2024 Third Quarter Earnings Webcast October 30, 2024 18-K October 30, 2024

NorthWestern Energy 2 Forward Looking Statements During the course of this presentation, there will be forward- looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements often address our expected future business and financial performance, and often contain words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” or “will.” The information in this presentation is based upon our current expectations as of the date of this document unless otherwise noted. Our actual future business and financial performance may differ materially and adversely from our expectations expressed in any forward-looking statements. We undertake no obligation to revise or publicly update our forward-looking statements or this presentation for any reason. Although our expectations and beliefs are based on reasonable assumptions, actual results may differ materially. The factors that may affect our results are listed in certain of our press releases and disclosed in the Company’s 10-K and 10-Q along with other public filings with the SEC.

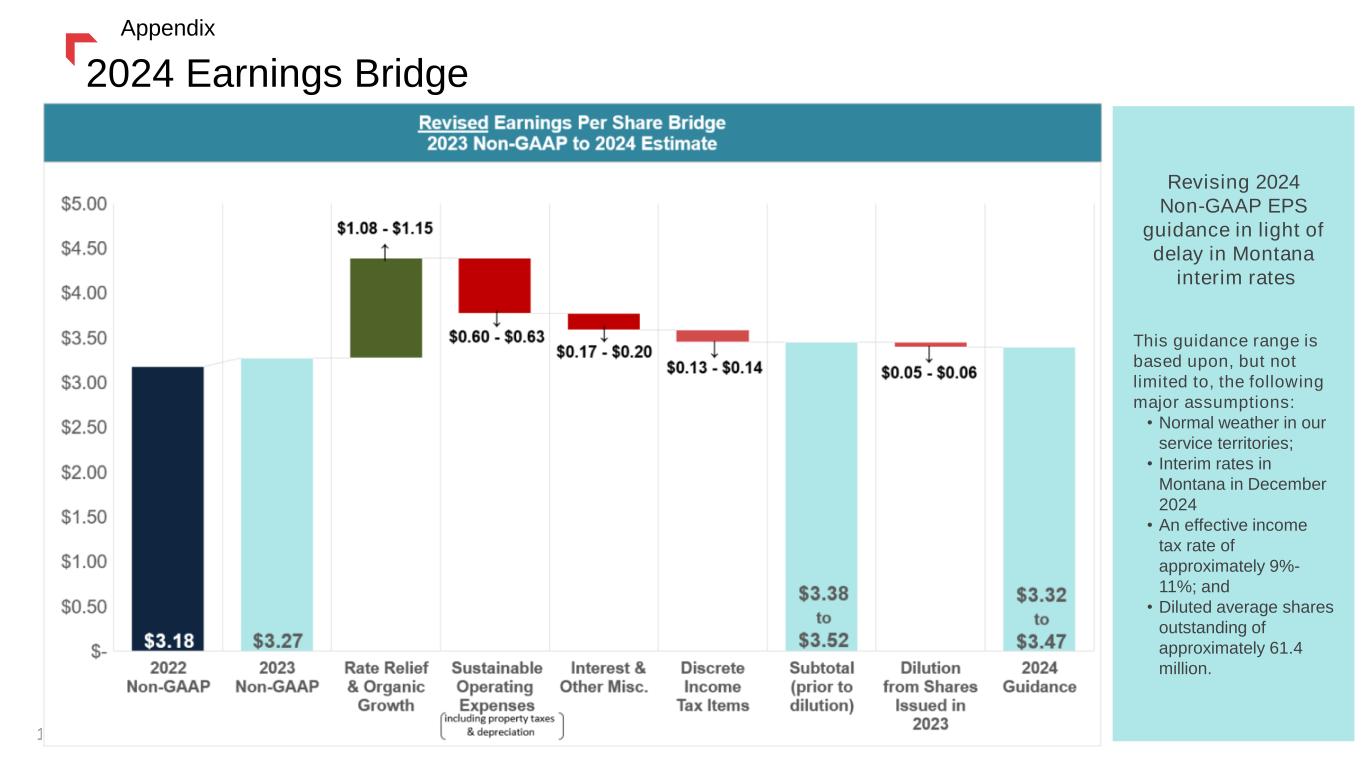

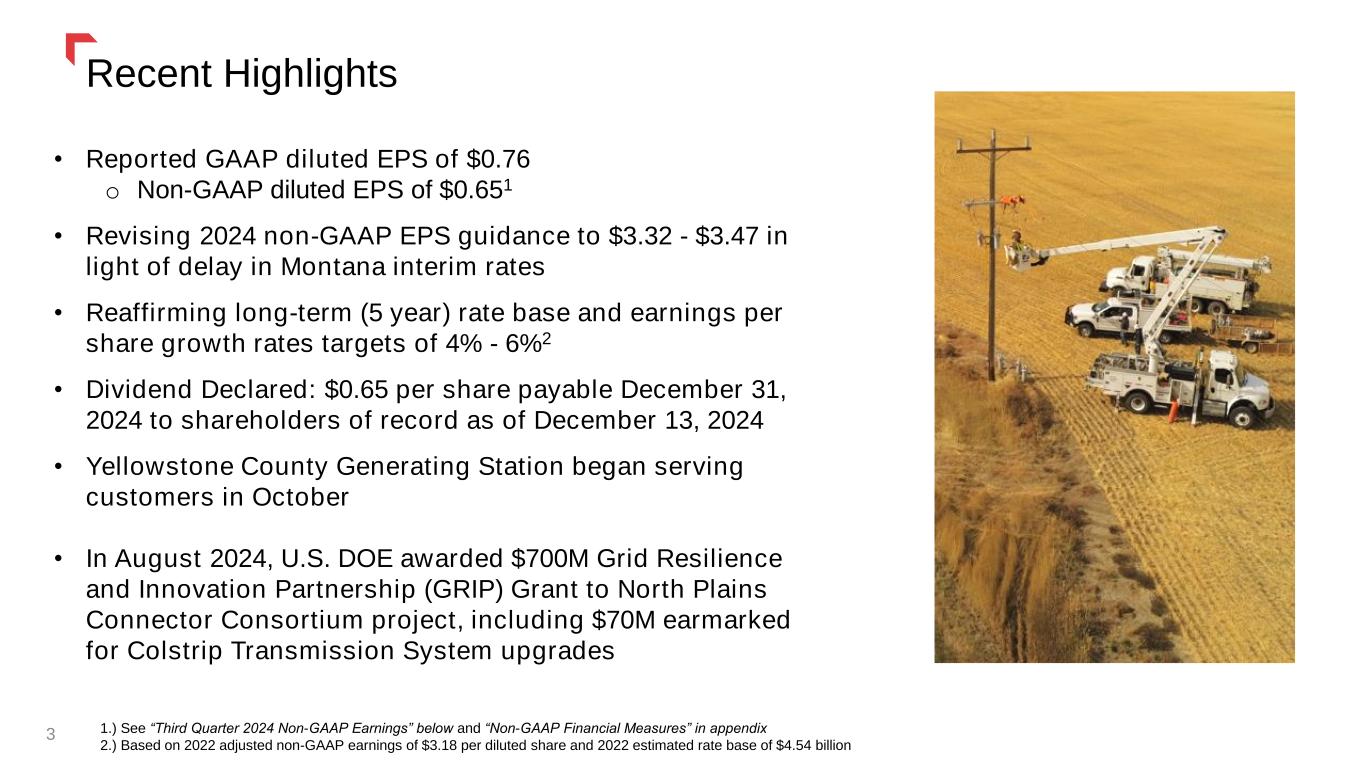

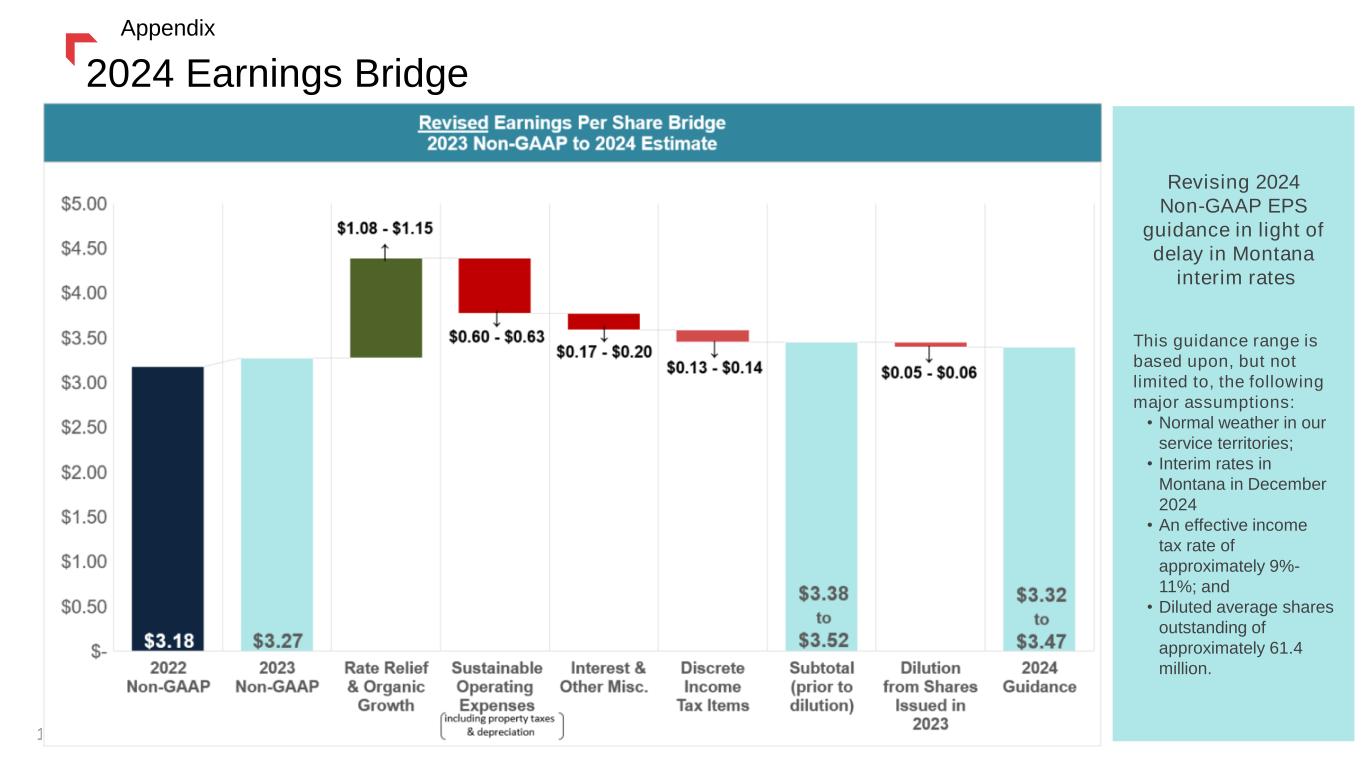

Recent Highlights • Reported GAAP diluted EPS of $0.76 o Non-GAAP diluted EPS of $0.651 • Revising 2024 non-GAAP EPS guidance to $3.32 - $3.47 in light of delay in Montana interim rates • Reaffirming long-term (5 year) rate base and earnings per share growth rates targets of 4% - 6%2 • Dividend Declared: $0.65 per share payable December 31, 2024 to shareholders of record as of December 13, 2024 • Yellowstone County Generating Station began serving customers in October • In August 2024, U.S. DOE awarded $700M Grid Resilience and Innovation Partnership (GRIP) Grant to North Plains Connector Consortium project, including $70M earmarked for Colstrip Transmission System upgrades 1.) See “Third Quarter 2024 Non-GAAP Earnings” below and “Non-GAAP Financial Measures” in appendix 2.) Based on 2022 adjusted non-GAAP earnings of $3.18 per diluted share and 2022 estimated rate base of $4.54 billion 3

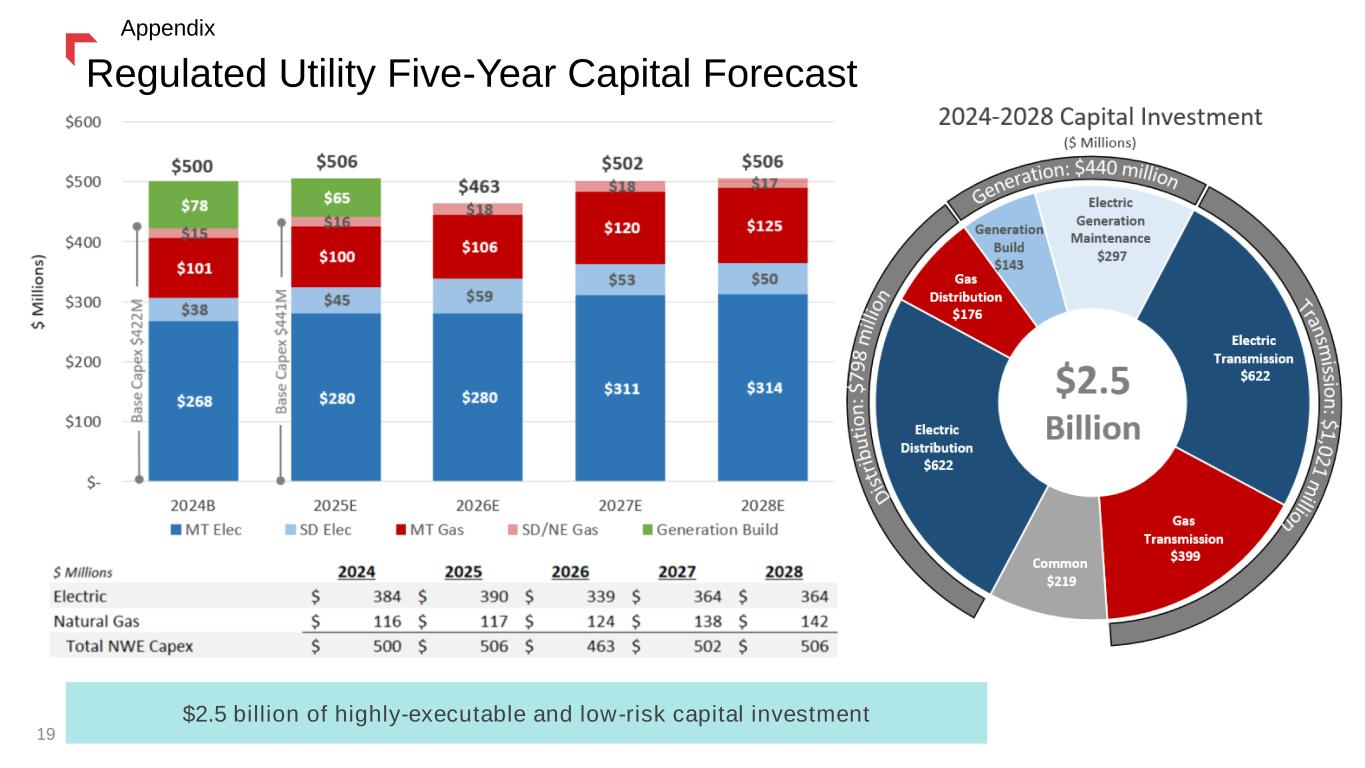

9%-11% Total Growth 11%+ Total Growth Incremental Opportunities: 6% + EPS Growth ~5% Dividend Yield Base Capital Plan: 4%-6% EPS Growth FERC Transmission Incremental generating capacity (subject to successful resource procurement bids) Qualifying Facility and / or Power Purchase Agreement buyouts Electrification supporting economic development Nearly $2.5 billion of highly executable and low-risk capital investment forecasted over the next five years. This investment is expected to drive annualized earnings and rate base growth of approximately 4% - 6%. See slide titled “Strong Growth Outlook” for additional information. + The NorthWestern Value Proposition + 4 = =

Thank youQ3 Financial Results 5

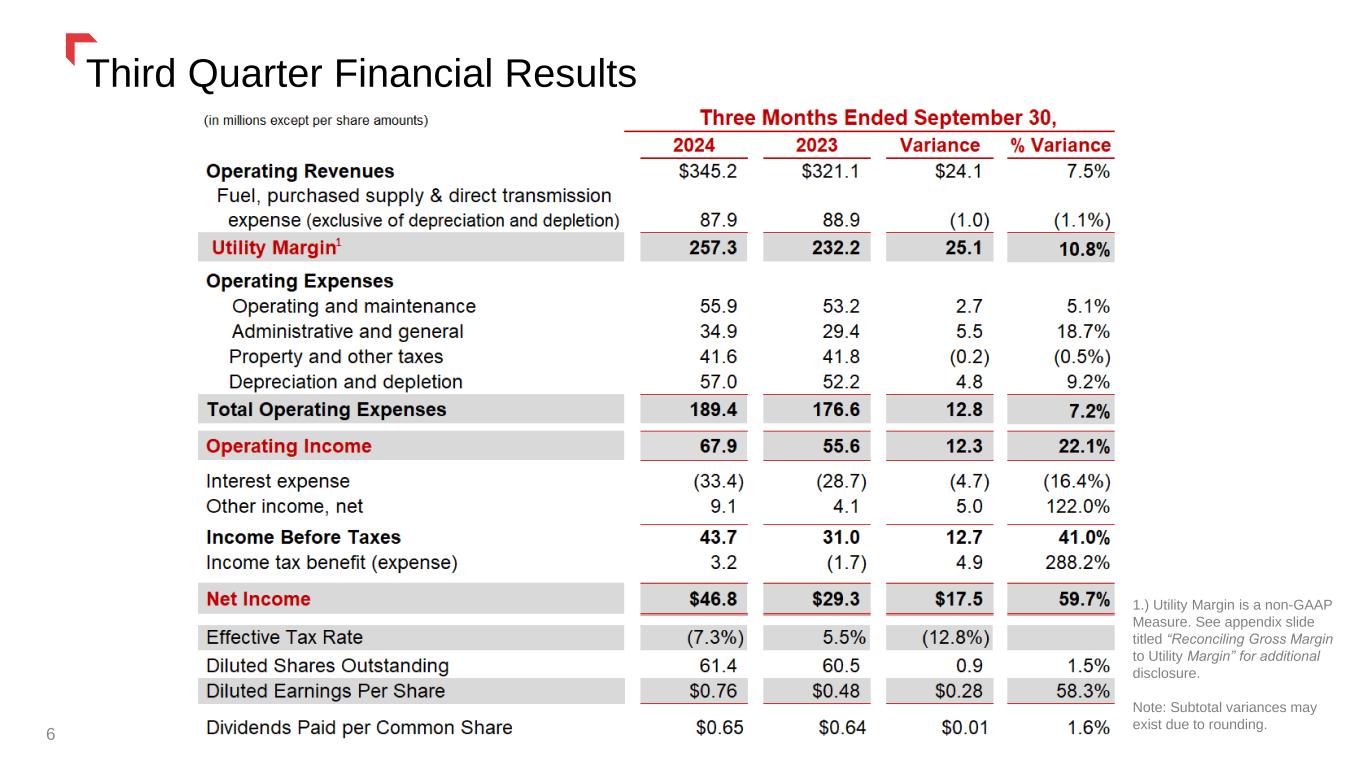

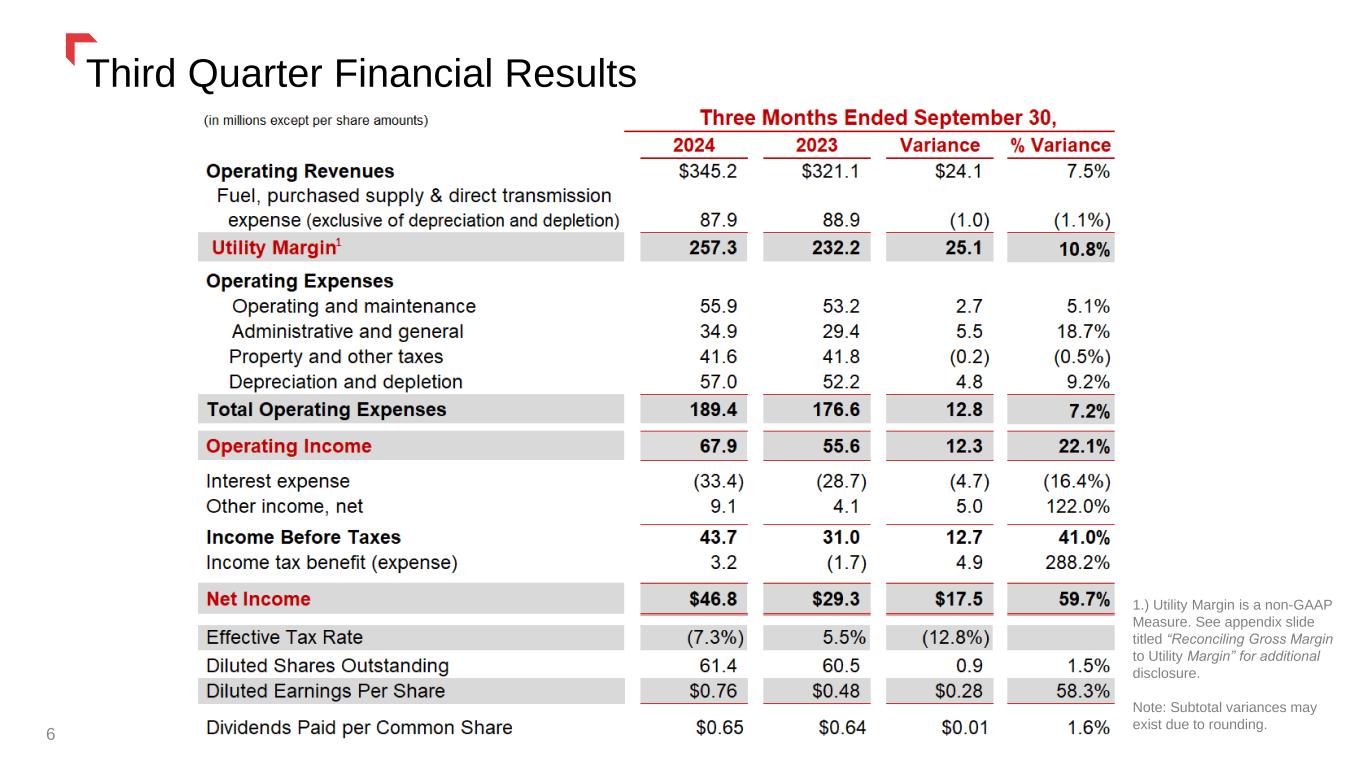

Third Quarter Financial Results 6 1.) Utility Margin is a non-GAAP Measure. See appendix slide titled “Reconciling Gross Margin to Utility Margin” for additional disclosure. Note: Subtotal variances may exist due to rounding.

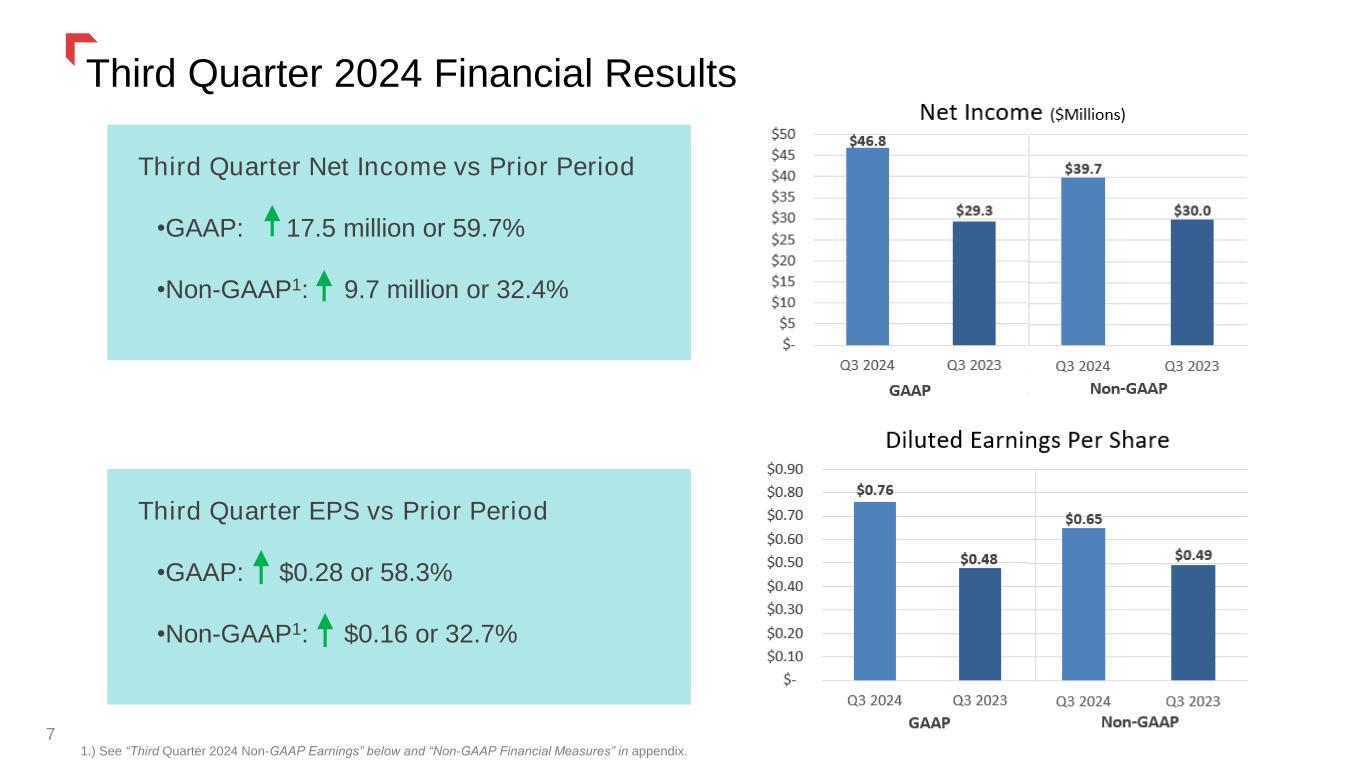

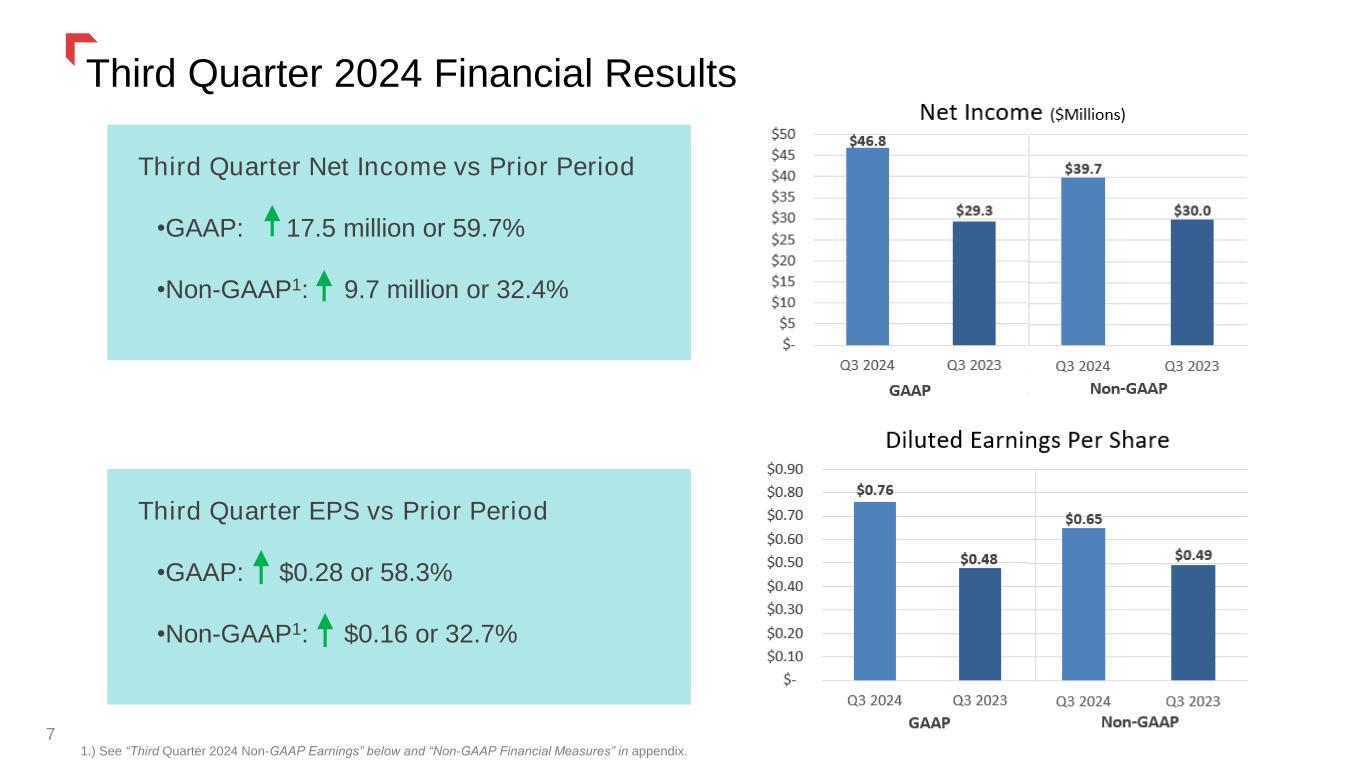

Third Quarter 2024 Financial Results 7 1.) See “Third Quarter 2024 Non-GAAP Earnings” below and “Non-GAAP Financial Measures” in appendix. Third Quarter Net Income vs Prior Period •GAAP: 17.5 million or 59.7% •Non-GAAP1: 9.7 million or 32.4% Third Quarter EPS vs Prior Period •GAAP: $0.28 or 58.3% •Non-GAAP1: $0.16 or 32.7%

