Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ☒ | | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the fiscal year ended December 31, 2023 |

| ☐ | | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 000-56640

TRANS AMERICAN AQUACULTURE, INC.

(Exact Name of Registrant as Specified in its Charter)

| Colorado | | 02-0685828 |

| (State of other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | |

| 1022 Shadyside Lane, Dallas, TX | | 75223 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(972) 358-6037

(Registrant’s Telephone Number, including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| N/A | N/A | N/A |

Securities registered pursuant to Section 12(g) of the Act: Common Stock, par value $0.000001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes o No ☒

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes o No ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one)

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☒ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company, as defined in Rule 12b-2 of the Exchange Act. Yes ☐ No ☒

The aggregate market value of the voting and non-voting stock held by non-affiliates of the registrant as of the last business day of the registrants most recently completed second fiscal quarter, based on the price at which the common equity was last sold on the OTC Markets on June 30, 2023 was approximately $5,221,790. For purposes of this computation only, all officers, directors and 10% or greater stockholders of the registrant are deemed to be “affiliates.”

The number of shares of the registrant’s common stock, $0.000001 par value per share, outstanding as of June 27, 2024, was 1,416,654,274.

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (the “Form 10-K”) for Trans American Aquaculture, Inc., a Colorado corporation (the “Company”), and the exhibits attached hereto contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward looking statements concern the Company’s anticipated results and developments in the Company’s operations in future periods, planned development of the Company’s technology, plans related to its business and other matters that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. Such forward-looking statements include, among others, those statements including the words “expects”, “anticipates”, “intends”, “believes” and similar language. Our actual results may differ significantly from those projected in the forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to, those discussed in the section “Risk Factors.” We undertake no obligation to publicly release any revisions to the forward-looking statements or reflect events or circumstances after the date of this report.

Although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are a number of risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. These factors include are described further under the sections titled “Risk Factors,” and “Management’s Discussion and Analysis.” Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, believed, estimated or expected. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. We disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

We qualify all the forward-looking statements contained in this Form 10-K by the foregoing cautionary statements.

PART I

As used in this Form 10-K, the terms “we,” “us,” “our,” and the “Company” refer to Trans American Aquaculture, Inc., a Colorado corporation.

Organization

Trans American Aquaculture, Inc.

Trans American Aquaculture, Inc. was originally incorporated in the State of Delaware on September 18, 2006 as “Omega Environmental, Inc.” After several name changes, the entity was redomiciled in Colorado on July 25, 2018 as “XYZ Hemp Inc.” After several name changes, the Company filed Articles of Amendment on October 23, 2022 changing the name to “Gold River Productions, Inc.” On August 9, 2023, the Company filed Articles of Amendment changing the name to “Trans American Aquaculture, Inc.”

Our principal executive offices are located at 1022 Shady Side Lane, Dallas, TX 75223 and our phone number is (972) 358-6037.

Trans American Aquaculture, LLC

Trans American Aquaculture, LLC (“TAA”) was organized in the State of Texas on April 4, 2017. TAA was founded by Luis Arturo Granda Roman, Cesar Granda, and Adam Thomas.

Change of Control

On August 28, 2022, the Company entered into a Stock Purchase Agreement by, between, and among Adam Thomas and Richard Goulding (the “SPA”) pursuant to which Mr. Goulding sold to Mr. Thomas 9,078,000 shares of Series A Preferred Stock (retaining 640,000 shares of Series A Preferred Stock) and 5,000 shares of the Series B Preferred Stock (together, with the shares of Series A Preferred Stock acquired, the “Acquired Shares”) for $5,000. In addition to the cash payment, Mr. Thomas agreed to the following covenants:

| | · | take reasonable steps to cause to occur, within seven days of closing, the reverse merger or acquisition by the Company, of TAA; |

| | | |

| | · | form the Series C Preferred Stock of the Company to be issued in the reverse acquisition which will include a provision limiting conversion or transfer for a minimum of 12 months from issuance; |

| | | |

| | · | cancel and withdraw the Company’s Series A Preferred Stock; |

| | | |

| | · | refrain from transferring the Company’s Series B Preferred Stock and the Series A Preferred Stock prior to the cancelation of the Series A Preferred Stock for 12 months; |

| | | |

| | · | at closing, increase the authorized shares of common stock of the Company to 3,000,000,000; |

| | | |

| | · | immediately prior to closing, Mr. Goulding will convert his remaining, unacquired, 640,000 shares of Series A Preferred Stock into 64,000,000 shares of Common Stock of the Company; |

| | · | take reasonable steps to cause the similar conversion of the other outstanding shares of the Company’s Series A Preferred Stock, by the holders thereof; |

| | | |

| | · | enter into the Assumption Agreement (as defined below); |

| | · | issue an aggregate of 15,248,503 shares of previously-earned Common Stock of the Company to the following individuals: |

| | o | Scott Fetterman (748,503 shares); |

| | | |

| | o | Stephen Swinson (4,000,000 shares); |

| | | |

| | o | John Patrick Love (4,000,000 shares); |

| | | |

| | o | John Ohlin (1,500,000 shares); and |

| | | |

| | o | David Eckert (5,000,000 shares). |

In addition, each of the parties to the SPA covenanted that, within nine months of closing, to reasonably cooperate in the process of forming a new company to be formed by Mr. Goulding (“Newco”) and issuing not less than 35% of the shares of Newco, calculated fully diluted, pro rata, to the shareholders of the Company (including those holding in street name, through DTCC) as then existed, to once again attempt to become a separate public company (the “Makeup” or the “Makeup Company”), without dilution to the shareholders of the Company, by issuance of shares of the Newco to the existing shareholders of the Company. All parties to the SPA agreed to reasonably cooperate and work jointly, including providing all documentation when necessary, and upon request, to enable the Makeup Company to file with FINRA and the SEC in accordance with the reasonable desires of Mr. Goulding. The costs of the Makeup are to be borne by the Newco. Until the Makeup, the Makeup Company will operate as a separate entity, with Mr. Goulding maintaining operational autonomy and checkbook control under his sole control and authority, without interference by Mr. Thomas. There is no assurance that the Makeup Company will be formed or that the Company’s shareholders as then existed at the time of the closing of the SPA will receive shares of Newco.

The closing of the SPA took place on August 28, 2022. At the time of the closing, Mr. Goulding was Chairman and Chief Executive Officer of the Company and Mr. Thomas had no affiliation with the Company or Mr. Goulding.

As of the date hereof, the Makeup has yet to occur and the parties are contemplating an amendment to the SPA; however, no terms have been agreed.

On August 29 2022, pursuant to the SPA, the Company entered into an Assignment of Rights and Assumption of Liabilities Agreement with Mr. Goulding (the “Assumption Agreement”) pursuant to which the Company sold, assigned, transferred, conveyed, and delivered to Mr. Goulding all of the Assets (as defined in the Assumption Agreement) and Liabilities (as defined in the Assumption Agreement) and any rights or obligations in the Assets and Liabilities to which the Company was entitled or obligated.

Reverse Acquisition

On September 13, 2022, the Company entered into the Definitive Equity Exchange Agreement with TAA, the members of TAA, and Adam Thomas, the managing member of TAA and controlling shareholder of the Company (the “Exchange Agreement”), pursuant to which the Company issued to the members of TAA, on a pro-rata basis, 100,000 shares of the Company’s Series C Preferred Stock, representing 85% of the Company’s fully-diluted outstanding shares of common stock, on an as-converted basis. The members of TAA relinquished all of their ownership interests of TAA to the Company.

