UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

| |

☒ | Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the quarterly period ended September 30, 2024

| |

☐ | Transition report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 |

Commission File Number 001-42301

FRONTVIEW REIT, INC.

(Exact name of registrant as specified in its charter)

| |

Maryland | 93-2133671 |

(State or other jurisdiction of

incorporation or organization) | (I.R.S. Employer

Identification No.) |

| |

3131 McKinney Avenue Suite L10 Dallas, Texas | 75204 |

(Address of principal executive offices) | (Zip Code) |

(214) 796-2445

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock, $0.01 par value | | FVR | | The New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

Large accelerated filer | | ☐ | | Accelerated filer | | ☐ |

Non-accelerated filer | | ☒ | | Smaller reporting company | | ☐ |

Emerging growth company | | ☒ | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

There were 16,068,156 shares of the Registrants’ Common Stock, $0.01 par value per share, outstanding as of November 14, 2024.

FRONTVIEW REIT, INC.

TABLE OF CONTENTS

Cautionary Note Regarding Forward-Looking Statements

This Quarterly Report on Form 10-Q contains forward-looking statements, which reflect our current views regarding our business, financial performance, growth prospects and strategies, market opportunities, and market trends, that are intended to be made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements include all statements that are not historical facts. In some cases, you can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “approximately,” “projects,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” or the negative version of these words or other comparable words. All of the forward-looking statements included in this Quarterly Report on Form 10-Q are subject to various risks and uncertainties. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions, and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results, performance, and achievements could differ materially from those expressed in or by the forward-looking statements and may be affected by a variety of risks and other factors. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from such forward-looking statements.

Important factors that could cause results to differ materially from the forward-looking statements are described in “Business and Properties,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Prospectus Supplement, as filed with the U.S. Securities and Exchange Commission (“SEC”) on October 2, 2024. The “Risk Factors” of our Prospectus Supplement should not be construed as exhaustive and should be read in conjunction with other cautionary statements included elsewhere in this Quarterly Report on Form 10-Q.

You are cautioned not to place undue reliance on any forward-looking statements included in this Quarterly Report on Form 10-Q. All forward-looking statements are made as of the date of this Quarterly Report on Form 10-Q and the risk that actual results, performance, and achievements will differ materially from the expectations expressed in or referenced by this Quarterly Report on Form 10-Q will increase with the passage of time. We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments, or otherwise, except as required by law.

Regulation FD Disclosures

We use any of the following to comply with our disclosure obligations under Regulation FD: SEC filings, press releases, public conference calls, or our website. We routinely post important information on our website at www.frontviewreit.com, including information that may be deemed material. We encourage our shareholders and others interested in our company to monitor these distribution channels for material disclosures. Our website address is included in this Quarterly Report as a textual reference only and the information on the website is not incorporated by reference in this Quarterly Report.

BALANCE SHEETS

(Unaudited)

| | | | | | | |

| | September 30, 2024 | | December 31, 2023 | |

ASSETS | | | | | |

Cash | | $ | 1,000 | | $ | 1,000 | |

Total Assets | | $ | 1,000 | | $ | 1,000 | |

Stockholder's Equity | | | | | |

Common stock, par value $0.01 per share, 400,000,000 shares authorized and 100 shares issued and outstanding | | $ | 1 | | $ | 1 | |

Additional paid in capital | | | 999 | | | 999 | |

Total Stockholder's Equity | | $ | 1,000 | | $ | 1,000 | |

The accompanying notes are an integral part of the balance sheets.

NOTES TO BALANCE SHEETS

(Unaudited)

1. ORGANIZATION

FrontView REIT, Inc. (the “Company”) was formed on June 23, 2023 as a Maryland corporation and intends to qualify as a real estate investment trust (“REIT”) for U.S. federal income tax purposes. The Company has not had any corporate activity since its formation. The Company was organized to continue NADG NNN Property Fund LP’s (the “Predecessor”) business of investing in a portfolio of outparcel properties that are in prominent locations with frontage on high-traffic roads that are visible to consumers. The Company anticipates that its investments will be geographically diversified across the United States. The Company will be an internally-managed net-lease REIT.

The Company intends to conduct an initial public offering of shares of Class A common stock (the “IPO”). Before the completion of the IPO, the Company intends to establish its operating and capital structure including a REIT contribution transaction to create an UPREIT structure with the Predecessor and internalization of management.

2. CAPITALIZATION

As of June 23, 2023, the Company was authorized to issue up to 400,000,000 shares of Class A common stock, par value $0.01 per share, 50,000,000 shares of Class B common stock, par value of $0.01 per share, and 50,000,000 shares of preferred stock, par value of $0.01 per share.

On June 30, 2023, the Company issued 100 shares of Class A common stock to the founder in exchange for $1,000 in cash as its initial capitalization. The Company will repurchase these shares at cost upon completion of the IPO.

As of September 30, 2024, the Company has 100 shares of Class A common stock, 0 shares of Class B common stock and 0 shares of preferred stock.

3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The accompanying balance sheets have been prepared in accordance with accounting principles generally accepted in the United States, (“GAAP”). Separate statements of operations, changes in equity, and cash flows have not been presented in the financial statements because principal operations have not commenced.

Cash of the Company is held with a major financial institution and may exceed the federal insurable limits. Generally, these deposits may be redeemed upon demand and therefore bear minimal risk.

The Company elected to be taxed as a pass-through entity under subchapter S of the Internal Revenue Code of 1986, as amended (the “Code”), but intends to revoke its S election prior to the closing of the IPO. The Company intends to make an election to be taxed as a REIT under Sections 856 through 860 of the Code, commencing with its short taxable year ending December 31, 2024. Generally, the Company will not be subject to federal income taxes on amounts distributed to stockholders, providing it distributes 90% of its REIT taxable income and meets certain other requirements for qualifying as a REIT. If the Company fails to maintain its qualification as a REIT in any taxable year, the Company will then be subject to federal income taxes on its taxable income at regular corporate rates and will not be permitted to qualify for treatment as a REIT for federal income tax purposes for four years following the year during which qualification is lost unless the Internal Revenue Service grants the Company relief under certain statutory provisions. Such an event could have a material adverse effect on its net income and net cash available for distribution to its members.

The Company is required to file income tax returns with federal taxing authorities. As of September 30, 2024, the Company's U.S. federal income tax returns remain subject to examination by the Internal Revenue Service for the 2023 tax year.

4. SUBSEQUENT EVENTS

The Company identified the following events subsequent to September 30, 2024 that are not recognized in the accompanying balance sheets:

a.The Company was part of a series of transactions (“REIT Contribution Transactions”) to create an UPREIT structure, with a publicly-traded REIT that is internally managed and owns all of its assets and conducts all of its business through a subsidiary operating partnership. On October 2, 2024, pursuant to the Contribution Agreements (as defined below), the Common Limited Partners of NADG NNN Property Fund LP (the “Predecessor”) exchanged their Common Units (as defined below) (or interest in the entity that owns the Common Units) for units in FrontView Operating Partnership LP (“OP Units”) or Common Stock (as defined below) of FrontView REIT Inc. on a one-for-one basis. On October 2, 2024, pursuant to the REIT Contribution Transactions, existing Preferred Unit Holders (as defined below) exchanged their interests in the Predecessor’s private operating partnership (or interest in the entity that owns the preferred interests in the Predecessor’s private operating partnership) for OP Units.

b.On October 2, 2024, the Company, through the REIT Contribution Transactions described above, became the successor of its Predecessor and completed the IPO of its common stock and began trading on the New York Stock Exchange as FrontView REIT Inc. under the ticker symbol “FVR”). The Company sold 13,200,000 shares of common stock at a price of $19.00 per share. The net proceeds to the Company from the IPO were $233,871,000, which are net of underwriter fees and commissions of $16,929,000.

c.On October 23, 2024, the Company issued an additional 1,090,846 shares of common stock pursuant to the underwriters' over-allotment option in connection with the Company's IPO. The Company received net proceeds of $19,327,064, which are net of underwriter fees and commissions of $1,399,010.

d.The Company contributed the net proceeds of the IPO to FrontView Operating Partnership LP in exchange for 14,290,846 OP Units.

NADG NNN PROPERTY FUND LP

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(in thousands)

| | | | | | | | | | |

| | Note | | September 30,

2024 | | | December 31,

2023 | |

ASSETS | | | | | | | | |

Real estate held for investment, at cost | | | | | | | | |

Land | | | | $ | 312,143 | | | $ | 314,748 | |

Buildings and improvements | | | | | 328,121 | | | | 332,432 | |

Total real estate held for investment, at cost | | | | | 640,264 | | | | 647,180 | |

Less accumulated depreciation | | | | | (37,277 | ) | | | (28,734 | ) |

Real estate held for investment, net | | 3 | | | 602,987 | | | | 618,446 | |

Assets held for sale | | | | | — | | | | 2,859 | |

Cash, cash equivalents and restricted cash | | | | | 9,895 | | | | 17,129 | |

Intangible lease assets, net | | 4 | | | 103,109 | | | | 119,432 | |

Other assets | | 10 | | | 17,079 | | | | 14,141 | |

Total assets | | | | $ | 733,070 | | | $ | 772,007 | |

LIABILITIES, CONVERTIBLE NON-CONTROLLING

PREFERRED INTERESTS AND PARTNERS' CAPITAL | | | | | | | | |

Liabilities | | | | | | | | |

Debt, net | | 6 | | $ | 418,268 | | | $ | 436,452 | |

Intangible lease liabilities, net | | 4 | | | 14,242 | | | | 17,416 | |

Accounts payable and accrued liabilities | | 11 (a), (b) | | | 15,862 | | | | 17,452 | |

Total liabilities | | | | | 448,372 | | | | 471,320 | |

| | | | | | | | |

Contingencies (Note 12) | | | | | | | | |

| | | | | | | | |

Convertible non-controlling preferred interests | | 9 | | | 103,724 | | | | 103,616 | |

| | | | | | | | |

Partners' capital | | | | | | | | |

Partners' capital | | | | | 180,974 | | | | 197,071 | |

Total liabilities, convertible non-controlling preferred interests

and partners' capital | | | | $ | 733,070 | | | $ | 772,007 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

NADG NNN PROPERTY FUND LP

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(in thousands)

| | | | | | | | | | | | | | | | | |

| | | For the three months ended September 30, | | | For the nine months ended September 30, | |

| Note | | 2024 | | | 2023 | | | 2024 | | | 2023 | |

Revenues | | | | | | | | | | | | | |

Rental revenues | 3 | | $ | 14,534 | | | $ | 11,623 | | | $ | 44,403 | | | $ | 33,923 | |

| | | | | | | | | | | | | |

Operating expenses | | | | | | | | | | | | | |

Depreciation and amortization | 3, 4 | | | 7,119 | | | | 6,159 | | | | 21,415 | | | | 17,315 | |

Property operating expenses | | | | 2,003 | | | | 1,314 | | | | 5,694 | | | | 3,941 | |

Property management fees | 11 (b) | | | 494 | | | | 397 | | | | 1,501 | | | | 1,122 | |