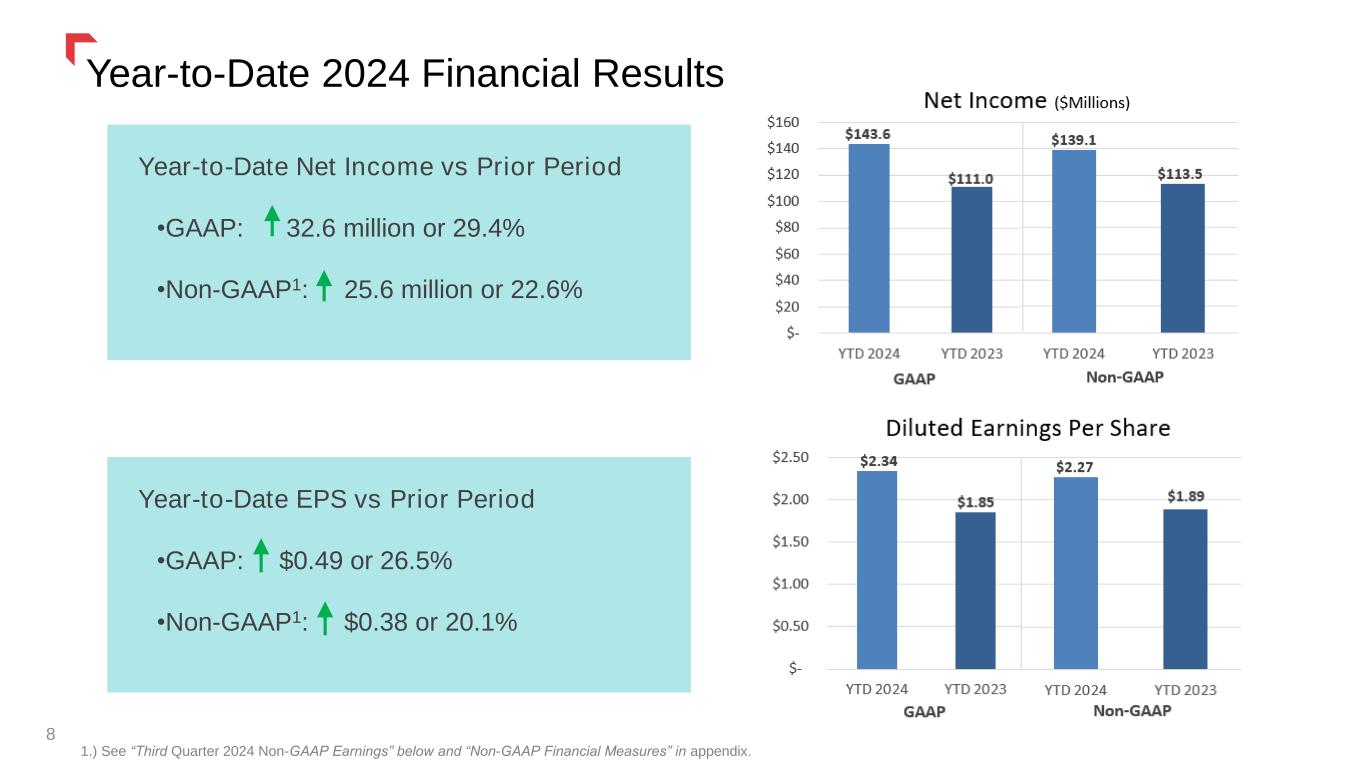

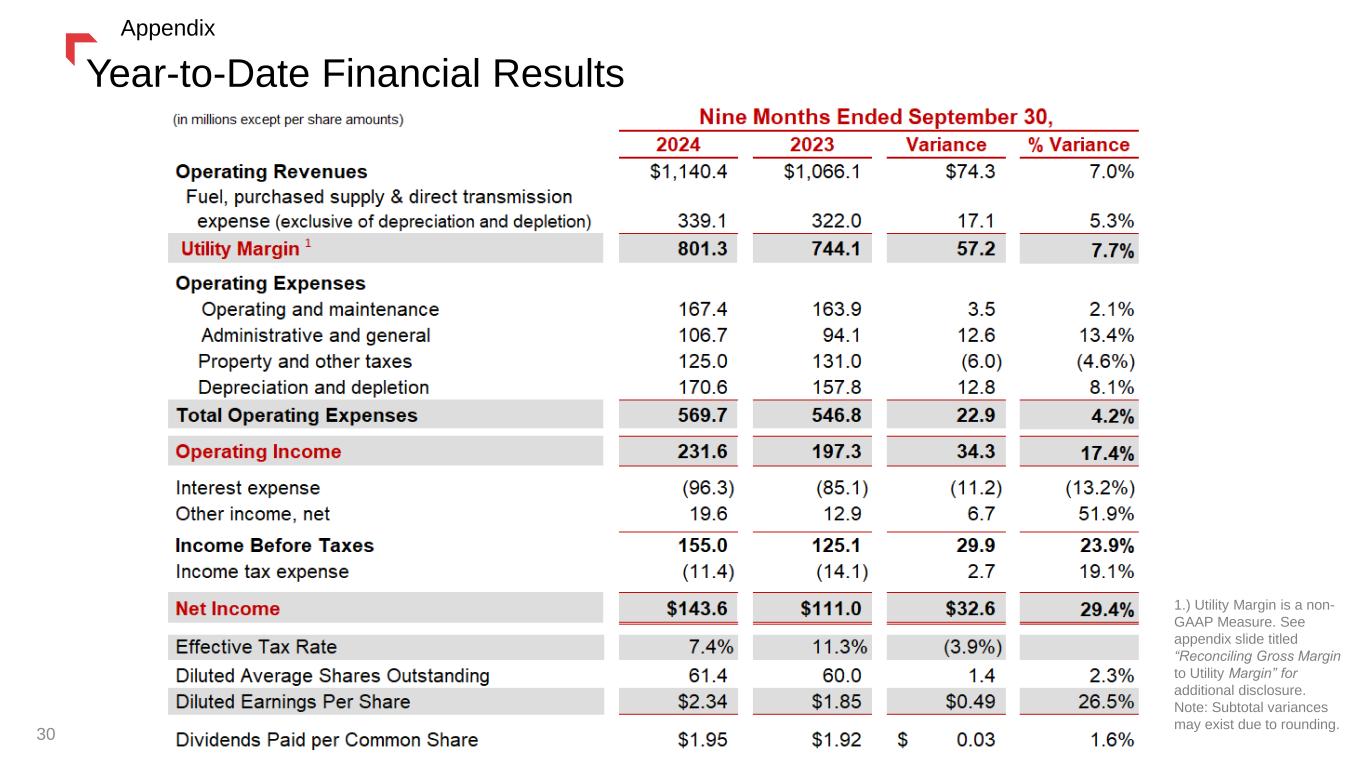

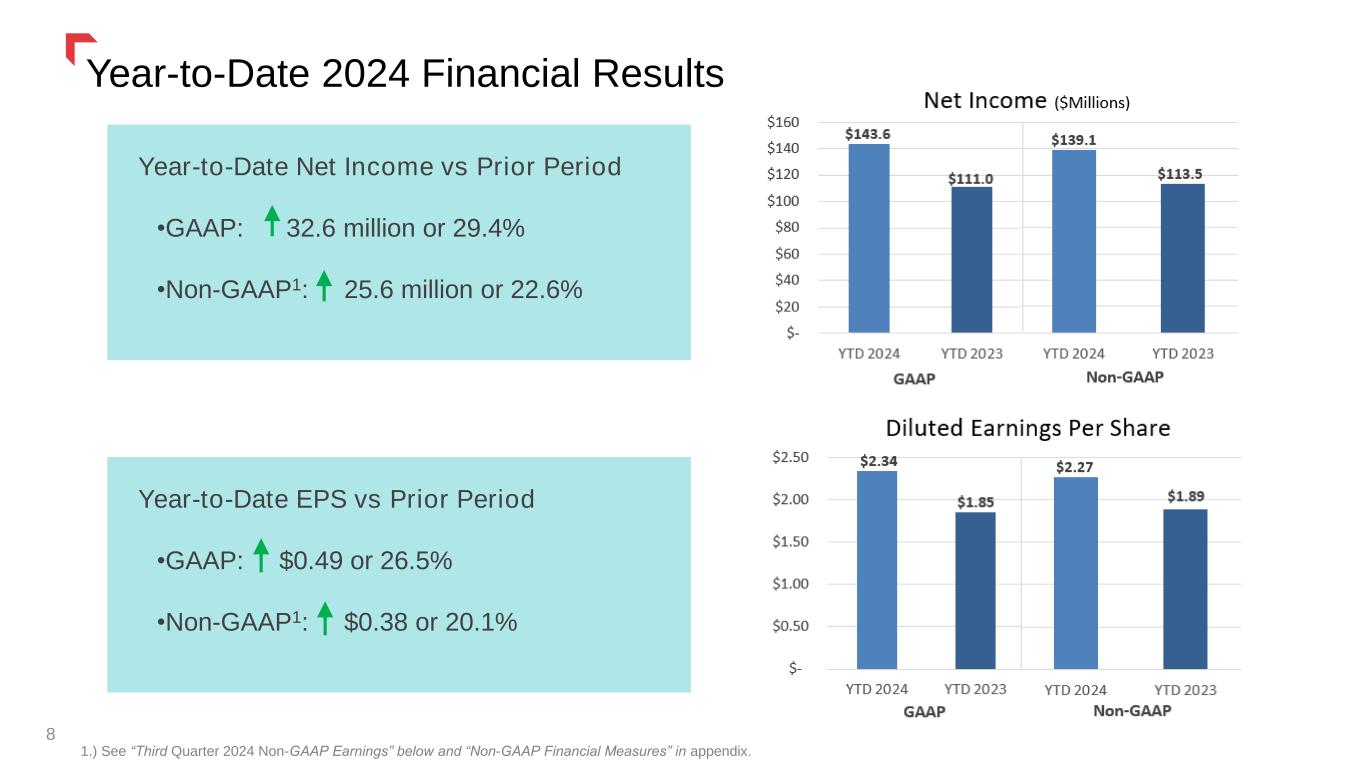

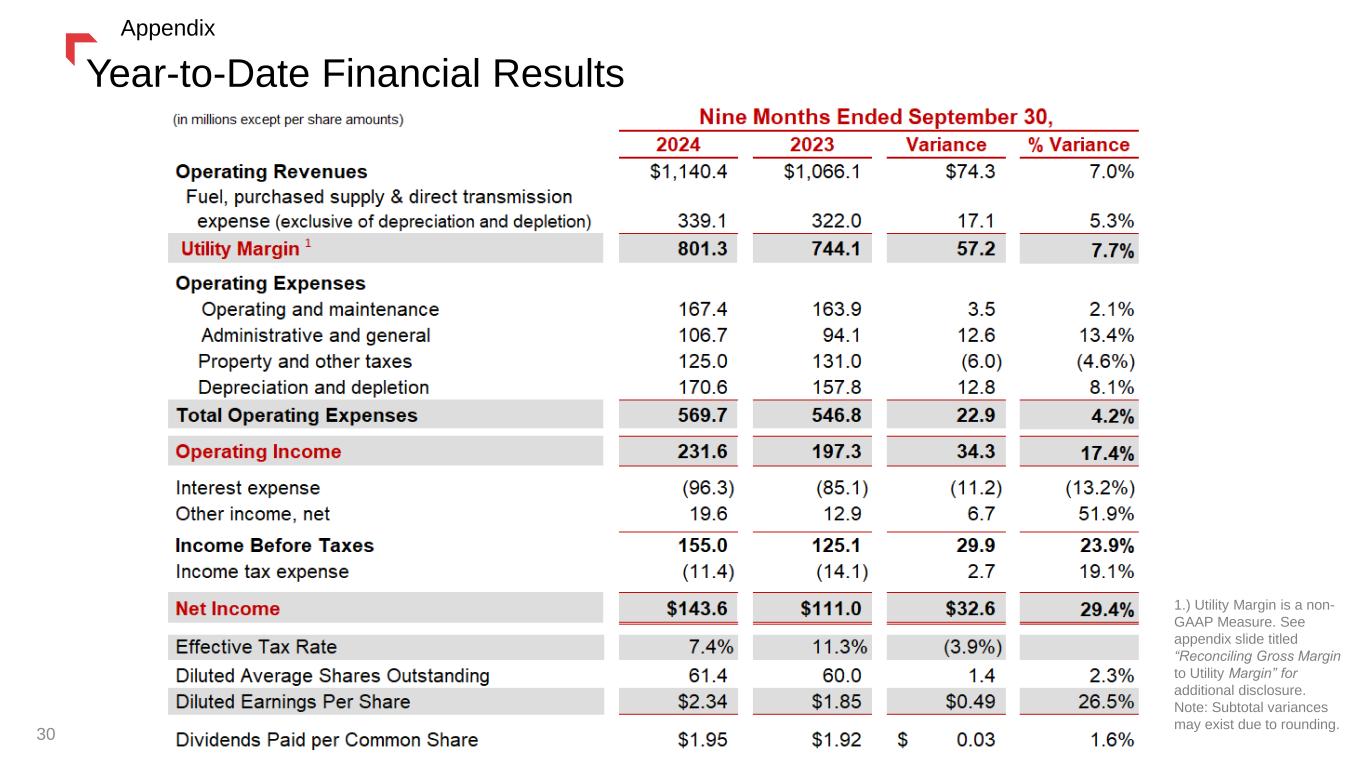

Year-to-Date 2024 Financial Results 8 Year-to-Date Net Income vs Prior Period •GAAP: 32.6 million or 29.4% •Non-GAAP1: 25.6 million or 22.6% Year-to-Date EPS vs Prior Period •GAAP: $0.49 or 26.5% •Non-GAAP1: $0.38 or 20.1% 1.) See “Third Quarter 2024 Non-GAAP Earnings” below and “Non-GAAP Financial Measures” in appendix.

Third Quarter Earnings Drivers 9 2 Increase in diluted EPS primarily due to rate relief, transmission revenues, and a tax benefit, offset by higher operating and interest expense. 1.) Utility Margin is a non-GAAP Measure. See appendix slide titled “Reconciling Gross Margin to Utility Margin” for additional disclosure. 2.) See “Third Quarter 2024 Non-GAAP Earnings” below and “Non-GAAP Financial Measures” in appendix. After-tax EPS vs Prior Year

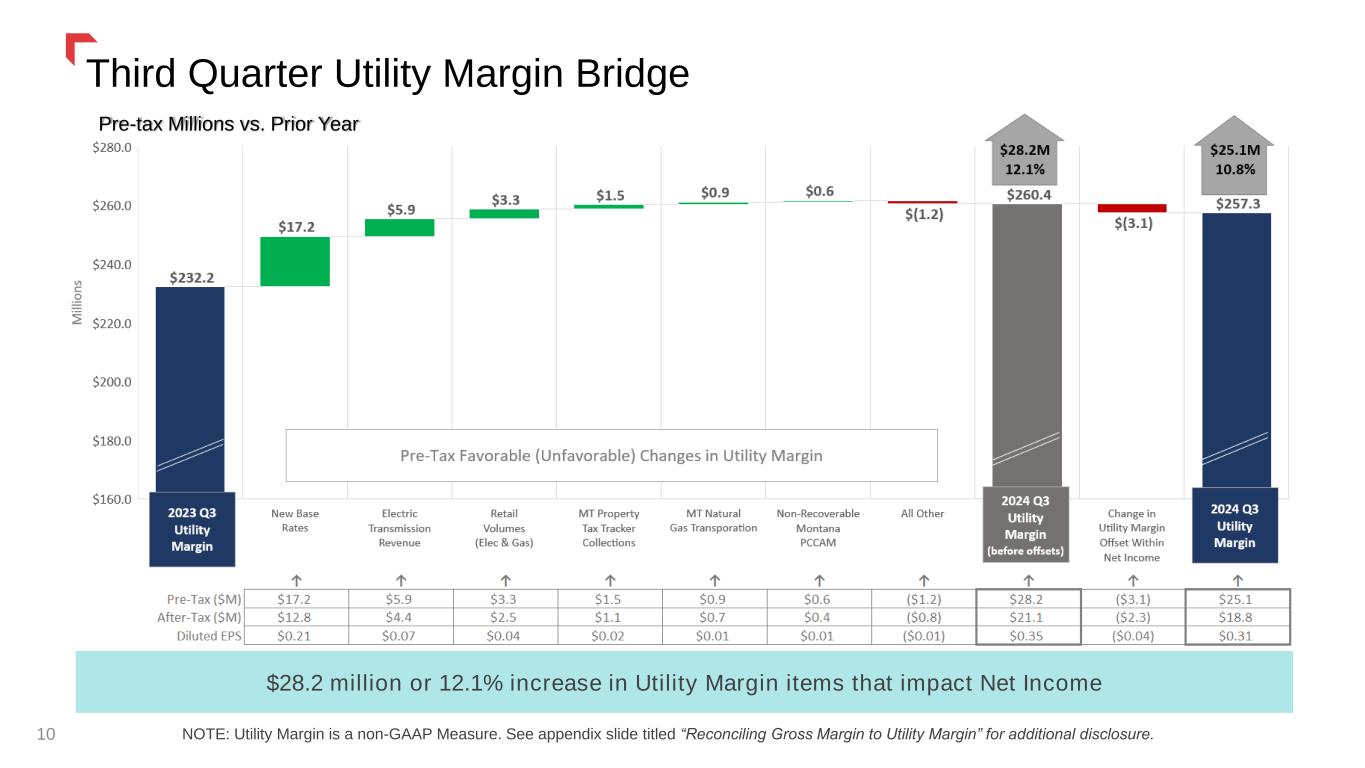

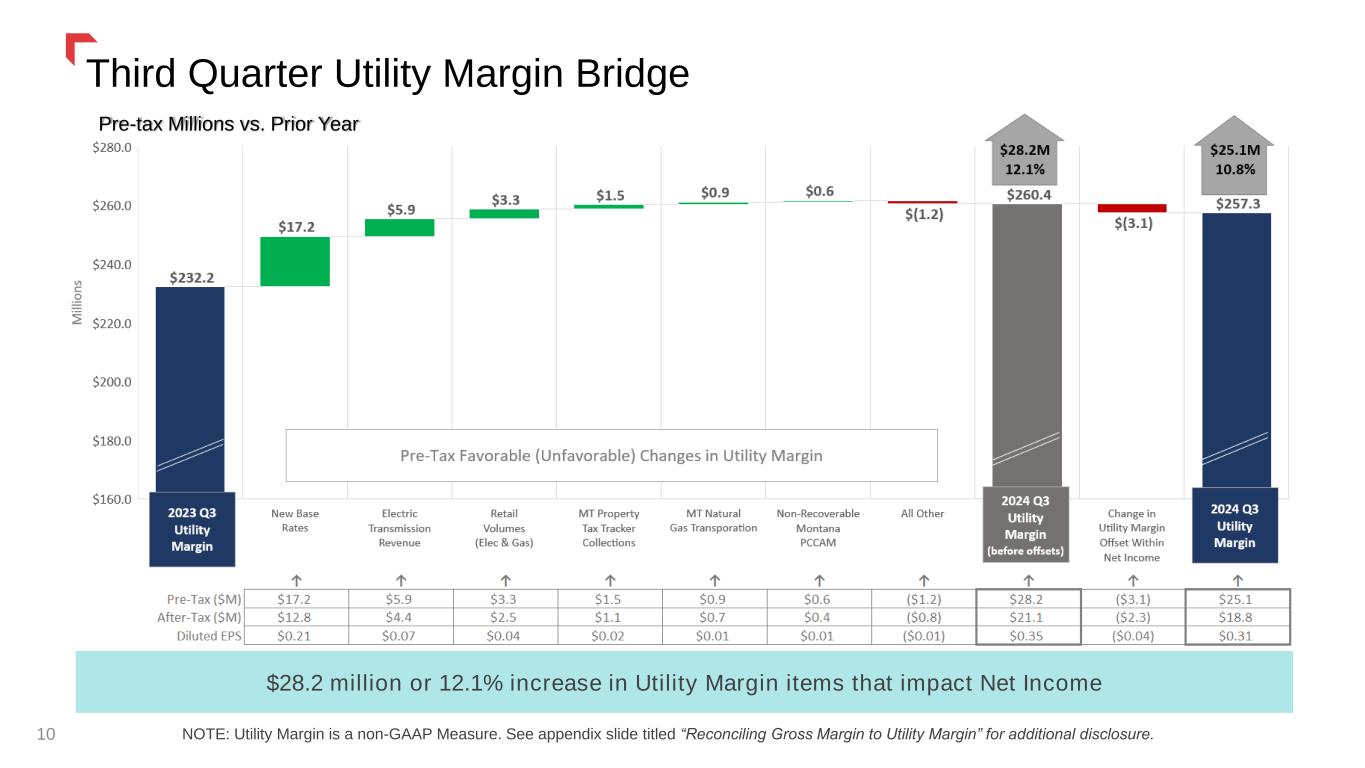

Third Quarter Utility Margin Bridge Pre-tax Millions vs. Prior Year $28.2 million or 12.1% increase in Utility Margin items that impact Net Income NOTE: Utility Margin is a non-GAAP Measure. See appendix slide titled “Reconciling Gross Margin to Utility Margin” for additional disclosure. 10

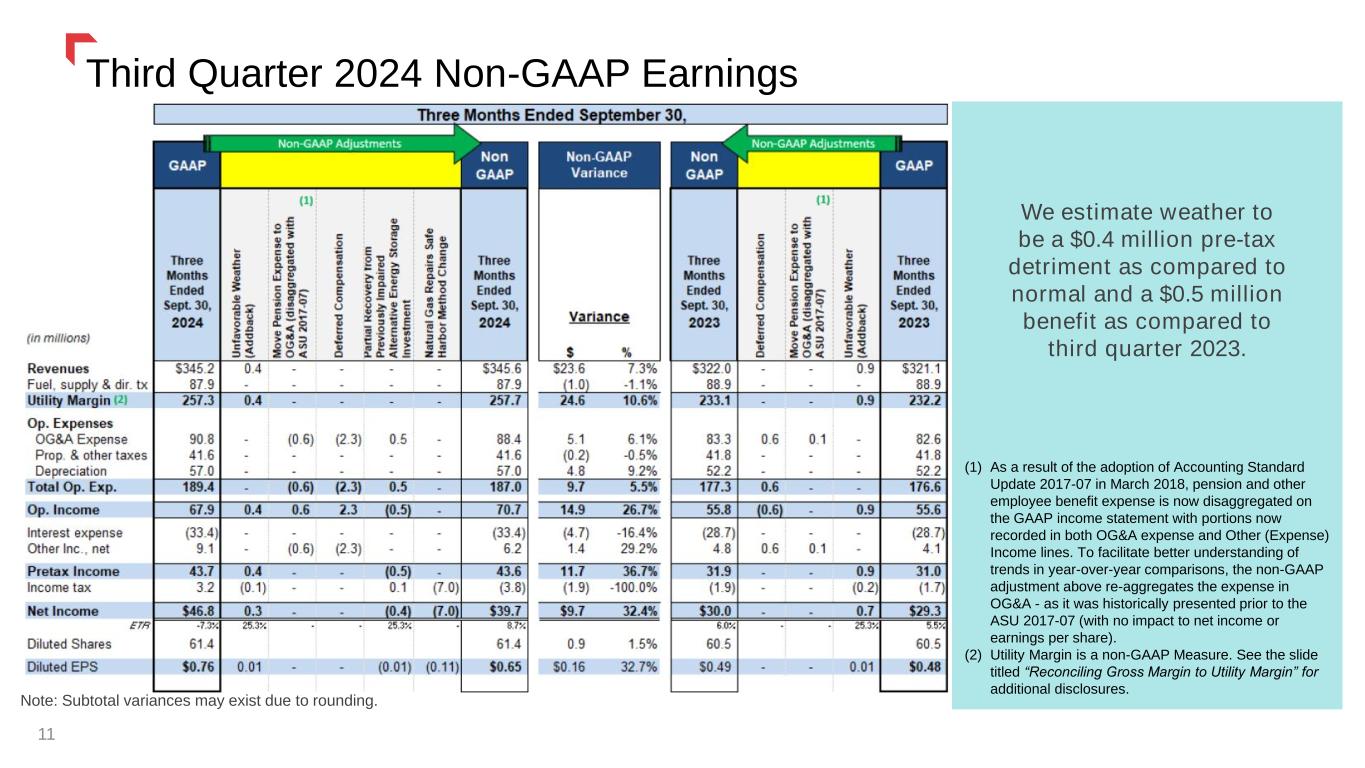

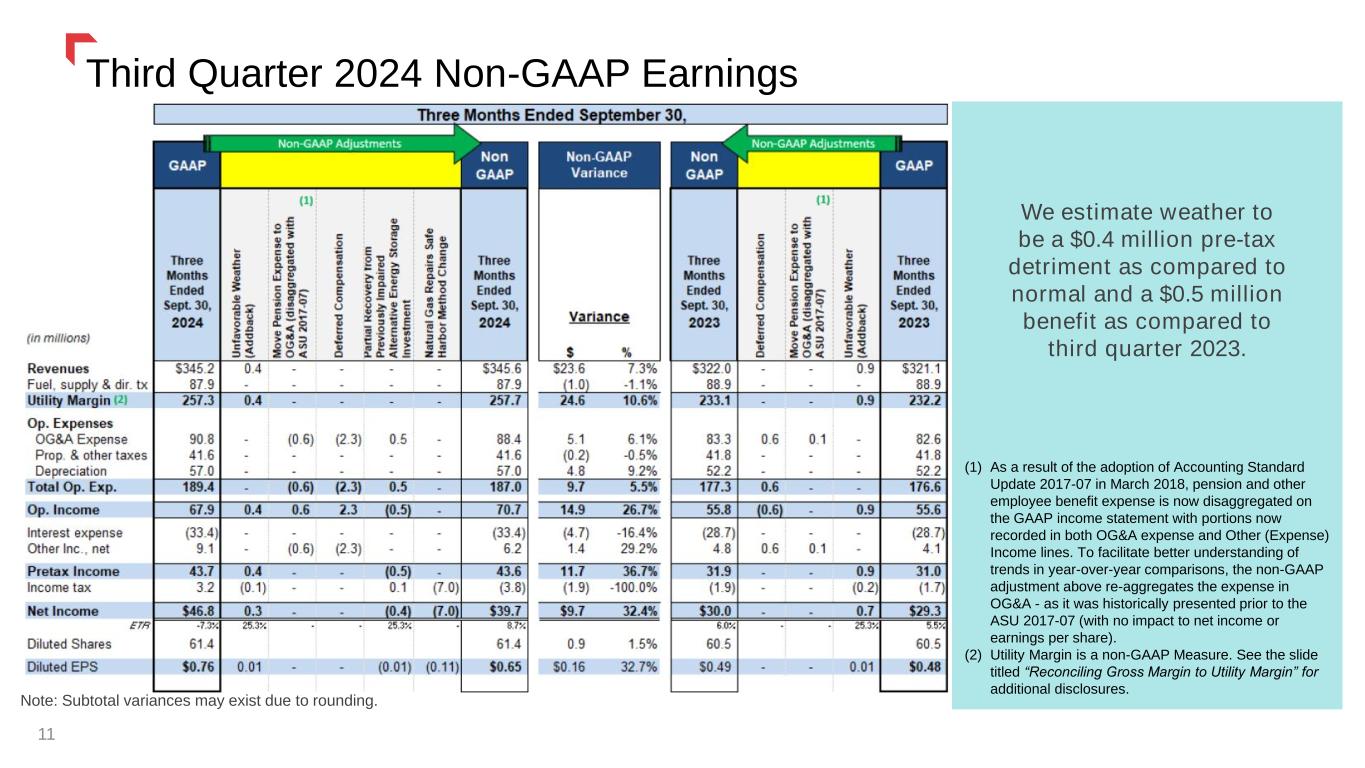

We estimate weather to be a $0.4 million pre-tax detriment as compared to normal and a $0.5 million benefit as compared to third quarter 2023. (1) As a result of the adoption of Accounting Standard Update 2017-07 in March 2018, pension and other employee benefit expense is now disaggregated on the GAAP income statement with portions now recorded in both OG&A expense and Other (Expense) Income lines. To facilitate better understanding of trends in year-over-year comparisons, the non-GAAP adjustment above re-aggregates the expense in OG&A - as it was historically presented prior to the ASU 2017-07 (with no impact to net income or earnings per share). (2) Utility Margin is a non-GAAP Measure. See the slide titled “Reconciling Gross Margin to Utility Margin” for additional disclosures. Third Quarter 2024 Non-GAAP Earnings 11 Note: Subtotal variances may exist due to rounding.

Credit, Cash Flow, and Financing Plans 12 Credit Ratings 2024 Financing Plan No equity expected to fund the current 5-year | $2.5 billion capital plan Financing plans (targeting a FFO to Debt ratio > 14%) are expected to maintain our current credit ratings. We expect to pay minimal cash taxes into 2028 due to utilization of our NOL’s and tax credits. Financing plans are subject to change.

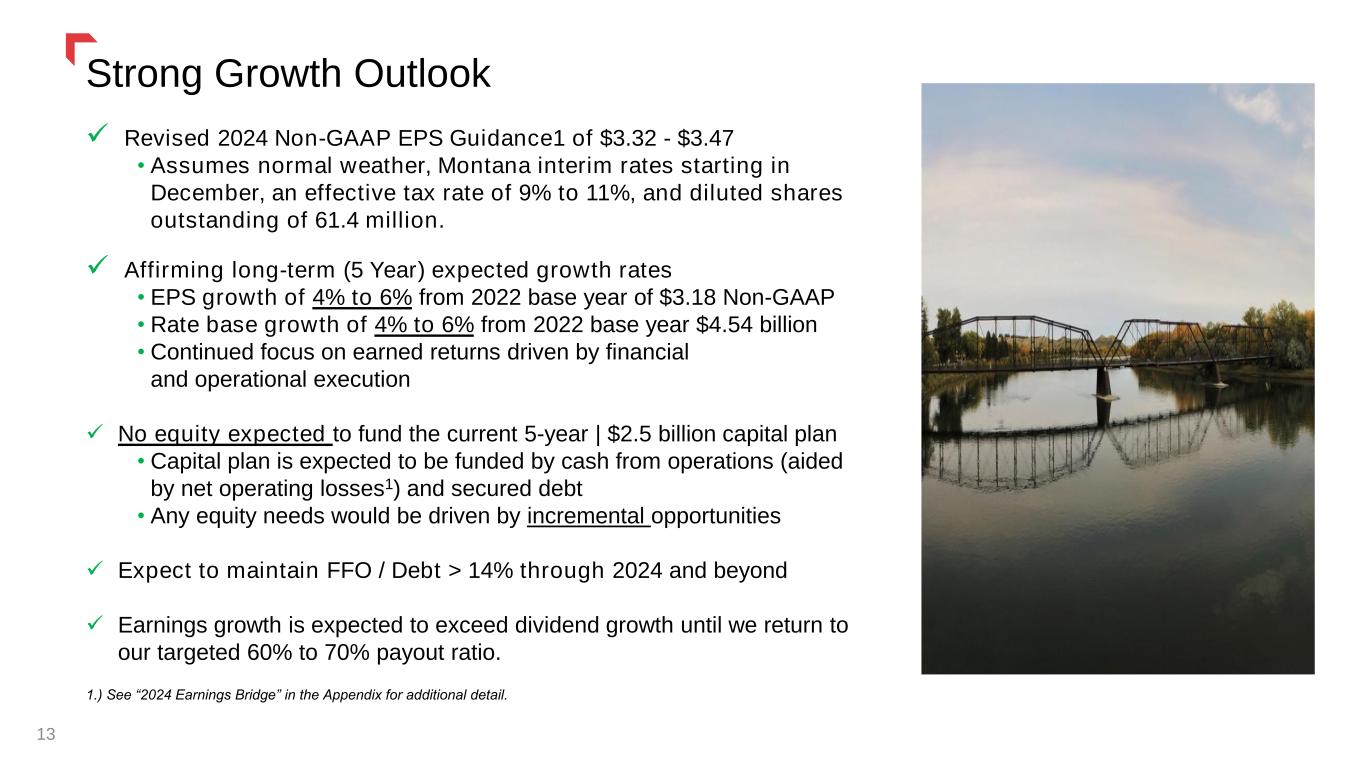

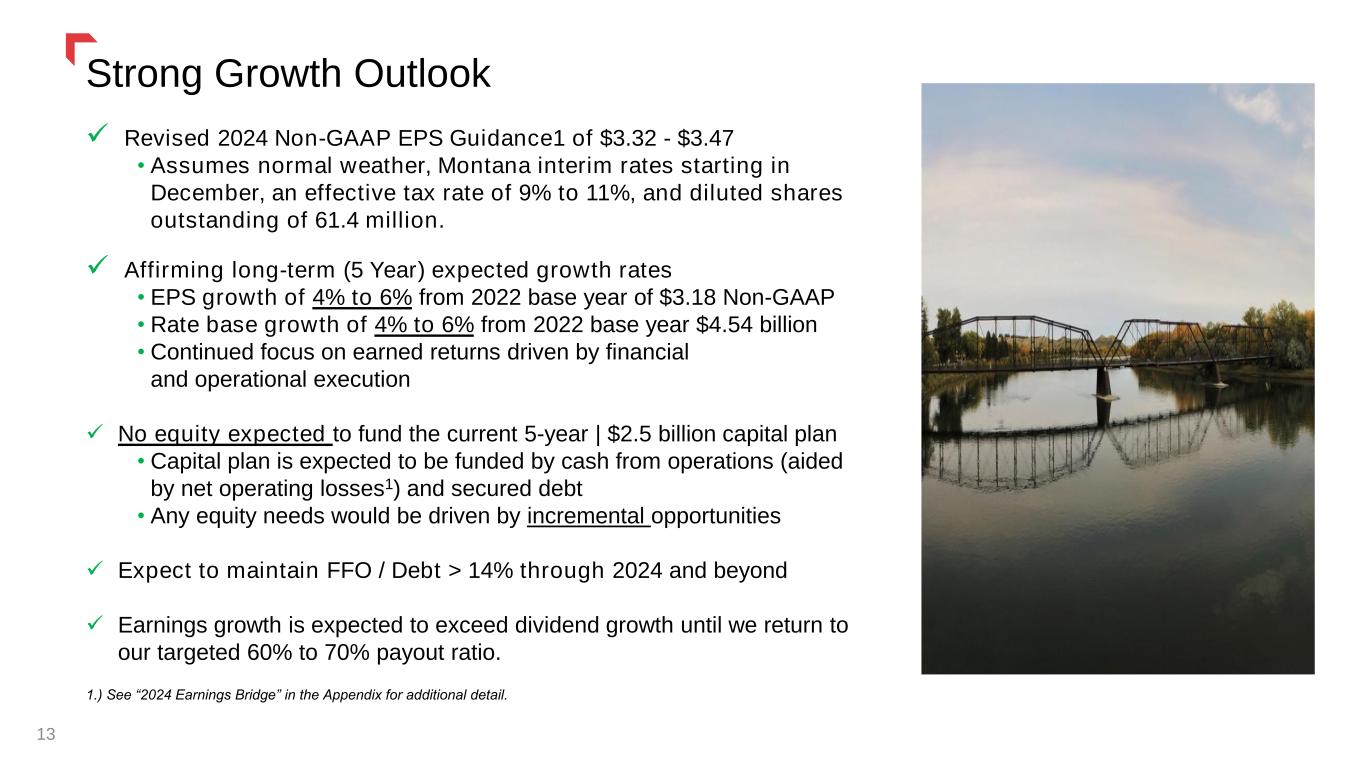

Strong Growth Outlook Revised 2024 Non-GAAP EPS Guidance1 of $3.32 - $3.47 • Assumes normal weather, Montana interim rates starting in December, an effective tax rate of 9% to 11%, and diluted shares outstanding of 61.4 million. Affirming long-term (5 Year) expected growth rates • EPS growth of 4% to 6% from 2022 base year of $3.18 Non-GAAP • Rate base growth of 4% to 6% from 2022 base year $4.54 billion • Continued focus on earned returns driven by financial and operational execution No equity expected to fund the current 5-year | $2.5 billion capital plan • Capital plan is expected to be funded by cash from operations (aided by net operating losses1) and secured debt • Any equity needs would be driven by incremental opportunities Expect to maintain FFO / Debt > 14% through 2024 and beyond Earnings growth is expected to exceed dividend growth until we return to our targeted 60% to 70% payout ratio. 13 1.) See “2024 Earnings Bridge” in the Appendix for additional detail.

