Exhibit 96.3

TECHNICAL REPORT SUMMARY

FRAC SAND RESOURCES AND RESERVES

KERMIT AND MONAHANS MINES

Ward and Winkler Counties, Texas

Prepared For

ATLAS ENERGY SOLUTIONS, INC

Austin, Texas

By

John T. Boyd Company

Mining and Geological Consultants

Pittsburgh, Pennsylvania, USA

Report No. 3871.009

FEBRUARY 2024

| |

| John T. Boyd Company |

Mining and Geological Consultants |

| | |

Chairman James W. Boyd | February 22, 2024 File: 3871.009 |

President and CEO John T. Boyd II | |

Managing Director and COO Ronald L. Lewis | Atlas Energy Solutions, Inc 5918 W. Courtyard Drive, #500 Austin, TX 78730 |

| |

Vice Presidents Robert J. Farmer Jisheng (Jason) Han John L. Weiss Michael F. Wick William P. Wolf | Attention: | Mr. John Turner Chief Financial Officer |

Managing Director - Australia Jacques G. Steenekamp | Subject: | Technical Report Summary Frac Sand Resources and Reserves Kermit and Monahans Mines Ward and Winkler Counties, Texas |

Managing Director - China Rongjie (Jeff) Li | |

| Dear Sirs: |

Managing Director – South America | |

Carlos F. Barrera Pittsburgh 4000 Town Center Boulevard, Suite 300 Canonsburg, PA 15317 (724) 873-4400 (724) 873-4401 Fax jtboydp@jtboyd.com | This S-K 1300-compliant technical report summary provides the results of John T. Boyd Company’s (BOYD) independent estimate of the frac sand (proppant) resources and reserves for Atlas Energy Solutions, Inc.’s (Atlas) Kermit and Monahans mines as of December 31, 2023. |

Denver (303) 293-8988 jtboydd@jtboyd.com Brisbane 61 7 3232-5000 jtboydau@jtboyd.com Beijing 86 10 6500-5854 jtboydcn@jtboyd.com Bogota +57-3115382113 jtboydcol@jtboyd.com www.jtboyd.com | We wish to acknowledge the cooperation of Atlas’s management and staff for providing the technical, financial, and legal information used in completing this project. Our findings are based on BOYD’s extensive experience in preparing frac sand resource and reserve estimates used in US Securities and Exchange Commission (SEC) filings, and our knowledge of frac sand mining in Texas and throughout North America. Respectfully submitted, JOHN T. BOYD COMPANY By:

John T. Boyd II President and CEO |

TABLE OF CONTENTS

| | | | |

| | | | Page |

| | | | |

LETTER OF TRANSMITTAL | |

| | |

TABLE OF CONTENTS | |

| | |

GLOSSARY AND ABBREVIATIONS | |

| | |

1.0 | EXECUTIVE SUMMARY | 1-1 |

| 1.1 | Introduction | 1-1 |

| 1.2 | Property Description and Control | 1-2 |

| 1.3 | Geology | 1-2 |

| 1.4 | Exploration | 1-5 |

| 1.5 | Frac Sand Reserves and Quality | 1-6 |

| 1.6 | Operations | 1-8 |

| | 1.6.1 | Mining | 1-8 |

| | 1.6.2 | Processing | 1-9 |

| | 1.6.3 | Infrastructure | 1-9 |

| 1.7 | Financial Analysis | 1-10 |

| | 1.7.1 | Market Analysis | 1-10 |

| | 1.7.2 | Sales, Production, and Cost Forecast | 1-11 |

| | 1.7.3 | Economic Analysis | 1-13 |

| 1.8 | Permitting and Compliance | 1-15 |

| 1.9 | Conclusions | 1-15 |

| | | | |

2.0 | INTRODUCTION | 2-1 |

| 2.1 | Registrant | 2-1 |

| 2.2 | Purpose and Terms of Reference | 2-1 |

| 2.3 | Expert Qualifications | 2-2 |

| 2.4 | Principal Sources of Information | 2-2 |

| | 2.4.1 | Personal Inspections | 2-3 |

| | 2.4.2 | Reliance on Information Provided by the Registrant | 2-4 |

| | 2.4.3 | Verification of Information | 2-4 |

| | 2.4.4 | Other Relevant Data and Information | 2-4 |

| 2.5 | Report Version | 2-5 |

| 2.6 | Units of Measure | 2-5 |

| | | | |

3.0 | PROPERTY OVERVIEW | 3-1 |

| 3.1 | Description and Location | 3-1 |

| | 3.1.1 | Kermit Mines | 3-1 |

| | 3.1.2 | Monahans Mine | 3-1 |

| 3.2 | History | 3-3 |

| 3.3 | Property Control | 3-3 |

| | 3.3.1 | Kermit Property | 3-5 |

| | 3.3.2 | Monahans Property | 3-5 |

TABLE OF CONTENTS - Continued

| | | | |

| | | | Page |

| | | | |

| 3.4 | Adjacent Properties | 3-5 |

| 3.5 | Regulation and Liabilities | 3-5 |

| 3.6 | Accessibility, Local Resources, and Infrastructure | 3-5 |

| | 3.6.1 | Kermit Property | 3-5 |

| | 3.6.2 | Monahans Property | 3-6 |

| 3.7 | Physiography | 3-6 |

| 3.8 | Climate | 3-7 |

| | | | |

4.0 | GEOLOGY | 4-1 |

| 4.1 | Regional Geology | 4-1 |

| 4.2 | Property Stratigraphy | 4-1 |

| | 4.2.1 | General Stratigraphy | 4-1 |

| | 4.2.2 | Structural Geology | 4-2 |

| | 4.2.3 | Frac Sand Geology | 4-3 |

| | | | |

5.0 | EXPLORATION DATA | 5-1 |

| 5.1 | Background | 5-1 |

| 5.2 | Exploration Procedures | 5-2 |

| | 5.2.1 | Drilling, Sampling, and Sample Security | 5-2 |

| | 5.2.2 | Frac Sand Testing | 5-4 |

| | 5.2.3 | Other Exploration Methods | 5-5 |

| 5.3 | Laboratory Testing Results | 5-6 |

| | 5.3.1 | Frac Sand Testing Overview | 5-6 |

| | 5.3.2 | Quality Summary | 5-11 |

| 5.4 | Data Verification | 5-12 |

| 5.5 | Adequacy of Exploration and Sampling Data | 5-12 |

| | | | |

6.0 | FRAC SAND RESOURCES AND RESERVES | 6-1 |

| 6.1 | Applicable Standards and Definitions | 6-1 |

| 6.2 | Frac Sand Resources | 6-2 |

| | 6.2.1 | Methodology | 6-2 |

| | 6.2.2 | Classification | 6-6 |

| | 6.2.3 | Estimation Criteria | 6-6 |

| | 6.2.4 | Frac Sand Exploration Results Areas | 6-7 |

| | 6.2.5 | Frac Sand Resource Estimates | 6-8 |

| | 6.2.6 | Validation | 6-8 |

| 6.3 | Frac Sand Reserves | 6-9 |

| | 6.3.1 | Methodology | 6-9 |

| | 6.3.2 | Classification | 6-9 |

| | 6.3.3 | Frac Sand Reserve Estimates | 6-9 |

| | 6.3.4 | Significant Risks and Uncertainties | 6-11 |

| | 6.3.5 | Reconciliation with Previous Estimates | 6-11 |

| | | | |

TABLE OF CONTENTS - Continued

| | | | |

| | | | Page |

| | | | |

7.0 | MINING OPERATIONS | 7-1 |

| 7.1 | Mining Method | 7-1 |

| 7.2 | Mine Schedule and Equipment | 7-1 |

| 7.3 | Mine Historical and Forecast Production | 7-2 |

| | 7.3.1 | Historical Mine Production | 7-2 |

| | 7.3.2 | Forecasted Production | 7-2 |

| 7.4 | Mine Plan (Life-of-Mine) | 7-3 |

| | 7.4.1 | Kermit Mines | 7-3 |

| | 7.4.2 | Monahans Mine | 7-3 |

| | 7.4.3 | Mining Risk | 7-6 |

| | | | |

8.0 | PROCESSING OPERATIONS | 8-1 |

| 8.1 | Overview | 8-1 |

| 8.2 | Wet Process Plants | 8-2 |

| 8.3 | Dry Process Plants | 8-2 |

| 8.4 | Product Storage/Truck Loadouts | 8-3 |

| | | | |

9.0 | MINE INFRASTRUCTURE | 9-1 |

| 9.1 | Overview | 9-1 |

| 9.2 | Transportation | 9-1 |

| 9.3 | Utilities (Power and Natural Gas) | 9-1 |

| 9.4 | Process Water | 9-1 |

| 9.5 | Tailings Disposal | 9-2 |

| 9.6 | Other Infrastructure | 9-2 |

| | | | |

10.0 | MARKET ANALYSIS | 10-1 |

| | | | |

11.0 | CAPITAL, REVENUES, AND OPERATING COSTS | 11-1 |

| 11.1 | Introduction | 11-1 |

| 11.2 | Kermit Mines | 11-1 |

| | 11.2.1 | Historical Capital Expenditures | 11-1 |

| | 11.2.2 | Historical Revenues and Sales | 11-1 |

| | 11.2.3 | Historical Cost of Production | 11-2 |

| | 11.2.4 | Projected Production, Sales, and Costs | 11-2 |

| 11.3 | Monahans Mine | 11-3 |

| | 11.3.1 | Historical Capital Expenditures | 11-3 |

| | 11.3.2 | Historical Revenues and Sales | 11-3 |

| | 11.3.3 | Historical Cash Operating Costs | 11-4 |

| | 11.3.4 | Projected Production, Sales, and Costs | 11-4 |

| | | | |

12.0 | ECONOMIC ANALYSIS | 12-1 |

| 12.1 | Introduction | 12-1 |

| 12.2 | Kermit Mines | 12-2 |

| | 12.2.1 | Economic Analysis | 12-2 |

| | 12.2.2 | Cash Flow Analysis | 12-2 |

| | 12.2.3 | Sensitivity Analyses | 12-4 |

| 12.3 | Monahans Mine | 12-5 |

| | 12.3.1 | Economic Analysis | 12-5 |

| | 12.3.2 | Cash Flow Analysis | 12-5 |

TABLE OF CONTENTS - Continued

| | | | |

| | | | Page |

| | | | |

| | 12.3.3 | Sensitivity Analyses | 12-7 |

| | | | |

13.0 | PERMITTING AND COMPLIANCE | 13-1 |

| 13.1 | Permitting Requirements and Status | 13-1 |

| 13.2 | Environmental Studies | 13-1 |

| 13.3 | Waste Disposal and Water Management | 13-2 |

| 13.4 | Compliance | 13-2 |

| 13.5 | Plans, Negotiations, or Agreements | 13-2 |

| 13.6 | Post-Mining Land Use and Reclamation | 13-2 |

| 13.7 | Local Procurement and Hiring | 13-3 |

| | | | |

14.0 | INTERPRETATION AND CONCLUSIONS | 14-1 |

| 14.1 | Findings | 14-1 |

| 14.2 | Significant Risks and Uncertainties | 14-1 |

| 14.3 | Recommendations | 14-2 |

TABLE OF CONTENTS - Continued

| | | |

| | | Page |

List of Tables | | |

1.1 | Kermit and Monahans Drilling Campaign Summary | 1-5 |

1.2 | Atlas Energy Solutions Reserves (As of December 31, 2023) | 1-7 |

1.3 | Atlas Energy Solutions Resources (As of December 31, 2023) | 1-7 |

1.4 | Proppant Characteristic Test Results for Kermit and Monahans Mines | 1-8 |

1.5 | Kermit Mines’ Sales Projections | 1-12 |

1.6 | Kermit Mines’ Annual Cash Cost of Production Projections | 1-12 |

1.7 | Monahans Mine’s Sales Projections | 1-12 |

1.8 | Monahans Mine’s Annual Cash Cost of Production Projections | 1-13 |

1.9 | Kermit Mines’ Five-Year Cash Flow Summary | 1-13 |

1.10 | Kermit Mines’ DCF-NPV Analysis | 1-14 |

1.11 | Monahans Mine’s Five-Year Cash Flow Summary | 1-14 |

1.12 | Monahans Mine’s DCF-NPV Analysis | 1-14 |

5.1 | Kermit and Monahans Drilling Campaign Summary | 5-4 |

5.2 | Particle Size Distribution | 5-6 |

5.3 | Proppant Characteristic Test Results for Kermit and Monahans Mines | 5-12 |

6.1 | Kermit and Monahans Frac Sand Resource Classification Criteria | 6-6 |

6.2 | Exploration Results Area Deposit Characteristics, Monahans Property | 6-8 |

