| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-255934-07 |

| | | |

| Dated August 3, 2023 | BMO 2023-C6 |

Structural and Collateral Term Sheet |

BMO 2023-C6 Mortgage Trust |

$604,423,959 (Approximate Mortgage Pool Balance) |

| |

$[ ] (Approximate Offered Certificates) |

| |

BMO Commercial Mortgage Securities LLC Depositor |

|

Commercial Mortgage Pass-Through Certificates, Series 2023-C6 |

|

Bank of Montreal KeyBank National Association Argentic Real Estate Finance 2 LLC Wells Fargo Bank, National Association LMF Commercial, LLC UBS AG Zions Bancorporation, N.A. Goldman Sachs Mortgage Company German American Capital Corporation Starwood Mortgage Capital LLC Sponsors and Mortgage Loan Sellers |

BMO

Capital

Markets | KeyBanc

Capital

Markets | UBS

Securities

LLC | Goldman

Sachs & Co.

LLC | Deutsche

Bank

Securities | Wells Fargo

Securities,

LLC |

| Co-Lead Managers and Joint Bookrunners |

Academy Securities

Co-Manager | Bancroft Capital, LLC

Co-Manager | Drexel Hamilton

Co-Manager |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| Dated August 3, 2023 | BMO 2023-C6 |

This material is for your information, and none of BMO Capital Markets Corp., Wells Fargo Securities, LLC, KeyBanc Capital Markets Inc., UBS Securities LLC, Goldman Sachs & Co. LLC, Deutsche Bank Securities Inc., Academy Securities, Inc., Bancroft Capital, LLC and Drexel Hamilton, LLC (collectively, the “Underwriters”) are soliciting any action based upon it. This material is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (File No. 333-255934) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the Securities and Exchange Commission for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or BMO Capital Markets Corp., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling 1-866-864-7760. The Offered Certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more Classes of Certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these Certificates, a contract of sale will come into being no sooner than the date on which the relevant Class has been priced and we have verified the allocation of Certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us.

Neither this document nor anything contained in this document shall form the basis for any contract or commitment whatsoever. The information contained in this document is preliminary as of the date of this document, supersedes any previous such information delivered to you and will be superseded by any such information subsequently delivered prior to the time of sale. These materials are subject to change, completion or amendment from time to time. The information should be reviewed only in conjunction with the entire offering document relating to the Commercial Mortgage Pass-Through Certificates, Series 2023-C6 (the “Offering Document”). All of the information contained herein is subject to the same limitations and qualifications contained in the Offering Document. The information contained herein does not contain all relevant information relating to the underlying mortgage loans or mortgaged properties. Such information is described elsewhere in the Offering Document. The information contained herein will be more fully described elsewhere in the Offering Document. The information contained herein should not be viewed as projections, forecasts, predictions or opinions with respect to value. Prior to making any investment decision, prospective investors are strongly urged to read the Offering Document its entirety. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this free writing prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This document has been prepared by the Underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Regulation (EU) 2017/1129 (as amended or superseded) and/or Part VI of the Financial Services and Markets Act 2000 (as amended) or other offering document.

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these Certificates. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the Certificates may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of the Underwriters or any of their respective affiliates make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the Certificates. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This document contains forward-looking statements. If and when included in this document, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in consumer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this document are made as of the date hereof. We have no obligation to update or revise any forward-looking statement.

BMO Capital Markets is a trade name used by BMO Financial Group for the wholesale banking businesses of Bank of Montreal, BMO Harris Bank N.A. (member FDIC), Bank of Montreal Europe p.l.c, and Bank of Montreal (China) Co. Ltd, the institutional broker dealer business of BMO Capital Markets Corp. (Member FINRA and SIPC) and the agency broker dealer business of Clearpool Execution Services, LLC (Member FINRA and SIPC) in the U.S., and the institutional broker dealer businesses of BMO Nesbitt Burns Inc. (Member Investment Industry Regulatory Organization of Canada and Member Canadian Investor Protection Fund) in Canada and Asia, Bank of Montreal Europe p.l.c. (authorized and regulated by the Central Bank of Ireland) in Europe and BMO Capital Markets Limited (authorized and regulated by the Financial Conduct Authority) in the UK and Australia.

Securities and investment banking activities in the United States are performed by Deutsche Bank Securities Inc., a member of NYSE, FINRA and SIPC, and its broker-dealer affiliates. Lending and other commercial banking activities in the United States are performed by Deutsche Bank AG and its banking affiliates.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 2 | |

| Dated August 3, 2023 | BMO 2023-C6 |

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this document is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE CERTIFICATES REFERRED TO IN THESE MATERIALS ARE SUBJECT TO MODIFICATION OR REVISION (INCLUDING THE POSSIBILITY THAT ONE OR MORE CLASSES OF CERTIFICATES MAY BE SPLIT, COMBINED OR ELIMINATED AT ANY TIME PRIOR TO ISSUANCE OR AVAILABILITY OF A FINAL PROSPECTUS) AND ARE OFFERED ON A “WHEN, AS AND IF ISSUED” BASIS.

THE UNDERWRITERS MAY FROM TIME TO TIME PERFORM INVESTMENT BANKING SERVICES FOR, OR SOLICIT INVESTMENT BANKING BUSINESS FROM, ANY COMPANY NAMED IN THESE MATERIALS. THE UNDERWRITERS AND/OR THEIR AFFILIATES OR RESPECTIVE EMPLOYEES MAY FROM TIME TO TIME HAVE A LONG OR SHORT POSITION IN ANY CERTIFICATE OR CONTRACT DISCUSSED IN THESE MATERIALS.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 2 | |

| Structural and Collateral Term Sheet | | BMO 2023-C6 |

| Collateral Characteristics |

Mortgage Loan Seller | Number of Mortgage Loans | Number of Mortgaged Properties | Aggregate

Cut-off Date Balance | | Roll-up Aggregate Cut-off Date Balance | Roll-up Aggregate % of Cut-off Date Balance |

| BMO | 5 | 8 | $126,125,000 | 20.9% | $126,125,000 | 20.9% |

| KeyBank | 2 | 63 | $63,950,000 | 10.6% | $103,950,000 | 17.2% |

| AREF2 | 3 | 6 | $48,889,660 | 8.1% | $76,385,187 | 12.6% |

| WFB | 1 | 1 | $46,200,000 | 7.6% | $72,684,196 | 12.0% |

| LMF | 7 | 9 | $45,372,210 | 7.5% | $50,372,210 | 8.3% |

| UBS AG | 2 | 2 | $28,350,000 | 4.7% | $48,350,000 | 8.0% |

| ZBNA | 2 | 2 | $44,957,366 | 7.4% | $44,957,366 | 7.4% |

| GSMC | 3 | 19 | $40,600,000 | 6.7% | $40,600,000 | 6.7% |

| GACC | 1 | 22 | $22,200,000 | 3.7% | $22,200,000 | 3.7% |

| SMC | 3 | 3 | $18,800,000 | 3.1% | $18,800,000 | 3.1% |

| WFB, AREF2 | 1 | 1 | $33,979,723 | 5.6% | - | - |

| KeyBank, AREF2 | 1 | 1 | $60,000,000 | 9.9% | - | - |

| UBS AG, LMF | 1 | 1 | $25,000,000 | 4.1% | - | - |

| Total: | 32 | 138 | $604,423,959 | 100.0% | $604,423,959 | 100.0% |

| Loan Pool | |

| | Initial Pool Balance (“IPB”): | $604,423,959 |

| | Number of Mortgage Loans: | 32 |

| | Number of Mortgaged Properties: | 138 |

| | Average Cut-off Date Balance per Mortgage Loan: | $18,888,249 |

| | Weighted Average Current Mortgage Rate: | 6.77038% |

| | 10 Largest Mortgage Loans as % of IPB: | 61.5% |

| | Weighted Average Remaining Term to Maturity: | 113 months |

| | Weighted Average Seasoning: | 1 month |

| | | |

| Credit Statistics | |

| | Weighted Average UW NCF Debt Service Coverage Ratio (“DSCR”): | 1.77x |

| | Weighted Average UW NOI Debt Yield (“DY”): | 13.2% |

| | Weighted Average Cut-off Date Loan-to-Value Ratio (“LTV”): | 53.5% |

| | Weighted Average Maturity Date/ARD LTV: | 51.7% |

| | | |

| Other Statistics | |

| | % of Mortgage Loans with Additional Debt: | 8.3% |

| | % of Mortgage Loans with Single Tenants(1): | 40.2% |

| | % of Mortgage Loans secured by Multiple Properties: | 22.1% |

| | |

| Amortization | |

| | Weighted Average Original Amortization Term: | 360 months |

| | Weighted Average Remaining Amortization Term: | 359 months |

| | % of Mortgage Loans with Interest-Only: | 62.7% |

| | % of Mortgage Loans with Amortizing Balloon: | 19.0% |

| | % of Mortgage Loans with Partial Interest-Only followed by Amortizing Balloon: | 10.7% |

| | % of Mortgage Loans with Interest-Only with Anticipated Repayment Date: | 7.6% |

| | | |

| Lockboxes | |

| | % of Mortgage Loans with Hard Lockboxes: | 72.2% |

| | % of Mortgage Loans with Springing Lockboxes: | 26.6% |

| | % of Mortgage Loans with Soft Lockboxes: | 1.3% |

| | | |

| Reserves | |

| | % of Mortgage Loans Requiring Monthly Tax Reserves: | 57.2% |

| | % of Mortgage Loans Requiring Monthly Insurance Reserves: | 40.3% |

| | % of Mortgage Loans Requiring Monthly CapEx Reserves: | 36.7% |

| | % of Mortgage Loans Requiring Monthly TI/LC Reserves(2): | 21.9% |

| (1) | Excludes mortgage loans that are secured by multiple properties with multiple tenants and includes two mortgage loans that are partially secured by single tenant. |

| (2) | Calculated only with respect to the Cut-off Date Balance of mortgage loans secured or partially secured by office, industrial, retail, and mixed use properties. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 3 | |

| Structural and Collateral Term Sheet | | BMO 2023-C6 |

| Collateral Characteristics |

| Ten Largest Mortgage Loans |

| |

| No. | Loan Name | City, State | Mortgage Loan

Seller | No.

of

Prop. | Cut-off Date

Balance | % of IPB | Square

Feet /

Rooms /

Units | Property

Type | UW

NCF DSCR | UW NOI DY | Cut-off

Date LTV | Maturity

Date/ARD

LTV |

| 1 | Healthcare Trust MOB Portfolio | Various, Various | KeyBank | 62 | $60,000,000 | 9.9% | 1,247,943 | Office | 1.75x | 12.1% | 52.7% | 52.7% |

| 2 | Skorpios Industrial | Temecula, CA | KeyBank, AREF2 | 1 | $60,000,000 | 9.9% | 450,000 | Industrial | 1.95x | 15.6% | 41.7% | 41.7% |

