UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-23893)

SP Funds Trust

(Exact name of registrant as specified in charter)

1331 S. International Parkway, Suite 2291

Lake Mary, FL 32746

(Address of principal executive offices) (Zip code)

The Corporate Trust Company

Corporation Trust Center

1209 Orange Street

Wilmington, DE 19801

(Name and address of agent for service)

With a Copy to:

Deborah Bielicke Eades

Vedder Price P.C.

222 North LaSalle Street

Chicago, Illinois 60601

(321) 275-5125

Registrant’s telephone number, including area code

Date of fiscal year end: October 31

Date of reporting period: October 31, 2024

Item 1. Reports to Stockholders.

SP Funds 2030 Target Date Fund Tailored Shareholder Report

annual Shareholder Report October 31, 2024 SP Funds 2030 Target Date Fund Ticker: SPTAX - Investor Shares |

This annual shareholder report contains important information about the SP Funds 2030 Target Date Fund (the "Fund") for the period June 28, 2024 to October 31, 2024. You can find additional information about the Fund at www.sp-funds.com. You can also request this information by contacting us at (425) 409‑9500 or by contacting the Fund at ShariaPortfolio, 1331 S. International Pkwy Ste 2291, Lake Mary, FL 32746.

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

SP Funds 2030 Target Date Fund - Investor Shares | $29 | 0.85% |

Cumulative Performance

(Initial Investment of $10,000)

Date | SP Funds 2030 Target Date Fund (Investor Shares) - $9,880 | Dow Jones Target 2030 Index - $10,380 |

6/28/2024 | 10000 | 10000 |

7/31/2024 | 9885 | 10204 |

8/31/2024 | 9970 | 10357 |

9/30/2024 | 10050 | 10517 |

10/31/2024 | 9880 | 10380 |

Annual Performance

Annualized Returns for the Periods Ended October 31, 2024 | Since Inception (6/28/2024) |

|---|

SP Funds 2030 Target Date Fund - Investor Shares | -1.20% |

Dow Jones Target 2030 Index | 3.80% |

The Fund's past performance is not a good indicator of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Visit www.sp-funds.com for more recent performance information.

Fund Performance Overview

For the period ending October 31, 2024, the SP Funds 2030 Target Date ETF sought a high level of total return in line with its target date of 2030. The fund’s performance was primarily driven by its diversified allocation across global equities and fixed income, adjusting its risk exposure as it approaches the target date. Despite volatility in global markets due to rising interest rates and inflation concerns, the fund maintained steady performance with a focus on long-term growth, benefiting from the strong performance of equities in technology and consumer sectors.

Factors Influencing Performance

The performance of the fund was influenced by the broad market dynamics, including macroeconomic factors such as higher interest rates and persistent inflation, which impacted bond prices. The fund's equity portion benefitted from strong performance in select growth sectors, while its bond exposure faced headwinds due to the rising interest rate environment. As the fund’s target date approaches, the asset allocation gradually shifted toward more conservative investments to reduce volatility, which helped cushion the impact of market fluctuations.

SP Funds 2030 Target Date Fund Tailored Shareholder Report

SP Funds 2030 Target Date Fund Tailored Shareholder Report

Key Fund Statistics

(as of October 31, 2024)

| |

|---|

Fund Size (Thousands) | $2,186 |

Number of Holdings | 6 |

Total Advisory Fee Paid | $2,464 |

Annual Portfolio Turnover | 13% |

What did the Fund invest in?

(as of October 31, 2024)

Sector Breakdown

(% of net assets)

Sector | % |

Exchange Traded Funds | 0.908 |

Cash & Cash Equivalents | 0.092 |

Percentages are based on total net assets. Cash & Cash Equivalents represents other assets in excess of liabilities.

Top Holdings | (% of net assets) |

|---|

SP Funds Dow Jones Global Sukuk ETF | 41.7 |

SP Funds S&P 500 Sharia Industry Exclusions ETF | 23.4 |

SP Funds S&P Global REIT Sharia ETF | 9.4 |

SP Funds S&P Global Technology ETF | 9.2 |

SP Funds S&P World (ex-US) ETF | 4.6 |

SPDR Gold Shares | 2.5 |

How has the Fund changed?

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants.

Householding

Householding is an option available to certain investors of the Fund. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Householding for the Fund is available through certain broker-dealers. If you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents, please contact your broker-dealer. If you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, visit www.sp-funds.com .

SP Funds 2030 Target Date Fund Tailored Shareholder Report

SP Funds 2030 Target Date Fund Tailored Shareholder Report

annual Shareholder Report October 31, 2024 SP Funds 2030 Target Date Fund Ticker: SPTMX - Institutional Shares |

This annual shareholder report contains important information about the SP Funds 2030 Target Date Fund (the "Fund") for the period August 29, 2024 to October 31, 2024. You can find additional information about the Fund at www.sp-funds.com. You can also request this information by contacting us at (425) 409‑9500 or by contacting the Fund at ShariaPortfolio, 1331 S. International Pkwy Ste 2291, Lake Mary, FL 32746.

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

SP Funds 2030 Target Date Fund - Institutional Shares | $45 | 0.45% |

Cumulative Performance

(Initial Investment of $10,000)

Date | SP Funds 2030 Target Date Fund (Institutional Shares) - $9,920 | Dow Jones Target 2030 Index - $10,043 |

8/29/2024 | 10000 | 10000 |

8/31/2024 | 9995 | 10021 |

9/30/2024 | 10085 | 10176 |

10/31/2024 | 9920 | 10043 |

Annual Performance

Annualized Returns for the Periods Ended October 31, 2024 | Since Inception (8/29/2024) |

|---|

SP Funds 2030 Target Date Fund - Institutional Shares | -0.80% |

Dow Jones Target 2030 Index | 0.43% |

The Fund's past performance is not a good indicator of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Visit www.sp-funds.com for more recent performance information.

Fund Performance Overview

For the period ending October 31, 2024, the SP Funds 2030 Target Date ETF sought a high level of total return in line with its target date of 2030. The fund’s performance was primarily driven by its diversified allocation across global equities and fixed income, adjusting its risk exposure as it approaches the target date. Despite volatility in global markets due to rising interest rates and inflation concerns, the fund maintained steady performance with a focus on long-term growth, benefiting from the strong performance of equities in technology and consumer sectors.

Factors Influencing Performance

The performance of the fund was influenced by the broad market dynamics, including macroeconomic factors such as higher interest rates and persistent inflation, which impacted bond prices. The fund's equity portion benefitted from strong performance in select growth sectors, while its bond exposure faced headwinds due to the rising interest rate environment. As the fund’s target date approaches, the asset allocation gradually shifted toward more conservative investments to reduce volatility, which helped cushion the impact of market fluctuations.

SP Funds 2030 Target Date Fund Tailored Shareholder Report

SP Funds 2030 Target Date Fund Tailored Shareholder Report

Key Fund Statistics

(as of October 31, 2024)

| |

|---|

Fund Size (Thousands) | $1,526 |

Number of Holdings | 6 |

Total Advisory Fee Paid | $2,464 |

Annual Portfolio Turnover | 13% |

What did the Fund invest in?

(as of October 31, 2024)

Sector Breakdown

(% of net assets)

Sector | % |

Exchange Traded Funds | 0.908 |

Cash & Cash Equivalents | 0.092 |

Percentages are based on total net assets. Cash & Cash Equivalents represents other assets in excess of liabilities.

Top Holdings | (% of net assets) |

|---|

SP Funds Dow Jones Global Sukuk ETF | 41.7 |

SP Funds S&P 500 Sharia Industry Exclusions ETF | 23.4 |

SP Funds S&P Global REIT Sharia ETF | 9.4 |

SP Funds S&P Global Technology ETF | 9.2 |

SP Funds S&P World (ex-US) ETF | 4.6 |

SPDR Gold Shares | 2.5 |

How has the Fund changed?

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants.

Householding

Householding is an option available to certain investors of the Fund. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Householding for the Fund is available through certain broker-dealers. If you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents, please contact your broker-dealer. If you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, visit www.sp-funds.com .

SP Funds 2030 Target Date Fund Tailored Shareholder Report

SP Funds 2040 Target Date Fund Tailored Shareholder Report

annual Shareholder Report October 31, 2024 SP Funds 2040 Target Date Fund Ticker: SPTBX - Investor Shares |

This annual shareholder report contains important information about the SP Funds 2040 Target Date Fund (the "Fund") for the period June 28, 2024 to October 31, 2024. You can find additional information about the Fund at www.sp-funds.com. You can also request this information by contacting us at (425) 409‑9500 or by contacting the Fund at ShariaPortfolio, 1331 S. International Pkwy Ste 2291, Lake Mary, FL 32746.

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

SP Funds 2040 Target Date Fund - Investor Shares | $29 | 0.85% |

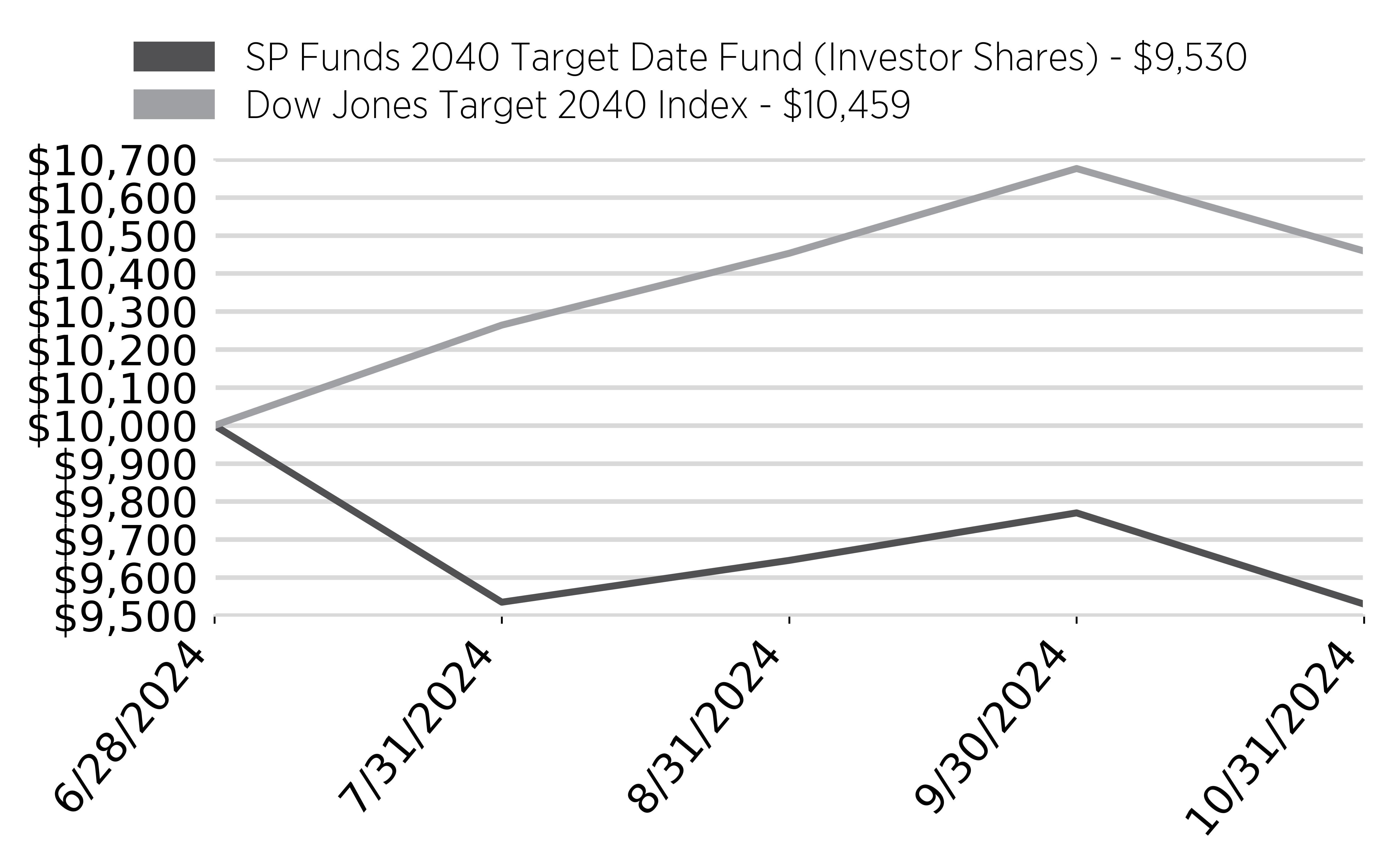

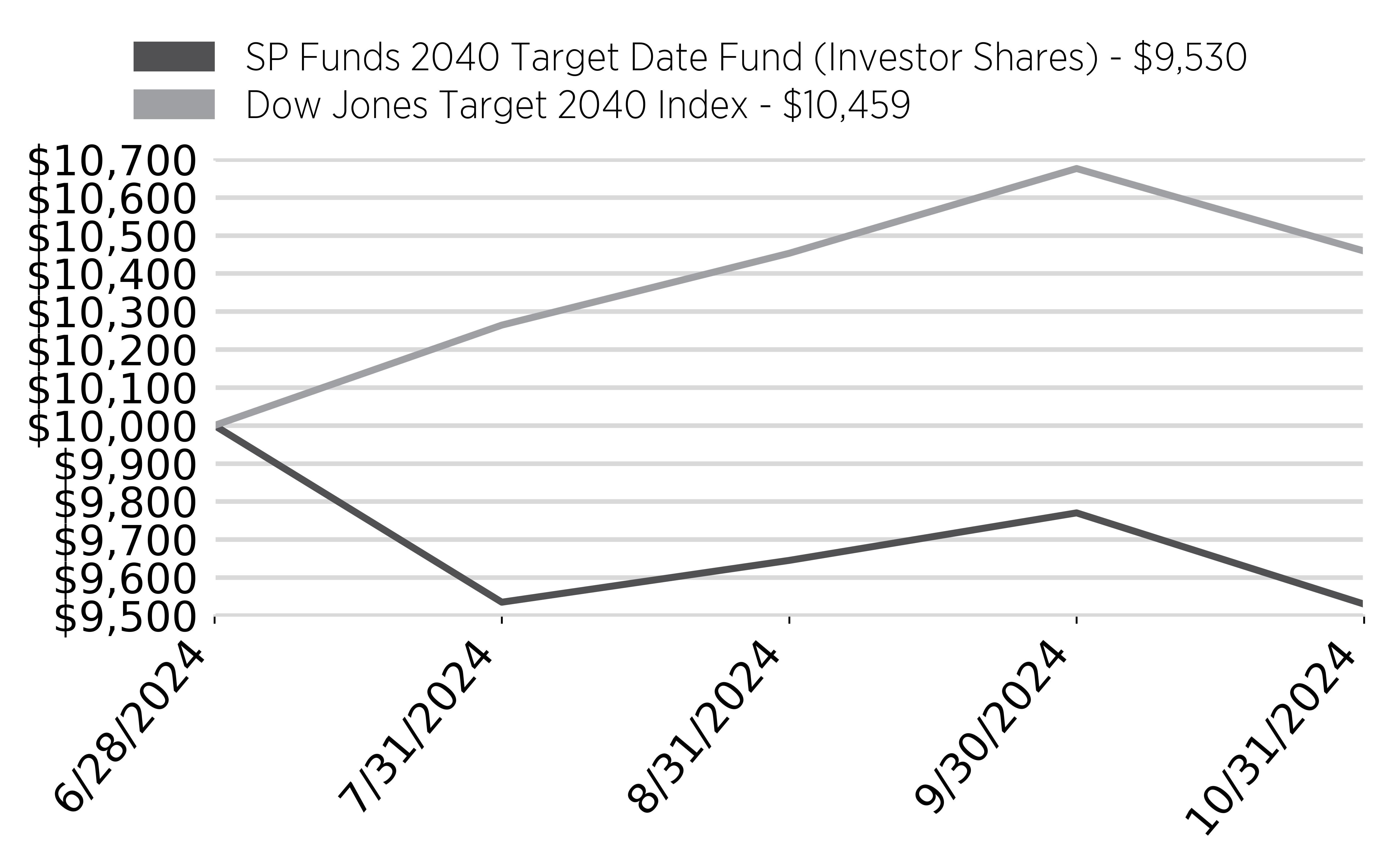

Cumulative Performance

(Initial Investment of $10,000)

Date | SP Funds 2040 Target Date Fund (Investor Shares) - $9,530 | Dow Jones Target 2040 Index - $10,459 |

6/28/2024 | 10000 | 10000 |

7/31/2024 | 9535 | 10264 |

8/31/2024 | 9645 | 10453 |

9/30/2024 | 9770 | 10676 |

10/31/2024 | 9530 | 10459 |

Annual Performance

Annualized Returns for the Periods Ended October 31, 2024 | Since Inception (6/28/2024) |

|---|

SP Funds 2040 Target Date Fund - Investor Shares | -4.70% |

Dow Jones Target 2040 Index | 4.39% |

The Fund's past performance is not a good indicator of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Visit www.sp-funds.com for more recent performance information.

