Exhibit 99.1

No securities regulatory authority has expressed an opinion about any information contained herein and it is an offence to claim otherwise. This prospectus does not constitute a public offering of any securities.

PROSPECTUS

| Non-Offering Prospectus |  | December 28, 2023 |

LEDDARTECH HOLDINGS INC.

No securities are being offered pursuant to this Canadian Prospectus.

This non-offering prospectus (the “Canadian Prospectus”) is being filed with the Autorité des marchés financiers (Québec) (the “AMF”) to enable LeddarTech Holdings Inc. (being the amalgamated corporation resulting from the Company Amalgamation (as defined herein) (the “Surviving Company” and, prior to the Company Amalgamation, “NewCo”)) to become a reporting issuer under the Securities Act (Québec), notwithstanding that no sale of its securities is contemplated herein.

NewCo was incorporated under the Canada Business Corporations Act (“CBCA”) on April 12, 2023 for the sole purpose of effecting the Business Combination (as defined below). The Surviving Company’s head and registered office is located at 4535 Wilfrid Hamel Blvd., Suite 240, Québec, QC, G1P 2J7.

On June 12, 2023, NewCo entered into a business combination agreement (as amended on September 25, 2023, the “Business Combination Agreement”) with LeddarTech Inc. (the “Company” or “LeddarTech”), a corporation incorporated under the laws of the CBCA and the parent corporation of NewCo, and Prospector Capital Corp. (“Prospector”), a Cayman Islands exempted company trading on Nasdaq Stock Market LLC (“Nasdaq”). Under the terms of the Business Combination Agreement, the following transactions were completed on December 21, 2023 on the terms set forth in a plan of arrangement (the “Plan of Arrangement”):

| i. | Prospector completed a continuance into the laws of Canada (the “Continuance” and Prospector as so continued, “Prospector Canada”); |

| ii. | Prospector Canada and NewCo amalgamated (the “Prospector Amalgamation” and Prospector Canada and NewCo as so amalgamated, “AmalCo”); |

| iii. | the preferred shares of the Company converted into common shares of the Company and AmalCo acquired all of the issued and outstanding common shares of the Company from the Company’s shareholders in exchange for common shares of AmalCo having an aggregate equity value of US$200 million (at a negotiated value of US$10.00 per share) plus an amount equal to the aggregate exercise price of the Company’s outstanding “in the money” options immediately prior to the Prospector Amalgamation plus additional AmalCo “earnout” shares (with the terms set forth in the Business Combination Agreement) (the “Share Exchange”); |

| iv. | the Company and AmalCo amalgamated (the “Company Amalgamation”); and |

| v. | in connection with the foregoing, the securities of AmalCo converted into an equivalent number of corresponding securities in the Surviving Company, each equity award of the Company that was not canceled pursuant to the Business Combination Agreement and the Plan of Arrangement became an equity award of the Surviving Company, and the Omnibus Incentive Plan adopted by the Company immediately prior to the completion of the Business Combination was assumed by the Surviving Company (together with the Continuance, the Prospector Amalgamation, the Share Exchange, the Company Amalgamation and the other transactions contemplated under the Business Combination Agreement, the “Business Combination”). |

On June 12, 2023, LeddarTech entered into the Subscription Agreement (as defined in the U.S. Prospectus) with the certain investors, including investors who subsequently joined the Subscription Agreement (collectively, the “PIPE Investors”), pursuant to which the PIPE Investors purchased secured convertible notes of LeddarTech (the “PIPE Convertible Notes”) in an aggregate principal amount of at least US$43.0 million, issued in two tranches: (i) a first tranche of PIPE Convertible Notes (the “Tranche A-1 Notes”) in the aggregate principal amount of approximately US$21.66 million (the “Tranche A-1 PIPE Financing”) was issued to the PIPE Investors (such investors, the “Tranche A-1 PIPE Investors”) in connection with the execution of the Business Combination Agreement, and (ii) a second tranche of PIPE Convertible Notes (the “Tranche B Notes”) in the aggregate principal amount of approximately US$22.0 million issued upon or prior to the completion of the Business Combination, as discussed below. Subsequent to June 30, 2023, LeddarTech issued additional first tranche PIPE Convertible Notes (the “Tranche A-2 Notes” and, together with the Tranche A-1 Notes, the “Tranche A Notes”) in the aggregate principal amount of US$0.34 million (the “Tranche A-2 PIPE Financing”). Pursuant to an amendment to the Subscription Agreement entered into on October 30, 2023, approximately US$4.1 million of the Tranche B Notes was issued on October 31, 2023 (the “Tranche B-1 Notes”) (the “Tranche B-1 PIPE Financing”), and the remaining US$17.9 million of the Tranche B Notes (the “Tranche B-2 Notes”) was issued upon completion of the Business Combination. At the times of the issuance of Tranche A Notes and Tranche B-1 Notes, the relevant PIPE Investors received warrants to acquire Class D-1 preferred shares of LeddarTech (the “Class D-1 Preferred Shares” and the warrants, the “PIPE Warrants”). The PIPE Investors received PIPE Warrants to purchase 595,648 Class D-1 Preferred Shares at the time of purchasing the Tranche A-1 Notes (2.75 Class D-1 Preferred Shares per US$100 principal amount of Tranche A-1 Notes purchased), PIPE Warrants to purchase 9,355 Class D-1 Preferred Shares at the time of purchasing the Tranche A-2 Notes (2.75 Class D-1 Preferred Shares per US$100 principal amount of Tranche A-2 Notes purchased), and PIPE Warrants to purchase 24,322 Class D-1 Preferred Shares at the time of purchasing the Tranche B-1 Notes (0.6 Class D-1 Preferred Shares per US$100 principal amount of Tranche B-1 Notes purchased). No PIPE Warrants were issued in connection with the issuance of the Tranche B-2 Notes. Altogether, the PIPE Warrants entitled the PIPE Investors to receive approximately 8,553,450 common shares in the capital of the Surviving Company (the “Surviving Company Common Shares”) upon the closing of the Business Combination (the “Closing”). Accordingly, the PIPE Investors held approximately 42.8% of the 20 million Company Common Shares outstanding immediately prior to the Closing. The PIPE Convertible Notes have an interest rate of 12% that compounds annually as an increase to the principal amount of the PIPE Convertible Notes (the “PIK Interest”) and are convertible into the number of Surviving Company Common Shares determined by dividing the then-outstanding principal amount by the conversion price of US$10.00 per Surviving Company Common Share. FS LT Holdings LP, a Delaware limited partnership (“FS Investors”), an affiliate of Prospector’s sponsor, Prospector Sponsor LLC, a Cayman Islands limited liability company (the “Sponsor”), and the Sponsor were participants in the PIPE Financing and invested US$17,025,000 in the PIPE Financing. Derek Aberle, the former Chief Executive Officer of Prospector, and a member of the board of directors of the Surviving Company, is an existing investor in LeddarTech and invested US$210,000 in the PIPE Financing.

The cash proceeds from the transactions contemplated by the Business Combination (including the PIPE Financing) will be used by the Surviving Company for working capital, to develop its software solutions and for general corporate purposes.

Upon completion of the Business Combination, the Surviving Company’s ownership was as follows:

| ● | Prospector’s former public shareholders owned approximately 9.3% of the Surviving Company Common Shares. |

| ● | The Sponsor (excluding securities acquired in the PIPE Financing) owned approximately 21.2% of the outstanding Surviving Company Common Shares. |

| ● | The former Company Shareholders (including affiliates of the Sponsor, but excluding securities acquired in the PIPE Financing) owned approximately 39.8% of the outstanding Surviving Company Common Shares. |

| ● | PIPE Investors (solely with respect to securities acquired in the PIPE Financing) owned approximately 29.7% of the outstanding Surviving Company Common Shares. |

The Surviving Company is a leading company in the development of software targeted at the advanced driver assistance system (“ADAS”) and autonomous driving (“AD”) market. The Surviving Company provides innovative low-level sensor fusion and perception ADAS and AD software technology that delivers high performance and is scalable, cost-effective and sensor-agnostic. These solutions enable customers to solve critical environmental sensing, fusion and perception challenges across the entire value chain. See the section entitled “Information about LeddarTech” in the U.S. Prospectus.