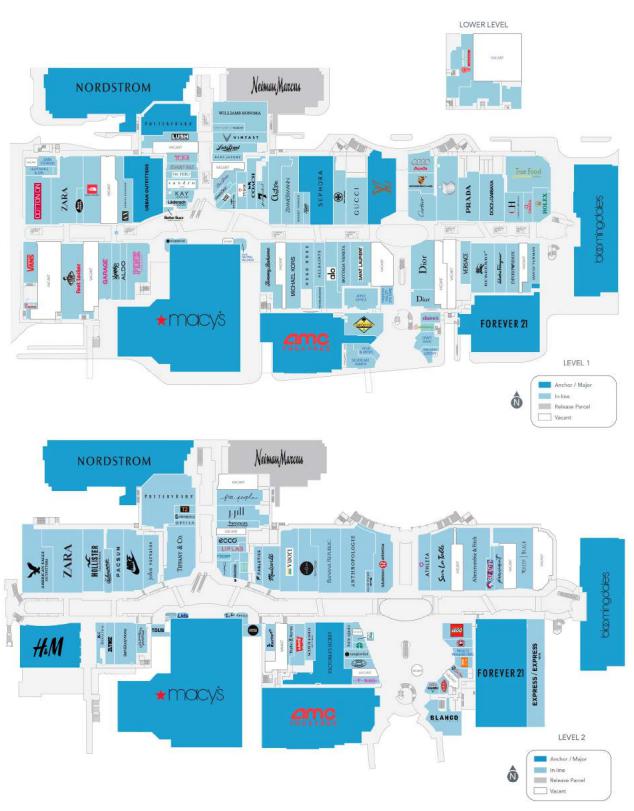

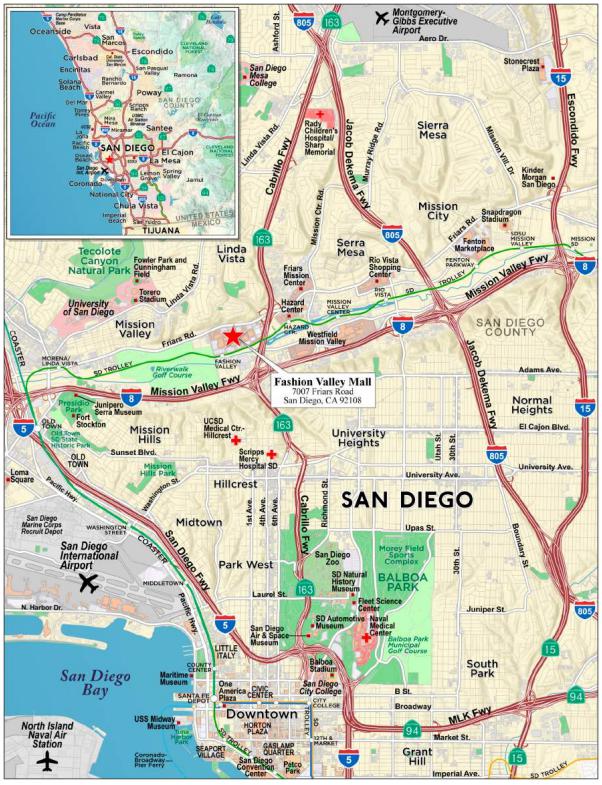

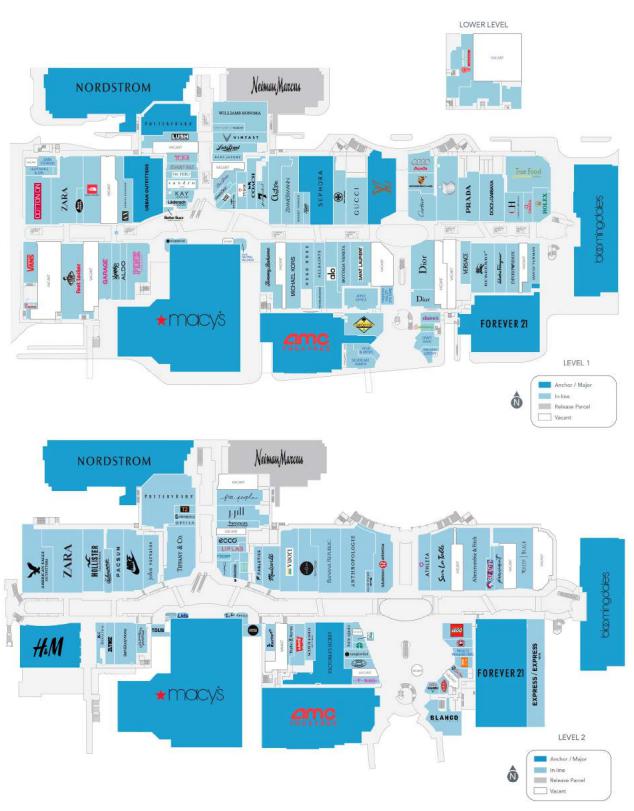

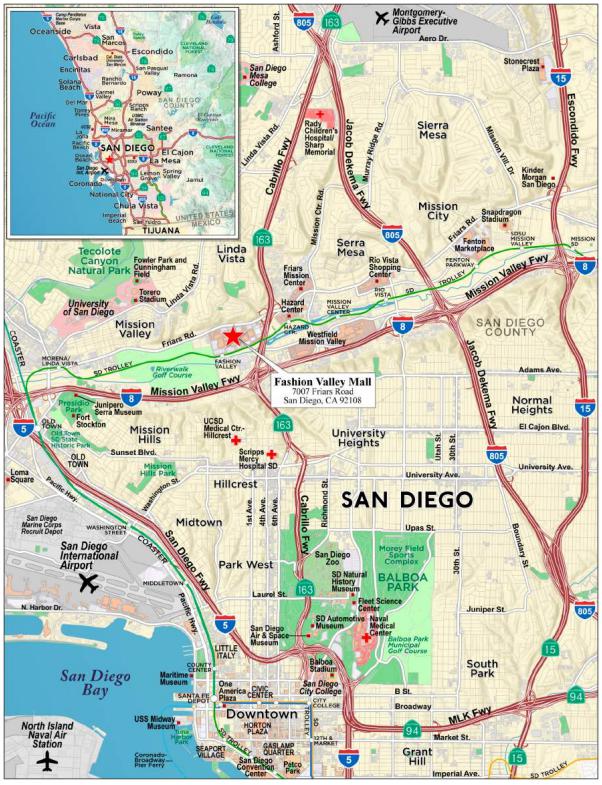

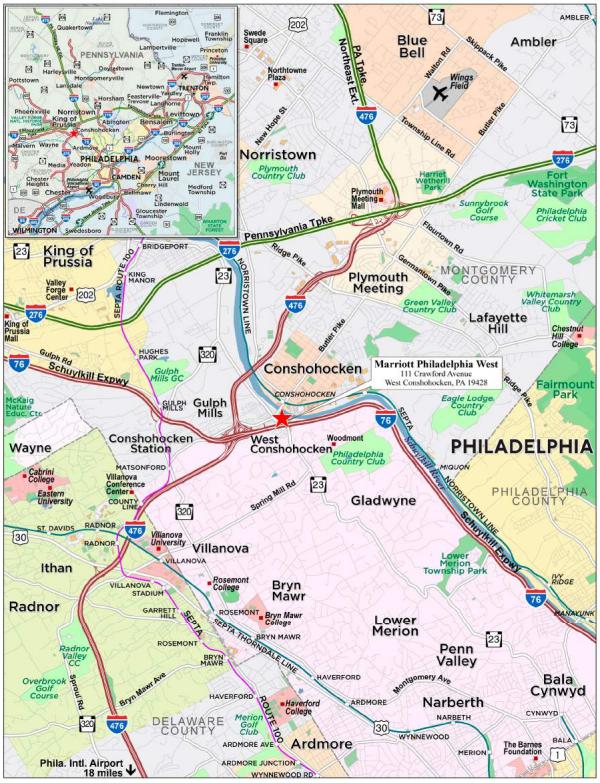

| 3 | Fashion Valley Mall | San Diego, CA | BMO | 1 | $50,000,000 | 8.3% | 1,377,155 | Retail | 3.15x | 18.7% | 31.5% | 31.5% |

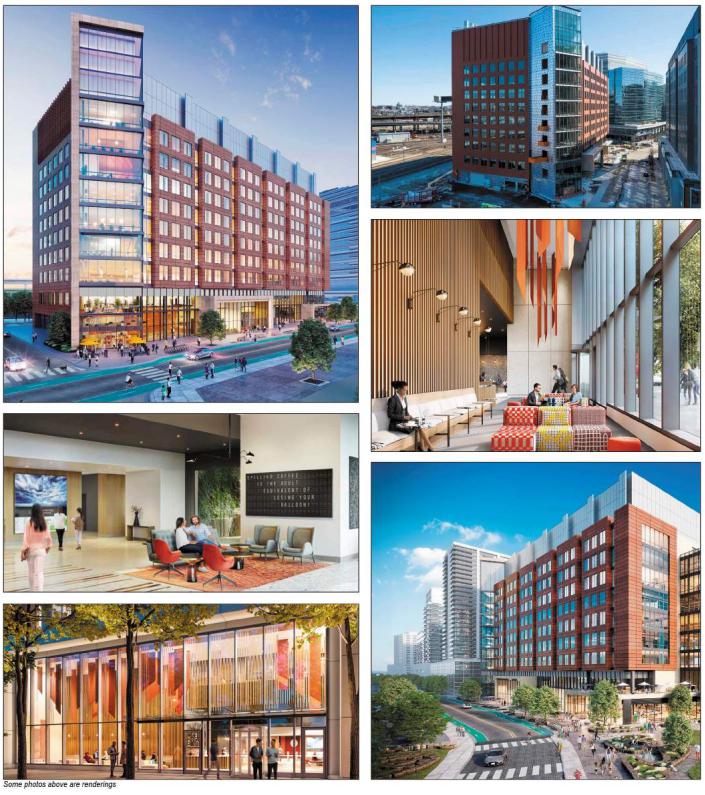

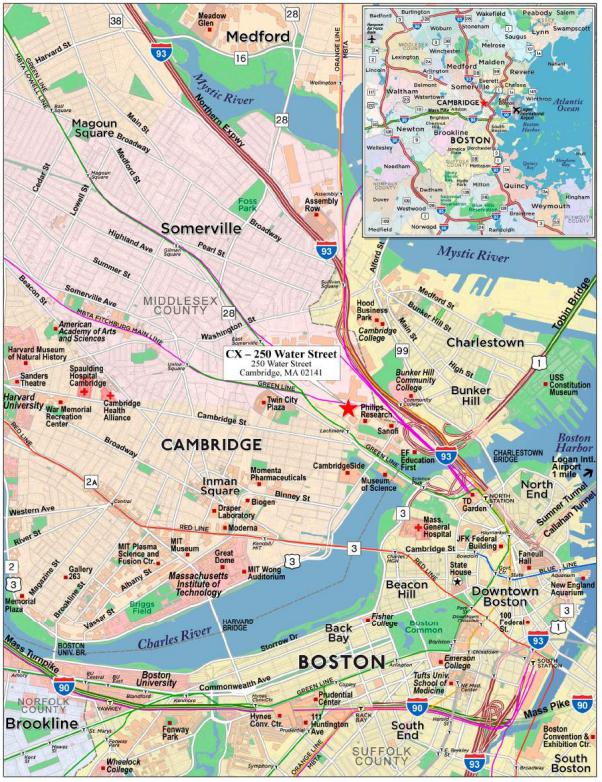

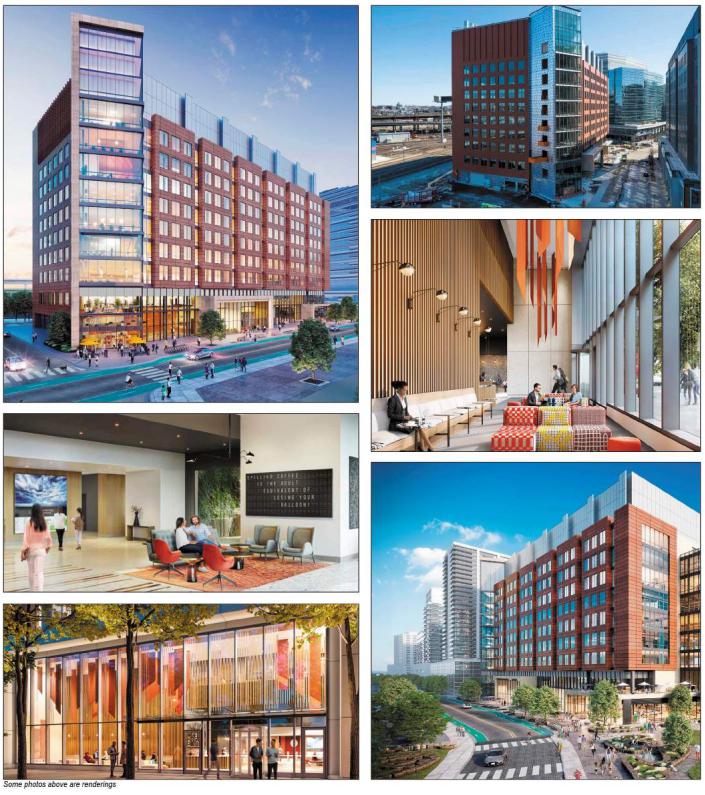

| 4 | CX - 250 Water Street | Cambridge, MA | WFB | 1 | $46,200,000 | 7.6% | 479,004 | Mixed Use | 1.66x | 9.3% | 48.8% | 48.8% |

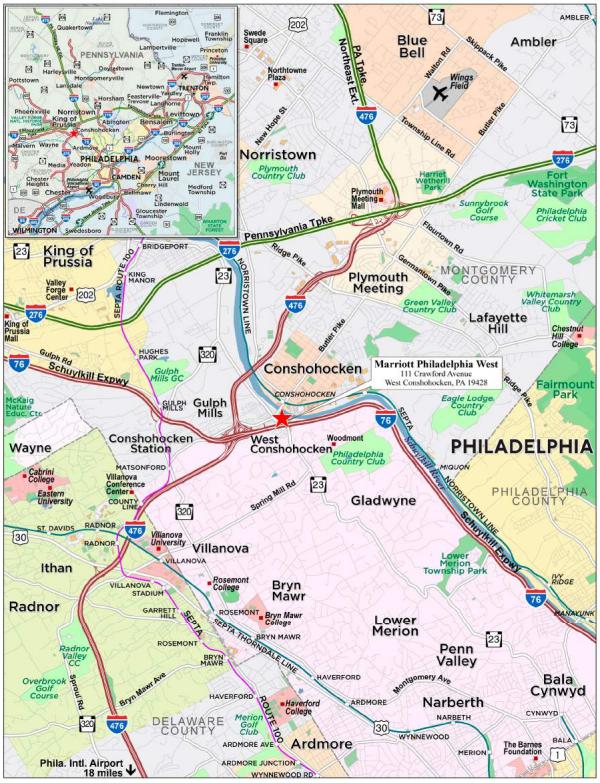

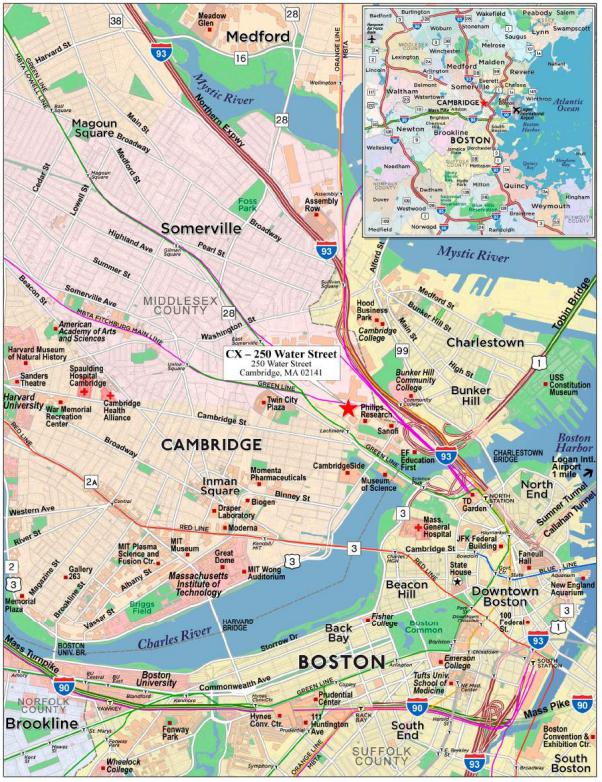

| 5 | Marriott Philadelphia West | West Conshohocken, PA | WFB, AREF2 | 1 | $33,979,723 | 5.6% | 289 | Hospitality | 1.52x | 14.3% | 49.7% | 43.6% |

| 6 | Maple Creek Village | Indianapolis, IN | BMO | 1 | $28,200,000 | 4.7% | 247 | Multifamily | 1.43x | 10.6% | 68.8% | 68.8% |

