closing of the Transaction and would remain effective for two years from the date of its execution and thereafter from year-to-year if approved at least annually by (a) the vote of the Board or a majority of the outstanding voting securities of the Company and (b) the vote of a majority of the Independent Trustees.

Pursuant to the terms of the Transaction Agreement, the approval by the shareholders of the Company of the New Investment Advisory Agreement is a condition to the closing of the Transaction, and therefore if the Company’s shareholders do not approve the New Investment Advisory Agreement, the affiliates of HPS and BlackRock that are parties to the Transaction Agreement may choose not to close the Transaction, and the Transaction will not close unless such closing condition is waived. If such closing condition is waived and the Transaction is consummated without the Company’s shareholders approving the New Investment Advisory Agreement, the Current Investment Advisory Agreement with the Adviser will remain in effect until the Transaction is consummated and, following the consummation of the Transaction, the Board may be required to approve a temporary investment advisory agreement in accordance with the 1940 Act. If the Transaction does not occur, the Adviser will continue to manage the Company pursuant to the Current Investment Advisory Agreement.

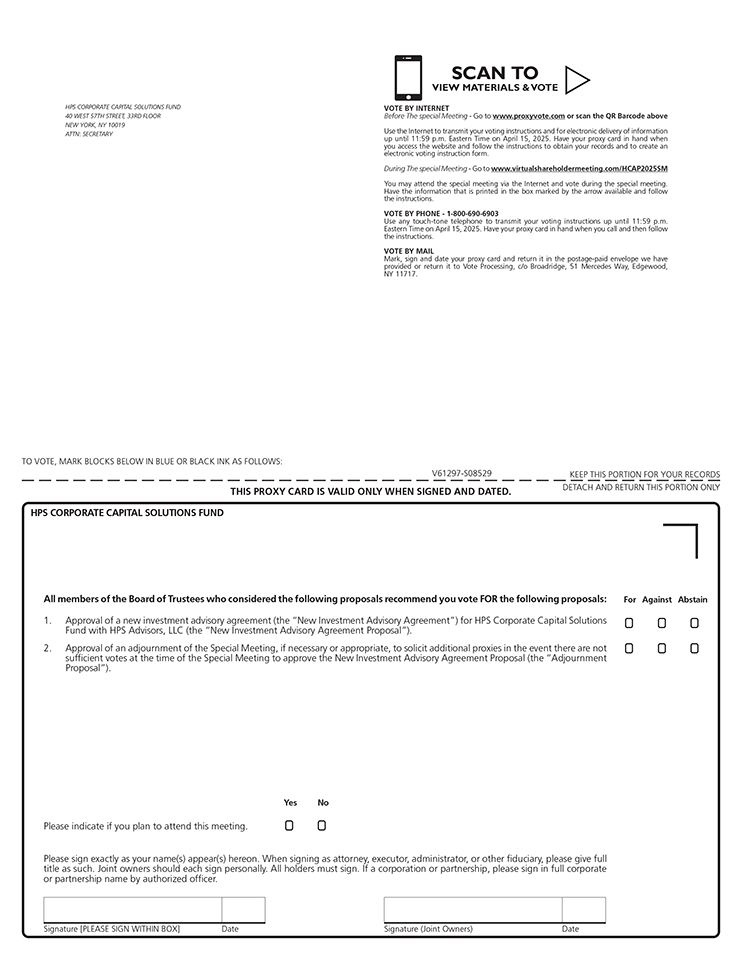

At the Special Meeting, the shareholders of the Company will be asked to (i) approve the New Investment Advisory Agreement between the Company and the Adviser, that will replace the Current Investment Advisory Agreement with the Adviser and will become effective at the closing of the Transaction and (ii) approve the adjournment of the Special Meeting, if necessary or appropriate, to solicit additional proxies.

THE SIX (6) TRUSTEES, INCLUDING THREE (3) TRUSTEES WHO ARE INDEPENDENT TRUSTEES, PRESENT AT THE BOARD MEETING TO CONSIDER THE APPROVAL OF THE NEW INVESTMENT ADVISORY AGREEMENT UNANIMOUSLY DETERMINED THAT ENTERING INTO THE NEW INVESTMENT ADVISORY AGREEMENT IS IN THE BEST INTERESTS OF THE COMPANY AND ITS SHAREHOLDERS, AND UNANIMOUSLY APPROVED THE NEW INVESTMENT ADVISORY AGREEMENT, AND THEREFORE RECOMMEND A VOTE “FOR” THE NEW INVESTMENT ADVISORY AGREEMENT PROPOSAL, AND “FOR” THE ADJOURNMENT PROPOSAL, AS DESCRIBED IN THE ACCOMPANYING PROXY STATEMENT.

Enclosed is a copy of the proxy statement and proxy card. The close of business on February 7, 2025 has been fixed as the record date for the determination of holders of Common Shares, entitled to notice of, and to vote at, the Special Meeting or at any adjournment or postponement thereof. The enclosed voting materials allow you to vote your shares without attending the Special Meeting virtually.

If your shares are held in “street name”, the broker, bank, trustee, nominee or other intermediary that holds your shares has the authority to vote them, absent your approval, only as to routine matters, of which there are none at the Special Meeting. As a result, for all matters to be voted on at the Special Meeting, the broker, bank, trustee, nominee or other intermediary that holds your shares will need to obtain your authorization to vote those shares, and they will vote your shares as you direct. If you fail to provide voting instructions to your broker, bank, trustee, nominee or other intermediary, those uninstructed shares held by the broker, bank, trustee, nominee or other intermediary will not be voted. Accordingly, such uninstructed shares will not be counted as voted for the New Investment Advisory Agreement Proposal, and will not contribute to the affirmative vote required for the approval of the New Investment Advisory Agreement Proposal. Uninstructed shares will not be counted as a vote cast either “for” or “against” the Adjournment Proposal. You can vote by completing the enclosed proxy card and returning it in the enclosed U.S. postage-prepaid envelope. If you want to vote your shares electronically via the live webcast at the Special Meeting, you must obtain a valid proxy from your broker, bank, trustee, nominee or other intermediary. Additionally, the availability of telephone or Internet voting depends on the voting process used by the broker, bank, trustee, nominee or other intermediary that holds your shares.

Your vote and participation in the governance of the Company is extremely important to us. Whether or not you plan to attend the Special Meeting virtually, we urge you to please follow the instructions on the enclosed

ii