Asset management fees | 7, 11 (b) | | | 1,034 | | | | 1,035 | | | | 3,102 | | | | 3,105 | |

General and administrative expenses | | | | 697 | | | | 2,947 | | | | 2,059 | | | | 6,028 | |

Total operating expenses | | | | 11,347 | | | | 11,852 | | | | 33,771 | | | | 31,511 | |

| | | | | | | | | | | | | |

Other expenses (income) | | | | | | | | | | | | | |

Interest expense | 6 | | | 6,463 | | | | 4,611 | | | | 19,755 | | | | 11,879 | |

(Gain)/ loss on sale of real estate | 3 | | | — | | | | — | | | | (337 | ) | | | 332 | |

Impairment loss | | | | — | | | | — | | | | 591 | | | | — | |

Income taxes | | | | 63 | | | | 48 | | | | 344 | | | | 206 | |

Total other expenses | | | | 6,526 | | | | 4,659 | | | | 20,353 | | | | 12,417 | |

Operating loss | | | | (3,339 | ) | | | (4,888 | ) | | | (9,721 | ) | | | (10,005 | ) |

Equity (loss)/ income from investment in an

unconsolidated entity | 5 | | | — | | | | (7 | ) | | | — | | | | 53 | |

Net loss | | | | (3,339 | ) | | | (4,895 | ) | | | (9,721 | ) | | | (9,952 | ) |

Less: Net loss attributable to convertible non-

controlling preferred interests | 9 | | | 908 | | | | 1,334 | | | | 2,652 | | | | 2,698 | |

Net loss attributable to NADG NNN Property

Fund LP | | | $ | (2,431 | ) | | $ | (3,561 | ) | | $ | (7,069 | ) | | $ | (7,254 | ) |

The accompanying notes are an integral part of these condensed consolidated financial statements.

NADG NNN PROPERTY FUND LP

CONDENSED CONSOLIDATED STATEMENTS OF PARTNERS' CAPITAL

(Unaudited)

(in thousands)

| | | | | | | | | | | | | | | | |

| | U.S. Limited Partners

(Note 1) | | | NADG NNN Property Fund (US) Limited Partnership

(Note 1) | | | Preferred Units (Note 8) | | | Total Partners' Capital | |

Partners' capital, December 31, 2023 | | $ | 91,613 | | | $ | 105,333 | | | $ | 125 | | | $ | 197,071 | |

Accretion of preferred units | | | (2 | ) | | | (2 | ) | | | 4 | | | | — | |

Accretion of non-controlling interests (Note 9) | | | (1,126 | ) | | | (1,406 | ) | | | — | | | | (2,532 | ) |

Distributions | | | — | | | | — | | | | (4 | ) | | | (4 | ) |

Net Loss | | | (1,091 | ) | | | (1,361 | ) | | | — | | | | (2,452 | ) |

Partners' capital, March 31, 2024 | | $ | 89,394 | | | $ | 102,564 | | | $ | 125 | | | $ | 192,083 | |

Accretion of preferred units | | | (2 | ) | | | (2 | ) | | | 4 | | | | — | |

Accretion of non-controlling interests (Note 9) | | | (1,086 | ) | | | (1,356 | ) | | | — | | | | (2,442 | ) |

Distributions | | | (671 | ) | | | (829 | ) | | | (4 | ) | | | (1,504 | ) |

Net Loss | | | (971 | ) | | | (1,215 | ) | | | — | | | | (2,186 | ) |

Partners' capital, June 30, 2024 | | $ | 86,664 | | | $ | 99,162 | | | $ | 125 | | | $ | 185,951 | |

Accretion of preferred units | | | (2 | ) | | | (2 | ) | | | 4 | | | | — | |

Accretion of non-controlling interests (Note 9) | | | (1,130 | ) | | | (1,412 | ) | | | — | | | | (2,542 | ) |

Distributions | | | — | | | | — | | | | (4 | ) | | | (4 | ) |

Net Loss | | | (1,081 | ) | | | (1,350 | ) | | | — | | | | (2,431 | ) |

Partners' capital, September 30, 2024 | | $ | 84,451 | | | $ | 96,398 | | | $ | 125 | | | $ | 180,974 | |

NADG NNN PROPERTY FUND LP

CONDENSED CONSOLIDATED STATEMENTS OF PARTNERS' CAPITAL (CONTINUED)

(Unaudited)

(in thousands)

| | | | | | | | | | | | | | | | |

| | U.S. Limited Partners

(Note 1) | | | NADG NNN Property Fund (US) Limited Partnership

(Note 1) | | | Preferred Units (Note 8) | | | Total Partners' Capital | |

Partners' capital, December 31, 2022 | | $ | 98,123 | | | $ | 119,053 | | | $ | 125 | | | $ | 217,301 | |

Contributions | | | 10,552 | | | | — | | | | — | | | | 10,552 | |

Issue costs (Note 11 (a)) | | | (316 | ) | | | — | | | | — | | | | (316 | ) |

Accretion of preferred units | | | (2 | ) | | | (2 | ) | | | 4 | | | | — | |

Accretion of non-controlling interests (Note 9) | | | (867 | ) | | | (1,109 | ) | | | — | | | | (1,976 | ) |

Distributions | | | (1,891 | ) | | | (2,417 | ) | | | (4 | ) | | | (4,312 | ) |

Distributions reinvested in Common Units | | | 22 | | | | 188 | | | | — | | | | 210 | |

Redemption of Common Units | | | (5,000 | ) | | | (250 | ) | | | — | | | | (5,250 | ) |

Net Loss | | | (496 | ) | | | (634 | ) | | | — | | | | (1,130 | ) |

Partners' capital, March 31, 2023 | | $ | 100,125 | | | $ | 114,829 | | | $ | 125 | | | $ | 215,079 | |

Contributions | | | 252 | | | | 75 | | | | — | | | | 327 | |

Issue costs (Note 11 (a)) | | | (8 | ) | | | (2 | ) | | | — | | | | (10 | ) |

Accretion of preferred units | | | (2 | ) | | | (2 | ) | | | 4 | | | | — | |

Accretion of non-controlling interests (Note 9) | | | (1,198 | ) | | | (1,507 | ) | | | — | | | | (2,705 | ) |

Distributions | | | (1,861 | ) | | | (2,337 | ) | | | (4 | ) | | | (4,202 | ) |

Distributions reinvested in Common Units | | | 21 | | | | 189 | | | | — | | | | 210 | |

Redemption of Common Units | | | (750 | ) | | | (312 | ) | | | — | | | | (1,062 | ) |

Net Loss | | | (1,133 | ) | | | (1,430 | ) | | | — | | | | (2,563 | ) |

Partners' capital, June 30, 2023 | | $ | 95,446 | | | $ | 109,503 | | | $ | 125 | | | $ | 205,074 | |

Accretion of preferred units | | | (2 | ) | | | (2 | ) | | | 4 | | | | — | |

Accretion of non-controlling interests (Note 9) | | | (1,327 | ) | | | (1,640 | ) | | | — | | | | (2,967 | ) |

Distributions | | | (1,965 | ) | | | (2,419 | ) | | | (4 | ) | | | (4,388 | ) |

Distributions reinvested in Common Units | | | 22 | | | | 198 | | | | — | | | | 220 | |

Redemption of Common Units | | | — | | | | 312 | | | | — | | | | 312 | |

Net Loss | | | (1,588 | ) | | | (1,973 | ) | | | — | | | | (3,561 | ) |

Partners' capital, September 30, 2023 | | $ | 90,586 | | | $ | 103,979 | | | $ | 125 | | | $ | 194,690 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

NADG NNN PROPERTY FUND LP

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(in thousands)

| | | | | | | | | | |

| | | | For the nine months ended September 30, | |

| | Note | | 2024 | | | 2023 | |

CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | | | |

Net loss | | | | $ | (9,721 | ) | | $ | (9,952 | ) |

Adjustments to reconcile net loss to net cash provided by operating activities: | | | | | | | | |

Depreciation and amortization | | 3, 4 | | | 21,415 | | | | 17,315 | |

Amortization of above/below market leases | | 4 | | | 1,338 | | | | 892 | |

Amortization of financing transaction and discount costs | | 6 | | | 3,145 | | | | 1,774 | |

Amortization of software costs | | | | | 25 | | | | — | |

Non-cash rental revenue adjustments | | | | | (970 | ) | | | (889 | ) |

(Gain)/ loss on sale of real estate | | 3 | | | (337 | ) | | | 332 | |

Impairment loss | | | | | 591 | | | | — | |

Equity income from investment in an unconsolidated entity | | 5 | | | — | | | | (53 | ) |

Distributions of equity earnings received from investment in an

unconsolidated entity | | 5 | | | — | | | | 1,650 | |

Changes in operating assets and liabilities: | | | | | | | | |

Other assets | | 10 | | | 214 | | | | (472 | ) |

Accounts payable and accrued liabilities | | | | | (428 | ) | | | 2,731 | |

Related party payable | | | | | — | | | | 2,262 | |

Net cash provided by operating activities | | | | | 15,272 | | | | 15,590 | |

CASH FLOWS FROM INVESTING ACTIVITIES | | | | | | | | |

Acquisition of real estate held for investment | | 3 | | | (523 | ) | | | (71,762 | ) |

Deposits on real estate held for investment | | | | | (350 | ) | | | (1,584 | ) |

Deferred leasing costs and other additions to real estate held for investment | | | | | (1,103 | ) | | | (1,533 | ) |

Net proceeds from sale of real estate held for investment | | 3 | | | 9,846 | | | | 1,861 | |

Distributions received from investment in an unconsolidated entity | | 5 | | | — | | | | 816 | |

Net proceeds from expropriation | | | | | 85 | | | | — | |

Additions to software costs | | | | | (21 | ) | | | — | |

Net cash provided by/ (used in) investing activities | | | | | 7,934 | | | | (72,202 | ) |

CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | | |

Capital contributions | | | | | — | | | | 10,879 | |

Redemption of Common Units | | | | | — | | | | (7,081 | ) |

Issue costs | | 11 (a) | | | — | | | | (326 | ) |

Proceeds from debt, net | | 6 | | | — | | | | 79,390 | |

Repayment of debt, net | | 6 | | | (20,913 | ) | | | (39,558 | ) |

Financing transaction costs | | 6 | | | (416 | ) | | | (149 | ) |

Deferred offering costs | | | | | (2,843 | ) | | | (1,146 | ) |

Cash distributions to Common Unit Holders | | | | | (1,500 | ) | | | (12,250 | ) |

Cash distributions paid to Preferred Unit Holders | | 8 | | | (12 | ) | | | (12 | ) |

Cash distributions to non-controlling convertible preferred interests | | 9 | | | (4,864 | ) | | | (4,091 | ) |

Contributions from non-controlling convertible preferred interests | | 9 | | | 108 | | | | 5,052 | |

Net cash (used in)/ provided by financing activities | | | | | (30,440 | ) | | | 30,708 | |

Net decrease in cash, cash equivalents and restricted cash during the period | | | | | (7,234 | ) | | | (25,904 | ) |

Cash, cash equivalents and restricted cash, beginning of period | | | | | 17,129 | | | | 41,077 | |

Cash, cash equivalents and restricted cash, end of period | | | | $ | 9,895 | | | $ | 15,173 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

NADG NNN PROPERTY FUND LP

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (CONTINUED)

(Unaudited)

(in thousands)

| | | | | | | | | | |

| | | | For the nine months ended September 30, | |

| | Note | | 2024 | | | 2023 | |

| | | | | | | | |

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | | | | | | | | |

Cash paid for interest | | | | $ | 16,531 | | | $ | 9,712 | |

Non-cash disclosures of non-cash investing and financing activities: | | | | | | | | |

Accrued real estate development and improvement costs | | | | $ | 1,627 | | | $ | 3,515 | |

Accrued deferred leasing fees | | | | $ | 559 | | | $ | — | |

Accrued deferred offering costs | | | | $ | 225 | | | $ | 1,995 | |

Distributions payable to convertible non-controlling preferred interests | | 9 | | $ | 1,633 | | | $ | 1,633 | |

Distributions reinvested in Common Units | | | | $ | — | | | $ | 640 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

NADG NNN PROPERTY FUND LP

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(in thousands)

1. BUSINESS OPERATIONS

NADG NNN Property Fund LP (the “Partnership”) was formed on January 6, 2016 (the “Inception Date”), to provide investors with the opportunity to invest in a portfolio of high quality, primarily single tenant net leased properties located in the United States (“U.S.”).

