As filed with the U.S. Securities and Exchange Commission on January 13, 2025.

Registration No. 333-283646

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 1 TO

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

The Great Restaurant Development Holdings Limited

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

| Cayman Islands | | 5812 | | Not Applicable |

(State or Jurisdiction of Incorporation or Organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

Ground Floor and 1st Floor

No. 73 Chung On Street

Tsuen Wan, New Territories

Hong Kong

(+852) 2487 3337

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

(212) 947-7200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

William Rosenstadt, Esq. Mengyi “Jason” Ye, Esq. Ortoli Rosenstadt LLP 366 Madison Avenue, 3rd Floor New York, NY 10017 Telephone: 212-588-0022 | | Huan Lou, Esq. Sichenzia Ross Ference Carmel LLP 1185 Avenue of the America, 31st Floor, New York, NY 10036 Telephone: 212-930-9700 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed or supplemented. We may not sell these securities until the Registration Statement filed with the Securities and Exchange Commission of which this prospectus is a part is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | Subject to Completion, dated January 13, 2025 |

The Great Restaurant Development Holdings Limited

1,500, 000 Ordinary Shares

and

375,000 Ordinary Shares offered by the Selling Shareholder

This is an initial public offering by our Company and the Selling Shareholder (defined below) of 1,875,000 ordinary shares (“Ordinary Shares”). We are a Cayman Islands exempted company with limited liability with a principal place of business in Hong Kong through our wholly-owned subsidiary, First Grade Group (H.K.) Company Limited (“First Grade” or “Operating Subsidiary”).

We and Sincere Virtue Limited (“Sincere Virtue” or “Selling Shareholder” or “Controlling Shareholder”) are offering an aggregate 1,875,000 Ordinary Shares on a firm commitment basis, of which 1,500,000 Ordinary Shares are offered by us and 375,000 Ordinary Shares are offered by the Selling Shareholder. We anticipate that the initial public offering price of the Ordinary Shares will be between US$4.00 and US$6.00 per Ordinary Share.

Prior to this Offering, there has been no public market for our Ordinary Shares. We have applied to list our Ordinary Shares on the Nasdaq Capital Market under the symbol “HPOT.” This Offering is contingent upon the listing of our Ordinary Shares on the Nasdaq Capital Market or another national securities exchange. There can be no assurance that we will be successful in listing our Ordinary Shares on the Nasdaq Capital Market or another national securities exchange and, if this listing is not successful, this Offering cannot be completed. We will not consummate and close this Offering without a listing approval letter from the Nasdaq Capital Market.

Investing in our ordinary shares involves a high degree of risk, including the risk of losing your entire investment. See “Risk Factors” beginning on page 19 to read about factors you should consider before buying our ordinary shares.

We were incorporated in the Cayman Islands on March 8, 2018, as a holding company of our business, which is primarily operated through our wholly-owned subsidiary, First Grade. Our Company is not a Chinese or Hong Kong operating company but a Cayman Islands holding company with operations conducted by our subsidiary in Hong Kong Special Administrative Region of the People’s Republic of China (“Hong Kong” or “HK”). As a holding company with no material operations of our own, we conduct our operations solely through our HK-incorporated wholly-owned subsidiary, First Grade. Investors in our Ordinary Shares should be aware that they will not and may never directly hold equity interests in the Hong Kong operating subsidiary, First Grade, but rather purchasing equity solely in our Cayman Islands holding company, The Great Restaurant Development Holdings Limited. Investors of our Ordinary Shares are not purchasing and may never directly hold equity interests in First Grade. This structure involves unique risks to the investors, and the PRC regulatory authorities could disallow this structure, which would likely result in a material change in the Company’s operations and/or a material change in the value of the securities the Company is registering for sale, including that such event could cause the value of such securities to significantly decline or become worthless. See “Risk Factors — Risks Relating to Doing Business in the Jurisdiction in which our Operating Subsidiary Operates — “Risk Factors — Risks Related to Doing Business in the Jurisdictions in which the Operating Subsidiaries Operate — If the PRC government chooses to extend the oversight and control over offerings that are conducted overseas and/or foreign investment in Mainland China-based issuers to Hong Kong-based issuers, such action may significantly limit or completely hinder our ability to offer or continue to offer Ordinary Shares to investors and cause the value of our Ordinary Shares to significantly decline or be worthless” on page 30.

The legal and operational risks associated in operating in the PRC may also apply to First Grade’s operations in Hong Kong, and we face the risks and uncertainties associated with the complex and evolving PRC laws and regulations and as to whether and how the recent PRC government statements and regulatory developments, such as those relating to data and cyberspace security, and anti-monopoly concerns, would be applicable to the Operating Subsidiaries and us, given the substantial operations of the Operating Subsidiaries in Hong Kong and the possibilities that Chinese government may exercise significant oversight over the conduct of business in Hong Kong. In the event that First Grade is to become subject to laws and regulations of the PRC, these risks could result in material costs to ensure compliance, fines, material changes in our operations and/or the value of the securities we are registering for sale, and/or could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless. There is also no assurance that there will not be any changes in the economic, political and legal environment in Hong Kong in the future. If there is a significant change to current political arrangements between Mainland China and Hong Kong, companies operating in Hong Kong may face similar regulatory risks as those operated in the PRC, including their ability to offer securities to investors, list their securities on a U.S. or other foreign exchange, and conduct their business or accept foreign investment. In light of PRC government’s recent expansion of authority in Hong Kong, there are risks and uncertainties which we cannot foresee for the time being, and rules, regulations and the enforcement of laws in the PRC can change quickly with little or no advance notice. See “Risk Factors — Risks Related to Doing Business in the Jurisdictions in which the Operating Subsidiary Operates — Through long arm provisions under the current PRC laws and regulations, the PRC government may exercise significant oversight over the conduct of our business and may intervene or influence our operations, which could result in a material change in our operations and/or the value of our Ordinary Shares. Changes in the policies, regulations and rules and the enforcement of laws of the Chinese government may also occur and our assertions and beliefs of the risk imposed by the PRC legal and regulatory system cannot be certain” on page 27; and “If the PRC government chooses to extend the oversight and control over offerings that are conducted overseas and/or foreign investment in Mainland China-based issuers to Hong Kong-based issuers, such action may significantly limit or completely hinder our ability to offer or continue to offer Ordinary Shares to investors and cause the value of our Ordinary Shares to significantly decline or be worthless” on page 30.

Neither we nor our HK based subsidiary is required to obtain permission from the People’s Republic of China (“China” or “PRC”) government to list our Ordinary Shares on the Nasdaq Capital Market.

We do not expect to be subject to the cybersecurity review by the China Securities Regulatory Commission (“CSRC”) and the Cyberspace Administration of China (“CAC”) in relation to this Offering, given that: (1) our Operating Subsidiary is incorporated in Hong Kong and is located in Hong Kong, (2) we have no subsidiary, variable interest entity (“VIE”) structure or any direct operations in mainland China, and (3) pursuant to the Basic Law of the Hong Kong Special Administrative Region of the People’s Republic of China (“Basic Law”), which is a national law of the PRC and the constitutional document for Hong Kong, national laws of the PRC shall not be applied in Hong Kong, except for those listed in Annex III of the Basic Law (which is confined to laws relating to defense and foreign affairs, as well as other matters outside the autonomy of Hong Kong), we do not currently expect the Measures for Cybersecurity Review (2021), the PRC Personal Information Protection Law and the Trial Administrative Measures of Overseas Securities Issuance and Listing by Domestic Enterprises (the “Trial Overseas Listing Measures”) to have an impact on our business, operations or this Offering, as we do not believe that our Operating Subsidiary would be deemed to be an “Operator” that is required to file for cybersecurity review before listing in the United States, because (i) our Operating Subsidiary was incorporated in Hong Kong and operate in Hong Kong without any subsidiary or VIE structure in mainland China and each of the Measures for Cybersecurity Review (2021), the PRC Personal Information Protection Law and the Trial Overseas Listing Measures remains unclear whether it shall be applied to a company based in Hong Kong; (ii) as of date of this prospectus, our Operating Subsidiary has in aggregate collected and stored personal information of less than one million users, and that data processed in our business does not have a bearing on national security and thus may not be classified as core or important data by the authorities; (iii) all of the data our Operating Subsidiary has collected is stored in servers located in Hong Kong; and (iv) as of the date of this prospectus, our Operating Subsidiary has not been informed by any PRC governmental authority of any requirement that it files for a cybersecurity review or a CSRC review. See Risk Factors – Risks Relating to Doing Business in the Jurisdiction in which our Operating Subsidiary Operates – We may become subject to a variety of PRC laws and other regulations regarding data protection or cybersecurity, and any failure to comply with applicable laws and regulations could have a material and adverse effect on our business, financial condition and results of operations” on page 27.