Fund Performance Overview

For the period ending October 31, 2024, the SP Funds 2040 Target Date ETF pursued its goal of high total return through its 2040 target date. The fund’s performance was influenced by global equity market trends, including robust growth in technology and healthcare sectors, which positively contributed to its overall returns. However, challenges such as inflationary pressures, rising interest rates, and geopolitical uncertainties created periods of volatility. The fund’s diversified portfolio balanced equities with fixed-income assets to manage risk while seeking long-term growth.

Factors Influencing Performance

Performance was impacted by a mix of strong returns from global equity markets, particularly in developed markets, and the challenges presented by the global economic landscape, including rising interest rates and inflation. The equity portion of the fund saw growth in technology and healthcare, while the fixed-income allocation faced headwinds as bond yields rose. The fund's asset allocation continued to shift toward more conservative investments, mitigating some of the risks associated with the more volatile equity markets. The strategic shift aimed to manage risk as the fund moves closer to its 2040 target date.

SP Funds 2040 Target Date Fund Tailored Shareholder Report

SP Funds 2040 Target Date Fund Tailored Shareholder Report

Key Fund Statistics

(as of October 31, 2024)

| |

|---|

Fund Size (Thousands) | $1,087 |

Number of Holdings | 5 |

Total Advisory Fee Paid | $976 |

Annual Portfolio Turnover | 0% |

What did the Fund invest in?

(as of October 31, 2024)

Sector Breakdown

(% of net assets)

Sector | % |

Exchange Traded Funds | 0.958 |

Cash & Cash Equivalents | 0.042 |

Percentages are based on total net assets. Cash & Cash Equivalents represents other assets in excess of liabilities.

Top Holdings | (% of net assets) |

|---|

SP Funds S&P 500 Sharia Industry Exclusions ETF | 39.0 |

SP Funds S&P Global Technology ETF | 37.3 |

SP Funds S&P World (ex-US) ETF | 9.7 |

SP Funds Dow Jones Global Sukuk ETF | 5.0 |

SP Funds S&P Global REIT Sharia ETF | 4.9 |

How has the Fund changed?

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants.

Householding

Householding is an option available to certain investors of the Fund. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Householding for the Fund is available through certain broker-dealers. If you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents, please contact your broker-dealer. If you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, visit www.sp-funds.com .

SP Funds 2040 Target Date Fund Tailored Shareholder Report

SP Funds 2040 Target Date Fund Tailored Shareholder Report

annual Shareholder Report October 31, 2024 SP Funds 2040 Target Date Fund Ticker: SPTNX - Institutional Shares |

This annual shareholder report contains important information about the SP Funds 2040 Target Date Fund (the "Fund") for the period August 29, 2024 to October 31, 2024. You can find additional information about the Fund at www.sp-funds.com. You can also request this information by contacting us at (425) 409‑9500 or by contacting the Fund at ShariaPortfolio, 1331 S. International Pkwy Ste 2291, Lake Mary, FL 32746.

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

SP Funds 2040 Target Date Fund - Institutional Shares | $8 | 0.45% |

Cumulative Performance

(Initial Investment of $10,000)

Date | SP Funds 2040 Target Date Fund (Institutional Shares) - $9,907 | Dow Jones Target 2040 Index - $10,041 |

8/29/2024 | 10000 | 10000 |

8/31/2024 | 10021 | 10036 |

9/30/2024 | 10156 | 10249 |

10/31/2024 | 9907 | 10041 |

Annual Performance

Annualized Returns for the Periods Ended October 31, 2024 | Since Inception (8/29/2024) |

|---|

SP Funds 2040 Target Date Fund - Institutional Shares | -0.93% |

Dow Jones Target 2040 Index | 0.41% |

The Fund's past performance is not a good indicator of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Visit www.sp-funds.com for more recent performance information.

Fund Performance Overview

For the period ending October 31, 2024, the SP Funds 2040 Target Date ETF pursued its goal of high total return through its 2040 target date. The fund’s performance was influenced by global equity market trends, including robust growth in technology and healthcare sectors, which positively contributed to its overall returns. However, challenges such as inflationary pressures, rising interest rates, and geopolitical uncertainties created periods of volatility. The fund’s diversified portfolio balanced equities with fixed-income assets to manage risk while seeking long-term growth.

Factors Influencing Performance

Performance was impacted by a mix of strong returns from global equity markets, particularly in developed markets, and the challenges presented by the global economic landscape, including rising interest rates and inflation. The equity portion of the fund saw growth in technology and healthcare, while the fixed-income allocation faced headwinds as bond yields rose. The fund's asset allocation continued to shift toward more conservative investments, mitigating some of the risks associated with the more volatile equity markets. The strategic shift aimed to manage risk as the fund moves closer to its 2040 target date.

SP Funds 2040 Target Date Fund Tailored Shareholder Report

SP Funds 2040 Target Date Fund Tailored Shareholder Report

Key Fund Statistics

(as of October 31, 2024)

| |

|---|

Fund Size (Thousands) | $459 |

Number of Holdings | 5 |

Total Advisory Fee Paid | $976 |

Annual Portfolio Turnover | 0% |

What did the Fund invest in?

(as of October 31, 2024)

Sector Breakdown

(% of net assets)

Sector | % |

Exchange Traded Funds | 0.958 |

Cash & Cash Equivalents | 0.042 |

Percentages are based on total net assets. Cash & Cash Equivalents represents other assets in excess of liabilities.

Top Holdings | (% of net assets) |

|---|

SP Funds S&P 500 Sharia Industry Exclusions ETF | 39.0 |

SP Funds S&P Global Technology ETF | 37.3 |

SP Funds S&P World (ex-US) ETF | 9.7 |

SP Funds Dow Jones Global Sukuk ETF | 5.0 |

SP Funds S&P Global REIT Sharia ETF | 4.9 |

How has the Fund changed?

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants.

Householding

Householding is an option available to certain investors of the Fund. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Householding for the Fund is available through certain broker-dealers. If you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents, please contact your broker-dealer. If you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, visit www.sp-funds.com .

SP Funds 2040 Target Date Fund Tailored Shareholder Report

SP Funds 2050 Target Date Fund Tailored Shareholder Report

annual Shareholder Report October 31, 2024 SP Funds 2050 Target Date Fund Ticker: SPTCX - Investor Shares |

This annual shareholder report contains important information about the SP Funds 2050 Target Date Fund (the "Fund") for the period June 28, 2024 to October 31, 2024. You can find additional information about the Fund at www.sp-funds.com. You can also request this information by contacting us at (425) 409‑9500 or by contacting the Fund at ShariaPortfolio, 1331 S. International Pkwy Ste 2291, Lake Mary, FL 32746.

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

SP Funds 2050 Target Date Fund - Investor Shares | $28 | 0.85% |

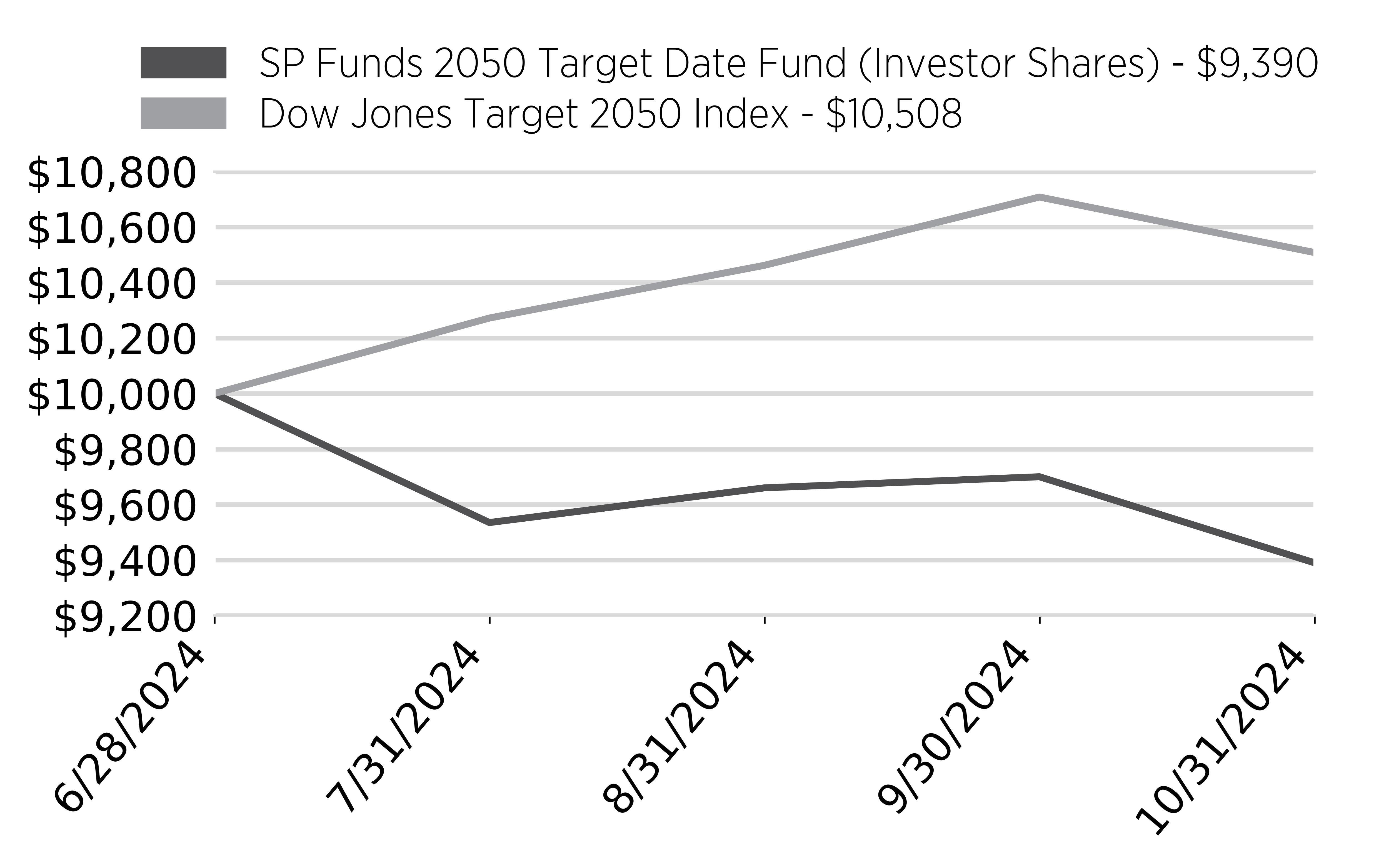

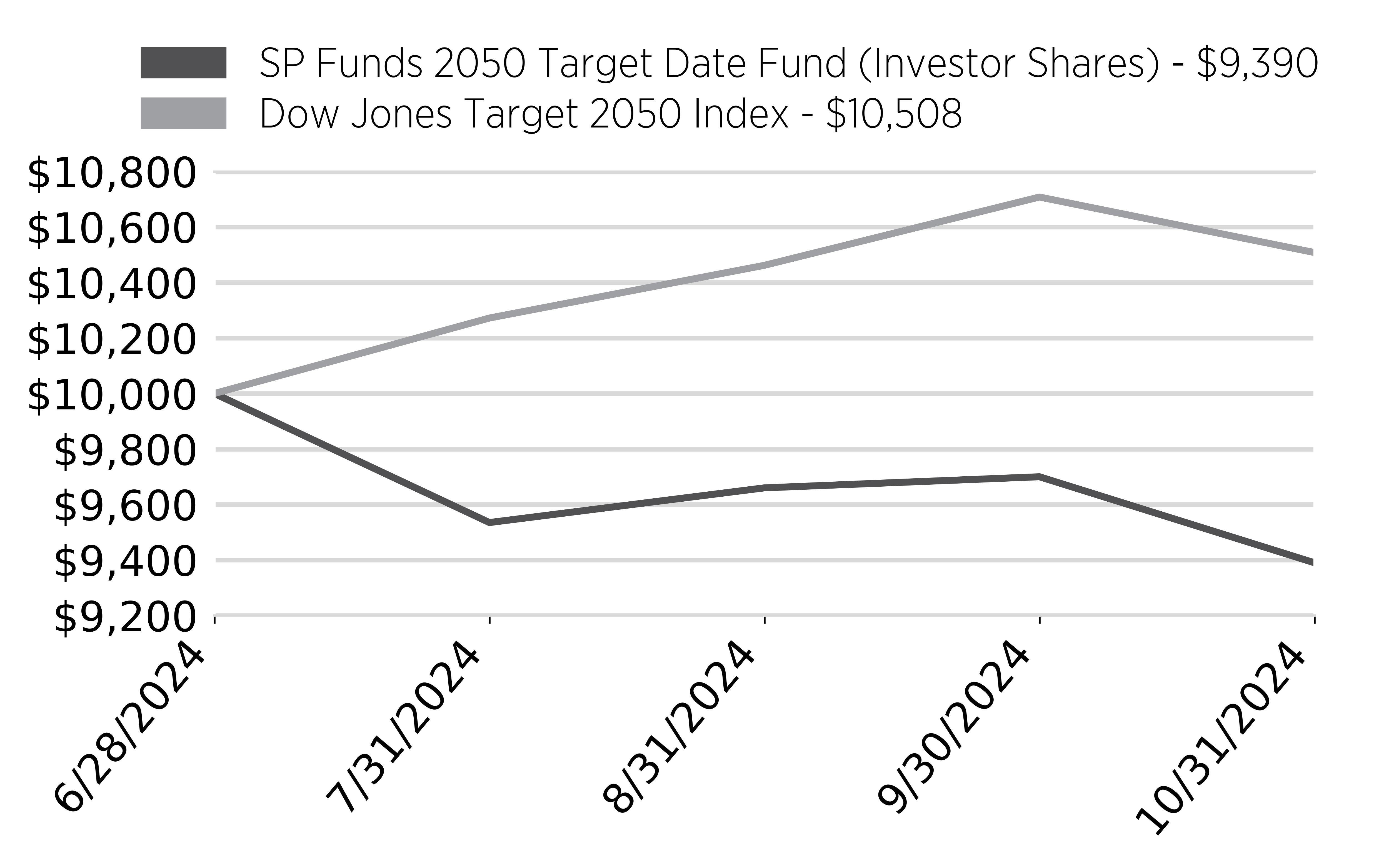

Cumulative Performance

(Initial Investment of $10,000)

Date | SP Funds 2050 Target Date Fund (Investor Shares) - $9,390 | Dow Jones Target 2050 Index - $10,508 |

6/28/2024 | 10000 | 10000 |

7/31/2024 | 9535 | 10272 |

8/31/2024 | 9660 | 10462 |

9/30/2024 | 9700 | 10708 |

10/31/2024 | 9390 | 10508 |

Annual Performance

Annualized Returns for the Periods Ended October 31, 2024 | Since Inception (6/28/2024) |

|---|

SP Funds 2050 Target Date Fund - Investor Shares | -6.10% |

Dow Jones Target 2050 Index | 4.83% |

The Fund's past performance is not a good indicator of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Visit www.sp-funds.com for more recent performance information.

