AN OFFERING STATEMENT PURSUANT TO REGULATION A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. INFORMATION CONTAINED IN THIS PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED BEFORE THE OFFERING STATEMENT FILED WITH THE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF SUCH STATE. THE COMPANY MAY ELECT TO SATISFY ITS OBLIGATION TO DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO BUSINESS DAYS AFTER THE COMPLETION OF THE COMPANY’S SALE TO YOU THAT CONTAINS THE URL WHERE THE FINAL OFFERING CIRCULAR OR THE OFFERING STATEMENT IN WHICH SUCH FINAL OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

As filed with the Securities and Exchange Commission on January 13, 2025

PART II — INFORMATION REQUIRED IN OFFERING CIRCULAR

Preliminary Offering Circular dated January 13, 2025

MANSE USA LLC

Up to 2,000,000 Nick Kyrgios Roy Investment Contracts

100 Bogart Street, Brooklyn, New York, 11206

Phone: +1 (646) 417-3936

MANSE USA LLC (“we” or the “Company”) is offering up to 2,000,000 “Roys” that carry remuneration rights that vary based on factors that seek to measure the success of a select public figure (“a Talent”). Users purchase contractual rights relating to Roys that are associated with a Talent they select on the website royaltiz.com. The price of a given Roy is identical for all Roys, currently $2.00. The remuneration attaching to a Roy is determined by a proprietary algorithm that adjusts the “yield” based on the commercial activities of the associated Talent. Yield payments are paid to holders of Roys on a monthly basis. The algorithm takes into account multiple factors related to a Talent’s social media presence on the Instagram platform, including their follower count, the geographic location of their followers, and the engagement levels on their posts. The Company may in the future choose to offer additional Roys of that Talent at the same price or at a different price but with the same yield payment calculation in absolute terms, after such price is qualified with the Securities and Exchange Commission (the “SEC”). If the Company decides to offer Roys at a different price it will cease to offer Roys at the original price. The Company will decide whether to issue Roys at a different price in its discretion, based on a number of factors including the level of yield payments for the Roy associated with the particular Talent. The total number of Roys issued cannot exceed the total number of Roys authorized for issuance. Roys and the associated contractual rights can be purchased by users of royaltiz.com as described herein, which operates as the sole marketplace for Roys. The Talent linked to the Roys being offered pursuant to this offering circular is Nick Kyrgios, the Australian tennis player, but the Company plans to issue additional Roys associated with additional Talents, following qualification by the SEC.

| | | Price to

Public | | | Proceeds to

Issuer | |

| Per Roy | | $ | 2.00 | (1) | | $ | 0.60 | |

| Total Minimum | | $ | 0 | | | $ | 0 | |

| Total Maximum | | $ | 4,000,000 | | | $ | 2,400,000 | (2) |

(1) The offering price of a Roy is $2.00. See “Description of Business” for additional details.

(2) After deducting expenses, estimated to be approximately $578,756 including legal fees and accounting fees. For more information about the expenses of this offering, please see “Plan of Distribution.”

We are offering the Roys in the United States through a platform hosted on the website at www.royaltiz.com, where potential purchasers will be able to review an electronic version of this offering circular and execute a participation agreement in order to purchase Roys (the “Participation Agreement”) described in the section of this offering circular captioned “The Company’s Business.” Such platform will be accessible only to users located in the United States of America, and will function separately from the existing platform hosted on www.royaltiz.com that facilitates the sale of Roys by our French affiliate under different terms and conditions to users located outside of the United States of America. There is currently no underwriter or sales agent for the Roys. We intend to use the proceeds of this offering, after deducting expenses, for general corporate purposes, including the monthly yield payments to holders of Roys.

There is no minimum number of Roys that we must sell in order to conduct a closing in this offering (the “Offering”). This offering will terminate at the earlier of the date at which the maximum offering amount has been sold, and the date at which the Offering is earlier terminated by the Company, in its sole investors will be available to the Company.

INVESTING IN THE INVESTMENT CONTRACTS OF MANSE USA LLC IS SPECULATIVE AND INVOLVES SUBSTANTIAL RISKS. YOU SHOULD PURCHASE THESE SECURITIES ONLY IF YOU CAN AFFORD A COMPLETE LOSS OF YOUR INVESTMENT. SEE “RISK FACTORS” BEGINNING ON PAGE 4 TO READ ABOUT THE MORE SIGNIFICANT RISKS YOU SHOULD CONSIDER BEFORE BUYING THE INVESTMENT CONTRACTS OF THE COMPANY.

THE SEC DOES NOT PASS UPON THE MERITS OR GIVE ITS APPROVAL OF ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE SEC; HOWEVER THE SEC HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

GENERALLY NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(d)(2)(i)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO www.investor.gov.

Sales of these securities will commence on approximately January 20, 2025.

This offering is inherently risky. See “Risk Factors” on page 4.

The Company is following the “Offering Circular” format of disclosure under Regulation A.

In the event that we become a reporting company under the Securities Exchange Act of 1934, we intend to take advantage of the provisions that relate to “Emerging Growth Companies” under the JOBS Act of 2012. See “Summary — Implications of Being an Emerging Growth Company.”

TABLE OF CONTENTS

In this offering circular, unless context indicates otherwise, the terms “the Company”, “we”, “us”, or “our” refers to MANSE USA LLC.

Other than in the table on the cover page, dollar amounts have been rounded to the closest whole dollar.

THIS OFFERING CIRCULAR CONTAINS FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY’S MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS “ESTIMATE,” “PROJECT,” “BELIEVE,” “ANTICIPATE,” “INTEND,” “EXPECT” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS, WHICH CONSTITUTE FORWARD LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT’S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE. THE COMPANY DOES NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS OR CIRCUMSTANCES AFTER SUCH DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

SUMMARY

Overview

MANSE USA LLC is a corporation formed under the laws of the State of Delaware on January 25, 2023. The Company offers eligible individuals (“Fans”), through the “Royaltiz” platform accessible to users located in the United States via the website www.royaltiz.com, a way to profit from the future success of their favorite talents (“Talents”). Fans enter into contracts in form and substance substantially the same as the Participation Agreement attached hereto as Exhibit 6.1. The resulting rights obtained by Fans are called “Roys,” each associated with a celebrity that they choose from those presented on the website, such as tennis, basketball, football, and soccer players, and TV hosts/entertainers. A purchaser of a Roy has the potential to benefit from a monthly “yield” payment. After purchasing a Roy, the initial “yield” is set by the algorithm, but for the life of the Roy will remain at least 2% of the sale price, and at most 50% of the sale price, per year, with such sale price currently being $2.00. The yield fluctuates based on the results of the algorithm designed to measure the success of the Talent, and an estimated “yield” for each series of Roys is updated and disclosed monthly, and payment amounts are disclosed to Fans through personalized user profile pages on the Royaltiz platform. There is no guarantee or assurance that the Company will be able to offer yields in excess of 2% of the current sale price of the Roys if such additional yields are not supported by revenue from the Company’s other planned sources of revenue disclosed in this offering circular. As noted above, the Company may offer Roys associated with a particular Talent at different prices in the future, following qualification by the SEC. The Company expects to have additional sources of income after its operations have commenced, including but not necessarily limited to the sale to third parties of aggregated dated received and processed by the Company, the sale of trademark licenses for certain brands owned by the Company, and the sale of products and experiences linked to Talents that the Company contracts with. The Company has entered into an agreement for the sale of the data collected on the platform in relation to the offering of Nick Kyrgios Roys.

The Company owns and operates the website platform upon which Roys are purchased. It has also entered into certain licenses and other agreements with affiliates to operate its business. MANSE France SAS (“MANSE France”) operates a similar business in France on a similar platform which is operated by MANSE Plateforme SAS (“MANSE Platform”), which is a wholly owned subsidiary of MANSE INTERNATIONAL SAS, a French société par actions simplifiée (“MANSE International”). The Company is a wholly-owned subsidiary of MANSE International. Although the Company has entered, and intends to enter into, its own agreements with Talents, focusing on those most relevant to the U.S. market, MANSE France has entered into an agreement with the Company (the “Master Agreement”) to enable the Company to offer through the Company’s own platform certain Roys in relation to Talents who have entered into agreements with MANSE France (each a “France Talent Agreement”). A copy of the Master Agreement is attached hereto as Exhibit 6.2. The Company licenses rights to use the algorithm from MANSE Platform, and a copy of the license agreement is attached hereto as Exhibit 6.3. Finally, a summary description of the algorithm itself is attached hereto as Exhibit 6.5.

