| | | | | | | | |

| | |

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549

|

SCHEDULE 14A Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. )

|

| | | | | |

| |

| Filed by the Registrant | x |

| |

| Filed by a Party other than the Registrant | o |

Check the appropriate box:

| | | | | |

| |

| o | Preliminary Proxy Statement |

| |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | Definitive Proxy Statement |

| |

| o | Definitive Additional Materials |

| |

| o | Soliciting Material Under Rule 14a-12 |

Centuri Holdings, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | |

| |

| x | No fee required. |

| |

| o | Fee paid previously with preliminary materials. |

| |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-(i)(1) and 0-11. |

| |

Dear Stockholder:

You are cordially invited to the Annual Meeting of Stockholders of Centuri Holdings, Inc., scheduled to be held on April 16, 2025 at 10:00 AM Mountain Standard Time in a completely virtual format at http://www.virtualshareholdermeeting.com/CTRI2025.

The matters to be acted on at the Annual Meeting are described in the enclosed notice and Proxy Statement. Your Board of Directors asks you to support the Board of Directors’ director nominees and to follow its recommendations with respect to the other proposals set forth in the Proxy Statement.

We realize that you may not be able to attend the Annual Meeting of Stockholders and vote your shares at the meeting. However, regardless of your meeting attendance, your vote is important to us. We urge you to ensure that your shares are represented by voting in advance of the meeting online or via a toll-free telephone number, as instructed in the Notice Regarding the Internet Availability of Proxy Materials, or if you have elected to receive a paper or e-mail copy of the proxy materials, by completing, signing and returning the proxy card that is provided. If you decide to attend the Annual Meeting of Stockholders, you may revoke your proxy at that time and vote your shares at such meeting.

Your interest and participation in the affairs of our Company are greatly appreciated.

Sincerely yours,

Christian I. Brown

President and Chief Executive Officer

| | | | | | | | |

| | 19820 North 7th Avenue, Suite 120,

Phoenix, Arizona 85027 |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

April 16, 2025

| | | | | | | | | | | |

| TIME: | 10:00 AM Mountain Standard Time / Pacific Daylight Time |

| | | |

| PLACE: | Webcast at http://www.virtualshareholdermeeting.com/CTRI2025 | |

| | | |

| PROPOSALS: | | BOARD RECOMMENDS: |

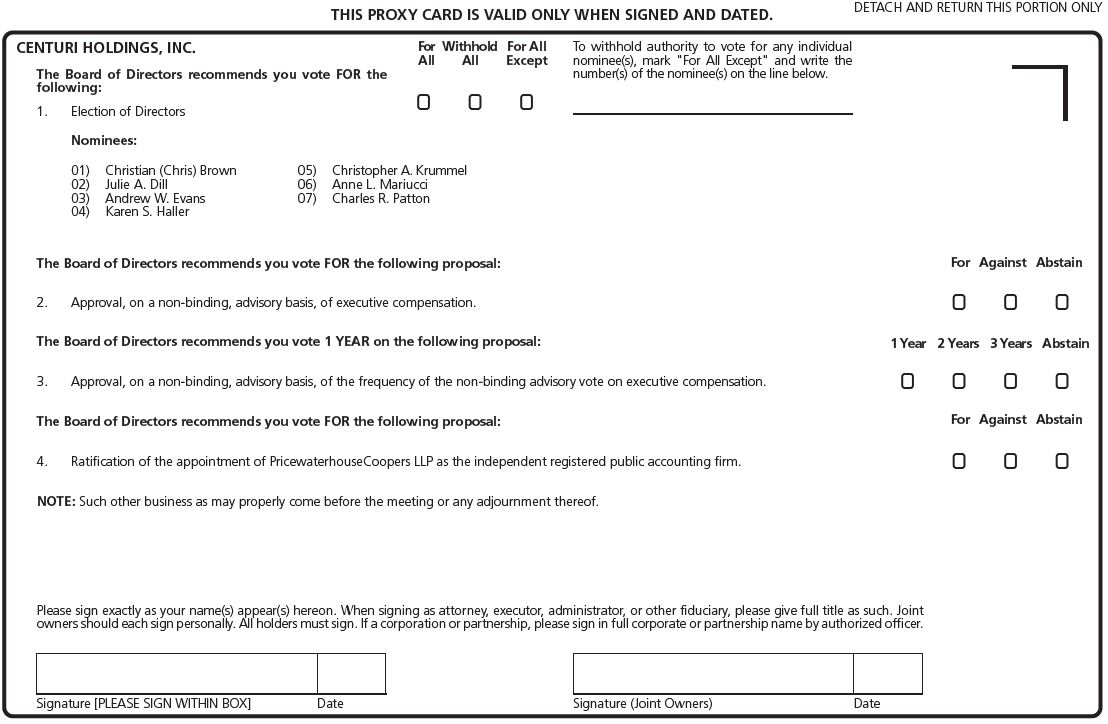

| (1) | The election of each of Christian I. Brown, Julie A. Dill, Andrew W. Evans, Karen S. Haller, Christopher A. Krummel, Anne L. Mariucci, and Charles R. Patton to our Board of Directors to serve until the next annual meeting of stockholders or until their successors are duly elected and qualified or until their earlier death, resignation or removal; | FOR each director nominee |

| (2) | To hold an advisory (non-binding) vote regarding the compensation of our named executives; | FOR |

| (3) | To hold an advisory (non-binding) vote regarding the frequency of the non-binding advisory vote on the compensation of our named executives; | 1 YEAR |

| (4) | To ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm of Centuri for the fiscal year ending December 28, 2025 (“fiscal 2025”); and | FOR |

| (5) | To transact such other business as may properly come before the 2025 Annual Meeting of Stockholders (the “Annual Meeting”) or any adjournment(s) or postponement(s) thereof. | |

| | | |

| RECORD DATE: | Holders of Centuri common stock of record at the close of business on February 24, 2025 are entitled to vote at the Annual Meeting. |

| | | |

| INTERNET AVAILABILITY OF PROXY MATERIALS: | On or about March 5, 2025, we expect to mail to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access both the proxy statement and our annual report. The Notice will also contain instructions on how to vote online or by telephone and how to receive a paper copy of the proxy materials by mail. The proxy statement and our annual report can be accessed at the following internet address: www.proxyvote.com. All you have to do is enter the control number located in the Notice or on your proxy card. |

| | | |

| NOTICE REGARDING THE VIRTUAL ANNUAL MEETING | The virtual format of the Annual Meeting ensures that stockholders are afforded the same rights and opportunities to participate as they would have at an in-person meeting, using online tools to ensure stockholder access and participation. For more information about the virtual Annual Meeting, see “General Information” in this Proxy Statement. |

| | | |

| PROXY: | It is important that your shares be represented and voted at the Annual Meeting. Whether or not you expect to attend the Annual Meeting in person or virtually, please vote your shares as promptly as possible, or via the internet or telephone as instructed in the Notice or on your proxy card, in order to ensure your representation at the Annual Meeting. You can revoke your proxy at any time prior to its exercise at the Annual Meeting by following the instructions in the accompanying proxy statement. |

| | | | | |

| |

| HOW TO VOTE |

| Please review the proxy statement and vote, at your earliest convenience, using any of the following methods: |

| ( | Call the phone number listed on your Proxy Card to vote BY TELEPHONE. |

| : | Visit the website listed on your Proxy Card to vote ONLINE. |

| Sign, date and return your Proxy Card in the provided postage-paid envelope to vote BY MAIL. |

| I | Access the virtual meeting to vote by ballot. See “How Do I Attend the Annual Meeting?” (page 1) for instructions. |

By Order of the Board of Directors,

Jason S. Wilcock

Executive Vice President, Chief Legal & Administrative Officer and Corporate Secretary

TABLE OF CONTENTS

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

To Be Held on April 16, 2025

GENERAL INFORMATION

We are providing these proxy materials to you in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Centuri Holdings, Inc. (“we,” “us,” “our,” or the “Company”) for the 2025 Annual Meeting of Stockholders (the “Annual Meeting”) and for any adjournment or postponement of the Annual Meeting. The Annual Meeting will be held in a completely virtual format on April 16, 2025 at 10:00 AM Mountain Standard Time.