The Exchange Agreement went effective on September 13, 2022 and, at that time, TAA became a wholly owned subsidiary of the Company.

Our Business

We provide extra-large farm-raised Pacific white shrimp, 100% free of antibiotics and hormones, to the U.S. domestic seafood market. Grown at our 1,880 acre farm located in Rio Hondo, Texas, our shrimp are meticulously raised in line with industry best practices according to the Best Aquaculture Practices (BAP) farm guidelines[1] using only authentic, sustainable practices. We believe our practices are “authentic” and “sustainable” because we do not discharge our water into the local environment thus there is no ecological impact to the surrounding areas. We use only the top-quality ingredients in our feed to ensure our animals are getting a proper and healthy diet. We never use antibiotics or chemicals, and we have proper working and living conditions for our workers, which have been approved by Texas Parks and Wildlife.

We believe our products are superior due to the following:

| | · | Our feed ingredients are sourced 100% from products from the U.S., which are rigorously inspected and tested and must meet USDA standards. Foreign competitors are under the administrative oversight of their local governments. |

| | | |

| | · | We are transparent in our production process meaning we are willing and able to provide all ingredients, treatments, and processes utilized to cultivate our shrimp. |

| | | |

| | · | Our products are eco-friendly in that our farm does not discharge into the environment. Our system is 100% closed and has zero impact to the local ecosystem and mangroves. |

| | | |

| | · | Our products are safe in that they are 100% chemical and antibiotic free. Currently, only 2% of imported shrimp is tested for antibiotics and toxins.[2] |

In addition to the quality of the products, what sets our shrimp apart from any other domestic shrimp is the clean, sweet taste to our shrimp. We believe this to be a byproduct of the natural environment along with our tried-and-true methods that provide a unique combination unlike anywhere else due to the soil content, mineral content, brackish water, and climate, which we believe are unique to any circumstance in North America and possibly the world.

We have and will continue to utilize strong genetic linage broodstock for cultivation of our own post larvae in our onsite maturation and hatchery. We believe that these facilities allow us to continually develop animals with increasing growth rates, lower mortality, and stronger disease resistance, which are all instrumental to increasing bottom line profits.

__________________

[1] https://www.bapcertification.org/Downloadables/pdf/BAP%20-%20BAP%20Farm%20Standard%20-%20Issue%203.1%20-%2007-February-2023.pdf

[2] https://civileats.com/2023/06/20/cheap-imports-leave-us-shrimpers-struggling-to-

compete/#:~:text=The%20U.S.%20Food%20and%20Drug,before%20entering%20the%20U.S.%20market.

We believe that our onsite maturation and hatchery facilities give us a distinct advantage on all other farms in Texas because no other farm in Texas develops their own lines of Broodstock in the manner that we do. This is due to our facilities and ability to support year-round sustainment of Broodstocks. There are other maturation and hatchery facilities but none in a combined facility in the manner that we have. In addition to being able to provide two full harvests, our team is the only one in the U.S. that has been capable of producing shrimp of greater than 28 grams on a large-scale consistent basis as we have both historically and currently done. We believe that this gives us a product that is unique worldwide, “a jumbo, farm raised shrimp that is 100% a product of the United States.”

We believe our animals have “strong genetic lineage” because our animals have a proven track record of disease resistance and to be disease free. In addition to that, our growth rates and tolerance for colder temperature water is superior to the current competitors in the U.S.

Our Products

We produce premium quality, sustainably raised, farmed shrimp for sale to markets, distributors, and restaurants. Our main product is Pacific White Leg Shrimp Head-on and Headless/Shell-on, which is favored by high-end markets, ethnic stores, and businesses in addition to American, Mexican, European, and Asian customers. Vannamei (species of shrimp we develop) is the most widely farm raised shrimp in the world, accounting for 80% of all farm raised shrimp in the world.[3]

We produce, market, and sell Pacific White Leg farm-raised shrimp for sale to markets, businesses, and restaurants. We also sell broodstock for sale to foreign producers of shrimp.

Head-on and Headless/Shell-on shrimp are the most common forms of shrimp sold throughout the world. The typical size is 18 grams, which translates to 31/35 count. This count means that there are 31-35 individual shrimp per pound. We focus on producing shrimp that are more than 28 grams, resulting in a 21/25 count. Our reason for focusing on this size is the lack of supply in the market and the premium selling price due to the scarcity. Many global producers are reluctant to sell shrimp at this size due to the complexity of the grow out once the shrimp reach a certain size. This is where we believe our competitive advantage comes in with our experience in growing “jumbo” shrimp.

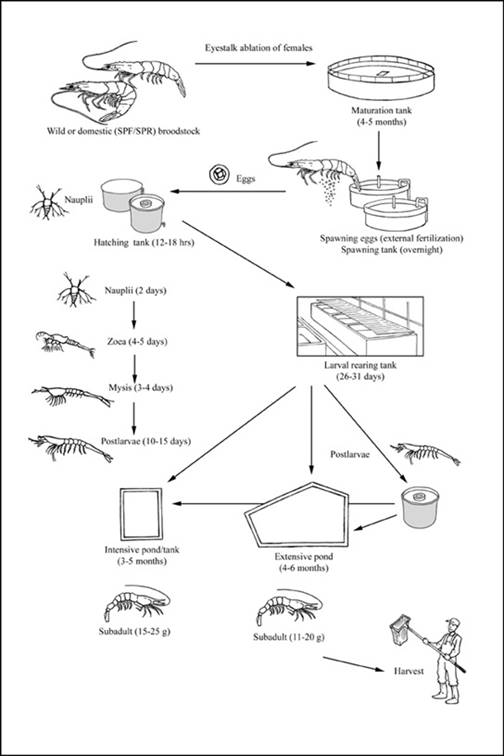

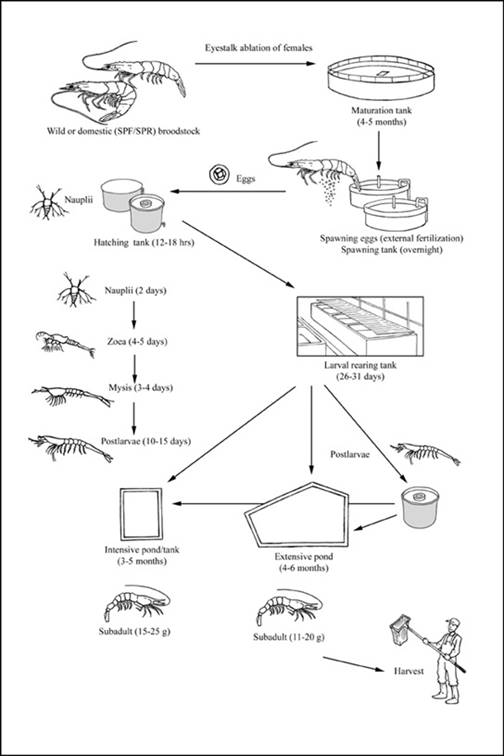

Broodstock are a group of mature shrimps that are used for breeding purposes. These are essentially the “alphas” of the group having grown to the largest sizes, resisted various strains of potential diseases, and adverse climate conditions. The males and females are then bred to produce larvae that are genetically superior than previous lines. The process continues over and over until a superior genetic line is achieved. The product cycle for post-larvae (PL) is 21 days, so new PLs can be sold every 21 days. The entire five-month process (as shown in the diagram below) is as follows:

| | · | Spawning to the hatching tanks – two days; |

| | · | Larvae rearing tanks – one month; and |

| | · | Grow out process – four months. |

This translates into us being able to produce two meaningful large harvests. We start the process in January, then end in November. Broodstock take longer to develop but we believe that this process is worth the wait as, in time, a superior shrimp is more consistently produced.

