UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | | | |

| Investment Company Act file number: | | 811-23894 | | |

| | |

| Exact name of registrant as specified in charter: | | PGIM Credit Income Fund | | |

| | |

| Address of principal executive offices: | | 655 Broad Street, 6th Floor | | |

| | Newark, New Jersey 07102 | | |

| | |

| Name and address of agent for service: | | Andrew R. French | | |

| | 655 Broad Street, 6th Floor | | |

| | Newark, New Jersey 07102 | | |

| | |

| Registrant’s telephone number, including area code: | | 800-225-1852 | | |

| | |

| Date of fiscal year end: | | 12/31/2024 | | |

| | |

| Date of reporting period: | | 12/31/2024 | | |

Item 1 – Reports to Stockholders

| | (a) | Report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1). |

PGIM CREDIT INCOME FUND

ANNUAL REPORT

DECEMBER 31, 2024

To enroll in e-delivery, go to pgim.com/investments/resource/edelivery

Table of Contents

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Mutual funds and certain closed-end funds are distributed by Prudential Investment Management Services LLC (PIMS), member SIPC. PGIM Fixed Income is a unit of PGIM, Inc. (PGIM), a registered investment adviser. PIMS and PGIM are Prudential Financial companies. © 2025 Prudential Financial, Inc. and its related entities. PGIM and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

2 Visit our website at pgim.com/investments

Letter from the President

| | |

| | Dear Shareholder: We hope you find the annual report for the PGIM Credit Income Fund informative and useful. The report covers performance for the 12-month period that ended December 31, 2024. Financial markets rallied and the global economy remained resilient throughout the period as inflation cooled and recession fears faded. Employers kept hiring, consumers continued spending, and home prices maintained their upward trajectory. |

With inflation falling, the US Federal Reserve (Fed) began reducing the federal funds rate, implementing a 50-basis-point cut in September and two additional 25-basis-point cuts in November and December. Investor enthusiasm for artificial intelligence-related stocks led equities markets to record highs during the period, with equities in the US posting robust gains while the international markets showed moderate returns. In the US, real estate, energy and utilities lagged most other sectors, with real estate under pressure from elevated interest rates and reduced demand for office space.

Bond markets faced greater challenges during the period as fixed income investors responded to shifts in monetary policy and ongoing, though easing, inflation. US and global investment-grade bonds, along with emerging market debt, produced mixed returns during the period, while high yield corporate bonds outperformed.

Regarding your investments with PGIM, we believe it is important to maintain a diversified portfolio of funds consistent with your tolerance for risk, time horizon, and financial goals. Your financial advisor can help you create a diversified investment plan that may include funds covering a broad spectrum of asset classes and that reflects your personal investor profile and risk tolerance. However, diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

At PGIM Investments, we provide access to active investment strategies across the global markets in the pursuit of consistent outperformance for investors. PGIM is the world’s 14th-largest investment manager with more than $1.4 trillion in assets under management. Our scale and investment expertise allow us to deliver a diversified suite of actively managed solutions across a broad spectrum of asset classes and investment styles.

Thank you for choosing our family of funds.

Sincerely,

Stuart S. Parker, President and Principal Executive Officer

PGIM Credit Income Fund

February 14, 2025

PGIM Credit Income Fund 3

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at pgim.com/investments or by calling (800) 225-1852.

| | | | |

| | |

| | | Average Annual One Year (%) | | Total Returns as of 12/31/24

Since Inception (%) |

Class A | | | | |

| | |

(with sales charges) | | 8.50 | | 9.31(12/11/2023) |

| | |

(without sales charges) | | 11.28 | | 11.95(12/11/2023) |

| | |

Class C | | | | |

| | |

(with sales charges) | | 9.40 | | 11.07(12/11/2023) |

| | |

(without sales charges) | | 10.40 | | 11.07(12/11/2023) |

| | |

Class Z | | | | |

| | |

(without sales charges) | | 11.55 | | 12.22(12/11/2023) |

| | |

ICE BofA US 3-Month Treasury Bill Index | | | | |

| | |

| | 5.25 | | 5.29 |

| | |

Bloomberg 1-5 Year US Credit Index | | | | |

| | |

| | | 4.72 | | 6.09 |

Since Inception returns are provided since the Fund has less than 10 fiscal years of returns. Without waiver of fees and/or expense reimbursements, if any, the returns would have been lower. Total returns are based on changes in net asset value. Net asset value total return assumes the reinvestment of all distributions, including returns of capital, if any.

Since Inception returns for the Indexes are measured from the closest month-end to the Fund’s inception date. All returns exclude the impact of redemption fees on shares purchased and held less than 12 months.

4 Visit our website at pgim.com/investments

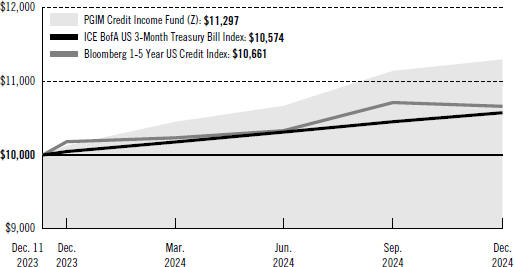

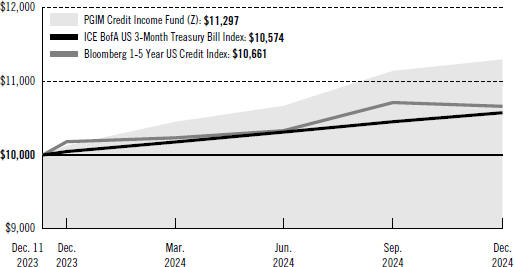

Growth of a $10,000 Investment (unaudited)

The graph compares a $10,000 investment in the Fund’s Class Z shares with a similar investment in the ICE BofA US 3-Month Treasury Bill Index and Bloomberg 1-5 Year US Credit Index by portraying the initial account values at the beginning of the 10-year period for Class Z shares (December 11, 2023) and the account values at the end of the current fiscal year (December 31, 2024) as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted and (b) all dividends and distributions were reinvested. The line graph provides information for Class Z shares only. As indicated in the table provided earlier, performance for other share classes will vary, due to the differing charges and expenses applicable to each share class (as indicated in the following paragraphs). Without waiver of fees and/or expense reimbursements, if any, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns in the table and the graph do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

The returns in the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares.

PGIM Credit Income Fund 5

Your Fund’s Performance (continued)

The Fund’s applicable sales charges, redemption fees, and distribution and service fees are described for each share class in the table below.

| | | | | | |

| | | | |

| | | Class A | | Class C | | Class Z |

| | | | |

Maximum initial sales charge | | 2.50% Prior to July 1, 2024: 3.25% of the public offering price | | None | | None |

| | | | |

Contingent Deferred Sales Charge (CDSC) | | 1.50% on shares purchased without a sales charge if the shares are repurchased during the first 12 months after purchase Prior to July 1, 2024: None | | 1.00% on

shares

repurchased

during the

first 12

months after

purchase

Prior to July 1,

2024: None | | None |

| | | | |

Redemption Fee | | None | | None | | None |

| | | | |

Annual distribution or distribution and service (12b-1) fees (shown as a percentage of average daily net assets) | | 0.75% Prior to July 1, 2024: 0.25% | | 1.00% | | None |

Benchmark Definitions

ICE BofA US 3-Month Treasury Bill Index—The ICE BofA US 3-Month Treasury Bill Index is an unmanaged index which is comprised of a single issue purchased at the beginning of the month and held for a full month. At the end of the month, that issue is sold and rolled into a newly selected issue. The issue selected at each month-end rebalancing is the outstanding Treasury bill that matures closest to, but not beyond, three months from the rebalancing date. To qualify for selection, an issue must have settled on or before the month-end rebalancing date.

Bloomberg 1-5 Year US Credit Index—The Bloomberg 1-5 Year US Credit Index is an unmanaged index of publicly issued US corporate and specified foreign debentures and secured notes that meet specific maturity (between one and five years), liquidity, and quality requirements. It gives an indication of how short- and intermediate-term bonds have performed.

Investors cannot invest directly in an index. The returns for the Indexes would be lower if they included the effects of sales charges, operating expenses, or taxes that may be paid by an investor.

6 Visit our website at pgim.com/investments

Strategy and Performance Overview* (unaudited)

How did the Fund perform?

The PGIM Credit Income Fund (the Fund) returned 11.55%, based on net asset value, in the 12-month reporting that ended December 31, 2024, outperforming the 5.25% return of the ICE BofA US 3-Month Treasury Bill Index (the Index).