NADG NNN Operating LP (the “Operating LP”) is the entity through which the Partnership conducts its business and owns (either directly or through subsidiaries) all of the Partnership’s properties. The Partnership has a 78.68% ownership interest in the Operating LP as of September 30, 2024 and 72.89% as of December 31, 2023 (see Note 2(a)).

The general partner of the Partnership is NADG NNN Property Fund GP, LLLP (the “General Partner”). The limited partners of the Partnership are U.S. investors (collectively, the “U.S. LP”) who invest directly in the Partnership and NADG NNN Property Fund (Canadian) Limited Partnership (the “CDN LP”), a Canadian partnership set up to admit Canadian investors, (the U.S. LP and the CDN LP, collectively the “Common Unit Holders”), which invests in the Partnership through its wholly-owned subsidiary, NADG NNN Property Fund (US) Limited Partnership (see Note 7).

NADG (US), LLLP is the sponsor of the Partnership (the “Sponsor”). The General Partner undertook to ensure that the Sponsor or its affiliates would subscribe for common units in the Partnership (“Common Units”) representing at least 10% of the total committed capital up to a maximum of $5,000. As of December 31, 2016, an affiliate of the Sponsor had subscribed for and been issued 500 Common Units, on the same terms as other limited partners, and had contributed $5,000 to the Partnership representing its full commitment to the Partnership. A director of such affiliate of the Sponsor is also a director of the Sponsor and the General Partner.

Excess available cash (as determined by the General Partner) from net sales proceeds, net financing and refinancing proceeds, net rental income and all other revenues of the Partnership, will be distributed in accordance with the provisions and priorities set out in the limited partnership agreements, including any distributable cash payable to the General Partner.

2. ACCOUNTING POLICIES FOR FINANCIAL STATEMENTS

These unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and with the rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”). These unaudited condensed consolidated financial statements do not include all the information and notes required by GAAP for complete financial statements and should be read in conjunction with the Company’s audited consolidated financial statements as of and for the years ended December 31, 2023 and 2022, and the Company's Prospectus filed with the SEC on October 2, 2024, which provide a more complete understanding of the Company’s accounting policies, financial position, operating results, business properties, and other matters. In the opinion of management, all adjustments of a normal recurring nature necessary for a fair presentation have been included. The results of operations for the three and nine months ended September 30, 2024 and 2023 are not necessarily indicative of the results for the full year. All amounts expressed in these condensed consolidated financial statements are in U.S. currency and in thousands, except per unit amounts, number of units, number of properties and where indicated.

a) Principles of consolidation

The accompanying condensed consolidated financial statements include the financial position, results of operations and cash flows of the Partnership and its consolidated subsidiaries. All intercompany amounts have been eliminated.

The Partnership has concluded that the Operating LP is a variable interest entity (“VIE”) under Financial Accounting Standards Board’s (“FASB”) Accounting Standards Codification (“ASC”) 810 “Consolidation” (“ASC 810”). The Partnership was deemed to be the primary beneficiary of the Operating LP as substantially all activities of the Operating LP are conducted of behalf of the Partnership. The Partnership consolidates its interest in the Operating LP. The portion of the Operating LP not owned by the Partnership is presented as convertible non-controlling preferred interests as of September 30, 2024 and December 31, 2023.

On October 20, 2023, the Partnership acquired the remaining 50% interest in NADG NNN 50/50 LP (the “Joint Venture”) and the Partnership is deemed the primary beneficiary. As such, commencing October 20, 2023, the Partnership has consolidated its interest in the Joint Venture (see Note 2(b) and 5).

NADG NNN PROPERTY FUND LP

b) Investment in an unconsolidated entity

As of September 30, 2024, the Partnership has a 100% ownership interest in the Joint Venture. On August 18, 2023, the Partnership entered into an Interest Purchase Agreement with the JV Partner to acquire the remaining 50% ownership interest in the Joint Venture. This acquisition closed on October 20, 2023 (see Note 5). Post-acquisition, the Partnership accounts for its ownership in the Joint Venture through consolidation (see Note 2 (a)).

For the nine months ended September 30, 2023, the Partnership had a 50% ownership interest in the Joint Venture. The Partnership had evaluated the investment in the Joint Venture under ASC 810 and concluded that the Joint Venture is a VIE, however, the Partnership is not the primary beneficiary. The Partnership accounted for its non-controlling partnership interest in an unconsolidated joint venture using the equity method of accounting, as the Partnership exercised significant influence, but did not control this entity. Under the equity method of accounting, the net equity investment of the Partnership was reflected in the accompanying condensed consolidated balance sheets and the Partnership’s share of net income or loss from this joint venture was included in the accompanying condensed consolidated statements of operations.

The Partnership classifies distributions received from its investment in an unconsolidated entity based on the “nature of distribution method”. Under this approach, distributions are classified on the accompanying condensed consolidated statements of cash flows as either cash flows from operating activities or cash flows from investing activities depending on the nature of activities that generated the distribution.

On a periodic basis, management assesses whether there are any indicators that the value of the Partnership’s investment in an unconsolidated joint venture may be impaired. An investment is impaired only if management’s estimate of the value of the investment is less than the carrying value of the investment, and such decline in value is deemed to be other-than-temporary. To the extent impairment has occurred, the loss is measured as the excess of the carrying amount of the investment over the estimated fair value of the investment. The estimated fair value of the investment is determined using a discounted cash flow model which is a Level III valuation under the ASC 820, “Fair Value Measurements and Disclosures” (“ASC 820”). Management of the Partnership considers a number of assumptions that are subject to economic and market uncertainties including, among others: demand for space; competition for tenants; changes in market rental rates; operating costs; capitalization rates; holding periods; and, discount rates. As these factors are difficult to predict and are subject to future events that may alter management’s assumptions, the values estimated by management in its impairment analyses may not be realized. No impairment loss with respect to the carrying value of the investment in an unconsolidated entity has been recorded for the period prior to acquisition on October 20, 2023.

c) Real estate held for investment

Real estate held for investment is stated at cost, less accumulated depreciation and impairment losses. Upon acquisition of real estate held for investment considered to be an asset acquisition, the purchase price and related acquisition costs (collectively, “the purchase price”) is capitalized as part of the cost basis. The purchase price is allocated between land, buildings and improvements, site improvements, and identifiable intangible assets and liabilities such as amounts related to in-place leases and origination costs acquired, above- and below-market leases, based upon their relative fair values. The allocation of the purchase price requires judgment and significant estimates. The fair values of the land and building assets are determined on an as-if-vacant basis.

Above- and below-market leases are based upon a comparison between existing leases upon acquisition and current market rents for similar real estate. The fair value of above- and below-market leases is equal to the aggregate present value of the spread between the contract and the market rate of each of the in-place leases over their remaining term. The values of the above- and below-market leases are amortized to rental revenues over the remaining term of the related leases.

The fair values of in-place leases and origination costs are determined based on the estimates of carrying costs during the expected lease-up periods and costs that would be incurred to put the existing leases in place under the same market terms and conditions.

In the event a tenant terminates its lease, the unamortized portion of the related intangible values is written off immediately.

NADG NNN PROPERTY FUND LP

Depreciation and amortization are calculated using the straight-line method over the estimated useful lives of the asset:

| |

Asset | Estimated useful lives |

Buildings and improvements | 16 – 52 years |

Site improvements | 4 – 28 years |

Tenant improvements | Shorter of the lease term or useful life |

In-place leases and origination costs | Remaining lease term |

Leasing fees | Remaining lease term |

Above- and below market leases | Remaining lease term |

Repairs and maintenance are charged to operations as incurred; major renewals and betterments that extend the useful life or improve the operating capacity of the asset are capitalized.

d) Assets held for sale

The Partnership classifies assets held for sale when all of the following criteria are met: (1) management commits to a plan to sell the property, (2) the property is available for immediate sale in its present condition, subject only to terms that are usual and customary for sale of real estate properties, (3) an active program to locate a buyer and conduct other actions required to complete the sale has been initiated, (4) the sale of the property is probably in occurrence and is expected to qualify as a completed sale, (5) the property is actively marketed for sale at a price that is reasonable in relation to its fair value, and (6) actions required to complete the sale indicate that it is unlikely that any significant changes will be made or that the plan to sell will be withdrawn.

For properties classified as held for sale, the Partnership suspends depreciation and amortization of the real estate properties, including the related intangible lease assets and liabilities, as well as straight-line revenue recognition of the associated lease. Properties held for sale are carried as the lower of cost or fair value, less estimated selling costs. If the estimated fair value less selling costs is lower than the carrying value, the difference will be recorded as an impairment on assets held for sale in the condensed consolidated statements of operations. As of September 30, 2024, there were no properties classified as held for sale. As of December 31, 2023, there were two properties classified as held for sale. No impairment loss was recorded for assets held for sale for the three and nine months ended September 30, 2024 and September 30, 2023. The Partnership has not reclassified results of operations for properties disposed of or classified as held for sale as discontinued operations as these events are a normal part of the Partnership’s operations and do not represent strategic shifts in the Partnership’s operations.

e) Impairment of long-lived assets

Long-lived assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying value of an asset may not be recoverable. The net recoverable amount represents the undiscounted estimated future cash flow expected to be earned from the long-lived asset. In the case of real estate, the undiscounted estimated future cash flows are based on expected cash flows from the use and eventual disposition of the property. The review of anticipated cash flows involves subjective assumptions of estimated occupancy, rental rates and residual value. If such impairment is present, an impairment loss is recognized based on the excess of the carrying amount of the asset over its fair value.

All investments in real estate are subject to elements of risk and are affected by, but not limited to, the general prevailing economic conditions, local real estate markets, supply and demand for leased premises, competition and governmental laws and other requirements.