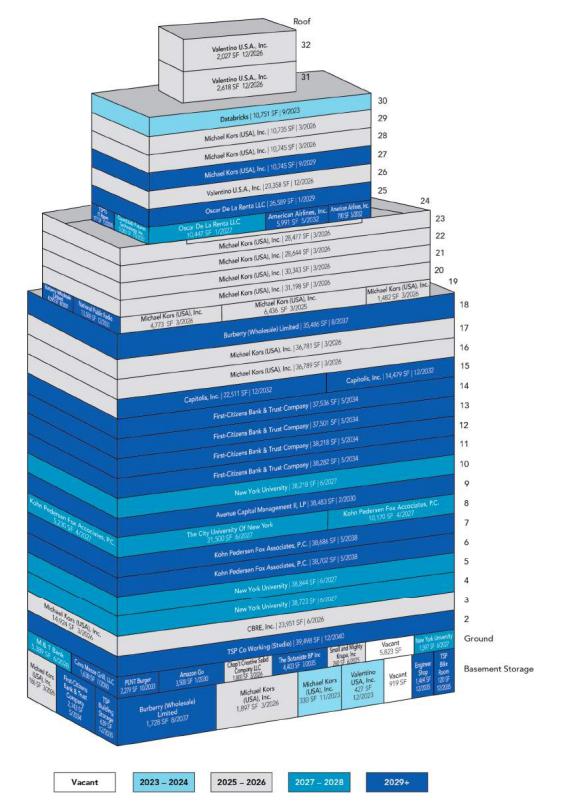

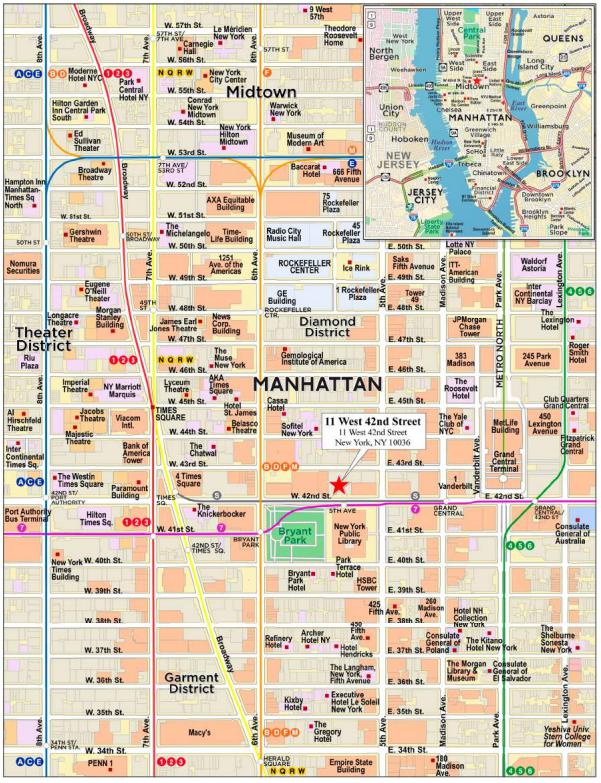

| 7 | 11 West 42nd Street | New York, NY | UBS AG, LMF | 1 | $25,000,000 | 4.1% | 960,568 | Office | 1.39x | 11.6% | 49.4% | 49.4% |

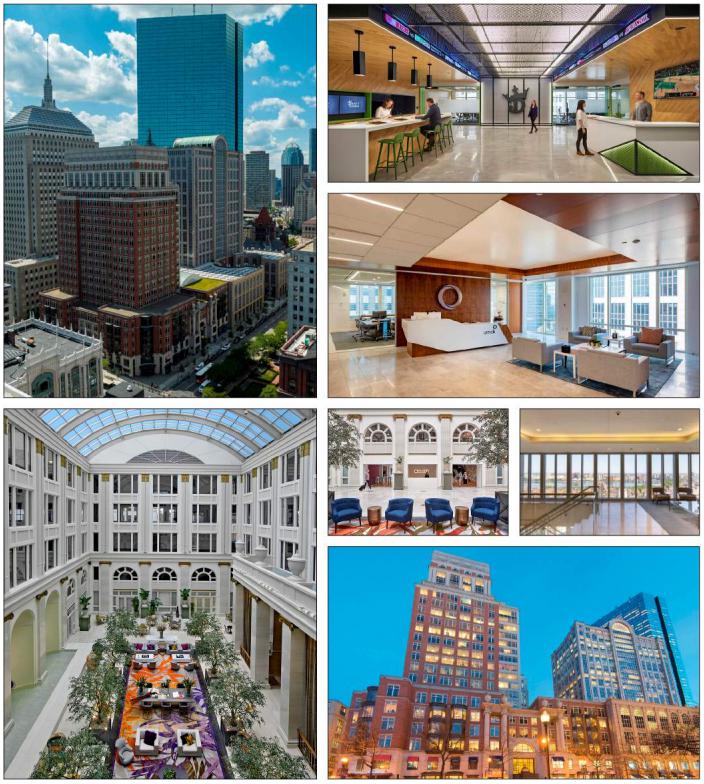

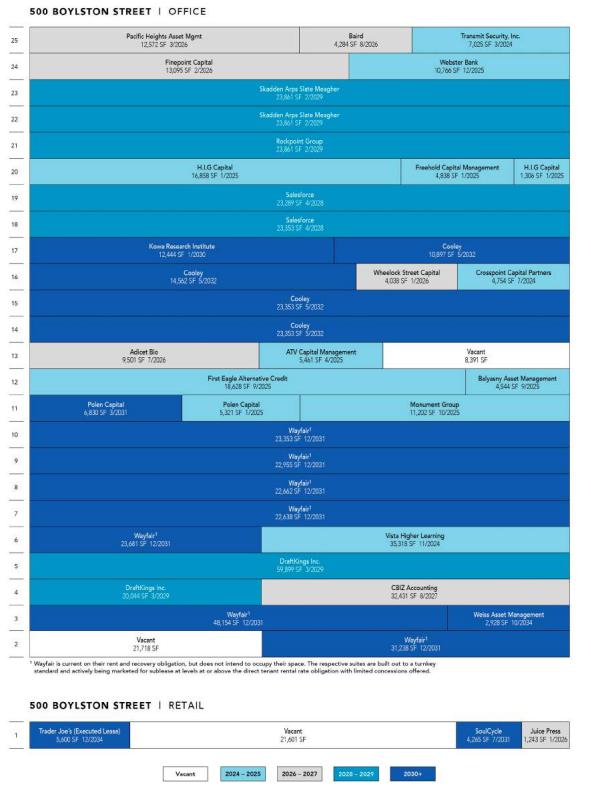

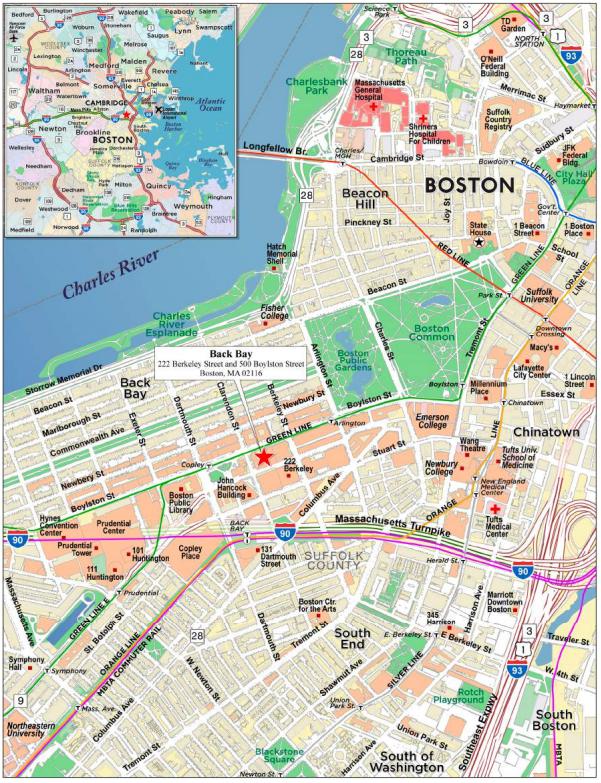

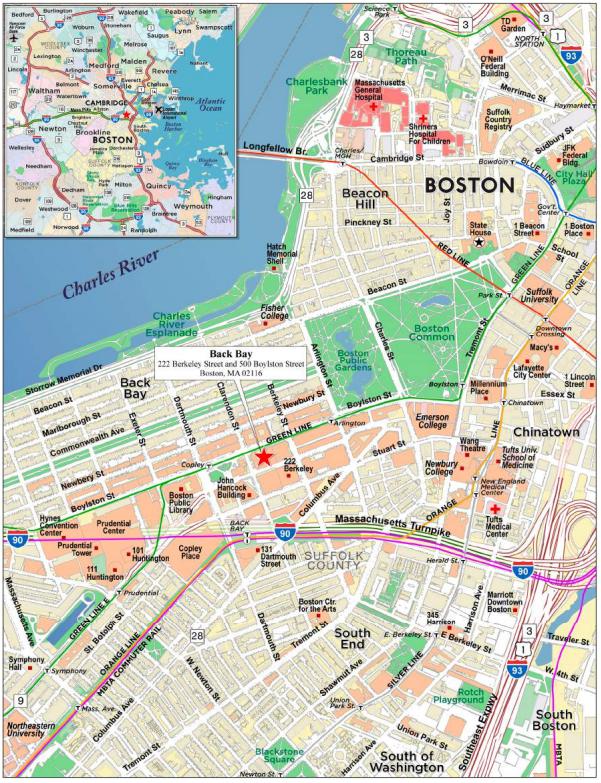

| 8 | Back Bay Office | Boston, MA | ZBNA | 1 | $25,000,000 | 4.1% | 1,283,670 | Office | 2.55x | 16.3% | 33.7% | 33.7% |

| 9 | Four Springs Net Lease Portfolio | Various, Various | GACC | 22 | $22,200,000 | 3.7% | 1,316,654 | Industrial | 1.88x | 11.3% | 54.7% | 54.7% |

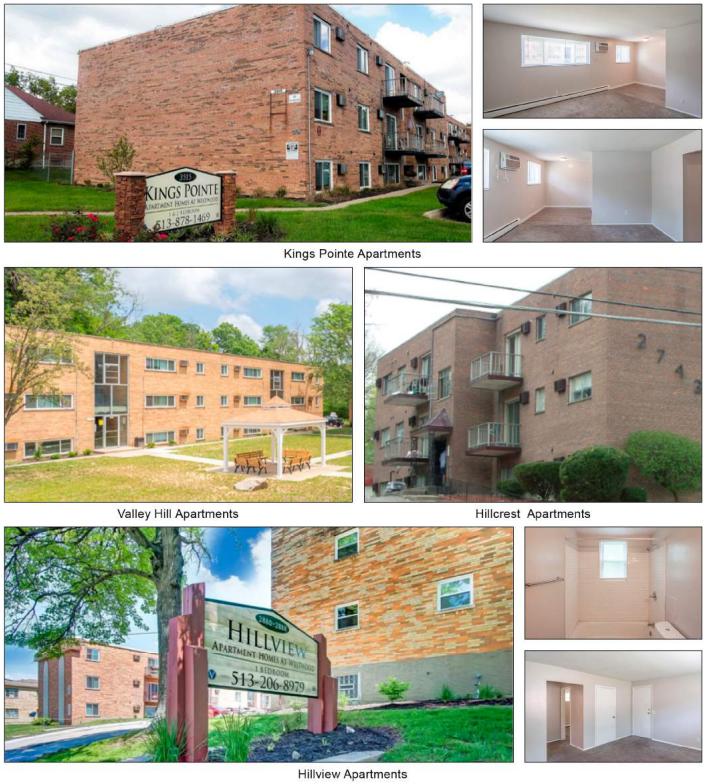

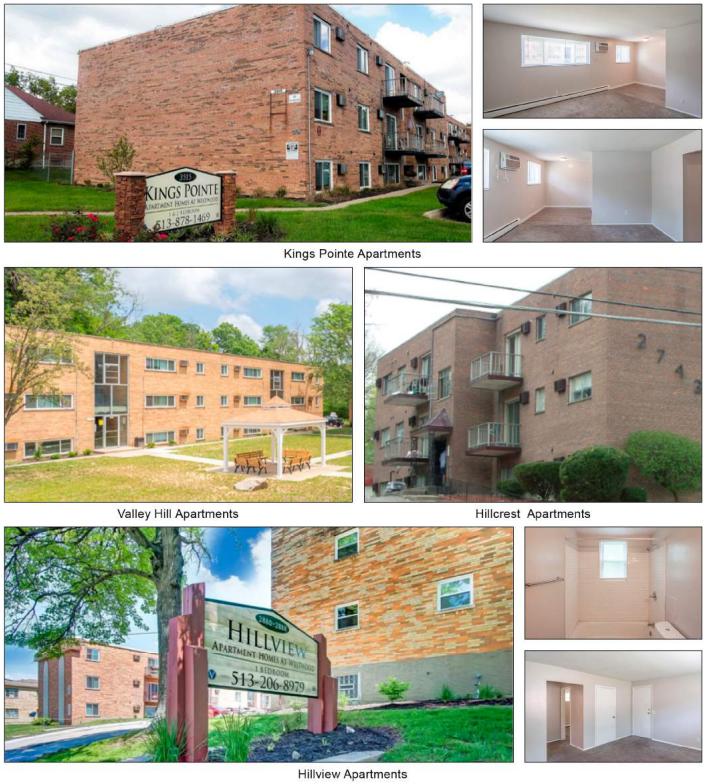

| 10 | Cincinnati Multifamily Portfolio II | Cincinnati, OH | BMO | 4 | $21,000,000 | 3.5% | 212 | Multifamily | 1.43x | 10.4% | 65.3% | 65.3% |

