Q2 2024 Earnings Call August 9, 2024

2 Forward Looking Statements Important Notices All statements, other than statements of present or historical facts included in this presentation, including, without limitation, FREYR Battery, Inc.’s (“FREYR”) ability to establish a profitable business; FREYR’s plan to extend its cash liquidity runway to 36 months and first revenue and EBITDA in 2025; the financial benefits of FREYR’s subject matter expertise; FREYR’s plan to expand on the battery value chain into high value adjacencies; FREYR’s efforts to accelerate the path to commercialization; the pursuit of project opportunities in accordance with the FREYR 2.0 initiative; potential inorganic growth opportunities and the ability to generate revenue in the near-term through possible acquisitions; the development, financing, construction, timeline, capacity, and other usefulness of FREYR’s CQP, Giga Arctic, Giga America, and other planned or future production facilities; any potential benefits of the U.S. Inflation Reduction Act; FREYR’s ability to reduce spending; and the implementation and effectiveness of FREYR’s overall business, technology, capital-raising, and liquidity strategies are forward-looking statements. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside FREYR’s control and are difficult to predict. Additional information about factors that could materially affect FREYR is set forth under the “Risk Factors” section in (i) FREYR’s Registration Statement on Form S-3 filed with the Securities and Exchange Commission (the “SEC”) on September 1, 2022 and subsequent post-effective amendment thereto filed on January 5, 2024, (ii) FREYR Battery, Inc.’s Registration Statement on Form S-4 filed with the SEC on September 8, 2023 and subsequent amendments thereto filed on October 13, 2023, October 19, 2023, and October 31, 2023, (iii) FREYR’s annual report on Form 10-K filed with the SEC on February 29, 2024; and (iv) FREYR’s Quarterly Reports on Form 10-Q filed with the SEC on May 8, 2024 and available on the SEC’s website at www.sec.gov. Except as otherwise required by applicable law, FREYR disclaims any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this presentation. Should underlying assumptions prove incorrect, actual results and projections could differ materially from those expressed in any forward-looking statements. FREYR intends to use its website as a channel of distribution to disclose information which may be of interest or material to investors and to communicate with investors and the public. Such disclosures will be included on FREYR’s website in the ‘Investor Relations’ sections. FREYR also intends to use certain social media channels, including, but not limited to, X (Twitter) and LinkedIn, as means of communicating with the public and investors about FREYR, its progress, products, and other matters. While not all the information that FREYR posts to its digital platforms may be deemed to be of a material nature, some information may be. As a result, FREYR encourages investors and others interested to review the information that it posts and to monitor such portions of FREYR’s website and social media channels on a regular basis, in addition to following FREYR’s press releases, SEC filings, and public conference calls and webcasts. The contents of FREYR’s website and other social media channels shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended.

Today’s Speakers and Topics 3 • Message from FREYR’s Board of Directors • Summary of leadership appointments and AGM results • Alignment with FREYR’s investors as fellow shareholders committed to shareholder value • The opportunities and challenges in today’s dynamic environment • FREYR’s plan to generate shareholder value • Summary of FREYR’s key priorities • FREYR’s commitment to financial discipline and a strong balance sheet • Approach to capital formation • Financial summary Tom Einar Jensen, Co-founder and CEO Evan Calio, CFO Daniel Barcelo, Board Chair

FREYR’s Value Proposition to Investors 4 Untapped asset and real option value • Current equity discount to cash on balance sheet reflective of FREYR’s pre-commercial state and challenging financing climate • Focused on unlocking value by developing projects with real assets (Giga America, Giga Arctic, CQP, Finland, Tech licenses) • FREYR's leadership team is executing its revised business plan targeting first revenue and EBITDA in 2025 Strong balance sheet and liquidity position • Debt free balance sheet and cash of $222 million at June 30th • FREYR is extending its cash liquidity runway to 36 months with spending rationalization Installed talent base of FREYR’s organization • Developed subject matter expertise across the battery value chain creates optionality across adjacent technology spectrum • Demonstrated ability to produce cells on the 24M next-generation production platform at CQP • Technical execution-oriented team is a differentiator in the battery industry Thematic exposure to secular growth trends across expanding partner network • FREYR’s equity story is tied to long-term supply and demand investment themes in the global battery and power markets • Accelerating electricity demand growth driven by data centers introducing new opportunities for FREYR