Important Notice Regarding the Availability of Proxy Materials for

the Annual Meeting to be Held on April 16, 2025

Pursuant to the rules adopted by the U.S. Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the internet. Accordingly, we are sending a Notice Regarding the Internet Availability of Proxy Materials (the “Notice”) to certain of our stockholders of record. We are also sending a paper copy of the proxy materials and proxy card to other stockholders of record who have indicated they prefer receiving such materials in paper form. Brokers and other nominees who hold shares on behalf of beneficial owners will be sending their own similar Notice. We intend to commence mailing the Notice or paper copies of this proxy statement and proxy card, as applicable, on or about March 5, 2025 to all stockholders entitled to vote at the Annual Meeting.

Stockholders will have the ability to access the proxy materials on the website referred to in the Notice or may request to receive a paper copy of the proxy materials by mail or electronic copy by electronic mail on a one-time or ongoing basis. Instructions on how to request a printed copy by mail or electronically may be found on the Notice.

The Notice will also identify the date, time and location of the Annual Meeting; the matters to be acted upon at the Annual Meeting and the Board’s recommendation with regard to each matter; a toll-free telephone number, an e-mail address, and a website where stockholders can request to receive, free of charge, a paper or e-mail copy of this proxy statement, our Annual Report on Form 10-K for the fiscal year ended December 29, 2024 (the “Annual Report”) and a form of proxy relating to the Annual Meeting; information on how to access and vote the form of proxy; and information on how to obtain instructions to attend the virtual meeting and vote in person at the virtual meeting, should stockholders choose to do so.

| | |

| What is the purpose of the Annual Meeting? |

At the Annual Meeting, stockholders will be asked to vote on the following matters:

•The election of seven directors of the Company;

•The approval, on a non-binding, advisory basis, of the Company’s executive compensation;

•The frequency, on a non-binding, advisory basis, of the advisory vote on the Company’s executive compensation;

•The ratification of the selection of PricewaterhouseCoopers LLP as the independent registered public accounting firm for the Company for fiscal 2025; and

•Any other matter that may properly come before the Annual Meeting or any adjournment thereof.

| | |

| How do I attend the Annual Meeting? |

The Annual Meeting will be a completely virtual meeting of stockholders. You will be able to attend the Annual Meeting online, submit questions and vote by logging on to www.proxyvote.com using the 16-digit control number found in the proxy materials previously distributed to you. Attendance at the Annual Meeting will be limited to stockholders of the Company as of February 24, 2025, the record date for the Annual Meeting, and guests of the Company. You will not be able to attend the Annual Meeting in person at a physical location.

You may attend the Annual Meeting by visiting http://www.virtualshareholdermeeting.com/CTRI2025. You will need your unique control number, which appears in the Notice, the proxy card or voting instructions that accompanied the proxy materials. In the event that you do not have a control number, please contact your broker, bank or other nominee as soon as possible so that you can be provided with a control number and gain access to the meeting.

Although the meeting webcast will begin at 10:00 AM Mountain Standard Time on April 16, 2025, we encourage you to access the meeting site 15 minutes prior to the start time to allow ample time to log into the meeting webcast and test your computer system.

Technical Disruptions. In the event of any technical disruptions or connectivity issues during the course of the Annual Meeting, please allow for some time for the meeting website to refresh automatically, and/or for the meeting operator to provide verbal updates.

Stockholder List. As required by Delaware law, we will make available a list of registered stockholders as of February 24, 2025, the record date of the Annual Meeting, for inspection by stockholders for any purpose germane to the Annual Meeting from April 5, 2025, through April 15, 2025 at our headquarters located at 19820 North 7th Avenue, Suite 120, Phoenix, Arizona 85027. If you wish to inspect the list, please submit your request, along with proof of your share ownership, by e-mail to jwilcock@centuri.com.

| | |

| How can I submit questions prior to and during the Annual Meeting? |

Prior to the Annual Meeting, you may submit questions pertaining to the business of the meeting by accessing www.proxyvote.com using the 16-digit control number found in the proxy materials distributed to you any time before 11:59 p.m., Eastern Time, on the day before the meeting. During the Annual Meeting, as well as 15 minutes prior to the start time, stockholders will also be able to submit questions through the online platform used for the Annual Meeting at http://www.virtualshareholdermeeting.com/CTRI2025. The Company will respond to germane questions during the meeting or shortly after the meeting. We will endeavor to answer as many questions submitted by stockholders as time permits. We reserve the right to edit questions to remove inappropriate language and to exclude questions regarding topics that are not pertinent to meeting matters. If we receive substantially similar questions, we may group such questions together and provide a single response.

| | |

| Who is entitled to vote at the Annual Meeting? |

Only stockholders of record at the close of business on February 24, 2025, the record date for the Annual Meeting, are entitled to receive notice of and to vote at the Annual Meeting. If you are a stockholder of record on that date, you are entitled to vote all of the shares that you held on that date at the Annual Meeting, or any adjournment or postponement of the Annual Meeting.

| | |

| How many votes do I have? |

You have one vote for each share of the Company’s common stock (“Common Stock”) owned as of the record date for the Annual Meeting.

If your shares are registered directly in your name, you are the holder of record of those shares and can vote your shares either by proxy, whether or not you attend the virtual Annual Meeting, or by ballot by attending the virtual Annual Meeting. Whether or not you plan to attend the virtual Annual Meeting, we encourage you to submit your proxy promptly to ensure that your votes are counted. You may still attend the virtual Annual Meeting and vote by ballot even if you have already submitted a proxy.

Stockholders have a choice of voting online, by telephone, by mail, or at the Annual Meeting:

•If you received a printed copy of the proxy materials, please follow the instructions on your proxy card or voter instruction form. Your proxy card or voter instruction form provides information on how to vote.

•If you received a Notice of Internet Availability, please follow the instructions on the notice. The Notice of Internet Availability provides information on how to vote.

•If you received an e-mail notification, please click on the link provided in the e-mail notification and follow the instructions on how to vote.

If you hold your shares in a brokerage account or through a bank, trust or other nominee (collectively, a “broker”), you are the beneficial owner of the shares, and the shares are held in “street name.” You will receive instructions from your broker on how to vote your shares. Your broker will allow you to deliver your voting instructions over the internet and may also permit you to submit your voting instructions by telephone or by completing, dating and signing the proxy card included with your proxy materials if you request a paper copy of them by following the instructions on the notice provided by your broker.

| | |

| Can I revoke or change my vote? |

Yes, a record holder can revoke or change a vote at any time prior to the voting of shares at the Annual Meeting by (a) casting a new vote by telephone or online; (b) sending a new Proxy Card with a later date; (c) sending a written notice of revocation that is received on or prior to April 15, 2025, by mail to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717; or (d) voting by ballot at the virtual Annual Meeting. If a broker, bank, trustee or other nominee holds your shares, you must contact them in order to find out how to change your vote.

| | |

| What are the Board’s recommendations? |

The Board’s recommendations are set forth within the description of each proposal in this Proxy Statement. In summary, the Board recommends a vote:

•FOR the election of the slate of directors nominated by the Board (see Proposal 1);

•FOR the approval of the Company’s executive compensation (see Proposal 2);

•1-YEAR frequency for future advisory votes on executive compensation (see Proposal 3); and

•FOR the ratification of the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for fiscal 2025 (see Proposal 4).

| | |

| How many votes must be present to hold the Annual Meeting? |

In order to conduct business at the Annual Meeting, the holders of a majority of the outstanding shares of Common Stock entitled to vote must be present at the meeting. Shares are counted as present at the meeting if (i) you are present online and vote at the meeting, or (ii) you have properly and timely submitted your proxy as described above under “How do I attend the Annual Meeting?” This is called a quorum. As of the close of business on February 24, 2025, 88,517,521 shares of Common Stock were outstanding and entitled to vote. Proxies received but marked as abstentions and any broker non-votes will be included in the calculation of the votes considered to be present at the meeting.

