Exhibit 5.1

| 7 November 2024 Our Ref: MRC/WPTL/BLUI T5772-H25135 TEN-LEAGUE INTERNATIONAL HOLDINGS LIMITED Walkers Corporate Limited 190 Elgin Avenue, George Town Grand Cayman KY1-9008 Cayman Islands Dear Sirs TEN-LEAGUE INTERNATIONAL HOLDINGS LIMITED We have acted as Cayman Islands legal advisers to Ten-League International Holdings Limited (the “Company”) in connection with the Company’s registration statement on Form F-1, including all amendments or supplements thereto (the “Registration Statement”), filed with the Securities and Exchange Commission pursuant to Rule 462(b) under the U.S. Securities Act of 1933, as amended, relating to the offering by the Company of Ordinary Shares of a par value of US$0.000025 each (the “Ordinary Shares”). We are furnishing this opinion as exhibit 5.1 to the Registration Statement. For the purposes of giving this opinion, we have examined and relied upon the originals, copies or translations of the documents listed in Schedule 1. In giving this opinion we have relied upon the assumptions set out in Schedule 2, which we have not independently verified. We are Cayman Islands Attorneys at Law and express no opinion as to any laws other than the laws of the Cayman Islands in force and as interpreted at the date of this opinion. We have not, for the purposes of this opinion, made any investigation of the laws, rules or regulations of any other jurisdiction. Based upon the foregoing examinations and assumptions and upon such searches as we have conducted and having regard to legal considerations which we consider relevant, and subject to the qualifications set out in Schedule 3, and under the laws of the Cayman Islands, we give the following opinions in relation to the matters set out below. |

| | 1. | The Company is an exempted company duly incorporated with limited liability, validly existing under the laws of the Cayman Islands and is in good standing with the Registrar of Companies in the Cayman Islands (the “Registrar”). |

| 2. | Based on our review of the Second Amended and Restated M&A (as defined in Schedule 1), the authorised share capital of the Company is US$500,000 consisting of 20,000,000,000 ordinary shares with a par value of US$0.000025 each with such rights, preference and privileges as set forth in the Second Amended and Restated M&A. |

Walkers (Hong Kong)

滙嘉律師事務所 (香港)

15th Floor, Alexandra House, 18 Chater Road, Central, Hong Kong

T +852 2284 4566 F +852 2284 4560

Bermuda | British Virgin Islands | Cayman Islands | Dubai | Guernsey | Hong Kong | Ireland | Jersey | London | Singapore