The Company’s website platform is the only place in which Fans in the United States may purchase Roys, and is only accessible to users located in the United States (the “U.S. Platform”), and Fans will not at any time be able to sell their Roys. Consequently, Roys have no liquidity and Fans will likely be forced to hold their Roys for the entire contract term, which is ten years. The U.S. Platform is separate from the similar platform operated by our French affiliate whereby users located in other territories are able to transact in Roys under different terms and conditions to the ones described in this Offering Statement (the “Foreign Platform”). We currently have no plans to offer the Roys qualified in this offering on the Foreign Platform. Users located in the United States are not authorized to register on the Foreign Platform.

The Offering

| Securities offered: | Maximum of 2,000,000.00 Nick Kyrgios Roys |

| | |

| Minimum Investment: | $ 2.00 |

| | |

Securities outstanding before the Offering (as of January 13, 2025): | |

| | |

| Nick Kyrgios Roys | 0 |

| | |

| Securities outstanding after the Offering: | |

| | |

| Nick Kyrgios Roys | 0 |

When Roys are introduced and purchased, the Company receives a fee from the purchaser of $1.00, irrespective of the number of Roys being purchased. Additionally, the Company receives a 2.5% fee calculated on the basis of the sale price in addition to the sale price itself when Roys are purchased. After payments to its affiliates, the Company will net approximately $0.60 from each Roy sold. The Company intends to use any proceeds from this offering for general corporate purposes, including monthly yield payments to holders of Roys.

Implications of Being an Emerging Growth Company

We are not subject to the ongoing reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) because we are not registering our securities under the Exchange Act. Rather, we will be subject to the more limited reporting requirements under Regulation A, including the obligation to electronically file:

| | ● | annual reports (including disclosure relating to our business operations for the preceding two fiscal years, or, if in existence for less than two years, since inception, related party transactions, beneficial ownership of the issuer’s securities, executive officers and directors and certain executive compensation information, management’s discussion and analysis (“MD&A”) of the issuer’s liquidity, capital resources, and results of operations, and two years of audited financial statements), |

| | | |

| | ● | semiannual reports (including disclosure primarily relating to the issuer’s interim financial statements and MD&A) and |

| | | |

| | ● | current reports for certain material events. |

In addition, at any time after completing reporting for the fiscal year in which our offering statement was qualified, if the securities of each class to which this offering circular relates are held of record by fewer than 300 persons and offers or sales are not ongoing, we may immediately suspend our ongoing reporting obligations under Regulation A.

If and when we become subject to the ongoing reporting requirements of the Exchange Act, as an issuer with less than $1.07 billion in total annual gross revenues during our last fiscal year, we will qualify as an “emerging growth company” under the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and this status will be significant. An emerging growth company may take advantage of certain reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. In particular, as an emerging growth company we:

| | ● | will not be required to obtain an auditor attestation on our internal controls over financial reporting pursuant to the Sarbanes-Oxley Act of 2002; |

| | | |

| | ● | will not be required to provide a detailed narrative disclosure discussing our compensation principles, objectives and elements and analyzing how those elements fit with our principles and objectives (commonly referred to as “compensation discussion and analysis”); |

| | | |

| | ● | will not be required to obtain a non-binding advisory vote from our shareholders on executive compensation or golden parachute arrangements (commonly referred to as the “say-on-pay,” “say-on-frequency” and “say-on-golden-parachute” votes); |

| | | |

| | ● | will be exempt from certain executive compensation disclosure provisions requiring a pay-for-performance graph and CEO pay ratio disclosure; |

| | | |

| | ● | may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations, or MD&A; and |

| | | |

| | ● | will be eligible to claim longer phase-in periods for the adoption of new or revised financial accounting standards. |

We intend to take advantage of all of these reduced reporting requirements and exemptions, including the longer phase-in periods for the adoption of new or revised financial accounting standards under Section 107 of the JOBS Act. Our election to use the phase-in periods may make it difficult to compare our financial statements to those of non-emerging growth companies and other emerging growth companies that have opted out of the phase-in periods under Section 107 of the JOBS Act.

Under the JOBS Act, we may take advantage of the above-described reduced reporting requirements and exemptions for up to five years after our initial sale of common equity pursuant to a registration statement declared effective under the Securities Act of 1933, as amended, or such earlier time that we no longer meet the definition of an emerging growth company. Note that this offering, while a public offering, is not a sale of common equity pursuant to a registration statement, since the offering is conducted pursuant to an exemption from the registration requirements. In this regard, the JOBS Act provides that we would cease to be an “emerging growth company” if we have more than $1.07 billion in annual revenues, have more than $700 million in market value of our common stock held by non-affiliates, or issue more than $1 billion in principal amount of non-convertible debt over a three-year period.

Certain of these reduced reporting requirements and exemptions are also available to us due to the fact that we may also qualify, once listed, as a “smaller reporting company” under the SEC’s rules. For instance, smaller reporting companies are not required to obtain an auditor attestation on their assessment of internal control over financial reporting; are not required to provide a compensation discussion and analysis; are not required to provide a pay-for-performance graph or CEO pay ratio disclosure; and may present only two years of audited financial statements and related MD&A disclosure.

Selected Risks Associated with Our Business

Our business expects to be subject to a number of risks and uncertainties, including those highlighted in the section titled “Risk Factors” immediately following this summary. These risks include, but are not limited to, the following:

| | ● | The U.S. Platform hosted on www.royaltiz.com is the only place where Roys can be purchased, and no other avenue will develop, and Roys cannot be resold and yield payments over the life of a Roy may not compensate the holder for the purchase price resulting in losses. |

| | | |

| | ● | The Company relies in some cases on affiliates to assign rights to issue certain Roys based on agreements initiated by the affiliate rather than by the Company and to allow the Company to use the algorithm. |

| | | |

| | ● | The Company is a start-up, and its continued financial health and existence is dependent on its ability to establish and grow its business, and there are no guarantees or other assurances of financial support from MANSE International, its corporate parent. |

| | | |

| | ● | The Roys will not increase in value, and economic benefits will be limited to yield payments. |

| | | |

| | ● | Although the data used by the algorithm to determine yield is updated daily, the algorithm only updates a Roy’s yield once per month. Moreover, we are unable to verify the accuracy of most of the data being processed by the algorithm. |

| | | |

| | ● | The yield income from the Roys is dependent on the success of the Company’s algorithm to successfully measure the commercial success of a particular Talent in setting yield levels, and there is no assurance that it will do so effectively in every instance. |

| | | |

| | ● | We may be subject to cyberattacks that could expose private information, or interfere with or prevent the functioning of our platform and the purchase and sale of Roys. |

| | | |

| | ● | The regulatory landscape for transactions involving contractual rights and digital assets is uncertain, and regulatory actions may result in the suspension or termination of our operations. |

| | | |

| | ● | Holders of Roys will not have most of the traditional rights associated with holders of debt instruments. |

| | | |

| | ● | The tax treatment of the Roys is uncertain and there may be adverse tax consequences for purchasers, and purchasers are solely responsible for properly reporting any income or losses to relevant taxation authorities. |

| | | |

| | ● | Talents are natural persons and may die or become unable or unwilling to continue their careers during the existence of the associated Roy. |

| | | |

| | ● | Yield payments may never increase from the introductory level or may stop, and/or the Roys may have no value as a result of a dispute with a Talent or other event, and the Company may have to remove the Talent and/or the Roy from the platform without reimbursing any losses to holders. |

| | | |

| | ● | Talents may make declarations or take positions publicly which may adversely affect their image and the Roys and the Company has no control over such declarations or positions and takes no responsibility for such positions. |

| | | |

| | ● | Roys are expressed in contractual rights, and if a Fan breaches the agreement with the Company or the terms of the website it is subject to consequences involving its Roys that may result in a loss of value and/or other losses to the breaching purchaser. |

RISK FACTORS

An investment in the Roys involves a high degree of risk. You should consider carefully the risks described below, together with all of the other information contained in this offering circular, and in your purchase agreement, if applicable, before making an investment decision. The following risks entail circumstances under which our company’s business, financial condition, results of operations and prospects could suffer or the Roys you purchase could lose value and result in losses to you. The below risks are not exclusive of all risks that could materialize.