| | |

| What is a “broker non-vote”? |

A “broker non-vote” occurs when a broker lacks discretionary authority to vote on a “non-routine” proposal and a beneficial owner fails to give the broker voting instructions on that matter. The rules of the New York Stock Exchange (“NYSE”) determine whether matters presented at the Annual Meeting are “routine” or “non-routine” in nature. The election of directors is considered a “non-routine” matter. Similarly, the advisory vote to approve the Company’s executive compensation and the advisory vote to determine the frequency of the advisory vote on the Company’s executive compensation are considered “non-routine” matters. Therefore, beneficial owners who hold their shares in street name must provide voting instructions to their brokers in order for their broker to vote their shares on these matters. As a result, if you do not instruct your broker on how to vote your shares, then your shares will not be voted on these proposals. We urge you to instruct your broker about how you wish your shares to be voted. The ratification of the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for fiscal 2025 is considered a “routine” matter, and brokers will have discretionary authority to vote on this matter without any instruction from the beneficial owners.

| | |

| What vote is required to approve each Proposal? |

The seven nominees for director who receive the highest number of votes “FOR” their election will be elected as directors. This is called a “plurality vote.” The affirmative vote of the holders of a majority of the shares of Common Stock represented in person or by proxy and entitled to vote on the matter will be required to ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm for the Company for fiscal 2025 and to approve, on an advisory basis, the Company’s executive compensation. Finally, the frequency of the advisory vote on executive compensation receiving the greatest number of votes (either “1 YEAR,” “2 YEARS,” or “3 YEARS”) will be deemed the frequency recommended by our stockholders. Although the results of the vote to approve executive compensation and the vote to determine the frequency of the advisory vote on executive compensation are non-binding, the Board will consider the outcome of such votes when making future executive compensation decisions and when determining the frequency of future advisory votes on executive compensation.

| | |

| How are my votes counted? |

•Election of Directors: You may vote “FOR ALL,” or “WITHHOLD ALL,” or “FOR ALL EXCEPT.” If you mark “FOR ALL,” your votes will be counted for all of the director nominees. Abstentions and any broker non-votes will not be counted as votes cast and will, therefore, have no effect on the election of directors.

•Advisory Vote to Approve Executive Compensation: You may vote “FOR,” “AGAINST,” or “ABSTAIN” with respect to the advisory vote to approve the Company’s executive compensation. The result of this vote is non-binding. However, the Board will consider the outcome of the vote when making future executive compensation decisions. Abstentions will have the same effect as a vote AGAINST this proposal, and broker non-votes will have no effect on the outcome of this proposal.

•Advisory Vote on the Frequency of Advisory Votes on Executive Compensation: You may vote “1 YEAR”, “2 YEARS,” “3 YEARS,” or “ABSTAIN” with respect to the advisory vote on the frequency of the advisory vote on executive compensation. The result of the vote on the frequency of the advisory vote on executive compensation is non-binding, and the Board will consider the outcome of the vote when deciding how often an advisory vote on executive compensation will be submitted to the Company’s stockholders. Abstentions and any broker non-votes will have no effect on the outcome of this proposal.

•Ratification of the selection of PricewaterhouseCoopers LLP: You may vote “FOR,” “AGAINST,” or “ABSTAIN” with respect to the ratification of the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for fiscal 2025. Abstentions will have the same effect as a vote AGAINST this proposal, and broker non-votes will have no effect on the outcome of this proposal.

We will appoint an independent inspector of election in advance of the meeting to tabulate votes, to ascertain whether a quorum is present, and to determine the voting results on all matters presented to Company stockholders.

| | |

| What if I do not vote for any or all of the matters listed on my Proxy Card? |

As a stockholder of record, if you return a signed Proxy Card without indicating your vote on any or all of the matters to be considered at the Annual Meeting, your shares will be voted “FOR” the director nominees listed on the Proxy Card, “FOR” the advisory vote to approve executive compensation, “1 YEAR” as the frequency of future advisory votes on executive compensation, and “FOR” the ratification of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for fiscal 2025, if you have not voted otherwise on a particular proposal. With respect to any other matter that properly comes before the Annual Meeting, Gregory A. Izenstark and Jason S. Wilcock, the proxies designated by the Board and identified in the accompanying Proxy Card, will vote all proxies granted to them at their discretion.

| | |

| Are proxy materials available online? |

You can obtain complete copies of the Notice of 2025 Annual Meeting of Stockholders, this Proxy Statement and the 2024 Annual Report to Stockholders by logging on to www.proxyvote.com with the 16-digit control number found in the proxy materials previously distributed to you.

| | |

| What happens if the Annual Meeting is postponed or adjourned? |

If the Annual Meeting is postponed or adjourned, your proxy will still be valid and may be voted at the postponed or adjourned meeting. You will still be able to change or revoke your proxy until it is voted at the Annual Meeting.

| | |

| Who is soliciting my proxy? |

Your proxy is being solicited by the Board, and the Company will bear the entire cost of the proxy solicitation. Arrangements have also been made with brokerage houses and other custodians, nominees and fiduciaries to send proxies and proxy materials to you if your shares are held in “street name.” In addition, our directors, officers or employees may solicit proxies in person or by telephone, e-mail or facsimile. No additional compensation will be paid for such services.

| | |

| How can I find out the results of the voting at the Annual Meeting? |

We will report the voting results in a filing with the SEC on a Current Report on Form 8-K within four business days of the conclusion of the Annual Meeting. If the official results are not available at that time, we intend to file a Form 8-K to publish the preliminary results within four business days after the Annual Meeting and file an additional Form 8-K to publish the final results within four business days after the final results are known to us.

GOVERNANCE OF THE COMPANY

Under the provisions of the Delaware General Corporation Law (the “DGCL”) and the Company’s bylaws, the Company’s business, property and affairs are managed by or under the direction of the Board. The Board is kept informed of the Company’s business through discussions with the Chief Executive Officer and other officers and by reviewing reports and other materials provided to it by management at the Board and committee meetings.

Director Independence

The Board assesses on a regular basis, and at least annually, the independence of directors and, based on the recommendation of the Nominating and Corporate Governance Committee, makes a determination as to which members are independent. The Board determines the independence of our directors by applying the independence principles and standards established by the NYSE and included in the Company’s Corporate Governance Guidelines. The Board determined that directors Julie A. Dill, Andrew W. Evans, Christopher A. Krummel, Anne L. Mariucci and Charles R. Patton have no material relationships with the Company and are independent (the “Independent Directors”).

In making these determinations, the Board reviewed all transactions or relationships with the Company using a definition of “material relationships” that (i) includes the criteria listed in Section 303A of the listing requirements of the NYSE and (ii) includes, on a case-by-case basis, such other criteria that may be deemed to affect a director’s independence, including without limitation, relationships that would require disclosure under Item 404 of Regulation S-K (“Item 404”) of the Securities Exchange Act of 1934 (“Exchange Act”) and non-tariff transactions with the Company in excess of the Item 404 threshold. The definition of “material relationships” for directors on the Audit Committee also includes the criteria listed in Section 10A(m)(3) of the Exchange Act. The definition of “material relationships” for directors serving on the Compensation Committee also includes the criteria listed in Section 16(b) of the Exchange Act. The independence criteria used are included in the Company’s Corporate Governance Guidelines, which are available on the Company’s website at www.centuri.com. The Board based its independence determination primarily on a review of the responses of the directors and officers to questions regarding employment and compensation history, affiliations and family relationships, discussions with directors, and a review of Company and subsidiary payment histories.