The national laws adopted by the PRC are generally not applicable to Hong Kong according to the Basic Law. The Basic Law came into effect on July 1, 1997. It is the constitutional document of Hong Kong, which sets out the PRC’s basic policies regarding Hong Kong. The principle of “one country, two systems” is a prominent feature of the Basic Law, which dictates that Hong Kong will retain its unique common law and capitalist system for 50 years after the handover of Hong Kong by the United Kingdom in 1997. Under the principle of “one country, two systems”, Hong Kong’s legal system, which is different from that of the PRC, is based on common law, supplemented by statutes. See “Risk Factors — Risks Relating to Doing Business in the Jurisdiction in which our Operating Subsidiary Operates — HK and PRC’s legal systems are evolving and have uncertainties that could limit the legal protection available to you and us” on page 31.

Pursuant to Article 18 of the Basic Law, national laws adopted by the PRC shall not be applied in Hong Kong, except for those listed in Annex III to the Basic Law, such as the laws in relation to the national flag, national anthem, and diplomatic privileges and immunities. Further, there is no legislation stating that the laws in Hong Kong should be commensurate with those in the PRC. Despite the foregoing, the legal and operational risks of operating in China also apply to businesses operating in Hong Kong and Macau. See “Risk Factors — Risks Relating to Doing Business in the Jurisdiction in which our Operating Subsidiary Operates — The Hong Kong legal system is subject to uncertainties in the interpretation and enforcement of PRC laws and regulations, which could change at any time with little advance notice and could limit the legal protections available to our Operating Subsidiary” and us on page 31.

Furthermore, there remains uncertainty as to how the existing PRC regulations will be interpreted or implemented and whether the PRC regulatory agencies, including the CAC and the CSRC, may adopt new laws, regulations, rules, or detailed implementation and interpretation. If any such new laws, regulations, rules, or implementation and interpretation comes into effect, we will take all reasonable measures and actions to comply and to minimize the adverse effect of such laws on us. Based on the foregoing, we cannot assure you that PRC regulatory agencies, including the CAC and the CSRC, will take the same view as we do. Similarly, there is no assurance that we can fully or timely comply with such laws promulgated by the CAC and the CSRC if an alternative view is applied to Hong Kong. In the event that we are subject to any mandatory cybersecurity review and other specific actions required by the CAC or filing procedures with the CSRC, we face uncertainty as to whether any clearance or other required actions can be timely completed, or at all. Given such uncertainty, we may be further required to suspend our relevant business, shut down our website, or face other penalties, which could materially and adversely affect our business, financial condition, and results of operations. See “Risk Factors – Risks Relating to Doing Business in the Jurisdiction in which our Operating Subsidiary Operates – We may become subject to a variety of PRC laws and other regulations regarding data protection or cybersecurity, and any failure to comply with applicable laws and regulations could have a material and adverse effect on our business, financial condition and results of operations” and “The Opinions recently issued by the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council and the New Overseas Listing Rules promulgated by the CSRC may subject us to additional compliance requirements in the future” on page 27 to 30.

We believe that we have been in compliance with the data privacy and personal information requirements of the CAC for the above-mentioned reasons. Further, we are not a PRC based “domestic company” for the purposes of the Trial Overseas Listing Measures. As of the date of this prospectus, our Company and its subsidiaries have not received any inquiry, notice, warning, or sanctions regarding our planned overseas listing from the CSRC or any other PRC governmental authorities. None of our business activities appears to be within the immediate targeted areas of concern by the Chinese government. For more details, see “Risk Factors — Risks Relating to Doing Business in the Jurisdiction in which our Operating Subsidiary Operates — We may become subject to a variety of PRC laws and other regulations regarding data protection or cybersecurity, and any failure to comply with applicable laws and regulations could have a material and adverse effect on our business, financial condition and results of operations” on page 27.

Pursuant to the Holding Foreign Companies Accountable Act (“HFCAA”), the Public Company Accounting Oversight Board United States (“PCAOB”) issued a Determination Report on December 16, 2021 which found that the PCAOB is unable to inspect or investigate completely registered public accounting firms headquartered in: (1) the PRC because of a position taken by one or more authorities in mainland China; and (2) Hong Kong, a Special Administrative Region and dependency of the PRC, because of a position taken by one or more authorities in Hong Kong. Furthermore, as more stringent criteria have been imposed by the United States Securities and Exchange Commission (“SEC”) and the PCAOB recently, our Ordinary Shares may be prohibited from trading on a national exchange or over-the-counter under the HFCAA if the PCAOB is unable to inspect our auditors for two consecutive years beginning in 2021. On June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, and on December 29, 2022, legislation entitled “Consolidated Appropriations Act, 2023” (the “Consolidated Appropriations Act”) was signed into law, which contained, among other things, an identical provision to the Accelerating Holding Foreign Companies Accountable Act and amended the HFCAA by requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years, thus reducing the time period for triggering the prohibition on trading. Our auditor WWC, P.C. (“WWC”) is not subject to the determinations as to inability to inspect or investigate registered firms completely announced by the PCAOB on December 16, 2021. Our auditor is headquartered in San Mateo, California, and has been inspected by the PCAOB on a regular basis, with the last inspections in December 2021. If trading in our Ordinary Shares is prohibited under the HFCAA in the future because the PCAOB determines that it cannot inspect or fully investigate our auditor at such future time, Nasdaq may determine to delist our Ordinary Shares and trading in our Ordinary Shares could be prohibited. On August 26, 2022, the PCAOB announced that it had signed a Statement of Protocol (the “SOP”) with the CSRC and the Ministry of Finance of China. The SOP, together with two protocol agreements governing inspections and investigations (together, the “SOP Agreement”), establishes a specific, accountable framework to make possible complete inspections and investigations by the PCAOB of audit firms based in mainland China and Hong Kong, as required under U.S. law. On December 15, 2022, the PCAOB announced that it was able to secure complete access to inspect and investigate PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong completely in 2022. The PCAOB Board vacated its previous 2021 determinations that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in mainland China and Hong Kong. However, whether the PCAOB will continue to be able to satisfactorily conduct inspections of PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong is subject to uncertainties and depends on a number of factors out of our and our auditor’s control. The PCAOB continues to demand complete access in mainland China and Hong Kong moving forward and is making plans to resume regular inspections in early 2023 and beyond, as well as to continue pursuing ongoing investigations and initiate new investigations as needed. The PCAOB has also indicated that it will act immediately to consider the need to issue new determinations with the HFCAA if needed. See “Risk Factors – Risks Relating to Doing Business in the Jurisdiction in which our Operating Subsidiary Operates – A recent joint statement by the SEC and the PCAOB, rule changes by Nasdaq, and the HFCAA all call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments could add uncertainties to our Offering.” on page 32.