During the nine months ended September 30, 2024, the Partnership recorded an impairment loss of $591 on real estate held for investment with remaining carrying value of $1,961, which declined due to the tenants' vacancy. No impairment loss was recorded for assets held for investment for the three and nine months ended September 30, 2023. The Partnership determined the fair value measurement using a range of significant unobservable inputs, including broker market information and recent comparable sales transactions.

f) Revenue recognition and accounts receivable

Leases with tenants are accounted for as operating leases. Minimum rents are recognized on a straight-line basis over the term of the respective leases and reasonably certain renewal periods. The difference between rental revenue recognized and the cash rent due under the provisions of the lease is recorded as deferred rent receivable and included as a component of other assets in the condensed consolidated balance sheets.

NADG NNN PROPERTY FUND LP

Variable rental amounts include rent increases that are based on changes in the Consumer Price Index (“CPI”), percentage rent or lease terminations. Variable rental amounts are not recognized until the specific events that trigger the variable payments have occurred.

The Partnership evaluates the collectability of its accounts receivable related to base rents and expense reimbursements. The Partnership analyzes accounts receivable, individual tenant credit worthiness and current economic conditions and trends when evaluating the adequacy of the allowance for credit losses. Management has evaluated the collectability of accounts receivable and determined that no allowance for credit losses is required as of September 30, 2024 and an allowance for credit losses in the amount of $328 is required as of December 31, 2023.

g) Cash, cash equivalents and restricted cash

Cash and cash equivalents comprise amounts held in operating bank and money market accounts.

Restricted cash includes cash proceeds from sale of assets included in the asset backed securitization in anticipation of replacement properties and a maintenance reserve required as part of the asset backed securitization. The Partnership had $1,123 and $5,532 of restricted cash as of September 30, 2024 and December 31 2023, respectively.

h) Financing transaction and discount costs

Financing transaction costs incurred in connection with obtaining debt are deferred and amortized over the term of the related debt. For any debt acquired at a discount, where the fair value of debt is less than the carrying amount, the fair value discount is amortized over the term of the related debt using the effective interest method. The amortization of financing transaction costs and fair value discount is charged to interest expense on the accompanying condensed consolidated statements of operations, and the unamortized balance of deferred financing transaction costs and fair value discount is shown as a reduction of debt on the accompanying condensed consolidated balance sheets.

i) Concentration of credit risk

Credit risk arises from the potential that a counterparty will fail to perform its obligations. The Partnership is not exposed to significant credit risk as the Partnership maintains a number of diverse tenants which mitigates the credit risk.

j) Use of estimates

The preparation of these condensed consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of these condensed consolidated financial statements, and the reported amounts of revenues and expenses during the reporting period. The most significant assumptions and estimates relate to the valuation of real estate and related intangible assets and liabilities upon acquisition, including the assessment of impairments, as well as depreciable lives, and the collectability of trade receivables. On an on-going basis, the management of the Partnership reviews its estimates and assumptions. These estimates are based on historical experience and various other assumptions that the management of the Partnership believes to be reasonable under the circumstances. Actual results could differ from those estimates.

k) Income taxes

The Partnership has elected to be treated as a real estate investment trust (“REIT”) under Sections 856 to 860 of the Internal Revenue Code of 1986, as amended (the “Code”) and expects to continue to qualify as a REIT. To qualify as a REIT, the Partnership is subject to various requirements including that it must distribute at least 90% of its taxable income to its shareholders as dividends. As a REIT, the Partnership will be subject to federal income tax on its undistributed REIT taxable income and net capital gain and to a 4% non-deductible excise tax on any amount by which distributions it pays with respect to any calendar year are less than the sum of (1) 85% of its ordinary income, (2) 95% of its capital gain net income and (3) 100% of its undistributed taxable income from prior years. The Partnership intends to operate in such a manner so as to qualify as a REIT, but no assurance can be given that the Partnership will operate in a manner so as to qualify as a REIT. If the Partnership fails to meet these requirements, it could be subject to federal income tax on all of the Partnership’s taxable income at regular corporate rates for that year. The Partnership would not be able to deduct distributions paid to shareholders in any year in which it fails to qualify as a REIT. Additionally, the Partnership will also be disqualified from electing to be taxed as a REIT for the four taxable years following the year during which qualification was lost unless the Partnership is entitled to relief under specific statutory provisions. As of September 30, 2024, the Partnership believes it is in compliance with all applicable REIT requirements.

NADG NNN PROPERTY FUND LP

For the nine months ended September 30, 2024 and 2023, the Partnership has distributed 100% of its taxable income and, therefore, is not required to pay any federal income tax in its own right.

The Partnership is subject to state and local income or franchise taxes in certain jurisdictions in which some of its properties are located and records these within income taxes in the accompanying condensed consolidated statements of operations.

Taxable income from certain non-REIT activities is managed through a taxable REIT subsidiary (“TRS”) and is subject to applicable federal, state, and local income and margin taxes. The Partnership had no significant taxes associated with its TRS for the nine months ended September 30, 2024 and 2023.

The Partnership is required to file income tax returns with federal and state taxing authorities. As of September 30, 2024, the Partnership’s U.S. federal and state income tax returns remain subject to examination by the respective taxing authorities for 2021 through 2023 tax years.

l) Fair value measurement

ASC 820 defines fair values as the price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. ASC 820 also establishes a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair value. In instances, where the determination of the fair value measurement is based on inputs from more than one level of the fair value hierarchy, the entire fair value measurement is classified based on the lowest-level input.

The hierarchy is measured in three levels based on the reliability of inputs:

Level 1 – Quoted prices that are available in active markets for identical assets or liabilities.

Level 2 – Pricing inputs other than quoted prices in active markets, such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities.

Level 3 – Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities.

The Partnership has financial instruments which include cash and cash equivalents, restricted cash, other assets, accounts payable and accrued liabilities, which are carried at amortized cost and approximate their fair value unless otherwise noted.

Non-recurring fair value measurements

The fair value of the Partnership’s debt was estimated using recent secondary markets, recent financing transactions, estimates of the fair value of the property that serves as collateral for such debt, historical risk premiums for loans of comparable quality, current SOFR and discounted estimated future cash payments to be made on such debt. The discount rates estimated reflect the Partnership’s judgment as to the approximate current lending rates for loans with similar maturities and assumes that the debt is outstanding through maturity.

The following table summarizes the fair value of the Partnership’s aggregate debt:

| | | | | | | | | | | | |

(in thousands) | | | | | | September 30, 2024 | | | December 31, 2023 | |

Carrying amount | | $ | 419,466 | | | $ | 440,379 | |

Fair value (Level 2) | | $ | 418,623 | | | $ | 433,465 | |

The Partnership estimates fair value for real estate using inputs such as operating income, estimated capitalization rates or multiples, information obtained from third parties and estimated or negotiated selling price. Based on these inputs, the Partnership determined that its valuations of impaired real estate may fall within Level 2 and Level 3 of the fair value hierarchy under ASC Topic 820. The Partnership determines the valuation of impaired assets using generally accepted valuation techniques including discounted cash flow analysis, income capitalization, analysis of recent comparable sales transactions and negotiated offers received from third parties.

The Partnership's non-recurring fair value measurements at September 30, 2024 and September 30, 2023 also consisted of fair value of impaired assets (see Note 2(e)) that were determined using Level 3 inputs.

NADG NNN PROPERTY FUND LP

m) Segment reporting

The Partnership currently operates in a single reportable segment, which includes the acquisition, leasing and ownership of net leased properties. Management assesses, measures, and reviews the operating and financial results at the consolidated level for the entire portfolio, and therefore, each property or property type is not considered an individual operating segment. The Partnership does not evaluate the results of operations based on geography, size, or property type.

n) Subsequent events

The Partnership evaluates subsequent events for disclosure in these condensed consolidated financial statements through the date of which these condensed consolidated financial statements were available to be issued.

o) Recent adopted accounting pronouncements

In September 2016, FASB issued an Accounting Standards Update ("ASU") 2016-13, “Measurement of Credit Losses on Financial Instruments” (“ASU 2016-13”). ASU 2016-13 requires entities to use a forward-looking approach based on current expected credit losses (“CECL”) to estimate credit losses on certain types of financial instruments, including Accounts Receivables. This may result in the earlier recognition of allowances for losses. ASU 2016-13 was effective for the Partnership beginning January 1, 2023. The adoption of ASU 2016-13 did not have a material impact on the Partnership’s financial position, results of operations and cash flows.

In March 2020, the FASB issued ASU 2020-04, “Reference Rate Reform (Topic 848) – Facilitation of the Effects of Reference Rate Reform on Financial Reporting”, which provides temporary, optional expedients and exceptions to the GAAP guidance on contract modifications and hedge accounting to ease the financial reporting burdens related to the expected market transition from London Interbank Offered Rate (“LIBOR”) and other interbank offered rates to alternative reference rates. Further, in January 2021, the FASB issued ASU 2021-01, “Reference Rate Reform (Topic 848) – Scope”, to clarify that certain optional expedients and exceptions in Topic 848 for contract modifications and hedge accounting apply to derivative instruments that use an interest rate for margining, discounting or contract price alignment that is modified as a result of the reference rate reform. On December 31, 2022, the FASB issued ASU 2022-06, “Reference Rate Reform (Topic 848) – Deferral of the Sunset Date of Topic 848”, which extends the sunset (or expiration) date of Topic 848 from December 31, 2022 to December 31, 2024. The Partnership modified its debt, cap and floor agreements from LIBOR to SOFR during 2023 and has elected to use the optional expedient for contract modifications. The Partnership has concluded that the amendments should be treated as non-substantial modifications of the existing contracts, resulting in no impact to the Partnership's condensed consolidated financial statements.

p) Recent accounting pronouncements issued but not yet adopted

In November 2023, the FASB issued ASU 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures (“ASU 2023-07”). ASU 2023-07 is intended to improve reportable segment disclosures by requiring disclosure of incremental segment information on an annual and interim basis such as, annual and interim disclosure of significant segment expenses that are regularly provided to the chief operating decision maker, interim disclosure of a reportable segment’s profit or loss and assets, and the requirement that a public entity that has a single reportable segment provide all the disclosures required by ASU 2023-07 and all existing segment disclosures in Topic 280. The amendments in ASU 2023-07 do not change how a public entity identifies its operating segments, aggregates those operating segments, or applies the quantitative thresholds to determine its reportable segments. The amendments in ASU 2023-07 are effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024. The disclosures are applied retrospectively to all periods presented and early adoption is permitted. The Partnership has one reportable segment and continues to evaluate additional disclosures that may be required for entities with a single reportable segment.

In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures (“ASU 2023-09”). ASU 2023-09 requires annual disclosure of specific categories in the rate reconciliation and provide additional information for reconciling items that meet a quantitative threshold within the rate reconciliation. In addition, the amendments require annual disclosure of income taxes paid disaggregated by federal, state and foreign jurisdictions as well as individual jurisdictions in which income taxes paid is equal to or greater than 5 percent of total income taxes paid. ASU 2023-09 is effective for annual periods beginning after December 15, 2024 on a prospective basis, however early adoption and retrospective application is permitted. The Partnership continues to evaluate the potential impact of the guidance and potential additional disclosures required.

