Exhibit 25.1

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM T-1

STATEMENT OF ELIGIBILITY

UNDER THE TRUST INDENTURE ACT OF 1939 OF A

CORPORATION DESIGNATED TO ACT AS TRUSTEE

| ☐ | CHECK IF AN APPLICATION TO DETERMINE ELIGIBILITY OF A TRUSTEE PURSUANT TO SECTION 305(b)(2) |

Truist Bank

(Exact name of trustee as specified in its charter)

| North Carolina | | 56-0149200 |

| (Jurisdiction of incorporation if not a U.S. national bank) | | (I.R.S. Employer Identification No.) |

223 West Nash Street Wilson, North Carolina | | 27893 |

| (Address of principal executive offices) | | (Zip Code) |

Patrick Giordano

Vice President

223 West Nash Street

Wilson, North Carolina 27893

(904) 463-6762

(Name, address and telephone number of agent for service)

HEICO Corporation

(For other obligors, please see “Table of Co-Registrants” on the Following Page)

(Exact name of obligor as specified in its charter)

| Florida | | 65-0341002 |

| (Jurisdiction of incorporation) | | (I.R.S. Employer Identification No.) |

3000 Taft Street Hollywood, Florida | | 33021 |

| (Address of principal executive offices) | | (Zip Code) |

Debt Securities

Guarantees of Debt Securities

(Title of the indenture securities)