What Were the Market Conditions?

| · | | During the reporting period, market expectations for both the timing and number of rate cuts fluctuated significantly as inflation slowed and employment data showed some signs of softening. The US Federal Reserve’s (Fed) easing cycle—which began in September 2024 with a 50-basis-point (bp) rate cut and was followed by two separate 25-bp cuts—was preceded by a re-steepening of the US Treasury curve and greater market volatility due to both election and fiscal uncertainty. (One basis point equals 0.01%.) Nevertheless, as demand for yield remained robust, credit spreads largely tightened, and performance across fixed income sectors was mostly positive. |

| · | | US high yield bonds produced positive total and excess returns over the period, as spreads tightened amid resilient economic growth, stable corporate earnings, and strong technicals. That stated, yields rose to a four-month high in December, as the Fed delivered a hawkish cut amid a combination of firmer growth and inflation data. |

| · | | US bank loans also posted positive total returns, amid a lack of net new supply, ongoing collateralized loan obligation (CLO) demand, inflows into bank loan exchange-traded funds, and high all-in coupons. |

| · | | Securitized credit spreads tightened over the period, with US CLO spreads seeing material tightening across the capital structure and high-quality commercial mortgage-backed securities (CMBS) trading wide to comparable corporate bonds. |

| · | | Emerging-markets debt spread performance was mixed, with most emerging-markets sectors posting negative total returns for the reporting period. Notably, within emerging-markets hard currency, emerging-markets high yield outperformed. Meanwhile, emerging-markets foreign exchange (FX) and local rates lagged, impacted by the strong US dollar, Fed policy repricing, and country-specific fundamental factors. |

What Worked?

| · | | Overall security selection and sector allocation contributed to performance. Within security selection, selection in US high yield corporates, non-agency CMBS AA-and-below, US Treasuries, US bank loans, non-agency MBS, and US investment grade corporates contributed the most. Within sector allocation, overweights to emerging market high yield, British pound high yield corporates, and non-agency CMBS AA-and-below contributed the most. |

| · | | Within credit, positioning in retailers & restaurants, chemicals, technology, gaming/lodging/leisure, and consumer non-cyclical contributed the most to performance. |

PGIM Credit Income Fund 7

Strategy and Performance Overview* (continued)

| · | | In aggregate, the Fund’s duration and tactical yield curve positioning also contributed to performance, as the US Treasury curve re-steepened. (Duration measures the sensitivity of the price—the value of principal—of a bond to a change in interest rates.) (A yield curve is a line graph that illustrates the relationship between the yields and maturities of fixed income securities. It is created by plotting the yields of different maturities for the same type of bonds.) |

What Didn’t Work?

| · | | While overall security selection contributed, selection in British pound high yield corporates and European high yield corporates detracted from performance. |

| · | | While sector allocation contributed, overweights to the US high yield corporate, BBB CLO, US bank loan, and emerging market investment grade sectors detracted the most. |

| · | | Within credit, positioning in telecom detracted the most. |

Did the Fund Use Derivatives?

| · | | During the period, the Fund used credit default swaps, total return swaps, financial futures, and FX forwards to hedge credit risk and help manage the overall beta of the portfolio. (Beta is a measure of the volatility or risk of a security or portfolio compared to the market or index.) Credit default swaps contributed to performance, while financial futures, total return swaps, and FX forwards positions detracted from performance. |

What was the impact of the Fund’s distribution policy?

| · | | The Fund has a practice of seeking to maintain a relatively stable level of distributions to shareholders. This practice has no impact on the Fund’s investment strategy. PGIM Fixed Income believes the practice helps maintain the Fund’s competitiveness. For the fiscal year ended December 2024, the tax character of dividends paid included an ordinary income distribution of $9,984,397, which had no material impact on the next asset value (NAV) during the reporting period. There was no tax return of capital distribution during the fiscal year ended December 31, 2024. |

Current Outlook

| · | | The Fed’s rate path now appears far shallower than when it launched last September. The most recent Summary of Economic Projections, released alongside the December Federal Open Market Committee (FOMC) meeting, indicated improving labor stability (with 2024’s unemployment rate projection falling slightly from 4.4% in September to 4.3% in December) and lingering inflation pressures (with the 2025 core PCE inflation projection rising from 2.2% to 2.5%). |

| · | | At the December FOMC meeting, the Fed halved its expected rate cuts for 2025 to only 50 bps, amid terminal rate and neutral rate projections that rose to 3.1% and 3.0%, respectively. Additional increases may follow in 2025. As conditions unfold, PGIM Fixed Income thinks three 25-bp cuts by the Fed is a reasonable expectation. |

8 Visit our website at pgim.com/investments

| · | | While historically tight credit spreads and the experience of the past 20 years point to caution when it comes to credit exposure, this may not be the right approach in the current environment. Given the prospects for continued moderate economic growth, generally benign credit fundamentals, and strong demand for fixed income, PGIM Fixed Income thinks an extended period of narrow spreads is a more likely outcome. This could manifest as a slightly more volatile version of the 1992–1997 or 2004– 2007 periods, in which case credit product may continue to deliver positive excess returns. |

| · | | High yield bond spreads remain within striking distance of the all-time tights achieved prior to the Global Financial Crisis (GFC) of 2007–2009. Moreover, a net-supply deficit, attractive absolute yields, and an overall robust credit environment provide a supportive backdrop for the market entering 2025. However, certain notable risks (e.g., geopolitics) are not sufficiently reflected in current spreads. As such, PGIM Fixed Income is maintaining a close-to-home defensive positioning with an underweight to spread duration, but a spread-carry at, or close to, benchmarks. |

| · | | Bank loans continue to be supported by high all-in current coupons and yields, strong CLO formation, and continued inflows into bank loan funds. PGIM Fixed Income continues to favor public BB- and high single-B loans over sponsor-owned, low single-B and CCC loans, as PGIM Fixed Income expects those lower-quality loans to be most impacted by the challenging fundamental backdrop. |

| · | | In securitized products, credit curves appear very flat, and the downside risks to indiscriminately allocating down the capital stack outweigh the potential rewards. PGIM Fixed Income expects spreads to remain around historical averages, making carry the dominant theme. |

| · | | In a macroeconomic environment of on-trend (or potentially below-trend) growth and fairly valued US Treasury yields, carry is likely to be the primary driver of dollar-denominated returns for emerging-markets debt. Despite material spread tightening, elevated emerging markets yields still offer among the highest yields across public fixed income. In addition, performance dispersion within and between emerging-markets sectors provide opportunities to generate alpha. (Alpha is a measure of an investment’s active return compared to a market or index.) With that stated, PGIM Fixed Income remains measured in overall risk taking, considering the macro uncertainties, and continues to favor a barbell of emerging-markets credit across the ratings spectrum where it finds value. In emerging-markets rates and emerging-markets FX, PGIM Fixed Income is more selective, focusing on relative value, and remains focused on fundamentals—particularly fiscal, FX, and financing vulnerabilities. |

*This strategy and performance overview, which discusses what strategies or holdings (including derivatives, if applicable) affected the Fund’s performance, is compiled based on how the Fund performed relative to the Index and is viewed for performance attribution purposes at the aggregate Fund level, which in most instances will not

PGIM Credit Income Fund 9

Strategy and Performance Overview* (continued)

directly correlate to the amounts disclosed in the Statement of Operations which conform to US generally accepted accounting principles.

10 Visit our website at pgim.com/investments

Schedule of Investments

as of December 31, 2024

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | | | | |

LONG-TERM INVESTMENTS 120.9% | | | | | | | | | | | | | | | | |

| | | | | |

ASSET-BACKED SECURITIES 23.8% | | | | | | | | | | | | | | | | |

| | | | | |

Automobiles 0.3% | | | | | | | | | | | | | | | | |

| | | | | |

Huntington Bank Auto Credit-Linked Notes, | | | | | | | | | | | | | | | | |

Series 2024-01, Class D, 144A, 30 Day Average SOFR + 5.250% (Cap N/A, Floor 0.000%) | | 9.855%(c) | | 05/20/32 | | | | | | | 307 | | | $ | 314,068 | |

| | | | | |

Collateralized Loan Obligations 21.8% | | | | | | | | | | | | | | | | |

| | | | | |

Atlas Senior Loan Fund Ltd. (Cayman Islands), | | | | | | | | | | | | | | | | |

Series 2021-16A, Class D, 144A, 3 Month SOFR + 3.962% (Cap N/A, Floor 3.700%) | | 8.579(c) | | 01/20/34 | | | | | | | 1,100 | | | | 1,106,346 | |

Barings Euro CLO DAC (Ireland), | | | | | | | | | | | | | | | | |

Series 2024-01A, Class D, 144A, 3 Month EURIBOR + 4.500% (Cap N/A, Floor 4.500%) | | 8.161(c) | | 07/20/37 | | | EUR | | | | 1,000 | | | | 1,039,568 | |

Barrow Hanley CLO Ltd. (Cayman Islands), | | | | | | | | | | | | | | | | |

Series 2024-03A, Class D, 144A, 3 Month SOFR + 4.150% (Cap N/A, Floor 4.150%) | | 8.767(c) | | 04/20/37 | | | | | | | 1,000 | | | | 1,020,810 | |

Carlyle Euro CLO DAC (Ireland), | | | | | | | | | | | | | | | | |

Series 2022-05A, Class CR, 144A, 3 Month EURIBOR + 4.150% (Cap N/A, Floor 4.150%) | | 7.236(c) | | 04/25/37 | | | EUR | | | | 1,000 | | | | 1,040,300 | |

CQS US CLO Ltd. (United Kingdom), | | | | | | | | | | | | | | | | |

Series 2023-03A, Class D, 144A, 3 Month SOFR + 4.200% (Cap N/A, Floor 4.200%) | | 8.826(c) | | 01/25/37 | | | | | | | 1,500 | | | | 1,531,112 | |

Elevation CLO Ltd. (Cayman Islands), | | | | | | | | | | | | | | | | |

Series 2021-12A, Class D2R, 144A, 3 Month SOFR + 5.360% (Cap N/A, Floor 5.360%) | | 9.977(c) | | 04/20/37 | | | | | | | 1,000 | | | | 1,025,413 | |

Harvest CLO DAC (Ireland), | | | | | | | | | | | | | | | | |

Series 32A, Class D, 144A, 3 Month EURIBOR + 3.600% (Cap N/A, Floor 3.600%) | | 7.298(c) | | 07/25/37 | | | EUR | | | | 1,000 | | | | 1,048,786 | |

Hayfin Emerald CLO DAC (Ireland), | | | | | | | | | | | | | | | | |

Series 05A, Class DR, 144A, 3 Month EURIBOR + 4.160% (Cap N/A, Floor 4.160%) | | 6.925(c) | | 11/17/37 | | | EUR | | | | 1,000 | | | | 1,035,339 | |

Invesco Euro CLO DAC (Ireland), | | | | | | | | | | | | | | | | |

Series 03A, Class DR, 144A, 3 Month EURIBOR + 3.850% (Cap N/A, Floor 3.850%) | | 7.293(c) | | 10/30/38 | | | EUR | | | | 1,000 | | | | 1,028,011 | |

KKR CLO Ltd. (United Kingdom), | | | | | | | | | | | | | | | | |

Series 2022-43A, Class DR, 144A, 3 Month SOFR + 4.950% (Cap N/A, Floor 4.950%) | | 9.606(c) | | 01/15/36 | | | | | | | 2,000 | | | | 2,050,211 | |

Monument CLO DAC (Ireland), | | | | | | | | | | | | | | | | |

Series 01A, Class D, 144A, 3 Month EURIBOR + 4.350% (Cap N/A, Floor 4.350%) | | 8.092(c) | | 05/15/37 | | | EUR | | | | 1,500 | | | | 1,589,762 | |

Nassau Euro CLO DAC (Ireland), | | | | | | | | | | | | | | | | |

Series 04A, Class D, 144A, 3 Month EURIBOR + 3.950% (Cap N/A, Floor 3.950%) | | 7.661(c) | | 07/20/38 | | | EUR | | | | 1,000 | | | | 1,045,457 | |

See Notes to Financial Statements.