6.3 | In-Place Frac Sand Resources as of December 31, 2023 | 6-8 |

6.4 | Frac Sand Reserves as of December 31, 2023 | 6-10 |

7.1 | Historic ROM Sand Production (000 tons) | 7-2 |

7.2 | Forecasted ROM Sand Production (000 tons) | 7-2 |

11.1 | Kermit Mines’ Historical Capital Expenditures | 11-1 |

11.2 | Kermit Mines’ Historical Sales | 11-1 |

11.3 | Kermit Mines’ Historical Cost of Production | 11-2 |

11.4 | Kermit Mines’ Sales Projections | 11-2 |

11.5 | Kermit Mines’ Cash Cost of Production Projection | 11-3 |

11.6 | Monahans Mine’s Historical Capital Expenditures | 11-3 |

11.7 | Monahans Mine’s Historical Sales | 11-3 |

11.8 | Monahans Mine’s Historical Cost of Production | 11-4 |

11.9 | Monahans Mine’s Sales Projections | 11-4 |

11.10 | Monahans Mine’s Cash Cost of Production Projections | 11-5 |

12.1 | Kermit Mines’ Five-Year Cash Flow Summary | 12-2 |

12.2 | Kermit Mines’ DCF-NPV Analysis | 12-2 |

12.3 | Pre-Tax And After-Tax Cash Flow Analysis, Kermit Mines | 12-3 |

12.4 | Price Adjustments for Sensitivity Analysis | 12-4 |

12.5 | Sensitivity of Kermit Mines’ After-Tax DCF-NPV at 10% | 12-4 |

12.6 | Monahans Mine’s Five-Year Cash Flow Summary | 12-5 |

12.7 | Monahans Mine’s DCF-NPV Analysis | 12-5 |

12.8 | Pre-Tax And After-Tax Cash Flow Analysis, Monahans Mine | 12-6 |

12.9 | Price Adjustments for Sensitivity Analysis | 12-7 |

12.10 | Sensitivity of Monahans Mine’s After-Tax DCF-NPV at 10% | 12-7 |

13.1 | Permit/Registration Summary | 13-1 |

TABLE OF CONTENTS - Continued

| | | |

| | | Page |

List of Figures | | |

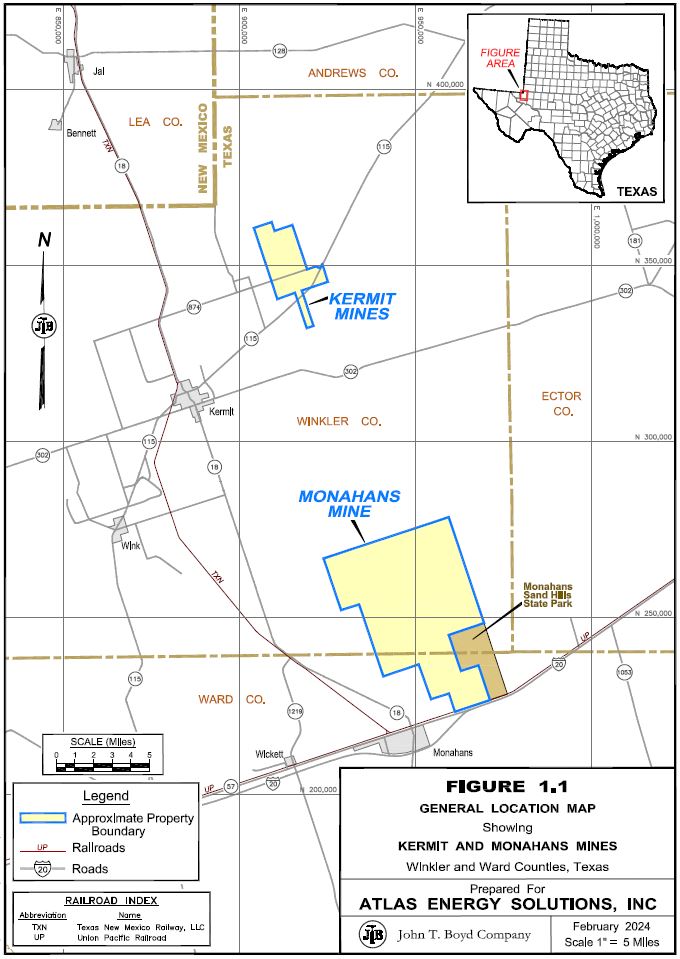

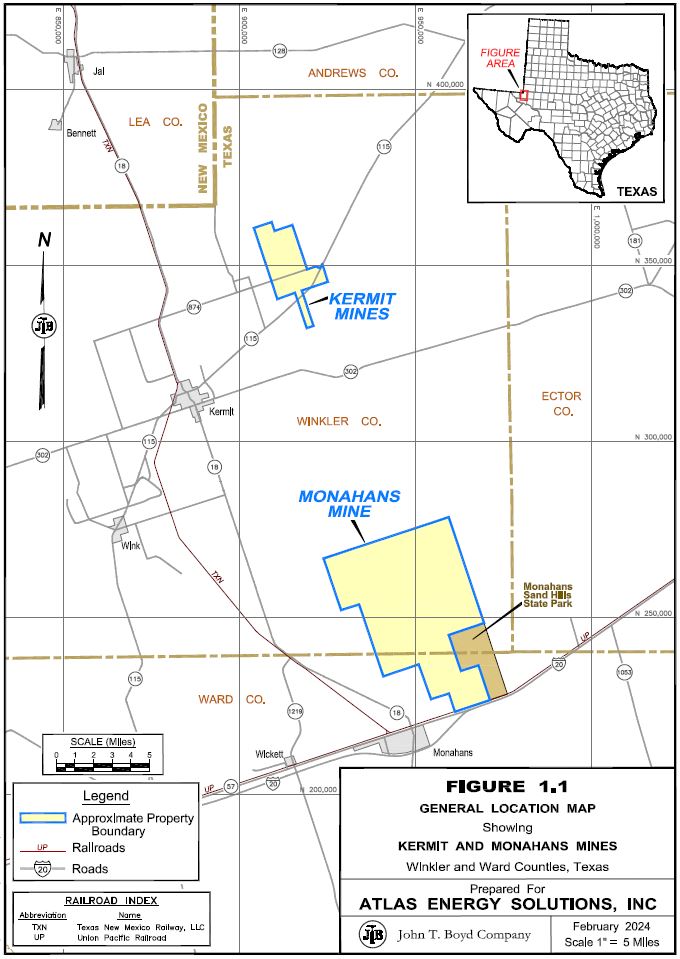

1.1 | General Location Map Showing Kermit and Monahans Mines | 1-4 |

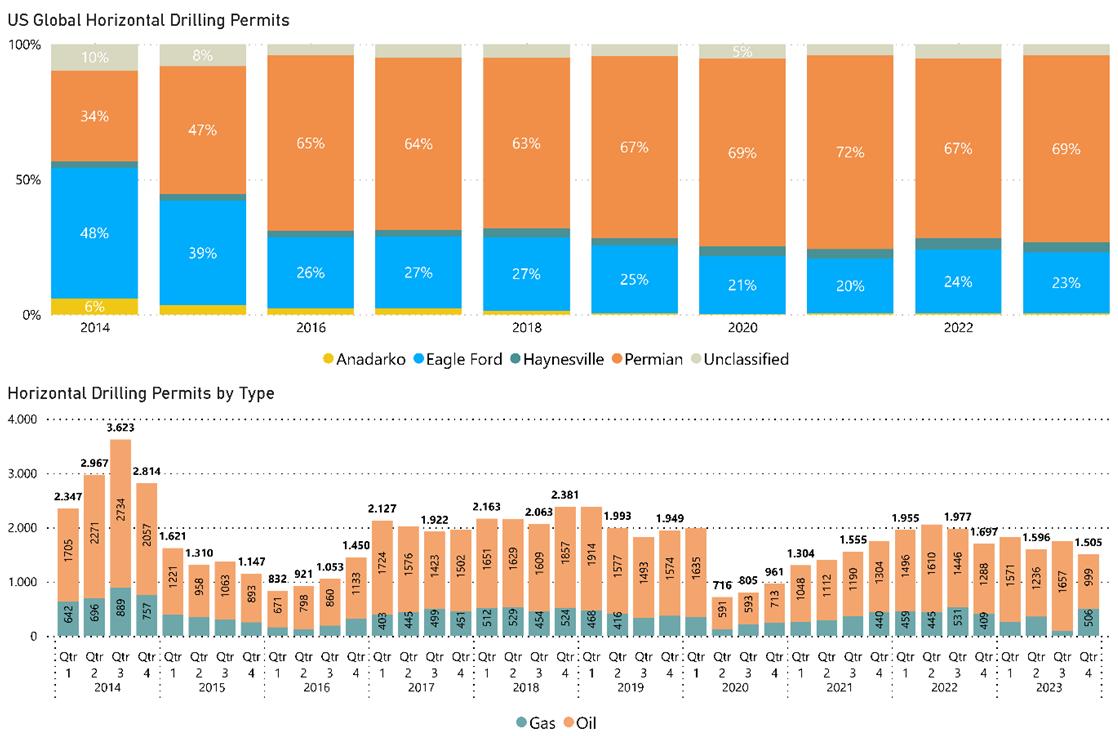

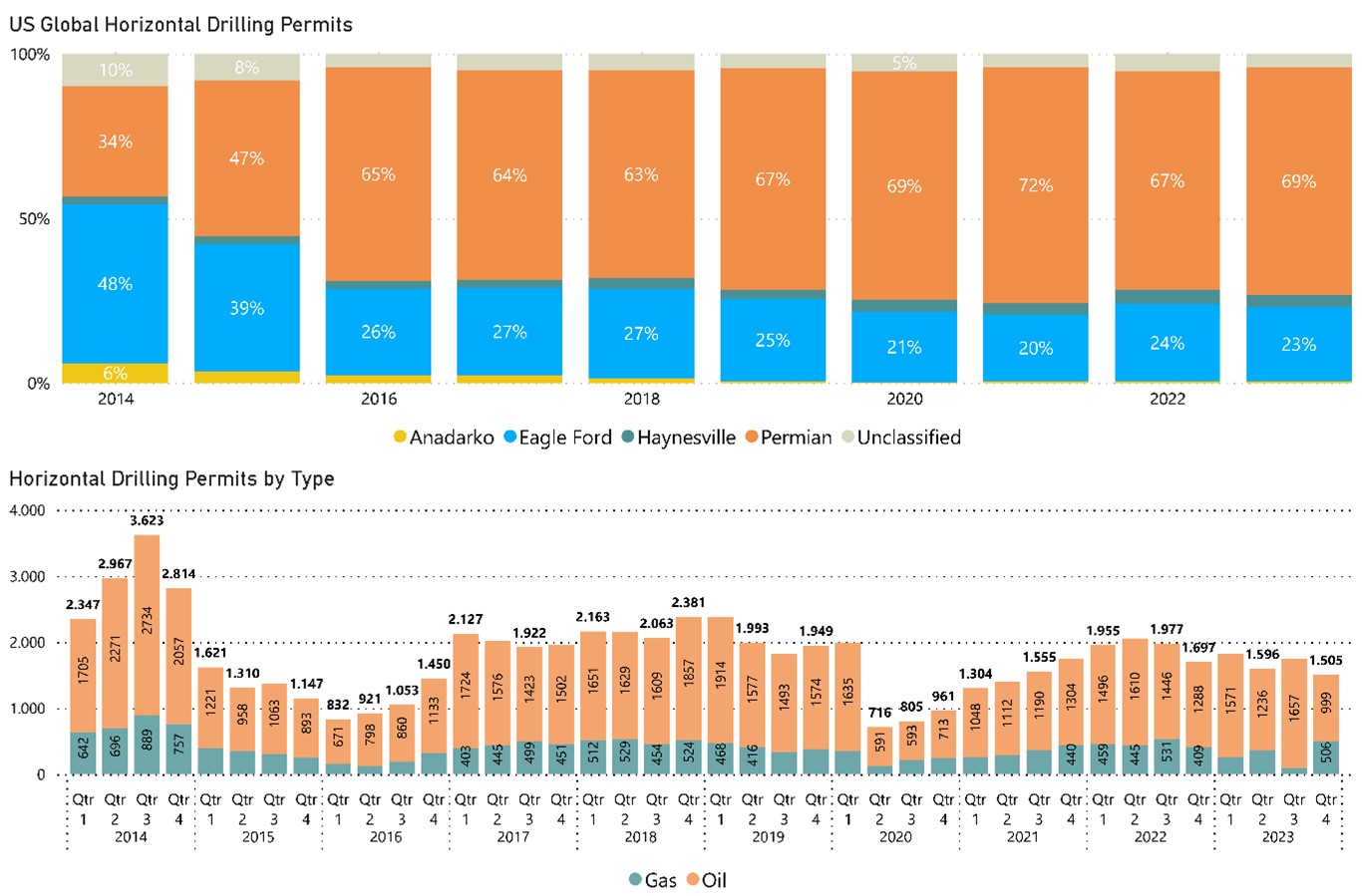

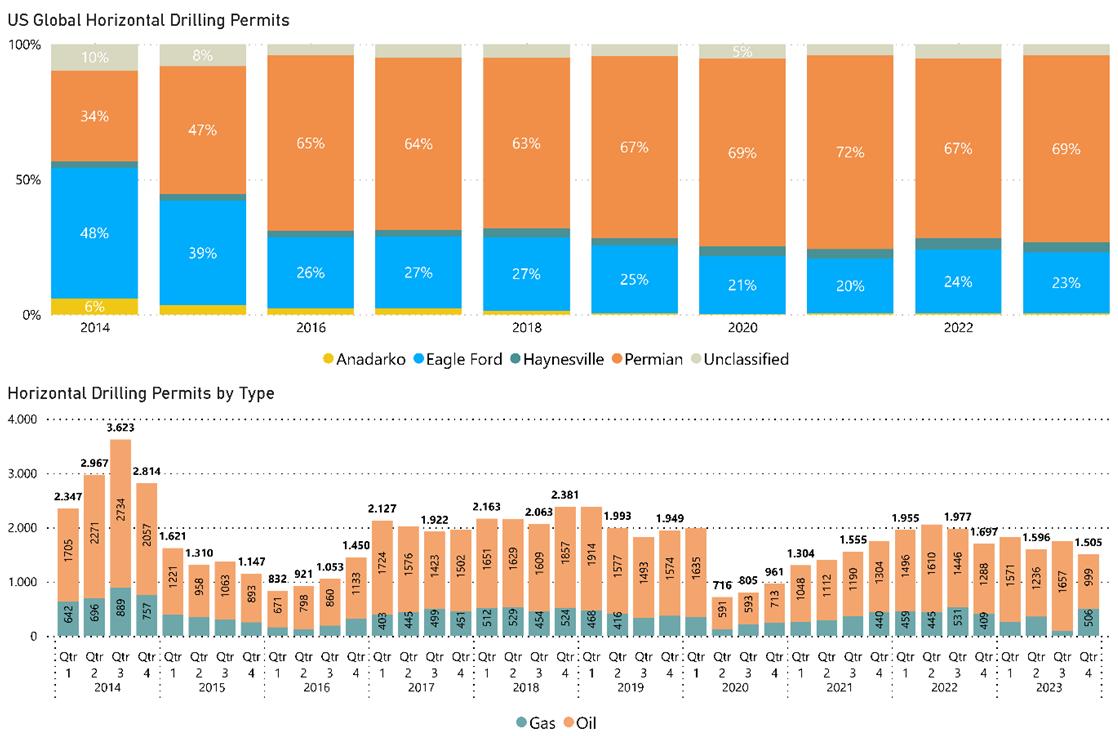

1.2 | Permian Basin HZ Permit Submissions | 1-10 |

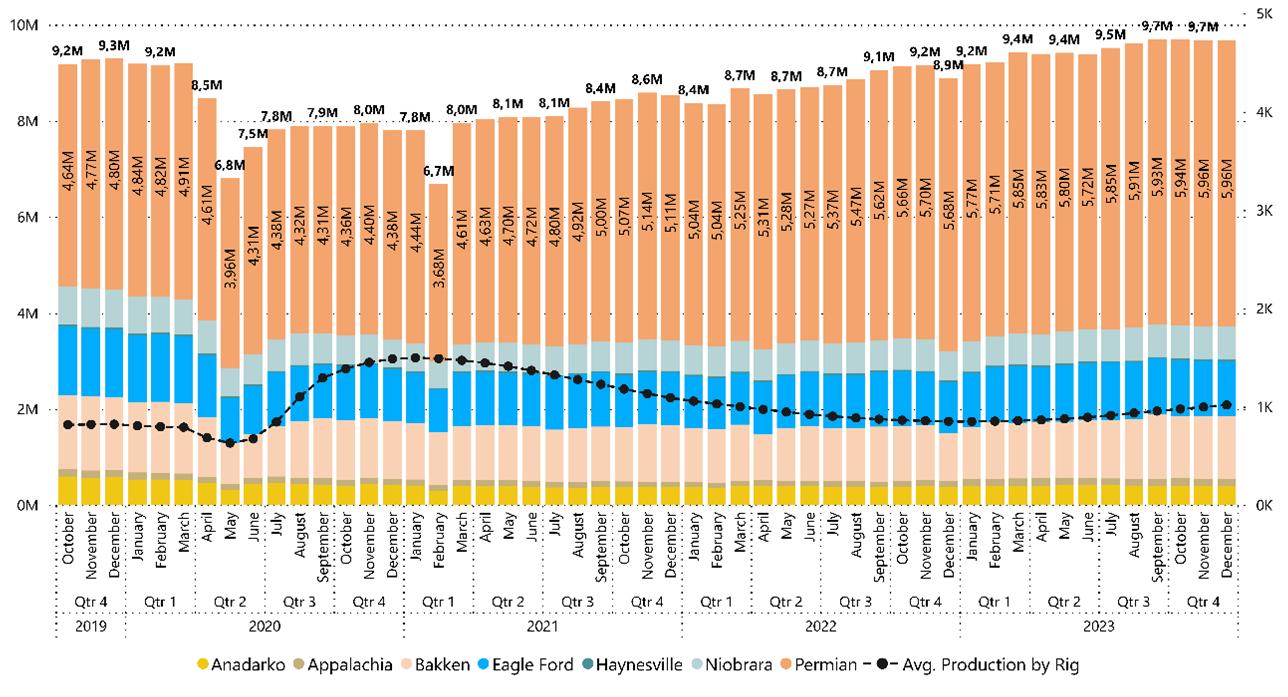

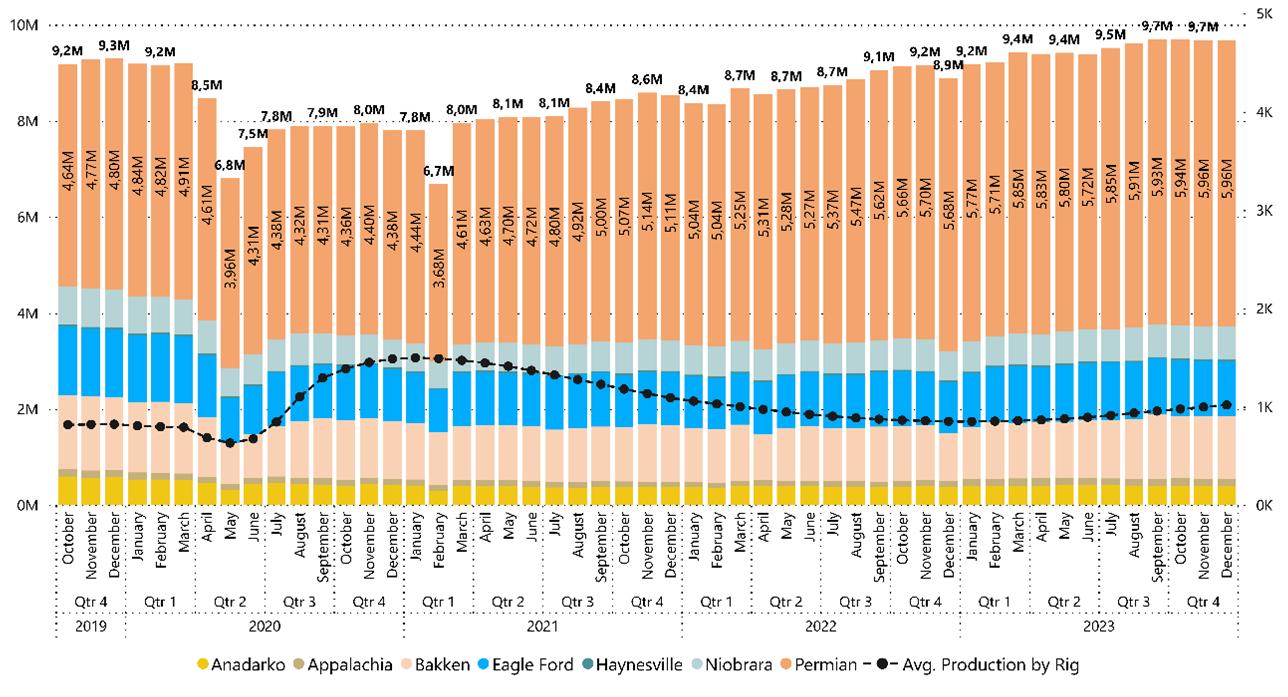

1.3 | Oil Production (bbl/d) | 1-11 |

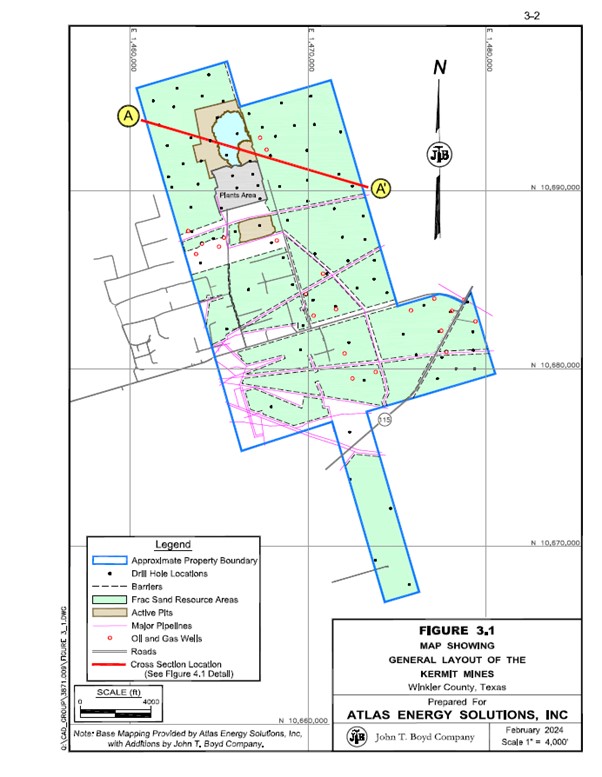

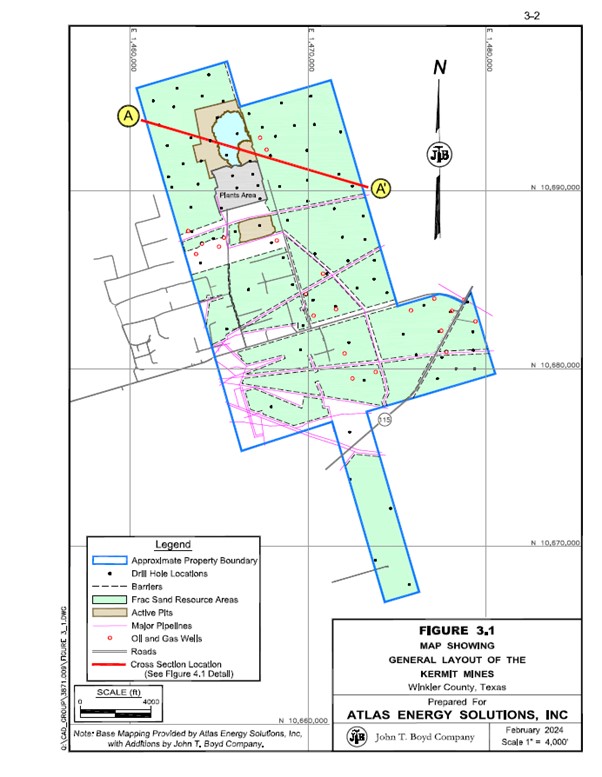

3.1 | Map Showing General Layout of the Kermit Mines | 3-2 |

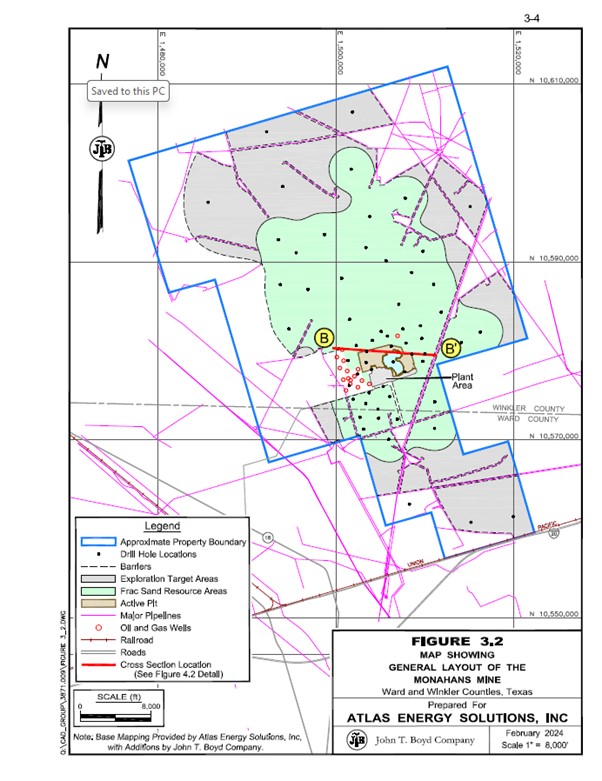

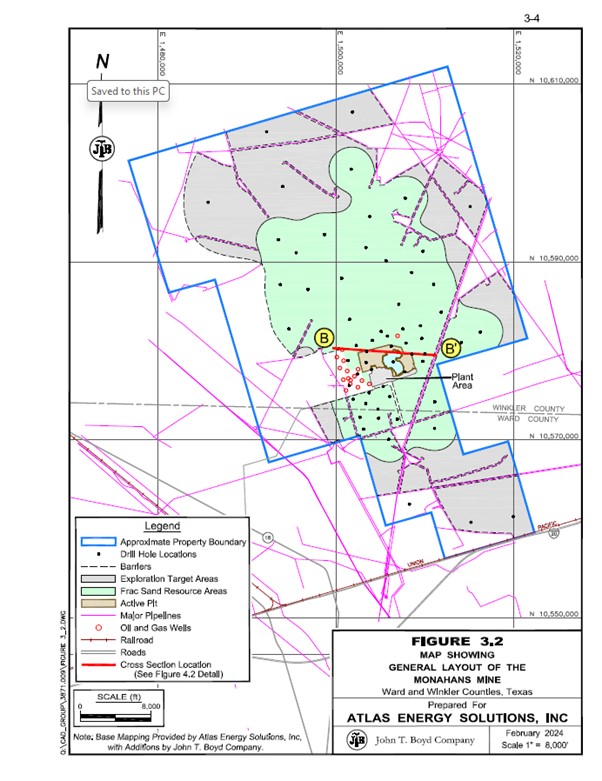

3.2 | Map Showing General Layout of the Monahans Mine | 3-4 |

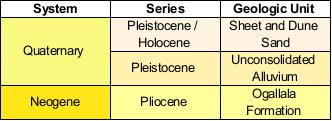

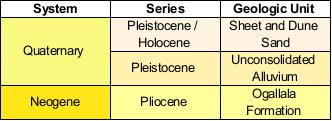

4.1 | Generalized Stratigraphic Chart, Surficial Deposits of Ward and Winkler Counties, TX | 4-2 |