TABLE OF CO-REGISTRANTS

| Exact Name of Co-Registrant as Specified in its Charter | | State or Other

Jurisdiction of

Incorporation or

Organization | | I.R.S. Employer

Identification No. |

| 16-1741 PROPERTY, INC. | | Florida | | 45-4350389 |

| 26 WARD HILL PROPERTY, LLC | | Florida | | 86-3142182 |

| 3 MCCREA PROPERTY COMPANY, LLC | | Florida | | 83-2312708 |

| 34 FREEDOM COURT, CORP. | | Florida | | 92-1754605 |

| 3D PLUS U.S.A., INC. | | Delaware | | 74-2947071 |

| 60 SEQUIN LLC | | Connecticut | | 82-4758526 |

| 8929 FULLBRIGHT PROPERTY, LLC | | California | | 88-3653335 |

| ACCURATE METAL MACHINING, INC. | | Ohio | | 34-1193166 |

| ACTION RESEARCH CORPORATION | | Florida | | 46-1086859 |

| AEROANTENNA TECHNOLOGY, INC. | | California | | 95-4322670 |

| AERODESIGN, INC. | | Tennessee | | 62-1858631 |

| AEROELT, LLC | | Florida | | 82-4804644 |

| AEROSPACE & COMMERCIAL TECHNOLOGIES, LLC | | Florida | | 47-4759100 |

| AIRCRAFT TECHNOLOGY, INC. | | Florida | | 65-0233725 |

| ANALOG MODULES, INC. | | Florida | | 59-2074349 |

| APEX HOLDING CORP. | | Delaware | | 46-0732506 |

| APEX MICROTECHNOLOGY, INC. | | Arizona | | 46-0624696 |

| ASTRO PROPERTY, LLC | | Connecticut | | 47-4786567 |

| ASTROSEAL PRODUCTS MFG. CORPORATION | | Connecticut | | 06-0808406 |

| BAY EQUIPMENT CORP. | | Delaware | | 82-4356384 |

| BLUE AEROSPACE LLC | | Florida | | 27-4313205 |

| BREIDON, LLC | | Maryland | | 46-1563733 |

| CAMTRONICS, LLC | | Florida | | 86-3999996 |

| CARBON BY DESIGN CORPORATION | | Florida | | 82-1858021 |

| CARBON BY DESIGN LLC | | California | | 20-1043190 |

| CHARTER ENGINEERING, INC. | | Florida | | 59-3400419 |

| CONNECTRONICS CORP. | | Florida | | 20-1971140 |

| CONXALL CORPORATION | | Illinois | | 36-2944789 |

| CSI AEROSPACE, INC. | | Florida | | 45-5531151 |

| DB CONTROL CORP. | | Florida | | 27-1784894 |

| DECAVO LLC | | Oregon | | 26-4673544 |

| DIELECTRIC SCIENCES, INC. | | Massachusetts | | 04-2603559 |

| DUKANE SEACOM, INC. | | Florida | | 27-1050226 |

| ENGINEERING DESIGN TEAM, INC. | | Oregon | | 93-0964386 |

| FLIGHT MICROWAVE CORPORATION | | California | | 55-0883855 |

| FUTURE AVIATION, INC. | | Florida | | 65-1011336 |

| HARTER AEROSPACE, LLC | | Florida | | 47-2458702 |

| HEICO AEROSPACE CORPORATION | | Florida | | 59-0791770 |

| HEICO AEROSPACE HOLDINGS CORP. | | Florida | | 65-0831428 |

| HEICO AEROSPACE PARTS CORP. | | Florida | | 65-1146790 |

| HEICO EAST CORPORATION | | Florida | | 65-0271411 |

| HEICO ELECTRONIC TECHNOLOGIES CORP. | | Florida | | 65-0680321 |

| HEICO FLIGHT SUPPORT CORP. | | Florida | | 46-0627157 |

| HEICO PARTS GROUP, INC. | | Florida | | 26-3082967 |

| HEICO REPAIR GROUP AEROSTRUCTURES, LLC | | Florida | | 82-2700627 |

| HEICO REPAIR, LLC | | Florida | | 84-2205144 |

| HETC I, LLC | | Florida | | 83-1444190 |

| HETC II CORP. | | Florida | | 83-2596259 |

| HETC III, LLC | | Florida | | 83-3243681 |

| HETC IV, LLC | | Florida | | 84-4050584 |

| HETC V, LLC | | Florida | | 85-2422715 |

| HFSC III CORP. | | Florida | | 47-2451008 |

| HFSC IV CORP. | | Florida | | 81-5140246 |

| HFSC V, LLC | | Florida | | 83-2178482 |

| Exact Name of Co-Registrant as Specified in its Charter | | State or Other

Jurisdiction of

Incorporation or

Organization | | I.R.S. Employer

Identification No. |

| HFSC VI, LLC | | Florida | | 84-2575273 |

| HFSC VII, LLC | | Florida | | 85-1245696 |

| HFSC VIII, LLC | | Florida | | 86-3453082 |

| HFSC XI CORP. | | Florida | | 87-4380214 |

| HNW 2 BUILDING CORP. | | Florida | | 20-1971031 |

| HNW BUILDING CORP. | | Florida | | 65-0880442 |

| HVT GROUP, INC. | | Delaware | | 04-3502230 |

| INERTIAL AIRLINE SERVICES, INC. | | Ohio | | 34-1823836 |

| INTELLIGENT DEVICES, LLC | | Delaware | | 52-1943471 |

| IRONWOOD ELECTRONICS, INC. | | Minnesota | | 27-4686945 |

| IRCAMERAS LLC | | Florida | | 47-4956282 |

| JET AVION CORPORATION | | Florida | | 59-2699611 |

| JETSEAL, INC. | | Delaware | | 91-1433851 |

| LEADER TECH, INC. | | Florida | | 04-2667972 |

| LPI INDUSTRIES CORPORATION | | Florida | | 65-0054782 |

| LUCIX CORPORATION | | California | | 77-0504129 |

| LUMINA POWER, INC. | | Florida | | 20-2350926 |

| MASTIFF DESIGN, INC. | | Florida | | 88-1101204 |

| MCCLAIN INTERNATIONAL, INC. | | Georgia | | 58-0876596 |

| MIDWEST MICROWAVE SOLUTIONS, INC. | | Iowa | | 27-0124198 |

| NIACC-AVITECH TECHNOLOGIES INC. | | Florida | | 51-0453669 |

| NORTHWINGS ACCESSORIES CORPORATION | | Florida | | 65-0312802 |

| OPTICAL DISPLAY ENGINEERING, INC. | | Florida | | 46-1634579 |

| OPTICAL DISPLAY ENGINEERING, LLC | | Florida | | 38-4203543 |

| PACIWAVE, INC. | | California | | 77-0413439 |

| PIONEER INDUSTRIES LLC | | Delaware | | 11-1746409 |

| PRIME AIR, LLC | | Florida | | 20-5545289 |

| PYRAMID SEMICONDUCTOR CORP | | Florida | | 86-2249124 |

| QUELL CORPORATION | | Colorado | | 46-0507356 |

| R.H. LABORATORIES, INC. | | New Hampshire | | 02-0527375 |

| RADIANT POWER CORP. | | Florida | | 65-0892651 |

| RADIANT POWER IDC, LLC | | Florida | | 82-3217339 |

| RADIANT-SEACOM REPAIRS CORP. | | Florida | | 46-4846094 |

| RAMONA RESEARCH, INC. | | California | | 45-4786673 |

| REINHOLD HOLDINGS, INC. | | Delaware | | 20-8005591 |

| REINHOLD INDUSTRIES, INC. | | Delaware | | 13-2596288 |

| RESEARCH ELECTRONICS INTERNATIONAL, L.L.C. | | Tennessee | | 62-1597816 |

| RIDGE ENGINEERING, LLC | | Maryland | | 02-0527375 |

| RIDGE HOLDCO, LLC | | Florida | | 52-0908121 |

| ROBERTSON FUEL SYSTEMS, LLC | | Arizona | | 87-1755561 |

| ROCKY MOUNTAIN HYDROSTATICS, LLC | | Colorado | | 86-0775241 |

| SANTA BARBARA INFRARED, INC. | | California | | 58-2428936 |

| SEAL DYNAMICS LLC | | Florida | | 77-0111325 |

| SEAL Q CORP. | | Florida | | 00-0000000 |

| SENSOR SYSTEMS, INC. | | Nevada | | 95-2127229 |

| SENSOR TECHNOLOGY ENGINEERING, LLC | | Florida | | 95-2127229 |

| SIERRA MICROWAVE TECHNOLOGY, LLC | | Delaware | | 82-4199356 |

| SOLID SEALING TECHNOLOGY, INC. | | New York | | 46-3801015 |

| SPECIALITY SILICONE PRODUCTS, INC. | | New York | | 20-0539521 |

| SUNSHINE AVIONICS LLC | | Florida | | 82-3091838 |

| SWITCHCRAFT HOLDCO, INC. | | Delaware | | 00-0000000 |

| SWITCHCRAFT, INC. | | Illinois | | 20-2476580 |

| THE BECHDON COMPANY, LLC | | Maryland | | 36-2051512 |

| THERMAL ENERGY PRODUCTS, INC. | | California | | 52-0895348 |

| THERMAL STRUCTURES, INC. | | California | | 98-1285293 |

| TRAD TESTS & RADIATIONS, INC. | | Florida | | 95-3575611 |

| TRANSFORMATIONAL SECURITY, LLC | | Maryland | | 00-0000000 |

| TSID HOLDINGS, LLC | | Florida | | 33-0689721 |

| TTT CUBED, INC. | | California | | 85-2433352 |

| TURBINE KINETICS, INC. | | Florida | | 27-5248226 |

Address of each Co-Registrant’s Principal Executive Offices: 3000 Taft Street Hollywood, Florida 33021.

| Item 1. | General Information. |

Furnish the following information as to the trustee:

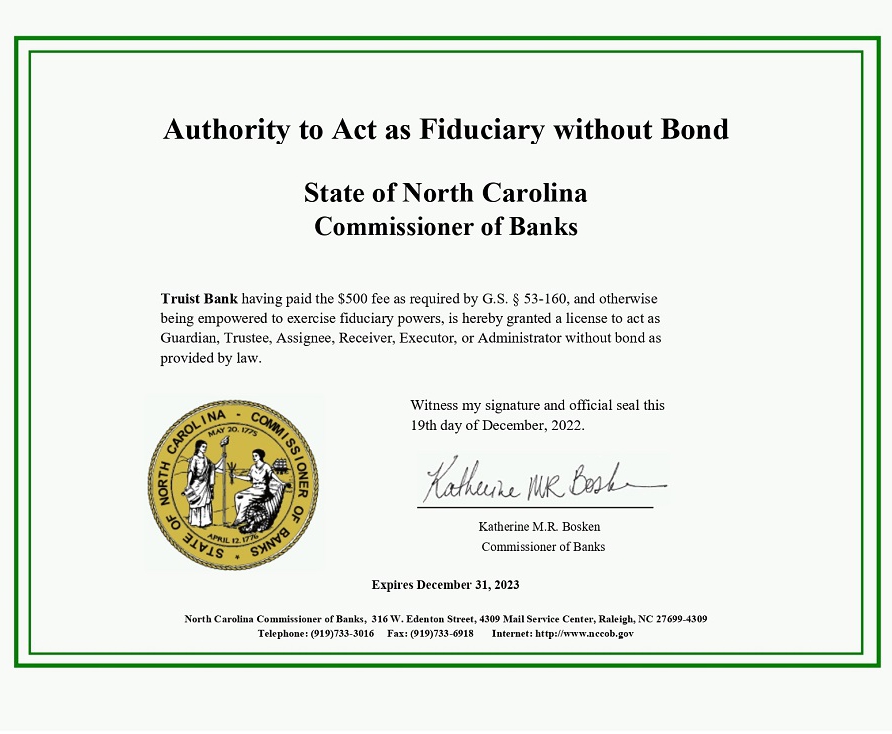

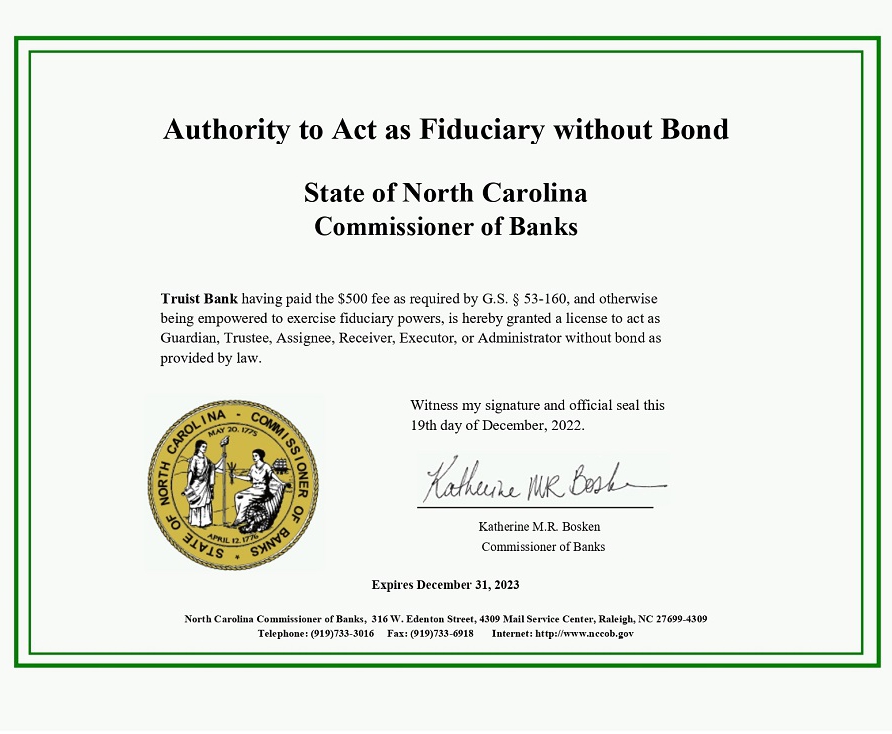

| (a) | Name and address of each examining or supervising authority to which it is subject. |

State of North Carolina – Commissioner of Banks

State of North Carolina

Raleigh, North Carolina

Federal Reserve Bank of Richmond

Post Office Box 27622

Richmond, Virginia 23261

Federal Deposit Insurance Corporation

Washington, D.C.

| (b) | Whether it is authorized to exercise corporate trust powers. |

Yes.

| Item 2. | Affiliations with Obligor. |

If the obligor is an affiliate of the trustee, describe each such affiliation.

Based upon an examination of the books and records of the trustee and upon information furnished by the obligor, the obligor is not an affiliate of the trustee.

Items 3-15.

No responses are included for Items 3-15. Responses to those items are not required because, as provided in General Instruction B, the obligor is not in default on any securities issued under indentures under which Truist Bank is a trustee and Truist Bank is not a foreign trustee.

| Item 16. | List of Exhibits. |

List below all exhibits filed as a part of this statement of eligibility; exhibits identified in parentheses are filed with the Commission and are incorporated herein by reference as exhibits hereto pursuant to Rule 7a-29 under the Trust Indenture Act of 1939, as amended, and Rule 24 of the Commission’s Rules of Practice.

SIGNATURE

Pursuant to the requirements of the Trust Indenture Act of 1939 the trustee, Truist Bank, a banking corporation organized and existing under the laws of the State of North Carolina, has duly caused this statement of eligibility and qualification to be signed on its behalf by the undersigned, thereunto duly authorized, all in the City of Jacksonville and the State of Florida, on the 17th day of July, 2023.

| | By: | /s/ Patrick Giordano |

| | Name: | Patrick Giordano |

| | Title: | Vice President |

Exhibit 1 to Form T-1

Exhibit 3 to Form T-1

EXHIBIT 4 TO FORM T-1

BYLAWS OF TRUIST BANK

As Amended and Restated, Effective December 7, 2019

ARTICLE I

Offices

1. Principal Office: The principal office of Truist Bank (the “bank”) shall be located at 214 N. Tryon Street, Charlotte, North Carolina, or at such other place as the Board of Directors may fix from time to time.

2. Registered Office: The bank shall maintain a registered office or registered offices at such place or places as may be required by applicable law.

3. Other Offices: The bank may have offices at such other places as the Board of Directors may from time to time determine, or as the affairs of the bank may require.

ARTICLE II

Meetings of Sole Shareholder

1. Place of Meetings: All meetings of the bank’s sole shareholder, Truist Financial Corporation, shall be held at the principal office of the bank, or at such other place, either within or without the State of North Carolina, as shall, in each case, be fixed by the Chairman of the Board, the Chief Executive Officer, the President, the Chief Operating Officer, the Secretary or the Board of Directors and designated in the notice of the meeting.

2. Annual Meetings: The annual meeting of the bank’s sole shareholder shall be held on such date and at such time as may be designated by the Chairman of the Board, the Chief Executive Officer, the President, the Chief Operating Officer, the Secretary or the Board of Directors for the purpose of the election of directors and for the transaction of such other business as may properly come before the meeting.

3. Substitute Annual Meeting: If the annual meeting shall not be held on the day designated by these bylaws, a substitute annual meeting may be called in accordance with the provisions of this Article relating to special meetings. A meeting so called shall be designated and treated for all purposes as the annual meeting.

4. Special Meetings: Except as otherwise provided by any applicable law, special meetings of the bank’s sole shareholder may be called at any time by the Chairman of the Board, the Chief Executive Officer, the President, the Chief Operating Officer, the Secretary or the Board of Directors of the bank.