Thank youRate Reviews 14

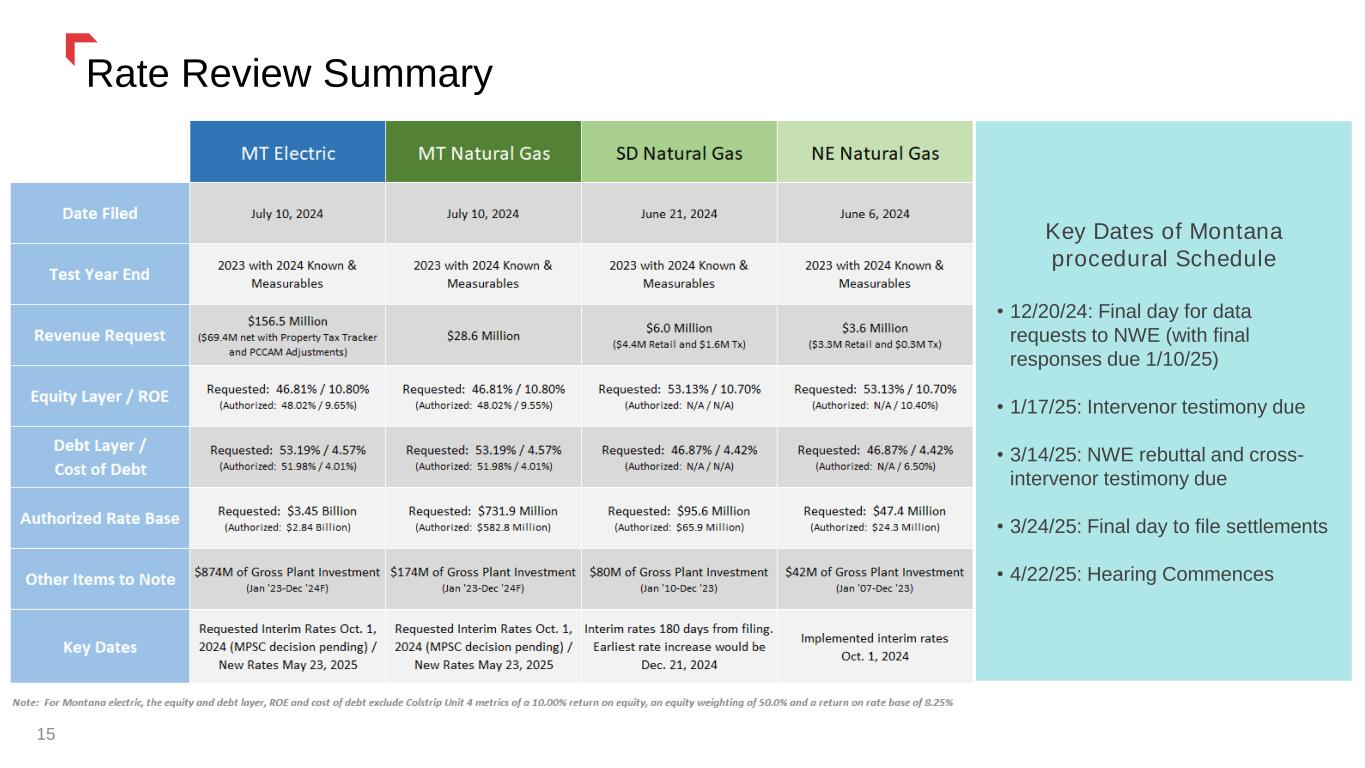

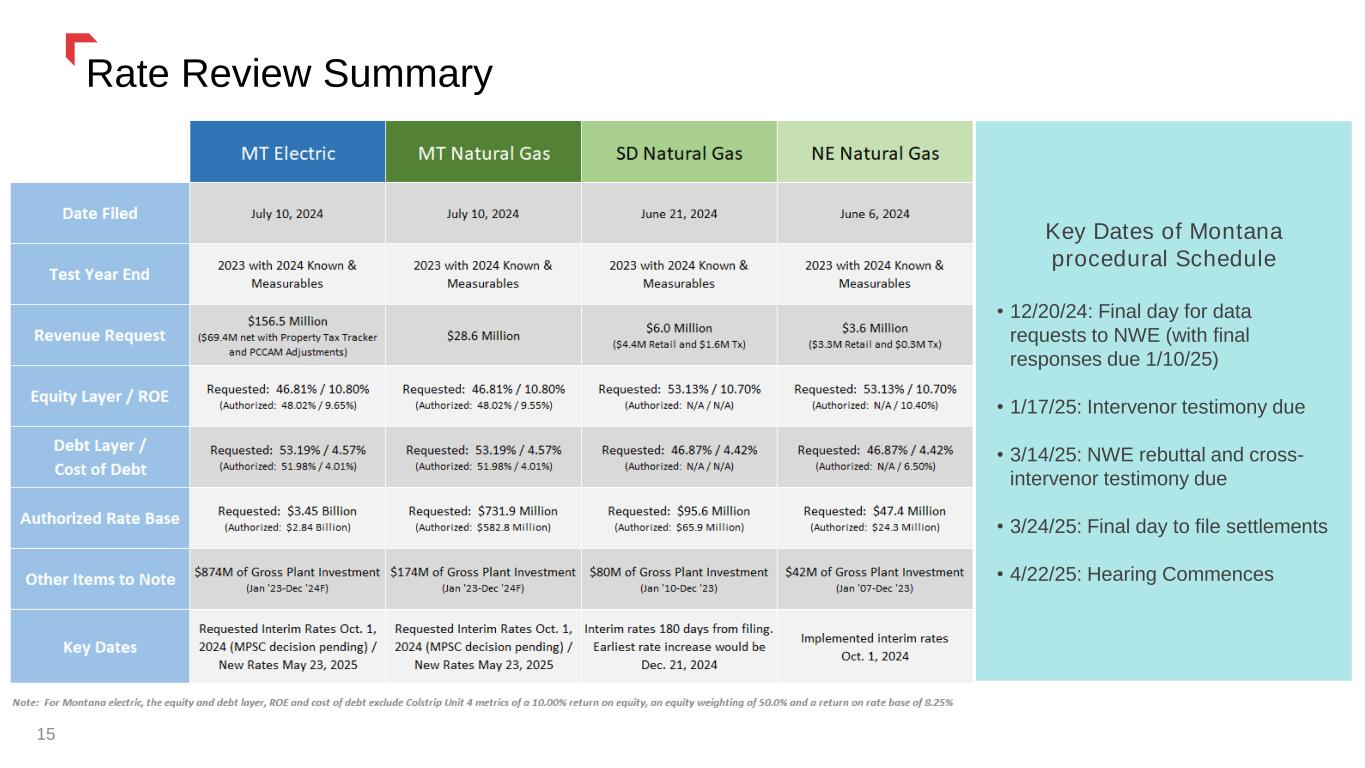

15 Rate Review Summary Key Dates of Montana procedural Schedule • 12/20/24: Final day for data requests to NWE (with final responses due 1/10/25) • 1/17/25: Intervenor testimony due • 3/14/25: NWE rebuttal and cross- intervenor testimony due • 3/24/25: Final day to file settlements • 4/22/25: Hearing Commences

Conclusion Pure Electric & Gas Utility Solid Utility Foundation Best Practices Corporate Governance Attractive Future Growth Prospects Strong Earnings & Cash Flows 16 NorthWestern Energy Group, Inc. dba: NorthWestern Energy Ticker: NWE (Nasdaq) www.northwesternenergy.com Corporate Support Office 3010 West 69th Street Sioux Falls, SD 57108 (605) 978-2900 Investor Relations Officer Travis Meyer 605-978-2967 travis.meyer@northwestern.com

Thank youAppendix: 17

2024 Earnings Bridge Revising 2024 Non-GAAP EPS guidance in light of delay in Montana interim rates This guidance range is based upon, but not limited to, the following major assumptions: • Normal weather in our service territories; • Interim rates in Montana in December 2024 • An effective income tax rate of approximately 9%- 11%; and • Diluted average shares outstanding of approximately 61.4 million. 18 Appendix

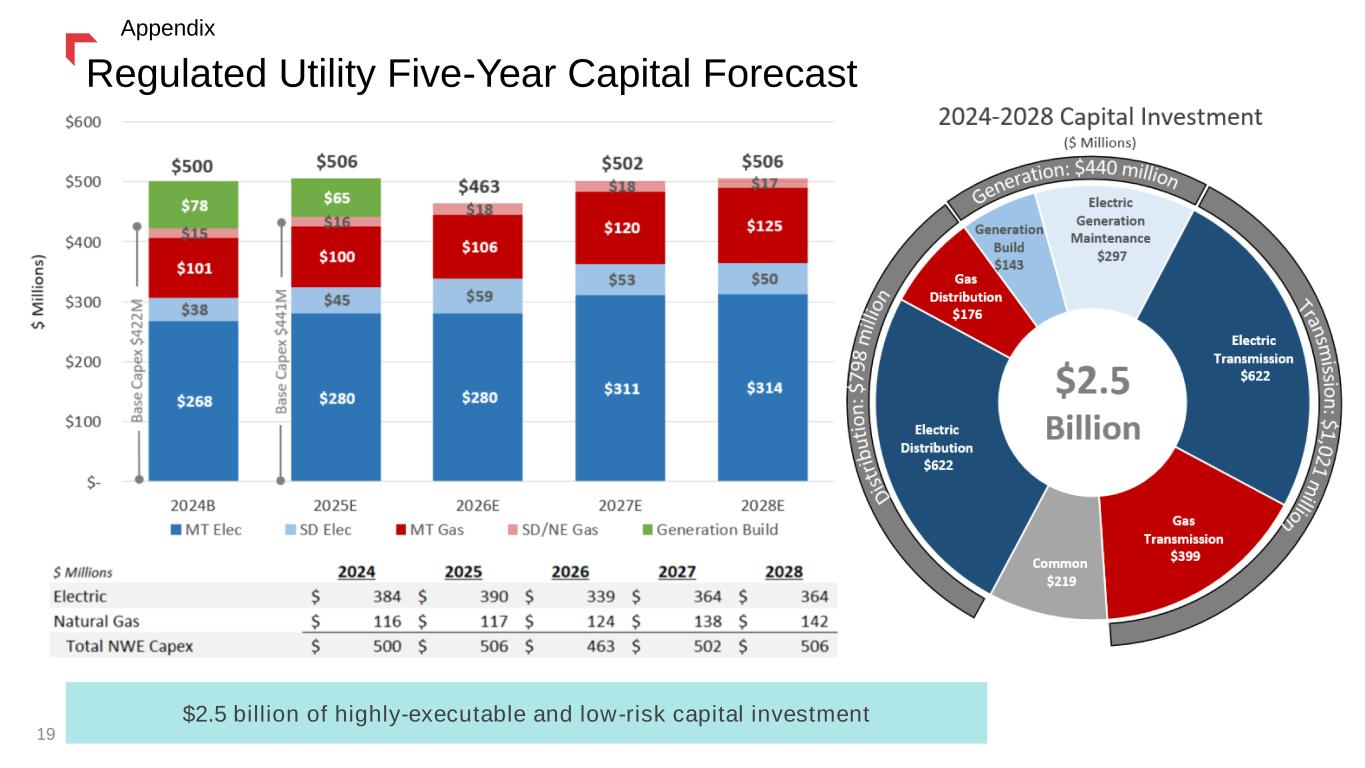

$2.5 billion of highly-executable and low-risk capital investment Regulated Utility Five-Year Capital Forecast 19 Appendix

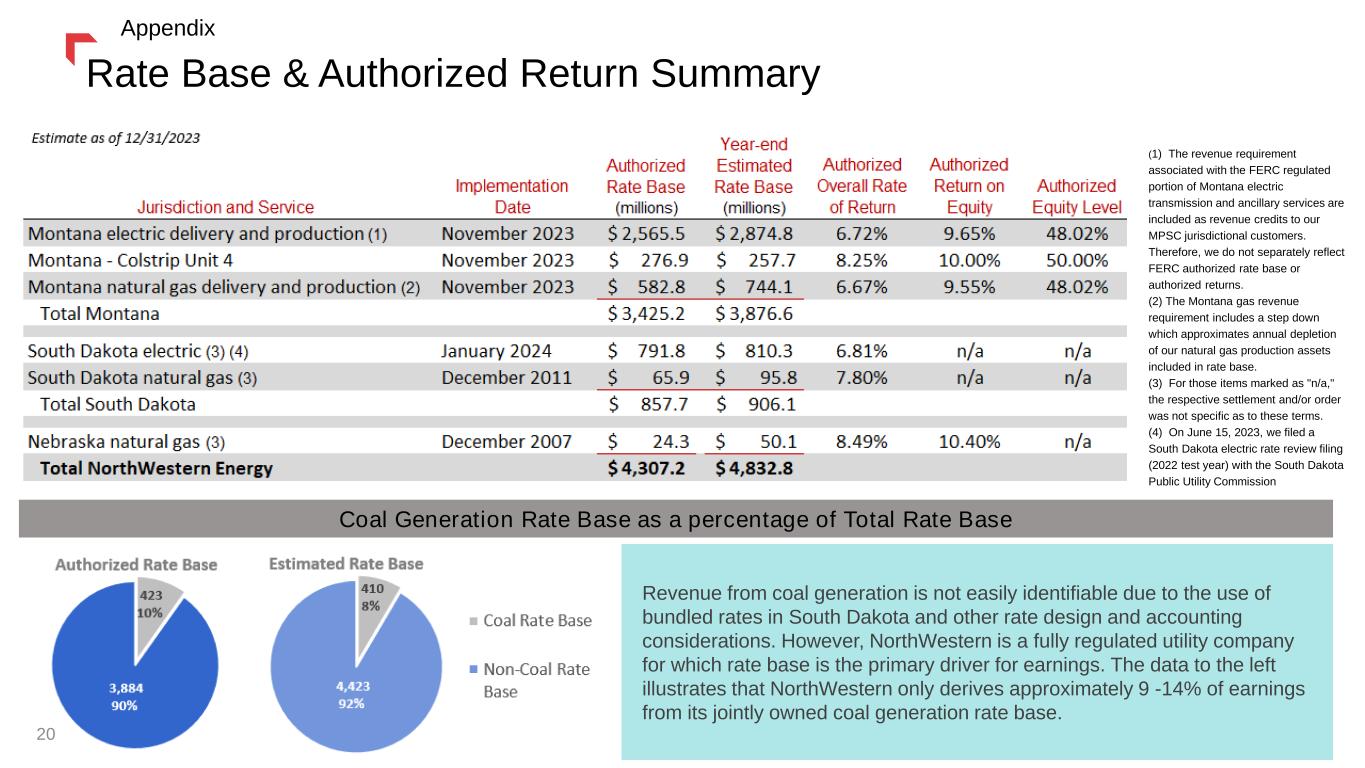

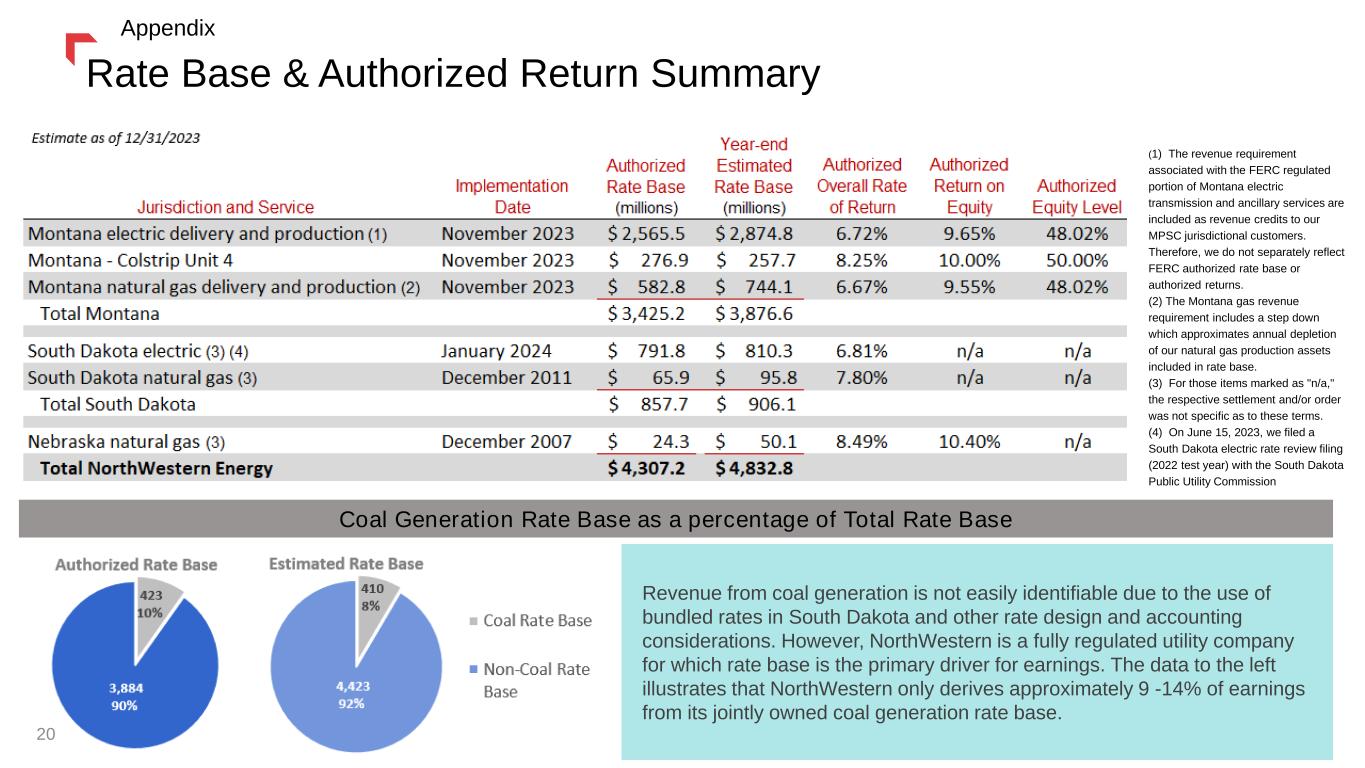

(1) The revenue requirement associated with the FERC regulated portion of Montana electric transmission and ancillary services are included as revenue credits to our MPSC jurisdictional customers. Therefore, we do not separately reflect FERC authorized rate base or authorized returns. (2) The Montana gas revenue requirement includes a step down which approximates annual depletion of our natural gas production assets included in rate base. (3) For those items marked as "n/a," the respective settlement and/or order was not specific as to these terms. (4) On June 15, 2023, we filed a South Dakota electric rate review filing (2022 test year) with the South Dakota Public Utility Commission Coal Generation Rate Base as a percentage of Total Rate Base Revenue from coal generation is not easily identifiable due to the use of bundled rates in South Dakota and other rate design and accounting considerations. However, NorthWestern is a fully regulated utility company for which rate base is the primary driver for earnings. The data to the left illustrates that NorthWestern only derives approximately 9 -14% of earnings from its jointly owned coal generation rate base. Rate Base & Authorized Return Summary Appendix 20

Thank youThird Quarter Appendix 21

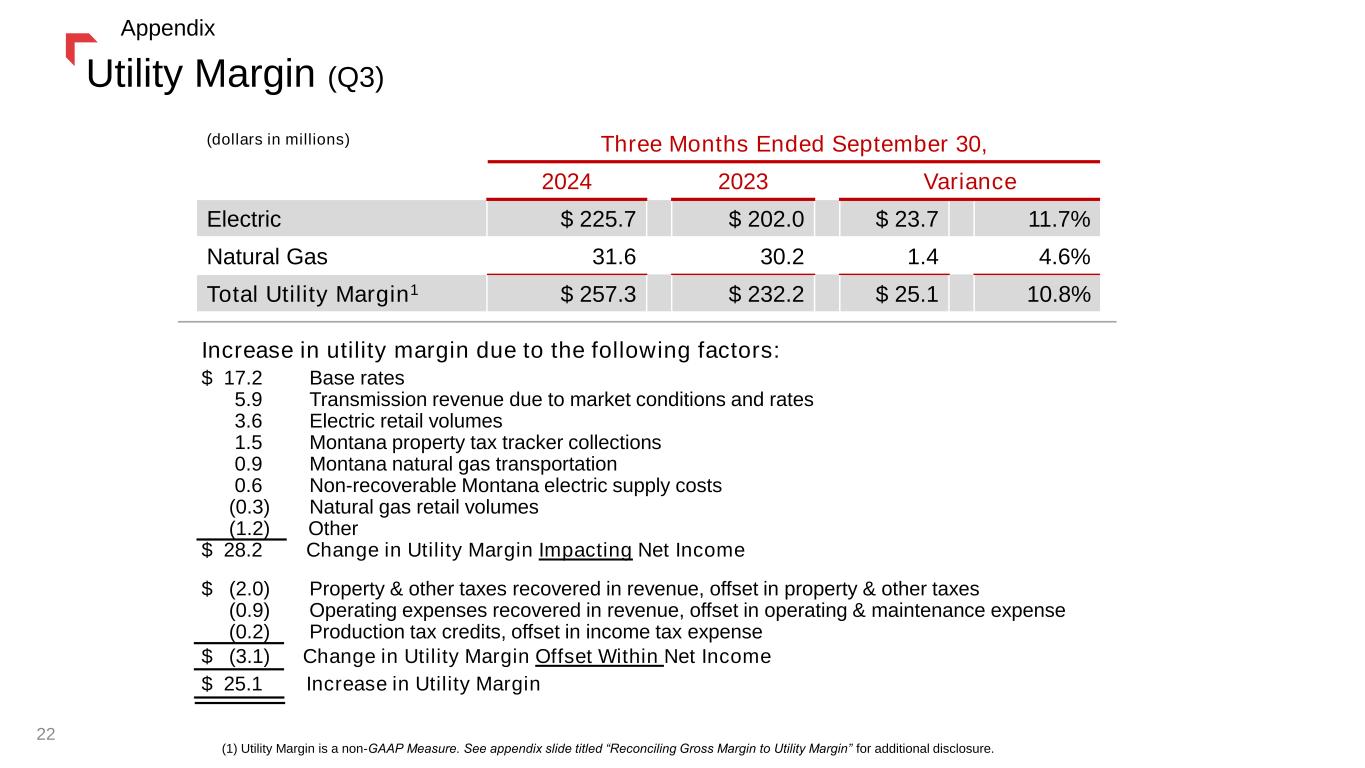

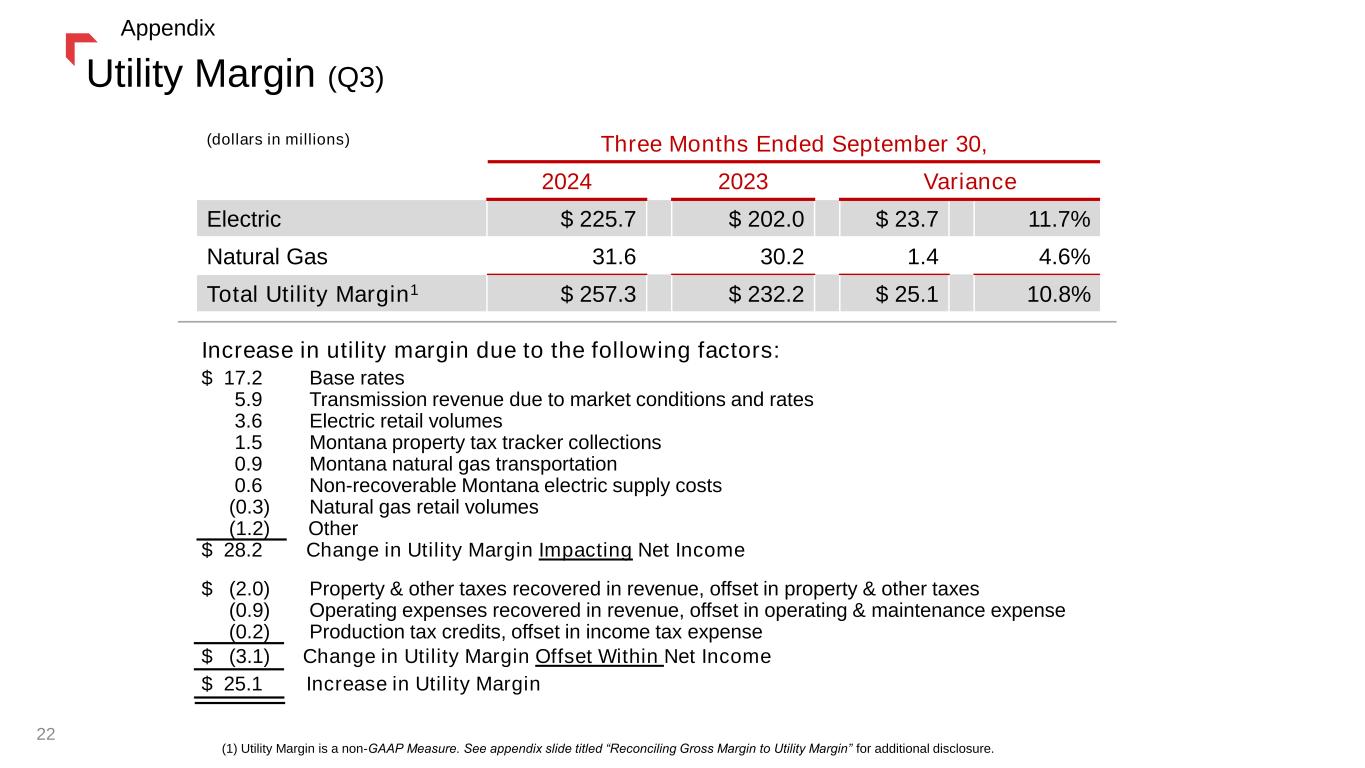

Utility Margin (Q3) (dollars in millions) Three Months Ended September 30, 2024 2023 Variance Electric $ 225.7 $ 202.0 $ 23.7 11.7% Natural Gas 31.6 30.2 1.4 4.6% Total Utility Margin1 $ 257.3 $ 232.2 $ 25.1 10.8% (1) Utility Margin is a non-GAAP Measure. See appendix slide titled “Reconciling Gross Margin to Utility Margin” for additional disclosure. Increase in utility margin due to the following factors: $ 17.2 Base rates 5.9 Transmission revenue due to market conditions and rates 3.6 Electric retail volumes 1.5 Montana property tax tracker collections 0.9 Montana natural gas transportation 0.6 Non-recoverable Montana electric supply costs (0.3) Natural gas retail volumes (1.2) Other $ 28.2 Change in Utility Margin Impacting Net Income $ (2.0) Property & other taxes recovered in revenue, offset in property & other taxes (0.9) Operating expenses recovered in revenue, offset in operating & maintenance expense (0.2) Production tax credits, offset in income tax expense $ (3.1) Change in Utility Margin Offset Within Net Income $ 25.1 Increase in Utility Margin 22 Appendix

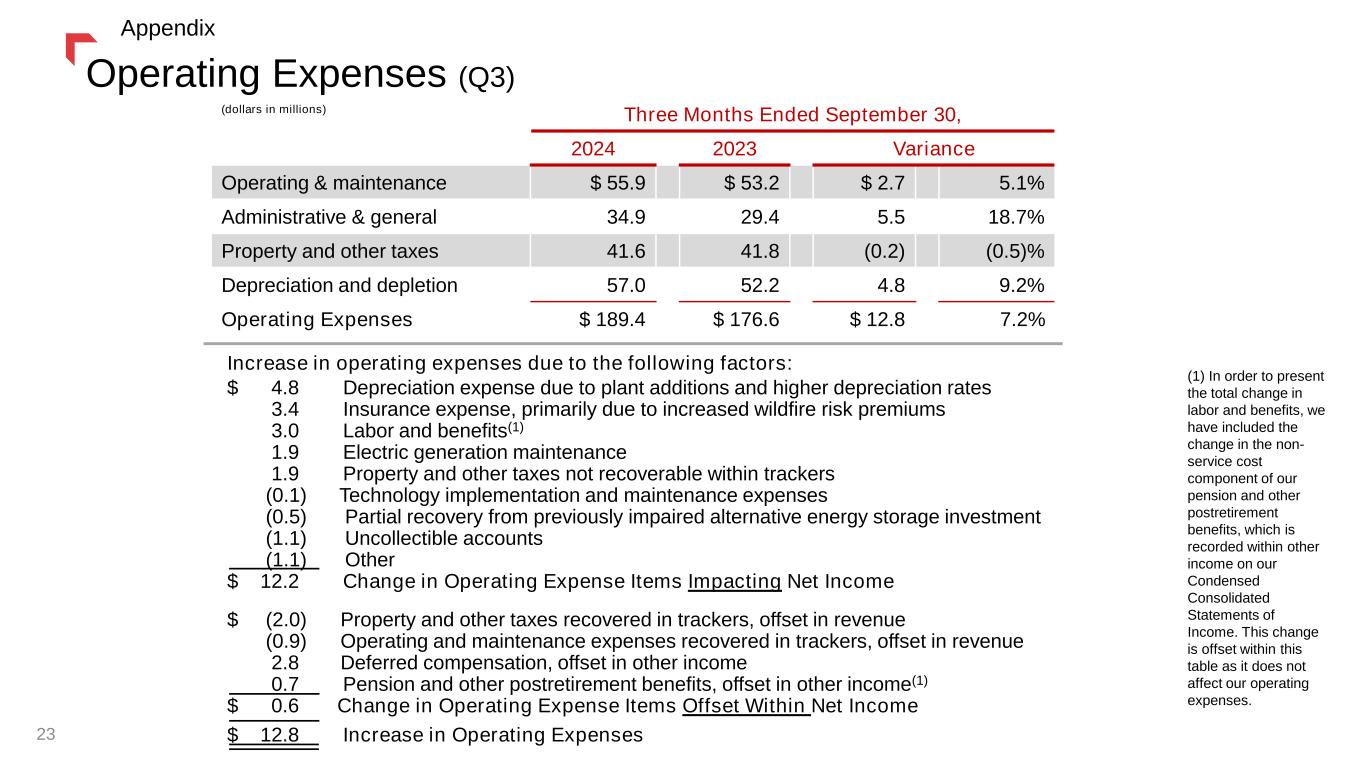

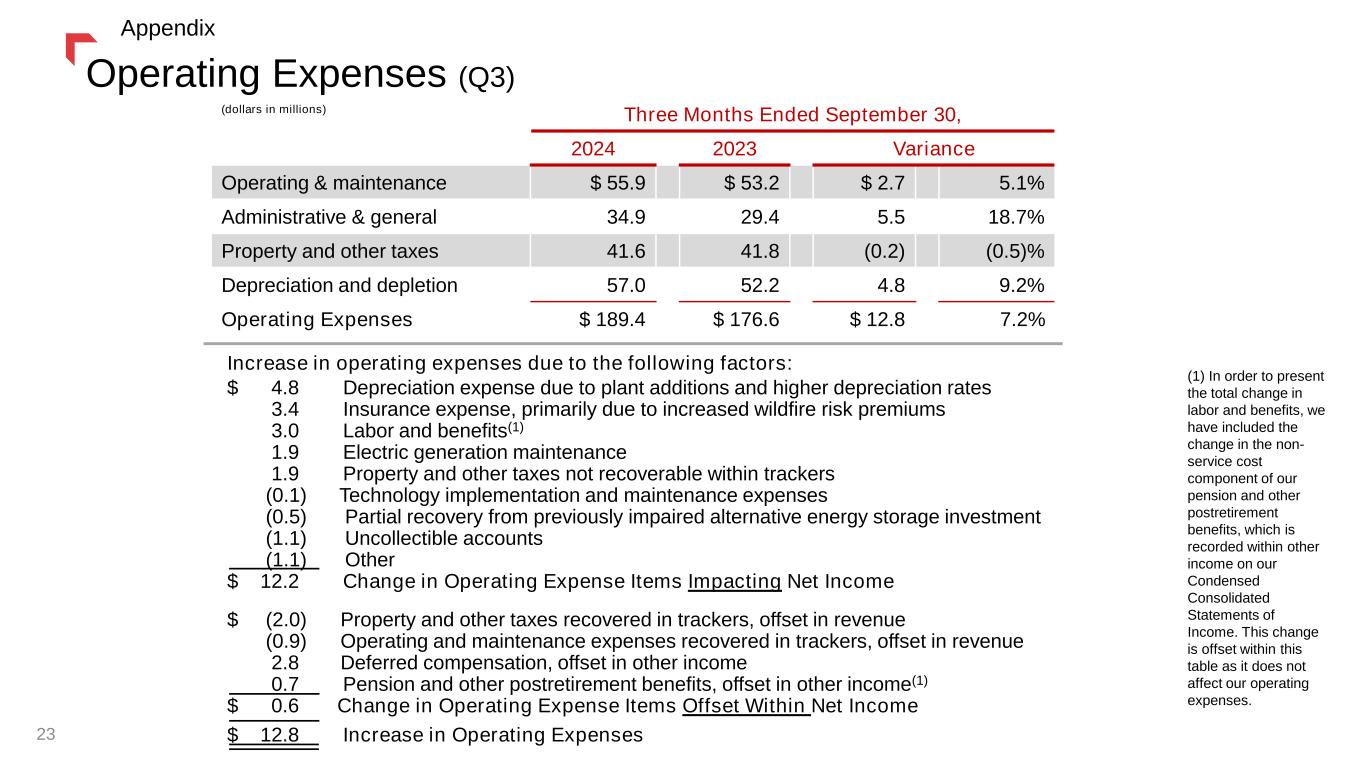

Operating Expenses (Q3) Increase in operating expenses due to the following factors: $ 4.8 Depreciation expense due to plant additions and higher depreciation rates 3.4 Insurance expense, primarily due to increased wildfire risk premiums 3.0 Labor and benefits(1) 1.9 Electric generation maintenance 1.9 Property and other taxes not recoverable within trackers (0.1) Technology implementation and maintenance expenses (0.5) Partial recovery from previously impaired alternative energy storage investment (1.1) Uncollectible accounts (1.1) Other $ 12.2 Change in Operating Expense Items Impacting Net Income (dollars in millions) Three Months Ended September 30, 2024 2023 Variance Operating & maintenance $ 55.9 $ 53.2 $ 2.7 5.1% Administrative & general 34.9 29.4 5.5 18.7% Property and other taxes 41.6 41.8 (0.2) (0.5)% Depreciation and depletion 57.0 52.2 4.8 9.2% Operating Expenses $ 189.4 $ 176.6 $ 12.8 7.2% $ (2.0) Property and other taxes recovered in trackers, offset in revenue (0.9) Operating and maintenance expenses recovered in trackers, offset in revenue 2.8 Deferred compensation, offset in other income 0.7 Pension and other postretirement benefits, offset in other income(1) $ 0.6 Change in Operating Expense Items Offset Within Net Income $ 12.8 Increase in Operating Expenses (1) In order to present the total change in labor and benefits, we have included the change in the non- service cost component of our pension and other postretirement benefits, which is recorded within other income on our Condensed Consolidated Statements of Income. This change is offset within this table as it does not affect our operating expenses. 23 Appendix