Fund Performance Overview

For the period ending October 31, 2024, the SP Funds 2050 Target Date ETF focused on achieving high total returns in line with its 2050 target date. The fund’s performance was characterized by a more growth-oriented approach, with a larger allocation to equities, which benefitted from strong market performance in the technology and energy sectors. However, the global economic environment, including concerns about inflation, interest rate hikes, and geopolitical risks, created some volatility. Despite this, the fund maintained an emphasis on long-term growth potential, taking advantage of market opportunities in global equities.

Factors Influencing Performance

The performance of the fund was driven by the strong performance of global equity markets, especially in technology and energy sectors, which contributed to growth. On the other hand, inflationary pressures and rising interest rates created challenges, particularly in the fixed-income portion of the portfolio, where bond prices were negatively impacted. As a more growth-oriented target date fund, the 2050 ETF maintained a higher equity allocation, which helped to capitalize on long-term growth trends despite short-term market volatility. The asset allocation strategy remained focused on maximizing growth potential while managing risk as the fund continues to evolve toward its 2050 target date.

SP Funds 2050 Target Date Fund Tailored Shareholder Report

SP Funds 2050 Target Date Fund Tailored Shareholder Report

Key Fund Statistics

(as of October 31, 2024)

| |

|---|

Fund Size (Thousands) | $403 |

Number of Holdings | 5 |

Total Advisory Fee Paid | $220 |

Annual Portfolio Turnover | 12% |

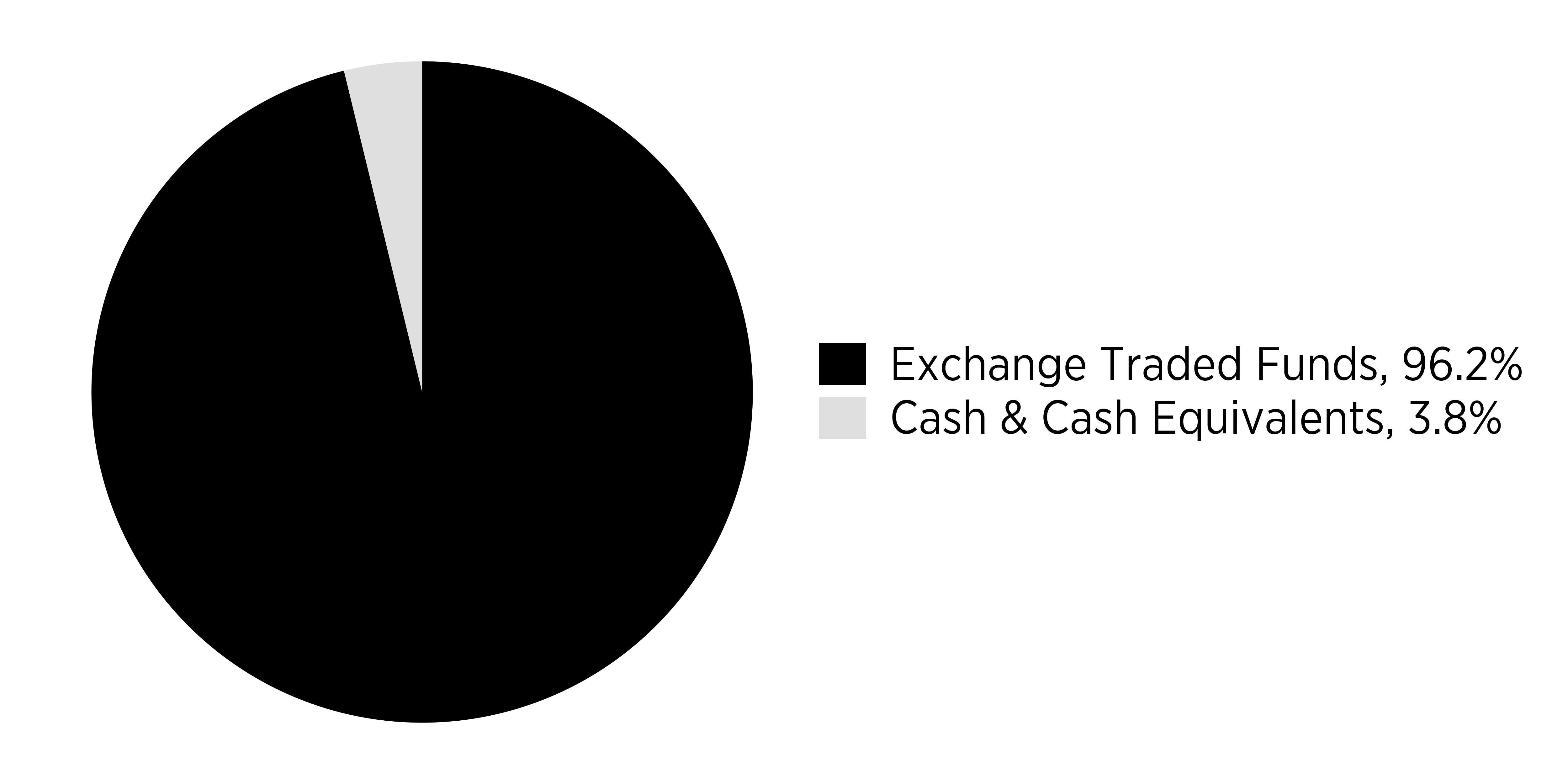

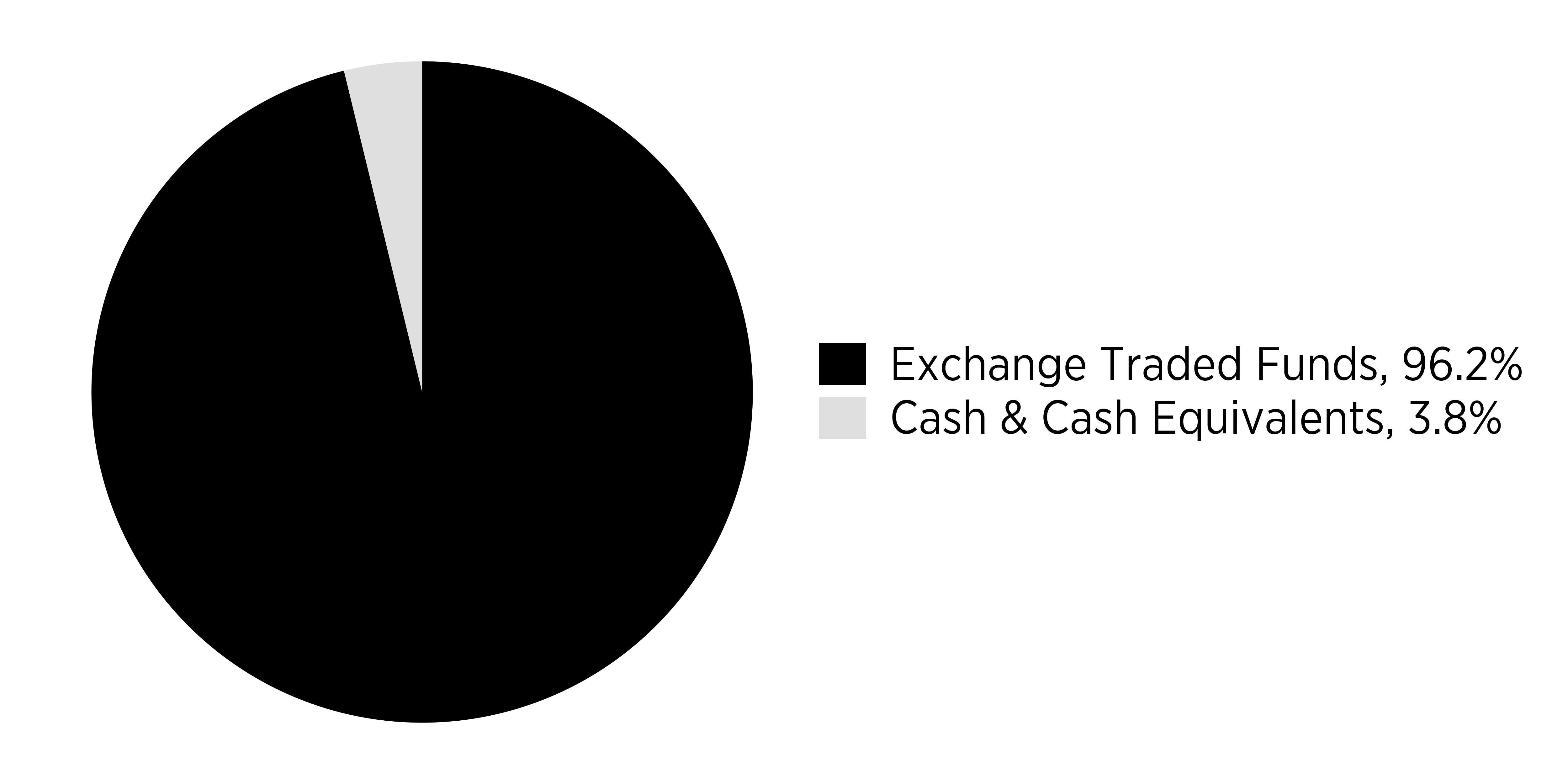

What did the Fund invest in?

(as of October 31, 2024)

Sector Breakdown

(% of net assets)

Sector | % |

Exchange Traded Funds | 0.962 |

Cash & Cash Equivalents | 0.038 |

Percentages are based on total net assets. Cash & Cash Equivalents represents other assets in excess of liabilities.

Top Holdings | (% of net assets) |

|---|

SP Funds S&P 500 Sharia Industry Exclusions ETF | 39.1 |

SP Funds S&P Global Technology ETF | 37.4 |

SP Funds S&P World (ex-US) ETF | 9.7 |

SP Funds Dow Jones Global Sukuk ETF | 5.0 |

SP Funds S&P Global REIT Sharia ETF | 4.9 |

How has the Fund changed?

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants.

Householding

Householding is an option available to certain investors of the Fund. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Householding for the Fund is available through certain broker-dealers. If you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents, please contact your broker-dealer. If you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, visit www.sp-funds.com .

SP Funds 2050 Target Date Fund Tailored Shareholder Report

SP Funds S&P Global Technology ETF Tailored Shareholder Report

annual Shareholder Report October 31, 2024 SP Funds S&P Global Technology ETF Ticker: SPTE (Listed on NYSE Arca, Inc.) |

This annual shareholder report contains important information about the SP Funds S&P Global Technology ETF (the "Fund") for the period November 30, 2023 to October 31, 2024. You can find additional information about the Fund at www.sp-funds.com. You can also request this information by contacting us at (425) 409‑9500 or by contacting the Fund at ShariaPortfolio, 1331 S. International Pkwy Ste 2291, Lake Mary, FL 32746.

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

SP Funds S&P Global Technology ETF | $59 | 0.55% |

Cumulative Performance

(Initial Investment of $10,000)

Date | SP Funds S&P Global Technology ETF - $13,434 | S&P Global 1200 Shariah Information Technology Capped Index - $12,912 |

11/30/2023 | 10000 | 10000 |

12/31/2023 | 10569 | 10578 |

1/31/2024 | 11090 | 10932 |

2/29/2024 | 11955 | 11674 |

3/31/2024 | 12249 | 12105 |

4/30/2024 | 11569 | 11383 |

5/31/2024 | 12495 | 12186 |

6/30/2024 | 13580 | 13290 |

7/31/2024 | 13200 | 12952 |

8/31/2024 | 13434 | 13094 |

9/30/2024 | 13585 | 13125 |

10/31/2024 | 13434 | 12912 |

Annual Performance

Annualized Returns for the Periods Ended October 31, 2024 | Since Inception (11/30/2023) |

|---|

SP Funds S&P Global Technology ETF | 34.34% |

S&P Global 1200 Shariah Information Techology Capped Index | 29.12% |

The Fund's past performance is not a good indicator of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Visit www.sp-funds.com for more recent performance information.

Fund Performance Overview

For the period ending October 31, 2024, the S&P 500 Global Technology ETF (SPTE) sought to track the performance of the S&P Global 1200 Shariah Information Technology Capped Index. The fund’s performance was impacted by a combination of global market conditions and sector-specific trends. Strong demand for technology services and products, particularly in areas like artificial intelligence, cloud computing, and cybersecurity, contributed to positive returns. However, broader macroeconomic factors, such as interest rate fluctuations and geopolitical tensions, created volatility, which somewhat restrained the fund’s performance during the period.

Factors Influencing Performance

Key factors influencing the fund’s performance included the technology sector’s resilience amidst economic uncertainty, supported by the rapid expansion of AI and tech innovation. However, inflation concerns, rising interest rates, and global trade challenges led to volatility. The fund’s Shariah-compliant investment strategy also guided its exposure to companies in line with ethical guidelines, which may have limited its exposure to certain high-growth technology stocks. The investment adviser employed a passive management strategy, aiming to closely track the performance of the underlying index while maintaining sector-specific diversification.