In connection with the Business Combination, on November 29, 2023, NewCo filed with the U.S. Securities and Exchange Commission (the “SEC”) an amendment no. 2 to a registration statement on Form F-4 (as may be further amended from time to time, the “Registration Statement”). The Registration Statement (Registration No. 333-275381) was declared effective by the SEC on December 4, 2023. The Registration Statement contains a proxy statement and prospectus dated November 29, 2023 (the “U.S. Prospectus”), a copy of which is attached to and forms part of and is incorporated in this Canadian Prospectus, which constitutes a prospectus of NewCo under Section 5 of the U.S. Securities Act of 1933, as amended, with respect to the securities of the Surviving Company issued following the consummation of the Business Combination. The U.S. Prospectus also constitutes a proxy statement for Prospector under Section 14(a) of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), and a notice of meeting with respect to the extraordinary general meeting of shareholders of Prospector (the “Prospector Shareholders Meeting”) held on December 13, 2023 to consider and vote upon a proposal to approve the Business Combination by the approval and adoption of the Business Combination Agreement, among other matters. At the Prospector Shareholders Meeting, Prospector shareholders approved, among other things, the Business Combination. A copy of the Registration Statement and U.S. Prospectus is attached to and forms part of and is incorporated in this Canadian Prospectus.

There is no market in Canada through which the securities of the Surviving Company may be sold and security holders may not be able to resell securities of the Surviving Company owned by them. This may affect the pricing of the securities in the secondary market, the transparency and availability of trading prices, the liquidity of our securities and the extent of issuer regulation. See the section entitled “Risk Factors” in the U.S. Prospectus.

The Surviving Company Common Shares are listed and posted for trading on Nasdaq under the symbol “LDTC”. On December 27, 2023, the last trading day prior to the date of this Canadian Prospectus, the closing price of the Surviving Company Common Shares on Nasdaq was US$2.69.

The risk factors outlined in this Canadian Prospectus should be carefully reviewed and considered. See the sections entitled “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in the U.S. Prospectus.

No underwriters or selling agents have been involved in the preparation of this Canadian Prospectus or performed any review or independent due diligence of its contents. No person is authorized by us to provide any information or to make any representation other than those contained in this Canadian Prospectus with respect to us or our securities.

This Canadian Prospectus does not constitute an offer to sell or the solicitation of an offer to buy any securities. Since no securities are being offered pursuant to this Canadian Prospectus, no proceeds will be raised and all expenses in connection with the preparation and filing of this Canadian Prospectus will be paid by us from our general corporate funds.

This Canadian Prospectus is in three sections. The first section consists of the cover page disclosure that is required to be included herein pursuant to Regulation 41-101 respecting General Prospectus Requirements and Form 41-101F1 – Information Required in a Prospectus (together, “Regulation 41-101”). The second section is a supplement to the U.S. Prospectus, which sets out required disclosure to be included herein pursuant to Regulation 41-101 and not otherwise included in the U.S. Prospectus. The third section is the U.S. Prospectus.

This Canadian Prospectus does not contain all the information set forth in the Registration Statement and its exhibits. With respect to the statements in this Canadian Prospectus about the contents of any contract, agreement or other document filed as an exhibit to the Registration Statement, we refer you, in each instance, to the copy of such contract, agreement or document filed as an exhibit to the Registration Statement, and each such statement is qualified in all respects by reference to the document to which it refers.

A copy of the Registration Statement and the exhibits that were filed with the Registration Statement may be inspected without charge at the public reference facilities maintained by the SEC in Room 1590, 100 F Street, N.E., Washington, D.C. 20549 and copies of all or any part of the Registration Statement may be obtained from the SEC upon payment of the prescribed fee. Information on the operation of the public reference facilities may be obtained by calling the SEC at 1800-SEC-0330. The SEC maintains a website that contains reports, proxy and information statements, and other information regarding registrants that file electronically with the SEC. The address of the site is www.sec.gov.

Certain of the expected directors and officers of the Surviving Company reside outside of Canada. The persons named below have appointed the following agent for service of process. However, it may not be possible to enforce judgments obtained in Canada against any person or company that is incorporated, continued or otherwise organized under the laws of a foreign jurisdiction or resides outside of Canada, even if the party has appointed an agent for service of process.

Name | Name and Address of Agent |

Derek Aberle Nick Stone Michelle Sterling

Yann Delabrière Christopher Stewart | LeddarTech Holdings Inc., 4535 Wilfrid Hamel Blvd., Suite 240, Québec, QC, G1P 2J7 |

TABLE OF CONTENTS

| GENERAL MATTERS | 6 |

| | |

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | 6 |

| | |

| EXCHANGE RATE INFORMATION | 8 |

| | |

| SUMMARY OF PROSPECTUS | 8 |

| | |

| CORPORATE STRUCTURE | 8 |

| | |

| DESCRIPTION OF BUSINESS | 9 |

| | |

| PRIOR SALES | 10 |

| | |

| OPTIONS TO PURCHASE SECURITIES | 11 |

| | |

| SECURITIES SUBJECT TO CONTRACTUAL RESTRICTION ON TRANSFER | 12 |

| | |

| CONSOLIDATED CAPITALIZATION | 12 |

| | |

| DIVIDEND POLICY | 15 |

| | |

| DIRECTORS AND OFFICERS | 16 |

| | |

| CORPORATE GOVERNANCE DISCLOSURE | 17 |

| | |

| AUDIT COMMITTEE | 18 |

| | |

| CEASE TRADE ORDERS | 19 |

| | |

| BANKRUPTCIES | 19 |

| �� | |

| SECURITIES PENALTIES OR SANCTIONS | 20 |

| | |

| INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS | 20 |

| | |

| PRINCIPAL SECURITYHOLDERS | 21 |

| | |

| INTERESTS OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 22 |

| | |

| MATERIAL CONTRACTS | 22 |

| | |

| LEGAL MATTERS | 23 |

| | |

| INTERESTS OF EXPERTS | 23 |

| | |

| AUDITOR, TRANSFER AGENT AND REGISTRAR | 23 |

| | |

| EXEMPTIONS | 23 |

| | |

| U.S. PROSPECTUS | 24 |

| | |

| LEDDARTECH FINANCIAL STATEMENTS AND MANAGEMENT’S DISCUSSION & ANALYSIS | F-1 |

| | |

| EXHIBIT A – BOARD MANDATE | A-1 |

| | |

| EXHIBIT B – AUDIT COMMITTEE CHARTER | B-1 |

| | |

| CERTIFICATE OF LEDDARTECH HOLDINGS INC. | C-1 |

GENERAL MATTERS

Unless otherwise noted or the context otherwise indicates, “Surviving Company”, “we”, “us” and “our” refers to LeddarTech Holdings Inc., together, if the context requires, with its consolidated subsidiaries upon completion of the Business Combination. The “Company” refers to LeddarTech Inc., the previous operating private company amalgamated with AmalCo pursuant to the Business Combination.

No person has been authorized by the Surviving Company or any of its predecessors (including NewCo, LeddarTech and Prospector) to give any information or make any representations in connection with the transactions herein described other than those contained in this Canadian Prospectus and the Registration Statement and, if given or made, any such information or representation must not be relied upon as having been authorized by the Surviving or any of its predecessors (including NewCo, LeddarTech and Prospector), as applicable. All information contained in this Canadian Prospectus with respect to Prospector has been supplied by Prospector for inclusion herein, and with respect to that information, the Surviving Company and its directors and officers have not independently verified such information.

References to “management” in this Canadian Prospectus mean the persons who are identified in this Canadian Prospectus as the senior executive officers of the Surviving Company. Any statements in this Canadian Prospectus made by or on behalf of management are made in such persons’ respective capacities as senior executive officers of the Surviving Company, and not in their personal capacities. See the section entitled “Management of Surviving Company after the Business Combination” in the U.S. Prospectus.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this Canadian Prospectus and the U.S. Prospectus may constitute “forward-looking statements” within the meaning of applicable securities laws.

