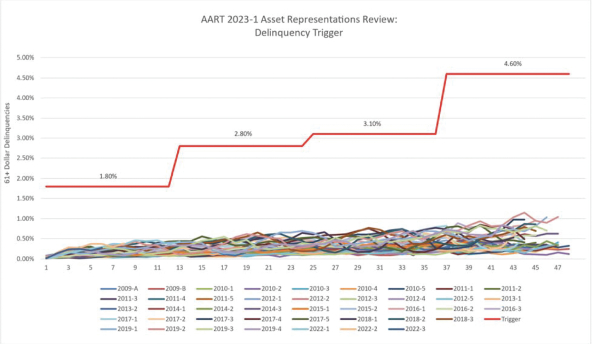

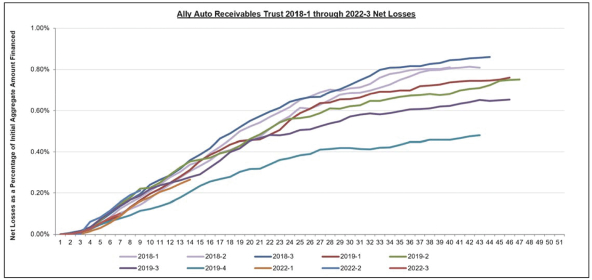

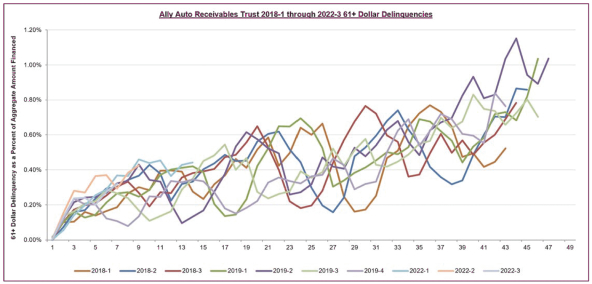

(15) delinquency and loss information for the period and any material changes in determining or defining delinquencies, charge-offs and uncollectible accounts,

(16) the amount of receivables with respect to which material breaches of pool asset representations or warranties or transaction covenants have occurred,

(17) any material modifications, extensions or waivers relating to the terms of or fees, penalties or payments on, pool assets during the distribution period or that, cumulatively, have become material over time,

(18) the outstanding notional amount of the certificates to the extent the certificates are held by third parties,

(19) whether a delinquency trigger has been met or exceeded,

(20) if applicable, a statement that the servicer has received a communication request from a noteholder interested in communicating with other noteholders regarding the possible exercise of rights under the transaction documents, the name and contact information for the requesting noteholder and the date such request was received,

(21) a summary of the findings and conclusions of any asset representations review conducted by the asset representations reviewer,

(22) the nature and amount of any material change in the seller’s or an affiliate’s interest in the notes or certificates from their purchase, sale or other disposition,

(23) information with respect to any change in the asset representations reviewer,

(24) the commencement of an arbitration proceeding relating to a request to repurchase receivables and instructions for the noteholders to participate in any such proceeding,

(25) any voting instructions and procedures relating to a vote to require an asset representations review, and

(26) the required asset-level data for the receivables, which will be filed on Form ABS-EE.

In addition, each year the indenture trustee will send by email, facsimile or, if requested by the indenture trustee, first class mail a brief report, as described in “The Indenture Trustee” in this prospectus, to all noteholders.

Within the prescribed period of time for tax reporting purposes after the end of each calendar year during the life of the notes, the indenture trustee will mail to each holder of a class of notes who at any time during that calendar year has been a noteholder, and received any payment thereon, a statement containing information for the purposes of that noteholder’s preparation of federal income tax returns. As long as the holder of record of the notes is Cede & Co.,

81