5. Notice of Meetings; Waiver:

(a) Written, printed or electronically transmitted notice of a meeting stating the date, time and place of the meeting shall be delivered to the bank’s sole shareholder not fewer than 10 nor more than 60 days before the date thereof, by or at the direction of the Chairman of the Board, the Chief Executive Officer, the President, the Chief Operating Officer, the Secretary or the Board of Directors.

(b) In case of an annual or substitute annual meeting, the notice of meeting need not specifically state the business to be transacted at the meeting, unless a description of the matter is required by the provisions of applicable law. In the case of a special meeting, the notice of meeting shall specifically state the purpose or purposes for which the meeting is called.

(c) The bank’s sole shareholder may waive notice of any meeting before or after the date and time stated in the notice. The waiver must be in writing, signed by the shareholder and delivered to the bank for inclusion in the minutes or filing with the corporate records. Attendance at a meeting by the sole shareholder waives objection to lack of notice or defective notice of the meeting, unless the shareholder at the beginning of the meeting objects to holding the meeting or transacting business at the meeting.

6. Proxies: Shares may be voted either in person or by one or more proxies authorized by a written appointment of proxy signed by the bank’s sole shareholder.

7. Action without Meeting: Any action that is required or permitted to be taken at a meeting of the sole shareholder may be taken without a meeting if a written consent, setting forth the action so taken, shall be signed by the sole shareholder, and delivered to the bank for inclusion in the minutes or filing with the corporate records.

8. Conduct of Meetings:

(a) Unless determined otherwise by the Board of Directors, the Chief Executive Officer of the bank shall act as chairman at all meetings of the sole shareholder and the Secretary or an Assistant Secretary of the bank shall act as secretary at all meetings of sole shareholder.

(b) The Board of Directors or, in its absence, the chairman of the meeting may, to the extent not prohibited by applicable law, establish such rules or regulations for the conduct of meetings of the sole shareholder as the Board or the chairman, as the case may be, shall deem necessary, appropriate or convenient.

ARTICLE III

Directors

1. General Powers: All corporate powers shall be exercised by or under the authority of, and the business, affairs and operations of the bank shall be managed by or under the direction of, the Board of Directors, except as otherwise provided by applicable law or in the articles of incorporation or bylaws.

2. Number, Term, and Qualification: The Board shall consist of not less than five nor more than thirty members and the number of members shall be fixed and determined from time to time by a resolution of the majority of the full board or by resolution of the sole shareholder. Each director shall be elected to serve a term of one year, with each director’s term to expire at the annual meeting next following the director’s election as a director. Each director shall hold office until his or her death, resignation, retirement, removal, disqualification, or his or her successor is elected and qualified. Unless otherwise permitted by applicable law, not less than three-fourths of the directors shall be citizens of the United States of America and satisfy the eligibility requirements for bank directors imposed by federal law and Chapter 53C of the North Carolina General Statutes or any successor thereto. In addition, a director must do either of the following: (i) appoint an agent in Wake County, North Carolina, for service of process; or (ii) consent, on a form satisfactory to the North Carolina Commissioner of Banks, to the following: that the North Carolina Commissioner of Banks may serve as the director’s agent for service of process and that the director consents to jurisdiction in Wake County, North Carolina, but only for purposes of any action or proceeding brought by the North Carolina Commissioner of Banks.

3. Election of Directors: Except as provided in Section 5 of this Article, directors shall be elected by the sole shareholder of the bank.

4. Removal: Any director may be removed from office by the bank’s sole shareholder with or without cause.

5. Vacancies: A vacancy occurring in the Board of Directors, including a vacancy created by an increase in the number of directors, may be filled by a majority of the remaining directors. The bank’s sole shareholder may elect a director at any time to fill a vacancy not filled by the directors. In addition, at any meeting of the sole shareholder, the shareholder may authorize not more than two additional directorships which may be left unfilled to be filled in the discretion of the Board during the interval between shareholders’ meetings. A director elected to fill a vacancy shall be elected for the unexpired term of his or her predecessor in office.

6. Compensation: The Board of Directors may compensate non-management directors for their services as such and may provide for the payment of expenses incurred by all directors, as appropriate, in connection with such services.

7. Director Retirement: A director, upon reaching age seventy-five, shall retire as a director effective as of the end of that calendar year without any further action by the sole shareholder or the Board of Directors.

8. Chairman of the Board; Vice Chairmen: There shall be a Chairman of the Board of Directors elected by the directors from their members. The Chairman may also be the Chief Executive Officer of the bank. The Chairman shall preside at all meetings of the Board of Directors and shall perform such other duties as may be incident to the office of Chairman or as may be directed by the Board. There may also be one or more Vice Chairmen of the Board of Directors elected by the directors from their members. Such Vice Chairman or Vice Chairmen shall perform such other duties as may be incident to the office of Vice Chairman or as may be directed by the Board.

9. Executive Committee: The Board of Directors shall appoint an Executive Committee composed of not less than three members of the Board. The Executive Committee shall have such powers and duties as may be stated in its charter, if any, or as may be prescribed from time to time by the Board, subject to any restrictions imposed by applicable law. Without limiting the foregoing, to the extent permitted by applicable law and authorized by the Board of Directors, the Executive Committee shall have and may exercise, during the intervals between the meetings of the Board, all the powers and authority of the Board of Directors in the management of the business affairs and operations of the bank.

10. Audit Committee: The Board of Directors shall appoint an Audit Committee, composed solely of not less than three independent directors. Members of the Audit Committee shall be elected by a majority of the Board and in compliance with Section 363 of the Federal Deposit Insurance Corporation Rules and Regulations. The Audit Committee shall have such powers and duties as may be stated in its charter or as may be prescribed from time to time by the Board, subject to any restrictions imposed by applicable law.

11. Other Committees: The Board of Directors may appoint such other committees of the Board (including a Trust Committee, a Compensation Committee, a Risk Committee and a Loan Committee) as: (i) the Board shall deem appropriate for the safe and sound operation of the bank in a manner consistent with applicable law and regulations; (ii) as required by the North Carolina Commissioner of Banks; or (iii) as may be required by applicable law. Members of such committees shall be elected by a majority of the Board. Each committee shall have a minimum of three members. Each such committee shall have such powers and duties as may be stated in such committee’s charter, if any, or as may be prescribed from time to time by the Board, subject to any restrictions imposed by applicable law.