| | | | | | | | | | | | | |

| | Top 3 Total/Weighted Average | | 64 | $170,000,000 | 28.1% | | | 2.23x | 15.3% | 42.6% | 42.6% |

| | Top 5 Total/Weighted Average | | 66 | $250,179,723 | 41.4% | | | 2.03x | 14.0% | 44.7% | 43.9% |

| | Top 10 Total/Weighted Average | | 95 | $371,579,723 | 61.5% | | | 1.93x | 13.4% | 47.9% | 47.3% |

| | Non-Top 10 Total/Weighted Average | | 43 | $232,844,236 | 38.5% | | | 1.50x | 12.9% | 62.4% | 58.6% |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 4 | |

| Structural and Collateral Term Sheet | | BMO 2023-C6 |

| Collateral Characteristics |

| Pari Passu Companion Loan Summary |

| |

No. | Loan Name | | Trust Cut-off

Date

Balance | Aggregate Pari

Passu Loan

Cut-off Date

Balance | Controlling

Pooling/Trust &

Servicing

Agreement | Master Servicer | Special Servicer | Related Pari Passu

Loan(s) Securitizations | Related Pari

Passu Loan(s)

Original Balance |

| 1 | Healthcare Trust MOB Portfolio | KeyBank | $60,000,000 | $180,000,000 | BBCMS 2023-C20 | KeyBank | LNR | BBCMS 2023-C20

Future Securitization(s) | $61,500,000

$118,500,000 |

| 2 | Skorpios Industrial | KeyBank, AREF2 | $60,000,000 | $15,000,000 | BMO 2023-C6 | Midland | Rialto | Future Securitization(s) | $15,000,000 |

| 3 | Fashion Valley Mall | BMO | $50,000,000 | $400,000,000 | BBCMS 2023-C20(1) | KeyBank(1) | LNR(1) | BMARK 2023-B39

BBCMS 2023-C20

Future Securitization(s) | $85,000,000

$82,500,000

$167,500,000 |

| 4 | CX - 250 Water Street | WFB | $46,200,000 | $485,300,000 | BANK 2023-BNK45(2) | Wells Fargo Bank(2) | LNR(2) | BANK 2023-BNK45

MSWF 2023-1

BMARK 2023-B38

BBCMS 2023-C20

BANK 2023-BNK46

Future securitizations | $55,000,000

$65,625,000

$53,150,000

$75,125,000

$72,000,000

$164,400,000 |

| 5 | Marriott Philadelphia West | WFB, AREF2 | $33,979,723 | $4,997,018 | BMO 2023-C6 | Midland | Rialto | Future Securitization(s) | $5,000,000 |

| 7 | 11 West 42nd Street | UBS AG, LMF | $25,000,000 | $249,000,000 | BMO 2023-5C1(3)(4) | KeyBank(3)(4) | 3650 REIT(3)(4) | BMO 2023-5C1

Future Securitization(s) | $62,500,000

$186,500,000 |

| 8 | Back Bay Office | ZBNA | $25,000,000 | $450,000,000 | BMARK 2023-B39 | Midland | Situs | New York Life

TIAA

BMARK 2023-V3

BMARK 2023-B39

BANK5 2023-5YR2

BMO 2023-5C1

Future Securitization(s) | $137,500,000

$100,000,000

$45,000,000

$50,000,000

$60,000,000

$30,000,000

$27,500,000 |

| 9 | Four Springs Net Lease Portfolio | GACC | $22,200,000 | $50,000,000 | BMARK 2023-B39 | Midland | Situs | BMARK 2023-B39 | $50,000,000 |

| 12 | J&O Industrial Facility | GSMC | $20,000,000 | $26,480,000 | BMARK 2023-B39 | Midland | K-Star | BMARK 2023-B39 | $26,480,000 |

| 13 | Brier Creek Commons | ZBNA | $19,957,366 | $64,861,440 | BMO 2023-C5 | Midland | Rialto | BMO 2023-C5 | $65,000,000 |

| 20 | Novolex Portfolio | GSMC | $10,500,000 | $114,500,000 | BMARK 2023-B39 | Midland | K-Star | BMARK 2023-B39

Future Securitization(s) | $89,500,000

$25,000,000 |

| (1) | In the case of Loan No. 3, until the securitization of the related controlling pari passu companion loan, the related whole loan will be serviced and administered pursuant to the pooling and servicing agreement for the BBCMS 2023-C20 securitization transaction by the parties thereto. Upon the securitization of the related controlling pari-passu companion loan, servicing of the related whole loan will shift to the servicers under the servicing agreement with respect to such future securitization transaction, which servicing agreement will become the Controlling Pooling/Trust & Servicing Agreement. |

| (2) | In the case of Loan No. 4, until the securitization of the related controlling pari passu companion loan, the related whole loan will be serviced and administered pursuant to the pooling and servicing agreement for the BANK 2023-BNK45 securitization transaction by the parties thereto. Upon the securitization of the related controlling pari-passu companion loan, servicing of the related whole loan will shift to the servicers under the servicing agreement with respect to such future securitization transaction, which servicing agreement will become the Controlling Pooling/Trust & Servicing Agreement. |

| (3) | In the case of Loan No. 7, until the securitization of the related controlling pari passu companion loan, the related whole loan will be serviced and administered pursuant to the pooling and servicing agreement for the BMO 2023-5C1 securitization transaction by the parties thereto. Upon the securitization of the related controlling pari-passu companion loan, servicing of the related whole loan will shift to the servicers under the servicing agreement with respect to such future securitization transaction, which servicing agreement will become the Controlling Pooling/Trust & Servicing Agreement. |

| (4) | Based on a publicly available prospectus. The BMO 2023-5C1 transaction is expected to close prior to the closing of this securitization transaction. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| �� | 5 | |

| Structural and Collateral Term Sheet | | BMO 2023-C6 |

| Collateral Characteristics |

| Mortgaged Properties by Type |

| | | | | | Weighted Average |

| Property Type | Property Subtype | Number of

Properties | Cut-off Date

Principal

Balance | % of

IPB | UW

NCF DSCR | UW

NOI DY | Cut-off

Date

LTV | Maturity

Date/ARD

LTV |

| Industrial | Manufacturing | 15 | $87,278,582 | 14.4% | 1.82x | 14.2% | 48.6% | 48.6% |

| | Warehouse | 8 | 22,503,852 | 3.7 | 1.56x | 12.1% | 59.2% | 57.2% |

| | Warehouse / Distribution | 11 | 11,095,022 | 1.8 | 1.87x | 11.4% | 55.3% | 55.3% |

| | Manufacturing / Warehouse | 4 | 3,945,498 | 0.7 | 1.85x | 11.5% | 57.5% | 57.5% |

| | Warehouse / Manufacturing | 2 | 2,482,249 | 0.4 | 1.88x | 11.3% | 54.7% | 54.7% |

| | Cold Storage | 1 | 2,382,380 | 0.4 | 1.88x | 11.3% | 54.7% | 54.7% |

| | Flex | 2 | 1,662,417 | 0.3 | 1.88x | 11.3% | 54.7% | 54.7% |

| | Subtotal: | 43 | $131,350,000 | 21.7% | 1.78x | 13.4% | 51.5% | 51.2% |

| Office | Medical | 63 | $65,500,000 | 10.8% | 1.74x | 12.2% | 53.2% | 53.2% |

| | CBD | 2 | 50,000,000 | 8.3 | 1.97x | 14.0% | 41.6% | 41.6% |

| | Suburban | 1 | 6,100,000 | 1.0 | 1.44x | 13.2% | 59.2% | 55.0% |

| | Subtotal: | 66 | $121,600,000 | 20.1% | 1.82x | 13.0% | 48.7% | 48.5% |

| Hospitality | Full Service | 5 | $82,479,723 | 13.6% | 1.59x | 15.1% | 57.5% | 52.2% |

| | Limited Service | 4 | 36,886,869 | 6.1 | 1.59x | 15.3% | 64.4% | 57.3% |

| | Subtotal: | 9 | $119,366,593 | 19.7% | 1.59x | 15.1% | 59.6% | 53.8% |

| Retail | Super Regional Mall | 1 | $50,000,000 | 8.3% | 3.15x | 18.7% | 31.5% | 31.5% |

| | Anchored | 6 | 46,057,366 | 7.6 | 1.25x | 11.1% | 63.2% | 55.9% |

| | Subtotal: | 7 | $96,057,366 | 15.9% | 2.24x | 15.1% | 46.7% | 43.2% |

| Multifamily | Garden | 6 | $69,700,000 | 11.5% | 1.50x | 11.0% | 65.7% | 65.7% |

| | Mid Rise | 2 | 12,200,000 | 2.0 | 1.31x | 9.3% | 61.9% | 61.9% |

| | Low Rise | 2 | 2,200,000 | 0.4 | 1.22x | 9.8% | 74.4% | 74.4% |

| | Subtotal: | 10 | $84,100,000 | 13.9% | 1.47x | 10.7% | 65.3% | 65.3% |

| Mixed Use | Lab / Office | 1 | $46,200,000 | 7.6% | 1.66x | 9.3% | 48.8% | 48.8% |

| | Multifamily / Retail | 1 | 1,800,000 | 0.3 | 1.22x | 9.8% | 74.4% | 74.4% |

| | Subtotal: | 2 | $48,000,000 | 7.9% | 1.64x | 9.3% | 49.8% | 49.8% |

| Self Storage | Self Storage | 1 | $3,950,000 | 0.7% | 1.49x | 10.4% | 36.9% | 36.9% |

| Total / Weighted Average: | 138 | $604,423,959 | 100.0% | 1.77x | 13.2% | 53.5% | 51.7% |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 6 | |

| Structural and Collateral Term Sheet | | BMO 2023-C6 |

| No. 1 – Healthcare Trust MOB Portfolio |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 7 | |

| Structural and Collateral Term Sheet | | BMO 2023-C6 |

| No. 1 – Healthcare Trust MOB Portfolio |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 8 | |

| Structural and Collateral Term Sheet | | BMO 2023-C6 |

| No. 1 – Healthcare Trust MOB Portfolio |

| Mortgage Loan Information | | Property Information |

| Mortgage Loan Seller: | KeyBank | | Single Asset / Portfolio: | Portfolio |

| Original Principal Balance(1): | $60,000,000 | | Title: | Various |

| Cut-off Date Principal Balance(1): | $60,000,000 | | Property Type – Subtype: | Office – Medical |

| % of IPB: | 9.9% | | Net Rentable Area (SF): | 1,247,943 |

| Loan Purpose: | Refinance | | Location: | Various |

| Borrowers(2): | Various | | Year Built / Renovated: | Various / Various |

| Borrower Sponsor: | Healthcare Trust Operating | | Occupancy: | 96.5% |

| | Partnership, L.P. | | Occupancy Date: | 5/24/2023 |

| Interest Rate: | 6.45300% | | 4th Most Recent NOI (As of)(5): | $15,108,391 (12/31/2020) |

| Note Date: | 5/24/2023 | | 3rd Most Recent NOI (As of)(5): | $18,702,482 (12/31/2021) |

| Maturity Date: | 6/6/2033 | | 2nd Most Recent NOI (As of)(5): | $26,544,839 (12/31/2022) |

| Interest-only Period: | 120 months | | Most Recent NOI (As of): | $26,932,240 (TTM 3/31/2023) |

| Original Term: | 120 months | | UW Economic Occupancy: | 95.0% |

| Original Amortization Term: | None | | UW Revenues: | $39,365,086 |

| Amortization Type: | Interest Only | | UW Expenses: | $10,218,760 |

| Call Protection(3): | L(12),YM1(14),DorYM1(87),O(7) | | UW NOI: | $29,146,326 |

| Lockbox / Cash Management: | Hard / Springing | | UW NCF: | $27,420,277 |

| Additional Debt(1): | Yes | | Appraised Value / Per SF(6): | $455,000,000 / $365 |

| Additional Debt Balance(1): | $180,000,000 | | Appraisal Date(6): | 3/24/2023 |