3. REAL ESTATE HELD FOR INVESTMENT AND LEASE ARRANGEMENTS

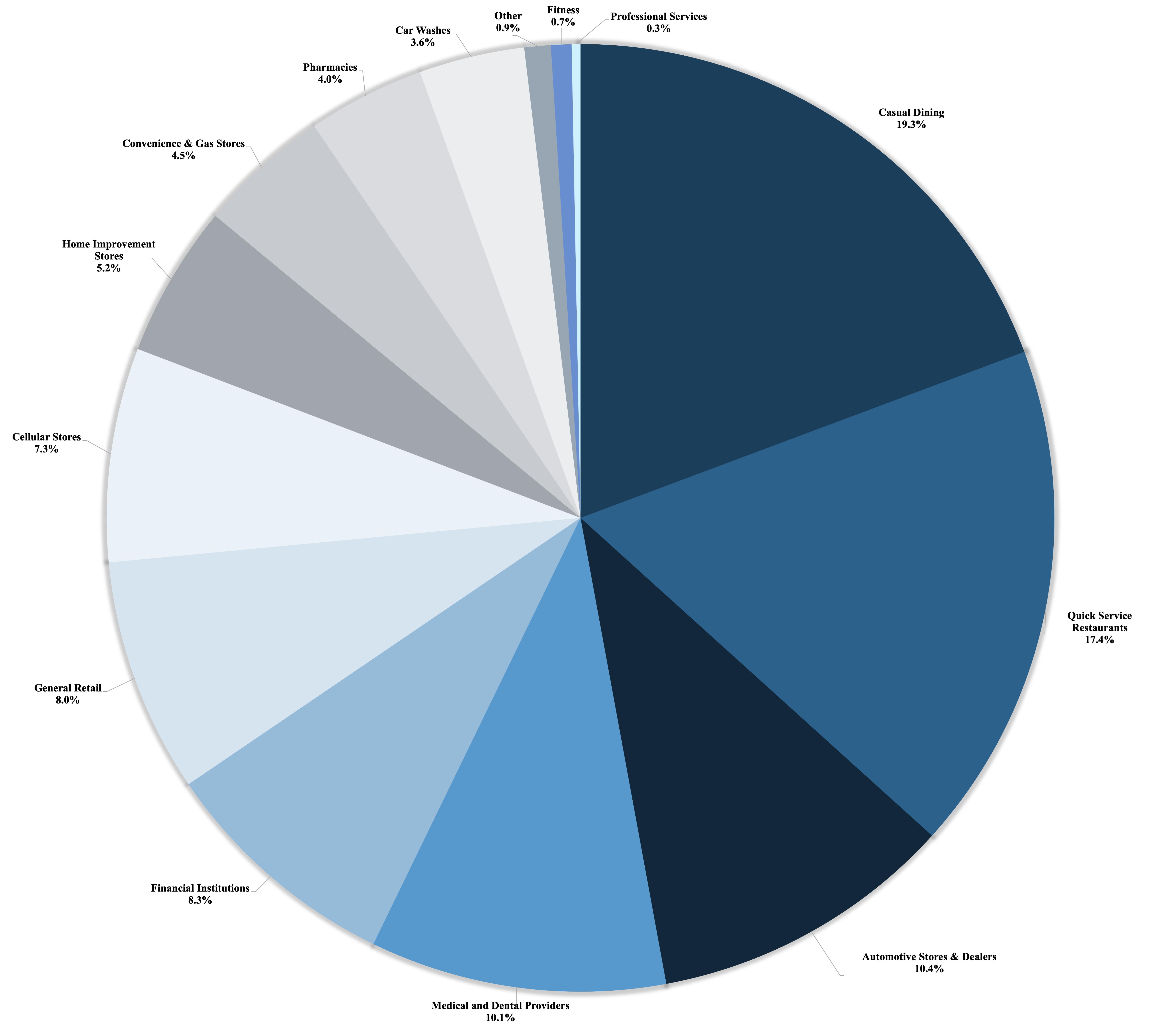

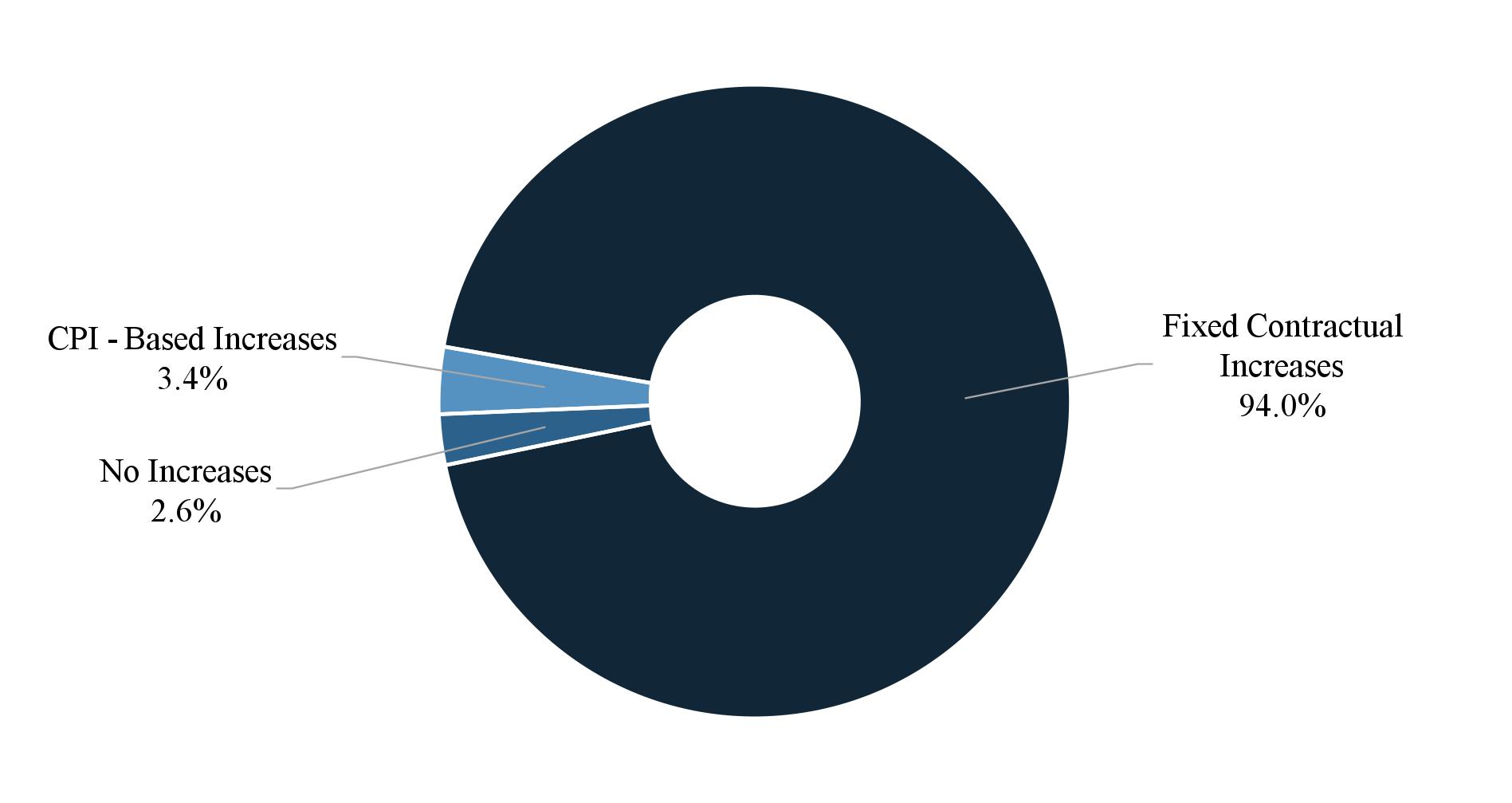

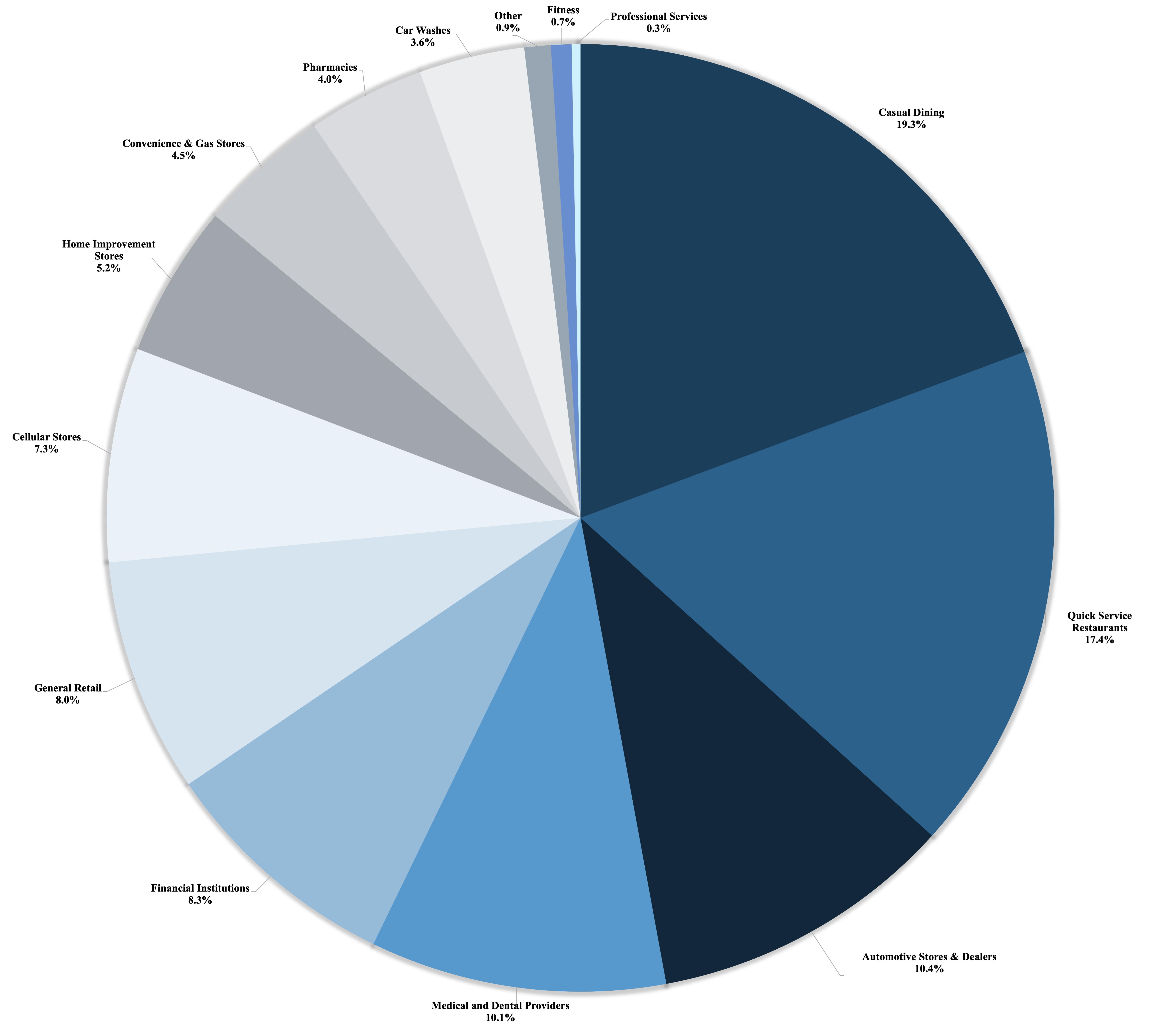

The Partnership acquires, owns, and manages net-leased outparcel properties. The leases are generally net leases, where the tenants are responsible for the payment of real estate taxes, insurance premiums and maintenance costs related to the leased property. The leases