__________________

[3] https://www.worldwildlife.org/industries/farmed-shrimp.

Our business is seasonal. We grow shrimp in outdoor, open air ponds which are subject to weather conditions. Our process starts in January where we mate the broomstick to produce nauplii, this is the first larval stage of the shrimp. The mating and collection of the eggs takes roughly one month. After that, the nauplii are transferred into our larviculture building, where they grow for roughly 21 days into post larvae. At this point they start to resemble the shrimp that is seen in our final product. Post the 21-day larviculture stage, the shrimp move into nurserys where they are grown for another 14-21 days in order to increase their robustness prior to stocking in the open air ponds. Roughly 2.5 months into the process, they are ready for stocking in the open air ponds, which brings the process to middle of March, which is when we start to stock the grow out ponds. The shrimp take on average 95 days to reach harvest size (27 grams) which brings the process to the middle of June when we begin our harvest. We will conclude the harvest by June 30th, let the ponds settle for two weeks then restock all the ponds by mid-July, early August first for an end of October/early November second harvest. The larviculture cycle for the second stocking and harvest begins in May, following the timeline given above for the larval and post larval stages, gives us the second stocking of the grow our ponds in mid-July to early August.

Our revenue recognition cycles will be June & July for the first harvest, and October and November for the second.

Sourcing

The main source of our nauplii (the first development stage of shrimp) will be at our hatchery and maturation operation. We believe that it will be important to develop and maintain our own genetic linage to ensure differentiation and genetic variability to grow stronger, healthier shrimp. Since the post-larvae development stage is a relatively short on (21 days), it will allow us to quickly develop genetically superior shrimp.

Sales and Distribution

Historically we have sold our products directly to the companies that are processing the shrimp. They then take this shrimp and sell it to big box retailers. Our plan for this year is no different and we had multiple offers for our shrimp, ultimately settling on one with the best growth probability. We generate revenue by selling shrimp. Our plan as we expand our production capacity is to work directly with big box retailers such as supermarkets. To manage our exposure, we solicit multiple offers for our shrimp. At our current capacity, it is more efficient for us to sell to one buyer; however, in the future we will look to expand that, as needed.

Recent trends in the shrimp industry, including that, according to preliminary 2023 data from the National Marine Fisheries Service, shrimp prices have dropped as much as 44% since 2022.[4] Our business, prospects, revenues, profitability, and future growth are highly dependent upon the prices of and demand for shrimp. Our ability to borrow and to obtain additional capital on attractive terms is also substantially dependent upon shrimp prices. These prices have been and are likely to continue to be extremely volatile for seasonal, cyclical, and other reasons. Any substantial or extended decline in the price of shrimp will have a material adverse effect on our financing capacity and our prospects for commencing and sustaining any economic commercial production. In addition, increased availability of imported shrimp can affect our business by lowering commodity prices. This could reduce the value of inventories, held both by us and by our customers, and cause many of our customers to reduce their orders for new products until they can dispose of their higher-cost inventories.

__________________

[4] https://civileats.com/2023/06/20/cheap-imports-leave-us-shrimpers-struggling-to-compete/#:~:text=The%20U.S.%20Food%20and%20Drug,before%20entering%20the%20U.S.%20market

Shrimp Life Cycle

Our Markets

United States

The United States is the second largest import market and second largest consumer market for shrimp in the world having consumed 1.6B lbs. of shrimp in 2021.[5] The majority of imported and consumed shrimp is of smaller variety (<22 grams). We focus on growing larger shrimp (28+ grams) as there is strong demand for large, sustainably produced shrimp but limited quantities as we believe some of our competitors focus on intensive methods that produce smaller shrimp. Our focus will be to sell to retailers first and niche markets second, where the pricing makes economic sense.

Worldwide

The total global value for shrimp trade in 2022 was $24B USD.[6] The total global production of farm raised shrimp in 2022 was slightly over 4.0 MMT or 8.8 billion pounds. In the last decade, to keep up with global demand, production of farm raised shrimp has grown 60% and now accounts for more than 54% of all global shrimp produced for food.

The demand and production of farm raised shrimp is at an all-time high with annual production growth estimated to be 6.72% CARG (compounded annual growth rate) through 2028.[7] Global growth rates had stagnated during the COVID Pandemic, however in the U.S., imports grew by 7.4% YoY, with global consumption rates increasing by 14% by late 2021. Post COVID production output increased significantly for Ecuador, which is now on par with India in terms of total production volume, resulting in a total global supply in line with demand, which had impacted global prices negatively. The demand for shrimp continues to rise and, more importantly, the demand for premium quality product should impact prices positively going forward as demand starts to again outpace supply.[8]

The world's largest consumer markets for shrimp are (in order): China, the U.S., and the EU+UK, with China consuming roughly 24% (1.8 MMT) of all produced shrimp. The U.S. and EU account for roughly 10% each. Japan, being the 4th largest consumer of shrimp, prefers larger, higher quality head on shrimp, but per capita consumption is very dependent on the value of the Yen.[9]

Recent developments around the use of antibiotics in Indian grown shrimp by the EU, could significantly impact the exports by Indian countries. Indian shrimp imports account for almost 40% of total imports for both the EU and the U.S. While the U.S. has not expressed the same concern as the EU, the Food and Drug Administration (the “FDA”) does follow closely the decisions of the EU on seafood imports. Any reduction in importation of Indian shrimp to either the EU or U.S. will have dramatic effects on regional prices.[10]

__________________

[5] https://research.rabobank.com/far/en/documents/124852_Rabobank_Global-Seafood-Trade_Sharma-Nikolik_Oct2022.pdf

[6] https://www.prnewswire.com/news-releases/global-shrimp-market-report-2023-sector-to-reach-69-35-billion-by-2028-at-a-6-7-cagr-301835697.html

[7] https://siamcanadian.com/us-shrimp-imports-see-second-straightmonth-of-y-o-y-volume-value-declines-undercurrentnews/

[8] https://www.globalseafood.org/advocate/with-growing-demand-for-sustainably-farmed-seafood-oman-tests-the-waters-with-shrimp-farming-in-the-desert/

[9] https://www.fao.org/in-action/globefish/market-reports/resource-detail/en/c/1650814/

[10] https://www.globalseafood.org/advocate/eu-antibiotics-india-shrimp/

Pacific Vannemei is the leading species of farm raised shrimp and is the preferred shrimp in China, the U.S., and the EU.[11] Head on/shell on (“HOSO”) are preferred in both China and the EU.