Such forward-looking statements include, but are not limited to, statements regarding the expectations, hopes, beliefs, intentions or strategies of the Surviving Company’s management team with respect to the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including, but not limited to, any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this Canadian Prospectus may include, for example, statements about:

| ● | the benefits of the Business Combination; |

| ● | the Surviving Company’s financial performance following the Business Combination; |

| ● | our ability to raise additional capital; |

| ● | our ability to comply with the covenants in our debt financing agreements; |

| ● | our ability to enter into a forbearance agreement, waiver or amendment with, or obtain other relief from, our lenders under our debt instruments; |

| ● | changes in the Surviving Company’s strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects and plans; |

| ● | expansion plans and opportunities; and |

| ● | the outcome of any known and unknown litigation and regulatory proceedings. |

These forward-looking statements are based on information available as of the date of this Canadian Prospectus, and current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

You should not place undue reliance on these forward-looking statements in deciding whether to invest in the Surviving Company’s securities. As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Some factors that could cause actual results to differ include:

| ● | our ability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition and the ability of the Surviving Company to grow and manage growth profitably following the Business Combination; |

| ● | our ability to raise additional capital; |

| ● | our ability to comply with the covenants in our debt financing agreements; |

| ● | our ability to enter into a forbearance agreement, waiver or amendment with, or obtain other relief from, our lenders under our debt instruments; |

| ● | changes in applicable laws or regulations; |

| ● | the possibility that the Surviving Company may be adversely affected by other economic, business, and/or competitive factors; |

| ● | any implementation of significant operating cost reductions to maintain available liquidity; and |

| ● | other risks and uncertainties described in this Canadian Prospectus or the U.S. Prospectus, including, but not limited to, those under the section entitled “Risk Factors” in the U.S. Prospectus. |

Such estimates and assumptions are made in light of the experience of the Surviving Company’s management and their perception of historical trends, current conditions and expected future developments, as well as other factors believed to be appropriate and reasonable in the circumstances. However, there can be no assurance that such estimates and assumptions will prove to be correct.

Given these risks and uncertainties, you are cautioned not to place undue reliance on these forward-looking statements. Any forward-looking statement that we make in the Canadian Prospectus and the U.S. Prospectus speaks only as of the date of such statement, and we undertake no obligation to update any forward-looking statements or to publicly announce the results of any revisions to any of those statements to reflect future events or developments, except as required by applicable law. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless specifically expressed as such, and should only be viewed as historical data.

EXCHANGE RATE INFORMATION

Unless otherwise specified, all monetary amounts are presented in Canadian dollars, all references to “dollars,” “$” and “C$” means Canadian dollars and all references to “US$” mean U.S. dollars. On December 27, 2023, the daily exchange rate was C$1.00 = US$0.7573.

SUMMARY OF PROSPECTUS

For a summary of the U.S. Prospectus, please see the section entitled “Summary of the Proxy Statement/Prospectus” in the U.S. Prospectus. That section is a summary of the principal features of the Business Combination and should be read together with the more detailed information and financial data and statements contained elsewhere in this Canadian Prospectus and the U.S. Prospectus.

CORPORATE STRUCTURE

LeddarTech was incorporated under the CBCA on July 3, 2007. The Surviving Company was formed on December 21, 2023 upon the Company Amalgamation pursuant to the Business Combination. The head and registered office of the Surviving Company is located at 4535 Wilfrid Hamel Blvd., Suite 240, Québec, QC, G1P 2J7. Over the years, LeddarTech’s articles were amended in order to, among other things, amend the terms and conditions of the Company’s share capital in connection with previous investments.

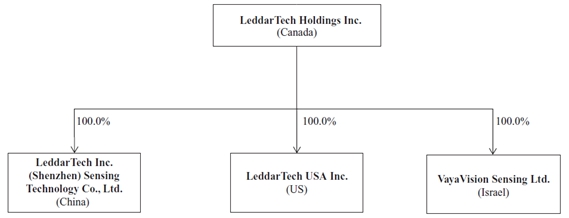

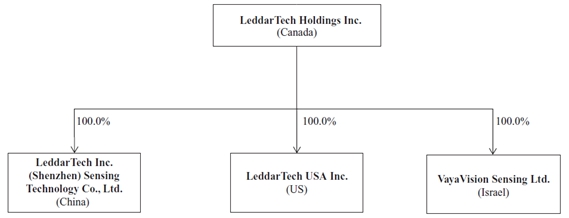

The following diagram depicts the organizational structure of the Surviving Company following the consummation of the Business Combination:

See the sections entitled “The Business Combination Agreement – Organizational Structure – Prior to the Business Combination” and “The Business Combination Agreement – Organizational Structure – Following the Business Combination” in the U.S. Prospectus.

DESCRIPTION OF BUSINESS

For a description of the Surviving Company’s business, see the section entitled “Information about LeddarTech” in the U.S. Prospectus.

Recent Developments

LeddarTech Meeting

Prior to the consummation of the Business Combination, LeddarTech Shareholders approved the Plan Arrangement at the special meeting of LeddarTech Shareholders held on November 6, 2023.

Redemptions of Prospector Class A Shares by Prospector Shareholders

Pursuant to Prospector’s constating documents, a holder of Prospector Class A Shares (as defined in the U.S. Prospectus) could have requested that Prospector redeem all or a portion of such holder’s Prospector Class A Shares (which became Surviving Company Common Shares following completion of the Business Combination) prior to the applicable redemption deadline on December 12, 2023, for a cash amount equal to their pro rata portion of the funds in the Trust Account. Prospector Shareholders holding 855,440 Prospector Class A Shares properly demanded redemption of their Prospector Class A Shares prior to such deadline. As a result, approximately US$9.3 million were removed from the Trust Account to pay such holders following consummation of the Business Combination. Prospector Shareholders holding 1,338,616 Prospector Class A Shares were not redeemed, resulting in the issuance of Surviving Company Common Shares upon the exchange thereof in accordance with the terms of the Business Combination Agreement and the Plan of Arrangement.

PRIOR SALES

During the 12-month period before the date of this Canadian Prospectus, (i) NewCo did not issue any common shares, other than 10 common shares issued to the Company upon the incorporation of NewCo at a price of C$1.00 per share; and (ii) the Company did not issue any common shares of the Company or securities that are convertible into common shares of the Company, except as described in the following table:

| Date of Issuance or Sale | | Number and type of Securities / Principal

Amount Issued | | Issue Price / Exercise Price Per Security | |

| June 13, 2023 | | 8 Tranche A-1 Notes in the aggregate principal amount of approximately US$21.66 million | | | -- | |

| From June 16, 2023 to July 5, 2023 | | 595,648 Class D-1 Preferred Shares(1) | | US$ | 0.01 | |

| From August 3, 2023 to August 12, 2023 | | 22 Tranche A-2 Notes in the aggregate principal amount of US$0.34 million | | | -- | |

| From August 3, 2023 to August 12, 2023 | | 9,355 Class D-1 Preferred Shares(2) | | US$ | 0.01 | |

| October 31, 2023 | | 24,322 Class D-1 preferred shares(3) | | US$ | 0.01 | |

| October 31, 2023 | | 21 Tranche B-1 Notes in the aggregate principal amount of approximately US$4.1 million | | | -- | |

| November 1, 2023 | | 66,550 common shares of LeddarTech(4) | | US$ | 0.63 | |

| December 20, 2023 | | 4,428,690 common shares purchase warrant of LeddarTech(5) | | $ | 0.01 | |

| December 21, 2023 | | 30 Tranche B-2 Notes in the aggregate principal amount of approximately US$17.9 million | | | -- | |

Notes:

| (1) | Class D-1 Preferred Shares issued in connection with the exercise by PIPE Investors of PIPE Warrants issued under the Tranche A-1 PIPE Financing. The Class D-1 Preferred Shares were convertible into common shares of the Company in accordance with its articles of incorporation. |

| (2) | Class D-1 Preferred Shares issued in connection with the exercise by PIPE Investors of PIPE Warrants issued under the Tranche A-2 PIPE Financing. The Class D-1 Preferred Shares were convertible into common shares of the Company in accordance with its articles of incorporation. |

| (3) | Class D-1 Preferred Shares issued in connection with the exercise by PIPE Investors of PIPE Warrants issued under the Tranche B-1 PIPE Financing. The Class D-1 Preferred Shares were convertible into common shares of the Company in accordance with its articles of incorporation. |

| (4) | For additional details, see the section entitled “Unaudited Pro Forma Condensed Consolidated Financial Information – Description of the Business Combination, Related Transactions and Adjustments for Other Material Events – Acquisition of Non-Controlling Interest” in the U.S. Prospectus. |

| (5) | For additional details, see the section entitled “Options to Purchase Securities – Desjardins Warrants” in this Canadian Prospectus. |

OPTIONS TO PURCHASE SECURITIES

The following table shows the aggregate number of options to purchase the Surviving Company Common Shares that were outstanding upon closing of the Business Combination. See also the sections entitled “Executive and Director Compensation,” “Description of Surviving Company’s Securities,” “Shares Eligible for Future Sale” and “Security Ownership of Certain Beneficial Owners and Management” in the U.S. Prospectus.