NADG NNN PROPERTY FUND LP

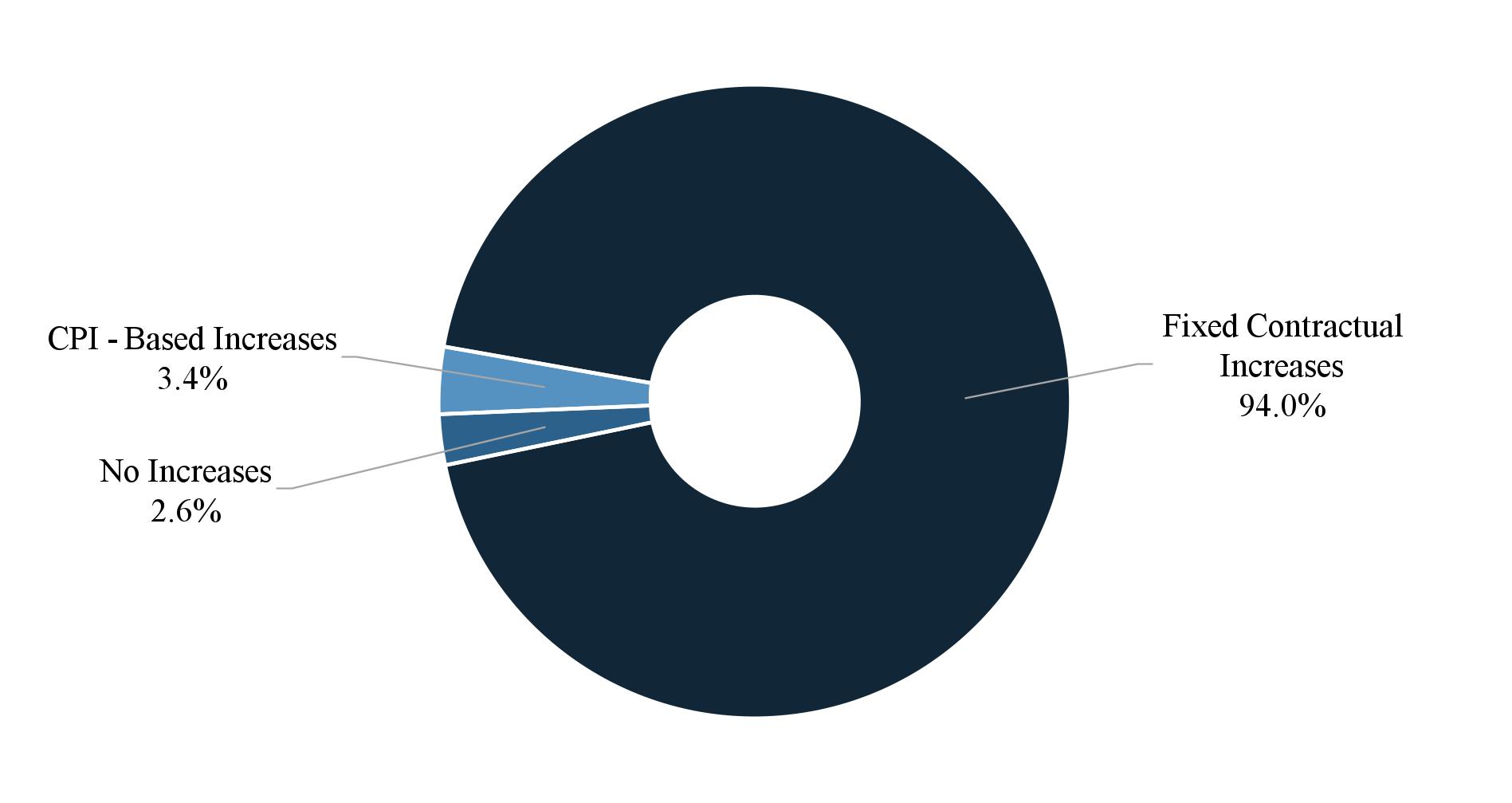

have been classified as operating leases and generally provide for limited increases in rent as a result of fixed increases, increases in CPI, or increases in tenant’s sales volume.