Major Producers: (According to Food & Agriculture Organization of the United Nations): China, Thailand, Indonesia, Brazil, Ecuador, Mexico, Venezuela, Honduras, Guatemala, Nicaragua, Belize, Viet Nam, Malaysia, Taiwan P.C., Pacific Islands, Peru, Colombia, Costa Rica, Panama, El Salvador, the United States of America, India, Philippines, Cambodia, Suriname, Saint Kitts, Jamaica, Cuba, Dominican Republic, Bahamas.

Imports: Shrimp demand improved in the U.S., supported by lower import prices. Demand was slightly higher among all European markets in early 2021, which was up from 2020.[12]

Target Markets and Segmentation

We plan to focus exclusively on the U.S. domestic market at this time.

Marketing

We are currently marketing directly to retail through our sales team. We understand the immediate needs to establish our brand and position. We also recognize the limitations of our competition in this space (lack of promotion, no or improper use of social media, etc.). This allows us to develop appropriate strategies and clear goals both long and short term.

Strategic Relationships: We have partnerships with marketing professionals who can help us with building our brand, differentiate from the competition and generate leads.

Investment: We will seek to invest time and money into promotional efforts that will help us reach our goals.

Differentiation: We believe that we have a top-tier quality product, responsible and sustainable means of production, and the ability to quickly increase our scale to meet demand. These are all attractive features to our buyers and their customers.

Competition

We face competition from various importers of shrimp to the U.S. including Chicken of the Sea, Order, Aqua Star Importers, Eastern Fish Co., Mseafood Corporation. Locally, we face competition from Bower’s Shrimp Farm located in Collegeport, Texas.

Intellectual Property

Besides our company name and website (www.transamaqua.com) and trade secrets, we don’t own any material intellectual property.

__________________

[11] https://www.globalseafood.org/advocate/annual-farmed-shrimp-production-survey-a-slight-decrease-in-production-reduction-in-2023-with-hopes-for-renewed-growth-in-2024/

[12] https://siamcanadian.com/us-shrimp-imports-see-second-straightmonth-of-y-o-y-volume-value-declines-undercurrentnews/

Suppliers

We do not rely on a single supplier and have multiple options for almost all our required inputs.

Government Regulation

Our farm and operations require approval from the Texas Parks and Wildlife Department (“TPWD”) to stock and harvest our ponds. The permission requires an animal health testing to confirm no presences of disease. We have obtained permission from the TPWD. We are technically considered a mariculture facility and thus exempt from requiring a water intake permit from the Arroyo Colorado River. Other than the permission from the TPWD, there are no licenses or permits needed to operate our business other than our business license from the State of Texas.

The plants that process shrimp are subject to the rules and regulations of the U.S. Food and Drug Administration.[13] As a domestic aquaculture producer, we are not considered a Processor and as such are not subject to any specific rules or regulations governed by the Food & Drug Administration. We focus only on the production of the shrimp, we do not own or operate any processing plants.

Properties

Our farm sits on 1,880 acres in Arroyo City, Texas with 1,144 acres of grow out ponds suitable for shrimp farming. The development of the maturation-hatchery complex and 484 acres of grow-out ponds are fully operational as of today. The remaining 660 acres will be cleared and prepared for stocking in March 2025 with funds raised and cashflow reinvested from harvests in 2024. Both the farm and hatchery are in the process of GAA/BAP certification.

Our principal executive offices are located at 1022 Shadyside Lane, Dallas, TX 75223. Our CEO allows us to use this address free of charge.

Employees

As of June 27, 2024, we had six full-time employees and no part-time employees.

Readers of this Form 10-K should carefully consider the risks and uncertainties described below.

Our failure to successfully address the risks and uncertainties described below would have a material adverse effect on our business, financial condition and/or results of operations, and the trading price of our common stock may decline and investors may lose all or part of their investment. We cannot assure you that we will successfully address these risks or other unknown risks that may affect our business.

As an enterprise engaged in the commercialization of new technology, our business is inherently risky. Our common shares are considered speculative during the development of our business operations. Prospective investors should consider carefully the risk factors set out below.

__________________

[13] https://www.fda.gov/food/guidance-documents-regulatory-information-topic-food-and-dietary-supplements/seafood-guidance-documents-regulatory-information

Risks Related to Our Business

We need to continue as a going concern if our business is to succeed.

Our independent registered public accounting firm reports on our audited financial statements for the years ended December 31, 2023 and 2022, indicate that there are a number of factors that raise substantial risks about our ability to continue as a going concern. Such factors identified in the report are our accumulated deficit since inception, our failure to attain profitable operations, the excess of liabilities over assets, and our dependence upon obtaining adequate additional financing to pay our liabilities. If we are not able to continue as a going concern, investors could lose their investments.

If we do not obtain additional financing or sufficient revenues, our business will fail.

Our current operating funds are less than necessary to fulfill our operating costs and we will need to obtain additional financing in order to continue our business operations. Although we are generating revenues, we are not generating net income.

We will require additional financing to execute our business plan through raising additional capital and/or generating greater revenues.

Obtaining additional financing is subject to a number of factors, including acceptance of our products and current financial condition as well as general market conditions.

These factors affect the timing, amount, terms or conditions of additional financing unavailable to us. If additional financing is not arranged, we will face the risk of going out of business.

The most likely source of future funds presently available to us is through the additional sales of equity or through convertible debt instruments. Any sales of share capital or conversion of convertible debt will most likely result in dilution to existing shareholders.

There is no history upon which to base any assumption as to the likelihood we will prove successful, and we can provide investors with no assurance that we will generate any operating revenues or achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

We are currently in forbearance of secured debt, which may go into default, and, if the lender forecloses, you may lose all of your investment and our business would fail.

On June 15, 2017, we issued a Secured Promissory Note, as addended, to King’s Aqua Farm, LLC (“KAF”) in the principal amount of $5,600,000, which is currently in default. The note is secured by a deed of trust and security agreement dated June 15, 2017. The deed of trust contains a security agreement that covers the personal property located at 16455 FM 1847 Rio Hondo, TX 78583. On May 31, 2024, we entered into a Forbearance and Modification Agreement with KAF. Under the agreement, KAF agreed that it would not exercise or enforce its rights or remedies against the Company to which it would be entitled under the terms of the Real Estate Lien Note dated June 15, 2017 in the original principal amount of $5,600,000, and the Deed of Trust executed by us as grantor in favor of Jizhong Wang, as trustee, for the benefit of KAF by occurrence of the failure by the Company to pay principal and interest installments from May 1, 2022 through May 31, 2024 before August 6, 2024. The forbearance is conditioned on the obligation of us to pay to KAF $77,374.56, which was paid.

In the event we are unable to make required payments under the loan, KAF may foreclose and, in the event that KAF forecloses on the collateral secured by the loan, you could lose all of your investment and our business would fail.

Our liquidity is significantly impacted by current debt, some of which is currently in default. In the event we are unable to increase our liquidity, our business will fail.

Our liquidity is significantly impacted by the farm note to King’s Aqua Farm LLC, dated June 15, 2017, in the original amount of $5,600,000 bearing interest at 6.0% per annum, due in 2039, yielding a monthly payment of $38,687.28. Secured by the farm property, the outstanding principal balances at December 31, 2023 and 2022, are $4,707,902 and $4,750,369, respectively. See the risk factor above titled, “We are currently in forbearance of secured debt, which may go into default, and, if the lender forecloses, you may lose all of your investment and our business would fail.”

