2023 Year-End Earnings Webcast February 15, 2024 8-K February 15, 20241

NorthWestern Energy 2 Forward Looking Statements During the course of this presentation, there will be forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward- looking statements often address our expected future business and financial performance, and often contain words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” or “will.” The information in this presentation is based upon our current expectations as of the date of this document unless otherwise noted. Our actual future business and financial performance may differ materially and adversely from our expectations expressed in any forward-looking statements. We undertake no obligation to revise or publicly update our forward-looking statements or this presentation for any reason. Although our expectations and beliefs are based on reasonable assumptions, actual results may differ materially. The factors that may affect our results are listed in certain of our press releases and disclosed in the Company’s 10-K and 10-Q along with other public filings with the SEC. NorthWestern Energy Group, Inc. dba: NorthWestern Energy Ticker: NWE (Nasdaq) www.northwesternenergy.com Corporate Support Office 3010 West 69th Street Sioux Falls, SD 57108 (605) 978-2900 Investor Relations Officer Travis Meyer 605-978-2967 travis.meyer@northwestern.com

Recent Highlights • Reported GAAP diluted EPS of $3.22 o Non-GAAP diluted EPS of $3.271 • Affirming 2024 diluted EPS guidance of $3.42 - $3.622 • Affirming long-term (5 year) rate base and earnings per share growth rates targets of 4% - 6%2 • Unanimous approval of multi-party rate review settlements • Montana electric and natural gas rate reviews • South Dakota electric rate review • Completed second and final phase of holding company reorganization on Jan.1, 2024 • Dividend Declared: $0.65 per share payable March 29, 2024 to shareholders of record as of March 15, 2024 Celebrating 100 Powerful Years! 1.) See reconciliation of Non-GAAP adjustments on page 12 and “Non-GAAP Financial Measures” in appendix 2.) Based on 2022 adjusted non-GAAP earnings of $3.18 per diluted share and 2022 estimated rate base of $4.54 billion 3

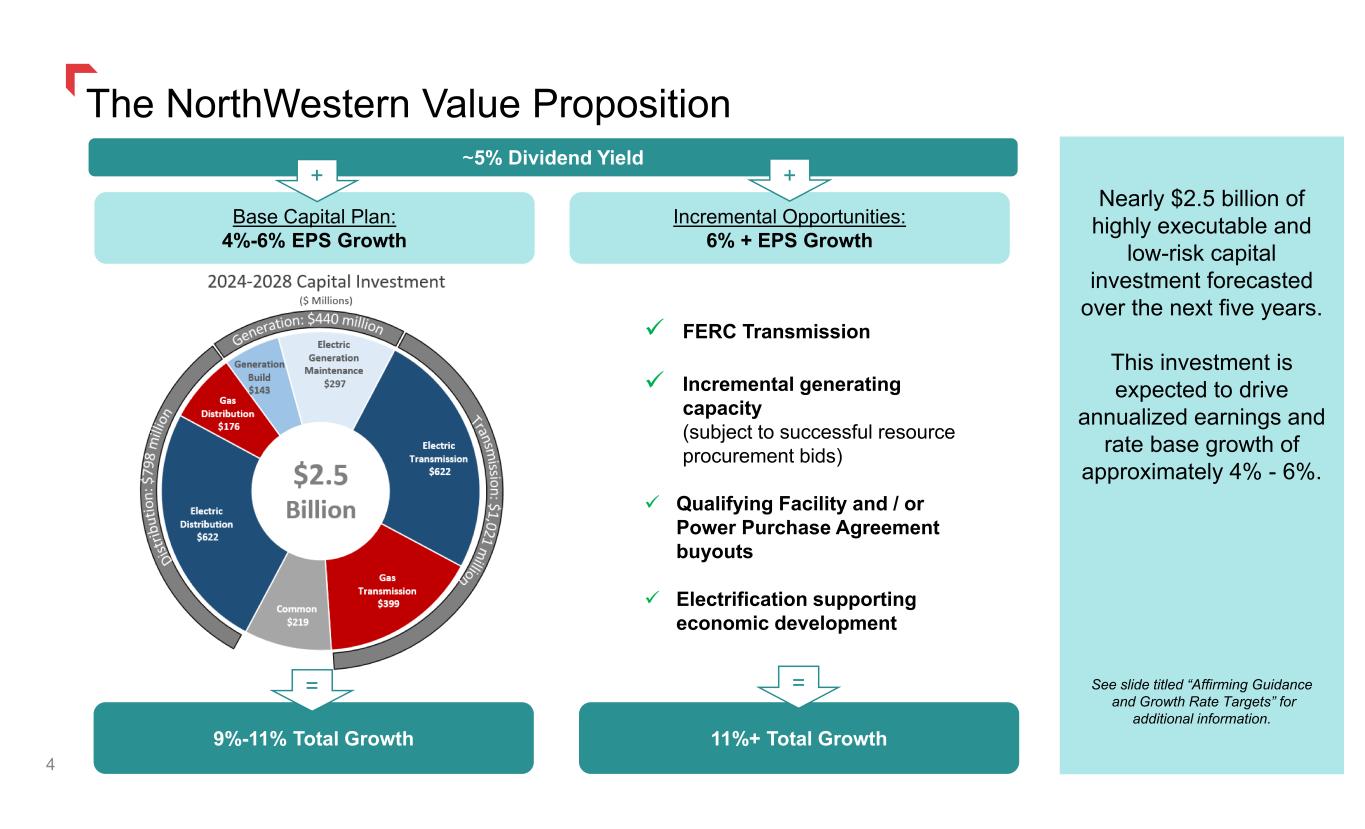

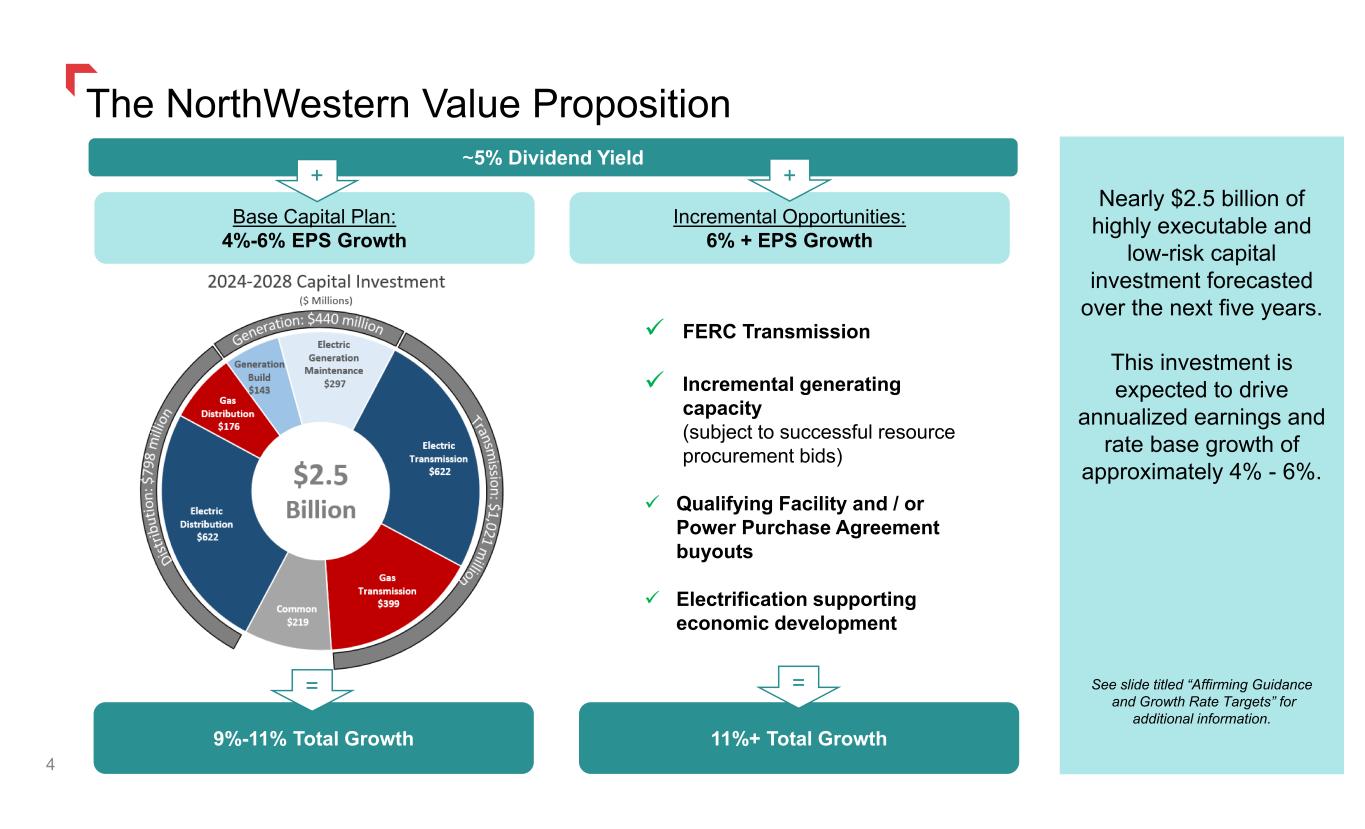

9%-11% Total Growth 11%+ Total Growth Incremental Opportunities: 6% + EPS Growth ~5% Dividend Yield Base Capital Plan: 4%-6% EPS Growth FERC Transmission Incremental generating capacity (subject to successful resource procurement bids) Qualifying Facility and / or Power Purchase Agreement buyouts Electrification supporting economic development Nearly $2.5 billion of highly executable and low-risk capital investment forecasted over the next five years. This investment is expected to drive annualized earnings and rate base growth of approximately 4% - 6%. See slide titled “Affirming Guidance and Growth Rate Targets” for additional information. + The NorthWestern Value Proposition + 4 = =

2023 Financial Results 5 1.) See reconciliation of Non-GAAP adjustments on pages 8 & 12 and “Non-GAAP Financial Measures” in appendix Fourth Quarter 2023 EPS vs Prior Period •GAAP: 21 cents or 18.1% •Non-GAAP1: 25 cents or 22.1% Full Year 2023 EPS vs Prior Period •GAAP: $0.03 or (0.9%) •Non-GAAP1: $0.09 or 2.8% Fourth Quarter Earnings Per Share Full Year Earnings Per Share

Fourth Quarter Financial Review 6

After-tax EPS vs Prior Year Fourth Quarter Earnings Drivers 7 1 2 Improvement in Utility Margin and income tax impacts offset weather, depreciation, interest expense and share count dilution 1.) Utility Margin is a non-GAAP Measure. See appendix slide titled “Explaining Utility Margin” for additional disclosure. 2.) See reconciliation of Non-GAAP adjustments on page 8 and “Non- GAAP Financial Measures” in appendix