| Additional Debt Type(1): | Pari Passu | | | |

| | | | | |

| Escrows and Reserves(4) | | Financial Information(1) |

| | Initial | Monthly | Initial Cap | | Cut-off Date Loan / SF: | $192 | |

| Taxes: | $643,802 | $321,901 | N/A | | Maturity Date Loan / SF: | $192 | |

| Insurance: | $6,283 | $1,257 | N/A | | Cut-off Date LTV(6): | 52.7% | |

| Replacement Reserves: | $0 | Springing | N/A | | Maturity Date LTV(6): | 52.7% | |

| TI/LC Reserve: | $0 | Springing | N/A | | UW NCF DSCR: | 1.75x | |

| Other: | $5,319,348 | Springing | N/A | | UW NOI Debt Yield: | 12.1% | |

| | | | | | | |

| Sources and Uses |

| Sources | Proceeds | % of Total | | Uses | Proceeds | % of Total |

| Whole Loan | $240,000,000 | 100.0% | | Loan Payoff | $196,076,830 | 81.7 | % |

| | | | | Return of Equity | 29,390,626 | 12.2 | |

| | | | | Closing Costs(7) | 8,563,111 | 3.6 | |

| | | | | Upfront Reserves | 5,969,433 | 2.5 | |

| Total Sources | $240,000,000 | 100.0% | | Total Uses | $240,000,000 | 100.0 | % |

| (1) | The Healthcare Trust MOB Portfolio Mortgage Loan (as defined below) is part of a whole loan evidenced by 14 pari passu notes with an aggregate original principal balance of $240.0 million. The Financial Information in the chart above reflects the Cut-off Date Balance of the Healthcare Trust MOB Portfolio Whole Loan (as defined below). |

| (2) | The borrowers are 59 Delaware limited liability companies and special purpose entities that are subsidiaries of Healthcare Trust Operating Partnership, L.P., a Delaware limited partnership. See the footnotes to Annex A-1 in the Preliminary Prospectus for the names of each entity. |

| (3) | Defeasance of the Healthcare Trust MOB Portfolio Whole Loan is permitted at any time after the date that is the earlier to occur of (i) two years after the closing date of the securitization that includes the last note to be securitized and (ii) May 24, 2026. The assumed defeasance lockout period of 26 payments is based on the anticipated closing date of the BMO 2023-C6 securitization trust in August 2023. The actual defeasance lockout period may be longer. |

| (4) | For a full description of Escrows and Reserves, see “Escrows and Reserves” below. |

| (5) | The borrower sponsor progressively acquired the Healthcare Trust MOB Portfolio Properties (as defined below) between 2013 and 2023, which resulted in an increase in historical NOI. For additional information on how many Healthcare Trust MOB Portfolio Properties were owned by the borrower sponsor in each year, see “Historical and Current Occupancy” below. |

| (6) | The Appraised Value represents the “as portfolio” value which includes a portfolio premium to the Healthcare Trust MOB Portfolio Properties if sold together on a bulk basis. The sum of the “as-is” appraised values on a stand-alone basis is $444,475,000. The Cut-off Date LTV Ratio and Maturity Date LTV Ratio based on the aggregate stand-alone appraised “as-is” values are 54.0% and 54.0%, respectively. Appraisal dates for the Healthcare Trust MOB Portfolio Properties range from March 20, 2023, to April 5, 2023. |

| (7) | Closing Costs include an interest rate buydown of $3,240,000. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 9 | |

| Structural and Collateral Term Sheet | | BMO 2023-C6 |

| No. 1 – Healthcare Trust MOB Portfolio |

The Loan. The largest mortgage loan (the “Healthcare Trust MOB Portfolio Mortgage Loan”) is part of a fixed rate whole loan (the “Healthcare Trust MOB Portfolio Whole Loan”) evidenced by 14 pari passu promissory notes in the aggregate original principal amount of $240,000,000. The Healthcare Trust MOB Portfolio Whole Loan is secured by the borrowers’ fee and/or leasehold interests in a 1,247,943 square foot medical office portfolio comprised of 62 properties located in 19 states (the “Healthcare Trust MOB Portfolio Properties”). The Healthcare Trust MOB Portfolio Whole Loan was co-originated on May 24, 2023, by Barclays Capital Real Estate Inc. (“Barclays”), Societe Generale Financial Corporation (“SGFC”) and KeyBank National Association (“KeyBank”). The Healthcare Trust MOB Portfolio Whole Loan has a 10-year interest-only term and accrues interest at a rate of 6.45300% per annum on an Actual/360 basis. The Healthcare Trust MOB Portfolio Mortgage Loan is evidenced by the non-controlling notes A-12 and A-13, with an aggregate original principal balance of $60,000,000. The Healthcare Trust MOB Portfolio Whole Loan is serviced pursuant to the pooling and servicing agreement for the BBCMS 2023-C20 securitization trust. See “Description of the Mortgage Pool—The Whole Loans—The Outside Serviced Pari Passu Whole Loans” and “Pooling and Servicing Agreement—Servicing of the Outside Serviced Mortgage Loans” in the Preliminary Prospectus.

| Whole Loan Summary |

| Note | Original Balance | Cut-off Date Balance | | Note Holder | Controlling Piece |

| A-1 | $40,000,000 | $40,000,000 | | BBCMS 2023-C20 | Yes |

| A-2(1) | $30,000,000 | $30,000,000 | | Barclays | No |

| A-3(1) | $20,000,000 | $20,000,000 | | Barclays | No |

| A-4(1) | $10,000,000 | $10,000,000 | | Barclays | No |

| A-5(1) | $5,000,000 | $5,000,000 | | Barclays | No |

| A-6 | $3,000,000 | $3,000,000 | | BBCMS 2023-C20 | No |

| A-7(1) | $20,600,000 | $20,600,000 | | SGFC | No |

| A-8 | $18,500,000 | $18,500,000 | | BBCMS 2023-C20 | No |

| A-9(1) | $9,100,000 | $9,100,000 | | SGFC | No |

| A-10(1) | $6,400,000 | $6,400,000 | | SGFC | No |

| A-11(1) | $5,400,000 | $5,400,000 | | SGFC | No |

| A-12 | $40,000,000 | $40,000,000 | | BMO 2023-C6 | No |

| A-13 | $20,000,000 | $20,000,000 | | BMO 2023-C6 | No |

| A-14(1) | $12,000,000 | $12,000,000 | | KeyBank | No |

| Whole Loan | $240,000,000 | $240,000,000 | | | |

| (1) | Expected to be contributed to one or more future securitization trust(s). |

The Properties. The Healthcare Trust MOB Portfolio Properties are comprised of 62 medical office buildings located across 19 different states and totaling 1,247,943 square feet. The Healthcare Trust MOB Portfolio Properties are currently 96.5% leased to approximately 107 tenants, with approximately 24.0% of the tenancy being investment-grade rated. 57 of the Healthcare Trust MOB Portfolio Properties are located on-campus or near a hospital and/or are affiliated with a hospital campus or health system and all Healthcare Trust MOB Portfolio Properties provide outpatient care. The borrower sponsor acquired the Healthcare Trust MOB Portfolio Properties between 2013 and 2023 for a reported cost of $403.7 million. The five largest individual properties based on allocated loan amount are the Belpre V Cancer Center - Belpre, OH property (6.2% of square feet, 17.6% of underwritten base rent), the Glendale MOB - Farmington Hills, MI property (3.6% of square feet, 3.7% of underwritten base rent), the 1600 State Street property (2.5% of square feet, 2.6% of underwritten base rent), the Palm Valley Medical Plaza - Goodyear, AZ property (3.1% of square feet, 2.9% of underwritten base rent) and the Eastside Cancer Institute - Greenville, SC property (2.5% of square feet, 2.1% of underwritten base rent), with no other individual property representing more than 3.6% of square feet or 3.0% of underwritten base rent.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 10 | |

| Structural and Collateral Term Sheet | | BMO 2023-C6 |

| No. 1 – Healthcare Trust MOB Portfolio |

The following table presents certain information relating to the Healthcare Trust MOB Portfolio Properties:

| Portfolio Summary |

| Property Name/Location | Year Built/ Renovated | SF(1) | Occupancy(1) | Allocated Whole Loan Amount (“ALA”) | % of ALA | Appraised Value(2) | UW NOI |

| Belpre V Cancer Center - Belpre, OH | 2020/NAP | 77,367 | 100.0 | % | $47,060,000 | 19.6 | % | $87,150,000 | $5,465,509 |

| Glendale MOB - Farmington Hills, MI | 1988/NAP | 44,639 | 93.9 | | 7,990,000 | 3.3 | | 14,800,000 | 1,047,768 |

| 1600 State Street | 1977/2006 | 30,642 | 100.0 | | 6,860,000 | 2.9 | | 12,700,000 | 814,292 |

| Palm Valley Medical Plaza - Goodyear, AZ | 1995/NAP | 38,637 | 96.8 | | 5,720,000 | 2.4 | | 10,600,000 | 722,580 |

| Eastside Cancer Institute - Greenville, SC | 1999/NAP | 30,924 | 100.0 | | 5,560,000 | 2.3 | | 10,300,000 | 686,452 |

| Aurora Healthcare Center - Waterford, WI | 1999/NAP | 23,662 | 100.0 | | 5,130,000 | 2.1 | | 9,500,000 | 612,774 |

| Beaumont Medical Center - Warren, MI | 2005/NAP | 35,219 | 54.5 | | 5,080,000 | 2.1 | | 9,400,000 | 467,769 |

| Millennium Eye Care - Freehold, NJ | 1985/2009 | 25,164 | 100.0 | | 4,990,000 | 2.1 | | 9,250,000 | 698,290 |

| 757 Franciscan Medical - Munster, IN | 2008/2012 | 37,040 | 100.0 | | 4,970,000 | 2.1 | | 9,200,000 | 760,957 |

| Vascular Surgery Associates - Tallahassee, FL | 2008/2018 | 20,000 | 100.0 | | 4,700,000 | 2.0 | | 8,700,000 | 553,992 |

| Decatur Medical Office Building - Decatur, GA | 1993/2022 | 20,800 | 100.0 | | 4,590,000 | 1.9 | | 8,500,000 | 535,783 |

| Aurora Healthcare Center - Wautoma, WI | 2004/NAP | 21,048 | 100.0 | | 4,540,000 | 1.9 | | 8,400,000 | 545,079 |

| Greenfield Medical Plaza - Gilbert, AZ | 2001/NAP | 28,488 | 90.5 | | 4,270,000 | 1.8 | | 7,900,000 | 594,151 |

| Swedish American MOB - Roscoe, IL | 2014/NAP | 25,200 | 93.7 | | 4,270,000 | 1.8 | | 7,900,000 | 523,490 |

| West Michigan Surgery Center - Big Rapids, MI | 1982, 2015/NAP | 20,404 | 100.0 | | 4,180,000 | 1.7 | | 7,750,000 | 552,983 |

| UPMC - Sir Thomas Court - Harrisburg, PA | 1994/NAP | 24,000 | 100.0 | | 4,170,000 | 1.7 | | 7,725,000 | 462,232 |

| Eastern Carolina ENT - Greenville, NC | 2001/NAP | 22,528 | 100.0 | | 4,160,000 | 1.7 | | 7,700,000 | 509,976 |

| Lancaster Medical Arts MOB - Lancaster | 1988/NAP | 30,623 | 100.0 | | 4,140,000 | 1.7 | | 7,675,000 | 477,483 |

| UPMC - Fisher Road - Mechanicsburg, PA | 1990/NAP | 15,000 | 100.0 | | 3,980,000 | 1.7 | | 7,375,000 | 434,519 |

| Pensacola Nephrology MOB - Pensacola, FL | 2011/2021 | 18,435 | 100.0 | | 3,830,000 | 1.6 | | 7,100,000 | 451,276 |

| Kingwood Executive Center - Kingwood, TX | 2005/NAP | 29,120 | 88.0 | | 3,830,000 | 1.6 | | 7,100,000 | 462,467 |

| Lee Memorial Health System - Fort Myers, FL | 1998/2021 | 24,174 | 100.0 | | 3,560,000 | 1.5 | | 6,600,000 | 448,229 |

| Greenville Health System - Greenville, SC | 1997/NAP | 21,603 | 100.0 | | 3,560,000 | 1.5 | | 6,600,000 | 461,316 |

| UPMC - Chambers Hill - Harrisburg, PA | 1955/2018 | 11,000 | 100.0 | | 3,510,000 | 1.5 | | 6,500,000 | 384,791 |

| Rockwall Medical Plaza - Rockwall, TX | 2008/NAP | 18,176 | 100.0 | | 3,420,000 | 1.4 | | 6,330,000 | 456,104 |

| Pioneer Spine Sports - West Springfield | 2008/NAP | 15,000 | 100.0 | | 3,350,000 | 1.4 | | 6,200,000 | 423,804 |

| Women’s Healthcare Group MOB - York, PA | 1993/NAP | 21,316 | 100.0 | | 3,330,000 | 1.4 | | 6,175,000 | 356,226 |

| OrthoOne Hilliard - Hilliard, OH | 2006/NAP | 24,836 | 100.0 | | 3,210,000 | 1.3 | | 5,950,000 | 452,536 |

| Metropolitan Eye Lakeshore Surgery - St. Clair Shores, MI | 1985/NAP | 17,594 | 100.0 | | 3,130,000 | 1.3 | | 5,800,000 | 370,923 |