We are also a party to an SBA Loan through a bank in the original amount of $150,000 bearing interest at 3.75% per annum, due in 2050, yielding a monthly payment amount of $719.02.

Liquidity is also affected by notes to our shareholders. At December 31, 2023, shareholders have loaned us approximately $1,667,985 which notes accrue interest at 12.0% per annum and were due December 31, 2023 but have been extended to July 1, 2024. In the event we are unable to raise funds to pay our existing obligations when they come due, our business may fail. Also, our existing liquidity may impact our ability to incur additional debt in the future. In the event we cannot raise capital through equity, we will need to raise capital through debt and, if we are unable to incur additional debt due to existing liquidity, our business will fail.

We are currently in a legal dispute with King’s Aqua Farm LLC and, if we were to lose, it would have a negative impact on our business.

As disclosed further in “Legal Proceedings” herein, in January 2024, King’s Aqua Farm LLC filed a petition against TAA claiming damages of $250,000 to $1,000,000. Although we will be zealously disputing the petition, if we were to lose or have to settle the legal proceedings being required to pay within the range of damages claims, it would have a negative impact on our business operations.

We are heavily reliant on Adam Thomas, our Chief Executive Officer, and Fernando Granda, farm manager, and the departure or loss of either Mr. Thomas or Mr. Granda could disrupt our business.

We depend heavily on the continued efforts of Adam Thomas, Chief Executive Officer and director and Fernando Granda, farm manager. Mr. Thomas is essential to our strategic vision and day-to-day operations and would be difficult to replace. Mr. Granda is a farm manager with 35 years of experience. The departure or loss of either Mr. Thomas or Mr. Granda, or the inability to hire and retain qualified replacements, could negatively impact our ability to manage our business.

If we are unable to recruit and retain key management, technical and sales personnel, our business would be negatively affected.

For our business to be successful, we need to attract and retain highly qualified technical, management and sales personnel. The failure to recruit additional key personnel when needed with specific qualifications and on acceptable terms or to retain good relationships with our partners might impede our ability to continue to commercialize and sell our products. To the extent the demand for skilled personnel exceeds supply, we could experience higher labor, recruiting and training costs in order to attract and retain such employees. We face competition for qualified personnel from other companies with significantly more resources available to them and thus may not be able to attract the level of personnel needed for our business to succeed.

Our financial results are substantially dependent on shrimp prices, and those prices are subject to large short– and long–term fluctuations due to variations in supply and demand caused by factors such as biological factors, shifts in consumption and license changes.

Our chief product is shrimp. Accordingly, the results of our operations will be substantially dependent on shrimp prices. Global and regional prices of shrimp are subject to significant fluctuations due to supply and demand. Historically, prices have been driven primarily by the global and regional supply and demand for shrimp. The demand for shrimp is affected by a number of different factors, such as changes in customer preferences, changes in public attitude towards shrimp, relative pricing of substitute products, such as fish, poultry, pork, turkey, and beef, as well as general economic conditions, such as levels of employment, inflation, growth in gross domestic product, or GDP, disposable income and consumer confidence. Demand for shrimp could decrease in the future and put downward pressure on shrimp prices. The variable global supply and demand for shrimp causes drastic price fluctuations on the regional level.

The supply of shrimp fluctuates strongly due to variations in factors, such as feeding efficiency, biological factors, including the temperatures of waters and shrimp diseases. Also, shrimp are generally sold as a fresh commodity with a limited time span available between harvesting and consumption further limiting producers’ ability to control supply. The consequence of these dynamics is that shrimp farmers are expected to be price takers in the market from week-to-week. Increases in harvests may therefore result in a significant reduction in shrimp prices.

In addition, an increased utilization of current production licenses or issuance of new production licenses could result in short– and/or long–term over-production in the industry, which may result in a significant reduction in shrimp prices. Short-term or long-term decreases in the price of shrimp may have a material adverse effect on our revenues. We will have limited flexibility to adjust our product mix away from shrimp in order to accommodate changing pricing circumstances.

We may be unable to effectively hedge our exposure to short– and medium– term fluctuations in shrimp prices.

We may seek to manage our exposure to short– and medium-term fluctuations in shrimp prices through sales contracts and shrimp futures as well as through secondary processing activities (as prices for secondary processed shrimp may be more stable than for primary processed shrimp). However, our contracts and financial future may not be fulfilled, or may not be available in the future, or may be ineffective in hedging our exposure to shrimp price fluctuations. In addition, our sales contracts and financial futures may result in price achievement below prices in an environment of rising prices. Furthermore, our secondary processing activities may not reduce the impact of fluctuating shrimp prices on our operations. Lastly, we don’t currently engage in secondary processing activities but the practices would be to process the shrimp as value added. Currently we only process our shrimp as head-on individually quick frozen (IQF) or be-headed (tails) IQF. The value added would be to reprocess the shrimp by either peeling, cooking, deveining, or bloc packing. All of which we believe would be value added products. Since we don’t currently engage in secondary processing activities, there is no assurance we would be able to execute at a level to add the expected value.

An inability to effectively hedge our exposure to shrimp prices may have a material adverse effect on our financial condition, results of operations or future cash flows.

Our financial results are substantially dependent on the procurement of broodstock strong genetic lineages.

Our end product success is dependent upon the procurement of broodstock genetic lineages of shrimp. This is vital for the continued genetic programs necessary to create larvae and ensure successful shrimp production for human consumption.

Our success is dependent on sales channels and the ability to sell the shrimp.

We believe that we currently have a strong sales program with various buyers, but we do not have contracts in place with those buyers. If our sales channels were to cease doing business with us, our sales programs and profitability would be negatively affected.

We require funding in order to have meaningful harvests.

We produced and are in contract to sell 140,000 lbs. of shrimp from our 2023 harvest. During 2023, we did not produce a meaningful harvest prior to September 30th. Our projected harvest for 2024 is greater than 1 million lbs. over two harvests; however, this harvest is contingent upon receipt of sufficient financing. We did not have sufficient operating capital to produce a full harvest in 2022 and in the first half of 2023. In the event we are unable to secure sufficient financing, we will not be able to generate meaningful harvests, and in the event we are unable to generate meaningful harvests, our business will fail.

The seasonality of our business could negatively impact our operations.

Our business is seasonal. We grow shrimp in outdoor, open air ponds which are subject to weather conditions. Cold weather can affect shrimp grown rates and mortality. Too much rain can affect salinity levels which could cause a slowdown in growth. Excessive heat could cause the shrimp to burrow in the bottoms of the ponds for a period of time, thus not eating. Hurricanes can impact the water levels and reduce salinity. In the event that any of these seasonality factors occur, it could negatively impact our operations and impede us from having two meaningful harvests per year.

Our business and operations are affected by the volatility of prices for shrimp.

Recent trends in the shrimp industry, including that, according to preliminary 2023 data from the National Marine Fisheries Service, shrimp prices have dropped as much as 44% since 2022.[14] Our business, prospects, revenues, profitability, and future growth are highly dependent upon the prices of and demand for shrimp. Our ability to borrow and to obtain additional capital on attractive terms is also substantially dependent upon shrimp prices. These prices have been and are likely to continue to be extremely volatile for seasonal, cyclical, and other reasons. Any substantial or extended decline in the price of shrimp will have a material adverse effect on our financing capacity and our prospects for commencing and sustaining any economic commercial production. In addition, increased availability of imported shrimp can affect our business by lowering commodity prices. This could reduce the value of inventories, held both by us and by our customers, and cause many of our customers to reduce their orders for new products until they can dispose of their higher-cost inventories.