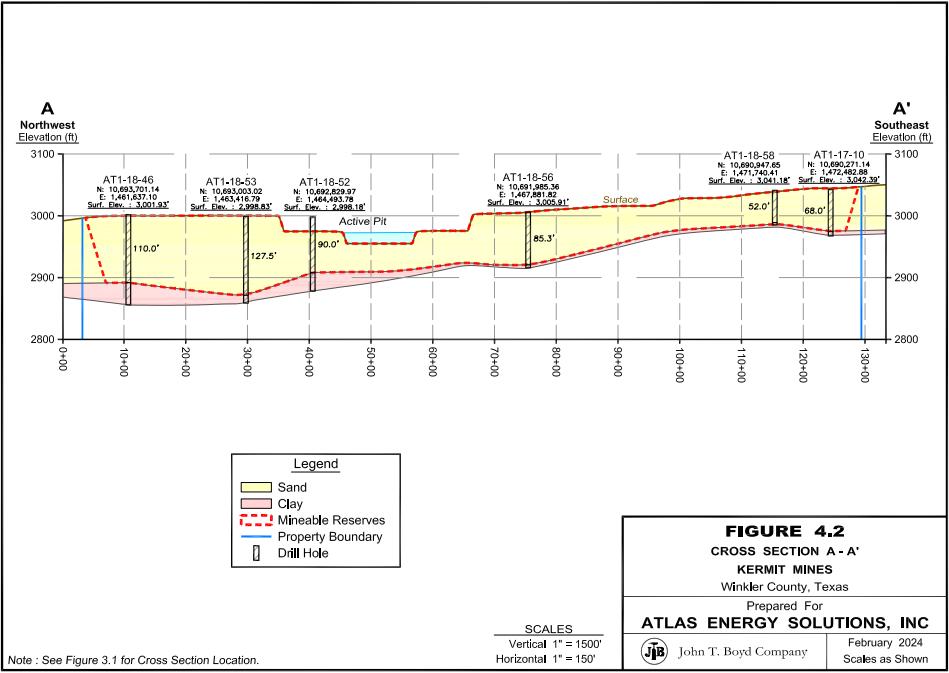

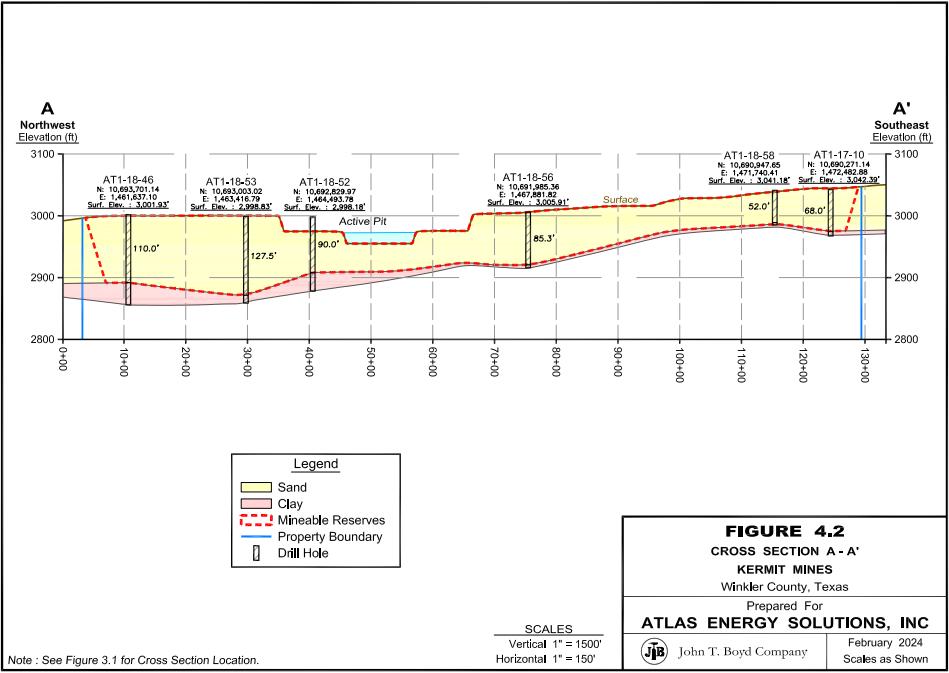

4.2 | Cross Section A-A’, Kermit Mines | 4-3 |

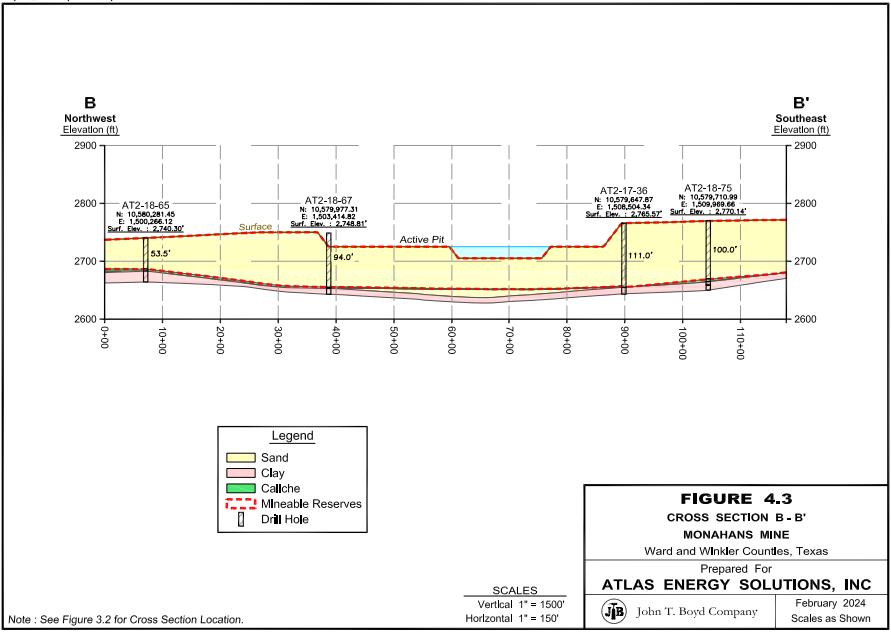

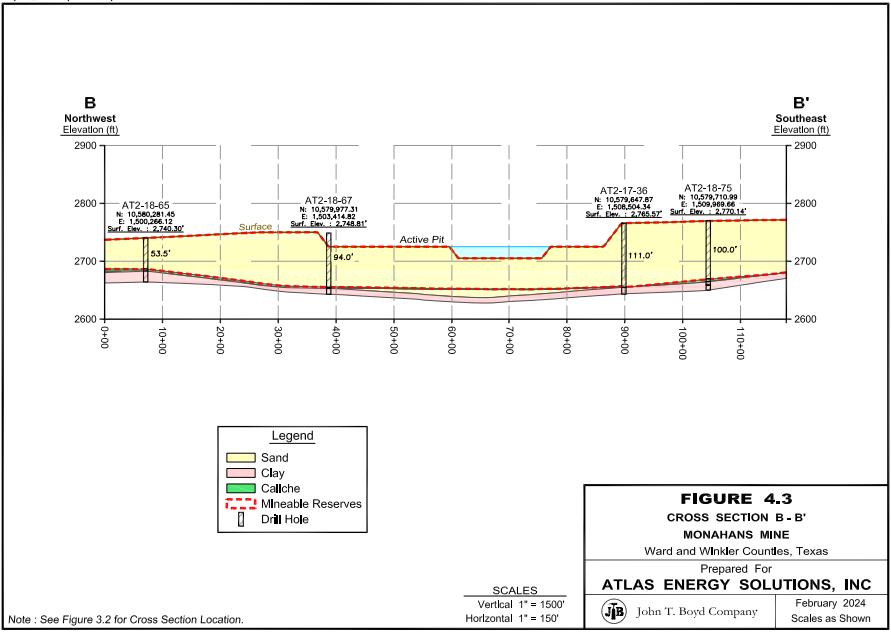

4.3 | Cross Section B-B’, Monahans Mine | 4-4 |

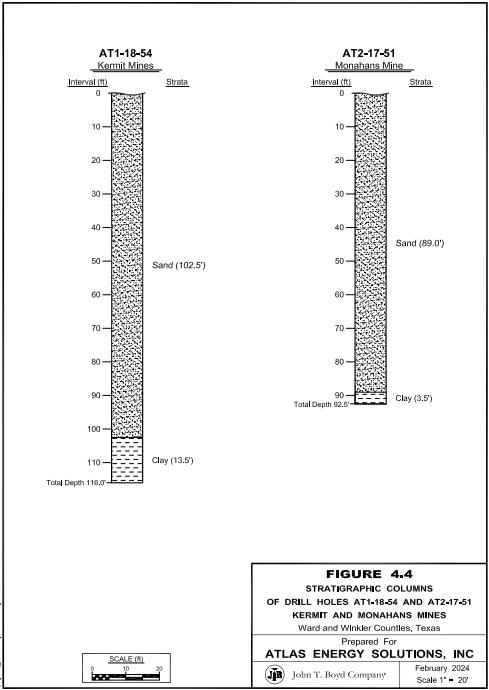

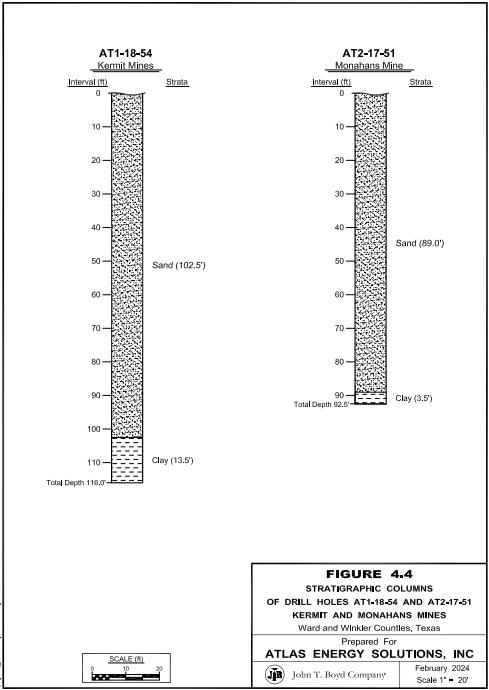

4.4 | Stratigraphic Columns of Drill Holes AT1-18-54 and AT2-17-51 Kermit and

Monahans Mines | 4-5 |

5.1 | Drill Hole Sand Sample | 5-3 |

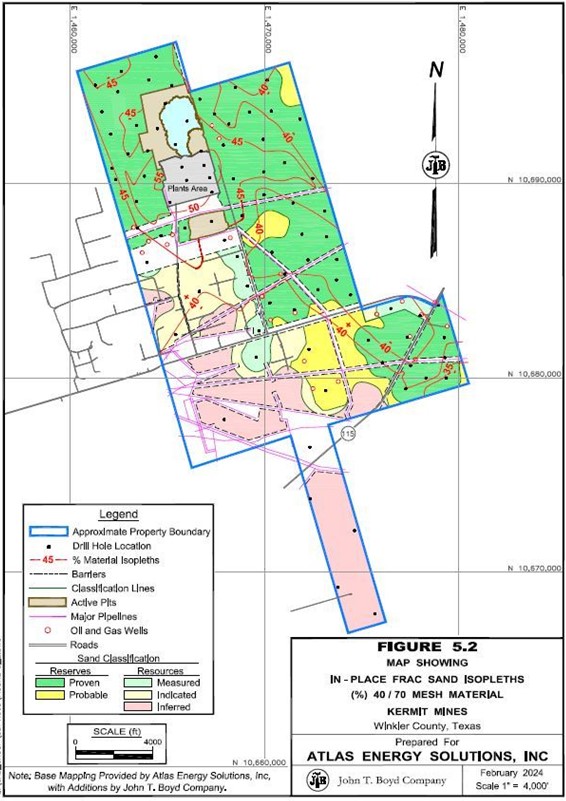

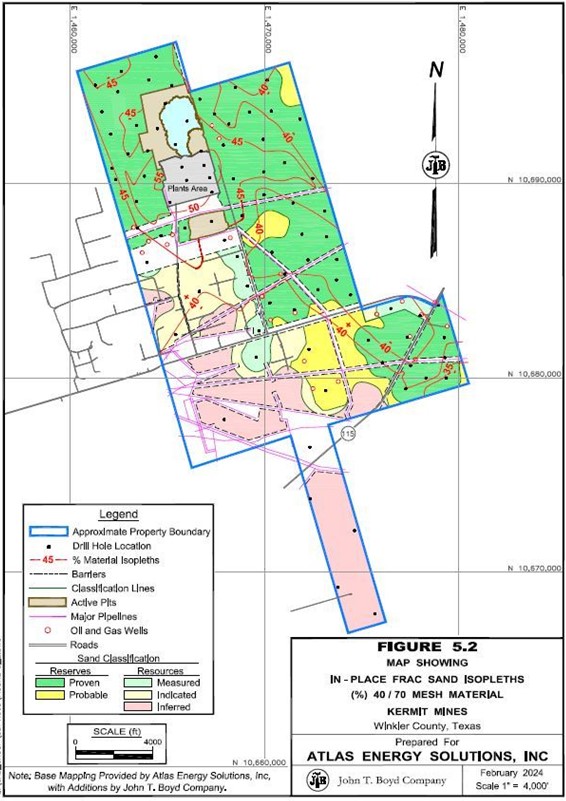

5.2 | Map Showing In-Place Frac Sand Isopleths (%) 40/70 Mesh Material Kermit Mines | 5-7 |

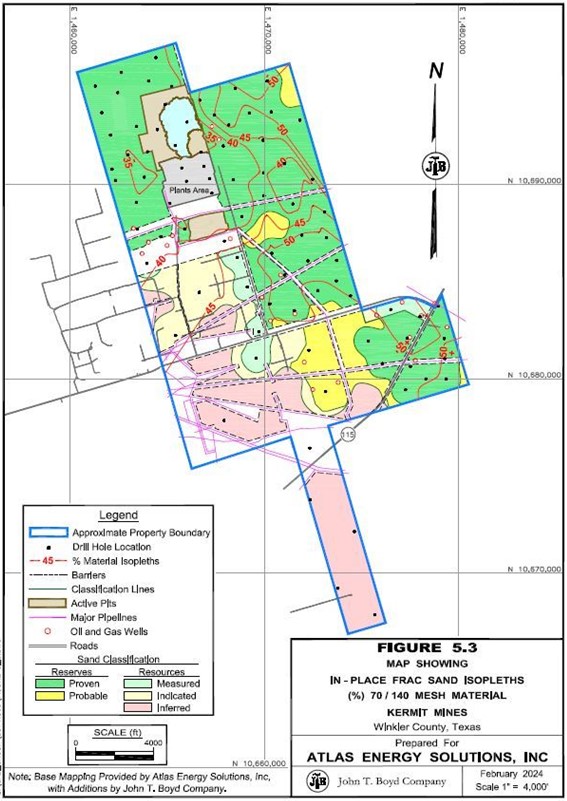

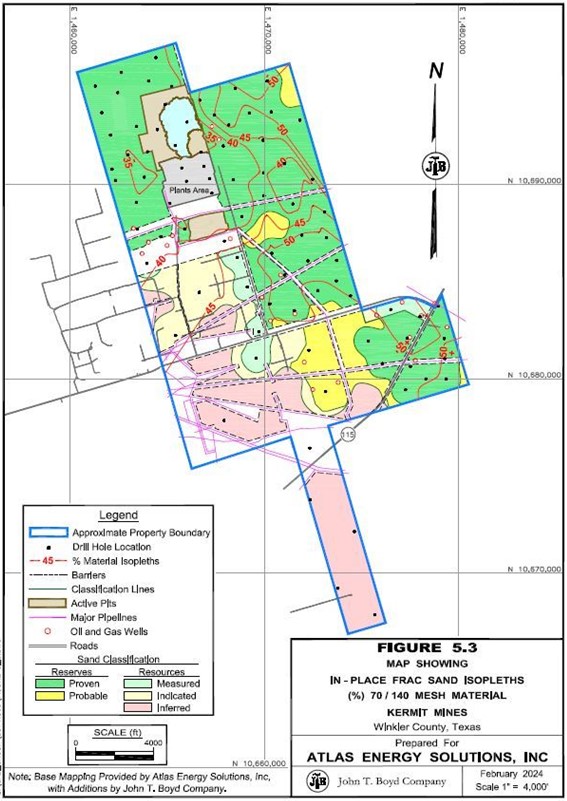

5.3 | Map Showing In-Place Frac Sand Isopleths (%) 70/140 Mesh Material

Kermit Mines | 5-8 |

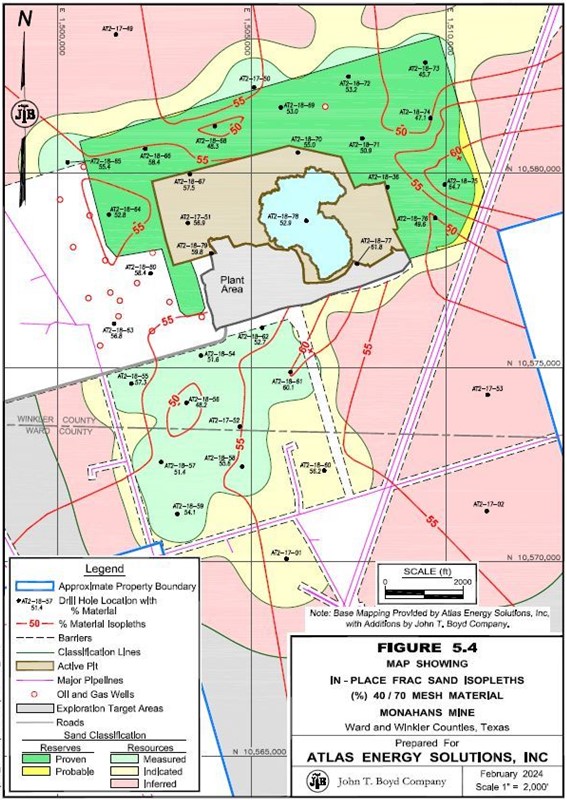

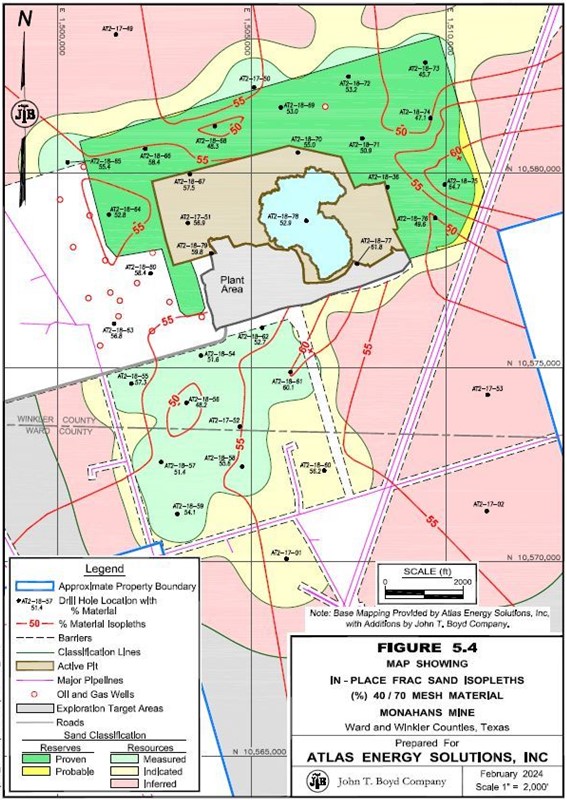

5.4 | Map Showing In-Place Frac Sand Isopleths (%) 40/70 Mesh Material Monahans Mine | 5-9 |

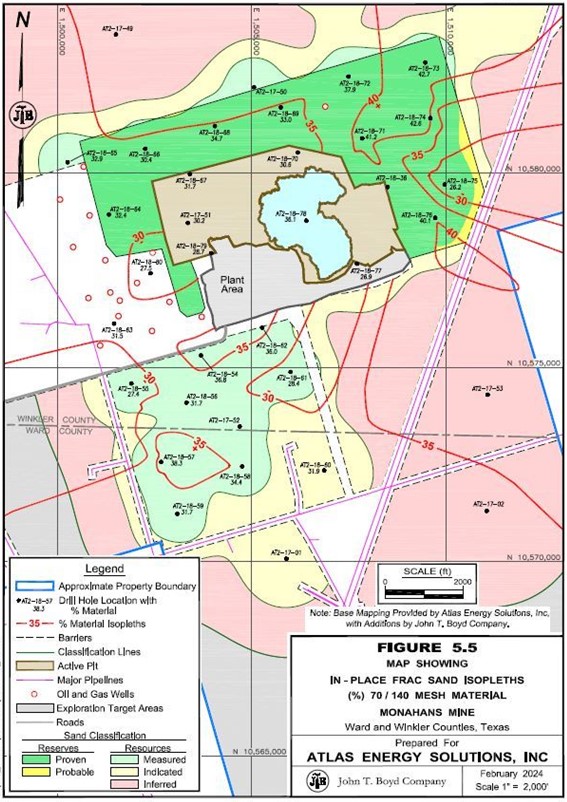

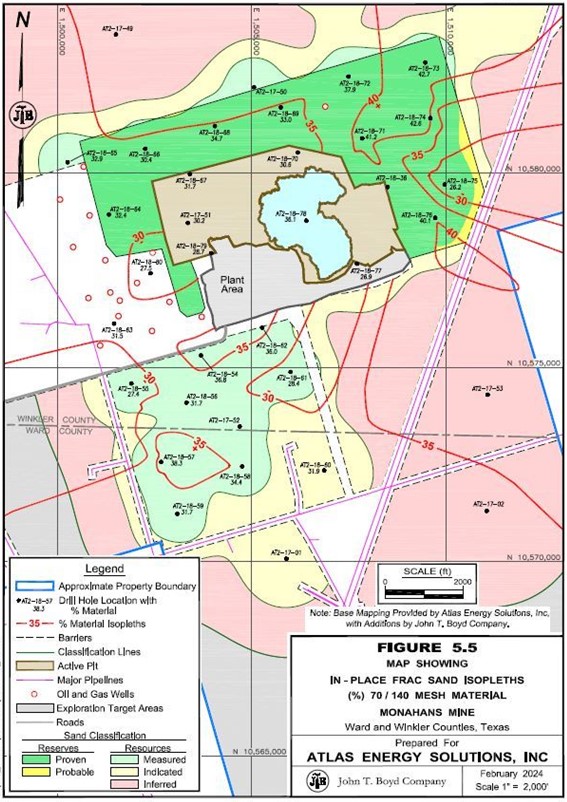

5.5 | Map Showing In-Place Frac Sand Isopleths (%) 70/140 Mesh Material Monahans Mine | 5-10 |