Category | | Number of

Options | | Exercise Price | | | Expiry Date |

| Executive officers and past executive officers, as a group (5 in total) | | 5,061 | | $ | 0.01 | | | Five years following closing of the Business Combination |

| Directors and past directors who are also not executive officers or past executive officers, as a group (5 in total) | | 3,202 | | $ | 0.01 | | | Five years following closing of the Business Combination |

| All other employees and past employees (89 in total) | | 4,314 | | $ | 0.01 | | | Five years following closing of the Business Combination |

| Other | | - | | | - | | | - |

| TOTAL | | 12,577 | | | - | | | - |

Surviving Company Warrants

Upon the consummation of the Business Combination, 17,465,749 Surviving Company Common Share purchase warrants (the “Surviving Company Warrants”) were issued to former Prospector warrant holders. Each Surviving Company Warrant entitles the holder thereof to purchase one Surviving Company Common Share at a purchase price of US$11.50 per share, subject to adjustment, on the terms and subject to the conditions set forth in the Warrant Agreement, and, as applicable, the Sponsor Letter Agreement (as such terms are defined in the U.S. Prospectus). Such Surviving Company Warrants replaced the 10,833,333 Public Warrants, 4,250,000 Private Placement Warrants and 965,749 warrants from the exercise of the conversion option of the Prospector Convertible Promissory Note (as such terms are defined in the U.S. Prospectus).

Desjardins Warrants

In conjunction with the Desjardins Facility October 2023 Amendments (as defined in the U.S. Prospectus), LeddarTech issued to Desjardins 4,428,690 common share purchase warrants prior to Closing, which are being assumed by the Surviving Company and became exercisable, upon the Closing and based on the exchange ratio for the Business Combination, for 250,000 Surviving Company Common Shares at $0.01 per share (the “Desjardins Warrants”). The Desjardins Warrants may be exercised, in whole or in part, for a period of five years following completion of the Business Combination and are subject to a lock-up with one third being released four months after Closing, another third being released eight months after Closing and the final third being released 12 months after Closing.

IQ Warrants

In the fiscal year ended September 30, 2021, in conjunction with the IQ Loan Agreement (as defined in the U.S. Prospectus), the Company issued Class D-1 Preferred Share purchase warrants to IQ (as defined below) at $138.68 per share, which are being assumed by the Surviving Company and exercisable for an aggregate of 13,890 Surviving Company Common Shares (the “IQ Warrants”). The IQ Warrants may be exercised, in whole or in part, for a period of five years following the issue of the IQ Warrants.

SECURITIES SUBJECT TO CONTRACTUAL RESTRICTION ON TRANSFER

Upon the Closing, the Surviving Company, the Sponsor, the PIPE Investors and certain former shareholders of LeddarTech (together with the PIPE Investors, the “New Holders”) entered into a Registration Rights Agreement (the “Registration Rights Agreement”), pursuant to which, among other things, the Sponsor and the New Holders were granted certain customary registration rights with respect to the Surviving Company Common Shares.

With respect to the PIPE Investors, the Registration Rights Agreement provides that the Surviving Company Common Shares (other than any shares issuable upon conversion of any securities obtained through the PIPE Financing) are subject to a lock-up period of six months following the Closing.

With respect to the New Holders other than the PIPE Investors, the Surviving Company Common Shares are subject to a lock-up for a period of four years following the Closing. Surviving Company Common Shares held by certain investors are subject to such lock-up through the delivery by the investors of letters of transmittal.

With respect to the Sponsor, the Surviving Company Common Shares issued upon conversion of the Sponsor’s Prospector Class B Shares (as defined in the U.S. Prospectus) are subject to certain transfer restrictions until six months following the Closing, and Surviving Company Common Shares issued upon conversion of the Sponsor’s Private Placement Warrants (as defined in the U.S. Prospectus) are subject to certain transfer restrictions until 30 days following the Closing.

Based on the number of Surviving Company Common Shares issued upon consummation of the Business Combination and the PIPE Financing, the Surviving Company Common Shares which are subject to lock-up restrictions represented approximately 61% of the total number of Surviving Company Common Shares on a non-diluted basis following consummation of the Business Combination.

See the sections entitled “Certain Agreements Related to the Business Combination” and “Risk Factors” in the U.S. Prospectus.

CONSOLIDATED CAPITALIZATION

Other than as described in this Canadian Prospectus and the U.S. Prospectus, there have been no material changes in the Company’s share or loan capital on a consolidated basis since June 30, 2023, the date of the Company’s financial statements for its most recently completed financial period included in this Canadian Prospectus.

In connection with the completion of the Business Combination, the Surviving Company has updated the unaudited pro forma condensed consolidated statement of financial position of the Surviving Company and its consolidated subsidiaries as of June 30, 2023 (the “Pro Forma Financial Position”) contained in the U.S. Prospectus solely to reflect the actual number of Prospector Class A Shares that were redeemed. The following updated Pro Forma Financial Position (the “Updated Pro Forma Financial Position”) gives pro forma effect to the Business Combination, related transactions and adjustments for other material events as disclosed in the section entitled “Unaudited Pro Forma Condensed Consolidated Financial Information” in the U.S. Prospectus as well as the redemption of 855,440 Prospector Class A Shares as if they had occurred on June 30, 2023.

The following Updated Pro Forma Financial Position should be read in conjunction with the Pro Forma Financial Position and the notes thereto and the accompanying disclosure contained in the section entitled “Unaudited Pro Forma Condensed Consolidated Financial Information” in the U.S. Prospectus.

The following Updated Pro Forma Financial Position (i) is being provided for information purposes only, (ii) has not been prepared in accordance with Item 11.01 of Regulation S-X under the Securities Exchange Act of 1934, (iii) is not indicative of what Surviving Company’s financial position would have been at June 30, 2023 if the Business Combination had taken place at that date and (iv) does not purport to project the future financial position of the Surviving Company.

See the sections entitled “Description of Business – Recent Development – Redemptions of Prospector Class A Shares by Prospector Shareholders,” “Prior Sales” and “Options to Purchase Securities” in this Canadian Prospectus, and the section entitled “Unaudited Pro Forma Condensed Consolidated Financial Information – Description of the Business Combination, Related Transactions and Adjustments for Other Material Events” in the U.S. Prospectus.

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at June 30, 2023

(in Canadian dollars)

| | | Historical | | | Final Redemption | |

| | | LeddarTech

Inc. | | | Prospector

Capital

Corp. | | | Pro Forma

Adjustments | | | Pro Forma

Financial

Position | |

| ASSETS | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| CURRENT ASSETS | | | | | | | | | | | | |

| Cash | | | 18,289,703 | | | | 132,153 | | | | 29,597,436 | | | | 55,761,662 | |

| | | | | | | | | | | | 18,964,072 | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | (331,551 | ) | | | | |

| | | | | | | | | | | | 446 | | | | | |

| | | | | | | | | | | | (31,208 | ) | | | | |

| | | | | | | | | | | | (264 | ) | | | | |

| | | | | | | | | | | | (5,665,909 | ) | | | | |

| | | | | | | | | | | | (5,193,216 | ) | | | | |

| Trade receivable and other receivables | | | 2,143,984 | | | | — | | | | — | | | | 2,143,984 | |

| Government assistance and R&D tax credits receivable | | | 1,957,487 | | | | — | | | | — | | | | 1,957,487 | |

| Inventories | | | 1,870,822 | | | | — | | | | — | | | | 1,870,822 | |

| Prepaid expenses | | | 1,123,322 | | | | 64,032 | | | | — | | | | 1,187,354 | |

| Total current assets | | | 25,385,318 | | | | 196,185 | | | | 37,339,806 | | | | 62,921,309 | |

| | | | | | | | | | | | | | | | | |

| NON-CURRENT ASSETS | | | | | | | | | | | | | | | | |

| Investment held in Trust Account | | | — | | | | 31,083,026 | | | | (31,083,026 | ) | | | — | |

| Property and equipment | | | 2,636,565 | | | | — | | | | — | | | | 2,636,565 | |

| Right-of-use assets | | | 4,995,658 | | | | — | | | | — | | | | 4,995,658 | |

| Intangible assets | | | 40,237,800 | | | | — | | | | — | | | | 40,237,800 | |

| Other assets | | | 264,523 | | | | — | | | | (264,523 | ) | | | — | |

| Goodwill | | | 7,318,126 | | | | — | | | | — | | | | 7,318,126 | |

| Total assets | | | 80,837,990 | | | | 31,279,211 | | | | 5,992,257 | | | | 118,109,458 | |