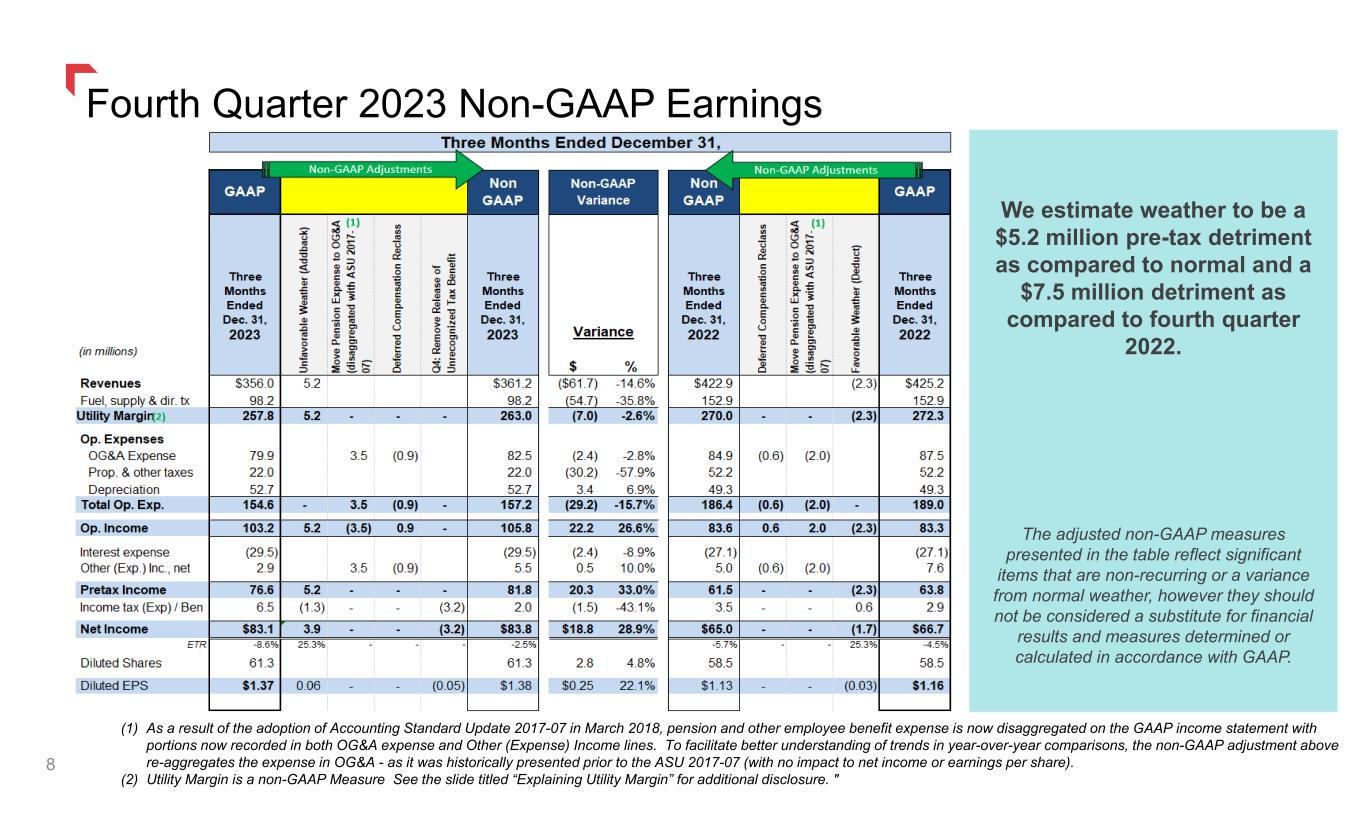

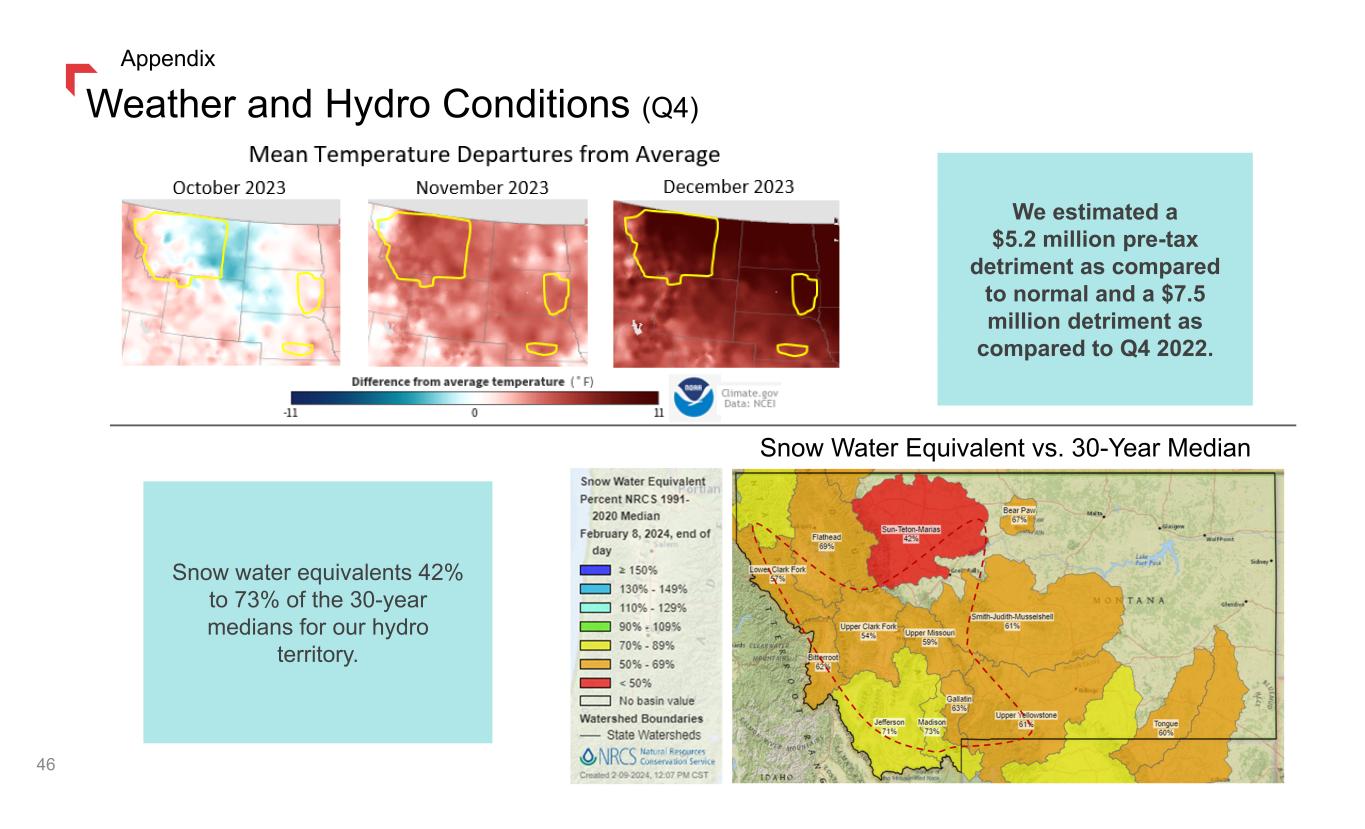

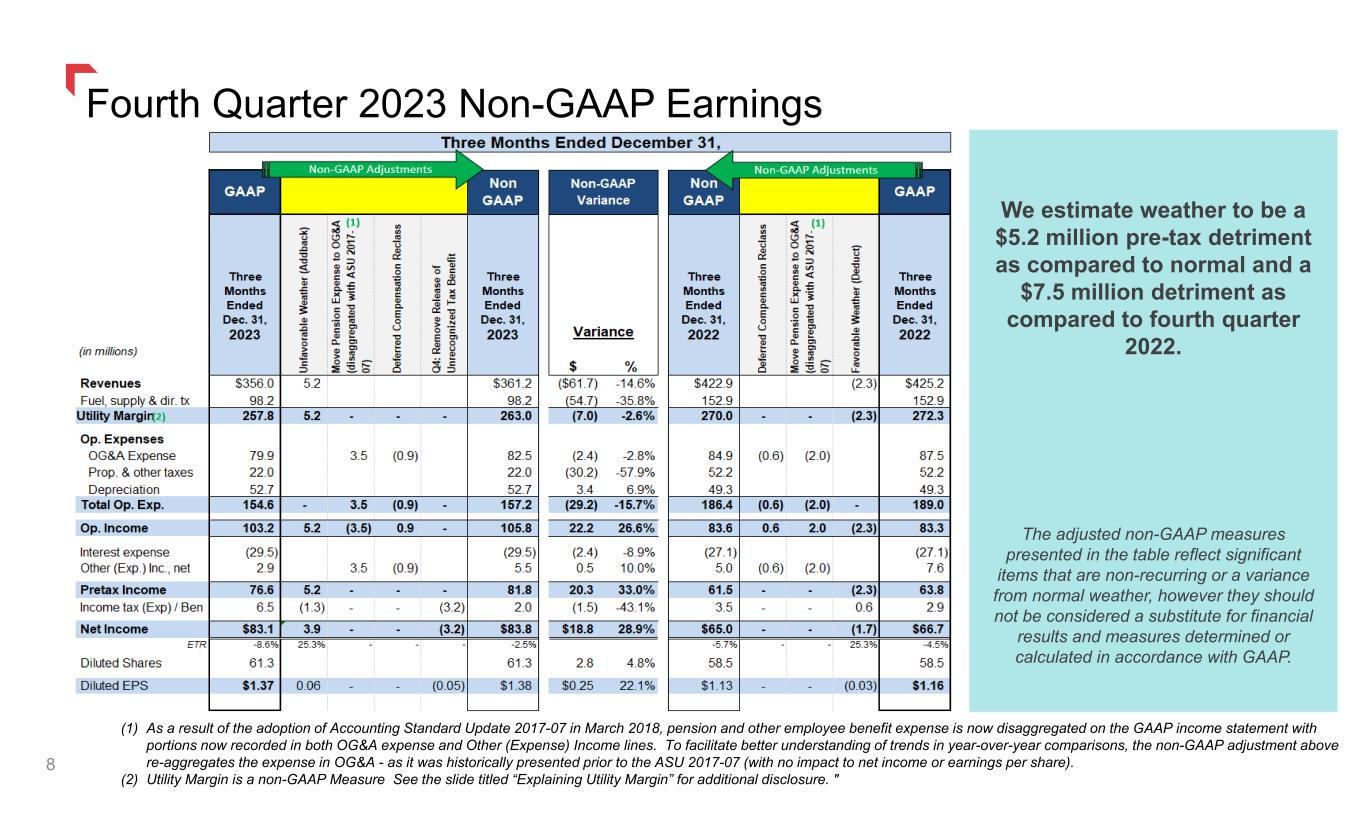

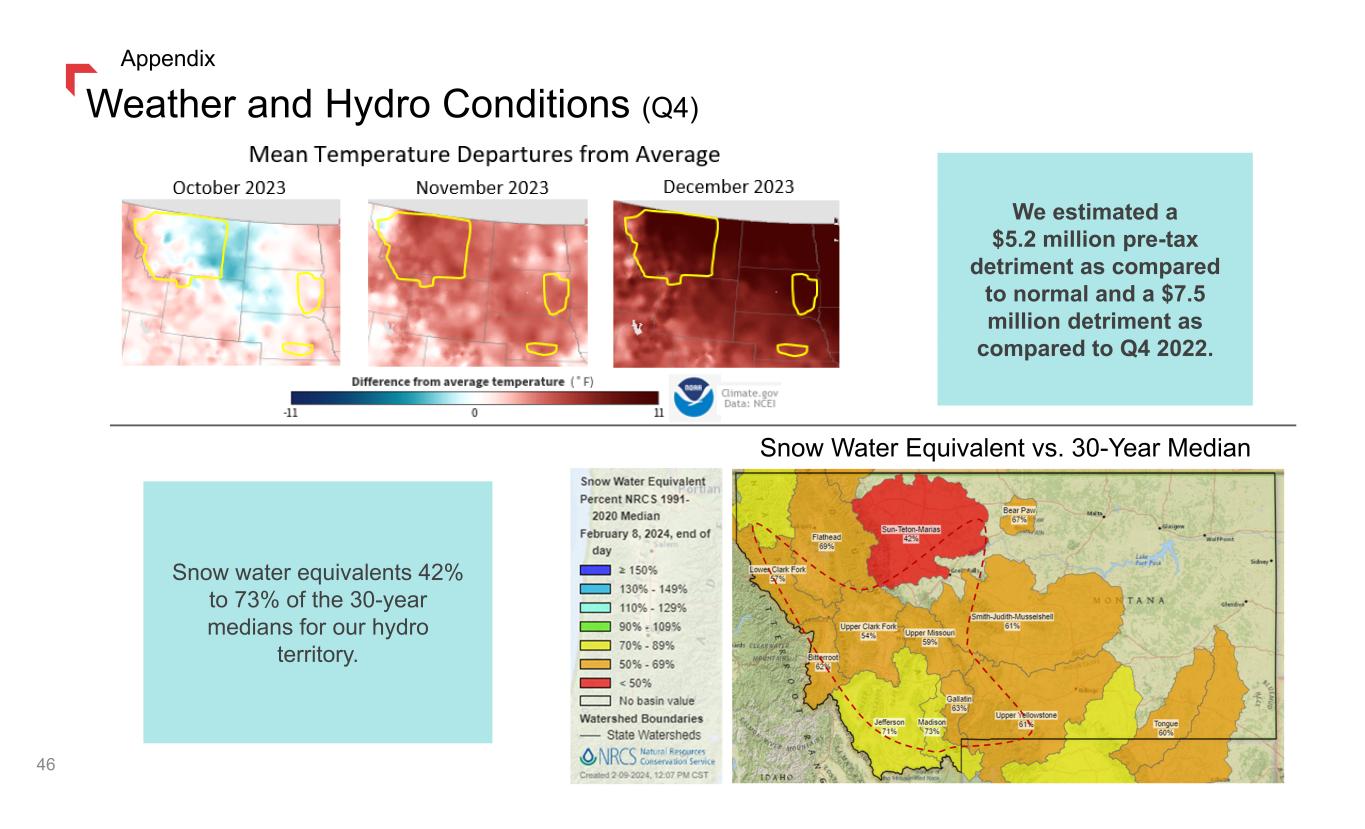

Fourth Quarter 2023 Non-GAAP Earnings (1) As a result of the adoption of Accounting Standard Update 2017-07 in March 2018, pension and other employee benefit expense is now disaggregated on the GAAP income statement with portions now recorded in both OG&A expense and Other (Expense) Income lines. To facilitate better understanding of trends in year-over-year comparisons, the non-GAAP adjustment above re-aggregates the expense in OG&A - as it was historically presented prior to the ASU 2017-07 (with no impact to net income or earnings per share). (2) Utility Margin is a non-GAAP Measure See the slide titled “Explaining Utility Margin” for additional disclosure. " 8 We estimate weather to be a $5.2 million pre-tax detriment as compared to normal and a $7.5 million detriment as compared to fourth quarter 2022. The adjusted non-GAAP measures presented in the table reflect significant items that are non-recurring or a variance from normal weather, however they should not be considered a substitute for financial results and measures determined or calculated in accordance with GAAP.

Full Year Financial Review 9

Improvement in Utility Margin offset weather, inflationary impacts, depreciation, interest rates and share count dilution 1.) Utility Margin is a non-GAAP Measure. See appendix slide titled “Explaining Utility Margin” for additional disclosure. 2.) See reconciliation of Non-GAAP adjustments on page 12 and “Non- GAAP Financial Measures” in appendix After-tax EPS vs Prior YearYear Over Year Earnings Drivers 10 1 2

Year Over Year Utility Margin Bridge Pre-tax Millions vs. Prior Year 5.3% increase in Utility Margin NOTE: Utility Margin is a non- GAAP Measure See appendix slide titled “Explaining Utility Margin” for additional disclosure. 11

Full Year Non-GAAP Earnings We estimate weather to be a $4.3 million pre-tax detriment as compared to normal and a $13.2 million detriment as compared to 2022. The adjusted non-GAAP measures reflect significant items that are non-recurring or a variance from normal weather, however they should not be considered a substitute for financial results and measures determined or calculated in accordance with GAAP. (1) As a result of the adoption of Accounting Standard Update 2017-07 in March 2018, pension and other employee benefit expense is now disaggregated on the GAAP income statement with portions now recorded in both OG&A expense and Other (Expense) Income lines. To facilitate better understanding of trends in year-over-year comparisons, the non-GAAP adjustment above re-aggregates the expense in OG&A - as it was historically presented prior to the ASU 2017-07 (with no impact to net income or earnings per share). (2) Utility Margin is a non-GAAP Measure See the slide titled “Explaining Utility Margin” for additional disclosure. 12

Credit, Cash flow and Financing Plans 13 Credit Ratings 2024 Financing Plan No equity expected to fund the current 5-year | $2.5 billion capital plan Financing plans (targeting a FFO to Debt ratio > 14%) are expected to maintain our current credit ratings. We expect to pay minimal cash taxes into 2028 due to utilization of our NOL’s and tax credits. Financing plans and are subject to change. FFO / Total Debt