PGIM Credit Income Fund 11

Schedule of Investments (continued)

as of December 31, 2024

| | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount (000)# | | | Value | |

| | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | |

| | | | |

Collateralized Loan Obligations (cont’d.) | | | | | | | | | | | | |

| | | | |

Northwoods Capital Ltd. (Cayman Islands), | | | | | | | | | | | | |

Series 2017-15A, Class DR, 144A, 3 Month SOFR +4.012% (Cap N/A, Floor 4.012%) | | 8.366%(c) | | 06/20/34 | | | 2,000 | | | $ | 2,004,991 | |

Series 2020-22A, Class DRR, 144A, 3 Month SOFR + 4.950% (Cap N/A, Floor 4.950%) | | 9.309(c) | | 09/16/31 | | | 950 | | | | 973,826 | |

OFSI BSL CLO Ltd. (Cayman Islands), | | | | | | | | | | | | |

Series 2024-13A, Class D1, 144A, 3 Month SOFR +4.500% (Cap N/A, Floor 4.500%) | | 9.117(c) | | 04/20/37 | | | 1,000 | | | | 1,021,041 | |

Silver Rock CLO (Cayman Islands), | | | | | | | | | | | | |

Series 2023-03A, Class D, 144A, 3 Month SOFR + 5.050% (Cap N/A, Floor 5.050%) | | 9.667(c) | | 01/20/36 | | | 1,000 | | | | 1,025,149 | |

Tikehau US CLO Ltd. (Bermuda), | | | | | | | | | | | | |

Series 2022-02A, Class D1R, 144A, 3 Month SOFR + 5.150% (Cap N/A, Floor 5.150%) | | 9.767(c) | | 01/20/36 | | | 2,000 | | | | 2,050,404 | |

Trinitas CLO Ltd. (Bermuda), | | | | | | | | | | | | |

Series 2023-26A, Class D, 144A, 3 Month SOFR + 4.500% (Cap N/A, Floor 4.500%) | | 9.117(c) | | 01/20/35 | | | 1,000 | | | | 1,005,752 | |

Z Capital Credit Partners BSL CLO Ltd. (Cayman Islands), | | | | | | | | | | | | |

Series 2024-01A, Class C, 144A, 3 Month SOFR + 3.650% (Cap N/A, Floor 3.650%) | | 8.297(c) | | 04/16/36 | | | 1,500 | | | | 1,524,360 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 24,166,638 | |

| | | | |

Consumer Loans 0.8% | | | | | | | | | | | | |

| | | | |

Affirm Asset Securitization Trust, | | | | | | | | | | | | |

Series 2024-A, Class 1E, 144A | | 9.170 | | 02/15/29 | | | 850 | | | | 865,918 | |

| | | | |

Credit Cards 0.9% | | | | | | | | | | | | |

| | | | |

Genesis Sales Finance Master Trust, | | | | | | | | | | | | |

Series 2024-B, Class B, 144A | | 6.260 | | 12/20/32 | | | 1,000 | | | | 999,513 | |

| | | | | | | | | | | | |

| | | |

TOTAL ASSET-BACKED SECURITIES

(cost $26,072,158) | | | | | | | | | 26,346,137 | |

| | | | | | | | | | | | |

| | | | |

COMMERCIAL MORTGAGE-BACKED SECURITIES 7.9% | | | | | | | | | | | | |

Benchmark Mortgage Trust, | | | | | | | | | | | | |

Series 2024-V05, Class XD, IO, 144A | | 2.973(cc) | | 01/10/57 | | | 8,000 | | | | 823,102 | |

Series 2024-V06, Class XD, IO | | 3.260(cc) | | 03/15/57 | | | 6,000 | | | | 701,035 | |

Series 2024-V12, Class A3 | | 5.738 | | 12/15/57 | | | 230 | | | | 235,777 | |

BFLD Mortgage Trust, | | | | | | | | | | | | |

Series 2024-VICT, Class B, 144A, 1 Month SOFR +2.589% (Cap N/A, Floor 2.589%) | | 6.986(c) | | 07/15/41 | | | 700 | | | | 700,438 | |

See Notes to Financial Statements.

12

| | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount (000)# | | | Value | |

| | | | |

COMMERCIAL MORTGAGE-BACKED SECURITIES (Continued) | | | | | | | | | | | | |

BFLD Mortgage Trust, (cont’d.) | | | | | | | | | | | | |

Series 2024-WRHS, Class E, 144A, 1 Month SOFR +3.689% (Cap N/A, Floor 3.689%) | | 8.086%(c) | | 08/15/26 | | | 946 | | | $ | 950,835 | |

BMO Mortgage Trust, | | | | | | | | | | | | |

Series 2024-05C03, Class XD, IO, 144A | | 2.859(cc) | | 02/15/57 | | | 7,250 | | | | 728,963 | |

Series 2024-05C05, Class XD, IO, 144A | | 2.477(cc) | | 02/15/57 | | | 3,975 | | | | 371,798 | |

BPR Trust, | | | | | | | | | | | | |

Series 2021-TY, Class D, 144A, 1 Month SOFR + 2.464% (Cap N/A, Floor 2.350%) | | 6.862(c) | | 09/15/38 | | | 1,000 | | | | 992,656 | |

ONE Mortgage Trust, | | | | | | | | | | | | |

Series 2021-PARK, Class D, 144A, 1 Month SOFR +1.614% (Cap N/A, Floor 1.500%) | | 6.011(c) | | 03/15/36 | | | 1,000 | | | | 954,373 | |

ROCK Trust, | | | | | | | | | | | | |

Series 2024-CNTR, Class E, 144A | | 8.819 | | 11/13/41 | | | 1,000 | | | | 1,033,935 | |

Wells Fargo Commercial Mortgage Trust, | | | | | | | | | | | | |

Series 2021-FCMT, Class C, 144A, 1 Month SOFR +2.514% (Cap N/A, Floor 2.400%) | | 6.912(c) | | 05/15/31 | | | 1,300 | | | | 1,264,606 | |

| | | | | | | | | | | | |

| | | |

TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES

(cost $8,831,550) | | | | | | | | | 8,757,518 | |

| | | | | | | | | | | | |

| | | | |

CORPORATE BONDS 55.9% | | | | | | | | | | | | |

| | | | |

Aerospace & Defense 1.9% | | | | | | | | | | | | |

| | | | |

Bombardier, Inc. (Canada), | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A(v) | | 8.750 | | 11/15/30 | | | 2,000 | | | | 2,147,500 | |

| | | | |

Airlines 0.2% | | | | | | | | | | | | |

| | | | |

United Airlines, Inc., | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | 4.375 | | 04/15/26 | | | 200 | | | | 196,576 | |

| | | | |

Apparel 0.8% | | | | | | | | | | | | |

| | | | |

Wolverine World Wide, Inc., | | | | | | | | | | | | |

Gtd. Notes, 144A | | 4.000 | | 08/15/29 | | | 975 | | | | 854,962 | |

| | | | |

Auto Parts & Equipment 0.8% | | | | | | | | | | | | |

| | | | |

Tenneco, Inc., | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A(v) | | 8.000 | | 11/17/28 | | | 900 | | | | 837,213 | |

| | | | |

Banks 6.6% | | | | | | | | | | | | |

| | | | |

Bank of America Corp., | | | | | | | | | | | | |

Jr. Sub. Notes, Series MM(v) | | 4.300(ff) | | 01/28/25(oo) | | | 2,550 | | | | 2,541,377 | |

Cassa Depositi e Prestiti SpA (Italy), | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A(v) | | 5.875 | | 04/30/29 | | | 200 | | | | 202,897 | |

See Notes to Financial Statements.