6.1 | Relationship Between Frac Sand Resources and Frac Sand Reserves | 6-2 |

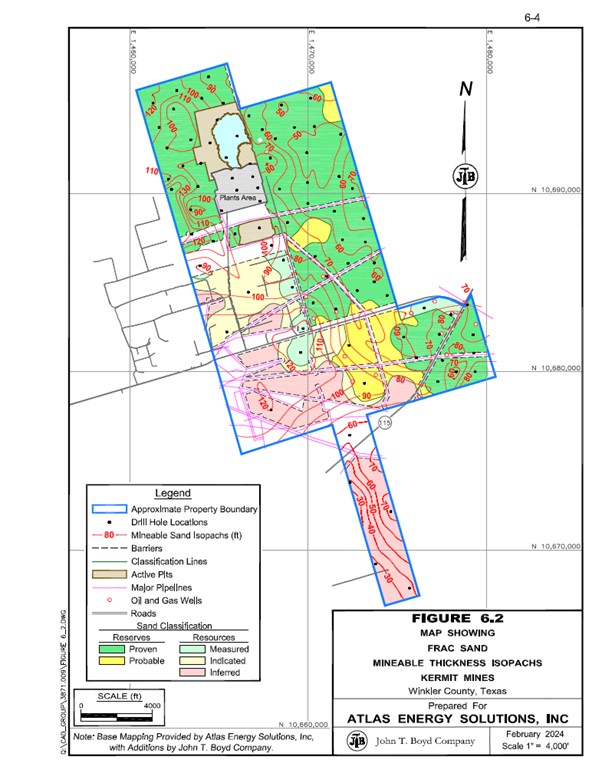

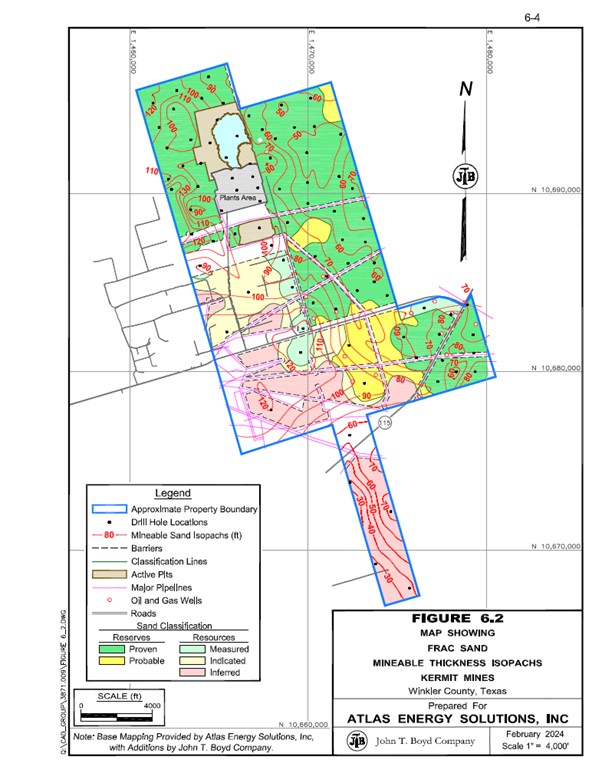

6.2 | Map Showing Frac Sand Mineable Thickness Isopachs, Kermit Mines | 6-4 |

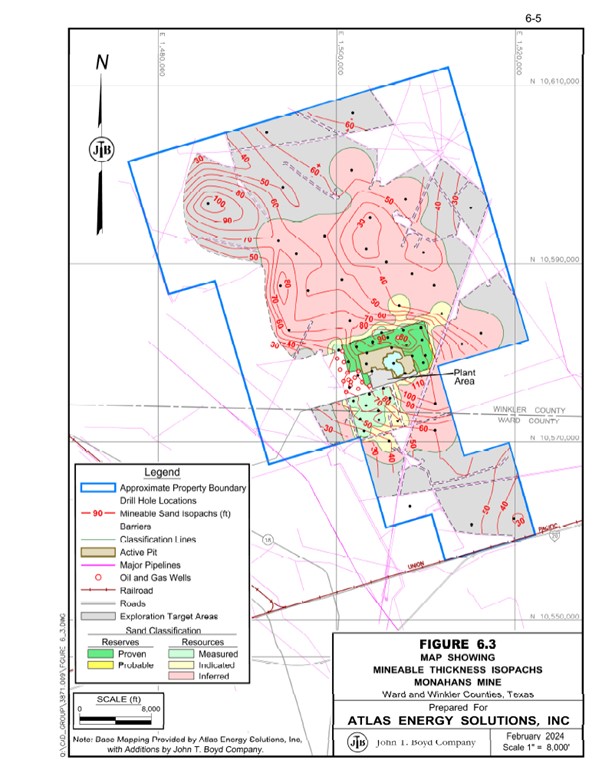

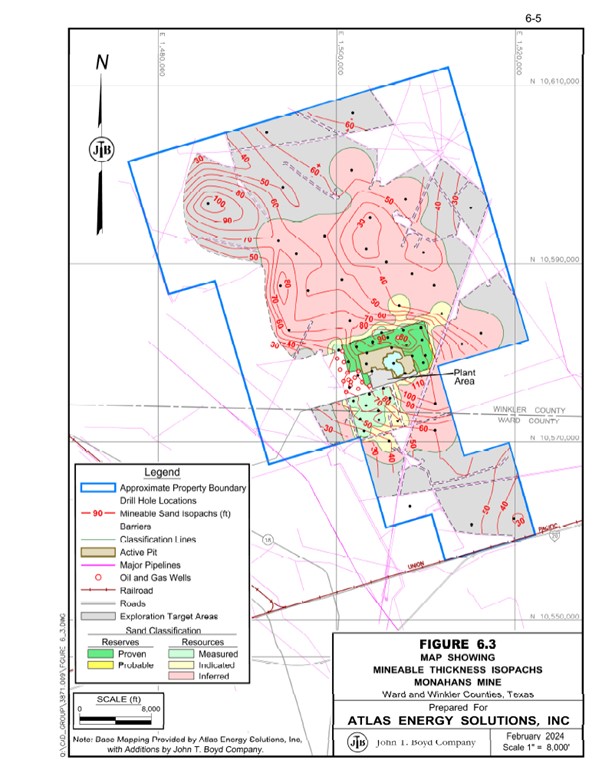

6.3 | Map Showing Frac Sand Mineable Thickness Isopachs, Monahans Mine | 6-5 |

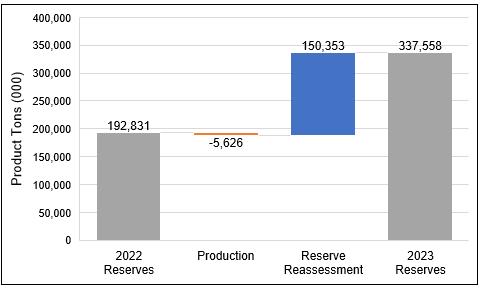

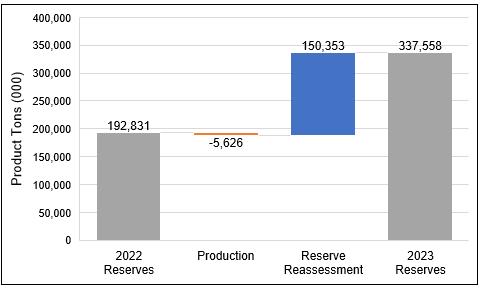

6.4 | Kermit Reconciliation with Previous Frac Sand Reserves Estimate | 6-11 |

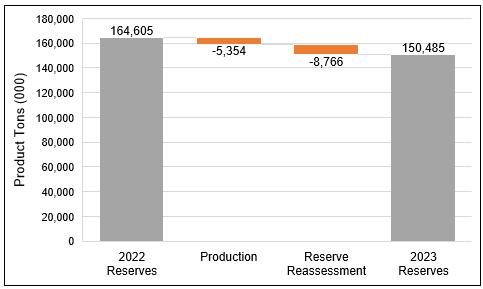

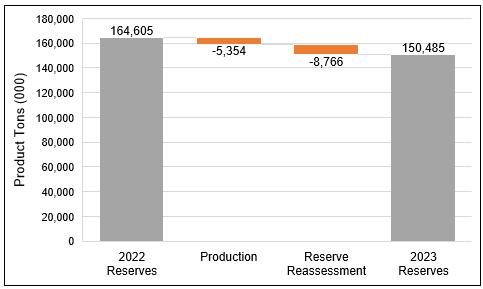

6.5 | Monahans Reconciliation with Previous Frac Sand Reserves Estimate | 6-12 |

7.1 | Kermit Mines’ Dredge Pond | 7-1 |

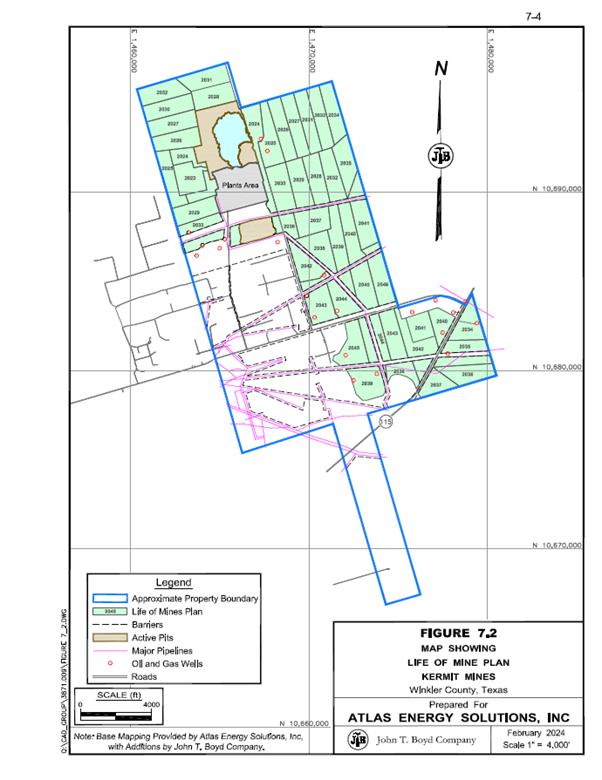

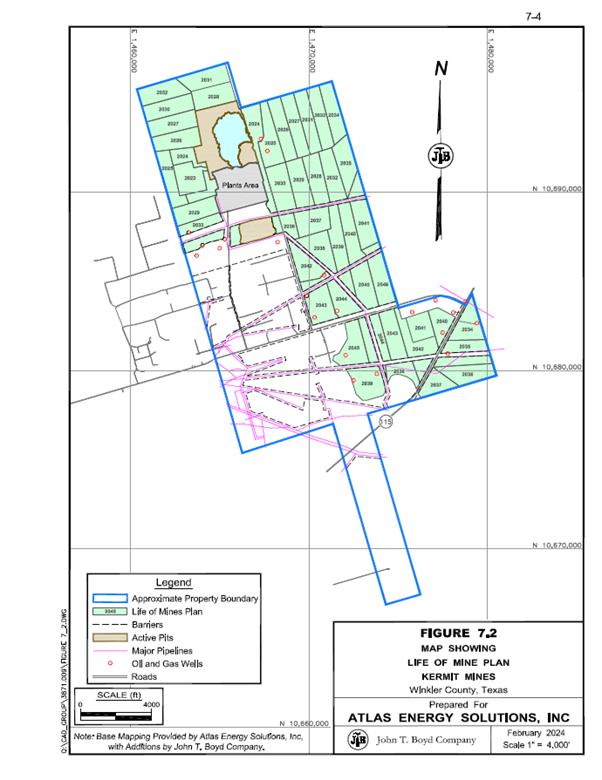

7.2 | Map Showing Life of Mine Plan Kermit Mines | 7-4 |

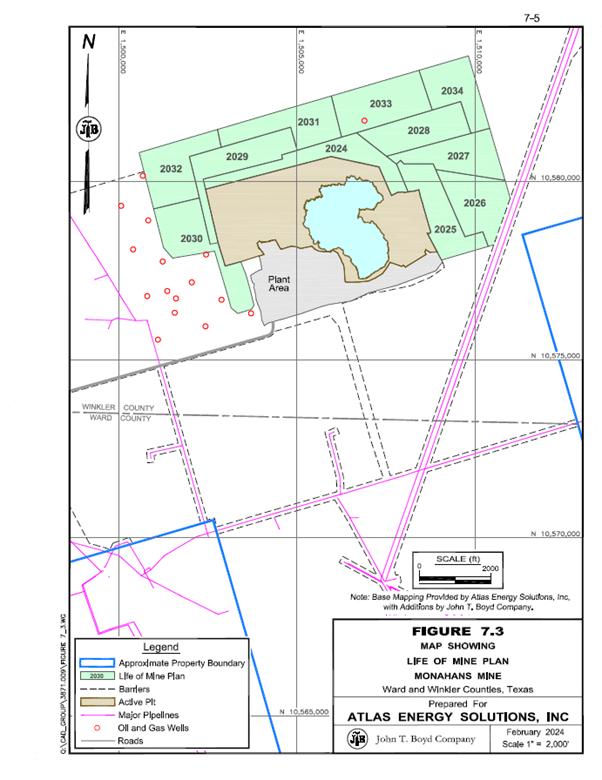

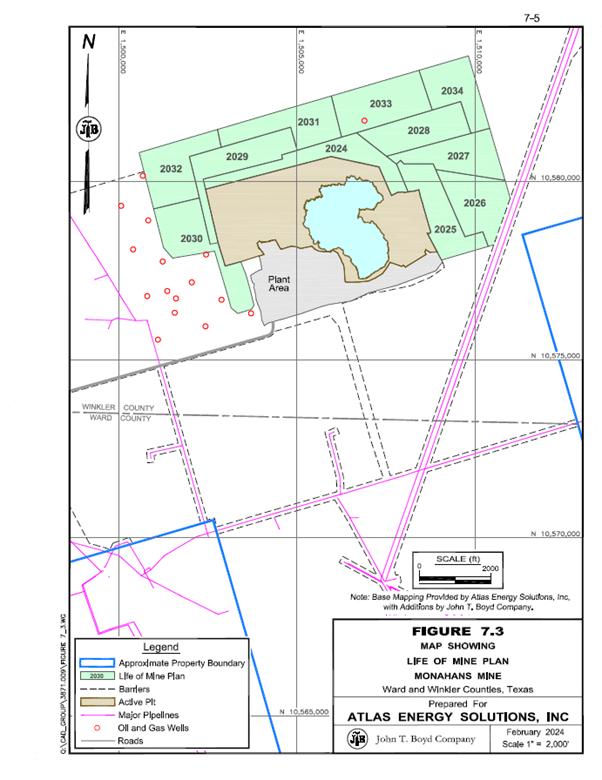

7.3 | Map Showing Life of Mine Plan Monahans Mine | 7-5 |

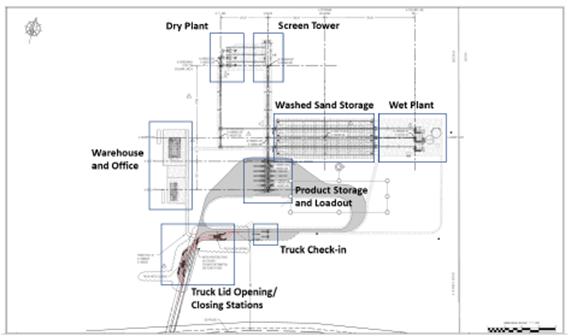

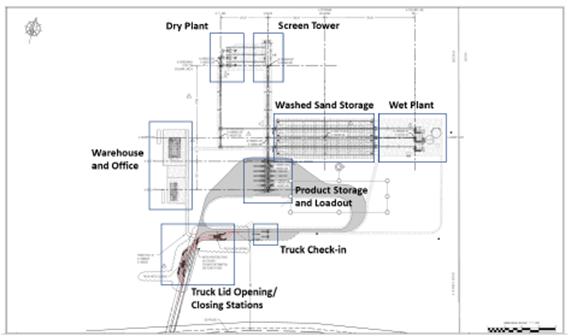

8.1 | General Arrangement Layout of Atlas Processing Plants | 8-2 |

8.2 | Kermit Plant with Capacity Expansion | 8-3 |

8.3 | Monahans Plant with Truck Loadouts | 8-4 |

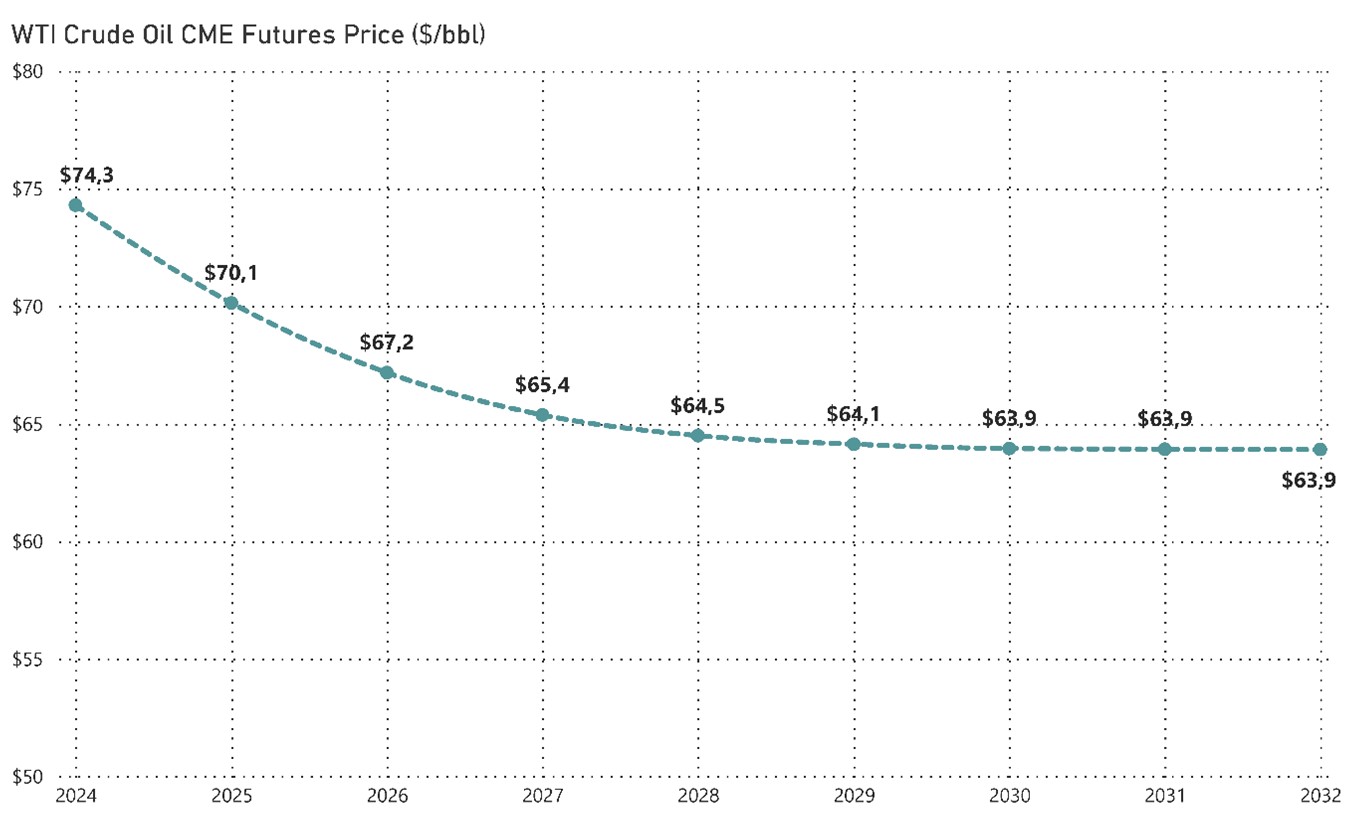

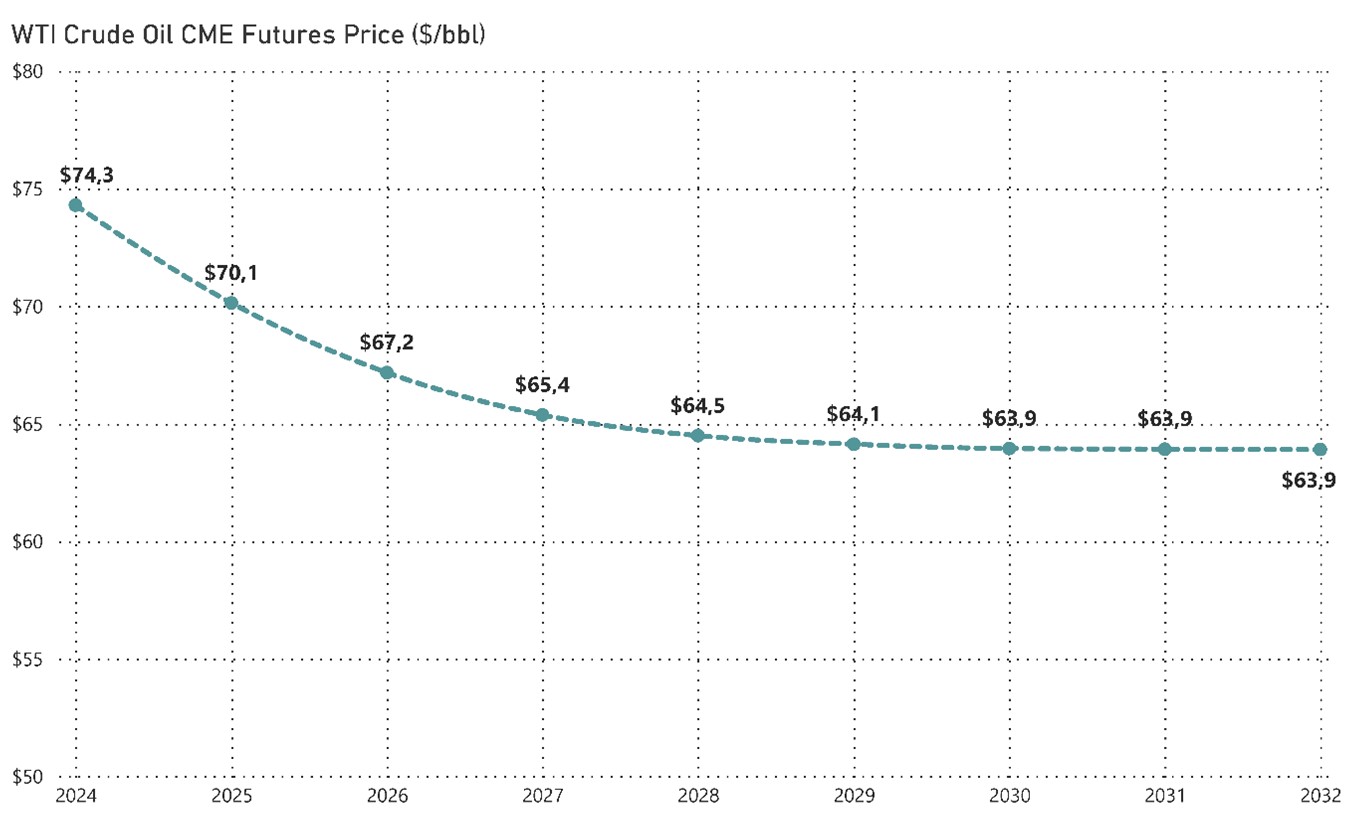

10.1 | WTI Crude Oil CME Futures Price | 10-2 |

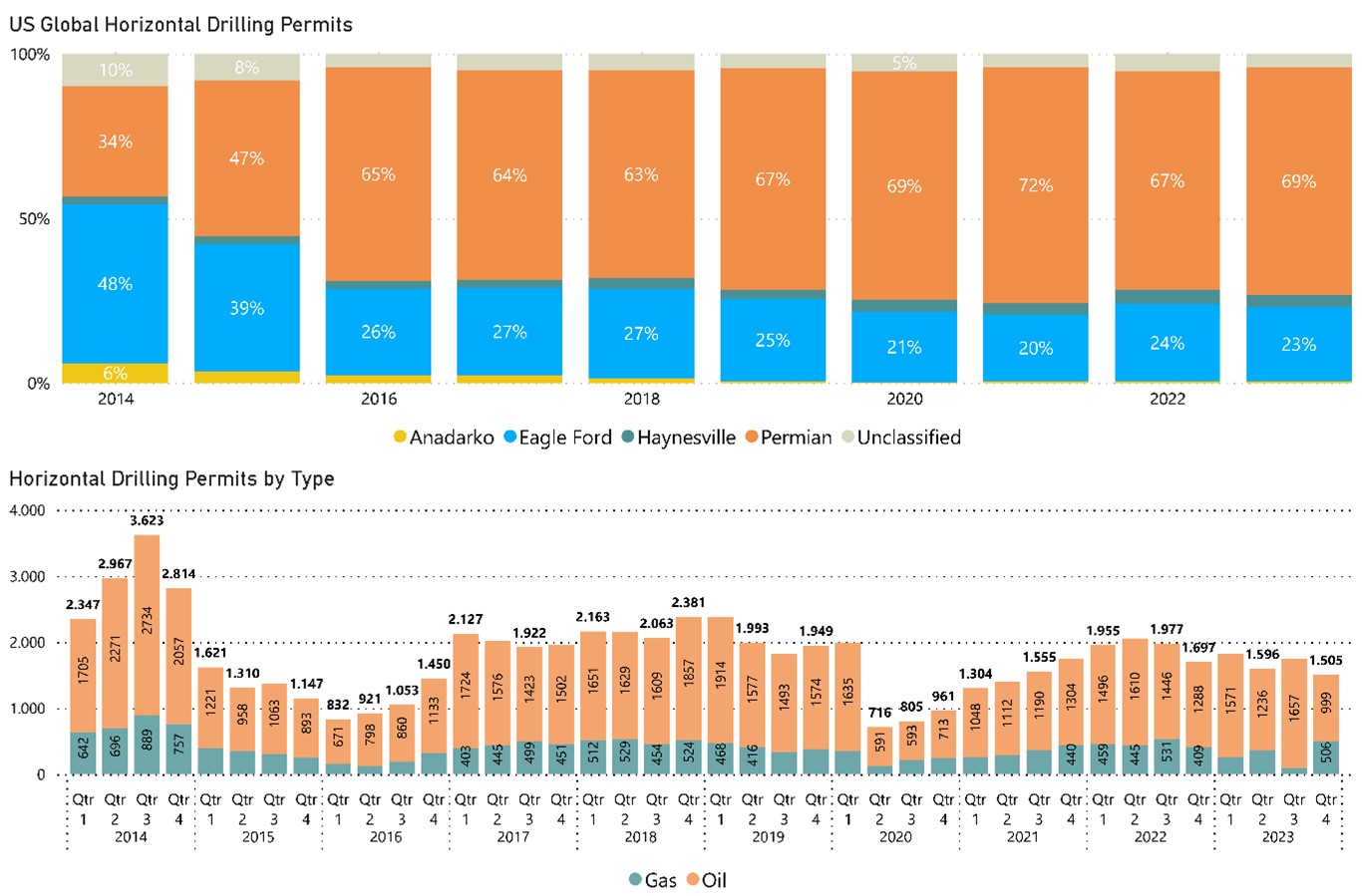

10.2 | U.S. Global Horizontal Drilling Permits by Region and Type | 10-3 |

10.3 | Permian Region Horizontal Drilling Permits by Type | 10-3 |

10.4 | U.S. Horizontal Drilling Permits | 10-4 |

10.5 | Oil Production (bbl/d) | 10-5 |

10.6 | Natural Gas Production (Mcf/d) | 10-5 |

10.7 | U.S. Drilled but Uncompleted Wells (DUC) | 10-6 |

10.8 | Permian Drilled but Uncompleted Wells (DUC) | 10-6 |

10.9 | All U.S. Regions Mine Hours (Quarterly) | 10-7 |

10.10 | Permian Wide In-Basin Mine Hours (Quarterly) | 10-7 |

|

GLOSSARY OF ABBREVIATIONS AND DEFINITIONS |

| | |

$ | : | US dollar(s) |

% | : | Percent or percentage |

Atlas | : | Atlas Energy Solutions, Inc. |

API | : | American Petroleum Institute |

BOYD | : | John T. Boyd Company |

CapEx | : | Capital expenditures |

CCAA | : | Candidate Conservation Agreement with Assurances |

COGS | : | Cost of goods sold |

Constant Dollar | : | A monetary measure that is not influenced by inflation and used to compare time periods. Sometimes referred to as “real dollars”. |

CY | : | Cubic yards |

DCF | : | Discounted Cash Flow |

Discount Rate | : | A rate of return used to discount future cash flows based on the return investors expect to receive from their investment. |

DSL | : | Dunes sagebrush lizard (Sceloporus arenicolus) |

DUC | : | Drilled but uncompleted gas or oil well. |

FOB | : | Free-on-Board |

Frac Sand | : | Frac sand is a naturally occurring, high silica content quartz sand, with grains that are generally well rounded and exhibit high compressive strength characteristics relative to other silica sand. It is utilized as a prop or “proppant” in unconventional shale frac well completions. |

Frac Sand

Resource | : | Frac sand resource is a concentration or occurrence of sand material of economic interest in or on the Earth’s crust in such form, grade or quality, and quantity that there are reasonable prospects for economic extraction. A mineral resource is a reasonable estimate of mineralization, taking into account relevant factors such as quality specifications, likely mining dimensions, location or continuity, that, with the assumed and justifiable technical and economic conditions, is likely to, in whole or in part, become economically extractable. It is not merely an inventory of all mineralization drilled or sampled. |

| | |

| | |

Frac Sand

Reserve | : | Frac sand reserve is an estimate of tonnage and grade or quality of mineral resources that, in the opinion of the qualified person, can be the basis of an economically viable project. More specifically, it is the economically mineable part of a mineral resource, which includes diluting materials and allowances for losses that may occur when the material is mined or extracted. |

gpm | : | Gallons per minute |

Indicated Sand

Resource | : | An Indicated Sand Resource is that part of a Sand Resource for which quantity, grade or quality, densities, shape, and physical characteristics are estimated with sufficient confidence to allow the application of Modifying Factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Geological evidence is derived from adequately detailed and reliable exploration, sampling and testing, and is sufficient to assume geological and grade or quality continuity between points of observation. An Indicated Sand Resource has a lower level of confidence than that applying to a Measured Sand Resource and may only be converted to a Probable Sand Reserve. |

IRR | : | Internal rate-of-return |

ISO | : | International Organization for Standardization |

lb | : | Pound |

LOM | : | Life-of-Mine |

Measured Sand

Resource | : | A Measured Sand Resource is that part of a Sand Resource for which quantity, grade or quality, densities, shape, and physical characteristics are estimated with confidence sufficient to allow the application of Modifying Factors to support detailed mine planning and final evaluation of the economic viability of the deposit. Geological evidence is derived from detailed and reliable exploration, sampling, and testing and is sufficient to confirm geological and grade or quality continuity between points of observation. A Measured Sand Resource has a higher level of confidence than that applying to either an Indicated Sand Resource or an Inferred Sand Resource. It may be converted to a Proven Sand Reserve or to a Probable Sand Reserve. |

Mesh | : | A measurement of particle size often used in determining the size distribution of granular material. |

Mineral Reserve | : | See “Frac Sand Reserve” |

| | |

Mineral Resource | : | See “Frac Sand Resource” |

Modifying Factors | : | The factors that a qualified person must apply to indicated and measured sand resources and then evaluate to establish the economic viability of sand reserves. A qualified person must apply and evaluate modifying factors to convert measured and indicated resources to proven and probable reserves. These factors include, but are not restricted to: mining; processing; metallurgical; infrastructure; economic; marketing; legal; environmental compliance; plans, negotiations, or agreements with local individuals or groups; and governmental factors. The number, type and specific characteristics of the modifying factors applied will necessarily be a function of and depend upon the mineral, mine, property, or project. |

Mscf | : | Thousand standard cubic feet per day |

MSHA | : | Mine Safety and Health Administration. A division of the U.S. Department of Labor. |

NOAA | : | National Oceanic and Atmospheric Administration |

NSR | : | New Source Review |

NTU | : | Nephelometric turbidity units |

NPV | : | Net Present Value |

| | |

Permian Basin | : | A large sedimentary shale basin in the southwestern part of the United States in mainly Texas and New Mexico. The basin produces approximately 6 million barrels per day of oil and holds some of the largest oil and gas reserves in the world. |

Probable Sand

Reserve | : | A Probable Sand Reserve is the economically mineable part of an Indicated and, in some circumstances, a Measured Sand Resource. The confidence in the Modifying Factors applying to a Probable Sand Reserve is lower than that applying to a Proven Sand Reserve. |

Proppant Sand | : | See “Frac Sand” |

Proven Sand

Reserve | : | A Proven Mineral Reserve is the economically mineable part of a Measured Sand Resource. A Proven Sand Reserve implies a high degree of confidence in the Modifying Factors. |

PSI | : | Pounds per square inch |

| | |

ROM | : | Run-of-Mine. The as-mined including in-seam clay partings mined with the sand, and out-of-seam dilution. |

Rotosonic Drilling | : | A type of core drilling combining rotary drilling with ultrasonic frequency to drill through loosely consolidated soil and rock. |

SEC | : | U.S. Securities and Exchange Commission |

S-K 1300 | : | Subpart 1300 and Item 601(b)(96) of the U.S. Securities and Exchange Commission’s Regulation S-K |

S&S | : | The Sealey and Smith Foundation |

Surficial | : | Relating to the earths surface or the geology that is on the surface. |

TCEQ | : | Texas Commission on Environmental Quality |

Ton | : | Short Ton. A unit of weight equal to 2,000 pounds |

tph | : | Tons per Hour |

Westward | : | Westward Environmental Inc |

1.0 EXECUTIVE SUMMARY

BOYD was retained by Atlas to complete an updated independent technical audit of mineral resource and mineral reserve estimates—hereafter referred to as frac sand resource and frac sand reserve estimates—for their active mining and processing operations located near Kermit, Texas (the “Kermit Mines”) and Monahans, Texas (the “Monahans Mine”). Throughout the report, the Kermit and Monahans mines may also be referred to as the Kermit and Monahans “operations”, “plants”, “properties”, or “facilities”. This report summarizes the results of our resource and reserve estimation and satisfies the requirements for Atlas’s disclosure of frac sand resources and reserves set forth in Subpart 1300 and Item 601(b)(96) of the SEC’s Regulation S-K (S-K 1300).