The U.S. Platform hosted on Royaltiz.com is the only place in which Roys offered pursuant to this Offering Statement may be purchased, and Roys cannot be resold and yield payments over the life of a Roy may not compensate the holder for the purchase price resulting in losses.

The U.S. Platform hosted on Royaltiz.com will provide the only place for Fans to purchase Roys offered pursuant to this offering circular, and Roys cannot be resold. Consequently, Roys are inherently illiquid, and Fans will likely be forced to hold their Roys for the term of the Participation Agreement, even if the level of yield payments is lower than anticipated. The yield payments over the life of a Roy may not compensate the holder for the purchase price resulting in losses.

The Company in some cases relies on affiliates to grant licenses or assign rights upon which the Company obtains contractual rights to issue Roys related to Talents who have been initially contracted by the affiliate rather than by the Company and to allow the Company to use the algorithm.

The Company relies on MANSE France to assign image rights to the Company to issue Roys in relation with Talents recruited by that affiliate, since the Company currently has only one Talent engaged, although it plans to engage multiple additional Talents immediately prior to commencing operations, and ultimately expects to have many more Talents that it originates in the U.S. market. The Company does not plan to rely initially on any Talents assigned by MANSE France, but does expect to rely on assignments of such Talents from time to time in due course. The Company relies on MANSE Platform for rights to use the algorithm. The Company has no control over its affiliates, and cannot assure that they will remain affiliates, continue to be willing to enter into agreements with the Company on terms favorable to the Company, or that they will be managed in an optimal manner, or even remain in existence. If the Company’s affiliates are unable or unwilling to provide the services currently provided to the Company, we may be unable to replace those services, or to replace them on terms that are acceptable to us.

The Company is a start-up, and there is no assurance that it will establish a successful business and continue to operate successfully in the United States, and its continued financial health and existence is dependent upon its ability to establish and grow its business.

If the Company is unable to successfully establish and maintain its operations in the United States for any reason, whether for example due to bankruptcy, insolvency, or a decision to wind the business down, or due to a regulatory obstacle, Fans would cease receiving yield payments from their Roys, which would essentially become without value. Furthermore, the Company expects to depend on revenue from the sale of Roys in addition to other sources of revenue to meet its obligations as an operating company, including making monthly yield payments in the amounts determined by the Company’s algorithm. The Company has no business history and limited capitalization, and there is no assurance that it will successfully establish its platform in the United States, or that it will be able to continue as a going concern indefinitely.

There is no guarantee that yield payments will increase from their minimum introductory levels, and you may lose the amount of your investment in the Roys in whole or in part.

The value of yields associated with Roys associated with a particular Talent depends on the Talent’s willingness and ability to maintain commercial success as measured by the factors taken into account by the algorithm. If the Talent is unsuccessful in his/her career as measured by the algorithm then the estimated and actual yield payments associated with the associated Roy may remain constant, or decrease, and you could lose part or all of your investment.

Although the data used by the algorithm to determine yield is updated daily, the algorithm only updates a Roy’s yield once per month. Moreover, we are unable to verify the accuracy of most of the data being processed by the algorithm.

The data considered by the algorithm when calculating yield is updated continuously by the third-party provider that we obtain it from. In addition, some Instagram metrics considered by the algorithm, such as number of followers, are publicly available and update quickly and normally within the same day. However, the algorithm only calculates yield once per month, using the most recently published data at that time. Consequently, if a Talent experiences a temporary spike in the metrics considered by the algorithm, and those metrics reduce by the point in time at which the algorithm calculates the yield, users will be unable to benefit from that Talent’s temporary increase in the relevant Instagram metrics. In addition, the majority of the data that is processed by the algorithm in order to calculate yields is publicly available Instagram data that is synthesized by a third party. The algorithm digests and processes large quantities of that data automatically, and consequently we are unable to verify the accuracy of such data. It is possible that some of the data provided by the third party is inaccurate, in which case the yield calculated by the algorithm may not accurately reflect the actual or perceived Instagram presence of a given Talent. The yield levels anticipated by an investor may not align with the actual yield in such cases.

Roys are fixed term contracts.

Roys are fixed term contracts and upon their termination, all contractual rights shall terminate, including the right to remuneration via the yield. Upon occurrence of the term of the Roy, there shall be no compensation by the Company to the holder of the Roy. All Roy contracts terminate after 10 years unless they are extended in accordance with the Roy contract terms or terminated earlier upon the occurrence of certain events set out in the Participation Agreement, including:

| ● | the Roy holder decides in its sole discretion to terminate the Participation Agreement; |

| ● | the Performance Agreement with the Talent is terminated prior to its 10-year term pursuant to its terms; |

| | ● | in the case of a breach by the Roy holder of its contractual obligations, including the payment of the Roy price. |

For Roys of a Talent issued subsequent to the introduction of that Talent’s Roys, the termination date of the subsequent Roys will be the same date as the termination date of the introductory Roys of that Talent, meaning that the term of the subsequent Roys will be shorter than ten years.

The yields attaching to Roys are impacted by the success of the algorithm to accurately measure the commercial success of a particular Talent. Although the algorithm has been designed to make those determinations as effectively as possible, no software is perfect, and there is no assurance that the algorithm will operate effectively in every instance, nor that every Roy holder will agree with the assumptions and judgements made by the algorithm’s designers.

The accuracy of the yield levels set for particular Roys is impacted by the success of the algorithm to accurately measure the commercial success of a particular Talent in establishing yield levels Although the algorithm has been designed to make determinations regarding the yields as effectively as possible, no software is perfect, and there is no assurance that the algorithm will operate effectively in every instance, nor that every Roy holder will agree with the assumptions and judgements made by the algorithm’s designers. Furthermore, while the Company intends for the algorithm to take into account only accurate information, there is a possibility that some information from time to time will be inaccurate, although the Company will require MANSE Platform to make any appropriate adjustments upon learning that any information has proven, or strongly suspected, to be inaccurate.

The website used by the Company and algorithm, or other essential systems, may be the target of malicious cyberattacks or may contain exploitable flaws in their underlying code, which may result in security breaches and the loss or theft of Roys. If these attacks occur or security is compromised, this could expose your private information, prevent the platform on which Roys are purchased from functioning for indefinite periods of time, expose us to liability and reputational harm, and seriously curtail our ability to continue to make yield payments and maintain the platform for buying Roys.

The website on which the Roys are offered for sale and purchased and the algorithm, or other essential systems, may be the target of malicious cyberattacks or may contain exploitable flaws in their underlying code, which may result in security breaches and the loss or theft of Roys. If these attacks occur or security is compromised, this could expose your private information, prevent the platform or buying Roys from functioning for indefinite periods of time, expose us to liability and reputational harm, and seriously curtail our ability to continue to make yield payments and our affiliate’s ability to maintain the platform for buying Roys. Furthermore, customers’ deposits may be lost, and there is no governmental insurance program to protect such deposits.

The website or algorithm we use may have inherent flaws, or flaws that develop, or we may suffer damage to our physical infrastructure, that may result in suspension of operation for indefinite periods of time, as well as the loss of data and/or inaccurate levels of yield payments.

No software is perfect, and flaws in our software or damage to our physical infrastructure or that of our affiliate that operates the platform may result in suspension of operations of the website or algorithm, or inaccurate operation of the website, yield payments, or algorithm, losses of customer deposits, and losses for holders of Roys.

Our business model operates in a context where the regulation of transactions involving remuneration contracts and digital assets is uncertain, and regulatory actions may result in the suspension or termination of our operations, or result in expenses that result in our decision to suspend operations, in which case users may lose some or all of their investment in Roys.

Roys are securities and the regulation of the contractual rights is a developing area of the law where there is some uncertainty about how to properly comply with governmental regulations. Although Roys are not cryptocurrency or tokens, and are not issued or transferred using distributed ledger or blockchain technology, they may still be associated with or mistaken as such, and transacting of crypto or digital assets has been subject to significant regulatory scrutiny. Accordingly, it is possible that government investigations or other actions could result in the suspension or termination of our operations, or result in the Company incurring expenses or anticipated expenses as a result of government investigations or other inquiries that make it unwise to continue operations, even if those investigations or inquiries are expected to conclude without any regulatory action. If that happens, holders of Roys may suffer losses if the prices of their holdings decrease, or if their Roys terminate in the event that the Company is liquidated, curtails or ceases operation. Holders of Roys may lose some or all of their investment in Roys.