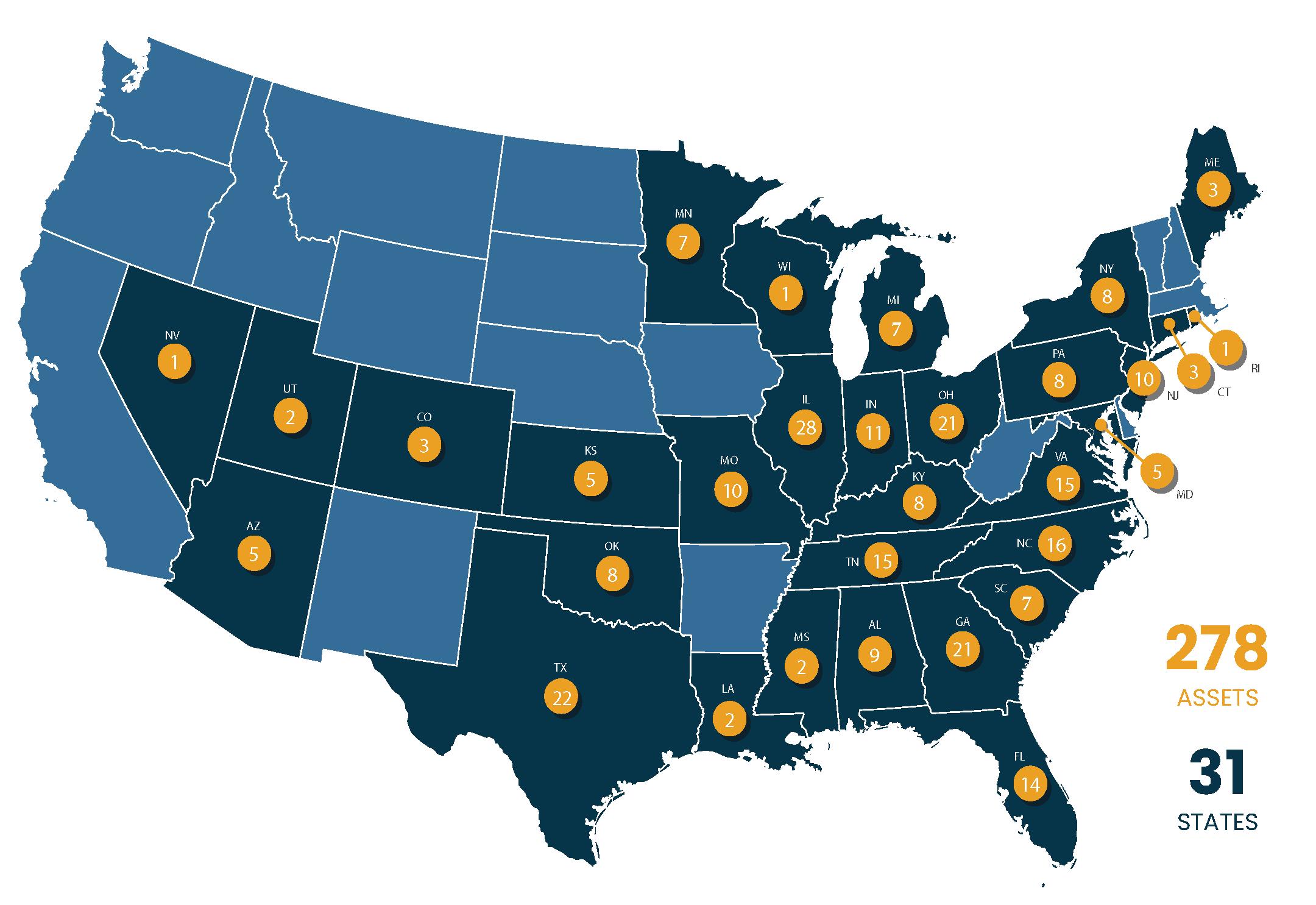

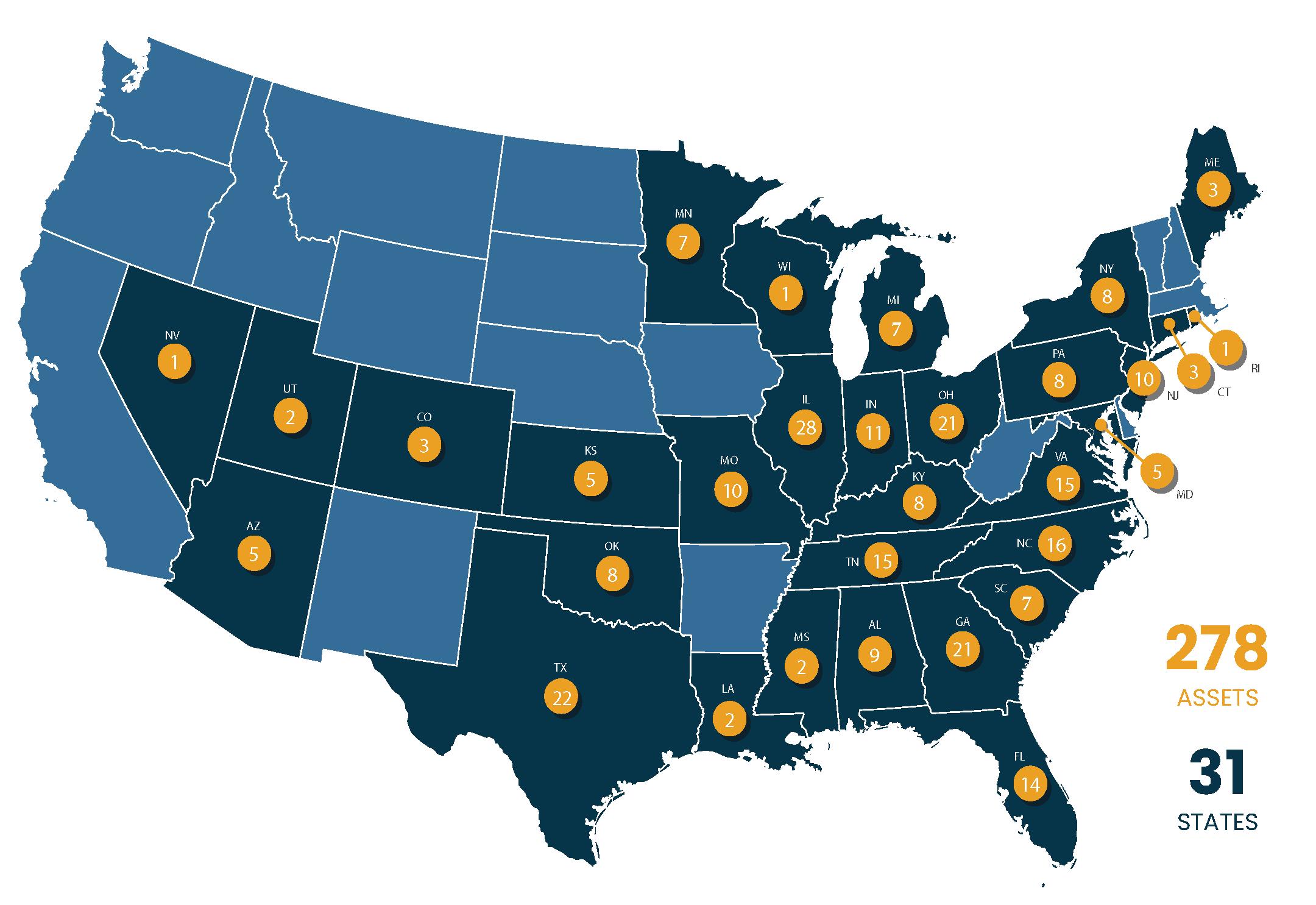

As of September 30, 2024 and December 31, 2023, the Partnership has 100% ownership interests in 278 and 284 real estate properties, respectively. The average remaining lease term for real estate properties owned by the Partnership as of September 30, 2024 and December 31, 2023 was approximately 7.0 years and 7.4 years, respectively.

During the year ended December 31, 2023, the Partnership acquired 100% ownership interests in 26 properties for an aggregate purchase price of $75,389, including acquisition costs totaling $1,380. The majority of properties acquired during the year ended December 31, 2023, were leased at acquisition with an average remaining lease term of approximately 8.2 years. Additionally, the Partnership acquired the remaining 50% interest in the Joint Venture held by the JV Partner, which consists of 54 properties as of the date of acquisition (see Note 5).

The acquisitions were all accounted for as asset acquisitions. The Partnership allocated the purchase price of these properties to the fair values of the assets and liabilities assumed, which is summarized in the following table:

| | | | |

(in thousands) | | December 31, 2023 | |

Land | | $ | 27,115 | |

Buildings | | | 33,934 | |

Site improvements | | | 4,695 | |

Intangible assets: | | | |

Above-market leases | | | 1,262 | |

In-place leases and origination costs | | | 10,176 | |

| | | 77,182 | |

Liabilities assumed: | | | |

Below-market leases intangible liabilities | | | (1,793 | ) |

Purchase price (including acquisition costs) | | $ | 75,389 | |

During the nine months ended September 30, 2024, the Partnership sold five real estate properties for $10,773. The Partnership received net proceeds of $9,846 after paying closing costs of $927 and recorded a gain on sale of $337. The aggregate cost and associated accumulated depreciation and amortization of the properties sold, at the date of sales, were $10,248 and $739 respectively.

The depreciation expense on real estate held for investment was as follows:

| | | | | | | | | | | | | | | | |

| | For the three months ended September 30, | | | For the nine months ended September 30, | |

(in thousands) | | 2024 | | | 2023 | | | 2024 | | | 2023 | |

Depreciation | | $ | 2,923 | | | $ | 2,268 | | | $ | 8,783 | | | $ | 6,217 | |

The following table summarizes amounts reported as rental revenues on the accompanying condensed consolidated statements of operations:

| | | | | | | | | | | | | | | | |

| | For the three months ended September 30, | | | For the nine months ended September 30, | |

(in thousands) | | 2024 | | | 2023 | | | 2024 | | | 2023 | |

Revenues: | | | | | | | | | | | | |

Contractual rental amounts billed | | $ | 13,971 | | | | 11,473 | | | $ | 42,987 | | | $ | 33,511 | |

Adjustment to recognize contractual rental amounts on a straight-line basis | | | 187 | | | | 328 | | | | 964 | | | | 901 | |

Variable rental amounts earned | | | 798 | | | | 58 | | | | 1,547 | | | | 182 | |

Above/below market lease amortization, net | | | (423 | ) | | | (316 | ) | | | (1,338 | ) | | | (892 | ) |

Other income | | | 1 | | | | 80 | | | | 243 | | | | 221 | |

Total rental revenues | | $ | 14,534 | | | | 11,623 | | | $ | 44,403 | | | $ | 33,923 | |

NADG NNN PROPERTY FUND LP

Total estimated future minimum rents to be received under non-cancelable tenant leases in effect as of September 30, 2024, are as follows:

(in thousands)

| | | | | | | |

2024 (Remaining) | | | | | $ | 12,938 | |

2025 | | | 50,278 | |

2026 | | | 48,172 | |

2027 | | | 44,066 | |

2028 | | | 38,110 | |

2029 | | | 33,921 | |

Thereafter | | | 173,005 | |

| | $ | 400,490 | |

Since lease renewal periods are exercisable at the option of the tenant, the above amounts only include future lease payments due during the initial lease terms. Such amounts exclude any potential variable rent increases that are based on changes in the CPI or future variable rents which may be received under the leases based on a percentage of the tenant’s gross sales.

4. INTANGIBLE ASSETS AND LIABILITIES

The following is a summary of intangible lease assets and liabilities and related accumulated amortization:

| | | | | | | | | | | |

(in thousands)

As of September 30, 2024 | Cost | | | Accumulated Amortization | | | Net Book Value | |

Intangible lease assets: | | | | | | | | |

In-place leases and origination costs | $ | 134,782 | | | $ | 58,547 | | | $ | 76,235 | |

Above-market leases | | 45,214 | | | | 20,266 | | | | 24,948 | |

Leasing fees | | 2,163 | | | | 237 | | | | 1,926 | |

Total intangible lease assets | $ | 182,159 | | | $ | 79,050 | | | $ | 103,109 | |

| | | | | | | | |

Intangible lease liabilities: | | | | | | | | |

Below-market leases | $ | 25,100 | | | $ | 10,858 | | | $ | 14,242 | |

Total intangible lease liabilities | $ | 25,100 | | | $ | 10,858 | | | $ | 14,242 | |

| | | | | | | | | | | |

(in thousands)

As of December 31, 2023 | Cost | | | Accumulated Amortization | | | Net Book Value | |

Intangible lease assets: | | | | | | | | |

In-place leases and origination costs | $ | 136,907 | | | $ | 47,328 | | | $ | 89,579 | |

Above-market leases | | 45,513 | | | | 16,641 | | | | 28,872 | |

Leasing fees | | 1,120 | | | | 139 | | | | 981 | |

Total intangible lease assets | $ | 183,540 | | | $ | 64,108 | | | $ | 119,432 | |

| | | | | | | | |

Intangible lease liabilities: | | | | | | | | |

Below-market leases | $ | 26,292 | | | $ | 8,876 | | | $ | 17,416 | |

Total intangible lease liabilities | $ | 26,292 | | | $ | 8,876 | | | $ | 17,416 | |

The amortization and net adjustment to rental revenue of intangibles lease assets and liabilities was as follows:

| | | | | | | | | | | | | | | |

| For the three months ended September 30, | | | For the nine months ended September 30, | |

(in thousands) | 2024 | | | 2023 | | | 2024 | | | 2023 | |

Amortization: | | | | | | | | | | | |

Amortization of in-place leases and leasing fees | $ | 4,196 | | | | 3,891 | | | $ | 12,632 | | | | 11,098 | |

| | | | | | | | | | | |

Net adjustment to rental revenue: | | | | | | | | | | | |

Above-market and below-market leases | $ | 423 | | | | 316 | | | $ | 1,338 | | | | 892 | |

NADG NNN PROPERTY FUND LP

The remaining weighted average amortization period for the Partnership’s intangibles assets and liabilities as of September 30, 2024 and December 31, 2023 by category are as follows:

| | | | | | | | | |

Years remaining as at | | September 30, 2024 | | | December 31, 2023 | |

In-place leases and origination costs | | | | 9.0 | | | | 9.2 | |

Leasing fees | | | 9.7 | | | | 8.3 | |

Above-market leases | | | 8.3 | | | | 8.6 | |

Below-market leases | | | 9.2 | | | | 9.7 | |

The estimated future amortization expense for intangible lease assets, net of intangible lease liabilities, are as follows:

(in thousands)

| | | | | | | |

2024 (Remaining) | | | | | $ | 4,319 | |

2025 | | | | | | 15,805 | |

2026 | | | | | | 14,374 | |

2027 | | | | | | 11,710 | |

2028 | | | | | | 9,010 | |

2029 | | | | | | 7,391 | |

Thereafter | | | | | | 26,258 | |

| | | | | $ | 88,867 | |

5. INVESTMENT IN AN UNCONSOLIDATED ENTITY

On October 20, 2023, the Partnership purchased the remaining 50% interest in the Joint Venture from the Joint Venture Partner. The purchase price was equal to the product of: (1) The JV Partner’s aggregate percentage interest, multiplied by (2) (a) $138,250 less (b) the indebtedness of the Joint Venture together with the Joint Venture’s general partner (the Joint Venture and the Joint Venture’s general partner collectively the “Target Entities”), plus (c) retained cash of the Target Entities as of the closing, (d) plus proration items, if the net amount thereof is in the JV Partners’ favor, or minus the proration items if the net amount therefore is in the Partnership’s favor, and (e) minus the asset disposition amount of any properties sold by the Joint Venture following the date of the agreement and prior to closing. The Partnership funded the purchase price of $26,910 through cash, cash equivalents and restricted cash and borrowings under the Revolving Credit Facility. The acquisition was accounted for as an asset acquisition. As such, as of October 20, 2023, the Partnership owned 100% of the Joint Venture and is consolidated.

The 54 properties acquired had a fair value of $138,768, including acquisition costs totaling $518. The Joint Venture was considered a variable interest entity and the acquisition of the entity resulted in a gain of $12,988, which was recorded in gain on acquisition of equity method investment in the year ended December 31, 2023 consolidated statements of operations.

For the nine months ended September 30, 2023, the Partnership had a 50% ownership interest in the Joint Venture. The remaining 50% interest in the Joint Venture was owned by another investment fund (the “JV Partner”) managed by affiliates of the General Partner. The Joint Venture was established to allow the Partnership and its JV Partner to co-invest in properties that meet the investment criteria of both parties to the extent that the Joint Venture has funds available under the ABS Notes (see Note 6 (a)). For the three and nine months ended September 30, 2023, the Joint Venture generated net loss of $14 and net income of $106, of which the Partnership's share is a net loss of $7 and a net income of $53 respectively. This has been reflected in the condensed consolidated statements of operations under "Equity (loss)/ income from investment in an unconsolidated entity".