| | | | | | | | | | | | | | | | | |

| LIABILITIES | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| CURRENT LIABILITIES | | | | | | | | | | | | | | | | |

| Accounts payable and accrued liabilities | | | 11,742,501 | | | | 6,414,960 | | | | | | | | 18,157,461 | |

| Provisions | | | 958,761 | | | | — | | | | — | | | | 958,761 | |

| Due to Sponsor | | | — | | | | 264 | | | | (264 | ) | | | — | |

| Current portion of lease liabilities | | | 702,420 | | | | — | | | | — | | | | 702,420 | |

| Current portion of government grant liabilities | | | 557,029 | | | | — | | | | — | | | | 557,029 | |

| Conversion option | | | 690,123 | | | | — | | | | 147,987 | | | | 838,110 | |

| Prospector Convertible Promissory Note | | | — | | | | 1,422,336 | | | | (1,422,336 | ) | | | — | |

| Class A ordinary shares subject to possible redemption | | | — | | | | 31,083,026 | | | | (31,083,026 | ) | | | — | |

| Liability classified warrants | | | — | | | | 2,543,616 | | | | (1,338,514 | ) | | | 1,205,102 | |

| | | | | | | | | | | | 6,021,878 | | | | | |

| | | | | | | | | | | | (6,021,878 | ) | | | | |

| Total current liabilities | | | 14,650,834 | | | | 41,464,202 | | | | (33,696,153 | ) | | | 22,418,883 | |

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at June 30, 2023 — (Continued)

(in Canadian dollars)

| | | Historical | | | Final Redemption | |

| | | LeddarTech

Inc. | | | Prospector

Capital

Corp. | | | Pro Forma

Adjustments | | | Pro Forma

Financial

Position | |

| NON-CURRENT LIABILITIES | | | | | | | | | | | | |

| Credit facility | | | 28,668,498 | | | | — | | | | (331,551 | ) | | | 28,336,947 | |

| | | | | | | | | | | | | | | | | |

| Convertible notes | | | 9,983,643 | | | | — | | | | 23,163,048 | | | | 33,146,691 | |

| Term loan | | | 7,099,498 | | | | — | | | | | | | | 7,099,498 | |

| Lease liabilities | | | 4,940,960 | | | | — | | | | — | | | | 4,940,960 | |

| Redeemable stock options | | | 6,102,496 | | | | — | | | | (6,102,496 | ) | | | — | |

| Government grant liability | | | 1,153,409 | | | | — | | | | — | | | | 1,153,409 | |

| Total liabilities | | | 72,599,338 | | | | 41,464,202 | | | | (16,967,152 | ) | | | 97,096,388 | |

| | | | | | | | | | | | | | | | | |

| SHAREHOLDERS’ EQUITY (DEFICIENCY) | | | | | | | | | | | | | | | | |

| Capital stock – LeddarTech | | | 451,967,396 | | | | — | | | | 6,022,324 | | | | — | |

| | | | | | | | | | | | 73,177 | | | | | |

| | | | | | | | | | | | (458,062,897 | ) | | | | |

| Prospector Class B Shares | | | — | | | | 1,077 | | | | (1,077 | ) | | | — | |

| Capital stock – Surviving Company | | | — | | | | — | | | | 35,473,324 | | | | 618,728,409 | |

| | | | | | | | | | | | 80,742,188 | | | | | |

| | | | | | | | | | | | 458,062,897 | | | | | |

| | | | | | | | | | | | 44,450,000 | | | | | |

| Reserve – warrants | | | 670,703 | | | | — | | | | — | | | | 670,703 | |

| Reserve – stock options | | | 30,462,500 | | | | — | | | | 186,214 | | | | 186,214 | |

| | | | | | | | | | | | 1,316,810 | | | | | |

| | | | | | | | | | | | (31,779,310 | ) | | | | |

| Contributed surplus | | | — | | | | — | | | | 20,068,750 | | | | 20,996,110 | |

| | | | | | | | | | | | 927,360 | | | | | |

| Other component of equity | | | 2,431,688 | | | | — | | | | (2,431,688 | ) | | | — | |

| Deficit | | | (468,903,855 | ) | | | (10,186,068 | ) | | | 10,186,068 | | | | (619,568,366 | ) |

| | | | | | | | | | | | (124,744,331 | ) | | | | |

| | | | | | | | | | | | (44,450,000 | ) | | | | |

| | | | | | | | | | | | 5,916,282 | | | | | |

| | | | | | | | | | | | (6,062,477 | ) | | | | |

| | | | | | | | | | | | (1,316,810 | ) | | | | |

| | | | | | | | | | | | 31,779,310 | | | | | |

| | | | | | | | | | | | (5,665,909 | ) | | | | |

| | | | | | | | | | | | (927,360 | ) | | | | |

| | | | | | | | | | | | (5,193,216 | ) | | | | |

| Equity attributable to owners of the capital stock of the parent | | | 16,628,432 | | | | (10,186,068 | ) | | | 14,569,629 | | | | 21,013,070 | |

| Non-controlling interests | | | (8,389,780 | ) | | | — | | | | 8,389,780 | | | | — | |

| Total shareholders’ equity | | | 8,238,652 | | | | (10,186,068 | ) | | | 22,959,409 | | | | 21,013,070 | |

| Total liabilities and shareholders’ equity | | | 80,837,990 | | | | 31,279,211 | | | | 5,992,257 | | | | 118,109,458 | |

Further, the following table summarizes the outstanding securities of the Surviving Company immediately after giving effect to the Business Combination:

Description | | Outstanding immediately after giving effect to

the Business Combination | |

| Surviving Company Common Shares | | | 28,770,930 | |

| Surviving Company Class A Non-Voting Special Shares | | | 2,031,250 | |

| Surviving Company Class B Non-Voting Special Shares | | | 999,963 | |

| Surviving Company Class C Non-Voting Special Shares | | | 999,963 | |

| Surviving Company Class D Non-Voting Special Shares | | | 999,963 | |

| Surviving Company Class E Non-Voting Special Shares | | | 999,963 | |

| Surviving Company Class F Non-Voting Special Shares | | | 999,963 | |

Surviving Company Warrants

| | | 17,465,749 | |

| PIPE Convertible Notes | | $ | 4,400,106 | |

| Options to purchase Surviving Company Common Shares | | | 12,577 | |

| Desjardins Warrants | | | 250,000 | |

| IQ Warrants | | | 13,890 | |

DIVIDEND POLICY

The Company has not paid any cash dividends on its shares to date. The Surviving Company currently intends to retain its future earnings, if any, to finance the further development and expansion of its business and does not intend to pay cash dividends in the foreseeable future. Any future determination to pay dividends will be at the discretion of the Surviving Company’s board of directors and will depend on its financial condition, results of operations, capital requirements, restrictions contained in future agreements and financing instruments, business prospects and such other factors as its board of directors deems relevant.

DIRECTORS AND OFFICERS

Board Composition

For a description of the individuals serving as directors and executive officers of the Surviving Company and the number and percentage ownership of the Surviving Company Shares beneficially owned, or controlled or directed, directly or indirectly, by all directors and executive officers of the Surviving Company as a group, see the sections entitled “Management of Surviving Company after the Business Combination” and “Security Ownership of Certain Beneficial Owners and Management” in the U.S. Prospectus. After giving effect to the redemption of Prospector Class A Shares and completion of the Business Combination, the directors and officers of the Surviving Company beneficially owned, or controlled or directed, directly or indirectly, approximately 229,845 Surviving Company Common Shares or approximately 0.8% of the outstanding Surviving Company Common Shares on a non-diluted basis.