Holders of Roys will not have many of the rights traditionally associated with holders of debt instruments, nor will they have any rights traditionally associated with holders of equity.

We believe that the Roys are currently equity securities, for purposes of the definition of security in Section 2(a)(1) of the Securities Act of 1933 and in Section 3(a)(10) of the Securities Exchange Act of 1934, solely because they are investment contracts under the Howey test. However, holders of Roys will not have many of the rights traditionally associated with equity. For example, holders of Roys will not receive an interest in the profits or losses of the Company or any of its affiliates, will not have redemption rights, nor any rights to distributions from the Company, or any legal or contractual right to exercise control over the operations or continued development of the Company, which are rights typically afforded to equity holders.

The Roys provide holders no rights to direct how the Roys or the Company’s algorithm will be designed or governed.

The Roys provide no rights to direct how the Roys, the platform, or the algorithm will be designed or governed. Consequently, you may disagree with the ways in which we operate the Company, changes we may make to the algorithm, or changes we make to the terms on which the Roys are structured, and your ownership of Roys will not entitle you to direct an alternative course of action.

We may not be subject to ongoing reporting requirements in the future.

We will eventually be eligible to file an exit report to suspend or terminate our ongoing reporting obligations. If we become eligible, and if we make this election in the future, we may choose to not file annual reports, semiannual reports, current reports, financial statements and audited financial statements. As a result, holders of the Roys would receive less information about the current status of the Company, which could adversely affect their ability to accurately gauge the risks described in this offering circular.

Roys are not legal tender, are not backed by any governmental entity, and accounts and value balances are not subject to Federal Deposit Insurance Corporation or Securities Purchaser Protection Corporation protections.

Roys are not legal tender, are not backed by any government, and accounts and value balances with the Company are not subject to Federal Deposit Insurance Corporation or Securities Purchaser Protection Corporation protections. Any investment in Roys is made at the risk of the purchaser. If the Company suspends or terminates operation for any reason, you could suffer a total loss of your investment in Roys and any unrealized gains related to your Roys.

The tax treatment of the Roys may be uncertain and there may be adverse tax consequences for purchasers.

We expect that the tax implications of purchasing Roys will be that income tax may be payable on the grounds of the collection of yields. However, the tax characterization of the Roys and transactions involving them may be uncertain, depending on a number of factors including the purchaser’s tax status and state of residency, and each purchaser must seek its own independent legal and tax advice with respect to the United States and non-U.S. tax treatment of an investment in Roys. An investment in Roys may result in adverse tax consequences to purchasers, including withholding taxes, income taxes and tax reporting requirements.

The loss or potential loss of our exclusion from regulation pursuant to the Investment Company Act of 1940 could require us to restructure our operations.

The SEC heavily regulates the way “investment companies” are permitted to conduct their business activities. We believe we will conduct our business in a manner that does not result in us being characterized as an investment company, as we do not believe that we will engage in any of the investment activities that require registration under the Investment Company Act of 1940. We intend to continue to conduct our business in such manner. If, however, we are deemed to be an investment company, we may be required to institute burdensome compliance requirements and our activities may be restricted, which would affect our business to a material degree. The treatment or potential treatment as an investment company could require us to restructure our operations, which could have an adverse effect on our financial condition and results of operations, or to terminate our business. In addition, if we are determined to have engaged in activities that require any such registration, without obtaining such registration, we could be subject to civil and/or criminal liability, which could have an adverse effect on our financial condition and results of operations.

Although we do not believe that our business involves wagering, regulators may conclude that aspects resemble wagering, such as online sports betting, and investigations and other actions by state and/or federal wagering regulators may result in the suspension or termination of our operations, or require us to incur costs that result in the limitation of our operations or a decision to cease operations, and this could result in losses for holders of Roys.

Although we do not believe that our business involves wagering, regulators may conclude that aspects resemble wagering, such as online sports betting, and investigations and other actions by wagering regulators may result in the suspension or termination of our operations, or require us to incur costs that result in the limitation of our operations or a decision to cease operations, and this could result in losses for holders of Roys, even if such regulatory inquiries are expected to be resolved in the Company’s favor.

It is possible that yield payments for a given set of Roy may cease as a result of a dispute with a Talent or other event, and the Company may have to remove the Talent and/or the Roy from the platform.

The Company’s relationship with individual Talents is contractual, and in the event of the death or illness of a Talent, yield payments for the associated Roy may cease, and the Talent’s image may be deleted from the platform. In the case of Talents initially engaged by MANSE France whose intellectual property rights have been assigned to the Company, the same risks are present, and the Company may lack control over the relationship with the Talent in those cases, and the issues are also subject to the terms of the Company’s agreement with MANSE France. Although we do not introduce Talents that we believe will experience any of the above issues, if such issues materialize you may lose some or all of the value of your Roys. Under our agreement with users, the users assume the risk that the Talent and/or associated Roy will be removed from the platform for reasons beyond the Company’s control. The Company and the holder of Roys share the risk that there will be an unforeseen interruption to the relationship with a particular Talent, and that is part of the risk-reward calculation that a user should take into account when purchasing a Roy.

A Talent’s image and likeness used to identify his/her Roys may not be available for use during the full term of the Roys.

A Talent’s image rights and likeness are sold and/or licensed to the Company or to MANSE France under contracts which are subject to termination or cancellation. In case of such termination or cancellation of an agreement between the Company or MANSE France and a Talent, the Roys may need to be renamed by the Company and the Roy may not bear the name or image of the Talent to which the yield is attached.

Roys are expressed in contractual rights, and if a Fan breaches the terms of the Participation Agreement with the Company or the terms of the website, it is subject to consequences involving its Roys that may result in a loss of value.

Roys are expressed in contractual rights, and if a Fan breaches the Participation Agreement with the Company it is subject to consequences involving its Roys that may result in a loss of value. Fans should read the Participation Agreement carefully, a copy of which is attached hereto as Exhibit 6.1, before purchasing Roys.

Purchasers of Roys may not be entitled to a jury trial with respect to claims arising under the Participation Agreement, which could result in less favorable outcomes for the plaintiffs in any such action.

Our Participation Agreement, which users are required to execute in order to purchase Roys, provides that each party to such agreement waives its right to a jury trial for any claim they may have arising out of the Participation Agreement, except for such claims arising under U.S. federal securities laws.

If we opposed a jury trial demand based on the waiver, the court would determine whether the waiver was enforceable based on the facts and circumstances of that case in accordance with the applicable state and federal law. We believe that a contractual pre-dispute jury trial waiver provision is generally enforceable, including under the laws of the State of New York, which govern the Participation Agreement. In determining whether to enforce a contractual pre-dispute jury trial waiver provision, courts will generally consider whether a party knowingly, intelligently and voluntarily waived the right to a jury trial. We believe that this is the case with respect to our Participation Agreement. It is advisable that you consult legal counsel regarding the jury waiver provision before entering into the Participation Agreement.

If a user brings a claim against us in connection with matters arising under our Participation Agreement (excluding claims under federal securities laws), such user may not be entitled to a jury trial with respect to such claims, which may have the effect of limiting and discouraging lawsuits against us. If a lawsuit is brought against us under our Participation Agreement, it may be heard only by a judge or justice of the applicable trial court, which would be conducted according to different civil procedures and may result in different outcomes than a trial by jury would have, including results that could be less favorable to the plaintiffs in any such action.

DILUTION

There is no potential for dilution, because the number of Roys that can be issued for a particular Talent is limited to the maximum number that is disclosed on the platform, and the algorithm evaluates the yield payments based on the maximum number that may be issued even if we have not yet introduced the maximum number of Roys into our platform. Therefore, it is possible that the introduction of new Roys within those parameters does not have a negative impact on the price of a Roy under the algorithm.

Dilution means a reduction in value or earnings of the shares the investor owns.