Controlled Company Status

The Company is a “controlled company” as defined under the corporate governance rules of the NYSE and, therefore, it qualifies for exemptions from certain corporate governance requirements of the NYSE. Accordingly, the Company is not required to have a majority of “independent directors” on the Board as defined under the rules of the NYSE and is not required to have a compensation committee or a nominating and corporate governance committee, in each case, composed entirely of independent directors. The Company has taken advantage of these exemptions, as Ms. Karen S. Haller, who is not an independent director, serves as the chairperson of the Board. However, the “controlled company” exemption does not modify the independence requirements for the Audit Committee, and the Company is in compliance with the applicable requirements of the Exchange Act and the NYSE.

When Southwest Gas Holdings, Inc. (“Southwest Gas” or “Southwest Gas Holdings”) no longer owns a majority of the voting power of the Company’s outstanding common stock, the Company will no longer qualify as a “controlled company” as defined under the corporate governance rules of the NYSE. At that time, to the extent it has not done so already, the Company will be required to fully implement the corporate governance requirements of the NYSE within the applicable transition periods.

Board Meetings

The Board meets regularly throughout the year and also holds special meetings from time to time. The Board held three regular meetings and three special meetings in 2024. During 2024, each member of the Board attended at least 75% of the aggregate of (i) the total number of meetings of the Board held during the period for which he or she has been a director and (ii) the total number of meetings held by all committees of the Board on which he or she served during the periods that he or she served.

Pursuant to the Corporate Governance Guidelines, the Company’s non-management directors are expected to meet in executive session at least four times per year, and its independent directors are expected to separately meet in a private session at least once annually. The director who presides at these meetings will be appointed by the non-management and independent directors, respectively.

| | |

| Board Leadership Structure |

The policy of the Board is that the role of Chair should be separate from that of the Chief Executive Officer. The Chair is appointed annually by the full Board following an in-depth assessment by the Nominating and Corporate Governance Committee regarding the needs of the Board and potential candidates for the position, and a recommendation to the Board by the Nominating and Corporate Governance Committee. The Board believes that this leadership structure is the appropriate structure for the Company because it aids the Board’s oversight of management. It is the Board’s intention to reappoint Ms. Haller as Chair, subject to her reelection as a director at the Annual Meeting. As a member of the Board, Ms. Haller may represent the Board in meetings with various constituencies, including investors. Prior consultation with Company management in these instances helps to ensure consistency and context for Board member communications.

The Board believes the structure described above provides strong leadership for the Board, while positioning the Chief Executive Officer as the leader of the Company for its investors, counterparties, employees and other stakeholders. The Board believes that the current structure helps ensure independent oversight of the Company and allows the Chief Executive Officer to focus his energies on management of the Company.

All members of the Board are independent, with the exception of Ms. Haller and Mr. Christian I. Brown, the Chief Executive Officer. A number of the independent Board members are currently serving or have served as directors or as members of senior management of other public companies and large institutions. The Board believes that the number of independent, experienced directors that make up our Board, along with the oversight of the Board by the non-executive Chair, benefits the Company and its stockholders.

The Board recognizes that in the event that the circumstances facing the Company change, a different leadership structure may be in the best interests of the Company and its stockholders.

Our management has day-to-day responsibility for assessing and managing our risk exposure and the Board and its committees oversee those efforts, with particular emphasis on the most significant risks facing the Company. Each committee will report to the full Board on a regular basis, including as appropriate with respect to the committee’s risk oversight activities.

| | | | | |

| Board/Committee | Primary Areas of Risk Oversight |

| Full Board | Risks associated with the Company’s strategic plan, acquisition and capital allocation program, capital structure, liquidity, organizational structure and other significant risks, and overall risk assessment and risk management policies. |

| Audit Committee | Risks related to financial controls, legal and compliance risks and major financial, privacy, security (including cybersecurity and data privacy), operational and business continuity risks. |

| Compensation Committee | Risks associated with compensation policies and practices. |

| Nominating and Corporate Governance Committee | Risks related to corporate governance and management of the Board. |

| | | | |

| Analysis of Risk in Company Executive Compensation Policies |

Formally on an annual basis, and in its execution and consideration of compensation plans, Company management reviews, analyzes and considers whether the Company’s compensation policies and practices encourage unnecessary or excessive risk taking that is reasonably likely to have a material adverse effect on the Company. One of the primary purposes of this review is to ensure that the Company’s incentive compensation programs do not inappropriately encourage unnecessary or excessive risk taking at any level in the organization that would be reasonably likely to have a material adverse effect on the Company. The Compensation Committee oversees the risk review process. In 2024, management concluded, and discussed with the Compensation Committee, that the Company’s compensation policies and practices do not encourage executives or other employees to take inappropriate risks that are reasonably likely to have a material adverse effect on the Company.

Cybersecurity is a risk overseen by the Board along with subject matter experts within the Company. It is a priority that is regularly addressed by the Board with the relevant functional leaders of the Company, with the Board receiving regular

cybersecurity briefings from the Company's Vice President of Information Technology, who has operational oversight over cybersecurity matters. The Audit Committee discusses with management and auditors at least annually the Company’s guidelines and policies with respect to risk assessment and risk management, including cybersecurity, data privacy and security, business continuity and operational risks. On a quarterly basis, the Vice President of Information Technology provides a formal cybersecurity update to the Company's Chief Legal & Administrative Officer, which highlights relevant key metrics, events, efforts, risks, and risk mitigation activities. The full Board receives these updates from management to help it oversee and manage the Company’s cybersecurity risks.

Sustainability is ingrained in our business operations. Our vision for building a sustainable business is guided by six guiding principles: ensure the safety of our employees and communities; maintain high standards for environmental stewardship; foster a positive impact in the communities in which we live and work; contribute to a sustained local economy by creating jobs and growing business; bring our differentiated expertise to every quality project we deliver; and maintain a diverse, fair, and welcoming work environment. We regularly engage our various stakeholder groups to ensure our business processes align with their most pressing concerns while supporting our core business strategy. We track and measure an established set of sustainability performance metrics to help us understand and report our overarching impact.

The standing committees of the Board are the Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee. The table below shows the directors who are currently members or chairs of each committee.

| | | | | | | | | | | | | | | | | |

| Name of Director | Audit Committee | | Compensation Committee | | Nominating and Corporate Governance Committee |

| Christian I. Brown | | | | | |

| Julie A. Dill | Chair | | | | ✓ |

| Andrew W. Evans | ✓ | | Chair | | |

| Karen S. Haller | | | ✓ | | |

| Christopher A. Krummel | ✓ | | | | ✓ |

| Anne L. Mariucci | | | ✓ | | Chair |

| Charles R. Patton | ✓ | | ✓ | | |

| | | | | |

Audit Committee Meetings Held in 2024: 5 | Separately designated standing committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The committee meets periodically with management to consider, among other things, the adequacy of the Company’s internal control and financial reporting. The committee also discusses these matters with the Company’s independent registered public accounting firm, internal auditors and Company financial personnel. The Board has determined that directors Julie A. Dill, Andrew W. Evans and Christopher A. Krummel each qualifies as an “audit committee financial expert,” as the term is defined in Item 407(d)(5)(ii) of Regulation S-K under the Exchange Act. |

Compensation Committee Meetings Held in 2024: 3 | Responsible for determining Chief Executive Officer compensation and making recommendations to the Board annually on such matters as executive compensation and benefits and director compensation and benefits. The committee’s responsibilities, as outlined in its charter, can be delegated to subcommittees made up of committee members. The committee receives recommendations from management on the amount and form of executive and director compensation, and the committee has the ability to directly employ consultants to assess the executive compensation program and director compensation. The committee is also responsible for the “Compensation Committee Report” and related disclosures contained in this Proxy Statement. Administration of the Company’s clawback policy is the responsibility of the Compensation Committee. |

Nominating and Corporate Governance Committee Meetings Held in 2024: 3 | Responsible for making recommendations to the Board regarding nominees to be proposed for election as directors; evaluating the Board’s size, composition and classification; developing criteria for the selection of directors; and overseeing our environmental, social and governance ("ESG") initiatives. The committee will consider director candidates suggested by stockholders. The process for selecting directors is addressed in more detail below under the caption “Selection of Directors.” The committee is responsible for developing and recommending to the Board corporate governance guidelines, reviewing such guidelines annually and implementing and monitoring compliance with the Company’s Code of Business Conduct and Ethics. |

The charters for the Audit, Compensation and Nominating and Corporate Governance Committees, the Company’s Corporate Governance Guidelines and the Company’s Code of Business Conduct and Ethics that applies to all employees, officers and directors are available on the Company’s website at www.centuri.com. The information on our website is not part of this Proxy Statement and is not incorporated into any of our filings made with the SEC. Print versions of these documents are available to stockholders upon request directed to the Corporate Secretary, Centuri Holdings, Inc., 19820 North 7th Avenue, Suite 120, Phoenix, Arizona 85027.