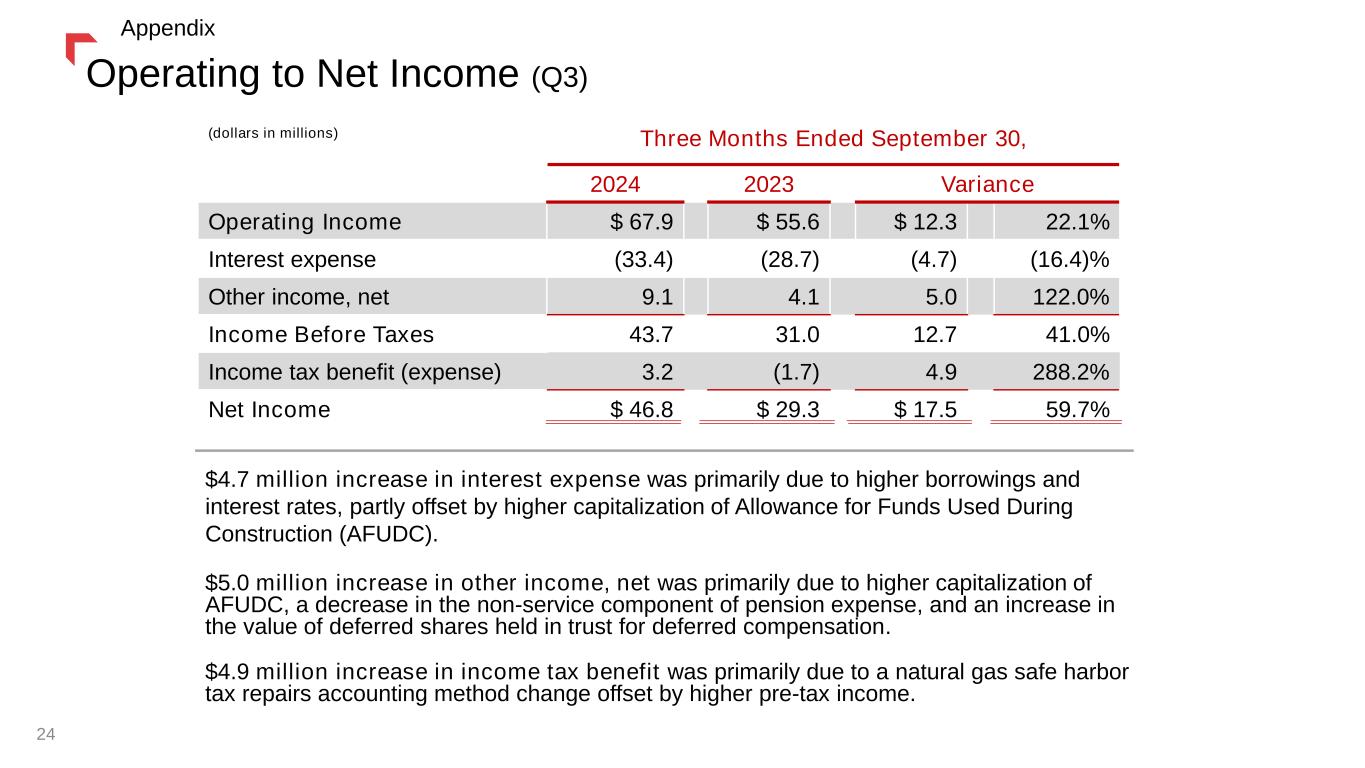

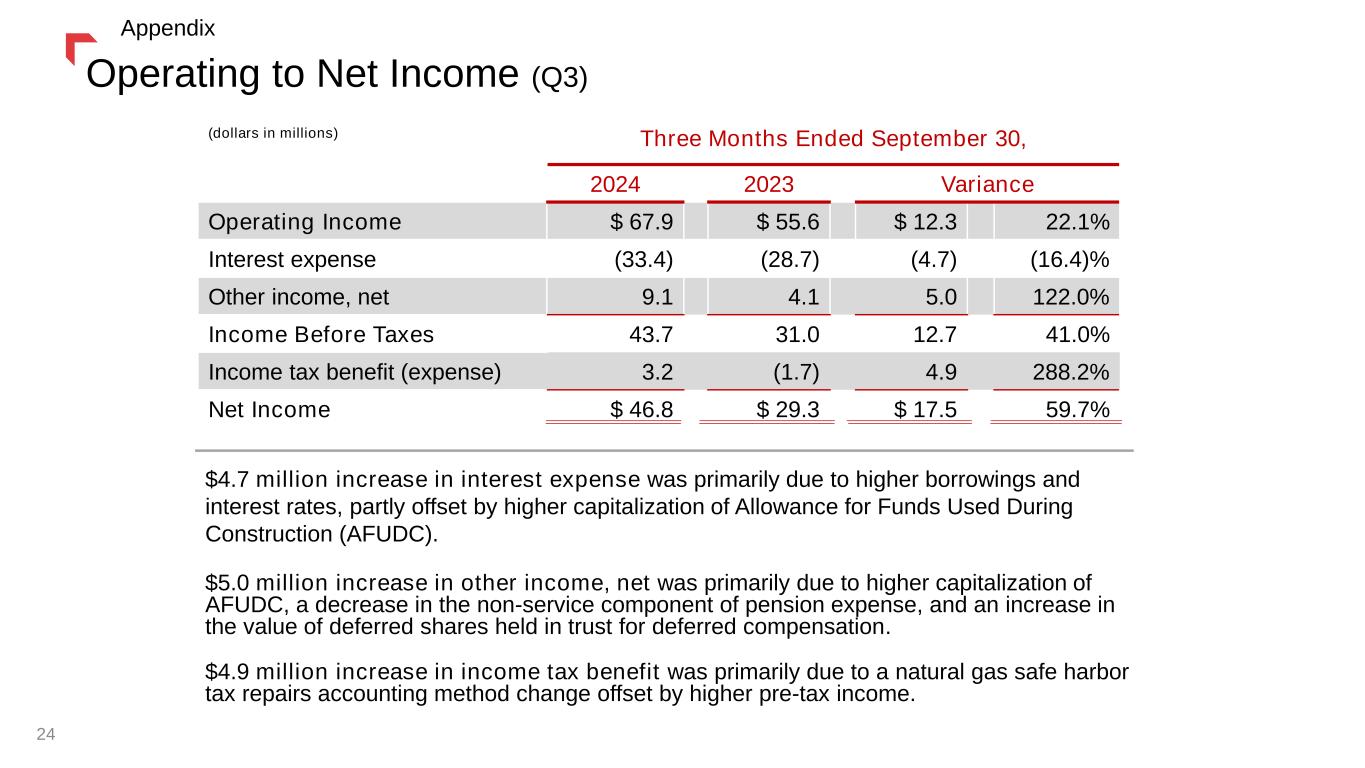

Operating to Net Income (Q3) (dollars in millions) Three Months Ended September 30, 2024 2023 Variance Operating Income $ 67.9 $ 55.6 $ 12.3 22.1% Interest expense (33.4) (28.7) (4.7) (16.4)% Other income, net 9.1 4.1 5.0 122.0% Income Before Taxes 43.7 31.0 12.7 41.0% Income tax benefit (expense) 3.2 (1.7) 4.9 288.2% Net Income $ 46.8 $ 29.3 $ 17.5 59.7% $4.7 million increase in interest expense was primarily due to higher borrowings and interest rates, partly offset by higher capitalization of Allowance for Funds Used During Construction (AFUDC). $5.0 million increase in other income, net was primarily due to higher capitalization of AFUDC, a decrease in the non-service component of pension expense, and an increase in the value of deferred shares held in trust for deferred compensation. $4.9 million increase in income tax benefit was primarily due to a natural gas safe harbor tax repairs accounting method change offset by higher pre-tax income. 24 Appendix

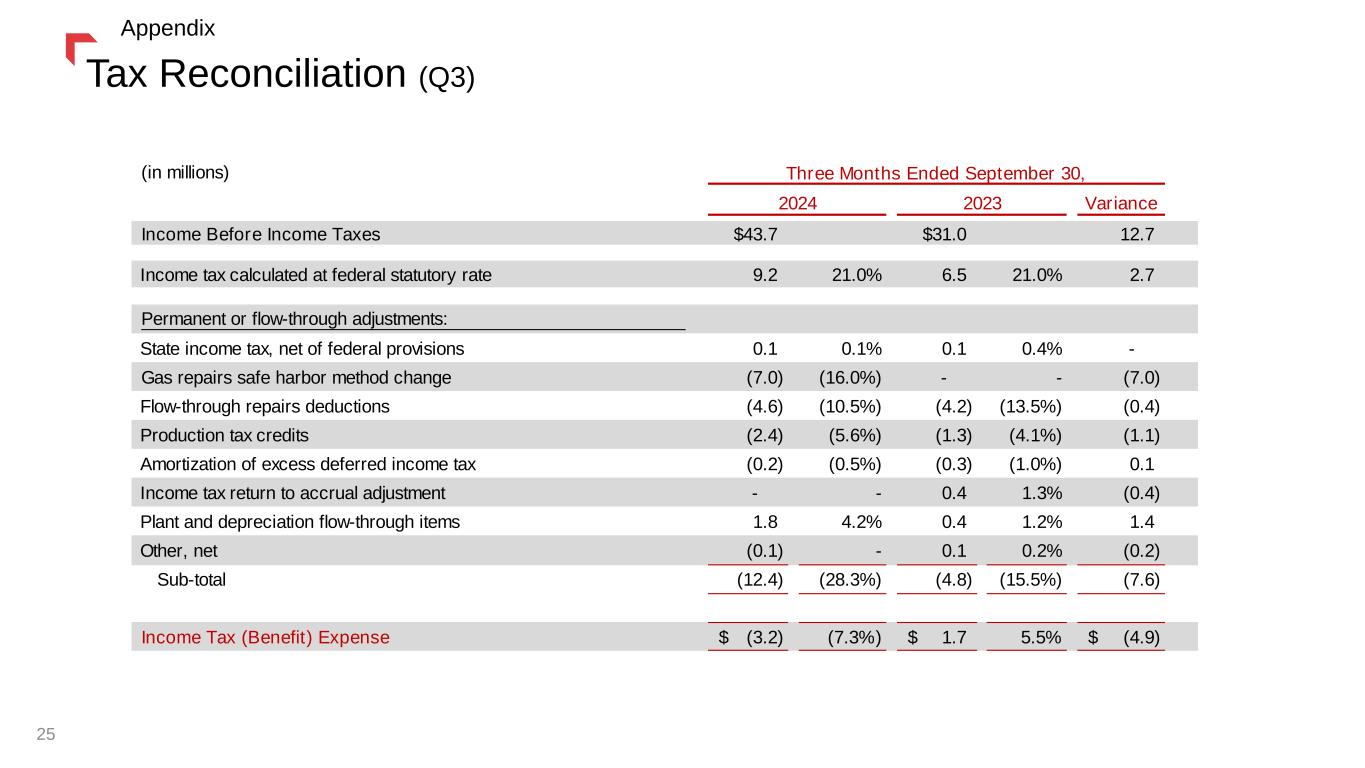

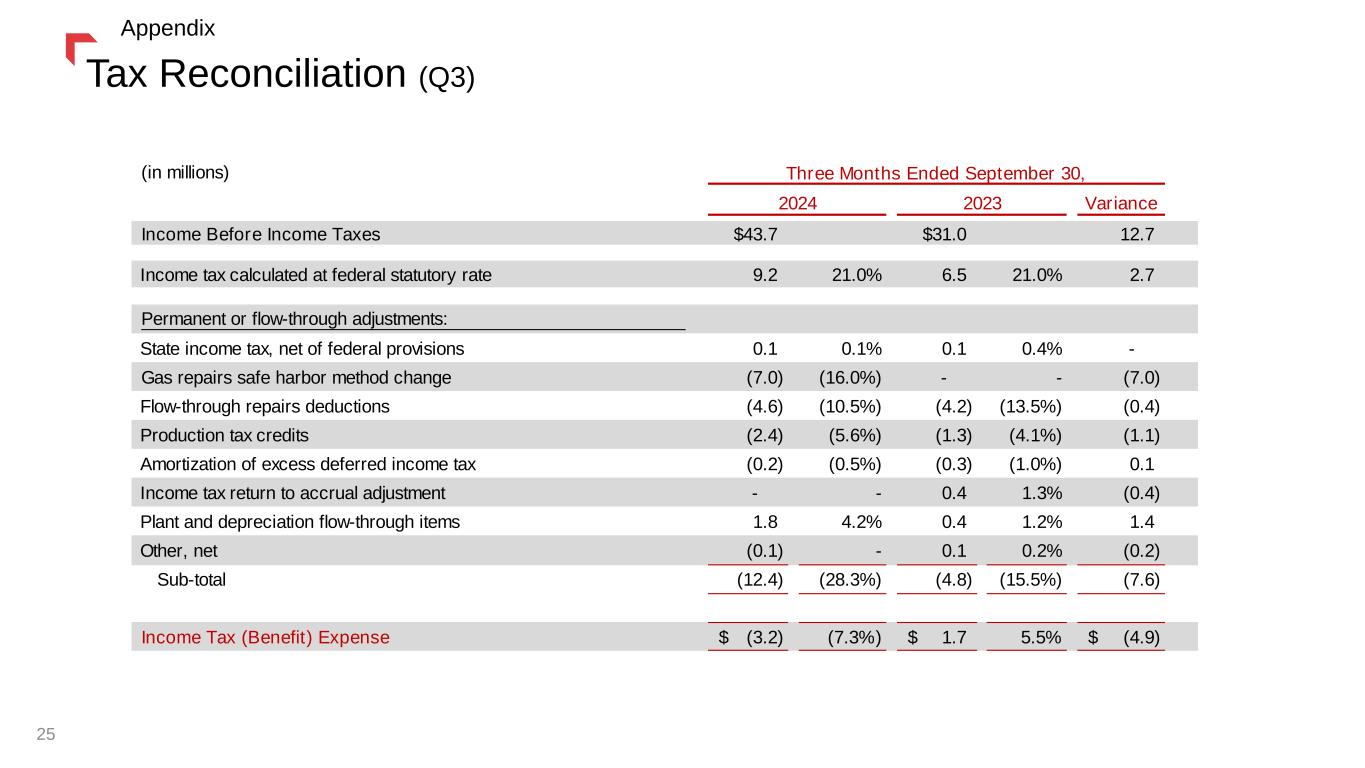

Tax Reconciliation (Q3) 25 Appendix (in millions) Variance Income Before Income Taxes $43.7 $31.0 12.7 Income tax calculated at federal statutory rate 9.2 21.0% 6.5 21.0% 2.7 Permanent or flow-through adjustments: State income tax, net of federal provisions 0.1 0.1% 0.1 0.4% - Gas repairs safe harbor method change (7.0) (16.0%) - - (7.0) Flow-through repairs deductions (4.6) (10.5%) (4.2) (13.5%) (0.4) Production tax credits (2.4) (5.6%) (1.3) (4.1%) (1.1) Amortization of excess deferred income tax (0.2) (0.5%) (0.3) (1.0%) 0.1 Income tax return to accrual adjustment - - 0.4 1.3% (0.4) Plant and depreciation flow-through items 1.8 4.2% 0.4 1.2% 1.4 Other, net (0.1) - 0.1 0.2% (0.2) Sub-total (12.4) (28.3%) (4.8) (15.5%) (7.6) Income Tax (Benefit) Expense (3.2)$ (7.3%) 1.7$ 5.5% (4.9)$ Three Months Ended September 30, 2024 2023

Segment Results (Q3) (1) Utility Margin is a non-GAAP Measure. See appendix slide titled “Reconciling Gross Margin to Utility Margin” for additional disclosure. 26 Appendix Three Months Ended September 30, 2024 Electric Gas Other Total Operating revenues 306,478$ 38,683$ -$ 345,161$ Fuel, purchased supply & direct transmission* 80,761 7,127 - 87,888 Utility margin 225,717 31,556 - 257,273 Operating and maintenance 42,491 13,375 - 55,866 Administrative and general 24,892 9,887 145 34,924 Property and other taxes 32,251 9,345 - 41,596 Depreciation & depletion 47,540 9,414 - 56,954 Operating income (loss) 78,543 (10,465) (145) 67,933 Interest expense (24,188) (7,537) (1,672) (33,397) Other income 6,057 3,017 42 9,116 Income tax (expense) benefit (7,635) 9,734 1,068 3,167 Net income (loss) 52,777$ (5,251)$ (707)$ 46,819$ Three Months Ended September 30, 2023 Electric Gas Other Total Operating revenues 280,030$ 41,060$ -$ 321,090$ Fuel, purchased supply & direct transmission* 77,995 10,948 - 88,943 Utility margin 202,035 30,112 - 232,147 Operating and maintenance 39,990 13,250 - 53,240 Administrative and general 20,682 8,249 424 29,355 Property and other taxes 33,740 9,574 (1,551) 41,763 Depreciation & depletion 43,230 8,929 - 52,159 Operating income (loss) 64,393 (9,890) 1,127 55,630 Interest expense (21,300) (4,426) (2,999) (28,725) Other income (expense) 3,380 1,328 (581) 4,127 Income tax (expense) benefit (3,223) (41) 1,567 (1,697) Net income (loss) 43,250$ (13,029)$ (886)$ 29,335$ * Direct Transmission expense excludes depreciation and depletion (in thousands) 1 1

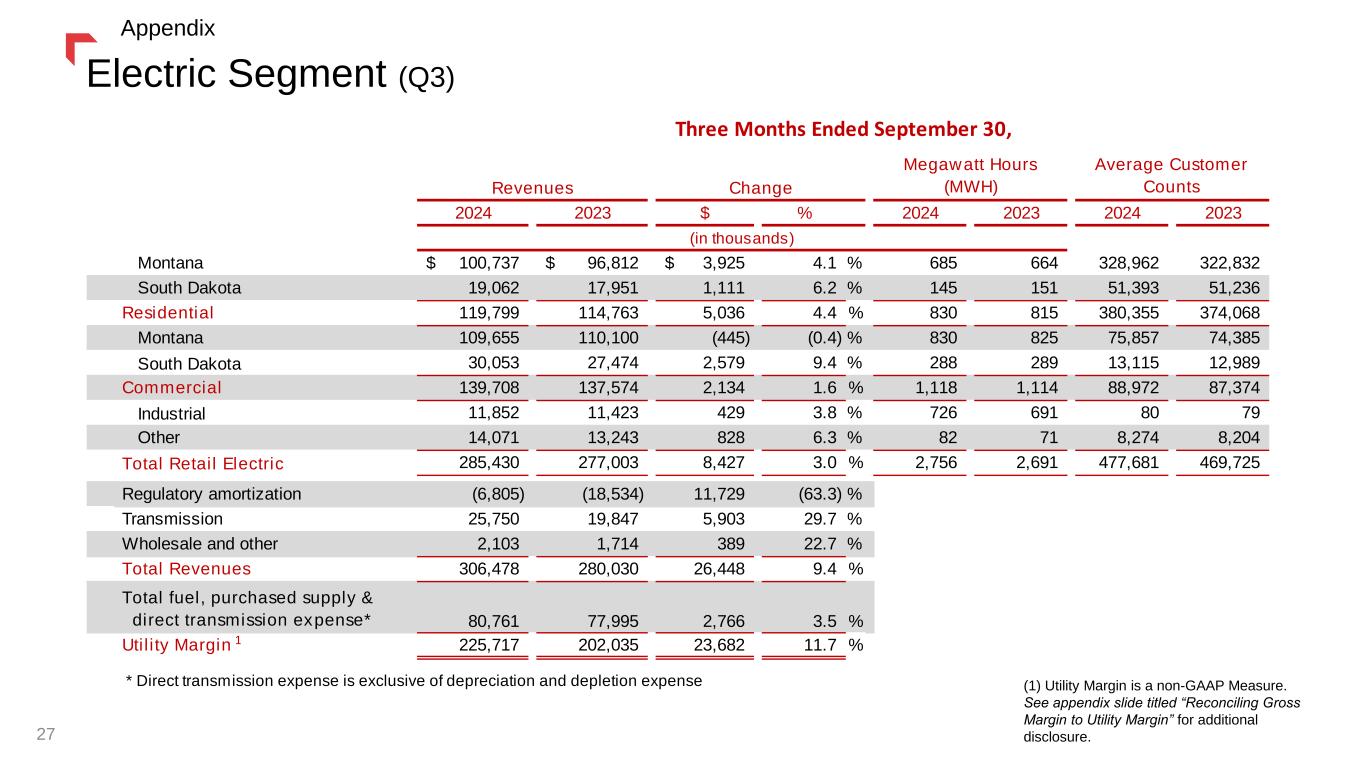

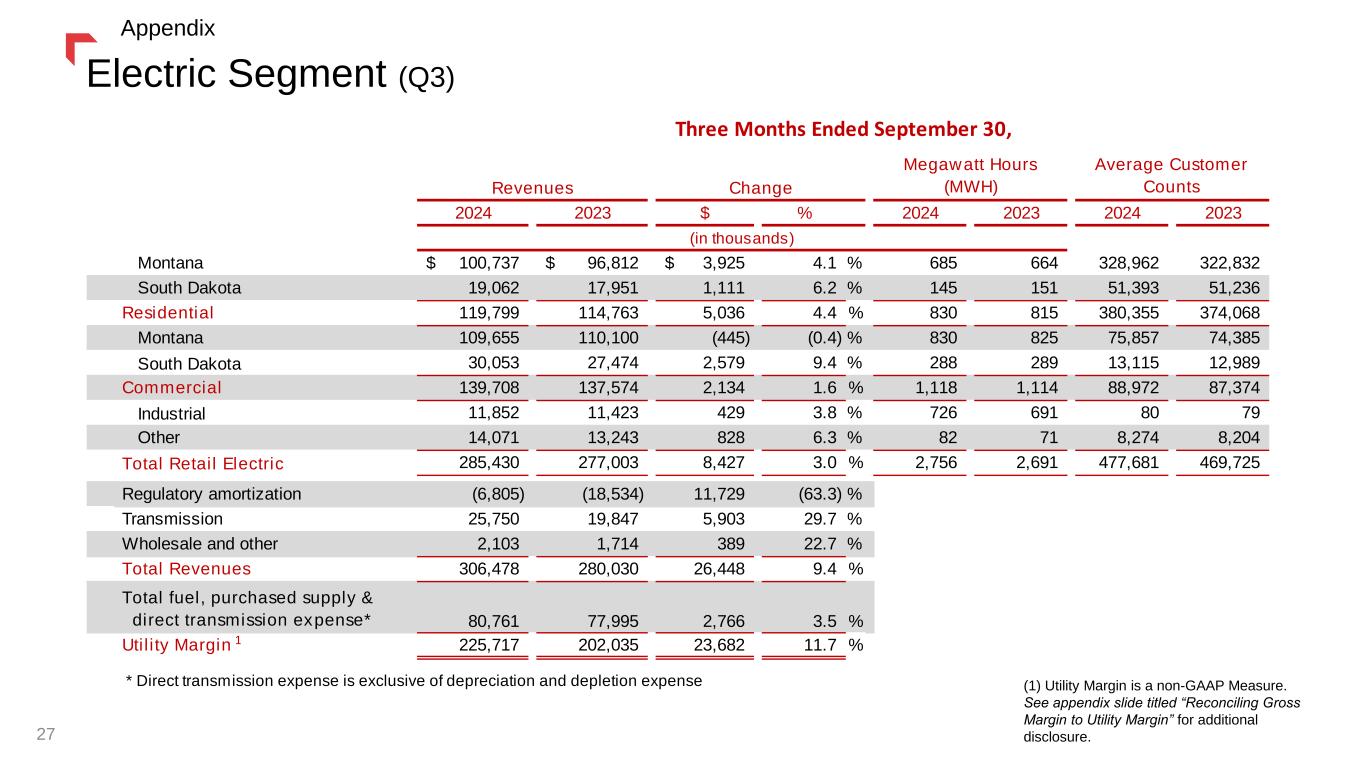

2024 2023 $ % 2024 2023 2024 2023 Montana 100,737$ 96,812$ 3,925$ 4.1 % 685 664 328,962 322,832 South Dakota 19,062 17,951 1,111 6.2 % 145 151 51,393 51,236 Residential 119,799 114,763 5,036 4.4 % 830 815 380,355 374,068 Montana 109,655 110,100 (445) (0.4) % 830 825 75,857 74,385 South Dakota 30,053 27,474 2,579 9.4 % 288 289 13,115 12,989 Commercial 139,708 137,574 2,134 1.6 % 1,118 1,114 88,972 87,374 Industrial 11,852 11,423 429 3.8 % 726 691 80 79 Other 14,071 13,243 828 6.3 % 82 71 8,274 8,204 Total Retail Electric 285,430 277,003 8,427 3.0 % 2,756 2,691 477,681 469,725 Regulatory amortization (6,805) (18,534) 11,729 (63.3) % Transmission 25,750 19,847 5,903 29.7 % Wholesale and other 2,103 1,714 389 22.7 % Total Revenues 306,478 280,030 26,448 9.4 % Total fuel, purchased supply & direct transmission expense* 80,761 77,995 2,766 3.5 % Utility Margin 225,717 202,035 23,682 11.7 % * Direct transmission expense is exclusive of depreciation and depletion expense (in thousands) Megawatt Hours (MWH) Average Customer CountsChange Three Months Ended September 30, Revenues 1 Electric Segment (Q3) (1) Utility Margin is a non-GAAP Measure. See appendix slide titled “Reconciling Gross Margin to Utility Margin” for additional disclosure. 27 Appendix