This update was requested by Atlas to replace BOYD’s original Technical Report Summary (TRS) for their Kermit and Monahans mines (BOYD Report No.: 3871.006), as Atlas has made the following material updates: (1) expanded their Kermit production capacity in 2023 by adding a new mining and processing facility with 5.5 million tons of annual production capacity, for a combined total production capacity at Kermit of 11.0 million tons per year, (2) converted significant portions of the Kermit Mines’ frac sand resources to frac sand reserves by revising the extents of the mine plans to support the expanded production capacity, and (3) continued construction of their Dune Express, a 42-mile long electric conveyor system that originates at the Kermit Mines and ends in New Mexico.

BOYD’s findings are based on our detailed examination of the supporting geologic, technical, and economic information obtained from: (1) Atlas provided files, (2) discussions with Atlas personnel, (3) records on file with regulatory agencies, (4) public sources, and (5) nonconfidential BOYD files. Our analysis was performed to obtain reasonable assurance that Atlas’s frac sand resource and reserve statements are free from material misstatement. This report provides an independent estimate of the frac sand resources and reserves underlying the Kermit and Monahans controlled properties.

This report provides a summary of the material technical and scientific information for the subject mining properties. The Economic Analysis and resulting Net Present Value (NPV) estimate in this report were made for the purpose of confirming the economic viability of the reported sand reserves and not for the purpose of valuing Atlas or its assets. Internal Rate of Return (IRR) and project payback were not calculated, as there was no initial investment considered in the financial model.

Weights and measurements are expressed in US customary units. Unless noted, the effective date of the information, including estimates of frac sand reserves, is December 31, 2023.

1.2.Property Description and Control

From mid-2018 through late-2023, Atlas operated one mining and processing facility at Kermit and one at Monahans. The combined total production capacity of these two operations was 11 million tons of finished frac sand per year. In response to the increase in market demand, and also in connection with the expansion of their logistics offerings, Atlas expanded their Kermit production capacity in 2023 by adding a new mining and processing facility with 5.5 million tons of annual production capacity. By the end of 2023, Atlas operated three mining and processing facilities with a combined total production capacity of 16.5 million tons annually.

The Kermit Mines, in Winkler County, Texas, are located approximately seven miles northeast of the town of Kermit and are surface frac sand mining and processing facilities, located on approximately 5,826 “gross” acres (the “Kermit Property”) of which 5,341 “net” acres are controlled (leases and fee-owned). After applying requisite mining setbacks and observing any easements and/or rights-of-way, approximately 4,521 acres (or 78% of the property) have been explored and are considered as either mineable frac sand resources or frac sand reserves.

Atlas owns a portion of the Kermit Property in fee (including the property on which the Kermit Mines are located). The remaining land is leased from various parties, and Atlas pays either a royalty or delay rental to the lessors to retain the leased properties.

The Monahans Mine, in Ward and Winkler counties, Texas, is located approximately three miles northeast of the town of Monahans and is a surface frac sand mining and processing facility, located on approximately 32,224 “gross” acres (the “Monahans Property”) which is entirely leased by Atlas. After applying requisite mining offsets, a total area covering approximately 11,187 acres (or 35%) of the Monahans Property has been explored with sufficient drilling and sampling to be considered, as of the date of this report, frac sand resources or frac sand reserves. Atlas has also completed a reconnaissance-level of exploration drilling and sampling work on an additional 9,575 acres (or an additional 30%) outside of the resource and reserve areas of the Monahans Property. This “exploration target” area has been drilled with a wider spacing (or less density) than the aforementioned frac sand resource and reserve areas; however, drilling and testing indicates these portions of the deposit exhibit similar characteristics, both in thickness and frac sand quality, to the reported frac sand resources and reserves. The general location of the subject mines is provided in Figure 1.1, following this page.

Frac sand is a naturally occurring, high silica content quartz sand with grains that are generally well-rounded and monocrystalline. The main difference between frac sand and other sands is that frac sand grains are relatively pure in composition, consisting almost entirely of quartz; other sands have numerous impurities that may be cemented to the quartz grains. The pure quartz composition of frac sand grains, along with being well‑rounded and spherical in shape, gives these sands the characteristics (crush strength, high acid solubility, low turbidity) that are sought after by oil and gas producers for use in developing wells.

Surficial geologic units overlying the properties and surrounding areas are predominantly Quaternary age unconsolidated deposits, ranging from windblown dunes and sheet sands to alluvial sands, silts, clays, and caliche. The Llano Estacado Caprock Escarpment marks the eastern-most extent of the surficial sand deposits. Winds transporting particles into the area are thought to have collided with the escarpment, slowing their velocity and dropping particles out of suspension where they have accumulated over time. Winnowing processes have caused some degree of particle sorting to occur. Due to the mechanisms and long distances of particle transport, sand grains were abraded and rounded as they reached their current locations. Quaternary unconsolidated deposition covers nearly all of the subject properties, with the surficial deposits on Atlas’s properties noted as generally ranging from 60-ft to over 100-ft in thickness. Both the Kermit and Monahans properties contain no discernable overburden materials except for sparse areas of vegetation and roots that are removed during processing and are mineable from the surface down to the total defined depth of the deposits. Data from extensive crush testing along with the API RP-19C/ISO 13503-2 (API/ISO) testing performed on the composite samples by Atlas indicate little variability within the overall mineable deposits on each property.

Atlas contracted Westward Environmental, Inc. (Westward) to perform a series of drilling and sampling programs on the Kermit and Monahans properties, which occurred from June 2017 through September 2021.

The drilling and sampling programs were executed in an equivalent manner on each property as Westward supervised the field work and sampled each hole. Holes were drilled using a rotosonic drill rig, and each hole was sampled on 5-ft increments from the surface on the initial exploration drill programs and 10-ft increments on the follow up infill drilling programs. Westward geologists and geological technicians determined the terminus of the sampling interval of a hole, as drilling would be stopped when the amount of sand in a recovered interval was neither the first nor second most abundant material present in a given sample interval. All drilled intervals were geologically logged, photographed, and sampled in duplicate. One set of samples was retained by Atlas for archival purposes, while the other set of samples was sent to a lab for grain size analyses and proppant sand quality testing.

In 2017, an initial drilling and sampling program utilized widely spaced exploration drill holes, with nominal spacing of 3,000-ft to 4,500-ft between drill holes (one hole drilled per section of controlled property), in order to determine the depth and lateral extent of the sand deposits across the Kermit and Monahans properties. This phase of work resulted in 36 drill holes being drilled and sampled on the Kermit Property, and 53 drill holes being drilled and sampled on the Monahans Property. Sample analyses were performed by PropTester in Cyprus, Texas and FracTAL in St. Paul, Minnesota.

An infill drilling program was subsequently initiated in March 2018 to increase geologic confidence on each of the subject properties. This campaign consisted of completing an additional 25 drill holes on the Kermit Property and 27 drill holes on the Monahans Property. Upon completion of the infill drilling programs, each property had been drilled to a nominal 1,500-ft spacing within their respective initial mining areas, which provided enough geoscientific information to classify the infill drilled areas as Proven and Probable Reserves.

Most recently, Atlas retained BOYD to design a 2021 infill drilling and sampling campaign over select areas of the Kermit Property. This campaign was completed as Atlas considered constructing a second mine on the Kermit Property, increasing the existing frac sand reserve base of Kermit by approximately 3.5 sections of land (over 2,200 acres). An additional 26 drill holes were completed in late September 2021, following the same procedures undertaken during the first two campaigns.

A summary of all drilling completed to date on the Kermit and Monahans properties is included in Table 1.1.

| | | | | | | | |

Table 1.1: Kermit and Monahans Drilling Campaign Summary |

| | Rotosonic Drill Holes Completed |

| | By Drilling Campaign |

| | 2017 | | 2018 | | 2021 | | Total |

Kermit Property | | 36 | | 25 | | 26 | | 87 |

Monahans Property | | 53 | | 27 | | - | | 80 |

Total | | 89 | | 52 | | 26 | | 167 |

1.5.Frac Sand Reserves and Quality

This technical report summary provides an estimate of frac sand reserves for Atlas’s Kermit and Monahans mines in accordance with the requirements set forth in S-K 1300. These estimates were independently prepared by BOYD utilizing relevant mining, processing, economic (including independent estimates of capital, revenue, and cost), marketing, legal, environmental, socio-economic, and regulatory factors for each operation.

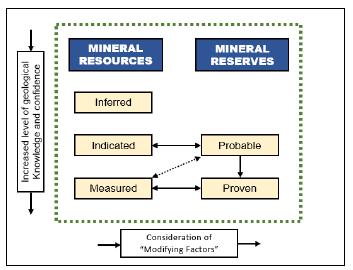

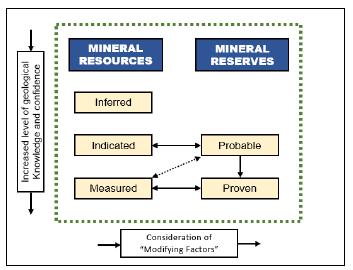

Estimates of mineral resources and reserves are always subject to a degree of uncertainty. The level of confidence that can be applied to a particular estimate is a function of, among other things: the amount, quality, and completeness of exploration data; the geological complexity of the deposit; and economic, legal, social, and environmental factors associated with mining the resource/reserve. BOYD used the definitions provided in S-K 1300 to describe the varying degree of certainty associated with the estimates reported here.

Estimates of frac sand resources are subdivided to reflect the different levels of geological confidence into measured (highest geological confidence), indicated, and inferred (lowest geological assurance). Upon application of modifying factors that include adjustments for mining loss, processing loss, and economic factors, a measured resource may be converted to either a proven or probable reserve, while an indicated resource may only be converted to a probable reserve. An inferred resource may not be converted to a reserve without further exploration, due to the lower level of geological confidence.

A mineral reserve is the economically mineable part of a measured or indicated mineral resource, which includes diluting materials and allowances for losses that may occur when the material is mined or extracted. Estimates of mineral reserves are subdivided to reflect geologic confidence, and potential uncertainties in the modifying factors, into proven (highest assurance) and probable.

In this report, the term “frac sand reserves” represents the tonnage and quality of product sand that will be available for sale after washing and drying the run-of-mine (ROM) sand. When material variations in thickness, depth, and/or sand quality occur between drill holes, the allowable spacing distance is reduced. The following drill hole spacing criteria were determined by the Qualified Person and used in this report to define the sand resources within Atlas’s properties:

| | |

| | Spacing Requirement (ft) |

Classification | | (Nominal Maximum) |

Measured | | 1,500 |

Indicated | | 2,500 |

Inferred | | 5,000 |

BOYD’s estimate of frac sand reserves for the Kermit and Monahans mines as of December 31, 2023, total 488.1 million tons of saleable product (i.e., greater than 140 mesh and less than 40 mesh in size). There are 337.6 million tons underlying the Kermit Property and 150.5 million tons underlying the Monahans Property.

Table 1.2 presents the estimated frac sand reserves by product mesh size, reserve classification, and mineral ownership status for the Kermit and Monahans mines:

| | | | | | | | | | | | | | | | | | |

| | Table 1.2: Atlas Energy Solutions Reserves (As of December 31, 2023) |

| | Tons (000) By Classification and Mesh Size |

| | Proven | | Probable | | Total By Mesh Size |

Control | | 40/70 | | 70/140 | | Total | | 40/70 | | 70/140 | | Total | | 40/70 | | 70/140 | | Total |

Kermit Mines |

Owned | | 81,869 | | 67,718 | | 149,587 | | 254 | | 317 | | 571 | | 82,123 | | 68,035 | | 150,158 |

Leased | | 70,709 | | 80,410 | | 151,119 | | 16,215 | | 20,066 | | 36,281 | | 86,924 | | 100,476 | | 187,400 |

Total | | 152,578 | | 148,128 | | 300,706 | | 16,469 | | 20,383 | | 36,852 | | 169,047 | | 168,511 | | 337,558 |

Monahans Mine |

Leased | | 90,294 | | 58,000 | | 148,294 | | 1,372 | | 819 | | 2,191 | | 91,666 | | 58,819 | | 150,485 |

Projecting sales volumes of approximately 10.5 million tons per year, the expected life of the Kermit Mines’ frac sand reserves are approximately 31 years. Likewise, at projected sales volumes of 5.0 million tons per year, the expected life of the Monahans Mine’s frac sand reserves is approximately 29 years.

Additional in-place frac sand resources consist of: 1) measured and indicated resources that have not been formally included in mine plans by Atlas, and 2) inferred resources in areas that generally need additional exploration drilling and sampling to classify them as measured or indicated resources. These resources are estimated at 1.4 billion tons—including 170.5 million tons at the Kermit Mines and 1.3 billion tons at the Monahans Mine—and represent the in-place material prior to applying any mining and processing losses. Table 1.3 presents the estimated in-place frac sand resources, exclusive of those frac sand resources already converted to frac sand reserves, for the Kermit and Monahans mines:

| | | | | | | | | | |

Table 1.3: Atlas Energy Solutions Resources (As of December 31, 2023) |

Resource | | | | Average

Sand | | Estimated In-Place Frac Sand Tons (000) |

Category | | Acres | | Thick (ft) | | Owned | | Leased | | Total |

Kermit Mines |

Measured | | 165 | | | | 2,750 | | 16,636 | | 19,386 |

Indicated | | 460 | | | | 563 | | 75,515 | | 76,078 |

Inferred | | 800 | | | | - | | 75,076 | | 75,076 |

Total | | 1,425 | | 74 | | 3,313 | | 167,227 | | 170,540 |

Monahans Mine |

Measured | | 487 | | | | - | | 71,730 | | 71,730 |

Indicated | | 785 | | | | - | | 102,755 | | 102,755 |

Inferred | | 8,908 | | | | - | | 1,094,030 | | 1,094,030 |

Total | | 10,180 | | 57 | | - | | 1,268,515 | | 1,268,515 |

PropTester performed API/ISO tests on composite samples created from sample material collected during the drilling programs on the Kermit and Monahans properties. A composite of the entire length of each selected hole was created, and for each composite sample, the testing labs created 40/70 mesh and 40/140 mesh product samples which were subjected to the full suite of API/ISO proppant sand tests.

Overall, this extensive testing indicates that a relatively uniform range of crush values exist through the entire depth of the deposit, except for one or two intervals where the caliche interval was not completely removed before performing the crush tests. These caliche intervals were about 1,000 psi less than all other intervals, and as such were not included in the summary quality data.

Combining the extensive crush testing conducted with the API/ISO testing performed on the composite samples, Atlas has completed a comprehensive review of grain characteristics for each of the reserve areas within each property. The data indicate little variability within the overall mineable deposit on each property.

Sample testing results are summarized in Table 1.4 below for each product size analyzed within each property:

| | | | | | | | | | |

| | Table 1.4: Proppant Characteristic Test Results for Kermit and Monahans Mines |

| | Average API/ISO Test Results By Product Size and Mine |

| | 40/70 mesh | | 40/140 mesh(1)(2) |

| | | | | | Recommended | | | | |

Test | | Kermit | | Monahans | | Specification | | Kermit | | Monahans |

Sphericity | | 0.7 | | 0.7 | | > 0.6 | | 0.7 | | 0.7 |

Roundness | | 0.8 | | 0.7 | | > 0.6 | | 0.7 | | 0.7 |

Acid Solubility (%) | | 1.1 | | 0.9 | | < 3.0 | | 2.6 | | 1.6 |

Turbidity (NTU) | | 15.0 | | 7.0 | | < 250 | | 15.0 | | 13.0 |

K-Value (000 psi) | | 7 - 8 | | 7 - 8 | | - | | 10 - 11 | | 10 - 11 |

(1)100 mesh proppant sand material currently does not have and API/ISO specification.

(2)test results were for a single 40/140 mesh product.

The extent to which the frac sand reserves may be affected by any known geological, operational, environmental, permitting, legal, title, variation, socio-economic, marketing, political, or other relevant issues has been reviewed as warranted. It is the opinion of BOYD that Atlas has appropriately mitigated, or has the operational acumen to mitigate, the risks associated with these factors. BOYD is not aware of any additional risks that could materially affect the development of the frac sand reserves.

Based on our independent estimate and operations review, we have a high degree of confidence that the estimates shown in this report accurately represent the available frac sand reserves controlled by Atlas, as of December 31, 2023.

The Kermit and the Monahans mines employ dredging as the primary sand extraction method. Most of the mineable areas at each property have minimal overburden and vegetation; as such, sand excavation normally begins at the surface throughout most of the mine plan area. The water forming the dredge ponds is sourced from a shallow aquifer which lies below each property. The dredge is a floating barge that lowers an arm or “ladder” with an attached submersible pump to the bottom of the deposit. Sand is pumped through poly pipe to the mine skid where waste material is removed. The sand is then further pumped to the wet plant with tailings and excess water returning to the dredge pit. All three mines operate continuously 24 hours a day, seven days a week. Conceptual mine plans with sequencing are illustrated in Chapter 7 of this report for the subject mine sites.

The first Kermit processing facility was commissioned in July 2018 with a nameplate capacity of 5.5 million tons per year of finished product, and a second Kermit processing facility was constructed in 2023, increasing total nameplate capacity at Kermit to 11 million tons per year. The Monahans processing facility was commissioned in October 2018 with a nameplate capacity of approximately 5.5 million tons per year of finished product. The Kermit and Monahans operations predominantly produce 40/70 mesh and 40/140 mesh frac sand. Since the commissioning of the wet plants in 2018 through the end of 2023, the recorded process yield for the plants is approximately 90%. That is, for every 100 tons of ROM material fed into the plant, 90 tons of saleable frac sand is produced. It should be noted that these achieved process yields are slightly different than the overall process yields used to estimate the frac sand resources and reserves which are based on the results of drill hole sample testing at each property.

Once the material has been mined from the pit, it proceeds to the processing plants as follows:

•Wet Process Plant- ROM material from the dredge is pumped to the wet plant and the greater than 40 mesh and less than 140 mesh sand and silt material is removed.

•Dry Process Plant- The damp 40/140 mesh material produced by the wet process plant is dried and screened into finished products. An on-site quality laboratory samples and monitors production and shipping sand quality daily.

•Storage and Loadout- Finished products are stored in silos and gravity loaded from under the silos into highway trucks for transport to the customer. The Atlas loadout operates 24 hours per day, 7 days per week every day of the year.

Each plant is supplied with three-phase line power. Substations access 138 kV lines and step voltage down to a 12.5 kV line which delivers power to the plants. Line natural gas is supplied to the plants. Natural gas line capacity and substation capacity at each of the plants is sufficient to serve much more than 100% of Atlas’s current requirements.

Plant process water is recycled within the plants and is pumped from the dredge pond reservoir. Additional makeup water is obtained from a wellfield containing 14 water wells having an approximate capacity of 1,600 gallons per minute (gpm) at Kermit, and 21 water wells having an approximate capacity of 2,500 gpm at Monahans. These wells are only utilized as a backup water supply.

On-site facilities at each site include a scale house, office, shop, and a quality laboratory located in the dry process plants. The surface facilities currently located at the mines are well constructed and have the necessary capacity/capabilities to support the three operations.