12. Advisory Directors: The Board of Directors may also appoint local advisory directors as it deems useful to the business of the bank; provided, however that the local advisory directors shall in no way be deemed to be directors serving on the Board of Directors.

13. General Committee Matters: Each committee member serves at the pleasure of the Board of Directors. The provisions in these bylaws governing meetings, action without meetings, notice, waiver of notice, quorum and voting requirements of the Board apply to committees of the Board established under this Article.

14. CEO and Chairman Position and Succession; Board Composition; Headquarters.

(a) The Board of Directors has resolved that, effective as of the effective time (the “Effective Time”) of the Bank Merger (for all purposes of this Section 14, as defined in the Agreement and Plan of Merger, dated as of February 7, 2019, as amended June 14, 2019, by and between BB&T Corporation (the “corporation”) and SunTrust Banks, Inc. (“SunTrust”), as the same may be amended from time to time (the “Merger Agreement”)), Mr. Kelly S. King shall continue to serve as Chairman of the Board of Directors and Chief Executive Officer of the bank and Mr. William H. Rogers, Jr. shall become the President and Chief Operating Officer of the bank. The Board of Directors has further resolved that (i) Mr. Rogers shall be the successor to Mr. King as the Chief Executive Officer of the bank, with such succession to become effective on September 12, 2021 or any such earlier date as of which Mr. King ceases for any reason to serve in the position of Chief Executive Officer of the bank (the date of such corporation succession, the “CEO Succession Date”); (ii) subject to Mr. King’s death, resignation or disqualification, from the CEO Succession Date through March 12, 2022, Mr. King shall serve as Executive Chairman of the bank; (iii) Mr. Rogers shall be the successor to Mr. King as the Chairman of the Board of Directors of the bank, with such succession to become effective on March 12, 2022, or any such earlier date as of which Mr. King ceases for any reason to serve in the position of Chairman of the Board of Directors of the bank (the date of such corporation succession, the “Chairman Succession Date”); and (iv) subject to Mr. King’s death, resignation or disqualification, from the Chairman Succession Date until September 12, 2022, Mr. King shall serve as a consultant to the bank. The corporation may enter into or amend appropriate agreements or arrangements with Mr. King and Mr. Rogers in connection with the subject matter of this Article III, Section 14(a) (any such agreement or arrangement, as may be amended, supplemented or modified from time to time, an “Employment Agreement”).

(b) (i) Prior to the date that is the third (3rd) anniversary of the Effective Time (such date, the “Expiration Date”), the removal of Mr. Rogers from, or the failure to appoint or re-elect Mr. Rogers to, any of the positions specifically provided for in this Article III, Section 14 and in any Employment Agreement with Mr. Rogers at the times specifically provided for in this Article III, Section 14 or in any Employment Agreement with Mr. Rogers, (ii) prior to the Expiration Date, the removal of Mr. King from, or the failure to appoint or re-elect Mr. King to, any of the positions specifically provided for in this Article III, Section 14 and in any Employment Agreement with Mr. King at the times specifically provided for in this Article III, Section 14 or in any Employment Agreement with Mr. King, (iii) prior to the Expiration Date, any determination not to nominate Mr. Rogers as a director of the bank or (iv) any determination not to nominate Mr. King as a director of the bank for each term of service of directors beginning at any time prior to December 31, 2023, shall each require the affirmative vote of at least 75% of the full Board of Directors.

(c) Effective as of the Effective Time, the Board of Directors shall be comprised of eleven (11) Continuing SunTrust Directors, including the Chief Executive Officer of SunTrust as of immediately prior to the Effective Time, and eleven (11) Continuing BB&T Directors, including the Chief Executive Officer of the corporation as of immediately prior to the Effective time. From and after the Effective Time through the Expiration Date: (i) the number of directors that comprises the full Board of Directors shall each be twenty-two (22); and (ii) no vacancy on the Board of Directors created by the cessation of service of a director shall be filled by the Board of Directors and the Board of Directors shall not nominate any individual to fill such vacancy, unless (x) such individual would be an independent director of the bank, (y) in the case of a vacancy created by the cessation of service of a Continuing SunTrust Director, not less than a majority of the Continuing SunTrust Directors have approved the appointment or nomination (as applicable) of the individual appointed or nominated (as applicable) to fill such vacancy, in which case the Continuing BB&T Directors shall vote to approve the appointment or nomination (as applicable) of such individual, and (z) in the case of a vacancy created by the cessation of service of a Continuing BB&T Director, not less than a majority of the Continuing BB&T Directors have approved the appointment or nomination (as applicable) of the individual appointed or nominated (as applicable) to fill such vacancy, in which case the Continuing SunTrust Directors shall vote to approve the appointment or nomination (as applicable) of such individual; provided, that any such appointment or nomination pursuant to clause (y) or (z) shall be made in accordance with applicable law and the rules of the New York Stock Exchange (or other national securities exchange on which the corporation’s securities are listed). For purposes of this Article III, Section 14, the terms “Continuing SunTrust Directors” and “Continuing BB&T Directors” shall mean, respectively, the directors of the corporation and SunTrust who were selected to be directors of the corporation and Truist Bank by SunTrust or the corporation, as the case may be, as of the Effective Time, pursuant to Section 6.12(a) of the Merger Agreement, and any directors of the bank who were subsequently appointed or nominated and elected to fill a vacancy created by the cessation of service of a Continuing SunTrust Director or a Continuing BB&T Director, as applicable, pursuant to this Article III, Section 14(c).

(d) (i) The headquarters of the bank shall be located in Charlotte, North Carolina; (ii) the hub for the bank’s wholesale business shall be located in Atlanta, Georgia; (iii) the hub for the bank’s consumer and community banking business shall be located in Winston-Salem, North Carolina; and (iv) the hub for the bank’s technology and innovation operations shall be located in Charlotte, North Carolina.