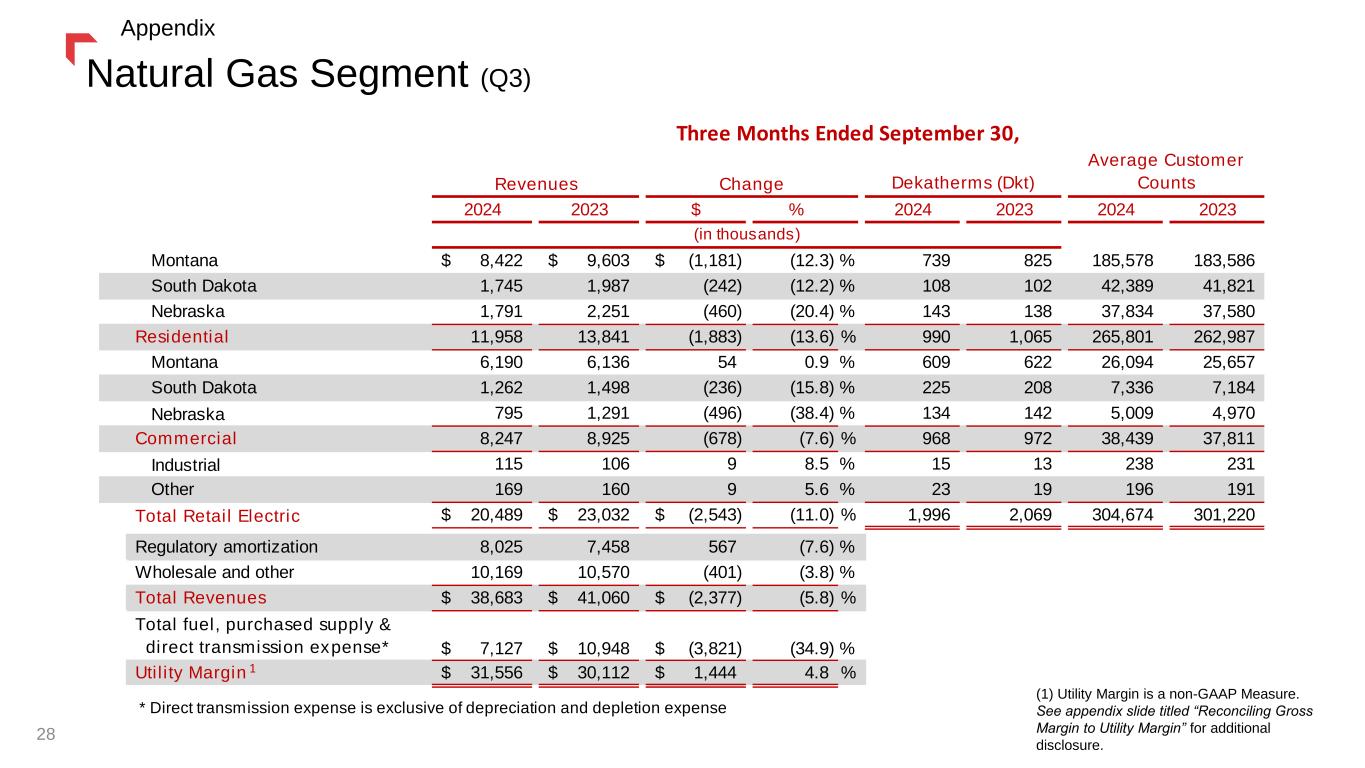

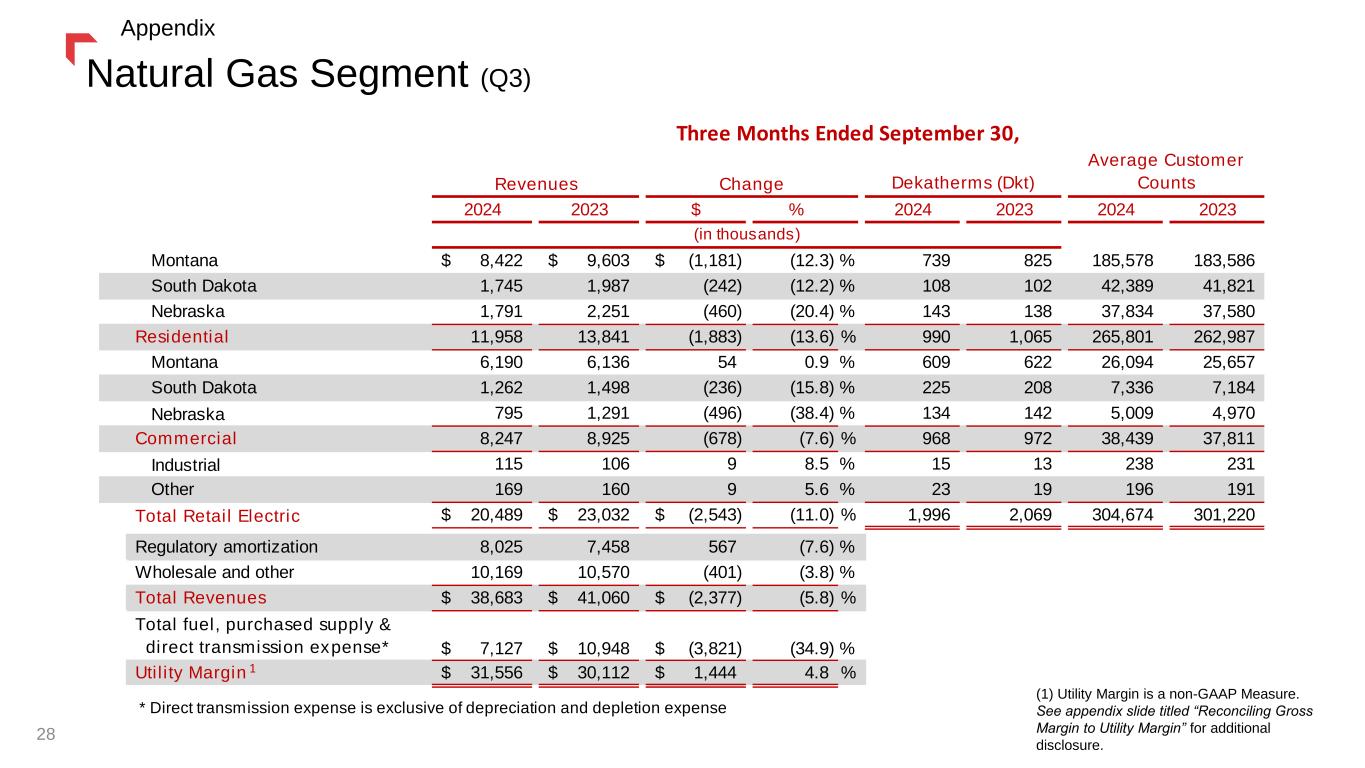

2024 2023 $ % 2024 2023 2024 2023 Montana 8,422$ 9,603$ (1,181)$ (12.3) % 739 825 185,578 183,586 South Dakota 1,745 1,987 (242) (12.2) % 108 102 42,389 41,821 Nebraska 1,791 2,251 (460) (20.4) % 143 138 37,834 37,580 Residential 11,958 13,841 (1,883) (13.6) % 990 1,065 265,801 262,987 Montana 6,190 6,136 54 0.9 % 609 622 26,094 25,657 South Dakota 1,262 1,498 (236) (15.8) % 225 208 7,336 7,184 Nebraska 795 1,291 (496) (38.4) % 134 142 5,009 4,970 Commercial 8,247 8,925 (678) (7.6) % 968 972 38,439 37,811 Industrial 115 106 9 8.5 % 15 13 238 231 Other 169 160 9 5.6 % 23 19 196 191 Total Retail Electric 20,489$ 23,032$ (2,543)$ (11.0) % 1,996 2,069 304,674 301,220 Regulatory amortization 8,025 7,458 567 (7.6) % Wholesale and other 10,169 10,570 (401) (3.8) % Total Revenues 38,683$ 41,060$ (2,377)$ (5.8) % Total fuel, purchased supply & direct transmission expense* 7,127$ 10,948$ (3,821)$ (34.9) % Utility Margin 31,556$ 30,112$ 1,444$ 4.8 % - * Direct transmission expense is exclusive of depreciation and depletion expense Revenues Dekatherms (Dkt) Average Customer CountsChange Three Months Ended September 30, (in thousands) 1 Natural Gas Segment (Q3) 28 Appendix (1) Utility Margin is a non-GAAP Measure. See appendix slide titled “Reconciling Gross Margin to Utility Margin” for additional disclosure.

Thank you2024 Year-to-Date Appendix 29

Year-to-Date Financial Results 30 1.) Utility Margin is a non- GAAP Measure. See appendix slide titled “Reconciling Gross Margin to Utility Margin” for additional disclosure. Note: Subtotal variances may exist due to rounding. Appendix

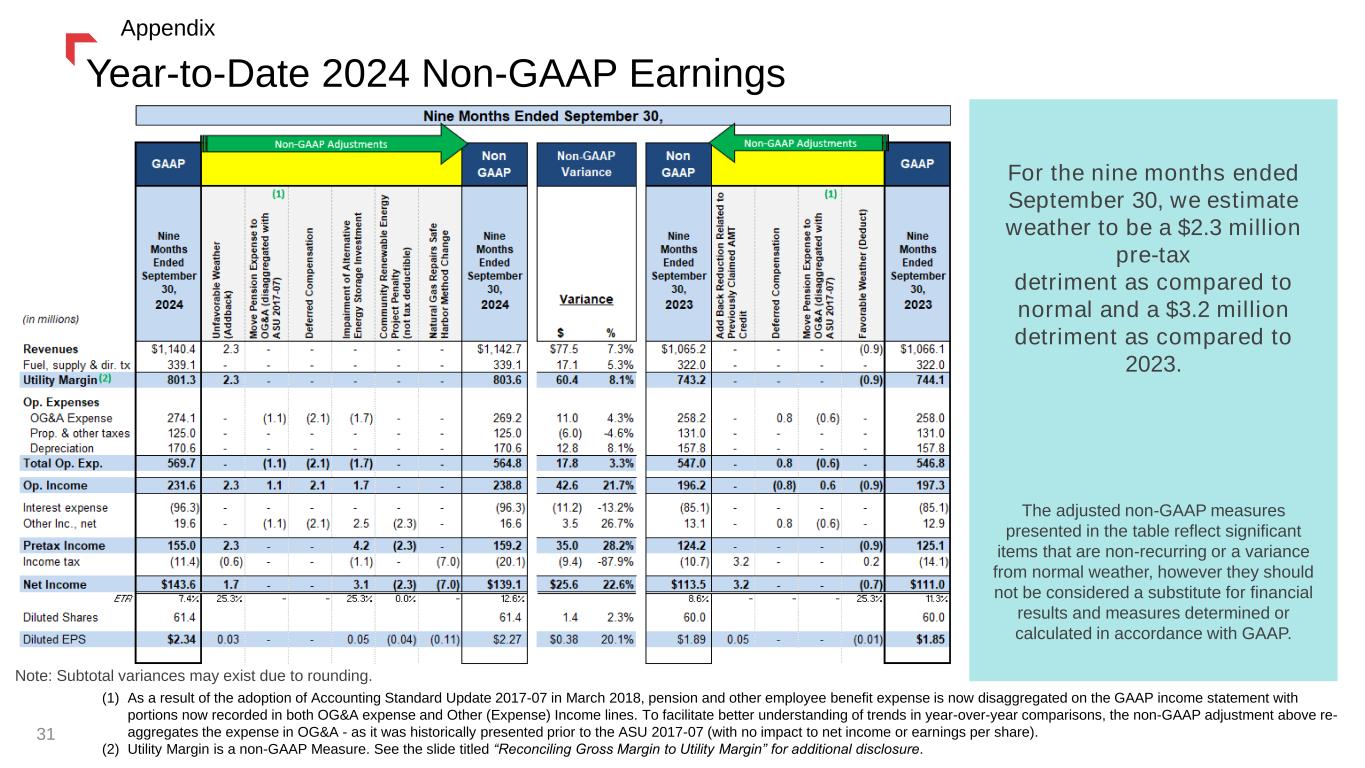

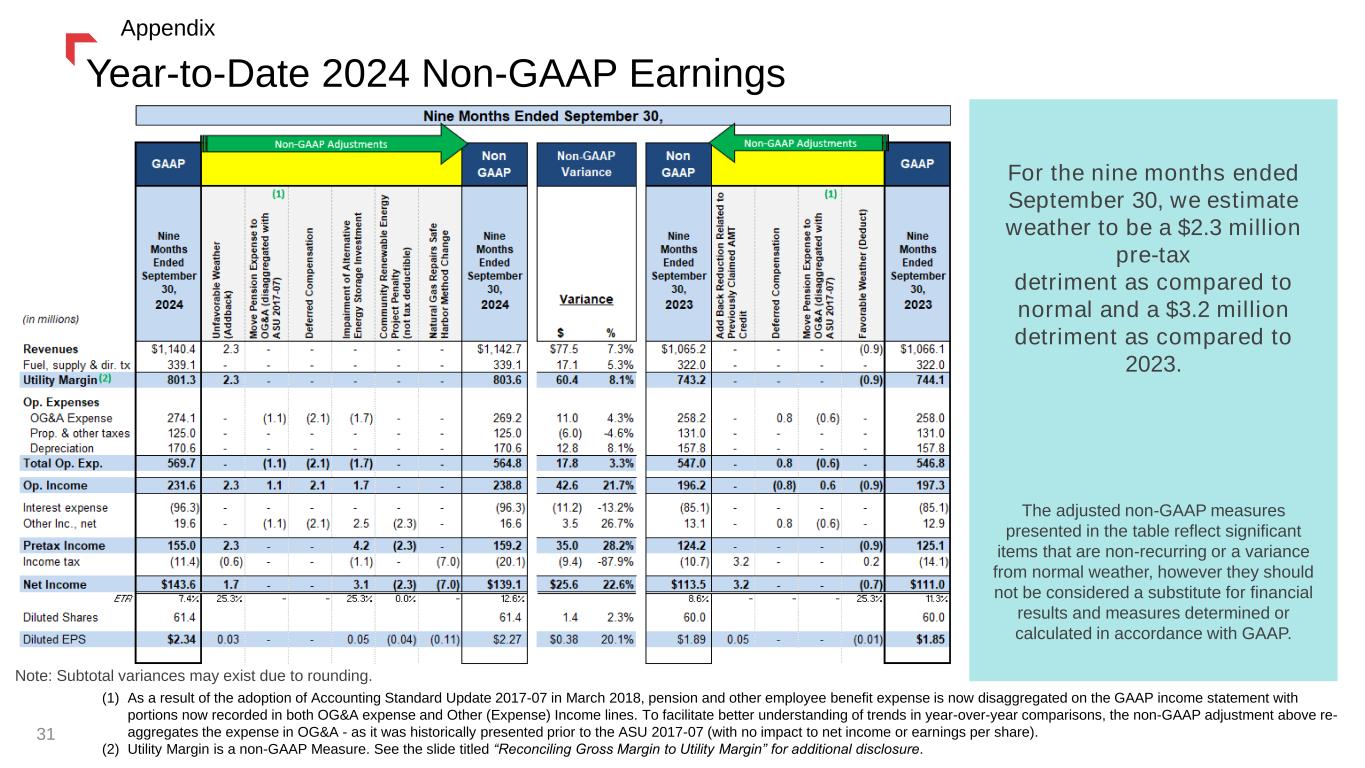

(1) As a result of the adoption of Accounting Standard Update 2017-07 in March 2018, pension and other employee benefit expense is now disaggregated on the GAAP income statement with portions now recorded in both OG&A expense and Other (Expense) Income lines. To facilitate better understanding of trends in year-over-year comparisons, the non-GAAP adjustment above re- aggregates the expense in OG&A - as it was historically presented prior to the ASU 2017-07 (with no impact to net income or earnings per share). (2) Utility Margin is a non-GAAP Measure. See the slide titled “Reconciling Gross Margin to Utility Margin” for additional disclosure. Year-to-Date 2024 Non-GAAP Earnings 31 For the nine months ended September 30, we estimate weather to be a $2.3 million pre-tax detriment as compared to normal and a $3.2 million detriment as compared to 2023. The adjusted non-GAAP measures presented in the table reflect significant items that are non-recurring or a variance from normal weather, however they should not be considered a substitute for financial results and measures determined or calculated in accordance with GAAP. Appendix Note: Subtotal variances may exist due to rounding.

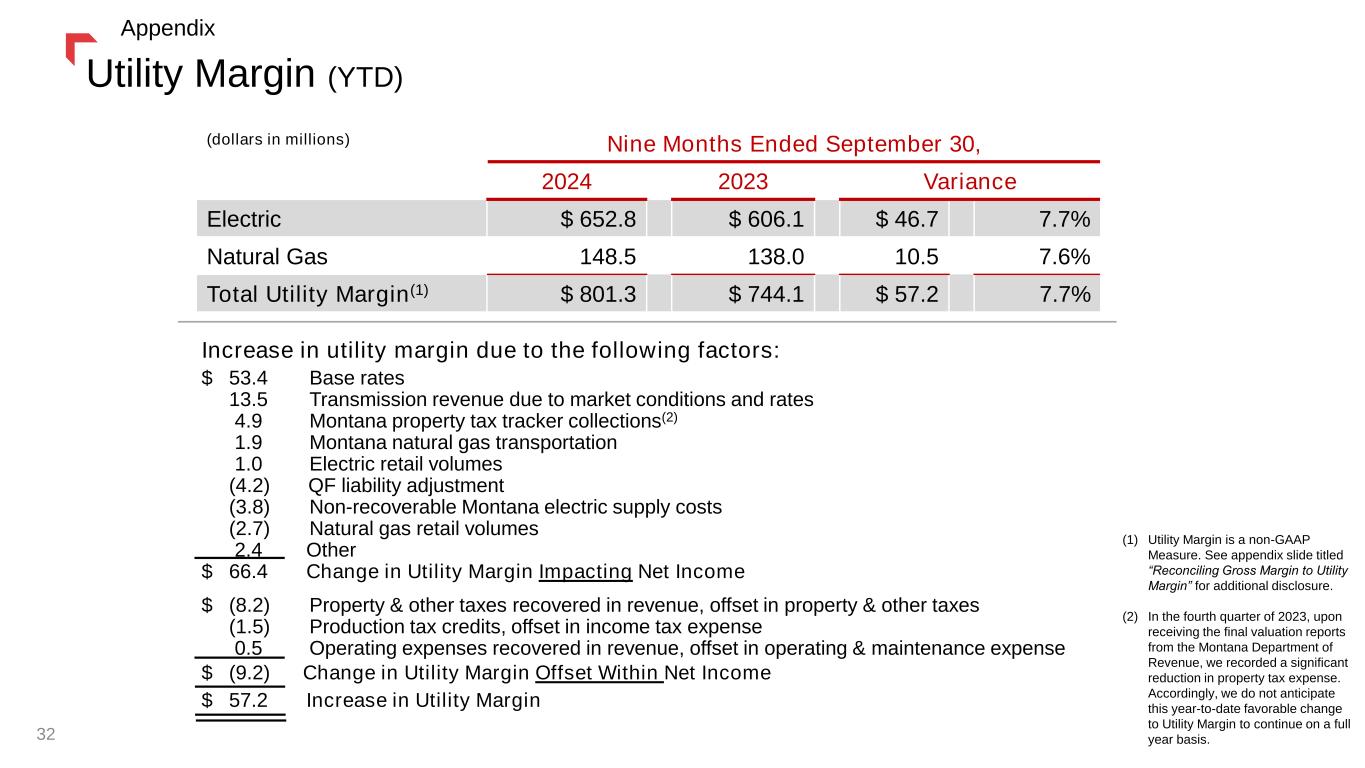

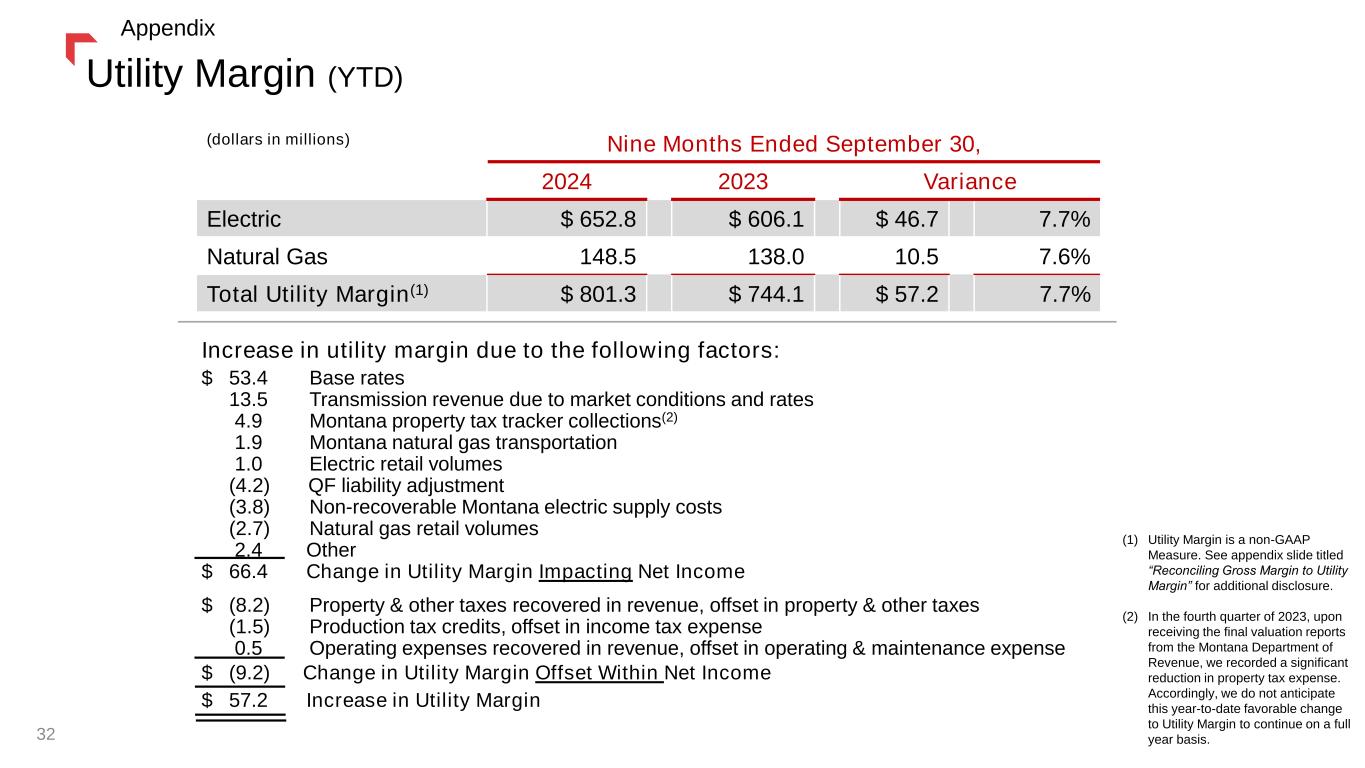

Utility Margin (YTD) (dollars in millions) Nine Months Ended September 30, 2024 2023 Variance Electric $ 652.8 $ 606.1 $ 46.7 7.7% Natural Gas 148.5 138.0 10.5 7.6% Total Utility Margin(1) $ 801.3 $ 744.1 $ 57.2 7.7% Increase in utility margin due to the following factors: $ 53.4 Base rates 13.5 Transmission revenue due to market conditions and rates 4.9 Montana property tax tracker collections(2) 1.9 Montana natural gas transportation 1.0 Electric retail volumes (4.2) QF liability adjustment (3.8) Non-recoverable Montana electric supply costs (2.7) Natural gas retail volumes 2.4 Other $ 66.4 Change in Utility Margin Impacting Net Income $ (8.2) Property & other taxes recovered in revenue, offset in property & other taxes (1.5) Production tax credits, offset in income tax expense 0.5 Operating expenses recovered in revenue, offset in operating & maintenance expense $ (9.2) Change in Utility Margin Offset Within Net Income $ 57.2 Increase in Utility Margin 32 Appendix (1) Utility Margin is a non-GAAP Measure. See appendix slide titled “Reconciling Gross Margin to Utility Margin” for additional disclosure. (2) In the fourth quarter of 2023, upon receiving the final valuation reports from the Montana Department of Revenue, we recorded a significant reduction in property tax expense. Accordingly, we do not anticipate this year-to-date favorable change to Utility Margin to continue on a full year basis.

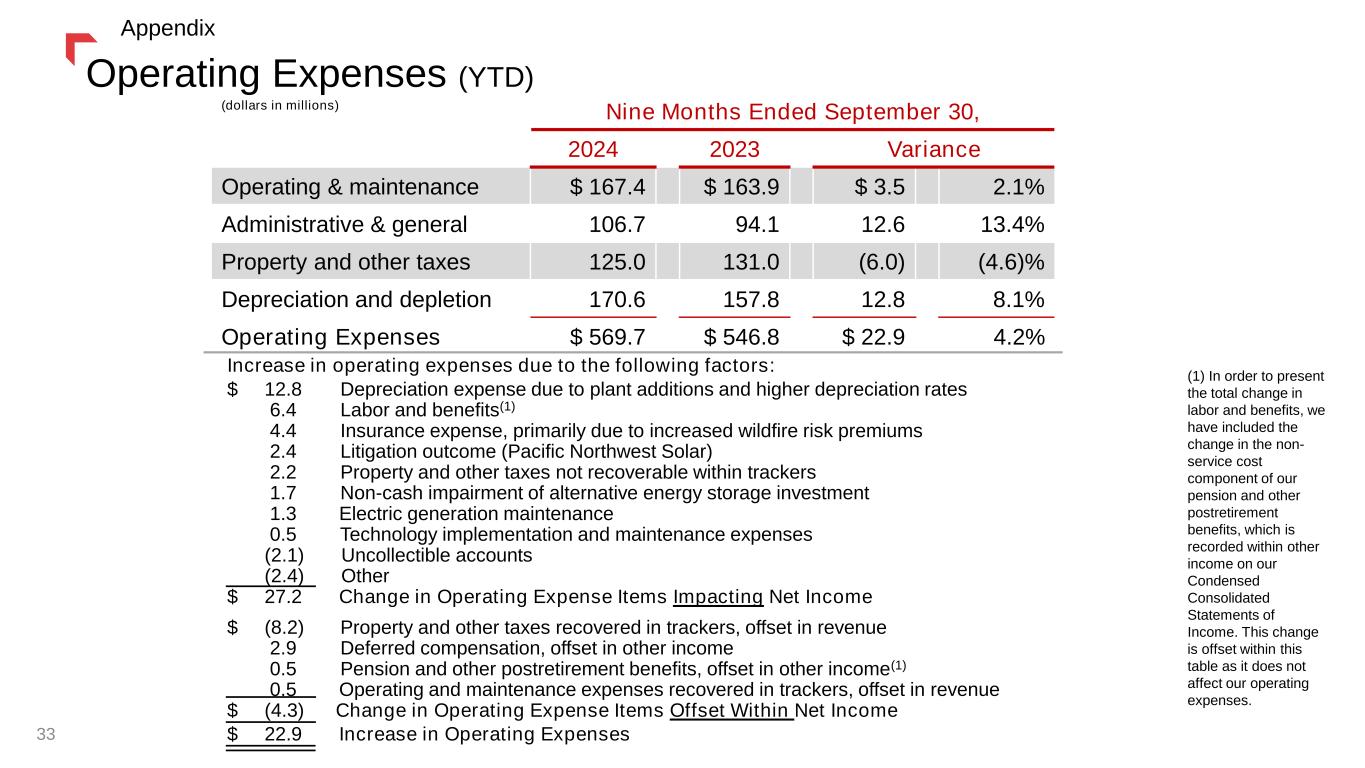

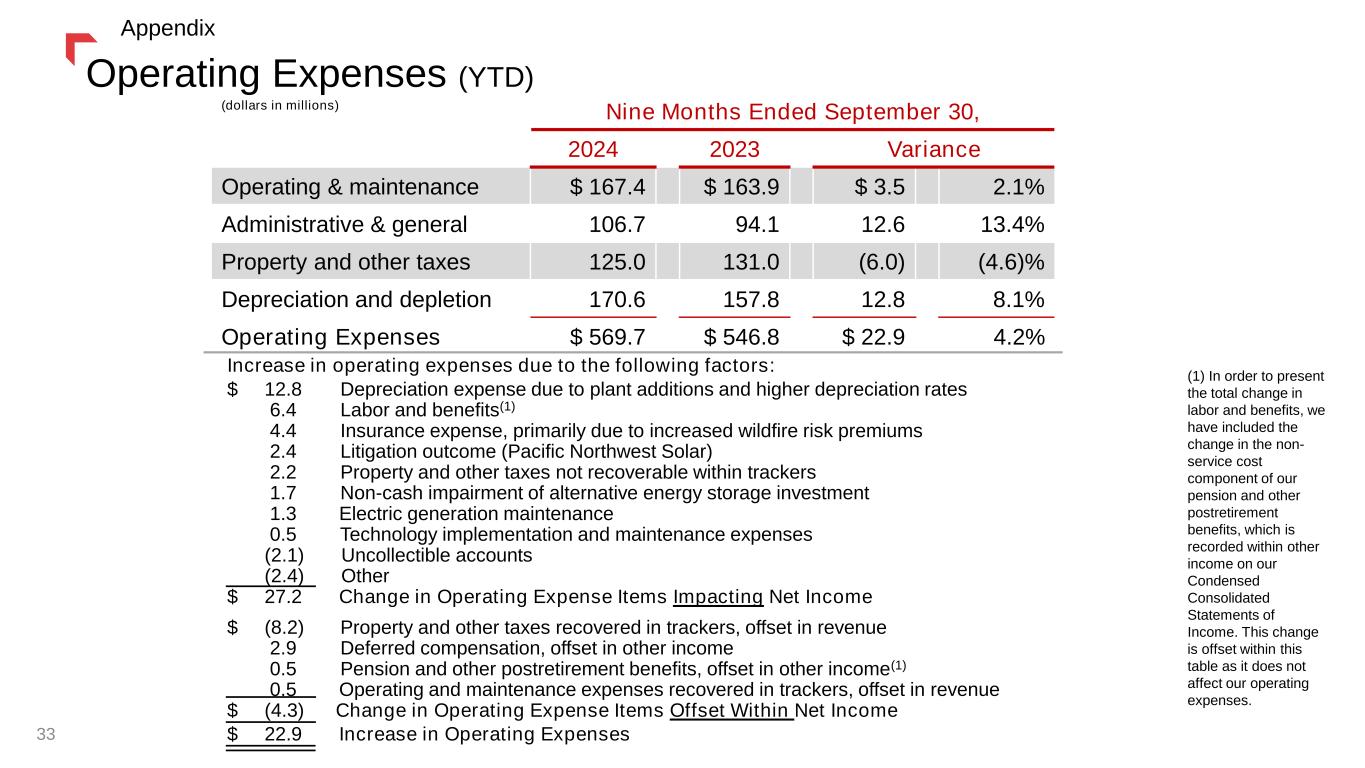

(dollars in millions) Nine Months Ended September 30, 2024 2023 Variance Operating & maintenance $ 167.4 $ 163.9 $ 3.5 2.1% Administrative & general 106.7 94.1 12.6 13.4% Property and other taxes 125.0 131.0 (6.0) (4.6)% Depreciation and depletion 170.6 157.8 12.8 8.1% Operating Expenses $ 569.7 $ 546.8 $ 22.9 4.2% Increase in operating expenses due to the following factors: $ 12.8 Depreciation expense due to plant additions and higher depreciation rates 6.4 Labor and benefits(1) 4.4 Insurance expense, primarily due to increased wildfire risk premiums 2.4 Litigation outcome (Pacific Northwest Solar) 2.2 Property and other taxes not recoverable within trackers 1.7 Non-cash impairment of alternative energy storage investment 1.3 Electric generation maintenance 0.5 Technology implementation and maintenance expenses (2.1) Uncollectible accounts (2.4) Other $ 27.2 Change in Operating Expense Items Impacting Net Income $ (8.2) Property and other taxes recovered in trackers, offset in revenue 2.9 Deferred compensation, offset in other income 0.5 Pension and other postretirement benefits, offset in other income(1) 0.5 Operating and maintenance expenses recovered in trackers, offset in revenue $ (4.3) Change in Operating Expense Items Offset Within Net Income $ 22.9 Increase in Operating Expenses Operating Expenses (YTD) (1) In order to present the total change in labor and benefits, we have included the change in the non- service cost component of our pension and other postretirement benefits, which is recorded within other income on our Condensed Consolidated Statements of Income. This change is offset within this table as it does not affect our operating expenses. 33 Appendix