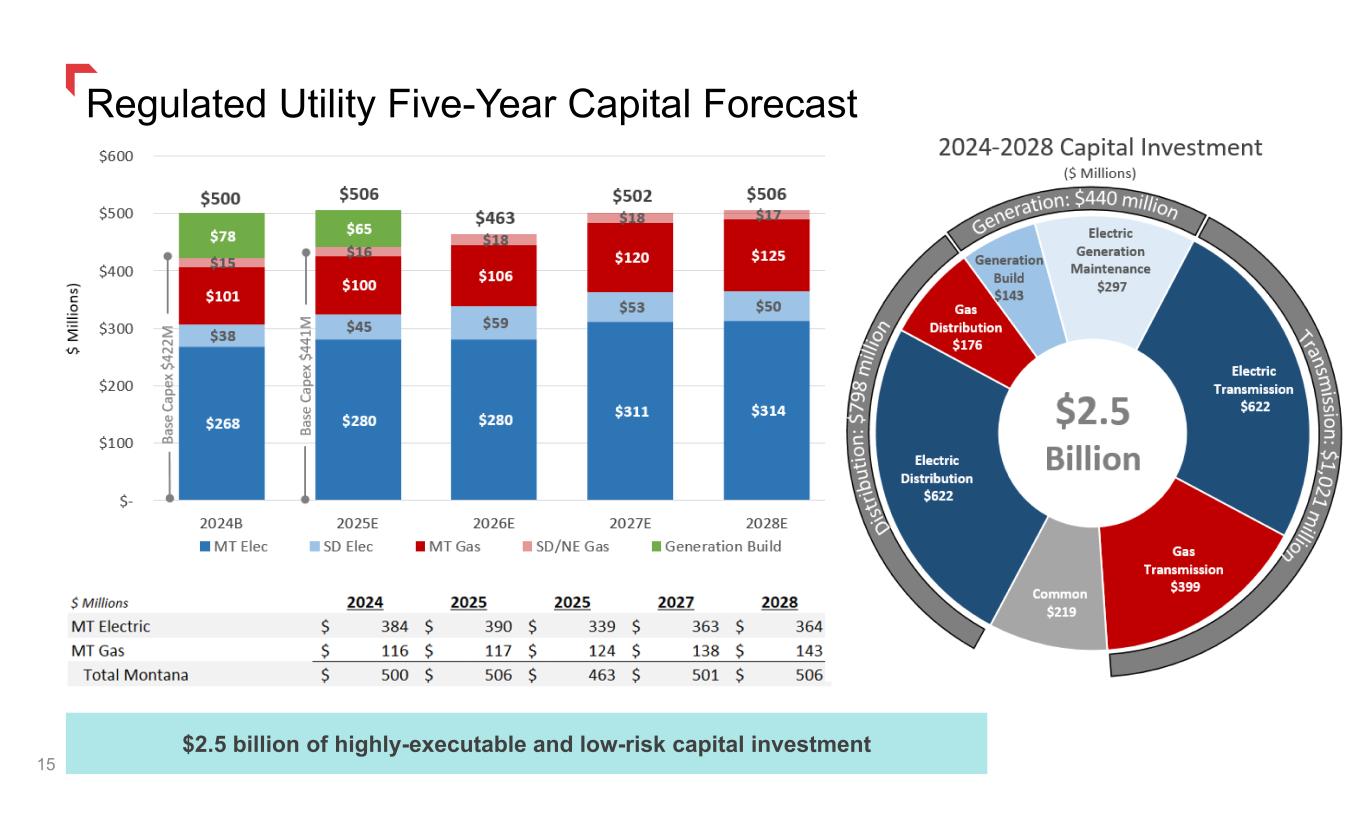

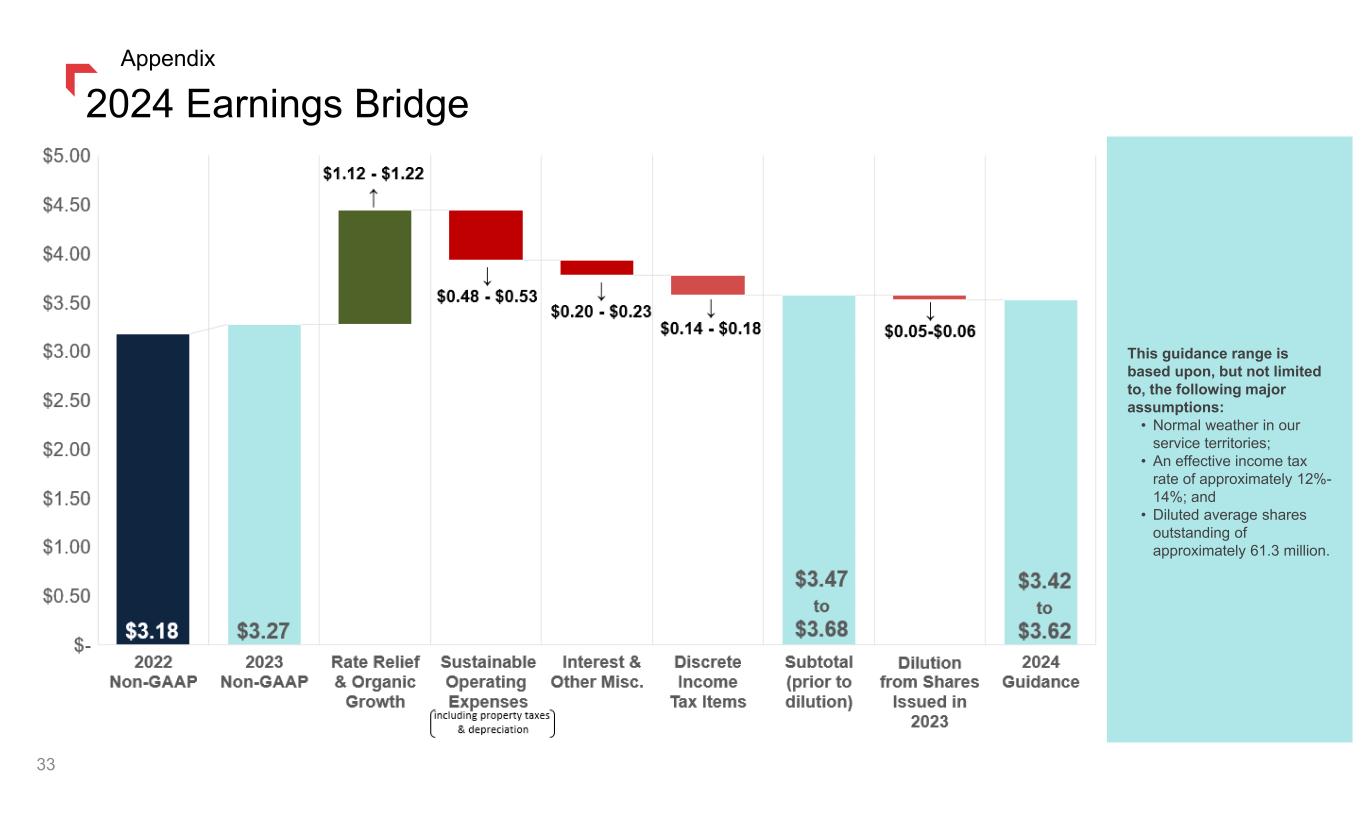

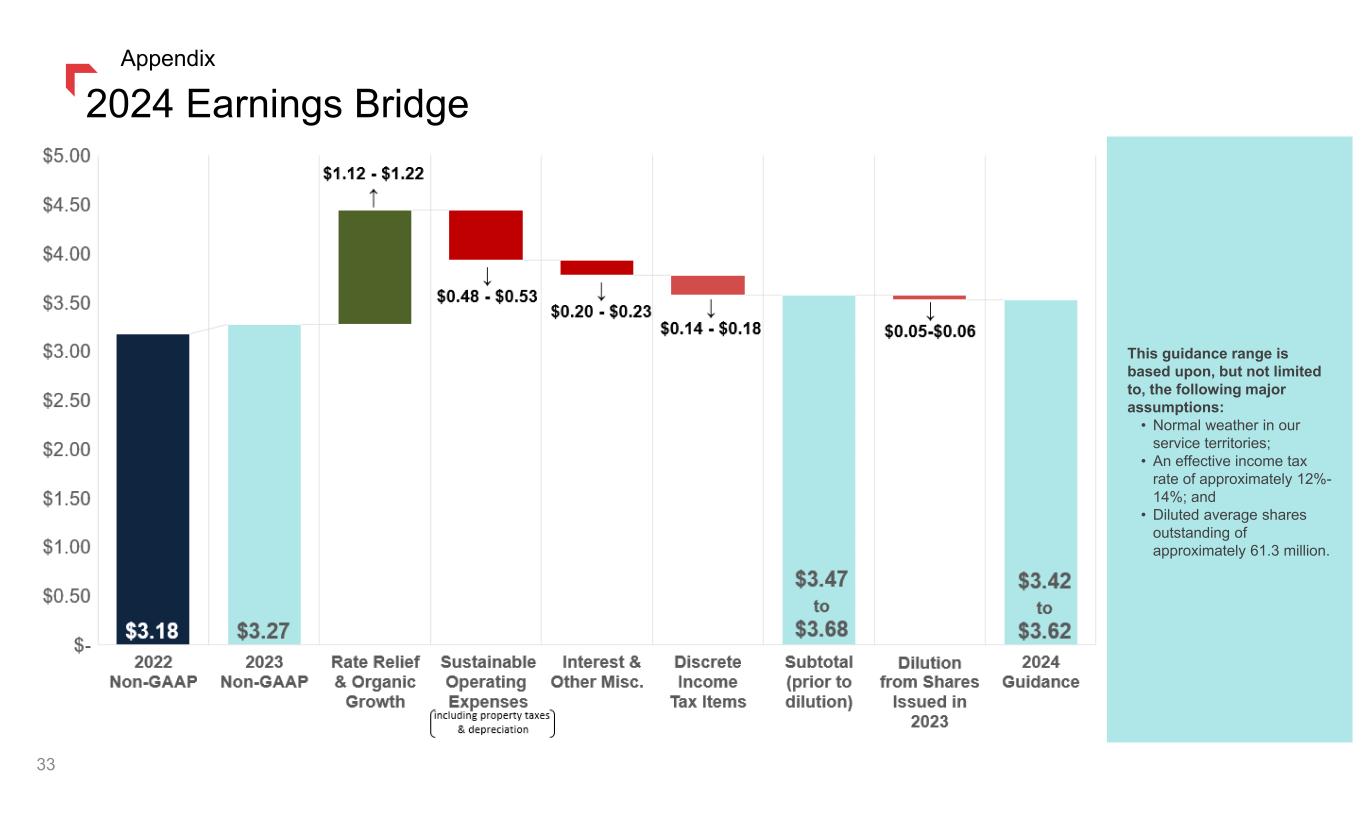

Strong Growth Outlook This guidance range is based upon, but not limited to, the following major assumptions: • Normal weather in our service territories; • An effective income tax rate of approximately 12%-14%; and • Diluted average shares outstanding of approximately 61.3 million. 2024 Non-GAAP EPS Guidance1 of $3.42 - $3.62 Affirming long-term (5 Year) expected growth rates • EPS growth of 4% to 6% from 2022 base year of $3.18 Non-GAAP • Rate base growth of 4% to 6% from 2022 base year $4.54 billion • Continued focus on earned returns driven by financial and operational execution No equity expected to fund the current 5-year | $2.5 billion capital plan • Capital plan is expected to be funded by cash from operations (aided by net operating losses1) and secured debt • Any equity needs would be driven by opportunities incremental to the plan Targeting FFO > 14% by end of 2024 and beyond Earnings growth is expected to exceed dividend growth until we return to our targeted 60% to 70% payout ratio. 14 1.) See “Earnings Bridge” in the Appendix for additional detail.

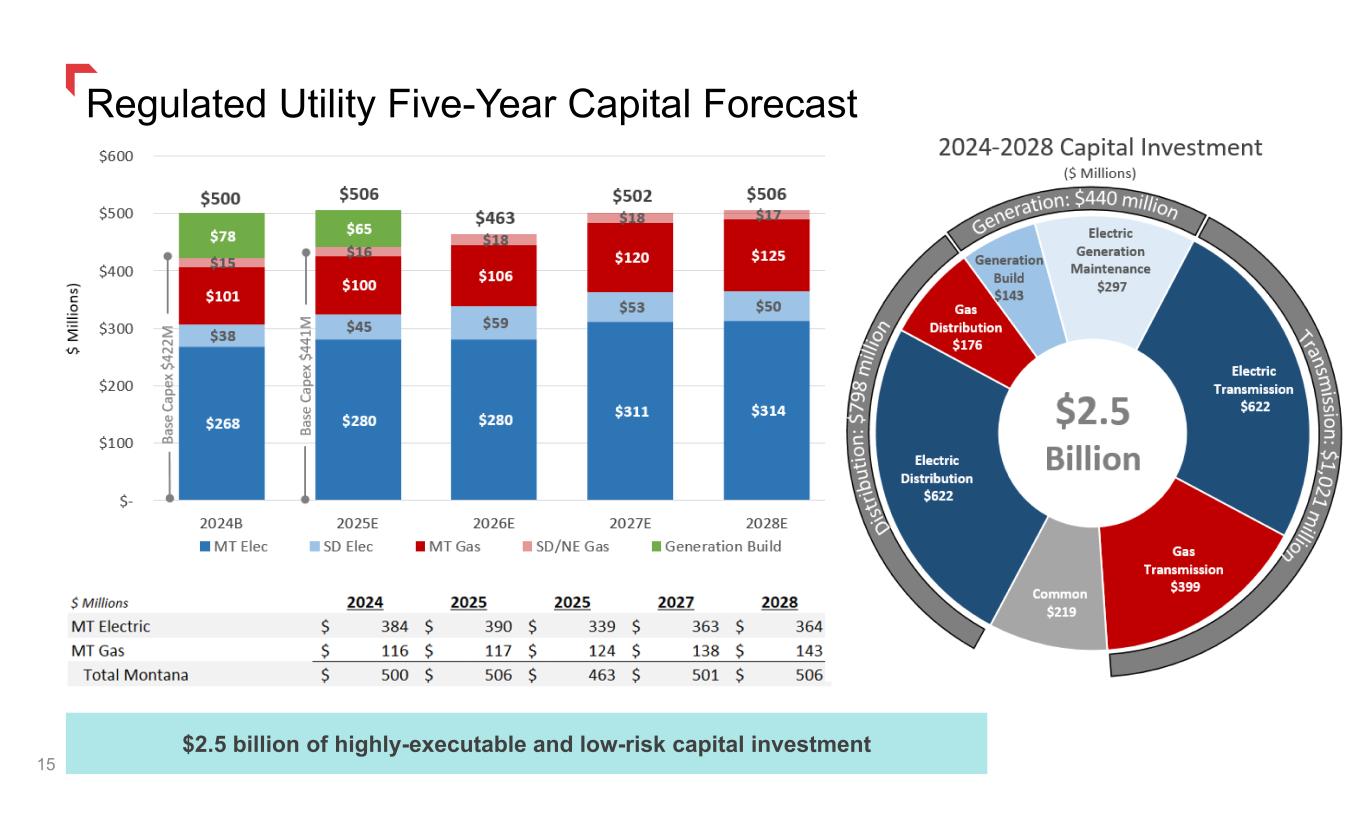

$2.5 billion of highly-executable and low-risk capital investment Regulated Utility Five-Year Capital Forecast 15

South Dakota Electric Rate Review • First rate review since 2015 with base rate increase driven by more than $267 million invested in South Dakota critical electric infrastructure, while keeping operating costs below the rate of inflation, since our last electric rate review. • Received nearly 70% of our ask ($21.5M vs request of $30.9M) in base rates with 6.81% authorized rate of return vs 7.54% as requested. • Rates went into effect January 10, 2024 16 Category Pre‐Filing Rates Requested Rates Final Rates Test Year (Trailing Twelve Months) Sep. 30, 2014 Dec. 31, 2022 Effective Jan. 10, 2024 Equity Ratio 50.50% 50.50% Return on Equity 10.70% Cost of Debt 4.32% Rate of Return 7.24% 7.54% 6.81% Authorized Rate Base $557.3M $787.3M $791.8M Rate Relief $30.9M $21.5M Unanimous approval from the South Dakota Public Utility Commission of a constructive settlement with the PUC staff

Holding Company Reorganization Completed 17

Conclusion Pure Electric & Gas Utility Solid Utility Foundation Best Practices Corporate Governance Attractive Future Growth Prospects Strong Earnings & Cash Flows 18

Appendix: 19

Full Year Appendix 20

Full Year Financial Results 21 Decrease in revenues is primarily related to pass-through property tax and supply trackers and non-cash regulatory amortizations. 1.) Utility Margin is a non-GAAP Measure. See appendix slide titled “Explaining Utility Margin” for additional disclosure. Appendix

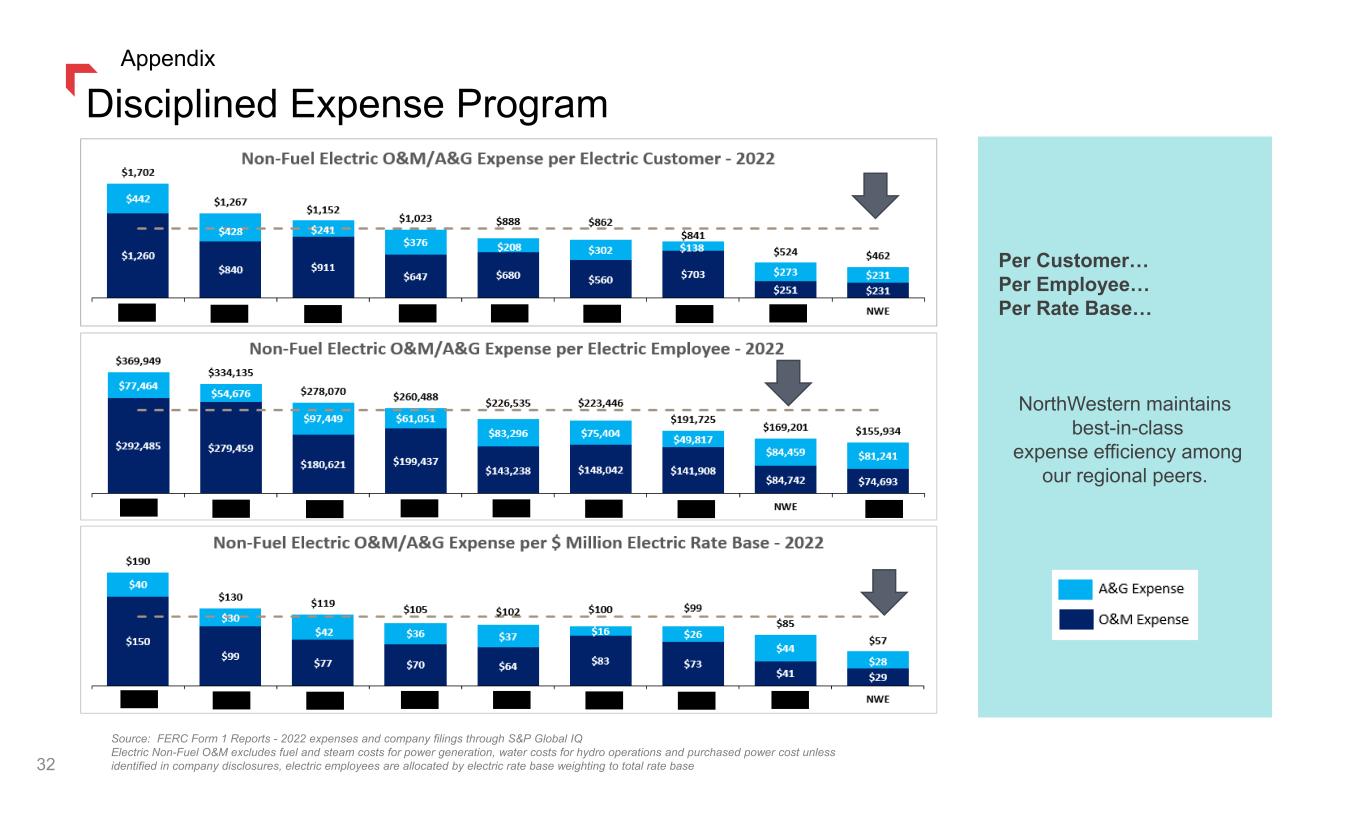

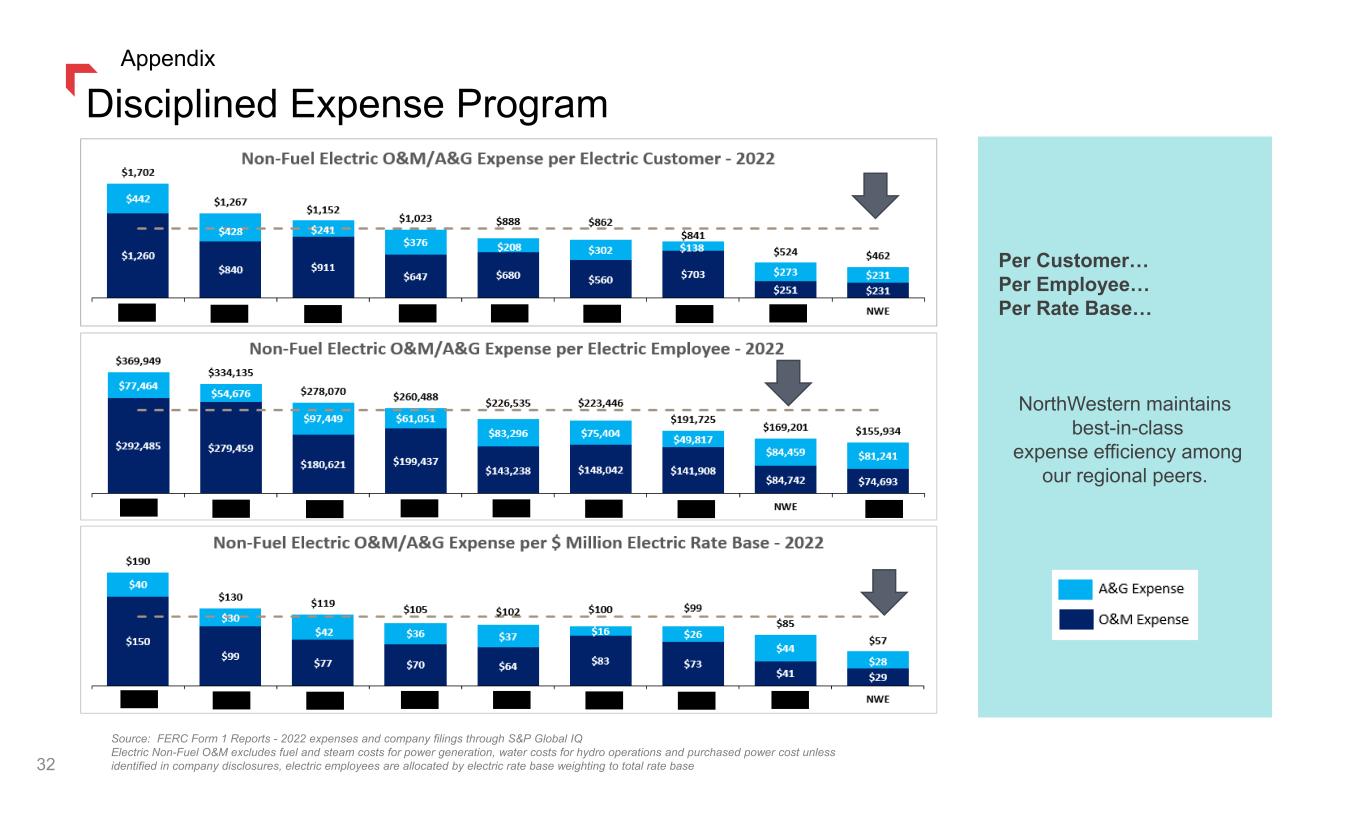

NorthWestern maintains best- in-class expense efficiency among our regional peers. (See slide “Disciplined Expense Program” that follows in appendix) Pre-tax Millions vs Prior Year Year Over Year Operating & Administrative Costs 22 Appendix