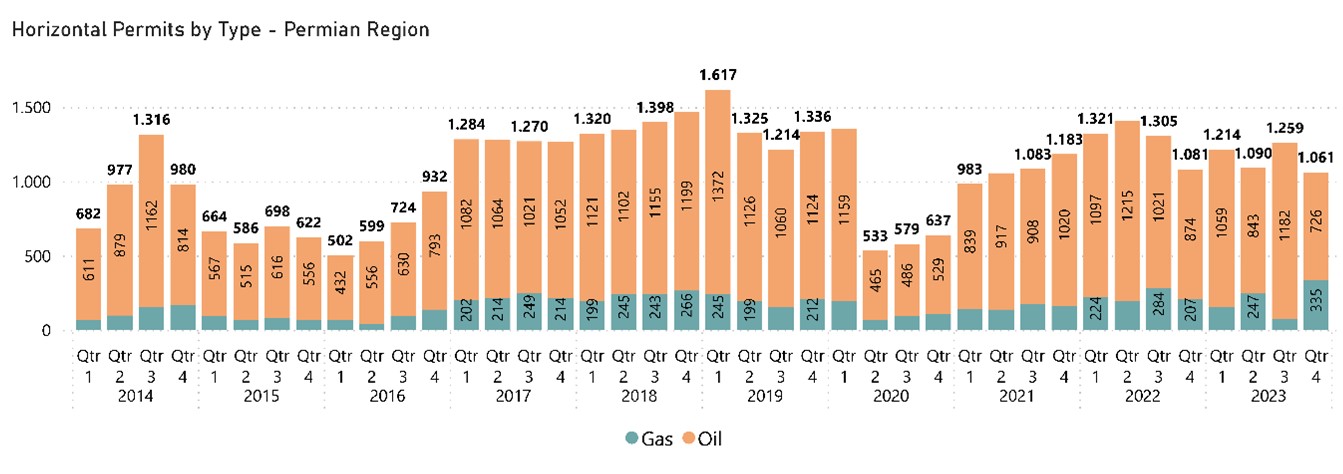

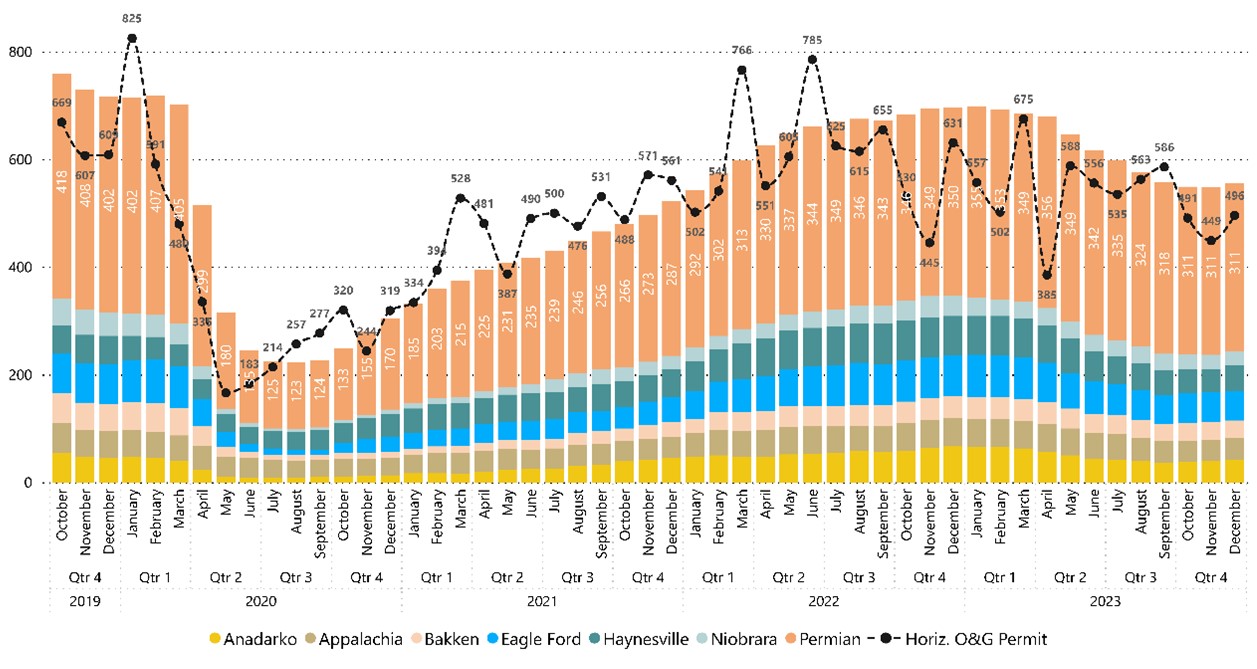

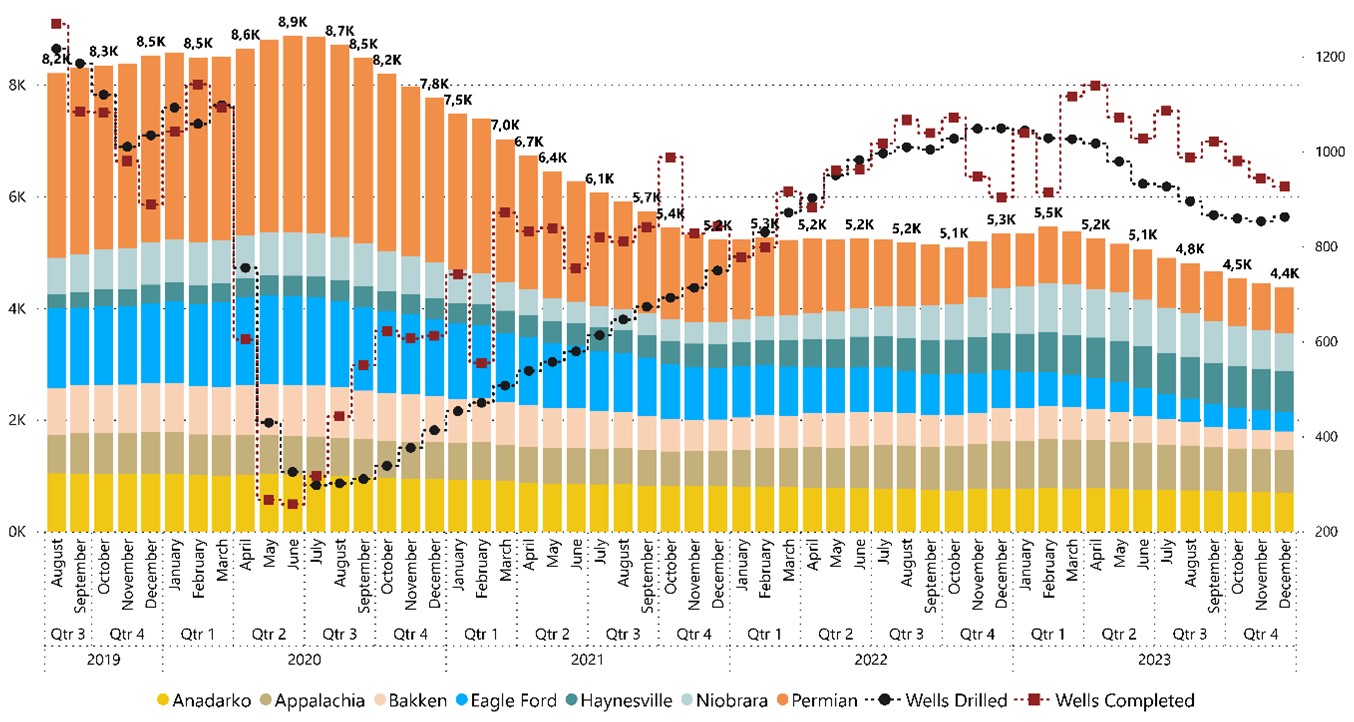

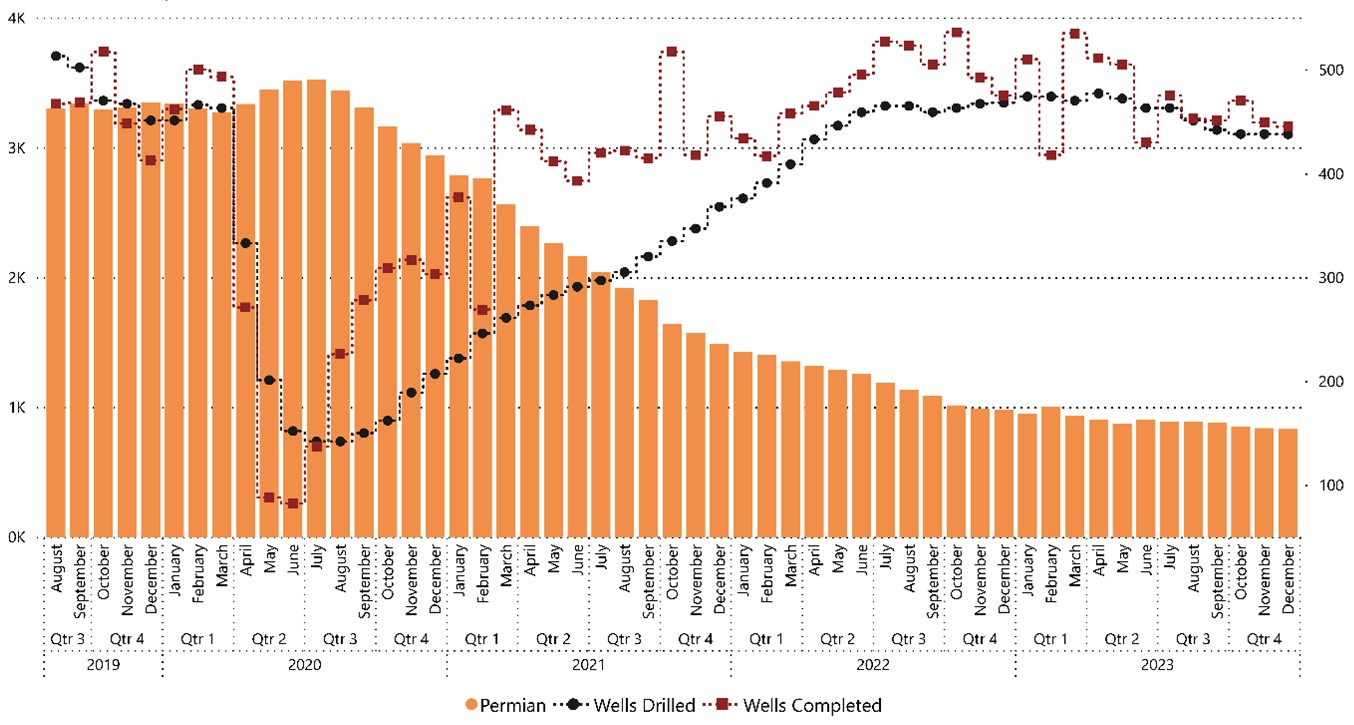

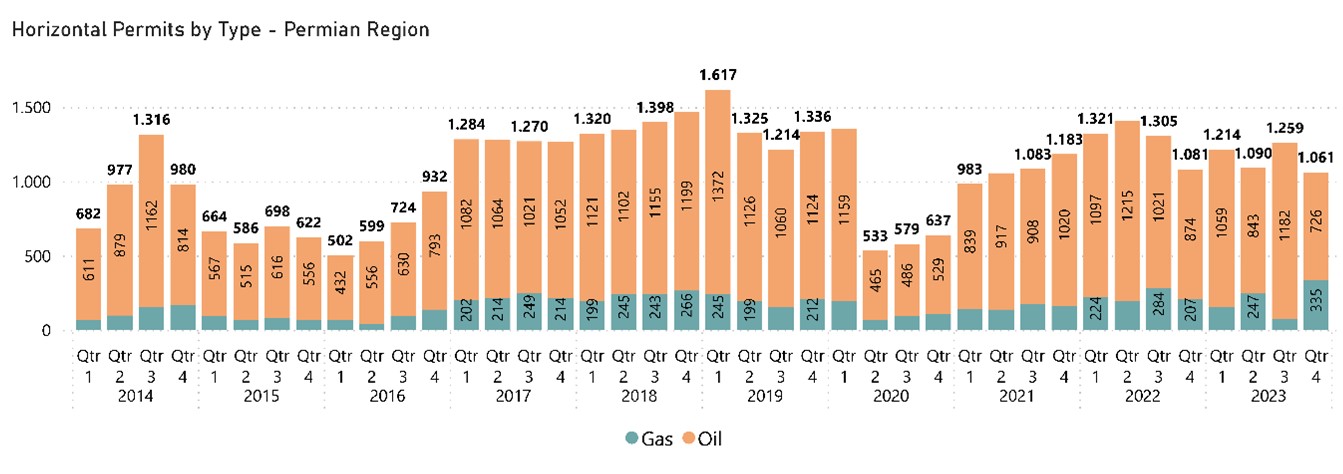

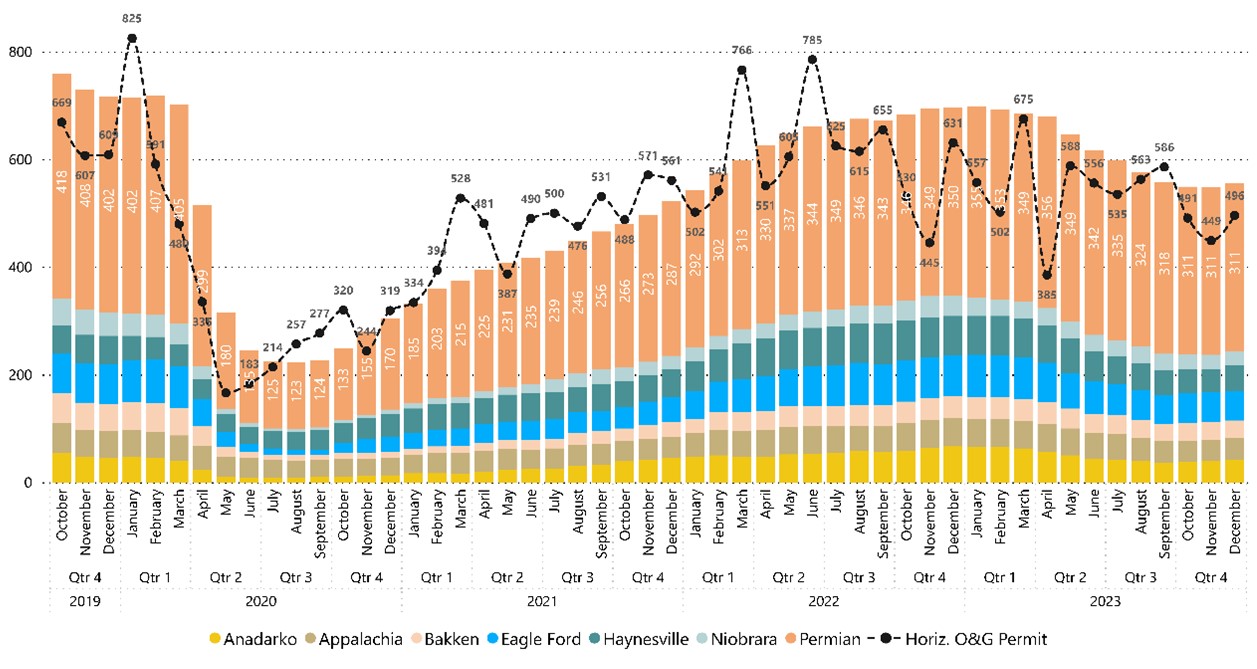

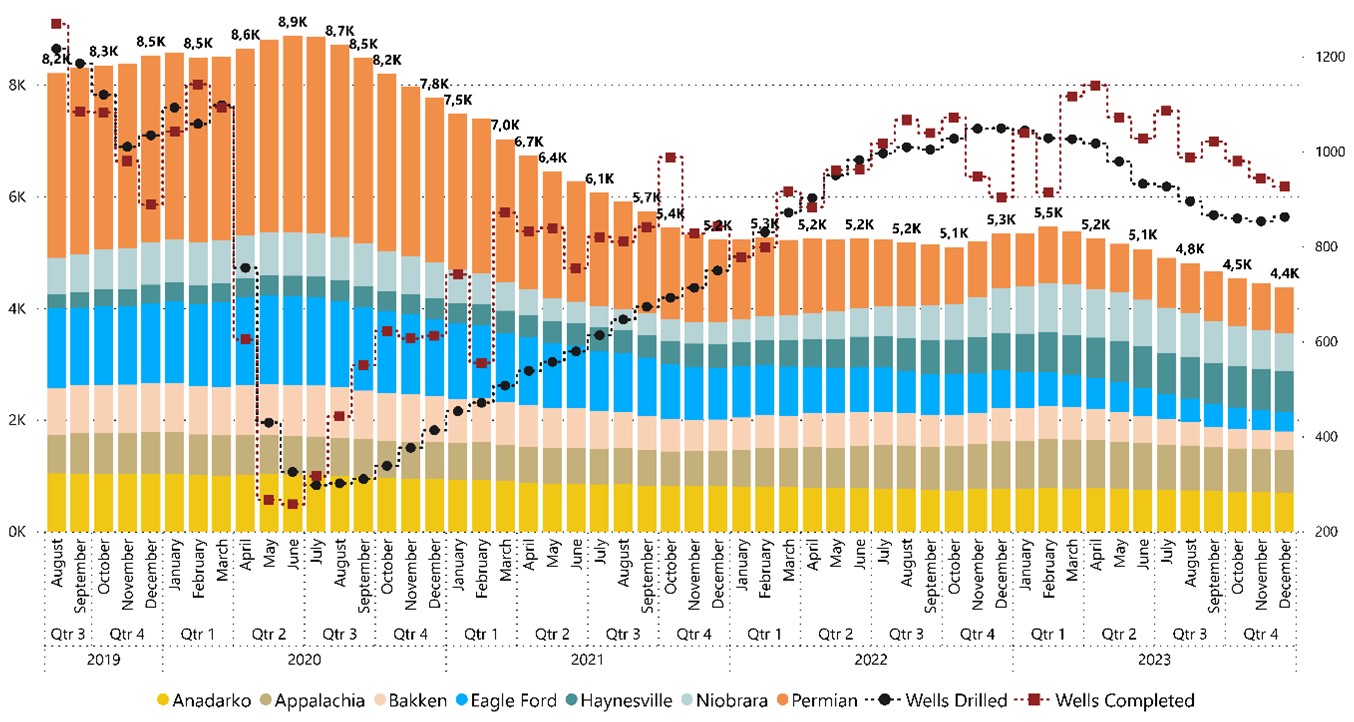

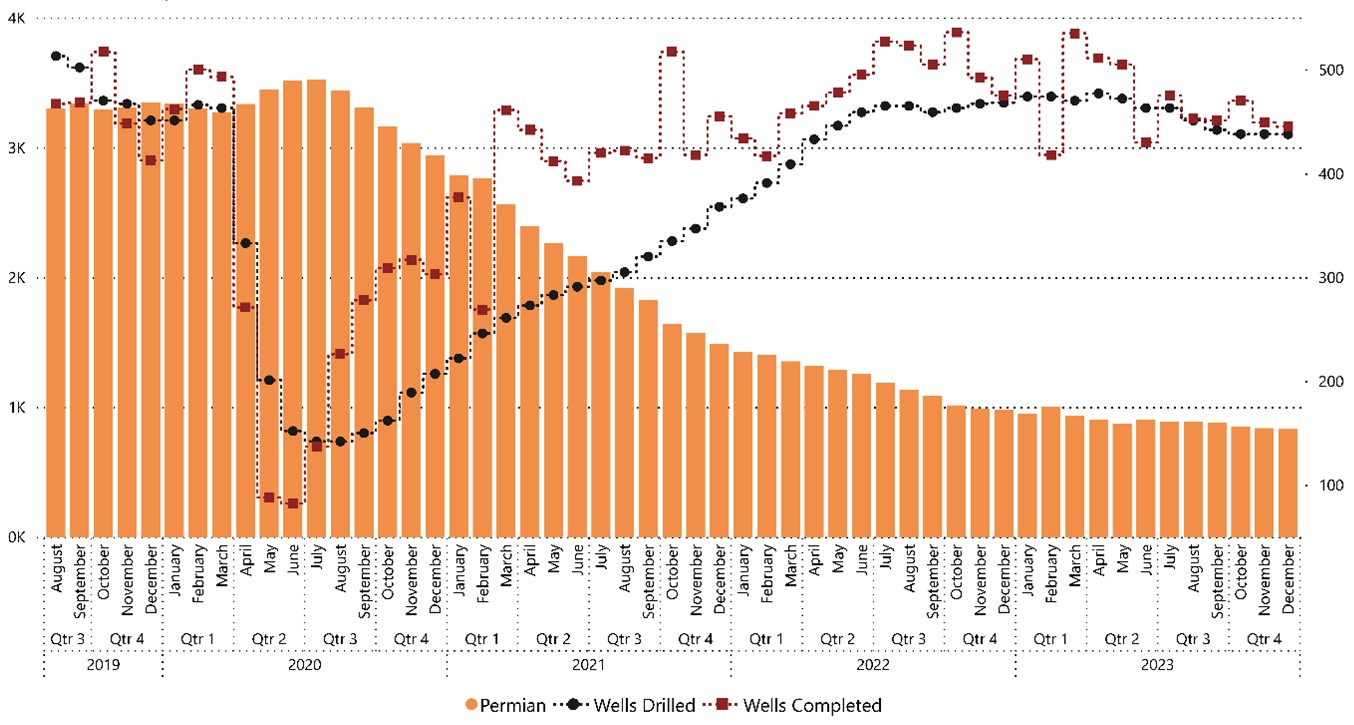

Permit submissions for horizontal oil and gas wells in the Permian Basin indicate a continuation of strong drilling ahead. Utilizing data from Baker Hughes and the Railroad Commission of Texas (RRC), the total number of permits filed ranges between 1,000 and 1,600 per quarter in 2023, a strong rebound from the pandemic lows of 2020.