The Company holds all of the equity interests in the Operating Subsidiary in Hong Kong through a subsidiary incorporated in the British Virgin Islands. As we have a direct equity ownership structure, we do not have any agreement or contract between our Company and any of its subsidiaries that are typically seen in a variable interest entity structure. Within our direct equity ownership structure, funds from foreign investors can be directly transferred to our Operating Subsidiary in Hong Kong by way of capital injection or in the form of a shareholder loan from the Company following this offering. As a holding company, we may rely on dividends and other distributions on equity paid by our Operating Subsidiary in Hong Kong for our cash and financing requirements. We are permitted under the laws of the Cayman Islands and our memorandum and articles of association (as amended from time to time) to provide funding to our Hong Kong Operating Subsidiary through loans and/or capital contributions. Our Operating Subsidiary is permitted under the laws of Hong Kong to issue cash dividends to us without limitation on the size of such dividends. However, if our Operating Subsidiary incurs debt on its own behalf, the instruments governing such debt may restrict their ability to pay dividends. As of the date of this prospectus, no transfers were made from the Company to its Operating Subsidiary and our Operating Subsidiary has not encountered difficulties or limitations with respect to its ability to transfer cash between each other. As of the date of this prospectus, neither the holding company nor our Operating Subsidiary maintains cash management policies or procedures dictating the amount of such funding or how funds are transferred. See “Prospectus Summary - Transfers of Cash to and From Our Subsidiaries” on page 9, “Implications of Being a Holding Company” on page 15 and “Dividends and Dividend Policy” on page 44 of this prospectus. There can be no assurance that the PRC government will not restrict or prohibit the flow of cash in or out of Hong Kong. Any restrictions, prohibitions, interventions or limitations by the PRC government on the ability of the Company or our Operating Subsidiary to transfer cash or assets in or out of Hong Kong may result in these funds or assets not being available to fund operations or for other uses outside of Hong Kong. See “Risk Factors - Risks Relating to Our Initial Public Offering and Ownership of Our Ordinary Shares - Because we may not expect to pay dividends in the foreseeable future, you may rely on price appreciation of our Ordinary Shares for a return on your investment” on page 36. For additional information, see also the Company’s consolidated financial statements for the six months ended June 30, 2023 and 2024 and the years ended December 31, 2022 and 2023, and notes thereto starting on page F-1.

For the six months ended June 30, 2023 and 2024 and the financial years ended December 31, 2022 and 2023, the Company has paid dividend in the amount of $499,058, $1,395,961, $374,136 and $2,872,134, respectively, to offset the current accounts with directors and related parties. The Company also plans to distribute a dividend in the amount of approximately US$550,000 prior to the closing of this Offering (the “Pre-IPO Dividend”). Except for the anticipated Pre-IPO Dividend, Company intends to keep any future earnings to finance business operations, and does not anticipate that any cash dividends will be paid in the foreseeable future. See “Transfers of Cash to and From Our Subsidiaries” on page 9 and “Risk Factors – Risks Relating to Doing Business in the Jurisdiction in which our Operating Subsidiary Operates – Because we may not expect to pay dividends in the foreseeable future, you may rely on price appreciation of our Ordinary Shares for a return on your investment.”

First Grade conducts its business in Hong Kong and some customers of our restaurants may be PRC individuals. Conducting business in Hong Kong involves risks of uncertainty about any actions the Chinese government or authorities in Hong Kong may take. See “Prospectus Summary - Recent Regulatory Development in the PRC” beginning on page 12 and “Risk Factors – Risks Relating to Doing Business in the Jurisdiction in which our Operating Subsidiary Operates” beginning on page 27.

There are significant legal and operational risks associated with being based in or having the majority of our operations in Hong Kong, including potential changes in the legal, political and economic policies of the Chinese government, and the relations between China and the United States. Chinese or U.S. regulations may materially and adversely affect our business, financial condition and results of operations. Any such changes could significantly limit or completely hinder our ability to offer or continue to offer our securities to investors, and could cause the value of our securities to significantly decline or become worthless.

Upon completion of this Offering, we will be a “controlled company” as defined under the Nasdaq Stock Market Rules as long as our majority and eventual controlling shareholder Sincere Virtue will be the beneficial owner of an aggregate of 18,625,000 Ordinary Shares, which will represent 90.85% of the total issued and outstanding Ordinary Shares. For so long as we are a controlled company under that definition, we are permitted to elect to rely, and may rely, on certain exemptions from corporate governance rules, including:

| | ● | an exemption from the rule that a compensation committee comprised solely of independent directors governed by a compensation committee charter oversee executive compensation; |

| | | |

| | ● | an exemption from the rule that the compensation of our chief executive officer must be determined or recommended solely by independent directors; |

| | | |

| | ● | an exemption from the rule that director nominees be selected or recommended for selection by either a majority of the independent directors or a nomination committee comprised solely of independent directors; and |

| | | |

| | ● | an exemption from the rule that independent directors have regularly scheduled meetings with only the independent directors present. |

As a result, you will not have the same protection afforded to shareholders of companies that are subject to these corporate governance requirements. Although we do not intend to rely on the “controlled company” exemption under the Nasdaq listing rules, we could elect to rely on this exemption in the future. If we elected to rely on the “controlled company” exemption, a majority of the members of our board of directors might not be independent directors and our nomination and compensation committees might not consist entirely of independent directors upon closing of the Offering. If we cease to remain as a foreign private issuer, we may rely on these exemptions. Furthermore, Sincere Virtue will be able to exert significant control over our management and affairs, including approval of significant corporate transactions. For additional information, see “Risk Factors – Risks Relating to Our Initial Public Offering and Ownership of Our Ordinary Shares - Our Controlling Shareholder has substantial influence over the Company. Its interests may not be aligned with the interests of our other shareholders, and it could prevent or cause a change of control or other transactions” on page 38.

We are an “Emerging Growth Company” and a “Foreign Private Issuer” under applicable U.S. federal securities laws and, as such, are eligible for reduced public company reporting requirements. Investing in our Ordinary Shares involves risks. Please see “Implications of Our Being an Emerging Growth Company” and “Implications of Our Being a Foreign Private Issuer” beginning on page 15 of this prospectus for more information.

| | | Per Share | | | Total Without Over-Allotment Option (3) | | | Total With Over-Allotment Option | |

| Initial public offering price(1) | | US$ | 5.00 | | | US$ | 9,375,000 | (4) | | US$ | 10,500,000 | |

| Underwriting discounts(2) | | US$ | 0.375 | | | US$ | 703,125 | | | US$ | 787,500 | |

| Proceeds to us, before expenses(3) | | US$ | 4.625 | | | US$ | 6,937,500 | | | US$ | 7,978,125 | |

| Proceeds to the Selling Shareholder(3) | | US$ | 4.625 | | | US$ | 1,734,375 | | | US$ | 1,734,375 | |

(1) Initial public offering price per share is assumed to be US$5.00, which is the midpoint of the range set forth on the cover page of this prospectus.

(2) We and the Selling Shareholder have agreed to pay the underwriters a discount equal to 7.5% of the initial offering price. This table does not include a non-accountable expense allowance equal to 1% of the gross proceeds received by us and the Selling Shareholder from the sales of the Ordinary Shares in this Offering payable to the underwriters. For a description of the other compensation to be received by the underwriters, see “Underwriting” beginning on page 128.

(3) Excludes fees and expenses payable to the underwriters. See “Underwriting – Underwriting Discounts and Expenses” on page 128.

(4) Includes US$7,500,000 gross proceeds from the sale of 1,500,000 Ordinary Shares offered by our Company and US$1,875,000 gross proceeds from the sale of 375,000 Ordinary Shares offered by the Selling Shareholder.