PGIM Credit Income Fund 13

Schedule of Investments (continued)

as of December 31, 2024

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount (000)# | | | Value | |

| | | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | |

| | | | | |

Banks (cont’d.) | | | | | | | | | | | | | | | | |

| | | | | |

Citigroup, Inc., | | | | | | | | | | | | | | | | |

Jr. Sub. Notes, Series CC(v) | | 7.125%(ff) | | 08/15/29(oo) | | | | | | | 470 | | | $ | 478,454 | |

Jr. Sub. Notes, Series X(v) | | 3.875(ff) | | 02/18/26(oo) | | | | | | | 1,233 | | | | 1,194,312 | |

Goldman Sachs Group, Inc. (The), | | | | | | | | | | | | | | | | |

Jr. Sub. Notes, Series U | | 3.650(ff) | | 08/10/26(oo) | | | | | | | 1,000 | | | | 955,007 | |

Royal Bank of Canada (Canada), | | | | | | | | | | | | | | | | |

Jr. Sub. Notes | | 7.500(ff) | | 05/02/84 | | | | | | | 750 | | | | 776,250 | |

Toronto-Dominion Bank (The) (Canada), | | | | | | | | | | | | | | | | |

Jr. Sub. Notes | | 7.250(ff) | | 07/31/84 | | | | | | | 785 | | | | 795,794 | |

Wells Fargo & Co., | | | | | | | | | | | | | | | | |

Jr. Sub. Notes | | 6.850(ff) | | 09/15/29(oo) | | | | | | | 335 | | | | 344,942 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 7,289,033 | |

| | | | | |

Chemicals 2.7% | | | | | | | | | | | | | | | | |

| | | | | |

Ashland, Inc., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A(v) | | 3.375 | | 09/01/31 | | | | | | | 300 | | | | 255,064 | |

Braskem Netherlands Finance BV (Brazil), | | | | | | | | | | | | | | | | |

Gtd. Notes | | 8.500 | | 01/12/31 | | | | | | | 400 | | | | 399,400 | |

Herens Midco Sarl (Luxembourg), | | | | | | | | | | | | | | | | |

Gtd. Notes | | 5.250 | | 05/15/29 | | | EUR | | | | 710 | | | | 606,014 | |

Monitchem HoldCo 3 SA (Luxembourg), | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes | | 8.750 | | 05/01/28 | | | EUR | | | | 1,345 | | | | 1,440,358 | |

OCP SA (Morocco), | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A(v) | | 6.750 | | 05/02/34 | | | | | | | 260 | | | | 264,810 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 2,965,646 | |

| | | | | |

Coal 0.5% | | | | | | | | | | | | | | | | |

| | | | | |

Coronado Finance Pty Ltd. (Australia), | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A(v) | | 9.250 | | 10/01/29 | | | | | | | 550 | | | | 554,125 | |

| | | | | |

Commercial Services 0.3% | | | | | | | | | | | | | | | | |

| | | | | |

Alta Equipment Group, Inc., | | | | | | | | | | | | | | | | |

Sec’d. Notes, 144A | | 9.000 | | 06/01/29 | | | | | | | 45 | | | | 42,927 | |

Autopistas del Sol SA (Costa Rica), | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes | | 7.375 | | 12/30/30 | | | | | | | 257 | | | | 253,417 | |

DCLI Bidco LLC, | | | | | | | | | | | | | | | | |

Second Mortgage, 144A | | 7.750 | | 11/15/29 | | | | | | | 20 | | | | 20,438 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 316,782 | |

See Notes to Financial Statements.

14

| | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount (000)# | | | Value | |

| | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | |

| | | | |

Computers 0.5% | | | | | | | | | | | | |

| | | | |

McAfee Corp., | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | 7.375% | | 02/15/30 | | | 575 | | | $ | 559,662 | |

| | | | |

Diversified Financial Services 0.8% | | | | | | | | | | | | |

| | | | |

Nationstar Mortgage Holdings, Inc., | | | | | | | | | | | | |

Gtd. Notes, 144A(v) | | 5.750 | | 11/15/31 | | | 500 | | | | 477,714 | |

OneMain Finance Corp., | | | | | | | | | | | | |

Gtd. Notes | | 6.625 | | 05/15/29 | | | 150 | | | | 151,836 | |

PennyMac Financial Services, Inc., | | | | | | | | | | | | |

Gtd. Notes, 144A(v) | | 5.750 | | 09/15/31 | | | 250 | | | | 237,983 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 867,533 | |

| | | | |

Electric 4.9% | | | | | | | | | | | | |

| | | | |

Aydem Yenilenebilir Enerji A/S (Turkey), | | | | | | | | | | | | |

Sr. Sec’d. Notes | | 7.750 | | 02/02/27 | | | 210 | | | | 209,015 | |

Calpine Corp., | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A(v) | | 4.625 | | 02/01/29 | | | 575 | | | | 542,300 | |

Eskom Holdings SOC Ltd. (South Africa), | | | | | | | | | | | | |

Sr. Unsec’d. Notes, MTN | | 8.450 | | 08/10/28 | | | 404 | | | | 423,695 | |

NRG Energy, Inc., | | | | | | | | | | | | |

Jr. Sub. Notes, 144A(v) | | 10.250(ff) | | 03/15/28(oo) | | | 1,800 | | | | 1,989,386 | |

Vistra Corp., | | | | | | | | | | | | |

Jr. Sub. Notes, 144A(v) | | 7.000(ff) | | 12/15/26(oo) | | | 2,300 | | | | 2,299,777 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 5,464,173 | |

| | | | |

Engineering & Construction 0.5% | | | | | | | | | | | | |

| | | | |

Mexico City Airport Trust (Mexico), | | | | | | | | | | | | |

Sr. Sec’d. Notes | | 5.500 | | 07/31/47 | | | 400 | | | | 321,124 | |

Sr. Sec’d. Notes, 144A | | 5.500 | | 07/31/47 | | | 300 | | | | 240,843 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 561,967 | |

| | | | |

Entertainment 2.3% | | | | | | | | | | | | |

| | | | |

Caesars Entertainment, Inc., | | | | | | | | | | | | |

Gtd. Notes, 144A(v) | | 4.625 | | 10/15/29 | | | 1,100 | | | | 1,030,521 | |

Jacobs Entertainment, Inc., | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | 6.750 | | 02/15/29 | | | 150 | | | | 144,693 | |

Penn Entertainment, Inc., | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | 5.625 | | 01/15/27 | | | 200 | | | | 196,907 | |

See Notes to Financial Statements.

PGIM Credit Income Fund 15

Schedule of Investments (continued)

as of December 31, 2024

| | | | | | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal Amount (000)# | | | Value | |

| | | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Entertainment (cont’d.) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Scientific Games Holdings LP/Scientific Games US FinCo, Inc., | | | | | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | | 6.625% | | | | 03/01/30 | | | | | | | | 500 | | | $ | 479,187 | |

Wynn Resorts Finance LLC/Wynn Resorts Capital Corp., | | | | | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A(v) | | | 5.125 | | | | 10/01/29 | | | | | | | | 675 | | | | 646,525 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | 2,497,833 | |

| | | | | |

Foods 2.8% | | | | | | | | | | | | | | | | | | | | |

| | | | | |

B&G Foods, Inc., | | | | | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 5.250 | | | | 09/15/27 | | | | | | | | 225 | | | | 213,597 | |

Bellis Acquisition Co. PLC (United Kingdom), | | | | | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 8.125 | | | | 05/14/30 | | | | GBP | | | | 825 | | | | 996,535 | |

Bellis Finco PLC (United Kingdom), | | | | | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 4.000 | | | | 02/16/27 | | | | GBP | | | | 1,325 | | | | 1,561,315 | |

Lamb Weston Holdings, Inc., | | | | | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 4.125 | | | | 01/31/30 | | | | | | | | 200 | | | | 182,967 | |

Post Holdings, Inc., | | | | | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 6.250 | | | | 02/15/32 | | | | | | | | 140 | | | | 139,030 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | 3,093,444 | |

| | | | | |

Forest Products & Paper 0.2% | | | | | | | | | | | | | | | | | | | | |

| | | | | |

LD Celulose International GmbH (Brazil), | | | | | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 7.950 | | | | 01/26/32 | | | | | | | | 200 | | | | 200,062 | |

| | | | | |

Healthcare-Services 1.2% | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Chrome Holdco SAS (France), | | | | | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 5.000 | | | | 05/31/29 | | | | EUR | | | | 750 | | | | 430,201 | |

DaVita, Inc., | | | | | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A(v) | | | 3.750 | | | | 02/15/31 | | | | | | | | 975 | | | | 842,838 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | 1,273,039 | |

| | | | | |

Home Builders 0.3% | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Brookfield Residential Properties, Inc./Brookfield Residential US LLC (Canada), | | | | | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 6.250 | | | | 09/15/27 | | | | | | | | 100 | | | | 98,750 | |

Sr. Unsec’d. Notes, 144A | | | 5.000 | | | | 06/15/29 | | | | | | | | 300 | | | | 278,250 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | 377,000 | |

See Notes to Financial Statements.

16

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000)# | | | Value | |

| | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | |

| | | | |

Household Products/Wares 0.1% | | | | | | | | | | | | | | | | |

| | | | |

Kronos Acquisition Holdings, Inc. (Canada), | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | | 10.750% | | | | 06/30/32 | | | | 100 | | | $ | 91,545 | |

| | | | |

Housewares 0.2% | | | | | | | | | | | | | | | | |

| | | | |

Scotts Miracle-Gro Co. (The), | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 4.375 | | | | 02/01/32 | | | | 250 | | | | 217,867 | |

| | | | |

Iron/Steel 0.5% | | | | | | | | | | | | | | | | |

| | | | |

Mineral Resources Ltd. (Australia), | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | | 9.250 | | | | 10/01/28 | | | | 500 | | | | 523,426 | |

| | | | |

Leisure Time 1.5% | | | | | | | | | | | | | | | | |

| | | | |

Carnival Corp., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 6.000 | | | | 05/01/29 | | | | 450 | | | | 449,114 | |

NCL Corp. Ltd., | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A(v) | | | 8.125 | | | | 01/15/29 | | | | 650 | | | | 683,312 | |

Viking Cruises Ltd., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 5.875 | | | | 09/15/27 | | | | 525 | | | | 520,406 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 1,652,832 | |

| | | | |

Lodging 1.3% | | | | | | | | | | | | | | | | |

| | | | |

MGM Resorts International, | | | | | | | | | | | | | | | | |

Gtd. Notes(v) | | | 4.750 | | | | 10/15/28 | | | | 1,075 | | | | 1,028,854 | |

Wynn Macau Ltd. (Macau), | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A(v) | | | 5.625 | | | | 08/26/28 | | | | 425 | | | | 408,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 1,436,854 | |

| | | | |

Machinery-Diversified 0.6% | | | | | | | | | | | | | | | | |

| | | | |

Chart Industries, Inc., | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 7.500 | | | | 01/01/30 | | | | 225 | | | | 233,996 | |

Maxim Crane Works Holdings Capital LLC, | | | | | | | | | | | | | | | | |

Sec’d. Notes, 144A | | | 11.500 | | | | 09/01/28 | | | | 400 | | | | 423,036 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 657,032 | |

| | | | |

Media 5.4% | | | | | | | | | | | | | | | | |

| | | | |

CCO Holdings LLC/CCO Holdings Capital Corp., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A(v) | | | 4.250 | | | | 02/01/31 | | | | 548 | | | | 477,339 | |

DISH DBS Corp., | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 5.125 | | | | 06/01/29 | | | | 25 | | | | 15,873 | |

See Notes to Financial Statements.