We believe the Board should be comprised of individuals with varied backgrounds, who possess certain core competencies, some of which may include broad experience in business, finance or administration and familiarity with national and international business matters. Additional factors that will be considered in the selection process include the following:

•personal and professional integrity and character;

•prominence and reputation in his or her profession;

•skills, knowledge and expertise (including business or other relevant experience) that in aggregate are useful and appropriate in overseeing and providing strategic direction with respect to our business and serving the long-term interests of our stockholders;

•the capacity and desire to represent the interests of the stockholders as a whole; and

•availability to devote sufficient time to the affairs of the Company.

We define “diversity” in a broad sense, i.e., age, race, color, gender, geographic origin, ethnic background, religion, disability and professional experience. The Nominating and Corporate Governance Committee takes diversity into consideration as it does the other factors listed above in selecting the director nominees for approval by the Board. The Nominating and Corporate Governance Committee does not assign a specific weight to any one factor. The Board Skills and Composition Matrix below enumerates some diversity factors regarding the Board’s nominees.

The Nominating and Corporate Governance Committee has an ongoing program for identifying and evaluating potential director candidates. When seeking a candidate for director, the Nominating and Corporate Governance Committee may solicit suggestions from incumbent directors, management or others. As candidates are identified, their qualifications are reviewed in light of the selection criteria outlined above. Whether any of such candidates are selected depends upon the current Board composition, the dynamics of the Board and the ongoing requirements of the Company (see “Board Evaluation and Director Succession Planning” below).

In its discretion, the Nominating and Corporate Governance Committee will also consider recommendations of qualified nominees by stockholders by evaluating the same factors as described above.

In addition to the process described above, our bylaws permit stockholders to nominate directors for election at an annual meeting of stockholders. To nominate a director, the stockholder must meet certain deadlines established by our bylaws and provide certain information required by our bylaws. For a description of the process for nominating directors in accordance with our bylaws, see “Stockholder Proposals for the 2026 Annual Meeting.”

| | |

| Board Evaluation and Director Succession Planning |

In accordance with the Company’s Corporate Governance Guidelines, the Board and its committees conduct annual self-evaluations of their performance to determine whether they are functioning effectively. The Nominating and Corporate Governance Committee oversees the annual evaluation of the Board’s performance, whereas each committee reports annually to the Board with an assessment of its performance. As part of the Board’s self-evaluation process, the directors consider various topics relating to Board composition, structure, effectiveness and responsibilities, as well as the overall mix of director skills, experience and backgrounds. The Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee self-evaluation processes are led by their respective committee chairs, as provided in the committee charters. Each committee performance evaluation includes a review of the committee charter to consider the necessity and appropriateness of changes.

We expect that annual evaluations are likely to be a key component of the director nomination process and director succession planning. In planning for succession, the Nominating and Corporate Governance Committee and the Board consider the results of Board evaluations, as well as other appropriate information, including the overall mix of tenure and experience of the Board, the types of skills and experience desirable for future Board members and the needs of the Board and its committees at the time.

Given the importance of recruiting qualified, independent individuals to serve as directors of the Company, the Board believes that it is prudent to conduct a dedicated search for potential director candidates in order to preserve the high quality of the Board and maintain its breadth of experience. Ms. Mariucci is the current chairperson of the Nominating and Corporate Governance Committee, which is responsible to lead the execution of our succession plans over the course of the next several years.

The Company believes that maintaining an active dialogue with our stockholders is of utmost importance in delivering sustainable, long-term value for our stockholders. Since the closing of Centuri's initial public offering on April 22, 2024 (the "Centuri IPO"), the Company’s Investor Relations group has engaged with stockholders on a variety of topics to ensure the Company addresses questions and concerns, seeks input, and provides perspective on the Company’s policies and practices. Feedback gathered from this outreach is regularly reviewed and considered by the Board and is reflected in adjustments and enhancements made to the Company's policy and practices, particularly with regard to executive compensation and Company subsidiary structure. The Company highly values the time spent with stockholders and actively seeks to increase transparency and to better understand stockholder views on key issues.

| | |

| Director Attendance at Annual Meetings |

We strongly support and encourage each member of the Board to attend our annual meeting of stockholders. We expect all of the seven director nominees to attend the Annual Meeting.

| | |

| Communications with Directors |

Anyone who would like to communicate with, or otherwise make his or her concerns known directly to the chairperson of any of the Audit, Nominating and Corporate Governance, and Compensation Committees, or to the Independent Directors as a group, may do so by addressing such communications or concerns to the Corporate Secretary of the Company, Centuri Holdings, Inc., 19820 North 7th Avenue, Suite 120, Phoenix, Arizona 85027, who will forward such communications to the appropriate party. Such communications may be made confidentially or anonymously. Advertisements, solicitations for business, requests for employment, requests for contributions, or other inappropriate material will not be forwarded to our directors.

The following table sets forth the name, age, position and period the position was held during the last five years for each of the executive officers as of December 29, 2024. There are no family relationships between the directors and executive officers.

| | | | | | | | | | | |

| Name | Age | Position | Period Position Held During Last 5 Years |

| Christian I. Brown | 55 | President and Chief Executive Officer | December 2024 - Present |

| Gregory A. Izenstark | 45 | Executive Vice President, Chief Financial Officer | February 2024 - Present |

| | Senior Vice President, Interim Chief Financial Officer | November 2023 - February 2024 |

| | Senior Vice President, Chief Accounting Officer | September 2021 - November 2023 |

| | Vice President, Corporate Controller | January 2018 - September 2021 |

| James W. Connell Jr. | 51 | Executive Vice President, Chief Commercial and Strategy Officer | June 2024 - Present |

| | President of Centuri Gas Group | July 2023 - June 2024 |

| | Executive Vice President, Chief Strategy and Corporate Affairs Officer | November 2022 - July 2023 |

| | Executive Vice President, Chief Customer Officer | December 2018 - November 2022 |

| Jason S. Wilcock | 46 | Executive Vice President, Chief Legal & Administrative Officer and Corporate Secretary | July 2023 - Present |

| | Executive Vice President, General Counsel and Corporate Secretary | August 2018 - July 2023 |

Christian I. Brown. Mr. Brown has served as our President, Chief Executive Officer and Director since December 2024. His biography is included with those of the rest of our director nominees under the section “Election of Directors” below.

Gregory A. Izenstark. Mr. Izenstark has served as our Executive Vice President and Chief Financial Officer since February 2024. Prior to assuming this role, Mr. Izenstark served as our interim Chief Financial Officer beginning in November 2023. Mr. Izenstark initially joined the Company as the Corporate Controller in July 2014 before assuming the positions of Senior Vice President and Chief Accounting Officer in September 2021. Prior to his tenure at the Company, Mr. Izenstark held the position of Manager of Financial Reporting at CF Industries (NYSE: CF) from October 2008 until August 2013 before being promoted to Director of Financial Reporting, a position that Mr. Izenstark held from August 2013 until July 2014. Mr. Izenstark holds a B.S. in Accounting from Bradley University and an M.B.A from the Lake Forest Graduate School of Business. Mr. Izenstark is also a licensed Certified Public Accountant.