This Offering is being conducted on a firm commitment basis and underwriters are obligated to take and pay for all of the shares if any such shares are taken. The underwriters have agreed to purchase and pay for all of the Ordinary Shares offered by this prospectus if they purchase any Ordinary Shares. We have granted the underwriters an option for a period of 45 days after the closing of this offering to purchase up to 15% of the total number of the Ordinary Shares to be offered by us pursuant to this offering (excluding Ordinary Shares subject to this option), solely for the purpose of covering over-allotments, at the public offering price less the underwriting discounts. If the Underwriter exercises the option in full, the total underwriting discounts payable will be $787,500 based on an assumed offering price of $5.00 per Ordinary Share, which is the midpoint of the estimated initial public offering price range set forth on the cover page of this prospectus, and the total gross proceeds to us, after underwriting discounts and expenses, will be $7,978,125. If we complete this Offering, net proceeds will be delivered to us and the Selling Shareholder on the closing date. The underwriters expect to deliver the Ordinary Shares to the purchasers against payment therefor on or about 2024.

Neither the United States Securities and Exchange Commission nor any state securities commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

You should not assume that the information contained in the Registration Statement of which this prospectus is a part is accurate as of any date other than the date hereof, regardless of the time of delivery of this prospectus or of any sale of the Ordinary Shares being registered in the Registration Statement of which this prospectus forms a part.

No dealer, salesperson or any other person is authorized to give any information or make any representations in connection with this Offering other than those contained in this prospectus and, if given or made, the information or representations must not be relied upon as having been authorized by us. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any security other than the securities offered by this prospectus, or an offer to sell or a solicitation of an offer to buy any securities by anyone in any jurisdiction in which the offer or solicitation is not authorized or is unlawful.

The date of this prospectus is [●], 2024

TABLE OF CONTENTS

Until , 2024 (the 25th day after the date of this prospectus), all dealers that buy, sell or trade our Ordinary Shares, whether or not participating in this Offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as an underwriter and with respect to their unsold allotments or subscriptions.

ABOUT THIS PROSPECTUS

Neither we, the Selling Shareholder nor any of the underwriters have authorized anyone to provide you with any information or to make any representations other than as contained in this prospectus or in any related free writing prospectus. Neither we, the Selling Shareholder nor the underwriters take responsibility for, nor provide any assurance about the reliability of, any information that others may give you. This prospectus is an offer to sell only the securities offered hereby, and only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the securities. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: neither we, the Selling Shareholder nor the underwriters have done anything that would permit this Offering or possession or distribution of this prospectus in any jurisdiction, other than the United States, where action for that purpose is required. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the Ordinary Shares and the distribution of this prospectus outside the United States.

We are incorporated under the laws of the Cayman Islands as an exempted company with limited liability and a majority of our outstanding securities are owned by non-U.S. residents. Under the rules of the SEC, we currently qualify for treatment as a “foreign private issuer.” As a foreign private issuer, we will not be required to file periodic reports and financial statements with the SEC, as frequently or as promptly as domestic registrants whose securities are registered under the Securities Exchange Act of 1934, as amended, or the Exchange Act.

Unless otherwise indicated, all financial information contained in this prospectus is prepared and presented in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP” or “GAAP”), and all information in this prospectus assumes no exercise by the underwriters of their over-allotment option.

Certain amounts, percentages and other figures included in this prospectus have been subject to rounding adjustments. Accordingly, amounts, percentages and other figures shown as totals in certain tables or charts may not be the arithmetic aggregation of those that precede them, and amounts and figures expressed as percentages in the text may not total 100% or, when aggregated may not be the arithmetic aggregation of the percentages that precede them.

Our reporting currency is the Hong Kong dollar. We make no representation that the Hong Kong dollar or U.S. dollar amounts referred to in this prospectus could have been or could be converted into U.S. dollars or Hong Kong dollars, as the case may be, at any particular rate or at all.

This prospectus contains translations of certain HK$ amounts into U.S. dollar amounts at specified rates solely for the convenience of the reader. The relevant exchange rates are listed below:

| | | For the Year Ended

December 31, | |

| | | 2022 | | | 2023 | |

| Period Ended HK$: USD exchange rate | | | 7.8015 | | | | 7.8109 | |

| Period Average HK$: USD exchange rate | | | 7.8306 | | | | 7.8292 | |

Numerical figures included in this prospectus have been subject to rounding adjustments. Accordingly, numerical figures shown as totals in various tables may not be arithmetic aggregations of the figures that precede them.

Investors should not place undue reliance on the facts, statistics and data contained in this prospectus with respect to the economies and the industry. Certain market and industry data included in this prospectus were obtained from independent third-party surveys, market research, publicly available information, reports of governmental agencies and industry publications and surveys. All market and industry data used in this prospectus involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Although we believe the information from industry publications and other third-party sources included in this prospectus is reliable, we do not guarantee the accuracy and completeness of such information. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section titled “Risk Factors.” These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements that relate to our current expectations and views of future events. These forward-looking statements are contained principally in the sections entitled “Prospectus Summary,” “Risk Factors,” “Use of Proceeds,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Industry Overview” and “Business.” These statements relate to events that involve known and unknown risks, uncertainties and other factors, including those listed under “Risk Factors,” which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

In some cases, these forward-looking statements can be identified by words or phrases such as “believe,” “plan,” “expect,” “intend,” “should,” “seek,” “estimate,” “will,” “aim” and “anticipate” or other similar expressions, but these are not the exclusive means of identifying such statements. All statements other than statements of historical facts included in this document, including those regarding future financial position and results, business strategy, plans and objectives of management for future operations (including development plans and dividends) and statements on future industry growth are forward-looking statements. In addition, we and our representatives may from time to time make other oral or written statements which are forward-looking statements, including in our periodic reports that we will file with the SEC, other information sent to our shareholders and other written materials.

These forward-looking statements are subject to risks, uncertainties and assumptions, certain of which are beyond our control. In addition, these forward-looking statements reflect our current views with respect to future events and are not a guarantee of future performance. Actual outcomes may differ materially from the information contained in the forward-looking statements as a result of a number of factors, including, without limitation, the risk factors set forth in “Risk Factors” and the following:

| | ● | our business and operating strategies and our various measures to implement such strategies; |

| | | |

| | ● | our operations and business prospects, including development and capital expenditure plans for our existing business; |

| | | |

| | ● | changes in policies, legislation, regulations or practices in the industry and place in which we operate that may affect our business operations; |

| | | |

| | ● | our financial condition, results of operations and dividend policy; |

| | | |

| | ● | changes in political and economic conditions and competition in the business in which we operate; |

| | | |

| | ● | the regulatory environment and industry outlook in general; |

| | | |

| | ● | future developments in the food and beverage business and actions of our competitors; |

| | | |

| | ● | catastrophic losses from man-made or natural disasters, such as fires, floods, windstorms, earthquakes, diseases, epidemics, other adverse weather conditions or natural disasters, war, international or domestic terrorism, civil disturbances and other political or social occurrences; |

| | | |

| | ● | the loss of key personnel and the inability to replace such personnel on a timely basis or on terms acceptable to us; |

| | | |

| | ● | the overall economic environment and general market and economic conditions in Hong Kong; |

| | | |

| | ● | our ability to execute our strategies; |

| | | |

| | ● | changes in the need for capital and the availability of financing and capital to fund those needs; |

| | | |

| | ● | our ability to anticipate and respond to changes in consumer performances, tastes and trends; and |

| | | |

| | ● | legal, regulatory and other proceedings arising out of our operations. |

The forward-looking statements made in this prospectus relate only to events or information as of the date on which the statements are made in this prospectus. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this prospectus and the documents that we reference in this prospectus and have filed as exhibits to the Registration Statement, of which this prospectus is a part, completely and with the understanding that our actual future results or performance may be materially different from what we expect.