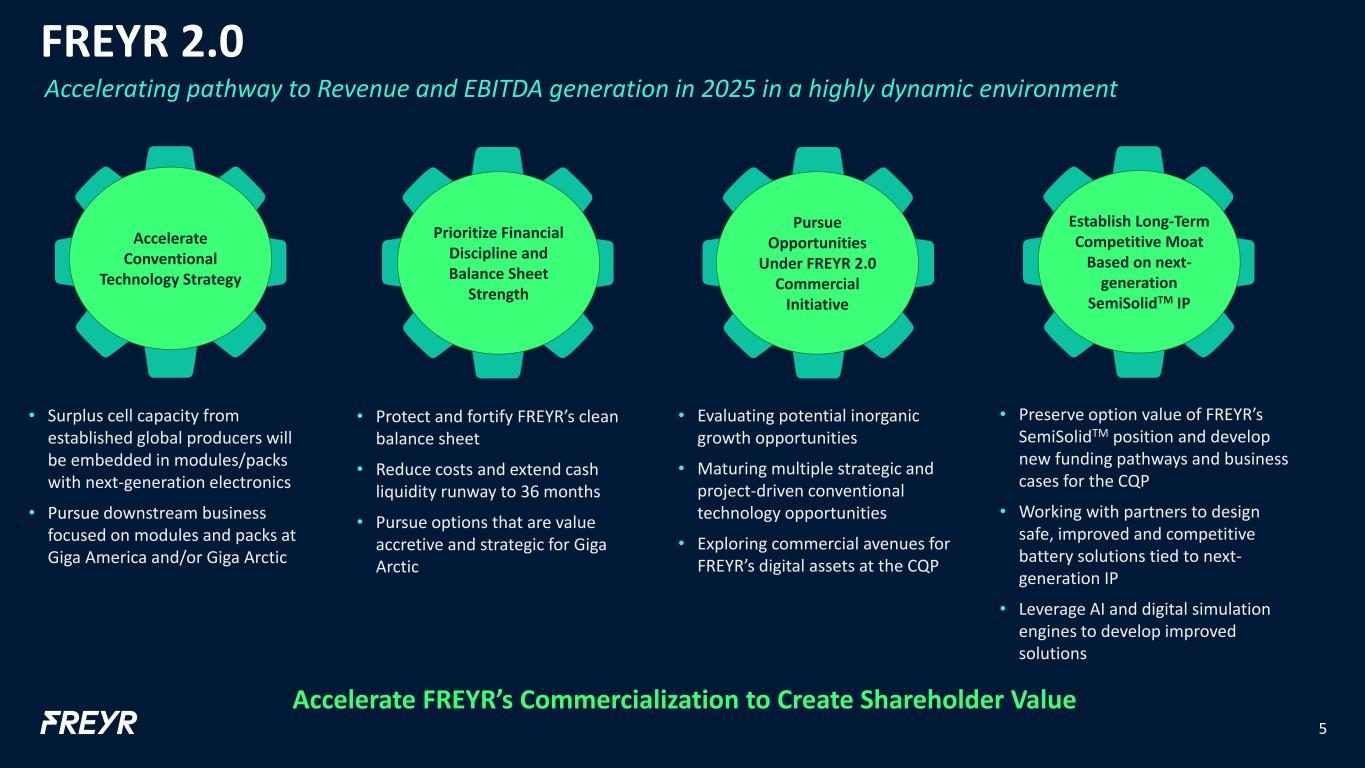

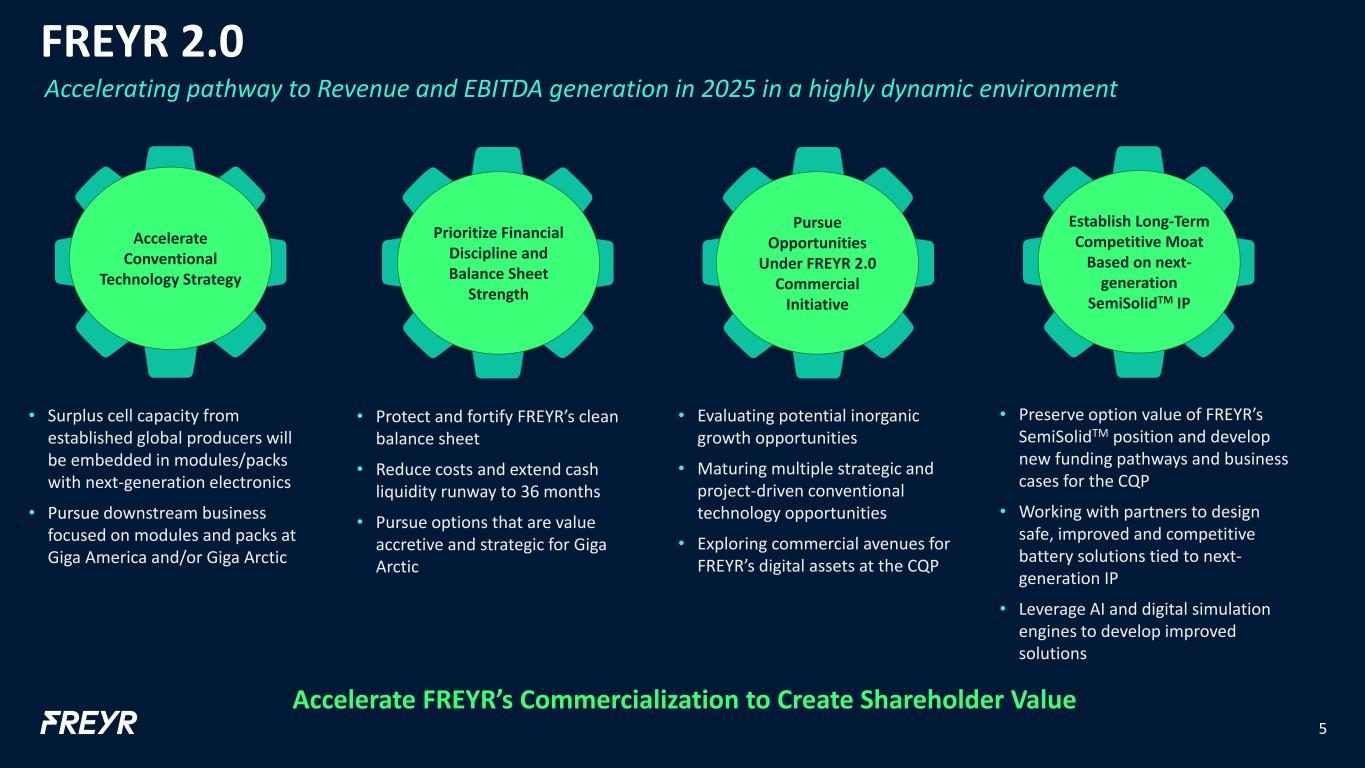

FREYR 2.0 5 Accelerating pathway to Revenue and EBITDA generation in 2025 in a highly dynamic environment Accelerate Conventional Technology Strategy Establish Long-Term Competitive Moat Based on next- generation SemiSolidTM IP Prioritize Financial Discipline and Balance Sheet Strength Pursue Opportunities Under FREYR 2.0 Commercial Initiative Accelerate FREYR’s Commercialization to Create Shareholder Value • Surplus cell capacity from established global producers will be embedded in modules/packs with next-generation electronics • Pursue downstream business focused on modules and packs at Giga America and/or Giga Arctic • Preserve option value of FREYR’s SemiSolidTM position and develop new funding pathways and business cases for the CQP • Working with partners to design safe, improved and competitive battery solutions tied to next- generation IP • Leverage AI and digital simulation engines to develop improved solutions • Protect and fortify FREYR’s clean balance sheet • Reduce costs and extend cash liquidity runway to 36 months • Pursue options that are value accretive and strategic for Giga Arctic • Evaluating potential inorganic growth opportunities • Maturing multiple strategic and project-driven conventional technology opportunities • Exploring commercial avenues for FREYR’s digital assets at the CQP

6 FREYR is commercially focused on storage applications that are fundamental to power grid reliability Batteries – The Core Enabler of the Energy Transition Batteries are a renewable energy catalyst Batteries enable intermittent energy sources that are growing exponentially to be viable, dispatchable, affordable sources of power generation. Wind and solar power growth are just part of the story Wind and solar dispatchability varies with weather, as does power demand. Batteries fortify the electric grid and improve cost and reliability regardless of the source of power generation. Batteries are an interface for electrified energy assets Batteries provide an AC/DC interface and energy storage that enables integration of heat pumps, EVs, distributed solar generation, etc. to be cheaper, more valuable, and more efficient. Source: Rocky Mountain Institute