PGIM Credit Income Fund 17

Schedule of Investments (continued)

as of December 31, 2024

| | | | | | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal Amount (000)# | | | Value | |

| | | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Media (cont’d.) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

DISH DBS Corp., (cont’d.) | | | | | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 7.375% | | | | 07/01/28 | | | | | | | | 25 | | | $ | 17,842 | |

Gtd. Notes | | | 7.750 | | | | 07/01/26 | | | | | | | | 125 | | | | 105,056 | |

DISH Network Corp., | | | | | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 11.750 | | | | 11/15/27 | | | | | | | | 1,525 | | | | 1,612,917 | |

Globo Comunicacao e Participacoes SA (Brazil), | | | | | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 4.875 | | | | 01/22/30 | | | | | | | | 250 | | | | 222,515 | |

Summer BidCo BV (Slovenia), | | | | | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A, Cash coupon 10.000% or PIK 10.750% | | | 10.000 | | | | 02/15/29 | | | | EUR | | | | 434 | | | | 456,392 | |

Univision Communications, Inc., | | | | | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 6.625 | | | | 06/01/27 | | | | | | | | 525 | | | | 523,297 | |

Virgin Media Secured Finance PLC (United Kingdom), | | | | | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes | | | 4.250 | | | | 01/15/30 | | | | GBP | | | | 2,275 | | | | 2,496,657 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | 5,927,888 | |

| | | | | |

Mining 1.7% | | | | | | | | | | | | | | | | | | | | |

| | | | | |

First Quantum Minerals Ltd. (Zambia), | | | | | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 6.875 | | | | 10/15/27 | | | | | | | | 200 | | | | 198,938 | |

Hudbay Minerals, Inc. (Canada), | | | | | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A(v) | | | 6.125 | | | | 04/01/29 | | | | | | | | 1,050 | | | | 1,048,688 | |

New Gold, Inc. (Canada), | | | | | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A(v) | | | 7.500 | | | | 07/15/27 | | | | | | | | 675 | | | | 677,531 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | 1,925,157 | |

| | | | | |

Oil & Gas 4.9% | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Ascent Resources Utica Holdings LLC/ARU Finance Corp., | | | | | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 9.000 | | | | 11/01/27 | | | | | | | | 75 | | | | 90,598 | |

Ecopetrol SA (Colombia), | | | | | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 7.750 | | | | 02/01/32 | | | | | | | | 380 | | | | 369,170 | |

Sr. Unsec’d. Notes(v) | | | 8.875 | | | | 01/13/33 | | | | | | | | 350 | | | | 355,323 | |

Energean Israel Finance Ltd. (Israel), | | | | | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 5.375 | | | | 03/30/28 | | | | | | | | 85 | | | | 79,002 | |

Expand Energy Corp., | | | | | | | | | | | | | | | | | | | | |

Gtd. Notes(v) | | | 4.750 | | | | 02/01/32 | | | | | | | | 850 | | | | 789,571 | |

Hilcorp Energy I LP/Hilcorp Finance Co., | | | | | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A(v) | | | 8.375 | | | | 11/01/33 | | | | | | | | 975 | | | | 995,512 | |

See Notes to Financial Statements.

18

| | | | | | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

| | | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Oil & Gas (cont’d.) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

New Generation Gas Gathering LLC, | | | | | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A, 3 Month SOFR + 5.750% (Cap N/A, Floor 2.000%)^ | | | 10.335%(c) | | | | 09/30/29 | | | | | | | | 230 | | | $ | 226,284 | |

Petroleos Mexicanos (Mexico), | | | | | | | | | | | | | | | | | | | | |

Gtd. Notes, MTN | | | 8.750 | | | | 06/02/29 | | | | | | | | 300 | | | | 300,188 | |

Preem Holdings AB (Sweden), | | | | | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 12.000 | | | | 06/30/27 | | | | EUR | | | | 1,536 | | | | 1,684,541 | |

Wintershall Dea Finance 2 BV (Germany), | | | | | | | | | | | | | | | | | | | | |

Gtd. Notes, Series NC8 | | | 3.000(ff) | | | | 07/20/28(oo) | | | | EUR | | | | 600 | | | | 577,920 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | 5,468,109 | |

| | | | | |

Packaging & Containers 0.2% | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Pactiv Evergreen Group Issuer, Inc./Pactiv Evergreen Group Issuer LLC, | | | | | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 4.000 | | | | 10/15/27 | | | | | | | | 225 | | | | 223,368 | |

| | | | | |

Pharmaceuticals 1.3% | | | | | | | | | | | | | | | | | | | | |

| | | | | |

AdaptHealth LLC, | | | | | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A(v) | | | 6.125 | | | | 08/01/28 | | | | | | | | 850 | | | | 833,055 | |

Grifols SA (Spain), | | | | | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 7.125 | | | | 05/01/30 | | | | EUR | | | | 580 | | | | 617,495 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | 1,450,550 | |

| | | | | |

Pipelines 0.2% | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Venture Global LNG, Inc., | | | | | | | | | | | | | | | | | | | | |

Jr. Sub. Notes, 144A | | | 9.000(ff) | | | | 09/30/29(oo) | | | | 260 | | | | 271,898 | |

| | | | | |

Real Estate 0.5% | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Howard Hughes Corp. (The), | | | | | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A(v) | | | 4.125 | | | | 02/01/29 | | | | | | | | 575 | | | | 530,604 | |

| | | | | |

Real Estate Investment Trusts (REITs) 0.5% | | | | | | | | | | | | | | | | | | | | |

| | | | | |

MPT Operating Partnership LP/MPT Finance Corp., | | | | | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 3.500 | | | | 03/15/31 | | | | | | | | 225 | | | | 142,778 | |

Gtd. Notes | | | 5.000 | | | | 10/15/27 | | | | | | | | 100 | | | | 84,515 | |

See Notes to Financial Statements.

PGIM Credit Income Fund 19

Schedule of Investments (continued)

as of December 31, 2024

| | | | | | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

| | | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Real Estate Investment Trusts (REITs) (cont’d.) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

RHP Hotel Properties LP/RHP Finance Corp., | | | | | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 6.500% | | | | 04/01/32 | | | | | | | | 190 | | | $ | 190,889 | |

Uniti Group LP/Uniti Group Finance 2019, Inc./CSL Capital LLC, | | | | | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 10.500 | | | | 02/15/28 | | | | | | | | 150 | | | | 159,894 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | 578,076 | |

| | | | | |

Retail 3.9% | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Brinker International, Inc., | | | | | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A(v) | | | 8.250 | | | | 07/15/30 | | | | | | | | 975 | | | | 1,029,379 | |

Carvana Co., | | | | | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A, Cash coupon 9.000% or PIK 12.000% | | | 9.000 | | | | 12/01/28 | | | | | | | | 86 | | | | 91,746 | |

Sr. Sec’d. Notes, 144A, Cash coupon 11.000% or PIK 13.000% | | | 13.000 | | | | 06/01/30 | | | | | | | | 275 | | | | 302,864 | |

Constellation Automotive Financing PLC (United Kingdom), | | | | | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes | | | 4.875 | | | | 07/15/27 | | | | GBP | | | | 250 | | | | 296,224 | |

eG Global Finance PLC (United Kingdom), | | | | | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes | | | 11.000 | | | | 11/30/28 | | | | EUR | | | | 1,085 | | | | 1,259,653 | |

Sr. Sec’d. Notes, 144A | | | 11.000 | | | | 11/30/28 | | | | EUR | | | | 625 | | | | 725,613 | |

Fertitta Entertainment LLC/Fertitta Entertainment Finance Co., Inc., | | | | | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A(v) | | | 4.625 | | | | 01/15/29 | | | | | | | | 625 | | | | 578,531 | |

Sally Holdings LLC/Sally Capital, Inc., | | | | | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 6.750 | | | | 03/01/32 | | | | | | | | 25 | | | | 25,049 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | 4,309,059 | |

| | | | | |

Telecommunications 3.3% | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Colombia Telecomunicaciones SA ESP (Colombia), | | | | | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 4.950 | | | | 07/17/30 | | | | | | | | 250 | | | | 207,250 | |

Eutelsat SA (France), | | | | | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | | 9.750 | | | | 04/13/29 | | | | EUR | | | | 500 | | | | 487,479 | |

Frontier Communications Holdings LLC, | | | | | | | | | | | | | | | | | | | | |

Sec’d. Notes, 144A | | | 6.750 | | | | 05/01/29 | | | | | | | | 200 | | | | 200,949 | |

Level 3 Financing, Inc., | | | | | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A(v) | | | 10.500 | | | | 05/15/30 | | | | | | | | 525 | | | | 571,598 | |

Sr. Sec’d. Notes, 144A(v) | | | 11.000 | | | | 11/15/29 | | | | | | | | 1,100 | | | | 1,238,195 | |

Lorca Telecom Bondco SA (Spain), | | | | | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 5.750 | | | | 04/30/29 | | | | EUR | | | | 100 | | | | 108,825 | |

See Notes to Financial Statements.