The following table sets forth each such director’s and executive officer’s position and province or state and country of residence:

| | Position | | Province/State and Country of Residence |

| Executive Officers | | | | |

| Frantz Saintellemy | | Chief Executive Officer, Director | | Québec, Canada |

| Christopher Stewart | | Chief Financial Officer | | California, United States |

| David Torralbo | | Chief Legal Officer | | Québec, Canada |

| Claude Savard | | Chief Accounting Officer | | Québec, Canada |

| | | | | |

| Non-Employee Directors | | | | |

| Charles Boulanger | | Director | | Québec, Canada |

| Derek Aberle | | Director, Chairman | | California, United States |

| Nick Stone | | Director | | California, United States |

| Michelle M. Sterling | | Director | | California, United States |

| Yann Delabrière | | Director | | Île-de-France, France |

Nomination Rights

Under the Sponsor Letter Agreement (as defined in the U.S. Prospectus), FS Investors has the right to designate for nomination a number of directors to the board of directors of the Surviving Company (the “Surviving Company Board”) as follows: (i) two members designated by FS Investors so long as FS Investors and the Sponsor in the aggregate beneficially own at least 20.0% of the outstanding the Surviving Company Common Shares, and (ii) one member designated by FS Investors thereafter until the date that FS Investors and the Sponsor in the aggregate beneficially own at least 10.0% of the outstanding Surviving Company Common Shares.

Under the Investor Rights Agreement entered into at Closing between the Surviving Company and Investissement Québec, a legal person established under the Act Respecting Investissement Québec, acting as agent for the government of Québec as part of the Fonds de développement économique (“IQ”), IQ also has the right to designate for nomination one director to the Surviving Company Board for so long as IQ holds more than 60.0% of the equity interests in the Company that it owns at closing of the second tranche of the PIPE Financing, provided, however, that IQ shall nonetheless maintain its nomination right in respect of the next shareholders meeting relating to the election of directors of the Surviving Company that is called after the date upon which IQ’s equity interest falls below the foregoing threshold.

CORPORATE GOVERNANCE DISCLOSURE

For a description of the Surviving Company Board’s mandate and oversight role, the committees established by the Surviving Company Board and the Surviving Company’s corporate governance practices, see the section entitled “Management of Surviving Company after the Business Combination” in the U.S. Prospectus.

The Canadian Securities Administrators have issued corporate governance guidelines pursuant to National Instrument 58-201 – Corporate Governance Guidelines (the “Corporate Governance Guidelines”), together with certain related disclosure requirements pursuant to Regulation 58-101 – Disclosure of Corporate Governance Practices (“Regulation 58-101”). The Corporate Governance Guidelines are recommended as “best practices” for issuers to follow. We recognize that good corporate governance plays an important role in our overall success and in enhancing shareholder value and, accordingly, we have adopted in connection with the Business Combination certain corporate governance policies and practices which reflect our consideration of the recommended Corporate Governance Guidelines.

In addition to those matters described under the section entitled “Management of Surviving Company after the Business Combination” in the U.S. Prospectus, the disclosure set out below includes disclosure required by 58-101 describing our approach to corporate governance in relation to the Corporate Governance Guidelines.

Director Independence

The Surviving Company’s board of directors has undertaken a review of its composition, the composition of its committees and the independence of each director. Based upon information requested from and provided by each director concerning his or her background, employment and affiliations, including family relationships, our board of directors has determined that out of six directors who are serving on the Surviving Company Board, four directors qualify as “independent” within the meaning of Regulation 58-101, namely Derek Aberle, Nick Stone, Michelle M. Sterling and Yann Delabrière. Derek Aberle is also the Chairman of the Surviving Company Board.

Charles Boulanger was determined as not being independent as he was the Chief Executive Officer of LeddarTech until the consummation of the Business Combination, and Frantz Saintellemy was determined as not being independent as he was the President and Chief Operating Officer of LeddarTech until the consummation of the Business Combination and is currently the Chief Executive Officer of the Surviving Company.

Insider Trading Policy

The Surviving Company adopted an insider trading policy which prohibits its directors, officers, employees and consultants, while aware of material non-public information about the Surviving Company, from (i) trading in its securities; (ii) recommending the purchase or sale of its securities, (iii) disclosing such material non-public information to persons within the Surviving Company whose duties do not require them to have such information, or outside of the Surviving Company to any other persons (unless the disclosure is made in accordance with the Surviving Company’s disclosure policy) and (iv) assisting any person or entity engaged in the foregoing activities. The insider trading policy applies to all transactions in the Surviving Company’s securities, as well as derivatives and related financial instruments.

Diversity

The Surviving Company recognizes the importance and benefit of fostering and promoting diversity among board members and senior management, and believes that boards of directors should have diverse backgrounds and possess a variety of skills, qualifications, experience and knowledge that complement the attributes of other board members and enable them to contribute effectively to the board’s oversight role. While the Surviving Company does not have formal policies or targets regarding board diversity requirements for the representation of women, Indigenous peoples, people with disabilities or members of visible minority (collectively, the “Designated Groups”) on the Surviving Company Board or senior management, the nominating and corporate governance committee and the Surviving Company’s senior executives will take gender and other diversity representation into consideration as part of their overall recruitment and selection process.

The composition of the Surviving Company Board will, in the future, be shaped by the selection criteria to be established by the nominating and corporate governance committee, which is expected to consider a variety of factors in addition to gender, race and other diversity considerations, including a potential director’s judgment, independence, business and educational background, stature, public service, conflicts of interest, integrity, ethics, diversity considerations, as well as his or her ability and willingness to devote sufficient time to serve on the Surviving Company Board. Diversity considerations will also be taken into account with respect to senior management positions, including seeking to broaden recruiting efforts to attract and interview qualified people from the Designated Groups, and committing to retention and training to ensure that the Surviving Company’s most talented employees are promoted from within the organization.

In accordance with Nasdaq’s listing requirements with respect to diversity of boards of directors, foreign private issuers (such as the Surviving Company) listing on Nasdaq must have two diverse directors, or provide an explanation for not meeting such requirement, within two years for the date of listing or December 31, 2026, whichever is later. Foreign private issuers can meet the diversity requirement with either two female directors or one female director and one director who is an underrepresented individual based on national, racial, ethnic, indigenous, cultural, religious or linguistic identity in its home country or LGBTQ+.

The Surviving Company currently has one woman on the Surviving Company Board and none as executive officer, representing 16.67% of the Surviving Company’s directors and 0% of its senior management team.

Other than Frantz Saintellemy, no director or senior management identifies himself or herself as a member of the other Designated Groups. The Surviving Company Board as a whole is responsible for monitoring the evolution and involvement of the Designated Groups within the Surviving Company Board and senior management of the Surviving Company.

AUDIT COMMITTEE

Audit Committee

The Surviving Company is a “SEC issuer” within the meaning of Regulation 52-107 – Acceptable Accounting Principles and Auditing Standards and is required to comply with the rules with respect to audit committees adopted by the SEC, Nasdaq rules and Regulation 52-110 – Audit Committees, including with respect to composition and independence. The initial members of the Surviving Company’s audit committee are Yann Delabrière, Nick Stone and Derek Aberle. Each member of the audit committee has an understanding of the accounting principles used to prepare financial statements and varied experience as to the general application of such accounting principles, as well as an understanding of the financial controls and procedures necessary for financial reporting. For additional details regarding the Surviving Company’s audit committee generally, see the section entitled “Management of Surviving Company after the Business Combination – Committees of the Board of Directors – Audit Committee” in the U.S. Prospectus.

External Auditor Service Fee

For LeddarTech’s fiscal years ended September 30, 2022 and 2021, LeddarTech incurred the following fees with its external auditor, Ernst & Young LLP:

| | | Year ended

September 30,

2022 | | | Year ended

September 30,

2021 | |

| Audit fees(1) | | $ | 2,587,257 | | | $ | 1,751,072 | |

| Audit related fees(2) | | $ | - | | | $ | 19,286 | |

| Tax fees(3) | | $ | 203,566 | | | $ | 174,779 | |

| All other fees(4) | | $ | - | | | $ | - | |

| Total fees paid | | $ | 2,790,823 | | | $ | 1,945,137 | |

| (1) | Fees for audit services on a billed basis. |

| (2) | Fees for assurance and related services not included in audit services above. |

| (3) | Fees for tax compliance, tax advice and tax planning. |

| (4) | All other fees not included above. |

CEASE TRADE ORDERS

None of the individuals serving as directors and executive officers of the Surviving Company are, as at the date of this Canadian Prospectus, or have been, within the ten years prior to the date of this Canadian Prospectus, a director, chief executive officer or chief financial officer of any company that, while such person was acting in that capacity (or after such person ceased to act in that capacity but resulting from an event that occurred while that person was acting in such capacity), was the subject of a cease trade order, an order similar to a cease trade order, or an order that denied the company access to any exemption under securities legislation, in each case, for a period of more than 30 consecutive days.