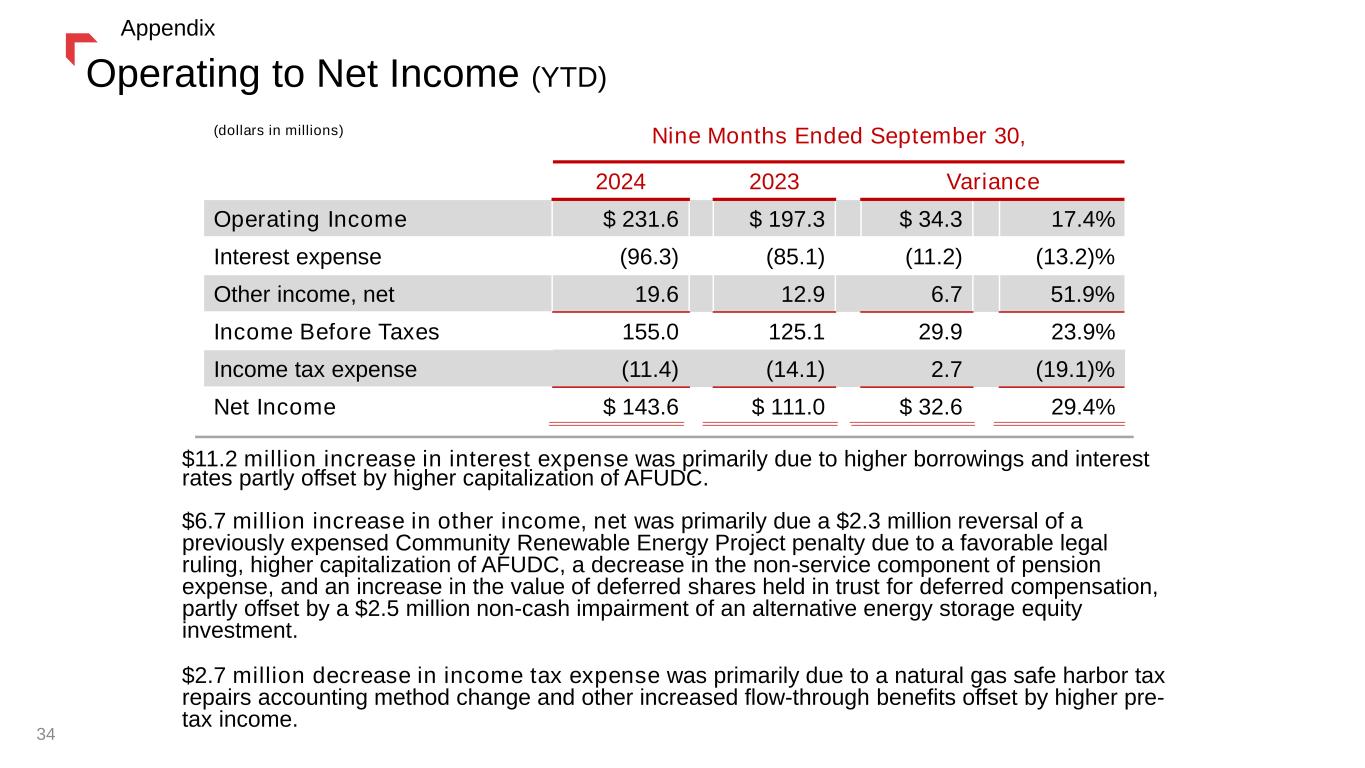

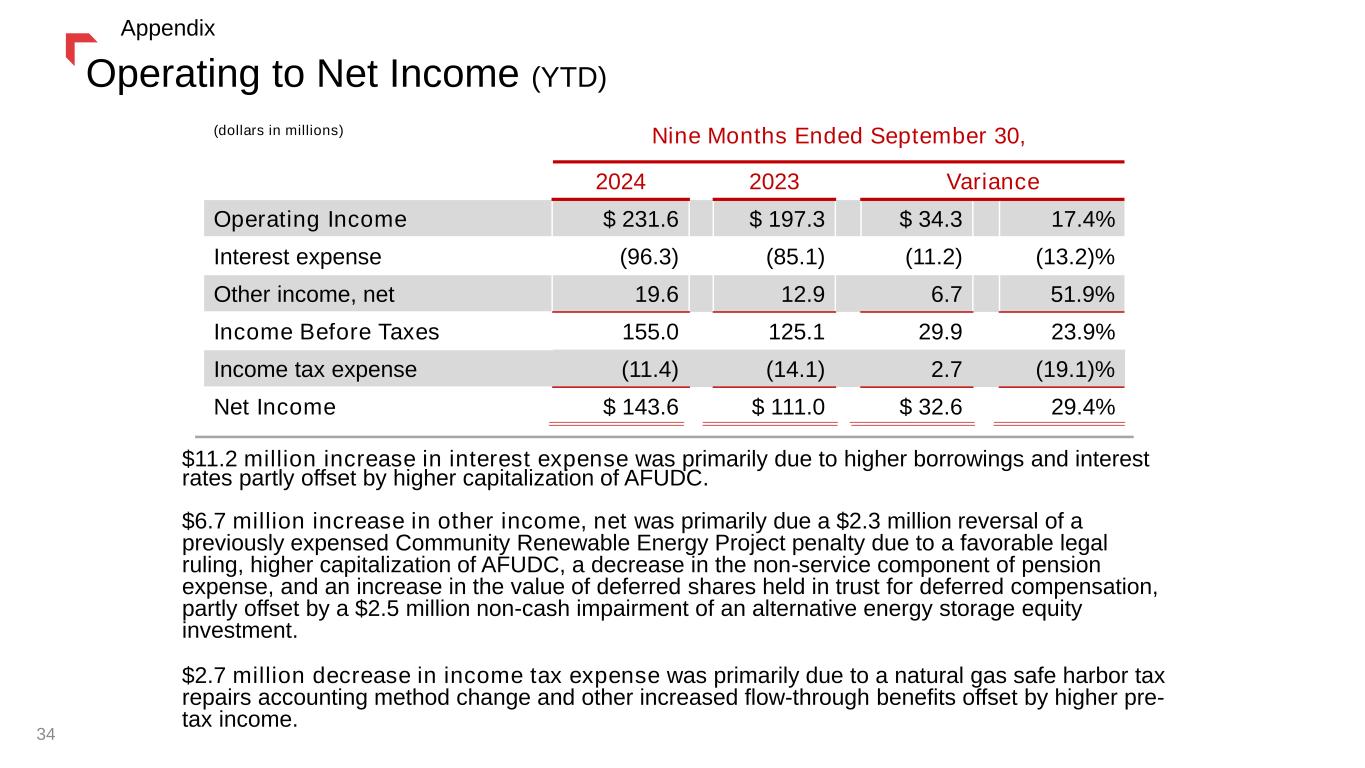

Operating to Net Income (YTD) (dollars in millions) Nine Months Ended September 30, 2024 2023 Variance Operating Income $ 231.6 $ 197.3 $ 34.3 17.4% Interest expense (96.3) (85.1) (11.2) (13.2)% Other income, net 19.6 12.9 6.7 51.9% Income Before Taxes 155.0 125.1 29.9 23.9% Income tax expense (11.4) (14.1) 2.7 (19.1)% Net Income $ 143.6 $ 111.0 $ 32.6 29.4% $11.2 million increase in interest expense was primarily due to higher borrowings and interest rates partly offset by higher capitalization of AFUDC. $6.7 million increase in other income, net was primarily due a $2.3 million reversal of a previously expensed Community Renewable Energy Project penalty due to a favorable legal ruling, higher capitalization of AFUDC, a decrease in the non-service component of pension expense, and an increase in the value of deferred shares held in trust for deferred compensation, partly offset by a $2.5 million non-cash impairment of an alternative energy storage equity investment. $2.7 million decrease in income tax expense was primarily due to a natural gas safe harbor tax repairs accounting method change and other increased flow-through benefits offset by higher pre- tax income. 34 Appendix

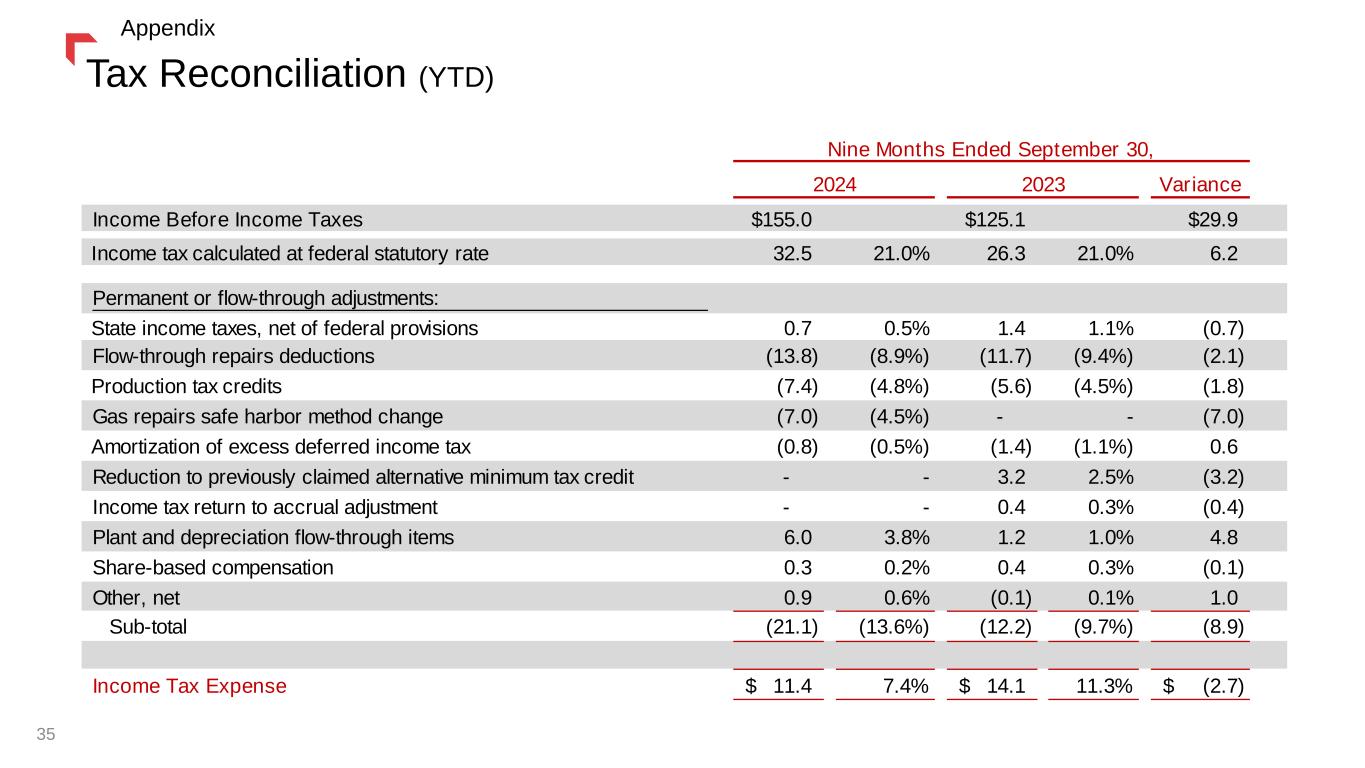

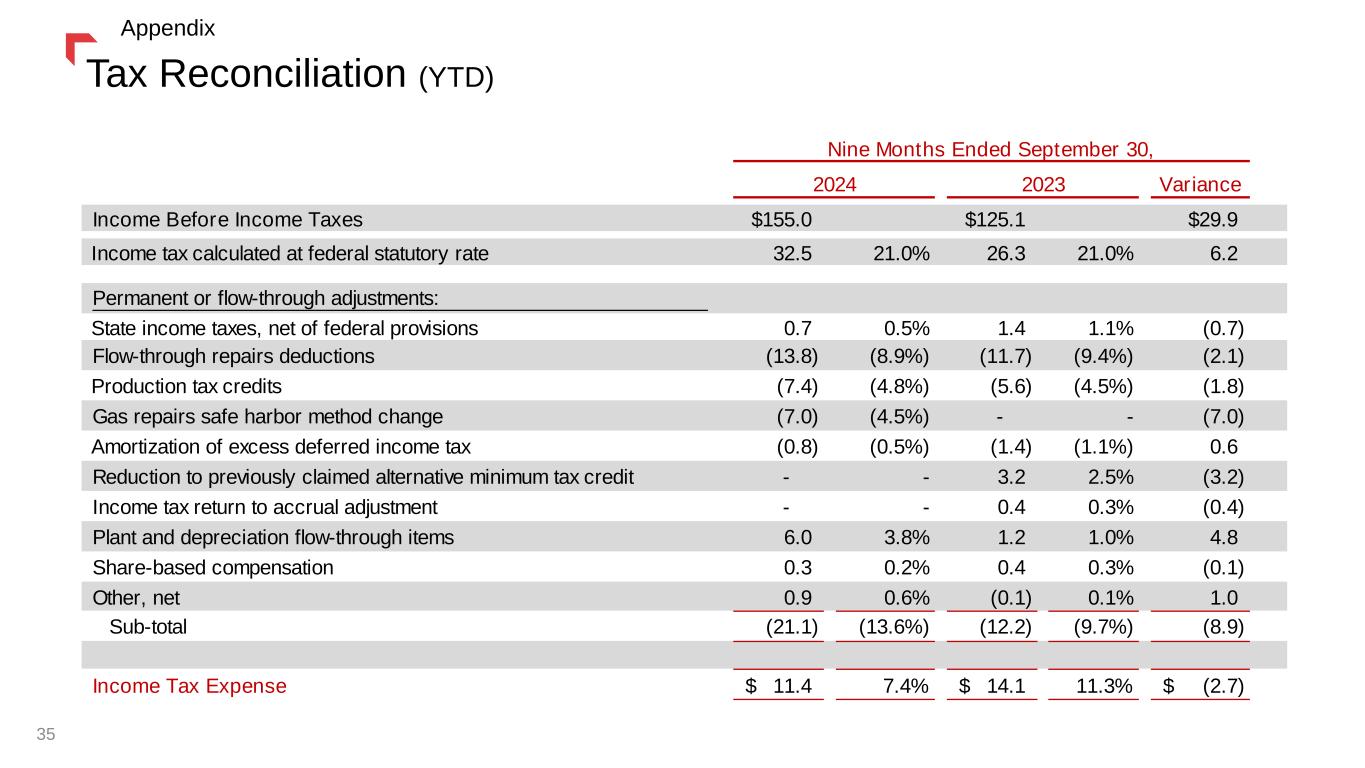

Tax Reconciliation (YTD) 35 Appendix Variance Income Before Income Taxes $155.0 $125.1 $29.9 Income tax calculated at federal statutory rate 32.5 21.0% 26.3 21.0% 6.2 Permanent or flow-through adjustments: State income taxes, net of federal provisions 0.7 0.5% 1.4 1.1% (0.7) Flow-through repairs deductions (13.8) (8.9%) (11.7) (9.4%) (2.1) Production tax credits (7.4) (4.8%) (5.6) (4.5%) (1.8) Gas repairs safe harbor method change (7.0) (4.5%) - - (7.0) Amortization of excess deferred income tax (0.8) (0.5%) (1.4) (1.1%) 0.6 Reduction to previously claimed alternative minimum tax credit - - 3.2 2.5% (3.2) Income tax return to accrual adjustment - - 0.4 0.3% (0.4) Plant and depreciation flow-through items 6.0 3.8% 1.2 1.0% 4.8 Share-based compensation 0.3 0.2% 0.4 0.3% (0.1) Other, net 0.9 0.6% (0.1) 0.1% 1.0 Sub-total (21.1) (13.6%) (12.2) (9.7%) (8.9) Income Tax Expense 11.4$ 7.4% 14.1$ 11.3% (2.7)$ 2024 2023 Nine Months Ended September 30,

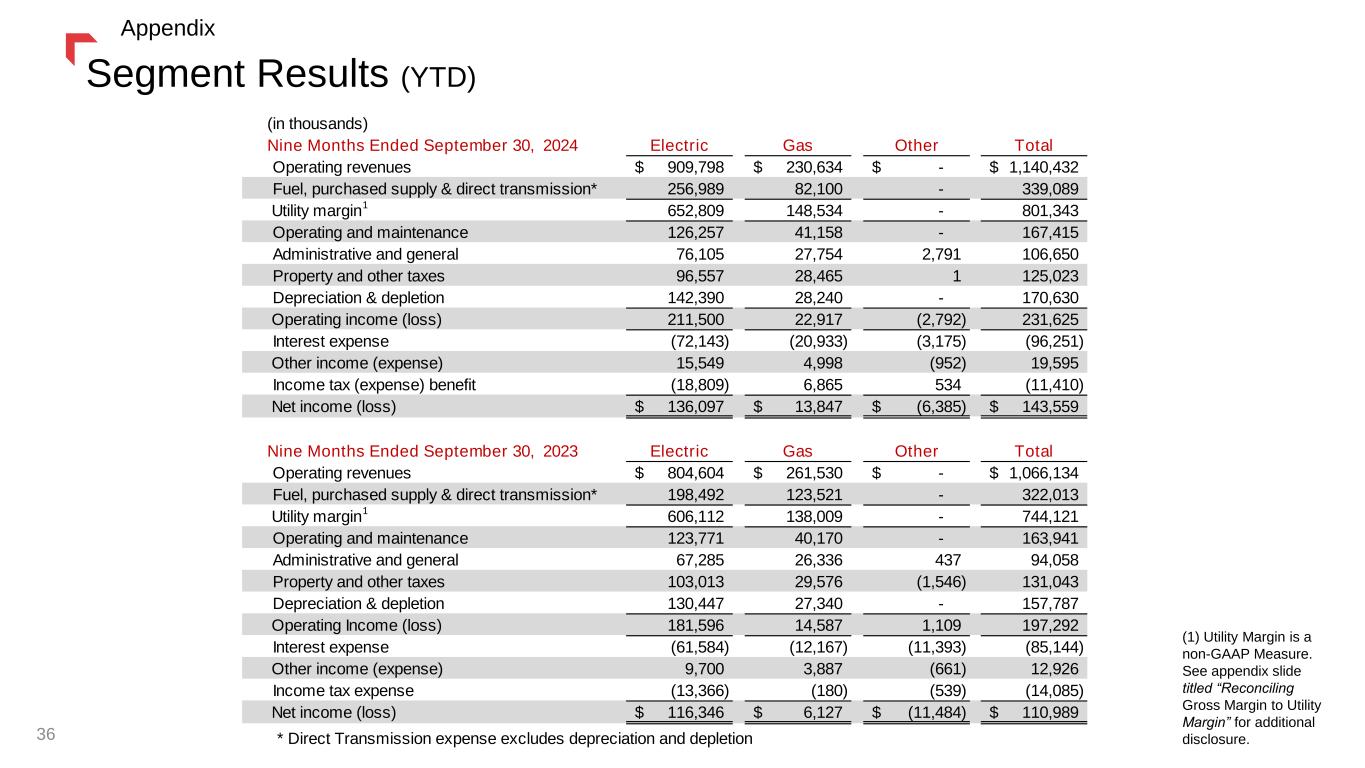

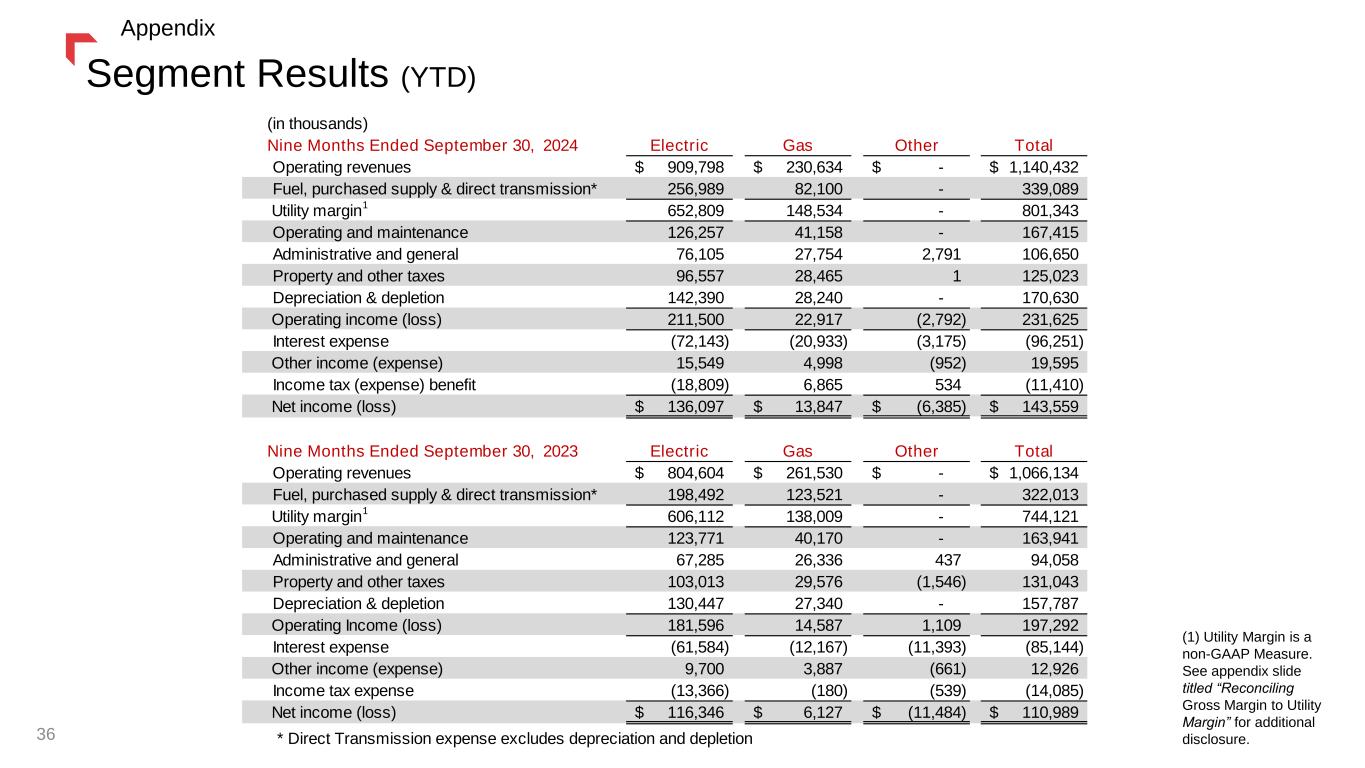

Segment Results (YTD) (1) Utility Margin is a non-GAAP Measure. See appendix slide titled “Reconciling Gross Margin to Utility Margin” for additional disclosure. 36 Appendix Nine Months Ended September 30, 2024 Electric Gas Other Total Operating revenues 909,798$ 230,634$ -$ 1,140,432$ Fuel, purchased supply & direct transmission* 256,989 82,100 - 339,089 Utility margin 652,809 148,534 - 801,343 Operating and maintenance 126,257 41,158 - 167,415 Administrative and general 76,105 27,754 2,791 106,650 Property and other taxes 96,557 28,465 1 125,023 Depreciation & depletion 142,390 28,240 - 170,630 Operating income (loss) 211,500 22,917 (2,792) 231,625 Interest expense (72,143) (20,933) (3,175) (96,251) Other income (expense) 15,549 4,998 (952) 19,595 Income tax (expense) benefit (18,809) 6,865 534 (11,410) Net income (loss) 136,097$ 13,847$ (6,385)$ 143,559$ Nine Months Ended September 30, 2023 Electric Gas Other Total Operating revenues 804,604$ 261,530$ -$ 1,066,134$ Fuel, purchased supply & direct transmission* 198,492 123,521 - 322,013 Utility margin 606,112 138,009 - 744,121 Operating and maintenance 123,771 40,170 - 163,941 Administrative and general 67,285 26,336 437 94,058 Property and other taxes 103,013 29,576 (1,546) 131,043 Depreciation & depletion 130,447 27,340 - 157,787 Operating Income (loss) 181,596 14,587 1,109 197,292 Interest expense (61,584) (12,167) (11,393) (85,144) Other income (expense) 9,700 3,887 (661) 12,926 Income tax expense (13,366) (180) (539) (14,085) Net income (loss) 116,346$ 6,127$ (11,484)$ 110,989$ * Direct Transmission expense excludes depreciation and depletion (in thousands) 1 1

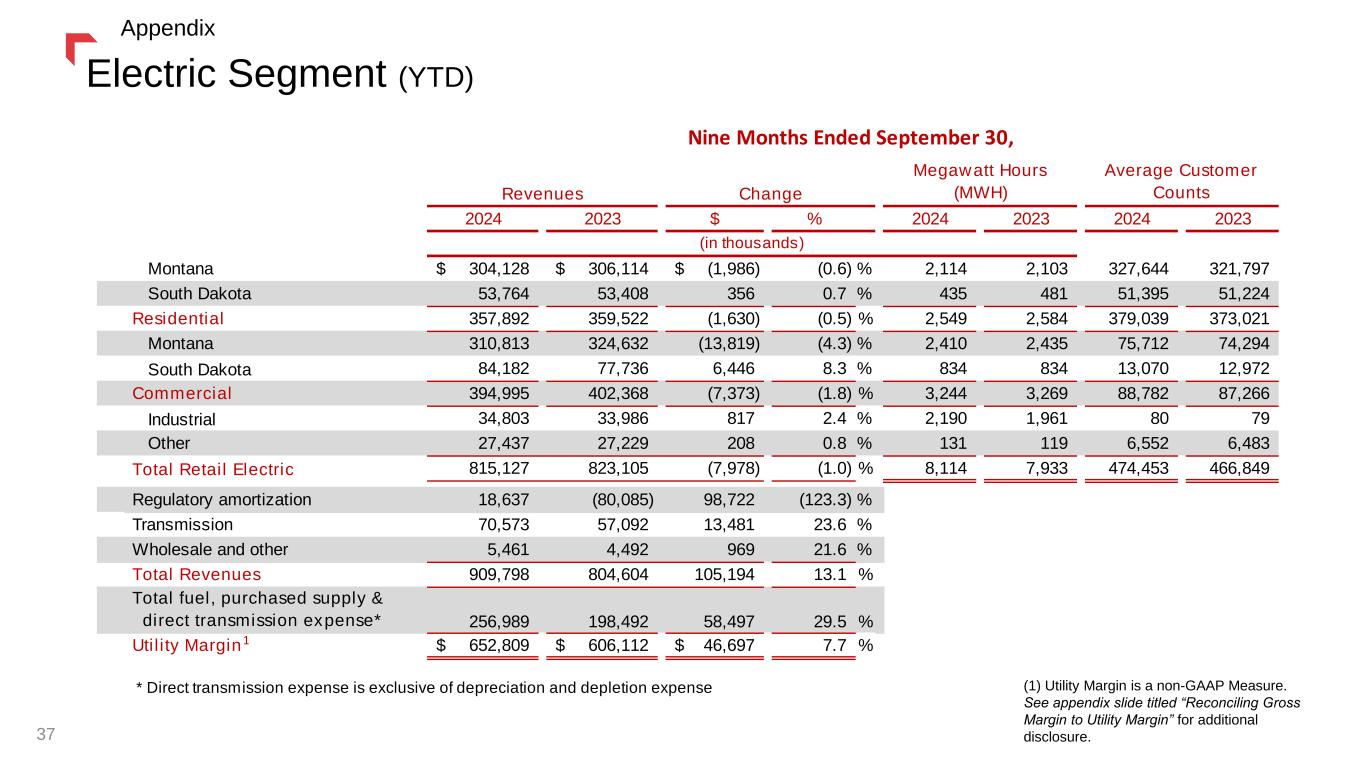

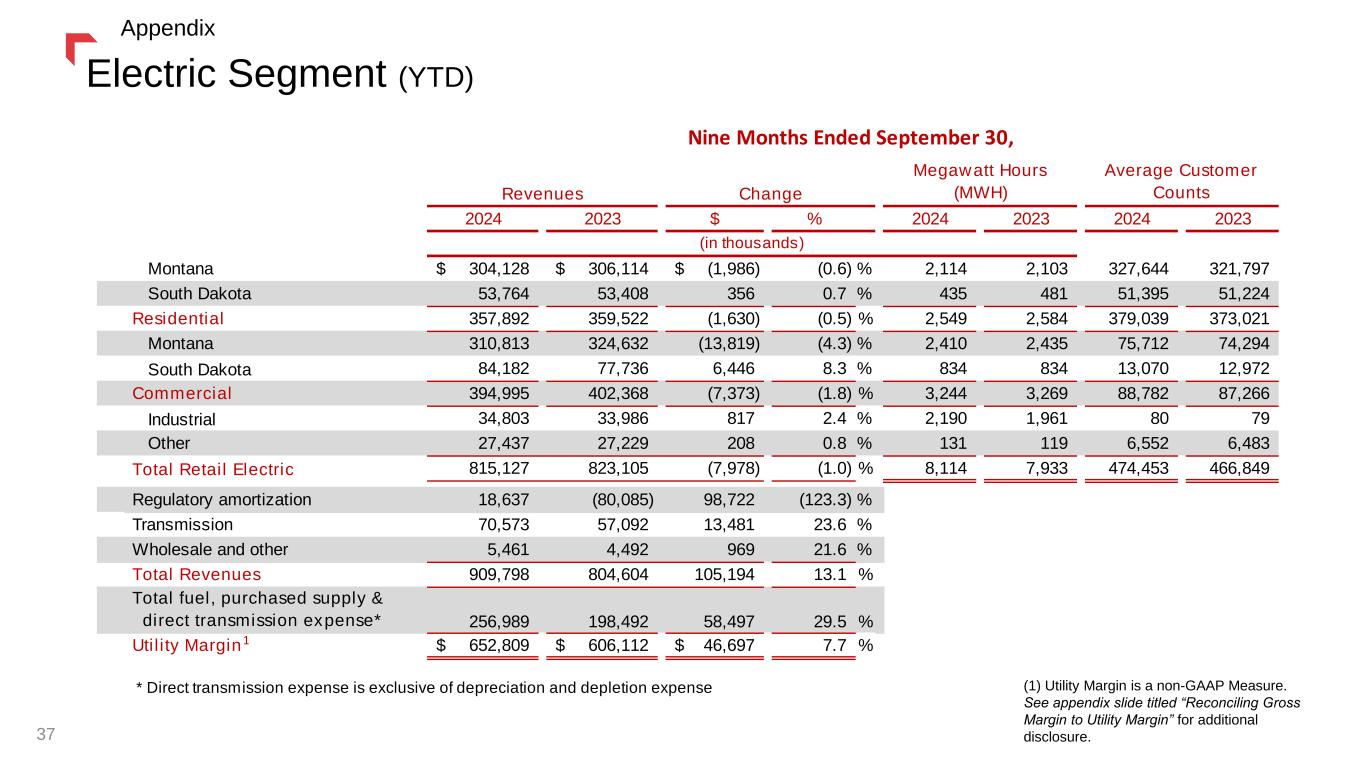

2024 2023 $ % 2024 2023 2024 2023 Montana 304,128$ 306,114$ (1,986)$ (0.6) % 2,114 2,103 327,644 321,797 South Dakota 53,764 53,408 356 0.7 % 435 481 51,395 51,224 Residential 357,892 359,522 (1,630) (0.5) % 2,549 2,584 379,039 373,021 Montana 310,813 324,632 (13,819) (4.3) % 2,410 2,435 75,712 74,294 South Dakota 84,182 77,736 6,446 8.3 % 834 834 13,070 12,972 Commercial 394,995 402,368 (7,373) (1.8) % 3,244 3,269 88,782 87,266 Industrial 34,803 33,986 817 2.4 % 2,190 1,961 80 79 Other 27,437 27,229 208 0.8 % 131 119 6,552 6,483 Total Retail Electric 815,127 823,105 (7,978) (1.0) % 8,114 7,933 474,453 466,849 Regulatory amortization 18,637 (80,085) 98,722 (123.3) % Transmission 70,573 57,092 13,481 23.6 % Wholesale and other 5,461 4,492 969 21.6 % Total Revenues 909,798 804,604 105,194 13.1 % Total fuel, purchased supply & direct transmission expense* 256,989 198,492 58,497 29.5 % Utility Margin 652,809$ 606,112$ 46,697$ 7.7 % * Direct transmission expense is exclusive of depreciation and depletion expense (in thousands) Revenues Change Megawatt Hours (MWH) Average Customer Counts Nine Months Ended September 30, 1 Electric Segment (YTD) (1) Utility Margin is a non-GAAP Measure. See appendix slide titled “Reconciling Gross Margin to Utility Margin” for additional disclosure. 37 Appendix