(e) In the event of any inconsistency between any provision of this Article III, Section 14 and any other provision of these bylaws or the bank’s other constituent documents, the provisions of this Article III, Section 14 shall control. The provisions of Article III, Section 14(d)(i) and this second sentence of this Section 14(e) may be modified, amended or repealed, and any bylaw provision inconsistent with such provisions may be adopted, only by the affirmative vote of at least 75% of the full Board of Directors and solely in connection with the corporation’s entry into or consummation of a business combination transaction with another corporation (i) in which the corporation merges with and into such other corporation, (ii) which is a merger of equals or (iii) as a result of which the shareholders of the corporation prior to the effective time of the business combination hold less than 60% of the outstanding common stock of the surviving entity in such business combination. The first and third sentences of this Section 14(e) may be modified, amended or repealed, and any bylaw provision inconsistent with such provisions may be adopted, only by the affirmative vote of at least 75% of the full Board of Directors. Until December 31, 2023, the provisions of Article III, Section 14(b)(iv) and this fourth sentence of this Section 14(e) may be modified, amended or repealed, and any bylaw provision inconsistent with such provisions may be adopted, only by the affirmative vote of at least 75% of the full Board of Directors. Until the Expiration Date, the provisions of this Article III, Section 14 (other than Section 14(b)(iv), Section 14(d)(i) and the first four sentences of this Section 14(e), which are subject to the standards set forth in the preceding sentences) may be modified, amended or repealed, and any Bylaw provision inconsistent with such provisions may be adopted, only by an affirmative vote of at least 75% of the full Board of Directors.

ARTICLE IV

Meetings of Directors

1. Regular Meetings: Regular meetings of the Board of Directors and the committees thereof may be held without notice of the date, time, place or purpose of the meeting, either inside or outside the State of North Carolina, as the Board of Directors shall determine in accordance with North Carolina law. Minutes of all board and committee meetings, regular or special, shall be kept and maintained by the bank, and all such minutes shall be submitted to the Board for its review at or prior to its next meeting and for approval at such meeting as required by applicable law.

2. Special Meetings: Special meetings of the Board of Directors may be called by the Chairman of the Board, the Chief Executive Officer, the President, the Chief Operating Officer or the Secretary of the bank, or at the request of three or more directors. Each member of the Board of Directors shall be given notice stating the date, time and place, by letter, electronic delivery or in person, of each special meeting not less than one day before the meeting. Such notice need not specify the purpose for which the meeting is called, unless required by the North Carolina Business Corporation Act, the articles of incorporation or the bylaws.

3. Waiver of Notice: A director may waive notice of any meeting before or after the date and time stated in the notice. The waiver must be in writing, signed by the director entitled to the notice, and filed with the minutes or corporate records. In addition, attendance at or participation by a director at a meeting shall constitute a waiver of notice of such meeting, unless the director at the beginning of the meeting (or promptly upon his or her arrival) objects to holding the meeting or transacting business at the meeting and does not later vote for or assent to action taken at the meeting.

4. Quorum: Unless the articles of incorporation, the bylaws or applicable law require a greater number, a majority of the number of directors prescribed by or pursuant to these bylaws shall constitute a quorum for the transaction of business at any meeting of the Board of Directors or, if no number is so prescribed, a majority of directors in office immediately before the meeting shall constitute a quorum.

5. Adjournment: Any duly convened regular or special meeting may be adjourned to a later date or time without further notice.

6. Manner of Acting: Except as otherwise provided by applicable law or in the articles of incorporation or bylaws, the affirmative vote of a majority of the directors present at a meeting at which a quorum is present shall be the act of the Board of Directors.

7. Presumption of Assent: A director who is present at a meeting of the Board of Directors or a committee of the Board of Directors when corporate action is taken is deemed to have assented to the action taken unless: (i) he or she objects at the beginning of the meeting (or promptly upon his or her arrival) to holding the meeting or transacting business at the meeting;

(ii) his or her dissent or abstention from the action taken is entered in the minutes of the meeting; or (iii) he or she files written notice of his or her dissent or abstention with the presiding officer of the meeting before its adjournment or with the Secretary immediately after adjournment of the meeting. The right of dissent or abstention is not available to a director who votes in favor of the action taken.

8. Action without Meeting: Action required or permitted to be taken at a Board of Directors meeting may be taken without a meeting if the action is taken by all members of the Board. The action must be evidenced by one or more written consents signed by each director before or after such action, describing the action taken, and included in the minutes or filed with the corporate records. A director’s consent to action taken without meeting may be in electronic form and delivered by electronic means.

9. Attendance by Electronic, Telephonic or Similar Means: Except as otherwise provided by applicable law or the Board or in the articles of incorporation or bylaws, any or all directors may participate in a regular or special meeting by, or conduct the meeting through the use of, any means of communication by which all directors participating may simultaneously hear each other during the meeting. A director participating in a meeting by this means is deemed to be present in person at the meeting.

ARTICLE V

Officers

1. Title and Number: The officers of the bank may consist of a Chief Executive Officer, a President, a Chief Operating Officer, a Chief Financial Officer, a Chief Administrative Officer, a Chief Risk Officer, a Secretary, a Treasurer, a Controller, and one or more Corporate Executive Vice Presidents, Senior Executive Vice Presidents, Regional Presidents, and Executive Vice Presidents, as the Board of Directors may from time to time elect. The Chief Executive Officer may also appoint other officers, including such Senior Vice Presidents, Vice Presidents, Assistant Secretaries, Assistant Treasurers and other officers as deemed appropriate. The Chief Executive Officer may delegate the authority to appoint officers to other officers of the Bank. Any two or more offices may be held by the same person, except that no individual may act in more than one capacity where action of two or more officers is required.

2. Election and Term: The officers of the bank shall be elected by the Board of Directors or by a duly designated committee of the Board. Each officer shall hold office until a successor is elected and qualified, or until his or her resignation, retirement, death, removal or disqualification.

3. Removal: The Board of Directors may remove or terminate any officer at any time with or without cause. In addition, any officer other than the Chief Executive Officer may be removed or terminated at any time with or without cause by a duly designated Board committee or by a superior officer. Removal, resignation or termination of an officer shall be without prejudice to the contract rights, if any, of the person so removed.

4. Compensation: The compensation of all officers of the bank shall be fixed by the Board of Directors or by or under the direction of a duly designated committee of the Board or other officer or officers designated by the Board.

5. Chief Executive Officer: The Chief Executive Officer shall have full executive powers, shall be the principal executive officer of the bank, shall have and exercise all powers, duties and authority incident to the office of Chief Executive Officer or as prescribed by the Board and shall, subject to the direction and control of the Board, supervise, direct and control the management of the bank in accordance with these bylaws. The Chief Executive Officer may also serve as Chairman of the Board in accordance with Article III, Section 8.