Our success is dependent on external factors that affect shrimp mortality.

We must ensure that our shrimp are safe and are not contaminated by a various diseases (both known and unknown). This includes ensuring the shrimp are not contaminated by: new or previously unknown diseases; known diseases that appear for the first time in new shrimp species (meaning the disease has expanded to a new host range); known diseases that appear for the first time in a new location (meaning the disease has expanded to a new geographic range); and known diseases with a new presentation or higher virulence due to changes in the causative agent. We must also ensure that our shrimp are not contaminated by infections that commonly affect shrimp, including: white spot, yellow head, early mortality syndrome (EMS), taura syndrome, infectious hypodermal and hematopoietic necrosis, and infectious myonecrosis. Each of these diseases and infections can contaminate the shrimp and result in a loss of all distribution supply and related revenue.

We rely on steady winds in the valley to help with oxygen levels. If we increase the stocking densities of our shrimp, we will need to add artificial aeration (supplemental oxygen) to ensure that the shrimp receives consistent oxygen levels. Failure to maintain adequate oxygen levels will result in shrimp that is not safe to distribute.

__________________

[14] https://civileats.com/2023/06/20/cheap-imports-leave-us-shrimpers-struggling-to-compete/#:~:text=The%20U.S.%20Food%20and%20Drug,before%20entering%20the%20U.S.%20market

Our shrimp product is subject to external factors, like weather. Low temperatures affect the mortality rates of the shrimp. While more applicable to the end of the harvest season, occasional cold fronts will increase the mortality rates in late September and early October. Natural disasters, including hurricanes and floods, also increase the mortality rates of shrimp.

Failure to ensure food safety and compliance with food safety standards could result in serious adverse consequences for the Company.

As our end products are mainly for human consumption, food safety issues (both actual and perceived) may have a negative impact on the reputation of, and the demand for, our products. In addition to the need to comply with relevant food safety regulations, it is of critical importance that our products are safe, and perceived as safe and healthy in all relevant markets.

Our products may be subject to contamination by food-borne pathogens, such as listeria monocytogenes, clostridia, salmonella and E. coli, or other contaminants. These pathogens are substances are found in the environment; therefore, there is a risk that one or more of these organisms and pathogens can be introduced into our products as a result of improper handling, poor processing hygiene or cross-contamination by us, the ultimate consumer or any intermediary. We will have little, if any, control of handling procedures once we ship our products for distribution.

Furthermore, we may not be able to prevent contamination of our shrimp by pollutants, such as polychlorinated biphenyls, or PCBs, dioxins or heavy metals. Such contamination is primarily the result of environmental contamination of shrimp feed raw materials, such as shrimp meal or raw materials from crops, which could result in a corresponding contamination of our shrimp feed and our shrimp. Residues of environmental pollutants present in our shrimp feed may pass undetected in our products and may reach consumers due to failure in surveillance and control systems.

An inadvertent shipment of contaminated products may be a violation of law and may lead to product liability claims, product recalls (which may not entirely mitigate the risk of product liability claims), increased scrutiny and penalties, including injunctive relief and plant closings, by regulatory agencies, and adverse publicity.

Increased quality demands from authorities in the future relating to food safety may have a material adverse effect on our business, financial condition, results of operations or cash flow. Legislation and guidelines with tougher requirements are expected and may imply higher costs for the food industry. In particular, the ability to trace products through all stages of development, certification and documentation is becoming increasingly required under food safety regulations. Further, limitations on additives and use of medical products in the shrimp industry may be imposed, which could result in higher costs for us.

The food industry in general experiences high levels of customer awareness with respect to food safety and product quality, information and traceability. If we fail to meet new and exacting customer requirements, we could see reduced demand for our products.

Government regulation, including food safety and aquaculture regulation, affects our business.

Shrimp farming and processing industries are subject to regional, federal and local governmental regulations relating to the farming, processing, packaging, storage, distribution, advertising, labeling, quality and safety of food products. New laws and regulations, or stricter (or otherwise adverse to that of the Company) interpretations of existing laws or regulations, may materially affect our business or operations in the future. Our operations are also subject to extensive and increasingly stringent regulations administered by environmental agencies in the jurisdictions in which we plan to operate. Failure to comply with these laws, regulations or interpretations could have serious consequences, including criminal, civil and administrative penalties, loss of production, injunctions, product recalls and negative publicity. Some environmental Non-Government Organizations, or NGOs, have advocated for shrimp farming to be restricted to farming in a contained environment, which would substantially increase our costs.

Relevant authorities may introduce further regulations for the operations of aquaculture facilities, such as enhanced standards of production facilities, capacity requirements, shrimp feed quotas, shrimp density, site allocation conditions, water allocation or other parameters for production. Furthermore, authorities may impose stricter environmental requirements upon shrimp farming, e.g., restrictions or a ban on discharges of waste substances from the production facilities, stricter requirements for seabed restoration, stricter requirements to prevent shrimp escapes and new requirements regarding animal welfare. Investments necessary to meet new regulatory requirements and penalties for failure to comply with such requirements could be significant. Likewise, an absence of or ineffective government regulation may lead to unsustainable farming practices at an industry-wide level. The industry has been unable to cooperate to create sustainable practices in the absence of government regulation. We may rely on such regulation to help create and enforce practices that ensures the long-term sustainability of the industry. Ineffective regulation can hinder the industry's ability to implement sustainable and profitable practices. Accordingly changes in regulation or ineffective government regulation may have a material adverse effect on the shrimp farming industry as a whole, which could harm our business, financial condition, results of operations or cash flow.

Trade restrictions resulting in suboptimal distribution of shrimp may be intensified, creating a negative impact on the price of ours shrimp in some countries.

Farmed shrimp is produced in a limited number of countries and sold globally. Historically, trade restrictions have inhibited the optimal distribution of some species of farmed shrimp to the markets and impacted the price yield for the farmed shrimp producers in the countries affected by such restrictions. Trade restrictions could include import prohibitions, minimum import prices and high import duties, reducing the competitiveness of our products as compared to other available products. Continuous effects of such trade restrictions or introduction of new trade restrictions may have a significant impact on our ability to sell in certain regions, or our ability to charge competitive prices for its products in such regions.

Our shrimp farming operations may be dependent on shrimp farming licenses.

Most of the jurisdictions in which we plan to operate may require us to obtain a license for each shrimp farm owned and operated in that jurisdiction. We plan to obtain and hold a license to own and operate each of our shrimp farms where a license is required. In order to maintain the licenses, we will have to operate each of our shrimp farms and, if we pursue acquisitions or construction of new shrimp farms in the future, we will need to obtain additional licenses to operate those farms, where a license is required. Licenses in each jurisdiction are subject to certain requirements, and we will be at risk of penalties (including, in some cases, criminal charges), sanctions or even loss of license if we fail to comply with license requirements or related regulations. We may also be exposed to dilution of our licenses where a government issues new licenses to shrimp farmers other than us, thereby reducing the current value of our shrimp farming licenses. Governments may change the way licenses are distributed or otherwise dilute or invalidate our licenses. If we are unable to maintain or obtain new shrimp farming licenses, or if new licensing regulations dilute the value of our licenses, this may have a material adverse effect on our business.