DEFINITIONS

| “Anti-epidemic Fund” | means the six rounds of anti-epidemic fund amounting to HK$348.47 billion granted by the Hong Kong government to (i) help businesses stay afloat; (ii) keep workers in employment; (iii) relieve financial burdens of individuals and businesses; and (iv) assist the economy to recover once the Pandemic is contained. |

| | |

“Articles of Association” | means the articles of association of our Company adopted on December 6, 2024, as amended from time to time, a copy of which is filed as Exhibit 3.1 to this Registration Statement. |

| | |

| “Basic Law” | means the Basic Law of the Hong Kong Special Administrative Region of the People’s Republic of China. |

| | |

“Business Day” | means a day (other than a Saturday, Sunday or public holiday in the U.S.) on which licensed banks in the U.S. are generally open for normal business to the public. |

| | |

| “BVI” | means British Virgin Islands. |

| | |

| “CAC” | means the Cyberspace Administration of China. |

| | |

| “CAGR” | means compound annual growth rate. |

| | |

| “Chicken Rice Box” | means chicken rice featuring different ingredients cooked with our Signature Chicken Sauce in our own food factory, which is packed in a sealed microwavable plastic container and frozen before it is being sold to a customer through our restaurants or online food delivery platforms. |

| | |

| “China” or the “PRC” | means the People’s Republic of China and only in the context of describing PRC laws, regulations, rules, regulatory authority and other legal or tax matters in this prospectus, excludes special administrative regions of Hong Kong, the Macau Special Administrative Region and Taiwan. |

| | |

“Companies Act” | means the Companies Act (as revised) of the Cayman Islands, as amended, supplemented or otherwise modified from time to time. |

| | |

| “Companies Ordinance” | means the Companies Ordinance (Chapter 622 of the Laws of Hong Kong), as amended, supplemented or otherwise modified from time to time. |

| | |

| “Company”, “the Company”, or “our Company” | means The Great Restaurant Development Holdings Limited, a company incorporated in the Cayman Islands as an exempted company with limited liability on March 8, 2018. |

| | |

| “COVID-19” | means the novel strain of coronavirus identified in 2019, an infectious virus causing severe acute respiratory syndrome, which was deemed a pandemic by the World Health Organization. |

| | |

| “COVID-19 Business and Premises Regulation” | means Prevention and Control of Disease (Requirements and Directions) (Business and Premises) Regulation (Chapter 599F of the Laws of Hong Kong), as amended, supplemented or otherwise modified from time to time. |

| | |

| “COVID-19 Catering Business Premises Directions” | means directions issued by the Secretary FH under the COVID-19 Business and Premises Regulation which are applicable to catering business premises for preventing, protecting against, delaying or otherwise controlling the incidence or transmission of COVID-19 in Hong Kong, which covers the mode of operation of the business or activity of any catering business premises, the closing of any catering business premises and the opening hours of any catering business premises. |

| “CSRC” | means the China Securities Regulatory Commission. |

| | |

| “Director(s)” | means the director(s) of our Company. |

| | |

| “Dutiable Commodities (Liquor) Regulations” | means the Dutiable Commodities (Liquor) Regulations (Chapter 109B of the Laws of Hong Kong), as amended, supplemented or otherwise modified from time to time. |

| | |

| “Dutiable Commodities Ordinance” | means the Dutiable Commodities Ordinance (Chapter 109 of the Laws of Hong Kong), as amended, supplemented or otherwise modified from time to time. |

| | |

| “Electronic Payment” | means an instant electronic payment made via a mobile payment app (including Alipay, WeChat Pay, BoC Pay and PayMe) or a reusable contactless stored value smart card known as “Octopus” in Hong Kong. |

| | |

| “Employees’ Compensation Ordinance” | means the Employees’ Compensation Ordinance (Chapter 282 of the Laws of Hong Kong), as amended, supplemented or otherwise modified from time to time. |

| | |

| “Employment Ordinance” | means the Employment Ordinance (Chapter 57 of the Laws of Hong Kong, as amended, supplemented or otherwise modified from time to time). |

| | |

| “Environmental Protection Department” | means the Environmental Protection Department of Hong Kong. |

| | |

| “Exchange Act” | means the United States Securities Exchange Act of 1934, as amended. |

| | |

| “FEHD” | means the Food and Environmental Hygiene Department of Hong Kong. |

| | |

| “FINRA” | means Financial Industry Regulatory Authority, Inc. |

| | |

| “Fire Services Department” | means the Hong Kong Fire Services Department. |

| | |

| “First Grade” or “Operating Subsidiary” | means First Grade Group (H.K.) Company Limited, a company incorporated in Hong Kong with limited liability on April 12, 2011 and an indirect wholly-owned subsidiary of our Company. |

| | |

| “Food Business Regulation” | means the Food Business Regulation (Chapter 132X of the Laws of Hong Kong), as amended, supplemented or otherwise modified from time to time. |

| | |

| “Frost & Sullivan” | means Frost & Sullivan Limited, an independent business consulting firm. |

| | |

| “Frost & Sullivan Report” | means the market research report commissioned by us and prepared by Frost & Sullivan. |

| | |

| “Group,” “our Group,” “we” or “us” | means our Company and our subsidiaries, including our Operating Subsidiary. |

| | |

| “HK$,” “Hong Kong dollars” or “HK dollars” | means Hong Kong dollars, the lawful currency of Hong Kong. |

| | |

| “Hong Kong” or “HK” | means the Hong Kong Special Administrative Region of the PRC, comprising the Hong Kong Island, the Kowloon Peninsula and the New Territories. |

| | |

| “Independent Third Party(ies)” | means a person or company who or which is independent of and is not a 5% beneficial owner (as defined in Rule 13d-3 promulgated under the Exchange Act) of, does not control and is not controlled by or under common control with any 5% owner and is not the spouse or descendant (by birth or adoption) of any 5% beneficial owner of the Company. |

| “Liquor Licensing Board” | means the Liquor Licensing Board of Hong Kong. |

| | |

“Listing” | means the listing of our Ordinary Shares on the Nasdaq Capital Market or other national securities exchange. |

| | |

“Mandatory Provident Fund Schemes Ordinance” | means the Mandatory Provident Fund Schemes Ordinance (Chapter 485 of the Laws of Hong Kong), as amended, supplemented or otherwise modified from time to time. |

| | |

“Memorandum of Association” or “Memorandum” | means the memorandum of association of our Company adopted on December 6, 2024 and as supplemented, amended or otherwise modified from time to time, a copy of which is filed as Exhibit 3.1 to our Registration Statement of which this prospectus forms a part. |

| | |

| “Memorandum and Articles of Association” | means the Memorandum of Association and the Articles of Association. |

| | |

| “Minimum Wage Ordinance” | means the Minimum Wage Ordinance (Chapter 608 of the Laws of Hong Kong), as amended, supplemented or otherwise modified from time to time. |

| | |

| “MPF” | means mandatory provident fund to be contributed by an employer in accordance with the Mandatory Provident Fund Schemes Ordinance. |

| | |

| “MPF Authority” | means the Mandatory Provident Fund Scheme Authority of Hong Kong. |

| | |

| “Mr. Chu” | means Mr. Tak Wah Chu, Co-chairman and an executive Director of our Company. |

| | |

“Mr. Law” | means Mr. Siu Ming Law, Co-chairman, Chief Executive Officer and an executive Director of our Company. |

| | |

| “Offering” | means the offer of Ordinary Share by our Company and the Selling Shareholder pursuant to this prospectus. |

| | |

| “Ordinary Shares” | means ordinary share(s) with par value of US$0.00005 per share in the share capital of our Company. |

| | |

| “Pandemic” | means the pandemic of COVID-19 which persisted from early 2020 to late 2022. |

| | |

| “POS System” | means our point-of-sale system which captures our customers’ spending data, including time and date of meal, quantities of each menu item sold, drinks consumption and means of payment. |

| | |

“Prevention and Control of Disease Ordinance” | means the Prevention and Control of Disease Ordinance (Chapter 599 of the Laws of Hong Kong), as amended, supplemented, or otherwise modified from time to time. |