Utility Margin (Full-Year) Increase in utility margin due to the following factors: $ 32.6 Higher Montana rate review – new base rates 14.2 Lower non-recoverable Montana electric supply costs 12.8 Higher Montana property tax tracker collections 2.2 Higher Montana natural gas transportation 0.6 Higher electric transmission revenue due to market conditions (7.0) Lower natural gas retail volumes (1.8) Lower electric retail volumes (1.7) Other $ 51.9 Change in Utility Margin Impacting Net Income (dollars in millions) Twelve Months Ended December 31, 2023 2022 Variance Electric $ 806.1 $ 782.1 $ 24.0 3.1% Natural Gas 195.8 203.7 (7.9) (3.9)% Total Utility Margin $ 1001.9 $ 985.8 $ 16.1 1.6% $ (35.8) Lower property taxes recovered in revenue, offset in property tax expense (3.1) Lower operating expenses recovered in revenue, offset in O&M expense (0.7) Lower natural gas production taxes recovered in revenue, offset in property & other taxes 3.8 Higher revenue from lower production tax credits, offset in income tax expense $ (35.8) Change in Utility Margin Offset Within Net Income $ 16.1 Increase in Utility Margin (1) Utility Margin is a non-GAAP Measure See appendix slide titled “Explaining Utility Margin” for additional disclosure. 23 Appendix

Operating Expenses (Full-Year) Decrease in operating expenses due to the following factors: $ 15.5 Higher depreciation due to plant additions 6.1 Higher labor and benefits expense(1) 2.1 Higher insurance expense 1.1 Increase in uncollectible accounts 1.0 Higher expenses at our electric generation facilities 0.8 Higher cost of materials (3.0) Lower property and other taxes not recoverable within trackers 3.3 Other $ 26.9 Change in Operating Expense Items Impacting Net Income (dollars in millions) Twelve Months Ended December 31, 2023 2022 Variance Operating & maintenance $ 220.5 $ 221.4 $ (0.9) (0.4)% Administrative & general 117.3 113.8 3.5 3.1% Property and other taxes 153.1 192.5 (39.4) (20.5)% Depreciation and depletion 210.5 195.0 15.5 7.9% Operating Expenses $ 701.4 $ 722.7 $ (21.3) (2.9)% $ (35.8) Lower property and other taxes recovered in trackers, offset in revenue (8.7) Lower pension and other postretirement benefits, offset in other income(1) (3.1) Lower operating expenses recovered in trackers, offset in revenue (0.7) Lower natural gas production taxes recovered in trackers, offset in revenue (0.1) Higher deferred compensation, offset in other income $ (48.2) Change in Operating Expense Items Offset Within Net Income $ (21.3) Decrease in Operating Expenses (1) In order to present the total change in labor and benefits, we have included the change in the non- service cost component of our pension and other postretirement benefits, which is recorded within other income on our Condensed Consolidated Statements of Income. This change is offset within this table as it does not affect our operating expenses. 24 Appendix

Operating to Net Income (Full-Year) (dollars in millions) Twelve Months Ended December 31, 2023 2022 Variance Operating Income $ 300.5 $ 263.1 $ 37.4 14.2% Interest expense (114.6) (100.1) (14.5) (14.5)% Other income, net 15.8 19.4 (3.6) (18.6)% Income Before Taxes 201.6 182.4 19.2 10.5% Income tax (expense) / benefit (7.5) 0.6 (8.1) (1350)% Net Income $ 194.1 $ 183.0 $ 11.1 6.1% $14.5 million increase in interest expense was primarily due to higher borrowings and interest rates, partly offset by higher capitalization of AFUDC. $3.6 million decrease in other income, net was primarily due to an increase in the non- service cost component of pension expense, partly offset by the prior year CREP penalty and higher capitalization of AFUDC. $8.1 million increase in income tax expense was primarily due to higher pre-tax income and lower permanent or flow through adjustments. 25 Appendix

Tax Reconciliation (Full-Year) 26 Appendix

27 Segment Results (Full-Year) Appendix (1) Utility Margin is a non-GAAP Measure See appendix slide titled “Explaining Utility Margin” for additional disclosure.

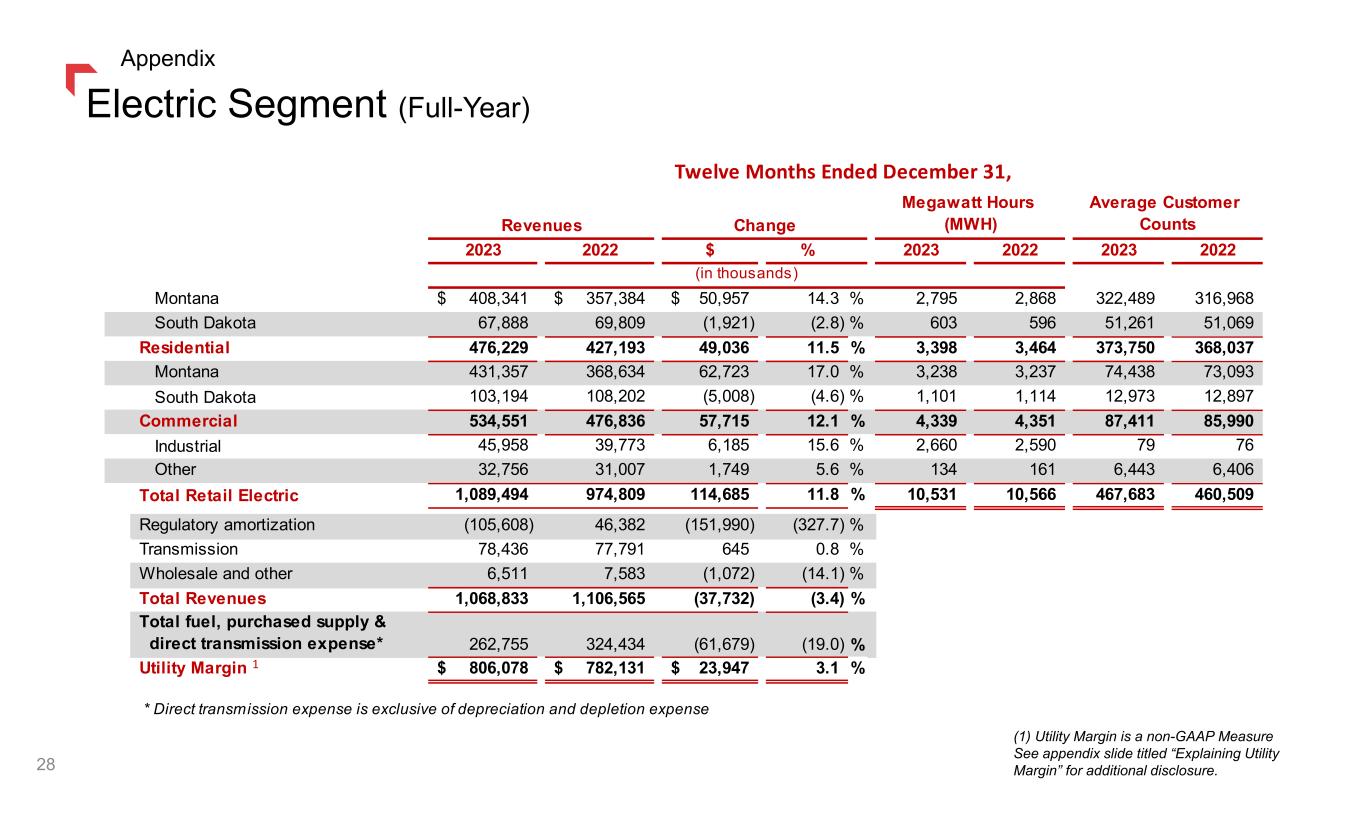

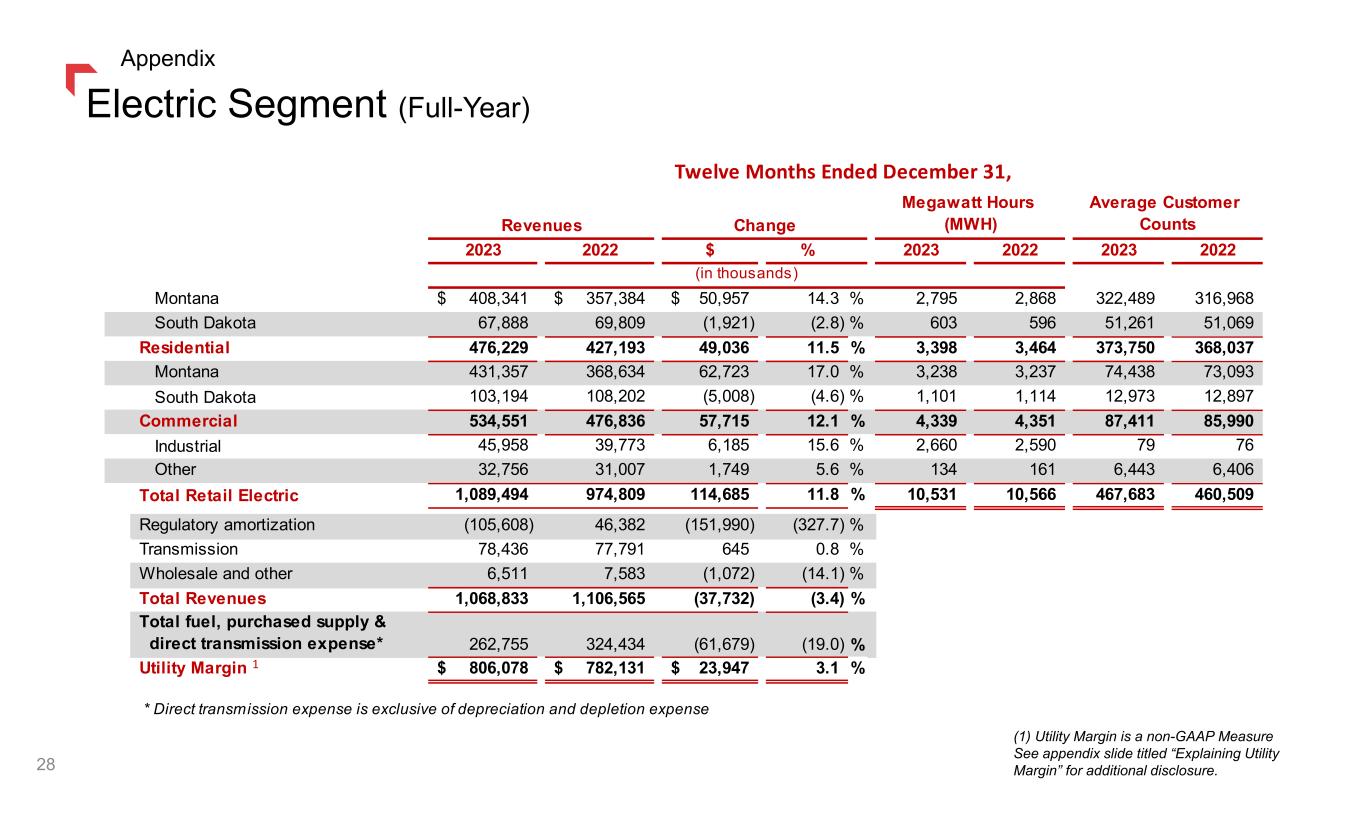

Electric Segment (Full-Year) 28 (1) Utility Margin is a non-GAAP Measure See appendix slide titled “Explaining Utility Margin” for additional disclosure. Appendix 2023 2022 $ % 2023 2022 2023 2022 Montana 408,341$ 357,384$ 50,957$ 14.3 % 2,795 2,868 322,489 316,968 South Dakota 67,888 69,809 (1,921) (2.8) % 603 596 51,261 51,069 Residential 476,229 427,193 49,036 11.5 % 3,398 3,464 373,750 368,037 Montana 431,357 368,634 62,723 17.0 % 3,238 3,237 74,438 73,093 South Dakota 103,194 108,202 (5,008) (4.6) % 1,101 1,114 12,973 12,897 Commercial 534,551 476,836 57,715 12.1 % 4,339 4,351 87,411 85,990 Industrial 45,958 39,773 6,185 15.6 % 2,660 2,590 79 76 Other 32,756 31,007 1,749 5.6 % 134 161 6,443 6,406 Total Retail Electric 1,089,494 974,809 114,685 11.8 % 10,531 10,566 467,683 460,509 Regulatory amortization (105,608) 46,382 (151,990) (327.7) % Transmission 78,436 77,791 645 0.8 % Wholesale and other 6,511 7,583 (1,072) (14.1) % Total Revenues 1,068,833 1,106,565 (37,732) (3.4) % Total fuel, purchased supply & direct transmission expense* 262,755 324,434 (61,679) (19.0) % Utility Margin 806,078$ 782,131$ 23,947$ 3.1 % * Direct transmission expense is exclusive of depreciation and depletion expense Megawatt Hours (MWH) Average Customer Counts Twelve Months Ended December 31, (in thousands) Revenues Change 1

Natural Gas Segment (Full-Year) (1) Utility Margin is a non-GAAP Measure See appendix slide titled “Explaining Utility Margin” for additional disclosure. 29 Appendix 2023 2022 $ % 2023 2022 2023 2022 Montana 136,097$ 152,343$ (16,246)$ (10.7) % 14,008 15,319 183,810 181,879 South Dakota 36,638 39,178 (2,540) (6.5) % 3,179 3,280 42,053 41,524 Nebraska 35,539 35,756 (217) (0.6) % 2,581 2,558 37,793 37,693 Residential 208,274 227,277 (19,003) (8.4) % 19,768 21,157 263,656 261,096 Montana 73,721 79,274 (5,553) (7.0) % 8,036 8,329 25,725 25,319 South Dakota 25,869 28,487 (2,618) (9.2) % 3,169 2,981 7,232 7,058 Nebraska 22,114 22,071 43 0.2 % 1,916 1,846 5,023 5,003 Commercial 121,704 129,832 (8,128) (6.3) % 13,121 13,156 37,980 37,380 Industrial 1,392 1,520 (128) (8.4) % 157 163 232 232 Other 1,681 1,932 (251) (13.0) % 209 232 190 178 Total Retail Electric 333,051$ 360,561$ (27,510)$ (7.6) % 33,255 34,708 302,058 298,886 Regulatory amortization (25,012) (27,964) 2,952 (10.6) % Wholesale and other 45,271 38,675 6,596 17.1 % Total Revenues 353,310$ 371,272$ (17,962)$ (4.8) % Total fuel, purchased supply & direct transmission expense* 157,507$ 167,577$ (10,070)$ (6.0) % Utility Margin 195,803$ 203,695$ (7,892)$ (3.9) % * Direct transmission expense is exclusive of depreciation and depletion expense (in thousands) Change Dekatherms (Dkt) Average Customer CountsRevenues Twelve Months Ended December 31, 1