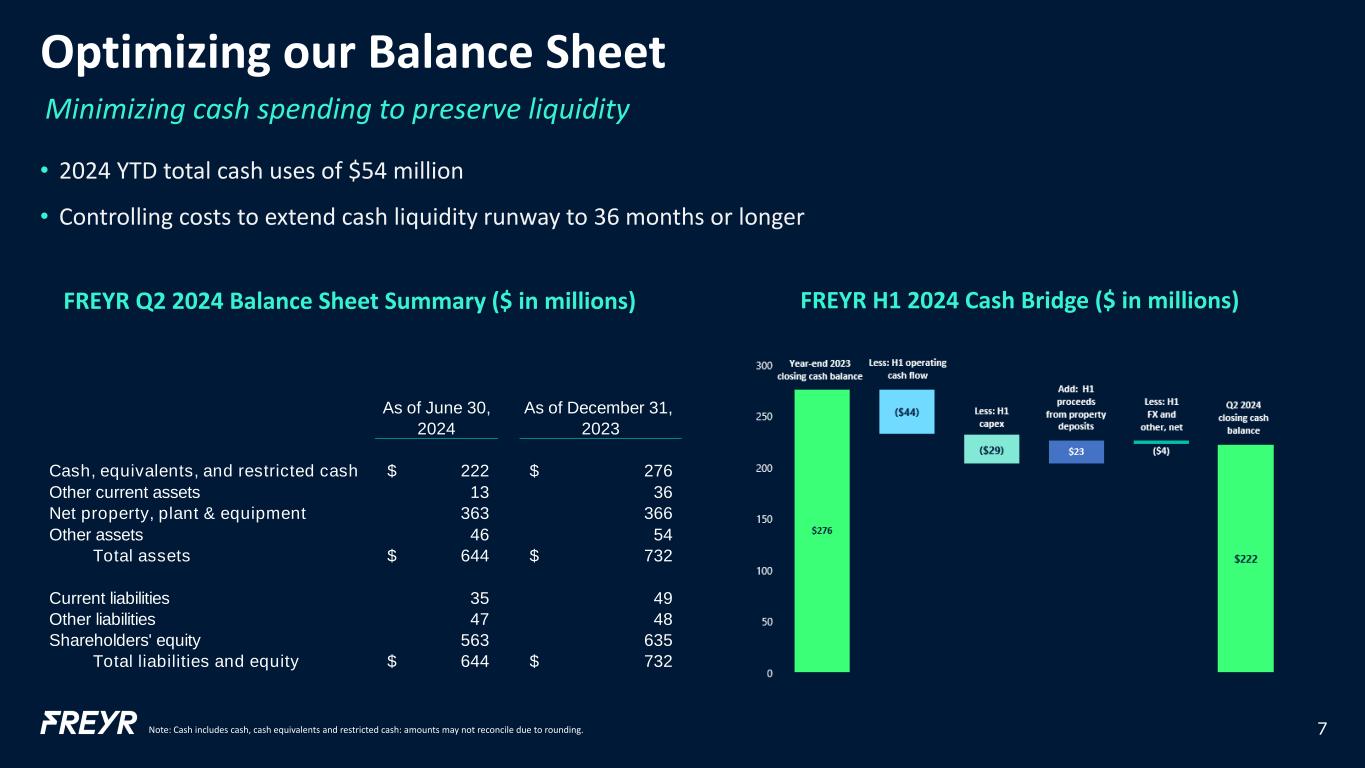

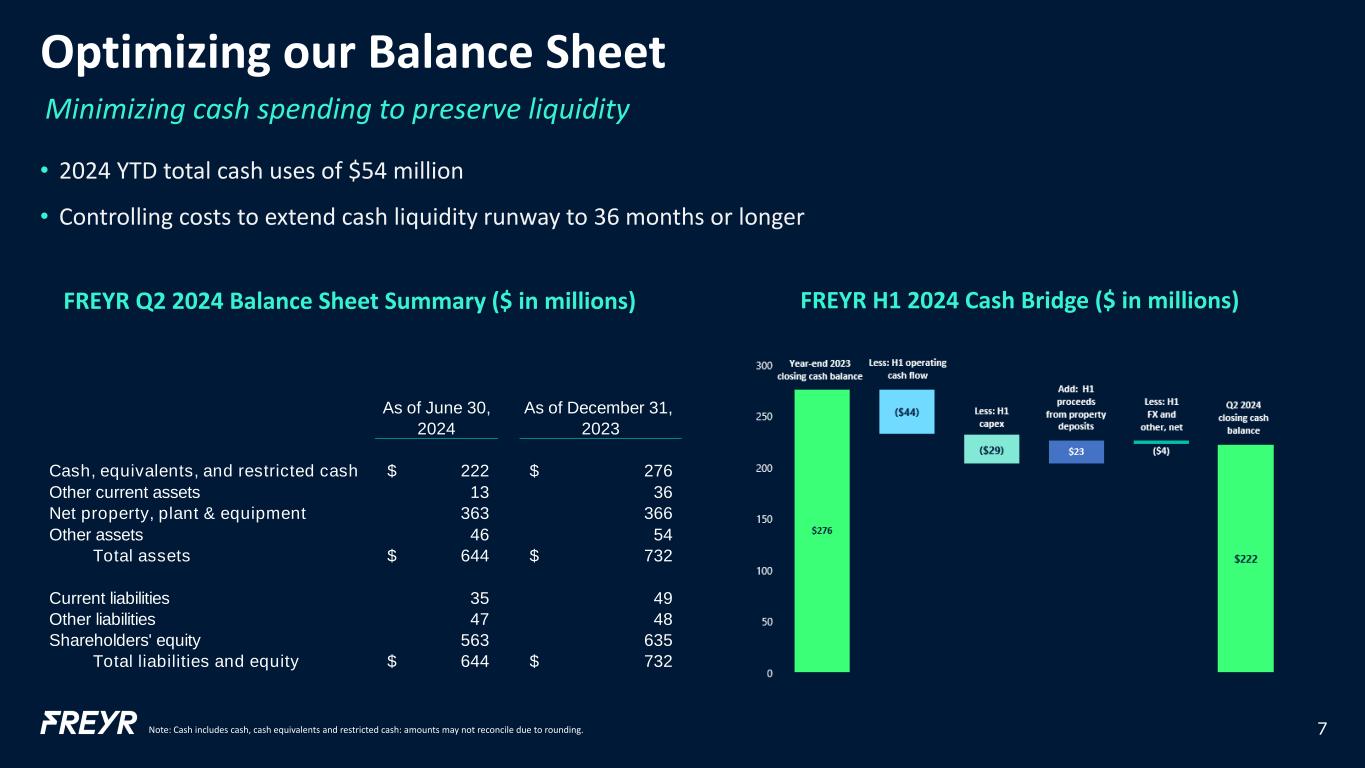

Optimizing our Balance Sheet 7 • 2024 YTD total cash uses of $54 million • Controlling costs to extend cash liquidity runway to 36 months or longer Minimizing cash spending to preserve liquidity FREYR H1 2024 Cash Bridge ($ in millions) Note: Cash includes cash, cash equivalents and restricted cash: amounts may not reconcile due to rounding. FREYR Q2 2024 Balance Sheet Summary ($ in millions) As of June 30, As of December 31, 2024 2023 Cash, equivalents, and restricted cash 222$ 276$ Other current assets 13 36 Net property, plant & equipment 363 366 Other assets 46 54 Total assets 644$ 732$ Current liabilities 35 49 Other liabilities 47 48 Shareholders' equity 563 635 Total liabilities and equity 644$ 732$

Summary of Key Messages 8 Accelerating path to market with conventional technology strategy • Executing plan to achieve first revenues and EBITDA as soon as 2025 • Pursuing multiple opportunities with emphasis on downstream Module and Pack production • Potential downstream projects tied to Giga America and Giga Arctic • Continuing to progress cell production opportunities in parallel Prioritizing financial discipline and balance sheet strength • Optimizing spending to extend cash liquidity runway to 36 months or longer • Evaluating strategic and value accretive options for Giga Arctic Continuing to advance new business opportunities under FREYR 2.0 commercial initiative • Evaluating potential inorganic deals • New use cases for FREYR's existing facilities emerging Establish long-term competitive moat around the 24M next-generation IP technology stack • Preserve option value of FREYR’s SemiSolidTM position • Evaluating commercial pathways to leverage FREYR’s growing digital asset portfolio at CQP and Giga Arctic Committed to building on FREYR’s strong competitive position to create sustainable shareholder value