Licenses generally require—and future licenses may require—that we leave the seabed under our shrimp farms fallow for a period of time following harvest. We may resume operation after a set period of time, provided that certain environmental and shrimp health targets are met. These requirements may increase or become more stringent, which could increase our costs.

Natural disasters may have an adverse effect on our business.

Natural disasters such as major fires, floods, tropical storms and hurricanes could also adversely impact our business and operating results. Such events could lead to the loss of use of one or more of our properties for an extended period of time and disrupt our operations. If any such event were to affect our business, we would likely be adversely impacted. Although we may be covered by insurance from a natural disaster, the timing of our receipt of insurance proceeds, if any, is out of our control. In some cases, however, we may receive no proceeds from insurance for natural disasters. Additionally, a natural disaster affecting our business may affect the level and cost of insurance coverage we may be able to obtain in the future, which may adversely affect our financial position.

We are subject to general business risks.

Ownership and operation of our Company involves certain risks, including without limitation, changing consumer spending patterns and behavior, adverse changes in general economic and local market conditions, changes in the global economy, changing tax rates, the ability of the enterprise to provide for proper staffing, and increases in shrimping operations and labor costs. Most, if not all of such risks are beyond the control of the Company and our management, including the Board of Directors. If cash flow is insufficient to pay for operations and management does not desire to invest additional capital into the Company and we are unable to raise additional capital from other sources, investors may sustain a loss of all their investment.

Our business lacks diversification which increases the risk of failure.

We have a single business strategy, which is an aquaculture company that specializes in the growth and development of farm-raised shrimp. Our success is entirely dependent upon the success of our business. If our business were to suffer adverse economic consequences, there would be substantially greater impact on the Company than if we had a number of different streams of product lines and revenues.

Risks Related to Our Organization and Our Common Stock

You may experience dilution of your ownership interests because of the future issuance of additional shares of our common or preferred stock or other securities that are convertible into or exercisable for our common or preferred stock.

We are authorized to issue an aggregate of 3,000,000,000 shares of common stock and 20,000,000 shares of “blank check” preferred stock (106,295 of which have been designated). In the future, we may issue our authorized but previously unissued equity securities, resulting in the dilution of the ownership interests of our present stockholders. We may issue additional shares of our common stock or other securities that are convertible into or exercisable for our common stock in connection with hiring or retaining employees, future acquisitions, future sales of our securities for capital raising purposes, or for other business purposes. The future issuance of any such additional shares of our common stock may create downward pressure on the trading price of the common stock. We will need to raise additional capital in the near future to meet our working capital needs, and there can be no assurance that we will not be required to issue additional shares, warrants or other convertible securities in the future in conjunction with these capital raising efforts, including at a price (or exercise or conversion prices) below the price an investor paid for stock.

Because the SEC imposes additional sales practice requirements on brokers who deal in our shares that are penny stocks, some brokers may be unwilling to trade them. This means that investors may have difficulty reselling their shares and may cause the price of the shares to decline.

Our shares qualify as penny stocks and are covered by Section 15(g) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which imposes additional sales practice requirements on broker/dealers who sell our securities in this offering or in the aftermarket. In particular, prior to selling a penny stock, broker/dealers must give the prospective customer a risk disclosure document that: contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; contains a description of the broker/dealers’ duties to the customer and of the rights and remedies available to the customer with respect to violations of such duties or other requirements of Federal securities laws; contains a brief, clear, narrative description of a dealer market, including “bid” and “ask” prices for penny stocks and the significance of the spread between the bid and ask prices; contains the toll free telephone number for inquiries on disciplinary actions established pursuant to section 15(A)(i); defines significant terms used in the disclosure document or in the conduct of trading in penny stocks; and contains such other information, and is in such form (including language, type size, and format), as the SEC requires by rule or regulation. Further, for sales of our securities, the broker/dealer must make a special suitability determination and receive from you a written agreement before making a sale to you. Because of the imposition of the foregoing additional sales practices, it is possible that brokers will not want to make a market in our shares, the liquidity of our stock could decrease, and the transaction cost of sales and purchases of our stocks could increase compared to other securities. This could also prevent reselling of shares and may cause the price of the shares to decline.

We do not expect to declare or pay any dividends.

Besides dividends owed to the holder of the Series D Preferred Stock, we have not declared or paid any dividends on our common stock since our inception, and we do not anticipate paying any such dividends for the foreseeable future.

Volatility of Stock Price.

Our common shares are currently publicly quoted on the OTC Pink marketplace under the symbol “GRPS.” In the future, the trading price of our common shares may be subject to wide fluctuations. Trading prices of the common shares may fluctuate in response to a number of factors, many of which will be beyond our control. In addition, the stock market in general, and the market for technology companies in particular, has experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of such companies. Market and industry factors may adversely affect the market price of the common shares, regardless of our operating performance. Readers should carefully consider the risks and uncertainties described below before deciding whether to invest in shares of our common stock.

Our failure to successfully address the risks and uncertainties described below would have a material adverse effect on our business, financial condition and/or results of operations, and the trading price of our common stock may decline, and investors may lose all or part of their investment. We cannot assure you that we will successfully address these risks or other unknown risks that may affect our business.

As an enterprise engaged in the development of new technology, our business is inherently risky. Our common shares are considered speculative during the development of our new business operations. Prospective investors should carefully consider the risk factors set out herein. The market price of our common stock has fluctuated significantly.

Being a public company is expensive and administratively burdensome.

As a public reporting company, we are subject to the information and reporting requirements of the Securities Act, the Exchange Act and other federal securities laws, rules and regulations related thereto, including compliance with the Sarbanes-Oxley Act. Complying with these laws and regulations requires the time and attention of our Board of Directors and management team and increases our expenses. We estimate we will incur approximately $200,000 to $300,000 annually in connection with being a public company.

Among other things, we are required to:

| | · | Maintain and evaluate a system of internal controls over financial reporting in compliance with the requirements of Section 404 of the Sarbanes-Oxley Act and the related rules and regulations of the SEC and the Public Company Accounting Oversight Board; |

| | | |

| | · | Prepare and distribute periodic reports in compliance with our obligations under federal securities laws; |

| | | |

| | · | Institute a more comprehensive compliance function, including with respect to corporate governance; and |

| | | |

| | · | Involve, to a greater degree, our outside legal counsel and accountants in the above activities. |

The costs of preparing and filing annual and quarterly reports, proxy statements and other information with the SEC and furnishing audited reports to stockholders are expensive and much greater than that of a privately-held company, and compliance with these rules and regulations may require us to hire additional financial reporting, internal controls and other finance personnel, and will involve a material increase in regulatory, legal and accounting expenses and the attention of management. There can be no assurance that we will be able to comply with the applicable regulations in a timely manner, if at all. In addition, being a public company makes it more expensive for us to obtain director and officer liability insurance. In the future, we may be required to accept reduced coverage or incur substantially higher costs to obtain this coverage.

If we fail to establish and maintain an effective system of internal control, we may not be able to report our financial results accurately or to prevent fraud. Any inability to report and file our financial results accurately and timely could harm our reputation and adversely impact the trading price of our common stock.