20

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

| | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Telecommunications (cont’d.) | | | | | | | | | | | | | | | | |

| | | | |

TalkTalk Telecom Group Ltd. (United Kingdom), | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 8.250% | | | | 09/01/27 | | | | GBP 646 | | | $ | 677,360 | |

Gtd. Notes, 144A | | | 11.750 | | | | 03/01/28 | | | | GBP 382 | | | | 135,687 | |

Windstream Services LLC/Windstream Escrow Finance Corp., | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 8.250 | | | | 10/01/31 | | | | 70 | | | | 72,288 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 3,699,631 | |

| | | | |

Transportation 2.5% | | | | | | | | | | | | | | | | |

| | | | |

GN Bondco LLC, | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A(v) | | | 9.500 | | | | 10/15/31 | | | | 1,450 | | | | 1,523,628 | |

XPO, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A(v) | | | 7.125 | | | | 02/01/32 | | | | 1,225 | | | | 1,254,271 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 2,777,899 | |

| | | | | | | | | | | | | | | | |

| | | | |

TOTAL CORPORATE BONDS

(cost $60,635,463) | | | | | | | | | | | | | | | 61,798,345 | |

| | | | | | | | | | | | | | | | |

| | | | |

FLOATING RATE AND OTHER LOANS 27.3% | | | | | | | | | | | | | | | | |

| | | | |

Aerospace & Defense 0.2% | | | | | | | | | | | | | | | | |

| | | | |

Azorra Soar TLB Finance Limited (Cayman Islands), | | | | | | | | | | | | | | | | |

Initial Term Loan, 3 Month SOFR + 3.500%^ | | | 7.859(c) | | | | 10/18/29 | | | | 249 | | | | 247,505 | |

| | | | |

Agriculture 0.3% | | | | | | | | | | | | | | | | |

| | | | |

Alltech, Inc., | | | | | | | | | | | | | | | | |

Term B Loan, 1 Month SOFR + 4.114% | | | 8.471(c) | | | | 10/13/28 | | | | 274 | | | | 275,407 | |

| | | | |

Auto Parts & Equipment 1.0% | | | | | | | | | | | | | | | | |

| | | | |

First Brands Group LLC, | | | | | | | | | | | | | | | | |

2022-Ii Incremental Term Loan, 3 Month SOFR + 5.262% | | | 9.847(c) | | | | 03/30/27 | | | | 207 | | | | 193,515 | |

Second Lien 2021 Term Loan, 3 Month SOFR + 8.762% | | | 13.347(c) | | | | 03/30/28 | | | | 500 | | | | 450,000 | |

Tenneco, Inc., | | | | | | | | | | | | | | | | |

Term A Loan, 3 Month SOFR + 4.850% | | | 9.371(c) | | | | 11/17/28 | | | | 198 | | | | 191,144 | |

Term B Loan, 3 Month SOFR + 5.100% | | | 9.525(c) | | | | 11/17/28 | | | | 250 | | | | 242,031 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 1,076,690 | |

See Notes to Financial Statements.

PGIM Credit Income Fund 21

Schedule of Investments (continued)

as of December 31, 2024

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

| | | | |

FLOATING RATE AND OTHER LOANS (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Beverages 0.2% | | | | | | | | | | | | | | | | |

| | | | |

Pegasus Bidco BV (Netherlands), | | | | | | | | | | | | | | | | |

2024-2 Dollar Term Loan, 3 Month SOFR + 3.250% | | | 7.774%(c) | | | | 07/12/29 | | | | 193 | | | $ | 193,049 | |

| | | | |

Building Materials 0.6% | | | | | | | | | | | | | | | | |

| | | | |

Emerald Debt Merger Sub LLC, | | | | | | | | | | | | | | | | |

Second Amendment Incremental Term Loan, 3 Month SOFR + 2.500% | | | 6.829(c) | | | | 08/04/31 | | | | 474 | | | | 475,293 | |

Vector WP HoldCo, Inc., | | | | | | | | | | | | | | | | |

Initial Term B Loan, 1 Month SOFR + 5.114% | | | 9.471(c) | | | | 10/12/28 | | | | 198 | | | | 196,729 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 672,022 | |

| | | | |

Chemicals 1.3% | | | | | | | | | | | | | | | | |

| | | | |

A-Ap Buyer, Inc., | | | | | | | | | | | | | | | | |

Initial Term Loan, 1 Month SOFR + 3.250% | | | 7.607(c) | | | | 09/09/31 | | | | 175 | | | | 176,021 | |

Consolidated Energy Finance SA (Switzerland), | | | | | | | | | | | | | | | | |

2024 Incremental Term Loan, 3 Month SOFR + 4.500% | | | 9.014(c) | | | | 11/15/30 | | | | 273 | | | | 264,749 | |

Geon Performance Solutions LLC, | | | | | | | | | | | | | | | | |

2024 Refinancing Term Loan, 3 Month SOFR + 4.512% | | | 8.840(c) | | | | 08/18/28 | | | | 347 | | | | 346,600 | |

Iris Holdings Ltd., | | | | | | | | | | | | | | | | |

Initial Term Loan, 3 Month SOFR + 4.850% | | | 9.435(c) | | | | 06/28/28 | | | | 212 | | | | 204,021 | |

LSF11 A5 HoldCo, LLC, | | | | | | | | | | | | | | | | |

2024 Refinancing Term Loan, 1 Month SOFR + 3.614% | | | 7.971(c) | | | | 10/15/28 | | | | 197 | | | | 198,338 | |

Nouryon Finance BV (Netherlands), | | | | | | | | | | | | | | | | |

November 2024 B-1 Dollar Term Loan, 3 Month SOFR + 3.250% | | | 7.657(c) | | | | 04/03/28 | | | | 191 | | | | 192,082 | |

Paint Intermediate III LLC, | | | | | | | | | | | | | | | | |

Paint Intermediate/Wesco Group Cov-Lite Term B Loan, 3 Month SOFR + 3.000% | | | 7.522(c) | | | | 09/11/31 | | | | 100 | | | | 100,438 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 1,482,249 | |

| | | | |

Commercial Services 2.2% | | | | | | | | | | | | | | | | |

| | | | |

Belron Finance US LLC, | | | | | | | | | | | | | | | | |

2031 Dollar Incremental Term Loan, 3 Month SOFR + 2.750% | | | 7.273(c) | | | | 10/01/31 | | | | 324 | | | | 326,889 | |

Catawba Nation Gaming Authority, | | | | | | | | | | | | | | | | |

Term B Loan, 1 Month SOFR + 4.750% | | | 9.125(c) | | | | 02/28/32 | | | | 150 | | | | 150,282 | |

See Notes to Financial Statements.

22

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

| | | | |

FLOATING RATE AND OTHER LOANS (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Commercial Services (cont’d.) | | | | | | | | | | | | | | | | |

| | | | |

CoreLogic, Inc., | | | | | | | | | | | | | | | | |

First Lien Initial Term Loan, 1 Month SOFR + 3.614% | | | 7.971%(c) | | | | 06/02/28 | | | | 266 | | | $ | 262,690 | |

Crisis Prevention Institute, Inc., | | | | | | | | | | | | | | | | |

2024 Term Loan, 1 Month SOFR + 4.000% | | | 8.428(c) | | | | 04/09/31 | | | | 200 | | | | 200,000 | |

DS Parent, Inc., | | | | | | | | | | | | | | | | |

Term B Loan, 3 Month SOFR + 5.500% | | | 9.829(c) | | | | 01/31/31 | | | | 149 | | | | 141,539 | |

Grant Thornton LLP, | | | | | | | | | | | | | | | | |

Initial Term Loan, 1 Month SOFR + 3.250% | | | 7.607(c) | | | | 06/02/31 | | | | 150 | | | | 149,500 | |

Jupiter Buyer, Inc., | | | | | | | | | | | | | | | | |

Initial Term Loan, 1 Month SOFR + 4.750% | | | 9.303(c) | | | | 10/10/31 | | | | 202 | | | | 202,796 | |

MavisTire Express Services Topco Corp., | | | | | | | | | | | | | | | | |

Term Loan, 1 Month SOFR + 3.500% | | | 7.857(c) | | | | 05/04/28 | | | | 50 | | | | 50,040 | |

Neon Maple Purchaser, Inc., | | | | | | | | | | | | | | | | |

Tranche B-1 Term Loan, 1 Month SOFR + 3.000% | | | 7.444(c) | | | | 11/17/31 | | | | 625 | | | | 625,391 | |

TruGreen LP, | | | | | | | | | | | | | | | | |

Second Refinancing Term Loan (First Lien), 1 Month SOFR + 4.100% | | | 8.457(c) | | | | 11/02/27 | | | | 202 | | | | 196,631 | |

Verde Purchaser, LLC, | | | | | | | | | | | | | | | | |

Initial Term Loan, 1 Month SOFR + 4.500% | | | 9.104(c) | | | | 11/30/30 | | | | 150 | | | | 149,858 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 2,455,616 | |

| | | | |

Computers 2.0% | | | | | | | | | | | | | | | | |

| | | | |

Fortress Intermediate, | | | | | | | | | | | | | | | | |

Initial Term Loan, 1 Month SOFR + 3.500% | | | 7.857(c) | | | | 06/27/31 | | | | 479 | | | | 480,296 | |

