The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED OCTOBER 10, 2023

PRELIMINARY PROSPECTUS

$601,600,000 SENIOR SECURED SECURITIZATION BONDS, SERIES 2023A

DTE ELECTRIC COMPANY

Sponsor, Depositor and Initial Servicer

Central Index Key Number: 0000028385

DTE ELECTRIC SECURITIZATION FUNDING II LLC

Issuing Entity

Central Index Key Number: 0001988880

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Tranche | | Expected

Weighted

Average Life

(Years) | | | Principal

Amount

Offered(1) | | | Scheduled

Final

Payment

Date(1) | | | Final

Maturity

Date(1) | | | Interest Rate | | | Initial Price

to Public | | | Underwriting

Discounts and

Commissions(2) | | | Proceeds to

Issuing Entity

(Before

Expenses) | |

A-1 | | | | | | $ | 300,800,000 | | | | 03/01/2032 | | | | 03/01/2033 | | | | | | | | | | | | | | | | | |

A-2 | | | | | | $ | 300,800,000 | | | | 09/01/2037 | | | | 09/01/2038 | | | | | | | | | | | | | | | | | |

| (1) | Preliminary, subject to change. |

| (2) | We have agreed to pay or reimburse the underwriters for certain fees and expenses in connection with this offering. See “Plan of Distribution” and “Use of Proceeds”. |

The total price to the public is $ . The total amount of the underwriting discounts and commissions is $ . The total amount of proceeds to DTE Electric Securitization Funding II LLC before deduction of expenses (estimated to be $ ) is $ . The distribution frequency is semi-annually. The first expected distribution date is September 1, 2024.

Investing in the Senior Secured Securitization Bonds, Series 2023A involves risks. See “Risk Factors” beginning on page 18 to read about factors you should consider before buying the Bonds.

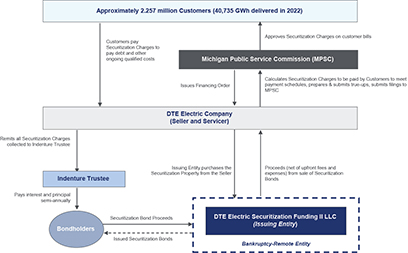

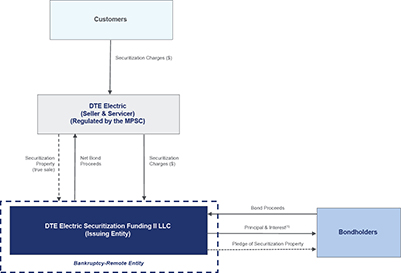

DTE Electric Company, or DTE Electric, as Depositor, is offering $601,600,000 aggregate principal amount of the Senior Secured Securitization Bonds, Series 2023A, in two tranches, referred to herein as the Bonds, to be issued by DTE Electric Securitization Funding II LLC, as the Issuing Entity. DTE Electric is also the Seller, Initial Servicer and Sponsor with regard to the Bonds. The Bonds will be issued pursuant to Public Act 142 of 2000, which amended Public Act 3 of 1939, MCL 460.1 et seq., or the Statute, and an irrevocable Financing Order issued by the Michigan Public Service Commission, or MPSC, on June 22, 2023.

The Bonds are senior secured obligations of the Issuing Entity supported by Securitization Property, which includes the right to irrevocable nonbypassable charges, known as Securitization Charges, paid by all existing and future retail electric customers (as defined in this prospectus and subject to the exceptions described in this prospectus), of DTE Electric, or its successors, based on their electricity usage as discussed in this prospectus. The Statute mandates that the Securitization Charges be adjusted at least annually, and the Financing Order further permits true-up adjustments to occur semi-annually (and in certain circumstances quarterly or more frequently) if necessary, in each case to ensure the expected recovery of the applicable charges during the succeeding annual period of amounts required for the timely payment of debt service and other required amounts and charges in connection with the Bonds, as described further in this prospectus.

Credit enhancement for the Bonds will be provided by such “true-up” mechanism as well as by Accounts held under the Indenture for the Bonds.

The Bonds represent obligations only of the Issuing Entity, and do not represent obligations of DTE Electric or any of its affiliates, other than the Issuing Entity. The Bonds are secured by the assets of the Issuing Entity, consisting principally of the Securitization Property and funds on deposit in the Accounts held under the Indenture for the Bonds. Please read “Security for the Bonds” in this prospectus. The Bonds are not a debt or liability of the State of Michigan and are not a charge on its full faith and credit or taxing power.

In its Financing Order, the MPSC affirms that it will act pursuant to its Financing Order to ensure that the expected Securitization Charges are sufficient to pay on a timely basis scheduled principal of and interest on the Bonds and the ongoing other qualified costs as described below in this prospectus. The Financing Order, together with the Securitization Charges authorized by the Financing Order, are irrevocable and not subject to reduction, impairment, postponement, termination or adjustment by further action of the MPSC, except by use of the true-up mechanism approved in the Financing Order.

Interest will accrue on the Bonds from the date of issuance. The Bonds are scheduled to pay principal and interest semi-annually on March 1 and September 1 of each year. The first Scheduled Payment Date is September 1, 2024. On each payment date, sequentially, each Bond will be entitled to payment of principal, but only to the extent funds are available in the Accounts held under the Indenture for the Bonds after payment of certain fees and expenses and after payment of interest.

DTE Electric is the sole member of the Issuing Entity and is the sole owner of the Issuing Entity’s equity interests. DTE Electric’s Central Index Key number is 0000028385. The Issuing Entity’s Central Index Key number is 0001988880.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The Bonds will be ready for delivery in book-entry form through the facilities of The Depository Trust Company, or DTC, for the accounts of its participants, including Clearstream Banking, Luxembourg, S.A. and Euroclear Bank SA/NV, as operator of the Euroclear System, against payment of immediately available funds in New York, New York on or about , 2023.

Sole Book-Running Manager

Citigroup

Co-Managers

| | | | |

| Comerica Securities | | Fifth Third Securities | | Huntington Capital Markets |

| | |

| Ramirez & Co., Inc. | | Siebert Williams Shank |

The date of this prospectus is , 2023.