SP Funds S&P Global Technology ETF Tailored Shareholder Report

SP Funds S&P Global Technology ETF Tailored Shareholder Report

Key Fund Statistics

(as of October 31, 2024)

| |

|---|

Fund Size (Thousands) | $39,539 |

Number of Holdings | 97 |

Total Advisory Fee Paid | $143,710 |

Annual Portfolio Turnover | 15% |

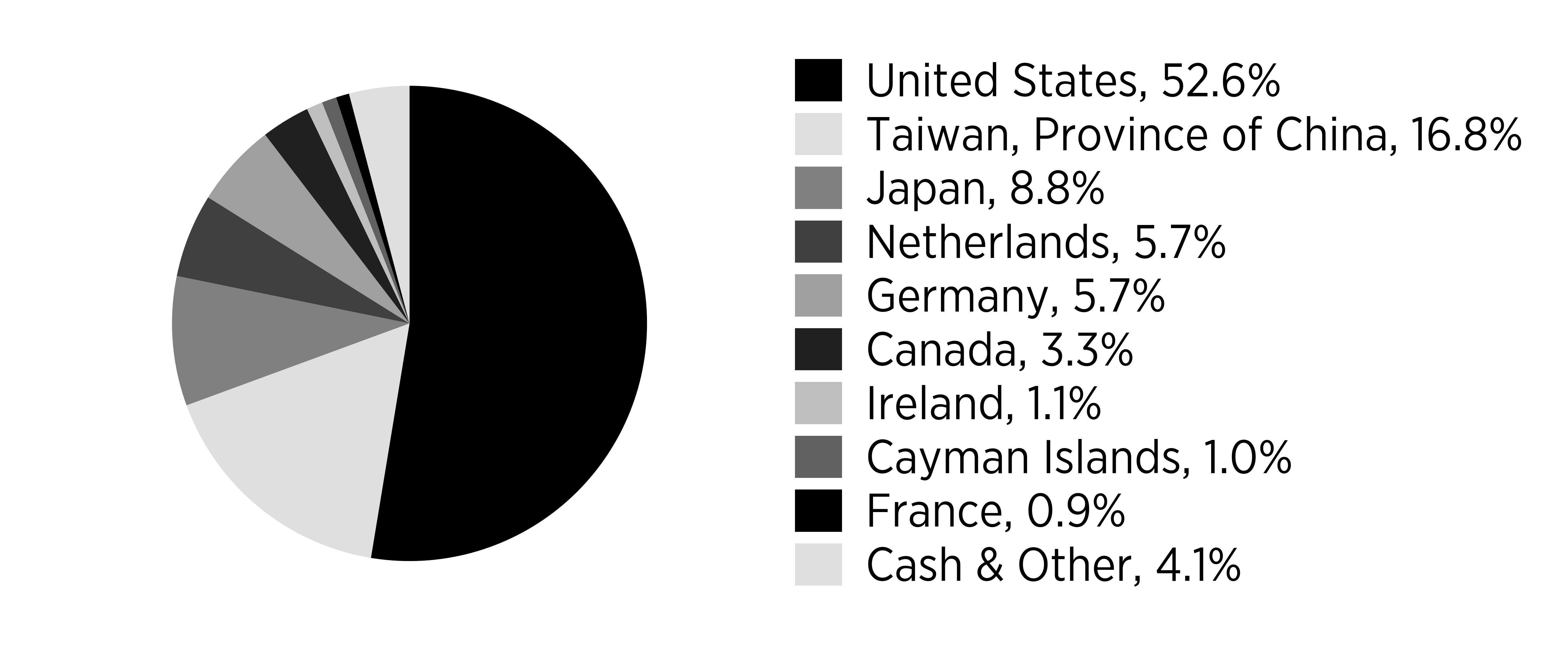

What did the Fund invest in?

(as of October 31, 2024)

Sector Breakdown (% of net assets)

Sector | % |

Technology | 0.873 |

Communications | 0.066 |

Industrial | 0.043 |

Consumer, Non-cyclical | 0.006 |

Energy | 0.001 |

Cash & Cash Equivalents | 0.011 |

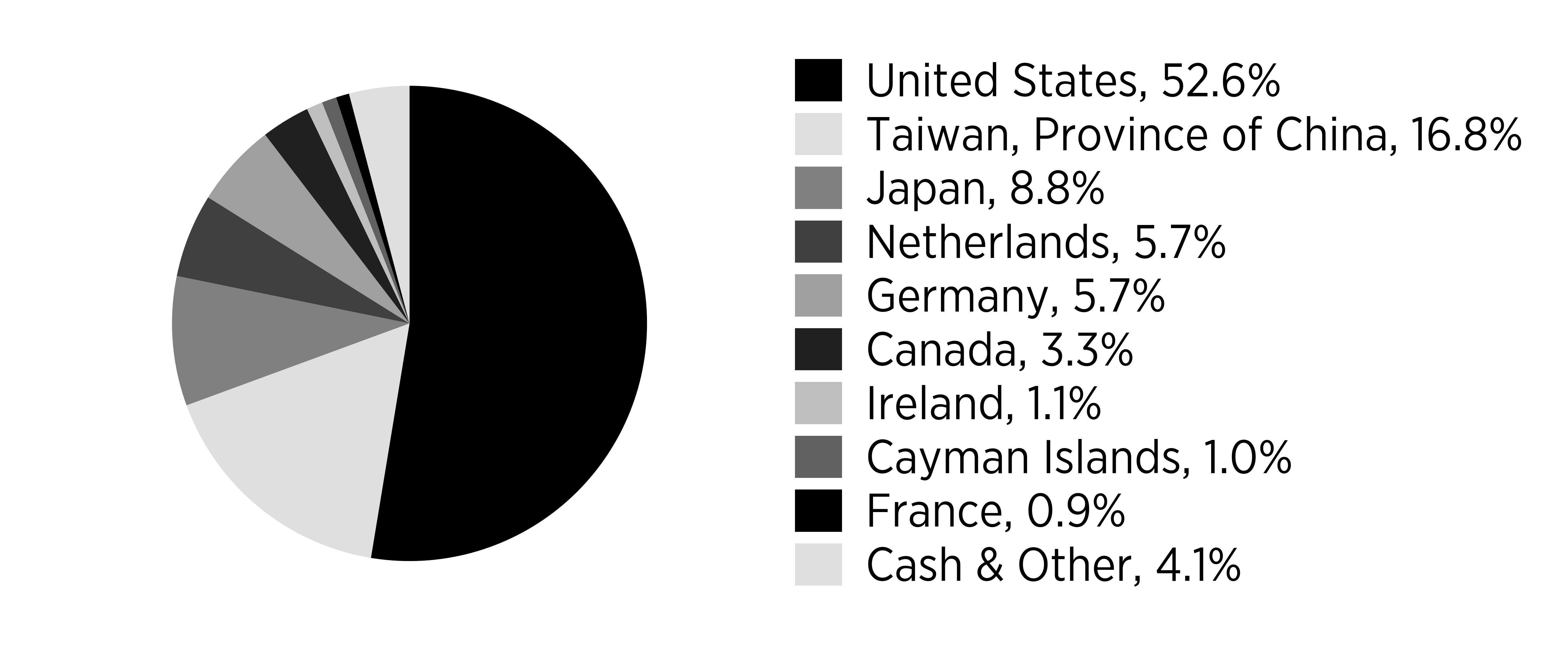

Geographic Breakdown (% of net assets)

Sector | % |

United States | 0.526 |

Taiwan, Province of China | 0.168 |

Japan | 0.088 |

Netherlands | 0.057 |

Germany | 0.057 |

Canada | 0.033 |

Ireland | 0.011 |

Cayman Islands | 0.01 |

France | 0.009 |

Cash & Other | 0.041 |

Percentages are based on total net assets. Cash & Cash Equivalents represents other assets in excess of liabilities.

Top Ten Holdings | (% of net assets) |

|---|

Taiwan Semiconductor Manufacturing Co Ltd. | 15.5 |

NVIDIA Corp. | 11.1 |

Apple, Inc. | 10.9 |

Microsoft Corp. | 10.8 |

SAP SE | 4.9 |

ASML Holding NV | 4.8 |

Broadcom, Inc. | 3.3 |

Shopify, Inc. - Class A | 1.8 |

Keyence Corp. | 1.7 |

Tokyo Electron Ltd. | 1.4 |

How has the Fund changed?

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants.

Householding

Householding is an option available to certain investors of the Fund. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Householding for the Fund is available through certain broker-dealers. If you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents, please contact your broker-dealer. If you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, visit www.sp-funds.com .

SP Funds S&P Global Technology ETF Tailored Shareholder Report

SP Funds S&P World (ex-US) ETF Tailored Shareholder Report

annual Shareholder Report October 31, 2024 SP Funds S&P World (ex-US) ETF Ticker: SPWO (Listed on NYSE Arca, Inc.) |

This annual shareholder report contains important information about the SP Funds S&P World (ex-US) ETF (the "Fund") for the period December 19, 2023 to October 31, 2024. You can find additional information about the Fund at www.sp-funds.com. You can also request this information by contacting us at (425) 409‑9500 or by contacting the Fund at ShariaPortfolio, 1331 S. International Pkwy Ste 2291, Lake Mary, FL 32746.

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

SP Funds S&P World (ex-US) ETF | $51 | 0.55% |

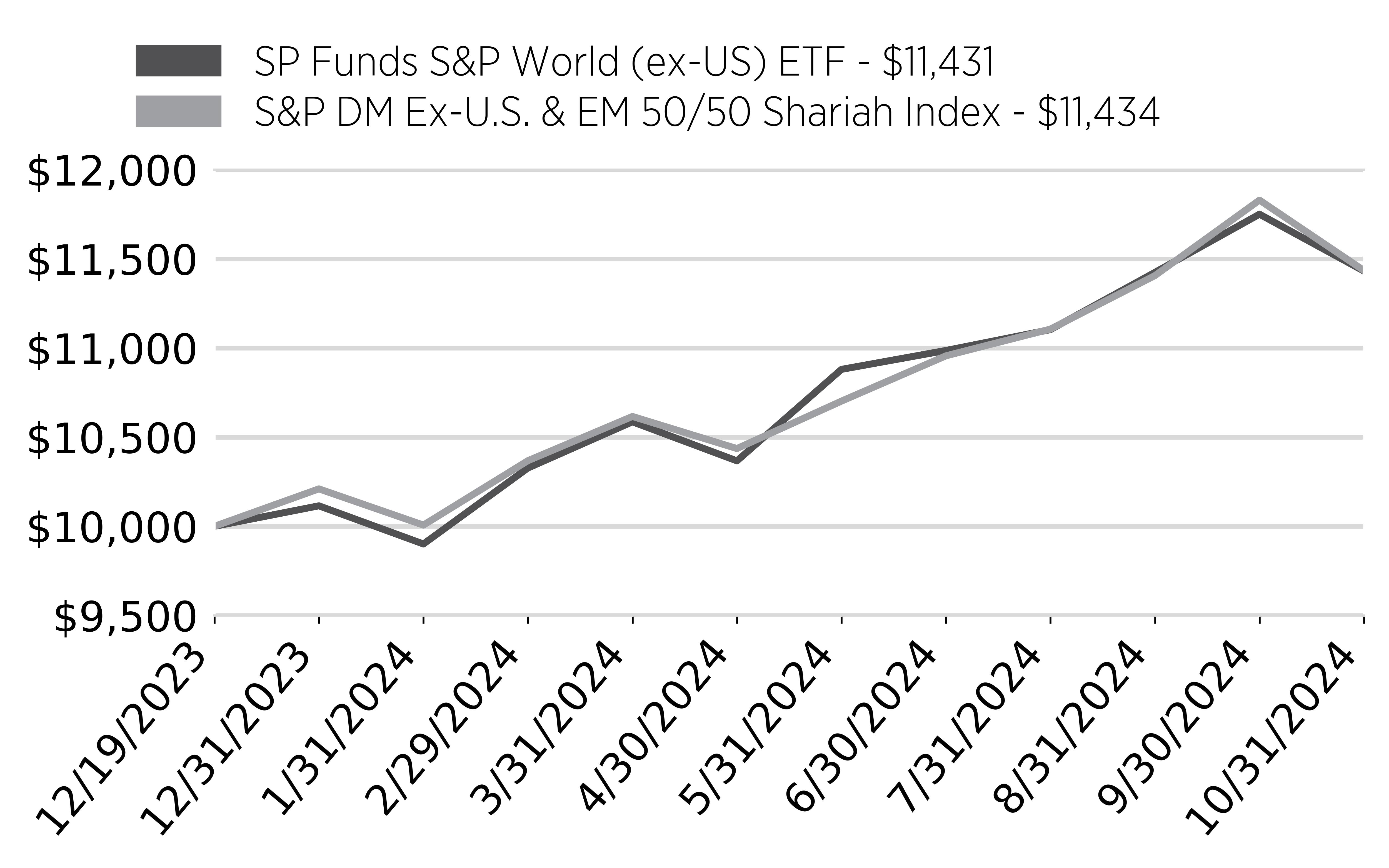

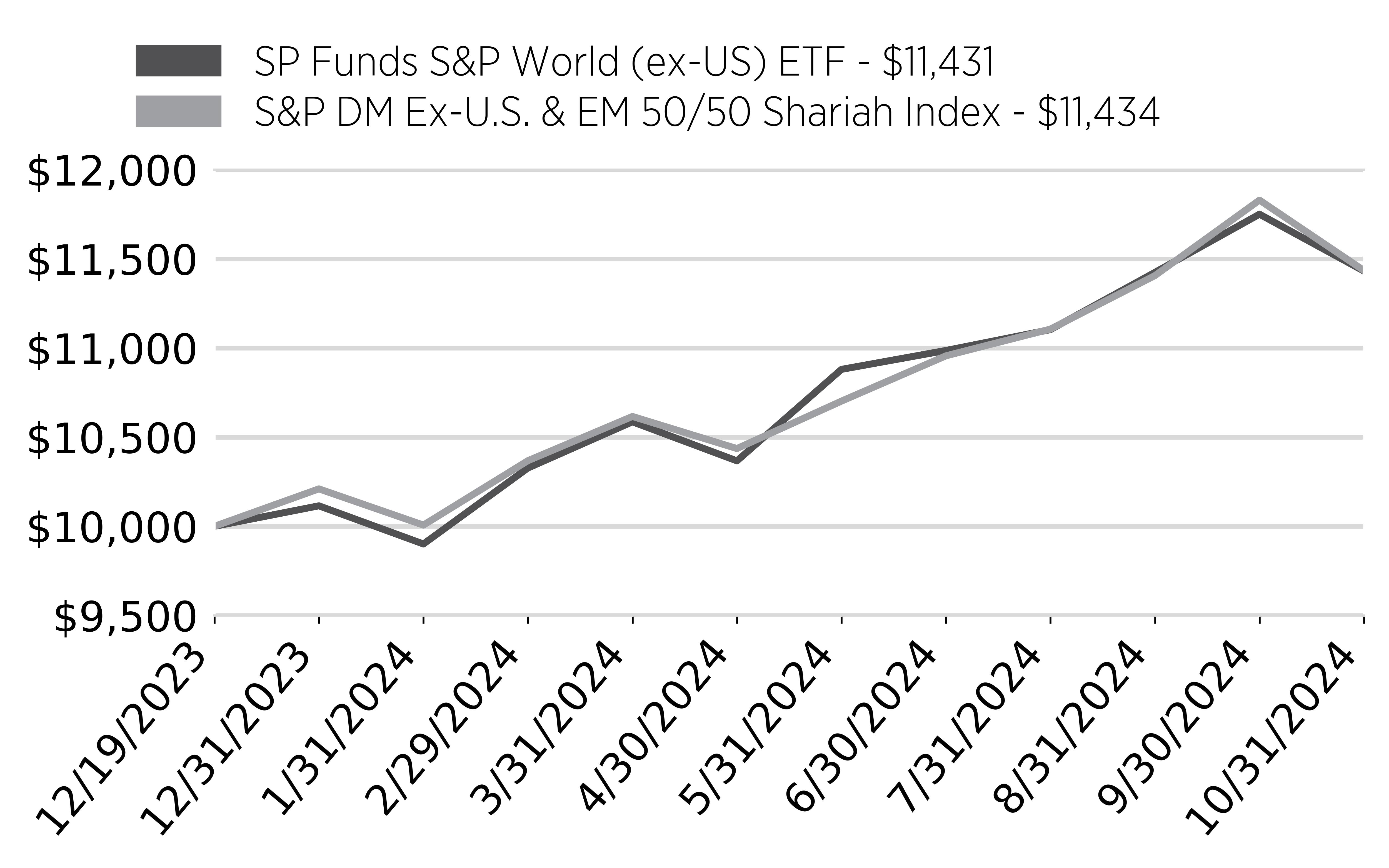

Cumulative Performance

(Initial Investment of $10,000)

Date | SP Funds S&P World (ex-US) ETF - $11,431 | S&P DM Ex-U.S. & EM 50/50 Shariah Index - $11,434 |

12/19/2023 | 10000 | 10000 |

12/31/2023 | 10115 | 10210 |

1/31/2024 | 9901 | 10007 |

2/29/2024 | 10327 | 10368 |

3/31/2024 | 10586 | 10616 |

4/30/2024 | 10367 | 10436 |

5/31/2024 | 10880 | 10702 |

6/30/2024 | 10986 | 10956 |

7/31/2024 | 11103 | 11106 |

8/31/2024 | 11424 | 11406 |

9/30/2024 | 11750 | 11829 |

10/31/2024 | 11431 | 11434 |

Annual Performance

Annualized Returns for the Periods Ended October 31, 2024 | Since Inception (12/19/2023) |

|---|

SP Funds S&P World (ex-US) ETF | 14.31% |

S&P DM Ex-U.S. & EM 50/50 Shariah Index | 14.34% |

The Fund's past performance is not a good indicator of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Visit www.sp-funds.com for more recent performance information.