Indy US Bidco, LLC, | | | | | | | | | | | | | | | | |

Ninth Amend Dollar Term Loan, 1 Month SOFR + 4.750% | | | 9.107(c) | | | | 03/06/28 | | | | 207 | | | | 206,301 | |

McAfee Corp., | | | | | | | | | | | | | | | | |

Tranche B-1 Term Loan, 1 Month SOFR + 3.250% | | | 7.803(c) | | | | 03/01/29 | | | | 482 | | | | 482,474 | |

NCR Atleos Corp., | | | | | | | | | | | | | | | | |

Term B Loan, 3 Month SOFR + 3.750% | | | 8.397(c) | | | | 04/16/29 | | | | 143 | | | | 142,979 | |

Peraton Corp., | | | | | | | | | | | | | | | | |

First Lien Term B Loan, 1 Month SOFR + 3.850% | | | 8.207(c) | | | | 02/01/28 | | | | 247 | | | | 229,198 | |

Sandisk Corporation, | | | | | | | | | | | | | | | | |

Term B Loan | | | — (p) | | | | 03/31/32 | | | | 450 | | | | 443,250 | |

Synechron, Inc., | | | | | | | | | | | | | | | | |

Initial Term Loan, 1 Month SOFR + 3.750%^ | | | 8.107(c) | | | | 09/26/31 | | | | 250 | | | | 250,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 2,234,498 | |

See Notes to Financial Statements.

PGIM Credit Income Fund 23

Schedule of Investments (continued)

as of December 31, 2024

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

| | | | |

FLOATING RATE AND OTHER LOANS (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Diversified Financial Services 1.5% | | | | | | | | | | | | | | | | |

| | | | |

Blackhawk Network Holdings, Inc., | | | | | | | | | | | | | | | | |

Term B Loan, 1 Month SOFR + 5.000% | | | 9.357%(c) | | | | 03/12/29 | | | | 249 | | | $ | 251,548 | |

CPI Holdco B, LLC, | | | | | | | | | | | | | | | | |

Incremental Term B Loan | | | — (p) | | | | 05/19/31 | | | | 275 | | | | 274,484 | |

Hudson River Trading LLC, | | | | | | | | | | | | | | | | |

Term B-1 Loan, 1 Month SOFR + 3.000% | | | 7.483(c) | | | | 03/18/30 | | | | 771 | | | | 772,944 | |

Jefferies Finance LLC, | | | | | | | | | | | | | | | | |

Initial Term Loan 2024, 1 Month SOFR + 3.000% | | | 7.356(c) | | | | 10/21/31 | | | | 300 | | | | 300,938 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 1,599,914 | |

| | | | |

Education 0.2% | | | | | | | | | | | | | | | | |

| | | | |

Dukes Education Group Ltd. (United Kingdom), | | | | | | | | | | | | | | | | |

Accordion Facility, SONIA + 5.500%^ | | | 10.703(c) | | | | 11/27/28 | | | | GBP 68 | | | | 84,580 | |

Acquisition/Capex Facility 1, SONIA + 5.500%^ | | | 10.350(c) | | | | 11/27/28 | | | | GBP 61 | | | | 76,257 | |

Acquisition/Capex Facility 5, 6 Month EURIBOR + 6.500%^ | | | 6.693(c) | | | | 11/27/28 | | | | EUR 3 | | | | 4,269 | |

Facility B, SONIA + 5.500%^ | | | 10.209(c) | | | | 11/27/28 | | | | GBP 25 | | | | 31,520 | |

Term Loan, 6 Month EURIBOR + 5.500%^ | | | 8.587(c) | | | | 11/27/28 | | | | EUR 34 | | | | 35,661 | |

Term Loan, 6 Month EURIBOR + 5.500%^ | | | 8.775(c) | | | | 11/27/28 | | | | EUR 18 | | | | 18,826 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 251,113 | |

| | | | |

Electric 0.2% | | | | | | | | | | | | | | | | |

| | | | |

Discovery Energy Holding Corp., | | | | | | | | | | | | | | | | |

Initial Dollar Term Loan, 1 Month SOFR + 3.750% | | | 8.107(c) | | | | 05/01/31 | | | | 252 | | | | 251,414 | |

| | | | |

Electronics 0.4% | | | | | | | | | | | | | | | | |

| | | | |

Indicor, | | | | | | | | | | | | | | | | |

Tranche D Dollar Term Loan, 3 Month SOFR + 2.750% | | | 7.079(c) | | | | 11/22/29 | | | | 198 | | | | 198,706 | |

Ingram Micro, Inc., | | | | | | | | | | | | | | | | |

2024 Term B Loan, 3 Month SOFR + 2.750% | | | 7.077(c) | | | | 09/22/31 | | | | 240 | | | | 240,615 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 439,321 | |

See Notes to Financial Statements.

24

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

| | | | |

FLOATING RATE AND OTHER LOANS (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Engineering & Construction 0.3% | | | | | | | | | | | | | | | | |

| | | | |

Azuria Water Solutions, Inc., | | | | | | | | | | | | | | | | |

2024 Second Additional Replacement Term Loan, 1 Month SOFR + 3.750% | | | 8.107%(c) | | | | 05/17/28 | | | | 248 | | | $ | 248,868 | |

Brown Group Holding LLC, | | | | | | | | | | | | | | | | |

Initial Term Loan, 1 Month SOFR + 2.500% | | | 6.857(c) | | | | 07/01/31 | | | | 99 | | | | 99,807 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 348,675 | |

| | | | |

Entertainment 1.1% | | | | | | | | | | | | | | | | |

| | | | |

AP Gaming I LLC, | | | | | | | | | | | | | | | | |

Term B Loan, 1 Month SOFR + 3.750% | | | 8.107(c) | | | | 02/15/29 | | | | 148 | | | | 149,471 | |

Caesars Entertainment, Inc., | | | | | | | | | | | | | | | | |

Incremental Term B-1 Loan, 1 Month SOFR + 2.250% | | | 6.607(c) | | | | 02/06/31 | | | | 347 | | | | 348,330 | |

Cinemark USA, Inc., | | | | | | | | | | | | | | | | |

Term B Loan, 3 Month SOFR + 2.750% | | | 7.100(c) | | | | 05/24/30 | | | | 248 | | | | 248,493 | |

ECL Entertainment LLC, | | | | | | | | | | | | | | | | |

Term B Loan, 1 Month SOFR + 3.528% | | | 7.857(c) | | | | 08/31/30 | | | | 75 | | | | 74,998 | |

Entain PLC (United Kingdom), | | | | | | | | | | | | | | | | |

Facility B3, 3 Month SOFR + 2.750% | | | 7.079(c) | | | | 10/31/29 | | | | 348 | | | | 348,903 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 1,170,195 | |

| | | | |

Environmental Control 0.8% | | | | | | | | | | | | | | | | |

| | | | |

Action Environmental Group, Inc. (The), | | | | | | | | | | | | | | | | |

2024 Term B Loan 4th Amendment, 3 Month SOFR + 3.750%^ | | | 8.079(c) | | | | 10/24/30 | | | | 414 | | | | 416,515 | |

Term Loan, 1 Month SOFR + 4.000%^ | | | 2.471(c) | | | | 10/24/30 | | | | 6 | | | | 5,668 | |

JFL-Tiger Acquisition Co., Inc., | | | | | | | | | | | | | | | | |

Initial Term Loan, 3 Month SOFR + 4.000% | | | 8.337(c) | | | | 10/17/30 | | | | 75 | | | | 75,208 | |

Madison Iaq LLC, | | | | | | | | | | | | | | | | |

Initial Term Loan, 6 Month SOFR + 2.750% | | | 7.889(c) | | | | 06/21/28 | | | | 197 | | | | 198,148 | |

Tidal Waste & Recycling Holdings LLC, | | | | | | | | | | | | | | | | |

Term B Loan, 3 Month SOFR + 3.500% | | | 7.829(c) | | | | 10/03/31 | | | | 200 | | | | 201,126 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 896,665 | |

| | | | |

Forest Products & Paper 0.1% | | | | | | | | | | | | | | | | |

| | | | |

Magnera Corp., | | | | | | | | | | | | | | | | |

New Term Loan, 3 Month SOFR + 4.250% | | | 8.764(c) | | | | 10/31/31 | | | | 150 | | | | 150,187 | |

See Notes to Financial Statements.