Balance Sheet Debt to Total Capitalization remains at the bottom of our targeted 50% - 55% range. 30 Appendix

(dollars in millions) 2023 2022 Operating Activities Net Income 194.1$ 183.0$ Non-Cash adjustments to net income 210.1 183.1 Changes in working capital 115.6 (37.0) Other non-current assets & liabilities (30.6) (21.9) Cash provided by Operating Activities 489.2 307.2 Cash used in Investing Activities (570.8) (516.8) Cash provided by Financing Activities 84.3 213.3 Cash provided by Operating Activities 489.2$ 307.2$ Less: Changes in working capital 115.6 (37.0) Funds from Operations 373.6$ 344.2$ PP&E additions 566.9 515.1 Capital expenditures included in trade accounts payable (22.4) 35.7 AFUDC Credit 17.6 14.2 Total Capital Investment 562.1$ 565.0$ Twelve Months Ending December 31, Cash from Operating Activities increased by $182.0 million driven primarily by a $123.9 million increase in collection of energy supply costs from customers and Montana rates. Funds from Operations increased by $29.4 million over prior period. Net Under-Collected Supply Costs (in millions) Beginning (Jan. 1) Ending (Dec. 31) (Outflow) / Inflow 2022 $99.1 $115.4 $(16.3) 2023 $115.4 $7.8 $107.6 2023 Improvement $123.9 Equity Issuances in 2023 • Issued remaining $73.6 million of common stock under our At-the-Market program Financing plans (targeting a FFO to Debt ratio > 14%) are expected to maintain our current credit ratings and are subject to change. Debt financing in 2023 • Issued $239 million, 5.57% coupon, 10 year Montana FMBs priced in Q1 • Issued $31 million, 5.57% coupon, 10 year South Dakota FMB’s priced in Q1 • Issued $30 million, 5.42% coupon, 10 year, South Dakota FMBs in Q2 • Refinanced $144.7 million, 3.88% coupon, 5 year Pollution Control Revenue Refunding Bonds in Q2 Full Year Cash Flow 31 Appendix

32 Disciplined Expense Program Source: FERC Form 1 Reports - 2022 expenses and company filings through S&P Global IQ Electric Non-Fuel O&M excludes fuel and steam costs for power generation, water costs for hydro operations and purchased power cost unless identified in company disclosures, electric employees are allocated by electric rate base weighting to total rate base Per Customer… Per Employee… Per Rate Base… NorthWestern maintains best-in-class expense efficiency among our regional peers. Appendix

2024 Earnings Bridge This guidance range is based upon, but not limited to, the following major assumptions: • Normal weather in our service territories; • An effective income tax rate of approximately 12%- 14%; and • Diluted average shares outstanding of approximately 61.3 million. 33 Appendix

PCCAM Impact by Quarter 34 In 2017, the Montana legislature revised the statute regarding our recovery of electric supply costs. In response, the MPSC approved a new design for our electric tracker in 2018, effective July 1, 2017. The revised electric tracker, or PCCAM established a baseline of power supply costs and tracks the differences between the actual costs and revenues. Variances in supply costs above or below the baseline are allocated 90% to customers and 10% to shareholders, with an annual adjustment. From July 2017 to May 2019, the PCCAM also included a "deadband" which required us to absorb the variances within +/- $4.1 million from the base, with 90% of the variance above or below the deadband collected from or refunded to customers. In 2019, the Montana legislature revised the statute effective May 7, 2019, prohibiting a deadband, allowing 100% recovery of QF purchases, and maintaining the 90% / 10% sharing ratio for other purchases. In 2023, the PCCAM base increased from the Montana rate review, supporting a benefit in 2023 as compared to expense in 2021 & 2022. Appendix Pretax millions – shareholder (detriment) benefit

Qualified Facility Earnings Adjustment Our electric QF liability consists of unrecoverable costs associated with contracts covered under PURPA that are part of a 2002 stipulation with the MPSC and other parties. Risks / losses associated with these contracts are born by shareholders, not customers. Therefore, any mitigation of prior losses and / or benefits of liability reduction also accrue to shareholders. 35 Appendix

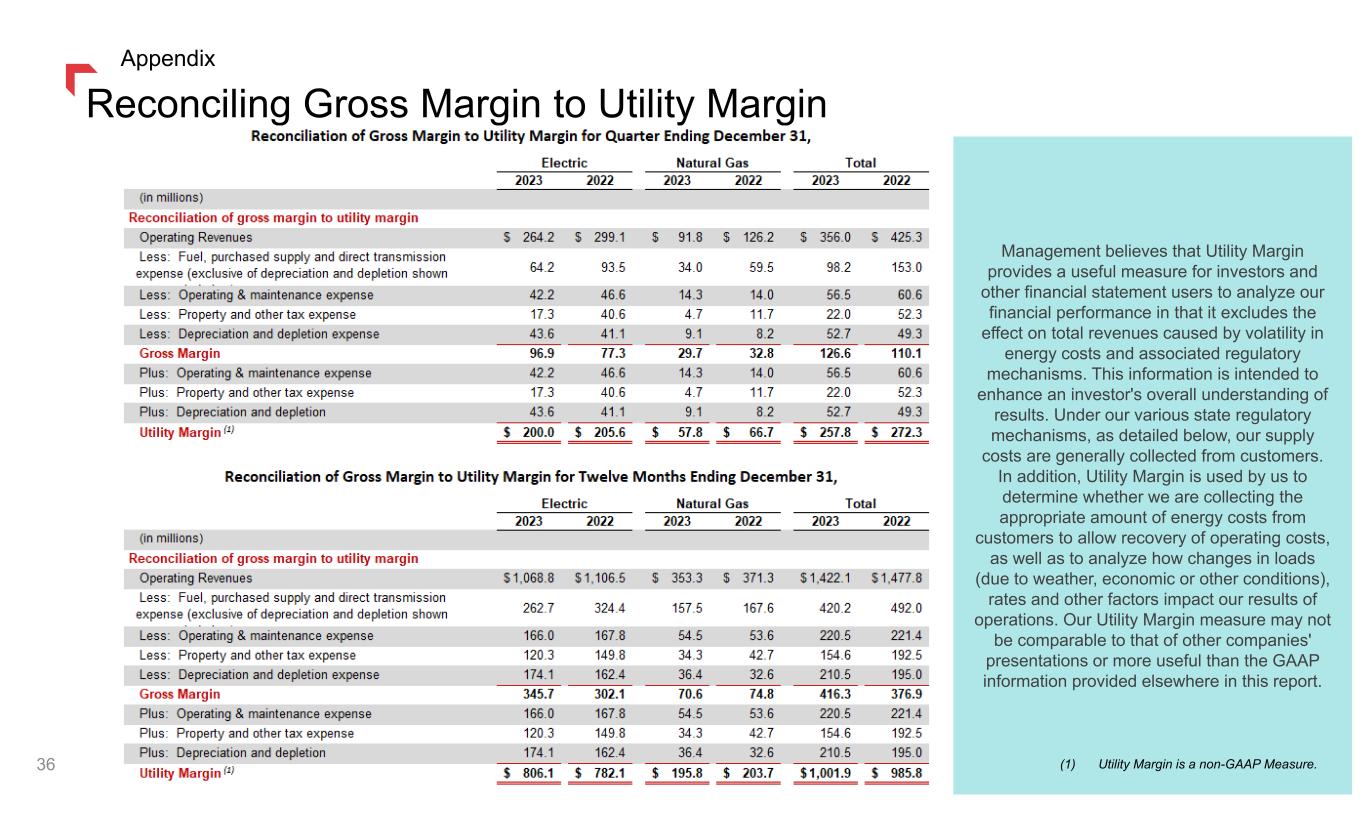

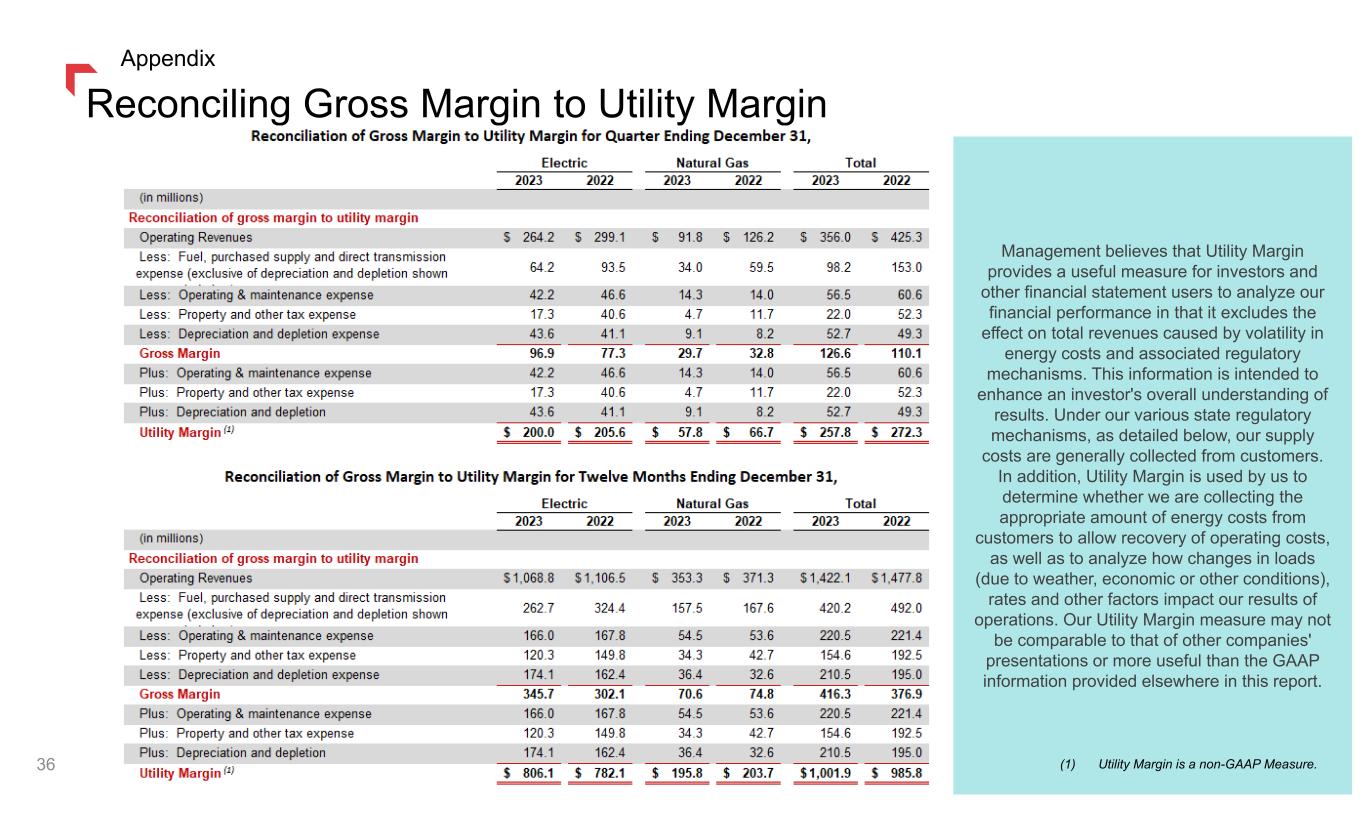

Reconciling Gross Margin to Utility Margin Management believes that Utility Margin provides a useful measure for investors and other financial statement users to analyze our financial performance in that it excludes the effect on total revenues caused by volatility in energy costs and associated regulatory mechanisms. This information is intended to enhance an investor's overall understanding of results. Under our various state regulatory mechanisms, as detailed below, our supply costs are generally collected from customers. In addition, Utility Margin is used by us to determine whether we are collecting the appropriate amount of energy costs from customers to allow recovery of operating costs, as well as to analyze how changes in loads (due to weather, economic or other conditions), rates and other factors impact our results of operations. Our Utility Margin measure may not be comparable to that of other companies' presentations or more useful than the GAAP information provided elsewhere in this report. (1) Utility Margin is a non-GAAP Measure. 36 Appendix

Fourth Quarter Appendix 37

Financial Results (Q4) 38 Decrease in revenues is primarily related to pass- through property tax and supply trackers and non-cash regulatory amortizations. 1.) Utility Margin is a non-GAAP Measure. See appendix slide titled “Explaining Utility Margin” for additional disclosure. Appendix

Utility Margin (Q4) (dollars in millions) Three Months Ended December 31, 2023 2022 Variance Electric $ 200.0 $ 205.6 $ (5.6) (2.7)% Natural Gas 57.8 66.7 (8.9) (13.3)% Total Utility Margin $ 257.8 $ 272.3 $ (14.5) (5.3)% (1) Utility Margin is a non-GAAP Measure See appendix slide titled “Explaining Utility Margin” for additional disclosure. Decrease in utility margin due to the following factors: $ 9.2 Higher Montana rates 8.0 Higher Montana property tax tracker collection 5.9 Lower non-recoverable Montana electric supply 1.6 Higher electric transmission revenue 0.4 Higher Montana natural gas transportation revenue (6.0) Lower natural gas retail volumes (3.8) Lower electric retail volumes (0.6) Other $ 14.7 Change in Utility Margin Impacting Net Income $ (28.1) Lower property taxes recovered in revenue, offset in property tax expense (1.7) Lower operating expenses recovered in revenue, offset in operating expense (0.1) Lower natural gas production taxes recovered in revenue, offset in property & other taxes 0.7 Higher revenue from production tax credits, offset in income tax expense $ (29.2) Change in Utility Margin Offset Within Net Income $ (14.5) Decrease in Utility Margin 39 Appendix

Operating Expenses (Q4) Decrease in operating expenses due to the following factors: $ 3.4 Higher depreciation expense 0.6 Higher insurance expense 0.2 Higher materials expense (2.1) Lower property and other taxes not recovered in trackers (1.9) Lower electric generation facilities expense (1.4) Lower labor and benefits expense (0.3) Decrease in uncollectible accounts 2.2 Other $ 0.7 Change in Operating Expense Items Impacting Net Income (dollars in millions) Three Months Ended December 31, 2023 2022 Variance Operating & maintenance $ 56.6 $ 60.7 $ (4.1) (6.8)% Administrative & general 23.3 26.8 (3.5) (13.1)% Property and other taxes 22.0 52.2 (30.2) (57.9)% Depreciation and depletion 52.7 49.3 3.4 6.9% Operating Expenses $ 154.6 $ 189.0 $ (34.4) (18.2)% $ (28.1) Lower property taxes recovered in trackers, offset in revenue (5.5) Lower pension and other postretirement benefits, offset in other income (1) (1.7) Lower operating expenses recovered in trackers, offset in revenue (0.1) Lower natural gas production taxes recovered in trackers, offset in revenue 0.3 Higher deferred compensation, offset in other income $ (35.1) Change in Operating Expense Items Offset Within Net Income $ (34.4) Decrease in Operating Expenses (1) In order to present the total change in labor and benefits, we have included the change in the non- service cost component of our pension and other postretirement benefits, which is recorded within other income on our Condensed Consolidated Statements of Income. This change is offset within this table as it does not affect our operating expenses. 40 Appendix