PLAN OF DISTRIBUTION AND SELLING SECURITYHOLDERS

Plan of Distribution

The Company is offering a minimum of one (1) Nick Kyrgios Roy and a maximum of two million (2,000,000) Nick Kyrgios Roys for a price of $2.00 each, as described in this offering circular. The information in the “Description of Business” section is incorporated by reference into this section. The Roys are distributed on the U.S. Platform subject only to the fees described in this offering circular, subject to change in the future. No securities are being sold for the account of security holders; all net proceeds of this offering will go to the Company.

After the offering statement has been qualified by the SEC, the Company will launch its website in the United States, and investors will have the opportunity to purchase Nick Kyrgios Roys. In order to invest, investors will be required to register with the U.S. Platform, subscribe to the offering, and agree to the terms of the offering and any other relevant exhibit attached thereto. The Company plans to finalize agreements with additional Talents and seek qualification for Roys linked to those Talents.

USE OF PROCEEDS TO ISSUER

The Company intends to use the proceeds from the offering for general corporate purposes, including the payment of monthly “yields” to holders of Roys, and payment of general corporate expenses.

THE COMPANY’S BUSINESS

Overview

The Company will offer Fans through its U.S. Platform, accessible via the website www.royaltiz.com, a way to profit from the future success of their favorite Talents. Investors enter into contracts called “Roys” associated with a celebrity that they choose from those presented on the website, such as tennis, basketball, football, and soccer players, and TV hosts/entertainers. The Company will focus on recruiting Talents that are popular in the U.S. market. A purchaser of a Roy has the potential to benefit from monthly “yield” payments which are determined by an algorithm that seeks to measure the commercial success of Talents. The higher the commercial success, the higher the yield, up to a maximum discussed below. The Company expects to have additional sources of income after its operations have commenced, including the sale to third parties of aggregated data received and processed by the Company, the sale of trademark licenses for certain brands owned by the Company, and the sale of products and experiences linked to Talents that the Company contracts with. Depending on the level of yield payments for a given Talent’s Roys, the Company may in the future decide to offer Roys of that Talent at a different price with the same yield payment calculation in absolute terms, meaning at a different percentage of the sale price of such newly offered Roys, after qualifying such price with the SEC. The Company intends to use the proceeds of this offering, after deducting expenses, for general corporate purposes, including the monthly yield payments to holders of Roys.

The Company was established to initiate operations in the United States, and accordingly it has no operating history. The Company’s parent in France, MANSE International, and its affiliate MANSE France, have operated a similar business model in France since July 2021 conducted on the Foreign Platform. Our affiliates’ business in France has been successful, with approximately 115,000 active users, 170 Talents, and more than 40 million Roys issued since inception. There is active transacting in Roys available through the French operations of our affiliate on the Foreign Platform, with 1620 average transactions per day, and the French operations have paid approximately $206,000 in yield payments since August 2022. The Company will offer Roys qualified in this offering through the U.S. Platform, which is a separate platform to the Foreign Platform that conducts sales to users under different terms and conditions to transactions carried out on the Foreign Platform. The Company currently has no plans to offer its Roys through the Foreign Platform. Users located in the United States are not permitted to register on the Foreign Platform. There is no guarantee that the Company will experience the same or similar levels of success as MANSE France.

The Talents

The Royaltiz platform recruits all types of celebrities, from emerging celebrities to those who are already famous, and the Company intends to continue to recruit Talents, focusing on those popular in the U.S. market. It believes that making the Royaltiz platform available in the United States will facilitate recruitment of Talents based in the United States. The Company will not initially, but may from time to time, be assigned some Talents’ image rights held by MANSE France pursuant to the Master Agreement so that the Company may issue to its users, through the U.S. Platform, the Roys associated with such Talents who have been or are currently engaged by MANSE France. There are currently 170 Talents engaged by MANSE France. The Company is just initiating operations, and accordingly currently has engaged at this point only one Talent, but it expects to recruit additional Talents after launching operations, primarily Talents associated with the U.S. market. There is no guarantee that the Company will be able to engage as many Talents as MANSE France, or at the same pace.

The relationship with each Talent is contractual. The Company enters into a contractual agreement with each Talent that provides the Company with intellectual property rights to use the Talent’s likeness and other personal characteristics on the platform, and to issue contractual rights or interests to Fans in the nature of securities in connection with those intellectual property rights. Talents receive cash compensation in return. A copy of the standard agreement that the Company enters into with primarily U.S.-based Talents (the “U.S. Talent Agreement”) is attached hereto as Exhibit 6.4.

The Company and MANSE France are party to the Master Agreement, attached hereto as Exhibit 6.2, pursuant to which they have reciprocally permitted assignment of each of the agreements they have with Talents to one another to facilitate the offering of Roys of those assigned Talents in their respective jurisdictions. The Master Agreement requires each of the Company and MANSE France to use its best efforts to include in each of its talent agreements a clause permitting the agreement to be assigned to the Company or MANSE France, as applicable. The consideration payable by the assignee to the assignor is in each case calculated by multiplying the consideration paid to the Talent under the primary talent agreement by (i) the number of Roys issuable by the assignee for that Talent divided by (ii) the number of Roys issuable by both the assignor and the assignee for that Talent. Either party may terminate the Master Agreement at any time without cause by notice to the other party of not less than six months, or, in the case of termination for cause, five business days. However, the Company initially intends to only introduce Roys of Talents with whom it has contracted with directly. The Company has entered into one definitive agreement with a Talent, Nick Kyrgios, whose Roys are the subject of this offering. The Company has also negotiated agreements with six other Talents. Agreements with those six Talents are expected to be entered into upon the qualification of this offering. The Company intends to recruit numerous additional Talents after it launches operations.

While some terms may vary depending on the agreement negotiated with an individual Talent, all Talent Agreements, whether originally entered into with the Company or with MANSE France, are based on and substantially consistent with the Talent Agreement attached hereto as Exhibit 6.4.

Nick Kyrgios

Nick Kyrgios is a twenty-nine-year-old Australian professional tennis player who peaked at number thirteen in the ATP singles rankings. Mr. Kyrgios has earned over $12 million in prizes in his career, and has won seven ATP Tour singles titles. Mr. Kyrgios has also been featured as a commentator for various tennis events, including the Australian Open, and hosts an interview series on the Tennis Channel called “Good Trouble with Nick Kyrgios”. Mr. Kyrgios has over four million followers on Instagram and has a number of brand deals with sports, leisure and watch brands.

The yield of Mr. Kyrgios’ Roys will be determined by the SparkMind algorithm, as described in more detail on page 11 of this Offering Statement. In the month of May 2024, Mr. Kyrgios had a total of 4,191,154 followers on Instagram, down 0.2% from April 2024, an engagement rate of 3% per post on Instagram and a total of one sponsored posts on Instagram. The geographical breakdown of Kyrgios’ Instagram followers as of the end of May was as follows: 17.17% Brazil, 11.8% USA, 10.5% Australia, 7.2% Italy, 5% UK, 50% rest of world.

Characteristics of a Roy

The basic economic and legal functionality of all Roys is substantially the same, regardless of the Talent with whom a particular Roy is associated. Based on historical data from the operations of MANSE France, the Company expects to typically offer between 250,000 and 2,000,000 Roys for a given Talent based on the anticipated demand for those Roys. We assess anticipated demand based on the managers’ business judgement as well as experience operating a similar business in France.

The Company sets a fixed price for the associated Roy when a new Talent is introduced, which is currently $2.00. After introduction, the remuneration attaching to a Roy is determined by a proprietary algorithm that adjusts the yield based on the commercial activities of the associated Talent. After qualification of the Nick Kyrgios Roys that are the subject of this offering, more Nick Kyrgios Roys may be periodically introduced and sold to investors at the same price or at a different price, after such different price is qualified by the SEC, up to the maximum number of Roys authorized for issuance. Roys offered at a different price will be offered with the same yield payment calculations in absolute terms as the Roys that had been offered at the original price. If Roys are offered at a different price, the Company will cease to offer the Roys at the original price.

The yield attaching to the Roy fluctuates based on the algorithm’s updated evaluation of the commercial success of the Talent. For more information on the algorithm and how it operates, see the section titled “The Company’s Business—The Algorithm.” The website is not a gaming platform; for Talents who are athletes, the algorithm does not directly take into account athletic successes such as tournament or match victories, and the Roys sold under this offering do not take into account the reported income of Talents.