| | |

“Public Health and Municipal Services Ordinance” | means the Public Health and Municipal Services Ordinance (Chapter 132 of the Laws of Hong Kong), as amended, supplemented or modified from time to time. |

| | |

| “Regulation S” | means Regulation S under the U.S. Securities Act. |

| | |

| “Sarbanes Oxley Act” | means The Sarbanes-Oxley Act of 2002. |

| | |

| “SEC” | means the United States Securities and Exchange Commission. |

| “Secretary FH” | means the Secretary for Food and Health in Hong Kong. |

| | |

| “Signature Chicken Sauce” | means our self-formulated and homemade signature chicken sauce, which can be served with different level of spiciness according to the taste preference of our customers. |

| | |

| “Sincere Virtue” or “Selling Shareholder” or “Controlling Shareholder” | means Sincere Virtue Limited, a company incorporated in the BVI with limited liability on January 15, 2018 and owned as to 50% by Mr. Law and 50% by Mr. Chu, being an existing shareholder of our Company that is selling a portion of its Ordinary Shares pursuant to this prospectus. |

| | |

| “Specialty Chicken Hotpot” | means our signature chicken hotpot which is first served as a chicken claypot dish cooked with our Signature Chicken Sauce and the leftovers of which, plus any refills of our Signature Chicken Sauce, may be used at the customer’s option as a soup base to cook his/her selected raw ingredients as a self-serve hotpot. |

| | |

| “U.S.”, “United States” or “US” | means the United States of America. |

| | |

| “US$” or “U.S. dollars” | means United States dollars, the lawful currency of the United States of America. |

| | |

| “U.S. GAAP” | means the generally accepted accounting principles in the United States of America. |

| | |

| “U.S. Securities Act” | means the United States Securities Act of 1933, as amended. |

| | |

| “VIE” | means variable interest entity. |

| | |

| “Water Pollution Control Ordinance” | means the Water Pollution Control Ordinance (Chapter 358 of the Laws of Hong Kong), as amended, supplemented or modified from time to time. |

| | |

| “West Image” | means West Image Limited, a BVI business company incorporated in the BVI with limited liability on January 2, 2013 and our direct wholly-owned subsidiary. |

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. This summary may not contain all of the information that may be important to you, and we urge you to read this entire prospectus carefully, including the “Risk Factors,” “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections and our consolidated financial statements and notes to those statements, included elsewhere in this prospectus, before deciding to invest in our Ordinary Shares. This prospectus includes forward-looking statements that involve risks and uncertainties. See “Special Note Regarding Forward-Looking Statements.” Unless otherwise indicated, all information in this prospectus assumes no exercise of the underwriters’ over-allotment option.

Overview

We operate a multi-award-winning Chinese restaurant chain and specialize in various types of Specialty Chicken Hotpot under the brand name “The Great Restaurant (一品雞煲火鍋)” in Hong Kong. As of the date of this prospectus, we operate seven restaurants in our chain, out of which three are located in the New Territories, three in the Kowloon Peninsula and one on Hong Kong Island. We have over 12 years of experience in the restaurant services industry in Hong Kong and utilize one food factory to support our operations.

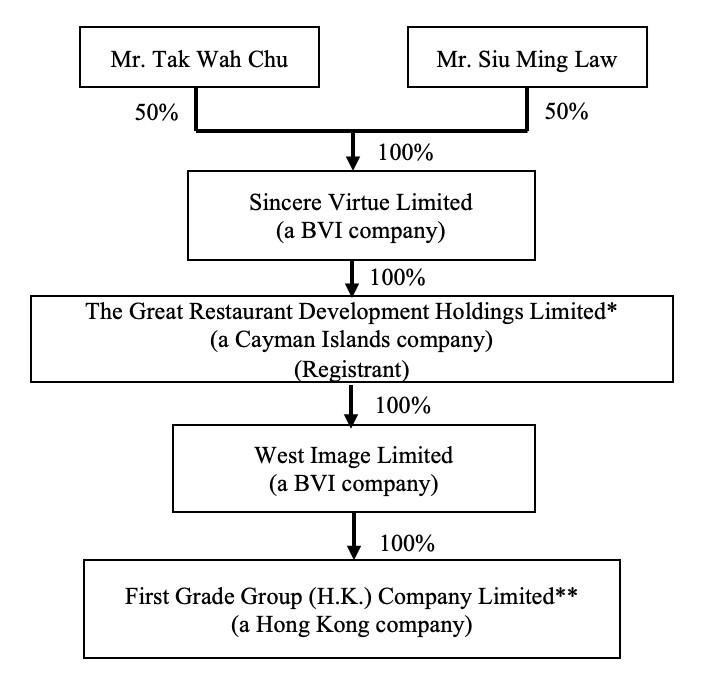

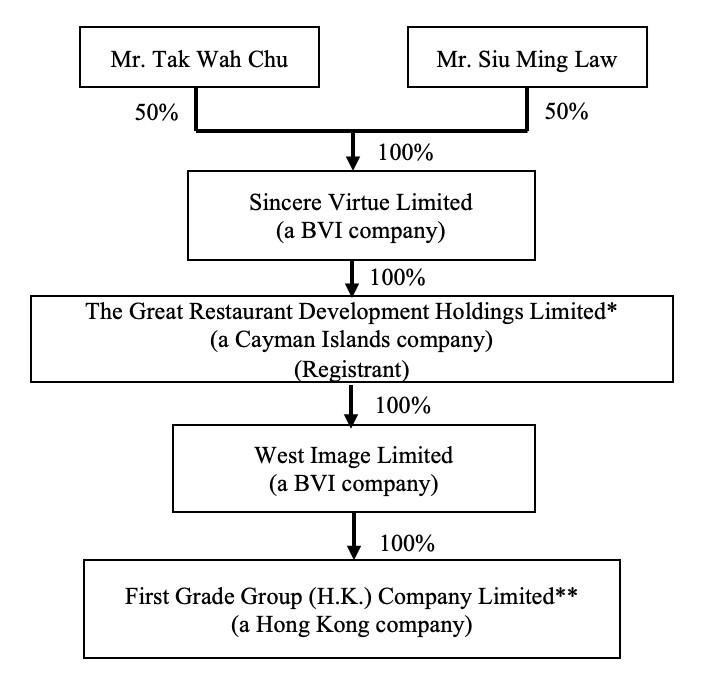

Corporate Structure

We were incorporated in the Cayman Islands on March 8, 2018. Our registered office in the Cayman Islands is at Cricket Square, Hutchins Drive, P.O. Box 2681, Grand Cayman, KY1-1111, Cayman Islands. Our principal executive office is at Ground Floor and 1st Floor, No. 73 Chung On Street, Tsuen Wan, New Territories, Hong Kong. Our telephone number is +852 2487 3337. Our website address is https://thegreatrestaurant.neocities.org. The information contained on our website does not form part of this prospectus. Our agent for service of process in the United States is Cogency Global Inc., 122 East 42nd Street, 18th Floor, New York, NY 10168.

The chart below sets out our corporate structure as of the date of this prospectus.

A description of our principal subsidiary is set out below.

First Grade was incorporated in Hong Kong as a private company limited by shares on April 12, 2011. Since May 2011, First Grade has been owned directly or indirectly as to 50% by Mr. Law and 50% by Mr. Chu. Following an internal group reorganization completed in March 2019, First Grade became our indirect wholly-owned subsidiary. Since its incorporation, First Grade has been operating our restaurants under the brand “The Great Restaurant (一品雞煲火鍋)”.

Investors in our Ordinary Shares should be aware that they will not and may never directly hold equity interests in the Hong Kong operating subsidiary, First Grade, but rather purchasing equity solely in our Cayman Islands holding company, The Great Restaurant Development Holdings Limited.