Fund Performance Overview

For the period ending October 31, 2024, the SP Funds S&P World (ex-US) ETF aimed to track the performance of the S&P DM Ex-U.S. & EM 50/50 Shariah Index. The fund’s performance was influenced by both positive and negative global market trends. While developed markets (ex-U.S.) experienced moderate growth, emerging markets faced headwinds due to economic instability and geopolitical concerns. The fund’s Shariah-compliant strategy guided its exposure to regions and companies adhering to ethical investment principles, which provided a unique risk and return profile relative to traditional global equity indices.

Factors Influencing Performance

The fund’s performance was impacted by a combination of global economic factors, including fluctuating interest rates, inflationary pressures, and regional political instability. Developed markets saw steady performance, driven by strong corporate earnings in Europe and Asia. However, emerging markets faced challenges such as slower economic growth and rising geopolitical risks, which affected overall performance. The Shariah investment strategy led to selective exposure to sectors and companies that met ethical guidelines, which may have constrained the fund’s participation in some high-growth but non-compliant sectors. The fund's passive management approach aimed to track the underlying index, balancing exposure to both developed and emerging markets while adhering to Shariah principles.

SP Funds S&P World (ex-US) ETF Tailored Shareholder Report

SP Funds S&P World (ex-US) ETF Tailored Shareholder Report

Key Fund Statistics

(as of October 31, 2024)

| |

|---|

Fund Size (Thousands) | $26,593 |

Number of Holdings | 342 |

Total Advisory Fee Paid | $76,318 |

Annual Portfolio Turnover | 30% |

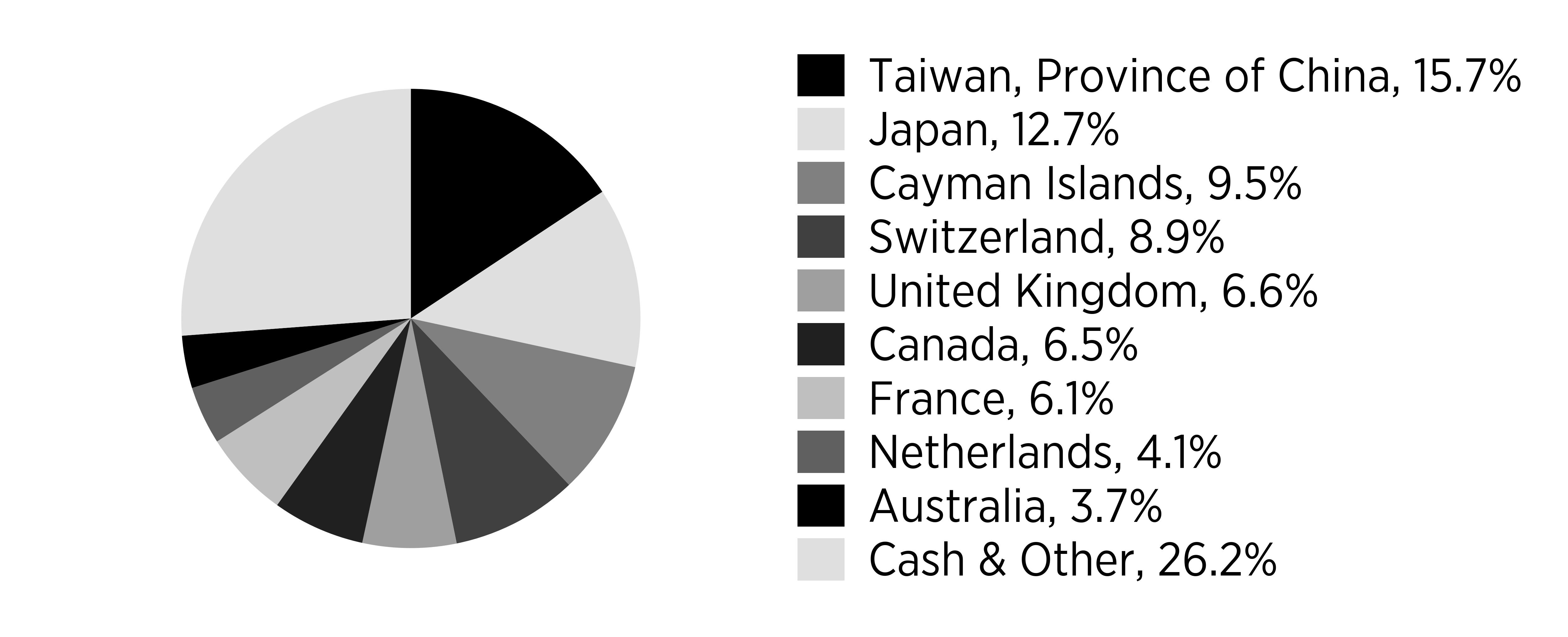

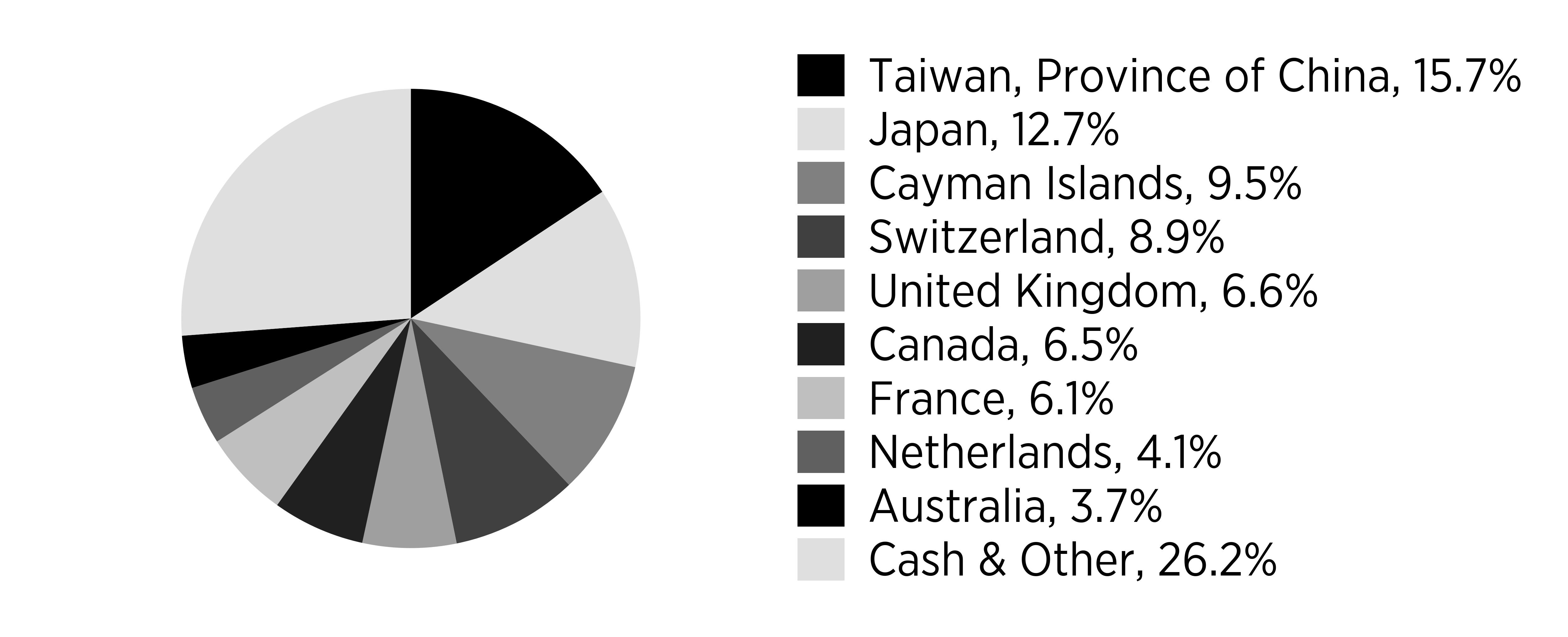

What did the Fund invest in?

(as of October 31, 2024)

Sector Breakdown (% of net assets)

Sector | % |

Technology | 0.269 |

Consumer, Non-cyclical | 0.252 |

Industrial | 0.147 |

Communications | 0.108 |

Consumer, Cyclical | 0.094 |

Basic Materials | 0.088 |

Energy | 0.026 |

Financial | 0.014 |

Utilities | 0.002 |

Cash & Cash Equivalents | 0 |

Geographic Breakdown (% of net assets)

Sector | % |

Taiwan, Province of China | 0.157 |

Japan | 0.127 |

Cayman Islands | 0.095 |

Switzerland | 0.089 |

United Kingdom | 0.066 |

Canada | 0.065 |

France | 0.061 |

Netherlands | 0.041 |

Australia | 0.037 |

Cash & Other | 0.262 |

Percentages are based on total net assets. Cash & Cash Equivalents represents other assets in excess of liabilities.

Top Ten Holdings | (% of net assets) |

|---|

Taiwan Semiconductor Manufacturing Co Ltd. | 15.0 |

Meituan | 2.8 |

Novo Nordisk A/S | 2.7 |

ASML Holding NV | 2.0 |

Nestle SA | 1.9 |

SAP SE | 1.8 |

PDD Holdings, Inc. | 1.8 |

Roche Holding AG | 1.7 |

AstraZeneca Plc | 1.6 |

Novartis AG | 1.6 |

How has the Fund changed?

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants.

Householding

Householding is an option available to certain investors of the Fund. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Householding for the Fund is available through certain broker-dealers. If you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents, please contact your broker-dealer. If you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, visit www.sp-funds.com .

SP Funds S&P World (ex-US) ETF Tailored Shareholder Report

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable for semi-annual reports.

Item 6. Investments.

| (a) | Schedule of Investments is included within the financial statements filed under Item 7 of this Form. |

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

SP Funds 2030 Target Date Fund

Investor Class Ticker: SPTAX

Institutional Class Ticker: SPTMX

SP Funds 2040 Target Date Fund

Investor Class Ticker: SPTBX

Institutional Class Ticker: SPTNX

SP Funds 2050 Target Date Fund

Investor Class Ticker: SPTCX

SP Funds S&P Global Technology ETF

Ticker: SPTE

SP Funds World ex-US ETF

Ticker: SPWO

Financial Statements

October 31, 2024

SP Funds 2030 Target Date Fund

Schedule of Investments

October 31, 2024

| EXCHANGE TRADED FUNDS - 90.8% | | Shares | | | Value |

| SP Funds Dow Jones Global Sukuk ETF (a)(b) | | | 85,355 | | | $ | 1,548,340 | |

| SP Funds S&P 500 Sharia Industry Exclusions ETF (b) | | | 21,152 | | | | 867,655 | |

| SP Funds S&P Global REIT Sharia ETF (b) | | | 16,862 | | | | 349,212 | |

| SP Funds S&P Global Technology ETF (b) | | | 12,693 | | | | 340,766 | |

| SP Funds S&P World (ex-US) ETF (b) | | | 7,554 | | | | 172,035 | |

| SPDR Gold Shares (c) | | | 366 | | | | 92,785 | |

| TOTAL EXCHANGE TRADED FUNDS (Cost $3,387,268) | | | | | | | 3,370,793 | |

| | | | | | | | | |

| TOTAL INVESTMENTS - 90.8% (Cost $3,387,268) | | | | | | | 3,370,793 | |

| Other Assets in Excess of Liabilities - 9.2% | | | | | | | 341,034 | |

| TOTAL NET ASSETS - 100.0% | | | | | | $ | 3,711,827 | |

Percentages are stated as a percent of net assets.

| (a) | Fair value of this security exceeds 25% of the Fund’s net assets. Additional information for this security, including the financial statements, is available from the SEC’s EDGAR database at www.sec.gov. |

| (b) | Affiliated company as defined by the Investment Company Act of 1940. |

| (c) | Non-income producing security. |

The accompanying notes are an integral part of these financial statements.

SP Funds 2040 Target Date Fund

Schedule of Investments

October 31, 2024

| EXCHANGE TRADED FUNDS - 95.8% | | Shares | | | Value |

| SP Funds Dow Jones Global Sukuk ETF (a) | | | 4,257 | | | $ | 77,222 | |

| SP Funds S&P 500 Sharia Industry Exclusions ETF (a)(b) | | | 14,687 | | | | 602,461 | |

| SP Funds S&P Global REIT Sharia ETF (a) | | | 3,658 | | | | 75,757 | |

| SP Funds S&P Global Technology ETF (a)(b) | | | 21,484 | | | | 576,777 | |

| SP Funds S&P World (ex-US) ETF (a) | | | 6,556 | | | | 149,307 | |

| TOTAL EXCHANGE TRADED FUNDS (Cost $1,497,864) | | | | | | | 1,481,524 | |

| | | | | | | | | |

| TOTAL INVESTMENTS - 95.8% (Cost $1,497,864) | | | | | | | 1,481,524 | |

| Other Assets in Excess of Liabilities - 4.2% | | | | | | | 64,632 | |

| TOTAL NET ASSETS - 100.0% | | | | | | $ | 1,546,156 | |

Percentages are stated as a percent of net assets.

| (a) | Affiliated company as defined by the Investment Company Act of 1940. |

| (b) | Fair value of this security exceeds 25% of the Fund’s net assets. Additional information for this security, including the financial statements, is available from the SEC’s EDGAR database at www.sec.gov. |

The accompanying notes are an integral part of these financial statements.