In addition to the current price and the anticipated yield, the Company discloses on the website the maximum supply of Roys for a particular Talent that could potentially become available, the number of Roys made available at the introduction of the Talent, and the current number of Roys currently outstanding. The maximum supply includes Roys introduced for sale and Roys that may be issued in the future.

Each holder of a Roy can view the estimated “yield,” which is set currently at $0.04 per year when the Roy is first introduced, and then updated monthly. The yearly yield of a given Roy is calculated on a monthly basis, and one-twelfth of such amount is paid as a monthly yield. The minimum annual yield for the ten-year duration of a Roy equals 2% of the Roy’s sale price. The maximum annual yield for the ten-year duration of a Roy equals 50% of the Roy’s sale price. At a price of $2.00 per Roy, these minimums and maximums correspond to a minimum yearly yield of $0.04 and a maximum yearly yield of $1.00. The algorithm is responsible for determining the yield of a Roy between those two poles. To the extent that the algorithm calculates yields outside of this range, the yield is adjusted to the minimum or maximum, as applicable. Consequently, the minimum monthly yield will always be at least one-twelfth of the minimum yearly yield, which is currently set at $0.04. During a Roy’s ten-year term, a Roy holder will receive a total yield of between $0.40 and $10.00 per Roy. The ongoing monthly yield rate is determined using the algorithm noted above that is designed to evaluate commercial success based on criteria tracked by the algorithm. There is no guarantee or assurance that the Company will be able to offer yields in excess of 2% of the current sale price of the Roys if such additional yields are not supported by revenue from the Company’s other planned sources of revenue disclosed in this Offering Statement.

Users are restricted to purchasing a certain number of Roys for an individual Talent at introduction, as specified in the Participation Agreement. Currently, the maximum number of Roys for a “non-accredited” user is less than 5% of the total number of Roys offered pursuant to this Offering Circular. In addition, there is an overall maximum of 10% of the total number of Roys for the Talent. Moreover, pursuant to Rule 251(d)(2)(i)(C) of Regulation A, users that are not “accredited investors” (as defined in Rule 501(a) of Regulation D under the Securities Act of 1933, as amended) cannot invest more than 10% of the greater of their (i) annual income or net worth (in the case of natural persons) or (ii) revenue or net assets for the most recently completed fiscal year (in the case of non-natural persons) in a single offering, which, for the purposes of Roys, means all Roys offered on the Platform. For example, an individual user who is not an “accredited investors” and has $50,000 annual income and $100,000 net worth may invest a maximum of $10,000 in Roys offered on the website (with such $10,000 reflecting 10% of the greater of that user’s annual income and net worth). If that user purchased $5,000 worth of Nick Kyrgios Roys, then they would be permitted to invest a maximum additional amount of $5,000 in Roys of Nick Kyrgios or other Talents that we subsequently qualify with the SEC. The value of your primary residence cannot be considered an asset in calculating net worth, but a mortgage or other indebtedness secured by such primary residence is not counted as a liability up to the fair market value of the residence. A person is an “accredited investor,” and thus not subject to the above limitation, if he or she had an individual income in excess of $200,000 in each of the two most recent years or joint income with your spouse or spousal equivalent in excess of $300,000 in each of those years, and you have a reasonable expectation of reaching the same income level in the current year. Alternatively, you are an accredited investor if you have net worth in excess of $1,000,000 alone or together with your spouse or spouse equivalent, calculated in the manner noted above.

The Roys can be purchased only on the website.

Roys do not provide a profits or earnings interest in the Company, and holders do not benefit from the economic success of the Company. The Company believes, however, that Roys are “securities” under the U.S. federal securities laws.

The purchase of a Roy provides to the holder a contractual right, whose terms are set forth in the Participation Agreement described in more detail below and attached hereto as a model form as Exhibit 6.1, and which will be available for review on the Company’s website.

The offering price of a Roy is fixed, but in the future we may seek to qualify with the SEC Roys of a given Talent offered at a different price based on the level of yield payments made in connection with those Roys.

The Algorithm

The yield attaching to each Roy will be determined by the Company’s proprietary algorithm, which is designed to be based on the approximate net value of a Talent’s commercial success over the ten-year period beginning with the introduction of the Talent and associated Roy on the royaltiz.com platform.

The algorithm is designed to project a Talent’s future income by using publicly available Instagram data. The algorithm draws from the following sources of data in determining the yield of a Talent’s Roys:

| | ● | The number of Instagram followers, and trends in numbers of followers |

| | ● | Instagram post fan engagement rate, represented by the interaction rate on a Talent’s Instagram posts |

| | ● | The number of sponsored posts made by a Talent on Instagram |

| | ● | The geographical provenance of the Talent’s Instagram followers. |

We use the following core assumptions based on our belief that the foregoing sources are each correlated to a given Talent’s probable future income:

| ● | Accounts with a higher follower counts on Instagram (and positive trends in follower counts) command higher fees for sponsored (paid) posts. |

| ● | The level of engagement on each post (i.e., the amount of users who “like,” comment on, or otherwise interact with a Talent’s Instagram post) affects how much a Talent can charge for a sponsored post on their profile, as higher engagement among followers implies a greater likelihood of them engaging with the sponsored post. |

| ● | The number of sponsored posts made by a Talent directly numbers the amount of sponsored posts that a Talent is selling to advertisers. |

| ● | The geographic provenance of followers affects how much a Talent is able to charge for a sponsored post, as followers from certain countries can be seen as more “valuable” to advertisers, depending on the product or service being advertised. |

More generally, we believe that increased social media activity is positively related to popularity and commercial success, including interest by companies bestowing endorsements.

At the time of a Talent’s offering on the platform, the algorithm calculates a Talent’s revenue probabilities over the next ten years on a Gaussian or “bell” curve. Each month the Talent is listed on the platform, the Talent’s position on the curve is recalculated by the algorithm based on the Talent’s actual performance as of the monthly anniversary of the applicable Roy’s introduction date, and these monthly positions determine the yield payments to be made for each Talent. The minimum yield for any Roy is 2% of the Roy’s nominal value ($2.00) per year and the maximum is 50% per year. There is no guarantee or assurance that the Company will be able to offer yields in excess of 2% of the current sale price of the Roys if such additional yields are not supported by revenue from the Company’s other planned sources of revenue disclosed in this Offering Statement.

The Company utilizes two versions of the algorithm that are broadly the same but with certain differences designed to produce more accurate results. The first permutation of the algorithm, called “Sparkmind,” is applied to all of the Company’s Talents except for soccer players. Sparkmind takes into account data from Instagram. The second permutation of the algorithm is called “SoccerMind,” which takes into account the same Instagram data as Sparkmind as well as publicly available player salary data accessible for free via www.salarysport.com, which aggregates data from athletes’ contracts.

The Company may in the future and in its judgment and discretion create new permutations of the algorithm similar to SparkMind and SoccerMind to evaluate Talents of another industry with the goal of producing more accurate results. For example, if in the future the Company determines that music streaming data is a reliable and useful indicator of commercial success, the Company may create a new permutation of the algorithm that applies to recording artists that considers streaming data in determining yield. The Company discloses on the platform all of the customized algorithms that have been established, including SparkMind and SoccerMind. Fans are able to see the name of the version of the algorithm that is being used to determine the yield of any given Talent. The Company discloses on the platform the factors that the algorithm takes into account in measuring the success of a Talent. The Company may, in its judgment and discretion, adjust the relative weights assigned to such factors in determining yield over time with the goal of ensuring that it is tuned to changes in the applicable industry. For example, if the number of Instagram followers that a Talent has becomes more valuable to advertisers, thus increasing the amount of money a Talent is able to charge for a sponsored post on Instagram, then the algorithm may assign a greater weight to the number of followers that a Talent has, or relevant group of Talents have, in determining yield. Moreover, the Company may in the future decide to incorporate new categories of information that are relevant to Talent’s commercial success in the Company’s judgement and in the judgement of the designers of the algorithm. For example, if Instagram publishes a new metric by which the value of an account can be measured – i.e., the time users spend on a given profile – the Company may choose to consider this metric alongside the existing factors considered by the algorithm when determining yield. Such new categories of information may draw from social media platforms other than Instagram. While differences in the algorithm do exist across Sparkmind and SoccerMind, each variation of the algorithm is substantially the same as the other, and those variations and any future variations will always take into account the key universal Instagram data factors referenced above. Such variations are also designed to render more accurate results. For example, in addition to the Instagram data that Sparkmind uses, SoccerMind also takes into account publicly available salary data regarding football players accessible on www.salarysport.com, and such data is not available for athletes in other sports. We do not customize the algorithm on an individual Talent-by-Talent basis. The yield of the Nick Kyrgios Roys will be determined by the Sparkmind algorithm.