Jason S. Wilcock. Mr. Wilcock has served as our Executive Vice President, Chief Legal and Administrative Officer since July 2023. Prior to that, Mr. Wilcock served as our Executive Vice President, General Counsel and our Corporate Secretary since August 2018. Mr. Wilcock joined Centuri in September 2015 as Assistant General Counsel before being promoted to Deputy General Counsel in January 2017. Prior to joining Centuri, Mr. Wilcock held various roles at Southwest Gas Corporation, including Senior Counsel, a position he held from April 2011 to November 2013, and Associate General Counsel, a position he held from November 2013 to September 2015. Prior to joining Southwest Gas Corporation in April 2011, Mr. Wilcock practiced law in the private sector in Nevada and Utah beginning in September 2005. Mr. Wilcock holds a B.S. in Accounting from Utah State University and a Juris Doctorate degree from Gonzaga University School of Law.

James W. Connell, Jr. Mr. Connell has served as our Executive Vice President, Chief Commercial and Strategy Officer since June 2024, pursuant to which he is focused on bridging company and customer focused strategies across Centuri’s enterprise. Mr. Connell joined Centuri in 2006 as Director of Supply Chain and Asset Management for NPL Construction Co. He has led a number of initiatives across the organization in roles of increasing responsibility as Director of Risk Management and Director of Business Development and Strategic Partnerships. He was promoted to Vice President, Business Development and Corporate Communications in 2017, and then to Executive Vice President, Chief Customer Officer in 2018. Mr. Connell was appointed Executive Vice President, Chief Strategy and Corporate Affairs Officer in 2021, and most recently served as President, Centuri Gas Group beginning in July 2023. Prior to joining Centuri, Mr. Connell held various roles at Deere & Company in the Worldwide Construction and Forestry Division. Upon becoming Division Manager, Corporate Business Division in 2000, Mr. Connell built a number of executive relationships throughout the industry while developing strategies for growth. Mr. Connell serves on the board of directors of the National Safety Council and is a member of the Phoenix Children’s Hospital GI Advisory Board. Mr. Connell received a B.S. in Technical Systems Management from the University of Illinois at Urbana-Champaign.

| | |

| Securities Ownership by Directors, Director Nominees, Named Executive Officers, and Certain Beneficial Owners |

Directors, Director Nominees and Named Executive Officers. The following table discloses all Common Stock beneficially owned by the Company’s directors, the nominees for director and the named executive officers (“NEOs”) of the Company, as of February 24, 2025.

| | | | | | | | | | | |

| | | |

| Directors, Nominees & Executive Officers | Number of Shares of Common Stock Beneficially Owned | | Percent of Outstanding Common Stock |

| | | |

Paul M. Daily(1) | — | | | * |

William J. Fehrman(2) | — | | | * |

Paul J. Caudill(3) | — | | | * |

| Christian I. Brown | — | | | * |

| Gregory A. Izenstark | 5,250 | | | * |

Robert C. Lyons(4) | — | | | * |

Stephen J. Adams(5) | — | | | * |

| Jason S. Wilcock | 5,000 | | | * |

| James W. Connell Jr. | 20,000 | | | * |

| Karen S. Haller | 12,000 | | | * |

| Anne L. Mariucci | 71,400 | | | * |

| Andrew W. Evans | — | | | * |

| Christopher A. Krummel | 2,500 | | | * |

| Julie A. Dill | 5,000 | | | * |

| Charles R. Patton | 11,000 | | | * |

| All Directors and Officers (15 individuals) | 132,150 | | | * |

*Represents less than 1% of the issued and outstanding shares of the Company’s common stock as of February 24, 2025. Our shares of common stock outstanding at February 24, 2025 were 88,517,521.

(1)Mr. Daily is the Company’s former President and CEO. Mr. Daily’s employment terminated on January 31, 2024, and Mr. Fehrman began serving as President and CEO of the Company on January 12, 2024.

(2)Mr. Fehrman’s employment terminated on July 31, 2024, and Mr. Caudill began serving as interim President and CEO of Centuri on July 31, 2024.

(3)Mr. Caudill’s service as the Company's interim President and CEO terminated on December 3, 2024 in connection with the onboarding of Mr. Brown as President, CEO and director on December 3, 2024.

(4)Mr. Lyons is the Company’s former Executive Vice President and Chief Operating Officer. Mr. Lyons’ employment terminated on February 2, 2024.

(5)Mr. Adams is the Company’s former President of Centuri Power. His employment terminated on July 3, 2024.

Beneficial Owners. The following table discloses all Common Stock beneficially owned by anyone that the Company believes beneficially owns more than 5% of the Company’s outstanding shares of common stock based solely on the Company’s review of filings with the SEC pursuant to Section 13(d) or 13(g) of the Exchange Act.

| | | | | | | | |

| Beneficial Owner | Number of Shares Beneficially Owned | Percent of Outstanding Common Stock as of February 24, 2025 |

Southwest Gas Holdings, Inc.(1) Las Vegas, Nevada 89113 | 71,665,592 | 81.0% |

FMR LLC(2) 245 Summer Street, Boston, Massachusetts 02210 | 8,226,974 | 9.3% |

| | |

(1)According to Schedule 13G filed on November 13, 2024, Southwest Gas Holdings, Inc. have 71,665,592 shares with sole voting power, no shares with shared voting power, 71,665,592 shares with sole dispositive power, and no shares with shared dispositive power.

(2)According to Schedule 13G filed on February 12, 2025, FMR LLC have 8,223,513 shares with sole voting power, no shares with shared voting power, 8,226,974.46 shares with sole dispositive power, and no shares with shared dispositive power.

CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS

| | |

| Policies and Procedures with Respect to Related Person Transactions |

The Company has a written policy detailing the procedures for the review, approval or ratification of any transaction involving more than $120,000 between the Company and any director or officer of the Company, any director nominee, any person who is the beneficial owner of more than 5% of the Common Stock, or any immediate family members of the foregoing (each, a “Related Person”), who had a direct or indirect material interest (the “Related Person Transactions”) in said transaction. In accordance with the written policy and pursuant to the Corporate Governance Guidelines, any potential Related Person Transaction, including transactions that involve less than $120,000, must first be reported to the chief legal officer of the Company and reviewed by the Audit Committee. Each of the agreements between us and Southwest Gas Holdings that were entered into prior to the completion of the Centuri IPO were not subject to the terms of such policy. However, to the extent any such transaction is materially amended, then the Audit Committee is required to review and approve such transaction.

The Audit Committee will approve and ratify the Related Person Transaction only if the committee determines that the transaction is not inconsistent with the best interests of the Company and may, in its discretion, impose any conditions it deems appropriate on the Company or the Related Person in connection with the Related Person Transaction.

Each transaction with a related person is unique and must be assessed on a case-by-case basis. In determining whether or not to approve, the Audit Committee considers all of the relevant facts and circumstances available to the committee, including without limitation:

•The Related Person’s interest in the proposed transaction;

•The approximate dollar value of the amount involved in the proposed transaction;

•The approximate dollar value of the amount of the Related Person’s interest in the proposed transaction without regard to the amount of any profit or loss;

•Whether the transaction is proposed to be, or was, undertaken in the ordinary course of business of the Company;

•Whether the transaction is proposed to be, or was, entered into on terms no less favorable to the Company than terms that could have been reached with an unrelated third party;

•The purpose of, and the potential benefits to the Company from, the transaction;

•The impact on a director’s independence in the event the Related Person is a director, an immediate family member of a director or an entity in which a director is a partner, stockholder or executive officer; and

•Any other information regarding the transaction or the Related Person in the context of the proposed transaction that would be material to investors in light of the circumstances of the particular transaction.

| | |

| Certain Relationships and Related Person Transactions |

We describe below transactions and series of similar transactions, since the beginning of our last full fiscal year or currently proposed, to which we were a party or will be a party, in which:

•the amounts involved exceeded or will exceed $120,000; and

•any of our directors, executive officers or beneficial holders of more than 5% of any class of our capital stock had or will have a direct or indirect material interest.