Effective internal control is necessary for us to provide reliable financial reports and prevent fraud. If we cannot provide reliable financial reports or prevent fraud, we may not be able to manage our business as effectively as we would if an effective control environment existed, and our business and reputation with investors may be harmed. As a result, our small size and any current internal control deficiencies may adversely affect our financial condition, results of operation and access to capital. We have not performed an in-depth analysis to determine if historical un-discovered failures of internal controls exist, and may in the future discover areas of our internal control that need improvement.

Public company compliance may make it more difficult to attract and retain officers and directors.

The Sarbanes-Oxley Act and new rules subsequently implemented by the SEC have required changes in corporate governance practices of public companies. As a public company, we expect these new rules and regulations to increase our compliance costs in 2024 and beyond and to make certain activities more time consuming and costly. As a public company, we also expect that these new rules and regulations may make it more difficult and expensive for us to obtain director and officer liability insurance in the future and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified persons to serve on our Board of Directors or as executive officers.

You could lose all your investment.

An investment in our securities is speculative and involves a high degree of risk. Potential investors should be aware that the value of an investment in the Company may go down as well as up. In addition, there can be no certainty that the market value of an investment in the Company will fully reflect its underlying value. You could lose your entire investment.

The ability of our Board of Directors to issue additional stock may prevent or make more difficult certain transactions, including a sale or merger of the Company.

Our Board of Directors is authorized to issue up to 20,000,000 shares of preferred stock (106,295 of which have been designated) with powers, rights and preferences designated by it. Shares of voting or convertible preferred stock could be issued, or rights to purchase such shares could be issued, to create voting impediments or to frustrate persons seeking to affect a takeover or otherwise gain control of the Company. The ability of the Board of Directors to issue such additional shares of preferred stock, with rights and preferences it deems advisable, could discourage an attempt by a party to acquire control of the Company by tender offer or other means. Such issuances could therefore deprive stockholders of benefits that could result from such an attempt, such as the realization of a premium over the market price for their shares in a tender offer or the temporary increase in market price that such an attempt could cause. Moreover, the issuance of such additional shares of preferred stock to persons friendly to the Board of Directors could make it more difficult to remove incumbent officers and directors from office even if such change were to be favorable to stockholders generally.

Due to being quoted on the OTC Pink marketplace, our stock may be traded infrequently and in low volumes, so you may be unable to sell your shares at or near the quoted bid prices if you need to sell your shares.

Until our common stock is listed on a national securities exchange such as the New York Stock Exchange or the Nasdaq, we expect our common stock to remain eligible for quotation on the OTC Markets, or on another over-the-counter quotation system. In those venues, however (and, especially on the OTC Pink marketplace), the shares of our common stock may trade infrequently and in low volumes, meaning that the number of persons interested in purchasing our common shares at or near bid prices at any given time may be relatively small or non-existent. Due to being quoted on the OTC Pink marketplace, an investor may find it difficult to obtain accurate quotations as to the market value of our common stock or to sell his or her shares at or near bid prices or at all. In addition, if we fail to meet the criteria set forth in SEC regulations, various requirements would be imposed by law on broker-dealers who sell our securities to persons other than established customers and accredited investors. Consequently, such regulations may deter broker-dealers from recommending or selling our common stock, which may further affect the liquidity of our common stock. This would also make it more difficult for us to raise capital.

There currently is no active public market for our common stock and there can be no assurance that an active public market will ever develop. Failure to develop or maintain a trading market could negatively affect the value of our common stock and make it difficult or impossible for you to sell your shares.

There is currently no active public market for shares of our common stock, and one may never develop. Our common stock currently is quoted on the OTC Pink marketplace. The OTC Markets (and, especially the OTC Pink marketplace) is a thinly traded market and lacks the liquidity of certain other public markets with which some investors may have more experience. We may not ever be able to satisfy the listing requirements for our common stock to be listed on a national securities exchange, which is often a more widely traded and liquid market. Some, but not all, of the factors which may delay or prevent the listing of our common stock on a more widely traded and liquid market include the following: our stockholders’ equity may be insufficient; the market value of our outstanding securities may be too low; our net income from operations may be too low; our common stock may not be sufficiently widely held; we may not be able to secure market makers for our common stock; and we may fail to meet the rules and requirements mandated by the several exchanges and markets to have our common stock listed. Should we fail to satisfy the initial listing standards of the national exchanges, or our common stock is otherwise rejected for listing, and remains quoted on the OTC Markets or is suspended from the OTC Markets, the trading price of our common stock could suffer and the trading market for our common stock may be less liquid and our common stock price may be subject to increased volatility, making it difficult or impossible to sell shares of our common stock.

Our common stock is subject to the “penny stock” rules of the SEC and the trading market in the securities is limited, which makes transactions in the stock cumbersome and may reduce the value of an investment in the stock.

Rule 15g-9 under the Exchange Act establishes the definition of a “penny stock,” for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require: (a) that a broker or dealer approve a person’s account for transactions in penny stocks; and (b) the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

To approve a person’s account for transactions in penny stocks, the broker or dealer must: (a) obtain financial information and investment experience objectives of the person and (b) make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market, which, in highlight form: (a) sets forth the basis on which the broker or dealer made the suitability determination; and (b) confirms that the broker or dealer received a signed, written agreement from the investor prior to the transaction. Generally, brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our common stock.

Disclosure also must be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker or dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

Our stock price may be volatile.

The market price of our common stock is likely to be highly volatile and could fluctuate widely in price in response to various factors, many of which are beyond our control, including the following:

| | · | The continued effects of the COVID-19 pandemic and its variants; |

| | | |

| | · | Changes in our industry; |

| | | |

| | · | Competitive pricing pressures; |

| | | |

| | · | Our ability to obtain working capital financing; |

| | | |

| | · | Additions or departures of key personnel; |

| | | |

| | · | Sales of our common stock; |

| | | |

| | · | Our ability to execute our business plan; |

| | | |

| | · | Operating results that fall below expectations; |

| | | |

| | · | Loss of any strategic relationship; |

| | | |

| | · | Regulatory developments; and |

| | | |

| | · | Economic and other external factors. |

In addition, the securities markets have from time-to-time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of our common stock.

Offers or availability for sale of a substantial number of shares of our common stock may cause the price of our common stock to decline.

If our stockholders sell substantial amounts of our common stock in the public market, including upon the expiration of any statutory holding period under Rule 144, or issued upon the conversion of preferred stock or exercise of warrants, it could create a circumstance commonly referred to as an "overhang" and in anticipation of which the market price of our common stock could fall. The existence of an overhang, whether sales have occurred or are occurring, also could make more difficult our ability to raise additional financing through the sale of equity or equity-related securities in the future at a time and price that we deem reasonable or appropriate.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

For purposes of this section:

“Cybersecurity incident” means an unauthorized occurrence, or a series of related unauthorized occurrences, on or conducted through our information systems that jeopardizes the confidentiality, integrity, or availability of our information systems or any information residing therein.

“Cybersecurity threat” means any potential unauthorized occurrence on or conducted through our information systems that may result in adverse effects on the confidentiality, integrity, or availability of our information systems or any information residing therein.

“Information systems” means electronic information resources, owned or used by us, including physical or virtual infrastructure controlled by such information resources, or components thereof, organized for the collection, processing, maintenance, use, sharing, dissemination, or disposition of our information to maintain or support our operations.

Risk Management and Strategy