BANKRUPTCIES

Other than as disclosed in this Canadian Prospectus, (i) none of the individuals serving as directors and executive officers of the Surviving Company are, as at the date of this Canadian Prospectus, or have been, within the ten years prior to the date of this Canadian Prospectus, a director or executive officer of any company, that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or comprise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets, and (ii) none of the individuals serving as directors and executive officers of the Surviving Company has, within the ten years prior to the date of this Canadian Prospectus, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or comprise with creditors, or had a receiver, receiver manager or trustee appointed to hold its assets.

Nick Stone was a director of a company based in Oklahoma named International Energy Inc. (“International Energy”). To comply with the Australian Securities Exchange listing rules, International Energy was required to file for bankruptcy in the United States under international treaty requirements. The bankruptcy was subsequently dismissed in the United States because the U.S. trustee believed that it was not required in the U.S., even though it was required in Australia. As a result, the entire case has been dismissed.

SECURITIES PENALTIES OR SANCTIONS

Other than as disclosed in this Canadian Prospectus, none of the individuals serving as directors and executive officers of the Surviving Company, nor any personal holding company of any such person, has:

| · | been subject to any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or |

| · | been subject to any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable investor in making an investment decision. |

In December 2014, the Enforcement Committee of the French Financial Markets Authority (the “FFMA”) found that Faurecia SA (“Faurecia”) and its Chairman and Chief Executive Officer, Mr. Yann Delabrière, had failed to meet certain obligations defined in Articles 223-1, 223-2 and 223-10-1 of the FFMA’s General Regulation pertaining to information related to Faurecia’s objectives for 2012. The FFMA fined Faurecia and Mr Yann Delabrière €2 million and €100,000, respectively. Supported by Faurecia’s board of directors, in February 2015, Faurecia SA and Mr. Delabrière lodged an appeal against this decision with the Paris Court of Appeal. The Paris Court of Appeal found no evidence of personal wrongdoing by Mr. Delabrière and maintained the penalty solely in his capacity as legal representative of Faurecia. In August 2016, Faurecia and Mr. Delabrière lodged an appeal against this ruling before the French Supreme Court. The appeal was withdrawn, and the French Supreme Court recorded this withdrawal by a judgment dated September 26, 2018.

In June 2022 and July 2022, stockholders of Digital Turbine Inc. (“Digital Turbine”) filed class action complaints against Digital Turbine and certain of its officers, including independent director Ms. Michelle Sterling, in the Western District of Texas related to Digital Turbine’s announcement in May 2022 that it would restate some of its financial results. The claims allege violations of certain federal securities laws. On July 19, 2023, the Western District court granted Digital Turbine’s motion to dismiss the case. The plaintiffs had twenty-one days from such date to file an amended complaint. Several derivative actions have been filed against Digital Turbine and its directors, which all assert claims of breach of fiduciary duties arising out of the same facts as the securities class action. The federal derivative cases have been stayed under a court order, pending a ruling on any motion to dismiss the federal class action. Digital Turbine and the individual defendants filed a motion to dismiss the Delaware Chancery case on May 11, 2023. Digital Turbine and individual defendants deny any allegations of wrongdoing and plan to vigorously defend against the claims asserted in these complaints. In July 2023, a derivative action was filed against Digital Turbine and the members of Digital Turbine’s Compensation and Human Capital Management Committee that asserts a claim of breach of fiduciary duties related to the grant of equity awards to Digital Turbine’s CEO in excess of the annual share limit set forth in Digital Turbine’s 2020 Equity lncentive Plan. Digital Turbine and individual defendants deny any allegations of wrongdoing.

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS

None of the individuals serving as directors and executive officers of the Surviving Company, is or has been indebted to LeddarTech or the Surviving Company, or is indebted to another entity that is, or has been at any time, the subject of a guarantee, support agreement, letter of credit or similar arrangement provided by LeddarTech or the Surviving Company.

PRINCIPAL SECURITYHOLDERS

To the knowledge of the Surviving Company, no persons beneficially owned, or controlled or directed, directly or indirectly, voting securities carrying 10.0% or more of the voting rights attached to any class of voting securities of the Surviving Company immediately following the closing of the Business Combination, other than as set out below:

Name | | Number and type of Securities | | Type of Ownership | | Percentage of Class(1) | | | Percentage of Class (fully diluted)(2) | |

| Prospector Sponsor, LLC(3) | | 1,521,265 Surviving Company Common Shares

2,411,565 Surviving Company Common Shares issuable upon conversion of Surviving Company Non-Voting Special Shares

6,632,416 Surviving Company Common Shares issuable upon exercise of Surviving Company Warrants

782,500 Surviving Company Shares issuable upon conversion of PIPE Convertible Notes | | Registered and Beneficial | | | 5.3 | % | | | 19.6 | % |

| FS LT Holdings LP(4) | | 5,213,325 Surviving Company Common Shares

1,303,330 Surviving Company Common Shares issuable upon conversion of Surviving Company Non-Voting Special Shares

920,000 Surviving Company Shares issuable upon conversion of PIPE Convertible Notes | | Registered and Beneficial | | | 18.1 | % | | | 12.8 | % |

| Investissement Québec(5) | | 4,364,838 Surviving Company Common Shares

1,091,205 Surviving Company Common Shares issuable upon conversion of Surviving Company Non-Voting Special Shares

1,500,000 Surviving Company Shares issuable upon conversion of PIPE Convertible Notes

13,890 Surviving Company Common Shares issuable upon exercise of IQ Warrants | | Registered and Beneficial | | | 15.2 | % | | | 12.0 | % |

Notes:

| (1) | Based on 28,770,930 outstanding Surviving Company Common Shares as of the date of this Canadian Prospectus. |

| (2) | Based on 57,944,317 outstanding Surviving Company Common Shares on a fully diluted basis. |

| (3) | The Surviving Company Common Shares and Surviving Company Warrants reported above are held in the name of the Sponsor. Derek Aberle, Nick Stone, Steve Altman and Mike Stone are among the members of the Sponsor and are its managers. Each manager has one vote, and the unanimous approval of the managers is required for approval of an action of the Sponsor. No individual manager exercises voting or dispositive control over any of the securities held by the Sponsor, even those in which he directly owns a pecuniary interest. Accordingly, none of the individuals will be deemed to have or share beneficial ownership of such securities. |

| (4) | The Surviving Company Common Shares reported above are held in the name of FS LT Holdings LP, a Delaware limited partnership. FS Investment Management, L.P., a Delaware limited partnership, is the general partner of FS LT Holdings LP and exercises sole voting and dispositive control of the securities held by FS LT Holdings LP. Nick Stone Management II, LLC, a Texas limited liability company, is the general partner of FS Investment Management, L.P. Nick Stone is the manager of Nick Stone Management II, LLC. The address of the principal business office of each of FS LT Holdings LP, FS Investment Management, L.P., Nick Stone Management II, LLC and Nick Stone is 1250 Prospect Street, Suite 200, La Jolla, CA 92037. |

| (5) | IQ is a mandatary of the Government of the Province of Quebec, Canada. Decisions to vote or dispose Surviving Company’s securities are made (i) by the Government of Québec, through the adoption of a decree of the Cabinet or by the Minister of the Economy, Innovation and Energy, in both cases under recommendations of the personnel at the ministry and of IQ or (ii) with respect to securities acquired by IQ acting for its own account (and not as mandatary of the Government of Québec), by IQ’s Credit Committee (which is typically comprised of six (6) persons) upon recommendations of IQ’s personnel. Accordingly, no person individually can exercise voting or investment power over the shares held by IQ and none are deemed to have or share beneficial ownership of such securities. The business address for Investissement Quebec is 1001, boulevard Robert Bourassa, Suite 1000, Montréal, Québec H3B 0A7. |

INTERESTS OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS

To the best of the Surviving Company’s knowledge, other than as may be described in this Canadian Prospectus and/or the U.S. Prospectus, (i) there are no material interests, direct or indirect, of any of Surviving Company’s directors or executive officers, any shareholder that beneficially owns or controls or directs (directly or indirectly), more than 10.0% of any class or series of outstanding voting securities of the Surviving Company, or any associate or affiliate of any of the foregoing persons, in any transaction within the three years before the date of this Canadian Prospectus that has materially affected or is reasonably expected to materially affect the Surviving Company or any of its subsidiaries, and (ii) there are no known existing or potential material conflicts of interest between the Surviving Company and its subsidiaries and the Surviving Company’s directors, officers or other members of management as a result of their outside business interests except that (a) Derek Aberle and Nick Stone, Prospector’s Chief Executive Officer and Chief Financial Officer, respectively, were both directors of Prospector, and are managers of the Sponsor and managers of FS Investors, which owned approximately 25.8% of the Company prior to the Business Combination and serve on the board of directors of the Surviving Company, (b) certain of the directors and officers of the Surviving Company invested in the PIPE Financing, and (c) certain of the directors and officers of the Surviving Company serve as directors and officers of other companies, and therefore it is possible that a conflict may arise between their duties to the Surviving Company and their duties as a director or officer of such other companies. See the sections entitled “Certain Prospector Relationships and Related Person Transactions,” “Certain Agreements Related to the Business Combination” and “Risk Factors – Risks Related to Conflicts of Interest” in the U.S. Prospectus.

