November 9, 2023

Note 3. Significant accounting policies

Revenue recognition, page F-55

| 2. | We note your expanded disclosure in response to prior comment 18. We further note your product and services offerings on page 4. It appears that you have not provided disclosure in your revenue recognition policy for several of your offerings including Advertising, Classifieds, BNPL and Car financing. Please advise or revise accordingly. |

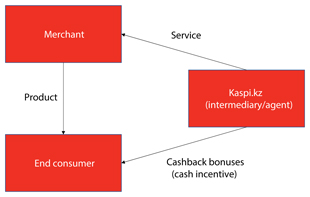

In response to the Staff’s comment, the Company has revised the disclosure on pages F-56 to F-58 to provide further information regarding its revenue recognition policies for all of its material product and service offerings. The Company respectfully advises the Staff that it has not included detailed information regarding its revenue recognition policies in respect of its product and service offerings that are immaterial. In particular, the Company notes that revenue generated from its Advertising and Classifieds and other immaterial offerings represented less than 10% in the aggregate of the Company’s total revenues for each of the periods presented. Included as Appendix No. 1 is a breakdown of the Company’s revenue for the years ended December 31, 2022, 2021 and 2020 and the nine months ended September 30, 2023 for the products and services set forth in the chart on page 4 of Amendment No. 2.

The Company has further revised the disclosure on pages 111-112, 116-117 and 120-121 to provide the amounts of Payments fee revenue and Marketplace fee revenue generated from the material offerings included within each revenue type for each period presented.

The Company further notes that Fintech revenue from financial assets such as consumer loan, BNPL, merchant financing and car financing constitutes interest revenue only, which is recognized using the effective interest rate method under IFRS 9. As disclosed in note 3 to the consolidated financial statements on page F-55, BNPL and car financing are recognized as financial assets.

Additionally, we note your expanded disclosures discuss fees revenue in general. Disclose how your Marketplace fees are calculated.

In response to the Staff’s comment, the Company has revised the disclosure on page F-57 to provide further information regarding the basis on which 3P Marketplace fees are calculated and has revised the disclosure on pages 112, 117 and 121 to provide the amounts of 3P Marketplace business seller fees for each period presented. The Company respectfully advises the Staff that 3P Marketplace business seller fees are the only material revenue type among various Marketplace services.

Expand your disclosures to address Steps 1 through 5 in recognizing revenue under IFRS 15. Your disclosure should disclose more specifically your recognition policy for all of your significant products and services. Refer to paragraphs 110 through 129 of IFRS 15.

In response to the Staff’s comment, the Company has revised the disclosure on pages F-56 to F-58 to provide further information on its consideration of Steps 1 through 5 in recognizing revenue under IFRS 15 in respect of its products and services that generate a material portion of its total revenue. The Company respectfully advises the Staff that in preparing the disclosure of its revenue recognition policy for its products and services, the Company has taken into consideration the financial significance of these products and services and, as such, has not included details on its revenue recognition policy to address Steps 1 through 5 under IFRS 15 for certain of its products and services that are immaterial. Included as Appendix No. 1 is a breakdown of the Company revenue for the years ended December 31, 2022, 2021 and 2020 and the nine months ended September 30, 2023 for the products and services set forth in the chart on page 4 of Amendment No. 2.

2