SP Funds 2050 Target Date Fund

Schedule of Investments

October 31, 2024

| EXCHANGE TRADED FUNDS - 96.2% | | Shares | | | Value |

| SP Funds Dow Jones Global Sukuk ETF (a) | | | 1,113 | | | $ | 20,190 | |

| SP Funds S&P 500 Sharia Industry Exclusions ETF (a)(b) | | | 3,842 | | | | 157,599 | |

| SP Funds S&P Global REIT Sharia ETF (a) | | | 957 | | | | 19,819 | |

| SP Funds S&P Global Technology ETF (a)(b) | | | 5,620 | | | | 150,879 | |

| SP Funds S&P World (ex-US) ETF (a) | | | 1,715 | | | | 39,058 | |

| TOTAL EXCHANGE TRADED FUNDS (Cost $397,053) | | | | | | | 387,545 | |

| | | | | | | | | |

| TOTAL INVESTMENTS - 96.2% (Cost $397,053) | | | | | | | 387,545 | |

| Other Assets in Excess of Liabilities - 3.8% | | | | | | | 15,447 | |

| TOTAL NET ASSETS - 100.0% | | | | | | $ | 402,992 | |

Percentages are stated as a percent of net assets.

| (a) | Affiliated company as defined by the Investment Company Act of 1940. |

| (b) | Fair value of this security exceeds 25% of the Fund’s net assets. Additional information for this security, including the financial statements, is available from the SEC’s EDGAR database at www.sec.gov. |

The accompanying notes are an integral part of these financial statements.

SP Funds S&P Global Technology ETF

Schedule of Investments

October 31, 2024

| COMMON STOCKS - 98.9% | | Shares | | | Value |

| Computers - 15.7% | | | | | | | | |

| Accenture PLC - Class A | | | 1,078 | | | $ | 371,716 | |

| Apple, Inc. | | | 19,034 | | | | 4,299,971 | |

| Capgemini SE - ADR | | | 5,918 | | | | 204,171 | |

| CGI, Inc. (a) | | | 1,417 | | | | 156,790 | |

| Cognizant Technology Solutions Corp. - Class A | | | 958 | | | | 71,457 | |

| Crowdstrike Holdings, Inc. - Class A (a) | | | 418 | | | | 124,092 | |

| EPAM Systems, Inc. (a) | | | 118 | | | | 22,261 | |

| Fortinet, Inc. (a) | | | 1,133 | | | | 89,122 | |

| Fujitsu Ltd. - ADR | | | 12,744 | | | | 237,675 | |

| Gartner, Inc. (a) | | | 136 | | | | 68,340 | |

| HP, Inc. | | | 1,594 | | | | 56,619 | |

| Logitech International SA | | | 1,126 | | | | 92,143 | |

| NEC Corp. | | | 2,030 | | | | 176,380 | |

| NetApp, Inc. | | | 413 | | | | 47,623 | |

| Nomura Research Institute Ltd. - ADR | | | 3,363 | | | | 100,789 | |

| Obic Co. Ltd. | | | 2,360 | | | | 77,326 | |

| | | | | | | | 6,196,475 | |

| | | | | | | | | |

| Electronics - 2.0% | | | | | | | | |

| Amphenol Corp. - Class A | | | 2,071 | | | | 138,799 | |

| Halma PLC - ADR | | | 1,306 | | | | 83,042 | |

| Jabil, Inc. | | | 205 | | | | 25,234 | |

| Keysight Technologies, Inc. (a) | | | 300 | | | | 44,703 | |

| Kyocera Corp. - ADR | | | 10,384 | | | | 105,086 | |

| Murata Manufacturing Co Ltd. - ADR | | | 27,979 | | | | 244,816 | |

| SCREEN Holdings Co. Ltd. | | | 740 | | | | 48,726 | |

| TE Connectivity Ltd. | | | 546 | | | | 80,491 | |

| Trimble, Inc. (a) | | | 374 | | | | 22,627 | |

| | | | | | | | 793,524 | |

| | | | | | | | | |

| Energy-Alternate Sources - 0.1% | | | | | | | | |

| Enphase Energy, Inc. (a) | | | 183 | | | | 15,196 | |

| First Solar, Inc. (a) | | | 194 | | | | 37,729 | |

| | | | | | | | 52,925 | |

| | | | | | | | | |

| Healthcare-Products - 0.6% | | | | | | | | |

| FUJIFILM Holdings Corp. - ADR | | | 18,768 | | | | 223,715 | |

| | | | | | | | | |

| Internet - 2.7% | | | | | | | | |

| CDW Corp. | | | 227 | | | | 42,728 | |

| F5, Inc. (a) | | | 118 | | | | 27,598 | |

| GoDaddy, Inc. - Class A (a) | | | 253 | | | | 42,201 | |

| Palo Alto Networks, Inc. (a) | | | 566 | | | | 203,947 | |

| Shopify, Inc. - Class A (a) | | | 9,206 | | | | 719,335 | |

| VeriSign, Inc. (a) | | | 149 | | | | 26,349 | |

| | | | | | | | 1,062,158 | |

| | | | | | | | | |

| Machinery-Diversified - 2.2% | | | | | | | | |

| Hexagon AB - ADR | | | 16,225 | | | | 150,568 | |

| Keyence Corp. | | | 1,464 | | | | 670,658 | |

| Omron Corp. - ADR | | | 1,421 | | | | 56,101 | |

| | | | | | | | 877,327 | |

| | | | | | | | | |

| Miscellaneous Manufacturing - 0.1% | | | | | | | | |

| Teledyne Technologies, Inc. (a) | | | 78 | | | | 35,515 | |

SP Funds S&P Global Technology ETF

Schedule of Investments

October 31, 2024

| Office-Business Equipment - 0.7% | | | | | | |

| Canon, Inc. - ADR | | | 7,449 | | | | 239,783 | |

| Zebra Technologies Corp. - Class A (a) | | | 66 | | | | 25,210 | |

| | | | | | | | 264,993 | |

| | | | | | | | | |

| Semiconductors - 46.9%(b) | | | | | | | | |

| Advanced Micro Devices, Inc. (a) | | | 2,827 | | | | 407,286 | |

| Advantest Corp. - ADR | | | 5,856 | | | | 338,360 | |

| Analog Devices, Inc. | | | 896 | | | | 199,907 | |

| Applied Materials, Inc. | | | 1,437 | | | | 260,930 | |

| ASM International NV | | | 346 | | | | 192,400 | |

| ASML Holding NV | | | 2,798 | | | | 1,886,982 | |

| BE Semiconductor Industries NV | | | 542 | | | | 57,630 | |

| Broadcom, Inc. | | | 7,703 | | | | 1,307,738 | |

| Disco Corp. - ADR | | | 7,113 | | | | 203,290 | |

| Infineon Technologies AG - ADR | | | 9,900 | | | | 313,335 | |

| KLA Corp. | | | 241 | | | | 160,561 | |

| Lam Research Corp. | | | 2,370 | | | | 176,210 | |

| Microchip Technology, Inc. | | | 1,006 | | | | 73,810 | |

| Micron Technology, Inc. | | | 1,921 | | | | 191,428 | |

| Monolithic Power Systems, Inc. | | | 77 | | | | 58,466 | |

| NVIDIA Corp. | | | 32,938 | | | | 4,372,849 | |

| NXP Semiconductors NV | | | 472 | | | | 110,684 | |

| ON Semiconductor Corp. (a) | | | 717 | | | | 50,541 | |

| Qorvo, Inc. (a) | | | 236 | | | | 16,817 | |

| QUALCOMM, Inc. | | | 1,916 | | | | 311,867 | |

| Renesas Electronics Corp. - ADR | | | 25,845 | | | | 175,229 | |

| Skyworks Solutions, Inc. | | | 296 | | | | 25,924 | |

| STMicroelectronics NV | | | 4,566 | | | | 124,075 | |

| Taiwan Semiconductor Manufacturing Co Ltd. - ADR | | | 32,152 | | | | 6,126,242 | |

| Teradyne, Inc. | | | 239 | | | | 25,384 | |

| Texas Instruments, Inc. | | | 1,571 | | | | 319,164 | |

| Tokyo Electron Ltd. - ADR | | | 7,469 | | | | 556,216 | |

| United Microelectronics Corp. - ADR | | | 76,369 | | | | 522,364 | |

| | | | | | | | 18,565,689 | |

| | | | | | | | | |

| Software - 24.0% | | | | | | | | |

| Adobe, Inc. (a) | | | 772 | | | | 369,078 | |

| Akamai Technologies, Inc. (a) | | | 295 | | | | 29,819 | |

| ANSYS, Inc. (a) | | | 178 | | | | 57,033 | |

| Autodesk, Inc. (a) | | | 368 | | | | 104,438 | |

| Cadence Design Systems, Inc. (a) | | | 475 | | | | 131,157 | |

| Constellation Software, Inc. | | | 150 | | | | 451,850 | |

| Dassault Systemes SE - ADR | | | 4,957 | | | | 168,835 | |

| Fair Isaac Corp. (a) | | | 40 | | | | 79,724 | |

| Microsoft Corp. | | | 10,466 | | | | 4,252,859 | |

| Oracle Corp. | | | 2,644 | | | | 443,769 | |

| PTC, Inc. (a) | | | 236 | | | | 43,738 | |

| Roper Technologies, Inc. | | | 193 | | | | 103,782 | |

| Sage Group PLC - ADR | | | 2,008 | | | | 100,380 | |

| Salesforce, Inc. | | | 1,683 | | | | 490,376 | |

| SAP SE - ADR | | | 8,235 | | | | 1,924,025 | |

| ServiceNow, Inc. (a) | | | 350 | | | | 326,547 | |

| Synopsys, Inc. (a) | | | 263 | | | | 135,079 | |

| Temenos AG - ADR | | | 472 | | | | 32,783 | |

| Tyler Technologies, Inc. (a) | | | 72 | | | | 43,602 | |

| WiseTech Global Ltd. | | | 1,264 | | | | 97,926 | |

| Xero Ltd. (a) | | | 968 | | | | 94,789 | |

| | | | | | | | 9,481,589 | |

SP Funds S&P Global Technology ETF

Schedule of Investments

October 31, 2024

| Telecommunications - 3.9% | | | | | | |

| Arista Networks, Inc. (a) | | | 438 | | | | 169,261 | |

| Cisco Systems, Inc. | | | 6,922 | | | | 379,118 | |

| Corning, Inc. | | | 1,361 | | | | 64,770 | |

| Juniper Networks, Inc. | | | 708 | | | | 27,541 | |

| Motorola Solutions, Inc. | | | 295 | | | | 132,558 | |

| Nokia OYJ - ADR | | | 41,541 | | | | 195,658 | |

| Telefonaktiebolaget LM Ericsson - ADR | | | 24,427 | | | | 204,699 | |

| Xiaomi Corp. - ADR (a) | | | 22,666 | | | | 387,815 | |

| | | | | | | | 1,561,420 | |

| TOTAL COMMON STOCKS (Cost $32,442,008) | | | | | | | 39,115,330 | |

| | | | | | | | | |

| TOTAL INVESTMENTS - 98.9% (Cost $32,442,008) | | | | | | | 39,115,330 | |

| Other Assets in Excess of Liabilities - 1.1% | | | | | | | 423,228 | |

| TOTAL NET ASSETS - 100.0% | | | | | | $ | 39,538,558 | |

Percentages are stated as a percent of net assets.

AB - Aktiebolag

ADR - American Depositary Receipt

AG - Aktiengesellschaft

NV - Naamloze Vennootschap

OYJ - Julkinen Asakeyhtio

PLC - Public Limited Company

SA - Sociedad Anónima

SE - Societas Europeae

| (a) | Non-income producing security. |

| (b) | To the extent that the Fund invests more heavily in a particular industry or sector of the economy, its performance will be especially sensitive to developments that significantly affect those industries or sectors. |

SP Funds S&P World (ex-US) ETF

Schedule of Investments

October 31, 2024

| COMMON STOCKS - 99.5% | | Shares | | | Value |

| Aerospace/Defense - 1.8% | | | | | | | | |

| Airbus SE - ADR | | | 5,029 | | | $ | 191,354 | |

| Melrose Industries PLC | | | 2,934 | | | | 17,917 | |

| MTU Aero Engines AG - ADR | | | 206 | | | | 33,718 | |

| Rheinmetall AG - ADR | | | 445 | | | | 45,808 | |

| Saab AB - ADR | | | 1,329 | | | | 13,689 | |

| Safran SA - ADR | | | 2,744 | | | | 155,201 | |

| Thales SA - ADR | | | 911 | | | | 29,352 | |

| | | | | | | | 487,039 | |

| | | | | | | | | |

| Agriculture - 0.1% | | | | | | | | |

| IOI Corp. Bhd | | | 18,747 | | | | 16,140 | |

| Kuala Lumpur Kepong Bhd | | | 3,434 | | | | 16,782 | |

| | | | | | | | 32,922 | |

| | | | | | | | | |

| Airlines - 0.1% | | | | | | | | |

| Ryanair Holdings PLC - ADR | | | 405 | | | | 17,925 | |

| | | | | | | | | |

| Apparel - 1.4% | | | | | | | | |

| adidas AG - ADR | | | 671 | | | | 80,211 | |

| Asics Corp. - ADR | | | 1,525 | | | | 26,687 | |

| Hermes International SCA - ADR | | | 720 | | | | 162,454 | |

| Kering SA - ADR | | | 1,561 | | | | 38,744 | |

| LPP SA | | | 5 | | | | 18,100 | |

| Shenzhou International Group Holdings Ltd. - ADR | | | 4,517 | | | | 34,691 | |