MATERIAL CONTRACTS

The following are the only material contracts, other than those contracts entered into in the ordinary course of business, which the Surviving Company has entered into since the beginning of the last financial year of LeddarTech before the date of this Canadian Prospectus, entered into prior to such date but which contract is still in effect, or to which the Surviving Company became a party to in connection with the consummation of the Business Combination:

| · | the Business Combination Agreement referred to under the section entitled “The Business Combination Agreement” in the U.S. Prospectus; |

| · | the Amendment No. 1 to the Business Combination Agreement referred to under the section entitled “The Business Combination Agreement” in the U.S. Prospectus; |

| · | the Investor Rights Agreement referred to under the section entitled “Certain Agreements Related to the Business Combination – Investor Agreement” in the U.S. Prospectus; |

| · | the Subscription Agreement for the PIPE Financing referred to under the section entitled “Unaudited Pro Forma Condensed Consolidated Financial Information – PIPE Financing” in the U.S. Prospectus; |

| · | the Amendment No. 1 to the Subscription Agreement referred to under the section entitled “Unaudited Pro Forma Condensed Consolidated Financial Information – PIPE Financing” in the U.S. Prospectus; |

| · | the Sponsor Letter Agreement referred to under the section entitled “Certain Agreements Related to the Business Combination – Sponsor Letter Agreement” in the U.S. Prospectus; |

| · | the Registration Rights Agreement referred to under the section entitled “Certain Agreements Related to the Business Combination – Registration Rights Agreement” in the U.S. Prospectus; |

| · | the Warrant Agreement (as defined in the U.S. Prospectus); |

| · | the Amended and Restated Financing Offer dated as of April 5, among LeddarTech Inc., Fédération des caisses Desjardins du Québec and VayaVision Sensing Ltd., as amended on May 1, 2023, May 31, 2023, September 29, 2023, October 13, 2023, October 20, 2023, October 31, 2023 and December 8, 2023; |

| · | the Loan Offer dated as of January 23, 2020 among LeddarTech and IQ., as amended on March 29, 2023 and June 12, 2023; and |

| · | the Bridge Loan Agreement dated May 1, 2023 among LeddarTech and IQ. |

Copies of the above material contracts (including those annexed to the Registration Statement), if not already entered into then once executed, may be inspected during ordinary business hours at the offices of the Surviving Company at 4535 Wilfrid Hamel Blvd., Suite 240, Québec, QC, G1P 2J7 and will be filed, as required, via EDGAR (available at www.sec.gov) and via SEDAR+ (available at www.sedarplus.ca).

LEGAL MATTERS

Certain Canadian legal matters relating to the Business Combination, have been or will be passed upon on behalf of the Company, NewCo and/or the Surviving Company by Stikeman Elliott LLP, and the matters referred to under the section entitled “Material U.S. Federal Income Tax Considerations” in the U.S. Prospectus, as well as certain other U.S. legal matters relating to the Business Combination, have been or will be passed upon on behalf of the Company, NewCo and/or the Surviving Company by Vedder Price LLP and on behalf of Prospector by White & Case LLP. Certain legal matters relating to the Business Combination have been or will be passed upon on behalf of Prospector by Osler, Hoskin & Harcourt LLP with respect to Canadian legal matters. The partners and associates of each of Stikeman Elliott LLP, Vedder Price LLP, White & Case LLP and Osler, Hoskin & Harcourt LLP, respectively, as a group, beneficially own, directly and indirectly, less than 1.0% of the issued and outstanding Surviving Company Common Shares and less than 1.0% of the issued and outstanding common shares of any of its affiliates or associates.

INTERESTS OF EXPERTS

Current Capital Securities LLC (“Current Capital”) is named as having delivered a written fairness opinion to the board of directors of Prospector on June 8, 2023, the full text of which is included as Annex J to the U.S. Prospectus. The designated professionals (as such term is defined in Form 51-102F2 – Annual Information Form) of Current Capital beneficially own, directly and indirectly, less than 1.0% of the issued and outstanding Surviving Company Common Shares and less than 1.0% of the issued and outstanding common shares of any of its affiliates or associates.

AUDITOR, TRANSFER AGENT AND REGISTRAR

The independent auditors of the Surviving Company are Richter LLP, independent registered public accounting firm, 1981 McGill College Av., Montréal, QC H3A 0G6. See the section entitled “Additional Information – Change in Registered Public Accounting Firm” in the U.S. Prospectus.

The transfer agent and registrar for the Surviving Company Common Shares and the warrant agent for the Surviving Company Warrants is Continental Stock Transfer & Trust Company at its principal office in New York, New York.

EXEMPTIONS

Pursuant to a decision of the AMF dated December 12, 2023, the Surviving Company was granted exemptive relief from the requirement in section 2.2(2) of Regulation 41-101 that requires that this Canadian Prospectus be publicly filed in both the French and English languages.

U.S. PROSPECTUS

See attached.

LEDDARTECH FINANCIAL STATEMENTS AND MANAGEMENT’S DISCUSSION & ANALYSIS

See attached.

EXHIBIT A – BOARD MANDATE

The board of directors (the “Board”) of LeddarTech Holdings Inc. (the “Company”), a publicly traded company subject to securities laws in Canada and the United States, is responsible for the stewardship of the business and affairs of the Company. The Board seeks to discharge such responsibility by reviewing, discussing and approving the Company’s strategic planning and organizational structure and supervising management to oversee that the strategic planning and organizational structure enhance and preserve the business of the Company and its underlying value. Its members (the “Directors”) are elected by the shareholders of the Company. The purpose of this mandate of the Board (the “Mandate”) is to describe the primary duties and responsibilities of the Board, as well as some of the policies and procedures that apply to the Board in discharging its duties and responsibilities.

Although Directors may be elected by the shareholders to bring special expertise or a point of view to Board deliberations, they are not chosen to represent a particular constituency. The best interests of the Company must be paramount at all times.

RESPONSIBILITIES

Pursuant to applicable laws, in exercising their powers and discharging their duties, Directors are duty-bound toward the Company to act with prudence and diligence, honesty and loyalty and in the interest of the Company. The Board discharges its responsibility for overseeing the management of the Company’s business by delegating to the Company’s senior officers the responsibility for the day-to-day management of the Company. The Board discharges its responsibilities both directly and through its committees, the Audit Committee, the Nominating and Corporate Governance Committee, and the Compensation and Human Capital Committee. In addition to these regular committees, the Board may appoint ad hoc committees periodically to address certain issues of a more short-term nature. The Board’s primary roles are overseeing corporate performance and providing quality, depth and continuity of management to meet the Company’s strategic objectives. Other principal duties include, but are not limited to the following categories:

Appointment and Compensation of Officers

| 1. | The Board is responsible for approving the appointment of the Chief Executive Officer, other executive officers and other officers of the Company, following a review of the recommendations of the Compensation and Human Capital Committee. |

| 2. | In approving the appointment of the Chief Executive Officer, other executive officers and other officers, the Board shall, to the extent feasible, satisfy itself as to the integrity of these individuals and ensure that they create a culture of integrity throughout the Company. |

| 3. | The Board shall also annually review and approve, on the recommendation of the Compensation and Human Capital Committee, the compensation of the Company’s executive officers (including the Chief Executive Officer) as well as their objectives and the position description of the Chief Executive Officer. |

| 4. | The Board may from time to time authorize certain officers to enter into certain types of transactions, including financial transactions, subject to specified limits. Investments and other expenditures above the specified limits, and material transactions outside the ordinary course of business shall, however, be reviewed by and are subject to the prior approval of the Board. |

| 5. | The Board oversees that succession planning programs are in place, including programs to train and develop management. |

Board Organization