| St Peter’s - Albany, NY - 5 Palisades | 1999/NAP | 44,323 | 100.0 | | 3,130,000 | 1.3 | | 5,800,000 | 541,122 |

| Crittenton MOB - Washington Township, MI | 2002/2021, 2022 | 19,561 | 92.7 | | 3,100,000 | 1.3 | | 5,750,000 | 398,182 |

| Surgery Center of Temple - Temple, TX | 2008/NAP | 10,400 | 100.0 | | 3,020,000 | 1.3 | | 5,600,000 | 330,966 |

| RAI Care Center-Clearwater, FL | 1973/2009 | 14,936 | 100.0 | | 2,970,000 | 1.2 | | 5,500,000 | 384,937 |

| Medical Center V - Peoria, AZ | 2002/NAP | 33,615 | 100.0 | | 2,920,000 | 1.2 | | 5,400,000 | 459,358 |

| MetroHealth Buckeye Health - Cleveland, OH | 2004/NAP | 25,070 | 100.0 | | 2,920,000 | 1.2 | | 5,400,000 | 350,365 |

| South Douglas MOB - Midwest City, OK | 2004/NAP | 20,756 | 100.0 | | 2,890,000 | 1.2 | | 5,350,000 | 371,363 |

| Crittenton MOB - Sterling Heights, MI | 1997/2019, 2021-2022 | 16,936 | 72.0 | | 2,860,000 | 1.2 | | 5,300,000 | 203,889 |

| SPHP MOB, Albany, NY | 1994/NAP | 20,780 | 100.0 | | 2,810,000 | 1.2 | | 5,200,000 | 354,946 |

| Atlanta Gastroenterology Associates - Lawrenceville, GA | 2007/NAP | 10,500 | 100.0 | | 2,780,000 | 1.2 | | 5,150,000 | 333,945 |

| Bone and Joint Specialists - Merrillville, IN | 1985/2008 | 15,504 | 100.0 | | 2,590,000 | 1.1 | | 4,800,000 | 339,002 |

| St. Peter’s - Albany, NY - 2 Palisades | 1989/NAP | 27,840 | 100.0 | | 2,540,000 | 1.1 | | 4,700,000 | 340,876 |

| 1550 State Street | 1977/NAP | 13,968 | 100.0 | | 2,540,000 | 1.1 | | 4,700,000 | 302,452 |

| St Lukes Heart Vascular Center - East Stroudsburg | 2008/NAP | 13,410 | 100.0 | | 2,440,000 | 1.0 | | 4,525,000 | 254,237 |

| Naidu Clinic - Odessa, TX | 1984/NAP | 12,901 | 100.0 | | 2,120,000 | 0.9 | | 3,920,000 | 259,087 |

| Aurora Healthcare Center - Kiel, WI | 2004/NAP | 9,842 | 100.0 | | 2,110,000 | 0.9 | | 3,900,000 | 254,878 |

| | | | | | | | |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 11 | |

| Structural and Collateral Term Sheet | | BMO 2023-C6 |

| No. 1 – Healthcare Trust MOB Portfolio |

| Property Name/Location | Year Built/ Renovated | SF(1) | Occupancy(1) | Allocated Whole Loan Amount (“ALA”) | % of ALA | Appraised Value(2) | UW NOI |

| Florida Medical Heartcare - Tampa, FL | 1988/NAP | 10,472 | 100.0 | | 2,050,000 | 0.9 | | 3,800,000 | 240,885 |

| Florida Medical Wesley Chapel - Tampa, FL | 1990/NAP | 10,368 | 100.0 | | 2,000,000 | 0.8 | | 3,700,000 | 238,588 |

| Aurora Healthcare Center - Green Bay, WI | 2007/NAP | 9,318 | 100.0 | | 2,000,000 | 0.8 | | 3,700,000 | 240,858 |

| Center for Advanced Dermatology - Lakewood, CO | 2005/NAP | 7,650 | 100.0 | | 1,890,000 | 0.8 | | 3,500,000 | 222,720 |

| Pioneer Spine Sports - Springfield | 1981/2005 | 11,000 | 80.7 | | 1,890,000 | 0.8 | | 3,500,000 | 180,773 |

| Pioneer Spine Sports - Northampton | 2008/NAP | 10,563 | 83.2 | | 1,840,000 | 0.8 | | 3,400,000 | 88,180 |

| DaVita Dialysis - Hudson, FL | 1982/2009 | 8,984 | 100.0 | | 1,730,000 | 0.7 | | 3,200,000 | 225,326 |

| Florida Medical Clinic - Tampa, FL | 1985/NAP | 9,724 | 100.0 | | 1,730,000 | 0.7 | | 3,200,000 | 204,772 |

| St Peter’s - Albany, NY - 4 Palisades | 1992/NAP | 28,597 | 88.5 | | 1,620,000 | 0.7 | | 3,000,000 | 198,759 |

| 5825 Shoreview Lane North | 1999/NAP | 6,510 | 100.0 | | 1,300,000 | 0.5 | | 2,400,000 | 153,777 |

| Fresenius Medical Care - Winfield, AL | 2008/NAP | 5,564 | 100.0 | | 1,240,000 | 0.5 | | 2,300,000 | 178,762 |

| Florida Medical Tampa Palms - Tampa, FL | 2006/NAP | 6,522 | 100.0 | | 1,240,000 | 0.5 | | 2,300,000 | 151,324 |

| Florida Medical Somerset - Tampa, FL | 2002/NAP | 6,027 | 100.0 | | 1,190,000 | 0.5 | | 2,200,000 | 139,984 |

| DaVita Bay Breeze Dialysis Center - Largo, FL | 1995/2012 | 7,247 | 100.0 | | 1,080,000 | 0.5 | | 2,000,000 | 130,422 |

| St. Peter’s - Troy, NY - 2 New Hampshire | 2000/NAP | 18,842 | 83.4 | | 1,080,000 | 0.5 | | 2,000,000 | 180,509 |

| Aurora Healthcare Center - Greenville, WI | 2005/NAP | 4,088 | 100.0 | | 860,000 | 0.4 | | 1,600,000 | 105,867 |

| 1586 State Street | 1956/NAP | 3,486 | 100.0 | | 430,000 | 0.2 | | 800,000 | 51,466 |

| Total/Wtd. Avg. | | 1,247,943 | 96.5 | % | $240,000,000 | 100.0 | % | $455,000,000 | $29,146,326 |

| (1) | Based on the underwritten rent roll dated as of May 24, 2023. |

| (2) | The Total Appraised Value reflects the “as portfolio” value which includes a portfolio premium to the Healthcare Trust MOB Portfolio Properties if sold together on a bulk basis. The sum of the “as-is” appraised values on a stand-alone basis would result in a Total Appraised Value of $444,475,000. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 12 | |

| Structural and Collateral Term Sheet | | BMO 2023-C6 |

| No. 1 – Healthcare Trust MOB Portfolio |

Major Tenants.

St. Peter’s Health Partners (98,078 square feet; 7.9% of the NRA; 6.7% of underwritten base rent): St. Peter’s Health Partners includes St. Peter’s Health Partners Medical Associates, P.C., St. Peter’s Hospital of Albany, St. Peter’s Health Partners and SPHPMA (collectively, “St. Peter’s”). St. Peter’s is a healthcare system that runs hospitals in the Albany, New York area. St. Peter’s is the largest not-for-profit health care network in northeastern New York with more than 185 locations. St. Peter’s is a tenant at five of the Healthcare Trust MOB Portfolio Properties totaling 98,078 square feet, including the SPHP MOB, Albany, NY property, the St. Peter’s - Troy, NY - 2 New Hampshire property, the St. Peter’s - Albany, NY - 2 Palisades property, the St Peter’s - Albany, NY - 4 Palisades property and the St Peter’s - Albany, NY - 5 Palisades property. St. Peter’s provides a variety of services at these properties including cardiology, pulmonology, critical care and internal medicine. St. Peter’s has lease expiration dates spanning from October 2023 to July 2028 at the Healthcare Trust MOB Portfolio Properties. At the St Peter’s - Albany, NY - 4 Palisades property, St. Peter’s has the right to terminate its lease covering suite 100A, representing 857 square feet, upon delivery of written notice four months prior to December 31, 2023.

Pinnacle Health Hospitals (80,623 square feet; 6.5% of the NRA; 5.3% of underwritten base rent): Pinnacle Health Hospitals includes UPMC Pinnacle Lancaster and Pinnacle Health Hospitals (collectively, “Pinnacle”). Pinnacle is a health care group based primarily in the Northeast Philadelphia, Pennsylvania and Bucks County, Pennsylvania areas. Pinnacle has seven hospitals and over 160 outpatient clinics and ancillary facilities. Pinnacle is located at four of the Healthcare Trust MOB Portfolio Properties totaling 80,623 square feet, including the UPMC - Chambers Hill - Harrisburg, PA property, the UPMC - Fisher Road - Mechanicsburg, PA property, the UPMC - Sir Thomas Court - Harrisburg, PA property and the Lancaster Medical Arts MOB - Lancaster property. Pinnacle provides a variety of services at these properties, including chronic care, pediatric care, gynecology, skin care and mental health services. Pinnacle has lease expiration dates spanning from October 2027 through January 2032, with each lease containing various renewal options and no early termination options.

Belpre V Cancer Center (77,367 square feet; 6.2% of the NRA; 17.6% of underwritten base rent): Belpre V Cancer Center (“Belpre V”) is part of the Memorial Health System, which is a not-for-profit integrated health care provider in the Mid-Ohio Valley. Belpre V is the sole tenant at the Belpre V Cancer Center - Belpre, OH property. The Belpre V Cancer Center - Belpre, OH property is used as a cancer center, providing gastroenterology services, heart and vascular services, neuroscience services, pulmonary and respiratory services, a spine center and diagnostic services. Belpre V has a lease expiration date in February 2038, with three, five-year extension options and no early termination options.

Environmental. According to the Phase I environmental assessments dated between January 3, 2023, and April 14, 2023, there was no evidence of any recognized environmental conditions at the Healthcare Trust MOB Portfolio Properties, with the exception of the South Douglas MOB - Midwest City, OK property, at which the potential for petroleum contamination was identified based on the property’s historical use as an automobile sales facility from the early 1960s until the early 2000s. A Phase I environmental assessment also identified a controlled recognized environmental condition at the Belpre V Cancer Center - Belpre, OH property in connection with residual concentrations of petroleum-impacted soil associated with former underground storage tanks and fuel dispensers, for which a no further action letter was issued subject to certain restrictions. See “Description of the Mortgage Pool—Mortgage Pool Characteristics—Environmental Considerations” in the Preliminary Prospectus.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 13 | |

| Structural and Collateral Term Sheet | | BMO 2023-C6 |

| No. 1 – Healthcare Trust MOB Portfolio |

The following table presents certain information relating to the historical and current occupancy of the Healthcare Trust MOB Portfolio Properties:

| Historical and Current Occupancy(1) |

| 2020(2) | 2021(3) | 2022(4) | Current(5) |

| 96.2% | 97.0% | 96.9% | 96.5% |

| (1) | Historical occupancies represent the average portfolio occupancy of each year. |

| (2) | 2020 historical occupancy is based on 39 of the Healthcare Trust MOB Portfolio Properties as the other properties were subsequently acquired. |

| (3) | 2021 historical occupancy is based on 53 of the Healthcare Trust MOB Portfolio Properties as the other properties were subsequently acquired. |

| (4) | 2022 historical occupancy is based on 57 of the Healthcare Trust MOB Portfolio Properties as the other properties were subsequently acquired. |

| (5) | Current occupancy is as of May 24, 2023. |

The following table presents certain information relating to the largest tenants based on net rentable area at the Healthcare Trust MOB Portfolio Properties:

Top Tenant Summary(1) |

| Tenant | Ratings

Moody’s/S&P/Fitch(2) | Number of Leases | Net Rentable Area (SF) | % of

Total NRA | UW Base Rent PSF(3) | UW Base Rent(3) | % of Total

Base Rent(3) | Lease Expiration Date |

| St. Peter’s | NR/NR/NR | 5 | 98,078 | 7.9 | % | $21.98 | $2,155,979 | 6.7 | % | Various(4) |

| Pinnacle | A2/NR/NR | 4 | 80,623 | 6.5 | | $21.17 | 1,707,123 | 5.3 | | Various(5) |

| Belpre V | NR/NR/NR | 1 | 77,367 | 6.2 | | $73.21 | 5,664,109 | 17.6 | | 2/28/2038 |

| Aurora Health Center | Aa3/NR/NR | 5 | 67,958 | 5.4 | | $24.48 | 1,663,612 | 5.2 | | 12/31/2032 |

| Willamette Orthopedic Group LLC | NR/NR/NR | 4 | 54,606 | 4.4 | | $25.09 | 1,370,023 | 4.3 | | 2/28/2035 |

| Prisma Health-Upstate | A3/NR/A- | 2 | 52,527 | 4.2 | | $21.25 | 1,116,247 | 3.5 | | Various(6) |

| Top Tenants | | 21 | 431,159 | 34.5 | % | $31.72 | $13,677,093 | 42.5 | % | |

| Remaining Tenants | | 114 | 772,541 | 61.9 | % | $23.97 | $18,521,404 | 57.5 | % | |

| Occupied Collateral Total / Wtd. Avg. | 135 | 1,203,700 | 96.5 | % | $26.75 | $32,198,497 | 100.0 | % | |

| | | | | | | | |

| Vacant Space | | NAP | 44,243 | 3.5 | % | | | | |

| | | | | | | | | |

| Collateral Total | | 135 | 1,247,943 | 100.0 | % | | | | |

| | | | | | | | | |

| (1) | Based on the underwritten rent roll dated as of May 24, 2023. |

| (2) | In certain instances, ratings provided are for the parent company of the entity listed in the “Tenant” field whether or not the parent company guarantees the lease. |

| (3) | UW Base Rent PSF, UW Base Rent and % of Total Base Rent are inclusive of $414,557 of underwritten rent steps. |

| (4) | St. Peter’s leases 98,078 square feet across five properties: (i) 18,433 square feet with a lease expiration date of December 31, 2027, and 2,347 square feet with a lease expiration date of April 30, 2027, at the SPHP MOB, Albany, NY property; (ii) 27,840 square feet with a lease expiration date of July 31, 2028, at the St. Peter’s - Albany, NY - 2 Palisades property; (iii) 857 square feet with a lease expiration date of December 31, 2024, 880 square feet with a lease expiration date of March 31, 2025, and 9,229 square feet with a lease expiration date of April 30, 2025, at the St. Peter’s - Albany, NY - 4 Palisades property; (iv) 17,222 square feet with a lease expiration date of July 31, 2027, and 5,555 square feet with a lease expiration date of December 31, 2027, at the St. Peter’s - Albany, NY - 5 Palisades property; and (v) 15,715 square feet with a lease expiration date of October 31, 2023, at the St. Peter’s - Troy, NY - 2 New Hampshire property. |

| (5) | Pinnacle leases 80,623 square feet across four properties: (i) 30,623 square feet with a lease expiration date of August 31, 2031, at the Lancaster Medical Arts MOB - Lancaster property; (ii) 15,000 square feet with a lease expiration date of January 31, 2032, at the UPMC - Fisher Road - Mechanicsburg, PA property; (iii) 24,000 square feet with a lease expiration date of October 31, 2027, at the UPMC - Sir Thomas Court - Harrisburg, PA property; and (iv) 11,000 square feet with a lease expiration date of December 31, 2028, at the UPMC - Chambers Hill - Harrisburg, PA property. |

| (6) | Prisma Health-Upstate leases 52,527 square feet across two properties: (i) 21,603 square feet with a lease expiration date of September 30, 2033, at the Greenville Health System - Greenville, SC property and (ii) 30,924 square feet with a lease expiration date of June 30, 2028, at the Eastside Cancer Institute - Greenville, SC property. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 14 | |

| Structural and Collateral Term Sheet | | BMO 2023-C6 |

| No. 1 – Healthcare Trust MOB Portfolio |

The following table presents certain information relating to the tenant lease expirations at the Healthcare Trust MOB Portfolio Properties:

| Lease Rollover Schedule(1) |

| Year | Number of Leases Expiring | Net Rentable Area Expiring | % of NRA Expiring | UW Base Rent Expiring(2) | % of UW Base Rent Expiring(2) | Cumulative Net Rentable Area Expiring | Cumulative % of NRA Expiring | Cumulative UW Base Rent Expiring(2) | Cumulative % of UW Base Rent Expiring(2) |

| Vacant | NAP | 44,243 | 3.5 | % | NAP | NAP | 44,243 | | 3.5% | | NAP | NAP | |

| 2023 & MTM | 12 | 33,266 | 2.7 | | $787,817 | 2.4 | % | 77,509 | | 6.2% | | $787,817 | 2.4% | |

| 2024 | 15 | 54,800 | 4.4 | | 1,353,113 | 4.2 | | 132,309 | | 10.6% | | $2,140,930 | 6.6% | |

| 2025 | 15 | 64,335 | 5.2 | | 1,401,695 | 4.4 | | 196,644 | | 15.8% | | $3,542,624 | 11.0% | |

| 2026 | 13 | 64,198 | 5.1 | | 1,372,107 | 4.3 | | 260,842 | | 20.9% | | $4,914,731 | 15.3% | |

| 2027 | 21 | 228,532 | 18.3 | | 4,701,311 | 14.6 | | 489,374 | | 39.2% | | $9,616,042 | 29.9% | |

| 2028 | 13 | 158,533 | 12.7 | | 4,417,143 | 13.7 | | 647,907 | | 51.9% | | $14,033,185 | 43.6% | |

| 2029 | 8 | 105,843 | 8.5 | | 2,338,027 | 7.3 | | 753,750 | | 60.4% | | $16,371,212 | 50.8% | |

| 2030 | 12 | 105,960 | 8.5 | | 2,828,719 | 8.8 | | 859,710 | | 68.9% | | $19,199,931 | 59.6% | |

| 2031 | 4 | 45,030 | 3.6 | | 802,638 | 2.5 | | 904,740 | | 72.5% | | $20,002,569 | 62.1% | |

| 2032 | 9 | 110,245 | 8.8 | | 2,874,624 | 8.9 | | 1,014,985 | | 81.3% | | $22,877,193 | 71.1% | |

| 2033 | 6 | 60,863 | 4.9 | | 1,374,264 | 4.3 | | 1,075,848 | | 86.2% | | $24,251,457 | 75.3% | |

| 2034 & Beyond | 7 | 172,095 | 13.8 | | 7,947,040 | 24.7 | | 1,247,943 | | 100.0% | | $32,198,497 | 100.0% | |

| Total | 135 | 1,247,943 | 100.0 | % | $32,198,497 | 100.0 | % | | | | |

| (1) | Based on the underwritten rent roll dated as of May 24, 2023. |

| (2) | UW Base Rent Expiring, % of UW Base Rent Expiring, Cumulative UW Base Rent Expiring and Cumulative % of UW Base Rent Expiring are inclusive of $414,557 of underwritten rent steps. |

The following table presents certain information relating to the operating history and underwritten cash flows of the Healthcare Trust MOB Portfolio Properties.

| Operating History and Underwritten Net Cash Flow(1)(2) |

| | 2020 | 2021 | 2022 | TTM(3) | Underwritten(3) | Per Square Foot | %(4) |

| Base Rent | $16,229,547 | $20,379,355 | $29,092,788 | $29,515,569 | $31,783,940 | $25.47 | 76.8 | % |

| Rent Steps(5) | 0 | 0 | 0 | 0 | 414,557 | 0.33 | 1.0 | |

| Straight-Line Rent | 0 | 0 | 0 | 0 | 441,050 | 0.35 | 1.1 | |

| Expense Reimbursements | 3,867,555 | 4,328,265 | 5,371,645 | 5,464,468 | 7,655,965 | 6.13 | 18.5 | |

| Vacant Income | 0 | 0 | 0 | 0 | 1,073,403 | 0.86 | 2.6 | |

| Gross Potential Rent | $20,097,102 | $24,707,619 | $34,464,433 | $34,980,037 | $41,368,915 | $33.15 | 100.0 | % |

| Miscellaneous Income | 5,003 | 55,850 | 80,943 | 80,008 | 64,617 | 0.05 | 0.2 | |

| (Vacancy/Credit Loss) | 0 | 0 | 0 | 0 | (2,068,446) | (1.66) | (5.0) | |

| Effective Gross Income | $20,102,104 | $24,763,470 | $34,545,376 | $35,060,045 | $39,365,086 | 31.54 | 95.2 | % |

| Total Expenses | $4,993,714 | $6,060,988 | $8,000,537 | $8,127,805 | $10,218,760 | $8.19 | 26.0 | % |

| Net Operating Income | $15,108,391 | $18,702,482 | $26,544,839 | $26,932,240 | $29,146,326 | $23.36 | 74.0 | % |

| Capital Expenditures | 0 | 0 | 0 | 0 | 478,107 | 0.38 | 1.2 | |

| TI/LC | 0 | 0 | 0 | 0 | 1,247,943 | 1.00 | 3.2 | |

| Net Cash Flow | $15,108,391 | $18,702,482 | $26,544,839 | $26,932,240 | $27,420,277 | $21.97 | 69.7 | % |

| (1) | Based on the underwritten rent roll dated as of May 24, 2023. |

| (2) | The increases in historical Net Operating Income are due to the borrowers acquiring the Healthcare Trust MOB Portfolio Properties on a rolling basis throughout these years. |

| (3) | TTM represents the trailing 12-month period ending March 31, 2023. The increase between TTM Net Operating Income and Underwritten Net Operating Income is due to the borrowers acquiring five of the Healthcare Trust MOB Portfolio Properties in 2023 prior to loan origination. |

| (4) | % column represents percent of Gross Potential Rent for all revenue lines and represents percent of Effective Gross Income for the remainder of fields. |

| (5) | Represents contractual rent steps through May 31, 2024. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 15 | |

| Structural and Collateral Term Sheet | | BMO 2023-C6 |

| No. 1 – Healthcare Trust MOB Portfolio |

The Market. The Healthcare Trust MOB Portfolio Properties are geographically diverse with properties located in 19 different states. According to the appraisal, demand for medical office buildings (“MOB”) across the United States has experienced continued growth due to healthcare job growth, the aging population and medical office demand.

| Healthcare Trust MOB Portfolio Properties Market Summary(1) |

| Property Name | Appraiser-Defined Market/Area(2) | MOB Market Occupancy | UW Rental Rate PSF(3) | Appraiser’s Concluded Market Rent |

| Belpre V Cancer Center - Belpre, OH | Marietta | NAV | $73.21 | $51.00 |

| Glendale MOB - Farmington Hills, MI | Detroit-Warren-Dearborn | 90.6% | $28.33 | $26.00 |

| 1600 State Street | Salem | 96.2% | $27.54 | $27.00 |

| Palm Valley Medical Plaza - Goodyear, AZ | Phoenix-Mesa-Scottsdale | 88.6% | $24.81 | $23.50 |

| Eastside Cancer Institute - Greenville, SC | Greenville-Anderson-Mauldin | 93.0% | $22.02 | $21.50 |

| Aurora Healthcare Center - Waterford, WI | Racine County | 88.9% | $24.48 | $22.50 |

| Beaumont Medical Center - Warren, MI | Detroit-Warren-Dearborn | 90.6% | $35.87 | $26.00 |

| Millennium Eye Care - Freehold, NJ | Monmouth County | 93.6% | $29.27 | $25.00 |

| 757 Franciscan Medical - Munster, IN | Chicago-Naperville-Elgin | 92.8% | $20.47 | $18.50 |

| Vascular Surgery Associates - Tallahassee, FL | Tallahassee | 97.0% | $28.71 | $28.00 |

| Decatur Medical Office Building - Decatur, GA | Atlanta-Sandy Springs-Roswell | 90.7% | $28.19 | $27.50 |

| Aurora Healthcare Center - Wautoma, WI | Waushara County | 96.0% | $24.48 | $23.00 |

| Greenfield Medical Plaza - Gilbert, AZ | Phoenix-Mesa-Scottsdale | 88.6% | $24.45 | $25.00 |

| Swedish American MOB - Roscoe, IL | Rockford | 92.8% | $26.00 | $25.08 |

| West Michigan Surgery Center - Big Rapids, MI | Big Rapids | 94.5% | $28.09 | $27.00 |

| UPMC - Sir Thomas Court - Harrisburg, PA | Harrisburg-Carlisle | 92.9% | $19.28 | $19.00 |

| Eastern Carolina ENT - Greenville, NC | Greenville | 94.6% | $23.46 | $23.00 |

| Lancaster Medical Arts MOB - Lancaster | Lancaster | 96.7% | $14.44 | $14.00 |

| UPMC - Fisher Road - Mechanicsburg, PA | Harrisburg-Carlisle | 92.9% | $28.01 | $27.50 |

| Pensacola Nephrology MOB - Pensacola, FL | Pensacola-Ferry Pass-Brent | 95.0% | $25.96 | $26.00 |

| Kingwood Executive Center - Kingwood, TX | Houston-The Woodlands-Sugar Land | 87.9% | $20.14 | $22.00 |

| Lee Memorial Health System - Fort Myers, FL | Cape Coral-Fort Myers | 95.1% | $18.04 | $18.00 |

| Greenville Health System - Greenville, SC | Greenville-Anderson-Mauldin | 93.0% | $20.15 | $20.00 |

| UPMC - Chambers Hill - Harrisburg, PA | Harrisburg-Carlisle | 92.9% | $34.72 | $31.50 |

| Rockwall Medical Plaza - Rockwall, TX | Dallas-Fort Worth-Arlington | 90.1% | $26.55 | $26.00 |

| Pioneer Spine Sports - West Springfield | Springfield | 95.0% | $29.28 | $28.00 |

| Women’s Healthcare Group MOB - York, PA | York-Hanover | 95.8% | $17.32 | $17.00 |

| OrthoOne Hilliard - Hilliard, OH | Columbus | 92.3% | $19.30 | $16.56 |

| Metropolitan Eye Lakeshore Surgery - St. Clair Shores, MI | Detroit-Warren-Dearborn | 90.6% | $21.85 | $24.00 |

| St Peter’s - Albany, NY - 5 Palisades | Albany County | 93.9% | $21.68 | $23.50 |

| Crittenton MOB - Washington Township, MI | Detroit-Warren-Dearborn | 90.6% | $23.03 | $24.00 |

| Surgery Center of Temple - Temple, TX | Killeen-Temple | 97.0% | $33.00 | $33.00 |

| RAI Care Center-Clearwater, FL | Tampa-St. Petersburg-Clearwater | 93.8% | $26.74 | $28.71 |