6. Other Officers: Each officer other than the Chief Executive Officer shall have such title or titles, perform such duties and exercise such powers as may be incident to his or her office or prescribed by the Board, a duly designated committee of the Board or the Chief Executive Officer or his or her designee.

7. Bonds: To the extent required by law, the bank shall require security in the form of a bond for the fidelity and faithful performance of duties by its officers and employees. The bond shall be issued by a bonding company authorized to do business in the State of North Carolina and upon such form as may be approved by the North Carolina Commissioner of Banks. Except as otherwise required by the North Carolina Commissioner of Banks or applicable law, the amount, form, and terms of the bond shall be such as the Board of Directors may require. The premium for the bond is to be paid by the bank.

ARTICLE VI

Contracts, Loans and Deposits

1. Contracts: The Board of Directors may authorize such officers as it deems appropriate to enter into any contract or execute and deliver any instrument on behalf of the bank, and such authority may be general or confined to specific instances. In addition, unless the Board determines otherwise, each officer of the bank shall have such authority as may be incident to his or her particular office to enter into contracts and execute and deliver instruments on behalf of the bank.

2. Loans: No loans shall be contracted on behalf of the bank, as debtor, and no evidence of indebtedness on behalf of the bank shall be issued in its name unless authorized by the Board of Directors. Such authority may be general or confined to specific instances.

3. Checks and Drafts: All checks, drafts or other orders for the payment of money issued in the name of the bank shall be signed by such officer or officers or agent or agents of the bank and in such manner as shall from time to time be determined by the Board of Directors or the Chief Executive Officer.

4. Deposits: All funds of the bank not otherwise employed shall be deposited from time to time to the credit of the bank in such depositories as may be selected by or under the authority of the Board of Directors.

ARTICLE VII

Certificates for Shares and Their Transfer

1. Certificates for Shares and Stock Transfer Records: The Board of Directors may authorize the issuance of some or all of the shares of the bank without issuing certificates to represent such shares. If shares are represented by certificates, the certificates shall be in such form as required by applicable law and as determined by the Board of Directors. Certificates shall be signed, either manually or in facsimile, by: (i) the Chairman of the Board, the Chief Executive Officer, the President or a Senior Executive Vice President; and (ii) the Secretary or an Assistant Secretary. All certificates for shares shall be consecutively numbered or otherwise identified and entered into the stock transfer records of the bank. When shares are represented by certificates, the bank shall issue and deliver to each shareholder to whom such shares have been issued or transferred, certificates representing the shares owned by such shareholder. When shares are not represented by certificates, then, within a reasonable time after the issuance or transfer of such shares, the bank shall send the shareholder to whom such shares have been issued or transferred a written statement of the information required by applicable law. Unless otherwise provided by applicable law, the rights and obligations of shareholders are identical whether or not their shares are represented by certificates.

2. Transfer of Shares: Transfers of shares shall be made and recorded on the stock transfer records of the bank only: (i) by the record holder thereof or by his, her or its duly authorized agent, transferee or legal representative; and (ii) in the case of certificated shares, upon the surrender of the certificate thereof, which shall be cancelled before a new certificate or uncertificated shares shall be issued. No transfer of shares shall be valid as against the bank for any purpose until it shall have been made and recorded on the stock transfer records of the bank by an entry showing from and to whom transferred.

3. Lost, Stolen or Destroyed Certificates: The Board of Directors may authorize the issuance of a new share certificate in place of a certificate claimed to have been lost, stolen or destroyed, upon receipt of a written statement of such fact from the person claiming that the certificate has been lost, stolen or destroyed. When authorizing such issuance of a new certificate, the Board may require the claimant or his, her or its legal representative to give the bank a bond in such sum and with such surety or other security as the Board may direct to indemnify the bank against loss from any claim with respect to the certificate claimed to have been lost, stolen or destroyed; or the Board may, by resolution, authorize the issuance of the new certificate without requiring such a bond.

ARTICLE VIII

Indemnification of Officers and Directors

1. Right to Indemnification: Any person who at any time hereafter serves or heretofore has served: (i) as an officer, director or advisory director of the bank; (ii) at the request of the bank as a director, advisory director, officer, partner, or trustee (or in any position of similar authority, by whatever title known) of any other foreign or domestic corporation, partnership, joint venture, trust or other enterprise; or (iii) as a trustee or administrator under any employee benefit plan, shall have a right to be indemnified by the bank to the fullest extent permitted by law against:

(a) All liability and expenses, including without limitation costs and expenses of litigation and reasonable attorney’s fees, actually and reasonable incurred by him or her in connection with or as a consequence of any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative, including appeals, and whether or not brought by or on behalf the bank or by or on behalf of any third party, outsider or any other person, seeking to hold him or her liable by reason of or arising out of his or her status or his or her activities in any of the foregoing capacities; and

(b) Liability incurred by him or her for any judgments, money decrees, fines, penalties or amounts paid in settlement in connection with or as a consequence of any action, suit or proceeding described in (a) above;

provided, however, the bank shall not indemnify or agree to indemnify any person against any liability or expenses he or she may incur on account of his or her activities which were at the time taken known or believed by him or her to be clearly in conflict with the best interest of the bank.

2. Recovery of Expenses: Any person entitled to indemnification under this Article shall be entitled to recover from the bank his or her reasonable costs, expenses and attorneys’ fees incurred in connection with enforcing his or her right to indemnification.

3. Advancement of Expenses: Expenses incurred by a director, advisory director or officer of the bank in defending an action, suit or proceeding described above shall, at the request of such director, advisory director or officer, and subject to authorization by the Board, be paid by the bank in advance of the final disposition of such action, suit or proceeding upon receipt of an undertaking by or on behalf of the director, advisory director or officer to repay such amount unless it shall ultimately be determined that he or she is entitled to indemnification from the bank under this Article or otherwise.

4. Reliance: Any person who at any time after the adoption of this Article serves or has served in any of the capacities described in Section 1 herein for or on behalf of the bank shall be deemed to be doing so and to have done so in reliance upon, and as consideration for, the rights provided herein. Such rights shall inure to the benefit of the heirs and legal representatives of any such person and shall not be exclusive of any other rights to which such person may be entitled apart from the provisions of this Article.

5. Amendment: Any amendment, alteration, repeal or other change hereof limiting or restricting in any way the rights, fixed or contingent, granted hereunder shall operate prospectively only and shall not prejudice, defeat or impair any rights of any person existing at the time of such amendment, alteration, repeal or other change.