Our Competitive Strengths

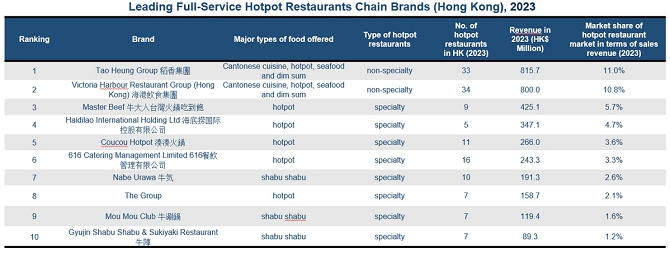

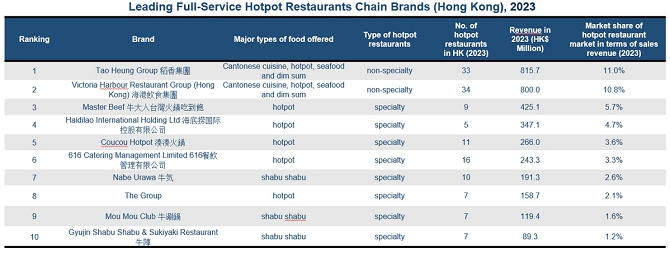

Strong brand recognition in the hotpot restaurant market in Hong Kong

We operate a multi-award-winning Chinese restaurant chain that specializes in various types of Specialty Chicken Hotpot under the brand name “The Great Restaurant (一品雞煲火鍋)” in Hong Kong. With our over 13 years of operating history, we believe that we have built our “The Great Restaurant (一品雞煲火鍋)” brand name to represent high-quality specialty chicken hotpot dining in Hong Kong among locals and tourists. We have received the various awards over the years that reflect our market recognition in Hong Kong.

Strategic locations of our restaurants and food factory

Our locations are either strategically located on the street level with high pedestrian traffic or in the basements/lower floors of shopping malls or commercial buildings with direct access by private stairways or escalators from the street level with feature conspicuous signages of our “The Great Restaurant (一品雞煲火鍋)” brand name. Moreover, we have opened our restaurant storefronts in a variety of locales, all of which are densely populated middle-income residential or mixed commercial and residential districts in Hong Kong.

Our Specialty Chicken Hotpots, Signature Chicken Sauce and our strong commitment to food quality

Specialty Chicken Hotpot

We created the concept of our signature Specialty Chicken Hotpot. This dish incorporates the combination of a claypot dish and a self-serve hotpot, both of which are popular and used in traditional Chinese cuisine. We believe combining both the claypot dish and self-serve hotpot is a modern and fresh take on traditional Chinese cuisine that is equally intriguing as it is delicious. We believe our success lies in the novelty of our Specialty Chicken Hotpots and the iconic taste of our self-formulated and homemade Signature Chicken Sauce.

Fresh and quality food

We endeavor to use fresh ingredients as much as possible. Therefore, we generally arrange for our suppliers to directly deliver all fresh ingredients to our restaurants for preservation of freshness.

We deploy an efficient and standardized operations management system

We believe our standardized operations and efficient management system have enabled us to control our operation costs, maximize profitability, achieve economies of scale, maintain quality control and establish a scalable business model, as evidenced by our growth to date. Our standardized and efficient operations primarily consist of the following elements:

| ● | Our food factory |

| | |

| ● | Our standardized quality control system and menu |

| | |

| ● | Our POS System |

| | |

| ● | Our Comprehensive staff training |

Established and stable relationship with our major suppliers

As of the date of this prospectus, we maintained established business relationship for an average of over eight years with our five largest suppliers during the years ended December 31, 2022 and 2023. Our established and stable business relationships with our major suppliers enable us to secure continuous, timely and steady supply of quality food ingredients at commercially viable prices. This supply of high-quality ingredients enables us to offer stable, safe and fresh food offerings to our customers at an affordable price.

A team of experienced managerial personnel

Our executive Directors and members of senior management are highly experienced in the catering services industry and restaurant management. Our Group was founded in 2011 by Mr. Law and Mr. Chu who we believe have been instrumental in the growth and development of our Group over our 13 years of operations. Mr. Wong Ka Wah, our culinary director, who has over 41 years of experience in the catering services industry, is responsible for the creation of new dishes and control of output quality. Similarly, Mr. Lo Tung Ming, our executive chef, is critical to our operations due to his over 17 years of experience in the catering services industry. To that end, he is in charge of the daily operation of our food factory, the procurement of ingredients and managing our relationship with the suppliers. Further, Ms. Weng Shuling, our general manager, who has over 17 years of experience in the catering services industry, is responsible for overseeing the daily operation of our restaurants. All of them joined our Group since our founding in 2011 and have established good rapport with our executive Directors.

Our Growth Strategies

We intend to leverage our successful track record, our brand image and the experience of our management team to facilitate an expansion plan that we believe will increase our share in the hotpot restaurant market in Hong Kong. To this end, we intend to implement the following strategic growth strategies:

| ● | expand our restaurant network; |

| ● | expand the production and/or sales channels of our peripheral food products including our Chicken Rice Boxes; |

| ● | set up a new food factory encompassing an automatic production line for our Chicken Rice Boxes and a training center; |

| ● | enhance our brand awareness in Hong Kong and Southeast Asia; |

| ● | set up a new head office; |

| ● | invest in service and system upgrade to improve operational efficiency; and |

| ● | redesign and refurbish our existing restaurants. |

Our auditor has expressed substantial doubt about our ability to continue as a going concern.

The audited financial statements for the fiscal years ended December 31, 2022 and 2023 contain an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern based upon our working capital deficits for the years ended December 31, 2022 and December 31, 2023. Our ability to continue as a going concern is dependent on obtaining necessary financing or negotiating terms of existing short-term liabilities to meet our current and future liquidity needs. As such an uncertainty exists that may cast significant doubt on our ability to continue as a going concern. The audited consolidated financial statements for fiscal year ended December 31, 2023 do not include any adjustments that might result from the outcome of this uncertainty. This going concern opinion could materially limit our ability to raise additional funds through the issuance of equity or debt securities or otherwise.

As of June 30, 2024, December 31, 2022 and 2023, although the Company had a working capital deficit in an amount of $3,183,004, $3,919,681 and $2,200,980, respectively, it generated a positive cash flow from its operating activities in an amount of $586,772, $1,604,499 and $4,146,154, respectively. As of the date of this prospectus, the Company has monthly repayments of bank borrowings of approximately $35,000, and will continue to borrow a renewable 3-month revolving loan in the amount of HK$2.5 million from the bank. Therefore, the amount of new borrowings to fund our operations in the next 12 months is approximately HK$10 million (US$1.28 million). The Company does not expect to incur other borrowings in this period.

To sustain its ability to support the Company’s operating activities, the Company will supplement its sources of funding through cash and cash equivalent generated from operations and seeking financing via the offering.

Based on the above considerations, management believes that the Company has sufficient funds to meet its operating and capital expenditure needs and obligations in the next 12 months.

Corporate Information

We were incorporated in the Cayman Islands on March 8, 2018. Our registered office in the Cayman Islands is located at Cricket Square, Hutchins Drive, P.O. Box 2681, Grand Cayman, KY1-1111, Cayman Islands. Our administrative office is located at Ground Floor and 1st Floor, No. 73 Chung On Street, Tsuen Wan, New Territories, Hong Kong. Our telephone number is +852 2487 3337. Our website address is https://thegreatrestaurant.neocities.org. The information contained on our website (https://thegreatrestaurant.neocities.org) does not form part of this prospectus. Our agent for service of process in the United States is Cogency Global Inc., 122 East 42nd Street, 18th Floor, New York, NY 10168.

Transfers of Cash to and From Our Subsidiaries

Our business is primarily conducted through our indirectly wholly-owned HK subsidiary, First Grade. The Cayman Islands holding company will rely on dividends paid by its subsidiaries, West Image, our wholly-owned BVI subsidiary and the latter’s wholly-owned HK subsidiary, First Grade, for our Company’s working capital and cash needs, including the funds necessary to pay any dividends. Our Company and West Image are Cayman Islands and BVI holding companies, respectively. Only First Grade operates in HK.