| Medical Center V - Peoria, AZ | Arrowhead | 88.8% | $25.69 | $25.00 |

| MetroHealth Buckeye Health - Cleveland, OH | Cleveland-Elyria | 93.9% | $13.00 | $15.00 |

| South Douglas MOB - Midwest City, OK | Oklahoma City | NAV | $18.54 | $20.00 |

| Crittenton MOB - Sterling Heights, MI | Detroit-Warren-Dearborn | 90.6% | $26.60 | $24.00 |

| SPHP MOB, Albany, NY | Albany | 93.9% | $17.70 | $21.00 |

| Atlanta Gastroenterology Associates - Lawrenceville, GA | Atlanta-Sandy Springs-Roswell | 90.7% | $32.96 | $32.00 |

| Bone and Joint Specialists - Merrillville, IN | Chicago-Naperville-Elgin | 92.8% | $22.66 | $24.00 |

| St. Peter’s - Albany, NY - 2 Palisades | Albany County | 93.9% | $24.39 | $23.50 |

| 1550 State Street | Salem | 96.2% | $22.44 | $22.00 |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 16 | |

| Structural and Collateral Term Sheet | | BMO 2023-C6 |

| No. 1 – Healthcare Trust MOB Portfolio |

| Property Name | Appraiser-Defined Market/Area(2) | MOB Market Occupancy | UW Rental Rate PSF(3) | Appraiser’s Concluded Market Rent |

| St Lukes Heart Vascular Center - East Stroudsburg | East Stroudsburg | 93.7% | $19.69 | $20.00 |

| Naidu Clinic - Odessa, TX | Midland-Odessa | 94.5% | $20.21 | $19.50 |

| Aurora Healthcare Center - Kiel, WI | Manitowoc County | 88.7% | $24.48 | $22.50 |

| Florida Medical Heartcare - Tampa, FL | Tampa-St. Petersburg-Clearwater | 93.8% | $23.06 | $22.52 |

| Florida Medical Wesley Chapel - Tampa, FL | Tampa-St. Petersburg-Clearwater | 93.8% | $23.06 | $22.52 |

| Aurora Healthcare Center - Green Bay, WI | Brown County | 92.8% | $24.48 | $23.00 |

| Center for Advanced Dermatology - Lakewood, CO | Denver-Aurora-Lakewood | 91.3% | $30.17 | $30.00 |

| Pioneer Spine Sports - Springfield | Springfield | 95.0% | $24.42 | $24.00 |

| Pioneer Spine Sports - Northampton | Springfield | 95.0% | $17.77 | $25.00 |

| DaVita Dialysis - Hudson, FL | Tampa-St. Petersburg-Clearwater | 93.8% | $25.86 | $26.00 |

| Florida Medical Clinic - Tampa, FL | Tampa-St. Petersburg-Clearwater | 93.8% | $21.82 | $21.40 |

| St Peter’s - Albany, NY - 4 Palisades | Albany | 93.9% | $18.08 | $23.50 |

| 5825 Shoreview Lane North | Salem | 96.2% | $24.48 | $24.00 |

| Fresenius Medical Care - Winfield, AL | Birmingham | 91.0% | $31.42 | $26.75 |

| Florida Medical Tampa Palms - Tampa, FL | Tampa-St. Petersburg-Clearwater | 93.8% | $23.06 | $22.52 |

| Florida Medical Somerset - Tampa, FL | Tampa-St. Petersburg-Clearwater | 93.8% | $23.06 | $22.52 |

| DaVita Bay Breeze Dialysis Center - Largo, FL | Tampa-St. Petersburg-Clearwater | 93.8% | $18.65 | $18.00 |

| St. Peter’s - Troy, NY - 2 New Hampshire | Albany | 93.9% | $26.26 | $23.84 |

| Aurora Healthcare Center - Greenville, WI | Outagamie County | 91.6% | $24.48 | $22.75 |

| 1586 State Street | Salem | 96.2% | $15.30 | $15.00 |

| (2) | Appraiser data was based on the medical office market for each property if available. If unavailable, the appraiser data was based on the surrounding area. Some medical office market or area data was unavailable. |

| (3) | UW Rental Rate PSF is based on the underwritten rent roll dated as of May 24, 2023. |

The Borrowers. The borrowers are 59 Delaware limited liability companies and special purpose entities that are subsidiaries of Healthcare Trust Operating Partnership, L.P., a Delaware limited partnership. See the footnotes to Annex A-1 for the names of each entity. Each borrower has two independent directors. Legal counsel to the borrowers delivered a non-consolidation opinion in connection with the origination of the Healthcare Trust MOB Portfolio Whole Loan.

The Borrower Sponsor. The borrower sponsor and non-recourse carve-out guarantor is Healthcare Trust Operating Partnership, L.P. Healthcare Trust Operating Partnership, L.P. is a subsidiary of Healthcare Trust, Inc., a publicly registered real estate investment trust that is externally managed by AR Global Investments, LLC. Healthcare Trust, Inc. is focused on acquiring a diversified portfolio of healthcare real estate, with an emphasis on senior housing real estate and medical office buildings located in the United States. As of year-end 2022, Healthcare Trust, Inc. owned 202 properties, totaling approximately 9.1 million square feet across 34 states.

Property Management. The Healthcare Trust MOB Portfolio Properties are managed by Healthcare Trust Properties, LLC, an affiliate of the borrower sponsor, and by Hiffman Asset Management LLC and Plaza Del Rio Management Corp., each a third-party property management company.

Escrows and Reserves. At origination, the borrowers deposited into escrow $289,100 for deferred maintenance, $4,760,872 for outstanding tenant improvements and leasing commissions, $269,376 for unfunded obligations of free rent, approximately $643,802 for real estate taxes and approximately $6,283 for insurance premiums.

Tax Escrows – On a monthly basis, the borrowers are required to escrow approximately $321,901 for real estate taxes. The borrowers are not required to make monthly tax deposits for an individual property if (i) no event of default has occurred and is continuing, (ii) the applicable property is leased to a single tenant and that tenant is paying any taxes directly with satisfactory evidence given to the lender, (iii) no Cash Sweep Period (as defined below) is in effect and (iv) the applicable lease is in full force and effect and there is no event of default under the lease.

Insurance Escrows – On a monthly basis, the borrowers are required to escrow approximately $1,257 for insurance premiums. The borrowers are not required to pay monthly insurance premiums if they obtain a blanket policy satisfactory to the lender or, in regard to an individual property, if (i) no event of default has occurred and is continuing, (ii) the applicable property is leased to a single tenant and that tenant is paying any insurance premiums directly with satisfactory evidence

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 17 | |

| Structural and Collateral Term Sheet | | BMO 2023-C6 |

| No. 1 – Healthcare Trust MOB Portfolio |

given to the lender, (iii) no Cash Sweep Period is in effect and (iv) the applicable lease is in full force and effect and there is no event of default under the lease.

Replacement Reserve – During a Cash Sweep Period, the borrowers are required to escrow 1/12th of the product obtained by multiplying $0.20 by the aggregate square footage of the Healthcare Trust MOB Portfolio Properties (initially equal to approximately $20,799 per month).

TI/LC Reserve – During a Cash Sweep Period, the borrowers are required to escrow 1/12th of the product obtained by multiplying $1.50 by the aggregate square footage of the Healthcare Trust MOB Portfolio Properties (initially equal to approximately $155,993 per month).

A “Cash Sweep Period” will commence upon a Cash Sweep Event (as defined below).

Lockbox / Cash Management. The Healthcare Trust MOB Portfolio Whole Loan is structured with a hard lockbox and springing cash management. The borrowers were required to establish a lockbox account and deliver letters to the tenants at the Healthcare Trust MOB Portfolio Properties directing them to pay all rents directly into a lender-controlled lockbox account. Additionally, all revenues and other monies received by the borrowers or related property manager are required to be deposited into the lockbox account within one business day after receipt. During the occurrence and continuance of a Cash Sweep Event, all funds are required to be swept each business day into the cash management account controlled by the lender and disbursed on each payment date in accordance with the Healthcare Trust MOB Portfolio Whole Loan documents, with all excess cash flow to be held as additional security for the Healthcare Trust MOB Portfolio Whole Loan.

A “Cash Sweep Event” will commence upon any of the following: (i) an event of default under the Healthcare Trust MOB Portfolio Whole Loan documents has occurred and is continuing; (ii) the debt yield being less than 9.5% for two consecutive calendar quarters; or (iii) a Belpre V Trigger Event (as defined below). A Cash Sweep Event will end upon, with respect to clause (i), the end of such event of default, with respect to clause (ii) above, an occurrence of a Debt Yield Cure (as defined below), or with respect to clause (iii) above, a Belpre V Trigger Event Cure (as defined below).

A “Debt Yield Cure” will occur upon the debt yield being greater than or equal to 9.5% for two consecutive calendar quarters based on the trailing 12-month period preceding the date of determination. The borrowers have the option to cure the debt yield event by (i) making a partial prepayment in the amount that results in a reduction of the then-outstanding principal balance of the Healthcare Trust MOB Portfolio Whole Loan sufficient to achieve a debt yield of at least 9.5% or (ii) obtaining a letter of credit in the amount equal to the excess cash flow that would have been swept in the three-month period immediately preceding the applicable determination date as acceptable to the lender. Each letter of credit will be effective for a three-month period, upon expiration of which the borrowers can submit subsequent letter(s) of credit if the debt yield remains less than 9.5%.

A “Belpre V Trigger Event” will commence upon any of the following: (i) Belpre V giving notice of its intent to terminate its lease; (ii) Belpre V going dark; (iii) Belpre V or its parent company filing for bankruptcy or insolvency; or (iv) Belpre V defaulting under the terms of its lease. A Cash Sweep Event due to a Belpre V Trigger Event will not commence if a Belpre V Reserve Funds Cap Cure (as defined below) occurs within five business days of such Belpre V Trigger Event.

A “Belpre V Trigger Event Cure” will occur, with respect to clause (i), (a) Belpre V rescinding its termination notice or (b) satisfaction of the Belpre V Replacement Lease Criteria (as defined below); with respect to clause (ii), (a) Belpre V resuming occupancy of the premises and delivery of an estoppel that the lease is in full force and effect or (b) the satisfaction of the Belpre V Replacement Lease Criteria; with respect to clause (iii), (a) Belpre V or its parent no longer being in bankruptcy or insolvency proceedings and the Belpre V lease or its guaranty (as applicable) has been affirmed, is unmodified and is in full force and effect or (b) satisfaction of the Belpre V Replacement Lease Criteria; and with respect to clause (iv), (a) the borrowers providing evidence satisfactory to the lender that the event of default is cured or (b) satisfaction of the Belpre V Replacement Lease Criteria.

The “Belpre V Replacement Lease Criteria” will occur upon the following: (i) the borrowers have entered into one or more Belpre V replacement leases; (ii) each Belpre V Replacement Tenant (as defined below) being in occupancy of the space covered by the replacement lease; (iii) the borrowers providing (a) a copy of each executed Belpre V applicable replacement lease and updated tenant estoppels, (b) a subordination, non-disturbance and attornment agreement if requested by the lender, (c) satisfactory evidence that the borrowers have paid for and performed all tenant improvements related to such Belpre V Replacement Tenant, and (d) an updated rent roll.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 18 | |

| Structural and Collateral Term Sheet | | BMO 2023-C6 |

| No. 1 – Healthcare Trust MOB Portfolio |

A “Belpre V Replacement Tenant” means a new tenant or tenants reasonably approved by the lender and leasing all or part of the Belpre V premises.

A “Belpre V Reserve Funds Cap Cure” means that (i) the borrowers have deposited $10,750,000 in cash or in a letter of credit with the lender, less, if applicable, the Belpre V replacement rent amount or (ii) during the applicable Cash Sweep Event, the amount on deposit in the excess cash flow reserve account exceeds $10,750,000.

Subordinate Debt. None.

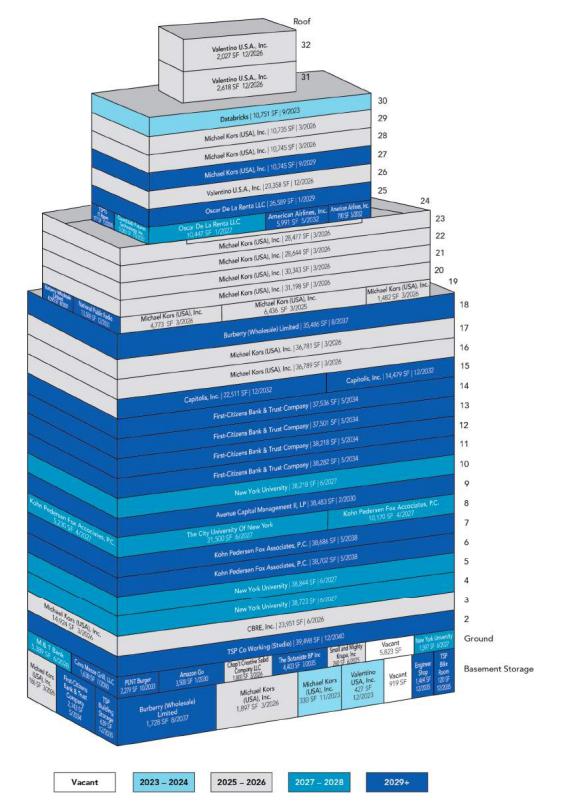

Mezzanine Debt. None.