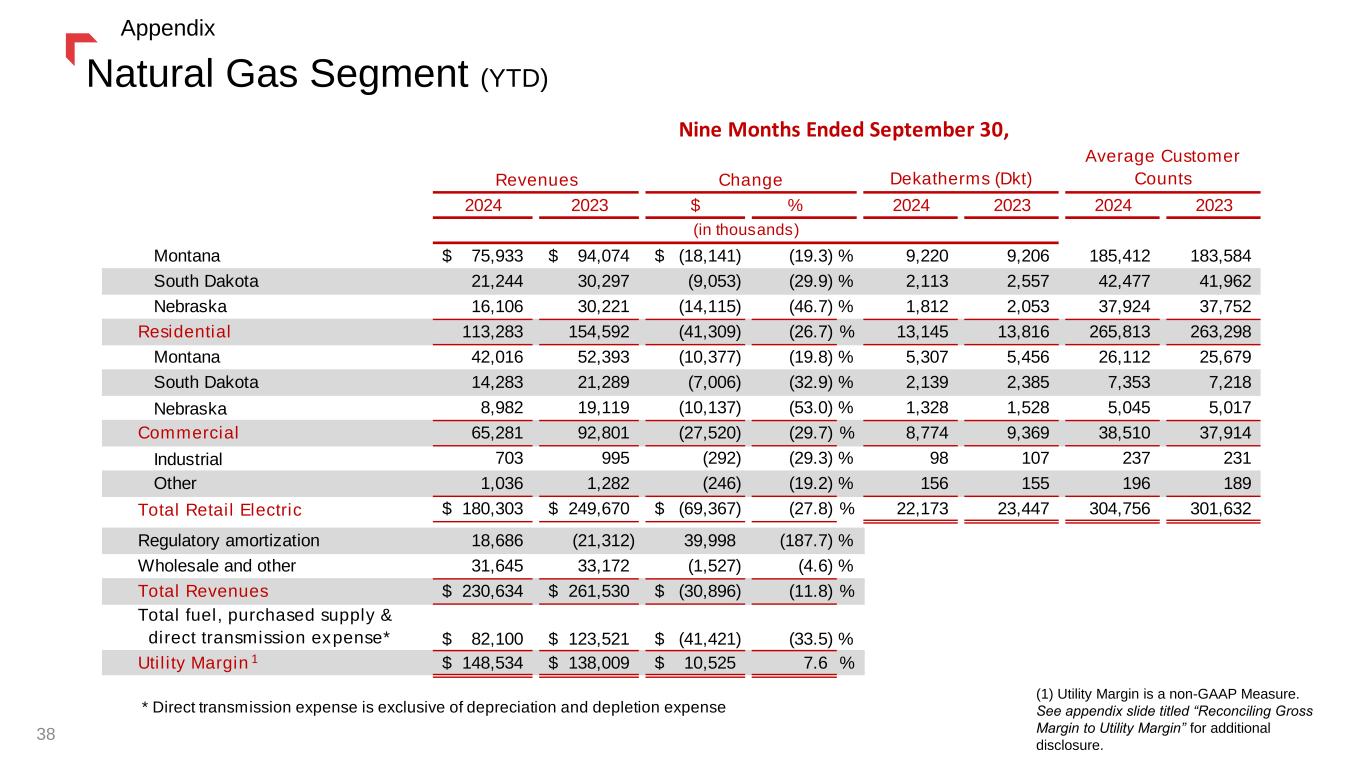

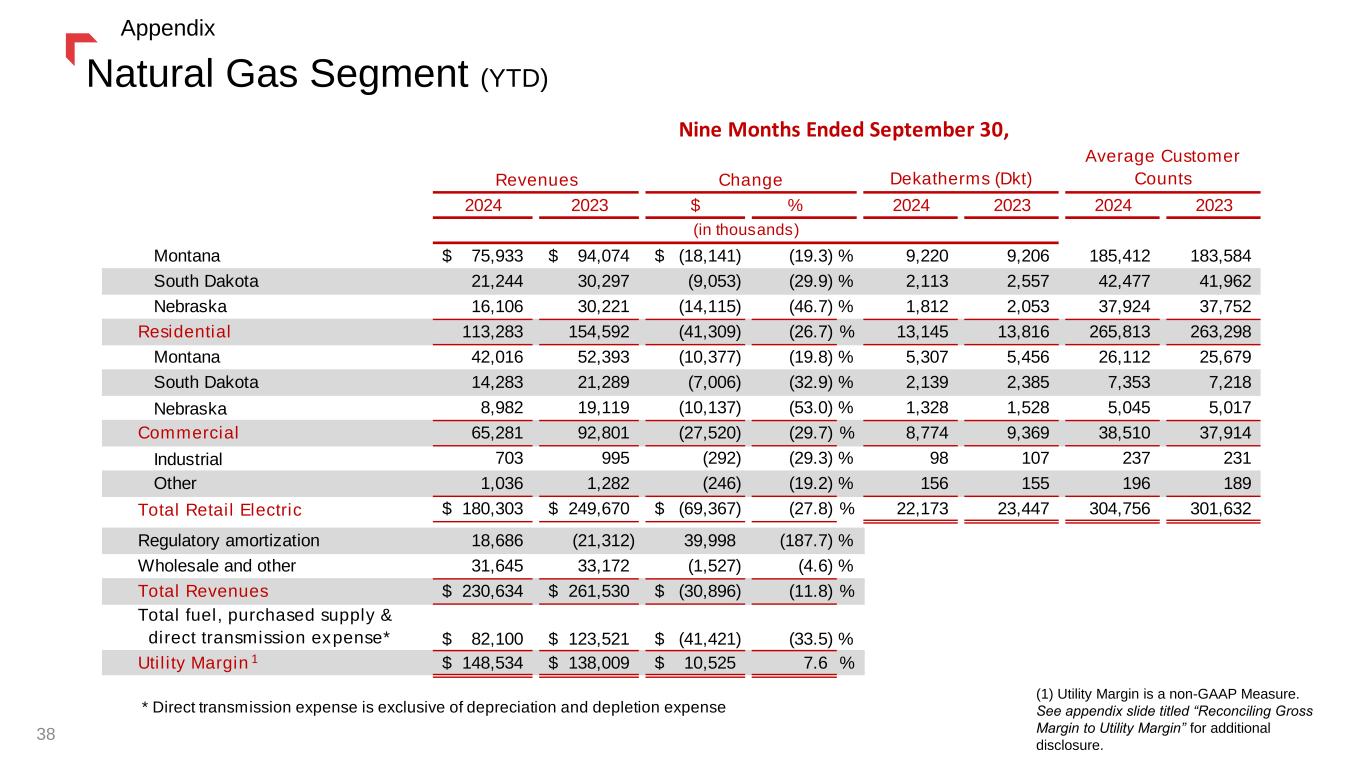

2024 2023 $ % 2024 2023 2024 2023 Montana 75,933$ 94,074$ (18,141)$ (19.3) % 9,220 9,206 185,412 183,584 South Dakota 21,244 30,297 (9,053) (29.9) % 2,113 2,557 42,477 41,962 Nebraska 16,106 30,221 (14,115) (46.7) % 1,812 2,053 37,924 37,752 Residential 113,283 154,592 (41,309) (26.7) % 13,145 13,816 265,813 263,298 Montana 42,016 52,393 (10,377) (19.8) % 5,307 5,456 26,112 25,679 South Dakota 14,283 21,289 (7,006) (32.9) % 2,139 2,385 7,353 7,218 Nebraska 8,982 19,119 (10,137) (53.0) % 1,328 1,528 5,045 5,017 Commercial 65,281 92,801 (27,520) (29.7) % 8,774 9,369 38,510 37,914 Industrial 703 995 (292) (29.3) % 98 107 237 231 Other 1,036 1,282 (246) (19.2) % 156 155 196 189 Total Retail Electric 180,303$ 249,670$ (69,367)$ (27.8) % 22,173 23,447 304,756 301,632 - Regulatory amortization 18,686 (21,312) 39,998 (187.7) % Wholesale and other 31,645 33,172 (1,527) (4.6) % Total Revenues 230,634$ 261,530$ (30,896)$ (11.8) % Total fuel, purchased supply & direct transmission expense* 82,100$ 123,521$ (41,421)$ (33.5) % Utility Margin 148,534$ 138,009$ 10,525$ 7.6 % * Direct transmission expense is exclusive of depreciation and depletion expense Revenues Nine Months Ended September 30, (in thousands) Change Dekatherms (Dkt) Average Customer Counts 1 Natural Gas Segment (YTD) 38 Appendix (1) Utility Margin is a non-GAAP Measure. See appendix slide titled “Reconciling Gross Margin to Utility Margin” for additional disclosure.

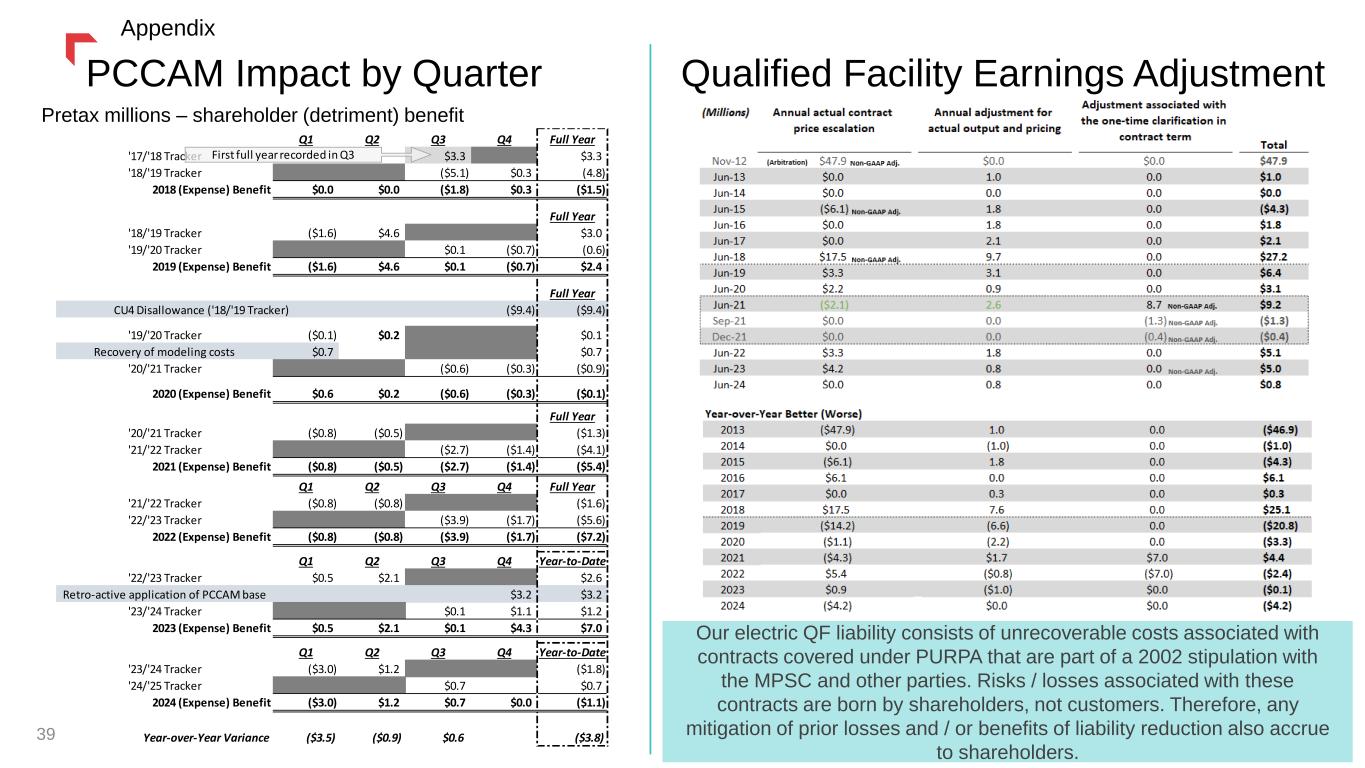

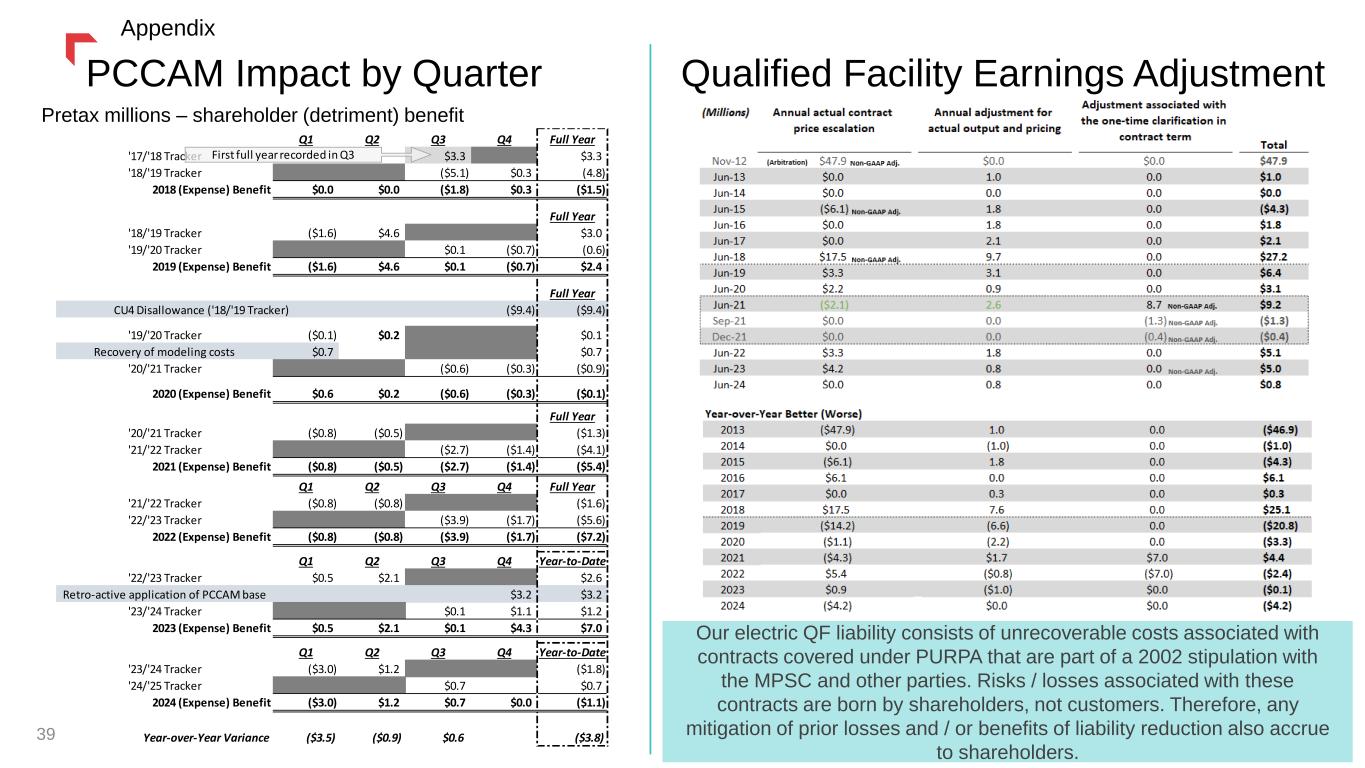

Q1 Q2 Q3 Q4 Full Year '17/'18 Tracker $3.3 $3.3 '18/'19 Tracker ($5.1) $0.3 (4.8) 2018 (Expense) Benefit $0.0 $0.0 ($1.8) $0.3 ($1.5) Full Year '18/'19 Tracker ($1.6) $4.6 $3.0 '19/'20 Tracker $0.1 ($0.7) (0.6) 2019 (Expense) Benefit ($1.6) $4.6 $0.1 ($0.7) $2.4 Full Year ($9.4) ($9.4) '19/'20 Tracker ($0.1) $0.2 $0.1 Recovery of modeling costs $0.7 $0.7 '20/'21 Tracker ($0.6) ($0.3) ($0.9) 2020 (Expense) Benefit $0.6 $0.2 ($0.6) ($0.3) ($0.1) Full Year '20/'21 Tracker ($0.8) ($0.5) ($1.3) '21/'22 Tracker ($2.7) ($1.4) ($4.1) 2021 (Expense) Benefit ($0.8) ($0.5) ($2.7) ($1.4) ($5.4) Q1 Q2 Q3 Q4 Full Year '21/'22 Tracker ($0.8) ($0.8) ($1.6) '22/'23 Tracker ($3.9) ($1.7) ($5.6) 2022 (Expense) Benefit ($0.8) ($0.8) ($3.9) ($1.7) ($7.2) Q1 Q2 Q3 Q4 Year-to-Date '22/'23 Tracker $0.5 $2.1 $2.6 Retro-active application of PCCAM base $3.2 $3.2 '23/'24 Tracker $0.1 $1.1 $1.2 2023 (Expense) Benefit $0.5 $2.1 $0.1 $4.3 $7.0 Q1 Q2 Q3 Q4 Year-to-Date '23/'24 Tracker ($3.0) $1.2 ($1.8) '24/'25 Tracker $0.7 $0.7 2024 (Expense) Benefit ($3.0) $1.2 $0.7 $0.0 ($1.1) Year-over-Year Variance ($3.5) ($0.9) $0.6 ($3.8) CU4 Disallowance ('18/'19 Tracker) First full year recorded in Q3 PCCAM Impact by Quarter Qualified Facility Earnings Adjustment Our electric QF liability consists of unrecoverable costs associated with contracts covered under PURPA that are part of a 2002 stipulation with the MPSC and other parties. Risks / losses associated with these contracts are born by shareholders, not customers. Therefore, any mitigation of prior losses and / or benefits of liability reduction also accrue to shareholders. 39 Appendix Pretax millions – shareholder (detriment) benefit

(dollars in millions) As of September 30, As of December 31, 2024 2023 Cash and cash equivalents 2.5$ 9.2$ Restricted cash 25.4 16.0 Accounts receivable, net 144.2 212.3 Inventories 121.6 114.5 Other current assets 74.8 55.0 Goodwill 357.6 357.6 PP&E and other non-current assets 7,128.1 6,836.1 Total Assets 7,854.1$ 7,600.7$ Payables 93.7 124.3 Current Maturities - debt and leases 403.4 103.3 Other current liabilities 316.1 307.3 Long-term debt & capital leases 2,570.7 2,690.1 Other non-current liabilities 1,653.6 1,590.3 Shareholders' equity 2,816.5 2,785.3 Total Liabilities and Equity 7,854.1$ 7,600.7$ Capitalization: Short-Term Debt & Short-Term Finance Leases 403.4 103.3 Long-Term Debt & Long-Term Finance Leases 2,570.7 2,690.1 Less: Basin Creek Finance Lease (6.3) (8.8) Shareholders' Equity 2,816.5 2,785.3 Total Capitalization 5,784.3$ 5,569.9$ Ratio of Debt to Total Capitalization 51.3% 50.0% Balance Sheet 40 Appendix Debt to Total Capitalization up from last quarter and inside our targeted 50% - 55% range.

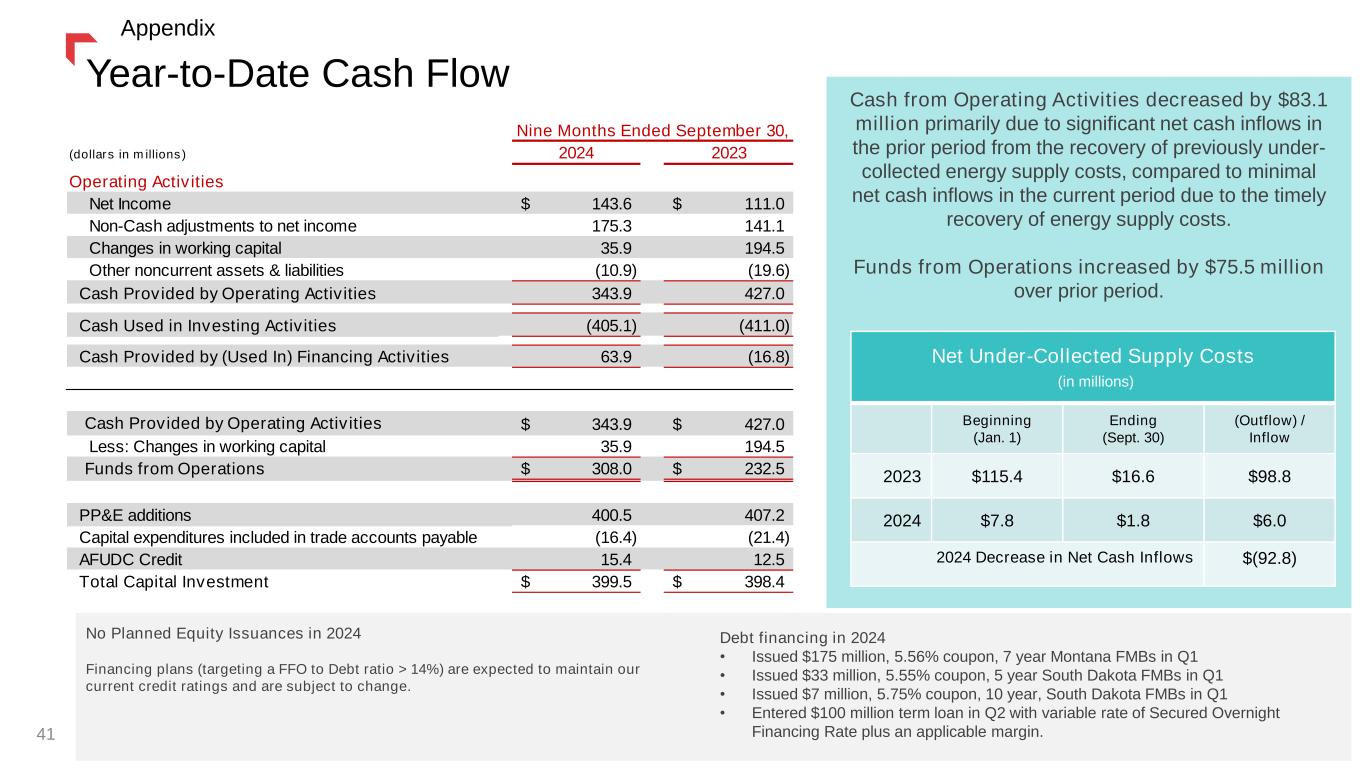

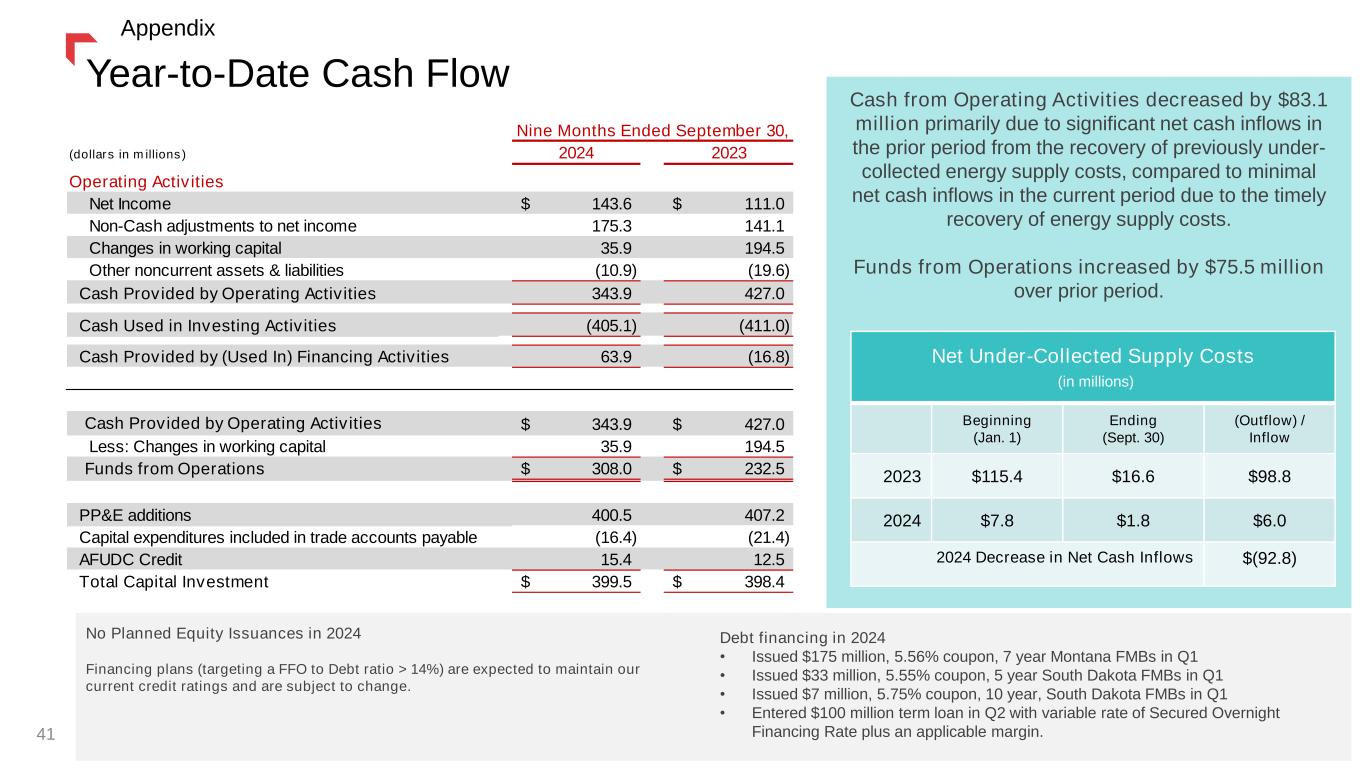

(dollars in millions) 2024 2023 Operating Activities Net Income 143.6$ 111.0$ Non-Cash adjustments to net income 175.3 141.1 Changes in working capital 35.9 194.5 Other noncurrent assets & liabilities (10.9) (19.6) Cash Provided by Operating Activities 343.9 427.0 Cash Used in Investing Activities (405.1) (411.0) Cash Provided by (Used In) Financing Activities 63.9 (16.8) Cash Provided by Operating Activities 343.9$ 427.0$ Less: Changes in working capital 35.9 194.5 Funds from Operations 308.0$ 232.5$ PP&E additions 400.5 407.2 Capital expenditures included in trade accounts payable (16.4) (21.4) AFUDC Credit 15.4 12.5 Total Capital Investment 399.5$ 398.4$ Nine Months Ended September 30, Cash from Operating Activities decreased by $83.1 million primarily due to significant net cash inflows in the prior period from the recovery of previously under- collected energy supply costs, compared to minimal net cash inflows in the current period due to the timely recovery of energy supply costs. Funds from Operations increased by $75.5 million over prior period. Net Under-Collected Supply Costs (in millions) Beginning (Jan. 1) Ending (Sept. 30) (Outflow) / Inflow 2023 $115.4 $16.6 $98.8 2024 $7.8 $1.8 $6.0 2024 Decrease in Net Cash Inflows $(92.8) Year-to-Date Cash Flow 41 No Planned Equity Issuances in 2024 Financing plans (targeting a FFO to Debt ratio > 14%) are expected to maintain our current credit ratings and are subject to change. Debt financing in 2024 • Issued $175 million, 5.56% coupon, 7 year Montana FMBs in Q1 • Issued $33 million, 5.55% coupon, 5 year South Dakota FMBs in Q1 • Issued $7 million, 5.75% coupon, 10 year, South Dakota FMBs in Q1 • Entered $100 million term loan in Q2 with variable rate of Secured Overnight Financing Rate plus an applicable margin. Appendix

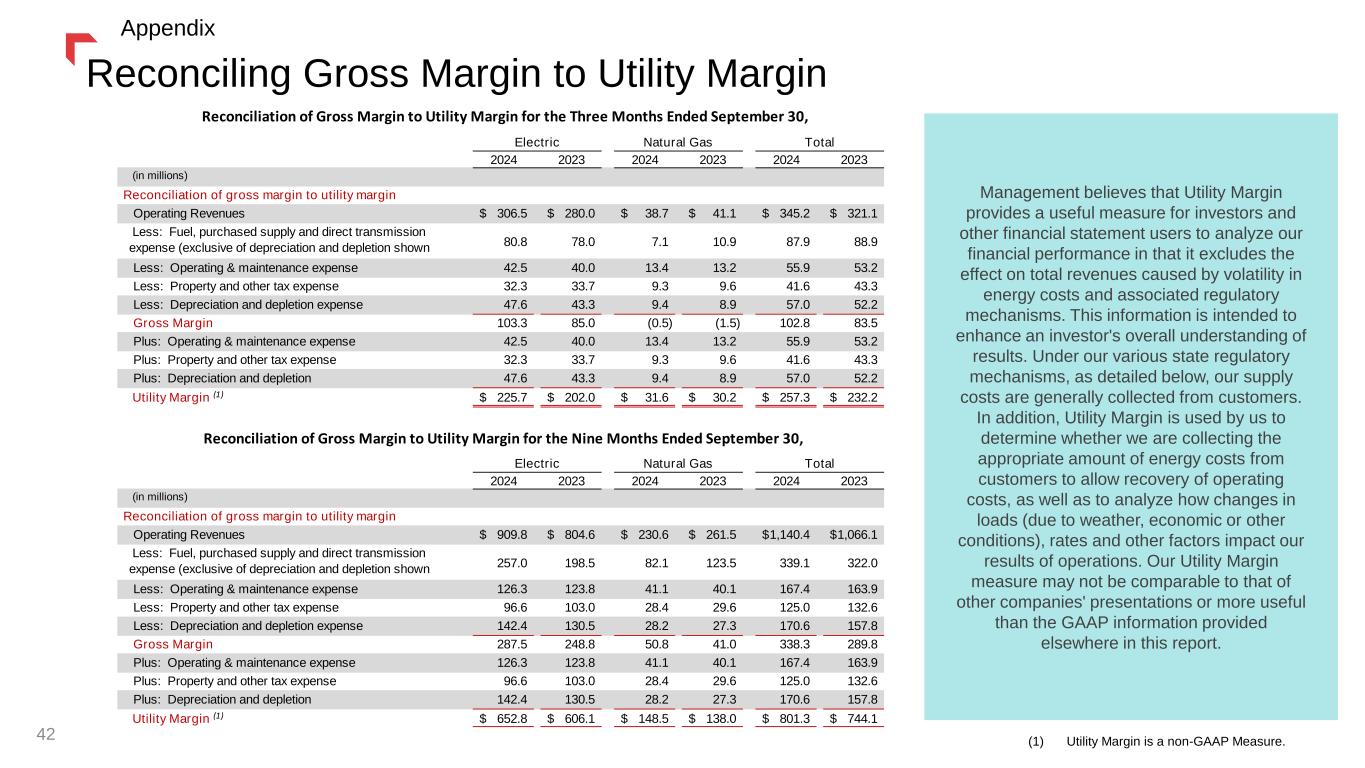

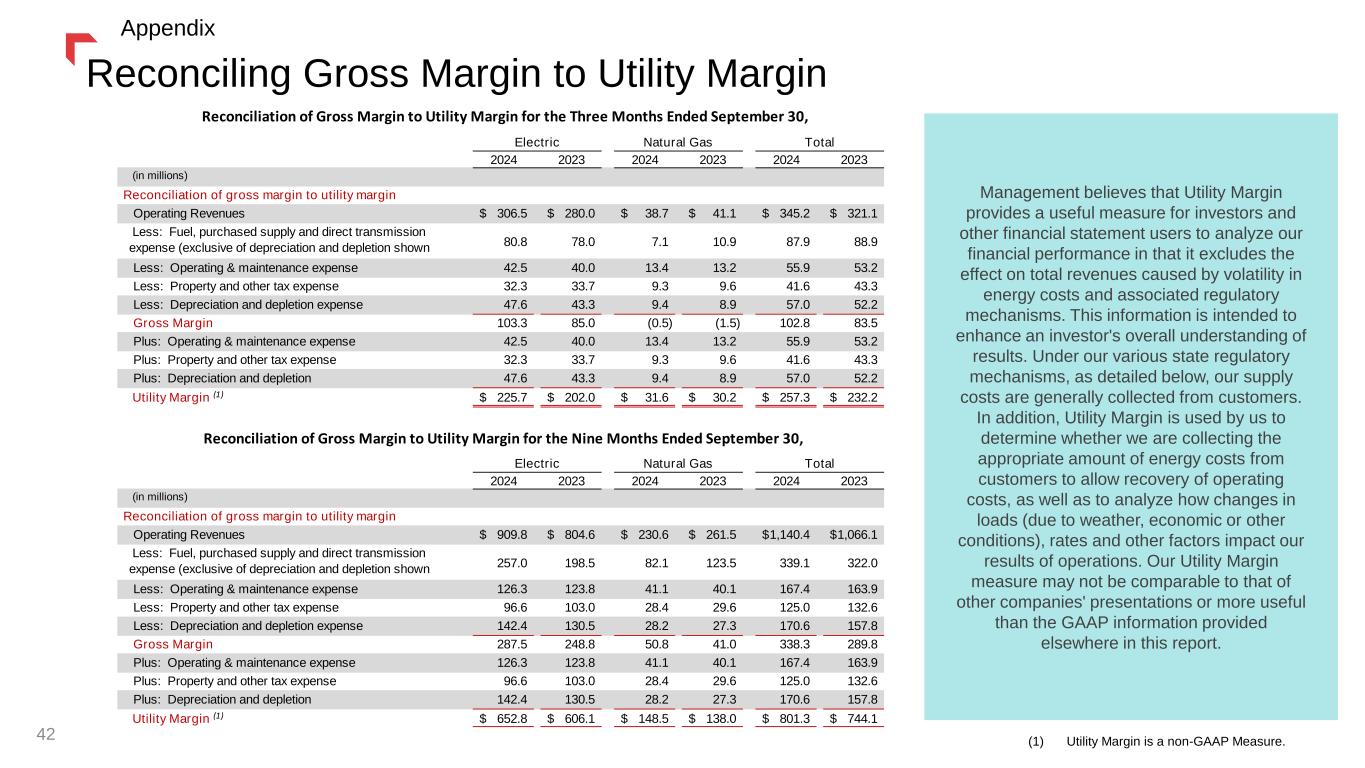

Reconciling Gross Margin to Utility Margin Management believes that Utility Margin provides a useful measure for investors and other financial statement users to analyze our financial performance in that it excludes the effect on total revenues caused by volatility in energy costs and associated regulatory mechanisms. This information is intended to enhance an investor's overall understanding of results. Under our various state regulatory mechanisms, as detailed below, our supply costs are generally collected from customers. In addition, Utility Margin is used by us to determine whether we are collecting the appropriate amount of energy costs from customers to allow recovery of operating costs, as well as to analyze how changes in loads (due to weather, economic or other conditions), rates and other factors impact our results of operations. Our Utility Margin measure may not be comparable to that of other companies' presentations or more useful than the GAAP information provided elsewhere in this report. (1) Utility Margin is a non-GAAP Measure. 42 Appendix 2024 2023 2024 2023 2024 2023 (in millions) Reconciliation of gross margin to utility margin Operating Revenues 306.5$ 280.0$ 38.7$ 41.1$ 345.2$ 321.1$ Less: Fuel, purchased supply and direct transmission expense (exclusive of depreciation and depletion shown separately below) 80.8 78.0 7.1 10.9 87.9 88.9 Less: Operating & maintenance expense 42.5 40.0 13.4 13.2 55.9 53.2 Less: Property and other tax expense 32.3 33.7 9.3 9.6 41.6 43.3 Less: Depreciation and depletion expense 47.6 43.3 9.4 8.9 57.0 52.2 Gross Margin 103.3 85.0 (0.5) (1.5) 102.8 83.5 Plus: Operating & maintenance expense 42.5 40.0 13.4 13.2 55.9 53.2 Plus: Property and other tax expense 32.3 33.7 9.3 9.6 41.6 43.3 Plus: Depreciation and depletion 47.6 43.3 9.4 8.9 57.0 52.2 Utility Margin 225.7$ 202.0$ 31.6$ 30.2$ 257.3$ 232.2$ 2024 2023 2024 2023 2024 2023 (in millions) Reconciliation of gross margin to utility margin Operating Revenues 909.8$ 804.6$ 230.6$ 261.5$ 1,140.4$ 1,066.1$ Less: Fuel, purchased supply and direct transmission expense (exclusive of depreciation and depletion shown separately below) 257.0 198.5 82.1 123.5 339.1 322.0 Less: Operating & maintenance expense 126.3 123.8 41.1 40.1 167.4 163.9 Less: Property and other tax expense 96.6 103.0 28.4 29.6 125.0 132.6 Less: Depreciation and depletion expense 142.4 130.5 28.2 27.3 170.6 157.8 Gross Margin 287.5 248.8 50.8 41.0 338.3 289.8 Plus: Operating & maintenance expense 126.3 123.8 41.1 40.1 167.4 163.9 Plus: Property and other tax expense 96.6 103.0 28.4 29.6 125.0 132.6 Plus: Depreciation and depletion 142.4 130.5 28.2 27.3 170.6 157.8 Utility Margin 652.8$ 606.1$ 148.5$ 138.0$ 801.3$ 744.1$ Reconciliation of Gross Margin to Utility Margin for the Three Months Ended September 30, Reconciliation of Gross Margin to Utility Margin for the Nine Months Ended September 30, Electric Natural Gas Total Electric Natural Gas Total (1) (1)