Figure 1.2: Permian Basin HZ Permit Submissions

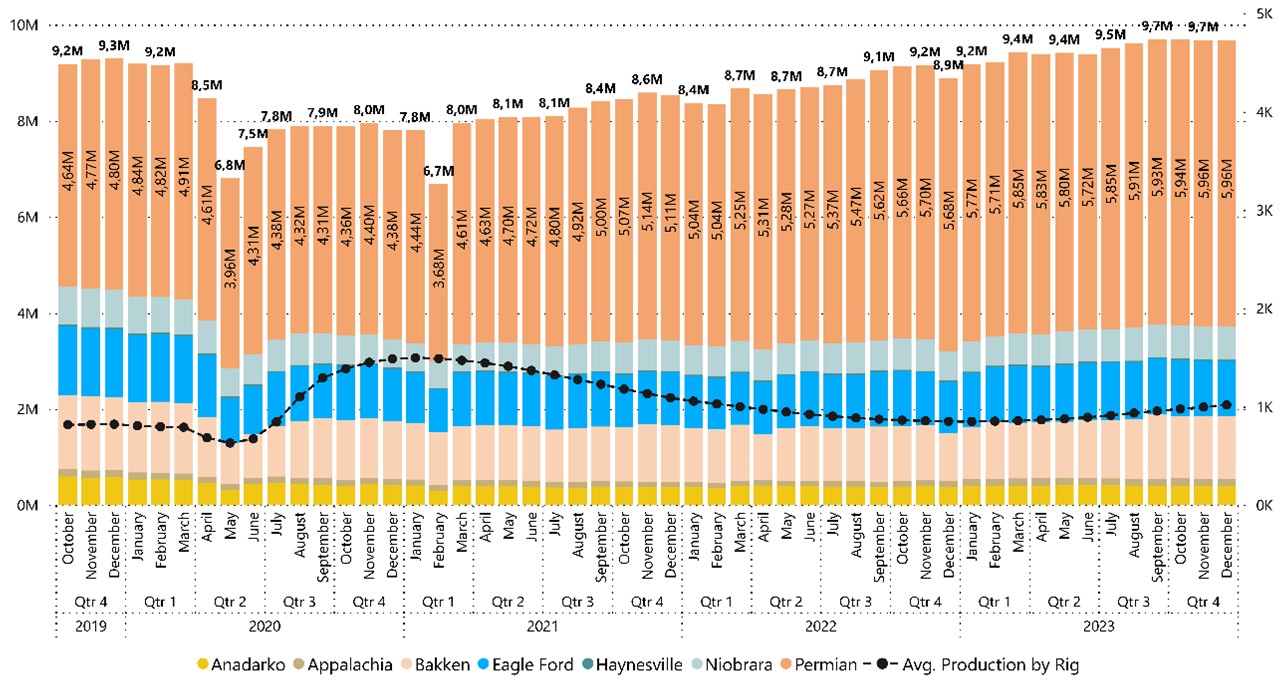

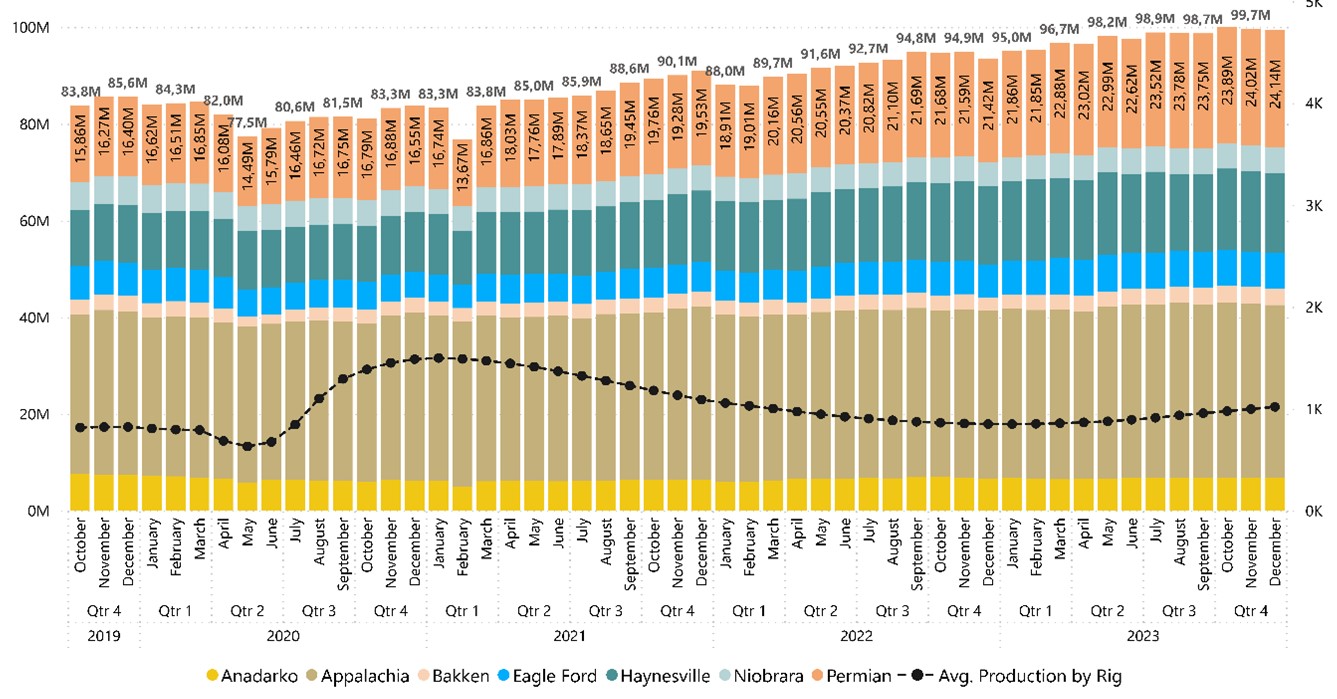

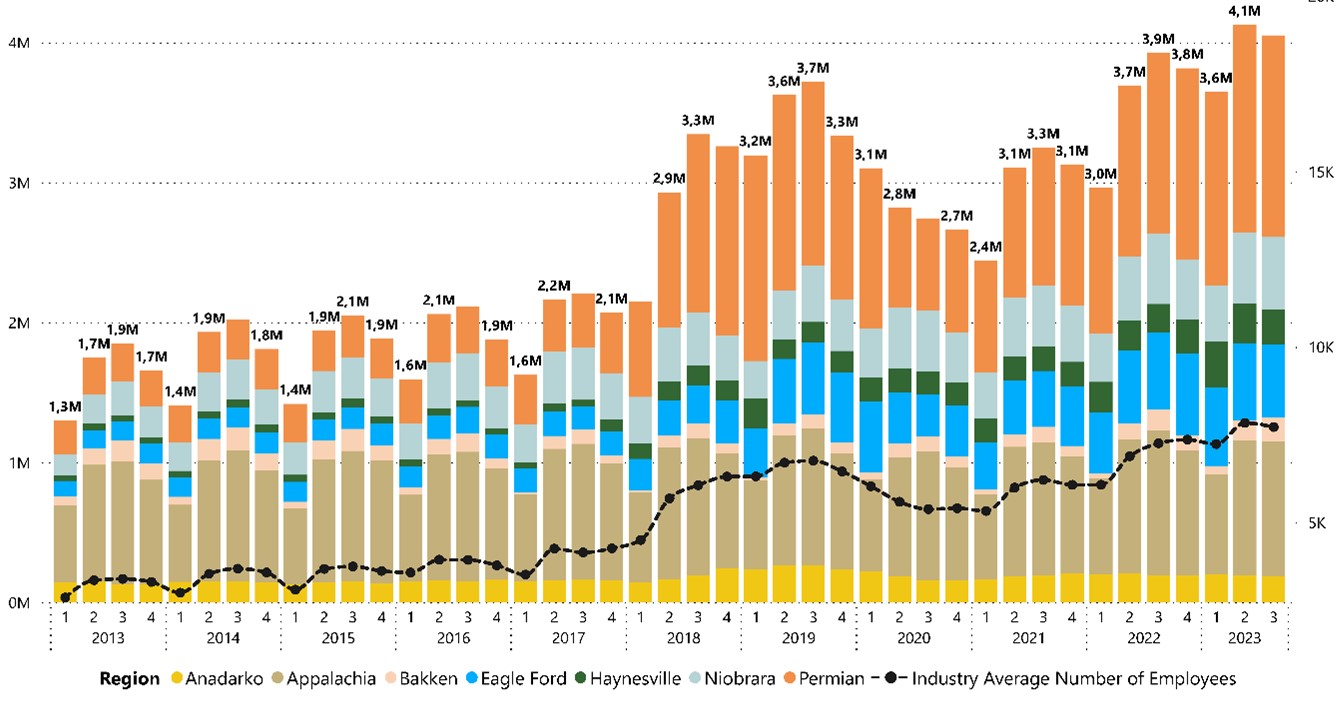

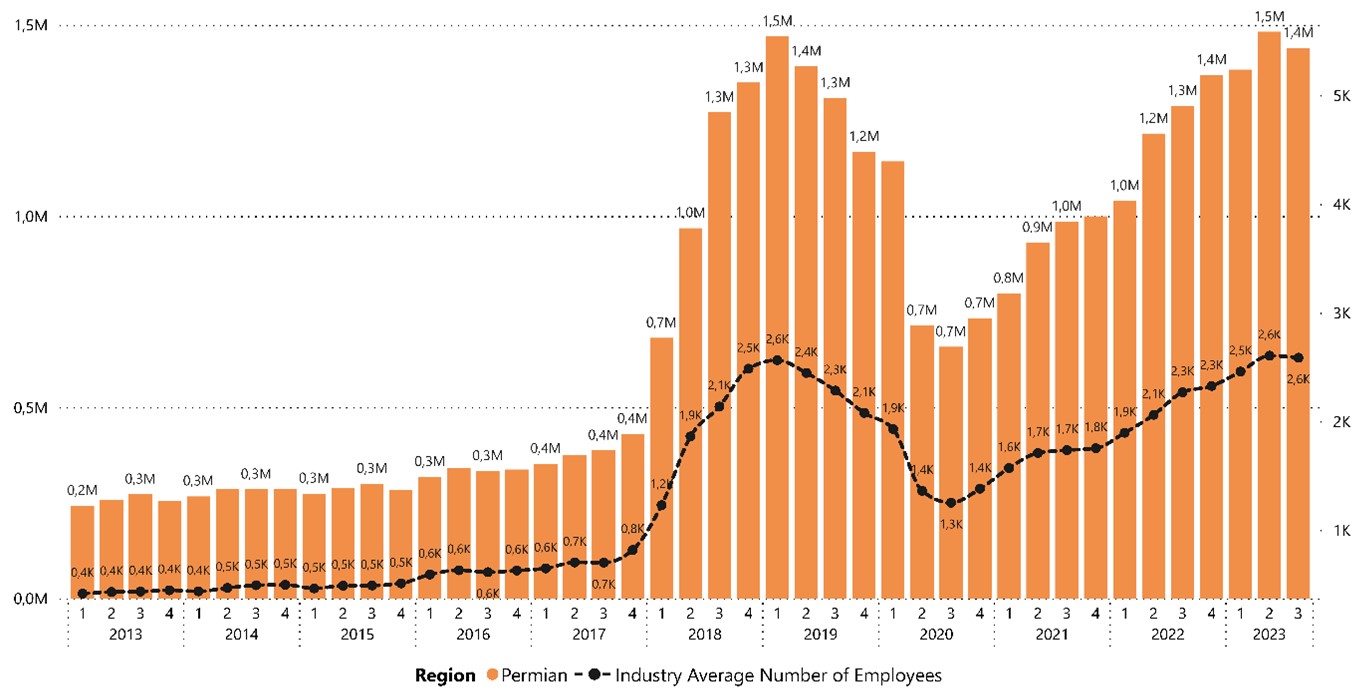

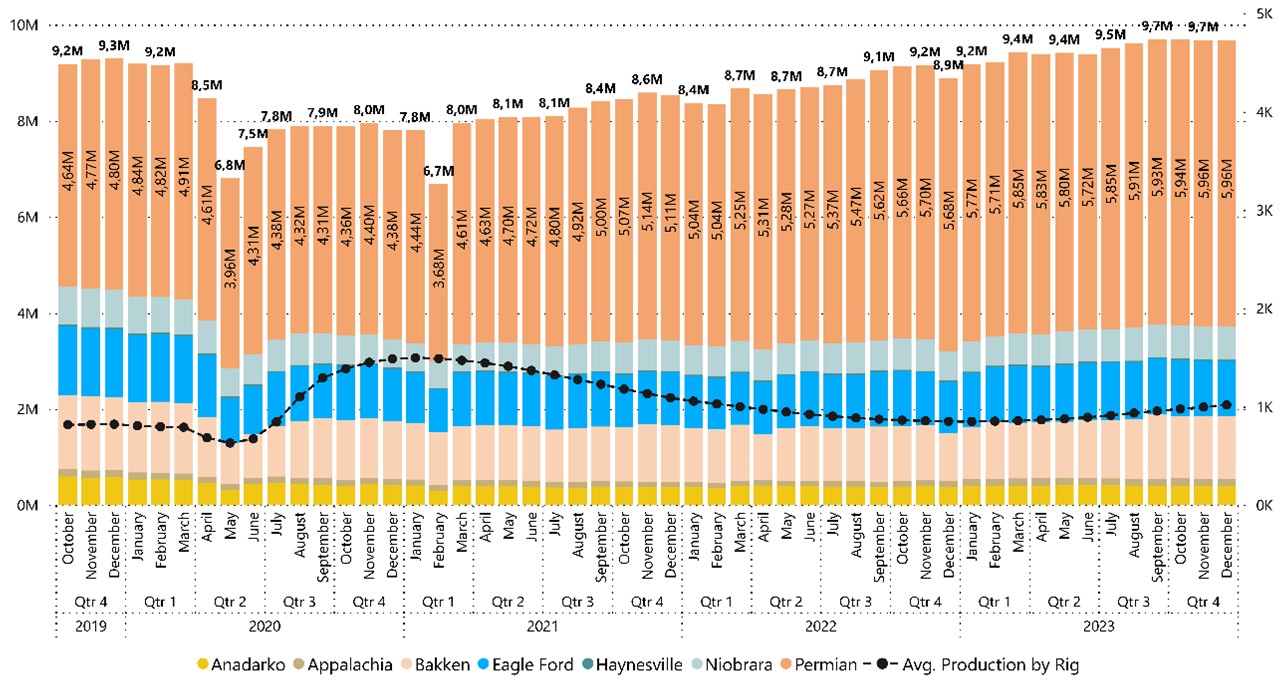

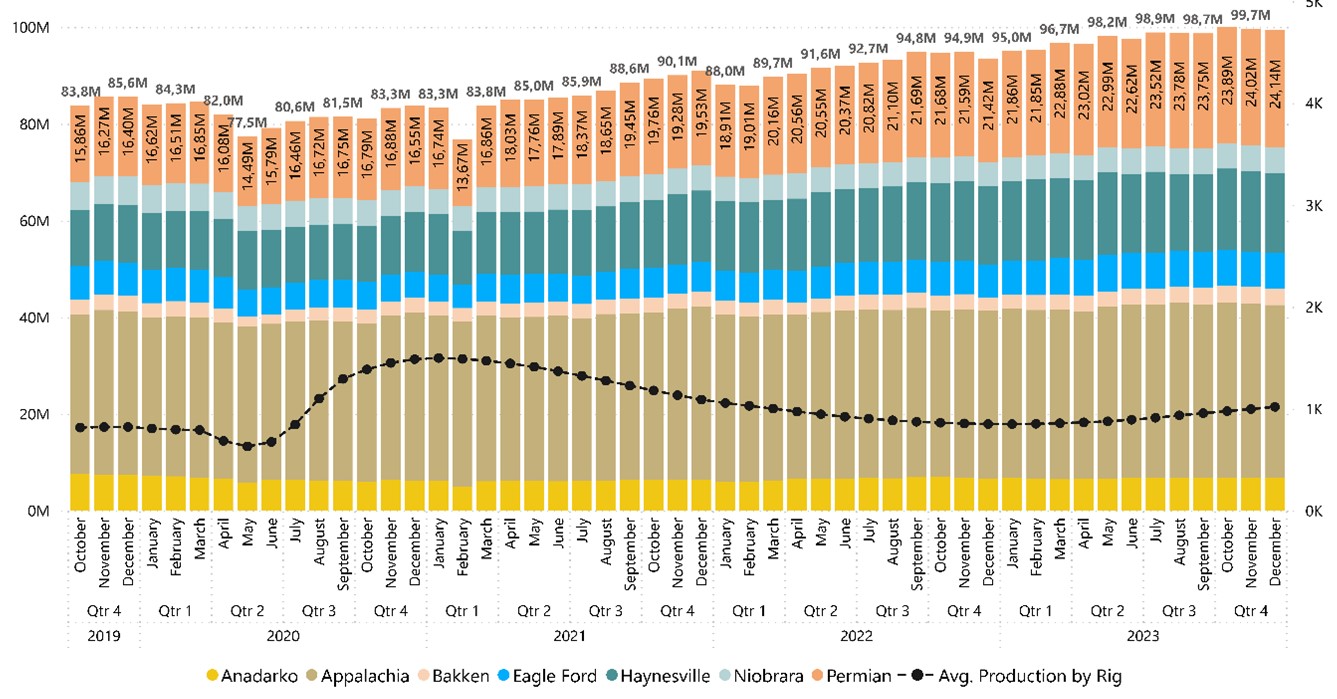

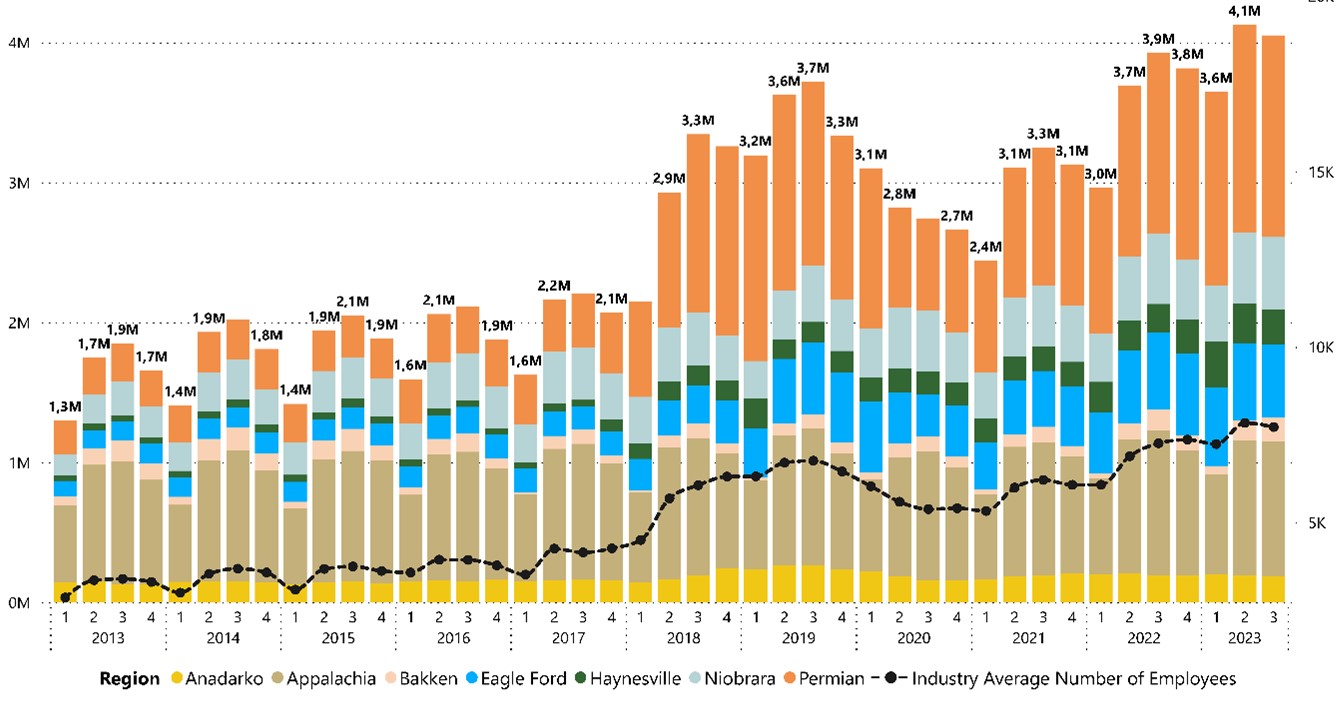

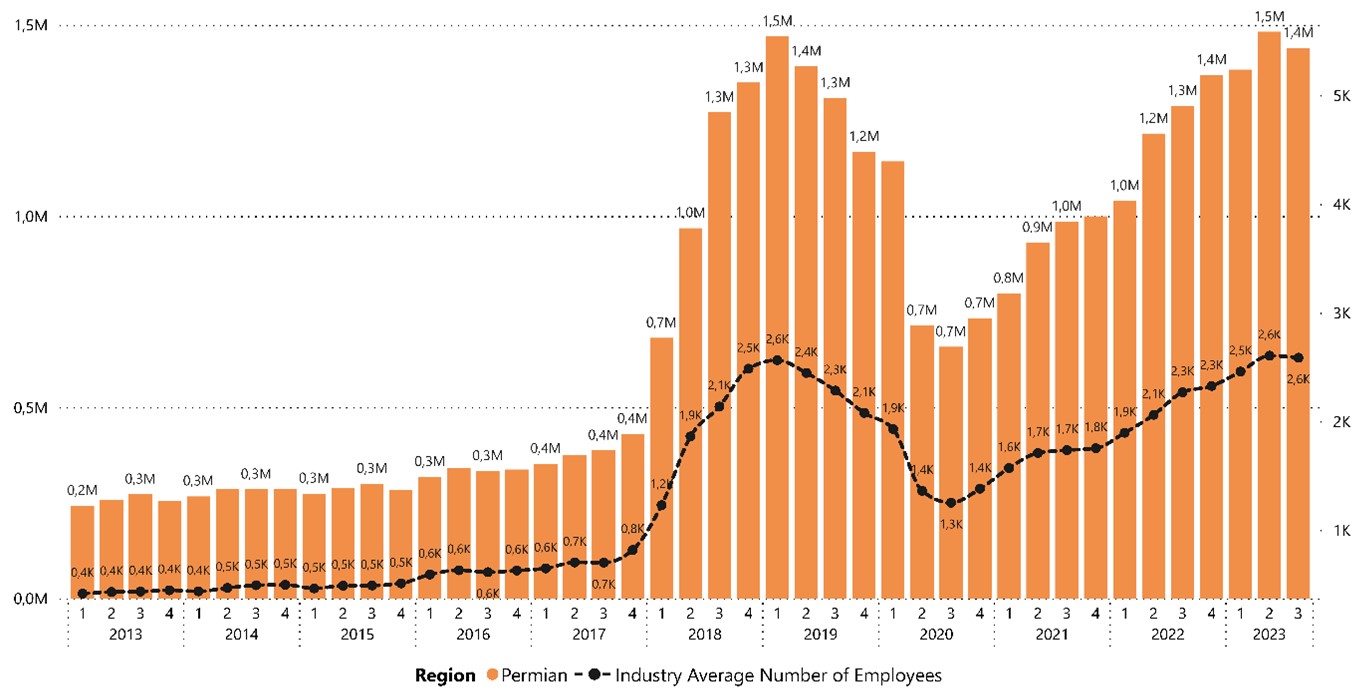

Domestic oil production continues to increase with the Permian leading the way at almost 6 million barrels per day by late 2023.

Source EIA (U.S. Energy Information Administration)

Figure 1.3: Oil Production (bbl/d)

Current frac sand production in the Permian Basin is estimated at 60 million to 65 million tons per year with fairly balanced demand and stable pricing. BOYD anticipates stable frac sand pricing substantially above the $30 per ton pricing used to estimate frac sand reserves for the subject mines. Additionally, we anticipate continued upward sand consumption in the basin due to economic and geopolitical influences on energy demand.

1.7.2.Sales, Production, and Cost Forecast

Annual forecasted ROM production of approximately 12.4 million tons per year is based on the dry plants producing 10.5 million tons per year of saleable product after a processing (wet and dry processing plant) loss of approximately 15%, as discussed in Chapter 6. Forecasted dry processing plant production is within the Kermit Mines’ current infrastructure capacities and capabilities.

As noted in Table 1.5, the dry processing plants are projected to produce approximately 10.5 million tons per year of saleable 40/70 mesh and 40/140 mesh frac sand, as discussed in Chapter 6.

The forecasted sales price of $30 per ton sold, for all products, presented in Table 1.5 is based on long-term forecasted average product prices as provided by Atlas, and reflects the doubling of sales to 10.5 million tons per year.

| | | | | | | | | | |

Table 1.5: Kermit Mines' Sales Projections |

| | 2024 | | 2025 | | 2026 | | 2027 | | 2028 |

Tons Sold (000) | | 10,500 | | 10,500 | | 10,500 | | 10,500 | | 10,500 |

Revenues ($ 000) | | 315,000 | | 315,000 | | 315,000 | | 315,000 | | 315,000 |

Product Pricing ($ per ton sold) | | 30.00 | | 30.00 | | 30.00 | | 30.00 | | 30.00 |

Table 1.6 following this page, presents the cash cost projections for the period 2024 through 2028. Operating cost projections were provided by Atlas and are based on prior year actuals. BOYD considered their estimates to be reasonable. However, adjustments were made based on our review of historical operating costs as well as other information and our experience with such operations.

| | | | | | | | | | |

Table 1.6: Kermit Mines'Cash Cost of Production Projections |

| | 2024 | | 2025 | | 2026 | | 2027 | | 2028 |

Total Cash cost of Production ($ 000) | | 92,265 | | 91,818 | | 91,818 | | 91,818 | | 91,818 |

$ per ton sold | | 8.79 | | 8.74 | | 8.74 | | 8.74 | | 8.74 |

Annual forecasted ROM production of approximately 5.7 million tons per year is based on the dry plant producing 5.0 million tons per year of saleable product after a processing (wet and dry processing plant) loss of approximately 12%, as discussed in Chapter 6. Forecasted dry processing plant production is within the operation’s current infrastructure capacities and capabilities.

As noted in Table 1.7, the dry processing plant is projected to produce approximately 5.0 million tons per year of saleable 40/70 mesh and 40/140 mesh frac sand, as discussed in Chapter 6.

The forecasted sales price of $30 per ton sold, for all products, presented in Table 1.7 is based on forecasted average product prices for the long term as provided by Atlas. We opine that this is a reasonable average sales price.

| | | | | | | | | | |

Table 1.7: Monahans Mine's Sales Projections |

| | 2024 | | 2025 | | 2026 | | 2027 | | 2028 |

Tons Sold (000) | | 5,000 | | 5,000 | | 5,000 | | 5,000 | | 5,000 |

Revenues ($ 000) | | 150,000 | | 150,000 | | 150,000 | | 150,000 | | 150,000 |

Product Pricing ($ per ton sold) | | 30.00 | | 30.00 | | 30.00 | | 30.00 | | 30.00 |

Table 1.8 presents the cash cost projections for the period 2024 through 2028. Operating cost projections were provided by Atlas and are based on prior year actuals. BOYD considered their estimates to be reasonable. However, adjustments were made based on our review of historical operating costs as well as other information and our experience with such operations.

| | | | | | | | | | |

Table 1.8: Monahans Mine's Cash Cost of Production Projections |

| | 2024 | | 2025 | | 2026 | | 2027 | | 2028 |

Total Cash cost of Production ($ 000) | | 57,450 | | 57,250 | | 57,250 | | 57,250 | | 57,250 |

$ per ton sold | | 11.49 | | 11.45 | | 11.45 | | 11.45 | | 11.45 |

The Discounted Cash Flow - Net Present Value (DCF-NPV) estimates presented herein were made for purposes of confirming the general economic viability of the reported frac sand reserves and not for purposes of valuing Atlas, the Kermit and Monahans operations, or its assets. Internal rate-of-return (IRR) and project payback were not calculated, as there were no initial investments considered in the Kermit and Monahans financial models.

All DCF-NPV values are as of January 1, 2024, for the Kermit and Monahans operations. The intent of this exercise is to demonstrate that the operations generate positive cash flows (based on a 10% discount rate), on a pre-tax and after-tax basis, which supports their statements of frac sand reserves.