Other than as described below, there have not been, nor are there any currently proposed, transactions or series of similar transactions meeting these criteria to which we have been or will be a party other than compensation arrangements, which are described under “Executive Compensation” and “Director Compensation” below.

Transactions with American Electric Power Company Inc (“AEP”)

William J. Fehrman, our former chief executive officer and former member of our Board began serving as the chief executive officer and president of AEP in August of 2024. AEP is one of our current customers. Revenue with AEP for the year ended December 29, 2024 was $143.7 million. As of December 29, 2024, approximately $26.5 million (9%), and $26.0 million (11%) of the Company’s accounts receivable and contract assets, respectively, were related to contracts with AEP. There were no significant contract liabilities as of December 29, 2024 with AEP.

Relationship with Southwest Gas Holdings

Southwest Gas Holdings as our Controlling Stockholder

Prior to the completion of the Centuri IPO, through a series of steps, Southwest Gas Holdings transferred to us substantially all of the assets and liabilities of Centuri Group’s business (the “Separation”). Immediately following the completion of the Centuri IPO, Southwest Gas Holdings beneficially owned approximately 81.0% of our outstanding shares of common stock.

For as long as Southwest Gas Holdings continues to control more than 50% of our outstanding shares of common stock, Southwest Gas Holdings or its successor-in-interest will be able to direct the election of all the members of our Board. Similarly, subject to applicable laws relating to the protection of minority stockholders in certain situations, Southwest Gas Holdings will have the power to determine matters submitted to a vote of our stockholders without the consent of our other stockholders, will have the power to prevent a change in control of us and will have the power to take certain other actions that might be favorable to Southwest Gas Holdings. In addition, the Separation Agreement (as defined below) provides that, as long as Southwest Gas Holdings beneficially owns at least 50% of the total voting power of our outstanding share capital entitled to vote in the election of our Board, we will not (without Southwest Gas Holdings’ prior written consent) take certain actions.

Southwest Gas Holdings has informed us that its current intent is to effect a disposition of all or a portion of its remaining indirect equity interest in us through one or more sales of our common stock or exchange offers of our common stock for Southwest Gas Holdings common stock. However, Southwest Gas Holdings may complete such dispositions through one or more other methods, including by way of a distribution of shares of our common stock by Southwest Gas Holdings to holders of its common stock, one or more other distributions in exchange for Southwest Gas Holdings shares or other securities, or any combination of the foregoing. To facilitate the disposal of shares by Southwest Gas Holdings, among other things, we entered into the Separation Agreement with Southwest Gas Holdings, which sets out certain representations, warranties and covenants of the parties, together with certain rights of termination. Southwest Gas Holdings has no obligation to pursue or consummate any further dispositions of its ownership interest in us by any specified date or at all and it may retain its ownership interest in us indefinitely or dispose of all or a portion of its ownership interest in us.

Relationships with Southwest Gas Holdings and Southwest Gas Corporation

We perform various construction services for Southwest Gas Corporation, a wholly owned subsidiary of Southwest Gas Holdings. Approximately $106.8 million of our revenue for the fiscal year ended December 29, 2024 (“fiscal 2024”) was related to contracts with Southwest Gas Corporation. We recognized gross profit related to the Southwest Gas Corporation revenue of $10.0 million in fiscal 2024. Approximately $9.6 million of our accounts receivable, $2.6 million of contract assets and no significant contract liabilities as of December 29, 2024 were related to contracts with Southwest Gas Corporation.

Additionally, certain costs incurred by Southwest Gas Holdings have been allocated to us which are settled in cash during the normal course of operations. For the fiscal 2024 we recorded $0.5 million of such allocated costs.

Agreements between Southwest Gas Holdings and Our Company

In connection with the Separation, we and Southwest Gas Holdings entered into certain agreements that provide a framework for our ongoing relationship with Southwest Gas Holdings. Of the agreements summarized below, the material agreements are filed as exhibits to the registration statement of which this prospectus is a part, and the summaries of these agreements set forth the terms of the agreements that we believe are material. These summaries are qualified in their entirety by reference to the full text of such agreements.

Separation Agreement

On April 11, 2024, in connection with the Separation and prior to the completion of the Centuri IPO, we entered into a Separation Agreement with Southwest Gas Holdings that, together with the other agreements summarized below, govern the relationship between Southwest Gas Holdings and us following the Separation (the “Separation Agreement”).

Separation of Assets and Liabilities. The Separation Agreement identified certain transfers of assets and assumptions of liabilities that were necessary in advance of the Separation so that we and Southwest Gas Holdings retained the assets of, and the liabilities associated with, our respective businesses. The Separation Agreement generally provided that the assets comprising our business consisted of those exclusively related to our current business and operations or otherwise allocated to the business through a process of dividing shared assets. The liabilities we assumed in connection with the Separation generally consisted of those related to the assets comprising our business or to the past and future operations of our business. The Separation Agreement also provided for the settlement or extinguishment of certain liabilities and other obligations between us and Southwest Gas Holdings.

Intercompany Arrangements. Subject to exceptions set forth in the Separation Agreement (including all existing commercial agreements between us and Southwest Gas Holdings), all of the agreements, arrangements, commitments or understandings, including all intercompany accounts receivable, loans and accounts payable, between us, on the one hand, and Southwest Gas Holdings, on the other hand, outstanding as of the Separation date, were terminated and/or repaid, settled or otherwise eliminated as promptly as practicable after the Separation date by means of cash payment, dividend, capital contribution, a combination of the foregoing, or otherwise as determined by Southwest Gas Holdings.

Representations and Warranties. In general, neither we nor Southwest Gas Holdings made any representations or warranties regarding any assets or liabilities transferred or assumed, any consents or approvals that may have been required in connection with these transfers or assumptions, the value or freedom from any security interest of any assets or liabilities transferred, the absence of any defenses or right of setoff or freedom from counterclaim relating to any claim of either party, or the legal sufficiency of any conveyance documents. Except as expressly set forth in the Separation Agreement or any ancillary agreement, all assets were transferred on an “as is,” “where is” basis.

Disposition Transactions. The Separation Agreement governs Southwest Gas Holdings’ and our respective rights and obligations regarding the tax-free distribution to Southwest Gas Holdings and its stockholders (the “Distribution”), if effected, and other alternative disposition transactions.

Exchange of Information. We and Southwest Gas Holdings each agreed to use commercially reasonable efforts to provide each other with information required by the other to comply with its obligations under the Separation Agreement and the other ancillary agreements contemplated thereby and any obligations imposed on it by any governmental authority. We and Southwest Gas Holdings each also agreed to use commercially reasonable efforts to retain such information in accordance with specified record retention policies. We and Southwest Gas Holdings each also agreed to use our respective commercially reasonable efforts to assist the other with its financial reporting and audit obligations.

Termination. The Separation Agreement may be terminated at any time upon the mutual consent of Southwest Gas Holdings and Centuri.

Indemnification. We and Southwest Gas Holdings each agreed to indemnify the other and each of the other’s subsidiaries, current and former directors, officers, employees and agents (in each case, in their respective capacities as such), and each of the heirs, executors, successors and assigns of any of the foregoing, against certain liabilities incurred in connection with the Separation and the Distribution and our and Southwest Gas Holdings’ respective businesses. The amount of either Southwest Gas Holdings’ or our indemnification obligations will be reduced by any net insurance proceeds the party being indemnified receives. The Separation Agreement also specifies procedures regarding claims subject to indemnification.

Corporate opportunities. For so long as Southwest Gas Holdings beneficially owns at least 10% of the total voting power of our outstanding common stock with respect to the election of directors or has any directors, officers or employees who serve on our (or any of our subsidiaries’) board of directors, our (or any of our subsidiaries’) board of directors will renounce any interest or expectancy of ours in any corporate opportunities that are presented to Southwest Gas Holdings or any of its directors, officers or employees in accordance with Section 122(17) of the DGCL.

Dispute resolution. If a dispute arises between us and Southwest Gas Holdings under the Separation Agreement, we and Southwest Gas Holdings will negotiate to resolve any disputes for a reasonable period of time. If any such dispute has not been resolved within such period of time, then either party may submit the dispute to final and binding arbitration.