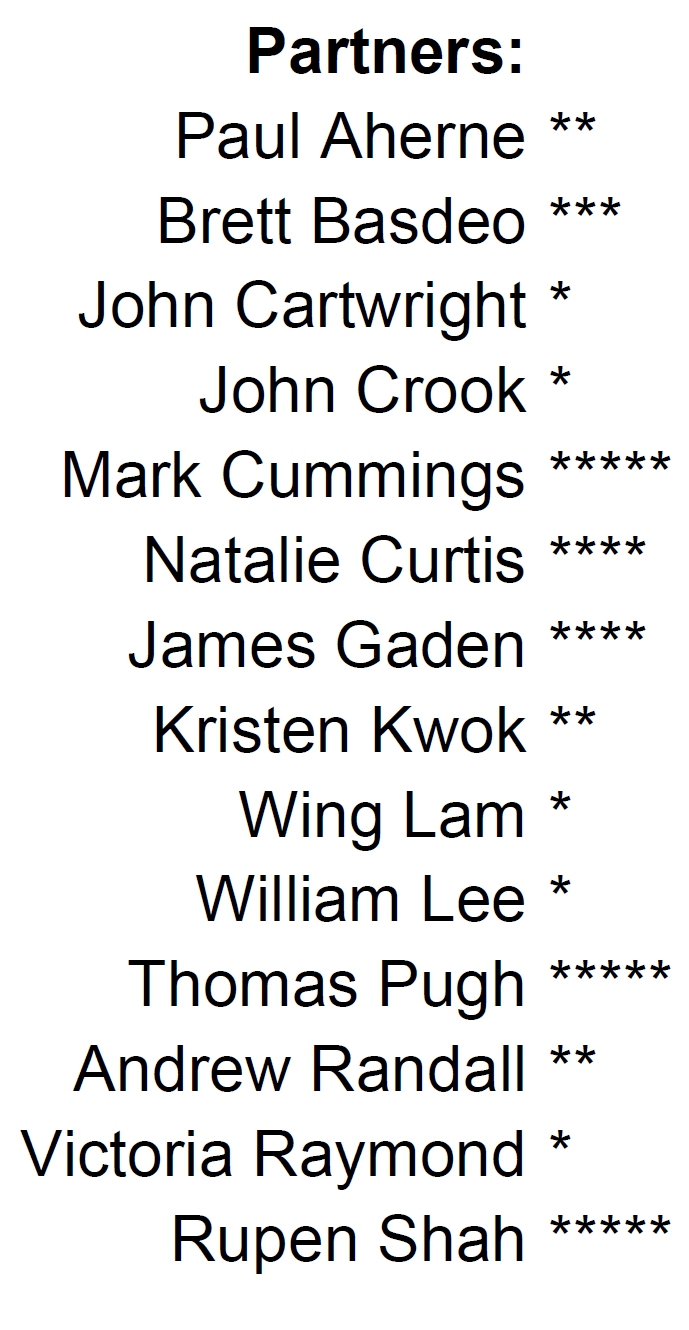

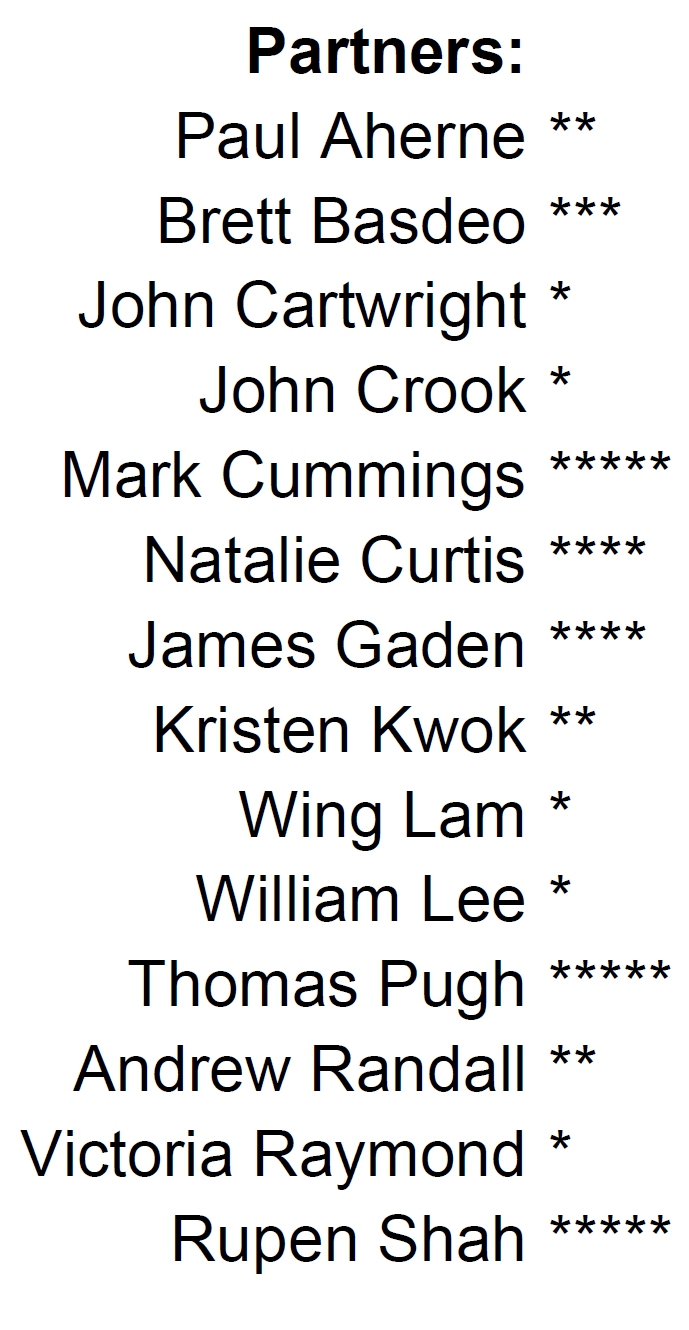

*England and Wales; **BVI; ***Cayman Islands; ****New South Wales (Australia); *****Bermuda

| 3. | The issue and allotment of the Ordinary Shares pursuant to the Registration Statement has been duly authorized. When allotted, issued and fully paid for as contemplated in the Registration Statement and when appropriate entries have been made in the Register of Members of the Company, the Ordinary Shares will be validly issued, allotted and fully paid, and there will be no further obligation on the holder of any of the Ordinary Shares to make any further payment to the Company in respect of such Ordinary Shares. |

| 4. | The statements under the caption “Material Tax Considerations” in the prospectus forming part of the Registration Statement, to the extent that they constitute statements of Cayman Islands law, are accurate in all material respects. |

| 5. | Save as set out in qualification 3 in Schedule 3, there are no stamp duties, income taxes, withholdings, levies, registration taxes, or other duties or similar taxes or charges now imposed, or which under the present laws of the Cayman Islands could in the future become imposed: |

| (i) | the filing with the SEC, issue, circulation or distribution of the Registration Statement; |

| (ii) | the issuance and sale of the Ordinary Shares to the underwriters and by the underwriters to the initial purchasers thereof; or |

| (iii) | the listing of the Ordinary Shares on NASDAQ; |

| (b) | in respect of the Ordinary Shares or any acquisition, ownership or disposition of the Ordinary Shares; or |

| (c) | on any payment to be made by the Company or any other person pursuant to the Ordinary Shares or in relation to the issue or transfer of the Ordinary Shares. |