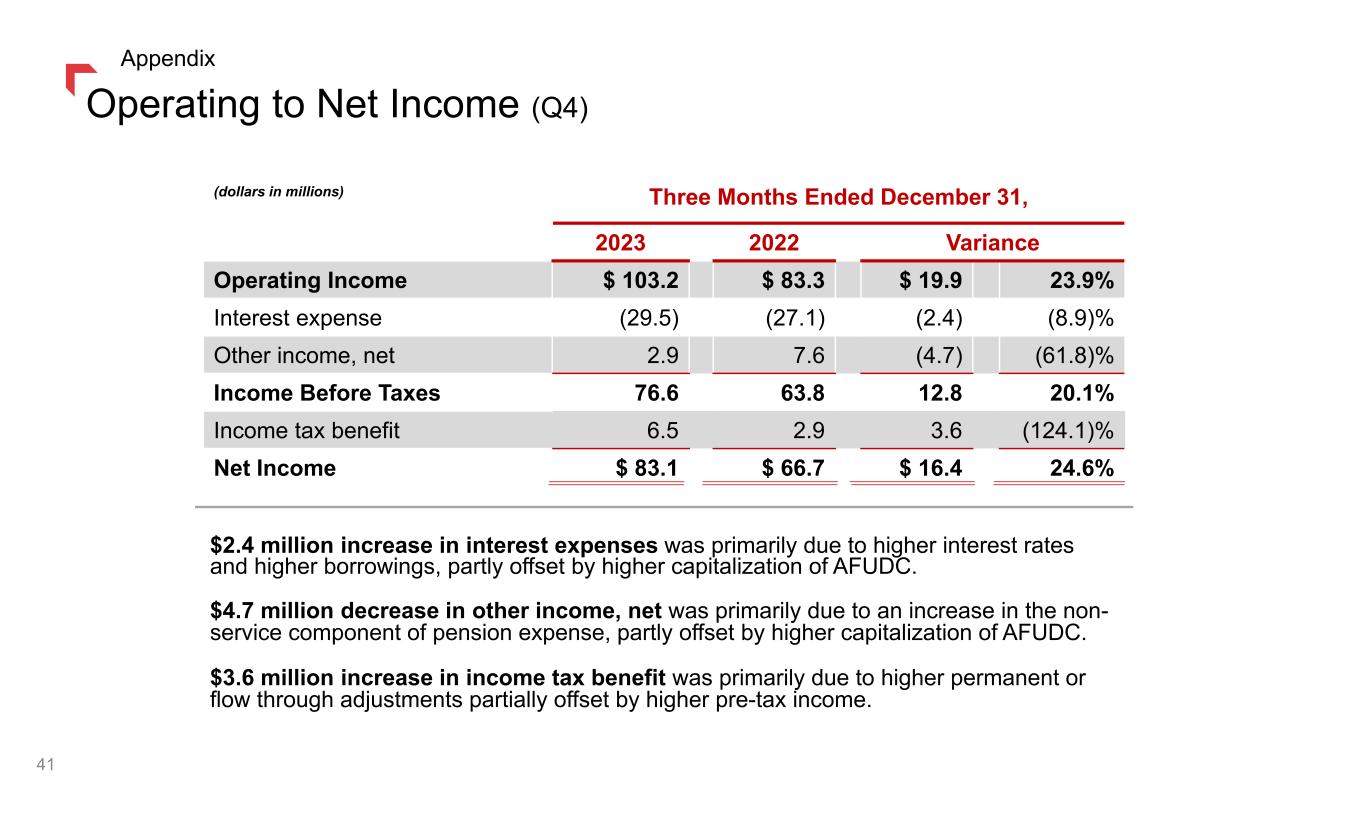

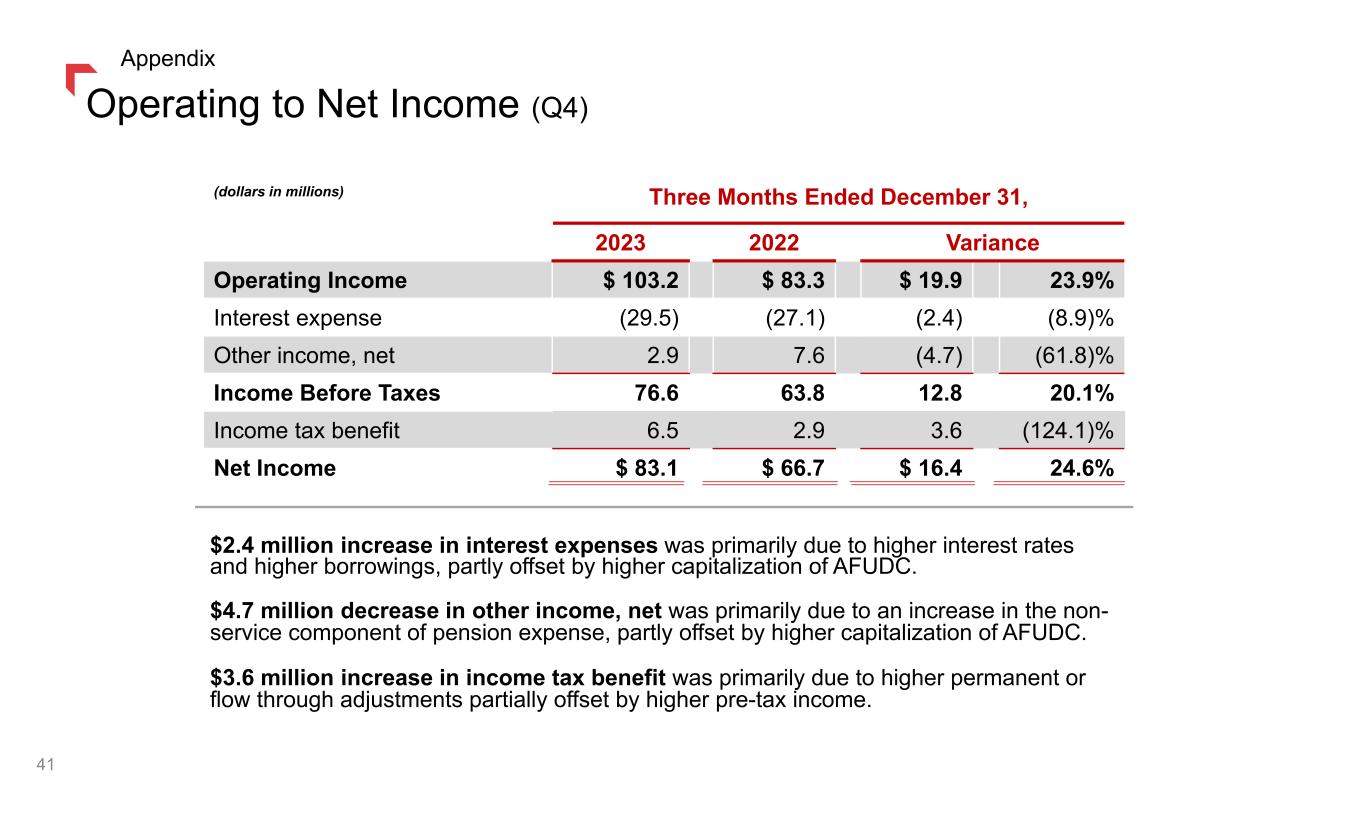

Operating to Net Income (Q4) (dollars in millions) Three Months Ended December 31, 2023 2022 Variance Operating Income $ 103.2 $ 83.3 $ 19.9 23.9% Interest expense (29.5) (27.1) (2.4) (8.9)% Other income, net 2.9 7.6 (4.7) (61.8)% Income Before Taxes 76.6 63.8 12.8 20.1% Income tax benefit 6.5 2.9 3.6 (124.1)% Net Income $ 83.1 $ 66.7 $ 16.4 24.6% $2.4 million increase in interest expenses was primarily due to higher interest rates and higher borrowings, partly offset by higher capitalization of AFUDC. $4.7 million decrease in other income, net was primarily due to an increase in the non- service component of pension expense, partly offset by higher capitalization of AFUDC. $3.6 million increase in income tax benefit was primarily due to higher permanent or flow through adjustments partially offset by higher pre-tax income. 41 Appendix

Tax Reconciliation (Q4) 42 Appendix

Three Months Ending December 31, 2023 Electric Gas Other Total Operating revenues 264,229$ 91,780$ -$ 356,009$ Fuel, purchased supply & direct transmission* 64,263 33,986 - 98,249 Utility margin 199,966 57,794 - 257,760 Operating and maintenance 42,257 14,326 - 56,583 Administrative and general 16,236 6,321 745 23,302 Property and other taxes 17,276 4,747 2 22,025 Depreciation & depletion 43,624 9,063 52,687 Operating income (loss) 80,573 23,337 (747) 103,163 Interest expense (22,505) (3,552) (3,416) (29,473) Other income (expense) 1,880 (543) 1,569 2,906 Income tax (expense) benefit (830) 4,807 2,569 6,546 Net income (loss) 59,118$ 24,049$ (25)$ 83,142$ Three Months Ending December 31, 2022 Electric Gas Other Total Operating revenues 299,150$ 126,133$ -$ 425,283$ Fuel, purchased supply & direct transmission* 93,562 59,455 - 153,017 Utility margin 205,588 66,678 - 272,266 Operating and maintenance 46,561 14,081 - 60,642 Administrative and general 18,814 7,245 707 26,766 Property and other taxes 40,577 11,736 2 52,315 Depreciation & depletion 41,148 8,167 - 49,315 Operating income (loss) 58,488 25,449 (709) 83,228 Interest expense (18,389) (3,079) (5,561) (27,029) Other income 5,246 1,730 667 7,643 Income tax benefit (expense) 3,588 (1,845) 1,159 2,902 Net income (loss) 48,933$ 22,255$ (4,444)$ 66,744$ * Direct Transmission expense excludes depreciation and depletion (in thousands) 1 1 Segment Results (Q4) (1) Utility Margin is a non-GAAP Measure See appendix slide titled “Explaining Utility Margin” for additional disclosure. 43 Appendix

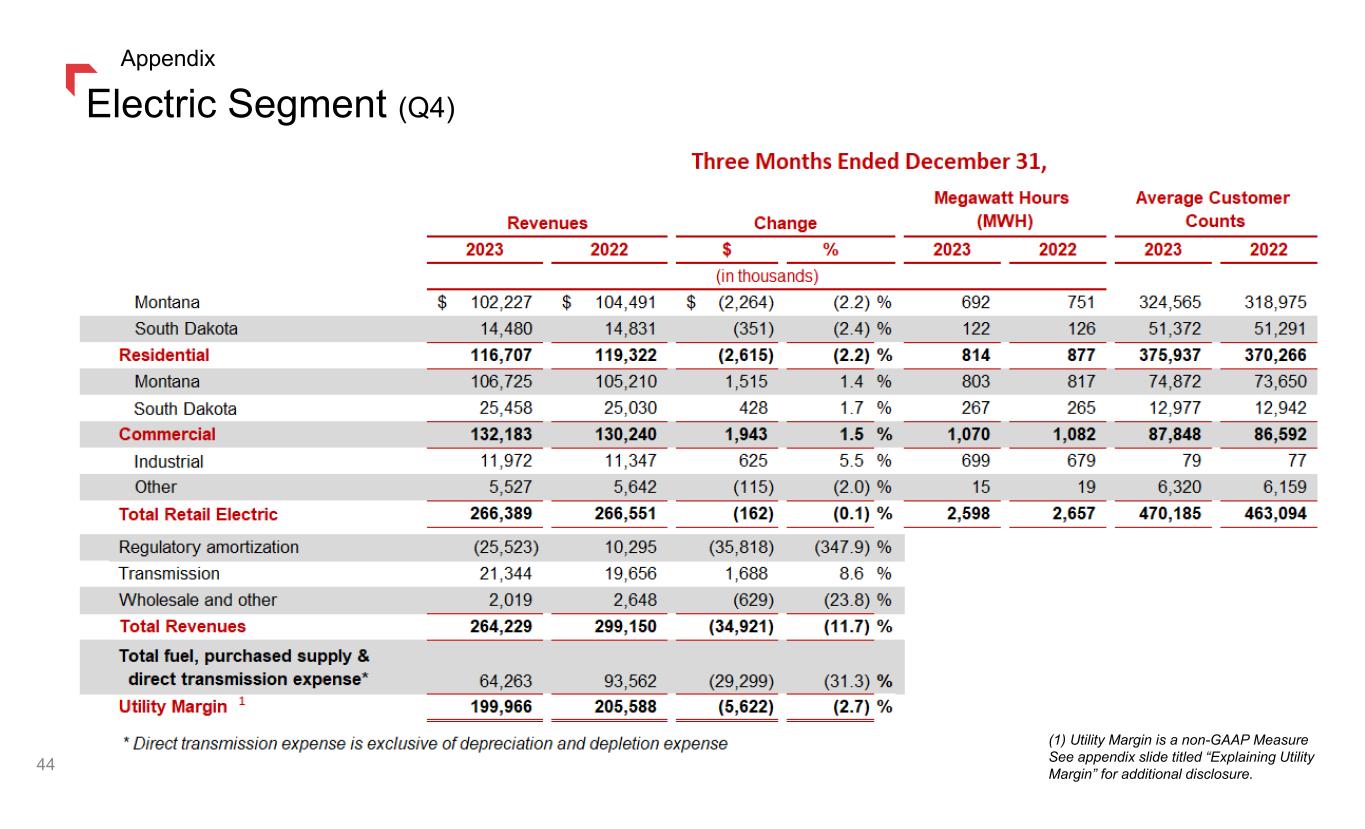

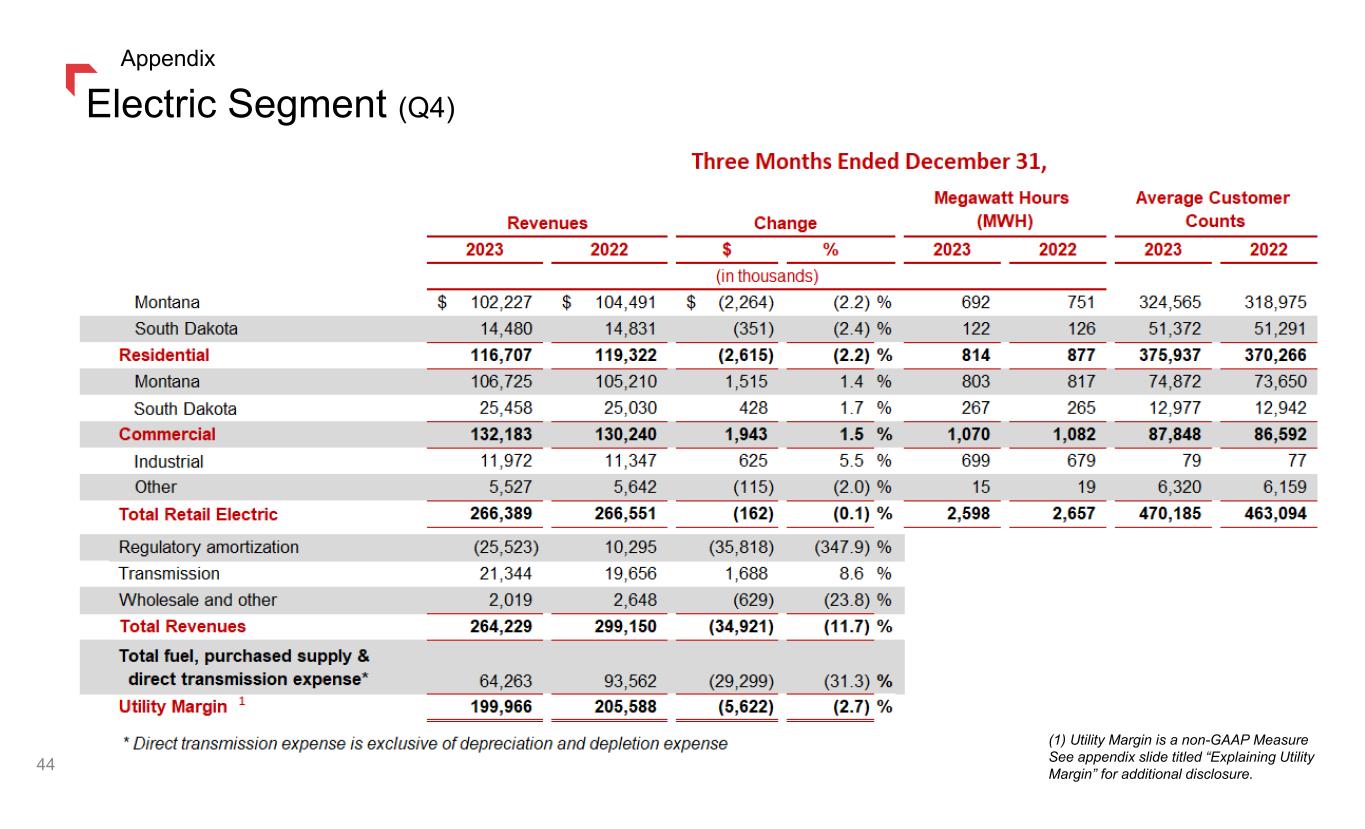

Electric Segment (Q4) (1) Utility Margin is a non-GAAP Measure See appendix slide titled “Explaining Utility Margin” for additional disclosure. 44 Appendix