Board and Committee Representation. Southwest Gas Holdings has the right, but not the obligation, to nominate (i) 85.7% of our directors, as long as it beneficially owns more than 70% of the combined voting power of our outstanding common stock, (ii) 71.4% of our directors, as long as it beneficially owns more than 60%, but less than or equal to 70% of the combined voting power of our outstanding common stock, (iii) 57.1% of our directors, as long as it beneficially owns more than 50%, but less than or equal to 60% of the combined voting power of our outstanding common stock, (iv) 42.9% of our directors, as long as it beneficially owns more than 30%, but less than or equal to 50% of the combined voting power of our outstanding common stock, (v) 28.6% of our directors, as long as it beneficially owns more than 20%, but less than or equal to 30% of the combined voting power of our outstanding common stock, and (vi) 14.3% of our directors, as long as it beneficially owns more than 5%, but less than or equal to 20% of the combined voting power of our outstanding common stock.

Moreover, pursuant to the Separation Agreement, for so long as Southwest Gas Holdings beneficially owns a majority of the total voting power of our outstanding common stock with respect to the election of directors, Southwest Gas Holdings has the right, but not the obligation, to designate for nomination a majority of the directors (including the Chair of our Board). In addition, unless Southwest Gas Holdings otherwise consents, any committee of the Board, and any subcommittee thereof, shall be composed of a number of Southwest Gas Holdings designees such that the number of Southwest Gas Holdings designees serving thereon is proportional to the number of Southwest Gas Holdings designees serving on our Board as compared to the total number of directors serving on our Board, subject to compliance with committee independence requirements taking into consideration applicable controlled company exemptions. In addition, for so long as Southwest Gas Holdings owns at least 50% of the outstanding capital stock of Centuri, the roles of Chief Executive Officer and Chair of the Board will be held by separate individuals.

In addition, prior to the time at which Southwest Gas Holdings ceases to own 30% or more of our then-outstanding common stock, Southwest Gas Holdings shall be permitted to designate three non-director observer attendees, from among members of Southwest Gas Holdings management or the board of directors of Southwest Gas Holdings, to attend all meetings of the Board and its committees.

Financial Reporting Covenants. We agreed to comply with certain covenants relating to our financial reporting for so long as Southwest Gas Holdings is required to consolidate our results of operations and financial position or to account for its investment in us under the equity method of accounting. These covenants include, among others, covenants regarding:

•delivery or supply of monthly, quarterly and annual financial information and annual budgets and financial projections to Southwest Gas Holdings;

•conformity with Southwest Gas Holdings’ financial presentation and accounting policies;

•disclosure to Southwest Gas Holdings of information about our financial controls and any occurrence of significant deficiencies or material weaknesses of such controls, instances of fraud or violations of law;

•provision to Southwest Gas Holdings of access to our auditors (which shall not be changed without prior written consent of Southwest Gas Holdings) and certain books, policies, procedures and records related to internal accounting controls or operations;

•cooperation with Southwest Gas Holdings to the extent requested by Southwest Gas Holdings in the preparation of Southwest Gas Holdings’ public filings and press releases; and

•provision to Southwest Gas Holdings of advance copies of our regular annual or quarterly earnings release or any financial guidance for a current or future period and substantially final drafts of our public filings, press releases and other public statements concerning any matters that could be reasonably likely to have a material financial impact on our or our subsidiaries’ earnings, results of operations, financial condition or prospects.

Additional Covenants. We agreed that until the later of (i) the time at which Southwest Gas Holdings ceases to beneficially own a majority of the total voting power of our then outstanding common stock with respect to the election of directors, and (ii) the time at which we cease to be a consolidated subsidiary of Southwest Gas Holdings for financial reporting and accounting purposes, except if and to the extent such actions require the consent of Centuri stockholders under the DGCL, we will not take the following actions (among others) without Southwest Gas Holdings’ prior written consent:

•Amend our amended and restated certificate of incorporation (the “Charter”) or our bylaws;

•Make any acquisitions or dispositions (including by subsidiaries) (i) in the ordinary course of business with a total value above $50 million in the aggregate over any one-year period or (ii) outside the ordinary course of business;

•Incur indebtedness of over $10 million individually or $50 million in the aggregate over any one-year period;

•Change our independent registered public accounting firm;

•Make material changes in our accounting policy;

•Hire, designate or terminate executive officers;

•Enter into any agreement that imposes obligations or liabilities on Southwest Gas Holdings or any subsidiary of Southwest Gas Holdings;

•Take any action that would restrict Southwest Gas Holdings’ ability to transfer its shares of our common stock or limit the rights of Southwest Gas Holdings as a stockholder of ours in a manner not applicable to our stockholders generally;

•To the extent that Southwest Gas Holdings is a party to any contracts that provide that certain actions of Southwest Gas Holdings’ affiliates (including us) may result in Southwest Gas Holdings being in breach of such contracts, we may not take any actions that reasonably could result in Southwest Gas Holdings being in breach of such contracts;

•Enter into any transaction, the result of which would be a change of control of Centuri, the transfer of all or substantially all of the business and assets of Centuri and its subsidiaries (taken as a whole) or other similar transaction, however effected;

•Make gross capital expenditures exceeding $130 million for 2024 (on an annualized basis) and 2025, and $150 million for 2026, and gross capital expenditures exceeding the amount of gross capital expenditures for the preceding year multiplied by a percentage obtained by adding (1) one hundred percent, plus (2) the consumer price index, for 2027 and beyond; or

•Take action that effects material change in the nature of our business.

Prior to the termination of the Separation Agreement, with respect to the amendment of certain provisions in our Charter and Bylaws relating to the Separation Agreement or the Tax Matters Agreement (as defined below), Southwest Gas Holdings and any and all successors to Southwest Gas Holdings by way of merger, consolidation or sale of all or substantially all of its assets or equity is entitled to a number of votes (which may be a fraction) for each share of common stock held of record by Southwest Gas Holdings on the record date for determining stockholders entitled to vote on such proposal that is equal to the greater of (A) one and (B) the quotient of (i) the sum of (y) the aggregate votes entitled to be cast by all holders of our capital stock (including common stock and preferred stock) other than Southwest Gas Holdings on such proposal plus (z) one divided by (ii) the number of shares of common stock held of record by Southwest Gas Holdings on the record date for determining stockholders entitled to vote on such proposal.

We also agreed that for so long as Southwest Gas Holdings beneficially owns at least 25% of the total voting power of our then outstanding common stock with respect to the election of directors, we will not take the following actions (among others) without Southwest Gas Holdings’ prior written consent:

•Change the size of the Board;

•Declare dividends or payments on our securities;

•Any action (i) restricting Southwest Gas Holdings’ ability to transfer, assign, pledge or dispose of our capital stock or (ii) limiting the rights of Southwest Gas Holdings as our stockholder in a manner not applicable to our stockholders generally;

•Issue any common or preferred stock or grant rights to subscribe for or securities convertible into shares of common or preferred stock, except pursuant to any benefit plan or arrangement approved by the Board; provided that we (i) shall notify Southwest Gas Holdings at least five (5) business days prior to any such proposed issuance pursuant to any approved benefit plan or arrangement and (ii) shall not issue any such securities unless Southwest Gas Holdings determines, in its sole discretion, that such issuance would not result in Southwest Gas Holdings owning less than 80.1% of the total combined voting power of our capital stock and 80.1% of the total number of shares of our capital stock; or

•Adopt any new equity incentive plan or expand an existing plan.

In addition, prior to the date on which Southwest Gas Holdings ceases to beneficially own a majority of the total voting power of our then outstanding common stock with respect to the election of directors, we are required to consistently implement and maintain Southwest Gas Holdings’ business practices and standards in accordance with Southwest Gas Holdings’ policies and procedures, and we are required to notify Southwest Gas Holdings of any acts that have resulted in or would reasonably result in noncompliance with our governing documents.