The algorithm updates the Roy’s estimated yield on a monthly basis based on publicly available Instagram data and, in the case of SoccerMind, sports contract information as well. The Instagram data that the algorithm takes into account is synthesized by a third party, Favikon. We pay a fee to Favikon to access the synthesized data. We do not have an individual agreement with Favikon. Instead, we are bound by Favikon’s general terms and conditions of use which apply to all users of the platform. The terms and conditions can be accessed on Favikon’s website. Such terms and conditions grant us a non-exclusive license to use the Favikon platform and the data that it provides. Favikon is able to terminate our access and use of the platform at its sole discretion at any time, and we are able to cancel our subscription to the service at will.

The algorithm takes into account information that the Company believes is accurate, but because the algorithm operates automatically due to the high volume of data, the Company and its affiliates are unable to verify the accuracy of information. Any information that the Company discovers to be inaccurate will be removed, as well as information that the Company strongly suspects to be inaccurate.

The algorithm has been operational in MANSE France’s platform that has been available in France since November 1, 2021, and it is continuously refined by software engineers employed by the Company’s affiliated entities.

The following table displays three indicative examples of the algorithm calculating the yield of a Roy of a fictional talent, assuming in each case a price of $2.00. Because the first-month yield is the same for every Roy, this table displays yields as of the second month following the Roy’s introduction:

| Factor | | Roy 1 | | Roy 2 | | Roy 3 |

| Followers/trend | | 31,292 | | 44,024 | | 1,511,078 |

| Engagement rate | | 10.24% | | 21.07% | | 4.86% |

| Sponsored posts | | 1 | | 1 | | 0 |

| Geographical breakdown of followers | | France: 37.3%

USA: 12.1%

Italy: 7.2%

Spain: 3.3%

Brazil: 3%

Other: 37.1% | | Switzerland: 33.5%

USA: 20%

France: 7%

Spain: 2.3%

Other: 34.3% | | France: 71.2%

Belgium: 3.6%

Algeria: 3.2%

Morocco: 2.1%

Senegal: 2.1%

Other: 17.8% |

| Monthly Yield | | $0.0093 | | $0.01695 | | $0.0174 |

The monthly yield is equal to one-twelfth of the yearly yield as recalculated each month by the algorithm.

Thus, for example, for Nick Kyrgios, the following factors among others would be taken into account by the algorithm as of May 2024, 2024: 4,191,154 followers on Instagram, his one sponsored posts made on Instagram in the month of May 2024, his engagement rate of 3% on each Instagram post, and his follower base consisting of mostly Brazilian, American, Australian, Italian, and British followers.

A summary description of the algorithm is attached hereto as Exhibit 6.5.

The Company licenses the right to use the algorithm from MANSE Platform pursuant to the Technical Assistance Agreement (the “License Agreement”) attached hereto as Exhibit 6.3. Pursuant to the License Agreement, MANSE Platform licenses to the Company the right to use the algorithm for a price of 50,000 euros per year. MANSE Platform is obligated to provide the Company with updated yield calculations for each Talent on a monthly basis. Under the License Agreement, the Company is also permitted to conduct an audit of the algorithm and the accuracy of the yield calculations which result from the algorithm formula. The License Agreement is terminable at any time by either party without cause by written notice of not less than six months. There is no termination fee under the License Agreement. Either party may terminate the License Agreement for cause, in which case the notice period is one month. The License Agreement contains confidentiality provisions related to the algorithm.

The Participation Agreement

Each user must enter into a Participation Agreement with the Company in order to purchase Roys. The Company’s agreement requires that a user have registered as a resident of the United States, and provide an address in the United States. The website will block purchases of Roys with the Company by users who are physically outside the United States when they communicate with the platform.

The Participation Agreement includes the principal terms and conditions that govern the Roys and purchases of the Roys, including the rights that users have, including the right to remuneration or “yield” payments and their obligations to pay fees and/or commissions. It also includes, under certain circumstances including a breach of the agreement, the Company’s unilateral right to terminate or amend the agreement, or assign the agreement and Roys to a third party. The agreement also provides for the situation where the Company’s agreement or relationship with a particular Talent is terminated prematurely, in which case the Company may be required to remove the likeness and/or personal information about the Talent from the royaltiz.com website, and possibly suspend or terminate purchases of and yield payments for the associated Roy, in which case the Company takes no financial responsibility for any financial losses suffered by the holder of the associated Roys. The Participation Agreement includes a waiver whereby each party to the agreement agrees to waive its right to a jury trial with respect to any controversy arising under the Participation Agreement, except for any controversy arising under U.S. federal securities laws.

The Royaltiz.com Website

Participants register on the website by providing certain information about themselves, and they may also open an account, deposit funds, and remove funds. In order to purchase Roys, a user must provide certain additional information, review and execute a Participation Agreement, and confirm that they will abide by the investment limitations set forth in Rule 251(d)(2)(i)(C) of Regulation A. A user must also confirm compliance with those limitations in order to execute each individual purchase. The website describes the Talents available and provides a mechanism to purchase associated Roys. Talents are divided by category, such as soccer, football, or entertainers. The website provides a photo for each talent together with an “information sheet,” which includes a summary biography, introduction date of the Roy, estimated annual yield, historical yield data, the maximum number of Roys that may be issued, and the total outstanding Roys currently. The information sheet also describes which algorithm is used to determine the Yield of the Talent.