6. No Limitation on Other Rights to Indemnification: If this Article or any portion hereof shall be invalidated on any ground by any court or agency of competent jurisdiction, then the bank shall nevertheless indemnify each person described in Section 1 herein to the full extent permitted by the portion of this Article that is not invalidated and also to the full extent permitted or required by other applicable law.

7. Nonexclusivity: The entitlements to advancement of expenses and/or indemnification provided for in this Article VIII are nonexclusive and are separate from any similar rights provided under any law, agreement or otherwise.

ARTICLE IX

General Provisions

1. Dividends: The Board of Directors may from time to time declare, and the bank may pay, distributions and share dividends to its sole shareholder in the manner and upon the terms and conditions provided by N.C.G.S. §53C-4-7 and other applicable law.

2. Seal: The seal of the bank shall be in any form approved from time to time or at any time by the Board of Directors.

3. Fiscal Year: Unless otherwise ordered by the Board of Directors, the fiscal year of the bank shall be from January 1 to December 31.

4. Amendments: Except as otherwise provided by applicable law or in the articles of incorporation or the bylaws, the Board of Directors of the bank shall have the authority, without the assent or vote of the bank’s sole shareholder, to adopt, make, alter, amend and/or rescind the bylaws or any bylaw of the bank. The bank’s sole shareholder may amend or repeal the bank’s bylaws even though the bylaws may also be amended or repealed by the Board of Directors.

5. Voting of Shares of Other Corporations: Except as otherwise directed by the Board of Directors of the bank or required by applicable law, shares of other corporations and associations held by the bank shall be voted in the manner directed by the Chief Executive Officer, the President, the Chief Operating Officer or any Senior Executive Vice President of the bank. All such officers are authorized on behalf of the bank to vote shares of other corporations and associations by proxy and to execute other instruments in connection therewith.

6. Applicability of the North Carolina Business Corporation Act and Chapter 53C of the North Carolina General Statutes: To the extent not inconsistent with or otherwise provided for in these bylaws, management of the bank’s business and regulation of its affairs shall be governed by the provisions of the North Carolina Business Corporation Act and Chapter 53C of the North Carolina General Statutes.

7. Definitions: Unless the context otherwise requires, terms used in these bylaws shall have the meanings assigned to them in the North Carolina Business Corporation Act and Chapter 53C of the North Carolina General Statutes to the extent defined therein. In addition, without limiting the effect of the foregoing, the term “applicable law” used in these bylaws shall refer to any applicable laws, rules or regulations, including the North Carolina Business

EXHIBIT 6 TO FORM T-1

Section 321(b) Consent

Pursuant to Section 321(b) of the Trust Indenture Act of 1939, as amended, Truist Bank hereby consents that reports of examinations by Federal, State, Territorial or District authorities may be furnished by such authorities to the Securities and Exchange Commission upon requests therefor.

Dated: July 17, 2023

| | By: | /s/ Patrick Giordano |

| | Name: | Patrick Giordano |

| | Title: | Vice President |

EXHIBIT 7 TO FORM T-1

CONSOLIDATED BALANCE SHEETS

TRUIST FINANCIAL CORPORATION AND SUBSIDIARIES

| (Dollars in millions, except per share data, shares in thousands) | | Dec 31,

2022 | | | Dec 31,

2021 | |

| | | | | | | |

| Assets | | | | | | |

| Cash and due from banks | | $ | 5,379 | | | $ | 5,085 | |

| Interest-bearing deposits with banks | | | 16,042 | | | | 15,210 | |

| Securities borrowed or purchased under agreements to resell | | | 3,181 | | | | 4,028 | |

| Trading assets at fair value | | | 4,905 | | | | 4,423 | |

| AFS securities at fair value | | | 71,801 | | | | 153,123 | |

| HTM securities ($47,791 and $1,495 at fair value, respectively) | | | 57,713 | | | | 1,494 | |

| LHFS (including $1,065 and $3,544 at fair value, respectively) | | | 1,444 | | | | 4,812 | |

| Loans and leases (including $18 and $23 at fair value, respectively) | | | 325,991 | | | | 289,513 | |

| ALLL | | | (4,377 | ) | | | (4,435 | ) |

| Loans and leases, net of ALLL | | | 321,614 | | | | 285,078 | |

| Premises and equipment | | | 3,605 | | | | 3,700 | |

| Goodwill | | | 27,013 | | | | 26,098 | |

| CDI and other intangible assets | | | 3,672 | | | | 3,408 | |

| Loan servicing rights at fair value | | | 3,758 | | | | 2,633 | |

| Other assets (including $1,582 and $3,436 at fair value, respectively) | | | 35,128 | | | | 32,149 | |

| Total assets | | $ | 555,255 | | | $ | 541,241 | |

| Liabilities | | | | | | | | |

| Noninterest-bearing deposits | | $ | 135,742 | | | $ | 145,892 | |

| Interest-bearing deposits | | | 277,753 | | | | 270,596 | |

| Short-term borrowings (including $1,551 and $1,731 at fair value, respectively) | | | 23,422 | | | | 5,292 | |

| Long-term debt | | | 43,203 | | | | 35,913 | |

| Other liabilities (including $2,971 and $586 at fair value, respectively) | | | 14,598 | | | | 14,277 | |

| Total liabilities | | | 494,718 | | | | 471,970 | |

| Shareholders’ Equity | | | | | | | | |

| Preferred stock | | | 6,673 | | | | 6,673 | |

| Common stock, $5 par value | | | 6,634 | | | | 6,639 | |

| Additional paid-in capital | | | 34,544 | | | | 34,565 | |

| Retained earnings | | | 26,264 | | | | 22,998 | |

| AOCI, net of deferred income taxes | | | (13,601 | ) | | | (1,604 | ) |

| Noncontrolling interests | | | 23 | | | | — | |

| Total shareholders’ equity | | | 60,537 | | | | 69,271 | |

| Total liabilities and shareholders’ equity | | $ | 555,255 | | | $ | 541,241 | |

| Common shares outstanding | | | 1,326,829 | | | | 1,327,818 | |

| Common shares authorized | | | 2,000,000 | | | | 2,000,000 | |

| Preferred shares outstanding | | | 223 | | | | 223 | |

| Preferred shares authorized | | | 5,000 | | | | 5,000 | |

The accompanying notes are an integral part of these consolidated financial statements.

Truist Financial Corporation 83