| | | | | | | | 360,887 | |

| | | | | | | | | |

| Auto Manufacturers - 2.3% | | | | | | | | |

| BYD Co. Ltd. - ADR | | | 2,855 | | | | 207,701 | |

| Ferrari NV | | | 225 | | | | 107,430 | |

| Geely Automobile Holdings Ltd. - ADR | | | 1,606 | | | | 56,113 | |

| Great Wall Motor Co. Ltd. - ADR | | | 1,054 | | | | 16,395 | |

| Kia Corp. | | | 378 | | | | 25,173 | |

| Li Auto, Inc. - Class A (a) | | | 6,694 | | | | 92,475 | |

| Subaru Corp. - ADR | | | 2,777 | | | | 24,910 | |

| Suzuki Motor Corp. - ADR | | | 997 | | | | 39,710 | |

| XPeng, Inc. - Class A (a) | | | 6,254 | | | | 36,320 | |

| | | | | | | | 606,227 | |

| | | | | | | | | |

| Auto Parts & Equipment - 0.7% | | | | | | | | |

| Bridgestone Corp. - ADR | | | 2,450 | | | | 43,659 | |

| Denso Corp. - ADR | | | 4,276 | | | | 60,719 | |

| Fuyao Glass Industry Group Co. Ltd. - Class H | | | 3,529 | | | | 25,034 | |

| Hyundai Mobis Co. Ltd. | | | 92 | | | | 16,633 | |

| LG Energy Solution Ltd. (a) | | | 63 | | | | 18,603 | |

| Samsung SDI Co. Ltd. | | | 77 | | | | 18,246 | |

| | | | | | | | 182,894 | |

| | | | | | | | | |

| Banks - 0.2% | | | | | | | | |

| Abu Dhabi Islamic Bank PJSC | | | 6,030 | | | | 20,686 | |

| Computershare Ltd. - ADR | | | 1,150 | | | | 19,895 | |

| Dubai Islamic Bank PJSC | | | 12,021 | | | | 20,455 | |

| | | | | | | | 61,036 | |

| | | | | | | | | |

| Beverages - 0.3% | | | | | | | | |

| Arca Continental SAB de CV | | | 2,400 | | | | 20,446 | |

| Coca-Cola Femsa SAB de CV - ADR | | | 298 | | | | 24,844 | |

| Nongfu Spring Co. Ltd. - Class H | | | 9,638 | | | | 35,828 | |

| | | | | | | | 81,818 | |

SP Funds S&P World (ex-US) ETF

Schedule of Investments

October 31, 2024

| Biotechnology - 1.2% | | | | | | | | |

| Akeso, Inc. (a) | | | 3,417 | | | | 27,602 | |

| BeiGene Ltd. - ADR (a) | | | 384 | | | | 77,814 | |

| CSL Ltd. - ADR | | | 1,967 | | | | 184,434 | |

| Samsung Biologics Co. Ltd. (a) | | | 28 | | | | 20,330 | |

| | | | | | | | 310,180 | |

| | | | | | | | | |

| Building Materials - 1.2% | | | | | | | | |

| Anhui Conch Cement Co. Ltd. - ADR | | | 1,468 | | | | 21,345 | |

| Daikin Industries Ltd. - ADR | | | 5,959 | | | | 71,448 | |

| Geberit AG - ADR | | | 717 | | | | 44,963 | |

| James Hardie Industries PLC - ADR (a) | | | 913 | | | | 29,125 | |

| Kingspan Group PLC - ADR | | | 334 | | | | 29,118 | |

| Nibe Industrier AB - Class B (a) | | | 3,354 | | | | 16,124 | |

| Sika AG - ADR | | | 3,480 | | | | 96,814 | |

| Svenska Cellulosa AB SCA - Class B | | | 1,320 | | | | 17,376 | |

| | | | | | | | 326,313 | |

| | | | | | | | | |

| Chemicals - 2.7% | | | | | | | | |

| Air Liquide SA - ADR | | | 5,895 | | | | 210,982 | |

| Chandra Asri Pacific Tbk PT | | | 73,051 | | | | 40,726 | |

| Croda International PLC - ADR | | | 481 | | | | 11,828 | |

| DSM-Firmenich AG | | | 430 | | | | 50,931 | |

| Givaudan SA - ADR | | | 808 | | | | 76,671 | |

| Nippon Paint Holdings Co Ltd. | | | 2,357 | | | | 18,166 | |

| Nitto Denko Corp. - ADR | | | 1,432 | | | | 23,456 | |

| Novonesis (Novozymes) B - ADR | | | 760 | | | | 47,682 | |

| Petronas Chemicals Group Bhd | | | 17,026 | | | | 21,073 | |

| Shin-Etsu Chemical Co. Ltd. - ADR | | | 8,161 | | | | 150,326 | |

| Sociedad Quimica y Minera de Chile SA - ADR | | | 757 | | | | 29,061 | |

| Symrise AG - ADR | | | 1,101 | | | | 33,069 | |

| | | | | | | | 713,971 | |

| | | | | | | | | |

| Coal - 0.3% | | | | | | | | |

| China Shenhua Energy Co Ltd. - ADR | | | 4,708 | | | | 80,730 | |

| | | | | | | | | |

| Commercial Services - 2.8% | | | | | | | | |

| Brambles Ltd. - ADR | | | 1,422 | | | | 34,270 | |

| Dai Nippon Printing Co. Ltd. - ADR | | | 1,852 | | | | 16,001 | |

| Experian PLC - ADR | | | 1,854 | | | | 90,512 | |

| Intertek Group PLC - ADR | | | 297 | | | | 17,796 | |

| New Oriental Education & Technology Group, Inc. - ADR | | | 711 | | | | 44,509 | |