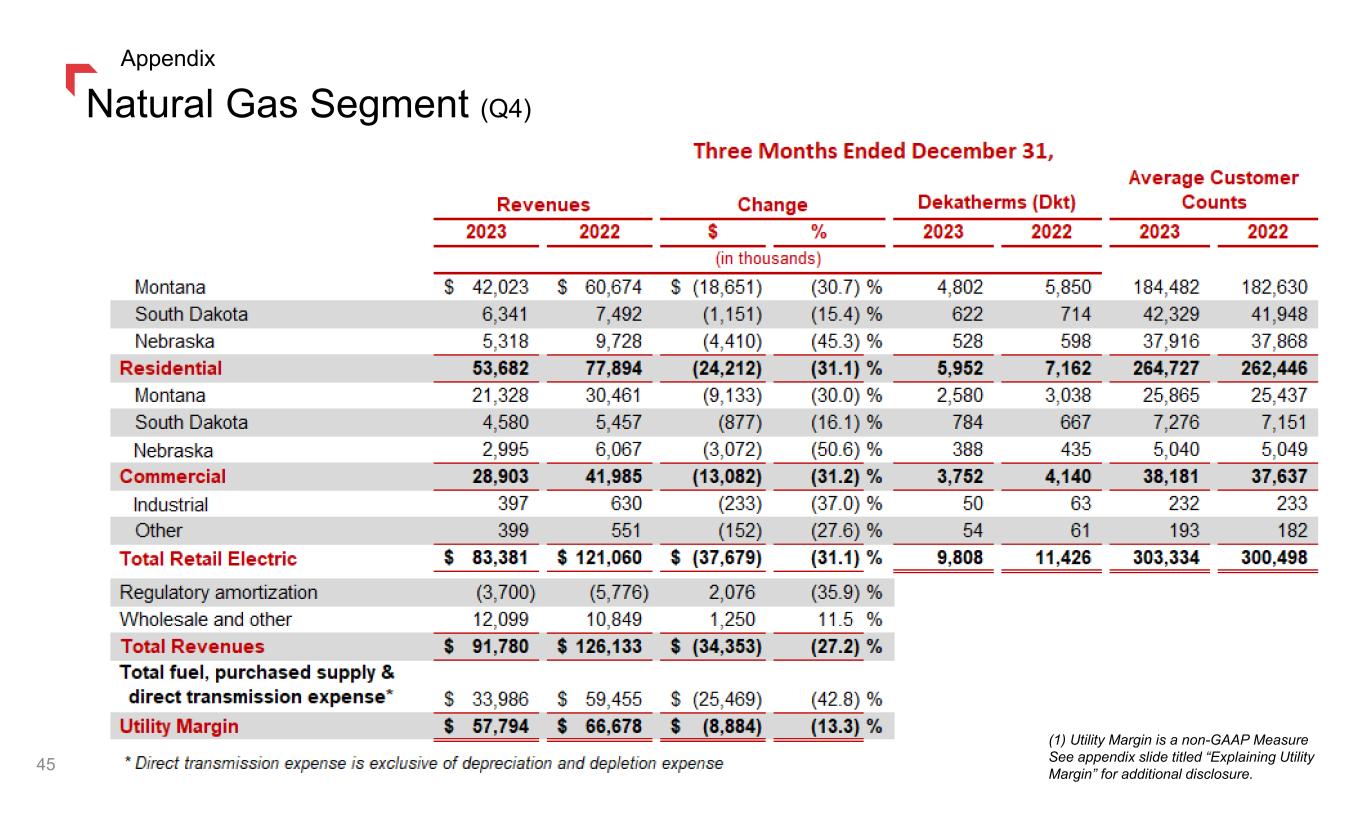

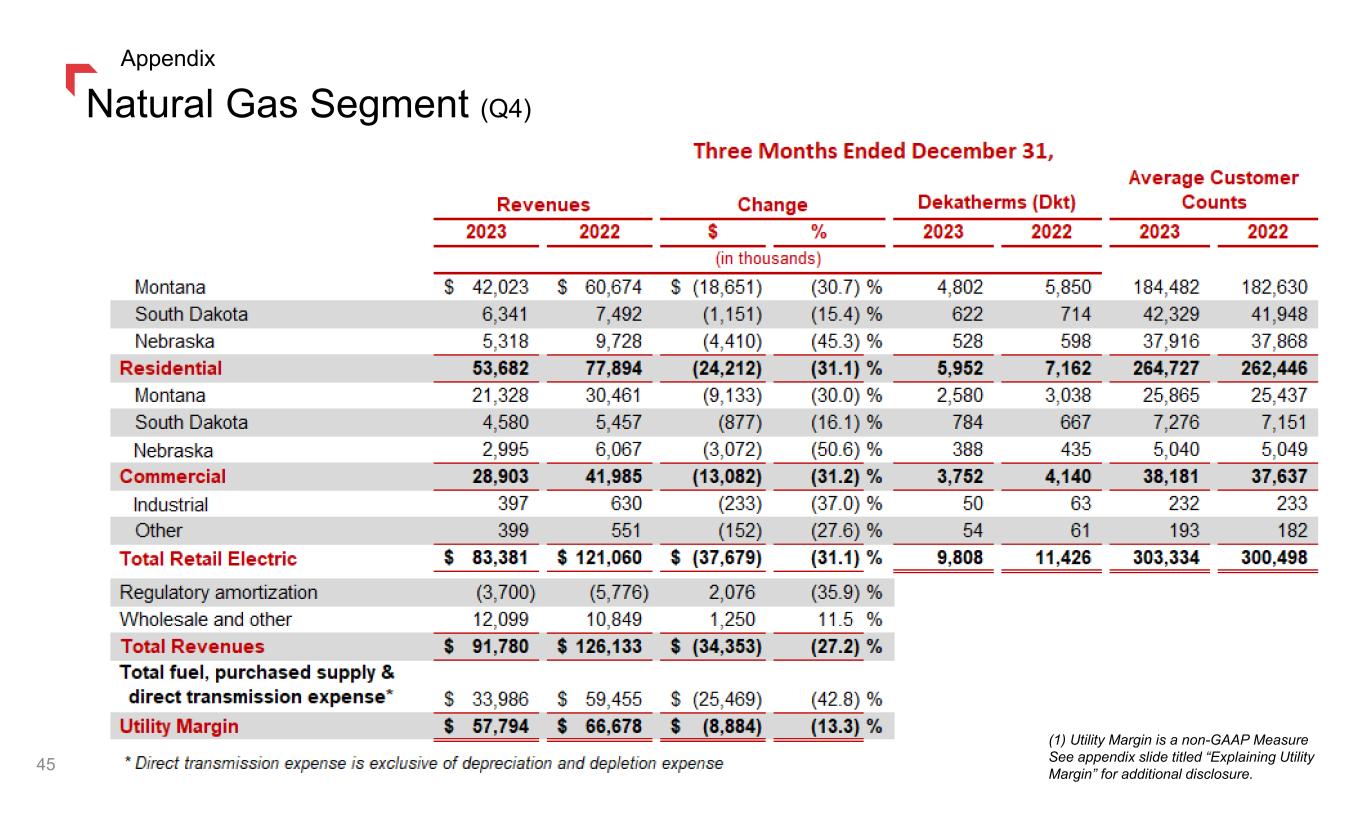

Natural Gas Segment (Q4) 45 Appendix (1) Utility Margin is a non-GAAP Measure See appendix slide titled “Explaining Utility Margin” for additional disclosure.

Weather and Hydro Conditions (Q4) Snow water equivalents 42% to 73% of the 30-year medians for our hydro territory. We estimated a $5.2 million pre-tax detriment as compared to normal and a $7.5 million detriment as compared to Q4 2022. Snow Water Equivalent vs. 30-Year Median 46 Appendix

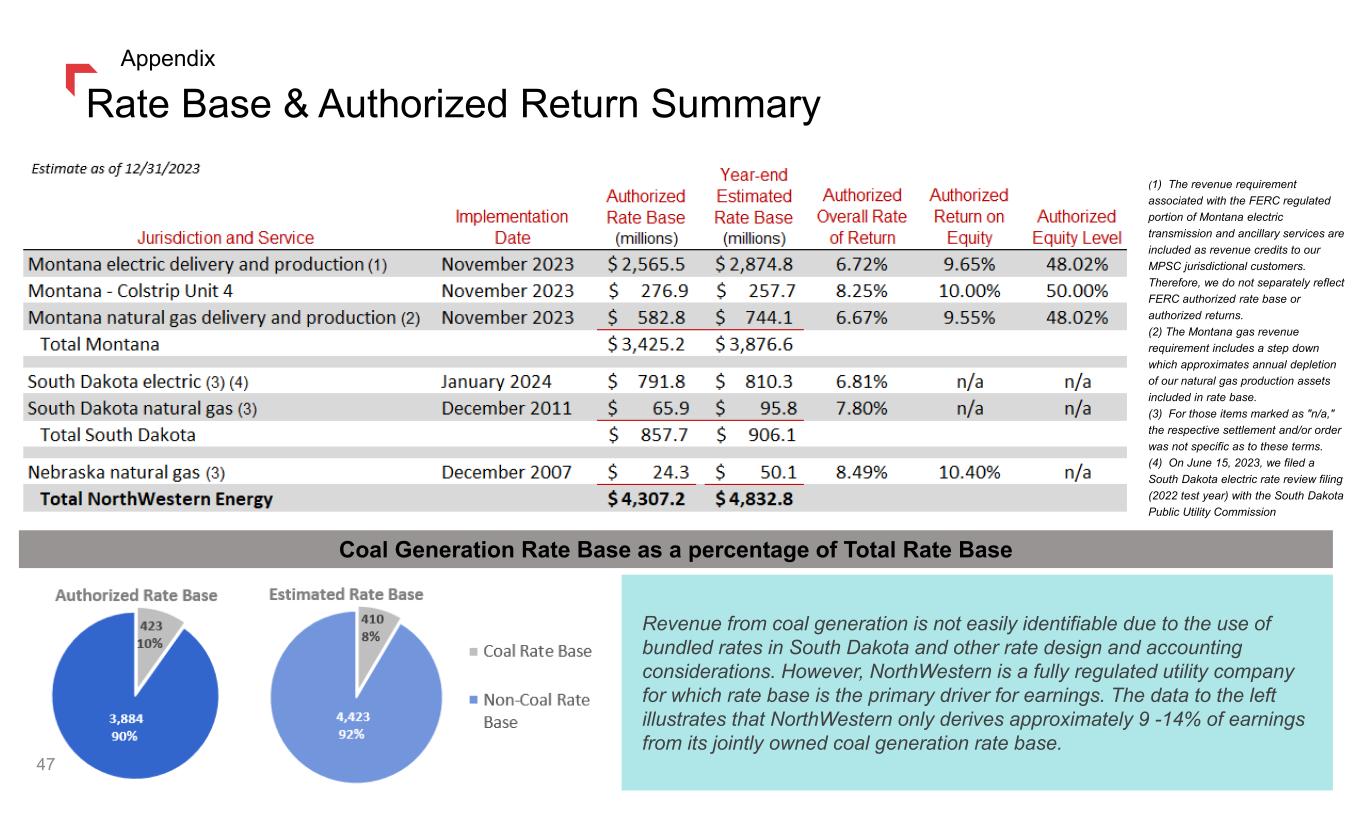

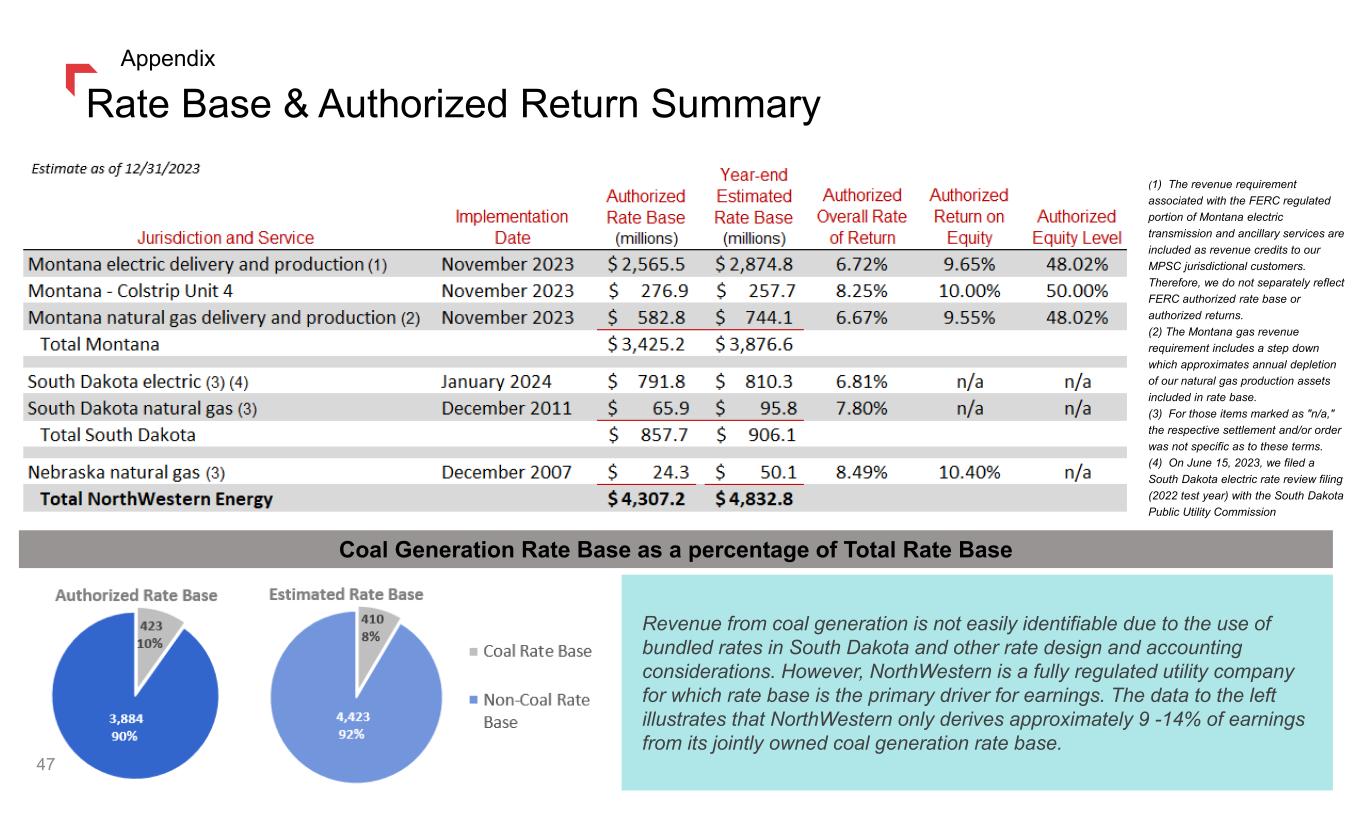

(1) The revenue requirement associated with the FERC regulated portion of Montana electric transmission and ancillary services are included as revenue credits to our MPSC jurisdictional customers. Therefore, we do not separately reflect FERC authorized rate base or authorized returns. (2) The Montana gas revenue requirement includes a step down which approximates annual depletion of our natural gas production assets included in rate base. (3) For those items marked as "n/a," the respective settlement and/or order was not specific as to these terms. (4) On June 15, 2023, we filed a South Dakota electric rate review filing (2022 test year) with the South Dakota Public Utility Commission Coal Generation Rate Base as a percentage of Total Rate Base Revenue from coal generation is not easily identifiable due to the use of bundled rates in South Dakota and other rate design and accounting considerations. However, NorthWestern is a fully regulated utility company for which rate base is the primary driver for earnings. The data to the left illustrates that NorthWestern only derives approximately 9 -14% of earnings from its jointly owned coal generation rate base. Rate Base & Authorized Return Summary Appendix 47

$2.3 billion invested into our operations over the last five years of which 65% was transmission and distribution. Historic 5-Year Capital Investment Appendix 48