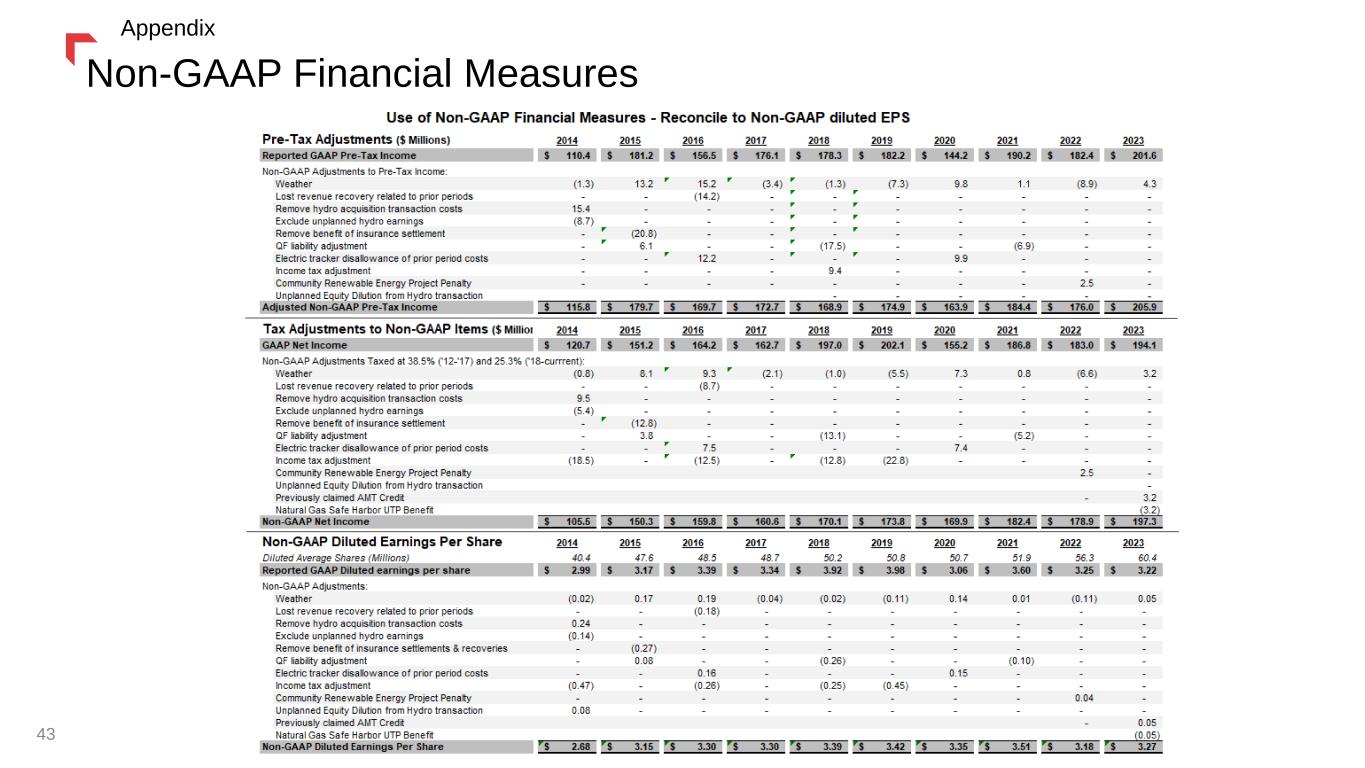

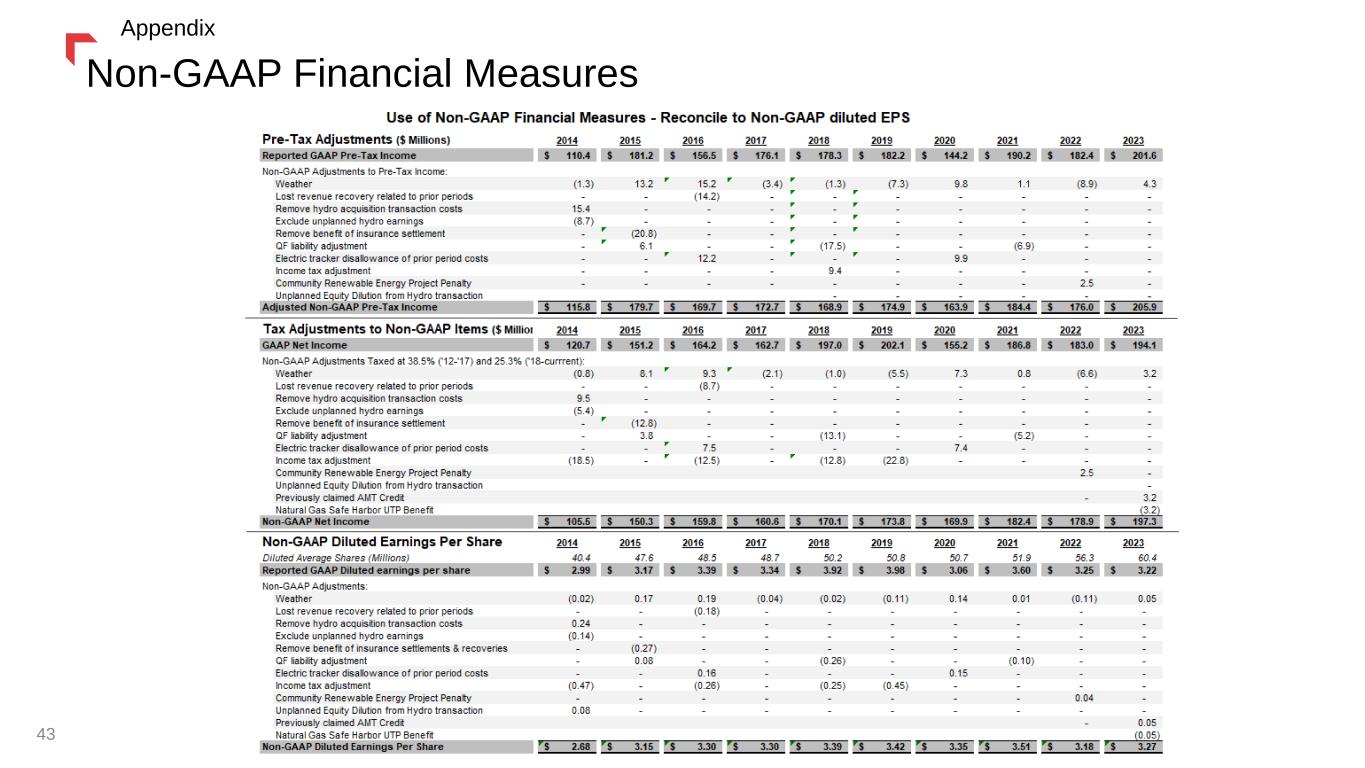

Non-GAAP Financial Measures 43 Appendix

Non-GAAP Financial Measures This presentation includes financial information prepared in accordance with GAAP, as well as other financial measures, such as Utility Margin, Adjusted Non-GAAP pretax income, Adjusted Non-GAAP net income and Adjusted Non-GAAP Diluted EPS that are considered “non-GAAP financial measures.” Generally, a non-GAAP financial measure is a numerical measure of a company’s financial performance, financial position or cash flows that excludes (or includes) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP. We define Utility Margin as Operating Revenues less fuel, purchased supply and direct transmission expense (exclusive of depreciation and depletion) as presented in our Consolidated Statements of Income. This measure differs from the GAAP definition of Gross Margin due to the exclusion of Operating and maintenance, Property and other taxes, and Depreciation and depletion expenses, which are presented separately in our Consolidated Statements of Income. A reconciliation of Utility Margin to Gross Margin, the most directly comparable GAAP measure, is included in this presentation. Management believes that Utility Margin provides a useful measure for investors and other financial statement users to analyze our financial performance in that it excludes the effect on total revenues caused by volatility in energy costs and associated regulatory mechanisms. This information is intended to enhance an investor's overall understanding of results. Under our various state regulatory mechanisms, as detailed below, our supply costs are generally collected from customers. In addition, Utility Margin is used by us to determine whether we are collecting the appropriate amount of energy costs from customers to allow recovery of operating costs, as well as to analyze how changes in loads (due to weather, economic or other conditions), rates and other factors impact our results of operations. Our Utility Margin measure may not be comparable to that of other companies' presentations or more useful than the GAAP information provided elsewhere in this report. Management also believes the presentation of Adjusted Non-GAAP pre-tax income, Adjusted Non-GAAP net income and Adjusted Non-GAAP Diluted EPS is more representative of normal earnings than GAAP pre-tax income, net income and EPS due to the exclusion (or inclusion) of certain impacts that are not reflective of ongoing earnings. The presentation of these non-GAAP measures is intended to supplement investors' understanding of our financial performance and not to replace other GAAP measures as an indicator of actual operating performance. Our measures may not be comparable to other companies' similarly titled measures. 44 Appendix

Thank youRate Review Appendix 45

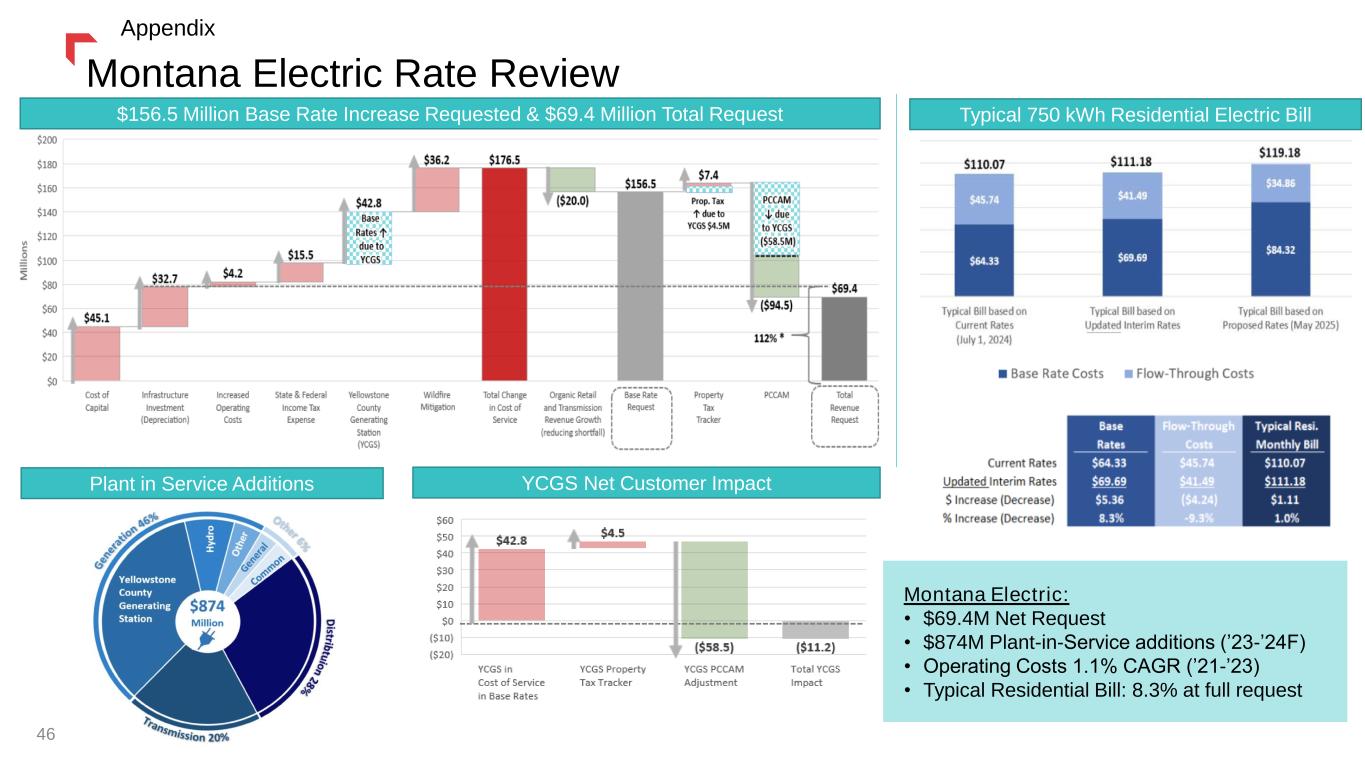

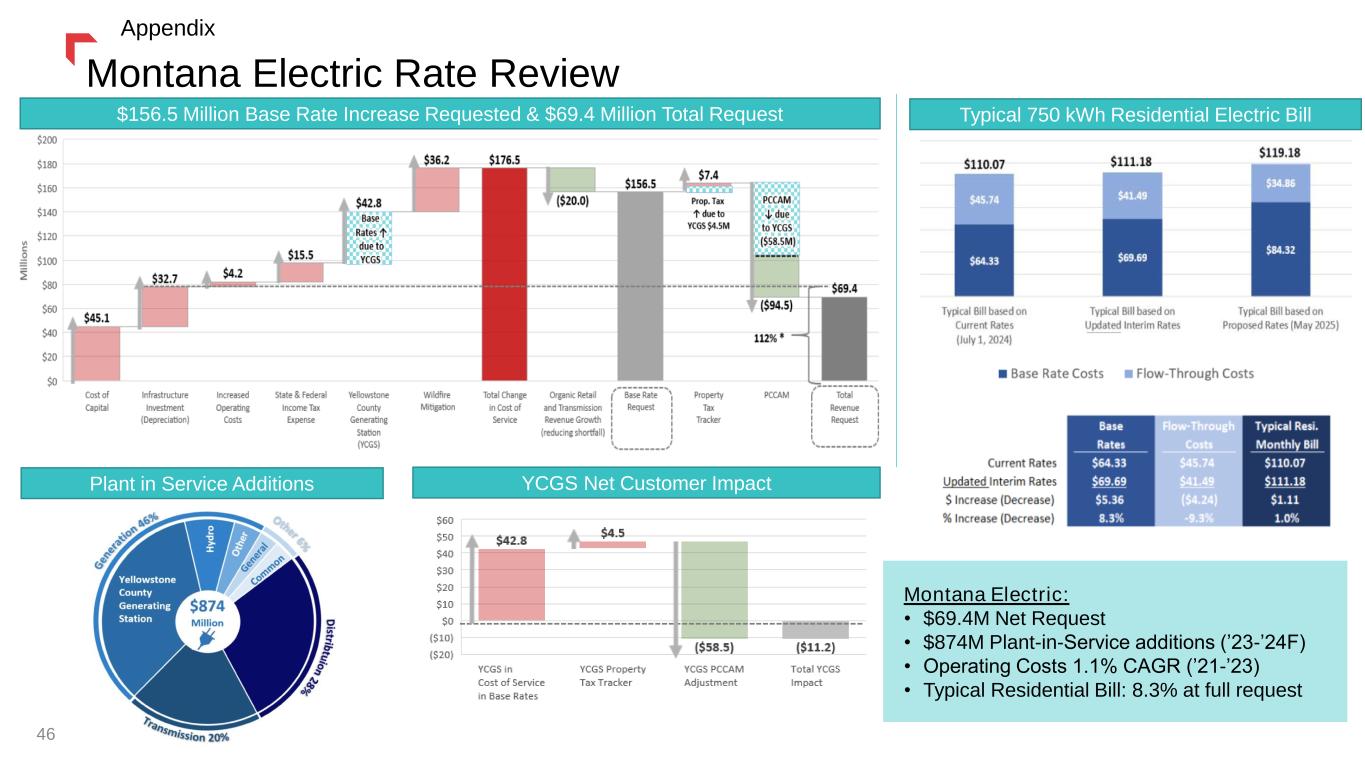

Montana Electric Rate Review Montana Electric: • $69.4M Net Request • $874M Plant-in-Service additions (’23-’24F) • Operating Costs 1.1% CAGR (’21-’23) • Typical Residential Bill: 8.3% at full request 46 $156.5 Million Base Rate Increase Requested & $69.4 Million Total Request Typical 750 kWh Residential Electric Bill YCGS Net Customer Impact Appendix Plant in Service Additions

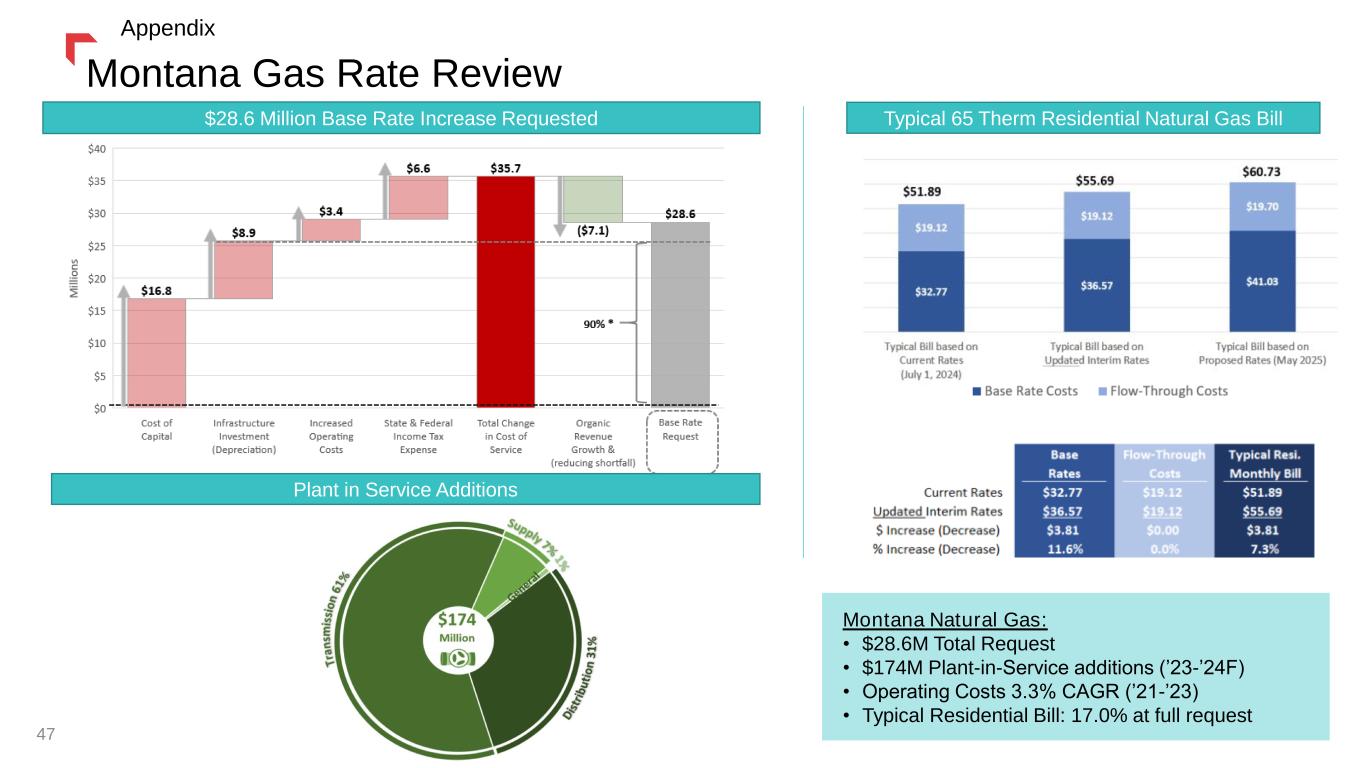

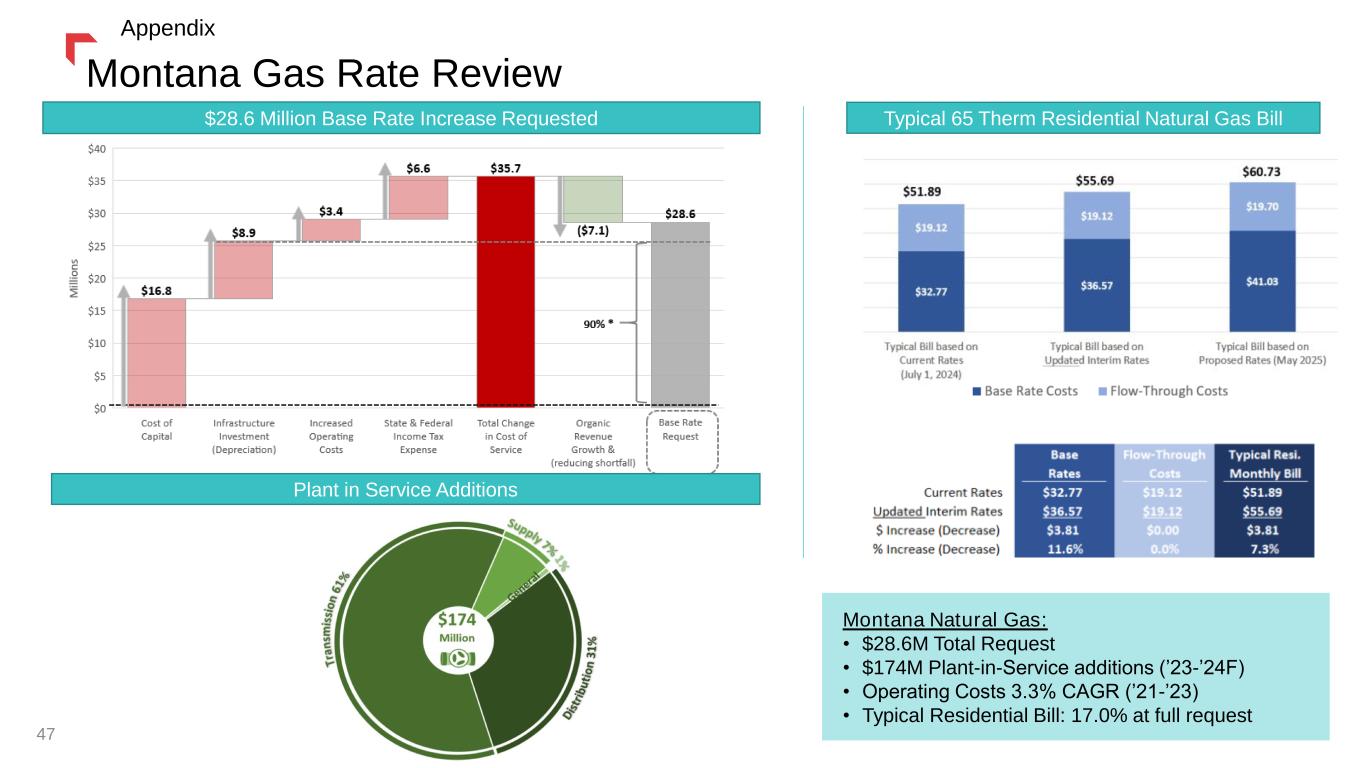

Montana Gas Rate Review 47 $28.6 Million Base Rate Increase Requested Montana Natural Gas: • $28.6M Total Request • $174M Plant-in-Service additions (’23-’24F) • Operating Costs 3.3% CAGR (’21-’23) • Typical Residential Bill: 17.0% at full request Typical 65 Therm Residential Natural Gas Bill Appendix Plant in Service Additions

South Dakota Natural Gas Rate Review 48 South Dakota Natural Gas: • $6.0M Total Request • $80M Plant-in-Service additions (’10-’23) • Operating Costs 1.9% CAGR (’10-’23) • Typical Residential Bill: 7.9% at full request $6.0 Million Rate Increase Requested Typical 100 Therm Residential Natural Gas Bill Appendix

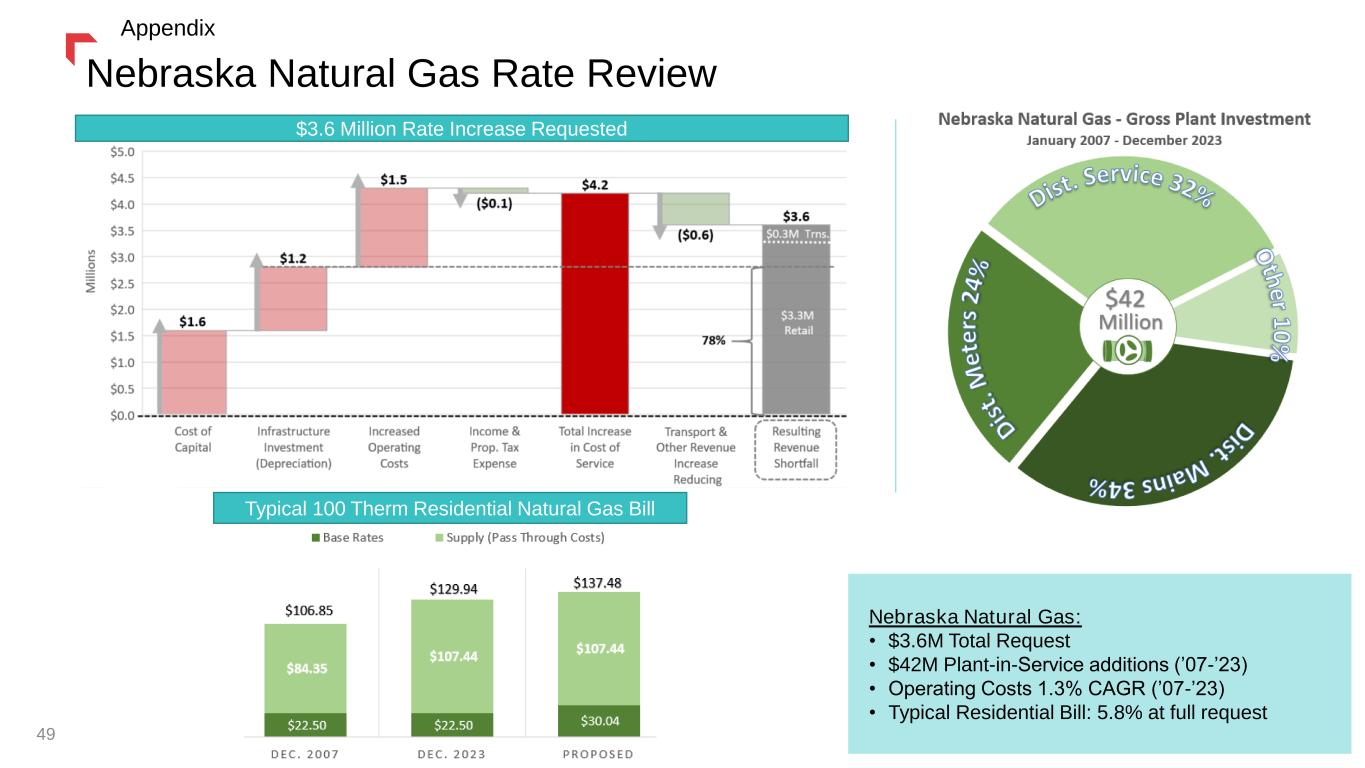

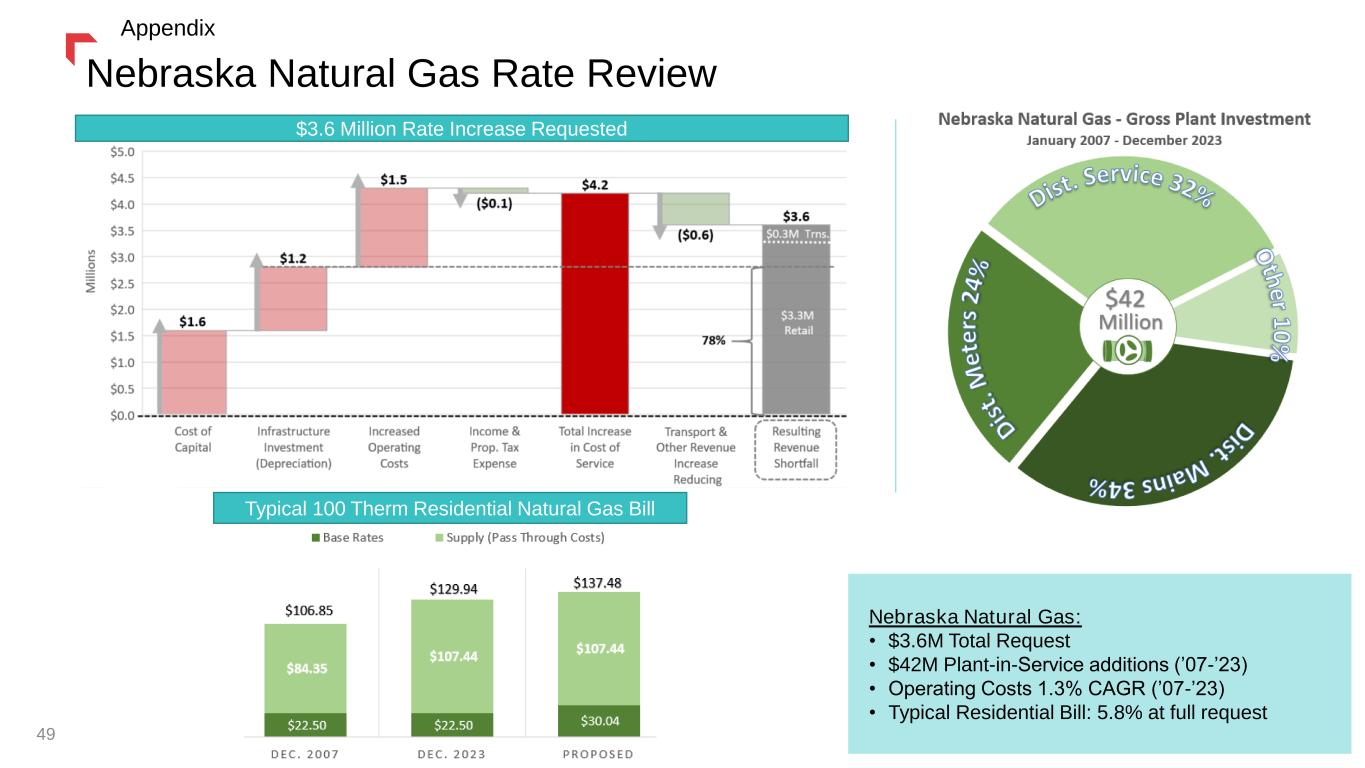

Nebraska Natural Gas Rate Review 49 $3.6 Million Rate Increase Requested Typical 100 Therm Residential Natural Gas Bill Nebraska Natural Gas: • $3.6M Total Request • $42M Plant-in-Service additions (’07-’23) • Operating Costs 1.3% CAGR (’07-’23) • Typical Residential Bill: 5.8% at full request Appendix

Thank youDelivering a bright future 50