The Joint Venture pays fees to an entity affiliated with the General Partner and the Sponsor of the Partnership for property management services. For the three and nine months ended September 30, 2023, such fees amounted to $68 and $204 respectively, in aggregate, of which the Partnership’s share was $34 and $102, respectively. These fees are recorded as part of the property operating expenses.

NADG NNN PROPERTY FUND LP

6. DEBT, NET

| | | | | | | | | | |

| | As of September 30, 2024 | |

(in thousands, except interest rate) | | Note | | Maturity | | Interest Rate | | | |

Asset Backed Securities | | (a) | | 28-Dec-2024 | | 3.37% | | $ | 253,499 | |

CIBC Bank USA, Revolving Credit Facility | | (b) | | 8-Mar-2025 | | Adjusted Term SOFR + 2.25% * | | | 150,000 | |

CIBC Bank USA, Term Loan | | (c) | | 31-Mar-2027 | | Term SOFR + 1.80% * | | | 15,967 | |

Unamortized financing transaction and discount costs | | | | | | | | | (1,198 | ) |

| | | | | | | | $ | 418,268 | |

* The approximate one-month Term SOFR rate (as defined below) at September 30, 2024 was 4.84%. | |

| | | | | | | | | | |

| | As of December 31, 2023 | |

(in thousands, except interest rate) | | Note | | Maturity | | Interest Rate | | | |

Asset Backed Securities | | (a) | | 28-Dec-2024 | | 3.37% | | $ | 254,489 | |

CIBC Bank USA, Revolving Credit Facility | | (b) | | 8-Mar-2024 | | Adjusted Term SOFR + 2.25% ** | | | 168,890 | |

CIBC Bank USA, Term Loan | | (c) | | 31-Mar-2027 | | Term SOFR + 1.80% ** | | | 17,000 | |

Unamortized financing transaction and discount costs | | | | | | | | | (3,927 | ) |

| | | | | | | | $ | 436,452 | |

** The approximate one-month Term SOFR rate (as defined below) at December 31, 2023 was 5.38%. | |

As of September 30, 2024 and December 31, 2023, the weighted average interest rate was 4.96% and 5.17%, respectively.

The aggregate principal repayment of the Partnership’s debt, excluding the unamortized financing transaction and discount costs of $1,198, due in each of the years under the remaining term, are as follows:

(in thousands)

| | | | |

2024 (Remaining) | | $ | 253,499 | |

2025 | | | 150,000 | |

2026 | | | — | |

2027 | | | 15,967 | |

| | $ | 419,466 | |

(a) Asset Backed Securities (“ABS Notes”)

On December 9, 2019, the Partnership and the Joint Venture issued 3.37% Series 2019-1, Class A (rated by Standard & Poors and Kroll Bond Rating Agency) Net-Lease Mortgage Notes (the “ABS Notes”) for gross proceeds of $192,935 and $71,065, respectively, pursuant to the Master Indenture Agreement, among the 95 and 40 properties directly or indirectly owned, as of that date, by the Partnership and Joint Venture, respectively (collectively, the “Issuers”), and the Indenture Trustee. On October 20, 2023, the Partnership acquired the remaining 50% interest in the Joint Venture held by the JV Partner and assumed debt at fair value of $66,907, net of a discount of $2,824.

As of September 30, 2024, the ABS Notes are secured by 130 Issuers consisting of 132 properties directly owned by the Partnership having a carrying value of $310,635, an assignment of leases and rents and are guaranteed by the Partnership in the aggregate.

The anticipated repayment date for the ABS Notes is December 2024 even though the stated maturity date is December 2049 because the remaining outstanding principal balance becomes due and payable and additional interest begins to accrue on the ABS Notes if not paid in full by December 2024. Payments of interest and scheduled payments of principal of $110 on the ABS Notes are payable to the holders of the ABS Notes on the 28th day of each month beginning in January 2020. The ABS Notes can be prepaid in whole, or in part, by the Issuers on any day at a price equal to: (1) the outstanding principal amount of the ABS Notes to be prepaid; (2) all accrued and unpaid interest owing as of that date; and (3) all amounts related to such ABS Notes that are outstanding to the Indenture Trustee and the other parties to the transaction documents as of that date. The Partnership maintains a segregated trust account established by the Indenture Trustee to reserve $1,050 required to be paid for maintenance and repair obligations under certain net leases.

NADG NNN PROPERTY FUND LP

For the three months ended September 30, 2024 and 2023, amortization of financing transaction costs recorded by the Partnership were $317 and $317 respectively. For the nine months ended September 30, 2024 and 2023, amortization of financing transaction costs recorded by the Partnership were $943 and $940, respectively. For the three and nine months ended September 30, 2024, amortization of discount costs recorded by the Partnership were $602 and $1,779 respectively.

In accordance with the Master Indenture Agreement, the Issuers in aggregate are required to maintain a monthly debt service coverage ratio of at least 1.25x. As of September 30, 2024, the Issuers were in compliance with this requirement.

In accordance with the private placement memorandum associated with the ABS Notes, all receipts of cash are held in trust by the Partnership for the Issuers and the Indenture Trustee to satisfy the conditions of the ABS Notes. On a monthly basis, the cash receipts pertaining to any Issuers are deposited to the bank account held by the Partnership and then the total cash receipts as of the 20th of every month are swept into a payment account controlled by the Indenture Trustee. The excess cash from each monthly payment after debt service costs is transferred back to the Partnership’s operating account.

(b) CIBC Bank USA Credit Facility

On March 8, 2021, the Partnership entered into a credit facility agreement with CIBC Bank USA, which provides for a secured revolving line of credit of $65,000 (the “Revolving Credit Facility”). The Revolving Credit Facility has a three-year term expiring on March 8, 2024, with two one-year extensions. On March 8, 2024 the Partnership exercised its option to extend the term for one year to mature on March 8, 2025. The extension is in management’s control as the Partnership is compliant with the required covenants and can pay the extension fee. The Revolving Credit Facility bears interest at a rate equal to LIBOR subject to a floor of 0.25% plus 2.25%. Interest only payments are due until maturity. The Revolving Credit Facility is also subject to an unused commitment fee equal to (1) 0.25% of the unused loan amount if utilization is less than 50% of the Revolving Credit Facility or (2) 0.15% of the unused loan amount if the utilization is greater than or equal to 50% of the Revolving Credit Facility. The unused commitment fee is payable quarterly in arrears on the first day of each calendar quarter and is included in interest expense on the accompanying condensed consolidated statements of operations.

On July 31, 2021, the Revolving Credit Facility was amended to increase the maximum commitment under the revolving line of credit to $202,500. In addition, Montgomery Bank, OceanFirst Bank N.A., Hancock Whitney Bank, Bank of Blue Valley, South State Bank N.A. and Woodforest National Bank were added as additional lenders under the Revolving Credit Facility.

On March 17, 2023, the Partnership amended the credit agreement for the Revolving Credit Facility to replace U.S. dollar LIBOR with the Term Secured Overnight Financing Rate (“Term SOFR”) plus an adjustment of 0.11% as of March 17, 2023. Under this amendment, the loan bears interest at a rate equal to Adjusted Term SOFR plus 2.25%.

The Revolving Credit Facility is secured by certain of the Partnership’s properties having a carrying value of $349,328 and an assignment of rents and leases. The Partnership is required to maintain minimum liquidity reserves of no less than the greater of: (1) $4,000 and (2) an amount equal to 4% of the principal amount outstanding under the Revolving Credit Facility, but up to a maximum of $8,000 pursuant to the terms of its guarantee.

For the three months ended September 30, 2024 and 2023, the Partnership recorded amortization of financing transaction costs of $134 and $291, respectively, relating to the Revolving Credit Facility. For the nine months ended September 30, 2024 and 2023, the Partnership recorded amortization of financing transaction costs of $423 and $834, respectively, relating to the Revolving Credit Facility.

(c) CIBC Bank USA Term Loan

On October 20, 2023, the Partnership purchased the remaining 50% interest in the Joint Venture from the Joint Venture Partner. The Partnership assumed a loan (the “Term Loan”) with CIBC Bank USA, which provides for a secured loan of $17,000. The Term Loan has a maturity date of March 31, 2027 and bears interest at a rate equal to Term SOFR plus 1.80%. The Term Loan is secured by certain of the Partnership's properties having a carrying value of $26,703 and an assignment of rents and leases.

On April 10, 2024, the Partnership sold a property secured under the Term Loan for $1,157. The Partnership received net proceeds of $1,033 after paying closing costs of $118 and proration adjustments of $6. The net proceeds were used to repay the Term Loan.

NADG NNN PROPERTY FUND LP

7. PARTNERS’ CAPITAL

The Partnership had its initial closing on March 30, 2016, and as of September 30, 2024, investors had subscribed for 30,078.08 Common Units for a total committed capital of $306,978. As of September 30, 2024, all Common Units subscribed for had been issued. The Partnership is authorized to issue an unlimited number of Common Units. Subsequent to period ended September 30, 2024, the Partnership effected a stock split that was approved by the General Partner and Executive Committee, resulting in each outstanding Common Unit being converted into 250 Common Units, with no fractional shares being issued (the “Stock Split”). As of September 30, 2024, after retrospectively adjusting for the effects of the Stock Split, the Partnership had 7,519,613 Common Units outstanding.

Pursuant to the limited partnership agreement of the Partnership, limited partners holding Common Units (the “Common Limited Partners”) may elect to reinvest any cash distributions that they would otherwise receive from the Partnership in additional Common Units. As of April 27, 2023, the Partnership has suspended reinvestment rights in connection with the steps taken towards the IPO.

| | | | | | | | | | |

(in thousands, except ownership percentage)

Limited Partners | | Ownership Percentage | | Committed Capital (Common Units Subscribed) | | | Contributed Capital (Common Units Issued) | |

U.S. LP | | 44.80% | | $ | 137,530 | | | $ | 137,530 | |

CDN LP | | 55.20% | | | 169,448 | | | | 169,448 | |

| | 100.00% | | $ | 306,978 | | | $ | 306,978 | |

Common Limited Partners have the right to redeem their Common Units as of the end of any fiscal quarter of the Partnership for a redemption price equal to the NAV of each Common Unit issued (the “Redemption Price”), subject to the provisions of the limited partnership agreement. In accordance with the limited partnership agreement, the redemption of the Common Units is within the control of the Partnership and the Common Units are presented within Partners' Capital on the accompanying condensed consolidated balance sheets. The General Partner can suspend the redemption right at its reasonable discretion. As of April 27, 2023, the Partnership has suspended redemption rights in connection with the steps taken towards an IPO. The Partnership’s valuation committee, comprising of three members, two of whom are independent of the Sponsor and the General Partner (the “Valuation Committee”), was established in December 2017, to determine, pursuant to the terms of the limited partnership agreement and at least on a semi-annual basis, the Partnership’s NAV, commencing no later than January 6, 2018, the second anniversary of the Inception Date. In accordance with the planned IPO, valuation guidance cannot be provided.