During the normal course of our business, cash is maintained by our Operating Subsidiary, First Grade, in 23 separate Hong Kong Dollar bank accounts and one foreign currency savings account in HK.

For the six months ended June 30, 2023 and 2024, the financial years ended December 31, 2022 and 2023, the Company has paid dividends in the amounts of $499,058, $1,395,961, $374,136 and $2,872,134, respectively, to offset the current accounts with directors and related parties. However, there has not been any additional transfers, dividends, or distributions between the holding company, our Company, its subsidiaries, or to its investors. If we decide to pay dividends on any of our Ordinary Shares, as a holding company, we will depend on the receipt of funds from our Operating Subsidiary through dividend payments. We are permitted under the laws of the Cayman Islands to provide funding to our Operating Subsidiary through loans and/or capital contributions without restriction on the amount of the funds loaned or contributed.

We currently intend to retain all of our available funds and future earnings, if any, for the operation and expansion of our business and do not anticipate declaring or paying any dividends in the foreseeable future. Any future determination related to our dividend policy will be made at the discretion of our board of directors after considering our financial condition, results of operations, capital requirements, contractual requirements, business prospects and other factors the board of directors deems relevant, and subject to the restrictions contained in any future financing instruments.

Investors in our Ordinary Shares should note that, to the extent cash in the business is in Hong Kong or a Hong Kong entity, the funds may not be available to fund operations or for other use outside of Hong Kong due to interventions in or the imposition of restrictions and limitations on the ability of First Grade by the PRC government to transfer cash.

Cayman Islands. Subject to the Cayman Act and our Memorandum and Articles of Association, our board of Directors may declare dividends and distributions on our Ordinary Shares and authorize payment of the dividends or distributions out of the funds of the Company. No dividend or distribution shall be paid except out of our realized or unrealized profits, or out of our share premium account unless immediately following the payment we are able to pay our debts as they fall due in the ordinary course of business. Under Cayman Islands law, a Cayman Islands company may pay a dividend out of either its profit or share premium account, provided that in no circumstances may a dividend be paid if such payment would result in the company being unable to pay its debts as they fall due in the ordinary course of business.

British Virgin Islands. Under BVI law, the board of directors of our BVI subsidiary may authorize payment of a dividend to its shareholders as such time and of such an amount as they determine if they are satisfied on reasonable grounds that immediately following the dividend the value of our assets will exceed our liabilities and we will be able to pay our debts as they become due.

Hong Kong. Under Hong Kong law, dividends may only be paid out of distributable profits (that is, accumulated realized profits less accumulated realized losses) or other distributable reserves. Dividends cannot be paid out of share capital. There are no restrictions or limitations under the laws of Hong Kong imposed on the conversion of HK dollars into foreign currencies and the remittance of currencies out of Hong Kong, nor is there any restriction on foreign exchange to transfer cash between the Company and its subsidiaries, across borders and to U.S. investors, nor are there any restrictions or limitations on distributing earnings from our business and subsidiaries to the Company and U.S. investors. Under the current practice of the Inland Revenue Department of Hong Kong, no tax is payable in Hong Kong in respect of dividends paid by us.

For more information, see “Dividend Policy,” “Risk Factors”, “Summary Consolidated Financial and Data” and “Consolidated Statements of Changes in Shareholders’ Equity” in the Report of the independent registered public accounting firm.

Risks and Challenges

Investing in our Ordinary Shares involves risks. You should carefully read and consider all of the information contained in this prospectus (including in “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the notes thereto) before making an investment decision. The risks summarized below are qualified by reference to “Risk Factors” beginning on page 19 of this prospectus, which you should carefully consider before making a decision to invest in our Ordinary Shares. If any of these risks actually occurs, our business, financial condition or results of operations would likely be materially adversely affected. In such case, the trading price of our Ordinary Shares would likely decline, and you may lose all or part of your investment. In reviewing this prospectus, you should bear in mind that past results are no guarantee of future performance. See “Cautionary Statement Regarding Forward-Looking Statements” for a discussion of forward-looking statements, and the significance of forward-looking statements in the context of this prospectus.

The following is a summary of what our management views as our most significant risk factors:

Risks Relating to Our Business and Industry

Risks and uncertainties relating to our business, beginning on page 19 of this prospectus, include but are not limited to the following:

| | ● | Our success depends significantly on the market’s recognition of our brand, and if we are not able to maintain or enhance our brand recognition, our business, financial condition and results of operations may be materially and adversely affected. See “Risk Factors – Risks Relating to Our Business and Industry – Our business depends significantly on market recognition of our brand and recipes. Measures taken to prevent intellectual property infringement or taken to protect our recipes may be insufficient” on page 22. |

| | | |

| | ● | Our auditor has expressed substantial doubt about our ability to continue as a going concern. See “Risk Factors – Risks Relating to Our Business and Industry – Our auditor has expressed substantial doubt about our ability to continue as a going concern” on page 19. |

| | | |

| | ● | Health-related outbreaks amounting to diseases as well as negative publicity relating to such incidents may from time to time adversely affect our financial condition and results of operations in the future. See “Risk Factors – Risks Relating to Our Business and Industry – Health-related outbreaks amounting to epidemics and/or pandemics of infectious or contagious diseases, diseases of animals, foodborne illnesses as well as negative publicity relating to such incidents may from time to time adversely affect our financial condition and results of operations in the future” on page 20. |

| | | |

| | ● | Our business is heavily dependent on the macroeconomic conditions of Hong Kong. See “Risk Factors – Risks Relating to Our Business and Industry – Our business is heavily dependent on the macroeconomic conditions of Hong Kong, the overall economic growth of which could adversely affect our business” on page 21. |

| | | |

| | ● | Our current restaurant locations or rental rates may become unattractive may affect our expansion plan. See “Risk Factors – Risks Relating to Our Business and Industry – Our current restaurant locations or rental rates may become unattractive and the lack of new suitable locations on commercially viable terms, or any increase in rental costs may result in a failure to renew the existing tenancy agreements of our leased properties or a failure to seek new premises elsewhere for existing and new restaurants, and/or may affect our expansion plan” on page 21. |

| | | |

| | ● | Our success depends on our key management personnel and experienced and capable personnel, as well as our ability to attract, motivate and retain a sufficient number of capable employees. See “Risk Factors – Risks Relating to Our Business and Industry – Our success depends on our key management personnel and experienced and capable personnel, as well as our ability to attract, motivate and retain a sufficient number of capable employees” on page 23. |

| | | |

| | ● | The hotpot restaurant market in Hong Kong is highly competitive. |

Risks Relating to Doing Business in the Jurisdiction in which our Operating Subsidiary Operates

Risks and uncertainties relating to doing business in the jurisdiction in which our Operating Subsidiary operates, beginning on page 27 of this prospectus, include but are not limited to the following:

| | ● | Through long arm provisions under the current PRC laws and regulations, the PRC government may exercise significant oversight over the conduct of our business, which could result in a material change in our operations and/or the value of our Ordinary Shares. Changes in the policies, regulations and rules and the enforcement of laws of the Chinese government may also occur and our assertions and beliefs of the risk imposed by the PRC legal and regulatory system cannot be certain. See “Risk Factors – Risks Relating to Doing Business in the Jurisdiction in which our Operating Subsidiary Operates – Through long arm provisions under the current PRC laws and regulations, the PRC government may exercise significant oversight over the conduct of our business, which could result in a material change in our operations and/or the value of our Ordinary Shares. Changes in the policies, regulations and rules and the enforcement of laws of the Chinese government may also occur and our assertions and beliefs of the risk imposed by the PRC legal and regulatory system cannot be certain” on page 27. |

| | | |