| Recruit Holdings Co. Ltd. - ADR | | | 16,863 | | | | 206,066 | |

| RELX PLC - ADR | | | 3,806 | | | | 175,913 | |

| Secom Co. Ltd. - ADR | | | 3,212 | | | | 28,490 | |

| SGS SA - ADR | | | 3,212 | | | | 33,887 | |

| TOPPAN Holdings, Inc. - ADR | | | 1,055 | | | | 15,551 | |

| Wolters Kluwer NV - ADR | | | 509 | | | | 85,090 | |

| | | | | | | | 748,085 | |

| | | | | | | | | |

| Computers - 3.1% | | | | | | | | |

| Capgemini SE - ADR | | | 1,787 | | | | 61,652 | |

| CGI, Inc. (a) | | | 433 | | | | 47,911 | |

| Check Point Software Technologies Ltd. (a) | | | 194 | | | | 33,603 | |

| CyberArk Software Ltd. (a) | | | 88 | | | | 24,334 | |

| Fujitsu Ltd. - ADR | | | 3,491 | | | | 65,107 | |

| Infosys Ltd. - ADR | | | 20,315 | | | | 424,787 | |

| LG Corp. | | | 139 | | | | 7,625 | |

SP Funds S&P World (ex-US) ETF

Schedule of Investments

October 31, 2024

| NEC Corp. | | | 555 | | | | 48,222 | |

| Nomura Research Institute Ltd. - ADR | | | 941 | | | | 28,202 | |

| Obic Co. Ltd. | | | 800 | | | | 26,212 | |

| Wipro Ltd. - ADR | | | 7,855 | | | | 50,900 | |

| | | | | | | | 818,555 | |

| | | | | | | | | |

| Cosmetics/Personal Care - 2.7% | | | | | | | | |

| Beiersdorf AG - ADR | | | 849 | | | | 22,880 | |

| Essity AB - Class B | | | 1,230 | | | | 34,578 | |

| Haleon PLC - ADR | | | 7,113 | | | | 68,925 | |

| Kao Corp. - ADR | | | 5,408 | | | | 47,374 | |

| L’Oreal SA - ADR | | | 2,447 | | | | 183,109 | |

| Shiseido Co. Ltd. - ADR | | | 1,100 | | | | 23,397 | |

| Unicharm Corp. - ADR | | | 4,751 | | | | 30,739 | |

| Unilever PLC - ADR | | | 5,000 | | | | 304,550 | |

| | | | | | | | 715,552 | |

| | | | | | | | | |

| Distribution/Wholesale - 0.3% | | | | | | | | |

| AddTech AB - Class B | | | 529 | | | | 14,604 | |

| Bunzl PLC - ADR | | | 680 | | | | 30,148 | |

| Pop Mart International Group Ltd. | | | 3,483 | | | | 31,584 | |

| Toromont Industries Ltd. | | | 162 | | | | 14,295 | |

| | | | | | | | 90,631 | |

| | | | | | | | | |

| Electric - 0.2% | | | | | | | | |

| Dubai Electricity & Water Authority PJSC | | | 38,304 | | | | 25,967 | |

| Origin Energy Ltd. | | | 3,510 | | | | 22,140 | |

| | | | | | | | 48,107 | |

| | | | | | | | | |

| Electrical Components & Equipment - 1.3% | | | | | | | | |

| Ecopro BM Co. Ltd. (a) | | | 79 | | | | 9,760 | |

| Legrand SA - ADR | | | 2,680 | | | | 60,300 | |

| Schneider Electric SE - ADR | | | 5,375 | | | | 277,834 | |

| | | | | | | | 347,894 | |

| | | | | | | | | |

| Electronics - 2.6% | | | | | | | | |

| ABB Ltd. | | | 3,358 | | | | 186,016 | |

| Assa Abloy AB - ADR | | | 4,613 | | | | 71,871 | |

| BYD Electronic International Co. Ltd. | | | 4,327 | | | | 18,645 | |

| Delta Electronics Thailand PCL | | | 27,405 | | | | 112,073 | |

| Halma PLC | | | 813 | | | | 25,869 | |

| Hoya Corp. - ADR | | | 715 | | | | 96,003 | |

| Kyocera Corp. - ADR | | | 2,972 | | | | 30,077 | |

| Murata Manufacturing Co. Ltd. - ADR | | | 7,558 | | | | 66,132 | |

| NIDEC Corp. - ADR | | | 9,048 | | | | 44,969 | |

| Samsung Electro-Mechanics Co. Ltd. | | | 83 | | | | 7,121 | |

| SCREEN Holdings Co. Ltd. | | | 207 | | | | 13,630 | |

| Shimadzu Corp. | | | 611 | | | | 18,259 | |

| | | | | | | | 690,665 | |

| | | | | | | | | |

| Energy-Alternate Sources - 0.2% | | | | | | | | |

| Vestas Wind Systems AS - ADR (a) | | | 7,066 | | | | 43,950 | |

| | | | | | | | | |

| Engineering & Construction - 0.7% | | | | | | | | |

| Airports of Thailand PCL | | | 24,074 | | | | 43,696 | |

| Grupo Aeroportuario del Pacifico SAB de CV - ADR | | | 205 | | | | 35,689 | |

| Grupo Aeroportuario del Sureste SAB de CV - ADR | | | 115 | | | | 30,967 | |

| Samsung C&T Corp. | | | 112 | | | | 9,496 | |

| Stantec, Inc. | | | 240 | | | | 19,445 | |

| WSP Global, Inc. | | | 249 | | | | 44,455 | |

| | | | | | | | 183,748 | |

SP Funds S&P World (ex-US) ETF

Schedule of Investments

October 31, 2024

| Environmental Control - 0.3% | | | | | | | | |

| Waste Connections, Inc. | | | 526 | | | | 92,876 | |

| | | | | | | | | |

| Food - 2.9% | | | | | | | | |

| Ajinomoto Co., Inc. - ADR | | | 978 | | | | 37,624 | |

| Bid Corp Ltd. | | | 2,162 | | | | 51,011 | |

| BIM Birlesik Magazalar AS | | | 2,327 | | | | 31,658 | |

| Chocoladefabriken Lindt & Spruengli AG | | | 2 | | | | 23,523 | |

| Kerry Group PLC - ADR | | | 297 | | | | 29,652 | |

| Mowi ASA - ADR | | | 895 | | | | 15,430 | |

| Nestle SA - ADR | | | 5,235 | | | | 494,812 | |

| Nissin Foods Holdings Co. Ltd. | | | 533 | | | | 14,416 | |

| Orkla ASA - ADR | | | 1,468 | | | | 13,726 | |

| SD Guthrie Bhd | | | 21,544 | | | | 22,631 | |

| Sumber Alfaria Trijaya Tbk PT | | | 85,834 | | | | 18,157 | |

| Want Want China Holdings Ltd. | | | 32,472 | | | | 20,216 | |

| Yakult Honsha Co. Ltd. | | | 389 | | | | 8,473 | |

| | | | | | | | 781,329 | |

| | | | | | | | | |

| Food Service - 0.4% | | | | | | | | |

| Compass Group PLC - ADR | | | 3,397 | | | | 112,407 | |

| | | | | | | | | |

| Forest Products & Paper - 0.1% | | | | | | | | |

| Mondi PLC - ADR | | | 346 | | | | 11,131 | |

| UPM-Kymmene Oyj - ADR | | | 987 | | | | 28,870 | |

| | | | | | | | 40,001 | |

| | | | | | | | | |

| Hand/Machine Tools - 0.4% | | | | | | | | |

| Fuji Electric Co Ltd. | | | 359 | | | | 18,737 | |

| Makita Corp. - ADR | | | 527 | | | | 17,217 | |

| Schindler Holding AG | | | 67 | | | | 19,479 | |

| Techtronic Industries Co. Ltd. - ADR | | | 572 | | | | 41,516 | |

| | | | | | | | 96,949 | |

| | | | | | | | | |

| Healthcare-Products - 2.3% | | | | | | | | |

| Alcon AG | | | 992 | | | | 91,296 | |

| Cochlear Ltd. - ADR | | | 310 | | | | 29,084 | |

| Coloplast A/S - ADR | | | 2,179 | | | | 27,281 | |

| EssilorLuxottica SA - ADR | | | 1,192 | | | | 139,333 | |

| Fisher & Paykel Healthcare Corp Ltd. | | | 1,275 | | | | 27,310 | |

| FUJIFILM Holdings Corp. - ADR | | | 5,284 | | | | 62,985 | |

| Olympus Corp. | | | 2,396 | | | | 42,635 | |

| Siemens Healthineers AG - ADR | | | 1,224 | | | | 31,824 | |

| Smith & Nephew PLC - ADR | | | 803 | | | | 20,147 | |

| Sonova Holding AG - ADR | | | 519 | | | | 37,918 | |

| Straumann Holding AG - ADR | | | 2,404 | | | | 31,516 | |

| Sysmex Corp. - ADR | | | 859 | | | | 15,909 | |

| Terumo Corp. - ADR | | | 3,480 | | | | 66,190 | |

| | | | | | | | 623,428 | |

| | | | | | | | | |

| Healthcare-Services - 1.0% | | | | | | | | |

| Bangkok Dusit Medical Services PCL | | | 27,515 | | | | 22,423 | |

| Bumrungrad Hospital PCL | | | 1,376 | | | | 11,091 | |

| ICON PLC (a) | | | 190 | | | | 42,201 | |

| IHH Healthcare Bhd | | | 13,946 | | | | 23,089 | |

| Lonza Group AG - ADR | | | 1,612 | | | | 99,412 | |

| Sonic Healthcare Ltd. - ADR | | | 849 | | | | 14,858 | |

| Wuxi Biologics Cayman, Inc. - ADR (a) | | | 11,007 | | | | 46,229 | |

| | | | | | | | 259,303 | |

SP Funds S&P World (ex-US) ETF

Schedule of Investments

October 31, 2024

| Home Builders - 0.1% | | | | | | | | |

| Sekisui Chemical Co. Ltd. | | | 527 | | | | 7,508 | |

| Taylor Wimpey PLC - ADR | | | 705 | | | | 13,402 | |

| | | | | | | | 20,910 | |

| | | | | | | | | |

| Home Furnishings - 0.2% | | | | | | | | |

| Haier Smart Home Co. Ltd. - ADR | | | 3,396 | | | | 49,140 | |

| | | | | | | | | |

| Household Products/Wares - 0.4% | | | | | | | | |

| Henkel AG & Co. KGaA - ADR | | | 665 | | | | 12,901 | |

| Reckitt Benckiser Group PLC - ADR | | | 7,066 | | | | 85,428 | |

| | | | | | | | 98,329 | |

| | | | | | | | | |

| Internet - 7.9% | | | | | | | | |

| Allegro.eu SA (a) | | | 2,589 | | | | 22,685 | |

| Auto Trader Group PLC - ADR | | | 6,081 | | | | 16,540 | |

| CAR Group Ltd. | | | 768 | | | | 19,005 | |

| Coupang, Inc. (a) | | | 2,409 | | | | 62,128 | |

| GoTo Gojek Tokopedia Tbk PT (a) | | | 3,990,444 | | | | 17,289 | |

| JD.com, Inc. - ADR | | | 8,018 | | | | 325,691 | |

| Kanzhun Ltd. - ADR | | | 1,560 | | | | 22,698 | |

| MakeMyTrip Ltd. (a) | | | 320 | | | | 32,477 | |

| Meituan - ADR (a) | | | 15,484 | | | | 732,393 | |

| PDD Holdings, Inc. - ADR (a) | | | 3,966 | | | | 478,260 | |

| Prosus NV - ADR | | | 14,071 | | | | 118,478 | |

| Shopify, Inc. - Class A (a) | | | 2,465 | | | | 192,609 | |

| Trend Micro, Inc.- ADR | | | 295 | | | | 15,420 | |

| Vipshop Holdings Ltd. - ADR | | | 1,238 | | | | 17,877 | |

| Wix.com Ltd. (a) | | | 113 | | | | 18,884 | |

| | | | | | | | 2,092,434 | |

| | | | | | | | | |

| Iron/Steel - 1.1% | | | | | | | | |

| BlueScope Steel Ltd. | | | 997 | | | | 13,263 | |

| Fortescue Ltd. - ADR | | | 1,939 | | | | 48,417 | |

| Vale SA - ADR | | | 21,279 | | | | 227,685 | |

| | | | | | | | 289,365 | |

| | | | | | | | | |

| Leisure Time - 0.4% | | | | | | | | |

| Amadeus IT Group SA - ADR | | | 1,037 | | | | 75,048 | |

| Shimano, Inc. - ADR | | | 1,468 | | | | 21,579 | |

| | | | | | | | 96,627 | |

| | | | | | | | | |

| Lodging - 0.1% | | | | | | | | |

| H World Group Ltd. - ADR | | | 803 | | | | 29,462 | |

| | | | | | | | | |

| Machinery-Construction & Mining - 1.6% | | | | | | | | |

| Epiroc AB - ADR | | | 1,146 | | | | 22,221 | |

| Hitachi Ltd. - ADR | | | 4,697 | | | | 237,199 | |

| Metso Oyj | | | 895 | | | | 8,459 | |

| Mitsubishi Electric Corp. - ADR | | | 2,188 | | | | 75,595 | |

| Sandvik AB - ADR | | | 2,538 | | | | 49,567 | |

| Siemens Energy AG - ADR (a) | | | 1,054 | | | | 43,035 | |

| | | | | | | | 436,076 | |

| | | | | | | | | |

| Machinery-Diversified - 2.3% | | | | | | | | |

| Atlas Copco AB - ADR | | | 3,634 | | | | 52,766 | |

| Atlas Copco AB - ADR | | | 5,220 | | | | 85,556 | |

SP Funds S&P World (ex-US) ETF

Schedule of Investments

October 31, 2024

| Daifuku Co. Ltd. - ADR | | | 1,559 | | | | 14,670 | |

| FANUC Corp. - ADR | | | 3,867 | | | | 51,392 | |

| Hexagon AB - ADR | | | 4,993 | | | | 46,335 | |

| Keyence Corp. | | | 407 | | | | 186,446 | |

| Kone Oyj - ADR | | | 1,846 | | | | 50,470 | |

| Omron Corp. - ADR | | | 389 | | | | 15,358 | |

| SMC Corp. - ADR | | | 2,837 | | | | 60,768 | |

| Spirax Group PLC | | | 151 | | | | 12,531 | |

| Wartsila OYJ Abp - ADR | | | 4,904 | | | | 18,998 | |

| Yaskawa Electric Corp. - ADR | | | 205 | | | | 11,794 | |

| | | | | | | | 607,084 | |

| | | | | | | | | |

| Media - 0.3% | | | | | | | | |

| Informa PLC - ADR | | | 1,238 | | | | 25,305 | |

| Pearson PLC - ADR | | | 1,238 | | | | 18,075 | |

| Thomson Reuters Corp. | | | 275 | | | | 44,962 | |

| | | | | | | | 88,342 | |

| | | | | | | | | |

| Metal Fabricate/Hardware - 0.2% | | | | | | | | |

| Prysmian SpA - ADR | | | 1,209 | | | | 42,388 | |

| SKF AB - ADR | | | 573 | | | | 10,830 | |

| Tenaris SA - ADR | | | 389 | | | | 12,790 | |

| | | | | | | | 66,008 | |

| | | | | | | | | |

| Mining - 4.8% | | | | | | | | |

| Agnico Eagle Mines Ltd. | | | 1,042 | | | | 89,836 | |

| Amman Mineral Internasional PT (a) | | | 69,400 | | | | 40,570 | |

| Antofagasta PLC | | | 703 | | | | 15,654 | |

| Barrick Gold Corp. | | | 3,570 | | | | 68,918 | |

| BHP Group Ltd. - ADR | | | 5,068 | | | | 281,071 | |

| Boliden AB - ADR | | | 205 | | | | 12,714 | |

| Cameco Corp. | | | 994 | | | | 51,884 | |

| Franco-Nevada Corp. | | | 395 | | | | 52,372 | |

| Gold Fields Ltd. - ADR | | | 5,002 | | | | 82,433 | |

| Grupo Mexico SAB de CV - Class B | | | 18,410 | | | | 96,470 | |

| Impala Platinum Holdings Ltd. - ADR (a) | | | 5,462 | | | | 36,705 | |

| Ivanhoe Mines Ltd. - Class A (a) | | | 1,457 | | | | 19,243 | |

| Kinross Gold Corp. | | | 2,501 | | | | 25,208 | |

| Norsk Hydro ASA - ADR | | | 2,363 | | | | 14,414 | |

| Pan American Silver Corp. | | | 739 | | | | 17,262 | |

| Pilbara Minerals Ltd. (a) | | | 3,493 | | | | 6,520 | |

| Press Metal Aluminium Holdings Bhd | | | 18,896 | | | | 20,497 | |

| Rio Tinto Ltd. | | | 767 | | | | 59,939 | |

| Rio Tinto PLC - ADR | | | 2,170 | | | | 140,811 | |

| South32 Ltd. - ADR | | | 1,790 | | | | 21,337 | |

| Southern Copper Corp. | | | 452 | | | | 49,517 | |

| Wheaton Precious Metals Corp. | | | 997 | | | | 65,766 | |

| | | | | | | | 1,269,141 | |

| | | | | | | | | |

| Miscellaneous Manufacturing - 0.3% | | | | | | | | |

| Alfa Laval AB - ADR | | | 683 | | | | 30,127 | |

| Indutrade AB | | | 542 | | | | 14,619 | |

| Smiths Group PLC - ADR | | | 619 | | | | 12,244 | |

| Sunny Optical Technology Group Co. Ltd. - ADR | | | 297 | | | | 19,406 | |

| | | | | | | | 76,396 | |

| | | | | | | | | |

| Office-Business Equipment - 0.2% | | | | | | | | |

| Canon, Inc. | | | 1,954 | | | | 64,190 | |

SP Funds S&P World (ex-US) ETF

Schedule of Investments

October 31, 2024

| Oil & Gas - 1.9% | | | | | | |

| ADNOC Drilling Co. PJSC | | | 10,625 | | | | 14,666 | |

| ARC Resources Ltd. | | | 1,335 | | | | 22,085 | |

| Canadian Natural Resources Ltd. | | | 4,334 | | | | 147,218 | |

| Cenovus Energy, Inc. | | | 2,647 | | | | 42,517 | |

| Imperial Oil Ltd. | | | 343 | | | | 25,566 | |

| Neste Oyj - ADR | | | 1,790 | | | | 14,195 | |

| PTT Exploration & Production PCL | | | 8,086 | | | | 30,312 | |

| Suncor Energy, Inc. | | | 2,588 | | | | 97,583 | |

| Tourmaline Oil Corp. | | | 660 | | | | 30,392 | |

| Turkiye Petrol Rafinerileri AS | | | 5,104 | | | | 21,523 | |

| Woodside Energy Group Ltd. - ADR | | | 3,895 | | | | 61,346 | |

| | | | | | | | 507,403 | |

| | | | | | | | | |

| Pharmaceuticals - 11.5% | | | | | | | | |

| Astellas Pharma, Inc. - ADR | | | 3,918 | | | | 45,762 | |

| AstraZeneca PLC - ADR | | | 6,158 | | | | 438,142 | |

| Celltrion, Inc. | | | 215 | | | | 28,433 | |

| Chugai Pharmaceutical Co Ltd. - ADR | | | 2,611 | | | | 62,220 | |

| CSPC Pharmaceutical Group Ltd. | | | 46,219 | | | | 34,184 | |

| Daiichi Sankyo Co. Ltd. - ADR | | | 3,918 | | | | 127,609 | |

| Dr Reddy’s Laboratories Ltd. - ADR | | | 672 | | | | 49,661 | |

| Eisai Co. Ltd. | | | 624 | | | | 21,212 | |

| GSK PLC - ADR | | | 4,216 | | | | 154,980 | |

| Merck KGaA - ADR | | | 1,513 | | | | 49,989 | |

| Novartis AG - ADR | | | 3,920 | | | | 424,928 | |

| Novo Nordisk A/S - ADR | | | 6,313 | | | | 706,740 | |

| Ono Pharmaceutical Co. Ltd. - ADR | | | 3,212 | | | | 13,266 | |

| Otsuka Holdings Co. Ltd. - ADR | | | 2,225 | | | | 67,328 | |

| Roche Holding AG | | | 61 | | | | 20,684 | |

| Roche Holding AG - ADR | | | 11,327 | | | | 439,601 | |

| Sandoz Group AG - ADR | | | 881 | | | | 40,182 | |

| Sanofi SA - ADR | | | 4,378 | | | | 231,509 | |

| Shionogi & Co. Ltd. - ADR | | | 2,992 | | | | 21,273 | |

| Sino Biopharmaceutical Ltd. | | | 57,115 | | | | 25,933 | |

| UCB SA - ADR | | | 481 | | | | 46,162 | |

| | | | | | | | 3,049,798 | |

| | | | | | | | | |

| Pipelines - 0.2% | | | | | | | | |

| Adnoc Gas PLC | | | 31,855 | | | | 28,707 | |

| Petronas Gas Bhd | | | 5,698 | | | | 22,485 | |

| | | | | | | | 51,192 | |

| | | | | | | | | |

| Real Estate - 0.8% | | | | | | | | |

| Aldar Properties PJSC | | | 15,664 | | | | 32,497 | |

| Daito Trust Construction Co. Ltd. - ADR | | | 481 | | | | 13,081 | |

| Emaar Properties PJSC | | | 25,679 | | | | 60,754 | |

| FirstService Corp. | | | 84 | | | | 15,535 | |

| KE Holdings, Inc. - ADR | | | 3,771 | | | | 82,698 | |

| | | | | | | | 204,565 | |

| | | | | | | | | |

| Retail - 3.4% | | | | | | | | |

| Abu Dhabi National Oil Co. for Distribution PJSC | | | 11,932 | | | | 11,727 | |

| ANTA Sports Products Ltd. - ADR | | | 247 | | | | 66,186 | |

| Associated British Foods PLC - ADR | | | 527 | | | | 15,077 | |

| Cie Financiere Richemont SA - ADR | | | 11,423 | | | | 165,291 | |

| Clicks Group Ltd. - ADR | | | 559 | | | | 24,233 | |

| Dollarama, Inc. | | | 584 | | | | 60,702 | |

| Fast Retailing Co. Ltd. - ADR | | | 4,215 | | | | 134,669 | |

| H & M Hennes & Mauritz AB - ADR | | | 5,002 | | | | 14,506 | |

| Industria de Diseno Textil SA - ADR | | | 4,749 | | | | 136,344 | |

SP Funds S&P World (ex-US) ETF

Schedule of Investments

October 31, 2024

| JD Health International, Inc. (a) | | | 5,840 | | | | 20,883 | |

| JUMBO SA | | | 440 | | | | 11,703 | |

| Li Ning Co. Ltd. - ADR | | | 531 | | | | 27,347 | |

| MatsukiyoCocokara & Co. | | | 435 | | | | 5,969 | |

| Moncler SpA | | | 434 | | | | 24,001 | |

| Mr Price Group Ltd. | | | 1,448 | | | | 20,953 | |

| Nitori Holdings Co. Ltd. - ADR | | | 1,514 | | | | 18,986 | |

| Pan Pacific International Holdings Corp. - ADR | | | 1,087 | | | | 26,990 | |

| Raia Drogasil SA | | | 5,346 | | | | 22,580 | |

| Wesfarmers Ltd. - ADR | | | 4,657 | | | | 102,501 | |

| | | | | | | | 910,648 | |

| | | | | | | | | |

| Semiconductors - 20.7% | | | | | | | | |

| Advantest Corp. - ADR | | | 1,661 | | | | 95,973 | |

| ARM Holdings PLC - ADR (a) | | | 235 | | | | 33,206 | |

| ASM International NV | | | 94 | | | | 52,270 | |

| ASML Holding NV | | | 801 | | | | 540,197 | |

| Disco Corp. - ADR | | | 1,983 | | | | 56,674 | |

| Infineon Technologies AG - ADR | | | 2,882 | | | | 91,215 | |

| Lasertec Corp. - ADR | | | 807 | | | | 22,168 | |

| Renesas Electronics Corp. - ADR | | | 6,683 | | | | 45,311 | |

| Samsung Electronics Co. Ltd. | | | 7,258 | | | | 311,358 | |

| STMicroelectronics NV | | | 1,375 | | | | 37,364 | |

| Taiwan Semiconductor Manufacturing Co. Ltd. - ADR | | | 21,000 | | | | 4,001,340 | |

| Tokyo Electron Ltd. - ADR | | | 1,917 | | | | 142,759 | |

| United Microelectronics Corp. - ADR | | | 13,083 | | | | 89,488 | |

| | | | | | | | 5,519,323 | |

| | | | | | | | | |

| Shipbuilding - 0.2% | | | | | | | | |

| Kongsberg Gruppen ASA - ADR | | | 345 | | | | 17,975 | |

| Yangzijiang Shipbuilding Holdings Ltd. | | | 15,235 | | | | 29,712 | |

| | | | | | | | 47,687 | |

| | | | | | | | | |

| Software - 2.9% | | | | | | | | |

| Constellation Software, Inc. | | | 39 | | | | 117,481 | |

| Dassault Systemes SE - ADR | | | 1,520 | | | | 51,771 | |

| Descartes Systems Group, Inc. (a) | | | 174 | | | | 18,056 | |

| Nice Ltd. - ADR (a) | | | 115 | | | | 19,976 | |

| Sage Group PLC - ADR | | | 532 | | | | 26,595 | |

| SAP SE - ADR | | | 2,055 | | | | 480,130 | |

| WiseTech Global Ltd. | | | 389 | | | | 30,137 | |

| Xero Ltd. (a) | | | 294 | | | | 28,789 | |

| | | | | | | | 772,935 | |

| | | | | | | | | |

| Telecommunications - 2.6% | | | | | | | | |

| Celcomdigi Bhd | | | 20,304 | | | | 15,811 | |

| Chunghwa Telecom Co Ltd. - ADR | | | 2,311 | | | | 87,102 | |

| Elisa Oyj | | | 381 | | | | 18,100 | |

| Emirates Telecommunications Group Co. PJSC | | | 14,438 | | | | 69,655 | |

| Hellenic Telecommunications Organization SA - ADR | | | 1,974 | | | | 16,246 | |

| Nokia Oyj - ADR | | | 12,463 | | | | 58,701 | |

| Singapore Telecommunications Ltd. - ADR | | | 1,330 | | | | 31,122 | |

| Telefonaktiebolaget LM Ericsson - ADR | | | 6,598 | | | | 55,291 | |

| Telekom Malaysia Bhd | | | 12,244 | | | | 18,147 | |

| Vodacom Group Ltd. - ADR | | | 3,442 | | | | 21,581 | |

| Xiaomi Corp. - Class B (a) | | | 84,225 | | | | 289,258 | |

| | | | | | | | 681,014 | |

| | | | | | | | | |

| Transportation - 1.8% | | | | | | | | |

| Canadian National Railway Co. | | | 1,128 | | | | 121,665 | |

SP Funds S&P World (ex-US) ETF

Schedule of Investments