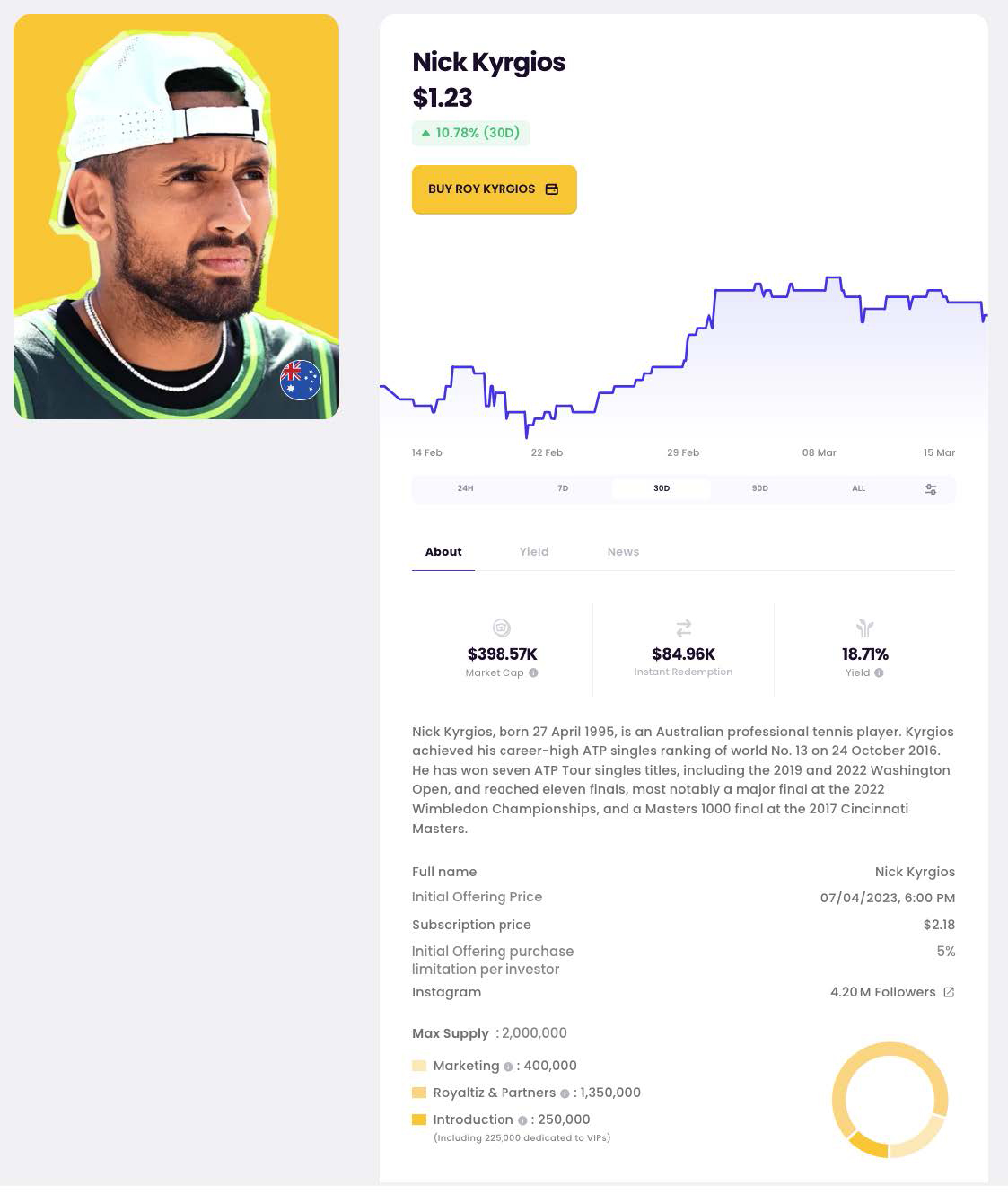

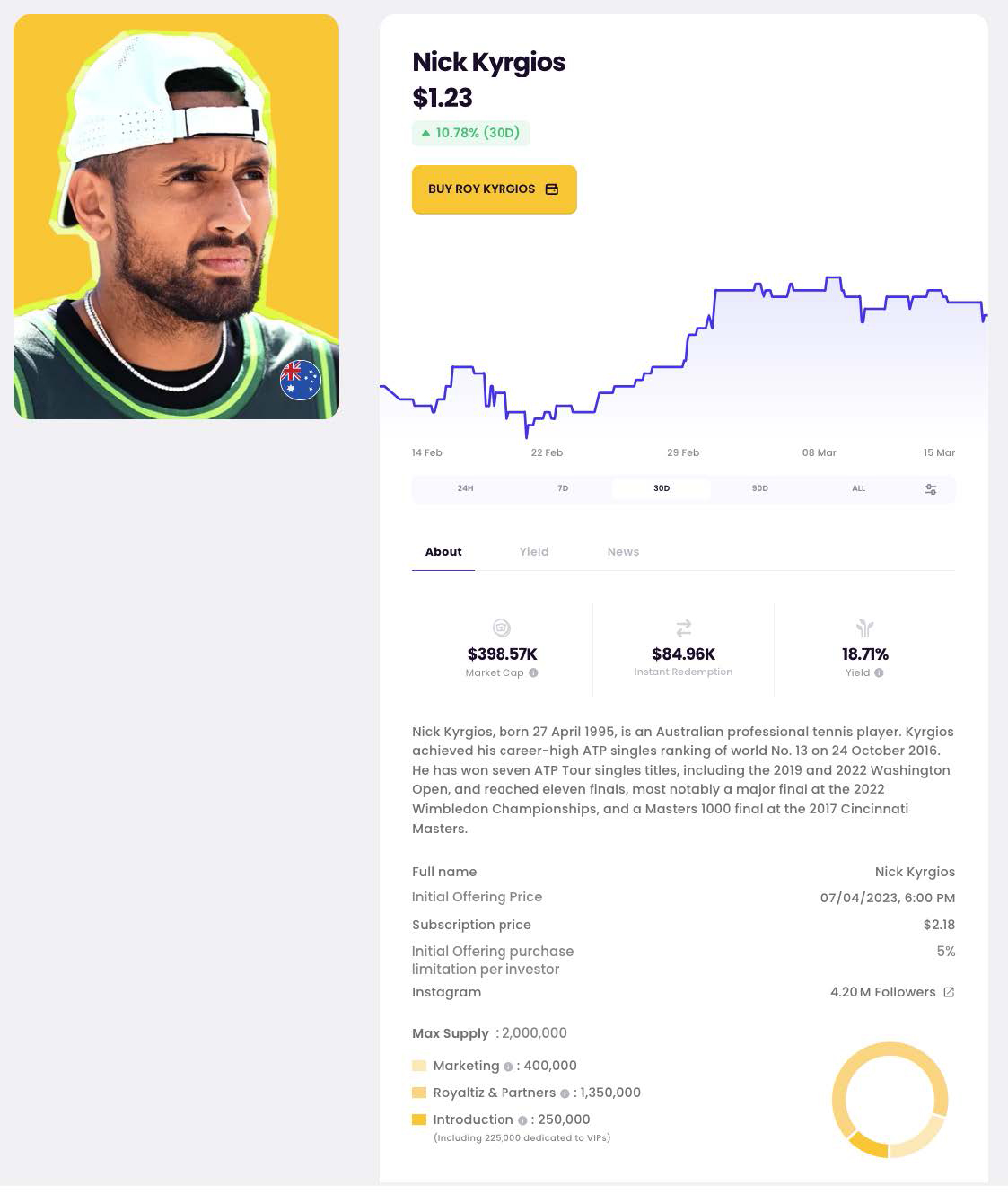

Below is an illustrative information sheet:

The Company and Management

The Company is a Delaware limited liability company organized on January 25, 2023 whose sole member and equity holder is MANSE International, a company organized in France. The management of the company is reflected in the table in the section entitled “Directors, Executive Officers, and Significant Employees.” The Company is headquartered at 100 Bogart Street, Brooklyn, New York, 11206, which is office space leased by MANSE USA LLC.

When Roys are introduced and purchased, the Company receives an introduction charge from the purchaser of $1.00, irrespective of the number of Roys being purchased. Additionally, the Company receives 2.5% of the sale price when Roys are purchased.

The Company does not expect to be dependent on this offering as its only source of income. Based on the historical success of operations of MANSE France that are similar to other business operations the Company plans to launch, the Company expects to have additional sources of income after its operations have commenced. Those sources of income are expected to include:

| | ● | The sale to third parties of aggregated data received and processed by the Company, including the sale of aggregated, anonymized transaction data to individuals and companies; |

| | ● | The sale to related party entities and third parties of trademark licenses for the brands “Royaltiz” and “Buy is the New Like;” |

| | ● | The sale of products and experiences, including items and experiences unique to a specific Talent, to users of the Platform in an online shop; and |

| | ● | The sale to Fans of insurance products insuring their investment in Roys in the event of death or serious injury to the Talents they invest it. |

As of the date of this offering circular, the Company has one agreement in place with Isidore Paris SAS (“Isidore”) pursuant to which the Company has agreed to license data relating to the introduction of the Nick Kyrgios Roys that are the subject of this offering. Pursuant to the agreement, the Company will provide Isidore with data concerning usage statistics of Nick Kyrgios’ Roys on the Company’s platform in exchange for a fee of $10,000. Isidore is permitted, on a non-exclusive basis, to access, copy and extract data from the database provided by the Company for its own research purposes. Isidore is prohibited from using the data to create “output data” in the forms of reports, charts, graphs, or other pictorial representation that is sold or licensed to any third party. The agreement contains customary confidentiality provisions regarding the data. The agreement has a term of one year from the first date on which Nick Kyrgios’ Roys are offered on the Company’s platform, and automatically renews for successive one-year terms until either party terminates. Isidore will pay an additional $10,000 licensing fee upon each successive automatic one-year renewal. Each party is permitted to terminate the agreement with or without cause. The Company may in the future license data related to the Roys of other Talents to Isidore or one or more other third parties.

The Company’s Property

The Company owns no physical property, but leases its headquarters at 100 Bogart Street, Brooklyn, New York, 11206.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

MANSE USA LLC. is a corporation formed under the laws of the State of Delaware on January 25, 2023. The Company offers eligible individuals (“Fans”), through the “Royaltiz” platform accessible via the website www.royaltiz.com, a way to profit from the future success of their favorite talents (“Talents”). The Company has not yet launched operations but intends to do so within a short time after this offering is qualified by the SEC. Currently, it has incurred start-up expenses, and its income has been limited to a loan from the Company’s corporate parent. The Company intends to use the proceeds of the offering as its primary source of operating revenue going-forward.