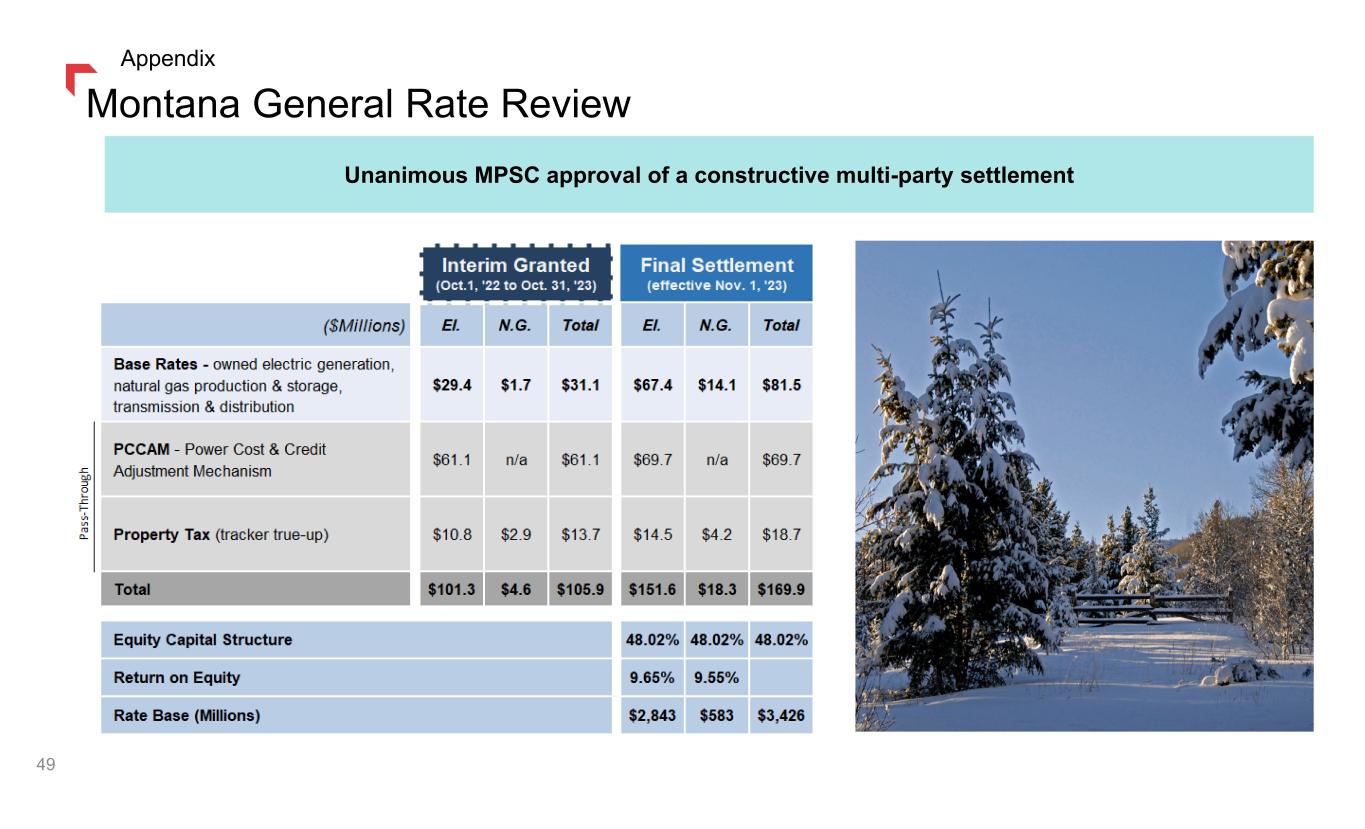

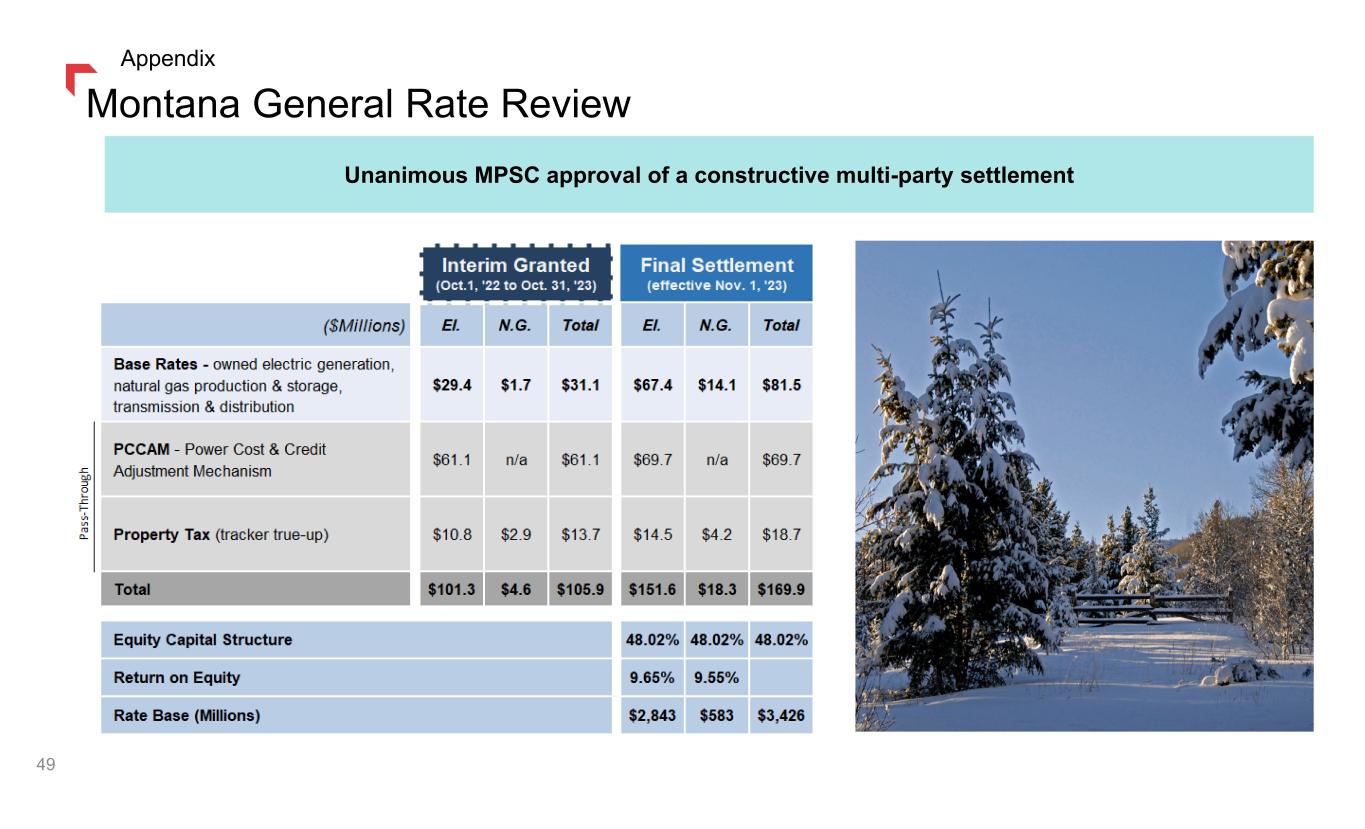

Montana General Rate Review 49 Unanimous MPSC approval of a constructive multi-party settlement Appendix

South Dakota Electric Rate Review Electric $13.67 Per month Increase for an average residential electric customer that uses 750 kWh with our new rates. 50 Appendix

Colstrip Transfer 51

Colstrip Transfer Overview NorthWestern Energy executed an agreement with Avista Corporation (Exit Agreement) for the transfer of Avista’s ownership interests in Colstrip Units 3 and 4. • Effective date of transfer: December 31, 2025 • Generating capacity: 222 MW (bringing our total ownership to 444 MW) • Transfer price: $0.00 • NorthWestern will be responsible for operational and capital costs beginning January 1, 2026. • The agreement does not require approval by the Montana Public Service Commission (MPSC). We expect to work with the MPSC in a future docket for cost recovery in 2026. • NorthWestern will have the right to exercise Avista’s vote with respect to capital expenditures1 between now and 2025 with Avista responsible for its pro rata share2. • Avista will retain its existing environmental and decommissioning obligations through life of plant. • Under the Colstrip Ownership & Operating Agreement, each of the owners will have a 90-day period in which to evaluate the transaction between NorthWestern and Avista to determine whether to exercise their respective right of first refusal. • We filed our Montana Integrated Resource Plan on April 28, 2023. This transaction is expected to satisfy our capacity needs in Montana for at least the next 5 years. 1. Avista retains the vote related to remediation activities. 2. Avista bears its current project share (15%) costs through 2025, other than “Enhancement Work Costs” for which it bears a time-based pro-rata share. Enhancement Work Costs are costs that are not performed on a least-costs basis or are intended to extend the life of the facility beyond 2025. See the Exit Agreement for additional detail. 52 Appendix

Colstrip Facility Ownership Overview NorthWestern is actively working with the other owners to resolve outstanding issues, including the associated pending legal proceedings. Additionally, the owners intend to pursue a mutually beneficial reallocation (swap) of megawatts between the two units that would ideally provide NorthWestern with a controlling (> 370 megawatts) share of Unit 4. 53 Appendix

Why Colstrip? Reliable Existing resource, ready to serve our Montana customers. Avoids lengthy planning, permitting and construction of a new facility that would stretch in-service beyond 2026. Reduces reliance on imported power and volatile markets, providing increased energy independence. In-state and on-system asset mitigating the transmission constraints we experience importing capacity. Adds critical long-duration, 24/7 on-demand generation necessary for balancing our existing portfolio. Affordable 222 MW of capacity with no upfront capital costs and stable operating costs going forward. o Equivalent new build would cost in excess of $500 million. o Incremental operating costs are known and reasonable. Resulting variable generation costs represent a 90%+ discount to market prices incurred during December’s polar vortex. In addition to no upfront capital, low and stably priced mine-mouth coal supply costs. Sustainable We remain committed to our net zero goal by 2050. This additional capacity, with a remaining life of up to 20 years, helps bridge the interim gap and will likely lead to less carbon post 2040. Yellowstone County Generating Station is potentially our last natural gas resource addition in Montana. Partners are committed to evaluate non-carbon long-duration alternative resources for the site. Keeps the existing plant open and retains its highly skilled jobs vital to the Colstrip community. Protects existing ownership interests with an ultimate goal of majority ownership of Unit 4. NorthWestern Energy executed an agreement with Avista Corporation for the transfer of Avista’s ownership interests in Colstrip Units 3 & 4. • Effective date of transfer: 12/31/2025 • Generating capacity: 222 MW • Transfer price: $0.00 54 Appendix

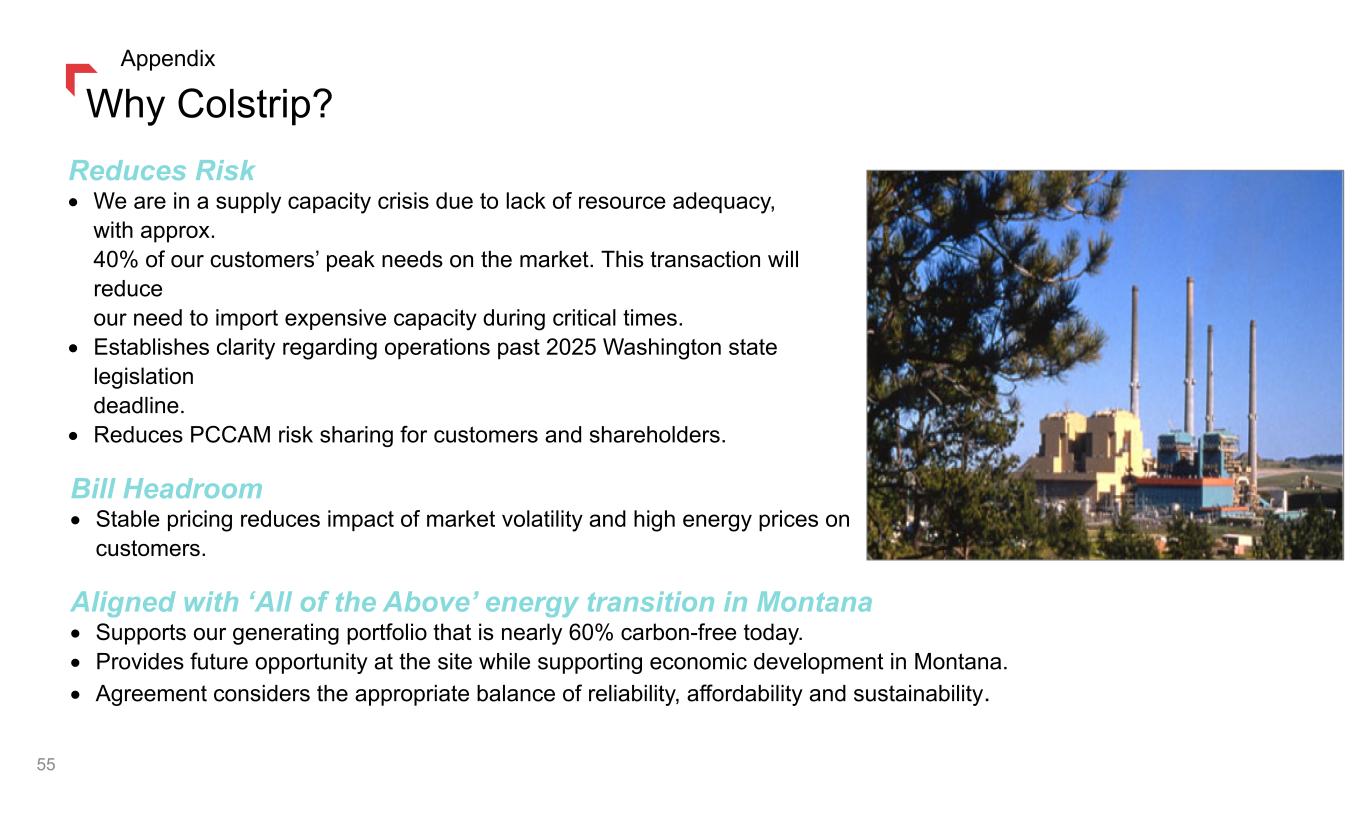

Why Colstrip? Reduces Risk We are in a supply capacity crisis due to lack of resource adequacy, with approx. 40% of our customers’ peak needs on the market. This transaction will reduce our need to import expensive capacity during critical times. Establishes clarity regarding operations past 2025 Washington state legislation deadline. Reduces PCCAM risk sharing for customers and shareholders. 55 Appendix Bill Headroom Stable pricing reduces impact of market volatility and high energy prices on customers. Aligned with ‘All of the Above’ energy transition in Montana Supports our generating portfolio that is nearly 60% carbon-free today. Provides future opportunity at the site while supporting economic development in Montana. Agreement considers the appropriate balance of reliability, affordability and sustainability.

January 2024 Cold Weather Event - Montana 56 Appendix The above charts illustrate our resource nameplate capacity, the actual resource specific contribution of energy, the capacity deficit we faced, and the market price of power during the January 2024 multi-day cold weather event in Montana. As a result of our capacity deficit, we were reliant upon the high and volatile power market a majority of the time to meet customer demand.

Our Net-Zero Vision Over the past 100 years, NorthWestern Energy has maintained our commitment to provide customers with reliable and affordable electric and natural gas service while also being good stewards of the environment. We have responded to climate change, its implications and risks, by increasing our environmental sustainability efforts and our access to clean energy resources. But more must be done. We are committed to achieving net zero emissions by 2050. • Committed to achieving net-zero by 2050 for Scope 1 and 2 emissions • Must balance Affordability, Reliability and Sustainability in this transition • No new carbon emitting generation additions after 2035 • Pipeline modernization, enhanced leak detection and development of alternative fuels for natural gas business • Electrify fleet and add charging infrastructure • Carbon offsets likely needed to ultimately achieve net-zero • Please visit www.NorthWesternEnergy.com/NetZero to learn more about our Net Zero Vision. 57 Appendix

Non-GAAP Financial Measures 58 Appendix

Non-GAAP Financial Measures This presentation includes financial information prepared in accordance with GAAP, as well as other financial measures, such as Utility Margin, Adjusted Non-GAAP pretax income, Adjusted Non-GAAP net income and Adjusted Non-GAAP Diluted EPS that are considered “non-GAAP financial measures.” Generally, a non-GAAP financial measure is a numerical measure of a company’s financial performance, financial position or cash flows that excludes (or includes) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP. We define Utility Margin as Operating Revenues less fuel, purchased supply and direct transmission expense (exclusive of depreciation and depletion) as presented in our Consolidated Statements of Income. This measure differs from the GAAP definition of Gross Margin due to the exclusion of Operating and maintenance, Property and other taxes, and Depreciation and depletion expenses, which are presented separately in our Consolidated Statements of Income. A reconciliation of Utility Margin to Gross Margin, the most directly comparable GAAP measure, is included in this presentation. Management believes that Utility Margin provides a useful measure for investors and other financial statement users to analyze our financial performance in that it excludes the effect on total revenues caused by volatility in energy costs and associated regulatory mechanisms. This information is intended to enhance an investor's overall understanding of results. Under our various state regulatory mechanisms, as detailed below, our supply costs are generally collected from customers. In addition, Utility Margin is used by us to determine whether we are collecting the appropriate amount of energy costs from customers to allow recovery of operating costs, as well as to analyze how changes in loads (due to weather, economic or other conditions), rates and other factors impact our results of operations. Our Utility Margin measure may not be comparable to that of other companies' presentations or more useful than the GAAP information provided elsewhere in this report. Management also believes the presentation of Adjusted Non-GAAP pre-tax income, Adjusted Non-GAAP net income and Adjusted Non-GAAP Diluted EPS is more representative of normal earnings than GAAP pre-tax income, net income and EPS due to the exclusion (or inclusion) of certain impacts that are not reflective of ongoing earnings. The presentation of these non-GAAP measures is intended to supplement investors' understanding of our financial performance and not to replace other GAAP measures as an indicator of actual operating performance. Our measures may not be comparable to other companies' similarly titled measures. 59 Appendix

Delivering a bright future 60