The Cayman Islands currently have no form of income, corporate or capital gains tax and no estate duty, inheritance tax or gift tax.

We hereby consent to the use of this opinion in, and the filing hereof, as an exhibit to the Registration Statement and to the reference to our firm under the headings “Enforceability of Civil Liabilities – Cayman Islands”, “Certain Cayman Islands Company Considerations”, “Material Tax Considerations “, “Legal Matters” and elsewhere in the prospectus included in the Registration Statement. In giving such consent, we do not thereby admit that we come within the category of persons whose consent is required under Section 7 of the U.S. Securities Act of 1933, as amended, or the Rules and Regulations of the Commission thereunder.

This opinion is limited to the matters referred to herein and shall not be construed as extending to any other matter or document not referred to herein.

This opinion shall be construed in accordance with the laws of the Cayman Islands.

Yours faithfully

/s/ Walkers (Hong Kong)

Walkers (HONG KONG)

Schedule 1

LIST OF DOCUMENTS EXAMINED

| 1. | The Certificate of Incorporation dated 17 March 2023, the Memorandum and Articles of Association as adopted on 17 March 2023, the Amended and Restated Memorandum and Articles of Association as adopted by special resolution on 16 February 2024, the Second Amended and Restated Memorandum and Articles of Association as adopted by special resolution on 8 March 2024 and effective conditional and immediately prior to the completion of the Company’s initial public offering of Ordinary Shares (the “Second Amended and Restated M&A”), the Register of Members, Register of Directors and the Register of Mortgages and Charges of the Company, copies of which have been provided to us by its registered office in the Cayman Islands (together the “Company Records”). |

| 2. | A Certificate of Good Standing dated 18 October 2024 in respect of the Company issued by the Registrar (the “Certificate of Good Standing”). |

| 3. | The Cayman Online Registry Information System (CORIS), the Cayman Islands’ General Registry’s online database, searched on 25 October 2024. |

| 4. | A copy of executed written resolutions of the Board of Directors of the Company dated 8 March 2024, and a copy of executed written resolutions of the shareholders of the Company dated 8 March 2024 (the “Resolutions”). |

| 5. | A certificate from a director of the Company, a copy of which is attached hereto (the “Director’s Certificate”). |

| 6. | The Registration Statement. |

Schedule 2

ASSUMPTIONS

| 1. | The originals of all documents examined in connection with this opinion are authentic. All documents purporting to be sealed have been so sealed. All copies are complete and conform to their originals. Any translations are a true translation of the original document they purport to translate. |

| 2. | The Second Amended and Restated M&A reviewed by us are the memorandum and articles of association of the Company that will be in effect on the issue and sale of the Ordinary Shares. |

| 3. | The Company Records are complete and accurate and all matters required by law and the Memorandum and Articles to be recorded therein are completely and accurately so recorded. |

| 4. | The Contents of the Director’s Certificate are true and accurate as at the date of this opinion and there is no information not contained in the Director’s Certificate that will in any way affect this opinion. |

| 5. | The conversion of any shares in the capital of the Company will be effected via legally available means under Cayman Islands law. |

SCHEDULE 3

QUALIFICATIONS

| 1. | Our opinion as to good standing is based solely upon receipt of the Certificate of Good Standing issued by the Registrar. The Company shall be deemed to be in good standing under section 200A of the Companies Act (as amended) of the Cayman Islands (the “Companies Act”) on the date of issue of the certificate if all fees and penalties under the Companies Act have been paid and the Registrar has no knowledge that the Company is in default under the Companies Act. |

| 2. | We accept no responsibility for any liability in relation to any opinion which was given in reliance on the Director’s Certificate. |

| 3. | Cayman Islands stamp duty will be payable on any document if it is executed in or brought to the Cayman Islands, or produced before a court of the Cayman Islands. |

| 4. | The Company may be required to submit (or to cause to be submitted on its behalf) a notification and report to the Cayman Islands Department for International Tax Cooperation to ensure compliance with any obligations it may have under the laws of the Cayman Islands relating to the automatic exchange of financial account information. |