PGIM Credit Income Fund 25

Schedule of Investments (continued)

as of December 31, 2024

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount (000)# | | | Value | |

| | | | | |

FLOATING RATE AND OTHER LOANS (Continued) | | | | | | | | | | | | | | | | |

| | | | | |

Hand/Machine Tools 0.5% | | | | | | | | | | | | | | | | |

| | | | | |

Alliance Laundry Systems LLC, | | | | | | | | | | | | | | | | |

Initial Term B Loan, 1 Month SOFR + 3.500% | | 7.837%(c) | | 08/19/31 | | | | | | | 350 | | | $ | 351,914 | |

Madison Safety & Flow LLC, | | | | | | | | | | | | | | | | |

Initial Term Loan, 1 Month SOFR + 3.250% | | 7.607(c) | | 09/26/31 | | | | | | | 150 | | | | 150,607 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 502,521 | |

| | | | | |

Healthcare-Services 0.5% | | | | | | | | | | | | | | | | |

| | | | | |

LifePoint Health, Inc., | | | | | | | | | | | | | | | | |

Term B Loan, 3 Month SOFR + 3.750% | | 8.406(c) | | 05/16/31 | | | | | | | 249 | | | | 250,061 | |

Phoenix Guarantor Inc, | | | | | | | | | | | | | | | | |

Tranche B5 Term Loan, 1 Month SOFR + 2.500% | | 6.857(c) | | 02/21/31 | | | | | | | 248 | | | | 248,709 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 498,770 | |

| | | | | |

Holding Companies-Diversified 0.5% | | | | | | | | | | | | | | | | |

| | | | | |

Belfor Holdings, Inc., | | | | | | | | | | | | | | | | |

Initial Tranche B-1 Term Loan, 1 Month SOFR + 3.750%^ | | 8.107(c) | | 11/01/30 | | | | | | | 256 | | | | 258,800 | |

Clue OpCo LLC, | | | | | | | | | | | | | | | | |

Term B Loan, 3 Month SOFR + 4.500% | | 9.085(c) | | 12/19/30 | | | | | | | 314 | | | | 315,476 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 574,276 | |

| | | | | |

Home Furnishings 0.2% | | | | | | | | | | | | | | | | |

| | | | | |

TGP Holdings III LLC, | | | | | | | | | | | | | | | | |

First Lien Closing Date Term Loan, PRIME + 3.350% | | 7.707(c) | | 06/29/28 | | | | | | | 250 | | | | 242,818 | |

| | | | | |

Household Products/Wares 0.2% | | | | | | | | | | | | | | | | |

| | | | | |

Kronos Acquisition Holdings, Inc. (Canada), | | | | | | | | | | | | | | | | |

2024 Initial Loan, 3 Month SOFR + 4.000% | | 8.584(c) | | 07/08/31 | | | | | | | 198 | | | | 186,165 | |

| | | | | |

Insurance 0.7% | | | | | | | | | | | | | | | | |

| | | | | |

Acrisure LLC, | | | | | | | | | | | | | | | | |

2024 Repricing Term B-6 Loan, 1 Month SOFR + 3.000% | | 7.357(c) | | 11/06/30 | | | | | | | 273 | | | | 272,777 | |

Assured Partners, Inc., | | | | | | | | | | | | | | | | |

2024 Term Loan, 1 Month SOFR + 3.500% | | 7.857(c) | | 02/14/31 | | | | | | | 267 | | | | 267,068 | |

Asurion LLC, | | | | | | | | | | | | | | | | |

New B-11 Term Loan, 1 Month SOFR + 4.350% | | 8.707(c) | | 08/21/28 | | | | | | | 197 | | | | 197,549 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 737,394 | |

See Notes to Financial Statements.

26

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount (000)# | | | Value | |

| | | | | |

FLOATING RATE AND OTHER LOANS (Continued) | | | | | | | | | | | | | | | | |

| | | | | |

Internet 0.2% | | | | | | | | | | | | | | | | |

| | | | | |

MH Sub I LLC, | | | | | | | | | | | | | | | | |

2023 May New Term Loan, 1 Month SOFR + 4.250% | | 8.823%(c) | | 05/03/28 | | | | | | | 262 | | | $ | 262,453 | |

| | | | | |

Investment Companies 1.5% | | | | | | | | | | | | | | | | |

| | | | | |

AAL Delaware Holdco, Inc., | | | | | | | | | | | | | | | | |

Initial Term Loan, 1 Month SOFR + 3.500% | | 7.857(c) | | 07/30/31 | | | | | | | 100 | | | | 100,374 | |

Hurricane CleanCo Ltd. (United Kingdom), | | | | | | | | | | | | | | | | |

Facility A, 3 Month LIBOR + 6.250% (Cap N/A, Floor 0.000%)^ | | 6.250(c) | | 10/31/29 | | | | | | | 1,260 | | | | 1,577,375 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 1,677,749 | |

| | | | | |

Leisure Time 0.6% | | | | | | | | | | | | | | | | |

| | | | | |

International Park Holdings BV (Netherlands), | | | | | | | | | | | | | | | | |

Term Loan^ | | — (p) | | 12/31/31 | | | | | | | 500 | | | | 507,566 | |

Recess Holdings, Inc., | | | | | | | | | | | | | | | | |

Initial Term Loan, 3 Month SOFR + 4.500% | | 9.085(c) | | 02/21/30 | | | | | | | 149 | | | | 150,240 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 657,806 | |

| | | | | |

Lodging 0.2% | | | | | | | | | | | | | | | | |

| | | | | |

Travel Leisure Co, | | | | | | | | | | | | | | | | |

Term B Loan, 3 Month SOFR + 2.500% | | 6.927(c) | | 12/14/29 | | | | | | | 200 | | | | 200,500 | |

| | | | | |

Machinery-Diversified 0.9% | | | | | | | | | | | | | | | | |

| | | | | |

Hyster-Yale Group, Inc., | | | | | | | | | | | | | | | | |

Term B Loan Facility, 1 Month SOFR + 3.614% | | 7.971(c) | | 05/26/28 | | | | | | | 346 | | | | 345,977 | |

Innio Group Holding GmbH., | | | | | | | | | | | | | | | | |

Amended Facility B (USD), 3 Month SOFR + 3.250% | | 7.897(c) | | 11/02/28 | | | | | | | 124 | | | | 124,528 | |

TK Elevator US Newco, Inc. (Germany), | | | | | | | | | | | | | | | | |

Facility B2 (USD), 6 Month SOFR + 3.500% | | 8.588(c) | | 04/30/30 | | | | | | | 519 | | | | 522,462 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 992,967 | |

| | | | | |

Media 1.0% | | | | | | | | | | | | | | | | |

| | | | | |

Altice Financing SA (Luxembourg), | | | | | | | | | | | | | | | | |

2022 Dollar Loan, 3 Month SOFR + 5.000% | | 9.656(c) | | 10/31/27 | | | | | | | 248 | | | | 210,063 | |

CSC Holdings LLC, | | | | | | | | | | | | | | | | |

2022 Refinancing Term Loan, 1 Month SOFR + 4.500% | | 8.897(c) | | 01/18/28 | | | | | | | 247 | | | | 241,758 | |

See Notes to Financial Statements.

PGIM Credit Income Fund 27

Schedule of Investments (continued)

as of December 31, 2024

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount (000)# | | | Value | |

| | | | | |

FLOATING RATE AND OTHER LOANS (Continued) | | | | | | | | | | | | | | | | |

| | | | | |

Media (cont’d.) | | | | | | | | | | | | | | | | |

| | | | | |

Univision Communications, Inc., | | | | | | | | | | | | | | | | |

2022 Incremental First-Lien Term Loan, 3 Month SOFR + 4.250% | | 8.579%(c) | | 06/24/29 | | | | | | | 193 | | | $ | 193,094 | |

2024 Replacement First-Lien Term Loan, 1 Month SOFR + 3.614% | | 7.972(c) | | 01/31/29 | | | | | | | 398 | | | | 398,746 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 1,043,661 | |

| | | | | |

Metal Fabricate/Hardware 1.0% | | | | | | | | | | | | | | | | |

| | | | | |

Crosby US Acquisition Corp, | | | | | | | | | | | | | | | | |

Amendment No. 4 Replacement Term Loan, 1 Month SOFR + 3.500% | | 7.857(c) | | 08/16/29 | | | | | | | 297 | | | | 299,553 | |

Doncasters US Finance LLC (United Kingdom), | | | | | | | | | | | | | | | | |

Initial Term Loan, 3 Month SOFR + 6.500%^ | | 10.829(c) | | 04/23/30 | | | | | | | 268 | | | | 265,295 | |

Grinding Media, Inc., | | | | | | | | | | | | | | | | |

2024 Term B Loan, 3 Month SOFR + 3.500% | | 8.021(c) | | 10/12/28 | | | | | | | 299 | | | | 299,998 | |

Trulite Glass & Aluminum Solutions LLC, | | | | | | | | | | | | | | | | |

Initial Term Loan, 3 Month SOFR + 6.000%^ | | 10.604(c) | | 03/01/30 | | | | | | | 221 | | | | 220,230 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 1,085,076 | |

| | | | | |

Mining 0.2% | | | | | | | | | | | | | | | | |

| | | | | |

Arsenal Aic Parent LLC, | | | | | | | | | | | | | | | | |

2024 Term B Loan, 1 Month SOFR + 3.250% | | 7.607(c) | | 08/18/30 | | | | | | | 267 | | | | 268,742 | |

| | | | | |

Miscellaneous Manufacturing 0.2% | | | | | | | | | | | | | | | | |

| | | | | |

AMG Advanced Metallurgical Group NV (Netherlands), | | | | | | | | | | | | | | | | |

2021 Term Loan, 1 Month SOFR + 3.614% | | 7.971(c) | | 11/30/28 | | | | | | | 248 | | | | 247,307 | |

| | | | | |

Oil & Gas 0.2% | | | | | | | | | | | | | | | | |

| | | | | |

Apro LLC, | | | | | | | | | | | | | | | | |

Initial Term Loan, 3 Month SOFR + 3.750% | | 8.272(c) | | 07/09/31 | | | | | | | 200 | | | | 201,079 | |

| | | | | |

Oil & Gas Services 0.1% | | | | | | | | | | | | | | | | |

| | | | | |

MRC Global (US) Inc., | | | | | | | | | | | | | | | | |

Term Loan, 6 Month SOFR + 3.500%^ | | 7.931(c) | | 10/24/31 | | | | | | | 100 | | | | 100,000 | |

| | | | | |

Packaging & Containers 0.4% | | | | | | | | | | | | | | | | |

| | | | | |

Closure Systems International Group, | | | | | | | | | | | | | | | | |

Amendment No. 5 Term Loan, 1 Month SOFR + 3.500% | | 7.857(c) | | 03/22/29 | | | | | | | 75 | | | | 75,325 | |

See Notes to Financial Statements.

28