Resource tons have not been included in the DCF-NPV analyses, although substantial additional saleable product may be available as the in-place frac sand resources and other exploration target areas are converted to reserves.

Table 1.9 below presents the five-year pre-tax and after-tax cash flow projections based on the proposed LOM production schedule and revenue, cost of production, and capital expenditures (CapEx) estimates discussed above for the Kermit Mines.

| | | | | | | | | | | | |

Table 1.9: Kermit Mines' Five-Year Cash Flow Summary |

| | 2024 | | 2025 | | 2026 | | 2027 | | 2028 | | Total |

Total Tons Sold (000) | | 10,500 | | 10,500 | | 10,500 | | 10,500 | | 10,500 | | 52,500 |

Revenues ($ 000) | | 315,000 | | 315,000 | | 315,000 | | 315,000 | | 315,000 | | 1,575,000 |

Cost of Production ($ 000) | | 92,265 | | 91,818 | | 91,818 | | 91,818 | | 91,818 | | 459,537 |

CapEx ($ 000) | | 3,300 | | 3,300 | | 3,300 | | 3,300 | | 3,300 | | 16,500 |

Net Pre-Tax Cash flow ($ 000) | | 219,435 | | 219,882 | | 219,882 | | 219,882 | | 219,882 | | 1,098,963 |

Federal Income Tax ($ 000) | | 43,786 | | 43,811 | | 43,741 | | 43,672 | | 43,603 | | 218,613 |

Net After-Tax Cash Flow ($ 000) | | 175,649 | | 176,071 | | 176,141 | | 176,210 | | 176,279 | | 880,350 |

Three DCF-NPVs on a pre-tax basis and three DCF-NPVs on an after-tax basis, using discount rates of 8%, 10%, and 12%, were calculated utilizing the cash flows above. The DCF-NPV values used mid-year discounting and all cash flows were on a constant dollar basis. Table 1.10 summarizes the results of the NPV analyses:

| | | | | | |

Table 1.10: Kermit Mines'

DCF-NPV Analysis |

| | DCF-NPV ($ millions) |

| | 8% | | 10% | | 12% |

Pre-Tax | | 2,613 | | 2,196 | | 1,887 |

After-Tax | | 2,100 | | 1,764 | | 1,514 |

Please refer to Table 12.3, in Chapter 12, for the LOM cash flow analysis and corresponding pre-tax and after-tax DCF-NPV analyses at a 10% discount rate.

Table 1.11 below presents the five-year pre-tax and after-tax cash flow projections based on the proposed LOM production schedule and revenue, cost of production, and CapEx estimates discussed above for the Monahans Mine.

| | | | | | | | | | | | |

Table 1.11: Monahans Mine's Five-Year Cash Flow Summary |

| | 2024 | | 2025 | | 2026 | | 2027 | | 2028 | | Total |

Total Tons Sold (000) | | 5,000 | | 5,000 | | 5,000 | | 5,000 | | 5,000 | | 25,000 |

Revenues ($ 000) | | 150,000 | | 150,000 | | 150,000 | | 150,000 | | 150,000 | | 750,000 |

Cost of Production ($ 000) | | 57,450 | | 57,250 | | 57,250 | | 57,250 | | 57,250 | | 286,450 |

CapEx ($ 000) | | 3,300 | | 3,300 | | 3,300 | | 3,300 | | 3,300 | | 16,500 |

Net Pre-Tax Cash Flow ($ 000) | | 89,250 | | 89,450 | | 89,450 | | 89,450 | | 89,450 | | 447,050 |

Federal Income Tax ($ 000) | | 16,993 | | 16,966 | | 16,896 | | 16,827 | | 16,758 | | 84,439 |

Net After-Tax Cash Flow ($ 000) | | 72,257 | | 72,484 | | 72,554 | | 72,623 | | 72,692 | | 362,611 |

Three DCF-NPVs on a pre-tax basis and three DCF-NPVs on an after-tax basis, using discount rates of 8%, 10%, and 12%, were calculated utilizing the cash flows above. The DCF-NPV values used mid-year discounting and all cash flows were on a constant dollar basis.

Table 1.12 summarizes the results of the pre-tax and after-tax analyses:

| | | | | | |

Table 1.12: Monahans Mine's |

DCF-NPV Analysis |

| | DCF-NPV ($ millions) |

| | 8% | | 10% | | 12% |

Pre-Tax | | 1,046 | | 884 | | 762 |

After-Tax | | 848 | | 717 | | 619 |

Please refer to Table 12.3, in Chapter 12, for the LOM cash flow analysis and corresponding pre-tax and after-tax DCF-NPV analyses at a 10% discount rate.

1.8.Permitting and Compliance

Several permits are required by federal and state law for mining, processing, and related activities at each of the Kermit and Monahans operations. BOYD reviewed the permits necessary to support continued operations at Kermit and Monahans. The approved permits and certifications appear to be valid, in good standing, and adequate for the continued operation of the mining and processing facilities. New permits, permit revisions, and/or renewals may be necessary from time to time to facilitate future operations. Given sufficient time and planning, Atlas should be able to secure new permits, as required, to maintain its planned operations within the context of current regulations.

Under current regulations, the State of Texas does not require reclamation or remediation of surface mined lands by aggregate (including frac sand) operations. While there are no formal state or federal reclamation obligations, the leased portions of the Monahans property have defined reclamation requirements for post mining land use, including removal of any equipment, structures, and other improvements. Additionally, Atlas voluntarily participates in a Candidate Conservation Agreement with Assurances (CCAA) for the Dune Sagebrush Lizard (DSL). This mitigates DSL regulatory risk for each of the mining operations. Atlas has the option to either set aside acreage for the DSL habitat or contribute cash based on the acreage within the habitat area.

The Kermit and Monahans mines are regulated by TCEQ on matters involving air and water pollution and inspected periodically by the state if issues arise.

Mine safety is regulated by the U.S. Department of Labor’s Mine Safety and Health Administration (MSHA). MSHA inspects the facilities a minimum of twice yearly. Atlas’s safety record compares favorably with its regional peers.

BOYD is not aware of any regulatory violation or compliance issue that would materially impact the reported frac sand reserves for the subject mines.

It is BOYD’s overall conclusion that Atlas’s frac sand resources and frac sand reserves, as reported herein: (1) were prepared in conformance with accepted industry standards and practices, and (2) are reasonably and appropriately supported by technical evaluations, which consider all relevant modifying factors. We do not believe there is other relevant data or information material to the properties that would render this technical report summary misleading. Our conclusions represent only informed professional judgment.

Given the operating history and actual performance of Atlas through the COVID-19 pandemic and volatile energy market conditions, we consider the going concern to be viable under the current and foreseeable operating environment. A general assessment of risk is presented in the relevant sections of this report.

The ability of Atlas, or any mine operator, to recover all of the reported frac sand reserves is dependent on numerous factors that are beyond the control of, and cannot be anticipated by, BOYD. These factors include mining and geologic conditions, the capabilities of management and employees, the securing of required approvals and permits in a timely manner, future sand prices, etc. Unforeseen changes in regulations could also impact performance. Opinions presented in this report apply to the site conditions and features as they existed at the time of BOYD’s investigations and those reasonably foreseeable.

2.0 INTRODUCTION

Atlas provides high quality proppant (frac) sand products, as well as proppant supply chain logistics services to the Permian Basin oil and gas industry. The company was founded in 2017 by long-time exploration and production (E&P) operators and is headquartered in Austin, Texas. Mining and processing operations commenced on their Kermit, Texas property in June 2018, and at their Monahans, Texas property in July 2018. In 2023, Atlas added a second mining and processing facility at their Kermit property.

The company’s common stock is listed on the New York Stock Exchange under the symbol AESI. Additional information regarding Atlas can be found on their website at www.atlas.energy.

2.2.Purpose and Terms of Reference

Atlas retained BOYD to complete independent estimates of frac sand resources and reserves and a technical report summary encompassing their sand mines in accordance with the disclosure requirements set forth in S-K 1300. As such, the purpose of this TRS is threefold: (1) to summarize technical and scientific information for the subject mining properties, (2) to provide the conclusions of our review of the information for each of the properties, and (3) to provide statements of frac sand resources and frac sand reserves for the Kermit and Monahans mines.

BOYD’s opinions and conclusions are based on our detailed review of the supporting geologic, technical, and economic information provided by Atlas, which were used in formulating the estimates of frac sand resources and frac sand reserves disclosed in this report. We independently estimated the frac sand resources and frac sand reserves from first principles using exploration information provided by Atlas or by third-party experts engaged by Atlas. We employed standard engineering and geoscience methods, or a combination of methods, that we considered to be appropriate and necessary to establish the conclusions set forth herein. As in all aspects of mining property evaluation, there are uncertainties inherent in the interpretation of engineering and geoscience data; therefore, our conclusions necessarily represent only informed professional judgment.

The ability of Atlas, or any mine operator, to recover all of the estimated frac sand reserves presented in this report is dependent on numerous factors that are beyond the control of, and cannot be anticipated by, BOYD. These factors include mining and geologic conditions, the capabilities of management and employees, the securing of required approvals and permits in a timely manner, future sand prices, etc. Unforeseen changes in regulations could also impact performance. Opinions presented in this report apply to the site conditions and features as they existed at the time of BOYD’s investigations and those reasonably foreseeable.

This report is intended for use by Atlas, subject to the terms and conditions of its professional services agreement with BOYD. We also consent to Atlas filing this TRS with the SEC pursuant to S-K 1300. Except for the purposes legislated under US securities law, any other uses of or reliance on this report by any third party is at that party’s sole risk.

2.3.Expert Qualifications

BOYD is an independent consulting firm specializing in mining-related engineering and financial consulting services. Since 1943, BOYD has completed over 4,000 projects in the United States and more than 90 other countries. Our full-time staff comprises mining experts in: civil, environmental, geotechnical, and mining engineering; geology; mineral economics; and market analysis. Our extensive experience in frac sand resource and frac sand reserve estimation, and our knowledge of the subject properties, provides BOYD an informed basis on which to opine on the frac sand resources and frac sand reserves available at the Kermit and Monahans mines. An overview of BOYD can be found on our website at www.jtboyd.com.

The individuals primarily responsible for the preparation of this report and the estimates of frac sand resources and frac sand reserves herein are by virtue of their education, experience, and professional association considered qualified persons (QPs) as defined in S-K 1300.

Neither BOYD nor its staff employed in the preparation of this report have any beneficial interest in Atlas, and are not insiders, associates, or affiliates of Atlas. The results of our assignment were not dependent upon any prior agreements concerning the conclusions to be reached, nor were there any undisclosed understandings concerning any future business dealings between Atlas and BOYD. This report was prepared in return for fees based on agreed upon commercial rates, and the payment for our services was not contingent upon our opinions regarding the project or approval of our work by Atlas and its representatives.

2.4.Principal Sources of Information

The information, estimates, opinions, and conclusions presented herein are informed by: (1) data, reports, and other information provided by Atlas; (2) discussions with Atlas personnel; (3) records on file with regulatory agencies; (4) data, reports, and other information from public sources, and (5) nonconfidential information in BOYD’s possession.

The basis for this report is the following previously compiled BOYD technical reports:

•BOYD Report No. 3871.000, dated December 7, 2018, which provided an independent estimate of frac sand resources and frac sand reserves for the Kermit and Monahans mines as of the commencement of mining in 2018.

•BOYD Report No. 3871.006, dated May 13, 2022, which was Atlas’s first TRS for the Kermit and Monahans frac sand mines.

The following information was provided by Atlas:

| | |

| - | “Geologic Exploration & Reserves Estimate: Atlas 1”, prepared by Westward Environmental, Engineering, Natural Resources (Westward), dated November 2017. |

| - | “Exploration Summary Report, Atlas 2 Site (AT2), Monahans, Ward County, Texas, Project No.: 10977-025”, prepared by Westward, dated July 17, 2018. |

| - | “Infill Drilling Summary Report, Atlas 1, Kermit, Winkler County, Texas”, prepared by Westward, dated October 28, 2021. |

•Exploration records (e.g., drill hole location maps, drilling logs, and lab testing summaries) associated with the above noted exploration reports.

•Mapping data, including:

| | |

| - | Property control boundaries |

| - | Infrastructure locations |

| - | Easement and right-of-way boundaries |

| - | Topographic site surveys |

| - | Recent mining extents |

•Overview of mining and processing operations, including detailed flow diagrams.

•Financial forecasting models.

•Historical information, including:

| | |

| - | Production reports and reconciliation statements |

| - | Financial statements |

| - | Product sales and pricing |

| - | Mine plans |

| - | Site plans |

| - | Operational data |

•Files related to mining and operating permits.

Any other information from sources external to BOYD and/or Atlas is referenced accordingly.

The data and workpapers used in the preparation of this report are on file in our offices.

2.4.1.Personal Inspections

Personal inspections of the Atlas operations were made by two of BOYD’s senior geology and mining staff, both qualified persons and co-authors of this report, on April 4, 2018. The site visits included: (1) observation of the active mining operations, (2) a tour of each mine site’s surface infrastructure, and (3) a tour of the process plants and truck loadouts. BOYD’s representatives were accompanied by Atlas’s General Manager who openly and cooperatively answered questions regarding, but not limited to: site geology, mining conditions and operations, equipment usage, labor relations, operating and capital costs, current and proposed processing operations, and frac sand marketing.

Significant operational changes to the mines since the time of our site visit include: (1) the transition to utilizing a combination of dry and dredge mining methods (dredges were not being utilized at the time of the site visit), and (2) the recent addition of the new mining and processing facility and subsequent production capacity expansion at Kermit.

2.4.2.Reliance on Information Provided by the Registrant

In the preparation of this report, we have relied, exclusively and without independent verification, upon information furnished by Atlas with respect to:

•Property title and status

•Encumbrances, easements, and rights-of-way

•Permits, bonds, and reclamation liability

•Sustainability initiatives

•Surface tailings management

•Mine closure requirements and plans

•Monitoring/compliance requirements for protected areas/species

•Market overview and strategy

•Marketing and sales contracts

•Inflation and discount rates

•Current and historical production

•Current and historical costs of operation and production

Our opinions and conclusions regarding this information are provided in the relevant sections of this report.

2.4.3.Verification of Information

BOYD exercised due care in reviewing the information provided by Atlas within the scope of our expertise and experience (which is in technical and financial mining issues) and concluded the data are valid and appropriate considering the status of the subject properties and the purpose for which this report was prepared.

We have no reason to believe that any material facts have been withheld, or that further analysis may reveal additional material information. However, the accuracy of the results and conclusions of this report are reliant on the accuracy of the information provided by Atlas. While we are not responsible for any material omissions in the information provided for use in this report, we do not disclaim responsibility for the disclosure of information contained herein which is within the realm of our expertise.

2.4.4.Other Relevant Data and Information

BOYD is not aware of any additional information which would materially impact the frac sand resource and frac sand reserve estimates reported herein.

The effective (i.e., “as of”) date of this TRS is December 31, 2023. The estimates of frac sand resources and frac sand reserves and supporting information presented in this report are effective as of December 31, 2023.

This is the second TRS filed for Atlas’s Kermit and Monahans mines and supersedes the previously filed TRS (BOYD Report No. 3871.006). The user of this document should ensure that this is the most recent disclosure of frac sand resources and frac sand reserves for Atlas’s Kermit and Monahans mines, as this report is no longer valid if more recent estimates are available.

The US customary measurement system has been used throughout this report. Tons are dry short tons of 2,000 pounds-mass. Historic prices and costs are presented in nominal (unadjusted) dollars. Future dollar values are expressed on a constant (unescalated) basis as of the effective date of this report.

3.0 PROPERTY OVERVIEW

3.1.Description and Location

Referring to Figure 1.1 (General Location Map), the Kermit and Monahans properties are approximately 15 miles apart. From the Kermit Property, it is approximately a 40-mile drive southeast to reach the Monahans Property.

The two Kermit Mines, in Winkler County, Texas, are active surface frac sand mining and processing operations, located on approximately 5,826 “gross” acres (the “Kermit Property”) of which 5,341 “net” acres are controlled (leases and fee-owned) by Atlas. After applying requisite mining setbacks and observing any easements and/or rights‑of‑way, approximately 4,521 acres (or 78% of the property) have been explored and are considered as either mineable frac sand resources or frac sand reserves.

The Kermit operations are located approximately seven miles northeast of the town of Kermit, with a majority of the property on the north side of State Route 115. The southeast corner of the Texas-New Mexico border is less than five miles from the northwest corner of the property.

Geographically, Kermit’s frac sand processing plants are located at approximately 31° 58’ 6.29” N latitude and 103° 0’ 39.46” W longitude. Please refer to Figure 3.1, following this page, which illustrates the general layout of the Kermit Mines.

The Monahans Mine, in Ward and Winkler Counties, Texas, is an active surface frac sand mining and processing operation, located on approximately 32,224 “gross” acres (the “Monahans Property”) which is entirely leased by Atlas. After applying requisite mining setbacks and observing any easements and/or rights-of-way, approximately 11,187 acres (or 35% of the property) have been explored and are considered as either mineable frac sand resources or frac sand reserves. Atlas has also completed more widely spaced and reconnaissance-level exploration drilling and sampling work on an additional 9,575 acres (or 30% of the property) outside of the above-described resource and reserve areas, which are being reported as “exploration target” areas.

Drilling density in the exploration target areas is more widely-spaced, resulting in less geologic confidence within these areas; although drilling and testing results indicate very similar characteristics, both in thickness and frac sand quality, to the frac sand resource and frac sand reserve areas within the Monahans Property.

The Monahans operation is located approximately three miles northeast of the town of Monahans and is situated on the north side of Highway 20. Monahans Sand Hills State Park borders the southeastern corner of the property.

Geographically, the Monahans Mine’s frac sand processing facility is located at approximately 31° 39’ 32.53” N latitude and 102° 52’ 55.46” W longitude. Please refer to Figure 3.2, following this page, which illustrates the general layout of the Monahans Mine.

Since the first “in-basin” frac sand mine opened in August 2017 and began selling frac sand to the Permian Basin oil and gas industry, numerous mines have opened in the general vicinity of the Kermit and Monahans operations.

Atlas began developing the Kermit and Monahans properties by completing initial subsurface exploration, sampling, and testing work mid-2017. Operations commenced on both properties in mid-late 2018. Ongoing development of the properties has continued since, with additional exploration work completed in 2021, and construction of a second mining and processing facility at Kermit in 2023.

Property control data provided for the Kermit and Monahans properties included maps, mining lease agreements, and royalty agreements, which have been accepted as being true and accurate for the purpose of this report.

Under the Monahans Lease and the Kermit Royalty Agreement, Atlas makes monthly royalty payments to Permian Dunes Holding Company, LLC, based on a percentage of their gross monthly proppant sand sales. The lease also includes an annual minimum royalty payment in the amount of $1,000,000 (the “Minimum Annual Royalty Payment”) in any year of the term following an occurrence of a Capital Event. Royalty expenses are recorded as products are sold, and is included in cost of sales, totaling less than 5% of costs of sales.

The Kermit Property comprises approximately 5,826 “gross” acres of which 5,341 “net” acres are controlled by Atlas (3,887 acres leased and 1,454 acres owned in fee).

The Monahans Property comprises approximately 32,224 “gross” acres which is entirely leased by Atlas.

Several existing frac sand mining operations are located in the general vicinity of Atlas’s Kermit and Monahans frac sand mines, including ProFrac’s Kermit and Monahans mines; Hi-Crush’s Kermit Mine; and Black Mountain’s Vest and El Dorado mines located between Atlas’s mines.

3.5.Regulation and Liabilities

Mining and related activities for the Kermit and Monahans operations are predominantly regulated by the TCEQ. The subject mines operate under several permits and must comply with various federal, state, and municipal law regulations that do not require specific permits. Atlas reports that necessary permits are in place or applied for to support immediate operations. New permits or permit revisions may be necessary from time to time to facilitate future operations. Given sufficient time and planning, Atlas should be able to secure new permits, as required, to maintain its planned operations within the context of current regulations.

Atlas participates in a voluntary CCAA for the DSL. The agreement, which Atlas signed in January 2021, lasts for 23 years. Their voluntary participation in the CCAA effectively mitigates DSL regulatory risk for Atlas’s Kermit and Monahans mining operations.

Atlas can either set aside acreage for DSL habitat or contribute cash to continue participating in the CCAA. Atlas holds significant sand acreage outside of their current resources and reserves that would be able to be contributed or set aside for the CCAA, allowing them to continue mining operations, even if the DSL is listed as an endangered species. Atlas did not inform BOYD of any issues related to the DSL with regards to mining of the Kermit and Monahans properties.

To the extent known to BOYD, there are no violations, fines, liens, or other significant factors and risks that may affect access, title, or the right or ability to perform work on the Kermit or Monahans properties.

3.6.Accessibility, Local Resources, and Infrastructure

The Kermit Property is located near small rural towns in western Texas and southeastern New Mexico. The surrounding region has a well-established history of oil and gas production, being located within the center of the Permian Basin. Winkler and the surrounding counties have a combined population of over 280,000 people, according to 2020 population estimates by the Texas Demographic Center and Lea County, New Mexico.

General access to the Kermit Property is via a well-developed network of primary and secondary roads serviced by state and local governments. These roads offer direct access to the mines and processing facilities, and are generally open year-round. Primary vehicular access to the property is via SR 115, running north-south. Various state highways (302, 115, 18, 128) in Texas and New Mexico are accessible to the subject property and provide primary access to various portions of the oil and gas fields.

The Midland International Air and Space Port is located approximately 45 miles southeast of the Kermit Mines, and there are additional local/regional airports located within a 65-mile radius of the Kermit Property.

With regards to utilities, three phase electrical power is supplied to the property from a local utility, a natural gas line supplies gas to the dry plants, and other miscellaneous services are readily available. Water is gathered in a central collection pond or mine pit reservoir which acts as the primary source of water. In addition, 14 water wells drilled throughout the property function as a backup source of water.

The Monahans Property is located near small rural towns in western Texas. The region has a well-established history of oil and gas production, being located within the center of the Permian Basin. Ward, Winkler, and the surrounding counties have a combined population of over 225,000 people, according to 2020 population estimates by the Texas Demographic Center.

General access to the Monahans Property is via a network of primary and secondary roads serviced by state and local governments. These roads offer direct access to the mine and processing facilities and are generally open year-round. Primary vehicular access to the property is via SH 18, which runs northeast-southwest, and Interstate 20 which also runs northeast-southwest below the southern boundary of the property. These roads provide access to various portions of the oil and gas fields. In addition, a connection to the UP railroad via the Texas-New Mexico railroad branch line is located in the city of Monahans.

The Midland International Air and Space Port is approximately 40 miles east of the Monahans operation, and there are additional local/regional airports located within a 50‑mile radius of the Monahans property.

Regarding utilities to the property, three phase electrical power is supplied from a local utility, a natural gas line supplies gas to the dry plant, and other miscellaneous services are available. Water is gathered in a central collection pond which acts as the primary source of water. In addition, 21 water wells drilled throughout the property provide a backup supply of water.

The Kermit and Monahans properties are situated within the Texas Great Plains physiographic province, a region encompassing much of northwestern and western Texas. The surrounding areas generally consist of desert valleys covered with windblown sheet and dune sands, high plains covered with thick alluvium (the Llano Estacado or Staked Plains), or plateaus consisting of thin carbonate-based soils (the Caprock Escarpment). The two properties encompass a majority of the active dune complexes found in this area. The plateau areas, typically covered by a weathering-resistant caliche (a hardened natural cement of calcium

carbonate that binds other materials―such as gravel, sand, clay, and silt), may abruptly stand up to 1,000 ft above the plains. Much of the region may be covered by various types of desert scrub grasses, sages, yuccas, junipers, shin oaks, and mesquites.

Surface elevations across the properties range from approximately 2,960 ft to 3,050 ft above mean sea-level (AMSL) on Kermit, and 2,660 ft to 2,930 ft AMSL on Monahans.